Forget a single personalized Bud Light can thirstily sent to a transgender influencer. Anheuser-Busch InBev executives have shown their true colors this spring, and they aren’t rainbows – they’re just a cowardly yellow.

And no amount of Pride cans will undo the dangerous caving to bigotry that was shown by A-B leadership in their betrayal of the LGBTQ community in recent months, one that came about because they ran scared from boycott bullies symbolized by minor league gun-wielders like Kid Rock and Travis Tritt, rather than stand up to these and other social media flamethrowers who are all too happy to trade lives for likes.

Faced with a social-media amplified boycott of their products that has led to share loss and threats – all following a playbook of political outrage that has little to do with that single message and personalized can shared with trans entertainer Dylan Mulvaney –Brendan Whitworth (U.S. CEO of A-B) and Michael Doukeris (CEO, A-B InBev) have both shown little backbone.

Smarter executives might have recognized the boycott as what it is – an outgrowth of the venomous fertilizer sprayed by a group of antitrans conservative activists to devolve an America that believes, rightly and by a wide majority, in protecting trans people from discrimination.

Braver leaders would have pushed back.

Here’s the right thing to do, regardless of the media environment: rather than lean into not wanting to be “divisive,” draw the line at hate. Acknowledge that you’re absolutely frightened by threats against your drivers and your company; wonder if you maybe didn’t pick the right spokesperson as an ally (Mulvaney’s own flamboyant, stage-entertainer driven style is by no means typical of many trans people, it should be noted), but, please stand up for the LQBTQ people you’ve tried to court, because those are the ones who suffer the most at the hands of a years-long political movement driven by bigotry and hatred against trans rights, and because even if you’ve decided they aren’t your intended core customer, it would be a show of moral decency toward a threatened group.

Instead, they put Bud Light’s marketing chief, Alissa Heinerscheid, and her boss, Daniel Blake, on leave. Whitworth backed away from the issue by saying A-B “never intended to be part of a discussion that divides people.” Doukeris blamed the social media environment, telling investors that Mulvaney’s post was “not an advertisement” while lamenting that “The reality is no longer what the fact is,” but is more about the comments the fact generates.

Here’s the reality, gentlemen: Since losing the battle over same-sex marriage, and particularly over the past five years, the religious right has thrown itself into battle against transgender rights as an increasingly vituperative rallying point to gather support and maintain its relevance in the national conversation. The number of anti-trans bills and executive actions introduced in states has grown from about under 20 in 2019 to more than 500 last year, with more than 11 states enacting laws limiting or banning gender-affirming care for minors, not to mention restrictions on books and lesson plans in schools and threats against drag performers. It’s a campaign that, starting with the wedge issue of whether transgender youth should be allowed to participate in girls’ sports, has evolved into templated letters and bills that are supplied by a variety of conservative groups that have pushed their agenda under the guise of “parental rights” or “defense of women.”

What’s so gross about this movement is that it’s political bullying of the worst kind, picking on the vulnerable to achieve political power.

“We knew we needed to find an issue that the candidates were comfortable talking about,” Terry Schilling, the head of social

conservative advocacy group American Principles Project, told the New York Times. “And we threw everything at the wall.”

That transgender kids are 7.6 times more likely to commit suicide that their peers is a fact that has been hammered into the mind of any parent whose child has come to them with the feeling that they aren’t who they are simply by what’s represented by their genitalia. In places like Texas, under its governor’s anti-trans fiat, here’s the grim calculus: If you support your trans kids, you risk getting handed a prison sentence. If you don’t, you risk handing your kids a death sentence.

Here’s how things have changed:In 2019, two major campaigns dealing with trans visibility hit the market, with little to no reaction from those same forces who now have both Bud and Target, which pulled Pride apparel after threats against employees, on the retreat.

The 2019 campaigns weren’t small, by the way: One was the Mastercard True Name campaign, in which the credit card company let cardholders with participating banks allow a chosen name to appear on the front of a credit or debit card without requiring a legal name change. It’s a move that removed danger and embarrassment for thousands of trans Mastercard customers in the U.S. The other was “First Shave, the story of Samson” – a short video in which a young trans man, Samson Bonkeabantu Brown, was shown shaving for the first time, under the guidance of his father. It went viral as part of Gillette’s #MyBestSelf campaign.

I reached out to Lucas Crigler, the ad exec – and trans man –behind True Name about the differences between 2019 and 2023 with regard to marketing campaigns based on trans outreach.

A veteran ad man, Crigler allowed that Mulvaney might not have been the right partner for Bud Light, that the company may have misjudged both its audience and the timing with the outreach. But he also lamented that the poor timing was nothing compared to the ginned-up outrage.

“This is not the first ad campaign in all of history to flop,” Crigler told me, “Yet the backlash is wildly disproportionate to the blunder. It’s abhorrent, the amount of violence that’s been threatened against not only Ms. Mulvaney, but also the A-B execs. What is this world coming to? It’s heartbreaking and terrifying, really.” If he’d pitched True Name in 2023, Crigler said, “I absolutely do believe it would not have been as easy to sell. There would have been more fears the MC execs would have had to work through. And I don’t think our campaign would have been as successful, no. We were lucky. Good prevailed, while evil seems to be running rampant these days. With none other than drag queen artists being the scapegoats and kids being the Trojan horses.”

I also reached out to Samson Bonkeabantu Brown, the young trans man featured in the First Shave commercial in 2019 about whether he thought things had changed.

“There probably was blowback on the First Shave ad, but I thankfully wasn’t privy to much of it,” he said. “Between the work that the PR, marketing and social media teams at P&G and Grey Advertising Canada did to delete comments and my own performance schedule at that time – 2 theatre shows back to back that I wrote and performed in – I was pretty shielded from negative responses.”

I asked him if he felt like he would have done the same ad today.

“I would have still done the ad today, in spite of the threat of controversy,” he said. “It’s possible that the results would have been the same for Gillette, but it’s hard to say. It may seem naive to say, but I wholeheartedly trust that I would still be protected from the vitriol due to the protections that are in place in my life.”

I didn’t ask him whether he felt he could put that trust in a company like Anheuser Busch. Of course it’s a different product, and he’s an artist, not an ad man. But at the same time, I have to worry – with cowardly friends like Bud, who needs enemies?

By Barry Nathanson

By Barry Nathanson

Spring is finally sprung and it’s time to do some housekeeping in my little satellite office here in Manhattan. It is no simple task as every time I reduce the cases of beverages, they are quickly replaced by new submissions. That is actually a good thing as it means there are launches, new packaging and SKUs to be added to an array of brands that dot our shelves. There is great churn of products coming and going. My office is a reflection of that. I am grateful that the brand creators want me to sample their wares, though, a quick personal note must be added: When you send in product, I am just a palate of one and sending me cases fi lls up my usually small neat office with product I can never consume. There are simply too many brands that want my attention. I’m losing myself in the midst of all this liquid!

Activity is fast and furious as a bold new generation of marketers try their hand, trying to reach the same retailers, distributors/ wholesalers and investors who control beverages. Remember, something must be removed to make way for your brand. Shelf space is finite. There must be some compelling reason

for them to take on new brands. I am but one arbiter, but I want to give a small observation on what I’m seeing.

