BACKIN BUSINESS FULLYUP & RUNNING ANNUALREPORT2022

From zero to one hundred and beyond in just one year… That’s perhaps the best way to summarise 2022. Our conversation below with Paul Riemens (CEO) and Maurits van der Sluis (COO) barely mentions January and February. The first two months of the year under review saw the doors of the RAI remain firmly closed. Thankfully, that feels like a long time age ago now and events have since returned to a degree that has exceeded all expectations. One thing’s for sure… RAI Amsterdam is very much back in business.

How did you personally experience 2022?

Paul: “For me, the past year was all about resilience. The way people and markets recovered could be felt in so many places, including within the walls of our exhibition and conference centre.”

After a brief moment of thought, Maurits continues: “We were always convinced that COVID would not limit the desire and necessity for physical meetings in the long term Naturally, everyone hoped that business would return soon and we fought extremely hard to make it so To see the results pan out has been a wonderful and experience ” “Yes,” Paul agrees, ”the increasing excitement in the runup to an event, the opening itself, the enormous pleasure of people bumping into each other again on the exhibition floor for the first time in two or sometimes even three years The rich sense of satisfaction when looking back on a successful event To experience all this as a team again has been amazing ”

Do you have any specific moments in mind?

Paul: “We have facilitated a number of sector-leading events over the past year, such as PLMA, Money20/20 Europe, IBC and METSTRADE These international gatherings serve as a central meeting place for the entire industry but I’m not sure it’s fair to single one out ” His hesitation doesn’t last long “Ok, let’s say IBC This major broadcasting convention was celebrating its 30th anniversary in the RAI I found myself immensely enjoying the return of such a world-class event to Amsterdam after a hiatus of two years It was wonderful to welcome so many professionals from around the world to the RAI, to our city "

Maurits: “I’ve attended nearly all the exhibitions and conferences held in the RAI over the past year The joy and energy of physical meetings was clearly perceptible during them all Naturally, I enjoyed the RAI’s own titles hosted here and abroad, including Intertraffic, Interclean, Aquatech, Greentech and METSTRADE One of the stand-outs for me was TwitchCon: this hybrid event in a cheerful and colourful setting for the global livestream and gaming community was truly something different.”

The RAI was still completely closed in early 2022. Take us back to the reopening.

Maurits: “It feels like a lifetime ago All our efforts during 2020 and 2021 had gone into moving forward planned events We also had some successful acquisitions during that time, adding new international exhibitions to the agenda. This meant that our 2022 programme was bursting with events. From the moment the Dutch government reopened access to conferences and exhibitions in February we hit the ground running.”

Paul: “Some organisers had too little time to prepare their event for the second quarter of the year. Or too little

certainty, because behind the organisers there’s an entire sector of exhibitors and visitors who can’t easily be mobilised in a matter of weeks. Nevertheless, business returned and did so incredibly quickly in hindsight. By the second quarter we faced the challenge of upscaling at full speed ”

What did this challenge entail?

Paul: “A key factor was to ensure that as an organisation we had enough people in place who could quickly get used to working together again. We had taken the decision to reorganise during the pandemic to address the reality and uncertainty it was causing. This meant saying goodbye to many colleagues. Others left while our doors were closed, flowing into other sectors This also applied to the entire team of temps Over the past year we have expanded our formation, welcoming on balance over 100 new employees in 2022 Our suppliers and partners went through a similar process It was a huge operation, but the resilience shown by our organisation, employees and suppliers was impressive ”

Was it difficult to find staff in the tight labour market?

Paul: “To be honest it wasn’t too bad, especially compared to the stories I’ve heard The RAI has a good reputation so, with the exception of a few specific positions, we did pretty well in attracting the right people ” Maurits: “Working at the RAI is a challenge and a great experience Young people are given lots of responsibility and can learn fast This is all due to the speed of events: preparation, realisation and evaluation come after each other quickly ”

Over the past years the RAI has placed itself more at the service of the city Will it continue to do so?

Maurits: “We did a lot for the GGD municipal health service, facilitating them in many ways and becoming the largest vaccination station in the Netherlands In partnership with the municipality we also provided space to the Red Cross as they supported refugees from Ukraine The RAI functioned as a key coordination centre, and we welcomed some 200 refugees a day – a process that continued 24/7 We also provided support on other fronts ” Paul: “And we worked on our future vision for 2030 As a location, too, the RAI aims to structurally improve its connections to the city We want to be more of a place where locals eat, exercise and enjoy cultural activities Our goal is to better serve visitors to and residents of Amsterdam and enhance the liveability of the RAI area For this purpose, we started a multifunctional area development programme to help us prepare the convention centre for the coming decades, and make use of all the social and societal opportunities in a sustainable way ”

How do you see 2023 panning out and what are your personal goals?

Maurits: “I have a positive outlook and am sure this will be a good year My goal is to ensure stability in our operations and bring an end to the hectic nature of such a rapid return to business In those moments we saw that the pressure on the organisation was too great for our people and to consistently deliver the quality we expect This is something we’re working on and we do so by learning from the unique year that was 2022 ”

Paul: “Our confidence in the future is strong After all, very few companies could go from zero to one hundred in such a short time like we did. Not all exhibition and conference organisations recovered so quickly and fully. The RAI is privileged to facilitate many events that are world leaders in their sector. The added value of online working and meeting has proven itself in the past two years, but the moments when a sector comes together physically has proven to still be the best experience. They are so valuable that no one wants to miss out.”

Any final thoughts?

Paul: “Yes, I would like to thank our people for the responsibilities they took on and their incredible perseverance. None of the above would have been possible without them.”

Maurits: “Absolutely. Together we have ensured that the RAI is back in business.”

RAI Amsterdam is an international exhibition and conference organisation. Its convention centre in Amsterdam – known simply as ‘the RAI’ – facilitates a wide range of events from small to large. In addition, RAI Amsterdam owns a range of trade and public events which it organises onsite and in other cities outside of Europe.

RAI Amsterdam convention centre

Our venue on the Europaplein square in Amsterdam hosts a large number of events every year From trade shows and congresses that fill the RAI with 50,000 people to meetings of ten: everything is taken care of down to the smallest detail as the RAI ensures a hospitable reception All the multifunctional facilities one could need are available, and we continuously strive to increase sustainability and enhance our business operations, products and service provision

RAI Amsterdam is located on the edge of the city centre next to the A10 ring road, and is easy to reach by air, public transport and car The Amsterdam RAI train/metro station and Europaplein metro station are adjacent It takes just ten minutes to get to the main hall at Schiphol Airport and even less to the heart of the Dutch capital At just four kilometres, the distance from the RAI to the middle of the city centre is very short and visitors can easily combine their business trip with a pleasant urban stay in Amsterdam

RAI Amsterdam has a portfolio of its own events that are organised in Amsterdam and other convention centres outside of Europe We are active in various key sectors including professional cleaning, remanufacturing, traffic technology, maritime, water technology and horticulture We also have our own national events, including trade exhibitions such as Horecava (food service and hospitality) and consumer events like the Huishoudbeurs (lifestyle) All in all, the RAI has a well-rounded portfolio of titles which generates turnover, protects our market share and facilitates knowledge sharing, network expansion and business in the relevant sectors

The (international) meetings we organise and the networks which are created as a result are crucial to the exchange of knowledge, information and capital They enable us to contribute to the (sustainable) development of people, markets and society, as well as meeting the United Nations’ sustainable development goals (SDGs) in various sectors

Sustainable and social business

We are constantly focused on our ecological footprint and social environment. Preventing any damage or nuisance from goods, visitor flows and noise is a major spearhead At the same time, we continually seek out ways to increase our contribution to society, for instance by working with local suppliers and social partners, and by helping organisers develop sustainable and responsible events

Value for the region

Hotels, restaurants, museums, transport operators and suppliers all benefit from the exhibitors and visitors who come to the city for the (often international) exhibitions, conventions and events in RAI Amsterdam Business visitors who stay for a few days are also good for the city and the wider region, contributing more to the local economy on average than recreational tourists

RAI Amsterdam has the following certifications:

Recognised conference venue

YOIN excellent meeting places (previously 5-hammers)

AIPC Gold

EarthCheck 4 0 Platinum*

ITs (Integrated Access Standard)

ISO-9001 (Quality management)

ISO-14001 (Environmental management

UN Global Compact

BREEAM-Excellent certification (for construction of the Amtrium)

Recognised training company (Samenwerkingsorganisatie Beroepsonderwijs - Bedrijfsleven)

RAI Amsterdam aims to be a respected and profitable event location while contributing to the wellbeing and development of visitors, the city and society as a whole. Our primary commercial focus is on multi-day international business-to-business events using the appeal and reachability of Amsterdam as a basis. From a social perspective we are especially keen to contribute to the city and local region. The RAI is for everyone and we set ourselves apart by offering modern, innovative and sustainable facilities and a genuinely hospitable organisation.

