EMPIRICAL ECONOMIC BULLETIN

THE CENTER FOR CLOBAL AND RECIONAL ECONOMIC STUDIES BRYANT UNIVERSITY

EEB--UNDERGRADUATE ECONOMICS JOURNAL f--..... f �'-'"•fl.'IC,NI \ t �--· ___,

Hit I •

--- '

EDITOR: Ramesh Mohan

EDITOR: Ramesh Mohan

DESIGN & LAYOUT: Ramesh Mohan and Rebecca Marcus

MISSION STATEMENT: The Empirical Economics Bulletin is the undergraduate journal for the Department of Economics, Bryant University. The journal is produced in conjunction with the Bryant Economic Undergraduate Symposium. The focal point of the Symposium is on training undergraduate students in the art of writing, presenting, and publishing empirical research papers on a range of socio-economic and economic topics. The Symposium’s primary emphasis is empirical studies with policy relevance. Students are then able to publish their empirical papers in the Empirical Economics Bulletin. An objective of the Economics’ Department, Bryant University is to train students to conduct quantitative economic data analysis and to present the results in a coherent and meaningful way. This objective is met through having the Symposium and the publication of the Empirical Economics Bulletin. The first issue was in Spring 2008 and has been published annually with original work from an array of student authors.

SUBMISSION GUIDELINES: Students may submit their socio-economic and economic work here: Ramesh Mohan at rmohan@bryant.edu. Limit one submission per author. Each submission should have a title page with the title; name of author; abstract; keywords; JEL classification; author’s email. Previously published work is not accepted. The reading period is September 1 to December 1. Copyright reverts to author upon publication.

Any questions may be directed to Professor Ramesh Mohan at rmohan@bryant.edu.

© 2023 Empirical Economics Bulletin

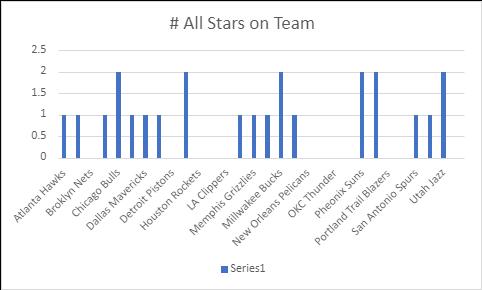

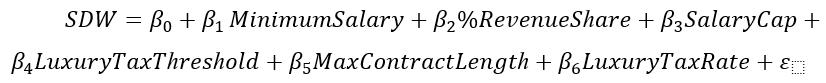

The Effects of Cultural Values on Economic Growth: An Empirical Investigation, Jake Barlow .. 1 Fenway and Crime: Opportunity, Geographic Differences, and Team Rivalry at Boston Red Sox Games, Cole McGovern ……………………………………………………………………………… 22 Empirical Analysis of Firearm-Related Deaths in the United States Based on Sex, Race, and Age, Dominick DaCruz ……………………………………………………………………………….. 44 Educations Effect on Income Inequality: A Panel Data Analysis, Nicholas Garbarino ,,,,,,,,,,,,,,, 57 An Empirical Analysis of the Impact of Unemployment Rate and Economic Development Level on Income Inequality, Wenyi Gu …………………………………………………………………….. 71 The Determinants of Carbon Emission in Asia and Europe: A Panel Data Analysis, Erika Hauser 86 An Empirical Analysis of Inflation and Its Effect on the Stock Market, Marley Hines 100 An Empirical Analysis of Foreign Trade and Institutional Quality on Economic Growth in Asian Countries, Ruixi Huang 114 An Empirical Analysis of the Impact Specific Crimes Have on Property Values in Massachusetts, Jack Scott 134 An Empirical Exploration of U.S Healthcare Discrimination and Obesity Prevalence, Arinzechukwu Maduka 144 Empirical Analysis of Institutional Quality and Financial Development on Income Inequality in Central America, Odette Mansour 161 Empirical Analysis of NBA Ticket Prices Correlation to NBA All-Stars, Michael McNeil …… 177 Empirical Analysis of NFL Ticket Price Determinants, Kenny Page …………………………… 194 An Empirical Analysis of the Effects of Government Influence on Deforestation in Latin America, Francine Roberge …………………………………………………………………………………… 214 An Empirical Analysis of Prime Performing Age of NBA Players; When Do They Reach Their Prime?, Tony Salameh ……………………………………………………………………………... 229 The Happiness-Income Paradox: A Cross Sectional Analysis, Samantha Sczepanski …….. 243 Empirical Analysis of NBA 2011 CBA Changes and Their Effects on Competitive Balance, Derek Smith …………………………………………………………………………………………. 256 Granger Causality Test for Agricultural Production to Economic Growth in Thailand, Joshua Soares 270

Table of Contents

A Granger Causality Test on the Misery Index Effects on Domestic Violence, Talia Vicente 285 How International Trade and Government Integrity Affect the Structural Transformation of Lao PDR and Cambodia, Yixin Wan 303 Exploring the Relationship Between Exchange Rate Pass-Through and CPI Inflation in Mainland China and India, Edward Zhou 317

The Effects of Cultural Values on Economic Growth: An Empirical Investigation

Jake Barlowa

Abstract:

This study explores the relationship between cultural attitudes and national GDP growth, across several countries. Data from the World Values Survey from the 2010 through 2014 and 2005-2009 wave have been utilized to determine cultural attitudes, and data from the World Bank and USAID has been utilized for building the economic growth model. The purpose of this study is to inform policy makers regarding the effects of different cultural factors and their interactions on economic growth outcomes. The main contribution of this study is the positive impact that attitudes towards the environment have on economic growth outcomes.

JEL Classification: O47, Z10

Keywords: GDP Growth, Cultural Attitudes.

a Department of Economics, Bryant University, 1150 Douglas Pike, Smithfield, RI02917. Email: jbarlow1@bryant.edu.

1

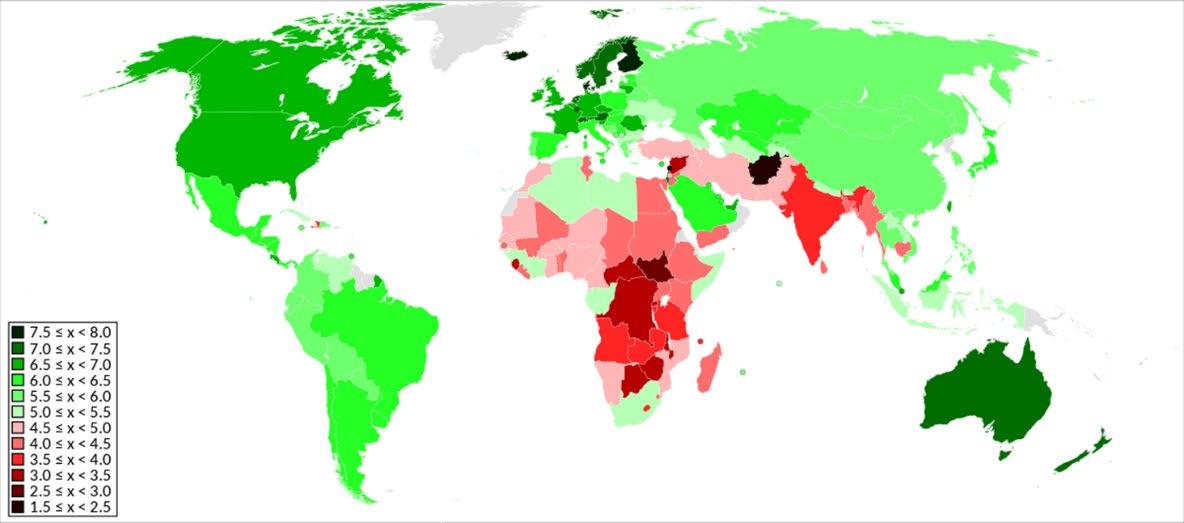

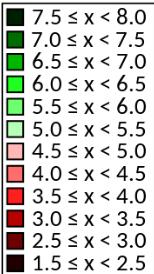

Cultural attitudes vary greatly from nation to nation, even when controlling for items such as levels of economic development. The goal of this study is to investigate how these cultural attitudes and their interactions impact economic growth, along with country wealth, when controlling for other economic factors. Certain cultural attitudes have been shown to have a positive effect on growth, while others have been related to negative effects on economic growth. The purpose of this investigation is to look at the interactions between these variables and their impacts on the economic growth factor.

The purpose of creating and analyzing cross variables is to analyze the impacts of several cultural factors working together, and what these outcomes are on economic growth. Previous literature has explored, in depth, the relationship between individual cultural factors and economic growth, but they have not explored how these cultural variables interact with one another when impacting economic growth. This study aims to fill this specific gap in the literature by proposing a method of accounting for multiple cultural factors through only one variable.

This study aims to enhance general understanding of how cultural factors and attitudes and their interactions impact growth and wealth outcomes. From a policy perspective, this analysis is important in understanding the economic implications of policies that encourage or discourage certain cultural attitudes. The economic implications of all policy decisions are crucial considerations that have to be accounted for and are likely underrepresented when considering the implications of socially and culturally impactful policies. The relevance of this study is that it brings together a pool of different cultural variables and their interactions and looks at how these items relate to economic growth, allowing policy makers to more accurately predict and understand how cultural attitudes may be impacting the economic outcomes of their respective nations.

This paper was guided by the research objective of investigating the relationships between a plethora of different cultural variables, along with their interactions, and macroeconomic

1.0 INTRODUCTION

2

growth outcomes from nation to nation. There is literature looking at the relationships between several cultural variables and economic growth, but there is a lack of investigation into the interactions of these cultural variables, when impacting economic outcomes, a void which this study hopes to fill in the literature. In addition to this analysis utilizing synthesized cultural variables, this study tests several variables with previously established relationships to economic growth, against the same data set, so that results can be compared from cultural data point to cultural datapoint.

The rest of the paper is organized as follows: Section 2 gives a brief review of the existing literature surrounding cultural attitudes and economic growth outcomes. Section 3 outlines the empirical model that was used. Data and estimation methodology are discussed in section 4. Finally, section 5 presents and discusses the empirical results. This is followed by a conclusion in section 6.

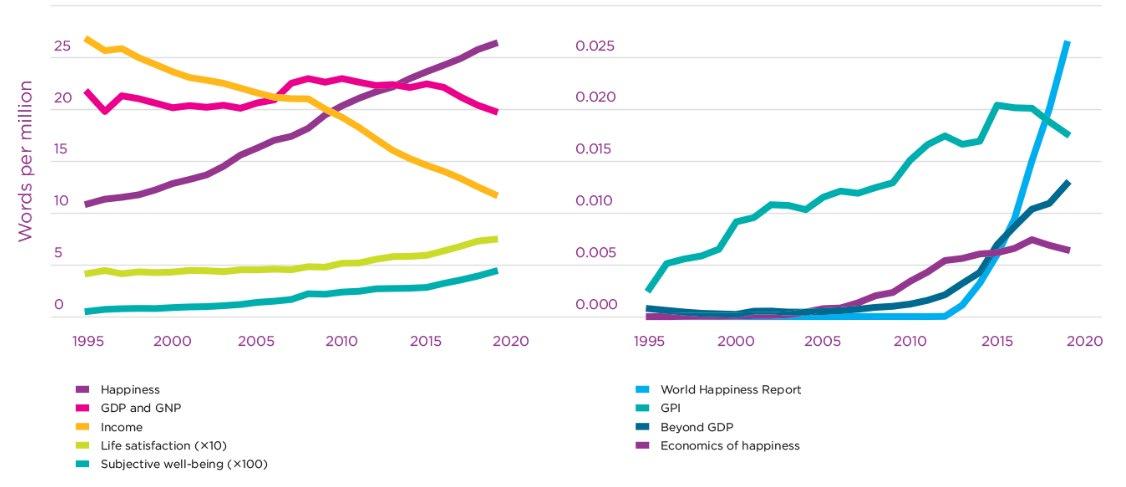

2.0 Preliminary Trends, Cultural Attitudes and Growth

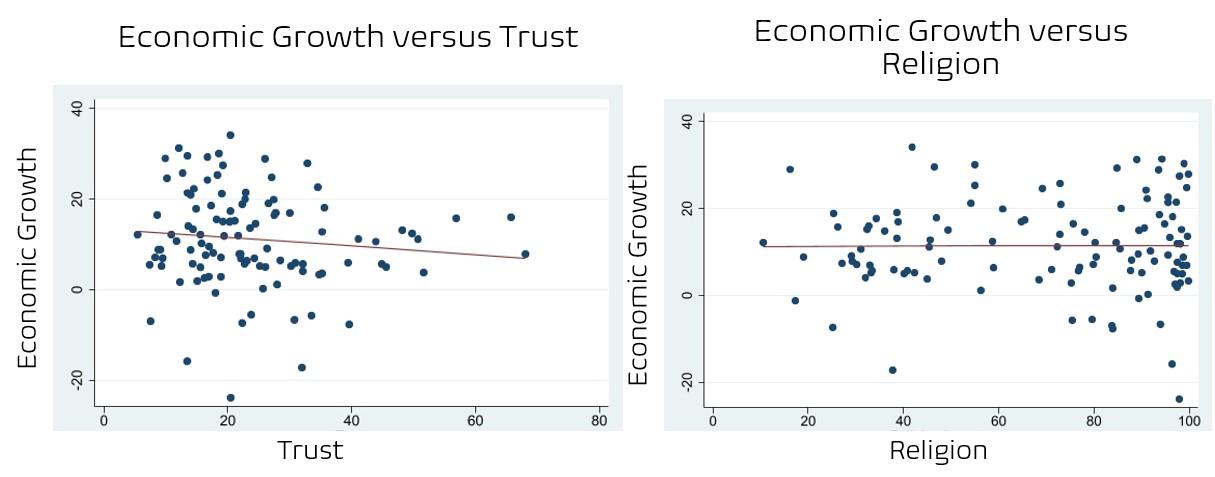

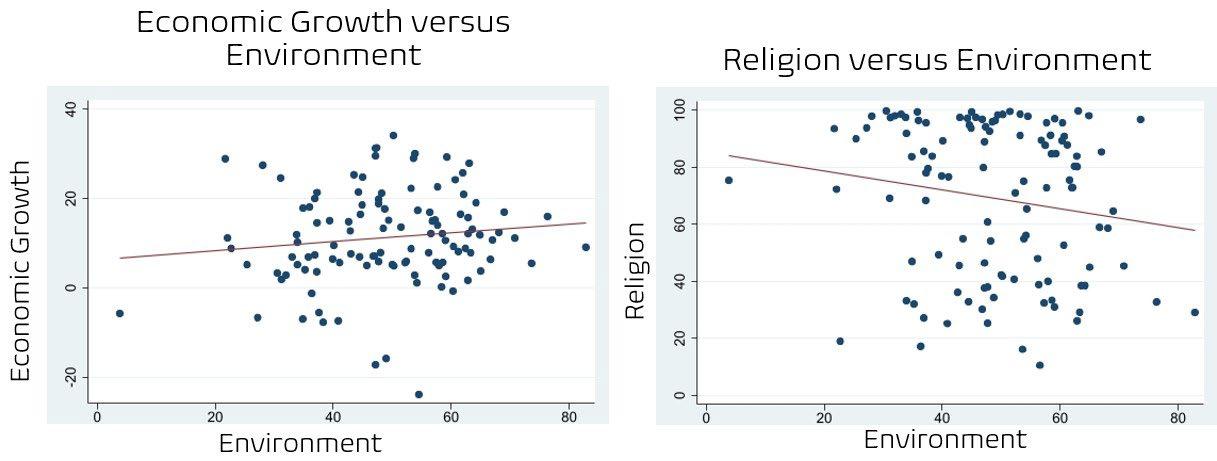

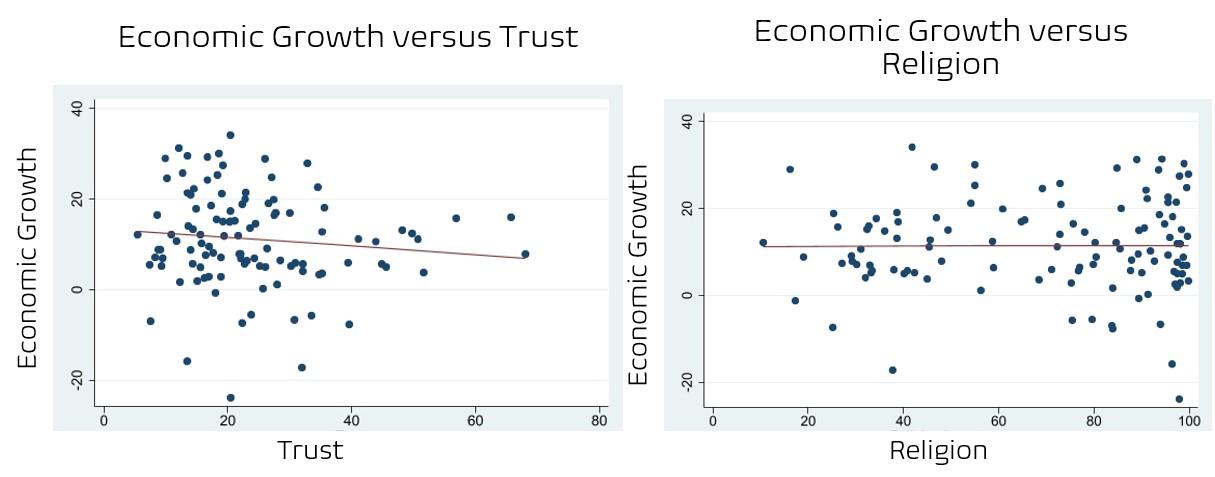

The figures below show the preliminary trends found between several different cultural indicators and economic growth over the available dataset and one figure shows the preliminary relationship between two of the cultural variables that will be crossed in this study. In three of the four figures, economic growth is listed on the y-axis and the independent variable of interest for each case is listed on the x-axis. Figures 1 and 2 below show the relationships between trust, religion and economic growth and Figures 3 and 4 show the relationship between pro environmental views and economic growth and pro environmental views and intensity of religious beliefs.

