BY MICHELLE ALDEN

Jerry and Sherri Alexander have gener ously come forward to support this year’s Equal Access to Justice Campaign with an outstand ing contribution of $25,500. The Alexan ders have a long and distinguished history of contributing to the Campaign. Including this gift, they have donated more than $214,000 to legal aid for low-income people in Dallas since 2006. The Equal Access to Justice Cam paign is the annual fundraising campaign that supports the activities of the Dallas Volunteer Attorney Program (DVAP).

Jerry Alexander practices complex busi ness litigation at Passman & Jones, served as the 107th President of the Dallas Bar Asso ciation, was Chair of the Board of the State Bar of Texas in 2019-2020, and presently is a candidate for President-Elect of the State Bar of Texas. Sherri Alexander serves as Chair of the Health Care Litigation practice at Polsi nelli. Together, the Alexanders believe in sup porting and benefiting the Dallas community. They know that their contributions to DVAP benefit the Dallas community in many ways.

This year, Jerry would like to highlight the people working behind the scenes.

“DVAP is difficult to execute. Think about it. Attorneys must be encouraged to volun teer, then matched up with a qualified client in need and the services monitored and ren dered successfully, and funds need to be raised yearly to keep it going. But, in many ways, it is the most important thing we do. Michelle Alden and Alicia Hernandez, before her, have done a splendid job of making all this happen. But beyond Michelle and Alicia, here is a listing of the people who also deserve the credit. They work day in and day out, just like the courts: Holly Griffin (Managing Attorney), Kristen Salas (Mentor Attorney), Katherine Saldana (Mentor Attorney), Carolyn Johnson (Paralegal), Charnese Garrett (Legal Secretary), Andrew Musquiz (Parale gal), Whitney Breheny (Referral Paralegal), Alicia Perkins (Paralegal), Miriam Caporal

(Paralegal), Susan Matthews (Paralegal), Tina Douglas (Paralegal), Laci Payton (Pro gram Assistant), and Marisela Martin (Community Engagement Coordinator). Sherri and I sincerely thank these dedicated staff who are such an integral part of the program!”

The DVAP staff have seen the number of people seeking help rise substantially this year. Low-income residents of Dallas have faced many additional challenges during the pandemic and urgently need legal assistance. Sole practitioner Jaha Thomas helped Rita, one recent applicant.

According to Jaha, “I represented an upstanding citizen who was down on her luck. She faced eviction as an employee who was paid hourly and caught Covid twice. Her employer did not provide sick leave and required employees to quarantine if they were exposed to Covid. She did everything she could to pay her rent, but due to her illness and the employer’s quarantine rules, she was stuck. We had three hearings. The first two were continued, but in the third hearing, Rita received an abatement of 60 days, which was just enough time for her to get a new job and move to a different apartment. The joy and gratitude in her voice helped me understand DVAP’s mantra ‘billable hours for your soul.’”

Rita’s story shows what a profound differ ence a few hours of a pro bono attorney’s time can make in a DVAP client’s life. In addition to wonderful volunteers like Jaha, the reality is, helping people like Rita requires financial support too.

As Sherri stated, “A little legal guidance at the right time is sometimes the difference that prevents someone from becoming home less. Attorneys should contribute, if they can, but should always remember they can con tribute their time, and that ‘office work’ is just as important as ‘courthouse work’ in helping those who cannot afford an attorney.”

Jerry emphasizes the importance of access to the civil court system for all: “It is the place where citizens go to resolve their dis putes, and without it, people would be forced

to take matters into their own hands. Our society works because people do not do so, but instead find a lawyer to address their dis putes in court. Everyone must be given access to the system--otherwise, societies and even entire civilizations can fall if enough citizens are denied access. The Equal Access to Justice Campaign is there to prevent that—it facili tates access to the civil courts for people who really need help and truly cannot afford an attorney. For such citizens to have their day in court is the goal. No one feels as if they were turned away—the courts are for everyone, and

the outcome is sometimes not as important as simply not being excluded.”

“Contributing to DVAP is something we have done for years and hopefully can con tinue. It simply feels like the right thing for us, as lawyers, to do,” said Sherri.

DVAP is a joint pro bono program of the DBA and Legal Aid of NorthWest Texas. For more information, or to donate, visit www. dallasvolunteerattorneyprogram.org. HN

Michelle Alden is the Director of the Dallas Volunteer Attorney Program. She can be reached at aldenm@lanwt.org.

Focus | Probate, Trusts & Estates/Tax Law HEADNOTES Dallas Bar Association HEADNOTES 8 Options for Correcting Mistakes and Omissions on Tax Returns 14 What About Fido!? Planning for Pets Upon Incapacity or Death 25 John Goren Receives Kim Askew Distinguished Service Award 32 Pro Bono Attorney & Firm of the Year 37 The Reach out and Pluck Statute Inside December 2022 |Volume 47 |Number 12 DBA MEMBER REMINDER – RENEW ONLINE NOW You may renew your 2023 DBA Dues now! Go to dallasbar.org and click on the My DBA button to log in and Renew online. Your 2023 DBA DUES must be paid by December 31, 2022 in order to continue receiving ALL your member benefits. Thank you for your support of the Dallas Bar Association!

and

Jerry

Sherri Alexander Support DVAP

$900,000

$1.4 Million $50,0000 $250,000 $350,000 $500,000 $700,000 $200,000 $300,000 $400,000 $600,000 $800,000 $150,000 To Give: www.dvapcampaign.org.

G O L D P A T R O N Capital One Margaret & Jaime Spellings D I A M O N D S P O N S O R S Anonymous Foundation Gibson Dunn & Crutcher LLP Haynes and Boone Foundation Nexstar Charitable Foundation Vistra Corp. P L A T I N U M S P O N S O R S Akin Gump Strauss Hauer & Feld LLP AT&T Business Litigation Section Condon Tobin Sladek Thornton Nerenberg PLLC Covington & Burling LLP Jackson Lewis Foundation Jackson Walker LLP Latham & Watkins LLP Munsch Hardt Kopf & Harr, P.C. Rosewood Foundation Vinson & Elkins LLP *As of November 14, 2022 C H A I R M A N ’ S C O U N C I L Jerry & Sherri Alexander Kirkland & Ellis LLP Morrison Foerster Sidley Austin Foundation Toyota Motor North America/ Toyota Financial Services P R E S I D E N T ’ S C O U N C I L Hartline Barger LLP T hank You to Our Major Donor s

Sherri & Jerry Alexander

THURSDAY, DECEMBER 1

FRIDAY, DECEMBER 2

MONDAY, DECEMBER 5

Tort & Insurance Practice Section

“Winning at Persuasion for Lawyers,” Shane Read. (MCLE 1.00)* In person only

5:00 p.m. Appellate Law Section Topic Not Yet Available (MCLE 1.00)* In person only

WEDNESDAY, DECEMBER 7

Noon Employee Benefits & Executive

Compensation Law Section

“Executive Compensation Trends in the Energy Sector,” James Deets and Dylan Hernandez. (MCLE 1.00)* Virtual only

Solo & Small Firm Section

“Bullying in the Legal Profession: How to Recognize, React, and Remedy,” Mike Bassett, Amy M. Stewart, and moderator Scott Solley. (Ethics 1.00)*

Child Welfare & Juvenile Justice Committee. Virtual only

4:00 p.m. LegalLine E-Clinic. Volunteers needed. Contact mmejia@dallasbar.org.

TUESDAY, DECEMBER 6

THURSDAY, DECEMBER 8

Noon Legal Ethics Committee CLE

“End of the Year Roundup,” Jerry Hall, Prof. Fred Moss, and Ken Rubenstein. (Ethics 1.00)*

Christian Lawyers Fellowship. In person only DAYL Fellows Luncheon. Visit dayl.com for more information.

7:00 p.m. Dallas LGBT Bar Association Gala For more information, visit dlgbtba.org

FRIDAY, DECEMBER 9

Noon Friday Clinic

“Lawyer Mental Health and Challenges and Strategies for the Holidays,” Michelle Fontenot and John McShane. (Ethics 1.00)* Presented by the CLE & Peer Assistance Committees. Virtual only

Government Law Section Topic Not Yet Available

Trial Skills Section

“Taking and Defending Depositions for Use at Trial,” Chandler Rognes, Natali Wyson, and Angela Zambrano. (MCLE 1.00)* In person only

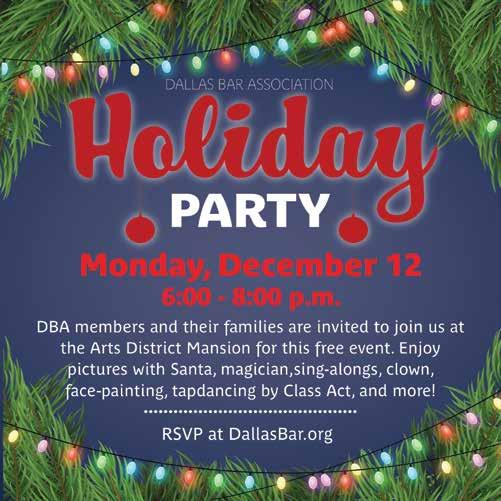

MONDAY, DECEMBER 12

Noon Real Property Law Section

“Environmental Considerations for Real Estate Lawyers,” Timothy Wilkins. (MCLE 1.00)* Virtual only

DVAP CLE “Small Estate Affidavits,” Hon. Lincoln Monroe. (MCLE 1.00)* In person only

Peer Assistance Committee. In person only

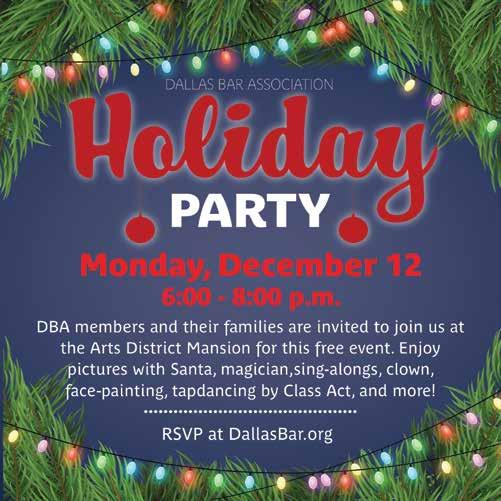

6:00 p.m. DBA Holiday Party Enjoy pictures with Santa, face-painting, balloon animals, sing-alongs and more! Please bring an unwrapped toy to be donated to charity. For more information, contact yhinojos@dallasbar.org.

