Spring 2023 thepfs.org

HOME REPAIR The UK mortgage market aims to rebuild in 2023 SPRING FORWARD Tax opportunities following the Autumn Statement HELPING CLIENTS NAVIGATE THE RISKY ROUTE TO RETIREMENT Pension

DUTY BOUND Firms prepare for the new Consumer Duty this July

PROFESSIONAL

puzzle

Start your journey at thepfs.org/connect Connections that matter Learn from others or give back. With Connect the choice is yours. In 2023 we’re growing the number of mentees AND mentors on Connect. Find your perfect match.

Spring

Sector Focus

Business Focus

News & Opinion

04-05 Opinion

Events, learning and benefits PFS members can look forward to in 2023

06-09 News

UK and regional news from the PFS

40-41 Events

The return of the PFS graduation ceremony

CONTACT US

Cover

Personal

of the Personal Finance Society (PFS). Members receive a copy as part of their membership. The cost to non-members is £7 per copy. Views expressed by contributors or advertisers are not necessarily those of the PFS. The PFS will accept no responsibility for any loss occasioned to any person acting or refraining from action as result of the material included in this publication. Reading issues of Personal Finance Professional can be included as part of members' CPD requirement (35 hours per year).

EDITORIAL

Editor: Luke Holloway luke.holloway@cii.co.uk

Contributing editor: Liz Booth

DESIGN

Art editor: Yvey Bailey

Picture editor: Claire Echavarry

Production: Jane Easterman

Printing:

For sales and advertising please contact us on pfs-sales@redactive.co.uk or 020 7880 7661

3

2023

Personal Finance Society 20 Fenchurch Street, London, EC3M 3BY Tel: (020) 8989 8464

(020) 8530 3052

CONTENTS

Fax:

illustration: Solji Lee

magazine

Finance Professional is the

The Manson Group

Publishing Ltd,

Dallington St,

EC1V 0LN

PUBLISHER Redactive

9

London

Personal Finance Society.

2334 17 40 34-35 Tax How advisers can help UK adults understand their taxes 36-38 Funds How to find investment value in 2023 39 Tech Refresher 44-45 Advice process The POWER panel proposes a new way to engage clients 46 Education We meet the Education Champion of the Year 2022 47 Learning Updates from the PFS on members' continuing professional development 48 Tech Q&A 50 The Big 10 Test your knowledge with our Q&A 14

ISSN 1754-8055 ©

10 Regulation Updates on regulation and legislation across the UK and Europe 12-13 Edinburgh Reforms What the UK government’s regulatory reforms will mean for advisers 14-16 Consumer Duty How firms can prepare for the new requirements this July

Pensions Clients’ retirement plans impacted by the cost-of-living crisis 20-22 Economy The difficult economic backdrop affecting clients and businesses 23-25 Mortgages Will 2023 see a revival of the mortgage market? 26-31 Tax planning Key tax planning opportunities following the Autumn Statement

Fraud An increasing number of financial scams is a growing concern for retirees

17-19

32-33

WHAT’S ON THE HORIZON?

Megan Webb reveals what members can look forward to this year

ith spring on the horizon, now is an excellent time to look ahead at some of the key activity and initiatives involving members across 2023. Volunteers from our PFS regions will guarantee you a warm welcome at one of our 75 PFS Local Conferences taking place across the UK this year. Held in three blocks – spring, summer and autumn – each conference will focus on topical updates from subjectmatter experts.

4 MEMBERSHIP W

thepfs.org | Personal Finance Professional | SPRING 2023

During the spring period, expect updates on:

● What the Consumer Duty means for research and due diligence.

● Investment planning in the new tax environment.

● Financial planning essentials for small businesses, and much more. We have also freshened things up with some subtle changes throughout the day, including:

● A friendlier feel, with more of a workshop style (say goodbye to ‘death by PowerPoint’).

● Instant polling, which creates natural talking points, making it easier for you to talk with other delegates.

● Designated times for ‘lunch and learn’ and ‘conversations over coffee’ slots.

● A real sense that this is your community of good practice.

ROADSHOWS THAT DELIVER

Alongside our PFS Local Conferences, you are invited to attend any of our 12 Accumulation & Investment Roadshows and six Retirement and Later Life Roadshows. These will explore the latest thinking around each area, while providing practical planning points and actions to support advisers in continuing to deliver better consumer outcomes. Our in-person events are supplemented by a varied programme of digital events, available to watch live or on demand at a time that suits you. Forthcoming events are always listed in the PFS member newsletter, with the following taking place later in February:

● Adviser pain point: First conversations with clients

● Goodbye greenwashing, hello greenproving

● Raising awareness of economic abuse and transforming responses to it.

POWER UP

The Financial Planning Practitioner Panel is working hard to shape another year of inspiring financial planning content for the profession on PFS POWER. Head over to www.pfspower. org to check out the latest POWER

EASY ACCESS TO KEY BENEFITS

Get more from this article by visiting:

thepfs.org/events

Local conferences, roadshows, digital events

thepfs.org/connect

The Connect eMentoring platform

pfsfestival2022.org

Festival of Financial Planning 2022 pfsawards.org

Personal Finance Awards 2023/24

podcasts, articles and weekly webinars, covering every aspect of financial planning. There’s plenty to catch up on in the on-demand library too.

Elsewhere, our paraplanning community is delivering a series of ‘paraplanner lab’ sessions on the first Wednesday of each month. These onehour virtual workshops welcome all paraplanners to hear from a variety of experts, participate in open discussions and network with peers. To book, follow the links in your PFP newsletter.

PROUD PROFESSION

Looking further ahead, the PFS’s annual conference will return on Thursday 2 November 2023 – save the date now. The Festival of Financial Planning 2022 was enthusiastically received by the 2000-plus delegates who attended and highlighted that the desire to network and catch up with old friends at large-scale face-to-face events remains strong.

We are committed to delivering another informative and inspiring event for planners, paraplanners, compliance specialists, mortgage advisers, support teams and business leaders.

It is also important to recognise and celebrate the best our profession has to offer and we will be looking forward to presenting the Personal Finance Awards 2023/2024 later in the year. They are an opportunity to showcase high standards and the invaluable work of our profession in supporting consumers with financial reliance and independence.

Finally, throughout 2023 we are seeking to grow the number of mentees and mentors on Connect – our e-mentoring platform – as well as build the number of active relationships. Whether you are seeking support to develop your career, or have knowledge and experience you can share by giving back, this remains a satisfying way of engaging with other personal finance professionals. ●

5 SPRING 2023 | Personal Finance Professional | thepfs.org ISTOCK

MEMBERSHIP

Megan Webb is programme development & partnership manager of the PFS

PFS PUBLISHES CONSUMER DUTY GOOD PRACTICE GUIDE FOR FINANCIAL ADVISERS

In support of the Financial Conduct Authority’s (FCA) flagship regulatory reform, the Consumer Duty, the PFS has created a good practice guide for personal finance firms.

The Consumer Duty began with a campaign by the Financial Services Consumer Panel to create a statutory ‘duty of care’ in January 2017.

Marking a crossroads in the way financial services works in the UK, the Consumer Duty lists four outcomes, against which firms should judge their impact on consumers. They are:

● Price and value.

● Consumer understanding.

● Products and services – ensuring products are designed properly for their target market.

● Consumer support – ensuring claimants don’t face unnecessary barriers.

Dr Matthew Connell, director of policy and public affairs at the PFS, said: “There is no greater discipline for a professional than sitting in front of a client for an annual review and explaining how their

PFS RESPONDS TO FUTURE DISCLOSURE FRAMEWORK DISCUSSION

The Financial Conduct Authority (FCA) has published its Discussion Paper on a Future Disclosure Framework.

In response, Dr Matthew Connell, director of policy and public affairs at the PFS, said: “The PFS welcomes the FCA’s review of the disclosure framework. The EU disclosure regime for investors did not work well for consumers for two reasons. Firstly, it was not based on rigorous consumer research, so the content and format of the information given to investors was not based on what

investors needed to know, when they needed to know it, or in the best format to engage consumers.

“Secondly, the disclosure information for consumers also relied on a high degree of wishful thinking about the power of distributors over product providers. This is because issues around standardisation of information from investment houses were not addressed properly by EU regulators. Instead these issues were left to distributors to resolve. For example, regulators did not

@elliotguthrie

Great weekend in London graduating from @pfsconf as a Chartered financial planner, a nice way to celebrate five years of study, 22 exams (not counting a few resits!) and an estimated 1,830 hours of study

investments have performed.

“The Consumer Duty recognises the unique position advisers have in assessing value for clients, saying ‘the adviser can often also have the clearest oversight of the customer’s overall position and an overview of the total proposition’.

