Lake City is America’s Hottest

Market p. 8 Is the Housing Market Recession Over? p. 22

REALTOR MAY 2024 Salt Lake Magazine ®

Salt

Job

David Weekley Homes is expanding in the Salt Lake City area!

Call or scan the QR Code to learn how your Clients can embrace the lifestyle they’ve always wanted in one of these six upcoming communities.

Utah County

Grove Acres

Pleasant Grove, UT

Coming May 2024

Brixton Park

Saratoga Springs, UT

Coming June 2024

Beacon Pointe

Saratoga Springs, UT

Coming July 2024

Salt Lake County

Bonneville Towns

West Valley City, UT

Coming July 2024

Terraine

West Jordan, UT

Coming September 2024

Davis County

Eastridge Park

East Layton, UT

Coming June 2024

See a David Weekley Homes Sales Consultant for details. Prices, plans, dimensions, features, specifications, materials, and availability of homes or communities are subject to change without notice or obligation. Illustrations are artist’s depictions only and may differ from completed improvements. Copyright © 2024 David Weekley Homes - All Rights Reserved. Salt Lake City, UT (SLC-24-001678)

Learn more by contacting 385-509-4313

Turning Houses into Homes® Are you set to grow? We can help you find more leads and convert more shoppers into buyers. Partner with us to go beyond surving to thriving and blossoming. SecurityNational Mortgage Company complies with Section 8 of RESPA and does not offer marketing services in exchange for referrals or the expectation of referrals. This is not a commitment to make a loan. Loans are subject to borrower and property qualifications. Contact loan originator listed for an accurate, personalized quote. Interest rates and program guidelines are subject to change without notice. SecurityNational Mortgage Company is an Equal Housing Lender NMLS 3116. HelpYourClient@snmc.com

Business is Blooming

Angel

Salt Lake Realtor® Magazine is self-supporting. The advertisers in this magazine pay for all production and distribution costs. Help support this magazine by advertising. For advertising rates, please contact Mills Publishing at 801.467.9419. The paper used in Salt

Realtor® Magazine comes from trees in managed timberlands. These

are planted and grown specifically to make paper and do not come from parks or wilderness areas. In addition, a portion of this magazine is printed from recycled paper.

The Salt Lake REALTOR® (ISSN 2153 2141) is published monthly by Mills Publishing, located at 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106. Periodicals Postage Paid at Salt Lake City, UT. POSTMASTER: Send address changes to: The Salt Lake REALTOR,® 772 E. 3300 South, Suite 200 Salt Lake City, Utah 84106-4618. May 2024 volume 84 number 5 This

Magazine is Self-Supporting

Lake

Contents slrealtors.com Features 8 Utah's Tech Hub

America's Hottest Job Market

trees

Table of

Powers

Au-Yeung

Corrigan 12 A Playbook for Agents Working With First-Time Buyers Barbara Ballinger 16 Four Ethical Missteps to Avoid Professional Standards Committee Salt Lake Board of Realtors® 20 92% of Baby Boomers Plan to Stay in Their Homes Barbara Ballinger 26 Top Golf for RPAC Columns 5 How Does NAR Advocate for Realtors® and Homeowners Dawn Stevens – President’s Message Departments 6 Happenings 6 In the News 28 Housing Watch 4 | Salt Lake Realtor ® | May 2024 On the Cover: Cover Photo: Kartik Deshpande©/Adobe Stock 12 A Playbook for Agents Working With First-Time Buyers 20 92% of Baby Boomers Plan to Stay in Their Homes Salt L ake REALTOR® Magazine slrealtors.com Andrii©/ Adobe Stock 16 Four Ethical Missteps to Avoid Artur©/ Adobe Stock Syda Productions©/Adobe Stock

and Tom

President Dawn Stevens Real Broker

First Vice President

Claire Larson Woodside Homes of Utah LLC

Second Vice President Jodie Osofsky

Summit Sotheby's

Treasurer

Amy Gibbons

KW South Valley Keller Williams

Past President Rob Ockey Berkshire Hathaway

CEO Curtis Bullock

DIRECTORS

Janice Smith

CB Realty (Union Heights)

Laura Fidler

Summit Sotheby's (Draper)

Jenni Barber Berkshire Hathaway

J. Scott Colemere Colemere Realty Assoc.

Chris Anderson Windermere Real Estate - Utah

Morelza Boratzuk RealtyPath (South Valley)

Michael Rowe CB Realty (SL-Sugarhouse)

Eric Santistevan Engel & Volkers (Holladay)

Hannah Cutler CB Realty (Union Heights)

Michael (Mo) Aller Equity RE (Advantage)

Linda Mascher Realtypath LLC (Advisors)

Advertising information may be obtained by calling (801) 467-9419 or by visiting www.millspub.com

Managing Editor Dave Anderton

Publisher Mills Publishing, Inc. www.millspub.com

President Dan Miller

Art Director Jackie Medina

Graphic Design

Ken Magleby

Patrick Witmer

Office Administrator

Cynthia Bell Snow Sales Staff Paula Bell Dan Miller

Salt Lake Board: (801) 542-8840 e-mail: dave@saltlakeboard.com Web Site: www.slrealtors.com

REALTOR is the monthly magazine of the Salt Lake Board of REALTORS . Opinions expressed by writers and persons quoted in articles are their own and do not necessarily reflect positions of the Salt Lake Board of REALTORS® Permission will be granted in most cases, upon written request, to reprint or reproduce articles and photographs in this issue, provided proper credit is given to The Salt Lake REALTOR as well as to any writers and photographers whose names appear with the articles and photographs. While unsolicited original manuscripts and photographs related to the real estate profession are welcome, no payment is made for their use in the publication.

Views and opinions expressed in the editorial and advertising content of the The Salt Lake REALTOR are not necessarily endorsed by the Salt Lake Board of REALTORS . However, advertisers do make publication of this magazine possible, so consideration of products and services listed is greatly appreciated.

OFFICIAL PUBLICATION

How Does NAR Advocate for Realtors® and Homeowners?

In Washington, D.C., individual voices often get lost in the political noise. This underscores the importance of national associations like the National Association of Realtors® (NAR), one of the U.S.’s largest and most influential lobbying groups. NAR effectively represents and safeguards its members—Realtors®—while also advocating for homeownership and protecting private property rights.

While valid criticisms of NAR exist, such as those pertaining to its handling and settlement of the class-action lawsuits, it is essential to acknowledge the considerable influence of one of the most formidable lobbying entities in the nation. NAR plays a pivotal role in advocating for programs that significantly benefit our profession, notably the 30-year fixed-rate mortgage and the mortgage interest deduction. NAR diligently works to safeguard the continuity of these invaluable programs by actively participating in decision-making processes.

NAR’s advocacy addresses issues crucial to Realtors® and the wider realm of achieving the American dream of homeownership. By leveraging its network of over 1.4 million members, NAR ensures that real estate professionals are heard at every government level.

What concrete advantages and tangible benefits does this representation offer?

Policy Influence: NAR significantly shapes real estate-related policies. Its lobbying efforts help promote a healthy housing market and protect the interests of property owners and real estate professionals. This includes advocating for homeowner-friendly tax policies, supporting mortgage accessibility programs, and opposing harmful property ownership regulations.

Economic Advocacy: Homeownership is vital for many Americans’ economic stability. NAR supports policies that foster a robust real estate market, advocating for lower interest rates and home buying support programs, benefiting Realtors® and homeowners alike. For example, the 30-year fixed-rate mortgage is particularly prevalent in the United States, whereas in most countries, there is less emphasis on long-term homeownership stability.

Protecting Property Rights: A key role of NAR is defending private property rights, ensuring owners can enjoy their property free from excessive government interference. This advocacy is crucial in preserving fundamental property ownership rights.

Educating Stakeholders: Beyond lobbying, NAR educates lawmakers, stakeholders, and the public on real estate issues, influencing public opinion and legislative agendas to support a sustainable and equitable housing market.

Networking and Support: NAR provides Realtors® access to a professional network and resources that support various aspects of their work, including legal resources, market data, and educational opportunities.