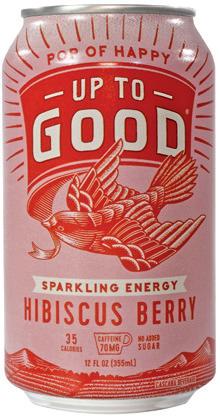

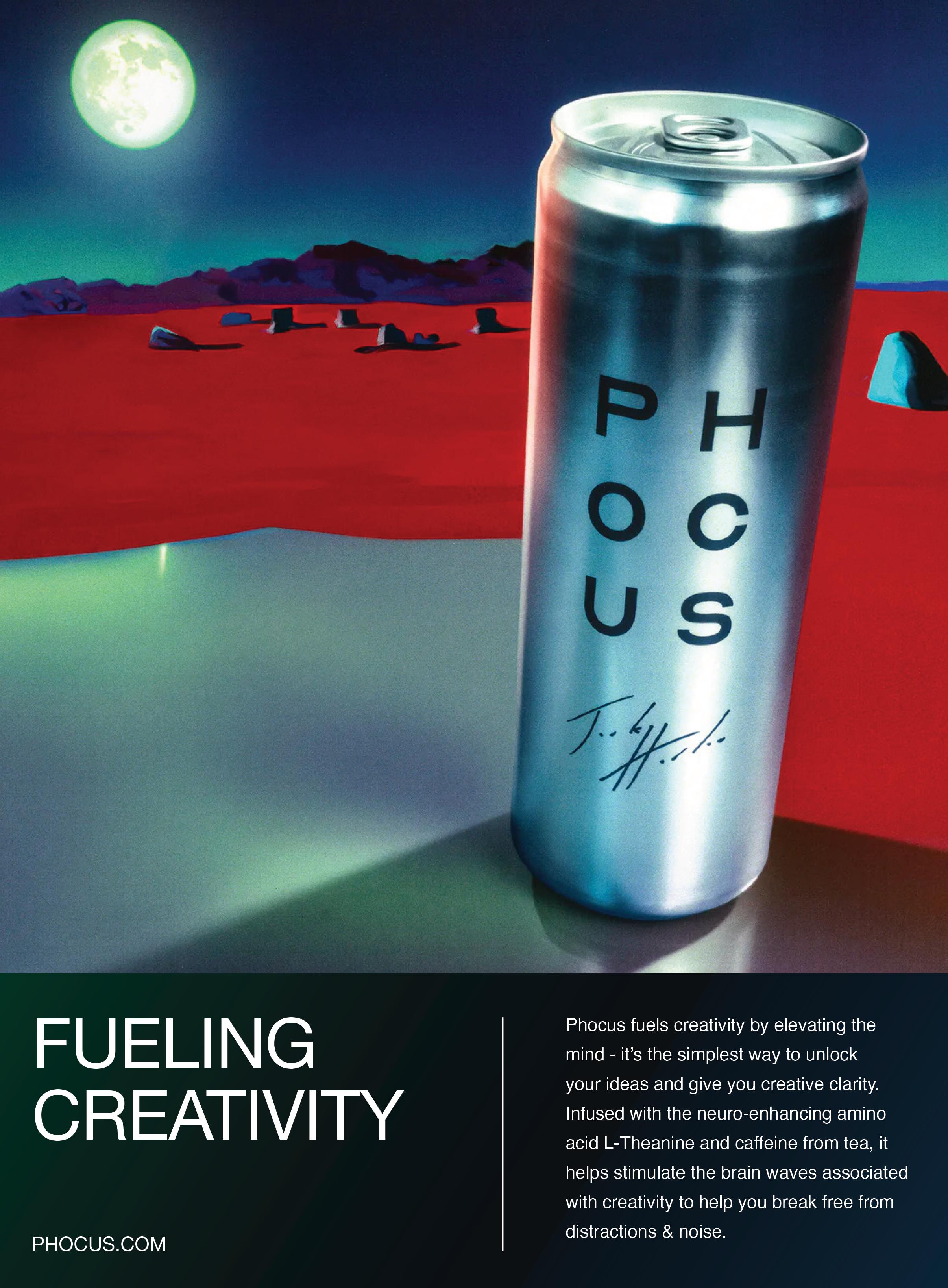

We are covering the energy drink in this issue, so I cite this category. I have been impressed with many brands that recently crossed my desk. Still, as I’ve stated many times, I don’t think the taste aspect has caught up to functionality, efficacy and positioning of the claims of many brands. Whether it’s the sweeteners, the formulations or creating the wrong SKUs, so many that I sample are just okay. The recent added negative sweetener coverage will exacerbate the hesitancy to take on new brands, and put pressure on creators to give great taste, but that is your task. Carve out your niche in the marketplace, be it with targeted demographics or lighter taste. Knowing if you can’t compete with the “big guys” , strive to compete in your unique way and hopefully you’ll succeed.

As we head to our BevNET Live here in my hometown next month, I look forward to a whole array of brands to sample on a bigger scale than my office, and hope for the best for them. And not too many leftovers.

www.bevnet.com/magazine

Barry J. Nathanson PUBLISHER bnathanson@bevnet.com

Jeffrey Klineman EDITOR-IN-CHIEF jklineman@bevnet.com

Martín Caballero MANAGING EDITOR mcaballero@bevnet.com

Ray Latif CONTRIBUTING EDITOR rlatif@bevnet.com

Brad Avery REPORTER bavery@bevnet.com

Justin Kendall NEWS EDITOR, BREWBOUND jkendall@bevnet.com

Carol Ortenberg EDITOR, NOSH cortenberg@bevnet.com

Adrianne DeLuca REPORTER adeluca@bevnet.com

SALES

John McKenna DIRECTOR OF SALES jmckenna@bevnet.com

Adam Stern SENIOR ACCOUNT SPECIALIST astern@bevnet.com

John Fischer ACCOUNT SPECIALIST jfischer@bevnet.com

Jon Landis BUSINESS DEVELOPMENT MANAGER jlandis@bevnet.com

ART & PRODUCTION

Aaron Willette DESIGN MANAGER

Nathan Brescia DIRECTOR OF PHOTOGRAPHY BEVNET.COM, INC.

John F. (Jack) Craven CHAIRMAN

John Craven CEO & EDITORIAL DIRECTOR jcraven@bevnet.com

HEADQUARTERS 65 Chapel Street Newton, MA 02458 617-231-8800

PUBLISHER’S OFFICE 1120 Ave. of the Americas, Fourth Floor New York, NY 10036 646-619-1180

SUBSCRIPTIONS

For fastest service, please visit: www.bevnet.com/magazine/subscribe email: magazinesupport@bevnet.com

BPA Worldwide Member, June 2007

I wrote this column during one of four periods in the year when my chosen profession of journalist starts to blur with that of stenographer: I’m in the thick of earnings season, when publicly traded beverage companies come (mainly) clean to their investors on how the past three months have gone financially and operationally. True, this was a calendar obligation through all the years I’ve done this job, since the likes of Coca-Cola, PepsiCo and Nestle have long been publicly reporting entities. (As I recall it, the information flow wasn’t always as wide open as now, and in my early days as a journo it helped to buy a single share of each company I followed to gain access to their events. Now I’m not supposed to buy any.) The past few years, though, those ranks of publicly traded beverage companies have swelled as many took advantage of a rare window of opportunity, both for strait-laced IPOs and for those kind of creepy SPAC deals, at a time potential exits to strategics were getting more elusive. There can be days now that I spend four or five hours dutifully chronicling the utterances of CEOs and CFOs on the webcasts, all while wishing I’d learned to type quicker.

Some of these reporting companies are exceedingly small entities, revenue-wise, and I occasionally wonder whether they’re worth the time and effort. But I always decide they are, if for no other reason than that some serve to highlight the blunders and overreaching that can sabotage the prospects of companies that otherwise have an appealing concept at their core. Unlike private companies, they more or less have to fess up to these blunders at some point, so these calls collectively provide an interesting laboratory of case histories with lessons for brand builders operating in both the public and private realms.

Let’s ponder the tradeoffs of taking the public route. Over the years, many – maybe most – senior leaders of publicly traded beverage companies of modest size have at some point confided to me that they regretted the whole idea. The expensive and time-consuming reporting requirement itself is pretty unwelcome, particularly for early-stage companies that have barely built sufficient infrastructure to generate revenue (meaning, like, sales guys). It kind of distorts their staffing priorities. Then there’s the fact that you render yourself naked to your competitors, disclosing what would otherwise be closely guarded information on your cost of goods, gross margins and salaries. There are less apparent ones too.

One that particularly irks me is the impulse to bring in senior managers with big-company resumes that may dazzle investors but who may be poorly suited to the all-hands-on-deck scramble of an early-stage company. Don’t get me wrong: there often comes a time when the gifted amateur running a public company needs backstopping, or outright replacement, but on the private side we’ve seen any number of youthful entrepreneurs show an impressive capacity to grow into the job. (Mike Kirban at Vita Coco, for instance.) The public markets don’t have the patience for that kind of evolution.

I question whether Flow Beverage’s recruitment of a semi-retired Nestle executive really added as much to its capabilities as it touted to investors. Whether because that proved to be true or because a depressed share price soured his dreams of quick riches, he soon enough moved on, the founder reclaimed that role and, honest, Flow’s operations seem tighter now than then as it fights through a thicket of challenges and tries to get the share price up again. (On that note, kudos to Celsius’ board for going with a bright but youthful bean counter for its CEO choice a few years ago rather than some of the fancy-resume types I heard it was pursuing. The results speak for themselves.)

Then there’s the need to continually placate those pesky investors. Let’s start with individual investors. Read the stock bulletin boards or listen to some of the questions that come up on the earnings calls of small-cap companies and it’s hard to maintain any belief that these people all are highly schooled in imputing performance trajectories from the minutiae of earnings statements and balance sheets. But the little people don’t matter, right? It’s those smart and ruthless institutional guys who count. The sad truth seems to be that these professionals can change their deeply held investment principles on a whim. Like consumers, they’re always right. So if the same investors who enthusiastically bought into your growthat-all-costs plan suddenly have turned skittish and hammered down your shares because you’re not making money, that’s not just their problem, it’s yours. If they’re being smart now, then they couldn’t have been that smart when they bought in just two years ago, right?

Obviously, we’ve seen a lot of that. Take the case of Oatly, whose road show on the path to its IPO didn’t include much discussion of profitability. The oatmilk pioneer painted a picture of an advantaged first mover that would plow every dollar of gross profit into building new extraction plants across the globe as it marched on to world domination. Investors clearly didn’t have any problem with that vision, sending its $10 billion valuation on its IPO issue date even further into the stratosphere, by a few billion. In the space of less than a year, market sentiment did a U-turn and investors turned on Oatly, sending its valuation down to the $1.25 billion range as I write this. In desperation, the company even briefly resorted to touting a suddenly “asset-light” operating model, which really meant spinning off a few filling operations to outside partners. Never mind that the brand continues to conquer new markets and new channels. Of course, dozens of other beverage companies are in the same boat.

