There’s a fairly regular pivot we’ve seen many functional beverage brands make when they are having trouble gaining traction: they turn to caffeine.

The addition of that wonderful compound, with its incredible ability to make our minds feel more awake than they have any right to be, is one way that a product whose more holistic, subtle, hard-to-feel functional effects (we used to call them “long-lead functionalities – as in, you’ll know they’ve worked if you pass away sometime after you would have died before you started taking them) can start to feel like it’s working pretty much right away.

In other words, the ginseng or amino acids or CBD-laced water that you drank might not otherwise cause you to feel anything (whether or not they’re actually working to provide you benefit). But when you deal in a lot of holistic additives your results tend to vary with your own, uh, faith in their experiential effects, and caffeine is one of those things whose systemic benefits are near-immediate, palpable and – even better – addictive. Once you start getting into the habit of using it as part of your functional beverage routine, you notice a difference when it’s gone.

And for some products, the addition of caffeine can definitely charge sales as much as it charges the consumer. Certainly we’re seeing that with Odyssey, the functional mushroom product that recently launched a “222” line, which adds a heft y 2-cup-of-coffee kick to its Cordyceps and Lion’s Mane fungi mix.

One set of products that has only recently started to work with caffeine is the hydration space, where Gatorade Fast Twitch has catapulted that long-time brand into the energy drink realm with a product that dumps 200 mg of caffeine into the category leader’s trademark blend of electrolytes. It’s a potent mix – that’s more than two regular Red Bulls in a chuggable 12 oz. bottle – but it’s one that has long been so long in the offing it makes one wonder why it took so long to get there.

That’s not because there’s competition for Gatorade from inside the sports drink category – although we do believe that Body Armor may yet find a second, generational wind, and that Prime remains an unpredictable competitor – but from a constellation of other product types that have moved in on its core market, exercise.

Right now much of the growth in the energy drink category, in fact, is coming from hyper-caffeinated products that fit a gym rat’s mentality. Everything from Celsius to Ghost to C4 to Alani Nu to, yes, strange bedfellows Bang and Reign are designed to feel at home in the cupholder of the health-club bound. If these brands have proven a commercial viability for something that trainers, scientists, and baseball players who chug Red Bulls between innings have long known – that well-timed doses of caffeine can improve athletic performance – Gatorade has slowly come to understand that the workout space has more to it than electrolyte replenishment.

But energy products aren’t the only ones forcing Gatorade and its traditional competitors into a competitive stance. With new brands on board, right now there’s something of an electrolyte arms race, one that includes both powdered and liquid formats. In the past decade, the rapid growth of both powdered and liquid brands like Electrolit, LMNT, Hydrant,

Biolyte, Liquid IV and others have brought a new level of functionality to the rapid rehydration game, creating a premium, almost clinical subcategory that demands the attention of the established brands.

These saltier solutions tend to have a higher concentration of electrolytes, making them popular among athletes and among those who might be depleted from that other great recreational activity, boozing. Once again, though, it’s a move into Gatorade territory, both among elite athletes and elite partiers alike. Morning after recovery has long been one of Gatorade’s great unspoken uses; with the growth of actual IV infusions as an achievable - albeit elite - hangover relief possibility, products in the mold of Liquid IV were sure to follow.

Whether it’s for competitive sports or competitive drinking, the identification of this super-hydration space by these insurgent brands has led Gatorade and Body Armor to lean into the trend via rapid relief products of their own, like Gatorlyte and Flash. Pedialyte itself is aiming for a more commercial approach, watching its popularity among athletes and celebrities create a secondary use market that transcends the clinical.

As this electrolyte arms race cranks up, one has to wonder if there’s a crackdown coming — if not from regulators, who have once again started to look at the energy space over, among other things, the caffeine in PRIME, a brand that has feet in both the energy and sports drink worlds — than from doctors and sports medicine experts themselves. They’ve long been clear that in most cases, hydration is perfectly achievable through basic H2O, and that recovery is as well served by chocolate milk as by Gatorade.

And the brands like Gatorade and Body Armor recognize this as well, extending their brands into water - but for heavy use cases, whether it’s after a long run or a long night out, electrolyte based hydration is one of the few other areas that a consumer can actually “feel” working. Now, chugging water is certainly a fine way to rehydrate in most cases, but throw a sports drink to someone who is hurting from fluid loss – for whatever reason – at the right time, and see them feel better, and you’ve probably won a convert.

By Barry Nathanson

By Barry Nathanson

I’m about to head out to Expo East, followed by NACS, with sundry other shows to follow for our entire BevNET team. The events cycle never ends. That’s a good thing. It’s always great to attend for a myriad of reasons, foremost is to see old friends and make new ones. I’ve been attending trade shows and conferences for over 40 years, with beverages being my beat for the last 33. I am never disappointed. There you get a first- hand look at the offerings that will fill the truck bays, warehouses and store shelves heading into the fall, and more importantly 2024.

These shows put Innovation on full display and highlight the art of beverage marketing. We get to see the newest launches and line extensions. The latest packaging trends and formats are introduced at the shows, along with the graphics that will help to differentiate the brands. Hot tip: It’s always accepted that you get three seconds or less to make an impression in the aisle, so make sure your look stands out. Suppliers of all sorts are also present at the shows, both to support their customers exhibiting there, but more importantly, to reach potential brands to work with.

Companies spend an inordinate amount of time and money attending

these events. For years, the results merited the expenditure. But over the past few years, Covid fears have adversely impacted the success of these events. We saw fewer launches with less marketing muscle behind them. There was a timidity, mostly justified, in many companies’ plans for the shows. That was reality then, but this is now.

One of the most enjoyable aspects of my job is to be privy to what companies plan to put together for their marketing activities. Over the past few weeks, I’ve been encouraged, actually elated, that companies are back on track in aggressively pursuing agendas. Heading into the new year you’ll see so much activity, it’ll make your head spin. New SKUs will hit the shelves, powered by new formulations and packaging options. Marketing dollars will finally be allocated to support their efforts. I’m hearing enthusiasm all around.

Yes, I’m a cockeyed optimist and a cheerleader for the beverage industry, but I feel that my excitement is justified. I believe that 2024 will be a great year for beverage companies, and we’re getting our first look at the products and plans that will help them get there.

www.bevnet.com/magazine

Barry J. Nathanson PUBLISHER bnathanson@bevnet.com

Jeffrey Klineman EDITOR-IN-CHIEF jklineman@bevnet.com

Martín Caballero MANAGING EDITOR mcaballero@bevnet.com

Ray Latif CONTRIBUTING EDITOR rlatif@bevnet.com

Brad Avery REPORTER bavery@bevnet.com

Justin Kendall NEWS EDITOR, BREWBOUND jkendall@bevnet.com

Carol Ortenberg EDITOR, NOSH cortenberg@bevnet.com

Adrianne DeLuca REPORTER adeluca@bevnet.com

SALES

John McKenna DIRECTOR OF SALES jmckenna@bevnet.com

Adam Stern SENIOR ACCOUNT SPECIALIST astern@bevnet.com

John Fischer ACCOUNT SPECIALIST jfischer@bevnet.com

Jon Landis BUSINESS DEVELOPMENT MANAGER jlandis@bevnet.com

ART & PRODUCTION

Aaron Willette DESIGN MANAGER

Nathan Brescia DIRECTOR OF PHOTOGRAPHY BEVNET.COM, INC.

John F. (Jack) Craven CHAIRMAN

John Craven CEO & EDITORIAL DIRECTOR jcraven@bevnet.com

HEADQUARTERS 65 Chapel Street Newton, MA 02458 617-231-8800

PUBLISHER’S OFFICE 1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

SUBSCRIPTIONS

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com

BPA Worldwide Member, June 2007

Like many of you, I’m sure, over the years I’ve developed various coping mechanisms to keep myself on an even keel through life’s little challenges and indignities. (Just to be clear: I don’t have any mechanisms for the big challenges and massive indignities, besides sitting in my armchair, opening a beer and sobbing.)

So when we get a scorching, humid summer day in New York, I just remind myself of how much I hate February, and suddenly the weather doesn’t seem so oppressive. When I find myself embarrassed to find myself rooting for such perennially hapless teams as the Brooklyn Nets and Tottenham Hotspur, I turn on the TV and see the Giants down 40-0 to the Cowboys on opening day. Glad I’m not a Giants fan! It’s the same as I look ahead to the daunting challenge of covering the essentially unmanageable, back-to-back Natural Products Expo East and NACS expos, with their hundreds of beverage exhibitors whose staffers will take it as a personal affront if I don’t get to their booth while they’re on the premises. My coping mechanism here is simply to remind myself how grateful we all were to have those shows resume after their pandemic cancellations. Remember how glad you were? Well, me too. So bring them on!

