MAY / JUNE 2023 | MHINSIDER.COM Changing the Rules for Affordable Homes in Opportunity Zones Industry Trends and Statistics Updates on New Department of Energy Standards THE MAGAZINE FOR MANUFACTURED HOUSING PROFESSIONALS STATE OF THE INDUSTRY

Manufactured Home Loans In A Zip © 2023. Zippy, Inc. All rights reserved. Zippy is an Equal Housing Lender. As prohibited by federal law, we do not engage in business practices that discriminate on the basis of race, color, religion, national origin, sex, marital status, age (provided you have the capacity to enter into a binding contract), because all or part of your income may be derived from any public assistance program, or because you have, in good faith, exercised any right under the Consumer Credit Protection Act. The federal agency that administers our compliance with these federal laws is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC, 20580. Home lending products offered by Zippy Loans, LLC. Zippy Loans, LLC is a direct lender. NMLS #2189776. 2807 Allen St., Suite 335, Dallas, TX, 75204. Not available in all states (www.nmlsconsumeraccess.org). Full-Service Provider We finance new & used homes, LTOs, RTOs, RPOs, and down payment assistance programs. Close in As Little As 5 Days 100% digital process means loans close in a zip. No Personal Recourse We replaced the personal guarantee with a short-term community guarantee to better address community owners’ needs. The Zippy Difference Contact us today to learn how to partner with Zippy! Chris Donsbach HEAD OF COMMUNITY PARTNERSHIPS chris@zippymh.com (865)257-8249 Innovative Funding Solutions Community Funding Zippy Funding Community-set lending criteria 100% digital experience No personal guarantee Zippy-serviced No fees out of pocket Market-set lending criteria &

MANUFACTURED & MODULAR HOMES ■ championhomes.com ■ skylinehomes.com ■ genesishomes.com PARK MODEL RVS ■ athenspark.com ■ shoreparkrvs.com ACCESSORY DWELLING UNITS (ADUS) ■ genesishomes.com EXPLORE OUR BRANDS AND DESIGNS AT THESE WEBSITES BUILD WITH A PROVEN LEADER Strong national manufacturing footprint Vast array of home designs for builders, communities, and retailers Complete line of homes for MH Advantage® and CHOICEHome® programs Leading builder of Park Model RVs Innovative builder of Accessory Dwelling Units (ADUs)

In March, UMH Properties CEO Sam Landy introduced a letter to the Senate Finance Committee in support of potential changes to opportunity zones that would allow for an influx of much needed affordable housing.