3

Source: World Values Survey and World Bank

When analyzing the trends shown in Figures 1 and 2, there is almost no relationship to be observed when graphing each of these variables one on one with economic growth. This result is to be expected as even if either of these factors influence economic growth outcomes they would be severely overshadowed by omitted variable bias, as economic variables are not controlled for. These relationships are observed almost across the board when graphing cultural attitudes against economic growth, from this particular dataset, although a slight relationship can be observed between economic growth and environmental views in Figure 3 below.

Figure 1: Economic growth versus Trust & Figure 2: Economic growth versus Religion

Figure 1: Economic growth versus Trust & Figure 2: Economic growth versus Religion

4

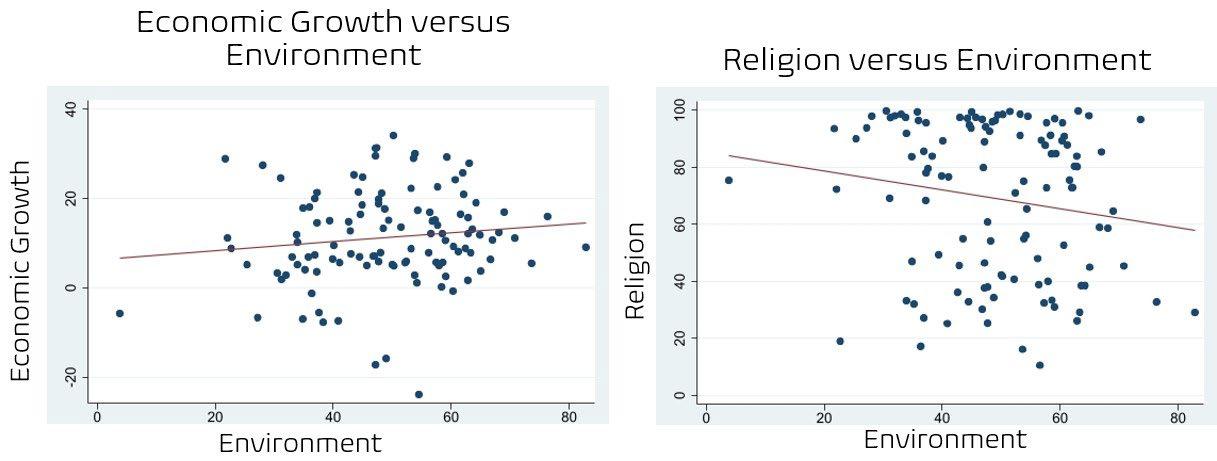

Source: World Values Survey and World Bank

In Figure 3 we see a slight positive correlation between environmental views and economic growth, running counter intuitive to basic common sense and a trade off which nearly all accept as true. When people become more willing to sacrifice economic growth for environmental protections, one would expect that economic growth levels would drop, but this is not the trend observed in this graph nor is this assumption consistent with the results from the model of this study. In Figure 3 we observe a weak but somewhat defined relationship between the two cultural variables of religion and environment. The more defined the relationship between the two cultural variables is, the more interpretable the results of the parameter estimate for their cross variable, as values are more likely to follow a continuous trend that represents a change in both variables.

3.0 LITERATURE REVIEW

3.1 The Effects of Cultural Values On Economic Outcomes

“ Throughout history, one of the defining features of different societies have been the values that they each hold. These values influence every aspect of the culture, including the outcomes that it is capable of producing.

Figure 3: Economic growth versus Environment & Figure 4: Religion versus Environment

Figure 3: Economic growth versus Environment & Figure 4: Religion versus Environment

5

Values which influence economic outcomes of a nation can be broken down into two categories, individual preferences, which exist at the level of the individual, and political preferences, which reflect attitudes towards the way that government should be run. According to Guiso et al. (2006), “We distinguish between values that influence economic preferences (such as fertility or labor participation preferences) which can be thought of as parameters of a person’s utility function and political preferences (such as preferences for fiscal redistribution). Culture, thus, can affect economic outcomes through both these channels.” Political preferences are likely to reflect the political outcomes of nations, so this variable must be controlled for when analyzing how individual preferences towards women, within a culture, influence economic growth.

Several studies have found connections between cultural backgrounds and types of economic outcomes, including willingness to complete workplace duties. According to Ichino and Maggi (2000), “The prevalence of shirking within a large Italian bank appears to be characterized by significant regional differentials'' . A relationship between shirking and region of origin displays a relationship between an individual's culture and their willingness to work and to what degree that they are willing to do so. Two other studies that also found relationships between cultural attitudes and economic outcomes are from Fernández and Fogli (2005), and Fernández et al. (2004). Fernández et al. (2004) found that men growing up in homes where mothers worked, were significantly more likely to have wives who participated in the labor force. Fernández and Fogli (2005) explored the effects of cultural proxies on first generation immigrants and labor force outcomes for women, using prior women's labor force participation rate and fertility rates as cultural proxies, and economic indicators of women’s labor force participation rate as control variables. These studies found a relationship between past female labor force participation and fertility outcomes with those of modern outcomes, within the same cultural proxies, and the impacts of men growing up with working mothers on female labor participation, respectively.

An additional study from Ferraro and Cummings (2007), found differences in the economic behavior of Navajo and Hispanic groups, including spending, even when controlling for

6

demographic differences, including economic indicators of economic behavior. This study used the ultimatum game, a commonly used tool in behavioral economics, to determine the differences in bargaining behavior between the two ethnic groups. In the ultimatum game, each player is assigned to the role of either proposer or responder, and the proposer is given 10 dollars to split between themselves and the responder, who will decide whether to accept or reject the proposers offer, where rejection leads to an outcome of zero dollars for both players. This study was conducted in Albuquerque, New Mexico with 60 Hispanic participants and 60 Navajo participants. These studies lay the foundation for the claim that economic outcomes are influenced by culture. “ (Barlow 2022).

3.3 Determinants of Economic Growth:

“Measuring economic growth, and determining the factors that contribute to economic growth is a challenge faced by many economists over the past several decades. One of the largest challenges faced is the issue that different countries have different determinants of economic growth. One way economists deal with this issue is by dividing countries into several groups, Developing nations, developed nations, and the nations of SouthEast Asia and Central Europe, which take on a middle ground role between the developed and developing nations.

In a study from Anyanwu (2014), using data from 53 African nations over 3 year periods between 1996 and 2010, and data from China from 1980 to 2010, creates a model of economic growth for developing nations, and compares these factors with the factors that have influenced China’s massive economic growth over a three decade period. The model utilized was a log-log model, with gdp per capita growth as the dependent variable and initial real gdp per capita, government consumption expenditure as a percentage of GDP, the investment rate, official development aid as percentage of GDP, foreign direct investment as a percentage of GDP, total trade a percentage of GDP, external debt as percentage of GDP, secondary school enrolment, inflation rate, institutionalized political regime, government effectiveness, urban population, domestic credit to the private sector as a percentage of GDP, agricultural materials price index, metals price index, oil price

7

index, and the industrial materials price index as independent variables. The study found domestic investment, ODA to GDP, secondary school enrollment, government effectiveness, urban population, and metal price index to be statistically significantly related to GDP per capita growth for the African sample (Anyanwu 2014). When using pooled OLS regression, Domestic investment to GDP, ODA to GDP, secondary education enrollment, gov effectiveness, urban population, and the metal price index to be statistically significantly positively related controls.

In a study from Checherita-Westphal and Rother (2012), using data from 12 countries that use the Euro over the time period from 1970-2008, found that governmental issues, like debt levels, trade openness, and government savings are positively and significantly related to GDP per capita growth for developed nations. The empirical model used for developed nations included GDP per capita growth as the dependent variable, and government debt, government balance, private savings, and trade openness as the independent variables of interest for the study, along with a plethora of economic control variables(ChecheritaWestphal & Rother 2012).

In a study from Fetahi-Vehapi et al. (2015), a model is created to attempt to relate trade openness to economic growth in south eastern European nations, when controlling for other economic variables. The control variables used in this study, when compared to models of economic growth for developing and developed nations, are slightly different as follows; human capital, gross fixed capital formation (GFCF), Active Population, and the FDI (Fetahi-Vehapi et al. 2015). One interesting conclusion of this study to keep in mind is that, population was found to be negatively and significantly correlated with economic growth for these southeastern European countries. The study also found GDP per capita in the prior year, gross fixed capital formation, and human capital to be statically significant and positively related to economic growth.

A study from Barlow (1994) finds no correlation between levels of population growth and economic growth and suggests that there is likely no relationship between the two variables. This study does not explore the relationship when looking at the population

8

growth metrics lagged by the length of a generation, which may have some relationship, given the relationship between increased population and increased human capital.

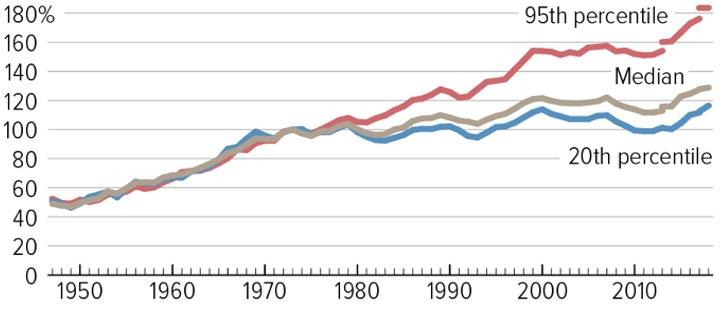

The theory of convergence, which is suggested by the findings of Barro (2003), suggests that countries with lower GDP per capitas will grow faster than countries with high GDP per capitas. Under this theory, smaller economies will grow at higher rates, relative to their larger economic counterparts, leading to all economies theoretically converging to one size.” Barlow (2023).

3.3 A Note on Environmental Regulation and Economic Growth

Two important studies from Grossman and Krueger (1995) and Jaffe et al. (1995) analyzed the relationship between environmental regulation and a certain contributing factor of economic growth. Grossman and Krueger (1995) analyze the positive relationship between environmental regulation and productivity growth by forcing innovation in capital. Jaffe et al. (1995) analyzed the impacts of the Clean Air Act on innovation in US manufacturing and found that the increased regulation led to increased innovation among firms. It is important to note that each of these studies was only focused inside of the United States.

Despite the conclusions of the previous two studies, a more recent study regarding the economic impacts of environmental regulation comes from Antweiler et al. (2001) This study found that increased environmental regulations culminate in reducing competitiveness and cause businesses to relocate to countries with less environmental regulations in place.

4.0 DATA AND EMPIRICAL METHODOLOGY

4.1 Data

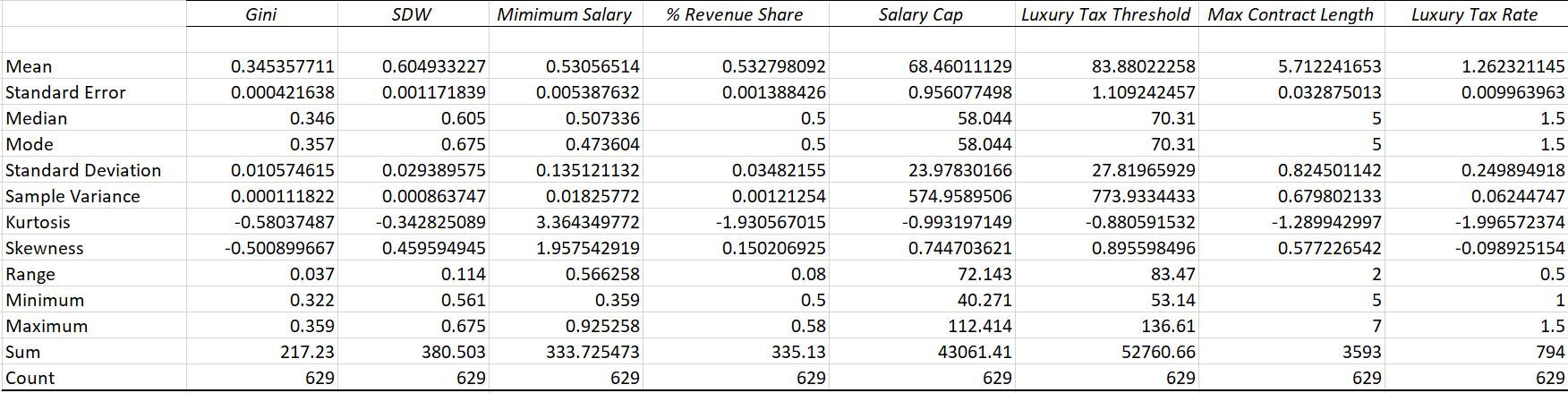

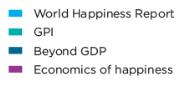

The study uses panel data, based on WVS availability, from 2004 to 2016. Data was obtained from the USAID website IDEA data query system. The summary statistics for both the cultural and economic variables are included below, in Table 1. Note that these summary statistics represent a handful of additional observations that were not utilized in certain models in this study due to a lack of data completeness.

9

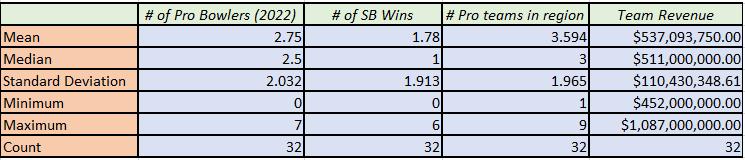

Table 1 Summary Statistics

Var N Mean Std. Dev. Min Max Family Importance 116 98.54741 1.49669 87 100 Friends Importance 116 87.69052 8.680443 52.6 98.8 Work Importance 116 88.71638 6.318598 70.8 99.3 Religion Importance 116 69.54569 26.76564 10.6 99.8 Hard-Work-Luck-Scale 113 4.293274 0.9194811 2.12 8.63 Trust 109 23.78073 12.31223 5.4 68.1 Would Serve 116 61.80086 16.94084 15.1 97.8 GDP 114 8.99E+11 2.26E+12 3.16E+09 1.56E+13 GDP (y-1) 114 8.32E+11 2.13E+12 2.89E+09 1.50E+13 Econ Grow 114 11.39599 10.64111 -23.8594 34.16632 Pop Grow 114 1.321661 1.692289 -0.88425 12.72727 Patents Per 100k 96 20.69512 52.41377 0.014635 287.9795 Environment 114 49.07456 13.18656 3.8 82.8 Corruption 114 47.61404 22.84016 16 96 Education 101 80.60396 23.47087 9 100 Infant Mortality 113 19.00885 18.70709 2 92 10

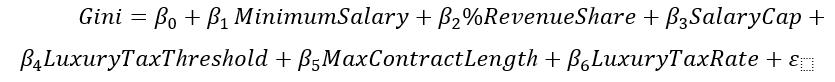

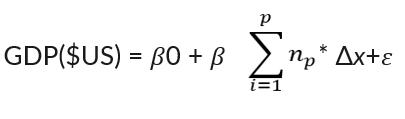

4.2 Empirical Model

This study adapts the standard economic growth model by including potential cultural indicators of economic growth into the model and testing each cross combination for significance. The model utilized in this study has been written below.

Economic Growthit = β0 + β1CulturalVariableit +β2Xit+uit + β3lnGDP(y-1)it + β4PopulationGrowthit + β5Innovationit + β6Corruptionit + β7Educationit + β8InfantMortit + β9CapitalFormationRateit + eit

Economic Growthit is the dependent variable and is measured by the growth rate of GDP from the previous year to this year, with both values measured in 2023 US dollars. The independent variables of interest are all products of two of the cultural variables, all listed below in Table 2.

