The benefits of AI are countless. But have we truly considered its impact on the current workforce and its hidden business risks?

The benefits of AI are countless. But have we truly considered its impact on the current workforce and its hidden business risks?

COO, EDITOR IN CHIEF

Julian Perry EDITOR

Tim Poole

Tim.Poole@gamblinginsider.com

STAFF WRITERS

Matthew Nicholson

Matthew.Nicholson@gamblinginsider.com

Lucy Wynne

Lucy.Wynne@gamblinginsider.com

Robert Prendergast

Robert.Prendergast@gamblinginsider.com

LEAD DESIGNER

Brendan Morrell

DESIGNERS

Olesya Adamska, Christian Quiling

DESIGN ASSISTANTS

AI. It ain't going away, is it?

Its use within the gambling industry is increasing ever-more, so too its frequency in every-day use across all facets of life.

Is this necessarily a good thing? From an e ency point of view, 100%. From a moral point of view? That's a different story – and, luckily for me, not one I really have to answer in this edition's cover feature (page 32). This being a B2B gambling magazine, we aren't too interested in whether AI will take over the world just yet. If you're a movie bu , you're probably already convinced it will, anyway.

In said cover feature, I present my initial thesis to OPTX's Steve Bright, while also including contributions from Sportradar's recent White Paper on the topic, essentially questioning whether AI might cause businesses a few problems before the gambling industry can truly reap the rewards of its advantages. The technical term I use for this is "deskilling." The layman's term is downright laziness. For, if workers now have AI programs that can do their job for them, what is to stop them from doing nothing beyond letting AI do their work for them? We've seen such examples, even here...

It's a complicated topic and one our contributors cover well. AI is also the subject of our Roundtable (page 62), while a number of our regular columnists are out in force through the body of the magazine, tackling the industry's hottest topics as always.

You'll see below we have dedicated special mention to Johnny Aitken and Anton Yakovenko. It has to be said these are for two very di erent reasons. Aitken is a key gure in our spread on page 28 – a timeline of PointsBet's US operations. Despite seemingly making a lot of progress in North America (and spending heavily on marketing), the operator recently announced a strategic review with a view to potentially selling its US operations, re ecting just how tough it is for brands to actually break into the market Stateside.

Yakovenko, meanwhile, has made a successful transition to the US – thanks to the support from his employer Eclipse Gaming that allowed him to leave war-torn Ukraine. During a time of negative headlines, especially in Ukraine, his is a heartwarming story we can all do with – and its our pleasure to bring you some real human news in this issue (page 44); separate, of course, to our traditional blend of data, business insight, and online product and casino oor discussion.

TP, Editor

Radostina Mihaylova, Svetlana Stoyanova, Gabriela Baleva

MARKETING & EVENTS MANAGER

Mariya Savova

FINANCE AND ADMINISTRATION ASSISTANT

Julia Olivan

PRODUCTION CONTROLLER

Oleksandra Myronova

IT MANAGER

Tom Powling

COMMERCIAL DIRECTOR

Deepak Malkani

Deepak.Malkani@gamblinginsider.com

Tel: +44 (0)20 7729 6279

SENIOR ACCOUNT MANAGER

Michael Juqula

Michael.Juqula@gamblinginsider.com

Tel: +44 (0)20 3487 0498

SENIOR BUSINESS DEVELOPMENT MANAGER - U.S.

Aaron Harvey

Aaron.Harvey@playerspublishing.com

Tel: +1 702 425 7818

ADVERTISING SALES EXECUTIVE - U.S.

Ariel Greenberg

Ariel.Greenberg@playerspublishing.com

Tel: +1.702 833 9581

ACCOUNT MANAGERS

William Aderele

William.Aderele@gamblinginsider.com

Tel: +44 (0)20 7739 2062

Irina Litvinova

Irina.Litvinova@gamblinginsider.com

Tel: +44 207 613 5863

Martin O'Shea

Martin.Oshea@gamblinginsider.com

Tel: +44 (0) 207 729 0643

Serena Kwong

Serena.kwong@gamblinginsider.com

Tel: +44 (0)20 3435 5628

BUSINESS DEVELOPMENT MANAGER

Michelle Pugh

Michelle@GlobalGamingAwards.com

Tel: +44 (0)20 7739 5768

CREDIT MANAGER

Rachel Voit

WITH THANKS TO:

Fantini Research, GBGC, Alex Donohue, Jack Mansell, Steve Bright, Sportradar, PointsBet, Alex Czajkowski, Carl-Fredrik Stenstrom, Anton Yakovenko, Steve McDonald, Ignacio Iglesias, Hugo Llanos, Dr Joerg Hofmann, Sverker Skogberg, Richard Williams, Richard McCall, Mike Ward, Malcolm Atuona, Anton Komukhin, Joe Hall, Rasmus Kjaergaard, Mridula Saini, Olga Ivanchik, Jonny Bennet, Ashot Sahakyan, Gil So er, Frank DiGiacomo and Charlie Johnson

Gambling Insider magazine ISSN 2043-9466

Produced and published by Players Publishing Ltd

All material is strictly copyrighted and all rights reserved. Reproduction without permission is forbidden. Every care is taken in compiling the contents of Gambling Insider but we assume no responsibility for the e ects arising therefrom. The views expressed are not necessarily those of the publisher.

Julian Perry, COO, Editor-in-Chief JONNY AITKEN CEO USA, PointsBet ANTON YAKOVENKO Eclipse Gaming Tim Poole, Editor

08 Facing facts

Gambling Insider takes a closer look at various facts and figures from Asia-focused operators from their fourth quarter and full-year results for 2022

14 In numbers

In partnership with Gambling Insider, Fantini Research provides US data

20 GBGC

GBGC, the global gaming data expert, provides exclusive statistical data to Gambling Insider from markets around the globe

22 Taking stock

We track Asian operator stock prices across a six-month period

26 The B2B Cheltenham review Press Box's Alex Donohue and Jack Mansell join the GI Huddle to discuss this year's Cheltenham Festival

28 Global Gaming Awards Las Vegas

Gambling Insider previews the Global Gaming Award Las Vegas, which celebrate their 10th edition this year

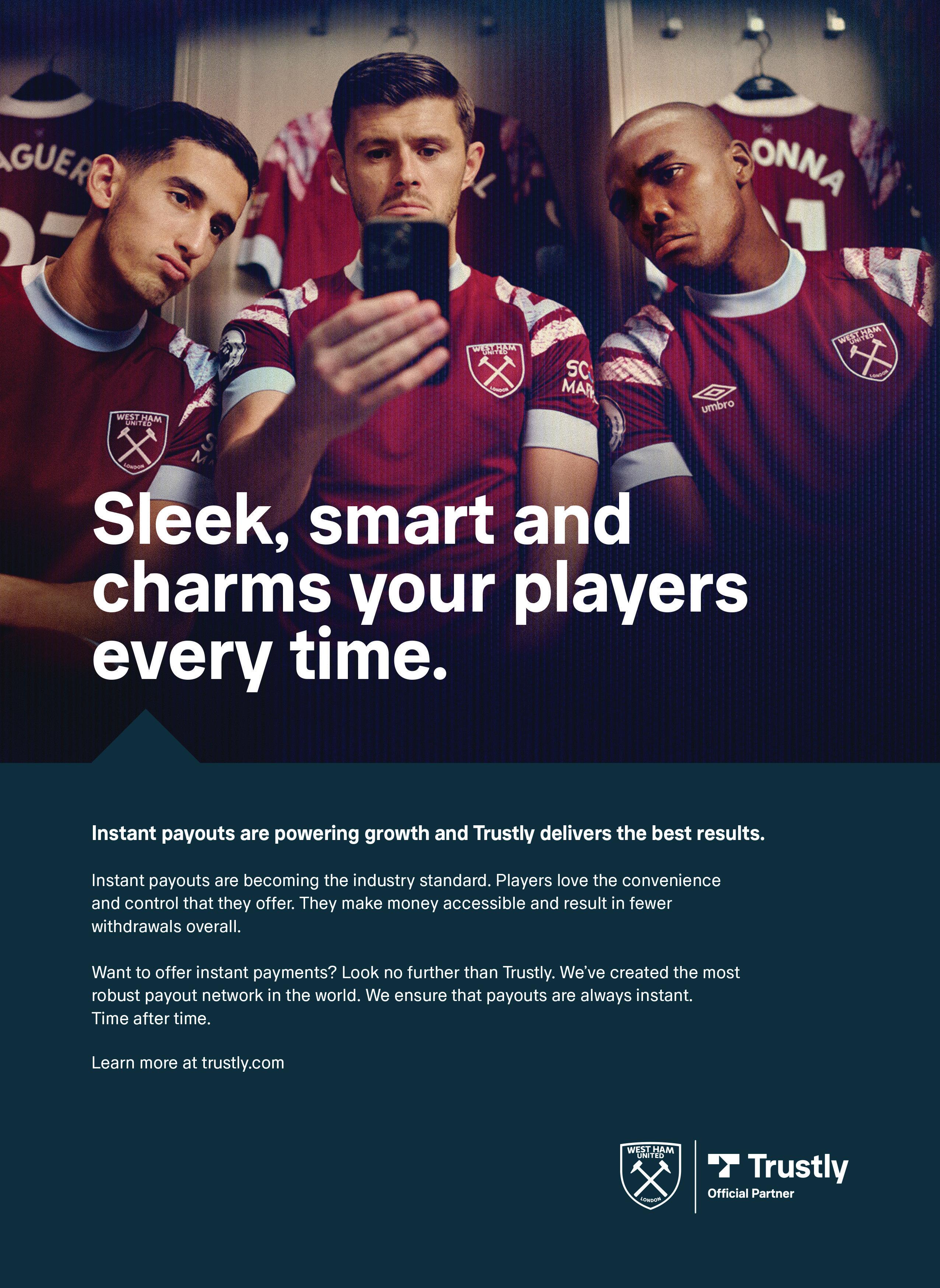

30 AI: Evolving or deskilling?

With insight from OPTX and Sportradar, Gambling Insider Editor Tim Poole explores the benefits and potential costs of AI to the labour force

