TotalFinance

• Create a strong financial structure and healthy economic ecosystem to ensure capital and cash flow keep their engines running?

• Determine who their customers should be, how they can reach them most effectively, and how they can turn data-driven marketing into profitable sales?

• Build efficient and effective financial systems to enhance payments and billings between their companies and their customers and vendors?

• Convert all the data and information they collect from every contact point into tangible benefits that increase revenue and reduce costs?

• Equip their companies with the tools, technology, systems and hardware needed to manage their operations, to create new services or products, and deliver them to their market?

• Manage their customers with smoothly functioning support departments that are properly staffed and equipped to solve problems, foster loyalty and retain customers?

• Make any or every step in that chain better, faster, cheaper, and more profitable?

905-201-6600

225 | 1-800-668-1838 |

We can help you tap into the ecosystem at the points that will drive your campaigns.

THE FUTURE OF PAYMENTS IS COMING TO THE SUMMIT. Take part in the conversations shaping payments in Canada and around the globe at The 2024 SUMMIT from Payments Canada. Welcome back to Canada’s premier payment event, designed just for you: build new relationships, reconnect with familiar faces, engage with exciting ideas and contribute to the payment revolution. Immerse yourself in the future of payments! Attendees of The SUMMIT benefit from unrestricted access to the main stage, lively breakouts, engaging workshops and the Idea exchange, unlimited opportunities to forge meaningful in-person connections and collaborate with leaders in payments, the chance to explore a vibrant interactive space designed to facilitate learning and exciting conversations, an open invitation to exclusive social events bringing together the who’s who of payments, and a wide selection of future-focused content in varying formats, allowing you to tap into the collective expertise of the payment ecosystem.

The SUMMIT is the payment community’s annual opportunity to convene and forge a vision for the future. As part of our continued effort to foster diversity and inclusion at Payments Canada, we affirm our commitment to create an inclusive, respectful event environment that includes participation from people of all races, ethnicities, gender identities, ages, abilities, religions and sexual orientations. We’re actively seeking to increase the diversity of our attendees, speakers and sponsors through our Calls for Speakers, other open submission processes and through dialogue with the communities we serve.

TRENDING TOPICS FOR 2024: AI & MACHINE LEARNING; AUTHENTICATION; CBDC/DIGITAL CURRENCIES; COMPLIANCE; CORPORATE BANKING; CYBER SECURITY; DATA GOVERNANCE; DIGITAL ID; ESG; FASTER PAYMENTS; FINANCIAL INCLUSION; FINTECH; FRAUD; GIG ECONOMY; INTEROPERABILITY; ISO 20022; LOYALTY; METAVERSE BANKING; MICROPAYMENTS; MOBILE PAYMENTS; OPEN BANKING; PAYMENTS AS A SERVICE; PAYTECH; POLICY; REGULATIONS; RETAIL PAYMENTS; RISK; SECURITY; TOKENIZATION; TRUST.

The SUMMIT attracts the best payment leaders, innovators, influencers and decision-makers. The charts below represent the types of organizations that attend and the job function of a typical delegate. Coming to Toronto from May 29 to 31 at the Beanfield Centre. Attendees connect to 200 payment leaders to share their expertise in more than 70 sessions.

$ $ $

Financial Executives International Canada (FEI Canada) connects, engages and inspires CFOs and senior financial executives as business leaders, creating a competitive advantage within their organization, contributing to the success of Canadian businesses in a global market. Members connect with peers, colleagues, business leaders through local chapters.

The FEI Canada 2024 Annual Conference being held in from June 5-7 in Edmonton, Alberta. Brimming with more than 300 senior financial executives, the conference features impactful keynote speakers, in-depth concurrent sessions, thought leadership, and fun-filled networking events. The trade show within the conference offers a first-hand glimpse at the latest products, solutions and services geared towards the senior financial executive.

The agenda includes opening keynote speaker Shawn Kanungo, a globally recognized innovation strategist, keynote speaker and bestselling author whose talk is Strategy in a World of Disruption

As a globally recognized innovation strategist and bestselling author, Shawn Kanungo works at the intersection of creativity, business, and technology. He spent 12 years at Deloitte working closely with leaders to help them better plan for the opportunities associated with disruptive innovation. In his high energy keynotes, Kanungo draws on his extensive experience to provide audiences with an optimistic roadmap for the future; one that embraces unexpected approaches to innovation to remain competitive and relevant. His speech is followed by a Keynote CFO Panel called Adaptation in Action: The CFO’s Evolution in a Rapidly Changing Business Terrain. The evolving landscape of the CFO’s role is marked by profound shifts in the face of an ever-accelerating business environment. As we navigate the future of the workplace, dynamic changes are underway, such as the use of predictive analytics, hybrid workplaces, supply chain shifts and the knowledge loss from the retirement of baby boomers. As we embrace the future, the reskilling of finance teams becomes paramount. The evolving skill requirements necessitate a proactive approach to equip teams with the capabilities needed to thrive in a rapidly changing landscape. This commitment to reskilling not only ensures adaptability but also positions finance professionals as strategic contributors to the organization’s success. In essence, the changing role of the CFO is intertwined with the broader transformations in the workplace and the strategic adaptation to emerging trends. Embracing resiliency, navigating the accelerated pace of business, and strategically addressing workforce dynamics are at the core of ensuring success in the future landscape.

34

3

11 Canadian CFO Insights from PwC

12

18

How Top CFOs See 2024 Unfolding and What They’re Doing About GenAI

A New Perspective: The Shift in Payment Trends Through the COVID-19 Pandemic

24 Canadian asset management deal trends M&A Trends for Canadian Asset Managers: BLG’s Observations and Insights Looking Ahead to 2024

28 Treasury Technology Trends in 2024: How APIs, AI, and RPA change the treasury landscape?

32 Treasury Trends 2024: Can We Learn from New Zealand’s Insights?

34

A Preview of 2024: 10 Trends That GCs and Boards Need to Know

38 Locking the Piggy Bank: Keeping Prying Hands Out in 2024

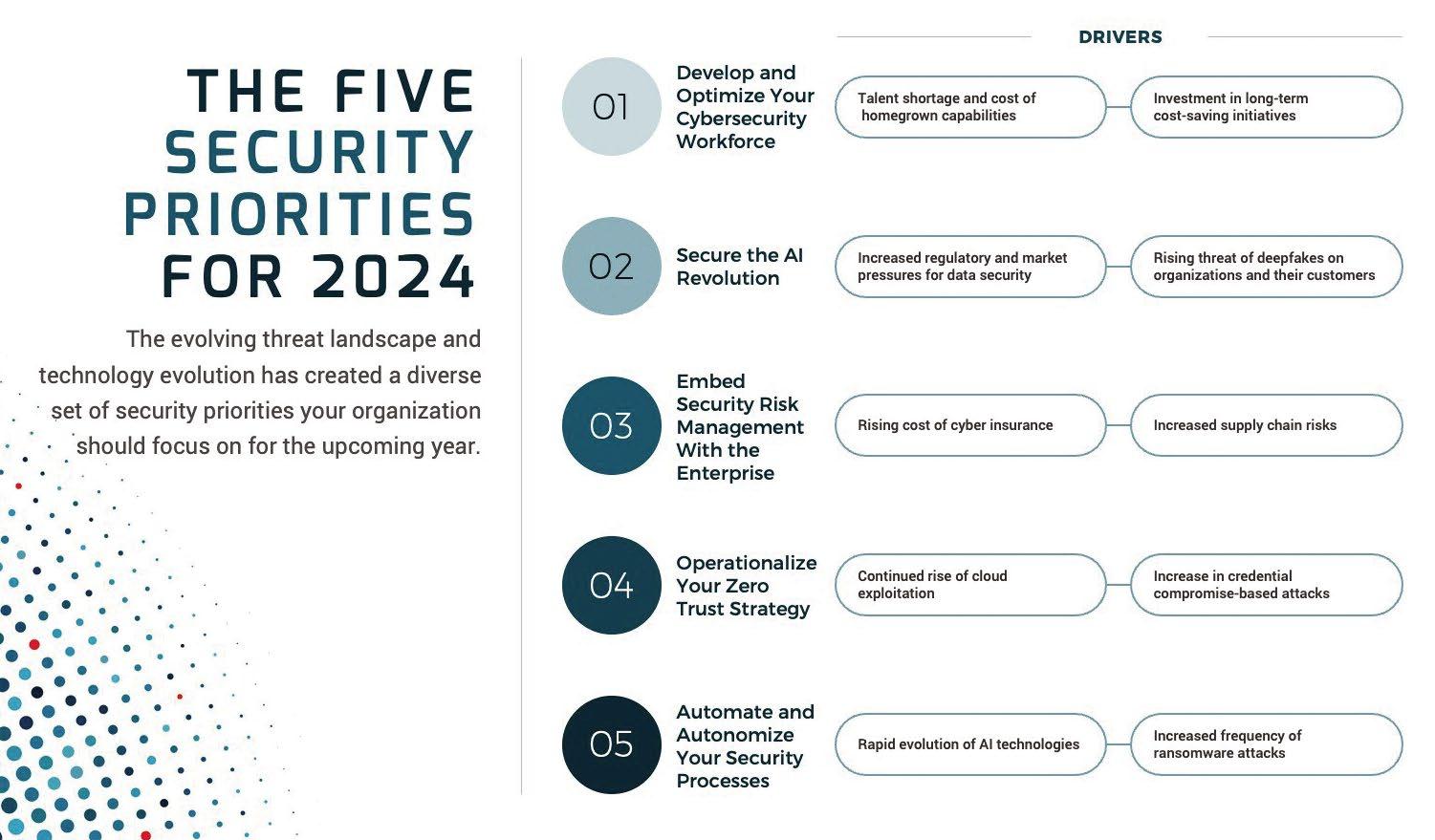

Top 2024 Cybersecurity Priorities revealed in a new report by Info-Tech Research Group