“Our good practice guide sets out the regulator’s expectations and is designed to start a conversation about how advisers can discharge the Consumer Duty in a practical and achievable way.”

To read the full good practice guide, visit: https://bit.ly/3DfKgm1

Read our article on the Consumer Duty on page 14 of PFP

establish proper, standardised approaches to transaction costs within investment funds and instead left it to distributors to request information from providers that those providers were unwilling or unable to deliver.”

Dr Connell concluded: “The new rules must also be based on rigorous consumer research built around the real-life interactions that consumers have with advisers and investment providers and should recognise changes in technology that can improve both the presentation of information to consumers and the ability of advisers to keep records.”

The discussion period ends on 7 March 2023.

To find out more and contribute to the discussion, visit: https://bit.ly/3Jjpfe8

@IFA_Dan

Fantastic to talk to @spallister1 after just a “few” years. A great opportunity to raise awareness of My Personal Finance Skills and talk through the good and bad times which shaped my outlook

@phoenixibiza1

Thank you @pfsconf and Alison @bankofengland for the opportunity to host the quarterly MPR. Valuable insights

6 thepfs.org | Personal Finance Professional | SPRING 2023

Tweet Talk

REGULATION

NEWS REGULATION

PFS HOSTS FIRST GRADUATION CEREMONY SINCE 2019

The PFS once again welcomed members to a graduation ceremony for those qualifying as Chartered financial planners, Associates or Fellows of the PFS in the period 1 July 2019 to 30 June 2022.

The graduation ceremony was the first since 2019, as the Personal Finance Society paused ceremonies due to the Covid-19 pandemic.

The graduation took place on Friday 11 November across two ceremonies in Westminster’s Central Hall. Of those in attendance, 51% graduated as Chartered financial planners, 1% graduated with an Advanced Diploma in Financial Planning, and 48% graduated as Fellows of the PFS.

AWARDS

CII APPRENTICESHIP AWARDS

The Chartered Insurance Institute (CII) is delighted to announce the CII Apprenticeship Awards celebrating the achievements of exceptional apprentices from across the UK in seven categories – including four categories in the financial services profession – with cash prizes for each award funded by the Education and Training Trust.

FINANCIAL SERVICES CATEGORIES

● Financial Services Administrator Apprentice of the Year – Level 3 (£500).

● Mortgage Adviser Apprentice of the Year – Level 3 (£500).

● Paraplanner Apprentice of the Year – Level 4 (£600).

@FTAdviser

It will not only be advisers who are expected to promote better consistency and certainty going into 2023, but regulation and the FSCS levy should also follow suit, says Matthew Connell of the PFS

● Financial Adviser Apprentice of the Year – Level 4 (£800).

WHO CAN APPLY?

● The CII Apprenticeship Awards are open to all apprentices in England, Northern Ireland, Scotland and Wales that meet the criteria.

● CII qualifications must have been completed as part of the apprenticeship standards and frameworks.

● Nominations are welcome from employers, training providers and apprentices themselves.

HOW WILL THEY BE JUDGED?

● All applications will be examined to find the highest scoring category entrants for each standard.

The PFS would like to congratulate all the graduates on their qualifications and new designations. Watch the video below for some graduation highlights and find out what it means to some of the graduates to achieve these qualifications. For further qualification opportunities from the PFS, visit: https://bit.ly/405Lslx

To see a list of those graduating at the ceremony and watch highlights of the day, visit: www.thepfs.org/105702

Read our feature on the PFS graduation on page 40 of PFP

● These then proceed to judging panels who deicide category finalists. Criteria for entrants includes:

● Completed a CII qualification as part of an apprenticeship standard or framework.

● Passed overall apprenticeship standard or framework.

● In 1,000 words, explain how your nominee has made a positive contribution to their profession and wider society while completing an insurance or financial services apprenticeship in the last three years – up to 31 December 2022. The judges will be looking for quantifiable accomplishment, creativity and innovation, and demonstration of standards, professionalism and trust. Nominations are open and close on 12 May 2023. To enter, visit: https:// forms.office.com/e/ Dawu1bV2Lk or follow the QR code, right.

@LIFTFinancial

Today Ed attended the @pfsconf graduation ceremony, celebrating his qualification as a Fellow of the PFS and his Chartered status. Well done, Ed, we’re so glad the ceremony could finally take place after the events of the last few years

Twitter followers

10,447

EVENTS

7 SPRING 2023 | Personal Finance Professional | thepfs.org

Find us on linkedin.com/company/thepersonal-finance-society

NEWS

CII GROUP REPORTS NARROWING GENDER AND ETHNICITY PAY GAPS

The CII Group has reported declines in its median gender and ethnicity pay gaps. The group’s median gender pay gap stood at 9.31% in 2022, the lowest since the organisation began reporting in 2019. Its median ethnicity pay gap fell to 9.9%, from 14.1% in 2021, the first year it reported this statistic.

The organisation’s gender pay gap data is based on 203 individuals employed by the CII Group in April 2022, while the ethnicity data reflects information provided by 177 individuals at that time.

The organisation also published data that shows an increase in its mean gender pay gap to 21.19%, reflecting fewer males employed in lower- and middle-quartile pay roles. The figure remains lower than the 28% differential the organisation reported

MORTGAGES

in its first statistics in 2017. The CII Group’s mean ethnicity pay gap nearly halved year on year, falling to 13.1% in 2022.

Mean and median data on the CII Group’s pension gap shows an increase in

FCA SETS OUT HOW MORTGAGE FIRMS SHOULD BE SUPPORTING BORROWERS

The Financial Conduct Authority (FCA) has set out ways that mortgage firms can help customers worried about or already struggling with their mortgage payments as a result of the cost-ofliving squeeze.

The FCA said it expects firms to support their customers in a range of ways that meet their needs. It has published guidance setting out the options firms can use to help their customers to manage their monthly mortgage payments, alongside new information for borrowers affected by rising prices.

The FCA’s draft guidance sets out the flexibility firms must show in supporting customers who have missed monthly

mortgage payments, or who are worried they may not be able to make payments in future. It covers options such as extending the term of their mortgage, switching to interest-only for a temporary period, moving to a different interest rate or making reduced monthly payments for a temporary period.

The regulator stressed that mortgage borrowers should carefully consider any steps they take and customers who can keep up with their payments should continue to do so.

The FCA says it is closely monitoring the mortgage market and will continue to act so consumers get the support they need.

2022 compared to 2021. The figures used in this calculation include both employer and employee contributions.

Alan Vallance, the CII’s CEO, said: “We choose to publish this data despite our headcount being below the required reporting threshold, because we believe it is the right thing to do. It is reassuring to see further improvement in these latest figures, while recognising that small changes in our employee composition can make a significant difference to these important measures, which we must bear in mind when making historical comparisons.

“There is clearly more to be done and we will continue to take positive action in collaboration with other organisations to improve diversity across our sector.”

8 thepfs.org | Personal Finance Professional | SPRING 2023 NEWS DIVERSITY

CII PILOTS NEW FORM OF FINANCIAL PLANNING ASSESSMENT

The Chartered Insurance Institute (CII) is piloting a new form of assessment for the R06 Financial Planning Practice unit.

The Shaping the future together consultation gave members and other key stakeholders the opportunity to feed back on the CII’s proposed plans, as well as the services it delivers and how the professional body can best meet their needs and expectations in the future.

The CII is conducting this pilot as the majority of financial planners who took part in the Shaping the future together consultation said they wanted more flexibility and realistic assessed tasks to some assessments.

In place of the scheduled written exams, the professional body is piloting coursework assessments for the R06

PENSIONS

Financial Planning Practice unit of the CII Level 4 Diploma in Regulated Financial Planning.

The format of the coursework assessments for R06 will be assignments based on client case studies.

Gill White, chief customer officer at the CII, said: “The assessment is designed to meet the same syllabus learning outcomes and assessment criteria as the current R06 exam, and meets the Level 4 qualification descriptors set out by education regulators. The assessment criteria include a requirement for analysis and justified recommendations, which are appropriate to assess in longer responses such as case study-based assignments.

“We worked with practitioners within the profession, advisory groups and the PFS board to discuss how these skills are demonstrated in a professional context, to design the coursework assessment approach and tasks.”

A review will be undertaken later this year once the pilot is completed and feedback from candidates has been received.

The CII will then decide during 2023 whether assessment for the R06 Financial Planning Practice unit will switch from written examinations to coursework and agree the timetable for any changes.

