CFO SPOTLIGHT: THE NUMBERS GAME

How important is the role of the CFO in gaming? And can this key figure determine whether a company ends up in the red or black?

GLOBAL GAMING AWARDS

We reveal the winners of the Asia-Pacific Awards 2023

BIG QUESTION We ask suppliers: Self-production or aggregation?

ROUNDTABLE Industry experts assess the latest market trends in sports betting

Jul/Aug 2023

EDITOR’S LETTER

COO, EDITOR IN CHIEF

Julian Perry

EDITOR

Tim Poole

Tim.Poole@gamblinginsider.com

STAFF WRITERS

Matthew Nicholson

Matthew.Nicholson@gamblinginsider.com

Lucy Wynne

Lucy.Wynne@gamblinginsider.com

Robert Prendergast

Robert.Prendergast@gamblinginsider.com

LEAD DESIGNER

Brendan Morrell

DESIGNERS

Olesya Adamska, Christian Quiling

DESIGN ASSISTANTS

The role of the CFO is integral to any large organisation. That is as applicable in gaming as it is in ecommerce, healthcare or finance.

But, perfectly naturally, a company's CFO can get a little bit less of the limelight than its CEO. We ourselves at Gambling Insider hold an annual CEO Special issue of our magazine. And yet it is often a company CFO that can help make or break that quarterly report for an operator, supplier or a liate.

This is one of several reasons we have, in this edition, decided to shine a spotlight on the CFO, with our cover feature (starting on page 38) dedicated to the position. As part of this feature, we interviewed FanDuel CFO David Jennings, Bragg Gaming CFO Ronen Kannor, Better Collective CFO Flemming Pedersen and EveryMatrix CFO

Gonzalo De Osma Bucero, who all provided a variety of opinions on the role itself and how best to approach it. Although there was an array of different thoughts, one theme all four CFOs agreed on, rather unanimously, was the need for interdepartmental teamwork – not just within the finance team itself.

Elsewhere in this issue, we include our staple stats and data features, of which some figures really jump out – like just how big the Japanese sports betting and horseracing market is (page 20).

Sticking with an Asia-Paci c theme, from page 30, we bring you the winners of the Global Gaming Awards Asia-Paci c 2023. And we also have a write-up of Marcus Lim's GI Huddle on page 28, where he compares the likes of Singapore, Macau and Australia.

On page 82, the new Venue Director of the Victoria Casino in London, Peter Turpin, speaks exclusively to Gambling Insider for the Final Word of this issue, while our regular Roundtable feature focuses specifically on sports betting, and we ask suppliers whether the market is currently geared more towards self-production or aggregation in our Big Question feature.

For those of you at iGB Live, we hope you enjoy the show and we hope you enjoy reading this magazine – of which there will be numerous copies at that event. It's been a busy summer for gaming but long may it continue. We're not done yet.

TP, Editor

FEATURED IN THIS ISSUE

Radostina Mihaylova, Svetlana Stoyanova, Gabriela Baleva

MARKETING & EVENTS MANAGER

Mariya Savova

PRODUCTION CONTROLLER

Oleksandra Myronova

IT MANAGER

Tom Powling

COMMERCIAL DIRECTOR

Deepak Malkani

Deepak.Malkani@gamblinginsider.com

Tel: +44 (0)20 7729 6279

SENIOR ACCOUNT MANAGER

Michael Juqula

Michael.Juqula@gamblinginsider.com

Tel: +44 (0)20 3487 0498

SENIOR BUSINESS DEVELOPMENT MANAGER - U.S.

Aaron Harvey

Aaron.Harvey@playerspublishing.com

Tel: +1 702 425 7818

ADVERTISING SALES EXECUTIVE - U.S. Ariel Greenberg

Ariel.Greenberg@playerspublishing.com

Tel: +1.702 833 9581

ACCOUNT MANAGERS

William Aderele William.Aderele@gamblinginsider.com

Tel: +44 (0)20 7739 2062

Irina Litvinova Irina.Litvinova@gamblinginsider.com

Tel: +44 207 613 5863

Serena Kwong Serena.kwong@gamblinginsider.com

Tel: +44 (0)20 3435 5628

BUSINESS DEVELOPMENT MANAGER

Michelle Pugh Michelle@GlobalGamingAwards.com

Tel: +44 (0)20 7739 5768

CREDIT MANAGER

Rachel Voit

WITH THANKS TO:

Marcus Lim, Flemming Pedersen, Ronen Kannor, David Jennings, Gonzalo De Osma Bucero, Iain Hutchison, Marina Ostrovtsova, Gil Soffer, Peter-Paul de Goeij, Björn Fuchs, Antonino Barra, Dima Reiderman, Dotan Lazar, Alexander Kamenetskyi, Matthew Charlesworth, Araksi Sargsyan, Leo Judkins, Edoardo Narduzzi and Peter Turpin

Gambling Insider magazine ISSN 2043-9466

Produced and published by Players Publishing Ltd

All material is strictly copyrighted and all rights reserved. Reproduction without permission is forbidden. Every care is taken in compiling the contents of Gambling Insider but we assume no responsibility for the e ects arising therefrom. The views expressed are not necessarily those of the publisher.

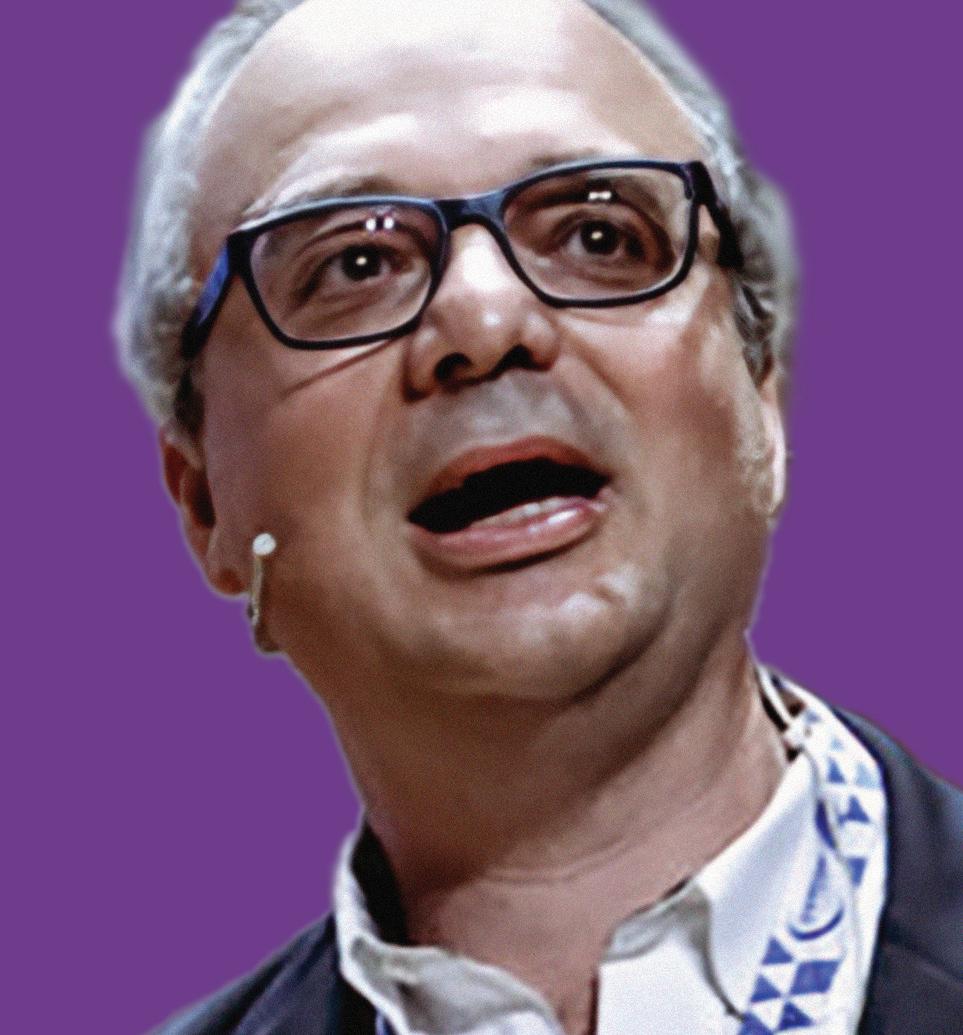

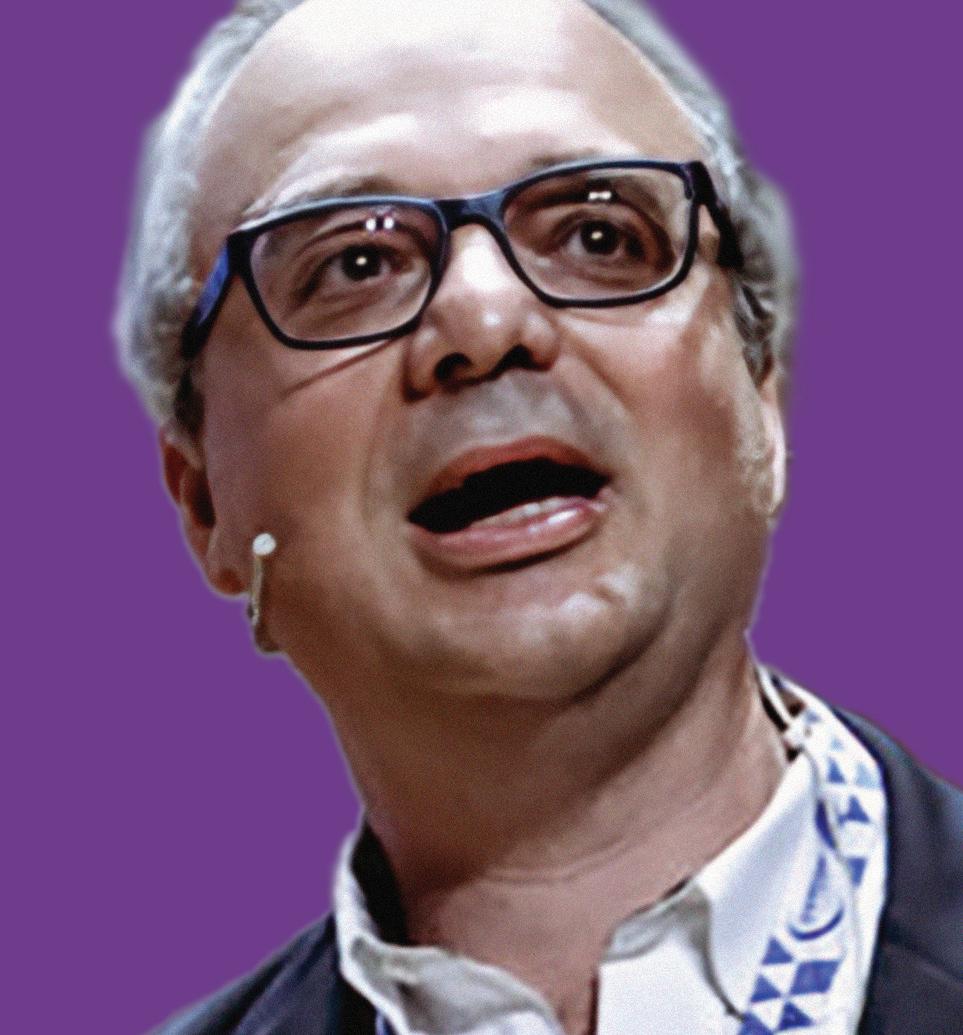

Julian Perry, COO, Editor-in-Chief

MARCUS LIM CEO, Vault Corporation

DAVID JENNINGS CFO, FanDuel

Tim Poole, Editor

C ONTENTS

48 60

ISSUES

12 Facing facts

Gambling Insider tracks the Q1 performances of Asian casinos, affiliates, Las Vegas casinos and US sports betting operators

