March 2011

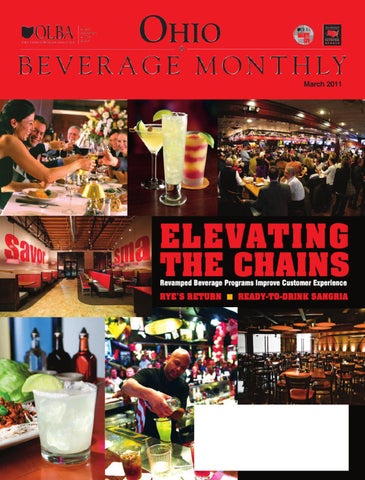

ELEVATING THE CHAINS Revamped Beverage Programs Improve Customer Experience

RYE’S RETURN ■ READY-TO-DRINK SANGRIA

MARCH 11

20 FEATURES

DEPARTMENTS

20 ELEVATING THE CHAINS Innovative beverage programs at multi-unit restaurants are creating improved consumer drinking experiences.

32 RED, SWEET & PROUD Ready-to-drink sangria emerges as a dynamic wine category.

4 PUBLISHER'S MESSAGE 7 SUPERINTENDENT OF OHIO LIQUOR CONTROL REPORT 8 MEET THE NEW DIRECTOR OF THE OHIO DEPARTMENT OF COMMERCE

28 BEFORE BOURBON, THERE WAS RYE America’s once-beloved whiskey is back in demand.

9 MESSAGE FROM THE OLBA EXECUTIVE DIRECTOR 10 & 11 LEGAL ISSUES 13 LAST CALL

32

28

38 AUSTRIA ON THE CUSP Led by grape varietal, Grüner Vetliner, Austrian wines are making a play for shelf space.

15 EVENTS & BENEFITS 17 THEBARBLOGGER.COM 43-45 SHOPPING NETWORK 46 WHOLESALE PRICE LIST 57 VIOLATIONS

March 2011 OHIO BEVERAGE MONTHLY 3

INSIDEOHIO

Publisher's Message

Ohio Beverage Monthly Volume 2, No 3 (ISSN 1065-9846) www.bevnetwork.com

BY PHILIP A. CRAIG surrounding privatization, as well as other informative legal updates on issues the OLBA is currently monitoring. To read more about these topics see pages 10 and 11.

Publisher

Philip A. Craig pcraig@craiggroup.com

General Counsel

Jacob C. Evans, Esq. jevans@craiggroup.com

EDITORIAL Editor In Chief

Philip A. Craig, Publisher

T

he Ohio Beverage Monthly's goal each month is to bring you the latest information pertaining to all aspects of the licensed beverage industry. We want you to feel like you know exactly what is going on in the industry. The Superintendent of Liquor Control, Bruce Stevenson, starts us off this month. His very informative article detailing the rules of building an expansion onto a liquor premise is an extemely helpful reference for permit holders. Also this month we welcome the new Director of Commerce, David Goodman. Mr. Goodman is familiar with the licensed beverage industry and supportive of small businesses. Make sure to read his article on page 8 to get to know him better. Other articles in this issue bring you information on the discussion

WE WANT YOU TO FEEL LIKE YOU KNOW EXACTLY WHAT IS GOING ON IN THE INDUSTRY. Meet the OLBA's 2011 officers! These officers were recently sworn in at the OLBA's Annual Meeting and Lobbying Day. Be sure to read my article on page 9 to meet the new officers and to read about another successful legislative luncheon. Barry Chandler of thebarblogger. com informs bar owners of how much Facebook can aid them in gaining new customers as well as keeping in touch with loyal cutomers. This issue contains much, much more valuable information inside! And remember, just reading the Ohio Beverage Monthly keeps you ahead of your competition.

MARCH POST-OFF SPECIALS INCLUDE: 9169B TARANTULA AZUL 9170B TARANTULA REPOSADO 4895B IRISHMAN 6620B MONOPOLOWA VDK

Graphic Designer

Ohio Art Director

Larry Lee llee@bevmedia.com Dana Buonincontri dbuonincontri@bevmedia.com Josue Romero jromero@bevmedia.com Megan W. Jordan mjordan@craiggroup.com

PRINT & PRODUCTION Print Services Manager

Lee Stringham lstringham@bevmedia.com 410.519.7034

ADVERTISING Ohio Ad Sales

National & Regional Ad Sales

Sales Promotion Manager

Megan W. Jordan 614.241.2222 mjordan@craiggroup.com Jody Slone-Spitalnik 212.571.3232 ext. 101 jslone@bevmedia.com Jessica Roszkowiak 212.571.3232 ext. 117 jroszkowiak@bevmedia.com

OPERATIONS Circulation Finance & Accounting

$15.00 $12.35 $17.65 $11.40

Renae C. Davies rdavies@craiggroup.com

ART & DESIGN Art Director

Assistant Designer

MARCH POST-OFF SPECIALS

4 OHIO BEVERAGE MONTHLY March 2011

Executive Editor

Molly K. McKee mmckee@craiggroup.com

Sylvia Prince sprince@bevmedia.com Seth Niessen sniessen@bevmedia.com Randye Benvenisti randye@bevmedia.com

Ohio Beverage Journal (ISSN 1065-9846) March 2011, Vol. 2 No. 3. Postmaster, send change of address information to Ohio Beverage Monthly, 37 W. Broad St, Suite 480, Columbus, OH 43215 Ohio Beverage Monthly is published monthly for $20 per year and $28 for (2) years.

NATIONAL COVERAGE, LOCAL ADVANTAGE The Beverage Network Publications are serviced by Beverage Media Group, Inc., 116 John Street, 23rd Floor, New York, NY 10038. Telephone: (212) 571-3232 FAX: (212) 571-4443. www.BevNetwork.com

The Brandy category just got an exciting, new taste lift. Introducing Christian Brothers Honey ™

By infusing real, natural honey with Christian Brothers Brandy, an historic new taste sensation has emerged. Not surprisingly, it’s made by Christian Brothers, a name celebrated for ultra-smooth taste and high brand recognition. Brandy lovers are sure to enjoy Christian Brothers Honey when they want their brandy with a new twist. And, real honey adds sweet to smooth, attracting new consumers to the category. Get onboard now, because this is a honey of an opportunity to profit from a category first.

The Christian Brothers™ Honey. Bottled by CB Vineyards, Bardstown, KY 40004 35% Alc./Vol. © 2010

christianbrothershoney.com

March 2011 OHIO BEVERAGE MONTHLY 5

BEAMBRANDFOCUS

The Smallest Batch of All: Knob Creek Single Barrel Reserve

Single Barrel Reserve Decades ago, legendary master distiller, Booker

ensure a complex, smoky and robust flavor. The

Noe, set out on a mission to capture the purest

best-selling super-premium bourbon is bottled

essence of pre-Prohibition whiskey with Knob

at 100-proof and has distinct notes of vanilla

Creek. Now, 20 years later, his son, current

and caramel.

seventh-generation family distiller, Fred Noe,

Knob Creek Single Barrel Reserve Bourbon

has created another memorable small-batch

Whiskey is hand-selected, barrel by barrel,

bourbon experience: Knob Creek Single Barrel

offering a distinct expression of the well-loved

Reserve, the cream of the connoisseur’s crop.

Knob Creek, with richer wood and vanilla notes.

One sip of Knob Creek bourbon - part of

Bottled at 120-proof, it is extraordinarily smooth.

the elite Small Batch Bourbon Collection - and

Throughout history, bourbon and the Beam

the efforts that go into making this whiskey

family have always been intertwined. Standing

are evident. Modeled after the rich American

out from this heritage is Knob Creek, recognized

whiskey available prior to Prohibition, it is aged

among whiskey fans that value craftsmanship

for nine years in charred American white oak to

and nuanced flavors in their glasses.

For more information about Knob Creek, visit www.knobcreek.com or www.facebook.com/knobcreek

DRINK SMART. Knob Creek® Single Barrel Reserve Whiskey, 60% Alc./Vol. ©2011

6 OHIO BEVERAGE MONTHLY March Knob Creek Distillery, Clermont, KY. 2011

INSIDEOHIO

SUPERINTENDENT OF OHIO LIQUOR CONTROL REPORT Expansion/Diminution of A Liquor Permit Premises BY BRUCE D. STEVENSON

A

t this time of year, many businesses that hold onpremises liquor permits are making plans to accommodate patrons who want to dine and/or drink outdoors by expanding their defined permit premises to include a patio, balcony or other outdoor area. The Division also receives a smaller number requests to reduce or eliminate part of a defined permit premises – a process called “diminution.” Between now and July 4th, the Division of Liquor Control becomes inundated with such requests. Permit holders who are planning any kind of expansion or diminution of their permit premises should submit their requests as soon as possible. It is also important that they understand the law regarding where on their liquor permit premises they can sell and allow alcohol to be consumed, and what is required to be granted approval by the Division for an expansion or diminution. Your permit premises is defined when the inspection is made of the premises prior to the liquor permit being issued. The definition of your permit premises is found on a form maintained at the Division of Liquor Control. No sale, storage, serving or consumption of alcoholic beverages may take place outside of the defined premises. In addition, your permit, indicating your sales privileges, must be conspicuously displayed on the premises at all times. Any expansion or diminution of the defined permit premises must be approved by the Division, and such approval must be received before using the expanded area as part of your permit premises. Requests should be submitted in writing to the Division’s Investigative Services Unit using the “Request for Expansion/Diminution of Permit Premises” form (form DLC 4248). This form should include a diagram, rough sketch or blueprint showing the proposed expansion or deletion. Please note that all requests must be

signed by the permit holder of record, not a manager or other employee. In addition, the permit holders must show that they have tenancy to operate in the area of the proposed expansion.

