INSIDE: ELITE WOMEN 2024

Highlighting the industry’s finest

Industry Icon

The rise of The Mortgage Mum

Champion of the Mortgage Professional

SARAH TUCKER

roundtable debate explores a dynamic and rapidly growing sector – see pages 24-28

WHY AGE IS ALL THE RAGE Our

WITHOURUNDERWRITERSTOFINDA FLE X I B LE SOLUTION FORTHECLIENT.

Mr and Mrs Smith, aged 72 and 73, were mortgage free. They wanted to raise capital of £220,000 from their property worth £400,000; £80,000 for home improvements, and £140,000 to gift to their son and daughter.

Both had a state pension amounting to £20,000 between them. Mrs Smith has a fixed private pension of £4,000, whilst Mr Smith has a pension pot of £500,000 – but he hadn’t drawn down on it because they hadn’t needed to.

Most lenders the broker had spoken to would not consider the pension pot at all because it had not been drawn down or at most would consider 3-5% of it.

Our flexible criteria allowed us to consider 90% of Mr Smith’s £500,000 pension pot – equating to £450,000. We were able to o er Mr and Mrs Smith a mortgage term of 10 years and divide the allowable pension pot of £450,000 by the 10 years, giving them a usable income of £45,000.

Taking this income into account, plus the desire to take it on an Interest-Only basis, we were able to o er them a fi ve-year fixed rate mortgage.

COULD WE HELP ONE OF YOUR CLIENTS? SEE JUST HOW FLEXIBLE WE CAN BE! VISIT intermediaries.familybuildingsociety.co.uk

CALL US ON 01372 744155

OR EMAIL mortgage.desk@familybsoc.co.uk

A BROKER CAME TO US WITH A COMPLICATED LATER LIFE LENDING CASE HE WAS STRUGGLING TO PLACE. WE WERE ABLE TO HELP BY WORKING CLOSELY FAMILY

KT17 4NL

L E SOLUTI O NS F O R LATE

LIFE LENDIN G

FLEXIB

R

BUILDING SOCIETY, EBBISHAM HOUSE, 30 CHURCH

SURREY

Family Building Society is a trading name of National Counties Building Society which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. National Counties is on the Financial Services Register. Firm Reference Number 206080.

ST, EPSOM,

Managing editor

Paul Lucas

paul.lucas@keymedia.com

Editor Simon Meadows simon.meadows@keymedia.com

Senior news writer Rommel Lontayao rommel.lontayao@keymedia.com

Commercial director Matt Bond matt.bond@keymedia.com

Campaign coordinator Raniella Alonzo raniella.alonzo@keymedia.com

Vice president, sales

Chris Anderson

Vice president, production Monica Lalisan

Production coordinators

Kat Guzman & Loiza Razon

Lead production editor

Roslyn Meredith

Art director

Marla Morelos

Designer

Khaye Cortez

President, Tim Duce

Director, people and culture, Julia Bookallil HR business partner, Alisha Lomas-Oliver Chief information officer, Colin Chan Chief revenue officer, Dane Taylor

CEO, Mike Shipley

COO, George Walmsley

KM Business Information UK Ltd

Signature Tower 42, 25 Old Broad Street Tower 42, London EC2N 1HN www.keymedia.com

UK ∙ Canada ∙ Australia ∙ USA ∙ NZ ∙ Philippines

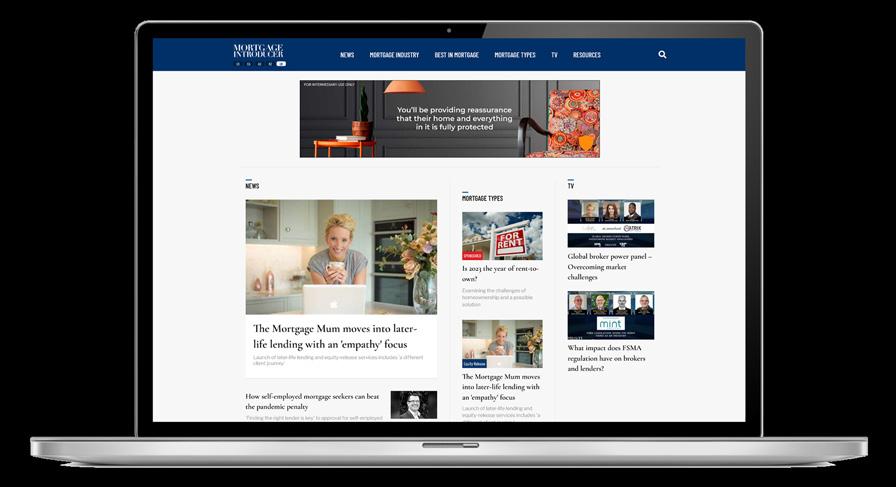

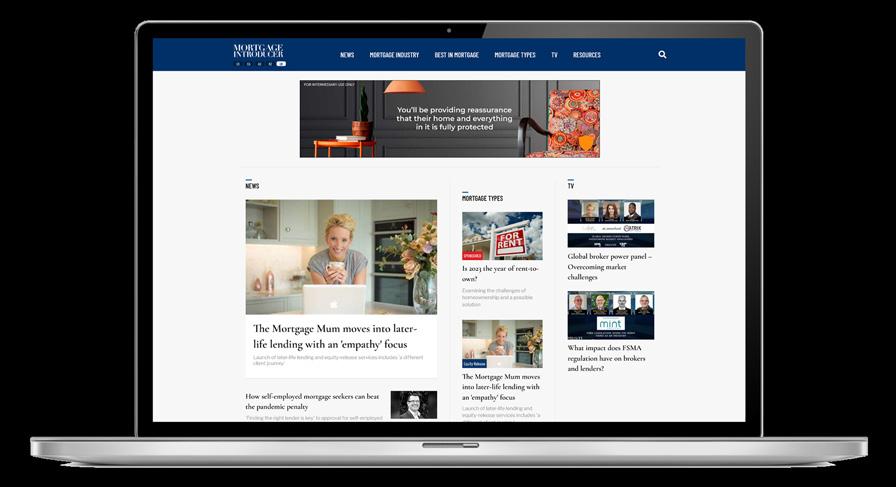

Mortgage Introducer is part of an international family of B2B publications, websites and events for the mortgage industry

CANADIAN MORTGAGE PROFESSIONAL cmpadvertise@keymedia.com

MORTGAGE PROFESSIONAL AMERICA mpaadvertise@keymedia.com

MORTGAGE PROFESSIONAL AUSTRALIA claire.tan@keymedia.com

AUSTRALIAN BROKER simon.kerslake@keymedia.com

NZ ADVISER alex.knowles@keymedia.com

Copyright is reserved throughout. No part of this publication can be reproduced in whole or part without the express permission of the editor. Contributions are invited, but copies of work should be kept, as the magazine can accept no responsibility for loss.

Opportunity knocks

When I was a fresh-faced teenager with a head full of dreams, there was a bold new song getting plenty of airplay across radio stations – Opportunities by an emerging band called Pet Shop Boys. The intriguing lyrics seemed to embody the time:

“Oh, there’s a lot of opportunities

If you know when to take them, you know?

There’s a lot of opportunities

If there aren’t, you can make them

Make or break them

“I’ve got the brains, you’ve got the looks

Let’s make lots of money

Let’s make lots of… money”

Nearly 40 years on and the importance of opportunity holds true, particularly in the mortgage industry. Most of us need a set of circumstances to put us on course to achieving our goals. And so it is that opportunity runs through the pages of this edition of Mortgage Introducer like letters through a stick of seaside rock.

Our cover star, Sarah Tucker, co-founder of The Mortgage Mum, recalls her journey from wannabe pop star to fully fledged industry icon. She believed the opportunity she craved on a TV talent show could lead her to chart stardom. Curiously, it instead gave her the profile she needed to establish a groundbreaking female brokerage. It’s a fascinating story.

Then we examine the opportunities that later-life lending offers to those who all too often believe they won’t be able to borrow in their advancing years. With our roundtable sponsor, Family Building Society, we have brought together some key industry experts for a deep dive into how the market is growing.

In our inspiring profile of Just Mortgages adviser Konstantinos Kepesoglou, we learn how he moved from Greece to make a new life in the UK. The British mortgage industry has given him the chance to build a career he loves.