In fostering a sense of unity and togetherness among Realtors®, we recognize that our collective strength lies in our shared commitment to our profession and the clients we serve. By standing together, supporting one another, and upholding the highest standards of integrity and professionalism, we forge a bond that not only strengthens our individual practices but also elevates the real estate industry as a whole. Together, we are stronger, and together, we navigate the challenges and celebrate the triumphs that define our journey in this emotional and dynamic field.

Dawn Stevens President

REALTOR

May 2024 | Salt Lake Realtor ® | 5

letter and spirit of U.S. policy for the achievement of equal housing opportunity throughout the nation. We encourage and support the affirmative advertising and marketing program in which there are no barriers to obtaining housing because of race, color, religion, sex, handicap, familial status, or national origin. The Salt Lake

The Salt Lake Board of REALTORS® is pledged to the

October 2005

OF THE SALT LAKE BOARD

REALTORS ®

OF

is a registered mark which identifies a professional in real estate who subscribes to a strict Code of Ethics as a member of the NATIONAL ASSOCIATION OF REALTORS

Salt L ake

® Magazine slrealtors.com

REALTOR

Happenings In the News

Utah is the Top-Ranked State for Economic

Outlook

Americans are fleeing high-tax, high-regulation states like California, New York, and Illinois for pro-growth, pro-employment havens such as Utah, Idaho, and Arizona, according to a report by the American Legislative Exchange Council (ALEC). The report highlights that Utah is the top-ranked state in the nation for economic outlook. Completing the top five are Idaho, Arizona, North Carolina, and Indiana, while the bottom five include New Jersey, California, Illinois, Vermont, and New York.

“This past year marked the fourth consecutive tax cut, allowing Utahns to keep a cumulative $1.3 billion of their hard-earned money,” said Utah State Senate President J. Stuart Adams. “This has provided them with more financial freedom and has directed more funds back into Utah businesses.” The report examined 15 economic policy variables to rank the economic outlook of each state.

Salt Lake City is No. 2 in Most EV-Friendly Housing Markets

Salt Lake City ranked second in the nation as the most EV-friendly housing market, according to a report by Realtor.com and Cox Automotive. In 2023, 1.2 million U.S. vehicle buyers chose electric vehicles, as reported by Kelley Blue Book, a Cox Automotive company. For EV owners, certain factors like home-charging capabilities and easy access to charging facilities are necessary for smooth ownership. According to the report, 1.6% of the active house listings in Salt Lake City were considered EV-friendly. EV-friendly homes are defined as single-family homes and condominiums/townhomes/rowhomes/co-ops listed for sale on Realtor. com with features such as “electric vehicles” and “240-volt outlet” mentioned in the listing descriptions. Additionally, Salt Lake City had, on average, one public charging port for every 17 EVs. San Jose, California, was ranked as the No. 1 EVfriendly housing market.

Crackdown on Investors Buying Homes

According to The Wall Street Journal, more lawmakers want to force large owners of single-family homes to sell houses to family buyers.

Democrats in the U.S. Senate and House have sponsored legislation that would do just that. A Republican’s bill in the Ohio state legislature aims to drive out institutional owners through heavy taxation. Lawmakers in Nebraska, California, New York, Minnesota, and North Carolina are among those proposing similar laws.

“These lawmakers say that investors that have scooped up hundreds of thousands of houses to rent out are contributing to the dearth of homes for sale and driving up home prices,” the Journal article stated. “They argue that investor buying has made it harder for first-time buyers to compete with Wall Street-backed investment firms and their all-cash offers.

Investors of all sizes spent billions of dollars buying homes during the pandemic. At the 2022 peak, they bought more than one in every four single-family homes sold, though more recently their activity has slowed as interest rates rose and supply became tighter. Two of the largest home-buying firms, Invitation Homes and AMH, are publicly traded companies, while a number of other companies, backed by private equity, hold portfolios of tens of thousands of homes nationwide.

6 | Salt Lake Realtor ® | May 2024

VICHIZH©/Adobe Stock

Image licensed by Ingram Image

READY TO GET REAL ABOUT REAL ESTATE?

As part of the legendary Berkshire Hathaway family of companies, we have the depth, strength and brand power to help grow your real estate business. Our network extends globally in reputation and strength. Locally, our company is the largest brokerage in Utah, ensuring that your property reaches a broad audience of real estate professionals and buyers. We are committed to providing you with the resources and support that will create greater success and enjoyment in your real estate career. So, talk with us at Berkshire Hathaway Utah Properties and let’s get you settled without ever settling for less.

2023 NETWORK AWARDS – CONGRATULATIONS TO OUR TEAM OF AMAZING REAL ESTATE PROFESSIONALS AND THANK YOU TO OUR VALUED CLIENTS FOR A VERY SUCCESSFUL 2023.

COMPLETE SERVICE ADVANTAGE / (801) 990-0400 / BHHSUTAH.COM RESIDENTIAL / MORTGAGE/LOANS / COMMERCIAL / RELOCATION PROPERTY MANAGEMENT & LONG TERM LEASING / TITLE & ESCROW SERVICES ©2024 BHH Affiliates, LLC. An independently owned and operated franchisee of BHH Affiliates, LLC. Berkshire Hathaway HomeServices and the Berkshire Hathaway HomeServices symbol are registered service marks of Columbia Insurance Company, a Berkshire Hathaway affiliate. Equal Housing Opportunity.

PROPERTIE

SALE S STATEWIDE 2020-2023

UTAH PROPERTIE

OVER 500 AGENTS ACROSS 30+ OFFICE S

THAN

AMERICA, SOUTH AMERICA, EUROPE

@BHHSUTAH

• UTAH

S – $17.3 BILLION IN

•

S –

• MORE

50,000 NETWORK SALE S PROFE SSIONALS AND 1,500+ MEMBER OFFICES THROUGHOUT NORTH

AND ASIA

#1 UTAH PROPERTIES IS THE #1 INDEPENDENTLY OWNED AND OPERATED BROKERAGE IN OUR GLOBAL NETWORK #9 UTAH PROPERTIES IS THE #9 BROKERAGE OVERALL IN OUR GLOBAL NETWORK #2 OUR PARK CITY OFFICE IS THE #2 OFFICE IN OVERALL TOTAL PRODUCTION IN OUR GLOBAL NETWORK TOP 100 UTAH PROPERTIES HAS 10 OF THE TOP 100 AGENTS & TEAMS IN OUR GLOBAL NETWORK #1 PRIVATELY OWNED BROKERAGE #9 BROKERAGE OVERALL #2 OFFICE IN OVERALL TOTAL PRODUCTION 10 OF THE TOP 100 AGENTS & TEAMS

Utah’s Tech Hub Powers America’s Hottest Job Market

For over a decade, Salt Lake City has attracted white-collar workers from the San Francisco Bay Area and Los Angeles.

By Angel Au-Yeung and Tom Corrigan

Follow the mountains and sunshine for the best job markets in America.

Salt Lake City was the country’s hottest job market in 2023, followed by three cities in Florida: Jacksonville, Orlando, and Tampa. Miami also made the top 10, making Florida the top state last year.

The Mountain West and Sunbelt cities bucked the trend in a year marked by layoffs in the technology, manufacturing and financial sectors. Workers flocked

Due to limited rights, this story is only available in the print issue of the Salt Lake Realtor® magazine. A copy of this article is available on the Wall Street Journal website but charges may apply.

to these areas for their plentiful job opportunities, wage growth, affordability and recreational offerings.

The Wall Street Journal, working with Moody’s Analytics, assessed about 380 metro areas. The rankings determined the strongest labor markets based on five factors: the unemployment rate, the labor-force participation rate, changes to employment levels, the size of the labor force and wages. Larger areas, with more than one million residents, were ranked separately from smaller ones.

8 | Salt Lake Realtor ® | May 2024

Data continue to show a strong U.S. economy, tempering expectations for interest-rate cuts by the Federal Reserve. Employment in March rose by 303,000 jobs, according to the Labor Department, which was much higher than economists’ expectations, while the unemployment rate ticked down to 3.8%.

Cities with strong job markets were those wellpositioned as affordable alternatives to the traditional tech and financial hubs.

‘Silicon Slopes’

For over a decade, Salt Lake City has attracted whitecollar workers from the San Francisco Bay Area and Los Angeles. Many of the workers have taken jobs in Salt Lake City’s tech hub, aptly referred to as “Silicon Slopes.” They have also been able to buy homes after being priced out of California cities.

young workers with a deepened desire for easy access to the great outdoors.

