DOWNTOWN RALEIGH

SUMMARY AND HIGHLIGHTS:

Six new development projects broke ground in 2022. In total, these new projects will deliver 1,020 residential units, 149 hotel rooms, and 32,000 square feet of retail to downtown.1 Overall, there are 16 projects under construction while another 42 projects are either in site preparation, are being planned, or have been proposed.1 Residential mixed-use projects still encompass the majority of the development pipeline with only 20 projects not containing at least some residential component.1

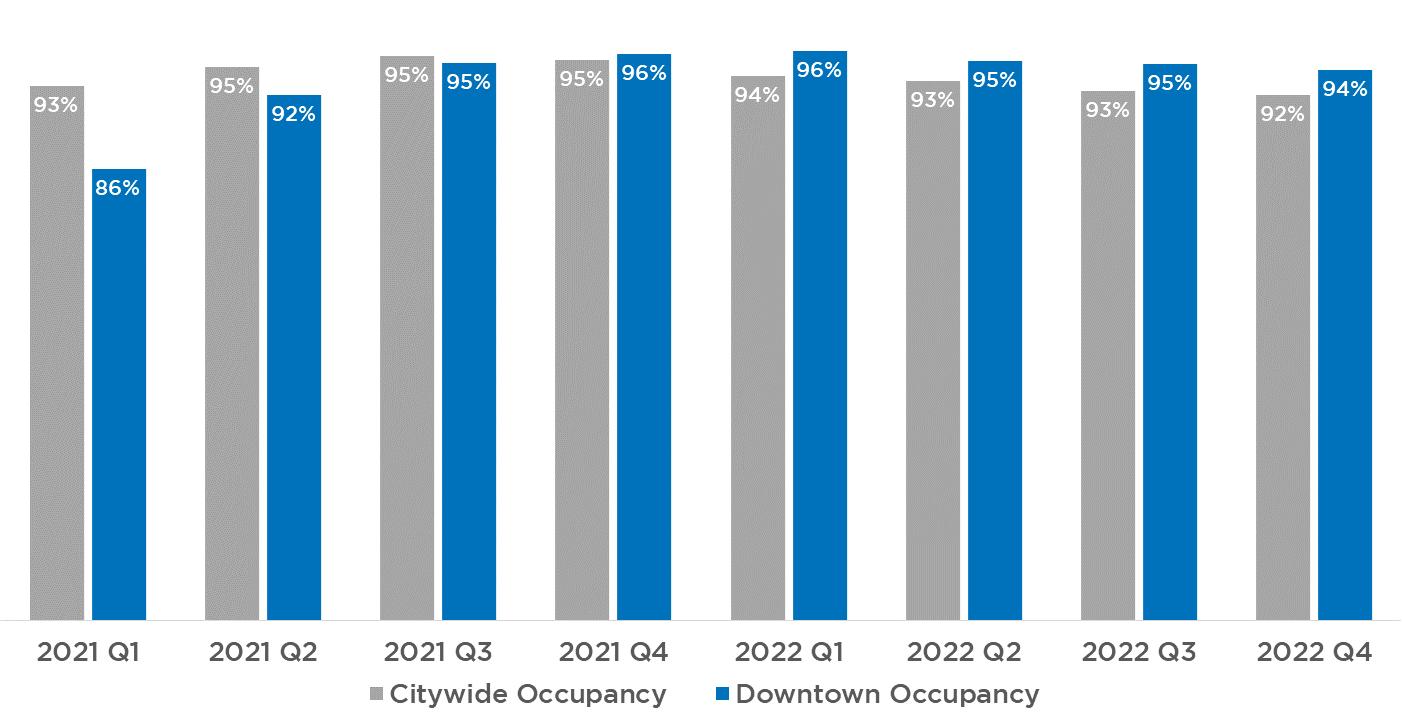

There are currently 2,034 residential units under construction across 11 projects while another 8,460 units have been proposed in 27 projects.1 Apartment market rents ended the year at $2.32 per square foot. Apartment occupancy remained high at 94.6% but decreased very slightly year over year.2 Multiple projects are set to occupy in 2023 starting with The Signal apartments (Seaboard Station Block A) in Q1 which will be the first apartment product delivered in downtown since The Line in 2021.1

