FLEXIBLE, HIGH PRECISION SOLUTIONS FROM R&D TO END OF LINE

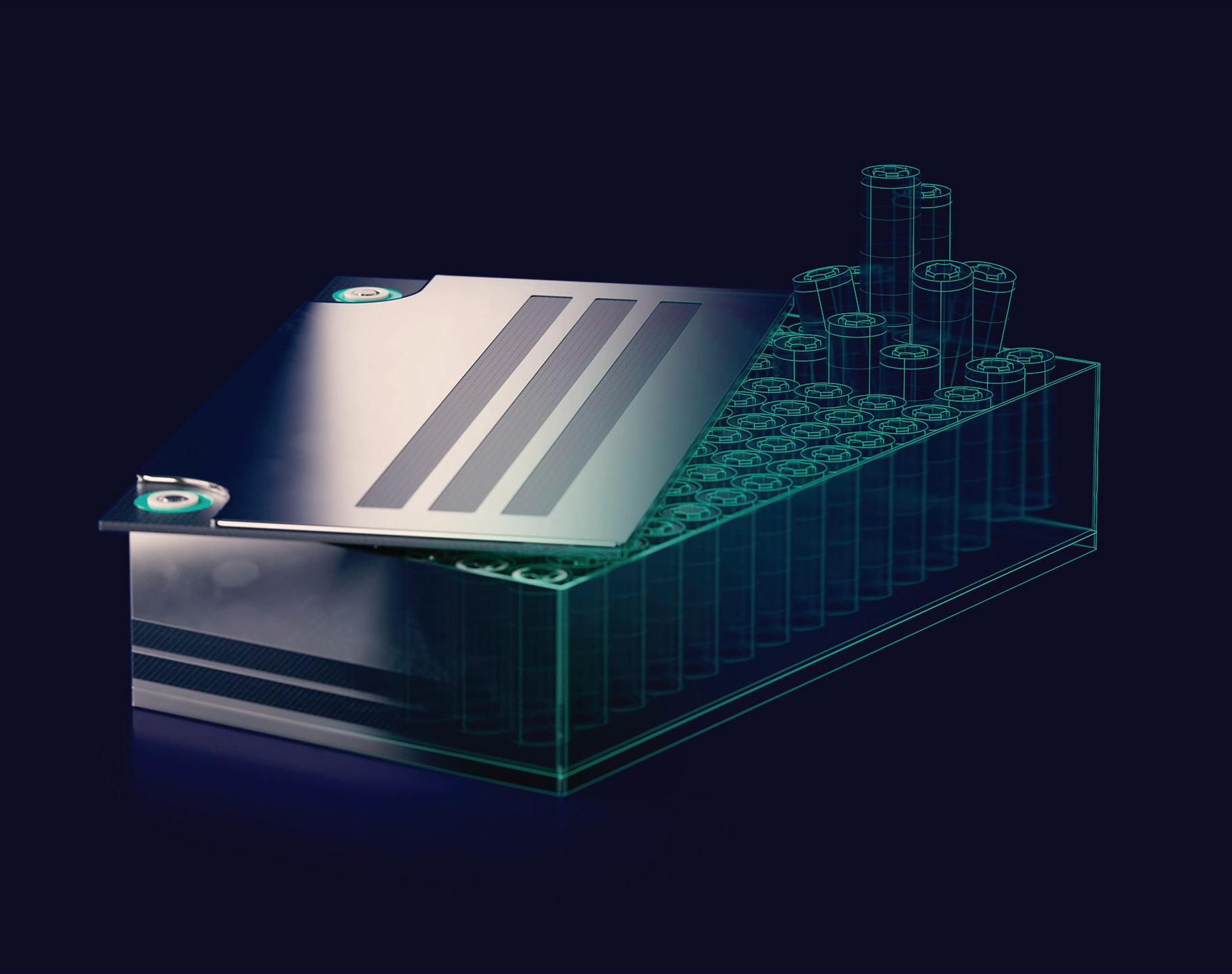

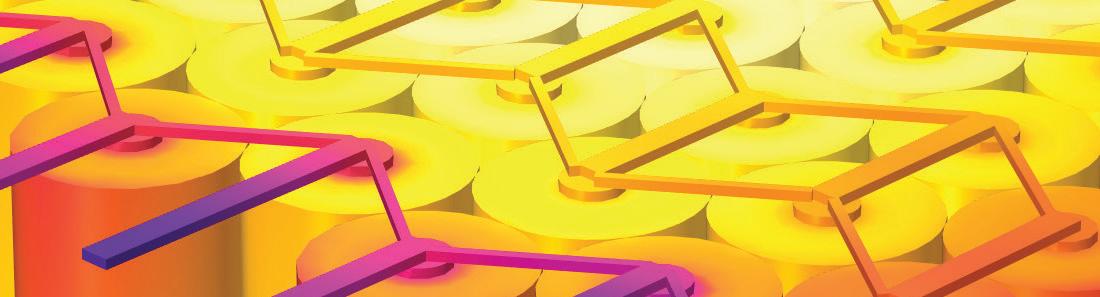

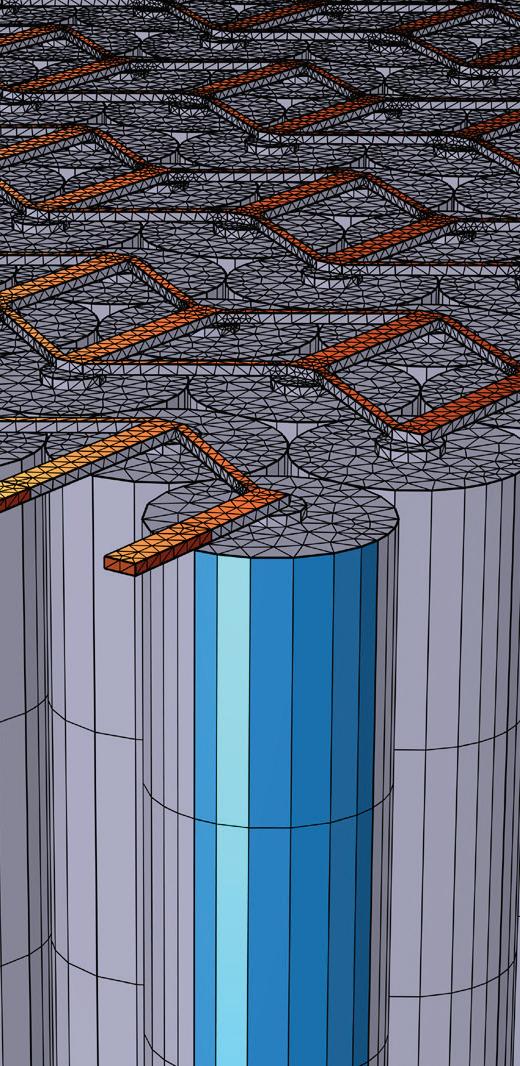

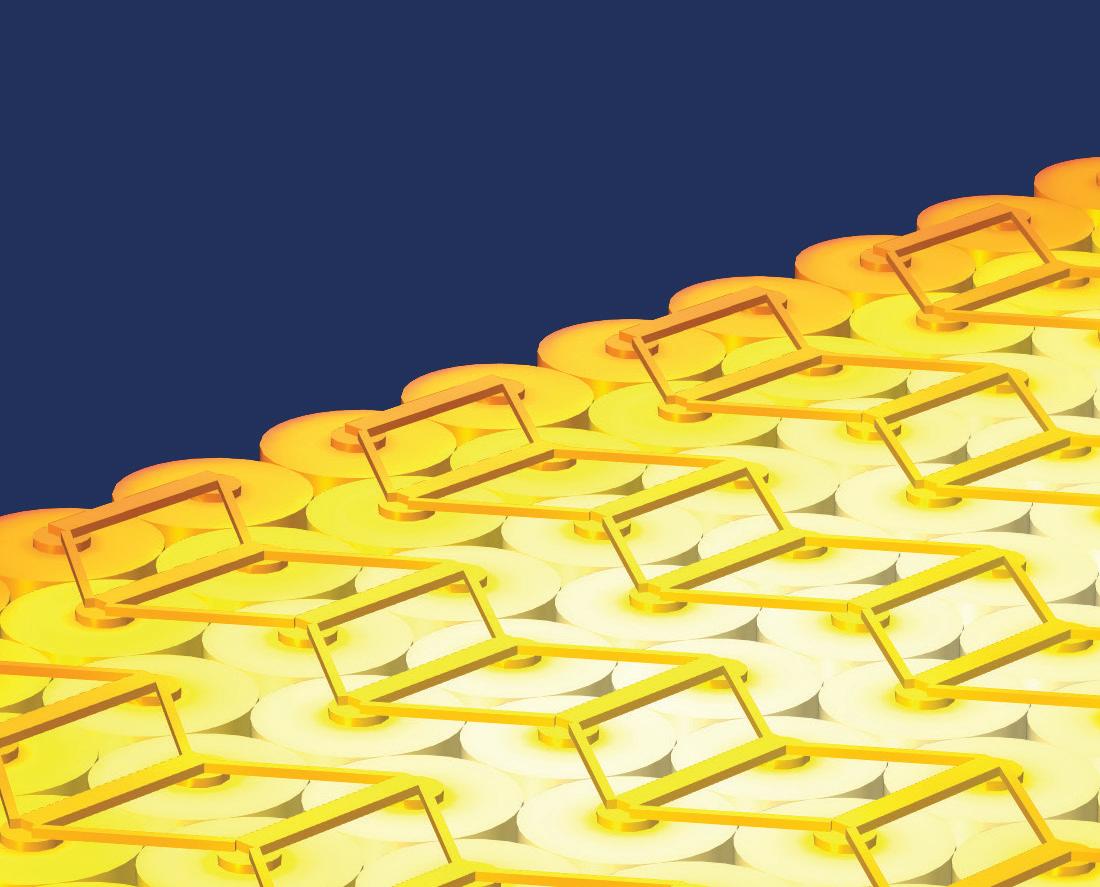

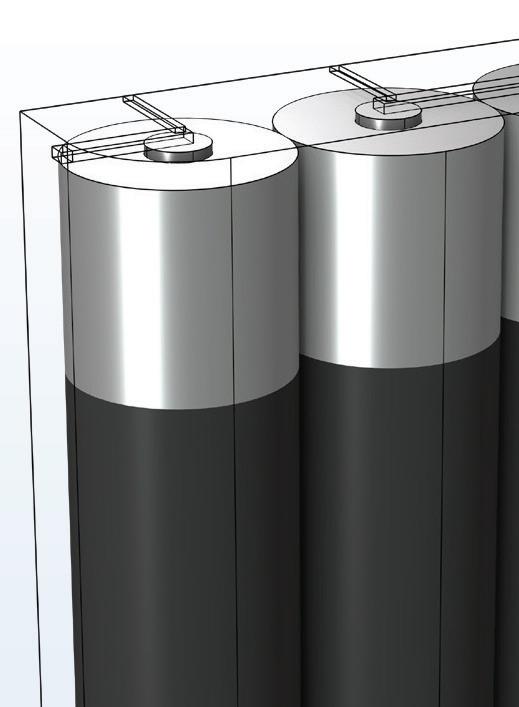

Battery cell, module and pack level charge/discharge cycle testing solutions designed to provide high accuracy measurement with advanced features. Regenerative systems recycle energy sourced by the battery back to the channels in the system or to the grid.

Battery simulation for testing battery connected devices in all applications to confirm if the device under test in performing as intended. Battery state is simulated which eliminates waiting for the charge/discharge of an actual battery. Real time test results include voltage, current, power, SOC%, charge/discharge state and capacity.

To learn more about our Battery Test Solutions visit chromausa.com

30 Designing a plug-andplay second-life battery system

Magna launches modular motor eDecoupling device for EVs

TE Connectivity develops HIVONEX connector and PowerTube charging solutions

Petro-Canada Lubricants launches purpose-built EV fluids

Chroma releases new software platform for multi-coupler EVSE testing

Proterial prototypes 100 kW motor using ferrite magnets

DOE funds 10 projects for lithium extraction from geothermal brines

Lyten opens pilot line in the US to produce lithium-sulfur batteries

DoD to award $37.5 million to Graphite One for graphite mining in Alaska

Green Watt Power releases new 500 W DC/DC converters for EVs

Stellantis and Samsung SDI plan second battery gigafactory in the US

Electric motor impregnation specialist Tecnofirma opens new North Carolina facility

Amprius unveils ultra-high-power, high-energy lithium-ion battery for aviation

Marelli launches new thermal management system for EVs

Stellantis and Saft unveil EV battery modules with integrated inverter and charger