Table 2 - Cultural Variable Descriptions

Variable Definition

Family Importance % Responded important or rather important to question: “Important in Life: Family”

Friends Importance % Responded important or rather important to question: “Important in Life: Friends”

Work Importance % Responded important or rather important to question: “Important in Life: Work”

Religion Importance % Responded important or rather important to question: “Important in Life: Religion”

Hard-Work-Luck Scale Average of Responses measured on 1-10 scale that “Hard Work Brings Success”; where higher values indicate a view that success is more based on luck

Trust Sum of % responded trust completely and trust somewhat to question: “ Trust: People you meet for the first time”

Would Serve % Would serve for their country's military

Cap Form 106 23.04717 5.625422 12 45

11

Environment

% Believe environment should be given priority over economic growth interests

Source: World Values Survey

Independent control variables consist of seven variables obtained from the World Bank and USAID Query system. First, lnGDP(y-1)it (the natural log of the GDP in the previous year of country i at year t ) represents the size of the economy already present within the nation. PopulationGrowthit (the growth rate of population of country at year ) represents the increase in the workforce. Innovationit (the natural log of the total number of patent applications by residents of country at year ) represents the growth of technology within the country. Corruptionit (perceptions of corruption from transparency international of country at year ) represents the level of political corruption in a country, higher levels indicate less corruption. Educationit (the percentage of individuals who have completed secondary school of country at year) represents the average level of education in the nation. InfantMortit (the number of deaths per 1,000 live births of country at year ) represents the quality and accessibility of healthcare within the country. Finally, CapitalFormationRateit (the gross fixed capital formation rate as a percentage of GDP of country at year ) represents the investment into new non-human capital.

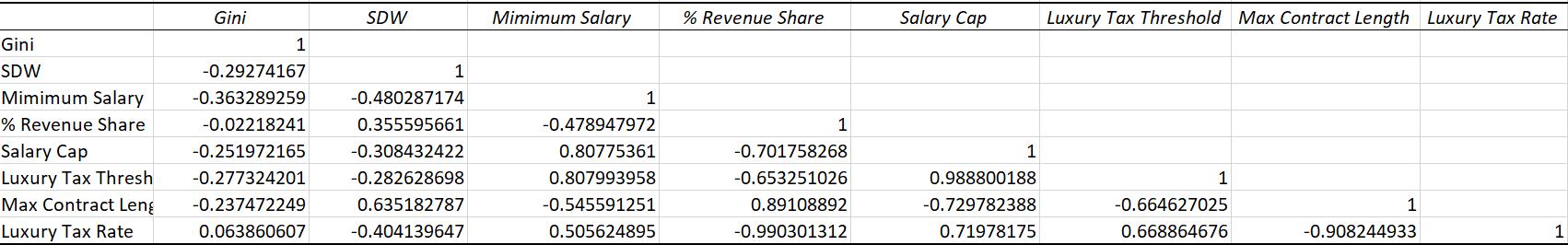

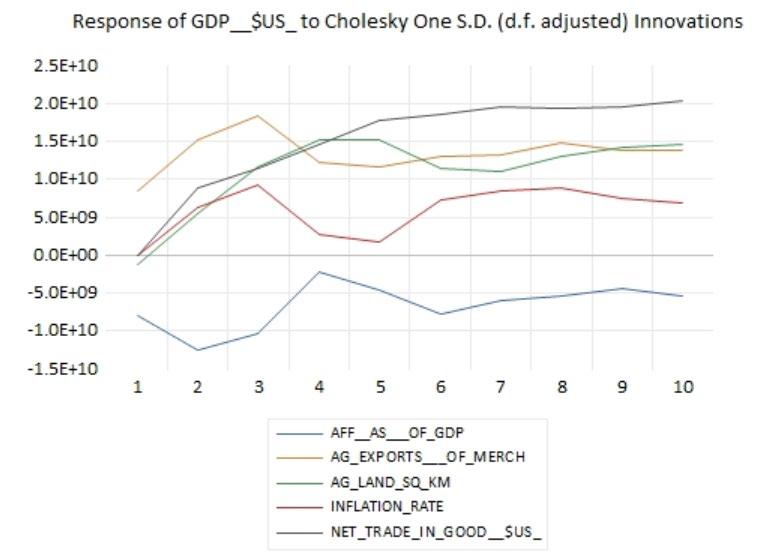

5.0 EMPIRICAL RESULTS

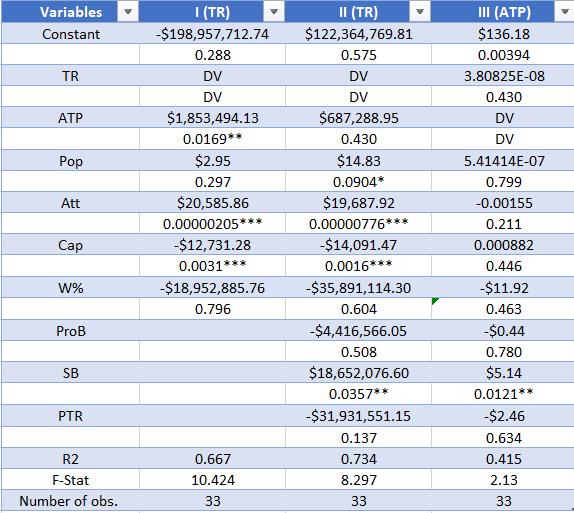

The empirical estimation results are presented in Table 3. The primary results displayed relationships between religiosity and environment and the dependent economic growth variable. The results of each of these regressions along with the cross variable, enviroreligion, which is a product of the two variables, are displayed below. In order to determine the success of the cross variable, we must see if the adjusted r squared raises to a significant degree from the two solo variable models. As we see in Table 3, the adjusted R-squared is the highest in model III, at .6606, but this is not enough of a difference from the adjusted R-squared’s found in model I and II respectively, at .6274 and .6595, to conclude that this difference would continue to be accurate using a larger data se

Table 3: Regression results

12

Economic Growth

Note: *** , **, and * denotes significance at the 1%, 5%, and 10% respectively. Standard errors in parentheses

Variables I Religion II Environment III Cross Religion Importance .6343** (.2424) Environment .4719*** (.102) EnviroReligion Cross .0061** (.0025) ln(GDP (y-1)) -3.0144 (5.1239) -6.5393 (6.1745) -2.5852 (6.0256) Pop Grow 3.097 (3.3877) .8029 (3.9241) 1.3526 (3.9868) Innovation -.2194*** (.0706) -.2972** (.1133) -.2335*** (.0869) Corruption -.5364 (.3686) -.3796 (.4323) -.4244 (.4085) Education .1153 (.2227) .1040 (.1581) .0572 (.1839) Infant Mort 1.4777*** (.4929) 1.3246** (.6432) 1.6877*** (.6265) Capital Formation .6896 (.4406) .1840 (.5706) .2489 (.5277) R2 0.6274 0.6595 0.6606 F-statistics 17.38*** 9.59*** 12.33*** Number of obs. 87 87 87

13

Both the religion and environment variables were found to have significance in their respective models at the 1% level. In the case of Religion, this parameter estimate displays a relationship in the same direction as Barro & McCleary (2003), showing that increased intensity of religious beliefs leads to higher levels of economic growth, ceteris paribus. The parameter estimate for the environmental belief factor is positive, displaying a positive relationship to economic growth, running contrary to the idea of the environmental-economic trade off suggested in Antweiler et al. (2001). This positive parameter estimate also is not accounted for by the results found in Grossman and Krueger (1995) and Jaffe et al. (1995), as these models all control for the innovation variable. The cross variable, Enviro-religion, analyzed in model three, is significant at the 5% level.

The natural log of GDP in the prior year was not found to be significant in any of the three models, which goes against the theory of convergence proposed in Barro (2003). Population growth was not found to have significance in any of the three models, although a larger population lag, longer than a year, was not utilized. This finding aligns with the findings of a study from Barlow (1994).

The innovation variable was found to be significant in all three models with a negative parameter estimate, at the 1%, 5%, and 1% level respectively. This parameter estimate directly contradicts the findings of Fetahi-Vehapi et al. (2015), who found a positive relationship between patent applications and economic growth. Both corruption and education were found to be insignificant in all of the regressions. Infant Mortality was found to be significant in all three models at the 1%, 5% and 1% level, respectively, with positive parameter estimates. The sign of this parameter estimate is counter intuitive to economic growth, but may have some relationship to the idea of convergence with more developed nations growing slower. Capital formation was not found to be significant in any of the models which contradicts the findings of FetahiVehapi et al. (2015), who found that capital formation rate was an important indicator of economic growth.

14

5.0 CONCLUSION

This study aims to expand upon the existing literature regarding the impacts of cultural values on economic growth by analyzing the effects of several cultural factors working together in one quantifiable variable. The major contribution of this study is the positive relationship discovered between positive attitudes towards the environment and economic growth. This relationship suggests that environmental protection may not have to come at the cost of positive economic outcomes, which could prove extremely beneficial to human society.

Policy makers should look to apply this study in informing policy decisions regarding environmental regulation of businesses. Protecting the environment is not found to have a negative relationship with economic growth in this study and therefore, environmental regulation may not be as harmful to the economy of a nation as previously estimated.

The major limitation of this study was the lack of availability of cultural variables due to the structure of the World Values Survey. Future research should look to analyze an increased number of cultural-cross variables, which quantify more than one cultural attitude. In addition, future studies should further explore the depth of certain cultural factors and their own individual aspects, to avoid oversimplification of factors like intensity of religious beliefs, or the importance of work and family in your life, etc.

15

Appendix A: Variable Description and Data Source

Acronym Description

Family Importance

Friends

Importance

Work Importance

Religion

Importance

% Responded important or rather important to question: “Important in Life: Family”

Data source

World Values Survey

% Responded important or rather important to question: “Important in Life: Friends”

% Responded important or rather important to question: “Important in Life: Work”

% Responded important or rather important to question: “Important in Life: Religion”

Hard-Work-Luck Scale Average of Responses measured on 1-10 scale that “Hard Work Brings Success”; where higher values indicate a view that success is more based on luck

Trust

Sum of % responded trust completely and trust somewhat to question: “ Trust: People you meet for the first time”

Would Serve

World Values Survey

World Values Survey

World Values Survey

World Values Survey

World Values Survey

% Would serve for their country's military World Values Survey

Environment

% Believe environment should be given priority over economic growth interests

GDP

GDP

World Values Survey

World Bank

16

GDP (y-1) GDP in the previous year

Econ Grow

Change in GDP from previous to current year

Pop Grow

World Bank

calculated

Change in population from previous to current year calculated

Patents Per 100k The number of patent applications by residents per 100k residents

Corruption The levels of corruption present in the nation (higher is less corrupt)

Education % of people who completed secondary school

Infant Mortality number of infant deaths per 1,000 live births

Cap Form gross fixed capital formation rate

World Bank

Transparency international

World Bank

World Bank

World Bank

17

Acronym

Religion

Appendix B- Variables and Expected Signs

% Responded important or rather important to question: “Important in Life: Religion”

Average intensity of religious beliefs +

Environment

% Believe environment should be given priority over economic growth interests

Percentage believe in environment over economic interestsReligion-enviro

product of the Religion and Environment variables.

GDP (y-1)

in the previous year The size of the country’s economy in the previous year

Econ Grow Growth rate of GDP from previous year to year of survey

Pop Grow Growth rate of population from previous year to year of survey

Patents Per 100k

The growth of the nations economy

Increases in human capital +

The number of patent applications by residents per 100k residents Innovation levels +

it captures Expected sign

Variable Description What

cross

Represents

+/GDP GDP

the

economy N/A

The

a relationship between the two variables

The size of

country’s

GDP

-

N/A

18

Corruption

Average perceptions of levels of corruption

Education

% of people who completed secondary school

Infant Mortality number of infant deaths per 1,000 live births

Cap Form gross fixed capital formation rate

The levels of corruption present in the nation (higher is less corrupt)

Average levels of education +

Proxy for average quality of healthcare -

the increase in non human capital +

+

19

Anyanwu, J. C. (2014). Factors affecting economic growth in Africa: Are there any lessons from China? African Development Review 26(3), 468-493.

Antweiler, W., Copeland, B. R., & Taylor, M. S. (2001). Is free trade good for the environment? American Economic Review, 91(4), 877-908.

Barlow, J (2023). Economic Growth and Cultural Attitudes Towards Women: An Empirical Investigation. [Unpublished honors thesis]. Bryant University.

Barlow, R. (1994). Population Growth and Economic Growth: Some More Correlations. Population and Development Review, 20(1), 153–165. https://doi.org/10.2307/2137634

Barro, R.J. (2003). Determinants of economic growth in a panel of countries. Annals of Economics and Finance 4, 231–274. http://down.aefweb.net/WorkingPapers/w505.pdf

Checherita-Westphal & Rother. (2012). The impact of high government debt on economic growth and its channels: An empirical investigation for the Euro area. European Economic Review 56, 1392-1405.

Fernández, R., Fogli, A., & Olivetti, C. (2004). Mothers and sons: Preference formation and female labor force dynamics. Quarterly Journal of Economics, 119(4), 1249 –99.

Fernández, R & Fogli, A. (2005). Culture: An empirical investigation of beliefs, work, and fertility. American Economic Journal: Macroeconomics, American Economic Association, 1(1), 146-177. https://ideas.repec.org/a/aea/aejmac/v1y2009i1p146-77.html

Ferraro, P. & Cummings, R. (2007). Cultural diversity, discrimination, and economic outcomes:

BIBLIOGRAPHY

20

An experimental analysis. Economic Inquiry, 45(1), 217-232. https://doi.org/10.1111/j.14657295.2006.00013.

Fetahi-Vehapi, Sadiku, & Petkovski. (2015). Empirical analysis of the effects of trade openness on economic growth: An evidence of south east European countries. Procedia Economics and Finance 19, 17-26.

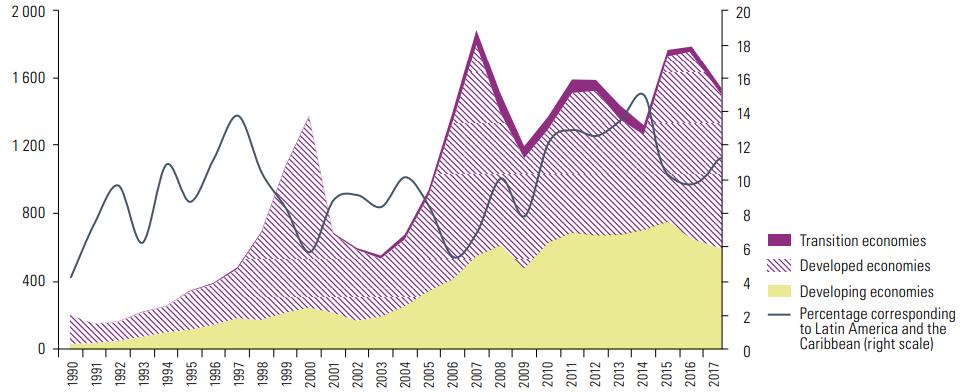

Grossman, G. M., & Krueger, A. B. (1995). Economic growth and the environment. The Quarterly Journal of Economics, 110(2), 353-377.

Guiso, L., Sapienza, P., & Zingales, L. (2006). Does culture affect economic outcomes? Journal of Economic Perspectives, 20(2). 23-48.

Ichino, A. & Maggi, G. (2000). Work environment and individual background:

Jaffe, A. B., Peterson, S. R., Portney, P. R., & Stavins, R. N. (1995). Environmental regulation and the competitiveness of US manufacturing: What does the evidence tell us? Journal of Economic Literature, 33(1), 132-163.

Explaining regional shirking differentials in a large italian firm. Quarterly Journal of Economics, 115(3). 1057–90.

21

Fenway and Crime: Opportunity, Geographic Differences, and Team Rivalry at Boston Red Sox Games

Cole McGovern

Abstract:

Although hosting professional sports are often seen as a financial benefit for cities, there are also associated costs. This paper investigates the possibility of interdependence between a variety of crimes and home game days of the Boston Red Sox. When adjusting for game attendance and length, minor assaults charges such as disorderly conduct and simple assault increase city-wide during game days. Despite this, all crime around the immediate stadium area decreases in volume. Additionally, this study examines differences in geographical impacts and crime levels, when a game was played, and games played against the New York Yankees, their historic rival

JEL Classification: L83, R23, Z21

Keywords: baseball, MLB, Boston, crime, team rivalry

Bryant University, 1150 Douglas Pike, Smithfield, RI02917. Phone: (860)-942-3918.

Email: cmcgovern3@bryant.edu.

22

1.0 INTRODUCTION

While Major League Baseball (MLB) has generally been seen as a family friendly sport, not many previous studies have not investigated the link between crime and hosting a professional baseball game. Several studies, however, have linked football and soccer to increasing crime rates. This gap in literature could be the result that baseball is considered a family friendly spectator sport and not associated with rioting sometimes seen during soccer or college football games (Seff, 2015). However, MLB games may result in an increase in crime due to a larger attendance and increased opportunity.

This study aims to enhance the overall understanding of professional sports impact on crime rates. From a policy perspective, this analysis is important because could lead to better crime prevention policies and programs to reduce crime caused by sports. Using nearly five years of daily data from Boston, MA, we examine how crime rates are likely to change in Boston during Red Sox game days.