To clearly communicate and implement our strategy we have defined the following six pillars:

Portfolio development: we work on the ongoing development, purchasing and acquisition of (new) titles, with a focus on business-to-business events in Amsterdam and abroad;

Client solutions: we provide clients with an even better service by constantly expanding our service portfolio and helping them realise safe, responsible and hospitable events;

Data & digitalisation: we apply the latest technological developments to generate value for our clients and work more efficiently We also use it to develop new business models;

Multifunctional area development: we are a meeting place for everyone We aim to facilitate business meetings and spontaneous encounters at our unique location in the heart of Amsterdam The RAI should be an attractive environment before, during and after events;

Building & infrastructure: we offer an accessible and safe place for valuable meetings We increase the available square metres of exhibition space within the existing options and substantially improve logistics and traffic management The location is fully equipped for business and leisure purposes;

A learning organisation: we challenge ourselves to constantly work in smarter ways and ensure the best possible working environment for our employees

The Executive Board report provides details for each pillar, including the related developments in 2022 Corporate Social Responsibility (CSR) is an integral part of our strategy and the six pillars: we aim to do what we do in a socially responsible way We work with clients and suppliers every day to integrate CSR within our operations and are proud that many of our activities have social value This also allows us to create added value for the city and society, as is further detailed in a separate section of the Executive Board report Recognising that our operations make use of resources, take up space, generate noise and can potentially impact society in other ways, we work hard to minimise any effects This issue is also clarified further elsewhere in this report

The diagrams on the following pages show how we create value for our stakeholders and to which Sustainable Development Goals we mainly contribute

The statutory Executive Board consists of two people.

Paul Riemens (1962), CEO

Appointed to first term on 7 April 2016. Reappointed on 16 December 2019 to second term until 16 December 2023. Dutch national. Areas of expertise: Finance, HR, ICT, Legal and Venue. Supervisory Board (RvC) memberships: none.

Additional functions: member of the Supervisory Board (RvT) of NEMO Science Museum, member of the Advisory Board of the University of Amsterdam for economics & business, chair of Concours Hippique International Jumping Amsterdam.

Maurits van der Sluis (1965), COO

Appointed to first term on 7 April 2016. Reappointed on 16 December 2019 to second term until 16 December 2023. Dutch national. Areas of expertise: Marketing & Communications, Commercial, Events & CSR. Supervisory Board (RvC) memberships: none.

Additional functions: chair of The Leading Centers of Europe, treasurer of the Voorfinanciering- en Garantie Fonds foundation, vice-chair of Nederlandse Ski Vereniging, vice-president EMECA (European Major Exhibition Centre Association), board member of Stichting Vrienden Stadsarchief Amsterdam, member of the Supervisory Board (RvT) of Stichting Cardiologie Centra Nederland, ambassador for Ambassadeurs tegen Armoede

The Supervisory Board consists of five members.

Otto Ambagtsheer (1969), chair

Appointed member to first term on 1 November 2020 until first general meeting after 1 November 2024. Dutch national. CEO of VIA Outlets.

Annemarie Macnack-van Gaal (1962), vice-chair

Member of the Remuneration Committee, member of the Selection and Appointment Committee Appointed on 15 September 2015 Reappointed to second term on 16 December 2019 until first general meeting after 16 December 2023. Dutch national. Chair and speaker, columnist for the De Telegraaf newspaper, member of Supervisory Board of Pathé Holding BV, member of Supervisory Board of Stichting Waarborgfonds Eigen Woningen, board member of Start Foundation, member of Committee of Recommendation for the foundation Het Vergeten Kind, member of Advisory Board of Dienst Uitvoering Onderwijs (DUO), ambassador for SOS Kinderdorpen.

Michiel Boere (1982)

Chair of the Audit Committee. Appointed to first term on 1 November 2020 until first general meeting after 28 October 2024. Dutch national. Vice President Finance at Uber Delivery.

Mariëlle de Macker (1967)

Chair of the Remuneration Committee Chair of the Selection and Appointment Committee Appointed to first term on 17 March 2017 Reappointed to second term on 21 April 2021 until first general meeting after 21 April 2025 Dutch national. Owner of MCKR-in-business. Advisor Human Capital & Leadership to Innovation Industries, member of Supervisory Board of MSD Animal Health, board member of Talent to the Top foundation, member of Supervisory Board of Teamshape, vice-chair of Supervisory Board of Maastro Clinics, vice-chair of Supervisory Board of Maastro Protonen, vice-chair of Supervisory Board of Stichting Cancer Foundation.

René Takens (1954)

Member of the Audit Committee. Appointed to first term on 1 October 2021 until first general meeting after 1 October 2025 on recommendation of shareholder RAI Association. Dutch national.

The RAI organised and facilitated a total of 300 events in 2022 By facilitating we mean that external organisers use our exhibition and conference venue in Amsterdam for their event while we provide an hospitable welcome This was the case for over 90 percent of events held in the RAI, with 23 events being organised by RAI Amsterdam Twenty of these took place in the RAI itself with the other three being organised abroad

Nearly 12,000 exhibitors presented their products, services, concepts and ideas during these events, 72% of which came from abroad This underlines the largely international nature of events in RAI Amsterdam

Some 1.19 million visitors were welcomed in 2022, less than the previous year total of 1.66 million. RAI Amsterdam was largely closed to the public in 2021 due to COVID measures and many of the visitors to the RAI came to get tested for the virus and/or vaccinated (1.14 million compared to 285,000 in 2022).

Satisfaction scores among our customers are a key indicator which we gauge structurally using a grade scale that ranges from 1 (minimum score) to 10 (maximum), with 6 considered sufficient. The organisers gave RAI Amsterdam an average of 7.7, the exhibitors 7.9 and visitors an 8.0. There are no comparative figures for 2021 when the venue was mostly closed. Although pleased with the scores we received, the hectic nature of 2022 meant we were unable to provide the desired quality at all times. It is pleasing then that our customers graded their experiences as ‘good’ in such circumstances

The Netherlands is doing well on the international trade and industry stage To remain competitive the government is investing in various ‘top sectors’, and works closely with businesses and scientists This impressive collaboration has received praise from around the world The economy is also strengthened by this partnership via innovations, the utilisation of international opportunities, the resolution of social challenges, the increase of human capital and investments in scientific research

RAI Amsterdam represents, connects and strengthens the Dutch top sectors and their ecosystems by stimulating knowledge exchange, innovation and social initiatives This makes the RAI – and the city of Amsterdam – a meeting place of the highest stature, a place where government officials, scientists, business people, subcontractors and other key players join forces to share knowledge, do business and work together

Examples of such events in 2022 include:

International medical science congress on Multiple Sclerosis Sector: Life Sciences & Health

Thousands of scientists from around the world came to Amsterdam in October to participate in ECTRIMS, with around 7,000 physically in the RAI and some 2,000 participating online

The Amsterdam Metropolitan Region is at the heart of the European Life Sciences & Health sector, with a high concentration of research institutes, universities, medical centres, businesses and startups They work together and form partnerships in specialised hubs, and use the most advanced technology and AI to resolve future challenges in the field of life, science and health Recent research shows that Amsterdam holds third place worldwide when it comes to cities with the most scientific influence, scoring especially high in the field of Life Sciences & Health

Largest Fintech event

The future of money and payments was showcased and discussed in June during the annual Money20/20 event, where professionals in payment systems exchanged experiences, enhanced their knowledge and met with existing and new relations All major European banks were represented, as well as new and well-known financial and legal institutions such as Visa, Klarna, Adyen and PayPal.