36 PointsBet – A US timeline

Gambling Insider looks at PointsBet's journey through the US gambling market, as it looks to sell off its North American operations

38 Don't underestimate the power of doing nothing

Regular Gambling Insider contributor Gustaf Hoffstedt discusses the intentions of politicians and how this – unfairly, he argues – impacts gambling policy

Regular Gambling Insider contributor and marketing expert Alex Czajkowski talks about the imortance of live sports streaming

54 Can we afford it? Armalytix CEO Richard McCall and Executive Chairman Mike Ward talk with Gambling Insider about affordibility checks

58 Big Question

Will cryptocurrencies ever be the preferred payment method?

62 Roundtable Industry experts explore the hot topic of AI and how it is used in their businesses. Gift & Go, IKASI, Softswiss and Mindway discuss...

How many European countries have similar ideas on regulation? Dr Joerg Hofmann, Sverker Skogberg and Richard Williams all have their say

70 Jonny Bennet Realistic Games

71 Ashot Sahakyan Relum

72 Gil Soffer Galaxsys

73 Frank DiGiacomo Gaming Industry Group

74 What's new on the market? GamblingInsidertakes a close look at some of the exciting products that are now available on the casino oor

82 Charlie Johnson VP, International at Digital Element

MGM China FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (HK$ billion)

Gambling Insider takes a closer look at various facts and figures from Asia-focused operators from the fourth quarter and full year 2022

MGM China FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (HK$ billion)

MGM China revenue (HK$ billion)

Source: MGM China

• MGM China saw a decrease of 44% in full-year revenue, and a decrease of 44% in Q4 revenue year-on-year

• Revenue decreases came after a third year of consecutive lockdown in Macau, as imposed by mainland China

Sands China FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (HK$ billion)

Sands China revenue (HK$ billion)

Sands China FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (HK$ billion)

Source: Sands China

• Sands China saw a fall of 44% for FY2022 compared to FY2021

• Q4 2022 revenue, however, rose 72% from Q4 2021

Wynn Macau & Palace FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (HK$ billion)

Wynn Macau & Palace FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (HK$ billion)

Wynn Macau & Palace revenue (HK$ billion)

Source: Wynn Macau & Palace

• Wynn Resorts’ Macau operations, from both Wynn Macau and Wynn Palace, were down a marked 52% year-on-year

• For Q4 2022 specifically, revenue decreased 42% year-on-year

against

Galaxy Entertainment revenue (HK$ billion)

Galaxy Entertainment FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (HK$

Source: Galaxy Entertainment

• Galaxy Entertainment suffered losses in Macau, too, in a trend which saw the region’s operators lose significant revenue year-on-year

• The operator’s full-year revenue decreased 42% year-on-year; its Q4 revenue also dropped 39% year-on-year

SJM Holdings FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (HK$ billion)

SJM Holdings revenue (HK$ billion)

Source: SJM Holdings

• Q4 2022 revenue decreased 47% year-on-year for SJM Holdings

• Full-year revenue represented a decrease of 37%

Melco FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (HK$ billion)

Melco revenue (HK$ billion)

Melco FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (HK$ billion)

Source: Melco

• Melco’s full-year 2022 revenue dropped HK$5.17bn, while Q4 saw a decline of HK$1.13bn

• Results play into a wider trend of year-on-year declines for Macau-based operators

Bloomberry Resorts FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (PHP billion)

Bloomberry Resorts FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (PHP billion)

Bloomberry Resorts revenue (PHP billion)

Source: Bloomberry Resorts

• The 2022 picture is far different in the Philippines, with full-year revenue up 81% year-on-year

• Q4 2022 revenue for the operator, which managed the casino resort Solaire, also rose 84% from the prior-year period

Genting Berhad FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (RM billion)

Genting Berhad revenue (RM billion)

Genting Berhad FY2022 against FY2021 revenue/Q42022 against Q42021 revenue (RM billion)

Source: Genting Berhad

• Malaysia-based Genting Berhad has seen full-year 2022 and Q4 2022 increase from 2021, much like Bloomberry Resorts in the Philippines

• This paints a picture of wider recovery in Asia for 2022, as opposed to Macau which continued its downward trend amid Covid-19 restrictions

• More recently, Macau has started to return to strength; this will be better reflected in 2023 data. 2022 remained a tough year

In partnership with Gambling Insider, Fantini Research data examines March sports betting revenue for the states of Maryland, Missouri and Ohio

Maryland: In reporting its sports betting revenue for March, Maryland has seen steadfast growth in its online and handle sectors, with online posting a near-17% monthly rise. However, its retail results were less positive, dropping 65% compared to the month prior.

Missouri: It was a level month overall for Missouri’s iGaming market, as it reported a circa 1% increase year-on-year, with Isle of Capri – Boonville posting an 8% monthly rise in revenue.

Finally, in Ohio, the Miami Valley Gaming racetrack reported a near-10% rise in monthly revenue, with Belterra Park falling by 6% in the same period. However, overall, racino revenue climbed by circa 2%.

www.FantiniResearch.com

MORE IMPORTANT THAN YOUR MORNING COFFEE

The graph shows gross gambling yield (GGY) of land-based and online casinos in Switzerland for the period 2015 to 2021 in millions of Swiss Franc.

• Switzerland opened its online gambling market to private competition in July 2019, when the regulator issued its first licence.

• Online casinos took a small percentage of the overall casino GGY in the initial year (3%), but the number grew to 29% during the Covid-19 pandemic (2020) and 37% in 2021.

• In April 2023, the number of online casino operators reached 11, while there are 21 land-based casinos.

• Online casino games can only be offered by established land-based casino operators, while online betting (and lotteries) are offered by two state-owned companies in Switzerland.

The graph shows horseracing handle in Kentucky for the period 2010-2022, in millions of US dollars.

• To help the falling horseracing industry, the legislator legalised historical horseracing machine (HHRs), also referred to as "instant racing machines," in 2011.

• Although the machines resemble slots, instead of randomising the outcome of a play, the HHRs replay races that have already been run.

• HHR handle took 6% of total handle in its initial year, climbing to 57% in 2016, and 92% in 2022, proving that the machines are a major source of revenue for the industry.

• There are seven US states where HHR machines are live: Alabama, Kansas, Kentucky, Louisiana, New Hampshire, Virginia and Wyoming.

This graph shows sports betting handle in Poland for the period 2014-2021, in billions of Zloty. Association (IBIA)

• Although the online sports betting market was legalised already in June 2011, only locally established operators could participate.

• Following law amendments, foreign operators gained access to the market only in 2018.

• Online sports betting handle took up 74% of total handle in 2018, climbing to 86% in 2021.

• As the online market took of, operators began to downsize their land-based presence.

• In 2017, there were over 2,500 betting shops, falling to below 1,000 in 2023.

This graph shows gross gambling yield (GGY) from the Netherlands online gambling market for the period Q4 2021-Q2 2022, in millions of Euros.

• After a lengthily legislative process of online gambling legalisation, which started in 2013, the market finally went live on 2 October 2021.

• Banked casino games (roulette, baccarat, blackjack, slots) took the largest part of the overall revenues in the Q2 2022-72%, followed by betting (24%) and non-banked games such as poker with a 4% share.

• In April 2023, the number of online operators reached 23, with 22 of those licensed for online casino games, 13 licensed for sports betting and eight for horseracing betting.

The graph shows retail and online sports betting handle in West Virginia for the period FY 2019-FY 2022, as percentage of total handle.

• After legalisation in 2018, retail sports betting launched in the state in August 2018, followed by the online/mobile launch in December 2018.

• Already in FY 2019, online handle was US$133m (vs US$125m in retail handle), climbing to US$482m in FY 2022, when retail handle was just US$117m.

• As of April 2023, there are five retail sportsbooks at the state's casinos and 10 online/mobile sportsbooks licensed.