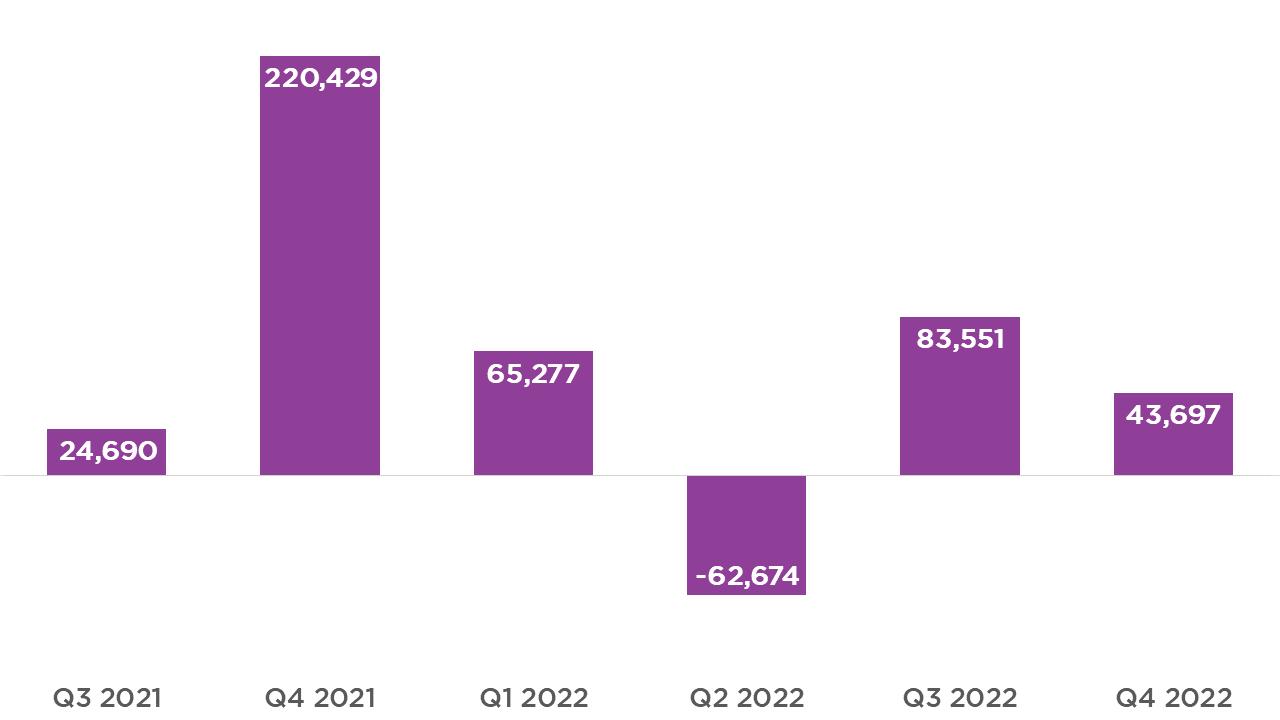

While no new office product broke ground in 2022, leasing activity continued on the three major new Class A office buildings delivered in 2021.2 Construction of 400H, which will add an additional 144,410 square feet of office, remains on pace for a topping out in Q1 of 2023.1 Class A market rent for downtown ended the year at $36.00 per square foot while occupancy increased slightly to end at 88.8%.3 The market absorbed 43,697 square feet of Class A office space in the fourth quarter.3

The downtown storefront economy added 10 new storefront businesses with one relocation/expansion in the fourth quarter including Sugar Euphoria, MILKLAB, and J. Lights Market & Cafe.1 Five storefront businesses closed during the same time period.1 Another 19 businesses have recently announced they’ll be opening new businesses or expanding into downtown soon.1 29 storefront businesses opened and 16 closed in 2022, with a net gain for the year of 13 additional businesses operating in downtown.