Amsterdam is considered the home base for Money20/20 due to the city’s leading position as a financial centre and hub. Amsterdam is the second most important FinTech city in the EU after Berlin and holds 12 spot in the world rankings. th

Media, broadcast and tech

Top sector: Creative

In September IBC celebrated its 30th anniversary in the RAI Over 37,000 visitors from 170 countries came together in Amsterdam to expand their networks, share knowledge and work together in person. More than 250 world-class speakers addressed the full theatres and halls, and over 1,000 leading exhibitors presented innovations and advanced technologies. This was the first physical edition of IBC since 2019.

Over 200,000 people from more than 20 nationalities work in the creative industry in the Amsterdam region. They create everything from games to memorable global ad campaigns, and have helped the region build an international reputation for creative excellence, with an eye for sustainability and inclusivity.

In 2022 we organised a total of three events abroad, with others being cancelled:

COVID measures in Shanghai, Hangzhou and Guangzhou meant that Aquatech China, Interclean China and ReMaTec Asia could not proceed.

The hurricane-force storm Ian which hit Florida in late September resulted in the cancellation of IBEX 2022, the main B2B event for pleasure craft in the USA, in order to ensure the safety and wellbeing of all team members, exhibitors and visitors. The exhibition floor had nearly sold out, with 170 exhibitors from 15 countries including Canada, the US, India, Turkey, Denmark, France, Germany, Italy Spain, Belgium, Mexico and the Netherlands due to take part.

The economic situation and associated hyperinflation led to the decision to cancel Intertraffic Istanbul

Our events abroad in 2022 were therefore limited to Mexico, which hosted the spin-off-editions Aquatech Mexico, Greentech Americas and Intertraffic Mexico.

RAI Amsterdam is constantly working to enhance its portfolio with leading events In 2022 it was announced that various new events had chosen Amsterdam and the RAI, and we also introduced a new event of our own

New in 2023: Coldwater Seafood

In 2022 we worked on the world’s first international trade exhibition and conference dedicated to coldwater fisheries. The event will attract exhibitors from the main fisheries and aquaculture sectors in Iceland, the Faroes, the UK, Ireland, Norway, Sweden, Denmark and the Netherlands. Coldwater Seafood is a joint project between RAI Amsterdam and the renowned Norwegian company Aqkva. See https://coldwaterseafood.eu/ for more details.

“Having an expert partner like RAI Amsterdam offers extra assurance that Coldwater Seafood will be the networking hub for the coldwater fisheries sector

Vidar Onarheim CEO of AqkvaNew in 2024: HLTH Europe

In 2024, HLTH will bring the European ecosystem of health care together in Amsterdam to tackle the most complex challenges and identify the most promising opportunities in health care HLTH is the world’s largest event for innovation in the health care sector, and its event in Las Vegas in 2022 broke all records It was during this fifth edition of the event that the launch of HLTH Europe was announced. HLTH Europe will take place in RAI Amsterdam from 18 to 20 June 2024.

“

As one of the most centrally located cities in Europe, with a world-class venue, Amsterdam has been selected as the home base for HLTH Europe

Jonathan Weiner CEO of HLTH IncRAI Hotel Services is the largest accommodation intermediary in Amsterdam and the surrounding region, mainly booking hotel reservations for conferences, exhibitions and other events. Its team looks for the perfect places to stay and uses its extensive knowledge and many years of experience to offer organisers, exhibitors and visitors the best hotels at the most favourable prices. RAI Hotel Services offers additional support, provides a custom range of hotels, and offers accommodation at the lowest prices and best conditions during events via an online application that allows clients to make changes if necessary

Bookings gradually started coming in after the RAI reopened in February 2022, with RAI Hotel Services booking more rooms in June than for the 2019 editions of the same events. A total of 26,936 bookings were processed in the year under review, involving more than 89,625 overnight stays. In the last fully operational pre-COVID year of 2019 we processed 31,500 bookings, involving over 105,000 overnight stays

The food & beverages experience is an important component of every exhibition, conference, stage show or other event RAI Amsterdam facilitates all aspects of this for organisers, exhibitors and visitors alike From stand socials to professional baristas and exciting cocktail shakers to fully catered receptions and gala dinners, we can provide a custom solution for any occasion ourselves and with selected suppliers

Heartwarming Amsterdam

Our ‘Heartwarming Amsterdam’ catering concept features a deliberate choice to work with regional products and make sustainable choices and partnerships All catering requests can be met using regional and/or seasonal products, with a clear positive impact on society being assured by working with suppliers from the region and other measures

Former Holland Restaurant becomes 'The Food Collective’

A new restaurant concept was introduced in 2022 The Food Collective accommodates three unique formulas: the Sushi Club, with a rotating sushi belt; the Twelve Restaurant, with a delicious lunch menu and accompanying wines; and the Balcony Bar Lounge, which serves a great cup of coffee, beers and snacks

In the run-up to Sibos 2022, an international event for financial services, the organisers and our Food & Beverage team expressed their joint ambition to focus on sustainability and quality The partnership resulted in new themes and creative dishes for a fully catered Food Court, including Plant Based Bars Our Basement Chefs served up a tasty vegetarian and vegan catering range, much to the liking of exhibitors and visitors alike.

Exhibition organisers and exhibitors are supported by the Design & Build team to make the most of their event A wide range of services include developing floor plans and stand design & construction to setting up registration rooms, hospitality suites, pods and internet zones

In addition to personal service, we offer many different products and services via our webshops Exhibition organisers regularly choose a total solution in which modular stand construction is often an attractive choice – we build a wide range of stands in a relatively short time while maintaining a focus on sustainability

Of all the stands placed in the RAI in 2022, 63% were supported by Design & Build. IBC also chose to have the team realise a large part of the stand construction in 2022. It included 1,200m2 of balcony suites, 1,000m2 of modular stand construction and 2,800m2 of uniform stand construction, all of which were completed to the full satisfaction of organisers and exhibitors The partnership will therefore be continued for the 2023 edition

Over 300 exhibitors at METSTRADE 2022 were given the opportunity to visualise the graphics for their stand using a 3D tool. This resulted in a 31% increase in the number of orders % compared to 2019 (128 in 2022 versus 98 in 2019), with graphics printed on reusable materials. The new tool will be rolled out further in other exhibitions in 2023 The METSTRADE 2022 exhibition floor also featured a new modular stand for 2023 that will be used in the SuperYacht Pavilion at the next edition

Great connection anywhere and at any time with wifi6 Wi-Fi connectivity is a constant challenge for exhibition and conference venues. Events require a huge network capacity and that network has to be suitable for the number of guests and devices that need to connect. In addition, no two events are the same and each has its own unique IT needs and setting requirements. In 2021 we started upgrading and stabilising our Wi-Fi network using the latest equipment and proven technology All our halls were equipped with wifi6 in 2022, which is the fast new standard for wireless internet communication

In addition to the fast wifi6 standard for wireless internet communication, OpenRoaming was also implemented in the RAI in 2022. This allows mobile devices to quickly, automatically and safely connect to the Wi-Fi network in our exhibition and conference complex OpenRoaming brings an end to the need to search for a network, type in Wi-Fi passwords and click pop-up windows Strong continuous connections and reachability contribute to a positive experience for exhibitors and visitors

In 2022 we also worked hard in the field of cyber security, rewriting the policy and making all the preparations for an ISO 27001-audit.

Migration to new content management system for all websites complete

The websites of all RAI Amsterdam exhibition titles were migrated to a new online environment in 2022, making them quicker and easier to manage We also added various options for personalisation and marketing automation The migration of the corporate website www rai nl is due to start in early 2023

App for uniform stand construction

A new mobile application for uniform stand construction was launched especially for METSTRADE, the exhibition with the most examples of this type of stand The app offers exhibitors the option to quickly explore a wide range of services, from stand furnishings to the delivery of materials and products

Our exhibition and conference venue on the Europaplein square in Amsterdam hosts many events each year. Every conceivable multifunctional facility is available and we continuously strive to increase sustainability and enhance our business operations, products and service provision. At the same time, we also realise that our activities consume natural resources, take up space, make noise and have other impacts on society that we constantly strive to minimise or avoid.