18 In numbers

In partnership with Gambling Insider, Fantini Research provides US data

20 GBGC data

Global Betting & Gaming Consultants (GBGC), the global gaming data expert, provides exclusive statistical data on markets from around the globe

24 Taking stock

Gambling Insider tracks operator and supplier stock prices across a six-month period

HUDDLE

28 Singapore Vs Macau

Marcus Lim, CEO of Vault Corporation, speaks to the GI Huddle about his career so far, Sands China and the differences between working in Singapore and Macau

GLOBAL GAMING AWARDS

30 Global Gaming Awards Asia-Pacific: The winners revealed

COVER FEATURE

38 CFO spotlight

Gambling Insider speaks to some of the industry’s biggest CFOs to find out the trials and tribulations associated with the role, as well as how each manages the landscape of the modern financial gaming field

FEATURE

44 "Data analysis is fundamental to growth"

Iain Hutchison, CRO at Digitain, speaks to Gambling Insider about the supplier's iGaming platform Centrivo and payment system Paydrom

48 Evolving the team structure

A few months on from her ICE London interview at the Gambling Insider booth, we catch up with BGaming CEO Marina Ostrovtsova for a H1 update

60

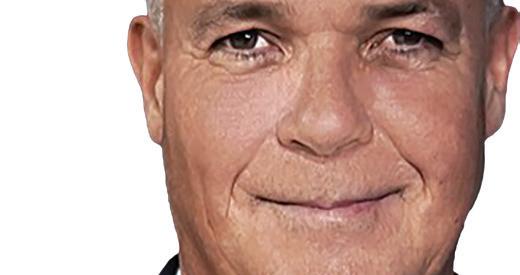

DOTAN LAZAR

JAANA REPO

MARINA OSTROVTSOVA

ONTENTS

50 The post-Covid-19 change

Gil Soffer, SVP Sales & Business Development at Galaxsys, speaks to Gambling Insider about the demographic and popularity of fast and skill games

54 The Wrexham effect

Has the Hollywood takeover of Wrexham impacted the popularity of non-league football betting? Gambling Insider explores...

56 #Winning

Peter-Paul de Goeij, Managing Director of the Netherlands Online Gambling Association, and Björn Fuchs, Chief Digital Officer at JH Group, explain why the Dutch market has won with its online gambling regulation

60 The Big Question: Self-production or aggregation?

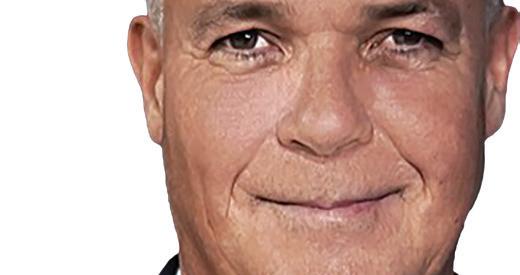

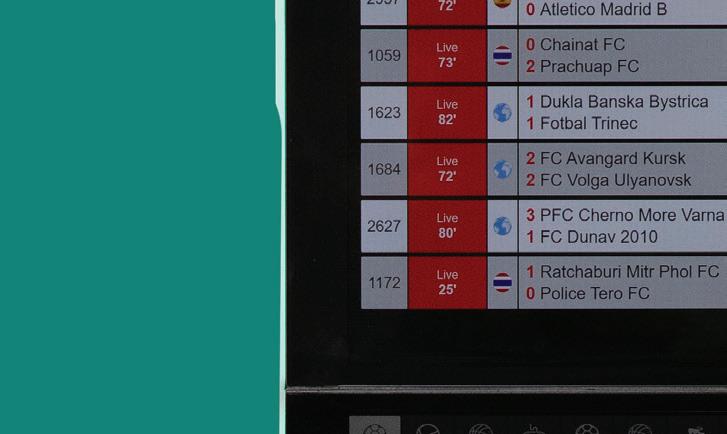

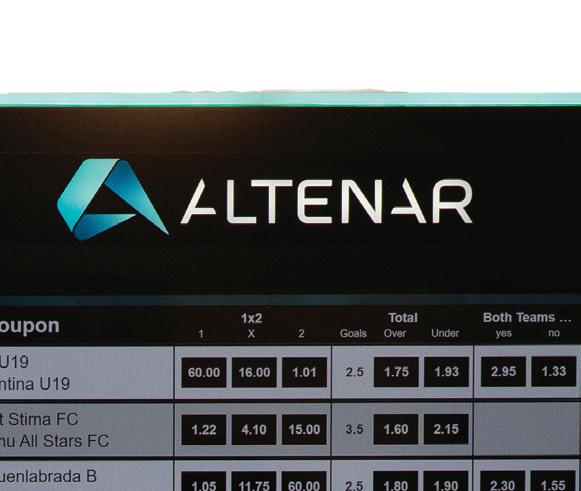

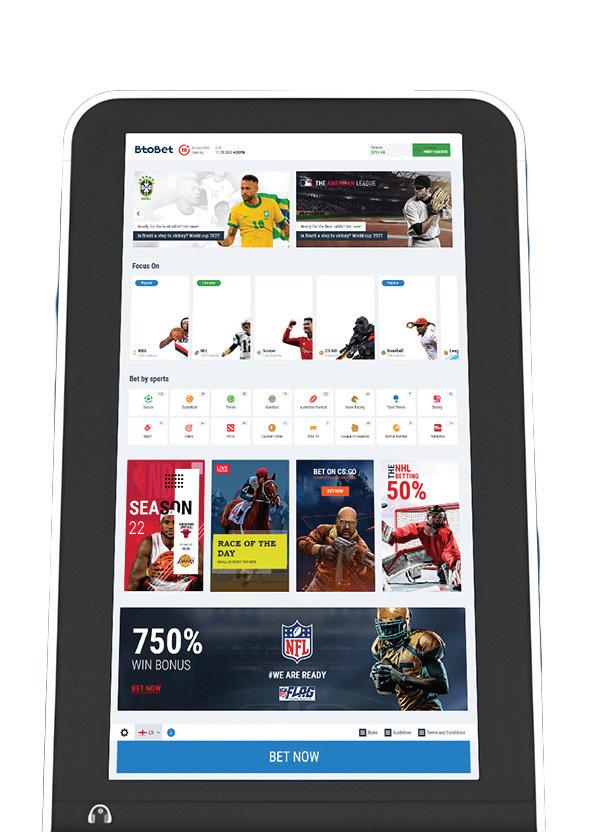

64 Roundtable: The sports betting outlook

Gambling Insider explores sports betting around the world with Softswiss, Altenar, LSport and BtoBet for company

INSIDERS

72 Matthew Charlesworth Imagine Live

73 Araksi Sargsyan DS Virtual Gaming

74 Leo Judkins HabitRewire

75 Edoardo Narduzzi Funtech Games

PRODUCT REVIEWS

76 What's new on the market?

Gambling Insider takes a close look at some of the exciting products that are now available on the casino floor

FINAL WORD

82 Peter Turpin

The Venue Director at The Rank Group's Victoria Casino sits down with Gambling Insider to talk about his new role and London's casino future

72 73 82

MATTHEW CHARLESWORTH ARAKSI SARGSYAN

PETER TURPIN

FACING FACTS

Gambling Insider provides an update on the performance of casinos across Asia, the affiliate market, Las Vegas' land-based casinos and the US sports betting market for Q1 2023

Affiliate EBITDA Q1 2022 vs Q1 2023 ($ million)

Source: Company reports

• Better Collective’s circa $9m jump in EBITDA year-on-year is contrasted by Catena’s 20% drop, a rival that Better Collective recently acquired a greater than 5% stake in

• Gambling.com saw a steady growth of $3.5m in EBITDA, primarily focusing on North America

Affiliate revenue Q1 2023 and Q1 2022 revenue ($ million)

Source: Company reports

• The biggest impact here is seen in Catena’s declining year-on-year revenue, which dropped by $10m across the first three months of 2023 compared with 2022 – this is primarily due to the launch of sports betting in New York in January 2022, which delivered strong growth

• Meanwhile, Better Collective has grown 31% between Q1 2022 and Q1 2023

12 GAMBLINGINSIDER.COM

FEATURES NUMBER CRUNCHING

2023 2022 2023 2022

20 40 0 Better Collective Catena Media Gambling.com 35.3 24.7 Affiliate EBITDA Asian Macau operator gross gaming revenue (GGR) Q1 2023 Revenue ($ million) 60 80 100 21.8 27.3 10.6 7.1 20 40 0 Better Collective Catena Media Gambling.com 94.1 72.1 Affiliate Revenue Revenue ($ million) 60 80 100 38 48.3 26.6 19.5 20 40 0 Better Collective Catena Media Gambling.com 35.3 24.7 Affiliate EBITDA Revenue ($ million) 1 60 80 100 21.8 27.3 10.6 7.1 20 40 0 Better Collective Catena Media Gambling.com 94.1 72.1 Affiliate Revenue Revenue ($ million) 2 60 80 100 38 48.3 26.6 19.5 EBITDA (US$million) Revenue ($million)

Asian Macau operator gross gaming revenue (GGR) Q1 2023 ($ million)