Crimes are examined based on likely perpetrators (disorder offenses) and likely victims (pecuniary offenses). An opportunity variable also considers attendance and game length in attempts to measure the elasticity of the crime during game time. Results indicate that Boston Red Sox games are likely responsible for increases in all common crime rates in Boston by 2.38%, Disorderly Conduct by 18.95%, and Simple Assault Charges by 6.67%.

When analyzing the impact by district, all crime in the districts surrounding Fenway Park decreased by 1.5%. Robbery also decreases by 6.5%, and Burglary by 16.8% in the immediate stadium area. When playing against teams that aren’t the New York Yankees, city-wide crime reduces by 0.95% and Burglary also decreases by 4.31%. Day games reduce city-wide Burglary by 4.94%.

This paper was guided by three research objectives: First it investigates the possibility of interdependence between game days and city-wide crime using time-series data; Second, it incorporates the opportunity-proxy model to examine the influence of location on crime; We also utilize the opportunity-proxy model to examine the impact of games against rival teams and the time of the games impact on city-wide crime. Although there has been similar

23

empirical work done in the past, no previous literature has examined a city with such a relatively low crime rate such as Boston. This paper successfully fills this void.

The rest of the paper is organized as follows: Section 2 provides an overview of trends. Section 3 gives a brief literature review. Section 4 outlines the empirical model, data, and estimation methodology. Finally, section 5 presents and discusses the empirical results. This is followed by a conclusion in section 6.

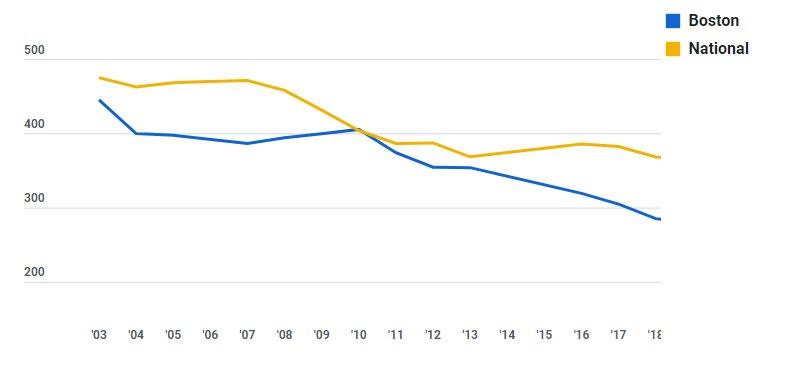

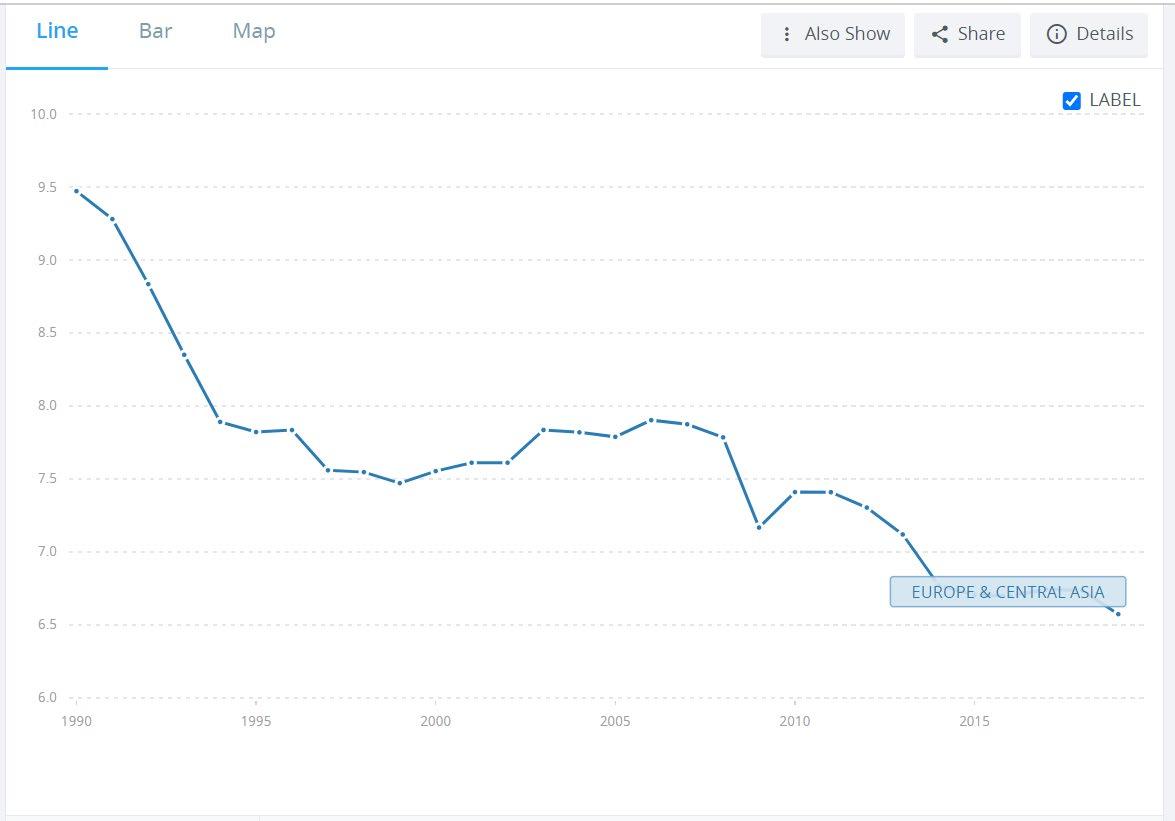

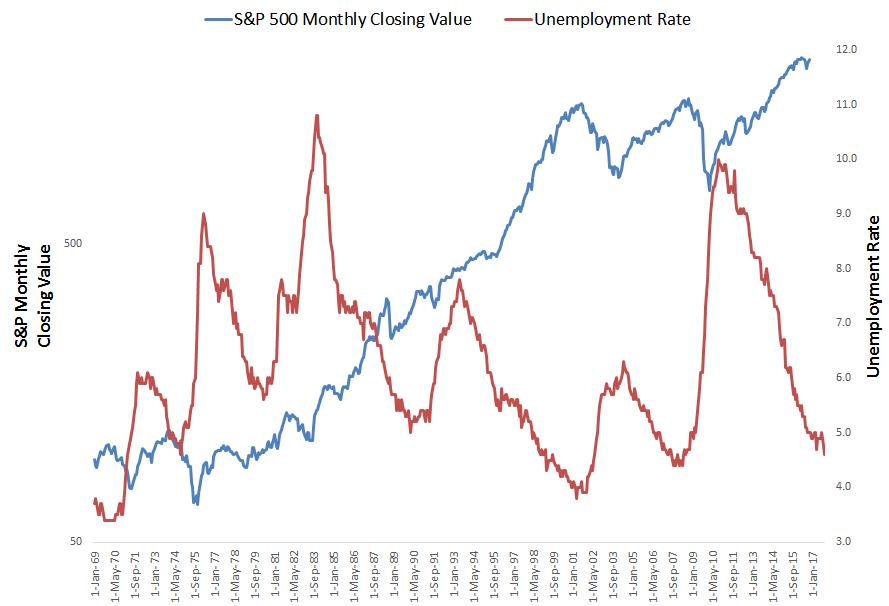

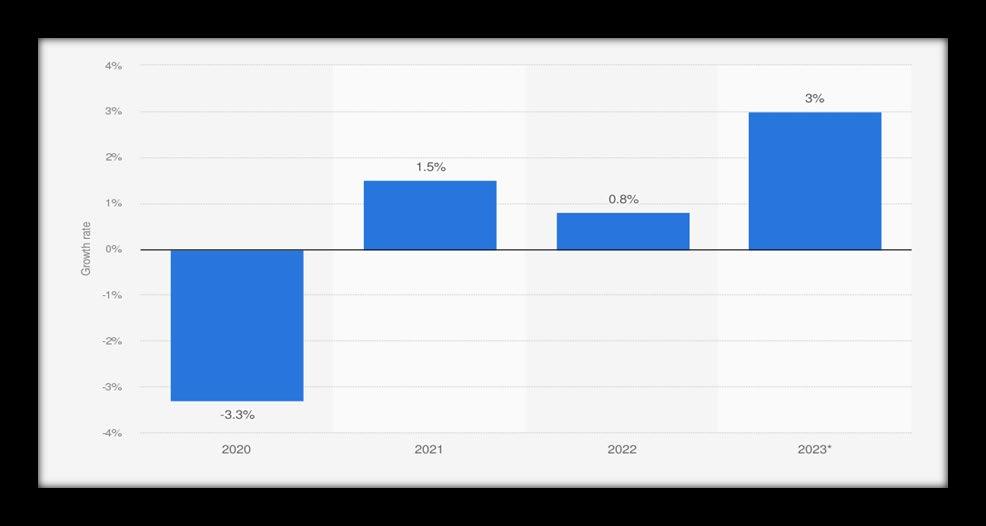

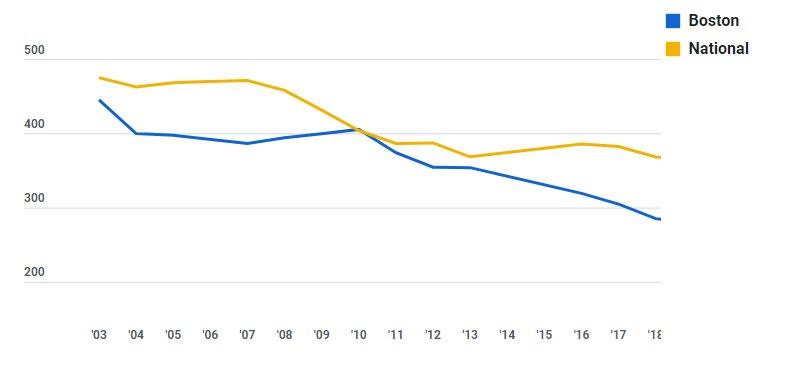

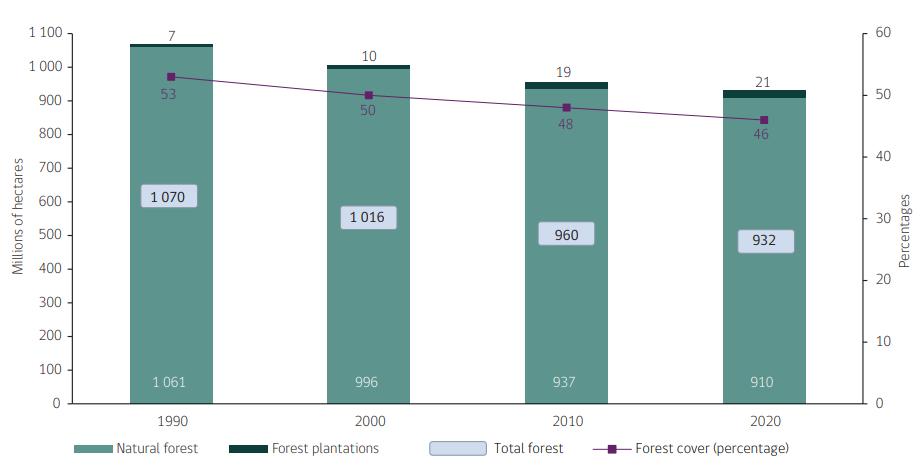

2.0 TRENDS OF BOSTON CRIME

Figure 1 shows that from 2003 to 2018, the crime rate in Boston has been on a clear downward trend with a significant decrease in the number of violent crimes. Although the national crime rate has also decreased during the same period, Boston’s crime rate has dropped relatively more. According to the Boston Police Department, the city's crime rate has dropped more than 25% since 2010. In contrast, the national crime rate has only decreased by less than 10% since. The decrease in the national crime rate can likely be attributed to improving economic conditions reducing poverty. The decrease in Boston can likely be attributed to increased policing efforts throughout the city.

Source: Federal Bureau of Investigation’s Uniform Crime Reports

Figure 1: Violent Crime Rate (Boston/National)

Figure 1: Violent Crime Rate (Boston/National)

24

Figure 2 shows that from 2016 to 2019, crime rates in Boston for some of the UCF Part I crimes such as Robbery, Burglary, Motor Vehicle Theft, Vandalism, and Disorderly Conduct have been massively trending downward. Since 2016, Robbery has decreased by 36.6%, Burglary by 32.7%, Motor Vehicle Theft by 23.6%, Vandalism by 29.8%, and Disorderly Conduct by 71.6%. Property crime in Boston has been occurring at a decreasing rate.

Figure 3 shows that from 2015 to 2020, the incident daily average for all crimes in Boston are higher on game days. Although Boston's crime rate has decreased significantly over the past decade, the city still faces significant challenges in reducing crime. For example, some districts have historically experienced higher levels of violence. Crime rates can also vary widely from one year to the next. As a result, it is important to examine long-term trends to get a more accurate picture of the overall trajectory of crime in each area.

Figure 2: Boston Yearly Crime Totals

Source: Boston Police Department

0 1000 2000 3000 4000 5000 6000 2016 2017 2018 2019 Robbery Burglary Motor Vehicle Theft Vandalism Disorderly Conduct 25

Incident Daily Average

Source: Boston Police Department

3.0 LITERATURE REVIEW

The relationship between sports and higher levels of crime can be explained by the team rivalry, alcohol consumption, disappointment over the game result, and an increased opportunity to commit during game times. When examining previous literature, violent crimes and aggressive behavior have been connected to European soccer. Ward (2002) suggests that the lower levels of violence in the United States are result of the lower popularity of soccer and a more diverse base of spectators. Marie (2016) finds a significant relationship between attendance and crime, with about a 4% increase in crime for each 10,000 attendees at a soccer match. In European soccer, a fan’s allegiance to a team is typically determined by where they grew up or familial ties Since professional teams in the United States typically have a shorter history when compared to European soccer and don’t have as much of a local pull when compared to soccer. Roberts and Benjamin (2000) state that, “The idea of Manchester United being ‘sold’ to another city is unthinkable in the United Kingdom”. However, teams are frequently sold in the United States.

Although the lack of deep team rivalries in the United States may be an outcome of the mobility of professional sports teams, violence and aggression have still been common enough make policing at sports events extremely challenging (Madensen & Eck, 2008). Roberts and Benjamin (2000) also believe that sports with highly violent player behavior

Figure 3: Incident Daily Average (Game Day/Non-Game Day)

0 10 20 30 40

Robbery Aggrivated Assault Burglary Larceny Motor Vehicle Theft Vandalism Disorderly Conduct Simple Assault

26

Game Day (n = 369) Non-Game Day (n = 1367)

reflect onto their spectators. For example, sports such as American football and hockey in the United States are often seen to have high levels of unpunished violence on the field. Whereas European soccer or basketball games highly regulate violent player behavior. Since baseball is a sport that highly regulates violent player behavior, we should expect to see less assault charges at MLB games when compared to other sports. On the other hand, MLB games may yield higher rates of aggressive spectator behavior because baseball is one of the oldest professional sports in the United States. Baseball is considered to be “Americas Game” and many teams in the MLB have historical roots dating before the 19th century. This makes it by far the oldest popular sport in the United States. Only a limited amount of MLB teams relocate when compared to other leagues like the NFL or NBA, which may explain why higher levels of historical team rivalries exist in the MLB. Due to this high amount of team rivalry in MLB, we should expect to see higher crime rates on games played against a rival team

When examining the levels of alcohol consumption at sports games, there has been an established connection between alcoholic intake and increased criminal behavior. Some increased behavior includes assaultive behavior, property damage, and vandalism (Boden, Fergusson, & Horwood, 2013; Ostrowsky, 2014). Card and Dahl (2011) also find that crime may not just increase in the immediate stadium area, but that spectators in a variety of locations may be impacted due to a big win or loss One sample found that 60% of males ages 20-35 at an MLB are likely to show evidence of alcohol consumption. By the fifth inning, 13% were legally impaired (Wolfe, Martinez, & Scott, 1998). When combining this information with evidence of excessive alcohol consumption leading to lower self-control and the large amount of people in a concentrated area, we should expect to see an increased rate of aggressive behavior at MLB games.

Cohen and Felson in 1979 developed the Routine Activities Theory (RAT). RAT useful to explain the framework of the opportunity for crime. Despite declining poverty rates in the 1970s, property offenses in the United States increased. Homes were becoming increasingly suitable targets for burglaries as supervision was reduced. This is a result of an increased female participation in the labor market, reducing neighbor supervision.

27

According to Cohen and Felson (1979), crimes occur when three elements are fulfilled: there is a motivated offender, a suitable target, and a lack of supervision. The likelihood of crime occurring can change depending on the supply of opportunities. Relating this information to professional sports games, the supply of suitable targets increases as their property is unsupervised MLB teams average around 30,000 spectators per game and the majority travel by vehicle (Humphreys & Pyun, 2018). Vehicles likely sit concentrated in parking garages and unattended during games. Those who arrive late often must park on side streets and areas with even less supervision. Spectators who live outside the area may not be very familiar with local crime patterns. Many attendees may not take typical precautions that many locals may take, such as putting valuables out of sight. The average MLB also game lasts over 3 hours and parking garages and streets heavily unsupervised. All these factors make spectators at MLB games suitable targets to be victims of crime.