“There’s a virtuous cycle where young, highly educated workers are moving into Salt Lake City and bringing in more money to that area,” said Adam Kamins, an economist at Moody’s Analytics.

Due to limited rights, this story is only available in the print issue of the Salt Lake Realtor® magazine. A copy of this article is available on the Wall Street Journal website but charges may apply.

Salt Lake City performed well across all five metrics, with the second-highest rate of labor-force participation and fifth-strongest growth in wages.

Austin, Texas, which fell five spots from the previous year but was still the seventh-highest-ranked labor market, had the strongest labor-force participation among large metro areas. Like Salt Lake City, Austin has become a cheaper alternative to the traditional tech hubs.

This migration increased after the pandemic, drawing in

While high interest rates and layoffs also affected Salt Lake City last year, it was easy for those workers to find employment given the area’s diverse economy, said Ron

May 2024 | Salt Lake Realtor ® | 9

Dansker Digital©/Adobe Stock

Zarbock, owner of Spherion Staffing Services, which specializes in professional, information technology and logistics industries.

“Some of the IT startups got diminished, but other organizations from the financial markets or manufacturing would pick them right up,” said Zarbock.

Friendly business laws and tax incentives have also made Salt Lake City a good place to build and expand businesses in other industries, said Jill Perelson, founder and chief executive of recruiting agency PrincePerelson & Associates. High-growth industries in Salt Lake City include life sciences, manufacturing and supply-chain logistics.

“There is so much land here that manufacturing and logistics companies can expand into the desert and beyond,” said Perelson.

In January, food company Mars Inc. announced a new 399,000 square-foot baking facility to make Nature’s Bakery snacks. Subzero Engineering, maker of data-center equipment, announced a 155,000-square-foot manufacturing facility in December.

Florida’s strong showing Florida dominated the top 10 rankings of the

10 | Salt Lake Realtor ® | May 2024

Andrew©/Adobe Stock

Due to limited rights, this story is only available in the print issue of the Salt Lake Realtor® magazine. A copy of this article is available on the Wall Street Journal website but charges may apply.

hottest job markets in 2023 with four spots, after holding three of the top 10 spots in 2022. Jacksonville has continued moving up the ranks, becoming the second-hottest job market after placing third in 2022. It is due to a continuation of companies ranging from corporate offices to warehouses relocating from the Northeastern corridor to Jacksonville, said Mike Brady, owner of two Express Employment Professionals staffing offices. His firm specializes in recruiting warehouse employees in the area. The abundance of jobs related to the gig economy has also forced employers to offer more competitive wages, he said. Florida as a whole continues to be a magnet for remote workers who like the affordability and the lack of a state income tax, said Kamins at Moody’s. Banks, mortgage lenders and real-estate businesses hired aggressively last year in Florida.

Third and PGIM announced in recent months they would open offices in Tampa.

Tampa and Miami came in first and second, respectively, in wage growth—indicating that employers are paying up to attract and retain workers. Meanwhile, New York and San Jose, Calif., metro areas, which are major financial and tech hubs, ranked toward the bottom of the list for wage growth.

Due to limited rights, this story is only available in the print issue of the Salt Lake Realtor® magazine. A copy of this article is available on the Wall Street Journal website but charges may apply.

While those industries didn’t have a banner year in 2023, Florida outperformed the rest of the country, Kamins said.

Hedge-fund giant Citadel announced two years ago that it was moving its headquarters from Chicago to Miami. Although the waterfront site for the planned headquarters remains empty, the project is finally starting to take shape. Financial firms including Fifth

Methodology

Rankings are based on five attributes: average unemployment rate throughout the year; yearly laborforce participation rate; change in the average monthly employment and labor-force levels from a year earlier; and the change in average weekly wages, not adjusted for inflation, in the first half of the year from a year earlier, reflecting the latest available wage data.

Each attribute was ranked, and those rankings were added together to create an overall score. Large metropolitan areas are those with a 2022 population above one million.

Write to Angel Au-Yeung at angel.au-yeung@wsj.com Reprinted by permission of The Wall Street Journal, Copyright © 2024 Dow Jones & Company, Inc. All Rights Reserved Worldwide. License number 5776650119488.

A Playbook for Agents Working With First-Time Buyers

Buying a single-family home for the first time is challenging; help ease anxiety by sharing these useful steps.

By Barbara Ballinger

A house is typically the largest investment people make. It keeps some up at night, worrying if they’ve budgeted properly to afford the downpayment and the maintenance of the home on top of their regular expenses like food and transportation. The process is an emotional one.

Help potential buyers by walking them through the process and dispelling common myths. One is that many first homes are temporary places to live before buyers trade up. In an era of housing shortages, it may become their long-term, even forever home, said salesperson Stephanie Mallios with Compass’ Stephanie Mallios Team in Short Hills, N.J.

Here are some of the most important factors to help first-time buyers understand.

Consider the Financial Pieces

First challenge: a down payment, for first-time buyers who can manage the cash, at least 20% of the sales price, if in a multiple offer situation, is still the gold standard, said Angie Golembiewski, broker at Baird & Warner in Chicago. Putting down more makes an offer stronger at a time when many of the buyers in the market are paying cash—around 32%, according to National Association of Realtors® (NAR) data, the highest rate of cash buyers in a decade.

That said, many first-time buyers don’t have the cash or the familial support to come up with a 20% down payment, which is why real estate agents need to be well-versed in alternative options. There are programs at the federal and state levels, and often county and

12 | Salt Lake Realtor ® | May 2024

Andrii©/ Adobe Stock

city, too. Housing-specific nonprofit organizations offer programs to alleviate the steep costs of buying a home. One such nonprofit is the Neighborhood Assistance Corporation of America (NACA), which offers what it refers to as “character-based” lending, mentorship and counseling to “close the racial wealth disparity” through homeownership.

Sometimes, it’s as simple as having a relationship with an experienced loan officer who can provide a variety of product options. Betsy Phillips, SRES, CSHIP, broker with Compass on Chicago’s North Shore, connects clients with savvy loan officers in her network. “There’s no magic option, but this helps, as does explaining certain rules and guidance related to credit counseling, so they have the best score possible,” she said.

Mallios refers clients to three different lenders to help educate them about different programs, as well as a local real estate attorney who can recommend a lender, too. “This gives them a second tier of support and experts who can show them a range of good options,” she said.

Another way new homeowners can compete is to get pre-approved for a loan, which means a lender is ready to underwrite a mortgage for them once they have a home in mind. This helps them figure out exactly what they can afford and shows the sellers that they’re prepared to make the purchase.

Interest rates make a big impact on payment and interest paid over time. First-time buyers will want to make sure that their financial situation is as healthy as possible so they can get approved for the best rate. “Lenders typically look at a borrower’s credit score, the stability of their employment and income, their savings and the downpayment they offer,” said Diane Mastay, Mortgage Director at Tropical Financial Credit Union. Mastay also recommends that borrowers visit at least two lenders to compare the dollar amount they will lend and the interest rate.

It’s also important that buyers understand the other short-term and long-term costs of homeownership: closing costs, real estate taxes, homeowners’ and liability insurance, yard work, heating, air conditioning and so on, plus an emergency fund for unexpected costs they didn’t incur in a rental situation. Phillips advises buyers to factor in these costs and figure out what they can afford comfortably when it comes to a mortgage payment, rather than take the maximum mortgage some lenders may offer.