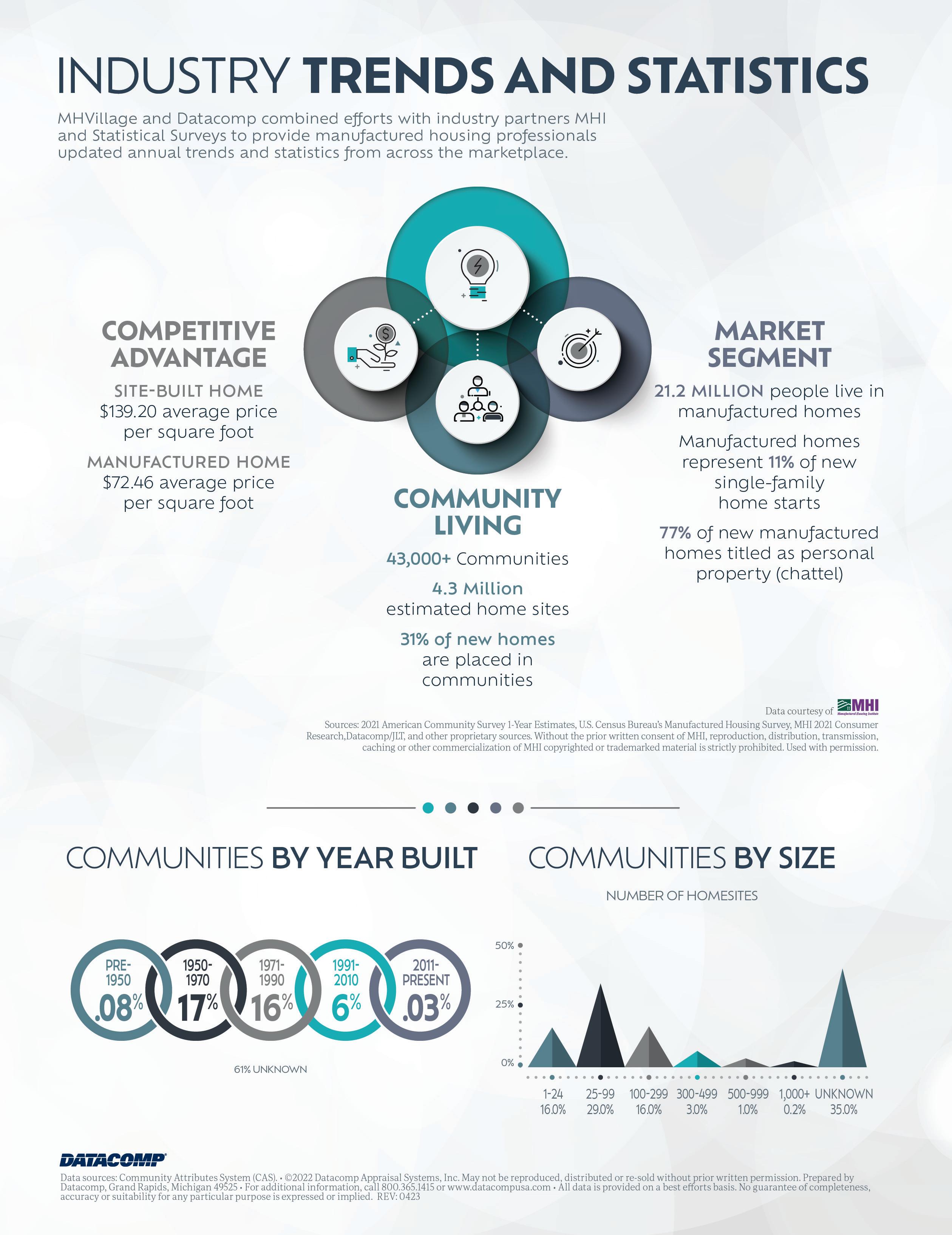

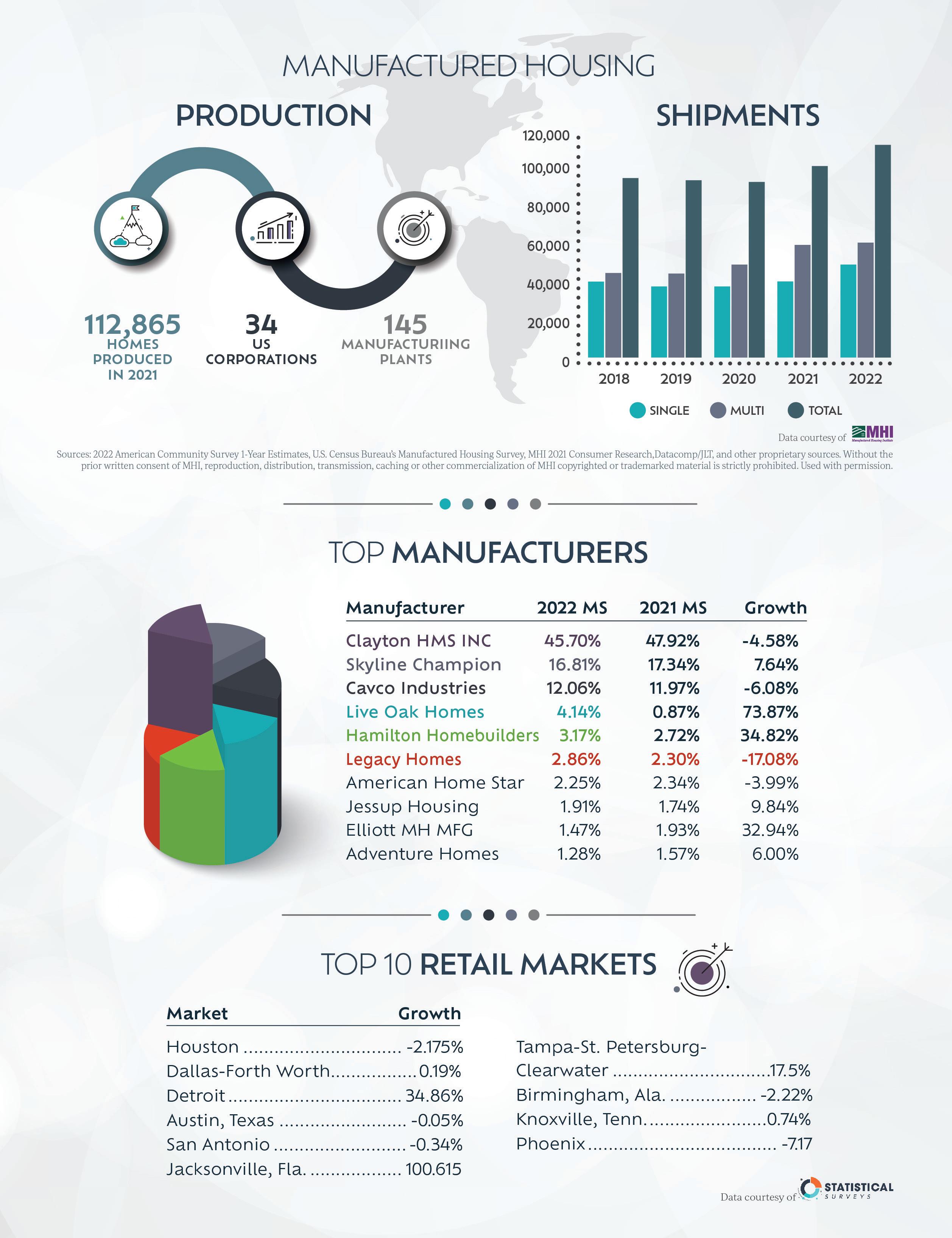

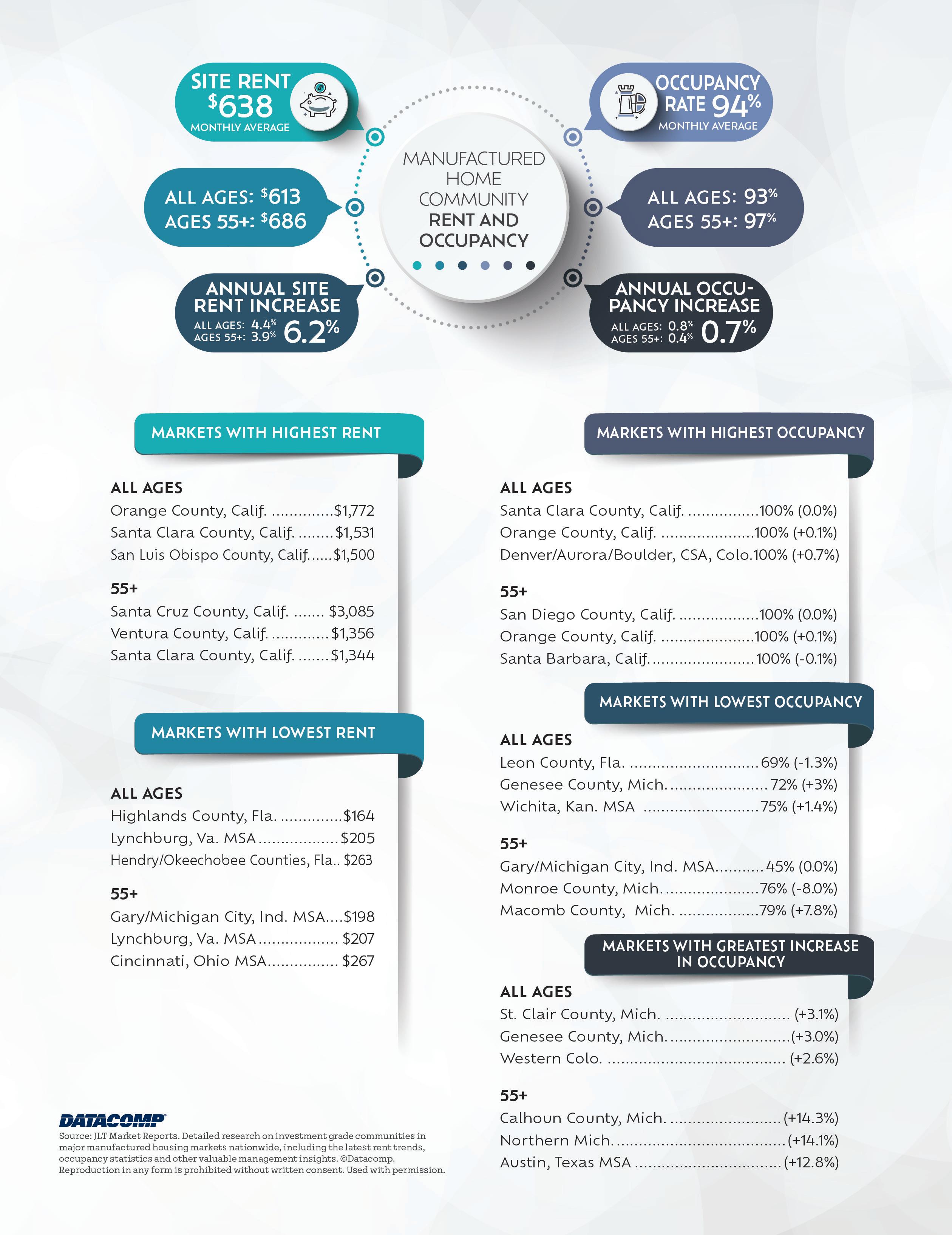

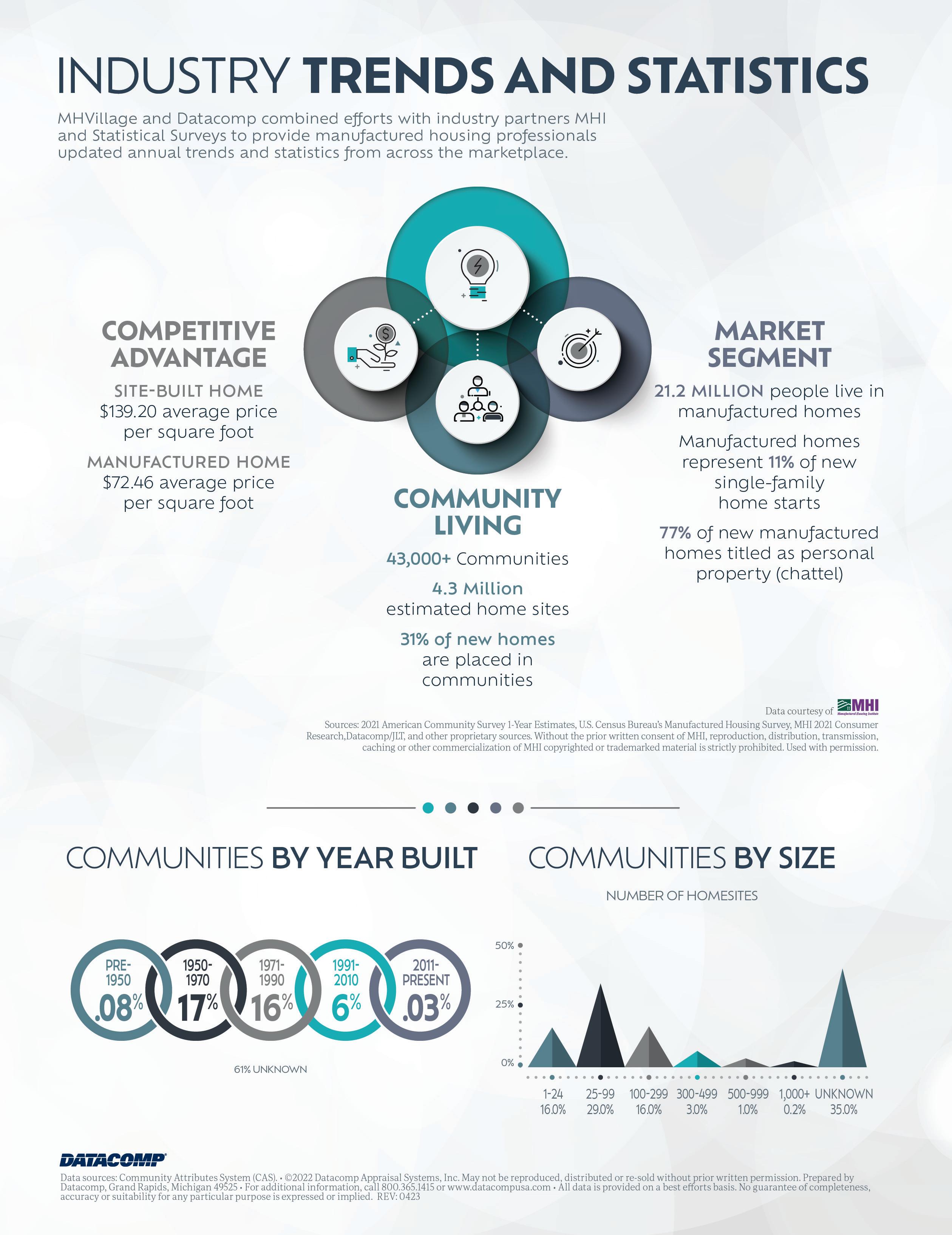

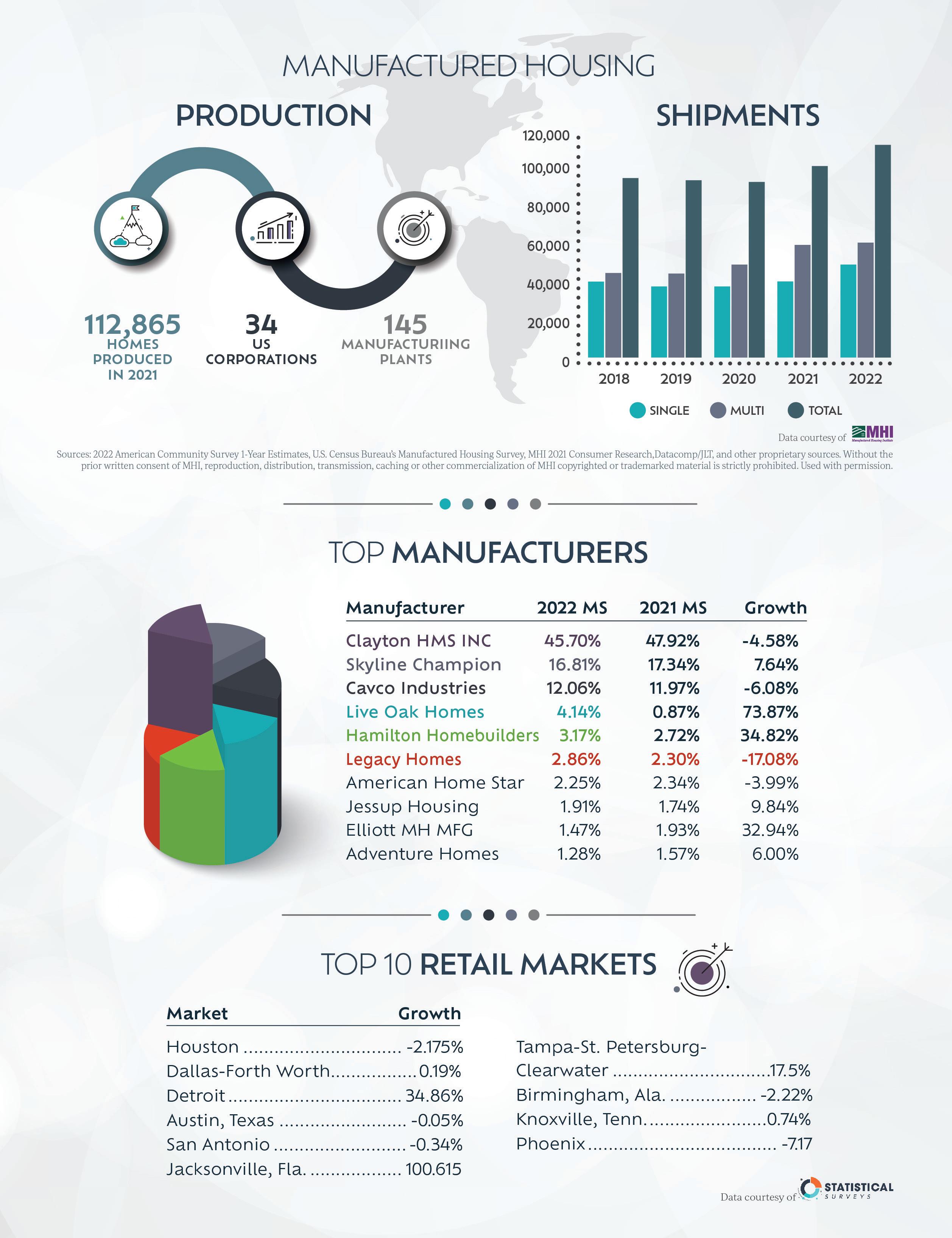

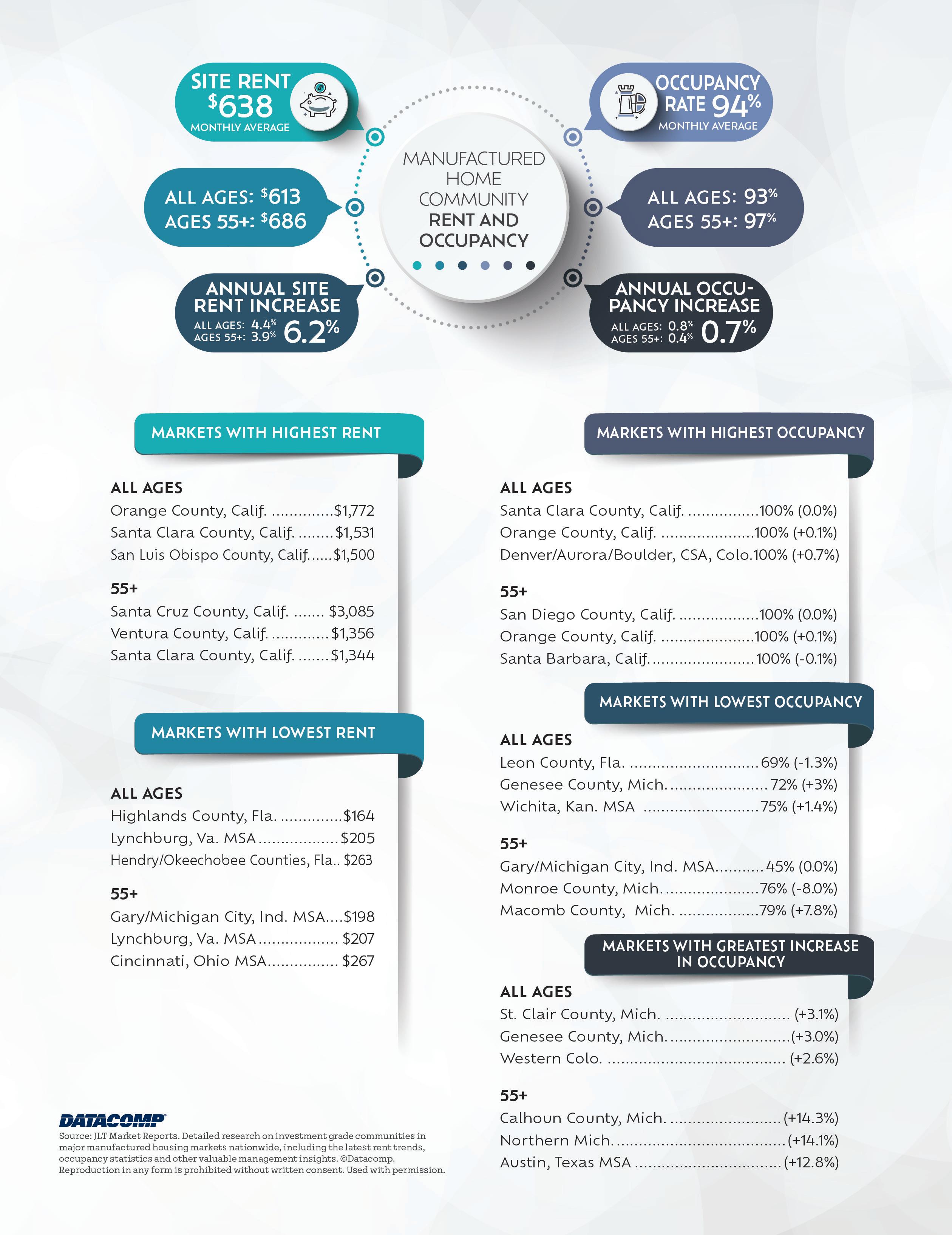

MHVillage and Datacomp combined efforts with industry partners MHI and Statistical Surveys to provide manufactured housing professionals updated annual trends and statistics from across the marketplace.

