SPECIAL TOPIC

Unconventionals and Pas sive Seismic

EAGE NEWS Association changes its structure

TECHNICAL ARTICLE Hydrogen and geothermal potential in Ireland

VOLUME 41 I ISSUE 4 I APRIL 2023

cgg.com/earthdata SE E THINGS DI FF ERE NT LY ALL-ROUND BETTER SUBSURFACE IMAGING Scan the QR code to see for yourself.

An EAGE Publication

CHAIR EDITORIAL BOARD

Gwenola Michaud (Gwenola.Michaud@cognite.com)

EDITOR

Damian Arnold (editorfb@eage.org)

MEMBERS, EDITORIAL BOARD

• Lodve Berre, Norwegian University of Science and Technology (lodve.berre@ntnu.no)

• Philippe Caprioli, SLB (caprioli0@slb.com)

• Satinder Chopra, SamiGeo (satinder.chopra@samigeo.com)

• Anthony Day, PGS (anthony.day@pgs.com)

• Peter Dromgoole, Retired Geophysicist (peterdromgoole@gmail.com)

• Rutger Gras, Consultant (r.gras@gridadvice.nl)

• Stephen Hallinan, CGG Stephen.Hallinan@CGG.com

• Hamidreza Hamdi, University of Calgary (hhamdi@ucalgary.ca)

• Clément Kostov, Freelance Geophysicist (cvkostov@icloud.com)

• John Reynolds, Reynolds Geo-Solutions Ltd (jmr@reynolds-geo.com)

• Peter Rowbotham, Apache (Peter.Rowbotham@apachecorp.com)

• Pamela Tempone, Eni (Pamela.Tempone@eni.com)

• Angelika-Maria Wulff, Consultant (gp.awulff@gmail.com)

EAGE EDITOR EMERITUS

Andrew McBarnet (andrew@andrewmcbarnet.com)

PUBLICATIONS MANAGER

Martha Theodosiou (mtu@eage.org)

MEDIA PRODUCTION

Saskia Nota (firstbreakproduction@eage.org)

PRODUCTION ASSISTANT

Ivana Geurts (firstbreakproduction@eage.org)

ADVERTISING INQUIRIES corporaterelations@eage.org

EAGE EUROPE OFFICE

Kosterijland 48

3981 AJ Bunnik

The Netherlands

• +31 88 995 5055

• eage@eage.org

• www.eage.org

EAGE MIDDLE EAST OFFICE

EAGE Middle East FZ-LLC

Dubai Knowledge Village

Block 13 Office F-25 PO Box 501711

Dubai, United Arab Emirates

• +971 4 369 3897

• middle_east@eage.org

• www.eage.org

EAGE ASIA PACIFIC OFFICE

UOA Centre Office Suite 19-15-3A

No. 19, Jalan Pinang

50450 Kuala Lumpur

Malaysia

• +60 3 272 201 40

• asiapacific@eage.org

• www.eage.org

EAGE AMERICAS SAS

Edificio Centro Ejecutivo Santa Barbara

Av. Cra. 19 #118-95 - Office: 501

• +57 310 8610709

• americas@eage.org

• www.eage.org

EAGE MEMBERS CHANGE OF ADDRESS NOTIFICATION

Send to: EAGE Membership Dept at EAGE Office (address above)

FIRST BREAK ON THE WEB www.firstbreak.org

ISSN 0263-5046 (print) / ISSN 1365-2397 (online)