FCA CONFIRMS PLANS TO DELIVER REDRESS TO MORE THAN 1,000 FORMER BSPS MEMBERS

The Financial Conduct Authority (FCA) has published final rules for a redress scheme for former members of the British Steel Pension Scheme (BSPS) who received unsuitable advice to transfer out. The FCA expects that more than 1,000 consumers will receive redress as a result.

Firms will have to review the advice they gave and pay redress to those who lost money because of unsuitable advice.

Dr Matthew Connell, director of policy and public affairs at the PFS, noted: “We recognise that a significant number of BSPS members were given unsuitable advice and that the FCA is right to set up a Section 404 scheme to ensure that redress is paid to those members who qualify for it. It

is right to take steps to ensure that firms have the resources to pay compensation.

“We should remember that the FCA estimates that more than half of transfer cases were found to be suitable, in spite

of a chaotic transition process to the new British Steel pension arrangements, in which key information was only given to members in a piecemeal way by the BSPS.

“This figure is in stark contrast to Financial Ombudsman Service (FOS) uphold rates for BSPS complaints, which were running at 98% at the beginning of 2022.

“It is important that FOS judgments follow the approach set up by the FCA for the Section 404 scheme. If a complaint to the FOS at the end of the process is almost certain to be upheld, then ultimately consumers will end up paying a compensation bill that is not justified by the facts.”

9 NEWS SPRING 2023 | Personal Finance Professional | thepfs.org LEARNING

WHAT’S ON THE RADAR?

In this issue, Dr Matthew Connell takes a look at pension income advice and BSPS retention rules

THEMATIC REVIEW OF PENSION INCOME ADVICE

The Financial Conduct Authority (FCA) has launched a thematic review assessing the advice consumers are receiving on meeting their income needs in retirement.

It described the review as “a piece of discovery work to explore how financial adviser firms are delivering retirement income advice and assess the quality of outcomes consumers are getting”.

The FCA will be looking at the quality of both initial and, where relevant, ongoing advice.

BSPS RETENTION RULES EXTENDED

In January, the FCA published a policy statement, PS23/1, confirming that the temporary British Steel Pension Scheme (BSPS) asset retention rules will be extended so that they continue to apply until firms have resolved all relevant BSPS cases that are subject to the rules of the BSPS consumer redress scheme, as well as other relevant BSPS cases outside the scheme.

The FCA said: “This intervention will help ensure that the firms responsible for giving bad BSPS advice meet the cost of the redress liabilities that arise and reduce the risk that the firm fails, with costs being passed to Financial Services Compensation Scheme (FSCS) levy payers. Accordingly, the intervention increases the likelihood that the ‘polluters’ that cause consumers harm and give rise to redress liabilities meet the cost of those liabilities. Where firms do fail, the intervention is designed to increase the likelihood of an orderly wind-up of the firm, reducing the impact on FSCS levy payers.”

The FCA also published a Dear CEO letter, which sets out its expectations of firms that have either received proceeds from a BSPS transfer or continue to be involved in managing the transferred assets, under the BSPS consumer redress scheme.

NEW FINANCIAL PROMOTIONS RULES

The FCA went on to explain that its wider Assessing Suitability Review 2 to allow resources to be concentrated on its response to Covid-19. Th continues to be on hold while the new thematic review focuses on the more specific issue of how the retirement income advice market is functioning. The FCA said it “will also focus on how firms are responding to changing consumer needs as a result of the rising cost of living”.

in that its wider had been paused 2 centrated

The review le new more irement nctioning cus g to

The FCA will begin the review in Q1 2023 and aims to publish a report setting out its findings in Q4 2023. The results will also feed into the FCA’s supervisory work connected with the Consumer Duty.

The FCA said: “Firms selected for the review can expect to be contacted early in 2023.”

PFS

ns gateway is will mean firms

e FCA if wish financial uthorised persons. orised orised cial ove financi uthorised

A new authorisations gateway is being introduced, which will mean fi need to apply to the FCA if they wish to continue or start approving fi promotions for unauthorised persons. Currently, any authorised person can generally approve fi promotions for unauthorised persons.

d a

w which

e ing

porting. gulatory repo

The FCA published a consultation paper (CP22/27) in December 2022, which includes proposals on how it intends to operationalise the gateway, including proposals on assessing applications and regulatory reporting.

Dr Matthew Connell is director of policy and public affairs of the CII

Briefings, updates, research papers and much more are available for download at: www.thepfs.org/insight

DearCEO 10

thepfs.org | Personal Finance Professional | SPRING 2023

REGULATION

ONLINE POLICY CONTENT

o

s a ving”. view in a report 4 2023.

P R O M O TI O N S R U L ES

SHUTTERSTOCK / ISTOCK

In 2023 you can look forward to nearly 100 CPD events across the UK, including: 75 PFS LOCAL CONFERENCES 12 ACCUMULATION AND INVESTMENT ROADSHOWS 6 RETIREMENT AND LATER LIFE ROADSHOWS Find out more and book now at thepfs.org/events

CUTTING RED TAPE THE

financial services regulations post-Brexit

In December 2022, the UK government introduced its package of ‘Edinburgh Reforms’, which it said would “turbocharge growth and deliver a smarter and homegrown regulatory framework for the UK – that is both agile and proportionate”. The argument is that the EU’s primacy in setting out financial services legislation left UK regulators simply as supervisors, not rulemakers.

As HM Treasury said: “This constrained the regulators’ ability to determine the most appropriate regulatory requirements for UK markets.” Returning the power to make rules to UK regulators will allow the UK “to seize the opportunities of EU exit

thepfs.org | Personal Finance Professional | SPRING 2023 12

Dr Matthew Connell provides an update on changes to the UK’s

REGULATION

and secure the UK’s position as a global financial hub”.

There is certainly merit to this argument – rules established at the EU level often mean committees of politicians were drafting detailed, prescriptive rules that, for example, required advisers to take on responsibilities to monitor their clients for money laundering even though the risks were very small. There was relatively little consumer research or piloting of new rules, which meant that many measures developed at EU level were a shot in the dark.

As a result, the government has been able to remove some of the worst mistakes of EU financial regulation of the last 20 years, including an overhaul of the Packaged Retail and InsuranceBased Investment Products regulation, which instituted a system of disclosure for investors that was introduced with very little consumer testing, and produced documents that are hard to read and comprehend.

It also made changes to the Markets in Financial Instruments Directive (MiFID) regulations to scrap the ‘10% drop’ rule. The PFS has campaigned for this rule to be scrapped, as it requires firms to inform investors when the value of their portfolio falls by more than 10% – encouraging clients to focus on falling markets at a time when most may well be best advised to ride out the volatility.

On the fund management side, the government has produced proposals for creating investment vehicles –long-term asset funds – which are designed to increase investment in illiquid assets by creating longer redemption periods (of at least 90 days) than exist for normal mutual funds. This is designed to create an

investment vehicle that has high standards of governance and consumer protection without creating systemic risks that might come if investors were able to withdraw their investment without notice.

The Treasury has also created proposals for a new tax regime for qualifying asset holding companies in certain fund structures.

The Chancellor has sought to reinforce the message of growth and trade in a letter to the FCA’s CEO, Nikhil Rathi, stressing:

● “The importance of the government’s agenda to encourage trade… and to promote inward investment into the UK.”

● “The government’s commitment to ensuring that the UK is attractive to internationally active financial services firms and activity.”

● “The government’s support of innovation and new developments in financial markets and active embracing of the use of new technology in financial services, such as crypto technologies, artificial intelligence and machine learning.”

PRAGMATIC APPROACH

There are, however, two features of the review that may cause scepticism about a tsunami of growth being unleashed by the reforms.

First, these are reforms being carried out by a new government that is already in the second half of its electoral term. As a result, the reforms have largely been hoovered up from a

range of ongoing reforms and tweaks to the system, rather than being a radical package based on a fundamentally new approach to markets and regulation.

For many working in financial services, this more pragmatic approach may be welcome, given the disruption caused by some more intrusive reforms in the past, but pragmatic reforms are not likely to radically change the experience of investors.

Second, the idea that EU regulations were holding back UK growth means that the reforms tend to reflect the sprawl of EU financial regulation, as the government repeals or replaces unwise decisions here and there, while the majority of EU rules, including rules on compulsory professional indemnity insurance, which have held back the growth of the financial advice profession for several decades, will remain for the foreseeable future.

One legal firm commenting on the package of reforms in the asset management sector complained that “the UK government appears to have had a failure of ambition that may see the sunlit uplands of a truly competitive UK funds industry remain tantalisingly out of reach for future generations”.