VOLUME 6, EDITION 3 | MAY JUNE 2023 | MHInsider.com

PUBLISHER Patrick Revere | patrick@mhvillage.com

SENIOR GRAPHIC DESIGNER Merit Kathan | merit@mhvillage.com

CONTRIBUTING EDITOR George Allen | gfa7156@aol.com

EDITORS Sean Vichinsky | sean@mhvillage.com, Dawn Highhouse | dawn@mhvillage.com

CONTRIBUTORS Steven Blank, Mitch Gonzalez, Kurt Kelley, Subhash Marineni, Vanessa Perry, Donald Westphal

ADVERTISING SALES (877) 406-0232 advertise@mhvillage.com

EDITORIAL & GENERAL INQUIRIES Patrick Revere | 2600 Five Mile Road NE Grand Rapids, MI, 49525 (616) 888-6994 patrick@mhvillage.com

contents

34 52

HAPPENINGS

6 Industry Happenings

EVENTS

10 Events & Tradeshows

13 Seen and Heard — Vegas

ECONOMY

16 Regulatory Environment, Stages of Development, and New Technology

18 Bank Failures Raise Questions for Community Investors

ENERGY & EFFICIENCY

22 Industry Continues to Rally Against Department of Energy Standards

25 New Communities: How to Best Capture and Use Solar Power

WORKFORCE DEVELOPMENT

28 WAMH’s Mission to Advance Women in the Industry

30 State, Local Impact on Industry Workforce

LAND USE

33 Tax Savings Strategies for Community Owners ‘Where Does the Money Go?’

44 Through the Eyes of a Landscape Architect

48 When to Close a Community

INDUSTRY TRENDS

58 State-By-State Home Sales Heat Map

60 MHInsider Marketplace Overview

64 Capstone MH Regional Expense Comparison

TECHNOLOGY

67 Zippy Streaks Full Circle from Finance, Through Community Ownership, Into Tech

71 Sky View Advisors Employ Tech-First Approach

INSURANCE

72 What Made Insurance So Much More Expensive?

ALLEN LEGACY

78 Dates, Groups & Books that Narrate Manufactured Housing Industry

Although we make every effort to ensure that the information in this issue was correct before publication, MHVillage, Inc. and the publisher do not assume and hereby disclaim any liability to any party for any loss, damage, or disruption caused by errors or omissions, whether such errors or omissions result from negligence, accident, or any other cause. Opinions expressed are those of the author or persons quoted and not necessarily those of MHInsider or the publisher MHVillage, Inc.

Copyright ©2023 MHVillage, Inc. All rights reserved. Reproduction of MHInsider content, MHI or other contributor content, in part or in whole, is prohibited without written authorization from MHVillage, Inc.

www.MHVillage.com

MHINSIDER.COM | 3

MHInsider™ is published by: 2600 Five Mile Road NE Grand Rapids, MI 49525 (800) 397-2158

Patrick Revere is vice president of communications at MHVillage and publisher for the MHInsider magazine and blog for industry professionals. His background is in print news, language, and communication.

from the PUBLISHER

‘What’s the Big Idea?’

I’ve been asking industry colleagues recently at shows and meetings to share with me the no-holdsbarred concept they feel could reshape the manufactured housing industry.

My caveats, to be clear, are that budget is not a concern, there are no approvals required, the regulatory environment will be dealt with, and hiring is the least of your worries.

What’s the big idea?

The answers, of course, ran far and wide.

As I cross paths with people in the weeks and months to come, I will continue to add to this vault of brave notions. At some future point, MHInsider will share a good lot of them.

The concept came up during the planning and production of this edition of the magazine. The State of the Industry edition looks to capture the grand themes in the industry.

Rather than curating in business categories, we tackle the industry challenges and opportunities at a higher level. It’s a way to raise our considerations from the daily tactical to the long-term strategic.

We, at MHInsider, want to hear from our audience and introduce you and your ideas to the marketplace.

“What’s the Big Idea” has become my very simple big idea to help carry this bold view of how the industry might evolve through the year rather than having it designated to any twomonth period. Yes, the tactical dayto-day aspects of our lives must be addressed, but not at the expense of that ringing inclination that you may have just landed on the next big idea.

So happy inventing, manufactured housing professionals, and look me up or flag me down if you want to share your big idea!

4 | MAY / JUNE 2023 EDITION

growth quality integrity focus team enjoy leader charity Privately Owned & Operated Since 1988 States where currently own MHCs Joshua Mermell Senior VP of Acquisitions Email Jmermell@rhp.com Cell 248.508.7637 Office/Direct 248.538.3312 rhp com • All Cash • Highest Price Paid for MHCs • 35 Years of Experience Buying • Communities of Every Size & Complexity • 100% Confidential • Comfortable with Private Utilities & • Community Owned Homes • Smooth & Efficient Closing Process Brokers Protected

industry HAPPENINGS

Transactions

Fannie Mae Multifamily Closes 2022 With $69 Billion in Volume

Fannie Mae provided more than $69 billion in debt financing to support the multifamily market in 2022 through the Delegated Underwriting and Servicing (DUS®) platform, along with Low-Income Housing Tax Credit (LIHTC) equity on the mission to provide access to affordable housing throughout the country. "This year marks the 35th anniversary of DUS, a platform that relies on shared risk and strong lender partnerships to serve the needs of the rental housing market," Fannie Mae Executive Vice President and Head of Multifamily Michele Evans said. "Our DUS program is well positioned to support the secondary market and play a key role as a stable source of liquidity. We look forward to working with our DUS lenders in the coming year to continue to serve the market and address its most pressing challenges.”

UMH Buys Land in NY Adjacent Community

UMH Properties, Inc. purchased a 24-acre parcel of land located in Monticello, N.Y., for $137,000. The property is adjacent Kinnebrook Estates and allows for expansion that will add homesites and generate added profits and better operating results. Kinnebrook is a

250-homesite community with near 100% occupancy. Site rent averages $660 per month and home rents average $1,200 per month.

Tennessee Association Launches New Website

The Tennessee Housing Association has unveiled a new website and marketplace for factory-built homes in the state. The consumer platform allows Tennessee homebuyers to browse, select, tour, and shop for manufactured and modular homes for sale. The new website tennesseemanufacturedhomes. com allows shoppers to learn more about homes by viewing floor plans , getting price quotes, finding lenders and communities, and even taking 3D tours of new homes available for sale. "Today's homebuyer wants to explore their options online in order to focus on what they really need and want," THA Executive Director Marla McAfee said. "This new experience allows Tennesseans to find a home that fits their lifestyle and budget."

Four Leaf Acquires Communities in Texas

Four Leaf Properties purchased a manufactured home community development project in Victoria, Texas. Phase I of the project began with development of a community plan for 195 home -

6 | MAY / JUNE 2023 EDITION

HAPPENINGS

sites by the previous owner. Four Leaf rebranded the community from Mornington Community to Bluewood Ranch, a lifestyle community that will offer modern, energy-efficient new homes along with community programming and events. The community will develop additional homesites and sell 3- and 4-bedroom, 2-bath homes with about 1,500 square feet of living space. “Quality connects everything we do at Bluewood Ranch from infrastructure, office/community center, new energy-efficient homes and professional on-site management that elevates the lifestyle experience,” Four Leaf’s Michael Callaghan said.

Firm Capital Property Trust Acquires 50% Interest in Two Manufactured Home Communities

Firm Capital Property Trust has purchased 50% interest in the 56-site Parkhill Estates for $3.1 million and in the 58-site Skyview Estates for $2.6 million. Parkhill is in Peterborough, Ont., on 15.9 acres of land and is 100% occupied. Skyview is in Trenton, Ont., on 5.3 acres and is also fully occupied. The properties are funded through existing cash resources of the trust on seven-year debt financing for approximately 65% of the purchase price.

Manufactured Housing Properties Inc. Acquires Five Communities

Manufactured Housing Properties Inc. has acquired Country Aire and Merritt Place Manufactured Housing Communities and the Wake Forest portfolio and Mobile Cottage. Country Aire consists of 105 homesites and is situated on approximately 20.8 acres in Simpsonville, S.C., near Greenville. Merritt Place has 40 developed homesites, and 14 more under development, as well as 24 homes, which expands

the company’s presence in Brunswick, Ga. The Wake Forest portfolio includes Cooley and Country Road Manufactured Housing Communities with 72 homesites and 54 homes in the North Raleigh area. Mobile Cottage adds 23 homesites and 18 homes to the company’s presence in Morganton, N.C. MHPC now owns and operates 57 manufactured home communities with 2,747 homesites.

The Home Gallery Curates New Offerings

Orbit Homes has launched a curated collection of new factory-built homes called The Home Gallery that includes California bungalows, traditional floor plans, CrossMod Homes, and more contemporary layouts all within a wide range of price points. "Contemporary factory-built homes are changing the homeowner landscape," Orbit CEO Or Michaelo said. "With the opening of The Home Gallery, we can offer people an opportunity to become a homeowner and have the experience of choosing a home that looks and feels like traditional new-build construction. Our goal is to get people the home of their dreams in the locations they want, at a price point they can afford."

‘Rent Stabilization’ Extended in L.A.

Annual rent increases for rental units subject to the City of Los Angeles Rent Stabilization Ordinance are now prohibited through 2023. Exceptions may apply, such as approved rent increases for capital improvements. Call the city Housing Department at (866) 557-7368 with any questions.

Vermont Gov. Announces Funds for Healthy Homes

Vermont Gov. Phil Scott and the Agency of Natural Resources have announced $12.6 million in funding for the state’s Healthy Homes Initiative to help 36 »

MHINSIDER.COM | 7

manufactured home communities with repairs to and replacement of water infrastructure. “This critical funding supports safe, affordable housing and improves the quality of life for those living in manufactured housing communities,” S cott said. “Through this round of funding, an estimated 3,975 residents – including 1,100 seniors and 830 children – will be able to more reliably access safe drinking water, and will be served by improved wastewater, stormwater, and drainage systems, protecting both them and the environment.”

Personnel Wisconsin Housing Alliance Member Services Director Retires

Julie Patten, director of member services for the Wisconsin Housing Alliance, announced her retirement after 33 years of service. During her tenure, membership increased from 423 to nearly 800 professionals, and more than 69,000 homes shipped in Wisconsin. “One of the many reasons why I love this industry is because of the hardworking, down-to-earth, and generous members that I have had the honor to work for,” Patten said.

Fannie Mae Names New Director

Fannie Mae has named Michael Seelig to the board of directors and stated that he will serve on the Audit Committee. Seelig was a senior executive at PricewaterhouseCoopers LLP, where he was a partner from 1997 until his retirement in September 2022. He has more than 35 years of experience serving clients in the financial services industry. In addition to helping companies navigate risk, regulatory, mergers and acquisitions, financial reporting, corporate governance, and strategy matters, Seelig served in a variety of leadership roles where he was responsible for driving the firm's strategy and operations in several national, market, and sector-based capacities. Seelig is a licensed certified public accountant and a member of the American Institute of Certified Professional Accountants.

Honors

Skyline Homes Awarded America’s Most Trusted® Manufactured Home Builder For Third Consecutive Year

Skyline Homes, a Champion Homes brand, has been recognized for the third consecutive year as America’s Most Trusted® Manufactured Home Builder. The annual study conducted by Lifestory Research is based on responses from 40,000 consumers shopping for a manufactured home. “To say it is an honor to receive this prestigious award for another year is an understatement,” Mark Yost, president and CEO of Skyline Champion Corporation, said. “We take our commitment to providing quality homes to hardworking Americans very seriously, and acknowledgments such as this one reflects the collective work of our team to earn and serve customers every day.”

Industry Giving

415 Families Receive Home Updates

Impact Communities provided home updates to 415 residents through their affiliate, Impact Cares, which teams with local volunteers and residents to serve together on improving the lives of residents and bettering homes and communities. Improvements included new skirting, power washing, painting, tree trimming, building decks and ramps, and replacing steps.