What will I be looking for as I explore the innovation on display and engage with company leaders and sales execs? For starters, I expect to see plenty of it, after the rigors of the pandemic, with its supply chain disruptions, retailers who moved into triage mode in overweighting staples and the inflationary burst that came just as consumers were cutting back. So I suspect we’ll see the pent-up release of more innovation that may have been sitting on the shelf since 2019 waiting for the right launch time. We saw some of that in the past year or so but I suspect innovation to really be unleashed this fall.

A lot of what we see, though, will be informed by this new fiscal austerity that’s emerged over the past year or so. It’s not receding, and it’s compelling beverage marketers to target segments of meaningful approachability and scale, and in a judicious way that doesn’t squander precious resources at a time that it’s not so easy to stoke the engine with another capital round. As I write this, some of the new stuff is trickling out. Venerable Waiakea Hawaiian Volcanic Water, for example, which has never been promiscuous with innovation, just unveiled the first details of a move into canned cold-brew coffee. True, coffee can’t be regarded as a close-in adjacency to packaged sourced water, but like the core line this one benefits from the state’s rich volcanic soil, which both filters and enriches the water and supports an admired coffee industry. So

We’ll also witness key pivots undertaken to accommodate this austere new reality. Take Odyssey Wellness, which initially launched a mushroom-infused coffee line that I personally admired. At this time, at least, that’s a niche segment, and the company’s founder Scott Frohman has heeded the feedback he received from the market and shelved the coffee line in favor of an easier-drinking elixir that nevertheless contains a potent mushroom ingredient bill. Investors seem to have bought in and he’s ready to hit the gas.

Or take energy. There’s no quibbling with the category’s continued growth, premium pricing and great margin, not to mention the voids that Celsius, C4 and Bang have created in the beer networks with their exit to soft drink partners. So expect to see a continued flocking of new entrants, including raw startups, supplement marketers edging into RTDs as did VPX and Nutrabolt before them, and incumbents in other categories hoping to get some rel-

evance, shelf velocity and topline growth from extensions there.

Super Coffee, grappling with a Bulletproof-like product whose taste is polarizing and which occupies what is still a niche, has made a more overt move into the energy space, offering the Anheuser-Busch network a sucralose-sweetened energy play that could sit neatly alongside another A-B partner brand, Ghost Energy. (In fact, the two are sharing a booth at NACS, I presume so as not to get lost in the crowd of beer swilling visitors to A-B’s pavilion.) For that matter, Odyssey has just ventured a line called 222 that’s overtly positioned as an energy drink, too.

Of course, that tactic can’t be a panacea for everyone’s growth dilemmas. There will only be so many winners and losers, even in such a growing category, one in which even struggling entries like A Shoc and Zoa have been able to bring in substantial new resources to try to get on track.

I’m also curious to see whether we start seeing more lower-caffeine entries from major energy players now that criticism has begun to heat up again over the possible health compromises of heavily caffeinated brands, some of them employing licensing partners that could lure younger drinkers into the mix. Of course, just in tilting from 16-oz. cans to 12-oz. cans, some incumbent players are cutting their caffeine by 25% right there. Still, maybe the time is right for more “sessionable” energy drinks, just as some brewers have moved away from high-ABV IPAs all the time.

Other trends to track? With fewer and fewer exceptions – GT’s Kombucha and Olipop come to mind – cold-stage players increasingly are hedging their bets with shelf-stable extensions, in the case of kombucha players those canned gut pops. Rowdy Kombucha was the latest, offering a line of ashwagandha-powered Good Mood Sodas that I’m certainly eager to try for the first time.

Entries from established entrepreneurs, with their deep reservoirs of credibility and goodwill and broad access to capital, always are worth a gander, since they possess the ability to keep tweaking the proposition until it resonates. One thinks of Lance Collins, of course, with brands like Zen WTR, My Muse and A Shoc, but also more newly minted second-timers like the Essentia Water team of Ken Uptain and Scott Miller with their flavored vitamin-infused Yesly line.

One also should keep a fresh mind about who the strategics are. That doesn’t just mean the beer and beverage giants, with their sprawling booths full of often late-to-the-game innovation (Gatorade IV anyone?) but the burgeoning array of newer platforms like Splash Beverage and Clear Cut. Splash, run by Red Bull vet Robert Nistico, just landed a credit line it says can support a series of acquisitions of brands doing $20 million and up in sales, even as it builds its own Tapout and Copa di Vino brands. Clear Cut, operated by Coke and Bang Energy vet Joey Nickell, acquired control of energy brand Phocus while launching a shot line called Levo and a sports drink called Hero.

Finally, there’s the matter of DSD. Several brands that had eased away from that distribution mode seem back in the hunt, such as Hint Water and Guayaki Yerba Mate. Others are making their initial foray into DSD, including Spindrift seltzers (prompted by the brand’s push into hard seltzer, where DSD is mandated) and Zevia stevia sodas. These are all well-established brands with DSD-conversant executives on their senior teams these days. Beer wholesalers and other distributors might find it worthwhile to sniff around those exhibitors’ booths while at the shows. Their heavy lifting already has been accomplished and they have a plethora of retailer authorizations.

Of course, though Expo East and NACS are the biggies on my fall calendar, there are lots of other events on the slate, including the National Beer Wholesalers’ Association conference and expo in Las Vegas and various retailer- and distributor-hosted shows. Whichever you choose to “indulge” in, happy hunting!

Yerbaé has raised over $4 million in the “fi rst tranche” of a new funding round backed by a variety of athletes and entertainers, the Arizona-based plantbased beverage brand announced in August.

In a LinkedIn post, Yerbaé co-founder and CEO Todd Gibson said the round includes investments from individuals from the NFL, MLB and the U.S. Soccer Federation.

Those individuals will be heavily involved in the brand: In the press release, Yerbaé said its new Sports & Entertainment Board will be “comprised of prominent celebrities and sports stars” who will “play a pivotal role in guiding Yerbaé’s strategic decisions, brand positioning, marketing campaigns and product innovation.”

According to the company, the board committee will include a “soccer phenomena,” a CrossFit champion, “a globally acclaimed country music sensa-

tion” and “four revered football stars.”

Yerbaé previously announced that it had added brand ambassador and CrossFit Games champ Annie Thorisdotter to a board advisory group earlier this year.

“We are excited to embark on this incredible journey with our exceptional Sports & Entertainment Board members,” Gibson said in the release. “Their dedication to wellness and performance perfectly aligns with our brand’s values. By working together, we aim to create products and experiences that resonate with our consumers on a deeper level.”

Yerbaé went public in February on the Toronto Stock Exchange through a reverse triangular merger. At the time, Gibson told BevNET that one top benefit of going public is the ability to raise capital on a consistent basis and provide the business with more flexibility in its fundraising capabilities.

This latest fi nancing is expected to support Yerbaé’s product innovation, distribution expansion and marketing efforts, the company said, as well as increased production, working capital and “general corporate purposes.”

The funding consisted of the issuance of over 2.2 million units made of one common share of the company and one common share purchase warrant at a price of $1.83 per unit. Each purchase warrant entitles the holder to one additional common share at a price of $2.15 for up to 24 months from the date of issuance.

In its Q1 2023 earnings report in May, Yerbaé reported net sales growth of 130% to $3.5 million in the quarter, with volume sales also up 130%.

On May 16, the company announced it had secured a $2.5 million new accounts receivable and inventory line of credit from Michigan-based bank Oxford Commercial Finance.