Although Baumann, Ciavarra, Englehardt, and Matheson (2012) found no evidence of professional sports teams leading to increased property or violent crimes, prior studies have found that robberies increase during NBA games and street crimes focused on pecuniary gain are likely to increase because a greater number of targets present themselves in a highly concentrated area. (Yu, McKinney, Caudill, & Mixon, 2016). We also must consider the time at which the game is played. Games played during evening hours may provide an increase in opportunities due to the darkness reducing supervision. This will likely increase the rate for property offenses, but likely won’t impact fan behavior. Alcohol use can also increase the risk of theft as it reduces a person’s situational awareness All these factors may lead them to become easy victims of theft or robbery. Rees and Schnepel (2009) concluded that home College football games are associated with a 9% increase in Assaults, 18% increase in Vandalism, 13% increase in DUI’s, and a 41% increase in Disorderly Conduct charges. However, away games did not significantly affect local crime levels. As a result, we should expect that property offenses, especially those focused on vehicles, are likely to increase during MLB game days.

It is important to note that the Red Sox provide additional security by hiring off-duty police officers and the city increases supervision around the stadium during game days, especially

28

against rival teams. Even an increase in crime around the stadium may not lift city crime levels if local offenders purposively travel to the stadium area to commit offenses. As a result, it will require a substantial increase in crime around the stadium area on game days to significantly change citywide crime levels in a big city such as Boston. Overall, we expect that property crime levels (such as larceny and motor vehicle theft) and minor aggressive offenses directly around Fenway Park will increase during game days

4.0 DATA AND EMPIRICAL METHODOLOGY

4.1 Data

The study uses annual data time-series data from 2015 to 2020. Boston daily crime data was collected from Boston Police Department of Innovation and Technology. Data was collected as far back as they offered (June 15th, 2015) to the date before the United States lockdown for COVID-19 (March 13th, 2020). The Boston Police Department uses Uniform Crime Reporting (UCR) to ensure a degree of consistency in recording crime All major crime categories (Part I crimes) were examined in this study as they report a reasonable daily frequency. For example, homicide is not considered to be a part of Part I crimes as they rarely occur at a daily level. All Part I crimes include robbery, aggravated assault, burglary, larceny, and motor vehicle theft, simple assault, disorderly conduct, and vandalism.

Boston was mainly selected due to the availability of their data. However, they have a relatively low crime rate when compared to other major cities. Although another study has analyzed the impact on a city with high crime rates, St. Louis, nobody has analyzed a city with lower crime rates to compare results. The Boston Red Sox are one of the main teams in the MLB due to their long history and loyal local fan base. This ensures a consistent high attendance and heated rivalry games against the New York Yankee’s. The average attendance at Red Sox games is slightly above 36,000 per game.

Instead of using distance bands, we group crime into four categories based on their relationship to Fenway Park: Fenway, Near Fenway, City Center, and City-Wide. Crime will be grouped into Fenway if it occurs in Fenway/Kenmore (D-4). Near Fenway if it

29

occurs in Allston/Brighton (D-14), Mason Hill/Roxbury (B-2), South Boston (C-6), and City Center (A-1). City center if occurs in A-1 and all districts if occurred city-wide. See Figure 4 for more information on district layouts in Boston.

Source: ResearchGate

Figure 4: Boston District Map

Figure 4: Boston District Map

30

The Red Sox play schedule was retrieved from Baseball-Reference as they post historical MLB schedules (https://www.baseball-reference.com). Included are the game dates, the name of the opposing team, whether a play occurred home or away, whether the game was played at day or night, attendance numbers, and game duration. Both regular season and postseason games are included. Home game days for the two other professional sports teams in Boston, the Celtics (NBA) and the Bruins (NHL) act as control variables. We generated binary variables for all home games for MLB, NHL and NFL games.

Because previous studies have found that daily crime counts are impacted by climatic variation such as Cohn & Rotton (2000), the current study includes a variety of weather data such as precipitation, snowfall, temperature, windspeed, hail, fog, and thunder. Daily climate data was collected from the National Oceanic and Atmospheric Administration at Boston Logan International Airport. Logan is located roughly 5.6 miles away from Fenway Park and has some of the most accurate weather data in the region.

Additional control variables are generated to account for time-varying influences on crime. Most daily crime studies incorporate binary indicators for federal holidays such as Cohn & Rotton (2003). Summary statistics for the data are provided in Table 1.

31

Table 1 Summary Statistics

4.2 Empirical Model

The analytical strategy of this study rests on time-series modeling. The distribution of crimes counts in our data was nonnormal due to the low frequency at which crimes occur on a daily level. Since most of the variables have a higher standard error when compared to their mean, a Negative Binomial Generalized Linear Model (GLM) employing a log link must be used instead of a traditional OLS regression.

Variable Observation Mean Std. Dev. Min Max Opportunity 454 7.21 1.467 4.73 16.82 RedSoxHome 1738 0.212 0.409 0 1 CelticsHome 1738 0.010 0.101 0 1 BruinsHome 1738 0.127 0.333 0 1 Precipitation 1738 0.118 0.294 0 2.7 Snowfall 1738 0.107 0.786 0 14.5 Temperature 1738 47.416 15.947 0 108 Temperature2 1738 2502.449 1475.542 0 11664 Windspeed 1738 11.059 3.827 3.2 38.1 Hail 1738 0.005 0.072 0 1 Fog 1738 0.083 0.276 0 1 Thunder 1738 0.047 0.212 0 1 Holiday 1738 0.031 0.174 0 1 AllP1 1738 73.932 15.62 0 133 Robbery 1738 3.534 2.15 0 12 Aggravated Assault 1738 6.473 2.99 0 23 Burglary 1738 5.665 3.06 0 20 Larceny 1738 30.372 7.70 0 58 Motor Vehicle Theft 1738 3.819 2.27 0 14 Vandalism 1738 11.845 4.72 0 35 Disorderly Conduct 1738 0.939 1.08 0 8 Simple Assault 1738 13.285 4.48 0 39 32

We modify Mare & Blackburn’s (2019) model on baseball affecting citywide crime as shown:

Ln E (crimet) = τt + β0 + β1RedSoxHomet + β2CelticsHomet + β3BruinsHomet + β4Precipitationt + β5Snowfallt + β6Temperaturet + β7Temperature2t + β8Windspeedt + β9Hailt + β10Fogt + β11Thundert + β12Holidayt + ε

The equation above describes that the expected level of crime at day (t) is the predicted outcome of: Binary variables for Boston Red Sox home games (RedSoxHome), Boston Celtics home games (CelticsHome), and Boston Bruins home games (BruinsHome). Weather controls such as precipitation (in), snowfall (in), temperature (F), a squared temperature term to account for the nonlinear effects of temperature, and windspeed (MPH). Lastly, binary variables that may impact game attendance (hail, fog, thunder). Federal holidays are also included as per Cohn & Rotton (2003).

Mare & Blackburn’s (2019) study also include an opportunity variable in attempts to capture the elasticity of crime:

The goal of the opportunity variable is to capture the changing crime opportunities on a game day (t) which are measured as the result of which the Red Sox either play at home (1) or do not play a home game (0) multiplied by attendance and game length (in minutes). Although not every additional attendee or minute of game creates an actual crime opportunity, it may increase the chance of a crime being committed. Although output is not listed due to the lack of significant results, models for Table 2 were also run using the opportunity variable.

33

5.0 EMPIRICAL RESULTS

The empirical estimation results for game days and city-wide crime are presented in Table 2. The empirical estimation shows that when the Red Sox play at home, city-wide common crime rates in Boston increase by 2.38% with significance at the 5% level, Disorderly Conduct increases by 18.95% with significance at the 1% level, and Simple Assault Charges by 6.67% with significant at the 1% level

34

Table 2: Game Day and City-Wide Crime

Note: ***, **, and * denotes significance at the 1%, 5%, and 10% respectively. Standard errors in parentheses

The empirical estimation results for game days and geographic crime differences are presented in Table 3 The empirical estimation shows that all crime in the districts surrounding Fenway Park decreased by 1.5% with significance at the 10% level. Robbery also decreases near Fenway by 6.5% with significance at the 10% level. Burglary

Dependent Variables All Part 1 Crimes Robbery Aggravated Assault Burglary Larceny Motor Vehicle Theft Vandalism Disorderly Conduct Simple Assault RedSoxHome 0.0237 (0.0116)** -0.0284 (0.0391) 0.0377 (0.0275) -0.0452 (0.0335) 0.0122 (0.0148) 0.035 (0.0354) 0.0246 (0.0246) 0.1895 (0.0699)*** 0.0667 (0.0205)*** CelticsHome -0.0777 (0.0445)* -0.1422 (0.1567) -0.0607 (0.1059) -0.1153 (0.1345) -0.1475 (0.0587)** -0.0611 (0.1429) 0.0252 (0.0922) -0.1735 (0.2765) -0.0067 (0.0753) BruinsHome 0.0065 (0.0136) 0.0019 (0.046) 0.0176 (0.0335) -0.0543 (0.0407) 0.0271 (0.0174) -0.0204 (0.0449) -0.0353 (0.0294 -0.0409 (0.0903) 0.027 (0.0247) Precipitation -0.0595 (0.017)*** 0.0291 (0.0561) -0.0913 (0.0421)** 0.0116 (0.0459) -0.0514 (0.0219)** -0.0287 (0.0544) -0.1114 (0.0366)*** 0.0093 (0.1041) -0.0926 (0.0317)*** Snowfall -0.0253 (0.0066)*** 0.0005 (0.0218) -0.0111 (0.017) -0.0354 (0.0212)* -0.0437 (0.0092)*** 0.0272 (0.0207) -0.0149 (0.0139) -0.0141 (0.0428) -0.0353 (0.0129)*** Temperature 0.0099 (0.0015)*** 0.0139 (0.0053)** * 0.0167 (0.0039)*** 0.0092 (0.0045)** 0.0072 (0.0019)*** 0.0019 (0.0049) 0.0135 (0.0033)*** 0.0305 (0.0108)*** 0.0116 (0.0028)*** Temperature2 -0.00004 (0.00001)*** -0.0001 (0.0001)* -0.0001 (0.0001)** -0.0001 (0.0001) -0.0001 (0.0001) 0.0001 (0.0001) 0.0001 (0.0001)** 0.0002 (0.0001)** 0.0001 (0.0001)*** Windspeed -0.0028 (0.0012)** -0.0072 (0.0041)* -0.0046 (0.003) -0.0059 (0.0035)* -0.0053 (0.0015)*** -0.0107 (0.0039)*** 0.0041 (0.0026) 0.0031 (0.0078) 0.0017 (0.0022) Hail -0.0928 (0.0637) -0.0507 (0.2135) 0.1199 (0.1518) 0.0362 (0.1535) -0.123 (0.054) -0.2535 (0.2347) -0.226 (0.1446) -0.5539 (0.5276) -0.0147 (0.116) Fog -0.0124 (0.0174) -0.0551 (0.0592) 0.0171 (0.0418) -0.0516 (0.051) -0.0035 (0.0222) -0.1577 (0.0572)*** 0.0306 (0.0365) 0.0743 (0.1071) -0.0123 (0.0319) Thunder -0.0935 (0.022) -0.0323 (0.0741) -0.0552 (0.0559) -0.0419 (0.0635) -0.0051 (0.028) -0.0369 (0.0672) -0.0045 (0.0466) 0.0592 (0.1314) 0.0072 (0.0399) Holiday -0.0995 (0.0255)*** -0.0557 (0.056) 0.1004 (0.0559)* -0.2193 (0.0783)*** -0.1922 (0.034)*** -0.0251 (0.0502) 0.0073 (0.0532) 0.0505 (0.1564) -0.0655 (0.0701) 35

decreases by 16.8% in the immediate stadium area with significance at the 10% level. Other significant variables include Celtics games reducing city-wide crime by 7.78% with significance at the 10% level and city-wide Larceny by 14.75% with significance at the 5% level. All weather variables showed some form of significance with worse weather decreasing crime rates. Lastly, federal holiday’s decreases the likelihood of property crimes such as Burglary and Larceny.

Note: ***, **, and * denotes significance at the 1%, 5%, and 10% respectively. Standard errors in parentheses

Dependent Variables Fenway Near Fenway City Center All Part 1 Crimes -0.0130 (0.0114) -0.0155 (0.0081)* -0.0154 (0.0147) Robbery 0.0112 (0.0492) -0.0658 (0.0357)* 0.0102 (0.058) Aggravated Assault -0.0559 (0.0475) -0.0068 (0.0244) -0.0274 (0.0516) Burglary -0.1681 (0.0662)** -0.0442 (0.0289) -0.0671 (0.0721) Larceny 0.0159 (0.0147) -0.0199 (0.0124) -0.0303 (0.0193) Motor Vehicle Theft -0.0609 (0.0583) 0.0086 (0.0345) 0.0365 (0.0667) Simple Assault 0.0374 (0.0252) -0.0053 (0.0164) -0.0094 (0.031) Vandalism 0.0206 (0.034) -0.0027 (0.0197) 0.0153 (0.0411) Disorderly Conduct -0.0661 (0.0861) -0.0032 (0.0568) 0.0912 (0.0735)

Table 3: Geographic and Crime Differences, Game Day Coefficients Only

36

The empirical estimation results for game days and geographic crime differences are presented in Table 4. The empirical estimation shows that when playing against teams that aren’t the New York Yankees, city-wide crime in Boston reduces by 0.95% with significant at the 10% level. Burglary also decreases city-wide by 4.31% with significant at the 10% level These estimates are inconsistent with Mare & Blackburn’s (2019) results as crime in the immediate area around the stadium is expected to increase.

Note: ***, **, and * denotes significance at the 1%, 5%, and 10% respectively. Standard errors in parentheses

The empirical estimation results for game days and geographic crime differences are presented in Table 5 The empirical estimation shows that day games reduce city-wide Burglary by 4.94% with significant at the 10% level. This estimate is inconsistent with previous literature as there are a lack of significant connecting night games to increased property crime.

Table 4: Team Rivalry—Red Sox Versus Yankee’s—Game Day Coefficients Only.

Dependent Variables All Part 1 Crimes Robbery Aggravated Assault Burglary Larceny Motor Vehicle Theft Simple Assault Vandalism Disorderly Conduct Yankee’s 0.0131 (0.0118) .0044 (.0557) -0.0226 (0.0429) -0.0144 (0.047) 0.0212 (0.0198) -0.0262 (0.0534) 0.0225 (0.0286) 0.0426 (0.0286) -0.2103 (0.1311) Other teams -0.0095 (0.0055)* -.0397 (.0255) -0.0016 (0.0166) -0.0431 (0.0221)* -0.0127 (0.008) 0.0045 (0.0224) 0.0066 (0.0117) -0.0069 (0.0148) -0.0017 (0.043) 37

Table 5: Time of Day—Night Versus Day Games—Game Day Coefficients Only.

Note: ***, **, and * denotes significance at the 1%, 5%, and 10% respectively. Standard errors in parentheses

6.0 CONCLUSION

Although our study did not find significant evidence, such as Mare & Blackburn’s (2019) study, that home games result in an increase of expected property crimes, we did find a significant relationship between home games resulting in an increase of expected minor assault charges (Disorderly Conduct and Simple Assault). Boston also had a much lower expected increase in common crime when compared to Mare & Blackburn’s (2019) study performed on St. Louis (15%).

Policy to reduce MLB games impact on crime should focus primarily on crowd control in the immediate stadium area to reduce the Disorderly Conduct and Simple Assault charges around the stadium. Regulations related to alcohol sales at games will likely reduce the likelihood of minor assault charges. We also echo Mare and Blackburn’s (2019) recommendations on increasing surveillance on parked vehicles since they appear to be at especially high-risk during games. Alerting spectators to park vehicles in well-supervised areas and to hide personal belongings may decrease property crimes on game days.

The main limitation of this study relates to the credibility of city-wide results. Boston is a large city that constantly hosts other events that could result in increases in crime. Trying to account for all variables affecting city-wide crime is nearly impossible and must be

Dependent Variables All Part 1 Crimes Robbery Aggravated Assault Burglary Larceny Motor Vehicle Theft Simple Assault Vandalism Disorderly Conduct Day game -0.0057 (0.0088) -0.0516 (0.0441) 0.0060 (0.0282) -0.0494 (0.0299)* 0.0011 (0.0129) 0.0056 (0.0362) 0.0109 (0.0182) -0.0112 (0.0232) -0.1079 (0.0781) Night game -0.0083 (0.006) -0.0274 (0.0268) -0.0063 (0.0188) -0.0419 (0.0262) -0.0155 (0.0094) 0.001 (0.0254) 0.0067 (0.0133) 0.0059 (0.0161) 0.0226 (0.0479) 38

assumed to occur randomly on game days and non-game days. As a result, the true impact of MLB games on crime could be much higher as analyzing the city-wide impact can reduce game effects to such small levels. Another limitation of the study is that cities and MLB teams and cities keep their police and security staffing private, so including it as a control variable is nearly impossible. However, we do know that the Boston Red Sox increase security on game days, especially for rival games against the Yankee’s.

