Tax Season Tips for

www.aussiepaintersnetwork.com.au Bulletproof Your Business Against the Unexpected Fortify your business against risks. Here's how you can do it...

Small Business Owners Ensure you submit a log of your business-related mileage, Cultivate a Positive Mindset Developing an optimistic mindset is the most effective thing you can do 4 Key Areas to Evaluate in Your Business Budget Here are some crucial topics to consider in your budget

From the Editor

Hey Everyone,

Welcome to the 136 th issue of The Aussie Painting Contractor Magazine.

In this month’s edition we are looking at building your business for more resilience as well as setting yourself up for the end of the financial year in a positive manner.

Aussie Painters Network have continued to bring more people to the industry through our programs and school engagement. Even with holidays in the last month, we still managed to attend 4 industry engaged events, run a couple of Try a Trade days for school kids to get a taste of what our industry expects when they enter it.

In the last month, our recruitment team have managed to get 72 people apply for an apprenticeship, place 18 of them into trials with another 14 in the process of getting signed up as apprentices. These are all from Qld, NSW, Vic and the NT. So, if you are looking for an apprentice, reach out and we can help.

Current Members, look out for some exciting news coming your way. We will be pre launching to you prior to sending out to the rest of the industry.

'Til next month, Happy Painting!!

Nigel Gorman nigel@aussiepaintersnetwork.com.au 07 3555 8010

CONTRIBUTORS

• Helen Kay

• Helena Cooper Thomas

• Irma Mooi-Reci

• James Greenslade-Yeats

• Jim Baker

• Leo Babauta

• Nicole Black

• Nigel Gorman

• Rachel Morrison

• Robert Bauman

• Sandra Price

EDITOR

Nigel Gorman

GRAPHIC DESIGNER

J. Anne Delgado

Advertise with us... 1800 355 344 07 3555 8010 info@aussiepaintersnetwork.com.au www.aussiepaintingcontractor.com

How to Break Dependence on the Phone

How to Bulletproof Your Business Against the Unexpected

Plan for the (other) ‘BIG DAY’

What’s the difference between a quote and an estimate?

Tax Season Tips for Small Business Owners

Office gossip isn’t just idle chatter. It’s a valuable – but risky – way to build relationships

Finding balance as a Small Business Owner

Cultivate a Positive MINDSET

Who Pays?

4 Key Areas to Evaluate in Your Business Budget

Unstable employment while you’re young can set you up for a wage gap later in life – even if you eventually land full-time work

Industry Idiots Important Contacts

Opinions and viewpoints expressed in the Aussie Painting Contractor Magazine

represent those of the editor, staff or publisher or any Aussie Painters Network’s staff or related

Aussie Painters Network and Aussie Painting Contractor Magazine personnel

any mistake, misprint or omission. Information contained in the Aussie Painting Contractor

inform and illustrate and should not be taken as financial, legal or accounting advice. You should seek professional advice before making business related decisions. We are not liable for any losses you September incur directly or indirectly as a result of reading Aussie Painting Contractor Magazine. Reproduction of any material or contents of the magazine without written permission from the publisher is strictly prohibited.

Contents

necessarily

publisher,

not

is intended

do not

parties. The

are

liable for

Magazine

to

06 08 12 14 16 20 30 34 36 44 27 45 24

How t o Break Dependence on the Phone

On average, people spend more than 3 hours on their phones each day, picking up their phones nearly 60 times a day … with some people spending closer to 4 hours.

These numbers aren’t meant to be judgments — it’s not a bad thing to look at your phone — but instead are meant to bring some awareness to our phone usage.

A lot of people I talk to want to decrease their usage of phones — not necessarily decreasing to zero, but decreasing impulsive usage of their phones.

Many of us tend to grab our phones anytime there’s a lull, and once you get on your phone it can lead to mindless scrolling.

So how can we develop more mindful use of our phones, and become less dependent on them? Let’s explore together.

Becoming More Mindful of Phone Usage

If you don’t have awareness, you can’t change something. So the most important first step is to start to bring mindfulness to your phone usage.

Here’s how:

• Get a small notebook or scrap of paper, and each time you reach for your phone, make a tally mark on the paper. This will bring awareness to reaching for your phone.

• Notice what you’re feeling when you reach for the phone. Write that down on the paper or notebook as well. Boredom, anxiety, overwhelm, sadness, loneliness, fear, frustration. This is the reason you’re reaching for the phone — in hopes of dealing with this emotion (hint: it doesn’t work).

• Take three breaths before you actually unlock the phone. You have the phone in your hand … pause for a moment and take three breaths. Notice the feeling you’re feeling that makes you want to reach for the phone. Do the breaths help with the feeling?

Commit to doing this for a week. You’ll develop beautiful mindfulness around your phone usage, even if you don’t stop using the phone.

6 | Aussie Painting Contractor

Breaking the Habit of Phone Dependence

At this point, your mindful practice has set you up for success to break the habit.

Let’s look at how to change the habit: Understand your Why: Before you start, ask yourself why you want to make this change. Is it important, or is it a “this would be nice” kind of thing? If it’s just going to be “nice” to make the change, you won’t stick with it, because it’s not more important than your urges. You need a more meaningful reason: it’s going to lead to better mental health, better relationships, better productivity with your meaningful work, or whatever would be meaningful for you. Write this reason down and have it somewhere you’ll see it each day.

Set an intention: Commit yourself to making this change. Is your intention to not look at social media or certain apps on your phone? Is it to only use those apps twice a day for 30 minutes each session? Is it to never use your phone except for reading or music? Set a clear intention, and commit yourself to it for a certain amount of time (let’s say 4 weeks).

Lock screen reminder: Make your phone lock screen something that will remind you of your intention. A nature scene, a quote, a photo of your kids, whatever it takes. This will help you bring awareness whenever the urge comes up.

Find other meaningful activities: What do you want to do instead of look at your phone? It should be something that 1) addresses the emotions you identified in the “mindful” section above and 2) you enjoy or find meaningful. For example, if you reach for your phone when you feel overwhelmed or anxious … maybe sitting in meditation, doing a few yoga poses, or going for a short walk will help you deal with those emotions, and lead to greater health or mental

clarity. Other ideas: connect with a friend, do some stretches or pushups, drink a cup of tea, do some breathing exercises, or write someone a love note.

