BATTERY CYCLERS AND SIMULATORS

CHARGE/DISCHARGE LIFE CYCLE TEST

Battery cell, module and pack level charge/discharge cycle testing solutions designed to provide high accuracy measurement with advanced features. Regenerative systems recycle energy sourced by the battery back to the channels in the system or to the grid.

BATTERY SIMULATION

Battery simulation for testing battery connected devices in all applications to confirm if the device under test in performing as intended. Battery state is simulated which eliminates waiting for the charge/discharge of an actual battery. Real time test results include voltage, current, power, SOC%, charge/discharge state and capacity.

To learn more about our Battery Test Solutions visit chromausa.com

THE TECH

SK Siltron wins $544-million DOE loan to expand production of SiC wafers

INFICON’s ELT Vmax enables individual leak testing for mass-produced EV cells

ABS wins $166-million DOE loan to expand Ohio and Michigan EV battery plants

POSCO International’s drive motor core to power millions of Hyundai-Kia EVs

Optiphase and Opal-RT collaborate on real-time simulation for 5-phase EV motors

Sion Power raises $75 million to commercialize its Li-metal tech for EV batteries

Schaeffler/Vitesco merger will create the largest global EV powertrain supplier

Samsung SDI announces plan to mass-produce solid-state batteries

Farasis Energy researches plastic battery housing for increased EV safety

Layered oxide cathode could make sodium-ion batteries an attractive option

Microchip’s motor drivers include controllers, gate drivers and communications

Magna unveils its next-generation 800 V eDrive solution

Green Watt Power’s new 300 W DC-DC converters for EVs

QuantumScape begins shipping Alpha-2 prototype battery cells

ENNOVI introduces new production process for EV battery cell contacting systems

CATL warrants its new EV battery to last for a million miles or 15 years

Projected EV battery recycling capacity to outstrip supply

Thermo Fisher’s in-line metrology enables comprehensive inspection of electrodes

Avery Dennison’s new electrode fixing tapes for EV battery cells

THE VEHICLES

Xos receives order for 12 of its SV electric stepvans

Skanska concludes North American pilot of Volvo EC230 Electric excavator

Volvo CE delivers electric excavator and refuse truck to Florida waste hauler

Thomas Built Buses delivers its 1,000th electric school bus

GILLIG to supply Seattle transit agency with up to 395 battery-electric buses

Daimler Truck North America delivers first electric Freightliner eM2 trucks

MAN rolls out battery repair centers across Europe

New fleet customer says Tesla Semi performs “well beyond expectations”

Fortescue’s electric excavator outperforms its diesel counterpart

Firstgreen reports growing US demand for its electric skid steer loaders

Electric trucks and buses show massive sales growth in Europe

Foxconn invests in light utility EV maker Indigo Technologies

Hyster to supply electric terminal tractors to APM Terminals in Alabama

THE INFRASTRUCTURE

EV charging part of the smart home

Q&A with Leviton’s Andrew Taddoni

Study finds EVs are lowering electricity bills for all customers, not just EV owners

ABB E-mobility and MAN demonstrate megawatt charging on electric truck

Fermata Energy, BorgWarner, Lion Electric win $3-million grant for V2G project

Einride opens 65-plug heavy-duty EV charging site near California ports

Shell to divest 1,000 retail locations, and also expand EV charging. Coincidence?

Mack’s mobile off-grid charging system helps customers evaluate EVs

Oomph’s new Powerstream mobile rapid DC charger

EVBox supplies 300 EV charging stations to EVzen network in France

Project aims to accelerate construction of heavy-duty truck charging hubs

FreeWire program lets hosts custom-brand chargers with no upfront costs

Greenlane plans charging corridor between Los Angeles and Las Vegas

EnviroSpark to supply EV chargers to IHG Hotels in the US and Canada

Dry electrode coating skips solvents for sustainable LiB solutions.

As lithium-ion battery (LiB) production ramps up to meet the growing demand for electric vehicles (EVs), manufacturers are choosing dry electrode coating as a more sustainable, cost-effective, high-performing alternative to the current wet slurry process:

NO EXPOSURE TO HAZARDOUS SOLVENTS

SMALLER FOOTPRINT

IMPROVED BATTERY PERFORMANCE

MORE COST EFFECTIVE

Publisher

Senior EditorTechnology Editor

Segment Leaders

Christian Ruoff

Charles Morris

Jeffrey Jenkins

Joel Franke

Mark Rogers

Greg Schulz

Graphic Designers

Tomislav Vrdoljak

Contributing Writers

Jeffrey Jenkins

Charles Morris

Christian Ruoff

John Voelcker

Cover Image Courtesy of

Stellantis North America

For Letters to the Editor, Article Submissions, & Advertising Inquiries Contact: Info@ChargedEVs.com

Special Thanks to

Kelly Ruoff

Sebastien Bourgeois

ETHICS STATEMENT AND COVERAGE POLICY AS THE LEADING EV INDUSTRY PUBLICATION, CHARGED ELECTRIC VEHICLES MAGAZINE OFTEN COVERS, AND ACCEPTS CONTRIBUTIONS FROM, COMPANIES THAT ADVERTISE IN OUR MEDIA PORTFOLIO. HOWEVER, THE CONTENT WE CHOOSE TO PUBLISH PASSES ONLY TWO TESTS: (1) TO THE BEST OF OUR KNOWLEDGE THE INFORMATION IS ACCURATE, AND (2) IT MEETS THE INTERESTS OF OUR READERSHIP. WE DO NOT ACCEPT PAYMENT FOR EDITORIAL CONTENT, AND THE OPINIONS EXPRESSED BY OUR EDITORS AND WRITERS ARE IN NO WAY AFFECTED BY A COMPANY’S PAST, CURRENT, OR POTENTIAL ADVERTISEMENTS. FURTHERMORE, WE OFTEN ACCEPT ARTICLES AUTHORED BY “INDUSTRY INSIDERS,” IN WHICH CASE THE AUTHOR’S CURRENT EMPLOYMENT, OR RELATIONSHIP TO THE EV INDUSTRY, IS CLEARLY CITED. IF YOU DISAGREE WITH ANY OPINION EXPRESSED IN THE CHARGED MEDIA PORTFOLIO AND/OR WISH TO WRITE ABOUT YOUR PARTICULAR VIEW OF THE INDUSTRY, PLEASE CONTACT US AT CONTENT@CHARGEDEVS.COM. REPRINTING IN WHOLE OR PART IS FORBIDDEN EXPECT BY PERMISSION OF CHARGED ELECTRIC VEHICLES MAGAZINE.

Publisher’s Note

What can we learn from China?

China and its auto industry are much in the news these days. e mainstream press seems to have suddenly discovered something that we’ve been writing about in Charged for years—Chinese automakers’ focus on electri cation poses a serious threat to the US (and other) auto industries.

ere are several aspects to this story. For years, China was considered a promising market for Western automakers, but now they’re running for home, tails between their corporate legs. Even Tesla let out a yelp recently when China sales fell below expectations. e reason for this setback is simple—the newest Chinese EVs deliver similar quality to that of US and European brands, at prices the latter can’t hope to match.

is is the same equation that the Chinese hope will help them conquer markets around the world. Chinese EVs are already on the streets of Europe, and they’re rolling o the country’s massive car-carrier ships (and, soon, o assembly lines at brand-new factories) in emerging markets in Asia, South America and elsewhere.

e world’s biggest EV maker, BYD, says it has no plans to sell passenger cars in the US for now (it’s been building e-buses in California for years), but Chinese suppliers and partly-Chinese-owned automakers (Volvo, Polestar) are already thriving in the US market.

Perhaps the most troubling of the China-related issues is the country’s dominance in raw material mining and processing. anks to the incentives in the 2021 Bipartisan Infrastructure Law and the 2022 In ation Reduction Act, companies are rushing to build supply chains in North America, but this will take time, and raw materials are likely to be a production bottleneck for years to come.

It’s hard to talk to any EV company these days without hearing about China. HummingbirdEV, pro led on page 56, recently provided 393 electric mining vehicles powered by its technologies to a China-based manufacturer.

ere is a silver lining here—the US and Europe badly need lower-priced EVs, and competition from China is one of the major factors spurring our automakers to cut costs and introduce new entry-level models, as Charles Morris discusses in this issue’s Charging Forward column, page 82. Localizing supply chains will also make them greener and more resilient.

Here at Charged, we’re happy to see China make the transition to EVs, but we’re well aware that the country is an economic competitor, and not a democracy. We support our home team, and we’d like to see Ford, GM, Stellantis, Tesla et al leading the EV transition. Unfortunately, the legacy brands are laps behind, and they’re not going to catch up using the compliance-based, quarterly-earningsobsessed mindset that’s prevailed in Detroit for decades.

I’m reminded of one of Stephen Covey’s 7 Habits of Highly E ective People: “ ink win/win.” Instead of trying to beat back the Chinese “threat,” the US should continue to take some pages from their book, bene ting from their EV expertise while still protecting US jobs and companies. China has been very strategic in experimenting with di erent pro-EV policies to establish its early lead in the market. We have a lot to learn about which policies work well and which get quickly ditched (at a speed only possible with China’s heavy hand).

For those who prefer a more combative aphorism, here’s one from Sun Tzu, recently cited by Michael Dunne, a top expert on the Chinese auto market: “Know the enemy and know yourself; in a hundred battles you will never be in peril.”

Christian Ruoff | Publisher EVs are here. Try to keep up.

SK Siltron wins $544-million DOE loan to expand production of SiC wafers for EV power electronics

e DOE’s Advanced Technology Vehicles Manufacturing Loan Program, which supports domestic manufacturing of fuel-e cient vehicles, components and materials, has given a conditional commitment to SK Siltron CSS for a $544-million loan to expand manufacturing of silicon carbide (SiC) wafers for EV power electronics at the company’s two Michigan manufacturing plants. SiC semiconductors potentially enable higher e ciency and higher voltages compared with traditional silicon semiconductors, which can translate to faster charging times and longer range for EVs. Demand for SiC wafers is expected to rise with EV sales. e expansion of SK’s Bay City plant is expected to create up to 200 construction jobs and 200 permanent skilled positions. rough the Michigan New Jobs Training Program, the company will train local workers for SiC wafer fabrication in partnership with Delta College, located less than a mile from the project site.

