ISSUE 111 | DISPLAY TO 31 MARCH 2024 | www.asian-power.com | A Charlton Media Group publication US$360P.A. BIOMASS AND RE IMPORTS DIVERSIFY TUAS POWER’S APPROACH TO GREEN GOALS HOW SOUTHEAST ASIA CAN UNLOCK ITS BIOGAS POTENTIAL SINGAPORE FACES COST, INVESTMENT HURDLES IN HYDROGEN PUSH PHILIPPINES MUST BE ‘MORE AGGRESSIVE’ ON RENEWABLE ENERGY TARGETS PLN IP LEADS IN NEXTGENERATION PLANT EFFICIENCY THINKING IN 4D Edwin Nugraha Putra CEO, PLN Indonesia Power p. 13

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton

EDITORIAL MANAGER Tessa Distor

PRINT PRODUCTION EDITOR Eleennae Ayson

LEAD JOURNALIST Vann Villegas

JOURNALISTS Paolo Alfar Ibnu Prabowo Aulia Pandamsari

GRAPHIC ARTIST Emilia Claudio

COMMERCIAL TEAM Janine Ballesteros Jenelle Samantila Cristina Mae Posadas

ADVERTISING Shairah Lambat shairah@charltonmediamail.com +65 3105 1200 ext. 402

AWARDS Julie Anne Nuñez awards@charltonmediamail.com

ADMINISTRATION Eucel Balala accounts@charltonmediamail.com

EDITORIAL ap@charltonmediamail.com

SINGAPORE

101 Cecil St., #17-09 Tong Eng Building, Singapore 069533

+65 3158 1386

HONG KONG

Room 1006, 10th Floor, 299 QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong

+852 3972 7166

MIDDLE EAST

FDRK4467,Compass Building,Al Shohada Road, AL Hamra Industrial Zone-FZ,Ras Al Khaimah, United Arab Emirates

www.charltonmedia.com

FROM THE EDITOR

Asia’s key players in the power sector are advancing towards a clean energy transition as market-set targets for adopting renewable energy draw closer. Michael Wong, chief operating officer at Tuas Power, shares that the company is aiming to increase biomass use for power generation and import renewable energy from Indonesia to align with Singapore’s carbon emission targets by 2030 and 2050. Read more on page 16.

We also look at the progress of renewable energy adoption in fossil fuel-reliant markets in the region. Whilst the Philippines is currently on track to achieving its clean energy goals by 2030 and 2040, an analyst says that the country could be “more aggressive” with its targets. See the full story on page 14. In Indonesia, TBS Energi partners with the state electricity firm to contribute to the country’s energy goals. Know more about their upcoming projects on page 20.

Finally, we sit down with PT PLN Indonesia Power CEO Edwin Nugraha Putra as he talks about adopting technologies to improve plant efficiency and reduce production costs. Read page 13 for more details.

Read on and enjoy!

Tim Charlton

Tim Charlton

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at ap@charltonmedia.com. To send a personal message to the editor, include the word “Tim” in the subject line.

Media Partnerships: Please email ap@charltonmedia.com with “partnership” in the subject line.

Subscriptions: Please email subscriptions@charltonmedia.com.

Asian Power is published by Charlton Media Group. All editorials are copyrighted and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as Asian Power can accept no responsibility for loss. We will, however, take the gains. *If

ASIAN POWER 1

Asian Power is a proud media partner and/or host of the following events and expos:

you’re reading the small print you may be missing the big picture

21

23

2 ASIAN POWER CONTENTS Published Quarterly by Singapore: Charlton Media Group 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 For the latest news on Asian power and energy, visit the website www.asian-power.com Hong Kong: Room 1006, 10th Floor, 299QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong FIRST 06 PLN app expands access to PV rooftop solar panels 07 Rooftop solar growth slowed by import costs, low-quality parts 08 Ammonia co-firing faces questions on safety, cost INTERVIEW BIOMASS AND RE IMPORTS DIVERSIFY TUAS POWER'S APPROACH TO GREEN GOALS 16 13 CEO INTERVIEW PLN INDONESIA POWER LEADS IN NEXT-GENERATION PLANT EFFICIENCY 14 COUNTRY REPORT PHILIPPINES MUST BE ‘MORE AGGRESSIVE’ ON RENEWABLE ENERGY TARGETS

VOX

ANALYSIS INTERVIEW

EVENT COMMENTARY

POP

World needs to triple renewables capacity and double energy efficiency

Partnerships, technology, and talent drive solutions for clean energy shift

22

Implementing Indonesia's JETP plan requires prioritisation, processes, and transparency

Can voluntary carbon markets accelerate decarbonisation in Asia? 10 How can vehicle-to-grid technologies boost energy transition? 12 Singapore faces cost, investment hurdles in hydrogen push 18 Policy alignment key for carbon credit goals 19 How Southeast Asia can unlock its biogas potential 20 TBS Energi makes the switch from coal to solar

24

Your shinesreliability

Energy & Storage solutions expertise

Securing energy supplies

Ensuring a reliable power supply is one of the key factors for progress and prosperity around the world. Building on decades of MAN innovation, we can help secure clean and efficient energy supplies for your customers. Our expertise covers solutions for power-to-X, LNG to power, long duration energy storage, thermal power plants and CHP. www.man-es.com

News from asian-power.com

Daily news from Asia

MOST READ

Asia turns to biomass co-firing in coal plants for energy security, transition

China continues coal plant ‘permitting spree’ in H1

Sembcorp Industries, through its subsidiaries, has signed separate deals to acquire a total of 428 megawatts (MW) of wind assets in China and India worth (S$200m) in total. It entered an agreement with Envision Energy to fully acquire the share capital in Qinzhou Yuanneng Wind Power Co., which owns 200 MW wind projects in Guangxi.

Japan could face difficulties in reaching hydrogen goals: report

Japan has set ambitious targets for hydrogen production but the country may face difficulty in meeting these goals due to various factors such as infrastructure, according to Wood Mackenzie. Japan announced increasing of domestic hydrogen production tenfold tenfold between now and 2030.

Coal-reliant Asia could not afford to phase out the fossil fuel industry immediately to accelerate the transition to renewable energy. They shift to cofiring biomass in the coal plants so as not to jeopardise energy security whilst reducing emissions. In a way, this results in prolonging the life of power plants and potentially reduce reliance of fossil fuels.

Cambodia’s 18-year energy plan sets ambitious targets for renewables

Cambodia, a nation saddled with power shortages, has underscored its commitment to energy security through the implementation of its Power Development Masterplan 2022-2040 (PDP) and the National Energy Efficiency Plan (NEEP). Despite this, experts caution that the journey may be met with technical and investment hurdles.

China has continued its “permitting spree” for coal power plants that started in 2022, with 52 gigawatts (GW) of new coal power permitted in the first half of 2023, according to a report by the Global Energy Monitor (GEM) and the Centre for Research on Energy and Clean Air (CREA). It maintained permitting two coal power plants per week.

Asia needs natural gas to balance ‘energy trilemma’

The region’s pursuit of energy transition and security would have to take into consideration balancing the “energy trilemma” — energy affordability, reliability and sustainability. Ensuring that all three are met would entail the adoption of natural gas in the energy mix, read a study by The Asia Natural Gas & Energy Association (ANGEA).

Sembcorp to buy 428 MW wind projects in China, India

Sembcorp to buy 428 MW wind projects in China, India

ENVIRONMENT POWER UTILITY REGULATION REGULATION REGULATION PROJECT

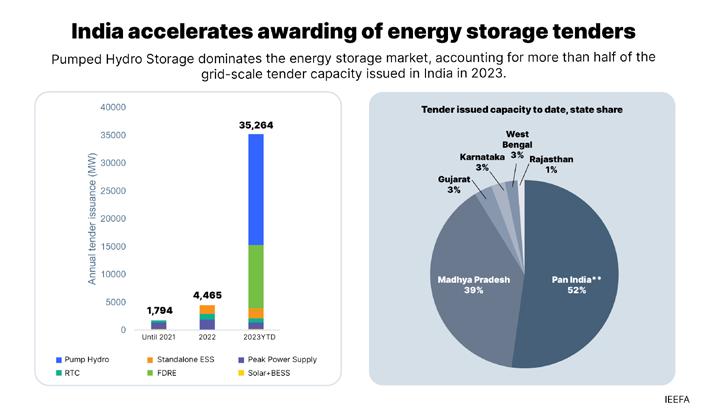

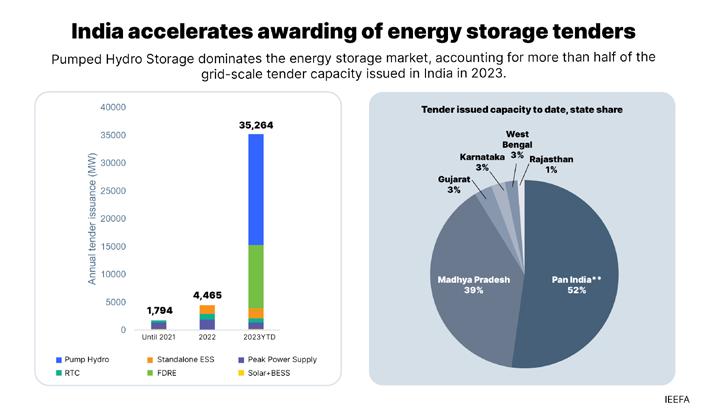

INDIA ACCELERATES ENERGY STORAGE SYSTEMS

India is ramping up expansion projects for its energy storage systems (ESS) to support the robust growth of the country’s renewable energy (RE) capacity. In a report, the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research and Analytics said India’s policymakers have awarded over eight gigawatts (GW) of ESS tenders, around 60% of which were already allocated in 2023.

By the Central Electricity Authority’s projection, the country will require 42 GW of battery-based ESSs and 19 GW of pumped hydropower storage by 2030. They make up two of the “most widespread and commercially viable” energy storage technologies in India.

“The exponential surge in renewable energy installations within the past decade has exposed the grid infrastructure to increased risks arising from renewables’ intermittent and variable nature, especially solar and wind,” Vibhuti Garg, Director for South Asia at the IEEFA, pointed out.

To better address these challenges, Garg said ESS has become “crucial in overcoming this intermittency and enabling a continuous energy supply when needed.” “For sustainable renewable energy addition, a concurrent growth of ESS capacity is also imperative,” she added.