78

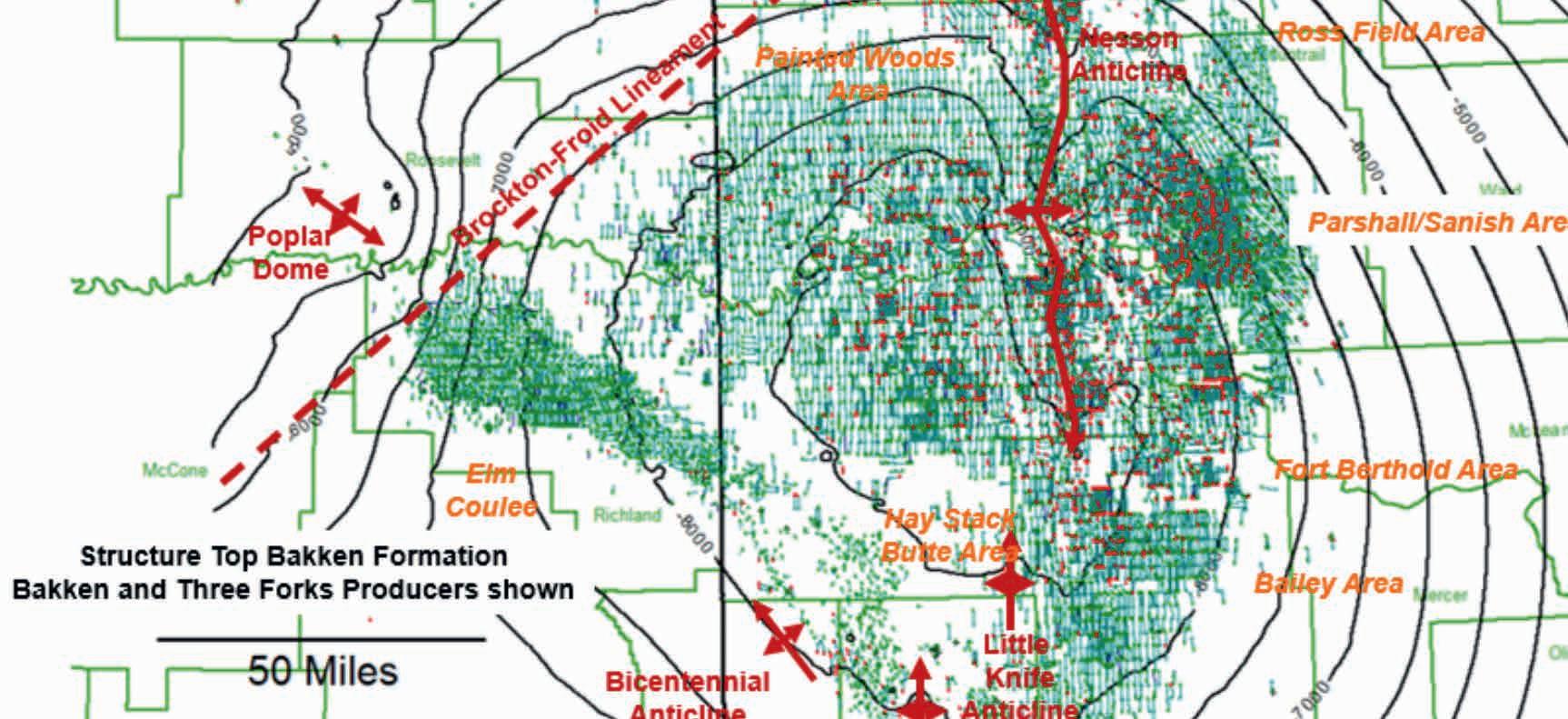

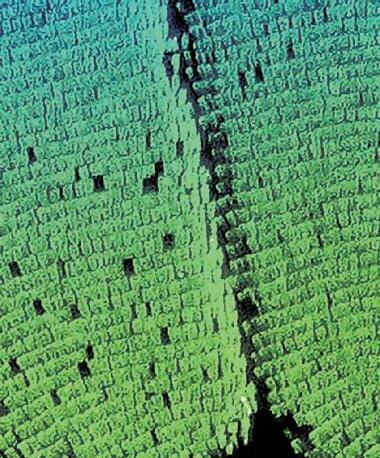

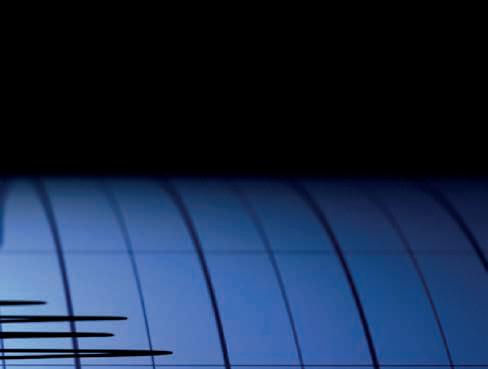

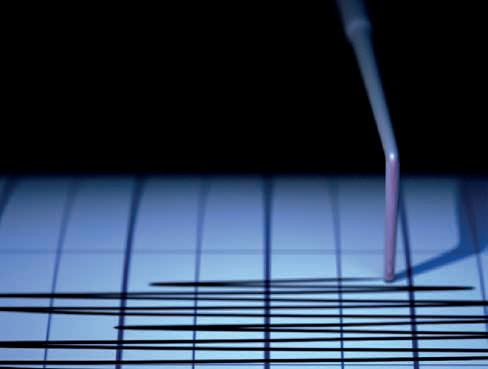

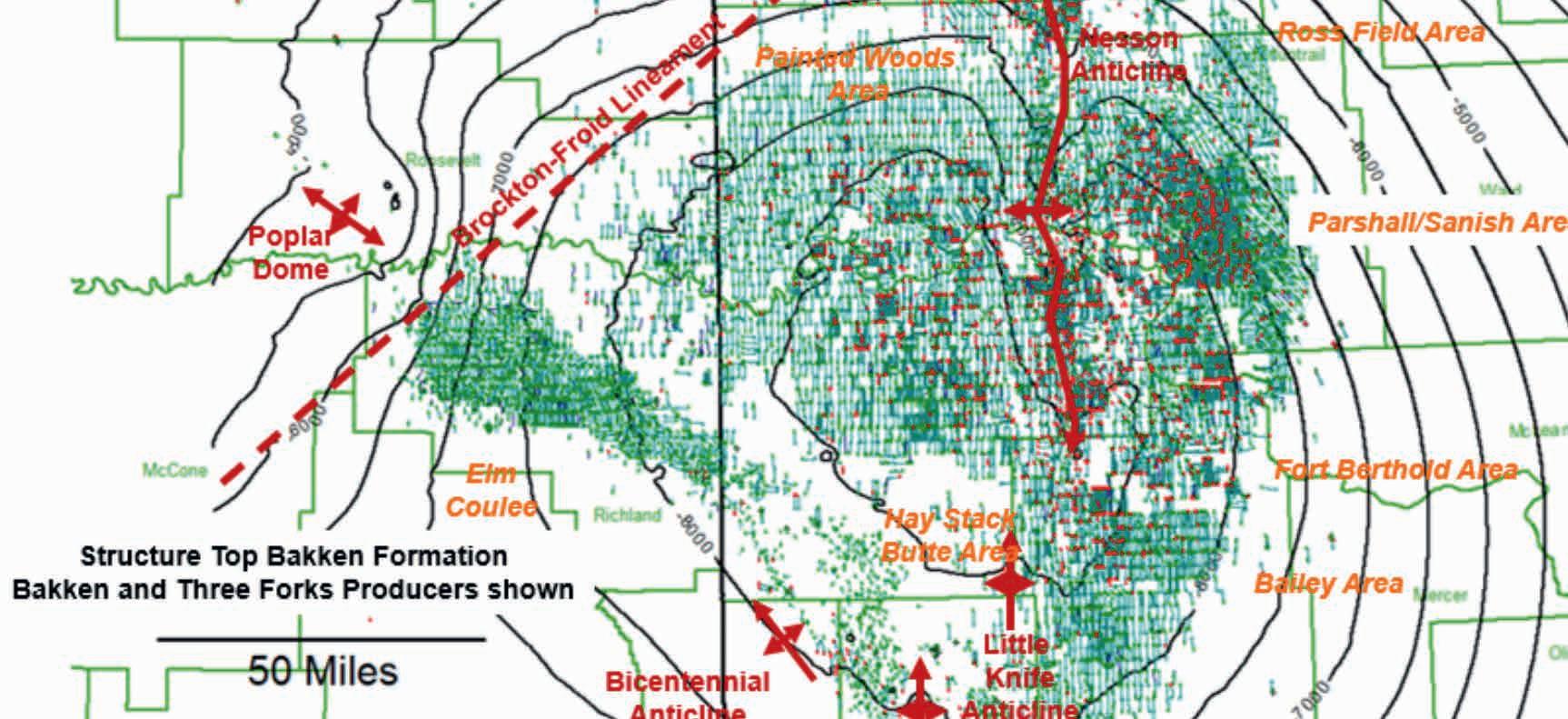

Microseismic Examples, Bakken Formation, Williston Basin

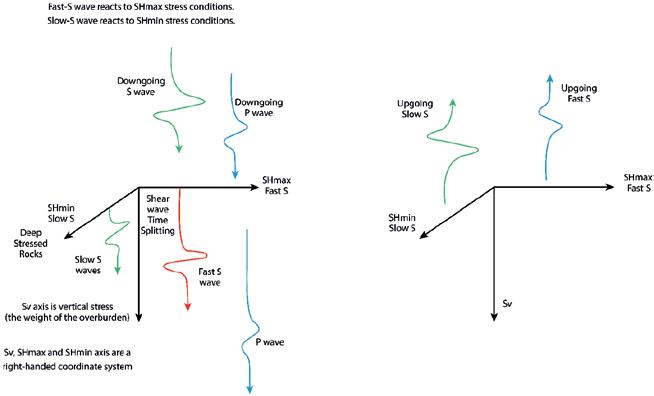

93 P and S wave seismic imaging are needed in CCS reservoir monitoring Dr. Bob Hardage CO2

94 Calendar

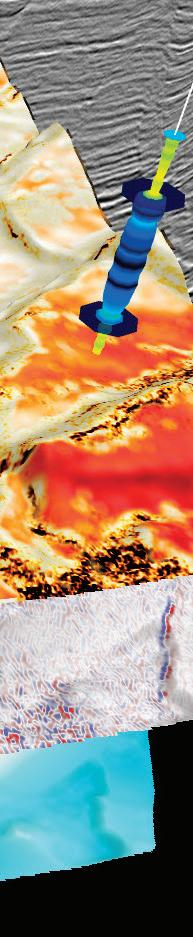

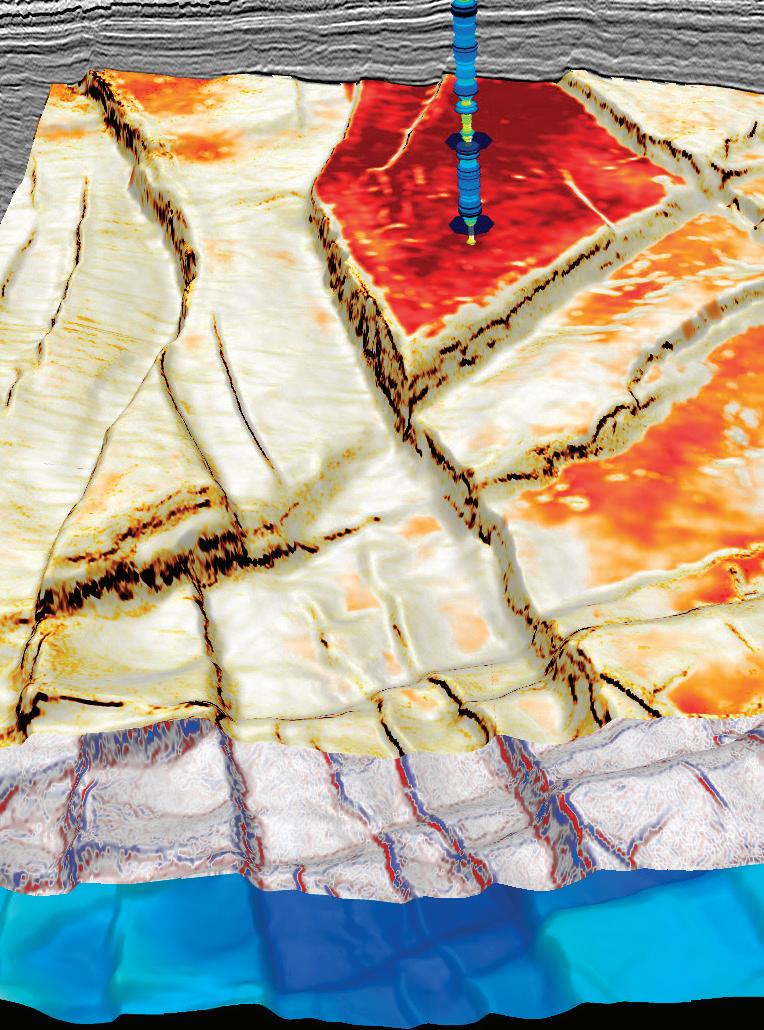

cover: Latest innovations in microsemisic data will be showcased.

FIRST BREAK I VOLUME 41 I APRIL 2023 1 Editorial Contents 3 EAGE News 17 Personal Record Interview 18 Monthly Update 20 Crosstalk 23 Industry News Technical Articles 33 A workflow for quantitative seismic fracture characterisation of hydrocarbon reservoirs Debasis Chaudhuri and Ankur Roy 41 Overview of hydrogen and geostorage potential in Ireland Joseph M. English and Kara L. English Special Topic: Unconventionals and Passive Seismic 51 Bringing change to shale reservoir development Tom Davis 56 Performance and outlook for the SADAR array network at the Newell County facility Paul A. Nyffenegger, Jian Zhang, Elige B. Grant, Derek Quigley, Kevin D. Hutchenson, Mark A. Tinker, Don C. Lawton and Marie Macquet 63 Potential production gains of multi-stage fractured wells in shale plays: sensitivity of well performance to changes in design parameters assessed with fast and accurate Gaussian solutions Ruud Weijermars 71 Sensitivity tests performed on passive low frequency seismic (LFS) data acquired in the Central North Sea to delineate hydrocarbon deposits Roy P. Bitrus, Vasilii Ryzhov, Dmitrii Ryzhov, Ilshat Sharapov, Sergey Feofilov and Evgeny Smirnov 78 Microseismic Examples, Bakken Formation, Williston Basin Stephen A. Sonnenberg 85 Analysis of hypotheses of reservoir saturation issues in the Achimov formation of Western Siberia Victor Gabrilyants, Bikbaev Fidan and Shegay Vadim Feature: WhatsUp!

BREAK ®

FIRST

European Association of Geoscientists & Engineers

Board 2022-2023

Near Surface Geoscience Circle

Esther Bloem Chair

Andreas Aspmo Pfaffhuber Vice-Chair

Micki Allen Contact Officer EEGS/North America

Adam Booth Committee Member

Hongzhu Cai Liaison China

Deyan Draganov Technical Programme Officer

Wolfram Gödde Liaison First Break

Hamdan Ali Hamdan Liaison Middle East

Vladimir Ignatev Liaison Russia / CIS

Musa Manzi Liaison Africa

Myrto Papadopoulou Young Professional Liaison

Catherine Truffert Industry Liaison

Panagiotis Tsourlos Editor in Chief Near Surface Geophysics

Florina Tuluca Committee member

Oil & Gas Geoscience Circle

Lucy Slater Chair

Yohaney Gomez Galarza Vice-Chair

Michael Peter Suess Immediate Past Chair; TPC

Erica Angerer Member

Wiebke Athmer Member

Juliane Heiland TPC

Tijmen Jan Moser Editor-in-Chief Geophysical Prospecting

Adeline Parent WGE SIC Liaison

Matteo Ravasi YP Liaison

Jonathan Redfern Editor-in-Chief Petroleum Geoscience

Giovanni Sosio DET SIC Liaison

Aart-Jan van Wijngaarden Technical Programme Officer

SUBSCRIPTIONS

First Break is published monthly. It is free to EAGE members. The membership fee of EAGE is € 80.00 a year including First Break, EarthDoc (EAGE’s geoscience database), Learning Geoscience (EAGE’s Education website) and online access to a scientific journal.

Companies can subscribe to First Break via an institutional subscription. Every subscription includes a monthly hard copy and online access to the full First Break archive for the requested number of online users.

Orders for current subscriptions and back issues should be sent to EAGE Publications BV, Journal Subscriptions, PO Box 59, 3990 DB, Houten, The Netherlands. Tel: +31 (0)88 9955055, E-mail: subscriptions@eage.org, www.firstbreak.org.

First Break is published by EAGE Publications BV, The Netherlands. However, responsibility for the opinions given and the statements made rests with the authors.

COPYRIGHT & PHOTOCOPYING © 2023 EAGE

All rights reserved. First Break or any part thereof may not be reproduced, stored in a retrieval system, or transcribed in any form or by any means, electronically or mechanically, including photocopying and recording, without the prior written permission of the publisher.

PAPER

The publisher’s policy is to use acid-free permanent paper (TCF), to the draft standard ISO/DIS/9706, made from sustainable forests using chlorine-free pulp (Nordic-Swan standard).

2 FIRST BREAK I VOLUME 41 I APRIL 2023

Caroline Le Turdu Membership and Cooperation Officer

Peter Rowbotham Publications Officer

Pascal Breton Secretary-Treasurer

Aart-Jan van Wijngaarden Technical Programme Officer

Esther Bloem Chair Near Surface Geoscience Circle

Lucy Slater Chair Oil & Gas Geoscience Circle

Edward Wiarda Vice-President

Jean-Marc Rodriguez President

Maren Kleemeyer Education Officer

Members vote to add Sustainable Energy as one of three Circles to replace old Divisions

EAGE members have passed a proposal from the Board to replace the existing two divisional structure of the Association, introducing instead three Circles which are felt to be more representative of the organisation in the energy transition era.

The change was passed at a Special Members Meeting on 16 February 2023 approving the creation of three Circles, namely Oil and Gas Geoscience Circle, Near-Surface Geoscience Circle and Sustainable Energy Circle.

At the meeting EAGE president Jean-Marc Rodriguez together with the vice-president Edward Wiarda introduced the modifications to the EAGE Constitution needed in line with these changes.

EAGE president Jean-Marc Rodriguez said: ‘The Board wanted to step away from the Divisions nomenclature, which to many feels dividing and implies having separate “silos” without appropriate overlap between the areas of interest that they represent. We carefully considered several possible options and concluded that the term Circle best encompasses the idea of multi-disciplinary collaboration and inclusivity.’

Edward Wiarda explained in more detail why the name Circle was chosen and the idea behind the name: ‘Circles embody the spirit of who we want to be as an Association – inclusive and giving members the feeling of being part of a single EAGE, with circles representing unity and a round table at which there is a place

for every member. Moreover, through visualization by Venn diagrams our three Circles – Oil & Gas, Near-Surface Geoscience and Sustainable Energy – now provide a well-rounded framework that allows for an increasing overlap between two or even three circles with time and a stepping stone for the energy transition within EAGE.’

According to Wiarda, the EAGE energy transition can be seen as the movement of the Near-Surface Geoscience and Oil & Gas Geoscience Circles towards the Sustainable Energy Circle, with increasing overlap between these Circles, as the global ‘new energy’ industry keeps growing. It also showed that, at this juncture, parts of the Oil & Gas and Near-Surface Geoscience Circles are already active in the fields of sustainability and energy transition, overlapping our new Sustainable Energy Circle. This proved the inclusiveness of the Circle concept.

