the

Since the roll-out of the ERTC, many CPAs have faced challenges and questions regarding the credit. Our team saw the need to educate—so we built a platform for CPAs created by experts in the industry. You won’t find content like this anywhere else.

The Remediation Program is a service offered through Silicon Ledger that aims to assist businesses in reviewing their supporting documents for compliance with the IRS guidelines regarding the Employee Retention Tax Credit.

Service Includes:

• Review of your underlying documentation to assess adherence to IRS guidelines

• Review of credit calculation to assess maximization

• If necessary, a consultation with an ERTC-focused tax attorney

Silicon Ledger is a turn-key ERTC solution: managing the process from qualification through submission.

Silicon Ledger’s qualification process is powered by Stout. Stout has an independent process to understand and analyze the challenges and impacts that each of our clients experienced during the pandemic.

Once your business qualifies, we coordinate the preparation of your 941-X with BDO, one of the nation’s leading accounting and advisory firms.

CPA’s who have Clients with insufficient documentation: It is important to identify the proper resources and services required to properly document the Client’s position before the IRS issues the Client an Information Document Request (IDR).

CPA’s are in a unique position to bring value to their Clients by providing clarity regarding ERTC: to protect shareholders, ALL Small Businesses should have thorough documentation and clarity surrounding why their business DOES OR DOES NOT file for ERTC.

2023-24 ASCPA BOARD OF DIRECTORS

James White, Jr., Chair

Sarah Propper, Chair Elect

Mandy Barksdale

Cathy Dover

Bruce Fryer

Matthew Hilburn

Kendra James

Michael Kassouf

Jeremy Mosteller

Amanda Paul

Paul Perry

Joseph Wynn

Dennis Sherrin, AICPA Council Rep

Jamey Carroll, AICPA Council Rep

S. Jon Heath, Past Chair

CHIEF EXECUTIVE OFFICER

Jeannine Birmingham, CPA, CAE, CGMA

CONTRIBUTING WRITERS

Jim Brady

Bruce P. Ely

Jerry W. Grant, CPA, PFS

Carolyn Tang Kmet

Gail Allyn Short

Jim Martin, CPA, CGMA

Anna Robinson

Marc Rosenberg, CPA

William T. Thistle, II

8

In the midst of what has been dubbed “The Great Resignation,” hear thoughts from leaders in our profession

Can pay transparency help CPA firms attract and retain talent?

It is all about Pipeline these days. Is this an area of focus for you? The AICPA recently announced the new National Pipeline Advisory Group, charged with developing a strategy to help address the profession’s talent shortage. The profession has a collective problem of students finding accounting as a suitable field of study, coupled with retention issues. The Advisory Group, of which I am honored to serve, will work on a national pipeline strategy that will be informed by technology, surveys, and inperson forums to collect insights from diverse groups nationwide. The strategy will be scalable to many users, state societies, firms, and businesses.

With that said, I’d like to mention the incredible work ASCPA is already doing. Our recent hire of Caroline Hale, Director of Pipeline Strategy, already benefits ASCPA efforts. In July Caroline participated in the American School Counselor Association Career Counselors Dream Big conference in Atlanta, where she learned about the upcoming FASFA changes, college and career planning, and so much more! Additionally, Caroline and two members from Wilkins Miller, Stacy Cummings, and Barou Ndaw, presented at the Alabama Association for Career and Technical Educators conference in Mobile to share their presentation, “The Language of Business.”

Stay tuned because there is so much in the pipeline!

ASCPA is also planning a January event - the inaugural Balance Sheet Bash - which will be a multi-city approach to connect with collegiates, no matter their classification, who have interest in studying accounting, or who want to learn more about career opportunities and the CPA designation. This is an HBCU, diverse, student-focused event that will include students from two-year programs and other Alabama HBCUs. Please see page 11 for a glimpse at this action-packed conference and to see how you can be a part.

Lastly, I would like to share a keen perspective of a young man who I met at the June NASBA Student CPT Leadership Conference. Jacody Bearden is a secondyear student at Alabama State University who is pursuing a degree in accounting with the goal of working for a public accounting firm. I sat down with Jacody to ask him questions around his desire to become a CPA. Jacody is from the Mobile area and knew that he wanted to do something in business when he went to college. He has three close friends who all started in business, but quickly found accounting the perfect match. These friends influenced Jacody to consider accounting. Once he learned that as a CPA he could do anything in business, including his goal of working for a firm and one day owning his own business - even a CPA firm, he was sold.

Jacody also shared there has been one influential professor to impact his studies. In a business orientation class, Professor Kim Smith talked about how accounting impacts real world issues and how today’s students, who are learning much about AI, data analytics, and economic trends, are the hope for a solid, growing business future. Jacody feels that a career in public accounting will open

his eyes to his future. He wishes for a big family one day and believes that a career in accounting will help him be financially stable. Jacody is clearly intelligent and hardworking. I asked him what skills or qualities are important to be successful, and he wisely answered, “CPAs need analytical skills. They need to be compatible and relatable, and they need to have effective communication skills. Being a CPA is less about the numbers and more about how you connect and communicate with clients.”

I do not think I could have said it any better. My last question to Jacody involved how he anticipates he will mentor future accounting students.

“If you are looking for a stable career, yet something that is not the same day after day, accounting can be what you make it to be,” he said. “Whatever your passion is, you can find a path there through accounting. Lastly, work hard and always take advantage of learning opportunities.”

Much of what Jacody shared with me are the exact messages we need to focus on as we change the image of accounting - positively directing students into a promising future career. I encourage you to get involved with ASCPA pipeline initiatives. As a CPA, we need leaders like you to share your story with students. Please contact me or Caroline Hale, chale@alabama.cpa, for ways you can get involved.

Time is definitely flying by. I hope you all were able to enjoy the last days of summer with your family members. My daughter is six years old and started 1st grade this August. It dawned on me that I have 12 more summers with her until she is off to college, with there likely only being nine more that she would actually “want” to spend with her ‘crazy dad.’ I say this as a little reminder to keep important things first and work with the rest of the world around them.

This Connections issue focuses on the Accounting Pipeline – the talented, new people entering our beloved and wellestablished profession. As you all are intimately and most likely painfully aware, the accounting profession is grappling with a talent shortage. During the 2019-2020 school year, the number of accounting graduates decreased by 3% for bachelor’s degrees and 8% for master’s degrees, according to the AICPA 2021 Trends report. Meanwhile, 43% of new firm hires have a non-accounting degree, signaling a growing demand for employees with diverse training and skillsets. The ASCPA Board is keenly focused on enlisting all resources available to do our part in addressing the issues the Profession is facing. We are aligned with the AICPA, with this being a primary focus. It felt prudent to refresh for you the key areas that are being addressed:

• Awareness: Increasing awareness about the accounting profession and promoting the benefits of a career in accounting

• Improved perceptions: Dispelling outdated perceptions and leveraging updated, positive messaging that can help the profession resonate with today’s students

• Training and education: Providing highquality accounting education and training opportunities

• Firm culture and business models: Equipping firms with the tools to offer competitive salaries and benefits, as well as career advancement opportunities and compelling work

• Diversity, equity, and inclusion: Attracting and retaining a broader range of talent

• Partnering with educational institutions: Affiliating with colleges and universities to offer internships, scholarships, and other programs to attract individuals to the profession, help defray costs, and assist students in developing the skills needed to succeed as a CPA

I am a firm believer that culture is what makes great organizations. I implore you to look at your organizations and make the necessary changes to ensure that we continue evolving in mindset and culture to get the best from this next generation of accounting professionals. Connecting this new talent to our organizations allows us to continue to serve our clients, customers, and stakeholders with a renewed sense of purpose and fresh perspectives while providing exciting and rewarding career possibilities to the next generation. We are working closely with educators, our student members, and the AICPA to gain all perspectives and tools to share with your respective organizations to help us facilitate the growth of the Accounting Pipeline.