History will tell whether these reforms are a pragmatic leg-up for the investment sector, or a big missed opportunity for economic growth. ●

Dr Matthew Connell is director of policy and public affairs

13 SPRING 2023 | Personal Finance Professional | thepfs.org REGULATION

For many working in financial services, this more pragmatic approach may be welcome, given the disruption caused by some more intrusive reforms in the past, but pragmatic reforms are not likely to radically change the experience of investors

DUTY BOUND

Dr Matthew Connell reports on the latest developments on the road to implementation of the Consumer Duty

thepfs.org | Personal Finance Professional | SPRING 2023 14 T

REGULATION CAMERON LAW / IKON IMAGES

he Financial Conduct Authority’s (FCA) launch of the final Consumer Duty rules and guidance in July 2022 was greeted with a huge amount of interest. It was the first major piece of regulation to come out after the pandemic and significantly increased the scope of conduct regulation, especially in the areas of communication and service for consumers.

Although the launch of the Consumer Duty rules feels relatively recent, we are already halfway along the road to implementation for all products and services that are on sale or open for renewal. Firms must be fully compliant for these products and services by July 2023. By July 2024, the Consumer Duty will apply to all closed products and services.

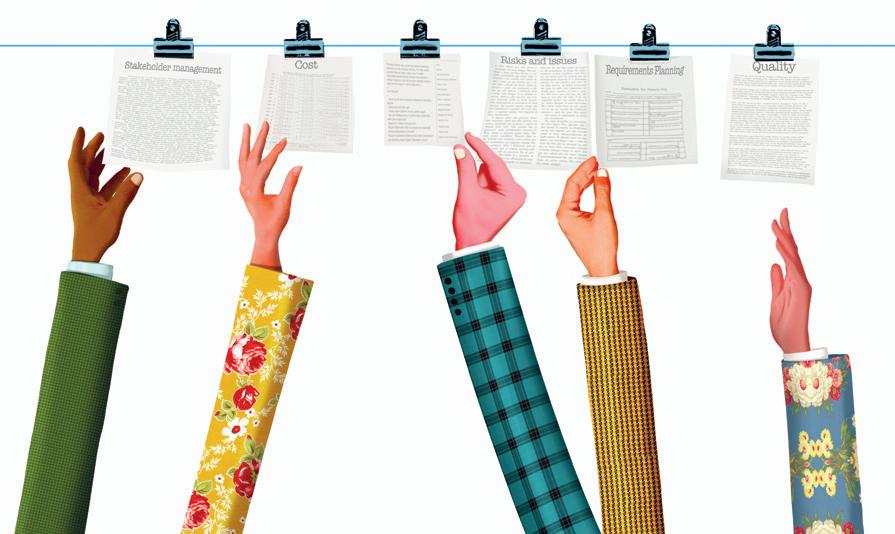

So, what should firms have already done in preparation for the Consumer Duty and what should they be doing in the spring to ensure they are meeting the FCA’s expectations?

WHERE FIRMS SHOULD BE NOW

In July 2022, the FCA said it expected firms to have an implementation plan ready by the end of October. Although this plan did not have to be an exhaustive list of actions needed to comply with the Consumer Duty, it should have set out an overall approach to the four key consumer outcomes:

● Products and services.

● Price and value, where “firms should avoid designing products and services to include elements that exploit consumer lack of knowledge and behavioural biases to increase the price paid”.

● Consumer understanding.

● Consumer support – this requires firms to “enable consumers to get what they paid for… without unreasonable barriers”. As we move into the second half of the implementation period, it is important for firms to have evidence that they have considered what they need to do to meet the new standards, that they have documented who is carrying out specific actions to meet those standards and how far along they are to completing those actions.

PRODUCTS AND SERVICES

For products and services, a useful place to start is the product intervention and product governance sourcebook (PROD) rules. The FCA says: “The PROD rules apply to investments [and] insurance... Our proposals aimed to provide a level playing field in all sectors, raising standards in those sectors to which the current rules do not apply… We agree it would be proportionate for firms to comply with the existing rules to satisfy this outcome, as we consider the existing rules meet our expectations.”

As a result, a review of a firm’s existing compliance with PROD rules is an essential part of preparing for the Consumer Duty. The review could be based on this high-level steer from the FCA: “Advisers (as distributors) will need to consider, among other things, the rules around information sharing between distributors and manufacturers. For example, advisers will need to gather information from manufacturers on the products on which they intend to advise; and they should consider how best to feed information back to manufacturers on how the product is meeting the needs of the target market to help with the manufacturer’s regular product reviews. These information flows may be made more effective by contractual provisions between advisers and manufacturers covering the exchange of relevant information.”

Where firms can show that they have considered their responsibilities under the PROD rules in the run-up to the Consumer Duty and they have taken action to ensure that the “information flows” are still working to product good consumer outcomes, they can be confident that they are in a strong position to comply with the products and services element of the Consumer Duty.

PRICE AND VALUE

The price and value element is likely to be a more demanding challenge for firms. Firms should bear in mind that the Consumer Duty does not apply at the level of the individual client, but on the level of client segments. The FCA says: “Our expectations apply based on what is reasonable. We do not expect firms to exhaustively segment their customer base to identify differences in outcomes between all possible groups of customers.”

The key evidence that firms need to be ready to present for the price and value element of the Duty is:

● How they segment their clients.

● Which goods and services are

15 SPRING 2023 | Personal Finance Professional | thepfs.org

T

REGULATION →

One question firms can ask themselves is whether they are applying the same consumer support standards to deliver good consumer outcomes as they are to generate sales and revenue

relevant to those clients and which are not.

● What kind of monitoring takes place to ensure that clients are being put into an appropriate segment. For example, many clients – perhaps the vast majority of clients – need ongoing advice to adapt to their changing circumstances and to a changing economic and fiscal environment. However, the FCA will expect firms to be able to explain why a certain proportion of clients need ongoing advice and, if the proportion is 100%, the FCA will be looking for a very robust explanation.

As the FCA says in a recent Dear CEO letter: “Consumers should receive a value for money service where an ongoing service is offered. The new Consumer Duty requires firms to ensure the service offered is appropriate for the client’s circumstances, is delivered within the terms of the agreement and is at a cost that is fair value. We are concerned firms are not adequately considering the relevance, nature and costs of these services for all their clients.”

CONSUMER UNDERSTANDING

The consumer understanding principle will also require thought and attention from firms. The FCA has made it clear that this does not mean firms must “verify that all individual consumers have in fact understood the information provided”. However, it does expect firms to “test, monitor and adapt communications to support understanding and good outcomes for customers”.

Firms should be able to show evidence that they have designed a system for testing consumer understanding – especially for consumers who may be in a more vulnerable situation because of health, life events, low levels of financial or emotional resilience, or low levels of financial capability. They should also be able to show that they at least carefully considered the way they

communicate in response to this information.

CUSTOMER SUPPORT

Finally, the customer support element is a key element of the Consumer Duty, and arguably expands the scope of FCA regulation further than any other aspect of the principles and rules. However, it suggests: “One question firms can ask themselves is whether they are applying the same consumer support standards to deliver good consumer outcomes as they are to generate sales and revenue.”

Given the importance of vulnerability in delivering good outcomes on consumer understanding, it is important that firms of any size ensure that they have access to diverse perspectives on consumers’ experience.

As the FCA says in its recent letter to CEOs in the advice sector: “We recognise the sector has taken some steps forward on diversity and

inclusion. But there is much more that needs to be done to create truly diverse and inclusive organisations that meet the diverse needs of those they serve.”

For the smallest firms, this may not mean recruiting new members of staff, but it could mean seeking out perspectives on investment and retirement from a wide range of different groups, for example investors who are experiencing issues with their mental health.

The Consumer Duty covers every aspect of firms’ contact with clients and so preparing for compliance can be daunting. However, if firms think carefully about every aspect of the Consumer Duty and take steps to address the issues raised, they will be in a much stronger place to show that they have complied with its principles by July this year. ●

KEY MILESTONES

Source: FCA thepfs.org | Personal Finance Professional | SPRING 2023

16

REGULATION 27 July 2022: Final rules and guidance published 31 October 2022: Firms agree implementation plans 30 April 2023: Manufacturers complete reviews to meet the outcome rules 31 July 2023: Rules start for open products/ services 31 July 2024: Rules start for closed products/ services 12345

Dr Matthew Connell is policy and public affairs director of the CII

The number of people receiving the state pension in the UK has risen by 1.1% to 12.5 million, according to the Department for Work and Pensions –something that is of little surprise as the baby-boomer generation retires.

But retirement is a difficult choice for many in the face of the cost-ofliving crisis and a changing political appetite on pension payments.

