EMPIRICAL ECONOMIC BULLETIN

THE CENTER FOR CLOBAL AND RECIONAL ECONOMIC STUDIES BRYANT UNIVERSITY

EEB--UNDERGRADUATE ECONOMICS JOURNAL f--..... f �'-'"•fl.'IC,NI \ t �--· ___,

Hit I •

--- '

EDITOR: Ramesh Mohan

EDITOR: Ramesh Mohan

DESIGN & LAYOUT: Ramesh Mohan and Rebecca Marcus

MISSION STATEMENT: The Empirical Economics Bulletin is the undergraduate journal for the Department of Economics, Bryant University. The journal is produced in conjunction with the Bryant Economic Undergraduate Symposium. The focal point of the Symposium is on training undergraduate students in the art of writing, presenting, and publishing empirical research papers on a range of socio-economic and economic topics. The Symposium’s primary emphasis is empirical studies with policy relevance. Students are then able to publish their empirical papers in the Empirical Economics Bulletin. An objective of the Economics’ Department, Bryant University is to train students to conduct quantitative economic data analysis and to present the results in a coherent and meaningful way. This objective is met through having the Symposium and the publication of the Empirical Economics Bulletin. The first issue was in Spring 2008 and has been published annually with original work from an array of student authors.

SUBMISSION GUIDELINES: Students may submit their socio-economic and economic work here: Ramesh Mohan at rmohan@bryant.edu. Limit one submission per author. Each submission should have a title page with the title; name of author; abstract; keywords; JEL classification; author’s email. Previously published work is not accepted. The reading period is September 1 to December 1. Copyright reverts to author upon publication.

Any questions may be directed to Professor Ramesh Mohan at rmohan@bryant.edu.

© 2022 Empirical Economics Bulletin

Table of Contents Effectiveness of Aid: Panel Data Analysis of Foreign Aid in Africa, Will Bittrich 1 Impact of Corrup�on on Economic Growth in Central America: A Panel Data Analysis, Ben Bresnee …… 13 Determinants of Real Median Household Income in the United States Using Time-Series and Panel Data Analysis, Evan Clark ..................................................................................................................................... 25 A Panel Data Analysis on Income Inequality on Life Expectancy in Asia, Julianna Flaccavento 43 The School-to-Prison Pipeline: A Panel Data Analysis, Samuel J. Guider …. 63 The Empirical Analysis of Motherhood Penalty: The Effect of Having Children on Women’s Career, Madison Henry 85 A Panel Data Analysis of Ins�tu�onal Quality, FDI, and Public Debts’ Impact on Economic Growth for ASEAN, Joshua Kearney ..…………………………………………………………………………………………………………………… 104 An Empirical Analysis on Dispari�es in Access to Healthcare in New York City, Olivia Lemire .. 119 Panel Data Analysis: Gender Wage Gap and Macroeconomic Factors Impacts, Yuzhe Lin …………………. 134 The Effect of Minimum Wage Increases on Employment of Teenagers in New England, Felicia O’Reilly 142 Panel Data Analysis of Import Tariff Policy on Economic Growth and Industrial Output in Developing Economies, Connor A. Palazzo .. 159 A Panel Data Analysis of the Effects of Macroeconomic Variables on Income Inequality in La�n American Countries, Scot Poretsky …………………………………………………………………………………………………………………. 171 Causal Rela�onship Between Defense Spending and Economic Growth in Countries with Different Income Levels, Kyle Sampson 188 Interna�onal Integra�on and Export-Led Growth in La�n America: A Panel Data Analysis, James Titus . 203 Granger Causality of the Rela�onship Between Tourist Flows and Household Expenditure in Jamaica, Ben Williams ……………………………………………………………………………………………………………………………………………. 215

Effectiveness of Aid: Panel Data Analysis of Foreign Aid in Africa

Will Bittrich

Abstract:

This paper investigates the effectiveness of international foreign aid flows into the continent of Africa. The study incorporates economic information into an econometric model to examine the influence of variables including natural resources, types of government, corruption, and education. The influence of gender equality and rule of law in relation to developed countries is factored in through a dependent variable. These findings provide an analysis on the efficiency of foreign aid and its effects on economic development in the region.

JEL Classification: H7, I3, F35

Keywords: Foreign Aid, Intergovernmental Relations, Poverty

Economics Student, Bryant University, 1150 Douglas Pike, Smithfield, RI 02917. Phone: (781-715-4091). Email: wbittrich@bryant.edu

1

Foreign Aid has become an increasingly contentious topic as a multitude of countries in Africa continue to diverge from the developed economies of the West. Cash payments, structuralized loans, and other subsidies have played a key role in development plans for decades, all which have had varying degrees of success. Attempts to effectively develop these nations in Africa have been constantly altered to suit our globalized world. Each nation in need has individual needs dependent on their resources, economy, and infrastructure, making the task of economic development a multidimensional issue.

This study aims to enhance understanding of how efficiently and effectively foreign aid is being used to help develop economies and enhance the quality of life of people living in these countries. From a policy perspective, this analysis is important because it can help identify the effective policies set by institutions such as the United Nations, developing nations, or other sovereign states responsible for many of the development projects internationally. The relevance of this study is to help contribute to the ongoing research regarding how to help the roughly 800 million people living in extreme poverty in Africa

This paper was guided by three research objectives that differ from other studies: First it investigates the possibility of institutional capacity as a nation using dynamic data; Second, it incorporates a multitude of national and international factors that could affect Foreign Aid; Last, it analyzes the relationship of Foreign Aid to institutional strength in relation to labor markets, economic freedom, and international aid.

1.0 INTRODUCTION

2

2.0 Foreign Aid to Africa

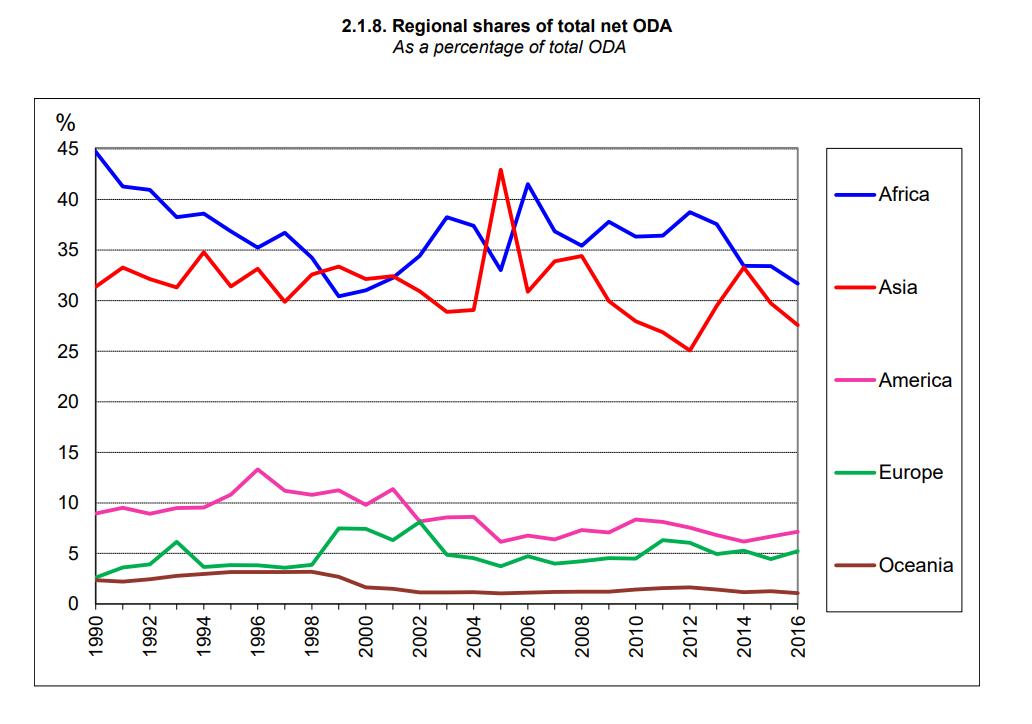

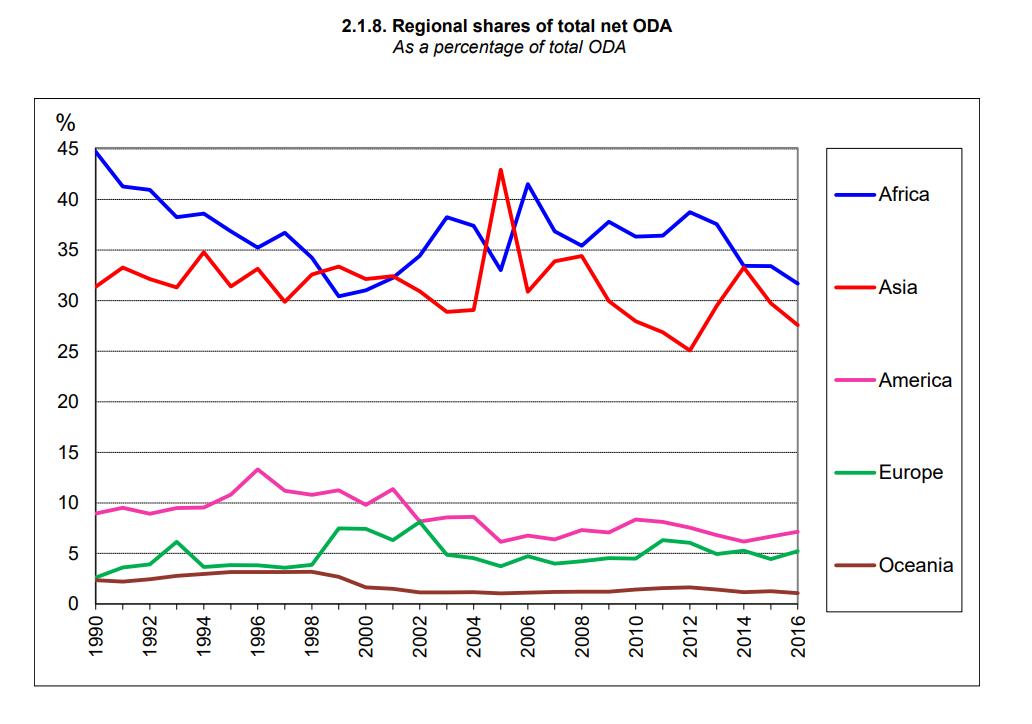

Figure 1 shows the breakdown of foreign aid payments internationally by continent. Using econometric techniques, the researchers identified recent trends of decreased aid flows towards the regions of Africa and Asia in the years leading up to 2016. The divestment is suspected to be due to the slight increase in aid towards Eastern European and South American countries also in need of capital. Moreover, aid has shifted greatly from debt relief to more social and economic purposes. Figure 2 identifies the trends of sectoral aid programs, drawing data from NGO’s, international agencies, and national aid programs.

Figure 1: Yearly Foreign Aid Flows Internationally

Figure 2: Yearly Foreign Aid by Sector

Figure 1: Yearly Foreign Aid Flows Internationally

Figure 2: Yearly Foreign Aid by Sector

3

Source: OECD, (2018)

3.0 LITERATURE REVIEW

Foreign aid has become a contentious issue in the past decades due to repeated failures and continuing divergence of many developing nations, specifically in subSaharan Africa (Kamguia, Tadadjeu, Miamo, et al 2022). Despite foreign aid almost tripling from 1970’s to the 1990’s, growth in Africa remained relatively stagnant. (Easterly, 2005) identifies this issue as not a lack of capital, rather an absence of responsibility from the wealthier nations to ensure effectiveness of development. He states that the quality of aid is being overlooked for more quantity-oriented marketing campaigns, where it delivers the “feel good” moment the public desires. While there are a multitude of reputable arguments criticizing the application and effectiveness of aid, (Moyo, 2011) suggests that aid has had a net negative effect on the continent Citing that Africa has diverged further, increased its debt load, increased civil conflict, and caused more volatile inflationary periods because of aid.

The debate over the application and effectiveness is what dominates the discourse regarding aid internationally and within development agencies. (Brautigam and Knack, 2004) argue that the central issue is of bad governance, citing that no matter the amount of aid if it is not allocated to trustworthy or qualified hands it will continue to be ineffective. The issue of governance can be attributed to a multitude of factors such as colonialism, indigenous institutions, and civil conflict. Contrary theories to identify the specific factors inhibiting aid have risen, (Andrews, 2009) claims that the focus on macro-economic factors have hindered development and believes that smaller sociocultural factors may be the root cause. Overall, the effectiveness of aid is a developing

4

argument with studies being constructed and cited to identify new trends in the effort to alleviate millions from poverty.

4.0 DATA AND EMPIRICAL METHODOLOGY

The study uses annual panel data from 2000 to 2020. Data was obtained from the World Development Banks (IRDB) website on World Development Indicators. Publicly available World Bank data excludes countries that are viewed as developed and in this study, I will only be using 20 countries in the African region. Shown below is the econometric model, ordinary least square regression, fixed effect regression, random effect regression, and the Hausman test results.

Model:

4.2 Empirical Model

I followed the Hongli and Vitenu-Sackey (2020) model for the relationship between foreign aid and development indicators.

The model:

There are six independent variables in the model, each with an individual relationship to the dependent variable of lnGDP Per Capita. Appendix A and B provide data source, acronyms, descriptions, expected signs, and justifications for using the

LnGDP Per Capita = β0 + β1 Rent + β2 SECEDU + β3 FDI + β4 WOMIDX + β5 BRDMONY + β6 BIRTHS + β7 HIV + β8 FAID + ε

5

variables. LnAid is the annual flow of foreign aid from international institutions and individual countries to the nation. It represents the total allocation of capital being transferred for development purposes. HDI represents the United Nations Development Project’s Human Development Index which is a measurement of average achievement in key dimensions of human development. Rule of Law is derived from the World Justice Project’s index that measures the perceived effectiveness and application of laws in the country. Corruption is reflected by the authors estimate of corruption control, indicating how many citizens believe that there is corruption in their government. Voice equality is a control variable used to identify freedom levels of press and speech. Lastly, Government Effectiveness is a proxy for the country’s ability to collect taxes, provide public goods, and implement policy.

The dependent variable in this model is the natural log of GDP Per Capita, a proxy for economic growth. GDP Per Capita as calculated by the World Bank is the country’s yearly GDP divided by the country’s population. This figure is associated with economic growth, although it does not necessarily reflect the distribution of the growth. The proxy is broad but provides a reliable macro-economic indicator for the nation’s economic success year over year. Studies such as Easterly (2005) and Acemoglu and Robinson (2010) utilize GDP Per Capita in models to identify growth patterns.

5.0 EMPIRICAL RESULTS

The results estimated by the model are presented below in Table 2, with Ordinary Least Squares, Fixed Effect, and Random Effect outputs presented. After performing the

6

Hausman test, I identified the Fixed Effect model to be the most accurate estimator for this data set.