This is to remind you of the culmination of the CPA Evolution initiative by the AICPA and NASBA to modernize the CPA Exam to meet the profession’s changing landscape. The new exam will go into effect in 2024. For more, visit evolutionofcpa.org.

Let’s not forget to salute the great work of the ASCPA Educational Foundation and their Scholarships for Student (S4S). We sincerely thank all of you for your generous donations that supported nearly $50,000 in scholarships

last year. For more, visit alabama.cpa/ educational-foundation.

The September 30th CPE deadline is drawing near. If you need CPE hours, then I encourage you to take advantage of the ASCPA offerings. See all the offerings and enroll at alabama.cpa/catalog/events.

Our profession is resilient, with a history of being dynamic and adaptable to economic, cultural, and regulatory change. We will meet this challenge head-on. We will continue to focus on the Pipeline to attract and retain the brightest and flourish. It’s such an honor and privilege to serve you.

A recent article in CPA Journal says the United States is facing “an acute” shortage of certified public accountants with many leaving their jobs “in unprecedented numbers” in corporations and audit firms.

In fact, the 2022 Rosenberg Survey reported that professional staff turnover in the industry is at 19%, up from 15% the previous year, and the number of college students earning undergraduate degrees in accounting fell 9%, from 57,500 in 2012 to 52,500 in 2020, according to the Association of International Certified Professional Accountants. And it’s dropped 4% more since the start of the COVID-19 pandemic.

All of this comes in the midst of what has been dubbed as “The Great Resignation,” in which millions of Americans, toward the end of the

pandemic, left their jobs. Experts in the accounting field worry that a drought of accounting and certified accounting talent is coming.

“There has definitely been a decrease in what we refer to as the pipeline,” says Jeannine Birmingham, CPA and president and CEO of the Alabama Society of Certified Public Accountants. “But the reality is that every industry is facing a reduction of pipeline. Everybody, no matter where you are, is looking for different skill sets or skill sets of higher levels, and the pipeline is not what it once was.”

And the crisis may be getting worse. The Controllers Council reports that “Almost 75% of the CPA workforce met the retirement age in 2020, as estimated by AICPA.”

At the same time, the demand for accountants is rising. And without adequate staff, a September/October 2022 CPA Journal article says, it could, for example, make it tougher for companies when it is time for financial reporting for the Securities and Exchange Commission.

The U.S. Bureau of Labor Statistics estimates that employment of accountants and auditors will grow 6% — a rate similar to most professions — from 2021 to 2031. Moreover, the bureau predicts 136,400 job openings for accountants and auditors annually, on average, over the decade.

Meanwhile, the Alabama Department of Labor lists accountants and auditors as one of the top in-demand jobs in the state with about 625 openings a year and an average salary of about $68,761. The U.S. Bureau of Labor

Statistics lists the annual mean wage for accountants in Alabama at $72,200 as of May 2021.

Experts say one reason for the decline may be burnout. CPAs often work long hours during tax season, but the PPP loans that the U.S. government made available at the height of the COVID-19 pandemic added to the already heavy workload for many CPAs.

“We didn’t slow down. We sped up because we had all the information that clients needed for the PPP loans,” says Angela Hamiter, a CPA and shareholder at JamisonMoneyFarmer (JMF) PC in Tuscaloosa. “We were very involved in helping clients, which was a great thing, but there was a two-year span where you didn’t feel like you ever had time off, and I think it really burned CPAs out.”

Another problem is the nationwide drop in the number of people taking the CPA exam, a rigorous test candidates must pass for a license to practice public accounting.

A recent article published by the Controllers Council reports that nationally, the number of CPA exam candidates dropped from nearly 50,000 in 2010 to just over 32,000 in 2021.

In Alabama, however, the number of first-time CPA exam candidates went from 897 in 2011 to 690 in 2015, but reached 1,165 in 2021.

It’s not an easy path. Accounting students must take a fifth year of college classes just to qualify to take the exam. And CPAs can go into other areas like corporate banking, become a financial analyst or join the FBI rather than join an accounting firm.

Amanda Barksdale, a senior lecturer in accounting at the University of North Alabama, however, says that enrollment in accounting has held relatively steady.

“Our department tracks enrollment numbers, and we have not seen significant changes in our accounting enrollment,” Barksdale says.

“The CPA certification is still a popular option for our accounting majors,” she says.

“Each semester, we have numerous firms and businesses come to campus to meet and interact with our students,” says Barksdale. “Many of our students accept internship offers while they’re completing their undergraduate degree.”

But still, Hamiter says finding accounting talent straight out of college is more challenging these days.

“We’re in Tuscaloosa so we’re at the back door of the University of Alabama,” she says. “We never had a problem. We just recruited from our interns.”

But over the last two to three years, the pool of candidates has grown smaller, Hamiter says.

“We’ve had to go to different schools. That’s one thing we’ve changed. We’ve gone to Auburn, Troy, Samford, Birmingham-Southern and spread our wings a little more in different places. And that’s good,” she says.

Bur even hiring experienced accountants is more difficult now, Hamiter says.

“We’ve used headhunters for the first time in my career here in the last two years,” she says. “We’ve hired two or three recently through that process.”

Recently, CPA Meg Hampton, an audit manager at Anglin Reichmann Armstrong in Huntsville, wrote an article for Accounting Today magazine on the accounting talent crisis. “Top talent can choose careers that allow them to work from anywhere and at any time (e.g. digital nomads). The accounting industry cannot ignore that reality,” she wrote.

She says that accounting firms should consider looking at the talent they currently have on hand and helping those employees gain new skills and expand their knowledge base instead of focusing entirely on hiring.

For instance, if a young accountant has specialized knowledge of a particular field or industry, they can ask managers how they can use that knowledge to help bring in new clients for the firm. And managers can offer opportunities for cross-training and allow employees to shadow their more experienced colleagues.

In addition, Hampton says firms should consider moving beyond traditional hires to hiring experts in-house who can give accountants a better understanding of niche industries.

“Accounting firms have traditionally been more focused on compliance like tax returns, audits and financial statements,” says Hampton. “But more and more, we’re seeing our clients’ needs in more consulting areas, advisory. So having knowledge of the industry, or of the clients or systems that they use, those are the kinds of things that are super valuable right now.”