FDRE tenders

The IEEFA and JMK Research said that large and grid-scale ESS projects are vital in meeting these targets, noting that the Firm and Dispatchable Renewable Energy (FDRE) tenders issued last year offer an “ideal model” for the country.

“FDRE tenders are demand profile-driven tenders to ensure firmness and dispatchability of renewable energy, and create a win-win scenario for power developers and offtakers,” said the report’s coauthor, Jyoti Gulia, Founder, JMK Research.

“With similar power quality and declining costs of renewable energy and ESS, FDRE can potentially replace thermal, a situation electricity distribution companies (DISCOMs) are already exploring,” she added.

The report also stated that FDRE is the “latest and most advanced iteration” of tender models like round-the-clock, Solar + BESS and standalone ESS, with tariffs comparable or lower to that of fossil fuel-based generation. Tariffs of grid-scale FDRE storage projects are also expected to be more attractive over time as they mature given the longer tenures of up to 25 years.

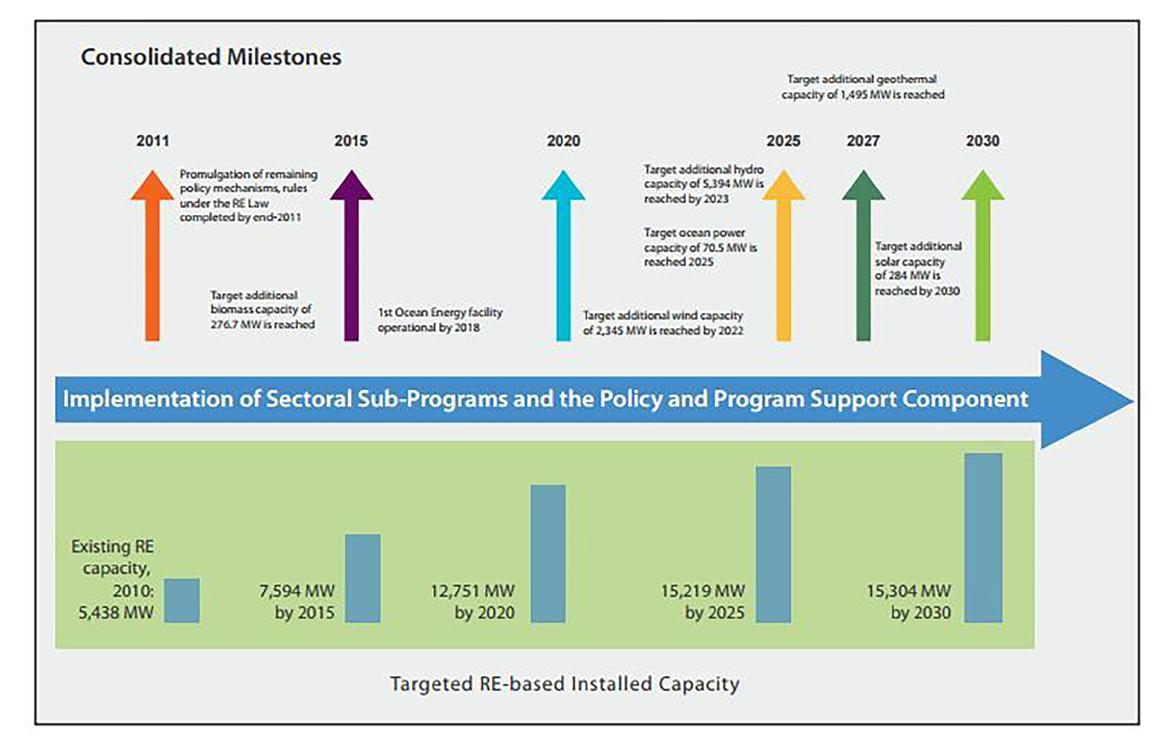

App connects PV rooftop solar panels to grid

Homeowners, businesses, and institutions can now integrate energy from photovoltaic (PV) rooftop solar panels into the power grid and enjoy smart home features using one app dashboard, a move by PLN Icon Plus to merge digital solutions with a sustainability ethos.

“What sets PLN Icon Plus apart is our bundling of green energy solutions through rooftop solar panels (PLTS) and integrating them with smart home services. Users will experience the use of rooftop solar panels while enjoying the convenience of reliable internetsupported smart home services,” said PLN Icon Plus CEO Ari Rahmat Indra Cahyadi, who spoke to Asian Power on the sidelines of the Enlit Asia 2023 event in Jakarta.

The electricity company plans to maximise the use of PLN’s digital asset, the PLN Mobile app, which has already been downloaded by 43 million customers across Indonesia. Through PLN Mobile, end-users can access and request PV Rooftop installations whilst monitoring them through the app.

“This (download count) represents a significant opportunity for us, as we can capitalise on existing PLN customers who are already using the PLN Mobile app to access PV Rooftop services,” told Asian Power

Success story

The Smart and Green solution has been implemented by PLN Icon Plus through collaboration with one of the universities

in Indonesia. This university utilises the integrated solution offered by PLN Icon Plus, where internet communication networks are combined with smart building technology.

Ari said innovated features of the smart building starts with access, then incorporates cameras, and also smart locks. This integrated solution is further enhanced with the installation of rooftop solar panels (PLTS Atap).

In addition to partnerships with universities, PLN Icon Plus has also forged collaborations with state-owned and private developers. “Hence, through collaborations with housing developers, when people buy a house, it already comes with internet access, smart home features, and additionally, rooftop solar panels are installed,” explained Ari.

Worthy collaborations

To further create a conducive environment for the energy retail market, PLN Icon Plus engages in various collaborations. One collaboration model the company adopts involves implementing a co-investment approach.

“So, we both invest, for instance, in digital platforms or materials, where there’s a contribution of services involved. This way, we grow together and share risks. For example, PLN Icon Plus excels in electricity and digital domains, and we can collaborate with investors who specialise in making solar panel costs highly efficient. This would create a very appealing service for the public,” Ari explained.

Such collaborations are crucial, especially considering the substantial market opportunities Ari sees in Indonesia. “I see growth in Indonesia still in the growing stage; currently, we are far below the potential of 1 gigawatt for rooftop PV potential in terms of end users,” the CEO said.

To achieve this, PLN Icon Plus has opened up collaboration opportunities with both domestic and global companies. Also, Ari hopes for policies that facilitate easier access for people to install rooftop solar panels.

Users will experience the use of rooftop solar panels while enjoying the convenience of reliable internetsupported smart home services

One aspect Ari highlighted during the interview concerned solar panel installations and their impact on the reliability of the PLN electrical system. If the electricity system is sufficiently reliable and has available capacity, customers can use rooftop solar panels according to their installed electrical capacity.

The awaited policy revolves around the revision of Minister of Energy and Mineral Resources Regulation No. 26 of 2021 concerning rooftop solar panels, particularly addressing the maximum power limitation based on the installed capacity.

6 ASIAN POWER

INDONESIA

Existing PLN customers can use a mobile app to request solar rooftop installations

INDIA

FIRST

Ari Ramat Indra Cahyadi

Projected growth in storage obligations (Chart from IEEFA)

Should import duties on rooftop solar accessories be waived?

Source: IEEFA

Source: IEEFA

Rooftop solar growth slowed by import costs, low-quality parts

High import costs for solar accessories are a major factor for the lagging rooftop solar market in Bangladesh, and calls for levy waivers and stricter quality assurances may aid in rescuing the sector, according to a report by the Institute for Energy Economics and Financial Analysis (IEEFA).

These accessories are required components for installing solar power systems, and with duties inflating the cost, many projects import cheaper, lower quality products and result in poorer performance in solar home systems.

Local support

Although the plan to jack up tariffs for imported goods are part of a move to drum up support for local manufacturers, few companies in Bangladesh assemble solar modules. This results in more dependence on importation and result in higher project costs and increased delays.

Essential goods

Alam notes that the rooftop sector is not classified by the government as essential, barring it from the import duties waiver enjoyed by utility-scale solar farms.

“The high import duties on rooftop solar accessories do not create a level playing field, as utility-scale solar projects are exempt,” he said in the report.

“The need for a waiver on prevailing import duties on solar panels and four accessories, ranging from 11.2% to 58.6%, at least for a limited period. Since utilityscale solar projects enjoy a complete duty waiver, the government should treat rooftop solar equally. We recommend fixing the rooftop solar installation capacity to 100% of the sanctioned load to make it more attractive,” he added.

The label also has an impact on securing funding for rooftop solar projects. Alam said, "Without a tag of essential goods, there were delays in

the opening of the letter of credit for the import of rooftop solar accessories, affecting project implementation."

Prices per unit have also risen in recent years due to larger economic factors. With the Taka depreciated against the US dollar by 28.8% between December 2021 and September 2023, no fiscal incentive goes to solar projects.

Quality assurance

While a waiver may alleviate the tight fiscal problem, more established standards in quality assurance for solar accessories may boost confidence and spur investments in the sector.

The task falls to the Bangladesh Standards and Testing Institute, and as it conducts periodic market monitoring, Alam suggests that a broader collaboration with Sustainable and Renewable Energy Development Authority (SREDA) is an imperative. SREDA could forward a proposal to increase the number of testing labs in the country, though the authority also needs resources to expand its pool of specialists.

Other hurdles

Besides import duties, the report also attributes the sector’s performance to a lack of urgency from financial institutions and a lack of awareness from consumers of the service’s benefits.