Note: ***, **, and * denotes significance at the 1%, 5%, and 10% respectively. Standard errors in parentheses

The most statistically significant variables are the Women’s Index, Birth Rate, Foreign Aid, and Secondary Education. Specifically, the WOMIDX variable was statistically significant at the 1% level, Hongli and Vitenu-Sackey (2020) also found high levels of significance in the Women’s Index variable proxy through their estimations.

Birth Rate and Secondary Education are also both statistically significant at the 1% level, with education representing the largest variable difference of 484.60. Foreign Aid holds a

FDI Model OLS Fixed Effect Random Effect RENT -22.06* (9.64) -1.70 (3.77) -4.29 (2.77) SECEDU 611.05*** (109.83) 484.60*** (178.32) 720.29*** (199 13) FDI 1.06* (3.58) .896* (.231) 9.37** (2.34) WOMIDX 18.92*** (4.73) 26.29*** (5.33) 25.06*** (5.08) BRDMNY 3.73 (2.55) 12.48* (4.96) 11.59* (4.49) BIRTHS -317.02*** (39.33) -77.43*** (10.82) -63.86** (12.37) HIV -.280* (.00927) -.116 (.0017) -.083* (.0015) FAID 14.77** (6.90) 22.15** (7.87) 19.32* (6.33) R2 6378 6211 5952 Number of obs. 394 394 394

Table 2: Regression results for African Aid Panel-Data

7

lower statistical significance at only a 5% level but still holds a relevant impact on the independent variable. Estimators that negatively affected GDP Per Capita were Birth Rate, HIV, and Resource Rents, with Birth Rate having the largest coefficient of -77.43. The variables that were not statistically significant to the 5% level were Resource Rents, Foreign Direct Investment, and HIV cases.

Examining these results, we find several trends and impacts of variables within the model that give us insight to the estimator’s significance. Increases in the variable Secondary Education had a large impact on GDP Per Capita, showing the correlation between increases in education and economic development. Alternatively, the second largest coefficient was the Birth Rate variable. Increases in birth per woman have negatively affected the GDP Per Capita of the entire population possibly due to the responsibility of raising children instead of participating in the workforce. Other notable estimators are the Women’s Index, where increases in the equality of genders results in a positive impact on GDP Per Capita. Additionally, Foreign Aid’s significance and coefficient is relatively low compared to other variables. This may be attributed to inefficient applications of aid, lackluster programs, or corruption within a country.

5.0 CONCLUSION

To conclude, this study attempted to expand on the literature presented identifying factors relevant to the development of African nations. I found there to be a statistically significant impact of increases in secondary education, foreign aid, and gender equality to increases in GDP Per Capita. Moreover, I found negative statistically significant impacts of increases in the Birth Rate on GDP Per Capita. Several coefficients that were not

8

significant to the 5% level were Resource Rents, Foreign Direct Investment, Broad Money, and HIV cases. Identifying indicators of economic growth in developing African countries is only one aspect of the research and it has several limitations. This study’s limitations include the use of proxy variables for variables with insufficient data points, exclusion of countries from the panel data set, and exclusion of possibly significant indicators from model. Nevertheless, the results of this study reinforced several empirical studies, Hongli and Vitenu-Sackey (2020) and Acemoglu and Robinson (2010). This research validated the impacts of variables such as the importance of education and institutional equality found in these studies Aid is a controversial and difficult concept to apply effectively to promote positive economic and social outcomes. The weaker relationship of GDP per capita growth to foreign aid in my model may be due to the ineffective application of aid but can also include other factors such as civil war, political conflict, global recessions, and resource dependence. Overall, my model identified key variables that played a role in GDP per capita growth in developing African countries.

Appendix A: Variable Description and Data Source

Acronym Description

FDI Net inflows of investment to acquire a lasting management interest.

WOMIDX A rating of laws, regulations, and reform trends that advance women's economic empowerment.

FAID Total yearly foreign aid inflows through bilateral and multi-lateral institutions.

Data source

World Development Indicators

World Development Indicators

World Development Indicators

9

RENT Sum of oil rents, natural gas rents, coal rents, mineral rents, and forest rents.

BRDMNY Measure of the amount of money, or money supply, in a national economy.

SECEDU Average years of secondary education.

HIV Total amount of HIV cases in the country yearly.

BIRTHS Birth rate, crude (per 1000 people)

World Development Indicators

World Development Indicators

World Development Indicators

World Development Indicators

World Development Indicators

Appendix B- Variables and Expected Signs

Acronym Variable Description

What it captures Expected sign

FDI Foreign Direct Investment Total yearly inflows of lasting FDI +

WOMIDX Women’s Business and Law Index Gender Equality Nationally +

FAID Foreign Aid Total inflows of bilateral and multi-lateral aid

RENT Total Yearly Resource Rents Amount of money received from natural resource sales

BRDMNY Broad Money Rate of movement of money within an economy

+

-

+/-

SECEDU Secondary Education Average education levels in a country +

HIV Total Positive HIV Cases Health crisis issues within a country -

10

BIRTHS Birth Rate Average amount of children per female 11

BIBLIOGRAPHY

Acemoglu, Daron, and James Robinson. “The Role of Institutions in Growth and Development.” Review of Economics and Institutions, vol. 1, no. 2, 2010, https://doi.org/10.5202/rei.v1i2.14.

Andrews, Nathan. “Foreign Aid and Development in Africa: What the Literature Says and What the Reality Is.” Journal of African Studies and Development, vol. 1, Nov. 2009.

Bräutigam, Deborah A., and Stephen Knack. “Foreign Aid, Institutions, and Governance in Sub‐Saharan Africa.” Economic Development and Cultural Change, vol. 52, no. 2, 2004, pp. 255–285., https://doi.org/10.1086/380592.

Easterly, William. “National Policies and Economic Growth: A Reappraisal.” Handbook of Economic Growth, 2005, pp. 1015–1059., https://doi.org/10.1016/s1574-0684(05)01015-4.

Hongli, Jiang, and Prince Asare Vitenu‐Sackey. “Assessment of the Effectiveness of Foreign Aid on the Development of Africa.” International Journal of Finance & Economics, 2020, https://doi.org/10.1002/ijfe.2406.

Kamguia, Brice, and Miamo, Clovis, and Tadadjeu, Sosson, and Njangang, Henri “Does Foreign Aid Impede Economic Complexity in Developing Countries?” International Economics, vol. 169, 2022, pp. 71–88., https://doi.org/10.1016/j.inteco.2021.10.004.

Moyo, Dambisa. Dead Aid: Why Aid Is Not Working and How There Is Another Way for Africa. Penguin, 2011.

12

Impact of Corruption on Economic Growth in Central America: A Panel Data Analysis

Ben Bresnee

Abstract

This paper investigates the possible impact of corruption on economic growth in Central America. This study incorporates information into a model to examine the influence of different factors such as population growth, aid, human capital, gross domestic investment, Corruption, and consumption. This study finds that there is a negative effect of corruption on economic growth in Central America.

JEL Classification: O40, O50

Keywords: Corruption, Economic Growth

a Department of Economics, Bryant University, 1150 Douglas Pike, Smithfield, RI02917. Phone: (617)-875-0457. Email: benbresnee@gmail.com.

13

1.0 INTRODUCTION

There has been a lot of debate over the years on if corruption has an impact on economic growth. Two theories have emerged to describe how corruption influences economic growth. The first is called “grease the wheels” hypothesis which explains that corruption has a positive impact on economic growth since it promotes efficiency since the private sector can get around regulations. The second is called “sand the wheels” hypothesis” which explains that corruption has a negative impact on economic growth because it suggests that there will be less investment in a country with high corruption.

This study aims to enhance understanding of how corruption affects economic growth in Central America through indicators such as GDP per capita, gross fixed capital formation, government expenditures, population growth, official aid received, GNI per capita, and the Corruption Perception Index. This study specifically investigates the countries of Central America and the affects of corruption on economic growth. From a policy perspective, this analysis is important because it provides information on whether a countries level of corruption is affecting its growth. This will not only help the people of that country formulate policies but also other countries and their decisions on wanting to give aid to areas with high level of corruption or use the money more efficiently.

The rest of the paper is organized as follows: Section 2 gives a brief analysis of the trends in Central America surrounding corruption and economic growth. Section 3 gives a brief literature review. Section 4 outlines the empirical model. Data and estimation methodology are discussed in section 5. Finally, section 6 presents and discusses the empirical results. This is followed by a conclusion in section 7.

14

2.0 TRENDS

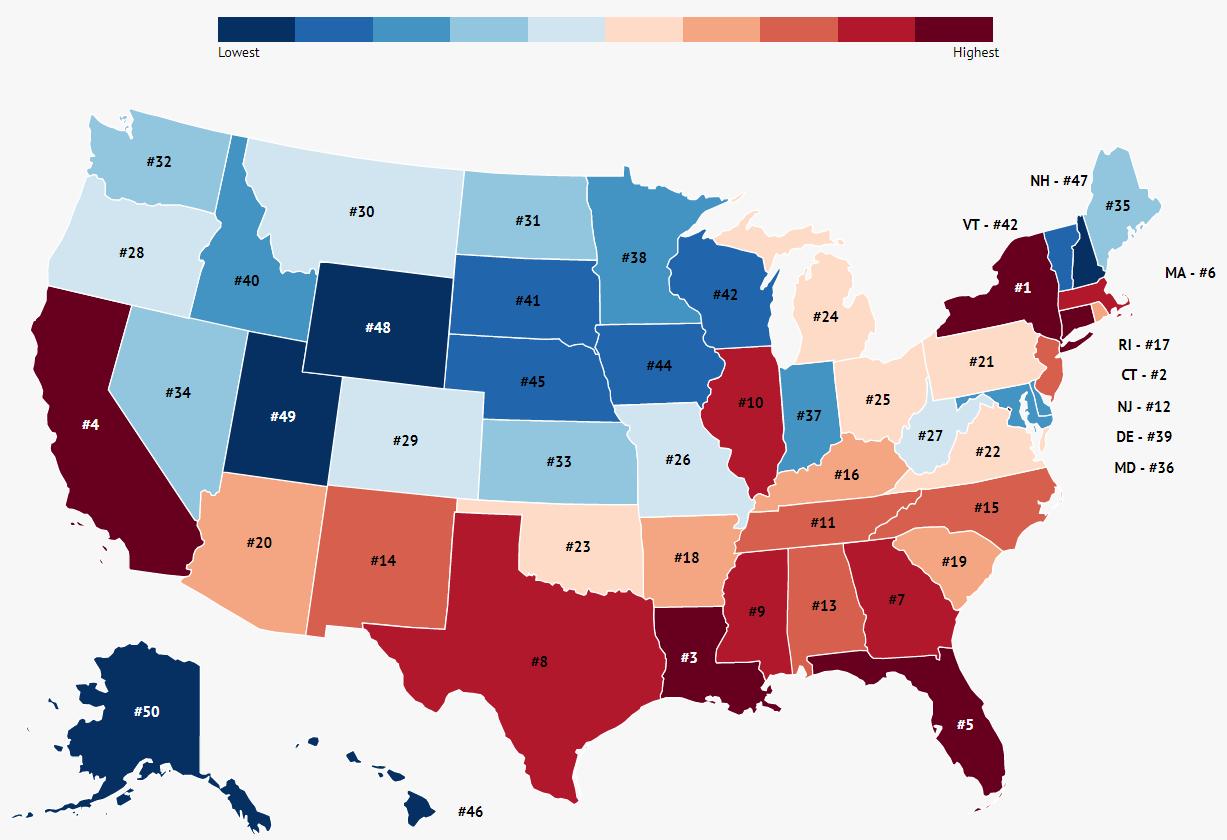

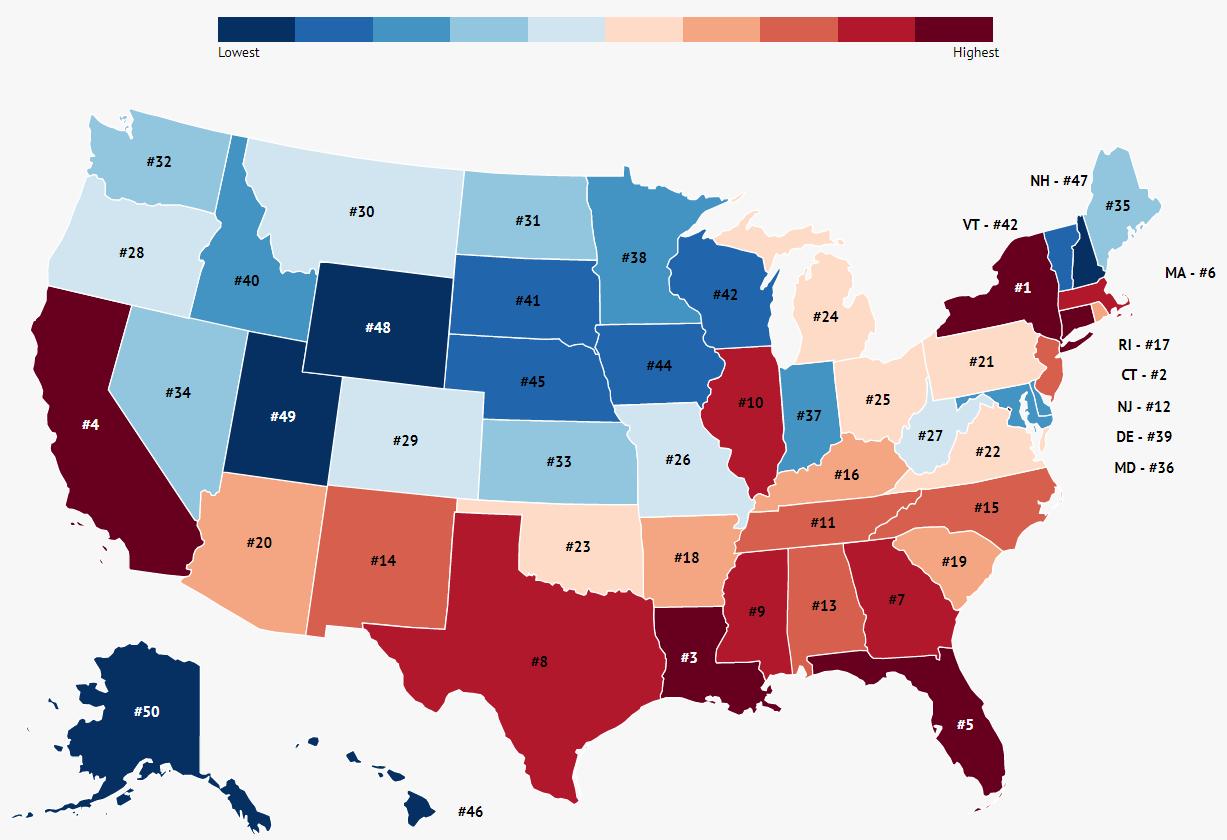

Figure 1 shows the corruption perception index of every country in 2018. This displays the level of corruption of each country and how they compare to other countries. Their scale shows countries with low corruption levels in blue and progresses into red with countries with a higher level of corruption. The map shows us that some of the highest areas of corruption are in parts of Asia, Sub Saharan Africa, and Central America where this study focuses on. A major trend in this figure is that countries with high levels of corruption tend to have neighboring countries with the same level of corruption or close to it. We can see this with places like Europe and Central America. In Europe, almost all of the countries have a CPI of 0-59 meaning there is low levels of corruption in these countries. On the other hand, if we look at Central America, we see the complete opposite. Each of their CPI is from 65-100 indicating that there are high levels of corruption in these neighboring countries.