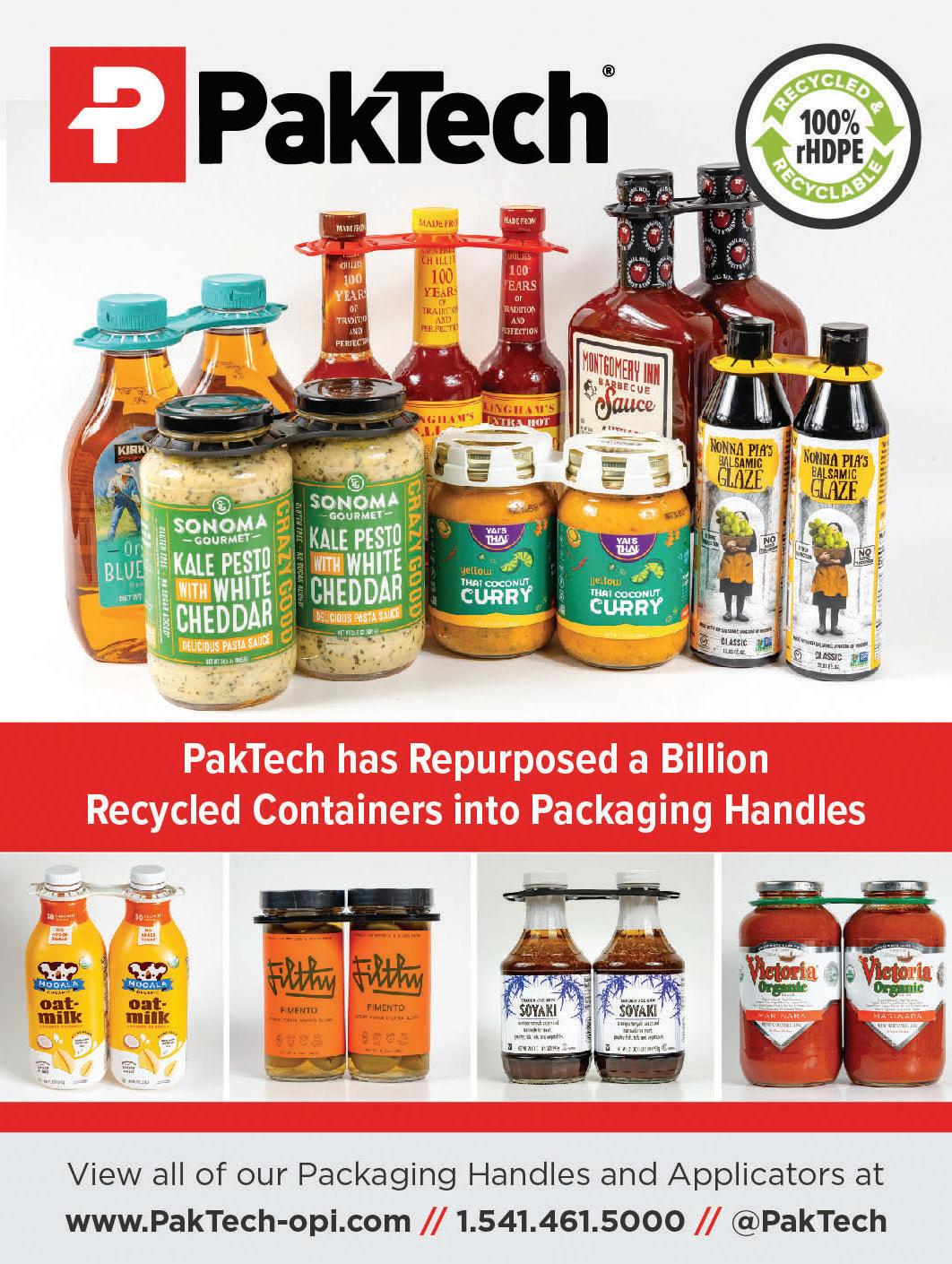

As part of its pep+ sustainability campaign, food and beverage giant PepsiCo announced in August its intention to progressively roll out paper-based packaging solutions to replace the company’s reliance on plastic rings across its beverage portfolio.

The paperboard packaging, first available on 6-packs, is made from recycled materials and is itself recyclable, reducing the company’s reliance on non-recyclable plastic rings. The new paper-based designs will begin to show up throughout the U.S. in a “phased regional approach” similar to a process already begun in the beverage company’s Canadian operations. The company reported that the innovation would be instituted through its Pepsi, Pepsi Zero, MTN DEW, Starry and Gatorade brands among others.

Launched in September 2021, PespiCo’s pep+ initiative (PepsiCo Positive) aims to make the food and drink maker’s operations more sustainable and achieve net-zero emissions by 2040. Under the pep+ pillars of “Positive Value Chain,” PepsiCo intends to “improve packaging sustainability including reducing virgin plastic per serving by 50%” by 2030.

In the company’s 2022 annual report, PepsiCo set a new goal for “20% of beverage servings would be delivered through reusable models by 2030” as it furthered its goals of reducing unsustainable packaging systems in its value chain.

The company conceded during the release of its 2022 ESG Report in June, that although progress had been made in nu-

trition, agriculture, social (people and communities), water-use efficiency and safe water access, reducing emissions and its packaging supply chain have been slower to transform into more sustainable models.

PepsiCo’s move is following consumer demand for more sustainable packaging solutions in large food and beverage brands. Coors Light announced in March 2022 it was ditching the plastic, six-pack rings in favor of a paper solution with hopes of removing the plastic rings from its supply chain by the end of 2025.

Coca-Cola reports that 90% of its packaging is currently recyclable with a goal to hit 100% by 2025. Coke’s bottlers have been transitioning to a paperboard holder for can multipacks in Europe. In the U.S., Liberty Coca-Cola adopted the KeelClip paper packaging system at its Elmsford, New York facility last summer. The company has also been experimenting with 100% plantbased bottles for nearly two years.

How these new packaging initiatives affect the bottom line of beverage companies is currently unknown. Yet, 82% of respondents in a recent survey said they would be willing to pay more for sustainable packaging, according to Trivium Packacking’s 2023 Buying Green Report.

It’s an international brand, and now, with cash in hand, it’s time for international growth.

That’s the way Icelandic Glacial CEO Reza Mirza categorized the news that the brand had received new equity funding from a group of new and existing investors. Reached by BevNET after his return from Europe in September, Mirza said the new financing and investment partners will position the brand for significant growth in the U.S. and elsewhere over the next year, with plans to expand its sales and marketing teams across channels and increase capacity at its Iceland production facility in order to meet demand and fuel innovation.

“We have been showing strong double-digit growth with very constrained resources,” Mirza said. “So now with this investment which is coming in, our team is very excited to not only have the right product selection for the channel, but for us to really invest in sales and marketing. Our marketing budgets have been so small all these years that now we really want to invest in building the brand and achieve the ambition that we have as an organization.”

The investment saw the nearly 20-year-old brand sell a “substantial stake” in the international brand to Iceland Star Property Ltd., a holding company based in Liechtenstein. The deal also included additional funding from existing investors, including the brand’s founders and Blackrock’s U.S. Private Credit team, which converted and reinvested the bulk of their existing debt in the company into equity.

As part of the deal, a new board of directors was appointed with incoming chairman Johan Dennelind, who has previously served as president and CEO of Swedish telecom multinational Telia.

Icelandic Glacial produces a line of naturally alkaline spring waters sourced from Iceland’s Ölfus Spring. In addition to still water offerings in various formats, including plastic and glass bottles, the brand has recently expanded its portfolio into flavored sparkling waters and, coming this fall, canned still water.

According to Mirza, about 75% of Icelandic Glacial’s business is in the U.S. where the brand has around a 60%-65% ACV in the conventional grocery channel. Because the com-

pany has been working from limited funds for years, Mirza said he has taken a channel-by-channel approach to the market to avoid spreading resources too thin.

With this new round, Icelandic Glacial is now setting its sights on convenience stores, as well as an expanded presence in on-premise and foodservice. Its upcoming 11 oz. canned line, Mirza said, will be a focus for both channels while its glass products – which are once again in production following a supply disruption last year – will be pushed for on-premise.

The company will be expanding its sales and marketing teams, he added, and has already finished hiring new positions in Los Angeles with the next target being a larger headcount on the East Coast and in Chicago, seeking area and regional sales managers. In particular growing the on-premise team is a goal – the company currently only has one person running that channel.

“Our strategy is to put people in markets where we [already] have retailers,” he said. “I’ve seen too many brands put in people and then they wait for the business to come; our strategy has been to get the business and then start the people.”

Internationally, Icelandic Glacial has around a 65% market share for bottled water in its namesake nation of Iceland, while the U.K., Canada and the Middle East are “growing significantly,” Mirza noted. Across all countries, he said the international business is up around 180% year-over-year.

The new investment group is expected to be helpful in opening up new opportunities in the European market, he said, and has already introduced the company to several major retail chains there.

The company is also putting funds into its manufacturing expansion, which it intends to expand by 30,000 square meters (about 323,000 square feet). That growth will also support Icelandic Glacial’s ability to innovate; Mirza said the brand is aiming to become an “all-around hydration” platform with “an Icelandic essence.”

“The heart [of the brand] is all about Icelandic and the purity,” he said. “That is going to be part of the factory expansion – to really supply all the innovation that we are going to be launching.”

Molson Coors Beverage Company’s faith in Dwayne Johnsonbacked energy drink brand ZOA is rock solid.

The beverage conglomerate announced in September that it “will strengthen its investment” in ZOA as part of its overall Beyond Beer non-alcoholic beverage growth strategy. As part of the investment, Molson Coors will remain ZOA’s exclusive distribution partner and will gain a seat on the brand’s board of directors. Financial terms of the deal were not disclosed.

After its launch in 2021, ZOA quickly established a prominent footprint in the U.S. and Canadian markets thanks to Molson’s distribution network with a strong trial sales period. But the new investment arrives as ZOA has faced sharp declines to its brick-and-mortar sales in the U.S. against a saturated energy category.

Initially introduced with a line of zero sugar 16 oz. canned energy drinks, ZOA unveiled a rebrand across its product line, shift ing to a 12 oz. canned format and reformulating the liquid to increase its caffeine and Vitamin C content, as well as

The challenge for ZOA has come as the energy drink category has become one of the fastest growing beverage segments with rising involvement from strategics. In addition to Monster Energy’s continued dominance of the space (which appears poised to continue with Bang in its portfolio) PepsiCo-backed Celsius surpassed $1 billion in sales this year, while Keurig Dr Pepper has aligned with C4 and AnheuserBusch has fueled Ghost. Independent beverage marketer Congo Brands has also had dual success in the space with Alani Nu and its PRIME Energy line, the latter of which launched in January and reported over $106.1 million in retail dollar sales in the 52-weeks ending August 26, according to NielsenIQ.