Gambling Insider tracks Asian operator stock prices across a six-month period (November 2022 to April 2023). The opening stock price is taken from the first day of each month

• Six-month high - 9.50 (April)

• Six-month low - 6.90 (November)

• Market capital - PHP 97.49bn (US$1.78bn)

• Six-month high - 2,463 (April 2023)

• Six-month low - 2,032 (November 2022)

• Market capital - JPY 197.52bn (US$3.11bn)

• Six-month high - 4.60 (January 2023)

• Six-month low - 2.42 (November 2022)

• Market capital - HK$26.35bn (US$3.36bn)

• Six-month high - 54.80 (March 2023)

• Six-month low - 36.30 (November 2022)

• Market capital - HK$28.19bn (US$3.59bn)

• Six-month high - 9.05 (February 2023)

• Six-month low - 3.17 (November 2022)

• Market capital - HK$38.82bn (US$4.95bn)

• Six-month high - 30.00 (February 2023)

• Six-month low - 13.86 (November 2022)

• Market capital - HK$216.9bn (US$27.63bn)

• Six-month high - 10.00 (February 2023)

• Six-month low - 3.15 (November 2022)

• Market capital - HK$35.34bn (US$4.5bn)

Six-month high - 13.94 (February 2023)

Six-month low - 6.02 (November 2022)

Market capital - US$5.29bn

Press Box PR Managing Director Alex Donohue and Press Box PR Director Jack Mansell speak to Gambling Insider Editor Tim Poole about this year’s Cheltenham Festival, how bookmakers fared and future aspirations for horseracing’s showpiece event

Overall, did operators have a good or bad Cheltenham Festival?

Alex Donohue: I think they had a great Cheltenham. I’ve got a couple of statistics here, for which I must credit Regulus Partners as the source. But it looks like the bookies had a great Cheltenham overround, which was up 16%. Margins were up and I think that’s down to the field sizes. We had 444 runners this year, compared to 405 last year. That means the average field size was 15.9, nearly 16. Simplistic bookmaking mathematics suggests the bigger the field size, the more overround, the more margin there is and the better that would be for bookmakers in the long term.

Results were better than they have been in previous years: there were eight winning favourites from 28 races, down from 12. I think it’s fair to say that bettors generally didn’t have a great Festival. It looked like a pretty torrid run of results in the middle of the week. I think on Tuesday there were a fair few punter-friendly horses that went in, Wednesday was okay and, on Thursday, the punters definitely drew a blank. On Gold Cup day, although the favourite did win the Gold Cup, there were a couple of results that went more in favour of the bookmaker. So, from looking at the statistics I have here, it looks like it was a pretty profitable Cheltenham.

Anecdotally, speaking to a couple of the bookmakers and affiliates we’re close to, it sounds like there was a real strong uptake of betting interest from recreational customers and people that don’t normally bet on horseracing. This is a really key thing for Cheltenham being a shop window for the sport. Average stakes, meanwhile, were pretty healthy; I think there was some suspicion

that stakes might be declining a little bit, possibly due to cost of living, possibly due to people wanting to have a bet on more of the races and spread their entertainment value around. But it looks like the bookmakers did well, margin-wise and also did really well in terms of attracting a new audience coming to bet on horseracing – which stands the sport in great stead for the future.

ALEX DONOHUE Press Box, PR Managing Director

"GENERALLY SPEAKING, IF THE BIGGER FIRMS ARE HAVING A GOOD CHELTENHAM, EVERYONE WILL MOSTLY HAVE A GOOD CHELTENHAM"

ALEX DONOHUE

Yes, on the Friday, I do remember the 66-1 shot that triumphed, which was definitely one of the more unexpected results...

AD: If you hadn’t backed the winner of the Gold Cup and were looking to try and redeem yourself in the Foxhunters Chase, I don’t think many people were able to use that to their advantage when the 66-1 shot came in. But that’s what makes Cheltenham brilliant. It’s the biggest and best horses – but of course, they don’t always win. I think the unpredictability and sporting drama is what makes it such an appealing sporting event, and therefore betting event. If all the big horses turned up and won every single time, we wouldn’t get these big field sizes because the others wouldn’t want to come and give it a go. And it’s these big field sizes that ultimately make it an entertaining proposition and more profitable for the industry as well. So long may that continue.

Do you have any insights into brands that did particularly better than others, or some that weren’t quite as profitable as some of their competitors?

AD: It’ll be interesting to see what comes out in the wash now in the quarterly reports and the varying statements in the City, thereafter, for some of the bigger listed groups. Some of the groups that have already reported post-Cheltenham have reiterated what I mentioned there that the numbers were healthy: lots of the factors they look for in terms of cross-selling the sport as a betting opportunity to new audiences are pretty healthy, as well. Generally speaking, if the bigger firms are having a good Cheltenham, everyone will mostly have a

good Cheltenham, unless anyone makes some sort of misjudged marketing offers. But that’s another point to make. Actually, in previous years, Cheltenham seemed a bit of a race to the bottom in terms of marketing offers. Bookmakers were giving too much away in a bid to attract customers. This year, you saw the industry collectively rein that in and there weren’t as many generous bonuses – without seeming to dampen the uptake. That, of course, is great news for operators, marketing department budgets and margins. They don’t feel like they have to give so much away to get people interested in betting on Cheltenham.

So a positive, profitable Cheltenham for operators – which isn’t always the case... But even if bookmakers don’t necessarily make money at Cheltenham, the marketing draw can bring customers in for the rest of the year. Was that very much the case this year, with the added bonus that operators were in the red?

Jack Mansell: I think it’s very encouraging, Tim, to see that there is growing cut-through for the sport into the mainstream. That’s got to be good, not just for betting operators, but also for the sport’s long-term prosperity. It’s raising the eternal problem of how you capitalise on the interest the Festival provides and creating either repeat customers from a betting point of view, or repeat spectators coming to the course. Clearly it’s incumbent upon Cheltenham as a showpiece fixture in the calendar to deliver on both those fronts. The early indications are that it certainly has from a betting point of view.

And time will indeed tell, now that we’re out of Covid-19 pandemic restrictions, as to whether we can capitalise on this audience. But seeing Rachael Blackmore on the front pages and on the evening news can only be a good thing for the marketing of the sport – for the benefit of everybody.

Given what you’ve both said here, is it fair to say Cheltenham has succeeded in appealing to a wider audience this year?

first-hand from working in a racecourse that really the bottom-line requirement is to get punters through the door, and that customer experiences tend to have been overlooked for racing fans for quite a long time. I think clearly limiting the numbers on each day has helped alleviate a lot of the issues Cheltenham was facing, with long queues for bars, long queues to get in and out of the racecourse, etc. So, I think what we have to keep in mind is discretionary spend for everybody right now is tight and so we need value for money for those who attend. It must be seen to be driving value for them and I think Cheltenham in its approach has attempted to appeal to the masses... but also given them a customer experience they would expect, whether they’re going for a day at the races or a day at Premier League football.

JM: Yes, I think credit must go to the Jockey Club and the authorities at Cheltenham for doing all they can to widen the interest in the sport. They took a bit of a risk at the start of the week with that DJ Cuddles Roar Remix, which for the traditionalists probably goes against the grain slightly. But I’m a great believer that racing needs to try new things, and test and learn. Clearly, those sorts of initiatives did generate lots of coverage outside the sport, which can only be a good thing for raising awareness. I think credit must also go to the authorities for making the brave call to improve the customer experience. Because I know

grain slightly. But I’m a great believer that

The Global Gaming Awards are the most prestigious in the gaming industry due to the strict rules and procedures put in place during the shortlisting and voting processes. Companies can only be nominated once per category, meaning that if they have multiple brands, only one of said brands can be nominated in a particular category.

In addition, every company and individual are nominated for a specific reason which is made publicly available. Finally, the winners are chosen by over 100 C-level industry executives with only one executive per company allowed to participate in the voting process. And if that’s not enough, KPMG in the Crown Dependencies independently adjudicates the voting process to ensure all is fair.

The Global Gaming Awards Las Vegas will

recognise the strongest performers from the Americas across the previous 12 months. The event will have 14 company categories rewarding operators and suppliers, and one category dedicated to the individual whose efforts drive their company and the industry forward – American Executive of the year.

“This year’s Global Gaming Awards Las Vegas are extra special for us,” said Gambling Insider and Gaming America Editor-in-Chief Julian Perry. “Not only has the US gaming industry shown phenomenal growth, but this year we’re celebrating the 10th edition of our flagship Awards event.

“We didn’t know what to expect when we first launched the Awards in 2014 and it’s amazing to see the respect our event

has gained, the companies’ excitement to just be nominated, the executives who agree to participate in the Judging Panel, and the number of people who attend the presentation ceremony,” he added.

The Global Gaming Awards Las Vegas are powered by leading B2B-gaming publications Gambling Insider and Gaming America KPMG in the Crown Dependencies is the official voting adjudicator.

BetConstruct is the Lead Partner of the event, and category sponsors include IGT, Bragg Gaming, Aristocrat Gaming, Interblock Gaming, CasinoTrac, Light & Wonder, EGT and Kambi. Shortlisted companies will be contacted in July, and the winners will be revealed at a luncheon ceremony on Day 1 of G2E 2023, 9 October.

FEATURES AI: EVOLVING OR DESKILLING?