Source: Transparency International

Figure 1: Corruption Perception Index 2018

Figure 1: Corruption Perception Index 2018

15

Figure 2 shows how people on Central America shows what percentage of the population thinks different groups and institutions are corrupt. As you can see the top three areas people think corruption is at its highest is in the police department, elected representatives, and the local government. Almost half the population believes that these groups are fully corrupted. This is because in Central America, organized crime and drug trades run rampant throughout the region. This is because police officers and elected officials tend get bribed to let these illegal actions take place.

Source: Transparency International

Figure 3 shows the correlation between CPI and development level using real GDP per capita Here it shows us that there is a negative corelation between CPI an the development level. Countries with high levels of corruption tend to have a lower development level while countries with low levels of corruption tend to have a high development level. This supports the “sand the wheels” hypothesis that corruption tends to slow growth in a country. This hypothesis suggests that because companies and civilians need to bribe people of power to be able to get what they want, there will be less investment which will slow down economic growth.

Figure 2: Corruption of Different Groups in Central America

Figure 2: Corruption of Different Groups in Central America

16

Source: Grundler and Potrafke (2019)

3.0 LITERATURE REVIEW

Corruption affects countries all over the world. There has been a debate on whether it actually helps a countries economic growth or slows it down. Grundler and Potrafke

(2019) examined the effects of corruption on economic growth. They concluded that there is no evidence to suggest that corruption has any positive impact on economic growth but the complete opposite. They found that it has a negative effect on growth since it steers money away from investment into the country. A study done by D’Agostino et al. (2016) analyzed where countries with high corruption were spending their money on. Since they don’t use it as investment into the economy this study found that a lot of these countries put it into their military. Due to the fact that they spend a lot of their money on their military, this study concludes that corruption does have a negative impact since a big portion of it goes into the military which did not have an impact on economic growth. A study done by Del Monte and Papagni (2001) suggest similar results. They concluded that due to corruption, their will be a negative effect on growth

Figure 3: Correlation between CPI and Development Level

Figure 3: Correlation between CPI and Development Level

17

since governments have less money to spend on economic activities. There were two effects that they pointed out. The first being the effects corruption has on private investment and how it discourages it. The second effect is the efficiency of government spending. With corrupted leaders, government spending in these countries do not go into projects that will benefit the country but just for themselves. To dig a little deeper into the idea of corruption and the effects it has, Becker et al. (2009) did a study to show the effects of a country’s corruption on its neighboring countries. They found that countries with high levels of corruption influence other governments in surrounding countries negatively. They found that countries with similar political structures tend to influence each other and drive corruption up. This is similar to a previous graph where we saw that most of the high corrupted countries are surrounded by other highly corrupted countries. This shows that not only does corruption have an effect on a countries economic growth but it also has regional affects.

4.0 DATA AND EMPIRICAL METHODOLOGY

4.1 Data

The study uses panel from 2001 to 2020. The data was obtained from the Transparency International website and the World Development Indicators. In order to capture corruption in a country, this study uses the corruption perception index. Countries with a low score have high levels of corruption while a high score shows low levels of corruption. Central America is the focus of this study but because of the lack of data and no corruption perception index, Belize was excluded from this study.

18

4.2 Empirical Model

This research follows Chakravorty (2020) model to capture the effects of corruption on economic growth. Two variables were modified from the original model. First, to capture human capital, GNI per capita will be used. Second, gross capital formation will be used to capture investment. The model could be written as follow:

GDP= β0 + β1COR + β2INVES + β3C +β4POP + β5AID + β6GNI+ ε GDP is the annual growth of GDP in a country. It measures the growth rate by comparing the economic output of a country comparing it the the previous year. Independent variables consist of six var965iables obtained from various sources.

Appendix A and provides acronyms and descriptions First, COR represents the corruption level of a country. This data was obtained through the Transparency International website. The rest of the variables were obtained through the world Development Indicators. Second, INVES represents gross capital formation. Third, C represents general government final consumption expenditure as an annual percentage growth. Fourth, POP represents the population growth rate in a country. Fifth, AID represents the net official development assistance and aid given to a country. Lastly, GNI represents the gross national income per capita in a country.

5.0 EMPIRICAL RESULTS

After running the Hausman test, it showed this research should the fixed effect model. The empirical estimation results are presented in Table 1 It is important to note that the higher CPI score you have, the less corruption there is in that country. The empirical

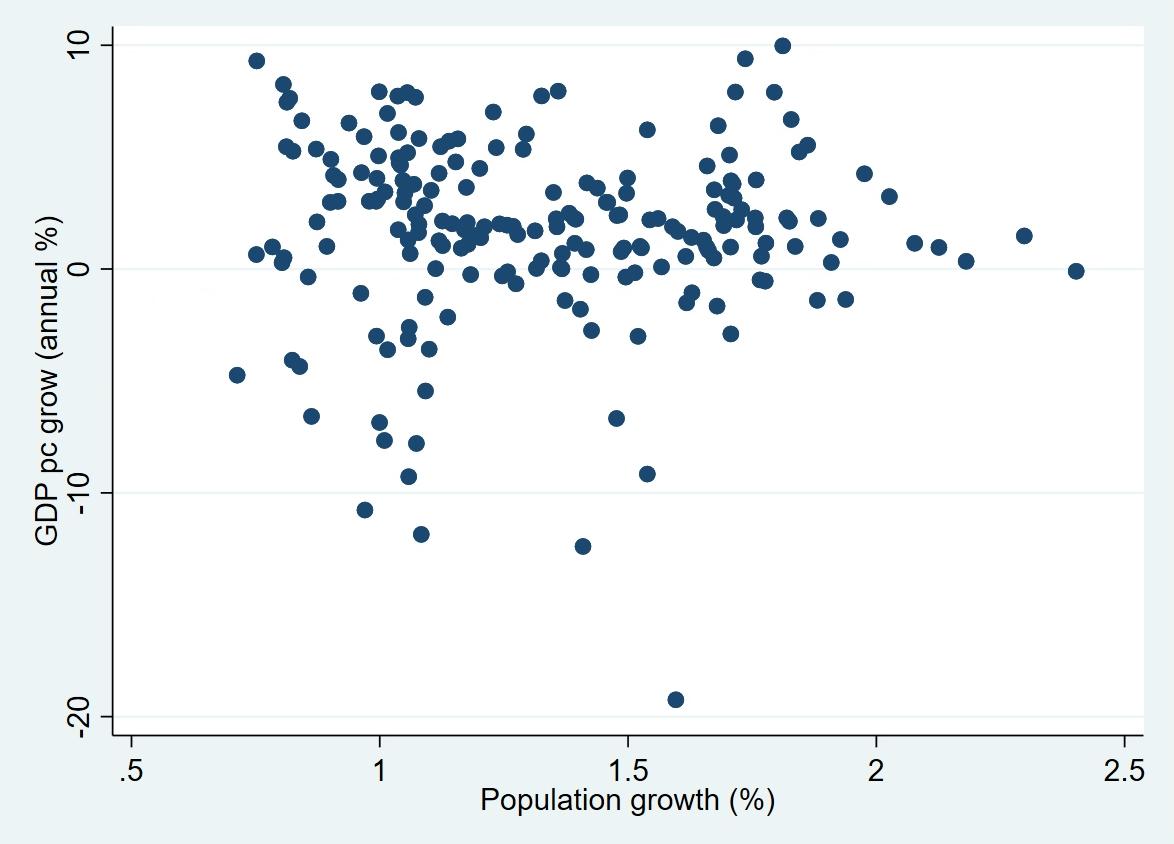

19

estimation shows a positive relationship between corruption and economic growth at the 5% level. Although it is positive, what this really means is as a country increases its CPI score and becomes less corrupt, we expect economic growth to increase as well. The table also points out other factors that will affect economic growth. The results show that both gross capital formation and GNI per capita growth both are significant at the 1% level. Population growth is also significant at the 10% level. With these four variables being statistically significant, there are two that are not significant. Those being gross government consumption expenditure and development/assistance aid. Interpreting these results, it is evident that corruption does have a negative effect on economic growth. This does align with current literature to support the “sand the wheels” hypothesis. Not only does corruption have a negative affect but there is no evidence to show that development aid actually has an impact on economic growth. This could be due to the fact that since elected officials are seen as highly corrupt, when countries in Central America receive aid, they don’t use it for the benefit for the country but on themselves to better themselves off.

20

Table 1: Regression results for Central America

Note: *** , **, and * denotes significance at the 1%, 5%, and 10% respectively. Standard errors in parentheses

5.0 CONCLUSION

In summary, corruption in Central America has a big impact on the economy and people of those countries. The results suggest that corruption negatively contributes to the slow economic growth that Central American countries go through. It also suggests that things like gross capital formation and population growth have a positive impact while development aid has no impact at all. With these results come policy implications.

GDP OLS Fixed Random Corruption 1.853** (.847) 1.682** (.842) 1.853** (.847) Gross Capital Formation .0724*** (.009) .073*** (.009) .0724*** (.009) Gross Gov. Consumption Exp. -.0195 (.021) -.023 (.021) -.0195 (.021) Population Growth 1.074*** (.124) .768* (.410) 1.074*** (.124) Development assistance/aid -8.41e-13 (.000) 1.06e-09 (.000) -8.41e-13 (.000) GNI per capita growth .610*** (.039) .587*** (.040) .610*** (.039) Constant .483* (.261) .923 (.751) .483* (.261)

21

Corruption is hard to solve since the people solving it are the corrupted ones. This is why international organizations such as the UN should come and teach ethical practices in these countries. Only then will these elected officials be able to see that if they put money more towards things like investment instead of personal gain, their whole country can prosper and grow. This study adds onto the extensive research done by others that suggest the same results. Corruption has a negative impact on economic growth.

22

Appendix A: Variable Description

Variable Definition

GDP

Gross domestic product

COR

Measure of corruption in a country

GDPCAP GDP per capita

INVES Gross capital formation as a percentage of GDP

C Gross government consumption expenditure as a percentage of GDP

POP

AID

Population growth in a country

Net development assistance and aid received

GNI GNI per capita growth

23

BIBLIOGRAPHY

Gründler, K., & Potrafke, N. (2019). Corruption and economic growth: New empirical evidence. European Journal of Political Economy, 60, 101810.

d’Agostino, G., Dunne, J. P., & Pieroni, L. (2016). Government spending, corruption and economic growth. World Development, 84, 190-205.

Del Monte, A., & Papagni, E. (2001). Public expenditure, corruption, and economic growth: the case of Italy. European journal of political economy, 17(1), 1-16.

Alfada, A. (2019). The destructive effect of corruption on economic growth in Indonesia: A threshold model. Heliyon, 5(10), e02649.

Becker, S. O., Egger, P. H., & Seidel, T. (2009). Common political culture: Evidence on regional corruption contagion. European Journal of Political Economy, 25(3), 300-310.

Chakravorty, N. N. (2019). How Does Corruption Affect Economic Growth? An Econometric Analysis. Journal of Leadership, Accountability & Ethics, 16(4).

24

Determinants of Real Median Household Income in the United States Using Time-Series and Panel Data Analysis

Evan Clark

Abstract:

This paper’s main objective was to explore the determinants of income inequality using real median household income in the United States. This paper utilizes time series analysis to examine the Gini coefficient, trends in the top 1%’s share of wealth, and the relationship between real median income and varying demographics. The Gini coefficient is a summary measure of income inequality in a country. Income inequality is how unevenly income is distributed throughout a population. The results show that there is a negative correlation between the top 1%’s share of total wealth and the United States Gini rating, and that inequality in the United States has been steadily increasing. This study utilizes panel data analysis through fixed effects, random effects, and pooled ordinary least squares. The study observed the two determinants that had the most impact on real median household income were poverty, which was significantly negative, and human capital, which was significantly positive.

JEL Classification: D140, I320, J310

Keywords: Gini Coefficient, Income Inequality, Real Median Household Income

Economics Student, Bryant University, 1150 Douglas Pike, Smithfield, RI 02917. Phone: (267) 406-5052. Email: eclark4@bryant.edu

25

1.0 Introduction

Income inequality is a problem that not only effects transitional economies and developed economies, but the world at large in the past decades (Allison 2014). In accordance with the wealth hypothesis and Rubin & Segal (2015), as a country demonstrates economic growth they should also demonstrate a reduction in income inequality. This point however is a misconception, as most countries (the United States included) that have experienced economic growth, have not elicited the corresponding decrease in income inequality, thus leaving the question as to why ultimately unanswered.

This study seeks to resolves the unanswered questions regarding the relationship between economic growth and income inequality utilizing a methodology that mirrors Tsaurai (2020). In their work Tsaurai contradicts the preexisting theoretical literature conducted by Ayala et al (2001); Rubin & Segal (2015); Kaplan & Rauh (2010); Balassa (1978); Jacoby (2000); and Stiglitz (1998). Their rationale for doing so is that much of the existing work on income inequality only examines the issue from a single perspective lens and fails to acknowledge the exhaustive list of potential determinants. In addition to the issue noted by Tsaurai, it has also been observed that much of the current literature possesses a misconceived notion that there is a linear relation between determinants making it acceptable to generalize them, this is an issue that is addressed.

The area in which this paper differs from the literature of Tsaurai (2020), is that while they were focusing on the determinants of income in equality in transitional economies, this study analyzes the developed economy of the United States.

2.0 Income Inequality in the United States

Figure 1 shows the breakdown of the Gini Coefficient by country (World Bank 2022). The Gini Coefficient is defined based on the Lorenz Curve in which the percentiles of population according to income or wealth are graphed against the cumulative income or wealth of a population. The Gini Coefficient ranges from zero to one (often written as a percent) where zero is perfect equality, with every person earning the same amount, and one is perfect inequality, where a specific sect or group of people controls all of the wealth or income in a country and everyone else has nothing. Currently the top five countries with the lowest Gini Coefficient are

26

Slovenia (24.6), Czech Republic (25.0), Slovakia (25.0), Belarus (25.3), and Moldovia (25.7).

The United States on the other hand is ranked 111th with a Gini Coefficient of 41.5 as of 2019.

Source: World Bank Database (2022)

Figure 2 demonstrates the relationship between the top one percent’s share of the total wealth and the United States Gini Coefficient. From 1990-2019 the United States top one percent has seen an increase in their total share by 27.92 percent, and the Gini coefficient has seen an increase of 9.21 percent. This demonstrates that there is a positive correlation between the two, so as the top one percent’s share total share of the wealth increases so too will the Gini Coefficient within the United States.

