A COMPLETE GUIDE TO CRYPTOCURRENCY TRADING

JOSH LAKA, TIM GENNES, ALEXANDRE HILLHOUSE, MICHAEL BROHIER

JOSH LAKA, TIM GENNES, ALEXANDRE HILLHOUSE, MICHAEL BROHIER

A COMPLETE GUIDE TO CRYPTOCURRENCY TRADING DR. MATTHEW HURST ROLAND GEORGE INVESTMENTS PROGRAM

CRYPTO 101

CRYPTO BASE CONCEPTS

BLOCKCHAIN APPLICATIONS

POTENTIAL TRADING STRATEGIES

ANALYSIS OF CRYPTO EXCHANGES

FUNDAMENTAL COIN ANALYSIS

TABLE OF CONTENTS

1.1 Exponential Returns or Investment Bubble? 1.2 Where Did It Start and Where Will It Go? 1.3 Is Reward Worth the Risk? 1.4 Hedging against Bubble Risk - A Correlation Analysis 4 4 5 6 8

2.1 Blockchain 2.2 Consensus Mechanism 2.3 Ecosystems & dApps 2.4 Smart Contracts 2.5 Bitcoin Dominance 2.6 ICOs 2.7 NFTs 2.8 Meme Coins 2.9 Decentralized Autonomous Organizations DAO 2.10 DeFi 2.11 Metaverse 2.12 Liquidity Pools 2.13 Automated Market Makers & Yield Farming 11 12 13 14 15 15 16 17 17 17 18 18 19 19

3.1 Web 3.0 3.2 Decentralized Currency 3.3 Smart Contracts 3.4 DAOs 3.5 NFTs 23 24 26 27 28 28

4.1 Long-Only Fundamental Analysis 4.2 Short Bitcoin Dominance 4.3 Yield Farming 4.4 Global Risk Factors 31 32 34 36 38

5.1 Centralized Exchange Platforms 5.2 Decentralized Exchanges (DEX) 5.3 Cryptocurrency Lending Platforms 5.4 Crypto Wallets 5.5 Recommendation 41 42 44 45 47 47

6.1 Market Movers 6.2 Alternative Infrastructure 6.3 NFT & Metaverse Adoption 6.4 Stablecoins for Defensive Portfolio 6.5 dApps & Governance 49 50 52 60 61 62 GLOSSARY 65

CRYPTO 101

EXPONENTIAL RETURNS OR INVESTMENT BUBBLE?

Currency of the future. Scam. Digital gold. Investment bubble. Cryptocurrency courts excitement and criticism from every corner of the financial universe. The lure of unprecedented returns draws many into cryptocurrency investment, while others decry the investment opportunity as speculative luck. Despite the broad spectrum of opinions, it appears cryptocurrency, or crypto as it is commonly known, is here to stay. Yet there remains a fundamental issue with crypto; ironically, most crypto investors do not understand cryptocurrency.

“Investment must be rational; if you can’t understand it, don’t do it.” The timeless adage of Warren Buffet is still regarded as wise advice by investors at the highest levels of the finance world. A recent survey indicated a third of crypto investors do not understand cryptocurrencies. Further studies found 35% of crypto investors trade cryptocurrencies because “it is exciting” compared to only 18% who trade the digital asset for “long-term stable growth.” Therefore, it is no surprise that cryptocurrency is susceptible to wild swings based on uncertain investor sentiment that is exacerbated by a lack of crypto knowledge.

This handbook aims to bridge the gap between the everyday investor and the inherent complexity of cryptocurrencies. Despite the wealth of resources available on the internet, the would-be crypto investor must trawl through hours of incomplete sources and misinformation to gain only a basic understanding of cryptocurrency. This handbook presents an introduction to cryptocurrency, an examination of exchanges and trading vehicles, a technical analysis of market trends, a proposal for basic trading strategies, and an all-important insight into the fundamentals of cryptocurrency. Key topics that underpin the digital asset market, including blockchain technology, proof-of-work and proof-of-stake protocols, smart contracts, NFTs, and liquidity pools are just some of the important concepts covered in this handbook that will prepare you for understanding cryptocurrency and creating the optimal portfolio tailored to your investment goals.

So why cryptocurrency? If the attraction of cryptocurrency could be summarized in one word, it would be this:

The potential for blockchain technology to reinvent a multitude of industries and professions is imminent and real.”

4

Reasons people invest in Crypto

Ease of making my trades

It is exciting

Potential for short-term high growth

It feels like a game

Social media personalities encourage investing

Friends & family encourage investing

Potential for long-term stable growth

decentralization. The traditional financial system depends on large institutions overseeing all monetary transactions, placing individuals and corporations at the mercy of banking organizations to hold and transfer their money.

Cryptocurrency — currency secured by cryptography — presents an opportunity to return financial power to individuals by allowing the secure transfer of assets between people without the need for a third-party intermediary. This has considerable potential in developing countries that struggle with high transaction fees and corrupt institutions. For example, in September 2021, El Salvador adopted Bitcoin as legal tender, promoting the cryptocurrency as the indebted nation’s path to financial freedom. Although El Salvador has been criticized for adopting Bitcoin and bringing uncertainty to the already fragile Central American economy, the country’s adoption of Bitcoin is proof that cryptocurrency has the potential to cross international borders and financial inequality to establish a secure, decentralized and digitized financial system.

However, the potential use cases for cryptocurrency technology are not limited to digital currency. Cryptocurrencies are underpinned by blockchain technology, which has many possible avenues for adoption. The expansion of blockchain technology through smart contracts, NFTs and Web 3.0 could potentially reinvent rental agreements and the real-estate industry, passport and personal ID verification, or online data storage and securitization. Beyond these examples, blockchain technology and cryptocurrency also have the potential for use in gaming and more obscure applications in the metaverse.

Whatever your take is on the longevity and investment credibility of cryptocurrency, it is undeniable that the potential for blockchain technology to reinvent a multitude of industries and professions is imminent and real. Whichever side of the investor debate you fall on and whatever profession you work in, awareness and education surrounding cryptocurrency and blockchain technology will be vital to keeping up with the continuously expanding digitalized world.

WHERE DID IT START AND WHERE WILL IT GO?

A popularized assumption is that cryptocurrency was created in the last decade and exists on the premise of entirely new technology. However, the idea of digitized currency secured by cryptography dates to the early 1990s when American computer scientist and cryptographer, David Chaum, created DigiCash, the world’s first digital currency. The goal of DigiCash was to facilitate monetary transactions that were anonymous and secure with a long-term vision to transition the financial world to a digital cash system that redefines a future of financial privacy ungoverned by the oligarchical banking industry. Despite high aspirations, in 1998, DigiCash filed for bankruptcy when it failed to convince banks to adopt its innovative technology.

Fast forward to the 2008 economic crisis when the value of gold and silver dropped dramatically, and a Japanese developer

43% 35% 31% 26% 23% 20% 18%

5

with the pseudonym “Satoshi Nakamoto” published the white paper for the world’s first decentralized cryptocurrency, Bitcoin (BTC). Bitcoin was the first digital asset that used encryption key cryptography to record and send monetary transactions via blockchain technology without the oversight of a central authority. The concept of a decentralized peer-topeer electronic payment system remained underutilized until other crypto’s including Litecoin (LTC), Ripple (XRP), and Ethereum (ETH) entered the market in 2011, 2012 and 2015.

As cryptocurrencies cemented their place on the global financial map, Bitcoin and other cryptocurrencies remained highly volatile, with 20X increases and 90% decreases in price not uncommon. Owning this asset class was also risky because of several hacks and instances of Bitcoin wallets disappearing due to the subpar security of cryptocurrency exchanges. It was not until 2017 and an exponential rise of other cryptocurrencies entering the market that the asset class gained traction. The ICO bubble took the crypto market to a high when Bitcoin reached $20,000 at its peak in December 2017, and the overall market cap exceeded $800 billion. Many people regard this initial boom in the digital asset class as the beginning of cryptocurrency. Since then, the market has undergone similarly volatile swings, but the year 2021 brought a dominant popularization of the cryptocurrency market to an unprecedented level. That November, the industry market cap touched $2.9 trillion, and Bitcoin’s price reached $68,990.

Today, cryptocurrencies have become an investment vehicle for many financial institutions. The cryptocurrency market is still a new and evolving industry that constantly supplies practical ideas to revolutionize the future. We anticipate that Smart Contracts, DeFi, NFTs and other emerging applications

will bring the cryptocurrency industry to a multi-trillion asset class in the upcoming decade and that the opportunity to invest has arrived. Disregarding the juvenile advice of “buy the dip” cryptobulls and focusing on the intrinsic value of blockchain technology and the potential for growth in an emerging digitalized world, the reality is that it is not too late to invest. An intelligently allocated crypto portfolio that hedges risk and focuses on blockchain technology applications promises the potential for real returns in an inflationary economy.

IS REWARD WORTH THE RISK?

A key rationale for expanding education on cryptocurrencies is the lack of correlation to equity markets. Contrary to intuition and frequent news headlines, an analysis of price movements between cryptocurrencies and the S&P 500 index in 2021 suggests negligible correlation between equity and crypto markets. In fact, over the 250 analyzed 24-hour time frames, Bitcoin and the S&P 500 moved in the same direction precisely 125 times and in opposite directions precisely 125 times. The lack of correlation between markets creates opportunities for investors to detect profitable trading strategies with little consideration for short-term macroeconomic factors.

Cryptocurrency can redefine a future of financial privacy ungoverned by the oligarchical banking industry.

” SP500 BTC SP500 1 BTC 0.109 1 ETH 0.143 0.751 ADA 0.022 0.594 SOL 0.142 0.363 MKR 0.128 0.466 LINK 0.118 0.677 XRP 0.112 0.514 FTT 0.103 0.721 AAVE 0.128 0.515 6

Low Treasury Yields Favor High-Risk Securities

It is known that the Federal Reserve’s policy to lower interest rates throughout the 2010s has benefited the U.S. economy and the economies of correlated markets in developed countries. The current relationship between the U.S. treasury and equity markets is relatively intuitive. Investors are not substantially compensated for lending capital to governments or corporations, which has forced increasing investment in riskier securities. Firms in high-risk sectors such as information technology or consumer discretionary were among the primary beneficiaries of the low-interest rate environment in 2020 and 2021. Seeking high returns, investors have developed an increasing appetite for securities even riskier than traditional growth stocks, which served as the breeding ground for the cryptocurrency boom in the early 2020s. The following graph shows how the postCOVID interest rate drops in early 2020 created a breeding ground for Bitcoin’s significant price rise in subsequent years.

BTC VS 10 YEAR TREASURY YIELD

BTC VS 10-YEAR TREASURY YIELD

$10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 3/29/17 3/29/18

Moreover, savers are being expropriated faster than ever due to monetary policies provoking rising inflation. The opportunity cost of holding cash is at a 50-year peak as CPI continues to rise, forcing retail investors towards risky assets. The Taylor Rule, which states interest rates should increase whenever inflation exceeds the target rate, has not been maintained since the great recession of 2008,

Consumer Price Index US

Price Index US

0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 $-

3/29/19 3/29/20 3/29/21 10 year Treasury Yield BTC Price

BTC Price 10-year Treasury Yield

-1% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 0 50 100 150 200 250 300 350 2013-03-012013-09-012014-03-012014-09-012015-03-012015-09-012016-03-012016-09-012017-03-012017-09-012018-03-012018-09-012019-03-012019-09-012020-03-012020-09-012021-03-012021-09-012022-03-01

CPI CPI YoY Consumer

7

causing a diminishing purchasing power from bond market returns. Retail investors are desperate for a risky alternative asset class that offers little or no correlation to established investment methods and high-return potential. Therefore, the economic framework in post-pandemic times portrays an excellent growth environment for cryptocurrency assets.