Much of ZOA’s retail business has been serviced by brand incubator L.A. Libations, in which Molson Coors also owns a minority stake. Danny Stepper, co-founder and CEO of L.A. Libations, told BevNET that while ZOA had a strong opening when it launched in 2021 – supported by a strong media push featuring The Rock, including a Super Bowl ad – he acknowl-

introducing several new flavors. The brand has been a prime component of Molson’s Beyond Beer strategy and comes on the heels of Molson’s acquisition of whiskey distiller Blue Run, which marked its first spirits portfolio brand.

According to the company, ZOA is available in over 42,000 retail locations with more than 160,000 total points of distribution across the U.S. and Canada, as well as online. The company said it reported more than $100 million in sales in 2022 with 138% year-over-year growth.

However, scanner data has suggested that the brand’s core energy drink line in U.S. brick-and-mortar MULO and convenience stores has struggled against the broader energy drink category: in the 52-weeks ending August 12, NielsenIQ reported the brand was down -26.1% (accelerating to a -41.1% drop in the two-week period), while Circana cited its dollar sales at -18% to $36.6 million in the 52 week period ending August 13, including grocery, drug, mass, convenience, military and select club and dollar retailers in its data set. Neither data set tracks Canadian sales, or ecommerce or foodservice sales.

edged that driving repeat sales over the past year has proved challenging.

“We opened on Broadway, really big and really fast,” Stepper said. “We made some mistakes, like all brands do, in the beginning.”

However, with the recent reformulation and rebranding, he said the company has learned from the initial rollout and now believes ZOA is poised to compete in the current energy drink landscape with repeat rates in the natural channel that are “super compelling.”

“What we have now is built for speed,” Stepper added.

Since March, ZOA has been run by CEO John Galloway, a former president at Godiva Chocolate and a veteran at PepsiCo overseeing marketing for Gatorade and IZZE, who initially joined the brand as president and CMO in December.

With the new investment, ZOA now intends to double its media spend and marketing budget for 2024, continuing to focus on its “Fuel Something Bigger” campaign consisting of digital, out-of-home and paid social media ads.

Mac and Cheese and pasta brand Goodles announced in September a $13 million in new capital as it looks to take on its blue box and bunny competitors.

The raise, which closed in May, was led by venture fi rm L Catterton with Gingerbread Capital, Springdale, Third Craft Partners, Willow Growth and more than 100 musicians, actors, athletes and influencers also taking part. The company had previously raised $11 million via several SAFE notes.

“[L Catterton] is the right partner at the exact right time,” Goodles cofounder and CEO Jen Zeszut said, adding that given the brand is trending towards profitability, this may be Goodles’ last raise. “We’re here to build a legendary business.”

According to Zeszut, the capital will be used to scale distribution beyond Goodles’ existing 30,000 doors. First launched in Target in 2021, in 2022 the brand launched in Whole Foods Market and this year, rolled out a club pack in Costco. In further natural channel expansion, Goodles is launching in Sprouts this week. Given the reach its competition has in grocery and mass, Zeszut said she felt it was important to

prove the concept in conventional retailers off the bat. The brand has found that not only is stealing share from larger players but is bringing incremental sales to the category.

Capital has also been used to add to Goodles’ exec team, with former Plum Organics and Cerebelly exec Stacie Hajduk joining as CMO and Nathan Lord, former CFO at Kodiak Cakes, taking on the role of CFO.

Founded in 2021 by a group of longtime CPG execs, Goodles counts Wonder Woman herself -- actress Gal Gadot -- as a co-founder. While the brand has a slate of more traditional flavors in retail, including a vegan option, Cheddar and white Cheddar, it’s also released more adult-forward options such as Elote, Hatch Chile and IPA, in a series of online-only limited flavors, with another to be released next week.

“We’re really margin focused and we’re margin agnostic in the sense that wherever we sell [online or brick and mortar], we’re making a ton of money,” Zeszut said. There’s no scenario where we are losing money.”

Product diversification may also be on the docket. Goodles released a three

SKU line of boxed pasta at Whole Foods this summer. While the company’s formal name is Gooder Foods, which could lend itself to future category expansion, Zeszut said the team has its hands full with mac and cheese and pasta.

“We got our hands full and I think, in general, crossing temperature states and doing anything other than shelf stables just sounds like a headache and a nightmare, she told NOSH. “So we’re going to focus and just hit this out of the park.”

Taking on category incumbents Kraft and Annie’s may be tricky, but the company has some institutional knowledge of the category on hand in Deb Luster, Goodles co-founder and Chief Impact Officer, who previously was the co-founder and former president of Annie’s.

“We’re going up against very big competitors with really deep pockets. We were never intending to raise a ton of money and just throw money at the problem,” Zesut said. “We’re throwing creativity at the problem. We’re out-weirding the competition, we are joyful, we are more joyful than the competition.”

Asian-inspired pantry staples maker Momofuku Goods raised $11.5 million this September in a funding round led by Alliance Consumer Growth to further its national expansion strategy. This is the “restaurant-grade” brand’s second, eight-figure raise this year.

Founded in 2019 as a subsidiary of chef David Chang’s Momofuku restaurant group, the brand was spun out into its own company in 2020, with a portfolio that includes a Chili Crunch line (its top performer), as well as air-dried noodles, soy sauce, rice vinegar and seasoned salts. While the restaurant group has shrunk its holdings from 15 to six restaurants over the last few years, the CPG line has been expanding. The brand is currently available in over 3,500 doors nationwide including Target, Whole Foods and Wegmans locations.

Momofuku’s new financing follows a $17.5 million round announced in March which was led by Siddhi Capital. Siddhi also participated in this latest round. To-date, Momofuku Goods has raised over $27 million.

“Alliance Consumer Growth has a remarkable track record of supporting consumer brands that have gone on to become iconic, and we’re thrilled that they see similar potential in Momofuku Goods,” said co-founder and CEO Marguerite Zabar Mariscal, in a release. “We’re grateful to have ACG’s expertise, alongside Siddhi, as we continue to navigate the world of consumer packaged goods.”

Alliance Consumer Growth – which has invested in CPG brands like Krave Jerky, Suja, Evol Foods and Athletic Brewing – also has experience with foodservice concepts and has backed Shake Shack, Tender Greens, Blaze Pizza and Snooze Eatery.

“Momofuku Goods is one of the most exciting emerging brands in food. In our view, it’s the most authentic, trusted brand in its category,” added Josh Goldin, co-founder of Alliance Consumer Growth, in a release. “Grocery consumers everywhere have just begun to discover Momofuku’s incredibly delicious and authentic products, which enable home cooks to make restaurant-quality food in minutes.”

The raise also marks another significant institutional investment for Asian pantry items. In 2022 alone, competing chili crisp maker Fly By Jing closed a $12 million round, Japanese barbecue sauce Bachans raised $13 million, and dumpling producer XCJ (now Mila) took in an additional $21 million.

While Chang certainly gives Momofuku a leg up when it comes to marketing, competition in both chili crisp and heat-and-eat noodles is fierce. Sauce maker Omsom added its own premium noodle kits earlier this year and Trader Joes has launched a private label “Squiggly Knife Cut” noodle offering. There’s also overseas entrants, with Taiwanese brand A-Sha Noodle debuting a revamped, “clean label” formula in Sprouts and Whole Foods earlier this summer.

Boxed.com is getting a second chance, with regional distributor MSG buying up the beleaguered online bulk food and household goods provider, the company announced in August.

Terms of the all cash transaction were not disclosed. The deal includes Boxed. com as well as other intellectual property portfolios and affi liates

Boxed declared bankruptcy earlier this year, after finding it was unable to turnaround net losses and deliver results for shareholders. It was a far cry from its heyday in 2018, when the company reportedly turned down a $400 million acquisition offer from Kroger. After fellow ecommerce player Amazon bought Whole Foods, the company raised $110 million later in 2018 at a $600 million valuation.

The retailer then went public in 2021 after merging with blank check company Seven Oaks. Last January executives told investors the company was considering a sale, subsequently raising $20

million to fund operations. However, it wasn’t enough and in March the company warned of an impending bankruptcy, which ultimately came to fruition in early April. Soon after it announced that Spresso, its proprietary technology platform for retailers, had been sold, but the retail side of the business was still up for grabs until now.