With expert industry insight from suppliers OPTX and Sportradar, Gambling Insider Editor Tim Poole explores whether the implementation of AI might bring some bumps in the road for gambling’s labour force... Not because humans fear AI will take over the world – but because they might be too eager to let AI do their work for them

In addressing artificial intelligence (AI), one of the most-discussed concepts in the world right now, Gambling Insider almost asked ChatGPT to write this article for us. Now, while that’s only a joke, its message presents a concept that mirrors the issues wider society is facing today. Are students getting lazier, when ChatGPT can get them through their college assignments? Are content producers getting worse, because they are letting Grammarly do their job every day? Are humans, overall, evolving through AI, or are they becoming deskilled – because new software can do so many of their daily tasks for them?

These are some of the primary considerations we’re undertaking in this cover feature of the May/June edition of Gambling Insider magazine. While ChatGPT did not write this article, we have no shame in admitting we used transcription software in helping produce the piece. Even if that software is, at this stage at least, incomplete. Were humans not on

hand to double check its output, the following pages would be littered with errors. An unerring example? “Hi there,

Tim Poole here” is regularly transcribed by AI as “Hi there, Temple here.” In the wider context of AI, beyond the mere writing of this article, there is of course an infinite list of benefits that have been brought to gambling companies; benefits that would have been unimaginable as recently as 10-15 years ago. Both sportsbooks and casinos – online and offline – can now use AI in sophisticated new ways that do not replace humans yet make their jobs easier, creating the potential for huge financial efficiencies.

But, if that potential is to be realised in the long term, what happens to companies and their human employees along the way? Across the world, there is also the potential for decline. Before AI can realise its true potential for gambling (and other) companies, could simple laziness and human nature cause problems for organisations looking to fast forward into the future? Speaking to OPTX, which specialises in using AI to enhance land-based casinos, and Sportradar, which

specialises primarily in online sports betting and data, we explore the phenomenon in-depth and ask: AI – is it truly evolving business technology, or simply deskilling those within it?

We’ve all seen the movies over the years. AI has been a contentious topic since the likes of The Terminator hit cinema screens in 1984, The Matrix in 1999, I, Robot in 2004 (and many other, even earlier examples). However, there has been a spout of AI – and particularly ChatGPT – related headlines of late. Not least was news that broke at the very time of writing this article. In early May, Geoffrey Hinton, known colloquially as the ‘Godfather of AI,’ left Google and told the New York Times of his regret at pioneering work that paved the way for systems just like ChatGPT. He is quoted as saying: “I console myself with the normal excuse: If I hadn’t done it, somebody else would have;” and “I don’t think they should scale this up more until they have understood whether they can control it.”

"What we’re working on at OPTX is really more of the co-pilot rather than the autopilot, in the sense of it’s trying to automate a lot of the boring math and data, and present you with some recommendations and predictions"

people will just sit in their apartments and watch the AI-generated ‘RoboKardashians,’ and some will write poetry, paint pictures and volunteer to help kids in their community learn to read.”

Indeed, were we to dig deeper into the morals involved here, we could still be writing come the May/June issue of 2024. But when it comes to the business case of AI, the gambling industry certainly offers a useful case study. First off, we spoke to Steve Bright, VP of Data Science at OPTX, to pitch our initial thesis: that, before we can ultimately see the utmost of AI’s vast benefits, its advancements may end up having an adverse effect on the very human labour force it is designed to enhance. While Gambling Insider is fully aware one or two examples cannot represent the planet’s eight or so billion people, we present Bright with a recent case: candidates for writer roles scored poorly on a proofing test went on to openly say they thought this was acceptable because Grammarly or ChatGPT would find the mistakes for them if they got the job. “Wow,” Bright replies.“Yeah, that’s funny that these are folks with English degrees or some sort of humanities background want to earn a living dealing with the written word. And yet that’s fascinating.”

“DIFFERENT SKILLING”

He continues: “Theoretical physicists and mathematicians are using computers a lot, so the interaction between the person and the machine will fundamentally change in that, rather than you doing these things manually, like multiplying 7-12 digit numbers together with a pen and paper, that is no longer a skill you need. The computer just does that for you; perhaps basic structural grammar is also going to go that way? Then the value add of an editor or a writer is trying to understand how to connect emotionally with the audience or the reader. Is that a different skill set? I would think of this less as deskilling and more as different skilling.

“Could AI ever get to a stage where it’s doing more artistic things, like playing a musical instrument? I would want to see AI do certain things, like if you can train ChatGPT to write jokes. Let’s see an AI be consistently funny and try to create a funny story. Are we close to having AI completing end-to-end content? You can imagine a world where all of your entertainment content is written by AI, so the question is how good does AI have to be before it displaces all other entertainment? And that’s probably hard to do. It’s probably not going to happen any time soon. It’s also possible that AI-generated information and entertainment eventually dulls the senses of humanity.

“This could happen to a point where you’re in this brave new world-type scenario where nobody’s intellectually engaged with anything. I think that’s probably pessimistic. But certainly some portion of humanity will take that route of not engaging intellectually, though most people, or at least enough people, will still want to retain some kind of intellectual engagement with the world just because it’s enjoyable. You can easily imagine a dystopian AI-curated future where people have their basic needs met. But I think it’s gonna depend on people, right? Some

Delving into some recent ChatGPT-related headlines with Bright, there are real extremes on either side of the scale. In Italy, for example, the AI program was banned due to privacy concerns. And, yet, on 28 March, live event and virtual production studio Mobeon appointed a Chat GPT-based AI as its CEO, while around the same time the first fully AI-driven podcast was launched. On the Italy news, Bright rightly points out that the likes of the UK or US are nowhere near to banning ChatGPT. And, on the CEO news, the OPTX executive says it’s “definitely worth a try” for a firm, although the real tricky job – in Bright’s opinion – is that of who would carry out that AI CEO’s wishes. It’s a “fascinating” consideration for the exec.

Back to his thesis on “different skilling,” Bright is keen to emphasise why AI does not necessarily “deskill” a worker, applying it specifically to the casino floor – where OPTX plies its trade. He tells Gambling Insider : “Certainly, the ability to effectively interact with an AI and use it is probably going to be more important than primary skills for some things in the future. At OPTX, our concern is in the domain of: if you have a slot machine on the floor, I want to know what will happen if I move this machine over to this location or if I change this machine from game theme A to game theme B. Via AI, that certainly is a huge value add to the industry, and it’s something that doesn’t really exist in the industry now. So we’re quite proud of it. But it’s not in the same realm as ChatGPT or anything like that.

“What we’re working on at OPTX is really more of the co-pilot rather than the autopilot, in the sense of it’s trying to automate a lot of the boring math and data, and present you with some recommendations and predictions. They’re not going to be right all the time because the underlying data is not going be completely right with things like ChatGPT, either. It’s based on text that’s on the internet. Well, that’s easy – you just throw the entire internet at it. That’s your training set and it’s the same for something like a casino operation. The source data is not clean, and it’s not complete, and the biggest value add that OPTX brings again is not really the AI part. What we bring is taking data that’s in this different format from all these disparate sources, and putting them in a unified format, which then allows you to do some of this cool AI stuff. The AI is incredibly nuanced

"This could happen to a point where you’re in this brave new world-type scenario where nobody’s intellectually engaged with anything. I think that’s probably pessimistic. But certainly some portion of humanity will take that route of not engaging intellectually" – Steve Bright

and very, very difficult, but also very, very valuable.

DON’T

On the sports betting side of our industry, provider Sportradar recently published a White Paper titled ‘Don’t get left behind: How AI-powered sportsbooks are shaping the sports betting industry.’ The evidence and projections put forward in this paper were, equally, consistent with the words of the company’s SVP of Managed Trading Services, Darren Small, who recently appeared on the GI Huddle . During that video interview, he echoed some of Bright’s sentiments, suggesting the role of the sports betting trader is now very

different – but very enhanced due to AI. The human trader, he concluded, is still very much in demand, just in a different capacity.

In Sportradar’s White Paper, it references the “breakneck speed” with which AI is growing, suggesting AI technology is poised to become an “integral part” of a sports betting operator’s playbook. According to a Sportradar survey of global bookmakers, as many as 71% of operators believe AI and machine learning technologies will be “game changers” for the betting industry.

In April 2022, Sportradar put its money where its mouth is regarding AI (so to speak), acquiring AI company Vaix. Naturally, Vaix played a key role in its White Paper, with

COO Jay Kanabar outlining where AI works best for the industry – notably in the area of personalisation.

“We’ve classified personalisation as the sexy product because no one’s really doing it, but everyone’s been doing marketing or CRM since day one,” Kanabar explained. “I often say the quick wins are optimising your marketing budget or retention strategy, which is where customers often overlook what they’ve been doing and don’t change things.” AI-driven personalisation models work by detecting patterns in player behavior and using that information to target messages, bonuses and bets more effectively. Bet recommendation models

"Once more, there is no evidence here of AI taking jobs or deskilling with the above practice. It is the operator that still sets the odds at the end of the day. And, as we return to Small for a final word on this, AI helps provide a litany of micro jobs on a macro level"

become key here and certainly allow for a more tailored sports betting experience.