Finally, Siobhan Holbrook, director at Mortgage Light, looks back to the first deal she ever wrote as she grabbed her moment to become a successful broker.

Enjoy the magazine… and don’t forget to grab those opportunities.

Simon Meadows

www.mortgageintroducer.com SPRING 2024 MORTGAGE INTRODUCER EDITORIAL COMMENT

1

MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com MAGAZINE WHAT’S INSIDE Contents 4 Market review 9 Advice review 35 Buy-to-let review 40 Protection review 42 General insurance review 44 Second charge review 45 Specialist lending review 10 Industry Icon From aspiring pop star to The Mortgage Mum, Sarah Tucker shares her journey

Special Report Celebrating The Elite Women of 2024 who are driving positive change in the mortgage sector

Interview Paul Roberts on the key role Family Building Society plays in creating lending options for later life borrowers 24 Roundtable Industry professionals give their insights into the rapidly growing later life lending market 30 Broker Focus The Mortgage Stone’s Konstantinos Kepesoglou finds his purpose in life as a broker 32 Sector Focus Growing customer awareness of its benefits is giving a boost to bridging finance 48 My First Deal How Siobhan Holbrook overcame hurdles to help a young Spanish client buy his first home in the UK 2 INTERVIEW: PAUL ROBERTS 22 10 SARAH TUCKER: THE MORTGAGE MUM 32

ELITE WOMEN 2024 BRIDGING IN FOCUS Cover photo: Sarah Tucker, co-founder, The Mortgage Mum

15

22

15

www.mortgageintroducer.com SEPTEMBER 2023 MORTGAGE INTRODUCER

Certainty meets flexibility: A mortgage solution for our times

At April Mortgages we recently launched our 5–15-year unique fixed-rate proposition to considerable media fanfare. It’s not hard to see why our product has become such a talking point.

Certainty and flexibility may seem like odd bedfellows, but the climate for a product that delivers both is now.

Inflation figures in December proved we are not out of the wars. Indeed, global instability is doing as much as anything to prop up prices. The war in Ukraine illustrated what could happen to energy and food prices under such tragic circumstances, and the current reaction by the West to the issues facing shipping trying to pass through the Suez Canal speaks volumes of western governments’ expectations of the economic consequences for western shoppers, especially in an election year.

The Bank of England held interest rates steady in February, and the likelihood is that any cut, if one comes at all, will not feature until the second half of this year. Swap rates have adjusted accordingly with lenders repricing. Going forward, what we can be sure of is that borrowers face more uncertainty, and the appetite for fixed rates will not diminish – not least because 1.5 million households are due to reach the end of their current fixed-rate deals in 2024, seeing mortgage bills rise by an average of £1,800.

All this means brokers’ advice to clients is incredibly important. Wage inflation data makes an interest rate cut seem less likely, and current volatility, the recent holding of rates

and subsequent uptick in swaps, means fixed rates still offer a lot of certainty in a market that is doing nothing to convince anyone one way or another that rates have peaked.

Fixed rates have always played an important role in delivering certainty. But longer-term fixed rates can now perform that important function in the market. Historically, their Achilles heel was always the lack of flexibility for borrowers and the fact that, in essence, long-term fixed rates did not support the intermediary business model.

Until now.

Taking inspiration from our Dutch parent and its success in that market, April does not charge early repayment fees when borrowers sell their homes or repay their loans from their own funds. In addition, as borrowers’ loans decrease, so do the interest rates they pay, because the lower the borrowing, the lower our risk.

But we recognise that addressing borrower concerns is only part of the equation. We believe in long-term relationships with our broker partners as well as our customers. Our mortgages are only available through intermediaries, and we work in partnership with brokers to ensure you receive the same excellent service as your clients and that you are fairly rewarded over the period of the loan for your hard work. This means that our broker partners benefit from income flows that help embed value in their businesses over the long term.

From arranging the initial product to product switches and further advances later on, we will work with our broker partners and reward them appropriately for the time and effort they put into our relationship. When the product period is up, we will always offer the same rates available to new customers and reward our partners for supporting us.

Part and parcel of delivering a new

proposition to market is developing in-depth, sound commercial relationships with our brokers. This means, of course, building slowly and responsibly as we make sure we can meet the expectations we are setting. We have started with limited distribution this year, which we plan to grow in line with our lending ambitions and in step with our proposition as we develop it over time. The key is that delivering service excellence is a cornerstone of our proposition, and we won’t try to run before we have learned to walk. It’s a huge undertaking and one we are working hard on, to broaden and roll out our proposition responsibly.

We are not alone in believing long-term fixed rates offer a solution to the issues of affordability and access to housing. Politicians have been espousing the benefits of long-term fixed rates as a means of broadening the base of homeownership in the country. Whether the market is ready for 25-year fixed-rate deals right now remains an interesting point. Our experience is that 5–15 years fixed represents a time frame everyone can understand and embrace while welcoming the other features that make our fixed-rate term lending so unique. M I

MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com 4 REVIEW MARKET

Tim Hague Commercial director, April Mortgages

It’s suggested that 1.5 million households are due to reach the end of their current fixed-rate deal this year

Using bridging finance to lock in longer-term opportunities

After speaking with a number of our introducers and various strategic partners over the first few weeks of 2024, it’s clear there are plenty of people across the industry who are looking forward to the next 12 months with growing levels of optimism and confidence – a highly encouraging sign on the back of such a challenging year from a lending, intermediary and borrowing perspective.

Intermediaries have often been referred to as a resilient bunch in the past, but let’s also give them credit for their more recent evolution as a more industrious, innovative and adaptive bunch. This is especially true when it comes to prising open opportunities across the specialist lending market to meet the changing needs of their clients in line with ever-shifting market dynamics and economic influences.

However, identifying these opportunities is not always easy, and this is where it pays to form a better understanding of underlying trends in certain sectors and how, where and when to tap into these prospects.

One area of the specialist market in which the scope and diversity of opportunities continue to rise is in the commercial and semi-commercial property space. This could be through the repurposing of retail property, mixed-use or semi-commercial mortgages, student housing, or a variety of development projects, large and small.

This is evident in the highly insightful Opportunities and Outlook: The Future of Commercial Property report from

Together, which found a strong appetite among commercial developers, investors and landlords who were either exiting or diversifying portfolios to mitigate falling yields and revenues.

According to the report, 23 percent of all respondents felt the commercial market was improving and far more opportunities were being generated; 18 percent said the opportunity to generate more money was high, and 16 percent reported that purchase prices had reduced to allow them to snap up deals and generate new opportunities. Almost a quarter of respondents (23 percent) said student housing offered the most appealing property investment opportunity over the next 12 months. This was followed by housing developments (21 percent) and luxury residential properties (19 percent).

While 29 percent of property investors surveyed were aware that falling property values could make securing lending difficult this year, this was not a factor preventing the majority from capitalising on emerging growth sectors. Nearly one in five property investors (18 percent) indicated that they were most excited to pursue retail projects this year, followed by 17 percent targeting housing developments and 16 percent student accommodation.

From a lending standpoint, 52 percent

of commercial landlords, investors and developers felt that specialist lenders were best equipped to deal with their particular lending needs. Meanwhile, over two thirds (69 percent) of respondents anticipated the amount they would have borrow to support their investment strategy would rise in the next 12 months.

When focusing on a particular sector it can be easy to forget, or in some instances ignore, the impact of other types of finance that can support growth and help convert opportunities. One such form of finance that has long been instrumental for a range of businesses, for purposes ranging from debt consolidation to refurbishment projects and securing future premises –is bridging finance.

This facility can work hand in hand with commercial finance in a similar manner to how it is used across the buy-to-let sector. It can be an effective funding vehicle to help corporate, commercial customers and portfolio landlords snap up advantageously priced investment properties and trading premises within the tightest of time frames and impending deadlines before exiting onto a longer form of finance.

As highlighted in Together’s report, if the commercial market is going to be able to lock in the longer-term opportunities that are undoubtedly out there in both the residential and commercial property sectors, bridging finance will play a critical role in this journey – as will the support of a specialist packaging partner who has the ability to add real value in any commercial transaction. And, after operating in the commercial lending space for over 20 years, this is why we work so closely with so many introducers to deliver commercial and bridging solutions that can meet all their clients’ specialist needs and add real value to their businesses. M I

MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com 6 REVIEW MARKET

Donna Wells Managing director, Envelop

Bridging finance can play a critical role in helping the commercial market lock in longer-term opportunities

Clients and brokers value the right kind of help in this market

An adviser’s life is one that is rarely straightforward and comes with a lot of responsibility for the clients they help. After more than a decade of a sub-one-percent base rate, the past 18 months necessitated a pretty seismic shift for advisers.