Privately held MSG is a 20 year-old national distributor focused on natural and sports nutrition goods, with its website listing brands such as Long Island Iced Tea, Amazing Grass, Protes, Red Bull, Zing and RxBar. The company has distribution centers in Florida, Texas, California and Farmingdale, New York (the latter also serving its headquarters), and also offers DSD services to New York City’s five boroughs and Long Island. In a press release MSG president Mark Gadayez said the pickup “strengthens [the company’s] inorganic growth strategy and diversifies [its] distribution models nationwide.”

According to the press release, and an FAQ on the Boxed website, MSG plans to relaunch the business later this year. The company cited its existing distribution and warehousing facilities as vital assets in bringing Boxed online again quickly. While promising the return of many of the “established” household brands Boxed once sold, the company said customers should expect to see “new and up and coming brands” as well.

“In synergy with this acquisition, MSG will further enhance its capacity for processing and distribution to Boxed customers nationwide,” Gadayez said. “In conjunction with our growing operations and patented innovations for distribution and warehouse management, the future of Boxed.com is bright.”

TreeHouse Foods announced in September that it will sell its Lakeville, Minn. manufacturing facility and snack bars business to global nut distributor John B. Sanfilippo & Son, Inc. for approximately $63 million as it shifts focus to becoming a private label leader. The deal is expected to close by early October.

The news comes as John B. Sanfilippo, which owns Fisher, Orchard Valley Harvest, Squirrel Brand, Southern Style Nuts and recently-acquired Just the Cheese brands, continues its push to diversify its snacking portfolio.

TreeHouse said it divested the snack bar assets after determining the business was unlikely to contribute positive adjusted EBITDA in fiscal year 2023. The Lakeville facility produces a range of fruit and grain, chewy, crunchy and protein bars and has been part of the company’s network since its acquisition of the Private Brands business in 2016.

“The sale of our Lakeville facility and snack bars business is another example of our strategy in action,” said Steve Oakland, TreeHouse chairman, president and CEO, in a press release. “We remain focused on deploying our capital in a manner that supports our longterm growth targets and enhances val-

The private label manufacturer has been working to shift focus and reshape its portfolio to center around higher growth and higher margin categories to “drive improved execution” – a process that began when Oakland took the helm in 2018. In July 2019, the company sold its nuts and trail mix business to private equity firm Atlas Holdings for $90 million. In June 2021, TreeHouse offloaded its cereal division to Post Holdings for $85 million.

Most recently, TreeHouse sold a majority of its meal preparation business to U.K.-based private equity firm Investindustrial for $950 million in August 2022. TreeHouse said the deal would reduce the company’s debt, strengthen its balance sheet and help focus the business on high margin snacks and beverage categories.

The sale dramatically reduced the company’s portfolio and retail footprint. Before selling the meal prep arm, TreeHouse was spread across 29 categories with 40 plants manufacturing approximately 40,000 SKUs. After the deal, the company was in 18 categories with 26 plants producing 9,000 SKUs. Core categories now include single-serve beverages and private-label crackers.

In Q1 2023, price increases and improvements in its supply chain helped TreeHouse beat analysts’ expectations and drove net sales up 15.8% year-overyear. In the quarter alone, net sales rose to $894.8 million.

Meanwhile, Sanfi lippo made its first foray into the snack bar category in Q2 2023 when it began shipping a line of private brand nutrition bars. In a press release, CEO Jeff rey T. Sanfi lippo said the deal with TreeHouse will help the company “offer [its] private label customers a complete portfolio of snack bars, including fruit and grain, crunchy, protein, sweet and salty and chewy bars that complement [its] internally developed nutrition bars.”

The acquisition is also expected to add between approximately $105 to $120 million in incremental net sales during the remainder of Sanfilippo’s 2024 fiscal year.

According to Mintel’s recent U.S. Snack, Nutrition and Performance Market Report, 75% of current snack bar buyers said they anticipated maintaining or increasing their category purchases in 2023. Senior food and drink analyst Sydney Olson in the report said, “[A] challenge stems from category crowding that will further intensify competition.”

G Fuel has long focused on selling better-for-you alternatives to mainstream energy drinks through its gamer-centric branding. As of August, the company is looking to trade on its authentic reputation in the gaming community by applying that same focus to snacks with its first food product:

G Fuel Protein Puffs.

Available in a single White Cheddar flavor, the puffs contain 17 grams of protein and just 3 grams of carbohydrates per 1 oz. bag. The snacks are available online direct-to-consumer for $10.99 per 3-pack or up to $35.99 for a 12-pack.

A press release in August indicated that the puffs are only available while supplies last, but G Fuel COO Jack LoParco told NOSH the product is one of several food and beverage innovations in the works that will further extend G Fuel’s presence into new categories.

While protein puffs are far from a new product format –options on the market range from standard nacho-flavored Cheetos alternatives to organic chickpea puffs – G Fuel’s credibility with gaming and pop culture aims to convert a new audience to the space.

Around three-quarters of U.S. households have at least one gamer and as of 2020 the Entertainment Soft ware Association reported 64% of American adults and 70% of people under 18 play games. As LoParco pointed out, that is more than the percentage of U.S. adults who drink alcohol.

“I always find that the misconception of marketing is that they treat gamers like different people, like it’s a subclass of people,” LoParco said. “Like myself, I start off every day working out in the morning, I play video games at night when I’m not working… when we look at the gamer we just look at them as ordinary people.”

But if you google “best gamer snacks,” you’ll find no shortage of lists recommending indulgences most often associated with an older stereotype of gamers as slackers: Cheetos, nachos, beef jerky, pizza, etc. And there’s been little to no healthy snacks marketed directly towards gaming culture.

While it may be a stereotype, LoParco said that consumer studies back up the belief that most players aren’t making the healthiest snacking choices during their gaming sessions. G Fuel, he believes, could be uniquely positioned to change that.

Brooklyn Brewery has taken a minority stake in Boulder, Colorado-based non-alcoholic (NA) hop tea maker Hoplark as part of a Series A funding round, the two companies announced September 11.

The New York City-headquartered craft brewery has forged “a comprehensive long-term strategic partnership” that will allow Hoplark to leverage Brooklyn’s infrastructure for production, warehousing, logistics, sales and administration.

Hoplark will also work with Brooklyn’s sales team “to broaden its representation with wholesalers and retailers around the country.”

Whipstitch Capital served as Hoplark’s financial advisor on the transaction. Financial details were not disclosed.

“We’re ecstatic with this financing and strategic partnership with Brooklyn Brewery,” Hoplark founder Dean Eberhardt said in the announcement. “As many people know, we’ve been production constrained

for the last 18 months, and we can’t wait to be able to keep up with the consumers who have been emptying our cans off the shelf faster than we can replenish them. Now we can lean back into working with our wholesale and retail partners to expand our sales to their maximum potential.”

Brooklyn Brewery CEO Eric Ottoway added: “The true attraction here goes way beyond just sales and logistics. We are captivated by Hoplark’s novel technological approach to hops. Their willingness to challenge established practices and think outside the box is extremely evident. They have crafted a unique brand narrative around using hops in a ‘triple zero’ concept – no alcohol, calories, or sugar – that is unparalleled in the beverage industry.”

Hoplark CEO Betsy Frost, who joined the company in January, said “this partnership is the next big step in supercharging Hoplark’s potential.”

In January, Hoplark reorganized the company into two subsidiaries: Hoplark, which will oversee the core brand, and Hoplark Labs, a tech-driven division that will launch new beverage brands and products under the leadership of Eberhardt.

Brooklyn Brewery was among the first craft breweries to push into the NA beer space, with its Special Effects line, which launched in Sweden in 2018 and hit the U.S. in 2020.

Brooklyn Brewery has continued to expand its NA investment, launching a NA variety pack in late 2021. Dollar sales for the variety pack are up +95% and volume +73.8% year-over-year in the last 52 weeks (ending August 12) in NIQ-tracked off premise channels, according to data shared by 3 Tier Beverages. The offering is Brooklyn’s third-largest by dollar sales, behind Brooklyn Lager and Black Chocolate Stout, with more than $1.1 million in sales in the period.

Earlier this year, a listing popped up for Lost Nation Brewing in Morrisville, Vermont.

The Beer Advocate forum lit up with questions and concerns about the brewery’s future, while other posters expressed sadness.

After receiving interest from a few parties over the summer, Lost Nation co-founder Allen Van Anda told Brewbound that he pulled the listing. He described the number of “tire kickers” and “interested parties” as “mind boggling.” However a sale of the business has yet to materialize, and time is beginning to run out on Lost Nation.

Lost Nation is in a similar position to Weathered Souls, Van Anda said. He and Lost Nation co-founder Jamie Griffith dissolved their partnership last October after around a decade in business together. They had founded the brewery in 2012 after working together at the Von Trapp Brewery in Stowe.

The partnership was no longer working for either party, Van Anda said. So the founders decided to go their separate ways. As cracks formed in the foundation of the partnership of Lost Nation’s founders, the business was struggling from a “perfect storm” of a COVID-19 hangover and an oversaturated craft beer market.