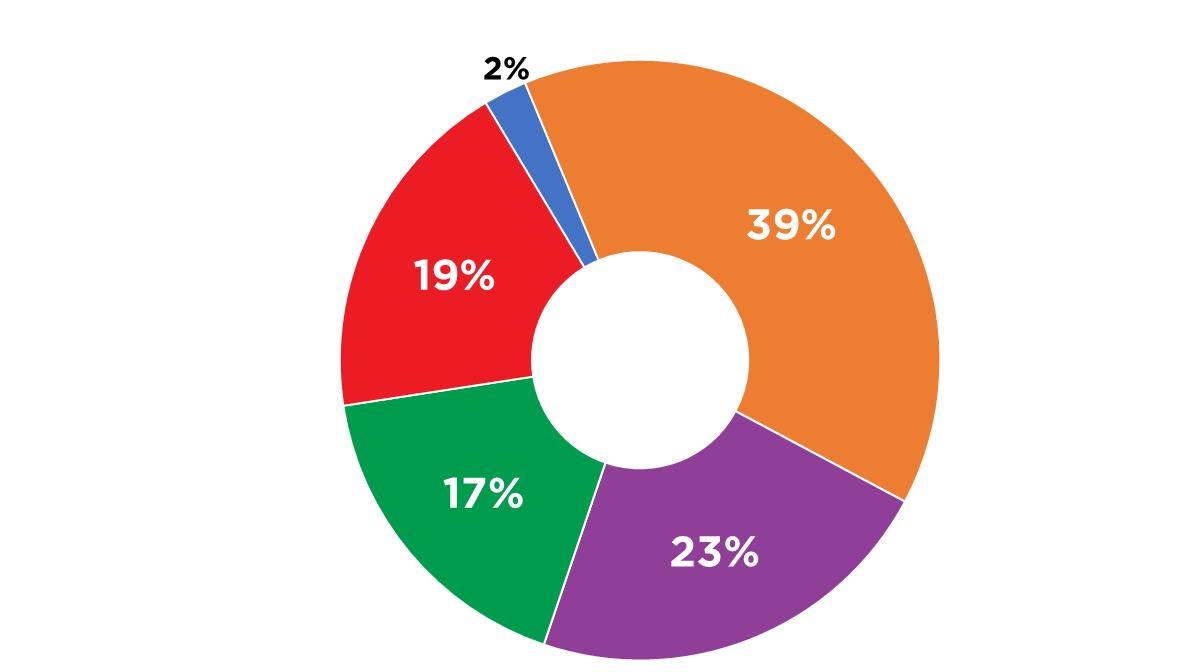

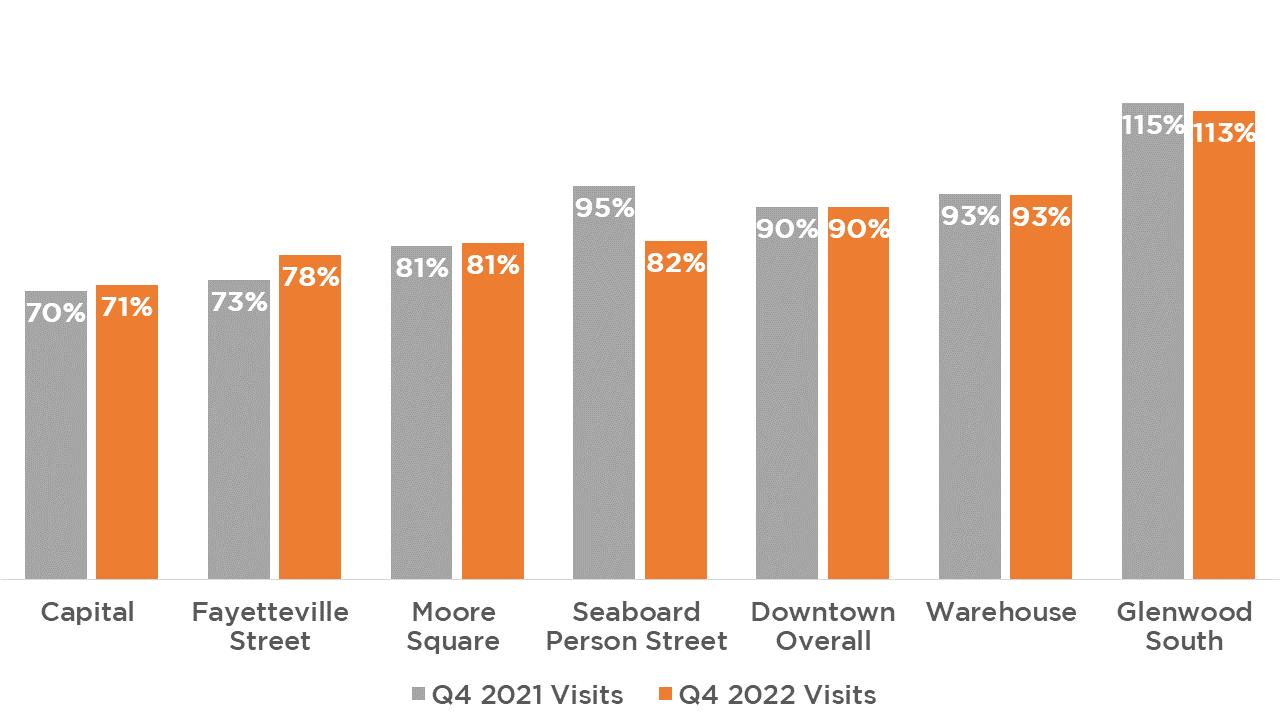

Average monthly food and beverage sales in downtown were up 10% year over year and level with Q3 of this year.2 Downtown Raleigh continues to recover unevenly from the pandemic with districts on the west side of downtown consistently at or surpassing pre-pandemic levels while the east and core districts still have ground to recover.2 Glenwood South district remains the downtown leader although its share of the total has