Asian Macau operator gross gaming revenue (GGR) Q1 2023

Asian Macau operator gross gaming revenue (GGR) Q1 2023

Source: Company Reports

• Las Vegas Sands continues its domination in Macau by posting 43% higher GGR than its nearest rival, Galaxy – which drew in $890m

• MGM China, Wynn and Melco were much closer together in GGR, with $85.7m separating the trio

individual casino revenue Q1 2023

Asian individual casino revenue Q1 2023

Source: Company reports

• Across Asia, Marina Bay Sands in Singapore is the behemoth that all others are trying to keep pace with, after it posted $848m in revenue – over double the amount that the Wynn Palace in Macau did

US sports betting revenue Q1 2023

• Resorts World in Singapore, though almost half the size of Marina Bay Sands, still took more than most of Macau’s casinos – with only Galaxy and The Venetian taking more in Q1

13 GAMBLINGINSIDER.COM NUMBER CRUNCHING FEATURES

Revenue ($ million) 400 200 600 800 1,000 1,200 1,400 0 Las

1.27 890 3 0 Better Collective Catena Media Gambling.com 610 600 524.3 470

million) 1,000 1,200 1,120 770 5

Revenue ($ million) 400 200 600 800 1,000 0

848 558 369.4 680 484.5 4

Vegas Sands Galaxy MGM China Wynn Melco SJM Holdings

Asian

Marina

Bay Sands Galaxy Macau The Venetian Macau Resorts World Sentosa Island Wynn Palace Macau

Revenue ($ million) 400 200 600 800 1,000 1,200 1,400 0 Las Vegas Sands Galaxy MGM China Wynn Melco

Holdings 1.27 890 3 0 Better Collective Catena Media Gambling.com 610 600 524.3 470 US sports betting

1,000 1,200 1,120 5 Asian individual casino

Revenue ($ million) 400 200 600 800 1,000 0

848 558 369.4 680 484.5 4 Revenue ($million) Revenue ($million)

SJM

revenue Q1 2023

revenue Q1 2023

Marina

Bay Sands Galaxy Macau The Venetian Macau Resorts World Sentosa Island Wynn Palace Macau

Source: Company reports

• The highly competitive US sports betting market recently saw its seventh-biggest sportsbook in PointsBet plan to exit the country, after the company agreed to sell its US operations to Fanatics

• Both FanDuel and DraftKings continue to dominate much of the sports betting market in the US, with both posing significantly higher revenues than the next largest competitors

Source: Company reports

• In Las Vegas, MGM continues to reign supreme with its casino resorts pulling in $2.2bn in revenue and $836m in EBITDA

• Caesars’ $1.13bn fell far behind MGM’s total but found itself significantly ahead of Wynn’s $586.7m – showing the vast disparity in company takings in Las Vegas

14 GAMBLINGINSIDER.COM US sports betting revenue Q1 2023 Revenue ($ million) 400 200 600 800 1,000 1,200 0 FanDuel (Flutter North America revenue) DraftKings BetMGM (Net Gaming Revenue) Caesars Sportsbook (Caesars Digital figures) 1,120 470 770 238 US land-based Las Vegas revenue 500 1,000 1,500 2,000 2,500 0 MGM Caesars Wynn 2,200 1,130 586.7 836 533 231.5 European supplier EBITDA Q1 2023

sports betting revenue Q1 2023 Revenue ($ million) 400 200 600 800 1,000 1,200 0 FanDuel (Flutter North America revenue) DraftKings BetMGM (Net Gaming Revenue) Caesars Sportsbook (Caesars Digital figures ) 1,120 470 770 238 5 US land-based Las Vegas revenue Revenue ($ million) 500 1,000 1,500 2,000 2,500 0 MGM Caesars Wynn 2,200 1,130 586.7 836 533 231.5 6 European supplier EBITDA Q1 2023 7 Revenue ($million) Revenue ($million)

US

US sports betting revenue Q1 2023

land-based Las Vegas

EBITDA Las Vegas revenue EBITDA

US

revenue and

European supplier EBITDA Q1 2023

Source: Company reports

• Evolution’s $321m in EBITDA is higher than many of its European competitors for Q1 2023 – showing the strength of live casino

• Meanwhile, Kambi and NeoGames are more closely matched, with Kambi’s EBITDA only $5.4m behind – while Bragg’s grew annually by 28%

European operator by region revenue Q1 2023

Regional operator revenue for Q1 2023

Source: Company reports

• Looking at multiple different markets across the European zone, Flutter’s operations in the UK are far ahead of the competition, with France’s gambling monopoly, the FDJ Group, $47.7m behind it

• Betsson and Svenska Spel’s figures correlate directly to the Nordic market, with Svenska Spel’s monopoly over the Swedish market bringing in $180m. Most of Betsson’s overall revenue came from other markets

16 GAMBLINGINSIDER.COM MGM Caesars Wynn

supplier EBITDA Q1

Revenue ($ million) 0 50 100 150 200 250 300 350 Evolution (live casino) NeoGames (iGaming) Kambi (sports betting) Bragg Gaming (iGaming) 321 13.7 19.1 4.3 7

Revenue ($ million) 0 200 400 600 800 1,000 Flutter UK & Ireland FDJ Group (France) Svenska Spel (Sweden) Betsson Nordics 755.1 180 707.4 55.4 8 0 MGM Caesars Wynn European supplier EBITDA Q1 2023 Revenue ($ million) 0 200 400 800 1,000 Evolution (live casino) NeoGames (iGaming) Kambi (sports betting) Bragg Gaming (iGaming) 321 13.7 19.1 4.3 7

Revenue ($ million) 0 200 400 600 800 1,000 Flutter UK & Ireland FDJ Group (France) Svenska Spel

Betsson Nordics 755.1 180 707.4 55.4 8 EBITDA ($million) Revenue ($million)

European

2023

European operator by region revenue Q1 2023

(Sweden)

IN NUMBERS

In partnership with Gambling Insider, Fantini Research provides May data for the state of New York

NEW YORK: In New York, the state saw a slight 3% decline in total casino revenue – while, as a whole, the state enjoyed a 15% rise in overall revenue.

NEW YORK: Online sports betting, which launched in January 2022, saw a 38% rise in revenue annually – totalling $151.9m. Meanwhile, DraftKings saw the biggest increase at 122.4%.

18 GAMBLINGINSIDER.COM FEATURES NUMBER CRUNCHING

MAY REVENUE (M) CHANGE (%) VS 2022 Vernon Downs (Am. Racing & Ent) $2.8 +15.4 Finger Lakes (Del North) $10.8 +11.9 Batavia $6.9 +10.0 Rivers Schenectady (Rush Street) $17.2 +8.3 Resorts World (Genting) $58.1 +6.4 Jake's 58 (Del North) $22.9 +5.2 Hamburg Fairgrounds Buffalo (Del North) $6.5 +3.9 Nassau OTB at Resorts World $23.4 +1.8 Saratoga $11.9 +0.8 Empire City Yonkers (MGM) $53.0 -0.6 Tioga Downs (Am. Racing & Ent) $8.7 -0.6 del Lago $12.6 -7.9 Resorts World Catskills (Genting) $17.0 -10.5 Resorts World Hudson Valley (Genting) $6.0 N/A State Total $410.0 +15.1 Racino Total $202.6 +7.1 Casino Total $55.6 -3.2

MAY REVENUE (M) CHANGE (%) VS 2022 FanDuel (FLTR) $75.9 +18.9 DraftKings (DKNG) $47.7 +122.4 Caesars (CZR) $13.9 +28.9 BetMGM (ENT, MGM) $8.9 +11.9 BetRivers (RSI) $3.2 +78.2 PointsBet (PBH) $1.2 -58.2 WynnBet (WYNN) $0.5 -41.4 Resorts World Bet $0.4 +76.5 Bally's $0.2 N/A Total $151.9 +38.4

GBGC: GLOBAL FOCUS

• The graph shows online gross gambling yield (GGY) as a percentage of global GGY between 2007 and 2025, with 2022 being an estimate and 2023-2025 being forecasts

• It is evident that during the Covid-19 pandemic the share of online GGY grew from 13% in 2019, to 19% in 2020, which is no surprise given that land-based venues were closed in most jurisdictions during the pandemic (2020, 2021). But the growth is set to continue.

Betting = sports betting and horseracing

• This graph shows the top five betting markets by GGY for 2021 in billions of US dollars

• Japan continued to lead the market, with US way back in second place. As US jurisdictions continue to legalise sports betting,it is projected that their share of global betting GGY will grow, but it will be hard to overshadown Japan's racing industry.

• The top 5 betting markets took up 48% of entire global GGY for 2021.

20 GAMBLINGINSIDER.COM 20 15 10 5 0 Japan US Australia UK Hong Kong 8.1 17.0 4.8 5.3 4.4 Top 5 Betting Markets 2021 Betting GGY (USD bn) Global Casino GGY 18-25 ($ billions) Revenue ($ billion) Revenue ($ billion) 150 100 250 200 50 0 2018 2019 2020 2022F 2021 2023F 2024F 2025F 165 168 111 131 193 210 151 175 2 1 Global Betting

Consultants

expert, provides exclusive

data

visit gbgc.com FEATURES NUMBER CRUNCHING Top 5 Betting Markets

GGY

iGaming GGY as % of total market GGY

& Gaming

(GBGC), the global gaming data

statistical

to markets from around the globe;

2021

(US$ billion)

iGaming GGY as % of total market GGY 5 22.2% casinos 9.4% us indian gaming 12.9% gaming machines 20 25 15 10 5 0 20072008200920102011 20122013201420152016201720182019202020212022e2023f2024f2025f

Global Lottery GGY-regions 2021

Market Share Graph 2021% Split

• The graph shows global lottery GGY distribution in 2021, in percentages

• Asia is the market with the largest share of lottery GGY in 2021 ($45.5bn), closely followed by Europe ($43.4bn)

• Oceania, South/Central America and Africa took only a 7% share of total lottery GGY in 2021, mainly due to the size of those markets, population and wealth of players.

• Here, we assess the market shares of gambling sectors worldwide for 2021 in percentages

• Lottery took the largest GGY of all gambling products, while casinos sit in second place with a share of 22% (before Covid-19, in 2019, casinos took the most GGY - 29.1%)

• The main reson is the Covid-19 pandemic, when most landbased gambling venues were closed (2020, 2021), but lottery outlets were allowed to operate in most countries.