TUESDAY, DECEMBER 13

Noon Business Litigation Section

“Trying Cases in Today’s Cultural Landscape,” Robert Hirschhorn, Brian Lauten, Dick Sayles and moderator Michael Lyons. (MCLE 1.00)* In person only

Immigration Law Section Topic Not Yet Available

Mergers & Acquisitions Section

“Underestimate the Indemnification Section at Your Peril,” Candace Groth and Vela Wood. (MCLE 1.00)* Virtual only

WEDNESDAY, DECEMBER

THURSDAY, DECEMBER

FRIDAY, DECEMBER

Intellectual Property Law Section

Ethics Issues for IP Lawyers,” David

Virtual only

Virtual only

& Community

Virtual only

Noon

“Current

Hricik. (Ethics 1.00)*

Judiciary Committee

Law in Schools

Committee.

Santa Brings a Suit Drive Drop Off

the Arts District

or at

firm

Muchin,

Life

9:00 a.m.

Circle Drive at

Mansion, (2101 Ross Ave.),

the

of Katten

Rosenman (2121 N. Pearl St., Ste 1100). Benefiting Dallas

Foundation.

Noon Franchise & Distribution Law Section “Topic Not Yet Available,” Sam Mallick and Wilson Miller. (MCLE 1.00)* Virtual only Tax Law Section “Latest Trends/Topics in Tax-Exempt Entities,” Jonathan Blum. (MCLE 1.00)*. In person only

Noon ABA Practice Forward Program “Where Does the Legal Profession Go from Here?

Home Project Committee. In person only 5:30 p.m. Bankruptcy & Commercial Law Section “Annual Judges’ Roundtable,” Hon. Scott Everett, Hon. Stacey G.C. Jernigan, Hon. Michelle Larson, and Hon. Edward Morris. (MCLE 1.00)* In person only

14

Noon Collaborative Law Section Topic Not Yet Available 4:00 p.m. LegalLine E-Clinic. Volunteers needed. Contact mmejia@dallasbar.org.

Noon

Topic

Publications

only Christian

only 4:00

15

Environmental Law Section

Not Yet Available

Committee. Virtual

Legal Society. In person

p.m. DBA Board of Directors Meeting

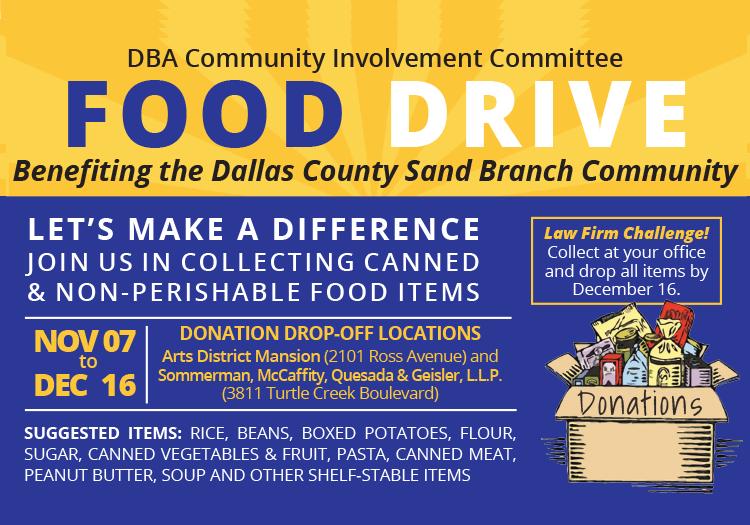

16 9:00 a.m. Last day to drop off donations for Sand Branch Food

19 No DBA Events Scheduled TUESDAY, DECEMBER 20 No DBA Events Scheduled WEDNESDAY, DECEMBER 21 No DBA Events Scheduled THURSDAY, DECEMBER 22 No DBA Events Scheduled FRIDAY, DECEMBER 23 DBA offices closed in observance of Christmas holiday MONDAY, DECEMBER 26 DBA offices closed in observance of Christmas holiday TUESDAY, DECEMBER 27 No DBA Events Scheduled WEDNESDAY, DECEMBER 28 No DBA Events Scheduled THURSDAY, DECEMBER 29 No DBA Events Scheduled

DECEMBER 30 DBA offices closed in observance of New Year’s Eve 2 Headnotes l Dallas Bar Association December 2022 Calendar December Events Visit www.dallasbar.org for updates on Friday Clinics and other CLEs. FRIDAY CLINICS DECEMBER 9 Noon “Lawyer Mental Health and Challenges and Strategies for the Holidays,” Michelle Fontenot and John McShane. (Ethics 1.00)* Virtual only. Presented by the CLE & Peer Assistance Committees If special arrangements are required for a person with disabilities to attend a particular seminar, please contact Alicia Hernandez at (214) 220-7401 as soon as possible and no later than two business days before the seminar. All Continuing Legal Education Programs Co-Sponsored by the DALLAS BAR FOUNDATION. *For confirmation of State Bar of Texas MCLE approval, please call the DBA office at (214) 220-7447. **For information on the location of this month’s North Dallas Friday Clinic, contact yhinojos@dallasbar.org. Programs and meetings are presented Virtually, Hybrid, or In-Person. Check the DBA Online Calendar (www.dallasbar.org) for the most up-to-date information. Programs in green are Virtual Only programs. In November, the DBA hosted two Living Legends programs: (top) Donald Godwin interviewed by DBA President Krisi Kastl, and (bottom) Hon. Ada Brown interviewed by Erin Nealy Cox. Find all the Living Legends videos on our YouTube Channel at https://buff.ly/3FwEmN3. DBA Living Legends we have your ct information. NG OUR EMAILS? Log in to your "My DBA Page," and click ‘Update Profile’ or email membership@dallasbar.org. WWW.DALLASBAR.ORG

Drive MONDAY, DECEMBER

FRIDAY,

December 2022 Dallas Bar Association l Headnotes 3

President’s

Goodbyes, Gratitude, and Growth

BY KRISI KASTL

You may forget what I said and did but I hope you do not forget the way I made you feel. My wish is that you felt wel come, appreciated, and engaged.

The DBA’s mission statement “To serve and support the legal profession in Dallas and to promote good relations among lawyers, the judiciary, and the community,” rests on the foundation of people. The people of our organization are what stand out as I look back on the many accomplish ments, challenges, and joys of our year together.

The Dallas Bar Association has a superstar Executive Director in Alicia Hernandez. Alicia embodies the DBA’s mission of putting people first. She has a heart for service and is an advocate for justice. She has the valuable skill of establishing value by fostering connection and respect among everyone she meets. Alicia accommodates diverse organizational needs, yet knows when to maintain healthy boundaries. I am struck by her calming ability that culti vates trust and deep-seated care.

Before coming to the DBA Alicia was an experienced non-profit leader who received her law degree from the University of Notre Dame in 1992. She worked as an attorney for the Legal Services of North Texas and as Assistant Regional Council for the U.S. Department of Health and Human Services. Her areas of practice included Non-Profits and Public Service. Before becoming Executive Director of the DBA in 2017, Alicia was the former director of the Dal las Volunteer Attorney Program, the Community Services, and the Lawyer Referral Service. We are so lucky to have Alicia as our Executive Director.

Every January a big deal is made of the incoming Presi dent of the Dallas Bar, but let’s be clear—the DBA Presi dents are merely cogs in a well-oiled machine. Although the Presidency is in the limelight, the exceptional DBA team members are a big part of the reason the DBA is a nationally recognized bar association.

What, Like It’s Hard?

In 2001 the film Legally Blond created a feminist hero ahead of her time in Elle Woods. The often-quoted line was the protagonist’s response to her boyfriend’s shock that she got into Harvard. The message of the movie was impact ful; You don’t have to change who you are to be successful. Twenty-one years later, the empowering lessons of indepen dence and integrity still inspire me. Rebounding from preconceived notions is what we strive for in the courtroom and beyond. Despite the hundreds of phone calls, the neverending number of emails, numerous Zooms, the countless appearances, and the deadlines that often competed with my lawyer deadlines, being DBA President is the best job that I have ever had. The interactions I had with the many people in our community contributed to a sense of ease that comes with the synchronicity of purpose. The DBA and our affinity bars celebrate the diverse path that has brought us together under one mission of service.