Pause practice: When you are about to use your phone, practice taking a short pause. Breathe. Notice your emotions. Tend to them. Consider your meaningful Why and your intention. If you can’t avoid using the phone after this pause, don’t beat yourself up. Just introducing the pause is a huge, huge step. Celebrate any progress.

Be willing to be with all of life: We most often use our phones because there are things we don’t want to feel or experience. It’s an avoidance mechanism. But what if we train ourselves to open up to all experiences, all parts of life? We don’t need our coping mechanisms anymore. So each time you reach for the phone, practice being with and opening to the experience you want to avoid. This is a training, and with practice, you’ll increase your capacity to experience and love every experience that life has to offer.

Daily review: At the end of each day, before you go to sleep, set a reminder to do a short review. How did you do with your intention? What got in the way? What feelings did you resist being with? What can you improve tomorrow? Be compassionate with yourself. But use this daily review for continual learning and improvement.

This is not an easy habit to change, but it’s changeable … if you commit yourself, and find a meaningful reason. And if you let yourself continue to learn and grow in this process.

Leo Babauta ZEN HABITS

2024 May Issue | 7

How to Bulletproof Your Business Against the Unexpected

Protecting Your Business: Be Proactive About Your Risks

It is always important to fortify your business against risks. Your business is not just an enterprise; it’s an empire you’ve built, deserving robust protection. This is where our Business Shield comes in, tailored to safeguard your business comprehensively through effective business protection strategies.

As commercial lawyers we see the same mistakes made time and time again by business owners that could have avoided costly issues and disputes.

These risks fall into 5 key areas of your business:

Your Business Structure

Your IP Protection

Your Clients

Your Business Partners

Your Suppliers

The Five Critical Areas of Business Risk

1. Business Structure: The Keystone of Stability

Your business’s structure is its backbone. It’s crucial to ensure that this foundation is solid, whether you’re a startup or scaling for growth. A well-planned structure not only supports your business operations but also shields your personal assets from business liabilities. Our contract lawyers specialise in creating the optimal structure for your business.

2. Intellectual Property: Guarding Your Genius

In the realm of business, ideas and brand identity are one of your most valuable assets. Ensuring these assets are legally protected by skilled intellectual property lawyers allows your business to thrive without fear of infringement. Remember, your intellectual property is as valuable as any physical asset.

8 | Aussie Painting Contractor

2024 May Issue | 9

3. Client Engagement: Keeping It Crystal Clear

The subtleties in client engagement are often overlooked. Clear, legally sound client agreements help you to get paid on time, pre-empt disputes and misunderstandings, paving the way for smooth client relationships. It’s about ensuring mutual clarity and expectations. This is where a contract lawyer can be invaluable.

4. Partnerships: More Than a Promise

Trust is the essence of any partnership, but in business, it’s fortified with ironclad agreements. Navigating the legal landscape of partnerships requires the expertise of commercial lawyers to ensure that both parties’ interests are equitably protected.

5. Supplier Arrangements: Smoothing Out the Supply Chain

Your supply chain is vital. Drafting and vetting supplier contracts ensures terms are favourable, protect your business and minimise risks of disruption. It’s not just about getting supplies on time; it’s also about legal safeguarding against unforeseen events. This is a crucial area where contract lawyers play a key role.

These five areas are not silos; they interlock to form a comprehensive shield that guards your business from every conceivable angle. Regularly assessing and fortifying these areas is not just wise; it’s imperative for weathering the storms ahead.

The Business Shield Quiz

To help you navigate this landscape, Rise Legal have introduce the Business Shield Quiz – a groundbreaking tool for Australian small businesses. This free, quick quiz assesses your business’s risk level across our Business Shield areas. It’s not just an assessment; it’s a step towards fortifying your business.

In mere minutes, the Business Shield Quiz walks you through a series of questions that span your business structure, intellectual property strategy, client relationships, partnerships, and supplier agreements.

The result? A comprehensive report that not only highlights your business’s fortifications but also pinpoints areas in need of reinforcement, enabling you to make informed decisions about your business’s legal health.

Why Take the Quiz?

Spot Issues Before They’re Issues: Spot potential legal landmines before they detonate.

Tailored Insights: Receive customised advice on bolstering your business’s legal framework.

Make Smarter Moves: Armed with knowledge about your legal standing, make decisions that steer your business towards sustainable growth.

Rise Legal: Your Ally in Business Protection

At Rise Legal, our mission extends beyond mere legal counsel; we aim to be the architects of your business’s enduring success. Our team of seasoned commercial and contract lawyers is committed to ensuring that your entrepreneurial journey is not just prosperous but also secure.

Remember, while this information provides a general overview, legal advice tailored to your specific circumstances is invaluable. Don’t hesitate to contact Rise Legal for personalised guidance or book in a free Discovery Call.

Disclaimer: This blog post is intended for informational purposes only and should not be considered legal advice. Consult with a qualified commercial lawyer for personalised advice related to your specific circumstances.

2024 May Issue | 11

------------------------------------------------------------------------------------

Plan for the (other) ‘BIG DAY’

This is now the 114th article I have written for the APN magazine. A heck of a lot has been covered in them in relation to what you need to know on how to run a successful business. One of the subjects I wrote in the 2014 August edition (pages 22 & 23), was ‘Plan For Tomorrow’. This was specifically about, ‘Planning for the unexpected’, (ie; bad debts, sickness, accidents), and ‘Planning for the expected’, (ie; holidays, lifestyle, retirement).

In this particular article I want to go into more depth of ‘Retirement’ and how to plan for it, mainly because I‘ve ‘been there’ and ‘done that’ and feel that I am experienced enough to share my views. Many of you are a long way from it but, it’s never too early to at least think about it.

I will ‘re-cap’ on part of a 2022 article to explain how I felt at the time of ‘closing down’ my business.