So go on the public stage and be prepared to be showered with rotten tomatoes. It’s worse, of course, for the companies that really do stumble. For those operating early-stage beverage companies, there are lots of lessons to be gleaned listening to those quarterly calls. Take the case of Laird Superfood, the Oregon company founded by big-wave surfer Laird Hamilton, his volleyball-star wife Gabrielle Reece and their friend and business partner Paul Hodge. Honest, over the years I’ve rarely encountered a Laird product that didn’t wow me. Kudos to the team for creating and continually improving good-tasting but functional products, whether their coffee creamers, coffees or hydration powders. But did it really make sense to be building and refining five separate product platforms with a collective top line of under $40 million, essentially all selfproduced? All while the ecomm-built company had to navigate a dramatically changed DTC and Amazon environment? Hodge wore out his welcome as CEO and was replaced by a CPG veteran, Jason Vieth, who’s been systematically rethinking the premises by which Laird operates. The production plant is gone. Laird has found ways to slash its DTC spend by two-thirds without dire consequences. So far he’s continuing all the product lines. As it turns out, Vieth is adept at explaining the headwinds the company has to push through. Whether or not he’s able to get Laird out of the woods, his quarterly discussions offer an informative primer on the changing economics of ecomm, and the levers one needs to pull to build a grocery-based business. Some day the company may be the subject of a formal business school case history, hopefully a positive one. In the meantime, you could do worse than follow Vieth’s narration on how the company is trying to get to a better place. And you don’t even need to own any shares to listen.

with stevia and monk fruit, PLEZi is formulated to have 75% less sugar than average leading 100% fruit juices, and is fortified with fiber and other nutrients.

In a piece of distribution news, Obama announced that the brand was planning to debut in Walmart over the summer, and that it had recently been added to the company’s online store.

“I want other companies to know that PLEZi is coming,” she said, adding that an important part of the idea behind the company was to make healthier options available outside of the just high-end stores.

Obama’s announcement also referenced the long-term plans for the brand as a healthy eating and drinking platform that could encompass both snacks and other drink products. PLEZi has promised 10% of its profits to a broader movement to promote kids’ health, while Obama herself announced a donation of $1 million to FoodCorps Nourishing Futures Initiative.

Michelle Obama, the former fi rst lady, announced in early May that she is joining fledgling kids drink brand PLEZi as a co-founder and strategic partner as part of her ongoing efforts to fight childhood obesity.

Obama cited a long record of work on children’s health and nutrition, including her Let’s Move! initiative and a record of working with food companies and restaurant chains to lower calories and remove salt, sugar, and trans-fats from products, as well as famously establishing a garden plot on the South Lawn of the White House. The next step, she said, was for her to get involved in the food and beverage industry as an owner and stakeholder.

“I’ve learned that on this issue, if you want to change the game, you can’t just work from the outside. You’ve got to get inside—you’ve got to find ways to change the food and beverage industry itself,” said Obama, speaking at The Wall Street Journal Future of Everything Festival.

“I’m proud to announce the national launch of a company designed not just to provide better products, but to jumpstart a race to the top that will transform the entire food industry.”

The theory will initially be tested by her work with PLEZi, a four-SKU line of beverages that is currently sold at Sprouts and Target stores. Sweetened

A public benefit corporation, PLEZi is currently led by CEO Leah Dunmore, who was hired recently after a career in which she had worked on wellness-focused brands at companies like Hain Celestial, Kraft, and Mars. The brand was largely shepherded through the product development, sales, and marketing process by L.A. Libations and also received financial backing investment group Juggernaut Capital. The two companies first worked together developing ZOA for Dwayne “The Rock” Johnson.

As part of the launch, Obama noted that she was bringing together a “kitchen cabinet” of public health and nutrition policy advisors. That team will be led by Debra Eschmeyer, the former Executive Director of the Let’s Move! Initiative and a senior advisor to President Barack Obama for nutrition policy. Sam Kass, the former White House chef and another Obama advisor, was also announced as the PLEZi board chair.

“I still believe that businesses can move faster when it comes to our kids’ nutrition,” Obama said. “Because I believe there is a way to build a successful company and do right by our kids… that we can make products that are tasty and healthy and good for the bottom line. And I’m putting some skin in the game to put this theory to the test.”

In addition to her work on nutrition issues from the White House, Michelle Obama has at least a passing familiarity with the food business – and one of PLEZi’s likely retail partners. From 2005-2007, while her husband was still a U.S. Senator in Illinois, she served as a corporate director on the board of TreeHouse Foods, which makes private label food and drinks for a wide range of retailers, including Walmart.

Constellation Brands has acquired a minority stake in TÖST, an alcohol-free sparkling beverage brand.

Founded in 2017, TÖST produces beverages made from an all-natural blend of white tea, white cranberry and ginger.The champagne alternative is a “never alcohol” product, meaning there is no alcoholic fermentation at any point in the production process.

“Our investment in TÖST allows us to continue to optimize our higher-end portfolio by providing an alcohol-free beverage with a complex flavor profile for consumers that complements their lifestyle across a variety of occasions,” said Mallika Monteiro, executive vice president and chief growth, strategy, and digital officer at Constellation Brands.

The investment, made through Constellation’s venture capital group, gives the company another position in the fast-growing non-alc segment. It also comes at the heels of another non-alc addition to Consellation’s portfolio, Corona NonAlcoholic, which launched last week. In 2021 the company acquired a minority stake in HOP WTR, a non-alcoholic, calorie-free sparkling water infused with adaptogens and nootropics.

Constellation Brands’ beer business topped $7.456 billion in net sales, an +11% year-over-year increase (YoY), during its 2023 fiscal year, which ended February 28, the company reported during its full-year and fourth-quarter earnings report. However, net sales of Constellation’s wine and spirits sales declined -4%, to more than $1.987 billion.

In a statement, Constellation Brands highlighted that 82% of non-alcoholic drink buyers are also still purchasing drinks that contain alcohol, according to data from Nielsen IQ, “meaning TÖST extends the options and opportunity for participation on traditional beer, wine, and spirits occasions, making it a strong complement to Constellation’s current portfolio.”

Between August 2021 and August 2022, total dollar sales of non-alcoholic drinks in the U.S. stood at $395 million, showing a YoY growth of +20.6%, according to Nielsen IQ.

TÖST is currently sold online and in more than 40 states. In September 2022, TÖST CEO Brooks Addington said the brand found traction by being positioned as an affordable luxury for sophisticated drinking occasions and as a gift. The company offers two

bottle sizes: 750 ml and 250 ml, and is working on a canned format.

Two years after entering the market, the product was distributed across over 1,300 different accounts domestically with 18 distributors in 24 states. In October of 2021, after revenue reached over $1 million during the prior ten months, the company raised $360,000 of equity crowdfunding in the form of SAFE notes via Republic.

“We are excited and humbled to have Constellation Brands as a partner in our mission to bring TÖST beverages to even more consumers,” said Addington. “We believe our mutual consumer-centric focus and desire to deliver premium product experiences positions TÖST for exponential growth in the coming years.”

G.O.A.T. Fuel, the mushroom-enhanced energy drink brand backed by three-time Super Bowl champion Jerry Rice, closed a $5 million seed funding round in May co-led by venture fi rms Stage 1 Fund and Morrison Seger Venture Capital Partners.

Founded in 2020 by CEO Jaqui Rice Gold, Rice’s daughter, and her husband and chief brand officer Trevion Gold, G.O.A.T. Fuel produces a line of 12 oz. canned, zero sugar energy drinks made with cordyceps mushrooms, electrolytes, BCAAs and 200 mg of natural caffeine. The brand offers eight fl avors and is sold in over 10,000 retail accounts nationwide, including about 600 Walmart and 700 Publix stores.

According to Gold, she and her husband came up with the idea for a healthier energy drink made with adaptogenic mushrooms in 2019, when both the performance energy category and functional mushrooms were gaining traction in the market.

“My background is not in beverage, I essentially was the consumer who was newly starting to drink energy drinks at the gym,” Gold told BevNET. “These better-for-you drinks were interesting to me and my husband, but some of the ingredients didn’t make us feel that great … we felt that there was an opportunity to really create a new formulation that was innovative, and that utilized an ingredient that we hadn’t seen in the marketplace before.”

Gold quickly involved her father, a former San Francisco 49ers wide receiver and 1988 Super Bowl MVP, whom she described as a “health nut.”

In addition to his own support – Gold said her father is “150% involved” in the business operations and regularly fields sales calls among other duties – Rice was able to tap into his broad

network of sports personalities to help Gold raise over $7 million in funding from individual angel investors, including former 49ers owner Eddie DeBartolo Jr. and Minnesota Timberwolves owner Marc Lore.

With the new round of funding, Gold said the brand is preparing to scale the business nationwide. Since launching DTC in 2020, G.O.A.T. Fuel has gone from under $1 million in annual sales to eight figures in revenue, Gold said, and the company projects revenue to triple year-over-year.

The company now has 20 full time

time to do it with the traction we have and the run rate that we’re getting as we continue to scale,” she said. “We didn’t want to embark on this journey prematurely. We wanted to make sure even from a valuation standpoint that we all felt comfortable with the starting point.”

Looking ahead, however, Gold acknowledged there’s more competition in the energy set today than when she conceived the business in 2019, when Bang was the leading brand in the performance subset. Since then, betterfor-you brands like Celsius, C4, and Ghost have experienced significant growth by partnering with strategics.

employees and Gold said the fi nancing will go towards expanding the sales team and to bring in seasoned operations executives to help grow the business.

“We’ve been nimble up until this point, and we’re really looking forward to seeing the company grow and expand,” she said.

Currently, G.O.A.T. Fuel is serviced through a network of DSD distributors and has recently added new accounts such as H-E-B in Texas. The brand is also in accounts like Safeway and Lucky’s in California.

Although G.O.A.T. Fuel had already raised significant funding through angels, she said the addition of institutional investors will help open more doors for the brand as it looks to break into new markets.