HEDGING AGAINST BUBBLE RISK - A CORRELATION ANALYSIS

The evolution of cryptocurrencies can also be viewed through a lens of technical analysis of the correlations between coins. A simple correlation analysis of daily price changes during 2021 reveals a few crucial starting points in creating a cryptocurrency portfolio.

1. Almost everything is correlated to BTC & ETH.

An analysis of 2021 daily price data finds almost all cryptocurrencies are correlated to Bitcoin and Ethereum. In fact, the lowest correlation of the major utility tokens is Solana, which experienced a lower correlation due to its 9,000% rise in value. All other correlations are greater than 0.5 and most are greater than 0.65, showing significant relationships in price movements. This is important because it indicates the potential for an effective market-neutral portfolio strategy.

2. Assets built on the Ethereum ecosystem are highly correlated to Ethereum.

The same correlation analysis finds that coins built on the Ethereum network strongly correlate to ETH. Assets such as Maker (MKR), Chainlink (LINK) and Aave (AAVE) are built on the Ethereum ecosystem, and they all have correlations to ETH of approximately 0.7 or higher. The same was found to be true for other ecosystems, where the network’s altcoins have high correlations to the ecosystem’s native asset.

3. Meme coins are not correlated.

Meme coins such as Dogecoin (DOGE) and Shiba Inu (SHIB) have a negligible negative correlation to other cryptocurrencies attesting to their lack of utility or intrinsic value. Analysis or investment in these coins is not relevant to any worthwhile fundamental or technical analysis of market trends.

BTC ETH SHIB DOGE

BTC 1 ETH 0.784 1

SHIB -0.068 -0.031 1

DOGE -0.107 -0.030 -0.084 1

4. During upswings, correlations generally decrease, and during downswings they increase significantly.

A time-series correlation analysis reveals the crypto market’s correlation with BTC and ETH decreases during overall market upswings but increases significantly during a market downswing. The 2021 upswing and downswing periods are defined by the distinct rises and falls of the overall crypto market cap that ended in April, July, November and December. For every coin in the correlation analysis, the correlation to BTC and ETH is higher during a market downswing by an average of 0.224 and 0.187 respectively. This is significant because it exposes various trading strategies that can be used to build a market-neutral portfolio.

BTC ETH BTC 1 ETH 0.784 1 BNB 0.600 0.596 ADA 0.576 0.620 SOL 0.401 0.504 MKR 0.529 0.694 LINK 0.686 0.786 XRP 0.547 0.535 UNI 0.555 0.698 AAVE 0.552 0.737 -100.00% -50.00% 0.00% 50.00% 100.00% 150.00% 200.00% 250.00% 0.000 0.100 0.200 0.300 0.400 0.500 0.600 0.700 0.800 0.900 Jan - April April - July July - Nov Nov - Dec % Change in Crypto Market Cap Alt coin correlation to BTC & ETH Crypto Market Cap vs Corrleation of Altcoins to BTC & ETH BTC ETH Change in Crypto Market Cap Crypto Market Cap vs Correlation of Alt-coins to BTC & ETH 8

An intelligently allocated crypto portfolio that hedges risk and focuses on blockchain technology applications promises the potential for real returns in an inflationary economy.”

9

CRYPTO BASE CONCEPTS

BLOCKCHAIN CONSENSUS MECHANISM ECOSYSTEM & DAPPS SMART CONTRACTS BITCOIN DOMINANCE ICOS NFTS MEME COINS DECENTRALIZED AUTONOMOUS ORGANIZATIONS (DAO) DEFI METAVERSE LIQUIDITY POOLS AUTOMATED MARKET MAKERS & YIELD FARMING 11

BLOCKCHAIN

The fundamental topic underpinning the cryptocurrency world is blockchain technology. Although blockchains were initially developed for decentralized cryptocurrencies, hype surrounding the emerging technology has led to blockchain engineers worldwide developing new applications for the revolutionary technology. Thus, the question “What is a blockchain?” is pertinent for cryptocurrency understanding and investment.

A blockchain is a chronological collection of blocks that link together in a chain-like formation to store data secured by cryptographic design. The main attraction of blockchains is their distributed ledger system, which enables public access to all information and data stored on the blockchains network.

Public availability means a blockchain’s data is secure through consensus protocol, cannot be altered or backdated, and, most importantly, a blockchain has no single point of failure. Instead of a centralized point of control susceptible to physical damage, blockchain data is stored by every node in the system, creating a decentralized network that prevents a singular person or organization from gaining an overriding control of information. By providing every node on the network with continuously updated real-time data, the network is secured by a consensus verification of all added information and records.

Structurally, a blockchain contains three main components: the block, a hash and the previous block’s hash. For every block, the preceding block is known as its parent block, and with each parent block also having a parent, every block can be traced back to the first block in the chain, called the genesis block.

The block is the data structure within the blockchain where information, data or records often detailing financial information on the exchange of assets are collected in a transaction list or general ledger. A block has limited information capacity before it becomes full, and a new block is added to the chain to store more information. The method for creating new blocks on a blockchain depends on the blockchain’s protocol or consensus mechanism.

The hash is the block’s digital fingerprint that uniquely identifies it from all other blocks in the chain. A block’s hash is calculated through a hashing function, and it is comprised of the block’s version number, timestamp, the hash of the previous block, the hash of the merkle root, nonce, and the difficulty target. For purposes of this resource, the composition of blockchain hashes is not necessary to understand. Further explanations and recommended external resources are provided in the glossary.

The essential concept for blockchain understanding is that each block contains the previous block’s hash, so if someone attempted to alter information in Block #1, the hash of Block #1 would change, in turn changing the hash of Block #2 and all other subsequent blocks. Thus, any corruption in block data is easily recognized and nullified. This feature gives blockchains their properties of immutable security because it is infeasible to alter or backdate an old block and then do so for every subsequent and already verified block in the chain.

12

CONSENSUS MECHANISM

A blockchain’s consensus mechanism is the system and protocol that provides its synchronized and distributed ledger characteristics. Since blockchain innovation is reliant on decentralization, such that all nodes have access to every record on the blockchain, a blockchain’s consensus mechanism is responsible for upholding a secure, reliable, real-time and transparent network.

In layman’s terms, a blockchain’s consensus mechanism sustains a “consensus” across the network where all nodes agree on new records or information as they are added to the blockchain. Therefore, the consensus mechanism manages blockchain use, monitors the legitimacy of transactions and prevents a 51% attack. Multiple consensus mechanisms exist today, with emerging blockchain projects constantly innovating new consensus protocols; however, the two most discussed are Proof-of-Work and Proof-of-Stake.

Proof-of-Work (PoW) is the original blockchain consensus mechanism brought to life by the Bitcoin blockchain. PoW is an algorithmic system that requires network participants to use trial and error methods to solve the exact hashing input for a known hash output. These network participants are called miners, and when miners solve the hashing algorithm, they are compensated with a miner's reward in the form of an asset connected to the blockchain. Aside from providing mining rewards, the fundamental purpose of mining and the PoW mechanism is to create new blocks for the chain and verify recent transactions as they are added to the blockchain. When a network participant solves a PoW problem, the solution is broadcasted to all other nodes and then immediately verified by other nodes who confirm the hashing algorithm solution.

Advantages: The key feature that makes PoW secure is its one-CPU-one-vote characteristic, meaning one CPU of mining equipment provides a miner with one vote for network verification. Therefore, as long as honest nodes control majority of the network’s CPU power, the blockchain will grow honestly. Thus, if someone attempted to create a fraudulent transaction,

they would need 51% of all CPU power in the network, which is simply infeasible for any major cryptocurrency. Moreover, due to the hashing nature of a PoW blockchain, modifying an old block would require an attacker to change the old block and then solve the new hashes for all subsequent blocks faster than honest nodes can grow the chain with honest transactions.

Disadvantages: Although effective for security purposes, the nature of a PoW protocol means miners with bigger and better equipment reap greater rewards. The faster you can solve the hashing functions cryptographic problem, the more likely you will create the next block and receive the mining rewards. This has created an environment where commercial Bitcoin mining pools and organizations dominate the mining industry, in turn centralizing the mining process and contradicting the entire purpose behind decentralized currencies. Commercialized mining pools also use massive amounts of electricity to power their CPUs every year, which is having drastic implications on the environment.

Proof-of-Stake (PoS) is a consensus mechanism where the network’s nodes commit a stake of their crypto assets in exchange for the chance to be selected to validate transactions and create new blocks. In this way, being chosen to validate a transaction is equivalent to mining a block in a PoW mechanism. PoS validators are chosen based on the total value of their staked assets. Thus, the more cryptocurrency a node stakes, the greater its chance of being selected to validate transactions and “mine” tokens. Consequently, the PoS protocol encourages nodes to hold more of the staked crypto asset, hence raising the crypto’s price.

When coins are staked in a PoS protocol, they are locked up via smart contracts until the holder wishes to trade them. Then, after a block of transactions is ready for verification, the PoS protocol selects a validator, at which point the validator either identifies the transactions as valid or invalid. If the validator accurately validates a transaction, they are rewarded with the blockchain’s native asset; if they incorrectly validate a transaction, they lose a portion of their staked assets. Anyone can set up a staking node as long as they meet the minimum staking requirements of the blockchain.

13

Advantages: PoS solves the problem of energy efficiency that affects PoW. By simply staking coins, there is no computational power required to validate transactions and create new blocks for the blockchain. It is also a faster and less-expensive process that does not require the validator to hold any special mining equipment. Instead, a PoS protocol only requires a person to set up a staking node on a regular computer of appropriate size.

Disadvantages: PoS has security concerns because anyone who holds over 51% of the native token has the power to attack the blockchain by maliciously verifying fraudulent transactions. Also, even if a PoS attacker failed to achieve a 51% share, having one person own a large portion of a crypto centralizes the blockchain’s procedures and provides them with significant voting power. Additionally, setting up a staking node on a PoS network can be relatively complex, and some blockchains require a minimum staking period, which decreases the owner’s freedom to manage assets as desired.