Although more analysis is needed, Boston’s lack of an increase in property crimes on game days is likely result of having stronger surveillance over personal property and should be strived to be replicated in other major cities.

39

Appendix A: Variable Description and Data Source

Acronym Description

Opportunity Proxy variable calculated based on game attendance & length

Data source

RedSoxHome Binary variable for when Boston Red Sox play at Fenway Park

CelticsHome Binary variable for when Boston Celtics play at TD Garden

BruinsHome Binary variable for when Boston Bruins play at TD Garden

Precipitation Daily precipitation in inches

Calculated based on attendance & game length data from BaseballReference

Baseball-Reference

Basketball-Reference

Snowfall Daily snowfall in inches

Hockey-Reference

National Oceanic and Atmospheric Administration

National Oceanic and Atmospheric Administration

Temperature Daily average temperature

National Oceanic and Atmospheric Administration

Temperature2 Squared temperature term

Calculated based on data from the National Oceanic and Atmospheric Administration

Windspeed Daily average windspeed in miles per hour

National Oceanic and Atmospheric Administration

Hail Binary variable for when hail occurs

National Oceanic and Atmospheric Administration

40

Fog Binary variable for when fog occurs

National Oceanic and Atmospheric Administration

Thunder Binary variable for when thunder occurs

National Oceanic and Atmospheric Administration

Holiday Binary variable for if the day is a Federally recognized Holiday

AllP1 Crimes of reasonable daily frequency: Robbery, Aggravated Assault, Burglary, Larceny, Motor Vehicle Theft, Vandalism, Disorderly Conduct, and Simple Assault

Robbery Taking of property unlawfully

Aggravated Assault

Unlawful attack of one person on another

US Department of Commerce

Boston Police Department of Innovation and Technology

Boston Police Department of Innovation and Technology

Boston Police Department of Innovation and Technology

Burglary Unlawfully entry into a building with intent to commit a crime

Larceny Theft of personal property

Boston Police Department of Innovation and Technology

Boston Police Department of Innovation and Technology

Motor Vehicle Theft Theft of a motor vehicle

Vandalism Deliberate destruction of public property

Boston Police Department of Innovation and Technology

Boston Police Department of Innovation and Technology

Disorderly Conduct Disturbing the peace; attempt to cause public alarm

Simple Assault Causing physical harm to another person

Boston Police Department of Innovation and Technology

Boston Police Department of Innovation and Technology

41

BIBLIOGRAPHY

Baumann, R., Ciavarra, T., Englehardt, B., & Matheson, V. (2012). Sports Franchises, Events, and City Livability: An Examination of Spectator Sports and Crime Rates. The Economic and Labour Relations Review, 23(2), 83-97.

Boden J. M., Fergusson D. M., Horwood L. J. (2013). Alcohol misuse and criminal offending. Drug and Alcohol Dependence, 128, 30–36.

Cohen L., Felson M. (1979). Social change and crime rate trends: A routine activity approach. American Sociological Review, 44, 588–608.

Cohn E. G., Rotton J. (2003). Even criminals take a holiday. Journal of Criminal Justice, 31, 351–360.

Card D, Dahl G. (2011). Family Violence and Football: The Effect of Unexpected Emotional Cues on Violent Behavior. The Quarterly Journal of Economics, 126(1), 103–143.

Humphreys B. R., Pyun H. (2018). Professional sports and traffic congestion: Evidence from US cities. Journal of Regional Science

Madensen T. D., Eck J. E. (2008). Spectator violence in stadiums. Washington, DC: Office of Community Oriented Policing Services (COPS).

Marie O. (2016). Police and thieves in the stadium: Measuring the (multiple) effects of football matches on crime. Journal of the Royal Statistical Society: Series A, 179, 273–292.

Ostrowsky M. R. (2014). The social psychology of alcohol use and violent behavior among sports spectators. Aggression and Violent Behavior. 19, 303–310.

42

Roberts J. V., Benjamin C. J. (2000). Spectator violence in sports: A North American perspective. European Journal on Criminal Policy and Research. 8, 163–181.

Rees, D. I., and Schnepel, K. T. (2009). College Football Games and Crime. Journal of Sports Economics. 10(1), 68–87.

Seff M. (2015) 20 Reasons why baseball is better than football. Draft America. http://draftamerica.com/20-reasons-why-baseball-is-better-than-football/

Ward E. R. (2002). Fan violence. Social problem or moral panic? Aggression and Violent Behavior. 7, 453–475.

Wolfe J., Martinez R., Scott W. A. (1998). Baseball and beer: An analysis of alcohol consumption patterns among male spectators of major league sporting events. Annals of Emergency Medicine, 31, 629–632.

Yu Y., Mckinney C. N., Caudill S. B., Mixon F. G. (2016). Athletic contests and individual robberies: An analysis based on hourly crime data. Applied Economics. 48, 723–730.

43

Empirical Analysis of Firearm-Related Deaths

in the United States Based on Sex, Race, and Age.

Dominick DaCruz

Abstract:

This empirical study examines firearm deaths via sex, race, and age in the United States. They have a look at making use of information from dependable assets such as the Centers for Disease Control and Prevention and the National Vital Statistics System. Descriptive and theoretical statistical analyzes are used to look at the relationship between those elements and firearm-associated mortality throughout agencies inside the US. The effects display that gun homicides have persisted to rise over the years, with guys and African Americans most tormented by gun violence Suicide is the main motive of gun deaths, observed through homicide and random shootings. Gun violence in the US has crucial implications for policymakers and practitioners in public health.

JEL Classification: I12 - Health Behavior, I18 - Government Policy; Regulation; Public Health

Keywords: Firearms, deaths, United States, sex, race, age, empirical analysis, public health, government policy.

a Department of Economics, Bryant University, 1150 Douglas Pike, Smithfield, RI02917. Phone: (802) 280-5828. Email: ddacruz@bryant.edu.

44

1.0 INTRODUCTION

The primary objective of this empirical paper is to analyze the prevalence of firearm-related deaths in the United States with a focus on intercourse, race, and age. This has a look at utilizes facts from credible assets, such as the Centers for Disease Control and Prevention and the National Vital Statistics System and employs a descriptive and inferential statistical evaluation to observe the relationship between those elements and firearm-associated deaths amongst different corporations in the US.

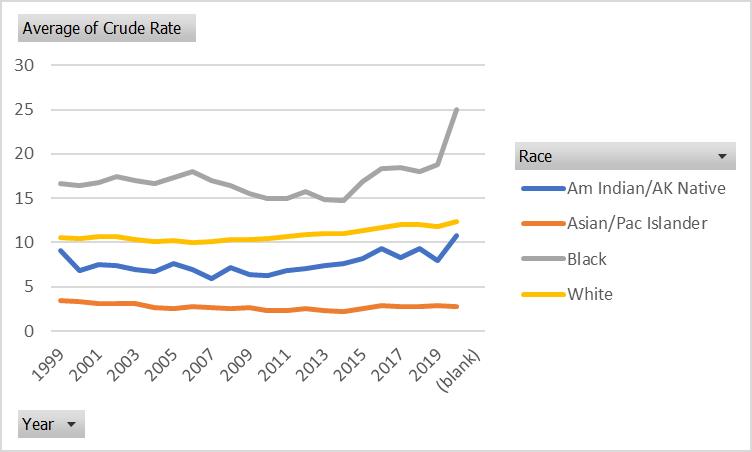

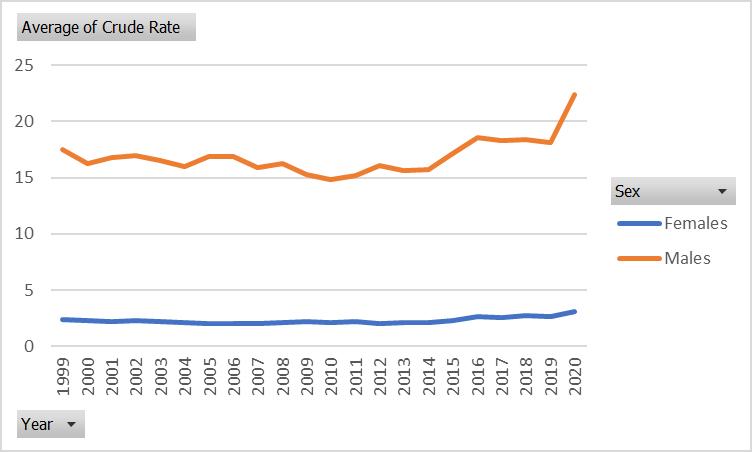

The results of this study reveal that firearm-related deaths in the US are more prevalent among males than females and that African Americans and Native Americans have a higher incidence of firearm-related deaths than other racial groups. Additionally, the study finds that individuals aged 18-24 have a higher likelihood of being victims of firearm-related deaths than those in other age groups. These findings underscore the need for targeted policies to reduce the incidence of firearm-related deaths among vulnerable groups in the US.

This research is important as it sheds light on the disparities and inequities that exist within society and aims to enhance understanding of the factors that contribute to these disparities. The analysis highlights the importance of evidence-based policies that are tailored to the specific needs of different populations to effectively reduce the incidence of firearm-related deaths.

This study is unique in that it distinguishes itself from other research on firearm-related deaths in the US by examining the interdependence between firearm-related deaths based on sex, race, and age using a dynamic panel data model, incorporating information asymmetry into the analysis to investigate the influence of geographic location on firearm-related deaths in the US, and analyzing the geographical spillover of firearm-related deaths among different demographic groups in the US.

The paper is structured as follows: Section 2 provides a brief review of the existing literature, Section 3 outlines the empirical model used in this study, Section 4 discusses the data sources and methodology used for estimation, Section 5 presents and interprets the empirical results, and

45

finally, the paper concludes with a discussion of the main findings and policy implications in Section 6.

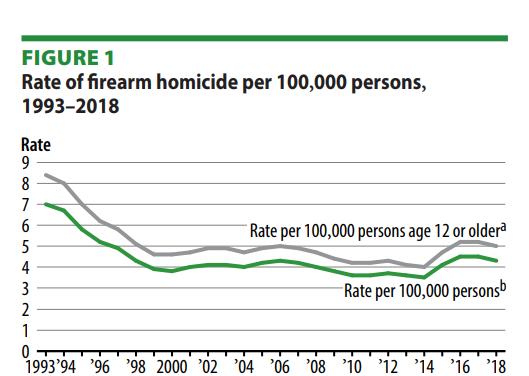

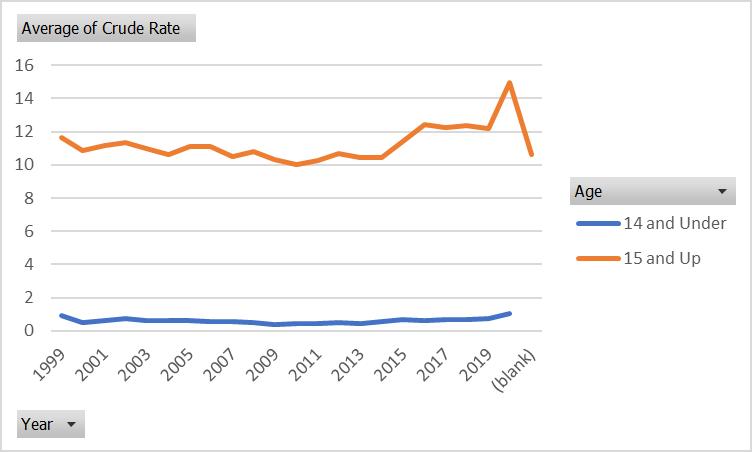

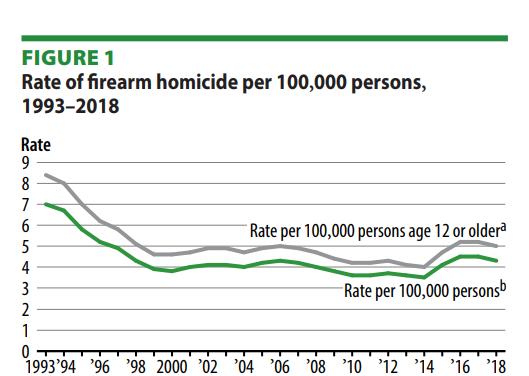

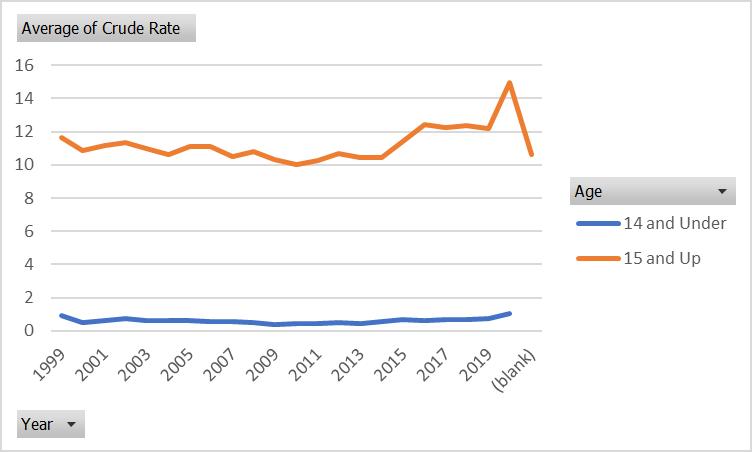

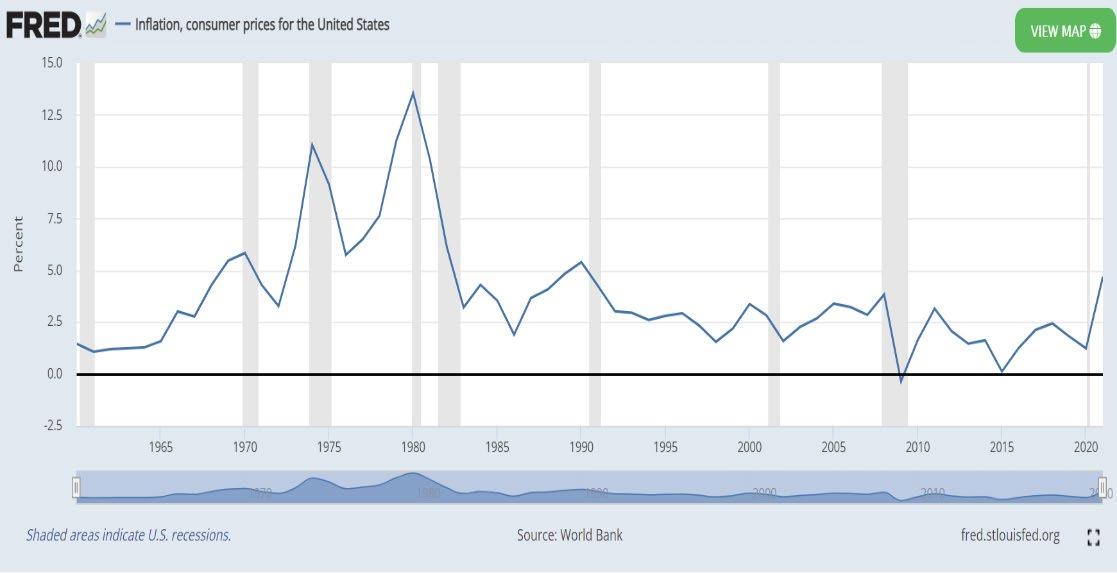

2.0 TRENDS OF FIREARM-RELATED DEATHS

Despite volatility over time, firearm homicides in the United States have persistently remained high. Homicides peaked in the mid-1990’s, with 7 per 100,000 people, and they peaked in 2013, with just 3.6 per 100,000 people. Some states have much higher rates of firearm homicides than others, despite the high rate across the country. Furthermore, certain populations, such as young men and communities of color, are disproportionately impacted by firearm violence.

The report emphasizes that the causes of firearm homicides are complex and multifaceted, with factors such as poverty, social inequality, and access to firearms all playing a role. In recent years, the debate over gun control has become increasingly polarized, with some advocating for stricter regulations while others assert their Second Amendment rights.

Despite some slight reductions in the rate of firearm homicides in recent years, the United States still faces a significant challenge in addressing this public health crisis.