‘The overlap zones,’ Wiarda said, ‘represent joint collaboration, synergy, integration, knowledge sharing and efficiencies (read: cost reduction), across geoscience and engineering disciplines and specialisations, regions, and industries. It is in these overlap sweet spots where

members, technologies and solutions, developed in one Circle, meet the members, applications and challenges of the other (two) Circles. Obviously, the shortterm focus of the Board is on stimulating and supporting all EAGE Communities, but especially those active within these overlap zones.’

Jean-Marc Rodriguez added: ‘We appreciate that this may appear quite abstract, and we feel the responsibility to

FIRST BREAK I VOLUME 41 I APRIL 2023 3

meeting 04 SE

energy transition conference 11 Strategic

set for Vienna 14 HIGHLIGHTS

Montevideo hosts offshore resources

Asia

programme

President Jean-Marc Rodriguez at the 2022 AGMM.

quantify, materialise and realise this concept of Circle overlap into the real world.’

Further steps and timeline will be announced during the Annual General Meeting for Members (AGMM) in Vienna in June when the leadership of the Sustainable Energy Circle, elected in the upcoming Ballot, will be introduced. Every member is invited to join multiple Circles and to start getting involved in their joint activities and communities.

The reorganisation was signalled at the 2022 AGMM in Madrid when the Board indicated that the Divisional structure would be reconsidered in order to be more inclusive. Once the concept of Circles and a Sustainable Energy Circle had been agreed, the necessary steps were launched to bring the new framework into being. A members vote was needed to approve the changes to the Association’s Constitution revising its references to Divisions.

Throughout January and February 2023 members were invited to cast their vote. At the Special Members Meeting on 16 February held online, the proposals were discussed before the final approval was confirmed.

Jean-Marc Rodriguez concluded the meeting: ‘The EAGE Board would like to thank all members who participated in the Special Members Meeting and to all members who voted on the proposed changes to the Constitution.’

Ahead of our Annual General Meeting for Members (AGMM) in Vienna in June, the election of EAGE Board members will be held in which all members are entitled and encouraged to vote.

The elections are the best opportunity for members to have a say in how the Association is run. This year the election will invite votes for the positions of Vice-President, Vice-Chair Oil and Gas

Geoscience Circle, Chair Sustainable Energy Circle, Vice-Chair Sustainable Energy Circle and Publication Officer, to be filled from July 2023. More information about the candidates and the election dates are available on our website. An invitation email will be sent to all members with instructions on how to vote in this year’s Ballot. Be sure to participate.

The AGMM will be held on Wednesday 7 June during the EAGE Annual Conference & Exhibition in Vienna. This is when the Board reports on the previous year’s activities and discusses topics of significance to members. The meeting provides the most important opportunity for members to have their say, interact with the Board and contribute to the future of the Association. Visit www.eage.org/about eage/agmm for more information.

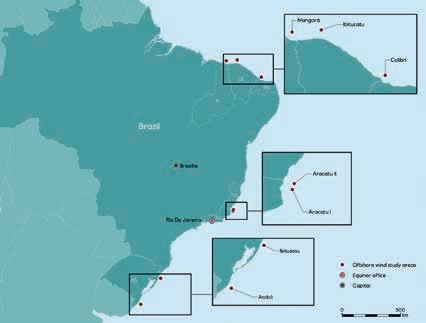

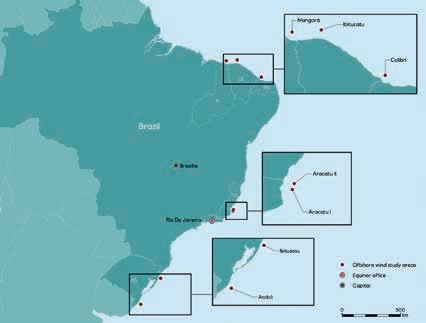

Uruguay to host first EAGE South Atlantic offshore resources conference

The First EAGE Conference on Offshore Energy Resources in the South Atlantic will be an in person meeting in Montevideo, Uruguay, on 20-22 September 2023. The timing is perfect given the recent significant light oil discoveries in the Orange Basin, offshore Namibia, associated with the TotalEnergies, Venus-1 and Shell, Graff-1 wells. These finds have led to revived exploratory interest in the conjugate offshore margins of Northern Argentina, Uruguay, and Southern Brazil.

In the current global political and economic climate, focusing on energy security, efficiency and environmentally responsible exploration have become critical. Aiming to contribute towards achieving these goals, the conference should facilitate and encourage sharing of experience by regulators, NOCs, IOCs, service providers as well as research and academic institutes working in the region.

The event will provide an excellent platform to share knowledge, learn from each other, have round table discussions and understand the challenges and the potential opportunities that this margin

hides. In combination with a strong technical programme, the conference will facilitate discussions and participation through several interactive sessions, panel debates and networking events. The South Atlantic has an important role to play in providing future energy resources in an environmentally responsible manner and

this event is designed to provide an ideal forum to define the best way forward. Join the discussion by submitting your abstracts before 5 May 2023.

Find out more!

4 FIRST BREAK I VOLUME 41 I APRIL 2023 EAGE NEWS

Centre of Montevideo.

DUG INSIGHT RELIABLE. EFFICIENT. SCALABLE.

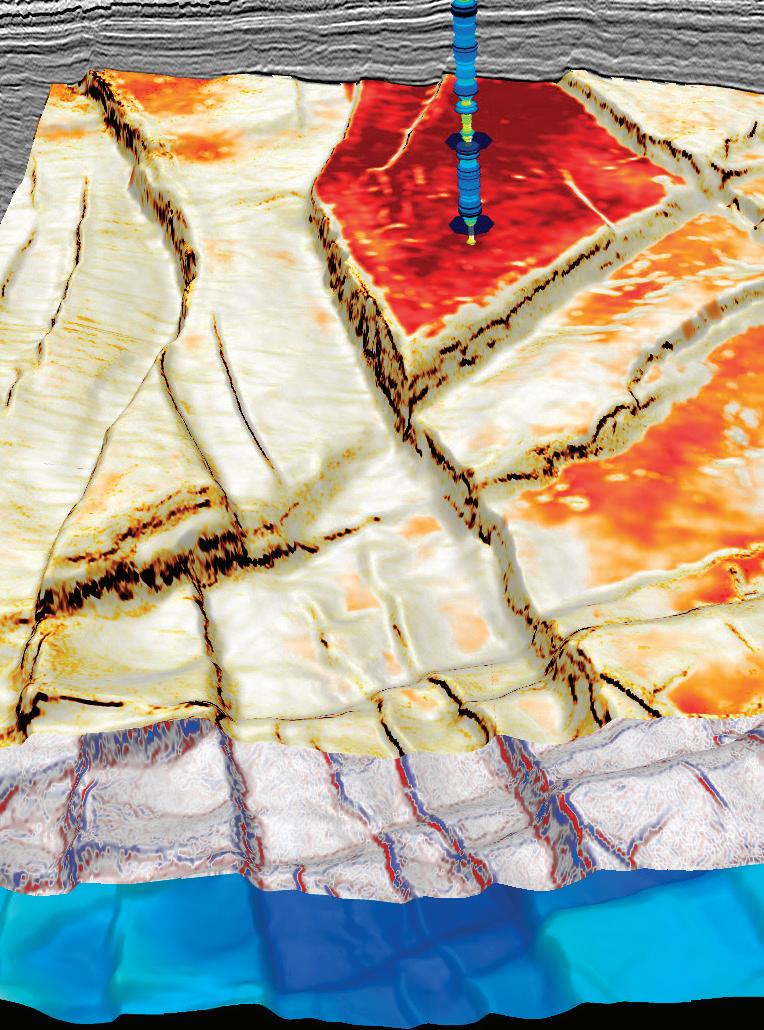

Modern interpretation workflows need modern software. Geoscientists must adapt to increasing data volumes and evolving technology requirements. Leaders must onboard new team members smoothly, and have a comprehensive set of tools to tackle any challenge across land, marine, and ocean-bottom surveys.

DUG Insight is a full-service solution for qualitative interpretation, visualisation, 2D/3D/time-lapse/prestack amplitude analysis and rock-property inversion, advanced seismic-data time-processing and depth-imaging, and FWI—this includes DUG’s revolutionary multi-parameter high-frequency FWI imaging technology. DUG Insight feels like a single package designed by a single team. Because it is.

Let DUG Insight's state-of-the-art technology help you make your next discovery.

•ISO 27001• OC M PASSASSURANCESERV SEC •ISO 9001• OC M PASSASSURANCESERV SEC

dug.com/insight For more information contact info@dug.com

Learning continues in latest Arabian Plate core workshop

Frans S. van Buchem (King Abdullah University of Science and Technology, KAUST), Khalid Alhmoud (Saudi Aramco) and Jeroen Kenter (TotalEnergies) report on the EAGE 8th Arabian Plate Core Workshop, held on 28-30 November 2022 in Dhahran, Saudi Arabia.

This long-running workshop focused on the prolific Mid Jurassic to Lower Cretaceous stratigraphic interval, and was well attended by 60 geoscientists and petrophysicists from industry (Saudi Aramco, ADNOC, KOC, TotalEnergies, CNPC) and academia (KAUST and KFUPM from Saudi Arabia, ENSEGID and CEREGE from France).

While the Middle East has been producing some of the world’s most prolific hydrocarbon reservoirs for more than 50 years, regional understanding of stratigraphy, architecture and resulting source rock, reservoir and seal partitioning still need improvements to meet the demands for optimal water drive, EOR, CCS and near field exploration targeting stratigraphic trapping concepts. The strong interest and lively debates during the workshop confirmed this need and the motivation to deliver these.

