AFRICAN BUSINESS

FEB

WEST AFRICA’S LARGEST SOLAR PLANT

An expansion project in Togo has broken ground

EU CARBON TAX AND AFRICAN TRADE

The EU’s newest carbon tax could harm African trade

NOT WAITING, BUT ACTING

The Shoprite Group is investing heavily in fighting climate change

BIOLOGICAL DIVERSITY PLAN FOR DRC MINES

CONNECTING AFRICA

Vodacom’s CTO outlines the group’s ambitious vision

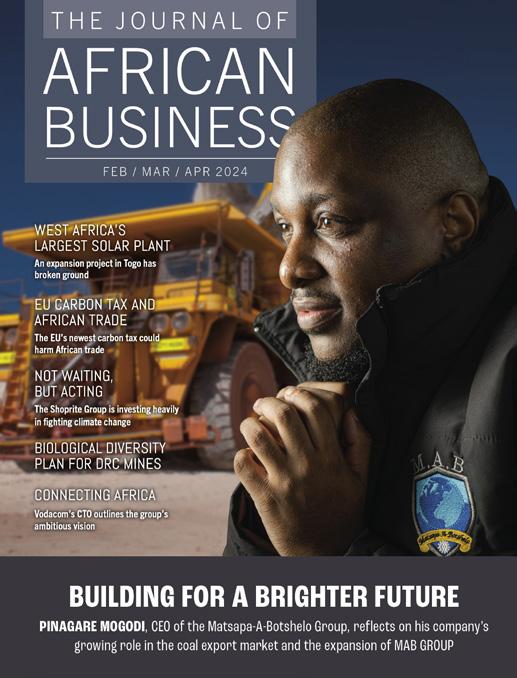

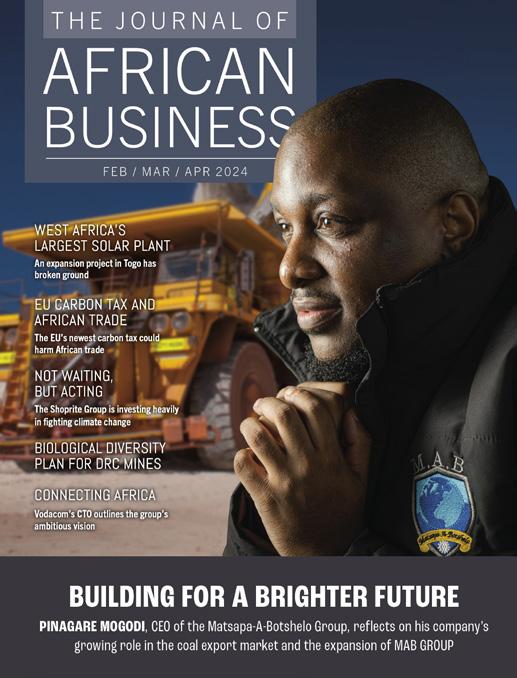

BUILDING FOR A BRIGHTER FUTURE

PINAGARE MOGODI , CEO of the Matsapa-A-Botshelo Group, reflects on his company’s growing role in the coal export market and the expansion of MAB GROUP

THE JOURNAL OF

/ MAR / APR 2024

PETROLEUM AGENCY SOUTH AFRICA IS PROMOTING GAS AS A TRANSITION FUEL

As Africa looks to wean itself of fossil fuels, South Africa’s regulator and promoter of the oil and gas sector is leading the way in encouraging exploration in vital gases.

TThe International Energy Association (IEA) has published a report, “Africa Energy Outlook 2022”, which tackles the supposed conflict between Africa’s developmental needs and the urgent imperative to move away from fossil fuels.

Both can be achieved, according to the report. A key factor in allowing Africa to continue to industrialise will be an uptick in the discovery and use of gas. If all the gas so far discovered in and off Africa was used, the continent’s share of global emissions would rise by 0.5% to 3.5%. Petroleum Agency South Africa (PASA) has welcomed the report as confirmation of its own findings. PASA has consistently argued that South Africa’s road to net zero emissions will be via gas. As the Agency has noted in the context of major discoveries of oil condensate off the southern coast, gas can be a bridge to a lower-carbon future in South Africa and Africa.

The distribution of licences in the oil and gas sector is of vital importance to a national economy and this is one of the key functions of PASA. The progress being made on a gas project in the northern part of the Free State province, about 300km south of Johannesburg, is illustrative of the progress being made in the South African oil and gas sector. The triangle made up of the towns of Virginia, Welkom and Theunissen used to be rich in gold mines, but for many years yields declined and the area’s economy struggled with job losses rising steadily. A fortuitous discovery of methane gas on a farm in Virginia in 1998 led to the creation of a company and to some entrepreneurs requesting licences to explore. Which is where Petroleum Agency South Africa comes in. PASA is responsible for evaluating, promoting and regulating oil and gas exploration and production activities in South Africa and archives all relevant geotechnical data. The Agency acts as an advisor to the government and carries out special projects at the request of the Minister of Mineral Resources and Energy.

“As the country’s first onshore commercial project, the Virginia gas project is exciting,” says Sibabalwenathi Magida, PASA’s Executive Manager: Communications and Stakeholder Relations. “We are looking forward to seeing some of the opportunities the industry can provide to the country being realised through the project,” she adds. Currently, natural gas supplies just 3% of South Africa’s primary energy. Opportunities for gas lie in the realisation of South Africa’s National Development Plan (NDP) and the Integrated Resource Plan (IRP).

Virginia project

In 2007 exploration rights to the Virginia area were granted to a company which later became Tetra4, a wholly-owned subsidiary of Renergen. In 2012 a full onshore petroleum production right was awarded and a full Environmental Impact Assessment was completed in 2017.

As custodian, Petroleum Agency SA ensures that companies applying for gas rights are vetted to make sure they are financially qualified and technically capable, as well having a good environmental track record. Oil and gas exploration requires enormous capital outlay and can represent a risk to workers, communities and the environment. Applicants are therefore required to prove their capabilities and safety record and must carry insurance for environmental rehabilitation. The Tetra4 Virginia Gas Project is the only holder of an onshore petroleum production licence issued by the Department of Mineral Resources and Energy through PASA.

In the years since the first rights were issued, the project leaders have rolled out various aspects of the project, particularly related to contracts with manufacturers and transport companies for the use of liquified natural gas (LNG). But helium production was also on line. In October 2022, the commercial operation of the LNG plant came on stream and in January 2023, helium started being produced. To put

Credit: APO Group

this into perspective, with the January announcement South Africa became one of only eight countries in the world to become a helium producer. There are now just 16 places on the planet where this valuable liquid is produced.

Renergen states that the economic (NPV) valuation for proved and probable reserves as of 2019 was R8.9-billion. Subsequent tests have suggested that the resource is even more plentiful than first thought. Helium is used in rocket launches and microchips and about 85 tons of it are used every day. The potential economic spinoffs for South Africa – and the effect that the availability of LNG could have on making the country’s transport industry less reliant on imported fuels – will be enormous. And PASA has played a vital role in bringing this about, by issuing licences in a responsible manner. There is growing interest in South Africa as an investment proposition. Notes Magida, “We are observing a growing interest and positive support for the sustainable development of upstream oil and gas in South Africa.”

Transitioning to gas

The transition to cleaner fuels and renewables is inevitable if the world is to reduce the negative impact of climate change. South Africa is a signatory to the Paris Agreement and has committed to a “Peak-Plateau-Decline” carbon emission trajectory. The government’s policy is to diversify the country’s energy mix which is currently coal-dominated to a lower-carbon future by introducing proportionately higher renewable-energy resources such as wind and solar, into the energy mix as well as gas-to-power. Gas is estimated to burn less than half the CO2 emissions from coal and additionally has no SOx emissions.

Gas is therefore a suitable transition fuel towards a lower-carbon economy for South Africa especially since gas-to-power technologies are flexible and would therefore complement the intermittent renewable energy being added to the national grid. South Africa’s energy mix is changing to include more gas through importing liquefied natural gas (LNG), using shale gas if reserves prove commercial and developing infrastructure for the import of LNG. Petroleum Agency SA plays an important role in developing South Africa’s gas market by attracting qualified and competent companies to explore for gas. Another major focus is increasing the inclusion of historically disadvantaged South African-owned entities in the upstream industry.