“We’ve done a little bit of this where we’ve hired someone as a consultant, where they don’t have an accounting degree or have an actual accounting job, but they have experience in a relevant industry that we have a niche in,” Hampton says.

Birmingham says, “It will take a renewed effort to educate high school students and maybe even middle school students about the opportunities for careers in accounting, whether that’s a CPA or whether that’s just an accountant.”

But meanwhile, the need for more accountants continues.

“What worries me the most is not having people to take care of these clients that I’ve taken care of for 30plus years,” Hamiter says. “Clients will pass away, but more are coming along after them, their children, and I hate for there not to be that someone here from our firm to take care of those folks.”

This article appeared in the July 2023 issue of Business Alabama.

Author Gail Allyn Short is a Birminghambased freelance contributor to Business Alabama.New pay transparency laws are requiring employers to disclose wages to prospective candidates and/or current employees. Though not required in all states, many employers—including CPA firms— are gambling on using the practice to attract and retain talent.

By Carolyn Tang Kmet

By Carolyn Tang Kmet

In March 2023, Alex Cheney was laid off from his role as a senior technical recruiter at a global software company headquartered in San Francisco. Having spent more than a decade in the talent acquisition space, Cheney is a seasoned professional who’s well aware of the latest trends impacting the hiring and recruiting landscape—and now he’s leveraging that knowledge in his own job search. One of those trends is the passing of pay transparency laws, which require companies to disclose salary ranges in job descriptions.

“As a current job seeker, seeing the pay range of a role has saved me from spending a lot of time applying to jobs that don’t align with my expectations, skill level, or needs,” Cheney explains.

Currently, about 20 states, including Illinois, have some variation of legislation designed to address wage disparities and promote fair compensation practices in the job market. Additionally, there are several cities that have passed their own ordinances. One of those cities is San Francisco, where the Parity in Pay ordinance requires employers with 20 or more employees to provide pay ranges in their job listings.

“Prior to California passing the ordinance, I worked for an organization where a lack of internal pay equity was uncovered,” Cheney says. “As you can imagine, this news quickly filtered through the entire team, causing multiple individuals to question

management.” Cheney says the incident contributed to a significant decrease in employee morale, leading to rapid attrition in a competitive job market, which made it challenging for the organization to backfill its vacated roles.

Of course, CPA firms are no stranger to these types of staffing challenges as retaining and attracting new talent continues to be one of greatest issues impacting the accounting profession today. The National Association of State Boards of Accountancy reports that the number of new CPA candidates has decreased by 33% in recent years, dropping from slightly over 48,000 candidates in 2016, to 32,186 candidates in 2021.

As a result, CPA firms have spent time gambling on ways to expand their hiring pool, and for some, that means being more transparent about their pay—whether they’re required by law or not.

Abraham Singer, assistant professor of business ethics at Loyola University’s Quinlan School of Business, believes secrecy turns wage negotiations into a game of poker. “Without pay transparency, job seekers can’t see the hiring company’s cards and must guess how much to wager,” Singer says. “Pay transparency can help turn everybody’s cards over, so everyone is operating with similar information.”

Shirley Borg, head of human resources at Energy Casino, agrees. She says being open and transparent with

employees is a priority for the company; they’ve implemented a system where employees can view their pay grade, along with the minimum and maximum salaries for that grade. “This helps employees understand how their pay compares to others in their position and ensures that there’s no pay discrimination based on gender or any other protected characteristic,” Borg says.

In her role, Borg regularly oversees salary reviews to ensure that employees are fairly compensated based on their experience and qualifications. “This helps us attract and retain top talent by showing that we value our employees and are committed to their growth and development,” Borg explains. “Additionally, we believe in providing a comprehensive benefits package to our employees, including health insurance, retirement plans, and paid time off. This helps create a culture of fairness and transparency and ensures that our employees feel valued and supported.”

Especially in today’s climate, where the demand for CPAs outstrips the supply, pay transparency laws provide job seekers with greater leverage. Neil Dickinson, vice president of compensation services and pay equity solutions for OutSolve, an affirmative action consulting firm, says that applicants who have a clear understanding of a job’s pay range are empowered to not undersell their services. “Pay transparency allows for applicants to apply for a job with confidence the salary range meets

their pay requirements and helps them avoid wasting efforts on jobs that won’t pay enough.”

For employers, pay transparency can also drive greater efficiency in the hiring process. If the salary an organization is offering doesn’t align with a candidate’s expectations, candidates will likely drop out of the hiring funnel earlier, reducing the amount of time hiring teams commit to applicants who aren’t likely to accept an offer.

In the past, discussing compensation was considered taboo, inappropriate, and improper in many workplaces. Unfortunately, this cultural norm resulted in negative consequences for employees, fostering a discriminatory corporate environment that led to significant pay gaps based on gender and race. For instance, employer biases against women and minorities could affect hiring, promotions, and salary decisions. Without accurate insight into pay ranges, female and minority job applicants may be unaware that their salaries are being undercut.

The impact of this can be seen in a 2021 income report issued by the U.S. Census Bureau, which shows that women who work full-time, year-round jobs earn 84 cents for every dollar earned by men in the same category. In regards to racial inequity, the U.S. Department of Labor found in 2021, for every dollar earned by white, nonHispanic men, Black women were paid 67 cents, and Hispanic women (of any

race) were paid 57 cents.

Singer stresses that lack of pay transparency disproportionately benefits those that have more access and privilege. “It tends to benefit the savvy, seasoned, and confident when it comes to negotiations over pay and salary,” Singer says. “If it’s not clear what the going rate is for a position, then those who have more experience know what to ask for in a way that someone new to the industry might not, including those from working-class backgrounds or recent immigrants. Similarly, those inclined to be more brazen tend to ask for more and are often rewarded for it.”

According to Singer, this method of negotiating pay can also affect wages in a gendered manner, contributing to the wage gap between men and women in the workforce. Recent research conducted by Linda Babcock and Sara Laschever and presented in their book, “Women Don’t Ask: Negotiation and the Gender Divide,” reports 2.5 times more women than men say they feel a great deal of apprehension about negotiating, and about 20% of adult women say they never negotiate.

Many experts believe that pay transparency can lead to greater equity in wages by forcing employers to be more thoughtful and equitable about salary decisions.

Jon Hill, CEO and chairman of The Energists, an executive search and

recruiting firm, advises companies to consider pay transparency as an opportunity to recognize and address potential biases, and to develop more open communication about equitable compensation across the organization. By doing so, organizations will not only build credibility with current employees, but also with potential new hires.

“In my experience, most companies that have inequitable pay practices didn’t establish them intentionally,” Hill says. “Instead, these practices are the result of unconscious biases and/ or a lack of communication between leadership and employees.”

Hill stresses that pay transparency sends a message that a company has nothing to hide when it comes to their salary rates, giving candidates more trust and faith in the organizations they’re applying to: “Transparency has additional benefits for companies that pay a competitive rate because it can help entice qualified professionals to join your organization when they know you pay your team members in accordance with industry standards.”