Facilities overview

RAI Amsterdam Convention Centre facilities

Properties

Total surface area

Conference centres

Facilities

116,600 m2

3 interlinked conference locations

Halls 12 interconnected halls, expandable with two semi-permanent halls

Rooms

Foyers and lounges

Entrances

Restaurants and bars

Parking garages

2 auditoriums, one large ballroom with 2,000 seats A total of 70 conference and meeting rooms Accommodation for 10 to 10,000 people per room

Multifunctional space for exhibitions, parties and celebrationsn

9 separate entrances: own entrance for each event

9 restaurants, bars and lounges From buffet to à la carte

Capacity for 4,000 spaces on the premises

Marina Own marina directly connected to the Amsterdam canals

Train station called Amsterdam RAI, adjacent to RAI Amsterdam Convention Centre

Two metro stations

Hotel (nhow)

Amsterdam RAI Station connects to the metro line that forms a circle around the city

The new Europaplein station is situated just 50 m from the entrance to the RAI and connects the RAI to the city centre

On-site congress hotel with 650 rooms and 200 parking spaces

The RAI Logistics Management System (LMS) was used in 2022 for all events that took place in the halls of the RAI. It allows us to manage truck transport from departure to arrival and help drivers optimise their journey, ensuring they reach their final destination at the right time and avoid inactivity once there. The aim is to further reduce the number of vehicles roaming the neighbourhood and any congestion from cargo transport. The new system was used for over 10,000 bookings in 2022

During exhibitions for which busy build-up and/or breakdown periods are expected, 15,000 m² of external premises in Westpoort (outside the Amsterdam ring-road) or parking areas 17 and 18 adjacent to Amstelpark (a smaller zone closer to the RAI) are used as a buffer zone Incoming traffic is directed to this area, where the vehicles are registered before being invited to drive through to RAI Amsterdam in an orderly fashion This significantly spreads lorry traffic around the RAI The buffer zones can accommodate 90 trucks and were used on 64 days in 2022 (2021: 16 days)

We proactively stimulate the use of public transport to offer visitors an alternative to driving. Deals that combine tickets to exhibitions and transport, offered in partnership with public transport companies NS and GVB, are more convenient and cheaper. Our webshop realised over 36,900 transactions online in 2022 (2021: 18,700).

RAI Amsterdam has over 4,000 parking spaces, around 200 of which are beneath the nhow Amsterdam RAI hotel Some 50 parking spaces at the RAI have charging stations for electric vehicles Concentrating parking spaces on the premises strengthens our position by increasing customer satisfaction, stimulating smooth traffic flows and reducing any nuisance to the neighbourhood The concept of registration-based payment for parking reduces the use of physical tickets and stimulates the flow at peak times, which in turn reduces traffic on surrounding access roads

Garages P1 to P4 are open as a P+R option for the city on days when no large events are taking place. They are accessible at an attractive rate to visitors to Amsterdam who can then travel further into the city by bike, tram, metro, bus or taxi. Visitors to Amsterdam used this service more than 263,000 times in the past year (2021: 213,000).

The RAI has had a Safety at Work policy since 2010 Unique in the event industry, the policy is aimed at minimising injuries during the build-up and breakdown of events in our halls These build-up and breakdown processes are subject to change, with the scope and complexity of events often increasing, while back-to-back events demand greater speed from the parties involved We regularly adapt our Safety at Work policy to address this issue, and did so again in 2022 The resulting experience, knowledge, policy and communication tools are actively shared by RAI Amsterdam with other event locations in the Netherlands and abroad within the framework of the RAI Amsterdam Safety Programme

RAI Amsterdam organised a ‘safety at Work’ meeting in the RAI at the start of 2023, welcoming representatives from various other event locations

An assessment of the condition of the built environment in accordance with NEN2767-1 helped the RAI map out the status of approximately 8,000 assets which comprise the convention centre. The baseline measurement was then used to plan an investment agenda for the coming years.

We try to prevent excessive noise as much as possible using a so-called acoustic map. This enables us to accurately predict when we need to apply for a noise exemption permit – four such permits are allowed per year. Monitoring the standards enables us to take preventive measures when necessary. In 2022 we applied for and were granted four noise exemption permits (2021: 0).

Despite the RAI welcoming a far larger number of events to Amsterdam in 2022 our energy consumption only rose slightly to 99 TJ (terajoule of energy) Some 55 6TJ was generated as electricity, 42 9 TJ as district heating and 3 5 by our own solar panels Our gas consumption was very limited

All energy consumed by the RAI is green power and leaves no CO2 footprint We receive certificates from Centriq confirming the purchase from Vattenfall of green power generated by hydroelectric plants in Scandinavia

RAI Amsterdam has 1,806 solar panels in use, including 1,632 on the roof of Hall 8. The roof of the Amtrium accommodates an additional 174 panels. A total of 2,164 panels have been placed on the nhow Amsterdam RAI hotel As the generated energy is provided to and used by the hotel, this does not affect our CO2 footprint

which generated by RAI solar panels (GJ)

Percentage of green electricity purchased

* no data available due to company closure

In 2022 RAI Amsterdam took the initiative to start a stakeholder dialogue with a range of parties related to the future generation and consumption of energy. Various meetings were held under the ‘Energy Table’ banner, focused on how the RAI area can become a net energy resource. A pilot project will now be started with Dutch agency InvestNL to equip Hall 7 with ultra-light solar cells to see how the roof surfaces might be optimally used. Other topics discussed included (drilling for) geothermal energy in a possible cooperation with Vattenfall. Various energy suppliers and Amsterdam council took part in the Energy Table

In the period from 20 July to 14 August various employees looked at how energy consumption might be further reduced when no events are being held in the RAI. The various measures resulted in a reduction of 38% (334 MWh) compared to a similar summer period the year before. These savings are equivalent to the annual energy consumption of some 134 Dutch households.

RAI supports the Net Zero Carbon Event Pledge (https://netzerocarbonevents.or...). This is developing a roadmap for the industry that shows how the organisations involved can move towards net zero in 2050 and halve their footprint

We have been calculating our carbon footprint since 2012. The calculation method was evaluated in 2019 under the supervision of an energy consulting firm and various changes were made to the principles: scope 3 was partially included and the reported emissions increased. Total emissions in 2021 were 2,948 tonnes of CO2. District heating, which is distributed via the city grid, is a more sustainable energy source than natural gas as it is based on the residual heat produced during industrial processes, power generation and/or waste separation. No figures are available for 2020 as the company was closed due to the COVID pandemic

Like many other companies, increasingly stringent European energy legislation (EED) means the RAI is subject to energy audits to prove we are implementing sustainable energy savings. Having now transitioned to the EarthCheck 4.0 certification, no further energy audits will be required.

*no data available due to company closure

* no data available due to company closure

The RAI aims to ensure that both its consumption and production are sustainable, with everything possible done to prevent waste. Where waste is unavoidable we work closely with partner CSU and subcontractor Beelen to enable high-quality recycling.

The RAI applies the ‘polluter pays’ principle whenever possible, making the parties who produce waste responsible for its proper separation (separated waste is cheaper and more eco-friendly than unseparated) We also use reusable materials whenever possible and actively search for market demand outside of the RAI to ensure valuable residual streams are identified and repurposed. The entire chain is involved and an example is provided in the ‘Value to city and society’ section.

We aim to further strengthen our position and add value to our surroundings by being a place where Amsterdam and the world meet, both now and in the future. Social, ecological and economic value creation all play a role herein. Part of the transition plan is to adapt the logistics process for deliveries. We are also looking to add public functions to our neighbourhood and make space available to the city.