New PASA leadership

In 2023, PASA appointed an Acting CEO. Dr Tshepo Mokoka will serve as acting CEO until the PASA board concludes a recruitment process to identify a permanent CEO. Outgoing CEO Dr Phindile Masangane has moved on to a position in the private sector. Mokoka is eminently qualified for this important position. He has a PhD in Economics, an MCom in Economics and Honours degrees Economic Science and Science. In addition, Dr Mokoka has many years of relevant experience as a key member of the Central Energy Fund (CEF), the body that has oversight over PASA. On his appointment, Dr Mokoka said, “I am committed to leveraging my experience and expertise to steer the organisation through this transitional period. With the unwavering support of the leadership team, we will maintain our focus on achieving our goals and upholding the values that define us. Together, we will build upon Pasa’s legacy of excellence and ensure its continued growth and success.”

PASA acting CEO Dr Tshepo Mokoka attended the Southern Africa Oil and Gas Conference 2023.

Credit: Renergen

PASA acting CEO Dr Tshepo Mokoka attended the Southern Africa Oil and Gas Conference 2023.

Credit: Renergen

The Journal of African Business

A unique guide to business and investment in Africa.

Welcome to The Journal of African Business. Since the inaugural issue was published as an annual in 2020, the quarterly format has been adopted, giving our team more opportunities to bring to readers up-to-date information and opinions and offering our clients increased exposure at specific times of the year.

We cover a broad range of topics, ranging from energy and mining to tourism and skills development. In the news section of this issue, a significant first corporate deal by Investec in Rwanda is noted, something that may have an impact on the volume of manufacturing in the region. Other news that has a regional impact is contained in the report on Engen and Vivo Energy combining their African businesses. This will create an entity with nearly 4 000 service stations and huge storage capability across 27 African nations.

Progressive rehabilitation is at the core of plans to protect biodiversity at Glencore’s two mines in the Democratic Republic of the Congo and we carry a report on the goals of this programme and the progress being made, in collaboration with a local university.

Solar power is coming to every part of Africa, and Togo is the latest country to expand its programme. AMEA Power has broken ground on phase 3 of the Sheikh Mohammed Bin Zayed Solar Power Plant. Once the expansion project in Togo is completed, the solar plant will be the largest of its kind in West Africa.

Editor: John Young

Publishing director: Chris Whales

Managing director: Clive During

Online editor: Christoff Scholtz

Design: Salmah Brown. Production: Sharon Angus-Leppan

Ad sales: Venesia Fowler, Tennyson Naidoo, Sam Oliver, Tahlia Wyngaard, Gavin van der Merwe, Graeme February, Shiko Diala, Gabriel Venter and Vanessa Wallace

Administration & accounts: Charlene Steynberg, Kathy Wootton, Sharon Angus-Leppan

Distribution & circulation manager:

With COP28 behind us, Sandra Villars, Partner, Financial Services at Oliver Wyman, examines the concept of nature-related risk and stresses the need for financing for climate adaptation that is relevant to the African context. She argues that the continent’s regulators also need to play a role in making sure that solutions are found that resonate with local conditions.

The EU’s newest carbon tax could significantly harm African trade, according to African Development Bank Group President, Dr Akinwumi Adesina. Speaking at the Sustainable Trade Africa Conference held at the UAE Trade Centre in Dubai, the bank president put the negative figure at $25-billion annually and warned that several classes of trade and commodities could be affected.

A United Nations Conference on Trade and Development (UNCTAD) report on how important Africa is set to become in global supply chains is the basis for an article by Times 3 Technologies (T3T) on how important technology will be in taking advantage of that position.

One often hears references to “Africa” as though it is one place with one set of conditions. Bernard van der Walt Roy Nkandau of BDO set out to change that mindset to one that looks at autonomous and independent markets that are worthy of research in themselves.

Global African Network is a proudly African company which has been producing region-specific business and investment guides since 2004, including South African Business and Nigerian Business, in addition to its online investment promotion platform www.globalafricanetwork.com.

JOHN YOUNG

Editor, The Journal of African Business

Email: john.young@gan.co.za

Edward MacDonald

The Journal of African Business is published by Global Africa Network Media (Pty) Ltd

Company Registration No: 2004/004982/07

Directors: Clive During, Chris Whales

Physical address: 28 Main Road, Rondebosch 7700

Postal: PO Box 292, Newlands 7701

Tel: +27 21 657 6200 | Email: info@gan.co.za

Website: www.globalafricanetwork.com

FOREWORD

No portion of this book may be reproduced without written consent of the copyright owner. The opinions expressed are not necessarily those of The Journal of African Business magazine, nor the publisher, none of whom accept liability of any nature arising out of, or in connection with, the contents of this publication. The publishers would like to express thanks to those who support this publication by their submission of articles and with their advertising. All rights reserved. Printing: FA Print

Member of the Audit Bureau of Circulations 2

2 4 6 12

FOREWORD

From the editor’s desk.

NEWS FROM ALL AROUND AFRICA

Recent investments, expansions and milestones.

SUPPORTING THE DOMESTIC ENERGY SECTOR

Matsapa-A-Botshelo Group (MAB GROUP) is making a big impact on the coal industry and MAB Construction is building communities and creating jobs across a wide variety of projects.

BIOLOGICAL DIVERSITY PLAN FOR DRC MINES

Progressive rehabilitation is at the core of plans to protect biodiversity at Glencore’s two mines in the Democratic Republic of the Congo.

WEST AFRICA’S LARGEST SOLAR PLANT BREAKS GROUND

AMEA Power has broken ground on phase 3 of the Sheikh Mohammed Bin Zayed Solar Power Plant in Togo.

HOW WILL THE COP28 RESOLUTIONS SHAPE AFRICA’S FINANCIAL FUTURE?

Sandra Villars, Partner, Financial Services at Oliver Wyman, examines the concept of nature-related risk.

AFRICA COULD LOSE $25-BILLION PER YEAR

The EU’s newest carbon tax could significantly harm African trade, according to African Development Bank Group President, Dr Akinwumi Adesina.

CONNECTING AFRICA

Vodacom Group’s Chief Techology Officer, Dejan Kastelic, outlines the group’s ambitious plans for the continent.

FOUR DECADES OF DRESSING AFRICA AND BEYOND

Imagemakers is celebrating more than 40 years of producing highquality products with expansion into Africa.

OPTIMISING AFRICAN SUPPLY CHAINS

Africa’s economies may become major players in global supply chains, according to a United Nations Conference on Trade and Development (UNCTAD) report.

AFRICA MUST NOT BE TREATED AS A HOMOGENOUS ENTITY

To become a global leader in telecommunications, Africa must first shift some fundamental misconceptions about the continent, writes Bernard van der Walt and Roy Nkandau of BDO.

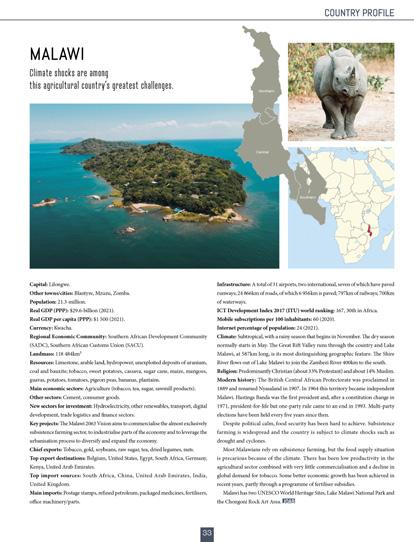

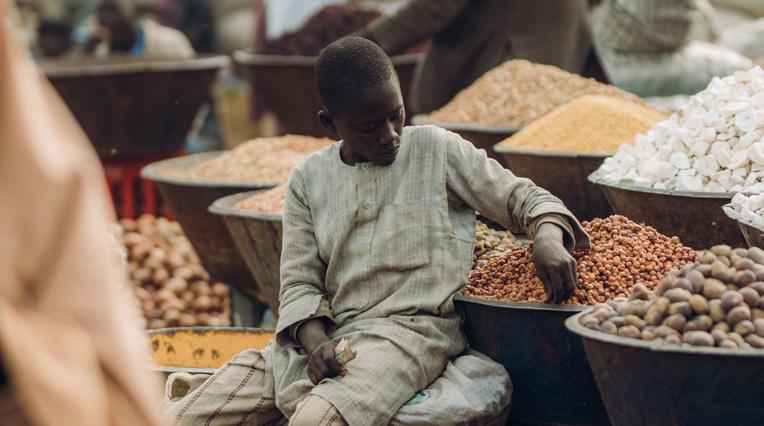

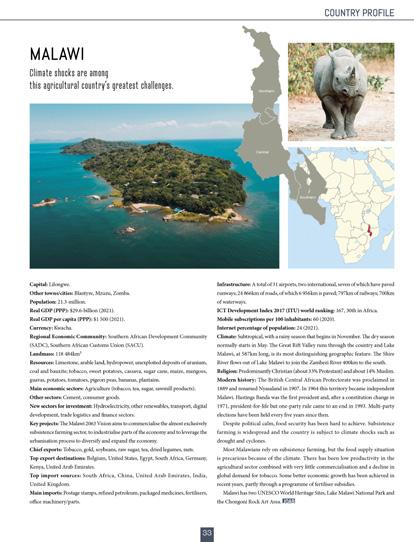

COUNTRY PROFILES

Democratic Republic of the Congo and Malawi.