The high import duties on rooftop solar accessories do not create a level playing field, as utility-scale solar projects are exempt

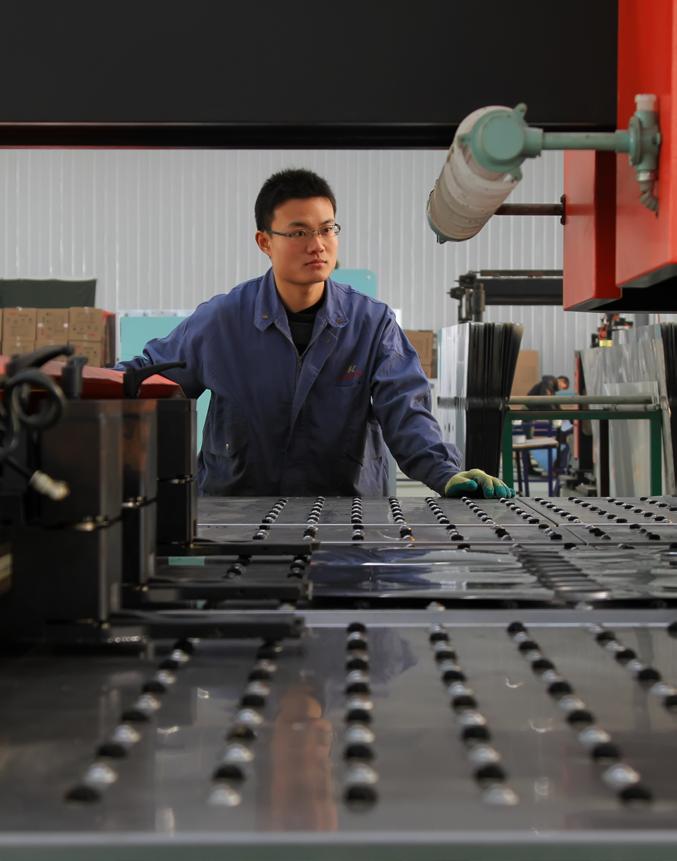

CHINA CUTS PRODUCTION COST BY 42% FOR CHEAPER SOLAR PANELS

Solar production costs in China have reached $0.15 per watt in December 2023, declining by 42% year-on-year from $0.26 in December 2022, providing manufacturers in the country with a cost advantage, read a report by Wood Mackenzie.

China currently dominates the solar manufacturing capacity. As such, various policies are issued to support the expansion of domestic supply chains for low carbon technologies and development of new critical mineral sources to reduce global dependence on China.

“As the world’s solar module powerhouse, China commands 80% of global manufacturing capacity and this is being reflected in soaring domestic installations. This year its domestic solar additions will be double those of the US and the EU combined,” the report read.

In India, solar production prices as of December 2023 were at $0.22 per watt, slightly higher than China. Costs in Europe and the United States were at $0.30 and $0.40 per watt, respectively.

Aside from the cost of solar production, Wood

Mackenzie also looked into the growth of renewable energy, noting that wind and solar power are leading the acceleration in the sector’s capacity.

Global renewables supply

By 2050, Wood Mackenzie expects renewable energy to account for over 50% of the global power supply, adding that renewables were able to provide “low-cost power at scale” in the last decade.

In 2023, the world saw a 50% year-on-year (YoY) growth in renewable energy capacity added, reaching nearly 510 gigawatts, according to the International Energy Agency (IEA) report. Solar power dominated the new projects, comprising 75% of the additions globally.

Per market, China led the deployment of new capacity, with its wind sector increasing by 66% compared to 2022, and installing solar capacity equivalent to the additions of the entire world. It is also expected to account for nearly 60% of the new renewables capacity to start operations in 2028.

Alam suggests that capacity development and awareness-building initiatives can also empower stakeholders and engage sectoral transformation. He cites Bangladesh’s Sustainable and Renewable Energy Development Authority (SREDA)’s position to create targeted training programs and exposure visits for projects. Furthermore, expanding SREDA's workforce and strengthening coordination with utilities can enhance policy formulation and sectoral coordination.

ASIAN POWER 7

BANGLADESH

FIRST

China commands 80% of global manufacturing facilities for solar modules

Shafiqul Alam

FIRST SYSTEM READINESS HAMPERS AI USE IN POWER PLANTS

APAC

The integration of artificial intelligence (AI) in power plants will be beneficial in monitoring the facilities’ performance and aid in optimising operations and controlling emissions. However, older plants may face challenges in adopting the technology as it might not be compatible with their systems.

Many power plants employ “heterogenous, legacy systems” that do not enable seamless data sharing outside their system or environment, shared Sharad Somani, partner & head of Infrastructure Advisory at KPMG with Asian Power Power plant operators would need to upgrade or retrofit their existing systems which could be costly and time-consuming as they also have to train personnel and maintain the systems, said Penny Murphy, Partner and Regional Digital Services

Lead for Asia and Robin Kennish, Asia Lead –Renewables & Climate Change Services at ERM.

“It can be a complex process that requires significant changes to existing infrastructure, such as hardware and software, as well as business processes and workflows,” Murphy and Kennish said.

“To ensure successful integration, it is essential to thoroughly understand the existing energy systems and plan for the integration of AI systems accordingly,” the ERM experts added.

Forecasting operations

AI tools will help analyse operation data and equipment performance, predicting when machinery or equipment might fail, Murphy and Kennish said. With this, the plant will be able to conduct maintenance even before costly failures happen.

Somani also noted that AI-drive maintenance platforms can also simulate scenarios to virtually assess equipment’s health.

He cited Philippines-based Aboitiz Power’s use of AI for predictive maintenance to monitor the availability and reliability targets of its Davao Thermal South coal plant which provided early warning of asset failures, allowing them to take a proactive maintenance approach.

For high-intensity power operators, the forecasting benefits will help them progress to smart grids as this will allow them to analyse data and coordinate supply management, Murphy and Kennish said.

CLP Power, for example, uses digital technologies such as big data and AI to monitor its wind and solar energy projects in China to get real-time data to manage over one gigawatt of assets.

However, the ERM experts flagged that the collection and storage of data in AI use creates data breach risks and unauthorised access to data.

“Robust security measures such as encryption and secure data storage must be implemented to mitigate these risks,” they said.

Safety, supply concern gloom over ammonia co-firing adoption

Ammonia co-firing is touted as one of the solutions to transition coal-fired power plants, however, there are still concerns over its effectiveness in supporting decarbonisation drives, safety, and supply challenges.

One challenge of co-firing ammonia in coal plants is delivering ammonia and ensuring that it is properly handled, said Frank Thiel, Managing Director, Quezon Power (Philippines) Limited Co and General Manager, San Buenaventura Power Ltd. Co.

“Ammonia is toxic, and it can be corrosive as well, so we have to be very careful. Ammonia as a fuel is something new, so we're learning as we go on. But we want to make sure that it is done properly and safely,”

Thiel told Asian Power

“The last thing we want is to create a problem, so we want to make sure that everything is done in accordance with all the latest regulations,” he added.

Supply constraint is also another hurdle, Thiel said, noting that ammonia is used mainly as a fertiliser, thus there will be competition with other companies in securing the needed amount for power.

Quezon Power plans to co-fire ammonia in its 460-megawatt power plant by up to 20% in a bid to reduce its carbon footprint.

2 new solar farms start in Aomori

VENA

Energy has begun operations for solar power plants, Nanbucho 2 and Nanbucho 3, all with a combined 20 MW capacity.

Located in Aomori Prefecture, Japan, the projects are estimated to power approximately 4,900 households, whilst preventing 10,652 tonnes of greenhouse gas emissions and conserving 18 million litres annually, as compared to thermal generation. With 16 renewable energy (RE) projects in Aomori Prefecture, Vena Energy continues to provide clean power to the region.

Nascent technology

For Attaurrahman Ojindaram

Saibasan, senior power analyst at GlobalData, ammonia co-firing “is not a viable strategy for decarbonisation,” adding that the technology is still new and “unproven on a large-scale.”

As such, retrofitting plants to accommodate ammonia could not be cost-effective. Ammonia use would also double the fuel costs, even with the use of its cheapest form, grey ammonia.

“Converting a coal plant to an ammonia co-firing coal plant would require massive investments in retrofitting which would not yield good returns if there were stricter regulations post 2030 to phase out coal-power plants,” he told Asian Power.

Ishikari Bay offshore wind farm begin ops

JERA Co., Inc. (JERA) and Green Power Investment Corporation (GPI) have started operations for the Ishikari Bay New Port Offshore Wind Farm, Japan’s largest commercial wind farm.

Located in Hokkaido, the facility contains 14 8,000 kW wind turbines – the first-ever in Japan –from Siemens Gamesa Renewable Energy with a capacity of 112,000 kW.

The power will be supplied to Hokkaido Electric Power Network, Inc. (HEPN) through a 180,000 kWh substation.

Onohama Power Plant shuts down

Sumitomo Corporation has ceased operations of the 56-megawatt

Onohama Power Plant, marking almost two decades of power generation from its launch in October, 2004.

Located in Iwaki City, Fukushima Prefecture, the Onohama Power Station consists of two units with 50 MW and 6 MW capacities.

Summit Energy Corporation owned 65% of the plant, whilst Nihonkaisui Corporation held 35%.

Plant operations will cease at the end of March 2024.

8 ASIAN POWER

APAC

PLANT WATCH

JAPAN

JAPAN

JAPAN

China’s annual investment in manufacturing has risen from $10b in 2016 to $140b in 2023

Ammonia Gas Abatement System demonstration facility tests safe treatment for surplus ammonia (Photo from Mitsubishi Heavy Industries)

Attaurrahman Ojindaram Saibasan

Frank Thiel

More transparency, more value.

With MWM Remote Asset Monitoring.

Remote Asset Monitoring (RAM) is the new digital application from MWM that enables you to continuously monitor your plant. The system displays the status of your MWM fleet in a well-structured, transparent manner, allowing you to act with foresight and more effectively.

www.mwm.net/ram

How can vehicle-to-grid technologies boost energy transition?

ASIA PACIFIC

Oliver Redrup Associate Partner, Strategy and Transactions – Infrastructure Advisory, EY Corporate Advisors Pte. Ltd.

Oliver Redrup Associate Partner, Strategy and Transactions – Infrastructure Advisory, EY Corporate Advisors Pte. Ltd.

Vehicle-to-grid (V2G) technology enables electric vehicles (EVs) to function as additional power sources by harnessing the electricity stored in the vehicle’s battery. V2G technology allows for the bi-directional flow of energy, where EVs can discharge electricity back to the grid when needed, in addition to the dynamic charging of EVs for mobility. It is useful in helping the grid supply electricity, especially during peak demand.

The EY-Parthenon study Capturing Southeast Asian EV market potential highlights that the EV market across the ASEAN-6 (Indonesia, Malaysia, Thailand, Vietnam, the Philippines and Singapore) is expected to record a compound annual growth rate of 16%–39% between 2021 and 2035. The region’s total EV sales volume is forecast to be about 8.5 million units by 2035. This suggests significant potential for V2G deployment and broad adoption across the region in time to come.

That said, the majority of renewable energy sources deployed in Asia are highly dependent on unpredictable weather conditions, making them an unstable and intermittent electricity source without the proper storage facilities. Hence, with V2G, we can manage renewable energy demand better and balance our energy system. The technology reduces the need to build standalone large-scale battery energy systems which require large capital investments. The same principles and benefits of V2G can also be replicated in vehicle-to-home (V2H) and vehicle-to-building (V2B) situations, reaping further benefits when it comes to energy transition.