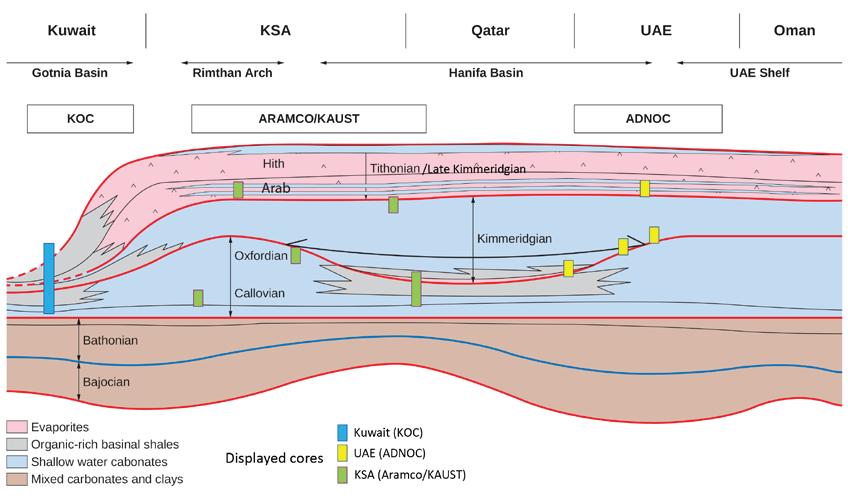

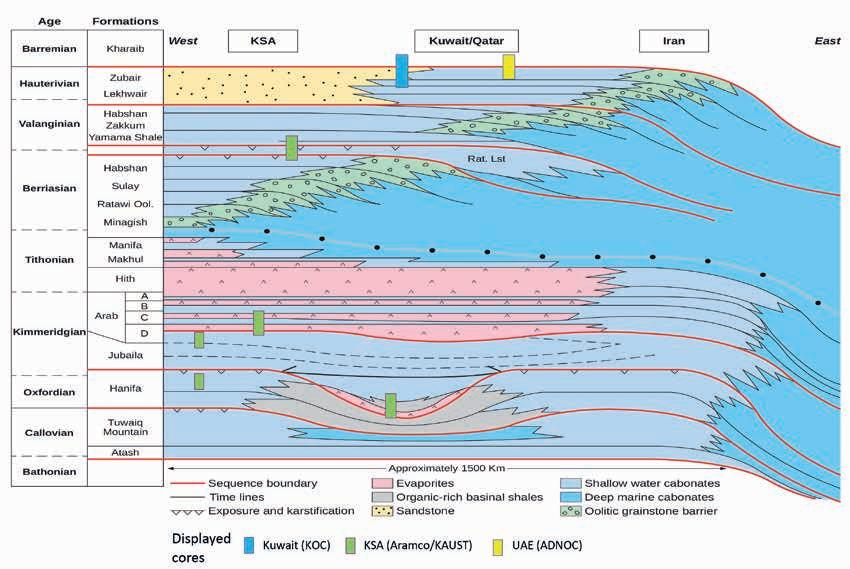

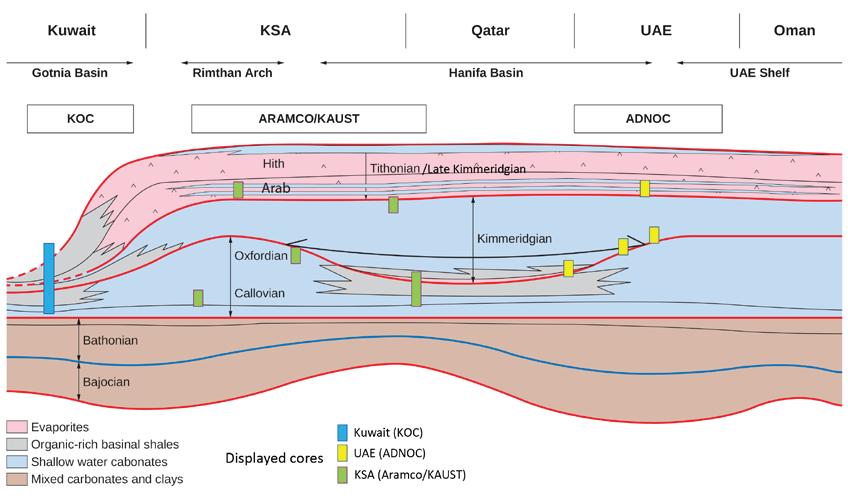

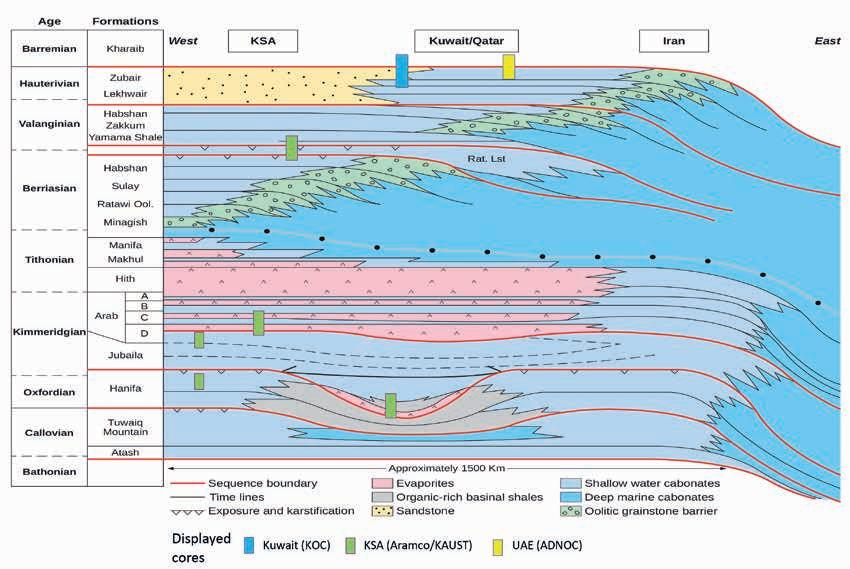

The main objective of the workshop was to provide access to a selection of core material from different countries and discuss these in the context of a conceptual regional stratigraphic model which resulted partly from the 4th EAGE core workshop in 2012, and completed with insights of the recent literature (Figures 1 & 2). This framework provided a unique

basis for the discussion of stratigraphic architecture, facies models, rock types and their significance for source, reservoir and seal presence at the scale of the Arabian Plate.

Cores covering the Early Jurassic to Early Cretaceous interval were provided by KOC, Saudi Aramco, ADNOC and KAUST and represented shallow platform, intrashelf basin and slope depositional domains (Figures 1 and 2). Several cores spanned stratigraphically identical platform to intra-shelf basin transitions in different countries, highlighting the symmetry of basin margins and regional consistency of sedimentation patterns. The core material also provided unique insight into lateral and vertical stratigraphic and depositional heterogeneity at the reservoir and seal scale. Presentations and discussion sessions were of high technical content and provided insights into new ideas, concepts and innovative workflows applied by industry and universities.

Three main topics were covered in this workshop. Firstly, the regional stratigraphic understanding of the Middle and Upper Jurassic has made significant progress over the last decade due to integrated studies crossing country boundaries (van Buchem

et al.; Wilson), dealing with large scale outcrop exposures (Razin & Al Mojel) and improved biostratigraphy and isotope stratigraphy (Hughes, Vahrenkamp, Deville de Pereire). The creation and infill of the proliferous Hanifa and Gotnia intra-shelf basins had a profound impact on the paleogeography and depositional environments and resulted in diverse facies associations and lithologies across the Arabian Plate. New insights include the paleobathymetry within and between the Hanifa and Gotnia Basins, the palaeogeography, the timing and regional impact of eustasy and tectonic events, and the relevance of these for heterogeneities of reservoir, source rock and seal intervals. The improved palaeogeographical understanding now also allows use of hydrodynamic modelling to understand the facies distribution of these sub-basins (Wicaksono et al.).

Secondly, excellent examples of reservoir-scale, digital outcrop analogue models were shown, including the application of a range of techniques: outcrop sedimentological and gamma-ray spectrometry logging, fracture mapping, hyperspectral sensors mapping dolomite distribution in outcrop, shallow cores and shallow ground penetrating radar displaying in 3D reservoir body distribution. These models provide better constraints on reservoir and seal partitioning and dimensions which can be used as input for reservoir modelling. The shown case studies covered the Hanifa and Arab D reservoirs, outcropping in Saudi Arabia (Ramdani et al., Gairola et al.), and oolitic ramp systems exposed in Morocco (Dujoncquoy et al.). This ‘new tech’ approach provides invaluable information addressing primary textural geometries and diagenetic modification that feed spatial statistics and rules as well as serve as input to flow diagnostics.

Thirdly, different carbonate rock typing approaches were presented, focusing on the complexity of the relationship between primary depositional facies (Al

6 FIRST BREAK I VOLUME 41 I APRIL 2023 EAGE NEWS

WORKSHOP REPORT

Figure 1 Schematic stratigraphic framework from Kuwait to Oman with position of core intervals displayed at the workshop. This transect is based on insights of the 4th EAGE Workshop on Arabian Plate Geology (2012, Abu Dhabi) and recent publications.

Shammeri) and the impact of early and later diagenetic overprints on ultimate reservoir properties. One of the case studies revealed a generally weak link between multi-scale, pore to core-log scale and reservoir quality parameters and sedimentary facies properties in Arab and Lower Kharaib formations and suggested a more dominant influence by tectonically driven fluid patterns and hydrocarbon migration (Kenter et al., Mangane et al.). This highlights the importance of testing and validating reservoir characteristics in the context of pore system modification, e.g., early to late burial fluids and hydrocarbon migration, in addition to depositional characteristics.

In conclusion, the core workshop progressed on several key themes that are relevant for future geoscience solutions in the region. It helped to further constrain the architecture of the Jurassic to Lower

Cretaceous strata in a regional approach, crossing country boundaries, and improve

the prediction of geological models from basin to reservoir scale.

Great opportunity to share advancements in borehole geology coming November

Following four successful meetings since 2015, borehole geologists and professionals of other subsurface disciplines have the opportunity to gather in Dhahran in November 2023 for the 5th edition of the EAGE Borehole Geology Workshop.

The event reflects how borehole geology has advanced rapidly in the last few decades with the detailed knowledge from vertical and horizontal wells now having relevance not just for hydrocarbons but

applications such as geothermal, CCUS, and energy storage.

The workshop will cover topics such as borehole geophysics, hydraulic fracturing, well and borehole hydraulics, borehole imaging technology and fracking for unconventional resources. It will emphasise best practices and identify frontiers of geoscience technology to improve transforming 1D borehole data to 3D earth digital models. The intention

EAGE Online Education Calendar

is to provide a forum for the geoscience community to consider most aspects of borehole geology, given that it is a fundamental discipline to several global industries serving the mining, energy, and environmental sectors. In addition to the talks the workshop will also include a field trip involving five stops at well-exposed Eocene carbonates.

The Call for Abstracts is open until 31 May 2023.

FIRST BREAK I VOLUME 41 I APRIL 2023 7 EAGE NEWS

FOR THE FULL CALENDAR, MORE INFORMATION AND REGISTRATION PLEASE VISIT WWW.EAGE.ORG AND WWW.LEARNINGGEOSCIENCE.ORG. * EXTENSIVE SELF PACED MATERIALS AND INTERACTIVE SESSIONS WITH THE INSTRUCTORS: CHECK SCHEDULE OF EACH COURSE FOR DATES AND TIMES OF LIVE SESSIONS 3-6 APR LAND SEISMIC SURVEY DESIGN BY PAUL RAS IOSC 4 HRS/DAY 10 MODULES 11 APR11 MAY DATA SCIENCE FOR DATA GEOSCIENCE BY JEF CAERS EXTENSIVE ONLINE COURSE 14 HRS. (INCL. 4 WEBINARS OF 1-2 HRS EACH) 17-18 APR BASICS OF CARBON CAPTURE STORAGE BY MIKE STEPHENSON IOSC/EET 4 HRS/DAY, 7 MODULES 26-27 APR NEW TOOLS AND APPROACHES IN RESERVOIR QUALITY PREDICTION BY DAVE CANTRELL IOSC 4HRS/DAY, 10 MODULES

Figure 2 Schematic stratigraphic framework from Saudi Arabia to Iran, and the position of the core presented during the workshop. This transect is based on insights of the 4th EAGE Workshop on Arabian Plate Geology (2012, Abu Dhabi) and recent publications.

EAGE highlights education and training related to energy transition

GET2023 to feature energy transition education and training

Henk Jaap Kloosterman, head of strategic accounts, L&D at RPS and technical committee member of GET2023 writes: There has been a fundamental change in the nature of work in the energy sector, related to increased digitalisation and energy transition developments in particular. As a result, conventional approaches to providing learning and building workforce capabilities simply cannot continue, and adapting energy training solutions to a new environment that is more agile, flexible, streamlined and accessible, is becoming vital for effective energy transition capability development.

There has never been a greater need for academia and energy industry specialists to come together to collectively shape the training portfolio. There is an increasing need for reskilling and upskilling for a future-proof workforce, leveraging the collective expertise of subject matter experts and specialists with academic prowess. A well-rounded understanding of theory and the outcomes of latest research, applied in-field with support from industry experts, is what any modern energy professional needs. This continued professional development helps organisations fill vital gaps in skills and helps them plan just how they would like to build their workforce and aligns with the required diversification of their business strategy.