Figure 1: Gini Coefficient by Country

27

Source: Federal Reserve Economic Data

Figure 3 shows how income inequality is distributed across the United States. The five states with the highest level of income inequality are New York, Connecticut, Louisiana, California, and Florida. The five states with the lowest level of income inequality are Alaska, Utah, Wyoming, New Hampshire, and Hawaii.

Source: United States Census Bureau (2021)

Figure 2: Top 1% Share of Wealth vs. Gini Coefficient

Figure 3: Inequality Distribution Across the United States

Figure 2: Top 1% Share of Wealth vs. Gini Coefficient

Figure 3: Inequality Distribution Across the United States

0 5 10 15 20 25 30 35 40 45

28

Top 1% Gini

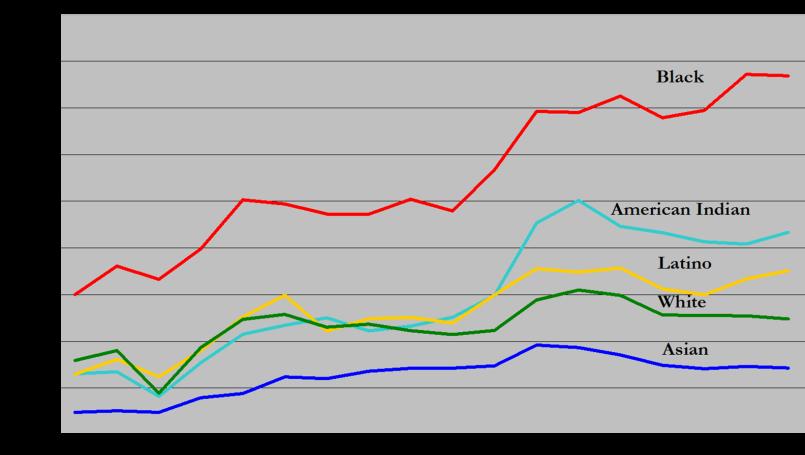

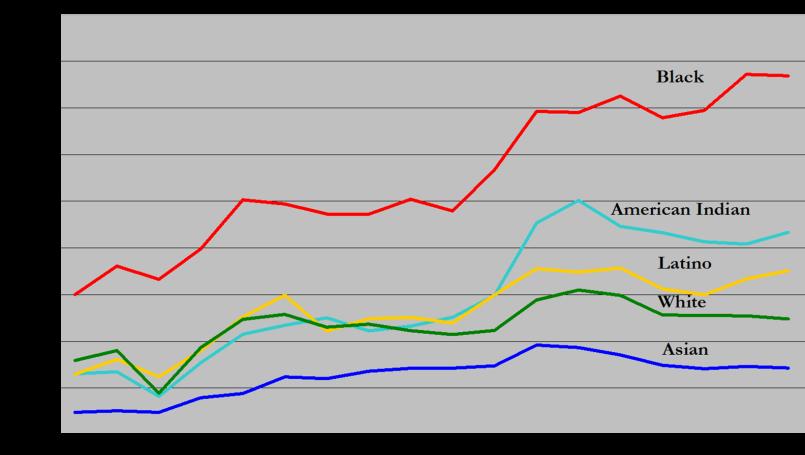

Figure 4 shows real median household income when observed through the demographics of race, gender, age, and educational attainment. Race broken up white, and nonwhite. Gender is broken up using the two rudimentary genders of male and female. Age is broken up into three groups, being 15-34, 35-64, and 65 and older. And educational attainment is broken into four groups that include: no high school diploma, high school diploma but no college, some college, and bachelor’s degree or higher. The real median household income was adjusted for using 2020 CPI-U-Rs Dollars (Consumer Price Index Retroactive Series), and it utilizes current methods to present an estimate for all Urban Consumers (CPI-U) (U.S. Bureau of Labor Statistics). The three most affected groups from this figure are those without a high school diploma, those 65 years old or older, and women. It can also be observed that there is a significant variance between the real median household income of white individuals and nonwhite individuals.

4: Real Median Household Income vs. Demographics

Figure

0 20000 40000 60000 80000 100000 120000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 U.S white nonwhite male fem edu1 edu2 edu3 edu4 age1 age2 age3 29

Source: United States Census Bureau Historical Income Tables (2019)

3.0 Literature Review

Who is it that suffers from income inequality? According to Alaya et al (2001) in a study done on OECD countries, those who are unemployed are the group most susceptible to the effects of income inequality. It was in this same study that it was also noted that unemployment is also responsible for inflating the effects of income inequality because in most cases those who are unemployed are poorer than those with jobs who hail from a wealthier background and have received a higher level of education. This point is expanded upon by Fuceri and Ostry (2019). In their study it was explained that demographics, unemployment, level of development and trade integration were some of the key drivers of income inequality. Paweenawat and McNown (2014), also discussed the effect of demographics while saying that gender differences of the head of the household, as well as differences in the composition of the household are significantly related to income inequality.

The study conducted by Rubin and Segal (2015), brings in the determinant of economic growth as it relates to income inequality. Through this it is discussed that according to the wealth hypothesis, if there is even the slightest increase in economic growth it will elicit a positive multiplier effect on the value of labor income, GDP per capita, and general wealth. All of this reduces the levels of income inequality present in a community. This is why the unit utilized for economic growth in this study is GDP per capita. Relating to economic growth trade openness also enhances economic growth (Balassa 1978). This trend is noted because trade openness allots local firms the opportunity to easily compete in international markets which has the ability to boost their expansion capacity and create employment. Inversely it was also noted by Kaplan and Rauh (2010), that economic growth can also be a driving factor for income inequality as it can cause more sensitivity to wealth than labor income. Additionally, Richmond and Triplett (2017) also noted that information and communication technology could potentially exacerbate income inequality. This was equated to the differences that ICT creates in the access to skills as not all socioeconomic classes have equal opportunities. On the opposite side of economic growth is the presence of poverty in an economy. Within the United States rural communities demonstrated a 2.4% higher rate of poverty than those of urban communities (USDA 2017). This was expanded upon by Akin-Olagunju and Omonona (2013) in their study of the households of Ibadan in the

30

Oyo State. Here it was revealed that there was a high presence of income inequality among rural households.

One of the most notable determinants that had a positive effect on real median household income was the presence of human capital development. The rationale behind this is described in Becker and Chiswick (1966) who mention hat high human capital development reduces the levels of income inequality at workplace and society in general. Education enhances the skills and competencies of individuals as well as their productivity. So, as it stands, those with a higher educational attainment have an increase’s chance of making more money, as their human capital is raised.

As it was stated before, those who are unemployed, are directly associated with an individual who has less money. But according to Jacoby (2000), as infrastructure development increases, so too do the benefits and opportunities present to the poor, thus making them more connected to economic activities. This is disputed by Tsaurai and Nyoka (2019) however. In their literature they discuss the possibility that infrastructure development can demonstrate negative effects on the poor. Resources that has the potential to boost labor income for citizens through small loan provisions are now being diverted towards long term infrastructure development. Another, determinant that was also noted to have the potential to negatively affect lower socioeconomic classes is financial development. Dhrifi (2013) discusses that as financial development increases it also increases the income inequality gap because the rich are able to become richer due to their ability to access credit. This ability allows them to invest in income generating projects.

4.0 Data and Empirical Methodology

4.1

Data

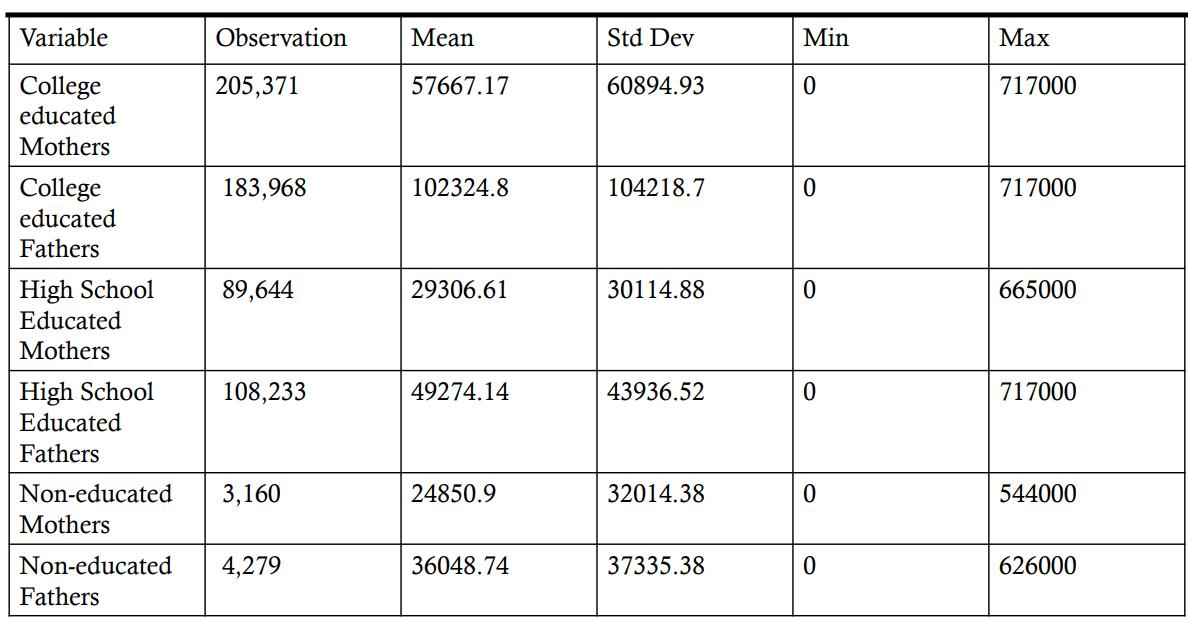

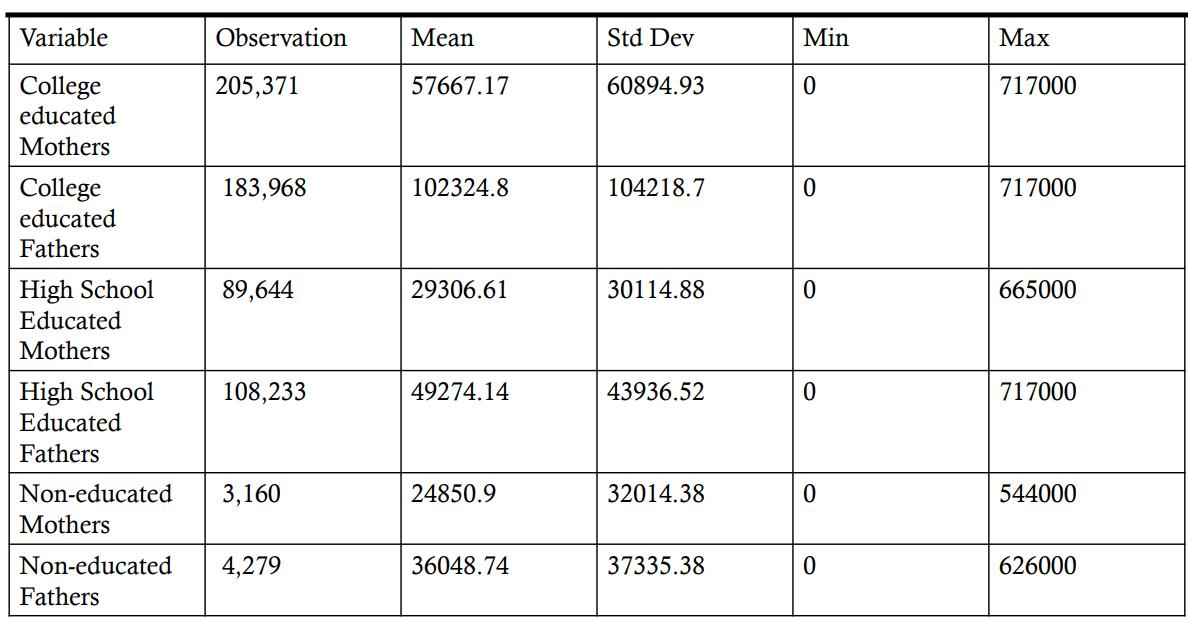

This project draws data from the United States Census Bureau, U.S. Bureau of Labor Statistics, U.S. Bureau of Economic Analysis, and Federal Reserve Economic Data (Fred). This data encompasses all fifty states from 2008-2019 and is utilized through panel data analysis. Summary Statistics for the data are provided in table 1.

31

Table 1: Summary Statistics

4.2 Pre-estimation Diagnosis

The Pearson Correlation method is the pre-estimation diagnosis that is covered under this subsection. According to table 2, the variables with were found to have a meaningful relationship with real median household income include unemployment, economic growth, poverty, information and communication technology, human capital, and finance. These results are backed says these variables are key determinants of income inequality. Trade openness, credit, transportation, and phone were all found to positively effect real median household income, although their results were insignificant. Loans were also insignificant, but they negatively impacted real median household income.

Variable Observation Mean Std. Dev. Min Max INC 600.00 62009.92 10262.62 35992.00 96765.00 UNEMPL 600.00 5.95 2.29 2.10 13.70 GROWTH 600.00 343435.70 429199.70 25999.25 3052645.00 POV 600.00 12.94 3.42 3.70 23.10 ICT 600.00 3083.25 9169.87 23.00 113659.90 OPEN 600.00 2337.21 3581.69 37.82 27371.12 HCAP 600.00 29.27 5.23 17.10 45.00 CREDIT 600.00 10607.75 20107.34 69.34 174053.30 LOANS 600.00 151000000.00 291000000.00 1565802.00 1640000000.00 TRANSP 600.00 16227.57 18389.72 1069.10 129829.40 PHONE 600.00 0.02 0.01 0.00 0.06 FIN 600.00 0.07 0.05 0.00 0.32

32

Table 2: Correlation Analysis

4.3 Empirical Model

The general model that this study is derived from is as follows:

Publicly available data for the fifty states excludes INEQ, ICT, HCAP, FDI, INFR, and FIN as they are defined by the first model, so the variables had to be adjusted accordingly to accurately represent this study. To this model we have added POV, CREDIT, LOANS, TRANSP, AND PHONE. The rationale behind adding poverty was to introduce an alternative perspective to economic growth. This perspective was discussed, but not included in Tsaurai (2020). The rationale behind the other four were to cover the variables that were not able to be included as much as possible in order to achieve comparable results. The reason that there is more than the base model is because the original variable encompassed a broader range of information then the data accessible for the fifty states, so additional data needed to be utilized.

The model utilized in this study can written as follows:

33

Independent Variables

There are eleven independent variables within this model, each possessing an individual relationship to the dependent variable of real median household income. Their data, description, expected sign, and what they capture are provided by appendix A and B. The variables, descriptions, and proxies that were not included in this study and used by the model this study is based on are provided by appendix C.