In Memoriam Industry Mourns Longtime Wisconsin Community Owner, Retailer

Mary Ann Sommer, a longtime Wisconsin community owner and retailer, passed away Dec. 19, 2022 at the age of 95. Mrs Sommer, from Sheboygan, owned and operated Sommer’s Homes Inc. and Sommer’s Woodhaven Manufactured Home Community, which was started in 1947. Her husband and partner in business, Lloyd Sommer, preceded her in death. She also was involved in nearly every aspect of 4-H for more than five decades, and was on the 100-mile endurance ride committee for the Plymouth Trail Riders, among her many civic activities. MHV

8 | MAY / JUNE 2023 EDITION

HAPPENINGS

Events

& Tradeshows

MHI on the Hill

Tuesday, June 6 — Wednesday, June 7, 2023

Washington, D.C. | National Mall

The Salamander Resort and Spa

Held annually in conjunction with National Homeownership Month and HUD’s Innovative Housing Showcase, MHI invites members to the Capitol to convey industry priorities to Congress, staff, and policymakers, and to network with colleagues within the industry and in other segments of housing, as well as with guests, and the general public.

2023 MHCA Annual Conference and Golf Tournament

Wednesday, June 7 — Friday, June 9, 2023

WeKoPa Casino & Resort | Fort McDowell, Ariz.

MHCA offers a prime locale to meet, exhibit, and shop for the latest industry developments and trends. With awe-inspiring views and a day of great golfing, Manufactured Housing Communities of Arizona invites manufactured housing professionals for a productive three-day outing in the desert. Exhibit and sponsorship opportunities are available!

Innovative Housing Showcase

Friday, June 9 — Sunday, June 11, 2023

Washington, D.C. | National Mall

The U.S. Department of Housing and Urban Development, four years following its inaugural event, has announced the return of the Innovative Housing Showcase to provide a large, public display of innovative designs, structures, and advances in housing, particularly with a mind toward energy-efficiency, durability, and availability. The gathering coincides with National Homeownership Month as well as industry- and state-specific lobby efforts, including Manufactured Housing Institute’s annual industry fly-in event at the Capitol.

Florida Manufactured Housing Association Annual Convention

Thursday, June 15 — Friday, June 16, 2023

Orlando, Fla. | Orlando Hyatt

There is a return to Orlando with the FMHA Annual Convention, where members and guests will find help from other manufactured housing professionals in making connections or learning best practices. There will be an economic update, a review of recent and pending legislation, a disaster recovery update, and other trending topics in Florida and around the country. Attendance, exhibitor, and sponsorship opportunities are currently available.

EVENTS

10 | MAY / JUNE 2023 EDITION

Manufactured Housing Institute of South Carolina Summer Convention

Thursday, June 20 — Saturday, June 22, 2023

Myrtle Beach, S.C. | Hilton Oceanfront Resort

MHISC is meeting at the Hilton Oceanfront Resort for its annual summer gathering. It will host a golf tournament, committee meetings, and a state hall of fame awards ceremony and dinner. Join other manufactured housing professionals at the beach for networking, learning, and industry development. Exhibitor and sponsor opportunities remain, please contact the association for details.

2023 Multi-State Convention

Saturday, July 29 — Monday, July 31, 2023

Orange Beach, Ala. | Perdido Beach Resort

Join the Alabama, Louisiana, and Mississippi manufactured housing associations to explore valuable networking opportunities, attend banquets, educational seminars, and state-specific continuing education. Attendees can explore an upscale marina near the resort that offers deep-sea fishing, dolphin excursions, boutique shopping, a day spa, and local eateries. Of course, a round of golf is nearby at a number of signature courses. Registration, exhibit, and sponsorship opportunities are available.

RV/MH Hall of Fame Induction Dinner & Ceremony

Monday, Aug. 21, 2023

Elkhart, Ind. | RV/MH Hall of Fame and Conference Center

The RV/MH Hall of Fame each year invites industry professionals, family, and friends to celebrate the recent lineup of hall of fame inductees. The event starts with a cocktail mixer, followed by dinner and the induction ceremonies. The hall in Elkhart details the careers of hundreds of RV and MH professionals, including a library, event center, and museums for each of the industries.

MH FacTOURy Summit

Tuesday, Aug. 22 — Wednesday, Aug. 23, 2023

Elkhart, Ind. | RV/MH Hall of Fame and Conference Center and Northern Indiana Homebuilding Facilities

Attend two full days of factory tours and learning for retailers, community owner/operators and vendors from around the nation. G et the chance to come together to learn about the latest trends in product development, home building, management, finance, and sales.

SECO National Conference of Community Owners

Sunday, Sept. 10 — Wednesday, Sept. 13, 2023

Atlanta | Renaissance Atlanta Waverly Hotel and Convention Center

From industry panels, presentations, and roundtable discussions, to the networking mixers and professional exhibits, the SECO National Conference of Community Owners again seeks to improve on that fresh, compelling interaction and camaraderie. The event provides manufactured housing professionals with four days of high-level interaction, including educational seminars, panels, roundtables, fireside chats, mini TED talks, and open time for networking and deal-making.

If you have an event or gathering you would like to have listed with MHInsider, please contact us at:

www.mhvillage.com/pro/manufacturedhousing-industry-trade-shows/

MHINSIDER.COM | 11

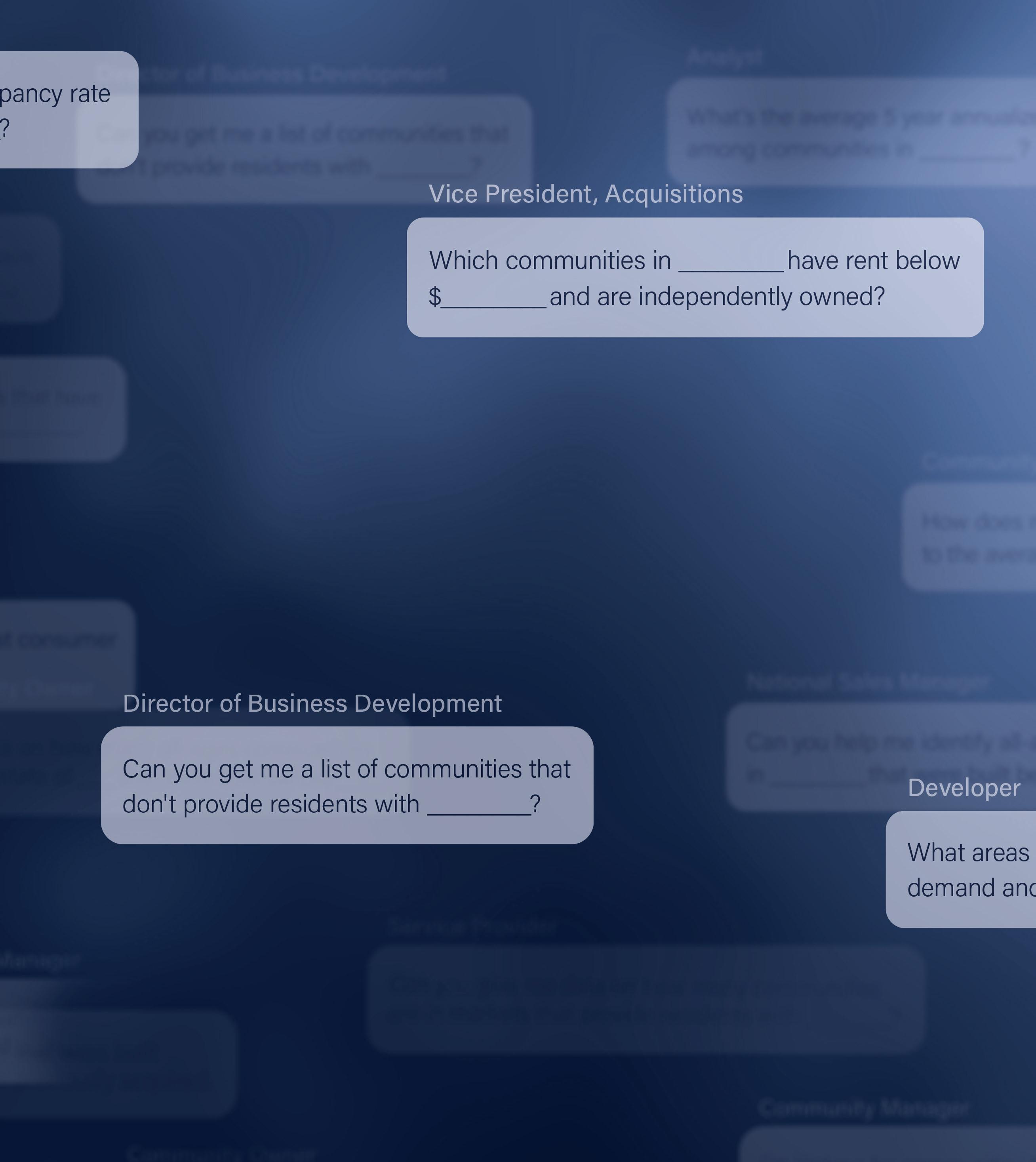

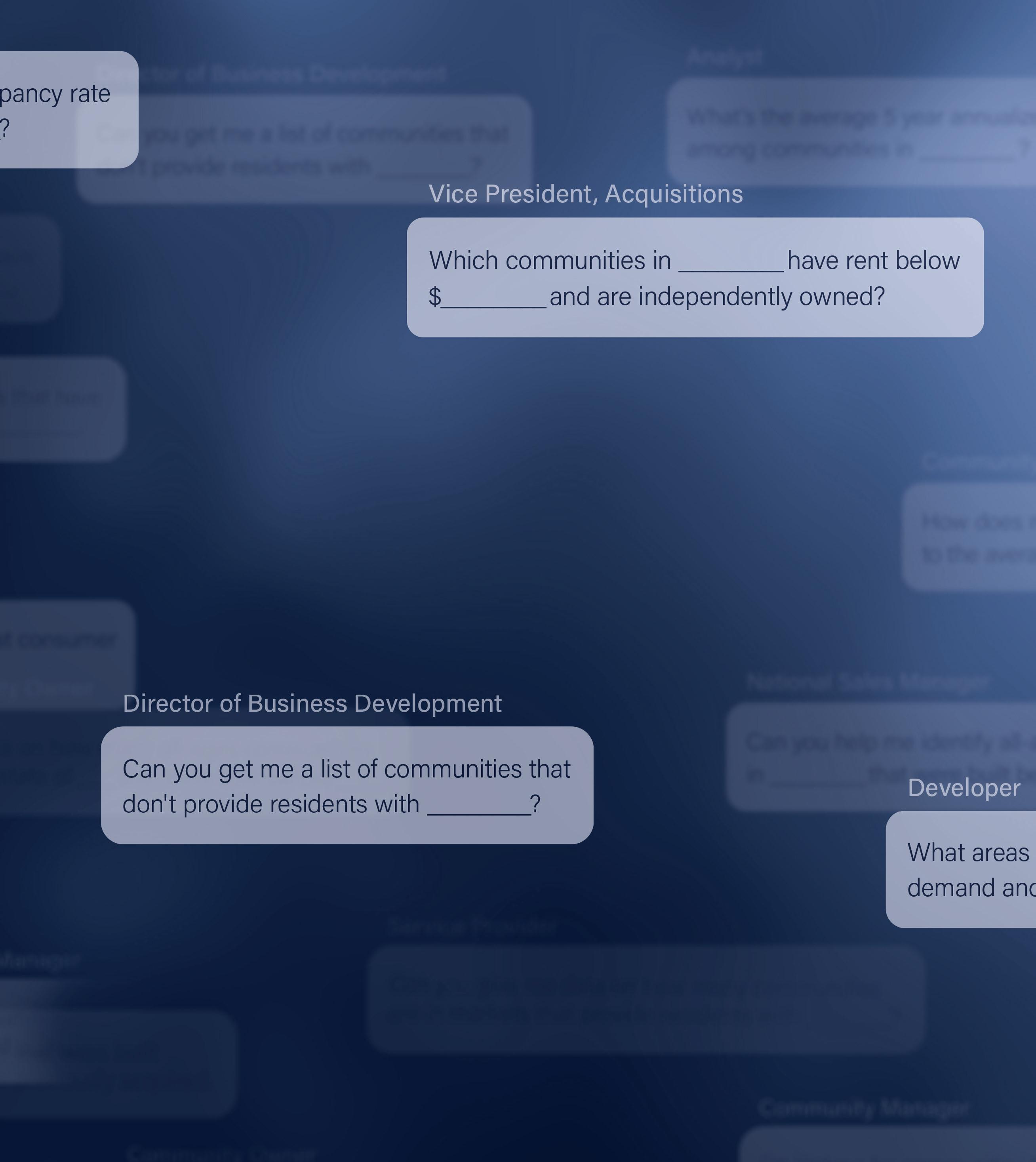

Let’s Fill In The Blanks TOGETHER. Datacomp Get the Answers You Need at: info.DatacompUSA.com/data Insights Powered by Data

There’s no such thing as one-size-fits all when it comes to data. That’s why Datacomp offers the most customizable and detailed insights in the manufactured housing industry. Whether you need rent and occupancy data, community attributes, home sales activity or overall industry trends, our custom data solutions can help fill in the blanks. From evaluating potential acquisitions, to benchmarking existing properties or uncovering new business opportunities, Datacomp can provide the answers you need for informed decision-making.

