PRODUCTIVITY BOOST

How to lift your firm without the need for expensive investments

FINANCIAL MANAGEMENT Coping with the current economic challenges

LANDLINE SWITCH-OFF Are you ready for this infrastructure shake-up?

SUSTAINABILITY IN ACTION The small businesses taking giant leaps

PRODUCTIVITY FINANCIAL MANAGEMENT LANDLINE SWITCH-OFF FEBRUARY-MAY 2023 DRIVING BUSINESS AMBITION FIRSTVOICE.FSB.ORG.UK | FEBRUARY-MAY 2023

Call 020 3962 8009 any weekday 9am - 5.30pm www.fsb-insurance-service.com Everyone could do with a helping hand on their business journey. Scan me to book a call back Insurance broking created by FSB. For FSB members. FSB Insurance Service Limited is authorised and regulated by the Financial Conduct Authority (FCA Registration No: 788654) Registered Office: 20 Fenchurch Street, London, United Kingdom, EC3M 3AZ. Company Number: 10831430

heads up

first steps

44 Making tax digital Preparing for the transition

48 My journey

Clive Loseby on making the internet more accessible

50 Ask the experts

Limited company liability and the rules on direct marketing

member spotlight

51 Member news

Free-from brand’s sweet deal, bow-maker hits 60 years in business, and MBE awarded to allergy campaigner

54 My business

Kristian Cuffin on growing Cuffed-in Coffee from a mobile horse trailer to two bricks-andmortar coffee shops

55 Member benefits

Answering your pressing insurance queries – and how FSB membership has helped one business in the Scottish Highlands

16 Turbo charge your firm

Peter Crush reports on the productivity crisis facing British businesses, and ways of boosting your own firm’s output

20 Stay in control

As costs rise and recession looms, Penelope Rance considers how businesses can help mitigate the economic pressures they face

26 Brave new world

Many small businesses are unprepared for the PSTN switch-off in 2025, says David Adams

30 Deep dive

SMEs are finding access to finance both difficult and out of date

32 Making a difference

Alex Wright on how firms are doing their bit for the environment, from going electric to plastic alternatives

36 Decisive action

Penelope Rance outlines steps that businesses can take to help ride out the next few months

february-may 2023 | firstvoice | 3

6 Need to know Upcoming tax changes to watch out for, more small businesses switch to challenger banks, and the widespread problem of under-insurance 9 Data centre Small business confidence falls to a record low amid ongoing economic challenges 10 Regional voice Round-up of regional news 13 Opinionated Tina McKenzie on US exports, Liz Barclay on tackling late payment culture, and Bernard Marr on upcoming tech trends advice 40 How to ...Secure the best talent for your firm; use marketing automation to drive sales 43 Legal Reducing employee costs without having to resort to redundancies inside firstvoice.fsb.org.uk

features

FEBRUARY-MAY 2023

26

6

40

MARTIN McTAGUE, NATIONAL CHAIR

tech bits

Publisher: Aaron Nicholls

Editor: Nick Martindale

Email: firstvoice@redactive.co.uk

Lead designer: David Twardawa

Picture researcher: Claire Echavarry

Sub-editor: Kate Bennett

Production: Aysha Miah-Edwards

Email: aysha.miah@redactive.co.uk

Advertising Email: fsb@redactive.co.uk

Tel: 020 7324 2726

SMALL BUSINESS OWNERS ARE generally an optimistic and adaptable bunch, pivoting and innovating to respond to challenges and opportunities that come our way. It doesn’t take me to tell you that the last three years, through pandemic, political upheaval and a cost-of-doingbusiness crisis, have tested that resilience.

While many headwinds are blowing strongly, and there is hardship out there, I feel it’s good for us to look at reasons for a hint of cautious optimism. Tough times force us to question how we do what we do, thinking of new ideas or ways of working.

In this edition of First Voice, we look at assessing productivity, and also at different ways of approaching our finances. FSB’s Policy Chair Tina McKenzie gives her thoughts on how more small firms could potentially benefit from new international trade deals, in particular with the US.

One feature looks at efforts to be more sustainable in our businesses longer-term, doing our bit for the planet while also bringing down energy bills. However, for many, investment in greener energy is unaffordable, which is why I would like to see the government introduce ‘help-to-green’ vouchers to support small firms with the cost of the changes.

As we head towards the Spring Budget, the UK Government should be focused on pro-growth, pro-enterprise measures that support economic recovery and improve our optimism. Bringing down the tax burden, better support through the energy crisis, new ways of financially incentivising innovation, and real action to tackle late payments would be a good start.

With the right policies to support entrepreneurship, there would be light at the end of the tunnel.

Follow Martin on Twitter @MMcTagueFSB

First Voice is available on subscription at £42 per annum. For details, contact publications@fsb.org.uk

First Voice has an audited net average circulation of 112,657 (July 2021 to June 2022).

AccessAbility help. If you require this document in an alternative format, please ring 01253 336036 or email: AccessAbility@fsb.org.uk

First Voice is published on behalf of the Federation of Small Businesses (FSB) by Redactive Publishing Ltd (Tel: 020 7880 6200) firstvoice.co.uk | redactive.co.uk 4 | firstvoice | february-may 2023 firstvoice.fsb.org.uk

58 New kit and apps The best new gadgets and apps for small businesses 60 Digital voice Member December winners out of office 62 Try something new Giving back by sponsoring a local sports team 64 Out and about Take advantage of the UK’s breathtaking scenery last word 66 Guy Browning The connections that can alter the course of your business

62 This edition of First Voice went to press on 31 January. All information is correct as of that point. inside february-may 2023 first word

hope you enjoy reading this edition of First Voice which you receive as part of your membership with FSB. We'd like to ask you to please consider the environment when you've finished reading it and pass it on to colleagues, friends, family or your business associates to have a read too before recycling it. FSB takes the privacy and protection of your data very seriously, and if you would like to find out more about this, please visit www.fsb.org.uk/privacy. If you would prefer not to receive the magazine at any time, please contact Customer Services on 0808 20 20 888 or by email to customerservices@fsb.org.uk Federation of Small Businesses Registered Office: Sir Frank Whittle Way, Blackpool, Lancashire, FY4 2FE. VAT No. 997 3427 63. The National Federation of Self-Employed and Small Businesses Ltd (FSB) is registered in England, number 1263 540. While every care has been taken in the compilation of this magazine, errors or omissions are not the responsibility of the publishers or of the editorial staff. Opinions expressed are not necessarily those of the publishers or editorial staff All rights reserved. Unless specifically stated, goods or services mentioned are not formally endorsed by FSB, which does not guarantee or endorse or accept any liability for any goods and/or services featured in this publication. ISSN 2399-5467 Copyright: FSB Publications Ltd This copy of First Voice magazine, and the paper envelope it was delivered in, are 100% recyclable FSB Publications: Email: publications@fsb.org.uk Tel: 0808 20 20 888 fsb.org.uk FSB Editorial Director: Alan Soady able o hat u c, feelit’sgoodforustolookat R Printed by Warners

We

ORG ID REGISTERED ORGANISATION

heads up

Recognition for FSB stalwart

Natalie Gasson-McKinley, FSB Development Manager for Derbyshire and Nottinghamshire, has been awarded an MBE for services to business in the East Midlands.

Tax changes coming into force in April

ARANGE OF TAX CHANGES WILL come into effect from April:

Corporation tax: Rises to 25 per cent for companies with annual profits of over £250,000. Those with profits of £50,000 or less will remain at 19 per cent, with a marginal relief system in between.

Business rates: Rateable values will reflect the property market as of 1 April 2021. In England, a support package will help firms whose bill is increasing and that stand to lose small business or rural rate relief. The Government, in this case, has pledged bills will go up by no more than £600 for the 2023-24 tax year.

In Wales, the non-domestic rates multiplier is frozen for 2023-24, and a transitional relief applies to all ratepayers whose bills increase by over £300. Those in retail, leisure and hospitality will get 75 per cent non-domestic rates relief.

The Scottish Government intends to freeze the business rates poundage and “reform and extend eligibility for the Small Business Bonus Scheme (SBBS)”. The threshold for 100 per cent relief will fall to £12,000, and the upper rateable value for individual properties to qualify for SBBS relief will rise to £20,000.

The Scottish Government will also offer Small Business Transitional Relief for properties that lose SBBS or rural rates relief. The increase in the rates liability will be capped at £600 in 2023-24.