Rate certainty became an assumption; fixing for two years or five came down more to how flexible borrowers felt they could be, given the potential for moving home or coming into money they wanted to use to pay down their mortgages.

Today, there are more nuanced questions for intermediaries faced with clients seeking advice. The base rate has risen steadily since December 2021 and has sat at 5.25 percent since August last year.

Markets are pricing in a small cut later this year, dependent on GDP, the inflation trajectory and the effect that a general election could have on the value of the pound. No small number of variables to consider and explain to clients who turn to brokers for insight and advice.

Price margins on mortgage rates have also been less consistent over the past two years, fluctuating more sensitively in relation to market confidence and external geopolitics. Product choice has risen to a 15-year high, according to Moneyfacts, and borrowers need to look more regularly at options to flex their term, loan-to-value and repayment plans.

A context such as this makes advice all the more important – especially

because the regulatory requirement to ensure good consumer outcomes under the Consumer Duty rules means a much broader scope for compliance.

In practice, what this means is understanding the borrower inside out and the full market range of propositions. Clients are understandably overwhelmed at the moment – fixing short-term gives certainty but could lock them into a higher rate than if they waited on a variable rate for nine months.

Fixing over five years might make a product more affordable than taking a two-year deal, but should there be a base rate cut in the next 12 months, that could mean paying considerably more interest.

Full-term fixed rates are also in the news and slowly becoming available –and are garnering public attention as media outlets and various politicians look to capitalise on supporting access to mortgage finance and thus homeownership in the run-up to the election.

Tens of thousands of borrowers are now on their lenders’ standard variable rates, paying over 8 percent based on Moneyfacts’ latest market average. There are those with plenty of equity split across two homes but whose affordability has been shot by the rise in mortgage rates since they last took a deal.

Mortgage advice is not about finding the cheapest rate and choosing between a five-year and two-year fix. It has always been about understanding the borrower and their needs and matching them with the most appropriate product. It’s increasingly more complex than that now. There’s a strong expectation from the Financial Conduct Authority that firms take extra care when advising and working with vulnerable customers under its Consumer Duty rules.

In a buoyant market, where it’s cheap to borrow and employment is high, fewer people fall into that bracket. In today’s market, simple mathematical dynamics have pulled a lot more borrowers into a vulnerable financial position. Firms must not just be on top of product and price; they must be thinking consistently about who clients are as people. That relationship has always been key – and it remains so, now more than ever.

So, while we know that the lot for a directly authorised firm is harder than it’s been for some time, we want to remind brokers that we are here to support them. As the world evolves, so do mortgage club propositions. Yes, we provide the support you would normally expect of a club, but, as part of LSL, we are able to offer more on a club basis when it comes to regulatory, educative and technological support. I suspect a lot of it is very welcome when you look at what firms are facing right now.

The market challenges facing firms underline my conviction that in today’s market, where every business could do with an extra pair of hands, having the support you need to hand when you need it is a compelling idea. M I

www.mortgageintroducer.com SPRING 2024 MORTGAGE INTRODUCER 7 REVIEW MARKET

Lisa Martin Development director, LSL Property Services

Firms must not only be on top of product and price but also think about who their clients are as people

Service aligned with speed can make all the difference

In a service context, speed is becoming ever more important and is a key differential for businesses that enables them to not only win and retain more customers but also achieve greater margins. This is true across industries and sectors, not just ours. In a study in 2022, Jay Baer, a customer experience and marketing expert, measured the impact of speed and responsiveness on customer experience and loyalty. Of the 1,900 consumers studied, the key findings included:

• 75 percent of customers have contacted or mentioned a business or brand and never received a response

• Two thirds of customers believe

that speed is as important as price

• 64 percent of customers say speed and responsiveness is as important as price when they decide where to make a purchase

• More than half of customers have appointed the first business to respond, even if it was more expensive

• More than anything else, customers hate having to contact a business two or more times

• Baby boomers are the least patient generation, and Gen Z is the most patient

We shouldn’t be surprised by the above findings, and there are parallels within our industry, especially as price differentials with constant rate fluctuations can be fleeting. So, maintaining constant competitiveness will always be about more than just price.

A good example of this is Atom bank, which was named best bank in the latest edition of Smart Money People’s Mortgage Lender

Benchmark. In November, the bank announced that over the previous four months, more than one in five applications had been approved on the same day, with over a third gaining approval the same or next day. The correlation between this performance and its subsequent ratings from the 790 mortgage brokers who provided our 3,666 reviews is clear.

However, Atom’s performance doesn’t appear to be the norm as, in our latest study, overall satisfaction with lenders slightly decreased by 0.5 percent to 82.9 percent. Building societies were once again the top-rated sector for broker satisfaction but were down 1.0 percent to 84.7 percent. Broker ratings of specialist lenders were down 2.4 percent to 79.6 percent, and for lifetime lenders ratings were up 3.4 percent, now at 83.6 percent.

This demonstrates that we may have plateaued a little in terms of service delivery improvement. But it also suggests there’s room for lenders to seek a competitive advantage as rates become more commoditised and similar across the different lending types and borrower profiles.

As highlighted in the above 2022 consumer study, lenders who fail to deliver a good customer–broker experience risk being left behind and with only one lever to pull – price – to obtain the business they need.

With mortgage rates steadily decreasing and more lenders mooted to enter the intermediary mortgage sector in 2024, if we feel the market is competitive now, we probably haven’t seen anything yet! Therefore, I expect to see more and more lenders investing in new technology and processes to improve their service delivery, and some of these new entrants will undoubtedly cite service as a key differentiator. Change is coming… M I

MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com 8 REVIEW MARKET

Jess Rushton Head of business development, Smart Money People

Lenders who fail to deliver a good customer–broker experience risk being left behind, a study suggests

What does the future hold for green mortgages?

GJoshua Downes Content editor, The London Institute of Banking & Finance (LIBF)

GJoshua Downes Content editor, The London Institute of Banking & Finance (LIBF)

reen mortgages have been touted as a way to help homeowners prepare for a greener future, while allowing banks and financial institutions to boost their green credentials. But just how effective have these products been so far? And what can green-minded mortgage advisers do to play their part in reaching Net Zero?

LIBF spoke to Rachael Hunnisett, green mortgage campaign lead at the Green Finance Institute, about the current state of the market and what we can expect to see in the coming years.

THE RISE OF GREEN MORTGAGES

The UK has one of the oldest housing stocks in Europe. According to a Lloyds report, Decarbonising the UK’s Homes, Britain’s 28 million residential properties produce 16% of the UK’s total carbon emissions. This makes housing a significant consideration for the UK’s climate change ambitions.

“The climate change committee has estimated that £250 billion needs to be invested in upgrading UK housing stock to meet the UK’s 2050 Net Zero legally binding target,” says Hunnisett. “Not all of that can come from the government; a large portion will need to be provided by the private sector. Green mortgages are one of many financial solutions that seek to meet this funding gap.

“As well as lenders’ own ESG targets, it’s likely that a significant share of most lenders’ Scope 3 emissions are held within their mortgage portfolio. Essentially, they are unlikely to be able to decarbonise their business without

dealing with the carbon emissions on their back book.”

Banks and lenders appear to be taking up the mantle: at the time of writing, there are 61 different products from 38 lenders, up from just four in 2019.

“The first-tier products incentivise through rate or product features,” says Hunnisett. These products include Halifax’s Green Living Reward, which offers mortgage holders cashback on several green home improvements, including heat pumps (£1,000), solar panels (£500) and triple glazing (£500). Meanwhile, those with a Lloyds mortgage may qualify for its Eco Home Reward, which offers £1,000 cashback to cut the cost of a heat pump.

But Hunnisett believes the biggest growth area in 2024 will be the second tier of products, which incentivise purchasing decisions by offering enhanced affordability. For example, Leeds Building Society will offer additional lending for those buying an already energy-efficient home.