“The more interesting content you see, the likelier you come back,” added Kanabar.

“If you see college football, you might bet twice a week rather than once a week on NFL. And that’s how it increases retention – by showing you content you want to see before you even know it existed.”

Again, what’s important to highlight is the above application of AI does not necessarily impinge on any human labour. Traders can choose to use this technology to their advantage – but they

cannot simply stop trading. Similarly, Sportradar puts risk management and the ability to profile players at the forefront of the benefits AI offers sportsbooks. Its White Paper states: “These technologies allow operators to create sharper, more accurate odds in real time. Self-learning AI analyses

"Yet AI is moving certain aspects of the industry forward at cutthroat speed and one unconditional requirement this does create is the need for adaptation. Traders, content creators and games designers may see their goalposts shift over the next few years"

historical data using sophisticated algorithms, thus giving sportsbooks a better sense of how likely an event is to occur. In turn, operators can set odds accordingly and reduce their exposure to risk. Not only does this help bettors and operators win more often, but it also increases betting activity overall. As a result, the operator can offer better pricing to its customers and maximise its margins.”

Once more, there is no evidence here of AI taking jobs or deskilling with the above practice. It is the operator that still sets the odds at the end of the day. And, as we return to Small for a final word on this, AI helps provide a litany of micro jobs on a macro level. He comments: “If you have more than 12 million active accounts a month that you have to manage, it would be near impossible to profile all of those accounts in a real-time environment and do that process manually. You’ll be more exposed to risk and volatility and you’d be less efficient in your transaction handling and how much profit you take out of each transaction.”

Based on both Optx and Sportradar’s observations, it is interesting to see the consistency of a “different skilling” idea from two very different sides of the industry. On this basis, Gambling Insider is prepared to conclude that AI is not necessarily “deskilling” gambling’s labour force. We have attempted to throw an AI-powered cat among the pigeons with our thesis and the consensus would appear that AI is not hurting anyone’s ability to do their jobs – nor is it necessarily yet hurting their chances of getting a job and instead being replaced by an AI.

Yet AI is moving certain aspects of the industry forward at cutthroat speed and one unconditional requirement this does create is the need for adaptation. Traders, content creators and games designers may see their goalposts shift over the next few years – with AI able to do the most basic parts of their job, perhaps

quicker and more effectively than them. But that ability to connect emotionally with an audience? The ability that really drives sales, brings people to an online sportsbook or casino floor – that’s the real moneymaker and something AI can’t yet do. It’s simply there to help. People must remain as sharp as ever, refusing to overtly game the system by utilising that help, or perhaps that’s when AI will start to be used more with a view to replacing them…

STEVE BRIGHT BIO:

Steve Bright leads OPTX’s Data Science team, which designs, develops, tests, and monitors new Artificial Intelligence (AI) features for OPTX’s data modules. The data intelligence used by OPTX creates actionable recommendations for casino operators, provides real-time individualised insights to ensure that no actionable player is missed, and empowers teams to spend less time compiling the data and more time implementing strategies that increase guest visitation, revenue and profitability.

Prior to joining OPTX, Steve Bright worked as a Data Scientist in many different industries, and has over 30 published papers in fields ranging from Experimental High Energy Physics to Pharmacovigilance (Drug Safety). He also has several years of experience applying Data Science to problems in the Gaming Industry, including Machine Learning (ML) algorithms to forecast and optimise slot floor performance.

Steve holds a B.S. in Physics from the Georgia Institute of Technology and earned his M.S. and Ph.D. in Physics from the University of Chicago. Steve is also a recreational poker player, gambler and an avid runner. Steve is a long-time resident of Las Vegas where he lives with his girlfriend Julie and two German Shorthaired Pointers, Vonnegut and Joey, who are often running together in training for the next half marathon.

"Again, what’s important to highlight is the above application of AI does not necessarily impinge on any human labour. Traders can choose to use this technology to their advantage – but they cannot simply stop trading. Similarly, Sportradar puts risk management and the ability to profile players at the forefront of the benefits AI offers sportsbooks"

In April, Australian operator PointsBet announced it is looking to sell its North American operations, despite heavy marketing that had resulted in at least some market share of note. Below, we examine a timeline of the brand’s operations in North America (and mainly the US)

Final Post-Game Show

The operator becomes first US ‘ always on’ sports betting provider and offers live same-game parlay bet types for NFL and NBA

‘Sanctuary’ 30-second advert launched but not featured on TV due to its “edgy nature.” PointsBet mobile app also goes live in Louisiana

The Massachusetts Gaming Commission announces that PointsBet will be withdrawing its temporary licence application for the state

Moelis & Company hired as investment bank to help sell its North American operations

PointsBet launches online casino in West V irginia and adds live casino games to New Jersey portfolio

PointsBet reports 122% increase in total North America net revenue ($93.9m). Turnover totalled $2.4bn

PointsBet launches retail sportsbook in Illinois and mobile sportsbook in Ohio

PointsBet announces US revenue has doubled... but posts net loss of AU$178m (US$119m)

The Swedish Government’s Covid-19 pandemic intervention in the gambling market has been the subject of much scrutiny. In a recent LinkedIn post, Georg Westin, founder of Hero Gaming, expressed his frustration with the Government’s approach. Westin noted that, while the Covid-19 lockdown did not cause a surge in Swedish problem gambling, the Government had been busy imposing new gaming regulations, including a weekly SEK 5,000 ($4486) deposit limit for online casinos, a requirement for players to specify their login times and a SEK 100 cap on bonuses.

While it is somewhat understandable that the Responsible Gambling Minister, Ardalan Shekarabi, would be concerned about the potential for harmful gambling during a time of isolation and economic distress, it is unreasonable for him to have acted without first ascertaining whether his concerns were warranted.

In the realm of gambling policy, such knee-jerk reactions are nothing new, nor unique to Sweden, but rather a disappointingly common approach in many European jurisdictions, where the act of taking action often becomes more important than solving the problem presented. In the case of the alleged pandemic-fueled increase in problem gambling rates, the first step should have been to ascertain if there was a problem to begin with.

Once the facts were presented in a March 2022 report by the Swedish Gambling Authority, evidence collected from state authorities, problem

gambling associations and academia revealed that the proportion of problem gamblers had not increased compared to the time before the pandemic and the introduction of the more restrictive deposit and bonus limits.

As a former politician, I recognise the situation Shekarabi found himself in. It was not unreasonable to ask whether problem gambling had increased during the pandemic, and that was precisely what journalists in Sweden did. What was the Minister’s solution to this problem, the journalists asked, since most of them did not bother to test the underlying premise.

Minister Shekarabi proved unable to resist the false hypothesis presented to him, and it can even be argued that he capitalised on the gaming industry’s poor reputation to score political points. Who really cares that the Minister acted first and asked questions later? Probably not the average Swede whom I meet in the grocery store or at the hair salon. The only thing most people in Sweden possibly remember is that Shekarabi took the fight to the predatory gambling industry... and that can never be wrong, right?

Unfortunately, by acting on a false hypothesis, imposing onerous regulations and limiting Swedish consumers’ access to legal gambling options, Minister Shekarabi may have inadvertently driven players into the arms of unregulated or illegal gambling operators who prey on vulnerable customers, offer no consumer protections and do not ensure integrity or fair play.

As the pandemic-era limits finally expired in November 2021, and the Government abandoned its plan for a new temporary deposit limit, the Swedish Parliament’s Committee on the Constitution rebuked Shekarabi for his intervention in the gambling market. It is clear that the Minister should have waited for the facts before imposing new regulations on the gambling industry, rather than acting on perceived-but -unfounded concerns.

Ultimately, it is concerning that policies are increasingly judged not by their outcomes but by the intentions of politicians. While it is important for politicians to take forceful action when faced with real problems, it is equally important for them to resist the urge to act on fabricated problems. Instead, they should heed the advice of Winnie the Pooh and “not underestimate the value of doing nothing, of just going along, listening to all the things you can’t hear and not bothering.” I, for one, look forward to the day when a Minister is asked what he or she intends to do about a purported problem and replies, “nothing.”