We observe the requirement for energy transition skills that have strong adjacency with those that are already widespread and well developed in the oil and gas sector, supplemented with those that are specific to low carbon and renewables subject areas, like CCS, geothermal, hydrogen and offshore wind. We therefore need to nurture a learning environment that is more agile, responsive to disruption, more integrated with real-time activities and presented in a better learning experience, at reduced cost.

This raises some important issues that we would like to see addressed in the Edu-

cation and Training session at GET2023, e.g., What critical skills and expertise do we need for the energy transition?, What forms of training are most effective to upskill oil and gas staff for the energy transition?, and How can we accelerate the capability building for the energy transition?

We are inviting relevant contributions from industry, academia and training providers to the discussion on the Education and Training topic. Please submit your abstract for a presentation at

GET2023 before 15 August 2023. Visit www.eageget.org for more information on the topic and submission guidelines.

EAGE energy transition short courses up and running

‘Geoscience and geo-engineering specialists need to jointly educate the public and each other about the role they can play in the energy transition,’ according to Maren Kleemeyer, EAGE education officer and learning advisor geoscience at Shell. ‘This means that we all need to learn fast and educate others about our current and possible future contributions to maximise our position for the new energies. We are all learners and instructors!’

EAGE has created the Energy Transition category and label in its Short Course Catalogue, adding novel and up-to-date courses focused on energy transition applications. An example of these offerings are the courses ‘Geological CO2 storage’ with instructors

Andreas Busch, Eric Mackay, Florian Doster, Martin Landro, and Philip Ringrose; ‘Basics of Carbon Capture and Storage’ by Prof Michael H. Stephenson (Stephenson Geoscience Consulting);

‘An Introduction to Offshore Wind’ with Jeroen Godtschalk (BLIX Consultancy); and ‘Medium and Low-Grade Geother-

mal Energy: Geoscience and Geomechanics’ by Grant Wach (Dalhousie University, Canada) and Maurice Dusseault (University of Waterloo, Canada).

The Energy Transition courses continue to be the most popular in terms of attendance. This reflects the growing interest and importance of discovering and discussing the latest technologies and developments towards sustainable practices and a more sustainable energy future. It is the mission of EAGE to continuously offer and develop new courses to facilitate knowledge creation and sharing in this field of great importance.

Other initiatives include the creation of a coaching programme dedicated to the development of soft-skills and practices that will make members more competitive in accessing opportunities provided by energy transition, as well as the upcoming interactive session ‘Skills for the Energy Transition’ at the Annual conference in Vienna. Visit learninggeoscience.org for more information on all the available EAGE short courses.

8 FIRST BREAK I VOLUME 41 I APRIL 2023 EAGE NEWS

Amplifying the CCS conversation in Asia Pacific region

EAGE is holding a second workshop on carbon capture and storage (CCS) in the Asia Pacific region and event chairperson Azmir Zamri (Head Resource Exploration at PETRONAS) says ‘it is a must-attend for subsurface professionals - geoscience and engineering - who want the latest updates on the enablers seeking to make CCS projects successful, particularly in the storage domain.’

The workshop entitled ‘Unlocking Carbon Capture and Storage Potential’ being held on 22-23 August 2023 in Kuala Lumpur presents an opportunity for industry players to discuss CCS efforts in the context of SE Asia. It is the second EAGE event in the region following the first workshop on CO2 Geological Storage last year in Perth, Australia. The inaugural workshop was a success attracting over 160 participants.

CCS is expected to play a pivotal role in tackling the world’s energy trilemma. Provided the unprecedented scale of challenge to the upstream energy sector, collaboration and concerted effort between industries and other stakeholders are key to ensuring the right approach is being adopted to see these CCS efforts come to fruition.

This workshop will be a great knowledge-sharing arena where the main goals are to learn about the latest subsurface workflows for CCS evaluation through technical presentations, accelerate further consideration of the application of mainstream CCS technologies in the SE Asia region, and exchange ideas and issues around CCS technology.

This latest workshop will draw on the expertise of subsurface specialists including geologists, geophysicists, reservoir engi-

neers, project managers, and petrophysicists, as well as academia. Viewpoints from policymakers, activists, financial professionals, and strategists are expected to round out the discussion and as carbon capture efforts scale up in the SE Asia Region.

The topics to be explored via roundtables with industry leaders and practitioners from the region and beyond include Subsurface geological storage; CO2 enhanced hydrocarbon recovery; Reservoir monitoring and risk assessment; Case studies; Industry applications; Economics, incentives, and policy; Infrastructure and non-technical considerations. Abstract submissions are welcome until 31 May 2023.

Learn more about this event and abstract submission information via https://eage.eventsair.com/2nd-eage-workshop-on-unlocking-carbon-capture-and-storage-potential/

Make the most of EAGE’s professional community

When he was pursuing his Master’s degree, Ilius Mondal, now a petrophysicist at the Oil and Natural Gas Corporation (ONGC) in India, seized the chance to present a paper at the EAGE Annual. He says: ‘Participating in various sessions and activities, gaining insights and diving deep into the oil and gas industry, as well as recent energy developments, gave me valuable knowledge which helped me a lot in advancing my career.’

Mondal relates the experience of just one of our many members who are grateful for what the EAGE community has to offer in its extensive range of offerings and activities. Especially if you are a student or young professional, it is worth making sure that you are making the most of your Association membership.

For example, you can consider joining a mentoring programme: as a mentor you can transfer your valuable experience and, as a mentee, you can seek career guidance and advice. No matter which role you choose, mentoring is a great way to learn and to keep growing personally and professionally.

Richard Ayisi Mensah, a student at the University of Miskolc, Hungary, joined the EAGE Mentoring Programme 2022-2023 as a mentee. He says, ‘The programme so far has been immensely helpful. I’m starting to get a grasp of what I must do to advance my career. Direction from my mentor has been decisive and measured.’

Another way of getting more involved with professional colleagues is to join an EAGE Local Chapter, where you can keep up with industry developments and the activities of the Asociation. Or be part of one of our special interest groups, for instance, Women in Geoscience and Engineering or Young Professionals which address the concerns of particular sections of the membership. There are

also technical communities now covering a range of disciplines - Artificial Intelligence; Basin & Petroleum Systems Analysis; Decarbonization and Energy Transition; Geochemistry; Geohazards; Hydrogeophysics; Mineral Exploration Geophysics; Seismic Acquisition; Seismic Interpretation, and UAV (Uncrewed Aerial Vehicles).

As a student you can be more involved in geoscience and engineering fields by joining an EAGE Student Chapter.

Whatever stage you are in your career, the key is to keep developing your professional knowledge and expertise, and there’s no better way of doing that than engaging with the EAGE community.

Join or renew your membership: www.eage.org/membership/benefits/.

FIRST BREAK I VOLUME 41 I APRIL 2023 9 EAGE NEWS

Explore the multiple engagement opportunities EAGE has for you.

Journals call for papers on digitally enabled geoscience workflows

Petroleum Geoscience and Geoenergy are calling for papers to be submitted to a joint collection on digitally enabled geoscience workflows.

Guest editors for these articles say that data science, including automation, data analytics, machine learning and processing of extremely large datasets, is now an important part of everyday life and is

transforming the way scientists conduct research and develop new technologies, enabling specific tasks to be implemented with minimal human supervision.

These techniques are providing game-changing advances in subsurface workflows in terms of time-saving on complex tasks, improved consistency and repeatability of interpretation, and utilisation of scarce experienced geoscientists.

The special collection of papers will present the state-of-the-art in data science applications for geoscience, and particularly intends to highlight the recent advances of these technologies to solve subsurface problems across various disciplines including: data science and statistics with geological applications; AI and automation on downhole production

data; integrated studies in subsurface analytics production and operations optimization; exploration/production challenges; seismic and well log interpretation; the interface between engineering and geoscience; transfer of learning to solve geoscientific problems; and data science applications to the energy transition.

Submissions should be made via the Petroleum Geoscience Editorial Manager website or Geoenergy Editorial Manager website by the deadline of 31 October 2023.

Guest editors for this collection of papers are Daniel Austin (Earth Science Analytics), Paul Wilson (SLB, Petroleum Geoscience Editorial Board) and Runhai Feng (University of Copenhagen, Geoenergy Editorial Board).

Hydrocarbon seals workshop is back for a fourth time

The 4th EAGE/AAPG Hydrocarbon Seals Workshop to be held on 28-30 November 2023 in Dhahran offers participants the opportunity to obtain up-to-date knowledge about hydrocarbon seals in exploration and production plus exposure to regional case studies. Also included will be workflows and techniques utilised for seal detection and capacity assessment, the value of which is sometimes under-estimated.

The workshop programme will cover the stratigraphic and structural frameworks, petrophysical, geomechanics, special core analysis and advances in technologies of seal assessment.

Seals are a fundamental element of any hydrocarbon accumulation, and can control trap integrity, migration and charge volumes; the lateral and vertical distribution

of hydrocarbons in a trap; percent fill (or spill) of a reservoir; and the flow of hydrocarbons from the trap during production. As such, the long-term economic success or failure of an exploration to development project is very dependent on seal risking. Subsurface hydrocarbon seals should therefore have a high priority early on in any subsurface evaluation programme. In many areas, despite the clear importance of seals, they often remain the least studied and integrated element of the petroleum system and are subject to lasting dogmas (e.g., the thicker the seal the greater its capacity to seal). Elements that contribute to making seals effective, such as lithology, their brittle-ductile nature, the hydrocarbon column length, the pressure regime and trap type will be reviewed.

Overall, the workshop is an excellent opportunity for geoscientists, exploration managers, and other industry professionals to learn about the latest developments in hydrocarbon exploration and production in the Middle East.

The deadline to submit abstracts for the workshop technical programme is 31 May 2023.

10 FIRST BREAK I VOLUME 41 I APRIL 2023 EAGE NEWS

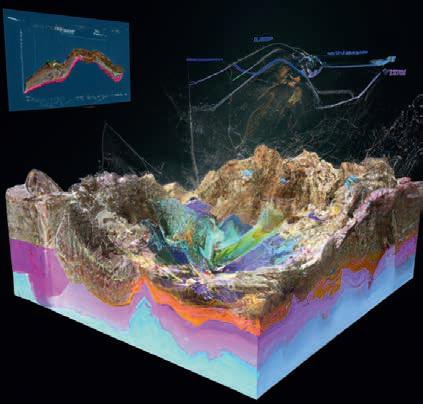

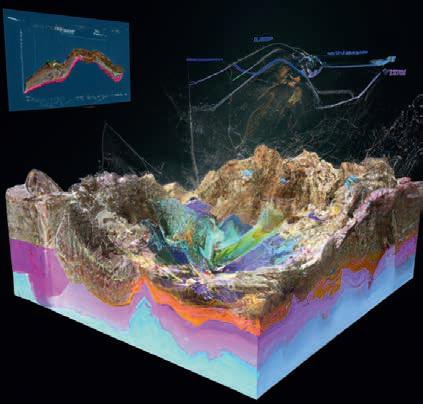

3D geological model with data flowing out into an artificial intelligence, produced via DALL·E 2. Courtesy of Earth Science Analytics.

Geoscience role in energy transition era subject of SE Asia conference

sition being held in Kuala Lumpur on 12-13 September 2023 aims to promote renewed understanding of the importance of geoscience and the earth sciences in the future energy space.

The conference programme will explore the best ideas, innovations, new methods, and best practices brought forward by geoscience and geoscience-related professionals, practitioners, researchers, academicians, and students from the oil and gas and energy-related industry.

Suhaileen Shahar (Custodian and Head of Petroleum Geoscience at PETRONAS), event chairperson, says, ‘The conference provides an ideal platform for geoscientists to upskill, reskill and repurpose by gaining actionable insights into contributions towards potential value creation in the energy transition and future energy mix.’

As the oil and gas industry presses for transition to meet our global climate

challenge, major key players are gaining momentum in diversifying their portfolio from oil and gas centric to various energy sources. Gas as the energy of choice to fuel the transition must also offer competitive and cleaner solutions. Hence, while we strive towards the development of sustainable new energy, innovative technologies to decarbonise new greenfields and enhance the optimisation of brownfields to reduce GHG emissions must continue at pace. As the oil and gas industry rethinks and drives the future global energy mix, what, where, and how could our geoscientists positively impact this momentous period?

Abstract submissions on a wide range of energy tranistion topics are welcome until 30 April 2023. Learn more about this event and abstract submission information via https://eage.eventsair.com/eage-conference-on-the-future-of-energy---role-ofgeoscience-in-the-energy-transition/

Support our EAGE Student Chapters

Here is a question for students. Have you ever taken part in one of the EAGE student webinars, E-summits, or challenges? If not maybe it’s time to participate.

And for EAGE membership in general, the question is: could you contribute to supporting activities of our students as they prepare for their career journey in geoscience and engineering? Donations are always very welcome.

Every year EAGE strives to set up an exciting programme to help our student members jump-start their integration into the professional geoscience community. Additionally, EAGE Student Chapters are encouraged to be creative and to become an essential part of local student communities involved in our energy future.

The EAGE Student Fund supports several student activities, bridging the gap between ambition and reality by offering our students and the wider geoscience community the opportunity to take advantage of the wealth of knowl-

edge and skills available in the extended EAGE network. Many of our students’ activities supported by the EAGE Student Fund are empowering an array of highly impactful initiatives developed by the EAGE Student Chapters worldwide.

Arpita Chakraborty, president of the EAGE Student Chapter of the Indian Institute of Technology Bombay, says, ‘Students are enthusiastic about EAGE and taking part in its activities, such as the Minus CO2 Challenge. As the president of the EAGE Student Chapter, I led my team in planning a two-day online global workshop and a one-day offline workshop. I am also grateful to the EAGE Student Fund for sponsoring our events ’

The Fund makes sure that student members can continue to enjoy access to high-quality events, learning opportunities, and exciting new prospects in bad and good times.

All donations to the EAGE Student Fund are welcome! You (or your company) can make a difference! You can be sure that your donation will support the present and future of geoscience and engineering: donate.eagestudentfund.org.

FIRST BREAK I VOLUME 41 I APRIL 2023 11 EAGE NEWS

The EAGE Student Chapter IIT Bombay has been active since 2021.

Looking beyond the horizon, the EAGE Conference on the Future of EnergyRole of Geoscience in the Energy Tran-

Join EAGE Conference on the Future of Energy at Kuala Lumpur, Malaysia.

LC Czech Republic launches annual student thesis competition

The EAGE Local Chapter Czech Republic is pleased to announce the eleventh edition of the Vlastislav Červený Student Prize for best Master or Bachelor thesis in theoretical and applied geophysics.

The prize is newly named after professor Vlastislav Červený, a former honorary member of EAGE, who passed away at the age of 90 in 2022 and devoted a large part of his life work to teaching young generations of geoscientists.

The competition is open to all students from universities in the Czech Republic, Hungary, Germany, Switzerland, Poland, Austria and Slovakia. In order to be eligible, thesis works must be written in English, Czech or Slovak languages and defended in the period

between 5 October 2022 and 4 October 2023. The deadline for entries is 13 October 2023.

The aim of this initiative is to encourage the application of scientific knowledge to real problems and innovativeness. This year the main sponsor of the Prize is RWE Gas Storage CZ. Seismik, G-Impuls, the Geophysical Institute of the Czech Academy of Sciences and EAGE will also contribute. Winners can look forward to a cash prize of CZK 25.000 (Master thesis) and CZK 15.000 (Bachelor thesis), in addition to an online course of their choice from EAGE’s Learning Geoscience library and a free EAGE membership for 2024.

Deadline for submitting entries is Friday, 13 October 2023. Visit www. eage.org for more information on conditions, criteria for evaluation and application forms.

4D geoelectrics insights presented at LC Czech Republic meeting

Dr Sebastian Uhlemann (Lawrence Berkeley National Laboratory) was the speaker at a lecture organised in February by LC Czech Republic on 4D geoelectrics for imaging groundwater driven processes. The meeting took place at the Faculty of Science in Prague with part of the audience connected remotely.

Dr Uhlemann presented an overview of his research, which he has conducted with numerous international groups of scientists. Although not a comprehensive overview of the use of 3D and particularly 4D measurements and interpretations of electrical resistivity tomography (ERT) due to the limited time, participants were given a basic understanding of the applicability of the method, especially in monitoring various geological and geomorphological phenomena e.g., active landslides,

permafrost melting, etc. A long Q&A followed the presentations, with many questions on the actual effect of temperature on resistivity measurements and whether the research team used surface or buried electrodes.

Some members of the Chapter have been involved in repeated measurements and even in monitoring as a part of their profession (including both basic research and commercial geophysical applications), so they found the presentation very beneficial, particularly as they had the opportunity to see some truly state-of-the-art use of ERT in monitoring applications. Dr Uhlemann shared several important messages. Firstly, changes in resistivity respond quite accurately to even slight (subtle) changes in ground water content (subsurface saturation) and therefore the method appears to be very useful for

monitoring purposes. Secondly, despite its limitations, for example in the Arctic environment, if permafrost is studied, we are able to monitor the active thawing layer very successfully. Anything below the freezing point already hits the limits of the measurement and therefore the method. Finally, time-lapse interpretations yield much more information when processed for 3D measurements or 3D models respectively (the measurements may be originally 2D) than just for 2D sections.

It was not only that some members are working on similar issues that Dr Uhlemann was able to capture the attention of the whole group. He is an outstanding scientist.

Next on LC Czech Republic’s agenda is another technical talk on DAS microseismic monitoring with Dr F. Staněk.

12 FIRST BREAK I VOLUME 41 I APRIL 2023 EAGE NEWS

2035 Vision to lead revival of Kuwait Local Chapter

This month brings encouraging news from our members in Kuwait, with the launch of a new EAGE Local Chapter. The founders invested a lot in cooperation and diversity, and have ambitious plans to make this project a success. We spoke with the Chapter president, Mohammad Dawas Manea Al-Ajmi, Exploration Group Manager at Kuwait Oil Company (KOC).

What are your plans for engaging and growing your local community?

We learned that diversity and inclusion are strengths that make EAGE unique from the other Associations. Taking this into consideration, we reached out to different groups and stakeholders - such as Kuwait University and the Kuwait Institute for Scientific Research - to secure a broad representation, including industry professionals, academics and students.

What is your vision on the energy transition?

What prompted your team to reactivate a EAGE Local Chapter in Kuwait?

Our Chapter brings together members from multiple organisations active in the country, but the project initially sparked from a team at the KOC, one of the leading players in the oil industry, interested in connecting with the EAGE global network. Having an official representation in Kuwait, where the EAGE is regarded as one of the most important professional associations in the world, will be key for the local community to thrive and a great opportunity for KOC to support their work. Our initiative

picks up from a road opened in 2017 and will lead LC Kuwait into the future.

Where would you like your Chapter to be in one year from now?

It’s important to know we have been preparing this Chapter months before submitting a petition and there is great excitement for the coming times. We set a high bar for ourselves and plan on engaging our local members through a variety of activities, including community meetings and collaborations with EAGE conferences and workshops in the region.

Energy shift and transition are the future of the O&G industry. Speaking from the point of view of KOC, the company and KPC (Kuwait Petroleum Corporation) are building their strategy as a part of multiple streams in the New-Kuwait 2035 Vision. We will continue supplying the world with oil and gas, keeping into consideration the carbon footprint and keeping CO2 emissions to the minimum.

The LC Kuwait was officially inaugurated in February. All interested members are welcome to connect via LinkedIn to learn about their upcoming activities.

FIRST BREAK I VOLUME 41 I APRIL 2023 13 EAGE NEWS 1 APR APPLICATIONS MINUS CO2 CHALLENGE 2023 OPEN ONLINE 21 APR SECOND SUBMISSION LAURIE DAKE CHALLENGE 2023 ONLINE 26 APR E-SUMMIT FACING STUDENT TEAM CHALLENGE ONLINE 5-8 JUN 84TH EAGE ANNUAL CONFERENCE & EXHIBITION (STUDENT ACTIVITIES) VIENNA, AUSTRIA EAGE Student Calendar FOR MORE INFORMATION AND REGISTRATION PLEASE CHECK THE STUDENT SECTION AT WWW.EAGE.ORG

The launch of the LC in February was also the opportunity for reboosting the collaboration with the EAGE Regional Office in the Middle East.

Strategic Programme panels to broaden scope of Annual Meeting in Vienna

The idea of the Strategic Programme is to add another dimension to our Annual Meeting. It will allow our global community of geoscientists and engineers not only to focus on the presentation of the many technology developments in the Technical Programme, but also come to grips with the serious challenges facing our traditional disciplines, the energy transition underway, and the way forward for the Association and its members.

current practices. In addition, 13 Dedicated Sessions are being organised to provide extra depth and variety.

You will notice a change in the traditional agenda at this year’s EAGE Annual Conference and Exhibition in Vienna. Alongside the usual Technical Programme we are introducing a Strategic Programme of panel sessions discussing major issues of the day, details of which will be forthcoming over the next few weeks.

Overall the Technical Programme offers 1000+ presentations spread over multiple parallel sessions. This year as ever we have a strong line-up of top quality papers covering every aspect of geoscience and engineering, providing the latest in multi-disciplinary research and development initiatives plus case studies of

Data science workshop coming to Kuala Lumpur

An upcoming workshop in Kuala Lumpur opens its doors to the geoscience community to explore the fundamentals, possibilities, career opportunities, and pitfalls of data science.

From state-of-the-art managed computing to better data discovery, you can hear from global leaders in the field, as well as independent innovators at EAGE’s Workshop on Data Science - From Fundamentals to Opportunities taking place on 17-18 October 2023.

There will be two keynote sessions, one by Dr Shivkumar Kalyanaraman (CTO, Energy & Mobility at Microsoft) and the other by Hussein Shel (director - enterprise technologist at Amazon Web Services). Dr Kalyanaraman will be discussing the digital aspects of data science in his talk on ‘The Software - and AI driven future of renewables’.

Taking a step back from the mysterious internal workings of data science applications, the workshop will discuss the foundations of data science and successfully integrating these techniques into critical exploration pipelines and focus on two levels.

As a workshop on data science, it will question what it is and how it ‘works’ including best practices and pitfalls. The second aspect would be the voyage of discovery finding out what can be done in the field of data science, the possibilities and opportunities.

Industry practitioners and researchers are welcome to contribute abstracts to the workshop on the suggested topics below until 28 May 2023: Fundamentals, pitfalls, case histories, and results; Out of the mainstream - a session dedicated to innovative applications of data science; Big oil and big data - how to derive value

The Strategic Programme builds on the previous popular Forum Sessions at the Annual Meeting to bring a great lineup of speakers over 10 panel discussions to address many broader issues impacting our industries and professions not covered in the Technical Programme, such as energy security and independence, decision quality and analysis, digitalisation, partnerships and stakeholder engagement, as well as how the workforce and skills will change in the coming years.

Make sure you head out to our website www.eageannual.org and check out these exciting new features at this year’s Annual meeting.

from exploration to development/production; Cracking the climate code through data science - an oil and gas industry perspective; Data science application beyond E&P; Healthcare, financial institutes, environmental studies, etc.; Driving the business - how data science can be used to gain insights to make business decisions and the human resources perspective; and Looking to the future - how data science is changing the world?

Learn more about this event and abstract submission information via https://eage.eventsair.com/eage-workshop-on-data-science/

14 FIRST

BREAK I VOLUME 41 I APRIL 2023 EAGE NEWS

Join EAGE workshop on Data Science in Kuala Lumpur.

Opening debate from EAGE Annual 2022.

Vienna Annual Exhibition is the place to be

With only two months away from our 84th Annual Conference & Exhibition, it’s great to see that everyone is just as excited as we are about the event, and especially the Exhibition. Heading to Vienna this June, we aim to provide you with a great earth science show as impressive as any in the past years.

tions related to topics like geothermal, CCS, wind farms, etc. In the International Prospect Centre, there is an opportunity to meet with key corporate players and national oil companies promoting exploration and investment opportunities. At the Start-up Area you can see what may be evolving as next generation technology. Also, there is a dedicated University Area at the Exhibition, where you can learn about the programme and research focus for departments in the 2023/2024 academic year.

The Exhibition in Vienna will once again be the place for you to explore state-ofthe-art products and innovative services in the industry, make new contacts and drive new business and partnerships.

Once again this year’s Exhibition continues to gather industry key players and representatives from national and international energy companies, service companies, consultancies, licensing agencies and governments, start-ups and universities. The Icebreaker Reception will kick-off the Exhibition immediately after the Opening Ceremony, a chance to maximise networking and socialising in an informal atmosphere.

Elements of the Technical Programme will also be featured in the Exhibition Hall, offering an integrated experience where following the technical presentations and networking becomes one. Free coffee points, wi-fi, working and seating areas are available across the Exhibition Hall.

Best place to start your Exhibition tour is at the EAGE Hub, where the daily programme is available with our staff in attendance to steer you to what you are looking for during the Annual. There you can also ask questions about the range of services that we provide, like membership, EarthDoc, Learning Geoscience and more. A few intriguing community and student

activities – such as speed mentoring, CV check, Young Professionals and Women in Geoscience and Engineering special sessions, Geosecrets of Austria, GeoQuiz, and education hunt – will take place on the Exhibition floor. More details are available on our website.

As ever, the multiple special interest areas in the Exhibition will bring you face-to-face with thought-leaders, innovators and disruptors in the global energy industry through a programme of talks and discussions alongside the main EAGE technical agenda. The Digital Transformation Area seeks to explore and showcase forward-thinking technology and workflows. The Energy Transition Area – a new feature introduced last year – is where you can dive into the world of renewables and learn about solu-

Visit www.eageannual.org for more information on the Exhibition, the list of exhibitors and all programmes on offer this year. Be sure to register as a delegate or Exhibition visitor sooner rather than later. You can still benefit from the discount registration rates until 15 May 2023.

For companies, universities and other relevant organisations, there is still room to participate in our Vienna Exhibition. We offer the opportunity to showcase your services and technologies, launch new products and heighten brand awareness. Our account managers are always ready to walk you through the possibilities. You can reach our account management team at corporaterelations@eage.org.

We look forward to welcoming you at the Messe Wien Exhibition and Congress Center this June.

FIRST BREAK I VOLUME 41 I APRIL 2023 15 EAGE NEWS

Exhibiting at the EAGE Annual was a perfect occasion to showcase our latest developments to a wide range of experts from the O&G, geothermal and CCUS industries. Everybody was keen to interact and to discuss the latest challenges and solutions in the energy industry.

Peter Haff inger

Co-founder and technical director, Delft Inversion

I really enjoyed hearing the energy transition and digitalization talks. It’s a great way to communicate our positive impact in that story, and EAGE is leading that conversation. I look forward to continuing to see them as part of the EAGE programme.

Jasmine Tran

Vice president of marketing, Ovation Data

Here’s how to make the most of your trip to Vienna

We’ve put together some useful information for members intending to travel to Vienna for the EAGE Annual Conference & Exhibition.

Travelling with accompanying persons

Attending the EAGE Annual week in Vienna presents a great opportunity for you to bring your partner and family members so they can experience some of the event atmosphere and the city. They are welcome to join the many social activities during the week.

You can register your partner and family members as accompanying persons to the Vienna Annual. An accompanying person will have access to the Opening Session, Exhibition (including coffee points and afternoon drinks), social programme (Icebreaker reception and Conference Evening) and an accompanying persons’ tour with a local guide for a wonderful experience of traditional Viennese coffee culture, historic gems and locals-only hotspots.

Please note that work colleagues do not qualify for the accompanying person registration.

Flight

We are pleased to partner with Lufthansa Group to offer you flight discounts for your trip to the EAGE Annual 2023 in Vienna. The global route network of Austrian Airlines, Lufthansa, SWISS, Brussels Airlines and Eurowings offers optimal connection and combination options, so you will benefit from quick and direct flights to the event.

Accommodation

We have appointed bnetwork as the official hotel booking partner for the 84th EAGE Annual Conference & Exhibition, as it has been able to secure a wide variety of hotel options across Vienna and

Visit eageannual.org for more details and booking links. By booking early, you can plan your stay in Vienna, save money and guarantee the best experience possible. Whilst there is no obligation to book your travel through our partners, please be aware of fraudulent and non-official sites that aim to take advantage of the EAGE Annual visitors. In case of any doubt, please do not hesitate to contact us at eage@eage.org.

For bookings

guarantee room stock for groups and for individual attendees alike.

Public transport in Vienna

As an EAGE Annual delegate, you get a 10% discount off the regular price of transportation tickets from ‘Wiener Linien’ valid on all public transport services in Vienna during the conference period. You can select a ticket for one, two, three or four days, depending on the duration of your stay.

Natural Museum History Vienna

If you are a museum lover, keep the Natural History Museum Vienna in your checklist when visiting the city. It is one of the most important natural history museums worldwide and an important centre of excellence for all matters relating to natural sciences. It covers the diversity of nature, the evolution of Planet Earth and life and the related cultural development of humankind in a building designed as a total work of art. As an EAGE Annual delegate, you get a 50% discount on tickets by showing your delegate badge at the museum entrance during the conference period.

16 FIRST BREAK I VOLUME 41 I APRIL 2023 EAGE NEWS

DONATE TODAY!

The EAGE Student Fund supports student activities that help students bridge the gap between university and professional environments. This is only possible with the support from the EAGE community. If you want to support the next generation of geoscientists and engineers, go to donate.eagestudentfund.org or simply scan the QR code. Many thanks for your donation in advance!

For accompanying persons

Family members of delegates are welcome to the Annual conference.

WHY ATTEND?

1. Connect with experts in the geoscience and engineering industry

2. Share ideas with professionals around the world

3. Engage with key operating service and technology companies

4. See, touch, experience and understand cutting-edge technologies

5. Grow a network of invaluable contacts for benchmarking, partnering and building your company and career

SPECIAL INTEREST AREAS

EXPAND YOUR KNOWLEDGE

The EAGE Annual offers various opportunities for you to gain new skills, new insights and new knowledge that are key to your academic or professional profile. With an All Access Registration, you can add Workshops, Field Trips, Short Courses or Hackathon to your event agenda.

PARTICIPATE IN OUR ENRICHING COMMUNITY PROGRAMME

Skills for the Energy Transition | Young Professionals Special Session Women in Geoscience and Engineering Special Session | Geosecrets of Austria

INTERACTIVE WORKSHOPS

WS1 Seismic Marine Sources: State of the Art

WS3 Geoscience Driving the De-risking of Commercially Viable Geothermal Systems in Europe

International Prospect Centre

See the full list of exhibitors on our website!

WWW.EAGEANNUAL.ORG

Are you (or your company) interested in the purchase of discounted group registrations (10+)? Contact your EAGE account manager or send a request to corporaterelations@eage.org to learn more about the details and advantages.

EXCITING HACKATHON

Natural Language Processing (NLP) is the theme of this year’s EAGE Annual Hackathon organized by the EAGE A.I. Community. We challenge you to collaborate with your fellows and develop innovative solutions for the industry.

CAPTIVATING FIELD TRIPS

ENGAGING SHORT COURSES

WS17 Fault and Top Seal Essentials

WS18 Seismic Interferometry: New Advances and New Applications

FT1

FT2

OMV Innovation & Technology Center –OMV TECH Center & Lab

Vienna: From Buildings Stones to an Urban Geothermal and Geophysical Testsite

SC1 An Introduction to Offshore Wind

SC2 Basics of Carbon Capture and Storage

SPETC Energy Transition for Oil & Gas Professionals*

WS5 The Role of Near-Surface Geophysics and Engineering in Renewable Energies and Low-Carbon Economy Transition

WS7 Natural Hydrogen Exploration

WS8 Last European Frontiers

WS12 FWI Imaging

WS13 Geostatistics and its Latest Developments Using Machine Learning Methods

WS14 Future Challenges in Geochemical Research for a Sustainable Environment

WS19 Six Steps Towards High Quality Decisions –Using the Example of Developing a Low Carbon Project

WS20 Distributed Fiber-Optic Sensing in Geotechnical Engineering and the Energy Sector

SPEWS1 Integrated Geochemistry Technology for

FT3 The Neogene of the Vienna Basin –A Visit to one of the Largest Onshore Hydrocarbon Fields in Europe

FT4 Geothermal Energy Utilization in the Styrian Basin: A Success Story of Sustainable Agriculture

OUR YOUNGER MEMBERS ARE ALSO INVITED TO BE PART OF THE STUDENT PROGRAMME

EAGE Global GeoQuiz Networking Cafe | Exhibition Tour Student Field Trip | Education Hunt (prizes included!) | EAGE Student Chapters’ meeting

Stay tuned for opportunities to publish your research in our academic journals and in our flagship magazine, First Break Find out more information about our publications and other activities at the EAGE Community Hub!

Engineering Applications SPEWS2 CCS Evaluation: From Geoscience to the Economics SPEWS3 Designing the Future of the E&P Business 1000 1100 1150 1004 2000 2200 2250 ETA 2300 250 100 ETA ETA 130 129 IPC16 3500 3400 3300 3275 3290 4700 4708 4710 4702 4707 4550 4500 4650 IPC116 211 IPC IPC10 IPC110 3000 4000 150 152 158 6000 7000 8020 8100 9000 9002 9004 DTA 230 DTA DTA 140 DTA 150 10032 10030 10028 10024 DTA 316 DTA 310 DTA 300 DTA 224 215 8000 8030 6200 6300 5310 5313 5314 5316 4314 6450 6600 6700E 6700D 6700C 5405 5401 5403 5505 5600 5650 UNI 6800 6950 8200 8300 5525 5530 5540 5520 5510 6700B 6475 5000 5100 3250 EAGE Community Hub IPC Area Transition Energy Transition Theatre Digital Transformation Area Digital Transformation Theatre 1 3 Entrance Entrance Galerie Rooms University Area * NOT included in the All Access Package. Digital Transformation Area Energy Transition Area SCAN THE QR CODE FOR THE FULL PROGRAMME Start-up Area Complete your EAGE Annual Experience!