The technology is still in the pilot stage and has not been commercialized, especially in Asia. There are several challenges to large-scale deployment including grid resilience and stability, interoperability, lack of charging infrastructure (including the technical capability for bi-directional flow of energy), and lack of awareness of consumers and building owners.

From the government perspective, most countries in Asia lack the regulatory infrastructure that supports V2G. Countries have been focusing on updating their regulations and safety systems to allow EV charging and the deployment of EV charging infrastructure. Only recently are they turning their attention to leveraging the EV infrastructure for V2G purposes. For example, last October, in Singapore, the Energy Market Authority (EMA) and Singapore Institute of Technology (SIT) awarded a grant to a consortium led by Strides to develop and test-bed V2G technology to provide grid services. This will be Singapore’s largest V2G testbed conducted to date with 15 commercial vans and 10 V2G-enabled EV chargers.

Additionally, once there is broader adoption of the V2G technology, it will also serve as further impetus and an enabling characteristic for a more extensive deployment of intermittent renewable power sources.

Preparing the current power grid for V2G technology calls for collaboration between multiple public sector agencies including energy, transport, and finance as well as the private sector. It will involve a combination of technical upgrades, regulatory adjustments, strategic planning, and investment from the private and public sectors to test and showcase the emerging technology and pilot it for large-scale deployment.

In addition to assessing how V2G can be incorporated into the current power grid, any new investments need to be ‘V2G ready’ to minimize the cost and technical complexity of future adoption of the technology.

There are three areas where vehicle-to-grid (V2G) implementations can contribute to energy transition. The first is demand-supply balancing. Vehicle-to-grid (V2G) implementations can help balance the demand and supply of electricity by providing energy back into the grid (storage for grid) during peak demand times. This balancing can help reduce the electricity supply by both coal and natural gas during peak hours by about 2.8% and 8.8%, respectively.

The second involves resilience during emergencies, where a V2G setup would have a high impact as a power source, as it is estimated that in the upcoming 20 years, 6% of the global electricity production could be stored in EV batteries, thus providing resilience to the grid.

Finally, the third is renewable energy management, which allows resilience during demands. V2G can store excess energy from renewable sources (solar or wind) during peak production times and feed back to the grid when needed. This increases utilisation of renewable energy plants and reduces curtailment. In addition, according to EMA, V2G technology can enhance the reliability of power grids by helping fill gaps in renewable energy generation that can be unpredictable.

Overall, V2G technology can contribute to energy transition by helping cleaner energy become effective and hence reducing reliance on fossil fuels.

One key benefit to be considered by EV owners and EV manufacturers is lower cost of EV batteries through returns from V2G schemes for EV owners. However, to realize this, business models need to evolve to support this. If V2G owners can take advantage of net-metering schemes used in solar/renewable power from homeowners, V2G would have a starting point. Hence, V2G could help reduce EV charging costs by 28 to 67%4 and help transportation move away from fossil fuels. In addition, the adoption of V2G by consumers can reduce the power generation cost and increase the power company’s revenue by approximately 3.65% as the peak power generator can be reduced.

However, the technology is still considered nascent, and so are the policies around them. Key issues to consider are in the areas of technology maturity, lack of interoperability, and unknown business models.

It is important to note that vehicle-to-grid (V2G) technology was originally conceived as vehicle-to-home, not vehicle-to-grid. In initial conceptual design and executions, this feature had been considered/implemented to give EV drivers the ability to charge another EV in cases of emergency.

This ability is now being extended to electric grids. There are several key factors that need to be considered as we explore V2G implementation: performance of battery chemistries in the V2G scenario, design of the EV batteries to suit V2G powering, wear on the vehicle's batteries - the potential reduction in capacity and hence loss of range in transportation, and case for EV manufacturers to equip EVs with bidirectional power features

Some key factors to consider from the perspective of the electric grid include infrastructure investments and a consistent policy in supporting business models. V2G will require investments on the grid side to accommodate bidirectional power flow and metering schemes to account for the bi-directional power flow. These investments would also need to consider investments in communications and related infrastructure for V2G to be realized.

Given the investments and the need for complex collaboration from multiple stakeholder groups (utilities, distributors, end-users, and EV manufacturers), market regulators need clear and consistent policies.

10 ASIAN POWER

VOX POP

Sharad Somani Head of Infrastructure, KPMG Asia Pacific

ANALYSIS: HYDROGEN POWER

Singapore faces cost, investment hurdles in hydrogen push

High production costs and developing technology cast doubts on the feasibility of reaching the 2050 set in the country's national hydrogen strategy.

SINGAPORE | by Vann Villegas

Natural gas-reliant Singapore is putting a premium on lowcarbon hydrogen for its energy transition as it faces land scarcity to accommodate other forms of renewable energy. However, the hydrogen sector is still nascent, posing significant challenges in achieving the national target due to cost and investment woes.

Under National Hydrogen Strategy, Singapore sees various use cases for hydrogen across industrial, maritime, and aviation sectors. For the power sector, which comprises 39.8% of the primary emissions in 2020, hydrogen is expected to supply half of Singapore’s power needs by 2050.

“Singapore’s National Hydrogen Strategy is a laudable start, but it is too early to conclude whether meeting its target is feasible or not. The target is a sort of conditional target depending on the technological development and international effort levels,” Kim Jeong Won, senior research fellow at the Energy Studies Institute of the National University of Singapore, told Asian Power

“However, the pace of technological development and diffusion and the level of international commitment in the relatively long term (by 2050) face considerable uncertainty,” she added, noting that hydrogen still accounts for less than 0.2% of the power generation globally.

Kim said one of the greatest challenges Singapore needs to address is the high production costs of low-carbon hydrogen. At $3.4 to $12 per kilogram, it is much higher than the levelised cost for fossil fuels which is around $1 to $3 per kilogram

in 2021, according to data from the International Energy Agency.

Won added that deploying large-scale hydrogen will entail infrastructure upgrades or new construction of hydrogen storage and utilisation, requiring huge investments. Add to that the fact that Singapore may not be able to produce green hydrogen domestically due to challenges in deploying renewable energy for public use.

“It will lead Singapore to be a net importer of low-carbon hydrogen, which could be impacted by production and market volatility in exporting countries,” she said.

For the infrastructure development, Are Kaspersen, Associate Partner at Bain & Company Singapore, said the country would have to establish a pipeline network, import terminals, and hydrogen turbines for power generation, amongst others.

It should also ensure that the development is “gradually phased” to replace existing infrastructure.

“There will be transition costs associated with the shift to hydrogen. While costs will come down over time, hydrogen for power generation comes at a cost premium over gas and renewables. Infrastructure investments will also have a material cost impact. Minimising the transition cost, and having a clear plan for who bears the cost will be critical,” Kaspersen said.

Progress

Despite these challenges, Singapore has made significant progress in developing its hydrogen sector. The Energy Market Authority (EMA) said that following the launch of the National Hydrogen Strategy,

it launched a joint expression of interest exercise with the Maritime and Port Authority for proposals to develop end-toend solutions for low-carbon ammonia, the most established hydrogen carrier.

Aside from this, the EMA also tapped the private sector through the launch of a request for proposal to build and operate a new generation, hydrogen-ready capacity of 600 megawatts that is targeted to start operations by the end of 2027.

It also partnered with the academe through the Low-Carbon Energy Research Funding Initiative to drive its research and development to explore cost-effective import and hydrogen use in Singapore, as well as its carriers for storage.

The EMA added that it is collaborating with other markets through governmentto-government deals to accelerate the development of hydrogen as a decarbonisation pathway in various areas including hydrogen supply chains, and Guarantee of Origin certification schemes.

Under the strategy, Singapore recognises the need for new infrastructure such as import and storage facilities, and distribution networks, amongst others. However, it does not expect to build significant infrastructure in the near term as this would require careful planning.

The country will also implement upskilling and reskilling of its workforce to allow them to adapt to a hydrogen-read economy, the strategy read.

Private sector contribution

Furthermore, the EMA has also appointed Meranti Power to develop two new open cycle gas turbines (OCGT) with 340 megawatts capacity each that are ready to take up 30% hydrogen and eventually fully switch to hydrogen. These new plants are expected to start operations by June 2025, replacing the retiring OCGTs.

Attaurrahman Ojindaram Saibasan, power analyst at GlobalData, noted that the private sector is also contributing to driving the green hydrogen sector in Singapore.

At present, the only operational green hydrogen production plant is the REIDSSPORE Hydrogen Plant by ENGIE SA. The power plant, which started in 2020, is composed of a 100-kilowatt wind turbine.

Meanwhile, Keppel Corp is collaborating with Mitsubishi Heavy Industries and IHI to develop a hydrogen-compatible power plant in Jurong Island with a total capacity of 600 megawatts. The power plant, which will use natural gas for the majority of production when it starts in 2026, is also set to increase the share of hydrogen gradually.

Accelerating hydrogen adoption

Hydrogen and its derivatives, such as ammonia, can provide various benefits to Singapore, according to Kaspersen. First, it is a dispatchable power source that will provide balancing and peaking power to the currently installed grid system.

12 ASIAN POWER

Artist impression of the new open cycle gas turbines to be built by Meranti Power (Photo from EMA)

Kim Jeong Won

Are Kaspersen

Attaurrahman Ojindaram Saibasan

CEO INTERVIEW

PLN IP leads in next-generation plant efficiency

Annually, the primary energy efficiency achieved by PLN IP is equivalent to IDR52.5b (US$3.36m).

INDONESIA

PT PLN Indonesia Power (PLN IP) is reducing production costs through specialised platforms that provide real-time predictive feedback on power plant efficiency. This ensures power plants always operate at their optimal conditions.

Since these programs were built for implementation throughout the whole company and its subsidiaries, they are core components in PLN Indonesia Power’s emphasis on cross-disciplinary coordination and highlight the shift from merely targeting efficiency for each generator. Instead, the focus is on a holistic approach to efficiency management involving all stakeholders.

Discussing the vision for the next level in power generation, CEO Edwin Nugraha Putra chats with Asian Power about the state-owned company’s initiatives to be a future-oriented service provider and to achieve a primary energy efficiency value equivalent to IDR521.5b (US$3.36m).