Contents The Journal of African Business

CONTENTS

14 18 20 22 26 28 30 32 3

NEWS FROM ALL AROUND AFRICA

Recent investments, expansions and milestones.

Master Steel, one of the largest manufacturing companies in Rwanda, has entered into a transaction agreement with Investec, which acted as co-mandated lead arranger in a facility worth $25-million. The funds raised will be used to enhance Master Steel’s financial capacity to import more raw materials to satisfy demand, both locally and regionally. Rwanda’s manufacturing output for 2022 was $1.3-billion, a 29.9% increase from 2021 and considering the ambitious plans that are in place for industrial and social development, this is likely to increase. Rwanda is often regarded as one of Africa’s economic and development success stories, an achievement underpinned by several factors. There has been political stability for almost two decades and a range of economic and structural reforms have been enacted, including a strong emphasis on public sector investment. Furthermore, despite the global challenges of high inflation and the knock-on effects of the war in Ukraine, the country has rebounded strongly since Covid-19, growing by 8.2% in 2022. According to the World Bank, Rwanda is also now aspiring to middle-income country status by 2035 and high-income country status by 2050. Despite this, the country is still highly dependent on public sector investment, which has meant high fiscal deficits and public sector debt (estimated at 71% of GDP). “To achieve these ambitious goals, Rwanda will have to tackle many challenges, including reducing poverty even further and encouraging greater private sector and international investment,” says Nonkululeko

Dlamini, a consultant in structured finance solutions at Investec Bank, and a member of Investec’s African Structured Debt Solutions team. “We believe that Rwanda’s business-friendly environment will ensure that the country remains an attractive destination for foreign investment, as it further diversifies its economy and develops trade in the region. Over the medium term, Rwanda is also likely to remain amongst the economic outperformers in Sub-Saharan Africa and we are encouraged by Master Steel’s building capacity now and for future growth.”

“In addition to growing its domestic market, Master Steel aims to contribute to trade with key neighbouring countries,” says Teddy Ndayambaje, General Manager of Master Steel. “Increasing the export sales in neighbouring countries is one of our key strategies to increasing sales, in hard currency, while reducing any challenges related to foreign currencies while importing raw materials.”

Master Steel is just one example of the fruits of investment facilitation in Rwanda that can help it grow its gross fixed capital formation (GFCF). “This is Investec’s first corporate deal in Rwanda, and we are proud to have been able to support one of Rwanda’s largest manufacturers in its growth by arranging this facility alongside Etihad Cap Africa and I&M Bank Rwanda. This deal aligns with our strategy of exploring new markets in Africa while partnering with trusted partners on the ground,” concludes Rowan King, Head of Business Development and Origination in Africa at Investec.

INVESTEC’S FIRST CORPORATE DEAL IN RWANDA WILL BOOST MANUFACTURING CAPACITY 4

ENGEN AND VIVO ENERGY ARE COMBINING TO CREATE AN AFRICAN ENERGY GIANT

Engen and Vivo Energy have announced a combination of their African businesses to create one of Africa’s largest energy distribution companies. The combined group will have over 3 900 service stations and more than two-billion litres of storage capacity across 27 African countries. Engen is the clear market leader in South Africa and has around 1 300 service stations across seven African countries. Vivo Energy is a major pan-African retailer and distributor of fuels and lubricants to retail and commercial customers, with over 2 600 service stations across 23 African countries, using the Engen and Shell brands. PETRONAS will sell its 74% shareholding in Engen to Vivo Energy at completion. The Phembani Group, PETRONAS’ longstanding partner in Africa and Engen’s B-BBEE shareholder,

is continuing its strong association with Engen and will remain invested as a 21% shareholder in the South African business. The transaction will further benefit employees of Engen through a newly implemented 5% employee share ownership programme, resulting in Engen South Africa being 26% owned by previously disadvantaged parties. Stan Mittelman, CEO of Vivo Energy said, “Vivo Energy’s focus has been to invest to grow our business, and I am proud that we have more than doubled the size of our network since our formation in 2011. Four years ago, we acquired the Engen business in nine African markets, and have since worked to enhance and develop these. Vitol’s acquisition of 100% of Vivo Energy last year brings more opportunity to grow even faster.” The transaction is pending regulatory approvals

and fulfilment of certain conditions. Rand Merchant Bank (a division of FirstRand Bank Limited) and Standard Bank advised Vivo Energy. Morgan Stanley and Rothschild and Co are advisors to PETRONAS on this transaction.

INTRA-AFRICAN TRADE VOLUMES ARE SET TO INCREASE

Improving transport infrastructure between Cairo and Johannesburg will greatly improve trade within the African continent. This is according to Egypt’s Ambassador to Kenya, Wael Nasr Eldin Attiya, who says the road infrastructure within the continent is 70% complete. Various countries such as Egypt have completed their sections of important routes, which will consequently see increased volumes of trade. “We are sure that trade within our two countries and the continent in general will improve once the ongoing infrastructure projects are complete. By this we mean that both roads and railways are crucial in facilitating movement of goods,” said Ambassador Attiya, who was speaking on the sidelines of the Kenya-Egypt trade mission in Nairobi in January 2024. The ambassador noted that problems have been encountered in countries that have conflict, but expressed confidence that once those issues were resolved, “we believe it will be complete in no time.” The ambassador added that countries must also work to eliminate

various non-tariff and tariff barriers as they continue to stifle trade within the continent. The port of Mombasa continues to be a pivotal point in facilitating trade between Egypt and Kenya with the proximity between the two countries also working to

the advantage of exporters and importers. Furthermore, the imbalance in trade between Kenya and Egypt is due to Mombasa being as a gateway to East and Central Africa. Trade volumes between the two countries continues to increase thanks to

E-COMMERCE IN BENIN GETS A HELPING HAND

The Board of Directors of the African Development Fund, the African Development Bank Group’s concessional window, has approved a €38.8-million loan to Benin to help implement the initial phase of the Economic Governance and Private Sector Development Support Programme. This programme will increase the private sector’s contribution to economic growth by enhancing the overall business climate, developing the agri-food sector and strengthening climate action. “The aim of the Economic Governance and Private Sector Development Support Programme is to assist the Beninese government in its efforts to accelerate, develop

improved relations. “Transport by ship from Cairo to Mombasa currently takes about 14 days which is quite fast. Thus, we are encouraging companies from both Kenya and Egypt to explore this route as we wait for the completion of other logistics infrastructure,” the ambassador added. The ambassador also praised the entry of an Egyptian bank, Commercial International Bank (CIB), into the Kenyan market saying it will enable trade between both countries. CIB, which has assets of $24-billion, opened its first branch in Nairobi in 2023. Speaking at the same event, CIB Kenya CEO Daphne Maina said the bank will enable facilitate trade between the two COMESA nations. The Kenya-Egypt trade mission is organised by the Egyptian Food Export Council and consists of a series of visits by Egyptian companies to wholesale market areas and supermarket chains in Nairobi. The Kenyan companies will also have an opportunity to have meetings with the 26 visiting companies during the two-day event.

and implement the structural reforms that are fundamental to boosting wealth creation,” said Robert Masumbuko, the Bank’s Country Manager for Benin. The programme provides for the establishment of a technical committee to finalise the national e-commerce strategy, which will define the regulatory framework for online commerce and facilitate financial transactions. It will also result in an update of the communication plan for the National Gender Strategy for the agricultural sector. Finally, the initiative will support a project to set up an electronic window to facilitate investment and exports in Benin.

NEWS

5

SUPPORTING THE DOMESTIC ENERGY SECTOR AND GROWING A DIVERSE PORTFOLIO

Pinagare Mogodi, CEO of the Matsapa-A-Botshelo Group (MAB GROUP), reflects on the coal industry, where his company is increasingly making a big impact, and notes the remarkable strides being made by MAB Construction in building communities and creating jobs across a wide variety of projects.

6

IIn the global environment where fossil-fuels are under pressure, how do you see the future of coal for South Africa and Africa?