INFICON’s ELT Vmax enables individual leak testing for mass-produced EV

battery cells

INFICON, a manufacturer of leak testing solutions, introduces the ELT Vmax—a leak detector speci cally designed for integration into leak testing systems for the industrial high-speed mass production of lithium-ion and sodium-ion battery cells.

e ELT Vmax tests the leak tightness of all battery cells lled with liquid electrolyte—lithium-ion or sodium-ion—in all formats, including prismatic, round and button cells with a rigid housing, or pouch cells with a so , bag-like housing. e device uses INFICON’s patented method of direct electrolyte leakage testing—it detects electrolyte leaking from lled cells in a vacuum chamber.

While INFICON’s ELT3000 PLUS can be used as a stand-alone device, INFICON created the new ELT Vmax speci cally for use in mass production, as a testing device for integrators’ individually designed, automatic leak testing stations. Designed to provide the same levels of accuracy and sensitivity as the ELT3000 PLUS, the ELT Vmax can identify the smallest leaks down to a helium equivalent leak rate of 5∙10-7 mbar∙l/s, equivalent to a diameter in the range of 1-5 micrometers for common battery designs.

e vacuum pumps are provided by the integrator to achieve industrial quality assurance. e ELT Vmax is designed for installation in 19-inch racks, making it easy to integrate into a mass battery cell assembly operation. With its multi-chamber mode in test stations, the ELT Vmax is designed to operate in near-constant measuring mode, eliminating the waiting time during evacuation and ventilation processes and optimizing the production line for maximum throughput.

ABS wins $166-million DOE loan to expand Ohio and Michigan EV battery plants

e DOE has o ered American Battery Solutions (ABS) a $169-million loan under the Advanced Technology Vehicles Manufacturing (ATVM) Loan Program.

e company plans to use the funds to expand its battery pack assembly facilities in Springboro, Ohio and Lake Orion, Michigan.

e project will support the company’s goal of delivering standardized and customized battery packs for various battery market segments. Applications in high-voltage market segments include electri ed eet and commercial vehicles and other EVs. Low-voltage market segments include low-speed EVs and industrial equipment, as well as auxiliary batteries for EVs. ABS has customers and o ake agreements in both market segments.

POSCO International’s drive motor core to power millions of Hyundai-Kia EVs

South Korean manufacturer POSCO International has secured an order for several million drive motor cores to be tted on Hyundai-Kia’s Seltos class EVs and produced locally in Europe from 2025 to 2034.

e order supports POSCO’s plans to build a production plant in Brzeg, Poland, which will become the center of its European drive motor core business. Construction of the new 100,000-square-meter facility is expected to start in the rst half of this year and nish in the rst half of 2025.

POSCO aims to produce 1.2 million drive motor cores per year in Europe by 2030. By 2030, the company also hopes to produce and sell over 7 million drive motor cores per year in South Korea (Pohang, Cheonan), Mexico, Poland, China and India.

“ is order is meaningful because Hyundai Motor Group, an eco-friendly automobile company, will continue to collaborate with us in Europe following the US,” said an o cial from POSCO International.

Optiphase and Opal-RT collaborate on real-time simulation for 5-phase EV motors

Optiphase Drive Systems and OPAL-RT, a specialist in simulation and hardware-in-the-loop testing, have formed a strategic alliance to o er real-time simulation capabilities for vehicle designers that integrate Optiphase’s 5-phase electric motor and drive system.

Optiphase says it developed its 5-phase electric power and control technologies to overcome the limitations and workarounds inherent to 3-phase systems.

“When you look at the research and testing data, 5 phases provide the optimal balance of power and reliability with minimized cost and complexity,” said Siavash Sadeghi, CTO for Optiphase. “Even the most innovative 3-phase systems in the market today still use technology from the last century and require redundancy, stacking, or other workarounds to meet the demanding requirements of advanced vehicles.”

Optiphase designs o er outputs from <5 kW to over 1 MW, speci c power in excess of 8 kW/kg, and sha speeds from 1,000 RPM to over 100,000 RPM.

“ is collaboration unlocks greater access for advanced vehicle designers to the groundbreaking advantages of 5-phase electric motor technology,” said Daniel Vicario, CEO of Optiphase.

Sion Power raises $75 million to commercialize its Licerion tech for lithium metal EV batteries

As the EV market expands, there’s a pressing need for more standardization of DC power distribution, especially for buses and heavy-duty vehicles. SAE International’s new standard, SAE J-3105: Electric Vehicle Power Transfer System Using Conductive Automated Connection Devices Recommended Practice, promotes the safe testing and performance of mechanized conductive power transfer systems, primarily for vehicles using a conductive automated-charging device .

SAE J-3105 addresses three interfaces required to ensure power delivery is consistent. It de nes a conductive power transfer method, including the curbside electrical contact interface, the vehicle connection interface, the electrical characteristics of the DC supply, and the communication system. It also covers the functional and dimensional requirements for the vehicle-connection interface and supply-equipment interface.

In addition to the main document, there are three supplements, which address connection-interface requirements for power transfer systems based on cross-rail designs, conventional rail vehicle pantograph designs and enclosed pin-and-socket designs.

“SAE J-3105 will help industry ensure that each connection type is safe and interoperable among manufacturers,” said Task Force Committee Chair Mark Kosowski. “ e industry has been waiting for this Recommended Practice.”

Schaeffler/Vitesco merger will create the largest global EV powertrain

supplier

EV component suppliers Schae er and Vitesco Technologies Group have entered into a merger agreement. e transaction is expected to be completed in the fourth quarter of 2024.

e two companies make components such as e-drives, power modules, BMS, control units, motors, steering systems and much more. Schae er recently built an electric version of the Ford F-250 pickup to showcase the EV technology that the company o ers to vehicle OEMs.

According to HSBC Global Research, the combination of Schae er and Vitesco will create the largest EV powertrain supplier in the world, with 25 billion euros in current sales and a cumulative order intake of 36 billion euros over 2021-23.

“Vitesco enhances Schae er’s EV o er with battery management systems (BMS), in our view the most pro table product thanks to its high technological content and more limited competition,” wrote HSBC’s analysts. “Otherwise, the EV portfolios of the two companies overlap completely. In our view, this allows for unprecedented cost saving potential.”

“Preparations for the integration of Vitesco into Schae er are making good progress,” said Klaus Rosenfeld, CEO of Schae er. “We are con dent that we will complete the transaction as planned in the fourth quarter and successfully realize our plan to establish a leading motion technology company in the best interest of our customers, shareholders and employees.”

Samsung SDI announces plan to mass-produce solid-state batteries

EV battery manufacturer Samsung SDI has announced a suite of battery technologies, including fast charging and ultra-long-life batteries, as well as its roadmap for mass production of all-solid-state batteries (ASBs).

Samsung SDI plans to mass-produce 900 Wh/L solid-state batteries using its solid electrolyte and anodeless technologies, the latter of which enables higher cathode capacity. e design’s energy density is 40% higher than that of P5, Samsung SDI’s prismatic battery in production.

Samsung SDI has also unveiled its ultra-fast charging technology, which delivers high charging speeds by optimizing lithium-ion transfer path and enabling low resistance. e company aims to develop the technology to mass production by 2026.

Samsung SDI also plans to create and mass-produce a battery that has a 20-year lifespan by 2029; cell-to-pack (CTP) technology for prismatic cells, which reduces the number of components by more than 35% and the weight by 20%; and its “no thermal propagation” technology, a safety feature that prevents propagation of thermal runaway in the event of a re or impact.

“Our preparations for mass-producing next-generation products of various form factors such as an all-solid-state battery are well underway,” said Yoon-ho Choi, President of Samsung SDI.

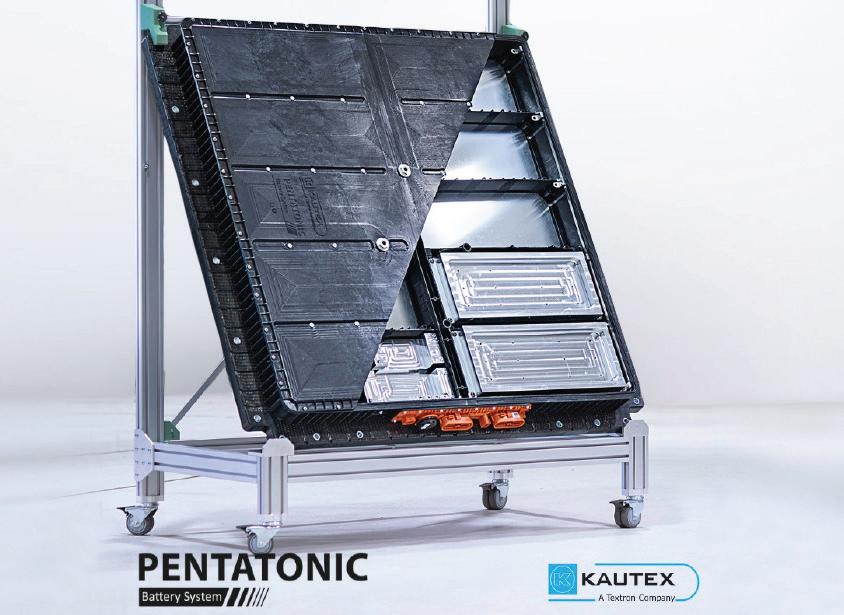

Farasis Energy researches plastic battery housing for increased EV safety

Farasis Energy, a battery manufacturing company, Kautex Textron, a supplier of energy storage systems, and the Fraunhofer Institute for High-Speed Dynamics are working together to make plastic-based EV battery housings safer by means of virtual design.

Farasis, which develops and produces lithium-ion battery technology and pouch cells for electromobility, is developing a simulation model for mapping the thermal runaway of individual cells and module propagation.

e company also supports all battery topics within the three-year SiKuBa project, which has received €2.6 million from the German Federal Ministry for Economic A airs and Climate Action.

e project aims to analyze the formation and propagation of hot gas and particle ows and their interaction with structural elements, transferring the data to simulation models. It will also assess battery safety using various load case scenarios, materials and component designs.

Farasis Energy and its partners will develop a detailed model for simulating thermal runaway, or enhance the existing models within the company. ese simulation models will enable the company to achieve a quicker and safer integration of plastic-based module and pack enclosures.