Global Casino GGY 2018 - 2025 (US$ billion)

• Our final graph shows the GGY of the global casino market between 2018 and 2025; years between 2022 and 2025 are forecasts, with its data being in billions of US dollars.

• Covid-19 is the reason for the drop in revenues in 2020 (a fall of 34% YoY), recovery in 2021 (+18% YoY), and all subsequent years.

Covid-19 whiped out $57bn from casinos in 2021.

5 Betting Markets 2021 Betting GGY

22 GAMBLINGINSIDER.COM

•

Top

(USD bn) Global Casino GGY 18-25 ($ billions) Revenue ($ billion) 150 100 250 200 50 0 2018 2019 2020 2022F 2021 2023F 2024F 2025F 165 168 111 131 193 210 151 175 2 1 0 Japan US Australia UK Hong Kong Global Lottery GGY-regions 2021 3 Market share graph 2021 4 iGaming GGY as % of total market GGY 5 43.4% Europe 1% Africa 5.9% south/central america 46.5% Asia 38.8% North America 2.8% Oceania 22.2% casinos 2.5% Other (bingo, etc) 33.4% Lotteries 19.6% betting 9.4% us indian gaming 12.9% gaming machines 20 25 15 10 Market share graph 2021 4 iGaming GGY as % of total market GGY 5 43.4% 22.2% casinos 2.5% Other (bingo, etc) 33.4% Lotteries 19.6% betting 9.4% us indian gaming 12.9% gaming machines 20 25 15 10 5 0 2007200820092010201120122013201420152016201720182019202020212022e2023f2024f2025f

FEATURES NUMBER CRUNCHING

TAKING STOCK

Gambling Insider tracks operator and supplier stock prices across a six-month period (January 2023 to June 2023). The stock price is taken from the close of the first available date of the month

OPERATORS

WYNN RESORTS

MGM RESORTS

• Six-month high - 115.38 (Mar)

• Six-month low - 85.6 (Jan)

• Market capital - US$10.98bn

• Six-month high - 46.04 (May)

• Six-month low - 33.28 (Jan)

• Market capital - US$15.05bn

• Six-month high - 15,710 (June)

• Six-month low - 11,450 (Jan)

• Market capital - £28.14bn (US$35.28bn)

• Six-month high - 1,587.5 (Feb)

• Six-month low - 1,259 (April)

• Market capital - £7.82bn (US$9.8bn)

24 GAMBLINGINSIDER.COM

FEATURES NUMBER CRUNCHING

ENTAIN

FLUTTER ENTERTAINMENT OPERATORS Entain 888 Holdings 10,000 Flutter 12,000 14,000 16,000 8,000 6,000 4,000 0 POUND STERLING 100 Wynn Resorts 120 80 60 40 0 January US DOLLAR February March May June April January February March May June April SUPPLIERS 40 50 30 20 10 0 January US DOLLAR February 1,000.00 1,200.00 1,400.00 1,600.00 800.00 600.00 400.00 0.00 POUND STERLING January February Entain 888 Holdings Flutter May June April March May June April 40 50 30 20 10 0 January US DOLLAR February March May June April 1,000.00 1,200.00 1,400.00 1,600.00 800.00 600.00 400.00 0.00 POUND STERLING January February March May June April OPERATORS Entain 888 Holdings 10,000 Flutter 12,000 14,000 16,000 8,000 6,000 4,000 0 POUND STERLING 100 Wynn Resorts 120 80 60 40 0 January US DOLLAR February March May June April January February March May June April SUPPLIERS 40 50 30 20 10 0 January US DOLLAR February March May June April 1,000.00 1,200.00 1,400.00 1,600.00 800.00 600.00 400.00 0.00 POUND STERLING January February March May June April OPERATORS Entain 888 Holdings Flutter POUND STERLING Wynn Resorts January DOLLAR February March May June April January February March May June April SUPPLIERS 40 50 30 20 10 0 January US DOLLAR February March May June April 1,000.00 1,200.00 1,400.00 1,600.00 800.00 600.00 400.00 0.00 POUND STERLING January February March May June April

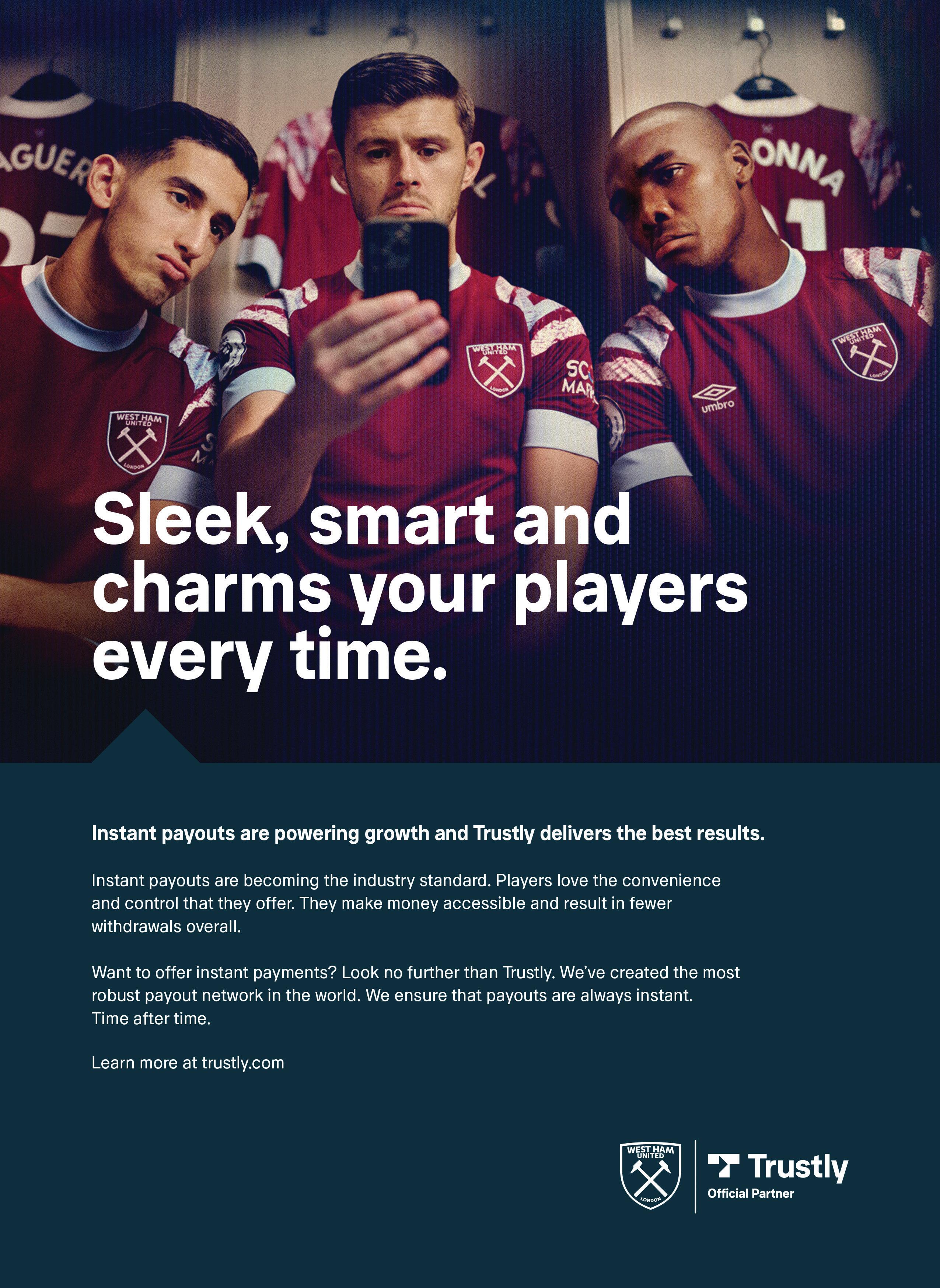

One hub, one API and instant access to a world of gaming content.

From new partnerships to new products, with Hub88’s Back Office and Mobile App, you’ll never be out of the loop. Coming soon: the HubWallet where we've made it easier to move money than ever before.

Looking to join our Hub? Contact sales@hub88.io

FEATURES NUMBER CRUNCHING

SUPPLIERS

• Six-month high - 604 (June)

• Six-month low - 520 (April)

• Market capital - £1.89bn (US$2.37bn)

• Six-month high - 213.60 (June)

• Six-month low - 174 (April)

• Market capital - SEK6.56bn ($610m)

• Six-month high - 13.03 (Feb)

• Six-month low - 9.71 (Jan)

• Market capital - US$3.61bn

• Six-month high - 1,425.80 (June)

• Six-month low - 1,059.40 (Jan)

• Market capital - SEK309.31bn (US$28.9bn)

26 GAMBLINGINSIDER.COM

SPORTRADAR EVOLUTION KAMBI PLAYTECH

SUPPLIERS Evolution Gaming Kambi Sportsradar Playtech 400 500 600 700 300 200 100 0 POUND STERLING January February March May June April 10 12 14 8 6 4 0 US DOLLAR January February March May June April 1,000.00 1,200.00 1,400.00 1,600.00 800.00 600.00 400.00 0.00 SWEDISH KRONA January February March April 400 500 600 700 300 200 100 0 SWEDISH KRONA January February March April SUPPLIERS Evolution Gaming Kambi Sportsradar Playtech 400 500 600 700 300 200 100 0 POUND STERLING January February March May June April 10 12 14 8 6 4 0 US DOLLAR January February March May June April 1,000.00 1,200.00 1,400.00 1,600.00 800.00 600.00 400.00 0.00 SWEDISH KRONA January February March May April 400 500 600 700 300 200 100 0 SWEDISH KRONA January February March May April SUPPLIERS Evolution Gaming Kambi Sportsradar Playtech STERLING February March May June April DOLLAR January February March May June April 1,000.00 1,200.00 1,400.00 1,600.00 800.00 600.00 400.00 0.00 SWEDISH KRONA January February March May June April 400 500 600 700 300 200 100 0 SWEDISH KRONA January February March May June April Evolution Gaming Kambi Sportsradar Playtech February March May June April February March May June April 1,000.00 1,200.00 1,400.00 1,600.00 800.00 600.00 400.00 0.00 SWEDISH KRONA January February March May June April 400 500 600 700 300 200 100 0 SWEDISH KRONA January February March May June April

SINGAPORE VS MACAU

Marcus Lim, CEO of Vault Corporation, speaks to the GI Huddle about his career so far, Sands China and the di erences between working in Singapore and Macau

Welcome to the GI Huddle, Marcus! Could you give us an intro into your earlybackground and tell us a little bit about how it all started in gaming for you?