ANY EXPANSION OR DIMINUTION OF THE DEFINED PERMIT PREMISES MUST BE APPROVED BY THE DIVISION, AND SUCH APPROVAL MUST BE RECEIVED BEFORE USING THE EXPANDED AREA AS PART OF YOUR PERMIT PREMISES. An expansion such as a deck or patio must be on a common piece of ground and/or adjacent to the current permit premises with proper ingress and egress. In addition, the expansion area must be well defined, properly secured, and delineated by some type of physical structure such as a fence, wall, or dense shrubbery. Temporary expansions or deletions to the permit premises will not be approved. Because all rights granted by a liquor permit shall be exercised at not more than two fixed bars, a duplicate bar permit will be required if the proposed expansion will include a third fixed bar or service counter. The environmental impact on the surrounding area of the permit premises will also be taken into consideration as to whether the request will be approved or denied, and all changes in the permit premises must comply with state and city/ township codes, as well as all Division of Liquor Control rules and regulations. Once a request is received, a

Bruce D. Stevenson, Superintendent

Compliance Officer will visit your permit premises to view the completed expansion or diminution, take photos, and record any other pertinent information. At the time of inspection, the Compliance Officer will need to see the food service operator’s license, vendor's license and liquor permit. Approval or denial of the proposed expansion or diminution shall be made within 20 working days from the date the premises is inspected by the Division. Permit holders who would like more information regarding an expansion or diminution of their permit premises should call the Division’s Investigative Services Unit at (614) 644-2455, or visit the Division’s web site at www. com.ohio.gov/liqr. Requests can be mailed, faxed to (614) 644-4891, or e-mailed to the Division at webliqr@ com.state.oh.us . More information on the definition of a permit premises and premises expansions/diminutions can be found in Ohio Administrative Code Section 4301-1-02.

March 2011 OHIO BEVERAGE MONTHLY 7

INSIDEOHIO MEET THE NEW DIRECTOR OF THE OHIO DEPARTMENT OF COMMERCE Welcome David Goodman!

E

ffective January 10, 2011, former State Senator David Goodman became the Director of the Ohio Department of Commerce, which includes the Ohio Division of Liquor Control. Director Goodman was finishing his second term as an Ohio Senator and had also served in the Ohio House of Representatives. Many permit holders in Ohio may recall that Director Goodman was the sponsor of Senate Bill 23 from the 125th General Assembly (2003 – 2004). The passage of Senate Bill 23 requires that the Liquor Control Commission, when considering enforcement actions against the holder of a liquor permit to take into consideration whether the permit holder and the permit holder's employees have successfully completed a training program on specified topics; provides, if a particular location is allowed to sell beer or intoxicating liquor on Sunday between 1 p.m. and midnight and a question allowing those sales from 10 a.m. to midnight is defeated, the location can continue sales between 1 p.m. and midnight; requires that liquor permit holders be notified after they have been the subject of a compliance check conducted by a law enforcement agency to enforce the Underage Drinking Law; requires the Liquor Control Commission in disciplinary actions to consider whether such a compliance check was conducted with trickery, deceit, or deception involved; and makes changes relating to the penalties that may be imposed because of a permit holder's violation of the Liquor Control Law. With Director Goodman’s support of small businesses in Ohio, including those with liquor permits, the Ohio Beverage Monthly was excited to talk to him about his new position. Ohio Beverage Monthly: What issue impacting alcohol beverage permit holders is the most concerning to you? In other words, what problem would you like to solve? Dir. Goodman: Having now been the Director for only a short period of time, I am now finishing up meeting with many interested parties that the Department of Commerce Regulates. As the Governor has indicated, it is the goal of his Administration to make sure we are protecting the public, but ensuring that we are not over-regulating or putting burdensome issues on the backs of those businesses that employ Ohioans. To that end, I have asked interested parties to let me know what the Department, and the Division of Liquor Control, can do better to make sure we are helping them and not hurting them.

holders and anyone the Department of Commerce interacts with, to know that I am an accessible person. I do not believe that I can just sit in my office and always have the necessary information to make decisions that are in the best interest of the State. Accessibility is critical in order for there to be a free exchange of information and I plan to continue to have an open door policy so I can hear input from those we need to hear it from. OBM: Permit holders face difficult issues based upon recent statewide ballot issues. What are your thoughts on the smoking ban and casinos? DG: As a former legislator, I have heard many discussions about both of these issues over the years and I can understand the difficulty businesses face based upon the passage of these two issues. Whether for good or for bad, the voters have spoken on these issues. While there may be some things that could be changed through statute that is a decision left to the Legislature. As part of the Executive Branch, it is my job to execute the laws, not pass them anymore. OBM: Most of our members are smallbusinesses. In light of today’s economic climate, what do you think can be done to ensure small businesses stay in business? DG: Small business owners are entrepreneurs and entrepreneurs have built not only Ohio’s economy, but the nation’s economy. From a government standpoint, it is my belief that we need to make sure that we balance the regulation we are required to do under the law and make sure that we are not making it more difficult for the entrepreneur to do what he or she does best . . . grow their business. I believe that liquor permit holders understand that there are necessary regulations and the Department must be diligent in ensuring that everyone is operating under the same rules. However, we also need to make sure that we are not over-regulating or doing things that are unnecessary. I am optimistic with an open door policy, I can hear from businesses to make sure we are striking the right balance. OBM: What impact do you expect to see casino-gaming have on bars and restaurants in their general vicinity?

OBM: If you wanted to make sure permit holders knew one thing about you what would it be?

DG: I think that is left to be seen; however, in order for bars and restaurants to compete with casinos, the rules for the sale and distribution of alcohol have to be even. Casinos cannot have 24 hour sales or be able to give away free drinks if bars and restaurants are not able to do the same thing. I believe that fairness is the key in order for there to be competition.

DG: I want to make sure liquor permit

OBM: What improvements do you

8 OHIO BEVERAGE MONTHLY March 2011

David Goodman Director, Ohio Department of Commerce

think can be made to Ohio’s permitting process? DG: Truthfully, I think we have made steady improvements through the Revised Code over the years. The key now is making sure that it is being carried out properly. The appointment of Bruce Stevenson as Superintendent of the Division of Liquor Control ensures permitting process will be carried out efficiently and that any problems that may arise are addressed. Superintendent Stevenson has served for more than 20 years at the Division of Liquor Control (including time at the Department of Liquor Control). He understands the regulatory side of the alcoholic beverage world as well as anybody and I believe the Department of Commerce, the Division of Liquor Control, liquor permit holders and Ohioans will be pleased with the way the Division does business. OBM: What do you think of the concept of privatization of liquor sales? Why do you think it would help or hurt Ohio? DG: I think Ohio is at a critical juncture that requires us to examine everything we do and whether it can be done better, more efficiently. To that end, I think reviewing or studying the privatization of the distribution of liquor is part of the overall examination the State must do. However, privatization of the distribution of spirituous liquor will only occur if it is deemed to be in the best interest of the taxpayers of Ohio and those impacted by such a decision. I do not think there is anything wrong with thoughtful review. OBM: Any final thoughts? DG: I, like many people, am sure, have fond family memories from times spent in restaurants for family events or being together with friends at a bar or tavern. These are places of fond memories not only for the customers that go in, but also the families that run these businesses and are supported by them. We need to make sure those future memories can be made by allowing businesses to be successful.

DIRECTOR'SMESSAGE

OLBA ANNUAL CONVENTION AND LEGISLATIVE LUNCHEON Congratulations 2011 OLBA Officers and Award Winners! BY PHILIP A. CRAIG

O

LBA President Kathy Bean was elected to her eighth term in office at the OLBA’s Annual Convention and Annual legislative Luncheon held January 30 – February 1, 2011 at the Doubletree Hotel - Worthington. Bean is co-owner of the Petticoat Junction in Mentor, Ohio. The prized Permit Holder of the Year Award went to Keith Jones, owner of the Paint Grill in Chillicothe. Max Eckenwiler presented the award for the Ohio Tavern News. Jones’s father, Bob, won the award exactly 20 years ago.