“Plastic enclosures have many advantages over metal enclosures,” the company notes. “ ey are lighter, more sustainable, and cheaper to produce, and have better electrical insulation. In the event of a damaged cell, the battery housing can be exposed to enormous thermal loads if thermal runaway of individual cells occurs.”

Layered oxide cathode could make sodium-ion batteries an attractive

option for EVs

Researchers at the DOE’s Argonne National Laboratory have invented and patented a new battery cathode material that replaces lithium ions with sodium and could be signi cantly cheaper.

e research team has developed a layered oxide cathode for sodium-ion batteries. A layered sodium nickel-manganese-iron (NMF) oxide cathode e ciently inserts and extracts sodium, which is available abundantly and is more easily mined than lithium. e absence of cobalt in the cathode reduces cost, scarcity and toxicity.

e team says its cathode has a higher energy density than other sodium-ion technologies, and that its cathode material allows battery cells to be charged and discharged as many times as lithium-ion batteries. e sodium-ion batteries can also retain their charging capability at below-freezing temperatures.

e research has transitioned from the laboratory phase, and the cathode will now be tested within battery cells similar to those in a real EV battery. e team is also working to develop di erent electrolyte and anode materials to further increase energy density.

“Our estimates suggest that a sodium-ion battery would cost one third less than a lithium-ion one,” said Christopher Johnson, Senior Chemist and Argonne Distinguished Fellow. “ ere is one catch to this wonder battery. Sodium metal is about three times heavier than lithium, and that adds considerably to the battery weight.”

Microchip’s new integrated motor drivers include controllers, gate drivers and communications

Microchip Technology has launched a new family of dsPIC digital signal controller-based integrated motor drivers. ese devices incorporate a dsPIC33 digital signal controller (DSC), a three-phase MOSFET gate driver, and optional LIN or CAN FD transceiver into one package.

is integration is designed to reduce the component count of a motor control system design, and allow smaller printed circuit board (PCB) dimensions. e devices are supported by development boards, reference designs and application notes, and will be included in Microchip’s eld-oriented control (FOC) so ware development suite, the motorBench Development Suite.

e integrated motor driver devices can be powered by a single power supply up to 29 V (operation) and 40 V (transient). An internal 3.3 V low dropout (LDO) voltage regulator powers the dsPIC DSC, which eliminates the need for an external LDO to power the device. Operating between 70 and 100 MHz, the dsPIC DSC-based integrated motor drivers provide high CPU performance, and can support e cient deployment of FOC and other motor control algorithms.

“Automotive, consumer and industrial designs are evolving, and require higher performance and reduced footprints,” said Joe omsen, VP of Microchip’s digital signal controllers business unit. “ ese expectations o en come at a higher expense and increase in dimensional size. By integrating multiple device functions into one chip, the dsPIC DSC-based integrated motor drivers can reduce system-level costs and board space.”

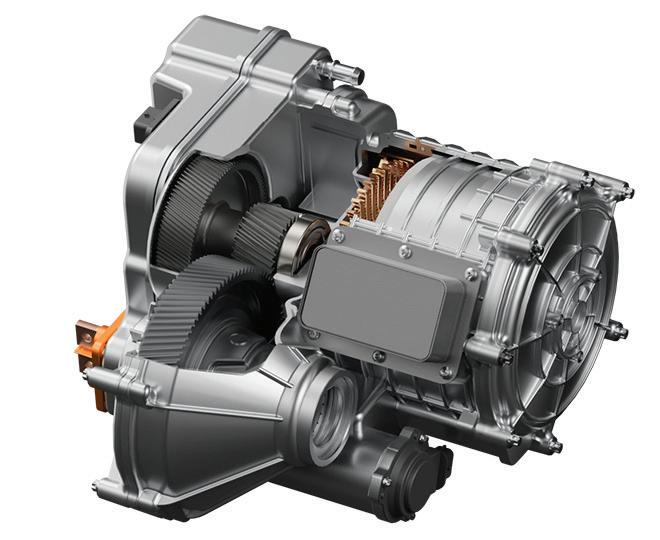

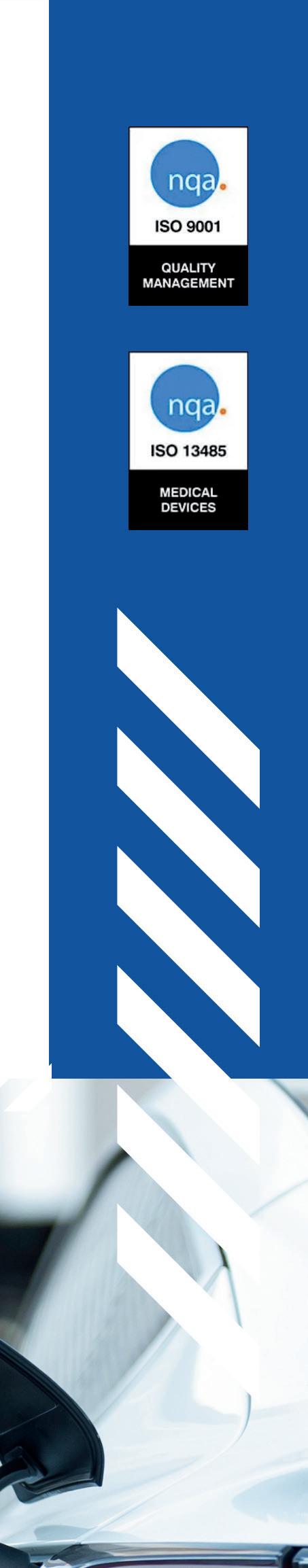

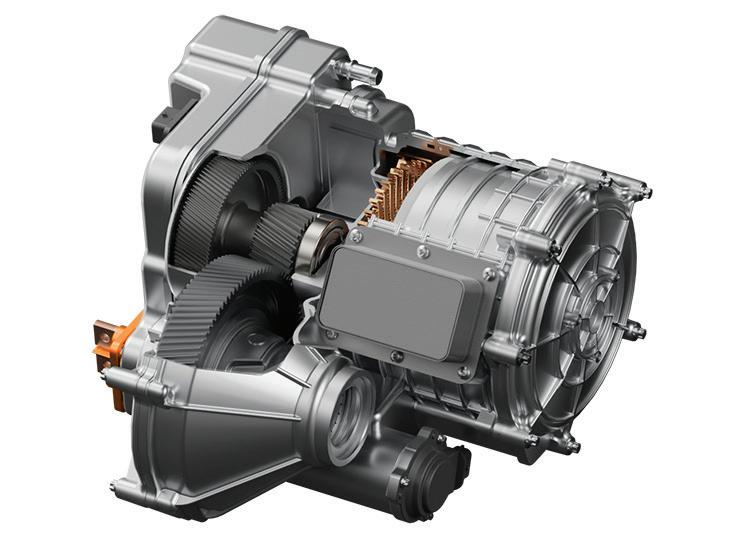

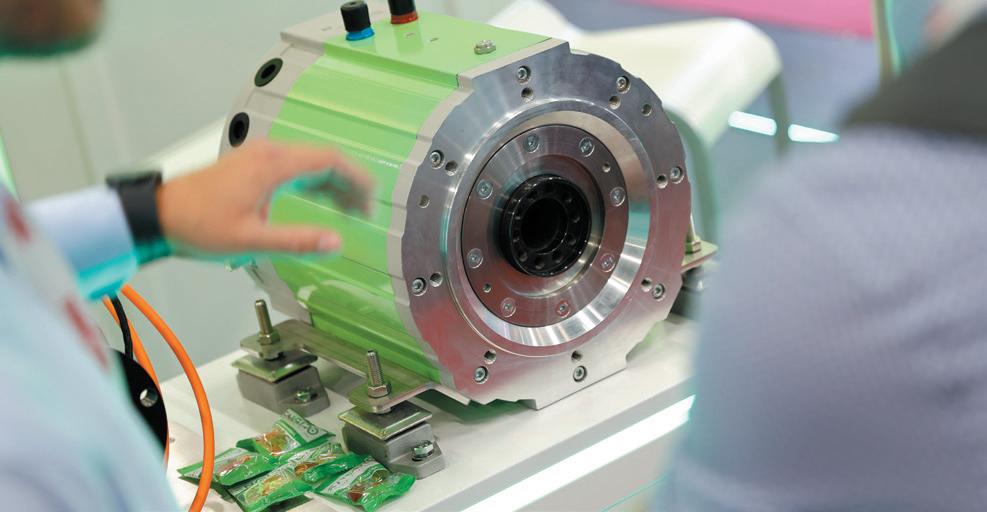

Magna unveils its nextgeneration 800 V eDrive solution

Magna has unveiled its next generation 800 V eDrive solution, which it says o ers improved e ciency, powerto-weight ratio and torque density.

Magna claims that its 75 kg next-generation eDrive is lighter, 20% shorter in height and faster than its prior generation eDrive, providing a longer driving range. Rotating the eDrive 90° around the drive axis improves system integration in the front and rear vehicle area. e system delivers up to 93% e ciency in real-world driving, based on Worldwide harmonized Light duty Test Cycle (WLTC) and highway testing.

Magna’s next-generation eDrive can be applied as a primary or complementary secondary drive solution with an optional eDecoupling unit for vehicles in the C, D, and E segments. It delivers a peak power of 250 kW and a peak axle torque of 5,000 Nm.

“We have successfully reduced our reliance on aluminum and heavy rare earth materials, resulting in a signi cant reduction of CO2 emissions during production by approximately 20% compared to previous generation eDrives,” said Diba Ilunga, President of Powertrain at Magna.

Green Watt Power’s new 300 W DC-DC converters for EVs

Green Watt Power, a division of Powerland Technology, has launched a new addition to its Marble Series line of DC-DC converters. e new EVD300 is a fully encapsulated, IP67-class ruggedized DC-DC converter designed for EV applications. It has two DC input ranges (30-65 V and 50-130 V), and two output voltages (13.2 V and 24 V) for powering vehicle accessories.

Output power is 300 W, and up to 10 units can be connected in parallel for total power of up to 3,000 W. E ciency is up to 93%. e operating temperature range is -40° to 85° C. e converters are designed to meet IEC, UL and CSA safety standards.

e Marble Series has a constant current function, so it can connect directly to a battery load—a feature that most DC-DC converters in the EV market lack, according to the company. Additional features include Enable/ Remote on/o , a quiescent current draw of less than 30 uA, and IP67 ingress protection.

e EVD300 Marble Series is fully input-to-output isolated. Protection features include Input Under Voltage Lockout, Reverse Polarity, Over Voltage, Short Circuit and Over Temperature. e converter can be connected either via ying leads or via a standard Molex connector. Parts are available direct for high-volume OEMs, or through DigiKey. Higher-power Marble Series variants, additional output voltages, and other isolated and non-isolated single and dual output DC-DC converters are also available.