While lenders have been upping their offering of green mortgage products, the reception from house buyers appears to have been somewhat lukewarm. It’s been reported that just 0.4% of UK lending falls under the banner of green mortgages. However, Hunnisett emphasises that it’s early days yet.

“We’re in a nascent stage of the market,” she explains. “The shift to decarbonised housing stock won’t happen overnight. Sustainable, scalable growth will ensure homeowners have access to finance while achieving their home-upgrade ambitions.”

WHAT CAN ADVISERS DO?

Despite the relatively slow start to the green mortgage market, the Lloyds report revealed that most UK homeowners are keen to decarbonise their properties. However, they feel they need more support to do this.

So, how do mortgage advisers point them in the right direction? Hunnisett recommends caution.

“Advisers need to be careful about encouraging customers to spend money on retrofitting,” she says. “It’s more appropriate for them to direct them to a qualified retrofit assessor, get a home survey done, help the customer understand what work may need to be carried out, then arrange the finance.

“They don’t have to become experts on construction or solar panels or batteries. Instead, they need to have a really deep understanding of what finance products are available to their customers, rather than recommending specific tech, like heat pumps or solar panels, which may not be right for that customer or their property”.

And prioritisation of any work will be a factor to consider, which will be different for each customer, based on what the home survey says as well as the costs and affordability of any work.

“Advisers [will also] need to be aware of compliance in relation to Consumer Duty and the FCA’s anti-greenwashing rules coming into force later this year,” Hunnisett says.

AN EVOLVING MARKET

Green mortgages may not be seeing huge demand, but the market is still young, and Hunnisett believes things may evolve quickly.

“Where green mortgages are today, I don’t believe is where they’ll be in two years’ time. It’s an emerging market which will require significant adaptation at all levels, from the mortgage advice process to product design and pricing,” she says.

“Understanding how to support your customers in achieving their financial goals while maximising the opportunity to support the UK in reaching Net Zero is an exciting way for mortgage advisers to move their businesses forward.” M I

www.mortgageintroducer.com SPRING 2024 MORTGAGE INTRODUCER 9 REVIEW ADVICE

THIS WOMAN’S WORK

She may have been thwarted (so far) in her dream of becoming an iconic pop star, but Sarah Tucker is, without doubt, an industry icon, following the success of her female brokerage, The Mortgage Mum. Simon Meadows hears

how she swapped chasing record deals for mortgage deals

“I SAW very few female brokers around me,” says Sarah Tucker, co-founder and managing director of The Mortgage Mum, reflecting on her early experience of the industry. “The women that I could see were having to work like male brokers. So they were working long hours, evenings and weekends.

“They were doing late-night appointments, they were going round to people’s homes in different areas, and I felt very vulnerable at the idea of having to go to strangers’ houses. Suited and booted, they were having to play the corporate game to advance their careers, which I greatly admired, but I didn’t see anyone like me, anywhere.”

The business model for The Mortgage Mum was born out of Tucker’s own needs; it was designed to reflect her lifestyle as a new mother who didn’t want to be office-based, who needed to do school runs and couldn’t easily work all hours, as brokers often did.

A female-led brokerage with a nationwide reach, it’s resourced entirely with self-employed women, all advising remotely under its striking, high-profile brand, and some of whom – but not all –are mothers.

“It’s a very uplifting, safe space for a female broker to thrive, with a group of women who support each other,” Tucker says. “You’re being managed very differently as a woman in this space, compared to working in a predominantly male-dominated business. We notice that really helps people to do well, and it’s a great foundation for any working woman. We have a lot of empathy with our clients, leading to a deeper, hopefully

lifetime connection with them, and the focus is on the quality, not the quantity, of our work.”

THE IMPORTANCE OF WORKING REMOTELY

Today, 30 brokers work at The Mortgage Mum from home, collectively writing mortgages worth £200 million in lending a year, according to its 2023 figures. Its nurturing proposition offers the women an in-house support team, including a wellbeing coach.

“I’ve always wanted to be a national brand, with women all over the UK flexibly working, working brilliantly and

from home, conducting meetings online. “I was part of self-development groups that were doing things on Zoom, and I was so connected to these people, whom I never met,” she explains.

“I used to think, this is crazy. I could do this with a client and connect with them just as easily as if I was in their house, maybe better, because the idea of sitting in front of someone made me incredibly anxious when I was a new broker, and anxiety can be a massive blocker for connection. I knew it worked because my life was changed by these sessions with performance coaches.”

She confides: “I also took meetings

“If you want something done, ask the busiest person in the room. Mums are generally the busiest people; we’re juggling loads of things”

making a difference,” says Tucker, “and a beacon for education as well, whether that’s learning how to be a broker, or learning about mortgages and the basics of finance, and taking this into schools, which we do.”

Tucker became a broker in 2015, trained in the evenings by Graham Sayer –a one-man band who was her mortgage broker at the time – while she held down an office role in London, alongside caring for her 18-month-old daughter, Sienna. From 2017, Tucker worked for Jamie Lewis as part of his Southendon-Sea brokerage, Affinity Mortgages. She told Lewis that she wanted to work

online because when I was getting a mortgage, I hated my broker coming round. I used to think, oh God, I can’t wear my pyjamas tonight and sit and chill after dinner. I’m going to have to look smart and keep my make-up on for longer. I would have loved them to just do a Zoom call or a phone call with me and just let me live my life.”

STRUCTURING WORK AROUND MATERNAL RESPONSIBILITIES

Crucially, when Tucker became a mother, this remote, online approach enabled her to work around her maternal responsibilities. It also shrewdly foresaw the home working

10 MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com COVER INDUSTRY ICON

PROFILE

Name: Sarah Tucker

Company: The Mortgage Mum

Age: 35

Children: 3

Years in the industry: 5

Other roles: Mortgage expert on ITV’s This Morning

Interests: Singing, wellbeing, spirituality

Claim to fame: Tucker appeared on ITV’s The Voice, coached by Jennifer Hudson

that would become standard for millions of people during the pandemic years.

“I felt much more comfortable on a screen, with that separation of being in my own space,” Tucker recalls. “I felt that if people knew they could work like me, they would come into the industry and do it.”

Tucker quickly established a pipeline of work and a Facebook following of mums, who recommended her to each other.

The turning point in properly establishing what would become The Mortgage Mum was Tucker’s appearance on the ITV singing competition, The Voice. Here, inspired by her favourite iconic female singers, Mariah Carey, Celine Dion and Whitney Houston, Tucker would sow the seeds of her own iconic profile in the mortgage industry.

Tucker had long harboured an ambition to become a pop star. To understand how deeply that ambition burned, you have to look back to her early years growing up in Hockley in Essex as part of a close family.

“We didn’t have money throughout my childhood, until I was much older,” Tucker says. “Mum worked for schools, budgeting accounts, and taught me all

I know about budgeting and doing spreadsheets and putting money in different pockets, in different places. My dad was a trader in the city, working on a LIFFE [London International Financial Futures and Options Exchange] floor, wearing his red jacket. I saw him take risks and his career go from strength to strength. He never stopped working towards his dream.

“We came home one day, and he threw a load of money from the top of the stairs to show us that he’d got a bonus of £100,000. So, that rags to riches story probably influenced me quite a bit. I saw that play out and knew what was possible if you worked hard.

“My parents used to jump houses, make

Despite panic attacks at the prospect of singing publicly and having to seek hypnosis to calm her nerves, Tucker attended multiple auditions for ITV’s The X Factor in her 20s, only to be let down time and again.

Heeding her parents’ advice to turn her back on the cut-throat show business machine, she focused instead on her day-to-day work in administration. While working as a recruiter, she was tasked with filling an admin vacancy at a mortgage broker – and she put herself forward instead. Her successful application introduced her to the industry.

“All the while I had this gut feeling I’m meant to sing on a TV show one day,” Tucker shares. “Even if it’s just one

“I wanted someone to take me under their wing, see the potential in me and make me what I’m able to be… I’d never teach that to my daughter now”

their money and then jump to another property, so they’re entrepreneurial in that sense – it was admirable. I think I moved 13 times with my parents, and the houses got better with each move. It definitely gave me a keen interest in property as a consumer.”

CHASING A DREAM... LED TO SOMETHING ELSE ENTIRELY

Whenever her parents were away from home, Tucker would secretly practise singing.