Harland Hale and are listed as follows: President Kathy Bean, Willoughby OH Senior Vice President Max Sorensen, Madison OH Vice President Sandy Bossert, Perry OH Vice President Dave Grusenmeyer, Huber Heights OH Phil Craig, Executive Director

Vice President Keith Jones, Chillicothe OH Treasurer Dick Allen, Columbus OH

the opportunity to formally meet legislators and to discuss important issues in a relaxed atmosphere.

Sergeant at Arms Boris Lazoff, Lorain OH From Left: OLBA Exec. Director Phil Craig, Vice President Keith Jones and Max Eckenwiler from the Ohio Tavern News

Kathy Bean then presented the President’s Award to OLBA staff member, Molly McKee.

ABL Director Jerry Gasber, St. Clairsville OH Alternate Director Nancy Gasber, St. Clairsville OH

From Left Back: Nancy Gasber, Jerry Gasber, Max Sorensen, Dick Allen, Boris Lazoff, Keith Jones and Judge Harland Hale From Left Front: Dave Grusenmeyer, Kathy Bean and Sandy Bossert

From Left: OLBA President, Kathy Bean and Molly McKee

Installation of officers and the Annual Banquet at Bravo Italian Restaurant was held on the evening of Monday January 31, 2011. The officers were sworn in by Judge

OLBA members and our State Legislators then enjoyed lunch at this year’s OLBA State Lobbying Day Legislative Luncheon on February 1, 2011 from 11:30 a.m. until 1:30 p.m. in the OLBA State Office. The luncheon provided members with

From Left: Senator Tom Sawyer, Senate Minority Leader Capri Cafaro and Vice President Sandy Bossert

As a service organization, the OLBA does everything to try to ensure the rights and privileges as owners, and would like to help all permit holders in the state of Ohio protect their rights, whether they are members or not. If you have any questions about any issues pertaining to the liquor industry, our main office will gladly answer them. The OLBA is always welcoming to new members. For more information about this meeting or how to get more involved with the OLBA, please contact the OLBA office at 800-6785995.

March 2011 OHIO BEVERAGE MONTHLY 9

LEGALISSUES

OHIO'S BUDGET SHORTFALL Privatization Discussions BY DAVE RABER

O

hio’s budget shortfall in 2009 was rescued by $8 billion of onetime federal stimulus money, money that is not available for the 2011 budget. Governor Kasich has stated that “Ohio is under a siege” and everything is on the table in Ohio’s attempt to fix this budgetary and reoccurring fiscal problem. In 2011, the budget shortfall is estimated at $8 to $10 billion, so the question becomes: “What will Ohioans do about this?”

Dave Raber, OLBA Legal Co-Counsel

Calls for reform in the areas of Medicaid, prisons and education have been raised. Additional questions concern Ohio’s five public pension systems, Bureau of Worker’s Compensation, and the word “privatization” has been bantered about. Privatization generally refers to such matters as: granting interests less than a fee in real property owned by the State of Ohio, turning the management of the state lottery over to a private party, leasing the Ohio Turnpike to a private entity and turning over the state monopoly as the wholesaler of spirituous liquors to a private party. The privatization of spirituous liquor is somewhat misleading as Ohio did close the state liquor stores and contracted the retail sales of spirituous liquor to private mercantile businesses in the 1990’s. The Division of Liquor Control “Division” operates a model distribution system that is unmatched by private industry. The Division reported last week “that the dollar sales of spirituous liquor reached a record level of $753.7 million for calendar year 2010, exceeding [2009] by $19 million or 2.57 percent.” The Division, through its efficiency, has over a 30% operating profit margin, which are revenues net of expenses. Unquestionably the Division’s system is a model of efficiency that moves at the speed of business – and doing it for less money. However, a private investment banking firm submitted an unsolicited proposal to the Governor’s Office. The proposal recommends Ohio sell its public liquor

10 OHIO BEVERAGE MONTHLY March 2011

distribution monopoly for an estimated price of $2 to $2.5 billion. That is a lot of money, which is why the proposal was submitted, but is this a good deal for Ohio? After the redemption of an estimated $700 million in outstanding liquor profits backed state economic development bonds and taking into consideration the loss of $300 million in foregone FY 2012-2013 liquor profits, the state would generate $1 to $1.5 billion in one-time revenue for the 2011 budget shortfall.. The foregone revenue is important to consider as $167 million from the Division’s liquor revenues was transferred to Ohio’s General Revenue Fund. An additional $66.7 million funded state services such as liquor enforcement; alcohol treatment, education and prevention programs; and the retirement of economic development and Clean Ohio revitalization bonds. This reoccurring revenue will no longer be available for 2013 or any future budgets if the State sells the spirituous liquor operations it manages. Taking away this stable and growing net annual revenue stream of $167 million per year would create funding problems for these sectors in good economic times; in difficult fiscal and economic times, which is what the state of Ohio is experiencing today, these fiscal pressures could become unmanageable and simple result in cuts to essential services – or, potentially, higher taxes. How would the above mentioned state services be funded? These one-time resources ($1-1.5 billion) could be used to pay for onetime spending. An example would be placing the money in the state’s depleted “rainy day” savings account. Yet history suggests that these one-time funds may be spent on ongoing expenses and thus result in a short-term response to a longterm problem that could then result in even bigger fiscal problems when the money runs out. A leading example of this phenomenon is the state’s use of tobacco settlement funds. The one time fix in 2009 did not rectify the problem for the upcoming 2011 budget. What asset will Ohio have left to sell to cure the 2013 deficit? Ohio needs to correct the budget problem this year and move forward. Selling off Ohio’s highly productive liquor distribution enterprise for one-time money doesn’t make sense. It doesn’t make sense in good times and it certainly doesn’t make sense during these difficult fiscal times Ohio is currently facing. Governor Otter of Idaho may have put it best when he rejected a proposal to “privatize” spirituous liquor to help bridge Idaho’s budget deficit by saying “that Idaho’s liquor stores are a cash cow for the state, as is.” Associated Press, 1/31/11.

Congratula ons on your new venture, The Ohio Beverage Monthly, from your friends at The Wholesale Beer & Wine Associa on of Ohio

Anheuser-Busch Sales of Canton, Canton Beerco, Fostoria Beverage Distributors, Cleveland Bobby Fisher Distribu ng, Springfield Bonbright Distributors, Dayton Brown Distribu ng Co., Newark Buckeye Distribu ng, Columbus C & G Distribu ng Co., Lima/Versailles Choice Brands of Ohio, Mingo Junc on City Beverage Co., Defiance Classic Brands, Athens/Chillicothe Clermont Distribu ng, Batavia Columbus Distribu ng Co., Columbus Cu ng Edge Selec ons, Mariemont Delmar Distribu ng, Waldo Dickerson Distribu ng Co., Monroe Glazer’s Distributors of Ohio, Columbus/Fairfield Goodman Beverage Co., Lorain The Hammer Co., Maumee/Streetsboro Heidelberg Distribu ng Co. Cincinna /Toledo/Dayton/ Cleveland/ Columbus Hill Distribu ng Co., Columbus The House of LaRose, Brecksville Iron City Distribu ng, Mingo Junc on Kerr Distribu ng Co., Athens

Kerr Wholesale Co., Chillicothe Klepper’s of Lima, Lima Klepper’s of Tiffin, Tiffin Mansfield Distribu ng Co., Mansfield Maple City Ice Co., Norwalk Matesich Distribu ng Co., Newark Mid-Ohio Wines, Inc., Norwalk Miller Brands of Southeast Ohio, Glouster Muxie Distribu ng Co., Bellaire NWO Beverage, Inc., Northwood Ohio Valley Wine & Beer Co., Cincinna Ohio Wine Imports Co., Youngstown R. L. Lipton Distribu ng, Cleveland Spriggs Distribu ng Co., Ironton Stagnaro Distribu ng LLC, Cincinna Superior Beverage Group, Columbus/Youngstown Tramonte Distribu ng Co., Akron Treu House of Munch, Northwood Tri County Wholesale Distributor, Youngstown Vanguard Wines, Columbus Vintage Wine Distributor, Inc., Columbus/Solon Vintner Select, Mason W. Berman & Co., Perrysburg Wine Trends, Cleveland

THE WHOLESALE BEER AND WINE ASSOCIATION OF OHIO 37 W. Broad Street, Suite 710 Columbus, Ohio 43215 614/224-3500 • OHIO WATS LINE 1-800-282-7639 • FAX 614/224-1348