In line with the new policy framework for ‘connected parties’, the City of Amsterdam’s municipal executive has combined the various public interests involving the RAI in a unilateral vision. The vision can be summarised as working towards ‘a flourishing RAI in a flourishing environment’. It is the council’s starting point for reaching agreements with the RAI on how public interests can best be served and how Amsterdam, the RAI and other partners can contribute. The municipal executive is positive about the plans and sees the potential added value of the masterplan. At the same time, there are many steps to take toward its realisation and many choices remain open. The executive plans to make these choices within the frameworks of the formulated vision and in close consultation with the RAI

“We will work closely with the RAI to see how we can develop the area to make it greener and more sustainable, realise residential development and strengthen Amsterdam’s position as a conference city.

Text from the coalition agreement, 25 May 2022 Amsterdam municipal council coalition

In the interest of the city

The public added value of the masterplan translates into the addition of residential housing, making the RAI premises more accessible to local residents by adding a ‘non-RAI’ element, and reducing pressure on the surrounding road network Arcadis performed a social costs and benefits analysis of the masterplan in 2020 on behalf of the RAI, concluding that it will make a positive contribution to the earning capacity of the Netherlands and improve the living environment of Amsterdam and the region.

Significant positive effects of the masterplan include an improved flow-through on the Dutch road network, improved traffic safety and air quality in the city and a reduction of noise pollution for the neighbourhood. These effects are mainly related to the logistical aspects of the masterplan. The urban effects in the field of air quality, noise and traffic safety are important to the residents of Amsterdam, and contribute to city council goals related to its programmes for reducing traffic in the city (Amsterdam Autoluw) and realising cleaner air (Actieplan Schone Lucht). The construction of a green strip on Wielingenstraat and green roofs contribute to council goals related to

biodiversity and climate. The masterplan also includes a reduction in the number of traffic movements (because of the hub and developments in standbuilding/circularity, among other things), which has a positive effect on the climate This in turn allows Amsterdam to contribute to the national climate agreement

Modern convention centre at the heart of the city

The masterplan is initially focused on investing in the digitisation and modernisation of the venue. These investments are crucial for preserving the economic spin-off value of the RAI for the city. Secondly, the masterplan is focused on transforming the RAI premises into a sustainable and multifunctional meeting place. The starting point is the installation of an underground tunnel infrastructure which will make the logistical processes of the RAI more efficient, effective and flexible

In addition to new real estate for RAI functions, the masterplan also has potential opportunities for the significant housing challenges facing Amsterdam. Adding residential buildings and the related infrastructure and facilities will make the RAI premises more accessible to non-exhibition visitors. The transformation and blending of RAI and nonRAI functions will make our premises more attractive to Amsterdam residents in a recreational and sporting sense

A limited addition of retail and hospitality in the area along Europaweg will enhance the appeal of the route from the RAI train station via the hotel nhow to the RAI premises Further development of the plan aims to ensure that the route design and any limited addition of commercial facilities on the RAI premises does not affect the already available retail and hospitality venues in the nearby area, instead having a strengthening and complementary effect

A well-organised and safe (main) cycling route from Beatrixpark through the heart of the RAI premises to the surrounding neighbourhoods (Kop Zuidas, Rivierenbuurt) and vice versa is a major pillar of the masterplan In addition, the RAI aims to reduce waste streams and recycle any remaining waste via various routes, including modular and circular standbuilding

One of many sketches made in the framework of the Masterplan2030

The masterplan is not strictly outlined and needs to be further developed by the RAI and the council into financial, programme-based and legal agreements It will be crucial to simplify this process, reduce the number of dependencies and integrate flexibility and freedom of choice into the detailed plan The masterplan will be shaped step-by-step as a growth and choice selection in which development areas are prepared and realised in stages

Amsterdam will benefit from a major redevelopment after an agreement was reached with the Dutch government to extend the North/South metro line from Amsterdam Zuid via Schiphol to Hoofddorp. According to the current planning the activities will start in 2028. They will create a direct and high-frequency connection to the airport directly from the Europaplein metro station located right in front of the main entrance of the RAI.

RAI Amsterdam is a company for people, by people. Our employees are the outward face of the RAI and function as hosts during events. We realise our company goals to a large extent by empowering employees with responsibilities, streamlining their tasks and enabling them to make the most of their talents. The RAI is for everyone –and this includes candidates in the labour market. Our diversity profile is designed to be in line with society and our stakeholders.

Employee satisfaction is a crucial yardstick and instrument for the continuous improvement of our company The long period without physical events in 2021 and abrupt return of business in 2022 made it even more important to monitor employee satisfaction on a regular basis The focal point of the latest survey, performed in late 2022, was to map the experience of the employees and collect their suggestions for improvement 78% of all employees gave working at the RAI an average score of 4 or 5, with 70% grading their work 8 or higher, and 80% feeling a (very) strong connection to the company. Work pressure is a focal point: 44% felt a (very) high work pressure in their daily activities. There is a broad recognition herein that this first year after our closure was a tumultuous year. We will use the valuable input from this survey to increase the satisfaction, involvement and enthusiasm levels of our staff, and improve our operational processes.

Despite the tight labour market in 2022, we were able to attract employees for relevant positions in the organisation This was partly due to our participation in the National Career Fair (Nationale Carrièrebeurs) which took place in our halls in April 2022 We used the event to further strengthen the employer branding of RAI Amsterdam and succeeded in filling various vacancies, both permanent and internship-related In late 2022 the occupancy was at nearly the level of formation In total we welcomed 108 new colleagues in 2022

RAI Amsterdam achieved four number one positions in the MT500, a survey by the University of Amsterdam (UvA) of the 500 companies with the best reputation in the Netherlands We are the leader in the ‘Media’ category, and in the ‘customer-orientation’, ‘sustainable business’ and ‘good employership’ sub-categories The MT500 is the annual benchmark of the reputation of Dutch companies among managers, decision-makers and directors

RAI Amsterdam for everyone

We strive to ensure the diversity of our departments in terms of age, experience, gender and competencies, and aim to further broaden the concept in the years to come. To anchor diversity in the organisation requires creating a place where everyone feels safe, equal and welcome to contribute, act and decide in all aspects.

In 2022 we started research into diversity and inclusion in the RAI The first step was to gain insight into our current situation This baseline measurement will be the start of a sustainable policy along with associated interventions in coming years that were initiated in 2022.

Inclusive acquisition and selection

In terms of acquisition and selection we apply a method that avoids discrimination It includes communicating in a culture-neutral way and not asking questions about gender, age and place of birth

The percentage of vacancies for managers and Executive & Supervisory Board members that was filled with our inclusive acquisition and selection method cannot be provided as none of these functions were filled in 2022

Balanced male/female ration

At the end of 2022 we had a well-balanced employee database with 52% female and 48% male staff (on an FTE basis)

Goal of Talent to the Top charter achieved

The objective in the field of gender diversity as described in the Talent to the Top charter was also met: the share of women in the policy team and second echelon of managers is 50% (2021: 47%)

Employee contract terms

In late 2022, 76% of the RAI Amsterdam employees had a permanent contract and 24% a temporary contract

Temporary staff

As an organiser and facilitator of events, the RAI faces major peaks in staff occupancy. This is why we often make use of temporary employees. In 2022 this involved 4,047 people. Adding up all hours, their joint effort amounted to 156 FTE.

Interns

The RAI offers work experience to many interns from a wide range of schools/institutions. In 2022, we accommodated around 80 interns, including three work experience spots for intermediate vocational (MBO 1 and 2) students, and one in the framework of BBL & BOL practical training programmes. RAI Amsterdam also took part in the SDG House Traineeship in 2022. This programme for young consultants offers them and the companies they work for the chance to further develop in the field of sustainable operations and business

Personnel composition

Below are some cross-sections of the RAI’s employees.