17 SPRING 2023 | Personal Finance Professional | thepfs.org

ILLUSTRATIONS: SOLJI LEE PENSIONS

The cost-of-living crisis and politics are playing havoc with many people’s retirement plans, as Liz Booth reports

And for those with a private pension, it is still not as straightforward as it once was. In November last year, BDH Sterling noted: “The effect of the cost-of-living crisis could mean £2.5bn of ‘lost’ pension contributions. This is the startling figure revealed in the latest Retirement Report published by Scottish Widows.”

The report also reveals that:

● 11% of UK adults have already cut back or stopped their pension contributions.

● If the average reduction of £47 each month is maintained for a year, it could result in more than double that amount being lost at retirement.

● The cost of not raising contributions again after the current crisis ends could mean ‘lost’ contributions of £7,000.

Despite those figures, it is clear retirees need another income beyond the state pension. A recent Pensions and Lifetime Savings Association report says pensioners need at least £12,800 a year to live with dignity and cover basic needs – an extra £2,000 on top of the state pension.

Last year, the average cost was £10,900.

UNDER PRESSURE

Simpson Financial Services is among the financial planning experts warning that individuals who choose to retire now will need higher levels of savings to see them through.

“The cost-of-living crisis will affect everyone at every stage of life, because incomes are remaining static while the costs of goods and services have gone up,” the firm’s experts say.

“All incomes are under pressure. It doesn’t matter what type of household or how the income is earned – salaries, pension plans, savings, investments, or an annuity.”

The UK is not alone in its pension woes – in France there is an expected €13.5bn (£11.9bn) shortfall by 2030 unless changes are made and, controversially, the government is trying to raise the retirement age from

62 to 64. And in Germany, people already have to wait until they are 67 to receive the state pension.

The US is no better off. Nicole Lehman of Clever, a US real estate data company, says a new study shows “the average American retiree has $170,726 (£139,962) saved for retirement – about 10% less than the $191,000 (£156,583) they had at the start of 2022”, adding: “This is just 31% of the $556,400 (£456,142) that experts recommend.”

Back in the UK, the government has already confirmed plans to raise the age threshold for receiving pensions in the next couple of years. From 2028, someone will become a state pensioner

once they reach 67 years of age, for those born on or after April 1960. Furthermore, there will be a gradual increase to 68 between 2044 and 2046 for anyone born on or after April 1977.

Under the Pensions Act 2014, the government is legally obligated to review the state pension age on a regular basis. In the government’s first review in 2017, it was found that the next review should debate whether the increase to age 68 could be brought forward to 2037-2039.

According to the law, the next review of the state pension age must take place in early 2023 and be published by 7 May 2023 – watch this space.

18 PENSIONS thepfs.org | Personal Finance Professional | SPRING 2023

All incomes are under pressure. It doesn’t matter what type of household or how the income is earned – salaries, pension plans, savings, investments, or an annuity

POLITICAL CONCERNS

The triple-lock was introduced to the UK state pension in 2010, to guarantee that the state pension would not lose value in real terms and that it would increase at least in line with inflation. The three-way guarantee was that each year, the state pension would increase by the greatest of the following three measures: average earnings; prices, as measured by the Consumer Pricing Index; or 2.5%.

In November 2022, Rishi Sunak confirmed the triple-lock would continue, but for how long remains a politically contentious issue. The government has said it will stay in place until at least 2024.

As experts have been pointing out, if pensions increase again in 2024 in line with inflation, pensioners could receive more than the existing personal tax allowance threshold (which is frozen for some years to some). This would mean pensioners paying income tax on a portion of their pension – an administrative nightmare for them and the tax authorities.

Demographics play a huge part in this conversation and there are signs that life expectancy has stalled –something that would legally oblige the government to change tack on the pensionable age.

But there are other factors at play too. During the Covid-19 pandemic, many people chose to retire early on a lifestyle basis. That was a choice for the comfortably off, it appears. The Office for National Statistics (ONS) shows that in the period from 10-29 August 2022, based on adults aged 50 to 65 in Great Britain who have left or lost their job since the start of the pandemic and not returned to work:

● The majority (66%) owned their homes outright and were more likely to be debt-free (61%), compared with those who left their job since the pandemic and returned to work (42% debt free).

● Financial resilience varied by age: those aged 50 to 54 were significantly less likely to be

Source: L&G

debt-free, excluding a mortgage (49%), compared with those aged 60 to 65 (62%) and more likely to have credit card debt (39%, compared with 24%).

● More than half (55%) of those aged 60 to 65 were confident or very confident that their retirement provisions would meet their needs, compared with just over one-third (38%) of those aged 50 to 54.

● Age was also a factor when considering whether to return to work; the younger cohort were more likely to say that they would consider returning to work (86% for those aged 50 to 54, 65% for those aged 55 to 59, and 44% for those 60 to 65).

● Adults aged 50 to 59 were more likely to report mental health reasons (8%) and disability (8%) as a reason for not returning to work, when compared with those aged 60 to 65 (3% and 3%, respectively).

● Adults aged 50 to 59 (14%) were also more likely to be currently looking for paid work, compared with adults aged 60 to 65 (6%).

However, that takes us back to the point about the cost-of-living crisis. The Financial Times was among those reporting that, by the end of 2022, and according to the ONS, the number of people over 65 in work or looking for work hit close to 1.5 million during the summer – the highest level on record –before falling slightly of late.

DELAYING RETIREMENT

Research from Legal & General confirms that 38% of those in their late 50s or early 60s are opting to put off retirement for at least another year, following the pandemic and current economic conditions.

Legal & General research also shows nearly one million people are considering annuities for the first time to guarantee stable incomes, avoid market volatility and make the most of higher rates. However, misconceptions about the product are still high, as 44% of people want a guaranteed income in retirement but less than half recognise an annuity as a potential solution.

However, Lorna Shah, managing director of retail retirement, Legal & General Retail, stresses: “Despite annuities becoming more popular, we still need more awareness of the flexibility of fixed-term annuities and the benefits of enhanced annuities. Our research shows there is still a lack of understanding about what an annuity is and what it can offer. This means people risk having an ‘either, or’ approach to funding their retirement, when in fact a blended approach might be more suitable.”

A further opportunity for financial planners to show their value. ●

Liz Booth is contributing editor of PFP

19 PENSIONS SPRING 2023 | Personal Finance Professional | thepfs.org

38%

OF THOSE IN THEIR LATE 50S OR EARLY 60S IN THE UK ARE OPTING TO PUT OFF RETIREMENT FOR AT LEAST ANOTHER YEAR

Strikes, strikes and more strikes. When broadcasters start issuing monthly calendars with strikes on every day, you know there’s a problem.

That is the situation in the UK as 2023 gets underway. Whether it is Royal Mail, the rail services, teachers or the NHS – everyone seems to be intransigent.

Sadly, at the time of writing, it seems there is little progress and it is all having a negative impact on the economy. Combined with the winter weather, high cost-of-living and

thepfs.org | Personal Finance Professional | SPRING 2023 20

ECONOMY

ECONOMY BITES

been found at national level to replace Russian oil supplies, while even gas supplies are being successfully replaced from “friendly” countries, meaning wholesale energy costs will drop – hopefully followed by retail costs soon after.

NOT OUT OF THE WOODS

However, in the meantime, it seems there is still some pain to go through. Mortgage holders, for example, are set to lose up to an eighth of their income on mortgage rate rises in the coming months, according to the Resolution Foundation, with three million households set to renew their existing mortgage arrangements in the next year and with some predicting that rates will effectively triple for up to 800,000 homeowners.

Added to that, credit card debt grew by £1.2bn in November, according to the Bank of England – the highest monthly increase since back in 2004. That debt grew even though retail spending was down, suggesting, according to Ashley Webb of Capital Economics, that people are using credit to tie them over through the rising costs, such as for energy bills.

All in all, it paints a picture in which financial advisers should be more valued than ever, with clients seeking reassurance that their money is being managed in the best possible way.

energy cost rises, it is a pretty grim picture all round.

Many clients of financial planners are financially sound and probably among the best placed to weather such a perfect storm. And there are also some green shoots of optimism.

In the US, inflation is still increasing but the rate of increase has slowed. There is a feeling that interest rate rises have done their work and that the economy will start to recover.

In the UK, there are tiny but hopeful signs. House prices actually rose in December after a few months

of declining prices and analysts are saying that inflation may have peaked, as rising interest rates may have done their job. But they are cautious, warning there will be some way to go before people feel confident about spending money.

Added to that, the FTSE100 was actually the world’s best-performing stock index in 2022, despite all the doom and gloom, delivering a 0.9% gain in 2022 – a tiny amount but at least positive compared to the 20% drop in global markets as a whole.

Alternative energy sources have

There is often debate about how often clients need contact – this, according to the experts, is something that could possibly be reviewed now. Is an annual meeting or call still appropriate? Should the touchpoints become more frequent?