decreased to 39% as districts like Fayetteville Street and Warehouse recover.2

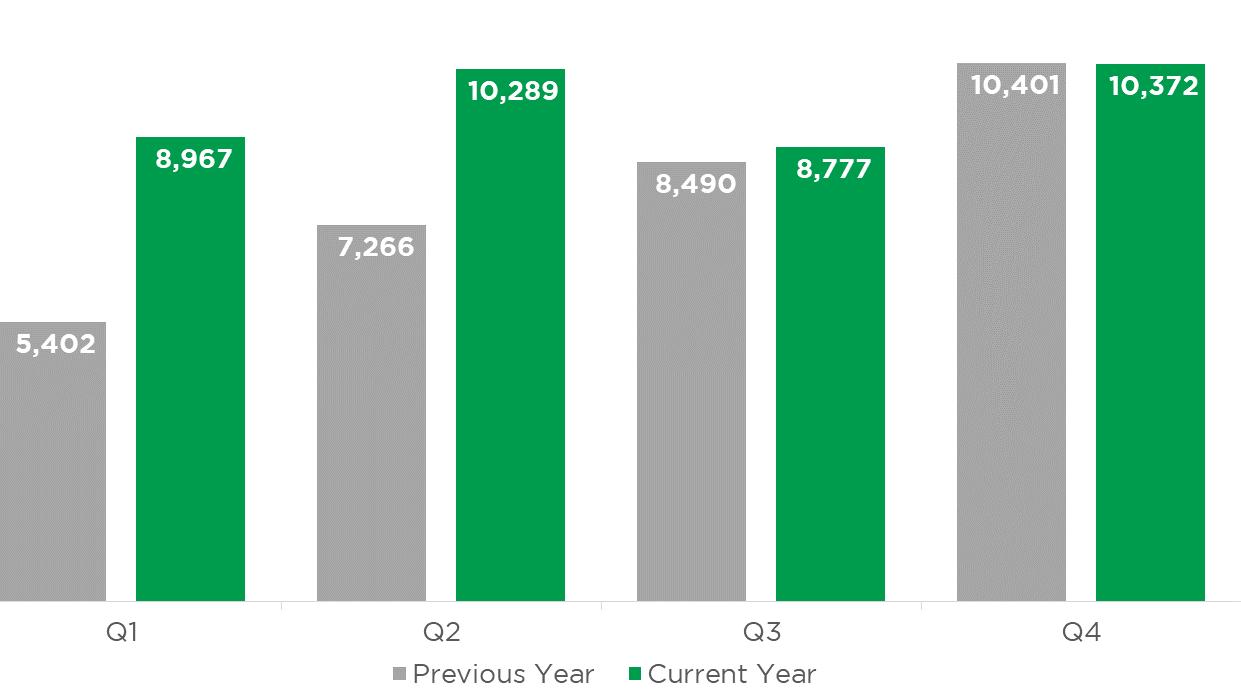

Average daily pedestrian counts in Q4 increased 18% from the previous quarter but remained approximately the same year over year.3

Average monthly hotel room sales increased 58% year over year for the fourth quarter, averaging $9.4 million between October and November.2 Overall visitor visits to downtown recovered to near pre-pandemic levels in Q4, recovering to 90% of 2019 values.4