46

Source: “Special Report APRIL 2022 NCJ 251663 Trends and Patterns in Firearm Violence, 1993–2018”

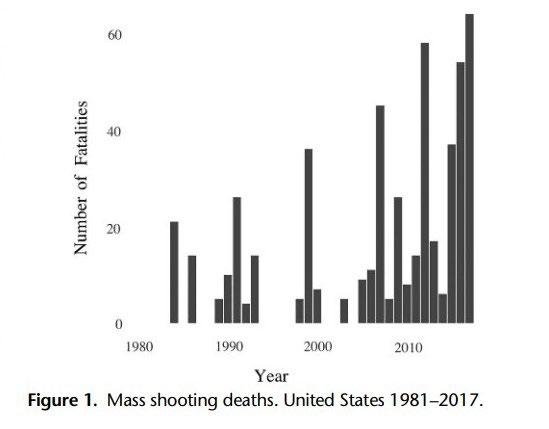

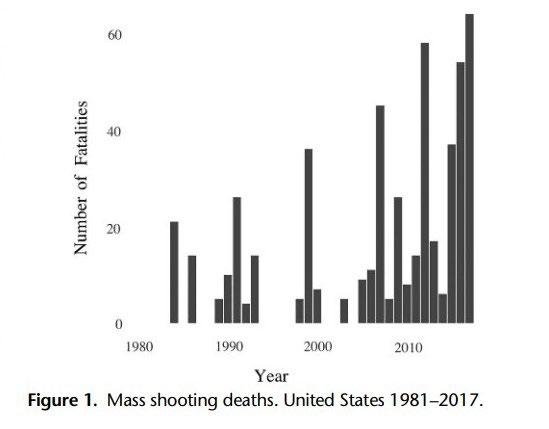

Source: “AAST Continuing Medical Education Article 2018”

Figure 1: US Department of Justice to Homicide Rate

Figure 2: AAST 2018 PODIUM PAPER to Mass Shooting Deaths

Figure 1: US Department of Justice to Homicide Rate

Figure 2: AAST 2018 PODIUM PAPER to Mass Shooting Deaths

47

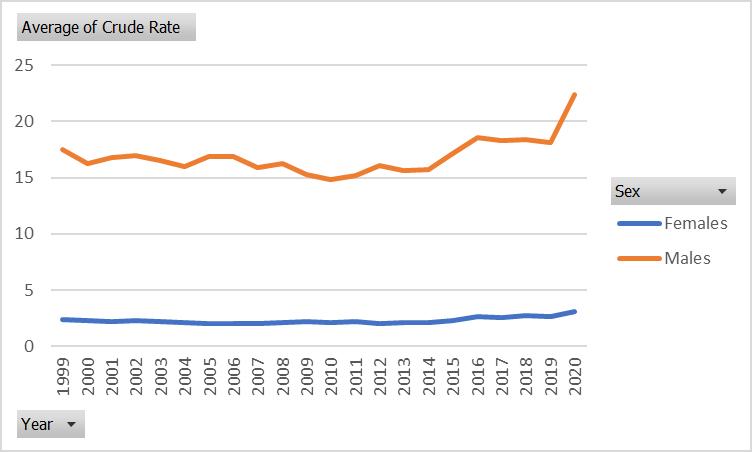

Figure 2 in the report illustrates this trend. Despite fluctuations in the number of such incidents, the overall trend is unmistakably upward, with a sharp upswing observed in the mid2000s.

The report acknowledges the lack of a universally accepted definition of "mass shooting," with some sources setting the bar at four or more individuals killed or injured, while others adopt a more stringent criterion. Regardless of the definition employed, the data evinces a clear trend toward increased frequency and severity of mass shootings.

The root causes of this trend are intricate and multifaceted, involving factors such as firearm accessibility, mental health, and societal dynamics. The report refutes the assertion that mass shootings are predominantly the result of mental illness and instead posits that it is the ease with which firearms, particularly high-capacity assault weapons, can be obtained that is most closely associated with these incidents.

The report further notes that most mass shooters are white men, although this demographic group is not overrepresented in the general population. This suggests that broader cultural and societal factors may contribute to the prevalence of mass shootings.

In conclusion, the rising fatality rate of mass shootings in the United States is a pressing concern and emphasizes the imperative for decisive action to address this public health crisis.

Effective strategies may encompass a spectrum of measures, ranging from stricter gun control regulations to tackling the underlying societal issues that fuel these events.

3.0 LITERATURE REVIEW

American gun deaths exceed 30,000 each year. Sex, race, and age are three characteristics that have been linked to firearm-related deaths and have been extensively researched. This literature review will provide an overview of the empirical research on firearmrelated deaths in the United States based on sex, race, and age.

The literature suggests that there are significant disparities in firearm-related deaths based on demographic characteristics. Firearm-related injuries cause more deaths among men than among women. According to a study by Anglemyer et al. From 2003 to 2012, 87% of deaths in the United States were caused by firearms. The same study also found that the firearm-related homicide rate was 6.8 times higher among men than among women.

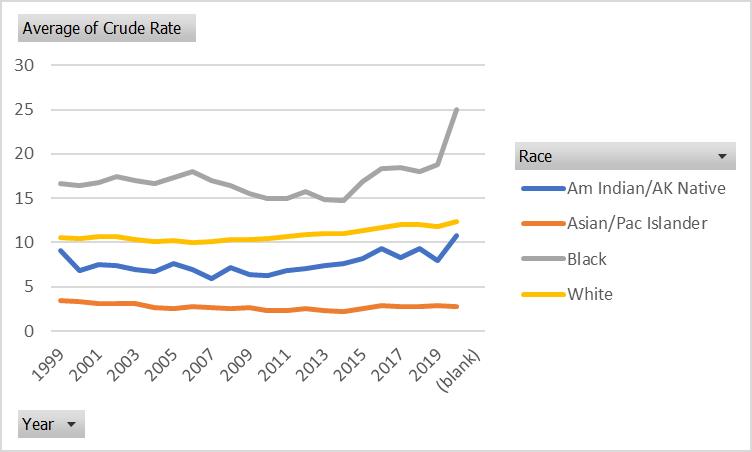

48

There are also significant racial disparities in firearm-related deaths. The CDC estimated that African Americans died from firearm-related crimes 10 times more frequently than white non-Hispanics in 2021. Ahmad et al. Other minority groups, such as Native Americans and Hispanics, also have higher rates of firearm-related deaths than non-Hispanic whites (CDC, 2021).

Age is another demographic characteristic that is associated with firearm-related deaths. The Grinshteyn and Hemenway (2016) study found that individuals aged 15-34 die more frequently from firearm-related injuries. During 2014, firearm-related homicides disproportionately occurred among young adults. In addition, older adults are more likely to die from firearm-related suicides (CDC, 2021).

Several factors have been identified as contributing to firearm-related deaths. One of the most significant is firearm availability. 's study. Among states with higher firearm ownership rates, homicide, and suicide rates were higher. A firearm's type is also important. According to a study by Kivisto and Phalen (2018), states with more permissive laws regarding assault weapons have higher rates of mass shootings.

Other factors that have been associated with firearm-related deaths include mental illness and substance abuse. However, the research on these factors is mixed, with some studies suggesting a strong association and others finding little to no association (Swanson et al., 2015).

In conclusion, the empirical research suggests that demographic characteristics such as sex, race, and age are significant predictors of firearm-related deaths in the United States. Those aged thirty and under, African Americans, and men are particularly at risk. Availability and type of use of firearms also factor into firearm-related deaths. Therefore, evidence-based interventions are needed to address firearm-related deaths and public health crises.

4.0 DATA AND EMPIRICAL METHODOLOGY

4.1 Data

The study uses statistical data on firearm-related deaths in the United States. United States firearm-related deaths are analyzed using statistical data. National Centers for Health Statistics (NCHS) and the CDC provided reliable data sources. The data used in the study date

49

from 1999 to 2020. This data came from WISQARSTM (Web-based Injury Statistics Query and Reporting System), an official source for firearm-related deaths in the USA.