IR35: Rules remain in place, and HMRC is expected to ramp up compliance.

Income tax: The personal allowance remains £12,570, with 20 per cent payable on earnings of £12,571-£50,270, 40 per cent on £50,271–£150,000, and 45 per cent on £150,000+. In Scotland, a 42 per cent rate will come in on £43,663£125,140 and 47 per cent on £125,140+.

Dividend tax rates: The same as 2022-23, but the annual dividend allowance will fall to £1,000 in April 2023, and to £500 from April 2024.

Annual Investment Allowance: This will remain at £1 million.

Making Tax Digital’s extension to Income Tax and Self Assessment has been pushed back. It will now apply to those earning £50,000+ from April 2026, and £30,000–£50,000 from April 2027.

See our feature on how to prepare for Making Tax Digital on page 44

The honour was awarded for her work championing small businesses to councils, education providers and other stakeholders. “Very often large businesses can dominate a conversation, so my role is to ensure the views of small businesses are heard,” she says.

It was also recognition for her activities outside of the day job.

“There was an element of the award that was for me using my voice to diversify boardrooms and decision-making spaces,” she says.

“That was for the work that I do with Nottingham Playhouse, and because I was one of 30 people selected from over 1,000 to take part in Lord Woolley’s Operation Black Vote leadership programme to nurture Britain’s future black, Asian and minority ethnic leaders.”

Ms Gasson-McKinley says she’d no idea she had been nominated when she received an email from the Cabinet Office.

“I spent a good while not being able to process the magnitude of it all,” she says. “Then, as the letter was sent in the strictest dence, a whole month of not being able to share my news followed and that was a real challenge.” Congratulations from all at FSB.

1 2 firstvoice.fsb.org.uk 6 | firstvoice | february-may 2023 8 THINGS YOU NEED TO KNOW

AWARDS

TAX

Cabi “I spent

go

t says.

in confidence month able new an re C f e

end n 2024. nce: on to nt m

be receiv

a

able

“Then was sent

as

Bank move on the agenda for SMEs

3 heads up need to know

Flexibility is the order of the day

quarter of small businesses are considering switching to a challenger bank in 2023, research by financial services review site Smart Money People finds.

A

Medium-sized businesses with 50-250 staff members are most likely to switch to a challenger bank or fintech.

The main reasons given for considering challenger banks were lower fees (45 per cent), higher interest rates (33 per cent), better online services (33 per cent), incentives such as cashback or free banking for a period of time (31 per cent) and better customer service (29 per cent).

The study suggests 51 per cent of small firms are thinking of reviewing their bank this year, with over half of these (54 per cent) considering a switch to a challenger bank or fintech firm, and 46 per cent looking at a high street bank.Jacqueline Dewey, CEO of Smart Money People, said: “Many so-called challenger banks are now household names as their user experience and agile approach has proven attractive and lured people away from the traditional high street providers. Our research shows that 2023 may be the year when small businesses follow this trend.”

Energy support significantly scaled back

The Government has announced that the energy support scheme to support businesses will be curtailed from April.

Under the new scheme, until March 2024, businesses with energy costs of over £107 per MWh for gas and £302 per MWh for electricity will receive a discount. Bills will be reduced by up to £6.97 per megawatt hour (MWh) for gas bills and up to £19.61 per MWh for electricity bills. Heavier users will get larger discounts.

Martin McTague, FSB National Chair, described the move as a “huge

firstvoice.fsb.org.uk

disappointment”. “For those struggling, the discount through the new scheme is not material,” he said. “Many small firms will not be able to survive on the pennies provided through the new version.”

Most small firms would now face a cliff-edge after March, he warned. “The fish and chip shop around the corner, your local pub, and the independent laundrette will see higher bills,” he added. “Gambling that wholesale energy prices will continue to fall is transferring the risk of further energy price shocks to small businesses.”

More employees would prefer to work flexibly than from home, according to a survey by HR and payroll firm MHR.

FINANCE HOME WORKING 5

It found 51 per cent would prefer to work from an office with flexible hours, while only 41 per cent chose working from home with structured hours.

The research suggests a lack of support and company puts many off home working. Two-fifths (41 per cent) noticed a fall in support from management and team members when home working, and 37 per cent said they felt lonely. A quarter (26 per cent) said a lack of social interaction contributed to burnout and 24 per cent said it made them less productive.

Anton Roe, CEO at MHR, said: “What is clear is the atmosphere and comradery present in the office simply cannot be replicated in a remote working environment.

“Flexible working puts employees in control of their hours and work environment, allowing them to tailor their ways of working to their own needs and resulting in increased engagement.”

41%

said their preference would be to work from an office with flexible hours chose working from home with structured hours

4 february-may 2023 | firstvoice | 7

UTILITIES

51%

Downing St do for Welsh food firm

AT THE END OF NOVEMBER

FSB member SamosaCo, based in Rhondda Cynon Taf, South Wales, was invited to feature as part of the Downing Street Festive Showcase 2022. The event saw Downing Street transformed into a bustling street market with 12 small businesses from across different sectors and regions of the UK.

Approximately 100 guests were invited to attend, including ministers, MPs, national and international journalists and photographers, along with a selection of entrepreneurs and business leaders.

At the event, SamosaCo representatives Tee Sandhu, Goldie Sandhu and Karen McCarthy presented Prime Minister Rishi Sunak and his wife Akshata Murty with their range of tasty food. They

INSURANCE

also discussed the background and ethos of the family business and the role the company plays as Export Champions of Wales for the Department of International Trade.

Goldie, Tee and Karen also met other members of the UK Government at the event, including Chancellor Jeremy Hunt and Minister for Small Business Kevin Hollinrake.

SamosaCo has gone from making fresh samosas for friends, family and customers in its Cardiff store to having a purpose-built factory making a wide range of authentic products, including its famous onion bhaji scotch egg.

Recession to spark new generation of businesses

One in three Brits plans to start a business in 2023 – up from just one in 10 people in 2022 – according to research by Quickbooks.

The study found that 34 per cent – or 17.9 million people – want to start their own firm, with 84 per cent planning to do so as a side hustle. Some 16 per cent intend to devote all their attention to their new venture.

The economic outlook is a factor, with 56 per cent saying inflation means they need to additional income and 42 per cent saying they are looking to protect their income.

Most (70 per cent) plan to finance the business with their own resources, 24 per cent aim to borrow from family or friends and 15 per cent plan to use government funding.

Many entrepreneurs are looking to the internet to build their business, with 43 per cent planning to launch a website and sell online, and 27 per cent expecting most income to come from social media as a creator or influencer business.

Small firms warned about under-insurance

Small businesses are risking catastrophe by failing to ensure their buildings are adequately insured, FSB Insurance Service has warned.

Research by RebuildCost ASSESSMENT.com suggests a staggering 79 per cent of properties are under-insured,

by an average of 31 per cent.

Even contracts that were originally based on accurate valuations may now be undervalued, says David Perry, Managing Director of FSB Insurance Service.

“Under-insurance is becoming a major concern in the

insurance industry,” he says. “It was initially fed by supply chain and labour issues and has been made significantly worse as we see inflation soar.

“The impact can be devastating to SMEs as any claim payment is reduced in proportion to

the percentage of underinsurance. We’re urging all members not just to check their rebuild and contents replacement valuations but also to make sure their business interruption and liability coverage meet requirements too.”

7 heads

up need to know

firstvoice.fsb.org.uk 8 | firstvoice | february-may 2023

FOOD AND DRINK

6 K

ENTREPRENEURS

SamosaCo founders Tee and Goldie Sandhu

8

data centre

CONFIDENCE

Confidence hits record low as economic concerns rise

Small business confidence fell to a record low outside of lockdowns in Q3 2022, as concerns over a looming recession grew.

FSB’s Small Business Index fell to -35.9, with those in Scotland and Cornwall the most downbeat. Confidence fell across every sector apart from IT and communication.

Small businesses across all sectors are being hit by rising costs, with a net balance of 85.4 per cent reporting increased operating costs. This was down on the previous quarter’s figure of 85.9 per cent – the first fall since Q1 2021.

This is also hitting revenue, with a net balance of -11.8 per cent reporting revenue growth during the quarter, and just 47 per cent having growth aspirations in 2023. More than one in 10 (14.1 per cent) expect to downsize or close in the next year. The domestic economy is seen as the biggest barrier to growth, cited by 60.6 per cent, but there was also a rise in those pointing to falling consumer demand, at 32.9 per cent.