Understand the Timeline

From start to finish, finding a home to reaching the closing table is six to eight weeks, said Re Associate Broker Kimberly Cantine from Halter Associates Realty. “This is a point that is usually open to negotiation by both

May 2024 | Salt Lake Realtor ® | 13

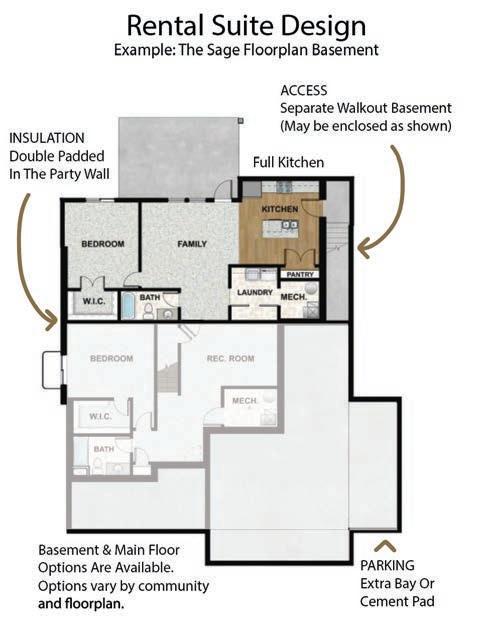

We build stylish innovative homes that offer joinable private suites (ADU), fully sound insulated and customized for rent or independent generational living. Come see our affortable FLEX-ADU models. (801) 871-9098 | R5homes.com Your Home Built Your Way R5 Homes.indd 1 5/7/24 2:56 PM

sides,” she said. “Also, it’s an ‘on’ or ‘about’ closing date so there’s usually flexibility,” she said.

Timelines, however, can sometimes be specific to the area. As a real estate professional, you’ll want to be able to tell your buyers what the average timeframe is for your community.

Prioritize Location

Homeowners should understand they can change much about their home once they purchase it—exterior materials and windows as well as interior features such as a kitchen, but the location is a permanent feature that can’t be changed. They should figure out what matters most to them in a community and decide on a location first.

First-time buyers who are millennials often favor walkability to downtown areas and local trails, and they will sacrifice house size or other features to achieve that, said Golembiewski.

Also help them understand how communities have different vibes, said Phillips. That way they can choose one that compliments their living style.

Weigh Curb Appeal

Most real estate experts stress how important the exterior of a home and its yard are when selling to entice buyers, but at a time of low inventory, buyers might want to consider upgrading their yards once they’re homeowners.

One exterior feature that many expect to remain popular is a small yard, which lets them avoid expensive, time-consuming upkeep. “The amount of yard most want is just enough to toss a ball occasionally with a child or dog,” Phillips said.

Factor in Condition

In a sellers’ market, fewer sellers may be willing to take on the expense of certain repairs or split the cost with the buyer. Yet, fewer millennials want to tackle big projects and prefer move-in-ready conditions, said Golembiewski. Data shows that many young buyers do not have the extra funds to make substantial renovations.

If a home needs work, have a frank discussion with buyers about the amount of effort and cost they can undertake or pay out to professionals. The reality is that finding a turn-key home at a favorable price point is the exception rather than the norm right now. Here’s where a detailed home inspection report is essential as a roadmap—and sometimes also a structural engineer’s input, depending on the age and location of the home.

Consider New Construction

While existing home inventory is in short supply, many builders are trying to meet demand with new products. New construction is an appealing option for many first-time buyers. Helping spur the appetite for new construction are the lower costs of maintaining

new housing, due to the lower insurance costs—40% to 50% less versus older homes, said Whitney Dutton, Residential Sales Director of Native Realty, in Fort Lauderdale, Fla.

Montgomery, Ala.-based Lowder New Homes’ Bradshaw Tyson, Vice President of Marketing said, one distinct advantage of buying a new-build home over a re-sale is that oftentimes builders are able to offer buyer incentives, or ways to help offset the cost of the new home. “At Lowder New Homes, we run promotions throughout the year that offer buyers an allowance, anywhere from $5,000 to $25,000, to use towards lowering their interest rate, help cover closing costs, or on home upgrades. We also have a group of preferred mortgage lenders who partner with us on our buyer incentives and can provide guidance to the buyer on how to utilize the promotion to best suit their needs.”

In Dutton’s South Florida market, insurance costs have skyrocketed due to climate-related activity. “The insurance companies have increased their regulations on roof age, plumbing and elevation,” he said. “Some companies won’t even insure properties with a 10-yearold roof for example. New homes are also built to new stricter building codes. “While some newer homes may be more to purchase initially than comparable older homes, they are cheaper to own, maintain and overall, a much safer product—with things like high impact windows and doors. This has brought a lot of investors to the table tearing down older homes, building new and selling them to eager first-time buyers,” he said.

The buying process is a complicated one, especially for first-timers. By providing all these tips, you’re helping first-time homeowners do their due diligence and communicating your value through your knowledge. This can help your buyers get into the best choice possible, which they may enjoy for years.

Barbara Ballinger is a freelance writer and the author of several books on real estate, architecture, and remodeling. Reprinted from Realtor® Magazine Online, April 2024, with permission of the National Association of Realtors®. Copyright 2024. All rights reserved.

14 | Salt Lake Realtor ® | May 2024

Image licensed by Ingram Image

Four Ethical Missteps to Avoid

Realtors® are subject to disciplinary action and sanctions if they violate the duties imposed by the Code of Ethics. By the Professional Standards Committee Salt Lake Board of Realtors®

1. Negative Reviews Published for “Likes”

Imagine trying to sell your home and finding out that someone has posted negative, even misleading, information about it online. In this case, the Respondent published a series of videos on different social media outlets, featuring footage of listings he had personally toured. As no one accompanied the Respondent while touring these listings, it’s clear that the showing appointments were not intended for a prospective buyer to see the property, but rather, for the Respondent to create social media content. Neither the listing agents nor property owners gave consent to

the Respondent to record these tours and feature their homes online in social media posts.

The videos created and published by the Respondent contained critical commentary toward the listings and received thousands of “likes.” The commentary on these videos, some of which was misleading, shed a negative light on the real estate professionals associated with the listings and potentially hurt the property owners’ ability to successfully market and sell the properties. The Respondent did not include the name of his brokerage on the video posts. The Respondent waived the right to a hearing, expressing remorse for publishing such

16 | Salt Lake Realtor ® | May 2024

content, and removed the posts. The Respondent was found in violation of Articles 1, 12 and 15of the Code of Ethics. He has been fined $1,500 and is required to take a live Code of Ethics course for no continuing education credit. Failure to comply results in a suspension of membership.

2. False Advertising Doesn’t Pay Off

The Complainant in this case was the listing agent for the property. The Complainant received an offer to purchase from the Respondent, a Realtor® representing himself as the buyer in the transaction. The sellers of the property countered the offer the same day, and it was accepted by the Respondent. The purchase price was $225,000.

After communicating acceptance to the Complainant, the Respondent asked if it was okay to share some photos and take more photos. The Complainant reached out to the Respondent to clarify that he was not going to market the home for the sale or an assignment. The

Respondent confirmed and said he wanted to share details with a couple of investor friends.

The Complainant later received an addendum from the Respondent asking for the seller’s permission to share photos and purchase details with potential partners and contractors. The Complainant emailed the Respondent, again asking to clarify as the Respondent had previously said he was not going to market the contract for sale for assignment or wholesale purposes.

The Complainant also expressed concern over use of the listing photos potentially creating licensing issues, as they were taken by a professional photographer.

The Respondent replied that he was just looking for a partnership and would share the photos only with potential partners and contractors. The Complainant confirmed that the Respondent was only looking for permission to share photos the Respondent had taken himself, and the Respondent confirmed that was correct. The seller then accepted the addendum.

The Respondent did not attend the showing. The Complainant found out later that the Respondent’s business partner came to the showing along with a contractor. The Complainant was not asked permission or informed of this before or at the time of the showing.

The Complainant became aware of an advertisement for the property distributed via email by the Respondent. This email showed the purchase price as $230,000 while the current list price of the Property was $240,000, and provided comps and a link to schedule walk-throughs of the property. At the bottom of the advertisement, it stated: “Available to cash buyers who can close by [Date]. Buyers pay both (buyers and sellers) sides of title fees. Home figures provided as a courtesy, buyer to verify all information. Buyer to perform Due Diligence prior to signing contract. Agents are welcome to add their commission on top. We may consider partnering on this deal. We may or may not own this property.”

At the end of the email there was a disclaimer in small type that stated: “[Company] and/or one of its partners is in possession of an Assignable Purchase Agreement that will allow us to purchase the property. *As part of our Due Diligence we are considering selling the Purchase Agreement that will allow you to purchase this property. *Available to cash buyers who can close by [Date].”

The outside photo of the home in the advertisement was taken from the MLS and used without permission. The Complainant confronted the Respondent about the advertisement and her belief that she was misled and lied to by the Respondent. The Respondent sent a cancellation of the contract, and the seller removed the listing from the market. The seller received offers on the Property well below list price from buyers who had seen the advertisement sent out by the Respondent.

