A NARFE PUBLICATION FOR FEDERAL EMPLOYEES AND RETIREES April 2024 VOLUME 100 ★ NUMBER 3 P. 26 Best Places to Retire 2024 P. 36 CSRS vs. FERS: Which Came Out on Top? P. 42 State Tax Treatment of Federal Annuities

brookdale.com A great movefor NARFE members Experience a senior living lifestyle that features restaurant-style dining, housekeeping, laundry and more with special savings for NARFE members. 1058444 SR monthly fee/basic service rate* 7.5 OFF SENIOR LIVING: % OFF 10 service rate** % IN-HOME SERVICES: DISCOUNTED RATES VARY BY COMMUNITY*** SHORT-TERM STAY: For more information, call (866) 787-9775 or visit brookdale.com/NARFE. ©2024 Brookdale Senior Living Inc. All rights reserved. BROOKDALE SENIOR LIVING is a registered trademark of Brookdale Senior Living Inc. *Discount is only applicable to new residents of a Brookdale independent living, assisted living, or memory care community admitting under an executed residency agreement. Discount applies only to the monthly fee/basic service rate, excluding care costs and other fees and is calculated based on the initial monthly fee/basic service rate. **Discount is only applicable to new clients of personal assistance services by a Brookdale agency under an executed service agreement. ***Discount is only applicable to new residents of a Brookdale assisted living or memory care community admitting under an executed respite agreement. Discount applies to the daily rate. Applicable to all discounts: Residents under a Life Care Agreement are not eligible for the discounts. These discounts do not apply to any room, board or services which are paid for all or in part by any state or federally funded program. Discounts are available to members and their family members, including spouse, adult children, siblings, parents, grandparents, and corresponding in-law or step adult children, siblings, parents, and grandparents through current spouse. Subject to availability. Further restrictions may apply.

NARFE MAGAZINE www.NARFE.org 1 P. 26 Best Places to Retire 2024 P. 36 CSRS vs. FERS: Which Came Out on Top? P. 42 State Tax Treatment of Federal Annuities Contents APRIL 2024 PAGE 26 COVER STORY FEATURE PAGE 36 Special Feature 42 State Tax Treatments of Federal Annuities Washington Watch 8 The NARFE Halftime Report 10 Harnessing Digital Platforms for Grassroots Advocacy 11 Bill Introduced to Increase Federal Pay Rates in 2025 12 Submit Proposed Changes to NARFE’s Advocacy Positions for the 119th Congress 14 Bill Tracker Columns 4 From the President 24 Benefits Brief 48 Managing Money Departments 6 NARFE Online 20 Questions & Answers 21 Countdown to COLA 50 NARFE News 54 NARFE Perks 56 The Way We Worked ON THE COVER Illustration by TGD FOR FEDERAL EMPLOYEES April 2024 P. 26 Best Places to Retire 2024 P. 36 CSRS vs. FERS: Which Came Out on Top? P. 42 State Tax Treatment of Federal Annuities CSRS VS. FERS: WHICH CAME OUT ON TOP? We compare the Civil Service Retirement System and the Federal Employees Retirement System after nearly 40 years since the latter plan was introduced to federal workers. BEST PLACES TO RETIRE 2024 Where do you see yourself happiest in retirement? Our latest advice helps federal workers weigh all financial considerations when choosing the right location. Connect with us! Visit us online at www.narfe.org Like us on Facebook NARFE National Headquarters Follow us on Twitter @narfehq Follow us on LinkedIn NARFE

APRIL 2024

VOLUME 100 ★ NUMBER 3

EDITORIAL DIRECTOR

Jenn Rafael

CREATIVE SERVICES MANAGER

Beth Bedard

CONTENT MANAGER

Matt Sanderson

ADDITIONAL GRAPHIC DESIGN

TGD

EDITORIAL BOARD

William Shackelford, Kathryn E. Hensley, Johann De Castro

CONTACT US

NARFE Magazine

606 North Washington St. Alexandria, VA 22314-1914

Phone: 703-838-7760 Fax: 703-838-7781

Editorial: communications@narfe.org

Advertising Sales: Francine Garner advertising@narfe.org

NARFE FOR THE VISUALLY IMPAIRED

ON THE TELEPHONE: This publication can be heard on the telephone by persons who have trouble seeing or reading the print edition. For more information, contact the National Federation of the Blind NFBNEWSLINE® service at 866-504-7300 or go to www.nfbnewsline.org.

ON DIGITAL AUDIO: Issues of NARFE Magazine are also available in audio format through the National Library Service for the Blind and Physically Handicapped (NLS). For availability, call 202-727-2142 or your local NLS service provider.

The Association, since July 1970, has been classified by the IRS as a tax-exempt labor organization [not a union]; however, dues and gifts or contributions to the Association are not deductible as charitable contributions for income tax purposes.

NATIONAL OFFICERS WILLIAM SHACKELFORD President; natpres@narfe.org

KATHRYN E. HENSLEY Secretary/Treasurer; natsectreas@narfe.org

CHIEF OF STAFF

JOHANN DE CASTRO jdecastro@narfe.org

TO JOIN NARFE, RENEW YOUR MEMBERSHIP OR FIND A LOCAL CHAPTER:

CALL (TOLL-FREE) 800-456-8410 OR GO TO www.narfe.org

TO CHANGE YOUR ADDRESS, PHONE NUMBER OR EMAIL

LISTING:

CALL (TOLL-FREE) 800-456-8410 EMAIL memberrecords@narfe.org

OR GO TO www.narfe.org, log in and click on “My Account”

TO REACH A FEDERAL BENEFITS SPECIALIST: EMAIL fedbenefits@narfe.org

NARFE HEADQUARTERS

606 N. Washington St. Alexandria, VA 22314 703-838-7760

Hours of operation: Monday-Friday, 8 a.m.-5 p.m. ET

REGIONAL VICE PRESIDENTS

REGION I Jeff Anliker (Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island and Vermont)

Tel: 413-813-8136

Email: jeff.anliker@outlook.com

REGION II Larry Walton (Delaware, District of Columbia, Maryland, New Jersey and Pennsylvania)

Tel: 443-831-1791

Email: rvp2@narfe.org

REGION III Lynn Harper (Alabama, Florida, Georgia, Mississippi, South Carolina and Puerto Rico)

Tel: 478-951-3260

Email: lynn_harper@msn.com

REGION IV Robert L. Helfrich (Illinois, Indiana, Michigan, Ohio and Wisconsin)

Tel: 317-501-1700

Email: rlhelfrich@yahoo.com

REGION V Cindy Reneé Blythe (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota)

Tel: 785-256-1450

Email: mrsdocbusyb@yahoo.com

REGION VI Marshall L. Richards (Arkansas, Louisiana, Oklahoma, Republic of Panama and Texas)

Tel: 903-660-2784

Email: pappysdad@cobridge.tv

REGION VII Sharon Reese (Arizona, Colorado, New Mexico, Utah and Wyoming)

Tel: 575-649-6035

Email: rvp7@narfe.org

REGION VIII Robert H. Ruskamp (California, Hawaii, Nevada and Republic of Philippines)

Tel: 703-628-3234

Email: ruskampr@gmail.com

REGION IX Steven Roy (Alaska, Idaho, Montana, Oregon and Washington)

Tel: 425-344-3926

Email: stevenroy1@yahoo.com

REGION X Robert Allen (Kentucky, North Carolina, Tennessee, Virginia and West Virginia)

Tel: 757-404-3880

Email: rvp10@narfe.org

NARFE Magazine (ISSN 1948-4453) is published monthly except in February

reasonable precaution is taken. All submissions become the property of NARFE. Copyright © 2024, NARFE. Advertisements in the magazine are not endorsements of products and/or services by NARFE, unless officially stated in the ad. We shall accept advertising on the same basis as other reputable publications: that is, we shall not knowingly permit a dishonest advertisement to appear in NARFE Magazine, but at the same time we will not undertake to guarantee the reliability of our advertisers.

2 NARFE MAGAZINE APRIL 2024

and July by the National Active and Retired Federal Employees Association (NARFE), 606 N. Washington St., Alexandria, VA 22314. Periodicals postage paid at Alexandria, VA, and additional mailing offices. Members: Annual dues includes subscription. Nonmember subscription rate

Postmaster: Send address change to: NARFE Attn: Member Records, 606 N. Washington St., Alexandria, VA 22314. To ensure prompt delivery, members should also forward changes of address without delay. Because of the volume involved, NARFE cannot acknowledge nor be responsible for unsolicited pictures and manuscripts, although every

$48.

A health center with doors open

and with our arms even

At Falcons Landing, exceptional care doesn’t end with our healthcare. Sure, we’re recognized by U.S. News & World Report as a “Best Nursing Home for Short-Term Rehabilitation and Long-Term Care,” and yes, we offer state-ofthe-art, specialized Memory Care in a brand-new, standalone neighborhood. But look closer and you’ll also find a close-knit community of people who excel at caring. So while our healthcare is outstanding, the common bonds that unite us are what’s truly remarkable.