Spring 2024

Volume 3 Number 1

Publisher / Corporate Sales

Steve Lloyd

steve@totalfinance.ca

Contributors

Aaron Atkinson, Partner, Davies Ward Phillips & Vineberg LLP

Bruno Atristain, Partner, Operations M&, KMPG Canada

Barbara Babati, Head of Marketing, Nomentia

Craig Bannon, Director of Regional Financial Planning Support, RBC

David Francescucci, Partner, Transformative Tax Advisory, KMPG Canada

Alison Glober, Partner, Operations Excellence, Management Consulting, KMPG Canada

Ben Keen, Partner, Borden Ladner Gervais LLP

Duncan Lau, Partner, Restructuring and Turnaround, Deal Advisory, KMPG Canada

Creative Direction / Production

Julie Mansi, Partner, Borden Ladner Gervais LLP

Andrew McLean, Partner, Borden Ladner Gervais LLP

Andrew Mihalik, Partner, Davies Ward Phillips & Vineberg LLP

Marc Pontone, Partners, Davies Ward Phillips & Vineberg LLP

Brett Seifred, Partner, Davies Ward Phillips & Vineberg LLP

Juan Uro, EY-Parthenon Principal, Strategy and Transactions, Ernst & Young LLP

Stephen Yun, Senior Analyst, Market Insights, Payments Canada

Jennifer O’Neill, jennifer@totalfinance.ca

Photographer

Gary Tannyan

President

Steve Lloyd, steve@totalfinance.ca

For subscription, circulation and change of address information, contact: subscriptions@totalfinance.ca

Publications Mail Agreement No. 40050803

Return undeliverable Canadian addresses to:

40

42

Seven Levers to Business Value Creation Considerations for Creating and Preserving Value

Millennials Weighed Down by Financial Worries: RBC Poll

Circulation

302-137 Main Street

t: 905.201.6600 • f: 905.201.6601 info@totalfinance.ca www.totalfinance.ca Twitter:

Subscriptions

Printed in Canada. Reprint permission requests to use materials published in

Total Finance should be directed to the publisher.

Payments Canada Announces CEO Transition. Tracey Black to Depart; Kristina Logue and Jude Pinto Appointed Interim Co-Chief Executive Officers, Effective April 1, 2024. The Payments Canada Board of Directors said Black, who joined Payments Canada in 2018, made the decision not to renew her term as President and CEO of Payments Canada. Over the last five years, Black has led a series of major payment modernization initiatives, serving Canadians with secure, efficient, and resilient payment systems, and laying the foundation for continued innovation. The Payments Canada Board of Directors and Black feel it is an opportune moment to seek her successor in advance of the next phase of payment modernization. Black will complete her leadership term through the end of March 2024. The Board will initiate a comprehensive internal and external search process to identify Black’s successor, who will lead the organization through the next phase of payment innovation. Until a successor is named, the Board has appointed Kristina Logue, Chief Financial Officer (CFO) and Jude Pinto, Chief Delivery Officer (CDO), as interim co-CEOs, effective April 1, 2024.

“On behalf of the Payments Canada Board of Directors, and all of our employees, members, and stakeholders, I want to thank Tracey for her many contributions to the organization through her leadership over the past five years,” said Garry Foster, Chair of the Payments Canada Board of Directors. “Tracey’s leadership has been crucial to the progress Payments Canada has made in modernizing the payment ecosystem in Canada and positioning the organization for the next phase in its advancements. As we search for Tracey’s successor, Kristina and Jude’s combined experience as seasoned industry leaders, and their expertise in leading critical operational aspects of our business,

will serve Payments Canada well as interim co-CEOs. Kristina and Jude will work closely with support from our exceptional executive leadership team. I look forward to working with the Board during the search process to find our next successor to support the next phase of payment innovation in Canada.”

Through Black’s leadership, Payments Canada has worked collaboratively with the payment ecosystem to innovate payment systems and rules to benefit Canadians, and to ensure Canada and Canadian businesses remain globally competitive. Over the duration of Tracey’s leadership, Payments Canada systems have operated with almost 100% availability with demonstrated resiliency and safety. Fundamental to this work, in 2021 Black led the seamless implementation of Lynx, replacing the Large Value Transfer System (LVTS), which served as Canada’s high-value payment system since 1999. In March 2023, Black led the second release of Lynx, which introduced the ISO 20022 financial message standard (MX messages) to enable data-rich payments. More recently, Black played an instrumental role in supporting the expansion of access to Canada’s national payment infrastructure, laying the foundation for continued future innovation in digital payments. Under Black’s leadership, Payments Canada has also made significant strides in the design and preparation for the implementation of the new Real-Time Rail (RTR) payment system in Canada, readying the RTR initiative for its next phase.

“It has been a privilege to lead this organization during my time as President and CEO. I am proud of what our team at Payments Canada has achieved in the continued modernization of our nation’s payment systems, in partnership with our members and in collaboration with Canada’s payment ecosystem. Together, we have achieved major progress in advancing innovations that serve Canadian consumers and businesses, and support our nation’s broader economic interests on the global stage,” said Black. “Kristina and Jude have been incredible partners, and together they bring a deep understanding of the organization and the payment industry more broadly. I feel extremely confident that Payments Canada, our

members, partners and employees are in excellent hands – and perfectly poised for the next phase of continued payment innovation in Canada.”

In her role as interim co-CEO, Kristina Logue will be responsible for the day-to-day functions of the organization, in addition to her responsibilities as CFO. This includes providing financial oversight, planning and analysis of all Payments Canada’s activities as well as its Human Resources, Program Management, Procurement, Corporate Strategy and Business planning functions. Beyond her financial expertise, Logue is a respected people leader, mentor and organizational champion.

Jude Pinto, who brings 30 years of executive-level leadership within the financial services sector, has successfully led industry transformation and innovation, nationally and internationally. In his role as interim co-CEO, Pinto will continue to play a pivotal role in innovating Canada’s payment ecosystem with a focus on safety, resilience and inclusiveness, enabling fair competition in Canada’s thriving economy. Pinto will continue to lend his expertise and experience leading large-scale delivery programs in leading the next phase of the RTR, working in collaboration with members and the broader ecosystem. In his expanded role, he will take on oversight of Payment Canada’s information technology and operations business unit.

Logue and Pinto will report to the Chair of the Payments Canada Board of Directors, and continue to be supported by the full executive leadership team, including Donna Kinoshita, Chief Payments Officer; Peter Dodic, Chief Risk Officer; and Shawn Van Raay, Chief Information Officer.

Laurentian Bank has three new directors. Michael Boychuk, Chair of the Board of Directors of Laurentian Bank of Canada revealed the appointments effective February 2024: Prof. Johanne Brunet, Jamey Hubbs, and Paul Stinis. These appointments are part of the Board’s commitment to ongoing renewal to enhance its overall effectiveness, which ensures an appropriate balance between skills and experience and a diversity of perspectives.

Prof. Brunet is a Professor of Marketing at HEC Montréal. Her interests and research

have focussed on managing creativity in complex environments, innovation, global economies, international marketing, and business planning. Prof. Brunet serves on a number of major boards including as Chair of the Société des alcools du Québec (SAQ). She is a Member of the Order of Chartered Professional Accountants of Quebec (CPA), holds a PhD in Industrial and Business Studies from the University of Warwick, England, and a Masters in Business Administration from HEC Montréal. She also earned the University Certification in Corporate Governance, designation from Laval University.

Hubbs is a seasoned banker and regulator with extensive experience in banking, capital markets, prudential regulation and risk management, and has held senior positions with a federal prudential regulator and in several large corporations in the Canadian financial industry. Hubbs holds a Bachelor of Arts from the University of Waterloo, a Master’s Certificate in Project Management from Schulich School of Business, and the ICD.D. designation from the Institute of Corporate Directors.

Stinis is an accomplished senior business executive and is currently Vice Chair of the Board for Hydro Quebec. He has an extensive background in the capital markets, risk management, business development, and the Canadian banking industry. He was previously Senior VicePresident and Corporate Treasurer of BCE Inc. and Bell Canada and served as President of Bimcor Inc. Stinis holds a Bachelor in Engineering from McGill University and a Masters in Business Administration from Concordia University.

“We are delighted to welcome Prof. Brunet, Mr. Hubbs, and Mr. Stinis to the Bank’s Board of Directors,” stated Mr. Boychuk. “Their collective expertise in areas such as innovation, risk management,

and corporate leadership will be excellent additions to the skillsets and depth of our Board. As we continue our focus on customer service excellence and consolidating our position as a strong Québec-based institution, their valuable contributions will undoubtedly play an instrumental role in Laurentian Bank’s continued success.”

Founded in Montréal in 1846, Laurentian Bank helps families, businesses and communities thrive. They have approximately 3,000 employees working to provide a broad range of financial services and advice-based solutions for customers across Canada and the United States. They protect, manage and grow $49.9 billion in balance sheet assets and $25.8 billion in assets under administration.

Rob Palmer joins Porter Airlines as Chief Financial Officer. Porter Airlines is announcing that Rob Palmer has joined the company as its new executive vice president and chief financial officer.

Palmer has a robust industry background, most recently with The Calgary Airport Authority as its vice president, commercial, strategy and chief financial officer. His responsibilities included long-term planning, capital requirements, budgeting, internal controls, treasury and reporting. This experience complements previous time spent at WestJet as vice president and controller.

“Rob has a clear understanding of airport operations and airline finances, and we expect to benefit from his knowledge in these areas,” said Michael Deluce, CEO, Porter Airlines. “His time at WestJet came during a period when it was quickly expanding, similar to today’s situation at Porter as we develop into a North American carrier. We welcome Rob as a new and valued member of our team.”