The largest transaction of the quarter is the recent sale of the 401-key Marriott City Center hotel on Fayetteville Street which sold in October for just over $77 million, or $193,000 per hotel room.5 The purchase was part of a 25 property bulk portfolio transaction by Brookfield Asset Management, Inc. Also in the Fayetteville Street district, Monarch Realty Co. purchased the former Turner Printing location at 216 S. Wilmington Street for $1.25 million in November.2

+10%

INCREASE

Average Monthly Food & Beverage Sales from Q4 20212

20223

Average

Q4 20212

DEVELOPMENT UPDATES:

The downtown development pipeline expanded significantly in 2022 with several new projects being proposed. Among them is a 2.9 acre project located at 707 Semart Drive in the growing Seaboard Person District which aims to deliver over 1 million square feet and 680 residential units including 42 3-bedroom units. The development will also include over 11,000 square feet of additional retail space and 26,000 square feet of amenity space.

The first phase of the $500 million Seaboard Station project, The Signal, is nearing completion and is set to deliver 298 residential units and 30,000 square feet of retail to the Seaboard Person District. Construction has begun on the next two buildings, Blocks A and C, which will deliver another 279 residential units, a 149 key hotel, and a rooftop bar.

Demolition and site preparation work has begun on GoTriangle’s new downtown transportation hub, Union West (formerly known as RUS BUS). The 200 room hotel portion of the development has been replaced with additional residential units, bringing the total up to 587 resiedntial units, up 187 from before. When completed the project will enhance downtown’s regional connections.

An interactive development map with updated listings of project information and images is viewable at downtownraleigh.org/ do-business/ developments

2020

1 CAMERON CREST

$4,207,192 16,200 SF

6 units Townhome

2 CITY PLAZA RENOVATION $3,100,000 N/A N/A Public Space

3 HARGETT WEST $4,000,000 25,500 SF N/A Office/Retail

4 LONGLEAF HOTEL $6,500,000 20,812 SF 56 rooms Hotel/Retail

5 THE CASSO $22,702,726 71,794 SF 126 rooms Hotel/Retail

6 PEACE (SMOKY HOLLOW PHASE I) $150,000,000 652,500 SF 417 units Apartment/Retail

7 THE SAINT $23,000,000 53,199 SF 17 units Townhome

8 SIR WALTER APARTMENTS (RENOVATION) $15,000,000 20,000 SF 18 new units Apartment

9 SOUTH DAWSON RETAIL RENOVATIONS $471,857 9,746 SF N/A Retail

2021

10 HEIGHTS HOUSE HOTEL

9 rooms Hotel

Not available 10,000 SF

11 THE FAIRWEATHER $28,000,000 103,250 SF 45 units Condo/Retail

12 THE LINE APARTMENTS (SMOKY HOLLOW PHASE II) $95,000,000 271,589 Residential SF / 30,000 Retail SF 283 units Apartment/Retail

13 421 N. HARRINGTON ST (SMOKY HOLLOW PHASE II) $95,000,000 225,000 Office SF / 20,000 Retail SF N/A Office/Retail

14 TOWER TWO AT BLOC[83] $108,000,000 241,750 Office SF / 30,000 Retail SF N/A Office/Retail

15 JOHN CHAVIS MEMORIAL PARK IMPROVEMENTS $12,000,000 N/A N/A Public Space

16 AC HOTEL RALEIGH DOWNTOWN $25,000,000 88,454 Hotel SF / 3,860 SF Retail 147 rooms Hotel

17 FIRST CITIZENS BANK BUILDING (RENOVATION) $9,000,000 N/A N/A Public Space

18 208 FAYETTEVILLE (RENOVATION) Not available 18,000 Office SF / 9,000 Retail SF N/A Office/Retail

19 RALEIGH CROSSING PHASE I $160,000,000 287,252 Office SF / 12,100 Retail SF N/A Office/Retail 20 333 FAYETTEVILLE (RENOVATION) $750,000 N/A N/A Office

TOTALS:

SEABOARD STATION BLOCK C $125.000.000 34,656 Retail

THE PLATFORM (WEST END PHASE I) Not announced 26,000 Retail SF 442 units Apartment/Retail 28 615 PEACE $7,000,000 2,200 Retail SF 24 units Condo/Retail 29 HILTON GARDEN INN/HOMEWOOD SUITES Not announced 1,810 Retail SF 259 rooms Hotel/Retail 30 GIPSON PLAY PLAZA (DIX PARK) $55,000,000 N/A N/A Public Space 31 NC FREEDOM PARK $5,400,000 N/A N/A Public Space 32 210 FAYETTEVILLE ST (RENOVATION) Not announced Not announced Not announced Retail 33 216 FAYETTEVILLE ST (RENOVATION) Not announced Not announced Not announced Retail 34 DUKES AT CITY VIEW Not announced N/A 8 units Townhome 35 ROW 12 Not announced N/A 12 units Townhome 36 CITY GATEWAY APARTMENTS Not announced 4,000 Retail SF 286 units Apartment/Retail IN

37 320 W SOUTH Not announced 10,000 Retail SF 296 units Apartment/Retail 38 865 MORGAN Not announced 900 Retail SF 401 units Apartment/Retail 39 SALISBURY

Overall office vacancy in downtown decreased to 11.2%, down 50 basis points, as Class A asking rent increased by $.12 in Q4 to end the year at an even $36.00 per square feet 1 Two recently delivered office developments, 301 Hillsborough and Tower Two at Bloc[83] are both about 75% percent leased with only 59,000 and 56,000 square feet remaining, respectively.3 Both their strong lease up and the markets’ positive net absorption, at 121,881 square feet for the year, indicate continued demand for downtown office space.1 Of the 1.7 million square feet delivered downtown since 2015 only 438,670 square feet remain available.3 400H remains the only

tower under construction with 144,410 square feet while another 1.2 million square feet have been proposed across eight projects.2

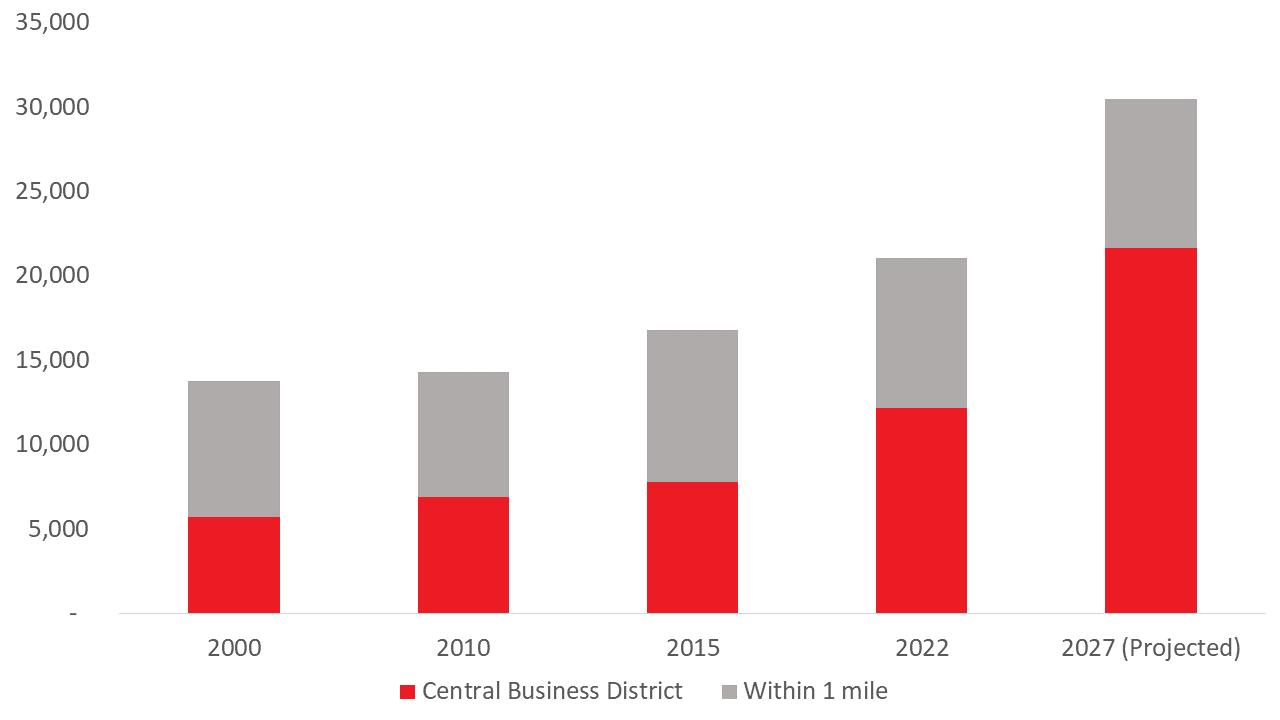

The downtown residential market is expanding with 11 projects and 2,034 residential units under construction and while another 1,650 units in four projects are in site preparation work.2