LEGALISSUES

LEGISLATIVE UPDATES Current Issues the OLBA Is Monitoring BY JACOB EVANS

T

he Ohio Licensed Beverage Association strives to keep you informed on the latest issues pertaining to our industry. Below are issues we are currently monitoring: 1. Guns in Bars – like the last General Assembly, a House Bill (HB 45) and a Senate Bill (SB 17) have been introduced to allow a person with a valid concealed carry (CCW) permit to bring a handgun onto a liquor permit premise SO LONG AS THEY ARE NOT CONSUMING LIQUOR OR UNDER THE INFLUENCE OF ALCOHOL OR DRUGS. This is an issue that many OLBA members have expressed concern about. The OLBA believes that having guns on a liquor permit premise brings about no social benefit to Ohio and presents potential social harm. While we recognize that the person bringing in the handgun may not consume any alcohol or be under the influence, there is no way for the bar owner or bartenders to verify whether the person they are serving has a weapon or whether they have a valid CCW permit. In short, the liquor permit premises will be blind as to whether the person is violating the law. While many have spoken of the safety that may be brought about by being able to bring a handgun onto the permit premises, the OLBA has concerns that the reality is that not everyone with a CCW permit is a “crackshot.” In fact, most individuals that have a very good accuracy remind you that the vast majority of others do NOT have very good accuracy. Additionally, the only time the handgun would be needed would be in an emergency – when nerves are short, the scene is chaotic and things are out of control. How accurate would anyone be at that time? Is it possible that someone sees the weapon and they take it? In short, the OLBA sees no social benefit of such a change and would encourage the Legislature to keep guns out of bars. Please be aware that current law allows the owner or lessee of a premise to post signs disallowing firearms on the premises. If either of these bills were

to pass, you may still post a sign stating, “No Firearms.” For the language of HB 45, visit http:// www.legislature.state.oh.us/bills. cfm?ID=129_HB_45 For the language of SB 17, visit: http:// www.legislature.state.oh.us/bills. cfm?ID=129_SB_17

THE OHIO LICENSED BEVERAGE ASSOCIATION STRIVES TO KEEP YOU INFORMED ON THE LATEST ISSUES PERTAINING TO OUR INDUSTRY. 2. Smoking Ban – part of Governor Kasich’s initial review of State Government includes the review of burdensome or unnecessary regulations and regulations that impede business. While he cannot undo the smoking ban via Executive Order, please contact his office to let them know the impact the smoking ban has had on your business. The telephone number is (614) 466-3555 or via the Governor’s website, http:// governor.ohio.gov/ShareYourIdeas.aspx 3. Gaming – from VLTs to Games of Skill to Sweepstakes to Charitable Gaming! Let’s start with those that you can do today and do legally: Games of Skill and Charitable Gaming – in both instances there are easy ways to conduct games of skill or charitable gaming in order to provide your customers another hospitality and entertainment component. For Games of Skill, work with your coin machine vendor and be clear on how you are able to legally reward skilled gamers! For charitable gaming, please contact me or the State Office at 800 678-5995 to be put in contact with a charitable organization that can help get you up and running. Sweepstakes – many places have popped up as “internet cafes” or another moniker in which individuals

Jacob Evans, OLBA Legal Co-Counsel

go in and play sweepstakes games; the Columbus Dispatch (http://www. dispatch.com/live/content/local_news/ stories/2011/02/10/sweepstakesgames-violate-gambling-law-judgesays.html) printed an article on Thursday regarding a Franklin County court decision ruling the sweepstakes games violate gambling laws; a 2009 Toledo Municipal Court decision came to a different conclusion. In short, the law is less than clear and the OLBA would encourage you not to engage in sweepstakes, particularly as there are other forms of entertainment that have far clearer ways in which they can be LEGALLY conducted. VLTs – as you may recall, Governor Strickland has issued an executive order allowing for the installation of VLTs at the 7 racetracks and run through the lottery. That issue is still before a court awaiting a determination on whether it can be done. However, the OLBA still believes that VLTs are a viable revenue source for the state AS LONG AS THEY ARE PUT IN VARIOUS ENTERTAINMENT LOCATIONS, INCLUDING BARS. As always, please do not hesitate to contact the state office if you have questions about any issue relating to your business.

March 2011 OHIO BEVERAGE MONTHLY 11

CORPORATEPROFILE

The newly renovated 1881 Carriage House, a popular site for fundraising and VIP tastings

Overlooking the vineyards

A Pioneer's Tale Charles Krug—Napa’s Oldest Winery—Celebrates 150 Years BY KRISTEN BIELER

I

t isn’t every day that a winery turns 150-years-old. In Napa, there is only one to reach that milestone: Charles Krug Winery. But while reflecting on a century and a half of being in business is pretty cool, the Peter Mondavi family is more interested in their future, particularly now that the recently-completed $30 million renovation has transformed Charles Krug into one of the region’s most vibrant producers, in addition to the most historic.

American viticulturist to apply knowledge of soil and micro-climate to improve fruit quality—a novel idea at the time. Charles Krug wines were among the first in California to bear vintage dates and single varietal names. Cesare and Rosa Mondavi purchased the winery in 1943 for $75,000 (after an interim ownership following Krug’s death in 1893) and ran it with their sons, Peter and Robert. Throughout the

A History of Firsts So just who was Charles Krug? A 27-year-old Prussian immigrant, Krug built Napa’s first winery in 1861 and quickly emerged as an important figure shaping the future of the industry. He was nothing if not an innovator: he introduced the cider press for winemaking (it is still on display at the winery) and was the first

An Estate Reborn Since the 1980s, Peter’s sons— Marc and Peter, Jr.—have been Peter Mondavi family

12 OHIO BEVERAGE MONTHLY March 2011

1960s and '70s the family added to their vineyard portfolio with acreage in St. Helena, Howell Mountain, Yountville and the Carneros appellations. In 1966 when Robert moved south to Oakville to start his own winery, Peter became president of Krug. Much like founder Charles Krug, Peter Mondavi, Sr. is a fearless innovator who changed the course of California winemaking. He pioneered the Carneros region with Chardonnay and Pinot Noir plantings, introduced cold fermentation for white wines as well as cold sterile filtration techniques and was the first to bring in French oak barrels to Napa Valley (American oak was traditionally used)—all methods that are standard practice today.

LASTCALL

LAST CALL How A POS System Can Help You Manage Your Operations Better BY CHUCK DEIBEL

H

i and welcome back to The Last Call! This month’s topic is POS Systems. I thought I would provide an actual experience I had to demonstrate how a POS system can help you manage your operations better and ensure you are making more of the money you should be making. A few years ago I was hired by a bar owner to provide our sales and inventory management service and we did the first audit of the sales and inventory. The bar used a regular manual cash register where the staff indexed in the price of each sale into a department button. This means they would press in the $2.25 by hitting the number buttons and then the beer department button. The staff had no idea we were doing our inventory analysis. The bar went through about 2500 bottles of beer in one week. The regular selling price was $2.25 for domestic bottles (imports were $3.00) and the happy hour price for the domestics was $1.50. They had a pretty busy happy hour, so the average selling price should have been in the $1.80 to $2.00 per beer bottle range overall. After going in the bar for the second time we produced the audit report on the operations for one week. The bar was about 450 bottles of beer short. This meant the bar went through 2500 bottles, but only sold about 2050. But what was equally alarming, if not more so was the average selling price of each bottle was not $1.90 but $1.25 each. So the bar was missing about $900 per week on sales of the missing 450 bottles and about 75 cents for each bottle actually sold or $1,537, for a total amount of $2,437 missing in one week. The beer was being sold for a dime each, 50 cents, $1.00, etc., along with the regular prices of $1.50 and $2.25 and $3.00. This resulted in the low average. This owner thought the $5,000 pos system was too expensive and an unnecessary expense, so the bought a $200 register. So in his effort to save $4,800, he lost that in two weeks. By

having a POS system this wouldn’t have happened. I can’t tell you how many operators I have met that will step over dollars to pick up pennies. After we put in a POS system; his profit increased by about $2,000 per week. This decision increased his net profit by $100,000 for a year. A POS system records the sale by a button that is programmed for a specific price for each item, for the time and the day. The staff can’t over ring and they can’t index in any price they want to. A POS system also records the tabs directly in the system. This means no lost pieces of paper and you are more likely to record the sales properly.

AFTER WE PUT IN A POS SYSTEM; HIS PROFIT INCREASED BY ABOUT $2,000 PER WEEK. THIS DECISION INCREASED HIS NET PROFIT BY $100,000 FOR A YEAR. Another nice advantage is the end of shift or day processing is much faster and accurate. You can also intergrate the POS system with the credit card processing function and as a time clock. There are many other advantages. A cash register is ok as a way of recording a limited selection of beverages, such as bottles of beer and draft beer. You should program it to have preset prices and lock out the buttons if possible from being able to index in the sale. This could be used in a side or temporary side station in your bar. If you have a POS system you probably already know about the big differences and advantages over a manual cash register. These days the prices of POS systems have come down. And they have become so easy to use compared to the way they used to be. There are many out there: Micros, Aloha, Two Touch, Pixel Point, Digital Dining, Restaurant Manager, R Power and a host

Chuck Deibel

of others. Each one has its advantages and disadvantages. They generally cost around the same; although many of the manufacturers have different versions and options for their POS systems. You should interview several. Make sure you find out the price of the entire system, including the service agreement over a 5 year period of time. Just as important as the hardware and software is the person selling it and servicing it. Make sure you feel comfortable not only with the POS system but the company selling it.