Palmer has more than 20 years of public company, capital markets, financial and strategic management experience across numerous industries that include the chief financial officer with Northview Residential REIT and senior leadership roles with Molson and BCE Emergis.

“The opportunity to join Porter at a moment when it is reshaping airline competition is incredibly exciting,” said

Palmer. “I truly enjoy working in the aviation industry and with the people who choose to make their careers in it. My goal is to contribute to making Porter one of the strongest and best airlines in North America.”

Porter currently flies to over 30 destinations in Canada and the U.S., and will be announcing numerous new destinations and routes in 2024.

Since 2006, Porter Airlines has been elevating the experience of economy air travel for every passenger, providing genuine hospitality with style, care and charm. Porter’s fleet of Embraer E195-E2 and De Havilland Dash 8-400 aircraft serves a North American network from Eastern Canada. Headquartered in Toronto, Porter is an Official 4 Star Airline® in the World Airline Star Rating

Mandalay Resources announced the appointment of Hashim Ahmed as EVP and Chief Financial Officer. Mandalay Resources Corporation (TSX: MND) (OTCQB: MNDJF) said Ahmed will take the position effective March 1, 2024. As previously announced, current CFO Nick Dwyer resigned for personal reasons and will be supporting the transition to Ahmed.

Frazer Bourchier, President and CEO, commented, ““We are delighted to welcome Hashim to Mandalay. His extensive industry experience, focus on capital discipline and strategic financial acumen make him an ideal fit for our leadership team. As we embark on our next phase of growth, Hashim will play a crucial role in steering our financial strategies and ensuring our continued financial success.”

Ahmed said, “I am thrilled to be joining Mandalay at such an exciting time. The Company’s commitment to growth and operational excellence aligns with my own professional values. I look forward to contributing to the financial success of the Company and working collaboratively with the talented team in place.”

Ahmed has a proven history of success with over 20 years of experience, with the past 15 years focused on the mining industry. He has expertise in financial management, corporate strategy, organizational restructuring, and capital markets. Ahmed has held a number of finance executive roles, most recently

as CFO at both Nova Royalty and Jaguar Mining before that. Prior to Jaguar, Hashim worked with Barrick Gold for over seven years, where he held progressively senior positions in finance functions in Canada, and with site finance teams in Chile. At the start of his professional career, he obtained his CA/CPA designation with PricewaterhouseCoopers LLP and later worked with Ernst & Young LLP in their advisory practice.

Mandalay Resources is a Canadian-based resource company with producing assets in Australia (Costerfield gold-antimony mine) and Sweden (Björkdal gold mine). The Company is focused on growing its production and reducing costs to generate significant positive cashflow. Mandalay is committed to operating safely and in an environmentally responsible manner, while developing a high level of community and employee engagement.

Greenbrook TMS Inc. (NASDAQ: GBNH) announced the Company’s Board of Directors has appointed Peter Willett as the Company’s full-time Chief Financial Officer, effective immediately. Willett was appointed Interim Chief Financial Officer of the Company in October 2023, prior to which he has been a key player on the Greenbrook finance team over the past six years, serving as its Senior Vice President of Finance. Peter brings over 11 years of finance experience, providing a broad base of experience and specialized knowledge about the financial and accounting matters that are unique to the mental health services industry.

Peter has been instrumental in developing and implementing the financial strategies that have been successful in improving reporting functions and cost controls for Greenbrook. Peter

has a proven track record of identifying effective processes and procedures to improve quality, accuracy, and efficiency in accounting and financial operations.

Operating through 130 Companyoperated treatment centers, Greenbrook is a leading provider of Transcranial Magnetic Stimulation (“TMS”) therapy and Spravato® (esketamine nasal spray), FDA-cleared, non-invasive therapies for the treatment of Major Depressive Disorder (“MDD”) and other mental health disorders. TMS therapy provides local electromagnetic stimulation to specific brain regions known to be directly associated with mood regulation. Spravato® is offered to treat adults with treatment-resistant depression and depressive symptoms in adults with MDD with suicidal thoughts or actions. Greenbrook has provided more than 1.3 million treatments to over 40,000 patients struggling with depression.

Groupe Dynamite Inc., a leading integrated retailer in fashion, appointed Jean-Philippe D. Lachance as its Chief Financial Officer effective in January 2024. This move comes as part of GDI’s commitment to growing the strength of its executive team and further driving financial excellence across the organization.

With an extensive background in Corporate Finance and Treasury, JeanPhilippe D. Lachance brings an exceptional track record of success along with his wealth of experience. Prior to joining GDI, Lachance most recently served as Vice-President, Investor Relations, Treasury and Financial Planning and Analysis of Alimentation Couche-Tard, a global leader in convenience and mobility. Preceding that, he served for nearly 10 years as the Vice-President of Corporate Finance and Treasurer of Dollarama, a recognized Canadian value retailer. In both organizations he played an instrumental

role in transforming the capital market activities, along with the budgeting, and forecasting disciplines. Lachance holds a Bachelor of Commerce from HEC Montreal, as well as the CFA designation.

In his new role as CFO, Lachance will oversee GDI’s financial organization, as well as the company’s short and long-term strategic financial initiatives.

“We are very excited to welcome Jean-Philippe to our executive team and couldn’t be happier with his contribution just a few days into the role. His prior experience in senior finance roles along with his extensive knowledge of capital markets and public companies, will benefit GDI as we pursue efficient and profitable growth, execute on our broader strategic objectives, including our rapid expansion into the United States,” said Andrew Lutfy, President and Chief Executive Officer.

Lachance echoed his enthusiasm for joining GDI, adding, “I am honored to join the GDI team and sincerely look forward to contributing to its success, generating tangible value for all stakeholders as we continue our efforts to deliver on our longer-term objectives.”

Groupe Dynamite Inc (GDI) is a Montrealbased, privately held, house of integrated omnichannel brands, designing and distributing accessible, trend-forward fashion for women since 1975. The organization’s mission of “Empowering YOU be YOU, one outfit at a time” is brought to life through the GARAGE and DYNAMITE banners and represents the consumer-centric core of GDI’s longstanding success as a leading retailer in North America. Today, GDI operates nearly 300 stores across the United States and Canada, as well as shoppable brand experiences at GarageClothing.com and DynamiteClothing.com

Odd Burger Corporation (TSXV: ODD) (OTCQB: ODDAF) (FSE: IA9) Murtaza

Chevel as the Company’s new Chief Financial Officer effective January 2024.

Chevel holds a Chartered Professional Accountants designation and is a seasoned strategic finance leader with multi-faceted global business experience in corporate finance, debt restructuring, investor relations and franchising. Most recently,

he was the CFO of Quesada Franchising of Canada Corporation since January 2020 until it was acquired by Foodtastic Inc. in 2023.

Chevel’s extensive experience over the past three decades includes time with Ernst & Young in auditing, management consulting and corporate finance, and as CFO of two publicly listed entities abroad in the property development and private equity sectors.

“We are delighted to welcome Murtaza to our organization,” says James McInnes, CEO & Co-Founder of Odd Burger. “We believe that Murtaza has the right skill set to help Odd Burger in our next phase of growth and will provide us with the strategic leadership needed to achieve our goals.”

Odd Burger Corporation is a franchised vegan fast-food restaurant chain and food technology company that manufactures a proprietary line of plant-based protein and dairy alternatives. Its manufactured products are distributed to Odd Burger restaurant locations through its foodservice line and also sold at grocery retailers through its consumer-packaged goods (CPG) line. Odd Burger restaurants operate as smart kitchens, which use state-of-the art cooking technology and automation solutions to deliver a delicious food experience to customers craving healthier and more sustainable fast food.