Seen & Heard

From the Tee Box

Jeff Merrill, business development manager for MHVillage, strikes the ball during the 17th Annual Oliver Technologies Golf Open at the Las Vegas Paiute Golf Resort.

80s Networking Lounge

MHInsider sponsored a networking lounge at the 2023 Congress and Expo, complete with full-size vintage arcade games.

A Community Overview

Lesli Gooch, the CEO of MHI, moderates a panel of industry leaders in community ownership and management, from left Steve Schaub of Yes Communities, Sam Landy from UMH Properties, and Bill Raffoul of Sun Communities.

EVENTS

UMH PROPERTIES, INC. A PIONEER IN MANUFACTURED HOUSING

As a publicly traded REIT (NYSE:UMH), we have been providing quality a ordable housing since 1968. Our portfolio provides high pro t margins, recession resistant qualities, reliable income streams and the potential for long-term value appreciation.

• $1.9 billion in total enterprise value

• 135 communities, 25,700 homesites, 2 joint venture communities containing 363 homesites, 11 states

• Housing approximately 21,000 families

• 7,600 total acres, 3,800 acres in Marcellus and Utica Shale regions

UMH Awarded 2021 Manufactured Home Community Operator of the Year and 2021 Retail Sales Center of the Year by the Manufactured Housing Institute For more information, visit www.umh.reit or contact ir@umh.com

UMH Awarded 2021 Manufactured Home Community Operator of the Year and 2021 Retail Sales Center of the Year by the Manufactured Housing Institute For more information, visit www.umh.reit or contact ir@umh.com

Advocating at the Expo

Gay Westbrook from MHI catches up with a member on the expo hall floor during the Congress and Expo at MGM Grand.

Catching up, Talking Shop

Rob Shouhyib and Kamal Shouhyib, of Choice Properties, talk with John Rogosich, center, of I. R. Management Group.

Blast from the Past

Manufactured housing professionals at Congress and Expo in Vegas found some time for an alternate type of gaming.

Learn the Latest

The educational offerings at the Congress and Expo in Vegas were well attended, and appreciated by new and seasoned professionals alike.

EVENTS MHINSIDER.COM | 15

Regulatory Environment, Stages of Development, and New Technology

by Mitch Gonzalez

The history of manufactured housing in its earliest form dates to 1764, when a two-story panelized frame dwelling was shipped from London to Cape Ann, Mass. By the early 1900s, the English were building custom vans, and an American devised a fifth-wheel hitch to attach a travel wagon to his roadster.

During World War II, the U.S. government purchased mobile homes for workers near plants. By the late 1940s, trailer lengths had increased to more than 30 feet and small bathrooms were added. In the 1960s, two-section mobile homes became popular, and a mobile home construction code was developed by the Mobile Home Craftsmen Guild.

In the 1970s, one mobile home was built for every three site-built homes compared to the last three years, where we have seen one manufactured home built for every 10 site-built homes. This is one of the many reasons our country has a severe lack of affordable housing.

Manufactured housing is a type of prefabricated housing that is largely assembled in factories and then transported to sites of use. It is regulated by the U.S. Department of Housing and Urban Development (HUD) since 1976. Manufactured homes are different from modular homes, which are also factory-built but comply with the building code for where they will be placed and are often treated as equivalent to site-built homes for zoning purposes.

Details on Zoning

Zoning is a tool that cities use to govern the use, size, and relation of buildings to their surroundings. Zoning for manufactured housing varies from jurisdiction

to jurisdiction and may restrict or eliminate their placement in certain areas.

Some of the common zoning devices that affect manufactured housing are…

· Outright bans

· Lot size requirements

· Density limits

· Restrictions on manufactured home communities

· Aesthetic standards

· Compatibility criteria

These zoning regulations may reduce the supply of affordable housing and may be discriminatory under the Fair Housing Act. State-level zoning restrictions against manufactured homes and communities are being targeted by legislators in Arizona, Maine, Mary-

16 | MAY / JUNE 2023 EDITION ECONOMY

land, Massachusetts, and North Carolina. As these states turn the corner in accepting our industry again, we will see more viable development opportunities.

Land Entitlement for Manufactured Housing

The process of entitlement for land development involves obtaining approvals from local authorities for the use and development of land. It may include rezoning, subdivision, site plan review, environmental review, variance, special use permit and other approvals depending on the project and location.

The entitlement process can be complex, time-consuming, and costly for developers of manufactured housing communities. It may also involve public hearings, community meetings, and negotiations with stakeholders.

Professional Services Involved in Land Development

A successful entitlement of a manufactured housing community requires a good land-use attorney, engineer, and site plan designer. These professionals can help navigate the complex zoning and permitting regulations, ensure compliance with environmental and safety standards, and optimize the layout and design of the community.

A good land-use attorney can advise on the legal aspects of the project, such as negotiating with local authorities, securing approvals and variances, and resolving any disputes or challenges. A good engineer can provide technical expertise on the infrastructure and utilities of the community, such as water, sewer, drainage, roads, and lighting. A good site plan designer can create a functional and attractive plan for the community, such as maximizing space utilization, enhancing aesthetics and accessibility, and incorporating amenities and features.

During the last year, we at Yale have tracked over 25,000 sites being developed across Texas, Arizona, and the Southeast. We are excited for what the future holds for new manufactured housing communities and hope the progress being made by some of these states continues to spread to other areas of the country. MHV

Mitch Gonzalez is the director of land sales and development for Yale finding the highest and best use of a property leveraging a diverse background in real estate investment. He previously ran a construction company providing general contracting services for brands such as Emcure Urgent Care, Jonna Properties, and Safeway Oil Company, overseeing $70M in closings.

Bank Failures Raise Questions for Community Investors

by Subhash Marineni

by Subhash Marineni

18 | MAY / JUNE 2023 EDITION

ECONOMY

In the wake of recent banking crises, park owners may be concerned about the impact on the manufactured housing sector, particularly the ability to finance acquisitions and greenfield developments. The crisis is expected to limit the availability of bank financing, cause an increase in the cost of borrowing, and perhaps a higher likelihood of a recession.

While attempting to predict the future, it is crucial to understand the drivers of the recent capital activity in the sector and assess their variability in a crisis.

The failure of three banks and questions on others during the past two months triggered a brief but deep panic in the capital markets, along with losses in stock markets. »

MHINSIDER.COM | 19

Silicon Valley Bank, the 16th largest bank in the U.S., precipitated the concern and caused investors to survey small to midsize banks that primarily served the technology sector. Once the second institution, Signature Bank, went down, the inevitable spillover effects began. The Federal Reserve’s inflation curbing efforts, including raising the interest rates, has resulted in unrealized losses on the bank’s loan portfolios – particularly those holding low yielding, longer duration bonds and loans. Given that the banks are not required to disclose “mark to market” losses on their bond and loan portfolios, we cannot fully understand the extent of the losses.

With the assurances from the regulators that tax payers will not pay for banks’ losses, it is critical that the banks are amply capitalized to cover all depositor claims. Bank regulators will continue to scrutinize the liquidity at the banks. Bank financing, tightening already, will experience further tightening.

Institutional capital activity in the manufactured housing sector has increased in recent years as institutional investors look for new investment opportunities to diversify their portfolios and generate attractive returns. This is driven by several factors, including:

· Growing demand: The need for affordable housing, particularly among aging baby boomers, has increased demand for manufactured homes, making them an attractive investment option.

· Strong returns: Manufactured home parks can offer attractive returns, particularly in areas with high demand for affordable housing.

· Lack of competition: The manufactured home park industry has not received the same level of investment as other real estate sec -

tors, creating opportunities for institutional equity to enter the market.

· Stable cash flow: Mobile home parks generate a steady stream of income from lot rents, offering the potential for long-term, inflation-protected income.

The role of institutional capital has been in the form of debt financing from banks (direct, and agency guarantees), commercial mortgage-backed securities issuers, and specialty finance companies. Equity financing has been in the form of direct equity investments, joint ventures, and other types of structured investments. Non-bank institutional capital providers to the sector include private equity groups, investment divisions of insurance companies and pension funds, structured capital groups, and REITs. The fragmented nature of the industry has limited the participation of a large number of institutional capital groups due to the lower number of investment opportunities that meet their minimum investment size criteria.

Historically, the manufactured housing sector has performed well during economic recessions. During a recession, demand for affordable housing tends to increase as more people seek lower-cost housing options, and manufactured homes offer an attractive alternative to traditional site-built homes.

Moreover, manufactured home parks tend to have lower turnover rates than traditional multifamily apartments during recessions, which helps maintain stable cash flows for park owners/investors. This is because residents who own their manufactured homes typically have lower mobility due to the cost of

20 | MAY / JUNE 2023 EDITION

ECONOMY

During a recession, demand for affordable housing tends to increase as more people seek lower-cost housing options, and manufactured homes offer an attractive alternative to stickbuilt homes.

moving and setting up their homes in a new location, which reduces the likelihood of vacancy.

Another trend particularly driving housing in general is the under supply of homes due to historic under building of single-family homes since the housing recession of 2008. For these reasons, manufactured housing sector is expected to continue to be one of the top performing asset classes in a recession case — therefore, institutional capital interest in the sector is expected to remain strong.

Cost and availability of debt are critical drivers of investor returns in any assets, particularly in real estate and related asset classes like manufactured homes given the high debt-to-equity ratios used to finance developments or acquisitions. As with any bank tightening, appetite for both quantum of debt and leverage tolerance in a deal decreases. Hence, park owners will be required to capitalize deals with more equity, which will lower the equity returns unless the rent increases net the increased cost of debt. Interest rate increases have a broad impact on the development or acquisition of the parks everywhere, but more so in rent-controlled states.

Financing acquisitions of existing communities has been and, will continue to be,more attractive for institutional capital than greenfield development of new communities. In addition to the existence of stable rent cash flows, sizable acquisitions provide an opportunity to deploy meaningful capital with one sponsor. Recent large equity/JV transactions in the sector have primarily centered around acquisitions. Given the risk associated with lot development, land banking by smaller investment groups remains the dominant way to finance development projects. Minimal large institutional capital appetite exists today in development financing. However, park owners with JV partners are better positioned to cultivate trust and garner capital partner’s support to fund opportunistic development projects.

In summary, due to the recession-resistant nature of the sector and limited opportunities for attractive returns in other asset classes, investor interest in the manufactured housing sector is expected to remain strong. MHV

Subhash Marineni is a director at Bridgepoint Investment Banking with expertise advising business owners on capital raising involving equity and debt private placements, and mergers and acquisitions. Bridgepoint has deep capital connectivity and ability to source flexible capital to support acquisitions and growth. Subhash has recently advised on a preferred equity/JV partnership for a 2,300-homesite portfolio acquisition financing in New York. In 2021, he was presented with America’s Rising Star Dealmaker Award from Global M&A Network and was recognized in 2022 by The M&A Advisor with the Emerging Leaders Award.

MHINSIDER.COM | 21

Go to http://subscriber.mhinsider.com on your computer or mobile device Manage Your MHInsider Subscription Online!

Industry Continues to Rally Against Department of Energy Standards

by Sean Vichinsky

The long-in-development “Energy Conservations Standards for Manufactured Housing” proposed by the U.S. Department of Energy were scheduled to take effect on May 31, and continue to face scrutiny from the manufactured housing industry even as a delay of the implementation seems likely.