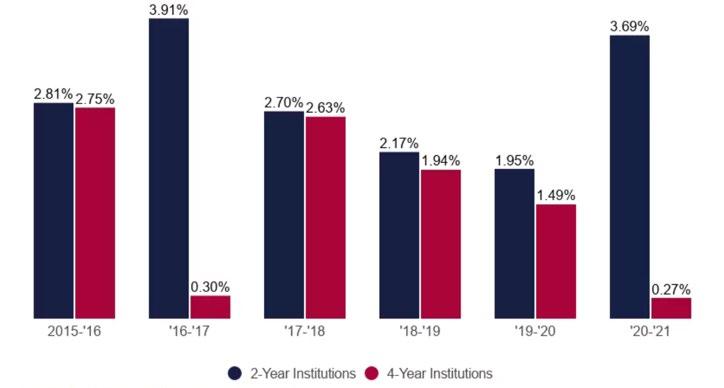

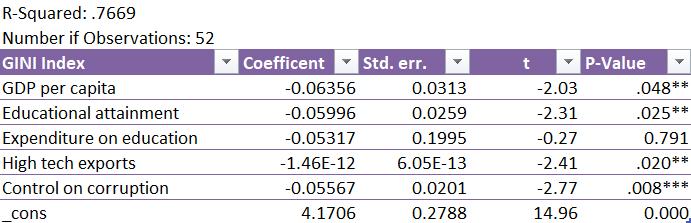

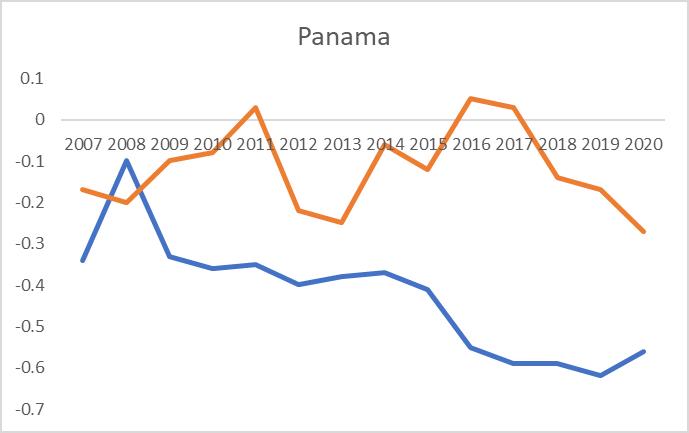

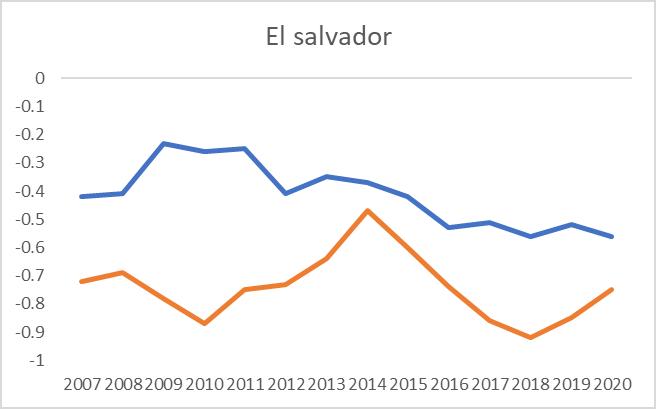

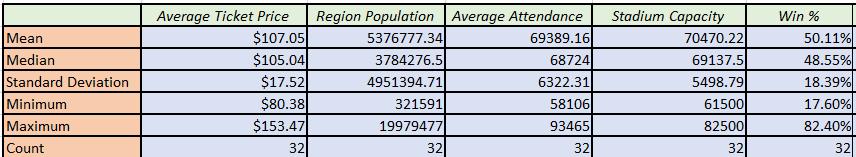

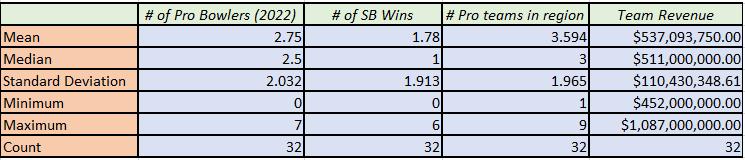

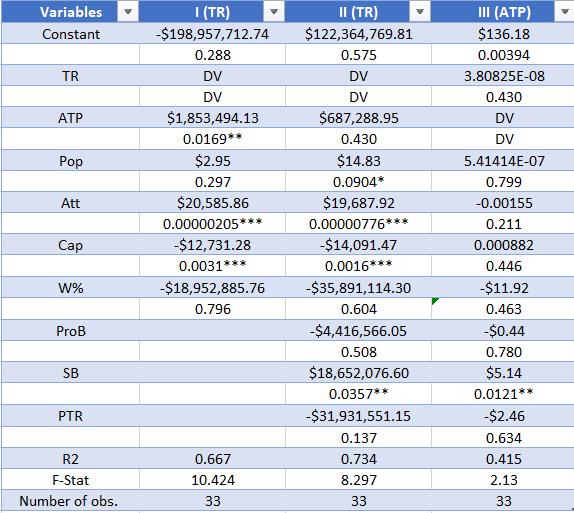

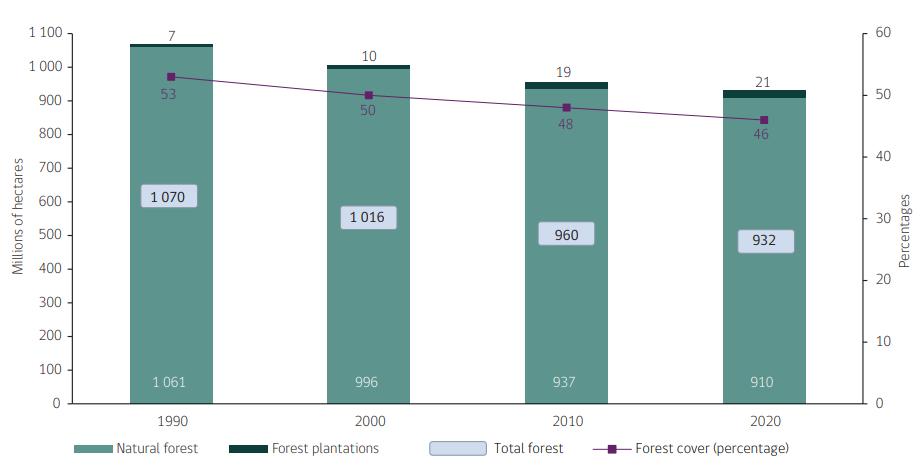

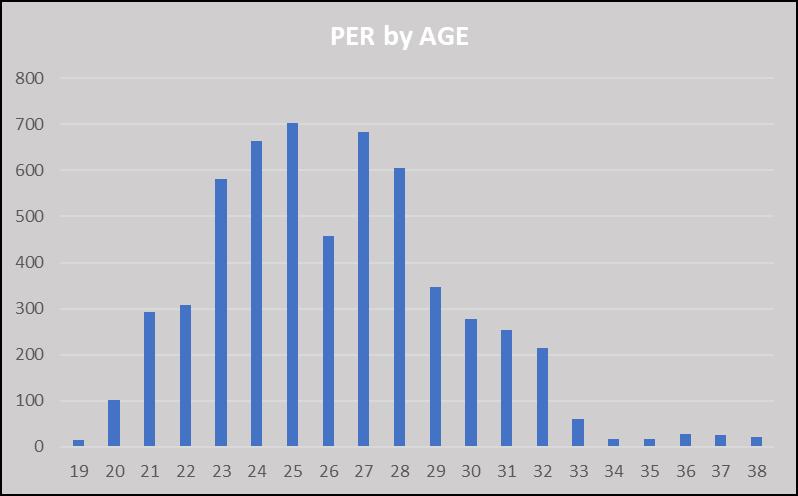

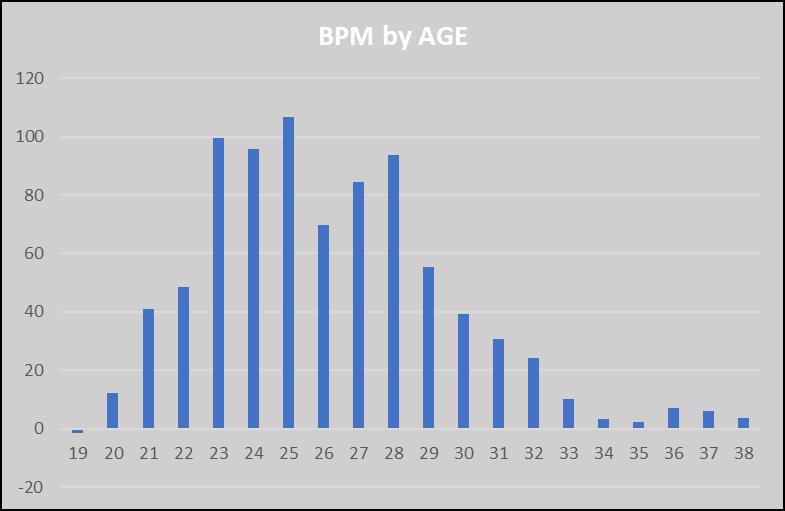

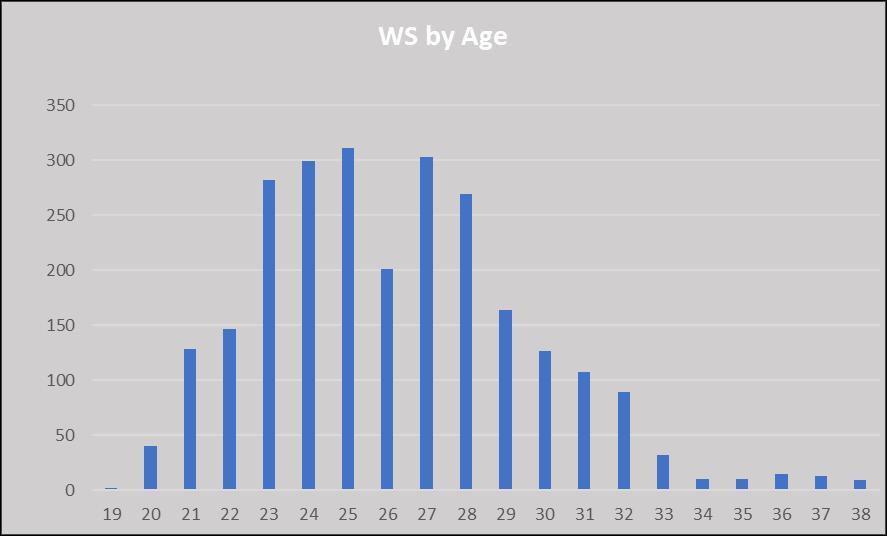

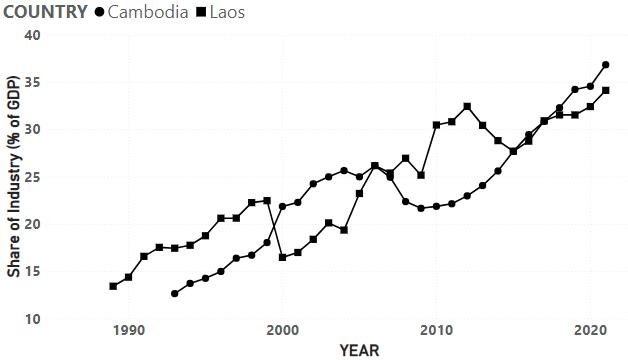

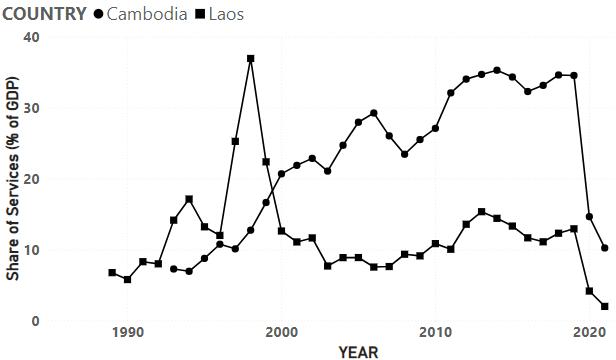

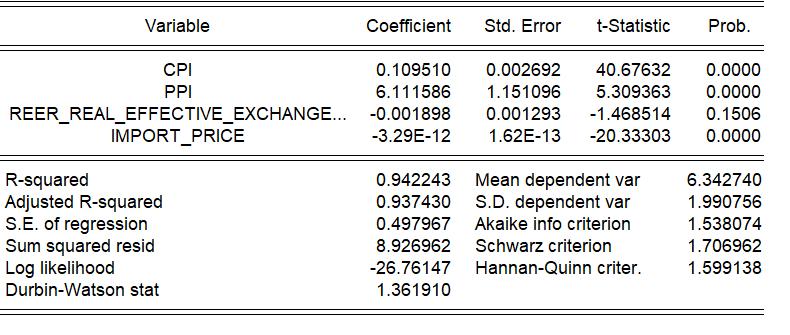

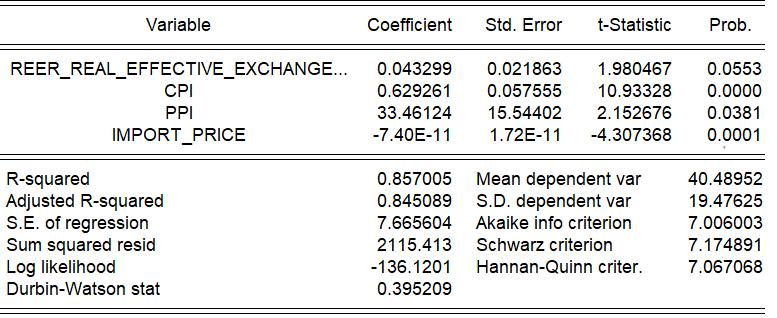

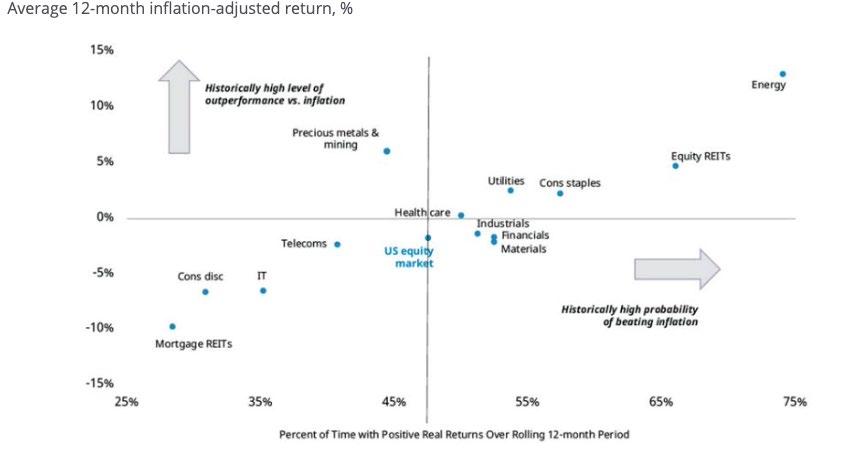

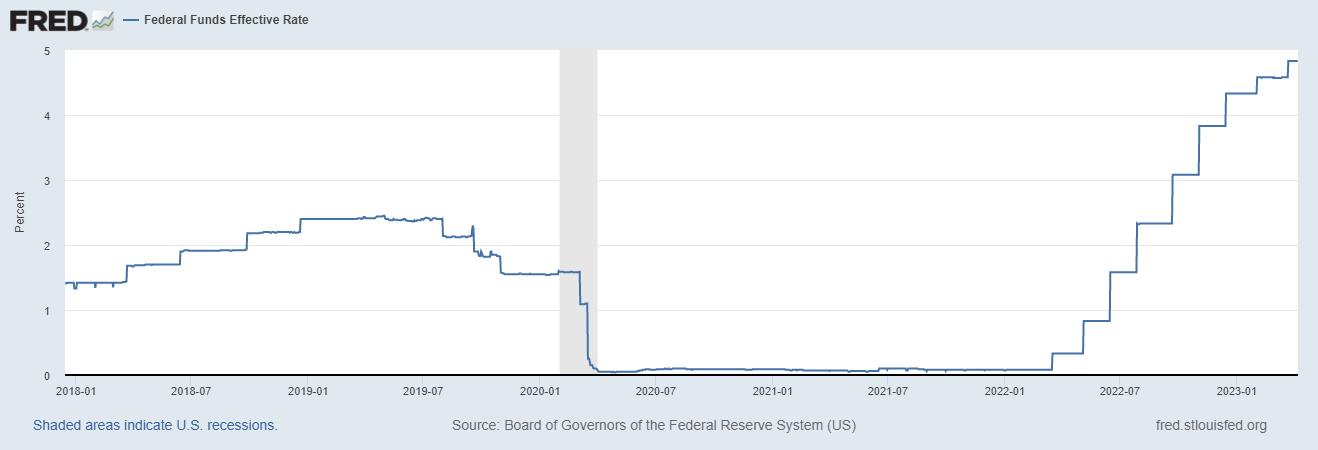

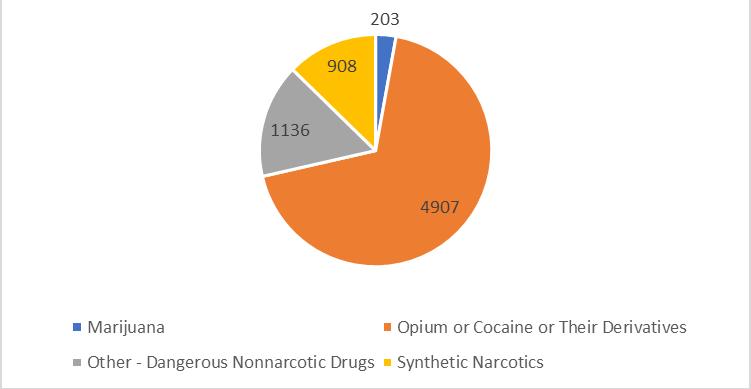

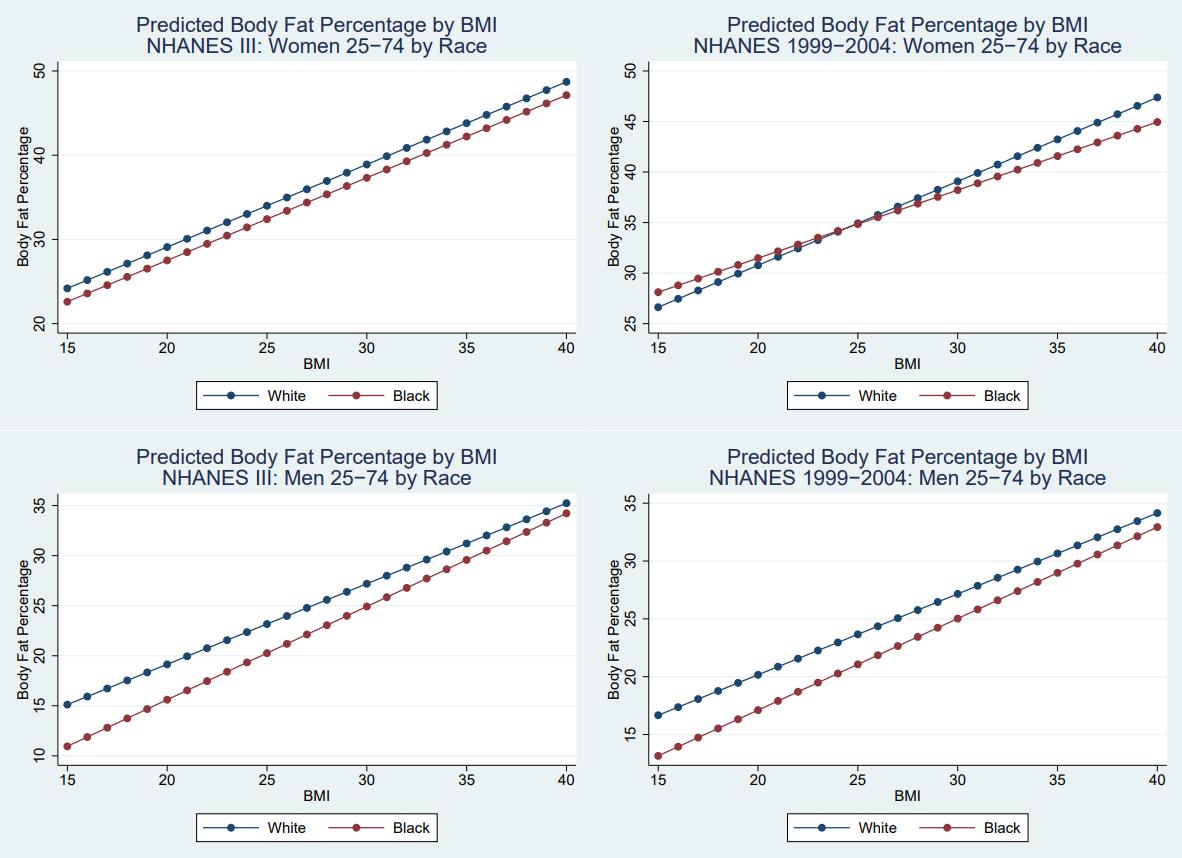

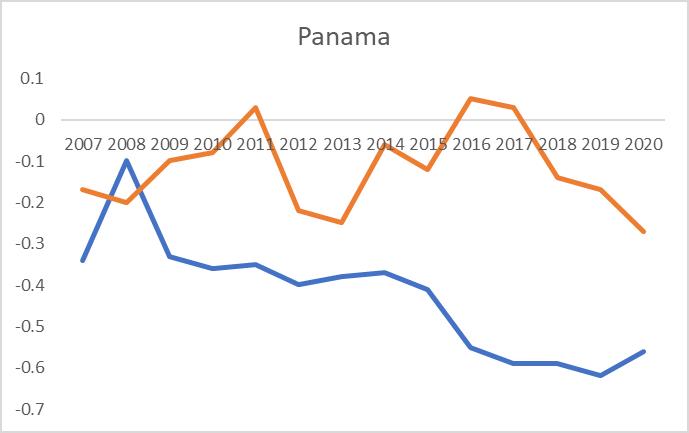

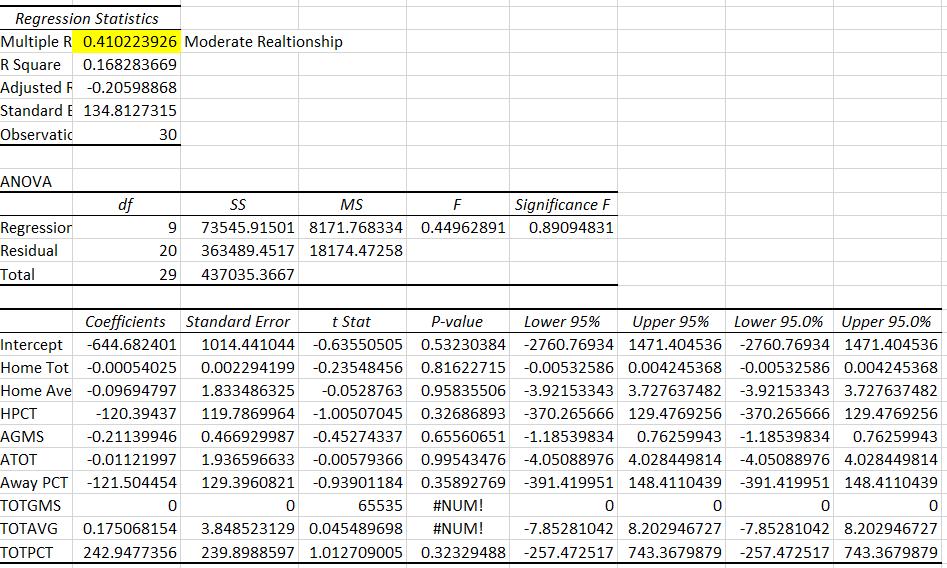

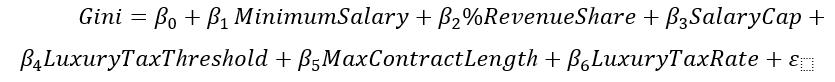

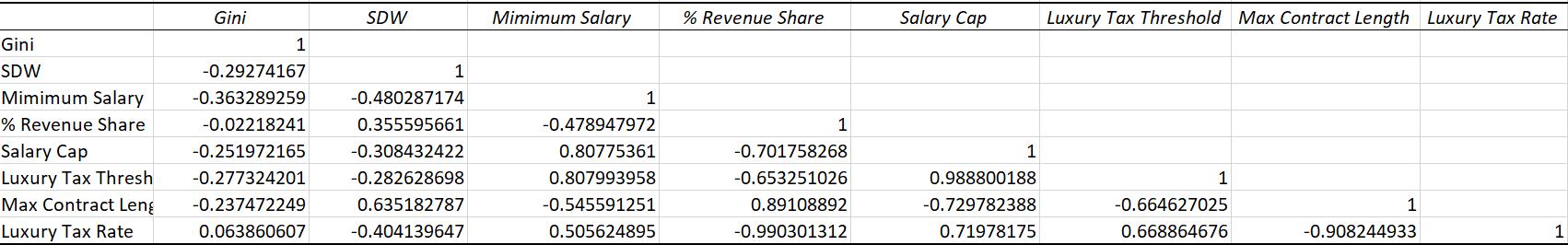

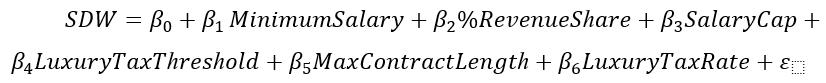

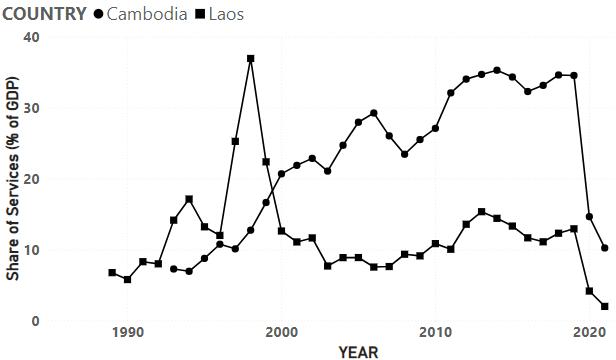

4.2 Empirical Model