When you did your inventory last week, how many shots of Crown Royal were you missing? How many pints of draft beer were you missing? If you can’t answer those questions you should give us a call at 800-891-1012 or go to www.bevinco.com Our clients do know how much.

March 2011 OHIO BEVERAGE MONTHLY 13

14 OH 14 OHI OHIO HIO O BEVE BEVERAGE V RAGEE MONTHLY VE MONT ONTHLY HLY LY Ma March arch rch 2011

EVENTS&BENEFITS

FREE TECHNIQUES OF ALCOHOL MANAGEMENT TRAINING! Schedule a Class Today!

BY RENAE DAVIES AND MOLLY MCKEE

Renae Davies, OLBA Management Team

A

s we embark upon a new year, don’t forget that the OLBA has a program that can help you get ahead of the competition! Permit holders in all counties in Ohio can now take advantage of FREE Techniques of Alcohol Management training or TAM until September 30, 2011. A grant provided through the Ohio Department of Public Safety has enabled the OLBA to offer TAM FREE to permit holders and their employees in ALL Ohio counties. All permit holders should take advantage of this opportunity! These classes are usually $60 per student! The OLBA has been working with the Ohio Department of Public Safety’s Investigative Unit office to make these free classes possible. TAM is a comprehensive servertraining program offered by the OLBA in partnership with the Michigan Licensed Beverage Association. All permit holders should learn more about this excellent training program and take advantage of it. TAM training offers a complete overview o f a l l a s p e c t s o f b e ve r a g e a l c o h o l sales from effectively identifying false identification, how to detect and manage intoxication, alcohol laws, rules and regulations, customer disturbances and alcohol management. The TAM program is nationally recognized as the leading program for responsible server training. The course is also offered online at www.

Molly McKee, OLBA Management Team

olba.org, permit holders will need to enter a “discount code” to begin the course. The current discount code is OHTAM2011. The online course offers the same instruction as the classroom and can be taken at whatever pace the student desires. Students then receive certification upon completion of the course.

THE SUCCESS OF A PERMIT HOLDER’S BUSINESS LARGELY DEPENDS UPON THE EDUCATION AND TRAINING OF EMPLOYEES, ESPECIALLY IN THE AREA OF ALCOHOLIC BEVERAGE SERVICE. In addition to the obvious benefit of having well-trained and knowledgeable employees, permit holders may find a d d i t i o n a l b e n e f i t s i n h av i n g t h e i r employees attend a TAM course. For instance, some insurance companies require permit holders provide alcohol awareness training to employees. Some insurers also may reduce premiums for

permit holders who make server training mandatory for employees. Fur ther, the Liquor Commission will consider whether permit holders have provided some form of training to their employees when deciding penalties i n l i q u o r v i o l a t i o n c a s e s. Th e O h i o Revised Code, section 4301.253 states, “In considering whether to suspend or revoke a permit issued or to issue an order allowing a permit holder to elect to pay a forfeiture, the control commission shall consider whether the permit holder and the permit holder’s employees have successfully completed a training program that includes all of the following: A. Instruction on the statutes and rules that govern the sale of beer, wine, mixed beverages, and intoxicating liquor; B. Instruction on the prevention of the illegal serving of beer, wine, mixed beverages, and intoxicating liquor to persons under twenty-one years of age; C. Use of conflict management skills in alcohol-related situations; D. Instruction on methods to safely evacuate the premises of a permit holder in an emergency. The success of a permit holder’s business largely depends upon the education and training of employees, especially in the area of alcoholic beverage service. Mistakes by employees can subject the permit holder to both administrative penalties and potential civil liability. Trained employees hopefully make better employees who, in turn, will be less likely to commit violations of the law. The TAM program offers excellent training to employees in many vital areas. All permit holders should consider having their employees attend a TAM course. If you are a permit holder interested in scheduling TAM for you and your employees please give the OLBA office a call, 1-800-678-5995, and we will get you scheduled.

March 2011 OHIO BEVERAGE MONTHLY 15

AROUNDOHIO WITH RNDC

1. Agency 795 in Whitehall, Ohio displays Absolut Cosmo with Lisa Jones 2. Agency 703 displays Absolut Seagrams with Cindy Hougland 3. Agency 746, Giant Eagle Dublin displays Absolut 20 cases with Ian Thompson & Evan Robinson

1

2

3

4

5

6

4. Agency 743 displays Jameson 50 cases with Zack Bieber, Dirk Benetar, Ron Tabius, Mark Brunswick and Jerry San 5. Giant Eagle Lewis Center agency 740 Ready with Jameson for St Patty's with Erica Adams from Giant Eagle 6. Giant Eagle Columbus, Agency 769 ready for St Patrick's day with Jameson and Bobbi Kyser from Giant Eagle

16 OHIO BEVERAGE MONTHLY March 2011

THEBARBLOGGER.COM

5 WAYS TO GET MORE CUSTOMER INTERACTION ON FACEBOOK Facebook Is An Ideal Platform For Bars And Restaurants To Socialize BY BARRY CHANDLER

F

acebook is an ideal platform for bars and restaurants to socialize, actively look for new customers and re-connect with current ones but it often gets looked at as a platform to simply post happy hour specials and links to events rather than being used as the valuable engagement channel that can increase customer loyalty and drive more sales when used correctly. I often get asked by bar owners what I recommend they post to Facebook and how often they should post. While it varies from bar to bar depending on user interaction, what you post on Facebook should reflect your business and not be something that exists independently of

know what content you should post to get the best return on your time. Here are some recommendations for types of content that you can post to best reflect your brand online and get customer engagement:

POST PHOTOS It’s important to visually showcase your bar or restaurant for potential customers to see. Posting photos to your Facebook page allows for customers to get a feel for your establishment before stepping into it. These can range from staff photos to convey a friendly environment or enticing photos of new menu items.

ACTIVELY LOOK FOR NEW CUSTOMERS AND RE-CONNECT WITH CURRENT ONES Social media savvy restaurant AJ Bombers in Milwaukee recently posted a photo of the newest addition to their burger line-up, The Ahlfy. This post garnered 10 likes and a 14 comment long discussion and allowed customers to see what they might get long before they even entered the door of the restaurant. (www.facebook.com/ AJBombersMKE) it. What I mean by this is that if your bar is known for it's live bands and electric atmosphere at the weekends, then the Facebook page should reflect that energy with videos of the bands, photos of the crowd, feedback about the music and not just boring status updates where you PUSH information about happy hour down your visitor's throats! Remember, your Facebook page is an extension of your brand so it might be worth checking your Facebook Page to see if you are happy with how it reflects on your bar. What you may NOT have been aware of is the fact that not all content posted to Facebook is treated equally. In fact, Facebook has created an algorithm that ranks each piece of content posted, whether it be to a personal profile page or a fan page. This is important for you to know, because in order for you to stay near the top of your Fan's News Feeds on Facebook, (in other words, be the first thing they see when they log in) you need to follow a few guidelines. Photos receive the heaviest weight, with videos, links and status updates following, respectively. Knowing this allows you ti

UPLOAD VIDEOS Uploading videos to your Facebook page can make your customer feel as if he or she were actually there. Videos can range in topic from a virtual tour of your bar or restaurant to a more personal clip displaying the atmosphere during a big game. Bar 43 in Sunnyside, New York, a very Jets-centric sports bar, posted a video to their Facebook page of the crowd reaction to Santonio Holmes scoring a touchdown recently and it really captured the atmosphere of the bar. (www.facebook.com/Bar43)

SHARE LINKS As the third heaviest weighted item to post, there’s a lot of room to roam when sharing links. Your bar or restaurant can show community interest by posting links to local events that may draw your customers to your neighborhood. You also have the freedom to post links to articles that may appeal to your fans. The Little Bar, in Columbus, Ohio, recently shared a link on their Facebook

page to a news article from USA Today about babies in Pittsburgh being wrapped in Terrible Towels after they were born. This was done leading up to the Super Bowl as The Little Bar actively supported The Steelers and it helped remind customers that they were using Facebook for sharing information and not just pushing promotions at them. (www.facebook.com/thelittlebar.cbus)

ACTIVELY UPDATE STATUSES While a status update may not carry much weight, it may be one of the best ways to interact with your customers. If your bar or restaurant has a regular trivia night, update the fan page status with a trivia question to engage your customers. If your bar or restaurant regularly shows NFL or college basketball games, challenge your fans to sports trivia. Kildare's Irish Bar in Newark, DE holds a trivia night every Monday and posts trivia questions to their Facebook Page throughout the day leading up to the event. Not only do some of these questions get upwards of 20 responses, it reminds everyone that they will be holding a live Trivia Night in the bar that night. (www.facebook.com/Newark. Kildares)

LEVERAGE YOUR EVENTS CALENDAR One of the easiest steps in creating a content strategy is to simply look at your own marketing or event calendar. If your bar or restaurant doesn’t have a set schedule of events or marketing and promotion dates, create some. On the days that you may struggle to come up with content to post, simply refer to your marketing and promotional guide to entice customers with your latest specials. A rule to remember though is the 4:1 rule. This states that for every 1 piece of content you push promoting your specials or events, you post 4 pieces of content promoting local events, replying to customers or just sharing something interesting. Remembering that Facebook is not a sales channel but rather an engagement platform will ensure you get more interaction with your content. So, now that you are armed with ideas on what to post, create a 14 day content calendar with some content ideas for you to post to Facebook and refer to it each day. You'll soon see what content your customers are interacting with and you can tweak your calendar accordingly. It won't be long before it becomes second nature to you and your customers to interact with your Facebook Page. For more social media tips and free video tutorials visit Barry Chandler's blog at www.thebarblogger.com.