I chose to highlight the past women Presidents of the DBA in my Headnotes columns to celebrate empowering women. It is hard to fathom that there have been only 10 female Presidents since 1985, but we have come a long way and continue to progress. Cheryl Camin Murray will lead the DBA into its 150th year in 2023. In 2025 Vicki Blanton is in line to be President and Sarah Rogers is right after her in 2026. I have always been about women helping women and I will never forget how Cheryl encouraged me. In the Fall of 2006, Cheryl encouraged me to run for the DAYL board. I lost that race, but I didn’t give up. I won the next race for Collin County Young Lawyers Association in 2007 and then the DAYL in 2008.

The Honor of My Life

It has been the honor of my life to serve as your Presi dent. I am so grateful for the opportunity to connect with members of the bar, the community, and the judiciary and to share the passion that I have for the DBA. I am grateful for the powerful bonds forged through acts of service, educa tion, and celebration. I value the hard-working staff of the DBA. Thank you for your encouragement, professionalism, sincerity, and friendship. Thank you to the affinity bars and members for being a living example of our institution’s mis sion.

I cannot fully express my gratitude to the many people who have helped me along this path. I met lifelong friends in the 2006 DAYL leadership class that would encourage and inspire me. Thank you, Cherie Harris , Laura Benitez Geisler , Rob Crain , Jonathan Childers , and Aaron Tobin , among others. There are so many to thank it would take up an entire page, but you know who you are.

The late Karen D. McCloud is the most influential part of my journey. When she was President of the DAYL in 2008, I recall her encouraging me to support one of our DAYL programs, The Ties That Bind, early on a Satur day morning. Karen convinced me to put on my best suit to show up and support Mike Coles as he taught a group of young men how to tie a necktie. She was always lead ing by example. I am sad that she did not get to serve as President of the DBA due to her untimely passing.

Looking Ahead

The holiday season is upon us. Along with the many in-person and online CLEs, the DBA has a lot going on. On December 2, the season of giving opens with the Santa Brings a Suit Dropoff at 9:00 a.m. at the Arts District Man sion, and the DBA Sand Branch Community Food Drive goes through December 16. Let’s celebrate together on December 8 with the DLGBT Bar Association gala, and on December 12, at the DBA Family Holiday Party. For more information check out www.dallasbar.org

Inspired by the People

When all is said and done, my gratitude circles back to the people who make the impossible, possible. In January, I highlighted the importance of connection and charged us to find innovative ways to connect during a pivotal point in our global history. We have succeeded. One of the accomplishments I am most proud of this year is that we were able to amend the bylaws to secure a voting seat for the Dallas LGBT Bar Association. The Arts District Mansion has once again welcomed the people of our community to celebrate and learn. The incredible gathering of people of the DBA will be a cherished memory as President.

Butterflies are a symbol of resurrection and rebirth and often are symbols of those that we have lost too soon. I carry great affection for the symbolism of the butterfly, which sig nifies the power of the transformative process and know ing that wings are on the other side. Karen McCloud knew this too. The DBA will continue to thrive, and I am for ever grateful for my time as President. Like the butterfly, these 12 months seem fleeting when compared to the his tory of our institution. I appreciate the incredible feats we can achieve when we trust ourselves and fly.

From the bottom of my heart, thank you for the honor, opportunity, and the memories. I am glad we were able to get back into the groove in 2022.

Krisi Kastl

Headnotes

Published by: DALLAS BAR ASSOCIATION

2101 Ross Avenue Dallas, Texas 75201 Phone: (214) 220-7400 Fax: (214) 220-7465 Website: www.dallasbar.org Established 1873

The DBA’s purpose is to serve and support the legal profession in Dallas and to promote good relations among lawyers, the judiciary, and the community.

OFFICERS

President: Krisi Kastl

President-Elect: Cheryl Camin Murray

First Vice President: Bill Mateja Second Vice President: Vicki D. Blanton Secretary-Treasurer: Liz Cedillo-Pereira Immediate Past President: Aaron Z. Tobin

Directors: Lauren Black, Rob Cañas, Jonathan Childers (Chair), Stephanie G. Culpepper, Rocio Garcia Espinoza, Hon. Dennise Garcia, Ashlei Gradney (President, J.L. Turner Legal Association), Hon. Martin Hoffman, Andrew Jee, Andy Jones (President, Dallas Association of Young Lawyers), Jennifer King, Jonathan Koh (President, Dallas Asian American Bar Association), Elsa Manzanares (President, Dallas Hispanic Bar Association), Hon. Audrey Moorehead, Timothy Newman, Marisa O’Sullivan (President, Dallas Women Lawyers Association), Kelly Rentzel, Sarah Rogers (Vice Chair), Drew Spaniol, and Amy M. Stewart

Advisory Directors: Alison Ashmore (President-Elect, Dallas Women Lawyers Association), Carla Green (President-Elect, Dallas Hispanic Bar Association), Amber Hamilton Gregg (President-Elect, J.L. Turner Legal Association), Nadia Haghighatian (President, Dallas LGBT Bar Association), Nicole Munoz Huschka (President-Elect, Dallas Association of Young Lawyers), and Janet Smith (President-Elect, Dallas Asian American Bar Association)

Delegates, American Bar Association: Rhonda Hunter, Mark Sales

Directors, State Bar of Texas: Chad Baruch, Mary Scott, Paul Stafford, Robert Tobey, Aaron Z. Tobin

HEADNOTES

Executive Director/Executive Editor: Alicia Hernandez Communications/Media Director & Headnotes Editor: Jessica D. Smith In the News: Judi Smalling Display Advertising: Annette Planey, Jessica Smith

PUBLICATIONS COMMITTEE

Co-Chairs: James Deets and Joshua Smeltzer

Vice-Chairs: Elisaveta (Leiza) Dolghih and Ted Huffman

Members: Logan Adcock, Benjamin Agree, David Brickman, Catherine Bright Haws, Ian Brown, Srinivasan Chakravarthi, Gracen Daniel, Lindsay Drennan, Alexander Farr, Dawn Fowler, Neil Issar, Beth Johnson, Andrew Jones, Alexandra Jones, Krisi Kastl, Jon Kettles, Brian King, Jared Knight, John Koetter, Alan Lightfoot, Margaret Lyle, Derek McKee, Majed Nachawati, D. Mason Parham, Keith Pillers, David Ritter, Carl Roberts, Sarah Rogers, John Shipp, Jared Slade, Sarah Spires, Jay Spring, Sarah-Michelle Stearns, Scott Stolley, Robert Tarleton, Paul Tipton, Anastasia Triantafillis, Pryce Tucker, Kathleen Turton, Peter Vogel, Benton Williams, Jason Winford

DBA & DBF STAFF

Executive Director: Alicia Hernandez

Accounting Assistant: Jessie Smith

Legal Education Coordinator: Viridiana Rodriguez

Communications/Media Director: Jessica D. Smith

Controller: Sherri Evans

Events Director: Rhonda Thornton

Executive Assistant: Elizabeth Hayden

Executive Director, DBF: Elizabeth Philipp

LRS Director: Biridiana Avina

LRS Interviewer: Giovanna Alvarado

LRS Program Assistant: Marcela Mejia

Marketing Coordinator: Mary Ellen Johnson

Membership Director: Shawna Bush

Publications Coordinator: Judi Smalling

Receptionist: Araceli Rodriguez

Staff Assistant: Yedenia Hinojos

Texas High School Mock Trial & Law Related Education Director: Melissa Garcia

DALLAS VOLUNTEER ATTORNEY PROGRAM

Director: Michelle Alden

Managing Attorney: Holly Griffin

Mentor Attorneys: Kristen Salas, Katherine Saldana

Paralegals: Whitney Breheny, Miriam Caporal, Tina Douglas, Carolyn Johnson, Suzanne Matthews, Andrew Musquiz, Alicia Perkins

Community Engagement Coordinator: Marísela Martin

Program Assistant: Laci Payton Secretary: Charnese Garrett

Copyright Dallas Bar Association 2022. All rights reserved. No reproduction of any portion of this publication is allowed without written permission from publisher.

Headnotes serves the membership of the DBA and, as such, editorial submissions from members are welcome. The Executive Editor, Editor, and Publications Committee reserve the right to select editorial content to be published. Please submit article text via e-mail to jsmith@dallasbar.org (Communications Director) at least 45 days in advance of publication. Feature articles should be no longer than 800 words. DISCLAIMER: All legal content appearing in Headnotes is for informational and educational purposes and is not intended as legal advice. Opinions expressed in articles are not necessarily those of the Dallas Bar Association.

All advertising shall be placed in Dallas Bar Association

Headnotes at the Dallas Bar Association’s sole discretion.

Headnotes (ISSN 1057-0144) is published monthly by the Dallas Bar Association, 2101 Ross Ave., Dallas, TX 75201. Non-member subscription rate is $30 per year. Single copy price is $4.00, including handling.

Periodicals postage paid at Dallas, Texas 75260.