"In the realm of gambling policy, such knee-jerk reactions are nothing new, nor unique to Sweden, but rather a disappointingly common approach in many European jurisdictions"Gustaf Hoffstedt

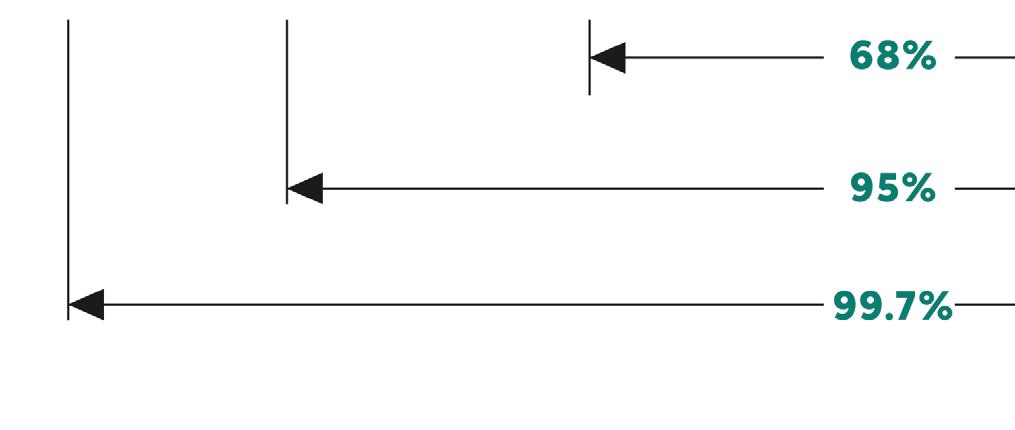

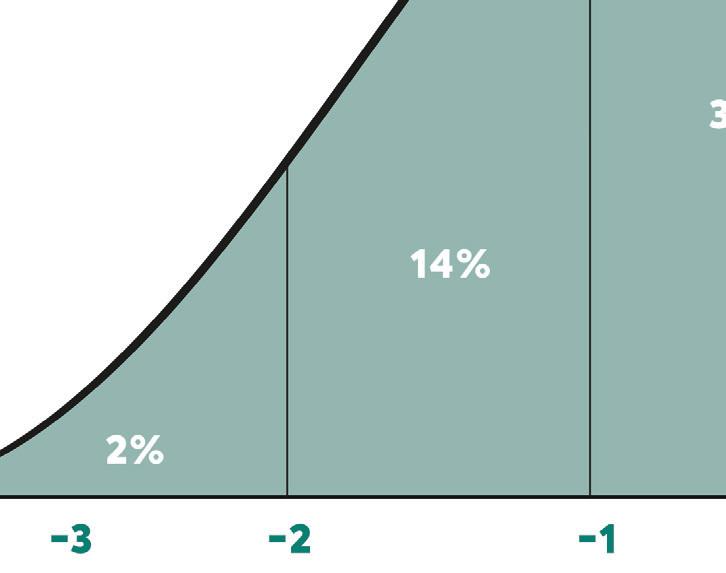

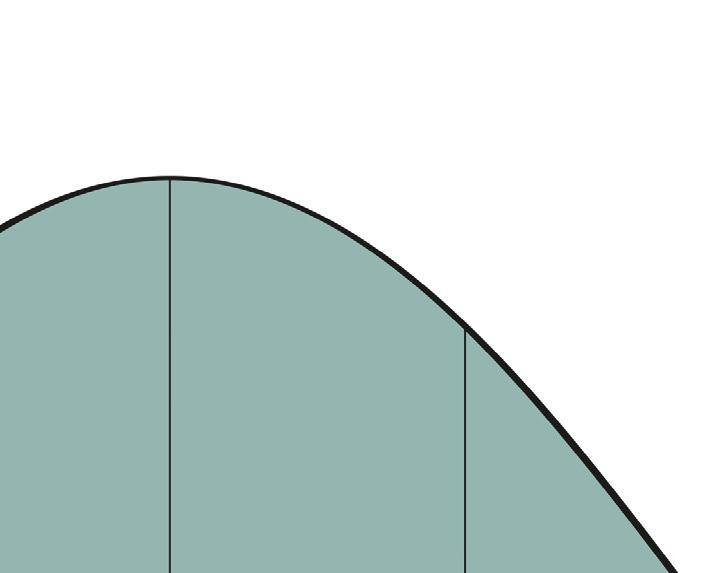

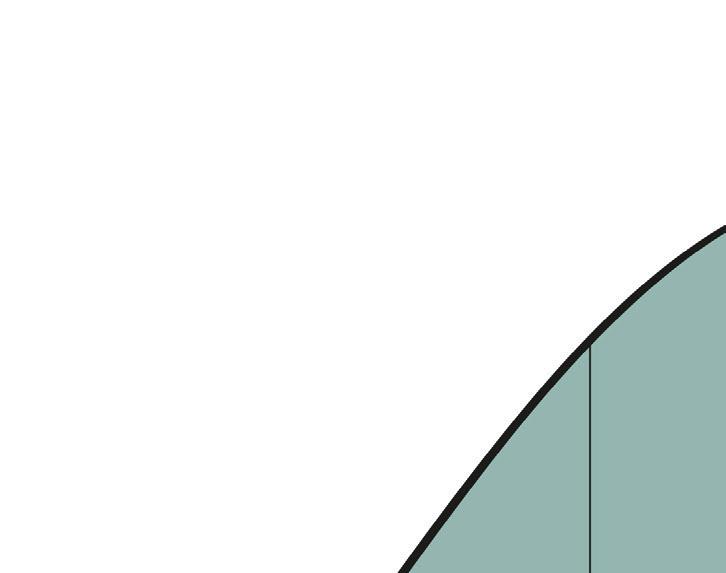

Remember in high school asking if the teacher would be grading “based on the curve?” That’s the “curve of normal distribution” and it applies when you’re interviewing for jobs (both ways!), dating and your playerbase. It looks like this our Graph X on page 41.

The centre line is the “norm,” the average and each segment is “one standard deviation” from the “norm.” That’s as technical as we’ll get here. When you have a lot of dates, or a lot of companies to choose from to work for, you can “grade” them on this curve. Those few are on the far left you should join or marry at all costs. The far right, avoid. Most, 68%, will fall somewhere in the middle.

Take any group of players that’s large enough and you’ll see the curve or "normal distribution” apply. Starting from the far left, the first two segments could be called “die-hards,” 16% of your player base, watching sports is their life. The next 34% are “super sports enthusiasts.”

"All streaming services have some degree of lag and varying availability and quality, from HD to, well, tolerable"

The next 34% “sports fans.” And the last 16% are “sports followers”. You can create your own categorisation labels...

Now their value to you may change significantly in the curve, “diehards" may be killing you, or the “followers” may (you can also grade your players by lifetime value following the same methodology). But here, we’re looking to see how to best engage these segments.

“Die hards” will find the streams for the games they must watch. They’ll go to the end of the Earth to watch them live. At the opposite end of the curve, “followers” may just bet on teams that they have determined to be good bets based on the maths (“the maths work, considering the odds and teams’ performances I’m betting on X”), or emotions (“I always bet for or against my home team”). They may or may not care to see the match; they’ve made up their minds.

It’s that vast majority that are really of interest. How do you get the semi-engaged or less-engaged segments to bet on various sports?

By streaming it to them live.

The biggest firms in sports betting offer live streaming of games – usually only to players with a recent deposit or more strictly a bet on the game. It can be an expensive proposition, but companies like bet365 see a positive ROI for the investment: more time on site, more live betting, more reasons to explore their secondary or tertiary interests (i.e. ping pong, archery, volleyball and smaller football leagues).

Major players like Sportradar and Betgenius provide these feeds at a price that’s unaffordable to most sportsbook operators.

Now, firms like Sportstream.network are offering thousands of aggregated streams for smaller books, smaller markets, even grey or darker markets, which are delivered via a worldwide streaming CDN (content delivery network). “Literally every sport, imaginable” they claim; and looking at their demo, it appears true, from US NBA to Puducherry National Doctors League cricket, and from World Masters table tennis to Asian badminton.

Like the big boys, they advise to only allow “qualified” players to watch, not the general public. While the streams can be “integrated” into your sportsbook for ease of navigation, they are delivered on a server separate from your own servers; and of course the streaming section of the site can be branded to match your book.

But unlike the big guys paying $50,000 to $100,000 a month for the service, it’s offered at a fraction of that price ballpark of $5,000 per month for the first 100,000 views.

All streaming services have some degree of lag and varying availability and quality, from HD to, well, tolerable. So with a one to five-second delay on the action, you do have to watch for live betting opportunities that could be taken advantage of. Which team will get the next score or red card is largely safe, the next corner throw in could be trickier.

Even with these qualifications, livestreaming sports does appeal to the sports betting masses in most markets, especially with under-served leagues/sports or in smaller markets. Coincidentally (or is it math?) exactly 63.64% of sports bettors said “yes” when asked “would you like to be able to live stream games on your sports betting site?” The appetite for sport streaming is certainly there. Eventually it’ll be as de rigueur as live betting - no doubt.

"It’s that vast majority that are really of interest. How do you get the semi-engaged or less-engaged segments to bet on various sports? Streaming to them live"

The Norwegian gambling monopoly is in the process of being erased due to the grey areas it has knowingly and willfully moved into, writes

Carl-Fredrik Stenstrøm, Secretary General Norsk Bransjeforening for Onlinespill (NBO)The Norwegian gambling debate has for a long time been characterised as partly nonexistent, or partly simplified to stereotypes about the good and the bad. This is now changing. Not least thanks to good journalistic revelations of all the grey areas one would rather not talk about so much, in a world where everything should be black or white.

In a series of articles, Norway’s largest daily newspaper VG has showcased how Norwegian sporting federations make a lot of money by selling viewing rights out of the country. Who pays? Non-Norwegian regulated gambling companies who can offer customers streaming of Norwegian football, volleyball and ice hockey on their websites.