The proportion of small firms applying for credit was 12.6 per cent, from 11.5 per cent in Q2.

BUSINESS CONFIDENCE BY SECTOR

27%

The proportion of SMEs planning to make cost savings through their workforce this year. Of these, some 44 per cent are looking at restructuring or redundancies, research from WorkNest claims

67%

The amount of small business owners who say they are happy with the state of their business despite the economic outlook, according to a survey by Vista

The amount of planned small business investment which didn’t go ahead in 2022, research from Together finds. SMEs invested £565,000 out of a planned £710,000

heads up in-depth

february-may 2023 | firstvoice | 9 firstvoice.fsb.org.uk

£145,000

SMALL

Most confident Least confident SMALL BUSINESS CONFIDENCE BY REGION -70 -60 -50 -40 -30 -20 -10 0 10 20 QUICK FIRE STATS Q4 2021Q1 2022Q2 2022Q3 2022 +15.3 -24.7 -35.9 20 15 10 5 0 -5 -10 -15 -20 -25 -30 -35 -40 -8.5 Information and communication Construction Wholesale and retail Manufacturing Accommodation and food service activities Professional, scientific and technical -46 -47 -28 -38 -37 -33 -28 -33 -29 -33

SMALL

BUSINESS INDEX SNAPSHOT

-67 -63 -57 -22 -16 +12

regional voice

Welsh Government heeds FSB call on business rates

The Welsh Government has responded to FSB’s calls and announced a package of support to ease business rates over the next two years.

NORTH OF ENGLAND Report assesses entrepreneurial potential amid lofty aspirations

FSB’s north of England team is undertaking research to feed into an upcoming report on what is needed to make the region the best place in the UK and beyond to start and grow a business.

The Entrepreneurial North research will look into the barriers to success impacting the small business community, giving small business owners the chance to feed in their views on what they need to thrive.

FSB’s recent Small Business Index found business owners across the north of England are among the least confident in the UK when it comes to their business outlook for the coming months.

Both FSB members and non-members have been invited to input their views, to ensure the experiences of grassroots business owners inform and direct the outputs of the report.

FSB’s Policy Representative for Yorkshire, The Humber and the North East, Mohammed Hussain,

said: “Across the north-west, north-east, Yorkshire & The Humber, 99 per cent of the 1.05 million businesses are SMEs and sole traders. Small business confidence and sentiment is at an all-time low, with businesses across the north faring below the national average.

“By their nature, small business owners and entrepreneurs are dynamic and innovative – resilience and optimism are core attributes of those who choose to take the self-employment leap. Their confidence and optimism taking such a huge plunge is indicative of the significance of the challenges they face.

“Now more than ever it’s crucial to ensure policy and decisionmakers understand the challenges for businesses in the north and act to address them.”

If you’d like to share your experiences and views as part of the research, please email Reshma.Begum@fsb.org.uk

The upcoming draft Welsh Government Budget will see the non-domestic rates multiplier frozen for 2023–24 to combat inflationary pressures, and a transitional relief for ratepayers whose bills increase by more than £300 following the UK-wide rates revaluation in April.

The Welsh Government also announced that those within the retail, leisure and hospitality sectors will receive 75 per cent non-domestic rates relief for 2023-24, up from the 50 per cent provided in 2022-23. The support package is expected to be worth more than £460 million over the next two years.

Ben Cottam, Head of Wales at FSB, said: “This announcement provides some much-needed certainty for small businesses.

“FSB Wales has long called for the Welsh Government to use its business rates levers to support small businesses, and are pleased to see Welsh Government respond with a package that provides breathing space and support to the firms that hold the key to reviving our economy.”

10 firstvoice.fsb.org.uk 10 | firstvoice | february-may 2023 heads up area update

WALES

ROUND-UP

OF REGIONAL NEWS

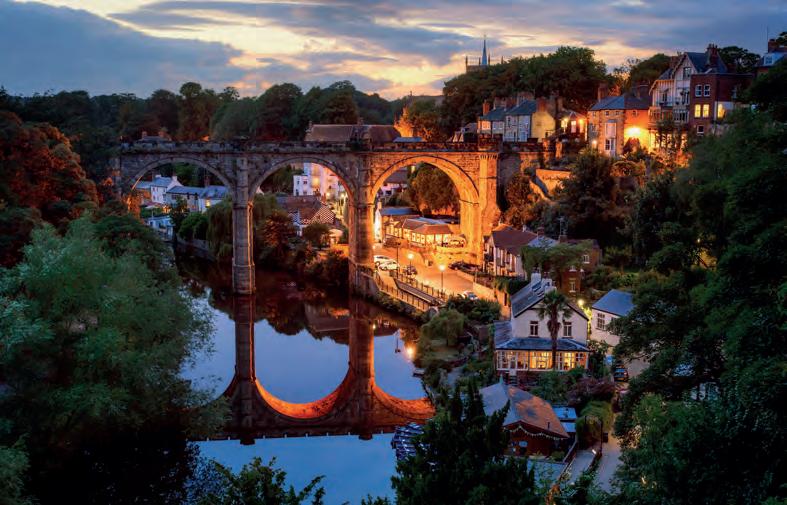

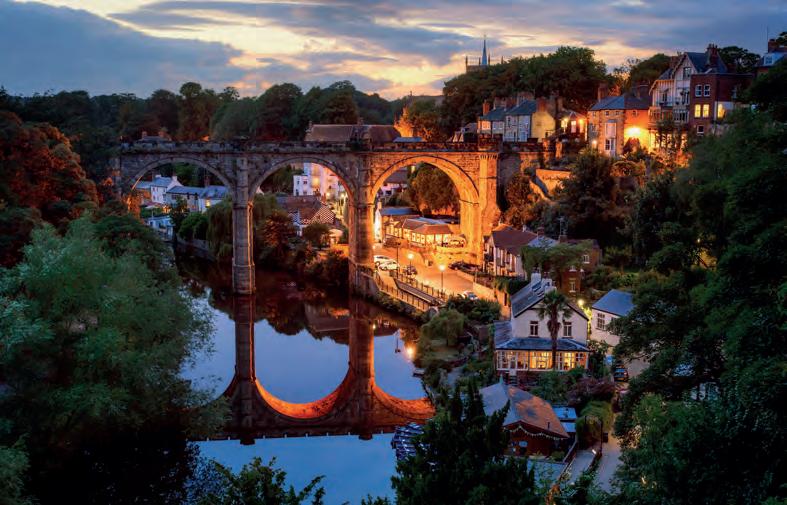

Knaresborough, North Yorkshire

South-west councils rewarded for SME support

Four south-west councils have been awarded prestigious FSB ‘best in the region’ awards for their support for the local small business community.

The four – Cheltenham, Cornwall, East Devon and Bristol – were among 250 councils in England that entered the inaugural FSB Local Government Awards, to recognise the councils that go the extra mile to try to support and encourage their local SMEs and self-employed business owners.

Cheltenham Borough Council was named as the south-west regional winners in the Covid-19 support category, East Devon District Council scooped the future-ready prize, Cornwall CIOS was honoured for its programme of business support while Bristol was named as the south-west champion in the ‘all round business friendly’ category.

Gloucester City Council, South Gloucestershire Council, Cotswold District Council, Swindon Borough Council, Somerset County Council, Stroud District

SCOTLAND

First Minister recognises Scottish entrepreneurism

FSB was pleased to accept an invitation from Scotland’s First Minister Nicola Sturgeon to her official residence to celebrate winners of its Celebrating Small Business Awards. Winners from 2020 and 2022, including representatives of both years’ overall Small Business of the Year Award winners, came together to talk about their achievements with the First Minister.

Speaking after the event, FSB’s National Chair Martin McTague (pictured with Nicola Sturgeon) said: “It was a great honour to receive such a warm welcome from the First Minister. Our Celebrating Small Business Awards showcase the best of the small business community across the country and, in these difficult times, it’s

more important than ever that they know we’ve got their back.

“We welcomed businesses from every part of Scotland – from the urban bustle of the cities, to the rural splendour of the Highlands – and in every sector from manufacturing, ecommerce, education, tourism, retail and more. They are hugely diverse, but have one thing in common – they’ve come through several exceptionally difficult years and are still delivering for their customers.

“If this is what they can do in the teeth of a pandemic and cost-of-doing-business crisis, just imagine what they’ll be doing when more favourable trading conditions return. The sky will be the limit.”