Developers are planning or have proposed an additional 6,644 units in 22 developments.2 Downtown apartment occupancy remains high at 94.6% even as asking rent ended the year at $2.32 per square foot.1

There were 11 storefront openings and expansions in the fourth quarter while another 19 are slated to open in the near future as businesses look to capitalize on opportunity downtown.1 There were only five business closings in the quarter.1

East Coast Electric Speed Shop, Raleigh’s first dedicated E-bike store opened in downtown at 418 Peace at the start of the year. Also among the businesses expanding into downtown is Midwood Smokehouse, a North Carolina based barbecuer that will have a 24-hour smoker and ample outside seating at Smoky Hollow.1

Average daily pedestrian counts across DRA’s six downtown counters were level year over year but increased 18% from Q3.2

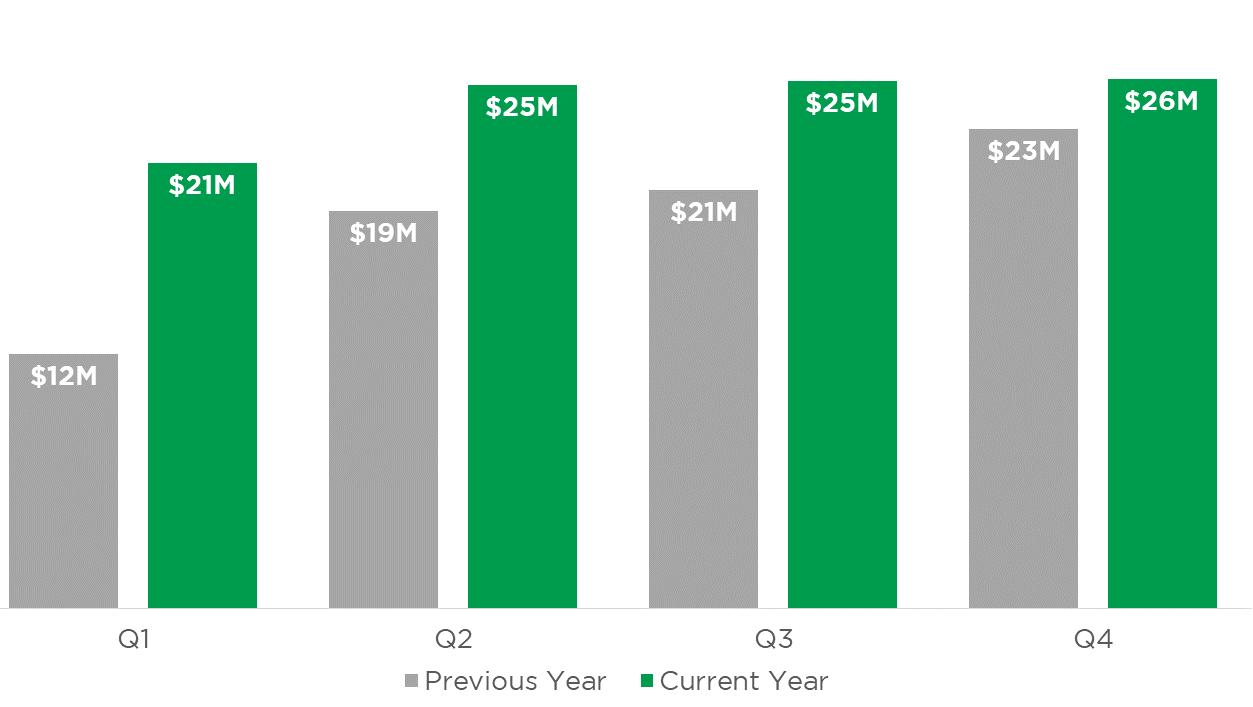

Average monthly downtown food & beverage sales for the first two months of Q4 increased 10% year over year to average over $25 million per month as sales reached 109% of Q4 2019’s monthly average.

Glenwood South District remains the downtown leader although its share of the total has decreased to 39% as districts like Fayetteville Street and the Warehouse recover.