The hearing panel found the Respondent in violation of Article 1 of the Code of Ethics. The Respondent failed to act honestly with all parties. The Respondent was dishonest and misleading in his communications about

May 2024 | Salt Lake Realtor ® | 17

Artur©/ Adobe Stock

advertising the Property, in allowing others access to the Property without supervision or permission, in using a photo without permission, and misleading viewers of the advertisement about the status of the parties, the buyer’s possession of an Assignable Purchase Agreement, and the transaction.

The Respondent was also found in violation of Article 12 of the Code of Ethics. The Respondent failed to be honest and truthful in their real estate communications and did not present a true picture in his marketing and other representations. Respondent was dishonest and misleading in his communications about advertising the Property, in allowing others access to the Property without supervision or permission, in using a photo without permission, and misleading viewers of the advertisement about the status of the parties, not taking every additional available measure to remove this advertisement from the public domain, and the transaction.

Respondent was fined $4,000 and required to take a live Code of Ethics class in addition to the normal hours required for license renewal. Respondent’s membership will be suspended if he does not comply with these sanctions.

3. Don’t Get Too Comfortable

The listing involved in this case was placed on RealTours by the Complainant. Upon entering the listing, the Respondent ignored the request to remove his shoes and proceeded to walk through the home with

his shoes on. Respondent entered the basement, where he saw an expensive drum set (owned by the seller) and decided to bang on it while making a video recording. No permission had been given for him to use the equipment. The seller became very upset after learning that their personal property was used without permission.

The Respondent waived the right to have a hearing. The Respondent was fined $250 and required to take the live Code of Ethics class for no continuing education credit. Failure to comply results in a suspension of membership.

4. Securing Rights to Use Photos

The Complainants in this case are the listing broker and the photographer hired to take listing photos. The Respondent is a subsequent listing agent.

The Complainant Broker hired the Complainant Photographer to take listing photos. These photos were posted on UtahRealEstate.com. The Respondent subsequently listed the same property and used these photos that had been taken by the Complainant photographer without obtaining permission from either of the Complainants.

The panel found the Respondent in violation of Article 12 of the Code of Ethics for using photos without permission. The Respondent was fined $250 and required to take the live Code of Ethics class for no continuing education credit. Failure to comply results in a suspension of membership.

18 | Salt Lake Realtor ® | May 2024

Kuzmaphoto©/ Adobe Stock

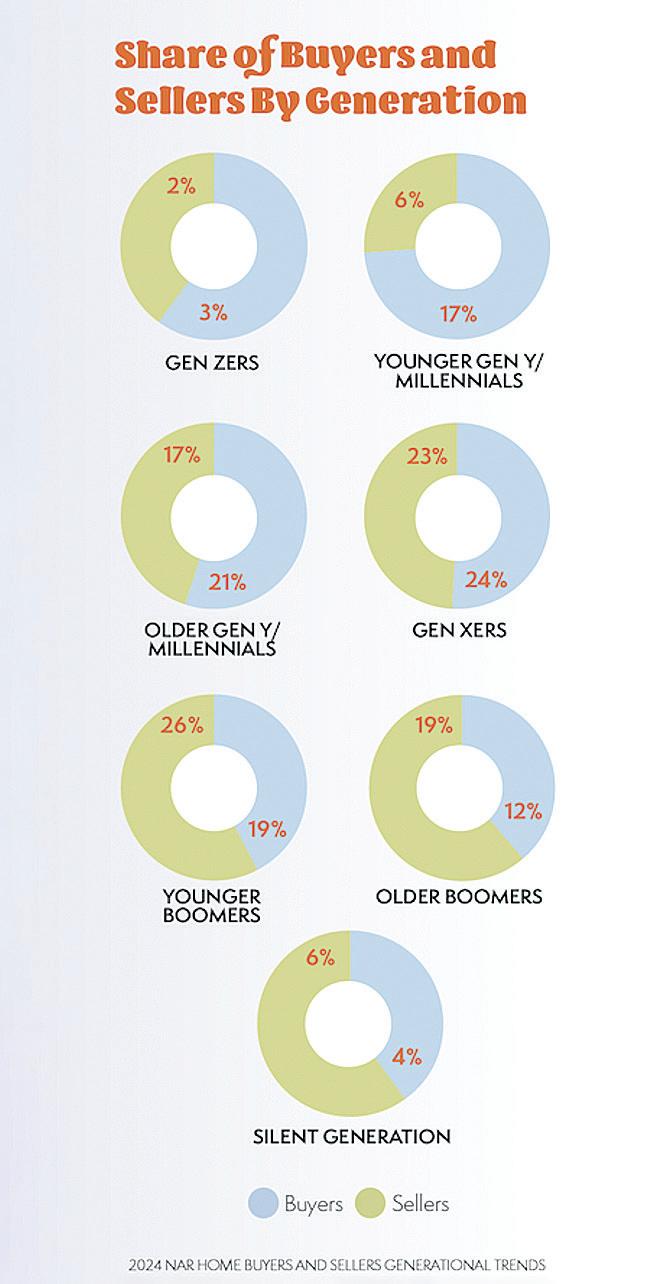

92% of Baby Boomers Plan to Stay in Their Homes

Baby boomers aren’t rushing to relocate to senior and assisted-care facilities in the Sunbelt. What’s a real estate agent to do?

By Barbara Ballinger

With a mindset that they are healthier than their parents were, have adequate nest eggs to maintain their homes, and are emotionally attached to their neighborhoods and belongings, many boomers are revising the anticipated script of where they’ll live as they enter the last chapter of their lives.

Baby boomers, a huge cohort of 68.6 million Americans born between 1946 and 1964, aren’t rushing to relocate to senior and assisted-care facilities in the Sunbelt. Rather, the vast majority—92%—say they want to age in place, even if they haven’t yet planned how to do so safely, according to American Advisors Group, which offers reverse mortgage loans to help those over age 62 to stay put.

Home sales statistics reflect the trend. According to National Association of Realtors® Chief Economist Lawrence Yun, home sales in 2023 fell to their lowest levels in nearly 30 years, but are finally on the uptick as of February. Boomers are said to be one reason inventory has been in short supply and the housing market has been frozen.

“Lower mortgage rates seem to be the only way to bring in more listings—reducing the spread between the prevailing mortgage rate and the 3% rates homeowners locked in,” said Jonathan Miller, CEO of appraisal firm Miller Samuel Inc. in New York and author of the Housing Notes newsletter. “At the same time falling rates increase demand, steadily rising prices

20 | Salt Lake Realtor ® | May 2024

Syda Productions©/Adobe Stock

make for an inventory stalemate that may last for several years,” Miller said.

So, what might spur boomers to move and add inventory for eager millennials?

Retirement, including pending retirement, is a potential trigger for boomers, pushing them to move to places they want to live, including closer to friends and family, said Jessica Lautz, deputy chief economist and vice president of research at NAR.

If they move, it may be to a different type of home, she said. “They often seek a newer property, and are not necessarily downsizing,” Lautz added. “The lack of downsizing may be due to the lack of smaller housing inventory, but also the desire for a bigger home” to accommodate children and grandchildren. She agrees with Miller that it’s unlikely housing inventory will increase as was anticipated when boomers purchased 20 years ago or so.

With 10,000 boomers reaching age 65 every day, it’s a good time to think about how you might help them navigate this complicated life stage. “So many

[boomers] say, ‘I’m not moving.’ But what is left out of most conversations is what comes next. The follow-up statement is almost always, ‘unless I have to,’ ” said Nikki Buckelew, CEO and founder of the Seniors Real Estate Institute in Oklahoma City.

Crises—a fall, illness, lower fixed income—may necessitate change, even though many in this group like to remain in control and are accustomed to researching to find what’s best, said Jean-Marie Minton, GRI, SRES, with Minton Regan Homes, Keller Williams Realty in Beverly, Mass.

No single solution works for all. “Unlike first-time buyers, this group typically has several options. It’s part of my job to help formulate which might be best,” said broker Tia Hunnicutt, ABR, SRES, founder and broker of Proxima Realty Group in Oakland, Calif.