“It’s essentially for us a catalyst for that [growth] process and it was the

However, Gold said the brand’s use of adaptogenic mushrooms has been a strong differentiator for the brand. When G.O.A.T. Fuel launched online only in 2020, she said 49% of the brand’s consumers – primarily Gen Z and millennials – were aware of cordyceps and the benefits of mushrooms. Much like performance energy, mushrooms as both a standalone food and an ingredient have grown their mainstream popularity over the past four years; Grand View Research reported in March that the global adaptogenic mushroom market is expected to reach $26.6 billion at a CAGR of 10.8% between 2023 and 2030.

As well, G.O.A.T. Fuel’s connection to the sports world has also been valuable. Beyond Rice’s involvement, the brand is also now the official energy drink of the Los Angeles Lakers and Gold said the focus on sports – down to the brand name – will continue to be a key part of maintaining its momentum.

“Early on, we were the fi rst to include the adaptogen mushrooms in an RTD energy drink,” she said. “I think by getting a head start in that space, we definitely have an advantage.”

In April, Cure Hydration raised $5.6 million in a Series A funding round led by Lerer Hippeau. The new capital arrives as the New York-based functional drink mix brand has expanded its retail presence to over 15,000 doors nationwide.

Launched in 2019, Cure produces a line of better-for-you hydration mixes made with ingredients including coconut water and pink Himalayan salt. According to the company, Cure has grown an average of 230% annually since its launch and its retail expansion marks a rapid rise in footprint. Last year the brand reported it was entering over 6,500 new doors, and speaking to BevNET at Natural Products Expo West 2023 last month, founder and CEO Lauren Picasso put Cure’s door count around 13,000.

Lerer Hippeau, an early stage venture capital firm and existing stakeholder in Cure, led the round and was joined by a mix of new and existing investors including Valedor Partners, Simple Food Ventures, Great Oaks Venture Capital, Joyance Partners, Silas Capital and Kim Clijsters among others. Cure previously closed a $2.6 million funding round in 2020.

“We continue to invest in Cure because the team has proved that they can scale beyond direct-to-consumer to become an omnichannel brand with a national footprint,” said Caitlin Strandberg, partner at Lerer Hippeau, in a press release. “We are excited to see Cure’s continued retail distribution and disruption of the hydration category.”

The company said it will put the capital towards supporting its retail growth, product innovation, brand awareness and team expansion. Picasso said Cure is aiming to carve out market share in the functional drink mix market and has seen triple-digit growth in the natural channel over the last 12-weeks, up around 316% according to SPINS.

The brand’s expanded retail presence includes rollouts into Sprouts, Kroger, Albertsons, Stop & Shop, Wegmans and H-E-B. “This year, we will also be launching conventional Grocery with the launch of Kroger and Albertsons where we will be testing double placement both in mainline sets as well as checklane.”

“We will support this growth through demos and sampling programs since we’ve found this to be the most successful conversion tactic for Cure,” Picasso wrote.

In retail, Cure has sought to merchandise its products in the sports nutrition set. At Expo West, Picasso noted that many of the brands in the sports nutrition space today have a “medicinal” or “clinical” positioning, or feel intended for hardcore athletes, whereas Cure aims to be an inviting everyday product. Via email, she also pointed to recent disruption in the sports drink category that has seen some consumers move away from legacy brands like Gatorade and Powerade while embracing innovative new products.

“Sports Nutrition sets are supporting brands in the functional drink mix category and we prefer placement on shelf with functional foods and beverages, where shoppers have been trained to find our kind of product,” she wrote. “We drive conversion by offering our products at the single stick lev-

el and supporting stores with demos and sampling programs.”

Cure currently has 10 full time employees, recently bringing on a new CMO, former SmartyPants Vitamins senior director of marketing Laura Kendrick, and a VP of innovation, Stacey Gillespie, who held similar positions at Ora Organic, Rritual Superfood and Gaia Herbs. Picasso said the company is not immediately hiring additional roles but will seek to expand its team further next year.

Last year, the company rebranded its portfolio with new packaging that better visualizes its fruit flavors. Following the rebrand, Cure reformulated its Lemon flavor, relaunching the SKU as Lemonade. Most recently, the brand introduced a Strawberry Kiwi variety.

Beyond new flavors, Picasso said that the brand is currently developing innovations in additional product categories to launch in the next 12 months.

Chamberlain Coffee made its much anticipated ready-to-drink debut in late April, partnering exclusively with Walmart to release its four-SKU line of canned plant-based lattes and further extend the influencer-driven coffee brand’s reach.

The launch had originally been scheduled for early May, but Chamberlain Coffee CEO Christopher Gallant explained in an email that the date was moved up to hit store shelves, Walmart.com and the retailer’s app simultaneously. The dairy-free line includes four flavors — Mocha Latte, Cinnamon Bun Latte, Vanilla Latte and Cold Brew Latte — in 12 ounce slim cans, each of which are sweetened with date syrup and made with almond milk and coconut cream. All SKUs contain 70 mg caffeine, 110-120 calories and 1 gram of sugar per can. The listed unit price on Walmart.com is $2.98.

In a press release, Chamberlain Coffee founder and YouTube star Emma Chamberlain called the RTD collection, inspired by her daily cold brew recipe, “a product I have been dreaming of making since we started the brand.”

“We’re inspired by all of the ways you can enjoy coffee, and are eager to continue exploring innovative coffee products,” she said.

Founded by Emma Chamberlain in 2019, Chamberlain Coffee started off as a D2C brand that marketed a range of organic blends in whole bean, ground, pods and steeped varieties. Since then, the business has grown into categories such as matcha, hot chocolate and chocolate covered espresso beans and into flavored blends (Witty Fox Hazelnut and Fluff y Lamb Vanilla) while expanding beyond D2C into limited retail with partners including

Sprouts, Bristol Farms and Erewhon, Pop Up Grocer and digital delivery market Gopuff. Last August, the brand announced it had closed a $7 million funding round led by venture builder Blazar Capital and Chamberlain herself.

The brand had previously flirted with RTDs through a collaboration with low-calorie lemonade maker Swoon last year.

Describing the Walmart launch as a “big moment for the brand,” Gallant said Chamberlain was well prepared to adapt quickly to the new launch date across the organization. The brand’s founder and namesake has taken a leading role in building awareness around the RTD release on her social channels, on her podcast and in one-on-one media interviews, while also shooting a commercial and conducting photoshoots.

The entrepreneur was a “big part” of the brand’s RTD-specific activation at this year’s Coachella Valley Music and Arts Festival earlier this month, he said.

Within the current RTD coffee set, Chamberlain Coffee’s products are positioned to offer popular indulgent flavors with less sugar and no dairy. The line will face competition from the likes of La Colombe, Pop & Bottle (another brand with close ties to Walmart) and Dunkin’, which launched a three-SKU line of iced coffees in 11 ounce cans in February.

Whole Foods Market has redrawn its national footprint and dropped from nine to six total regions to create a new organizational structure that will result in “a more consistent number of stores per region,” the Amazonowned retailer said.

Though this may change which regions brands are sold in, a spokesperson told NOSH that suppliers will not be impacted when it comes to merchandising or distribution.

The news accompanies an April announcement that the company had laid off team members in its global and regional headquarters.

“We are evolving our operating structure and making adjustments to some corporate teams, so we can better support our stores as Whole Foods Market continues to grow and expand its reach to serve more customers,” the spokesperson said.

According to an internal company memo sent in April, the new structure will divide the retailer’s 500plus stores across six regions, resulting in “a more consistent number of stores per region.” The company said that the change will not result in any store closures, though it will decrease the number of regional presidents and some roles in regional offices.

Some notable changes include:

• The North Atlantic region will include all international stores in Canada and the UK.

• California is now its own unified region. The state’s stores were previously split between the Northern California and Southern Pacific regions.

• The rest of the Northern California region (which included part of Nevada), the Mountain Pacific and much of the Midwest regions have been combined into a new Central West region -- which will include the company’s flagship store in Austin.

• The majority of the stores in the former Southwest region, are now in the Southeast region.

In order to adequately staff these larger geographic areas, five regions will have multiple regional offices. For example, the North Atlantic will have staff in Boston, Vancouver, Toronto and London while the Central West will maintain headquarters in Denver, Austin and Seattle.

A spokesperson for Whole Foods Market said the regional realignment will not impact the company’s category review schedule, merchandising plans, or merchandising team, and brands should expect to have continuity in their points of contact.

Brands will also continue to be sold in their existing stores, even if that store is now part of a region

that does not currently sell its products. Stores are continuing to place and receive orders from their current distribution centers, the spokesperson confirmed.

Whole Foods Market sources new products using two methods: local foragers and global category managers. The former will remain a vital part of the organization, the spokesperson said, seeking out products from their respective individual regions.

Whole Foods defines a “global” brand as one having products sold in four or more regions, a designation that also requires commitment to a higher promotional spend. Despite the chain consolidating its regions, that point of delineation will remain steady, with the spokesperson noting that any brand sold in multiple regions is already managed by the global team.

The changes to the business come roughly six months after Jason Buechel, Whole Foods’ COO, took on the role of CEO from founder John Mackey, who retired in September 2022. Parent company Amazon has made trimming operations related to its “Stores Business” a core focus for 2023, CEO Andy Jassey said on the company’s fourth quarter earnings call in February. The news accompanies April’s announcement that Whole Foods had laid off team members in its global and regional headquarters.

At Whole Foods, regional and global departments including Team Member Services (TMS), Operations and Supply Chain Management will see their structures change: regional, category-specific store operations, for example, have moved to a new global Field Support team. Global and regional Support Team members were notified if their positions had been eliminated.