Q4 2022 STOREFRONT BUSINESS ACTIVITY

# Business Openings in Q4 Type Date 1 Joy Worth Co. Experiential November 2022 2 J. Lights Market & Cafe Restaurant November 2022

MILKLAB Restaurant November 2022

WHY NOT CAFE Restaurant November 2022

Longleaf Swine Restaurant November 2022

The Rainbow Luncheonette Restaurant November 2022

Sugar Euphoria Retail October 2022

Aesthetic Appeal Jewelry Retail October 2022

Fifi + Talbot Retail October 2022

Lip Print Beauty Bar Service October 2022

Revolver Consignment Boutique (Relocation) Retail October 2022

Early

Q1 Openings 12 East Coast Electric Speed Shop Retail/Service January 2023

Kings (Reopening) Entertainment January 2023

Neptunes Parlour (Reopening) Bar January 2023

Cuya Bar January 2023

Business Closings in Q4 16 The Brightening Co Service December 2022

Short Walk Wines Retail December 2022

Plaza Cafe and Deli Restaurant November 2022

Turner Printing Services Inc. Service October 2022 20 House of Swank Retail October 2022 Coming Soon 21 Co-Lab Raleigh Experiential

Raleigh Popsicle Co. Restaurant

Taste of Himalaya / Mustang House Restaurant

Amitie Macarons Restaurant

Rolley Retail

La Terrazza Restaurant

Chido Taco Restaurant

Anthony’s La Piazza Italian Restaurant & Bar Restaurant

Sky Cafe Restaurant

CrossFit Serve Service

First Watch Restaurant

El Toro Loco Taqueria Restaurant

Jew Fro Restaurant

Raleigh Midwood Smokehouse Restaurant

Madre Restaurant

The Crunkleton Bar

Heat Studio Service

Arch & Edge Service

New Anthem Beer Project Brewery

The downtown hotel market has regained its pre-pandemic position as the market leader, consistently having a higher occupancy rate than the market as a whole after losing this position at the onset of the pandemic.3 Average monthly hotel room tax revenue increased 58% year over year for the fourth quarter to average $9.4 million while total visits to downtown have actually remained the same year over year.1,2 The next phase of the Seaboard Station development has broken ground and will bring a 149 room Hyatt House hotel with High Rail, a rooftop bar, and is expected to deliver in 2024.

NEWS & EVENTS

ILLUMINATE ART WALK

Parts of Fayetteville Street and Glenwood South districts have been transformed with over a dozen unique family-friendly illuminated art installations through the Illuminate Art Walk presented by Wake Tech.

Installations like the Sonic Runway and Tinsel: A Walk Through Ornament, both pictured to the right, brought thousands downtown to experience the self-guided and free walking tour which began on December 2nd and ended on January 14th. Pedestrian activity at Fayetteville Street and Davie Stree between 4PM and midnight on Friday December 2nd was more than twice as high, +109%, as November 2022’s average Friday night.1

MOORE SQUARE EAST & SOUTH RFP

In November Raleigh City Council authorized city staff to move forward on two proposals that would redevelop two city-owned sites across from the recently renovated Moore Square. The first site, located on the same block as City Market, proposes to relocate the historic Norwood House, bring at least 150 hotel rooms, and 25,000 square feet of creative space. The second site, due east of the park, would create 160-190 affordable housing units and 400 market rate units, a 135 room hotel, a 22,000 square foot grocery store with additional retail in addition to developing a new building for Raleigh Rescue Mission. Raleigh City Council has put an emphasis on prioritizing the creation of affordable in these projects.

ABOUT DOWNTOWN RALEIGH ALLIANCE (DRA)

DRA has a mission of advancing the vitality of Downtown Raleigh for everyone. DRA facilitates this mission through five goals:

Building a culture of authentic engagement and inclusion with Downtown’s diverse community; Fostering a thriving and diverse storefront economy; Facilitating strategic partnerships to produce positive, balanced activations across Downtown; Improving physical connectivity and accessibility within and around Downtown; Positioning DRA as a reliable, responsive, representative, and mission-directed.

For additional information and resources visit: downtownraleigh.org/do-business

CONTACT FOR QUESTIONS: Gabriel Schumacher Research Manager Downtown Raleigh Alliance 919.821.6981 gabrielschumacher@downtownraleigh.org

Photo by Patrick Maxwell

Photo by Patrick Maxwell