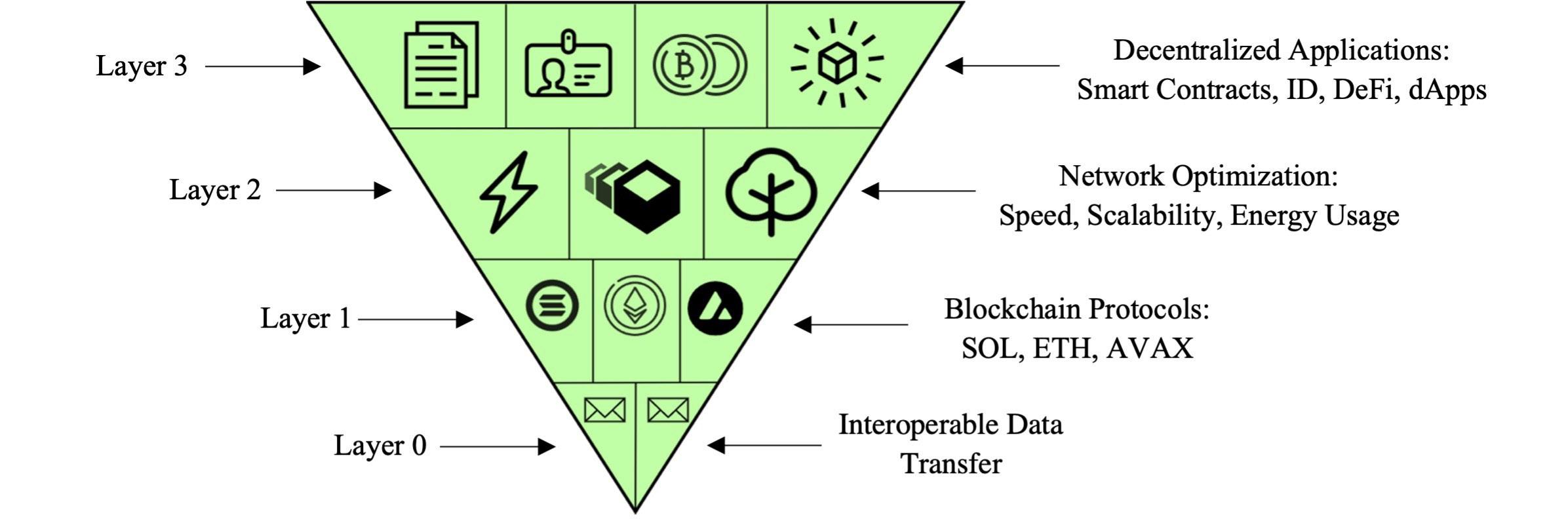

ECOSYSTEM & DAPPS

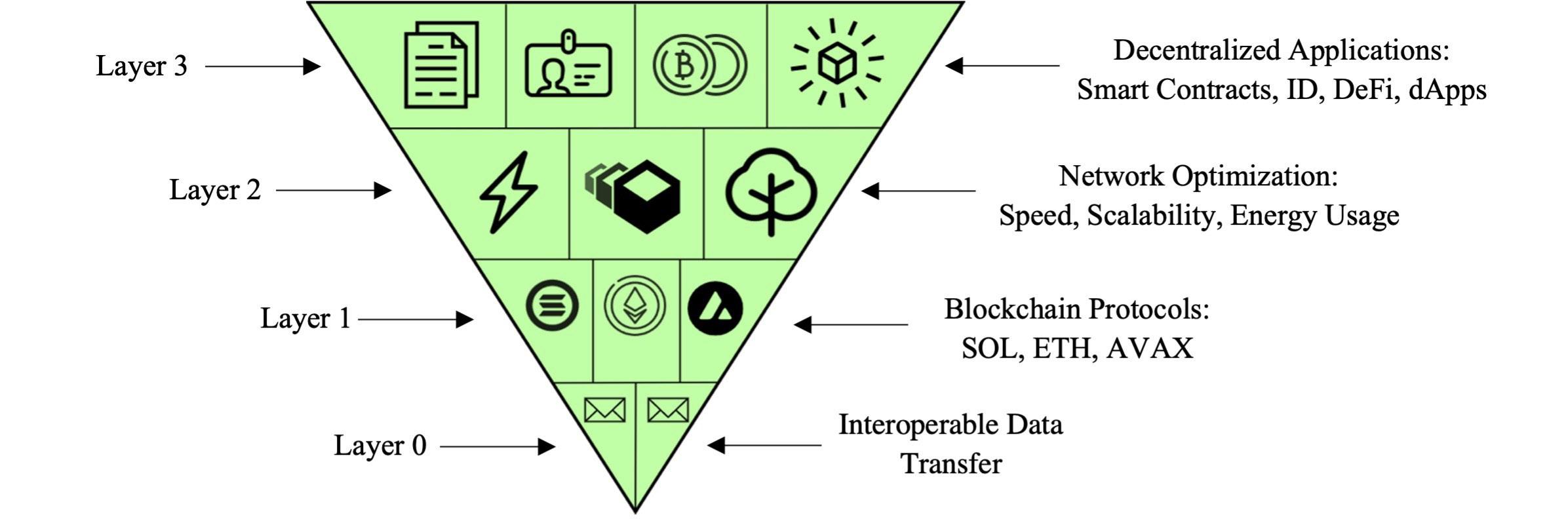

A blockchain ecosystem is a group of cross-enterprise workflows interacting to provide an “environment” for blockchain technology collaboration. Essentially, an ecosystem is a platform for blockchain developers to build new blockchain applications and cryptocurrencies within the ecosystem of the host platform. The purpose of ecosystems providing this service is that small-scale blockchain developers can save time and money, as they do not need to create an entirely new blockchain. Instead, they build their blockchain application or cryptocurrency within the host ecosystem. The pioneering

example of an ecosystem in the crypto space is Ethereum and the development of ERC-20 token standards.

The Ethereum ecosystem is the largest blockchain ecosystem. As of December 2021 it was home to over 1,000 developers and empowered many major networks, including Maker (MKR) and the DAI stablecoin. However, other ecosystems are quickly rising as potential competitors to Ethereum. The most notable include the Solana, NEAR, Avalanche, and Kusama/Polkadot protocols. Each of these ecosystems have specific purposes that provide a competitive advantage for growth potential, such as developing new consensus mechanisms or improving blockchain interoperability.

Since these blockchain ecosystems provide a form of governance and space for developers to collaborate, they have been criticized for being operated like a public or private company wherein the blockchain developers are employees “hired” by the platform. However, the central governance of a blockchain ecosystem also allows smaller and underfinanced projects to get off the ground because the ecosystem can fund the project for a small portion of its native assets. This particular use of ecosystems is comparable to a venture capitalist providing tools and capital to a start-up company.

Although every ecosystem has a different purpose and distinct features that make it attractive for blockchain developers, they all share the common goal of encouraging developers to build dApps in their ecosystem. When dApps or cryptos are built on an ecosystem, the host network gains usage and publicity, correlating directly to price growth and increasing network revenue. The other critical function of blockchain ecosystems is they facilitate collaboration between developers like a “thinktank” to advance the progress of a blockchain’s applicability.

14

dApps are decentralized applications built within a blockchain ecosystem. dApps are built on smart contract networks and operate on open-source code, so anyone can read what dApps do and how data is collected and used. This is the primary appeal of dApps as they provide a real-world application to blockchain technology and allow for full transparency in data usage. dApps are also far less likely to have network-wide shutdowns because the blockchain is stored on multiple nodes and turning off every node in the network would be completely infeasible. One of the fastest-growing dApp ecosystems is Chainlink, which currently has companies, including Google and PayPal, testing and developing dApps compatible with their ecosystem.

contracts able to hold assets and execute commands based on the agreements of the two parties entering the contract. Yet, the use cases for smart contracts expand beyond the addressed topics as they are also applied to the financial services, gaming, and healthcare industries.

BITCOIN DOMINANCE

WHAT IS BITCOIN DOMINANCE?

SMART CONTRACTS

Smart contracts are one of the most appealing applications of blockchain technology and are the basis of the ethereum blockchain. They are similar to regular legal contracts as they execute some outcome based on a sequence of events. However, instead of requiring extensive legal understanding or human subjectivity, smart contracts are a sequence of code that performs a function whenever the contract's requirements are met. Therefore, when two parties agree on a smart contract, the contract's code locks the assets associated with the contract from both parties and transfers the assets to the appropriate party after the relevant event occurs. Essentially, smart contracts operate as a string of complex "if...; Then ..." Statements that perform exact instructions with no bias or subjectivity and execute immediately without delay or review from third parties. Thus, smart contracts are credited with being a more secure, faster, and more applicable method of handling contracts, particularly for small-scale contracts.

Smart contracts have applications ranging from facilitating financial lending and borrowing, to functioning as legally binding contracts, to assisting with the growth of machine learning and artificial intelligence software. However, the most noteworthy applications are situations wherein third parties are involved in agreements. For example, real estate agents could have their roles made redundant in upcoming years with smart

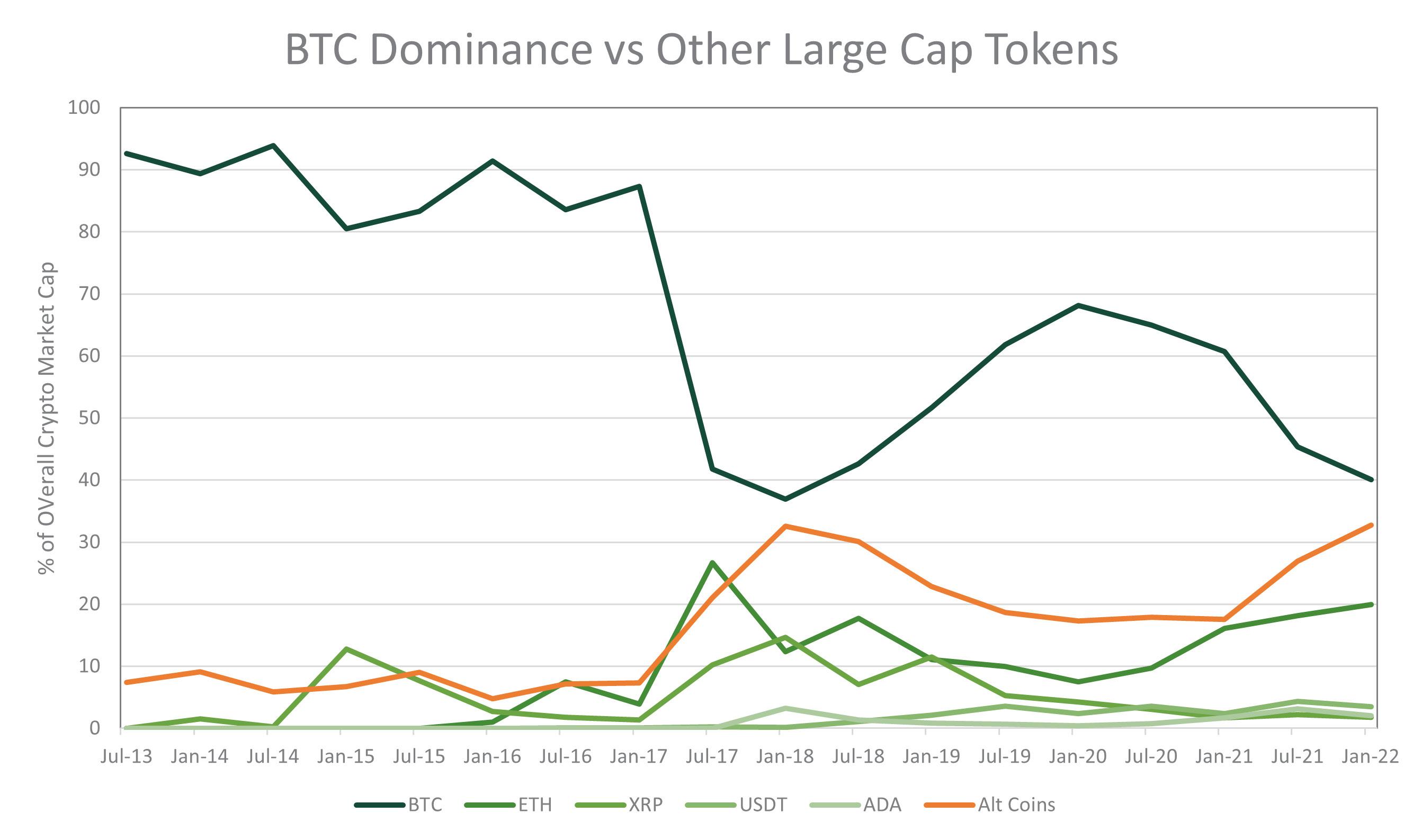

Bitcoin is the largest cryptocurrency in the world by market capitalization. Market capitalization, or market cap as it is commonly known, is a basic financial metric measuring the total global investment in a cryptocurrency. It is used as an indicator of a coin's overall dominance and popularity across the market, and it is determined by multiplying the current price by the circulating supply.