Council and Somerset West and Taunton Council were all featured in the regional shortlists, with judges admitting to being very impressed with the quality of entries from all across the region.

All the winners were announced at an online FSB awards final – which recognised SMEs throughout the whole of the UK – and, following the presentations, FSB volunteers and staff visited the local councils that had won prizes to present them with trophies.

heads up area update

SOUTH-WEST

february-may 2023 | firstvoice | 11 firstvoice.fsb.org.uk

FSB Gloucestershire’s Russell Warner presents Cheltenham Borough Council representatives with their FSB award for support during Covid

heads up area update

LONDON

Council awarded for promoting pop-ups

Representatives from Westminster City Council called into FSB’s new Westminster offices to pick up its Local Government award for its work in promoting pop-up businesses.

The award recognised Westminster’s Meanwhile Activations Programme, which aimed to enliven vacant premises and provide a unique opportunity for small businesses and artists to occupy rent and rate-free space in the West End. This included applying National Non-Domestic Rates Localism Relief to remove rates liability.

The first phase of the scheme focused on emerging local and UK artists and cultural organisations, and the second on attracting up-and-coming local and UK-based entrepreneurs to deliver experiential retail, transforming larger vacant stores on Oxford and Regent Street into mini-department stores.

At the time of writing, the programme has activated 12 void units and supported over 43 brands, emerging artists, social enterprises and start-ups.

WEST MIDLANDS

Event highlights eco benefits for businesses

FSB took part in a sustainability event run in conjunction with other organisations, with the aim of highlighting how environmentally sound policies can also be good for business.

Michael Goodall, Development Manager, Shropshire, Herefordshire and Worcestershire, was involved on the steering group, and helped to shape content for the event. “My main aim was to imbue a strong small business focus, highlighting the commercial benefits of being more sustainable as well as the ecoarguments,” he said. “This included coming up with the ‘Be Leaner, Be Greener’ tagline, which was adopted in pre, during and post-event publicity.”

Sue Tonks, FSB Regional Chair West Midlands, gave a closing statement to the audience of local businesses and stakeholders, which highlighted FSB’s sustainability hub and work on Clean Air Zones.

Other bodies taking part in the event included The Business Environment Network, Shropshire Growth Hub, Oswestry BID and the Wildlife Trust.

The event was hosted by Oswestry-based business Aico, which manufacturers smoke and CO detectors.

SOUTH-WEST

FSB part of ambitious new south-west ‘powerhouse’ vision

FSB is supporting plans to establish a new economic ‘powerhouse’ in the south-west that could bring jobs and support for small businesses across a wide area of the region.

The Great South West powerhouse had its official Parliamentary reception in the middle of January to launch its ambitious prospectus. FSB representatives from both Devon and Cornwall joined forces with MPs, local authorities and Local Enterprise Partnerships at the event to stress the collective desire to make this a success for the region.

The new Great South West powerhouse will cover Cornwall, Isles of Scilly, Devon, Somerset and Dorset. It aims to secure the sort of financial and economic support already enjoyed by established powerhouses elsewhere including Greater Manchester, the West Midlands and the recently formed Western Gateway, which covers the northern part of the south-west including Gloucestershire, Bristol, Bath, Wiltshire and North Somerset.

Karl Tucker, Interim Chair of the Great South West Partnership, said: “Together, we have the potential to become a world leader in the blue and green aspects of our economy, strengthening our region’s clean growth and contributing to the country’s journey to net zero.

“This is a key moment in the journey of the south-west, which is why we are delighted to set out the breadth and scale of our region’s blue and green opportunity in Parliament, as part of our work to gain further Government support.”

Pictured from left to right are Renata Guerra, West End Activation and Pop-up Project Manager; Councillor Geoff Barraclough, Cabinet Member for Business; Councillor Adam Hug, the new Leader of the Council; and FSB National Chair Martin McTague.

firstvoice.fsb.org.uk 12 | firstvoice | february-may 2023

Have your say

costs and complexities for small rms expanding into new markets.

We also touched on specific challenges faced by women-owned SMEs.

overshadowed by the ‘good vs. bad’ nature of the commentary around the dispute.

businesses to trade with.

THE US TOPS THE LIST FOR UK small

Nearly half (46 per cent) of FSB members who trade internationally pick the US as the most important individual country market to export to, and in a span of four quarters to the end of June last year, more than 20 per cent of the UK’s total export went to the US –totalling £142 billion, according to the most recent Government figures.

However, trading with the US is not without challenges. The complexity of federal and state rules and the lack of market knowledge are of particular concern for UK small firms.

Free trade agreements (FTAs) are essential to support small exporters in this space. More than a third of small business exporters think FTAs are the most useful intervention to help them increase the value of exporting activity. With the Government’s freedom to strike new trade deals, we’re campaigning to prioritise markets that our members flag as key, and the US is one of them.

At the UK-US SME Dialogue in Edinburgh last November, we made clear the importance of the US market to small businesses here and discussed the need to use digital tools to reduce paperwork, streamline trading practices and reduce

When it comes to UK-US trade negotiations, it’s inevitable that the Northern Ireland Protocol is looked at – Washington has been actively engaged in this discussion. As things stand, our members sit within a number of categories: those for whom the Protocol is working well; some that are protected from its worst impacts because of the grace periods; and others in service businesses where it has no real relevance.

One of the main tenets of the Belfast/ Good Friday Agreement was the need to support minorities, so it should be of great concern that the operation of the Protocol is seeing a significant minority of businesses badly impacted. Supporting this group, which is suffering as a result of the arrangement’s deficiencies, should be at the forefront of everyone’s minds.

In the runup to the 25th anniversary of the Belfast/Good Friday Agreement, I’ll be leading an FSB visit to Washington in March, picking up where we left off in November. It’ll be an occasion to meet and make friends and allies in different parts of the US polity and, most importantly, fly the flag for further co-operation to bring down trade barriers facing SMEs.

What enables FSB to engage in these dialogues and influence policy is evidence from our members. FSB’s Big Voice online research programme is a backbone of our policy and advocacy work. All members are encouraged to be part of the Big Voice community so that we get evidence from members across all sectors, from all regions and backgrounds, and of all sizes and stages in their business journeys.

However, a significant minority are really struggling to navigate the scale of customs declarations, compliance checks and increased staff and transport costs as a result of the new trading regime between Great Britain and Northern Ireland. The disproportionate impact of the Protocol on these businesses, mainly micro and small firms, has been

I encourage members who have not already done so to sign up to Big Voice at fsbbigvoice.co.uk. The surveys are designed with busy small business owners in mind and so take very little time, but the outcome is far-reaching.

february-may 2023 | firstvoice | 13 firstvoice.fsb.org.uk heads up UK/US trade relations

The US remains our most important country from an export perspective, but the Northern Ireland Protocol is causing headaches for many small firms. It’s time to ensure your voice is heard

A significant minority are struggling with customs declarations, compliance checks and increased staff and transport costs

an P fi cost c firm fi We al faced f fa a ac c ce When Wh negotiati negoti N Noorrtth

TINA MCKENZIE is UK Policy and Advocacy Chair, FSB

Illustrations: Sam Kerr

TINA MCKENZIE

heads up late payments

LATE LAST YEAR, I WAS TALKING to business owners in York. We talked about the state of small business and the situation in the city, where optimism is holding up as tourists make a beeline for it.

The issue of payments arose, but it isn’t the top concern. Skills shortages dominate, with the cost of doing business being the second-biggest concern. How do you protect margins and keep prices affordable when your materials costs are rising by 30 or 40 per cent?

Payments underly all this. Cashflow is king. If you have cashflow gaps, it’s increasingly difficult to bridge them. Banks suggest simply extending overdrafts – cheaper, many tell me, than invoice financing. Cards (personal and business) are maxed and friends and family are supportive but have their own cost-of-living increases to manage.

People working in accounts payable departments usually haven’t run their own small business – while small business owners, used to doing all their own marketing, invoicing, accounts and so on, don’t realise that their invoice is one of thousands caught up in complicated approvals and payment systems.

We hear from big businesses that aspire to pay 95 per cent of invoices to small businesses within 30 days. Many are spending millions on updating their processes – but not all firms will get board approval for the necessary spend while there are competing demands for R&D, equipment, training and so on.

understand how to make invoices payable, put payment performance on governance audit and environmental, social and governance agendas, and communicate.