In the short term (five-10 years), the demand for coal may remain relatively stable, especially in regions where coal is a significant part of the energy mix. However, as more countries and industries shift towards cleaner energy sources, the demand for coal is expected to decrease. In terms of economic impact, the coal industry is likely to continue contributing to the economy through employment and revenue. However, there might be a need for diversification to mitigate the economic impact as the global demand for coal diminishes. Environmental pressures could increase from international entities and environmental organisations to reduce coal usage due to its contribution to greenhouse gas emissions and climate change. This may lead to stricter regulations and scrutiny.

Medium-term future (10-20 years):

• Diversification: It becomes crucial for South Africa and Africa to diversify their energy mix. Investing in and adopting renewable energy sources such as solar, wind and hydroelectric power will be essential for energy security and sustainability.

• Infrastructure development: Countries might need to invest in new infrastructure for renewable energy production and transmission. This could create new job opportunities and stimulate economic growth.

• Global market dynamics: The global market for coal may continue to shrink, affecting export revenues for countries heavily reliant on coal exports. This emphasises the importance of transitioning to alternative energy sources and finding new economic opportunities.

• Environmental regulations: Stricter environmental regulations may be implemented globally, further incentivising the transition away from coal. This could lead to the phasing out of coal-fired power plants and a decrease in coal mining activities.

• Technology: Advances in clean-coal technologies or carbon capture and storage (CCS) could influence the medium-term outlook. If these technologies become economically viable and widely adopted, they could potentially extend the lifespan of the coal industry, albeit with reduced environmental impact.

Do you supply the domestic and export markets?

As MAB GROUP, our primary focus is on exporting high-grade coal to international markets, including countries such as India and China. Our coal portfolio consists of various grades, including RB1, RB2 and RB3. Recognising the significant demand in these markets, we are in the process of expanding our operations by opening offices in India. This strategic move aims to strengthen our presence and better serve our clients in one of our key markets.

Simultaneously, we understand the importance of maintaining a strong presence in the domestic market. To contribute to local energy needs, we are actively exploring partnerships with local power utilities such as Eskom

7 MINING AND CONSTRUCTION

Pinagare Mogodi, MAB GROUP CEO, right

People, communities and the environment

• More than 9 000 community members have benefitted from MAB’s expenditure of more than R72-million on corporate social responsibility projects.

• A total of R89-million was spent with historically disadvantaged South Africans (HDSA) suppliers over a seven-year period, including youth.

• MAB’s involvement as a construction partner in RDP housing projects hasbrought many employment opportunities to communities.

• The majority of water and land rehabilitation targets have been met.

• Between 2016 and 2022, a total of R239-million has been returned to shareholders.

and Kelvin Power Station. By becoming a reliable coal supplier to these entities, we aim to support the domestic energy sector. Furthermore, MAB GROUP is committed to continuous growth and diversification. We have plans for expanding our operations, including acquiring new mines. These acquisitions are part of our long-term strategy to ensure a sustainable and resilient position in the everevolving coal industry.

Our approach encompasses both global and local markets, reflecting our commitment to meeting the diverse needs of our clients and contributing to the energy landscape on a broader scale.

Transnet has been in the news lately regarding roads and ports: has transporting product to port been a problem for MAB, or is most of your coal transported by your own Trucking Department?

In the dynamic world of transportation and logistics, it’s not uncommon for challenges to arise, and Transnet, as a key player, is no exception. While recent headlines may suggest turbulence within the organisation, it’s essential to provide a balanced perspective to our potential clients and stakeholders. The truth is, despite the internal challenges that Transnet is working diligently to address, operations continue to run efficiently. Coal, one of the cornerstones of South Africa’s economy, is still being moved seamlessly, as are countless other commodities.

The media, with its penchant for sensationalism, can sometimes amplify issues beyond proportion. This undue sensationalism may inadvertently create unnecessary panic among potential clients who rely on Transnet’s services.

It’s important to separate fact from fiction. While Transnet acknowledges and is actively addressing internal issues, this should not overshadow the organisation’s overall capability to deliver on its commitments. Challenges are not unique to Transnet; they are part and parcel of any government parastatal or state-owned enterprise. What sets Transnet apart is its determination to resolve these challenges and emerge even stronger. The dedication to improving efficiency, reliability and transparency is an ongoing process and clients can expect to see positive developments in the near future. At MAB, we have not encountered significant challenges in transporting our coal to ports. While we utilise various transportation methods, including our own Trucking Department, we also engage with Transnet for certain logistics needs.

It’s important to note that we have not experienced any significant disruptions in our operations due to their services. We acknowledge that, like any organisation, Transnet has its challenges, but we also recognize the positive aspects of its operations, including new expansions, government budget allocations, and efforts to repair and enhance infrastructure. We

8

believe in a balanced perspective, understanding that challenges are part of the process of improvement and growth. As a company, our primary focus is on ensuring the efficient and reliable transportation of our coal products. We have found viable solutions, including utilising our own transportation resources, to navigate any potential challenges. Our commitment to delivering high-quality products to our customers remains unwavering and we remain optimistic about the improvements and developments within the transportation sector, including those led by entities like Transnet.

Please tell us about your Trucking Department, its scope and ambitions.

MAB Trucking, a reliable arm of our operations, handles short-distance transportation from mine to plant and onward to the railway siding. This is where our meticulous rail logistics come into play, orchestrating the journey of our coal to its final destination, which is the ports. We do long distance to Richards Bay where we have sub-contracting trucks under us, and where we create job opportunities for everyone.

What sort of work does MAB Construction do?

MAB GROUP has experienced remarkable growth in the construction field, starting from humble beginnings and expanding due to our commitment to quality assurance in the construction industry. Our construction department has successfully completed a diverse range of projects, including city development, human-settlement initiatives, mega-housing projects and government infrastructure undertakings. These projects have not only contributed to the physical development of various areas but have also played a crucial role in job creation, reflecting our commitment to both quality construction and socioeconomic impact.

•

•

•

•

•

•

•

•

•

Values

The company is driven and inspired by these values:

Quality service

•

Creative innovation

Reliability

Economic development and sustainability

Integrity and honesty

Customer orientation

Commitment

Accountability

Transparency

Accuracy 9 MINING AND CONSTRUCTION

•

BUILDING FOR A BRIGHTER FUTURE

Matsapa-A-Botshelo is a general construction and mining group committed to building a stronger South Africa through a commitment to reliability and high standards.

MMatsapa-A-Botshelo has two main divisions covering coal (domestic supply and export) and construction and trucking. MAB is a close corporation company which started as construction company and then added to its portfolio mining and trucking departments in 2016. What started as a humble building block, has now become a powerful brand that has created several milestones in its areas of operation.

The MAB Group CEO and Executive Head of Coal Operations is Pinagare Mogodi. The Executive Chairman is Setene Ketlele, who brings to the company considerable knowledge of the property management environment as a property manager and investor, with experience in arranging financing and administration.

Skills training

It has been a MAB goal from the beginning to continually improve in the wider construction arena and transfer skills to people, especially the unskilled and unemployed. More than 5% of the company’s payroll is paid on skills training and people development. We have inclusive programmes designed to upskill and develop our workforce.

10

MAB Coal

MAB supplies coal to Eskom (on medium-term contracts) and to Kelvin Power Station (a privately operated facility in Johannesburg) and is one of South Africa’s largest emerging exporters of thermal coal.

The company’s goal is to produce 36-million tons by 2028. The biggest proportion of MAB’s current saleable mix is local power-station coal (36-mpta), followed by export thermal coal (eight-mpta) and semi-soft coking coal (1.2-mpta). Products include duff, peas, small nuts and semi-coke. MAB Coal is strategically positioned for both domestic and export coal markets, currently exporting to countries such as India, China, Hong Kong and Israel. The company is exploring opening offices in India in support of its export operations. We are the most diversified multiproduct producer in terms of sized product at mine/DMS Wash plant level and export product mix at Richards Bay Multi-Purpose Terminal (MPT) and Richards Bay Coal Terminal (RBCT). Our newest largest contract is a five-year coal export contract for 150 000 tons with three different clients. Our strategic partners is Clarksons, one of the world’s biggest shipping services providers. Clarksons offers strategic maritime consultancy and shipping solutions in 23 countries. MAB is in the process of optimising its product mix to supply higher-value segments and to customers. Investments reflecting this diversification include taking significant stakes in manganese, iron ore, lithium and chrome assets.