Balance at the end of the year

Percentage / FTE (stand ultimo jaar)

Percentage / FTE (balance at the end of the year)

Absence due to illness in the year under review was 4 9% (2021: 5 0%) This can still be considered limited, especially when compared to other companies The effects of COVID-19 and an increase in long-term illness has had less impact on our organisation than is the national trend

Back

The major reduction of the personnel database in 2020 and long operational standstill – both due to COVID –complicated the restart of events. The 'Back in Business' programme was established in late 2021 to map bottlenecks in the organisation and facilitation of events. Improvement teams comprised of managers and employees sought out the underlying causes of bottlenecks and implemented solutions to prevent them The programme was linked to the four competencies relevant to the RAI, namely result-orientation, taking responsibility, innovation and cooperation (abbreviated as R E I S in Dutch) A custom training programme was developed in 2022 called the R E I S Academy to enhance these competencies among management and staff All RAI employees were offered two training sessions in 2022 focused on giving and receiving feedback, personal talent development, impactful influencing, mindset enhancement and coaching leadership We evaluated the sessions at the end of 2022 after which a selection of managers and staff worked together on a wish list for a new training programme in 2023

In implementing the reorganisation in 2020 due to the COVID crisis, we applied a horizontal organisational structure without too many intermediary management layers In 2022 the Clients and Operations departments merged into a single Events department

Remuneration policy in line with market average Directors, managers and employees are paid salaries in line with the market average The pay ratio that reflects the total remuneration of the best-earning director compared to the average employee is 7 1 (end 2021: 7 3)

A frequent and constructive dialogue was held with the works council in 2022. This year’s meetings mainly focused on [belangrijkste onderwerp], and [overig]. In addition to formal meetings with the Board, the dialogue continued in a number of subcommittees such as the HRM Committee, Financial Committee, Working Conditions Committee, Terms of Employment Committee, Pensions Committee and Temps Committee

RAI Amsterdam contributes to the prosperity of Amsterdam and its hinterland as well as society as a whole, and the events bring revenue into the city. Ecorys was commissioned by Amsterdam council in 2022 to research the economic value of the RAI for the city. Based on the figures from 2019 when we had a turnover of around 690 million euros, the RAI’s added value represented some 580 million euros and employment for 6,300 FTEs. On average, one euro of turnover in the RAI generates seven euros for the region.

From linking leftover items to social initiatives in the region that can benefit from them to connecting our facilities and knowledge, expertise and network with social initiatives that need them…. All these projects and more help prevent value going to waste on a daily basis and find ways to be of value to society.

The first Zuidas Sustainability Award was presented on 18 May 2022. The RAI’s submission ‘From waste to social value’ won the ‘society’ category. We mainly focus on preventing waste from a circular perspective, building awareness among organisers, exhibitors and employees, choosing reusable materials where possible and working with our partners on circular solutions for items like stand building and carpets.

We actively search for needs outside of the RAI to repurpose materials and products and prevent items from becoming waste. Our donation programme was implemented during all RAI-organised events and various facilitated events in 2022, including IBC and Sibos. This connected social initiatives in the region to leftover items after the events.

The municipal health service GGD had been using the halls and rooms of the RAI since 2020 to test the public for COVID-19. In January 2021 it added a vaccination facility to the existing test facility in RAI Amsterdam. GGD was able to scale the use of space up or down depending on the COVID situation in the Netherlands and the measures applicable during certain periods.

The vaccination capacity was at its largest by the end of the year as the government hoped to achieve a high level of immunity among the Dutch population. For a while we were was the largest (booster) location in the Netherlands, and former health minister Hugo de Jonge visited the GGD location in the RAI where 17,000 booster shots were given.

Since the reopening of the RAI in February 2022 the GGD has used a temporary pavilion in front of the Holland Complex and adjacent to Europaplein for testing and vaccinating. Around 285,000 people visited the GGD’s RAI Amsterdam location in 2022, bringing the total visits since it opened in 2020 to 1,825,000

The war in Ukraine forced millions of Ukrainians to flee to countries across Europe. In consultation with the municipality, we provided space to the Red Cross in March to allow the organisation to shelter refugees from Ukraine at the RAI. We served as a coordination centre where refugees could register. The RAI also provided space for them to rest before being assigned to locations in Amsterdam and surroundings The Red Cross organised and coordinated this process around the clock, welcoming an average of 200 refugees a day

Queen Máxima and Amsterdam’s mayor Femke Halsema visited the Humanitarian Service Point in the RAI on 16 March, speaking to employees from the Red Cross, the council and the RAI about the aid provision and temporary accommodation. The visit was concluded with a round-table meeting with staff from the Red Cross, Salvation Army, Dutch Refugee Council (Vluchtelingenwerk Nederland) and Takecarebnb, the organisation that brings refugees and host families together in the Netherlands

Voting and vote-counting location

In mid-March the RAI was at the heart of Amsterdam democracy as the municipal elections took place. All the votes from local polling stations were counted in the RAI and Amsterdam mayor Femke Halsema visited the RAI to take a look at the activities

The RAI was also open to other social initiatives, including being used by ROC Amsterdam, Vrije University (VU), the University of Amsterdam (UvA) and Amsterdam University of Applied Sciences as a teaching and exam location. It also provided parking facilities for teaching staff and sporting space for students, and served as a logistics centre for providing food parcels to vulnerable Amsterdam residents.

The impressive recovery in 2022 has enhanced our confidence in the future. The RAI expects a further resurgence of the event industry and an increasing number of international exhibitions and conferences. While inflation, rising prices, the war in Ukraine and measures against any new COVID wave in Asia may limit this expected growth, the overall expectations for RAI Amsterdam’s turnover in 2023 are positive.

The geopolitical tensions resulting from the war in Ukraine continue Although the turnover from Russia and Ukraine is very limited and non-material, and while even substantial, increases in energy costs and inflation do not (as things stand) pose a risk to our continuity, international events are always dependant on the willingness of exhibitors and visitors to travel. The past year has shown that their appetite remains the same as ever. Based on bookings and reservations, we can see – for now – that this also applies to 2023 and beyond. We will continue to monitor developments closely.

With the exception of specific (and impactful) measures in Asia to combat COVID, we see the situation normalising worldwide. Organisers and exhibitors are confident there will be no more COVID restrictions and the RAI agrees. Nonetheless, RAI Amsterdam is prepared and has its protocols and measures up-to-date and ready to use.

The events that took place in the RAI in 2022 have rekindled the fire. Exhibitor and visitor numbers have returned to the level of 2019 sooner than we expected. The RAI event calendar has also been enriched with a variety of exhibition and conferences over the coming years, including in the field of Life Sciences & Health, Technology and the creative industry, where scientists, business people and investors come together to discuss developments and challenges. We have entered into contract extensions with major international organisers who are keen to have their events take place in the heart of Amsterdam until at least 2028. These developments have confirmed our belief in the chosen course and continuity of RAI Amsterdam This trust is further underlined by our personnel occupancy rate and the clear enjoyment and satisfaction of employees who are doing their utmost to make each and every event a major success

The Board thanks all stakeholders for their involvement, efforts, understanding and perseverance.

Amsterdam, 20 April 2023

Executive Board of RAI Holding BV, P. (Paul) Riemens, CEO M. (Maurits) van der Sluis, COO

While the Welcome to the RAI (01) and Governance and risk management (04) sections of this report are part of the Executive Board report, they are provided separately for presentation purposes

The Board declares that these consolidated financial statements have been prepared assuming that the company will continue as a going concern

Dear reader,

The RAI organises and facilitates meaningful meetings. It brings together people, connects communities and inspires them in a wide range of sectors and focal areas; local, regional, national and, for the most part, international The pandemic had limited and at times prevented these activities from taking place over the last couple of years Thankfully, we saw a significant recovery in 2022 Events returned after the first quarter, gradually reaching pre-COVID levels and, in some cases, surpassing them This recovery confirmed what we already knew, that the demand for physical meetings is enormous and of a lasting nature Nonetheless, seeing everything and everyone come together again, sometimes even more so than we could have hoped, has been a genuine pleasure

With its well-filled agenda the RAI’s prospects are very positive, giving us lots of confidence for the road ahead We will continue to prepare for the future by redeveloping the RAI premises and improving its connections to the city At the same time we are increasing the sustainability of the logistics processes related to the build-up and breakdown of events based on the belief that a flourishing meeting place should also be an eco-friendly one A meeting place for leading players on the world stage from countless sectors, but also for the people of the city and region In other words, a place for everyone The goal for us in our role as Supervisory Board is to support the Executive Board in making the RAI the best exhibition and event company in the world In doing so we generate optimal value for our stakeholders, while structurally working toward a flourishing RAI in a flourishing environment

We would like to thank the Executive Board for all their hard work in 2022 and the good results Finally, thanks to the shareholders and other stakeholders for their ongoing involvement, support and cooperation

On behalf of my fellow Supervisory Board members,

Otto Ambagtsheer, chairThe Supervisory Board hereby presents the Annual Report of RAI Holding BV

It was compiled by the Executive Board and includes the financial statement for 2022 Deloitte Accountants BV has checked the financial statement and provided it with an approved audit statement

The Supervisory Board held four scheduled meetings in 2022. Recurring topics included the progress report (monitoring both financial and non-financial goals), the business update (focused on the main issues related to markets, clients and events) and the corporate annual plan.