Under these proposed DOE standards, manufactured homes would be subject to more stringent environmental scrutiny, a move that many in the industry have decried as unrealistic.

Chief among the criticisms is the fact that the May 31 deadline has offered industry professionals — most notably manufacturers — with barely a year to ensure they’re in compliance.

Others say that DOE’s enforcement standards are unclear, leaving manufacturers in the dark about how exactly they can reach full compliance.

On April 3, Sen. Tim Scott, (R), S.C., Ranking Member of the U.S. Senate Committee on Banking, Housing, and Urban Affairs, sent a letter to U.S. Department of Energy Sec. Jennifer Granholm urging her to immediately delay new standards.

“I am concerned the DOE Standards will unnecessarily limit consumer choices and raise costs for families seeking affordable homeownership opportunities,” Scott stated in his letter. “The DOE Standards are overly broad, unduly burdensome, and undermine commonsense efforts to increase supply and assist families looking for affordable housing opportunities.”

Some suppliers, amid lingering supply chain challenges, also face uncertainty when it comes to meeting the standards.

Craig Aspinall, the general manager of Michigan-based Capitol Supply & Services, spoke last year about the shortage of critical components and the ability to meet new energy regulations as a result.

“We have had to push back installs,” Aspinall said.

The Push to Delay Implementation

The Manufactured Housing Institute has launched a campaign to push the DOE toward a delay to help the industry better understand how to reach compliance, as well as how new standards will be enforced.

“Without a clear understanding of how the department intends to enforce these manufactured housing energy standards or how the standards will be evaluated for compliance, it is impossible for the industry to know whether or not its compliance efforts will be found satisfactory to DOE,” MHI stated in a message to members.

In an effort to push back the deadline, MHI is asking its members to speak out and convince the DOE to amend the ruling. Additionally, MHI has pursued legal action along with the Texas Manufactured Housing Association, and continue to await a response.

“The industry supports the Manufactured Housing Consensus Committee’s proposed updates to the energy efficiency requirements in the HUD Code, and HUD is currently in the process of updating the HUD Code with those recommendations,” MHI CEO Lesli Gooch said.

“However, that process will not be completed by the DOE deadline and MHI is asking the court to, at a minimum, delay the Final Rule until HUD has completed their process to ensure DOE standards are aligned with HUD Code regulations,” she said.

The Energy Department noted on March 23 in a request for input published to the Federal Register that a delay would offer more time to allow for greater understanding and education on how compliance will be handled. MHV

Sean Vichinsky is an editor of MHInsider and a marketing copywriter for MHVillage.

22 | MAY / JUNE 2023 EDITION ENERGY & EFFICIENCY

Get Online Reviews Working For Your Business Instead of Against It.

The new mh.reviews service from MHVillage is the only tool you need to collect, monitor and promote online reviews from happy customers.

Our system helps you tactfully ask and remind people for feedback, guides them through the process, and gives you a chance to reach unhappy customers before they write a negative review online.

Get More Stars and Real Reviews On Sites Like:

REVIEW MONITORING

Monitor reviews and respond to reviews on 100+ review sites. Make sure your team knows about reviews with daily email notifications.

REVIEW MARKETING

Automatically stream your best reviews with a widget on your website and share your best reviews on social media.

REVIEW REPORTING

Schedule review performance reports so you can clearly demonstrate the improvement of your reputation to everyone in your business.

GET MORE 5-STAR REVIEWS!

Call ( 877 ) 406-0232 to Get Started Or visit mh.reviews to check your online reputation for free.

93% OF CONSUMERS trust online reviews as much as personal recommendations from real people.

At GreenState Credit Union, our team of experienced lenders makes it easy to secure financing. Low Rates Low Closing Costs with No Points Fast Loan Closings in 7-10 business days No prepayment penalties In-House Lending Low Down Payments of just 10% of the home’s value Eric Oaks Assistant Vice President Regional Sales Representative EricOaks@GreenState.org NMLS# 728049 Serving: Illinois, Indiana, Iowa, and Wisconsin Tom Krehel Regional Sales Representative TomKrehel@GreenState.org NMLS# 1435538 Serving: Michigan and Ohio Contact us to learn more or apply online at GreenState.org/ManufacturedHomes Manufactured Home Loans Fast. Easy. Affordable.

New Communities: How to Best Capture and Use Solar Power

As the push for renewable energy continues, it’s becoming increasingly common for new residential developments, including new manufactured home communities, to plan for and implement solar efficiencies.

Incorporating solar power into designs can earn the developer tax credits, lower monthly operating expenses, and create perks for new residents.

But how can developers and builders ensure they're making the most of this sustainable resource?

How to Optimize Solar in New Construction

From the very start, it's important to conduct a feasibility study to determine the best locations for solar panels and the potential solar energy output for the area.

The purpose of a solar feasibility study is to identify any obstacles for a solar installation including shading

from trees or buildings, building orientation, or local weather patterns. When the best site locations for solar panels have been identified a developer can begin to contemplate incorporating solar power into the community design.

Tips for Installation, Infrastructure

Installation may involve the intentional design of south-facing roofs of common area buildings. Many community owners who use solar, whether in the design of a new development or as part of a project to upgrade amenities, have taken to installing solar panels atop parking structures. Solar installers are looking for flat, sturdy surfaces with that ideal south-facing perspective, although it should be noted that many sunny locations can do just fine with a mix of south-, east-, and west- facing structures. »

MHINSIDER.COM | 25

ENERGY & EFFICIENCY

In states and utility jurisdictions with strong net-metering regulations, solar installations are solid money-makers on their own. Net metering means that the power company credits you for times of day when you are over-producing and allows you to balance out non-producing times with near-zero fees. In other locations where net metering is weak or power rate structures are tilted to the evening, energy storage systems can help to maximize the benefits of solar power, including something as simple as a bank of batteries. This will allow excess energy produced during the day to be stored and used during times when solar energy production is lower or rates are higher, such as at night or on cloudy days.

With ample storage comes the opportunity to sell back to the electrical grid — coordinated by the local government or utility — any of the energy that would go unused by residents or the community.

“The economics for solar are sound across most of the Southeast, the Plains and Rocky Mountain states, and the Southwest. Getting a financial analysis for

your location and site plan is the key, and is a standard part of the evaluation process,” Nathan Stoddard of Phase 3 Photovoltaics said.

Homeowners and residents of all variety, from first-time homebuyers to retirees, have expressed an interest in using less energy to do more. Industry builders are constructing more energy-efficient homes with more insulation and better windows, for instance. Community owners have embraced sustainability and cost-saving strategies, too, which include the use of LED lights, motion sensors, high-efficiency HVAC, and smart devices. MHV

26 | MAY / JUNE EDITION

Manage Your Subscription Online Want MHInsider news in print and online, or just digital? Need to add or remove a colleague? Place a hold? Change an address? Use the subscriber number on your mailing label to manage your subscription or create your online account. Go to http://subscriber.mhinsider.com on your computer, tablet or phone. Thank You for Reading! ENERGY & EFFICIENCY To Advertise, call: 1-877-406-0232 Reach Over 30,000 Manufactured Housing Professionals in Print and Online

WAMH’s Mission to Advance Women in the Industry

by Vanessa Perry

by Vanessa Perry

When considering workforce development in the manufactured housing industry it is quite fitting to highlight an organization whose mission is to elevate the women who contribute to it. Women Advancing Manufactured Housing does that and more. Established in 2021, WAMH is a non-profit organization that supports the industry in a women-led effort to improve the perception of this vital housing category throughout the U.S., and by helping enhance the knowledge of WAMH membership.

WAMH leadership consists of five executive committee members:

· WAMH Co-chair and Owner/Co-Founder of Dynamic MH Solutions Justine Natalie

· WAMH Co-chair and Regional Manager/Director of Marketing for Newport Pacific Capital Company Maria Horton

· WAMH Deputy Chair and Vice President of Product Management at LightBox Sherrie Clevenger

· WAMH Secretary and Owner of Affordable Casa Group Kim Shultz-Rainford

· WAMH Treasurer and Executive Vice President/Comptroller of Pentagon Properties Maryuri Barberan.

The executive committee conducts quarterly member meetings to discuss industry topics and hear presentations from guest speakers. Membership in the organization has already exceeded 300 industry professionals and continues to grow.

“WAMH was created about two years ago by a group of women who attended the SECO Conference,” Clevenger said. “During one of the virtual conference chatrooms, someone asked if there was a group for women in manufactured housing. After several

28 | MAY / JUNE 2023 EDITION WORKFORCE DEVELOPMENT

women showed interest, a discussion about the need for a group turned into a roundtable discussion the next evening. At that roundtable, our mission was drafted. One month later, our goals were finalized.”

Women Advancing Manufactured Housing Objectives and Programs

WAMH’s goals are to:

· Provide a supportive network of women and men to increase the presence and voice of women in the manufactured housing industry. WAHM is led by women and is open to all.

· Improve the perception of the manufactured housing industry.

· Create a collaborative effort for general industry answers and expand the knowledge of each WAMH member.

WAMH’s Programs Include:

· Workwear For Success—Provides needed funding to purchase attire for those who work in manufactured housing or a related industry.

· Excellence Scholarship —Offers educational opportunities for people who work in manufactured housing.

· WAMH High Five —Recognizes individuals for accomplishments, collaboration, or expanding member knowledge.

Horton said she believes the need for this organization has been in the hearts and on minds of many women in the manufactured housing industry for quite a while.

“Looking for a place to network with others in the industry, this dream quickly became a reality,” she said. “With the support of those who truly believed in the need, we were able to form WAMH.

“WAMH wants to make a difference and help others in the industry,” Horton said. “Many thanks to the women behind the scenes as well as the women owners and executives who are leading the way for our career growth.”

Shultz-Rainford said the need for women to have an increased presence and voice in the industry is strong.

“We approach problems differently and have the potential to make drastic improvements, as our members work in all facets of manufactured housing

every day,” Shultz-Rainford said. “The industry has suffered from a negative perception in the past and we are striving to improve it through exposure, education, and knowledge.”

As stated in WAMH’s goals, the organization is open to everyone.

“Our goal is not only to help women, but to advance the industry as a whole,” Natalie said. “WAMH programs are meant to help anyone in need of assistance, and we encourage all professionals to apply.”

The collaboration and knowledge shared between members can be truly invaluable.

“We are constantly helping each other grow because it truly takes a village to make a difference,” Barberan said.

Rent Manager’s Involvement in Women

Advancing Manufactured Housing

Rent Manager®, a provider of property management software, is a sponsor of WAMH, and proud to endorse the mission and vision of the organization.

“Rent Manager has participated in many, if not all, of our events to date,” Clevenger said. “Its team has supported WAMH members by sharing perspectives on agenda topics, as well insight during general industry conversation.

“The Rent Manager team interacts with people on many different levels in the industry and brings so much knowledge and experience to our WAMH members.”

To become a member of WAMH, simply request to join the WAMH LinkedIn group. To learn more about WAMH and become a supporter of the organization, visit the website at www.womenadvancingmanufacturedhousing.com. MHV

Vanessa Perry is a content developer for London Computer Systems, a developer of business-critical software whose flagship product is Rent Manager property management software, a fully customizable program with features including a double-entry accounting system, short-term rental resources, metered utilities tools, home asset tracking capabilities, intuitive mobile apps, more than 450 insightful reports, and an API that integrates with the best proptech providers on the market.

MHINSIDER.COM | 29

State, Local Impact on Industry Workforce

Logan Hanes, the executive director of the Kentucky Manufactured Housing Institute, recently outlined a series of initiatives for MHInsider that involve association staff and members at work in the field helping young people understand the value of the trades.

Logan, how does KMHI directly impact opportunities for students who might want to enter our industry?

KMHI offers seven $1,000 scholarships every year. Five of these scholarships are targeted to students who will be attending a trade school, apprenticeship, or going to a traditional university with a construction trade major.

Are you involved in any efforts to provide an immersive experience for young people?

K4C is a group of construction-focused organizations with a focus on providing two career days every September. These career days are very hands-on and allow students to operate heavy machinery, work on welding projects, and build carpentry projects. We have set up obstacle courses where students drive a

house tug through them, and we serve on the board to help organize the event.