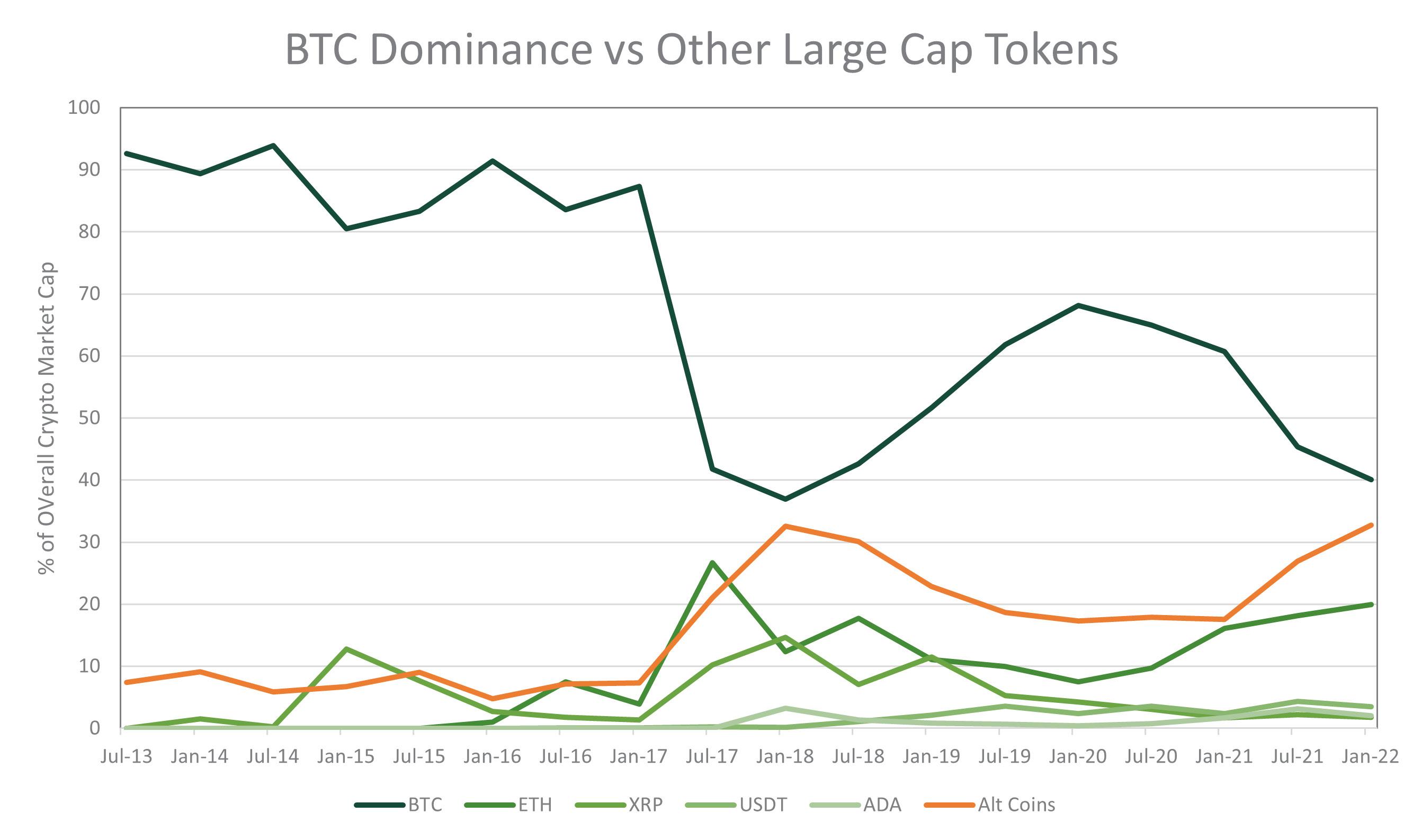

Bitcoin's market cap has dominated the cryptocurrency market for the past decade. In fact, even a decade after the cryptocurrency was created, investment in Bitcoin still represents over 40% of the total investment in all cryptocurrencies. This is referred to as Bitcoin Dominance. Thus, the simple definition of Bitcoin Dominance is the ratio of Bitcoin's market cap to the total investment in the entire cryptocurrency market.

THE BITCOIN DOMINANCE TREND

Before cryptocurrencies became a globally recognized asset class, Bitcoin dominated nearly 95% of the cryptocurrency market. Bitcoin maintained this dominance for several years between 2010 and January 2017. However, the coin's authority over the market was predominantly contributable to the lack of altcoins available on the cryptocurrency market during the early 2010s. So, in early 2017, Bitcoin Dominance decreased significantly due to the emergence of new coins in the ICO craze.

An ICO or initial coin offering is the cryptocurrency equivalent of an initial public offering (IPO). The 2017 ICO bubble saw investments in altcoins grow exponentially, and subsequently, Bitcoin's dominance dropped to a low of 35% in January 2018.

15

However, when the ICO bubble burst and many altcoins failed or were revealed as rug pull scams, investors grew concerned about the security and reliability of small-cap cryptos. Thus, investors turned to more reputable cryptocurrencies and Bitcoin's dominance returned to 70% in 2019. Since 2019, Bitcoin dominance has constantly been declining amidst negative news about Bitcoin's energy consumption and the outperformance of new market movers such as Ethereum, Solana and Cardano.

ICO’S

An ICO stands for initial coin offering. ICOs are the cryptocurrency equivalent of an IPO as they are a method to raise capital for cryptocurrency projects in a blockchain environment. ICO exchange platforms allow investors to receive unique cryptocurrency rewards in exchange for monetary investment in the project. This function gives investors exclusive access to features of a project run by the creators. Thus, similar to IPOs, ICOs allow for the funding of open-source projects that would otherwise be difficult to fund with traditional business structures. Most ICOs are issued on dApp platforms after they declare intentions to organize an ICO by publishing a "white paper." The white paper explains the entire blockchain project, its goals, its roadmap, the

amount of capital it needs to raise via the ICO, and other necessary information to help investors decide if they want to participate. Although investors can make significant profits from ICOs, the U.S. crypto market lacks regulation, making them extremely risky.

NFT (NON-FUNGIBLE TOKEN)

WHAT IS AN NFT?

Non-fungible tokens (NFTs) are unique and secure digital assets registered on a blockchain. NFTs are non-fungible, which means they cannot be altered or replicated due to their unique identification code. NFTs as digital assets are creating emerging applications for the ownership transfer of unique and original digital assets such as art, music, real estate, and videos.

HOW DOES IT WORK?

NFTs run on a blockchain, similar to traditional cryptocurrencies such as Ethereum, where anyone can see transactions, making it easy to verify and track ownership of assets. However, NFTs differ because they are being used to represent unique real-world objects such as real estate and art via a process known as tokenization. The concept of tokenizing

16

a real-world object with digital assets has promising features with the potential to change multiple industries. For example, an artist can connect with his audience by selling his music via NFTs. This would allow a direct relationship between buyers and sellers, and because NFTs are non-fungible and have their transaction data stored in a blockchain, it would prevent the artist's music from being replicated or stolen. A similar concept can also be applied in the art or real estate industries, where precious artworks or real estate properties could be tokenized into NFTs to prevent replication and allow for transparent transaction data.

MEME COINS

Meme Coins are cryptocurrencies inspired by memes or jokes and they have become astonishingly popular within the cryptocurrency market in recent years. A good example is Shiba Inu which went viral after Tesla founder Elon Musk tweeted a picture of his dog. A similar instance occurred with Dogecoin when the coin rose in value by 600% in one week after Musk and other influencers and celebrities promoted Dogecoin on Twitter. Incredibly, in May 2021, Dogecoin peaked at a market cap of almost $90 billion, twice the market cap of Ford Motors. Since then, Dogecoin has decreased in value by over 90%. Meme coins are extremely volatile and should not be taken seriously as a legitimate investment opportunity.

DAO - DECENTRALIZED AUTONOMOUS ORGANIZATION

DEFINITION

“A DAO is a blockchain-based system that enables people to coordinate and govern themselves mediated by a set of selfexecuting rules deployed on a public blockchain, and whose governance is decentralized” (Samer Hassan, Primavera de Filippi, 2021)

A Decentralized Autonomous Organization is a blockchainbased technology that enables the functions of a DAO to operate independently from its user's influence. Applications of DAO technology are most likely to appear in upcoming years in combination with internet-of-things devices and the metaverse. The Bitcoin blockchain is the most basic interpretation of a DAO because the Bitcoin network scales through fully transparent modifications suggested by the community. However, this interpretation has evolved with the development and broad implementation of Proof-of-Stake consensus mechanisms. Modern interpretations describe a DAO as a service-oriented network on a blockchain governed through either a native or foreign governance token. Staking tokens in the network enables holders to claim profits if applicable and covers the network's expenses if needed. Smart contracts set the rules for the execution and termination of the service offered, meaning that if pre-set conditions are met, then DAO rules are enforced without human confirmation.

ANALOGY

Imagine ordering pizza from your local pizza chain without human involvement in the delivery process as a self-driving vehicle delivers your pizza. Once the order is received, a DAO will track the contents of your order and the time until delivery. The DAO then charges the customer automatically based on the amount of pizza ordered and the distance covered. In case

17

of an unusual delay, it automatically issues a discount after delivery, based on predetermined dollar amounts contingent on predetermined discount rates per unit time. This process eliminates the need to negotiate with the delivery company in case of a delay and automatically uses internal data to charge the appropriate amount for the delivery.

DECENTRALIZED FINANCE (DEFI)

DEFI VS. CENTRALIZED FINANCE

The financial world currently relies on centralized intermediaries who specialize in financial services. These intermediaries provide services to a variety of market participants, and in its most basic form, financial intermediaries connect buyers and sellers. The core idea of DeFi can be described as the elimination of traditional intermediaries in exchange for automated open-source systems connecting buyers and sellers using a prespecified set of rules generally outlined in smart contracts. DApps typically drive DeFi systems to operate token swap exchanges such as Uniswap or gaming virtual realities such as Decentraland.

METAVERSE

“The Metaverse is the post-reality universe, a perpetual and persistent multiuser environment merging physical reality with digital virtuality. It is based on the convergence of technologies that enable multisensory interactions with virtual environments, digital objects and people such as virtual reality (VR) and augmented reality (AR).” Mystakidis, S. Metaverse. Encyclopedia 2022, 2, 486-497.

Functions of the metaverse range from gaming and entertainment to building a social life and creating a learning environment. The range of potential applications of a VR- and AR-based universe is immense, causing many tech companies to shift attention from Web 2.0 projects to metaverse projects.

BLOCKCHAIN APPLICATION

Blockchain technology provides a secure way of certifying ownership of digital assets within digital virtuality. The gaming industry has been selling digital assets through license agreements for many years, but ownership via individual hashes provides a clearer definition of property rights in a digital reality. Also, the concept of scarcity within a digital reality is still in its infant stage, which begs the question: Does rational human behavior even allow people to commit their social life to digital reality, or are people’s natural urges going to put a ceiling on the metaverse’s adoption? Is the metaverse here to stay? A psychological approach:

For this analysis, Freud’s “pleasure principles” suggest that creating an alternative reality has to come with an overload of artificial rewards to stimulate a human’s eros. A metaverse can only be adopted if rewards from entering the metaverse exceed the physical world’s pleasures, such that it will engage the user to frequently return. Also, from an economic perspective, the inflationary use of monetary rewards would pose a major challenge regarding the store of value in the metaverse.