POSTMASTER: Send address changes to Headnotes, 2101 Ross Ave., Dallas, TX 75201.

“I have learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel.” – Maya Angelou

❤

4 Headnotes l Dallas Bar Association December 2022

Column

DOWNLOAD OUR APP TO STAY CONNECTED SCAN THE QR CODE BELOW

December 2022 Dallas Bar Association l Headnotes 5

Dallas Bar Elects 2023 Officers

Bill Mateja Elected President-Elect

Members of the Dallas Bar Associa tion proudly elected its 2023 officers during the Annual Meeting on November 4. Bill Mateja was elected president-elect and will serve as the Association’s 115th president in 2024.

Mr. Mateja is a partner at Sheppard Mul lin. A graduate of Texas Tech University School of Law, he specializes in white collar defense and corporate investigations. He has been on the DBA Board of Directors since 2015 and is currently the Board Advisor to the Admissions & Membership and Mock Trial Committees and the Securities Sec tion. In addition to his DBA Board service, Mr. Mateja was Co-Chair of the 2015-2016 EAJ Campaign, which raised $1 million dol lars for access to justice.

Other officers elected at the Annual Meet ing were: Vicki Blanton, of AT&T, elected first vice-president; Jonathan Childers, of Lynn Pinker Hurst & Schwegmann, elected second vice-president; and Krisi Kastl, of Kastl Law, P.C., will serve as immediate past president, and Cheryl Camin Murray, of GI Alliance will serve as president in 2023.

Additionally, on November 10, ballots for director positions were sent to members and one of the following will assume the position of Secretary/Treasurer: Derek Mergele-Rust or Kandace Walter; and six of the following nominees will assume director positions in 2023: Katie Anderson, Alison Battiste Clement, Stephanie Culpepper, Martin Hoffman, Andrew Jee, Andy Jones, Andrew Milam Jones, Audrey Moorehead, and Sarah Rog ers. Ballots were due back November 21, and results were not available at press time. The 2023 presidents of the minority bar associa tions will also serve on the board as Directors, and the president-elects of these associations will serve on the board as Advisory Directors, including the president-elect of the Dallas LGBT Bar Association. The Dallas LGBT Bar Association president will have a direc tor position on the board, in accordance with an amendment to the DBA bylaws that was

approved at the meeting.

On November 9, the DBA hosted its annual Awards program where several award recipients were recognized. Each year, the Texas Center for Legal Ethics & Profes sionalism co-sponsors the presentation of the Morris Harrell Professionalism Award with the DBA. The award was created in 1999 in honor of DBA Past President Morris Harrell to recognize an attorney who best exemplifies, by conduct and character, truly professional traits who others in the bar seek to emulate. This year’s Morris Harrell Professionalism Award recipient is Carolyn Wright, Chief Justice of the Fifth Court of Appeals (Retired).

In 2017, the DBA created the Kim Askew Distinguished Service Award. The award recognizes DBA members who have demonstrated a lasting dedication to the DBA and Dallas community, consistently given back, and who gone above and beyond traditional service of DBA members. This year’s award went to John Goren, Attor ney at Law, for his many years of dedicated service to the DBA, especially for his work on the House Committee, as Chair of the Memorial & History Committee, and as a

founding member of the Appellate Law Sec tion.

The DBA created the Al Ellis Community Service Award in 2019 to honor and recognize those DBA members who exem plify the spirit of community involvement and service. This year’s recipient is Mar tha Hardwick Hofmeister, of Shackelford, Bowen, McKinley & Norton, LLP, for her many years of service to Bar None and the Dallas Bar Foundation, particularly her role in raising money for the Sarah T. Hughes Diversity Scholarships.

The Karen McCloud Outstanding Minority Attorney Award was presented to Alison Battiste Clement, of Battiste Clem ent PLLC. And E. Leon Carter, of Carter Arnett PLLC, received the Judge Merrill Hartman Support Award, for his continued support of the DBA Home Project.

This year two Committees received the Jo Anna Moreland Outstanding Commit tee Chair Award: the Home Project Com mittee Co-Chairs Mr. Michael Bielby, Jr., of Vinson & Elkins LLP; Mr. David Fisk, of Grotefeld Hoffmann, and Mr. Frank George III, of Vinson & Elkins LLP; and the Public Forum Committee Chair Mr. Andrew

M. Jones, of Publicis Resources. The Labor & Employment Law Section, chaired by Rob Wiley, of Rob Wiley, P.C., received the Cathy Maher Special Section Award.

Presidential Citations were also presented to behind-the-scenes members who have faithfully performed often time-consuming tasks for the association. This year’s recipi ents were: Dawn Budner, Laurie Pierce, and Rosalyn Tippett, for their work on the DBA Relaunch Program; Katie Anderson, Leslie Chaggaris, Marc Katz, Jervonne Newsome, Cortney Parker, and Koi Spur lock for their outstanding efforts on behalf of the Allied Dallas Bars Equality Commit tee; Vicki Blanton and Paul Wingo for their efforts on behalf of the DBA 2022 Law Day Program; Lisa George for her work on the DBA Trailblazers Program; Hilda C. Gal van and Harriet E. Miers for their wis dom and guidance, particularly as the DBA moves forward after the shutdowns of 2020 and 2021; Al Ellis, Liz Lang-Miers, and Peter Vogel for their efforts mentoring DBA leaders and members not only in 2022, but for many years before; Kandace D. Walter for her work on the 2022 DBA Presidential Inaugural; Katie Bandy Weber and Kate Kilanowski for their work on the Inaugural Silent Auction benefiting DVAP; Marifer Aceves for her outstanding effort on behalf of the DBA Law in the Schools & Com munity Committee; and Tim Newman and Drew Spaniol for their efforts on behalf of the DBA Bench Bar Conference Committee.

Also, the following court staff members were recognized: 134th District Court, Hon. Dale B. Tillery, Outstanding Civil District Court Staff; County Court at Law No. 2, Hon. Melissa Bellan, Outstanding County Court at Law Staff; Criminal Dis trict Court No. 2, Hon. Nancy Kennedy, Outstanding Criminal District Court Staff; County Criminal Court 3, Hon. Audrey Moorehead, Outstanding County Criminal Court Staff; 301st Family District Court, Hon. Mary Brown, Outstanding Family District Court Staff; and the Probate Court, Hon. Brenda Thompson, Outstanding Probate Court Staff; and Place 12, Hon. Ken Molberg, Outstanding Dallas Court of Appeals Staff. HN

~ In Memoriam ~

Since 1875, the DBA has honored recently deceased members by passing resolutions of condolences. This tradition continues through the work of the DBA Memorial & History Committee. To view the Memorial Resolutions presented to the families of deceased members, visit www.dallasbar.org.

Hon. Bill Hugh Brister (1930-2022), a 1958 graduate of The University of Texas School of Law

William Temple Burke, Jr. (1935-2022), a 1961 graduate of St. Mary’s University School of Law

Russell Dale Chapman (1951-2021), a 1978 graduate of University of Tulsa College of Law

Paul Raymond Clevenger (1957-2022), a 1983 graduate of Southern Methodist University School of Law

James Edgar Cowles (1934-2022), a 1961 graduate of The University of Texas School of Law

James Calvin Crain (1948-2021), a 1975 graduate of The University of Texas School of Law

Robert Edwin Davis, Sr. (1934-2022), a 1958 graduate of Southern Methodist University School of Law

Raymond John Elliott (1937-2022), a 1962 graduate of University of Michigan Law School

Forrest Lynn Estep, Jr. (1931-2022), a 1958 graduate of Southern Methodist University School of Law

Jerry Carl Gilmore (1933-2022), a 1957 graduate of The University of Texas School of Law

Thomas Andrew Giltner (1940-2022), a 1964 graduate of The University of Texas School of Law

Robert Tate Gorman (1976-2022), a 2001 graduate of St. Mary’s University School of Law

Jay Louis Gueck (1936-2021), a 1963 graduate of University of Colorado Law School

Orrin Lea Harrison, III (1949-2022), a 1974 graduate of Southern Methodist University School of Law

Norman Peters Hines, Jr. (1928-2022), a 1960 graduate of Southern Methodist University School of Law

Thomas Patton Jackson (1951-2022), a 1981 graduate of Southern Methodist University School of Law

Richard Archer Lempert (1932-2022), a 1955 graduate of Columbia Law School

Elaine Tran Lenahan (1972-2022), a 1998 graduate of Southern Methodist University School of Law

Curtis Lewis Marsh (1960-2022), a 1985 graduate of Washington University School of Law

Clark Jio Matthews, II (1936-2022), a 1961 graduate of Southern Methodist University School of Law

Frank Eugene McLain (1937-2022), a 1962 graduate of The University of Texas School of Law

Benjamin Prater Monning, III (1951-2022), a 1976 graduate of Southern Methodist University School of Law

Durward Dee Moore (1942-2022), a 1965 graduate of Baylor School of Law

Bruce Knox Packard (1960-2022), a 1985 graduate of University of Michigan Law School

John Theodore Palter (1960-2022), a 1985 graduate of Drake University School of Law

Philipa Tillery Remington (1949-2021), a 1978 graduate of Southern Methodist University School of Law

William Thomas Satterwhite (1933-2021), a 1958 graduate of Baylor School of Law

Kurt Allen Schwarz (1957-2022), a 1990 graduate of The University of Texas School of Law

Dorothy Elizabeth Houston Shead (1952-2022), a 1977 graduate of Southern Methodist University School of Law

William Coleman Sylvan, II (1950-2022), a 1975 graduate of Southern Methodist University School of Law

Steven Herb Thomas (1960-2021), a 1989 graduate of The University of Texas School of Law

Lee Daniel “Tom” Vendig (1931-2022), a 1955 graduate of Southern Methodist University School of Law

William D. White, Jr. (1935-2022), a 1960 graduate of The University of Texas School of Law

Gerry Neal Wren (1931-2022), a 1956 graduate of Southern Methodist University School of Law

6 Headnotes l Dallas Bar Association December 2022

STAFF REPORT

2023 Officers include: (left to right): Krisi Kastl, Bill Mateja, Cheryl Camin Murray, Johnathan Childers, and Vicki Blanton.