“I had this pipe dream,” she remembers. “You heard these stories of people being discovered on the streets of London and then they’re a pop star. I was living in a dream world. I used to think that everything would just happen, like a Disney movie, and I would be the star of it.

“I wanted someone to take me under their wing, see the potential in me and make me what I’m able to be, but I’d never teach that to my daughter now. I teach her that she has her own power, and you don’t wait for someone to take you under their wing. You go out there and get it.”

time, I’m supposed to do that as part of my journey.”

In Tucker’s early 30s, just as she was finding her feet as a broker, she attended a session of Reiki (the Japanese form of energy healing). The practitioner picked up on something around her throat and urged her to try singing again.

Tucker applied to The Voice and made it through to the televised heats, in front of a huge studio audience –including her husband, children and parents, all willing her on.

“There I was about to sing in front of the celebrity coaches,” she reminisces. “I was sitting on the side of the stage thinking, this is it, this is the moment that I’ve been waiting for all of this time. I couldn’t get on the stage for ages – it was like jumping out of a plane.”

By the end of the song, all four coaches turned their big, red chairs to face her –the show’s signature seal of approval for her truly astonishing vocal performance.

“The lights came up, everyone’s going crazy, and my daughter’s watching. She understood the whole thing, that you have

12 MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com COVER INDUSTRY ICON

Tucker with her family

got to believe in yourself,” Tucker reflects.

MAKING MAXIMUM USE OF A HIGH PROFILE TO BOOST YOUR BUSINESS

Tucker didn’t win the show, but she was rewarded with new-found confidence.

“The Mortgage Mum was born there, because I walked off that stage a very different version of myself,” she says. “I thought, OK, I can make things happen that I really want to happen. I just felt amazing. It’s the happiest I’ve ever felt in my life.”

Together with Jamie Lewis, co-founder of The Mortgage Mum, she moved fast to market the business while her prime time television profile remained high.

“Of course I wanted a record deal, that was my dream,” she says. “But I didn’t want to waste this. I wanted to do something where we could help other women become brokers, with me as the face of it. I had a profile; women were watching and following me and interested in the fact that I was a mum and I was a mortgage broker.”

It’s been hard to miss The Mortgage Mum since it emerged in the intermediary market in 2019 – the brightly marketed enterprise, of which Tucker is the recognisable figurehead.

“Men would underestimate me and say, ‘Oh, you make things nice and pretty, don’t you?’ That really annoyed me,” she explains. “There was nothing I could do about it because I hadn’t got any success to show them. So I’d think, just keep doing what you’re doing, and they’ll see it.”

Some grumbled that the premise of The Mortgage Mum was sexist.

“My answer to the men who said that was, ‘Look, I’m not trying to get rid of you. I want us to stand together in this amazing space. But right now, these women have challenges that other businesses aren’t meeting, so we have to be here until that’s ready, and one day maybe we don’t need to be called The Mortgage Mum; one day, maybe this can have men in it too’.”

She adds, “I don’t necessarily think that’s our USP any more, even though it is quite clearly a feminine brand. Interestingly, a lot of my allies in the

industry are men.”

How would Tucker feel if someone set up a rival business called The Mortgage Dad?

“I’ve already bought the name and website for The Mortgage Dad!” she confirms. “It’s something that I’ve always said would happen eventually, but I don’t know.”

PROVING YOU CAN BE A SUCCESSFUL BUSINESSWOMAN AND A MUM

The original Mortgage Mum has recently resumed work following maternity leave to have her third baby. From a swish, newly built office in her home garden, she advises a mixed client base of women and men, while also making appearances on ITV’s This Morning as its mortgage expert.

“I took 10 months off,” Tucker states, “and I was told many times, ‘as a managing director you’ll never be able to do that, not in this market, not from that business – they need you’. I’ve come back with the clearest perspective.

“There’s a phrase, ‘if you want something done, ask the busiest person in the room’. Mums are generally the busiest people; we’re juggling loads of things.”

Is she a workaholic? “No,” Tucker replies. “I was. It’s reset my schedule.” This enables her time to do what she loves outside of work; simple things, she says, like playing board games with her children, going for walks and indulging her spiritual side – her interest in crystals and healing.

Work remains important, though, and she’s returned to a market that, she believes, is calming.

“It’s definitely been a hard market for sure,” Tucker says. “The hardest ever time to be a broker, I would have said, other than back in the credit crunch days. This year is stable and about getting everything lined up ready for an influx of business next year, which I think will be amazing.

“For me, it’s all about taking market share, and making sure that you’re on top of your game, ready for things to shift. Having a clear vision and mission is key. Without this, you can lose your way, and this is the purpose behind it all. If you don’t have that, you can

THE MORTGAGE MUM UP CLOSE

Founders: Sarah Tucker, Jamie Lewis

Founded: 2019

USP:

All-female brokerage

Number of brokers: 30

Number of lenders worked with: Over 50

Value of lending overseen: £200m in 2023

Website users: Over 6,200 monthly

Ethos: More than a mortgage broking firm, it’s a movement

really get lost in the process.”

Does Tucker believe The Mortgage Mum is taken more seriously now?

“Yes,” she answers. “When we started, networks weren’t interested in us at all. Now networks are trying to get us every day. We had a five- to 10-year plan, and we are definitely on track for that. I want to grow the business and scale it beyond what it is, so that everyone knows us.

“My biggest lesson in business has been to take small steps. Sometimes it can feel like you’re not getting to where you want to be, or worse, that you’re not progressing at all. But my story has been a series of small steps and small decisions that have led to the greater ones.”

Tucker sums up: “Now I see that the success of one huge milestone in my life isn’t down to one big thing but a million little ones … And, whilst that sounds like a cliché, it is completely and utterly true and propels me to keep taking steps towards my next goals.” M I

www.mortgageintroducer.com SPRING 2024 MORTGAGE INTRODUCER 13

SCAN TO LEARN MORE www.mpamag.com/uk The champion of the mortgage professional, covering the latest news and updates within the world of mortgage management • Interviews with the biggest names in the industry • Best-practice profiles and case studies • Special reports and industry rankings •Business strategy content • Premium content

MORTGAGE INTRODUCER Champion of the Mortgage Professional SPECIAL REPORT The UK’s best women mortgage leaders are charting new paths forward with impressive displays of courage and conviction CONTENTS Feature article ..................................................................... 16 Methodology 17 Elite Women 2024 19 www.mortgageintroducer.com SPRING 2024 MORTGAGE INTRODUCER 15 2024

DRIVERS OF CHANGE

THROUGH THEIR expertise and passion, Mortgage Introducer’s Elite Women of 2024 demonstrate that female leaders in the mortgage industry are breaking gender barriers and achieving their goals.

MI’s data reveals that the winners have risen through the ranks in the UK’s financial sector, with 58% now holding roles at director and senior management level. That represents a 23% increase in female executive representation over the past two years, a testament to the Elite Women’s success and drive to positively affect progress and change.

ELITE WOMEN BY JOB TITLE

Women in Mortgages UK founder and Imogen Finance owner Kate Fuller highlights the attributes that anchor excellence in the 2024 Elite Women:

• boosting visibility through event participation and networking

• adopting a customer-centric approach

• demonstrating comprehensive industry and product knowledge

• mastering soft skills

• contributing to the community through mentoring and community involvement

“You need to be willing to put your head up and be noticed and recognised for doing well within your area,” she says. “Ultimately, your efforts should lead back to delivering the best customer experience.”

Talent and passion at the heart of the UK’s best female mortgage leaders

Karen Rodrigues – Market Financial Solutions

Winning the Woman of Influence award once is an accomplishment, but for three-time winner Rodrigues it affirms a lasting legacy.

“For me, it’s about giving back and adding value,” she says. “I want to be judged by my peers, whether male or female, and I think it’s massively important that we shout out women.”

In January 2023, Rodrigues was promoted to head of sales at Market Financial Solutions. Her problem-solving skills and solutions-oriented mindset shone as she evaluated and restructured the bridging finance provider’s teams to perform at their peak.

“It’s been great for me because I’ve been able to identify where the gaps were in knowledge or skill set, and everybody I’ve brought into the team has come with something to fill those gaps,” she says.

In her earlier role as the company’s national account manager, Rodrigues launched a national account proposition and negotiated large contracts with various networks and clubs while increasing brand awareness.