Join us for the second annual

EDUCATIONAL OPPORTUNITIES

Turnkey production solutions for hairpins, axial flux coils and busbars

Bending machinery for hairpin and busbar production

Keynote speakers

Technical presentations and exhibits from our event part n ers

NETWORKING OPPORTUNITIES

Meet key suppliers

• Magnet wire and wire processing

• Equipment for electric motor production

• Electronic a viation / e VTOL

THE TECH

QuantumScape begins shipping Alpha-2 prototype battery cells

QuantumScape is developing solid-state lithium-metal battery technology that promises signi cant performance improvements compared to current lithium-ion cells. Now the company has started customer shipments of Alpha-2 prototype battery cells, a significant milestone on the road to delivery of its rst planned commercial product, called QSE-5.

QuantumScape’s Alpha-2 prototypes integrate many signi cant component improvements made over the last year. e 6-layer Alpha-2 prototype is more energy-dense than the earlier 24-layer A0 prototype. is is primarily due to higher-loading cathodes (packed with more active material) and more e cient packaging within the cell. Packaging improvements include tighter internal margins, thinner current collectors and a slimmer design.

As an intermediate step between the A0 and the B0 prototypes planned for later this year, Alpha-2 cells feature the main functionality of the QSE-5, and represent an opportunity for customers to test key performance parameters and prototype-level reliability.

“Customer feedback is the most critical input in the product development cycle, as it provides insight into areas that need improvement, and strengthens collaboration,” said QuantumScape CEO Dr. Siva Sivaram. “ e faster we can get new product iterations into customers’ hands, the faster we get to production. We are encouraged by the initial Alpha-2 performance results and excited about the rst QSE-5 cells we expect to manufacture later this year.”

“ e improvements in energy and power densities demonstrated by the Alpha-2 prototypes indicate that QSE-5 can push the boundaries of solid-state battery performance,” said co-founder and CTO Tim Holme. “We continue to advance our anode-free, solid-state battery in performance and maturity with methodical execution on our milestones.”

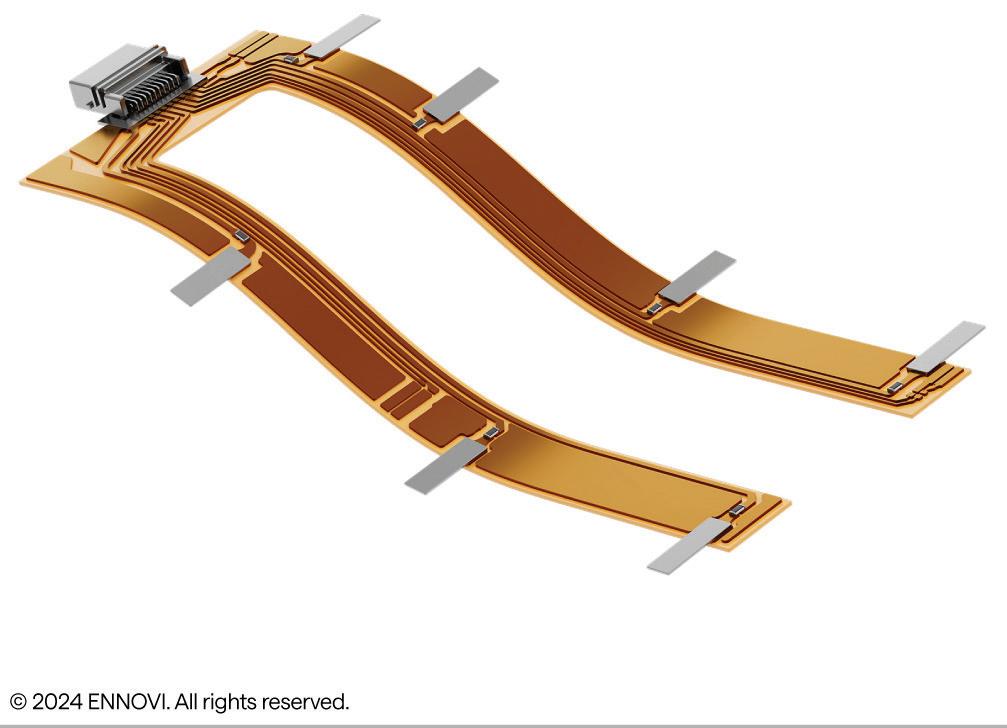

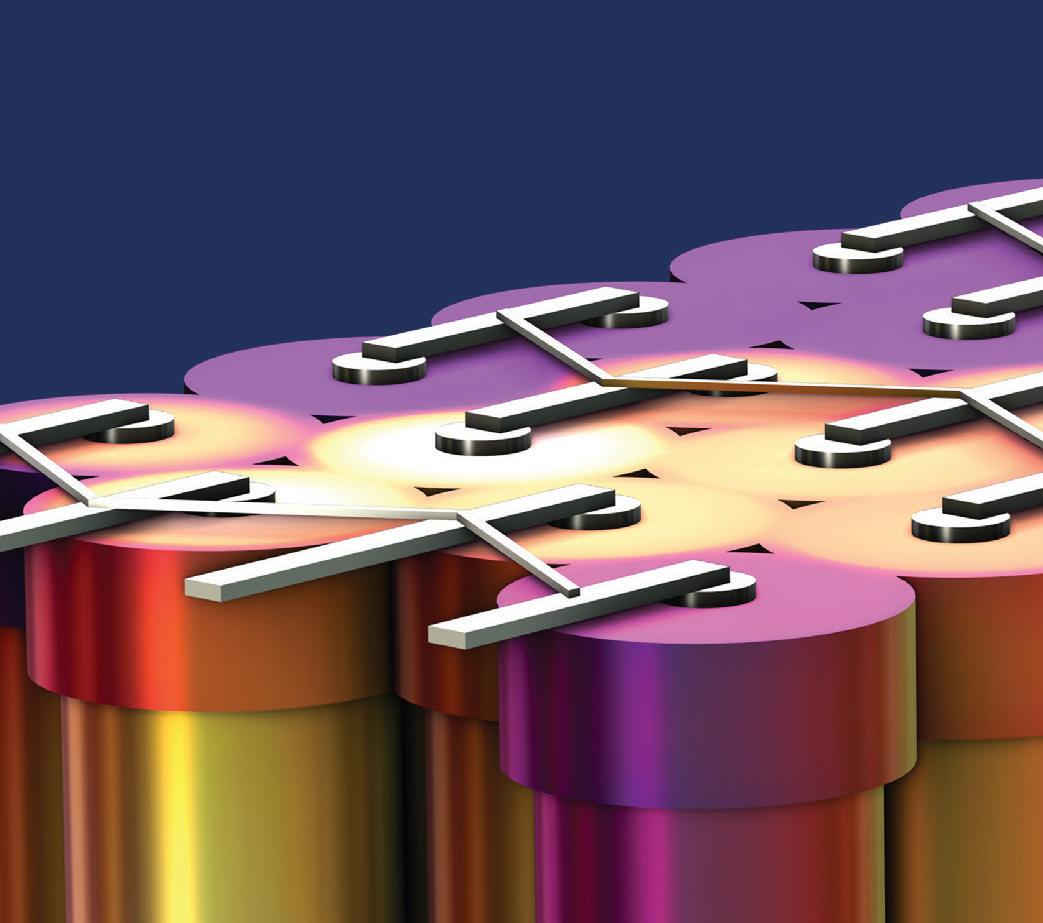

ENNOVI introduces new production process for low-voltage EV battery cell contacting systems

ENNOVI, a provider of mobility electri cation solutions, has introduced a new process for producing exible circuits for low-voltage signals in EV battery cell contacting systems. “While exible printed circuits (FPC) are o en employed in these systems, they are the most expensive component in the current collector assembly,” says the company. “ENNOVI’s exible die-cut circuit (FDC) technology o ers a more cost-e ective and sustainable solution, with fewer manufacturing procedures and faster continuous reel-to-reel production.”

ENNOVI explains that FPCs are typically manufactured using a multi-stage, batch photolithography process to etch copper traces for the exible circuit, using corrosive chemicals to dissolve the unwanted copper. Extracting the waste copper from the chemicals is a complex process, making it challenging to e ectively recycle. e die-cutting process allows for instant recycling of the waste copper.

Compared with FPCs, which have a size limitation of 600×600 mm, FDCs have no length restrictions, as they are manufactured reel-to-reel.

“Adapting the FDC capability for exible circuits enables ENNOVI to o er battery manufacturers a CCA design solution that balances their imperatives in terms of cost, time and performance, allowing them to design to cost,” said Gustavo Cibrian, Product Manager, Energy Systems at ENNOVI.

CATL warrants its new EV battery to last for almost a million miles or 15 years

e million-mile EV battery is in sight. Chinese battery supplier CATL and bus maker Yutong have partnered to launch an EV battery that’s warranted to last 1.5 million km (932,000 miles) or 15 years.

e new battery pack is designed to power commercial EVs such as buses and trucks. Yutong says the new pack, which it plans to use in upcoming EVs, exhibits zero degradation through the rst 1,000 cycles.

Yutong’s buses are sold in over 40 countries, including Italy, France, the UK, Spain and Qatar. CATL’s batteries are used by Tesla, Ford, BMW, Toyota, Mercedes, Kia, Toyota and other automakers. According to SNE Research, the company almost doubled its sales in the US and Europe last year.

ere’s more: in January, CATL said it would reduce the cost of LFP battery cells by 50% by the middle of this year.

Charge Ahead in Battery Design

with COMSOL Multiphysics®

Multiphysics simulation helps in the development of innovative battery technology by providing insight into mechanisms that impact battery operation, safety, and durability. The ability to run virtual experiments based on multiphysics models, from the detailed cell structure to battery pack scale, helps you make accurate predictions of real-world battery performance.