“Technology that’s built around people, and how we actually experience that world and interact with each other, that’s what the metaverse is all about..” (Mark Zuckerberg)

18

Thanatos, the drive for power, is another concept referencing Freud that poses a significant challenge for metaverse adoption, as the entire vision for a metaverse interferes with human nature. Early adopters of the metaverse naturally strive for power within the new reality, limiting the power of late adopters, who are likely to be left behind. Once matured, only a fraction of early and aggressive adopters may be able to truly reap the benefits of the metaverse. Thus, contradicting the metaverse's underlying vision.

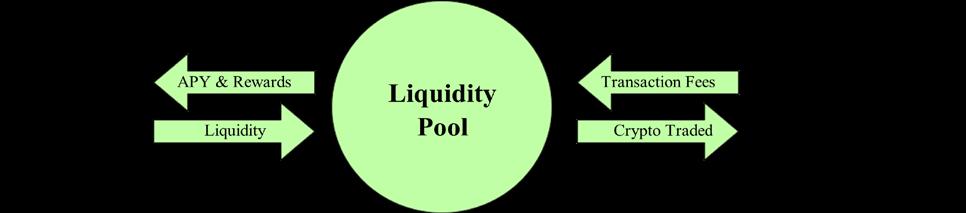

LIQUIDITY POOLS

DEFINITION

“A liquidity pool is a collection of funds locked in a smart contract. Liquidity pools are used to facilitate decentralized trading, lending, and many more functions.” (Binance Academy)

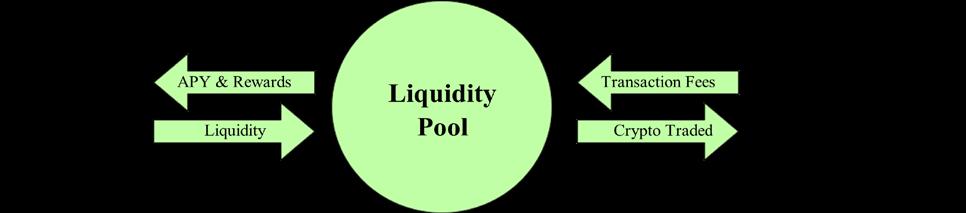

Liquidity pools are the core of any decentralized exchange’s (DEX) operational processes. Since DEXes do not use a clearinghouse to facilitate trades between willing buyers and sellers, liquidity pools are a decentralized alternative. Without the need for human interaction, users can lock their funds into a smart-contract-driven liquidity pool, which the DEX lends out if needed.

Liquidity pools are a pool of two assets that operate on the premise that the value of coins in the pool consistently remains at an equal ratio. For this to occur, algorithms known as Automated Market Makers (AMM) determine the price of coins being transferred via the liquidity pool. Trading on an AMM platform differs from trading on traditional blockchains because transactions are not made peer-to-peer (P2P). Instead, the user interacts with an automated algorithm that assigns each digital asset a fair market value based on economic forces. Essentially, there does NOT need to be a seller in the market. If a user wants to make a transaction on an AMM platform, as long as the pool has enough liquidity, the transaction can occur at fair value. Liquidity is provided by other users staking their

digital assets, and DEXes incentivize liquidity providers to stake their digital assets by giving Annual Percentage Yields (APY) in return for liquidity. Thus, A DEX guarantees its liquidity to the exchange by paying annual percentage yields derived from a network’s transaction fees to the network’s staking community.

AUTOMATED MARKET MAKER

Automated Market Makers (AMMs) are the algorithms that support liquidity pools and determine the price of coins to allow for permissionless and automatic trading processes. The most common form of an AMM is the common product AMM. An analogy is the best method to communicate the role of the common product AMM ...

Imagine you and your friend decide to establish a trade service in milk and eggs. The milk and eggs in the liquidity pool are kept in a refrigerator that initially holds 50 cups of milk and 50 eggs, each worth $1. Therefore, the total value of the refrigerator is $100.

When someone asks to trade 10 eggs for cups of milk, you need to decide how many cups to give them. Remember, you will have 60 eggs after the trade; therefore, supply has increased, and the value of eggs in the pool will fall.

The constant product method operates according to the simple formula: x×y=k.

x = number of cups of milk y = the number of eggs

Initially, when we had 50 cups of milk and 50 eggs: k=50×50=2500

19

Now we have 60 eggs, but according to the constant product method, we must retain the constant value of k.

x×60=2500

x = 2500 / 60

Therefore, the number of cups of milk that must be in the refrigerator after the trade is 41.67. Your friend receives approximately 8 cups of milk for the 10 eggs, and the trade is complete. Now, we have 60 eggs and 41.67 cups of milk in the refrigerator, but remember, the key principle of a liquidity pool is to retain a 50:50 split in the value of milk and eggs. So, to encourage economic forces, we reflect changes in supply in the price.

The price of Milk= $50/41.67 = $1.20

The price of Eggs = $50/60 = $0.83

Naturally, with the price of eggs lower, people will buy the 10 extra eggs at a discount, and the refrigerator will return to equilibrium. Of course, to return to cryptocurrency, the refrigerator is the liquidity pool, and the milk and eggs are two tokens being traded. Liquidity pools are desirable, as they remove the need for traditional clearing houses and their associated problems. Also, the more value in a liquidity pool, the more stable the price of the tokens. Therefore, decentralized exchanges reward liquidity providers — cryptocurrency owners who add their tokens to the liquidity pool — with annual percentage yields, funded by the DEXes transaction fees. The key concept to remember is that a liquidity pool aims to retain the 50:50 ratio of value within the pool, so as long as sufficient APYs incentivize sufficient liquidity, then the liquidity pool can remain effective.

“risk-free” cryptocurrency investment strategies within crypto markets. To properly understand the opportunities available to generate APY from cryptocurrencies, it is critical to understand the risks involved in yield farming, namely impermanent losses.

YIELD FARMING & ANNUAL PERCENTAGE YIELD (APY)

Annual Percentage Yield (APY) is a financial term that defines return on investment, accounting for the effect of compound interest. APY relates to the returns generated from passive cryptocurrency investment through staking in liquidity pools and other yield farming methods.

Yield farming is the term denoted to investors who seek

IMPERMANENT LOSS

Impermanent losses describe the opportunity costs of providing liquidity to a liquidity pool compared to simply holding the staked tokens. As the volatility of the crypto assets in the liquidity pool increases, so does the risk of experiencing impermanent losses. Assuming two crypto assets are staked at a 50:50 ratio and carry an identical dollar value, a 2X price appreciation in one of the assets (ceteris paribus) would result in a 5.72% impermanent loss because the market value of both assets within the liquidity pool must be equal. Thus, staking crypto assets in a liquidity pool does NOT protect against sudden price drops. Binance Academy has outlined approximate impermanent losses for changes in the price of one crypto asset for a liquidity pool consisting of two crypto assets.

Price Change Resultant Impermanent Loss

25% Increase 0.6% Loss

50% Increase 2.0% Loss

75% Increase 3.8% Loss

2X Increase 5.7% Loss

3X Increase 13.4% Loss

4X Increase 20.0% Loss

5X Increase 25.5% Loss

20

21

WEB 3.0 DECENTRALIZED CURRENCY SMART CONTRACTS DAOS NFTS BLOCKCHAIN APPLICATIONS 23

BLOCKCHAIN APPLICATIONS

The emerging applications of blockchains across many industries are becoming increasingly apparent. This chapter explores some of the most promising applications many global companies are already seeking to incorporate into their business operations. Like a venture capitalist seeking the newest revolutionary startup, crypto investors can find high returns in the crypto space by focusing on these applications and investing in the cryptocurrencies funding applicable blockchain projects.

