Our

Our

Our

Our

Thomas Chamberlain Chair

Iroquois Federal Savings & Loan Association

Anthony Nestler Chair-Elect

Hickory Point Bank and Trust

REGION 1

Rudy Gonzalez CIBC Bank USA

Frank Pettaway The Northern Trust Company

REGION 2

Peter Brummel Grundy Bank

Courtney Olson First Bank Chicago

REGION 3

Lawrence Horvath Heartland Bank & Trust Company

Kathy Williamson Bank of Farmington

T.J. Burge Vice Chair

Community Partners Savings Bank

REGION 4

Scott Bland First Neighbor Bank N.A.

Brett Tiemann INB, National Association

REGION 5

Rick Parks First National Bank of Waterloo

Bethany Shaw Peoples National Bank, N.A.

Lora Kalka FNBC Bank & Trust

Gustavus Bahr PNC Bank, N.A.

J. David Conterio Hometown National Bank

David Doedtman

Washington Savings Bank

Brian Hannon Cornerstone National Bank & Trust Company

Robert Kelly Old National Bank

Karlie Krehbiel Lisle Savings Bank

Ted Macon Farmers State Bank of Hoffman

Megan Collins Treasurer Bank of America

Frank Pettaway Member-at-Large

The Northern Trust Company

Courtney Olson

Member-at-Large First Bank Chicago

Michele Petrie Village Bank & Trust, N.A.

Amy Randolph Busey Bank

Timothy Smigiel Liberty Bank for Savings

Matthew Smith First Mid Bank & Trust, N.A.

Dan Wujek State Bank of Cherry

Two Offices to Serve You! Springfield Office: 800-783-2265 • Chicago Office: 800-878-2265

To connect with our staff, use this email format: firstinitiallastname@illinois.bank

Executive Administration

Randy Hultgren, President & CEO

Erich Bloxdorf, Executive Vice President & COO

Mindy Manci, Executive Assistant & HR Manager

Pam Macha, Springfield Office Coordinator

Finance and Administration

Mark Bennett, CPA, Executive Vice President and CFO

Marcia Stratton, CPA, Director Marie South, Financial Assistant

Law Department

Carolyn Settanni, Executive Vice President & General Counsel

Carly Berard, Associate General Counsel

Michael Schasane, Compliance Counsel

Nick Sladek, Administrative Assistant

Betsy Johnson Immediate Past Chair Solutions Bank

Randy Hultgren

Secretary Illinois Bankers Association

Government Relations

Ben Jackson, Executive Vice President

Aimee Smith, Assistant Vice President

Matt Imburgia, Director

Marketing and Member Relations

Julie Winterbauer, Senior Vice President

Tammy Squires, Vice President, Data & Digital Marketing

Robin Lane, Director, Associate Membership

Tim Robinson, Director, Bank Relations

Linda Koch, CAE, Manager, Member/Business Relations

Sarah Cowan, Membership Assistant

Illinois Bankers Business & Education Services, Inc.

Callan Stapleton, CAE, EVP & President of Business and Education Services

Adam Walsh, Vice President, Insurance Services

Lyndee Fein, Director, Education & Conferences

Rachel Selvaggio, Director, Forums & Future Leaders Alliance

Denise Perez, Director, Education & Training

Debbie Jemison, CAE, Director, Financial Literacy

Maddison Augustine, Manager, Marketing & Digital Communications

Amy Sale, Education Assistant

Illinois Bankers Group Insurance Trust

Erich Bloxdorf, Plan Administrator

Mike Mahorney, Senior Trust Advisor

Hillary Meyers, Trust Manager

Editorial Office 3201 West White Oaks Drive Ste. 400 Springfield, IL 62704

217-789-9340

www.illinois.bank

With the exception of official announcements, the Illinois Bankers Association disclaims all responsibility for opinions expressed and statements made in articles published in Illinois Banker. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that the publisher is not engaged in rendering legal or other professional services. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

Illinois Banker (ISSN 0019-185X) is published bi-monthly and is available at a cost of $45 per year for members and $90 per year for nonmembers. Regular issue single copy price is $8.50. Postmaster, send address change to Illinois Bankers Association, 3201 W. White Oaks Drive, Ste. 400, Springfield, IL 62704. News items from members of the Illinois Bankers Association are invited and are due on the first of the month preceding publication.

© Copyright 2023 by Illinois Bankers Association (unless individual articles list copyright). Reproduction of any material in the Illinois Banker is strictly prohibited without written permission of the publisher.

Serving on the IBA Board of Directors since 2016, I have become quite familiar with the expectations of a board member and am excited to take on my new role as IBA Chair. I look forward to embracing this opportunity to personally meet with many of you across the state and hear the needs of your bank. That made me wonder if every IBA member embraced our expectations of how to get the most out of your IBA membership.

I am leading the charge to help deliver the message to all our members that we expect you to take advantage of our critical resources and be active in our advocacy. Use our free compliance education and deliver our turnkey messaging to your legislator to protect our industry. Secure a competitive quote from our complete line of insurance products and vet our

Preferred Vendors. Share your knowledge about your Association with every banker on your team – each of you enjoy full IBA membership benefits. Everything that the IBA has brought to the table for you, our IBA members, has been crafted based on your expectations.

I invite you to hold our feet to the fire and dig into all that the IBA offers. We expect that you will be able to find AT LEAST one new product, service, resource, or solution that will benefit you and your bottom line. We have an amazing team at the IBA! Let us help you focus on being the best bank you can be for your customers, community, and shareholders and leave the tasks of protecting, educating, and transforming our member banks up to the IBA!

Inflation and interest rate risks are real threats to banking, but we have another looming threat. Legislative risk could destroy our banking industry. Unlike many other challenges and risks in banking, your voice and stories of community service can diminish the threat of destructive legislation. Are you willing to be engaged with your representatives?

Ben Jackson and I just met with our Illinois Congressional Delegation in D.C. Everyone we met wanted to know how your bank is doing. We assured them that Illinois banks are strong and resilient but need their help to stop over regulation and oppose bills that would damage your ability to serve your communities. We have been able to tell your stories of service to your community so they can pursue their dreams. We talked about the unfair position of Farm Credit and credit

unions and how that takes tax dollars out of communities. We told them about a bill filed called the Access to Credit in Rural Economies (ACRE) that would allow banks to provide the same type of loans that Farm Credit pushes. The Illinois Legislature recently adjourned and your Association government relations team worked tirelessly to protect you, stop bad legislation, and pass good legislation.

As hard as the IBA works, your voice is stronger than ours. Legislators listen when you speak. Will you join us in D.C. from September 18-20, 2023, to meet with regulators and Members of Congress? Would you host a state or federal elected official this summer in your bank to meet your staff and customers for them to see and hear about the impact you are having? Our banking system is precious and requires your extra involvement to survive.

Our vacation policy requires employees to take off work for five consecutive days. For employees who work forty hours over a six-day work week, would taking off five days fulfill this requirement, or should they take off forty consecutive hours?

If your bank’s internal time-off requirements are based on calendar days rather than hours worked, we do not believe you need to impose hourly time-off requirements for employees who work less than forty hours in a five-day span. However, your bank may want to consider requiring employees to be absent from their duties for two consecutive weeks for the reasons described below.

The FDIC (your primary regulator) recommends that banks require their officers and employees “to be absent from their duties for an uninterrupted period of not less than two consecutive weeks . . . in the form of vacation, rotation of duties, or a combination of both activities.” The FDIC also recognizes that exceptions to a two-week policy can occur and, in such cases, recommends establishing “adequate compensating controls — such as an effective rotation of personnel — that are strictly enforced,” as well as having your vacation policy annually reviewed and approved by your board of directors.

Consequently, your bank may want to require employees to rotate their duties for five consecutive days before or following a five-day vacation so that

they are absent from their regular duties for two consecutive weeks. The FDIC’s Risk Management Manual of Examination Policies measures this recommended absence in weeks (rather than hours) and notes that such time off policies “are highly effective in preventing embezzlements, which usually require a perpetrator’s ongoing presence to manipulate records, respond to inquiries, and otherwise prevent detection.”

The FDIC also recommends “suspending or restricting an individual’s normal IT access rights during periods of prolonged absence, especially for employees with remote or high-level access rights” and states that “[a]t a minimum, management should consider monitoring and reporting remote access during periods of prolonged absence.”

Additionally, we note that the OCC and Federal Reserve have published similar guidance, and the Federal Reserve has stated that for a required absence policy to be effective “individuals having electronic access to systems and records from remote locations must be denied this access during their absence.”

Our IBA Law Department provides many resources to help our bank members meet their compliance challenges, including a toll-free Compliance Hotline (1-800-GO-TO-IBA) and a dedicated compliance website (www.GoToIBA. com). We also publish a free weekly e-newsletter highlighting the latest regulatory developments, select recent Q&As, and other useful information – let us know if you want to subscribe!

Note: This information does not constitute legal advice. You should consult bank counsel for legal advice, even if the facts are similar to those discussed above.

What is the most common practice for handling requests to remove a living joint account holder from a demand deposit account? We usually close the account and open a new one, but we heard that some banks allow removal of a joint account holder if the proper paperwork is signed by all of the co-owners. Are there any benefits to using one method over the other? We are concerned about unauthorized transactions and disagreements between co-owners if we allow removal without closing the account.

We believe that there are more benefits to your bank’s approach when ownership of a joint account changes — closing the account and opening a new account, with a new account number and new account agreement signed by the owner.

As you have found, we are aware that some banks will remove a co-owner from a joint account without requiring the remaining owner(s) to open a new account, but we consider the creation of a new account to be the best practice in order to avoid any number of complications that could arise by re-titling an existing account. Opening a new account and asking your customer to sign a new signature card will create a clear record of the change in account titling and ensure that

your account records are updated to reflect that the removed co-owner is no longer on the account.

Whether you allow for re-titling of an existing account to remove a co-owner or require closure of the joint account and opening of a new account, we recommend that you require a written acknowledgement signed by all the co-owners indicating their consent to remove a co-owner. The written acknowledgement should clearly indicate the co-owner’s intent to be removed from the account and to relinquish any funds in the account to the remaining owner. You also may wish to include language requiring the removed co-owner to discontinue their use of any checks, debit cards, or other access devices for the account.

We are having some construction work done at our bank that will require us to close our drive-through windows for one day. Do we need to notify our customers or receive permission for the closure from our primary regulator, the OCC?

No, we do not believe you are required to notify your customers that your drive-through windows will be closed for one day or obtain permission for the closure from the OCC. However, we believe it would be a best practice to notify your customers and the OCC of the temporary closure.

The Branch Closings booklet of the Comptroller’s Licensing Manual provides that a “bank is not required to notify the OCC of a closing caused by a temporary interruption of service, but it would normally be sound practice to do so.” The Branch

Closings booklet also indicates that a bank may reduce certain functions or services at a branch “without being subject to the branch closing requirements” but notes that “giving customers appropriate advance notice of service changes [is] a good business practice even when statutory branch closing requirements are not applicable.”

Consequently, we recommend notifying the OCC that your drive-through windows will be closed for one day and posting advance notice of the temporary closure in a conspicuous manner at the affected branch.

Today, banks rely more on vendors and third-party technology providers to improve the customer experience and keep pace with the continuously evolving digital landscape. Fintech providers are well-equipped to design and deliver solutions rapidly, often at a lower cost than in-house development. For these relationships to be successful, banks must efficiently navigate contract negotiation and optimization.

Whether a financial institution is dealing with an existing vendor or coming to terms with a new provider, an inevitable power imbalance looms over the negotiation process for many reasons, including imperfect information and knowledge, limited negotiating skills, or an unobjective view of the underlying economics or alternatives.

To help contract negotiations be more successful, there are seven rules for optimizing vendor contracts:

A comprehensive vendor/contract review is a lengthy exercise. If a financial institution doesn’t begin the process with enough lead time (as early as 24 months), it’s a clear sign to their current vendor that the account is secure, and there’s no need to offer material concessions. The request for proposal (RFP) process also can be lengthy with numerous sequential steps, including document development, distribution to potential suitors, completion, interviews, presentations, and evaluations, not to mention detailed negotiations.

There must be a programmatic approach to financial technology contracts, which also means that it is helpful for the bank to assign a Project Lead — most likely the CFO, controller, or, in larger financial institutions, a delegate from the finance department — to be responsible for each agreement. These types of agreements require specialized knowledge, and taking the lead role out of the hands of the individual serving as the vendor’s ongoing main contact point can be financially beneficial. The Project Lead also should set clear priorities for the ongoing relationship and the negotiation process.

Financial institutions should never routinely renew or extend an agreement solely because they’re satisfied with the relationship. If a vendor approaches with an offer to extend at current contract terms, it’s an almost sure sign that money is being left on the table. Based on the typical technology curve, prices usually decline over time — particularly in a competitive market with high fixed costs and a steady stream of new entrants driving competition. The RFP process serves as a valuable opportunity to understand the market better. The evaluation process enables institutions to affirm they have made the best decision and to generate cost savings or other significant improvements in terms and service levels.

Most financial services technology contracts include a clause requiring the customer to formally notify the vendor of its intent to revisit the agreement’s parameters at the end of the term. Vendors might argue that such clauses are necessary to ensure continuity of service for mission-critical software and services; however, it’s easy to overlook a required notification date — when a bank does so, the agreement immediately locks in for multiple years at existing rates. Given the general downward trend in technology prices, inaction hands the vendor a clear win. Some common safeguards against this are for a client to deliver written notice of intent to terminate

immediately upon signing an agreement, limiting the duration of renewal periods, allowing clients to terminate at will during auto-renew periods, or requiring vendors to alert clients to an upcoming notification date.

Much of the power imbalance in a contract negotiation stems from the vendor’s deep knowledge of the space — precisely the type of expertise the bank aims to leverage through their relationship. Industry benchmarking data, conversations with colleagues at other financial institutions, and other forms of due diligence are all helpful and recommended steps. However, an even morevaluable step is to enlist a partner with similar domain expertise

and market insight to assist with vendor selection and contract negotiation. Having someone in your corner who has built a cache of benchmarking data and negotiation proficiency can level the playing field.

Expiration and notification dates aren’t the only contract-altering events that must be tracked. The acquisition of a vendor firm often triggers a renegotiation opportunity. Other operational thresholds — often volume related — also may trigger pricing changes. Renegotiation and pricing clauses can help incentivize vendor and client behaviors, accounting for financial institution-specific needs and providing for the unexpected.

Although contract negotiation is an important and valuable activity, it should constitute a relatively small portion of a constructive long-term vendor/client relationship. Solid relationships and open communication lines are highly desirable for ongoing operational success and customer service. To optimize negotiation leverage, a united front has to be maintained in the negotiation process. Consider retaining an independent, third-party negotiator to act in your best interest while maintaining respect and diplomacy with your vendors. Millions of dollars are at stake when negotiating a bank’s portfolio of vendor agreements. Financial institutions need to bring the proper skills to the table to solve the power imbalance in these discussions. These skills can be challenging to obtain, which makes enlisting the assistance of an objective and experienced third-party expert an important part of contract negotiations. Doing so can ultimately result in tremendous cost savings for institutions in the long run.

Patrick Goodwin is president of Strategic Resource Management (SRM), an independent advisory firm serving financial institutions and other industries across North America and Europe. Goodwin has nearly 20 years of contract negotiation experience spanning two dozen distinct specialties. His acquired knowledge of credit and debit card services, M&A contracts, and beyond remains vital to SRM’s continued diversification and success. For more information and details on optimizing vendor contracts, download SRM’s report

The Illinois Bankers Association (IBA) proudly recognizes Jim Roolf, Senior Vice President and Corporate Relations Officer at Old National Bank, as the 2023 Banker of the Year. Roolf received the award during the IBA’s Annual Convention held in Chicago on Friday, June 23, 2023.

The Banker of the Year award is the highest honor the IBA bestows on an individual whose dedication to excellence has profoundly enhanced the banking industry. This annual award recognizes the individual’s leadership and service qualities, applied not only to the banking industry but also to promoting civic, community, and charitable causes.

“Jim Roolf exemplifies everything we hold dear about banking in Illinois. His drive and commitment

to the industry and his community have created a lasting legacy,” said Randy Hultgren, President and CEO of the Illinois Bankers Association.

“We are honored to recognize Jim as our 2023 Banker of the Year and thank him for his years of exceptional service.”

Roolf began his banking career in 1974 with Union National Bank & Trust Company of Joliet which then evolved into First Midwest Bank in 1982. He has served at the same organization, now operating as Old National Bank, for more than 48 years. Known as a well-respected “face” of the company with the community, banking associations, and governmental bodies in Illinois as well as Old National's regional footprint, Roolf’s consistent presence and leadership are part of the bank's

long-term success in the community banking industry throughout our state and the other states where Old National operates.

He is known for mentoring and developing bankers throughout Illinois and has made numerous contributions to the banking industry at the state and federal levels. He served as a former member of the American Bankers Association Government Relations Council, representing Illinois, and as the ABA State Chair for Membership. He also served as Chair of the IBA Government Relations Committee from 1993-1996 and continuously served on the IBA’s Government Relations Committee for over 30 years. In 1995, he worked with the IBA on the Illinois Banking Act, which permitted statewide branch banking, regional reciprocal interstate banking, and national interstate banking.

Roolf is also a dedicated community servant, sitting on numerous boards, including the Will County Center for Economic Development, Silver Cross Hospital, American Red Cross, Chicago Regional Growth Corporation, and the Joliet City Center Partnership Board. He also served on the Illinois State Tollway Highway Authority Board of Directors for seven years, serving as the Chair of the Engineering Committee. He was the lead Director in support of the I-355 extension in Will County between Bolingbrook and New Lenox and led the effort to build the I-57 & I-294 interchange.

A critical challenge facing community banks is the ability to establish AND maintain a unified and driven executive management team to ensure the long-term success of the institution. Fundamental components of achieving these goals include:

u Retaining existing executive management talent for the long-term.

u Recruiting (and/or retaining) the next generation of executive leadership.

u Implementing a proper compensation structure to reward existing and future leadership for long-term service.

A properly designed non-qualified benefit plan can serve as an integral component to help community banks realize these objectives. The ultimate success of these arrangements is a direct function of whether they can inspire loyalty and create a culture that foster meaningful relationships which result in longstanding individual and corporate success. The post-pandemic environment has been characterized by a dramatic shift in employee expectations and motivations. Traditional employer recruitment methods and compensation practices are exceedingly less likely to achieve the desired results. Securing future executive leadership roles is critical to succession planning and long-term independence.

Employees (and customers) are loyal to companies when they feel valued by the company. To succeed, community

banks must invest in people, while prioritizing a performance and value-driven culture. This includes a proper balance of planning and incentivizing employees to enhance appreciation, motivation, and collaboration in a manner that can ultimately build upon the cultural identity of the institution.

Non-qualified benefit plans encompass an array of plan design structures to include defined contribution plans, defined benefit plans, stock options, restricted stock, and phantom stock arrangements. Banks can enhance their overall compensation packages and demonstrate their dedication to their employees' long-term financial security and well-being by offering these extra incentives. Non-qualified benefit programs allow employers to stand out from the competition to attract potential employees, while also assisting in the retention of top personnel by encouraging long-term dedication and loyalty. Moreover, these plans offer the flexibility to customize benefits based on individual employee needs, ensuring a personalized and appealing rewards system. By leveraging non-qualified benefit plans, banks can maximize the value of their compensation strategies, while optimizing benefit resources, thereby creating a win-win scenario for both employers and employees.

Non-qualified benefit plans are employer sponsored, tax-deferred arrangements that fall outside the scope of Employee Retirement Income Security Act (ERISA) guidelines. Plans are maintained primarily for a select group of management or highly compensated employees whose

benefits under the employer's qualified plan are limited by IRC §415 (or directors). Under the terms of a non-qualified plan, an employer simply defers compensation for the participant to a future date. The amounts are held back (deferred) during the accumulation/service period and are paid out to the participant at an explicit time and at specified intervals based upon prescribed plan triggers, i.e., on a specified date, separation from service, death, disability, or change of control. Employers deduct expenses when benefit distributions are paid to the plan participant and participants defer federal, state, and local income taxes to a future date, when they will presumably be in a lower tax bracket.

The ultimate success of a non-qualified benefit plan is a direct function of:

u Effective plan design that contemplates individual circumstances, while providing inherent and perceived value to plan participants

u Proper cost and benefit consideration in terms of the immediate and long-term financial and cultural value of the plan participants

u Balanced and deliberate structuring of vesting requirements to help ensure long-term service objectives and mitigation of underlying cost if service requirements are not achieved

u Clear, concise, and regulatory compliant legal plan documentation

u Opportune timing of plan implementation; i.e., consider the cost of waiting

u Appropriate selection of plan participants

In an effort to retain a successor to its current CEO, to reward the individual for their prior and future service, and to effectively share corporate profits based upon growth and profitability; a bank located in a rural Midwest community recently implemented a defined contribution plan for a 40-year-old officer based upon the on-going achievement of four (4) specific goals: Return on Assets, Loan Growth, Deposit Growth, and General Executive Performance.

The annual contributions to the plan are based upon a predefined, tiered scale of actual salary with metric weighting for each of the specified goals, and a maximum contribution equal to 35% of salary. The plan provides for both in-service distributions commencing at age 46 (to accommodate the officer's personal goal to fund their child's college education) and retirement benefits starting at age 65. To achieve

retention and to protect the bank, the plan was designed with a cliff vesting schedule for the in-service benefits and a linear vesting schedule for the retirement benefits. If the officer separates from service with the bank for any reason before attaining the prescribed vesting period, they will forfeit the principal contributions and associated interest.

From an accounting and recordkeeping perspective, the contribution amounts accrued each period are based upon the year-to-year employer contributions and the interest credited on the account balance, which is based upon the Prime rate on a designated date. To informally fund the benefit obligation, the bank insured the officer with BankOwned Life Insurance (BOLI). The daily earnings on the BOLI policy grow tax-deferred and the ultimate death benefit proceeds will be payable on an income tax-free basis. The superior credit quality, predictable earnings, and taxadvantaged status made BOLI the ideal asset to informally finance the cost of the defined contribution plan.

The implementation of the non-qualified defined contribution plan proved to be an effective strategy for the bank in lieu of simply increasing the officer’s cash compensation. The officer, who possesses unique skills and expertise, is not bound by geographical constraints imposed by competitors in the market. The specific plan design tailored to the officer’s needs demonstrates a long-term (mutual) commitment, while instilling a perception of value to foster long-term allegiance. From an overall plan design perspective, it proved to be mutually agreeable that a longterm financial investment on behalf of the bank necessitated a long-term financial commitment of the executive.

Regardless of economic, industry, or political factors, the challenges to the community bank marketplace present tremendous opportunity to the banks that choose to seize it. People are the “keystone” to success, and over the course of the past four decades, non-qualified benefit plans have proven to be one of the best methods to retain, recruit, and reward executive bank leadership. This can leverage opportunity and drive culture, motivation, profitability, and growth for years to come.

The design and implementation of a non-qualified benefit plan that effectively addresses the objectives of a bank and its employees requires an experienced partner. Banc Consulting Partners (BCP) is an industry leader in the design, implementation, and on-going administration of non-qualified benefit programs and Bank-Owned Life Insurance (BOLI). BCP is a privately held, national consulting firm with several hundred bank clients and numerous state banking association relationships, including the endorsement of the Illinois Bankers Association (IBA).

On March 12, the Federal Reserve launched the Bank Term Funding Program (BTFP), a lending program for eligible depository institutions—banks, savings banks, and credit unions—experiencing liquidity issues. The goals of the BTFP are to bolster institutions’ capacity to safeguard deposits and ensure the ongoing provision of credit to communities and the broader economy.

Use of the BTFP reduces the need for an institution to quickly sell securities, perhaps at a loss, in times of stress. As of April 5, outstanding loans through the program stood at $79 billion. BTFP usage is published weekly in the Board

1From the Board of Governors FAQ (PDF), “The Board will not criticize eligible depository institutions for participating in the Program. The Board believes banks’ use of the Program can be part of sound liquidity management. The Board established the Program to make additional funding available to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors. The Program provides an additional source of liquidity against high-quality securities, which eliminates an institution’s need to quickly sell those securities in times of stress.”

of Governors’ H.4.1 statistical release (“Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks”).

Some of the BTFP’s features and requirements follow. More detailed information can be found in a list of frequently asked questions (PDF) prepared for program users.

u Eligible Borrowers—U.S. federally insured depositories and U.S. branches or agencies of foreign

banks that are eligible for primary credit at the discount window. While the holding of a Federal Reserve master account is not required, borrowing institutions must at least have a correspondent relationship with an institution that does have a master account.

u Eligible Collateral—Direct obligations of certain U.S. government agencies, including the U.S. Department of the Treasury, government-sponsored enterprises such as Fannie Mae and Freddie Mac, and the Federal Home Loan Banks. In addition, mortgagebacked securities issued and/or fully guaranteed by Ginnie Mae, Fannie Mae and Freddie Mac are eligible.

2From the FAQ (PDF), “Under section 11(s) of the Federal Reserve Act, the Federal Reserve will publicly disclose information concerning the Program one year after it ends (the Program is currently scheduled to end on March 11, 2024). This disclosure will include names and identifying details of each participant that borrows from the Program, the amount borrowed, the interest rate or discount paid, and information concerning the types and amounts of collateral pledged or assets transferred in connection with participation in the Program.”

u Loan Terms—Institutions may borrow up to the value of eligible collateral pledged. Collateral is valued at par, i.e., with no haircuts. Loans can be prepaid at any time without penalty. The rate is fixed for the life of the loan (up to one year) and is calculated by adding 10 basis points to the overnight index swap rate. The rate is published daily on the Discount Window website. Advances will be available until March 11, 2024, or longer if the program is extended.

This program will help eligible institutions ensure that they have sufficient cash on hand to meet depositors’ needs. Supervisors will view the use of the BTFP as prudent liquidity management.1 Information about borrowing institutions and the advances they take will remain confidential for a year after the program ends;2 as of now, that date would be March 11, 2025, one year after the program is scheduled to end.

Bankers also are encouraged to use the discount window as a complement to the BTFP. The programs share some characteristics but differ in other ways. The discount window accepts a wider range of collateral than the BTFP, for example, which may make it a better choice for some banks.

Detailed information on the BTFP can be found on the Discount Window website. There, bankers also will find a standard template to request funds

and collateral pledging instructions. As with discount window loans, BTFP loans are issued by local Federal Reserve banks. Please reach out to your local Reserve Bank contact with questions or concerns. A list of contacts also can be found on the Discount Window website.

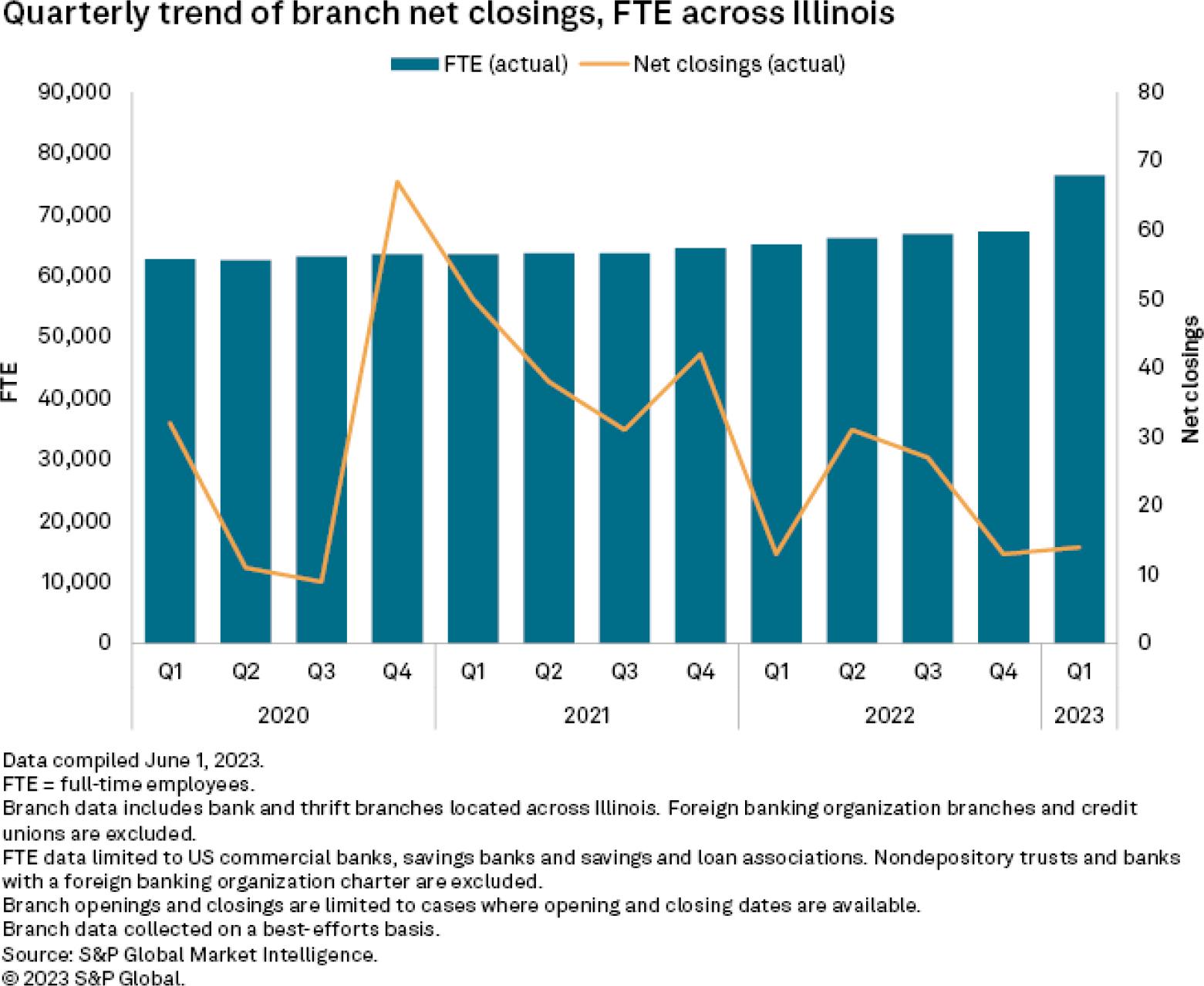

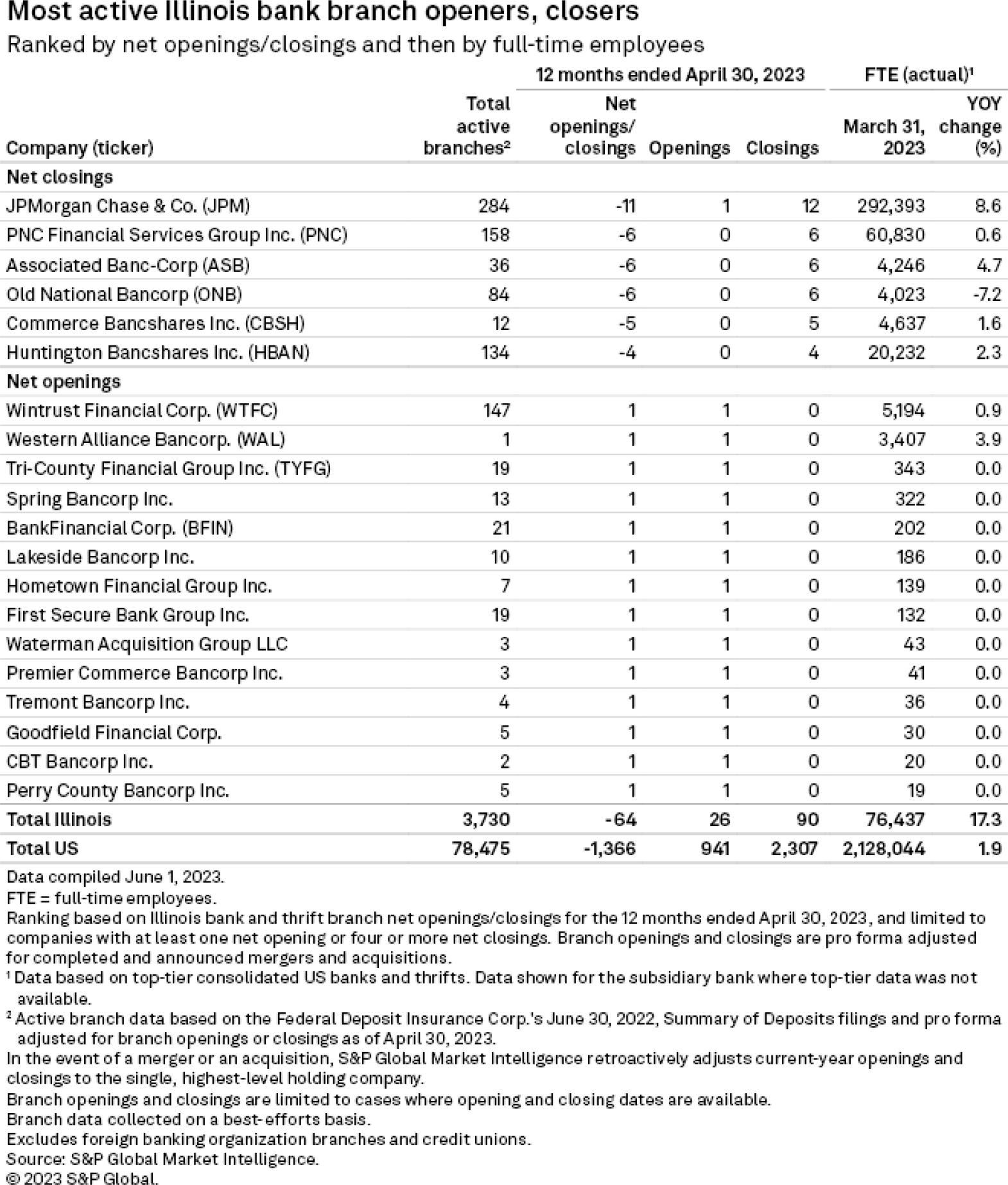

US banks closed more Illinois branches than they opened but increased their number of fulltime employees in the state. In the 12 months ended April 30, banks recorded 64 net branch closings in Illinois, as they shuttered 90 branches and opened 26, resulting in 3,730 active branches in the state, according to S&P Global Market Intelligence data. As of March 31, there were 76,437 full-time employees (FTEs) in Illinois-based bank branches, up 17.3% year over year. Overall, US banks recorded 1,366 net closings in the 12 months ended April 30, with 2,307 branches closed and 941 opened. Their total FTE count was 2,128,044 as of March 31, representing a yearly increase of 1.9%. Branch closures across the US have slowed compared to the torrid pace of closures during the COVID-19 pandemic as banks have attempted to strike a balance between increasing digital adoption and maintaining physical locations.

JPMorgan Chase & Co. was the top net branch closer in Illinois with 12 closings and only one opening as of the 12 months ended April 30. JPMorgan will build more branches than it will shutter as it continues a market expansion strategy that has been driving deposit share outperformance, executives said May 22 at the company’s investor day. PNC Financial Services Group Inc., Associated Banc-Corp and Old National Bancorp tied for the

second-most net closures in Illinois with six each. PNC anticipates bank branch traffic to keep declining across the country. “We’ll adjust our physical footprint and increase our digital footprint if that’s what clients demand as that continues to happen,” Chairman, President and CEO William Demchak said April 26 during the company’s 2023 annual meeting of shareholders. Commerce Bancshares Inc. ranked third with five closings and no openings. The company is focused on growing its digital channel, President and CEO John Kemper said April 19 during the company’s 2023 annual meeting of shareholders. “We’re making a lot of technology investments these days,” Kemper said. “This area has been a real focus for us in recent years as customers have shown more appetite for digital interaction.” Several banks were tied as the most active net openers in Illinois with one branch opening each, including Wintrust Financial Corp. and Western Alliance Bancorp.

During 2020, banks booked a record number of net branch closings amid the COVID-19 pandemic. Data from 2020 to the first quarter of 2023 shows that net branch closings in Illinois were the highest during the fourth quarter of 2020 at 67. Net closings in the state were the lowest in the third quarter of 2020 at nine. Banks logged the highest number of FTEs in Illinois in the first quarter of 2023 and the lowest in the second quarter of 2020.

The Illinois Bankers Association is proud to announce the 2023 Illinois Bankers Scholarship and the Linda J. Koch Scholarship recipients.

The Illinois Bankers Scholarship program and the Linda J. Koch Scholarship fund are administered through the Illinois Bankers Association. They are awarded to high school graduates or college students seeking a degree in the financial services sector. The Illinois Bankers Association has announced that six students have been selected as awardees of the prestigious Illinois Bankers Scholarship for the year

2023, and an additional two students have been awarded the esteemed Linda J. Koch Scholarship.

Applicants must be sponsored by an IBA member financial institution and demonstrate an interest in a future career in banking. To qualify for the Linda J. Koch Scholarship, candidates also must exhibit exceptional leadership and service attributes and meet other eligibility requirements.

“These scholarships are not only a testament to the academic achievements of our recipients but also celebrate the interest and passion

for learning more about the financial services sector,” said David Brandon, Chairman of the IBA Scholarship Committee. “These students have the potential to become future leaders in banking and we’re excited to foster young aspiration in the industry.”

The Illinois Bankers Scholarship Fund was established in 2019 to foster interest and fund the educational pursuits of students interested in the banking field. The Linda J. Koch Scholarship was established in 2021 in honor of the former president and CEO of the IBA.

IBA’s Linda Koch recently had the privilege of meeting with Jeff Kosobucki, President and CEO of Central Savings. f.s.b. Linda was treated to a tour of their history that honors the legacy of its former leader, Anthony Nichols, who served as President and CEO for over 50 years before retiring in 2017!

Cheering for members from both sides of the aisle for a great cause! Congresswoman Lauren Underwood and IBA President and CEO Randy Hultgren took to the stands to watch and support the annual Congressional Baseball Game, a bipartisan tradition held to raise money for charity.

APPI Energy

Jamie Polend jpolend@appienergy.com www.appienergy.com

Preferred Vendors

Deluxe Banker’s Dashboard

Bob Reid bob.e.reid@deluxe.com www.deluxe.com/businessoperations/bankers-dashboard

Ascensus

Michael Bush

Michael.bush@ascensus.com www.ascensus.com

EPIC Retirement Plan Services

Pat Bearss pbearss@abgrpis.com www.epicrps.com

BankMarketingCenter.com

Neal Reynolds nreynolds@bankmarketingcenter.com BankMarketingCenter.com

Evolv Nellie Schlachter nschlachter@poweredbyevolv.com www.poweredbyevolv.com

BankTalentHQ

Maddison Augustine mharner@illinois.bank www.banktalenthq.com

Floodplain Consultants, Inc. Craig Callahan ccallahan@floodplain.com www.floodplain.com

interface.ai

John Garey john.garey@interface.ai interface.ai Investors Title Insurance Company

Dana Lyons dlyons@invtitle.com www.invtitle.com

ODP Business Solutions

Kimberly Gilbert kimberly.gilbert@odpbusiness.com www.odpbusiness.com/ banksignup

SBS CyberSecurity

Chris Damato chris.damato@sbscyber.com www.sbscyber.com

Deluxe Bob Reid bob.e.reid@deluxe.com www.deluxe.com

Illinois Bankers Insurance Services

Adam Walsh awalsh@illinois.bank illinois.bank/solutions/insuranceproducts/insurance/

KeyState Captive Management

Travis Holdman tholdman@key-state.com www.key-state.com

Strategic Resource Management Scott Eaton seaton@srmcorp.com www.srmcorp.com

Liquid Capital

Tom Stamborski tstamborski@liquidcapitalcorp.com www.liquidcapitalcorp.com

UFS Tech Jamie Just JamieJ@ufstech.com www.ufstech.com

IBA members mutually benefit when working together to seek solutions within our industry! Your support of these companies helps build lasting relationships and allows us to continue to provide critical member benefits to Illinois banks and our Associate Members.

ABA Insurance Services Inc. Patricia Williams ppwilliams@abais.com www.abais.com

Allied Solutions, LLC

Sylvia Edwards sylvia.edwards@alliedsolutions.net www.alliedsolutions.net

Amundsen Davis LLC Michael Cortina mcortina@amundsendavislaw.com www.amundsendavislaw.com

Anders CPAs and Advisors Lindsay Suelmann lsuelmann@anderscpa.com www.anderscpa.com

Angott Search Group Mark Angott mangott@asgteam.com www.asgteam.com

Anthony Cole Training Group

Jeni Wehrmeyer jeni@anthonycoletraining.com anthonycoletraining.com

Armstrong Teasdale LLP

Paul Cambridge pcambridge@atllp.com www.armstrongteasdale.com

Artisan Advisors, LLC

Jim Adkins jadkins@artisan-advisors.com www.artisan-advisors.com

Association House of Chicago Filiberto Rios frios@associationhouse.org www.associationhouse.org

ATM Solutions Inc. Thomas Douthitt thomas.douthitt@atm-solutions.com http://www.atm-solutions.com

Aunalytics

Katie Horvath katie.horvath@aunalytics.com www.aunalytics.com

Backbase USA inc. Deb Garber deb@backbase.com www.backbase.com

Banc Card of America Inc. Tyler Cook tcook@banccard.com www.BancCard.com

Banc Consulting Partners Lon Haines LPHaines@yourbankpartner.com www.bancconsultingpartners.com

Bank Compensation Consulting

Stephanie Rogers stephanie.rogers@bcc-usa.com www.bcc-usa.com/

BankWork$

Ranko Fukuda ranko@careerworkstraining.org www.bankworks.org

Banzai Inc.

James Barsdorf james@teachbanzai.com www.teachbanzai.com

BOK Financial Institutions Group

Josh Hunt

jhunt@bokf.com www.bokfinancial.com/landingpages/financial-institutions

CBMS

John Miller jmiller@cbmsonline.com www.cbmsonline.com

Barack Ferrazzano Kirschbaum & Nagelberg LLP

John Freechack john.freechack@bfkn.com www.bfkn.com/

Berkley Financial Specialists www.BerkleyFS.com

Cennox

Shawna Allen shawna.allen@cennox.com www.cennox.com

Chapman and Cutler LLP Marc Franson franson@chapman.com www.chapman.com/

BancAlliance, Inc.

Jacqueline Kennedy jkennedy@alliancepartners.com www.bancalliance.com/banknetwork

Bancare, Inc.

James Cozzi jamescozzi@bancare.net www.bancare.net

BancMac - Community Banc Mortgage Corp

Stephanie Washko swashko@bancmac.com bancmac.com/

BHG Financial Nellie Szczech nellie@bhg-inc.com www.BHGBank.Network/ILBA

BigIron Auctions

Zack Witvoet zackery.witvoet@bigiron.com www.bigiron.com/

Blanchard Consulting Group

Matt Brei matt@blanchardc.com www.blanchardc.com

Charles Vincent George Architects

Bruce George bgeorge@cvgarchitects.com www.cvgarchitects.com

Chatham Financial David Sweeney dsweeney@chathamfinancial.com www.chathamfinancial.com/

Cinnaire Corporation Brett Oumedian boumedian@cinnaire.com cinnaire.com

CLA Erica Carlson erica.carlson@claconnect.com www.claconnect.com/

Community Investment Corporation

Monica Kirby monica.kirby@cicchicago.com www.cicchicago.com

Comptroller of the Currency Ryan Portell ryan.portell@occ.treas.gov www.occ.gov

CoNetrix

Kellie Hill khill@conetrix.com www.conetrix.com

Consolidated Communications

Brett Kingery brett.kingery@consolidated.com www.consolidated.com

Creatio, Inc. www.creatio.com

Kateryna Samoilenko k.samoilenko@creatio.com

CrossCheck Compliance LLC

Jim Jorgensen jjorgensen@ crosscheckcompliance.com www.crosscheckcompliance.com

Crowe LLP

Celeste Bessette celeste.bessette@crowe.com www.crowe.com

CSI

Pam Farnsworth pam.farnsworth@csiweb.com www.csiweb.com

DBE - Data Business Equipment, Inc

Lauren Miller lmiller@dbeinc.com www.databusinessequipment.com

Dickinson Wright PLLC Joseph Silvia jsilvia@dickinsonwright.com www.dickinson-wright.com

DocFox Angi Milano angi@docfox.io docfox.io

Edge One Stephanie Weir sweir@edgeone.com edgeone.com

Farmer Mac Patrick Kerrigan pkerrigan@farmermac.com www.farmermac.com

Farmers National Company Nick Westgerdes nwestgerdes@farmersnational.com www.farmersnational.com/

Federal Deposit Insurance Corporation Gregory Bottone gbottone@fdic.gov www.fdic.gov

Federal Home Loan Bank of Chicago

Sharon Gorrell sgorrell@fhlbc.com www.fhlbc.com

Federal Protection Inc.

Jenny Schulze jschulze@federalprotection.com www.federalprotection.com

Federal Reserve Bank of Chicago www.frbservices.org

Federal Reserve Bank of St. Louis James Fuchs james.w.fuchs@stls.frb.org stlouisfed.org

FHN Financial Trae Winston trae.winston@fhnfinancial.com www.fhnfinancial.com

Financial Shares Corporation

George Morvis george@financialshares.com www.financialshares.com

FORVIS

Christy Oldani christy.oldani@forvis.com www.forvis.com

Freddie Mac

Sally Sampson sally_sampson@freddiemac.com www.freddiemac.com

Genesys Technology Group Drew Kessler drew@genesystg.com www.genesystg.com

Finlytica Corporation www.finlytica.ai

FIPCO

Pamela Kelly pkelly@fipco.com www.fipco.com

First Bankers’ Banc Securities, Inc.

Taylor Brengard Healey thealey@fbbsinc.com fbbsinc.com

FirsTech Inc.

Elissa McGlaughlin Elissa.McGlaughlin@busey.com www.firstechpayments.com

Fiserv, Inc.

Michael Kosobucki michael.kosobucki@fiserv.com www.fiserv.com

forbinfi

Bailey Ronnebaum baileyr@forbinfi.com www.forbinfi.com

Foresight Research

Steve Bruyn steve@foresightresearch.com www.foresightresearch.com

Giffin Winning Cohen & Bodewes PC Creighton Castle crcastle@gwcblaw.com www.giffinwinning.com

Glia Elysia Hernandez elysia.hernandez@glia.com www.glia.com

Godfrey & Kahn, S.C. Thomas Homberg thomberg@gklaw.com www.gklaw.com

Graduate School of Banking Kathleen Berman kberman@gsb.org www.gsb.org

Greensfelder, Hemker & Gale, P.C. Scott Cruz scruz@greensfelder.com www.greensfelder.com

Grow UP Sales Consulting

Joe Micallef joe@growupsales.com www.growupsales.com

Haberfeld Mitchell Scheuler mscheuler@haberfeld.com www.haberfeld.com

Hartman Executive Advisors

Maria Selfridge mselfridge@hartmanadvisors.com www.hartmanadvisors.com

Hinshaw & Culbertson LLP

Timothy Sullivan tsullivan@hinshawlaw.com www.hinshawlaw.com

Holland Partners, Inc. Libby Kopff LibbyKopff@spectrum.net

Hovde Group LLC Kirk Hovde khovde@hovdegroup.com www.hovdegroup.com

Howard & Howard Attorneys PLLC Joseph VanFleet jbv@h2law.com www.h2law.com

Howell Financial Services, Inc.

Michael Howell michael.howell@lpl.com www.howellfinancialservices.com

Illinois Finance Authority

Lorrie Karcher lkarcher@il-fa.com www.idfa.com

Integrity Technology Solutions Chad Geiser cgeiser@integrityts.com www.integrityts.com

IntraFi Network Sue Kling skling@intrafi.com www.IntraFi.com

Ironcore Inc. Joe Carty Joe.Carty@ironcore-inc.com www.ironcore-inc.com

ISL Education Lending Dan Garrity dgarrity@studentloan.org www.iowastudentloan.org

J&P Site Experts Patrick Paquin patrick@jpsiteexperts.com jpsiteexperts.com

LKCS

Tim Turczyn tim.turczyn@lk-cs.com www.lk-cs.com

LRS Web Solutions

Jeffrey Enlow jeff.enlow@lrs.com www.lrswebsolutions.com

Luse Gorman, PC Kip Weissman kweissman@luselaw.com www.luselaw.com

Macha Mary Gilmeister MGilmeister@macha.org www.macha.org

Main Street, Inc. Jenny Wilson jwilson@mainstreetinc.com www.mainstreetinc.com

Marwedel Minichello & Reeb, P.C. Shari Friedman sfriedman@mmr-law.com www.mmr-law.com

National Notary Association

Chris Sturdivant csturdivant@nationalnotary.org www.nationalnotary.org

Newcleus, LLC

Sarah Grutka sgrutka@newcleus.com newcleus.com

NewGround Julie Molitor jmolitor@newground.com www.newground.com

NFP Executive Benefits Trené Pinnell trene.pinnell@nfp.com executivebenefits.nfp.com

Noonan & Lieberman, Ltd. James Noonan jnoonan@noonanandlieberman.com www.noonanandlieberman.com

Northland Securities Luke Wasylik lwasylik@northlandsecurities.com www.NorthlandSecurities.com

HR Source

Angela Adams aadams@hrsource.org www.hrsource.org

HUB – Taylor Advisors

Brett Walburn brett.walburn@hubinternational.com www.tayloradvisor.com

ICI Consulting Inc.

Thom Gresak thom.gresak@ici-consulting.com ici-consulting.com

Illinois Department of Financial & Professional Regulation Chasse Rehwinkel chasse.rehwinkel@illinois.gov www.idfpr.com

Jack Henry Haley Little hlittle@jackhenry.com jackhenry.com

Kadince Erin Letson erin@kadince.com www.kadince.com

Kerber, Eck & Braeckel LLP www.kebcpa.com

Kestner Insurance Randall Kestner randy@kestnerinsurance.com www.kestnerinsurance.com

Lewis Rice LLC Leonard Essig lessig@lewisrice.com www.lewisrice.com/Pages/ default.aspx

Mid America Banking Insurance Services, Inc. David Sheets dsheets@bankers-ins.com www.bankers-ins.com

Mills Marketing Derek Baker derekb@millsmarketing.com www.millsmarketing.com

Mindsight Kane Keirnan kkeirnan@gomindsight.com gomindsight.com

Momkus LLP

Martin Tasch mtasch@momkus.com www.momkus.com

Oak Ridge Financial Services Group, Inc. www.oakridgefinancial.com

Olsen Palmer LLC Roger Hernandez rhernandez@olsenpalmer.com www.olsenpalmer.com

Onovative Jenny Wilson jwilson@mainstreetinc.com www.onovative.com

OpenLending Julie Cournoyer jcournoyer@openlending.com www.openlending.com

Pehlman & Dold, P.C. Jamie Nichols jnichols@p-dcpas.com www.p-dcpas.com

Performance Trust Capital Partners, LLC

Pamela Shanahan pshanahan@performancetrust.com www.performancetrust.com

Petefish, Skiles & Co Bank

Christopher Barrett chris.barrett@petefishskiles.com www.petefishskiles.com

PG Design + Build

Tricia Cratty Tricia@pgarch.com www.pgarch.com

Plansmith Corporation

David Schwieder dschwieder@plansmith.com www.plansmith.com

Plante Moran Steve Schick steve.schick@plantemoran.com plantemoran.com/banks

Promontory MortgagePath LLC

Todd Campfield todd.campfield@mortgagepath.com www.mortgagepath.com

PULSE, a Discover Company

Marie Braeutigam mariebraeutigam@discover.com www.pulsenetwork.com

Purple Wave Auction

Bridget Hoover association@purplewave.com www.purplewave.com/

QSI

Kendall Tungate kendall.tungate@qsibanking.com www.qsibanking.com

Quarles & Brady LLP

James Kaplan jim.kaplan@quarles.com www.quarles.com

QwickRate/IntelliCredit

Ricki Dagosta ricki.dagosta@qwickrate.com www.qwickrate.com

R&T Deposit Solutions

David Keebler dkeebler@rnt.com www.rnt.com

Raymond James Katie Devine katie.devine@raymondjames.com www.raymondjames.com

Remedy Consulting Charlie Kelly ckelly@remedyconsult.net www.remedyconsult.net/ac Rivel, Inc. Melissa Randi mrandi@rivel.com www.rivel.com/cxlign.php

RSM US LLP

Nicholas Hahn nicholas.hahn@rsmus.com rsmus.com

Ruff Breems LLP

Timothy S. Breems, Sr. tbreems@ruffbreems.com rfbnlaw.com

S&P Global Market Intelligence

Ryan Chakalos ryan.chakalos@spglobal.com spglobal.com/ILBankers

Scantron Technology Solutions

Pat Heller pat.heller@scantron.com www.scantron.com

Scheffel Boyle

Suzi Seaton suzi.seaton@scheffelboyle.com scheffelboyle.com

Schiff Hardin LLP

Jason Zgliniec jzgliniec@schiffhardin.com www.schiffhardin.com

Scott & Kraus, LLC

Drew Scott dscott@skcounsel.com www.skcounsel.com

SEI Sphere

Emily Knechel eknechel@seic.com www.seic.com/sphere

Shield Compliance

Richard Drennen richard.drennen@shieldbanking.com www.shieldbanking.com

Signzy Saurin Parikh saurin.parikh@signzy.com www.signzy.com

The Kafafian Group, Inc. Jill Pursell jpursell@kafafiangroup.com kafafiangroup.com The Redmond Company Marty Steinert msteinert@theredmondco.com theredmondco.com

SomerCor

Kimberly Brisky kbrisky@somercor.com www.somercor.com

Steffes Group, Inc. Mason Holvoet mason.holvoet@steffesgroup.com steffesgroup.com/Home/Auctions

Titan Armored Jason Buckley jason.buckley@titanarmored.us www.titanarmored.us/1/

Vedder Price P.C. James Morrissey jmorrissey@vedderprice.com www.vedderprice.com

Verafin Amanda Evans amanda.evans@verafin.com verafin.com

Systemax

Cassandra Ostermeier costermeier@systemaxsolutions.com www.systemaxsolutions.com

TCA Compliance

Michelle Strickland m_strickland@tcaregs.com www.tcaregs.com

Vertical IQ Cole Teal cteal@verticaliq.com verticaliq.com

Virtual Innovation, Inc. Eric Kroeger ekroeger@vi-mw.com www.vi-mw.com

Visa Anne Doligale adoligal@visa.com www.usa.visa.com

Technology Advisors Inc. Molly Anderson molly.anderson@techadv.com www.techadv.com

Voluforms

Tom Bartle tom.bartle@s-gfx.com www.voluforms.com

Voya Investment Management

Michael Moran michael.moran@voya.com institutional.voya.com

Weltman, Weinberg & Reis Co., LPA

Casey Hicks chicks@weltman.com www.weltman.com

Whistle Systems Inc.

Stephanie Hunsche stephanie.hunsche@wewhistle.com wewhistle.com

Willing to Hunt, LLC

A. Gregory Hunt

agregoryhunt@willingtohunt.com www.willingtohunt.com

Wipfli LLP

Mary Boortz

mboortz@wipfli.com www.wipfli.com

Wolf & Company, P.C.

Nicholas Jesi njesi@wolfandco.com www.wolfandco.com

Wool Finance Partners LLC

Gary Wool

gary@woolfinance.com woolfinance.com

Works24

Cristopher Choate cchoate@works24.com www.works24.com

UNITED BANKERS' BANK

Dwight Larsen, President and CEO of United Bankers’ Bank

(UBB) is pleased to announce the promotion of Karen Von Guten to Vice President, USource Manager. In her role, Von Guten will lead the USource team while continuing to provide human resources consulting to USource customers. Von Guten has served UBB’s USource team since 2012. Before joining UBB, Karen worked in various industries, accumulating over 30 years of Human Resource generalist and management experience. She holds a Bachelor of Arts degree (Magna Cum Laude - Phi Kappa Phi honors recipient) in Business Administration with a concentration in Human Resources Management and Marketing from Minnesota State University, Mankato, and is a certified SHRM-SCP (Society of Human Resources Management –Senior Certified Professional).

ITASCA BANK & TRUST CO.

Itasca Bank & Trust Co. is pleased to announce the appointment of Hubert Cioromski, Jessica Mazza and John Skoubis to the Bank’s Board of Directors.

Cioromski is the Owner & CEO of Troy Realty Ltd., a family owned and operated commercial and residential real estate company, serving the Chicagoland area for over 60 years.

Mazza is the Senior Managing Director, Deputy Chief Auditor at TIAA. She has over two decades of experience in the financial services industry in the Chicagoland area, primarily in internal audit and consulting roles

Skoubis is a partner with Skoubis Alikakos LLC, a law firm in Schaumburg. He has over three decades of practicing law in the Chicagoland area.

FIRST MID BANK & TRUST

First Mid Bank & Trust proudly welcomes Laura Hughes as their new Chief Marketing & Deposit Officer. Hughes will be responsible for leading First Mid’s marketing and deposit strategy and overseeing its performance, culture, and overall customer experience. With over 20 years of marketing and customer-focused experience in the banking and insurance industries, Hughes brings a wealth of knowledge and expertise to her new role. She most recently served as Chief Marketing Officer at HTLF, Heartland Financial, Inc., which is a $20 billion bank headquartered in Denver, CO. Before that, she held executive positions as Digital Marketing Leader for Commercial Banking at JP Morgan Chase and Head of Marketing for the Federal Reserve Bank’s Financial Services Division.

Hughes is a graduate of Northern Illinois University and holds a Master of Business Administration from Northwestern University’s Kellogg School of Management. She dedicates her time and talents to numerous volunteer organizations. Hughes has contributed her expertise as a National Park Service Heritage Corridor board member and her local chamber of commerce. She’s also a devoted volunteer for the U.S. Marine Corps Toys for Tots program.

PNC Private Bank announced the appointment of Thaddeus Yasunaga to senior vice president and senior investment advisor. As part of the Private Bank team, Yasunaga will provide comprehensive investment advice for PNC Private Bank clients in the central Illinois region. Yasunaga will be based in Champaign-Urbana, Illinois.

He brings nearly 12 years of experience in investment advisory and wealth management to his new role. Most recently, he served as an investment portfolio manager for Busey Bank, specializing in asset allocation, investment research, and portfolio implementation.

Yasunaga earned a bachelor’s degree in mechanical engineering from the University of Illinois UrbanaChampaign and a Master of Business Administration from the University of Chicago Booth School of Business. He is a Chartered Financial Analyst and a member of the CFA Society Chicago and the CFA Institute.

Heather Trew has been named senior vice president for Bank Secrecy Act (BSA) and Anti Money Laundering (AML) at the American Bankers Association, the voice of the nation’s $23.6 trillion banking industry and its over two million employees.

Trew will lead ABA’s BSA advocacy at a critical time, as the Financial Crimes Enforcement Network (FinCEN) implements the Corporate Transparency Act and Anti-Money Laundering Act of 2020, legislation intended to increase the efficiency and effectiveness of BSA compliance.

Trew earned her J.D. at the University of Michigan Law School in Ann Arbor, Mich. She is also a graduate of Stanford University, where she received her bachelor’s degree in English.

Trew comes to the association from the U.S. Department of Treasury, where she served most recently as the counselor to the general counsel on virtual assets. Prior to that, she spent several years as Treasury’s assistant general counsel for enforcement and intelligence, including time serving as acting chief counsel for FinCEN and as acting chief counsel for the Office of Foreign Assets Control. Trew also served in the Department of Justice’s National Security Division’s Office of Intelligence, among other roles during her 16-year career in government.

Wipfli’s Financial Services practice team would like to recognize Mary Boortz for her 28 years as a dedicated associate as she retired in June. Mary started her career in the Eau Claire, Wisconsin office on March 27, 1995, where she worked as a client services assistant in HR & IT Consulting. As the firm grew, she moved to work exclusively in HR consulting as the firm's first senior client service assistant, which she did for 8 years. For the last 20 years, Mary has worked as the administrative manager (the first in the firm) for the Financial Institutions practice. A noteworthy contribution to the practice during her time has been the implementation of the FS University, which allows senior staff to network with one another while being educated by Wipfli leadership over three days.

During those 20 years, she has worked with several outstanding industry leaders, including Greg Barber, Deb Marshall, Dave Hanson, Mark Harrison, JoAnn Cotter, Mike Vesel, and Anna Kooi. Many of the partners that Mary has worked with have nothing but outstanding things to say about her work at Wipfli. Industry leader and partner Anna Kooi reflected on her three years working alongside Mary, "Her remarkable 28-year career has not only left a lasting impact on our team but on the clients of our financial services industry as a whole. Her extensive knowledge, unparalleled expertise, and unwavering commitment to excellence have set a high standard for all those who have enjoyed working alongside her. Mary has helped shape the financial services practice into what it is today, and her contributions will continue to benefit all impacted for years to come. We wish her a welldeserved retirement and thank her for her profound impact."

During her time at Wipfli, Mary said, “I’ve enjoyed the fact that every day is different and being a part of the growth that the financial services practice has seen over the years.” When asked about her favorite part of being

on the team at Wipfli, she stated, “I have been fortunate to meet many people over the years, both internally and externally, and have made many friends.” This can attest to how Wipfli has seen so many individuals, like Mary, who find long and fulfilling careers at the firm.

Mary currently resides in Eau Claire with her husband of 27 years, Tim Boortz. She has two children – Jim and Stacy, five grandchildren –Bryce, Abby, Zaira, Jetta, and Mya, and one great-granddaughter – Emery. In her retirement, Mary hopes to travel with her husband, as she stated, “[We] are hoping to travel after I retire. We both come from large families spread throughout the country, so [we have] many places to visit.” She also hopes to work on craft projects, one of her favorite hobbies.

Kathy Cook has retired as President of the Village Bank after a 46-year career in banking. She initiated the sale of the bank headquartered in St. Libory to the First National Bank of Waterloo, which became effective in late 2022.

Cook started working in the loan department in 1976 when her father, Otto B. Johnson, was president of the State Bank of St. Libory. She became a Vice President and Board member in the 1980s.

Cook has noticed a change in gender makeup at area banking events in the past four decades. "At the beginning of Illinois banking events for officers and directors, I was the only female out of hundreds of men to attend. I enjoyed the camaraderie extended to me, especially on the golf course, since I was a decent golfer then."

In the early 1990's Cook became the bank president and eventually Chairman of the Board. She opened two additional branches in New Athens and Marissa during her tenure. With branches in other towns, Cook decided

it might be preferable to have a generic name representing all the branches and their style of community banking. That led to the name change from State Bank of St. Libory to Village Bank.

At the same time, Illinois law changed so the bank could change its charter from a "C" Corporation to an "S" Corporation. That allowed the bank to share profits with shareholders without double taxation. As time passed, Cook became very involved with the organizations representing Illinois banks - Illinois Bankers Association and Community Bankers Association of Illinois. In doing so, she became aware of the need for physical presence in Springfield and eventually Washington, D.C., to support small community banks in Illinois and throughout the U.S.

Cook became involved in both organizations' political action groups and was eventually selected as a Community Bank Advisory Council member with the Community Financial Protection Bureau in Washington, D.C. After serving two terms, she was invited to become a committee member with the Independent Community Bankers Association in Washington D.C. Currently, she is still serving as a committee member of the ICBA on her fourth term.

At her retirement, Cook has gratitude for her rewarding career. "I have been so fortunate to have had support from fellow employees, customers, and shareholders throughout my time at the Village Bank. I was privileged to experience the change in the men’s profession to a field of qualified men and women."

Cook and her husband, Rodger, reside in St. Libory.

Robert L. CormierCongratulations to Robert L. Cormier Sr. for 60 years of service with Home State Bank in Crystal Lake, IL. Robert started as an Officer

Trainee in 1963. He moved on to Cashier in 1966. Robert served as President from 1991 through 2001. When he began, the bank was $23.3 million in assets and grew to $448.5 million in assets when he left the office of President. He has been serving on the Board of Directors since 1991. Currently, he is the Secretary of the Board. Over the years, he has served on various committees, including the Illinois Bankers Association Government Relations Committee on Federal Legislation and Regulation.

Dave Dodson

that her long and rewarding career in community banking ended, Jackie is looking forward to spending more time with her husband, Jim, their two daughters, and their five grandchildren. Congratulations, Jackie, on an outstanding banking career!

IBA’s Tim Robinson, Director of Bank Relations, inducted West Central Bank's Gaileh Tice, Roger Whitlow, and Mary Wessel into the IBA’s 50-Year Club. The 50-Year Club recognizes and celebrates bankers who have achieved 50-plus years in the industry! A 50-Year Club nomination is a capstone event for a banker filled with rewarding experiences and achievements.

to Chief Deposit Operations Officer and currently holds that position. Additionally, she participates in many bank-related activities including serving as chairperson and member of various in-house committees and banking organizations, was a founding member of a User's group of Illinois community bank, and in numerous educational courses.

Roger Whitlow started his professional financial industry career in 1964 as a loan officer at GA Finance Company, followed by two years in the U.S. Army. In 1968, he returned to the financial industry sector, serving as a loan officer at the Bank Service Co. This door opened many new opportunities at Citicorp, Salem National Bank, First State Bank of Beardstown, First State Bank, State Bank of Ashland, and West Central Bank. He was promoted to Assistant Vice President at West Central Bank and is now Vice President.

After 40-plus years in banking, Dave Dodson, President & CEO of the Peoples Bank of Colfax, retired on June 30, 2023. Dodson has been with the Peoples State Bank of Colfax since December 1984; before that, he was with the Mackinaw Illinois Bank.

Jackie Hanlon

Jackie Hanlon retired from OSB Community Bank on April 28, 2023, after nearly 41 years with the Bank. She began her banking career on November 8, 1982, as a teller with the Marseilles Building & Loan Association, the predecessor of Twin Oaks Savings Bank. She joined the OSB family in January 2015 when OSB acquired Twin Oaks and has served as Assistant Vice President of the Bank and its Marseilles branch manager for over 8 years. While it saddens her

Gaileh Tice was hired by the State Bank of Ashland on January 2, 1973, and trained in all areas of the Bookkeeping Department. In 1977, she became responsible for installing and operating the first computer systems at the State Bank of Ashland. She was subsequently promoted to Cashier and Manager of the Data Processing Department and was responsible for its development and mandatory conversions. Gaileh became Cashier and a Vice-President of West Central Bank in 2009, upon the merger of State Bank of Ashland and First State Bank of Beardstown. In 2019, she was promoted promoted

Mary Wessel began her career at First State Bank of Beardstown as a Teller on May 28, 1973. Upon the merger with the State Bank of Ashland, forming West Central Bank in 2009, she was promoted to Head Teller and is now Compliance Officer.

For 155 years, Busey has helped identify and bridge the needs of the communities they serve. They accomplish this by supporting prospective homebuyers with unique financing options and investing in low-to-moderateincome neighborhoods to ensure holistic community development. As of May 2023, the Busey Bank MyCOMMUNITY Home Loan Program, which started in 2014, has

provided over $100 million in home loan funding for over 850 families.

The MyCOMMUNITY Home Loan Program was developed to assist individuals who may not qualify for traditional banking products but still dream of owning a home. It offers special loan terms and qualifications to help prospective homebuyers build and establish a record of payment and other benefits to help

them through the mortgage process. Through innovative products, strategic partnerships, and financial education, we strive to help everyone in our communities achieve their dream of homeownership.

For eligibility requirements and more information on the benefits of this program, visit busey.com/ HomeLoanPrograms

CBI Bank & Trust is proud to announce its substantial support of the Mulberry Health Clinic Project. Recognizing the critical importance of accessible and state-of-the-art medical facilities, CBI Bank & Trust has contributed $250,000 to support the project. This significant investment underscores our unwavering commitment to enhancing the wellbeing and quality of life for individuals

and families in Muscatine and surrounding communities.

The Mulberry Health Clinic Project, led by the Community Foundation of Greater Muscatine in partnership with UnityPoint Health - Trinity Muscatine and the Muscatine Health Support Fund, will directly and immediately expand and improve patient equity and care, creating multi-generational,

social, and economic success for families in our community.

The proposed project timeline has construction site work beginning June 2023 and substantial completion in December 2024. To learn more about the Mulberry Health Clinic Project, visit www.givinggreater.org/clinic

Central Bancshares, Inc. of Muscatine, Iowa (“Central Bancshares”), the parent company of CBI Bank & Trust, and McLaughlin Holding Company, the parent company of SENB Bank, based in Moline, Illinois, have jointly announced the signing of an Agreement and Plan of Merger whereby Central Bancshares will acquire McLaughlin Holding Company and merge SENB Bank into CBI Bank & Trust. The transaction is subject to shareholder and regulatory approval and is anticipated to be completed in the third quarter of 2023. Terms of the transaction were not disclosed.

SENB Bank was organized in 1961 and has approximately $337 million in total assets. It serves the Quad Cities market in both Iowa and Illinois, as well as the state line (Rockford/Beloit) region of Illinois and Wisconsin, with six locations: Moline and Roscoe, IL; Davenport, Bettendorf, and Buffalo, IA; and Beloit, WI.

Central Bancshares is the privately held parent company of CBI Bank & Trust, based in Muscatine, Iowa, and F&M Bank, a Division of CBI Bank & Trust, based in Galesburg, Illinois. Central Bancshares serves approximately 40,000 consumers and businesses through 17 banking centers, with locations in Coralville, Davenport, Kalona, Muscatine, Walcott, Washington, and Wilton in Iowa, and Brimfield, Buffalo Prairie, Galesburg, Monmouth, and Peoria in Illinois. In addition, the bank’s Trust and Investment Divisions manage combined client assets of approximately $1.4 billion.

After the completion of the transaction, Central Bancshares will have total assets of over $1.45 billion. Both company boards of directors and executives believe the transaction

will create a strong partnership, bringing together two compatible, community-oriented banking enterprises.

Cummings & Company, LLC served as a financial advisor, and Barack Ferrazzano Kirschbaum & Nagelberg, LLP served as legal counsel to Central Bancshares concerning the transaction. Olsen Palmer LLC served as a financial advisor, and Dickinson Wright PLLC served as legal counsel for McLaughlin Holding Company.

Newsweek worked in partnership with LendingTree to evaluate thousands of FDIC-insured banks and credit unions on more than 50 different categories. Factors included the health of the bank, customer service performance and features, digital and branch presence, as well as account and loan options to identify the best-in-class options for consumers.

“Being recognized with an award of this magnitude is something we take great pride in,” remarked Jeffrey Mefford, President of Midland States Bank. “Providing a superior mix of products and services combined with robust online and mobile technology offerings allows our customers to experience personal focus along with digital excellence. This recognition is a rewarding affirmation of our customer commitment.”

Congratulations to the Community Bank of Elmhurst on reaching a significant milestone - their 30th Anniversary! The Community Bank of Elmhurst has been a pillar in their community for three decades! Here's to 30 years of excellence, integrity, and outstanding service.

Midland States Bank is pleased to announce that it has been named to Newsweek magazine’s ranking of America’s Best Banks. This national listing denoted Midland as Best Small Bank in Illinois.

“This acknowledgement emphasizes our mission of serving our customers where, when and how they want,” commented Jeffrey G. Ludwig, CEO of Midland States Bank. “We thank our customers and communities for placing trust in us to handle their financial needs in a responsible and transparent manner for more than 140 years.”

Top 10 firm marks “FORVIS Day” with the release of a new book detailing culture and client service approach.

In May, FORVIS, LLP marked its first anniversary following a successful year of robust growth, continued excellence in client service, and the firm’s cultural DNA rollout.

The top 10 accounting and advisory firm formed on June 1, 2022, via the merger of equals of legacy firms BKD and DHG—the most significant move in the accounting industry in over two decades. The new firm took on a new name, FORVIS, representing the firm’s forward vision and focusing on preparing for what’s next.

Across 72 locations in 28 states, team members celebrated “FORVIS Day” with office festivities and the launch of a book authored in-house and given to each employee, titled “Unmatched Client Experience: The FORVIS Way in Action.”

The hardcover book illustrates the firm’s approach to culture and client

service via oral histories and lessons learned through more than 100 years of experience in the marketplace.

Highlights of FORVIS’ first year include:

• An expanding team – With 6,000 team members today, the firm has seen a net increase of more than 500 people since the merger. The growth in headcount has occurred across all levels and service lines.

• Double-digit growth – With new market permission as a top 10 firm, FORVIS is winning new work with clients across all the

industry segments it serves, leading to double-digit revenue growth compared to one year ago.

• New markets – The firm has opened new offices to serve clients in the South Florida and Toronto markets.

• New offerings – With a keen focus on innovation, FORVIS has launched or significantly enhanced several new products this year and launched a new subsidiary, TALENT SHIFT, to engage gig workers.

• Sustained excellence in client

service – FORVIS maintains a Net Promoter Score of 84, significantly higher than the industry’s average of 39 in 2022, making it one of ClearlyRated’s Best of Accounting award winners.

• Giving back – Through the FORVIS Foundation, the firm has donated to the communities it serves nationwide, including a $500,000 gift to the United Way of Collier and the Keys to support ongoing hurricane recovery efforts on Florida’s southwest coast.

The Investment Will Provide Direct Capital That Will Help More LowerIncome Chicagoans Build Sustainable Wealth

to work for Chicagoans, especially those without equal access to financial resources. The goal is to help create economic opportunities that build sustainable wealth and strong communities while effectively managing the liquidity needs of the city. Of the 11 approved Municipal Depositories of the City of Chicago, Albank is the only financial institution that is an independent community bank, not a publicly traded regional or national bank.

“Albank and other community lenders supply the capital for affordable housing and small businesses that fuel the engine of our local economy,” said City Treasurer Melissa Conyears-Ervin.

Conyears-Ervin was elected in 2019. The investment in Albank builds on that work.