The Supervisory Board includes three committees: the audit committee, remuneration committee and the selection & reappointment committee.

In 2022, the audit committee – comprised of Michiel Boere (chair) and René Takens – met four times in the presence of the Executive Board and financial director Items discussed include the 2022 audit plan, the annual report, the financial statement and the accounting report for 2021. Other topics were the extension of the financing, the budget, planned investments, the dividend policy, inflation, high energy costs and their impact on the result. The audit committee also discussed in detail developments in the field of compliance and risk management. It found that the risks were well embedded in the business operations of the RAI and was pleased with the progress made in this regard.

The remuneration committee, made up of Mariëlle de Macker and Annemarie Macnack-van Gaal, met twice with the Executive Board and HR manager in 2022. Issues discussed included a safe working environment, diversity & inclusion, and the personal development programme. The committee also oversaw the annual evaluation of the Executive Board.

The selection & reappointment committee, which also consists of Mariëlle de Macker and Annemarie Macnack-van Gaal, had no reason to meet in 2022.

The Future Vision of the RAI is for ‘a flourishing RAI in a flourishing environment’ The Vision 2030 steering group includes representatives from both shareholders, the CEO, the financial director, the RAI company secretary, and Supervisory Board members Annemarie Macnack-van Gaal (chair of the steering group) and Otto Ambagtsheer It discusses all aspects relevant to and required for this vision Decision making takes place within the formal governance structures, which in this case is the general meeting, Supervisory Board and Executive Board

The audit committee discussed the financial statement and annual report 2022 with the Executive Board and external accountants Deloitte The financial statement 2022 that will be presented to the general meeting on 20 April 2023 was approved by the Supervisory Board The Supervisory Board proposes that the financial statement be approved, that the Executive Board be given discharge for its management and that the Supervisory Board be given discharge for its supervision.

Amsterdam, 20 April 2023

Supervisory Board RAI Holding BV

O (Otto) Ambagtsheer, chair

A M H (Annemarie) Macnack-van Gaal,vice-chair

M P (Michiel) Boere

W.C.M. (Mariëlle) de Macker

R.J. (René) Takens

RAI Holding BV is a private company in accordance with Dutch law. Our governance is based on Book 2 of the Dutch Civil Code (BW), the statutes, various internal regulations and the Dutch Corporate Governance Code. The governance structure of RAI Holding BV includes a general meeting, a Supervisory Board, an Executive Board and a works council.

Wherever this annual report mentions ‘RAI Amsterdam’, this should be understood to refer to RAI Holding BV and all its group companies.

The RAI’s management team comprises the statutory Executive Board, which consists of two members plus three titular directors and three business support managers.

The Executive Board and Supervisory Board of RAI Amsterdam recognise the 2016 Dutch Corporate Governance Code and apply the principles and best practice definitions therein insofar as they can be said to apply to RAI Holding BV. The principles and best-practice definitions do not apply in some cases as RAI Holding BV is not listed on the stock exchange and only has two shareholders. The following recommendations from the code are not or not fully applied:

provision 2.8.3 (publication of standpoint in takeover situations); principle 4.2 (supplying information to the general meeting).

In addition, RAI Holding BV deviates from the code regarding the terms of employment contracts for the Executive Board which has an indefinite employment contract. The management agreement applies for a period of four years, which means provision 2.2.1 of the Code is recognised.

As the Code prescribes, regulations for the Supervisory Board, its committees and the Executive Board also state that they endorse the code. In addition, a large part of the Code has been made part of the regulations. Said regulations serve as a supplement to the regulations and provisions that apply based on Dutch law. All regulations, the step-down roster and the Supervisory Board profile are published on https://www.rai.nl/organisatie-enorganogram/.

RAI Amsterdam (RAI Holding BV) has two shareholders: the RAI Association and the City of Amsterdam. While they are in principle paid a fixed dividend, this has not recently been possible due to the COVID pandemic.

The RAI Association owns 75% of the shares in RAI Amsterdam This trade association promotes the interests of manufacturers and importers of passenger cars, trucks, trailers, bodywork and special vehicles, motorcycles and scooters, mopeds and bicycles

The remaining shares are owned by the City of Amsterdam

Although it had previously been common practice to determine the dividend policy for a five-year period, this did not take place in 2019 A one-off dividend of €9 9 million was due to be paid in 2020, €3 75 million of which remains unpaid As a result of the pandemic it was decided in the spring of 2020 not to make any dividend decisions for the remaining part In 2020 and 2021 the RAI had negative results In April 2022 it was decided not to pay any dividend, which is also one of the conditions of the government’s corporate financing guarantee (GO-C) Dividend payments are not possible before the GO-C has been fully paid off and the solvency requirements met

During the COVID pandemic, RAI Amsterdam faced several periods in which the company was fully shut down We then used national schemes to contribute to our wage costs, for financing and to delay tax payments Shareholders were not compelled to contribute extra capital, however The RAI therefore survived the pandemic through to 2022 on its own strength

RAI Amsterdam continued and further enhanced its risk management activities during 2022, with policy steps taken in relation to the structural and systematic control of risks. Risk management is embedded in the strategic and operational processes. The integrated risk management system covers all levels of the business operations and all parts of the company.

Risk and control measures are periodically analysed, recorded in a register and monitored, as was the case in 2022.

This analysis also includes the fraud risks identified by the RAI A risk & compliance board oversees progress every quarter, with the Executive Board, senior management and risk & compliance officer taking part The Board monitors the effective functioning of the system and, together with the company, aims for continuous improvement and strengthening.

RAI Amsterdam aims to analyse and manage any (fraud) risks that may arise in realising its strategic, tactical and operational goals Management measures taken in this framework are focused on reducing the chance that the risk will occur and/or reducing any impact that the risk might have should that be the case The risk management system set up by the RAI is based on the principles and starting point of standards such as ISO 31000 and COSO.

Although we try to limit them as much as possible, it cannot be excluded that certain (fraud) risks not currently identified or considered significant may later have a negative effect on the capacity of the RAI to realise its goals

Entrepreneurship is one of the core values of the RAI and involves having the tolerance to take risks in a controlled way The goal of risk management is therefore not to exclude risks but to gain insights that enable us to properly address opportunities and threats

RAI Amsterdam does limit its risk tolerance in other ways Financial risks, for instance, may not threaten the financial resilience of the RAI The RAI always aims for a healthy safety margin with regard to its main financing ratio (net debt/EBITDA) of 15%

In addition, we reduce all safety and health risks as much as possible Compliance with laws and regulations is the starting point The RAI seeks to minimise the risks of non-compliance and applies a very low tolerance in this field

Integrity is important and the RAI applies a zero-tolerance policy with regard to bribery and corruption. The risk attitude of RAI Amsterdam can be schematically represented as follows