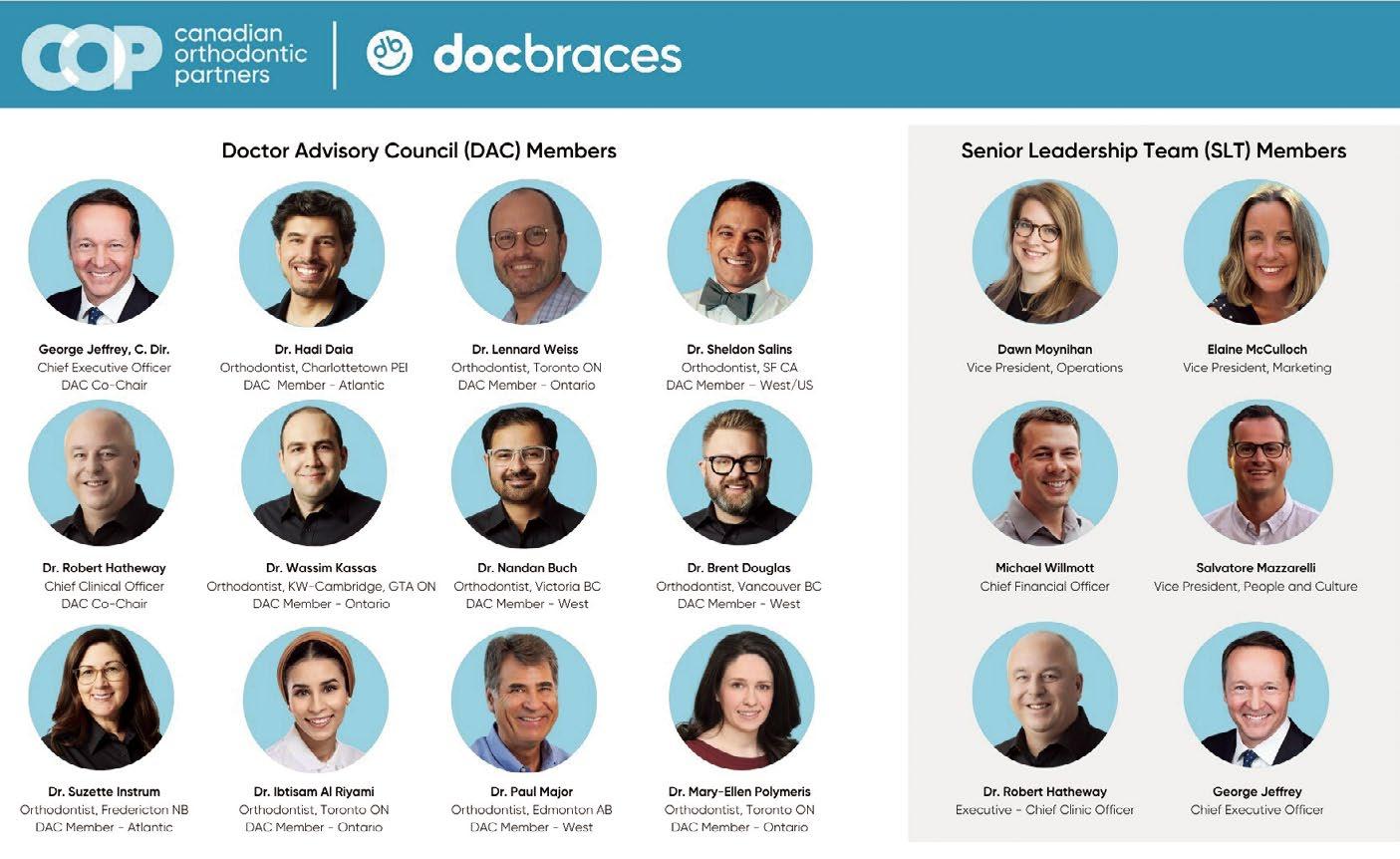

Canadian Orthodontic Partners appointed Michael Willmott as Chief Financial Officer. Canadian Orthodontic Partners, Canada’s orthodontics leader and the company behind the docbraces network, announces today the appointment of Michael Willmott, as its Chief Financial Officer. With the appointment, the company completes the formation of its Senior Leadership Team and, in parallel, its Doctor Advisory Council (DAC)– two groups on which it counts on for oversight of its plans for growth in Canada and the United States.

“The DNA of our company and vision revolves around passionate, caring professionals,” says George Jeffrey, CEO of Canadian Orthodontic Partners. “We are delighted to announce our slate of DAC Members, and Michael, our newly appointed CFO, who will now join each member of our Senior Leadership Team (SLT) in support of our DAC, our clinics, and our patients.

The future of our network and our plans for growth are in very capable hands.”

The SLT consists of six leaders who oversee key business areas including, clinical, operations, marketing, finance and people and culture. The team is led by Jeffrey and Dr. Robert Hatheway, Chief Clinical Officer. Members include Dawn Moynihan, Vice President of Operations, Elaine McCulloch, Vice President, Marketing, Salvatore Mazzarelli, Vice President People and Culture and Michael Willmott, the group’s newly appointed CFO.

“Since joining our team in late 2022 as Vice President of Finance, Michael has showcased his exceptional abilities and leadership in financial management, making a significant impact,” says George Jeffrey. “We are now excited to have him join our SLT and begin leveraging his expertise and knowledge as our CFO.”

Prior to joining COP, Michael Willmott served as director of accounting and investments at Dynacare. A certified Chartered Professional Accountant (CPA), Willmott is currently completing his Master of Business Administration (MBA) at Laurentian University.

Willmott expressed enthusiasm about his new role, stating, “I am honored and excited to take on the responsibilities of Chief Financial Officer at Canadian Orthodontic Partners. This promotion reflects not only my personal growth within the company but also the collective efforts of our finance

team. I look forward to collaborating with our SLT and our talented DAC professionals as we continue to drive financial excellence and support the company’s mission of delivering exceptional orthodontic care to our patients.”

Consisting of 12 members, the COP Doctor Advisory Council was created and is co-led by Dr. Hatheway and Jeffrey, who serve as its co-chairs. The DAC serves the purpose of reinforcing the company’s mission and its nature as a patient centric, doctor partnered operating network. Canadian Orthodontic Partners is a leader in orthodontic services in the markets it serves. Through its network of docbraces and other doctor-operated clinics, COP delivers personalized and industry-leading treatments that build confidence in patients, one beautiful smile at a time. By supporting the day-to-day administrative functions of each practice, COP empowers and encourages its clinic teams and doctors to focus their efforts on elevating patient care. Orthodontist-founded and led, the network values Trust, Learning, Confidence and Community. COP is committed to building a world-class culture where orthodontists want to practice, where team members want to work, and where patients want to visit. Through a network that shares, collaborates, and learns together, Canadian Orthodontic Partners is committed to becoming the leader in orthodontic excellence.

Based on a recent in-depth survey by PWC Canada of conversations with Canadian CFOS, they created a roadmap for finance transformation as CFOs navigate a ‘perfect storm’ of change, CFOs are facing rising expectations for what the finance function can deliver even as they grapple with emerging challenges like a fierce race for talent, a changing world of work and an evolving role around ESG reporting.

These forces of change are stretching finance teams’ capacity, requiring them to accelerate the transformation momentum they’ve seen during the COVID-19 pandemic.

While the challenges are significant, CFOs who embrace finance transformation opportunities that increase capacity to deliver critical business insights can elevate their role and build a brighter future for their teams.

Taking the pulse of Canadian CFOs

It has been an invigorating yet challenging time for many of Canada’s chief financial officers. They’ve successfully navigated the disruption caused by the COVID-19 pandemic only to face a new set of changes, from a shifting workplace amid a fierce race for talent to the increased urgency around the role their finance functions will play in their organization’s environmental, social and governance (ESG) journeys.

Despite the challenges, these changes are also creating new opportunities for CFOs to further increase the relevance of the finance function to the organizations they serve by accelerating their transformation journeys. Yes, finance transformation has been on the agenda of many CFOs for some time. But with recent events having upended assumptions about the pace of change and expectations continuing to evolve, CFOs need to take even bolder steps to reinvent their finance functions.

To understand how they’re responding, PWC took the pulse of CFOs at leading organizations across Canada. In recent months, they interviewed more than 20 CFOs to explore how they’ve been handling the latest wave of change and the

key trends uncovered in the CFO survey conducted recently with the Association of Chartered Certified Accountants. While the interviewees had a range of perspectives on the challenges they face, one thing became clear: How they navigate these changes and pressures will be key to their success now and in the future.

Explore below to learn more about the priorities of Canadian CFOs and how you can turn today’s challenges to your advantage.

Today’s key priorities for CFOs are:

◉ Navigating a fresh wave of change

◉ Winning the race for talent and skills

◉ Transforming and streamlining processes

◉ Helping businesses drive performance excellence

The pandemic forced finance functions to quickly rethink how they operate as they put a pause on in-person work and had to use digital tools for almost everything they do. While many have successfully adapted, other forces of change are putting further pressure on finance functions. As one interviewee told us, it all adds up to a “perfect storm” for CFOs as they navigate emerging challenges amid changing expectations from the business.

What do these trends and priorities say about the future role of the CFO? While not all interviewees agreed that the role is changing very much, many felt that it is, at the very least, evolving. We can see this in the changing landscape around ESG performance, which is just one example of the ways external forces are impacting the role of the CFO.

It became clear from our interviews that with the pace of change accelerating for the business as a whole, the CFO of the future will be an even better strategic partner in helping organizations navigate new and emerging trends. But to shift towards these big-picture issues, they need to drive more change within the finance function itself.

One interviewee had an interesting way of describing the CFO of the future: chief balance officer. In their case, the balance is

about translating the data expected by key external stakeholders, like investors, into insights the organization can use internally on the operational side to improve performance. Those internal and external stakeholders have different needs and perspectives, and it’s increasingly the CFO’s job to bridge the two.

This CFO’s description of this balancing act in many ways encapsulates the challenges and opportunities ahead for finance leaders. The good news is recent experiences have shown that the changes needed to balance new demands are indeed possible.

With the pandemic having highlighted the critical role of the finance function, you now have a chance to build on the momentum by connecting the changes you’ve made so far to a bigger transformation journey. You’ll be on the path to not only becoming the transformational CFO your business increasingly requires but will also be building a brighter future for your finance teams at a time when you need them more than ever.

The future of finance is now

Finance leaders play a pivotal role in helping their organizations navigate a changing business landscape. They’re balancing the need to generate insights to support the organization’s growth strategy with rising demands for efficiencies in how the finance function operates.

Striking this balance isn’t easy, but many chief financial officers (CFOs) are change agents who are planning to accelerate automation and new ways of working to tackle these challenges. But the executives they work with may not be seeing this. According to Harvard Business Review, while 83 percent of CFOs are happy with the finance function’s performance, only 44 percent of C level executives agree.

PwC’s purpose is to build trust in society and solve important problems. More than 9,000 partners and staff in offices across the country are committed to delivering quality in assurance, tax, consulting and deals services. PwC refers to the Canadian member firm and may sometimes refer to the PwC network

BY JUAN URO

BY JUAN URO

Finance executives remain vigilant, keeping a close eye on interest rates and inflation, while also exploring generative AI applications. In an EY roundtable, CFOs overwhelmingly show caution and prudence (but not pessimism) about 2024, while awaiting clarity on interest rates and inflation.

All CFOs are doing something about generative AI. As you test GenAI use cases, don’t overlook how processes and systems are reinvented to maximize impact.

Amid persistent concerns about inflation and interest rates, CFOs suddenly saw a new priority appear on the C-suite agenda over the past six months: generative AI (GenAI). As they steer their organizations through an uncertain growth outlook in 2024, how can leaders also help prioritize and guide AI projects so that they deliver ROI, whether throughout an organization or within finance?