» comsol.com/feature/battery-design-innovation

THE TECH

Projected EV battery recycling capacity to outstrip supply

According to new research from technology intelligence rm ABI Research, companies are planning to build enough EV battery recycling capacity by 2030 to recycle 1.3 million EV battery packs per year, but only some 341,000 per year are expected to be available at that time.

“ ere are concerns about a lack of capacity for EV battery recycling, but the opposite is true,” says Dylan Khoo, Electric Vehicles Industry Analyst at ABI Research. “Current plans for recycling plants see capacity greatly outstripping the supplies of waste batteries. is will lead to uneconomic utilization rates or, more likely, a delay or scaling down in recycling projects.”

ABI Research details its ndings in a new report, “Securing the EV Supply Chain: Battery Recycling in the United States.”

ABI believes that in 2030, around one third of waste EV batteries will be end-of-life batteries from vehicles. e rest will come from factory scrap—batteries that fail quality control on production lines and go directly to recycling.

“Given the expected shortage of waste EV batteries, battery recyclers must be highly competitive to win,” says ABI. Several companies, including Ascend Elements and Aqua Metals, are developing innovative recycling processes that they say are more cost-e ective and greener. If a shortage of recyclable batteries develops, such companies could have the advantage. “Recyclers that are building up a supply chain of non-recycled materials to ensure a consistent output of processed materials, such as Redwood Materials, will also be better poised to make it through the supply shortage,” says ABI.

Of course, battery recycling is still an emerging technology, and predictions about what the market will look like in six years must be taken with a dose of lithium salt. Some of the plants on the drawing board may not get built, and EV sales could grow faster than predicted (they always have). On the other hand, improvements in battery tech could lead to longer-lived batteries, and thus less feedstock for recyclers.

In any case, recycling rms will surely make their own predictions about the market, and plan their build-outs accordingly.

Thermo Fisher’s new inline metrology enables comprehensive inspection of electrodes during battery manufacturing

Uniform, defect-free electrode coatings are essential for battery performance. at’s why battery manufacturers inspect electrodes during production to ensure the uniform quality of the coatings. However, as ermo Fisher Scienti c explains, traditional in-line coating weight measurement gauges use a single spot sensor traversing the electrode sheet to assess coating quality, but several meters of electrode are produced in the time it takes to complete a single pro le scan, so much of the electrode goes unmeasured.

ermo Fisher says its new ermo Scienti c LInspector Edge In-line Mass Pro lometer measures the entire electrode in real time, at full production speed, providing battery manufacturers with the data needed to make better, safer batteries. e LInspector Edge analyzer uses a new analytical technique, in-line mass pro lometry, to measure complete edge-to-edge coating pro les in milliseconds with high resolution and precision.

“ anks to a greater insight into mass loading of active material on the coating edges and a complete mapping of mass loading on the entire electrode, battery manufacturers can now bene t from previously unobtainable richness of data for production control and full traceability for each electrode patch, stripe, or roll, allowing them to meet increasingly stringent quality requirements for energy storage devices,” says the company.

“ e LInspector Edge In-line Mass Pro lometer sets a new benchmark for electrode coating analysis and provides a foundation for higher-performance batteries, reduced risk to quality, better process control, and more pro table operation,” said Miguel Faustino, President of Chemical Analysis at ermo Fisher Scienti c.

Avery Dennison’s new electrode

fixing tapes for EV battery cells

Adhesives giant Avery Dennison has introduced new electrode xing tapes for use in the assembly of EV batteries.

Electrode xing tapes represent a highly specialized category of adhesive tapes. ey are used to bind multilayer electrode constructions consisting of current collector foils, anode and cathode material and separator lms in EV battery cells.

Avery’s new electrode xing tapes are available with polyethylene terephthalate (PET) and polypropylene (PP) plastic facestocks. e PP facestock is chemically inert to prevent self-discharge due to DMT redox shuttle.

e new electrode xing tapes feature electrolyte-compatible acrylic adhesives, and sport a highly visible green color. Various widths are available on plastic cores. ey are manufactured in the United States, and are fully compliant with the In ation Reduction Act.

PRACTICAL ASPECTS OF OFF-GRID EV CHARGING

By Jeffrey JenkinsThe holy grail for many EV owners is to obtain all of the energy needed for recharging from renewable energy sources, and while that’s difficult to justify on a purely economic basis if grid power is available, for those living off-grid it will be all but necessary to rely on renewable energy sources, as in this case running a fossil-fuel powered generator is the economically non-viable option (except on an occasional basis, as is its intended purpose).

An off-grid energy system basically consists of just four key components: 1) a battery to store energy; 2) one or more renewable energy sources (e.g. solar panels, wind turbines, hydroelectric turbines); 3) an appropriate DC-input charger for said source; and 4) a DC-to-AC inverter to power the house, EV charger, well pump, etc. from the battery. Since no renewable energy resource is available 100% of the time, you will probably need to incorporate a backup generator to supply an AC-input charger, but the good news is that this generator can be a lot smaller than if it were sized to power the house directly, because the inverter and storage battery will handle the peak power demands.

To properly size an off-grid energy system you need to know two key parameters: the peak power demanded by all of the loads that are likely to run concurrently; and the average daily energy consumption. The peak power demand sets the minimum size of the inverter, obviously, but it also influences the size of the battery (bigger batteries can supply more current, all else being equal), the size of the

For estimating the average daily energy consumption, a typical value for us spoiled Americans is going to be in the range of 10-25 kWh per day for the fi rst person in the house, and around another 2-5 kWh per day for each additional person.

To properly size an off-grid energy system you need to know two key parameters: the peak power demanded by all of the loads that are likely to run concurrently; and the average daily energy consumption.

wiring, fuses/breakers, etc. The average energy consumption dictates pretty much everything else, from the number of solar panels or the swept area of the wind turbine to the storage battery capacity, and the power rating vs runtime of the backup generator, its attendant AC charger, etc. A good way to get accurate values for these two parameters is with a whole-house energy monitor that uses current clamps on each incoming phase leg in the main breaker panel. If that isn’t an option (perhaps because the off-grid location isn’t yet up and running) then you can estimate the power demand with rules of thumb (e.g. assume that major appliances draw 80% of their breakers’ amperage ratings), appliance data labels, and even anecdotal evidence (e.g. the neighbor’s well draws 9 A at 240 VAC). As for estimating the average daily energy consumption, a typical value for us spoiled Americans is going to be in the range of 10-25 kWh per day for the first person in the house, and around another 2-5 kWh per day for each additional person. Given that the size of the storage battery scales directly with this figure, it pays to determine it as precisely as possible rather than just relying on a thumb rule in an article you read in a magazine…ahem. Lastly, factor in the power rating of the EV charger, and if said EV will be charged when the renewable energy source isn’t producing—say, at night with a photovoltaic system—then you’ll also have to add the typical daily consumption of its battery capacity to that of the storage battery rating (in kWh, not Ah, since the two batteries will not be the same voltage unless the EV is a golf cart).

Lithium iron phosphate is arguably the best all-around battery type for off-grid systems, as it has a very high cycle life, and it can tolerate high peak and continuous current draws of up to 4 C and 1 C, respectively.

e storage battery is what makes an o -grid energy system possible, so it is arguably the most important component, but it is also one with a fair amount of exibility. e three key parameters to consider here— assuming a nominal 48 V rating—are the energy capacity in kWh, the current rating vs time (that is, how much current is allowed over timescales of seconds, minutes and hours and/or continuously, o en given in C rather than amps) and the cycle life vs Depth of Discharge. When it comes to the size of the storage battery, bigger is better, budget (and space) permitting, but a practical minimum is enough energy capacity to run everything as per usual for at least a full 24 hours, so that if the renewable source isn’t producing you don’t have to immediately re up the generator (or, worse, go rushing o to get fuel for said generator…at night…in the rain). For those wanting more concrete numbers, I feel that 200 Ah (again, at 48 V nominal) is the bare minimum for a single person (speaking from experience here), while 400 Ah would allow for an almost carefree lifestyle (assuming there is su cient renewable energy available to feed said battery).

The most common choices of battery type are lithium iron phosphate (aka LFP or LiFePO 4), all of the other lithium-ion chemistries (including recycled batteries from junked EVs), and, finally, lead-acid. To reach the de facto standard of 48 V nominal (the actual voltage can go up to near 58 V, depending on battery chemistry) you can either wire four 12 V batteries in series, or the appropriate number of bare

cells (typically 16 for LFP). There are also ready-made “whole-house” batteries available, such as Tesla’s Powerwall, but these are often aimed at grid-tied solar systems to be installed by licensed contractors, rather than DIYers, and they carry a correspondingly hefty price tag.

LFP is arguably the best all-around choice for offgrid systems, as it has a very high cycle life (in the range of 2,000 cycles at 100% DoD to 10,000 cycles or more if operated over the range of 80% State of Charge down to 20%), and it can tolerate high peak and continuous current draws of up to 4 C and 1 C, respectively, with negligible impact on longevity or energy capacity. There are two main choices of LFP batteries: those intended as drop-in replacements for lead-acid batteries; and bespoke 48 V batteries—often in convenient 10-inch rackmount cabinets—that are specifically designed for off-grid use. The former come in a wide range of Ah ratings (from 7-10 Ah for a computer UPS to 200+ Ah for off-grid systems) and have an internal BMS that protects against overcharge, overdischarge and overcurrent.

These typically lack the ability to communicate with other batteries in a series string (or other devices), nor do they come with any means of monitoring total charge in and out of the battery. The former shortcoming can be addressed with an external active balancer (aka charge equalizer) that automatically shuttles charge from the highest-voltage battery in the series string to the lowest until all are at the same voltage. The latter shortcoming is easily handled by an external battery monitor/coulomb counter (ideally with the ability to report such data to a remote display or smartphone via Ethernet, Bluetooth or WiFi). Note, however, that charge equalizers typically have modest current ratings in the range of 1 A to 10 A, so they can’t correct a grossly out-of-balance pack, nor one with a battery that has significantly less Ah than the rest. The higher price of the rackmount 48 V batteries will be offset somewhat by not needing an external balancer, of course, as well as being easier to wire up. They will also likely be able to communicate with other batteries (wired in parallel) and/or devices (e.g. to notify the inverter to shut down at the minimum DoD, rather than a minimum voltage) and include some form of monitoring and/or coulomb

counting, along with a local display of such information. That said, an external battery monitor will still be more versatile and convenient, especially if the batteries are located in a different building.