Lost Nation and Van Anda are now at a crossroads. He’s seeking a new equity partner to buy out Griffith’s stake in the business or a complete turnkey sale of the brewery. Both options remain on the table.

Should someone purchase the business outright, they’ll be

buying a brewery with a capacity of around 8,000 barrels annually, a 50-seat restaurant and taproom and a 200-seat outdoor beer garden. They’ll also be receiving a warehouse that was converted to a live music venue.

Should someone buy into Lost Nation as an equity partner to Van Anda for $250,000, they’ll essentially be giving the business a clean slate. Van Anda said he’s negotiated a deal with the brewery’s bank to refinance its note should the investment come through.

“$250,000 would save this brewery,” he said.

“We live in the fastest growing community in the state of Vermont,” he continued. “It just takes the right person to believe in it, and it’s going to take off. It’s just going to fly.”

Time is running short though. Van Anda initially believed after his partnership with Griffith ended that the brewery wouldn’t survive to see the summer. However, he credited Lost Nation’s “amazingly dedicated small staff ” and restaurant business “floating cash flow” with keeping the Lost Nation alive.

Now, Van Anda expects the end of fall foliage to lead to a slowdown in Lost Nation’s business. Without a clear path forward, Van Anda has been reluctant to brew beer. Lost Nation has subsisted on batches of Pilsner and Mosaic brewed in January but supply is beginning to dry up.

Interested parties can contact Van Anda at allen@ lostnationbrewing.com.

Austin, Texas-based hard seltzer brand Mighty Swell has been acquired by Lemonati LLC, according to a press release from buy-side advisory firm Houlihan Lokey.

The transaction closed on July 28. However, the deal announcement was made August 24 by Houlihan Lokey.

Lemonati is described as “the beverage alcohol division of a major international company, recognized globally for its expertise in developing and manufacturing citrus flavors, organic flavors, beverage flavors, essential citrus oils, and other flavors that are applicable across a wide variety of finished food, beverage, and consumer products.”

Houlihan Lokey senior VP Sam Scanlan told Brewbound that family-owned Lemonati was looking to create a beverage-alcohol division but instead opted to acquire Mighty Swell and bring CEO Jeana Harrington onto the Lemonati team.

The issues for Mighty Swell began earlier this year when a round of funding expected to come through by December fell through.

“By February, it was getting a little dire in terms of being able to fund the year’s production going into the spring,” Harrington told Brewbound.

This led Mighty Swell to explore merger-and-acquisition options while it was gearing up to brew the bulk of its production for the summer selling season. Without the funding, Mighty Swell was unable to brew a follow-up batch of product in March, leading the company to allocate product in order to maintain its chain placements, Harrington said. She credited her team and Mighty Swell’s wholesalers with holding onto many of those placements.

Future production won’t be an issue with new ownership backing Mighty Swell and Lemonati, Harrington said.

“It’s gonna give us the opportunity and the resources to not have to fundraise again, which is a big plus for me and the leadership because that can take up a lot of time,” she added.

Lemonati will operate with little intervention from the family that bought Mighty Swell.

Harrington said their desire is to remain private and uninvolved in the business, allowing her and her team to run the new alcoholic beverage division of the company as a siloed business.

Following the sale, Mighty Swell did the first of two “big production runs” at City Brewing’s facility in Memphis, with product beginning to ship now, Harrington said. The company is also exploring West Coast production as expansion west is under consideration.

Mighty Swell brand family sales in off-premise retailers tracked by NIQ have declined -19.1%, to around $5.9 million, while volume declined -24% for the 52-week period ending August 12, according to data shared by 3 Tier Beverage. Declines accelerated in the latest four-week period, with dollars -47.8% and volume -50.5%, according to data shared by the firm.

The craft brewery that led the Black is Beautiful charitable beer initiative is seeking a new equity partner to buy out one of its co-founders and take a majority stake in the business.

Weathered Souls Brewing Company co-founder Mike Holt in September declared he is seeking an exit from the San Antonio craft brewery that he helped found with Marcus Baskerville in 2016.

“Building this alongside Marcus, and alongside all of the incredible people who helped get Weathered Souls to where

it is today, that’s been the adventure of my life,” Holt said in the announcement.

“Now it’s time for someone else to continue that good work, whether it’s raising millions to support charitable organizations in Black communities across

the country, winning awards for making some of the best beer on the market, or just creating an environment where everyone can feel comfortable enjoying craft beer regardless of who they are.

“The community deserves to see Weathered Souls continue in the hands of someone who will truly be the good steward and community leader that we’ve strived to be ourselves these last few years,” he continued.

Holt is asking interested parties to reach out directly to him at investor@ weatheredsouls.beer.

Craft Beer Cellar Belmont and Trinktisch European Food Hall are looking for new ownership.

Co-founders Suzanne Schalow and Kate Baker announced their intent to sell the Belmont, Massachusetts-based businesses in a letter to industry members and fans in August.

“We have had the time of our lives being your local beer and wine store, and now your beer hall and gathering place,” Schalow and Baker, who are also married, wrote. “But, we feel that the time has come for us to get back to ourselves, each other, and to look towards building on our experiences to further explore excellence in hospitality, in the retail and restaurant segment (Craft Beer Cellar Co.), and beer industry education, in a new light.”

The duo are “actively seeking a local individual, family, or group, to pick up where we will leave off ” and take over the businesses: “someone who has the same fi re and drive for providing an exceptional experience, by selling and supporting the very best in beer, wine, cider, food, and more.”

While the sale marks a new chapter for the individual businesses, Schalow and Baker are not done with the Craft Beer Cellar franchise, which includes 11 other locations.

Brewbound caught up with Baker following the announcement to discuss the decision, the interest they’ve received so far, and what’s next for her and Schalow.

Baker shared that four different groups of people have inquired about the business so far.

“It’s also something that it’s just not gonna happen overnight,” she said. “It’s easy to get overexcited, but you have to talk yourself down a little bit.

“We are encouraged by having such interest so early,” she continued.

Although Baker and Schalow are open to selling the businesses separately, the interest they’ve received thus far has been acquiring the package.

“There’s a lot of complementary aspects to having Craft Beer Cellar and Trinktisch right next door to each other,” Baker said, noting that the restaurant’s customers have often stopped by the bottle shop after, to purchase packages of the beers they’ve tried during dinner.

The timeline for a sale is “open ended,” but Baker said the hope is “by the end of the year” the business will be transitioning to new owners and she and Schalow will be in advisory roles.

Baker admitted that the last year and half has been difficult for her and Schalow, with no work-life balance. Baker added that the ideal buyers will have help to divide duties and avoid the grind that they’ve experienced amid labor shortages and the aftermath of the pandemic.

“We didn’t do this because we don’t want to work,” Baker said of offering the businesses for sale. “We love to

work, but we absolutely must stop the 14-hour work days six to seven days a week. It’s just not tenable any longer. We’re not old, but we are not 30 years old anymore.”

That’s why she’s been encouraged by the groups that have reached out, with multiple people involved, who will be able to “take something that we think is pretty cool and push the needle forward and make it even better and introduce some changes and streamline efficiencies.”

“All the people that have shown interest have some varying degree of prior experience and beer knowledge – which of course is paramount – restaurant work, etc.,” she said. “We’re not just going to pack our bags and drop the keys on the desk and run away. This means way more to us than that. We want to make sure that we’re leaving all that we’ve done and all that we’ve poured our souls into in good hands and that’s the main goal.

“Our challenge is to not have it leave any sort of a gaping, glaring hole, but to encourage people that we’re leaving it in the hands of somebody that can take it to the next level,” Baker continued. “In fact, we encourage whoever comes in here to do it better because it deserves it and so do the people of Belmont and the surrounding communities.”

Nevertheless, Baker said she and Schalow are “100% completely at peace with” the decision to sell the businesses. Still, she called the decision to sell “bittersweet,” as she and Schalow have built a loyal customer base after 13 years.

“We’ve had a good run,” Baker said. “We’ve had some bumps in the road. We’ve had some great successes. We still love what we do. We are just tired.”

Functional beverage brand Rowdy Mermaid has announced the release of its newest innovation, good mood soda. Available in four classic flavors – Cola, Grape, Orange and Lemon Lime – each 12 oz. can contains 200mg of KSM66 Ashwagandha and has just 5 grams of sugar. According to the brand, KSM-66 is one of the most potent forms of the herb and has been clinically shown to reduce stress. Rowdy Mermaid caffeine-free good mood soda is available at select retailers nationwide. For more information, visit rowdymermaid.com.

Coca-Cola-owned soft drink brand Fanta has launched a zero-sugar soda that turns consumers’ tongues black. The drink will be accompanied by a What The Fanta “5D drinking experience” campaign that includes activations, an online video game and social media posts. The spooky beverage will be available in 20 oz. bottles and 6-packs of 7.5 oz. mini cans in the U.S. To go along with the multichannel campaign, Fanta has tapped content creator and designer, Nava Rose, to create a special Halloween costume inspired by Fanta’s mystery flavor. For more information, visit fanta.com.

Juvee, the energy drink launched by gaming brand 100 Thieves founder Matt “Nadeshot” Haag and Sam Keene, has released a LTO Peachy Mangopuff flavor co-branded with Gopuff. Each 12 oz. can contains zero sugar and boasts 128mg of caffeine along with functional ingredients like L-Theanine, maca root, Vitamin C, B Vitamins and taurine. The limited time flavor will only be available on the Gopuff grocery delivery platform for $3.49 each. For more information, visit drinkjuvee.com.

Following the announcement of Monster Energy’s sponsorship of Call of Duty League, Activision and Monster have teamed up to launch three limited-edition Call of Duty cans. The cans, available in Monster Energy Original, Monster Zero Ultra and Monster Energy Zero Sugar, feature art showcasing COD’s iconic “Ghost” character. The limited-edition Monster Energy x COD cans are available in 16 and 24 oz. cans at retailers nationwide. For more information, visit monsterenergy.com/en-us.

GHOST will unveil its limited edition can of Orange Cream exclusively available at the Life is Beautiful Festival. The festival is held September 22 through 24 in Las Vegas, Nevada. This weekend, the brand also launches its Rainbow flavor partnership with Maxx Chewney’s candy brand Sour Strips in both its energy drink format and supplement powders. For more information, visit ghostenergy.com.

Plant-based dairy brand Elmhurst 1925 has expanded its seasonal collection with the introduction of Apple Pie Spice Blend. The LTO is made with the same oat-cashew base as the brand’s OatNog but also features tasting notes of baked apple and pie crust. The new addition joins Elmhurst’s returning seasonal products, Pumpkin Spice Oat Creamer ($5.99 per 16 oz. bottle) and OatNog ($6.99 per 32 oz. bottle). For more information, visit elmhurst1925.com.

Chobani has expanded its pumpkin patch with the release of its newest product, Chobani Oatmilk Pumpkin Spice. The dairy-free offering is currently rolling out at retailers nationwide with a SRP of $4.29. In anticipation of sweater weather, the brand is also launching Chobani Coffee Creamer Pumpkin Spice and Chobani Oat Coffee Creamer Pumpkin Spice. For more information, visit chobani.com.

Onyx Coffee has made its first foray into the concentrate space with the launch of Extractions. Available in two varieties – Monarch (tasting notes of chocolate and molasses) and Southern Weather (tasting notes of milk chocolate and plum) – the products are designed to “take the guesswork out of brewing an exceptional cup of coffee,” according to the brand’s website. Each extraction is available for $25 per 12.6 oz. bottle. Additionally, consumers can purchase the Extractions Set featuring both flavors for $45. For more information, visit onyxcoffeelab.com.

Super Coffee has expanded its lineup of protein-packed coffees with the return of Pumpkin Pie Latte. Like the rest of the brand’s offerings, the seasonal flavor packs 200 mg of caffeine and

10 grams of protein per 12 oz. bottle. Super Coffee Pumpkin Pie Latte is available on Amazon for $35.88 per 12-pack. For more information, visit drinksupercoffee.com.

Summer isn’t over yet, according to sparkling beverage maker LaCroix. The bubbly water company announced a seasonal mystery flavor this week with the essence of Sunshine in it. No other details were released about what exactly sunshine tastes like other than an equally cryptic tagline: “The Curiosity of Wonder.” The new flavor launch comes just as LaCroix announced a Mojito flavor coming this fall as well. Both flavors will soon be available in 24-packs of 12 oz. cans. For more information, visit lacroixwater.com.

To celebrate the onset of the fall season, Spindrift is bringing back two of its seasonal flavors: Spiced Apple Cider and Cranberry Raspberry. Both varieties are available online, nationwide at Target and regionally in select stores of Market Basket, Fred Meyer, King Sooper, Safeway, Jewel and Shaws. For more information, visit drinkspindrift.com.

In a truly unique collaboration, iconic frozen waffle brand Eggo has teamed up with Sugarlands Distilling Co. to launch its newest boozy innovation, Eggo Brunch in a Jar Sippin’ Cream. Inspired by classic brunch flavors, the new liqueur combines the flavors of toasted Eggo waffles, maple syrup and butter with a hint of smoky bacon. Bottled at 40 Proof, Eggo Brunch in a Jar Sippin’ Cream (20% ABV) is available at select retailers nationwide. For more information, visit sugarlands.com.

Film producer Richard Peete and actor Wyatt Russell have teamed up to launch Lake Hour sparkling cocktails. Available in four flavors at launch – Watermelon Cucumber, (tequila) Rosemary Yuzu (vodka), Peach Jasmine (vodka) and Honeysuckle Ginger (vodka) – the drinks are made with real juice and cane sugar and contain 5% ABV. Lake Hour cocktails are available in Pennsylvania, New Jersey, New York and Oklahoma for $12.99-$13.99 per 4-pack and $22.99$25.99 per 8-pack. For more information, visit lakehour.com.

VMC, the tequila-based canned cocktail brand born from a partnership between world champion boxer Saúl “Canelo” Álvarez, Spirit of Gallo and Casa Lumbre, has made its U.S. debut. The brand’s lineup includes Paloma, Jamaica Hibiscus Cocktail and Margarita varieties made with blanco tequila. VMC cocktails (5% ABV) will be available starting this month for $10.99 per 4-pack of 355mL slim cans. For more information, visit vmcdrinks.com/us/en.

Media personality Brooklyn Peltz Beckham, son of David and Victoria Beckham, has launched his newest creation, WESAKE “Sakura” Junmai Ginjo. Inspired by the Japanese Cherry Blossom viewing celebration, the new expression is said to feature fruity and floral tasting notes. WESAKE “Sakura” Junmai Ginjo (14.5% ABV) is available via the brand’s website and at select retailers nationwide for $24.99 per 720 mL bottle. For more information, visit wesake.co.

ICONIC Spirits, a division of The Brand House Group, has announced the U.S. debut of its newest innovation, HAIKEN Japanese Handcrafted Vodka. Available in three expressions – Original, Lychee and Yuzu – the spirit (40% ABV) is crafted with water from Mt. Katsuragi and rice from Hyogo. All three varieties are available online and at Total Wine & More locations in select markets for a SRP of $34.99 per 720 mL bottle. For more information, visit iconic-spirits.com.

Colorado-based craft malthouse Root Shoot has released its first completely locally-sourced spirit, American Single Malt Whiskey. Bottled at 50% ABV, the new offering incorporates 100% Colorado-grown and malted grain sourced from family-run Olander Farms and malted by Root Shoot. Root Shoot’s newest innovation is now available at retailers across Colorado. For more information, visit rootshootmalting.com.

To celebrate its 10th anniversary, Kenny Chesney’s Blue Chair Bay has released a limited edition 16-year-old rum from the U.S. Virgin Islands. The brand is holding its first-ever presale event for the LTO with exclusive access offered to Chesney’s No Shoes Nation fanbase. Following the pre-sale event, Blue Chair Bay’s 10th Anniversary Rum will roll out to select retailers next month for a SRP of $59.99 per 750 mL bottle. For more information, visit bluechairbayrum.com.

There’s something new in the mix — powdered mixes of established categories, and they reflect changing routes to market and the new ways consumers are willing to consume beverages. Look at Celsius, one of the fastest growing energy drinks — and the only one of the leading brands that’s putting energy into the mix space. Then check out the sports drinks, where Liquid IV has built an electrolyte empire. There, a rising tide is lifting some older boats, though, as both Gatorade and Propel are also on the rise. Look out for Prime and Alani, though: these stablemates come from fitness, and also understand D2C.

SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 08-13-23

SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 08-13-23

BevNET, NOSH and Taste Radio will be interviewing, broadcasting and filming throughout the event. If you’re attending or exhibiting, let’s connect! Reach out at news@bevnet.com, news@nosh.com, or ask@tasteradio.com

By: Adrianne De Luca

By: Adrianne De Luca

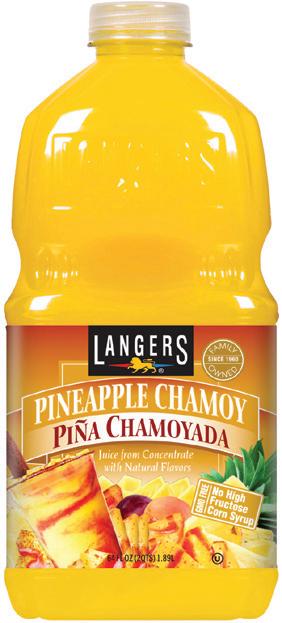

For juice makers today, success is where you squeeze it. Amidst a fractured market, the landscape can understandably appear in flux. Cast off from the CPG titans, the likes of Tropicana, Evolution Fresh and Suja are still settling into their new homes inside larger private equity portfolios. Family friendly brands like Simply and Sunny D are dabbling in alcohol, while shot specialists KOR, Sofresco and So Good So You continue to command top dollar even as shoppers feel the pain of rising retail prices. And that’s not even touching on lemonade, where sales numbers show that ongoing concerns over sugar content that have knocked loose juice’s health halo don’t seem to matter at all. In other words, the juice category feels more open and fragmented than in past years, a set of conditions that heightens both opportunity and risk.