Small firms need to be paid quicker. Worrying about your limited cash resources while waiting to be paid causes sleepless nights and mental health issues.

During the pandemic, many big fi realised it was in their own interest to pay small suppliers quicker than competitors, and average days-to-pay dropped slightly. However, research from EY and Xero shows that figure increasing again, to around 36 days. Some firms are offering extended payments terms; I heard a case where suppliers were told that terms were increasing immediately from 30 to 60 days, with no opportunity for negotiation.

Small firms can offer their own payment terms, negotiate better terms or walk away –which takes a brave person. Where will the next job come from? Will terms be any better? If you negotiate, will the customer find a new supplier? Does pushing back damage the relationship?

, than and nd ir own e ker. causes h issues. g firms st to pay petitors, EY and g again, re ms; I re told , with wn er terms rave b come

The Small Business Commissioner (OSBC) team resolves disputes involving amounts ranging from a few pounds to hundreds of thousands. Big firms often don’t realise that owing £300 to a small business for a few days can be existential.

We need to understand each other better, build closer relationships, apply the principles of partnership working and stewardship, onboard suppliers so they

better build closer the principles of partnership working and the pr steewwar

does the cl 30/60/90 d invoice? O month-en

What are your standards terms? When does the clock start ticking on ‘within 30/60/90 days’? On date of receipt of invoice? On approval? On 30 days month-end, as one woman in York gets paid? Small firms need certainty about when the cash will hit their account. Clear, consistent, comprehensible communications between small suppliers and bigger customers will help. Calls for legislation to mandate payment to small rms within 30 days may be heeded, but we must be clear what ‘30 days’ means and have resources for enforcement. is will take time. In the meantime, do the right thing. Paying quickly and fairly is reputationally positive, benefits everyone, and investors love it. Small rms need certainty. #PayDontDelay

LIZ BARCLAY is the Small Business Commissioner. Views expressed are those of the author and not necessarily those of FSB

Paying the price

firstvoice.fsb.org.uk 14 | firstvoice | february-may 2023

Closer relationships and better communication between small and larger businesses are needed if we are to break the devastating cycle of late payment

Big firms often don’t realise that owing £300 to a small business for a few days can be existential

r? If nd

when the Clear, c communi bigge legislation

wit we must and have This w the is reput everyo firms

Sma

firms

LIZ BARCLAY

ITH AN ECONOMIC DOWNTURN

Wlooming, small businesses are feeling uncertain. Running a small business has always been an evolving process that involves a lot of challenges, and never more so than now.

As a futurist, it’s my job to predict the critical future trends that businesses must be ready for. No matter what industry you’re in, technology will impact your business, and getting ready for change will be important to maintain your edge.

What’s the best way to prepare for 2023, specifically around technology? How can you make the right decisions for your company? These are the key business and technology trends you must be ready for.

Artificial intelligence

Artificial intelligence (AI) has become ubiquitous, and more small businesses are finding ways to optimise their processes and provide new products and services with AI tools. In 2023, ‘as-a-service’ and no-code AI platforms will make AI more accessible to small businesses that want to improve and manage products, automate services and leverage customer data.

Small business owners can also augment their workforce with AI. Some jobs will disappear, but new ones will emerge to replace them. The skills that machines can’t replace, such as critical

heads up future trends

In with the new

thinking, problem-solving and emotional intelligence, will be highly valued, and small businesses should have a training plan to upskill and reskill their workers.

Immersive customer experiences

One of 2022’s biggest trends was better customer experiences. Customers are demanding a high-quality experience as part of their buying journey, and this is one way to differentiate yourself.

Many consumers now make buying decisions based on ethics

Small companies can use technology to streamline the purchasing process. This can include customer service portals and recommendation engines, but could also expand into providing immersive experiences, both in-person and online.

The metaverse – a catch-all term to describe the next iteration of the internet, where we will interact with brands and peers through immersive technology such as virtual reality and augmented reality – will be one of the hottest trends in 2023.

Prepare by thinking about how you can use the metaverse to deliver more immersive, rewarding experiences. Also think about how you can use metaverse platforms to work collaboratively,

onboard and train employees, and make processes more efficient.

The talent challenge

Since the beginning of the pandemic, workers have been reassessing what they want from their careers. This has put pressure on employers to provide enticing work environments. Small businesses are competing for workers with the biggest companies. Rise to the challenge by providing:

The flexibility of remote or hybrid work

A diverse, values-oriented culture Opportunities to grow and learn Fulfilling, engaging work at all levels.

Conscious consumerism

Many consumers now make buying decisions based on ethics, with two-thirds saying they are “belief-driven” and want to buy environmentally-friendly products from businesses with environmental, social and governance principles.

Small businesses should reduce packaging waste, decrease energy and water consumption, and be fully transparent about manufacturing and supply chain practices.

Whether you’re new or established, change is afoot; keep your eye on these key trends to stay competitive.

BERNARD MARR is a futurist, strategic advisor and author of Future Skills: The 20 Skills and Competencies Everyone Needs to Succeed in a Digital World (Wiley). Views expressed are those of the author and not necessarily those of FSB

The start of a new year is a good time to engage in a bit of trend-spotting, helping you identify the big technological changes that will shape the world of work over the next 12 months

BERNARD

in th t think thhiin em va ha re Imm One o e custo t to o BER february-may 2023 | firstvoice | 15 firstvoice.fsb.org.uk

MARR

12% The productivity boost derived from having happy staff, according to the University of Warwick

1.8bn

The number of hours office workers lose as a result of dated technology, according to Insight

feature productivity 16 | firstvoice | february-may 2023

TURBO CHARGE YOUR FIRM

The one crumb of solace for small businesses upended by Covid-19 was that the two things it accelerated – digitisation and greater flexible working – were both supposed to have improved the UK’s much opined ‘productivity problem’. FSB data shows just that just 40 per cent of SMEs had or used cloud services in 2018 – a figure that will be much higher today.

But despite the greater uptake of technology, UK productivity is still in a parlous place. The UK’s productivity growth was already the second slowest of the G7 between 2009-19, and in Q3 of 2022 output per worker fell for the second consecutive quarter.

The timing for all this couldn’t be worse. With the country heading towards a recession, inflation hitting a record high, and consumers cutting back,

small firms are finding it extremely challenging to grow and invest further. But when productivity is an issue that’s confounded economists for so long, is there anything SMEs can do that would really make a difference?

Cold realities

A simple approach – suggest experts –is for SMEs to try and put their finger on exactly where their productivity problems lie. But, given this is no easy task, there is a risk they follow their own ideological view about how gains are driven, rather than confronting the actual reality in front of them. “Productivity tends to be talked about around three areas – staff skills; investment in technology/machinery; and cultural considerations,” suggests Chris Russell, Senior Policy Manager at FSB.

“Our own Scaling Up report talks about the link between skills and

february-may 2023 | firstvoice | 17 firstvoice.fsb.org.uk

feature productivity

Photography: iStock

At a time when the economic outlook is worsening, small firms need to do all they can to ensure they – and their staff – are operating as productively possible. Peter Crush outlines how to give your firm a boost without the need for expensive investments

productivity, as does our Innovation, but I suspect the real issue is trying to find out which will produce the most quick wins. Upskilling takes longer to show a return, but when firms are literally struggling for survival, are they really going to be implementing artificial intelligence or ecommerce or customer relationship management systems – even if they promise to yield efficiencies?”

Those who believe in investment suggest making iterative improvements, but only doing so if it’s aligned to an actual productivity-gain outcome. “Key is seeing where processes are disconnected, or which consume time, and then applying solutions, such as using invoice data automation that runs overnight,” says Stefano Maifreni, Founder of consultancy Eggcelerate, which aims to turbo-charge stagnating SMEs. “By focusing on the outcome – here tech can do the work of a fulltime employee for only 30 per cent of the cost – the decision to invest is clear. Just hiring someone to fix a problem doesn’t boost productivity, it worsens it.”

Rob Bright, CEO of training software provider Cloud Assess, agrees: “Training spend has to deliver new skills, otherwise what’s the point? Linked to this is understanding how employees best

learn new skills – whether it’s online or in-person. True skills development only happens when people make new connections in their brain and can practise and become exposed to a new skill time and again.”

Root causes

Studies say that poor productivity has structural roots, such as having too many meetings – Otter.ai research finds 31 per cent are ‘unnecessary’ – or not having the right equipment (UK workers waste 1.8 billion hours a year because of dated technology, according to research by Insight).

“We haven’t thought carefully enough about how time is used,” suggests Sharath Jeevan OBE –author of Intrinsic: A manifesto to Reignite our Inner Drive. “I’m not talking about time management – that’s been done to death – but rather whether time is being put to the right place.

“Leaders aren’t aligning their time to a specific mission – such as boosting customer

Getting more out of staff

Judith O’Leary, founder of Edinburghbased PR and digital marketing agency Represent Comms, faced a difficult question. “We were anticipating small growth, but with looming uncertainty too, I was at something of a crossroads about whether to hire a new person,” she recalls. “Would doing this take time away from other staff, thus impacting their productivity? Or could we accommodate more work using our existing resources by working smarter?”

Intrigued by the challenge of the latter, she enrolled staff on a neuroscientifi app-based programme called Positive

Intelligence (PQ), developed by Shirzad Chamine, author of Positive Intelligence

It helps people identify traits that are their ‘saboteurs’ (including the ‘judge’, ‘controller’, ‘avoider’, ‘stickler’, ‘victim’ and ‘hyperachiever’), and the aim is for employees to do daily mindfulness exercises, or ‘PQ-reps’.

“The app teaches us how our saboteurs make us unproductive,” says Ms O’Leary. “If people are experiencing stressful moments, they take short time-outs or meditations that allow them to re-centre themselves, rather than trying to tough things through.”

As a timesheet-based business, Ms O’Leary says she clearly sees the productivity benefits (faster press release writing, which contain fewer errors, meaning quicker proofreading, too) – but staff also report better mental health. Time saved is now used to develop new ideas or campaigns, meaning clients are serviced better.

“We feel we have capacity to take on extra tasks,” she adds. “There are only five of us, but we’re all quite senior, so our people are expensive. Getting more out of them without overwhelming them has given us a real productivity boost.”

firstvoice.fsb.org.uk 18 | firstvoice | february-may 2023

feature productivity

tise to again or tu entific m ut edit them to re-centre t an n s ne it’s on Tru e

31%

Otter.ai

The proportion of meetings that are unnecessary, according to

experience, which would boost orders and productivity,” he says.

“Rather than being ‘busy-being-busy’, they need to ask if they’re using their time to take the organisation to a place where it wouldn’t otherwise be.”

Create a clearer vision; experts argue this also tackles the staff engagement contribution to productivity. “Productivity is linked to strategy and staff knowing where they fit in,” argues Jeremy Campbell, business transformation expert and CEO of leadership and growth consultancy Black Isle Group.

At a time when the concept of the ‘Great Resignation’ is rife (not actually quitting, but mentally quitting and only doing the bare minimum), it makes sense that productivity will fall if staff don’t feel motivated to go the ‘extra mile’. He says: “Motivation, in combination with people doing the right tasks, is where productivity will rise.”

Gavin Howarth, Managing Director of Howarths Employment Law – which also runs a ‘Growth Club’ service for SMEs – agrees: “Disengaged staff will only be productive two days out of five, compared to engaged staff who will be productive for four days out of five. One top tip is to focus not so much on engagement, but what factors drive disengagement – from pay, to perks, having proper performance processes and opportunities for advancement.”

Additional measures

There are other areas in which small business owners can make a difference. FSB’s own New Horizons report found 41 per cent of SMEs say their broadband is unreliable, and 47 per cent say that they experience unreliable mobile data connectivity. Seeking better connectivity could solve this.

Better perks could be a pre-emptive spend. New data by Westfi suggests SMEs face spending £22.5 billion in recruitment costs alone to replace the 7.5 million small business workers looking to move roles next year, with all the productivity issues that losing staff brings.

Don’t ignore culture either, says Liz Villani, Founder, BeYourselfAtWork. “SMEs looking to address sluggish productivity must start with their people because they have the greatest impact on any business,” she says. “Too many people still believe that to succeed at work, they need to be someone –to adopt a ‘work’ persona – but it is exhausting and stressful, and it stops us all from doing our best work.” Adds Caroline Hawkesley, Chief Operations Officer at Progeny: “Job satisfaction tends to go hand in hand with increased workplace productivity, with research by economists at the University of Warwick finding happiness made people around 12 per cent more productive.”

The uncomfortable truth is that if productivity was so easy to fix, it wouldn’t be such a difficult issue to overcome, so the message for leaders is to try and understand what makes their own staff tick. “It’s people’s skills, knowledge and abilities that create competitive advantage,” says Heidi Thompson, HR Director and Head of Payroll at Duncan & Toplis chartered accountants.

“I would put most focus on retaining the talent you already have. During the cost-of-living crisis, SMEs may not be able to offer the sorts of pay increases employees might like, but enabling flexible working to help reduce commute times or travelling costs can still add real value, and will earn back better motivation and productivity.”

In these current difficult times, such simple steps could make a real difference to how well your business performs.

Unlimited training for FSB members

In November, FSB went live with a new partnership with training provider Staff Skills Training, offering members access to 685 (and growing) courses at a maximum cost of £80 per year.

“After an extensive selection process, we landed on working with Staff Skills Training because it is specifically geared up to working with SMEs,” said FSB Product Manager Connor Gibbs-Murray. “We want to save businesses money, but also give them access to skills that will count towards employees’ continuous professional development.

“An annual one-off payment per user gives unlimited access to the whole suite of courses offered – ranging from dealing with General Data Protection Regulation requirements to food hygiene and anything your business needs –and new ones will be added monthly,” he adds.

“Staff training can be one of the first casualties when times are tough, but we want to help SMEs to get into the habit of upskilling their staff. Removing cost barriers is one way of doing this.”

february-may 2023 | firstvoice | 19 firstvoice.fsb.org.uk feature productivity

PETER CRUSH is a freelance business journalist

experience uld fea produ nl

With the economic landscape worsening and interest rates rising, it’s vital small business owners stay on top of their finances and those of their firm, to ensure they operate as effectively as possible. Penelope Rance outlines how to cope with the various challenges that lie ahead

CONTROL STAY IN

firstvoice.fsb.org.uk feature financial

management

20 | firstvoice | february-may 2023

THE FINANCIAL situation is precarious for small businesses, with rising interest rates, loan repayments and energy costs, and the economy suffering.

FSB’s October Small Business Index (SBI) showed 43 per cent of SMEs experiencing falling revenue, with 41 per cent expecting this to continue in the coming quarter. Rising costs hit 89 per cent of small firms, with a growing number seeking finance to manage cashflow.

Action is essential before financial issues become unmanageable. “If you start to struggle, don’t leave it too late,” says Daryn Park, FSB senior policy adviser on finance, tax and economic policies. “If you flag issues early, you open more doors to pragmatically approach them. If you leave it, your options become limited.”

There is a range of support for SMEs facing economic hardship, and

practical steps they can take to proof the business against the most pressing financial issues.

1Covid loan repayments

The Bounce Back Loan Scheme lent £46.6 billion to businesses and repayments are now due, starting 12 months after the loan was taken out, for six years. If a company is dissolved, outstanding loans may be investigated.

Pay-as-you-grow arrangements are available to help firms to manage cashflow and grow. These include 10-year payment terms at the same interest rate; reducing payments to interest-only for six months up to three times during the repayment period; and taking a single repayment holiday of up to six months.

“Only around 30 per cent of businesses have taken up ‘pay as you grow’ options,” says Mr Park. “This is a good form of support, the full extent of which many businesses may not be aware of.”

The Little Sri Lankan

Started during the first lockdown, Stockport takeaway The Little Sri Lankan was founded by Malanie Tillekeratne and husband Michael Hooper to share their love of Sri Lankan cooking. It has expanded into curry packs, market stalls, supper clubs and pop-up events.

Based in the couple’s kitchen, the microbusiness is vulnerable to the economic climate. “People aren’t eating out as much, or they’re not in the offi ce needing lunch, which has impacted our sales,” says Mr Hooper. “We’ve scaled back to ensure we can continue.”

This has included reducing portion sizes and prices, and incorporating

more plant-based and seasonal foods. “We’re focusing on growing our supper club business, private events, and jarred goods,” he adds. “We had to increase supper club prices to reflect hikes on basics such as oil and flour. But we changed vegetable and meat suppliers to lower costs, and we’ll be doing a cheaper street-food concept.”

Free support has helped, such as from the Nationwide Caterers Association. “We’ve learnt from industry experts and fellow entrepreneurs,” says Mr Hooper. “We attended Meta’s Good Ideas Studios in Manchester – a free event with panels, workshops and training –to help us grow, primarily online.”

firstvoice.fsb.org.uk february-may 2023 | firstvoice | 21 feature financial management

IKON

If a director cannot meet their debts, they should speak with a regulated insolvency practitioner

Illustrations:

Companies struggling to clear Bounce Back loans should speak to their lender, as repayment options may depend on other finance arrangements.

2Energy price rises

FSB’s latest energy survey found that 46 per cent of small businesses have raised prices to mitigate energy costs, although it has been impossible to pass on full costs to consumers amid the cost of living rises. In addition, 32 per cent have cancelled or scaled down plans to invest in and expand the business, and 20 per cent have reduced staff numbers or suspended recruitment and temporarily closed part of all of their business.

There is also the Government’s Energy Bill Relief Scheme, providing discounts on wholesale electricity and gas prices for non-domestic customers on contracts agreed on or after 31 December 2021. Businesses get a supported wholesale price of £211 per MWh for electricity and £75 per MWh for gas (for fixed tariffs), under half the predicted wholesale price. Reductions depend on the tariff type.

“Businesses don’t have to do anything to access the scheme: suppliers include the discount in their bill,” says Friederike Andres, FSB’s energy, environment and transport policy advisor. “It runs until April, but after this point support will be dramatically reduced.”

Firms should also check they’re on the most suitable contract. Citizens Advice and providers can advise on this. “If you’re struggling to pay your bill, contact your supplier about a manageable debt repayment plan, because if you don’t pay, you’ll be disconnected, and face a disconnection charge, as well as a reconnection fee,” warns Ms Andres.

Government support

The Government’s interactive business finance and support finder (gov.uk/ business-finance-support) highlights 150-plus resources for loans, finance, grants, mentoring and funding, searchable by business sector, size and location

The Business Support Helpline (gov.uk/business-support-helpline) will connect you to a business adviser and other resources

Local Enterprise Partnerships run growth hubs (lepnetwork.net/local-growthhub-contacts) which have contacts for advice and funding

Citizen’s Advice has specific information on what to do if you can’t pay energy bills (citizensadvice.org.uk/consumer/energy/energy-supply/your-smallbusinesss-energy-supply/your-small-business-cant-afford-its-energy-bills)

Business Debtline can help those firms struggling more generally: businessdebtline.org

3 Tax increases

From April, corporation tax is increasing for businesses with profits of more than £50,000. The first £50,000 will be taxed at the existing rate of 19 per cent, but the next £200,000 will be taxed at 26.5 per cent, then 25 per cent on profits above £250,000. This is in addition to April 2022’s 1.25 per cent dividend tax increase.

“This is a massive increase for many businesses,” says Peter Bromley, Director

of AMS Accountancy. “They will have to find more money to pay the extra taxes. Some will have to make do with fewer staff, some will need to increase prices to survive, some will go bust, and all will have to tighten their belts.”

One way of managing the higher tax is to recognise income sooner and make expenditure later. “A pound spent after April 2023 saves more tax than one spent before April 2023,” says Mr Bromley. “It depends on a company’s year-end, but there is motivation to perhaps make optimistic stock valuations early, and make purchases later, to potentially save 7.5 per cent tax on a chunk of profit.”

4

Higher interest rates

“For those with unsecured loans, rapid interest rate rises have increased their effective debt exponentially,” says Mr Park. “This is a massive issue that many businesses weren’t factoring in when they took out debt. After a long period of low-

firstvoice.fsb.org.uk 22 | firstvoice | february-may 2023

feature financial management

41% The proportion of small firms that expect revenue to fall

interest rates, it’s creating a huge cost to small businesses.”

The first step in managing rising interest rates is understanding your liability, says Graham Lamont, Chief Executive of accountancy firm Lamont Pridmore. “Collect up-to-date information on the business, and get a forecast of how much the mortgage or loan will go up, then determine if you can afford it out of current cashflow predictions.”

If you can’t, ask your lender about flexibility in the repayment terms. “If you can extend the length of the loan, it’ll cost you more in the long run, but will take the heat out of the repayment process,” says Mr Lamont.

5

Debt management

The SBI found that 54 per cent of small businesses’ cashflow issues are compounded by late payment. While it’s hard to press clients for payment, being starved of cashflow is more so. FSB’s Debt Recovery offers specialist advice on recovering debts sooner, including a step-by-step process and downloadable guides for when a client won’t pay, plus experts on call. Visit fsb. org.uk/join-us/membership/ fsb-member-benefits for more information.

“Credit given to customers is important in managing cashflow,” says Mr Lamont. “The key is speaking to clients and making sure debt is caught with a payment plan and money’s flowing in rather than it stopping, and then having to manage debtors.”

6

Interlinked business and personal finances

Microbusinesses are often doubly vulnerable to financial upheaval. “Many sole traders and microbusinesses are treated by lenders as individuals, not businesses,” says Mr Park. “Directors’ business finances are often interlinked with personal finances, including loans with personal guarantees.”

Because microbusinesses and sole traders tend to be viewed as higher risk by lenders, the funding tap gets closed during economic turmoil, when they need it most. “For businesses unable to secure finance from traditional lenders, it’s a good time to start looking at alternative financing, which offers credit where you may otherwise not be able to in markets like this,” advises Mr Park.

7 Insolvency

For those who are struggling, having oversight of the business’s financial position and not ignoring requests from creditors is essential, says Kevin McLeod, Insolvency Practitioner at AABRS. “Often communication with creditors results in a better response than burying your head in the sand. Sometimes nothing can prevent insolvency, but working with creditors could resolve what may be a shortterm cashflow issue.”

If insolvency is unavoidable, act quickly to prevent additional debt accumulating. “As a partnership or sole trader, you’re personally responsible for that debt, and the sooner you can solve the problem the better, even if that means ceasing to trade earlier,” warns Mr Lamont.

“If directors cannot meet debts as they fall due or are aware that they’re heading for insolvency, they should speak with a regulated insolvency practitioner. An initial call will usually cost nothing,” adds Mr McLeod. “The more information you can provide, the better the advice will be. They will provide you with all the options available for your circumstances and explain the differences to you.”

PENELOPE RANCE is a freelance business journalist feature financial management

february-may 2023 | firstvoice | 23

54% The amount of small firms impacted by late payment

big picture PSTN switch-off 24 | firstvoice | february-may 2023 firstvoice.fsb.org.uk

BIG PICTURE

End of the line

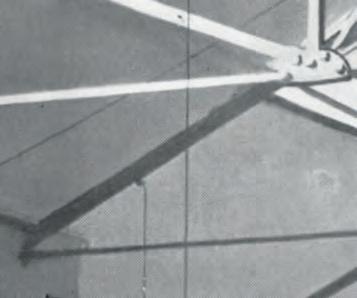

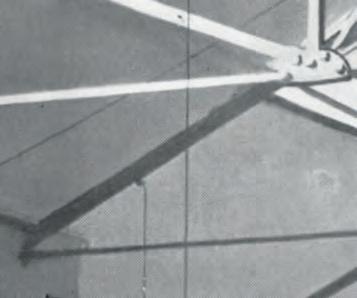

Telephone operators receive calls in the Post Office Central Telephone Exchange, City of London, around 1903. Telephone exchanges emerged in the late 19th century, following Alexander Graham Bell’s invention of the telephone in 1876, and the first public exchange in the UK opened in

big picture

PSTN switch-off

1879. In the early days operators would manually connect the small number of calls by hand, using the public switched telephone network (PSTN).

But after almost a century and a half the old analogue system is coming to the end of its life. In 2025, Openreach will stop the old PSTN (and ISDN)

service, meaning all customers –including businesses – requiring a landline will need to move to the digital network. It’s not just phones affected; businesses must also think about other services that connect to PSTN or ISDN lines, including alarms, point-of-sale systems and door-entry systems.

february-may 2023 | firstvoice | 25

firstvoice.fsb.org.uk

Getty

Photography:

BRAVE NEW WORLD

In under three years, the whole country will be using full-fibre infrastructure and internet technologies to make and receive calls, as well as for the delivery of other services. It’s time small firms woke up to the change, and started taking positive steps, says David

Adams

Adams

feature PSTN switch-off

26 | firstvoice | february-may 2023

ON 31 DECEMBER 2025, the UK’s public switched telephone network (PSTN) will be switched off. Although it has evolved to incorporate fibre optics and digital technologies, the PSTN – based on the first automated telephone exchange, invented in 1891 – is not fit for purpose in a fully digitally-enabled economy.