Neema Parikh, the recruiting manager at Topel Forman LLC, a tax and accounting firm with a presence in Chicago and Denver, says disclosing a pay range creates more equality between genders and minorities. “It enables you to be as least biased as possible, which opens your potential hiring pool up as much as possible,” Parikh says. “Because when you put in a salary range, you’re not thinking about whether you’re targeting a man

or a woman.”

While Illinois pay transparency laws require employers to provide equal pay to employees for work that requires equal skill regardless of sex or race, employers aren’t specifically required to disclose salary ranges in job descriptions. Colorado’s pay transparency laws are stricter, however, and require all employers regardless of size or industry to disclose the salary ranges for open positions in job postings and in discussions with job applicants. Although Topel Forman has offices in both states, the company opted to include salary ranges for job postings in both regions.

“Pay equity laws give us an opportunity to understand the market as a whole, without necessarily tying salaries to regional trends,” Parikh says.

Parikh notes that pay transparency in Colorado allows for the examination of salary ranges at competing firms, providing market-informed insight into pay parity. In fact, a recent new hire salary negotiation led to a salary analysis, which resulted in an increase in base associate pay at the firm.

“We thought we were competitive until one of our candidates countered our offer. So, we analyzed our competitors’ job descriptions and salary ranges and compared them to our internal salaries,” Parikh explains. “We discovered that our base pay was a few thousand dollars lower, so we adjusted our base associate pay across the board to align with the market.”

Of course, being transparent can present some challenges for firms to consider. One potential challenge is that it could result in a marketwide increase in salaries as workers are more likely to initiate informed

negotiations, and as employers start responding to market conditions.

“For CPA firms, pay transparency laws will create greater visibility to market pay within the industry,” Dickinson explains. “This may lead to more accounting applicants having higher expectations for pay and gravitating to employers that pay above market rates.”

Dickinson adds that another likely outcome of pay transparency is wage compression, which occurs when higher competition for new talent drives smaller differences in pay between new hires and long-term employees.

In anticipation of this market shift, many firms are exploring alternate methods of enhancing their compensation packages. “We’re seeing an increase in demand for collaborative work environments, flexibility in working hours, and an emphasis on the type of work and responsibilities associated with the positions,” Parikh says. “Culture, benefits, remote work, and flexibility are all huge benefits that candidates are looking for.”

Another challenge associated with pay transparency is that it only serves to regulate the quantitative aspect of wages. In reality, wages are also tied to an employee’s perceived value or worth within a company or industry. Higher wages may indicate that an individual is more highly skilled or experienced in their field, or that their contributions to the company are particularly valuable. Conversely, lower wages may suggest that an individual is less skilled or experienced. Additionally, wages are more than just a tool for compensation. Wages are also often used to motivate employees, which adds a psychological component to pay transparency.

“Wages mean different things in different contexts,” Singer emphasizes. “If we’re trying to incentivize hard or innovative work, for instance, we want to ask whether some wage effectively accomplishes that. If we’re trying to give people the market price for their skill sets, we’ll want to figure out how

relatively scarce their capabilities are relative to someone else, and whether the wage reflects that.”

Firms should also anticipate the potential negative consequences that may arise when salaries are released internally. “Transparency can breed resentment. If I know what everyone else makes, I may start making unflattering comparisons, which may undermine the effectiveness of the wage as an incentive,” Singer explains. “Someone may be happy with their wage until they learn they’re the lowest paid in their unit, and then they feel underappreciated.”

Singer also says that it can get tricky when firms reward long-standing, loyal employees by increasing their compensation. These wage increases aren’t necessarily tied to their specific skill sets or to the market rate for the position, yet they’ll impact the salary range disclosed in job descriptions, thus driving market salaries higher and making future negotiations with new talent more challenging.

While there are many important implications that companies need to consider when implementing pay transparency, the long-term societal and market benefits certainly outweigh the challenges.

“The equity and efficiency that pay transparency enables is worth these management difficulties,” Singer acknowledges. “One way to navigate such difficulties is to actually follow the logic of transparency all the way down. Companies shouldn’t just be transparent about pay ranges, but also with how and why pay can sometimes depart from the market rate.”

Pay transparency laws will undoubtedly shift the balance of power between job seekers and employers and intensify the hiring process in competitive fields like accounting. However, CPA firms willing to play the game may see pay transparency as an opportunity to not only correct systemic bias and create a path to pay parity, but also use it as a beneficial recruiting tool to attract and retain talent.

The pipeline paves the way for new generations of accounting professionals.

The Alabama Society of CPAs recognizes the importance of early exposure to accounting and has begun work on several initiatives at the high school and collegiate levels. These initiatives focus on a series of strategic endeavors and are designed to ignite interest, amplify awareness, and foster a comprehensive understanding of accounting as a career path.

ASCPA Director of Pipeline Strategy

Caroline Hale spent the summer building relationships with key partners. In July she attended the American School Counselor Association Dream Big conference in Atlanta and heard about the upcoming FASFA changes, as well as new tactics in college and career planning.

Hale also joined ASCPA members Stacy Cumming and Barou Ndaw of Wilkins Miller at the Alabama Association for Career and Technical Education’s conference where they presented a session called, “The Language of Business.” (Spoiler Alert:

the language of business is ACCOUNTING!)

School Initiatives Partnerships with the Alabama State Department of Education

Career counselors play a pivotal role in shaping students’ future career paths. In an effort to expose students to accounting as a career option, a letter has been sent to all high school counselors in Alabama. This letter serves as an open invitation for teachers to call on ASCPA members to come and share about their career, and the endless opportunities associated with accounting. This invitation has also been extended to any existing DECA, formerly Distributive Education Clubs of America, and Future Business Leaders of America (FBLA) chapter in the state.

According to the AICPA 2021 Trends Report, black or african americans accounted for only 5% of all professional staff in accounting/finance functions of US CPA firms. Similarly, fewer than 7,000 CPAs nationwide are black, according to estimates cited by the National Society of Black Certified Public Accountants. The 1% estimate has barely budged in decades. Within the narrower pool of public accounting firms, just 2% of CPAs are black. ASCPA feels this needs to change.

ASCPA has created a handson learning experience called Balance Sheet Bash, in an effort to promote the

profession to students from Alabama Historically Black Colleges and Universities (HBCUs). Over three consecutive days in January this event will travel to Huntsville (Jan. 16), Birmingham (Jan. 17), and Montgomery (Jan. 18). At each location students from accounting programs, or any business major who may be interested in accounting, will enjoy motivational speakers, leadership training, networking and on-site interviews with sponsors. Free of charge.

ASCPA is now a state partner with Beta Alpha Psi, who strives to expose students to industry leaders, networking opportunities, and professional development resources. There are ten active BAP chapters in Alabama, and this partnership will provide more exposure for ASCPA to the students we serve.

This fall ASCPA will re-launch a student-specific newsletter to keep them informed and engaged by sharing relevant updates, upcoming events, success stories, and career advice. The newsletter will be a constant source of motivation and keep students informed on the latest developments in the field.

Have something to share in the student newsletter? Want to learn more about getting involved in student initiatives? Email Caroline Hale at chale@alabama.cpa.

pipeline /pῑp lῑn/ n. a state of development, preparation, or production.