My first entry into the gaming industry was with Sands China. I was recruited into Sands China to be based in Macau; but before that, I’ve always been an entrepreneur at heart. I’ve tried various forms of industries, various forms of businesses.

I then started my own bakery, I’ve run a wakeboarding centre and I’ve dabbled into defence contraction, as well with the Government in Singapore. So when I was headhunted into a role in gaming in Macau, I was so excited and I just plunged in.

I have to ask after hearing those examples; how do the bakery, defence and gaming industry compare?

It’s weird! It’s all life experiences. Singaporeans, we need to serve time in the national service and I was a weapons specialist. I came in contact with some of my suppliers and they said ‘Hey, you have got a great personality and let’s try this out’. I tried it out right after my national service in the Army.

It was a little bit too boring for me because one tendering process takes about eight to nine months and right after that, when I was travelling to the Philippines, I just encountered this really nice bun they had called ensaymada and we did that for a while.

Margins are great, but it’s a terribly hard-working business, so although I admired all the chefs – it was too much work. And then the wakeboarding was really fun and in the sea right? So it was a trend, and I got into it, and it was real fun. But that was not my calling, I knew there was something else that was waiting for me. I was trying bits and pieces of everything here and then until I got involved with Sands China. That’s what I decided I wanted to do for the rest of my life because it just feels so comfortable.

Absolutely. Let’s get straight into your time with Sands and obviously, there’s the Marina Bay Sands as part of your experience as well, which is a fantastic property.

I think honestly, it is the best property in the world right now. In actual fact, my duration with Marina Bay Sands was just three months. I was with Sands China in Macau for a good 12-odd years. With me being from Singapore, I decided to come back to Singapore because my wife was expecting my first child. I came back to Singapore and realised that it’s too good of a property – you don’t

really need me. So I then took on the challenge with Crown.

But having said that, I think Marina Bay Sands is currently the best property in the world. They have the right hardware and I think they have the right software; they have the right team on board. It’s just fantastic and they’re embracing a lot of technology along the way – all customer preferences. You can get your room key card without having an actual key card: you can just use a phone. I think they are really innovating and I can only see great things coming from Marina Bay Sands in time to come.

How did your time compare when you were in Singapore and when you were in Macau? My first impression would be that when you’re working in a Macau casino, there’s a lot more focus on the gaming itself. Is that correct?

In actual fact we have different teams and Sands China is such a big company, right? The whole Sands group is such a big company. We have various teams and I’m in charge of my own team. The way I've done it all these years, ever since I started, is that I understand that gamblers – and the game itself – it’s the same everywhere in the world. What we're selling is the experience that comes with it and surrounds it.

Watch the full interview online by clicking the QR code on the far left.

28 GAMBLINGINSIDER.COM FEATURES THE HUDDLE

"I THINK MARINA BAY SANDS IS CURRENTLY THE BEST PROPERTY IN THE WORLD RIGHT NOW"

Watch the full video online

MARCUS LIM CEO, Vault Corporation

CONGRATULATIONS TO THE WINNERS

In May, Gambling Insider hosted the second edition of the Global Gaming Awards Asia-Pacific. The event recognised the strongest performers over the last 12 months across the huge, diverse and dynamic Asia-Pacific region.

The Global Gaming Awards events in Las Vegas and London have gained the reputation of being the most prestigious in the industry, as companies and individuals are always nominated for a specific reason which is made publicly available. The Asia-Pacific event is no exception. You can see this year’s full Shortlist on the Awards’ official site. “Last year, I said that despite Covid-19-related struggles, the gaming industry in Asia-Pacific still had plenty to celebrate. Well, this year there really is a lot to celebrate,” said Mariya Savova, Event Manager of the Global Gaming Awards.

“It was great to see so much engagement with our event from the industry this year. We received so many self-nominations from companies and, additionally, we asked independent industry consultants for their opinion. The final Shortlist makes it clear that the gaming industry in Asia-Pacific is back on the rise and has an exciting future,” she added.

The winners of the Global Gaming Awards Asia-Pacific 2023 were chosen by over 30 senior executives from the APAC gaming industry, with KPMG in the Crown Dependencies independently adjudicating the voting process to ensure fairness.

“Huge congratulations to all winners, as well as to all companies and individuals who made it to the Shortlist,” said Julian Perry, Editor-in-Chief

Lead Partner

of Gambling Insider. He added: “Following a challenging couple of years, it was great to see the APAC gaming industry return to profitability. We are already looking forward to what it will achieve over the next 12 months."

The Global Gaming Awards Asia-Pacific 2023 are powered by Gambling Insider. The event’s Lead Partner is BetConstruct. Other event sponsors include Interblock Gaming, Digitain, Light & Wonder, Upgaming, Pragmatic Play and Spribe. Our team would like to express its thanks to Micky Swindale, Partner at KPMG’s Global Gaming Team, the rest of the KPMG in the Crown Dependencies team involved in the adjudication process, all event sponsors and all the executives who dedicated their time to helping choose the winners. Overleaf, you can see the full list of winners.

Sponsored by Powered by

30 GAMBLINGINSIDER.COM FEATURES GLOBAL GAMING AWARDS

TABLE GAME of the year

Interblock Gaming

Live ETG Pits

John Connelly - Global CEO

Michael Hu - Sales Director Asia

CORPORATE SOCIAL RESPONSIBILITY of the year

Melco Resorts & Entertainment

DIGITAL OPERATOR of the year

Jade SportsBet

Joe Pisano - CEO

DIGITAL SUPPLIER of the year

BetConstruct

Sarkis Basmajian - Regional Director of Cyprus

32 GAMBLINGINSIDER.COM FEATURES GLOBAL GAMING AWARDS

CASINO OPERATOR of the year

Bloomberry Resorts Corporation

CASINO SUPPLIER of the year

Light & Wonder

Ken Jolly - Managing Director Asia

INTEGRATED RESORT of the year

Marina Bay Sands

CASINO PRODUCT of the year

Aristocrat Gaming

Tian Ci Jin Lu

Miguel Choi - Regional Marketing Manager Asia-Pacific

34 GAMBLINGINSIDER.COM FEATURES GLOBAL GAMING

AWARDS

EXECUTIVE of the year

Daesik Han Chairman & CEO

Hann Philippines

FEATURES GLOBAL GAMING AWARDS 36 GAMBLINGINSIDER.COM

CFO SPOTLIGHT: THE NUMBERS GAME

Gambling Insider speaks to some of the industry’s biggest CFOs to nd out the trials and tribulations associated with the role, as well as how each manages the landscape of the modern nancial gaming eld

Everybody knows the job of a CEO: it is to lead, to steer the good ship of a company through calm and treacherous waters, executing a vision of how each would like their specific company to operate. Depending on how well a CEO does, this determines the length of time their tenures will last, with some spanning decades and others mere weeks. However, a post considered to be paramount to the success of a business is the CFO, the role of Chief Financial Officer.

To be a CFO, one must possess many traits: a good grasp of mathematics is key, as is the ability to understand large figures and sums; it is the presentation of detailed financial information, though, that the Board and the public can clearly make sense of that holds the biggest weight. Any details that are wrong can lead to serious errors in company direction; it can mislead shareholders and, in extreme cases, lead to severe regulatory and punitive action. It is not just how these

details are presented, either, but what they entail. The role of CFO therefore comes with responsibilities some may feel are too much of a burden to carry. For those select few that do choose to carry the torch, each will know the pitfalls and benefits that come with the title.

First, studies show that a CFO will make the third-highest salary among C-level executives (behind the CEO and COO) – with a reported median salary of $363,500

38 GAMBLING

FEATURES

INSIDER.COM

COVER FEATURE

“Every company should have a strategic view of at least 10 years, knowing where they want to be – and they need to reverse engineer it”

Ronen Kannor – Bragg

– compensation that feeds into the fact that CFOs are statistically the people that move around the most. In short, they are hired and fired faster than the rest of their peers. In the case of Wynn’s Julie Cameron-Doe, her salary has been made public by the gaming giant, earning $950,000 – way above the average CFO, with Wynn's CEO Craig Billings taking home $2m. Or is it down to the idea that a CEO will generally believe a change in CFO can provide the quickest sharpening of company finances – without damaging their own position first? Over the next few pages, Gambling Insider explores the role of the CFO in gaming and how a select few can shape the post and the industry through their work. We reached out to four of the industry’s biggest CFOs, each of whom spoke exclusively to GamblingInsider about how they address the challenges of their role.

First there is Flemming Pedersen, the CFO of super affiliate Better Collective, dialling in from the company’s offices in Denmark on a warm spring day. Second, the Bragg Group’s Ronen Kannor gives his opinions from Israel – on a national holiday no less. Third, Gonzalo De Osma Bucero one of the two CFO’s at EveryMatrix opens up on the topic of his job, while offering his insight into the industry. Finally, David Jennings,

CFO of US sportsbook giant FanDuel, also shares his opinions on how the role operates within the gambling industry, and in a business as a whole from the company’s headquarters on ParkAvenue South in New York.

The four CFOs openly reveal their thoughts on a number of subjects their roles relate to, including remuneration, the importance of their relationship with the company’s CEO,

life expectancy within the CFO role and the benefits of having a good infrastructure around them.

YOU GOT WHAT IT TAKES?

As we start the conversation, first the big overarching question is asked; simply put, what does it take to be a successful gaming CFO? In New York, FanDuel’s Jennings begins the conversation, highlighting the impact of putting the right controls in place: “Well, first, the CFO must also make sure that the right internal controls and procedures are in place to protect the business – because ultimately, more than anything else, for a CFO to be successful, he/she must build a team of talented, smart, driven people with complementary skill sets.”

It is a perspective that EveryMatrix’s De Osma Bucero expands upon in his comments, discussing having the right understanding of the company, as well as operating independently with a ‘true voice.’ “A CFO must have a perfect understanding of the business he or she is in whatever it is – the deeper knowledge the better. Only from that point on can you contribute effectively and consistently with the CEO, and other executives and operational managers, offering best practice and advice; and presenting a

39 GAMBLINGINSIDER.COM COVER FEATURE FEATURES

David Jennings

true and independent voice.”

However, Better Collective’s Pedersen counters this point. Indeed, he believes a CFO of a gaming company does not absolutely need to know the sector, telling Gambling Insider: “CFOs in the gambling industry have the advantage of not necessarily needing industry-specific background, but it is crucial to comprehend and adapt quickly to the business.” Though the trio have different opinions on the roles they have, each speaks about contributing effectively with the right controls and, crucially, demonstrating adaptability.