Get to know us better!

your personal tour today: 703-844-3186

FALCONSLANDING.ORG Assisted Living • Skilled Nursing • Short-Term Rehabilitation • Memory Care FALCONSLANDING. ORG INDEPENDENT SENIOR LIVING | POTOMAC FALLS, VA Falcons Landing is proud to be a non-profit Life Plan Community.

WIDE

Schedule

WIDER

Eligibility for Independent Living at Falcons Landing is open to any officer that has served, senior level federal employees GS14 and above, spouses or surviving spouses. If you are looking for short-term rehab, long-term care, assisted living or memory care, no military or government background is required.

NARFE’S MISSION STATEMENT

To support legislation and regulations beneficial to federal civilian employees and annuitants and potential annuitants under any federal civilian retirement system and to oppose those detrimental to their interests.

To promote the general welfare of federal civilian employees and annuitants and potential annuitants, to advise and assist them with respect to their rights under retirement, health and other employee and retiree benefits laws and regulations, and to represent their interests before appropriate authorities.

To cooperate with other organizations and associations in furtherance of these general objectives.

Major Changes Are Coming

Changing times demand that organizations transform or be taken over by events.

Most members know that NARFE chapters have struggled to remain viable historically. One primary reason has been, and continues to be, the loss of members due to membership non-renewal. Additionally, as NARFE membership ages, leadership becomes a larger problem. Leaders age out and are unwilling or incapable of continuing. This problem is compounded by the unwillingness of other members to assume a leadership role in the chapter. The leadership scenario also exists in many of our federations.

Resolving this problem would require a significant organizational change. The National Executive Board (NEB) has been discussing a merger/closure plan since 2018 with no decision. There’s been no plan in five years! During the 2020 election period, Bylaw Amendment B-2009 was approved by NARFE membership, allowing federation mergers. National Bylaws, Article VIII Federation, Section 1 enables the NEB to authorize a federation merger consisting of two or more states.

In June 2023, I requested that the Strategic Planning Team, comprised of the regional vice presidents from Regions I, V and VII, move forward and develop federation merger and closure procedures. At the meeting of the NEB in December 2023, the federation merger and closure procedures were reviewed and approved, and a handbook was developed. Region VII Vice President Sharon Reese was approved to continue merging the Arizona and New Mexico federations, which will remain a part of Region VII. The first Federation Executive Board meeting of the new Southwest Federation was held in February. The success of this federation merger will truly demonstrate that the future of NARFE is in our hands.

2024 STRATEGIC PLAN

NARFE will continue to face several challenges in the future. We must take a measured approach to reform. The 2024 Strategic Planning Team/Committee continues to develop the strategic plan that makes sense for today while positioning our organization to attract a new generation of NARFE members.

MARKETING AND RECRUITMENT INITIATIVE

The NEB has been asked to authorize headquarters staff, under the guidance of Chief of Staff Johann De Castro and Member Engagement Director Nora MacDonald, to spend time formulating next steps in a plan which will work toward mitigating the decline of NARFE’s membership while beginning a process of growth. NARFE staff will incorporate the recommendations made by the NARFE federation presidents from their joint meeting with the NEB in August 2023. This plan will emphasize recruiting, retention and reinstatement. Admittedly, the timeline for this initiative will seem slow, but this is because the process should be a thoughtful and deliberate approach. Fulfillment will require doing things differently, but it is necessary to ensure that NARFE remains viable through the addition of members and improved member services.

FEDCON24 REMINDER

Online registration is open for FEDCon24, our premier NARFE conference, at fedcon.narfe.org in St. Louis. I hope you strongly consider joining us! As always, I appreciate your support so we can move NARFE forward together. The future of NARFE is in our hands. Stay healthy and stay safe!

WILLIAM SHACKELFORD NARFE NATIONAL PRESIDENT natpres@narfe.org

WILLIAM SHACKELFORD NARFE NATIONAL PRESIDENT natpres@narfe.org

4 NARFE MAGAZINE APRIL 2024

From the President

*With purchase of a new Safe Step Walk-In Tub. Not applicable with any previous walk-in tub purchase. Offer available while supplies last. No cash value. Must present offer at time of purchase. Other restrictions may apply. CSLB 1082165 NSCB 0082999 0083445 13VH11096000 Call Today For More Information! 1-800-253-0137 Visit BuySafeStep.com Scan to learn more BEFORE AFTER North America’s #1 Selling Walk-In Tub Professionally installed in as little as one day Easy to Use Premium Quality, Style, & Innovation Professional Installation Included Lifetime Warranty Made in Tennessee Bubbles, Massage Jets, & More + FREE SHOWER PACKAGE For a limited time only. $1600 * OFF

SAVE MONEY WITH NARFE PERKS

WHETHER you are planning your next vacation or move, buying a gift or planning for retirement, members can save money on every day purchases with special discounts from our Affinity Partners. Visit www.narfe.org/perks or see p.54.

Visit NARFE’s Legislative Action Center

NARFE’s team of professional lobbyists continues to work tirelessly on behalf of the federal community.

The association offers members a robust Legislative

Action Center at www.narfe. org/advocacy/legislativeaction-center. It is an easy way to send letters to your members of Congress, search for your legislators, report your congressional meetings,

STAY INFORMED

Stay on the pulse of key federal news and benefits information by subscribing to NARFE Daily News Clips. This newsletter features informative breaking news and informative articles curated just for NARFE members.

and more to supercharge your advocacy efforts.

Jump into the thick of several active grassroots campaigns and help them gain momentum. Your advocacy advances retirement security protections for all feds.

TSP

TSP Update Online

Get the most recent monthly and annual Thrift Savings Plan returns (G, F, C, S, I and L) online www. narfe.org/tsp-funds.

TRACKING RETIREMENT CLAIMS

Find out how many retirement claims OPM Retirement Services receives and processes each month, with average processing times and total inventory, at www.opm.gov/retirement-center/ retirement-statistics/

TAKE CHARGE OF YOUR BENEFITS

The NARFE Federal Benefits Institute is a membersonly resource designed to help you take charge of your benefits and guarantee a secure future. Visit narfe.org/ federal-benefits-institute.

Enjoy ongoing access to webinars, benefits briefs and other free resources, like contacting our special benefits expert to help with specific questions.

6 NARFE MAGAZINE APRIL 2024

NARFE Online

Does your mobility scooter keep you from being mobile?

MEET ATTO SPORT: THE MOST PORTABLE MOBILITY SCOOTER

With ATTO SPORT, Nothing Comes Between You and Being There

“Is your mobility scooter so hard to use that you don’t feel mobile? Too heavy or too complicated to take on trips? Too uncomfortable to use all day? I was frustrated with mine and with feeling stuck at home.

That’s why I found out about ATTO SPORT. Just one call and the nice people brought one to my home for a FREE test drive. The other scooter companies wouldn’t do that for me.

Folding Scooter Ad

Now I love my ATTO SPORT! It’s sturdy, splits into 2 pieces so I can lift it into my car trunk, and even carry it onto an airplane.”

Your new ATTO SPORT scooter is unlike any other scooter available today. It’s built to travel, whether around town or around the world. Ergonomically designed for your comfort and convenience.

ATTO SPORT splits into 2 pieces in under a minute for easy transport. You can even take it on an airplane as a carry-on. The heaviest piece is only 37 lbs., making it easy to put in your trunk. It even folds into a trolley shape with wheels for those times you need to move it without riding it.

Your ATTO SPORT snaps back together in seconds and you’re ready to go. The padded leather seat is adjustable, as is the tiller, to customize your riding position for comfort. Shock-absorbing tires and an extended wheelbase smooth out your ride. With ATTO SPORT, you’re looking good and feeling good all day long!

ATTO SPORT is more than just a stylish ride. Their super-smart engineers built-in quality and safety from day one. It’s a performance superstar with a 12-mile range and a top speed of over 6 miles per hour. With a 300 lbs. maximum capacity, it’s built to last. Electronic stability control and automatic slowing on downward slopes and turns keeps you safer than ordinary scooters. It even has front and rear lights for night visibility.

Don’t let a bulky or cheaply made scooter keep you from experiencing life. Join the thousands of ATTO SPORT owners worldwide.

comfortable seat Splits into 2 lightweight parts for easy lifting Folds in 3 seconds, rolls like a trolley suitcase

CRUISES ROAD TRIPS FLIGHTS

legroom,

Locations: Irvine CA, Burbank CA, Sacramento CA, Palm Desert CA, Phoenix AZ, Coconut Creek FL, Richmond VA, Chicago IL, Hartford CT, Houston TX Call Now FREE OFFICE AND HOME DEMOS 1-850-990-0111 | foldingscooterstore.com/narfe UP TO PROMO CODE: NARFE24 VALID UNTIL APRIL 15TH , 2024 $500 OFF! ONSCOOTER&ACCESSORIES WITH YOURNEWATTOSPORTPURCHAS E ! CANNOTBECOMBINED WITH OTHEROFFERS

The NARFE Halftime Report: Legislative Accomplishments from the First Session of the 118th Congress

NARFE’s advocacy efforts—a combination of grassroots and grasstops advocacy, direct lobbying and political action—in the first half of the 118th Congress spurred progress on top priorities while pushing back on continued threats.

Below are the highlights of how we made an impact on policy issues under consideration in the nation’s capital:

PROTECTING EARNED FEDERAL BENEFITS

No cuts to federal benefits were included in the two-year budget deal that reduced spending caps and raised the debt ceiling brokered between congressional leaders and President Joe Biden and codified via the Fiscal Responsibility Act of 2023.

Unfortunately, some in Congress continue to propose policies that would cut earned federal benefits and seek to include them in larger budget deals. Such proposals include reducing or eliminating costof-living adjustments to federal annuities, decreasing the government share of health insurance premiums under

the Federal Employees Health Benefits (FEHB) program, reducing the initial retirement benefit for current federal employees approaching retirement, and/or reducing the rate of return on federal civilian and military retiree savings in the Thrift Savings Plan G Fund. NARFE continues to prioritize fighting back against such

proposals, as they would renege on promised benefits earned via public service.

PROGRESS INCREASING SUPPORT FOR WEP/GPO REPEAL AND REFORM

The Social Security Fairness Act, H.R. 82/S. 597, to repeal the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) was reintroduced in both chambers of the 118th Congress with NARFE’s support.

At the end of 2023, H.R. 82 accrued 301 cosponsors, significantly higher than at the same time in the 117th Congress

APRIL ACTION ALERT: SUPPORT MARKUP OF THE SOCIAL SECURITY FAIRNESS ACT, H.R. 82

Visit NARFE’s Legislative Action Center at www.narfe.org to send a message to your lawmakers requesting they push the House Ways and Means Committee to advance the Social Security Fairness Act, H.R. 82, with a favorable recommendation, to the floor! With more than 300 cosponsors, this bill is closer to achieving legislative progress in repealing the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO)−two longstanding provisions that unfairly reduce the retirement benefits of hardworking public servants.

8 NARFE MAGAZINE APRIL 2024 Washington Watch

Washington Watch

(when the bill ended 2021 with 242 cosponsors), and S. 597 accrued 49 cosponsors, also higher than at the same time in the 117th Congress (when the bill ended 2021 with 37 cosponsors).

In another sign of progress, the House Committee on Ways and Means also held a hearing on WEP and GPO on November 20, 2023, in Baton Rouge, LA, highlighting the impact of WEP/ GPO on everyday Americans.

Momentum continues to build within Congress to address these issues, whether via full repeal or incremental reform, such as via H.R. 4260, the Public Servants Protection and Fairness Act, or H.R. 5342, the Equal Treatment of Public Servants Act, the reintroduction of which NARFE also supported.

IMPROVING CUSTOMER SERVICE PROVIDED BY THE OFFICE OF PERSONNEL MANAGEMENT’S (OPM) RETIREMENT SERVICES (RS) DIVISION

NARFE’s advocacy has helped highlight concerns within Congress and the administration regarding significant retirement processing delays and the inability of annuitants and their families to connect with OPM to receive needed assistance. NARFE-drafted language has been included in House Financial Services and General Government appropriations committee reports requiring OPM to publicize various retirement claims and benefits change processing times and

MYTH VS. REALITY

MYTH: A committee “markup” is simply about approving bills as introduced.

REALITY: Committee markup is a significant phase in which committee members debate, amend and rewrite proposed legislation. This process can alter the original bill, affecting its impact if it becomes law. Markup sessions provide an opportunity for detailed scrutiny and refinement of legislation.

call center response rates, along with quarterly congressional briefings on the issues. Senate appropriators have directed increased funding for OPM to improve OPM’s customer service.

NARFE continues to push for the modernization of processes and information technology, adequate funding for OPM, and continued congressional oversight. While the situation has improved recently, with the inventory of new retirement claims decreasing from 25,227 in October 2022 to 14,292 in December 2023, this may result from lower annual claims rather than increased monthly claims processing.

SUPPORTING CHOICE FOR FEDERAL HEALTH BENEFITS

As OPM began to encourage FEHB plans to provide Medicare Prescription Drug plans, NARFE continued to push for choice for federal retirees—to opt out (or in) to such plans, based on the individual’s circumstances. A hallmark of the FEHB program, NARFE will continue to push for individual choice to enable federal employees, retirees, and their survivors to select the best plan that meets their individual needs.

OPPOSITION TO GOVERNMENT SHUTDOWNS

While issues arising from extensive government funding debates are often out of NARFE’s control, NARFE continues to press lawmakers to avoid unnecessary and wasteful government shutdowns. This

comes most often from providing supporting arguments and information to allied lawmakers (and staff) and supporting centrist efforts to find common ground with the opposing party.

PROGRESS BUILDING SUPPORT FOR FULL COLAS FOR FERS RETIREES

NARFE supported the reintroduction of the Equal COLA Act, H.R. 866/ S. 3194, to provide Federal Employees Retirement System (FERS) annuitants with an annual COLA equal to the relevant CPI increase via passage of the. Current law holds the FERS COLA at 2% if the full COLA falls between 2% and 3%, and it reduces FERS COLAs by one percentage point if the full COLA exceeds 3%. The Equal COLA Act would eliminate these reductions, providing a full COLA.

At the end of 2023, H.R. 866 accrued 46 cosponsors, more than the total accrued at the end of the 117th Congress (when the bill had 34 cosponsors).

PROTECTING A MERITBASED CIVIL SERVICE

The merit-based civil service framework provides continuity of government through changing administrations, preserves institutional knowledge and expertise, and safeguards the rule of law and adherence to the Constitution. NARFE has opposed attempts to eliminate the merit-based system (via legislation) or to bypass it using

NARFE MAGAZINE www.NARFE.org 9

SEE HALFTIME REPORT ON P. 12

NARFE GRASSROOTS ADVOCACY

LEARN MORE about how you can take action to protect your earned pay and benefits by reviewing NARFE Grassroots materials at www.narfe.org/advocacy.

Harnessing Digital Platforms for Grassroots Advocacy: The Power of Social Media

In the realm of grassroots advocacy, embracing the digital world has become a strategic advantage and necessity. The rise of platforms like Facebook, X, formerly known as Twitter, LinkedIn, and other social media channels, has revolutionized how advocates engage with policymakers and the public. While traditional methods like letters, emails, and phone calls still hold value, the digital landscape offers a dynamic and immediate way to amplify messages and engage directly with lawmakers and a broader audience.

THE GROWING IMPORTANCE OF SOCIAL MEDIA IN ADVOCACY

Statistics show an increasing number of lawmakers are active on platforms like X. A report by the Pew Research Center reveals that every serving legislator (541 in total across both houses of Congress) has at least one X account. This offers a unique opportunity for advocates to engage with them directly. The immediacy and public nature of platforms like X make them powerful tools for advocacy. With a single tweet, advocates can reach their representatives and a wider audience, rallying support and raising awareness on critical issues.

X, FORMERLY KNOWN AS TWITTER: A KEY PLAYER IN MODERN ADVOCACY

X, often misunderstood as just a platform for short updates, is a potent advocacy tool. Its short-form blogging style allows for concise, impactful dialogue and messaging that can quickly capture attention. Retweeting and sharing posts help disseminate information rapidly, expanding the reach and influence of an advocacy campaign. Moreover, hashtags on X can link conversations and issues, creating a cohesive online movement that is easily trackable and joinable.

For instance, a study by the Congressional Management Foundation found that it takes only 30 tweets about an issue for Congressional staffers to take notice. This statistic underscores the efficacy of social media over traditional methods like letter writing or email, primarily due to the public visibility and direct engagement it offers.

SOCIAL MEDIA: AMPLIFYING ADVOCACY MESSAGES

One of social media’s greatest strengths in grassroots advocacy is its ability to amplify messages. By leveraging these platforms, advocates can spread their message far and wide, engage with a larger community, and build a network of supporters. Social media campaigns can quickly go viral, bringing unprecedented

attention to issues that might otherwise remain unnoticed in the corridors of power.

ENGAGEMENT BEYOND X

While tweeting is effective, engagement doesn’t stop there. Social media advocates can monitor their representatives’ activities and stances, participate in relevant online discussions, and organize virtual events like X “town halls” or Facebook Live discussions. This level of engagement creates a twoway communication channel between fellow advocates and policymakers, fostering a more interactive and responsive form of engagement.

EMBRACING THE DIGITAL SHIFT

The digital world has opened new grassroots advocacy avenues, making it more dynamic, immediate, and far-reaching. Platforms like X are not just tools for communication; they are instruments of change in the hands of skilled advocates. As the digital landscape continues to evolve, so must our strategies for NARFE advocacy. By embracing these platforms and learning to use them effectively, members can keep up with the changing times and lead the charge in shaping policies that concern our federal community.

—BY IVANA SARA, GRASSROOTS PROGRAM MANAGER

10 NARFE MAGAZINE APRIL 2024 Washington Watch

Washington Watch

Bill Introduced to Increase Federal Pay Rates in 2025

Rep. Gerry Connolly, D-VA, and Sen. Brian Schatz, D-HI, introduced their annual version of the Federal Adjustment of Income Rates (FAIR) Act on January 26, which would provide a 2025 pay raise to federal workers.

This year’s FAIR Act, H.R. 7127/S. 3688, would provide a 7.4% average federal pay raise for 2025 by introducing a 4.0% across-the-board increase and a 3.4% average increase in locality pay rates. The proposed pay increase is crafted to ensure federal pay rates keep up with inflation and bridge the gap between federal and private sector pay, strengthening the recruitment and retention of our nation’s civil service.

The Federal Salary Council reported that federal employees made 27.54% less salary and wage than their private sector counterparts in 2023. In 2022, the council reported a wage gap of 24.09%. This represents a percentage point increase and a trend of the growing gap in real wages between the two sectors.

In support of the bill, NARFE National President William “Bill” Shackelford stated, “Congressman Connolly and Senator Schatz propose a strong federal pay raise via the FAIR Act to counter a resilient labor market, steadily increasing private-sector pay, continued price increases, and the persistent gap between private-sector and federal

NARFE

q

q

q

q

q

q

pay for similar jobs. We’re grateful for their support for hardworking public servants and ensuring federal pay rates approach levels needed to recruit and retain an effective federal workforce.”

Thanks to an executive order signed by President Joe Biden, federal employees will see an average pay increase of 5.2% in 2024. While this represents the largest single increase in year-to-year federal pay since the Carter administration, the passage of the FAIR Act would help make the federal workforce more competitive with the private sector and give employees a much-deserved raise.

—BY KHAMARE GARNER, POLITICAL ASSOCIATE

To comply with federal law, we must use our best efforts to obtain, maintain and submit the name, mailing address, occupation and name of employer of individuals whose contributions exceed $200 each calendar year. NARFE-PAC is for the benefit of political candidates and activities on a national level. NARFE members have the right to refuse to contribute without reprisal, and NARFE will neither favor nor disadvantage anyone based on the amount of a contribution or failure to make a voluntary contribution. The suggested amounts are only suggestions and not enforceable. Only members of NARFE may contribute to the PAC. Contributions from non-members will be returned. NARFE-PAC contributions are not

NARFE MAGAZINE www.NARFE.org 11

Monthly contributors of $10 or more receive a sustainer lapel pin

deductible

q Charge my credit card q MasterCard q VISA q Discover q AMEX Card #: Exp. Date: _____ /_________ mm yyyy Name on Card: Signature: Date: Mail coupon and/or check payable to NARFE-PAC to: NARFE-PAC Budget & Finance | 606 North Washington St. | Alexandria, VA 22314

for federal income tax purposes.

Member #:

City:

ZIP: Occupation: Employer: CONTRIBUTE TO Make a one-time contribution:

Name: Address:

State:

$25

Basic lapel pin

–

$50

Bronze lapel pin

–

$100

Silver lapel pin

–

$250

Gold lapel pin

–

$500 – Platinum lapel pin

Other: _________ n No pin for me. I’d like 100 percent of my contribution to go to NARFE-PAC. OR Contribute monthly through your annuity or by credit card. Get started at narfe.org/pac-sustainer Contribution totals are cumulative for the 2023-2024 election cycle

LEGISLATIVE RESOURCES

NARFE NewsLine – A weekly newsletter that goes out to NARFE members on Tuesdays and includes weekly recaps of legislative news, compiled by NARFE’s advocacy and communications teams.

LEGISLATIVE ACTION CENTER – A one-stop site to send a letter to Congress, and more, at www.narfe.org.

Submit Proposed Changes to NARFE’s Advocacy Positions for the 119th Congress

While we’re still working with the current Congress, NARFE must also be ready for the next one. To do so, NARFE must adopt Advocacy Positions for the 119th Congress, which convenes on January 3, 2025. NARFE’s Advocacy Positions detail NARFE’s specific policy stances, and they direct and guide NARFE’s leadership and staff regarding whether to support a position—or not—when actions are taken by Congress or the Administration.

An advocacy Committee, appointed by NARFE’s National President, will consider proposed changes to NARFE’s Advocacy Positions, and recommend a final product

for adoption by the National Executive Board.

If you’d like the Advocacy Committee to consider a certain proposal, you or your chapter may submit proposals via webform at https://www.narfe. org/narfes-advocacy-positionssubmission-form-for-the-119thcongress-2024/, or you may mail in a hard copy form. You may request a hard copy form for your chapter or as an individual by calling NARFE’s advocacy department at 1-800-4568410, option 3, or via e-mail at advocacy@narfe.org

Proposals submitted by chapters must certify the chapter supported the proposal via a majority of those voting and present. You may also

certify endorsement from your federation, if the proposal receives support via a vote of the majority of those voting and present at a federation board meeting. These proposals will be posted on an Advocacy Positions thread in the Open Forum on FEDHub for comment.

Proposals submitted by individuals will also be posted on the Advocacy Positions thread. In lieu of chapter support, they must receive 5 recommendations from other NARFE members to receive consideration by the Advocacy Committee.

The deadline for submissions is June 1.

—BY NARFE ADVOCACY STAFF

a statutory loophole such as Schedule F. Schedule F was a new excepted service schedule that exploited statutory loopholes to create a broad new exception to merit-based civil service rules. It was created at the tail end of the Trump Administration but was not fully implemented before the change in administrations (and its revocation).

NARFE has worked with congressional allies to develop legislation prohibiting Schedule F’s return and supporting its reintroduction via the Saving the Civil Service Act,

H.R. 1002/S.399 in the 118th Congress to protect the meritbased system. NARFE has also supported attempts to include this legislation in the National Defense Authorization Act via amendments.

Additionally, NARFE has supported through formal comments the Office of Personnel Management’s proposed rule titled “Upholding Civil Service Protections and Merit System Principles,” which will provide new procedural protections to prevent – or at least delay – a future attempt to implement Schedule F (or a similar policy),

and by successfully opposing a House floor amendment to defund implementation of the proposed rule (which failed by a vote of 198-221).

SECURING A PAY RAISE FOR FEDERAL EMPLOYEES IN 2024

NARFE supported the presidential alternative pay plan to increase federal employee pay by 5.2% on average in 2024, at parity with the military and tracking recent private sector pay increases.

—BY JOHN HATTON, STAFF VICE PRESIDENT, POLICY AND PROGRAMS

12 NARFE MAGAZINE APRIL 2024 Washington Watch

HALFTIME REPORT FROM P.9

•

•

•

10/29/08 11:21:34 AM National Active and Retired Federal Employees Association CONGRESSIONAL DIRECTORY 118th Congress 2023-2024 NARFE’s CONGRESSIONAL DIRECTORY FOR THE 118 th CONGRESS (2023-2024) Features:

Members of Congress by state delegation, with color photos, biographical data and congressional district maps.

Members’ contact information, including addresses, phone and fax numbers, website addresses, social media contacts, district offices and key staffers.

Complete listings of committees, subcommittees and leadership.

Contact information for the White House, Cabinet, Supreme Court and federal agencies. Be a stronger advocate with NARFE’s Congressional Directory at your fingertips Order online at www.narfe.org/directory Order your copy of the new CONGRESSIONAL DIRECTORY today! Name Address City State ZIP Member ID# (as it appears on NARFE Magazine label) o Check (payable to NARFE) o Charge my credit card o MasterCard o VISA o Discover o AMEX Card # Exp. Date / (mm) (yy) Name on card (print) Signature Date Please allow 3-4 weeks for delivery. Call NARFE’s Advocacy Department at 800-456-8410, option 3, to order by phone. Quantity $25 each (includes shipping and handling) VA sales tax VA residents add 6% tax ($1.50) per book Total cost Only $25 Mail to: NARFE Congressional Directory 606 N. Washington Street Alexandria, VA 22314-1914

•

NARFE BILL TRACKER

THE NARFE BILL TRACKER IS YOUR MONTHLY GUIDE TO LEGISLATION NARFE IS FOLLOWING. CHECK BACK EACH ISSUE FOR UPDATES.

WHAT BILL WOULD DO

LATEST ACTION(S)

H.R.159/S.59: Chance to Compete Act of 2023 / Rep. Virginia Foxx, R-NC / Sen. Kyrsten Sinema, I-AZ

Cosponsors:

H.R. 159: 3 (D) 2 (R) S. 59: 1 (D) 2 (R) 0 (I)

H.R. 1002/S. 399: Saving the Civil Service Act / Rep. Gerry Connolly, D-VA / Sen. Tim Kaine, D-VA

Cosponsors:

H.R. 1002: 18 (D) 3 (R) S. 399: 16 (D) 0 (R) 1 (I)

Implements merit-based reforms to the civil service hiring system that replace degree-based hiring with skills- and competency-based hiring.

Prevents any position in the federal competitive service, created after September 30, 2020, from being reclassified into the excepted service, outside the protection of merit system rules without the express consent of Congress. The bill also requires the consent of an employee to be reclassified, mandates reporting of conversions to the Office of Personnel Management, and places caps on the number of employees converted to the excepted service via Schedule C.

FEDERAL PERSONNEL POLICY

H.R. 1487: The Strengthening the Office of Personnel Management Reform Act / Rep. Gerry Connolly, D-VA

Cosponsors: H.R. 1487: 1 (D) 0 (R)

Codifies several recommendations for OPM by the National Academy of Public Administration (NAPA), such as clarifying that OPM stands at the center of federal civilian human resource management and ensuring the director of OPM possesses human capital and leadership expertise.

Passed the House under suspension of the rules 1/24/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 1/24/2023

Referred to the House Committee on Oversight and Accountability 2/15/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 2/14/2023

Referred to the House Committee on Oversight and Accountability 3/9/2023

H.R. 3115/S. 1496: Public Service Reform Act / Rep. Chip Roy, R-TX / Sen. Rick Scott, R-FL

Cosponsors:

H.R. 3115: 0 (D) 15 (R)

S. 1496: 0 (D) 1 (R) 0 (I)

Would make all federal employees at-will and enable workers to be removed for good cause, bad cause or no cause at all. The legislation would also abolish the Merit System Protections Board and limit removal appeals to claims of whistleblower retaliation and Equal Employment Opportunity Commission complaints before the US Court of Appeals.

Referred to the House Committee on Oversight and Accountability 5/5/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 5/9/2023

14 NARFE MAGAZINE APRIL 2024 NARFE’s Position: Support Oppose No position

NUMBER / NAME / SPONSOR

ISSUE BILL

NARFE BILL TRACKER

THE NARFE BILL TRACKER IS YOUR MONTHLY GUIDE TO LEGISLATION NARFE IS FOLLOWING. CHECK BACK EACH ISSUE FOR UPDATES.

H.R. 82/S. 597: The Social Security Fairness Act / Rep. Garret Graves, R-LA / Sen. Sherrod Brown, D-OH

Cosponsors:

H.R. 82: 203 (D) 105 (R) S. 597: 40 (D) 7 (R) 3 (I)

H.R. 4260: The Public Servants Protection and Fairness Act / Rep. Richard Neal, D-MA

Cosponsors:

H.R. 4260: 102 (D) 0 (R)

SOCIAL SECURITY

H.R. 4583/S. 2280: Social Security 2100 Act / Rep. John Larson, D-CT / Sen. Richard Blumenthal, D-CT

Cosponsors:

H.R. 4583: 182 (D) 0 (R) S. 2280: 4 (D) 0 (R) 0 (I)

H.R. 5342: Equal Treatment of Public Servants Act of 2023 / Rep. Jodey Arrington, R-TX

Cosponsors: 1 (D) 27 (R)

Repeals both the Government Pension Offset (GPO) and the Windfall Elimination Provision (WEP).

The House Committee on Ways and Means held Field Hearing on 11/21/2023

Referred to the Senate Committee on Finance 3/1/2023

FEDERAL ANNUITIES

H.R. 716: The Fair COLA for Seniors Act / Rep. John Garamendi, D-CA

Cosponsors:

H.R. 716: 37 (D) 0 (R)

H.R. 866 / S. 3194: The Equal COLA Act / Rep. Gerry Connolly, D-VA / Sen. Alex Padilla, D-CA

Cosponsors:

H.R. 866: 43 (D) 3 (R) S. 3194: 6 (D) 0 (R) 1 (I)

Reforms the Windfall Elimination Provision (WEP) by providing a monthly rebate of $150 to current beneficiaries (age 62 or older before 2025) and creating a new formula to calculate benefits for future WEP-affected individuals (turning 62 in or after 2025).

Expands and strengthens Social Security benefits, improves solvency of the Social Security trust funds, repeals the Windfall Elimination Provisions and Government Pension Offset, and provides numerous other Social Security related improvements.

Reforms the WEP by providing a monthly payment of $100 to current WEP-affected beneficiaries and $50 for an affected spouse or child. Creates a new formula to calculate benefits for future WEP-affected individuals (turning 62 in or after 2025).

Requires Social Security and federal retirement programs to use the Consumer Price Index for the Elderly (CPI-E) to calculate cost-of-living adjustments (COLAs) to retirement benefits.

Provides Federal Employees Retirement System (FERS) retirees with the same annual cost-of-living adjustment (COLA) as Civil Serve Retirement System (CSRS) retirees.

Referred to the House Committee on Ways and Means 6/21/2023

Referred to the House Committees on Ways and Means, Education and the Workforce, and Energy and Commerce 7/12/2023

Referred to the Senate Committee on Finance 7/12/2023

Referred to the House Committee on Ways and Means 9/5/2023

Referred to the House Committees on Ways and Means, Veterans’ Affairs, Oversight and Accountability, and Armed Services 2/1/2023

Referred to the House Committee on Oversight and Accountability 2/8/2023

NARFE MAGAZINE www.NARFE.org 15 NARFE’s Position: Support Oppose No position

ISSUE

WHAT BILL WOULD DO LATEST ACTION(S)

BILL NUMBER / NAME / SPONSOR

NARFE BILL TRACKER

THE NARFE BILL TRACKER IS YOUR MONTHLY GUIDE TO LEGISLATION NARFE IS FOLLOWING. CHECK BACK EACH ISSUE FOR UPDATES.

H.R. 536/ S. 124: The Federal Adjustment of Income Rates (FAIR) Act / Rep. Gerry Connolly, D-VA / Sen. Brian Schatz, D-HI

Cosponsors:

H.R. 536: 77 (D) 1 (R)

S. 124: 19 (D) 0 (R) 1 (I)

H.R. 856/ S. 274:

Comprehensive Paid Leave for Federal Employees Act / Rep. Don Beyer, D-VA / Sen Brian Schatz, D-HI

Cosponsors:

H.R. 856: 36 (D) 3 (R)

S.274: 10 (D) 0 (R) 1 (I)

H.R. 1301/ S. 640: Federal Employees Civil Relief Act / Rep. Derek Kilmer, D-WA / Sen. Brian Schatz, D-HI

Cosponsors:

H.R. 1301: 3 (D) 0 (R)

S. 640 15 (D) 0 (R) 1 (I)

FEDERAL COMPENSATION

H.R. 5883 / S. 3029:

Honoring Civil Servants Killed in the Line of Duty Act of 2023 / Rep. Gerald Connolly, D-VA / Sen. Kyrsten Sinema, I-AZ

Cosponsors:

H.R. 5883: 1 (D) 2 (R)

S. 3029: 1 (D) 2 (R) 0 (I)

H.R. 5995: The Federal Retirement Fairness Act / Rep. Derek Kilmer (D-WA)

Cosponsors:

H.R. 5995: 53 (D) 21 (R)

Provides federal employees with an 8.7% average pay raise in 2024.

Referred to the House Committee on Oversight and Accountability 1/26/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 1/26/2023

Extends paid leave to federal and postal employees for all conditions covered by the Family and Medical Leave Act (FMLA).

Referred to the House Committee on Oversight and Accountability, Veteran’s Affairs and House Administration 2/7/2023

Referred to the Senate Committee on Homeland Security and Governmental Affairs 2/7/2023

Protects federal workers and contractors from a variety of civil financial penalties during a lapse in appropriations or a breach of the debt ceiling.

H.R. 7127: Federal Adjustment of Income Rates (FAIR) Act / Rep. Gerry Connolly (D-VA) / Sen. Brian Schatz (D-HI )

Cosponsors: 61 (D) 0 (R)

Aims to significantly increase death gratuities and funeral allowances for federal employees who tragically lose their lives while serving the nation. This bill would ensure that the families of dedicated civil servants receive greater financial support during their time of loss.

Allow federal employees who started their careers as temporary workers, but transitioned to permanent work, to buy credit towards retirement for their temporary work. The FRFA enables these workers to make catch-up contributions, ensuring they receive full retirement credit for their service.

Provides federal employees with a 7.4% average pay raise in 2025

Referred to the House Committees on Oversight and Accountability, Financial Services, Ways and Means, Judiciary, Education and Workforce, and House Administration 3/1/2023

Referred to the Senate Committee on Finance 3/2/2023

Referred to Committee on Homeland Security & Government Affairs 10/4/23

Referred to House Committee on Oversight and Accountability 10/25/23

Introduced in House 1/30/24

16 NARFE MAGAZINE APRIL 2024

NUMBER / NAME / SPONSOR WHAT BILL WOULD DO LATEST ACTION(S)

ISSUE BILL

NARFE’s Position: Support Oppose No position

Donate

Donate to NARFE

MAKE CHECK PAYABLE TO:

NARFE

PLEASE MAIL COUPON AND CHECK TO:

NARFE / 606 N. Washington St. / Alexandria, VA 22314 or donate online at www.narfe.org/ donate

With NARFE’s thanks, you will receive a NARFE Photo Calendar

NARFE safeguards the earned pay and benefits of America’s five million federal workers, retirees, their spouses, and survivors. NARFE is YOUR legislative voice and tireless advocate. NARFE contributions are NOT tax-deductible.

to NARFE programs

Enclosed is my NARFE Contribution: $ __________________

All donations go to the NARFE General Fund to support NARFE Programs and operations.

Name:

Address:

City:

State: ZIP:

Credit Card Information: q M/C q VISA q Discover q AMEX

Card Number:

Expiration Date: (mm)/ (yy) Security Code:

Signature:

Name: (please print)

Support Alzheimer’s Research

Date: / /

NARFE members contributed for Alzheimer’s research: $16 Million Fund $16,139,625.31*

*Total as of January 2024 All contributions go directly to Alzheimer’s research, with the exception of funds given to the Walk to End Alzheimer’s or The Longest Day.

If you have any questions, write to:

National Committee Chair

Olivia Williams

PO Box 2175 Columbia, SC 29202

OR E MAIL: oeashf3@gmail.com

MAKE CHECK PAYABLE TO:

NARFE-Alzheimer’s Research (w rite your chapter number on memo line)

PLEASE MAIL COUPON AND CHECK TO:

Alzheimer’s A ssociation

225 N. Michigan Ave., 17th Floor Chicago, I L 60 601-7633

Your charitable contribution is tax-deductible to the fullest extent allowed by law.

Give to the NARFE-FEEA Fund

MAKE CHECK PAYABLE TO:

NARFE-FEEA Fund

PLEASE MAIL COUPON AND CHECK TO:

FEEA

1641 Prince St. Alexandria, VA 22314

Your charitable contribution is tax-deductible to the fullest extent allowed by law.

Enclosed is my NARFE-Alzheimer’s contribution: $

Every cent that is contributed is used for research.

Name:

Address:

City:

State: ZIP:

Chapter number:

Credit Card Information: q M/C q VISA q Discover q AMEX

Card Number:

Expiration Date: (mm)/ (yy) Security Code:

Signature:

Name: (please print)

Date: / /

The NARFE-FEEA Fund supports NARFE members during disasters; provides scholarships to their children, grandchildren and great-grandchildren; and funds other programs to support NARFE members at the direction of NARFE and FEEA.

Enclosed is my NARFE-FEEA Fund Contribution: $ ________

Name:

Address:

City:

State: ZIP:

Email:

To make credit card or e-check contributions, visit www.feea.org/givenarfe.

1 The Service Benefit Plan may pay a hearing aid benefit for Basic and Standard Option members up to $2,500 total every 5 calendar years for adults age 22 and over, and up to $2,500 total per calendar year for members up to age 22. FEP Blue Focus does not have a hearing aid benefit. Do not rely on this communication piece alone for complete benefit information. All benefits are subject to the definitions, limitations, and exclusions in the Blue Cross and Blue Shield Service Benefit Plan brochure. The Blue365® Discount Program offers access to savings on items that you may purchase directly from independent vendors, which may be different from items covered under the Service Benefit Plan or any other applicable federal healthcare program. For hearing aids, acupuncture, chiropractic and vision services, you must exhaust your Service Benefit Plan benefit first before accessing the savings of the Blue365® Discount Program. To find out what is covered under your policy, contact the customer service number on the back of your member ID card. The products and services described herein are neither offered nor guaranteed under any local Blue company’s contract with the Medicare program. These items are not subject to the Medicare appeal process. Any disputes regarding these products and services are not subject to the Disputed Claims process. Blue Cross Blue Shield Association (BCBSA) may receive payments from Blue365 vendors. Neither the Service Benefit Plan, nor any local Blue company recommends, endorses, warrants or guarantees any specific Blue365 vendor or item. The Service Benefit Plan reserves the right to change, modify, or terminate any item and vendors made available through Blue365, at any time. 2 Price shown does not include cost of comprehensive hearing exam. Examination and testing for prescribing of hearing aids is covered under the Service Benefit Plan. The member should confirm that the provider rendering the hearing exam is a Preferred provider. If the provider is Non-preferred, the member Dedicated Hearing Consultant 3-year manufacturer warranty 1 year of follow-up visits 80 free batteries per non-rechargeable hearing aid Risk-free 60-day trial period TruHearing purchases include: Your allowance goes further with TruHearing®. TruHearing offers discounted pricing on the latest hearing aids with all styles and models from the leading manufacturers. Rechargeable | Listed products are smartphone-compatible 3 Prices and products subject to change. Sample product Average retail price TruHearing price Allowance (up to $2,500)1 ou pay2 TruHearing Advanced $5,440 $2,500 $2,500 $0 Widex Moment® Sheer™ 220 $4,536 $2,500 $2,500 $0 Signia® 3IX $4,588 $2,700 $2,500 $200 Oticon® Real™ 3 $5,116 $2,900 $2,500 $400 Starkey Evolv® AI 1600 $5,460 $3,100 $2,500 $600 ReSound OMNIA™ 7 $5,844 $3,390 $2,500 $890 Phonak® Audéo® Lumity® L-R 90 $7,590 $4,500 $2,500 $2,000 You pay2 Example savings (per pair) Cynthia is wearing the TruHearing Premium RIC hearing aid Find this and other great deals on fepblue.org/blue365

may be charged a maximum fee of $75 for the exam, and the member may need to submit a claim for reimbursement. Must be a Service Benefit Plan member to access TruHearing discounted pricing. TruHearing is offered through Blue365, which provides exclusive health and wellness deals and is a program of Blue Cross Blue Shield Association, an association of independent Blue Cross and Blue Shield companies. The Blue Cross® and Blue Shield® words and symbols, Federal Employee Program®, FEP® and Blue365® are all trademarks owned by Blue Cross Blue Shield Association. 3 Smartphone compatible hearing aids connect directly to Android, iPhone®, iPad®, and iPod® Touch devices. Connectivity also available to many Android® phones with use of an accessory. All content ©2023 TruHearing, Inc. All Rights Reserved. TruHearing® is a registered trademark of TruHearing, Inc. All other trademarks, product names, and company names are the property of their respective owners. Listed retail prices based on a survey of national average retail hearing aid prices compared to average TruHearing pricing. Savings may vary. Retail pricing of TruHearing-branded aids based on prices for comparable aids. Follow-up provider visits included for one year following hearing aid purchase. Free battery offer is not applicable to the purchase of rechargeable hearing aid models. Three-year warranty includes repairs and one-time loss and damage replacement. Hearing aid repairs and replacements are subject to provider and manufacturer fees. For questions regarding fees, contact a TruHearing Hearing Consultant. FEP_NARFE_AD_453254 TruHearing is an independent company that provides discounts on hearing aids. Great hearing aids are just the start. Great hearing aids are just the start. In addition to lowered pricing on high-quality hearing aids, Blue Cross and Blue Shield Service Benefit Plan members also get a full hearing care package and unmatched service when they use their allowance through TruHearing. Call TruHearing to get started saving today. 1-877-360-2432 | For TTY, dial 711 Made available through:

Q&A

EMPLOYMENT

HIGH-3 AVERAGE SALARY

QIf I take a lower paying job, will that reduce my high-3 average salary since I will be making less income at the end of my federal career?

AIf you take a lower-paying job, your high-three average salary will not go down, but it may not go up either. Your high-three average salary is based on the average of your highest three consecutive years of basic salary rates. Although it is often the final three years of employment, this does not have to be the case if the “highest” three-year average falls before the end of the career. This may happen when a federal employee transfers to an area where the locality pay is lower than their previous assignment or if there is a temporary promotion or an employee takes a lower salary rate. Since locality pay is included in the definition of basic pay, a change in locality rate can impact the high-three average. Once you are retired, however, your retirement benefit amount will not be affected by the location of where you live.

MILITARY LEAVE

QI used military leave to serve as a reservist for two weeks on active duty. Do I need to pay a deposit for this service period to receive credit towards my retirement?

ATHE FOLLOWING QUESTIONS & ANSWERS were compiled by NARFE’s Federal Benefits Institute experts. NARFE does not provide legal, financial planning or tax advice or assistance.

If you were receiving federal civilian pay while on military leave, the appropriate deductions for your retirement should have been withheld, so there is no need to pay a military deposit for these brief periods. This period of covered service should count towards your retirement service computation date (SCD). In most cases, federal employees simultaneously serving in military reserves have enough military leave each year to cover their annual training periods with their reserve units. Keep in mind that if you remain on active duty after exhausting your allotment of paid military leave, then your agency will typically place you on leave without pay for uniformed service (LWOP-US) status, and upon returning to pay status, you would have the option to pay a military deposit to your civil retirement system for the period of LWOP-US. Otherwise, the period of LWOP-US would not count toward your retirement SCD.

A fact sheet on military leave is available at

https://www.opm.gov/policy-data-oversight/ pay-leave/leave-administration/. The Office of Personnel Management’s (OPM) Retirement Support Center has a series of frequently asked questions, including ones regarding military service and leave https://www.opm.gov/support/ retirement/ and https://www.opm.gov/policydata-oversight/pay-leave/pay-administration/ fact-sheets/military-leave/

20 NARFE MAGAZINE APRIL 2024

Questions & Answers

FEGLI OPTION C—FAMILY COVERAGE

QI am a current federal employee. I got married 11 months ago and missed the 60-day “qualified life event” window to elect family coverage (Option C) under the Federal Employees Group Life Insurance (FEGLI) program. I currently have basic coverage under FEGLI, but can I use Standard Form 2822 to make this election if my spouse is healthy, or do I have to wait for a FEGLI open season to make this election?

AUnfortunately, Standard Form 2822 only allows you to add FEGLI Options A and/or B (or to re-enroll in Basic FEGLI). It does not allow you to add Option C (family coverage). If OPM offers another FEGLI open season while employed, you could use this opportunity to add Option C at that time. Also, while federally employed, if you experience a qualified life event (QLE) such as the adoption or birth of a child, you could elect to add Option C to your FEGLI within 60 days of any such QLE. These QLEs are listed in the instructions accompanying Standard Form 2817. You can find forms at https://www.opm.gov/forms.

If your spouse is healthy and otherwise insurable, a term life insurance policy may be an alternative to FEGLI. Worldwide Assurance for Employees of Public Agencies (WAEPA) provides two options for spouses of current and former federal employees: dependent coverage or an associate membership. Becoming an associate member is an option for you and your spouse if you seek higher coverage amounts and more benefits than dependent coverage. Learn more at https://www.waepa.org/products/associatemembership/ or call (800) 368-3484.

NON-DEDUCTION SERVICE

QI’m currently a FERS employee, and I started my federal career in the late 1990s with a temporary appointment before I was converted to FERS retirement coverage. Will I receive retirement service credit for this temporary service?

AUnfortunately, non-deduction service (federal civilian employment not covered by FERS retirement deductions) is not creditable for retirement eligibility or the computation of your FERS retirement benefit. FERS employees may pay a deposit for federal civilian service not covered by retirement deductions only if performed before January 1, 1989. There are exceptions for volunteers

with the Peace Corps and VISTA. The NARFE Federal Benefits Institute presented a webinar titled “Understanding Military and Civilian Federal Service Credit,” you can watch the recorded version of this webinar at www.narfe.org. NARFE believes all federal work should be credited toward retirement calculations. Ask your representative to cosponsor the Federal Retirement Fairness Act, H.R. 5995, introduced in 2023, allowing federal employees to credit their temporary service performed after 1988 into their retirement calculations.

RETIREMENT

SOCIAL SECURITY REDUCTION

QI’m a federal employee retiring at age 62, and I receive around $2,000 a month in Social Security and $3,000 a month in federal annuity payments. I may also withdraw $50,000 annually from the Thrift Savings Plan (TSP) regular pot (not Roth). I worked after retirement and earned $30,000 at a retail job for the year. In this scenario, here are my two questions:

1. Is it correct that the employee exceeded the income threshold for social security and would have to pay back $7,680 ($30,000-$22,320) to

COUNTDOWN TO COLA

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 0.49 percent in January 2024. To calculate the 2025 cost-of-living adjustment (COLA), the 2024 third-quarter indices will be averaged and compared with the 2023 third-quarter average of 301.236. The percentage increase determines the COLA. January’s index, 302.201, is up 0.32 percent from the base.

The CPI represents purchases of food and beverages, housing, apparel, transportation, medical care, recreation, education and communication, and other goods and services.

For FECA COLA updates, visit narfe.org and search for FECA.

NARFE MAGAZINE www.NARFE.org 21

MONTH CPI-W Monthly % Change % Change from 301.236 OCTOBER 2023 302.071 -0.06 0.27 NOVEMBER 301.224 -0.28 -0.0004 DECEMBER 300.728 -0.16 -0.17 JANUARY 2024 302.201 0.49 0.32 FEBRUARY

the Social Security Administration (SSA)?

2. Would an employee’s annuity payments and TSP withdrawals be considered ‘earned income’ for the Social Security income test?

AThe answer to your second question is that your annuity and TSP withdrawals will not be counted as earnings for the Social Security earnings test. When Social Security figures out how much to deduct from your benefits due to your retail job earnings, they count only the wages you make from your job or your net earnings if you’re selfemployed. They will include bonuses, commissions, and vacation pay. They will not count pensions, annuities, investment income, interest, veterans’ benefits, or other government or military retirement benefits. Your lump sum annual leave payment will not count against the limit because it was considered a “special payment” earned before you retire. Your benefits may increase when you work after you retire because you will continue to pay Social Security taxes on your earnings. Social Security will check your record every year to see whether your additional earnings will increase your monthly benefit. You will receive a letter about your new benefit amount if there is an increase.

You are correct in assuming that the work you plan to do following your retirement will be counted against the earnings limit because you will be retiring well under the full retirement age. For those individuals who retire mid-year, you may already have earned more than the annual earnings limit ($22,230 for 2024) by the time you retire, so that’s why there is a special monthly rule that applies to earnings for one year, usually the first year of retirement. Under this rule, you can get a full Social Security check for any month you retire, regardless of your yearly earnings. In 2024, a person younger than full retirement age for the entire year is considered retired if monthly earnings are $1,860 or less.

In your example, if the $30,000 you earn in your retail job is earned after your retirement date, it would be counted for the earnings test. The reduction is $1 for every $2 over the limit. If you retire on June 30, 2024, and you earn $30,000 from July through December, or $5,000 per month, which is $3,140 over the 2024 monthly earnings limit, your Social Security benefit would be reduced by $1,570 per month ($3,140 divided by 2) leaving you with a reduced Social Security benefit amount of $1,430.

You may want to consider delaying your Social Security application for a while to see if you will continue to work since your income will reduce your Social Security benefit. At age 62, your Social Security benefit payments are 30% less than if you waited until age 67 (your full retirement age) to apply. For individuals born in 1960 or later, the full retirement age is 67, and the reduction for applying early is computed at 5/9 of 1% per month for the first 36 months and 5/12 of 1% for each additional month. The following pamphlet on http://www.ssa.gov is titled “How Work Affects Your Benefit (2024).”

One additional tip: be careful about the amount of your TSP withdrawals, so you don’t deplete your TSP balance too soon in your retirement. Remember that at age 62, you may have several decades left to live.

REDUCING FEGLI COVERAGE

QWhen I retired from federal service years ago, I elected to keep FEGLI coverage with the “75% reduction” elected for my basic coverage. I elected to keep five multiples of my final salary with the “no reduction” option elected for Option B coverage. When I recently turned 65, I noticed that the cost associated with my basic coverage became premiumfree, but I’m still paying for my Option B coverage. I recently lost my spouse, and I’d like to cancel my Option B coverage. Can I do this?

AP lease accept our condolences for the recent loss of your spouse. At age 65, the cost per $1,000 of FEGLI Option B increases from $.953 to $1.17, which is almost a 25% increase in the price of this coverage. If you don’t reduce this coverage, it will continue to increase in premium cost at age 70 (to $2.080/$1,000 per month), age 75 (to $3.90/$1,000 per month), and finally at age 80 and over (to $5.72/$1,000 per month). Fortunately, you can change Option B of FEGLI after you have retired. These changes include the following: .

1. If you are under age 65, you, but not your assignee, can change from full reduction to no reduction.

2. You and your assignee (if you have “assigned” your life insurance) may change from no reduction to full reduction if you are under age 65.

3. You and your assignee (if you have “assigned” your life insurance) may change from no reduction to full reduction if you are 65 or older. In addition to changes that can be made after retirement, certain restrictions include:

22 NARFE MAGAZINE APRIL 2024 Questions & Answers

4. You cannot change from full reduction to no reduction if you are 65 or older.

5. If you have assigned your life insurance, your assignee cannot change from full reduction to no reduction if they are under age 65.

Suppose you change from “no reduction” to “full reduction” for Option B rather than cancel the coverage, and it has been less than 50 months since you turned 65. In that case, this election will allow you to retain a reduced amount of coverage until the coverage ends at noon on the day before the 50th reduction would occur. After that, no benefits are payable upon your death (for option B). Although this election will eventually eliminate your Option B coverage, you will continue to have 25% of your basic coverage payable as a death benefit regardless of how long you live, as you elected the 75% reduction for Basic FEGLI when you retired.

Once you have retired, OPM’s Retirement Operations Center (ROC) becomes your “agency employing office.” All records relating to your FEGLI are kept in that office, and any questions or actions you want to take regarding your FEGLI coverage must be directed to that office. This is true for all retired civilian employees, regardless of which retirement system they retire under. If you need to contact the ROC, the phone number is

1-88-US-OPM-RET (1-888-767-6738) outside the Washington, D.C., metropolitan area or 202-6060500 within the Washington area. Annuitants should send written inquiries to the Retirement Operations Center, P.O. Box 45, Boyers, PA 16017-0045. Annuitants may also contact OPM by email at retire@opm.gov or visit the OPM websites for Retirement (www.opm.gov/retire) or FEGLI (www.opm.gov/healthcare-insurance/ life-insurance).

MEDICARE PART B PREMIUMS

QIs the Income-Related Monthly Adjustment Amount (IRMAA) that applies to Medicare B premiums recalculated annually based on the latest tax returns filed? .

AThe Medicare Part B premium you are charged is based upon your Modified Adjusted Gross Income (MAGI) from two years prior, generally the most recent tax return information that Social Security has received from the IRS. For example, 2024 Medicare Part B premiums will be based on your MAGI from 2022. Suppose your Part B premium is subject to an IRMAA, and you have experienced a life-changing event that caused your income to go down, such

as work reduction or stoppage, divorce, death of a spouse, etc. In that case, you can use the SSA-44 form to request a drop to your premium. For more details, including the list of qualifying lifechanging events, please refer to the most recent version of this form, which is usually updated at the end of December each year, https://www.ssa. gov/forms/ssa-44.pdf.

CSRS OFFSET

QI retired as a Civil Service Retirement System Offset employee when I was 58. When should I expect OPM to apply the offset and reduce my annuity?

AOPM will contact the SSA to obtain an entitlement determination when you are close to age 62 (the average age of Social Security eligibility) or during OPM’s retirement adjudication process if you are over 62 when you retire. If you can receive Social Security benefits (you have worked and paid Social Security taxes for 10 years or more), SSA will provide OPM with information concerning your Social Security benefits.

Please note that even if you do not apply for Social Security benefits when first eligible, the reduction in your annuity must still be made if you are entitled or would, on proper application, be entitled to Social Security benefits. We have heard from a few CSRS Offset retirees who were not notified of the reduction to their CSRS retirements at age 62. Notifying OPM if you are CSRS Offset and your annuity was not reduced at age 62 is essential. This can result in an overpayment that must be repaid when discovered. The offset reduction is subtracted from the annuity rate to become your new gross annuity rate. The offset reduction is the lesser of:

• The difference between the Social Security monthly benefit amount with and without Federal earnings or

• The product of the Social Security monthly benefit amount, with federal earnings, multiplied by a fraction where the numerator (top of fraction) is the employee’s total CSRS Offset service, rounded to the nearest whole number of years and the denominator (bottom of fraction) is 40.

To obtain an answer to a federal benefits question, NARFE members should call 800-456-8410 and select option 2 for the Federal Benefits Institute; send the question by postal mail to NARFE Headquarters, ATTN: Federal Benefits; or submit it by email to fedbenefits@narfe.org.

NARFE MAGAZINE www.NARFE.org 23

SBENEFITS RESOURCES

NARFE OFFERS MEMBERS a wide range of information on federal benefits. Visit www.narfe.org/federal-benefits-institute.

Delaying Medicare Enrollment

ometimes, procrastination pays off. Consider enrollment in Medicare. The 2024 standard rate for Medicare Part B is $174.70. For beneficiaries who file an individual tax return with modified adjusted gross income over $103,000 in 2022 or a couple filing a joint return with income over $206,000, the premium is even higher due to the Income Related Monthly Adjustment Amounts (IRMAA) surcharges.

Parts A and B enrollment, known as original Medicare, typically occurs during the initial enrollment period (IEP). This begins three months before your 65th birthday and ends three months after your birthday. This seven-month period allows your coverage to begin the month you turn 65 or the month after you enroll if you delay enrollment past your birthday. Although most federal employees and retirees sign up for Part A during their IEP, for Part B, the feds have additional options to delay enrollment to save the cost of adding Part B:

• Special Enrollment Period (SEP): Use the SEP that lasts up to eight months following the end of “current employment” health coverage. The SEP allows federal employees covered by the Federal Employees Health Benefits Program (FEHB) through their current employment to delay enrollment and avoid the Part B late enrollment penalty. This also applies to the spouse of a current employee who has turned 65 but is under the FEHB enrollment of the still-employed spouse. See

Social Security Administration (SSA) Publication 05-10012, “How to Apply for Medicare Part B (Medical Insurance) During Your Special Enrollment Period.”

• General Enrollment Period (GEP): Use the GEP in any year from January 1 through March 31 with coverage effective the following month. If less than 12 months have elapsed since the end of the IEP, there would be no late enrollment penalty, so the cost of Part B coverage can be delayed. This would also apply if an individual worked past age 65 and used the GEP that followed the end of the SEP if less than 12 months had elapsed from the month the employment ended until the coverage began.

• Enroll in Part A only and delay Part B enrollment: Approximately 20% to 25% of federal retirees choose to enroll in Part A only at age 65, and some never enroll in Medicare Part B. Under the FEHB law, the plan must limit payments for inpatient hospital and physician care to those payments you would be entitled to if you had Medicare. Your physician and hospital must follow Medicare rules and cannot bill you for more than they could if you had Medicare. You and the FEHB benefit from these payment limits. See the chart in your FEHB plan brochure for more information about the limits. Let’s look at a couple of examples to see how this would play out:

Example 1: Roman is retiring on June 30, 2024, at age 69 and will be eligible to continue his FEHB coverage for himself and his wife, Anna. They are both enrolled in Medicare Part A only. Roman and Anna will have a SEP from July 2024 until February 2025 (eight months following his retirement) to enroll in Medicare Part B without a late enrollment penalty. He could also delay his enrollment until March 2025, the last month of the GEP, and not be assessed a penalty since less than 12 months have elapsed from when his employment ends in June until his coverage would begin in April 2025.

By delaying enrollment to April 2025, the couple saved $3,144.60 ($174.70 x 9 x 2).

Example 2: Penny retired in 2015 at age 56 and continued FEHB coverage. She will turn 65 in June 2024. Her IEP will last through September. She may decide to delay her enrollment until the end of the 2025 GEP to delay the premium and continue to avoid a late enrollment penalty. While Penny is enjoying good health, she is saving $2,094.40 (2024 rate) for every 12 months that she does not pay the Part B premium, and she has decided to delay her enrollment until the 2027 GEP.

Although she will incur a 20% late enrollment penalty (two 12-month periods during the 30 months between the end of her IEP and the date her coverage took effect), she saved over $5,000. Her penalty would be $174.70 x 20% = $34.94/month. Penny doesn’t mind paying the penalty since it would take almost 12 years before she would have paid as much penalty as she had saved by not enrolling.

24 NARFE MAGAZINE APRIL 2024 Benefits Brief

There are advantages to enrolling in Medicare Part B despite the additional premium that must be paid. Consider the following benefits:

• Many FEHB plans waive their cost-sharing (deductible, copays, coinsurance) when Medicare is the primary payer. When suffering from multiple chronic conditions, this can save thousands of dollars in out-of-pocket medical expenses.

• Enrollment in Medicare might add additional benefits that would not otherwise be available. For example, BC/BS Basic provides enhanced prescription drug coverage that includes access to mail-order prescriptions for members enrolled in Medicare.

• Some FEHB plans provide a health fund or Medicare Part B reimbursement to help lower the cost of enrolling in Medicare Part B.

• Many FEHB plans offer a Medicare Advantage option for Medicare A and B members. This coverage provides additional Part B rebates and benefits such as free gym membership, meal delivery following a hospital stay, and non-emergency transportation to doctor visits.

• For military retirees, TRICARE for Life requires Medicare A and B enrollment.

• Starting in 2025, the Postal Service Health Benefits (PSHB) Program will require Medicare Part A and

B enrollment. If you are an annuitant as of January 1, 2025, and did not enroll in Part B, you will not be required to enroll. However, if you are already enrolled, you are required to remain enrolled. Suppose you were an annuitant entitled to Medicare Part A before January 1, 2024, and did not enroll in Medicare Part B. In that case, you and your covered, eligible family members may be able to participate in the SEP for Medicare Part B that started April 1, 2024. Those who enroll during the SEP will not need to pay the late enrollment penalty.

There is no guarantee your current health plan or health will remain the same in the future.

Remember that you may have decades of life to live past age 65. Some retirees in their seventies told me they regretted not applying when their FEHB plan stopped participating or they moved out of the service area, and they needed to select a new plan with higher cost-sharing than the plan they had before.

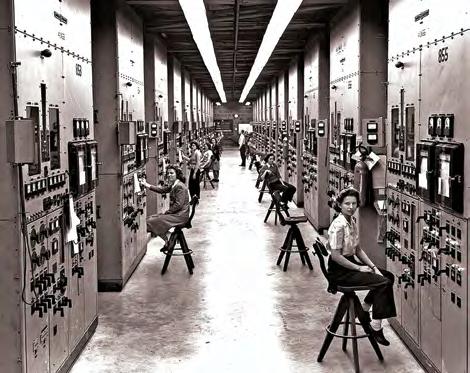

While there are people with high healthcare spending at all ages, overall, people aged 55 and over accounted for 55% of total health spending in 2021 despite making up only 31% of the population. In contrast, people under age 35 comprised 44% of the population but were responsible for only 21% of health spending.