The more adventurous (and technically capable) can drop the $/kWh metric even lower by repurposing old EV traction batteries for off-grid storage use, but this is not for the faint of heart (or short of time). Unless the EV was a golf cart, you’ll have to reconfigure the cells to deliver 48 V nominal, so don’t count on using the original BMS (which probably won’t work, anyway, without a lot of code-hacking) and you’ll still be taking the risk that the battery was abused so much that it has no real usable capacity left.

The last option is venerable old lead-acid, though perhaps it’s best to relegate it to the proverbial dustbin of history. Sure, the prohibitive weight of lead-acid batteries is less of an issue in off-grid systems than it is in EVs (until you need to build the racking to hold 10 kWh or more of capacity with them, anyway) and they are notorious for not liking to be discharged below 50% of their rated capacity, though even then you shouldn’t count on more than a few hundred cycles of life. Furthermore, continuous current draw needs to be limited to a fraction of a C (typically C/4) to avoid loss of capacity from the infamous Peukert effect. This basically means that a lead-acid storage battery will have to be 2x to 5x larger in energy capacity relative to LFP, which effectively eliminates all the cost differential between these two chemistries.

The next key component in an off-grid system is an inverter, which converts the nominal 48 VDC from the storage battery into the 120/240 VAC required by the house, EV charger, etc. Eliminate the cheaper “modified sine wave” type from consideration, as its output is really just a 50/60 Hz square wave of less than 50% duty cycle that a lot of devices won’t like (standard dimmers and induction motors being two notable examples). The other type creates a pure sine wave by sinusoidally modulating the duty cycle of a much higher-frequency square wave, then filtering out the high-frequency components with an LC network. If this sine wave is available directly, it’s called a “high-frequency” type, and if it feeds an internal 50/60 Hz transformer it’s called—somewhat misleadingly—a “low-frequency” type. The LF type

Eliminate the cheaper “modifi ed sine wave” type of inverter from consideration, as its output is really just a 50/60 Hz square wave of less than 50% duty cycle that a lot of devices won’t like.

is supposed to be better at starting heavy loads like AC compressors by virtue of the energy stored in its transformer’s inductance, but better HF inverters will cope with such loads by going into current limiting mode, rather than outright faulting off (this should be explained in the user manual [you did Read The Fine Manual, didn’t you?]), so this might be a distinction without a difference. Furthermore, the LF type draws more no-load power (1-2% of rated power is typical) to maintain the magnetizing flux in that LF transformer, and this can add up to a lot of energy over the course of a 24-hour period. The last major choice to consider is whether to go with a standalone inverter with separate DC- and AC-input chargers, or a unit that combines one or both charging functions (the latter is often called a “hybrid solar inverter” or AIO, for All In One). Note, however, that you do not want a “grid-tie” inverter in an off-grid system, as such will not function without the presence of AC from the mains. The AIO type can be a little less expensive, because it combines all three devices into one box, but its main advantage is the ability to prioritize whether energy for the AC loads comes from the solar panels (or, very rarely, a wind turbine), the AC mains or generator, or the battery. This is an excellent solution for partial off-grid operation—e.g. running off solar during the day and the grid at night—but if you’re going purely off-grid, there is more flexibility in using separate devices, as the intelligent prioritizing won’t be nearly as useful. And speaking of solar and wind (and hydro, for those lucky enough to have it), we’ll cover that—and the appropriate DC-input chargers for each—next time in Part Two.

ENABLING THE NEXT PHASE

OF EV CHARGING STATION MANUFACTURING

By Charles Morris

By Charles Morris

EcoG helps EVSE manufacturers streamline the process of bringing new products to market.

We tech writers o en refer to “ecosystems,” and biologists may shake their heads at our appropriation of the term, but the analogy is an apt one in many ways. A biological ecosystem has its charismatic megafauna (elephants, lions, whales), but it couldn’t function without its lessglamorous denizens (ants, fungi, bacteria). Likewise, a technological ecosystem has its headline rms (Apple, Microso , Tesla), but these rely on interrelated networks of companies that are little-known to the general public (FoxConn, Panasonic, ABB), but that provide indispensable services (and sometimes substantial pro ts).

you’re unlikely to see its name in a headline outside of the trade press. In fact, most of the journalists working for newspapers and consumer mags, who so o en write about the Teslas and ChargePoints of the world, might be hard-pressed to gure out what EcoG actually does (we’ll do our best to explain it).

EcoG is an example of the latter kind of company—its logo doesn’t appear on a lot of EV charging stations, and

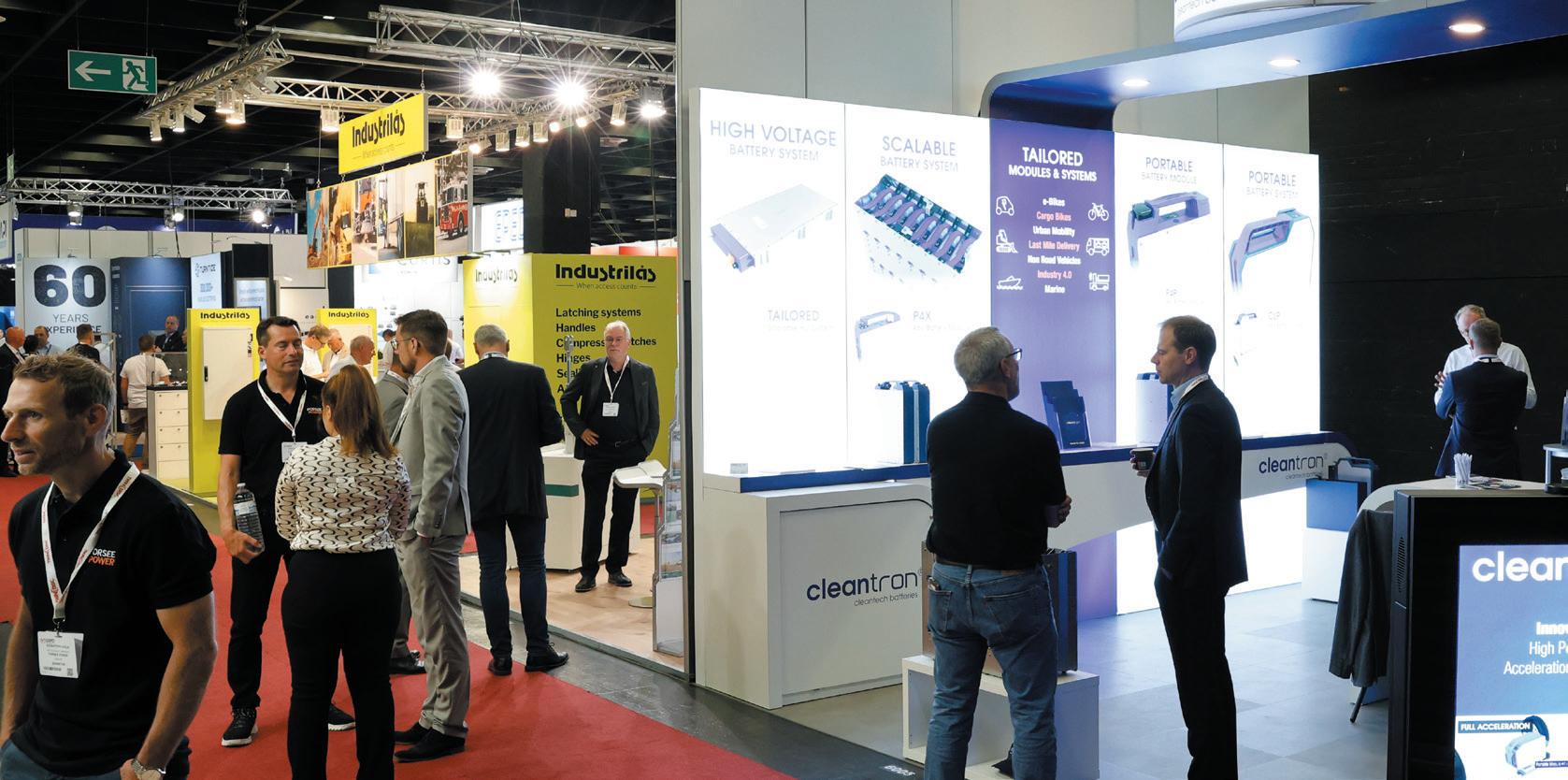

Like the ant, which makes up some 20% of the world’s biomass, Munich-based EcoG has a surprisingly large footprint in the EV charging infrastructure market. e company was founded by three former Siemens professionals in 2017. By 2022, its so ware was being used in 15% of the DC EV chargers sold within the EU. At the 2022 CharIN Testival, 30% of the new DC chargers being tested were running EcoG’s OS.

THE TECH

The tech behind the chargers

Like every other digital device, from a mainframe to a hearing aid, an EV charging station runs on so ware. EcoG’s Universal Core is a universal operating system designed to give charger manufacturers maximum exibility. According to the company, the OS supports six architectures that are used by more than 40 types of chargers, and it integrates over 15 di erent power converters, and all chipsets on the market. It can be delivered integrated in a charge controller device or as a rmware release for a customer’s own control hardware. e so ware features Open APIs and a customizable web platform to help customers build their own application layers.

EcoG also o ers a suite of hardware and so ware tools to help companies develop and manufacture charging stations as quickly and e ciently as possible. e EcoG Starter Kit prototyping environment is a fully-functional DC and AC charger that allows customers to modify components, develop their own applications, and verify charging functionality.

ree hardware tools provide additional functionality. e EcoG Charge Controller handles circuit control and charging status, and ensures vehicle interoperability. It works with multiple I/Os and interfaces. e CPPP Monitor provides a redundant monitor of the charging status between the vehicle and the charger, and can shut down the charging process if an irregular state is detected. e Application Board provides an application layer that interfaces with the user and with systems running in the cloud, allowing the EV charger to be upgraded with new features, and to use third-party services to run custom applications.