THE TEAM BEHIND

The conversation then moves to the subject of the importance of having the right team in place – something that Bragg’s Kannor discusses with relish, highlighting the importance of building an ‘ecosystem:' “My philosophy in management is that the less you need it, the better manager you are. And I believe that reporting is an ecosystem. Building a strong relationship with your team is extremely important and you need to assemble this team based on your targets, what you’re trying to achieve and your management approach. It’s an interesting dynamic.”

EveryMatrix’s De Osma Bucero wholeheartedly agrees with Kannor and how imperative it is to construct a team, describing it as “by far and away the most important responsibility.” The CFO gives further weight to the team atmosphere by stating that the role cannot be done individually: “The success or failure of a manager and his or her responsibilities very much depends on this. There’s no way a manager in a medium or large company can do all this alone.”

Jennings backs this up in his comments, remarking that the structure must also be open to evolution: “There are two components here. There is putting the right structures in place and then there is the talent you hire to fill those positions. As an organisation evolves, the supporting structure must evolve also.”

Jennings further adds that the company must not see the finance department as a ‘source of challenge:' “For the CFO function to work properly, we must ensure there are no silos within finance, and no silos between finance and the wider organisation. Once that culture is in place, the organisation sees finance as a partner rather than a source of internal challenge. That is very powerful.” Interestingly, each CFO pushes the concept of a team working as an ecosystem with flexibility – however, Jennings’ dialogue on the wider role of the department in a business is a reminder of the collaborative effort required.

THE CEO/CFO BOND

This leads the discussion to the kind of relationship a CFO must have with the CEO – and how that bond can affect the business’ C-level structure. For Pedersen, who believes the bond is sacrosanct, his close connection with CEO Jesper Søgaard was forged by the times the pair spent together flying across Europe trying to raise money for the business’ IPO (initial public offering): “We embarked on a joint endeavour of traveling to the capitals of Europe to raise funds and market the planned IPO. This dynamic defined our actions during that period.”

Pedersen goes on to talk more about how the pair have maintained their connection since the start: “The CEO and I established an alignment before commencing our collaboration and, as you can see, we have maintained a very close relationship. In fact, the CEO sits in the office adjacent to mine, and we engage in frequent daily interactions – except for today when he is traveling,” the CFO adds with some humour. However, for Ronen Kannor at Bragg Group, he sees the dynamic slightly differently. He highlights the importance of the relationship the pair must share, saying: “They have to work together,

hand in hand and trust each other, which is also an important part of ensuring the alignment between the strategy and financial targets. It’s teamwork. We’re talking about personalities that normally have to work very, very closely together.”

However, Kannor also notes that the roles are not perhaps linked by blood, “the CEO and CFO are not appointed together in the same position. Sometimes the CFO is there, while the CEO is replaced and sometimes the CEO is there while the CFO is replaced.”

Whereas Jennings believes the relationship between the pair helps to derive a “one-team” culture. He tells Gambling Insider: “the relationship between CEO and CFO is somewhat unique and the key to a successful partnership is trust. When trust has been built, the CEO comes to rely on the CFO for far more than just the output of the numbers.”

Further, Jennings highlights the strategic vision that should be shared between the two roles, stating: “What is also absolutely essential is that the CEO and CFO are fully aligned on what the strategy for the business should be. That drives where we direct our investments and, as importantly, where we will not.I believe that percolates throughout an organisation and helps to cultivate a ‘one-team’ culture.”

40 GAMBLINGINSIDER.COM FEATURES COVER FEATURE

“When trust has been built, the CEO comes to rely on the CFO for far more than just the output of the numbers” – David Jennings, FanDuel

Ronen Kannor Flemming Pedersen

STRESS

The experience of sitting at the C-level table is one that can undeinably have its ups and downs on a person, and the CFO is not immune from such feelings. Naturally, then, as part of our discussion, the subject of stress comes up. GamblingInsider asks the executives about how intense their positions are and the effect it has on them personally.

Pedersen, calmly sat at his desk in Denmark, smiles and (much like his demeanour suggests) admits “he doesn’t consider his role stressful,” adding that his relationship with the CEO is a big factor as to why he hasn’t felt stress in his role. Meanwhile, De Osma Bucero furthers the answer given by Pedersen, telling us that, so long as the CFO feels “well supported by the team” around them, then it is “not stressful.”

HARD FIGURES

Assessing the position of CFO from the outside, many might think it comes down to the figures – if the numbers don’t prove to be where the Board wants them to be, it amplifies the job the CFO is doing more so than every other C-level executive. However, when this is put to our CFOs, asking if each of them believes the post comes down to hard figures more than their peers, the response is mixed.

For Kannor, should the figures slip, it is an issue that comes from a number of factors – internal and external to the CFO’s office: “Sometimes delays can occur due to external factors such as customer-related issues. In such cases, it’s important not to solely focus on the numbers themselves, as they are a reflection of how the business is progressing. You need to monitor and sense how each customer is performing, understanding that some may be doing better while others may be performing less favourably. When evaluating team performance, especially in terms of budget and operational execution, it’s essential to consider the bigger picture. Therefore, it’s important to assess things within the context of the broader scheme of operations.”

Meanwhile, Jennings believes overall structure and long-term vision should be more important than immediate benefits and short-term profits. “If decisions were solely made based on what impact they are going to have on the numbers, then organisations would likely never invest in certain things that advance the strategic positioning of the business. At the end of the day, long-term sustainable returns should be what drive strategy and decision-making, even if the 'hard figures' are less compelling in the short term.”

As the discussions continue, it becomes clearer that each CFO sees long-term planning as the key to sustained success.

Kannor even attributes his philosophy of long-term vision to Sir Alex Ferguson’s domination at Manchester United football club. He tells Gambling Insider : “I think every company should have a strategic view of at least 10 years, knowing where they want to be. And they need to reverse engineer it, meaning they don’t start planning from the first year. Instead, they begin with the 10-year plan and work backward. Sir Alex Ferguson had a 10-year vision and consistently met both short-term and long-term goals. This is why he remained in his position for such a long time.”

REMUNERATION

Finally, the conversation turns to the delicate topic of remuneration. As we have already alluded to, some research has found that the CFO role is the third-highest paid at C-level (behind only the CEO and COO), but how much does that pay into the thinking of the person chiefly responsible for a company’s financial performance?

For Pedersen, the answer is very little. The CFO highlights that he is a shareholder at Better Collective, too – yet he and his COO and CEO colleagues try and separate this from the work, as he knows his position comes with a competitive package. “I think, actually, it’s very company-specific. Being a shareholder is one thing, but if you continue in an executive position, that should have a competitive package with it. And there, we benchmark with our Board and our remuneration committee.”

Additionally, Kannor is not too concerned with his financial package, as it is decided by a compensation committee at Bragg. “I never have to ask for a raise as it is determined automatically (by the committee). That’s the advantage. I always say that I never ask for a raise; it either comes or does not come

depending on market conditions.” However, Kannor agrees that it is entirely down to the company handing out the cheques, adding: “The remuneration of a CFO depends on the company in question. The remuneration of a CFO joining a distressed company may differ from that of a CFO joining an established company with a consistent performance over the past decade. Different requirements call for different remuneration structures.”

It seems none of the CFOs are overly worried about their remuneration packages and are, instead, focused on getting their businesses to a point where they are as noteworthy as possible.

– Gonzalo De Osma Bucero, EveryMatrix

THE CFO

Within the gambling industry, it seems the role of CFO does buck the trend within the greater realm of business – even though it also, according to our interviewees, doesn’t necessarily require a person with a gaming background to do it. When assessing the different ways that all four CFOs set themselves up at FanDuel, EveryMatrix, Bragg and Better Collective, what is striking is the similarities seen in how each sees their role. However, the way in which they operate does differ. FanDuel’s Jennings emphasises the role of the collective in his comments, ensuring that his team and the wider company are all pulling in the same direction with constant communication key to the CFO’s success. As is De Osma Bucero at EveryMatrix, who echo’s Jennings’ ideas.

Pedersen is much similar to Jennings, though he pushes his connectivity with the CEO as a way of ingraining himself with his fellow C-level executives. Meanwhile, for Kannor, his philosophy of reverse engineering a decade of growth drives his focus at Bragg. The role is demanding, requiring a dedicated mind that worries more about the company’s performance than in their yearly pay packet. But, still, even for some of the biggest names in the industry, it becomes clear that it takes a certain type of mind to stay the course.

42 GAMBLINGINSIDER.COM FEATURES COVER FEATURE

“A CFO must have a perfect understanding of the business he or she is in whatever it is – the deeper knowledge the better”

Gonzalo De Osma Bucero

"DATA ANALYSIS IS FUNDAMENTAL TO GROWTH"

Iain Hutchison, CRO at Digitain, speaks to Gambling Insider about the supplier's iGaming platform Centrivo and payment system Paydrom

How does Centrivo differ from other gaming platforms?

Digitain has delivered full-service plug-in or turnkey sportsbook and platform solutions for 20 years. Due to that market knowledge, reliability and reputation, the brand is working with regulated top-tier operators in double-digit numbers worldwide. We know the importance of business processes, planning and the need to put the partner and their end player at the centre of everything we do. In the early days, technological solutions were rigid and inflexible to the needs of operators. For today’s operators, there is no point in designing technical solutions if they are fixed and rigid to the needs of our partners.

The result was our GLI-certified iGaming platform, Centrivo. It offers a user-friendly and streamlined platform for launching and managing an iGaming business. This means gaming operators can focus on delivering a high-quality gaming experience to their users rather than dealing with the complexities of setting up and managing a gaming platform. The platform fully supports multiple languages and currencies, which allows gaming operators to reach the widest audience possible and provide a more personalised experience for their players. This can unlock increased player engagement, acquisition, retention and revenue optimisation.

Centrivo is an omnichannel platform that the player can access via desktop, mobile and tablet devices. This allows gaming operators to reach players at any moment in the early acquisition marketing lifecycle – wherever they are – and provide a seamless gaming experience across various devices. Of course, data analysis is fundamental to growth opportunities; we again recognise that as a core business need, of which Centrivo includes a full reporting suite and player-focused automation, which can help gaming operators better understand their users. The marketing team can then optimise their players’ gaming experience, increasing user retention and loyalty. With this, the product teams conceptualised and designed a central and flexible platform that connects all

aspects required to manage a gaming platform across multiple markets and territories.