C M Y CM MY CY CMY K

BY JOEL CROUCH

The federal tax system is a voluntary system that relies on taxpayers to file complete and accurate tax returns and other information with the IRS. How ever, sometimes after a tax return or other information is filed with the IRS, a taxpayer discovers it was incomplete or inaccurate. In order to avoid potential civil or criminal penalties, the tax payer may want to act. This article dis cusses some of the options that taxpay ers have for addressing incomplete or inaccurate tax filings.

In situations where there was a fraudulent position taken on a tax return and the taxpayer is concerned about potential criminal exposure, the taxpayer can make a voluntary disclo sure to the IRS. Although voluntary disclosure to the IRS does not automat

ically guarantee immunity from prose cution, as a matter of practice the IRS will not pursue criminal charges against a taxpayer who meets the requirements of the voluntary disclosure program. A voluntary disclosure occurs when a tax payer timely, truthfully, completely and voluntarily notifies the IRS about an inaccuracy in a tax return or other doc ument filed with the IRS. A disclosure is timely only if it is made before the IRS has provided notice of its intent to initiate, or has initiated, a civil exami nation or criminal investigation of the taxpayer. In addition, any disclosure must be made before a third party alerts the IRS of the taxpayer’s noncompli ance. A taxpayer who is concerned that a former spouse, disgruntled employee, or former business partner may provide information to the IRS should consider making a voluntary disclosure before

someone else contacts the IRS.

An IRS voluntary disclosure is initi ated by completing and filing IRS Form 14457. If the IRS accepts the taxpayer’s voluntary disclosure, the taxpayer must file all required returns and reports, and pay any additional tax and interest for the six most recent tax years. The returns will be assigned to an IRS exam iner for review and the taxpayer must cooperate with the IRS examination. A taxpayer who fails to cooperate will be kicked out of the voluntary disclosure program and be subject to all available civil and criminal penalties. For most taxpayers in the program, the IRS will assess one 75 percent civil fraud penalty for the year with the highest tax liabil ity. In cases involving undisclosed foreign bank accounts, the IRS will typi cally cap the penalty at 50 percent of the highest year’s account balance.

In situations involving an inaccu rate (but not fraudulent) tax return, a taxpayer can simply file an amended tax return that corrects any omis sion or inaccuracy and, in most cases, the amended return will be a Quali fied Amended Return (QAR) and the IRS will not assess a penalty. A QAR is defined as an amended return filed after the due date of the original return and before (1) the taxpayer is first con tacted by the IRS regarding an exam ination or (2) the date a summons is served on a third party with respect to an activity of the taxpayer for which the taxpayer directly or indirectly claimed a tax benefit.

Taxpayers who fail to report foreign financial assets and pay all tax due on those assets have the alternative of

on

using the Streamlined Filing Compli ance Procedure (SFCP). The SFCP procedure is available to taxpayers certify ing that their failure to report foreign financial assets and pay all tax related to those assets did not result from will ful conduct on their part. In addition to paying any additional tax due, a miscel laneous offshore penalty equal to five percent of the highest aggregate value of the taxpayer’s unreported foreign financial assets may be applicable.

Taxpayers who have paid all their taxes, but who have not filed a required Report of Foreign Bank and Finan cial Accounts (FBAR) (FinCEN Form 114), can use the Delinquent FBAR Submission Procedure. The IRS will not impose any penalty if the taxpayer has not previously been contacted regarding an income tax examination or a request for delinquent returns for the years for which the delinquent FBARs are submitted.

Finally, taxpayers who have paid all of their taxes, but who have not filed one or more required interna tional information returns, can use the Delinquent International Information Return Submission Procedures. The IRS will not impose a penalty for fail ure to file the delinquent international information returns if the taxpayer has reasonable cause for not timely filing the information returns and has not previously been contacted by the IRS about the delinquent information returns. HN

Joel Crouch is a Partner at Meadows Collier Reed Cousins Crouch & Ungerman, LLP and can be reached at jcrouch@ meadowscollier.com.

8 Headnotes l Dallas Bar Association December 2022

Options for Correcting Mistakes and Omissions

Tax

Focus Probate, Trusts & Estates/Tax Law 901 Main Street, Suite 3700 Dallas,Texas 75202 phone (214) 744-3700 (800) 451-0093 Meadows Collier has been providing business, tax and regulatory solutions to individuals and corporate clients since 1983. Our attorneys provide services in the following practice > Income Tax Litigation > Income Tax and Business Planning > Estate Planning and Probate > Estate and Gift Tax Litigation > State Tax Planning and Litigation > White Collar and Government Regulatory Litigation > Real Estate > Corporate > Commercial Litigation and Arbitration > Cryptocurrency and Digital Assets www.meadowscollier.com Meadows Collier: Guiding clients with superior service for nearly 40 years. Please Join Us! Dallas Bar Association Martin Luther King Jr. Luncheon Monday, January 16, 2023 Noon at the Arts District Mansion 2101 Ross Avenue, Dallas, TX MLK Justice Award to be presented to Judge W. Royal Furgeson

Returns

December 2022 Dallas Bar Association l Headnotes 9 IP LITIGATION + COMMERCIAL LITIGATION

#FreeBritney Puts Restorations in the Spotlight Focus Probate, Trusts & Estates/Tax Law

BY TANNER HARTNETT

BY TANNER HARTNETT

Britney Spears’s conservatorship (guardianship) recently took the world by storm. It has put a spotlight on guardian ships and raises questions about when, and if, a guardianship should be lifted. In Texas, there are numerous reasons individuals are placed under a guardianship includ ing intellectual disability, developmental delays, traumatic brain injuries, and diseases associated with aging. Britney’s case seemed to focus on a mental health break down that spiraled out of control, which is not something that typically gives rise to a guardianship in Texas, though it can. Ms. Spears ultimately made strides

towards independence, which, along with an avid fan base, gave rise to the #FreeB ritney movement, and her ultimate restoration. Though individuals in Texas may lack a worldwide army of keyboard warriors, their guardians should be their number one fans and advocate for their restoration the moment it is warranted.

The Texas Estates Code provides a cou ple of different ways to seek a restoration or modification of a guardianship. The first allows the ward, or anyone interested in the ward’s welfare, to write a letter to the court asking for the complete restoration of their rights or a modification to get some, but not all, rights back. These letters may be considered by the court annually. The sec

ond way is for the guardian to seek the res toration when they know that the ward has regained some or all of their abilities. This is actually required of them by the Ward’s Bill of Rights codified in the Estates Code, and is usually mentioned in their annual report. The moment the guardian is aware that the ward has regained some, or all, of their abilities they should immediately seek restoring the ward’s independence. Brit ney’s father certainly did not seek restoration on her behalf, but many parents want their kids to achieve independence.

should always be looking for when and how to restore rights and, when that is not pos sible, looking for any available less restrictive alternatives to guardianship that could continue to provide the assistance needed.

Thursday, December 8 | Noon - 1:00 PM

MCLE: 1.00 Ethics

Donna Yarborough specializes in difficult Estate, Trust and Guardianship litigation.

Donna’s ability to handle emergency cases and obtain temporary restrain ing orders has resulted in her being described by her peers as the “911 attorney” for probate litigation. In addition to estate administration, Donna has been successful in having her clients declared common law spouse and adoption by estoppel so they could

inherit from an Estate. With over 21 years experience, she is dedicated and a zealous advocate for her clients.

Donna was named a 2021 Super Lawyer and a Top Attorney in Texas selected by peer recognition and professional achievement in 2022 by Texas Monthly.

If your client has an emergency you do not want or cannot handle, call Donna on her cell at (214) 682-7557.

Holmes Firm PC International Plaza III 14241 Dallas Parkway Suite 800, Dallas, TX 75254 donna@theholmesfirm.com | 214-682-7557 | www.theholmesfirm.com

Regardless of how the restoration request is made, it will trigger a series of events leading up to a final hearing. An Application for Restoration and/or Modi fication (ask for both when you aren’t sure your client is ready for full independence) must be filed. The court investigator will visit the guardian and ward and file a report with the court. Then an attorney and/or guardian ad litem will be appointed to rep resent the ward. Additionally, a new doc tor’s letter will need to be obtained noting the improvement in cognitive functioning and the absence or improvement of any deficits. These steps should give every one ample opportunity to consider how the ward’s condition has improved, how circumstances may have changed, and whether any further protection of the ward is needed. This evidence should never be looked at through the perspective of what problems remain and instead should be looked through the perspective of what has improved. The parties and the Court

Many people focus only on the nega tive side of guardianships, where guard ians allegedly suppress the ward’s rights and exploit them for financial gain. Those same people often misunderstand how guardian ships truly work. When used appropriately, guardianships are a useful and necessary tool for individuals and their families, and they should continue to be granted when doing so will protect an individual during a period of vulnerability. Once that period ends, however, so too should the guardianship. It is important that guardians and wards do not get complacent within the confines of the guardianship and always look for oppor tunities to give wards more independence, with a final goal of restoration.