It is also becoming operationally and financially unfeasible for the network operators, BT, Virgin Media and KCOM, to maintain both the PSTN and the newer infrastructures that now support most of the UK’s internet use. Instead, the country is transitioning to a system based on ‘full fibre’ ethernet connectivity.

By the end of 2025, any telephony and other services that run on the PSTN – including fibre to the cabinet and asymmetric digital subscriber line-based telephony and broadband services, plus integrated services digital network lines, fax machines and many point of sale systems – will need to be delivered via a full-fibre infrastructure, rather than the copper wires that carry at least the final stage of the PSTN internet services used today. Landline phones will need to be internet-based, probably using Voice over Internet Protocol (VoIP) technology.

The switch to full-fibre technologies should deliver better quality telephony, broadband and other digital business services. But what do you need to know and do before 2025? And why do so few people seem to know about this change?

Advance warning

FSB research conducted in 2019 suggested that about 40 per cent of small businesses use broadband delivered via the PSTN, including many based outside larger urban areas. FSB senior policy advisor Chris Russell suspects that the proportion is probably very similar today, in

part because small businesses may have been even less likely than usual to have switched broadband providers during the past three years. “A significant chunk of businesses will be affected,” he says.

Network operators will give customers 12 months’ notice before sales of PSTNbased products and services end in their area. Nonetheless, it would clearly be wise to prepare for the switch-off in advance. The first step is to find out when and how your business will be affected, then consider which digital telephony and broadband services you might use instead. Some businesses may be able to keep using some current equipment, for example by plugging phones into a

Risk and reward

The switch to internet-based systems will create some new risks as businesses become more dependent on broadband connections. Internet-enabled systems are also vulnerable to power cuts in a way that phone lines are not – although many of the systems that use the PSTN today also require a mains connection.

Service providers should be able to help businesses understand new system features that will help to manage these risks. For example, internetbased telephony can be integrated and synchronised with mobile or email services based on cloud infrastructure, so businesses can access their business line from any location using a mobile device.

There are also cost advantages: calls made using VoIP tend to be cheaper than those made via the PSTN, as VoIP systems use monthly fees rather than charging by the minute. Hardware costs also tend to be lower, and it is more cost-effective to add new telephone lines than it was under the old system.

router instead of the old phone sockets. Others will need a full broadband connection upgrade.

Many businesses will face extra problems because other systems also run on the PSTN, including franking machines, security and door entry systems, fire or smoke alarms, CCTV, emergency phones in lifts, and some sector-specific solutions including telecare systems used by elderly or vulnerable people. In each case it will be necessary to contact manufacturers or service providers to see if and how systems can be replaced; some providers are already helping businesses through the transition. Businesses that face a more complicated transition may need to consult telecommunications specialists.

Integrated internet-based communications can be used to run videoconferencing, file sharing, instant messaging and other functions, making home working and other flexible working arrangements more straightforward. Working in the cloud also helps protect business systems from the effects of disruption that impacts the physical workplace, although it also increases dependence on cloud service providers.

Duncan Shaw, Operations Director at communications services provider Connectus, says that a business’s communications provider should be able to support it through the transition and help it understand whether it might benefit from using some of these other technologies. “Start talking to your provider now,” he advises.

“Take the opportunity to consider how your business works today. If you use hybrid working patterns, then VoIP offers a rich platform of features and benefits for your business. Your provider will deal with all the technical aspects of making

february-may 2023 | firstvoice | 27 feature PSTN switch-off

40% The proportion of small firms that used broadband delivered via the PSTN in 2019

sure things are set up correctly. This is key to making the transition painless.”

However, a November 2021 survey published by National Business Communications suggested that only one in five business owners were fully aware of the switch-off, with six out of 10 knowing nothing about it. BT will ramp up efforts to alert customers aduring the next three years, according to Chris Sims, Managing Director, SoHo and Marketing at the company. He says its research shows that businesses are worried about how quickly they might get a return on their investment in these systems.

“We are on a campaign to educate our customers on the benefits of the switch, such as enhanced flexibility, efficiencies, cash savings and increased mobility,” he adds, going on to say that BT’s website offers resources to help businesses, including advice on other affected systems, and that as the 2025 deadline approaches BT will provide extra support to smaller businesses, where required.

“Most of the advice BT is giving seems to be pretty good,” says Mr Russell. “But Ofcom and the government need to hold them to account, to make sure small businesses are aware that this is taking place and are making plans.”

Infrastructure worries

Mr Russell also stresses SMEs’ need for fast, reliable broadband connections. The government has pulled back from an earlier stated ambition for everyone in the UK to have access to Gigabit-capable broadband connections by 2025 – but the pandemic has increased the need to work more quickly towards those goals, with more consumers using more online services of all kinds, and more businesses allowing employees to work remotely.

The Foot Room

The Foot Room runs two podiatry clinics in Longridge and Broughton, Lancashire. Directors Sarah Carroll and Jen Royle opened the Longridge clinic in 2010 and today the company has 12 employees. Even before the switch-off deadline came into view, PSTN-based telephony was limiting their work – for example, using a card machine blocked the phone line. It was clear that a new system would be needed when the company prepared to open its Broughton clinic in 2021.

A VoIP telephony system, alongside a broader, cloud-based communications solution by Preston-based internet connectivity,

telephony and cybersecurity provider HM Network, means the same phone number can be used for both clinics, and receptionists can handle enquiries for either.

“The phone screen tells us if a call is for Longridge or Broughton, so we know which clinic the patient is calling before we answer,” says Ms Carroll. “If a call isn’t answered it goes to the answerphone, and as soon as there’s a message there I get an email to let me know.

“It’s definitely cheaper. There are parts of the system that we don’t use yet because I haven’t had the time to sit down and look at its capabilities, but for now it works – and the patients are happy.”

FSB research from 2019 suggested that 30 per cent of small businesses could only access broadband download speeds of under 10MB per second, including 39 per cent of those in rural areas. One in three said this was insufficient for their current needs, while 40 per cent expected it to be insufficient for the future. A further 45 per cent were experiencing unreliable voice connectivity, including 57 per cent in rural areas. Of poor connectivity, 26 per cent said they had lost sales as a result, 32 per cent said it created difficulties when communicating with customers, and 31 per cent said it hampered business growth.

“A lot of the policy debate at the moment is about business productivity and economic growth,” Mr Russell notes. “Small firms adopting digital and technology solutions can have a huge impact on productivity – but only if they have decent internet connections.”

In the meantime, Mr Sims stresses the need for small businesses to plan for the transition from the PSTN to digital

technologies. “Those who haven’t yet begun could find themselves rushing as the deadline approaches,” he warns.

FSB’s Mr Russell sympathises with small business owners and managers who have not yet focused on this issue, as inflation, the energy crisis and the wider economic climate occupy most of their attention. “When you’re struggling for survival, you’re not going to be thinking about something taking place in three years’ time,” he says. But the benefits of preparation will be worth it, he insists. “If everyone was aware and had a plan, the switchover would be a completely good thing: you get better quality phone calls and higher internet speeds.”

If you can spare the time and energy, start thinking about how the PSTN switch-off might affect you. You’ll have to confront it sooner rather than later, and it might give your business a timely boost.

firstvoice.fsb.org.uk 28 | firstvoice | february-may 2023

DAVID ADAMS is a freelance business journalist

feature PSTN switch-off

3 small business funding myths debunked for 2023

With costs rising exponentially, most businesses will need some financial help this year.

Here, we tackle the three biggest current funding misconceptions so you can make an informed decision when thinking about your funding options.

Businesses are only using funding to boost cashflow

It has been a difficult couple of years for small businesses. Throughout the pandemic, a lot of business funding was used purely for survival, and to cope with a dramatic reduction in trading.

The energy crisis, looming recession and general economic uncertainty dominated last year, and continue to present a dark cloud in 2023. But despite all the challenges, lots of businesses are seeking funding for growth.

From business loans to grow your operations, hiring or expanding locations, to asset finance to facilitate the purchase of more inventory and equipment, investing in the right funding option could be key to accelerating your business revenue in 2023.

Banks do not want to lend to small businesses