March 2011 OHIO BEVERAGE MONTHLY 17

INDUSTRYEVENT

State of the Industry WSWA Organizes Informative Industry Discussion

Critical Timing “Our goal was to project to the Washington press corps and beyond that wholesalers do much more than move boxes. We wanted to illustrate the strategic value of the middle tier by explaining that wholesalers are at the crossroad of industry trade, and transmit market forces up and down the three-tier system,” explains Wolf. “We felt it important for the press and others to know that few industries are as intertwined in the global economic web—and

18 OHIO BEVERAGE MONTHLY March 2011

few companies have the capacity and nimbleness to navigate this complex matrix. That’s important because the U. S. beverage alcohol industry is at a critical juncture. Retailers, wholesalers and particularly international suppliers must work together now more than ever before due to the rapidly changing economic environment.”

The Road Ahead Panelists brought tremendous insight to the event highlighting their industry expertise: While Baker confirmed the important role of the wholesaler, McDonnell offered his supplier perspective, stressing the need to work toward common goals. Afterwards, McDonnell shared one of the event’s guiding takeaways: “Despite challenging economic times, we saw some growth come back into the spirits industry in 2010. Simply put, for our industry to continue to be successful globally, we need to build global

brands,” he comments. “That means we shouldn’t be slashing prices, reducing advertising, cutting jobs and papering the world with coupons. That’s not the way to build the future, and that’s not what we do at Patrón.” Riehle, meanwhile, attested to the vital connection between the restaurant and beverage alcohol industries, and Reif shed light on challenges from abroad. As Wolf comments, “This was our second successful event, and it validates our belief that WSWA has a critical role to play in bringing together the voices of the industry.” ■ Pictured above: WSWA reception; Craig Wolf, WSWA presents WRAP president and CEO Kurt Erickson with $5,000 check; WSWA president and CEO Craig Wolf moderating the panel. Pictured below: WSWA Chairman John Baker; Patrón Spirits International COO John McDonnell; and National Restaurant Association senior VP, B. Hudson Riehle

Photograph courtesy of ????????????

O

n Tuesday, December 14th, Wine and Spirits Wholesalers of America presented “Domestic Industry, Global Impact,” a state of the alcohol industry briefing at the National Press Club in Washington D.C., followed by a VIP reception where media mingled with participating speakers one-on-one. WSWA president, Craig Wolf, opened the discussion by welcoming media and introducing an impressive panel that included Timothy Reif, general counsel, Office of the U.S. Trade Representative; John McDonnell, COO, Patrón Spirits International; John Baker, WSWA chairman and executive VP/COO, Republic National Distributing Company of Indiana; and B. Hudson Riehle, senior VP, research & knowledge group, National Restaurant Association.

E L E VAT I N G

THE

CHAINS WHY YOU SHOULD PAY ATTENTION TO M U LT I - U N I T

BEVERAGE PROGRAMS BY ALIA AKKAM

Opposite page, clockwise from top left: Diners toast with wine off the extensive list at Morton’s The Steakhouse; Customers at T.G.I. Friday’s spring for popular cocktails like the tableside Blackberry ‘Rita Shaker; Cocktail competitions at T.G.I. Friday’s maintain an element of theater barside; Morton’s invigorates the bar scene with an accessible menu. This page: It’s a full house at T.G.I. Friday’s

T

he chain restaurant: it beckons to us from unfamiliar streets. Numerous restaurants thrive on surprise and intrigue, but the one that’s part of a branded chain attracts customers— perhaps not for cutting-edge preparations, but for welcoming familiarity and reliable quality. For this reason, a table tent bearing the image of a slushy cocktail reminiscent of spring break or encouraging the sale of generic house wine pours, has been a familiar sight. Not anymore. Some chains have had the foresight to swap mixes for fresh ingredients long before it became commonplace, or offer a well-rounded wine list. Yet barraged by a flood of exciting mixology and wine trends, the average chain customer is shifting priorities. They want to sample the flavors and styles they’re hearing so much buzz over, and neither a frozen daiquiri pumped out of a machine nor the same old bottle of Chardonnay will suffice. The best part? Chains are responding with ambitious beverage offerings. An empowered chain consumer, one who converts to a new drink in a comfortable setting they trust, means the next time they’re at your restaurant they’ll be primed to experiment and trade up.

A DRINK BEFORE DINNER “When you find a chain that is a good match for your brand it can be a fantastic opportunity to showcase inspiring cocktails that allow many consumers to try something new, connecting with the brand in a way they wouldn’t at home,” notes Joel Selesnick, Pernod Ricard USA’s national account manager, Northeast. Selesnick says PRUSA has had particularly good luck in the chain realm with its Absolut and Malibu brands, which, for example, are featured in the apple daiquiri at Legal Seafoods developed by Tad Carducci of Tippling Brothers. At Ocean Prime, a Cameron Mitchell restaurant, the “Oxygen,” another Carducci creation with

Absolut Berry Açai, Plymouth gin, muddled white grapes, fresh basil and lemon is a success, presenting a modern alternative to the gin & tonic. It’s a particularly good time in our industry to engage the chain demographic, Selesnick believes, because the role of the bar in these environments has been altered. “I think what has happened is that many chains now embrace the bar, and instead of looking at it as a place for guests to wait as their table becomes available, it is an important part of the overall experience. This change has allowed guests to feel more comfortable and at ease in trying new drink concepts or, more importantly, modern expressions of classic cocktail concepts.” Tylor Field, VP of wine and spirits at Morton’s The Steakhouse, sees the clientele at his restaurants making exciting beverage choices with ease. “There’s a younger generation populating the bar,” he points out, “and they’re becoming more educated,” whether it’s not settling for anything less than a quality margarita or trying a caipirinha. To help meet this demand, each year Morton’s dreams up a new signature cocktail program, like the recent “Heavenly” series featuring custom foams. At Hard Rock Café, worldwide beverage director, Cindy Busi, says the key to helping customers make more adventurous choices is providing “them with a drink selection they could not easily make at home. The average guest won’t necessarily go to the store and purchase basil, mint, raspberries and coconut to make just one drink.” However, when these guests are in the restaurant, “they expect a wide selection and want a memorable experience.”

A memorable experience has never been hard to find at T.G.I. Friday’s, known for its entertaining bartenders who have mastered tricks à la Tom Cruise in Cocktail. Yet George Barton, VP beverage and bar innovation concept team, Carlson Restaurants/T.G.I. Friday’s, hardly relies on flare skills to drive interest. “Our Ultimate cocktails, premium size with premium liquors, are definitely what guests look for on our menu—drinks like our Ultimate Long Island Iced Tea and Ultimate Margarita,” he notes. “In the last few years, tableside Shakers have become an important part of our menu. Our guests enjoy the tableside service of cocktails like the ‘Tropical Berry Mojito Shaker’ and ‘Patrón Cosmo ‘Rita Shaker.’ This T.G.I. Friday’s ‘theater’ so to speak is what makes us famous with our drink heritage in casual dining.” Fun new cocktails like “The Pink Punk Cosmo,” made with Smirnoff and a fluff of cotton candy and the “Diddy Up” with Cîroc and Red Bull have, according to Barton, exceeded sales expectations.

“EXCUSE ME, IS THAT LEMON JUICE FRESHLY SQUEEZED?” Charles Steadman, a Palm Beach, FL-based bartender and consultant who developed forthcoming drinks for the Buffalo Wild Wings Grill & Bar chain, recently found himself in Chili’s. Taking a peek at the drink menu, he noticed a push for the “Fresh Margarita” with fresh lime juice. “In the past, cocktails have devolved from fresh, homemade components to bottled and canned juices. Nowadays, they are evolving again with more bartenders bringing back that fresh component to a cocktail,” he says.

INTRODUCING

THESUBTERRANEO.COM JOSE CUERVO TRADICIONAL TEQUILA. 40% ALC/VOL. ©2011 IMPORTED BY HEUBLEIN, NORWALK, CT UNDER LICENSE FROM THE TRADEMARK OWNER. HANDCRAFTED USING THE SAME METHODS SINCE 1795. DRINK RESPONSIBLY.