A final, interesting note about restora tion is that the order restoring rights will not restore the individual’s right to possess a firearm. That requires not only a separate request, which can be made within the original application, but also a separate order that complies with federal statutes. The issues sur rounding restoration of gun rights are exten sive, complicated by current events, and require an evaluation of judgement, which is nearly impossible to quantify, and will have to be saved for another day. HN

10 Headnotes l Dallas Bar Association December 2022

Tanner Hartnett is a Partner at The Hartnett Law Firm. She can be reached at tanner@hartnettlawfirm.com

Veronica Moyé Gibson, Dunn & Crutcher LLP

Your 2023 dues statements have arrived and we ask that you consider renewing as a Sustaining Member ($535). More than 200,000 members and guests use our building each year and your contribution at the Sustaining Member level will help us continue the essential upkeep needed to preserve our beautiful building—as the premiere bar headquarters in the nation. Thank you for your support. HELP PRESERVE OUR HEADQUARTERS: BECOME A SUSTAINING MEMBER All Sustaining Members will be prominently recognized in Headnotes and at our Annual Meeting.

Hosted virtually on Zoom. Register at Dallasbar.org. Interviewed by Gracen Daniel, Griffith Barbee PLLC

The Dallas Bar Foundation presented Hon. Karen Gren Scholer (center), of the U.S. District Court Northern District, with the Fellows Justinian Award. Judge Scholer is pictured with Alistair Dawson (left) and 2020-2021 Fellows Justinian Award recipient, Hon. Royal Furgeson (right).

Hon. Karen Gren Scholer

Receives Fellows Justinian Award

December 2022 Dallas Bar Association l Headnotes 11 But that comes with the territory when you retain one of the region’s most effective and accomplished personal injury firms. For over 25 years, we’ve worked relentlessly to help personal injury victims secure the justice they deserve, while actively spurring changes to make our world safer. If you know someone who is a victim of a catastrophic personal injury matter, visit paynemitchell.com to make a referral or to find out more about our notable results. OUR CLIENTS OFTEN GET CALLED NAMES IN COURT, LIKE COMPENSATED, VINDICATED + AWARDED. 214.252.1888 • paynemitchell.com AVIATION CRASHES • PRODUCT DEFECTS • NEGLIGENCE MEDICAL MALPRACTICE • VEHICLE COLLISIONS Left to right: Jim Mitchell, Andy Payne, Todd Ramsey PMR Firmad2022_Headnotes_021422.indd 1 2/23/22 11:04 AM

BY JEFF SHORE

One of the most troubling events for estate planning attorneys is when their married clients get divorced. This is because a divorce drives a wedge through the middle of the marital estate and puts the attorney who helped plan the estate at the center of the fray.

An impetus for problems arising in these types of situations is that married couples often start the estate planning process at a time when they are deeply in love, share mutual goals of building wealth together, and are not thinking about what happens if their relationship sours. By the time of divorce, however, these spouses’ interests will likely have changed dramatically. The mutuality of interest from years prior is often replaced by frantic and competing desires to reclaim property that they brought into the marriage, and achieve financial independence from the other spouse. Unfortunately, this sudden

change in their interests puts the couple’s estate planning attorney in the middle of the conflict. And clients, who once may have been very satisfied with the attorney’s work, often become angry about how their assets are tied up in the marital estate.

If not prepared to navigate this com mon scenario, the estate planning attorney will be put in a difficult position, and find him or herself at risk for a potential mal practice claim. However, there are a number of measures that lawyers can undertake at the outset of client representation to limit his or her future exposure.

First, the attorney should have both spouses complete and sign forms declaring all property they intend to maintain as sep arate property during the marriage. Sepa rate property is any property owned before marriage and any property acquired during the marriage by gift, inheritance, or as com pensation for personal injury damages such as pain and suffering. If a dispute arises in

Dedicates 32nd Habitat House

a future divorce regarding the treatment of any property that was not previously dis closed, the attorney will have a clear record of the clients’ stated instructions in the file.

Second, the attorney should develop a handout explaining joint representations for an estate plan and the potential con flicts that may arise. Prior to beginning the joint representation, have the clients sign a form acknowledging they were provided this information in writing and that they agree to waive any conflicts of interest. If the couple later divorces and one of the spouses tries to claim his or her interests were not appropri ately served, the attorney will have a clear record of the written waiver as reference.

Third, the attorney should provide other written disclosures that the attorney deems to be necessary at the outset of engagement. These disclosures can be tailored depending on particular client situations or other unique circumstances. At a minimum, include dis closures about the differences between sepa rate and community property. Also disclose how spousal interests often change in the event of divorce, family deaths, or other contingent events that may arise. A discussion of options for these possibilities is a necessary element of a client being able to provide “informed consent” for a particular estate plan. The lawyer may also want to ask the clients to sign a disclosure acknowledg ing that they are giving up important marital property rights to accomplish their desired estate plan. The lawyer should keep all signed disclosure forms in a file. These signed documents will help protect the lawyer from becoming a target for client unhappiness at the time of a future divorce.

Fourth, the attorney should be well prepared to field questions about the pos sibility of unwinding an estate in the event

of a future divorce. This is not always an easy task. For example, there are special rules when clients use legal entities as part of their estate planning goals. When a spouse as part of an estate plan conveys his or her separate property into entities such as a trust or family limited partnership, the contributed property loses its separate prop erty character and becomes the property of the entity itself. Additionally, if the enti ties are created during the marriage, the spouses’ ownership interests in these entities are treated as community property. They will have no direct interest in the property contributed to the entity. In some estate plans, only one of the spouses has manage rial powers over the entity, yet both spouses will still hold the same undivided, commu nity property interest in the entity itself. At the time of divorce, the court will value and award a spouse’s interest in the entity, but not the property owned by the entity. While a divorcing spouse can ask the court to dis solve an entity and distribute its assets, how readily that can be accomplished depends, in part, on the terms of the formation docu ments. Importantly, if a spouse contributed separate property to the entity and is suc cessful in getting the court to order disso lution of the entity and distribution of the assets, the property being returned out of the entity will be community property—and will not revert to its prior separate character.

By preparing in advance and taking the right steps at the outset of representing married couples, an estate planning attorney’s effort will go a long way in protecting them selves from the claims of their clients in the event of a future divorce. HN

l l e l e d a d v i c e a n d e x p e r t i s e a s t h e y d e t e r m i n e h o w t o b e s t a d d r e s s t h e i r e s t a t e n e e d s

12 Headnotes l Dallas Bar Association December 2022

Jeff Shore is a Partner at Goranson Bain Ausley, PLLC. He can be reached at jshore@gbafamilylaw.com.

Family Law Issues Often Complicate Estate Planning Focus Probate, Trusts & Estates/Tax Law D U F F E E + E I T Z E N | D E L A W . C O M W h i l e d i v o r c e m a y b e g i n a n d e n d w i t h D + E , a t t i m e s a m a r r i a g e m a y a l s o e n d i n d e a t h W h e n t h o s e t i m e s a r i s e , a t t o r n e y s a t D u f f e e a n d E i t z e n a r e g r a t e f u l f o r o u r p a r t n e r s h i p s w i t h m a n y s t r o n g e s t a t e p l a n n i n g a n d p r o b a t e f i r m s t o p r o v i d e o u r c l i e n t s u n p a r a

D U F F E E + E I T Z E N | F A M I L Y L A W

A W . C O M | 2 1 4 . 4 1 6 . 9 0 1 0

| D - E L

On October 22, the DBA dedicated its 32nd Habitat for Humanity home to the Garcia family, with DBA President Krisi Kastl making a special presentation to the family. Thank you to all the DBA members and firms who donated this year, and a special thank you to DBA Home Project Co-Chairs David Fisk and Michael Bielby, Jr. To participate in the project for next year, contact Mr. Fisk at dfisk@krcl.com. (Left to right): Araceli Rodriguez, Ms. Kastl, Al Ellis, Esperanza Garcia, Preston Rose, Mr. Fisk, and Mr. Fisk’s son.

DBA

December 2022 Dallas Bar Association l Headnotes 13

BY SHANNON A. WEBER

According to petpedia.com, over ninety percent of pet owners consider their animals to be part of the fam ily. Thus, it only makes sense that pet parents put a plan in place to care for their pets in the event of incapacity or death.