What companies are currently using Centrivo, and who would you ideally like to partner with in the future?

Digitain serves many top-tier regulated operators in diverse markets, growing significantly with a strong pipeline demand in continental Europe. We recently opened our office in Bucharest, Romania, to meet this growing demand across regulated markets. This shall allow us to service that growing market and continue serving existing partners across the European time zone.

We plan to be up and running in London with a sales team in 2023 where we will only focus on regulated markets. From a partner perspective, we have and continue to have interest in tier-one operators looking to replace their incumbent technology stack with our solutions; or other operators looking to augment their product set within other local markets, which the current provider is perhaps less flexible in fulfilling.

What are the biggest challenges you have had to face with both Centrivo and Paydrom?

From a brand DNA, mindset and administrative team setup, we view everything as an opportunity to listen, learn and look toward finding a solution, but problems do arise and that’s where we flourish. If we consider challenges, most software-as-a-service (SAAS) businesses would consider or cite which programming languages to use or not, with the impact of having developers skilled to use that code base. Digitain has invested heavily in its people; we have internal training academies and growth labs that strategically review what could be used within the current stack. The key here is investing in people; great talent writes and delivers stable code and solutions, which applies to not only Centrivo and Paydrom and all touchpoints of our business.

What differentiates Paydrom from other payment method providers?

Payments are the lifeblood of any iGaming business, and can be viewed as a huge influencer in the product proposition to acquire and retain players to an operator’s brand. From the technology angle, multiple payment integrations can be a debilitating overhead to any integration’s roadmap with different flows, UIs and back-offices. We reviewed these structural challenges with the operator and player in mind, and created a solution architecture. The result is Paydrom, our unique solution that allows a centralised payment management system. With 50+ providers, 400+ payment options and over 30 countries covered, it streamlines the day-to-day operational payment flows.

The Paydrom UI has an easy-to-use interface to configure payment account details and store them securely. It supports multiple merchant accounts to diversify transaction traffic with enhanced transaction management functionality. With increasing CPA costs of acquiring new players with welcome bonuses, Paydrom has components to detect risk and fraud patterns; and machine learning-based velocity checks to

44 GAMBLINGINSIDER.COM FEATURES DIGITAIN

Iain Hutchison

mitigate promotional abuse and financial irregularities, reducing perhaps unwelcome player behavioural traits.

How is regulation impacting Paydrom across different jurisdictions?

Regulation is sometimes perceived as a limiting factor in determining and delivering services across the gaming ecosystem, and will continue to polarise opinion. Headwinds are increasing, perhaps as an overhang from the Covid-19 pandemic, when economies suffered, and consumption habits changed digitally and offline. However, while certain economies have started to recover, other complex global events have impinged. Therefore, governments, regulators and providers must collaborate to look at the data, facts and trends to develop consumer protection systems.

What more would you like to add to both Paydrom and Centrivo?

Consumers wish to be in control or have access to services that assist in their decision-making regarding household or discretionary consumer spending and that can only be a positive change. Our payment solution engineers are therefore very aware of these needs at the business level and, indeed, the consumer level, as they are also consumers themselves. On the Centrivo front-end, dynamic CMS at each touchpoint in the marketing funnel should become central to delivering not fully personalised experiences but more relevance and authenticity within the critical moments of the new players’ onboarding lifecycle.

What is the future for Paydrom and Centrivo?

Technology and new technology sets will always be front and centre of the development road map. However, we will see more changes driven by machine learning and predictive data analytics, to discover future revenue opportunities, optimisation, automation and efficiency out of today’s current business processes.

46 GAMBLINGINSIDER.COM FEATURES DIGITAIN

"Payments are the lifeblood of any iGaming business and can be viewed as a huge influencer"

EVOLVING THE TEAM STRUCTURE

A few months on from her ICE London interview at the Gambling Insider booth, we catch up with BGaming CEO Marina Ostrovtsova for a H1 update

How has 2023 treated BGaming so far? BGaming’s year has been fantastic, with both quantitative and qualitative expansion. We have strengthened our leadership team with significant C-level appointments, bringing fresh perspectives and expertise. In game development, we constantly explore new mechanics, pushing innovation and delivering captivating experiences. We stay ahead of industry trends, explore new markets and use advanced analytics tools to understand player preferences.

approach. With his extensive gaming industry experience, Ulf brings a global perspective and valuable contacts to target key regions for expansion.

Under Ulf’s leadership, we prioritise a positive and inclusive culture, foster innovation and adapt to regional preferences. Over the next 12 months, Ulf aims to drive revenue from new markets, strengthen partnerships, enhance products and create employment opportunities in new regions. Latin America is a particularly important market for us, and we focus on expanding our presence there through partnerships and localisation.

What regions are you expanding into and how much emphasis are you placing on the hot topic of Latin America?

Latin America is a key market for us, and we have dedicated resources and efforts to tap into its potential. With its large and dynamic nature, Latin America offers tremendous growth opportunities for the gaming industry. We recognise the importance of this region and are committed to establishing a strong foothold.

experiences that resonate with players in the region.

How is your team structure progressing?

We are thrilled to see the evolution of our team structure at BGaming. In 2022, we experienced significant growth, doubling our workforce. Currently, we have a team of more than 120 experts, consisting of a perfect blend of seasoned professionals with years of experience and talented young individuals who bring fresh perspectives to game development. With the arrival of our new CCO, Norder, our sales and business development teams have expanded even further, welcoming new members from diverse parts of the world, such as Spain and the United Kingdom. As an employer, we are also elevating our standards by attracting employees with deep industry expertise.

Our streaming initiatives have seen remarkable growth, engaging players and influencers, and creating a strong bond with the streaming community. We actively participate in exhibitions in Europe and Latin America, and enter new markets to showcase our products and establish partnerships.

Tell us all about the appointment of your new CCO Ulf Norder and how that has changed your approach to business development?

The appointment of Ulf Norder as our new CCO has significantly changed our

In terms of our expansion strategy, we are actively focusing on expanding our footprint in Latin America by partnering with key operators and participating in industry events specific to the region. We understand that player preferences in Latin America differ from those in other regions, and we are actively working on adapting our game portfolio, to cater to the unique needs and preferences of Latin American players.

Localisation is a crucial aspect of our approach. We have translated approximately 90% of our portfolio into multiple languages, including Spanish and Brazilian Portuguese, to ensure a seamless and immersive gaming experience for players in Latin America. We are excited about the potential growth and success in the Latin American market and remain dedicated to delivering gaming

We are delighted to ongratulate our colleague, Yulia Aliakseyeva, on her new role as Co-CPO at BGaming. Yulia has been with us since the inception of the studio, and we are thrilled to retain such dedicated talent.

Over the past year, many members of our team have progressed up to team lead positions and are now building their own teams.

It’s pleasing to witness this growth and to know that many of our team members have advanced within the company.

48 GAMBLINGINSIDER.COM FEATURES BGAMING

"We are delighted to ongratulate our colleague, Yulia Aliakseyeva, on her new role as Co-CPO at BGaming"

Can you tell us a little more about your partnerships with the Casinolytics platform?

Our partnership with the Casinolytics platform has been incredibly valuable. Casinolytics has been a long-standing friend and business soulmate, sharing our passion for innovation and data-driven decision making. Casinolytics has been instrumental in helping us become experts in the growing live-streaming space, particularly in casino streaming on platforms like Twitch and YouTube. Their deep understanding of the livestreaming market and their expertise in analysing player behaviour has allowed us to tailor our game offerings and marketing strategies, to effectively engage with our target audience.

In 2023, we are excited to expand our partnership with Casinolytics as co-organisers of events for streamers from around the world. One notable event is the Streamer Battle, a series of competitions for streamers with a combined prize pool of £201,240 ($250,000). By hosting

these events, we aim to not only support and empower streamers but also create a vibrant and engaged community of players who are enthusiastic about our games.

How is your overall collaboration with streamers going?

As a game developer, we recognise the immense value that online casino streamers bring to the iGaming industry. They are not only sought-after affiliates for operators but also trusted influencers for players. Our collaboration with streamers has been instrumental in spreading awareness of our games, and creating a loyal following among players.We have established close partnerships with over 500 streamers who regularly broadcast BGaming’s games to their audiences. These collaborations have helped us gain valuable feedback, improve our products and refine our marketing strategies. Through our partnerships with the Scatters Club and Casinolytics, we have successfully hosted major events for streamers, offering substantial prize pools and attracting participation from prominent streamers worldwide.

Looking ahead to the rest of 2023, we are committed to further strengthening our collaboration with streamers. We have exciting plans in place, including five competitions and a grand award among streamers within the Scatters Club community. Additionally, we extend an invitation to operators and providers to join us as partners in these events, fostering a collaborative ecosystem that benefits all stakeholders.

Finally, what are you aiming to achieve with your exclusive casino games – and also the challenges, jackpots and tournaments you provide for player activation?

Our primary goal is to give players a truly unique and exceptional gaming experience. In a crowded market, it is essential to stand out and that’s precisely what our brand-exclusive and customised games allow us to do. These games have become a hallmark of BGaming, distinguishing us from the competition and attracting players who seek innovative and engaging content. To enhance player engagement and retention, we have developed a comprehensive player activation program that includes challenges, jackpots and tournaments. By participating in these activities, players have the opportunity to compete, win exciting prizes and immerse themselves in a thrilling gaming environment. We believe that such initiatives not only keep players entertained but also foster a sense of loyalty and connection with a brand.

49 GAMBLINGINSIDER.COM BGAMING FEATURES

Marina Ostrovtsova

HOW CONSUMER BEHAVIOUR HAS CHANGED POST-COVID-19

Gil Soffer, SVP Sales & Business Development at Galaxsys, speaks to Gambling Insider about the popularity of fast and skill games, as well as consumer behaviour trends post-Covid-19 pandemic

How is Galaxsys creating a growth trajectory in non-traditional slot games?

Galaxsys is a young company. However, in a short time, the business has still led the way in creating market demand in the non-traditional slots vertical, by creating product experiences that appeal to players seeking a deeper pace of gameplay. The business has already achieved some key milestones, such as attaining triple-digit growth over the previous year and we now have one hundred plus partners. Which includes: regulated operators, platform providers, and Tier 1 aggregators within the iGaming supply chain. We are on track to exceed these numbers this year.

The growth trajectory is due to several factors, one of which is our investment in people. The Galaxsys team comprises over 60 iGaming product specialists committed to providing games built with the latest technologies and innovative solutions. Our games pipeline is to deliver a further 20 games by December.