Upgraded systems

The predictive insights are made through sophisticated analytical dashboards in the Asset Performance Management (APM) through the Reliability Efficiency Optimization Center (REOC) platform, and integrated with Enterprise Asset Management (EAM) through the Maximo application, Edwin explained.

REOC is equipped with machine learning algorithms that process sensor data from power plant equipment, provide efficiency calculations, and offer recommendations to power plant operators. These recommendations are then linked to the digital governance of operational and maintenance processes through the Maximo EAM app.

“Seamless collaboration across operational actions and maintenance significantly influences efficiency and reliability improvements,” he told Asian Power magazine.

Previously, Edwin has described REOC as the “masterpiece” of the company’s digital pipeline ecosystem, since the platform is designed to be human-centered and focused on simplifying abnormal information for easier and faster decision-making.

In addition to plant monitoring, the ecosystem includes features for managing procurement, commerce, talent, employment, knowledge, and corporate strategy. Digitalising business processes, according to the CEO, is more than simply keeping up with the times; rather, it provides its own value in carrying out day-to-day transactions.

Programme implementation

To illustrate REOC’s effectiveness, Edwin shares an impressive success story from 2019. The REOC algorithm detected changes in the equipment conditions at the 400-MW Suralaya #1 Power Plant, predicting a significant thermal efficiency decrease in the next week.

Timely maintenance, guided by REOC recommendations implemented through Maximo EAM work orders, led to the equipment's recovery to its highest efficiency point. As a result, there was an annual energy efficiency improvement equivalent to 120 kCal/kWh or IDR 52.5b (US$3.36m).

“This latest advanced technology provides predictive insights into power plant efficiency changes through sophisticated analytical dashboards in the APM REOC platform. Realtime evaluations of power plant efficiency and precise

Seamless collaboration across operational actions and maintenance significantly influences efficiency and reliability improvements

recommendations in response to operational parameter changes are now possible,” said Edwin. In response to the progress of the PLN IP project, the CEO revealed an outstanding achievement of meeting an 82% connectivity target.

However, he acknowledged that challenges in day-to-day operations still exist, with the main obstacle being the prediction of disruptions in all power plant equipment.

PLN IP has collaborated with educational institutions and artificial intelligence technology vendors to expand prediction algorithms in the REOC APM platform, addressing opportunities to connect a larger percentage of the total power plant equipment, reaching over 5000 units.

Three key areas

The REOC is just one of the aspects that PLN IP eyes to improve, says Edwin. The CEO shares that PLN IP has strategically aligned efforts in three key areas: people, processes, and technology.

Edwin explained that initiatives to improve employee competence extend beyond operational skills, encompassing future technologies such as data science, big data analytics, and security systems. Continuous reviews of routine business processes ensure adaptability, whilst the integration of various digital applications simplifies and streamlines transactions between processes.

“Collaboration with educational institutions and technology vendors emphasises PLN IP’s commitment to staying at the forefront of technological advancements,” said Edwin.

Through the integration of cutting-edge technology, a culture of collaboration, and strategic investments in workforce development, PLN IP is shaping the power generation landscape. “The goal is a future where quality electricity remains accessible to all, reflecting PLN IP’s sustainable contribution to the country’s energy landscape,” he shared with Asian Power

ASIAN POWER 13

Edwin Nugraha Putra, CEO of PLN Indonesia Power

COUNTRY REPORT: PHILIPPINES Philippines must be ‘more aggressive’ on RE targets

The country’s renewable energy has accounted for 22% of the energy mix as of 2022.

by Vann Villegas

Aleading renewable energy finance analyst has warned the Philippines should be “more aggressive” on its renewable energy targets. Despite renewable energy accounting for 22% of current electricity production and a target of 35% by 2030 and 50% by 2040, the country is full of natural resources and these targets should be higher.

Ramnath Iyer, the research lead on Climate & Renewable Energy Finance for Asia at the Institute for Energy Economics and Financial Analysis (IEEFA), said recent relaxations on foreign investment into renewables coupled with a vibrant private and banking sector should help the Philippines reach its goals sooner. He added that policies that include active participation in the Green Energy Auction Programme (GEAP) would also help.

“The Philippines is on track, for now,” Iyer said. “The Philippines is doing pretty well because the policies are being implemented. There are no restrictions on foreign ownership, which means that the sector is open for investment. These

Given the entire range and the diversity of renewable resources available for the Philippines, it really can be pushing the envelope further and going for a more aggressive phase-out of fossil fuels

kinds of policies, the fact that investors can own the companies, are very positive for investments,” he added.

However, Iyer intimated that the Philippines could do more and over a shorter time frame given the favourable environmental and financing conditions. Iyer added that whilst the Philippines is on track for its targets, the country would still have to accelerate the pace of RE adoption and ensure better performance annually. Considering that the country has abundant resources in offshore wind, solar, geothermal, and hydro, its targets do not seem to be the “most aggressive,” he said. “So in some ways, the programme is not ambitious enough, and could be more ambitious,” he added.

Ongoing programs

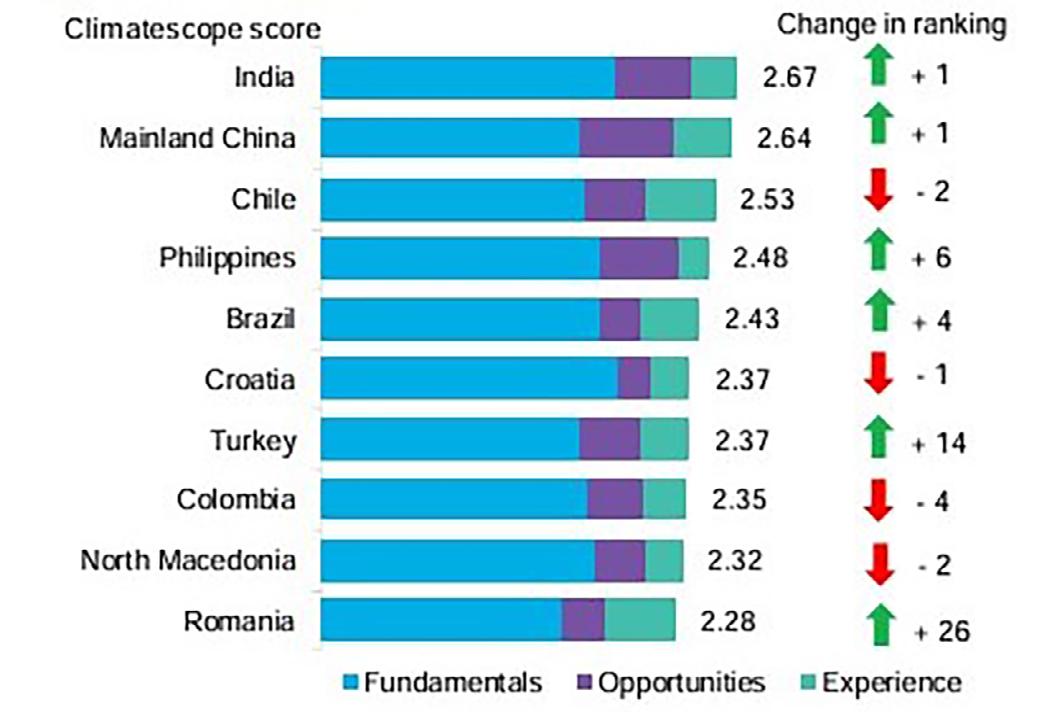

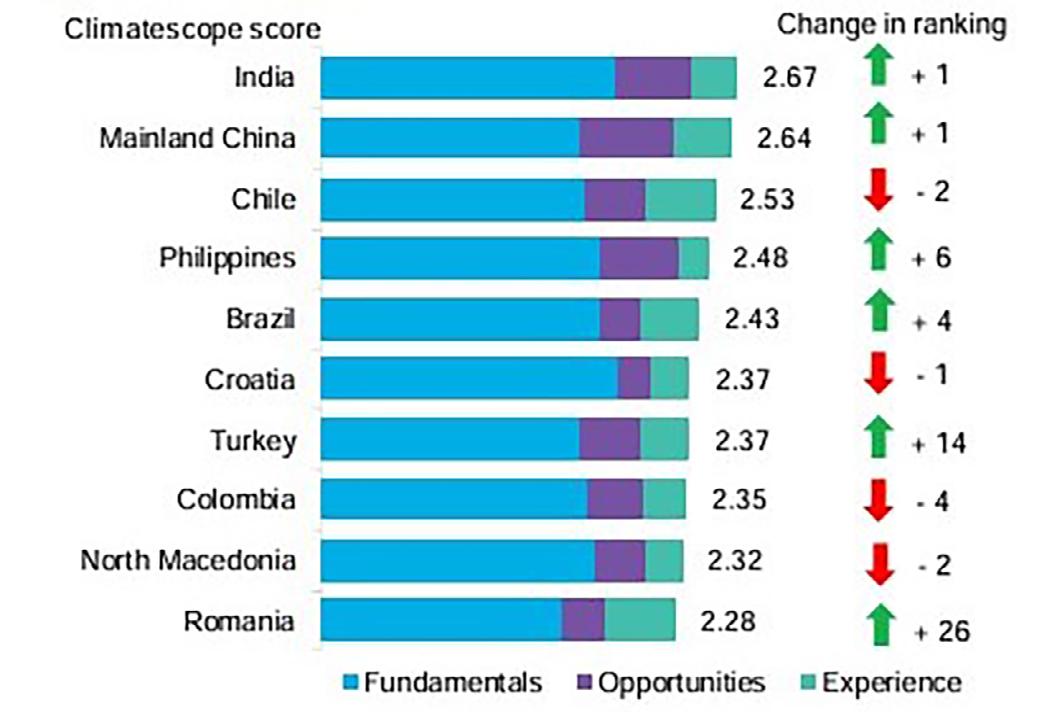

Presently, the country's flagship strategy is the National Renewable Energy Program (NREP), which sets the framework for expanding RE capacity and backs up the landmark Renewable Energy Act of 2008. Some of these goals include

increasing geothermal capacity by 75% and hydropower by 160%, attaining wind power grid parity by 2025, delivering an additional 277 MW of biomass power capacities, and developing the first ocean energy facility for the country.

In addition, the Department of Energy has released a number of circulars for more specific and short-term steps. It put a moratorium of endorsements for greenfield coal-fired power plants in 2020, and it mandated a minimum portfolio standard rate for all RE projects on grid in 2017.