‘At times it’s been quite emotional knowing that ‘James W Decorating’ and my tagline ‘Not Just A Painter’ will no longer exist. With 51 years in the trade (in which 38 of them had been self-employed), you would think that it would be easy to just stop and not think about having a business anymore. So why am I emotional about ‘shutting up shop’? I guess

it’s because I started up the business from absolutely nothing. I didn’t know anyone here in Brisbane (as my wife and I had just moved to Qld from WA). Yellow Pages was the only major source of advertising and my work vehicle at the time was a Mazda 323 Hatchback (I remember carrying multiple steel trestles and scaffold planks to work sites on the roof rack). You can’t really start any lower than that in business! But I grew the business to become stable and profitable. There was not one person, company, Tax Office or supplier that ever had to wait to be paid. I met a lot of people that are now close friends, I put through ten apprentices in which a few of them have started their own businesses and I can admit, I only had three customers in all that time that were not happy with my work.

So overall, I am very proud of my achievement and deserve the right to be a little bit ‘teary-eyed’ but then extremely thrilled at the fact of being a ‘retiree’. Imagine it yourself. Wouldn’t you just love it if the phone stopped ringing and didn’t have to go out to do quotes multiple times a week; or not having to get up early, or doing bookwork, or being stressed out not having enough work for your employees, or having cash flow problems because clients don’t pay on time? Believe me it is a great feeling.’

12 | Aussie Painting Contractor

I will point out four essential things that you should be considering before, what I call, ‘The Big Day’.

Although I retired officially in 2022, the retirement process started 30 years previously. This was by putting money away in a Superannuation fund (and which is what I suggest you do as well). It doesn’t have to be a lot, but every bit counts, and you will find it soon builds up. If there is extra money in the business account (which is always great to see), instead of taking an amount out as ‘all’ income, put some of it away into your ‘Super’ fund. For instance: If you draw out $10,000, you will be taxed on that $10,000, which could work out to be $2,500 in tax (25% depending on your tax bracket). If you kept $7,000 as income instead and put $3,000 into Super, you will only be taxed on the $7,000, which only works out at $1,750 tax. That is a saving of $750. (Please note that these are my calculations only so speak to your accountant first for any financial advice). The reason to have your own ‘Superannuation Fund’ also is that the Government Pension could change when you’re ready to retire and you may find that you cannot live on the Government allocated amount.

When you get closer to the retirement age (say five years out), my advice would be to work out how much you will need to pay your bills and living expenses per week (taking into consideration your home should be paid off). Factor in the discounts you will get because of your age, (like electricity, rates, car registration), and how much you will require for travelling, (either local or overseas). Doing this will at least give you an idea on what you need per year and if your Superannuation and/or pension (if eligible) will cover it. If not, you can always add to the fund before you do finally retire. I also suggest speaking to a Financial Advisor because you may be able to claim a part pension by shifting some of your money around (if you have too much invested that is). Even if it’s only $50 a fortnight, you will be entitled to a ‘Healthcare Card’ which is very well worth having. You may be surprised though (as did my wife and I), you do not need to ‘have a lot’ to ‘have a great lifestyle’.

If in the future you would like to sell your business, then there is one thing you should be doing right now. Build a client database. Keep a record of every person you have dealt with. You need their contact details, how they found you, when the job was completed, what you did, and if they have recommended you to anyone. The more information you have, the better it is for when you are selling. You should know that there’s not much money made from just

selling stock and equipment. Your database is the most valuable business asset you can have. 90% of my work derived from past clients and referrals from those clients. Think how much it’s worth to a painting business that is, ‘just starting up’, or for a larger business that ‘wants to expand’. A buyer of your business can then call all your clients to inform them that they have taken over and to keep them in mind for their next project. Contacts are priceless. Use it to your benefit.

Retiring is a huge step to take and for some, not as easy as they thought it would be. The reason being is there’s all this ‘free time’ ahead of them and not knowing what to do with it all. They’ve worked for 40 plus years getting up early (and maybe getting home late because of deadlines to meet or going out quoting), and then the ‘after-hours’ bookwork to do as well. Holidays are only taken when it fits in with work or taken over the school holiday breaks, and when was the last time you had a sick day. Now! You have all this time available and don’t know what to do. So I suggest you start thinking well before you ‘hang up your boots’. Are you going to play golf, join a ‘Men’s Shed’ group, become a volunteer, or simply, pack up and travel the world? If you don’t keep yourself and your mind active, you will soon become bored and start ‘pacing the house’. Being constantly at home can also become stressful on your partner. They have adapted to their ‘own space’ and won’t be used to you being around all the time which could cause friction between you both, and you definitely, don’t want that to occur.

So, all it takes is planning and smart business procedures now, to enjoy a well-earned retirement and to, ‘live the dream’.

Jim Baker

2024 May Issue | 13

www.mytools4business.com

What’s the difference between a quote and an estimate?

The nature of some types of businesses make it challenging to come up with a standard price list. For tradespeople and some freelancers, for instance, what’s required in terms of time, skill, labour, and materials frequently vary from job to job.

Offering an estimate or quote provides potential clients with a customized figure for what they can expect to pay, based on what will be required to complete a specific project.

Read on to learn the difference between estimates and quotes, and tips on how to prepare them like a pro.

Quotes

A quote is a legally binding fixed price a company prepares for a client; as such, they should always be in writing. A quote should summarize the work to be performed and include a detailed breakdown of all the costs and the final total, including taxes.

Once a business offers a quote and a client signs off on it, the price cannot change even if the job ends up costing more than originally anticipated. For this reason it’s important to always quote as accurately

as possible, allowing ample time to complete the job and carefully pricing out costs for materials and labour (e.g. subcontractors).

To protect your business from “scope creep”, a quote should also stipulate that additional charges for extra work beyond what the initial quote covers will apply.

Estimates

Unlike a quote, an estimate isn’t legally binding and it isn’t a guarantee of what the actual work will cost. Still, it’s recommended that estimates also be provided in writing. An estimate is offered as a ballpark figure, based on the information available about a project at that moment in time. As such, it’s understood that the estimate is subject to an increase or decrease once the work begins.