By Jerry W. Grant, CPA, PFS

By Jerry W. Grant, CPA, PFS

Everyone in our profession has read the articles and discussed this issue to the point of it becoming clichéd. Yes, record numbers of CPAs are retiring or changing careers, and yes, accounting program enrollments are down, and most young people do not include accounting on their lists of glamorous, rewarding, or highly compensated jobs.

It is time for the profession to “adapt and overcome!” We have survived decades of tax law changes and ambiguities, accounting and auditing professional guidance minutia and power struggles, and (for goodness’ sake) a pandemic. We can do this!

Okay, so much for the motivational portion of our discussion. Now back to reality. Just as with most aspects of practice management, my firm could probably best set the example as to what not to do. I’m still guilty of thinking that I understand what young people want from a career and what motivates them. Perhaps my greatest stride in reaching some level of wisdom is that I have begun to comprehend that my comprehension is “lacking.” Luckily, over the last few years, I have had the opportunity to discuss the “pipeline” issue with numerous other CPAs from across the country. Accordingly, I don’t claim any of the following ideas as my own but instead as nuggets that I have gleefully co-opted from others to the benefit of my firm:

1. Stop being a bad advertisement for the profession.

CPAs tend to relish commiserating about the long hours, stress, and overall challenging nature of our work. No wonder we’re not a magnet for the future’s best and brightest! Learn to emphasize the great things about our profession––the trust the public places in us, the good we do for our clients, the great opportunities we have to chart our own careers, and the degree of financial rewards. Perhaps we should proactively make our own careers everything that they should be––well balanced between work and personal time, financially rewarding, and great opportunities for growth and development. Let your professional life be a beacon to others!

5. Be a true ambassador for the profession.

Volunteer to speak to universities, accounting clubs, high school career days, and any other venue you can think of to enlighten students as to what the profession has to offer. Use your own experience and success stories. Tell them about the variety of work, the mental challenges, and the opportunities to help clients. My favorite: “I can truly say that for 35 years, I have never had a boring day at work! Every single day has presented some novel challenge/situation to apply myself to.”

6. Use your younger talent as bait.

Not everyone will want to work the hours that in the past we believed indicated “commitment” to the profession. Does it really matter if someone can only work 40 hours during “busy season” or needs to work remotely for a family situation? Compensation levels can be adjusted to better suit an employee’s situation. When firms had a seemingly limitless supply of new accounting graduates, we truly had the luxury of “our way or the highway.” Hopefully, we have all evolved beyond this viewpoint.

3. Ask current employees (particularly the younger group) and prospective employees what makes or would make our work environment a great fit for them now and in the future.

Some of the answers may surprise you and lead you in the right direction. My first inclination is to assume that everyone prizes additional monetary compensation, career advancement, and opportunities for leadership. I have learned that this is not always true. No need to get into the generalizations defining Millennials, Gen Z, etc. Simply remember that we are all different and have different goals and aspirations for our lives. Pose the questions and truly listen to what each person has to say. Take the information and use that knowledge to make your firm attractive to those employees that will add value and contribute to your firm’s future success.

4. Cast a wide net.

Obviously, there are limitations, but we all have jobs in our respective organizations that don’t require an accounting degree/background. Maybe take a chance and get a great person that will fill a staffing need. That opportunity may steer someone to love accounting and develop into a role that they otherwise would have never considered.

Probably poor terminology here, but let me share a funny story. The error was entirely mine. We have always tried to stay active in recruiting at local universities, particularly ones where we have strong relationships with the faculty. Our staff representing the firm advised me that we needed to focus on sending younger staff to the events instead of them. I thought of those guys as “young,” but they reminded me that they were a generation removed from most of the students they met and probably not the best choice to communicate with them. Lesson learned!

Accountants are some of the world’s best problem solvers! Let’s apply those skills to developing the “pipeline” of future members of the profession and guarantee its relevance and success for the coming generations.

2. Offer real flexibility for current and prospective employees.Congratulations also goes to the following scholarship recipients: Andrew Messier, Auburn University; Dalia N. Ortega, University of Alabama at Birmingham; Walker Young, Jacksonville State University

Since 1967, the ASCPA’s Educational Foundation has been providing support to students majoring in accounting at Alabama colleges and universities. Over time the scholarship amounts have grown from $500 to $2,500. The process of selecting scholarship recipients each year is the Foundation’s most visible activity. Each Spring our college and university contacts are asked to share our online application with their students. The application requires the student write an essay and share their journey. Our Educational Foundation and its mission to promote CPA careers through educational scholarships is just as vital now as it was in 1967. Thank you for your continuing support of that mission and in the nurturing of future Alabama CPAs.

Jaileigh Burch Auburn University at Montgomery

Latasha Davis Athens State University

Anna Giles BirminghamSouthern College

Jonathan C. Langston University of Montevallo

Cari Locklear Athens State University

Margaret Maxime Univ. of Alabama at Huntsville

Emily McBee Athens State University

Kristen Moore University of Montevallo

Audrey Osborne Auburn University

Savannah Owens Athens State University

Ashanti Peterson University of Alabama

Jade Sinness Troy University

Peyton Stephenson Univ. of Alabama at Birmingham

Samuel E. Weed Troy University

Olivia Williams University of West Alabama

Jaileigh Burch Auburn University at Montgomery

Latasha Davis Athens State University

Anna Giles BirminghamSouthern College

Jonathan C. Langston University of Montevallo

Cari Locklear Athens State University

Margaret Maxime Univ. of Alabama at Huntsville

Emily McBee Athens State University

Kristen Moore University of Montevallo

Audrey Osborne Auburn University

Savannah Owens Athens State University

Ashanti Peterson University of Alabama

Jade Sinness Troy University

Peyton Stephenson Univ. of Alabama at Birmingham

Samuel E. Weed Troy University

Olivia Williams University of West Alabama

In this section you will find a listing of our remaining CPE programming for the year, including live webcasts, webinars, in-person events and hybrid events featuring in-person and virtual attendance options.

We have a list of CPE FAQs on our website which address accessing your ASCPA account, logging into a CPE course, and finding your transcript. There is also a section on surveys, which must be completed within seven days after a course in order to process CPE certificates. Please read over this short FAQ page, found at alabama.cpa/cpe-faq, to ensure you are ready to finish the 2023 CPE Season without a hitch!