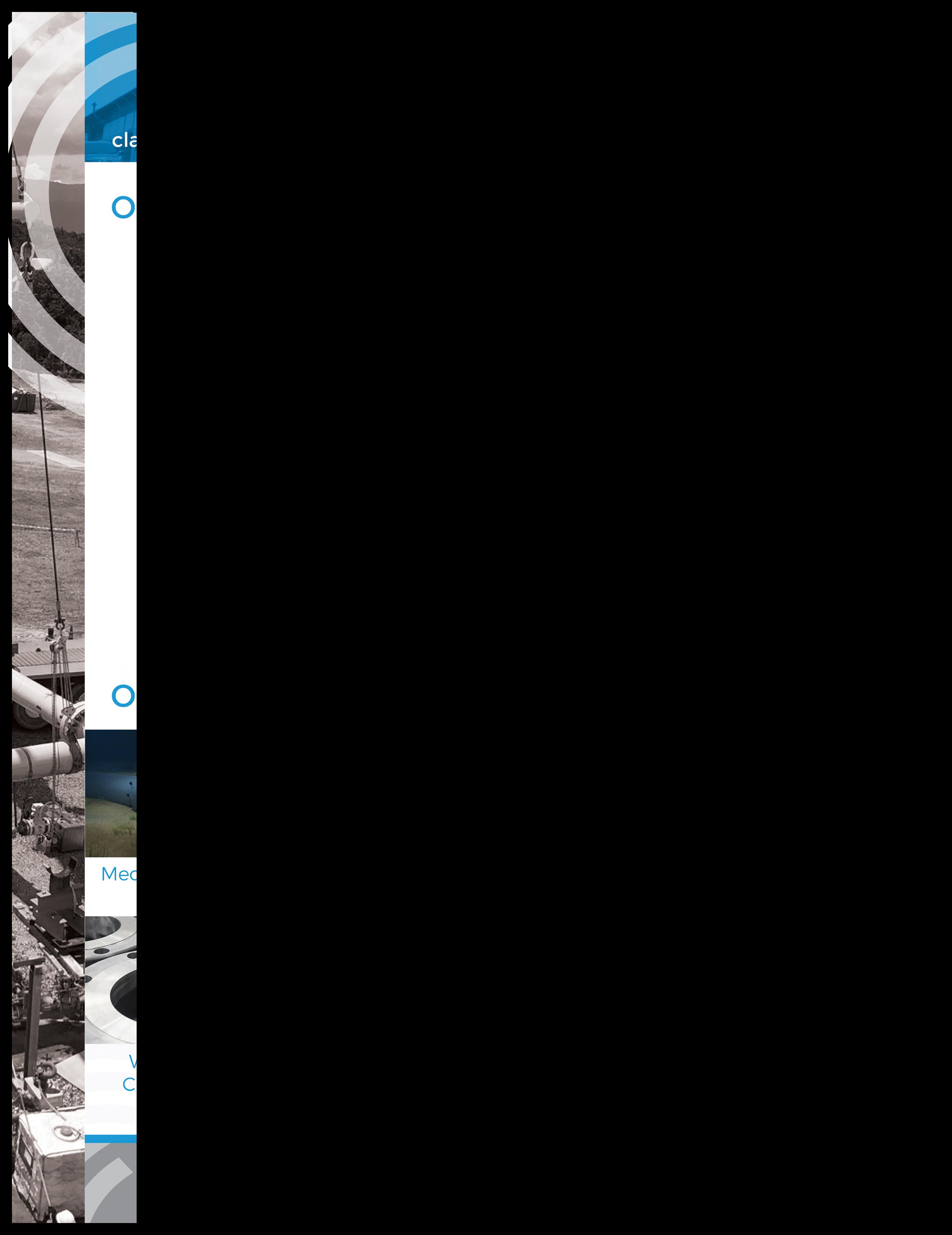

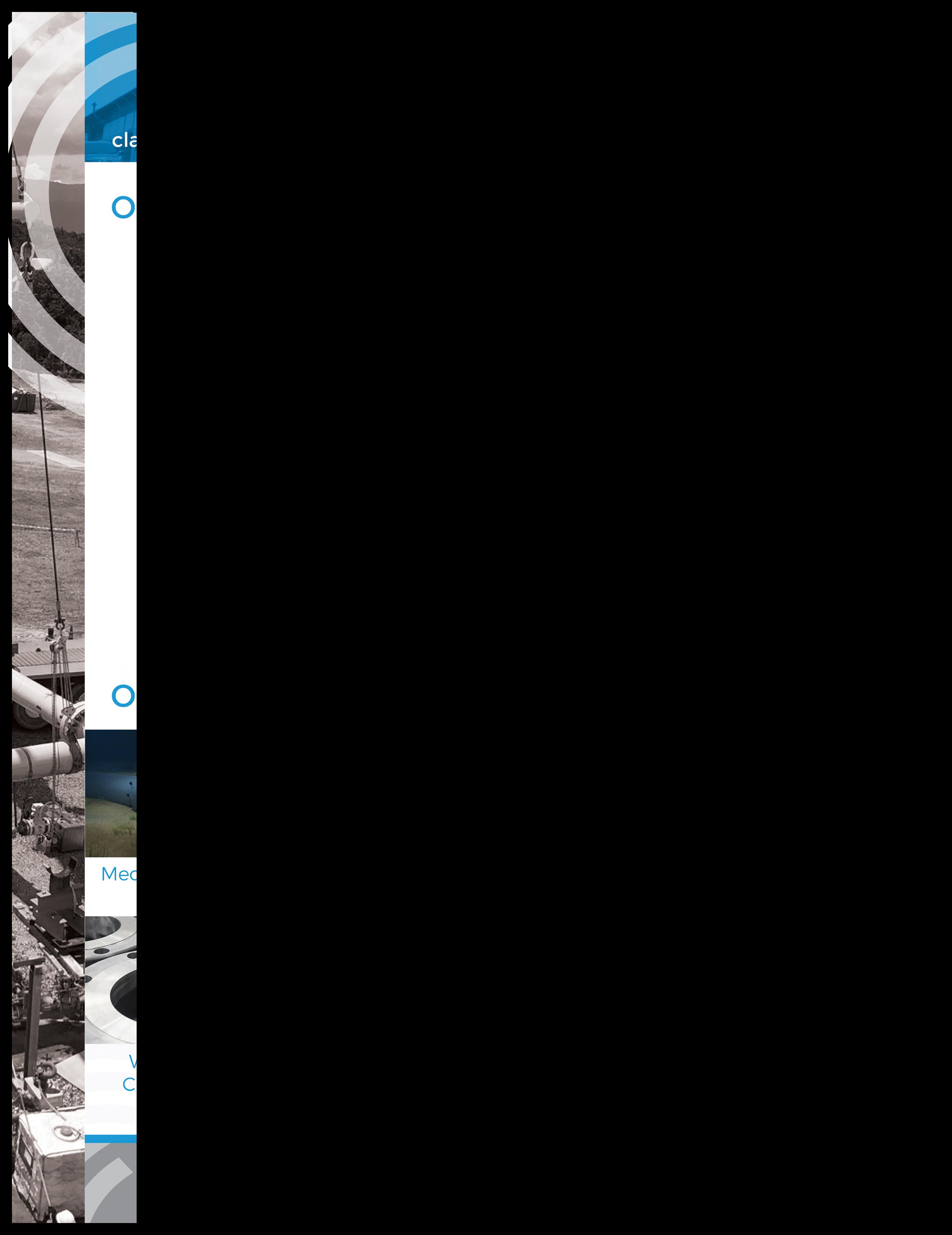

Market potential

The Philippines was ranked fourth amongst the most attractive emerging markets for renewable energy due to its auctions, feed-in tariffs, net-metering schemes and tax incentives, according to the Bloomberg New Energy Finance (BNEF) Climatescope 2023 report.

There is no shortage of new solar projects coming into completion following recent successful rounds of auctions for plants.

The Philippines has awarded 3.4 gigawatts (GW) of renewable energy capacity out of the 11.6 GW offered in its second green energy auction in 2023, of which 1.2 GW are scheduled for 2024 to 2045 for groundmounted and rooftop solar as well as onshore wind power, whilst 2.2 GW are expected by 2026. After the government lifted stipulations that required Filipino ownership of certain RE resources in November 2022, the investment in clean energy saw a significant 41% year-on-year increase to $1.34b (P74.57b), according to the report by Bloomberg.

This year is shaping up as a pivotal year for renewables with the third round of green energy auctions scheduled for August 2024, with over 4,000 MW of projects available for bidding.

Industry players

Despite being open to foreign investment, the largest players in the Phillipines renewable energy market remain to be the local conglomerates. The list of projects awarded reads like a who's who of the local business scene.

One of the leading private players is ACEN, a subsidiary of Ayala Group, which operates over 600 megawatts (MW) of wind and solar generation capacity in the Philippines and has operations in Australia, India, Laos and Vietnam. A major step that it took was the exit from its largest coal-fired plant in 2022 which had a total capacity of 246 megawatts (MW) run by South Luzon Thermal Energy Corporation through a privately financed transition mechanism, according to an IEEFA report.

Aboitiz Power, meanwhile, is the second-largest producer in the country with 3,495 MW in coal, oil, geothermal, and hydropower, with coal accounting for 60%

14 ASIAN POWER

With a 232.5-MW capacity, Malitbog Geothermal Power Plant is the largest one operated by EDC (Photo from First Gen)

COUNTRY REPORT: PHILIPPINES

and RE sources for 40% of the energy mix.

Solar Philippines, a company owned by Leandro Leviste and which started in 2013, operates 183 MW of solar generating capacity and won large bids on the first round of the auction programme.

Anther major player is Citicore Renewable Energy Corporation, with 163 MW installed and over 300 MW of renewable energy in various development stages. Citicore is also the first company to raise a real estate investment trust based on its solar power asset.

Energy Development Corporation, meanwhile, is the leader in domestic geothermal energy with a 1,188 MW capacity. It is a subsidiary of First Gen, the third-largest independent power producer in the country, which owns 30 power plants, none of which are coal-based, with a total capacity of 2,721 megawatts.

Marko Lackovic, managing director and partner at Boston Consulting Group (BCG), said the share of renewable energy generation currently stands at a low rate of 22%, based on data from the Philippines’ Department of Energy.

Despite this, there is still a reason to be “optimistic in the short to medium term” citing the increase in renewable portfolio standard (RPS) to 2.52% in 2023 from 1.0% in 2022 across distribution utilities, retail electricity suppliers, and generation companies, as well as the foreign ownership allowed for renewable energy projects.