Companies should take just as much care when providing an estimate as they would when drafting a quote. Ideally, an estimate should provide a number within roughly 20 per cent of the final price. It’s good practice for businesses to provide more than one estimate, to offer a range of options at different price points.

14 | Aussie Painting Contractor

Tips for costing out jobs

For Tradie’s, it’s important to appear as professional as your larger competitors whenever you communicate with clients, but especially when negotiating the details of a potential project.

Be sure when you’re preparing your quote or estimate that you include the following information:

• Your ABN

• Relevant Licence Details ( QBCC # etc)

• business contact info (phone, email, address)

• a detailed summary of the work to be performed

• a breakdown of what’s involved. Be specific. Outline who is responsible for what.

• the total cost

• a timeline for the work and completion date

• contract terms, including deposit and payment schedule

Another important bit of information to provide your clients when the quote or estimate expires. Many companies choose an expiry date of 30 days, to protect themselves from the possibility of rising costs for materials or other factors that may influence the cost of the job.

It’s worth repeating that you should always take care to state clearly in writing the terms of your quote or estimate, and offer a client the opportunity to ask questions before approving the work.

That way, both parties can avoid any misunderstandings about expectations and project costs before the work begins.

Tax Season Tips for Small Business Owners

Preparing for tax season is really a year-round endeavor. Tip number one for SMB owners is to update financials on a monthly basis, using a streamlined software or cloud-based system. This way, come tax time, everything you need is all in one place. And well organized SMBs are better positioned to minimize their tax bill while avoiding penalties associated with missing or inaccurate information.

Here are four more ways to take the stress out of tax time, and get the most out of your return.

Know your credits & deductions

Small businesses typically benefit from a wide range of tax credits. From special allowances for research and development, to programs that supplement wages for student employees and apprentices, knowing which credits apply to your business can save you a bundle on taxes.

It’s also important for SMBs to be savvy about deductions. After all, you want to keep as much of your hard-earned revenue as possible. Often-overlooked items you may be able to deduct include:

• Seminars, classes or conventions you attended to improve your professional skills;

• Unused inventory that you’ve donated to charity (a good reason to consider donating your overstock, rather than paying for storage); and

• Capital assets, such as office furniture, computers, and equipment.

Speak to your accountant about the full range of available deductions you can plan for each tax year.

16 | Aussie Painting Contractor

Be careful about what you claim

If you run your business out of your home, you may be able to claim a portion of expenditures like utilities, insurance, property tax, and rent. But you’ll need to keep good records, and all your receipts, to justify why you’ve allocated business costs to your home office.

The same goes for home office computers and mobile phone expenses. Tax authorities will want to see how you’ve separated the personal and professional use of these assets when you claim them as work expenses.

Want to claim drive-time as a work expense? Ensure you submit a log of your business-related mileage, so you can clearly demonstrate how your personal vehicle was used for professional purposes.

Don’t miss the deadline!

This should go without saying, but every year SMBs are hit with serious penalties for filing taxes late. Missing the deadline can have a range of negative repercussions, including:

• Added interest to amounts owing, plus a late payment penalty;

• Losing your claim to a refund;

• Loss of credits toward retirement/disability benefits;

• Delay of loan approvals (lenders require a copy of your filed tax return in order to process your application).

Seek expert advice well in advance

A recent survey of small business owners found that a full quarter don’t understand their tax obligations. What’s more, 27% only speak to their accountant at the last minute, just before the filing deadline.

Software has made it easier than ever for small business owners to file for themselves, but when it comes to thoroughness and accuracy, nothing can replace the expert advice of an accountant.

Consult a professional well in advance, to ensure you’re getting the most out of your tax return, and that your documentation is complete. On the bright side, accounting fees are often tax deductible!

Arrange a FREE No-Obligation Meeting with me to help you with a business systems check for tax planning. Call my office on 07 3399 8844, or just visit our website at www.straighttalkat.com.au and complete your details on our Home page to request an appointment.

Copyright © 2024 Robert Bauman.

2024 May Issue | 17

Office gossip isn’t just idle chatter. It’s a valuable – but risky – way to build relationships

Gossip flows through the offices and lunchrooms of our workplaces, seemingly filling idle time. But perhaps, through these ubiquitous and intriguing conversations, we are influencing our workplace relationships more than we realise.

Is gossiping a route to friendship or a surefire way to make workplace enemies? It turns out the answer hinges on how the recipient of the gossip perceives the intentions of the gossiper.

Workplace gossip – defined as informal and evaluative talk about absent colleagues – is pervasive yet often misunderstood.

Traditionally frowned upon and branded as unproductive or even deviant, recent research paints a more complex picture of gossip.

While some studies imply that gossip leads to friendships between coworkers, others suggest it undermines workplace relationships. Our research indicates these apparently contradictory findings stem from misunderstanding the nuances of how gossip shapes workplace social relations.

We focused on gossip recipients – the listeners – and asked how they perceived these exchanges, and what effect receiving gossip had on their relationships with coworkers.

Understanding workplace gossip

Researchers use three frameworks or concepts to make sense of workplace gossip.

20 | Aussie Painting Contractor

The “exchange perspective” holds that gossip binds coworkers to one another through a sort of quid pro quo. A colleague may offer informational morsels, with an expectation of social support and inside information in return.

Read more: The science of gossip: four ways to make it less toxic

The “reputational information perspective” focuses on how gossip shapes recipients’ views of targets –the people the gossip is about. Vital information might be shared to warn others about toxic personalities or to signal someone as particularly trustworthy.

Finally, the “gossip valence” refers to whether gossip conveys positive or negative information about its target.

The effect of hearing gossip

Our research looks at how gossip affects the recipient’s perception of the person sharing the gossip.

Data was collected from participants using two techniques: written incident reports and follow-up interviews. This approach provided the researchers with detailed descriptions of how workplace gossip incidents affected interpersonal relationships from the recipient’s perspective.

Our findings show that the recipients’ perceptions of these exchanges matter a great deal. In particular, their interpretation of the gossiper’s intentions can set off a chain reaction.