“As we simplify processes and improve how we operate, we will be able to quickly respond to evolving business needs, focus more on our most impactful work, and invest in new ways to serve all stakeholders,” the memo stated. “We are confident these changes will allow us to better support our stores, Team Members, and suppliers, elevate the customer experience position Whole Foods Market for continued growth.”

With snacks trending upward and vertically-integrated supply chains becoming increasingly appealing to large corporations amid continued market volatility, The Hershey Company is doubling down on both.

Hershey announced plans in April to acquire two Weaver Popcorn Manufacturing facilities – one in Bethlehem, Pennsylvania and another in Whitestown, Indiana – where its popcorn brand SkinnyPop is currently produced. The deal is still subject to standard regulatory approval and will be financed with cash on hand as well as short term loans, according to a press release. Terms of the deal were not disclosed, but a spokesperson for Weaver noted that the facilities’ current employees will transition to The Hershey Company.

“In response to consumer snacking trends, we continue to evolve our supply chain, making significant investments in the size, scale and capabilities of our network, improving resiliency while we continue to strengthen existing supplier relationships,” said Jason Reiman, chief supply chain officer at The Hershey Company, in a press release.

During the company’s Investor Day presentation in March, Hershey outlined its snack portfolio growth plans, which entails investing in supply chain capabilities and working to scale the operating model. According to its Q4 2022 earnings report, Hershey’s snack set brought in $272 million in net sales that quarter, a 71% increase year-over-year. In 2022, SkinnyPop’s retail sales alone totaled $495 million. According to IRI, U.S. packaged popcorn sales have increased 11.4% to over $2 billion in the past three years.

“Hershey has experienced tremendous growth over the past few years, stemming from a combination of successful strategy execution and an increase in more snacking occasions among consumers,” said Kristen Riggs, president of salty snacks at The Hershey Company, in a press release. “In fact, SkinnyPop has been number one in retail sales growth for ready-toeat popcorn over the last three years.”

Riggs added that over the next three years, the company would seek to grow gross margin for its salty snacking business by 300 basis points, by utilizing “multiple levers, both commercial and operational.

The confectionary and snacking giant currently owns six candy-focused manufacturing facilities in the U.S. in addition to nine plants located across Asia, South America and Canada. Hershey’s owns over 50 brands including leading snack businesses SkinnyPop, Pirate’s Booty and Dot’s Homestyle Pretzels.

The company has spent the last seven years transitioning from a focus on confection, building a portfolio targeting the broader snack set. In 2017, the chocolate maker acquired Amplify Snack Brands which included SkinnyPop, Paqui tortilla chips and Tyrrells potato chips. Brands under Amplify division have waxed and waned over the years, with SkinnyPop accounting for the majority of the group’s sales. Within the broader company,

there have also been moves to increase its snack brand holdings. In 2018 the company bought Pirate’s Booty from B&G Foods, followed a year later by the acquisition of One Brands, maker of protein bar One Bar, for $379 million.

Other recent deals have been aimed in part at improving margins. The company acquired Dot’s in 2021 for $1.2 million alongside the brand’s manufacturing arm, Pretzels Inc., to further expand its salty snacks manufacturing capabilities. During the investor day presentation, Riggs shared that Pretzel’s Inc is also now producing other Hershey’s products, such as Pirate’s Booty.

Her colleague, Will Bonifant, VP of U.S. & Canada Supply Chain, noted in his own presentation that owning manufacturing capabilities would allow the company to also explore innovation where salty snacks could cross over into confection, using a chocolate drizzled popcorn as an example.

“Being able to take products that were outsourced and then insource them, gives us opportunities to expand margin,” Riggs said. “In the long term, there’s more of those supply chain capabilities and opportunities out there.”

The Federal Trade Commission (FTC) has warned around 670 companies to stop making unsubstantiated product claims or face the prospect of steep civil penalties.

In April, the agency sent a Notice of Penalty Offenses to the companies, a wide spanning group involved in the marketing of OTC drugs, homeopathic products, dietary supplements and/or functional foods. The list includes retail giant Amazon, pharmaceutical maker Johnson & Johnson, drugstore chains CVS and Walgreens, and wellness influencer Gwenyth Paltrow’s Goop, Inc., among others. Inclusion on the list is not an indication of wrongdoing by the companies named, according to the agency.

Within CPG, the list featured ingredient companies ADM Ganeden and Cargill alongside global conglomerates like Danone, General Mills, Coca-Cola and Pepsi. Other names range from Bragg Live Foods and Brain Juice to Bigelow Tea, POM Wonderful, and Liquid I.V.

The Notice carries the potential for the FTC to incur civil penalties (up to $50,120 per violation) against any company that engages in conduct that it knows has been found unlawful. Such acts include having a lack of a “reasonable basis consisting of competent and reliable evidence” for product claims, lack of “reliable” scientific evidence to support health and safety claims, and at least one “well-controlled human clinical trial” that shows its effectiveness in “curing, mitigating or treating a serious disease.”

Other violations include misrepresenting the level or type of substantiation for a claim and misrepresenting that a product claim has been scientifically or clinically proven.

“The principles behind our substantiation program are simple. If a company makes a claim about what its product can do, it must back that claim up with reliable evidence,” said FTC Commissioner Kelly Slaughter in a statement on March 31. “If a company makes a claim about the health and safety benefits of a product, that claim must be based on scientific evidence. If a company claims that its product can cure, mitigate, or treat a serious disease such as cancer or heart disease, it must back up that claim through the accepted standards of scientific testing, including randomized control trials.”

Reigning in product claims has been a key piece of the FTC’s updated Health Products Compliance Guidance issued in December, which sought to tighten its interpretation of the “competent and reliable scientific evidence” standard. The Notice also represents a newfound willingness by the FTC to deploy its Penalty Offense Authority, which allows it to seek civil penalties if it can be proven that a company engaged in unfair or deceptive practices in violation of the FTC Act after receiving a warning.

The FTC’s interpretation of its authority may be challenged, though. Its position – that previously litigated cases, some from several decades ago, create precedent to justify penalties for current offenses – has not been the subject of court challenge

“The prospect of steep civil penalties will help ensure that advertisers don’t play fast and loose with the truth,” said Sam Levine, Director of the FTC’s Bureau of Consumer Protection.

Brands have faced similar scrutiny for wellness claims in the past, though those were often centered around specific dietary or health issues. For example, at the start of the COVID-19 pandemic both the FTC and FDA indicated they would crack down on products claiming to offer immune boosting or respiratory benefits that were not supported by scientific studies. CBD brands have also been the subject of warnings.

Meanwhile, other brands have challenged the validity of competitor’s claims via the National Advertising Review Board (NARB) and the National Advertising Division (NAD). After apple cider producer Bragg filed a complaint against supplement maker Goli, the latter was ultimately told to adjust their marketing and packaging.

After a tumultuous spring that saw the acrimonious breakup of vegan cheesemaker Miyoko’s Creamery and its jilted founder Miyoko Schinner unfold in an ugly public dispute, the two have settled their respective lawsuits.

According to posts shared on Schinner and Miyoko’s Instagram and LinkedIn accounts, all claims by both parties have been withdrawn. No further details were shared.

“Miyoko and the company wish each other well as they go their separate ways,” the posts read.

Days after the company announced in February that Schinner was no longer involved in the company’s day-to-day operations(a move that had actually occurred over six months prior), Miyoko’s sued its former leader alleging poor leadership skills and the theft of company assets and recipes. In March Schinner retaliated with her own suit, claiming misogynistic treatment by the company’s board of directors and that her dismissal was in retaliation for her complaints of gender discrimination. Her suit also stated that the company must stop using her image and name.

In a May statement, Miyoko’s called Schinner a “true pioneer in vegan creamery products” with “integrity” and credited her contributions to the company. Schinner’s half of the statement said she “appreciates the dedicated team of people at Miyoko’s Creamer” who will be continuing her “legacy” through the production and selling of vegan creamery products.

On her LinkedIn post Schinner wrote “I am moving on. So important to close the door behind you so that new ones can open.” She added on Instagram that her future would include “friends, community and activism.”

Earlier this year Schinner released The Vegan Good Life with Miyoko, a cooking series on YouTube where she has over 20,000 subscribers.

Miyoko’s turned off the ability to comment on its LinkedIn and Instagram posts.

In tandem with the announcement, plant-based foods association founder Michele Simon shared on LinkedIn that she no longer is a member of the vegan creamery’s board of directors. During the past three months Simon has been an outspoken advocate for Schinner.

Simon’s LinkedIn entry for the role now includes “I was asked to join the board to support the company’s founder, Miyoko Schinner… In the 3 [plus] months I was on the board, it became painfully clear there would be no positive resolution and I was forced to step down.”

Brewers Association (BA) president and CEO Bob Pease shared a message of optimism during the Craft Brewers Conference (CBC) in Nashville.

While craft brewers continue to deal with increased costs, supply chain disruptions, labor shortages and more, Pease and the BA still “firmly believe that craft’s best days are ahead,” Pease said in his opening remarks during the conference’s general session on May 8.

To reach those best days, Pease encouraged members to collaborate both in innovation and in problem solving. That message was echoed at the close of the session during a panel with Pease and fellow trade group leaders Brian Crawford, president and CEO of the Beer Institute (BI) and Craig Purser, president and CEO of the National Beer Wholesalers Association (NBWA).

“We know when a consumer has an occasion … they have a choice, and we’ve got to be more relevant,” Purser said. “[The solution] I think it’s focus, it is execution, but I also think it is everybody collectively coming together and deciding we’re going to stop that trend of category decline.”