2023 marks the first year of raising the minimum requirement to 2.52% annually for all operations covered by the RPS on-grid rules, a move by the Department of Energy to reach its target of at least 35% RE in the energy mix by 2030.

BCG’s Lackovic said the Philippines must increase the natural gas power plants’ capacity, whilst ensuring a well-planned exit from coal for the long-term as this will entail forward visibility to investors, and coordination of investments to ensure

that the capacity will be replaced by other sources as the coal plants go offline.

Financial and logistical barriers

The cost of financing for renewable energy projects remains a challenge for developers as this is affected by the increase in interest rates globally. For example, a project which typically takes two years starts with a 5% increase in borrowing cost. By the time it is completed, the project already costs 10% higher, Iyer said.

For wind projects, which usually take five years to finish, a 5% interest rate raises the project costs by around 25% to 30%, making the project uncompetitive.

He also raised concerns about the permit requirements at both the macro and micro level as the unclear processes lead to delays. Such problems are found in four specific areas such as defining the allowable areas for development, environmental studies, soil studies, and social studies of people who might be affected by the development.

One initiative the government can implement is conducting a study demarcating areas through zones to identify locations for potential projects. They can

put this on a website where investors and developers can easily pick their target areas.

“There needs to be a way to be able to expedite this process, moving from conceptualising an idea, or winning an auction to generating the power connecting it to the grid so that you and I can receive it in our homes,” Iyer told Asian Power.

Grid stability

One looming problem facing the Philippines is its grid network, which is not ready to take on the increase in renewable energy coming online in 2025 and 2026. A failure to enhance the grid to take account of intermittent renewable energy sources could lead to issues of curtailment.

To accommodate this growth, the country would need to expand its installed capacity by nearly fivefold, from 26, 286 MW in 2020 to an estimated 114, 601 MW in 2040. This figure also takes into account that peak demand is expected to increase by 7% annually, quadrupling from 2020 to 2040, according to the Power Development Plan for 2020-2040 released by the Department of Energy.

ASIAN POWER 15

Ramnath Iyer

Marko Lackovic

Top 10 emerging markets in the power sector, by Climatescope score

Top 10 emerging markets in the power sector, by Climatescope score

BloombergNEF Climatescope 2023 Power Transition Factbook

S&P Capital

IEEFA

company

and reports

NREP,

Consolidated RE roadmap for the National Renewable Energy Program

Source:

Source:

IQ;

compilation from

websites

Source:

Department of Energy

INTERVIEW

Biomass, RE boost Tuas Power's green energy mix

It is the sole operator of a coal/biomass cogeneration plant in Singapore.

SINGAPORE | by Vann Villegas

As Singapore embarks on its energy transition, Tuas Power, one of the leading power and utility firms in the country, faces a tall order to decarbonise its operations as it runs fossil fuel-power generating facilities, including the sole coal/ biomass power plant in the market.

Owned by China Huaneng Group through its subsidiary Huaneng Power International Inc., Tuas Power has a total licensed generating of 2,670MW (megawatts). Its total installed capacity at the Tuas Power Station is 1,876MW which comprises four units of 367.5MW gas turbine-driven combined cycle power plant (CCP) and one unit of 405.9MW gas turbine-driven CCP. These CCPs operate on natural gas. Tuas Power also operates the Tembusu Multi Utilities Complex which uses biomass and coal to produce steam for industrial customers on Jurong Island and for power generation, accounting for 20% of Singapore's energy supply.

Speaking to Asian Power, Tuas Power Chief Operating Officer Michael Wong candidly acknowledged that decarbonisation is a challenge for their operations. Unfazed, though, the power company has embarked on initiatives to enhance operational efficiency and reduce carbon emissions in its existing plants.

Wong said this entails significant upgrades. Some of the measures Tuas Power is implementing for the energy transition are increasing the share of biomass use for power generation, and exploring importation of renewable energy from Indonesia, he said.

The need for diversification becomes apparent and initiatives in that direction are being pursued by the company as a commitment to meeting the carbon emission targets by 2030 and 2050, he said.

Tuas Power employs what Wong referred to as “4D” strategies to ensure compliance with the country’s net-zero goals whilst ensuring sufficient supply. He shared more about it in detail in this interview.

How has the company performed so far this year? Please name some of your notable achievements.

Tuas Power has been successfully supporting the security of the supply of electricity to consumers in Singapore. We expect to generate more than 10,000 gigawatt-hours from our power plants. That will constitute more than 20% of the market share for the whole of Singapore. That is attributed to our efforts to make use of our capacity for running five combined cycle plants whenever available.

What challenges did you encounter, and how did you address them?

Singapore is going through an energy transition. There are a lot of concerns about this. For example, the carbon tax is going to escalate from $5 (US$3.74) per tCO2e to $25 (US$18.69) per tCO2e, starting from 2024, and then increasing to $45 from 2026 to 2027, with a view of reaching $50 to $80 (US$37.37–US$59.80) per tonne by 2030. There is a concern about how the energy transition can galvanise us towards the emission target by 2030 and then net zero by 2050.

One of the challenges for Tuas Power will be how we are going to decarbonise. There are several initiatives we have been working on. For our existing plants, we have been upgrading them to improve their efficiency to reduce carbon emissions. We are also embarking on a conversion project to increase the use of biomass for the multiutilities plant which will also help to reduce carbon emissions. We have a plant which is burning a mixture of coal and

Michael Wong, Tuas Power Chief Operating Officer

Michael Wong, Tuas Power Chief Operating Officer

We are also embarking on a biomass project for the multi-utilities plant that will also help to reduce carbon emissions.

biomass. The design of the plant allows a fuel mix of 80% coal and 20% biomass. Currently, we are using about 70% coal and 30% biomass, but we are still trying to increase the proportion of the biomass in our energy mix in the coming years.

At the same time, we are looking seriously into power import projects in Singapore. We have signed an MOU with a partner, PT Marubeni Global Indonesia, which is working on the Industrial Park National Strategy Project in the Batam area in Indonesia, to both supply the local market and export close to 600 megawatts of power to Singapore. We are working to start export and import as early as 2027.

The minister also shortlisted six out of 26 proposals for the hydrogen ammonia pilot project. Tuas Power consortium is one of the six. We are working with our partners, EDF and ITOCHU, on coming up with more detailed proposals for the government for the upcoming request for proposal process.

As for the challenges in the Singapore energy transition, there are many uncertainties and options; we are not sure which one will be more successful. We also need to balance the trilemma problem statement — which is how to make sure there’s a security of supply; sustainability in terms of reducing carbon emissions; and to make energy affordable for the consumers. We are working tirelessly to review all the options for the best ones.

What are the current trends in Singapore’s electricity market?

Since the Russia-Ukraine war, people have been concerned about energy security, meaning the security of supply for Singapore because we are heavily dependent on natural gas. Around 95% of the power

16 ASIAN POWER

generated in the country is by burning natural gas. Secondly, there are concerns about the prices, especially as you actually see the price going upward when the carbon tax progressively increases. People will be concerned about whether the cost of power will go up further.

‘What will be the acceptable or affordable level at the end of the day?’

‘What is the zero carbon price for electricity?’ People will also be more conscious of that sustainability factor.

How do these trends affect your operations?

One of our social responsibilities is to maintain our supply of electricity so that we can continue to sell and supply electricity and fulfil the contracts with our customers. Even when the market is tight, we actually have been supplying and renewing the contracts we have with our own customers. Although we are not the biggest player in Singapore — capacity-wise and in terms of generation — we have been taking a lead, either the No. 1 or No. 2 position in the market.

The first point is we have to take up the social responsibility to meet the expectations of the customers. Secondly, regarding the trend to go green, Tuas Power has also put into a pipeline, our plans on how to meet customer expectations to give them a choice of green energy. That is why we have signed an MOU, bringing in energy from Indonesia generated by solar power, giving our customers a choice between solar-generated or traditional gas-fired electricity, or even a bundle of both types.

What projects can we expect from Tuas Power?

There are four areas we focus on which I can summarise as “4D.” In Singapore, 4D is a lottery game where you bet on a four-digit number and hope to win a fortune. In the same way, the strategy for Singapore's energy transition also relies on 4Ds: decarbonise, digitalise, diversify and develop talents.

For Tuas Power, decarbonisation is vital, as I mentioned earlier. Digitalisation is important because we need to find a smart way to optimise the various supply sources and to ensure we achieve the best efficiency and most optimised outcomes. That is where digitalisation such as AI technologies can help.

When it comes to diversifying the business, it should be emphasised that there is no single solution to meet the carbon emission targets by 2030 and 2050. We still need to work on different options and this is how we can diversify into the different areas of the business. This year we have successfully commissioned the Jurong Island Desalination Plant (JIDP) under a joint venture partnership. The plant is capable of supplying up to 30 million gallons per day of potable water to the Public Utilities Board (PUB). Tuas Power is also participating in power import, hydrogen, and carbon capture projects.

At last of the 4Ds is the most important: how to develop our talents. Although we have a very strong workforce in the industry, we cannot be complacent as a lot of changes have evolved. We need to make sure our people are equipped with the necessary skill sets to take the lead in the new energy landscape.

Singapore’s energy transition also relies on 4Ds: decarbonise, digitalise, diversify and develop talents

INTERVIEW

LOOK: Southeast Asia's current biomass capacity

The biomass capacity of Southeast Asia is only around 6,000 MW as of 2020, and is mainly installed in Thailand with 2.2 gigawatts (GW), and Indonesia with 1.9 GW capacity, Suwanto, senior officer of Power, Fossil Fuel, Alternative Energy and Storage Department at the ASEAN Centre for Energy (ACE), said. This is compared to the power generation coming from oil and coal which accounts for 76% of the region’s total, he said.

Despite this, there is significant progress in driving biomass use in the power sector, particularly in Malaysia, Thailand, Vietnam, and Indonesia, as cited in an ACE report. In Indonesia, state-owned electric utility firm PT PLN issued a regulation that provides a basis for the implementation of co-firing in coal-fired plants.

Malaysia laid out four strategic pillars for renewable energy targets in power generation composition until 2035 under its roadmap, with the second pillar aimed at exploring potential support mechanisms for biomass cofiring. Thailand also included a “Community-Based Power Plant for Local Economic Project” in its plan with a total capacity of 1,993 MW comprising biomass, biogas, and solar hybrid, according to the ACE report.