If the recipient judges the gossiper’s intentions as genuine and authentic – a way of opening up about one’s real views of coworkers – gossip can spark a new friendship or rekindle an old one.

When one person says, “I find it so frustrating when Mark talks down to me like that”, for example, the recipient has been trusted with the gossiper’s true feelings about Mark, a problematic colleague. This creates a stronger bond – especially if the recipient agrees with the opinion.

Curiously – and perhaps a little worryingly – we found negative gossip was a stronger way of building friendships than positive gossip, provided intentions were interpreted as genuine.

Read more: Australian law says the media can't spin lies –'entertainment magazines' aren't an exception

If the recipient evaluates the intention as prosocial – in other words, sharing accurate and valuable information that benefits people other than the gossiper – trust increases and collegial relationships are strengthened.

As one research participant explained: I actually noticed that the source is the kind of guy that only really says positive things about people […] That’s why I think I began to trust him because he doesn’t run people down too much.

If the gossiper’s intentions are perceived as selfserving, the recipient’s trust in them goes down and there’s little likelihood of the two becoming friends.

One participant explained: They said this to damage her reputation and cause drama in the workplace.

While another said:

After listening to him gossiping about another waitress, I felt very uncomfortable. I was afraid of him saying negative things about me if I make mistakes.

Not just idle chatter

Our study supports the idea that gossip isn’t merely idle chatter but a valuable (and risky) social currency.

We often engage in gossip without even thinking about why we’re doing so. But our findings show other people pay a lot of attention to our motivations for gossiping.

Given we have little control over how our intentions are interpreted by others, this study is a timely reminder to think before you share gossip.

Rachel Morrison Associate Professor, Auckland University of Technology

Helena Cooper Thomas Professor, Auckland University of Technology

James Greenslade-Yeats Research Fellow in Management, Auckland University of Technology

2024 May Issue | 21

22 | Aussie Painting Contractor

Membership

Packages

2024 May Issue | 23

Finding balance as a Small Business Owner

As a small business owner, it can be incredibly difficult to maintain a healthy balance between work and life. Its easy to let the obligations and responsibilities of running your own business take priority to everything else. With the right strategies and mindset in place however, it is possible find a balance that works for you.

Set boundaries

As much as we might love our business, it’s important to remember that our mental and physical health needs constant attention. One of the best ways we can make sure we’re taking care of ourselves is by setting boundaries for our work schedule. For example, taking regular breaks throughout the day can help us avoid burnout and increase productivity when we return to our tasks. Or, if we know that certain tasks require more energy and focus, we can set aside specific days to tackle them. By sticking to a timetable

that puts our wellbeing first, we can ensure that we remain motivated and engaged in our work for the long haul.

Do what works for you

Ever feel like there is never enough hours in the day to get everything done? It can be stressful trying to keep track of everything . Implementing a good system helps you focus your time and not get side tracked easlity. That’s why it’s important to identify what system works best for you and create a process that keeps you on track and productive. Maybe you’re a fan of to-do lists or maybe you prefer to use a digital calendar or software. Perhaps you find that breaking tasks down into smaller, manageable steps helps you stay focused. Whatever it is, take the time to figure it out and stick with it. Your future self will thank you for it!

Sort out what is important and what is urgent

We often find ourselves juggling multiple tasks and trying to complete them all at once. This approach can often lead to poorer quality and burnout. A better approach is to sort our tasks based on their importance and urgency, focusing on the most important or urgent tasks first. This way, we can ensure that we are making progress in the right direction and achieving our goals. It may require some time and effort to identify the most important and urgent tasks, but it will pay off in the long run with increased productivity and reduced stress levels. So next time you feel overwhelmed with a list of tasks, take a step back.

24 | Aussie Painting Contractor

Learn to delegate

As much as we all might like to think of ourselves as superheroes who can handle anything and everything, the truth is that we’re all human. Recognising that we cannot do everything and learning where our strengths lie is cruical. In fact, knowing when to delegate tasks can be one of the most important skills you can develop as a leader or even just as a responsible adult. Knowing when to ask for help – whether it’s from family members, friends, or co-workers – can save you time, reduce stress, and improve the quality of the end result. So if you find yourself feeling overwhelmed by a project or task, don’t hesitate to reach out for help. It might just make all the difference in the world.

Rest

It’s easy to forget the importance of rest and selfcare. But the truth is, getting enough sleep and taking time to exercise or meditation can be crucial to our overall health and well-being. Not only can a good night’s sleep help boost our mood and energy levels, but it’s also been linked to a reduced risk of developing chronic health conditions. Similarly, selfcare activities like exercise, yoga or meditation can help us feel more relaxed, reducing stress and anxiety in the process. So if you’ve been neglecting your sleep or self-care routine, now is the perfect time to start making them a priority. Your body (and mind) will thank you for it!

Make time for family and friends

Yes, we have to say this!

It’s easy to get caught up in work and forget to set aside time for the people we care about. Not only does it help us avoid burnout, but it also strengthens our relationships with those we love. Whether it’s a weekly family dinner or a monthly game night with friends, committing to spend quality time can have a profound impact on our mental health and overall well-being. So, next time you’re feeling overwhelmed by work or life in general, remember the people who matter most. They’ll be there to lift you up when you need it most.

Final words ..

Efficiency is about working smarter, not harder. With a few tweaks to your day-to-day life, you can boost your productivity and reach more of your goals.

Take the steps necessary to establish successful systems for yourself and reap the benefits! Whether that means setting boundaries, delegating tasks, or even taking time off to spend with family and friends –make sure to design a process that works best for you.

It’s important to remember that balancing work and life should be a priority – so don’t forget to take care of yourself as you continue to strive for success! Sandra

2024 May Issue | 25

www.tradiebookkeepingsolutions.com.au

Price

Cultivate a Positive MINDSET

One of the best long-term things you can do for a happier life and better relationships is to cultivate a positive mindset.

People with positive mindsets live longer, happier lives. They have lower rates of heart disease, cancer. They live about 7.5 years longer, on average. That’s huge.