HOLD YOUR NERVE

Many financial experts are suggesting that investors should hold their nerve and not sell out or make rapid decisions that ultimately might prove costly as the recovery happens. A prime example of that is the housing market, where rising prices put paid to the idea that we were about to see the market spiral out of control. But as

21 SPRING 2023 | Personal Finance Professional | thepfs.org ECONOMY

ALICE MOLLON / IKON IMAGES

As 2023 begins where last year left off, with widespread strikes, high energy costs, bad weather and a cost-ofliving crisis, Liz Booth looks for signs of recovery

they say, one swallow does not a summer make – and the doommongers could be proved right. Either way, this is not necessarily a moment to dump assets or stock – unless it’s essential.

Joseph Hill, senior investment analyst at Hargreaves Lansdown, sums up the state of the economy: “The real income of most consumers has been squeezed, forcing them to cut back and prioritise. Forecasts show high inflation will erode average real pay and cut living standards by 7% in the two years to the end of March 2024 – wiping out the previous eight years of growth.”

Clients are very likely to include SME business owners and the strikes may be having a very direct impact on their bottom line. A Simply Business survey of more than 600 small businesses found that more than one in 10 had been affected by the rail strikes. Of those, almost 40% said they’d made it harder to plan in advance, while more than a fifth said they have had fewer customers on days when strikes took place.

Do they have the right insurances in place to support them? They may well be at a crisis point both financially and emotionally.

After the torrid experience of business interruption (BI) insurance claims during Covid-19, many business owners will have been talking to their insurance brokers about what is covered. Generally speaking, BI covers the operating expenses for a business due to problems covered by the policy, which are generally theft, wind, fire, lightning and falling objects, or in other words, physical triggers.

Strike insurance has to be bought separately but, as one definition puts it: “Strike insurance is a type of policy that covers the financial losses to a business owner if their employees go on strike, stage a walkout, or organise some other type of interruption that shuts down business operations. If a strike

continues, the strike insurance company pays the business owner to cover the income lost from being temporarily shut down.”

No mention, therefore, of lost income from strikes at external businesses that then directly impact others – something clients may need to be checking with their insurer.

RISING INSOLVENCIES

That brings us back to Hill, who warns: “In a typical recession, companies can be expected to make less profit and pay often falls.”

Advisory firm Cork Gully is predicting insolvencies will rise to 6,300 in Q1 of 2023 and to 6,400 in Q2, before falling slightly later in the year. It adds: “Businesses in consumer-facing sectors are expected to see the highest number of insolvencies in 2023, as they see demand decline amid the cost-ofliving crisis. This could also impact

city centres with large retail and hospitality industries.”

This confirms the picture being painted more broadly of city centres becoming ghost towns on certain days of the week as people work from home to avoid rail strikes.

As a financial adviser, you are not a counsellor or psychiatrist but a touchpoint might make all the difference – particularly if it comes with sound financial planning advice. Looking back at previous financial disasters when some individuals felt things were so bad that they took their own lives, almost always there was a friend or work colleague who wishes they had reached out because a simple call could have helped.

Checking in can make a real difference, particularly when it comes with sensible financial advice. ●

thepfs.org | Personal Finance Professional | SPRING 2023 22

Liz Booth is contributing editor of PFP

ECONOMY

Forecasts show high inflation will erode average real pay and cut living standards by 7% in the two years to the end of March 2024 – wiping out the previous eight years of growth

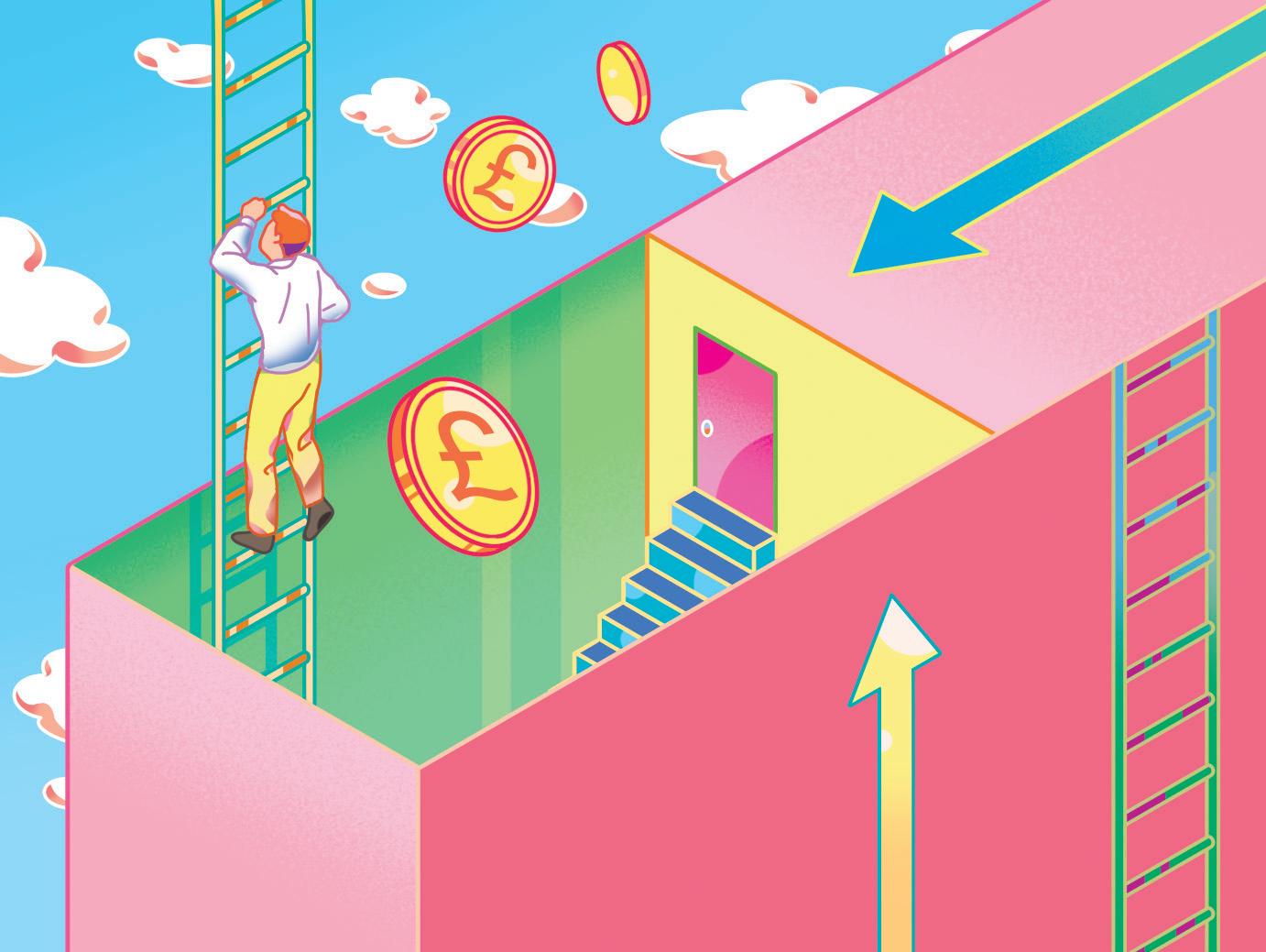

REBUILDING THE MORTGAGE MARKET

The start of this year has heralded a new dawn for the mortgage market, which is slowly recovering from a torrid final few months of 2022.

This positive projection comes from Karen Noye, financial adviser at Quilter, who anticipates an upturn in fortunes.

“The start of 2023 is starting to look a little less bleak than the back half of 2022,” Noye says. “While the increasing rates will still be causing huge pain for millions, there

23 SPRING 2023 | Personal Finance Professional | thepfs.org MORTGAGES

Aamina Zafar reports on a market still recovering from the disa strous mini-Budget and rising interest rates

does seem to be more light on the horizon, with rates set to drop by the end of the year.”

However, she predicts high interest rates will only gradually improve as we move towards spring.

“It is still difficult out there and it is unlikely to get much better before spring,” she says. “While it is difficult to predict the future, it is clear that higher rates are here for the foreseeable future and therefore, for some clients who perhaps are happy to take more risk, now might be the time to take a two-year tracker with no penalties, giving clients flexibility to refinance. This gives people that are a little braver the chance to take a rate that might rise in the short term but avoids locking in to an unnecessarily high rate now.”

Interestingly, Saira Haider, director at Mansion Mortgages, says that although business has slowed since September 2022, things are beginning to look up as borrowers become accustomed to higher rates.