MAB Construction and Trucking

Established in April 2010 with its main priority being to curb the high rate of unemployment in the metropolitan region of the city of Tshwane, MatsapaA-Botshelo is the original building block of the company and continues to be committed to providing a reliable service in projects, construction and quality management. MAB has since grown to become one of the largest black-empowered and diversified construction and mining companies in South Africa. The company operates facilities and offices in South Africa and has made mining acquisitions

BIOGRAPHY

Pinagare Mogodi (“Pina”) is co-founder and Managing Director of MAB. He comes from a family with a long history of construction, mining and trucking projects in the North West. He expanded this into a well-established mining and construction company which now boasts a management team with over 60 years’ collective experience in the industry. Pina holds a Bachelor’s Degree in Accounting and Management from Eduvos (Institute), has completed a Project Management and Pastel Accounting short course and has a certificate in Tactics: Strategic Planning and Management. His dream began when he started the company during his second year of university.

in other African countries. MAB’s offering spans engineering and construction activities throughout the built environment. The trucking division works with a mix of sub-contractors and trucks working directly under the company. There are 688 trucks who are working to deliver goods as sub-contractors while 150 leased vehicles are the sole responsibility of MAB. Our construction capabilities span a broad range of industries: building; concrete structure; road and rail; environmental; heavy industry; mining; water reticulation; housing/ township development; infrastructure and other related projects. Clients include governments, parastatals and local authorities, major mining houses, leading industrial and other corporations, financial institutions and property developers. Among MAB’s clients are the Rustenburg Local Municipality, the Kruger National Park and the Moses Kotane District Municipality. Since 2010, projects to the value of R2.5-billion have been dealt with efficiently by MAB.

Services

Our company offers the finest quality design, site preparation, cost estimates, construction, repair and alteration to clients needing large-scale construction services, whether it is office buildings, warehouses, large apartment complexes or public works.

• Earth works

• Civil works

• Refurbishment

• Water systems

Contact details

Harrogate Park, 1237 Pretorius St, Hatfield, Pretoria 0028

Tel: (010) 447 3799

Emails: info@m-a-b.co.za enquiry@m-a-b.co.za

11

CONSTRUCTION AND MINING

BIOLOGICAL DIVERSITY PLAN FOR DRC MINES

Progressive rehabilitation is at the core of plans to protect biodiversity at Glencore’s two mines in the Democratic Republic of the Congo.

GGlencore, a globally diversified natural resource company and producer of copper and cobalt in the Democratic Republic of the Congo (DRC), has announced a new biodiversity management plan for its DRC assets.

Aligning itself with various UN initiatives on biodiversity, the company’s stated goal is to minimise and manage its impacts and, upon completion of its activities in the DRC, return the land to sustainable use. In presenting its new plan, Glencore noted that it appreciates that biological diversity is a global asset of enormous value to future generations.

“We recognise the increasing focus in the area of biological diversity and the main outcomes of the 2022 UN Biodiversity Conference, known as COP15, that took place in December 2022. The theme for the UN International Day for Biological Diversity in 2023 ‒ “From Agreement to Action: Build Back Biodiversity” – not only coincides with the adoption of the Kunming-Montreal Global Biodiversity Framework at COP15, it also aligns with our renewed progressive rehabilitation intent and biodiversity management plan for our DRC assets,” said Clint Donkin, Head of Glencore Copper Africa.

“Some of Glencore’s industrial sites in the DRC date back decades, and as such, the company has in some instances inherited a significantly altered environment. Regardless of the legacy, for each site we work to understand the impact of each of our mining activities on different aspects of the environment and to compile a robust biodiversity management plan that specifies risk and mitigation strategies. We then draw on ongoing and detailed baseline studies on terrestrial and aquatic fauna and flora to improve our performance and project outcomes.”

Progressive rehabilitation is a proactive rather than reactive activity that brings to life rehabilitation measures at the same time as mining, way before mine closure.

Donkin adds, “Our DRC operations continually review and update our biodiversity management plans to incorporate new data and suggestions. For instance, the Miombo reforestation project comprising more than a dozen species of seedlings, will also include species for medicinal use and wild fruit after consultation with local communities. The environment also lends itself to growing a species of mushroom that is a local delicacy and presents a business opportunity for the community.”

Likewise, the research and development partnership with the University of Lubumbashi to create an artificial wetland includes trials and sampling pilots.

12

Glencore projects in the DRC include progressive rehabilitation and sitelevel biodiversity plans to drive progress.

• Artificial wetland research and development project partnership with the University of Lubumbashi: enhancing local ecological infrastructure and treating stormwater using native aquatic flora species.

• Reforestation of Miombo woodland which populates a large portion of the Kolwezi region.

• Project to plant up to 100 000 seedlings each year in allocated area surrounding KCC’s operations, for five years.

• Progressive site rehabilitation at MUMI, including planting of up to 600 seedlings per hectare, and three hectares per annum including more than 20 species.

According to Prof Mylor Ngoy Shutcha, Dean of the Faculty of Agronomic Sciences at the institution, “We greatly appreciate the collaboration with KCC and the focus on biodiversity restoration within its site. In particular, we appreciate the vision of sustainability based on the use of native species of the region and the development of a green infrastructure to improve the living environment of our workforce and communities.”

Donkin concludes, “We are hopeful that together, we can find workable solutions for surface water management as well as for enhancing and protecting the ecological infrastructure for generations to come. When all stakeholders work as a collective, the opportunity exists to put the local economy, the development and wellbeing of people and the stewardship of the environment at the centre of decision-making.”

About Glencore in the DRC

Glencore has been present in the DRC since 2008. Glencore Copper Africa operates two industrial copper and cobalt operations: Copper Company SA (KCC), a partnership with Gécamines and Mutanda Mining SARL (MUMI), of which the DRC Government holds a 5% stake. Both operations are located in Kolwezi in the Lualaba province. Across both operations Glencore has over 8 700 employees and more than 7 100 contractors.

Clint Donkin, Head of Glencore Copper Africa

Clint Donkin, Head of Glencore Copper Africa

13 SUSTAINABLE MINING

WEST AFRICA’S LARGEST SOLAR PLANT BREAKS GROUND

The Togolese Republic has embarked on an ambitious renewable energy programme.

AAMEA Power has broken ground on phase 3 of the Sheikh Mohammed Bin Zayed Solar Power Plant in Togo. Once the expansion project in Togo is completed by the end of 2023, the solar plant will be the largest of its kind in West Africa.

Located in the village of Blitta, the solar plant will be extended from 50MW to 70MW and will include a Battery Energy Storage System to prolong the availability of clean energy to the electricity network at night. The project will power more than 222 000 households and is supporting Togo’s National Development Plan, which has set out a goal to provide universal access to electricity across the country by 2030. AMEA Power is one of the fastest-growing renewable energy companies in the Middle East. Hussain Al Nowais, Chairman of AMEA Power, said: “The solar plant is providing a project blueprint that AMEA Power is using to deploy renewable energy across other parts of Africa. With the integration of battery storage, the plant can extend its power production to provide Togolese communities with clean energy at night.

“This project would not be possible without the ongoing support of the Togolese government, which continues to demonstrate its commitment to renewable energy and delivering energy access to the people of Togo.”

Phases 1 and 2 of the project were fully developed by AMEA Power during the Covid-19 pandemic, and took less than 18 months to complete from their initial inception. Both project phases became fully operational in June 2021, with AMEA Technical Services currently responsible for the operations and maintenance of the solar plant.

To finance the development of the third phase of the project, Abu Dhabi Exports Office (ADEX) has provided the Togolese Ministry of Economy and Finance with a loan of $25-million. The project will be constructed by AMEA Technical Services, a subsidiary of AMEA Power. ADEX also participated in the financing of the construction of the project’s second phase, with an envelope of $10-million of debt.

14

The President of the Togolese Republic, Faure Gnassingbé, attended the groundbreaking ceremony for the third phase of the Sheikh Mohammed Bin Zayed Solar Power Plant.

The Kael and Kahone solar plants, the first financed and tendered under the Scaling Solar programme in Senegal, became operational in 2021. Credit: Kahone Solaire SA

To support the economic and social development of Togo, AMEA Power’s investment in the region has also involved a range of initiatives to support the local community. These initiatives have comprised the construction and renovation of primary schools and the construction of a medical clinic with maternity support facilities. AMEA Power has also established an internship programme for engineering students from various technical institutions across Togo to gain practical experience at the solar plant.

About AMEA Power

Headquartered in Dubai, AMEA Power is a developer, owner and operator of renewable energy projects. As one of the fastest-growing renewable energy companies in the region, the company is rapidly expanding its investments in wind, solar, energy storage and green hydrogen, demonstrating its longterm commitment to the global energy transition. AMEA Power has assembled a world-class team of industry experts to deliver projects across Africa, the Middle East and other emerging markets.