So developing a positive mindset can be one of the most impactful things you can do for yourself.

And there are a ton of downstream effects: you are kinder to others when you’re happier, so your relationships are better. You are more playful, more joyful, more likely to take positive actions and focus on meaningful goals.

So how do we develop this positive mindset?

I’m going to share a handful of things I’ve found to be important …

• Notice your tendency toward negativity. We often don’t realize that we have a bias towards a negative mindset. This is a blind spot for most of us.

To uncover this blind spot, try to find places during the day when you have a negative mindset: complaining, criticizing, judging, catastrophizing, feeling helpless, feeling resentful, feeling victimized, feeling put upon or burdened, feeling bored or lonely. NONE of these feelings are wrong! They’re just things to notice, and as we notice it, we will have the ability to create big shifts.

• Notice the impact of negativity. Without judgment, get curious about how these moments of negativity impact your life. How does it affect your motivation? Your relationships? How much fun other people have around you?

• Accept your negative feelings. Start to take the stance that it’s OK to feel whatever you feel. Tend to the negative feelings — how can you soothe them? How can you fully express them? For example, if you’re angry, can you rage like a werewolf? If you’re feeling put upon, can you yell in frustration into a pillow? Exaggerate your feelings, allowing them to course through your blood, and you’ll let them through you instead of repressing them.

2024 May Issue | 27

• Find a new, positive stance to come from. Once you’ve exhausted the energy of the negative emotion, you might notice that your heart and mind are more open. In this place, you can choose something new. What stance would you like to come from in these moments? Pick one and practice it: maybe you will look for something to love in the other person. Maybe you’ll come from a stance of being of service to others, or compassionate, or giving unconditional love. This new stance takes practice.

• See the gift. Whatever stance you choose, it can be a beautiful practice to see the gift in any moment, even ones that feel negative. When someone is upset with you and you feel defensive … what is the gift in this person’s upsetness? When you are feeling tired and overwhelmed, what is the gift in such a moment of tenderness? When you have had a sad and lonely day, what gift can you find in your melancholy? There’s always a gift to be found in every moment in this brief and precious life, if we have the courage to look.

• Wonder practice. In the same way, we can practice awe and wonder in each moment. If we take on this practice, what we want to look for is seeing the wonder and beauty in each moment of life. Start with the easy stuff: going outside and seeing beautiful nature, or rejoicing in the light falling on our faces. Seeing laughter in a little kid, or love between two partners. Look for it everywhere! Even in the places we find more challenging: can we find wonder when people behave in ways we don’t normally like, or when the world is chaotic, or when we’re hurt? It’s powerful to take on this practice.

Change your physicality. If you normally act like Eyore (from Winnie the Pooh) — slumped over and mopey — then your mindset will stay negative. That’s OK! There’s nothing wrong with feeling this way. But you might practice taking on a Tigger physicality — more positive, excited, joyful, playful. If you dance around, your mindset will follow. How can you bring a joyful, grateful, awe-filled physical attitude toward life?

This isn’t meant to be a comprehensive guide to a positive mindset … but rather a place to start. Pick one of the ideas above that feels easy and helpful, and practice it!

See what starts to shift. One small shift at a time, this could change your entire life.

Leo Babauta ZEN HABITS

28 | Aussie Painting Contractor

Who Pays ?

The employment contract is the ultimate hidden extra contracts. It is rarely just the cost of wages that an employer pays. There are of course the obvious oncosts such as allowances, leave loading, superannuation, workers compensation, payroll tax. But what about the costs incurred by the employer or employee during the course of the employment?

Below are some of the more common surprise costs that we regularly come across.

Tools

Under the Building and Construction award, employees are entitled to a weekly allowance for the provision and maintenance of standard tools of the trade. For painters, this is $7.85 per week. If a specialised tool is required by the employer, then the employer will either reimburse the employee for the provision of the tool or the employer will purchase and provide the tool. If the employer purchases the tool, then it remains the property of the employer.

Clothing

The determination of who pays for the clothing is determined by the requirements of the items and if the clothing is company specific. The requirement to wear white clothing would not consider to be company specific and as such this would be at the employee’s expense. The requirement to wear a specific set of white overalls however may be classed as

company specific, even without a logo and as such could be determined to be at the employer’s cost. Certainly any clothing that has a logo would be determined to be at the employer’s expense.

The other factor involved is whether the item is required as a safety measure. If a company requires it workers to wear steel capped boots, or the site the employee is working on requires steel capped boots, then this would be classed as a safety measure and as such the employer is liable for either the provision or reimbursement of the boots. Interestingly though, the reimbursement does not need to be the exact cost of the boots. If a reasonable pair of boots can be purchased for $160 but an employee spends $200 then the employer is only liable to reimburse the employee $160. It is always best to have a set reimbursement allowance before purchases are made.

Other items you may not expect are to be the responsibility of the employer are dust masks, respirators, safety glasses, high vis vests and in some cases even sunglasses. Again, the employer does not have to provide the full amount only a reasonable allowance to cover the purchase of a suitable item ie a suitable pair of sunglasses can be purchased for $50 and as such an employer is not expected to cover the reimbursement of the employee’s latest Maui Jim purchase.

30 | Aussie Painting Contractor

Training

If the training is part of an apprenticeship then all training costs including course costs, books and in some instances travel and accommodation are at the expense of the employer. The Building and Construction award allows for the employer to pay for these costs directly to the RTO or reimburse the employee after they have made payment. Under the award, the employer can delay reimbursement if satisfactory progress hasn’t been made however this is best done in conjunction with action by the RTO.

For all other training then the costs are by agreement between the employer and employee. If it is a requirement of the position, then the employer may pay full or partial costs but if it is not a requirement of the position then the employee may pay the costs and include them as a tax deduction. If the employer pays the full or partial costs of the training, then they can by prior agreement with the employment seek back payment of the training costs if the employee leaves the employment within a certain timeframe. The timeframe and the amount are normally subject to the overall expense of the training. It would be reasonable for a $2,000 course to be back in full within 6 months and pro rata payment after 12 months but this would not be reasonable for a $300 course. Recovering of these costs is done through civil court action or by agreement with the employee could be withheld from the employee’s final pay but note you

must have the employee’s written agreement before withholding any money.