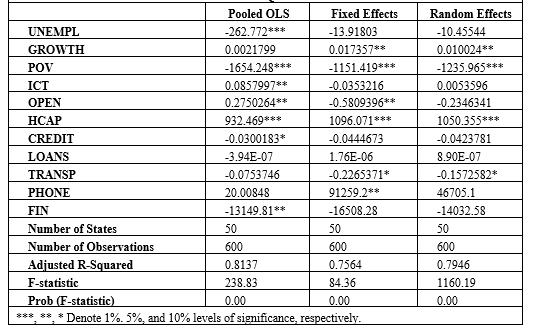

5.0 Empirical Results

5.1 Hausman Test

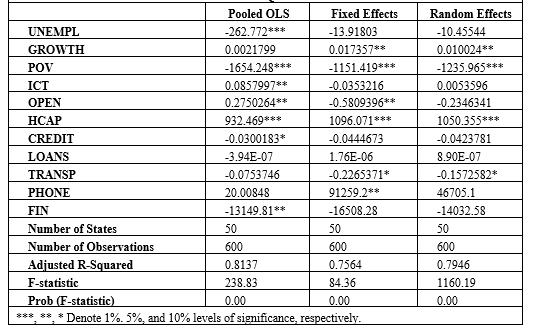

As it is demonstrated in the table 3, a Hausman test was conducted on the data that included the fixed effects test, the random effects test, and the pooled ordinary least squares test. It was determined that at a significance level of 5% the best test to explain the empirical model is the fixed effects test because the prob>chi value of .0232 was under .05.

34

Table 3: Hausman Test

a - Coefficients - a

(b) (B) (b-B) sqrt(diag(V_b-V_B))

b = Consistent under H0 and Ha; obtained from xtreg. B = Inconsistent under Ha, efficient under H0; obtained from xtreg.

Test of H0: Difference in coefficients not systematic

chi2(5) = (b-B)'[(V_b-V_B)^(-1)](b-B)

w = 13.02

iProb > chi2 = 0.0232

5.2 Regression Analysis

In table 4 the two variables of POV and HCAP were both significant at 1%. As educational attainment is a key factor in determining socioeconomic status, the results are consistent with Akin-Olagunju and Omonono (2013). Together they noted that rural households, which are more prone to poverty (USDA 2017), have high levels of income inequality, and that education reduced income inequality. Economic growth, trade openness, and phone were all significant at 5%, but trade openness significantly negatively impacted real median household income. This is backed up by Rubin and Segal (2015) and Kaplan and Rauh (2010). In there writings they state that a small increase in economic growth has got a positive multiplier effect on the value of labor income, GDP per capita, and the general wealth levels of the community. Economic growth and trade openness can also increase income inequality if it causes more

Fixed Random Difference Std. err. UNEMPL -13.91803 -10.45544 -3.462586 55.24206 GROWTH 0.0173576 0.010024 0.0073335 0.0066181 POV -1151.419 -1235.965 84.54663 30.71191 ICT -0.0353216 0.0053596 -0.0406812 0.0385111 OPEN -0.5809396 -0.2346341 -0.3463055 0.1394739 HCAP 1096.071 1050.355 45.71601 91.01297 CREDIT -0.0444673 -0.0423781 -0.0020891 0.0219339 LOANS 1.76E-06 8.90E-07 8.73E-07 8.30E-07 TRANSP -0.2265371 -0.1572582 -0.0692789 0.0798912 PHONE 91259.2 46705.1 44554.11 25053.79 FIN -16508.28 -14032.58 -2475.706 13811.6

35

sensitivity to wealth than labor income, meaning if only a small portion of the population are benefiting. Phone is supported by Jacob (2000) who claims infrastructure development benefits the previously disadvantaged and the poor as they can now be able to easily gain access to productive opportunities and more readily connect to economic activities. This is also why transportation only significant at 10% because the poor can now enjoy low transportation and production costs through easily accessing better road infrastructure. It also makes sense that their significance is lower because as Tsaurai and Nyoka (2019) state, resources that could have been used to boost small loans would now have to be diverted towards these long-term infrastructure projects.

6.0 Conclusion

This project’s main objective was to explore the determinants of income inequality using real median household income. It accomplishes this thoroughly the utilization of time-series data in the analysis of the Gini coefficient, the top one percent’s share of the wealth, and how the real median household income compares to varying demographics. It also accomplishes this through the use of a panel data analysis with a fixed effects regression, and random effects regression,

Table 4: Determinants of Income Inequality in the United States: Regression Analysis

Table 4: Determinants of Income Inequality in the United States: Regression Analysis

36

and a pooled ordinary least squares regression. The results of these regressions were that economic growth and human capital had a significant positive effect on real median household income, and that unemployment and poverty rate had significant negative effects on real median household income. These results demonstrated the opposite of the results found in Tsaurai (2019). This fact makes sense though because their dependent variable was the Gini coefficient, which directly analyses income inequality, whereas my dependent variable was real median household income. So, anything that negatively impact income inequality would inadvertently positively impact median income. The policy implications of this study are that the United States should be urged to continue implementing policies that aid in economic growth, and combat unemployment and poverty. Six potential recommendations for this could be: to decrease the mortgage interest tax deduction, then use the additional revenue as credit for first-time homebuyers; to utilize automatic savings for retirement plans; to reduce dependence on student loans while supporting success in postsecondary education; to offer universal savings accounts for children; to reform asset tests for safety net programs, because they can act as barriers to saving among low-income families, and to provide subsidies similar to those linked to tax time, in order to promote emergency savings. The United States government should also work to increase the accessibility to upper-level educational systems because a high level of human capital development has been demonstrated to significantly effect the real median household income for the better.

37

Appendix A: Variable Description and Data Source

Acronym Description

INC Real median household income in state i at time t

UNEMPL Unemployment rate in state i at time t

GROWT

H Economic growth in state i at time t

POV Poverty rate in state i at time t

Data Source

U.S. Census Bureau Historical Data

Tables

Federal Reserve Economic Data

Federal Reserve Economic Data

Federal Reserve Economic Data

ICT Information and communication technology in state i at time t Federal Reserve Economic Data

OPEN Trade openness in state i at time t

HCAP Human capital development in state i at time t

CREDIT Credit in state i at time t

LOANS Loans in in state i at time t

TRANP Transportation expenditures in state i at time t

PHONE Telephone expenditures in state i at time t

FIN Internal financing in state i at time t

Federal Reserve Economic Data

Federal Reserve Economic Data

Federal Reserve Economic Data

Federal Reserve Economic Data

Federal Reserve Economic Data

Federal Reserve Economic Data

Federal Reserve Economic Data

38

Acronym

Appendix B: Variables and Expected Signs

UNEMPL Unemployment

GROWTH Economic growth

POV Poverty

ICT Information and communication technology

OPEN Trade Openness

HCAP Human capital development

CREDIT Credit

LOANS Loans

TRANSP Transportation expenditures

PHONE Telephone expenditures

Percentage of the total population involved in the labor force

Gross domestic product per capita

The percentage of the population living below the set standard of living -

Accessibility to the internet

Total of exports and imports (% of GDP)

Educational attainment (Bachelor’s degree or higher)

Monetary authorities-central bank, credit Intermediation, and related Services +

Total loans and leases, net of unearned income for commercial banks +

Gross domestic product: transportation and utilities

Broadcasting (except internet) and telecommunications

FIN Internal financing Finance and insurance

it Captures Expected Sign

Income Inequality

Variable Description What

INC Real median household income

-

+/-

+

+/-

+

+/-

+/-

+ 39

Appendix C: Excluded Variables

Acronym Proxy Used

ICT Individuals using the internet (% of the population)

HCAP Human capital development index

FDI

INFR

Net foreign direct investment (% of GDP)

Fixed telephone subscriptions (per one hundred people)

FIN

Market capitalization of listed domestic companies (% of GDP)

40

Work Cited

Afandi, A., Rantung, V.P., & Marashdeh, H. (2017). Determinants of income inequality. Economic Journal of Emerging Markets, 9(2), 159-171.

Akin-Olagunju, O.A., & Omonona, B.T. (2013). Determinants of income inequality among rural households of Ibadan, Oyo State, Nigeria. Nigerian Journal of Rural Sociology, 13(3), 2737.

Allison, C., Fleisje, E., Glevey, W., & Johannes, W.L. (2014). Trends and key drivers of income inequality. Working Paper, Marshal Society, Cambridge.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277-297.

Ayala, L. Carbonell, J.R., & Martinez, R. (2001). The impact of unemployment on inequality and poverty in OECD countries. Economics of Transition, 9(2), 417-447.

Azher, B.A. (1995). Rural savings: Their magnitude, determinants, and mobilization. Pakistan Development Review, 34(4), 779-786.

Bahmani-Oskooee, M., Hegerty, S.W., & Wilmeth, H. (2008). Short run and long run determinants of income inequality: Evidence from 16 countries. Journal of Post Keynesian Economics, 30(3), 463-484.

Balassa, B. (1978). Exports and economic growth: further evidence. Journal of Development Economics, 5(2), 181- 189.

“Bureau of Economic Analysis.” U.S. Bureau of Economic Analysis (BEA), https://www.bea.gov/.

Bureau, US Census. Census.gov, 6 May 2022, https://www.census.gov/.

Education, Income, and Ability - JSTOR. https://www.jstor.org/stable/pdf/1831252.pdf.

“Federal Reserve Economic Data: Fred: St. Louis Fed.” FRED, Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/.

Furceri, D., & Ostry, J.D. (2019). Robust determinants of income inequality. Oxford Review of Economic Policy, 35(3), 490-517.

Gini Coefficient by Country 2022, https://worldpopulationreview.com/country-rankings/ginicoefficient-by-country.

“ICYMI... Rural Families Headed by Single Adults Had Higher Poverty Rates than Urban Counterparts in 2017.” USDA ERS - Chart Detail, https://www.ers.usda.gov/dataproducts/chart-gallery/gallery/chart-detail/?chartId=95521.

International Monetary Fund. (2015). World Economic Outlook: Adjusting to Lower Commodity Prices. Washington (October). Retrieved from https://www.imf.org/en/Publications/WEO/Issues/2016/12/31/WorldEconomic-OutlookOctober-2015-Adjusting-to-Lower-Commodity-Prices-43229.

41

Jacoby, H. (2000). Access to rural markets and the benefits of rural roads. Economic Journal, 110(465), 713-737.

Kunofiwa Tsaurai. An Empirical Study of the Determinants of Income Inequality.

https://www.abacademies.org/articles/An-Empirical-Study-of-The-Determinants-ofIncome-Inequality-1528-2635-24-6-614.pdf.

Kaplan, S., & Rauh, J. (2010). Wall street and Main street: What contributes to the rise in the highest incomes?. Revised Financial Studies, 23, 1004-1050.

Levin, A., Lin, C.F., & Chu, C.S.J. (2002). Unit ro

Odhiambo, N.M. (2009). Finance-growth-poverty nexus in South Africa: A dynamic causality linkage. Journal of Socio-Economics, 38(2), 320-325.

Paweenawat, S.W., & McNown, R. (2014). The determinants of income inequality in Thailand: A synthetic cohort analysis. Journal of Asian Economics, 31, 10-21.

Public Disclosure Authorized Income Inequality and Poverty

https://www.researchgate.net/profile/NanakKakwani/publication/37883350_Income_inequality_and_poverty_methods_of_estimation_ and_policy_applications/links/57e0b63608aece48e9e20225/Income-inequality-andpoverty-methods-of-estimation-and-policy-applications.pdf?origin=publication_detail.

Richmond, K., & Triplett, R. (2017). ICT and income inequality: A cross-national perspective. International Journal of Applied Economics, 32(2), 1-20.

Rubin, A. & Segal, D. (2015). The effects of economic growth on income inequality in the US. Journal of Macroeconomics, 45, 258-273

Stead, R., & Wisniewsk M. (1996). Foundation quantitative methods for business. Prentice Hall. England. Stjepanovic, S. (2018). Income distribution determinants and inequality in Croatia. 34th International Scientific Conference on Economic and Social DevelopmentXVIII International Social Congress, Moscow, 18-19 October.

Stiglitz, J.E. (1993). The role of the state in financial markets. The World Bank Economic Review, 7(suppl_1), 19-52. Su, B., & Heshmati, A. (2013). Analysis of the determinants of income and income gap between urban and rural China. China Economic Policy Review, 2(1), 1-29.

Tridico, P. (2018). The determinants of income inequality in OECD countries. Cambridge Journal of Economics, 42(4), 1009-1042.

Tsaurai, K., & Nyoka, C. (2019). Financial development-income inequality nexus in South Eastern European countries: Does the relationship vary with the level of inflation? International Journal of Services, Economics and Management, 10(2), 110-125.

U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, 6 May 2022, https://www.bls.gov/.

42

A Panel Data Analysis on Income Inequality on Life Expectancy in Asia

Julianna Flaccavento a

Abstract:

This paper aims to investigate the possibility of interdependence between income and life expectancy in countries across Asia. The study looks at the difference of life expectancies for men, women, and the two genders combined. We also looked at how health could have an impact on the model. We ran a fixed and random effect model on our panel data. We then ran the fixed and random effect model on the countries separated by income levels which we separated into low, middle, and high. The results show that the fixed effect was significant in Asia on both males and females and learned that the income separation does not have an impact at all.

JEL Classification: D33, E24, O15, P36

Keywords: Life Expectancy, Income Inequality.

a Department of Economics, Bryant University, 1150 Douglas Pike, Smithfield, RI02917. Phone: (845) 475-5075. Email: jflaccavento@bryant.edu.

43

1.0 INTRODUCTION

As life expectancies last longer, there has been a movement to live healthier and longer lives. With modern medicine we have increased the average life span from 52.5 years of age in 1960 to an average of 72 today. With the miracles of modern medicine and public health initiatives, we have helped ourselves extend lives so much that we may in fact be running out of innovations to extend life any further. The gains to further extend life expectancies are slowing worldwide (Ruggeri, 2018).

This study aims to enhance the understanding of income inequality on life expectancy. From a policy perspective, this analysis is important because it can help the government to implement policies to better balance out the income within each country across Asia. The relevance of this study is that it shows how an unequal spread of income can drastically affect how long people live. It affects the lifestyle that people live and can even hinder their health if they cannot afford proper healthcare. We also look to see how health expenditure within the different countries could impact life expectancies.

This paper was guided by three research objectives that differ from other studies: First, it investigates how income inequality can impact life expectancies in thirty-four countries across Asia using dynamic panel data; Second, it incorporates information on how different health expenditures within the countries can influence how long people live; Lastly, it looks at how incorporating an income separation can help to visualize how income inequality can impact life expectancies. There is very little empirical work in the literature concentrating on Asia as a country using a dynamic panel data model. This paper fills that void.

The rest of the paper is organized as follows: Section 2 gives a trend analysis Section 3 shows a brief literature review. Section 4 outlines the empirical model. Data and estimation methodology are discussed in section 4.2. Finally, section 5 presents and discusses the empirical results. This is followed by a conclusion in section 6.