Questions about the future of the global economy, inflation, interest rates and emerging technology were on the minds of the more

than 20 Fortune 250 CFOs who gathered in October. They traded ideas among themselves and with Gregory Daco, EY-Parthenon Chief Economist; Karim Lakhani, professor at Harvard Business School and Chair of The Data, Digital and Design (D^3) Institute at Harvard; and Dan Diasio, EY Global AI Consulting Leader. These CFOs — representing about $2 trillion in revenue altogether — are overwhelmingly approaching the current environment neutrally, while just 7 percent felt bearish or bullish. Six months ago, only half of them were neutral while 38 percent of CFOs said they were making targeted cutbacks and 15 percent were slowing down investments.

foresees a gradual reacceleration for the rest of the year.

“We’re looking at a slower first half in 2024,” said a CFO of a home improvement company. A CFO of a global retailer added: “I think there’s a lot of uncertainty about what’s coming ahead in Q1 with consumers experiencing more pressure on share of wallet.” Another said: “The opportunities in 2024 are more margin expansion and looking at improved processes and efficiencies rather than growth.”

“Looking to 2024, we’ll normalize to the mid-single digits,” added a CFO of a major airline. “In the last 90 days, the lower-end consumer has softened.” The CFO of a major financial institution noted a similar

“Intrigued by technology, CFOs are putting it to work in early use cases, leading impactful change. The internet existed long before it had easy-to-use consumer-facing uses. Similarly, AI and machine learning are not new concepts — Lakhani notes that most organizations today have AI somewhere in their plumbing.”

Which labor and investment are you likely to take in 2024?

This roundtable was hosted by Julie Boland, EY US Chair and Managing Partner and EY Americas Managing Partner; and Juan Uro, Americas Leader for the EY Center for Executive Leadership. “Our clients are trying to figure out how to jump on the AI bandwagon and streamline their operations at the front or back end, and we’re doing the same,” Boland said, in taking the pulse of companies she’s spoken with. Here is what’s on the mind of today’s leading CFOs.

Economy: the end of ‘free money’?

CFOs see inflation reducing but interest rates remain above typical levels in recent history.

In the US, the long-predicted recession has never materialized, with third-quarter growth expected to be strong, Daco said. However, consumer spending is slowing, and student debt payments are restarting amid autoworker strikes and rising energy prices. So while Daco predicts moderating growth through the beginning of 2024, he

trend: “We’re seeing spend per customer slowing at the lower end. They’ve depleted excess savings from the pandemic. We’re starting to see higher revolve rates on the credit side.”

Daco pointed out that this environment is showing different outlooks across sectors, with some sectors seeing a more positive outlook in 2024. One CFO of a major health care company said, “Overall, we’ve seen good utilization trends in the health care market and unlike a lot of businesses, ours is just not driven by macroeconomics.”

Behind these outlooks are two related variables — inflation and interest rates — and the resulting “pricing fatigue” from consumers, affirmed by CFOs at financial services companies. “It is somewhat more difficult to take price today than a year ago,” another CFO noted. In their businesses, most CFOs are expecting moderating inflation and taking action in the face of higher lending costs.

In 2024, do you anticipate________?

In light of the increasing cost of debt, which of these actions you are undertaking?

Although energy prices are on the upswing again, Daco has seen disinflation momentum, aside from some of the stickier service sector categories. Getting back to 2 percent inflation by 2024 is still a possibility. “We’re still in an environment that is undersupplied on a number of fronts, like in real estate and labor,” he noted. “In manufacturing, in the broad set of conditions we’re facing, where supply is an issue, any marginal increase in demand creates upward pressure.” This outlook is supported by the collective views of CFOs in the room. While two-thirds expect higher prices in 2024, the pace of increase is expected to slow down compared against 2023, bringing down inflation rates.

The ultimate question now is when will the Fed cut rates? “We’re expecting that the Fed is done with tightening, but that does not mean that interest rates are coming down fast,” Daco said. “They took the elevator up and will likely take the escalator down.” His prediction: maybe 75 basis points (bps) in cuts for 2024, beginning in June, then 100 to 125 bps in 2025. “We’re not going to have long-term rates like they were before the pandemic,” he concluded.

“There’s no doubt that the speed at which interest rates increased has been harmful … but 5 percent rates aren’t that unusual historically,” a CFO of a major business service provider said. “Do we settle into something that looks like pre-2008?”

Generative AI: enabling experimentation and driving change Intrigued by technology, CFOs are putting it to work in early use cases, leading impactful change. The internet existed long before it had easy-to-use consumer-facing uses. Similarly, AI and machine learning are not new concepts — Lakhani notes that most organizations today have AI somewhere in their plumbing, developed over the past 20 years. But today, generative AI (GenAI) has exploded onto the scene to be just as transformational, through a simple interface that greatly reduces the learning curve for new users.

“My perspective is that the bigger barrier right now on adoption is that very smart people use it as search tool instead of as a

thinking tool,” he said. “The worry I have with this tool is that we’ll all do chatbots and be happy with it, instead of thinking about them transformatively.”

All CFOs in the roundtable indicated they are doing something about GenAI, whether early experimentation or full implementation of capabilities. CFOs have been using the technology for detecting fraud, prepping for investor calls and gauging analyst sentiment, and recommending next best actions in customer journeys. “We started experimenting on mega-cases with productivity and revenue improvements,” one CFO said. “We’re trying to get our arms around how the supposed benefits are not arriving as quickly as anticipated.”

Where is your company on the Gen AI journey spectrum?

Lakhani and Diasio stressed that plugging GenAI into existing systems and processes likely will not deliver the optimum results. Lakhani likened it to the transition to the

“We’re trying to get our arms around how the supposed benefits are not arriving as quickly as anticipated.”

automobile: pouring asphalt onto horse paths is not the best way to build roads — cities needed to develop a grid plan. Diasio elaborated on that mindset with a realworld client example.

“One of our clients makes fashion accessories, and they have new releases every quarter,” he said. “The original ask was: how do you develop a system for a designer to ask for designs? It was a querying tool. Instead, after discussions, we helped develop a system that mines social media data to understand influencers and what’s trending, compared against the 34 characteristics of what this company produced. Then it enabled 3-D modeling and A/B testing. That’s a continuous process rather than every quarter.”

CFOs in our roundtable remain focused on inflation and interest rates, without feeling overly negative or positive about the economy. While each sector is facing different implications, reaccelerating growth is expected in the second half of 2024, and higher interest rates are likely to persist. In the short term, generative AI holds tremendous promise for those companies willing to experiment and rethink processes. CFOs should lead the discussions on where and how value can be created.

JUAN URO is EY-Parthenon Principal, Strategy and Transactions, Ernst & Young LLP. Experienced strategy, transaction and transformation advisor and operator.

BY STEPHEN YUN

BY STEPHEN YUN

On May 4, 2023, the World Health Organization downgraded the COVID-19 pandemic, declaring that it was now an established and ongoing health issue that no longer constituted a public health emergency of international concern. Following this decision, the Public Health Agency of Canada stated that it would “continue its work with provinces and territories to implement a long-term, sustainable approach to the ongoing management of COVID-19.” What does the downgrade of the COVID-19 emergency mean for Canada from a payments perspective?

Canadians continue to live with COVID-19 and have adjusted their lifestyles to this new reality. This paper looks at the major social and economic impacts of the pandemic on the lives of Canadians and their influences on overall payment habits and practices.

To understand how and why the pandemic changed Canadians’ payment habits and practices, it is helpful first to understand the social and economic impacts of the pandemic on Canadians. The COVID-19 pandemic triggered unprecedented financial support from the federal government to Canadians and businesses during the economic downturn, mainly through the Canada Emergency Response Benefit (CERB) and Canada Emergency Wage Subsidy (CEWS) payments. At one point in 2020, 11.7 million Canadians were receiving payments via CERB and CEWS, which meant about 40

percent of all Canadian adults were receiving government assistance. The government also provided continued access to credit and liquidity support for businesses. This was in response to the temporary restrictions imposed by the government on non-essential businesses, which led to job losses and reduced employment income.

These financial support payments were made through direct deposit or by cheque. For many Canadians, the payments represented a lifeline to pay their bills and keep businesses afloat.

Receiving a payment from the government in a timely manner was vital; for this reason, electronic payments were preferred over paper payments. Direct deposit payments outnumbered cheque payments by a ratio of over 7:1.5 The Receiver General of Canada issued 10.4 million cheques and 78.4 million direct deposit payments related to CERB and CEWS payouts between March and December 2020. An impact of the pandemic is that it pointed out to Canadians the speed, convenience and reliability of receiving digital instead of paper payments.

Canadian population growth was adversely affected by the pandemic. In 2020, population growth fell to levels not seen since the First World War. The dip in population growth was due to a decrease in international migration and the net loss of non-permanent residents.

The percentage of population growth from international migration decreased from a record high of 85 percent in 2019 to 68 percent in 2020. The largest net loss of non-permanent residents (-88,901) was caused by declines in students and work permit holders.

The pandemic contributed to more stress on consumer wallets as supply disruptions and pent-up demand stoked consumer inflation, which reached a 30year high (+5.1 percent) in January 2022. Prices for food and shelter continuously increased over 2021 and were above the headline rate (+5.7 percent and +6.2 percent, respectively). Consumer inflation has outpaced average wage growth since the spring of 2021. For further details, see Figure 1.

to job and income stability remained persistent in lower-paying, high-contact sectors throughout 2021.

The payment behaviour of Canadians, while living under these social conditions, was impacted. In 2020 and 2021 there was an exceptional demand for cash — specifically large-denomination notes. It is suggested that precautionary motives were important drivers for the extraordinary cash demand during this period.

The combination of financial challenges facing many businesses due to the winding down of pandemic emergency support programs, shrinking population growth and persistent consumer inflation led to an overall reduction in consumer and business spending. As a result, total payment transaction volume and value decreased and were below the pre-pandemic level from 2020 to 2021.