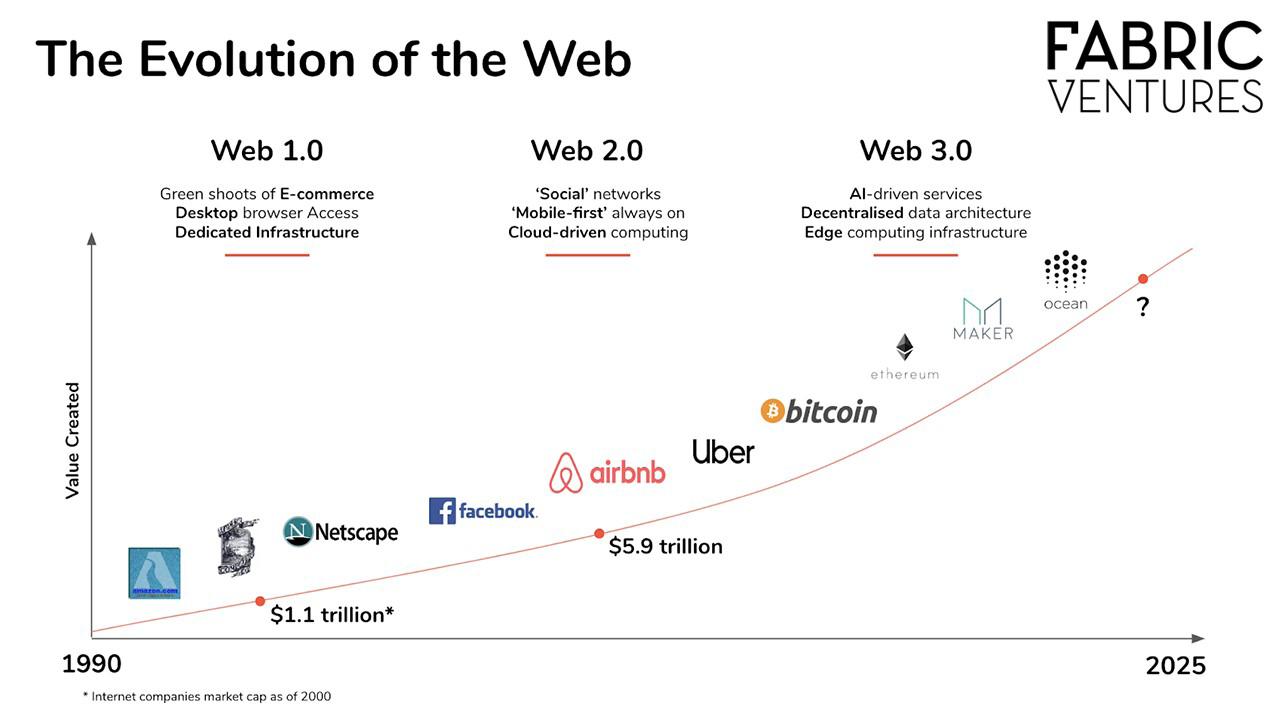

WEB 3.0

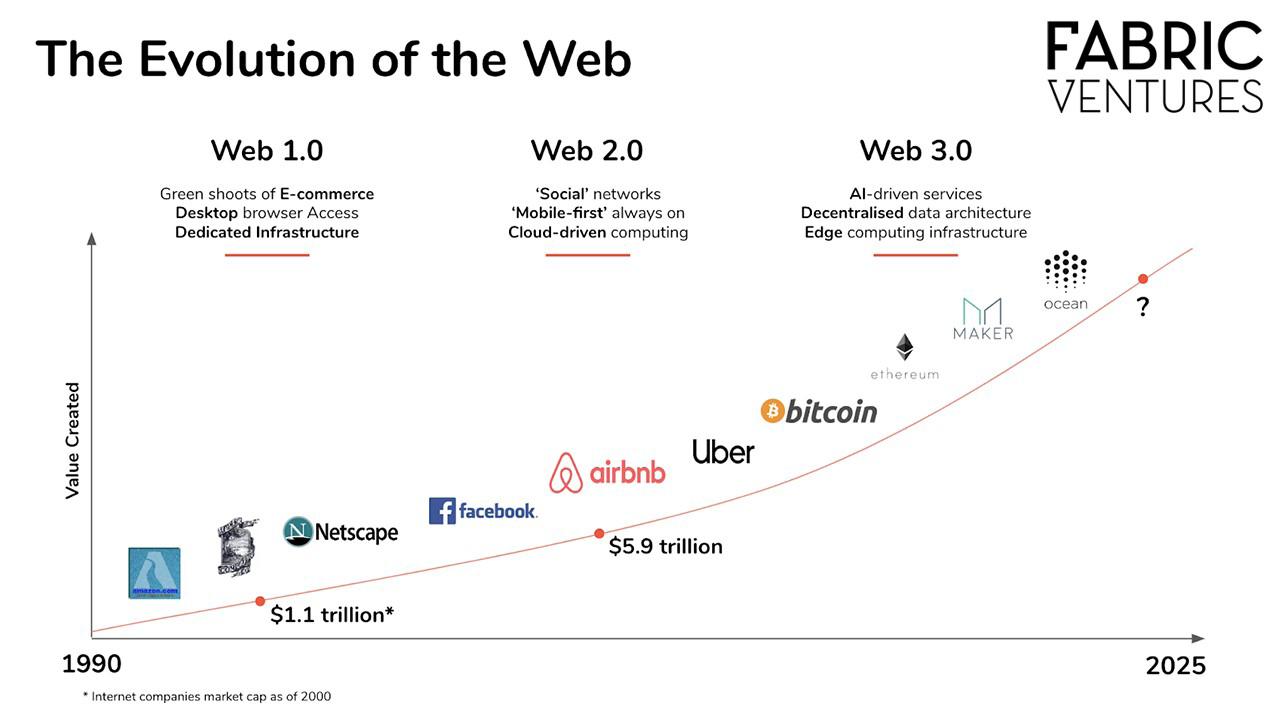

The term Web 3.0 was coined in 2014 by Gavin Wood, cofounder of Ethereum and Polkadot. To better understand the idea of Web 3.0, it is first necessary to understand Web 1.0 and the subsequent Web 2.0, which are seen as the first two major phases of the evolution of the internet.

Web 1.0 featured read-only content, where users were merely consumers. The internet consisted of static pages without interaction or input from the users. Web 2.0 saw increased interactivity between users and the internet, allowing users to interact with both webpages and fellow internet users. The interactivity between the internet and users ushered in the dawn of targeted marketing, using the data knowingly or unknowingly provided by users to display relevant advertisements to users on the platform. This new age of targeted advertising and reduced privacy saw users evolve from consumers to products, whose data is sold to help companies improve marketing and sales. It is this evolution Web 3.0 may have the capability to address.

This graphic from Fabric Ventures outlines the progression of the internet to the current day, including the blockchain

developments of Bitcoin and Ethereum. Fabric Ventures defines Web 3.0 as the development of a “composable humancentric and privacy-preserving computing fabric for the next wave of the web.” This definition highlights two of the key points that differentiate Web 3.0 from the current internet, creating an internet that is user-centric and protects user data. The client-server model that is the core of Web 2.0 is inherently centralized, with all data pertaining to one company stored on a centralized server. This model exposes users to the risk of server failure or data theft, requiring significantly high levels of trust in companies such as Amazon or Facebook to ensure data is kept safe. Vulnerability to data theft or misuse has been highlighted in incidents involving LinkedIn, when 700 million users had their data offered for sale online, or the Facebook’s data incident with Cambridge Analytica. A further challenge to the Web 2.0 model means users can only use a company’s service if the company gives the user permission.

In response to the privacy and centralization problems faced by the Web 2.0 era, Web 3.0 seeks to develop an internet based on greater decentralization, permissionless use and increased user connectivity. Blockchain is seen as the technology driving the development of Web 3.0, facilitating smart contracts, decentralized data storage, and increased use of DAOs

24

The potential for blockchain technology to reinvent a multitude of industries and professions is imminent and real.

” 25

to support and manage businesses. Charles Silver, Forbes Councils Member, believes “decentralized infrastructure and application platforms will displace centralized tech giants, and individuals will be able to rightfully own their data.” Thus, Web 3.0 seeks to tilt the scales of power away from corporations and back toward the individual.

While Web 3.0 holds promise in overcoming the issues of Web 2.0, Web 3.0 faces significant challenges to widespread adoption. The decentralized nature of data storage means the network is slower, and considerable upskilling is required for Web 3.0 to become mainstream. This has led to skepticism from influential voices in the technology space, such as Jack Dorsey and Elon Musk, who has said Web 3.0 is “more marketing than reality.”

Despite the clear challenges Web 3.0 faces, it appears certain that blockchain technology will become increasingly integrated into the internet, creating either a new third-generation internet or a vastly modified Web 2.0.

The applications of Web 3.0 also extend to the development of digital identities, with Atala Prism rolling out a decentralized digital identity protocol to support verifiable records without the need for a centralized database. A digital identity is a digital representation of the physical forms of identification often carried around, such as driver’s licenses and bank cards. The digital identity developed by Atala Prism would create a personally owned, verifiable digital identity that would also include features such as educational records that could be shared with a potential employer.

Atala Prism is collaborating with Input Output and the Ethiopian Ministry of Education to support the delivery of digital identities to students and teachers across Ethiopia. The program will extend to the broader population to facilitate digital identities, aiming to include additional information such as credit history to support loan applications. Therefore, the use of blockchain technology has the potential to generate meaningful change in addressing common difficulties of identity verification.

Social networks such as Secretum offer decentralized and encrypted messaging, allowing users to connect without an email address or phone number. Interestingly, Secretum is a dApp built on the Solana network, indicating the utility of the SOL cryptocurrency and the Solana network. This application alone demonstrates the potential for blockchain technologies to decrease centralization and improve user privacy while, in a negative sense, increasing the difficulty of tracing illegal activity. Similar Web 3.0 alternatives include DTube, a video sharing platform, and Steemit, a decentralized social blogging platform.

DECENTRALIZED CURRENCY

Use as a decentralized currency is one of the blockchain applications that forms a key pillar for Web 3.0. Even in the past few months, at the time of writing, the value of a borderless digital currency has become apparent during the early stages of the Russia-Ukraine conflict. At a time when the traditional, centralized banking institutions in Ukraine had frozen the transfer of assets, $54 million of cryptocurrencies was rapidly transferred to the Ukrainian government.

Decentralized currencies allow users to perform financial transactions without a third-party intermediary. Information relating to the currency transactions is publicly available and stored on the blockchain of that currency. By using distributed

26

ledger technology (DLT), the records of all transactions can be stored on a public ledger and accessed by individuals or nodes. While BTC is the most well-known decentralized currency, several alternatives may be adopted into mainstream financial transactions.

Currently, BTC is the cryptocurrency most widely accepted for payment, but the adoption of other cryptocurrencies for payment is commencing. In the United States, Paypal accepts Bitcoin, Bitcoin Cash, Litecoin and Ethereum as payment methods. The streaming platform Twitch accepts a broader range of coins for payment, including USDC and XRP. Pavilion Hotels & Resorts accepts more than 40 coins as suitable payment, while the travel agency Expedia also accepts payment in cryptocurrency.

While the uptake for the widespread use of cryptocurrencies for mainstream payments has been slow, there is a steady progression toward adoption. As decentralization becomes increasingly attractive, decentralized currencies offer a potential alternative to fiat currency with greater transaction speed and the removal of powerful institutions acting as financial intermediaries.

RealT uses blockchain technology and smart contracts to offer fractional ownership of real estate. RealT uses tokenization, a process where real assets can be divided into small portions, and tokens are created to represent each of the portions. Investors from around the world have the opportunity to invest in the U.S. housing market with token prices as low as $50 USD. Where real estate investing is traditionally accessible to only the wealthy, tokenizing real estate allows investors to enter the market with much less capital than a traditional real estate investment. As explained by RealT, tokenizing assets brings robustness, increased accessibility and immutability to real estate contracts.

SolidBlock is also an asset tokenization company that operates similarly to RealT on a smaller scale. SolidBlock is currently offering or in the process of acquiring properties in London, Phuket and across America.

SMART CONTRACTS

Of the many applications that blockchain technology offers, smart contracts may offer the broadest-use cases. From insurance to rental agreements, smart contracts have the potential to truly revolutionize methods that have remained unchanged for decades. Smart contracts have a wide range of applications in the real estate and financial sector, supporting lending and borrowing on a platform that is available 24/7 and at a lower cost than traditional financial services. The following applications utilize smart contracts in the real estate and finance sector.

Similar to the real estate industry, decentralized finance (DeFi) apps can improve the ease of access to financial services. Beyond improvements delivered by blockchain identity verification systems such as Atala Prism, DeFi apps powered by smart contracts simplify lending and borrowing. Traditional loans require users to go to a bank, provide identity verification and wait on the bank to determine if a loan will be paid out. By using decentralized finance, loans are accessible with greater speed and without the need for financial intermediaries.

While several blockchain-powered lending platforms are available online, smart contracts can also improve the way traditional financial services are managed by reducing the time required to monitor and enforce financial agreements. However, the extent to which smart contracts will be integrated into the traditional finance sector remains undetermined and is contingent upon the broader adoption of blockchain technology across multiple industries.

27

DAOs

DAOs have a wide range of applications, from use in corporate structures to philanthropy or insurance. In the context of a business, the native token of a company DAO will increase in value if the company succeeds. Therefore, the employees who receive native tokens as compensation are incentivized to perform. DAOs have potential-use cases in setting up company structures to reduce overheads and streamline processes by applying decentralized protocols across various industries.

A notable example of the use of DAOs to support charities is the Big Green DAO, founded by the brother of Elon Musk, Kimbal Musk. The Big Green DAO uses the decentralized governance unique to DAOs to determine the distribution of grant funding. The rationale behind the DAO, as explained by Musk, is that charities or insiders within the philanthropic often will know which charities are the best to receive funding. Therefore, a DAO has the ability to circumvent the often timeconsuming and bureaucratic grant processes and streamline funding to organizations that will do effective work.

A further application for DAOs is in the insurance industry. While there are yet to be major inroads made in pursuing a DAO-supported insurance company, Dynamis is attempting to establish a DAO model for redundancy insurance that removes the need for traditional insurance brokers.

NFTs

A further promising application for blockchain technology is the rapidly expanding NFT market. NFTs provide exclusive ownership rights for a digital asset. Currently, the NFT phenomenon revolves mainly around digital art, such as items from the Bored Ape NFT collection that have sold for millions of dollars. However, the use cases for NFTs extend beyond digital art, with several other applications looming to disrupt existing technology subindustries.

For example, universities could issue NFTs as diplomas for graduating students to show their certification. Hospitals could also use NFTs by issuing them for birth certificates of newborns, as well as for keeping medical history records. Similarly, NFTs could be used as passports, ID cards and driver’s licenses because of their non-fungible and immutable characteristics. Another central application of NFTs is to solve current supply chain problems by using their transparent data flow properties to track products in the supply chain between shipping and delivery. While NFTs are yet to be integrated into these industries in a meaningful way, there is potential for wide-scale adoption. Essentially, the list of real-world opportunities for NFT adoption is extensive and still growing fast.

28

Propy is a European-based startup that offers real estate for sale in the form of NFTs. Propy was the first company to complete an NFT property sale. Ownership of the NFT for a particular property gives access to all the necessary ownership documentation for that property, significantly simplifying the property-buying process.