In Vietnam’s recently-approved Power Development Plan, coal plants have to burn biomass and ammonia fuel after 20 years of operation starting at 20% and increasing to 100% as it aims to phase out coal by 2050.

“In terms of supply, Vietnam has become the world’s largest supplier of wood pellets (after the USA). Utilising resources from the furniture industry, the country has become a major player in the biomass sector in the region,” World Bioenergy Association said.

Whilst biomass co-firing is seen as beneficial, markets should take caution in dealing with blending it with coal, said Putra Adhiguna, research lead for Asia at the Institute for Economics and Financial Analysis.

“Forcing its application may seem to bring benefit, but to get more biomass in the energy mix you will need to consume more coal, a proposition which will increasingly be scrutinised by stakeholders,” he said.

ASIAN POWER 17

Tuas Power Station (Photo from Tuas Power)

Tembusu Multi-Utilities Complex, a bio-mass and coal-fueled power plant (Photo from Tuas Power)

INTERVIEW

Policy alignment key for carbon credit goals

The differing maturity levels of energy systems may inhibit collaboration in APAC markets.

Carbon credit schemes supporting the energy transition are growing in the Asia Pacific (APAC), with different markets implementing their respective policies. However, challenges to the full rollout remain as there is a lack of policy and collaboration amongst markets in the region.

Peter Rawlings, Global Industry Lead, Finance Sector, at Environmental Resources Management (ERM), said around 68 countries globally have implemented various forms of carbon trading mechanisms. China, Korea, New Zealand, Singapore, and Japan are amongst the notable markets in the APAC region that are engaged in such schemes, he said.

“We have to face the fact that it is a very complex region. Each country is very different in its own right. We have got to accommodate that diversity, the differing levels of maturity of the energy and power systems,” Rawlings told Asian Power

“We have to figure out the mechanisms to support them. We need consistency and alignment, and that doesn’t exist at the moment. You have varying policies and varying approaches, and that is limiting that kind of intercompany region-wide collaboration,” he added.

Singapore, for example, has partnered with 15 countries to collaborate on carbon credits, including Bhutan, Cambodia, Indonesia, Mongolia, Papua New Guinea and Sri Lanka.

Rawlings also shared how the carbon credits scheme supports the ramping up of green financing in the APAC region in this Asian Power exclusive interview.

Can you provide us with an overview of the carbon credit landscape in Asia Pacific, particularly in the power sector?

We are seeing a period of rapid growth in the carbon markets. A lot of that growth is aligned to agreements like the Paris Agreement. The voluntary carbon market in 2021 was worth about $2b. There are estimates that in 2030, that could be anywhere from $10b to $40b. You can see huge incremental growth there. Carbon markets in various guises certainly have a big opportunity to play in the region, given the growth that the region is seeing and the desire to move to net zero.

Which countries in the region are leading in terms of driving initiatives for carbon credits?

It would be wrong for me to say who the leader is because that is picking one or another against them. But when you think about a place like Singapore, it naturally is a finance centre for the region. Thus, you can see countries like Singapore playing a very prominent role, given the finance that they’re helping to mobilise through the different incentives and innovative ways of implementation.

China has a major role to play simply based on its scale. There is already a lot happening there, and that will continue to grow. You have subtleties based on each country, but, for overall success, it is going to require all countries to be working and collaborating.

What are the challenges in adopting carbon credit schemes in the region? How can governments help in addressing them?

There are challenges; but with challenge comes opportunity. We have to face the fact that it is a very complex region. Each country is very different in its own right. We have got to accommodate that diversity, the differing levels of maturity of the energy and power systems. You have to acknowledge that we have got a lot of infrastructure that may only be five to 10 years old. For example, there is a cost associated

Carbon markets in various guises certainly have a big opportunity to play in the region, given the growth that the region is seeing and the desire to move to net zero.

with rapidly looking to phase out coal-fired power stations. As such, we have to figure out the mechanisms to support them. We need consistency and alignment, and that doesn’t exist at the moment. You have varying policies and varying approaches, and that is limiting that kind of intercompany region-wide collaboration.

What are some of the recent carbon credit schemes or transactions in the region particularly in the power sector?

The Asian Development Bank (ADB) has been very prominent in its desire to help facilitate and accelerate the transition. Their energy transition mechanism is one of the kinds of outputs that is encouraging a move from fossil fuels to renewables. Similarly, you have the same happening here in Singapore, and the government has looked to accelerate, encourage, and incentivise a very similar mechanism. They’re phasing out fossil fuel, particularly coal-fired power stations and, as a result, encouraging alternative lower carbon options.

How will the carbon credits market evolving in the next five years?

The defining factor is going to be the policy environment. The more we see international collaboration and alignment around carbon mechanisms, the better it will be — which will encourage much wider uptake. My view for the next five years is that we will see the importance of carbon markets. I think we will see nature-based solutions come to the fore, with a real focus on nature and climate. The acceleration, though, I think is the voluntary side. The real acceleration will be if we achieve alignment of policies.

How do carbon credit schemes support the acceleration of green financing in APAC?

So much of the power system relies on fossil fuels, particularly coal. That means that to attract finance into the region, we have to look at phasing out fossil fuels and bringing in alternatives such as renewables, hydrogen, and other forms of clean energy, so carbon credits have a potential role to play there.

18 ASIAN POWER

Peter Rawlings, global industry lead of finance at Environmental Resources Management (ERM)

SCAN FOR FULL STORY

APAC

How Southeast Asia can unlock its biogas potential

The region only has around 1 GW capacity, led in production by Thailand, Indonesia and Malaysia.

SOUTHEAST ASIA

Aregion rich in feedstock that could be used for power generation, Southeast Asia holds the potential to accelerate the use of biogas to support its energy transition. However, the region only has around one gigawatt of biogas capacity and is yet to address challenges around policy and incentives that would encourage investments in the sector.

Dieter Billen, a partner and lead of Sustainability and Energy in Southeast Asia at Roland Berger, said that another challenge markets in the region face is the concentration of the feedstock in agricultural or remote areas with insufficient infrastructure.

Biogas and especially biomethane production in Southeast Asia is very small and dispersed. Despite this, Billen noted to Asian Power that the regional biogas sector will scale up, with Thailand, Indonesia, and Malaysia leading the deployment. Data from a report by the ASEAN Centre for Energy showed that Indonesia aims to reach a bioenergy capacity of 810 megawatts (MW) and Malaysia targets 1,065 MW by 2025. Thailand, meanwhile, targets a 5,570 MW bioenergy capacity by 2036.

The growth of the biogas sector will be driven by three key trends which include the involvement of larger players, particularly private companies from various sectors such as agriculture and livestock, the rise of bioclusters, and the emergence of international trade. More insights from Billen are shared in this interview.

What is the current state of biogas adoption in Southeast Asia?

Biogas adoption in Southeast Asia today is small with a capacity of around one gigawatt. It is generally used for electricity generation, like selling it to the grid. When the carbon dioxide and other gases are removed from the biogas, you get biomethane, which is the same as natural gas but from bio-based feedstock. While there are currently a few projects to upgrade biogas into biomethane in the region, the volumes are negligent at this point. But that will change.

Countries in the region with the most biogas production today are Thailand, Indonesia and Malaysia in that sequence. Thailand’s biogas production is from various feedstock sources, including cassava bulk, rice straws, etcetera. When it comes to biomethane production, there are only a few projects mostly in Malaysia and Thailand.

Large-scale adoptions also come with challenges. Could you identify the barriers to the deployment of biogas in the region’s energy sector?

There are indeed significant challenges, especially in scaling up biogas and biomethane in Southeast Asia from current small capacities. First, the feedstock is typically in agricultural or remote areas with relatively limited infrastructure, such as electricity grids or pipelines. And also the feedstock is dispersed with relatively small volumes across multiple locations.

Finally, there are a few incentives or regulations at this stage, limiting the willingness to pay for biogas or biomethane in Southeast Asia compared to fossil-based alternatives.

How can governments support the biogas sector?

There are mandates on the treatment of certain types of agricultural waste. For example, Malaysia has mandated the production of biogas from palm oil waste for new and expanding palm oil mills.

On the demand side, there are already feed-in tariffs in place, which provide incentives for deploying biogas and then selling the

There are no significant regulations or incentives yet to drive demand for biogas or by meeting beyond these feed-in tariffs

electricity to the grid. However, there are no significant regulations or incentives yet to drive demand for biogas or by meeting beyond these feed-in tariffs. For example, there is no blending mandate for biomethane for applications like in the power sector.

Apart from Singapore, there is no carbon tax or mandatory carbon markets across Southeast Asia, limiting the demand for biomethane at this stage, now, it is encouraging to see that countries in the region are increasingly emphasizing biogas and biomethane as part of their decarbonisation roadmaps, for example, Malaysia has included it as one of the pillars in its National Energy Transition Roadmap, which was released earlier in 2023.

How crucial is the role of biogas in Southeast Asia’s energy transition?

So, most countries have included biogas as part of their energy transition roadmap. It is not surprising given the abundance of bio feedstock in the region. Some countries also have plans specifically for biomethane production.

Thailand has an illustration plan to increase biomethane production to 4,800 tons per day in the next decade, so [that’s] almost two hundred times. But what we expect is that the role of biogas and biomethane will be much more important than what is currently in the energy transition plans of Southeast Asian countries. For example, the role that biomethane can play to decarbonise existing applications currently using natural gas such as combined-cycle gas turbines. It is typically not part of those plans yet.

What are the innovations in the biogas sector?

There are lots of technological innovations in the biogas and biomethane sector in terms of new types of feedstock called thirdgeneration feedstock, but also in terms of production processes, such as thermal and hydrothermal gasification, and landfill gas recovery.

Let us also not forget innovation in the business model, for example: virtual trading of biogas or biomethane rather than physical. The biogas or biomethane would still be produced and used, but at a different location to avoid transportation costs.

ASIAN POWER 19 INTERVIEW

Dieter Billen, partner and lead of sustainability and energy in Southeast Asia at Roland Berger

SCAN FOR FULL STORY

TBS Energi makes the switch from coal to solar

TBS Energi's wind and solar power projects aim to contribute 100MW capacity.

INDONESIA | by Ibnu Prabowo

The Indonesian government has set an ambitious goal of reaching a 23% renewable energy (RE) contribution to its energy mix within the next two years.