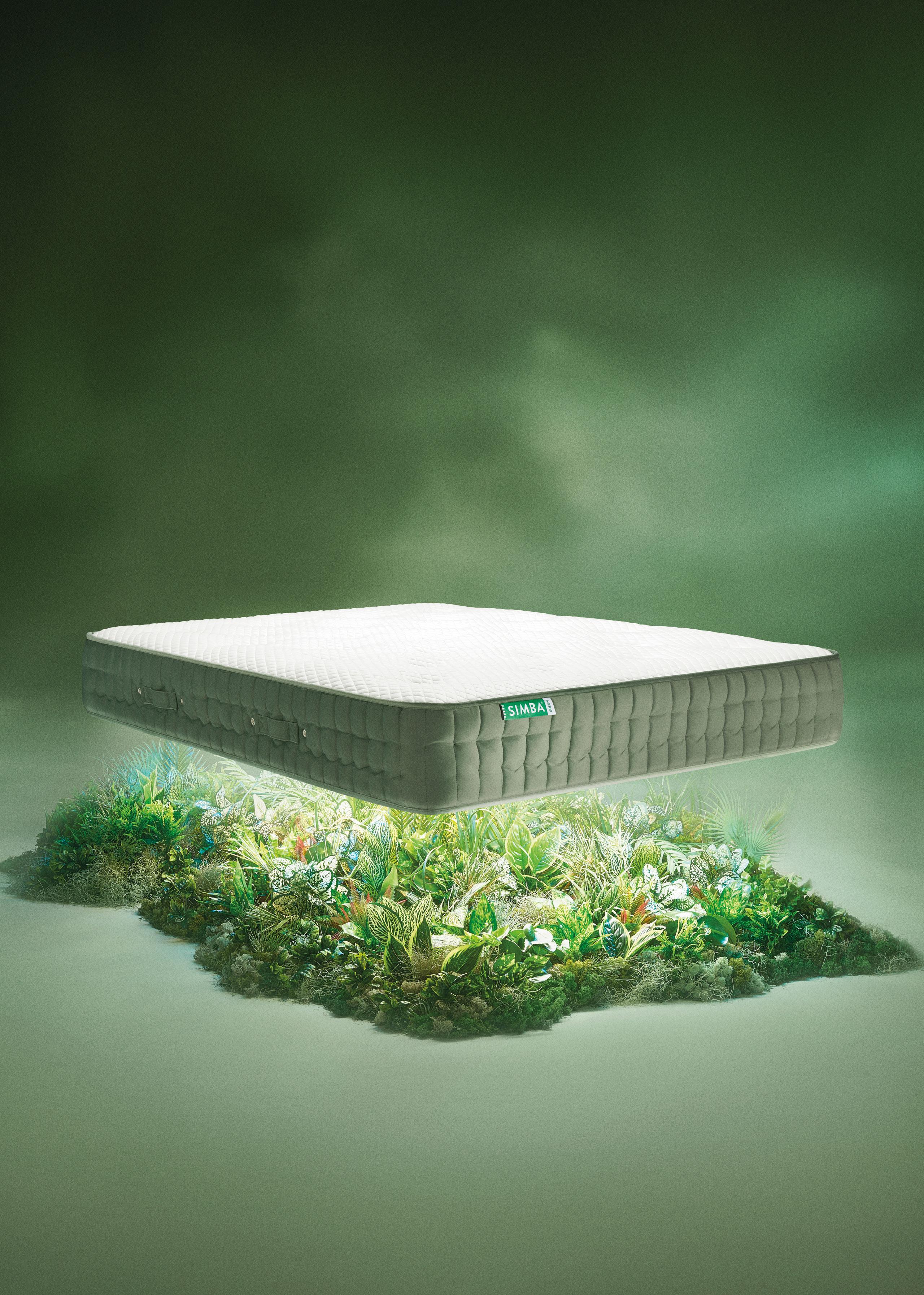

UNDERSTANDING THE FURNITURE SHOPPER Exclusive consumer insights report Fishpools turns 125 The Readers’ Choice Awards return #415 April 2024 www.furniturenews.net INDX BEDS & BEDROOM FURNITURE COMPONENTS EXPO BEDROOM | LIVING | TRADE SERVICES HEAVEN ON EARTH Go

sumptuous new

tech

greener with Simba’s

sleep

Become a partner

Salvation Army Trading Company Ltd (SATCoL) is the trading arm of The Salvation Army, raising money for charity through our nationwide reuse and repurposing schemes.

Donate your used furniture stock for reuse or repair...

We accept faulty, excess and returned furtniture

We support the circular economy

We help organisations achieve their CSR aspirations

Together, we protect our planet and transform lives

Your Donations

The profits recieved from the re-sale of the donated items, will be given to The Salvation Army to continue to support the great work they do across the U.K. The Salvation Army provide specialist support for survivors and potential victims of modern slavery, shelter for those experiencing homelessness and so much more.

@reuse2repurpose www.satcol.org

01424 776101

paul@gearingmediagroup.com

@FurnitureNewsED

@Furniture News

www.furniturenews.net

Editor's comment

“Hopefully these insights give you the confidence to make (the right) changes in your business

Welcome to April’s issue, which features our first-ever consumer insights report – Understanding the Furniture Shopper.

This represents something of a passion project for me. I’ve wanted to conduct a deep dive into what the nation thinks about furniture shopping for a long time, and, thanks to support from product visualisation wizard Chaos Cylindo (if you don’t know what they do already, I guarantee you’ll be impressed), it’s finally here.

I’m aware of how important it is to ‘know your customer’ – and that no-one knows yours better than you do. But it also helps to set your own experiences against a benchmark, and we’ve set out to provide just that.

After all, what’s the use in knowing what your customers want, if you have no idea what, or how, their children would like to buy? Why invest in an all-singing, all-dancing new website, without identifying which features are going to actually resonate with users? Where should you allocate your marketing spend, focus your store training, or refine your offer?

Although these questions echo themes I’ve explored in Furniture News over the years, it’s great to bring the answers into focus (and context) by whittling them down to simple percentages.

Admittedly, we’ve only been able to scratch the surface this time. The trade continues to negotiate the rocky relationship between the store and online, the challenges continue to mount, and each business must find its own way to handle sourcing, margins, staffing, presentation, marketing, expansion, technology, quality, brand, and a hundred other factors that set them apart.

But beneath it all lies a fundamental truth. We all care about our homes, and the furniture we live with, and it’s worth remembering the emotional value of what we sell. It matters.

Beyond this, it’s about making enough right decisions. They say the most dangerous phrase in business is, ‘Why change? We’ve always done it this way’. Well, no more excuses. Hopefully these insights give you the confidence to make (the right) changes in your business, and to keep building something that furniture shoppers – today and tomorrow – just can’t live without.

I’d like to hear if these findings align with your own experiences and, down the line, if they’ve helped take your business forward. In the meantime, turn to p50 and get reading!

Elsewhere in April’s issue, you’ll find meaty previews of two key trade shows taking place this month –AIS’ INDX Beds & Bedroom (p32), and the BFM’s inaugural Furniture Components Expo (p42 – at which I’ll be moderating a panel questioning the balance of automation and skills in UK manufacturing).

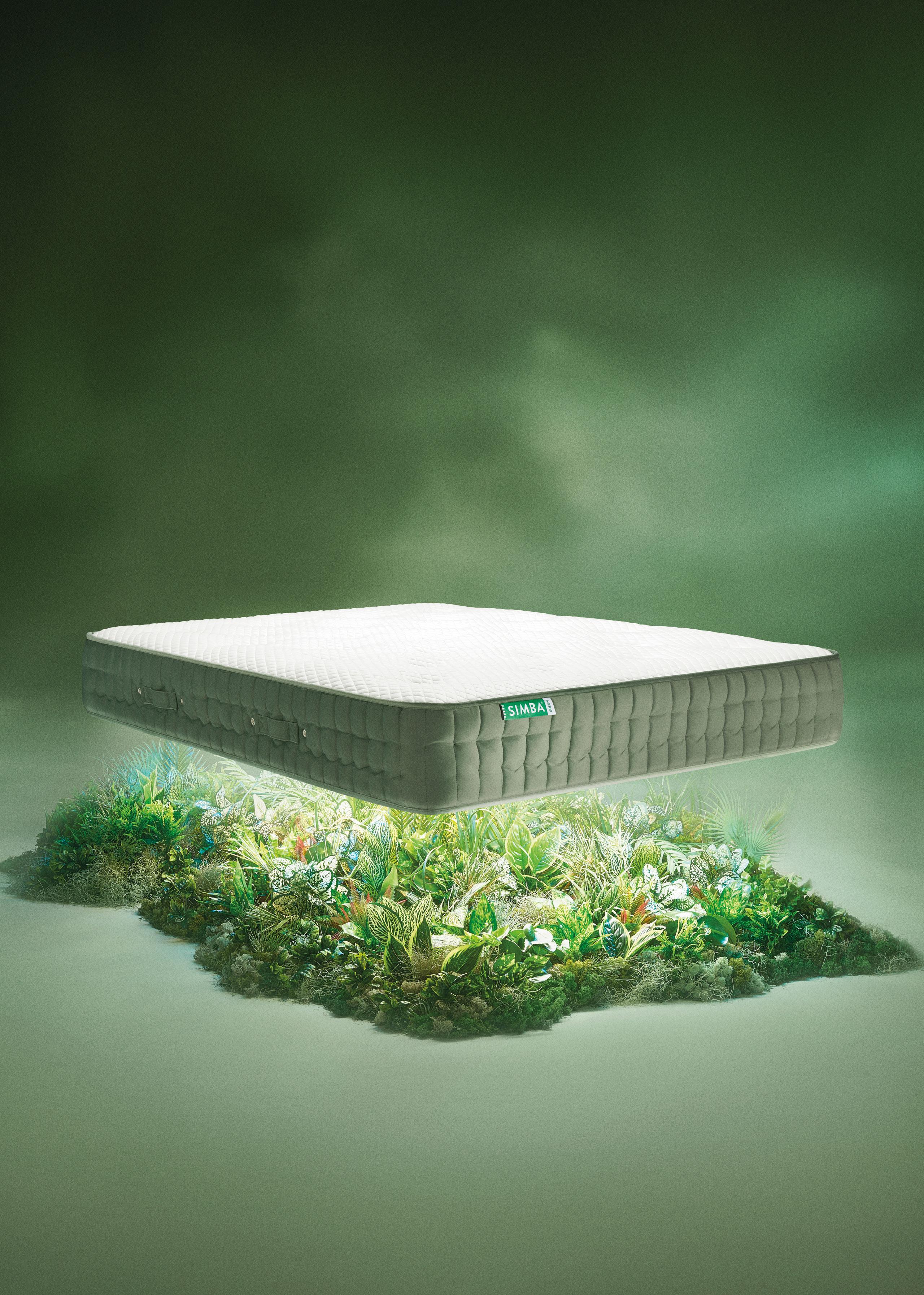

Discover how Fishpools celebrated its 125th birthday (p14), the latest from Mammoth (p18) and Hypnos (p20), and read all about cover star Simba’s new eco-conscious mattress collection (p78). You’ll find Gavin Boden’s take on the trade show calendar (p88), Gordon Hecht’s advice for retailers looking to expand (p92), Q&As with Neil Barker (p16) and Jarrad Belton (p24), and more. We’re also launching this year’s Readers’ Choice Awards – find out how to vote for and nominate your top suppliers on p10.

I sincerely hope you enjoy this issue!

Paul Farley

3

13TH 15TH MAY 2024

The Long Eaton Guild invites you to visit the UK's premier furniture exhibition, located in the famous furniture town of Long Eaton, just one mile from Junction 25 of the M1.

See the latest collections from leading UK and International brands of Upholstery, Cabinet, Bedroom and Lifestyle accessories.

Details and location of exhibitors are available on our website.

To request a personal copy, please send your details to ajm@leguild.co.uk

YOUR INVITATION TO

THE UK’S PREMIER FURNITURE EXHIBITION

www.longeatonguild.co.uk

EDITORIAL

EDITOR-IN-CHIEF

Paul Farley

01424 776101

paul@gearingmediagroup.com

X @FurnitureNewsED

SALES

SALES AND MARKETING DIRECTOR (FURNITURE NEWS PORTFOLIO)

Sam Horscroft 07764 650655

sam@gearingmediagroup.com

X @FurnitureNewsAD

SALES EXECUTIVE

Caroline Littler

07861 231461

caroline@gearingmediagroup.com

OVERSEAS AGENT

Casey Loo (Asia) +65 973 00123 (WhatsApp) casey@apsmediagroup.com

PRODUCTION

PRODUCTION MANAGER

James Ash james@gearingmediagroup.com

DIGITAL MANAGER

Nyall McCurrach

nyall@gearingmediagroup.com

COPY ADMINISTRATOR

Steve Merrick 01424 776108 production@gearingmediagroup.com

ACCOUNTS

ACCOUNTS/GENERAL MANAGER

Wendy Williams 01424 817433

wendy@gearingmediagroup.com

CHAIRMAN Nigel Gearing

SUBSCRIPTIONS

(UK-£65, Europe-£85, RoW-£95) subscriptions@gearingmediagroup.com

REPRO, PRINT AND DISTRIBUTION Stephens &

5 7 NEWS 10 READERS’ CHOICE AWARDS 2024 14 INSIGHT 14 Fishpools 16 Getting personal 18 Mammoth 20 Hypnos 24 60 seconds with … 26 EVENTS 32 INDX Beds & Bedroom 42 Furniture Components Expo 50 UNDERSTANDING THE FURNITURE SHOPPER 78 PRODUCTS 78 Bedroom 80 Living 82 Trade services 88 OPINION 88 Shows, shows, everywhere 90 Your reputation precedes you (or not) 92 Time to expand your retail empire? 94 Agency agreements – written or unwritten? 95 Yes, some staff are happy to work weekends 97 Partner comment 106 Feedback Contents

GEARING MEDIA GROUP LTD

Red Barn Mews, High Street

East Sussex

No:

© Gearing Media Group Ltd 2024 WWW.FURNITURENEWS.NET UNDERSTANDING THE FURNITURE SHOPPER Exclusive consumer insights report Fishpools turns 125 The Readers’ Choice Awards return #415 April 2024 www.furniturenews.net INDX BEDS & BEDROOM FURNITURE COMPONENTS EXPO BEDROOM LIVING TRADE SERVICES HEAVEN ON EARTH Go greener with Simba’s sumptuous new sleep tech GENERAL INFORMATION No part of this publication may be reproduced without the specific prior written agreement of the Publisher and may not be stored on any type of retrieval system. Furniture News/ Gearing Media Group Ltd accepts no responsibility for variations in colour reproduction. Special colours (Pantone etc) can be catered for with prior arrangement. Some elements of the editorial content in this publication are submitted by the trade, however, all efforts are made to ensure that the editorial remains true to fact and unbiased. Monies may have been accepted to offset the costs of colour reproduction. Gearing Media Group Ltd reserves the right to alter without prior notice any content other than customers’ advertisements. No correspondence will be entered into regarding altered or adjusted editorial content. The editor’s decision is final. All material submitted for inclusion in Furniture News is done so entirely at the owner’s risk and no responsibility is accepted for the safekeeping or return thereof. Advertiser information is reproduced in good faith and Gearing Media Group accepts no responsibility in respect of adverts appearing in the magazine, and the magazines expressed do not necessarily reflect the publisher’s views. The Publisher accepts no liability for any loss arising from an advertisement’s late or non-appearance. Simon Fishpool Fishpools 14 18 88 97 John Tuton Mammoth Gavin Boden Rhenus Home Delivery (UK) Imre Zilahi International Alliance of Furnishing Publications (IAFP) COVER FEATURE 78 SIMBA SLEEP

George

4

Battle,

TN33 0AG ISSN

1475 - 3731

OPEN TO ALL FURNITURE BUYERS Easy to access venue Free parking Complimentary lunch Relaxed environment to view the new season’s arrivals under one roof REGISTER NOW www.springfurnitureshow.co.uk Hosted by 21st & 22nd May 2024 21-22 MAY 2024 AT NAEC STONELEIGH CV8 2LZ OPEN TO ALL FURNITURE BUYERS

The Belfield Group (Westbridge, Tetrad, Belfield Home & Leisure and Clinchplain) has received a £7.5m transformation investment from its principal stakeholders, NorthEdge LLP and Virgin Money

The Furniture Makers’ Company’s eighth annual Curry Night, organised by its Yorkshire Region committee, raised £2000 for the industry charity

Barnes of Ipswich (The Bed Factory) is closing this month after nearly 100 years of business, with MD Chloe Last pursuing a new career direction

Arlo & Jacob is planning to open a new showroom in Solihull’s Mell Square this spring

LuxDeco went into administration on 15th March, with a team from Begbies Traynor (London) LLP appointed on the same date.

“The administration moratorium provides a ‘breathing space’ during which we will assess whether a rescue of the company is feasible,” states the brand’s website

John Lewis Partnership returns to profit

John Lewis Partnership has reported a return to profit in its unaudited results for the 52 weeks ended 27th January 2024. Following a “challenging” set of results in 2022/23, profit before tax and exceptional items was £42m, a £120m improvement on the prior year loss of £78m. Improvement was achieved through a combination of sales growth, gross margin rate improvement and sustainable productivity improvements.

The John Lewis business achieved improved profitability, helped by improved gross margin rate and productivity. However, sales were £4.8b, down -4%, and the retailer saw weaker sales in Home and Technology. “Trading operating profit of £689m was £13m better YoY as we converted sales into greater profit,” says JLP.

“Given the significant changes in the economy since we announced our strategy in 2020, we have refreshed our plan, in support of which we are entering a year of significant investment – £542m planned (over +70% up on the year) – much of which

will focus on modernising our technology, refreshing our shops and simplifying how we work.

“In John Lewis, we will improve our offer to customers with around 80 new brands and strengthened own-brand, while revitalising our Home category. We’re improving visual merchandising in stores, investing in technology to improve customer service and continuing to invest in value.”

Staff will not receive a bonus this year, but overall pay will be increased by £116m in 2024, which the partnership describes as “a record investment”.

Bensons reports sales and profit growth

Bensons for Beds has reported a return to profitability over the past year. Turnover for the 53 weeks to 30th September grew by +7.5% to £257.5m (from £239.4m in 2022), with reported EBITDA profit of just over £1.5m (from a loss of £15.4m in 2022). The increase follows the implementation of the brand’s recovery plan set out in 2022. Bensons states: “There is an old retail saying to the effect that you should focus on the KPIs that you can control. Faced with lacklustre market demand, the Bensons team have done just that – focusing on sales conversion and ATV in order to make the most of what demand there was, and on delivering a first-class customer experience both during and after sales were made and products delivered. That

focus proved extremely effective, with all these controllable KPIs moving in the right direction.”

During the last 12 months, Bensons has grown market share in its core categories, while continuing to invest in omnichannel and digital capability, with digital LFL at +22%. It increased store conversion with 14 new store openings across the year, and improved NPS scores by +15%, following significant investment in its customer service and delivery experience. Finally, since the eveSleep.co.uk brand was acquired in October 2022, the brand has shown strong growth and contributed positive EBITDA.

Bensons also bolstered its leadership team with several key hires, including the appointment of a new chief people officer, Linda Sleath.

Harmony Furnishings has appointed its first UK agent, Gary McGovern, who will represent the bedroom furniture supplier in the North West

The National Bed Federation (NBF) was awarded the ESG Initiative of the Year accolade in the Trade Association Awards 2024

Rehau has purchased the asset base of Manchester-based edgebanding firm DecorEdge, welcoming two key team members to the business

Next exceeds expectations

“In the context of the wider economic environment, the year to January 2024 was a very good year for Next, and the business materially outperformed our initial expectations,” states chairman, Michael Roney, at the top of the retail group’s year-end (27th January 2024) results.

Next Trading full-price sales were up +4.0%, and total group sales (including subsidiaries) up +5.9%. Store sales were up +0.2% YoY, and LFL full-price sales up +1.8% (online full-price sales were up +6.0% YoY). Across the group, PBT rose to a record high of £918m, up +5.0%. Cash flow remained strong, and £425m was returned to shareholders through a combination of dividends (£248m) and share buybacks (£177m).

Michael continues: “We launched three new Total Platform clients (JoJo Maman Bébé, Joules and Made), taking our total number of clients to seven.”

As well as launching the new Made website, Next opened a dedicated showroom in Leeds (Redbrick Mill) as well as dedicated retail space in its Sheffield store. Next is planning to expand its product ranges with “a focus on furniture and lighting”.

The year ahead will see a number of changes to Next’s board. FD Amanda James plans to retire in July, and will be succeeded by Jonathan Blanchard (ex-Reiss CFO and COO) on the board. Amy Stirling and Venetia Butterfield will join as independent non-executive directors in April, while non-executive director Dame Dianne Thompson leaves in May. For the coming year, Next forecasts underlying full-price sales growth of +2.5%, and an increase in total group sales of +6.0%. Group profit guidance is £960m (up +4.6%). While Next will continue to open and close a number of stores, it says it does not anticipate any material net change in selling space.

NEWS 7

READ MORE ONLINE AT WWW.FURNITURENEWS.NET

ACID celebrates 25th anniversary

At an event held at Furniture Maker’s Hall in February to celebrate 25 years since the foundation of Anti Copying in Design (ACID), representatives from the design world were present to welcome the Minister for Intellectual Property and AI, Viscount Camrose, Creative Industries co-chair Sir Peter Bazalgette, designer Sebastian Conran, Design Council CEO Minnie Moll, and ACID’s chief counsel Nick Kounoupias, who each spoke about the importance of intellectual property (IP) and design.

Viscount Camrose gave a speech applauding the design economy and congratulating ACID’s contribution, saying: “ACID has been a strong and consistent champion for SME designers for 25 years. Both in your own right and as a key member of the Alliance for IP, you have campaigned to ensure that IP rights are valued. The Government has been pleased to work with ACID to help ensure

our IP system continues to support creativity and innovation in design, and that our design system works effectively for smaller design-led businesses and lone designers.

“I know that the introduction of criminal sanctions for unregistered designs is an important issue for ACID. We will be seeking evidence on this topic within our design consultation, so I would urge you all to respond.”

Changes and investment at Marks & Spencer

Marks & Spencer has announced a record £89m investment in its retail pay offer, and a further £5m annual investment to enhance its maternity, paternity, and adoption policies. CEO Stuart Machin says: “Our vision is to be the most trusted retailer – and that starts with being the most trusted employer. That’s why we’re making our biggest-ever investment in our retail pay offer to recognise our colleagues for the vital role they play each day. It means that since March 2022, we’ve invested more than £146m in our retail pay offer and increased our standard hourly rate by more than +26%.”

In other news, in what it describes as a planned move, Katie Bickerstaffe will retire from M&S after its AGM in July 2024 to pursue a board career. Katie served as a non-executive director and co-COO of M&S prior to being appointed co-CEO, reporting to Stuart Machin, in March 2022.

Meanwhile, the Secretary of State’s decision to block the redevelopment of the retailer’s Marble Arch Store has been ruled “unlawful” by the High Court. After planning permission was refused – a move described by Stuart as “a short-sighted act of self-sabotage” – the retailer sought a judicial review. Operations director Sacha Berendji says: “The result has been a long, unnecessary and costly delay to the only retail-led regeneration on Oxford Street which would deliver one of London’s greenest buildings, create thousands of new jobs and rejuvenate the capital’s premier shopping district. The Secretary of State now has the power to unlock the wide-ranging benefits of this significant investment and send a clear message to UK and global business that the Government supports sustainable growth and the regeneration of our towns and cities.”

DFS “resilient” in H1 despite challenging market

DFS Furniture has announced its interim results for the 26-week period ended 24th December 2023. The retailer says it made progress on its cost-to-operate programme, with a gross margin improvement from 53.8% in H1 FY23 to 56.0% in the current period, and operating costs £11.5m lower. Despite “a more challenging and volatile than expected upholstery market”, with order volumes down some -10% YoY versus the -5% the business assumed in September, the group continued its long track record of market share gains, reaching a record level of 38.5%. It also saw continued improvement in customer NPS measures.

In the wake of H1, after a “solid start” to January, market demand weakened significantly, with market order volumes down some -16% YoY across January and February, says DFS, which has provided updated guidance for the year accordingly.

Revenues are now expected to be in the range of £1000m-£1015m, and PBT(A) in the range of £2025m, excluding the risk of Red Sea delays.

This represents a £60-£65m reduction in revenue guidance, partially mitigated to a £10m reduction in PBT(A) guidance. The guidance assumes that H2 market volumes will be broadly consistent with H1 YoY, in a range of -8% to -10%, supported by weaker Q4 comparatives and a level of pent-up demand following the weak January and February.

Group CEO Tim Stacey says: “Whilst the current macroeconomic situation has presented many challenges, we are pleased to have extended our market leadership while reporting a resilient profit performance through the first half. We remain well positioned to improve our profit margins without market recovery and remain confident in delivering our +8% PBT target when the market recovers.”

Fairway Furniture has embarked on a £1.5m internal refurbishment of its flagship Plymouth store

The Women in Furniture Network (WIFN) is launching an online mentorship platform, giving members the opportunity to connect with and learn from experienced industry professionals

A National Bed Federation (NBF) survey has revealed that, after a tough 2023, bed manufacturers and suppliers remain downbeat about their expectations for this year

Fabb Furniture opened its first Nottingham store last month, on Castle Marina Retail Park. The retailer’s 22nd store reflects a new partnership, and is split 50/50 with Bensons for Beds

Emma - The Sleep Company ended 2023 with revenues of €961.9m. Despite facing operational challenges while implementing new systems, the company grew revenues by +13% YoY and recorded its sixth consecutive year of profitability

Bed Kingdom MD Ashley Hainsworth was featured in Insider Yorkshire’s 42 Under 42 list of leading business figures for 2024

Oak Furnitureland opened its first new showroom since 2021 last month, on Grimsby’s Alexandra Retail Park

Longpre Furniture, which makes bespoke furniture in Somerset, has been sold out of administration, safeguarding 50 jobs

8 NEWS

READ MORE ONLINE AT FURNITURENEWS.NET

Choose your champions!

Our industry is home to a wealth of top-notch suppliers, which strive day in, day out, to deliver the best products and services their customers’ money can buy. At Furniture News, we tip our hat to their efforts – but when it comes to deciding which businesses are really at the top of their game, it’s your call …

Our Readers’ Choice Awards are back for 2024, and we’re again asking you to nominate your champions from the world of furniture supply, and give credit where it’s due!

We created the Readers’ Choice Awards to celebrate the suppliers leading the pack, and to let you have your say. Now in their fourth year, the awards have become an important seal of approval from the Furniture News readership, proudly displayed by the winners, far and wide.

Other than the addition of a few extra categories (best staff welfare, trade showroom, and training and marketing support), this year’s voting process is no different than the last. Simply go to our online form, and select or nominate your chosen supplier in each category. Encourage the rest of your team, and your customers, to do the same (only one submission per person please, and yes, we do check!) – then keep an eye out for August’s issue, in which we’ll unveil the winners.

How to vote

You can quickly and easily cast your votes by visiting www.bit.ly/fn-readers-choice-awards-2024 and making your selections through our online form. Voting closes at midnight on Friday 7th June.

www.bit.ly/fn-readers-choice-awards-2024

Last year’s winners

Best Bed Supplier: Sleepeezee

Best Bed Component Supplier: Leggett & Platt Springs UK

Best Bedroom Cabinet Supplier: Devonshire

Best Boxed Mattress Brand: Simba Sleep

Best Boxed Sofa Brand: Swyft Home

Best Buying Group:

Associated Independent Stores (AIS)

Best CGI Visualisation Provider: Chilli Pepper Designs

Best Children’s/Nursery Furniture Supplier: Julian Bowen

Best Decorative Accessories Supplier: Bluebone

Best Dining Furniture Supplier: Coach House

Best Display Support Provider:

Reborn Marketing and Design

Best European Exhibition: imm cologne

Best Fabric Supplier: Warwick Fabrics

Best Fabric Upholstery Supplier: Whitemeadow Furniture

Best Flatpack Furniture Supplier: Core Products

Best for Innovation: Orbital Vision

Best for Sustainable Thinking: Hypnos Beds

Best Fulfilment Provider: Rhenus Home Delivery (UK)

Best Furniture Care/Repair Provider: Emmiera Group

Best Furniture Component Supplier: Decorative Panels

Best Garden/Outdoor Furniture Supplier: Gallery Direct

Best Home Office Furniture Supplier: Jual Furnishings

Best Importer: Wiemann

Best International Exhibition:

Malaysian International Furniture Fair (MIFF)

Best Leather/Leather-Look Upholstery Supplier: La-Z-Boy UK

Best Lighting Supplier: där lighting group

Best Living Room Cabinet Supplier: Ercol

Best Machinery Manufacturer: MattressTek

Best Mattress Supplier: Sealy UK

Best Newcomer: Mattsons Beds (UK)

Best Occasional Chair/Recliner Supplier: Hydeline Furniture

Best Product Protection Supplier: Staingard

Best Rug Supplier: Think Rugs

Best Sales/Marketing Services Provider: Furniture Sales Solutions

Best Sofabed Supplier: Kyoto

Best Soft Furnishings Supplier: Scatter Box

Best Software/Technology Provider: Iconography

Best Testing Services/Certification Provider: FIRA International

Best Trade Association:

National Bed Federation (NBF)

Best UK Bed Manufacturer: Silentnight Group

Best UK Exhibition: January Furniture Show (JFS)

Best UK Upholstery Manufacturer: Tetrad

Best Upholstered Bed Supplier: Furmanac Group

Best Vehicle Manufacturer: Maxi Mover

10 READERS’ CHOICE AWARDS

Sealy UK’s (Best Mattress Supplier 2023) CCO Mark Tuley FIRA International’s team (Best Testing Services/Certification Provider 2023) Hypnos’ (Best for Sustainable Thinking 2023) group sustainable development director, Richard Naylor

Best (complete) Bed Supplier:

Best Bed Component Supplier:

Best Bedroom Cabinet Supplier:

Best Boxed Mattress Brand:

Best Boxed Sofa Brand:

Best Buying Group:

Best CGI Visualisation Provider:

Best Children’s/Nursery Furniture Supplier:

Best Decorative Accessories Supplier:

Best Dining Furniture Supplier:

Best Display Support Provider:

Best European Exhibition (outside the UK):

Best Fabric Supplier:

Best Fabric Upholstery Supplier:

Best Flatpack Furniture Supplier:

Best for Innovation:

Best for Staff Welfare:

Best for Sustainable Thinking:

Best Fulfilment Provider:

Best Furniture Care/Repair Provider:

Best Furniture Component Supplier:

Best Garden/Outdoor Furniture Supplier:

Best Home Office Furniture Supplier:

Best Importer:

Cast your votes at www.bit.ly/fn-readers-choice-awards-2024

Best International Exhibition (outside Europe):

Best Leather/Leather-Look Upholstery Supplier:

Best Lighting Supplier:

Best Living Room Cabinet Supplier:

Best Machinery Manufacturer:

Best Marketing Support:

Best Mattress Supplier:

Best Newcomer:

Best Occasional Chair/Recliner Supplier:

Best Product Protection Supplier:

Best Rug Supplier:

Best Sales/Marketing Services Provider:

Best Sofabed Supplier:

Best Soft Furnishings Supplier:

Best Software/Technology Provider:

Best Testing Services/Certification Provider:

Best Trade Association:

Best Trade Showroom:

Best (supplier) Training Support:

Best UK Bed Manufacturer:

Best UK Exhibition:

Best UK Upholstery Manufacturer:

Best Upholstered Bed Supplier:

Best Vehicle Manufacturer:

12 READERS CHOICE AWARDS

Market Leading Mattress Protector Brand, Featuring Cutting-Edge Materials Including Copper, Graphene, Charcoal and Bamboo!

• Professional Sales Training & Motivational Programme

• Best in Class Product Innovation and Cooling Technology

• Genuine 15 Year Guarantee Programme

• State of the Art Dynamic Display Bays

• Award Winning Customer Service & Claims Resolution

Contact Protect-A-Bed ® to start increasing your profit: sales@protectabed.co.uk | 02087 310020

Fishpools marks 125 years of business

Fishpools of Waltham Cross is one of the South East’s biggest retailers of quality furniture, and a destination popular with shoppers from Hertfordshire, Essex and London. Last month, the business celebrated its 125th birthday, with an in-store event and staff party – Furniture News asked MD Simon Fishpool to tell us more …

Fishpools is 125 years old – congratulations! How did you celebrate reaching this milestone, and how do you feel about it personally?

We marked this significant milestone by firstly saying thank you to our customers, employees and suppliers. We kicked off the celebrations with a big in-store event on 23rd and 24th March, with prize draws across the two days and gifting opportunities for previous customers. Following this, to celebrate our employees and suppliers, we hosted a big company party.

What do you think (founder) Ernest Fishpool would say if he could see the business today?

I would like to think that Ernest would like where we have ended up, but I’m pretty sure that he would urge us to keep evolving and growing all parts of the business, too.

Is there anything about retail as it was back in his time that you’d like to recapture?

“We’ve continued to be financially rock solid. This is the benefit of generations of sensible, commercial investment back into the business

I prefer to think about ‘reaffirming’ retail rather than recapturing, as we haven’t lost the best elements of the industry. We are reaffirming our great service and value, our huge product choice and selection, and ensuring we live up to our strapline, ‘furniture experts’.

What technological projects are you currently working on, and what’s in the pipeline for your online offer?

We are constantly working on how best to blend online and offline retailing, plus reviewing the IT and systems infrastructure required to support our proposition, in a way that makes the customer experience first rate.

Given that, how might the store look in 10 years’ time?

The industry has evolved so much – just think how much the customer journey has changed in the past 10 years! Everything will continue to evolve and the rate of change will probably increase, so it’s important that we continue developing and progressing the business with the times.

Can you summarise the business’ recent financial performance?

As trading has now normalised since the pandemic, we’ve continued to be financially rock solid. This is the benefit of generations of sensible, commercial investment back into the business, and no rent or borrowings to get in the way of long-term planning.

Some retailers see opportunities to grow their store portfolios in the current climate – are you tempted to expand?

Never say never, but the economics of land and property transactions in the South East are such that reinvesting in our store, DC, systems and brand is providing us with a better return at present.

Fishpools is one of the nation’s best-looking furniture stores. What does it take to keep it that way?

Reinvesting in store presentation and refreshing our product ranges is our 365-day-a-year, front-of-mind obsession.

14 INSIGHT

(Founder)

Fishpools, Waltham Cross

Ernest and Kate Fishpool outside the store in 1899 Simon Fishpool

You offer an interior design service for customers, but how else do you capitalise on the onestop shop nature of your offer, and encourage shoppers to buy everything they need from you? Presentation of complementary ranges is one of the best ways to impart inspiration to customers. They don’t have to guess as to what looks and feels like it works together – our store and our experienced sales teams make that super simple for them the moment they walk through the door.

What’s the balance of branded/unbranded product you offer? What do brands need to bring to the table in order to earn a place on your shop floor?

Brands that are always of interest to us have something different about their offer, produce great designs, a well thought-through value proposition and are easy to work with.

Has the business’ approach to product sourcing changed much since the pandemic?

The pandemic’s impact on sourcing and supply chains was, and in some ways remains, significant. That said, we ensure we understand what suppliers are up to globally, and the supply chain implications for each one we work with (or think about working with).

What was your reaction to the Spring Budget? Are there any important implications for Fishpools?

I don’t think that there was much scope for a radical budget. We had one of those a while back and it didn’t end well.

If you had to hazard a guess, what do you think the rest of 2024 might look like for you, and for independent furniture retail in general?

Election years can typically be a challenge for bigticket items, and against the current backdrop of a sluggish housing market, cost of living constraints, the war in Ukraine and who knows what else, I don’t see our sector setting any records this year. To be honest, we don’t overly worry about one year’s performance –we are making decisions as much for the long term.

Has your attitude to retail changed over the past decade?

It’s all change, no change. Online and broader technology have massively affected the supply-side and demand-side of retail. Our customers, however, still want inspiration, choice, value and service, which we give them every day.

“We don’t overly worry about one year’s performance –we are making decisions as much for the long term

www.fishpools.co.uk 15

GETTING PERSONAL Neil Barker

Neil runs two Barkers Furniture stores, in Hillsborough, Sheffield – one dedicated to bedroom and flooring products, the other selling upholstery, dining and occasional furniture. He also manages a furniture-focused website development business, Abacus Solutions.

How might a child describe what you do? Boring!

What’s the biggest long-term challenge you face? Keeping ahead of change.

If you had 10 x your working budget, what would you spend it on?

It depends what you define as ‘budget’ – our entire expenditure x 10? One huge building with both showrooms, offices and warehouse in, with a big, juicy car park, on a main road, if that’s the case.

What would be the title of your autobiography?

‘Doing What You Believe In’.

What does ‘work/life balance’ mean to you?

I’m not a good person to ask that question to. I need to spend more time with the family.

Who’s been your most influential professional mentor?

Not sure … I’ve learnt a lot from a lot of people – staff, family, agents, reps, our retailers, etc.

What should everyone in our industry either stop or start doing?

Make sure all sales staff input orders electronically –make the most of technology to cut costs.

What advice would you give your younger self? Don’t worry about what you cannot control. It’s worked out fine.

What’s been your best day in business to date?

That’s a hard one. I love the furniture shows, as furniture retailers and suppliers are generally great people.

What’s the biggest myth about our industry?

Consumers think they can get something for nothing.

Where do you see the industry going in the next 5-10 years?

The retailers that embrace technology keep getting stronger, and the groups then lose their competitive advantage.

What question do you wish we’d asked? How would you have answered?

Q. How does your family furniture business make online work for them?

A. Shop margin, debrand, drive sales into the shop and put a 30-mile radius on the shopping basket to expand the catchment area (but only as far as they can deliver themselves).

www.barkersfurniture.com

www.abacus-solutions.co.uk

“Our

entire expenditure x 10? One huge building with both showrooms, offices and warehouse in, with a big, juicy car park, on a main road

16 INSIGHT

2.0

The next generation of Comfort has landed

The new Mammoth Comfort collection combines market-leading health technologies with the most advanced materials to deliver a more comfortable and restorative night’s sleep.

Experienced a 7% increase in sleep efficiency Reported a 21% more enjoyable sleep Scientifically shown to improve sleep* where participants:

Manufactured by *See mammothcomfort.com for details. 69% Faster Cooling 47% Greater Pressure Relief Fell asleep 29% quicker

Ready to add a healthy choice to your shop floor, contact us today at sales@mammothuk.com

Independent testing* resulted

in Mammoth

Mammoth’s comfort-driven comeback

Having negotiated myriad challenges, healthy sleep brand Mammoth has emerged fitter than ever, explains its founder and CEO,

John Tuton …

“People know that sleeping better is crucial to a longer, happier life, and that’s something we’re committed to being a part of

What’s been keeping you busy over the last few weeks?

I’ve been out on the road with the Mammoth team supporting the roll-out of our all-new Comfort collection into our independent retailers. In particular, we’ve been running training and launch events with our Centres for Excellence around the country.

We know how important it is for retailers to be enhancing their in-store experience and delivering a service that keeps customers coming through their doors. That’s why we are putting time and resource into ensuring that sales staff are equipped with the knowledge and tools needed to educate customers about the benefits of quality sleep and the unique technologies in our products.

The Mammoth brand has gone through a good deal of upheaval in recent years. Can you summarise what happened, and where it stands today?

Today, I’m pleased to say that we are in great shape. It’s taken a lot of hard work from the Mammoth team, our licensed manufacturer Airsprung, and our trusted stockists to get us here, but we’re definitely seeing a positive response in the market to our product ranges in 2024. It is a real testament to the strong reputation we have built and the equity in the Mammoth brand.

It’s fair to say that it took some time for us to ride out the challenges of Covid-19, and our previous manufacturer going into administration. But I’m excited about the progress we’ve made and will continue to make over the coming years as we execute our growth strategy. Our Medical Grade technologies are more relevant than ever in today’s market, so the future is bright.

What was the most challenging aspect of that journey?

Going through the process of a financial turnaround. Having to be patient and focus so much attention on due diligence can be tough.

It’s not just about the numbers, though. The process requires careful management of people and the ability to apply diplomacy, grace and clear communication in a variety of situations.

Do you think the business is better equipped to meet demand because of it?

One hundred percent. Taking closer control of our business model, streamlining operations, working with the right partners and identifying the right opportunities for the future has meant that our capacity for scalability is now many times greater than it was previously. I’m extremely confident of that. Hitting the reset button is painful in the short term, but I know it has made us stronger in the grand scheme of things.

What sort of responses are you seeing from retailers to the ’new’ Mammoth?

The response has been brilliant. Retailers have shared that they love the new products we’ve recently brought to market and where we are positioned now. By having the entry-level Active mattress alongside the Comfort collection we’re giving retailers greater flexibility and playing to the strengths of our manufacturing partners, Airsprung.

What does the current product offer comprise?

Mammoth Active represents the entry point for our customers. It’s a perfectly packaged health and fitness proposition that we know appeals to those who want to be able to enjoy the benefits of Mammoth’s Medical Grade foam.

Our revamped Comfort collection is our flagship offering, which includes a number of new features across our Vitality, Altitude and Latex HyBlend products. We’ve had particularly good feedback to our IceClass cool-touch fabric – a thermoregulating textile designed to optimise temperature and keep the skin comfortable through the night. And the addition

18 INSIGHT

Mammoth Active mattress

John Tuton

of a Medical Grade latex mattresses represents a real point of difference for those who love the distinctive feel of the natural, breathable material.

What would you describe as your key differentiator in 2024?

It has to be our position as a genuine health and wellbeing brand, bringing Medical Grade technologies to the furniture market. Our heritage in healthcare, unique partnership with the Chartered Society of Physiotherapy and scientific testing combine to reassure both retailers and customers that we are doing more to deliver comfort, aid recovery and, ultimately, offer a healthy choice. Our higher purpose is all about helping people to live longer, happier lives.

Do you think consumer demand for sleep products has evolved in recent years?

Absolutely. We’ve seen a very clear growth in the public’s awareness of physical and mental health issues, and sleep is undoubtedly one of those key areas of focus. There’s plenty of research out there from the likes of McKinsey to back that up. The pandemic only accelerated that focus on health and wellbeing – at home, in the workplace and in elite sport.

Fundamentally, people know that sleeping better is crucial to a longer, happier life, and that’s something we’re committed to being a part of at Mammoth.

In January, you reported that you’d secured a six-figure investment from the North East Growth Capital Fund. What does it mean for the business, and how seriously are you looking at international growth?

The new investment is important in helping us accelerate our growth strategy in both the UK and internationally. As relative newcomers to the international market, it’s been incredible to see the positive response from people who are being introduced to Mammoth for the first time. People love the Mammoth story, our credentials in healthcare, our tech and our authenticity.

Is there anything else in the pipeline? Always.

Where/when can interested parties find out more?

As always, retailers can get in touch with our regional sales agents or via sales@themammothcompany. com. People can also follow our activity across Mammoth’s social media channels, and I’m providing regular business updates on LinkedIn, so I’d encourage people to connect with me there.

www.mammothcomfort.com

“We know how important it is for retailers to be enhancing their in-store experience

19

Mammoth’s Comfort Vitality Hybrid mattress Mammoth’s Centre For Excellence launch at Warrington’s Sleep Haven Former England and Warrington Rugby League star Paul Wood and John Tuton at the Sleep Haven Centre For Excellence launch

Hypnos looks ahead

In October 2022, driven by a desire to secure its long-term future, Hypnos embarked on a period of transformation which culminated this February with the decision to close its contract manufacturing facility in Castle Donington, and incorporate the workload at its Princes Risborough HQ. Furniture News paid the bedmaker a visit to find out more …

Despite making strong gains, it has been a turbulent time for the famed bedmaker, which marks its 120th anniversary this year. However, says group MD David Baldry, following the loss of its Premier Inn contract, and the winding down of its Keen & Able transport arm, the move to re-integrate contract production with the resulting site closure (and the 64 jobs lost with it) finally concludes a painful but necessary reinvention.

“The site closure was a difficult decision, of course,” he says, “but it’s one we needed to make if we wanted to grow sustainably for the next 120 years.”

In a statement, he wrote: “We’ve been working with the executive board and senior leadership team to build a secure foundation for future growth focused on quality bedmaking, and this unfortunate but necessary step marks the last phase of our two-year strategic focus to strengthen and build a foundation to achieve our ambitious goals for the coming decade.

the company’s knowledge, skills and industry under one roof, and closer to the hospitality sector’s London heartland.

“The opportunity to amalgamate all key business functions over one site needed to be fully considered,” David wrote, “but there are so many benefits to having all our manufacturing in one place. The move will improve overall efficiency and communication within the business, lower our CO2 footprint, and positively impact our approach to our premium position in the hospitality market.”

It will also enable Hypnos to make the most of a new ERP system coming online this summer – a change David has been looking to implement since he joined the business in 2022.

“For a business to be sustainable first, it has to be a sustainable business

“Production and administrative teams at the site are sadly affected by this news, and we’re working to give them support for their future. We’d like to thank our committed teams at both sites for their professional approach during the consultation period, and for ensuring a smooth transition.”

Despite the upheaval, the decision not to renew the site’s lease, and to instead absorb the hospitality operation and focus on “one home” for Hypnos at its fully owned facility in Princes Risborough, promises to deliver significant benefits.

Closing the 110-mile distance between the sites will naturally deliver greater efficiency, bringing all of

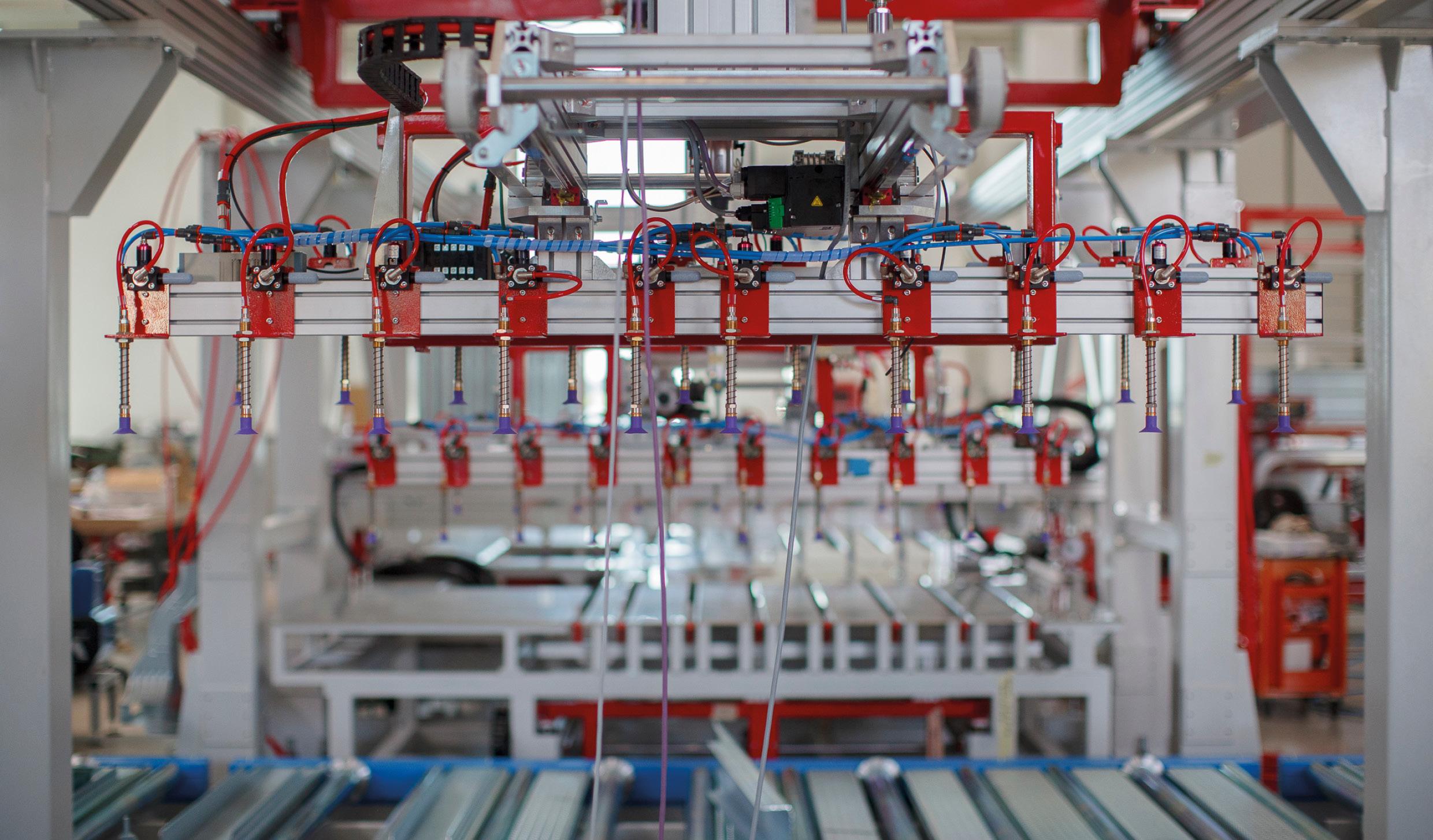

Yet the move would not have been possible without the significant improvements delivered by the team at Hypnos’ HQ. Contract manufacturing accounts for some 20% of the group’s business, and incorporating the additional volume would be no mean feat. Good news, then, that Hypnos’ production team had already stepped up to the challenge.

“Over the last year, the team, under the leadership of group operations director Stephen Faulkner, has successfully maintained and developed quality handcrafting whilst increasing manufacturing efficiency at the Princes Risborough site by almost +30%,” David stated. “In our dedicated batch production area alone, the bedmaking capacity has almost tripled, which means this can accommodate the needs of our hospitality partners without any

20 INSIGHT

David Baldry and Ashley Garside on the (newly optimised) factory floor

impact on the bespoke retail products.”

This work has been assisted by Ashley Garside, now head of operations, who oversaw the gradual rearrangement of the factory floor, adding new production lines, relocating operations, bolstering the staff training programme and pushing efficiency ever further.

“It’s all down to a combination of distance, machinery, multi-skilling and supervision,” says Ashley, “all taken forward as part of a smart, measured plan. It’s a process of testing and gradual improvement. Try it, learn it, improve it.”

In 2021, Hypnos was making 1200 units a week, says David – now its output is up to 2000, without having to resort to overtime or extra shifts. Average lead times are just north of two weeks – a sprint compared to what was executed during the pandemic.

Those huge output gains are the result of countless granular improvements – a new approach here, a rearrangement there – carefully tracked and monitored by Ashley’s team, and coming together as a “force multiplier” that means the factory is not only able to take on the extra work coming out of Castle Donington, but to promise even greater efficiency.

With the move meaning a loss of production staff, performance training in Princes Risborough has been crucial, and has included a concerted focus on multiskilling the teams based there. More and more of Hypnos’ mattressmakers are now able to tape-edge

and upholster, and there is a palpable hunger to grow, says Ashley: “We’re lucky that a lot of the younger workforce here are willing to learn more, and that means we can better flex to meet demand.”

A further, but no less important benefit of the move is the energy savings that will be made thanks to having all the operations in one place – a crucial factor for a business that prides itself on being a pioneer in the field of sustainability, and which recently partnered with logistics specialist DFDS to ensure a greener fulfilment operation (David is eagerly awaiting the chance to utilise Volvo’s new electric lorry).

“For a business to be sustainable first, it has to be a sustainable business,” notes David. “From a holistic, carbon-saving perspective, we had to go to a single site.”

The incorporation will take place over the coming months, and Hypnos has assured customers that they will not be affected by the move, with the division’s field-based sales specification team and installation services remaining in place.

“We will formally exit the Castle Donington site in September, after dilapidation works are complete,” David concludes. “It’s been painful, but, following a year of investment, optimisation and process changes across the business, we’re finally ready to start the next chapter in our 120-year story.”

www.hypnosbeds.com

“The site closure was a difficult decision, but it’s one we needed to make if we wanted to grow sustainably

21

YOUR BUSINESS sm a r ter f as te r THE UK’S LEADING BIG TICKET ERP RETAIL SOLUTIONYOUR BUSINESS sm a r ter f as te r ww w.s c i- n et. c o.u k Sci-Net Ltd ERP House, Duns Tew Grange Duns Tew Road, Chippin Oxon OX7 ERP Retail is the complete end-to-end solution for aspiring Big Ticket, Furniture & Flooring Retailers Built within the world’s most popular mid-market ERP system, Microsoft Dynamics 365 Business Central THE UK’S LEADING BIG TICKET ERP>RETAIL SOLUTION DESIGNED AND BUILT FROM THE GROUND UP WITH AND FOR FURNITURE & FLOORING RETAILERS YOUR BUSINESS sm a r ter f as te r CONNECTING THE DOTS FOR ALL YOUR BUSINESS OPERATIONS FIND US ON STAND 6B78 AT THE RETAIL TECHNOLOGY SHOW! ERP>Retail is the complete end-to-end solution for aspiring Big Ticket, Furniture & Flooring Retailers. Built within the world’s most popular mid-market ERP system, Microsoft Dynamics 365 Business Central. A solution to run your entire furniture & flooring retail business. Complete sales, supply, stock management, traceability and profitability reporting / Real-time analysis & management reporting. THE LAST ERP SYSTEM YOU WILL EVER HAVE TO INVEST IN! YOUR BUSINESS sm a r ter f as te r ERP Retail is the complete end-to-end solution for aspiring Big Ticket, Furniture & Flooring Retailers Built within the world’s most popular m d-market ERP system, Microsoft Dynamics 365 Business Central THE UK’S LEADING BIG TICKET ERP>RETAIL SOLUTION SCI-NET LTD, ERP HOUSE, DUNS TEW GRANGE, DUNS TEW ROAD, CHIPPING NORTON, OXON OX7 7DQ 01869 349949 www.sci-net.co.uk ARE YOU LOOKING FOR A NEW SOLUTION? Discover ERP>>>Rapid Your Fast Track to Efficiency. Built upon the foundation of ERP>Retail, ERP>>>Rapid is our new templated approach for a swift, seamless, and cost-effective implementation. GET IN TOUCH TO FIND OUT MORE! SciNet_411.indd 1 12/03/2024 20:33

Investment secures bedmaker’s legacy

Celebrating its 120-year heritage and 95 years as a Royal Warrant holder, Hypnos is firmly focused on building the foundations for the future, with key decisions and investment being made in its product, people and infrastructure …

It is an exciting time for the business, says Hypnos, as it celebrates special landmark anniversaries with launches with new and existing customers, a brandnew website, and the introduction of key mattress collections including Legacy, and the plant-based mattress collection uniquely created in collaboration with the Eden Project.

This year, the business is spending £1.4m on an improved ERP system to support the brand’s growth and development, which will help drive operational improvements across the business and improve the service experience for customers.

Hypnos has also appointed a new transport and logistics partner, DFDS, so customers can continue to benefit from a dedicated fleet with the additions of trackable, sustainable, state-of-the-art delivery systems. The partnership also includes a new, latestgeneration Volvo EV, and on-site charging points.

Group MD David Baldry explains: “The last two years have been a period of positive change for Hypnos, refocusing the business while developing our capabilities, to create a strong next chapter.

“This has resulted in a stronger team responsible for driving key improvements across the business, investments in the skills and wellbeing of our people, and resulting in significant increases in manufacturing capacity and efficiency thanks to the team at our wholly owned Buckinghamshire-based facilities. Retailers will have seen us fulfilling our promises when it comes to developing the services and products they need, made with the high-quality handcraftsmanship you’d expect from Hypnos, and supported by reduced lead times.

“Our website is delivering for our retailers with an enhanced consumer journey, increased visits and, crucially, exits targeted to our showroom partners. We are also committed to sharing more marketing assets with our partners and developing their online and in-store experience.

“The last two years have been a period of positive change for Hypnos

“Last year we made the decision to progress with a significant investment, moving to a latest-generation, cloud-based system with our ERP partners, Covalent and IFS, upgrading our IT systems and integrating systems across all our activities, from enquiry to delivery. By integrating every part of the business, it allows us to work better together, facilitates improved processes and ultimately drives more transparent relationships with our partner customers and suppliers.

“The DFDS logistics partnership has been selected as it will enhance our service to retail customers, integrating into our digital journey, and importantly aid us in the next steps of our sustainability journey – together, we can track and actively reduce the carbon footprint of our delivery fleet through strategic planning and a switch to more sustainable fuel types, including renewable bio diesel (HVO) and electric vehicles.

“We are passionate about building on our reputation for comfortable beds that enhance the wellbeing of people and the planet. Our partnerships are key to success and future successes, and we are committed to working with those who share our values.”

www.hypnosbeds.com/uk

Hypnos’ team visiting ERP partner IFS

22 INSIGHT

DFDS is Hypnos’ new transport and logistics partner

Harnessing the power of plants

Handcrafted mattresses made with pioneering plant fibres from the habitats that help support the wellbeing of people and the planet.

Discover more at the INDX Beds and Bedroom Show 23/24 April, and the Summer Furniture Show 21/22 May. Celebrating 120 years of british bedmaking

Carbon Neutral | Inspired by Nature | 100% Recyclable | hypnosbeds.com

60 SECONDS WITH … Jarrad Belton

To mark its 60th anniversary, The Furniture Makers’ Company looked to the future by highlighting 60 of the industry’s most promising young professionals (aged under 35) through its ‘60 for 60’ campaign. To discover how they view the trade, Furniture News is inviting these rising stars to share their stories – this month, our quickfire questions go to furnituremaker and tutor, Jarrad Belton.

In one sentence, describe what you do … I create unique, statement-piece furniture using sustainable timber from well-managed forests. I also teach students in the way of the blade at the Farnham School of Furniture Making.

What makes you well suited to the role?

I am incredibly passionate about what I do for a living, and being able to impart that with others is one of the great rewards of my role.

How did you come to work in the industry?

It would seem fate. I was originally considering training as a motorcycle mechanic when I left school, but when I viewed the college, the mechanic workshop felt cold and dark. I happened to walk past the carpentry workshop which was bright, warm and full of the sound of handsaws cutting and the smell of fresh plane shavings. It was much more attractive to me – I was completely enraptured.

It was from that day on I trained as a carpenter, working part time whilst studying. I enjoyed the first two years so much I stayed on for a third year of joinery, which wasn’t compulsory.

After then, working on site as a carpenter for a number of years, I discovered that I wanted more refinement to my work. I saved up enough money working part time at a local sawmill where I gained fundamental knowledge of timber, and then proceeded to pay to restudy furnituremaking (I was probably around 20 at this time). I had built up a small portfolio of work before retraining, so when I went for the interview at the college I was put in for the third year rather than starting from the beginning. I was thrown in at the deep end, but, as a wise person once told me, “a calm sea never made a good sailor.”

I thoroughly enjoyed my time in college, and after completing the course I went back to the sawmill part time for two days a week and then made furniture for the rest of the week, taking on as much commission work as I could and exhibiting at as many events as I could afford.

After building a name for myself, I left the sawmill and became self employed, making furniture for private clients and galleries. I then started work part time at weekends with a furnituremaker, Aidan McEvoy, in the craft town of Farnham. This led to me to now being an employed member of the company,

and Aidan’s apprentice at the Farnham School of Furniture Making. I absolutely love what I do for a living and feel so lucky to have found it so early in life. It is what I am most passionate about.

How has your career progressed since?

I have definitely improved my ability as a furnituremaker since I first started my journey, but I feel there is still much to learn. I am proud of what I have achieved with certain awards and shortlisted pieces, but there are still many pieces I need to challenge myself with.

Where do you want to be in five years’ time?

Making furniture to a higher level.

What’s been the biggest surprise in how the industry operates?

The lack of appreciation for where the trees we use actually come from. As a finite resource, it is crucial that we manage and use our woodlands accordingly. Organisations like Grown in Britain are doing a wonderful job of leading this topic, but more needs to be done. We as furnituremakers need to have an understanding of what trees we are using, and if it is truly a sustainable practise.

What does being named one of the ‘60 for 60’ mean to you?

I’m stoked! I feel very grateful to have my dedication to the craft recognised. I think it’s super important to celebrate the up-and-coming craftspeople of furnituremaking, and being able to network with likeminded individuals at the ‘60 for 60’ event was incredibly beneficial.

What would you say to encourage others to join the industry?

If you’re interested in the craft, then jump at it with everything you can. Don’t become a furnituremaker to seek wealth or fame, do it for the love of the craft. If you can pursue passion over money, you will be at home in the industry of furnituremaking – it’s important to have enthused people pioneering the next generation.

Find out more about the ‘60 for 60’ stars at www.furnituremakers.org.uk/60for60

“Don’t become a furnituremaker to seek wealth or fame – do it for the love of the craft

24 INSIGHT

May-k your mark!

May’s issue of Furniture News is bursting with show previews and special features, and the perfect opportunity for any furniture business taking their latest products/services to market this spring/ summer.

* Innovation in Bedding – the latest in leadingedge sleep technology

* Long Point and Spring Furniture & Bed Show previews

* The latest in Living, Dining, Bedroom and Trade Services

So May-k your way to Furniture News this spring!

“OH, HOW THEY LAUGHED WHEN WE BOOKED OUR GREENWOOD SALE, BUT, WHEN WE OPENED THE DOORS…”

“I’M SHELL-SHOCKED! I never in a million years thought we would do so much business!” [Almost 50% annual t/o in 3 weeks]

Jade Farthing, M.D., Haskins Furniture, Shepton Mallet.

“We took 42% of a year’s turnover in three weeks! It was absolutely mad! But I’m very glad we did it and we’d certainly do it again!”

Brendan Loughrey, M.D. HOMEMAKERS, Coleraine, N. Ireland.

“Our recent [5th] sale surpassed the first one! We are really happy. Highly recommended.”

Adam Tomlin, M.D. Jones and Tomlin. Horsham, Chichester and Worthing.

“DON’T HIRE A MARKETING COMPANY UNTIL YOU’VE SEEN GREENWOOD…”

Find Out More About Greenwood Sales…

Learn all about the new super-effective Greenwood Digital Sales Campaign. Ring me on 07771 700247 to discuss the exciting possibilities for your next big sales event without obligation or, send an e mail enquiry with your contact details and I’ll call you…

NOW BOOKING SALES FROM SUMMER 2024 AND INTO 2025. CALL BERNARD EATON 07771 700247

UK & Ireland’s Leading Experts in Retail Sales Promotion since 2002

sales@greenwoodretail.com www.greenwoodretail.com

25 GREENWOOD RETAIL LTD

GreenwoodRetail_APR2024.indd 1 26/03/2024 23:01

Book by Monday 15th April Want to be part of the furniture trade's favourite read? Contact Sam Horscroft on 07764 650655 or email sam@gearingmediagroup.com or Caroline Littler on 07861 231461 or email caroline@gearingmediagroup.com SHOWTIME BEDROOM TRADE SERVICES TAKE YOUR SEAT King’s CEO on design from down under Fresh formats from inspirational indies SPOILT FOR CHOICE COMPROMISE INDX BEDS BEDROOM DINING Get ahead with predictive SEO Back in Action’s perfect posture INDX FURNITURE SPRING FAIR BEDROOM DELIVERY FULFILMENT TRADE SERVICES How to get on trend in 2023 400th FN Nxt Month Advert vertical.indd 1 26/03/2024 23:16

VIFA EXPO’s international appeal

The 15th Vietnam International Furniture & Home Accessories Fair (VIFA EXPO 2024), took place from 26-29th February at Sky Expo Vietnam Center, Ho Chi Minh City, and featured 603 exhibitors, including 320 from Vietnam and 283 from 17 other countries …

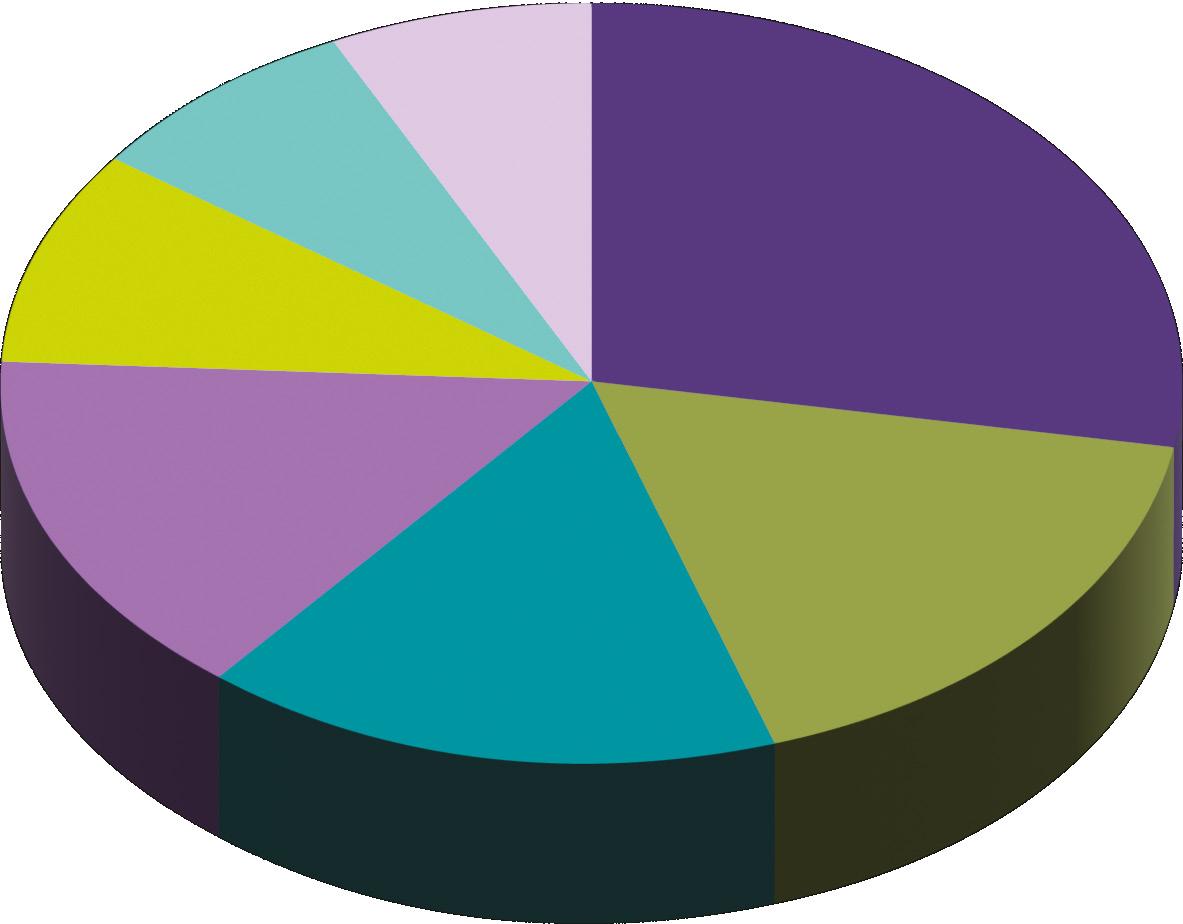

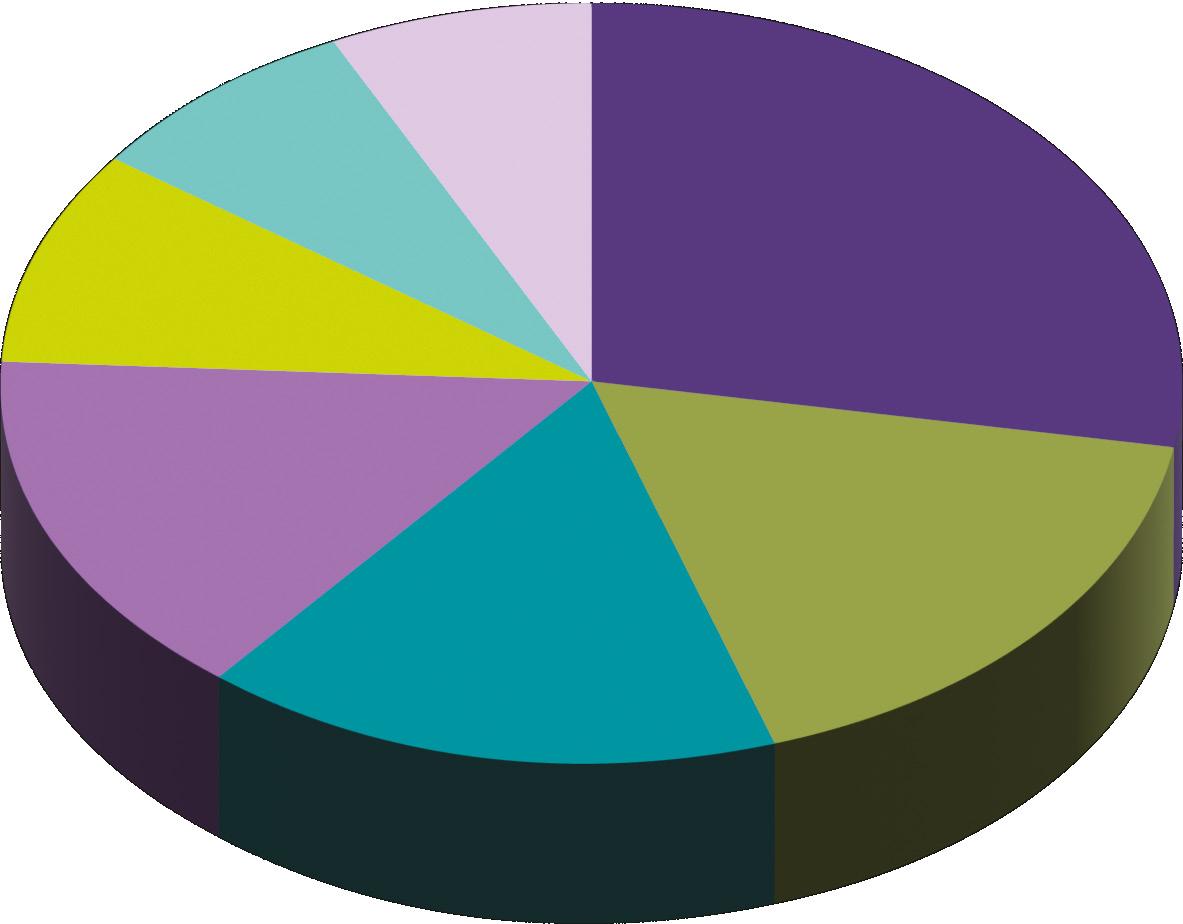

With nearly 2000 booths, the exhibition showcased a variety of products, with 61% focusing on furniture, 19% on furnishings, 8% handicrafts and home decor, and 12% comprising hardware, machines, wood materials and service products.

As a leading furniture exhibition brand in Asia – and the oldest in Vietnam – VIFA EXPO has always been a must-visit destination for international buyers seeking reputable and export-standard furniture sources in Asia.

This year’s edition attracted 13,149 visitors during the four trade days, including 5262 international visitors from 72 countries and territories – primarily from China, India, the US, Australia, Europe, Japan, Malaysia, Taiwan, South Korea and Singapore. This edition saw a significant percentage of international buyers, with 66% from Asia, 14% from Europe, 11% from the Americas, 8% from Oceania, and 1% from Africa.

According to the show’s organiser, more than two thirds (68.2%) of buyers intended to attend business matching events, 26% wanted to place orders, and 7% wanted to place orders to the value of over $1m.

According to the initial results of a survey conducted after the show, the reported value of contracts/memorandums of understanding (MOUs) signed at the fair amounts to some $84m, and 76% of the exhibitors surveyed left with contracts/MOUs.

The show was a pioneering event in the year’s biggest Asian furniture exhibition series, which also included IFEX, MIFF, EFE, 3F and CIFF.

VIFA EXPO’s organiser says it facilitated the “optimal conditions for international furniture buyers” with an exclusive suite of support programmes, covering everything from transportation to accommodation, including: complimentary hotel stays for VIP buyers; free airport support service; free shuttle bus service; and discounts of 20-50% on stays at the show’s official hotel.

“VIFA EXPO consistently welcomes a stable influx of international buyers

Tailored delivery

VIFA EXPO 2024 was co-organised by Lien Minh Company, the Vietnam Chamber of Commerce and Industry - Ho Chi Minh City branch (VCCI - HCMC), and the Vietnam Association for Building Materials (VABM), with active support from Vietnam Coconut Association (VCA), Ho Chi Minh City Advertising Association (HAA), and Vietnam Investment Construction - Services in Agriculture and Forestry Association (VICSAFA).

The key activities at and alongside the fair included factory visits, enabling buyers to visit eight typical furniture manufacturing factories in Binh Duong and Dong Nai provinces – Discovery Global Partners, Everfriendship, Godrej, Bradsense, Thanh Duong, Tay Ho Timber, Hiep Long and Full Support – so buyers could observe each stage of the export-standard furniture production process.

Specialised seminars included: the Global Furniture Outlook 2023 and Trends Forecast 2024, with speakers from CSIL Milano - World Furniture Online (Italy), Canadian Interiors, and Alibaba - OSB HCM (Vietnam); the application of new materials in interior and exterior production, with speakers from HCMC University of Technology, the Vietnam Association for Building Materials (VABM), and the Vietnam Handicraft Exporter Association (Vietcraft).

Meanwhile, the exhibitor and buyer’s night celebration honoured the businesses that have been with VIFA EXPO throughout its 16-year journey of promoting trade and connecting global furniture demand and supply. The gala also served as an opportunity for networking and expanding business connections between participating exhibitors and international buyers.

For this edition of the show, to enhance the connections between exhibitors and international buyers, the organiser further improved the exhibition’s online platform in the following ways: visitors could easily search and connect with the exhibitors; the exhibition and best booths were scanned and deployed on the platform, allowing busy buyers to easily “visit the online booth” after the exhibition; and an Online Business Matching Week (scheduled for

26 EVENTS

April) has been organised, to enable international buyers to continue seeking information, selecting businesses for connections, and negotiating online now the exhibition has concluded.

Cementing VIFA’s identity

VIFA EXPO has undergone 16 years of establishment and development through 15 editions, evolving into an annual event for Vietnam’s wood and furniture industry, with significant influence in the South East Asian region, and gaining international stature.

Despite now being delivered at a completely new venue and on different dates, VIFA EXPO continues to draw numerous enterprises from Vietnam’s various provinces, and countries worldwide, to participate. Additionally, it remains a top choice for international visitors in the annual Asian trade fair circuit.

“Consequently, VIFA EXPO consistently welcomes a stable influx of international buyers who are genuine importers with purchasing needs, further demonstrating the trustworthiness, appeal and influence of the event on international buyers,” states the organiser.

“Especially notable as one of the leading furniture trade promotion events in the region, VIFA EXPO holds the eighth position in the list of the top 100 global furniture events on the reputable www.10times. com website – and VIFA EXPO 2024 has expanded its co-operation and enhanced promotion with reputable furniture exhibitions in the same industry such as CIFF, 3F, Interzum (China), WMF (China), IFEX, Sofurn & Lifeshow (Korea), Hive Furniture Show (UAE), Index Plus (India), IIFF (India) and Momarik Expo (Turkey).

More to come

Upcoming events from the organiser include VIFA ASEAN 2024. Following the success of VIFA ASEAN 2023, the second edition of VIFA ASEAN will be held from 27-30th August 2024 at the Saigon Exhibition and Convention Center (SECC), and aims to expand

its scale, doubling the number of booths and participating enterprises. Specifically, the organiser plans to attract over 400 exhibitors with a total of 1200 booths.

VIFA ASEAN’s vision is to gather South East Asian furniture suppliers in Vietnam, so international buyers just need to visit Ho Chi Minh City to meet all the neighbouring countries – as well as helping shape the city’s role as Asia’s furniture trade hub.

The 16th edition of VIFA EXPO will take place from 5-8th March 2025. With the theme ‘One Show - Two Venues – Double Power’, VIFA EXPO 2025 will expand to cover SECC and Sky Expo Vietnam (also in Ho Chi Minh City). With an estimated scale of over 3000 booths, VIFA EXPO 2025 promises to be “the largest and most prestigious exhibition in Vietnam – and the region”.

www.vifaexpo.com

“VIFA EXPO 2025 promises to be the largest and most prestigious exhibition in Vietnam

27

Winning exports from Malaysia’s EFE

On 4-7th March, the Export Furniture Exhibition (EFE) returned to the Kuala Lumpur Convention Centre (KLCC) for its 17th edition, attracting exhibitors and buyers from all over the world.

EFE 2024 has been described by the show’s organiser as “a resounding success”, with foreign visitors, Malaysian government officials and representatives from embassies across Malaysia making their presence known at KLCC last month.

“Without the existence of a loyal base of supporters and customers over the years, it will be a monumental task for EFE to keep going after tribulations in the form of economic recessions and the Covid-19 pandemic devastated many industries across the globe,” says EFE chairman Chua Chun Chai.

“For that alone, we at EFE would like to express our sincere gratitude and appreciation to all the buyers and exhibitors for sticking with us through thick and thin. Your continuous support will be the very essence for us to keep improving our exhibition for the benefit of the industry and buyers alike.”

This year’s show saw the return of the Malaysian Furniture Creativity (MFC) Awards, a scheme designed to applaud innovation and inspire the future of furniture design – and to motivate manufacturers to embrace Original Design Manufacturing (ODM) as a consequence.

Furniture products across a total of three categories – Dining, Living and Bedroom – were assessed, and the final results were decided through a combination of voting from eligible buyers, as well as evaluation from a panel of judges comprising professional designers and media personnel.

“Let us aim higher than being merely in the top 10

The winner of the Dining category was HomeJS Furniture, with Deep Furniture and Novel Furniture taking second and third place respectively. Meanwhile, Natural Signature, a company renowned for taking bold steps by introducing self-service showrooms across the country, topped the Living category, followed by Dynamic Furniture Industries and THL Sofa. Novel Furniture was the champion in the Bedroom category, with Favorite Design as the runner-up, and Holong Wood Industries in third place.

Chua Chun Chai says that the effort these companies put into the MFC Awards demonstrates the determination of the industry to embrace creativity and sustainability. “Being a furniture manufacturer myself, it makes me extremely proud to see my compatriots trying their very best to offer the best products to consumers, by implementing bold designs without neglecting equally vital factors such as sustainability and comfort into account,” he says.

“It is my sincere hope to see this competition serve as a catalyst for the evolution of the Malaysian furniture industry, helping it become an even more prominent furniture manufacturer in the world. Let us aim higher than being merely in the top 10.”

The 18th EFE will take place from 3rd-6th March 2025, again at KLCC.

www.efe.my

28 EVENTS

The ONLY place to see so many UK and Irish bed manufacturers and component suppliers all under one roof

WHY YOU SHOULD VISIT

• Unprecedented gathering of UK bed manufacturers and suppliers

• Latest innovations, offers and promotions in one place

• Prime networking opportunities

• Supplier Innovation Zone

• Gala Dinner & Awards Ceremony with celebrity host

• Voted ‘Best Furniture Trade Show’ and ‘Best Furniture Exhibition’ 2023

From the biggest brands to smaller niche players

24 – 25 SEPTEMBER 2024 TELFORD www.bedshow.co.uk @thebedfed | #BedShow2024

Polish event grows global presence

Meble Polska – the largest furniture furniture fair in Central and Eastern Europe – cemented its global position at this year’s edition, which took place in Poznań from 20th-23rd February, and was attended by furniture buyers from nearly 70 countries.

“Although data from the pre-registration system suggested great interest among furniture buyers in coming to Poznań, only positive data after the first day of the event confirmed that the number of visitors would be at a high level,” says show director Józef Szyszka.

Ultimately, however, the total number of fair attendees amounted to 14,325 people, an increase of +4% YoY – and the proportion of that attendance from abroad also increased noticeably, accounting for 54%, breaking the records set by previous editions.

“‘It is clear that the importance of the Poznań furniture fair in our region is growing

Visitors from Poland’s biggest export partner, Germany, accounted for 18.2% of the foreign buyers, followed by those from the Czech Republic, Lithuania, Romania, the Netherlands, Great Britain, Ukraine, Slovakia, Hungary and Latvia. There were also representatives from key markets for the development of Polish furniture exports, such as the US, Canada, the UAE and Saudi Arabia.

This year’s event covered an area of almost 60,000m2, with products at every price level. As well as offering the most comprehensive offer of Polish furniture available, suppliers from China, the Czech Republic, Denmark, the Netherlands, Lithuania, Latvia, Moldova, Germany, Romania, Serbia, Slovakia, Turkey and Ukraine presented their latest lines in Poznań.

“‘It is clear that the importance of the Poznań furniture fair in our region is growing,” says Józef. “This is in line with our event development strategy. We would like Meble Polska to become a trade fair hub, presenting the offer of furniture manufacturers from Central and Eastern Europe in the coming years.”

As always, the fair was accompanied by the Home Decor interior design exhibition, showcasing new decor, lighting, textiles, ceramics and more.

In all, 335 companies from 15 countries presented their latest products and services at this year’s show.

Next year’s Meble Polska will take place from 2528th February.

www.meblepolska.pl/en/

30 EVENTS

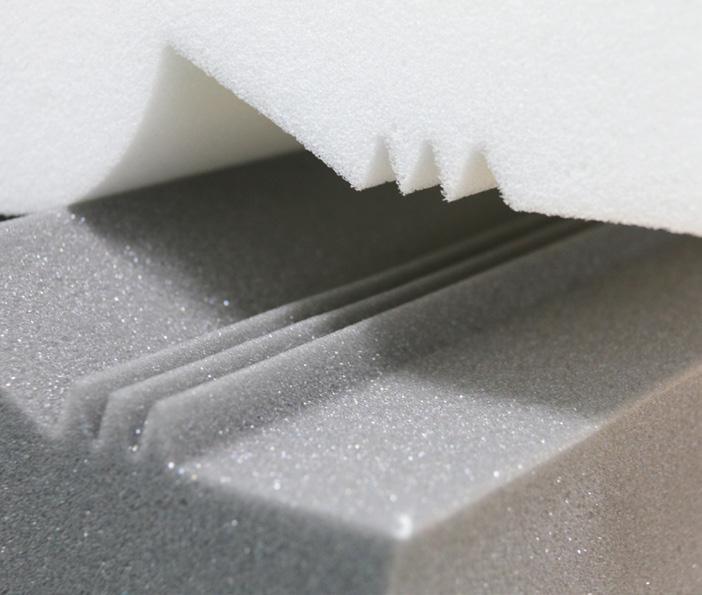

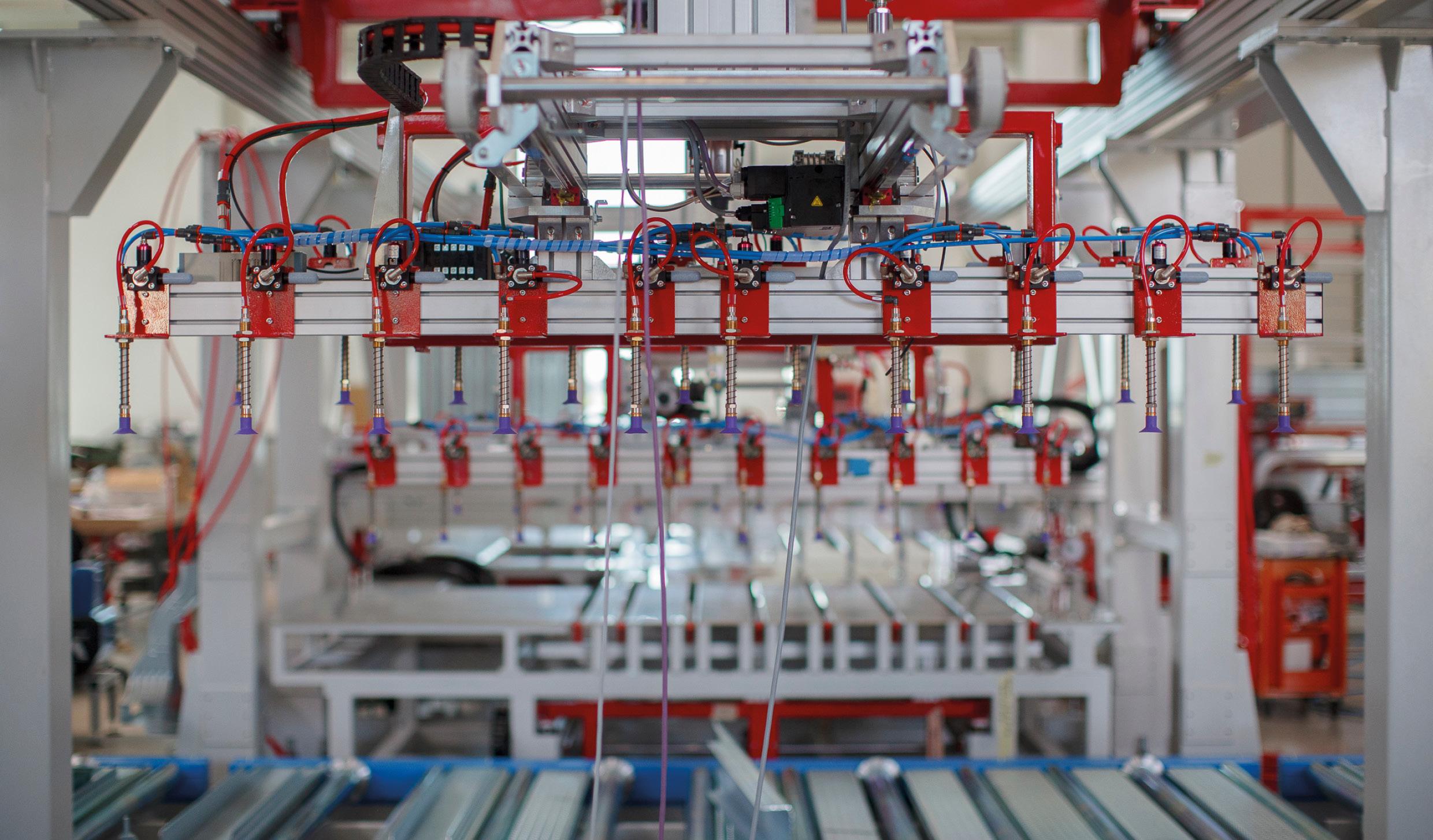

Visit us on Stand 78 at the Furniture Components Expo and discover how our products can enhance your creations. The Carpenter logo/We bring comfort to your life® are registered trademarks of Carpenter Co. For more information about our innovative products contact us on 01457 861141 or Email : sales.uk@carpenter.com www.carpenter.com FURNITURE BEDDING LEISURE SOLUTIONS

Discover newness and innovation at INDX

Providing retailers with a forum to meet with existing suppliers and discover new opportunities, INDX Beds & Bedroom returns to Cranmore Park, Solihull on 23rd24th April.

Curated by buyers from Associated Independent Stores (AIS), the UK’s leading buying, event and services group for fashion, home and leisure, the show’s first day is reserved for AIS members, with general trade visitors welcome to attend on the second.

Bringing together market insight, trends and design inspiration, visitors can look forward to exploring a strong product showcase comprising beds, sofabeds and bedroom furniture.

“Visitors can look forward to exploring a strong product showcase

To date, the exhibitor line-up will feature the latest developments from an impressive brand selection, including Alstons, Bell & Stocchero, Disselkamp, Dreamworld, Dunlopillo, Flooring One, Furmanac (Mi-Bed and Hestia), Gainsborough, Harrison Spinks, Healthbeds, Highgrove, HTL, Hypnos, Kaydian, Kaymed, Limelight, MA Living, Mammoth, Millbrook, Nectar, New Trend Concepts, Nolte, Protect-A-Bed, Pure Care, Rauch, Relyon, Rest Assured, Sealy, Silentnight, Sleepeezee, Sweet Dreams, TCH, Tempur, TFR Group, Trend Setter, Wiemann and X Sensor.

With a commercial focus on delivering newness, HTL, New Trend, Pure Care, and X Sensor are exhibiting for the first time.Meanwhile, other show highlights will include the new Exquisite range from

Sealy Posturepedic, the new Remi sofabed from Limelight, new VIP Lagos and versatile Genf ranges from Wiemann, and a new static bed design from Kaydian.

With a spotlight on wellness and innovation, the showcase will also present the latest latex technology and feature a new round bed design from Healthbeds – and it will play host to some notable industry anniversaries, such as Hypnos, celebrating 120 years in business, and Sleepeeze, celebrating its 100-year milestone.

INDX Beds & Bedroom promises a friendly, business- and buyer-focused environment, and registration can be completed online at www.indxshows.co.uk/indx-home/beds-bedroom/ beds-bedroom. All visitors will enjoy free entry, free on-site parking and complimentary refreshments. Read on to discover a few more of the show’s highlights …

www.indxshows.co.uk/indx-home/bedsbedroom/beds-bedroom

32 EVENTS INDX BEDS & BEDROOM

HTL

Disselkamp

Kirkley TV

ottoman, Kaydian

Remi

sofabed, Limelight

Flora, Silentnight

A century of quality sleep

A Landmark moment for INDX

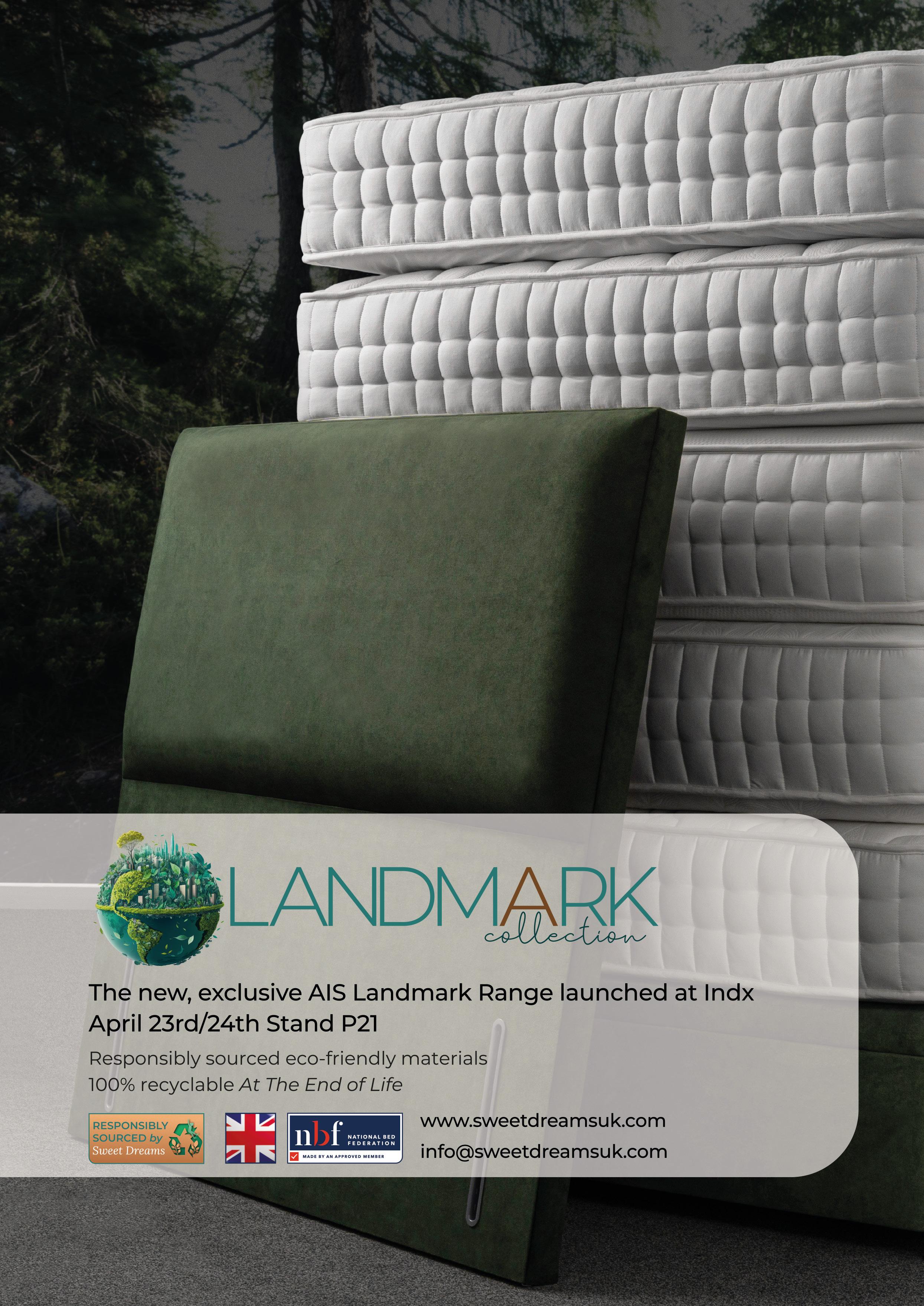

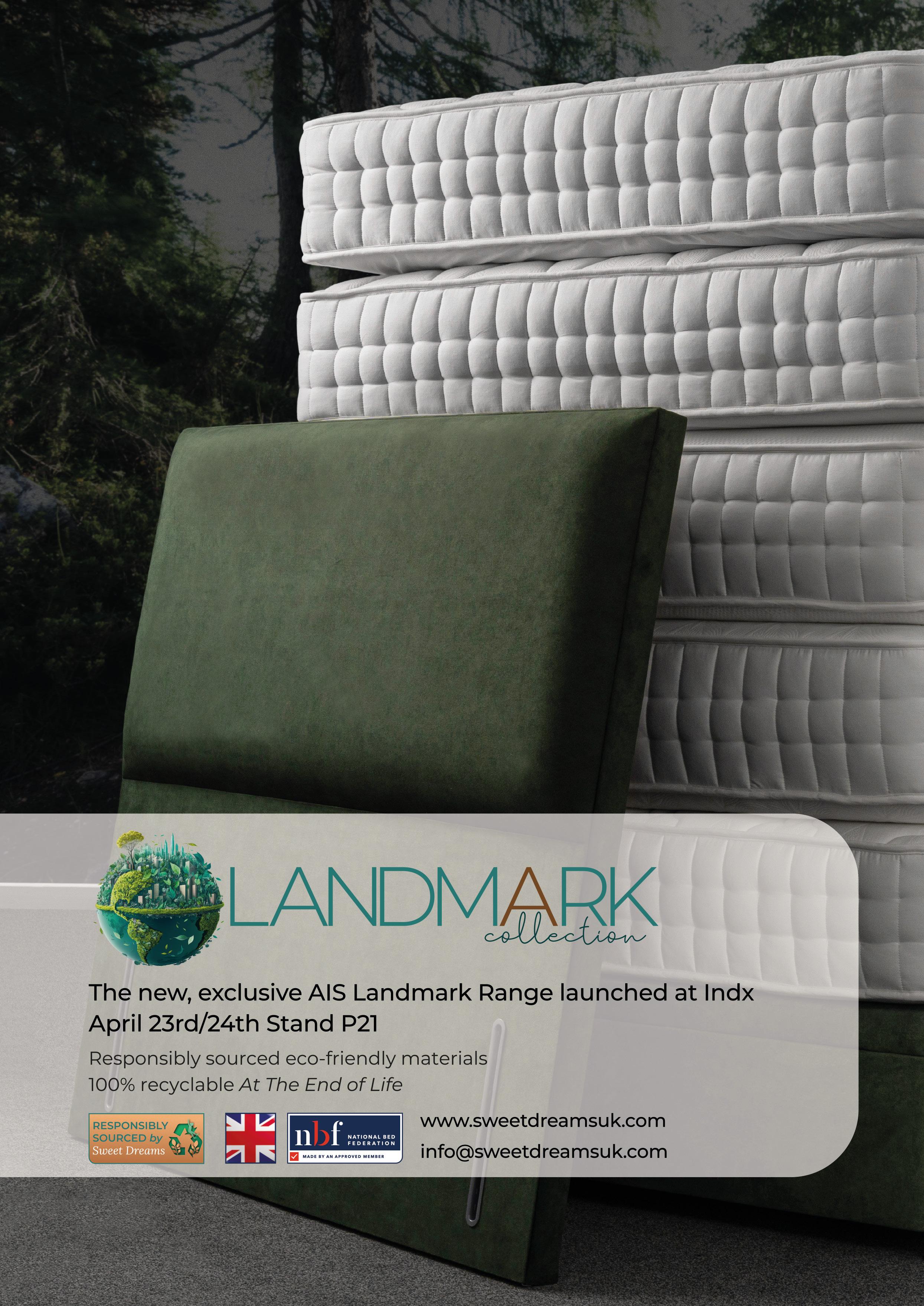

Following on from the successful launch of Sweet Dreams’ sustainable Landmark Collection at last year’s Bed Show, this month’s INDX Beds & Bedroom will see the unveiling of an AISexclusive, responsibly sourced Landmark bed range.

AIS Landmark comprises six beds, featuring 100% recyclable, foam-free mattress fillings, and sleep surfaces made from eco-friendly chemical-free sustainable fabrics.