To plan for incapacity, pet parents should execute a Durable Power of Attorney (a DPOA) including specific instructions regarding pet care. In a DPOA, a pet parent (the “principal”) may name an agent to handle his or her financial affairs on his or her behalf (e.g., in the event of incapacity). Texas Estates Code Section 752.051 provides a statutory form for a DPOA, which includes numerous “default” powers a principal may grant to an agent. One of

those powers regards personal and fam ily maintenance, which, in part, grants the agent legal authority to provide for the principal’s pets. A principal may also include specific instructions in the DPOA directing for pet care (e.g., naming a pet’s vet, medication, the general standard of care the principal intends for the pet to receive, or esti mated costs the principal deems rea sonable for pet care and maintenance). The more detail a principal provides in a DPOA, the more likely that the prin cipal’s intent will be achieved.

To provide for pets after death, pet parents should specifically provide for the ultimate disposition and care of pets in their wills or revocable trusts (their “estate planning documents”). Despite many pet owners’ feelings to the contrary, pets are considered

tangible personal property in Texas. Accordingly, if a pet owner does not provide for a specific disposition of his or her pets pursuant to his or her estate planning documents, then technically, the pets will be distributed in the same manner as the decedent’s tangible personal property (clothing, furnishings, etc.).

Therefore, pet parents should think about whom they wish to care for their pets in the event their pets survive them. To do so, pet parents may sim ply designate a succession of individu als to receive their pet at death in their estate planning documents. That des ignation may also be accompanied by a cash gift or specific pet-maintenance instructions. If taking this approach, a pet parent should ensure that the lineup of individuals to receive the pet is long enough so that there will always be someone to ultimately care for his or her pet. Naming a life care center at the back of the lineup for that purpose may be appropriate.

Of course, leaving pets and cash to individuals outright leaves no opportu nity for a deceased pet parent to pre vent abuse of that arrangement. If a pet parent is concerned about ensuring a pet is properly cared for and funds left for that purpose are prop erly expended, he or she may consider utilizing a pet trust. Pet trusts are also useful to provide continuing care and oversight with regard to specialty-use animals (e.g., breeding animals, race horses, etc.). Texas Trust Code Section 112.037 authorizes the creation of pet trusts. A pet trust can be created dur

ing the pet parent’s lifetime (in which case it will aide in a seamless transition of care for the pet in the event of inca pacity of the pet parent) or it can be created upon the pet parent’s death (in his or her estate planning documents).

A pet trust is created for the benefit of a human beneficiary who serves as the caretaker of the pet. The caretaker has the right to enforce the terms of the trust (on behalf of the animal). A trustee is appointed to distribute petcare funds to the caretaker and other wise administer the trust. Appointing different individuals to serve as caretaker and trustee introduces checks and balances, ensuring the pet is properly cared for. The trust instrument may be drafted to define and mandate certain care for the pet. Pet trusts are funded with a pet parent’s interest in his or her pets and an appropriate amount of cash to fund lifetime care expenses for the pets and compensation for the caretaker and trustee (if preferred). Notably, a court may reduce a pet trust’s funding amount if it is unreason ably large. Pet trusts terminate at the pet’s death, at which time any remain ing property will generally pass in the manner the pet parent provides in the agreement.

As is the case in providing for human family members, pet parents should give some thought to providing for pets in the event of incapacity or death. They have a lot of flexibility for doing so.

HN

14 Headnotes l Dallas Bar Association December 2022

Shannon A. Weber is an associate at Davis Stephenson, PLLC. She can be reached at shannon@davisstephenson.com.

What About Fido!? Planning for Pets Upon Incapacity or Death Focus Probate, Trusts & Estates/Tax Law FEDERAL & STATE CRIMINAL DEFENSE | FEDERAL & STATE CIVIL TRIAL MATTERS Knox Fitzpatrick ✯ Jim Jacks ✯ Bob Smith ✯ Mike Uhl ✯ Ritch Roberts 500 NORTH AKARD STREET, ROSS TOWER, SUITE 2150 DALLAS, TEXAS 75201-6654 | 214-237-0900 *Independent Law Offices Texas Lawyers’ Assistance Program TLAP provides confidential help for lawyers, law students, and judges who have problems with substance abuse and/or mental health issues. In addition, TLAP offers many helpful resources, including: Live Ethics CLE presentations TLAP Newsletter Request of specific educational materials 1-1, group telephone calls on topics Friday noon AA telephone meeting 1-800-393-0640, code 6767456 Find out more at www.texasbar.com.

December 2022 Dallas Bar Association l Headnotes 15 Spencer, Johnson & Harvell, PLLC focuses its practice on Will Contests, Trusts Disputes, Guardianships, and Fiduciary Litigation, and all associated litigation. Referrals Welcomed 500 N. Akard Street, Suite 2150 | Dallas, TX 75201 | 214-965-9999

P. Harvell

Spencer

E. Johnson

Brandan

R. Kevin

Zachary

O. Spencer Merry Christmas & Happy Holidays! Best Wishes for a Prosperous New Year!

Samuel B. Sheffer Blake

BY BROOKS CASTON

Despite the significant amount of time and money collectors invest in their col lections, I am routinely surprised at how often collectibles are neglected within the collector’s estate plan. While there are a multitude of considerations to examine when planning for a collection, this article is limited in scope to address ing insuring, inventorying, and commu nicating about a collection to facilitate more effective management, administra tion, and disposal of the collection.

Insurance

Many benefits result from properly insuring a collection, including providing the collector with a general inventory of the collection, a general value of the items comprising the collection, and financial security should a loss event occur. Many collectors mistakenly assume their home owners or umbrella insurance covers their collectibles. Most of the time, these policies do not cover the collection, or if they do, the coverage is often insufficient. Accordingly, a collector should revisit the terms of their relevant insurance policy to ensure sufficient coverage and, if needed, consider additional insurance coverage for their collectibles.

Inventory

An inventory is often ignored in the excitement of collecting, but if given the necessary time and attention, a well-pre pared inventory can serve as a useful col lection management and administrative tool for the collector, his or her personal

representative and the ultimate beneficiaries of the collection.

In general, an inventory should include the following information:

• Description (including condition) and picture of the item;

• Location of the item;

• Date of acquisition;

• Present value (depending upon the item, it may be advisable to obtain an appraisal);

• Cost basis (determination depends, in part, upon collector’s method of acqui sition, i.e., purchase, gift or devise/inheri tance);

• Paperwork associated with the item (e.g., bill of sale, authentication documentation; insurance documentation, receipt, invoice, assignment, condition report, appraisal, other title documenta tion, etc.);

• Documentation regarding marital property characterization (e.g., separate property or community property);

• Any other relevant information unique to the collection.

The inventory should be periodi cally revisited and revised as necessary to reflect an accurate and up-to-date catalog of the collection.

Communication

For a collector, when it comes to deciding upon a disposition plan, the resulting outcome is often simply a bequeathal of the collection to the col lector’s family members, such as spouse or children without further instruction or guidance. Unintended consequences may result in the absence of clear direc tion provided to the collector’s personal

representative or beneficiaries in connection with the administration of the col lection. For example, a family feud may erupt absent clear and direct communi cation during the planning phase result ing in undesirable (and costly) litigation. To mitigate the potential for unintended consequences, here are some pointers:

• Talk to family members. Many collectors mistakenly assume that their fam ily beneficiaries will want and be happy with the collection. However, oftentimes the foregoing assumptions are not the reality. If the beneficiaries do not want the collectibles, the collector should con sider an alternate method of disposition, such as liquidating the collection during life, directing a sale of the collection at the collector’s death and then distributing the net sales proceeds to the beneficiaries, or donating the collection to charity. The ultimate method of disposition should be informed by the beneficiaries’ desires and not what the collector assumes those desires to be.

• If the collector wants a specific indi vidual to receive a particular item from the collection, then he or she should ensure such outcome by making a spe cific bequest of the item in the appropri ate estate planning document, such as a will, trust, or tangible personal property memorandum

• It is likely that pieces of the collec tion will have to be temporarily stored and then shipped to beneficiaries who do

not reside in close proximity to the collector. Therefore, it is necessary to clearly define who bears the burden of such stor age and shipping costs.

• If a collector has identified a group of beneficiaries to receive the collection, he or she must consider setting forth the process by which such items are to be selected (e.g., specify the order of selection, lottery, auction, etc.).

• Frequently, the collector’s personal representative will lack a basic level of knowledge as it pertains to the collection. As a result, he or she should consider des ignating a third party who possesses the necessary collectible expertise to advise and assist the personal representative and beneficiaries in the administration of the collection, such as coordinating apprais als, inventorying the collection, if appli cable, or coordinating with an auction house for the sale of the collection.

Collectors are very intentional about curating and growing their collections. Planning for the proper disposition of the collection requires the same level of intentionality. It is therefore incumbent upon the advisor to encourage the col lector to dedicate the necessary time and attention to such planning so that the collection will be preserved, managed, and disposed of in accordance with the collector’s wishes. HN

Brooks Caston is Of Counsel at Steptoe & Johnson PLLC. He can be reached at brooks.caston@steptoe-johnson.com.