The pandemic also increased Canadians’ concern over public safety. According to a survey from Statistics Canada, Canadian Centre for Justice and Community Safety Statistics conducted in 2020, two in five Canadians expressed concern about the possibility of civil disorder. Concern was doubled among those expecting the pandemic to affect their personal finances, compared with those expecting no impact (61 percent vs. 32 percent). Social unrest concerns (e.g., hate crimes, assault, uttering threats, robbery, motor vehicle theft and shoplifting) were linked to income inequality among Canadians. Challenges

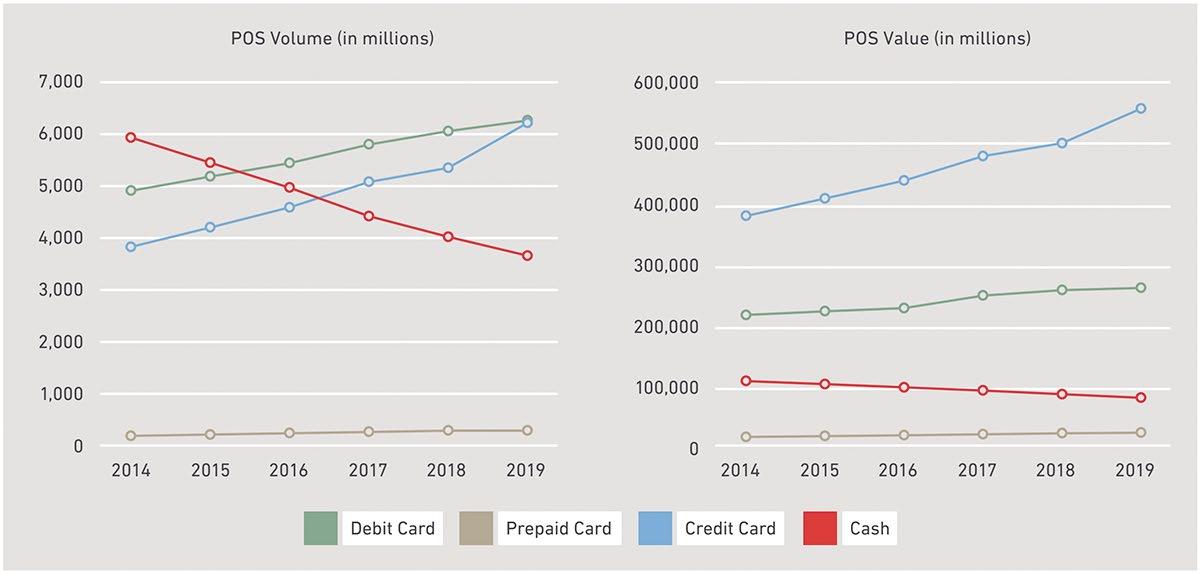

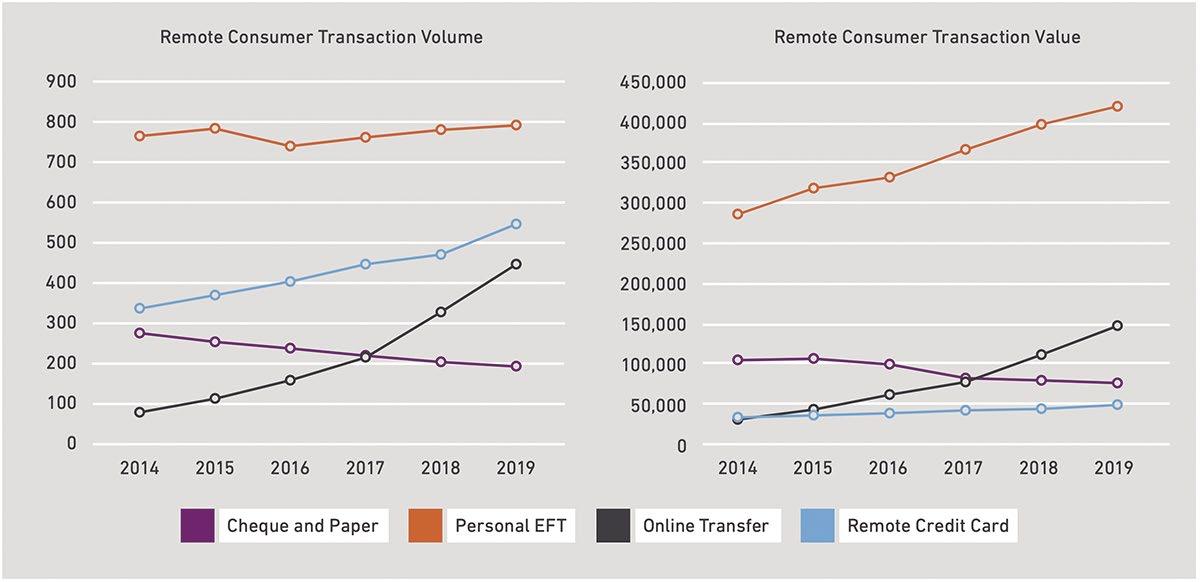

Looking back at the payment trends observed in the five-year period leading up to the COVID-19 pandemic (between 20142019), several notable patterns emerge. For further details, see Figures 2 and 3.

Cash payments were on a steady and sharp decline within the POS environment. Despite its decline, cash was still a common payment method in 2019, with 61 percent of Canadians reporting making a cash purchase to a business in a given week.

Electronic payment use continued to increase for POS payments, especially the use of debit and credit cards. Canadians preferred using debit and credit cards for their POS transactions because they were perceived to offer convenience, speed and rewards, which drove the use of these methods over traditional paper-based methods.

Another reason debit and credit cards were used more often by Canadians was the growth of contactless payments (card and mobile) at the POS. In 2019, 4.7 billion contactless transactions worth $156 billion were made, representing a 15 percent increase in volume and a 20 percent increase in value compared to the previous year. The significant rise in contactless transactions was driven by increased consumer and merchant familiarity with contactless payments and the ability to pay with contactless cards. While contactless card use was popular, mobile contactless had a slower uptake in Canada, even though more Canadians now had devices with near-field communication capabilities.

Bill payment transactions accounted for the largest proportion of consumerinitiated remote transactions. Electronic

Two charts. The chart on the left shows point-of-sale transaction volume in millions from 2014 to 2019. The chart on the right shows point-of-sale transaction value in millions from 2014 to 2019.

funds transfer (EFT) was the primary payment method used by Canadians based on transaction volume and value. Consumers generally opted to use EFT transactions to set up recurring payments to entities (for example, using online banking to pay household bills). EFT was also used when consumers set up preauthorized debits (using their deposit accounts) to pay for mortgages or auto loans. However, EFT numbers were being impacted by a migration towards the use of credit cards to pay bills.

While credit cards were mainly used in the POS environment, cardholders were using credit cards to remotely pay for a number of their bills, making up 15 percent of the total bills paid in Canada in 2018. Consumers used credit cards for paying recurring expenses, primarily because of rewards programs offered with credit cards. Between 2014 and 2019, the number of remote credit card payments increased by 55 percent. Much of this growth came at the expense of cheques and EFT.

Usage of online transfers continued to increase among Canadians in paying both people and businesses, overtaking cheques beginning in 2018. In 2019, online transfers accounted for 23 percent of the total volume of consumer remote transactions, while consumer cheque volume decreased to 10 percent (compared to 16 percent in 2015).

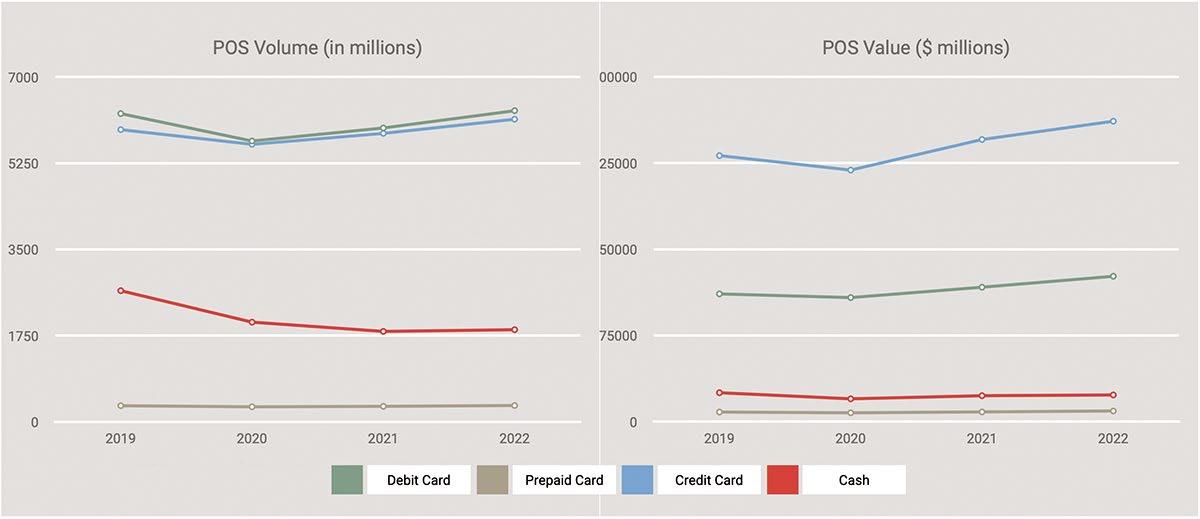

Looking back at the payment trends observed in the three years since the start

of the COVID-19 pandemic (between 20202022), several notable patterns emerge. For further details, see figures 4 and 5.

The COVID-19 pandemic accelerated the decline in cash usage as many Canadians avoided handling cash and touching payment terminals at the point-of-sale over concerns of virus transmission. In the first year of the pandemic, cash transaction volume and value at the point-of-sale decreased by 24 percent and 21 percent, respectively, from 2019. Following 2020, POS cash payments continued to decline, but the rate of decline slowed as public health measures lifted and the economy reopened. Cash payments rebounded for several reasons:

◉ Canadians were less concerned about the risk of transmission of the COVID-19 virus by handling paper currency and coins.