Her notable achievements and industry contributions include the following:

MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com 16 ELITE WOMEN 2024 SPECIAL REPORT

Executive or senior management

Middle management

First-level management

7 24 20 4 7

Intermediate or experienced (senior staff)

“The goal isn’t to make a sale but to make a difference. It’s about building relationships and making a difference, whether it’s the broker or the consumer”

Karen Rodrigues, Market Financial Solutions

• implementing anonymised CVs to eliminate bias as a member of the Diversity and Inclusivity Finance Forum

• earning Level 5 coach certification

• serving as a long-standing primary school governor

Inspired by the central theme of the movie Dead Poets Society – carpe diem, or seize the day – Rodrigues strives to make a positive difference in everything she does.

“That’s been my mantra: go for it, and get what you can out of the day,” she says.

Andrea Glasgow – Hampshire Trust Bank

This Elite Woman’s ascension in the mortgage industry has been nothing short of remarkable since she started out as a cashier in retail banking 18 years ago. After receiving several rapid promotions, culminating in her July 2023 appointment as sales director of specialist mortgages at Hampshire Trust Bank, Glasgow has

METHODOLOGY

Mortgage Introducer invited industry professionals from across the UK to nominate exceptional female role models for the third annual Elite Women list. Nominees had to be working in a role that related to, interacted with or in some way impacted the industry, and should have demonstrated a clear passion for their work.

Nominators were asked to describe the nominee’s standout professional achievements over the past 12 months, their initiatives and innovations, and their contributions to the mortgage industry.

After a thorough review of all the nominations, the Mortgage Introducer team narrowed down the list to the final 55 Elite Women who have made their mark in the industry.

INSIGHTS

As part of our editorial process, Key Media’s researchers interviewed the subject matter expert below for an independent analysis of this report and its findings.

Kate Fuller Founder, Women in Mortgages UK; Owner, Imogen Finance

Kate Fuller Founder, Women in Mortgages UK; Owner, Imogen Finance

solidified her status as a trailblazer within the company and industry.

“My concern is that if we don’t do more to push the industry forward, it will revert to what it used to be, and we don’t want that,” she says. “We’ve done so much work to get where we are as females, so let’s continue that.”

Glasgow has assembled a team of business development managers who have risen to diverse industry challenges under her leadership. Her dedication to gender diversity has resulted in five new female BDMs on her team, achieving a balance of 50% female representation.

“I don’t think there’s anything more rewarding than seeing the team grow into their own and find their feet; seeing them smiling is a reward in itself, especially after the tough market last year,” she says. “If I can manage a team in that market and troublesome times, 2024 should be a breeze.”

Highlighted among her numerous accomplishments are the following:

• fostering an inclusive work culture that promotes gender equity and equality

• pla ying an instrumental role in Hampshire Trust Bank’s sponsorship of Mortgage Introducer’s Women of Distinction award

• dedicating efforts to raise awareness of and funds for several charities, including £2,799 for the St Barnabas Hospice 25km Midnight Walk

Guided by the philosophy that you can’t grow if you don’t know, Glasgow encourages her team to share their expectations of her as a leader.

She says, “I like feedback, but I thrive on negative feedback about myself because it’s a challenge to change something and make it better. If it’s done in the right way and at the right time, it can be so powerful.”

Confidence leads to standout performance

The Elite Women of 2024 have developed novel approaches and strategies, enabling them to reach the pinnacle of success, overcome hurdles and inspire others.

Confidence, states industry expert Fuller, is an attribute underpinning the ability to stand out.

“It’s important and can be difficult to develop, and imposter syndrome is real,” she says. “Learn as much as you can to become experts in your field. Don’t be afraid to speak out, ask questions and join groups that support and empower women.”

www.mortgageintroducer.com SPRING 2024 MORTGAGE INTRODUCER 17

More than 31 years 5%

26–30 years 9%

21–25 years 14%

16–20 years

priority, and I need to ensure that we’re all delivering and doing a good job while also making sure they are enjoying it, and if they’re not, why not?”

Less than 10 years 25%

10–15 years

“I’m nothing without my team, and my destiny to be successful is in the palm of their hands”

Andrea Glasgow, Hampshire Trust Bank

The focus on curiosity resonates with Glasgow, who never hesitates to ask about something she is unsure of. Other strategies that have also served her well are:

• prioritising relationship-building

• emphasising solutions

• treating others as she wants to be treated

“You don’t need to overcomplicate things, and that’s what I’ve lived for for 18 years now,” she says. “I breathe that into my team every day. Build those relationships, and you

will know who supports you, and you will support them in return.”

Fellow top mortgage leader Rodrigues strives to stay positive through challenging times, adopting the following strategies:

• leading from the front

• prioritising open and honest communication

• promoting an open-door policy

“I roll up my sleeves and get my hands dirty,” she says. “My team is my number-one

Acknowledging the importance of attracting women and aspiring young mortgage leaders to choose a career in the industry, both Elite Women devote their time to various supporting endeavours, including school career days, speaking at public forums and appearing on panels.

Of 2024’s Elite Women who responded to whether they believe the industry has made strides in gender equity and equality, 65% said yes. However, they also point out that there is still a lack of role models for younger women, as evidenced by these comments:

• “Although it’s improving, there is an age and gender gap. The mortgage and financial services industries are ageing, and we must unite various people to make them more attractive to the younger generation”

• “In my experience, it’s not just my gender but also my status as an immigrant female that has made it challenging to achieve more in my career”

• “ There is a definite shift in the right direction, but until I attend an awards ceremony and there are fewer black ties and more dresses, there won’t be enough”

• “It is imperative that we work towards a more inclusive and supportive environment where women’s experiences and accomplishments in leadership are openly acknowledged and celebrated to inspire the next generation”

The significant impact that Elite Women can have on the future is reflected in one winner’s response: “I have achieved everything I wanted to in my current company. It could be due to the leadership of an amazing female CEO. But I know many women in the industry who feel they have been overlooked for positions they deserved.”

MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com 18 ELITE WOMEN 2024 SPECIAL REPORT

ELITE WOMEN BY YEARS IN THE INDUSTRY

19%

28%

Andrea Glasgow

Sales Director, Hampshire Trust Bank

Phone: 07498 132 388

Email: Andrea.Glasgow@htb.co.uk

Website: htb.co.uk

Karen Rodrigues

Head of Sales, Market Financial Solutions

Phone: 07377 435 790

Email: karen@mfsuk.com

Website: mfsuk.com

Alison Houghton-Corfield National Relationship Director, Master Private Finance

Amy Crighton Partner, CG&Co

Carolyn Thornley-Yates

Head of Commercial Development and Distribution, Stafford Railway Building Society

Charlotte Harrison

Chief Executive Officer – Home Financing, Skipton Building Society

Chloe Timperley

Senior Policy Adviser, The Association of Mortgage Intermediaries

Claire Cherrington

Head of Strategic and Technology Partnerships, Lloyds Banking Group

Clare Beardmore

Director, Mortgage Club, Legal & General

Cloe Atkinson

Chief Operating Officer, Mortgage Brain

Elise Coole

Managing Director, Keystone Property Finance

Eloise Hall

Head of National Accounts, Kensington Mortgages

Emma Roberts

Head of Intermediary Relationships, Connect For Intermediaries

2024

Emma Smith

Sales and Operations Manager, Clever Mortgages

Esther Dijkstra

Managing Director, Intermediaries, Lloyds Banking Group

Francesca James Analytics Manager, The Mortgage Brain

Gemma Cuff Director, Gemstone Mortgages

Hannah Bashford

Experienced, Impartial Mortgage and Protection Adviser and Owner, Model Financial Solutions

Hazel Johnston

Market Development Manager, Legal & General

Helen Carter

Head of Channel Engagement, Barclays

Jess Rushton

Head of Business Development, Smart Money People

Jo Carrasco

Business Partnerships Director, Stonebridge

Joanne Hollins

Head of Intermediary Mortgage Distribution, Metro Bank (UK)