An Overview of the Corporate Transparency Act & BOI New Reporting Requirements

Virtual

9/7/23 (11 AM-12 PM)

Vincent Schilleci | 1.2 CPE

Blockchain - Current Applications of Importance for CPAs

Hybrid

9/14/23 (8:30 AM-12 PM)

Marc Hamilton 2 AA, 2 Other

Insights from the Sam Friedman and FTX Cryptocurrency Fraud

Hybrid

9/14/23 (1-4:30 PM)

Marc Hamilton 4 AA

Real World SSARS Issues

Virtual

9/26/2023 (1 PM-4:30 PM)

Jim Martin | 4 AA

Management Accounting

Decision-Making Tools

Virtual

9/26/2023 (8 AM-3:45 PM)

Leah Donti | 8 AA

Capstone & Cocktails Event: Financial Wellness in the Workplace | Women + Wealth Creation

In-Person

9/27/23 (3-5 PM)

Sommer Morris | 1.2 Personal

2023 Financial Accounting & Auditing Conference

Hybrid

9/29/2023

Various | 8 AA

2023 Financial Institutions Conference

Nov. 15 - 17, 2023

Alabama Federal & State Tax Institute

Hybrid

11/15/2023-11/17/2023

2023 Government Accounting & Auditing Forum

Hybrid

12/4/2023 - 12/6/2023

Various | 16.0 CPE

Tax Webinar with Jim Martin

Virtual

Jim Martin City Visits: A&A in the Port City

In-Person

9/19/2023 (8:30 AM-4:00 PM)

Jim Martin 8 AA

Jim Martin City Visits: A&A in the Capital City

What’s Changing in A&A for Governmental Entities

Virtual

9/5/2023 (8:30 AM-12 PM)

Melisa Galasso | 4 AA

Common Yellow Book & Single Audit Deficiencies

Virtual

9/5/2023 (1 PM-4:30 PM)

Melisa Galasso | 4 AA

Not-For-Profit Accounting & Auditing Update

Virtual

9/6/2023 (8:30 AM-12 PM)

Melisa Galasso | 4 AA

Deep Dive into Common Auditing Deficiencies

Virtual

9/6/2023 (1 PM-4:30 PM)

Melisa Galasso | 4 AA

In-Person

9/20/2023 (8:30 AM-4:00 PM)

Jim Martin 8 AA

Sales & Use Tax Workshop

Virtual

9/22/2023

Bruce Ely & Will Thistle | 4 TX

2023 Sole Practitioners Conference

Virtual

9/26/2023

Various | 8 CPE

THE SQMS: A Couple of Years

Away, but Screaming for Attention

Virtual

9/26/2023 (8:30 AM-12 PM)

Jim Martin 4 AA

Virtual

10/19/2023

Various | 8.0 CPE*

Keeping Organization Assets

Safe

Virtual

10/30/2023 (1 PM-2:40 PM)

Karl Egnatoff | 2 AA

K2’s Technology Conference

Virtual

11/9/2023 - 11/10/2023

Various | 8 Other

Shorten Month End: Closing Best Practices

Virtual

11/10/2023 (7:30 AM-11 AM)

John Daly | 4 AA

2023 Business & Industry Conference

Virtual

11/15/2023 - 11/16/2023

Various | 8 CPE

12/12/2023 (8:30 AM-4:30 PM)

Jim Martin | 8 TX

To

Our law firm periodically receives requests for advice from Alabama CPAs regarding a client’s need to come into compliance with the relatively new and sometimes confusing “economic nexus” or “Wayfair” rules for selling goods or providing services to customers in another state. Often, the client realized only recently they had a sales tax collection problem and are now hinting (or more) that their CPA should have warned them earlier or voluntarily stepped in and handled the new compliance issue. The most common responses we’ve heard from CPAs are “you never asked us to look into the issue and that’s beyond the scope of our engagement” or “we thought you were…or someone else was… handling that issue for you.”

How far can or should a CPA firm stray outside the scope of its engagement letter to please a client? Is client education in areas outside the scope of the CPA firm’s engagement really the firm’s responsibility? Does going above and beyond in the name of client satisfaction open up the firm to threats of litigation if they didn’t achieve the result the client hoped for? An Ashville, North Carolina CPA firm is facing this exact challenge, after an online retail client filed a tax malpractice suit against the firm in North Carolina Business Court, Docket Number 23 CvS 01594.

Vista Horticultural, Inc. d/b/a Eden Brothers, a North Carolina-headquartered online company that sells seed and flower bulbs nationwide (“Eden Brothers”), recently filed suit against its now former CPA firm, Johnson Price Sprinkle, PA (“JPS”) (now DMJPS) for allegedly failing to advise the business of new sales tax obligations created by the U.S. Supreme Court’s landmark decision in South Dakota v. Wayfair, Inc. in June 2018 (more below) and alleged corollary violations of the North Carolina and AICPA Code of Professional Conduct. We summarize below the allegations by the plaintiff in its Amended Complaint and the CPA firm’s responses to date contained in its Answer.

Eden Brothers hired JPS in 2017, allegedly to provide “regular business consulting services, monthly accounting and bookkeeping services, federal and state tax return preparation, and periodic sales tax assistance.”

Soon after being hired, JPS informed Eden Brothers that its North Carolina sales tax process wasn’t correct and helped Eden Brothers set up a proper system for collecting and remitting sales tax to that state. JPS only helped implement a North Carolina sales tax system, since at the time online retailers were required to collect/pay state sales tax only where they had physical presence.

Though Eden Brothers claims “JPS was well aware that Eden Brothers had no internal financial or accounting staff and . . . would be relying entirely on JPS in those areas,” the engagement letters paint a different picture.

The 2018, 2019, and 2020 engagement letters between JPS and Eden Brothers state that “[JPS] will only be responsible for the preparation of the [income] tax returns and forms listed above . . . [but] tax returns may be required in other states and jurisdictions.”

As by now, you are hopefully all aware, in June 2018, the U.S. Supreme Court issued its ruling in South Dakota v. Wayfair, Inc., which replaced the previous physical presence rule from Quill with an economic presence standard. Many states quickly implemented sales tax filing requirements similar to South Dakota’s to require online retailers, like Eden Brothers, to collect state sales or seller’s use taxes based simply on their volume of taxable sales of goods or services to customers in a state.

In 2021, Eden Brothers received notice from the State of Arizona regarding its new law requiring certain remote sellers to collect/pay state sales taxes. Eden Brothers forwarded the notice to JPS and specially asked “[d]o you know anything about other states asking for sales tax now? . . . We are currently not charging tax to any other state customers. Let me know if we need to change any of that!” The engagement letters between Eden Brothers and JPS include that “[u]pon request [JPS] will assist you in evaluating any additional return or form filing requirements.” A JPS company representative “indicated the need to do some additional research” in response to Eden Brothers’ question, but Eden Brothers claims it didn’t receive relevant advice.

After receiving the Arizona DOR notice, the company hired a new CFO, who allegedly “discovered” that Eden Brothers had not been collecting sales tax in any state except North Carolina for the three years since Wayfair was decided. JPS was consulted and referred the CFO to another accounting firm, apparently with more expertise in multi-state sales tax compliance. Eden Brothers implemented procedures for collecting/paying sales tax in addition to applying for voluntary disclosure agreements (“VDAs”) in each state where it had delinquent sales tax obligations.

Thankfully, Eden Brothers’ VDA proposals apparently were granted, and the company avoided substantial penalties for its lack of sales tax collection. Nevertheless, Eden Brothers’ sales tax obligations and interest for the three years of missed tax payments totaled over $2 million and it sued JPS for more than $1 million plus punitive damages, attorney fees, etc. JPS has raised several defenses to the claims, including that Eden Brothers failed “to read communications from [JPS] concerning [Eden Brothers’] obligations,” and failed “to provide [JPS] sufficient

information to determine [Eden Brothers’] obligations, despite specific advice from [JPS] and requests for such information.” The case is still pending.