◉ Cash users returned to using cash for pre-pandemic use cases such as paying rent, meals, entertainment and professional and personal services.

◉ Canadians shifted towards using digital payments.

Contactless growth was supported by the increased availability of contactless and digital payment options, an increase in the contactless transaction limit from $100 to $250 for credit cards and the introduction of new payment alternatives, like QR codes by PayPal. In fact, when it came to making purchases, 37 percent of Canadians said they avoided shopping at places that didn’t

accept contactless payments. Contactless payments continued to be used frequently by Canadians after the first year of the pandemic. Almost nine in ten Canadians (89 percent) tapped any card (i.e., credit, debit or prepaid) at least once in a given month when making a store purchase in 2022.

The pandemic led to sharp growth in e-commerce payments in 2020, with 477 million transactions worth $56 billion (up from 420 million transactions valued at $47 billion a year ago). Close to half of all Canadians (47 percent) used e-commerce platforms more frequently to purchase a wider range of products throughout the pandemic. Despite the return to instore shopping, e-commerce transactions increased in 2022. E-commerce sales accounted for 6.5 percent of retail sales in 2022, up from a share of 6.2 percent in 2021.

Both debit and credit card payment transaction volume and value continued to build on the gains made in 2021 and returned to pre-pandemic levels in 2022, following a significant dip in 2020 caused by the pandemic.

Debit card transaction volume and value at the point-of-sale declined by nine percent and three percent, respectively, between 2019 and 2020. Debit cards continued to slightly lead credit cards in terms of volume.

Credit card transaction volume and value at the point-of-sale each declined by five percent during the same period. Credit cards made up the bulk of POS value.

Overall, the volume and value decline in card payments were less pronounced than that of cash captured above.

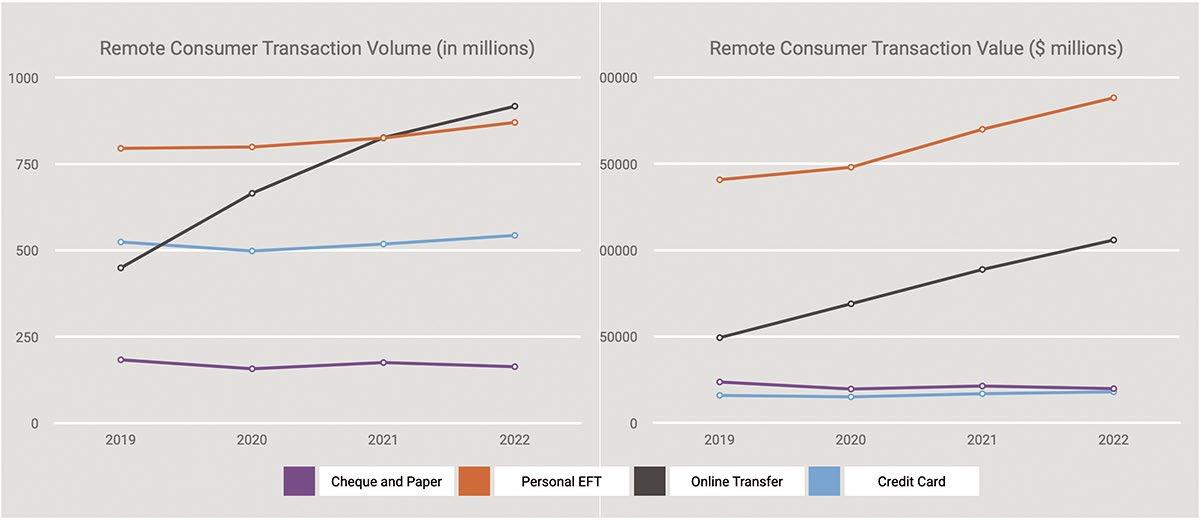

The COVID-19 pandemic had a low impact on personal EFT transaction volume and value in 2020. During the first year of the pandemic, personal EFT volume increased by one percent and personal EFT value increased by five percent. Both volume and value continued to grow and by 2022, personal EFT volume hit 870 million transactions worth $565 billion. It accounted for 35 percent of total remote consumer transaction volume and 57 percent of total remote consumer transaction value. EFT usage among consumers continued to be driven by recurring payment and online bill payment use cases.

Credit card transaction volume softened due to the pandemic in 2020, decreasing by five percent from 2019. It quickly rebounded and surpassed the pre-pandemic level in 2021 and continued to grow in 2022. Consumers carried on with using credit cards to pay recurring expenses and other household bills such as insurance, internet service, cell phone, subscriptions, memberships and home services (e.g., daycare, contractors).

Online transfers continued their growth in 2020, increasing significantly by 48 percent in volume and 40 percent in value and represented 31 percent of the total remote consumer transaction volume in Canada (compared to 23 percent in 2019).

New use cases emerged for online transfers during the pandemic, replacing cash and cheques. Due to physical distancing guidelines, many Canadians pooled grocery shopping responsibilities with family, roommates and neighbours. Interac reported that Canadians used Interac e-Transfers to split grocery bills and big-box store purchases more often than before the start of the pandemic. Another use case for online transfers during the pandemic was sending financial support to family and neighbours.

In 2022, online transfer payment volume surpassed personal EFT usage for the first time, mainly driven by the continued growth of Interac e-Transfer payments. Interac e-Transfer remained the most popular and preferred method for peer-topeer money (P2P) transfers in Canada by a large margin, driven by its perceived ease of use and convenience, helped in part by the daily limit increase from $3,000 to $5,000.

Even though Interac e-Transfers were being used more for P2P transfers, the level of use started to plateau in 2022 with more Canadians saying their use had stayed the same since the pandemic started (62 percent in 2022 versus 51 percent in 2020).

So, the number of new use cases for Interac e-Transfers linked to the pandemic did not significantly increase in 2022, likely because many Canadians perceived the pandemic to be largely over, or they had exhausted new use cases.

Canadians made fewer cheque payments due to the pandemic. Personal cheque usage continued to

decline in 2020, with a 14 percent decrease in volume and a 17 percent decrease in value from 2019. The overall decline was driven by the increased use of electronic payment methods such as EFTs, and online transfer payments by Canadians. The pandemic contributed to a rise in electronic payments at the expense of cheques, as many Canadians opted not to exchange cheques over concerns about virus transmission through surface contact.

However, the rate of decline in personal cheque usage slowed between 2021 and 2022. The year-over-year change in cheque volume was +11 percent for 2021 and -7 percent for 2022. Cheque value increased by nine percent in 2021 and decreased by seven percent in 2022.

Although personal cheque use was fairly low with 42 percent of Canadians stating

However, the end of cash is still far off. Besides being used to make day-today payments, especially for small-value transactions, many Canadians hold onto cash for precautionary motives. Most Canadians have no desire to go completely cashless. Only 13 percent of Canadians state that they have gone completely cashless. Older (55 and over) and middleaged (35-54) Canadians are much more likely than young Canadians (18-34) to want to continue using cash. Sixty-one percent of older Canadians and 57 percent of middle-aged Canadians have no plans to go completely cashless.

Population projections suggest that millennials, or people aged 25 to 40, will become the largest population segment in the country by the next decade. Generation Z, or people aged 9 to 24, may outnumber

Two charts. The chart on the left shows point-of-sale volume in millions from 2019 to 2022. The chart on the right shows point-of-sale value in millions from 2019 to 2022.

they rarely used cheques (i.e., less than once a month) and 39 percent never used cheques, some Canadians returned to using cheques for the same payment use cases as before the pandemic (e.g., rent, home services, gifts).

The pandemic accelerated the decline in cash usage at the point-of-sale, which had already been in steady decline. Contactless and electronic payments will continue to increase their hold on consumers as the preferred method for point-of-sale purchases for a number of reasons, such as receiving loyalty rewards, convenience, speed, ease of tracking spending and safety/security.

Baby Boomers in 2032. Cash usage is expected to rapidly decrease in Canada due to this demographic shift as both these generational cohorts prefer using electronic over paper payments.

As we emerged from the pandemic, more Canadians were comfortable using digital payments on an everyday basis and are embracing digital payment innovations that make their payment experiences more frictionless. More Canadians are comfortable with shopping online to buy different products such as clothing, groceries, restaurants/fast food and electronics. More Canadians are becoming comfortable with sending payments using wearables, social media channels, QR codes and smart devices, as well as using

biometrics to authenticate store payments. Over one-third of Canadians would likely adopt emerging payment innovations such as invisible payments and scan, pay and go when shopping at a store, or one-click pay when shopping online. A significantly larger proportion of older Canadians are also now using digital payments compared to 2020. This includes using contactless cards and mobile wallets to make a purchase and having their payment details stored on a website or in a payment app.

In the near future, the payment innovations that Canadians are most likely to adopt include the following:

A mobile wallet is an app on your mobile device that stores your payment information. It is like a physical wallet where you keep your credit, debit or prepaid cards, but in digital form.

The first mobile payment app to appear in Canada was the Suretap mobile wallet, launched in 2012 by CIBC. Since then, Canadians have been slow to adopt mobile wallets for making payments. But, that is now changing, driven by several factors.

Banks, big tech companies and fintechs all have released their own mobile wallet versions that are device-agnostic (i.e., operate on iOS and Android devices).

These payment apps have become more sophisticated in securing the user’s payment information. For example, a mobile wallet may encrypt your payment information and store it in the cloud. The cloud is an Internet-based secure network. Many payment apps utilize biometric or multi-factor authentication for payment authorization and tokenization for payment processing (i.e., a unique transaction code is used in place of your card number, which is never shared with a merchant).