Kate Burns

Mortgage and Protection Consultant, KB Mortgage Services

Kate Cowan

Chief Financial Officer, Hope Capital

Kate Davies

Executive Director, IMLA – The Intermediary Mortgage Lenders Association

Kelly Pallister

Managing Director, Operations, Foundation Home Loans

Kharla Mullen

Chief Operating Officer, Countrywide

www.mortgageintroducer.com SPRING 2024 MORTGAGE INTRODUCER 19

Leoni Alexandrou

Chief Operations Officer, Karis Capital UK

Lesley Cappellaro

Intermediary Regional Manager – West and North, Barclays

Lesley Sharkey Recruitment Director, Stonebridge

Lisa Stones Operations Director, Mortgage 1st

Liz Syms

Founder and Chief Executive Officer, Connect For Intermediaries

Louisa Sedgwick

Commercial Director, Paragon Banking Group

Louise Evans

Head of Operations, TMA Club

Maeve Ward

Director of Commercial Operations, Central Trust and Mercantile Trust

Megha Srivastava

National Account Manager, Twenty7tec

Melanie Spencer

Business Partnership and Growth Director, One Mortgage System

Miranda Khadr

Founder, Provide Finance and Yellow Stone Finance

Morgan Vinten Product Manager, Acre

Nicola Gauntlett

Senior Mortgage Specialist, Plus Financial Group

Nicola Goldie

Head of Strategic Partnerships and Growth, Aldermore Bank

2024

Rachel Edwards

Senior Policy Adviser, The Association of Mortgage Intermediaries

Rachel McGovern

Director of Financial Services, Brokers Ireland

Rebecca Shuttle

Principal Owner and Mortgage and Protection Broker, MIMA Mortgage and Protection Advice

Roz Cawood Managing Director, Property Finance, StreamBank

Sabinder Robinson-Sandhu Director of Operations, Avamore Capital

Sarah Butler

Head of Marketing and Communications, Hope Capital

Stacey Elizabeth Hoile Managing Director, Engage Financial Solutions

Stacy Penn

Senior Policy Adviser, The Association of Mortgage Intermediaries

Tanya Elmaz

Director of Intermediary Sales – Commercial and Personal Finance, Together

Toni Smith

Chief Distribution Officer, PRIMIS Mortgage Network

Tracie Burton

Senior Corporate Account Manager, HSBC

Uliana Kuzmis

Deputy Managing Director, Development Finance, Hampshire Trust Bank

Vikki Jefferies

Proposition Director, PRIMIS Mortgage Network

MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com 20 ELITE WOMEN 2024 SPECIAL REPORT

We keep you in the driving seat

To make it easier to ensure every client has the right protection for their property, you can now ask us to give your client advice about their insurance over the phone or you can invite your client to get a quote from us online. Whichever route your client chooses, you can easily keep track of their journey in Adviser Hub - all thanks to our transparent referral service.

paymentshield.co.uk/referral

For intermediary use only. Paymentshield and the Shield logo are registered trademarks of Paymentshield Limited. Authorised and regulated by the Financial Conduct Authority. © Paymentshield Limited 02/24 0270.

REFERRAL

FINDOUT MOR E

WITH OUR

SERVICE Stronger

Long live life!

An expanding later life market offers rich opportunities for brokers and their clients. Family Building Society’s Paul Roberts explains

WITH MANY OF us living to a greater age, the later life lending market continues to grow, and more customers are seeking help to realise their goals. Family Building Society believes that the intermediary community has a key role to play in supporting this growing market.

Borrowers may want to free up some equity to make the most of their retirement years, for example, or perhaps assist loved ones who are seeking to get onto the property ladder.

The intergenerational lender encourages advisers to embrace what is becoming an increasingly dynamic market, rich in opportunity, and to immerse themselves in its offering for older customers.

“We are all living longer – that means more consumers will need support,” says Paul Roberts, Family Building Society’s senior account director. “I think further enhancements to products and criteria will be developed and brought to market, especially by the lenders in this area.”

RESPONSIBLE

Family Building Society is the UK’s 11th largest building society, with over £2.2 billion in assets and more than 60,000 members. Its reputation for responsible lending stretches back across many generations in its long history, going back further than even its eldest customers today. Established as the National Counties Building Society in 1896 and assuming its ‘Family’ name from 2014, it supports customers across the age spectrum.

“We help customers onto the property

ladder, and to continue their journey up that ladder,” Roberts explains, “and in later life we continue to support them with mortgages to stay in those homes, downsize, make home improvements or help their children buy their first property.

“What stands us apart from the majority of lenders is our ability in particular to lend to clients past the age of 70–75 right the way up to 95. We do this by not credit scoring our lending. Each case is looked at on individual merit by our experienced underwriters, supported by our BDMs who invariably pre-discuss the case with the mortgage broker.”

He continues: “We support this underwriting approach with flexible lending criteria, and this includes how we assess income in later life. We are particularly helpful when assessing customers’ pensions and investments for use with affordability. We can create an income from them without the need for the applicant to be specifically drawing from them.

“This can be really helpful for customers with drawdown pensions, SIPPs [self-invested payment pensions], SSASs [small self-administered schemes] and lump-sum investments. It can make a significant difference when deciding if a case is affordable or not for the customers.”

EFFECTIVE

The building society offers Joint Borrower Sole Proprietor (JBSP) mortgages, which are an effective way of helping younger borrowers to get onto or up the property ladder with their parents’ assistance, while

retaining the property in their names.

“The fact we can offer these longer terms for older borrowers often means the monthly cost for the younger borrower is more manageable in those earlier years of the mortgage,” says Roberts.

He suggests that both brokers and consumers would benefit from greater awareness of the options available, because many don’t realise that they can get a mortgage past the age of 70.

“To be honest, I still think there is much more to do to educate both brokers and consumers in the later life arena,” Roberts

22 MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com SPECIAL PROMOTIONAL FEATURE INTERVIEW

says. “I still find brokers and consumers are surprised they can obtain a standard mortgage at such a late time in life. Many, I think, still believe they only have equity release as an option, but gradually we and other providers are changing that.

“Ninety-five percent of all the mortgages we do are via the broker community. We actively seek relationships with them and have now got coverage all over England and Wales with either a physical or telephone BDM.”

Casting his eye across the current market, Roberts is optimistic.

“Whilst purchase business slowed in 2023, we are starting to see some green shoots early in 2024,” he says. “In 2023, the market was dominated by product transfers and remortgages. The cost-ofliving crisis is a challenge widely seen across the industry, and the later life sector is not immune to it.

“Despite the evident growth of the later life lending market, it has faced its challenges in recent months, in common with many sectors of the industry. The one thing that has affected some of the scenarios we see has been the affordability – it is tighter. We have to be reasonable and cautious with our members’ deposits, to ensure that mortgage payments are as affordable now as they will be in the future.”

KNOWLEDGE

Roberts has spent 35 years in financial services and joined Family Building Society in 2015.

“I have worked with mortgage brokers, packagers, clubs and networks for the best part of 25 years, and they have helped me build up both a wealth of knowledge and support,” he says.

“My role involves me working with them in a large part of the north of England, along with working closely with colleagues in head office to deliver the society’s objectives. I provide insight into the market for our head of distribution from up here in Yorkshire, and work closely with our directors of lending to ensure the lending we provide is of good quality.”

Looking ahead, Roberts says: “Every

“The later life market is evolving and will continue to grow and evolve in the coming years as we all live longer”

PAUL ROBERTS, FAMILY BUILDING SOCIETY

day is a new challenge even after all these years in this industry. The later life market is evolving and will continue to grow and evolve in the coming years as we all live longer.

“Helping brokers and customers achieve the outcomes they need still gives me a real sense of reward. The range of options now open to later life clients is so much better than even five to 10 years ago, and I’m pleased Family Building Society is playing a significant role in the development of

product and criteria in this market.

“I know that even if I cannot help on a specific case, I can usually suggest another lender who will. The industry roadshows we all attend around the country are great places to pick up even more knowledge.”

What would Family Building Society’s message be to brokers about the later life lending market and working with the lender?

“Talk to us,” Roberts urges. “Simple as that.” M I

www.mortgageintroducer.com SPRING 2024 MORTGAGE INTRODUCER 23

Paul Roberts

Why age is all the rage

As a rapidly growing market, later life lending offers opportunities for lenders, advisers and customers. Mortgage Introducer’s latest roundtable debate explores a dynamic sector

IT USED to be said that people who lived a long time could expect to reach their ‘three score and ten’. Seventy was seen as the ballpark figure for those who enjoyed a longer life – and, indeed, there were many who, sadly, did not make this milestone age. But the general advancements in science and medicine mean that many of us can expect to live longer and celebrate more birthdays – potentially more than our grandparents and, quite possibly, our parents.