Welcome to

THE 84 TH EAGE ANNUAL CONFERENCE & EXHIBITION !

VIENNA, MESSE WIEN | 5-8 JUNE 2023

ABOUT THE EVENT

In June 2023 the global geoscience and engineering community will come together in Vienna to discuss the greatest resource challenges facing our industries as we navigate the need to reduce environmental impacts while meeting future needs for affordable energy and resources. EAGE, together with our local host OMV, invites you to join us for a week of transformational learning and networking opportunities under the theme "Securing a Sustainable Future Together".

Delegates 6000+

Ready to join us in Vienna this June?

STRATEGIC

PROGRAMME

HOST SPONSOR

Presentations 1300+

OUR ANNUAL IS SURE TO HAVE YOUR DESIRE TO LEARN SATISFIED !

• Technical Programme: Hear ground-breaking and innovative findings presented by your peers

• Strategic Programme: Join panel discussions on critical challenges and opportunities impacting our operation

• Exhibition: Meet decision-makers and people behind the products, services, technologies

• Workshops: Share experience and discuss some of the most relevant topics from a technical point of view

200+ Exhibitors

• Short Courses: Stay up to date with key knowledge relevant to developments in the energy transition field

• Field Trips: Explore regional geological outcrops and industrial facilities

• Hackathon: Work on real-world challenges and use-cases in geoscience

• Community & Student Programme: Participate in career development activities and connect with our communities

• Social Programme: Make new contacts during the ice breaker reception and conference evening

NEW REGISTRATION SETUP

All Access Package

Maximise your time at the event and experience the full content available!

THANK YOU TO OUR SPONSORS!

REMEMBER: YOU WILL BENEFIT FROM THE DISCOUNTED FEE IF YOU SIGN UP BEFORE 15 MAY 2023

MAIN SPONSORS REGISTER AT WWW.EAGEANNUAL.ORG

We bring together industry leaders to discuss the key issues of energy security and independence, a sustainable energy transition and how we all need to adapt our traditional ways of working and cooperation to address this uncertain future.

SVP

Kristian

Hans

Kathrin

SVP

Kevin

SVP

Mohd

Abdul

VP

John

VP-Head

Markus

SVP

Michael

VP

S&P

Greg

VP

Ann

President, GeothermEX Elizabeth

VP Exploration, Chevron

SVP

Production

Sophie

Christina

Angelika Zartl-Klik

Low Carbon Business, OMV

Johansen CEO, TGS

Kuehner Director International Exploration, Chevron

Dufour

Digitalization & Technology, Wintershall Dea

McLachlan

Exploration, TotalEnergies

Redhani bin

Rahman

Exploration, PETRONAS

Ardill

of Global Exploration, ExxonMobil Upstream

Berghofer

Technology & Innovation, OMV E&P

Wynne

International Upstream,

Global Commodity Insights

Rock

Exploration, OMV E&P

Robertson-Tait

Schwarze

Erling Vågnes

Subsurface Exploration

International, Equinor

Zurquiyah CEO, CGG Hugo Dijkgraaf CTO, Wintershall Dea

Verchere CEO, OMV Petrom

HOST SPONSOR MAIN SPONSORS

A story of overcoming adversity

PGS chief geoscientist Andrew Long survived a life-changing accident to become a leading geoscientist of his generation, respected lecturer and industry commentator. A prolific author and recipient of numerous awards, he has been involved in most of the company’s technology advances over the last 20 years.

Upbringing in Australia

I grew up in Bendigo, Victoria, which was a gold mining centre in the mid1800s. We didn’t have much money and lived a very basic life. Higher education was the obvious path for me as I loved science and math. Apparently from three onwards I wanted to become a surgeon as that seemed like the highest profession in life anyone could possibly achieve.

Geoscience over medicine

It wasn’t planned. I started in medicine at Melbourne University, switched to the advanced physics and mathematics stream for two years, and then I switched again to geophysics as my friends were doing it. It seemed like the only way to escape from a life splitting atoms in a lab somewhere. When I finished, I made the impulsive decision to take a 40-hour bus trip across Australia to start a postgraduate degree in seismic. I made great friends in Perth and lived a rollicking life playing rugby and studying. Unfortunately, life was interrupted a year later when I broke my neck.

Accident

It lives with me every day, but I generally don’t talk about it. I was standing over a shothole when 4 kg of gelignite went off, taking the full force in my chest. My cervical vertebrae were dislocated from my thoracic vertebrae. It was seven and a half months in a spinal unit before I got out, over 20 kg lighter, and wheelchair-bound.

Personal philosophy

On my first night in hospital, blinded with shrapnel, a nurse read the following passage to me from The Greatest Salesman in the World by Og Mandino: ‘I will persist until I succeed. I was not delivered unto this world in defeat, nor does failure course in my veins. I am not a sheep, waiting to be prodded by my shepherd. I am a lion and I refuse to talk, to walk, to sleep with the sheep. I will hear not those who weep and complain, for their disease is contagious. Let them join the sheep. The slaughterhouse of failure is not my destiny.’ While I never had any time for motivational books, I never forgot her act of kindness or the power of those words.

Back to work

Getting back into employment was the best rehabilitation, aided by my now long-suffering wife Ros who I had met in hospital. I wanted to prove everyone who doubted me wrong. I still hate the sheep … I just try to get on with things, exploit my dark sense of humor, and not make a big deal out of my situation.

Stanford connection

After a few years in seismic processing, I started a PhD at UWA with my supervisor Mike Dentith. I also had a cool job developing a commercial marine gravity product based upon satellite altimetry with World Geoscience. I met the Stanford prof, Jon Claerbout, at a conference in Perth where I was presenting my satellite altimetry stuff. He graciously funded a trip

to visit Stanford later that year, and I met another Stanford prof, Simon Klemperer, in Hungary en route to California. Two years later they teamed up with Ginger Barth, a research associate, to offer me a post-doctoral position. Stanford is the most extraordinary melting pot of truly inspirational and brilliant people from all backgrounds and demographics. I had a fabulous time and it has shaped my attitudes and methods ever since.

Career at PGS

I joined PGS at a time of amazing growth led by huge investments in technology and innovation. For the first few years my mentors, Sverre Strandenes and Magne Reiersgard, fostered a winning culture that felt like a messy but exciting family. I’ve always tried to span as many geoscience disciplines as possible, I love teaching (I can thank my high school teacher Mum for that) and being a ‘catalyst’ to make things happen. I’ve been fortunate to travel to many places with PGS (my favourite being Japan).

Favourite movie

The Fifth Element.

Life in Perth

Aside from a second short period back in the US, I’ve endured the Oslo timezone for over 20 years in Perth. It is beautiful and safe, and I felt I always owed it to my wife and now 23-year-old daughter Claire to live here. And PGS has generally supported my remote location.

FIRST BREAK I VOLUME 41 I APRIL 2023 17 PERSONAL RECORD INTERVIEW

Personal Record Interview

Andrew Long

3-7 SEPTEMBER 2023 | EDINBURGH, UK SUBMIT YOUR ABSTRACTS BEFORE 25 APRIL 2023! 18 FIRST BREAK I VOLUME 41 APRIL 2023 Make sure you’re in the know EAGE MONTHLY UPDATE 14 April 2023 Call for Abstracts First EAGE Conference on Deepwater Equatorial Margin 25 April 2023 Call for Abstracts Near Surface Geoscience Conference & Exhibition 2023 7 May 2023 Call for Abstracts 2nd EAGE Workshop on Fluid Flow in Faults and Fracture IMPORTANT DEADLINES 6-9 NOVEMBER 2023 • PARIS, FRANCE SUBMIT YOUR ABSTRACTS! CHECK OUT THIS MONTH’S ARTICLES REGISTER NOW! 10-15 SEPTEMBER 2023 • MONTPELLIER • FRANCE CHECK OUT THE AGENDA ! EAGEANNUAL.ORG WWW.EAGENSG.ORG

World Class Processing & Imaging

Powered by Reveal

Marine seismic processing and imaging services for all your ocean bottom and towed streamer challenges.

UNITED KINGDOM

STATES EGYPT INDIA

UNITED

MALAYSIA AUSTRALIA NIGERIA ANGOLA BRASIL

CROSSTALK

BY ANDREW M c BARNET

BY ANDREW M c BARNET

Consequences of war a year on …

Who does not feel guilty about following the relentless horror of Ukraine’s fight for survival from the comfort of their own living rooms, at least dimly aware that in reality a proxy war is being fought on behalf of NATO and its allies to curb Russian aggrandisement under its aggrieved and autocratic leader. Human nature is also such that, from the outset in February last year, we have selfishly speculated about disruption to the world’s political and economic order and of course how this might be reflected in our everyday life.

Understandably analysts have focused primarily on global energy supply and demand. The expectation was that strategic reductions in Russian gas supplies would cause havoc and hardship in Western Europe. The Kremlin hoped support for Ukraine would weaken. In fact, the blackmail has failed, as well argued by Szymon Kardaś, senior policy fellow, European Council on Foreign Relations.

In 2021, EU countries imported 155 billion cubic metres (bcm) of Russian gas, accounting for about 45% of total gas import, 108.1 million tonnes (mt) of oil, 91 mt of petroleum production plus 51.4 mt of coal. In 2022 Russian changes in gas supply rules including the gas for rouble decree and suspension of gas transport via the Nord Stream 1 pipeline reduced exports to the EU to 80 bcm. The shortfall was made up by increased gas imports from Azerbaijan and Norway plus more LNG (ironically an increase of 60% from Russia). Remarkably, in January, Foreign Minister Christian Lindner was able to state that Germany no longer depended on Russian imports for its energy supply. Diversifying its energy infrastructure included reopening some coal-fired power plants, delaying plans to shut down its three remaining nuclear power plants, stepping up LNG, and increasing capacity to store natural gas imported.

Kardaś acknowledges that in 2022 there was an estimated 10-12% decline in EU natural gas consumption aided by mild weather, some domestic ‘green’ behaviour and reduced industrial

production. Not all these factors will persist going forward, but Europe will focus on decoupling its energy dependence on Russia.

As for Russia, responsible for around 10% of world oil supplies, its oil output initially defied predictions of a decline, rising in 2022 by 2% to 535 mt (10.7 million b/d) largely due to sales to Asia, especially, India and China.

However, the price cap of $60 a barrel on seaborne cargoes of Russian oil imposed in December by the Group of Seven countries, EU and Australia appears to be having an impact. In February Russia announced a cut in output of 500,000 b/d. However, this has not persuaded OPEC+ countries to back away from the cut in quotas agreed last November apparently in the belief that Russia will continue to maintain supplies to countries where no sanctions apply.

During the period of global energy supply adjustment/uncertainty the price of oil soared, but this phenomenon has been only one factor in the global economic malaise. Government stimulus measures to counter economic dislocation of the Covid-19 pandemic, disruption to supply chains, and economic slowdown in China plus an unanticipated rise in product demand in 2021 all contributed to inflationary pressures before the oil and gas supply crisis provoked by war in Ukraine.

In other words, the high cost of energy was not the sole source of woes being experienced worldwide. In Europe, the UK with an economy already self-harmed by Brexit, has been notably affected by the combination of negative forces. That said, the unprecedented profits that have accrued to the major players in the oil business during this tumultuous period have touched a nerve with governments, not to mention motorists paying through the nose at the petrol pumps. There has been much speculation that the annual results from Big Oil, the most conspicuous consequence of the war, may prove some kind of tipping point in government and public thinking about energy and fossil fuel dependence.