What new demographic is fast & skill games falling into? And why is that?

This is an interesting question. We are seeing broad adoption of the games across specific demographic age groups and gender. There is a slight bias towards the Millennials, or Generation Y, who are digital natives. Given these digital natives have grown up with digital, their expectations are slightly different from Generation Z, whose DNA is entwined in digital content etc. Therefore, Millennials constantly seek newer, faster and

50 GAMBLINGINSIDER.COM FEATURES GALAXSYS

Gil Soffer

quicker experiences. Overall, the category driver is that digital players have less time; they are time-poor, not time rich. Gaming is brief, so it only lasts at that moment. Our fast and skilled games, with quicker in-play, appeal to that player base, in short-burst formats to accommodate their busy digital lifestyles and consumption patterns.

What demographics are you not reaching with non-traditional slot games and how do you plan on expanding your demographic reach?

Whil there may be a perceived early adopter situation of Millennials engaging, we are seeing a balanced usage across most significant social, economic and geo-demographic player groups. To broaden appeal, we constantly look at behavioural data with our operator partners and aggregators, and run various pattern data software with our data scientists. We are also undertaking focus groups and participating in other forms of qualitative and quantitative market research; so that we are agile from a marketing standpoint to react to market trends or, indeed, to create developing market demand.

Why is there a surge in demand for non-traditional slot games and fast and skill games?

It is not a surge in demand per se. Post-pandemic, back to normality or new standard, the supply

ecosystems have had to adapt from perhaps more rigid technology, and distribution infrastructure to deliver digital products and services at faster pace. With that, consumer consumption behaviours have changed in that perhaps there was more available leisure time during the pandemic era. But as we have moved to hybrid and different life situations, available free time has eroded. However, overall, digital consumers demand speed and near-instant gratification. Layer on top that games studios, like many businesses, had to get much better at listening to consumer signals. The result is Galaxsys is leading the way in meeting the demand but also creating demand generation within non-traditional slot games and fast and skill games category.

How many slot games, and fast and skill games do you currently have? How many more do you plan to have out by the end of this year?

For now, we have more than 17 fast games and five skills games, and by the end of the year we are planning to increase the number of fast games up to 30. In which we will include the game types that will cover the demand of players from all categories.

Which of your fast and skill games is the most popular, and in which regions are customers playing them the most?

Our games are popular everywhere, especially in LatAm, Africa and Asia,

but the craze is coming to Europe, US and Canada. Every region has its tastes: crash in LatAm, skill games in the Middle East and fast table and instant games in Asia; but the world is coming together, which makes the success of all our games.

Are there any ways you plan on improving your game? If so, what are your future plans for development?

The only way to effectively improve the games is to make data-driven decisions. To do that we are going to have the general data-gathering system, which will include: competitive analysing, player behaviour within our games and market trends analysing. This shall allow the business to improve its game development pipeline.

52 GAMBLINGINSIDER.COM FEATURES GALAXSYS

"The growth trajectory is due to several factors, one of which is our investment in people"

"The only way to effectively improve the games is to make data-driven decisions. To do that, we are going to have the general data-gathering system"

THE WREXHAM EFFECT

Has the Hollywood takeover of Wrexham impacted the popularity of non-league football betting? Gambling Insider explores...

There was shock around the football world in 2020 when actors Ryan Reynolds and Rob McElhenney purchased non-league football club AFC Wrexham. It has been one of the biggest talking points outside the Premier League in British football for the last few years.

This has resulted in huge worldwide coverage for Wales’ oldest football club: sponsors such as TikTok are now appearing on the front of its shirts, A-list stars are coming to watch its games, matches are being shown on ESPN and major sporting networks around the world. And Wrexham is the only non-league team in the UK that has appeared on FIFA video games, with an 18-part documentary (Welcome To Wrexham) being created to showcase the whole process as streamed worldwide on Disney Plus. With the huge amount of media attention that has surrounded the team, it is almost surprising to remember that, for 15 years up

until the end of the 2022-23 footballing season, Wrexham has played its football in the National League, the fifth division of English football; and the start of what is called ‘non-league’ football, the threshold between professional and unprofessional standards in the sport. As a result, the very word ‘Wrexham’ has changed, going from being just a noun, to a verb to showcase when a smaller team gets investment from high places.

To “do a Wrexham” is now a dream of most football teams in the UK. But what has the effect of this Hollywood takeover been on the betting activity in non-League football? Has non-league football wagering – in effect – had its own Wrexham effect?

Perhaps it would be fair to assume the increase in media attention will be directly reflected in the attention towards the amount of betting. But it is not as simple as that. We spoke to Alan Alger, betting industry expert who spent several years working for Betway owner Super Group, to find out more. Indeed, Alger suggested

54 GAMBLINGINSIDER.COM

FEATURES NON-LEAGUE BETTING

Rob McElhenney

that, while the National League has been popular for sports betting this year, it is less about the star power of the team and more due to the nature of football betting. The ‘accumulator’ continues to be one of the most popular ways to bet on football. With a huge list of games taking place all over the world, bettors can pick several teams to win and build up bigger odds.

With Wrexham enjoying a huge increase in funding, it is the wealthiest team in its division and subsequently won the 2022-23 National League. It was a league with one or two teams that are much stronger than the rest of the division. In this case, The National League is very similar to Scottish football, where it is heavily dominated by two teams, Rangers and Celtic. Teams like these are big hits with bettors – in this case, Wrexham and Notts County are the two most dominant in the division, providing the perfect mix for accumulator inclusion.

In the 2022-23 season, both Wrexham and Notts County had fantastic seasons, scoring over 100 points each. This made them a regular addition to most punters’ weekend accumulators. They were the new bankers – particularly league champion Wrexham. However, Alger argues that this has not had a huge effect elsewhere in the league: “I think the change in traffic has just been reflected by punters noticing Wrexham and Notts County are almost bankers for accumulator bets. The punter has so many more choices now in terms of foreign leagues and lower leagues. All they’re really looking for is a team that’s in a winning habit and seems to be returning a tick on their accumulator each week.”

It is hard to say with complete certainty how many bets elsewhere in the league are a direct result of the spotlight that has been placed on Wrexham. Alger tells Gambling Insider: “I don’t think it’s benefited the league overall in terms of people.” But it has certainly resulted in Wrexham being a hugely popular option for betting for the overall League Winner market, having odds of 6/5

at the start of the season and being a strong favourite. Alger even added that “most betting firms reported Wrexham was getting Championship-level amounts being wagered on.”

When asked whether there would be any increase in betting in League Two next season, Alger replied:

“The National League over the last two full seasons of Hollywood involvement at Wrexham has seen quite incredible statistics. There was an amazing stat that after the Liverpool v Arsenal 2-2 in April, the interactions on social media after the game with both clubs were lower than the Notts County v Wrexham interactions after the game the same weekend.

“That includes full-time interactions with posts from the clubs and even score updates during the matches. Now that is quite incredible because Twitter is global. There’s no real restriction to what and where you can consume. The tweets from the clubs and the fact that they were much higher than two firmly established global clubs like Liverpool and Arsenal really

shows you how many eyeballs were actually on the league. But I’m not entirely sure that will translate to betting interest. I think Wrexham will carry a little bit through to League Two next year. I think people are interested in seeing their title price.”

It is hard to judge what betting activity is directly caused by Wrexham simply being the most famous club in the league and whether this is because it is in fact one of the best teams in the league. In the United Kingdom, BT (soon to be TNT) televises around 20 to 25 games in the division each season. As a result of this, it is hard for fans to gain full knowledge of a team they may only have access to watch just once a season. Therefore, bettors don’t have the knowledge to necessarily place confident bets in the league. But this is no longer true of Wrexham. Incredibly, Wrexham is already the favourite to win League Two (its new division) in the 2023/24 season, with odds of 7/2. While this is a fair reflection on form, it will have been influenced by the increase in exposure around the club (as well as the funds available to it). Even compared to the clubs in top divisions, there is a huge amount of publicity, but when you compare this to that of the teams that are in the same league, it is astronomical.

55 GAMBLINGINSIDER.COM NON-LEAGUE BETTING FEATURES

“There was an amazing stat that after the Liverpool v Arsenal 2-2 in April, the interactions on social media after the game with both clubs were lower than the Notts County v Wrexham interactions after the game the same weekend” – Alan Alger

Ryan Reynolds

#WINNING

Peter-Paul de Goeij, Managing Director of the Netherlands Online Gambling Association, and Björn Fuchs, Chief Digital O cer at JH Group, explain why the Dutch market has won with its online gambling regulation

We regularly read in Dutch newspapers that politicians and addiction experts are very concerned about the increase in online gambling. They fear it is getting out of hand since the legalisation of online gambling. While the concerns are genuine, the real picture is much more nuanced and there are actually reasons for optimism. Indeed, initial, tentative results suggest that Dutch online gambling regulation is working well.

Since October 2021, the possibility of legal, and therefore safe, responsible online gambling has existed in the Netherlands. Before this, it was pretty much banned in the Netherlands. This did not mean it was not happening – quite the contrary. For instance, in January 2019, MotivAction estimated that over 1.8 million Dutch people regularly gambled online. This was online gambling without any protection from the Dutch Government and without the strict supervision of the Dutch regulator

Kansspelautoriteit (KSA). This unprotected and unsafe gambling was what the Government – rightly – wanted to put an end to. Consumers had to be properly protected from now on; gambling addiction had to be curbed, and crime and fraud had to be fought. Therefore, an open and strict licensing system was introduced in October 2021.

A lot has happened since then. Dutch people were treated to a hefty amount of advertising for online gambling. These advertisements came on top of the already existing advertisements for state and charity

lotteries, scratch cards, lotto, Toto and land-based casinos. Gambling advertisements seemed almost inescapable in all media. Annoyance was high and already in December 2021 – even before possible effects of such advertising were known – the House of Representatives forced the minister first to ban the use of role models and, eventually, to declare a ban on untargeted advertising for online gambling. This ban will take effect from 1 July.

At the end of April, the KSA reported in its fourth monitoring report that 762,000 Dutch people gambled online at least once in 2022. In addition, it estimated that 92% of Dutch online gamblers only gambled at providers licensed in the Netherlands. That percentage is reason for optimism, as the minimum legal

56 GAMBLINGINSIDER.COM FEATURES GAMBLING REGULATION

target was 80% by October 2024. The main government objective, to protect consumers, seems to be well within reach with this percentage already met in 2022.