She says: “Things have slowed down since September but we are seeing clients becoming more accepting of the higher rates, obviously not at the rate it was before but back to slow and steady. We are able to service existing clients better, which means product transfers and remortgages are up. We have 30% purchase clients currently, compared with more than 60% before. We foresee spring markets will stay the same, but we are hoping that markets move in a positive direction as that is seasonally peak time for people to move.”

PROPERTY PROBLEMS

It is not only homeowners that will continue to feel the pinch in the short term.

Adviser Jiten Varsani says higher interest rates may also see demand for buy-to-lets (BTLs) fall and force existing landlords to sell some of their property portfolio as their returns plummet or even turn negative.

The mortgage and protection adviser

at London Money Financial Services says: “I think that as a result of high interest rates, we will see the demand for new purchases of property, particularly BTLs, fall. In turn, we’ll also see existing landlords look to sell up as they see that returns are highly diminished and in some cases are

negative. This in turn should see a fall in asking prices. This can be a real benefit for first-time buyers (FTBs).”

Overall, mortgage lending is expected to fall by 15% in 2023, in a return to pre-pandemic levels, according to UK Finance forecasts. Despite the higher rates predicted

SDLT RATES FOR A SINGLE PROPERTY

The next £675,000 (the portion from £250,001 to £925,000)5%

The next £575,000 (the portion from £925,001 to £1.5 million)10%

The remaining amount (the portion above £1.5 million)12%

Source: UK Gov

thepfs.org | Personal Finance Professional | SPRING 2023 MORTGAGES

Property or lease premium or transfer valueSDLT rate Up to £250,000Zero

24

until at least spring, many borrowers may need to remortgage. Sadly, the high cost-of-living means many customers will be in arrears, as they struggle with high heating and electric bills during the winter, soaring food prices and potentially eyewatering monthly mortgage bills.

But Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, believes even this will not be as bad as some pundits have predicted. Even the Bank of England figures from Q3 2022 show that the value of outstanding balances with arrears fell 1.4% during the quarter and accounted for 0.78% of outstanding balances – the lowest since recording started in 2007.

She says: “The ONS separately tracks the proportion of people who say they are behind on rent or mortgage payments and only 2% are. This has fluctuated between 2% and 5% since they started measuring it in March, so it doesn’t indicate a flurry of new arrears.

“If you are in arrears it can be incredibly difficult to remortgage, but it’s not always impossible.”

This is why Varsani argues that the role of the adviser will be fundamental in the coming months to ensure borrowers can survive turbulent times.

He says: “The role of an adviser will be key at this time. We need to guide clients where we can. That means help with budgeting and prioritising spending in the right way. Sometimes, an external person is best placed to highlight some home truths about monthly spending cuts. Our advice should also be focused on how to reduce mortgage payments where possible. For example, overpayment using savings and/or extending mortgage terms. This is of course subject to this being suitable advice for the client.”

This is echoed by Liz Syms, vice-chair at the Society of Mortgages

Professionals and chief executive officer of Connect for Intermediaries.

She says: “Advisers can assist when reaching out to existing customers by educating them on the increased

importance of maintaining their credit to secure the best mortgage rates when their deal comes to an end. Where arrears are unavoidable, the adviser may still be able to assist clients by understanding the range of lenders that can consider credit blips. A rate transfer will often still be an option. The key thing is to ensure that customers understand that getting advice will potentially give them more options to improve or stabilise their position.”

TAXING TIMES

The high interest rates are not the only things shaking up the mortgage market.

In September 2022, the threshold at which stamp duty land tax (SDLT) became payable rose from £125,000 to £250,000, the nil-rate threshold for FTBs relief rose from £300,000 to £425,000, while the maximum value of a house that could benefit from FTBs relief rose from £500,000 to £625,000. In November, Chancellor of the Exchequer Jeremy Hunt announced that these changes would be temporary and revert back to the old thresholds in March 2025.

Commenting on how these changes will impact borrowers, Syms says: “Unlike during the lockdown, I don’t see these SDLT changes having a massive impact. The saving may help a few more FTBs onto the ladder a bit quicker as there is less money to find for the purchase, but it does not affect the affordability, which has become a bigger issue with the higher rates.”

A similar notion is echoed by Coles,

who says: “There will be less tax to pay on transactions in the interim, although the window is long enough not to have spurred a flood of sales in the same way as the short-term SDLT holiday during the pandemic. We are likely to see people bring purchases forward as we get closer to the deadline.”

There is no doubt that the biggest shakeup in the mortgage market came in the wake of the controversial mini-Budget by former Chancellor Kwasi Kwarteng, which spiked interest rates and saw multiple lenders pull mortgage products. Even now, mortgage deals remain significantly more expensive than before the chaos kicked off.

Varsani says this shook consumer confidence and it is still struggling to recover. He says: “Consumer confidence is shaken. The public has got very used to the low rates over the last decade. They do not understand why rates have suddenly increased so sharply. They will feel the impact of these increases on mortgage repayments, along with any other borrowings they may have.

“Some good news is that the pace at which lenders are changing products has eased. In turn, this has calmed the market somewhat and eased the time-sensitive burden advisers found themselves in. Additionally, we are seeing lenders bring back some previously withdrawn product ranges.”●

25 SPRING 2023 | Personal Finance Professional | thepfs.org MORTGAGES ISTOCK

Aamina Zafar is a freelance journalist

The key thing is to ensure that customers understand that getting advice will potentially give them more options to improve or stabilise their position

Niki Patel highlights key changes and tax planning opportunities for clients following the Autumn Statement

think it’s fair to say 2022 was a year of confusion. A year with three Prime Ministers, four Chancellors and an abundance of financial statements. Compared to the drastic announcements on 23 September 2022 in the Government’s Growth Plan, the Autumn Statement was somewhat restrained. That said, prior to the Autumn Statement, it was clear that personal tax and business tax would rise. As a result, the Autumn Statement confirmed a series of tax increases that will take effect during the following two tax years, which will, of course, have a financial impact on individuals and businesses.

In this article, I focus on what was announced and outline some of the potential planning opportunities that could be considered for your clients.

INCOME TAX

The basic rate of income tax will remain at 20%, the higher rate will remain at 40% and the additional rate will remain at 45%. The basic rate of tax applicable to dividends will remain at 8.75%; the higher rate will remain at 33.75%; and the additional rate will remain at 39.35%.

26 TAX →

thepfs.org | Personal Finance Professional | Spring 2023

AUTUMN STATEMENT:

→

SPring 2023 | Personal Finance Professional | thepfs.org

27 XXXXXXXXXXXXXXXXXXL IKON IMAGES TAX

KEY CHANGES LIZZIE ROBERTS / IKON IMAGES

The income tax personal allowance (PA) will remain at £12,570 until 5 April 2028. The higher rate threshold will also remain at £50,270 (made up of the £37,700 threshold plus the PA of £12,570) until 5 April 2028.

However, it was announced that the income tax additional rate threshold will be lowered from £150,000 to £125,140 from 6 April 2023. Most individuals are entitled to a PA, a personal savings allowance (PSA) and a dividend allowance. However, the PA of £12,570 is reduced by £1 for every £2 where an individual’s adjusted net income exceeds £100,000 (broadly net income less any gross pension contributions to a registered pension scheme or charitable donations). This means that once income exceeds £125,140 it is totally lost. For every £100 of income between £100,000 and £125,140, you only get to take £40 home – £40 is deducted in income tax, while another £20 is lost by the tapering of the PA (i.e. £50 of lost PA, taxed at 40%) which effectively amounts to a 60% tax rate on income within this range.

In addition, it was announced that the dividend allowance will reduce from £2,000 to £1,000 from 6 April 2023 and to £500 from 6 April 2024. There were no changes announced in respect of the PSA, which will remain at £1,000 for basic rate taxpayers and £500 for higher rate taxpayers.

Freezing the PA and tax bands further will mean that millions of individuals will end up paying more income tax. Further, reducing the additional rate threshold, combined with the current freezes in the PA and the higher rate tax band, will move more people into higher rate tax brackets. An individual earning £150,000 in the current tax year could be just over £1,240 (around £1,243) worse off from 6 April 2023, because an extra 5% of income tax will apply to the amount of their income that falls between £125,140 and £150,000; they could be even worse off if receiving dividend income.

Planning

● In terms of general planning, investing couples should aim to use their dividend allowances and PSAs in full (and ensure that they do not lose out on the ability to transfer the transferable marriage allowance where eligible to do so).

● Individuals should also try to arrange their investment holdings in such a way to ensure they fully use both PAs and starting/basic rate tax bands.