“Short term, there’s no doubt that hard liquor has been taking market share from us and part of it has been that beer has been somewhat asleep at the switch,” Crawford said. “We’ve been focusing inward and not watching what’s happening around us.

“We need to make sure that we’re aligned in fighting back and fighting for beer,” he continued. “The greatest opportunity is the fact that the three of us are on stage together and we’re singing off the same song sheet song sheet, and we’re aligned.”

While Pease and his compatriots preached for a positive craft beer future, BA chief economist Bart Watson gave craft brewers a bit of a wake-up call during his CBC keynote address. In it, he shared final numbers from the BA’s annual production survey, which indicate a “new normal” of slow to no growth for craft breweries.

Volume for BA-defined craft breweries in 2022 was flat yearover-year (YoY). The flat growth rate in a more mature marketplace – on the heels of two disrupted years due to the COVID-19 pandemic – has left craft brewers in a space where they need to innovate and reach new consumers to find future growth.

Over the last six years (2017-2022), Watson noted that the average annual growth rate over that period is +1.2%, a stark decline from growth rates in the previous decade.

“Those years of double-digit growth are clearly well in the rearview mirror,” he said. “And unless something changes, I don’t think we’re going to see them again anytime soon.”

Watson also added the caveat that “zero growth doesn’t mean no change,” and the industry is evolving with the convergence of non-alcoholic beverages with alcoholic beverages.

“All of the changes going on around us and beverage alcohol are one reason the craft industry growth is so slow, so we shouldn’t take this 0% number to mean that the industry is static,” he said.

Watson stressed multiple times that the things that got craft beer to the level it is now, with more than 9,500 breweries and over a decade of record growth, are not the things that will allow the segment to regain growth and momentum.

“The ideas that have gotten craft where it is were wonderful, they were ingenious, they changed the beverage alcohol world,” he said. “But that’s not the same thing as saying the ideas that got us here are the ones that are going to take us to the next level. We’re going to need new ways of thinking.

“I wish I could stand here and tell you that I have all the answers – that I know where the new occasions are, the new customers – but frankly, I don’t,” he continued. “What I do know is the first two-thirds of this talk showed us that if we continue to do things the same way we’ve been doing them, that’s the recipe for slow growth and stagnation.”

Watson’s suggestions:

• Expand where beer is sold, taking advantage of growing channels such as c-stores and reinvigorating “old channels” such as the on-premise;

• Create new beer occasions – like non-alcoholic beer has – and try to take back the occasions the spirits industry has taken over the last decade, including sporting events;

• Think differently about style trends, focusing more on what beer styles a craft brewery can make best and uniquely, rather than tying innovation to what style is growing the most in scan data – data that is often skewed by one or two companies anyway;

• And fi nd new consumers, including women and people of color, who are the largest demographics growing in beverage-alcohol and severely underindex in craft .

On the same day Founders Brewing announced it had permanently closed its Detroit location, a former employee filed a lawsuit against the company claiming the taproom’s work environment was “so objectively racially hostile that she had no choice but to resign.”

Plaintiff Naeemah Dillard filed a lawsuit in U.S. District Court in the Eastern District of Michigan Southern Division on May 1. On her behalf, attorney Jack Schulz detailed months of discrimination, unfair treatment and retaliation against Dillard in the complaint.

Dillard resigned April 23 and filed racial discrimination and retaliation charges with the Equal Employment Opportunity Commision (EEOC) on April 24, in which she alleged Founders violated Title VII of the Civil Rights Act of 1964.

Her complaint is the second high-profile lawsuit against Founders in which a Black employee alleged they were discriminated against at the Detroit taproom because of their race. Mahou San Miguel-owned Founders settled with Tracy Evans in his 2019 racial discrimination lawsuit, and closed the taproom for several months so it could handle “some challenges.”

“Throughout Ms. Dillard’s time as a manager at Founders’ Detroit Tap Room, she [was] utilized merely for the optics of having a Black manager while being treated completely different than her white counterparts,” Schulz wrote in a statement.

Dillard, a Black woman, was promoted to part-time taproom manager in July 2022 after joining the taproom staff as a server in June 2021. She was one of several managers, the rest of whom were white, and “was treated much differently than her Caucasian counterparts” “from the start,” according to the complaint.

Also on May 1, Founders announced it had permanently shuttered the Detroit taproom, which “has not been immune to the struggle to regain foot traffic after temporary COVID closure that have impacted restaurants and bars across the nation.” Founders added it was “working diligently to find new positions within the company for the [38] employees impacted by this closure.”

A press release issued to the media and social media posts announcing the closure made no mention of Dillard’s lawsuit, and Founders has since disabled comments on its Facebook and Instagram posts about the closure.

In a statement, Founders said it was “unaware” of Dillard’s complaint when it announced the taproom’s closing.

“We announced the closing to all of our Detroit staff on Monday morning, and did not learn about the lawsuit filed against Founders until that evening when a reporter contacted us,” the company said.

Since settling with Evans in 2019, the company has “instituted mandatory bias, discrimination and harassment training throughout our organization,” it said. “We have reexamined our policies and enacted new policies, along with implementing new procedures for the reporting of workplace concerns.”

The intent is to be completely transparent with the Rhinegeist team on the vision for the decade-old company and the changes being made to achieve that vision.

“We’re a much larger company than we were 10 years ago, stating the obvious, so some of the things really do need to have a little more rigor and discipline behind them,” Bankovich said. “That being said, it’s always been important to me to add a level of transparency and understanding so people understand the why behind what we’re doing, so that’s been my focus over the past six months.

“This complex, diverse company that we have here, everybody needs to take a pause and know that what we did for the past 10 years isn’t what’s going to take us to the next 10, and it’s worth re-evaluating things and asking questions and figuring out what else we can do together,” he continued.

Rhinegeist Brewery’s April was a month of “a lot of disruption” but also “minimal anxiety and the sense of calm,” following the appointment of chief commercial officer Adam Bankovich to interim CEO, Rhinegeist co-founder Bryant Goulding told Brewbound.

Bankovich, whose new title was announced April 26, takes over for Michael Parks, who served as CEO for two years. Parks was the Cincinnati, Ohio-based brewery’s first CEO after Goulding and co-founder Bob Bonder took a step back from the company’s day-to-day operations and began transitioning it to employee ownership.

“We hired a CEO recognizing that us founders weren’t the best managers,” Goulding said. “To step aside creates the space for someone to come in and manage the vision, the strategy to get there, develop leaders and deliver on all of the awesome potential that exists here at the brewery.

“For the next phase of Rhinegeist, we need to create a space for our leaders to build strategic direction, so that it is actually running itself and we’re not just dictating strategy, and then execution happens,” he continued. “That’s us still leading, but from afar, which is suboptimal.”

Bankovich joined Rhinegeist as CCO in October 2022, following a nine-year stint at Stone Brewing. While he carries the “interim” tag at the moment, the situation is more of a “living interview,” with Rhinegeist planning to explore outside options for CEO, but no intention to “definitely” find someone new, Goulding said.

“We’ll know when we know and then react accordingly,” he added.

Rhingheist is handling the CEO transition “a bit differently” than last time, “recognizing that what we want as a CEO is someone who is open and curious and empathetic and really human oriented,” Goulding said. Bankovich is someone who embodies “that spirit,” he added.

Employees were made aware of the transition on Monday, April 24, via email. Video interviews with different departments and leadership were held the following two days to share questions, department challenges and more, Goulding said.

Goulding and Bonder founded Rhinegeist with the intent to stay away from the “styrofoam-tasting speak” and culture of the corporate world. That goal led to the creation of “geistiness,” a word to describe the Rhinegeist spirit of embracing individuality, ambition and creativity. As craft beer tackles a particularly challenging time as a segment, Rhinegeist is looking into how it can evolve and grow its business, while still maintaining that culture.

“There is a geistiness that will always be a part of this place, and then there’s a mature stance on how do we really give our people a framework to excel so that we keep the culture of excellence,” Goulding said. “Because geistiness is cute, but excellence is what has brought us here, and what will get us there. And better defining there, and how we invest and resource in getting there, is what I’m excited about.”

Rhinegeist was the No. 23 largest Brewers Associationdefined craft brewery by volume in 2022, jumping five spots after ranking No. 28 in 2021. The brewery produced 103,561 barrels of beer in 2021 – the most recent production year available from the BA – increasing production +6% year-over-year.

Listen to the full interview with Goulding and Bankovich on the Brewbound Podcast. The episode is available on Brewbound.com and on popular podcast platforms, including iTunes, Google Play, Stitcher and Spotify.

The National Black Brewers Association (NB2A) announced its launch in May as the Brewers Association’s (BA) annual Craft Brewers Conference (CBC) kicked off in Nashville, Tennessee.

NB2A is a “first-of-its-kind non-profit organization” that aims to promote the Black brewing community; increase Black participation at all levels of brewery employment, “especially ownership and brewmasters;” develop and advocate for policies to bolster the community; and provide “historical context and legacy surrounding African American influence on brewing in the U.S.,” according to a press release.

The organization has tapped beverage industry veteran Kevin Asato as its first executive director. Asato’s career includes stints at PepsiCo, the former Dr Pepper Snapple Group, Bacardi and Republic National Distributing Company.

Asato made his first public appearance in the role in Nashville during Brewbound’s Brew Talks meetup.