The International Finance Corporation and African solar power

The International Finance Corporation (IFC), a member of the World Bank Group, has developed a programme called Scaling Solar in Africa.

Solar power has enormous potential as an energy source in Africa. At the same time, the cost of solar photovoltaic technology has fallen – solar PV can now deliver power less expensively and with more long-term price certainty, than fossil-fuel-based power. Many countries have struggled to develop utility-scale solar power plants due to challenges that include limited institutional capacity, lack of scale, lack of competition, high transaction costs and high perceived risk. To address these obstacles, Scaling Solar combines World Bank Group services under a single engagement aimed at creating viable markets for solar power in each client country. Scaling Solar can help speed up procurement and development of privately funded and operated grid-connected solar projects at competitive tariffs. The package includes advice on the size and location of the plants, simple and rapid tendering to encourage highquality investor participation, fully developed templates of bankable project documents to eliminate negotiation, an IFC financing term sheet attached to the tender and available to all bidders to accelerate financial close, and World Bank Group credit enhancement products – such as Partial Risk Guarantees from the International Development Association (IDA), Liquidity Support Guarantees from the IDA Private Sector Window's Risk Management Facility (RMF) and Political Risk Insurance (PRI) from MIGA – to lower financing costs and thereby deliver lower tariffs. IFC helped deliver 167MWp of operating solar capacity through Scaling Solar in Sub-Saharan Africa. Two Scaling Solar engagements have been completed on the continent. In Zambia, home of the first Scaling Solar deployment, two plants with cumulative capacity of 88MWp started producing clean electricity at flat tariffs of US¢6.02/ kWh and US¢7.84/kWh in 2019. Two years later, in Senegal, two plants with cumulative capacity of 79MWp came online, with initial tariffs of EUR¢3.80/ kWh and EUR¢3.98/kWh, subject to indexation. Meanwhile, IFC currently has active engagements totalling about 425MWp in five countries and is in early discussions with several others.

For more information contact: scalingsolar@ifc.org

15 SOLAR POWER

Steinmüller Africa’s specialised induction bending solutions benefit industries across South Africa

Steinmüller Africa, a specialist in the engineering and fabrication of high-pressure components, offers exclusive induction bending solutions to the South African market.

Steinmüller Africa’s pride – Cojafex PB 850 Bending Machine

Steinmüller has manufacturing capacity for two-million productive hours a year at its Pretoria facility and has 60 engineers on hand to develop, manufacture, install or retrofit components. Its manufacturing facility contains specialised pieces of equipment, including a R100-million specialised induction bending machine called Cojafex PB 850, capable of bending pipes between 48.3 mm (outside diameter) and 850 mm (outside diameter) with a wall thickness up to 100 mm.

Steinmüller Africa’s induction bending machine at work, bending thick-walled piping.

This Cojafex PB 850 induction bending machine is one of only two induction bending machines on the African continent, enabling paper and pulp, power, petrochemical and mining plants to source custom bends locally, as well as large radius, multiple or complex bends – all with quick turnaround times.

Induction bending is the process whereby a straight pipe is precision-bent by a specially-engineered machine. The front of the pipe protrudes through an induction coil and is clamped into position. The induction coil is heated to a specified temperature and then the arm of the machine moves in a predetermined radius, pushing the pipe through the coil. “This is programmed into the machine upfront and is an automated process,” explains Lee Chapman, Divisional Manager – Piping, Steinmüller Africa. The automation and machine control renders a precise and top-quality pipe bend. “Our Cojafex machine is capable of bending pipes between 48.3 OD and 850 OD with a wall thickness up to 100 mm. It can create bends up to 180 degrees,” adds Chapman.

Induction bending is ideal “when standard size bends are not available and custom or large radius bends are required,” states Chapman. Since it can create complex (multiple) bends without the need for welding, induction bending guarantees pipe system integrity and a reduced maintenance requirement, making it especially wellsuited to high pressure (HP) piping, steam piping and industrial piping systems. This also means it delivers a relatively low cost of ownership. In addition, if multiple bends are done at once then there is a cost saving during the erection and ongoing maintenance phases of a plant’s operation.

The benefit of partnering with Steinmüller is that it offers complementary services in addition to induction bending. “There is no need to move the component between

Our Cojafex machine is capable of bending pipes between 48.3 OD and 850 OD with a wall thickness up to 100 mm. It can create bends up to 180 degrees.

different suppliers as we are able to do all the necessary bending, welding and heat treatment in-house,” says Chapman. Using its Schlager gas furnace, Steinmüller conducts post bend heat treatment (PBHT), which ensures the pipe’s mechanical properties are restored following the bending process. In addition, Steinmüller specialises in various welding processes, enabling custom welding onto pipes.

A commitment to safety and quality, backed by international expertise, has made Steinmüller Africa the fabricator of choice for some of South Africa’s largest Power, Paper and Petrochemical companies. “Steinmüller has been carrying out induction bending for over ten years at its facility in Pretoria and has a number of qualified bending procedures to both EN and ASME standards for safety and quality. Our in-house quality management system ensures that our products meet all the necessary international standards,” adds Chapman.

Steinmüller Africa is a Bilfinger Power Africa company, and is a BBEE Level 1 company. For over six decades, Steinmüller has provided comprehensive solutions for steam generating plants, from design through to commissioning and after-service maintenance.

For more information, contact Jaco Gerber – Specialist: Outage Execution at Steinmüller Africa: Tel: +27 (0)87 759 0849 Email: jaco.gerber@bilfinger.com www.steinmuller.bilfinger.com

MEMBER OF THE BILFINGER GROUP OF COMPANIES

Your trusted partner in Engineering Excellence!

HOW WILL THE COP28 RESOLUTIONS SHAPE AFRICA’S FINANCIAL FUTURE, AND HOW CAN REGULATORS SAFEGUARD IT?

Sandra Villars, Partner, Financial Services at Oliver Wyman, examines the concept of nature-related risk and stresses the need for financing for climate adaptation that is relevant to the African context.

TThe COP28 Summit, which ran from 30 November to 13 December 2023, resulted in a variety of new climate-related financial, nature and infrastructure pledges from global leaders. While much of the focus was on the agreements to transition away from fossil fuels and triple global renewable-energy capacity by 2030, other resolutions will significantly impact Africa’s climate and financial future.

The launch of a Loss and Damage Fund, for example, is something the lowincome countries most affected by climate change have long wanted. The idea behind the fund is to help these countries better cope with losses that result from extreme climate events. Despite fears that the technical details might not be ironed out in time, an agreement was reached and several countries immediately announced commitments to the fund. There are, however, several unresolved issues that emerged from the summit. The lack of financing for climate adaptation and resilience on the continent is of particular concern. Another area where more movement is urgently needed is within global financing networks. Resolving those issues will be key to securing Africa’s financial future.

The African challenge

The lack of available financing for climate adaptation is particularly concerning. This financing is desperately needed to accelerate Africa’s climate change adaptability. In part, that’s because Africa is widely recognised as the continent most vulnerable to climate change. But it’s also because many of the legislative

changes adopted by high-income countries and regional bodies could do serious harm to African growth and development. Take the European Union (EU)’s Carbon Border Tax Adjustment Mechanism, for example. The wellintended legislation aims to equalise the price of carbon between domestic products and imports. The primary aim of the mechanism is to prevent European companies from moving their operations offshore to countries with more lax carbon protections. Still, it has profound potential implications for the African continent.

The mechanism could place significant constraints on the continent’s ability to export materials such as fertilisers, iron, cement, steel and aluminium to EU countries. Given that the bloc is one of Africa’s largest trading partners, that would force many African countries to revert to exporting raw commodities, a significant step backwards. Considering that the continent produces just 4% of global emissions, it also doesn’t seem particularly fair.

But with the right funding and incentives, that needn’t be the case. African countries will be able to successfully transition and even become leaders in sustainable business. Unfortunately, that funding has been thin on the ground despite years of pledges.

The $100-billion promised to developed countries in 2009 at the COP15 in Copenhagen, for instance, remains largely unfulfilled. Even the much-vaunted loss and damage fund will require billions of dollars more than the $700-million pledged at COP28 if it’s to have any impact on climate losses that low-income countries in Africa and other parts of the world will encounter in the coming years. After all, Nigeria’s 2022 floods alone caused more than $4.2-billion in damages.

The World Meteorological Organization (WMO)’s The State of the Climate in Africa 2022 report, meanwhile, shows weather and climate-related damage amounted to $8.5-billion in that year. Given that a report from Carbon Brief shows these extreme climate events are becoming more common and more deadly, it’s clear that more funding will be needed.

