Reimbursement, Medicare Advantage, Repair, and Labor Challenges: How HME Can Fight Back

Exhibitors’ Marketplace: What to See at Medtrade

4 for

SPECIAL MEDTRADE GAZETTE ‘24

DALLAS, TEXAS

Reimbursement, Medicare Advantage, Repair, and Labor Challenges: How HME Can Fight Back

Exhibitors’ Marketplace: What to See at Medtrade

4 for

SPECIAL MEDTRADE GAZETTE ‘24

DALLAS, TEXAS

The first sign I saw of my neighbor’s passing was the HME truck that pulled up to her family’s home.

“Gigi” was a young mother with gorgeous red hair. She and her husband, Ryan, had an 8-year-old daughter, Daisy, and a 6-year-old son, Andrew — happy kids who said please and thank you when coming to borrow the occasional egg to make brownies.

Gigi had been ill with cancer, and a few months earlier, had come home with a scarf tied over her head. Accompanying her were a hospital bed with a pressure-relieving mattress, oxygen equipment, a standard manual wheelchair. I’d seen HME delivery techs carrying the equipment into Gigi’s home. Now, I watched them carry the bed out and return it to their truck.

During the COVID public health emergency, the American public got a better look and perhaps a better understanding of the importance of HME and the professionals who provide it. Staying quarantined away from crowds and out of in-patient facilities was a best practice, especially for the medically vulnerable, and HME made that possible for many people.

But being a home medical equipment professional has never been easy. In addition to the mountains of documentation required, the privacy and legal policies that need to be followed, the delays in receiving payments — there is also the emotional toll of working with patients and their families during potentially the hardest times of their lives.

What was it like, I wondered, for the HME delivery technicians who go into these homes? Were the young techs removing Gigi’s bed the same ones who’d delivered it? Did they recall teaching Gigi and Ryan how to operate the bed? Did Daisy ask to learn, too, so she could help out? (She was that kind of kid.) As they carried out the bed, did the techs see Daisy or her brother?

In this issue, I talked to Dan Fedor, U.S. Rehab’s Director of Reimbursement and Education, about the biggest challenges facing today’s HME suppliers (page 8). Dan emphasized how challenging it is for suppliers to hire and retain, for example, repair and service technicians when fast-food restaurants are paying $20-plus an hour for positions that don’t require working with grieving families.

I’m not taking anything away from fast-food employees, who work hard in public-facing jobs. I’m just wondering how difficult it is for suppliers to compete for employees, given how emotionally and physically draining the HME industry can be.

It takes a special sort of person to excel in the HME industry. To choose this career path, given the surely less frustrating, less heart-wringing alternatives. Among my hopes for 2024 is that you are ultimately seen for who you are: professional, passionate, empathetic, dedicated, determined, unbowed. HMEB

March/April 2024

hme-business.com

CO-FOUNDER & CEO, WTWH MEDIA

EDITORIAL

EVP OF HEALTHCARE

MANAGING EDITORS

EDITOR

CONTRIBUTING WRITER

ART VP, CREATIVE DIRECTOR

GRAPHIC DESIGNER

SALES

VP OF SALES

©

Scott McCafferty

George Yedinak

Bob Holly

Tim Mullaney

Laurie Watanabe

lwatanabe@wtwhmedia.com

Joyce Famakinwa

Matt Claney mclaney@wtwhmedia.com

Shannon Pipik spipik@wtwhmedia.com

Sean Donohue sdonohue@wtwhmedia.com

The information in this magazine has not undergone any formal testing by WTWH Media, LLC, and is distributed without any warranty expressed or implied. Implementation or use of any information contained herein is the reader’s sole responsibility. While the information has been reviewed for accuracy, there is no guarantee that the same or similar results may be achieved in all environments. Technical inaccuracies may result from printing errors and/or new developments in the industry.

Corporate Headquarters: WTWH Media, LLC 1111 Superior Avenue, 26th Floor Cleveland, OH 44114

https://marketing.wtwhmedia.com/

Media Kits: Direct requests to George Yedinak, 312-248-1716 (phone), gyedinak@wtwhmedia.com.

Reprints: For more information, please contact Laurie Watanabe, lwatanabe@wtwhmedia.com.

To put it plainly, the home is important at Cardinal Health. This is the message Rob Schlissberg — president of Cardinal Health’s at-Home Solutions business — believes that his company is getting across after an organizational resegmentation. The shakeup allowed Cardinal Health’s at-Home Solutions business to branch out from under the company’s medical-surgical (med-surg) unit.

“We want to be a major player and an enabler, as we are continuing to find ways to drive that care,” Schlissberg said during a recent conversation with HME Business.

For Cardinal Health, being a major player also means being a vocal advocate for the HME industry. During the course of the conversation, Schlissberg touched on why the diabetes space is a big area of focus for Cardinal Health — and more.

The conversation has been edited for length and clarity.

Looking back at 2023, what would you say were some of the major highlights for your part of the business?

Schlissberg: Within our at-Home Solutions business, we really operate in three different business segments. In what we call our Cardinal Health at-Home business unit, which is our direct-to-home fulfillment and distribution services, we’re primarily focused on the HME space, but also in home health and hospice.

We have been really focused around investing to optimize and modernize our distribution network. We know that’s a real value that we can provide. We look at it as we are an extension of our

customers. We’re providing a service that goes directly to their patients, and we take that very seriously.

In 2023, we opened a new facility here, in Grove City, Ohio, that is highly automated and very technology enabled. We started work at another location in South Carolina, which is set to open this calendar year. We’re already in the Texas market, but we’ll be expanding and building a larger site.

All these will have the same advanced technology. We’ll be up to 10 or 11 buildings at that point. What is really unique about our distribution network is it only does our business. The rest of Cardinal Health has other distribution networks. There’s a distribution network for pharma, for med-surg, but ours only does direct-tohome fulfillment.

In our provider side of our business, Edgepark, I’m super proud of the work we have done really to focus on the customer experience. We’ve hit all-time highs with our NPS [net promotor scores] this past year, really focusing on simplifying a really complicated process.

The DME benefit is a complicated process, particularly for the patient, and now navigating the DME versus

We need more strong voices for the HME industry — Rob Schlissberg

pharmacy benefit, and all the challenges that come along with that. We really try to find ways to simplify and create that ideal experience for the actual end user, as well as our referral sources.

We have been building a new business that we call Velocare, a first-of-its-kind distributed supply chain logistical solution for health systems trying to set up a hospital-at-home program.

We are helping them transition patients to the home, providing all the medical supplies and DME they need in the home. We handle medicalgrade meals and waste disposal. All the things that you would get in the hospital — that bed just happens to be in the home instead of in the brick and mortar.

We are enabling that type of service, which is something that we’re really excited about, and will continue to invest in and look to grow. All three of our businesses are in good spots, and we’re excited about what’s ahead.

Can you provide an overview of strategic plans and objectives you’ll be focused on in 2024?

Schlissberg: On the provider side,

Edgepark, we’re going to be heavily focused in the diabetes space. The population of those with diabetes continues to grow.

When you think about some of the changes that the Centers for Medicare & Medicaid Services (CMS) has made recently (expanding coverage of CGM [continuous glucose monitoring] Type 2, basal insulin users), that market is growing. Our ability, as one of the larger diabetic providers in the country, is we provide a service that is needed, so we’ll continue to focus there both with our commercial populations, but really heavily focused on our government populations.

When you think about those chronic conditions that we serve, what comorbidities do these patients have? It might be something like a large portion of diabetics also have sleep apnea, for example. How can we provide a more comprehensive type of care with the supplies and services that we provide?

What challenges does the HME market face?

Schlissberg: We need more strong voices for the HME industry.

AAHomecare [American Association for Homecare] does an outstanding job. We as a company like Cardinal Health, large in size and stature across the health-care continuum, we’re trying to have a bigger voice.

We serve on certain committees within AAHomecare; we have lobbying efforts down on the Hill. We want to make sure that the HME itself is being recognized for the value in which it delivers.

I think there are still entities and different parts of the health-care system that believe that all HME [suppliers] do is push products — and that’s not true. The pandemic helped shed light on the value that HME can provide, so we want to be a big part of that and lend our voice to moving that forward.

Also, as with any aspect of health

care, reimbursement is the name of the game. Continuing to advocate on that behalf and making sure that value is commensurate, on all sides, is certainly an area of focus.

What do you see as some of the major tailwinds that will fuel the business in 2024?

Schlissberg: The expansion of the market in the diabetic landscape, CMS expanding coverage for CGM. CGM is the right type of therapy, and more should have access. Now that that Type 2 population, if they are using insulin, can get access to that type of therapy, I think it’s really important. That’s certainly a tailwind.

Also, you can’t open up any publication that is talking about health care and not have it mention the word “home.” HMEB

Managing Editor Robert Holly contributed to this report.

The Centers for Medicare & Medicaid Services (CMS) has announced its final coding, benefit category, and payment determinations for seat elevation on Complex Rehab Technology (CRT) power wheelchairs. But the agency is putting off its final coding and funding decisions for seat elevation on consumer power chairs.

The CRT determinations were included in CMS’s Second Biannual 2023 HCPCS Coding Cycle. CMS said new coding actions would be effective starting April 1, 2024, unless otherwise noted.

CRT industry asked for standard and bariatric codes

CMS initially provided only one code for seat elevation on Complex Rehab Technology (CRT) power wheelchairs and asked for public comments. In response, the CRT industry requested a second code for heavy-duty weight capacities from 301 through 450 lbs. The first code would function as a standard weight code, for weight capacities through 300 lbs.

Despite industry lobbying, CMS’s final coding decision added just one CRT seat elevation code. As of April 1, E2298 will be defined as “Complex rehabilitative power wheelchair accessory, power seat elevation system, any type.”

On March 31, CMS will discontinue the previous E2300 code, “Wheelchair accessory, power seat elevation system any type.”

In explaining why it did not create a heavy-duty code, CMS said, “The public comments confirmed that regardless of any differences in fabrication cost, there is no significant

difference in the commercial pricing for seat elevation equipment for heavy-duty power wheelchairs and seat elevation equipment for standard power wheelchairs.”

Group 2 coding decisions postponed CMS did agree with industry experts who recommended the agency pause its original proposal to delete HCPCS codes K0830 (Power wheelchair, group 2 standard, seat elevator, sling/solid seat/back, patient weight capacity up to and including 300 lbs.) and K0831 (Power wheelchair, group 2 standard, seat elevator, captain’s chair, patient weight capacity up to and including 300 lbs.).

CMS referenced the comments of Julie Piriano, PT, ATP/SMS, VP, Clinical Education, Rehab Industry Affairs and Compliance Officer, Quantum Rehab, who was the CRT industry’s primary presenter at the November meeting.

The CMS decision said, “The speaker also asked CMS to defer the creation of a new HCPCS Level II code for standard seat elevation and the deletion of codes K0830 and K0831 to a subsequent cycle until such time as NCART [National Coalition of Assistive and Rehabilitation Technology] has been able to thoroughly consider such changes. The suggested code language ‘Complex rehabilitative power wheelchair accessory, power seat elevation system, any type’ would make it so that the wheelchair user would have to install power tilt or recline, both described as ‘power seating systems’ in the current code set, to obtain additional components such as E1010 and E1012. Currently, the code language for those components, power leg elevation

On March 31, CMS will discontinue the previous E2300 code, ‘Wheelchair accessory, power seat elevation system, any type’

system and platform respectively, read as, ‘Wheelchair accessory, addition to power seating system.’

“In the interim, HCPCS Level II codes K0830 and K0831 will continue to be used for non-complex rehabilitative power wheelchairs with seat elevation equipment,” the decision added.

“HCPCS Level II code K0108 (Wheelchair component or accessory, not otherwise specified) can be used for claims for power seat elevation equipment added onto a non-complex rehabilitative power wheelchair owned by the beneficiary.”

Regarding reimbursement rates, the CMS decision added, “With respect to code K0830 and K0831, and claims for power seat elevation equipment added onto a non-complex rehabilitative power wheelchair owned by the beneficiary that are billed using code K0108, local fee schedule amounts would be calculated by the DME MACs for use in paying claims for any covered items.”

In a Feb. 29 bulletin to the industry, NCART said the fee schedule amount for the new E2298 code is $2,000.34, and that the fee schedule would be effective April 1.

The American Association for Homecare (AAHomecare) said in a March 1 bulletin, “Under the capped rental rules for complex rehabilitative power wheelchairs, the rental price would be approximately $200 for months 1 through 3, and $150 for months 4 through 13 for a total of $2,100 for 13 months of continuous use.”

“AAHomecare’s Complex Rehab & Mobility Council will share additional analysis as applicable,” the association said in response to the final coding decision.” HMEB

“ We continue to renew our DMEPOS

th The

Team because of the ease of the renewal process and the support we get from the advisors. Being an Exemplary Provider® has improved our internal processes, which benefits our patients and sets us apart from other providers.”

How policy, funding, repair and labor issues are shaping the hme industryBy Laurie Watanabe

ISTOCKPHOTO/DILOK KLAISATAPORN

ISTOCKPHOTO/DILOK KLAISATAPORN

When I caught up to Dan Fedor via phone in late February, he was in the Pacific Northwest, getting ready to do what he has been doing for more than 29 years: teaching about and advocating for the home medical equipment (HME) industry.

Fedor’s current title is Director of Reimbursement for U.S. Rehab, a division of The VGM Group. But he’s been the Director of Education and Compliance for Pride Mobility Products and Quantum Rehab, and before that served as senior manager for Provider Outreach and Education and Electronic Data Interchange for the Jurisdiction A DME MAC. Fedor currently sits on the Medicare Council, and he presents educational sessions at industry events across the country.

I’d asked him to think about the most pressing challenges that the HME industry is now facing, ones that will shape 2024.

“Overall, there are three things,” he said … though for this story, we’ll call them four.

At the top of the list, not surprisingly, is the fight for Medicare funding. The so-called 75/25 blended rate for non-rural, non-Competitive Bidding Areas expired at the end of 2023, and the industry has been urging Congress to extend the relief rate through 2024. At

press time, the 75/25 blended rate legislation had been excluded from March 1 and March 8 government spending bills. That means an uncertain funding future for HME suppliers.

“Basically, overall the allowable is not keeping up with inflation,” Fedor said. “It’s not keeping up with the changes caused by COVID, the increases in costs of goods and labor, the ability to find labor, everything that is associated with that. And now, other payers are seeing this, and it’s just an immense challenge for providers that are trying to do their job and stay in business and take care of the patients and keep them home.”

Fedor noted the pandemic push to enable patients to live at home rather than entering facilities, but notes a “disconnect” when it comes to funding that enables Medicare beneficiaries to stay in their homes. “With COVID, the government wanted people to stay at home,” he said. “Stay out of nursing homes. Stay out of the hospital, if you can.

“But their actions are not yielding that result. They’re going in the opposite direction now, especially by not keeping that 75/25 [rate]. And reimbursement should be even more than that to keep up with inflation and the cost of goods.”

Fedor added that while the COVID public health emergency (PHE) officially ended last May, the pandemic’s economic impact lingers.

“They didn’t revert back,” he said, referencing prices driven

skyward by COVID. “Maybe a little with some overhead costs — fuel did come down some. But overall, not even close. So maybe there’s the thinking that [higher allowables] were temporary because suppliers experienced increased costs, and now those costs have reverted to pre-pandemic, so [CMS] can take that money back. That’s not true.”

While the PHE is over, Fedor noted new events now impacting the industry. “There are two wars going on,” he said. “Everything that happens globally increases the costs of doing business because our market is global. Parts and products are coming from overseas. You have competition for resources. Of course that’s going to drive up the costs of goods. That’s going to drive up the end result.”

The pandemic also impacted workers around the country. “People’s whole mindsets changed,” Fedor said of what happened for many during the pandemic. “People reevaluated their lives: ‘Do I really want to work as much? Do I want to travel? Do I want to work remotely? Do I want to take a pay cut and enjoy life?’ Some people did.”

To attract workers at that time, employers raised pay rates. “You saw that increased cost of labor everywhere, significantly,” Fedor said. “Those rates didn’t go back down. [Employers] didn’t say, ‘The pandemic’s over: I was paying you $20 an hour and I’ll pay you $15 now.’ That’s not happening.”

And unlike other industries — for example, restaurants that can offset higher pay rates by raising the prices for their burgers or pizzas — HME suppliers are stuck with pre-determined allowables.

“Our providers have to compete for that [labor] resource while on a fixed fee schedule — actually, with a fee schedule that went down January 1,” Fedor said. “That’s the red-light-blaring-from-the-top-ofthe-building issue. We’re competing for labor within the country.”

While suppliers are getting squeezed by falling reimbursement rates, Fedor said too many seniors are suffering under Medicare Advantage [Part C] plans failing to live up to that name.

“Do you remember in the late 2000s, the word that was used with banks and mortgages?” Fedor asked. “Predatory lending. I think we could use the word predatory for insurance Part C [companies].

“Think about it: They can telemarket. They’re calling constantly. Supplier standard 11 in the DMEPOS quality standards says you can’t telemarket a beneficiary for equipment. They are limitations to telemarketing. So why can [Medicare Advantage plans] do it? What’s the disconnect there, that they can call any time they want?”

Fedor considers the rules for Part C insurers to be a double standard. He pointed out that Supplier Standard 11 states the DME supplier “must agree not to contact a beneficiary by telephone when supplying a Medicare-covered item” unless one of the following applies: (i) The individual has given written permission to the supplier to contact them by telephone concerning the furnishing of a Medicare-covered item that is to be rented or purchased; or (ii) the supplier has furnished a Medicare-covered item to the individual, and the supplier is contacting the individual to coordinate the delivery of the item; or (iii) if the contact concerns the furnishing of a Medicarecovered item other than a covered item already furnished to the

individual, the supplier has furnished at least one covered item to the individual during the 15-month period preceding the date on which the supplier makes such contact.

“There are limitations for the DME supplier in contacting the Medicare beneficiary,” Fedor said. “But for insurance companies, it’s a free-for-all. They’ve got money for the best advertising and marketing teams in the industry, in the United States, probably the world.”

Medicare Advantage plans are required to provide the same coverage as traditional Medicare, Fedor noted. In reality, seniors are often enticed by the gym memberships, meal deliveries, and other marquee Part C offerings, only to have trouble getting the plans to cover typical medical bills. “The results are denied claims or delayed claims that put you through the hoops to try to get medically necessary equipment,” Fedor said. “Most people give up, they can’t fight it.

“This is the reason Medicare was established in the ’60s, to protect [seniors] from this. And to allow this to happen is just so frustrating.”

While CMS has made modest efforts recently to remind Part C plans that they are obliged to cover what traditional Medicare would, “It’s not moving nearly fast enough,” Fedor said. “Because we see the

This is the reason Medicare was established in the ‘60s, to protect [seniors] from this. And to allow this to happen is just so frustrating

— Dan Fedor

switch from original Medicare to these plans increasing every year. The projection is by 2030 to 2035, more than 75% [of Medicareeligible beneficiaries] will be on a Part C plan.

“That’s scary. [Part C insurers] are for-profit; they have shareholders, and traditional Medicare does not. That was the intent, [for Medicare] to not be a for-profit so they could make the decision for the beneficiary, and not for a board of directors, not for the shareholders. That’s the difference now, that decisions are being made for shareholders who are being put above the beneficiary.”

Also expanding: right-to-repair laws, fueled by consumer frustration over lengthy waits for wheelchair service.

Here is another example, Fedor said, of a problem tied to inadequate funding. While a better service provision model inevitably leads to talk about eliminating prior authorizations for repairs, and compensating suppliers for house calls and diagnostic periods, Fedor also pointed out that having consumers or caregivers repair their own chairs is the opposite of what the industry is ultimately striving for.

“For the good of the patient, repairing their own product is not good when we’re trying to raise the standards for the technicians,” he said. “In the auto industry, there are certified technicians. We’re trying to do that here, along with many of the major institutions, like the University of Pittsburgh, RESNA, U.S. Rehab, NCART and NRRTS. But to counter that, we have bills being introduced for the beneficiary to repair their own product. It goes totally against the logic

of what we’re trying to do when repairing a health-care product.”

The complexity of creating solutions

As is generally true of complex problems, there are no easy fixes for these HME industry issues.

For example, the percentage of wheelchairs that can easily and safely be fixed by right-to-repair advocates is always going to be small. As Fedor pointed out, even swapping out batteries can be risky for someone who isn’t properly trained.

The ultimate solution to repairs will likely be multi-faceted, including preventive maintenance and encouraging wheelchair riders to bring their chairs to the supplier when possible, to reduce the number of house calls technicians need to make. There will always be a percentage of wheelchair breakdowns that require in-home visits. But if some chairs can be brought to the supplier’s office, which has more replacement parts and diagnostic equipment than a repair van can carry — that could be a win-win.

To counter unfair practices by Medicare Advantage plans, Fedor said, “My wish would be for a true resource in the industry, a resource for the beneficiary to call and say, ‘Give me an unbiased opinion or guidance on a Part C Medicare Replacement Plan compared to traditional Medicare.’ Because for some, [Part C] may be good, if you’re generally healthy. It possibly could be a good choice for a very limited few. But who’s going to guide [beneficiaries]? The only guides out there are for-profit insurances. Of course, they’re going to push you towards [Medicare Advantage plans]. They’re not going to steer you toward traditional Medicare, because they don’t make money off that.”

HME suppliers can encourage Medicare beneficiaries to learn about any Part C insurer they’re considering before making the switch. For example, if the beneficiary has a Part C plan that is known for denying medically necessary items, a prior authorization affirmation from traditional Medicare would demonstrate that the Part C plan is not following the coverage criteria they are required to follow.

“Use that [prior authorization] from the part B plan to show the patient and the patient’s family: ‘Your part B plan would approve your pressure-relieving support surface or your power wheelchair, but Part C is denying it,’” Fedor explained. “They’re restricting your access.”

Suppliers can also explain the process of switching from Part C back to traditional Medicare. “Helping them switch back is possible, even outside of open enrollment,” Fedor said. “If [the Part C insurer] is restricting access to medically necessary equipment, [the beneficiary] can switch anytime. But it’s not easy. They make it hard to get out once you get in. I just read something where someone referenced an Eagles song, ‘Hotel California,’ where you can check out anytime you like, but you can never leave.”

Perhaps the biggest issues are labor costs and the inability of fixed fee schedules to keep up with the real world. “In most industries, when the cost of producing the product — because of service, materials, whatever — goes up, that cost is passed on to the consumer,” Fedor said. “You can’t do that or it’s so hard to do that in our industry because of fixed fee schedules.”

So funding increases take years to achieve. “Long term, you could possibly fight it, but look what happens,” Fedor said. “We advocated for increases, they gave it to us, and now they took it back.” HMEB

The American Association for Homecare (AAHomecare) has served the HME industry for nearly four decades, setting the stage for manufacturers and providers to come together to advocate for improved access to quality homecare products and services that support millions of Americans and their caregivers. AAHomecare offers turn-key advocacy materials, research and relationshipbuilding advice to help members work with policymakers, regulators, payers, and other stakeholders to enact policies that support the growth and sustainability of the homecare industry.

AAHomecare

(202) 372-0107

aahomecare.org

Booth 750

Set customers on a journey of newfound freedom with the all-new Stella. Now available across North America, Stella is built for comfort and safety, weighing just 14 lbs. (6.4 kg). Its sturdy aluminum frame ensures durability without compromising ease of use. The padded, adjustable seat and oversized backrest provide unparalleled comfort. Navigate effortlessly indoors or out with Stella’s 8" urethane caster wheels. Adaptable handgrips encourage a natural posture, while thicker brake cables guarantee long-lasting reliability. Foldable using a single hand, Stella secures seamlessly for travel.

Amylior

(888) 453-0311

www.amylior.com

Booth 1240

The CG Air is a game-changer, thanks to cuttingedge materials and manufacturing. Crafted from non-permeable, medical-grade PVC using high-frequency welds and injection molding, the CG Air easily meets infection control and sterilization protocols. Toss it into the washing machine or autoclave to clean. CG Air’s unique cell shape provides unparalleled stability without compromising pressure reduction or comfort. Innovative air channels facilitate a controlled flow beneath the user. Choose from 2", 3", or 4" cell heights, with single- or dual-valve configurations in sizes from 14x14" to 30x24". Custom sizing and cell configurations are available.

Amylior

(888) 453-0311

www.amylior.com

Booth 1240

Lymphedema/Compression Accreditation is for providers and businesses offering care management solutions for lymphatic diseases. The accreditation targets DMEPOS product categories that cater to lymphatic patients, emphasizing quality care and treatment continuity. The accreditation enables reimbursement for four CMS product categories, including the lymphedema compression treatment items now billable under the new CMS Product Category S04.

Board of Certification/Accreditation (BOC)

(877) 776-2200

www.bocusa.org/accreditation/ lymphedema-compression-accreditation/ Booth 504

Amylior’s mid-wheel drive M3 and pediatric P3 power wheelchairs are available in a narrower base configuration. The N2221 boasts a base width of 21" with GP22 batteries (2 3/8" narrower than standard size), either with full-size 14" or 12.5" drive wheels and 6" front casters. With a weight capacity of 300 lbs., this configuration supports Amylior’s full line of power positioning: 50° of tilt; 160° degrees of recline; independent elevating legrests or power articulating centermount foot platform; and ALTA 11" seat elevation. At full elevation, ALTA allows the user to drive at 25% of programmed speeds with confidence and unsurpassed stability.

Amylior

(888) 453-0311

www.amylior.com

Booth 1240

Introducing the Glenshaw Collection, a breakthrough line of premium patient furniture. This meticulously crafted collection is designed to enhance the living experiences of people in long-term care and residential facilities. Discover Dynarex’s selection of nightstands, dressers, and wardrobes — as well as top-notch resident room chairs and dining chairs — each available in a selection of attractive wood finishes. Nightstands, wardrobes, and dressers feature ventilated backs for increased airflow through the interior, and rounded edges and soft-close hinges to reduce injury risk. Chairs feature fireretardant, high-density foam and upholstery.

Dynarex

(888) 396-2739

www.dynarex.com

Booth 947

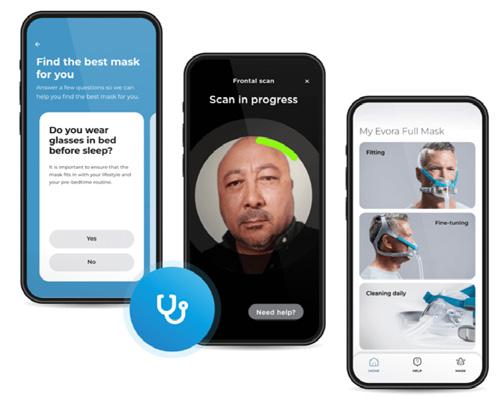

Fisher & Paykel’s newly updated myMask App now offers mask selection and sizing functions, in addition to the existing step-by-step education and support video content. Healthcare professionals can “Select, Size and Assist” while with a patient or can do so remotely by sending a text invitation to the patient’s smartphone. The new function eliminates the need for conventional physical sizing guides while reducing the time and guesswork associated with traditional invasive sizing. The optimal mask size can raise clinician confidence that the right mask is being used, and can improve adherence among patients.

Fisher & Paykel Healthcare Corp.

(800) 446-3908

www.fphcare.com/us

Booth 413

MaskFit AR was developed by a registered respiratory therapist with sleep apnea. MaskFit’s genesis includes work from scientists, computer engineers and physicians who created MaskFit AR, scanning software for PAP mask fitment. Its mission is to select the best-fitting mask the first time. With the largest global CPAP mask database, and using artificial intelligence and machine learning, MaskFit AR’s technology provides the most accurate scanning available, and is the only technology on the market that scans nostrils for sizing of nasal pillows/underthe-nose masks. For privacy, MaskFit does not take, store, or transmit images, and can be used in person or for remote, contactless mask fitting.

MaskFit AR by AR Medical Technologies

www.maskfitar.com

Booth 1013

Meet Nymbl Systems, the agile and simpleto-use billing and business management platform created intentionally to help you achieve better patient outcomes and higher profit margins. Get Nymbl, the all-in-one cloudbased solution that gives you greater access to your data and business insights without nickel and diming. Find out why it pays to be Nymbl.

Nymbl

(859) 657-8324

www.nymbl.healthcare

Booth 1227

Avid Rehab, a division of Merits Health Products Inc., is pleased to announce the launch of the industry’s first 22.5" wide front-wheel-drive power wheelchair. AXCEL Narrow maximizes the benefits of a front-wheel-drive chair with a minimum footprint. This chair’s elegantly simple design works well in narrow halls and doorways. The AXCEL is available in seat widths of 14-22" and seat depths of 14-22", and seat-to-floor heights (without cushion) of 17.5-19.5". It has a rider weight capacity of 300 lbs. and a maximum speed of up to 6 mph.

Avid Rehab, a division of Merits Health Products

(239) 772-0579

www.meritsusa.com

Booth 1441

Launching at Medtrade: the Go Go Elite Traveller 2 4-Wheel, a first-of-its-kind addition to the Go Go series with the tightest turning radius of any 4-wheel mobility scooter on the market. With Pride’s patented, intelligent-turning iTurn Technology, the Elite Traveller 2 4-Wheel will offer 4-wheel stability with 3-wheel maneuverability and a 37" turning radius for unprecedented agility in a range of environments. Users have two battery options and the ability to travel confidently with a weight capacity of 300 lbs. and a top speed of up to 4 mph. The scooter separates into five lightweight pieces for storage and transport.

Pride Mobility

(800) 800-8586

www.pridemobility.com

Booth 351

TCT’s DMEPOS Subcontractor Accreditation program is for contractors who deliver HME and train patients on use and care of the equipment; and DMEPOS providers who want to provide accreditation options for their contractors. The Compliance Team is a CMS-approved, nationally recognized accrediting organization (AO) that has provided accreditation solutions nationwide for 30 years. TCT was the first AO to offer simplified, operations-based standards and the only AO to offer Exemplary Provider Accreditation as a form of quality branding.

The Compliance Team Inc.

(215) 654-9110

thecomplianceteam.org

Booth 853

This is a tough industry to be in, yet you’re here.

If your WHY is like ours, it’s because we’re driven by our desire to ensure homecare’s rightful place in America. You see the impact your company makes in the lives you touch each day, and your customers remind you of your WHY when things get tough.

As America’s #1 homecare policy advocate, AAHomecare helps you achieve your goals by addressing payer issues, tackling reimbursement challenges, and offering you opportunities to network and collaborate with other industry thought leaders.

No matter your company size, product focus, or payer mix, there’s a seat at the table for you. We’re better together, and united, and our WHY is changing the game.

We’re so confident in the value of your AAHomecare membership, we’re offering 1/3 OFF your 1st year dues if you join by the end of March.

AAHomecare is proud to partner with Medtrade for 4 decades! Our team will be active participants at the show, we hope you will find us at one of the following events:

March 27, 2024 | 2:15-3:15 PM

Ballroom C1/C2

AAHomecare’s volunteer leaders bring their expertise to this forward-looking, interactive session on the major issues and trends impacting your business. Hear from Ryan Bullock, John Cassar, Josh Marx, David Siegel, and facilitator Tom Ryan on challenges facing the HME sector, leveraging new technology, and taking advantage of our industry’s unique role in the healthcare continuum.

March 27, 2024 | 5:30-7:00 PM d.e.c. on dragon street Network and fundraising for a great cause! Tickets available at the door.

March 26-28, 2024

We believe in the power of education to transform HME businesses and the communities you serve. Join our team of experts in payer relations, CRT, regulatory, and business operations sessions . Learn more at medtrade.org/conference-agenda.

AAHomecare is also bringing the education to you! Visit our website for information and to register for our monthly webinars.