Damage to Company Property

What happens when an employee damages company or client property? Can you hold them liable for the costs? Generally the answer to this is no. If during the course of employment, an employee damages property then the cost of this damage is worn by the employer and the employee is not held responsible. There may be some instances where the employer could take action to recover the costs from the employee, but they would either need to seek their employee’s agreement or pursue this through civil court action.

This is not an exhaustive list of all associated costs but represents some of the more common ones we come across. For the majority of these costs, there is an option to pay the employee a higher wage to offset these costs. For instance, our client’s employment contracts often contain a clause that the costs of their safety boots has been included in the calculation of the hourly rate. However, you need to ensure that the rate calculated passes the Better Off Overall Test before including this clause. If you have any questions about these extra costs or whether your rates pass the Better Off Overall Test, please don’t hesitate to reach out to us at vanessa@hrmaximised.com.au or 0418 190 106.

2024 May Issue | 31

4 Key Areas to Evaluate in Your Business Budget

Before we know it it will be EOFY so now is a perfect time to take a look at your budget and see where you may need to shift some of your priorities. Pay attention to how your spending over the past few years affected your business and either helped you achieve, or took you away from, your overall goals.

Considering how your business and your employees functioned in recent years can help you predict upcoming trends–which will enable you to plan for adjustments.

Here are some key areas to evaluate in your budget, so you can determine whether you need to spend more in these areas.

1. Technology

This is possibly the business area with the most room for growth–and the most evidence that adoption is needed. Technology has made it possible for employees to work remotely, for you to provide goods and services virtually, and for you to stay connected with your team while working from home.

If your business is enabling remote work, you’ll need to make sure you’ve got the proper systems and equipment in place, such as document storage, redundancies, cybersecurity and anything else the law might require of you.

Make sure everyone on your team has access to the equipment they’ll need, and knows how to use it.

34 | Aussie Painting Contractor

2. Human resources

With virtual work comes access to employees from across the globe. Geography is no longer a barrier when it comes to hiring skilled employees, at least not in companies that use remote work.

Having teams from across your country and around the globe is an incredible opportunity. Make sure you’ve invested resources in understanding the various rules and regulations that they’re governed by. They likely have different laws regarding payroll requirements and benefits plans. There may even be rules about how you can hire and fire employees.

Make sure you understand whose employment laws govern the work they’re doing for you, and then be certain you take the necessary steps to follow those laws.

3. Automated systems

There are many activities involved in running your own business. Some need your time and attention. Others can be shifted to automated systems, freeing you up for more vital tasks.

Take a look at the activities you regularly carry out. Even those that only take a few minutes a day add up over the course of a year, and chances are they can be automated.

Online invoicing systems make it easy to send invoices and follow up with people who haven’t paid you, all with the click of a button. Customer Relationship Management software (CRM) enables you to track leads as they move through your sales funnel and become your customers. Project management software lets you manage your projects from your smartphone, no matter where the jobsite is.

Most of these automated systems also produce comprehensive reports so you can gain valuable insights into your business processes.

4. Consultants

You don’t have to be an expert in every aspect of your business. If there are areas you aren’t certain of, or want to learn more about, you can hire outside parties to guide your decision-making. Consultants can help you with managing your business, evolving your career, building your relationships, and even marketing your goods and services.

Consultants provide an external and unbiased perspective on your business. Because they’re experts in their field, they have insights into what other companies are doing–and what has and hasn’t worked. They can also help you anticipate and plan for upcoming challenges.

Final thoughts

Examine these four key areas in your business to determine whether it’s worth spending more on them in 2023, as you grow your business.

Need some help?

Book a strategy session HERE to see how we can improve your bottom line.

2024 May Issue | 35

Sandra Price www.tradiebookkeepingsolutions.com.au

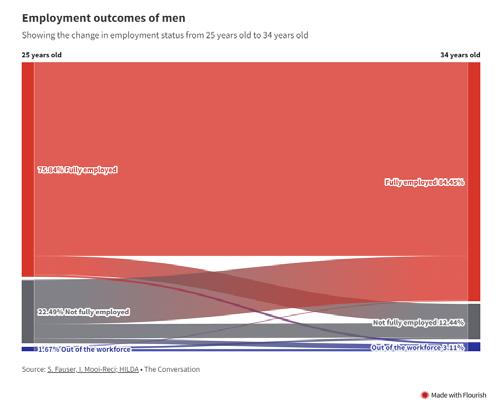

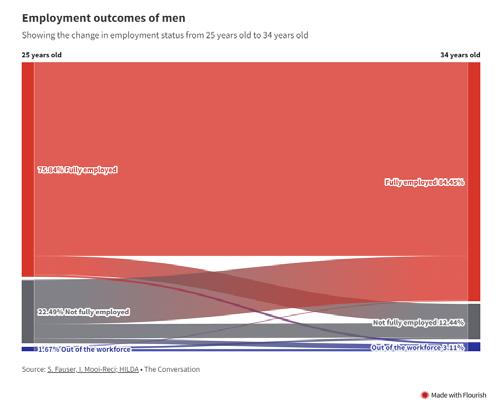

Unstable employment while you’re young can set you up for a wage gap later in life – even if you eventually land full-time work

As they kick off their careers, young people often have to navigate a maze of short-term and casual jobs.

In Australia, many of them also wish to work more hours than their current jobs allow, leading to a situation called “underemployment”.

Casual employment and underemployment often go hand in hand. But just how common are these experiences during Australians’ early careers, and what effect do they have on their future wage prospects?

Read more: It's getting even harder to find full-time work. So more people are taking second part-time jobs

Setting the trajectory of young people’s careers

Early underemployment, casual employment and joblessness can greatly impact an individual’s career prospects later in life. Our 2023 study, assessing data from the Household Income and Labour Dynamics in Australia (HILDA) Survey, explored this issue in depth.