“We want to be the most trusted and respected and impactful organization for Black brewers of America,” he said at Brew Talks. “We’re going to highlight the history and understanding of Black brewers, and from that history our mission is going to be driven towards, quite frankly, addressing the fact that only 1% of ownership is in the Black and African American communities, so we’re going to look to right that and increase that and be a little bit more rep of the demographics of the U.S.”

The NB2A’s inaugural year officers, as appointed by its board of directors, include:

• President Kevin Johnson, Oak Park Brewing;

• First vice president Garrett Oliver, Brooklyn Brewery;

• Second vice president Dr. J. Jackson-Beckham, Crafted for All;

• Treasurer Marcus Baskerville, Weathered Souls Brewing;

• Secretary Celeste Beatty, Harlem Brewing.

In addition to the aforementioned officers, the NB2A board of directors includes:

• Clarence Boston, Hippin’ Hops Brewing, Atlanta;

• Alisa Bowens-Mercado, Rhythm Brewing, New Haven, Connecticut;

• Denise Ford-Sawadogo, Montclair Brewing, Montclair, New Jersey;

• Rodney Hines, Métier Brewing, Seattle;

• Aaron Hosé, filmmaker;

• Teo Hunter, Crowns & Hops Brewing, Inglewood, California;

• Khris Johnson, Green Bench Brewing, St. Petersburg, Florida;

• Jon Renthrope, Cajun Fire Brewing, New Orleans;

• Dennis Malcolm Byron, Ale Sharpton beer media and content, Atlanta. Asato was joined on the Brew Talks stage by Beatty and Harris. The full discussion is available to watch on Brewbound.com.

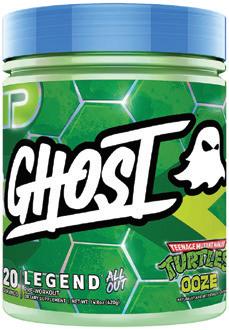

Turtle Power! GHOST has teamed up with Teenage Mutant Ninja Turtles to launch its latest limited-edition flavors, Ooze and Shredder. The former is available in the brand’s PreWorkout, Pump, Gamer and Gamer Non-Stim products, while Shredder is available in the GHOST’s Thermogenic product. Paying homage to the turtles’ favorite food, the brand has also released a GHOST x TMNT Pizza Box that contains all four Ooze-flavored products (4 tubs total) for $174.99. For more information, visit ghostlifestyle.com.

Just in time for summer, GNC has added Iced Tea Lemonade to its Beyond Raw powder lineup. The LTO is available in both Beyond Raw LIT and Beyond Raw LIT AF pre-workout formats designed to help consumers increase endurance and fight fatigue. Iced Tea Lemonade joins the Beyond Raw line’s existing flavors, which include Fruit Punch, Gummy Worm, Icy Fireworks, Strawberry Lemonade and Raw Mango. The new offering is available in-store and online for $44.99 per 14.5 oz. tub. For more information, visit gnc.com.

Prebiotic soda maker Poppi has announced the launch of its newest flavor, Grape. The nostalgic new offering provides a fresh twist on a childhood favorite with functional benefits and a hint of lemon “for a non-traditional flavor.” Each 12 oz. can has 25 calories and 5 grams of sugar. Poppi Grape is now available on Amazon for $28.99 per 12-pack. For more information, visit drinkpoppi.com.

In anticipation of the UEFA Champions League Final, Pepsi has rolled out limited edition cans featuring star players like Lionel Messi, Leah Williamson and Vini Jr. According to the brand, the cans were “designed as a canvas to capture the human emotion and energy that lives in football lovers everywhere.” As Pepsi is an official partner of the UEFA Champions League and Women’s UEFA Champions League, fans will be able to pick up the limited edition cans in countries across the world, including the U.K. For more information, visit pepsi.com.

Paying homage to the ‘King of Rock ‘n’ Roll’s favorite snack, Elvis Whiskey has released ‘Midnight Snack,’ a peanut butter, bacon and banana-flavored expression. The new whiskey joins the brand’s flagship offerings, Elvis ‘Tiger Man’ Tennessee Straight Whiskey and Elvis ‘The King’ Tennessee Straight Rye Whiskey. Bottled at 70 proof, ‘Midnight Snack’ is available at retailers nationwide for $34.99 per 750ml bottle. For more information, visit elviswhiskey.com.

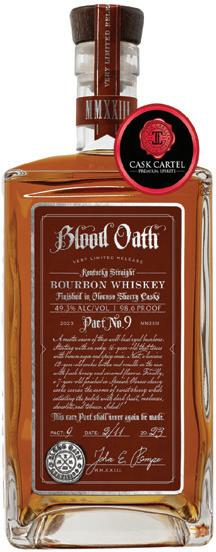

Lux Row has announced the launch of its Blood Oath Pact 9 Kentucky Straight Bourbon Whiskey. The LTO combines a 16-year-old ryed bourbon, a 12-year-old ryed bourbon and a 7-year-old ryed bourbon finished in oloroso sherry casks from the Sherry Triangle region in southwest Spain. Bottled at 98.6 proof, Lux Row Blood Oath Pact 9 Kentucky Straight Bourbon is available for a SRP of $129.99 per 750ml bottle. For more information, visit luxrowdistillers.com.

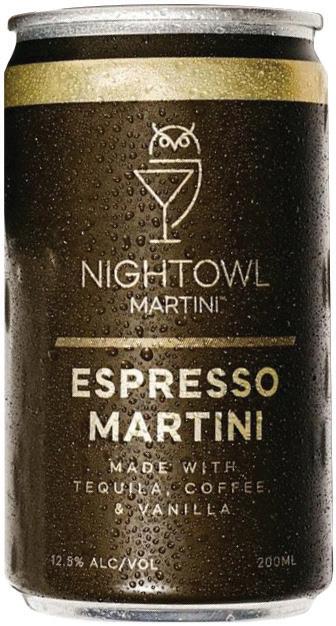

NightOwl splashed into the red hot espresso martini category with its two debut products: Vodka Espresso Martini and Tequila Espresso Martini. Canned at 12.5% ABV, both styles are offered in 4-packs of 12 oz. cans for a suggested retail price of $19.99. NightOwl’s espresso martinis are currently available in 38 states via its direct-to-consumer website. The brand also plans to self-distribute across New York and Florida via alignment with Park Street. For more information, visit drinknightowl.com.

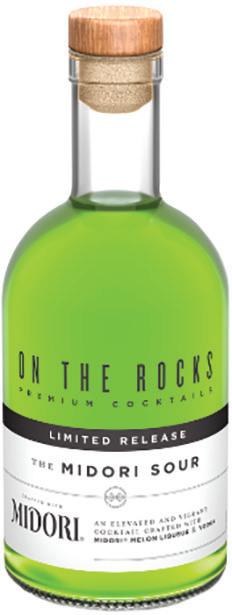

OTR Premium Cocktails has unveiled the first Midori Sour offered in a RTD format, the brand claims. The limited edition cocktail features midori melon liqueur infused with Japanese melons, vodka and notes of lemon and lime. Bottled at 20% ABV, the OTR Midori Sour is available in 375ml and 200ml formats in select markets nationwide. For more information, visit otrcocktails.com.

Grey Goose is capitalizing on the nationwide martini resurgence with the launch of a readyto-pour Classic Martini Cocktail. The new offering – crafted with Grey Goose vodka, dry

French vermouth and orange bitters – is available in two formats. The first (375 ml) serves four to five martinis while the second (750ml) serves eight to ten. The bottles retail for $16.99 and $27.99, respectively. For more information, visit greygoose.com.

So Delicious Dairy Free has splashed into the evergrowing oat milk category with the release of its Organic Oatmilk in Original and Extra Creamy flavors. The new offering joins the dairy-free brand’s other beverage offerings including coconut milk, wondermilk and coconut milk creamer. So Delicious Organic Oatmilk is now available at retailers nationwide for a SRP of $5.99 per 59 oz. carton. For more information, visit sodeliciousdairyfree.com.

Nutpods has launched its first sweetened oat creamer, Oat Brown Sugar. According to the brand, the new variety was the “perfect flavor to expand oat into our zero-sugar sweetened line.” The brand’s existing lineup of oat products includes Unsweetened French Vanilla Oat Creamer, Unsweetened Cinnamon Swirl Oat Creamer, Original Barista Oatmilk and Cinammon Dolce Barista Oatmilk. Nutpods Oat Brown Sugar Creamer is available on the brand’s website as well as Amazon for $14.95 per 3-pack of 11.2 oz. cartons. For more information, visit nutpods.com.

Portland, Oregon-based CBD beverage maker Aprch announced the release of its newest limited edition flavor, Huckleberry. According to the brand, the new variety was inspired by the mountains of the Pacific Northwest and features tasting notes of freshly picked wild mountain huckleberry and vanilla. Each 12 oz. can contains 25mg of broad-spectrum hemp extract as well as Vitamin C and L-theanine. Aprch Huckleberry is available for purchase via the brand’s website for $35.99 per 12-pack. For more information, visit drinkaprch.com.

Aptly timed for 4/20, ayrloom launched a THCinfused lemonade in New York dispensaries. Each 12 oz. can contains a 1:1 ratio of 5 mg of THC and 5 mg of CBD and the drinks retail for $16 per 4-pack. Lemonade joins ayrloom’s existing lineup of Pink Grapefruit, Pineapple Mango and Black Cherry flavors. For more information visit ayrloom.com/.

