Special Thanks to our 202 North Texas Home Builders Association Partners: Gold Silver

Just gonna break it down for y’all with some updates on housing affordability.

Best,

J. Tanner Wachsman RJ Wachsman Homes NTHBA President

J. Tanner Wachsman RJ Wachsman Homes NTHBA President

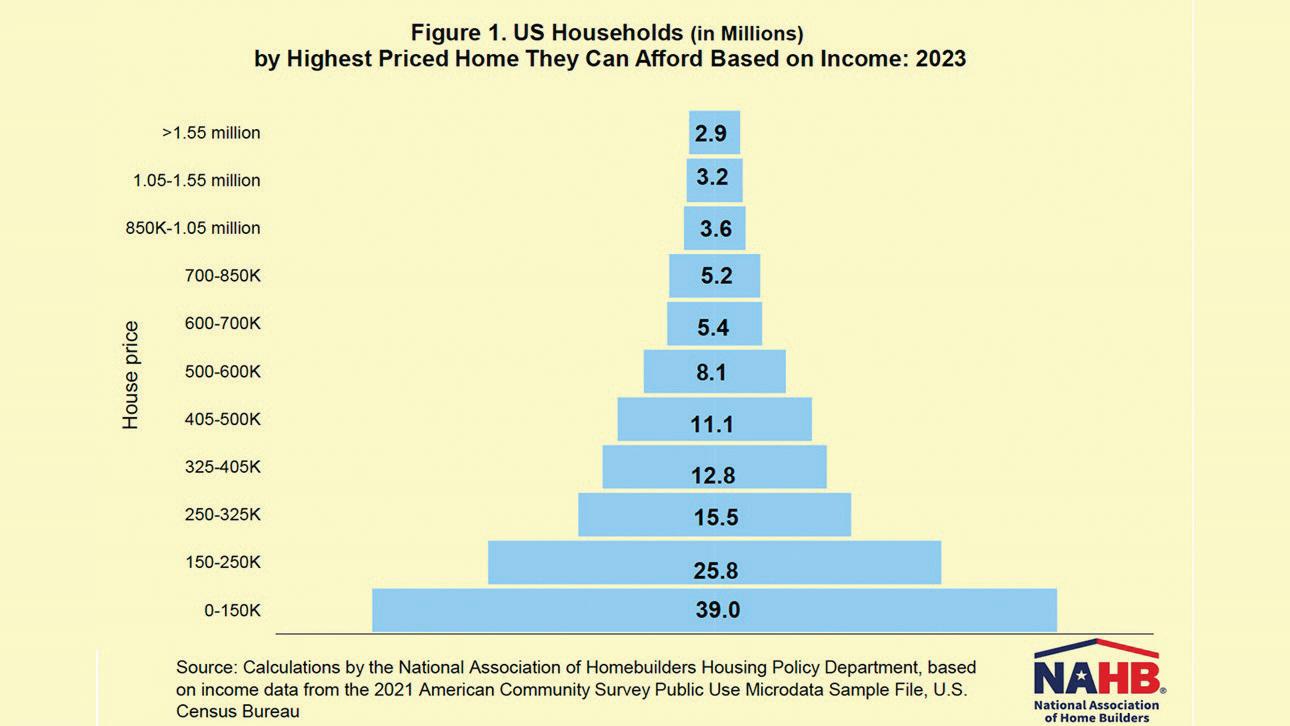

The National Association of Home Builders (NAHB) has updated its "housing affordability pyramid" for 2023, revealing that 64.8 million households out of 132.5 million cannot afford a $250,000 home. The pyramid is based on the assumption that mortgage, property taxes, and property insurance costs should not exceed 28% of household income. According to the data, 39 million households cannot afford a $150,000 home, while 25.8 million can only afford a maximum price between $150,000 and $250,000. With the nationwide median price of a new single-family home at $425,786, approximately 73% of all US households are unable to afford such a property. NAHB's Priced-Out Estimates for 2023 indicate that a $1,000 increase in the price of a median-priced new home would price 140,436 households out of the market, and even a quarter-point increase in interest rates could price out over 1.28 million households.

continued from pg. 1

The House of Representatives has passed the Lower Energy Costs Act (H.R. 1), addressing concerns about the adoption of costly and restrictive energy codes that could impact cities across the nation. Supported by the National Association of Home Builders (NAHB), the bill repeals a section of the Inflation Reduction Act that offers $1 billion in grants to encourage state and local governments to adopt stricter energy codes.

The State of Texas, and its cities (like Wichita Falls), often faces pressure from national code bodies that prioritize rapid adoption of energy codes over cost-effectiveness or practical safety concerns. These organizations create and manage the codebooks and claim impartiality, but are frequently populated by career inspectors and representatives tied to manufacturers who directly benefit from increased regulations on home building in the United States.

While these code bodies are open to participation from a wide range of professionals, many builders and contractors are preoccupied with constructing the country and may not have the time to engage in the process. This leaves bureaucrats and lobbyists with ample opportunity to push for new codes that may not provide significant benefits for everyday Americans.

The continuous push for increasingly stringent code policies can serve as a cover for politicians from both parties, who capitalize on new code adoptions as fuel for their political campaigns and media attention. This focus on ever-tightening regulations can sometimes overshadow the practical implications and effectiveness of such policies for everyday Americans. Even in Republican politics, this issue can be seen as a beneficial and productive tool for society, but this perception may be due to the fact that much of the monetary damage to affordability is delayed. This delay can be attributed to certain rollbacks, blockages in implementation, and varying regulations processes across different states and sub-localities, creating a maze of compliance timelines as these policies are gradually rolled out. For example, a state may adopt an energy code or other national code, and write in their legislation that the code shall only go into effect after a specific date, and only for certain areas, with specific conditions, etc. This complex implementation process can obscure the true impact of these regulations on affordability and practicality for everyday Americans.

While the NAHB supports the adoption of cost-effective energy codes, it opposes grant programs that do not allow for amendments that take local conditions and cost-effectiveness analysis into account.

In the context of Wichita Falls, the passage of the Lower Energy Costs Act will mean that our local and state governments are less pressured to adopt expensive energy codes that do not account for the unique needs and conditions of the city. This helps to ensure a balance between energy efficiency and affordability for residents.

The NAHB believes that the enforcement of the adoption of costly energy codes will exacerbate the housing affordability crisis and limit energy choices for consumers. The organization is now urging the Senate to advance these provisions in H.R. 1.

The increase in mortgage options such as rate buydowns and adjustable-rate mortgages (ARMs) may be deterring some potential homebuyers, as many prefer conventional financing options. Mortgage interest rates have risen for four consecutive weeks, averaging 6.65% as of March 2, which has strained affordability and caused a decline in mortgage applications. Builders have introduced mortgage- and price-related incentives to address affordability concerns, but conventional fixed-rate loans are still preferred by most consumers. While rate buydowns and ARMs offer lower initial rates, the variety of options can make it difficult for consumers to navigate the market and feel confident in their choices, especially for younger and first-time buyers. continues on pg. 4

GM Meeting

May 9, 2023

Annual Sporting Clay Shoot

May 19, 2023

2023 Parade of Homes

June 9-11, & 16-18, 2023

Member Tour of Homes

June 14, 2023

2023 Parade of Homes Wrap Up Dinner

June 22, 2023

Texas Builders Foundation’s Golf Tournament

July 11, 2023

Sunbelt Builder Show & TAB Summer Meetings

July 11-15, 2023

GM Meeting

July 18, 2023

GM Meeting

August 8, 2023

GM Meeting

September 12, 2023

Eddie Holcomb Memorial Golf Scramble

September 22, 2023

GM Meeting

October 10, 2023

GM Meeting

November 7, 2023

TAB Fall Committee, Council & BOD Meetings & Leadership Dinner

November 14-16, 2023

I t ’s not a dream home without natural gas.

The Texas Legislature's top Republicans, House Speaker Dade Phelan and Lt. Gov. Dan Patrick, have opposing proposals for reducing property owners' tax burden. Patrick favors raising the state's homestead exemption on school district property taxes, while Phelan supports tightening the "appraisal cap" on how much a homeowner's main residence's value can increase yearly for school district taxation. Patrick opposes Phelan's proposal and has vowed not to compromise on the issue, while Phelan questions how much relief homeowners would gain from raising the homestead exemption. Cutting the state's property taxes, among the highest in the nation, was a cornerstone of Gov. Greg Abbott's reelection bid last year, and Abbott promised to spend at least half of the state's nearly $33 billion surplus on property tax cuts. It is expected that Abbott will call a special session if the two sides cannot resolve their differences.

The House's main tax bill, the Property Tax Relief Act, would lower the appraisal cap from 10% to 5% for all types of property and result in more than $17 billion in property tax relief when combined with the proposed state budget for the next biennium. The bill would lower school district property taxes by 28% and reduce the amount of local property tax dollars redistributed to other school districts in Texas by about $4.5 billion for the next two years. While the House has not ruled out a compromise with the Senate, Phelan contends that raising the homestead exemption would not do anything for small- and medium-sized businesses and would not keep up with rapidly rising property values.

The population of Texas increased by 470,708 between 2021 and 2022, making it the second state to exceed 30 million residents. This growth has led to a surge in home building, with the National Association of Home Builders (NAHB) reporting strong growth in single-family permits. The state's largest metropolitan areas have seen the highest permit activity, with Austin-Round Rock leading. An interesting note is that in Houston… The Woodlands / Sugar Land have consistently issued more permits than Dallas / Fort Worth / Arlington since 2005, despite similar population growth rates.

- Pending home sales on rise;

- Metal roofing materials are slated to be the fastest rising product segment going forward into 2026;

- State of Utah officials are considering legisla on that would create ‘first time homebuyer’ credits of up to $20,000;

*All of the informaton above, save for some commentary – is directly sourced from artcles circulated to NAHB members through their email channels. The condensing done here is to help both me, and you – to understand our current climate as it relates to housing.

Member Atmos Energy sponsored lunch for the RESNET Energy Code lunch and learn hosted by North Texas Home Builders Association, RESNET and the Texas Association of Builders on Thursday, March 16th.

Builders from Axis Construction, Classic Builders, Deeb Custom Homes, Dennis Company Homes, Garnel Construction Company, Harmon & Holcomb Homes and Hughes & Son Construction were in attendance along with lunch sponsor Pam Hughes-Pak of Atmos Energy and Executive Vice President Teri Gibson.

Valerie Briggs flew in from Virginia to hold the RESNET Energy Code class for several Texas HBA’s. She had already spent time in Ft. Worth, Houston, Abilene and Tyler before landing in Wichita Falls.

Valeria said, “RESNET (Residential Energy Service Network) was founded in 1995 as a non-profit organization to help homeowners reduce their utility bills by making their home more energy efficient.

She explained RESNET is like the MPG for homes. They introduced what is called a HERS index. The HERS Index is:

• The national standard by which a home’s energy efficiency is inspected, tested and rated. • A simple, easy to understand system to compare energy performance of a home. • A lower HERS Index Score means a home uses less energy.

A typical home built to 2006 energy efficiency standards scores 100 on the HERS index.

A 1-point change in the HERS Index represents a 1% change in energy use.

A HERS Rating includes:

• Energy Modeling

• Pre-drywall Inspection

• Final Inspection and testing, including duct and envelope leakage and ventilation texting.

The benefits in using a HERS Index include:

• Potential reduction in construction costs compared to prescriptive energy code compliance.

• Third-party verification of the energy performance of the home that often reduces call backs.

• Homes are listed in the RESNET/Appraisal Institute Appraiser Portal and have the potential to receive a higher appraised value.

• Potential to be eligible for the Energy Star for Homes label.

• Ability to market the environmental impact of the home to consumers.

• Access to all HERS Rating data through the RESNET National Registry.

Over 337,000 homes were HERS Rated in 2022 with over 81,000 being in Texas making it the top state for 3 years in a row. Ratings have surpassed the 3.6 million milestone.

Large production builders are using their homes’ HERS Index Scores as part of the ESG reporting. Mortgage backed securities green bond market for single family energy efficient homes are based on HERS Ratings and the passage by Congress of the Veterans Home Energy Savings Act qualifies more veterans and service members to purchase energy-efficient homes.

The Inflation reduction act (IRA)

March 21, 2023 marked the 6th consecutive year the North Texas Home Builders Association was able to present the WFISD Career Education Center with a donation from the proceeds of web site banner ad sales. Thus far giving over $34,000 from website banner ad proceeds and an additional $5000.00 from Parade of Home ticket sales proceeds in 2021.

Thank you! American National Bank, Atmos Energy, Brazos Window & Door LLC, Breegle Abbey Carpet & Floor, Builders Lumber Company, Douglas Custom Homes, First Bank, FirstCapitalBank of Texas, First National Bank, Flat Branch Home Loans, Guarantee Title Company, Lance Friday Homes, On Site Solutions, Stewart Title Company, Stone Lake Development, Texoma Community Credit Union & Union Square Credit Union, for your continued support by purchasing these ads.

School Superintendent Dr. Donny Lee spoke at the luncheon prior to the check presentation and gave the audience an overall state of the schools.

With some of the past experiences citizens have had with the WFISD Dr. Lee decided he wanted to clarify some perceptions about what is happening with WFISD with the realities of what is actually happening with the WFISD. To begin Dr. Lee gave a sneak peek of the two new high schools being built by showing a short video of the construction that is currently going on.

When the video was over, he mentioned there is a perception from the community the WFISD will not be able to complete construction on the schools on time and the community will not get what they were promised. The reality is, both schools, Memorial and Legacy will be complete on time with both schools opening up in 2024. However, in order to keep in budget, due to the inflation, WFISD did have to do some value engineering which consist of changing a few items that the public typically would not notice unless they had initially known about it. Small things like the fabric in the carpet had to be changed. Areas that might have been tiled were changed to stained concrete. Everything else is the same and has been paid for up to about a 60% draw down of the bond.

A large problem WFISD is having, is there was also a proposition B which was a bond for $13.5 million for the athletic facilities. The original plan was to move 4 million from fund balance and there would be $17.5 million. For some reason there was a large delay in the construction and moving forward with bids for the athletic complexes. Since then, cost have skyrocketed and that same cost of $17.5 million will now cost $40 million. Therefore, WFISD will be able to afford everything on the ground, meaning there will be baseball fields that are turfed and all fields will be there. Anything above the ground, dugouts, bleachers, bathrooms, fencing and so on, they will not be able to afford. At this time they have reached out to several donors and there are some promising things there but it is not something they are ready to move forward and announce yet. They do have plans and are working with a lot of people but again, at this time they have no funds to complete the athletic facilities.

Dr. Lee mentioned the controversy over determining the mascots for the new schools. It has been determined Memorial will be the Mavericks and Legacy will be Leopards.

Other items that are being looked at are middle schools. The school board has come up with and ad hoc committee that will be researching and bringing recommendations back to the school board as to which locations will be used for the middle schools.

There is a perception that Students in WFISD are not performing academically. In reality, they are performing very well. The rating from TEA is a B district and that is with 2 of the campuses having an F rating. WFISD had 4 national merit semifinals and 6 national merit commended students which is unbelievable. You cannot find that anywhere else in the region. WFISD also has the national bachelorette program which will be at Legacy High School. WFISD has a lot of things going on academically and is a lot to be proud of.

WFISD is doing great with their extracurricular activities. All the sport teams are performing well every year. Football, swimming, golf almost every form of sports.

Another perception is that WFISD schools are not safe and overcrowded. Looking at numbers and discipline. McNiel has had zero incidents of violence this year. Barwise had one at the beginning of the year. Kirby has been extremely safe after being on the persistently dangerous list for 6 years in a row up until last year for fighting and also for what most people do not know, vapes. Vapes have been a huge problem. Since protocol for anyone bringing a vape to school that has any trace of THC in it, the kids will get arrested. WFISD has various things in place for safety. WFISD works with Crime Stoppers, WF Police Department, Region IX, Anti Bullying and they have gaggle software that will send a text to the team if students send a text that have any key words like suicide, gang, kill and they can go out and talk with those kids.

While talking about Safety of the kids, Dr. Lee was asked about metal detectors that were purchased but not being used. He explained they had been purchased most likely on a whim, thinking it would be a great idea. When they came in and they began realizing what was all entailed in order to use them, man power, mainstreaming kids through one location, weather while waiting to get kids in because of mainstreaming, the cost to an already struggling budget would be astronomical.

As for overcrowding, it is not that way at all. There are around 13 students per each class.

Dr. Lee mentioned some highpoints about the new schools such as classroom sizes will be large enough for around 25 students per room, some classes the teachers will rotate rather than the students and many of the classrooms are designed to where they can be converted easily for other purposes.

Along with the check presentation and update on WFISD, members enjoyed a delicious meal cooked by the CEC Culinary students.

It was a pleasure being able to have our luncheon in the state of the art Career Education Center while being able let the students show their talent of cooking and while being able to donate to help grow local workforce talent.

NAHB has updated its "housing affordability pyramid" for 2023, and the latest data show that 64.8 million households out of a total of 132.5 million are unable to afford a $250,000 home.

The pyramid is based on conventional underwriting standards that assume the cost of a mortgage, property taxes and property insurance should not exceed 28% of household income. Based on this methodology, NAHB economists have calculated how many households have enough income to afford a home at various price thresholds.

At the base of the pyramid are 39 million U.S. households with insufficient incomes to be able to afford a $150,000 home.

The pyramid's second step consists of 25.8 million with enough income to afford a top price somewhere between $150,000 and $250,000. Adding up the bottom two rungs shows that there are 64.8 million households who cannot afford a $250,000 home.

The nationwide median price of a new single-family home is $425,786, meaning half of all new homes sold in the U.S. cost more than this figure and half cost less. A total of 96.5 million households — roughly 73% of all U.S. households — cannot afford this median-priced new home.

This helps put affordability concerns into perspective and goes a long way toward explaining why housing affordability now stands at a more than 10-year low.

The top of the pyramid shows that 9.7 million households have enough income to buy a $850,000 home (adding up the top three rungs), and 2.9 million even have enough for a home priced at $1.55 million. But market analysts should never focus on this to the exclusion of the wider steps that support the pyramid's base.

On March 2, NAHB released its new Priced-Out Estimates for 2023, which shows that a $1,000 increase in the price of a median-priced new home will price 140,436 U.S. households out of the market for the home.

Prospective home buyers also are adversely affected when interest rates rise. NAHB's priced-out estimates show that 1.28 million households are priced out of the market for a new median priced home at $425,786 when interest rates rise a quarter-point from 6.25% to 6.5%. An increase from 6.5% to 6.75% prices approximately 1.29 million households out of the market.

703 E. Scott Wichita Falls, T X 76308 Pyramid Illustrates Housing Affordability Crisis