CHAIN RESTAURANTS

Cocktails clockwise from top left: Customers of The Cheesecake Factory sip cocktails like the Asian Pear Martini – and soon, Skinny-style libations; At Applebee’s, Beam products get the spotlight in the Perfect Margarita, Skinny Bee and Main St. Rita; Morton’s keeps its cocktail program interesting with holiday creations. Below: In addition to old-time favorites, Hard Rock Café is slated to roll out a local brew menu

The trend has crystallized. Fresh fruit is the cornerstone of Hard Rock Café’s cocktail program, and Busi says there is wide appeal for the tropical-inspired concoctions because they are made from scratch. “Visiting a Hard Rock is a little like taking a vacation and getting that permission slip to try something new,” she muses. Last year, Barton notes that after T.G.I. Friday’s guests sought out fresh ingredients, the chain responded by updating its margarita mix. Like the sprig of basil in the “Triple Berri Passion” fresh herbs began to make an appearance to boot. Morton’s had the prescience to get on board with fresh juices five years ago, and Field reiterates the importance of preparing a cocktail à la minute: “The rules have changed for the better. The standard was a chemical-tasting mix and soda gun, and now we’ve brought the kitchen to the bar.” Mary Melton, P.F. Chang’s director of beverage, echoes Field, recalling how the conversion to fresh-squeezed juice was the first sign cocktail menus were changing in the right direction. Each of her bars squeezes fresh juice and uses the likes of pure cane sugar simple syrup. “Gone are the days of the mixer,” she assures. Beyond the obvious, that both customers and bartenders have become savvier, Steadman says freshness has become a primary focus for additional reasons: “Liquor companies want to be on top of this wave and deliver a drink with their product(s) that has impact. And, recent economic events have shown that restaurants can focus on a beverage program while maintaining the brand integrity to generate higher revenues and have a better bottom line.”

KEEP THE SKINNY PANTS ON Bethenny Frankel’s Skinnygirl Margarita made waves last year for the calo-

rie-conscious set that likes to entertain at home. But chain bars are certainly capitalizing upon the interest. This month, The Cheesecake Factory will launch a menu of 150 calories-or-less “Skinny-style Cocktails” based on the chain’s five most popular libations. After conducting several tests last year, T.G.I. Friday’s decided to unveil a Skinny Margarita and Skinny Blackberry Margarita. This new approach to making cocktails is also popping up in the bars of hotel chains. Francesco Lafranconi, Southern Wine & Spirits of America’s national director of mixology, who has lent his expertise to Morton’s, recently created a range of cocktails for Westin Hotels and Resorts. Based on the SuperFoodsRX series of books, the drinks featured ingredients like blueberries, ginger, green tea and honey. At Applebee’s guests embrace the lowcal trend by ordering a “Skinny Bee Margarita” made with Hornitos Reposado premium Tequila, or a “Skinny Mojito” with Cruzan Light Rum. “We have seen a spike in awareness in our brands that are carried and promoted at Applebee’s,” shares Kevin Ruff, VP, national accounts, onpremise at Beam Global Spirits & Wine.

“A great example is the ‘Skinny Bee.’ This promotion has helped to expose Hornitos to thousands of new consumers.” Busi says there’s now a focus on “better-for-me” options at Hard Rock Cafés, too: “Any drink we serve that is made with sweet & sour can now be lightened up for a lower-cal version. Additionally, we are using coconut water as an alternative to soda or juice.”

DRINK LIKE A LOCAL Bud, Miller and Coors will always pull their weight at the chain bar, but ignoring the popularity of craft brews would be a mistake. Busi sees them on the rise and this year is launching a locals menu where Hard Rock Cafés will have the opportunity to focus on brews made close to home. “We are seeing that like great wine, guests are

A52 D<?91š@ @2996;4 /<B?/<;

A52 56452@A ?.A21 ;<?A5 .:2?60.; D56@82F

A52 :<@A @B002@@3B9 ;2D D56@82F 9.B;05 6; A52 =.@A 36C2 F2.?@

A52 ?F2 D56@82FÂ&#x152; WVZORNZ P\Z

Jim BeamÂŽ and Jim Beam BlackÂŽ Kentucky Straight Bourbon Whiskey, Jim BeamÂŽ Straight Rye Whiskey and Red Stag by Jim BeamÂŽ Kentucky Straight Bourbon Whiskey Infused With Natural Flavors, 40% and 43% Alc./Vol. Š2011 James B. Beam Distilling Co., Clermont, KY. *Beverage Testing Institute, Inc. â&#x20AC;&#x201C; 2008 Professional Tasting â&#x20AC;&#x201C; Chicago, Il. Compared to other top-selling North American whiskeys including Woodford ReserveÂŽ, Wild TurkeyÂŽ 101, Jack Daniel'sÂŽ Gentleman Jack, Crown RoyalÂŽ Blended Whiskey, and Jack Daniel'sÂŽ No. 7 Black **Based on Nielsen data 11/20/04 â&#x20AC;&#x201C; 10/17/09 â&#x20AC; Based on latest 13-week Nielsen data through January 8, 2011

CHAIN RESTAURANTS

Cocktails clockwise from top left: At Smashburger, beer helps to create “more burger occasions”; Buckets of beer=the perfect companion to a “smash burger”; Customers flock to Applebee’s for low-cal cocktails Below: P.F. Chang’s: the first nationwide chain to launch a bag-in-box wine, Vineyard 518

now starting to experiment with all types of beer, and are more open to a wide variety of flavor profiles,” she says. At Smashburger, beer sales are just another way for the chain to leverage its devotion to “creating more burger occasions in the marketplace,” says founder Tom Ryan. Instead of forcing guests to stand in line again if they crave a second frosted mug of beer, the pragmatic beer bucket, holding two to four beers that stay ice cold at the table, comes to the rescue. Along with the big national brands and a few imports, Smashburger also offers craft beers customized to each local market. “There’s not a market we go to where it’s difficult to find some great tasting local beers, which is important to Smashburger because our brand positioning is to become every city’s favorite place for a burger,” explains Ryan.

BEYOND RED AND WHITE Morton’s moves a lot of wine. Its core program features 225 selections; the manager at each unit has the opportunity to tweak it based on local market preferences. “In Miami, you’ll

see a lot more Spanish and Argentine wines,” Field points out. “In the Northwest, more Oregon Pinot Noir.” Melton is gearing up to introduce a new wine list at P.F. Chang’s locations in April. While she likes to feature favorites including Kendall Jackson and Beringer, she also incorporates up-and-coming varietals such as Albarino and Grenache. “Sales numbers show that customers see these as fun additions,” she points out.

PLAYING GATEKEEPER The chain customer demographic is a coveted one. “Chains have the power to introduce customers to new experiences. They have a larger audience, bigger advertising and a stronger presence in the market,” notes Steadman. “Brands are built on-premise, and national account res-

taurants, are very important ‘display windows’,” adds Southern’s Lafranconi. Beam’s Ruff agrees: “Today’s chain consumers are desirable because they are socially active, travel and entertain frequently. They will ask for our brands on many occasions and share their drink experiences with friends and family.” Bold changes aside, the chain can never forget its value-driven audience. T.G.I. Friday’s reinforces this with its $3 beer, $4 wine, $5 drink and $6 premium initiative, highlighting monthly selections. “This program has allowed us to offer great products at a real value price and gauges our guests’ interests to help determine what we will offer next,” shares Barton. In addition to the standard wine list, P.F. Chang’s became the first national chain to create a wine bag-in-box when it rolled out Vineyard 518 Sauvignon Blanc and a Syrah blend last May. Unlike a typical private label, P.F. Chang’s has control over the winemaking process. And by saving money on bottling costs with its ecofriendly packaging, Melton says they are able to pass down the value to guests. Morton’s draws in bar crowds with its more casual 12-21 lounge experience. “To make a bar relevant you have to make it a little different conceptually,” Field notes. Creativity, variety and value among chains will continue to encourage customers to confidently endorse and promote new drinking experiences once they’re through with dinner. But the real success of a chain beverage program circles back to the main reason they hold such appeal nationwide: consistency. ■

A pour of coveted Templeton Rye

BEFORE THERE WAS BOURBON,THERE WAS

rye ine and spirits delivery drivers in Iowa recently found themselves at the head of an unlikely procession, being intently trailed by multiple vehicles during their deliveries. A few drivers even called the police, although there was no real cause for alarm, according to Scott Bush, the man who could be held responsible for the situation. Bush is the founder and president of Templeton Rye, a relatively new entrant in the tiny 100,000-case American rye category that is inspiring incredible passion among drinkers in the hip lounges of Manhattan, the classic cocktail haunts of New Orleans and yes, even in Iowa, where de-

W

america’s beloved whiskey is back in demand

BY JEFFERY LINDENMUTH

mand for this local rye whiskey, conjured from the shadows of Prohibition, is 100 times what the distillery can produce. Rye whiskey is still tiny—representing less than 1% American whiskey production, which is dominated by bourbon and Tennessee whiskey. A handful of distillers, including Heaven Hill, can be credited with carrying the mantle of rye whiskey through its darkest days. By maintaining heritage brands like Rittenhouse Rye and Pikesville Rye, whose names hearken back to rye’s pre-bourbon roots in Pennsylvania and Maryland respectively, Heaven Hill kept alive this vestige of America’s earliest distillers. Wild Turkey and Jim Beam also contin-

ued to produce their own labels of rye whiskey, both similar footnotes for these Kentucky bourbon behemoths.