Of smart phones, mainframes and EV chargers

EcoG CEO Joerg Heuer has helped to shepherd several developing technologies from birth to maturity, and he sees parallels between the progression of the EV industry and the development of mobile telephony. As he sees it, 15 years or so into the EV industry’s development, it’s at a stage where companies need to “professionalize”—that is, to be able to quickly ramp up manufacturing of standards-based, interoperable vehicles and infrastructure. EcoG o ers an architecture that’s designed to enable manufacturers to build EV chargers at scale. Returning to the mobile phone analogy, Heuer says, “We are not targeting the Nokias, but the Foxconns. ose who

“

We are not targeting the Nokias, but the Foxconns. Those who really professionalize how to build chargers and make that a reliable, robust thing in the market, that’s where we focus.

really professionalize how to build chargers and make that a reliable, robust thing in the market, that’s where we focus.”

Heuer expects that there will be a few di erent operating systems in the EVSE market, and his company provides the reference architecture that allows manufacturers to build an ecosystem that can incorporate a wide variety of hardware. “We have 50 ecosystem partners on the component level—converters, isolation monitors and so on.”

Some of EcoG’s customers are charging network operators (aka charge point operators or CPOs) and some are site hosts or integrators, but most are manufacturers—two prominent customers are Siemens and icharging. “We are very much focused at this stage of the market on the manufacturing side,” Heuer tells us. “In Europe, we now have a 15% market share, so more than every tenth charger is produced with our architecture and operating system.” EcoG is also well-established in India, and is quickly moving into North America.

Heuer sees EcoG’s OS and its design tools not as separate products, but as integrated parts of a whole. “We are an IP tech company, something like a Qualcomm in the mobile phone industry,” he told Charged. “If you contract with Qualcomm, you not only get their chip, you get the whole ecosystem around it, so it makes you fast at building smart phones. at’s what we want to do in the EVSE market. We want to enable those who have manufacturing capability to be fast to build professional products. is wave of electric mobility is running, and the question is, are you fast enough to catch the wave? We address those who are really thinking not about how to design the product, but about how to scale the manufacturing.”

Walled garden or open ecosystem?

EcoG has called “infrastructure segmentation” one of the biggest obstacles to EV adoption at this stage of market development. But what is meant by segmentation in this case?

When Heuer started working in the EVSE market back in 2008, he was struck by the irony that one of the most global industries—automotive—is having to learn to work with one of the most regional industries—electric utilities, which operate di erently in di erent countries, and indeed in di erent US states. “What we saw then was that, especially in North America, the market started with very vertical o erings like ChargePoint and others. And this is good for a kickstart, but in the medium term, it o en results in user fragmentation. It’s good to get started fast, but to scale up the market it’s good to think of how you collaborate and integrate stu together.”

“ ink of roaming and the mobile phone networks— it increases reliability if you make it the right way. And that’s what we believe is going to happen. I think getting away from these vertical networks is important because electric mobility is really a cool opportunity to get more renewables into the electric grid. But this needs di erent business process integrations, and a monolithic company will not have the expertise in how to integrate into the energy system. We are an enabler of that.”

Enabling V2X

EcoG’s system supports bidirectional charging, which is widely expected to be a key technology enabling a variety of useful applications (V2X). Obviously, ensuring interoperability among V2X-capable chargers and EVs will be critical—and interoperability testing is one of EcoG’s specialties.

Last July, EcoG presented an ISO-compliant bidirectional charging solution that follows charging standards association CharIN’s guidelines. EcoG’s so ware is designed to support all V2G-capable vehicles—including those still under development. e company has tested its bidirectional solution with multiple vehicle manufacturers in accordance with the new ISO 15118-20 bidirectional power transfer (BPT) standard, as well as the BPT Application Guide from CharIN.

e company has partnered with power semiconductor manufacturer In neon to develop a starter kit with an integrated 22 kW bidirectional converter and controller.

“ e fact that bidirectional charging actually works according to ISO 15118-20 BPT is a major step forward,” said Xi Zhang, EcoG’s Director of E-mobility. “ is allows the technology to be applied to the mass market, as customers can now be sure that their wallbox can communicate with any V2G-enabled vehicle in the eld.”

“V2G as a standardized feature is essential for broad adoption of this technology,” said Heuer. “EcoG provides the V2G technology in the form of a starter kit to charger manufacturers to enable products with short lead times to market, and to OEMs for interoperability testing.”

Heuer told Charged that the key to enabling wider V2X tech is to make it available on a low-cost product. “When we look at chargers today, they’re built like photovoltaic inverters 20 years ago—they include something like 100 components. Today, if you look at PV inverters, they have maybe 10 components—and in the last 20 years, the price has declined by something like a factor of 10 to 20.”

Where does vehicle-to-grid tech stand today from a commercialization standpoint? Like most of the EVSE industry folks we talk to, Heuer concedes that V2G is still mostly a pilot-level technology, but he expects more commercial applications to start appearing soon. “We have several pilots, but Volkswagen recently announced that every Volkswagen is supporting V2G— it’s already in the menus of the vehicles.”

Ford, Hyundai and Tesla are also now selling EVs with power export capabilities, and the market for

THE TECH

bidirectional-capable charging hardware could expand quickly. “With partners like In neon, we are targeting this market, because then you are talking about 10,000 units per year [as a conservative estimate].”

Reliability, reliability, reliability

e poor reliability of public chargers is an industry-wide scandal. Some casual observers seem to assume that adopting Tesla’s NACS charging system will solve all the problems. However, like many industry players we’ve spoken to, Heuer believes that one of the main reasons Tesla’s Superchargers are so reliable is that the system is controlled by a single company—which will no longer be the case once large numbers of EVs from other brands start using the Superchargers.

“We have been working a long, long time in standardization, and I remember the days when we had the discussion of Microso versus Apple,” says Heuer. “Here we see basically the same. We see probably 20 or 30 implementations out there on the vehicle side and on the infrastructure side. With Tesla, you have both in one, and with their automation they can do testing to ensure that things are working with each other.”

“Right now, we’re looking at a landscape with about 100 charging station manufacturers and a growing number of EV manufacturers. Tesla might test its EVs with ve to ten charger types, but the broader challenge is much more complex. To achieve a truly seamless charging experience for any EV driver, we’re tasked with ensuring that every electric car can use any charging station. Achieving this interoperability means testing over 500 di erent combinations of cars and chargers.”

One thing that will hopefully facilitate interoperability over the coming years is the fact that Tesla’s NACS is not radically di erent from CCS. “ e plug is quite di erent, but all the processing behind it is quite similar,” Heuer explains. “ at’s also the reason why in Europe they can easily use a CCS plug, and in US they have these adapters. Of course, in the foreground, it looks very di erent because the plug looks di erent. But in the background, the automation, the really complex stu , that’s quite similar.”

“About two weeks a er the announcement that Ford would adopt NACS, a customer of ours just added a Tesla cable to their CCS station, and the thing worked with a Tesla vehicle. at’s the nice thing. It’s no longer this competition between CHAdeMO and CCS, which

“We’re tasked with ensuring that every electric car can use any charging station. Achieving this interoperability means testing over 500 different combinations of cars and chargers.

were really totally di erent systems. Compared to CHAdeMO, I would say 90% or 95% is really the same between CCS and NACS.”

Some nd it ironic that in Europe, Tesla adopted the CCS plug, whereas in the US, vehicle OEMs and EVSE manufacturers are adopting the Tesla plug. Heuer explains that there are several reasons for that. “One reason is that in Europe we have a three-phase AC system, so this would be a shortcoming of the Tesla plug because then they would be only be able to charge one phase. In Europe, we would then be limited to three kilowatts in most countries, maybe maximum seven. at’s one physical aspect.”

A second di erence between the North American and European markets is that the latter has developed in a less vertically-integrated way. “ e networks started quite early with roaming and so on—it was not so dependent on what network or mobility service provider you contracted with, so the advantage Tesla had compared to the rest of the networks was not as signi cant.”

e North American market could bene t by learning from some mistakes that were made in Europe. “ ere’s obviously a di erent development in markets and there are learnings out of that, which I think are bene cial for all. I think what’s interesting to see in North America is how to integrate vertically like a ChargePoint, for example how to integrate direct payment via app or credit card, conveniently including all the processing behind it with logistics and so on.”

“On the other hand, I think Europe is doing quite well to think about this more collaborative role, how you create ecosystems. What we see right now in the market in the US is really more the speed and integration, whereas we see more of an ecosystem approach in Europe. And now that things become more integrated with Tesla as a crystallization point, we have the opportunity to combine networks and to really move forward.”

THE VEHICLES

Xos receives order for 12 of its SV electric stepvans

US electric truck manufacturer and eet services provider Xos has received an order for 12 of its 22-foot SV stepvans from California-headquartered commercial laundry company Mission Linen Supply.

e vehicles will be among the rst of the longer 22-foot models to be delivered by Xos. ey are suited to a variety of applications, including linen services, parcel delivery, utility and repair services, and armored transport. e SV line has modular chassis and battery systems, and is o ered in a variety of con gurations to meet customers’ speci c needs.

“We are thrilled to partner with Mission Linen Supply on this signi cant step toward electric eet adoption,” said Dakota Semler, CEO of Xos. “Our electric stepvans are setting new standards for the textile and linen industries, and we are con dent that they will bring immense value to Mission Linen Supply’s operations.”

Skanska concludes North American pilot of Volvo EC230 Electric excavator

Construction giant Skanska has completed a 90-day pilot program using the Volvo EC230 Electric excavator on the Purple (D Line) Extension Transit Project in Los Angeles. e goal of the trial was to test the capability of a battery-powered excavator to match the performance of a legacy diesel-powered machine.

e excavator was used to load trucks with construction material. Results from the trial indicate that the Volvo EC230 Electric performed the necessary activities as intended while keeping the pace of work on schedule. Compared to a diesel-burner, the electric machine emitted 66% less carbon, and saved an estimated 74% in costs per hour of operation.

Operators also noted health and safety bene ts. ey found the electric excavator easier to use, and found that it generated much less vibration and noise than the old fossil-burners.

“ e successful completion of this pilot program represents a signi cant stride forward for the entire industry,” said Mason Ford, Director of Sustainability and Equipment Services for Skanska USA Civil. “Change doesn’t happen overnight, but this type of investigation into the possibilities furthers the conversation around electri cation and sustainable innovation within civil construction.”

Volvo CE and Mack Trucks deliver electric excavator and refuse truck to Florida waste hauler

Volvo Construction Equipment and Mack Trucks, both Volvo Group companies, recently delivered an electric excavator and an electric refuse truck to Boca Raton, Florida-based Coastal Waste & Recycling, which has 25 locations in Florida, Georgia and South Carolina, and operates more than 700 vehicles.