That takes more than a one-hour conversation, said Jae Wu, broker and co-owner of Heyler Realty in Los Angeles. “It’s the largest life move for a lot of seniors and requires asking thought-provoking questions and listening to their answers. I ask them what they like to do, if they’re an introvert or extrovert, and to share what they want their life to be like in 10 years, so we can plan,” Wu said.

Many seniors who are moving want to stay near what they know, said Stafford Manion, SRES, with Gladys Manion in St. Louis. His mother remained in her Florida home into her 90s. “It gave her purpose,” he said.

Other boomers want to “chase grandbabies, sometimes in another state,” said Lautz. Or they seek a warmer climate, said broker-associate Angie Golembiewski, SRES, C2EX, an agent with Baird & Warner in Crystal Lake, Ill. Some stay put to house their grown millennial offspring, which helps them save for a house or pay

May 2024 | Salt Lake Realtor ® | 21

Image licensed by Ingram Image

student loan debt. Another option, multigenerational living, has grown more popular in recent decades, according to the Pew Research Center.

Besides taking the time to under-stand boomers’ desires, here’s more advice on becoming a knowledgeable, compassionate guide.

Professionalize Your Knowledge

The Center for Realtor® Development offers the Seniors Real Estate Specialist (SRES) designation. The coursework provides useful information to help boomers make latelife housing decisions and can be done through NAR’s online self-paced platform or in a classroom.

Through the program, Minton said, she learned how to counsel older sellers and buyers; they know she understands their emotional and financial concerns and can help them evaluate choices. She’s also prepared to find other resources—perhaps a service to declutter, which often evokes fear and can delay starting the process.

Kickstart a Conversation

Find out what real estate questions are brewing in boomers’ heads.

They may be interested in knowing the value of their home, the available housing inventory, and options for homes and communities that suit their changing needs and lifestyles, said Golembiewski. “With their growing housing wealth and historic levels of equity, more

boomers are using their equity to fund their retirement,” she added.

Others may have grown children who are concerned about their living alone and who want them to move closer, said Minton, who at age 64 moved with her husband to Boston from Chicago, so they could be within walking distance of their daughter.

Often, sellers have mixed emotions about leaving a family home; Hunnicutt advises focusing on getting them excited about their move.

Strategize Finances

How much equity boomers have built up in their house—along with how much they’ve saved—is critical information for evaluating how ready they are to meet their financial and lifestyle goals, said Lawrence D. Mandelker, trusts and estate partner in the New York office of Venable LLP. He takes a holistic view of his clients’ situation, often working with the seller’s team of advisers, including their real estate salesperson, accountant, and financial planner.

When you’re working with older sellers who are buying a new property, encourage them to consult an attorney before buying to ensure ownership is structured appropriately, Mandelker advised. Many times, owners are encouraged to put assets, including real estate, into a trust, which may offer creditor protection or tax benefits. Explore with boomers whether “right-sizing” will

22 | Salt Lake Realtor ® | May 2024

better fit their finances, said Jessica Duncan of Better Homes & Gardens Real Estate–Main Street Properties in Pensacola, Fla. If they’re in a single-family home, a condo may be less costly—though it may not be if the unit is newer construction. Help boomers consider all potential expenses, including monthly HOA fees.

Another financial issue to raise is the possibility of a capital gains tax, which depends on what they paid, how long they lived there, if it was their primary residence, the amount spent on capital improvements and their marital status, Mandelker said. In areas where houses have seen big appreciation, homeowners may feel stuck and decide to stay, even if maintaining the house is becoming difficult, so their heirs benefit from the step-up in basis exemption upon their death.

However, the amount of the tax may be less than they imagine; if it’s a concern, encourage them to talk to a tax adviser.

Develop a Plan B

Because finding a forever home may not be possible, Buckelew helps older buyers develop both primary and backup plans. “The house advisable for someone healthy at 70 to 80 is likely different than for someone 80-plus and coping with health challenges,” she said. Local services are often available to help, said Brendan L. Ward, trusts and estate partner with Cherry Tree Legal PLLC in Lynn, Mass.

May 2024 | Salt Lake Realtor ® | 23

Jason©/Adobe Stock

Aging in place may be impractical for some. When needed, broker Betsy Phillips, SRES, with Compass in Glenview, Ill., is prepared to share information about full-service independent living, assisted care, memory care and continuing care retirement communities. New possibilities keep emerging, including “dementia villages” that offer a home-like setting with medical practitioners onsite.

For many seniors, though, these choices are unaffordable, said Jennifer Molinsky, director of the Housing and Aging Society Program at Harvard University’s Joint Center for Housing Studies. In the overwhelming majority of metro areas studied for the report Housing America’s Older Adults, only 13% of single adults 75 and older living alone could afford assisted living, she said. She advocates for more innovative housing models, accessory dwelling units, missing- middle housing, and zoning and building code changes.

Help Prioritize Condition and Location Goals

Older adults are more likely to have mobility difficulties and need services and support at home, Molinsky said. Yet less than 4% of the country’s housing stock offers three basic accessibility features: single-floor living, nostep entries and extra-wide hallways and doorways, she said. “In addition, many older adults live in low-density locations with limited-service options, and in-home assistance is expensive,” she said.

Many boomers don’t want to under-take a remodel, which is why Wu has found many favor new properties that offer less ongoing maintenance. Location goals also differ from their younger years when, for many,

having a school nearby was a must. Wu said proximity to a medical center and other services, an outdoor space, and a garage tend to be priorities. She and her husband moved his mother from Boston to California, into a 55-plus community near their Los Angeles home.

Discuss Whether to Buy or Sell First

There are always debates about whether sellers should first list or buy.

The advantage of selling first is that they know what liquidity they have, Manion said. “Too many times people think they’re going to get one price, and they don’t.”

Minton likes the idea of selling first and then temporarily renting to avoid a hasty purchase, which could be especially smart for boomers moving to a different city. But it will mean two moves and possibly storage expenses.

In a competitive market, said salesperson Allison Bond of Cummings & Co. in Ruxton, Md., sellers might ask buyers to sign a rent-back agreement to gain more time to find a home. Duncan has become a specialist in orchestrating simultaneous moves, so properties close the same day.

Because of sparse inventory, boomers who can afford to may choose to buy first. They might also offer buyer financing, Ward said.

Barbara Ballinger is a freelance writer and the author of several books on real estate, architecture, and remodeling. Reprinted from Realtor® Magazine Online, May 2024, with permission of the National Association of Realtors®. Copyright 2024. All rights reserved.

24 | Salt Lake Realtor ® | May 2024

Alessandro Biascioli©/Adobe Stock

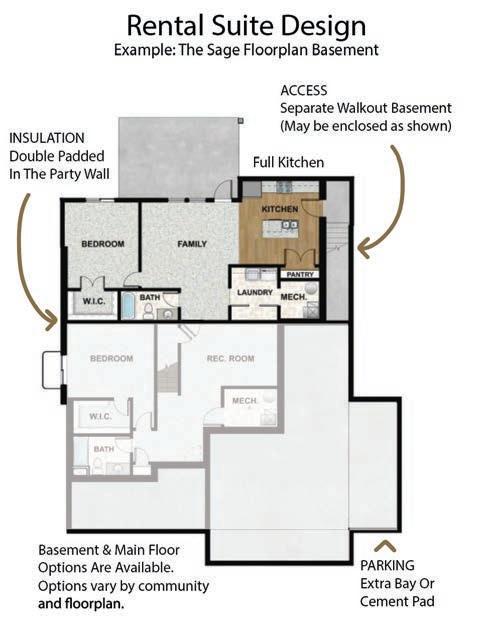

RENTAL SUITE/ADU

ADD AN APARTMENT FOR RENTAL INCOME OR FOR YOUR FAMILY.

FieldstoneHomes.com | 801.895.3526

NOW AVAILABLE IN 6 COMMUNITIES LEHI | SARATOGA SPRINGS | EAGLE MOUNTAIN | CLEARFIELD | MAPLETON | ST. GEORGE FINANCIAL BENEFITS

A NEW LOAN

TAX

ABOUT ADU’S ADU MODEL HOME IN SARATOGA

ACCESSORY DWELLING UNITS AVAILABLE RAMBLER & 2-STORY PLAN ADU OPTIONS AVAILABLE!