● Individuals should continue to maximise contributions to ISAs, particularly where dividends are likely to exceed the dividend tax allowance (reducing to £1,000 from 6 April 2023) and/or the higher rate tax threshold. They could also give consideration to investing into venture capital trusts (VCTs) – which pay tax-free dividends – and investment bonds (for tax-deferral).

● Consider redistributing investments between couples to potentially reduce the rate of tax suffered on income and gains. No income tax or capital gains tax (CGT) liability will arise on transfers between married couples or civil partners living together, or where the asset to be transferred is an investment bond. However, any transfer must be made on an outright and unconditional basis with ‘no strings attached’. This effectively means investments must be fully transferred, with no entitlement retained by the transferor.

● Where possible, couples should try to ensure that they both have adequate pension plans in place to provide them with an income stream in retirement, which will enable them to use their PA.

Due to these changes, advising clients to carry out planning, for example, where possible, timing income to fall into the current tax year, maximising the use of pension contributions and/or making gift aid payments, can help save on tax.

Example:

Evan has earnings of £115,500 in 2022/2023. This means that, without any planning, his PA would be reduced to £4,820. This is calculated as follows:

£115,500 - £100,000 = £15,500

£15,500/2 = £7,750

£12,570 - £7,750 = £4,820

His income tax liability would therefore be as follows:

Income £115,500

Less PA (£4,820) £110,680

£37,700 x 20% £7,540

£72,980 x 40% £29,192

£36,732

If he were to make a gross personal pension contribution of £15,500 (£12,400 net), this would mean that his adjusted net income would reduce to £100,000, so he would benefit from a full PA and, in addition, the basic rate threshold would be extended from £37,700 to £53,200, providing him with higher rate tax relief on the contribution.

Income £115,500

Less PA (£12,570) £102,930

£53,200 x 20% £10,640

£49,730 x 40% £19,892 £30,532

The difference in the tax bill of £6,200 (i.e. £36,732 - £30,532) simply illustrates the further 20% tax saving on the pension contribution (£15,500 x 20% = £3,100), plus the higher rate tax saving on retaining the lost PA (£7,750 x 40% = £3,100). In addition, the pension contribution has benefited from £3,100 basic rate tax relief at source.

Therefore, the total tax relief on the £15,500 contribution is £9,300, an effective rate of 60%.

NATIONAL INSURANCE

In the Growth Plan, which was announced on 23 September 2022, the previous Chancellor reversed the National Insurance increases of 1.25% that took effect from 6 April 2022. This means the rates from 6 November 2022, for employees, are 12% between the primary threshold (PT) and upper earnings limit (UEL) and

28 thepfs.org | Personal Finance Professional | SPRING 2023 TAX

2% above, and 13.8%, for employers, above the secondary threshold. Unlike most of the Growth Plan announcements, this change remains in force.

The lower earnings limit (LEL) remains at £6,396 for 2023/2024 and the small profits threshold (SPT) remains at £6,725 per annum.

The UEL and upper profits limit (UPL) will be fixed at their current levels until 5 April 2028.

From July 2022, the National Insurance PT and the Class 4 National Insurance lower profits limit (LPL) were increased from £9,880 to align with the PA of £12,570 and will be maintained at this level until 5 April 2028.

The government will fix the level at which employers start to pay Class 1 National Insurance for their employees (the secondary threshold) at £9,100 until 5 April 2028. According to HMRC, the employment allowance means that 40% of businesses do not pay National Insurance and will be unaffected by this change, and the largest employers will contribute the most.

The Class 2 lower profits threshold (LPT) will also be fixed until 5 April 2028 to align with the LPL.

The Class 2 rate will be £3.45 per week, and the Class 3 rate will be £17.45 per week.

Planning

● Consider salary sacrifice for pension contributions. Using salary sacrifice means that both the employee and the employer pay less National Insurance, so further savings can be achieved.

Example

Clara’s employer offers her a salary sacrifice arrangement. She decides that, from 6 April 2023, she is going to sacrifice £30,000 of her salary for an employer pension contribution of £30,000 in 2023/2024. By reducing her income to £100,000, she will benefit from the full PA. Her post-tax salary will reduce from £79,178.40 to £67,049.40, a reduction of £12,129 (£30,000 salary reduction minus a tax and National Insurance saving of £17,871) in return for pension contributions of £30,000. In addition, her employer may be willing to pass on some or all of their National Insurance savings and further enhance the pension contributions (see table 1 on the right).

CAPITAL GAINS TAX

The capital gains tax (CGT) annual exemption (AE) is currently £12,300, but will reduce to £6,000 for 2023/2024 and further reduce to £3,000 for 2024/2025.

The rate of CGT payable will depend on the individual’s other taxable income. Gains falling within the basic rate tax band are taxed at 10% and any amount falling above that will be taxed at 20%. This means that use of the AE in the current tax year can save up to £1,230 for a basic rate taxpayer and £2,460 for a higher/additional rate taxpayer. However, these savings will reduce to £600 for a basic rate taxpayer and £1,800 for a higher/additional rate taxpayer

BeforeAfter

Salary£130,000£100,000 PA (reduced by £1 for every £2 of income) on income between £100,000 and £125,140)

Taxable income£130,000£87,430 Tax at 20% on £37,700£7,540£7,540

Tax at 40% on £87,440 / £49,730£34,976£19,892

Tax at 45% on £4,860£2,187

12% National Insurance between £12,570 and £50,270

2% National Insurance between £50,270 and £130,000/£100,000

from 6 April 2023.

Gains incurred on residential property that are not covered by the private residence exemption are taxed at 18% for a basic rate taxpayer and 28% for a higher/ additional rate taxpayer.

Planning:

● Consideration ought to be given to maximising use of the current AE of £12,300 before it reduces to £6,000 from 6 April 2023, as the AE cannot be carried forward.

● A spouse/civil partner could make an outright and unconditional transfer (as mentioned above) of assets into their partner’s name to make use of their AE on subsequent disposal. This will mean that, between them, they can realise capital gains of £24,600 in 2022/2023 and £12,000 in 2023/2024.

● Such a transfer should not generally give rise to any inheritance tax (IHT) consequences or CGT implications. Indeed, it may even be worthwhile transferring an asset showing a gain if the asset is to be sold, if it would mean the surplus capital gain is taxed at 10% rather than 20%.

● Making use of losses. Current year losses must be deducted from capital gains of the same tax year, before deducting the CGT AE amount. However, where the loss is a

29 SPRING 2023 | Personal Finance Professional | thepfs.org →

£0£12,570

£44,703£27,432

£4,524£4,524

£1,594.60£994.60 £6,118.60£5,518.60 Total

Net income£79,178.40£67, 049.40 Plus pension fund£30,000 TAX TABLE 1

tax and National Insurance£50,821.60£32,950.60

carried-forward loss, the taxpayer need only use so much of the loss that reduces the taxable gain by an amount that leaves the CGT AE amount intact. Any balance of losses can be carried forward. Using losses in this way can therefore be tax-efficient, particularly for those who are higher/ additional rate taxpayers and therefore pay CGT at 20% (or 28%), and will become even more attractive when the AE reduces to £6,000 in 2023/2024.

Example

Ahmed, a higher rate taxpayer, has a share portfolio with gains of about £42,000 which he is looking to sell to help pay for home improvements. He has not made any capital losses in the current tax year but has brought forward losses of about £20,000.

Planning:

● Advisers should always seek to be at the heart of planning for SME owners in relation to their business and personal tax planning. These changes will offer great opportunities to collaborate with the client’s accountant, opening a broad discussion around remuneration and other profit extraction strategies, as well as sale and succession planning.

● Deductible contributions to registered pension schemes and relevant life policies will become even more attractive, providing greater advice opportunities.

● Companies looking to dispose of chargeable assets within the next few years should consider bringing forward the date of the disposals to before 1 April 2023 to benefit from the lower rate.

INHERITANCE TAX

There were no fundamental changes announced in the Autumn Statement in relation to IHT, although the nil rate band and residence nil rate band will now remain frozen at £325,000 and £175,000 respectively until the 2027/2028 tax year – so a further two years. This will no doubt mean that more and more individuals will be brought into the IHT net, so planning in this area is likely to become of more importance. Remember that the residence nil rate band is tapered by £1 for every £2 where the total estate exceeds £2m, so individuals ought to consider their own circumstances and consider whether they can plan to prevent any lost residence nil rate band.

Depending on how much Ahmed currently needs, better planning may be for him to sell a sufficient number of shares to use his AE of £12,300 in the current tax year and then sell the remaining shares next year to maximise use of both AEs and carried-forward losses.

Remember that individuals have up to four years after the end of the tax year that they disposed of the asset to report the loss to HMRC via their self-assessment tax return, or if they do not complete a return they can write to HMRC instead.

CORPORATION TAX