RAI Amsterdam’s risk attitude

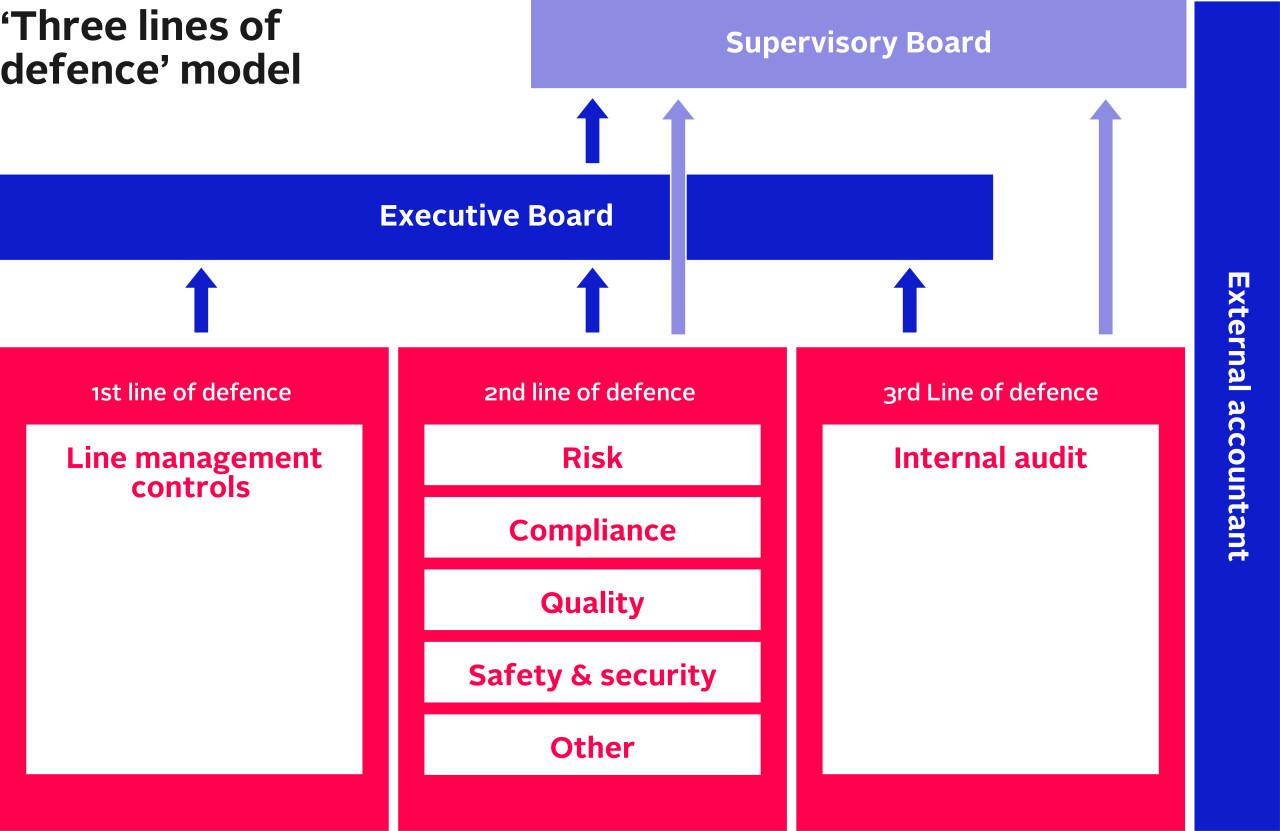

In setting up its risk management system, RAI Amsterdam applied the 'three lines of defence' model, a structure of measures comprised of an operational line, risk management function and internal audit function.

The first line of defence takes ownership of controlling related risks The second line of defence consists of the risk & compliance function that supervises the set-up and functioning of the risk management system The second line supports the first line, coordinates and reports to the Board and line management The third line of defence comprises an independent internal audit function Based on an internal audit plan, which is updated annually, the function supervises the set-up, existence and functioning of the administrative organisation, internal audit and control measures

The Supervisory Board approves (changes to) the risk management policy, and risk management is regularly included on the agendas of meetings of the audit committee and Supervisory Board The Supervisory Board employs the external accountants and approves their audit plan on an annual basis

The external accountants also act as supervisor and monitor the set-up, existence and functioning of the administrative organisation and internal supervision based on an annually updated audit plan The external accountants report to the Supervisory Board via a management letter and a statement in the annual report

An integrated update of the risk assessment was implemented during 2022 in light of the cyclical evaluation of current developments and any adjusted organisation goals Due to the explicit connection to the goals of RAI Amsterdam, risk management strengthens the performance management In total there are 17 risks which are considered most relevant and these are often interconnected The RAI has determined sub-risks for these 17 domains and defines, implements and monitors control measures

Main risks and mitigating measures

Evaluating the actual risks for RAI Amsterdam involves assessing both the current risk of an incident occurring and the likely consequences (measured in financial terms) this might have

A strategy evaluation took place in 2022 The six strategic pillars of the RAI remained applicable The evaluation systematically mapped out the risks and insecurities related to the Masterplan 2030, and closely aligned them with the various stakeholders (shareholders, Supervisory Board, municipality and works council)

The commercial playing field and competitive position of RAI Amsterdam can be affected by activities or developments by competitors and potential market partners With this in mind, the RAI has developed a strategic portfolio policy and keeps a close eye on the market position of this portfolio The merits of and conditions related to potential partners are identified and we proactively assess the available options in this field

The COVID pandemic continued to have major consequences in 2022, with events not being restarted until the spring Thankfully, the insecurity related to restrictions and a reluctance to travel and visit events has declined The RAI continues to believe in the strength of personal meetings and the very successful restart of events in 2022 is seen as encouraging in this sense

Another major outside factor that manifested itself in 2022 was the energy crisis resulting from the war in Ukraine. An energy transition is essential, both in the framework of costs and for the necessary increased sustainability of the RAI It is a complex issue with many uncertain variables that cannot be easily resolved RAI Amsterdam is

preparing for this factor in close consultation with many external stakeholders and other interested parties.

The labour market has been under pressure for a longer period. While RAI Amsterdam manages in general to fill its vacancies, it remains difficult to attract and preserve suitable talent in a few specific segments. This could make the organisation vulnerable to staff turnover. Bespoke recruitment policies and strategic personnel planning mitigate this risk significantly. The temp market is also tight, leading to uncertainty regarding finding sufficient competent staff. This in turn puts pressure on the RAI’s business operations. The risk can be mitigated by proactively and closely aligning the expected capacity demand in advance with temporary staff agencies and service providers

Cybercrime is one of the greatest threats to businesses worldwide, and RAI Amsterdam is not immune. We have therefore defined a cyber security policy and are taking organisational and physical measures to mitigate this risk as much as possible. The intention is also to reduce consequential risks such as operational disruptions and the loss of privacy-sensitive information A periodic external audit of the soundness of these measures is part of this approach

The economic outlook worsened in 2022. Sky-high inflation is a global issue that also affects the RAI. Rising costs are putting pressure on the profitability of our business operations. Dedicated cost savings and margin management are used to minimise the effect of these developments as much as possible

RAI Amsterdam is a multifunctional venue where lots of people come together and that can have health & safety risks for visitors and employees. The RAI has therefore developed an integrated safety management system that involves a risk-based focus on strategic and operational safety management issues. It also mitigates as much as possible the risk of business interruption caused by calamities The effective functioning of these measures is monitored

Financial risks usually originate from underlying strategic, operational or compliance risks, and the related control measures take place within the spectrum of financial management and treasury. The RAI responded to the COVID crisis by cutting costs, introducing a financing programme and having a maximum focus on cashflows Cash management was strengthened via scenario-based planning and helped support the organisation through these turbulent times

As any damage to the reputation of the RAI can have major long-term consequences a range of mitigation instruments have been deployed A compliance management system has been set up to ensure that laws and regulations are closely observed An integrity policy helps prevent undesirable or dishonest behaviour Intensive stakeholder management is partly focused on consolidating the good reputation of the RAI, while a corporate communication policy ensures effective communication to all stakeholders

RAI Amsterdam aims to comply with all legal and licencerelated requirements and guidelines that apply to the organisation.

RAI Amsterdam aims to comply with all legal and licence-related requirements and guidelines that apply to the organisation.

The RAI aims to minimise the risks of non-compliance as much as possible It has a low tolerance in this respect and has established a compliance management system In setting this up we closely followed the starting points and principles of the ISO 19600 standard for compliance management wherever possible. Key starting points included:

A dedicated, structured approach to a continuous process;

A clearly defined scope and a risk analysis-based prioritisation in the context of the specific characteristics of the RAI organisation;

A clear division and appointment of tasks and responsibilities, with a leading and committed role for senior management;

A cyclical process that enables the RAI to be a learning organisation;

A focus on culture and behaviour in line with the core values;

Transparency regarding the compliance approach and the way non-compliance is handled