Cannabis-infused soda brand CommCan has launched SIP Terp Tonic into Massachusetts dispensaries. Available in a single SKU, Pacifier x Ap-

ple Juice, the soda aims to highlight and celebrate the flavors of cannabis rather than mask them. Made with nano-emulsified THC, the drinks rolled out this week in time for 4/20. For more information visit commcan.com/.

Portland, Oregon-based small batch coffee company Water Avenue Coffee has introduced an RTD organic cold brew coffee line, ZigZag. The drinks are available in Original and Nitro varieties in 12 oz. slim cans, as well as 5 gallon kegs. ZigZag can also be purchased in concentrate form for wholesale. For more information visit https://wateravecoffee.com/.

BLK & BOLD unveiled its newest specialty offering, Nitro Sweet Cold Brew. The new variety joins the brand’s existing lineup including Unsweet Cold Brew, Sweet Cold Brew and Nitro Caramel Cold Brew. BLK & BOLD Nitro Sweet Cold Brew will be available at 247 Target stores nationwide for a suggested retail price of $3.29 per TK can and $10.99 per 4-pack. For more information, visit blkandbold.com.

Starbucks Coffee shared the latest additions to its long-running RTD partnership with Pepsi, which includes two non-coffee and non-caffeinated drinks from the cafe menu: Pink and Paradise. Other new drops include mini-sized Frappuccinos, Double Shot Caramel and a pair of Iced Americanos in multi-serve bottles. For more details, athome.starbucks.com.

Natalie’s Orchid Island Juice Company has expanded its lineup of juice blends with two new additions, Fresh Pressed Tomato Reishi and Tangerine Pineapple Aloe Juice. The former combines tomato juice, Himalayan salt, black pepper juice and Reishi mushroom to support the immune system and reduce stress. The latter features oranges, tangerines, pineapples, aloe vera and sweet basil. Both juices are available at select Publix stores and via the brand’s website. For more information, visit orchidislandjuice.com.

Minute Maid added Pineapple Horchata 52 oz. multi-serve bottle to its Latin American-inspired Aguas Frescas line. The new offering features a “twist on the traditional sweet and creamy flavor of horchata with a touch of tangy pineapple flavor,” according to the brand. The Aguas Frescas line also features 16 oz. cans available in three flavors: Hibiscus, Mango and Strawberry. For more information, visit minutemaid.com.

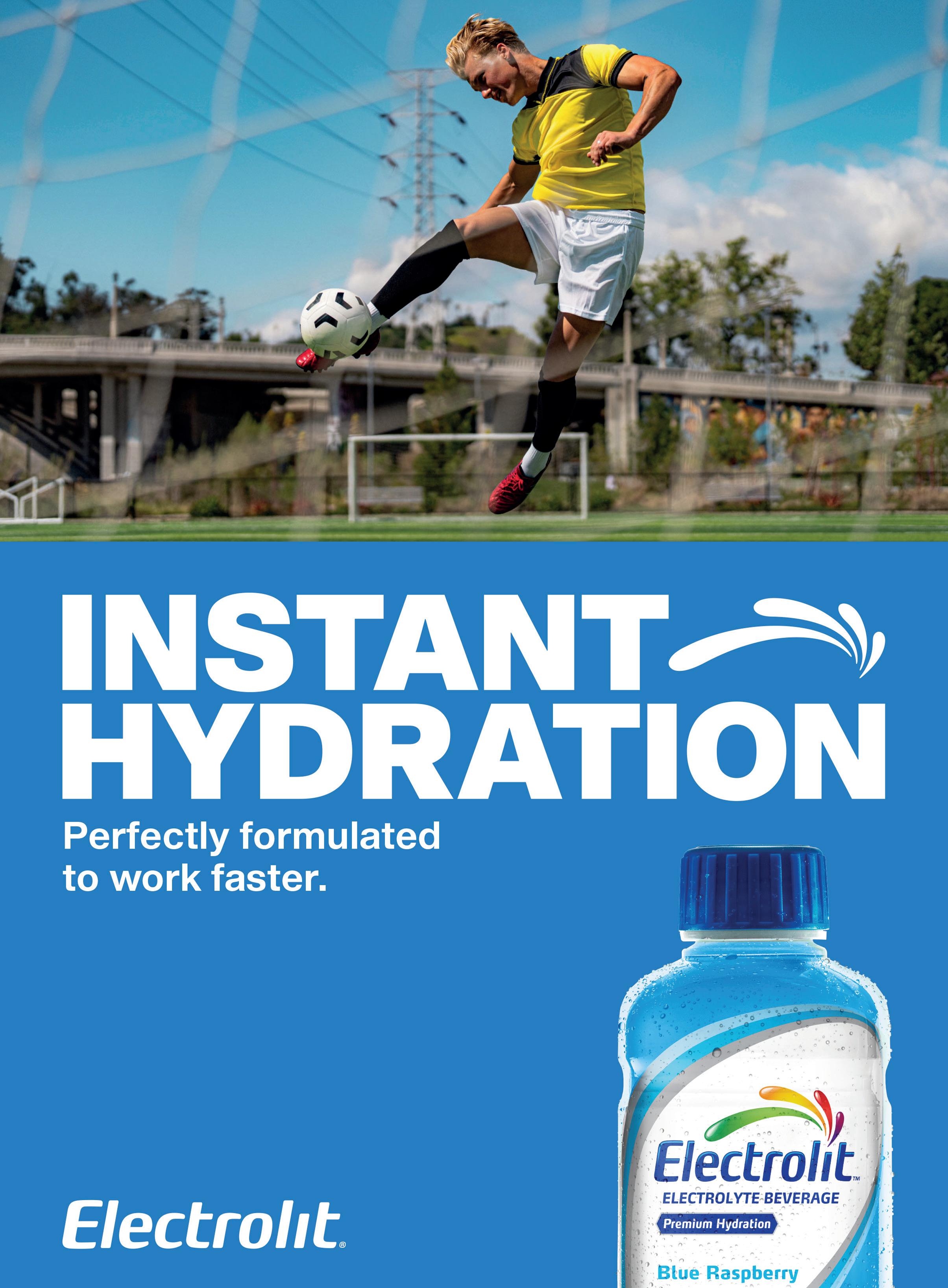

PRIME time? It looks that way — the sports drink powered by a partnership with Logan Paul has had a massive first year, shooting up to close to $275 million in sales with more to come as it continues to plow into conventional channels, particularly convenience. Electrolit has taken a much longer path but is cruising in the fourth place spot, up 29% over the past year from a solid base and leading a pack of other mega-strength functionals like Biolyte, Pedialyte and Hoist. Meanwhile, if powder brand Liquid IV was a liquid, its sales would be the same as PRIME’s. At $275 million, it’s far and away the powdered sports drink mix leader.

SOURCE: Circana OmniMarket™️ Shared BWS - 52 Weeks Ending 04-23-23

The Specialty Food Association’s Summer Fancy Food Show, the largest U.S. show devoted exclusively to specialty foods and beverages, is set to return to The Big Apple in June.

The 2023 edition of the show will take place in person on June 25-27 at the Javits Center in New York City and will feature a variety of educational seminars and exhibit halls. Highlights of the Summer Fancy Food program include:

• Celebrity chef Giada De Laurentiis will deliver a keynote address discussing the emerging trends in the food space that are propelling her businesses, including restaurants, catering, direct-to-consumer Italian food and lifestyle website Giadzy.

• SFA’s panel on the rise of specialty in alternate channels, where attendees will hear from buyers and decision makers who are redefining how food is selected, merchandised and sold.

• Ori Zohar, co-founder and CEO of social enterprise Burlap & Barrel, will present Perfect Pairings: Synch Your DTC and Grocery Strategies. During the session, he will cover the best uses and practices for each channel and way to build your direct-to-consumer following through product offerings and programs.

The show will also feature a startup pavilion, state and international pavilions, what’s new and what’s hot showcases, end-of-show food rescue and donation, and more. Additionally, scheduling will include ample time for networking and peer feedback from exhibitors and attendees.

In May 2019, around the height of Bang Energy’s rocketship rise towards becoming a billion dollar brand and the number three player in the energy drink category, Jack Owoc, the bombastic founder and CEO of Bang parent company Vital Pharmaceuticals (VPX) agreed to an email interview with BevNET to discuss the rapid growth and its ongoing legal battles with its chief rival, Monster Energy.

At the time, Owoc wrote that Bang had surpassed then-independent competitor Rockstar Energy in sales, achieved its first $5 million sales day, and opened a 250,000 square foot warehouse with seven canning lines, capable of producing 2,000 cans per minute. The company certainly had every reason to invest in expansion: In the 52-week period ending June 15, 2019, per NielsenIQ, retail dollar sales of Bang grew 724.7%, while its top competitors were facing muted

growth or declines. Within the fitness and performance energy niche, the brand’s only serious competition was Monster’s newly launched Reign, which had ignited a fresh set of lawsuits between the companies over alleged trade dress infringement (which Monster ultimately won).

took over Bang’s position as Pepsi’s exclusive energy drink distribution partner last year. Bang’s dollar sales performance was matched by its volume, which fell -61.4% in the two-week period. Extended to 52-weeks, Bang’s dollar sales were down -33.5% for the full year with volume at -35.7%.

As of this writing, Owoc is no longer with the company he founded and VPX is set to go up for auction – originally scheduled for April, it was pushed back to this summer. As the company’s struggles have been met with intrigue, opportunism and occasional schadenfreude, understanding how the billion dollar brand fell apart is just as important as knowing what will happen next.