2.0 LIFE EXPECTANCY TREND

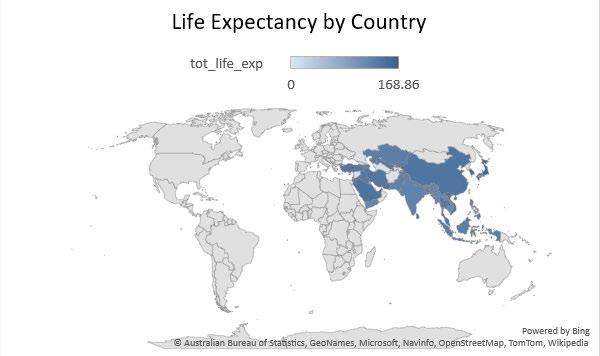

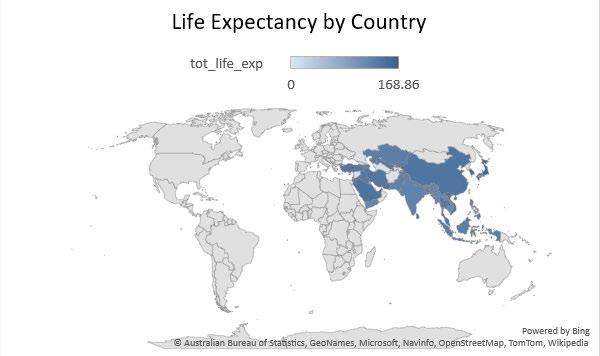

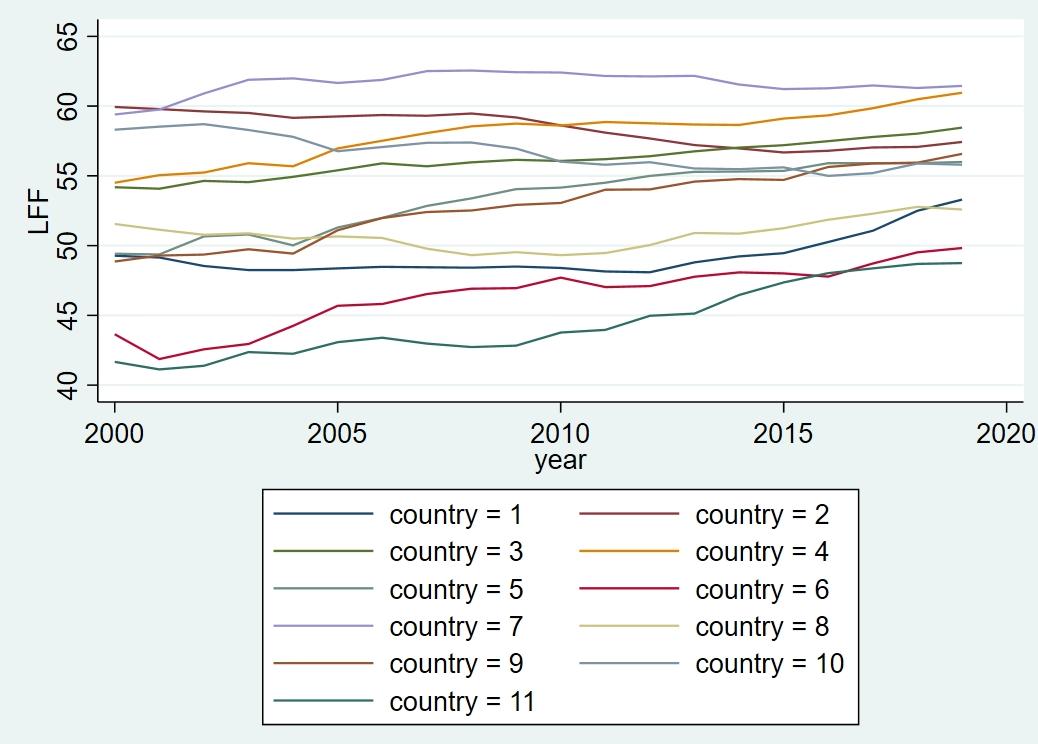

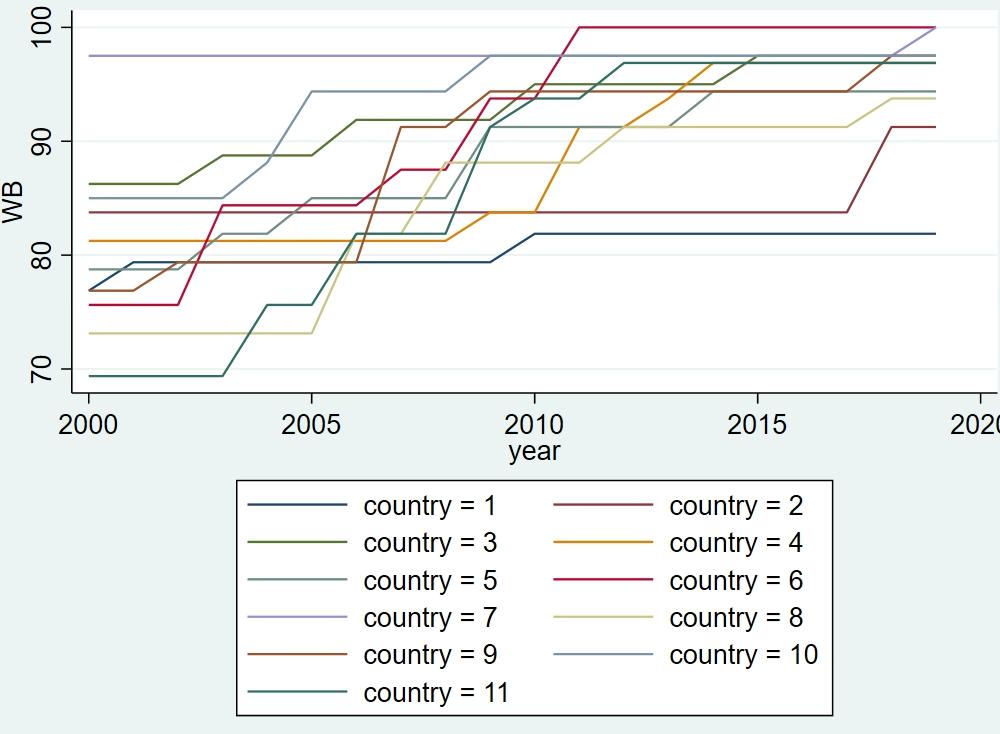

Figure 1 shows the countries in Asia that we are studying and the life expectancy associated with each. The darker the country is shaded, the longer the life expectancy. This graph

44

also shows total life expectancy rather than a breakup of women and men. Figure 2 shows income per capita by country. A majority of the countries have income per capita under one hundred (shown as a percentage of growth). Any country over one hundred shows growth of adjusted net national income per capita as more than 100%. As for countries under 0, they show negative growth or a contraction in their economy.

Figure 1: Life Expectancy by Country

Figure 1: Life Expectancy by Country

45

Source: Author Contribution

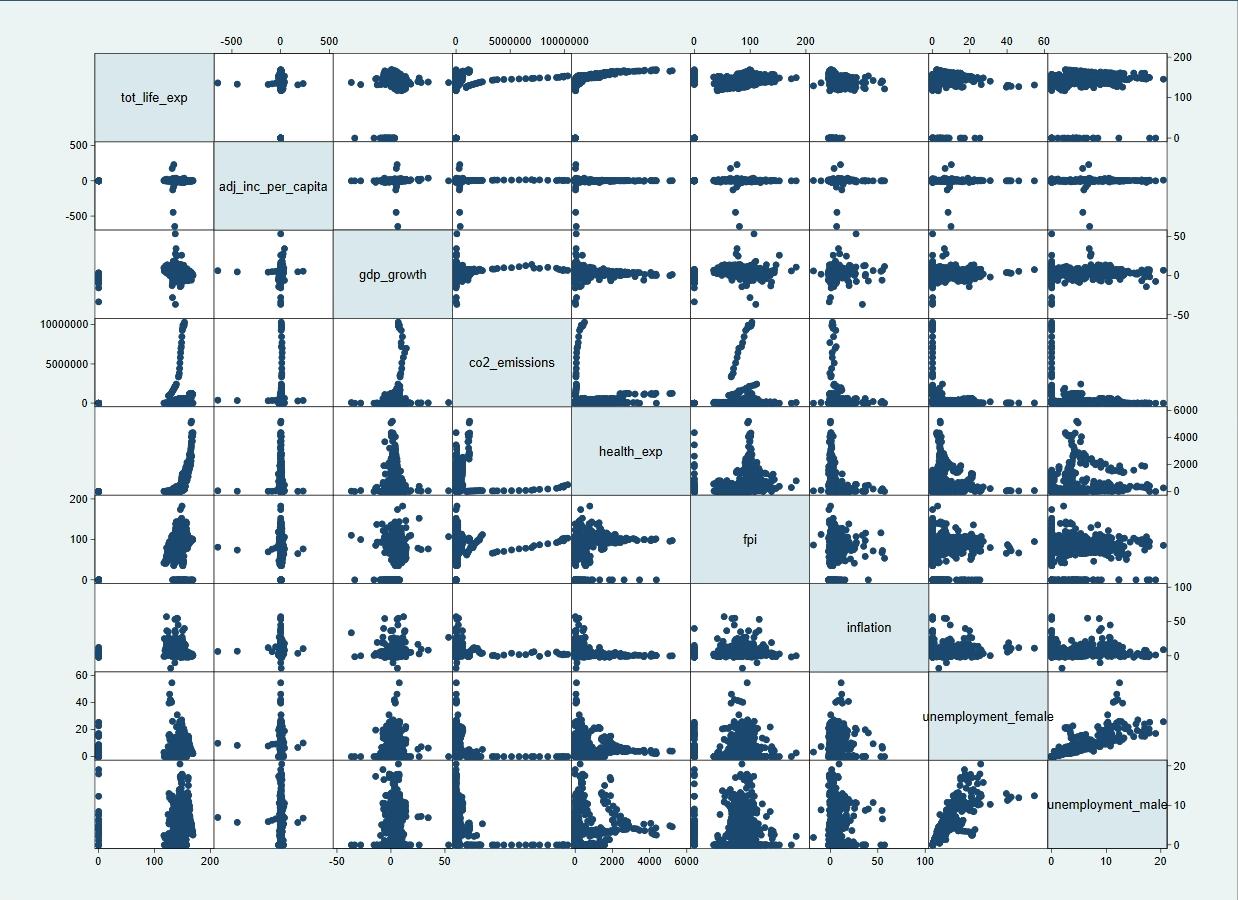

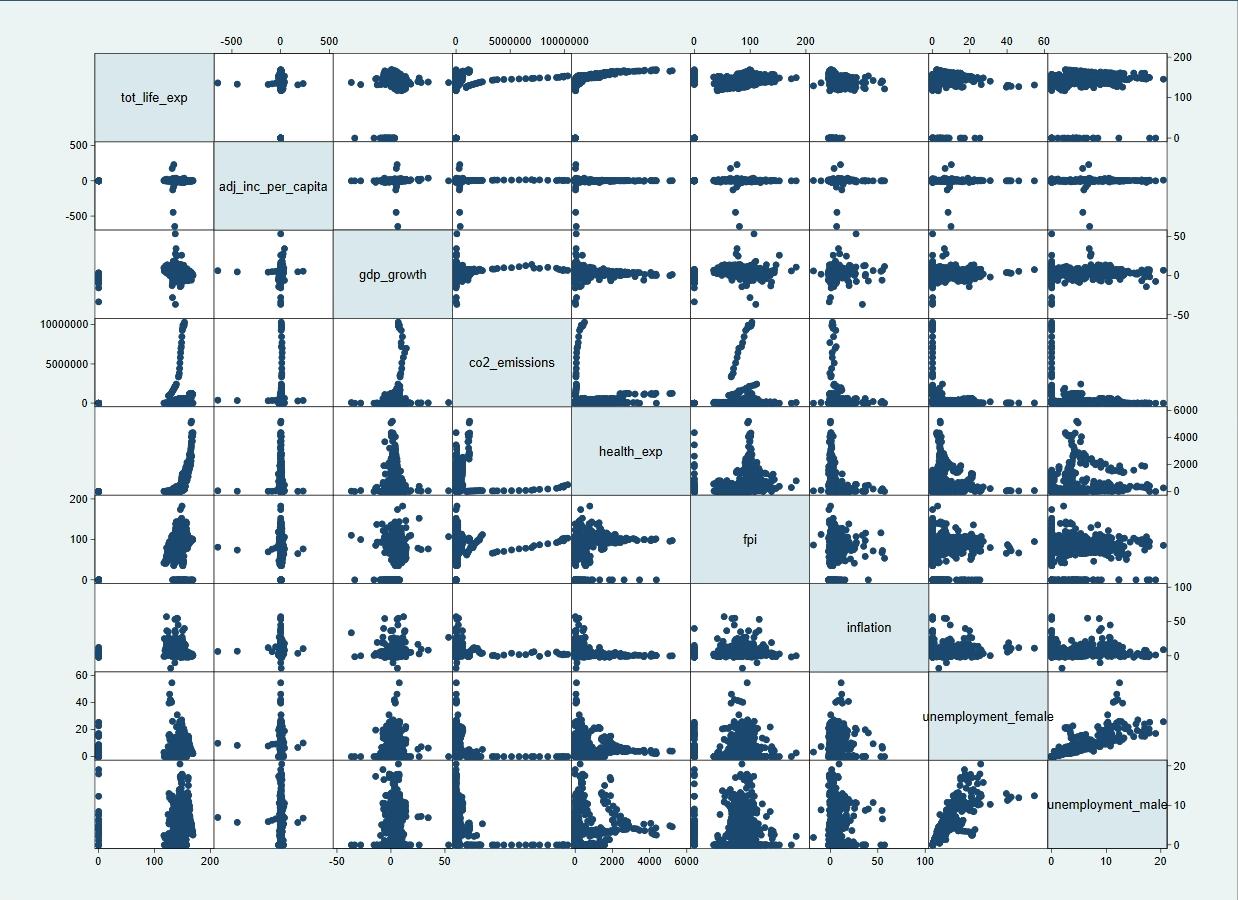

Figure 3 shows the correlation between variables run in the regression. As we can see below, we do not have any variables with multicollinearity or even a high correlation in general. The highest correlation we see is between the unemployment rate for men and women. Which is validated by the fact that if you aren’t a male, you are a female and vice versa. Figure 4 shows the variance inflation factor (VIF) which is a measure for testing multicollinearity. As a rule of thumb any variable with a VIF over 10 needs to be dealt with. This study did not have to deal with any of the consequences that are related to multicollinearity. The average VIF for the regression was 1.63 and the highest VIF was 3.30 which still is not high enough for us to act upon as it is well under our rule of thumb set at 10.