As we often reiterate, a detailed engagement letter, signed by the client and clearly limiting the scope of the engagement, goes a long way toward managing client expectations and mitigating the risk of potential lawsuits.

Another best practice is to send periodic questionnaires or alerts to clients that warn of new tax developments and offer to provide detailed advice if the CPA firm is called on – and to document the issuance of these alerts. Not only do these newsletters give clients the opportunity to request additional services, but they can also function as a subtle if not express reminder that the CPA firm is otherwise limited in its services to those listed in the engagement letter. Alternatively, although it may be painful, just as JPS did, it may be wise for the CPA firm to refer the client to another professional services firm or a sales tax consulting/ software firm for specialized services the CPA firm simply isn’t staffed to provide.

The states’ – and occasionally local governments’ – postWayfair aggressive “economic nexus” rules potentially expose CPA firms to surprise malpractice claims in the wrong circumstances. The Eden Brothers lawsuit is a cautionary tale for every CPA firm with clients who sell goods or services outside their state boundaries, whether online, via common carrier or otherwise.

Will is both a CPA and attorney and longtime member of ASCPA, while Bruce is an attorney and associate member of ASCPA. Both are partners in the multistate law firm of Bradley Arant Boult Cummings LLP, resident in the firm’s Birmingham office. Anna is a summer associate with the firm, a 2nd year student at the University of Alabama School of Law, and holds both an MBA and BS in Economics from the UAB School of Business.

by Marc Rosenberg, CPA

by Marc Rosenberg, CPA

We’ve written over 500 blogs in the past 15 years. Our material is pitched mostly to partners and managers. We would love it if this blog was read by entry-level hires, staff at CPA firms senior or below, and interns. Partners, you should forward a copy of this blog to your firm’s young people.

We really hope that partners also read this. Why? To answer that question, we need to understand the genesis of this blog. For over a decade, partners across the country have told us how disappointed they are that some of their most talented staff don’t want to be a partner. This has always puzzled me. Given the tremendous benefits of being a partner (cited below), this lack of ambition makes no sense.

I have always thought that staff have this attitude because they don’t know what it means to be a partner. They are blissfully unaware of the great reasons why being a partner is a fabulous job. Why don’t they know? Amazingly, it’s because the partners haven’t told them!

When partners tell me about their staff’s exasperating lack of ambition, I flip the conversation back to them. I ask what they have done to mentor and groom their staff. What have they done to educate their staff on why it’s great to work at a CPA firm and how wonderful it is to be a partner? When partners are honest, many admit that, sadly, they have not addressed these issues directly and clearly with staff.

When I started my first job out of college with Ernst & Young, my goal was to be a partner. I had absolutely no clue what it took to be a partner or even what it meant to be a partner. I just knew I wanted to be a partner because that was the pinnacle of success.

Today’s young people aren’t like my fellow baby boomers who started their careers when I did. Baby boomers share many personality traits. One is this: when our bosses said, “Jump,” we asked how high. Today’s young people say, “Why should I jump?” or “I’ve got a better way.” Plain and simple, they don’t want to be a partner until someone explains what it means.

Why do I want partners to read this? Because I hope this blog causes them to ask themselves if they are doing everything they can possibly think of to mentor staff, especially those with partner potential. Partners should share with their staff how fantastic it is to work at a CPA firm and eventually become a partner.

So here’s what I want readers of this blog to do:

• For young people, here are the reasons why working at a CPA firm is a great job and why it’s great to become a partner.

• For partners, consider this blog a crash course on how to get your staff chomping at the bit to work at your firm, stay at your firm, and eventually become a partner.

1. Here is what a CPA is not: a “numbers” person or a personality-less math nerd. It used to be so, but not anymore. Computers do all the math work for us so we can focus on what’s more important – helping clients solve their business problems. One caveat: You can’t suck at math. But you don’t have to be anything more than average at it.

2. When young staff are asked what the best part of their job is, the hands-down winner is the social aspect. They love the opportunity to interact with their peers and create a social network that they value highly.

3. It helps them build their interpersonal skills – a key to their future success, regardless of what they do later in their career. Forming effective relationships with clients and firm personnel is just as important a career-builder as filling out a 1040 or reading up on section 957 (d) 2(a) transactions.

4. The work is interesting and challenging; you help clients run their business, advise them, and solve their financial challenges.

5. Staff get paid a handsome salary and benefits package while the firm provides intensive training. You can’t get better than that!

6. Staff get to work with a diverse number of businesses; there’s lots of variety.

7. They learn how companies run and how the business world works.

8. Formal, continuous mentoring of partners.

9. Access to cutting-edge technology.

10. Should staff decide not to continue working at a CPA firm, they have a solid foundation for their next job, whatever it may be. Accounting is the language of business.

11. Tremendous flexibility in how they work: they set their own hours, have remote work options, and they decide when and where they work.

12. Job security – most CPA firms are recession-proof, thus being immune to layoffs.

13. If you do well, the ultimate reward is being a partner – see the next section.

Why would anyone say no to this?

1. Functioning as an entrepreneur in a small business.

2. Unlimited flexibility in how, when, and where you work.

3. Working with clients you love and who love you back.

4. Challenging and interesting work as you help clients grow and solve problems.

5. Having staff to delegate lower-level work to.

6. Mentoring young people.

7. Having tenure, just like professors (firms almost never fire partners).

8. Earning more than 99+% of all people. For 2021, CPA firm partners at local firms earned almost $600,000. It takes hard (though not excessive) work, but a staff person doesn’t have to be a genius to earn the partner promotion.

9. Earnings security – most CPA firms are recession-proof; almost every year, their revenue and profits increase.

10. Having almost no accountability (pardon the sarcasm).

There is one obstacle: when we talk to staff about being a partner and they don’t seem excited, the most common response by far is that they observe the partners working all the time, and they don’t want to work like that. They feel there is more to life.

When we discuss this with partners, they slough it off. Common responses:

• “I like my work and I don’t mind working the hours. Why should I stop doing what I love?”

• “I don’t work that much time. The national average of 2,350 total work hours is only 270 hours of overtime. That ain’t so bad. Besides, maybe 120 of those hours are additional vacation that staff don’t get.”

• “I tell staff that yes, some of our partners may work long hours, but it isn’t required. There are no rules that require partners to work long hours. We do it because we love it. And we get paid based on our overall performance, not how much overtime we work.”

• “A top executive in any business works overtime. If you want to be successful and rise in any organization, it’s very hard if you only work 9 to 5.”

I honestly don’t have an answer to this dilemma. Should partners work fewer hours to encourage their staff to remain with the firm? Possibly. I’d love to hear your thoughts on what partners can do to dispel the image that they work all the time.

CPA firms are all struggling with the talent shortage and many have started conversations on employing remote talent solutions to fill their gaps. This is a new era for CPA firms and choice of talent solution will determine whether a firm stagnates or grows.

Here are the top things you need to consider when choosing the right provider.