We also work with SkillsUSA, a high school and post-secondary club for students to compete at the school, regional, state, and national levels in areas such as basic carpentry, advanced carpentry, welding, and something we call teamwork, which is a group project where four students do carpentry, plumbing, electrical, and masonry. KMHI has sponsored these competitions and chaired many of them. Here, we create and design the project, assemble judges, and grade the projects.

Tell me something that you feel is important for students to consider.

A few years ago, I created a marketing campaign where we talked about how the average college graduate pays off their student loans at 42. Your net worth finally becomes zero assuming you have no other debt. If a student goes into a trade and makes $50,000 a year, which is the average gross salary in Kentucky for a construction trade worker, and they invest 10% of their income into an aggressive growth mutual fund, by 38 they would have a $1 million net worth based on historic compound interest. MHV

30 | MAY / JUNE 2023 EDITION

WORKFORCE DEVELOPMENT

EACH COMMERCIAL SOLAR PROJECT IS DESIGNED AND DEVELOPED IN-HOUSE, FROM START TO FINISH, BEGINNING WITH OUR PROPRIETARY

WWW.SHOREBREAKENERGY.COM 9 4 9 . 5 0 2 . 0 8 0 0 CLSB # A, C10-972616

HOME PARK SOLAR

THE LEADER IN MOBILE

ENERGY

SOLAR ENERGY AUDIT • DESIGN & ENGINEERING • INSTALLATION • MONITORING • MAINTENANCE

SOLAR

ANALYSIS/AUDIT

800-309-5008 or CLT@vmf.com Park Owned Home Income Considered Up to 80% LTV 30 Year Amortization Quick Closings Flexible Terms $700,000 min loan amount FLEXIBLE TERMS: Vanderbilt Mortgage and Finance, Inc., 500 Alcoa Trail, Maryville, TN 37804, 865-380-3000, NMLS #1561, (http: //www.nmlsconsumeraccess.org/), AZ Lic. #BK-0902616. Loans made or arranged pursuant to a California Finance Lenders Law License. All Loans Subject to Credit Approval. A Berkshire Hathaway Company MULTI PARK IN AUBURN, GA MULTI PARK IN WAKE FOREST, NC MULTI PARK IN EAST TENNESSEE $7,625,000 $4,500,000 $2,000,000 RECENT FUNDINGS We Finance Communities. Contact Seth, Austin & Libba today for your community financing needs at

Tax Saving Strategies for Community Owners

‘Where Does the Money Go?’

The Power of Choice: Exploring Real-World Examples

Bruce Jones is the founder and CEO of TaxWealth, a California-based tax analysis and solutions research company that helps its clients solve capital gains and other tax problems by using tax deferral and other planning methods.

As a manufactured home community owner, the decision to sell can be fraught with uncertainty, especially when it comes to tax implications. In today's market, many are wondering, "Where does my money go?" For those who have been operating for decades, this question is even more pressing.

But there are ways to improve financial outcomes when selling, by minimizing capital gains taxes and maximizing liquid assets to invest.

Understanding Tax Deferral Strategies: Exchange or Installment Sale

When selling a manufactured home community, the tax codes offer planning options that can significantly reduce out-of-pocket expenses, such as capital gains taxes. Two key strategies include tax-deferred exchanges and installment sales.

A tax-deferred exchange involves purchasing a new property of equal or greater value than the property being sold. This postpones the capital gains taxes the seller would have otherwise paid. However, this option may not be ideal for those looking to retire and divest from property ownership.

An installment sale is a contract that allows the seller to defer taxes for decades. This option allows for a tax-free lump sum that is nearly equivalent to the sale proceeds, with no qualification on how it may be reinvested.

“Property and business owners are often surprised to learn that their tax obligation when they decide to sell may be even higher than the current 20% federal capital gains tax and the state tax rate they would also have to pay,” Jones said. “Manufactured home community owners can benefit greatly from tax deferral strategies like exchanges or installment sales to address their tax obligations and achieve their financial goals. Understanding all the options and the potential tax implications when selling a property is crucial. The good news is that they have choices.”

For instance, a California property owner who had a $10 million property with a taxable gain of $7.5 million would face $2.8 million in capital gains taxes. If they opted for a conventional sale, they would receive $2.7 million after paying off the debt and taxes. But by using a tax deferral planning approach, the property owner was able to pay off the debt at the time of the sale, defer taxes for decades, and receive $5.5 million tax-free to reinvest. MHV

MHINSIDER.COM | 33 LAND USE

Your Hassle Free Solution to Risk Management mhwconline.com MHWC NEW HOME WARRANTIES Written Insured New Home Warranties for Manufactured Homes 800-247-1812 x2188 | sales@mhwconline.com

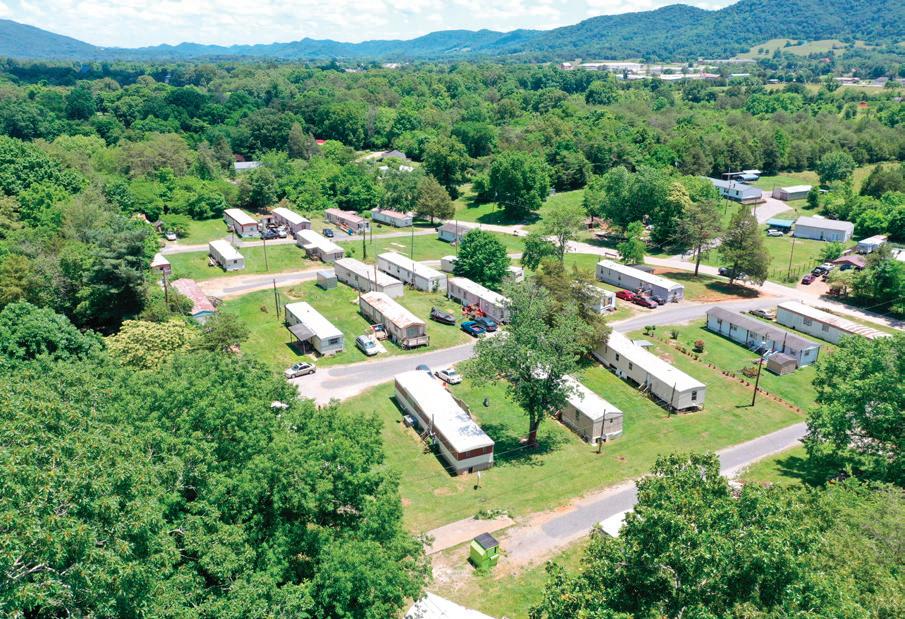

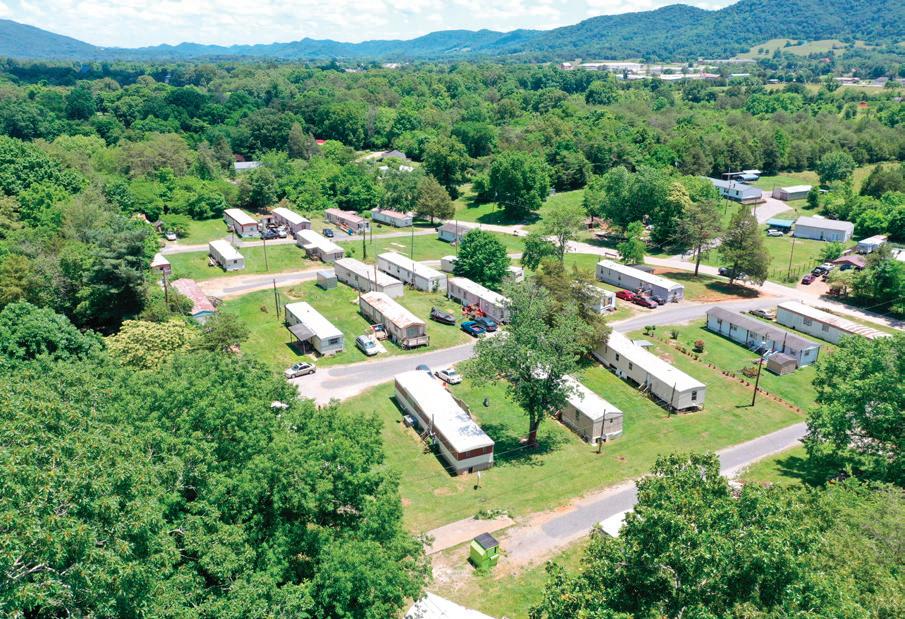

Changing the Rules for Affordable Homes in Opportunity Zones

LAND USE

In March, UMH Properties CEO Sam Landy introduced a letter to the Senate Finance Committee in support of potential changes to opportunity zones that would allow for an influx of much needed affordable housing.

An opportunity zone is a geographic area designated by the United States government where certain investments can receive preferential tax treatment in order to spur economic development and job creation in economically distressed communities. These zones were created as part of the Tax Cuts and Jobs Act of 2017.

Investors who invest capital gains into Qualified Opportunity Funds that then invest in qualified businesses or properties within designated zones may be eligible for tax benefits, such as temporary deferral, reduction, and even elimination of certain capital gains taxes. The purpose of this program is to encourage investment in underdeveloped communities and provide investors with a tax incentive to put their capital to work.

In a conversation with MHInsider, Landy said he and his team conducted a field survey of opportunity zones that would be viable locations for manufactured housing.

“There are manufactured home communities in opportunity zones that need to be upgraded, and promising properties where we can raise money to build new communities,” Landy said. “We have identified $100 million in investment opportunities in six months, and we continue to survey new areas.”

The lone caveat in taking advantage of an opportunity zone for manufactured housing professionals is the requirement that investment must come from equity interest income realized within the last 180 days.

“What does it matter where the money comes from when we’re talking about satisfying a need that everyone agrees on in affordable housing?” Landy asked.

The language change as proposed is captured in a simple 54-word appendix to the code:

(d) Additional Flexibility for Investments in Manufactured Home Communities

Investments in manufactured housing communities that meet all other requirements of this section shall be eligible for the tax treatment in subsection (c), notwithstanding a failure to meet the requirements of subsection (a)(1)(A) of having a gain during the 180-day period prior to such investment.

“We know everyone is interested in much-needed new housing, so we’re simply asking to waive that 180-day requirement for this reliable type of housing,” Landy said. “It’s going to fall right into the investment horizon for those interested in our efforts.”

The March 7 hearing on “Tax Policy’s Role in Increasing Affordable Housing Supply for Working Families” was called by Chairman Sen. Ron Wyden, (D), of Oregon, and Ranking Member Mike Crapo, (R), of Idaho. In addition to testimony provided by UMH and Landy, the Manufactured Housing Institute provided its support for the potential change, and suggested support for manufactured housing i n other areas of the tax code.

“MHI also asks the Committee to explore ways to make current tax incentive programs more effective in generating investments for manufactured home communities,” MHI stated for the record. “Manufactured home communities are a critical affordable housing model. Because of the financial and lifestyle benefits of owning a manufactured home versus the limitations that come with renting an apartment or buying a condominium or other site-built home, millions of individuals and families have chosen to live in land-lease manufactured home communities.”

The industry awaits discussion on the bipartisan topic of reducing barriers for affordable housing and the potential for a bill on the change in opportunity zone requirements.

“As much as anyone can be optimistic that legislation is going to be adopted, we are optimistic,” Landy said.

What follows is a full, unedited republishing of Landy’s letter to the committee. »

MHINSIDER.COM | 35

Written Statement of Sam Landy President and CEO of UMH Properties

3499 Route 9 Suite 3C Freehold, NJ 07728

Senate Finance Committee Hearing

March 7, 2023

“Tax Policy’s Role in Increasing Affordable Housing Supply for Working Families”

I am pleased to submit this statement for the record for the March 7, 2023, Senate Finance Committee Hearing on “Tax Policy’s Role Increasing in Affordable Housing Supply for Working Families.”

I am submitting this statement in order to request that the Committee consider adoption of legislation to amend the existing Opportunity Zone statute to promote affordable workforce housing.

I am the President and CEO of UMH Properties Inc., one of the premier owners and operators of manufactured home communities in the Nation. UMH Properties is publicly traded on the New York Stock Exchange. We currently own 135 manufactured home communities in 11 states with approximately 25,700 developed homesites. Seven of our communities are currently located in Opportunity Zones. I have worked in the manufactured housing industry since 1985 and have been President of UMH Properties since 1994.