Figure 2: Income per Capita by Country

Source: Author Contribution

46

Figure 3: Correlation Matrix for Total Life Expectancy

Source: Author Contribution

Source: Author Contribution

Figure 4: Variance Inflation Factor

47

Source: Gisbert (2020)

Figure 6: Life Expectancy and Distributionally Adjusted Life Expectancy at Birth by Sex

Source: Gisbert (2020)

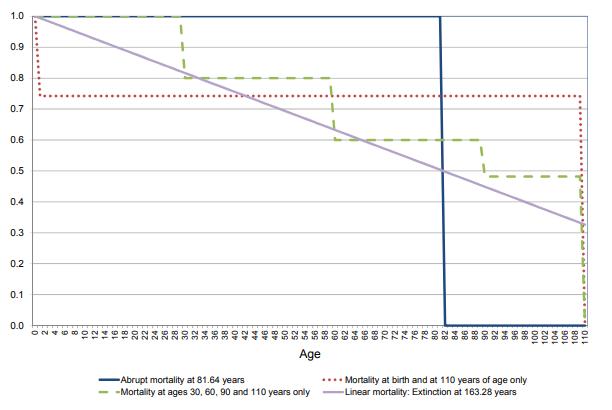

Figure 5: Alternative Survival Functions with the Same Life Expectancy at Birth

Figure 5: Alternative Survival Functions with the Same Life Expectancy at Birth

48

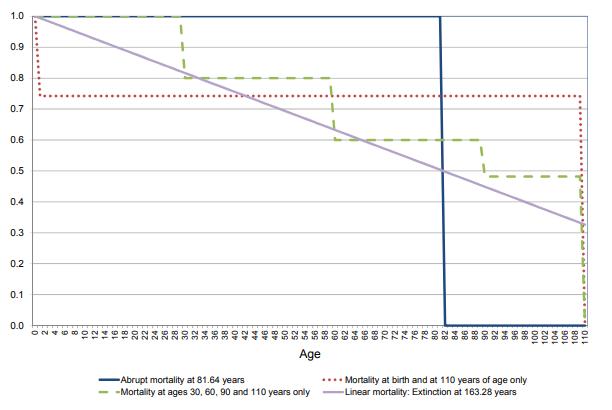

Figure 5 above shows different morality rates that we could experience. The solid blue line shows how everyone could live until they reach the age of 81.64 years old and then they die. In this case everyone has the same length of life. The dotted red line on the other hand, shows that at birth 25.78% of the population dies and the remaining 74.22% of the population survives until the age of 110. In this case mortality is concentrated at two points in the life of the generation, the beginning and the end. Nobody dies between these two extremes. In both the case of the solid blue line and the dashed red line, we see two extreme and unrealistic survival functions. In the case of the solid blue line, the survival function is a perfect rectangle. In the case of the dashed red line, a lottery determines whether you die just at the start of life or at the end of life. Since we only have two possible outcomes, the inequality in the distribution of life is at a peak. However, in both cases the population’s life expectancy is identical at 81.64 years although the two cases are extremely different. Now looking at the case of the dashed green line, every newborn survives until the age of 30 and then 20% of the population dies. Then the remaining 80% of the population lives until the age of 60 when another 20% of the population dies. Then the remaining 60% of the population survives until the age of 90 and then a further 11.8% of the initial population dies. The surviving 48.2% of the initial population then lives until the age of 110 when they all die abruptly. Lastly, we look at the solid purple line. According to this line, the newborns die at a linearly constant rate. The generation lives until the age of 163 years old although our graph only goes until the age of 110. All of these survival functions represent the same life expectancy but have very different implications for the age at death distribution (Gisbert, 2020).

Figure 6 above shows the life expectancies of men and women against inequity of life. In both cases we see the same convergence trend of the distributionally life expectancy approaching life expectancy over time. The reason behind the convergence is the strong negative correlation between the increases in life expectancy and the reduction in life length inequality. This reduction in inequality was strong during the mid-20th century and has slowed down considerably in recent years, essentially because infant mortality is so low in most developed countries that it is now difficult to reduce inequality in the length of life any further (Gisbert, 2020).

49

3.0 LITERATURE REVIEW

The impact of income inequality on life expectancy has been extensively studied and has led to a rise in a new front of empirical research. Gisbert (2020) studied how the impact of time across societies and the fact that populations have very different age structures can impact life expectancy while Hansen and Lonstrup (2011) looked at the correlation between schooling and life expectancy. Kriener et al. (2018) worked to compute the income gradient in period life expectancy that accounts for the mobility of income on life expectancy where Prus and Brown (2008) tested the income inequality population health hypothesis. Ali and Audi (2016) looked at the relationship between income distribution and health to see the impact that they might have on life expectancy. Regidor et al. (2003) looked at how both average income and measures of income inequality affect life expectancy.

Life expectancy at birth can summarize in a single number, the morality conditions of a given population (Gisbert, 2020). Since this single number can estimate morality conditions, it has become the most widely used indicator in international comparisons on development as well as the simplest summary measurement of population health for a community (Gisbert, 2020). Gisbert (2020) wanted to go beyond life expectancy by trying to introduce distributional aspects into a single life expectancy index that could be used more fluently over time and across countries. While Gisbert (2020) was trying to create an index that changed with each generation, Hansen and Lonstrup (2011) were looking at how an increasing life expectancy leads to more schooling. Their intuitive reasoning was, a longer expected working life, where the benefits of education are reaped, induces individuals to invest more into their human capital (Hansen & Lonstrup, 2011). These two economists saw a gap in the theoretical underlying concepts that didn’t include schooling when estimating life expectancy. The reasoning for the lack of including schooling into the life expectancy frameworks is due to the Ben-Porath mechanism which states that optimal schooling time increases if and only if lifetime working hours increase (Hansen & Lonstrup, 2011). Hansen and Lonstrup (2011) argue that the Ben-Porath mechanism relies heavily on the assumption of access to perfect financial markets. They relaxed this assumption to show that individuals’ optimal response to increased life expectancy may be

50

due to increase schooling time and at the same time decrease future working hours where the schooling investments pay off in terms of higher hourly wage (Hansen & Lonstrup, 2011). On the other hand, Kreiner et al. (2018) looked at how income mobility affects life expectancy. The relationship between income class and life expectancy within a society is important for evaluating equity and assessing the costs and benefits of public health and social security policies (Kreiner et al., 2018). It is well known that the morality rate is decreasing in income across individuals and this relationship is used to estimate the association between income and life expectancy (Kreiner et al., 2018). Using tax return data, it is expected that those in the top of the income distribution at age 40 can expect to live nearly 15 years longer than those in the bottom of the distribution. When they segregated period life expectancy by income class, the morality of older cohorts in the same income class is used to estimate future mobility which assumes that individuals stay in the same income classes over time (Kreiner et al., 2018). This is in contrast to evidence in economics and sociology documenting significant income mobility. The consequence of this is that estimates of the period life expectancy of the different income classes will in general not be equal to the observed average life length even when considering an unchanging society in which mortality and mobility rates are constant (Kreiner et al., 2018). Regidor et al. (2003) separated his population into males and females to see the effects of average income on life expectancy. They incorporated the Gini index and the Atkinson indices to see those effects as well.

The greater the dispersion of income within a country the lower its life expectancy which prompted Prus and Brown (2008) to study the health link on the topic at hand. They look at the psychosocial hypothesis which states that in addition to the importance of individual absolute income, relative income deprivation has a more direct effect on population health (Prus & Brown, 2008). Ali and Audi (2016) on the other hand look at how fair income distribution increases the health outcomes because it enables poor population to get a large share in profits and spend it on food and health cares. Environmental quality is an important factor which has a deep impact on human health of present and forthcoming generations. The way people value future is crucially affected by others moreover the present long life encourages people to become sympathetic to forthcoming generations (Prus & Brown, 2008).

51

4.0 DATA AND EMPIRICAL METHODOLOGY

4.1 Data

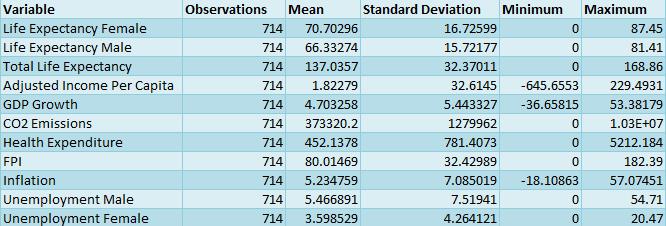

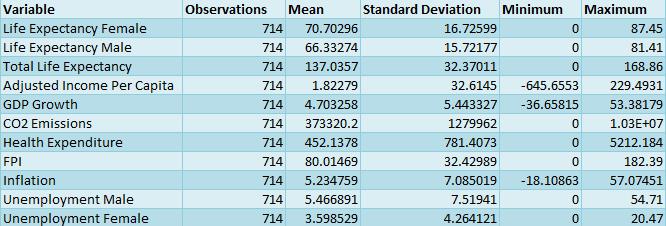

The study uses annual panel data from 2000 to 2020 for 35 countries in Asia. Data was obtained from the Bureau of Economic Analysis (BEA) website World Development Indicators. Summary statistics for the data are provided in Table 1.

4.2 Empirical Model

Following Ali and Audi (2016) this study was adapted and modified so we can run a fixed and random effect model. This study was modified to include multiple countries compared to the one country that Ali and Audi (2016) used so that we could run our panel data analysis regressions.

The ordinary least squares (OLS) model could be written as follows:

Table 1 Summary Statistics

Table 1 Summary Statistics

���������������� ������������������������������������������������ = �������� + �������� �������������������������������� ������������������������ ������������ ������������������������ + �������� ������������ ������������������������ + �������� ������������ ������������������������������������ + �������� ������������������������ �������������������������������������������� + �������� ���������������� ���������������������������������������� �������������������� + �������� ������������������������������������ + �������� ���������������� ������������������������������������������������ + �������� ������������������������ ������������������������������������������������ + ���� (1) 52

���������������� ������������������������������������������������ is the expectancy at birth for males and females for people in country i at year t. ���������������� ������������������������������������������������ is used as an endogenous variable. It represents the life expectancy at birth that would prevail if patterns of mortality at the time of its birth were to stay the same throughout its life. We used life expectancy in three different ways. One set of regressions used life expectancy of males as the endogenous variable. Another set of regressions used life expectancy of females as the dependent variable. Lastly, the third set of regressions used total life expectancy as the endogenous variable. Independent variables consist of eight variables obtained from the World Development Indicator (WDI). Appendix A and B provide data source, acronyms, descriptions, expected signs, and justifications for using the variables. First, �������������������������������� ������������������������

represents income inequality in the host country (used as a proxy for the Gini coefficient). ������������ ��������������������ℎ is used to show the growth within the host country so we can see how much the country has improved over the years. ��������2

is used to show the environmental degradation in the countries while

�������������������� are used to show how much the country spends on healthcare and the availability of food within the region respectively. Our last three variables

are all used to represent economic misery. The combination of these three variables is also referred to as the misery index which is used to measure the degree of economic distress felt by everyday people. ���� represents the random disturbance within the model that could be present and ����0 represents some constant.

In this study we ran an Ordinary Least Squares (OLS) regression on life expectancy for males, females, and the two genders combined. After we interpreted these results, we ran a fixed (FE) and random (RE) effect regression on our empirical model. After we ran these tests, we had to perform a Hausman test to see which model was superior.

5.0 EMPIRICAL RESULTS

5.1 EMPIRICAL RESULTS FOR MALES

The purpose of this study is to find the possible interdependence of income inequality on life expectancy. The empirical estimation results are presented in Tables 2, 3, and 4.

The empirical estimation shows the negative relationship between CO2 emissions and

ℎ����������������ℎ �������������������������������������������� ������������ ����������������

������������������������������������, ���������������� ������������������������������������������������ , ������������ ������������������������ ������������������������������������������������

������������ ������������������������

������������������������������������

����������������������������������������

53

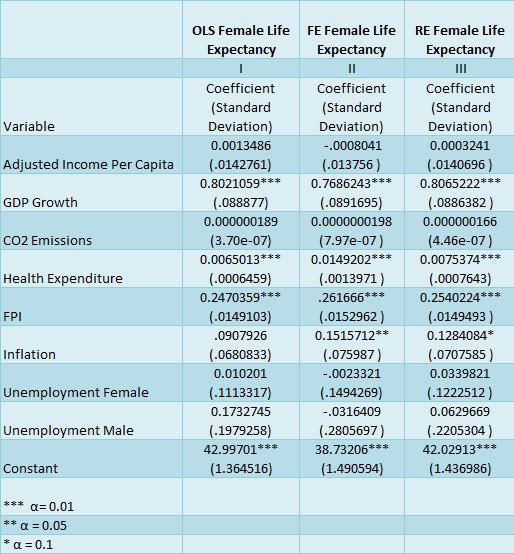

adjusted income per capita on life expectancy as well as the positive relationship between health expenditure and life expectancy. The fixed effect was the superior model for males, females, and the two genders combined when we tested the models under the Hausman test.