A large number of young men (22.5%) and women (19.4%) were found to have experienced underemployment when they first started their careers.

But Australian women, more so than men, endured extended and repeated periods of underemployment.

36 | Aussie Painting Contractor

This year, we explored these trends in a further study, analysing 20 years of data from the HILDA Survey to find out the common career paths young Australians take as they start working.

We started by looking into how often young people encounter a combination of casual work, underemployment, periods of not working and unemployment in the early stages of their careers.

Read more: HILDA data show women's job prospects improving relative to men's, and the COVID changes might have helped

Our research revealed a stark reality:

• Only 44% of young workers in our study had secured permanent jobs matching their working hours preferences within five years of graduating. The more than half that remained were dealing with employment situations that fell short of their ideal.

• Of this underemployed group – the majority of whom were women or had lower levels of education – 21% were stuck in a cycle of short-term and casual jobs, and 18% experienced careers marked by periods out of work and unemployment.

Finding a stable and satisfying job early on is a steep challenge for young Australians.

Underemployment creates a pay gap

Is moving between jobs while young good or bad for future earnings?

One argument is that switching between different short-term jobs during early careers can actually help young people gain work experience in different roles, give them time to explore their preferences and skills, and learn about better job opportunities. Ultimately, this can improve job matching and lead to higher wages later in life.

However, another argument is that when young people move randomly between jobs, companies or industries, it can slow down the rate at which they learn and grow. This is because they might not stick around at any one place long enough to really build up their experience.

We explored this issue in Australia and made three central findings.

1. Young Australians facing underemployment and casual employment at the start of their careers earn lower hourly wages on average. Even those who end up in permanent positions but are underemployed earn about 85 cents for every dollar earned by their peers in full-time permanent jobs.

2. This wage gap – between those with stable jobs early on and those who face early career challenges – does diminish over a 10-year period.

3. For young people who are primarily unemployed or inactive at the very start of their careers, wage penalties not only continue, but get worse over time. Importantly, among this group, men experienced the most significant wage penalties.

These findings tell us that jobless, underemployed youth face the heaviest career and wage penalties in later life.

What’s next?

A positive sign is the fact that the wage gap between young people in stable jobs and those facing instability closes over a 10-year period. However, this result does not fully address concerns about the uncertain career paths young people face.

38 | Aussie Painting Contractor

Aerial view people crossing pedestrian crosswalk

There are arguments both for and against changing jobs regularly while young. Varavin88/Shutterstock

Our study ultimately revealed that young people who cycle through short-term jobs and underemployment suffer wage penalties for a significant portion of their careers. These penalties have implications for their lifetime earnings and cumulative wages.

Addressing such lifelong setbacks requires us to create a more inclusive labour market that accommodates underemployed workers and those with non-standard employment experiences. This could mean introducing policies that promote job security, fair wages and benefits for workers in non-traditional jobs.

Think tank Per Capita suggests that better integrating underemployed workers into the workforce could significantly improve economic growth and national productivity.

So how do we help underemployed and jobless people find better jobs?

In many ways, underemployed jobless youth face the biggest career and wage penalties later in life. They often fall into precarious employment situations because their skills do not match what employers need, or because they don’t have the contacts, networks and connections to find appropriate job opportunities.

To deal with youth unemployment, we need better tools that enable us to show young people where the best jobs are, and also guide them on the best pathways to stable and secure jobs.

Many advanced tools that match skills to jobs are either not currently accessible without a paid subscription, or not effective enough at matching young people with the right job. Governments, industries and employment services should prioritise building new free tools that can facilitate better job searches and transitions between occupations to enhance workforce readiness for all Australians.

Read more: Half a million more Australians on welfare? Not unless you double-count

Irma Mooi-Reci Professor in Labour Sociology, The University of Melbourne

• Get your invoices out on time

• Stop ch asing debtor s and get paid quicker

• Better manage rece ipts and paperwork

• Lodge your BAS on time - don't cop a fine

• Stop mi ssing deductions

• Plan ahead and measure how you're going

A D V A N T A 6 [ Eliminate the B.S. in your business and your mates will be asking... "how do you have time to go fishing on the weekend?" Tradies Advantage offers you the COMPLETE FINANCIAL SOLUTION under one roofbookkeeping and accounting at a monthly FIXED price.

CONTACT US 07 3333 2415 info@tradiesadvantage.com.au 191 Wynnum Road, Norman Park QLD 4170

40 | Aussie Painting Contractor

IMPORTANT Contacts

Aussie Painters Network aussiepaintersnetwork.com.au

National Institute for Painting and Decorating painters.edu.au

Australian Tax Office ato.gov.au

Award Rates fairwork.gov.au

Australian Building & Construction Commission www.abcc.gov.au

Mates In Construction www.mates.org.au

Workplace Health and Safety Contacts

comcare.gov.au worksafe.act.gov.au worksafe.qld.gov.au

www.worksafe.vic.gov.au www.safework.nsw.gov.au

www.safework.sa.gov.au

commerce.wa.gov.au/WorkSafe/ worksafe.nt.gov.au worksafe.tas.gov.au

2024 May Issue | 41

Cancer Council Australia Ph. 0430 399 800 Ph. 1300 319 790 Ph. 13 72 26 / Ph. 13 28 65 Ph. 13 13 94 Ph. 1800 003 338 Ph. 1300 642 111 Comcare WorkSafe ACT Workplace Health and Safety QLD WorkSafe Victoria SafeWork NSW SafeWork SA WorkSafe WA NT WorkSafe WorkSafe Tasmania

1300 366 979 02 6207 3000 1300 362 128 1800 136 089 13 10 50 1300 365 255 1300 307 877 1800 019 115 1300 366 322 ACT NSW NT QLD SA VIC WA actcancer.org

cancerqld.org.au cancersa.org.au cancervic.org.au cancerwa.asn.au (02) 6257 9999 (02) 9334 1900 (08) 8927 4888 (07) 3634 5100 (08) 8291 4111 (03) 9635 5000 (08) 9212 4333

cancercouncil.com.au cancercouncilnt.com.au