Absolutely fine, says the Norwegian Confederation of Sports, which is otherwise the state-owned Norsk Tipping’s largest beneficiary and the monopoly’s most ardent defender. The reason is that it is sold via an intermediary. Or as Sports Confederation president Berit Kjøll stated in VG on 1 March: “These are a legal business and agreements that are not in conflict with the Norwegian gambling legislation”.

She was supported by responsible Government Minister Anette Trettebergstuen, who,when confronted by the opposition parties, stated on a general basis: “It is not contrary to Norwegian gambling regulations for Norwegian organisations to sell streaming and data rights to foreign agencies, who resell these rights to international gambling companies that block them from being shown in Norway.”

For the Minister, this was a classic Catch 22: If she went against the agreements, she would shake the historic trinity between her

Labour Party, sports and Norsk Tipping. If she supported it, she would in practice be politically sanctioning that Norwegian sports make money from the same non-Norwegian regulated gambling companies she has otherwise stated to be both irresponsible and a threat to problem gamblers. She chose the second option.

Many of the individual athletes who previously had sponsorship agreements with non-Norwegian regulated companies have probably taken note of this. Their agreements were met with both moral condemnation and threats of being kicked out of national teams and tournaments.

We find yet another grey area within the horse trotting sport. In an attempt to prevent further falls in turnover, the private monopoly entity Norsk Rikstoto takes part in pool games where it offers Norwegian customers bets on races organised in other countries. Who is behind this? The same non-Norwegian regulated companies that Norsk Rikstoto, the Ministry and the monopoly-friendly politicians otherwise forcefully distance themselves from. Once again, we are witness to stakeholders within the Norwegian gambling monopoly pointing a finger of condemnation with one hand and accept money with the other.

The real losers in these grey areas are the problem players who are otherwise pushed in front of them. The unison feedback from markets re-regulated to license systems is the value of collaboration: between the licensed companies who together have a far greater share of turnover, between authorities and the companies who together have a far greater share of turnover, between the companies and not least between companies

and treatment environments. Collaboration is the key to everything from effective tools such as Spelpaus.se to alignment between treatment and research, and development.

The good news is that the more these grey areas are exposed, the more difficult it becomes to continue a debate where everything is presented as black and white. The Netflix hit Troll showed how the Norwegian fairytale creatures, who may seem invulnerable, explode as soon as the sun shines on them. This is also the case with the gaming monopoly: constantly new revelations of double standards make it politically more difficult to defend.

And once it cracks, it can disappear fast. In Sweden, Svenska Spel and ATG themselves opened for a re-regulation, as did Finnish Veikkaus last summer. Both of the two stateowned gaming companies understood the developments in the political landscape and realised that their position in a new regulation would be stronger if it happened before they had lost further market share. In Norway, both Norsk Tipping, politicians and beneficiaries now have sun on them.

“Constantly new revelations of double standards make it politically more difficult to defend”

Eclipse Gaming’s Anton Yakovenko speaks to Gambling Insider Editor

Tim Poole, telling the heart-warming story of how he was able to leave war-torn Ukraine with his wife Kristina and dog Muha. We also hear what it was like for the supplier during the ordeal from Steve McDonald, Senior Director of HR

Thank you so much for joining us Anton. Can you, in your own words, walk us through your story of how you got from A to B, leaving Ukraine and ending up in Georgia working in the Eclipse Gaming office?

Anton Yakovenko: One morning in Kyiv, we woke up to explosions. Nothing can prepare you for that kind of experience; I literally could not control my body. I woke up screaming and I couldn’t understand why – but I couldn’t stop screaming. My body was out of my control. Then, when I calmed down a bit, we heard another series of explosions – and we understood. We understood that, yes, the war has started. There were lot of rumours for the previous two months, but we still did not believe a full-scale war would happen. Our first thoughts were to at least get

some information about what’s happening, because we didn’t know if there were already Russian forces in Kyiv. Was it even safe to go out, or was it safer to stay inside?

Checking social media and different news outlets, we found some information. Then President Volodymyr Zelenskyy also sent his recorded video message and we realised that, yes, while there were no Russian forces in Kyiv yet, it was clear Kyiv would be their main target and we decided to leave. Me and my wife Kristina had two cars and grabbed our most important things, like documents and medication, because I have diabetes. And, of course, our dog – that’s one of the most important parts of our life. We picked up Kristina’s mother and a couple of friends, and

set off to my native town, where my mother and grandfather live. It’s far from Russian borders so it was much safer there. Leaving the same day, it took us about 10 hours to get there, when usually it is at most a four-hour drive.

What were your next steps?

AY: From there, we wanted to move forward and leave Ukraine. The problem here was that Ukraine would not allow men from the age of 18 to 60 to leave the country if they could serve in the army. Because of my diabetes, this normally wouldn’t have been a problem. But when we were at the border with Poland, they said my existing papers were not relevant anymore and that I would have to go through the same process again to determine my ineligibility

to serve. This entire process took about eight months, because I had to go to a hospital, go through a bunch of different doctors, who would all come to their own conclusions.

After a lot of paperwork, eventually we did it. We also won the H1-B lottery, which would allow me and my wife to come to the US. This was actually something we had planned for a couple of years already. But when the war started, we had to move this plan forward. We couldn’t get an actual Visa interview in Ukraine because the US Embassy was closed, so we had to go to a different country to have that interview, leaving Ukraine on 1 October. On 1 December, we received an interview and got Visas. And on 14 December, we actually came to the US. I have to say it was a great relief, although the flight itself was pretty difficult. It was long and we had our dog with us. It was our first experience of travelling with the dog and it had some nuances. After everything, however, we are very happy that we did it. It was a great relief to finally reach safety and to reach this goal we were following for such a long time.

Of course, we still have in our mind that, while we are in a safe place, there is still a brutal war in Ukraine where I have friends who are fighting. It’s something that is always in the back of my mind. It’s great that my story has been highlighted – it’s very good to have some positivity. Yet I think it’s very important to remember that the war is still ongoing. Even though there are now fewer stories about major events in Ukraine, it is still happening. And the fact there is not any major news is only caused by the strong resistance Russian forces are getting in Ukraine. So I’m really grateful for all the support I’ve received.

A question for Steve: from the company’s perspective, what was going through your minds and was there constantly work being done from your side?

Steve McDonald: Yes is the short answer to your question! We’ve worked with Anton for more than a couple of years here at Eclipse. Anton was effectively a contractor for us in the Ukraine and we have definitely leaned on Anton’s skillset over the past four or five years. Anton’s been great all round and that’s one of the reasons we wanted him in the US. The Visa process isn’t just as simple as saying ‘hey, we want to get somebody here’ and magically it happens. There’s a lot of work that goes into it on the company’s end.

We needed to get documents filed, make sure we post a position here in the US, and make sure the

customs and immigration services are aligned on what we’re doing. Once we got an in with the H1-B lottery, it was fantastic because I think one in four people generally are successful with that. We were delighted when we received the news that Anton was successful, because he’s a good guy, good employee, we like him and we want him here. But then, unfortunately, it coincided with the news of the war in Ukraine. Winning the H1-B lottery was the tough part but there was still a lot of work to do after that. We had to make sure Anton could get to somewhere he could have an interview and secure his Visa. We had to carry out logistical arrangements, finding

Anton, his wife and his dog somewhere to live. And then, you know, in the time we were waiting for Anton to arrive, we were regularly in touch. Every week, we were going backwards and forwards asking if there was any news or if anything had changed. So there was a lot of contact between myself, Anton and our Executive Leadership team. Anton and his family’s welfare were very much at the forefront of our minds when we were talking with him and going through this process. When Anton and his family arrived in December, it was an overwhelming sense of relief to have them here and safe in the US, to build a new life.

Anton, were there any moments of doubt where you thought ‘ah, this might not happen,’ or were you confident you would end up in the US throughout?

AY: I wasn’t confident it would happen. Honestly, my main cause of concern was all the conditions and requirements for us to bring our dog here; because we were determined not to leave her behind. We had to send different certificates and test results to the CDC (Centers for Disease Control and Prevention). They said it could have taken 22 months but, in fact, it took three days, so that was great for us. But when I actually started looking at how to fly her to the US, that’s when I started finding all the requirements. Some airlines would not take a dog at all. Some airlines would take dogs, but only in the cabin. So there were lots of things that had to happen at the same time for us to do it. We actually found the only airline that would let us do it and, when I found that ticket, called customer support to make sure and it was all booked, that’s when I realised ‘okay, now it’s all good.’ Now it’s going to happen and it’s going to happen when we expected it to happen.

Was it the case that you wouldn’t have left Ukraine without Muha – and that you would have stayed until you could arrange for your dog to come with you?

AY: We would keep looking for ways to bring her because, really, she’s a very important part of our life. I always wanted to have a dog since I was a child but, for various reasons, we couldn’t. We finally got Muha from a shelter around two years ago and, when the war started, we were thrown out of our normal life. For us, life changed but it’s

always easier for animals. They don’t understand what’s happening or what the explosions are. They just live their life. And having her with us all the time was that little part of our previous peaceful life that really comforted us. So we just knew we wouldn’t abandon her, even though technically we could leave her with our

friends or family in Ukraine… for us, that would still feel like abandoning her. We knew we would find a solution. And that’s what we did.