African regulators have a role to play

While it’s obviously important that high-income countries play their part when it comes to funding, it’s also critical that African regulators provide the kind of environment that encourages funding and investment. In doing so, they must ensure that any regulations protect the continent’s natural assets while safeguarding against nature-related risks. Here, transparency and continuous engagement with the financial institutions they oversee as well as with state ministries is critical. This not only means that these bodies get a better understanding of why regulations are being implemented but also that regulators better understand the realities of the industries they oversee.

18

Rural entrepreneurs and farmers need protection from extreme climate events. The African Risk Capacity Group, an agency of the African Union, is trying to build resilience so that farmers can thrive, even in dry conditions. An improved response to climate-related food security emergencies includes providing insurance for extreme weather events. Credit: ARC

engage with environmental and nature-focused networks, such as the Sustainable Insurance Forum (SIF), the Network for Greening the Financial System (NGFS), the African Natural Capital Alliance (ANCA) and the Task Force on NatureRelated Financial Disclosures (TNFD). These networks not only provide the kind of frameworks that can easily be adapted for regulatory purposes but can also guide regulators, helping them develop regulations that mitigate nature and climaterelated financial risks.

Push for funding, but focus on self-sufficiency

Ultimately, while there were announcements at COP28 that deserve to be celebrated, it’s clear that Africa still has much work to do when it comes to securing both its climate and financial futures. Pushing for increased funding from high-income countries will, of course, be important in this regard. Perhaps even more important, however, will be regulators ensuring that the regulations they develop and enforce don’t just help build climate resilience but also the kind of innovation that allows African countries to demonstrate ever-greater degrees of self-sufficiency in this regard.

About Sandra Villars

Sandra is a senior professional with over 20 years’ experience with global top-tier financial-services institutions. She has worked with over 20 financial institutions in the US, UK, Europe, Middle East and Africa. Her areas of focus in Finance and Risk include ESG, treasury and prudential regulation.

About Oliver Wyman

Oliver Wyman is a leading international management consulting firm that combines deep industry knowledge and expertise to create breakthroughs for clients across industries.

19 CLIMATE CHANGE FINANCE

Sandra Villars, Partner, Financial Services at Oliver Wyman.

that encourages funding and investment so that business and trade can thrive. Darkshade

Pexels.

African regulators must provide an environment

Photos,

AFRICA COULD LOSE $25-BILLION PER YEAR

The EU’s newest carbon tax could significantly harm African trade, according to African Development Bank Group President, Dr Akinwumi Adesina.

AAfrican Development Bank Group President Dr Akinwumi Adesina has warned that a new EU carbon-border tax could significantly constrain Africa’s trade and industrialisation progress by penalising value-added exports including steel, cement, iron, aluminium and fertilisers. Speaking at the Sustainable Trade Africa Conference held at the UAE Trade Centre in Dubai, Adesina said, “With Africa’s energy deficit and reliance mainly on fossil fuels, especially diesel, the implication is that Africa will be forced to export raw commodities again into Europe, which will further cause de-industrialisation of Africa.

“Africa could lose up to $25-billion per annum as a direct result of the EU Carbon Border Tax Adjustment Mechanism,” the bank president told delegates.

“Africa has been short-changed by climate change; now it will be short-changed in global trade,” added Adesina.

“Because of weak integration into global value chains, Africa’s best trade opportunity lies in intra-regional exchanges, with the new Africa Continental Free Trade Area estimated to increase intra-Africa exports over 80% by 2035.”

Adesina stressed that Africa was already being overlooked in the global energy transition, according to data from the International Renewable Energy Agency.

“Africa received just $60-billion or 2% of the $3-trillion of global investments in renewable energy in the past two decades, a trend that will now impact negatively on its ability to export competitively into Europe,” said Adesina as he called for what he termed the Just Trade-for-Energy Transition (JTET) policies, which would enable Africa’s renewable ambitions without restricting its trade prospects.

Africa will need to use natural gas as a transition fuel to reduce the variability of renewable energy and stabilise its energy systems in support of its industrialisation, Adesina said.

The Chief Executive Officer of the UAE Trade Centre, Walid Mohammed Hareb Alfalahi, said that Africa is the new frontier for investment, contrary to widespread perceptions that the continent is a dangerous and difficult place to do business.

“What you hear about Africa is not the reality. I see the potential in Africa. I see the possibilities to do more,” said Alfalahi, as he recounted his positive experience of investing in a number of projects on the continent.

Adesina said a report by Moody’s Analytics showed that Africa had the least default rate on investment in infrastructure compared to other parts of the world.

According to the report, Africa’s default rate stands at 5.5%, compared to Latin America’s 12.9%, followed by Asia at 8.8%, Eastern Europe 8.6%, North America 7.6% and Western Europe 5.9%.

Adesina also highlighted some of the mega-projects that had attracted investor interest through the Africa Investment Forum that was created by the African Development Bank and seven other founding partners. The projects include Mozambique’s $24-billion liquefied gas project, the $15.2-billion Abidjan-toLagos Highway corridor covering five countries and the $3.6-billion Tanzania-toBurundi and DR Congo railway line.

“I’m talking about a different Africa. There is no project that as partners, we cannot handle,” said Adesina.

The conference, moderated by the African Development Bank President’s Senior Adviser for Communication, Dr Victor Oladokun, was also addressed by the President of the African Export-Import Bank (Afreximbank), Professor Benedict Oramah. He warned, “Preliminary results of a study recently commissioned by Afreximbank reveal that rapid decarbonisation by fossil fuel-exporting countries in Africa could cut merchandise exports by $150-billion.”

About the African Development Bank Group

The African Development Bank Group (AfDB) is the premier multilateral financing institution dedicated to Africa’s development. It comprises three distinct entities: the African Development Bank (AfDB), the African Development Fund (ADF) and the Nigeria Trust Fund (NSF). The AfDB has a field presence in 41 African countries with an external office in Japan, and contributes to the economic development and social progress of its 54 regional member states.

For more information: www.AfDB.org

20

Two of Africa’s most consequential financial office-holders spoke at the Sustainable Trade Africa Conference, which was held in Dubai. Pictured with the Chief Executive Officer of the UAE Trade Centre, Walid Hareb Al Falahi, left, and Mahmood Albastaki, the Chief Operating Officer, Digital Trade Solutions at DP World, right, are Dr Akinwumi Adesina, President of the African Development Bank Group, centre left, and Prof Benedict Oramah, President of the African Export-Import Bank (Afreximbank), centre right.

21 CARBON TAX

CONNECTING AFRICA

Vodacom Group Chief Technlogy Officer, Dejan Kastelic, outlines the group’s ambitious vision for Africa and notes how satellite technology is set to revolutionise a range of sectors.

WWhat is Vodacom’s current footprint in Africa?

Vodacom Group is a leading and purpose-led African connectivity, digital and financial services company. The Group, including Safaricom, serves a combined 196.2-million customers across the continent, with operations in South Africa, Tanzania, the DRC, Mozambique, Lesotho, Egypt and partners in Safaricom Kenya and Safaricom Ethiopia. Our population reach across our markets exceeds 500-million people. Through Vodacom Business Africa (VBA), we offer businessmanaged services to enterprises in over 45 countries on the continent.

What is Vodacom’s vision for Africa?

Our purpose as a company is to connect for a better future and our vision is connected to our purpose. At the core of our strategy is our vision to be the leading connectivity, digital and financial services company on the continent, connecting the next 100-million Africans.

Is the company positive about the continent as a place to do business?

Yes, and testament to this is our acquisition of a 55% shareholding in Vodafone Egypt. We are excited by the opportunities for further synergies that our strengthened footprint from Cape to Cairo presents given our ambition to create a digital society and drive inclusion for all. Core to this is our ongoing investment in Fintech, which includes M-Pesa and VodaPay. The impact of fintech on the African continent is extensive, with the potential to improve more lives significantly and we’ve been able to use our expertise to enable the launch of M-Pesa in Africa’s second most populous country, Ethiopia. Offering fintech platforms on the continent opens up the potential of

financial services to a largely unbanked population through the power of mobile technology. We look forward to being part of the fintech developments in Africa, which have the potential to create a game-changing impact on the continent.

What are some of the challenges presented by the African market?

Reducing the cost of deploying and operating rural networks to ensure that more people are connected remains a challenge in the context of exchange rates and having to source goods in hard currencies. Beyond mobile connectivity, access, 4G smartphone penetration and device affordability is another challenge, but bridging the digital divide on the continent remains a priority for us. Our footprint across Africa provides us with the opportunity to play a significant role in the continent’s socio-economic development by creating a digital society and driving inclusion for all. Vodacom’s pledge to democratise Internet access for over 500-million people across our markets is one we are tackling by focusing on accessibility of devices, including smart-feature phones.

Is the Rural Coverage Acceleration Programme only in South Africa or also in the rest of Africa?

This is available in all countries. The Group’s Rural Coverage Acceleration Programme is aimed at expanding network coverage to people who live in deep rural areas. So far, we have rolled out close to 9 000 sites in some of our markets, covering both 4G and 3G. We intend expanding this through strategic partnerships that will help achieve the goal of building low-cost sites and making 4G devices accessible. Partnerships have already helped launch low-cost 3G- or 4G-enabled smart-feature phones in Tanzania where Vodacom partnered with KaiOS Technologies to launch the 4G-enabled Smart Kitochi.

22

Nearly 9 000 sites have been reached as part of the Rural Coverage Acceleration Programme. Credit: Vodacom

Vodacom has partnered with KaiOS Technologies to launch the 4G-enabled Smart Kitochi in Tanzania. Credit: Vodacom

Dejan Kastelic, Vodacom Group Chief Technology Officer

Please explain how satellite could be a game-changer in terms of African telecoms?

The adoption of smart-feature phones among Tanzania’s mobile-Internet users is estimated at 10%, slower than in other African markets, but progressing, nonetheless.

Is Vodacom upbeat about fintech and its partnerships in Africa?

Yes, our financial services business is integral to our purpose-led business model, the largest component of our new services revenue and a clear strategic priority. The VodaPay and M-Pesa SuperApps, strategic partnerships and African expansion are key enablers to scaling our financial services and building a pan-African fintech ecosystem that supports e-commerce, banking and financial services that offer a single customer experience.

Our landmark partnership with technology leader Alipay provided an excellent opportunity to reinvent the mobile fintech ecosystem for consumers and merchants. Through this partnership, we could leverage the world-class technology of Alipay to develop the VodaPay super-app and promote greater financial inclusion for all South Africans.

We have also entered into a strategic partnership with Visa to introduce virtual cards linked to VodaPay and M-Pesa across our markets to accelerate the merchant payments ecosystem. This includes the enablement and adoption of our SuperApp in all markets where M-Pesa is available.

Satellite technology offers a versatile and scalable solution for enhancing connectivity on a global scale. The ability of satellites to cover vast areas, provide rapid deployment and support various applications makes them a game-changer in addressing connectivity challenges, particularly in remote and underserved regions. LEO satellites in particular have the potential to revolutionise the satellite industry by addressing key challenges such as latency, data throughput, global coverage and cost-effectiveness. LEO satellites operate at altitudes ranging from approximately 160km to 2 000km above the earth’s surface. This proximity results in significantly lower signal-travel times, leading to lower latency compared to higher-altitude satellite orbits. The closer proximity to earth also allows for more efficient use of available frequency bands, enabling faster data-transfer rates. This is particularly important for applications like real-time communications, online gaming, bandwidthintensive applications and video conferencing. As technology continues to advance and more LEO satellite constellations become operational, they are likely to play a significant role in shaping the future of satellite-based communications and services.

How far advanced is Vodacom in talks with satellite providers? How long before it becomes a reality?

Vodacom is continuing to work with Vodafone and AST SpaceMobile to develop the first space-based mobile network to connect directly to consumer 4G and 5G smartphones without specialised hardware. In September 2023, Vodafone and AST SpaceMobile successfully completed the world’s first spacebased 5G voice call using an unmodified Samsung Galaxy S22 smartphone and AST SpaceMobile’s BlueWalker 3 test satellite. In a separate test, AST SpaceMobile, supported by Vodafone, also broke its previous space-based cellular broadband data session record by achieving a download rate of nearly 14Mbps. With its ability to provide mobile broadband connectivity to standard, unmodified mobile devices across the continent, this new technology has the potential to connect millions of people in the remotest regions to the Internet for the first time.

Vodacom, in collaboration with Vodafone and Amazon, also plans to use Project Kuiper’s network to extend the reach of 4G and 5G services to more customers in Africa.

23

Connecting Africa is a priority. Credit: Vodacom

BRIDGING THE DIGITAL DIVIDE

Bridging the digital divide on the continent remains a priority for us

What role is Mezzanine playing in the Vodacom African story?

Mezzanine, a subsidiary of Vodacom, is a technology company that co-creates fitfor-purpose digital solutions to empower productive societies across Africa.

Some of the solutions include in the health space with Vodacom’s Stock Visibility Solution (with over 3 400 healthcare facilities registered) and more recently, the Electronic Vaccination Data System (EVDS) that enabled South Africa’s Covid-19 national vaccine rollout.

The latter supported the provision of 39-million vaccine doses to 22.8-million citizens over the course of the pandemic.

In agriculture, initiatives like eVuna – Connected Farmer, provide a digital platform that connects over four-million smallholder farmers to enterprise services across widely dispersed areas and provides them with, inter alia, access to financial services, information and markets. This is available in the Connected Farmer packages currently being used in Kenya, South Africa, Zambia and Tanzania. In the commercial agriculture space, MYFARMWEB enables farmers to collate precision agriculture sensor (IoT) datasets and overlay data layers in relation to each other to support day-to-day decisionmaking. This started in South Africa and has been introduced to several SubSaharan African countries.

In addition, Mezzanine was also behind the development of the first virtualwheeling platform in South Africa. This enables enterprises with a distributed geographical footprint to access renewable energy and achieve decarbonisation targets while being reimbursed by Eskom.

Vodacom and Eskom sign first virtual-wheeling agreement

In a first of its kind in South Africa, Vodacom signed a virtual-wheeling agreement with Eskom in August 2023 that will help accelerate efforts to solve the country’s energy crisis. In addition to adding capacity to the nation’s power grid, this agreement, a Vodacom innovation which has been co-developed with Eskom, will also play a significant role in moving Vodacom closer to its goal of sourcing 100% of its electricity demand from renewable energy sources by 2025.

This agreement will now enable Vodacom to execute the next phase of this innovative solution, securing Independent Power Producers (IPPs) under the same terms and conditions which underpin its agreement with Eskom. Vodacom Group CEO Shameel Joosub said, “Vodacom’s partnership with Eskom is transformational in that our virtual-wheeling solution will enable South Africa’s private sector to participate in resolving the energy crisis which continues to impact the country’s economy. It also provides a blueprint for other South African corporates to adopt, as we pool our collective resources with the common objective of bringing an end to loadshedding. The virtual-

wheeling solution has the potential to be fast-tracked, depending on the available licensed capacity of IPPs.”

The energy crisis in South Africa has been devastating for many businesses. Vodacom South Africa spent more than R4-billion on backup power solutions and R300-million in the past financial year alone on operational costs such as diesel for generators.

Traditional wheeling typically involves a one-to-one relationship between an IPP and a buyer using the national grid to convey their energy. While the concept of traditional wheeling is fairly common practice globally, it has certain limitations for companies with complex operating environments. The virtual-wheeling solution addresses these challenges. After a successful pilot phase, which concluded in 2022, and following rigorous testing, the newly co-developed solution is accessible to the public and private sector on a larger scale. The blueprint provides an easy-to-follow roadmap for others in the private sector, effectively involving those who want to benefit from cost saving in the process of stabilising South Africa’s grid and reducing overall emissions.

24

Mezzanine is active in developing e-vouchers for traders. Credit: Vodacom

NOT WAITING, BUT ACTING

The Shoprite Group, active in 10 African countries, is investing heavily in fighting climate change.

TThe Shoprite Group has almost doubled the amount of renewable energy used in its operations to 103 234MWh. In the 2022 financial year, the figure was 54 138 MWh.

The annual international conference which forces the world to think about carbon emissions, COP28, was held in December 2022 in Dubai. But the Shoprite Group’s CSI and Sustainability Manager Sanjeev Raghubir says that the world can’t wait before taking action: “Events like COP28 are absolutely crucial, but we – business, government, civil society, humankind in general – can’t and mustn’t wait for their decisions.

“This is especially true in the African context. Despite contributing the least of any region to global greenhouse-gas (GHG) emissions, the continent is being affected disproportionately by climate change.” It’s why, Raghubir adds, the Group invests heavily in reducing its carbon footprint across all aspects of its operations, with energy consumption a key priority.

Shoprite’s doubling of its supply of clean energy was achieved by increasing the amount of renewable energy bought from landlords and other suppliers by 91%.

“We have also reduced electricity consumption by 161-million kWh through our LED lamp replacement project, and our network of solar-panel installations now cover the equivalent of more than 26 soccer fields,” says Raghubir. The Group’s solar