“Juice purchase drivers can seem to come from clashing ends of the motivation spectrum – wellness and enjoyment – demonstrating that juice brands of any type can take both paths to reach the widest audience through messages of simple formulations, taste, flavor and even texture,” said Adriana Chychula, Mintel Consumer Food and Drink Analyst.

Within the aseptic, shelf-stable juice set in MULO (including c-stores), total dollar sales rose nearly 14% in the 52-week period ending August

13, 2023, according to retail data provider Circana. That sales growth was somewhat offset by significant volume declines among the top three juice drinks performers – Capri Sun, Kool Aid, and Honest Kids – which all ramped up prices nearly 20% in the past year.

Pure aseptic juices fared slightly better with sales increasing 13.6% and pricing growth a bit lower at 13.4% while volumes were flat. Coconut water category leader Vita Coco maintains a strong lead in the set with over $291 million in total dollar sales; in contrast, category runnerups Apple & Eve and Juicy Juice have brought in nearly $89 million and $75 million, respectively.

Over in the shelf-stable bottled juice market, volume growth also took a nosedive, dropping 5.6% as the segment saw positive pricing actions in the low double-digits (+12.7%). Total dollar sales of bottled fruit drinks – which includes brands like Snapple, Hawaiian Punch, Bai, V8 and Sunny D – rose 5.6% but volumes dropped over 7% as the subset took average price increases north of 13.7% .

As for the OG pure juice – orange juice – its pandemic-revived immune-supporting health halo continues to wane. Across shelf-stable, refrigerated and even concentrated formats OJ saw sales and volumes decline while pricing continue to rise. The leading four branded refrigerated orange juice producers – Tropicana, Simply, Florida’s Natural and Minute Maid – all saw sales decline over the past year.

However, among the ambient-temp bottled juices there may be a rising star. Cherry juice, known for its sleep support attributes, was the only subcategory in the shelf-stable, bottled category to notch positive gains in all key metrics: category sales increased nearly 29%, volumes grew 17% and prices increased at a rate of 5.6%.

R.W. Kundesen’s cherry juice remains in the lead with nearly double the market share than the second-in-command private label cherry juice players. But Antioxidant Solution’s bottled cherry liquid is quickly rising – sales grew 2057.5% to over $5 million, volume growth was up 3028.2% while prices dropped 31% in the past year. Further supporting the trendtoward-cherry: juice category leader Snapple introduced its Earth Elements flavor this year, featuring cherry and fig juice blended with a black tea base.

Refrigerated juice sales growth is also seemingly on-par with the category trends and it's clear that consumers continue to prioritize price when making purchasing decisions, as the category’s average dollar sales (-0.5%) and volumes (-8.4%) declined and prices went up (+8.7%). Juice drink dollar sales growth was flat and

volume dropped over 8% as prices increased 8.7%. Pure fruit juice saw modest results with sales increasing 6.5% and units declining only 1% as prices rose to an average of $2.61 (+7.6%).

Fruit juice blends also managed to notch positive sales gains (+2.6%) but saw volumes drop off by about 1%. That momentum is taking contributions from the shot space, with probiotic shot maker So Good So You reporting a 48% sales increase and its volume growth is keeping pace at the same rate (+48%) as the brand’s pricing remains flat.

“Some 100% options stretch their lead with simplicity; but blended formats and hybrid innovations like sparkling juices or plant waters subtly chip away at ‘pure’ fruit juice,” said Chychula. “100% juices clearly symbolize a sense of purity to consumers, contributing to securing purchase from the largest share of juice drinkers in the cluttered juice aisle.”

In the emerging juice brand arena, there has been a bit of consolidation. In October 2022, Suja Organic acquired Vive Organics in a deal it said at the time would help secure its position as a juice shot leader. Across Suja’s portfolio – which spans fruit juice, juice drinks and blended juices – this past year price increases of about 8% correspond with fairly substantial volume declines. Volume and sales of its juice drinks and blended formats dropped by 25% and 18%, respectively, while its leading fruit juice segment saw 4.2% volume declines and a low-single digit growth rate.

Vive Organic’s average pricing fell over 12% this year and during that period, sales increased nearly 112% to over $10 million and volume growth kicked up 142%.

The average consumer either sees juice with a health halo or with a sugary silhouette, according to a recent report from Mintel. But this year has seen several large juice brands embrace alcohol (or lack thereof) as a means of expanding outside the category’s traditional boundaries via RTD cocktails, mixers and the emerging nonalcoholic segment.

snack, a sweet treat, or mixed with other non-alcoholic beverages

“As younger consumers age, juices of all types can remain on the shopping list with messaging that conveys simplicity, even in blended and adapted juices when coupled with taste and flavor positioning and innovation that inspires use occasions beyond breakfast,” said Chychula. “Younger adults are more likely to drink juice as a snack, a sweet treat, or mixed with other non-alcoholic beverages and as a mixer with alcoholic beverages.”

Coca-Cola’s reinvention of Simply as an alcohol-friendly platform

ty going and introduced Simply Mixology, a new juice line targeted cocktail

Coca-Cola’s reinvention of Simply as an alcohol-friendly platform exemplifies the trend. Following the successful launch of Simply Spiked via its partnership with Molson Coors, Coca Cola kept the party going and introduced Simply Mixology, a new juice line targeted for at-home cocktail prep, in three SKUs – Strawberry Guava Mojito, Lime Margarita and Peach Sour. The line launched in January and at the time, Coke said in a press release that the Simply brand was also approaching another milestone: $2 billion in annual retail sales.

According to James Quincey, Coke’s chairman and CEO, during an earnings call with investors, Simply Mixology brings “both affordability and premiumization” to the mixer space and brand identity. That direction has provided a clearer distinction from Coke’s other juice brands like Minute Maid, which extended its juice-based, Gen Z-targeting Agua Fresca line with a new 52 oz. Pineapple Horchata flavor this year.

Elsewhere, farming cooperative-owned Ocean Spray is teaming up with Absolut and Pernod Ricard USA to launch a sparkling Cape Codder (cranberry juice and vodka) in 12 oz. cans at 4.5% ABV. Will the nearly 100-year-old juice maker’s “real juice credentials” make a difference in the alcohol category, as it seems to think?

Although the product won’t launch until next year, the duo is already working on integrated co-packing and innovations to go deeper into the RTD cocktails.

gistics, Armistead said it is also looking to reduce the risk of Happy Moose spoilage. The brand recently closed some initial deals contributing to a small Series C fundraise, he said, and is working on slight product reformulations with the goal of extending the shelf life of its juices. In turn, Armistead expects having logistics on-hand, and a lower risk product will create a solid margin cost structure as both businesses continue to expand.

Juice maker Uncle Matt’s is also working to assert more control over manufacturing. Earlier this month, the two-decade old company announced it was making the leap from copackers to self-bottling after purchasing a new facility it expects to be operational by the end of the year.

Anything to squeeze out a little more opportunity, even for the most well-established brands.

According to

After watching innovations built around energy or MCTs fail to catch fire, Vita Coco is taking an even bigger swing with its boozy RTD collaboration with Diageo’s Captain Morgan rum, Vita Coco Spiked. During an earnings call in August, Vita Coco co-founder and executive chairman Mike Kirban said the company is looking to drive penetration of its canned coconut juices in the c-store channel. Kirban believes those efforts will help coconut juice become common “at-home mixers” and expand consumption occasions. According to recent data from Numerator, household penetration for coconut water sits around 22% compared to cranberry juice at 55% and over 80% for orange juice.

At least one big name is standing pat, though: Tropicana’s sole innovation this year was the relatively safe three-SKU Tropicana Zero Sugar, its first new launch since its acquisition by private equity firm PAI Partners from PepsiCo in 2021.

At least one big name is standing pat, though: Tropicana’s Tropicana Zero Sugar, its first new launch since its acquisition by private equity firm PAI Partners from PepsiCo in 2021.

Though novel opportunities as well as challenges have impacted the juice set, a handful of startups have taken aim at solving chronic category challenges such as the refrigerated variety’s naturally short shelf-life and the associated challenges of cold-chain shipping.

San Francisco-based Happy Moose Juice announced it acquired its distressed, local cold storage partner back in April. While co-founder and CEO Ryan Armistead said the newlyacquired business will remain a separate entity, he believes the realized impact of having an in-house logistics provider will benefit the juice business’ bottom line over the long haul.

According to Armistead, the team also sees a large opportuwith the new business by building out “a suite of different loboth local and cross-country deliveries. He noted that another