UMH Properties has a 55-year history of providing quality affordable housing in manufactured home communities. Videos of our communities are available on our website and showcase the high-quality affordable housing that can be delivered through investment in manufactured home communities. We rent 1,000 sq. ft. three bedroom, two bath, modern, energy efficient, vinyl sided, shingle roofed homes on 5,000 sq. ft. lots for $800 per month and up, to families with household income of $32,000 and up. We also sell both single section 1,000 sq. ft. homes and 1,800 sq. ft. multi-section manufactured homes to people who buy the home and rent the lot. Those homes sell from $80,000 to $250,000 and have lot rents as low as $400 per month in our community.

Manufactured housing is the most affordable homeownership option available for low- and moderate-income families in America. The average income of a manufactured home buyer is $35,000

– while the average income of a home buyer buying a site-built home is over $100,000. Residents of manufactured home communities consist of people of all ages, family status, and incomes. We find that many residents seek manufactured housing based on the lower monthly payment derived from owning a financed manufactured home and renting a lot in a community as compared to owning land for the home and paying a mortgage and taxes on that land or renting an apartment or buying a house. Other residents use the proceeds of the sale of an existing home to pay all cash for a manufactured home and then only pay the lot rent. And other residents do not have the down payment or other ability to qualify for financing the purchase of a manufactured home and chose to rent the manufactured home. Further many people see themselves as needing a short term, less then three-year, affordable housing solution and see renting a manufactured home in a community as the best lowest cost solution. Since 2011 we have rented over 9,000 manufactured homes for monthly rent as low as $800 per month.

Manufactured home communities – also known as land-lease communities - are a critical model for the delivery of affordable manufactured homes. 51% of new manufactured homes are currently being placed in manufactured home communities. There are more than 43,000 land-lease communities in the U.S., representing almost 4.3 million homesites. These communities offer sites for families to place their manufactured homes, with professional management of the community and amenities that go with it.

One of the greatest challenges facing older manufactured home communities is the need for an infusion of funds to address neglected capital improvements like roads, sewer, and water. UMH Properties has been highly successful in purchasing aging manufactured home communities in need of significant capital repairs - in order to modernize them and thereby protect the value of the investments of the manufactured homeowners living in those communities at affordable land lease rental rates. Further we add rental homes to fill the vacant lots in those communities and increase the supply of affordable work force housing in the community.

36 | MAY / JUNE 2023 EDITION

LAND USE

These purchases and improvements of aging communities require significant investments.

UMH Properties has a total market capitalization of approximately $2 billion, with gross revenue of over $190 million per year. UMH invests over $70 million a year in new rental homes and capital improvements to improve our manufactured home communities. These investments allow us to provide our residents with the highest quality affordable housing at the most reasonable rates. UMH shareholders include the pension funds that our residents have equity interests in.

UMH has successfully renovated and upgraded seven manufactured home communities in opportunity zones and sees the brilliance of the idea of tax incentives attracting capital to previously underinvested areas of the country. UMH’s experience in opportunity zones and renovating communities in Nashville and Memphis convince us that the concept of providing investors who make ten-year investments in affordable housing in opportunity zones with tax benefits results in the increased supply of badly needed affordable housing and further attracts employers and additional jobs and tax revenue to areas of the country that previously suffered from economic stagnation.

increase the pool of capital flowing into opportunity zones to create affordable housing.

It is our opinion that the greater the supply of funds invested in affordable housing in opportunity zones the quicker the area will become economically able to be self-sufficient from growing tax revenue that employers seeking the quality work force a supply of affordable housing will bring to the areas provide.

There are more than 43,000 land-lease communities in the U.S., representing almost 4.3 million homesites. These communities offer sites for families to place their manufactured homes, with professional management of the community and amenities that go with it.

We therefore seek removal of the existing opportunity zone requirement that investments be a reinvestment of funds from a capital gain realized in the preceding 180 days provided the investment is for affordable housing through manufactured homes in opportunity zones. With this amendment any funds invested in affordable housing in opportunity zones should receive a stepped-up basis if the investment is held for ten years or longer. Legislatively, this could be achieved in a simple manner, by creating a short new subsection in the statute that would grant authority for this. We have attached a draft of our proposal.

UMH believes that the current opportunity zone fund law could be amended slightly so that far more meaningful investment is made in affordable housing in opportunity zones. Our experience is that the existing law inadvertently limits the pool of capital available to create affordable housing in opportunity zones by requiring those funds come from existing capital gains. That requirement is the basis for the criticism of the opportunity zone program only being available to the wealthy who have capital gains. We believe opening up affordable housing investments through opportunity zones to all investors will greatly

With this change, we are confident that UMH Properties and other manufactured home community operators could access significant new investment funds to help build and modernize communities in opportunity zones nationwide that facilitate the most affordable housing option available, manufactured homes.

This approach is narrow and targeted. It would not facilitate investments that could be criticized as deviating from the objectives and intent of the Opportunity Zone program. It is limited to investments that facilitate affordable manufactured housing- a high priority for Congress and the Administration and an important public policy objective.

Finally, it would not allow investors to access the deferment and potential permanent elimination for capital gains that have already taken place. Since the latter is the most costly component of Opportunity »

MHINSIDER.COM | 37

Zone tax treatment and since the proposed flexibility is narrowly targeted to a specific limited activity, we believe the tax scoring cost of this provision would be very small, while the societal and economic benefits would be substantial.

I also understand that inflation is currently creating hardship for some resident homeowners in manufactured home communities due to rent increases and I’d like to address that issue based on my 47-year experience in the industry. The solution to the problem regarding newly built communities is to follow the Florida policy of requiring a prospectus from the community owner disclosing all potential fees and rent increases before a person purchases a home or moves it into a community. That prospectus coupled with a long-term lease that matches the term of the loan on the home results in fairness for the community owner and the resident. In the case of UMH new home buyers are offered a long-term lease, usually 20-25 years, that allows rent increases of CPI or 5%, whichever is more, plus pass through of increases in water, sewer, garbage and taxes. This results in

reasonable rent increases that cause minimal to no friction between UMH and our residents. Except for the 2009-2011 period anyone who bought a home from UMH was able to sell it for more than they paid us for it, provided they properly maintained it.

Regarding existing communities there are laws on the books in most states prohibiting unconscionable rent increases. Further there is a covenant of good faith and fair dealing in all contracts. There are 43,000 existing communities and I am certain the problems you hear about pertaining to rent increases are coming from a very small percentage of those communities.

In closing, I thank the Committee for the opportunity to submit this statement and I would be happy to make myself available to Committee staff to discuss this initiative in more detail. MHV

40 | MAY / JUNE 2023 EDITION

LAND USE TWO TIME AWARD WINNER MHI SUPPLIER OF THE YEAR TWO TIME AWARD WINNER MHI SUPPLIER OF THE YEAR CONNECTING PEOPLE WITH PRODUCTS THAT ENHANCE HOMES www. BLEVINSINC .com Visit www.BLEVINSINC.com to find which of our 15 LOCATIONS is nearest YOU! Since 1971, Blevins has been family owned and operated. Our COMMITMENT to OUR CUSTOMERS is to o er the best products in the industry. Whether you are down the street or across the country, Blevins is proud of our ability to get product in your hands quickly with over $30 million in inventory from any one of our STRATEGICALLY LOCATED BRANCHES As an INDUSTRY LEADING SUPPLIER, our dependability ensures the right products get to you at the right time. Go to http://subscriber.mhinsider.com on your computer or mobile device Manage Your MHInsider Subscription Online!

Water Submetering Optimized for Mobile Home Parks Call us Now for Info: 303-217-5990 Save 30% on your Water Bill! www.MetronSubmetering.com with Advanced Analytics TM Flow Rate 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 GPM Consumption 05:00 07:00 09:00 11:00 13:00 15:00 17:00 19:00 21:00 0 10 20 30 40 50 60 70 80 G 00:00 02:00 04:00 06:00 08:00 10:00 12:00 14:00 16:00 18:00 20:00 22:00 Flow Rate 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 GPM Toilet Flush Sink Usage Shower Kitchen Use Toilet Flapper Leak! Time 5:05 5:10 5:15 5:25 5:20 5:30 5:35 5:40 5:45 5:50 5:55 Unit 21C Increase ROI + Property Value Protect your property from water damage and likely decrease insurance premiums with emergency leak detection Pinpoint water loss in your parks piping system

734-447-6952 MITCH GONZALEZ DIRECTOR OF LAND SALES & DEVELOPMENT 917-847-2304 JAKE LEVIN DIRECTOR OF EQUITY CAPITAL MARKETS 904-864-3978 GREG RAMSEY VICE PRESIDENT OF LENDING 305-760-9060 CHRIS SAN JOSE PRESIDENT OF LENDING 424-228-6200 CHAD LEDY PACIFIC NORTHWEST 818-474-1031 DAN COOK PACIFIC SOUTHWEST 415-686-8694 MAX HERNANDEZ GRAND CANYON 720-636-6551 BRIAN MCDONALD ROCKY MOUNTAINS 312-858-8906 KEN SCHEFLER UPPER MIDWEST 303-323-5649 DANA SMITH SOUTHWEST 305-978-0769 CHARLES CASTELLANO SOUTHEAST 305-588-5302 JAMES MCCAUGHAN MIDWEST 985-373-3472 HARRISON BELL MID-ATLANTIC 386-623-4623 JAMES COOK FL/NATIONAL YALE REALTY YALE CAPITAL YALE DEVELOPMENT The Only True Nationwide Team A Full-Service Shop Tailored Lending Options Yale Sellers Net 10-20% More Contact Us for a FREE Detailed Analysis & Valuation

Yale has successfully closed over 550 transactions. IN A CROWD OF OPTIONS ONE STANDS ABOVE THE REST Gain from our perspective. yaleadvisors www.yaleadvisors.com

44 | MAY / JUNE 2023 EDITION LAND USE

Baywood, a community in coastal Delaware, shows what is possible in thoughtful design.

Through the Eyes of a Landscape Architect

by Donald Westphal

There is a lot of talk within the manufactured housing industry about image these days. As a landscape architect and planner of manufactured housing communities for more than 50 years, image has been an important consideration in the design and the focus of my activities in the industry. It is the source of great frustration to me that many new communities are still being designed like the trailer parks of the past.

Row on row of new homes spread out like dominoes on the land, with little apparent thought given to the final appearance of the community and the image it will portray for generations to come. Most developments are laid out by draftsmen in engineering offices with little training in effective image planning.

Why is it so?

Do developers, engineers, designers,and planners feel that our customers don’t deserve better? Is there an assumption that creative planning is too costly? Is enough energy being expended by the national and state industry organizations to promote good design as an important part of our image building strategy? Are we doing enough to educate the planners in good design and encourage and approve projects that are attractive and desirable living environments?

Our counterparts in the site-built housing business are keenly aware of the benefits of

creative planning. The traditional neighborhood development movement, open space conservation planning, planned unit developments, cluster designs, and curvilinear concepts are stock in trade for the better developers. The appearance of their developments from the street, curb appeal, and sizzle of their homes is as important a part of their merchandising effort as their floor plans, interior decorating, and furnishings. Models are creatively furnished inside and attractively landscaped outside to excite and stimulate the customer. Builder’s displays at development model centers are creatively done with renderings illustrating the final and complete appearance of the home package.

Contrast this to the way the majority of manufactured homes and developments are merchandised. Far too often our industry’s homes are pictured as “plain Jane” boxes devoid of the elements that would make it a home rather than a house. These same units regularly are shown to the public at sales centers without these important added elements.

Manufactured home community owners and subdivision developers also miss an opportunity when houses are permitted in developments without the simplest of requirements that would assure curb appeal. Even simple appearance requirements would help to assure growth in the value of the »

MHINSIDER.COM | 45

improvement in the appearance of homes on narrower homesites.

Time after time I still hear negative comment from opponents to new developments at zoning hearings about the unattractive appearance of our homes and communities. Most of this is well earned from our past performance. Perhaps if our industry were to place more emphasis on the final product, the completed home, we could more rapidly move toward greater public acceptance of manufactured homes. We always show images of attractive homes and communities at zon-

rapidly Home Only Land Home FHA VA

Study upon study sponsored by MHI have shown that with sensitivity to detail and proper presentation our homes are welcomed in most neighborhoods.

Chris Turturro NMLS 134837 972-217-5186 cturturro@cascadeloans.com www.ask-cade.com Ask Cade Scan our QR code or visit or website: