January | February 2013 Vol 3 | No 1 $9.95

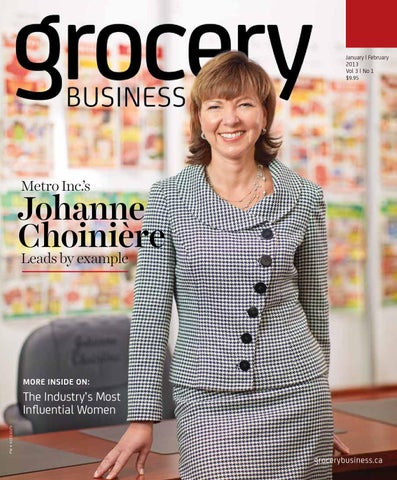

Metro Inc.’s

Johanne Choinière Leads by example

more inside on:

PM # 42211029

The Industry’s Most Influential Women

grocerybusiness.ca

2012 This is the year

that was

4

January | February 2013

grocerybusiness.ca

January | February 2013

5

Grocery Business January | February 2013 Volume 3, Issue 1

contents Departments

15

4

2012 - This was the year that was

8

Front End

People moves and more…

11 Open Mike

The power of private label

15 Shelf Life: Candy Counter

70 Launch It, List It

New products you need to know about

72 It Figures

Shopping for value

74 Perry’s Point of View

Rents, REITS and Risks

Create an experience and add drama to the candy aisle

52 6

January | February 2013

on the cover

30 ”If you want to succeed in the business, you have no choice Johanne Choinière: Leadership by Example

but to deliver on your customers’ highest expectations.”

68

45 features 16 What Women Want

63 Natural Selections

Canada’s shoppers are among the worlds’ most impulsive

27 Grocery Game Changers

Technology is changing everything

36 Profiles in Leadership

The industry’s most influential women

Organika shares its passion for health

65 2012 Top 10 Most

Innovative Products

66 Regional Appetites

NDP Group’s latest Eating Patterns in Canada report

45 Category Report: Coffee Buzz

68 Golden Pencil Awards

49 The ‘X’ factor

The single-serve coffee nation is growing

The grocery industry gathered in honour of Les Mann and Paul and Michael Higgins

More women in leadership roles = A better ROI

52 CO-OP Atlantic

85 years and counting

grocerybusiness.ca

72 January | February 2013

7

Front End

LCBO plans to “Express” itself in Ontario grocery stores Much to the surprise of many in the Ontario grocery industry, on the last day of 2012 the provincial government announced a pilot project to open “Express” Liquor Control Board of Ontario (LCBO) outlets in 10 grocery stores. Immediately following the announcement by Finance Minister Dwight Duncan, the Canadian Federation of Independent Grocers (CFIG) met with Duncan and other government officials. CFIG voiced its concerns regarding how the test stores were to be chosen and a request was made that the government consult with the industry prior to rolling out the pilot. “We’re not opposing it. Our biggest concern, frankly, is if they’re going to roll this kind of project out, that everyone gets equal access to it,” said John Scott, CFIG’s president and CEO. “If our members want to participate in this, they should have the opportunity to do so. We want a level playing field and the government has assured us that they will work with us on this.” According to Scott, not all independent stores have the space to accommodate an outlet, and for those that do want to participate there could be a capital cost burden for the retailer. The proposed projects will require stores to supply 2,500-square-feet for the outlets, which will be run by LCBO employees. The province says it intends to roll out the “Express” format outlets over the next eight to 10 months, although a possible spring provincial election could impact these plans significantly.

PARMALAT CANADA Cheryl Smith, Parmalat Canada’s newly appointed executive vicepresident of sales and marketing for cheese, tablespreads and cultured, has also been named one of Canada’s Most Powerful Women by the Women’s Executive Network. Roger McVety was recently named national vice-president, sales and marketing for fluid and distributors. Parmalat is one of Canada’s largest food companies with over $2.2 billion in annual revenue, a workforce of 3,000 people and 17 dairy processing facilities.

Grocery People Karen Brux has been appointed to lead the Chilean Fresh Fruit Association’s promotional efforts in the U.S. and Canada. As managing director for North America, Brux will oversee all promotional and support programs for Chile’s fresh fruit growers, packers and shippers. Timothy Brown was recently named president and CEO of Nestlé Waters North America. Brown was formerly president and CEO of Nestlé Canada.

8

January | February 2013

Shelley Martin has been appointed to the position of president and CEO of Nestlé Canada. Martin has a strong track record and multi-business and category leadership experience. She joined Nestlé Canada in 1990 and has managed the coffee/beverage, pet care and confectionery businesses. Tom Smith is the new executive director of Fairtrade Canada. As the former vice-president of Co-op Atlantic’s food division, Smith developed relationships with fruit

and vegetable producers in Central America and worked to create programs across Atlantic Canada. Michael Hsu recently joined Kimberly-Clark as president of North America consumer products. Hsu was most recently in a senior role with Kraft Foods in the U.S. and spent six years in executive positions at H.J. Heinz Company. At Kimberly-Clark, Hsu succeeds Robert Abernathy, who has announced his intent to retire after more than 30 years with the company.

Front End

We’ve Got Mail Hi Karen and Kevin, I just read your publishers’ message regarding the irradiation of meat. Frankly, I strongly disagree. My belief is that a food system that requires radiation to provide a safe product is a broken one. A single facility processing 4,500 head of cattle per day is just a small part of the problem. From my experience, I also believe the CFIA’s consistent and ongoing inability to enforce is another grave concern. If our store is any indication of consumer trends, people are more and more willing to purchase local meat from smaller suppliers and they are willing to pay a very hefty premium for it – often more than double. Best regards, Joe Karthein Operations Manager Kootenay Co-op, Nelson, B.C.

James Macintosh is the new general manager of Energizer Canada. Macintosh joined the organization in 2003. His most recent role was as general manager of Energizer, Personal Care.

health-care work. The company saw its 2012 third-quarter earnings rise 21 per cent with the $49 million sale of some of its Genuardi’s stores. As Burd transitions out of his role he will assist Safeway in finding a successor.

Safeway Inc. announced that its long-time chairman and CEO, Steve Burd, will retire in May. Joining Safeway 20 years ago, and being named CEO shortly after, Burd leaves his role to enjoy more personal time and to pursue his interest in

After over 30 years with Nielsen – including several international postings – John Mee retired as the senior vice-president of Retail Services in December. Mike Ljubicic assumes leadership of the Canadian Retail Services team.

grocerybusiness.ca

In Memorium: Lembit Janes Sr., Founder, Janes Family Foods An icon in the Canadian food industry and in his 90th year, Lembit Janes Sr. passed away recently in Toronto, Ont. Janes arrived in Canada with his wife Mary and young son Lembit Jr., from Estonia in 1948. After several years working in the seafood industry, Janes founded Grimms Foods in 1969 in Concord, Ont. The business grew to become the respected Janes Family Foods with four facilities around the Greater Toronto Area.

Acosta Canada has named Shaun McKenna as president. McKenna leads the newly combined Acosta and Mosaic sales and merchandising business unit. For the past year, McKenna has led Mosaic’s sales and merchandising business in Canada, after leading the integration of Mosaic and CIM. McKenna joined Mosaic from CIM where he led the sales management division. He began his career at the Coca-Cola Bottling Company where he held various positions of increased responsibility in sales and distribution management. McKenna replaces Bill Dunne who recently announced his departure after 10 successful years with Acosta. January | February 2013

9

The New BrandSpark Canadian Shopper Study Shopping habits revealed in one of Canada’s largest consumer studies January | February 2013 Volume 3, Number 1

60%

believe environmental claims are exaggerated or misleading

grocerybusiness.ca

50%

Co-Publisher and Executive Editor Karen James 416-561-4744 KarenJames@grocerybusiness.ca

regularly purchase store brand food

Co-Publisher and Content Director Kevin Smith 416-569-5005 KevinSmith@grocerybusiness.ca

67%

will pay more for a new product

Executive Vice-President Content and Market Development Dan Bordun 416-817-5278 DanBordun@grocerybusiness.ca

80%

use hand written shopping lists

Managing and Online Editor Noelle Stapinsky

90%

read flyers regularly Consumer Insight brought to you by:

Source: BrandSpark Canadian Shopper Study, December, 2012

Contributing Editors Sally Praskey, Angela Kryhul, Gabriella Nobrega Creative Agency Boomerang Art & Design Inc. boomart.net Cover Photo Matthew Plexman

Canada’s leading fresh fruit & vegetable industry event

FRESH SUCCESS

Subscription changes & updates or general inquiries: info@grocerybusiness.ca

Grocery Business Advisory Council Phil Donne, Campbell Company of Canada

88

th

John Scott, Canadian Federation of Independent Grocers

ANNUAL

Perry Caicco, CIBC World Markets Nancy Croitoru, Food and Consumer Products of Canada Bill Dunne Tim Berman, Kraft Canada Inc. Mark Ayer, Procter & Gamble Inc.

April 17-19, 2013

David Wilkes, Retail Council of Canada

DIRECT ENERGY CENTRE TORONTO (ON) CANADA

Michael Marinangeli, MIDEB Consulting Inc.

Cori Bonina, Stong’s Market

© Copyright 2012. All rights reserved. No part of this magazine may be reproduced without written permission of the publisher. GST Registration No. 83032 6807 RT0001 Publications Mail Agreement No. PM42211029 ISSN 1927-243X

Di re da ct na En Ca ) erg y Ce ON ntre • Toronto (

10

January | February 2013

cpma.ca

Grocery Business Media 390 Queen’s Quay W., RPO Box 4085 Toronto, ON M5V 0A4

Open Mike

The Power

of Private Label By Michael Marinangeli

Back in the 1980s and early ’90s, there was only one competitor whom I truly feared, and it wasn’t a banner. It was someone who ran a private-label department who kept me awake at night. That person was Dave Nichol, who launched President’s Choice at Loblaw in the mid-’80s.

Nichol is a marketing genius. He is a lover of food. He is the ultimate salesman. He revolutionized the way we develop, source and market private brands, even to this day. Over the past 20 years, most retailers have developed their own versions of Dave’s premium and mid-tier private-label program. We have come a long way from the days of slapping a label on a product and selling it at a lower price and at higher margins than the national brands. In the 1980s, with the launch of President’s Choice products, we saw private label split

into two tiers. Most retailers already had a mainstream private-label program, but no one else offered a premium line of unique and high-quality products that provided a credible alternative to the leading national brands. The launch of President’s Choice afforded Loblaw a sustainable competitive advantage that left everyone scrambling to catch up. This experience taught us the importance of understanding the role private-label brands play in each category. Incorporating this thinking is critical when developing strategies and tactics across the entire category management planning process. There are many ways in which private-label brands help boost sales; I have narrowed them down to five. Price Image: Great products at a lower price are the cornerstone of every private-label program. During weeks when there is little or no activity on national brands in a particular

grocerybusiness.ca

category, your private-label product can provide a value option for the consumer. Lower acquisition costs and superior product sourcing can create a competitive advantage. Simply put, better buying allows you to sell at lower prices, with higher margins than your competitors. Profit: In most cases, private label delivers a better penny profit than national brands. If it doesn’t, challenge your procurement department to reduce costs or review the product specs or viability. Increasing your private-label penetration in all categories across the store will lead to higher overall profitability when this strategy is combined with a solid nationalbrand option for the consumer; there needs to be a healthy balance between the two. Promotion: Retailers control the cards when it comes to promotion. During holiday periods, most retailers have an array of unique and

January | February 2013

11

Open Mike

We learned that the successful launch of Our Compliments was as much about motivating and inspiring the retailers as it was about the outstanding products themselves interesting products that differentiate them from their competitors. Grocers can achieve outstanding results because they control the product, price, shelves, displays, margins, quantities and ads. National brands need to work harder to compete and gain/ maintain share of promotional activity in your stores. Protection: We are in a high/low pricing environment today. Front-page lead items are sold at rock-bottom prices with little or no correlation to acquisition costs. Private-label products provide an element of protection by shielding margins against the losses wrought by deeply discounted features. Displaying and promoting your private brand at a lower price and higher margin than the loss leader can deflect some sales towards the more profitable alternative. Cross-merchandising – tying in and displaying related private-label items with the loss leader– also balances the mix. Passion: I had the unique opportunity of being on the launch team for the Our Compliments private-label line when I worked at Oshawa Foods in the 1990s. It was here that I learned the importance of being passionate about the brand, and doing whatever it takes to make it successful. More than 1,000 retailers, head-office staff and participating grocerybusiness.ca

suppliers attended the unveiling. The Our Compliments name had been kept secret until then. Everyone was hyped. Everyone was committed, and couldn’t wait to sell the products. We launched in our stores two weeks later, and the sales number was off the scale. The retail execution was flawless, and the enthusiasm was maintained into successive waves of product introductions. Having a passion for the brand moves you well beyond slapping a label on a product and putting it on the shelf; it ignites all the stakeholders to excel. We learned that the successful launch of Our Compliments was as much about motivating and inspiring the retailers as it was about the outstanding products themselves. Recently, I read an article on private label from a respected category management expert in the U.S. He said: “Private label should be viewed as a low-cost alternative to branded items and never as a business building solution.” I don’t think this guy ever heard of, or read about, Dave Nichol. Canada should be very proud of our leadership in private brands.

Michael Marinangeli is a principal at MIDEB Consulting Inc. and a retailing veteran with more than 40 years of experience. mjmarinangeli@gmail.com

January | February 2013

13

NEW IMPROVED! Resealable Packaging

Introducing

New Resealable Packages! Featured in

National TV Advertising Starting January 2013 Consumers Love Them ! “I love the new packaging … much more convenient !” ~ Jackie R.

“Fantastic improvement to a fantastic product !” ~ Marc G.

“Love it … now they don’t fall out all over my purse !” ~ Mars F.

“Eureka … thank you so much !” ~ Pauline M.

Canada’s Best Selling Throat Lozenges* Distributed by TFB & Associates Limited, Markham, ON L3R 9Z6 ® Registered trademark of Loft house of Fleetwood Ltd. * AC Nielsen Th roat Lozenge market 52 weeks to April 7, 2012

Shelf Life

Candy Counter By Noelle Stapinsky

At the grocery store, consumers are focused on value more than ever before. But when it comes to confectionery, they are brand diehards and won’t compromise on their sweet treats. “Today’s savvier consumer wants higher quality and lower cost especially in the candy category. There are so many SKUs to choose from, it’s a very competitive environment,” says Jenn Ellek, director of trade marketing and communication for the National Confectioners Association in the U.S. “Retailers need to work really hard in-store to capture and retain their shoppers. With the fun candy category, they should create an experience and a drama around the category.” With such a variety of innovative products and rapidly growing SKUs, one of the biggest Achilles Heels for many grocers is with offering variety and selection. Many consumers typically go to the drugstore to feed their sweet tooth because it has historically carried more candy SKUs than grocers. Ellek says, “An interesting thing retailers should pay attention to is the growth in confectionery. As a category, it has outpaced overall store growth.” And while Ellek agrees that health and wellness is a trend across all categories, she says, “at the end of the day, it’s the philosophy that when you go into the candy aisle, you want to buy that candy you know and love. It’s a small treat to be enjoyed, a little pleasure.”

The Big Chew The gum segment, which is broken out separately from chewy candy, is in a league of its own. The biggest gum chewers in Canada are adults aged 35 to 44, according to the NPD SnackTrack service. And children under 18 and adults 55+ account for 17 per cent of gum consumption. “What’s different is why consumers of different age groups choose gum,” says Joel Gregoire, NPD Group Canada. “For instance, children are more likely to chew gum for the simple enjoyment of the product, whereas oral health (or fresh breath) is more important to adults.”

Sweet Tooth The number of times Canadians enjoyed these treats in 2011 Source: NPD SnackTrack

174

30

25

Something To Chew On Gum

+1.6% Chewy Candy Sugar-free Gum Licorice Hard Candy Consumption Growth 2011 vs 2010 grocerybusiness.ca

Chewy Candy

Hard Candy

Sweet Insights +4.2% +4.4% +4.4%

While major seasonal occasions such as Halloween, Christmas and Easter drive major traffic down the candy aisle, the selling season often happens for as much as 10 weeks before the actual holiday. This is a perfect opportunity for retailers to create seasonal sets and displays to promote sales. Of course, for grocers to remain competitive in this candy land, more SKUs for variety and selection are needed. This is often a struggle for many grocers as aisle space is tight. “Retailers need to show the consumer that if they walk down the candy aisle, they’re going to find innovation,” says Ellek. January | February 2013

15

What Women Want By Catherine Yuile

Picture Canada’s primary grocery shopper: impulsive, time-pressed, a fan of “one-stop shopping” and, more often than not, a woman. Today, Canada’s primary grocery shopper struggles to juggle kids, a career and broader family responsibilities. Being the household’s primary grocery shopper is demanding and, as our research has shown, it’s not a responsibility that many women enjoy, although they appreciate the importance and value it brings to their family.

As this research shows, Canadian women are prime prospects for effective point-of-sale strategies. Retailers and consumer packaged goods companies that are able to effectively address the challenges that today’s women face, can maximize the opportunity with their female shoppers.

Canadian women, particularly those who are 35-plus, are more likely to find the shopping experience stressful and exhausting. They dislike the expense and view it as yet another chore on their weekly to-do list.

So what strategies can retailers employ to help these time-stressed shoppers? • Because women are twice as likely as men to indicate that a friendly and helpful staff impact their store selection, create an environment and shopping experience that helps women feel they are making the most of their time and money investment. • Cleanliness and freshness (particularly important for those 35-54) are key. • Present a well-organized, conveniently located store with a broad product selection to facilitate one-stop shopping.

Given these factors, our research has shown that time-pressed Canadian women are more impulsive shoppers than their male counterparts and less thorough when grocery shopping, particularly when compared to other regions in the world.

Keep in mind that women place more value on almost every element of in-store communications.

1 Highlight compelling promotions

16

January | February 2013

2 Be sure that the message is clear and easy to digest

3 Use bright colours and unique visuals

4 Be well-placed, leveraging key branding and messaging campaign elements

Only 16% of Canadian women strongly agree that they enjoy grocery shopping

How do Canadian shoppers compare? I always buy something that I had not planned to

% who strongly or somewhat agree

Middle East / Africa

59 55

Canada 49

U.S.

47

Europe

45

Latin America Asia/Pacific

39 Source: Ipsos Global Advisor 2012

In-store communications through effective displays and packaging are key to a successful execution. Consider Procter & Gamble Olympic in-store activation for the “Thank you

Canadian women who do enjoy shopping feel pride in taking care of their family. It gives a sense of accomplishment, I work hard therefore am able to take good care of and provide for my family

I enjoy looking for new items and seeing what is available

I can take care of my family members with pride. Buying thoughtful and nutritious food for my family is an enjoyable activity

Mom” campaign that focused on thanking the moms of athletes and honouring moms all over the world. P&G created specialized in-store displays and packaging activating their biggest corporate global campaign platform ever. Marc Pritchard, P&G’s global marketing and brand building officer, said that retailers who activated the campaign with in-store displays saw a five-to-20

“The odds of going to the store for a loaf of bread and coming out with only a loaf of bread are three billion to one.” erma bombeck, author

grocerybusiness.ca

per cent sales lift for P&G products during the three-to-four week Olympic merchandising period. (Source: Advertising Age)

Catherine Yuile is a senior vice-president with Ipsos ASI, leading the client service team overseeing pre-testing and in-market tracking. Catherine is Ipsos ASI’s global expert on ad transferability across borders.

January | February 2013

17

Kevin Smith Dan Bordun

Karen James

•

•

•

kevinsmith@grocerybusiness.ca

danbordun@grocerybusiness.ca

karenjames@grocerybusiness.ca

•

•

•

416 569-5005

416-817-5278

416-561-4744

Check out our website at: grocerybusinessmedia.ca

STRATEGIC LEADERSHIP COFFEE

STRATEGIC LEADERSHIP COFFEE

BREWING UP BEVERAGE SALES The coffee category is hotter than ever, with sales of roast and ground coffee up a whopping 17% over the previous year. The second-most-consumed beverage after tap water, coffee is one of the fastest-growing categories in Canada. • Chalk it up in large part to the trend to single serve (+114%, according to ACNielsen MarketTrack Nov. 2012), which has boosted sales in the category. Similarly, sales of single-serve tea and hot chocolate are up 142% and 177%, respectively. And recognition of this growth can lead to ever-increasing opportunities for your business. (continued on next page)

Brewing Up Beverage Sales More Canadians are forgoing take-out coffee in favour of the convenience and savings of single-serve beverages prepared at home, whatever the occasion or time of day. That’s why this type of technology is becoming increasingly popular. Single-serve coffees and other specialty beverages offer a wide range of roasts and flavours under a variety of brands, as well as hot and iced teas/

SINGLE-SERVE TECHNOLOGIES REVOLUTIONIZING THE COFFEE INDUSTRY

coffees, and hot cocoa. These single-serve shoppers not only drive incremental dollars to the coffee category, but also to the total grocery basket, spending about 21% more than the average shopper, according to Nielsen Homescan. Although traditional coffee is still important and growing,many

Single-serve brewers are the most

Keurig is the #1 player in the popular of the kitchen electrics, with a single serve brewer segment

growth of 98% in units versus last year. These types of brewers now account for 46% of the sales, a share gain of 10% versus last year. No surprise they are changing the way people consume (and buy) coffee.

consumers are willing to trade up to premium over mainstream coffee. Following this trend, GMCR Canada’s premium offering, Van Houtte® Specialty Collections – which includes Single Origin, Fair Trade

26%

KEURIG

Organic, and Espresso – grew by 40% in the past year. Recently, the company launched Barista Prima Coffeehouse® K-Cup® packs,

20%

a line of Super Premium coffees for the growing legions of consumers who are willing to pay more for a unique taste –

54%

AUTOMATIC DRIP & ESPRESSO BREWERS

an affordable luxury.

ALL OTHER SINGLE-SERVE BREWERS

Source: NPD All Channels , 52 weeks ending November 2012, includes all coffeemakers and espresso makers, estimated to represent 70% to 80% of the total marketplace.

Source: NPD All Channels,52 weeks ending November 2012, includes all coffeemakers and espresso makers. estimated to represent 70% to 80% of the total market

CATEGORY INSIGHTS

$ Sales evolution of Roast & Ground Coffee category

Ranking of Categories by Abs Chg (000’s) and $Vol %Chg

$177,516

29%

NATIONAL

$1,000,000,000

$126,670

$748,596,204

800,000,000

6% $85,709

13%

$926,682,971 TL Single-Serve Segment

$598,738,365 $79,444

3%

$71,617

4%

600,000,000

$64,529

9%

$59,008 $55,307 $54,475 $51,972

5%

4%

4%

6%

TL Roast and Ground (R&G) EXCL SINGLE-SERVE SEGMENT

400,000,000

200,000,000

Ranking

Coffee: Roast & Ground

Natural Cheese: Exact Weight

Luncheon Meat: Exact Weight

13

2

17

Milk

1

Bread: Commercial

Eggs

Yogurt Products: Refrigerated

Snack Foods

Chocolate

Household Appliances

3

14

8

5

7

11

0

Make sure R&G Coffee receives its fair share of the shelf space Source: Nielsen. Top 500 Category ranking, National, All Channels, 52 weeks ending January 14, 2012. Note: excludes remaining and unspecified categories, cosmetic, general merchandising and OTC pharmacy.

STRATEGIC LEADERSHIP

52 WKS 2010

L 52 WKS YA

L 52 WKS

Single Serve brings additional sales to the coffee category Source: Nielsen, MarketTrack, National GB+DR+MM+GM+WC, 52-week period ending November 17th, 2012.

KEY FACTS & FIGURES > Coffee is the most consumed drink after tap water; 65% of the Canadian population drink coffee.1 > 86% of shoppers have planned to buy coffee before they enter the store.2 > Despite the revolution brought by the single-serve segment, traditionnal coffee still represents 73% of the $Sales of the category, and is stable at +1% vs. last year.3 > Among traditionnal coffee, Premium brands (+7%) and Whole Beans (+8%) increased their dollar sales vs. last year.3 > 79% of consumers like the fact that they can buy premium brands at grocery stores.1 > In 2012, 43% of coffee drinkers said they like to experiment with different roasts and blends of coffee, compared with 35% in 2011.1

MERCHANDISING TIPS > T urn your hot beverages

Baskets Containing K-Cup® packs have a higher basket ring than the average basket

section into a destination coffee “boutique” by dedicating a section

Average Basket $Value

In-Store Impact > As coffee is part of most shoppers’ consideration set, retailers should pay attention to this section of the store. > Having an attractive coffee section can be a source of differentiation for the store. > Offering a wide variety of Premium coffees under a dedicated section enhances the shopping experience and can help the retailer become a destination for the shopper.

$88.27 $41.41 AVERAGE SHOPPER*

TL R&G COFFEE SHOPPER

to Premium and Specialty coffees. >A llocate a section to single serve,

$108.11

located at the end of the coffee

TL K-CUP® SHOPPER

section and before hot chocolate and tea, in order to reach consumers from many categories. >M erchandise single-serve products by technology (i.e. Keurig®) , so consumers can easily match them to the machine they have.

1. Coffee Association of Canda, 2012 Coffee Drinking Trends in Canada. 2. G MCR Canada study among a representative sample of 600 coffee shoppers across Canada, March 2011. 3. N ielsen Market Track, National GB+DR+MM, 52 weeks ending November 17 2012.

K-Cup® packs buyers are more valuable to the total store

> I nclude a Bulk Coffee section to satisfy shoppers who are seeking

Source: Nielsen Homescan, National GB+DR+MM, Latest 52 wks ending January 14th 2012. * Average Shopper = for TL Expenditure

a sensory experience and new flavours or blends.

SOURCE OF GROWTH IN TRADITIONAL COFFEE Traditional Coffee Tendency

NOW THE #1 COFFEE BRAND IN CANADA* ®

Van Houtte offers a wide range of products to help shoppers explore the world of coffee.

+7%

$115,523,575

Premium Growth

$434,074,299

0%

$123,935,742

$436,183,060

Premium Coffee

Mainstream Coffee

Mainstream Growth

Latest 52 WKS YA

Latest 52 WKS

Premium Coffee is a source of growth for the traditional coffee segment * Source: ACNielsen Market Track, National GB+DR+MM+GM+WC, 52 weeks ending December 15th 2012.

Source: Nielsen, MarketTrack, National GB+DR+MM, 52-week period ending November 17th, 2012. Mainstream includes Niche & Gourmet Coffee. Mainstream includes Private Label, Maxwell House, Folgers, Nabob & Tim Horton’s.

HOW TO LEAD IN SINGLE SERVE 1. H ave a dedicated space for the single-serve section. 2. D ivide and identify single-serve section by technology, Up/Down sections to facilitate shopping. 3. R egroup the beverages outside coffee (hot cocoa, hot teas, iced coffees/teas) together at a higher eye level and identify the different beverages if feasible (increase awareness). 4. C lassify products by brands and sub-collections (Premium higher, Value lower, single origin, flavoured).

Displays that Differentiate Grocery retailers can differentiate themselves by becoming a coffee destination. Consider adding a Premium Coffee dedicated section with a wide assortment for discriminating shoppers who select their coffee as they would a fine cheese or wine. GMCR Canada believes supermarkets should also include a single-serve section grouped by technology, as shoppers are looking first for products to brew with the machine they have at home. The best-in-class stores now have 12 feet of single serve, 8 feet of which are dedicated to Keurig®. As single-serve products are becoming increasingly popular, retailers will have to re-allocate space to increase the single-serve set without cutting into the popular existing coffee section.

PREMIUM SECTIONS SHOULD INCLUDE A WIDE VARIETY TO CHOOSE FROM According to our shopper study, more involved shoppers: > E xplore coffee

By carrying a variety of K-Cup® packs – caffeinated

> S eek sensory experience

and decaffeinated coffee, flavoured coffee, hot

> L ook for quality

cocoa, iced beverages, and tea – grocers can

> E njoy shopping and spend more time

capture more usage occasions, including breakfast,

Source: qualitative (20 face-to-face interviews) and quantitative study among a representative sample of 600 coffee shoppers across Canada, March 2011.

late morning, lunch, afternoon, dinner, and evening. After all, the more varieties consumers have at home, the more they’ll drink. Source: Kantar Retail Shopper Genetics®, U.S, 2011

OPPORTUNITIES OUTSIDE OF COFFEE NEW FOR SPRING 2013 Snapples® Iced Teas

Single Serve: Source of growth for Tea and Hot Chocolate categories $ Sales Total Tea + Hot Chocolate categories

Snapples®, a well-known brand coming under the Keurig® brewing system.

$12000

$10,626

10000

$7,577

8000

Single Serve Tea

6000 4000

$270,494,311

2000 0 -2000

$260,319,303

-4000

Reg. Tea

TEA

ICED BEVERAGES

HOT COCOA

SALES LAST 52 WKS

-8000

Reg. Hot Chocolate

- $1,441

-6000

SALES YAGO

Single Serve Hot Choc.

- $6,587

Shelf space should be re-allocated within the Tea and Hot Chocolate categories to make room for single serves Source: Nielsen Market Track and Strategic Planner, National GB+DR+MM+GM+WC, Dollars, 52 weeks periods ending November 17th 2012.

Takeaways > Coffee is a dynamic category and is bringing a high dollar growth to the store; make sure you allocate it a fair share of space. > Traditional coffee consumers are trading up: Premium coffees and Whole Bean format are growing faster than the market. > Having a dedicated space with a wide variety of Premium coffees can help the banner differentiate itself. > Single-serve beverages are still growing at triple-digit rate. Make sure you allocate a proper space identified by technology to help consumers find the products that fit with their brewer. > Single-serve segment is expanding outside coffee, creating growth by increasing the usage occasions. Make sure to regroup and better position these new products in order to capture more sales.

SUSTAINABLE ADVANTAGE

B

uilding demand for sustainable products is one of the key areas on which GMCR Canada is focusing as

part of its commitment towards sustainability. The Van Houtte® coffee brand has been a proud partner of Fairtrade Canada since 2000. As of today,

Future Focus The future growth of coffee remains bright as premium brands and single-serve formats continue to carve out their place in the category. With the consumer becoming more educated about the quality and origin of the coffee they buy, the category will benefit from the trade up in consumption. The opportunities for growth in single serve are also enormous. For example, 40% of households in Germany and even more in other countries, have adopted this technology, versus only 18% in Canada (CNBC, 2011). That translates into 5.5 times more annual sales! As the single-serve category continues to flourish, with innovations at the forefront, Keurig® Brewers’ penetration is expected to have strong growth in the coming years. As GMCR Canada expands into other beverage occasions, it will build additional usage via new products. In the future, grocers should consider expanding their coffee display to capitalize on this fastest-growing category.

three of its five coffee collections are Fairtrade Certified. Likewise, the Timothy’s® coffee brand has been partnering with Rainforest Alliance since 2004. For the fiscal year 2012, 50% of all Timothy’s® coffee sold came from Rainforest Alliance CertifiedTM farms. As consumers are getting more educated about the products they are consuming and their origins, offering sustainable products is essential in today’s market. You can learn more about GMCR Canada’s commitment to sustainability at GmcrCanadaSustainability.ca

EDUCATING THE CONSUMERS To encourage shoppers to discover new coffees, retailers can include educational signage in store. Van Houtte® brand has also developed different digital platforms to share its expertise and help people find premium coffees best suited to their individual taste. MyMasterRoaster.com website includes the Coffee Profile tool and C! The Coffee blog, which contains over 500 articles, tips and recipes on coffee.

STRATEGIC LEADERSHIP

Technology

Grocery Game Changers Technologies that will impact how groceries are sold, sampled and distributed By Sally Praskey

As online shopping continues to gain momentum, traditional grocers are deploying a variety of technologies to bring in customers and keep them involved with the store experience. Some are even choosing to capitalize on the trend by developing their own versions of online shopping services. But whatever their strategy, awareness of these technological “game changers” from around the world will help grocers stay in the game.

1

Converting “Showroomers” to Buyers

Customers are increasingly treating bricksand-mortar stores like showrooms to check out products in-person, and then use their mobile devices to purchase those products at lower prices online – a particular problem for retailers of big-ticket items, like electronics. But grocery retailers, too, could be at risk. With the increase in smartphone penetration, showrooming is here to stay, says a recently

released retail brief from Montreal-based Aimia, titled Through the Looking Glass: Building Relationships with Retail Showroomers. According to the brief, Millennial consumers (age 19-29) represent at least two-thirds of showroomers in Canada. But it’s not all bad news. The brief reveals that Canadian showroomers are 17 per cent more likely to participate in a retail reward program, and are more willing to share personal data in exchange for rewards and recognition. They are also 10 times more likely to respond to a location-based mobile offer. “Retailers should take advantage of

these behaviours to transform showroomers to become loyal – and paying – customers,” says Rick Ferguson, vice-president, knowledge development, Aimia. Meanwhile, a study by St. Louis-based GroupM Next, titled Showrooming and the Price of Keeping Buyers In-Store, notes that while showroomers – who are most often younger and with lower incomes – base their purchases almost exclusively on price, about 10 per cent of purchasers surveyed chose to complete the purchase in-store no matter what price discount was offered. Another 10 per cent are sensitive to price but can be swayed to stay in-store. The study says sales associates “can be influential, as customers who interact with an associate are 12.5 per cent more likely to purchase in-store.”

The takeaway: “Whether leveraging mobile apps, digital displays or social media, smart retailers can build loyalty with consumers by becoming a partner in their shopping experience,” says the Aimia retail brief.

grocerybusiness.ca

January | February 2013

27

GSW 2013

GROCERY SHOWCASE WEST: WHERE THE WEST MEETS GROCERY’S BEST

APRIL 14 AND 15, 2013, AT THE VANCOUVER CONVENTION CENTRE

CFIG.CA

APRIL 14 & 15, 2013 VANCOUVER CONVENTION CENTRE

GS W

GROCERY SHOWCASE WEST

3 Sampling as Adult Entertainment

2

Subscription Models = Customer Convenience An extension of online shopping and a variation on the traditional concept of standing orders, online subscription models are becoming increasingly popular. These are regular delivery services that send a particular group of products to subscribers – for example, Amazon.com’s Subscribe & Save program, which offers automatic delivery and savings in a variety of product categories. Other examples include Joyus (formerly Foodzie), for artisanal food products; and Citrus Lane, which sends regular care packages to paying subscribers for children ranging in age from newborn to three years. While these kinds of sites haven’t taken off in Canada as they have in the U.S., it is only a matter of time before they expand here or A case in point: New Canadians find York-based Mantry, a way to which specializes in replicate them foods that men for our market.

should have in their kitchen pantries, recently expanded and now offers its service in Toronto.

grocerybusiness.ca

When Kraft Foods launched a line of desserts for adults called Temptations, it offered an innovative, cheaper – and more entertaining – way for consumers to sample the products. The company teamed up with Intel to develop iSample machines, smart vending kiosks that deliver the right sample to the right person. Using an optical sensor, the kiosk determines the gender and age range of the consumer standing in front of it, and serves up a sample most likely to appeal to him or her. iSample does not collect personal information; it aggregates information about consumer usage patterns by gender and age range across all users. And sorry, kids. This dessert is just for adults, as a humorous message proclaims when children try to use the kiosk. So far, the machines have been piloted in two locations in the U.S.

4

Tesco goes to the “dark side” to support online shopping U.K. retailer Tesco is expanding its number of “dark stores” in order to cash in on the online shopping boom. So-called dark stores are not open to the public, but are used as inventory depots for nearby grocery stores overwhelmed with the orders generated by Tesco’s thriving online business. So far, there are four dark stores in London, with reportedly more to come. Since its launch in 1997, Tesco’s grocery home-delivery service has grown to be the world’s largest online grocery retailer, with sales of over £2 billion and a selection of some 25,000 products. These dark stores complement the company’s “click and collect” drive-through service, whereby customers can order online and pick up their groceries at a drive-through site. Based on its success in the U.K., Tesco has rolled out online shopping to Ireland, South Korea, the Czech Republic, Poland and Slovakia, and has set its sights on Thailand and Malaysia. It has also developed a prototype 3D Tesco store, which would allow customers to shop the aisles from home, virtually, thereby integrating both the in-store and online shopping experience.

January | February 2013

29

33

Leadership by Example by Sally Praskey

3

W

hen Johanne Choinière joined Metro Inc. in 1989 as a produce buyer, she had no industry experience. But her strong work ethic and passion for learning were evident, and that landed her the job. As she explains, “I was interviewing with three companies at the time. My last interview was with the vice-president of produce at Metro Inc. I really liked his approach, which was different from the other interviews I’d had. It was really straightforward and direct. He asked me about my experience, but I had none. He said to me: ‘If you can be on call 24 hours a day, seven days a week’ – because that is the nature of produce – ‘and you can handle hard work, we will teach you about produce.’ I really liked that. The vice-president’s name was Robert Sawyer, who

GB: What is your background – what did you do before you joined Metro? JC: I graduated from Bishop’s University in Lennoxville, Que., where I studied Business Administration. I worked briefly for Marks & Spencer, and then moved to Germany for two years. I worked there and travelled all over Europe before returning to Canada to start my career.

3 today is the executive vice-president and COO of Metro Inc., and is my boss once again.” Since then, she has never looked back, earning a succession of promotions and relocating to Toronto from Montreal to assume her current position. “Johanne brings a lot of passion and positive energy to work everyday,” says Eric La Flèche, president and CEO of Metro Inc. “She’s a hard worker, strong-willed and very organized. She has shown initiative and versatility by successfully taking on various challenges over the years, including relocating twice to other cities. She’s a real fighter who has grown to become an effective senior leader at Metro, always putting the company’s interest first.”

GB: What in particular makes grocery retail attractive for you? JC: I chose grocery retail because it was something I felt comfortable with. I’m the oldest in a family of four children. My Mom worked so she decided, when I was 12, that I was old enough and responsible enough to take care of the grocery shopping. The very first time she gave me a list and $100. I told her, just a few weeks

after, that I didn’t need a list anymore. I knew all of the products and prices, and my goal every week (because money was very tight) was to try to feed the whole family with less than $100 so that she could keep the extra cash. I didn’t know it back then, but the store I was shopping at was a small Richelieu store in Cowansville, and Richelieu is actually a banner of Metro Inc. So I guess I was destined.

P H O T O B Y M AT T H E W P L E X M A N

Johanne Choinière

s eni or vi ce -p res i d ent, ontari o d i vi s i on, metro inc.

30

January | February 2013

&&

April April30 30to toMay May2,2,2013 2013 Direct DirectEnergy EnergyCentre Centre Visit Visitus usatatsialcanada.com sialcanada.com

SIAL SIALCanada CanadaininToronto Toronto THE THEFOOD FOODINNOVATION INNOVATIONHUB HUB IN INNORTH NORTHAMERICA AMERICA

>>SUPPLY SUPPLYyour yourstores storeswith withinnovations innovations >>HARVEST HARVESTnew newproducts productswith withinternational internationalflavours flavours >>MAKE MAKEyour yourshelves shelvesstand standout outfrom fromcompetition competition >>MEET MEETallallthe theoffer offerininone oneplace place

an event an event by by

SIAL,SIAL, a subsidiary a subsidiary of Comexposium of Comexposium GroupGroup

GB: Would you recommend grocery retail as a career choice? JC: I would recommend it because I find it to be a really dynamic industry. It’s always evolving, and it’s part of everybody’s life. One thing that young people might not understand is that there are a lot of opportunities in grocery retail. Depending on your capacity and your experience, you can work in marketing, finance, merchandising, the legal department, or in-store operations. There’s a broad scope of things that you can do. GB: What advice would you give young people coming into the industry? JC: The first thing I would tell them is do the job that nobody wants to do and go to the places where nobody wants to go. Work hard, and work like you own the company. And always treat people, whatever their level, the way you want to be treated. And I would also tell them to be accountable and to never make excuses for mistakes. You’re allowed to make mistakes; just make sure you learn from them. Probably the most important thing is to always work with the highest integrity because it’s a small world, and I believe that you are your reputation. GB: What do you consider to be the essential elements of leadership? JC: I have my own style, but based on my experience, I would say always lead by example. Always walk the talk. Don’t blame others. You are the leader, so be accountable. Make sure you support your team – and

grocerybusiness.ca

make sure they know you support them – because alone you’re not going to achieve much. Again, act and work like it’s your own company. It shouldn’t be any different. Leaders should also welcome adversity, especially in Ontario as it’s such a competitive landscape. Take it on. See it as an opportunity to grow. Always recognize the people and their efforts. You can choose to give negative feedback, but in my opinion positive reinforcement goes a lot further. And finally, I would say to be passionate about what you do and never, ever stand still. Status quo is not an option. As a leader, you have to always keep learning and improving. GB: Does Metro have a training or mentorship program for young people who want to make a career of grocery retail? JC: Absolutely. At Metro, we have a large pool of employees and we recognize that some of them are pursuing their education as they work for us. So we really try to tap into this group of employees for career growth opportunities. We have an annual process for succession planning where we identify high-potential candidates and make sure they have access to the training and tools they need to get to the next position. We have a tuition assistance program that assists those interested in continued learning. We have training programs that are designed to provide our employees in Ontario and Quebec with the skills and abilities they need to build a long career in our company. I would say at least 70 per cent of the time, we promote from within.

Always lead by example. Be accountable. Make sure you support your team – and make sure they know you support them – because alone you’re not going to achieve much.

January | February 2013

33

A taste of CALIFORNIA...

Grilled Indian Spiced Pork Emphasizing vegetables and fruit is part of healthy eating. California Cling Peaches financially supports the Health CheckTM Program. This is not an endorsement. See www.healthcheck.org 130 g (1/2 cup) Cling Peaches in light syrup: 80 Calories, 0g Fat, 20g Carbohydrate, < 1g Protein.

Bring the taste of California to your table with quality canned California Cling Peaches! •

Convenient and economical, especially when fresh fruit is not in season.

•

We start with the freshest California Cling Peaches - hand sorted and quality inspected.

•

They are harvested and canned at their peak, sealing in their valuable nutrients and fresh taste.

•

California canned fruits are packed in either juice or light syrup with absolutely no additives or preservatives used in the canning process.

•

The canning process is one of the safest forms of packing – the high heat and vacuum seal prevent micro-organisms that cause food-borne illness.

For more recipe ideas visit the California Cling Peach Board at:

www.calclingpeach.ca

A participant of Heart & Stroke Foundation of Canada’s Health CheckTM Program

33

It’s such a competitive market that you can never stand still. You always have to innovate and evolve. 3 GB: What was the best advice you received in your career? JC: Someone once told me: Don’t worry about the future. Just try to be the best at what you’re doing now. Really try to do the best you can in your current position and focus on that. If you do that, promotions will come. I followed that advice, and I would give that advice to young people who are starting out. GB: What was the most important decision you made in your career? JC: Looking back, I think my first and most important decision was picking Metro as the company at which to start my career. I chose the right company, and I would choose it again. I admired Metro for its culture and its values, and that’s still the case 23 years later. GB: What do you find the most exciting about the grocery retail industry right now? JC: It’s such a competitive market, so you can never stand still. You always have to look for ways to improve your business and to innovate and evolve. You have to adapt very rapidly to the changing market trends. And if you want to succeed in the business, you

grocerybusiness.ca

3

have no choice but to deliver on your customers’ highest expectations. I like the fact that you have to remain open to overcoming adversity. You have to fight every day. I think that’s exciting.

four or five hours of quality time together, which was very rare. Growing up, those fishing weekends with my family taught me hard work and perseverance. And it was a lot of fun.

GB: Tell us a fun or interesting fact that people might not know about you. JC: I love ice fishing. When I was young, every Saturday and Sunday we went ice fishing; all four kids with my parents. We had no choice. I grew up in Quebec, so sometimes it was -25, -35 degrees – but it didn’t matter; we went every weekend. It was actually a lot of work. I think it taught us a great deal about accountability and responsibility because we all had 12 holes that were ours to take care of. There was a mini-competition among us because we wanted to catch the most fish. My parents showed us how to do it once, but after that, if we caught one, we had to unhook it and then put fresh bait on the hook. We had a little hut but we could only go in it to have our lunch. It was hard work but now I show all of the nieces and nephews in our family how to ice fish because we want to make sure we pass down the tradition. I loved it because it was

GB: How long have you lived in Ontario, Johanne? The move from Montreal must have been a big culture change. JC: It was four years this past October. It’s funny because everyone thinks I miss Montreal, but I really enjoy Toronto. There is a difference, for sure, but I love the ethnicity and diversity. I live by Lake Ontario and there are green spaces everywhere. And there’s never a dull moment. GB: Did you benefit from a mentor throughout your career? JC: Not specifically, but I always had great examples to follow. The first one was Mr. Lessard, who is our executive chairman of the board at Metro. And throughout my career I worked closely with Mr. La Flèche, who is our president and CEO. These are two men that I truly admire, and I learned quite a bit just by listening and watching them.

January | February 2013

35

Passion, integrity and authenticity are the driving forces behind Grocery Business’s

INFLUEN IAL

MOST

By Sally Praskey and Noelle Stapinsky

W MEN

CHERYL SMITH

Notable: Recognized as one of Canada’s Top 100 Most Powerful Women.

It comes as no surprise that Women’s Executive Network Canada named Cheryl Smith to its Most Powerful Women Top 100 in the corporate executive category for 2012. “Cheryl’s leadership and commitment to Parmalat’s brands is unwavering, and we are proud of her Top 100 recognition,” says Nash Lakha, president and CEO of Parmalat Canada. 36

January | February 2013

Executive Vice-President, Sales and Marketing, Cheese, Tablespreads and Cultured, Parmalat Canada Smith is a 22-year industry veteran who began her CPG career at Unilever. She was recruited based on her award-winning thesis – Defensive Marketing: Measuring the Profitability of Consumer Complaints Handling – for her Master of Applied Science degree in Management at the University of Waterloo. During her 13 years at Parmalat Canada, Smith has assumed positions of increas-

ing responsibility, and Parmalat has achieved the best-selling nationally ranked item status in cheese, yogourt, butter, premium milk, snack cheese and premium aged cheddar with brands such as Black Diamond, Astro, Lactantia, Cheestrings, Balderson and Beatrice. Smith now oversees sales and marketing for the company’s cheese, tablespreads and cultured businesses.

Profiles in Leadership, 2013

What qualities do you look for when hiring staff? Beyond the necessary technical skills, it’s passion that differentiates candidates. Passion for our brands, and then demonstrating that passion by taking full ownership of our business. How important is diversity in the workplace? Diversity is very important. It ensures competitive advantage. We need to hire from the whole universe of top talent – exclusion of any group will result in long-term competitive disadvantage. It’s critical that men support women. But it is also important that women support women. There is so much opportunity for good business people, and all resources should be utilized. Does Parmalat reflect that diversity? I’m very proud of Parmalat’s inclusiveness, and that’s really driven from the top. We hire the best people for the job, and the best includes both men and women. What do you consider the essential qualities of leadership? It is being able to effectively communicate the vision, and empower individuals to execute against clear objectives. It is important to celebrate successes along the way, and regroup and learn from the challenges in order to move forward with passion. And in this fast-paced business environment, a sense of urgency is critical. What is an interesting fact that people may not know about you? I’m a farm girl at heart. I really enjoy horses. That’s from my childhood, but now that my children are old enough to ride on their own, I’ve been horseback riding more often. Also, dairy is in my roots. My mother’s family had dairy farms, and now I work for Parmalat!

grocerybusiness.ca

DIANE BRISEBOIS

President and CEO Retail Council of Canada

What do you consider the essential qualities of leadership? I believe important leadership qualities include honesty, intelligence, empathy, courage, vision and creativity. Leaders need to foster an environment that demands honest, transparent and courageous communication in order to develop high levels of trust and respect. What is your most significant accomplishment as president of the RCC? To have built a team that is dedicated to the industry and its well-being. What can the industry do to attract young people to retail as a career? While I believe the industry has made substantial progress in this area over the last decade, it could still learn from other industry sectors in regards to how one recruits at college and university levels. Retailers need to be more present on campus, participate in

Notable: Recipient of the Canadian Society for Association Executives highly prestigious Pinnacle Award for outstanding leadership.

and support internship and co-op programs, and provide more scholarships and mentoring programs. Do you think that women are well represented within the senior ranks of retail in Canada? I believe women have made great strides in this area, but not in all segments of the retail sector. Women are better represented at the senior ranks in general merchandise retail versus other sectors, such as grocery. There is still much more that could be done to increase the representation of women in the corporate office. The sector could do much more in diversity hiring – not just women, but also visible minorities. What is your business mantra? What we know isn’t as important as what we can learn.

January | February 2013

37

What role has innovation played in the growth of Burnbrae Farms? Innovation has played a very big role in our growth. Some product categories, such as Naturegg Omega 3 shell eggs, that are now a large part of our business, didn’t exist prior to 1995. These products have also driven category management strategies with our customers, and have greatly improved category profitability. What do you consider the essential qualities of leadership? In my view, leadership means being decisive while creating an open environment where employees are free to offer their opinions and are actively engaged in contributing to decisions in their area of expertise. Not only does this drive better decision-making for the organization, it ensures a more engaged employee base. How much does instinct play into your decision-making process? We are very entrepreneurial at Burnbrae, and instinct often plays a big part in our decision-making. However, we are always working to build-in more processes with pre- and post-analysis on all major projects. What is your business mantra? I would sum up our business approach/mantra as “Growth through innovation.” What is an interesting fact that people may not know about you? I began picking eggs for $2 an hour when I was eight years old, which led to a decade-long part-time job. That bought a lot of candy in the Village of Lyn when I was a child.

MARGARET HUDSON President, Burnbrae Farms Canada Notable: Burnbrae Farms was chosen as one of Canada’s Best Managed Companies in 2012, and has the most Grand Prix wins for product innovation. Notable: Created the first carbon credit program in the industry.

BELINDA JUNKIN 38

January | February 2013

president and CEO, Canadian Pallet Council

Profiles in Leadership, 2013

KAREN KUWAHARA

President, NestlÉ Purina petcare Canada Why was CPG an attractive career choice for you? When I graduated from business school, I was interested in marketing. The best entry was through CPG, which was recognized as providing terrific training. And I enjoy the industry as much today as when I started out. Why do you think this industry is a good career choice for young people? This is a dynamic and constantly changing industry that plays an integral role in many of today’s high-priority social issues such as food safety and supply, environmental sustainability, and health and wellness. We need young people with fresh ideas, energy and passion to help shape the future of the industry.

What do you consider the essential qualities of leadership? I’d say that the two distinguishing qualities are passion and the ability to inspire and engage others. Leaders also understand the importance of teams and the power of many working towards a common goal. Supporting staff members and recognizing the value they bring to their work helps create and maintain highperformance teams. What is an interesting fact that people may not know about you? While playing a social basketball game with our agency years ago, I was nicknamed “Too Tall.” I’m five feet tall, but to this day some remember this and will sometimes refer to me by this nickname.

What are the main benefits of the carbon credit program? The program reduces costs, which attracts companies to the program, but it also, of course, reduces carbon emissions and monetizes the resulting carbon credits. What do you consider the essential qualities of leadership? Vision, passion and being authentic. You have to live it and believe in what you are doing. You have to walk the talk. Continuous learning, the ability to collaborate, and mentoring and being mentored are also very important.

Notable: Helped establish the Nestlé Purina PetCare Canada Chair in Communications at the University of Guelph

What is your business mantra? I joke that “pallets are my passion,” but it’s true. I believe in the program – it works, and I am passionate about it. What is an interesting fact that people may not know about you? I enjoy travelling to other parts of the world. grocerybusiness.ca

January | February 2013

39

Describe your background and how you got involved in GS1 Canada. I owned my own business for seven years, and then worked for Home Depot when it first came to Canada. I was recruited to GS1 – the attraction was the opportunity to build something and to stretch. I have been with them for 10 years, moving through several roles before becoming COO.

EILEEN MACDONALD Chief Operating Officer GS1 Canada Notable: Led GS1 Canada to institute globally recognized supply chain standards.

What is GS1 Canada’s most significant accomplishment? The accomplishment, from a global perspective, is our capacity to facilitate international collaboration. Specifically, it’s to bring together not only the organizations, but the individuals who represent them from over 145 countries, and to ensure that the proper foundations for communications are in place to enable global trade. Of all the sectors – and we deal with over 20 – grocery is the one that really leads the pack. We can take what we learn from grocery and transfer that into other sectors.

What do you consider the essential qualities of leadership? I think it starts with integrity – it permeates through everything you do. You need to have courage as a leader. You need to be passionate. Trust – you can attach that to integrity, but it needs to be reciprocal, so it’s not only that I can be trusted, but that I have the ability to trust my team. You have to be able to take risk. Communications – you must have the capacity to clearly articulate the big picture and vision. And you need to walk the talk, so that people will follow. What is your business mantra? I believe that business is all about people – cultivating relationships of trust and integrity. Surrounding yourself with these individuals is truly the key to success. What is an interesting fact that people may not know about you? I love to dance! Also, I come from a large family – six sisters who are my best friends. And I have eight children – four boys and four girls.

ROSANNE LONGO

chair, longo's family charitable foundation Tell us more about the Longo’s Family Charitable Foundation (LFCF). The LFCF is dedicated to the support of children’s and women’s causes, with a strong focus on health and fostering a sense of community. One of the ways we raise funds is through our annual golf tournament, which has been running for over 20 years and attracts 450 golfers each year.

40

January | February 2013

What do you consider the essential qualities of leadership? I think passion is important. When leaders are passionate about life and work, that inspires others and motivates you to be on a journey of continuous learning.

Profiles in Leadership, 2013 KATHY MARTIN

Senior Vice-president, Human Resources Loblaw Companies Limited How did you get involved in retail? I joined Loblaw, and grocery in particular, because I love the idea of working for an iconic Canadian company and I love food. Plus, grocery retailing is just so close to the customer. Would you recommend grocery retailing as a career? I think that if you are a person who is motivated by seeing results quickly and enjoy the innovation around food, then grocery retailing is a really attractive place to be. You’ve been involved with Loblaw’s diversity programs, which has led to some interesting opportunities. Yes, one of the principles Loblaw put in place a number of years ago was to be a company that reflects the country’s diversity. And then four months ago, the federal government announced a research project titled Labour Market Opportunities for Persons with

In addition to your LFCF role, you are also the Longo’s spokesperson. With the consumer changing so rapidly, what must retailers do to stay relevant? Consumers are more food savvy than ever and so our role, through our team of experts, is to provide ideas and solutions around healthy and convenient food options. And, as retailers, we need to keep listening to our customers and be willing to move with the trends. As a company, I think it’s important that we are consistent in our vision of staying true to our roots and core strengths.

grocerybusiness.ca

Disabilities. Loblaw was named to this panel, and I was asked to serve. It was an honour to be asked, and it’s been a real learning experience. We have been conducting research into best practices in a number of companies and have just reported our findings. It was obvious that there are many opportunities to do more, so we’ll see what happens from here. What do you consider the essential qualities of leadership? I see passion and authenticity as very important because that inspires trust in the people around you. What is your business mantra? Attitude is everything. It can make you or break you. Choose wisely!

Notable: Involved in the innovative grad@loblaw university recruitment program and appointed to the federal government’s Labour Market Opportunities for Persons with Disabilities advisory committee.

What is an interesting fact that people may not know about you? I use to sing jazz and blues for a living, and still do it for fun.

What is your business mantra? Our founders always taught us to “treat others the way you want to be treated,” and that has served us well in life and as a business mantra no matter who we are dealing with – customers, team members, vendor-partners and community partners. What is an interesting fact that people may not know about you? I play left wing on a women’s hockey team. The league started about four years ago, and we play once a week.

Notable: Longo’s Family Charitable Foundation has assisted numerous charitable organizations by giving more than $3 million in fundraising dollars to Toronto’s Sick Kids, women’s and children’s charities, local hospitals, and kids’ camps in the Greater Toronto Area.

January | February 2013

41

TYPE

MODULAR

TYPE

COMPACT

FLEXIBLE, ADAPTABLE, UNIQUE

CONVENTIONAL, STYLISH, MODERN

With K-class flex, screens, load cell, printers, etc. can be freely combined resulting in space-saving integrated solutions for your merchandising cases with all the technology features of the KH100.

Applesque design counter scale with the cutting edge Bizerba K scale App designed to inform your operator so the customer feels like they are talking to a foodie or a chef. Not to mention industry leading application integration and power savings backed by Bizerba workmanship.

K-FLEX

KH 100

Retail Portfolio: High performance with a wide range of different models and equipment variants.

A TRADITION OF INNOVATION. Bizerba has been focused on weighing technology since 1866. We provide state-ofthe-art PC Based Scale Hardware and Software solutions for full-service and pre-pack departments with a primary focus on increasing your sales and profits. Closer to your business, flexible for your needs, ready for the challenges of a global economy. www.bizerba.com

Profiles in Leadership, 2013

What do you consider the essential qualities of leadership? It’s a number of things. It takes passion, a strong vision for the future, and effective communication, and an ability to delegate. What is the most important issue facing CPG manufacturers? The biggest challenges are finding ways to grow in a flat market while continually innovating across the entire supply chain. It has to be true innovation of processes and systems in order to stay competitive, and innovation with new products to continually meet changing consumer needs.

Are women well represented in the industry? There are a number of female leaders in the industry, and I think that women are well represented overall. But are there as many as there should be? No, absolutely not. It’s our responsibility as an industry to mentor and sponsor women and to provide a work environment that provides the flexibility needed for women to move up through organizations while managing their family responsibilities. What is your business mantra? I value honesty and trust, and always being true to your word. I follow this motto in life and in business. What is an interesting fact that people might not know about you? I was originally planning on becoming a vet, but instead ended up with a B.Sc. and a registered dietician degree.

NANCY CROITORU

CEO, Food and Consumer Products of Canada Notable: In October 2012, was named as one of Canada’s Top 25 Women of Influence.

CORI BONINA

President, Stong’s Market Ltd. and Cori’s Kitchen Inc.

Notable: Industry innovator and first female Chair of the Canadian Federation of Independent Grocers.

grocerybusiness.ca

Your store in Vancouver is a laboratory for ideas. What do you consider your most successful product launch? It’s difficult to choose just one because we are considered a launch pad for new products. Food manufacturers, chefs, and even restaurants come to us for help in marketing and developing new products. Our most famous product affiliation would be Leslie Stowe Raincoast Crisps, which are now sold throughout North America. What do you consider the essential qualities of leadership? The main quality of a leader is the ability to communicate and to surround yourself with a great team that is given the latitude to succeed.

Can you tell us about Cori’s Kitchen? I’ve taken my passion for cooking and developed a state-of-the-art cooking facility which creates Cori’s Kitchen products for distribution to dozens of independent stores across B.C. What is your business mantra? Never be satisfied with the status quo. What is an interesting fact that people may not know about you? I’m an art lover and collector.

January | February 2013

43

The world didn’t even know what a coffee filter was until we invented it in 1908. And now our newest innovation is set to revolutionize the coffee industry once again. But don’t worry, you don’t need a new machine – it will work with most* brewers using Keurig Incorporated Brewing Systems. Find out more about the full-flavoured future of single serve at Melitta.ca.

*Melitta coffee pods are not affiliated with, nor approved by, Keurig Incorporated. Melitta coffee pods are not designated to work with VUE brewing systems. VUE is a registered trademark of Keurig Incorporated.

Coffee Report

CoffeE

Buzz Whether it’s getting that morning fix, grabbing a cup on the go or taking a break at work, Canadians love a good cup of Joe. In fact, the Coffee Association of Canada’s annual Coffee Drinking Trends Study – conducted by Maritz Research – shows that two-thirds of adult Canadians drink coffee every day, and 80 per cent consume it on a weekly basis. by Noelle Stapinsky

grocerybusiness.ca

January | February 2013

45

Coffee Report

According to Robert Carter, executive director of The NPD Group, Canadians average about two coffees per day, with 67 per cent brewing their java at home, and 37 per cent buying coffee at restaurants. Canada is second only to Italy when it comes to the percentage of cups of coffee consumed away from home. “The away-from-home market that sells coffee in Canada is huge,” says Sandy McAlpine, president of the Coffee Association of Canada. “The habit develops easily because of accessibility. We have proportionally more coffeefocused stores per capita than the U.S. And the overall quality of competition happens at a slightly higher level in the grocery stores, specialty stores, and coffee and donut shops.”

The café culture in Canada has had a significant influence on consumers. Canadian coffee drinkers are more educated; their palates are evolving; and, while they demand quality and variety, they also want it fast and cheap. “Espresso-based beverages and iced coffee, which were considered trends in the past, are now fixtures in the marketplace,” says McAlpine. Along with traditional coffee, consumers expect specialty beverages, not just from all foodservice operations, but at home too. It’s this demand that is propelling the extraordinary growth of the single-serve category, which has been deemed the most disruptive technology to ever hit the market.

All coffee beverages consumed in-home by age % + - refers to 2012 vs. 2011

100% 80%

+4%

60% 40% 20%

+10%

+5%

-7%

-10%

0% 18-24

25-34

35-49

50-64

65+

Source: Coffee Association of Canada. Coffee Drinking Trends in Canada 2012 Tracking Report prepared by Maritz.

Some Like It Hot – Out of Home Robert Carter, executive director of NPD Group, says the fastest-growing coffee consuming demographic is the 24-and-under group. “They have increased their consumption over the past three years,” says Carter. “Items such as iced coffee, lattes and other specialty-type beverages – with sweeter flavour profiles – are really resonating with the younger consumers.” But while this young demographic consumes most of its coffee beverages out of home, the innovation in single-serve technology has captured its attention.

46

January | February 2013

This is a great opportunity for grocery retailers to maximize sales. Increasing SKUs for the various formats will better meet the needs of the diverse hot-beverage preferences in today’s households. Apart from the regular gift-giving seasons, sales of single-serve brewers and products spike around the back-to-school time of year, which Carter says is driven mainly by this younger demographic moving out for post-secondary education.

Coffee Report CAFÉ ASSOCIATION DU CANADA

COFFEE ASSOCIATION OF CANADA

Where consumers shop for their homebrew % + - refers to 2012 vs. 2011

The coffee industry is abuzz with innovations in brewing technologies, and consumers are getting hooked on the ease of preparation – with the touch of a button, they can brew up whatever beverage they desire, whether specialty or traditional coffee. And such a shift in the in-home coffee market has created a wealth of opportunities for manufacturers, retailers and foodservice alike. “Tim Hortons, Starbucks and Second Cup, for example, are getting into the category and extending their brands to in-home,” says Carter. “From a consumer perspective, this is good news. And from a brand extension perspective – from restaurant into grocery – this is really good news.” McAlpine agrees. “Single-serve products offer a unique dollar-value

proposition that works for everybody. Grocery and manufacturer relationships can be fairly competitive, but here’s something that’s creating better margins for both parties, and allows retailers to enter into the system with their own brands. It also allows foodservice brands to get into grocery. It’s a win for everyone.” While sales of traditional ground coffee and instant coffee – with a 69 per cent and 29 per cent in-home penetration, respectively – remain strong in the grocery aisle, a wide variety of singleserve cups, pods and cartridges, all developed for specific machine platforms, are entering the marketplace. To stay in the game, McAlpine suggests that grocery retailers reconsider how much aisle space they allot to the hot beverage category.

Grocery Store

69% +3%

Club Stores

8%

+33%

Discount Store

6% Gourmet Specialty Coffee Store

0%

5% Food Service Location 2%

0%

-33%

Source: Coffee Association of Canada. Coffee Drinking Trends in Canada 2012 Tracking Report prepared by Maritz.

Type of coffee, made at home or work % + - refers to 2012 vs. 2011

Source: Coffee Association of Canada. Coffee Drinking Trends in Canada 2012 Tracking Report prepared by Maritz.

grocerybusiness.ca

January | February 2013

47

Coffee Report

CAFÉ ASSOCIATION DU CANADA