Some mobile wallet providers such as Apple and Google have also introduced their digital wallet products (e.g., Apple Wallet, Google Wallet), which represent the next step in the evolution of the mobile payment app. A digital wallet app allows an individual’s smartphone to truly be a virtual wallet by allowing the user to empty the entire contents of their wallet – not just their debit or credit cards but also their health card, driver’s licence, loyalty rewards cards, transit card, boarding passes, tickets,

Two charts. The chart on the left shows remote consumer transaction volume in millions from 2019 to 2022. The chart on the right shows remote consumer transaction value in millions from 2019 to 2022.

etc., — which makes the mobile/digital wallet a much more compelling value proposition. And, it is likely that the future generation of mobile/digital wallets will have other services built in, like couponing, loyalty and geo-based offers.

In 2022, smartphone penetration in Canada was 81 percent, consisting of 27 million smartphone subscribers. By 2027, smartphone penetration is expected to be 83 percent with smartphone subscriptions reaching 31 million. Also, it is expected that 83 percent of all smartphones will be NFC-enabled, allowing them to be used for contactless mobile payments in-store, by 2027.

Over four in five smartphone owners (82 percent) have at least one payment app installed on their smartphones (e.g., Apple Pay, Google Pay, PayPal). The proportion of smartphone owners who made a payment using their smartphone in the past six months increased by seven percent to 74 percent compared to 2021. The incidence of mobile payments increased across most categories (e.g., bill payment through a mobile banking app, online payments, P2P payments, in-store payments) over the past year.

By 2027, the number of mobile transactions is expected to reach two billion transactions, representing a compound annual growth rate of 14 percent over this period. The number of transactions will increase as mobile payment transactions become more frequent and the average value of a transaction drops due to a greater proportion of in-store and in-app purchases.

A virtual payment card is a digital representation of your physical card (i.e., debit, credit or prepaid cards). Like a physical payment card, it can be stored on a mobile wallet.

Plastic debit and credit cards still lead all other payment methods for in-store purchases while mobile/digital wallet is quickly establishing itself as a preferred payment method for making online purchases in Canada. The rise of virtual payment cards is closely tied to the fortunes of mobile/digital wallet use in Canada.

Virtual payment cards are beginning to gain more consideration as the Canadian payment ecosystem moves towards a cashless society where digital and contactless payment methods are becoming mainstream. Several global providers currently offer virtual payment card services in Canada including banks and fintechs (e.g., RBC, Wise, Stack, KOHO, Wealthsimple).

Virtual payment cards offer several advantages over their plastic counterparts:

◉ A virtual payment card works like your regular physical card, but instead of being a piece of plastic, it’s available through your smartphone. So, you don’t need to carry a physical card around with you.

◉ Once approved for a virtual payment card, you can immediately start using it instead of having to wait for a plastic payment card in the mail.

◉ Many virtual cards produce one-time use card numbers for each transaction to

protect your financial information.

◉ Virtual card numbers offer a secure way to make online payments because they can be set for one-time transactions or multiple use, which provides an added layer of security when it comes to protecting your online payment transactions.

◉ A virtual payment card can be used to make online purchases, transfer money, or linked to a mobile wallet app like Apple Pay or Google Pay. By adding a virtual payment card to a mobile wallet, you can make contactless payments in physical stores.

Pay-by-bank is a payment method that allows customers to make online purchases directly from their bank accounts, without the need for a credit or debit card. It enables customers to use their online banking credentials to authorize a payment and transfer funds from their bank account to the merchant’s account. This payment method is offered by payment providers that partner with banks to facilitate the payment process.

Many Canadians made more retail purchases online even after public health measures were lifted and stores reopened. They are looking for ways to make their online payment experiences more frictionless and, safe and secure. Pay-bybank represents an online payment method that “ticks several boxes” for consumers.

It offers enhanced security, as consumers do not need to provide their credit or debit card details to make a payment. This reduces the risk of fraud and helps to protect consumer financial data.

It offers faster payment processing times. Transactions are processed in near realtime, which means consumers can track their spending and bank account balances more effectively.

It may be more convenient for consumers who do not have a credit or debit card or who prefer not to use one when making online purchases.

Pay-by-bank may especially appeal to consumers focused on managing their finances while paying down revolving debt. Some Canadians avoid using credit cards altogether to stay out of debt or a debt build-up. But it may be hard to convince

consumers to switch to pay-by-bank when they are already comfortable with using debit cards as a way of using funds on hand for making online payments.

In fact, Interac stopped offering Interac Online, which is effectively a pay-by-bank service, in 2023. It continues to offer Interac Debit for online payments made through in-app or a mobile wallet. The reason for this move was because Interac Online transaction volume has been trending down, while Interac Debit transaction volume has been trending up. Interac Online transaction volume decreased by 19 percent from 2021 to 13.8 million transactions, with 16 percent of Canadians indicating that they used Interac Online in a given month when making a purchase online via their computer or mobile device (down from 21 percent in 2021).

Future consumer uptake of pay-bybank may come down to incentivizing Canadians for choosing this payment method. PYMNTS Intelligence data determined that the uptake of pay-bybank in retail may be especially desirable for consumers when rewards are offered. The data showed that 25 percent of consumers who made a pay-by-bank transfer for the first time in the last year did so because they could earn rewards with cash back being the most preferred (47 percent). Retailers and businesses may be motivated to offer rewards to customers for using pay-by-bank over credit and debit cards for purchases or bill payments because of the cost savings from avoiding interchange fees.

Being able to pay for in-store purchases using account-to-account transfers is also something that many consumers want in Canada. Forty-five percent of Canadians indicated they would be interested in being able to make a payment to a merchant using Interac e-Transfer for an in-store purchase. So, consumer interest and adoption of pay-by-bank may extend to both online and in-store payments.

The social and economic impacts of the pandemic on the lives of Canadians will be felt for years to come. The pandemic heightened Canadians’ concern over public safety. Lower immigration during COVID-19, combined with structural pressures related

to population aging, will continue to impact labour market imbalances, which will reduce overall productivity and economic output. High inflation, especially for food and shelter, coupled with modest wage increases will cause affordability to worsen in the near term. Social and economic mobility particularly for new Canadians and young families will be adversely affected as a result of these financial barriers to home ownership.

These outcomes have and continue to influence Canadians’ overall payment habits and practices. Social unrest and economic hardship and uncertainty is causing consumers to cut back on personal spending as well as store more cash for precautionary motives. The pandemic pointed out to Canadians the speed, convenience, safety and reliability of using digital instead of paper payments. It also accelerated consumer adoption of digital payments. Credit and debit card payments continue to lead all other payment types within the POS environment in transaction volume and value and continue to grow. EFT continues to lead all other payment types within the remote environment with AFT credit and debit leading the way. Online transfers continue to be the fastest growing payment type of all with Interac e-Transfers leading the way.

Even after health restrictions were lifted and the economy reopened, more Canadians continue to shop online for a wide variety of goods and services. This consumer shift towards digital payments has led to an increased demand for more digital payment options and frictionless payment experiences. In turn, this will fuel continued growth, competition and innovation within the Canadian payment market.

STEPHEN YUN is Senior Analyst, Market Insights, Payments Canada. Yun’s areas of focus include the Consumer Payment Methods and Trends and Payment Behaviour Tracking studies and leveraging research insights to create a consumer/business payment narrative and drive business action for his business partners. Stephen has more than 20 years of experience leading marketing and customer experience research. He holds MBA and BBA degrees from the Schulich School of Business (York University) specializing in marketing and finance.

The Canadian wealth and asset management industry continues to be attractive for M&A transactions with significant premiums paid for asset managers. During 2023, there was more interest in quality wealth and asset managers than there were asset managers available to acquire. We believe that M&A deals will continue to be especially competitive in the coming year as strategic acquirers look to build and expand in scale and scope. Institutions from across the financial services landscape and strategic private equity investors are looking to add scale to their existing platforms and/or to differentiate by entering new markets in the sector. If valuations continue to rise and, as M&A deals become an even more attractive option in the asset management sector, it also will become more strategically important.

In this Insight, we draw on BLG’s deep expertise in this area to focus on the important

aspects of M&A transactions for both potential purchasers and sellers. Asset management deals raise unique considerations, including risks, structuring and regulatory considerations. Additionally, the latest guidance from the securities administrators regarding conflicts of interest may inform how you plan and structure your M&A transaction.

We see a number of forces driving this demand for asset manager M&A transactions, including:

This has been a recurring feature of the postfinancial crisis period that continues to intensify and is driven by customers seeking better value for money and heightened transparency. Canadian asset managers have responded to this pressure by seeking increased scale in an effort to address the “race to the bottom” concerning fees.

High savings rates, market volatility, increasing interest rates and high inflation have all continued to impact asset flows for the asset management industry.

Despite ongoing fee pressure, asset managers remain valuable due to their nature as stable fee-generating businesses.

The industry faces increasing accounting, tech, margin, litigation, and regulatory pressures. Spurred by recent regulatory pushes to increase capital requirements for most core banking activities, banks in particular have been attracted to the asset management industry because of its relatively capital-light infrastructure and high returns on equity.

The industry remains inefficient and relatively antiquated from a technology standpoint, so there is significant scope to streamline further. Technology costs have risen to achieve solutions for both regulatory needs (compliance and reporting, investor transparency, antimoney laundering and anti-terrorist financing (AML) risks) and cyber-attack sophistication.

With respect to operations, investors expect modern and personalized digital wealth management services. On the investment side, asset managers are seeking capabilities in areas with higher potential returns, such as alternatives and environmental, social and governance (ESG) offerings.

Asset management participants continue to have significant capital available to deploy without dependency on external leverage.

Canadian asset managers are embracing purpose led growth alongside efforts to improve diversity, equity, and inclusion across the industry.

We see these factors combining to create an environment that will continue to foster strong M&A deal volume in 2024 and beyond for Canadian asset managers.

Anybody considering an M&A transaction with an asset manager should have a clear understanding of the unique challenges that deals in this industry present, including the highly regulated environment, reputational considerations and the risk of asset flight as a result of the transaction.