INCREASES INCOME TO QUALIFY FOR

RENTAL INCOME TO REDUCE MORTGAGE PAYMENTS

BENEFITS ADU

SPRINGS

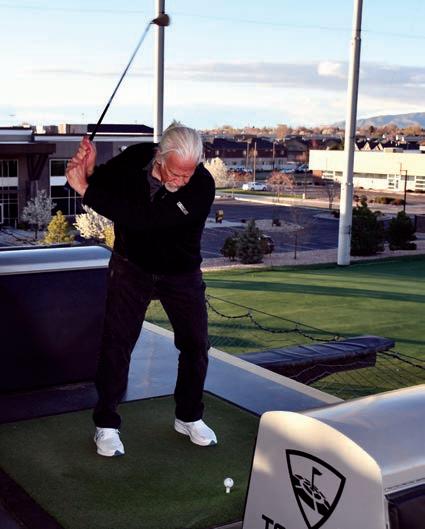

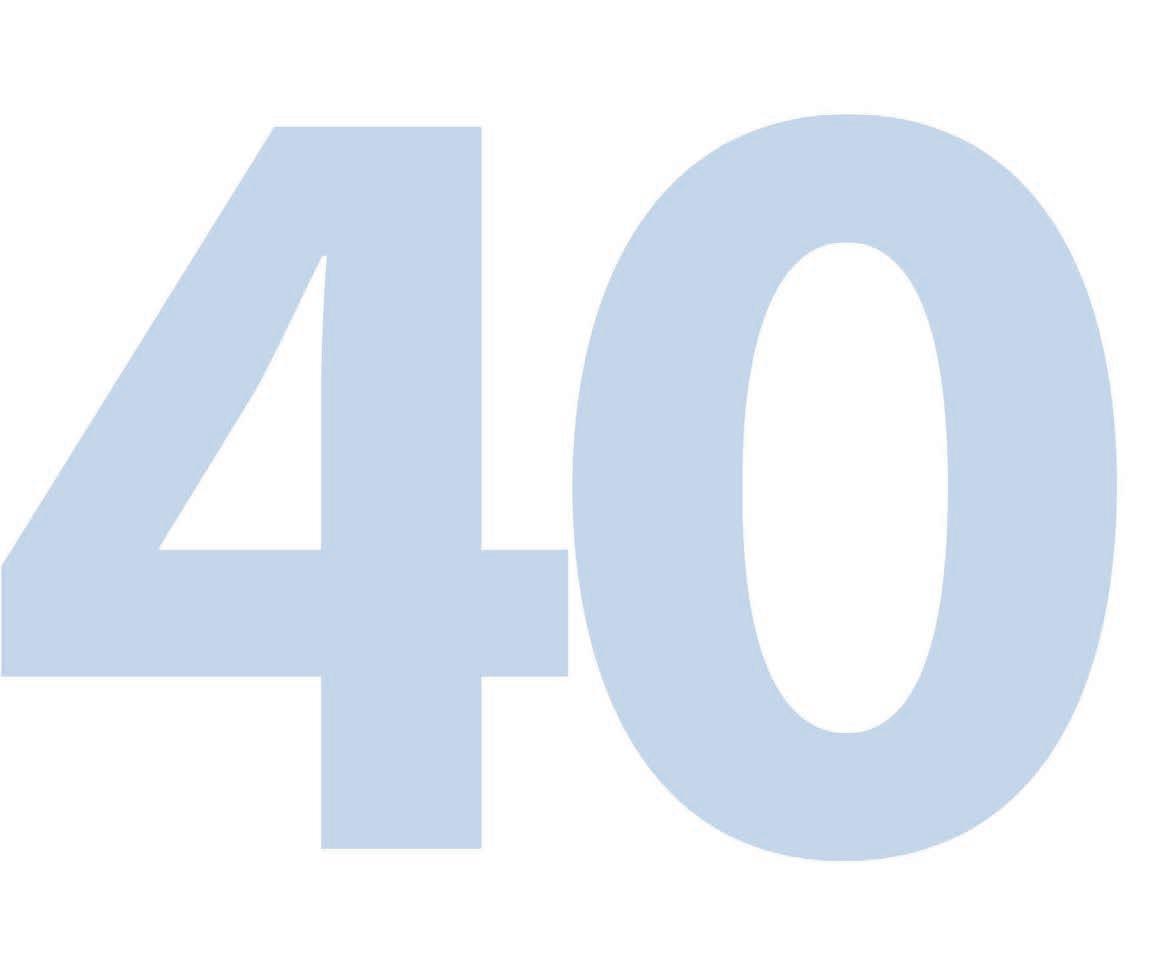

Top Golf for RPAC

About 100 members of the Salt Lake Board of Realtors® enjoyed an evening of Top Golf and dinner in support of the Realtors® Political Action Committee (RPAC). RPAC is one of the most bipartisan PACs in the country, giving to both Democrats and Republicans alike. The only stipulation is that the candidate support Realtor®-friendly issues. For every dollar given, 70 cents remains in Utah to focus on state and local government while the other 30 percent goes to protect your interests at the national level.

26 | Salt Lake Realtor ® | May 2024

May 2024 | Salt Lake Realtor ® | 27

March 2024

March Sees Decline in Home Sales Despite Quarterly Increase

In March, home sales in Salt Lake County experienced a slight decline, primarily due to higher mortgage interest rates. The county recorded 1,015 home sales, marking an 8% decrease from the 1,102 homes sold in March of the previous year. However, sales for the first quarter overall rose to 2,650 homes, a noticeable increase from 2,520 homes sold during the same period in 2023.

The median sale price of homes in March slightly increased to $525,000 across all housing types, up from $516,000 a year earlier. Prices for single-family homes reached $600,000, reflecting a 4% rise from the $575,000 recorded last year. Prices for multi-family homes also saw a modest increase to $425,000, up from $420,000 in March 2023. Additionally, homes spent an average of 28 days on the market in March, slightly less than the 29 days observed in March 2023.

Across the nation, total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – receded 4.3% from February to a seasonally adjusted annual rate of 4.19 million in March. Year-over-year, sales declined 3.7% (down from 4.35 million in March 2023), according to the National Association of Realtors®.

“Though rebounding from cyclical lows, home sales are stuck because interest rates have not made any major moves,” said NAR Chief Economist Lawrence Yun. “There are nearly six million more jobs now compared to pre-COVID highs, which suggests more aspiring home buyers exist in the market.”

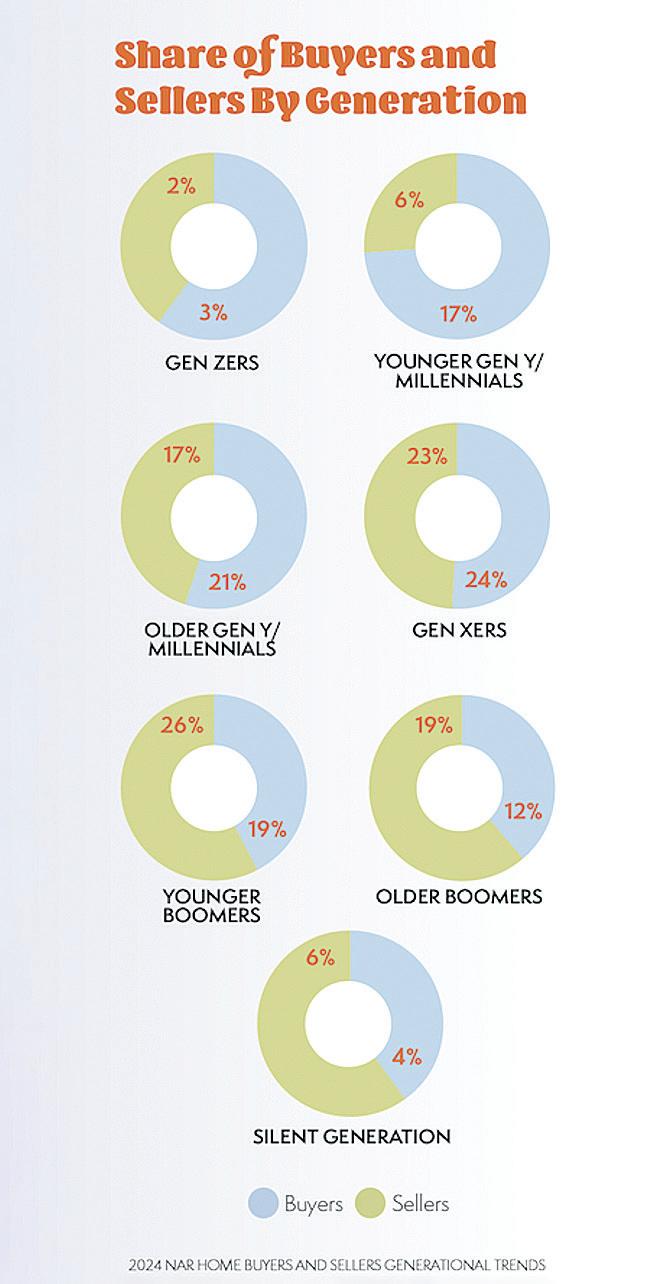

First-time buyers were responsible for 32% of sales in March, up from 26% in February and 28% in March 2023. NAR’s 2023 Profile of Home Buyers and Sellers – released in November 20234 – found that the annual share of first-time buyers was 32%.