So what are your next steps from here, Steve and Anton? How long is Anton’s Visa valid for and what is the long-term outlook?

SM: We’re delighted Anton and his family are here and we want to keep him here – both from a personal perspective and a company perspective. Anton is a great employee and does great work, so we see a very bright future for Anton. We will pursue a green card for Anton, so that will give him permanent resident status in the US. I’m sure after he has his green card for a period he may or may not want to seek US citizenship. But, personally, I would like to see a long-term future here for Anton at Eclipse. Here in the US, it’s a great opportunity. I’m an expat myself, so I’ve been through the green card and citizenship process. Anton can certainly go a long way, both with Eclipse and wherever he chooses in future years.

AY: My Visa is valid for three years, and then it can be extended for another three years. It’s enough time to take care of a green card and all future planning. I also want to add that my wife has dreamed about just visiting the US for a very long time. It’s difficult to even get a travel Visa for Ukrainians. So when she came here, she literally felt like she was in in some kind of movie. Things like school buses were something we had only seen in the movies! So I’m very glad my wife’s dream came true and we are really grateful for this, to Eclipse, to Steve and to everybody who helped us with this.

Sportsbooks have been name of the game across the Americas in recent years – the US, for example, has seen a gold rush, approving sports betting state by state since the Professional and Amateur Sports Protection Act of 1992 (PASPA) was overturned by the Supreme Court in 2018. Meanwhile, Canada has made Ontario its official gambling province and has worked to ensure a thriving market within the region. In Europe, betting on sporting events is a long-held tradition – one that pre-dates the eras of empire and aristocratic revelry watching horseracing.

But what about the much-anticipated LatAm market of Brazil?

Down in South America, gambling has been slowly building itself into a behemoth. The famously football-mad country now has legal sports betting and sportsbook operators are ready to fight for market share – however,

there is one point that is holding the market back: regulation.

The sports betting market in Brazil, though legal since 2018, has remained unregulated for the past five years – and those lack of rules have ensured some sportsbook operators have held off wholly challenging in the market. Yet, as the market begins its path to regulation – with recent news suggesting the country will require any sports betting companies operating in Brazil to have a headquarters there – moves for sportsbook operators jostling their way into the market have begun.

Kambi

For Kambi, a company that is currently undergoing the process of becoming regulated in Brazil, the market holds a lot of potential. Ignacio Iglesias, Kambi’s Director of Partner Success LatAm/EMEA, commented on the future of Brazil’s regulations and how it would affect sportsbooks such as Kambi’s in

the country. He told Gambling Insider: “We’re always assessing opportunities to enter newly regulated markets either through new partnerships or extending existing ones, and with a flexible technology stack which can quickly pivot to meet any local requirements across both regulation and consumer preferences we believe we are well placed to capitalise as regulation in Brazil approaches.” Confident words, but ones that show how transformative regulation will be for the Brazilian market for sportsbook operators. Iglesias then discussed the partnerships that it already has in Brazil and Kambi’s current position in other LatAm countries: “We have already announced a long-term partnership with Rei do Pitaco (RDP), which offers Kambi a platform upon which to expand into Brazil as regulation allows. RDP has generated millions of downloads for its DFS app, growing to have strong brand recognition throughout Brazil, and it has an impressive customer

database of passionate football fans that will continue to grow once sports betting is regulated. We are already established as a sportsbook supplier throughout Latin America, including Peru, multiple provinces in Argentina and Colombia, so we are enthused at the prospect of bringing our technology to Brazil.”

When talking about the next five years for sports betting in Brazil, Iglesias gave more on what that looked like from his perspective. “With a population of more than 200 million people, Brazil has the potential to become one of the world’s biggest regulated sports betting markets. Regulation in Brazil has been on the cards for many years now and it is pleasing to see that a country with such sports betting potential finally seems to be making headway in this regard. Brazil is a country known across the world for its passionate sports fans. The country’s heritage in soccer needs little introduction, but success in Brazil will require a depth of offering across all sports, in particular the likes of tennis and formula one.”

Finally, the Director of Partner Success spoke about sportsbook technology and how it should evolve in modern markets. He added: “Sportsbook technology will need to keep evolving to maintain pace with the demands of modern players, not only in Brazil but across the globe. Player preferences are increasingly shifting towards products-only algorithms.”

Meanwhile, Altenar’s software and services, which are live in Brazil, have been gathering pace in the country. Commenting exclusively to Gambling Insider , Hugo Llanos, Regional Director for Americas at Altenar, spoke of the sustained expansion that is currently being seen in Brazil’s sports betting market: “There is a

continuous growth in terms of interest towards sportsbooks and new companies going into the online sportsbook industry. This is for sure incentivised by the opportunity to be regulated in Brazil, plus the natural growth the industry had been having in the region.”

For Altenar, the Brazilian market has been a ground of intense competition due to its size and adoration for football in particular.

“It is always fierce,” added Llanos. “New competitors, strong brands getting in with big marketing budgets, there’s a huge interest in Brazil per the size of the population and the potential the entire country has due to its love and passion for footbal, and sports, in general.”

One of the other big topics in Brazil right now, which Llanos commented on prior, is the discussion of stricter regulations, which has drawbacks and benefits to any operators already involved in a jurisdiction. Llanos commented on Brazil’s plan to further regulate its sports betting market, explaining: “Regulation is always a good thing; we are not afraid of it and I believe no operator should be afraid of it either. It will create a need for better, improved reporting but that will actually come in favour of us and the industry so it will be for the better. Being in a regulated market

In terms of the future, Llanos further pushed his support for regulation in the market: “I hope we do get the see the regulation finally in place in Brazil, and having a very mature market, growing exponentially month after month, with people amazed at how much turnover Brazil could generate.”

Evidently, the Brazilian market is one that sportsbook operators can’t wait to get involved in, as the market value there is a gold mine for any that can grab a significant market share. However, right now, any efforts made by operators are being met with caution from within because of the unregulated status of the market. That said, Brazil is edging ever closer to regulating the market, with plans currently making a path through the country’s congress – though, this has been hampered by the unstable political situation that has gripped Brazil in recent years.

Suppliers and operators are readying for the day that Brazil finally passes its regulation bill, though. As seen by the comments made by Altenar and Kambi, both of which are focusing on the entire LatAm region for the next phase of the continent’s economic growth; through the legalisation and regulation of gambling, and sports betting in general.

provides the industry with a reputation and 'safety,' which is better than any branding campaign a company could do.”

Where Brazil stands now is the end of the beginning, it started allowing sports betting in 2018 and soon Brazil’s lawmakers will clear the regulation bill give the market fully regulated sports betting. When it does, the rush from operators and suppliers to take a firm foothold in the country feels like it will be akin to the streets of Rio during Carnival – a bright and blinding blend.

Across Europe there are many cultural and social differences, all of which are unique to each individual country – yet, together, each forms a part of a continent that has strong bonds of familial and cultural ties that comprise the whole. This all serves as a delicate part of the vast economic balance that produces billions per year in continental gross domestic product (GDP). The same can be said of gambling in many ways. While almost no two countries in Europe regulate the practice in the same way, and while attitudes towards it vary, the way each country chooses to approach regulating gambling does have similarities.

As each nation has opened up and regulated gambling across Europe, they have looked to those that have come before for inspiration to follow, taking parts from the other markets to form one that suits each country's own culture. Below, Gambling Insider looks across the European betting market to explore the similarities and differences in the approach to regulation, asking the experts to see if there is a place that has struck the right balance between free play and restrictions that help keep players safe.

The Finnish market, known for being one of the most carefully and heavily regulated in Europe, has spent significant amounts of time crafting laws that match with the vision of the country to allow gambling – however, some argue that the current system is making life difficult for all but the larger operators. Sverker Skogberg, SVP of Paf, spoke exclusively to Gambling Insider about the issue of regulation in Finland and further abroad.

When asked if there are markets in Europe that Paf avoids due to over-regulation,

Skogberg told Gambling Insider: “Paf prefers to be in tough regulated markets, creating a level playing field. Before we make a possible decision to go into a new market, we carefully analyse the coming competition situation. For instance, concerning the UK some years ago we did all the required compliance work to get a licence, but decided to leave it unused, because of the very tough competition situation in the country.”

He then spoke about over-regulation, and if whether believes it has killed some markets and driven channelisation towards black market operators: “No, we don’t think so, but the balance between a tough regulation and maintaining a good channelisation level will always be a challenge for the authorities to solve.”

Furthermore, Skogberg then explained that ‘cultural differences’ and ‘attitudes towards gaming tax levels’ play a big part in Europe’s varying regulations, stating the reasons were: “Mainly because of cultural differences, regulator attitudes to gaming tax levels and its purpose, attitudes to marketing, the ability of building functioning responsible gaming tools, B2B regulation etc.”

Lastly, Skogberg spoke of Finland’s

goal of achieving the perfect balance of regulation and free market policy, telling Gambling Insider: “That is what we all want to strive for, and Finland will with its upcoming regulation have a unique chance to achieve and build this balance.”