DBA/DAYL Moms in Law

16 Headnotes l Dallas Bar Association December 2022 4851 LBJ Freeway, Suite 601 Dallas, TX 75244 | 972-395-5600 | www.probatetriallawyers.com Trusted Experience. Relentless Resolve. Referrals Welcome Turning chaos into clarity in probate, trust, and guardianship disputes. RISK-TAKING CAN BE FUN... …BUT NOT WHEN IT’S A MALPRACTICE CLAIM. Personal Injury Claim* • Lawyer sued for allowing a default judgment taken against client • Damages of up to $4,000,000 sought ($200,000 policy limit) • TLIE settled case for $300,000 INSURED BY TLIE IF NOT INSURED Deductible $1,000 Defense costs $10,000 Amount over policy limit + $109,000 Settlement + $300,000 Total out-of-pocket = $110,000 Total out-of-pocket = $310,000 * Based on actual claim handled by TLIE. FIND OUT MORE: TLIE.ORG or (512) 480-9074

Focus Probate, Trusts & Estates/Tax Law

Estate Planning and Collectibles

Being a working mom can be challenging. Being a working lawyer mom can be a different ballgame with its own unique challenges. Moms in Law is a no pressure, no commitment, informal, fun, support group for lawyer moms. Join Moms in Law for lunch Monday, December 5, Noon, at the Zodiac Room (located on Level Six of Neiman Marcus downtown) To RSVP for this lunch, email Rebecca Nichols at rebecca.nichols@gmail.com

Bell Nunnally is proud to partner with the Dallas Cowboys.

We believe that behind every great company is a fiercely dedicated team that aids in its success.

Bell Nunnally is a Dallas-based, full-service law firm equipped to handle every legal need, whether in the boardroom or the courthouse.

For four decades, we have empowered our clients to exceed their goals by prioritizing trust, collaboration, respect and resolve.

From the clients we serve and the cases we win to the people we hire and the community we build.

Bell Nunnally. Behind Every Great Company.™ 2323 Ross Avenue, Suite 1900 | Dallas, Texas | 75201 | bellnunnally.com

December 2022 Dallas Bar Association l Headnotes 17

DBA Past President Orrin Harrison Passes Away

The Dallas Bar Association lost its 83rd president on October 12, 2022, at the age of 73. Orrin L. Harrison, III was president of the DBA in 1992.

Mr. Harrison studied political sci ence as an undergraduate at the Uni versity of the South, and in 1971 he graduated cum laude. He gained his legal education at the SMU Law School, graduating with honors in 1974. As a student he served as research editor of the Journal of Air Law and Commerce

In 1986 he was president of Dal las Association of Young Lawyers (DAYL). Mr. Harrison’s specialty as an attorney was business litigation and antitrust legislation. In addition to being president of the DBA, he served as president of the Dallas chapter of the American Board of Trial Advocates, and on the Board of Directors of the State Bar of Texas.

He was a trustee and life member of the Dallas Bar Foundation and a life fellow of the Southwestern Legal Foundation (now the Center for American and International Law), the Texas Bar Foundation, and the American Bar Foundation.

Mr. Harrison began his legal career at Locke Purnell Boren Laney & Neely. He would go on to become a partner at the firms of Akin, Gump, Strauss, Hauer & Feld, and Gruber Hail, and most recently at Foley Lard ner. In 2007 the American Jewish Congress Southwest Region presented him with the Torch of Conscience Award.

Mr. Harrison served as a former senior warden on the vestry of the

Church of the Incarnation (Episcopal).

He is survived by his loving and devoted wife of 51 years, Paula; son Orrin Lea “Guy” Harrison IV and his children, Giddings, Laney and Ben nett; daughter Erin Hart (Jason) and their children, Harrison, Lillian and Eloise; and daughter Lindsey Harrison and her son, Orrie. He is also survived by his brother, Chris Harrison (Bev erly), and sister, Carol Love, as well as numerous nieces, nephews and God children.

In lieu of flowers, please consider a designated gift to the Church of the Incarnation in memory of Orrin Harrison. Gifts can be made online at https://incarnation.org/orrin-har rison-memorial-fund/ or checks may be sent to the Church of the Incarna tion, 3966 McKinney Avenue, Dallas, Texas 75204. HN

Column Ethics

Keeping Your Fat Out of the Frying Pan: Tips to Avoid Grievances

BY ROBERT TOBEY AND CHAD BARUCH

Every lawyer dreads the prospect of a grievance. The most common reasons for grievance sanctions against Texas lawyers are:

• Lack of communication—28 percent

• Breaches of integrity—24 percent

• Neglect—23 percent

• Issues in declining or terminating representation—14 percent

• Safeguarding client property—11 percent

The top practice areas for sanctions are:

• Civil—39 percent

• Family—23 percent

• Criminal—22 percent

• Personal injury—9 percent

• Probate/wills—7 percent

Here are a few tips for steering clear of grievances:

Set Reasonable Expectations

Clients often file grievances as a result of frustration over the outcomes in their cases. Avoid the temptation to oversell the prospects for success and set reasonable expectations in terms of the overall case and particular matters that arise during litigation.

Establish Clear Payment Requirements

While fee disputes may not account for a substantial portion of the sanctions assessed against Texas lawyers, they do comprise a large percentage of the griev ances that are filed. Responding to these grievances takes time and money. Protect yourself by ensuring that clients under stand their obligations when it comes to fees. And resist the temptation to allow clients to accrue large unpaid balances.

Communicate, Communicate, Communicate

Rule 1.03 requires that you keep each client reasonably informed about the status of a matter and promptly comply with reasonable requests for information. The Rule also requires that you explain a matter to the extent reason ably necessary to permit the client to make informed decisions regarding the representation.

Many grievances arise simply because clients become frustrated when lawyers do not return phone calls or emails. Therefore, a steady flow of communica tion from lawyer to client is one of the most effective means to avoid griev ances.

Communicate Inside the Firm

Remote work presents special challenges for communication among firm staff. If you have lawyers or staff mem bers who work from home, establish pro tocols to ensure adequate communica tion within the firm.

Never Withhold Bad News

Bad news is like stinky cheese: it gets worse with the passage of time. Enough said.

Don’t Create the Client’s Best Exhibit

No matter how justified it may have been, your sarcastic, snarky, hostile, or demeaning email to the client will be exhibit number one in the grievance pro cess. Meanwhile, your consistent polite tone in emails will undercut any allega tion of unprofessional behavior. There fore, be civil in all communications with the client—no matter how much venom you receive in return.

Also, do not let the client create selfserving exhibits by misstating previous communications. The client may send you an email saying “You told me XYZ” when you said nothing of the sort (or even said the opposite). Do not let mis statements go unaddressed. Send a polite but firm email correcting them.

Avoid Forming Unintended Attorney-Client Relationships

If the client has a reasonable basis to believe that an attorney-client relation ship exists, then it probably does. Pro tect yourself against unintended attor ney-client relationships by spelling out the identity of the client explicitly in your engagement letter and disclaiming representation of anyone else.

Take particular care in the common trouble areas of multi-passenger car wrecks, majority and minority venture investors, corporate officers and share holders, limited and general partners, and controlling and non-controlling members of business entities. Disciplin ary Rule 1.07 contains an excellent con flicts checklist to use as a reference.

If you do undertake joint representa tion, your client letter should include at least the following:

• Written confirmation by each cli ent that no conflict exists.

• Client agreement to inform you if a conflict arises.

• Consent to joint representation.

• Your recommendation for separate representation.

Decline Matters Promptly and Clearly

Whether you or someone else does your intake, make sure that they get enough information for you to deter mine, with reasonable certainty, when the statute of limitations will run on the claim. Have a procedure in place for immediate rejection of potential clients whose claims are too close to limitations.

Always send a written communi cation stating clearly that you are not taking the case or otherwise doing any thing else to protect the potential cli ent’s interests. Advise the rejected client that limitations are running and they should retain other counsel to take steps to preserve their claims. But we caution against stating when limitations will expire unless you are absolutely certain.

Conclusion

Of course, an attorney may follow all of these tips and still be the target of a grievance. But adhering to these rules should reduce the risk of having to face the disciplinary process. HN

Robert Tobey is a Shareholder at Johnston Tobey Baruch, and Chad Baruch is Managing Shareholder at the firm. They can be reached at robert@jtlaw.com and chad@jtlaw.com, respectively.

18 Headnotes l Dallas Bar Association December 2022 TURLEY LAW CENTER Professional Friendly On-Site Staff 24-hour Cardkey Access Complimentary Valet Reserved Conference Room (No Charge) High-Speed Internet Deli Serving Breakfast & Lunch Full Service Salon & Spa ATM FedEx Drop Box Near Dart Station Satellite TV Connections Car Detail Service Furnished Executive Suites Conveniently located at N. Central Exp. & University Blvd. Competitive lease pricing. Is your office building “Dog Friendly?” OURS IS! TAKE A TOUR! Email us at Brendag@wturley.com or call 214-382-4118

STAFF REPORT

Orrin Harrison

December 2022 Dallas Bar Association l Headnotes 19 Divorce | Child Custody | Prenups and Marital Agreements Your answer to a better future. SERVING THE GREATER DALLAS AREA 5949 Sherry Lane, Suite 1070, Dallas, Texas 75225 | 972-232-7673 | epsteinpc.com Contact Us. Board Certified in Family Law –Texas Board of Legal Specialization

Epstein Managing Partner Resolve to be happier. Let us support you in your desire to move forward and help you strengthen your resolve. Happiness is a choice — Epstein Family Law knows the steps that will help you realize the brighter future you see for yourself and your family.

Robert