Life expectancy has increased in the UK over the last 40 years, albeit at a slower pace in the past decade. Interestingly, the most common age at death from 2018 to 2020 was 86.7 years for males and 89.3 years for females, the Office for National Statistics has reported.

Of course, an extended life expectancy, while welcome, presents additional considerations, be it for ourselves and how we might wish to spend those additional years to our fullest – or how we might want to assist those closest to us in our senior years by using our property wealth to make their lives easier.

This is why the later life lending market is evolving to become an ever-

more-dynamic space for lenders, intermediaries and their clients. From traditional mortgages to equity release and RIOs (retirement interest-only mortgages), there are a multitude of options for the over 55s to consider.

It can be a veritable minefield for brokers and consumers exploring the later life lending space for the first time. So, to gain a better understanding of the market currently and the challenges it faces, Mortgage Introducer, in association with Family Building Society, brought together three highly knowledgeable industry professionals for what proved to be an insightful and inspiring discussion.

Participants were Darren Deacon, head of intermediary sales at Family Building Society; Richard Merrett, managing

director at broker Alexander Hall; and Greg Cunnington, COO of mortgage brokerage LDN Finance.

“At Family Building Society, we do a lot of intergenerational lending and very much see ourselves as a later life specialist,” said Deacon, “supporting a group that we feel is underserved –the over 55s. We are bridging that gap between a high street lender and equity release, and provide an alternative to that. We are a bespoke underwriter you can talk with, taking sensible lending decisions and coming to the right solution for the customer.”

‘BANK OF FAMILY’ SUPPORT

Merrett said the later life market is a relatively small part of the work done by

“There’s a ticking time bomb that needs to be addressed. Customers are getting older and will need a solution, so there’s a lot to be done”

DARREN DEACON, FAMILY BUILDING SOCIETY

MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com 24 ROUNDTABLE

intermediaries.familybuildingsociety.co.uk LATER LIFE LENDING

FLEXIBLE SOLUTIONS FOR LATER LIFE LENDING

Alexander Hall, which is part of Foxtons Group, but added, “It’s strategically very, very important to what we do because our core business is definitely driven by first-time buyers and home movers, and over the last chunk of time, that area of the market has seen a massive reliance on the ‘bank of family’. Being able to offer solutions to customers who are providing deposits for family members is crucial to our core business.”

At LDN Finance, Cunnington said, the majority of the brokerage’s business is mortgages.“We also do a lot of specialist lending, so bridging and commercial development, and HNW financing.

“One gap we had was in the later life space. So last year we set up our laterlife lending department, which looks to holistically advise for later life mortgages, RIOs and equity release. That has become quite a prominent part of the business.”

The experts gave their appraisal of the later life space.

“It’s a misunderstood area of the market,” said Deacon, who suggested more awareness was needed in the broker community of the available options, beyond the main high street lenders.

“We would encourage them to develop their understanding of the later life market and reach out to one of our BDMs who will be able to guide them through the options that we have.”

He continued: “People in their late 50s, into their 60s, want to live their lives differently to their own parents. They’ve got other needs and wants. They want to live their life and benefit themselves by using the value in their property, perhaps, or they want to benefit other members of the family.

“Parents, and indeed grandparents, help their other family members get onto the housing ladder. But that aside,

people are working longer, it’s an ageing population, so the opportunity is there. These customers are not ready just to finish work and put their feet up – they want to live their lives.”

Merrett said the later life market, like all areas of the mortgage sector, had been impacted predominantly by rising interest rates, and fewer borrowers were looking at using housing equity for aspirational needs and lifestyle changes.

“So it becomes those that are borrowing out of necessity,” he said, “those that are coming to the end of an interest-only term deal or are having to help family because that’s their only solution to enable a firsttime buyer or grown-up son or daughter to get onto the property ladder.

“Equity release is a necessary but also quite small part of the market. At its peak, equity release typically ranges from about four to six billion [pounds] in terms of total lending debt, yet the total market size of lending to over 55s is in excess of £20 billion, so there are a huge number of customers to assist.

“From a societal perspective we’ve got a demographic of customers who’ve got a genuine pension gap. There’s a real opportunity through a combination of lender innovation – so a lot of great things that Family Building Society and other specialist lenders do – and access to good intermediary advice, to reimagine housing wealth and how we encourage customers to use it.”

WE’LL CONSIDER EARNED INCOME TO 70, OR 75 IF THE CLIENT IS IN A NON-MANUAL ROLE

www.mortgageintroducer.com SPRING 2024 MORTGAGE INTRODUCER 25

intermediaries.familybuildingsociety.co.uk

LATER LIFE LENDING

“There’s a real opportunity through a combination of lender innovation … and access to good intermediary advice, to reimagine the utilisation of housing wealth”

RICHARD MERRETT, ALEXANDER HALL

Cunnington pointed to those clients who are coming to the end of their interest-only mortgage terms and don’t want to downsize.

“They’re in their family home,” he said, “they’re very equity rich. They thought upon taking their standard mortgage and agreeing the term that 75 was going to be old, but when they get there they don’t feel old at all, and they want their grandkids to continue to come around.

“A lot of people said to us, you must be crazy to launch into that sector in this market. Actually, the education internally of our advisers meant a whole different type of business came in, in the later life space.

“We’ve helped a lot of clients whose need was clearly always there. There’s a huge opportunity and lots of clients where this would actually be a relevant option, but they’re probably just not aware of it, because it doesn’t come up.”

Cunnington believes the challenge is twofold.

“One, are the advisors being educated enough to be confident to discuss later life lending?” he said, “and, secondly, is [it about] the clients’ education? Though a lot of good has been done, I still feel equity release and later life lending is not really understood by the end clients, and therefore it needs that education piece. If you can combine the education of intermediaries and clients, it would be a much, much bigger market.”

Merrett said perception was absolutely crucial, particularly around any lingering, negative reputation associated with equity release. People needed to be encouraged to view their housing wealth more dispassionately, he said, and to treat it as an asset that could potentially provide a solution to support family in tax and wealth planning or in enhancing their lifestyle.

“I think it’s how we, as an industry, collaborate – broker and lender – to change that perception through education.”

OPPORTUNITIES TO BE TAPPED

Deacon noted that in the most recent figures from UK Finance, there was over £20 billion in later life lending, which was predicted to rise to £40 billion by 2030.

“The biggest population growth in 2020 was between the ages of 57 and 72,” he said, “and that’s expected to rise to between 75 and 87. So the biggest areas of growth of the age of a demographic are those later life customers. The opportunities are there.”

Merrett addressed how income could be used to improve affordability.

“The reality is, for the majority of customers, particularly those who are on that more aspirational side, you’re going to have a variety of different sources, a variety of different pots, and it’s how you reimagine the treatment of income,” Merrett said. “For me, the key point on

this is a lender being able to look at a customer’s situation with some degree of flexibility.”

Cunnington said seeing how lenders like Family Building Society took a very sophisticated, manual view of income had been a ‘light bulb’ moment.

“What we find is that most clients have pension pots, ISAs, assets, rental income,” he said. “Often they’ve been going down the equity release route. From those assets, you can work out an income of 60k for an affordability perspective; therefore, you can lend 300k via a normal mortgage route, which can mean more competitive rate and fee options.

“Now, they’re going with lenders in this later life space who will take that manual assessment, which means a better client outcome, because you’re getting a longer term, lower fee and a lower interest rate. But also that’s really, really positive for the adviser because it shows how forward-thinking some of these lenders are and where the sector is evolving.”

Deacon explained that Family Building Society took a “fairly unique” approach to improving affordability, in terms of monetising assets.

He elaborated: “For example, we’ll take the value of a pension pot, and if the mortgage term is 10 years or more, we can take 90 percent of its value and we’re then able to divide the mortgage term into it. That massively increases affordability. We will do this even when the pension is not currently in drawdown. Some lenders won’t touch it if it’s not being drawn, or some will take a very small percentage of that pension pot, which is not going to be at the level that is needed.

“We just need to see they’ve got the ability to repay the mortgage, and we’ll

MORTGAGE INTRODUCER SPRING 2024 www.mortgageintroducer.com 26 ROUNDTABLE

90%

INVESTMENTS , PLUS FIXED PENSIONS

RENTAL INCOME intermediaries.familybuildingsociety.co.uk