American Battery Factory raises capital for LFP battery gigafactory in Arizona

But

Tesla acquires German wireless charging startup Wiferion

ChargePoint introduces initiatives to improve EV charger uptime

ABB e-mobility earns CTEP and NTEP certifications for DC fast chargers

EnviroSpark to provide EV charging stations for 17 AD1 Global hotels in 6 states

New York State allocates $12 million to advance EV adoption

EVgo, in partnership with GM, opens its 1,000th charging stall

Zeem to provide Hertz with EV charging at LAX

EVBox introduces 400 kW EVBox Troniq High Power charging station

Siemens to acquire heavy-duty EV charging specialist Heliox

GM to offer V2H bidirectional charging tech for all Ultium-based EVs

Comcast, NovaCHARGE collaborate on smart EV charging tech

TeraWatt Infrastructure breaks ground on public EV charging hub for fleets

ADS-TEC Energy and eliso to install over 1,000 charging points in Germany

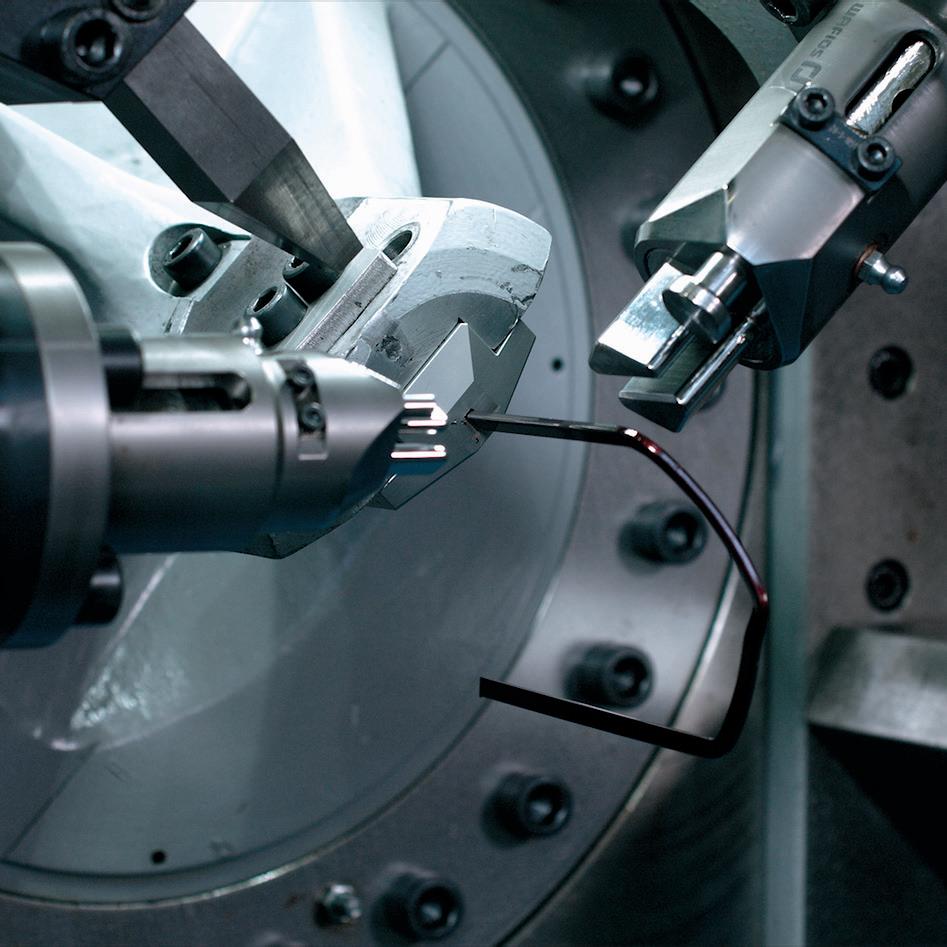

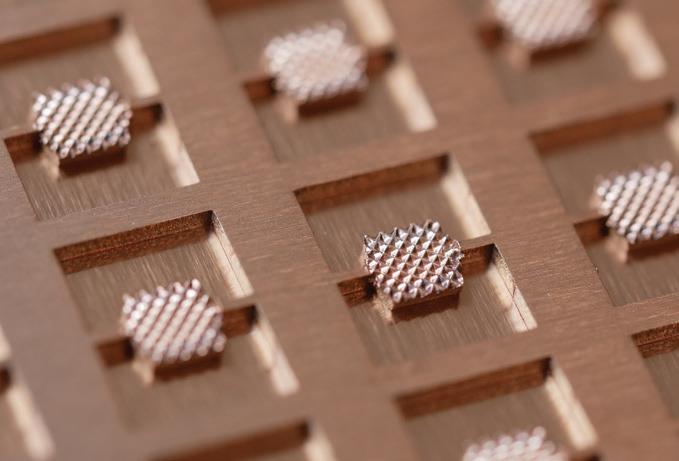

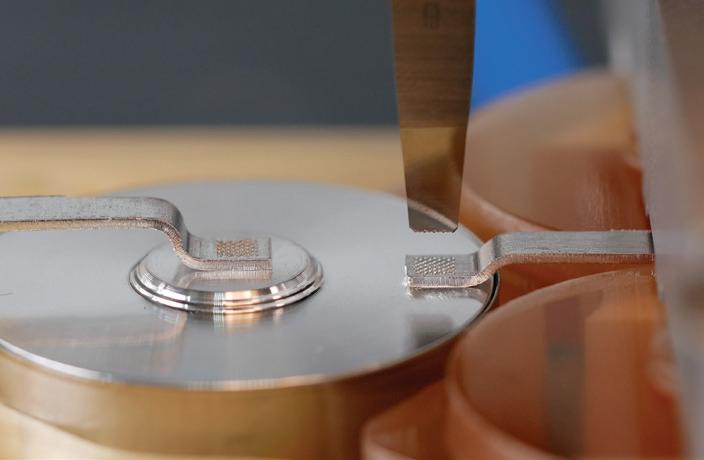

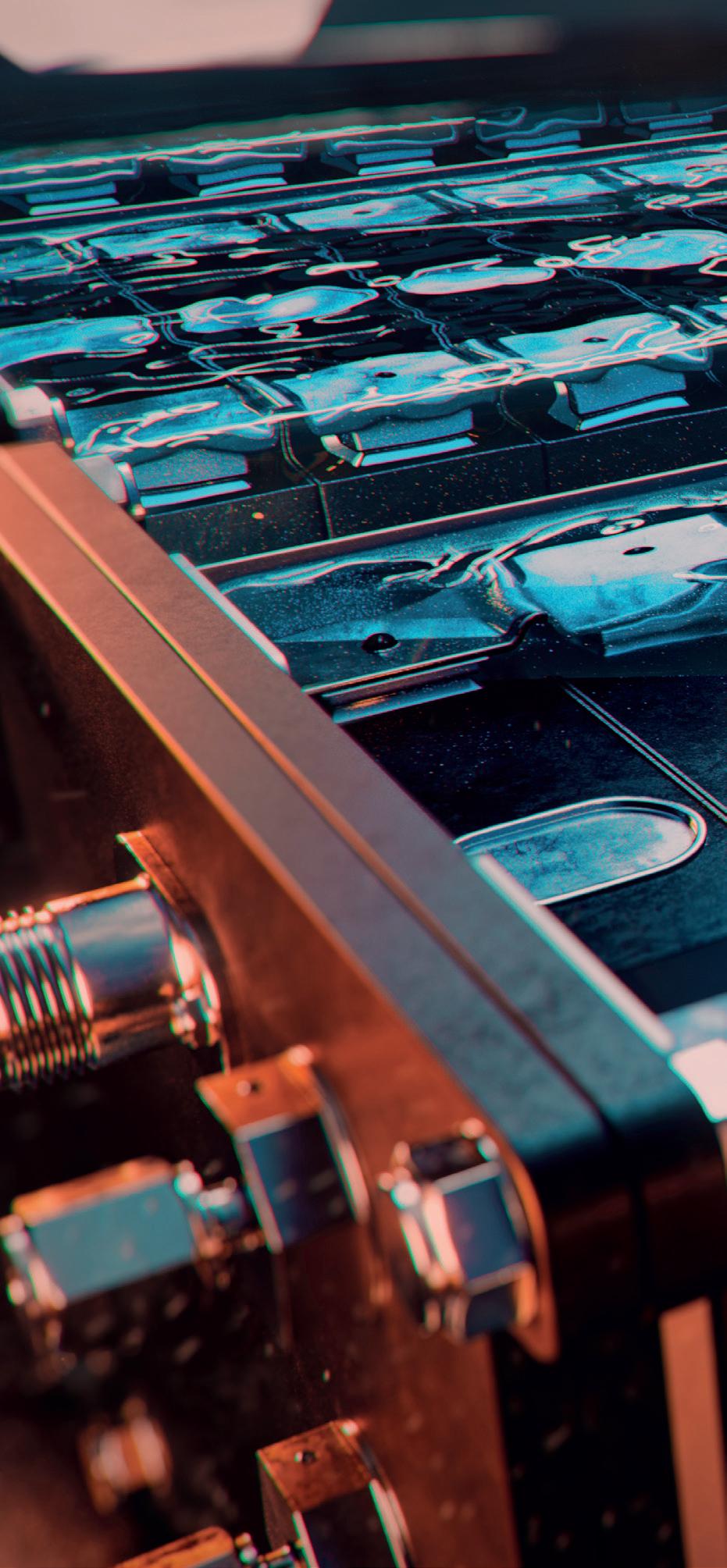

Form hairpins, I-pins & stator connector pins with ease using WAFIOS' new

With the rising demand driven by electromobility, it is time for battery manufacturers machine builders to embrace the Digital Enterprise. By seamlessly integrating digital worlds, our solutions offer increased transparency, speed, and efficiency design to production ramp-up and recycling. Unlock new levels of productivity Xcelerator, our simple, flexible, and open digital business platform that helps industry to innovate faster and become Digital Enterprises. www.siemens.com/battery

manufacturing manufacturers and integrating the real and efficiency from battery productivity with Siemens the battery

Publisher

Associate Publisher

Senior Editor

Technology Editor

Dir Business Dev

Account Executive

Events Director

Graphic Designer

Christian Ruoff

Laurel Zimmer

Charles Morris

Jeffrey Jenkins

Joel Franke

Jeremy Ewald

Chloe Theobald

Tomislav Vrdoljak

Contributing Writers

Jeffrey Jenkins

Charles Morris

Christian Ruoff

John Voelcker

For Letters to the Editor, Article Submissions, & Advertising Inquiries Contact: Info@ChargedEVs.com

Cover Image by

Special Thanks to

Roxane Bay

Kelly Ruoff

Sebastien Bourgeois

ETHICS STATEMENT AND COVERAGE POLICY AS THE LEADING EV INDUSTRY PUBLICATION, CHARGED ELECTRIC VEHICLES MAGAZINE OFTEN COVERS, AND ACCEPTS CONTRIBUTIONS FROM, COMPANIES THAT ADVERTISE IN OUR MEDIA PORTFOLIO. HOWEVER, THE CONTENT WE CHOOSE TO PUBLISH PASSES ONLY TWO TESTS: (1) TO THE BEST OF OUR KNOWLEDGE THE INFORMATION IS ACCURATE, AND

(2) IT MEETS THE INTERESTS OF OUR READERSHIP. WE DO NOT ACCEPT PAYMENT FOR EDITORIAL CONTENT, AND THE OPINIONS EXPRESSED BY OUR EDITORS AND WRITERS ARE IN NO WAY AFFECTED BY A COMPANY’S PAST, CURRENT, OR POTENTIAL ADVERTISEMENTS. FURTHERMORE, WE OFTEN ACCEPT ARTICLES AUTHORED BY “INDUSTRY INSIDERS,” IN WHICH CASE THE AUTHOR’S CURRENT EMPLOYMENT, OR RELATIONSHIP TO THE EV INDUSTRY, IS CLEARLY CITED. IF YOU DISAGREE WITH ANY OPINION EXPRESSED IN THE CHARGED MEDIA PORTFOLIO AND/OR WISH TO WRITE ABOUT YOUR PARTICULAR VIEW OF THE INDUSTRY, PLEASE CONTACT US AT CONTENT@CHARGEDEVS.COM. REPRINTING IN WHOLE OR PART IS FORBIDDEN EXPECT BY PERMISSION OF CHARGED ELECTRIC VEHICLES MAGAZINE.

Your

Here at Charged, we’re not into “gotcha” journalism or clickbait, and we don’t follow the popular practice of stirring up controversy in order to increase internet tra c. Most of our material consists of interviews with EV industry execs and engineers, and news derived from o cial company announcements, and we report what we hear.

Yes, we editorialize, but readers will nd that our editorial opinion is pretty simple and pretty consistent: EVs are better machines in many ways, and anything that impedes EV adoption (be it technical bottlenecks, industry inertia or political agendas) is bad. Di erent EV industry players have di erent ideas about how best to reach our common goal, and we generally let them tell their stories in their own words.

John Voelcker’s article in this issue, page 66, which explains how the failings of public charging providers—especially Electrify America— drove automakers into the arms of Tesla, is likely to cause o ense in some quarters, and the situation is unfortunate. We’ve had some great conversations with EA execs over the years, and have run many, many articles about the company’s achievements. But the article is no opinion piece— it’s the result of reporting on more than a dozen conversations that John had with execs and engineers at automakers and other companies. e dissatisfaction with EA and others is real, it’s news, and it’s something the industry needs to examine and act on.

Let’s be clear: we don’t want to see any charging company wither away—we want to see healthy competition that forces all the charging providers to raise their games, and provides more choices for EV drivers. We don’t want to see any one company dominate the public charging space, and we welcome the news that seven automakers will work together to build a major new US charging network alongside Tesla, EA and the others.

Yes, charging is changing, folks. Major upheavals are not uncommon in new, rapidly growing industries, and early innovators don’t always go the distance (remember AOL? Yahoo? MySpace?). We don’t know how things will shake out, but again, our position is simple: more and better charging choices mean more EV adoption, and that’s good news.

Electric utilities are also major players in the charging space—both directly, as charging station operators, and indirectly, as providers of the power. Utilities have come in for criticism from public charging providers, both for being slow to build the necessary grid hookups and, in a few cases, for unfairly using their monopoly power to the detriment of independent networks. In this issue, Peter Westlake of the Orlando Utilities Commission addresses both these issues and much more, page 74.

Speaking of utilities, vehicle-to-grid technology is a game-changer that’s right around the corner—or is it? In this issue’s Charging Forward column, page 82, Senior Editor Charles Morris reports on conversations he’s had with players in various parts of the charging ecosystem—some of them all in on V2G, some skeptical.

As a subsidiary brand of the Coroplast Group, we develop innovative cable & wire solutions. Discover our products for e-mobility:

• For tightest installation spaces – extremely flexible

• Special conductor design for excellent ultra sonic welding properties

• Highest centricity supports an optimal automated processing

• Excellent sealing properties

• Free of PCB and talcum

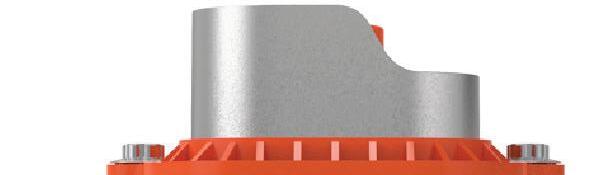

Magna, a Canadian automotive supplier, has begun production of a modular eDecoupling device to support several EV programs for a German premium vehicle OEM.

Magna’s electro-magnetic eDecoupling disconnects the e-motor from the drivesha in EVs when propulsion power isn’t needed, saving energy and improving eciency. It reduces drag torque losses of the e-motor and gearbox to boost electric driving range, while its eDecoupling controls so ware runs all shi ing sequences smoothly. e modular unit o ers seamless integration via powertrain controls to improve noise, vibration and harshness (NVH), and also features compact packaging and quick activation of less than 100 milliseconds. Magna’s Lannach, Austria powertrain factory will manufacture the new unit.

“Due to the compact design of the unit, we’ve minimized added package space and weight in both axial and radial directions, which has ensured that it is scalable for use across electric and hybrid vehicles from B segment up to SUVs and LCVs,” said Diba Ilunga, President at Magna Powertrain.

TE Connectivity has developed new connector and charging solutions for the EV transition. e HIVONEX range o ers modular, scalable products for harsh industrial and commercial vehicle settings, and includes the new PowerTube Connector Series for large electrical loads such as those in trucks, buses, and construction and agricultural vehicles. Other products in the portfolio include:

• IPT-HD Power Bolt Connector: a bolted solution for motor control unit (MCU), e-axle and e-motor applications. e connector can withstand extreme temperatures and engine-level vibrations, and o ers a new shielding design to improve electromagnetic compatibility (EMC) performance. It supports up to three positions: 50, 70, and 95 mm² wire size; and pre-made wire harnesses.

• ICT Charging Inlets: available in kits and pigtail cable assemblies.

• HVA HD400 Connector: developed for high-voltage accessory vehicle applications such as HVAC, heaters, hydraulic pumps and electronic power steering. is solution is capable of withstanding extreme temperatures (-40° C to +140° C) and transmission-level vibrations, meets IP68/IP6K9K ratings, and allows two or three conductors in the same interface.

“ e HIVONEX connector and charging products are designed for extreme environments—safe connectivity, scalability and high voltages for those operating in the eld,” said Sebastien Dupre, Director of Product Management for the E-mobility Product Portfolio at TE.

Petro-Canada Lubricants, a brand of oil company HF Sinclair, has launched a line of purpose-built lubricant solutions for EVs, including the following brands:

• EVR Driveline

• EVR ermal Management

• EVR Motor Greases

e company says the EVR uids and greases help OEMs create new driveline, axle and battery technologies for automotive, heavy- and medium-duty transportation and other industries by improving material compatibility, power transmission and equipment performance.

“Our new EVR product line will further enable OEMs, commercial eets and consumers to realize the promise of EV technology,” said Alex Buczek, Global Segment Manager Transportation at Petro-Canada Lubricants. “Our drive to continuously innovate has led us to launch EVR, our rst brand of uniquely formulated uids for EVs. We’re looking forward to supporting the development of technologies that drive the reliability and performance of EVs.”

Chroma, a test and measurement instrumentation company, has released a new so ware platform that has multi-threaded testing functionality for electric vehicle supply equipment (EVSE) test solutions.

PowerPro 5 can simulate up to four vehicles having identical or di erent communication protocols such as GB/T, CCS or CHAdeMO. e so ware controls the EVSE to serve multiple connectors at once based on the given test circumstances, and can simulate plugging in at di erent times in order to comprehensively test the equipment’s power sharing capability. is cuts testing time by 40% compared to single-coupler testing, according to the company, increasing test capacity.

Simulating single and multiple vehicle signals allows four-coupler power distribution testing and communication protocol veri cation.

Proterial (previously Hitachi Metals), a manufacturer of iron and metals, has found that optimizing the design of a motor using its patented high-performance ferrite magnet NMF-15 can achieve the same output as an EV drive motor that uses neodymium magnets.

Proterial has validated maximum power of 102 kW and maximum rotation speed of 15,000 rpm, compared to 110 kW and 10,000 rpm for a neodymium magnet. e output of neodymium magnets for EV drive motors and generators is predicted to rise as EV production increases, but neodymium magnets employ neodymium, a light rare earth, plus dysprosium and terbium, heavy rare earths that are in short supply.

Fast. Accurate. Reliable.

Scan to learn more about our battery pack leak test solutions

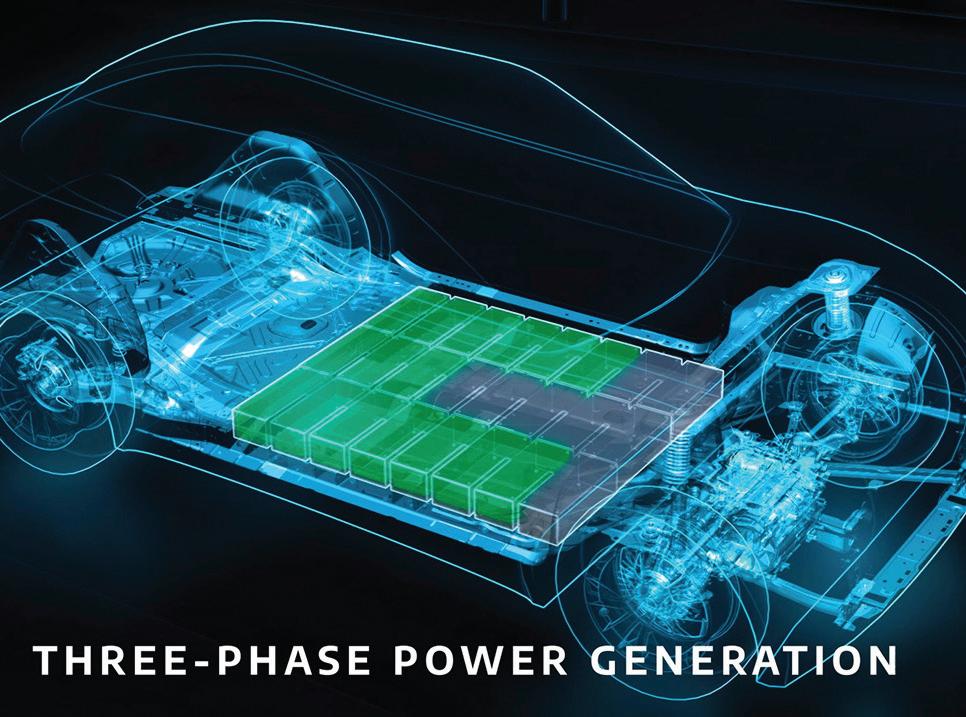

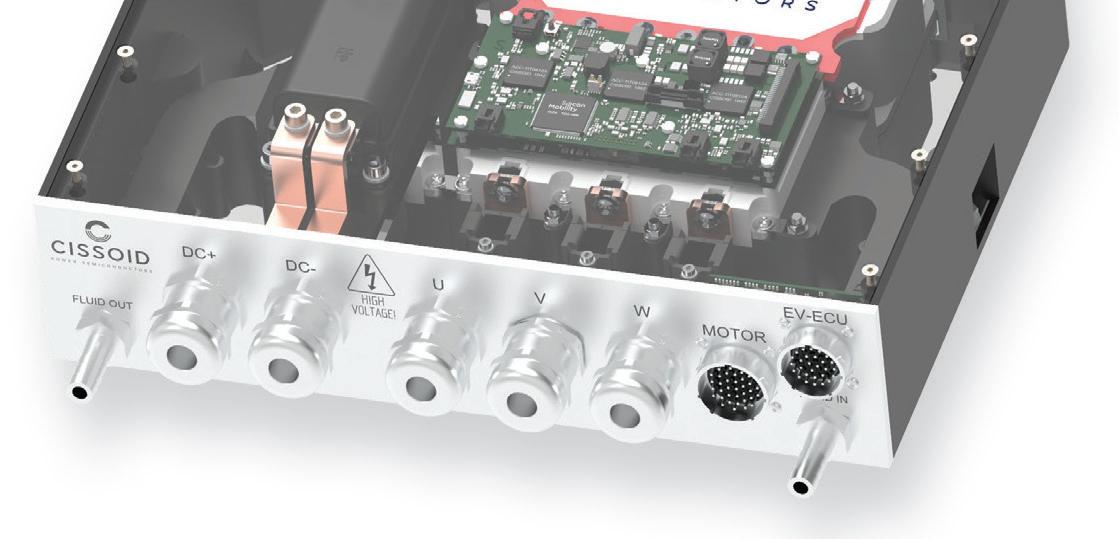

This inverter reference design offers a modular electrical and mechanical integration of a 3-phase 1200V/340A550A SiC MOSFET Intelligent Power Module from CISSOID combined with the OLEA® T222 FPCU control board and application software from Silicon Mobility.

This unique hardware and software platform supports the rapid development of e-motor drives up to 350kW/850V, setting new levels in terms of power density and efficiency.

• Up to 350kW/850V

• Modular SiC power module

• Low-ESL DC-Link capacitor

• 900V/400A EMI filter

• Liquid cooling

• Robust SiC gate driver

• OLEA® T222 FPCU controller

• DC & phase current sensors

• Advanced control algorithms

• SVPWM or DPWM up to 50kHz

Powered by the CISSOID Intelligent Power Module & Silicon Mobility’s OLEA® T222 FPCU & OLEA® APP INVERTER Software. www.cissoid.com

e US DOE has announced funding of $10.9 million for 10 projects in 9 states, designed to advance innovative technologies for the extraction and conversion of battery-grade lithium derived from US geothermal brine sources.

Two topic areas were chosen for the projects. e rst, “Field Validation of Lithium Hydroxide Production from Geothermal Brines,” involves pilot or demonstration projects to validate cost-e ective, innovative lithium extraction and lithium hydroxide conversion technologies. ese projects will be led by ExSorbtion and Energy Exploration Technologies.

e second topic area, “Applied Research and Development for Direct Lithium Extraction from Geothermal Brines,” encompasses R&D projects to advance emerging direct lithium extraction (DLE) process technologies to increase e ciency, reduce waste generation and/or reduce cost. Eight projects were chosen, led by University of Illinois at Urbana-Champaign, University of Texas at Austin, New Mexico Institute of Mining and Technology, Penn State University Park, Rice University, Lawrence Livermore National Laboratory, Paci c Northwest National Laboratory and University of Virginia.

Battery material supplier Lyten has commissioned a lithium-sulfur battery pilot line with a capacity of 200,000 cells per year at its facility in Silicon Valley. It will begin delivering commercial battery cells to early-adopting customers within the defense, automotive, logistics and satellite sectors in 2023.

e Lyten battery pilot line will produce lithium-sulfur cells in a range of pouch and cylindrical form factors to support a variety of customer requirements. It will allow Lyten to further develop manufacturing equipment capabilities for scaled lithium-sulfur cell production. e company says the pilot line will deliver cells that exceed conventional nickel-cobalt-manganese (NCM) lithium-ion battery energy densities.

To meet the expected demand for lithium-sulfur batteries, Lyten is exploring possibilities in multiple US states to expand its 3D graphene production capacity and build its rst lithium-sulfur cell gigafactory. Lyten is also securing domestic supply for its NMC-free battery materials, including sulfur and lithium.

“A projected 50% lower-cost bill of materials compared to conventional lithium-ion chemistries will enable signi cantly lower-cost automotive battery packs, making an EV eet economically achievable,” said Celina Mikolajczak, Lyten’s Chief Battery Technical O cer. “ e high energy density of the chemistry will make it appealing for application in heavy vehicles such as delivery vans, trucks, buses and construction equipment, as well as in aviation and satellites.”

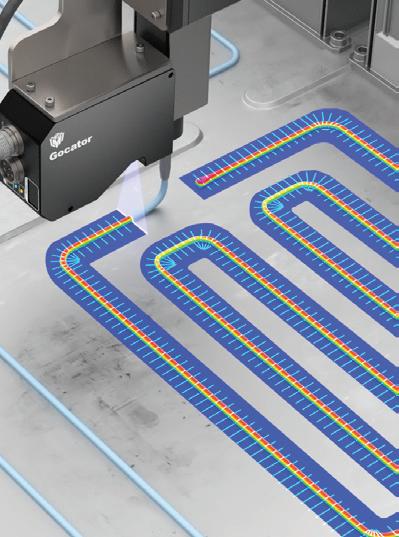

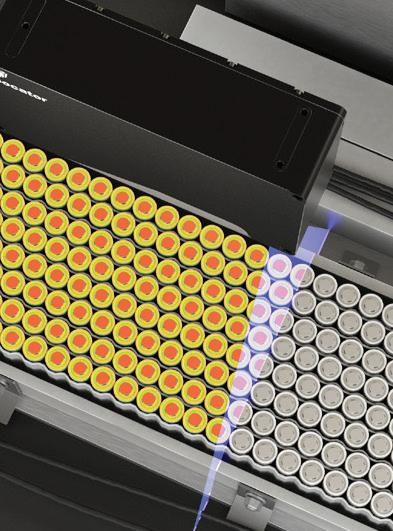

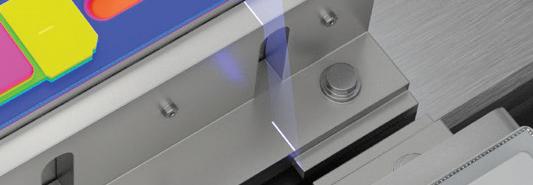

Our trusted Gocator smart 3D laser profilers solve a wide range of universal EV Battery manufacturing quality control applications including scanning electrode coating thickness; cylindrical and prismatic battery surface inspection; cell, module, and pack dimensional measurement (LxWxH); battery weld seam inspection; and final battery installation inspection.

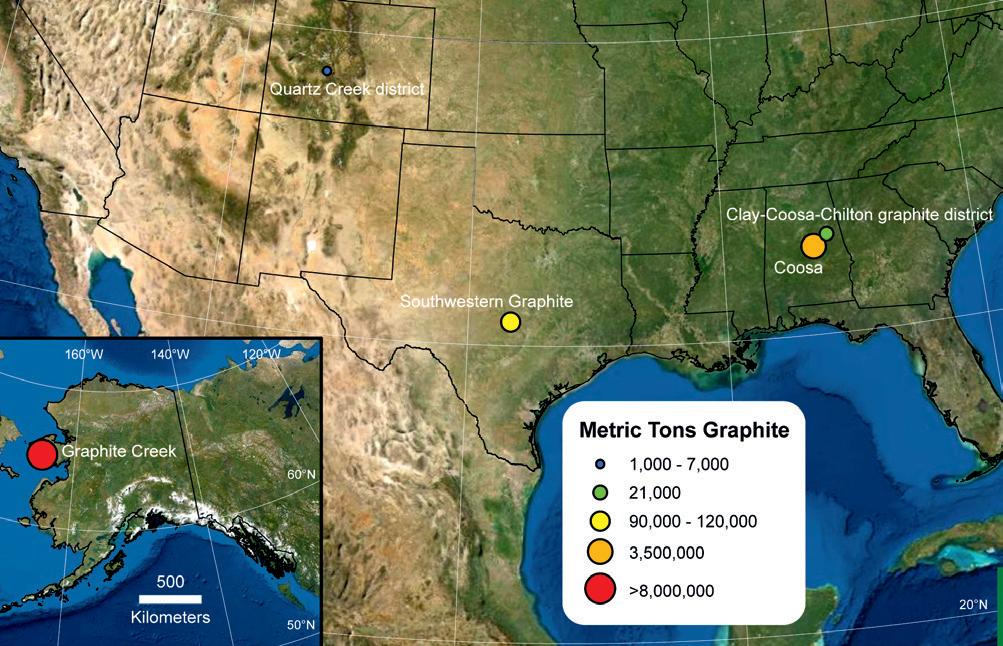

Using funds appropriated by the In ation Reduction Act, the O ce of the Assistant Secretary of Defense for Industrial Base Policy will award US mining company Graphite One $37.5 million to support development of a graphite supply chain solution based at the company’s Graphite Creek deposit on the Seward Peninsula about 37 miles north of Nome.

e grant follows the designation of graphite by the Defense Production Act as a battery material “essential to national defense.” e US is currently completely dependent on imported graphite, and China is the leading producer.

e proposed Graphite One project is a vertically integrated enterprise to mine, process and manufacture anode materials primarily for the lithium‐ion EV battery market. Initial processing into concentrate at a plant adjacent to the mine would be followed by the manufacture of natural and arti cial graphite anode materials and other value‐added graphite products from the concentrate and other materials at a proposed facility, expected to be located in Washington State. Plans also call for a co-located recycling facility to reclaim graphite and other battery materials.

Green Watt Power, a division of Powerland, has announced a new series of IP67-rated DC/DC converters for EVs.

e fully enclosed, IP67-ruggedized EVD500 Marble Series o ers two DC input ranges featuring output voltages of 12 V and 24 V to power auxiliary EV functions such as lights, instruments and accessories. It has Enable/ Remote on/o and a quiescent current draw of less than 30 µA for battery conservation. e EVD500 Marble Series is input-to-output isolated and protected against input under-voltage lockout, reverse polarity, over-voltage, short-circuit and over-temperature.

Main features include:

• DC input ranges of 30-65 V and 50-130 V

• DC output voltage of 13.5 V or 27.5 V

• Output power of 500 W to 5,000 W with parallel connection of up to 10 units

• E ciency of up to 93%

• All-around protections: IRPP, UVLO, OVP, SCP, OTP

• 1.5 kV input-to-output isolation test voltage

• Designed to meet IEC, UL and CSA safety requirements

• Working temperature range: -40° C to 85° C Tc

• Available with Molex connector or ying leads

“Unlike most DC/DC converters in the EV market, the EVD500 has a constant current function, so it can connect directly to a battery load,” the company said.

Amsterdam-headquartered multinational automaker Stellantis and South Korean EV battery maker Samsung SDI have entered into a provisional agreement under their existing StarPlus Energy joint venture to build a second EV battery factory in the US.

eir rst factory is targeted to launch in the rst quarter of 2025 with an annual production of 33 GWh. It is under construction in Kokomo, Indiana. e second, whose location is under review, is expected to start production in early 2027 with an initial annual capacity of 34 GWh. “ is new facility will contribute to reaching our aggressive target to o er at least 25 new electric vehicles for the North American market by the end of the decade,” said Stellantis CEO Carlos Tavares.

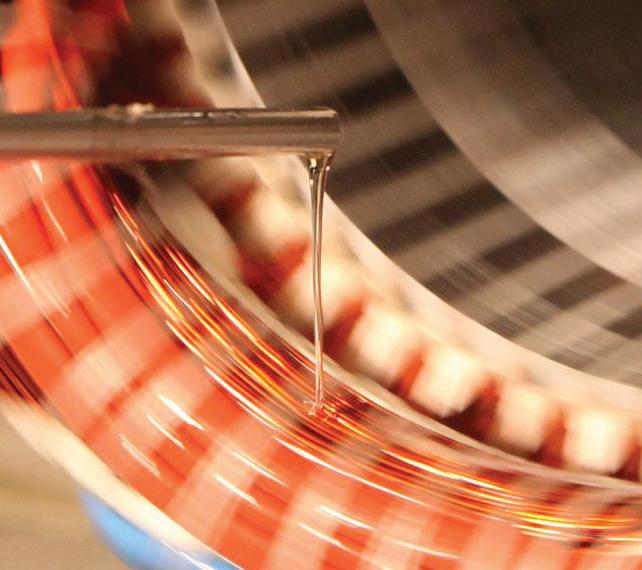

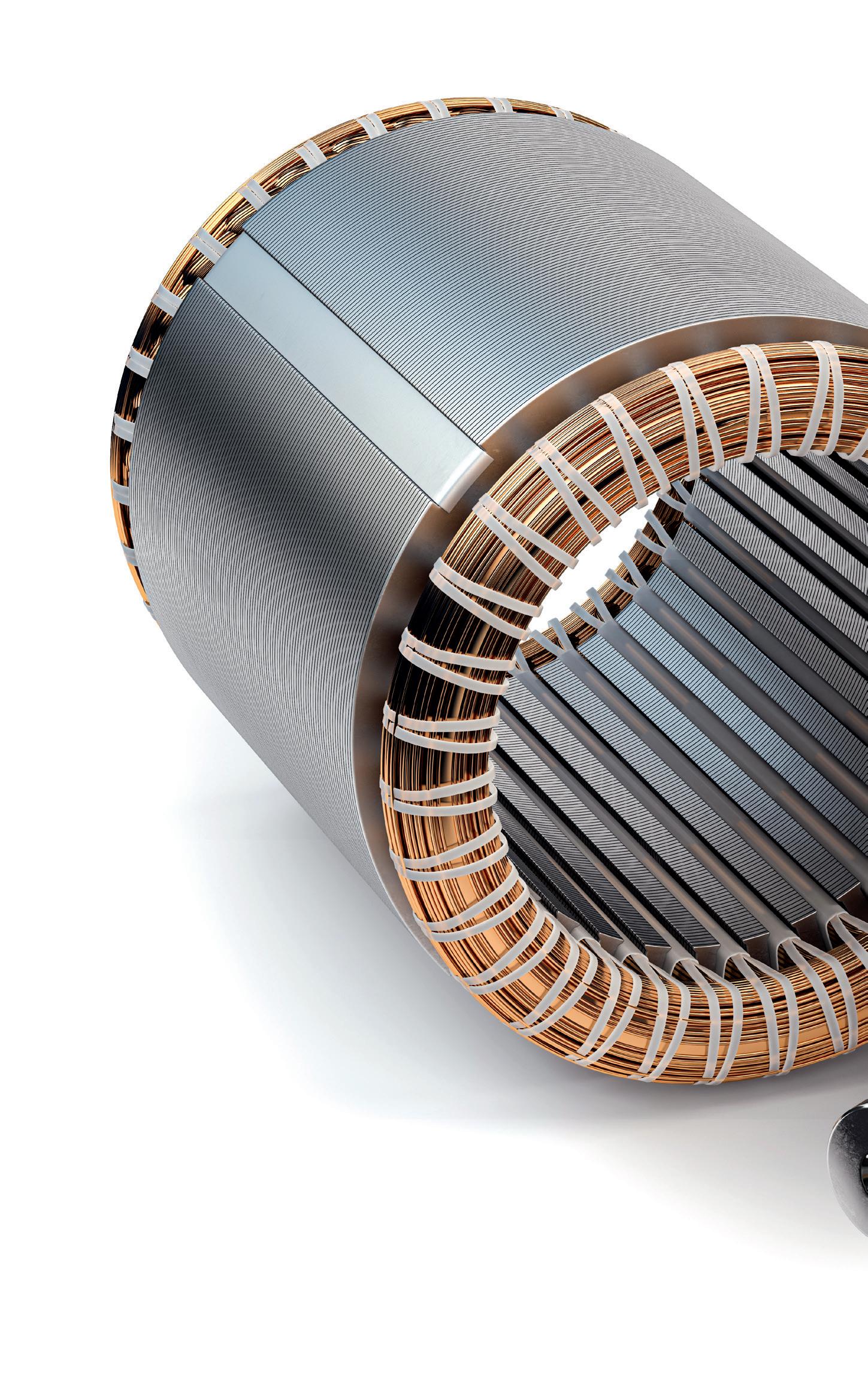

Tecno rma, a maker of impregnation machines for electric motors, has opened a new American branch in Charlotte, North Carolina. e company now has four di erent global branches, located in the most strategic areas for its market.

e Charlotte facility includes a well-equipped laboratory to validate technical cycles based on customer needs, as well as a spare parts warehouse that provides immediate availability of critical components and o ers a dedicated hot-line service.

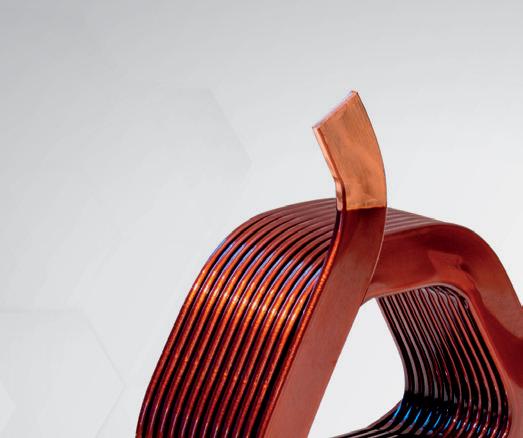

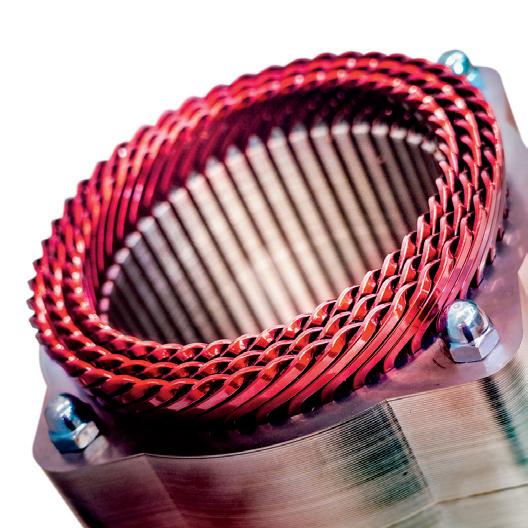

Tecno rma boasts over 70 years of experience in surface treatment, and is now moving into the e-mobility market. Impregnation of the copper windings and coils in electric motor rotors and stators provides secondary insulation, increases mechanical stability, improves heat dissipation, and adds protection from humidity, dirt and chemicals. Impregnation can greatly improve the e ciency and durability of a motor.

Tecno rma o ers a wide range of solutions for the insulation of windings, including both traditional and hairpin winding. e company works with customers to develop the best impregnation technology and method for a particular application. “An incorrect method or insu cient impregnation can considerably shorten the working life of your electric motor,” notes the company.

Amprius Technologies, a battery manufacturer in California, has announced a new ultra-high-power, high-energy lithium-ion battery cell that discharges at 10C and delivers 400 Wh/kg speci c energy.

e cell is designed to deliver high power output, making it suitable for the electric vertical takeo and landing aircra (eVTOL) and unmanned aerial vehicle (UAV) industries.

Amprius aims to o er samples by the end of 2023 and commercialize the new cell in early 2024.

“Our new cell delivers speci c power and energy density performance, approximately 200% higher than traditional graphite cells, while achieving a 10C discharge rate, signi cantly expanding application possibilities and driving cost-e ectiveness,” said Dr. Kang Sun, CEO of Amprius.

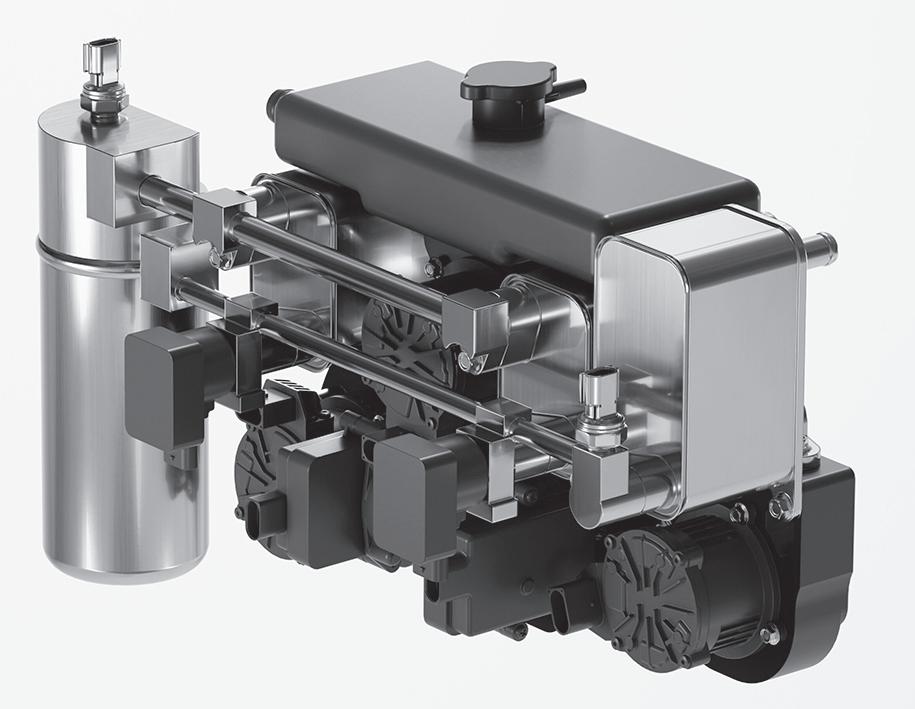

Marelli has launched a new thermal management system for EVs, which combines the di erent thermal circuits in the vehicle to increase e ciency.

Marelli’s integrated ermal Management Module (iTMM) modularizes water-cooled heat exchangers like the chiller or condenser with a smart valve arrangement that controls up to 6 channel combinations, unlike single-function heat exchangers. e iTMM integrates the 3 systems, using their synergies and sharing components, to optimize energy management using this combined valve. e iTMM’s e ciency in severe weather and low temperatures increases the vehicle’s driving range by 20% when coupled with a heat pump system in winter, the company said. e module also meets market demand for ultra-fast charging through pre-conditioning and OBD (on-board diagnostics) standards.

Alongside this technology, Marelli’s ermal Solutions division has developed a full range of thermal systems for both internal combustion engines and electric powertrains, allowing the control and balance of thermal energy.

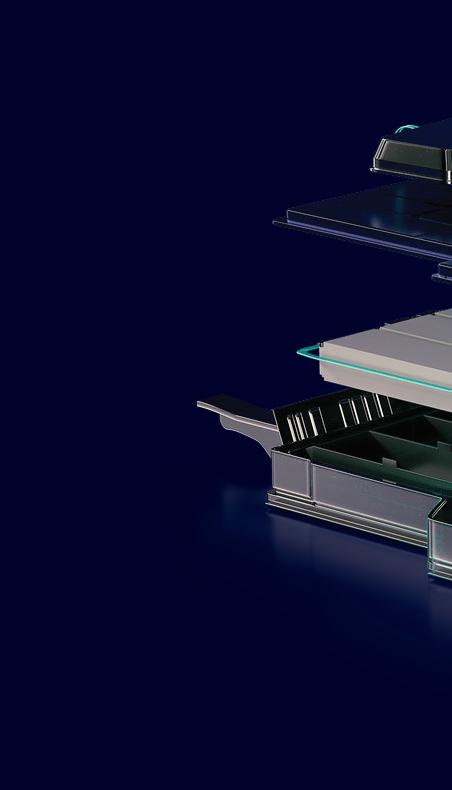

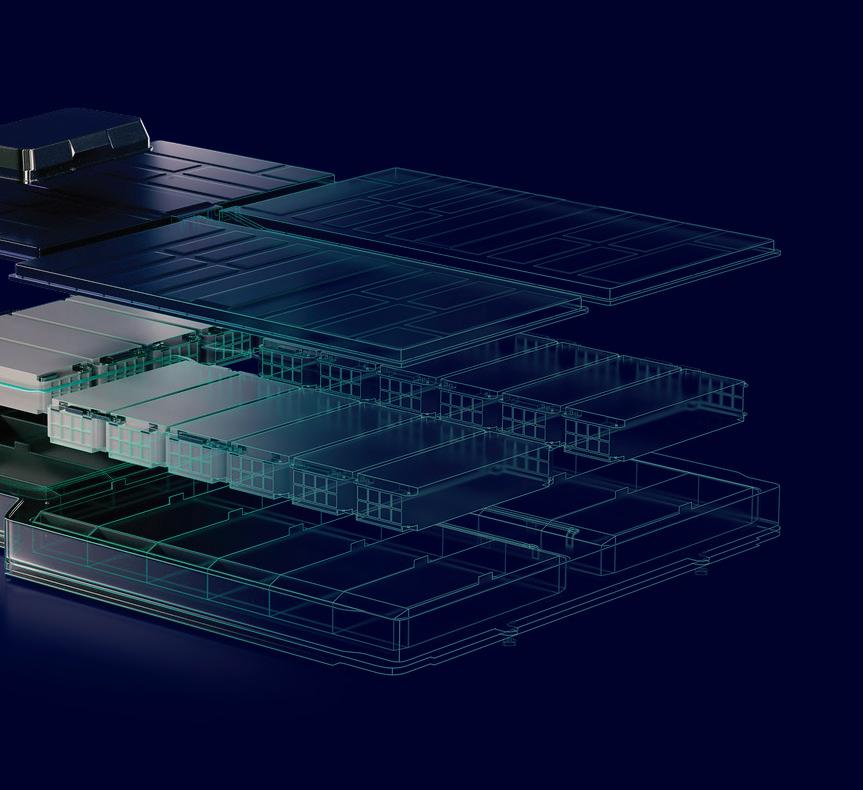

Greater integration of EV components can deliver increased cargo space, simplied manufacturing and lower costs. Now

Stellantis and Sa engineers have unveiled a prototype of an EV battery pack that integrates the inverter and charger functions into the modules.

e collaborative research project has produced the Intelligent Battery Integrated System (IBIS), in which the electronic conversion boards that perform the power inverter and charger functions are mounted as close as possible to the lithium-ion battery cells.

A demonstrator, operational since summer 2022, is the subject of numerous patents, and has enabled the companies to validate many new technical concepts.

e IBIS project partners are now focused on building a fully functional prototype vehicle that will be tested on Stellantis development benches and test tracks as well as on open roads. e IBIS project team hopes to make this technology available on Stellantis vehicles before the end of this decade.

“Our journey to electri cation is fueled by innovation and research excellence that uses the latest technology to address the real needs of our EV customers such as range, roominess and a ordability, while reducing carbon footprint by improving e ciency,” said Ned Curic, Stellantis Chief Engineering and Technology O cer.

“Sa has been at the heart of industrial battery innovation for over 100 years,” said Sa CEO Cedric Duclos. “As pioneers in this cutting-edge eld, our researchers are able to carry out research programs like IBIS over the long term.”

American Battery Factory (ABF), a battery manufacturer that plans to build a network of lithium iron phosphate (LFP) battery cell gigafactories in the US, has raised signicant development capital in Series A funding. ABF will use the funds to secure production equipment and security technology needed for the rst development phase of its recently announced gigafactory in Tucson, Arizona.

Investors in the Series A round include hybrid manufacturing partner FNA Group, Lion Energy, and an unnamed battery-cell equipment manufacturing company.

“Our vision is to help the US rapidly electrify, and energy storage is the only solution that makes this possible,” said Jim Ge, CEO of American Battery Factory. “ e rst major step on this journey will be the construction in Arizona of the largest US gigafactory for producing lithium iron phosphate (LFP) battery cells, and initial development will be funded by this Series A round. We anticipate delivering our rst battery cells within the next 18 months.”

Investor Lion Energy, a developer and manufacturer of energy storage products, incubated ABF for 18 months before unveiling the company to the public in March 2022. ABF entered into an o ake agreement with Lion Energy in May 2022 to deliver 18 GWh of LFP battery cells, beginning with high-capacity prismatic cells o ering 105 to 300 Ah outputs. ese are designed for a range of Lion Energy solutions, including portable solar generators and battery-based energy storage systems.

Investor FNA Group is a hybrid manufacturing partner that will provide its technology to ABF’s battery cell production. Formed in 1988, FNA Group is a vertically integrated power equipment manufacturer with a global presence across the United States, China, Italy and Australia.

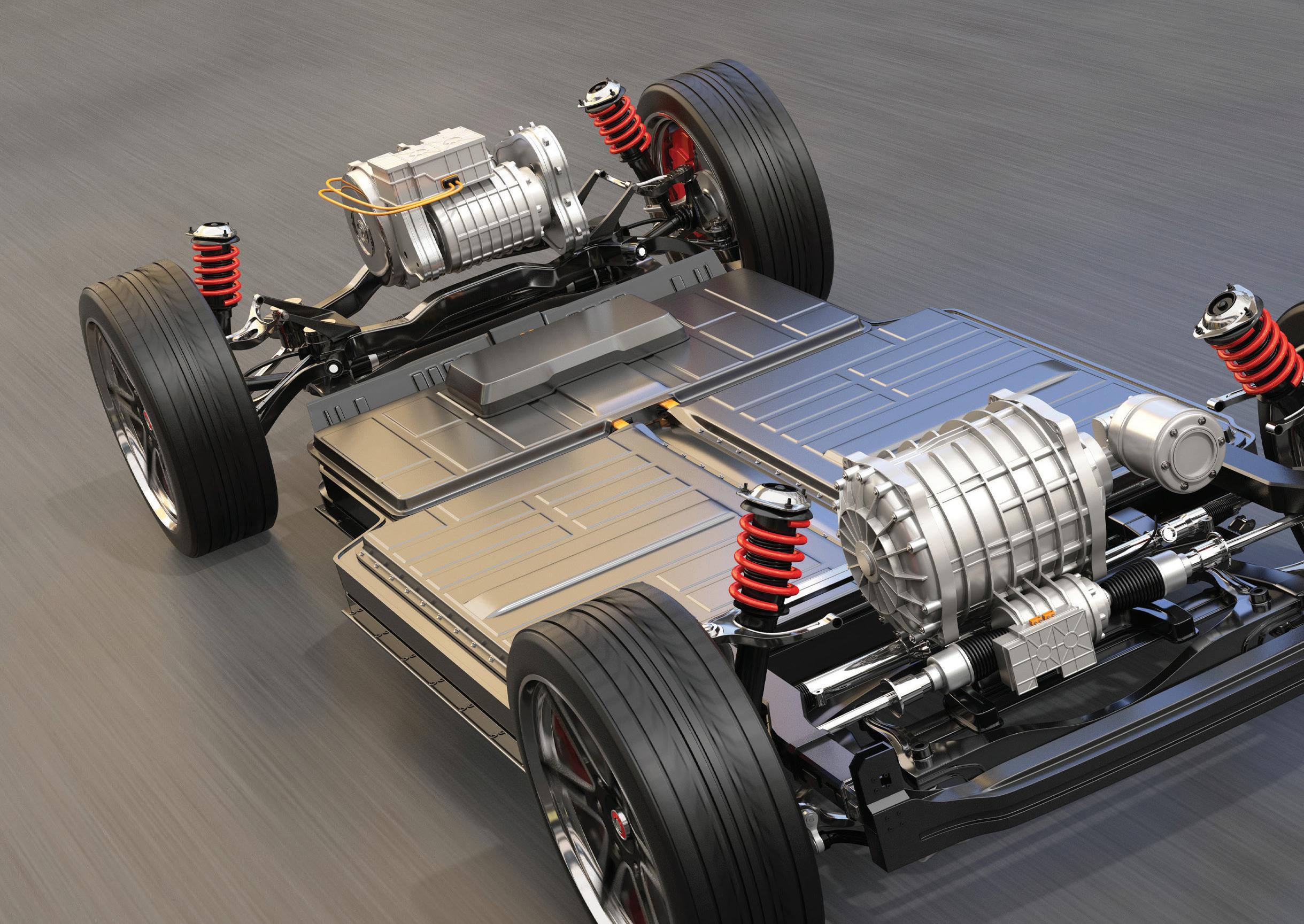

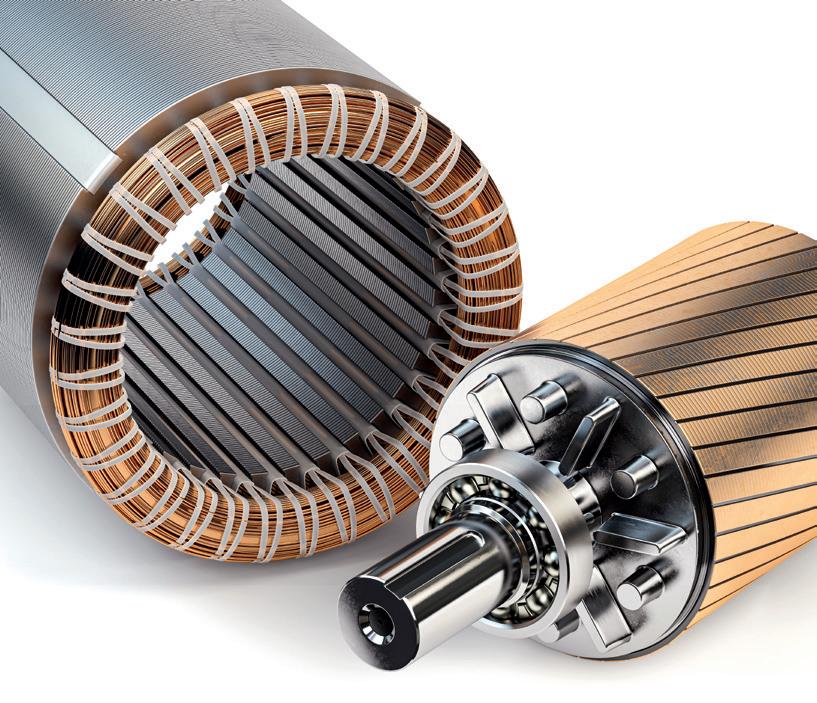

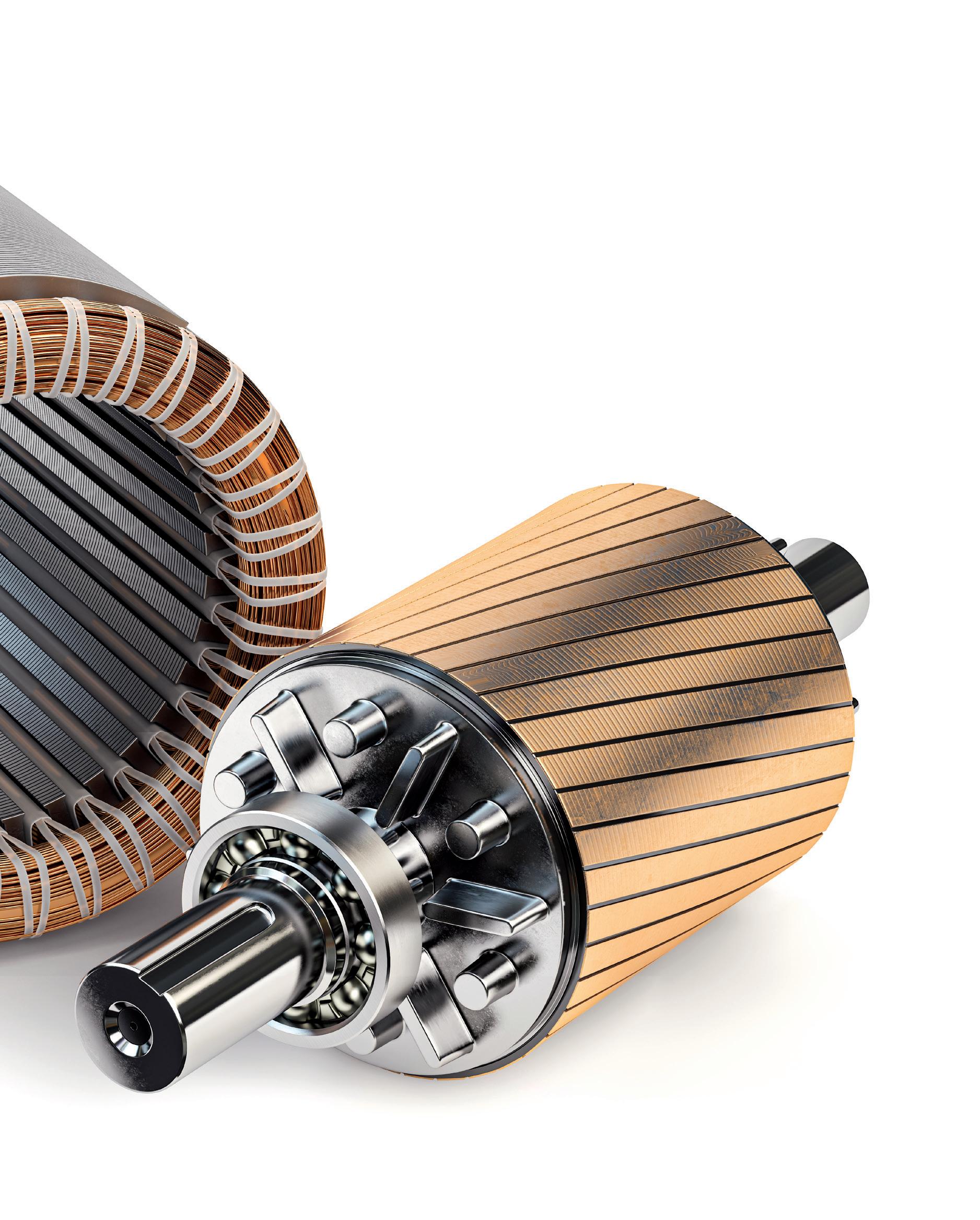

A look at improving motor efficiency in two main categories: electrical and mechanical.

Regular readers of Charged don’t need to be told that the typical EV drivetrain is way more e cient from battery to wheels than its ICEbased equivalent, but it is perhaps less wellknown that the approximate drivetrain e ciency ranges from 75-90% for the EV to a rather less impressive 20-35% for the ICE vehicle. e vast majority of losses in an ICE vehicle occur in the conversion of chemical energy to mechanical—the so-called Carnot E ciency—which might approach 40% in the best of cases. In contrast, the main drivetrain components in an EV—battery, inverter, motor, and gear reduction and/or transmission—all have e ciencies in the mid-to-high 90-percent range. Still, out of those individual drivetrain components, most of the losses come from the motor (tied, perhaps, with losses from the gear reduction/transmission), hence it is the most promising target for improving overall e ciency in an EV. at said, it’s worth pointing out that improving the e ciency of the traction motor from, say, 94% to 97%, would require cutting losses in half.

And to reach the same 99% e ciency

as the typical lithium-ion battery (de ned by the ratio of charge in vs. charge out, or the coulometric e ciency), would require a downright heroic reduction in losses of over 83%!

In gaming out the ways to improve motor e ciency, there are two main categories of losses to consider: electrical and mechanical. Electrical losses include the I2R, or conventional ohmic resistance, of the windings (including the shorting bars in the rotor of an AC induction motor), the frequency-dependent changes in those resistances due to skin and proximity e ects, and the various “iron” losses incurred in the magnetic circuit between stator and rotor, such as magnetic hysteresis—whose losses increase with frequency—and ux leakage—whose losses are more the result of the physical construction of the motor.

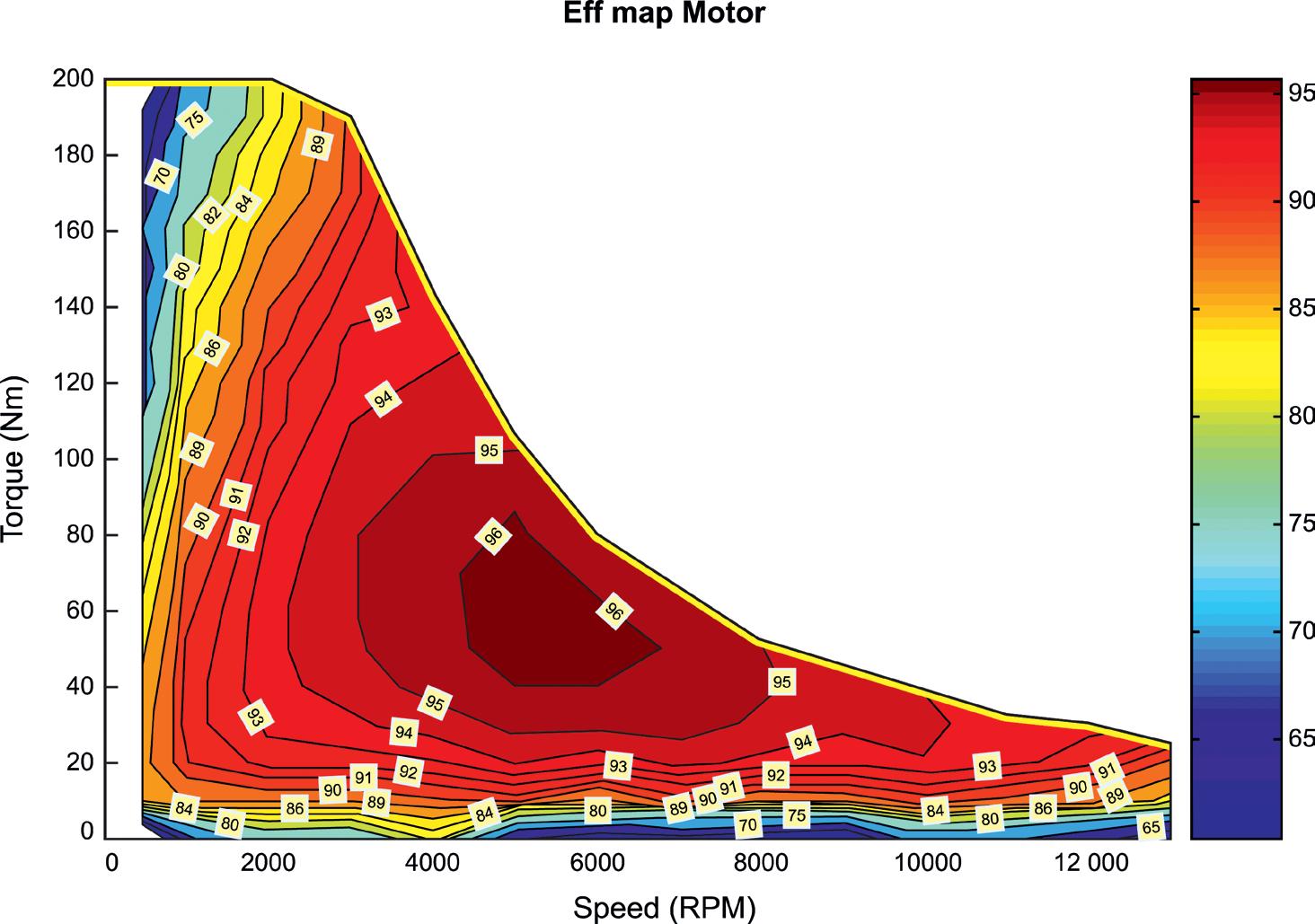

Mechanical losses include friction in the bearings (a linear function of RPM), displacement of grease in the bearings (a cubic[!] function of RPM), and displacement of air (or, worse, a liquid coolant such as glycol antifreeze, oil, etc) by the rotor assembly (aka windage, which is also a cubic function of RPM). Frictional losses should be such a small part of the total losses in an EV traction motor as to constitute a rounding error—if not, you’ll almost certainly be made aware of the issue by the horrendous squealing that unhappy bearings inevitably produce. It is worth mentioning, however, that the biggest driver of losses is, well, the driver—or, more speci cally, where on the e ciency map

Out of the main drivetrain components in an EV, most of the losses come from the motor (tied, perhaps, with losses from the gear reduction/transmission).

the motor spends most of its time operating (see Fig. 1). While the speci c e ciency values will vary from motor to motor, and with application, of course, the general distribution of those values will tend to apply to all cases, and the key takeaway here is that operating at the extremes of the torque or speed capability of any given motor results in drastically lower e ciency (plummeting to zero, in fact, at max torque and zero RPM—that is, stalled—or any RPM and zero torque—that is, unloaded).

Minimizing electrical losses requires a multi-pronged approach, and that usually implies that there will be some tradeo s involved. For example, torque is proportional to magnetic ux intensity, which itself is proportional to the product of current and the number of turns in each armature winding, so doubling the number of turns cuts the required current to produce the same torque in half. is will result in a winding with twice the resistance, but since losses are proportional to current squared, the net e ect is a 50% reduction in losses. So why not go with 10 times the turns and 1/10th the current—or however much further you want to take this argument? Well, the back EMF produced by a motor is proportional to the number of turns, too, so the battery voltage necessary to operate at a useful RPM would rapidly exceed what is practical. Another approach is to use silver wire rather than copper (or aluminum) for the windings, netting a reduction in resistance of about 7% (or 39% for aluminum), albeit at a tough-to-swallow 100x increase in cost. However, when extrapolated to a theoretical useful working life of, say, 10,000 hours, at an average power of 20 kW and a cost per kWh of $0.20, that would save around $2,800 in electricity, making a fairly compelling argument for silver windings right there. Of course, the best winding material would be one with no resistance at all—that is, a superconductor— but the recently broken promise of LK-99 shows us that that goal is still some ways o in the future, and even if it

were available today, there are other practical considerations, such as whether the superconducting material can be formed into a wire with an enamel insulating coating, as is needed for the windings in motors (and transformers, inductors and other electromagnetic components).

Resistive losses aren’t just a problem at high torque (i.e. high current) levels—they can sap e ciency at high RPM too, as the e ective resistance of a wire rapidly increases above a certain frequency due, primarily, to the phenomenon colloquially known as “skin e ect.” What basically happens is that an alternating current induces small loops, or “eddies,” of current in its own conductor. ese eddy currents oppose the ow in the center of the wire and add to it in the periphery, hence it appears

The key takeaway here is that operating at the extremes of the torque or speed capability of any given motor results in drastically lower effi ciency.

that the current is constrained to the outermost portion, or skin, of the wire. e e ective depth that current will use in a conductor is inversely proportional to frequency, and since motor RPM is directly proportional to frequency, this sets an upper limit either on wire diameter (and therefore current) or RPM. e usual solution to minimizing skin e ect is to break up a single wire into many individually insulated smaller wires—something which might need to be done, anyway, just to make winding the motor (or transformer, etc) practical. Note, however, that this increases the percentage of the winding area that is taken up by insulation, rather than copper (or silver, etc), so there is de nitely a law of diminishing returns here.

Turning now to the iron losses in a motor, a commonly used rule of thumb for any electromagnetic device which handles alternating current is that the iron and copper losses should be approximately equal. As this rule of thumb implies, there are mutually exclusive tradeo s between the two—for example, increasing the cross-sectional area to reduce ux density reduces iron losses but requires longer windings, which increases resistance (it also makes the motor signi cantly heavier). e vast majority of motors today use steel that is alloyed with silicon to construct the magnetic circuit—that is, the parts of the motor that conduct loops of magnetic eld—as it combines a relatively high saturation ux density, good formability, high electrical resistance, and relatively

With the rising demand driven by electromobility, it is time for battery manufacturers and machine builders to embrace the Digital Enterprise. By seamlessly integrating the real and digital worlds, our solutions offer increased transparency, speed, and efficiency from battery design to production ramp-up and recycling. Unlock new levels of productivity with Siemens Xcelerator, our simple, flexible, and open digital business platform that helps the battery industry to innovate faster and become Digital Enterprises.

www.siemens.com/battery

low cost, but at the expense of less-than-impressive hysteresis losses (roughly equivalent to frequency-dependent losses in wires). Worse still is that the losses in a magnetic material tend to increase at an exponential rate with frequency and ux swing (typically to the 1.5-2.5 power, depending on material), meaning that a relatively small increase in inverter fundamental frequency (which determines RPM) or phase current (which determines torque) can result in an outsized increase in losses.

ere are numerous magnetic materials with much lower losses, but few of them are suitable for use in motors. For example, the various ferrites commonly used in high-frequency magnetic components have a lower saturation ux density (in the range of 0.3-0.35 Tesla, compared to 1.8-2.0 Tesla for silicon steel) and are extremely brittle, so they’re di cult to form, and aren’t the best choice for a motor that will be bouncing along the road. Much more promising materials employ slight variations in the processing and/or alloying elements of silicon steel, resulting in either an extremely ne grain structure (nanocrystalline) or no grain structure at all (amorphous). Amorphous metals have been employed in transformers and motors for decades (and for those of a certain age, also in the heads in tape decks) and while they can achieve an impressive up to 70% reduction in losses (from around 1.4 W/kg to 0.4 W/kg, depending on frequency, ux swing, etc), they are more expensive to manufacture and more brittle (though not nearly as brittle as ferrite). Between the two variants, the nanocrystalline version has the edge in saturation ux density and mechanical properties, while amorphous is less expensive to produce and a more established material. Either way, reducing iron losses by up to 70% gets you closer to improving overall motor

e ciency to that mythical 99% gure than the relatively meager contribution from silver wire, and possibly at a lower cost.

As mentioned earlier, frictional losses in the sha bearings should be a tiny fraction of overall losses, so this isn’t really an area where further optimization is possible, although we should note that one insidious failure mode of motors supplied by a variable-frequency drive is spark erosion of the internal bearing surfaces caused by capacitively-coupled currents produced by the rapidly switching voltages from the inverter (i.e. from high dV/dt), hence the growing use of ceramics for the bearing balls and races. Otherwise, moving away from total-immersion liquid cooling—especially if the coolant is oil, which has a much higher viscosity than aqueous coolants like glycol and water—can signi cantly reduce windage loss. Another key factor is not operating at extremely high RPMs, as, again, windage loss scales with the cube of RPM, so a modest loss of 100 W at, say, 3,000 RPM turns into a far-less-tolerable 2.7 kW of loss at 9,000 RPM.

On a related note, the use of multi-speed transmissions (either mechanical or the rather novel electronic approach discussed below) rather than the single-speed gear reduction most commonly used in EVs today can help keep the traction motor in that sweet spot of moderate torque and moderate RPM for a greater percentage

Reducing iron losses by up to 70% gets you closer to improving overall motor effi ciency to that mythical 99% fi gure than the relatively meager contribution from silver wire, and possibly at a lower cost.

of time (while improving acceleration and top speed). With a mechanical transmission there will be some increase in frictional/windage losses (particularly for gears bathed in oil), but the typical 97-98% e ciency of a gear train will always compare favorably to operating in the sub-70% region of the motor’s e ciency map. For example, both Porsche and Audi have used a two-speed gear transmission in their EVs, but Bosch is currently making the case for its CVT4EV, which is a constant-velocity transmission that is optimized for EVs by cutting its speed reduction range in half to double its maximum torque capability (as compared to its ICE counterpart).

Alternatively, it is possible to simulate a multi-speed transmission electronically by breaking up the phase winding pairs into multiple sets that can be rewired on the y by the inverter to change either the apparent number of poles or the number of phases. Each of these solutions e ectively changes the rotational angle that the magnetic eld produced by the stator has to act upon—acting over a shorter arc trades a higher torque for a lower synchronous speed and vice versa—but a caveat is that this would require very di erent inverter hardware and so ware, so don’t expect to see these solutions implemented in an OEM EV anytime soon. at said, history shows that whenever a mechanical solution can be replaced by an electronic one, it is all but sure to be adopted… eventually.

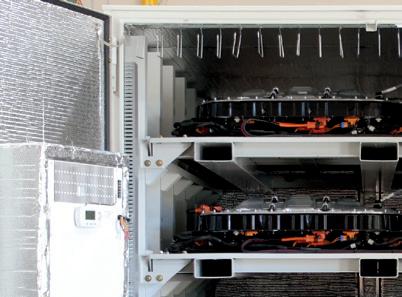

What do EV batteries have in common with athletes and politicians? Once they age out (or get voted out) of their positions, they have the opportunity to have a lucrative (and in the case of batteries, useful) second career. Repurposing depleted EV batteries for stationary storage applications will be a critical part of the future EV ecosystem.

However, there are complicating factors: battery packs come in many di erent sizes and form factors, and individual packs may retire from the road at di erent points in their lives, so their remaining capacity and overall health can vary greatly. How to assemble this motley mélange of used battery packs into a smoothly-functioning stationary storage system?

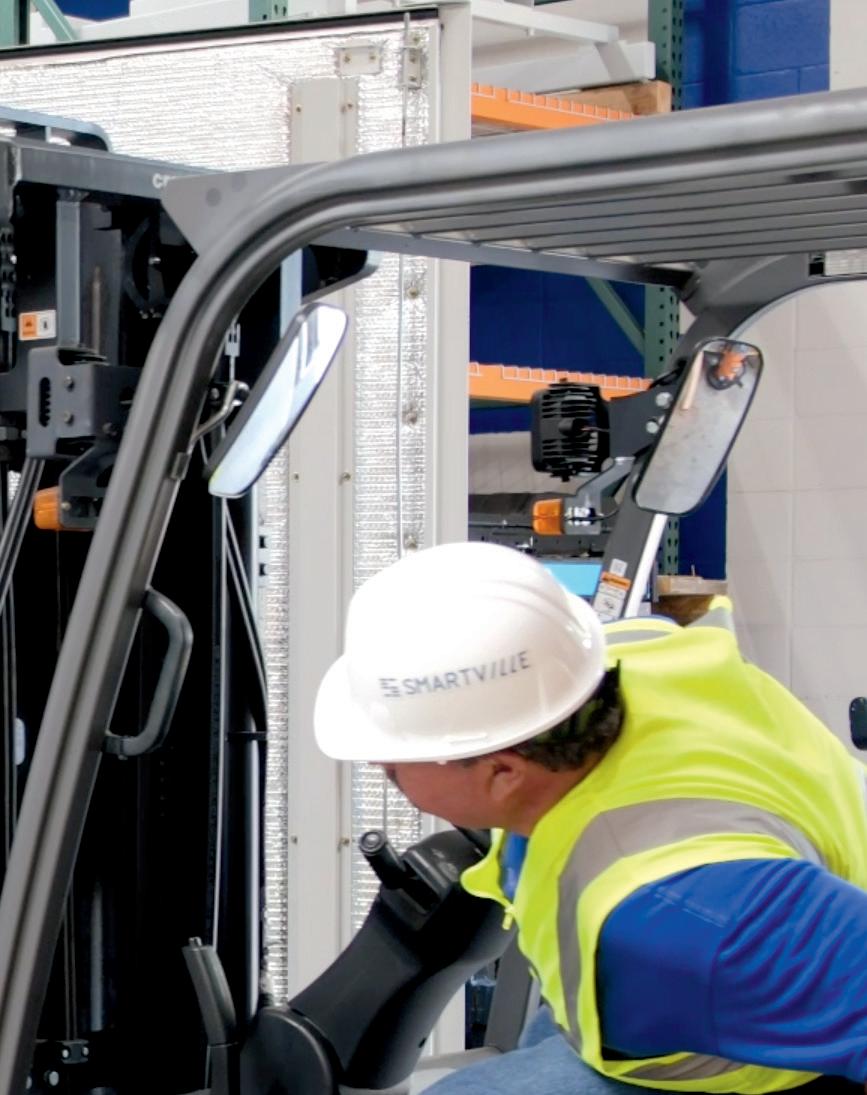

Smartville, which recently won a $5.9-million grant from the DOE, has developed a solution. e company’s new Smartville 360 ESS is a scalable second-life energy storage system that’s designed to incorporate battery packs from di erent manufacturers

(currently, Tesla and Nissan), at varying levels of health, into one unified system. Smartville currently has a pilot project up and running at the University of California San Diego.

The company claims Smartville 360 offers the lowest embedded emissions and the best value per kilowatt-hour of any storage solution on the market. Smartville also hopes to differentiate itself from competitors by tailoring solutions to the needs of different types of customers.

CEO and co-founder Antoni Tong recently explained to Charged how the system works, and how the company procures batteries and prepares them for successful second careers.

Q Charged: Let’s start at step one. Tell me more about where you source the used batteries from.

A Antoni Tong: We work with a variety of battery procurement partners across the value chain. For some battery procurement, we work with OEMs or battery service companies that are directly working with OEMs. For example, Nissan. They have manufacturing space in Tennessee, and they have repurposing programs through their North American headquarters, so we can source, procure and quality-control batteries directly from them.

We also work with Tesla Model 3 and Y packs, as they

are US market leaders in EV sales. In terms of volume of battery capacity that’s out there, 60% to 70% are Tesla Model 3 and Y packs. ose we procure through auctions, insurance write-o s and third-party dismantlers.

Q Charged: If a car gets totaled, you might buy the battery pack on the salvage market?

A Antoni Tong: Correct. e volumes actually are greater than we thought. We have seen at two of the major insurance auction sites, about 1% of the vehicles are coming through that pipeline in year one, and you will see about 15% of them before year 10. ose are fairly new and quali able batteries for reuse. Our market study indicates that over one GWh worth of batteries will be available for repurposing in the next three years.

Q Charged: Your Smartvlle 360 platform is designed to use batteries from di erent vehicles—any battery chemistry, any type of battery, correct?

A Antoni Tong: Yes, this is exactly the design-for-application approach we took to optimize the integration cost and competitiveness of our products, and reduce the risk of procurement. We are fairly con dent that the products are agnostic with regard to OEMs and chemistries.

ere’s only one nuance—typically, we design batteries by the class of voltage. Currently, more than 90% of vehicles are in the 400-volt class. We do start to see new trucks and buses using 800- or 1,200-class voltage, and that requires some retooling and update of power electronics on our end.

Q Charged: What do you physically have to do with a pack to install it into your device? Surely you don’t just take the whole battery pack and stick it in the cabinet?

A Antoni Tong: at’s exactly what we do. Let me give you some reasons. ere are di erent schools of repurposing—the teardown model or the whole-pack repurposing model. Smartville does a whole-pack repurposing model. ere are business models in Asia and Europe doing teardown, but there are two reasons that this is going to be exceedingly challenging. One is the economics. In this market space, to do this requires high labor costs for reintegration. You’re also tampering with a perfectly sealed and engineered pack to rebuild a system that introduces new components and controls, which may mix in a manufacturing defect.

e second reason is the trend of how battery packs are being engineered. You are seeing bigger form-factor modules, something like cell-to-pack design, which make the pack almost indestructible, so the pathway for the teardown model almost doesn’t exist. For example, Tesla Models 3 and Y, and other large-format battery packs that we are starting to see in the market.

For those reasons, we’re trying to repurpose directly on the pack level. However, I should have prefaced, it’s not directly sticking the pack into the Smartville 360. We do quali cation, we do cooling line integrations, we do quality checks, not only on the batteries but also on the critical parts within the pack. at includes the BMS, communications, cooling lines, seals, isolation detections, contact qualities. So, all that we’re going to be reusing outside of the battery will be quali ed before we integrate them.

There are different schools of repurposing—the teardown model or the whole-pack repurposing model. Smartville does a wholepack repurposing model.Images courtesy of Smartville

Q Charged: Tell me more about the quali cation that you do on these battery packs.

A Antoni Tong: Quali cation is extremely important for our business model, and we hope to build a di erentiating approach in that space.

What we do o en starts even before we touch the batteries. We work with service providers, dismantlers, some of them even before the batteries come o the vehicles. We provide them with hardware and protocols so they are able to do initial sni ng of the batteries—taking pictures, reading manufacturing marks, reading VINs. We also have a device that can read CAN buses

on the BMS to get odometer readings, mileage, accumulative cycles, so we can draw a map of the rough category of fitness of those batteries.

Once we determine some of the batteries are good, and get them to our factory, then we will conduct the testing we call “application-appropriate.” Because when they were in the vehicles, all the calibration, all the readings, all the BMS were reporting how the batteries operated in the vehicle. We test them on their quality for energy storage applications. We recalibrate their state of health and their state of charge, and then we prep them for integration. That procedure builds up a strong body of data intelligence that we are able to use to predict and guarantee performance.

Q Charged: Within the Smartville 360, you’ve got to connect the communication lines to the BMS, you’ve got to connect the coolant lines, and all those connections must be different for every different pack, right?

A Antoni Tong: This is one of the unique toolings we had to do. The form factor fits the majority of the EV packs. And within each Smartville 360, we use the same type of battery—not only the same models but also very close model years. Every time we become compatible with a

new type of battery pack, the first thing we do is retool the cables and retool the communication connections. But we find this to be largely similar, and we have a cable consultant and suppliers that are familiar with a lot of those retoolings in the automotive space.

Q Charged: So you don’t mix and match packs within a single Smartville 360 unit, but each different unit could be using different types of packs.

A Antoni Tong: Correct.

Q Charged: You describe the Smartville 360 as a plug-and-play device. How does a customer connect it into their electrical service for peak shaving, backup power or other applications?

A Antoni Tong: Our system can be configured for both DC and AC couplings. For the AC coupling, it comes with the inverter pre-integrated and fully turn-key. Our EMS system, despite our capability to work with batteries with different types and health, will coordinate the lower-level control so the customer will only see one unit of batteries to dispatch. A project developer will then take our EMS control interface and incorporate it with a larger site-level controller, which includes other energy components such as renewables, loads, grid-metering and switches.

The EMS is what they use to dispatch our ESS. For storage, it depends on applications. There are many, many different controls you can do. You mentioned a few: peak shaving, that’s looking at the time-of-use price; demand reduction. It’s more complicated looking at what’s the penalizing tier of the local utility. So, all those are different case-by-case situations.

Qualification is extremely important for our business model, and we hope to build a differentiating approach in that space.Image courtesy of Smartville

Q Charged: ere must be a so ware product that goes along with it. Is that something that you provide or can it work with di erent systems?

A Antoni Tong: Both. Our systems come with the EMS that allows the integrator to dispatch the batteries. We also can be compatible with other more powerful EMS systems that the customer might use.

Q Charged: I guess second-life battery technology has come a long way in the 10 years since you began in the industry. What are some of the improvements and innovations that have happened?

A Antoni Tong: In the past 10 years there have been a lot of pilots and trials, o en OEM-initiated, typically working with developers or integrators to do demonstration projects.

Over the last couple of years, we have seen growth in the volume of batteries, the procurement model being further diversi ed, and a lot of companies working on di erent batteries. We are starting to see the emergence of solutions really

Multiphysics simulation helps in the development of innovative battery technology by providing insight into mechanisms that impact battery operation, safety, and durability. The ability to run virtual experiments based on multiphysics models, from the detailed cell structure to battery pack scale, helps you make accurate predictions of real-world battery performance.

» comsol.com/feature/battery-design-innovation

targeting a competitive business model in the stationary storage space. Depending on the market sector they’re focusing on, the price structure might be di erent. But this is still in a very early stage.

Q Charged: What are some of the potential customers, and how do their needs di er?

A Antoni Tong: Di erent companies are focusing on di erent customer sectors. Smartville today is focusing on about 100 kilowatt-hours to multi-megawatt-hours of installation as a market entry. We are targeting systems for commercial and industrial customers, or a leg up to a small grid-integrated level, but not like a gigawatt level of storage yet, as those applications require much larger manufacturing scales and nancing vehicles than we are capable of today.

Q Charged: Smartville was founded in 2019. What stage in your development are you at? Are you still working on pilots or do you have some actual customer installations up and running?

A Antoni Tong: So far, we are at the scaling point. Our rst pilot-level product is Smartville 360, and right now, we are at iteration two. With iteration one, we had one installation done last year as a pilot. It’s subsidized by California Energy Commission funding.

We have four concurrent pilots ongoing right now. Smartville 360 version two is geared towards certi cation under the UL 9540 framework and is targeting low-rate production. With that product, we are doing our rst commercial delivery to a utility company. We are hoping to showcase our products and underlying solutions in September at the RE+ Convention. We also have a couple of utility, commercial and auto OEM customers in the pipeline.

Q Charged: What do the auto OEMs use stationary storage for?

A Antoni Tong: Some of them want a proof of concept on their batteries. ey have incentives to see cost di erences, should policy come that makes them responsible for battery packs that are in their vehicles or creating an internal application ecosystem for their battery packs.

Q Charged: e OEMs think there might be regulation in the future that will require them to support second-life batteries?

A Antoni Tong: Generally, OEMs don’t want to comply unless there is a strong nancial incentive. What I see is not only the risk of future policies, but also other nancial incentives. Because nowadays, battery pack chemistries are moving toward low-cost, low-supply-risk raw materials, such as shi ing from NCM to iron phosphate. e OEMs might see little to negative value in recycling only, meaning that they have more costs on their hands for end-of-life batteries. So hopefully, it’s a mix of policy push and the nancial incentive to drive to a reuse and recycle model.

Q Charged: So recycling is in some cases not economically viable? How does that relate to second-life applications?

Nowadays, battery pack chemistries are moving toward low-cost, lowsupply-risk raw materials, such as shifting from NCM to iron phosphate. The OEMs might see little to negative value in recycling only.Image courtesy of Smartville

A Antoni Tong: We see challenges on the pro t side on the battery materials. Maybe two years ago during the height of COVID, battery raw materials could fetch high prices, but the price has been down by more than 50% since COVID subsided.

We also see di erent pro t opportunities for di erent chemistries. e earlier batteries with high nickel, manganese and cobalt content fetch a better price, but batteries are not made this way nowadays. Very low nickel and cobalt contents today. e iron phosphate cells, they are basically iron and rust and some lithium. ose actually carry a cost to the end owner. It’s not a problem for OEMs today because they are not responsible for those packs. But once they do become liable for those costs, that’s a great nancial incentive to nd a responsible yet cost-e ective end-of-life solution. And I hope at that time, reuse becomes a solution before recycling.

As electric vehicle technology evolves, so should your expectations. Our customizable CoolTherm® products increase safety, reliability, and performance in electric vehicles.

Solutions:

▪ Gap Fillers

▪ Potting & Encapsulants

▪ Structural Adhesives

Applications:

▪ Battery Packs

▪ Motors

▪ Charging Systems

parker.com/ CoolTherm

When we talk to collaborators and potential customers, we always say our business model is not in competition with recycling. We are in a complementary position with recycling, because we and the recycling entities are using very similar processes of logistics, shipping and procurement. e batteries have to come out of the vehicles, have to be sorted, have to be transported. But if we can pick the batteries that are usable for us, the cost to the recycler for procuring the rejected batteries will be lower. At the same time, when we triage large quantities of batteries for repurposing, we make it easier for those end-of-life batteries eventually to get to the door of the recycling plant.

Q Charged: Tell me about the future of sourcing packs. When do you think you’re going to see a lot of actual end-of-life battery packs coming on the market?

A Antoni Tong: is is a very good question. Our retaining rate, which means the salvage rate on the vehicle side, is also driven by the signi cant growth of the EV space. We see north of gigawatt-hours of used batteries available as early as 2027. at’s a signi cant amount, much larger than our target procurement model within Smartville’s business objective. But there’s a nuance as to whether they are really end-oflife. ere is no clear line that a battery used beyond 80% remaining capacity is true end-of-life. ere will be a spectrum, and we continue to work with batteries of all ages. Some came right o the factory oor and got into accidents. Some people are driving old Nissans down to only 40 miles of range, and we have those batteries at our factory as well. e key here is to establish good battery data analytics to provide the prescribed service life and performance in our integrated product.

Q Charged: My LEAF is down to 80 miles of range, but it gets me where I need to go, so you won’t get that battery pack for a long time.

A Antoni Tong: Right. But to add to that, a lot of our motivation is also coming from sustainability objectives. Just to throw a number out there, a new EV needs to drive about 13,500 miles to equal the embedded carbon emissions compared to a gasoline car, according to Reuters. Which means if you have a vehicle that gets totaled before year three, year ve, that’s a more polluting car than gasoline. [Editor’s note: ere are widely varying estimates as to the mileage required to cancel out an EV’s “carbon backpack.”]

You have tons of battery assets out there that are being ground down for material. Alternatively, if we can pick them up and bring them a second life, we can ful ll their carbon emission reduction goals.

Q Charged: In California they’re introducing some incentives for stationary storage, and I think the IRA and the BIL address this too. Are there state and federal incentives that you’re able to tap into?

A Antoni Tong: ere are strong incentives for stationary storage in the IRA, but there are wrinkles for the line of business we do. For example, as the IRC section 48 Energy Investment Credit stands today, second-life batteries were le out of the technology candidates to receive project-wide tax incentives. However, we have a very strong case that this is a shi ing of application—it’s a battery that’s not purposely for stationary storage and we, through engineering, developed a new line of product. I think we can make a case for the product to be quali ed—but there is risk there.

And if you are quali ed for a certain percentage of domestic manufacturing, you qualify for additional tax rebates. Which, interestingly for Smartville, our products have very, very high percentages of domestic content. anks to our low-risk supply chain and localized manufacturing practice, our enclosures, our power electronics, interface stages, and the batteries, are sourced or manufactured in the US, as opposed to other energy storage products that you typically see—batteries are largely coming from overseas. is is one of the things that the battery circularity industry as a community is investigating. One possibility is that we submit projects for a private letter ruling (PLR) on qualifying under the IRA. We also look to see campaigning and lobbying e orts that could qualify these products for tax incentives. A er all, achieving scalable repurposing, in our opinion, is a key step to achieving a sustainable domestic lithium-ion battery supply chain.

We see north of gigawatt-hours of used batteries available as early as 2027...much larger than our target procurement model within Smartville’s business objective.

The Unimotive range is specially designed for applications in the automotive industry. Typical applications include temperature simulations as well as material testing and temperature-dependent stress and load tests for automotive parts and functional components.

Tesla’s founders set out to sell “not just the best electric cars, but the best cars.” In several markets around the world, the company’s EVs have now become the best-selling cars.

In Q2 of this year, Tesla had the two best-selling cars in California by a wide margin, helping to push the market share of battery-electric vehicles to a record 21% in the state.

According to the California New Car Dealers Association’s second-quarter 2023 California Auto Outlook report, Tesla had a record quarter in the Golden State. e best-selling vehicle in Q2 was the Tesla Model Y, which sold 74,765 units through June 2023. In second place, the Tesla Model 3 sold 41,718. In the number-three spot was the Toyota Camry with 27,169 sales, followed by the Toyota RAV4 with 26,032.

As Tesla’s sales soared by 62% compared to Q2 2022, Toyota’s shrank by 8%. e result: for the rst time ever, Tesla was the best-selling brand in California, edging out long-time front-runner Toyota. Tesla sold 69,212 cars in the quarter, while Toyota shi ed 67,482.

Is this signi cant? Well, Toyota, maker of the Prius, has been the top-selling brand in climate-conscious California for many years. To be bested by a 20-year-old company that sells only four models highlights how far the world’s second-largest automaker has fallen behind.

“If that doesn’t light a re under Toyota’s ass, I don’t know what will,” quipped Electrek’s Fred Lambert.

BC Transit, which oversees public transit in the Canadian province of British Columbia (outside of Greater Vancouver) has announced plans to invest some $396 million to purchase up to 115 battery-electric buses and install 134 charging points.

Of the total, the Canadian federal government is contributing around 170 million, the British Columbia provincial government is kicking in 159 mill, and recipients are coughing up 67 big ones.

BC Transit aims to transition to an all-electric eet by 2040. e Canadian government has set an objective of putting 5,000 zero-emission public transit and school buses on the country’s roads by 2026.

“Funding provided through the Zero Emission Transit Fund and the Investing in Canada Infrastructure Program supports phase 1 of BC Transit’s plans to have our eet fully electric by 2040,” said BC Transit CEO Erinn Pinkerton.

“ e future of transit is electric, and communities in British Columbia and across the country are leading the way,” said e Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities. “Our government’s investment will put quieter, cleaner buses on roads, making commutes more pleasant while protecting our environment.”

Nissan has announced that total worldwide sales of its EVs have surpassed one million. e company’s biggest seller, the Nissan LEAF, which was introduced in 2010, has sold more than 650,000 units in approximately 50 markets concentrated in Japan, the US and Europe.

Other Nissan EVs include the Sakura minivehicle and the Ariya crossover, both launched in 2022. e Ariya features the company’s e-4ORCE all-wheel control and ProPILOT 2.0 driver support.

Cumulative EV sales as of June 30 of this year are 320,000 in Europe, 230,000 in Japan, 230,000 in China, 210,000 in North America and 10,000 in other regions.

e company plans to launch 19 new EV models by scal year 2030 and to o er EVs by 2028 that are powered by all-solid-state batteries developed in-house.

Automaker Stellantis has announced a multiyear agreement with US eet-management company Merchants Fleet for the purchase of 12,500 Ram ProMaster EV vans, which are to debut later this year. e van will be available in multiple con gurations, roof heights, cargo lengths and body styles.

“Our all-new ProMaster EV is Rvam’s rst EV o ering in North America and an integral step in our electri cation journey that will o er more e cient options to all of our customers,” said Mike Koval Jr, Ram brand CEO. Introduction of the new van is part of the Stellantis Dare Forward 2030 strategic plan to o er EVs in the majority of its segments by 2025 and in all of its segments no later than 2030.

e agreement with Merchants Fleet follows an announcement that Amazon, as the rst commercial customer for the Ram ProMaster EV, will be adding thousands of the vans to its eet every year.

e Norway-based El y Group is building an electric amphibious aircra , inspired by the venerable de Havilland Twin Otter and Grumman’s Mallard. e Noemi seaplane is designed for 200-kilometer air journeys, and will be powered by two electric motors with up to 1 MW combined output. A prototype is expected to make its rst ight in 2025.

El y has selected Electric Power Systems (EPS) as the battery provider for the electric seaplane. EPS will deliver its EPiC battery line for the initial demonstration.

Electric Power Systems has numerous battery systems currently powering demonstrator aircra , including the NASA X-57, Bell Nexus, Aurora Pegasus, Embraer Ipanema and Boeing Cargo Air Vehicle. EPS has also partnered with the FAA to certify batteries for general aviation aircra , and will complete its rst Technical Standard Order this year.

“We are con dent that our advanced battery technology will contribute signi cantly to the success of the project,” said Nathan Millecam, CEO of Electric Power Systems.

“EPS’s highly relevant experience supporting battery technology on complementary, innovative programs positions them well for our next-generation seaplane, which we intend to build and y under our own Air Operator’s Certi cate in Norway,” said El y CEO and founder Eric Lithun.

New York-based Revel leverages the synergies between urban public charging and ridesharing. e company operates two public EV fast charging Superhubs, and plans to add at least 130 more plugs by the end of 2023. e company launched its electric rideshare service in 2021, and currently has a eet of about 300 EVs, including Tesla Model Ys and Model 3s and Kia Niro EVs, delivering rides throughout the NYC area.

Senate Majority Leader Charles Schumer (D-NY) recently paid a visit to Revel’s agship Superhub in Bedford-Stuyvesant, Brooklyn, and took a ride in one of the company’s distinctive blue EVs.

“Revel is on a new and exciting mission to build electric vehicle charging infrastructure throughout New York City and other American cities, so cars—whether they be cars like Revel’s, other rideshare vehicles, or privately owned cars—can have easy access to e cient charging,” said Senator Schumer. “ e Infrastructure Investment and Jobs Act included $2.5 billion to help pay for EV charging infrastructure, and developers like Revel can utilize these funds. We also extended the $7,500 tax credit in the IRA to encourage the adoption of more electric vehicles to lessen carbon emissions.”

“As a Brooklyn-born company, we were honored to have another native of the borough, Majority Leader Schumer, take our one-millionth zero-emission ride and show how electri cation is taking hold in New York City,” said Revel co-founder and CEO Frank Reig.

FireFly Automatix, a manufacturer of autonomous mowers, debuted its rst all-electric mower at the recent Turfgrass Producers International (TPI) convention in Michigan.

e M100-AV is a commercial reel mower that cuts a 100-inch-wide swath. It features a LiFePO4 battery pack. e company says it can mow up to 25 acres per charge at speeds of 7 acres/hour, and recharge in 2 hours. e company says it can decrease fuel costs by 87%, and maintenance costs by 65%, compared to a fossil-powered mower.

e M100-AV can operate without on-site supervision and includes LiDAR-enabled obstacle detection and avoidance for safety. It provides intelligent path planning, so no boundary wires are needed, and mowing patterns are optimized for maximum e ciency.

Four independent electric drive motors are synchronized with two independent steering motors. e drive motors are engineered for 100,000+ hours of life.

FireFly is currently accepting pre-orders, and anticipates delivering the rst production models this fall.

“I am highly impressed by the innovative FireFly reel automatic mower,” said Scott DeBuck, owner of the farm that hosted this summer’s TPI host farm. “Its cutting performance produces beautiful results, and the capability to program various mowing angles is astonishing. Owning a mower like this would be a dream come true, and I believe that the industry as a whole would greatly bene t from such a remarkable invention.”

Amtrak uses buses all over the US to run thruway connecting services, which are scheduled to connect with Amtrak trains. e agency’s rst electric bus will run between Seattle and Bellingham, lling the gap between the morning and evening trains on the Cascades route, saving approximately 10,000 gallons of diesel fuel per year.

Amtrak’s new electric bus (or motorcoach) is a 45-foot Van Hool CX45e. It has a 660 kWh Proterra battery system that delivers 260 miles of range. It’s owned by coach operator MTRWestern, and it can make the nearly 200-mile round trip on a single charge. e charging hub, which features ABB EV chargers, is at MTRWestern’s Seattle facilities.

Amtrak says it is evaluating other routes within its National Network for EVs.

“At Amtrak, we strive to give our passengers reliable, comfortable and sustainable travel options. By incorporating environmental considerations into our current operations, we continue to make Amtrak an even greener mode of transportation,” said Amtrak Sustainability Director Kara Oldhouser.

“ e future is electric, and we are committed to delivering carbon-free intercity and group transportation throughout the Paci c Northwest,” said MTRWestern President Jeremy Butzla .

Image courtesy of Amtrak

Image courtesy of Amtrak

Volvo Trucks has introduced new, more powerful batteries for its medium-duty electric trucks, the Volvo FL and Volvo FE.

e new batteries o er 42% more energy capacity, and are capable of delivering an increased range of up to 450 km (280 miles) in the Volvo FL Electric or 275 km (170 miles) in the Volvo FE Electric, the company said.

e trucks can now handle most types of routes and assignments in urban areas, as well as power equipment for energy-consuming assignments like refuse handling or city construction.

e higher capacity means that fewer batteries are needed to supply the same power. If customer assignments require shorter ranges, they can increase their payload by using fewer batteries—with a payload increase of 500 kg for every battery not carried.

“With a range of up to 450 km, our electric trucks are ready to replace our customers’ entire eet of diesel city trucks,” says Jessica Sandström, SVP Product Management at Volvo Trucks. “For some customers, it’s more important to get extra payload, rather than maximizing the range.”

Medium-duty commercial EV manufacturer Lightning eMotors has started production of its next-generation GM-based Lightning ZEV4 work trucks.

Lightning is o ering the ZEV4 for several vehicle applications, including box trucks, stake bed trucks, utility trucks, dump bed trucks and daily work/landscaping trucks, in addition to cargo delivery vehicles, shuttle buses, school buses and more.

e versatile Lightning ZEV4 model is equipped with 120 kWh batteries located within the frame rails, delivering 241 horsepower, 790 pound-feet of torque and a range of up to 130 miles, as well as improved weight distribution for better handling and improved safety, says the company. e Lightning ZEV4 is capable of Level 2 AC and 80 kW DC fast charging.

e Lightning ZEV4 is capable of Level 2 AC and 80 kW DC fast charging.

Also, Lightning’s ZEV4 platform is compatible with a variety of bodies from manufacturers including Knapheide, Rockport Trucks, Brown Industries and Morgan. At current production volumes, ZEV4 work trucks are typically available for delivery four to six months from the order date.

“ ere has never been a better time for Class 4 work truck operators to upgrade their eets to zero-emission vehicle technology,” said Lightning eMotors CRO Kash Sethi. “Aggressive funding programs—many of which can be stacked to optimize both purchase subsidies and tax incentives—combined with advanced data tracking and insights capabilities of our GM-based Lightning ZEV4 create an exciting environment for operators to act.”

TITAN Freight Systems, a less-than-truckload carrier headquartered in Portland, Oregon, plans to add three battery-electric Freightliner eCascadia Class 8 trucks to its eet by the end of the year. e trucks will be manufactured at Daimler Truck North America’s Portland Truck Manufacturing Plant, and delivered by Premier Truck Group of Portland. e new Freightliner eM2 medium-duty electric box trucks will provide deliveries to businesses throughout the Portland Metropolitan area. To power the electric eet, six Detroit eFill commercial charging stations have been installed at TITAN’s depot.

In 2019, TITAN began working with DTNA’s Electric Mobility Group to design the infrastructure that would be required to electrify its eet. In 2021, TITAN was awarded an Oregon Diesel Emissions Mitigation Grant to replace six diesel trucks with new Freightliner EVs. Portland General Electric provided technical analysis and its Make-Ready eet partner incentives to assist with charging infrastructure design and costs.

In spring 2023, the Portland Bureau of Transportation was awarded nearly $2 million through the DOT’s SMART Grants program. is funding is intended to enable Portland to pilot a zero-emission delivery zone. TITAN’s eet of electric trucks will help to facilitate emission-free deliveries within this 16-square-block area in downtown Portland.

“ ese heavy-duty electric trucks are a natural evolution in our journey to be a carbon-neutral transportation company,” said TITAN CEO Keith Wilson. “We now have a new zero-emission, lower-operating-cost tool to help us get closer to realizing our sustainability goals.”

Teflon (PTFE)

RIGID LAMINATES: G7, G10, G11, NEMA GRADES

ADHESIVES,

US-based venture capital rm bp ventures has made a £4-million investment in Series A funding for UK-based so ware company Dynamon, which specializes in developing data analytics and simulation tools for commercial transport and logistics companies. Dynamon will use the new funds to commercialize and scale up its ZERO platform and to expand its operations in Europe and into North America.

“As eets electrify,” said Stefan von Dobschüetz, General Manager for bp pulse Europe, “the commercial transport and logistics industry faces challenges balancing cost management and operational reliability, while understanding new vehicle technology.”

Dynamon’s ZERO so ware is designed to save energy and capital investment costs by calculating the best options for adoption through planning for vehicles, charging infrastructure, energy costs and operations analysis. It can also be used by existing EV eets to address cost management, support operational reliability, and monitor and manage battery degradation through data analytics.

Yellow school bus icon Blue Bird is going electric—the company has nearly 1,000 electric school buses in operation today. e latest order comes from Miami-Dade County Public Schools, which will add 20 electric buses to its all-Blue Bird eet of 1,000 school buses.

Miami-Dade County is the third-largest school district in the nation, serving more than 335,000 students. e school district received a $11.6-million grant from Florida’s Volkswagen Mitigation Settlement Trust fund to acquire the electric buses.

Blue Bird will provide its Vision electric school buses to Miami-Dade through its authorized dealer, Florida Transportation Systems in Tampa.

Each vehicle can carry 72 students, and has a range of up to 120 miles. Florida Power & Light will install 50 DC fast charging stations. Ten charging stations at the district’s Southwest Transportation Facility are expected to be operational by September 2023.

“Miami-Dade County Public Schools is excited to put its rst 20 electric, zero-emission school buses into service,” said Superintendent Dr. Jose L. Dotres. “We are looking forward to a successful pilot program and to building on our decades-long relationship with Blue Bird.”

“ is pilot program is a wonderful rst step in the electri cation of Miami-Dade’s eet and improving the air quality for its students and the community at large,” said Blue Bird President Britton Smith. “We could not be more pleased to help a long-term and highly valued customer transition to electric buses and clean student transportation.”

Motiv Power Systems, a manufacturer of electric trucks and buses, has announced a new electric truck featuring a medium-duty EV cab designed from the ground up.

e Argo Series is designed to support all medium-duty applications across Classes 4 to 6—including box trucks, step vans, shuttle buses, refrigerated vehicles, vocational vehicles and other specialties—and is built with Motiv’s next-generation powertrain, including an LFP battery pack that delivers 150 to 200 miles of range.

Motiv has been in the electric truck business for 14 years, and has deployed more than 180 vehicles for customers including Cintas, Bimbo Bakeries and Purolator.

e new Argo vehicles will boast a futuristic cab that was designed from the ground up as part of an EV. e cab is built from structural composites, and boasts many energy-e cient features, including windshields with builtin heat to save on defrosting energy, and seats heated with specially-designed air ow.

e Argo cab’s Command Seating Position was designed with the bene t of customer experience to relieve driver fatigue and increase safety. “ is feature provides superior visibility and ergonomics compared to conventional cabs, includes sightlines at the four points of the vehicle, incorporates lower belt lines for better visibility, and features door access with full-size interior steps.”

“A er years of helping eets put EVs on the roads, Motiv has the right combination of daily route experience and expertise to design and build its own cab—the next step toward becoming a full-featured original equipment manufacturer,” said Jim Castelaz, Motiv’s founder and CTO. “Many have joined the commercial EV space by jumping in head rst and starting with ultra-modern, ashy designs that don’t always o er practical driving experiences. Motiv, on the other hand, has carefully applied insights gathered over the last decade to create Argo, a truck that marries the reliability and work focus of Motor City with Silicon Valley innovation.”

e Argo Series vehicles are currently available for pre-order and will be on the road in late 2024. Argo vehicles will be manufactured in the US, and are eligible for the IRA tax credit and other incentive programs.

Austrian Federal Railways has awarded Swiss railway rolling-stock manufacturer Stadler a framework agreement for up to 120 FLIRT Akku battery-powered trains.

e rst 16 are expected to be delivered by fall of this year.

e vehicles are designed to replace the current diesel eet in the eastern region of Austria. ey will enable sustainable operation on lines that are only partially electri ed. is is accomplished on non-electri ed line sections by charging the batteries while traveling under overhead contact lines.

e normal battery-powered operating range is about 100 km, but Stadler says the FLIRT Akku holds the world’s record for the longest distance traveled by a regional train in battery-only mode without additional charging: 224 km.