Table 2: Regression Results for Males

Note: *** , **, and * denotes significance at the 1%, 5%, and 10% respectively. Standard errors in parentheses

GDP growth, health expenditure, and FPI were all significant at the 1% level. The results under the fixed effect are in accordance with Ali and Audi (2016). After we ran the fixed effect, we saw that inflation became significant at the 10% level. CO2 emissions is only in accordance with Ali and Audi (2016) when we ran the fixed effect model as well

54

5.2 EMPIRICAL RESULTS FOR FEMALES

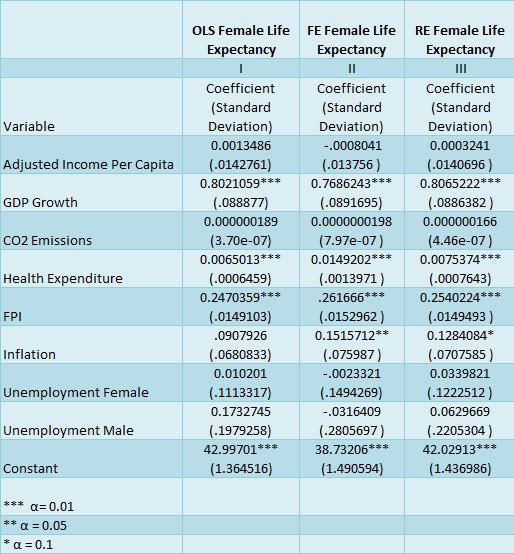

Table 3: Regression Results for Females

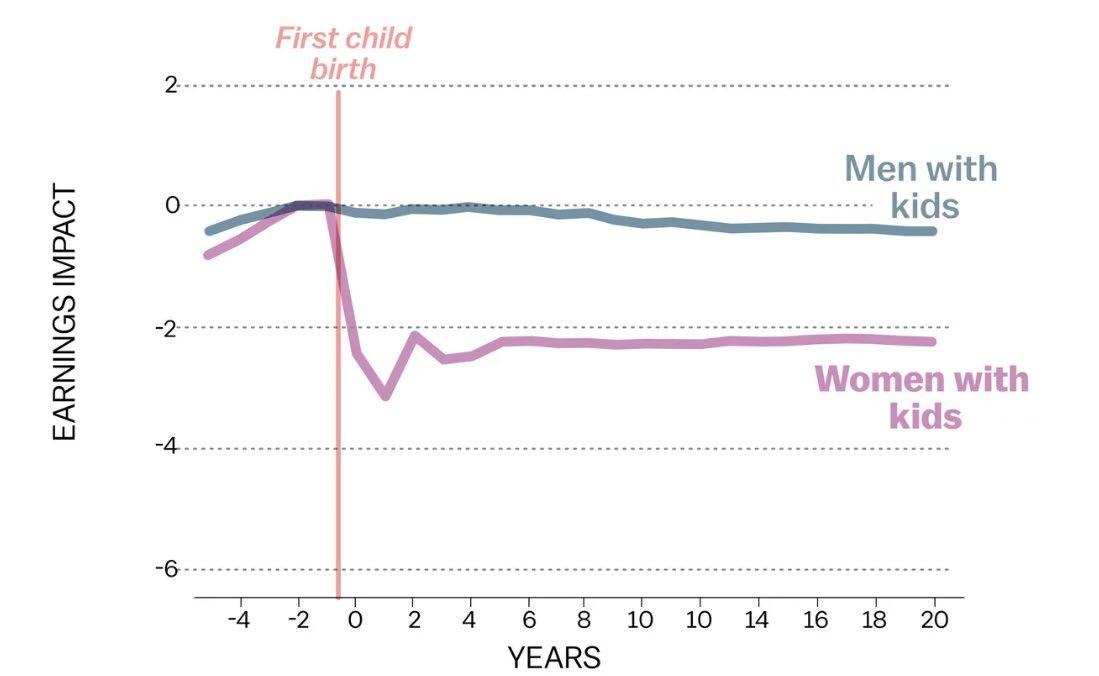

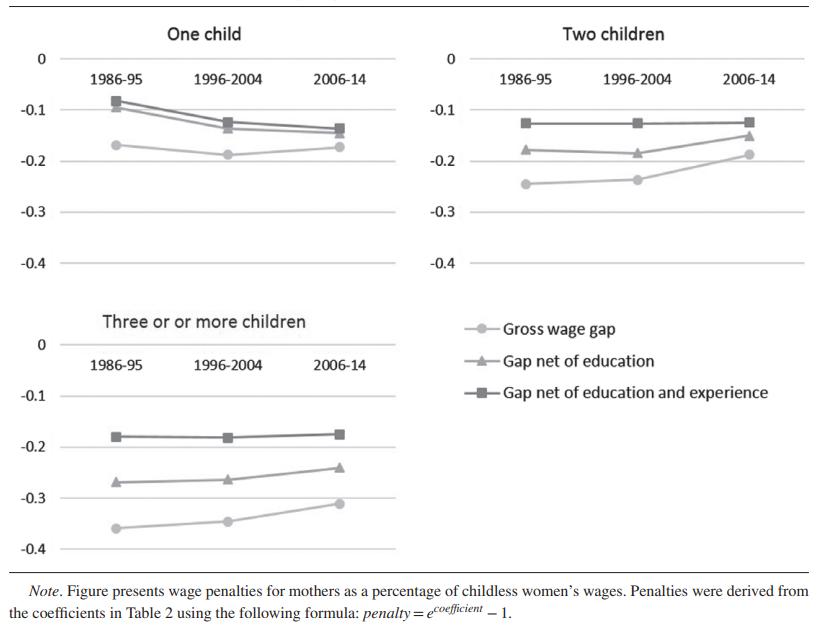

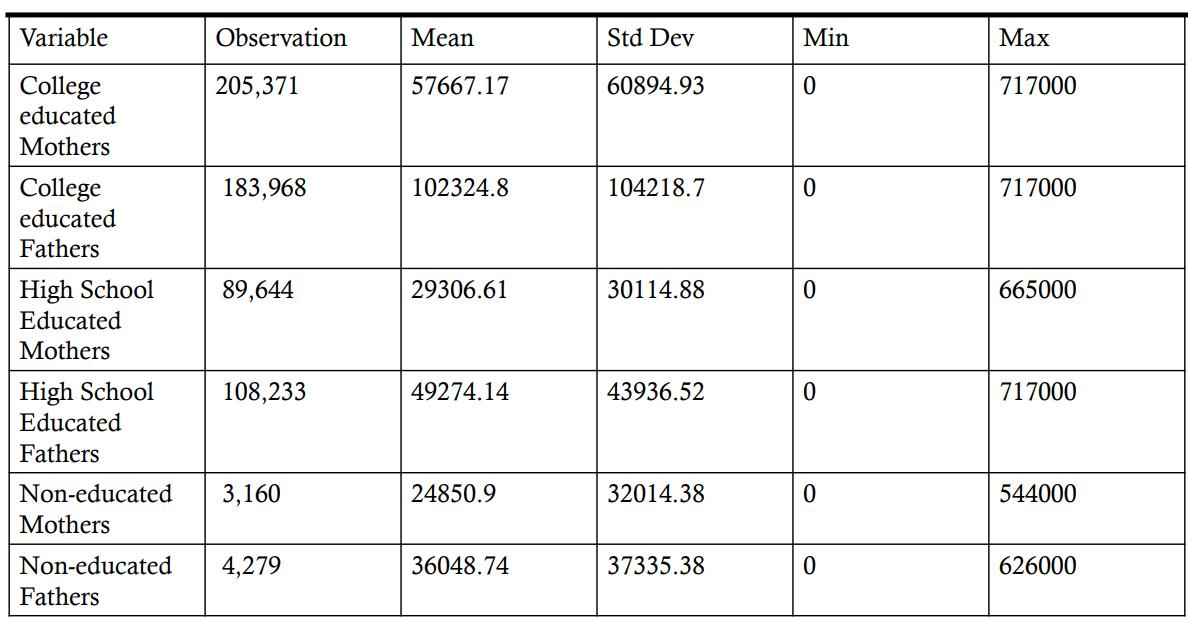

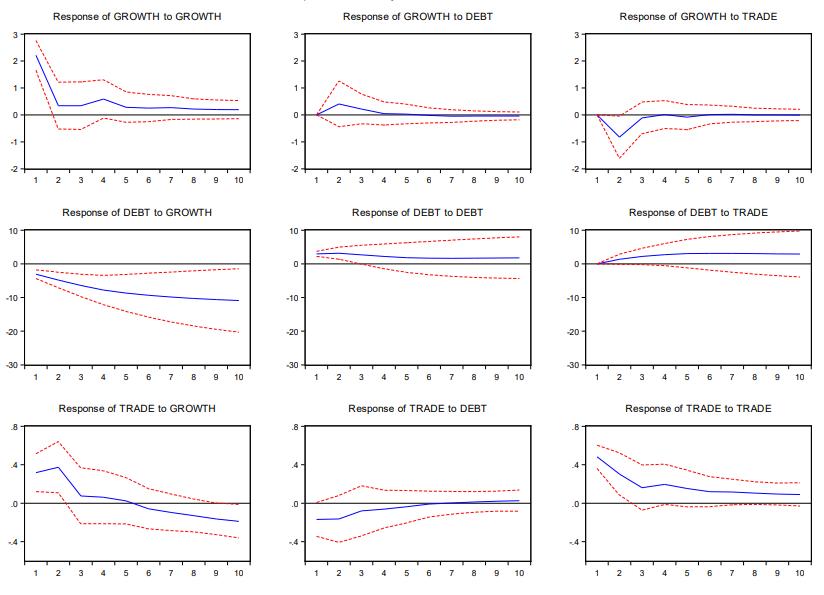

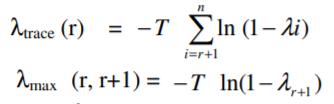

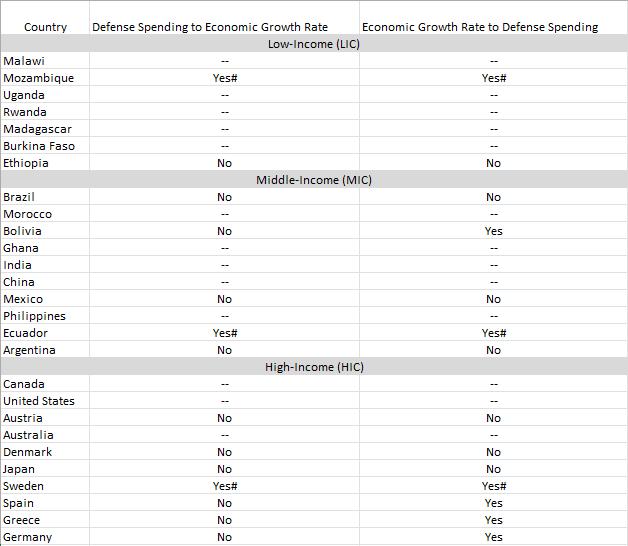

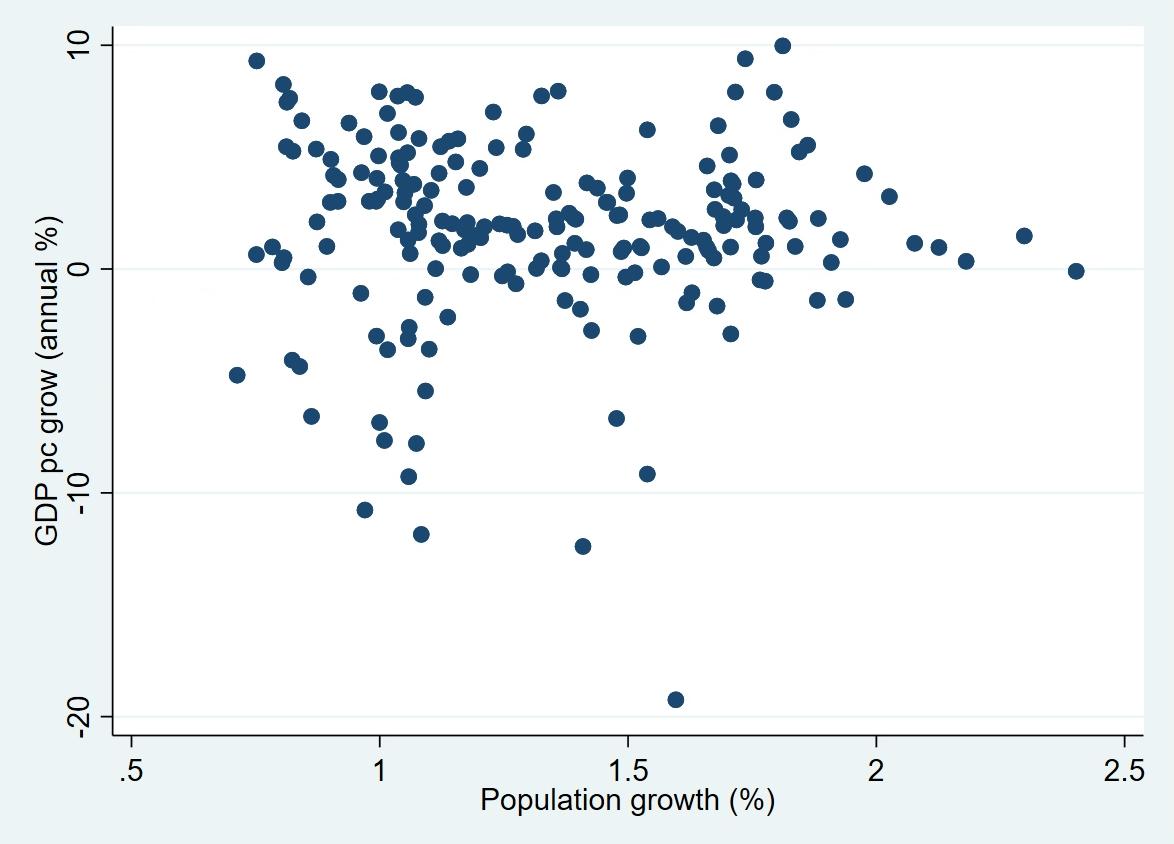

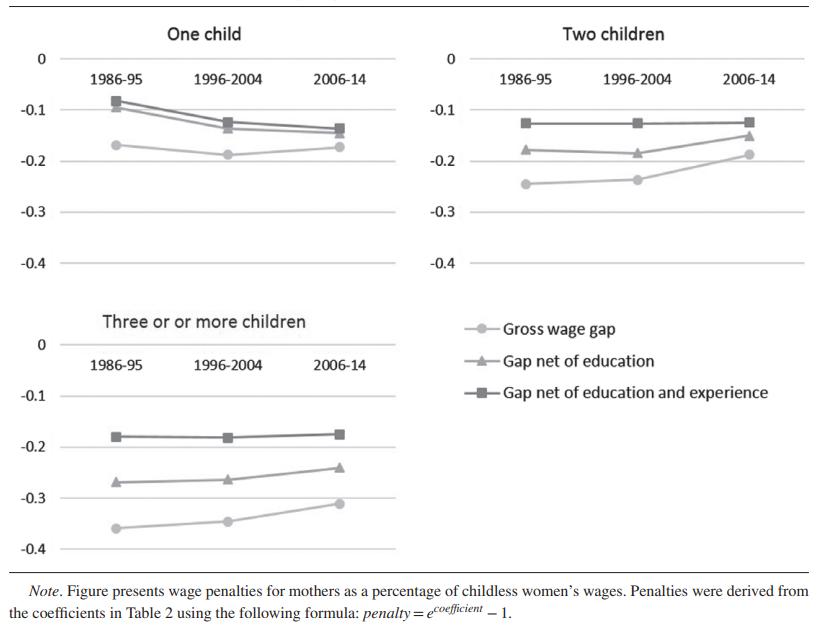

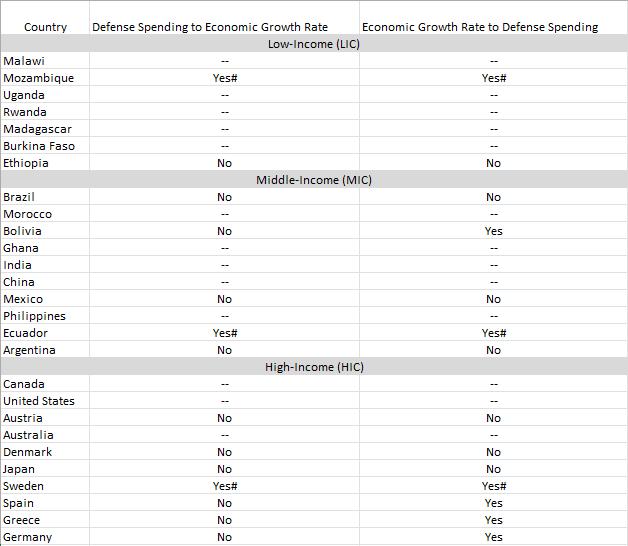

Note: *** , **, and * denotes significance at the 1%, 5%, and 10% respectively. Standard errors in parentheses