DOWNTOWN RALEIGH SUMMARY AND HIGHLIGHTS:

There are 19 developments under construction which when completed will deliver 2,230 residential units, 410 hotel rooms, and 116,616 square feet of retail space.1 There are 45 additional projects planned or proposed that if completed add 7,781 residential units, 1,840 hotel rooms, and 257,841 square feet of retail.

Construction continues on eight apartments and four for-sale residential projects.1 Downtown’s stabilized apartment occupancy rate is 94.1% 2 The average effective rent in Downtown Raleigh is $2.18 per square foot, or $1,808 per unit.2

The Class A downtown office market absorbed +75,619 square feet of space in Q1.3 Class A rent per square foot is $35.25.4 The Class A office occupancy rate is 86%.3

Also, 19 new businesses opened in Q1 downtown, four relocated or expanded, while five closed, for a net gain of +14 businesses. 1 Businesses have begun opening in The Signal at Seaboard Station, including The Yard, Biscuit Belly, and the recently relocated The Eye Institute. The full list of business openings, closings, and those coming soon can be found on page 11 of this report.

2,230 RESIDENTIAL UNITS UNDER CONSTRUCTION1 Q1 2024

+75,619 SF Q1 2024 CLASS A OFFICE NET ABSORPTION3

completed projects 19 NEW STOREFRONT BUSINESS OPENINGS1 Q1 2024

The average monthly estimated downtown food and beverage sales revenue increased +7.9% over the same period last year, averaging $24.1 million between January and February.2 The Moore Square District increased by +23.7%, the most of any district.2

Visitor visits to Downtown Raleigh increased +0.1% year over year in Q1. Glenwood South, which accounts for 39% of all Downtown Raleigh Q1 visits, increased +5.9% year over year.4 Glenwood South saw a record 635,986 visitor visits in March, 2.7% higher than the previous record set in August 2023.4 Visitor visits to Fayetteville Street increased +2.3% year over year in March. 4

Estimated hotel room revenue for January and February increased +6.7% over the same period last year, averaging $9.7 million.2 There are currently 410 hotel rooms under construction in two separate developments, both of which are set to deliver later this year.1

501 N West Street, a 0.24 acre parcel across from The Line, has been purchased by Vision Hospitality for $4.6 million. 5 The site is the location of the proposed Moxy Raleigh Downtown hotel, a 169-room hotel.5

+5.9%

Total Visits To Glenwood South Year Over Year Q1 20244 INCREASE 19 Developments Under Construction Q1 20241

$24.1M

Estimated Average Monthly Food & Beverage Sales January & February2

*Average Monthly Hotel Room Sales Revenue From Q1 20232

1.5M Q1 20244 UNIQUE VISITORS +6.7% INCREASE

1DRA

2Wake County

3Eco-Counter

4Placer.ai

5CoStar

Overall, there is $7.1 billion of investment in the current Downtown Raleigh development pipeline.1 This includes an estimated $2.4 billion in projects completed since 2015, $911 million in projects under construction, and $3.8 billion in proposed or planned developments.1

$2.4 Completed (since 2015) BILLION $911 Under Construction as of Q1 MILLION

$3.8 in Site Preparation/ Proposed/Planned Developments BILLION

$7.1 Completed since 2015, Under Construction, and Planned Developments BILLION

Demolition of the North Carolina State Administration Building located at 116 W Jones Street has begun.

The State Legislature allocated approximately $400 million to build a new office building and education complex at this site to house the offices of the UNC System, N.C. Community College System, and the Department of Public Instruction. Construction is expected to begin later this year.

Construction is wrapping up on The Acorn on Person Street, an 107-unit apartment development located on Person Street just south of City Market.

New residents begin moving in this spring. A proposed future phase of the development could add 138 hotel rooms in an adjacent building.

A site plan for the second phase of The Weld, a multi-phase development adjacent to Dorothea Dix Park, has been filed and includes plans for a 20-story building with 525 apartments, 20,885 square feet of retail space, and a rooftop terrace

Phase one of the development is actively under construction and consists of two 20-story towers totalling 675 apartment units.

An interactive development map with updated listings of project information and images is viewable at downtownraleigh.org/ do-business/ developments

Class A net absorption in Q1 totalled +75,619 square feet and direct occupancy is 86%, higher than the Raleigh-Durham market rate of 83.1%.1 Notable leasing activity includes Kimley-Horn’s renewed and expanded lease at One City Plaza, bringing their total footprint to 85,000 square feet2 and Morningstar Law Group which expanded into Two Hannover Square, leasing 14,500 square feet.4

Downtown Raleigh has 421,797 square feet of sublease space available, 12.5% of the Raleigh-Durham market’s total of 3,373,083 square feet of available sublease space.1

PERFORMANCE INDICATOR:

Class A Office Average Rent PSF2

Class A Office Net Absorption1 $35.24

Class A Office Occupancy Rate1

+75,619 SF

6,448,761 SF Total Office Inventory2 86%

1,972,889 SF Office Delivered Since 20153 Q1 2024

OFFICE MARKET 1JLL 2CBRE 3DRA 4Triangle Business Journal

421,797 SF Office Sublease Space Available1 + 1.8%

CLASS A OFFICE NET ABSORPTION AS PERCENT OF INVENTORY1

There are 2,230 residential units under construction, including 38 townhomes, 24 condos, and 2,168 apartment units.2 991 residential units delivered in 2023.2 The Acorn on Person Street, the next project to complete, will welcome new residents this spring. Downtown Raleigh’s stabilized apartment occupancy rate is 94.1%, this does not include recently completed developments.1

Average monthly rent per unit is $1,808 and the effective rent per square foot is $2.18, or $1,667 for a 1-bedroom apartment and $1,324 for a studio apartment.1

PERFORMANCE INDICATOR: APARTMENT STABILIZED OCCUPANCY RATE 1

Occupancy1

Effective Rent per SF1

8,897 units Residential Inventory2

2,230 Units Under Construction2 #3 U.S. News March 2023 Raleigh-Durham BEST PLACE TO LIVE IN THE U.S.

#1 U.S. News February 2023 Raleigh HOTTEST HOUSING MARKET IN THE U.S.

23 storefront businesses either opened, expanded, or opened in a new downtown location in Q1.1 Five storefront businesses closed in Q1 for a net gain of +14 storefront businesses in downtown. The Eye Institute has relocated and opened in the recently completed The Signal apartments along with The Yard and Biscuit Belly.

Overall, pedestrian counts in March 2024 increased +11% from February 2024.2 Average daily pedestrian counts across six downtown locations that have been deployed since 2019 decreased by 11.1% year over year for Q1.2 Overall, visitor visits to Downtown Raleigh increased +0.1% year over year in Q1.3

PERFORMANCE INDICATOR:

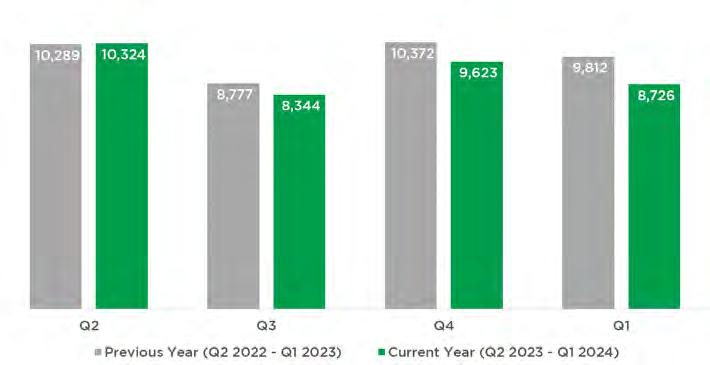

AVERAGE DAILY COMBINED PEDESTRIAN COUNT ACROSS SIX COUNTER SITES IN DOWNTOWN1

RETAIL MARKET

Q1 2024

Retail SF Under Construction1

116,616

Retail SF Planned or Proposed1

257,841

23 New Storefront Business Openings & Expansions (Q1)1

66 Storefront Business Openings & Expansions (2023)1

#1

LendingTree 2023 Raleigh BEST CITY TO START A BUSINESS 1DRA 2Eco-Counter 3Placer.ai

Average monthly food and beverage sales for Q1 in downtown increased by +7.9% over the same period last year.1

FOOD AND BEVERAGE SALES BY DISTRICT IN Q11

PERFORMANCE INDICATOR:

AVERAGE MONTHLY FOOD AND BEVERAGE SALES BY QUARTER1 Warehouse District Moore Square District

Average Monthly Food & Beverage Sales in Q11*

$24.1 MILLION

$23.8 Million in Q1 2023

160+ Restaurants & Bars In Downtown With Outdoor Seating2 1Wake County Tax Administration, DRA *Only January & February data available 2DRA 10 Craft Breweries & Distilleries In Downtown2

The monthly average for the Moore Square District increased by +23.7% year over year, the most of any district, and was 12.1% higher than in 2019.1 +7.9% INCREASE Q1 2023 TO Q1 2024*1

Q1 2019 TO Q1 2024*1

Looking for retail space?

Visit: downtownraleigh.org/ do-business/space-available

Two hotel developments underway, the 149-room Hyatt House and the 261-room dual branded Tempo by Hilton & Homewood Suites, have topped out and will deliver 410 rooms later this year. 3 Estimated downtown hotel room sales revenue for January and February totaled $19.4 million, increasing +6.7% over the same period last year.1

Visitor visits to Downtown Raleigh increased +0.1% year over year in Q1.2 Glenwood South saw a record 635,986 visitor visits in March, 2.7% higher than the previous record set in August 2023.2

PERFORMANCE INDICATOR:

DOWNTOWN AVERAGE MONTHLY HOTEL ROOM REVENUE1 Hotel revenue increased +6.7% year over year in Q1 20241

HOTEL + TOURISM MARKET

Q1 2024

410 Hotel Rooms Under Construction3

338 New Hotel Rooms Added Since 20203

1.5M Unique Downtown Visitors in Q12

$9.7M* Average Monthly Hotel Room Revenue Q1

1Wake County Tax Administration, DRA 2Placer.ai 3DRA

*Only January & February

#1 Southern Living MOST AFFORDABLE SOUTHERN CITY FOR 2022 FAMILY VACATION

Downtown Raleigh Alliance and the City of Raleigh are developing an economic development strategy for downtown to position Downtown Raleigh for the future. This effort is a twelve-month process of engagement, ideation, refinement, and strategy development which kicked off in July of 2023 lead by consultant Interface Studio.

In February 2024, project partners released an 80-page initial report focused on the downtown core surrounding Fayetteville Street. The “Activating Fayetteville Street” report provided ten big ideas to activate and transform the area over the next several years.

Develop a streetscape design for Fayetteville Street that offers variations on a theme.

Build a strong foundation to ensure downtown is clean, safe and vibrant.

Develop a family-friendly itinerary and route around Fayetteville Street attractions.

Design and market the dowtown core as North Carolina’s Main Street.

Celebrate Raleigh’s Black Business District.

Add more housing on and around Fayetteville Street.

Use public space to support neighborhood livability.

Reposition City Plaza as downtown’s front porch.

Grow Raleigh’s arts and entertainment district.

Create a bold connection south of downtown.

A comprehensive, downtown-wide final report will cover additional scope areas such as: a retail strategy for downtown, strategic positioning of the downtown office market, opportunities for supporting a thriving Minority- & Women-owned business community, and catalytic projects to stimulate and grow Downtown Raleigh’s economy.

The final strategy report is anticipated to be released in late summer of 2024. More information about the strategy and report elements released to date can be found at: downtownraleigh.org/ed-strategy

DOWNTOWN POPULATION GROWTH [2000-2028]

DOWNTOWN POPULATION BY AGE

11,000+

Resident Population Employees Within 1 Mile of the State Capitol

44,000+

31.7

Median Age

95K

Average Household Income

71.1%

Bachelor’s Degree or Higher

40% Of population between ages 20-34

DRA has a mission of advancing the vitality of Downtown Raleigh for everyone. DRA facilitates this mission through five goals:

1 2 3 4 5

Improve downtown economy through recruitment, pop-ups, financial support, research, marketing & promotions;

Advocate to make downtown a place for everyone that reflects evolving needs and interests of the community and lessons learned from the recent past;

Make downtown an engaging place to live, work, and visit through safe activations that appeal to a wide variety of stakeholders;

Improve and maintain a sense of safety and security in downtown through our Ambassador program, Social Services and work with RPD; and,

Elevate and improve DRA’s internal organization and processes through improved database, project management, communication, financial stewardship, and planning.

For additional information and resources visit: downtownraleigh.org/do-business

CONTACT FOR QUESTIONS: Gabriel Schumacher

Research Manager

Downtown Raleigh Alliance

919.821.6981 // gabrielschumacher@downtownraleigh.org

Photo by Patrick Maxwell

Photo by Patrick Maxwell