All-cash sales accounted for 28% of transactions in March, down from 33% in February but up from 27% one year ago.

Individual investors or second-home buyers, who make up many cash sales, purchased 15% of homes in March, down from 21% in February and 17% in March 2023.

Distressed sales – foreclosures and short sales – represented 2% of sales in March, virtually unchanged from last month and the prior year.

“There are nearly six million more jobs now compared to preCOVID highs, which suggests more aspiring home buyers exist in the market.”

Lawrence Yun

Chief Economist National Association of Realtors®

28 | Salt Lake Realtor ® | May 2024

Salt Lake County

May 2024 | Salt Lake Realtor ® | 29 Local Market Update for March 2024 Source: UtahRealEstate.com

KEY METRICS NO. OF SALES MEDIAN SOLD MEDIAN PRICE NEW LISTINGS PRICE PER SQ. FT All Housing Types 1015 $525,000 $251.00 1357 Single Family 691 $600,000 $242.54 874 Multi Family 302 $425,000 $273.41 442 COMPARISON TO LAST YEAR 2023 All Housing Types 1102 $516,000 $236.97 1243 Single Family 769 $575,000 $230.43 840 Multi Family 307 $420,000 $262.78 369 COMPARISON TO LAST YEAR -% DIFFERENCE All Housing Types -7.89% 1.74% 5.92% 9.17% Single Family -10.14% 4.35% 5.26% 4.05% Multi Family -1.63% 1.19% 4.05% 19.78% -7.89% 9.17% -3.45% 1.74% 1015 1102 NO. OF SALES ALL HOUSING TYPES MAR. 2023 ALL HOUSING TYPES MAR. 2024 ALL HOUSING TYPES MAR. 2024 ALL HOUSING TYPES MAR. 2024 ALL HOUSING TYPES MAR. 2024 ALL HOUSING TYPES MAR. 2023 ALL HOUSING TYPES MAR. 2023 ALL HOUSING TYPES MAR. 2023 NEW LISTINGS MEDIAN CDOM MEDIAN SOLD PRICE

29 28

$516,000

1243 1357

$525,000

Pamela Abbott

Barton Allan

Judy Allen

Suzanne Allred

George Anastasopoulos

Brent Anderson

Clay Anderson

Diane Anderson

Kay Ashton

Sue Avalos

Margaret Averett

Laurence Bailess

Les Bailey

Brent Barnum

Veda Barrie-Weatherbee

Edward Belka

Ken Bell

Raymond Bennett

Richard C. Bennion

Steven Benton

Michael Black

Gregg Bohling

Russell Booth

Virginia Bostrum

Robert Bowles

Mary Ann Brady

Janet Brennan

Steve Brown

Stephen Bryant

Barbara Burt

Hedy Calabrese

Gregory Call

Tracey Cannon

Julie Carli

Carol Cetraro

Scott Chapman

Garn Christensen

Byron Christiansen

Brian De Haan

Babs De Lay

Lynn Despain

Jerard Dinkelman

Darlene Dipo

Sally Domichel

Rebecca Duberow

James Dunn

Randy Eagar

Carol Edgmon

Douglas Edmunds

Michael Evertsen

Bijan Fakjrieh

Alan Ferguson

Jack Fisher

Gale Frandsen

David Frederickson

Howard Freiss

Brent Gardner

Heidi Gardner

Paul Gardner

Linda Geer

Sheila Gelman

J. Carolyn Gezon

Larry Gray

Richard Grow

D. Brent Gudgell

Klaire Gunn

James Haines

John Hamilton

Mark Handy

Grant Harrison

Stephen Haslam

Michael Hatch

Thomas Haycock

Bill Heiner

Jeffrey Helotes

Marvin Hendrickson

Blake Ingram

Kent Ingram

Esther Israelson

Jackson Jensen

Kevin Jensen

Ron Jenson

Jeffrey Jonas

Steve Judd

David Kenney

Kay Kenyon

Henry Kesler

Douglas Knight

Peggy Knight

Wayne Knudsen

Karl Koenig

Randall Krantz

Leah Krueger

Kathryn Kunkel

Gary Larson

Teresa Larson

Vann Larson

Michael Lawrence

Clark Layton

Shauna Leake

Kaye LeCheminant

Daniel Lindberg

Michael Lindsay

Martin Lingwall

Mildred Llewelyn

Don Louie

Ted Makris

Margaret Malherbe

Al Mansell

David Mansell

Dennis Marchant

Susan Mark-Lunde

Paul Markosian

Ronnald Marshall

Margene Wrigley

Henry Youngstrom

Elizabeth Memmott

Uwe Michel

Gordon Milar

Kyle Miller

Preston Miller

David Moench

Richard Moffat

Gary Monk

H.Craig Moody

Randal Moore

Thomas Morgan

Thomas Mulock

Charles Mulford

Melanie Mumford

Jacqueline Nicholl

John Nielson

Michael Nielson

Robyn Nielson

Van Nielson

Victor Oishi

Joseph Olschewski

Brent Parsons

Joan Pate

Yvonne Pauls

Derk Pehrson

Douglas Pell

Robert Plumb

Noel Quinton

Helen Rappaport

David Read

Jerry Reed

George Richards

W. Kalmar Robbins

Stan Rock

Emilie Rogan

John Romney

Elizabeth Smith

Kenneth Smith

Rick Smith

Skip Smith

David Clark

Deborah Clark

Terry Cononelos

Jeffery Cook

Philip Craig

Dan Davis

Robert Davis

Terry Hill-Black

Lynda Hobson

Ted Holmberg

Sheryl Holmes

Rhys Horman

Carol Howell

Gary Huntsman

Susie Martindale

Christopher McCandless

Curtis McDougal

Miriam McFadden

John McGee

Russell McKague

Andrew McNeil

Marie Rosol

Christopher Ross

David Sampson

Mark Schneggenburger

Gary Shiner

Jeff Sidwell

Debra Sjoblom

Jeffrey Snelling

Lorenzo Spencer

Kenneth Sperling

Anna Grace Sperry

Robert Spicer

Trudi Stark

Lee Stern

Sandra Straley

Gary Strang

John Strasser

Kevin Strong

Thomas Swallow

Sonny Tangaro

Joan Taylor

Rosanne Terry

Martin Vander Veur

Craig Vierig

Peter Vietti

Hilea Walker

H. Blaine Walker

Richar dWalter

Dana Walton

Sally Ware

Jerry Webber

William Wegener

David Weissman

Jeffrey Wells

Wayne Whetman

Jeff White

Darlene Whitney-Morgan

Clayton Wilkinson

Thomas Wilkinson

Kimball Willey

Douglass Winder

Robert Wiskirchen

James Witherspoon

Linda Wolcott

Cynthia Wood

Sherrill Wood

Let's Talk Tools, Success, & Leveraging Our Network. We saved you a seat at our Daybreak Office. Brad Hansen GENERAL MANAGER brad@winutah.com • 801.230.5236 Miriem Boss DIRECTOR / BUSINESS DEVELOPMENT miriemboss@wincre.com • 949.836.4029 Grady Kohler OWNER / PRINCIPAL BROKER grady@winutah.com • 801.815.4663 winutah.com/joinus