SlowJourney “Once Prohibition and the war happened, and the smaller distilleries went under, the bourbon companies said, ‘Okay we’ll make the rye,’” explains Larry Kass, Heaven Hill’s director of corporate communications. “Rye continued mostly as shot-and-a-beer stuff. It was really in a slow, moribund sort of state, but as a family-owned company, we were able to maintain a few small brands as a service to our customers and distributors.”

By the 1990s, interest in classic cocktails started to emerge, and bourbon began to play catch-up to Scotch in terms of innovation, courting a new class of American whiskey enthusiasts, while a few influential writers, like Jim Murray in Classic Bourbon, Tennessee & Rye Whiskey, had the prescience to spotlight rye as the next big spirit. Kass says it was a “perfect storm” brewing for the long-forgotten category. Now, DISCUS predicts that new brands from distilleries, large and small, will fuel growth of rye between 30 and 40%. Of course, the greatest issue is that you can’t simply produce aged rye whiskey with the speed of so much vodka. “We had a couple reactions. The initial was to start making more. For years we were literally mashing rye one or two days each year. Now, it’s one or two days each month. Obviously, we can’t age it any quicker, but we are at least creating the stocks,” says Kass. Heaven Hill was also inspired to search its vast warehouses for forgotten barrels of older ryes, which yielded a few treasures destined to become the single barrel releases of Rittenhouse Rye at 21-, 23- and 25-Years-Old. With careful management of existing stocks, Heaven Hill is now placing priority on supplying its reasonably priced flagship, Rittenhouse Bottled-in-Bond—a mainstay of luminary cocktail bars like New York’s Pegu Club.

THE BARTENDERS DO IT AGAIN Wild Turkey offers both its namesake rye and Russell’s Reserve Six-Year Old, both of which have become scarce in recent months. “The current surge in popularity around rye was very surprising to everyone in the industry. If you would have said 10 years ago that rye would see such a rebound, they would have laughed you out of the distillery,” explains Andrea Conzonato, chief marketing officer, Skyy Spirits. “The supply of rye for the entire industry is incredibly tight right now, and the popularity of Wild Turkey and Russell’s Reserve has resulted in them being on allocation in our key markets. Those constraints should clear up, however, this year.”

ry

e

According to Conzonato the new rye drinker behind the boom is very different from the traditional rye consumer, usually a 25-39-year-old The “Try” box urbanite who enjoys Heaven Hill master distiller, at Heaven Hill Craig Beam, pulls a sample cocktails and fine spirits. Distillery from a fermentation tank Conzonato explains that dedicated bourbon drinkers, while they may not be easily lured to other Hudson bourbons, will experiment with a rye whisManhattan Rye: a Tuthilltown key. At the same time, he credits mixolofavorite gists with spearheading much of the interest: “Bartenders are driving this revival because they are looking for spirits with more flavor. Also, the return to classic cocktails has played a very strong hand in the return of rye. I think most of the innovation in whiskey cocktails right now is coming from rye, rather than bourbon.” Tom Bulleit would agree. Known for his namesake bourbon, containing one of the highest percentages of rye on the market today, Bulleit has now unveiled a rye as an extension to the portfolio. “The launch of Bulleit Rye answers requests that bartenders and mixologists have made to me over the years. Many bartenders are reintroducing rye into their recreations of classic cocktails, and in my travels across the to produce a rye whiskey they could count country, many have asked me personally on,” says Bulleit. “It was really important, however, we create a rye that was a quality product, and one that reflected the spirit and heritage of the Bulleit brand.”

THE ELUSIVE SPIRIT

Jimmy and Eddie Russell, Wild Turkey’s father/son distilling team

At destination whiskey retailer Park Avenue Liquor in Manhattan, Jonathan Goldstein, VP, says he does nothing to promote rye in-store because he is already struggling to meet demand: “Tuthilltown Spirits from New York is allocated. Sazerac 18 is very hard to keep in stock. We get only a small amount of Templeton. These little brands try to fill in the gaps, but they are small, sometimes start-ups, so they can only produce so much. What is equally impressive is that the entry-level price point remains very low for the guys who have been into rye for a long time.”

ry

e

In legal terms a rye whiskey must be made from a minimum of 51% rye, much the way bourbon must be at least 51% corn. In general, rye offers more dry, peppery spice as compared to bourbon’s caramel, vanilla and corn sweetness. However, as the category resurfaces, a broader range of styles and prices is becoming apparent among ryes. The most traditional ryes, like Rittenhouse, Jim Beam and Russell’s Reserve Six-Year-Old, are usually aged four to six years and under $20. These are especially good choices for classic cocktails like a Manhattan, Old Fashioned or Sazerac. Older reserve ryes are better suited to sipping, calling to bourbon and

The current surge in popularity around rye has been an industry surprise.One reason: the demographic behind the boom is notyourtraditional rye drinker. single-malt enthusiasts on the back bar. Rittenhouse 25 and the soughtafter Sazerac 18 are current examples. “I think we were at the forefront when we launched Sazerac 18 about 10 years ago. It has set the standard, but we make it only one week a year,” points out Kris Comstock, brand manager, Buffalo Trace Distillery. “We have been increasing production, but with 18 years of aging that puts us at 2030. So, for now, I have to divvy it up state by state.” The standard Sazerac Rye, which av-

The stills at Tuthilltown Spirits in NY

erages six to seven years of aging, was an effort to increase availability with a younger product. While reports suggest reserves of older rye stocks are drying up, many craft distillers are still surprising the market with excellent rye whiskey gems. Tuthilltown Spirits crafts Manhattan Rye and Government Warning Rye, New York’s first whiskies since Prohibition, in the Hudson Valley. In Utah, High West offers Rendezvous Rye Whiskey, a blend of 6-year-old,16-year-old and 21-year-old ryes. WhistlePig Straight Rye Whiskey, a 10-year-old 100% rye whiskey of Canadian origin bottled by WhistlePig Farm Distillery in Vermont, is another example. And, if you can catch the delivery guy, there is, of course, Templeton. “The reason there are not many small whiskey companies with high volume is that it takes a lot of time and money to get there,” says Templeton’s Bush. “Our product sits in the barrel for at least four years, and while we thought we were being aggressive, we did not make nearly enough, and have to make due since we cannot go back in time.” Yet, each rye whiskey on the shelf represents an opportunity for a whiskey lover to go back in time, to an era before bourbon, when rye ruled the day. ■

INTRODUCING KNOB CREEK SINGLE BARREL RESERVE. ®

Our master distillers pour over each and every barrel to hand-select the very best bourbon distinct in its robust , mature a n d s m o o t h f l a v o r. A n d w h i l e t h a t m a y s o u n d e x h a u s t i n g , a f t e r y o u r c u s t o m e r s t r y i t n e a t , o n t h e r o c k s o r c u t w i t h d i s t i l l e d w a t e r, t h e y ’ l l b e g l a d w e ’r e d e d i c a t e d t o p e r f e c t i o n . Y o u w o u l d n ’ t w a n t i t a n y o t h e r w a y – n e i t h e r w o u l d w e .

H A ND- SE L E C T E D | 120 PROOF | ROBUS T F L AVOR

WORTH THE EFFORT Knob Creek ® Single Barrel Reserve Kentucky Straight Bourbon Whiskey, 60% Alc./ Vol. ©2011 Knob Creek Distillery, Clermont, K Y.

Join the Stillhouse at KnobCreek.com

READY-T TO-D DRINK SA ANGRIA EMERGES AS DYNAMIC WIN NE CATEGORY BY KRISTEN BIELER

S

om me crred i t mixologisstss w ithh kic k stt artin ng thhe prre-- madee san n g riaa grr ow wthh t ren n d byy igg niting an in nteeresst on-- premise that theen mo vee d too ree taai l . O thher s c itee thh e sw welll off a t-hh om m e en n tertainin ng or thhe p rooliferation n of Sp an issh tappa s baarss . Yeet pe r haa pss the mostt con n vinn cii ngg exxplana— wi thh its groo wthh ra t e off 14 %, itt is am mongg thh e fass teest-- grr owing tioon for saan grriaa ’ss receen t explossioon— winne catteg oriie s in thee U.S.—ii s thh e laar ge lyy u nm m e t deem an nd fo r r ed winn ess thh att a re sw weee t a ndd packed with fllavvo r.. A n d s anggr ia is jusst thh e bevv er a ge too fi t thh e b ill..