Blockchain technology, while still very much an emergent technology, is already finding its niche in multiple applications across various industries. Whether through smart contracts, decentralized currency or NFTs, blockchain technology has the potential to disrupt traditional methods by creating faster and decentralized processes. While the future of cryptocurrency is unclear, there is no doubt the adoption of blockchain technology will continue to increase, and it is conceivable that rises in cryptocurrency prices will correlate to increases in the adoption of Web 3.0 and blockchain applications.

29

TRADING

LONG-ONLY FUNDAMENTAL ANALYSIS SHORT BITCOIN DOMINANCE YIELD FARMING GLOBAL RISK FACTORS POTENTIAL

STRATEGIES 31

LONG-ONLY FUNDAMENTAL ANALYSIS

Despite crypto assets experiencing more volatility and risk than any traditional asset class, detailed fundamental analysis for cryptocurrencies can yield unprecedented returns. With any blockchain start-up being able to launch an ICO, retail and institutional investors can gain exposure to those organizations through investment in their token. Like investments in early-stage private equities, the blockchain industry (as long as it remains unsaturated) creates a marketplace for high-risk investments with large potential upside. Analyzing tokens with regard to utility, tokenomics and ESG factors sets promising projects apart from scams and unpropitious tokens. We propose a long-only fundamental portfolio based on weightings of the following blockchain subindustries.

Crypto Industry Allocations

Crpyto Industry Allocations

ALTERNATIVE INFRASTRUCTURE (40%) –AVAX, DOT, SOL, ADA, ONE, NEAR, ATOM

Market Movers Alternative Infrastructure NFT & Metaverse Defensive dApps & Governance

MARKET MOVERS (25%)ETH, XRP

Despite the highly volatile nature of cryptocurrencies, the leading market movers BTC and ETH have proven to be less volatile than other altcoins in the long run. With “Short-BTC Dominance” being one of the trading strategies outlined in this guide, ETH and XRP remain the other significant market movers by market cap. Many projects are layered on the Ethereum blockchain or are compatible with the network’s infrastructure, while Ripple has proven utility and strength in longevity within the crypto market. Therefore, an allocation of 25% in market movers is recommended for long-only fundamental investment.

With Ethereum conquering the DeFi space at earlier stages than competing blockchains, plenty of market share is up for grabs for projects with competent management and high adoption potential. Projects such as Avalanche, Polkadot and Solana represent enormous potential through superior scaling solutions compared to Ethereum. Despite the ease of accessing the existing Ethereum infrastructure being one of the network’s key competitive advantages, it can be expected this advantage will diminish as other blockchains rapidly adopt decentralized applications.

NFTs & METAVERSE GAMING ADOPTION (10%) –

MANA, SAND, AXS

Few industries have seen capital inflows like metaverserelated blockchain technology in Q4 of 2021. In response to losses caused by Facebook’s rebranding to “Meta” on October 28, equity investors did not estimate risk compensation to be appropriate due to the uncertainty surrounding the potentially revolutionary technology. Since October 2021, the attention given to metaverse technology has boosted the demand for respective tokens in the same time frame. The hype has since diminished, with highly valued tokens such as MANA, SAND

32

PORTFOLIO ALLOCATION TABLE

Solana

Cardano (ADA)

NEAR Protocol (NEAR)

Cosmos (ATOM)

Harmony (ONE)

and AXS dropping 50% or more from their all-time highs. If the adoptions of the metaverse and NFTs can make considerable progress, significant gains for token holders are a possibility, while the risk of substantial losses remains. Knowing the large swings within the industry, a weighting of 10% in NFT and metaverse tokens is recommended.

DEFENSIVE PORTFOLIO ALLOCATION (15%)USDC, DAI, PAXG

The highly volatile nature of cryptocurrencies presents a significant challenge from a portfolio management standpoint. The backbone of a well-diversified cryptocurrency portfolio must be capital allocation to stablecoins or tokens that hedge against crypto market risk. This portfolio’s thesis supports the rise of DeFi while moving away from centralization, which is applied through the use of crypto-collateralized and algorithmically-stabilized stablecoins instead of fiatcollateralization. An exception from this trend is recommended when using PAXG, an asset-backed token representing the value of physical gold, adding another layer of inflation hedging to the portfolio.

Maker (MKR)

DAPPS & DEFI GOVERNANCE (10%) - MATIC, UNI, AAVE, MKR

The “dApps & governance” segment comprises large and small-cap tokens identified to have exceptional utility and scalability potential. The dApps represented in this sector must be built on one of the blockchains placed in “Market Movers” or “Alternative Infrastructure.” Scalability solutions for existing blockchains such as MATIC are recommended as the core of this segment, while DEX governance tokens should be selected based on high growth potential, such as the AAVE token. Risky small-cap tokens with a promising vision can be incorporated at a lower weighting portion.

Market Movers 25% Alternative Infrastructure 40% NFT & Metaverse 10% Defensive Portfolio Allocation 15% dApps & DeFi Governance 10% Ethereum (ETH) 18% Avalanche (AVAX) 10% Decentraland (MANA) 4% USD Coin (USDC) 7% Polygon (MATIC) 4% Ripple (XRP) 7% Polkadot (DOT) 9% The Sandbox (SAND) 3% Dai (DAI) 5% Uniswap (UNI) 3%

(SOL) 8% Axie Infinity (AXS) 3% PAX Gold (PAXG) 3% Aave (AAVE) 2%

5%

1%

4%

2%

2% 33

SHORT BITCOIN DOMINANCE

Bitcoin Dominance is the term used to describe the control Bitcoin has over the cryptocurrency market. As of January 1, 2022, the total investment in Bitcoin represented 40.04% of the entire crypto market. Although this was a significant portion of the then $2.19 trillion asset class, it is only a fragment of what it once was. In January 2016, Bitcoin represented over 91% of the overall crypto market, and basic trend analysis indicates it will continue to decline based on multiple fundamental factors.

We suggest Bitcoin’s dominance within the crypto asset class is primarily due to its status as a first market mover. Bitcoin was the first decentralized currency, the first and only to break $10k and $50k price barriers, and has held the title for the highest market cap token for the entire existence of cryptocurrency. However, this significant first market mover advantage will decline over the coming years. Bitcoin has slower transaction speeds, operates on the slow and energy-inefficient proof-ofwork protocol, and most importantly, it has no sustainable competitive advantage.

Bitcoin’s only real utility is its potential use as a decentralized global currency. However, this is relatively insignificant compared to the competitive advantage of other large-cap tokens such as ETH, SOL and AVAX, which have created their own entire blockchain ecosystems. Thousands of dApps are being built on the major ecosystems, and multinational technology companies, including Google and PayPal, are adopting the technology presented by major blockchains.

Many of the largest blockchain tokens also have teams of highly skilled blockchain engineers and strategists constantly improving their projects and searching for growth opportunities in the emerging market. Therefore, Bitcoin’s lack of growth potential indicates the token is only valuable due to its first-mover advantage and presents no sufficient reason to grow.

Bitcoin’s lack of growth and progress in the emerging technology industry is comparable to the mobile phone industry boom in the early 2000s. Motorola and Nokia dominated the mobile phone market but failed due to their lack of innovation and product differentiation. History repeated itself in 2008 when Blackberry collapsed due to its lack of continual innovation. However, Apple has managed to overcome this challenge and has dominated the smartphone industry with its continual drive to improve its products and be leaders in innovation. Many industry professionals credit Apple’s longevity in the rapidly developing technology market to its continual drive to always improve and never settle on a good product. Making the assertion that the blockchain industry is similar to the mobile phone industry during the 2000s, we suggest blockchains that do not continually look for improvement and growth will collapse in the upcoming years. Therefore, short-selling Bitcoin dominance and investing with a long position in major altcoins presents itself as a profitable and hedged market-neutral strategy.

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% $$500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 Jul-13 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Jul-18 Jan-19 Jul-19 Jan-20 Jul-20 Jan-21 Jul-21 Jan-22 BTC Dominance (%) Overall Crypto Market Cap ($M) Crypto Market Capvs BTC Dominance Market Cap (Million) BTC Dominance Crypto Market Cap vs BTC Dominance 34

An analysis of a “Short-BTC Dominance” trading strategy confirms the profitability of this trading proposal. A simulation was conducted to evaluate the success or failure of a Short-BTC Dominance strategy between October 1, 2020, and March 31, 2022. The simulation involved constructing a hypothetical market-neutral portfolio with a short position in BTC and a long position in 10-12 selected altcoins. Altcoins were chosen based on criteria of high correlation to BTC and positions of high market cap status that indicate the unlikeliness of the asset failing. The 10-12 altcoins were reevaluated and reweighted every six weeks based on performance over the previous sixweek period. An individual token’s weight in the portfolio was minimized at 2% and maximized at 15%. The following graphic shows how the Short-BTC Dominance portfolio compared to a long-only investment in Bitcoin - R(b), as well as a long-only investment in the same altcoin portfolio - R(p), based on a hypothetical $10,000 initial investment.

The results of the strategy backtesting display a total return potential of approximately 150% over the 18-month time frame, with a geomean daily return of 0.17%. Although the effectiveness of this strategy may be questionable, considering long positions in both BTC and the altcoin portfolio outperformed the “Short-BTC Dominance” portfolio; risk aversion and mitigating “bubble-risk” drive this market-neutral

strategy. Although we acknowledge the outperformance of the long-only portfolios, the standard deviation of returns for the market-neutral strategy was significantly lower than the two long-only positions.

Moreover, similar to the line chart of a low beta stock, the strategy performs worse during expansionary periods, but has significantly limited downside whenever the market contracts as a whole. For example, in the Bitcoin boom during the early months of 2021, the Short-BTC Dominance portfolio significantly underperformed market returns, but during volatile periods of late 2021, the Short-BTC Dominance strategy saw steadier growth returns than traditional long-only positions.

Therefore, we believe this market-neutral strategy that short sells the future of Bitcoin Dominance is a profitable opportunity within the cryptocurrency space. Bitcoin is highly unlikely to maintain its dominance over the crypto market due to its lack of growth potential and competitive advantage. Therefore as the crypto market continues to grow and investors seek high rewards with higher risk, we predict using a market-neutral strategy that short sells BTC will generate highly profitable hedged returns.

Week

$100,000.00

$90,000.00

$80,000.00

$70,000.00

$60,000.00

$50,000.00

$40,000.00

$30,000.00

$20,000.00

$10,000.00

$-

1-Oct-20 1-Nov-20 1-Dec-20 1-Jan-21 1-Feb-21 1-Mar-21 1-Apr-21 1-May-21 1-Jun-21 1-Jul-21 1-Aug-21 1-Sep-21 1-Oct-21 1-Nov-21 1-Dec-21 1-Jan-22 1-Feb-22 1-Mar-22 Value of Portfolio ($) Short- BTC Dominance 6

Reweighting Short-BTC Dominance 6-Week Reweighting R(b) R(p) 35

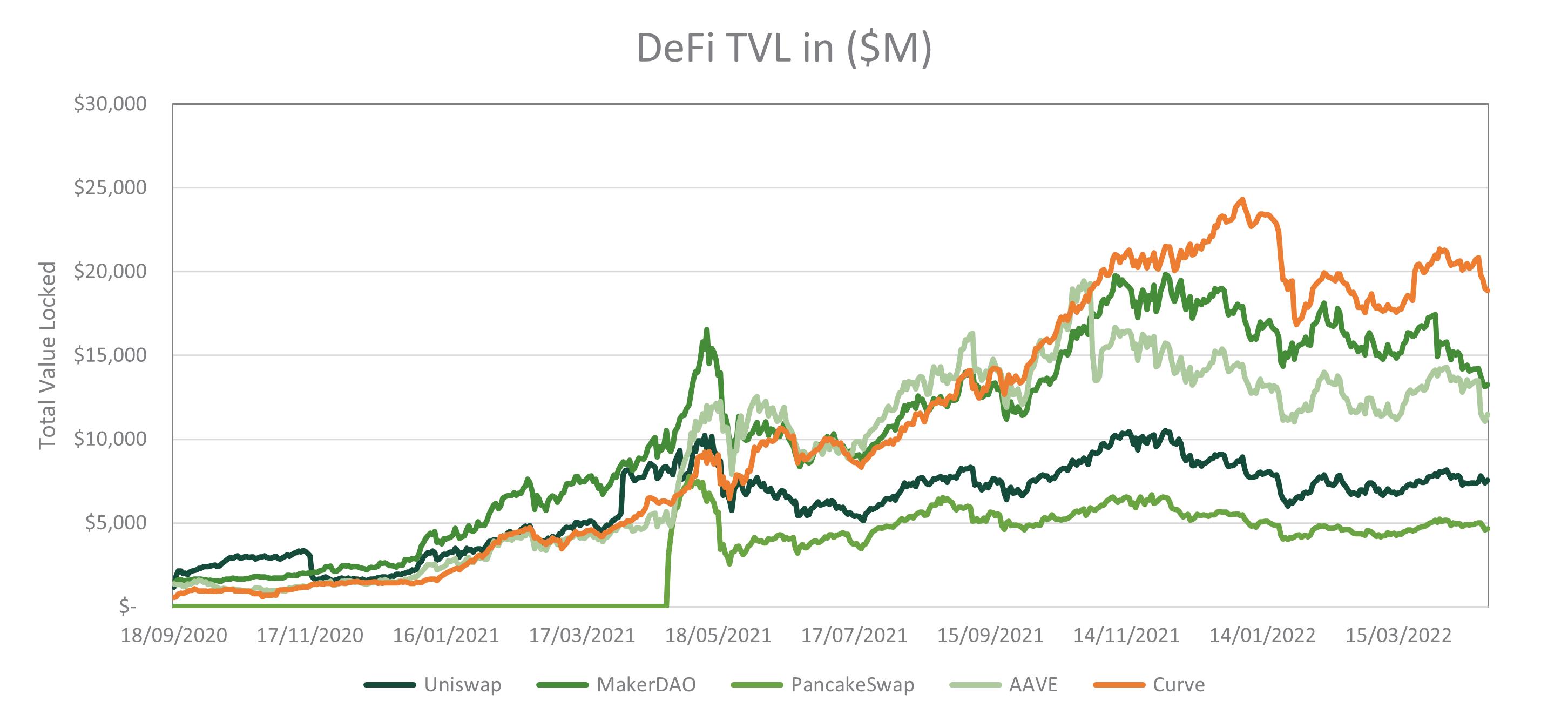

YIELD FARMING

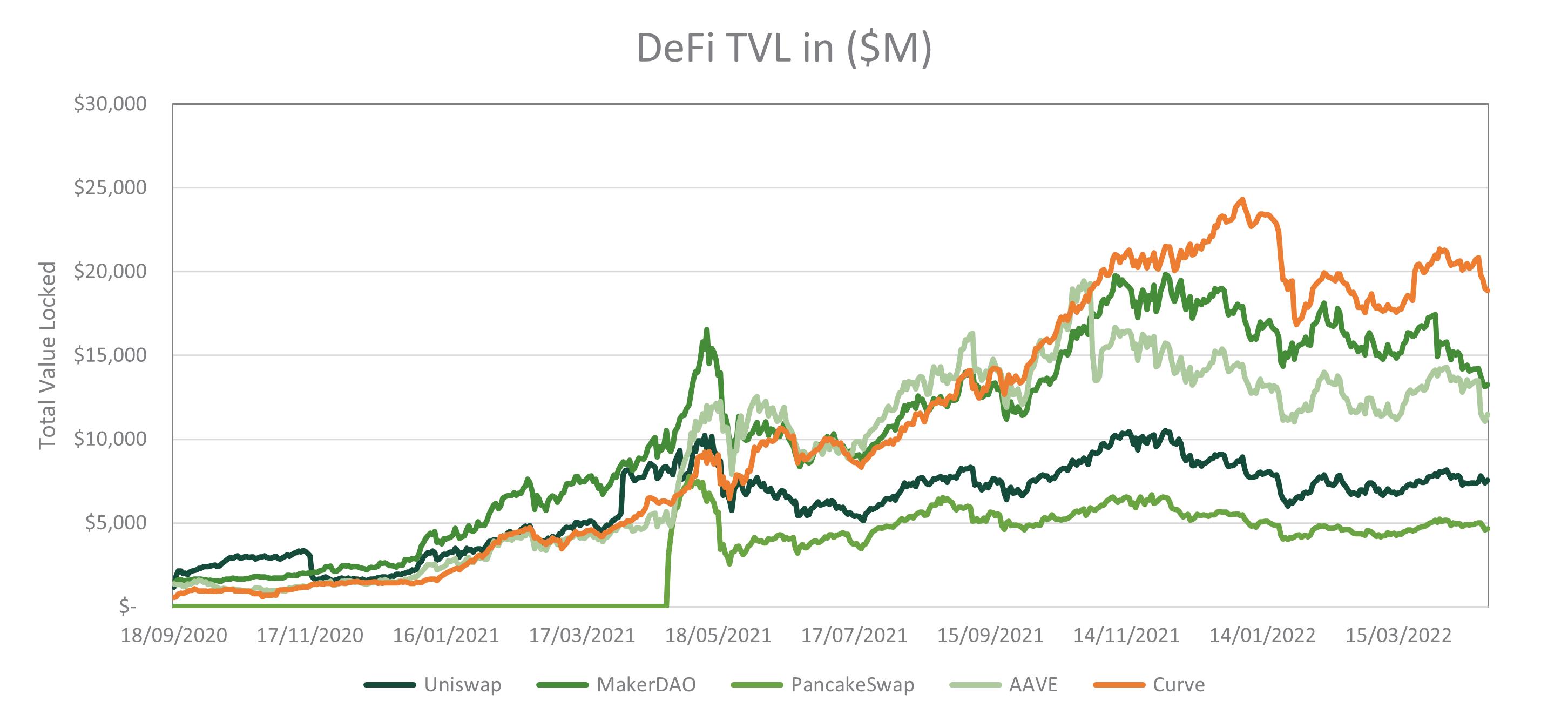

CRYPTO YIELDS: A VALUE INVESTMENT OR GLORIFIED JUNK BONDS?

Yield farming is the process of investing in multiple cryptocurrency liquidity pool protocols and compounding annual percentage yields (APYs). In 2020, yield farming netted DeFi pioneers immense profits from lending and providing liquidity to decentralized protocols. With some large dApps providing more than 100% APYs to lenders, the reward to lenders easily exceeded the risk. However, the DeFi landscape has changed a lot in a short time. As collateralization on the major networks has risen, the borrowing activity and trading volume have not. This caused the major liquidity pools to be oversupplied, decreasing the lending yields.

Alternatively, centralized lending platforms like Celsius and Nexo provide similar services. Unlike most DeFi lending platforms, centralized lending platforms do not just rely on borrowing and lending to ccreate an equilibrium interest rate, as they operate by actively lending out fund to other financial institutions. Robust demand from institutions causes APYs on centralized lending platforms to be more attractive during a DeFi drought, in which DeFi borrowing activity cannot keep up with lending volume.

APY STRATEGY

Passive investors with no desire to sell their crypto assets for a foreseeable time frame are highly encouraged to lend out that crypto using a trustworthy lending protocol. Even low yields can substantially enhance a passive portfolio’s performance in both bull and bear markets. An active yield farming strategy requires much more flexibility and thorough research regarding a lending platform’s risks, yields and pool offerings,

presenting a significant challenge in the constantly changing crypto world. It is also important to note that a lender has exposure to all cryptocurrencies within the liquidity pool. Therefore, an investor who is avoiding exposure to Tether is advised not to stake Wrapped BTC in the “tricrypto2” liquidity pool on Curve Finance, as the given pool is composed of wBTC, WETH and USDT.

Additionally, one must monitor the relationship between borrowing and lending activity. As many pools are overcollateralized, they do not provide attractive yields. Newer pools and emerging protocols typically provide higher yields, as the network compensates lenders with higher returns to meet borrowing demand. Emerging DeFi networks built on trustworthy blockchains that have been audited through multiple independent smart contract auditors offer the highest yields for low risks.

RECOMMENDATION

We recommend lending crypto-assets into liquidity pools on established platforms such as Curve or Aave. In the everchanging crypto ecosystem, locking up tokens for an extended period poses a significant risk for investors. One must monitor the borrowing and lending activity and ensure that borrowing and lending rates match borrowing and lending activity on that particular platform. After the collapse of Terra, generating interest from lending out stablecoins is not recommended because fiat currencies offer similar returns at lower risk. Instead, lending and staking rewards should generally be generated from promising crypto-projects with tokens already being held in a portfolio based on fundamental analysis.

36

GLOBAL RISK FACTORS

TETHER RISK

Tether is a fiat-backed stablecoin, and as of April 2022, it is the third-largest cryptocurrency by market cap. Due to its nature as a fiat-collateralized stablecoin, each USDT token must be backed by one U.S. Dollar in the firm’s reserve to guarantee solvency if large sums are withdrawn at once. However, in the past Tether has declined independent audits when rumors spread about Tether minting USDT without having the matching amount of currency in reserves. The management team’s ties to the Bitfinex exchange are also problematic, as Bitfinex’s founders face allegations regarding multiple acts of cybercrimes including participation in Ponzi schemes, software piracy and money laundering. If allegations about Tether minting USDT without proper backing of the U.S. Dollar were proven to be correct, billions of U.S. Dollars would have been invested in a currency that has no value and would cause the cryptocurrency ecosystem to lose $83 billion of capital, erasing nearly all trust within the crypto community.

REGULATORY RISKS

With the power of financial institutions threatened by the rise of decentralized finance and cryptocurrencies, regulators may be incentivized to impede cryptocurrency adoption. Many crypto assets are held on centralized exchanges that are subject to federal regulation. Crypto restrictions are enforced on those organizations relatively easily, diminishing the demand for crypto assets in the short run. As evidenced by the Bitcoin mining ban and heavy restrictions on Chinese divisions of centralized crypto exchanges, regulatory risks still present a major threat to cryptocurrencies.

It is no surprise that authoritarian governments like China, Qatar, Russia and others lead the charge against the decentralization of the financial system. However, many crypto-proficient users have shifted their crypto assets to DEXes to accommodate for regulatory burdens. This was evidenced by the rapid increase in transaction volume among

DEXes during Q4 of 2021, which provided price stability and allowed the cryptocurrency market to regroup. As long as large governments do not impose heavy restrictions and severe punishments for violations, the crypto industry will retain its utility.

CRIMINAL & SECURITY RISKS

Several security and criminal activity risks endanger the legitimacy of cryptocurrency. A survey conducted by the Association of Certified Anti-Money Laundering Specialists has broken the key risks down into the following seven categories:

1. Use of cryptocurrency for money laundering purposes

2. Use of cryptocurrency on the dark web

3. Use of cryptocurrency for procurement of illicit goods and services outside the formal financial system

4. Use of cryptocurrency by sanctioned actors to circumvent the formal financial system and evade international sanctions