Coastal is piloting a 23-ton Volvo EC230 Electric excavator at a materials recovery facility, where the company receives and sorts recyclable materials. e EC230 Electric is performing the same work as its equivalent diesel model, the EC220EL, feeding material into a sorting line.

e electric excavator not only produces zero emissions, but also o ers signi cantly lower noise and vibration levels, as well as instant torque. e company estimates that the EC230 Electric will deliver a 60-70% reduction in running costs compared with the legacy machine, as well as greatly simpli ed maintenance.

e EC230 Electric has been in testing with other companies in North America over the past year, and is expected to be commercially available later in 2024.

Coastal Waste & Recycling also took delivery of a Mack LR Electric Class 8 refuse vehicle, which will operate in residential and commercial areas in southern Florida. e company worked with Mack to develop favorable routing for the electric truck.

e next-generation Mack LR Electric features 4 NMC battery packs with total capacity of 376 kWh. Twin electric motors produce 448 continuous horsepower and 4,051 lb- of peak torque. Onboard accessories, including an automated side loader, are powered through 12 V, 24 V and 600 V circuits. A two-stage regenerative braking system helps recapture energy from the hundreds of stops the vehicle makes each day with an increasing load.

e EC230 Electric and the Mack LR Electric will both be fast-charged with a mobile Heliox 50 kW charger provided by Volvo CE. Volvo CE and Mack experts consulted with Coastal Waste on charging to help identify the ideal solution.

Nextran Truck Centers in Fort Lauderdale will provide service and support for the vehicles.

“We are excited to add both pieces of equipment to our eet,” said Brendon Pantano, CEO of Coastal Waste & Recycling. “As the rst private hauler in Florida to invest in electric, we look forward to harnessing the strength of this strategic move.”

“ e shi to o -road electri cation, especially in heavy construction machines, can’t be accomplished by one single team or company,” said Scott Young, head of the North American region for Volvo CE. “We’re grateful for the chance to partner with customers and other Volvo Group companies to advance sustainability in a variety of industries.”

“Coastal Waste & Recycling has been a great partner and has always been interested in any new technology they can incorporate to drive e ciency and excellence throughout their operations,” said Martin Mattsson, director of Key Account Sales, Waste and Recycling, Volvo CE. “Testing this electric excavator directly against its conventional equivalent will teach us a lot.”

THE VEHICLES

Thomas Built Buses

delivers its 1,000th electric school bus

US school bus manufacturer omas Built Buses, a brand of the Daimler Group, has delivered its 1,000th Saf-TLiner C2 Jouley battery-electric school bus as part of an order for eight of the buses placed by Meriwether County School System (MCSS) in Georgia.

e new buses are fully funded through the EPA’s Clean School Bus grant program. ey are MCSS’s rst electric models and will replace some of its current diesel eet of 46 buses.

e Saf-T-Liner C2 Jouley has a maximum passenger capacity of 81. It delivers 295 peak horsepower, has a standard battery capacity of 244 kWh, and has a range of up to 150 miles.

“Jouley was a natural choice because of the available long-term battery energy, access to fast DC charging and safety- rst construction,” said MCSS Superintendent Robert Gri n.

GILLIG to supply Seattle transit agency with up to 395 batteryelectric buses

Transit bus giant GILLIG has announced a new veyear contract with King County Metro, which serves the greater Seattle area. GILLIG will deliver an initial order of 89 Low Floor Battery Electric buses, with the option to purchase up to 306 more units.

Built on GILLIG’s Low-Floor platform, the GILLIG Battery Electric Bus features 686 kWh of onboard energy storage. GILLIG says King County’s buses are “equipped with opportunity charging capabilities in addition to plug-in charging.” We were unable to verify what the company means by this, but we do know that, in the past, GILLIG has sold buses equipped with wireless charging systems from WAVE Charging.

e initial deployment of these buses will equip King County Metro’s rst fully electri ed bus base in Tukwila, Washington, currently under construction. “ e buses operating out of this base will serve surrounding south King County communities, where air pollution levels are higher than in other parts of the region.”

“Acquiring these next-generation battery-electric buses from GILLIG moves us closer to our goal of being the rst large transit agency in North America that is 100% zero-emission,” said Dow Constantine, King County Executive. “With these new additions to our eet, our community members, customers, and operators will bene t from cleaner air as we continue to combat climate change.”

Daimler Truck North America delivers first electric Freightliner eM2 box trucks

Daimler Truck North America (DTNA) has announced that its electric Freightliner eM2, which went into series production at its Portland, Oregon, facility at the end of last year, is now being distributed to US customers.

PITT OHIO, a transportation and supply chain management company based in Pittsburgh, is the rst to deploy the medium-duty EVs. e company’s two eM2s, with 26-foot-long box bodies, will operate out of its Cleveland terminal as part of its less-than-truckload freight business.

e Freightliner eM2 has typical ranges of 180 miles for Class 6 and 250 miles for Class 7. It is designed for pickup and delivery applications. DTNA’s electric lineup also includes the Jouley electric bus from omas Built Bus, available since 2020; the FCCC MT50e walk-in van chassis for nal-mile delivery, available since 2021; and the Class 8 Freightliner eCascadia, available since 2022.

MAN rolls out battery repair centers across Europe

Over the next two years, MAN Truck & Bus, headquartered in Munich, Germany, plans to establish battery repair centers in Italy, Denmark, Norway, Austria, Belgium, the Netherlands, France, Poland and the UK. Two of the facilities, in Hanover-Laatzen, Germany, and Barcelona, Spain, are already in operation.

MAN is ramping up electric truck production as it plans to begin deliveries of its next-generation eTruck this year. More than 1,000 MAN electric buses and more than 2,400 MAN electric vans are already on European roads.

e knowledge gained at MAN’s rst repair center in Hanover-Laatzen, which launched in 2020, is being transferred to its other European markets, in each of which certain criteria must be met, based on practical experience and speci c legal standards.

Since 2023, MAN has been leading the three-year REVAMP project, a consortium of nine partners from industry and science. e aim is to automate assessment of used vehicle batteries in order to economically remanufacture them for use in vehicles or for other purposes.

“Battery repair is a necessity for MAN in order to ensure the economic e ciency and operational readiness of our customers’ electric vehicles at a high level,” said Christopher Kunstmann, Senior VP of Customer Service Management. “We also make a major contribution to the closed-loop approach of traction batteries, as this extends the battery life in the vehicle, which conserves important resources.”

THE VEHICLES

New fleet customer says Tesla Semi performs “well beyond expectations”

e rollout of the Tesla Semi has been slower than EVangelists would have liked. e electric semi tractor was rst unveiled in 2017, and o cially entered production in late 2022. Since then, it has been deployed in limited numbers.

Last October, it was reported that Tesla had built about 70 Semis, which were being used internally and by one con rmed customer, PepsiCo. Tesla recently broke ground on a new facility at its Nevada Gigafactory site, where Semis are slated to be produced.

Now Electrek reports that Tesla has delivered Semis to at least one more customer: Martin Brower (MB), a logistics company that serves the restaurant industry and operates a eet of hundreds of trucks.

MB has con rmed that it used two Tesla Semis in a pilot program earlier this year, and the company’s drivers certainly seem to like them. “A group of ve MB drivers…were trained to operate the Tesla Semi, which uniquely positions the steering wheel and driver’s seat in the center of the cockpit and has other design features to increase driver visibility and safety,” MB told Electrek. “Overall, our drivers had positive feedback on how the vehicle performs.”

“ e Tesla Semi rises above any other tractor with mobility, center seat con guration, and precise movement that allows the driver to navigate safely,” said MB driver Casey Kamp.

“ e Tesla Semi experience has been impressive since day one,” said Megan Yamaguchi, Assistant Transportation Manager at MB. “Our drivers had no problem learning the systems and maximizing the features that set these tractors apart. We’ve been able to push these tractors well beyond expectations and look forward to our electric future.”

Fortescue’s electric excavator outperforms its diesel counterpart

Australian mining giant Fortescue has been testing an electric excavator at its Chichester operation site. Over the past three months, the excavator has been running at partial capacity while the site team familiarized themselves with the new piece of equipment. Now the e-excavator is operating at full speed, and has reached the milestone of one million tonnes of rock moved since it became operational.

Fortescue says the excavator’s performance continues to steadily improve, and at times it performs better than its diesel equivalent.

Fortescue worked with Liebherr to convert several diesel excavators to run on electric powertrains. “ e modular design of Liebherr equipment makes it possible to repower existing diesel excavators to new zero-emission con gurations, such as electric powertrains,” said Liebherr Mining Executive VP Oliver Weiss. “ is means that the diesel equipment customers buy today is also future-proofed for many years to come.”

Fortescue is testing a couple of di erent ways to get power to the work sites. e machine in use at Chichester is partially powered by a solar installation. Fortescue installed a 6.6 kV substation and more than two kilometers of high-voltage trailing cable. At another site, the company is testing a hydrogen fuel cell-powered e-excavator.

Fortescue says it plans to deploy more than one gigawatt of solar, another gigawatt of wind energy, and around four gigawatt-hours of battery storage in its quest to reach zero emissions for its iron ore mining operations. e company’s eet of mining equipment that will eventually be electri ed includes 80 excavators, 350 haul trucks and 70 drills.

“We will have two additional electric excavators commissioned by the end of April,” said Fortescue Metals CEO Dino Otranto.

THE VEHICLES

Firstgreen reports growing US demand for its electric skid steer loaders

Electric skid steer loader manufacturer Firstgreen Industries, headquartered in the Czech Republic, reports North American sales growth: More than 120 of its loaders are operating in the US and Canada, and it sells through nearly 20 dealerships in New York, Washington, Missouri, Illinois, Iowa, Ohio and Maryland.

Firstgreen entered the American market in 2021 with US headquarters in Asheville, North Carolina. Sales are geared toward the agriculture, construction and demolition sectors. e company o ers four models in its Elise line as well as the MiniZ, designed to t through a standard doorway. It plans to unveil a cabinless teleoperated loader in 2024 and to begin production in 2025.

“In the US we’ve seen a signi cant spike in interest for our skid steer loaders over the last year, with expanding use cases in waste management, landscaping, power plants, mining and more,” said Marcus Suess, COO of Firstgreen Industries in the US.

Electric trucks and buses show massive sales growth in Europe