First, let’s be clear about the status of the domestic talent pool and why it’s not going to get any better. The Bureau of Labor Statistics estimated that more than 300,000 accountants and auditors quit their jobs in the last two years. That staggering number is only further exacerbated by the fact that the number of those graduating with accounting degrees is continually declining every year. The AICPA reports a 2.8% decline in 2021 at the bachelor’s level and a 8.4% decline at the master’s level. This follows five consecutive years of decline.

To put these numbers into context, it is estimated the profession needs 90,000 graduates every year to fill openings at a sustainable level. The AICPA’s last count only showed 52,481 graduates at the bachelor’s level.

The Big 4 has long relied on remote talent centers to supplement its workforce. In fact, more than 40% of Deloitte’s staff is based internationally. Smaller firms, however, are starting to leverage remote solutions as well, as it becomes clear that traditional hiring methods and staffing firms are no longer viable options.

Many have taken the plunge but yours may only be in the exploratory phase. If your firm is evaluating remote solutions, there are things we’ve learned from Big 4 solutions that you should insist are being provided to you. Here are the things to look for in a provider.

• U.S. Based Professionals – One of the biggest issues firms have with remote providers is poor communication. You need to ensure your provider has U.S. based professionals as part of their offering, including a partner level, point of contact that you always have immediate access to. This person should always be able to respond to your concerns and provide clarity on your work.

• Adherence to Firm Standards/Processes – Even if your remote talent team has the right credentials, are they trained up to your standards? You want to avoid black box models where you have no transparency on how your work is being produced. Your provider should ensure your standards of quality are met. You will also need to have oversight on anybody that touches your work product and that should include the option to train them yourself.

• Team Approach – Many Firms are turning to remote talent because they haven’t been able to find a replacement for a domestic professional. The last thing you would want is to then lose the remote professional you brought on and have to start over. That’s why any provider you engage with needs to have a full team approach, where multiple people are trained and educated on your firms practices and are available to step in regardless of the circumstances.

• Flexible Availability – The hours of some remote professionals often only overlap with your domestic professionals for 1 to 2 hours per day due to time zone differences. Your provider needs to ensure at least 17 hours of availability so you can collaborate with your team.

When we built alliantTALENT’s solution, we set out to solve the biggest problems CPA firms had with remote solutions. That meant addressing the concerns above, while delivering work of the highest quality. What alliantTALENT provides is truly an extension of your team. Your remote team is fully integrated, trained to your expectations and defined by your standards.

We’ve taken what I learned building Deloitte and Grant Thornton’s talent centers and making it available to you, so you can scale. Reach out to us today and find out more about what sets us apart.

Jim Brady, CEO alliantTALENT JimBrady@alliantgroupinfo.com

Jim Brady, CEO alliantTALENT JimBrady@alliantgroupinfo.com

These individuals completed all four parts of the CPA exam between May 1 - Jun. 30, 2023.

Rachel Elizabeth Almond, Tuscaloosa

Madison Ann Armstrong, Huntsville

Katie Vicktoria Atchison, Auburn

Allison Alena Bean, Notasulga

Lauryn Durham Beckham, Tallassee

Merrill Isaac Bennett, Peyton, CO

Daniel Phillips Bethea, Birmingham

Brandon Alan Bishop, Birmingham

Amy Lee Bober, Flint, MI

Latorius Deangello Bonner, Birmingham

Rachel Katherine Brinkley, Birmingham

Lucas Allen Brunson, Mobile

Michael Andrew Callahan, Gilmer, TX

Tae Young Choi, Suwanee, GA

Morgan Edward Clayton, Mountain Brook

Meghan Elizabeth Custer, Birmingham

Coleman Marcus Dewberry, Eufaula

Jessica Rose Fair, Huntsville

Jacob Andrew Feenker, Birmingham

David Grant Fielding, Chelsea

Maggie Terese Finn, Saline, MI

Janiah Yolanda Fryer, Louisville

Parker Lynn Grogan, Madison

Taylor Ann Hall, Owens Cross Roads

Lauren Grace Hawley, Auburn

Nicholas Len Hayes, Hoover

Terry Michael Hensley, Anniston

Morgan Rose Hill, Birmingham

William Dow Hodges, Birmingham

Cole Ingram Hunt, Birmingham

Heather Danielle Jackson, Opp

William Wood Jinright, Troy

Courtnei Jamise Johnson, Gardendale

Andrew Colin Kilgore, Alexandria

Emily Anne Klinefelter, Iowa City, IA

Ryan Thomas Lambert, Auburn

John Thomas Landers, Hoover

Christian Dawoon Lee, Montgomery

Keeley Mitchell Leisure, Alex City

William Anthony Levant, Auburn

Margaret Marie Livaudais, Birmingham

William Thomas Lowe, Mobile

Anna Nicole Macdonald, Birmingham

Ludmila Boykova Macginnis, Huntsville

Lauren Nicole Mardis, Dothan

Joe Walter Mellette, Huntsville

Margaret Claire Mince, Birmingham

Walter Fowlkes Morris, Auburn

James Louis Newman, Hartselle

John Paul Noland, Madison

Kanako Okazaki, Owens Cross Roads

Carson Raines Plan, Auburn

Lauren Nuwayhid Sanders, Madison

Ryan Keller Shamblin, Birmingham

Katelyn Leanna Smith, Daphne

Damien Ferris Stephens, Hoover

Emily Sears Stockard, Irondale

Benjamin Gregory Stocks, Hoover

Michael Roderick Taylor, Birmingham

Katherine Wang Wahlers, Toney

Campbelle Elise Wilkinson, Dallas, TX

Stewart Allen Wilson, Troy

Wai Lam Wong, Vestavia Hills

John Whitlow Wyatt, Springville

David Pierce Yancey, Marietta, GA

Alabama Family Trust has named Lesley Byars as their new Executive Director.

Byars, a Certified Public Accountant, was formerly the organization’s Chief Financial Officer. She has a bachelor’s degree in accounting from The University of Alabama. She began her career as an auditor working for PricewaterhouseCoopers in New York City. After returning to Alabama, she managed the trust tax departments for the Birmingham offices of two Fortune 500sized banks.

Byars has worked as a consultant to public accounting firms located in several states on issues related to taxation and administration of trusts, estates and nonprofit organizations. She is a member of the Alabama Society of CPAs.

Austal USA promoted Christy Taylor to the newly established position of Chief Operating Officer for Transformation. She will report to Austal USA president Rusty Murdaugh, and oversee Human Resources, Production Control, IT and Supply Chain Management operations in addition to other business integration, leadership, and strategy roles. Her focus will be developing and integrating company-wide systems and processes while identifying and enabling synergies across these functions to ensure the company is aligned in pursuit of Austal USA’s strategic goals.

Taylor holds a bachelor’s degree in accounting from Georgia State University and a master’s degree in accounting from University of Central Florida. She is a licensed CPA in the states of Alabama and Florida as well as a Chartered Global Management Accountant and a member of the American Institute of Certified Public Accountants (CPAs), the Alabama Society of CPAs, and the University of South Alabama Accounting Advisory Board.

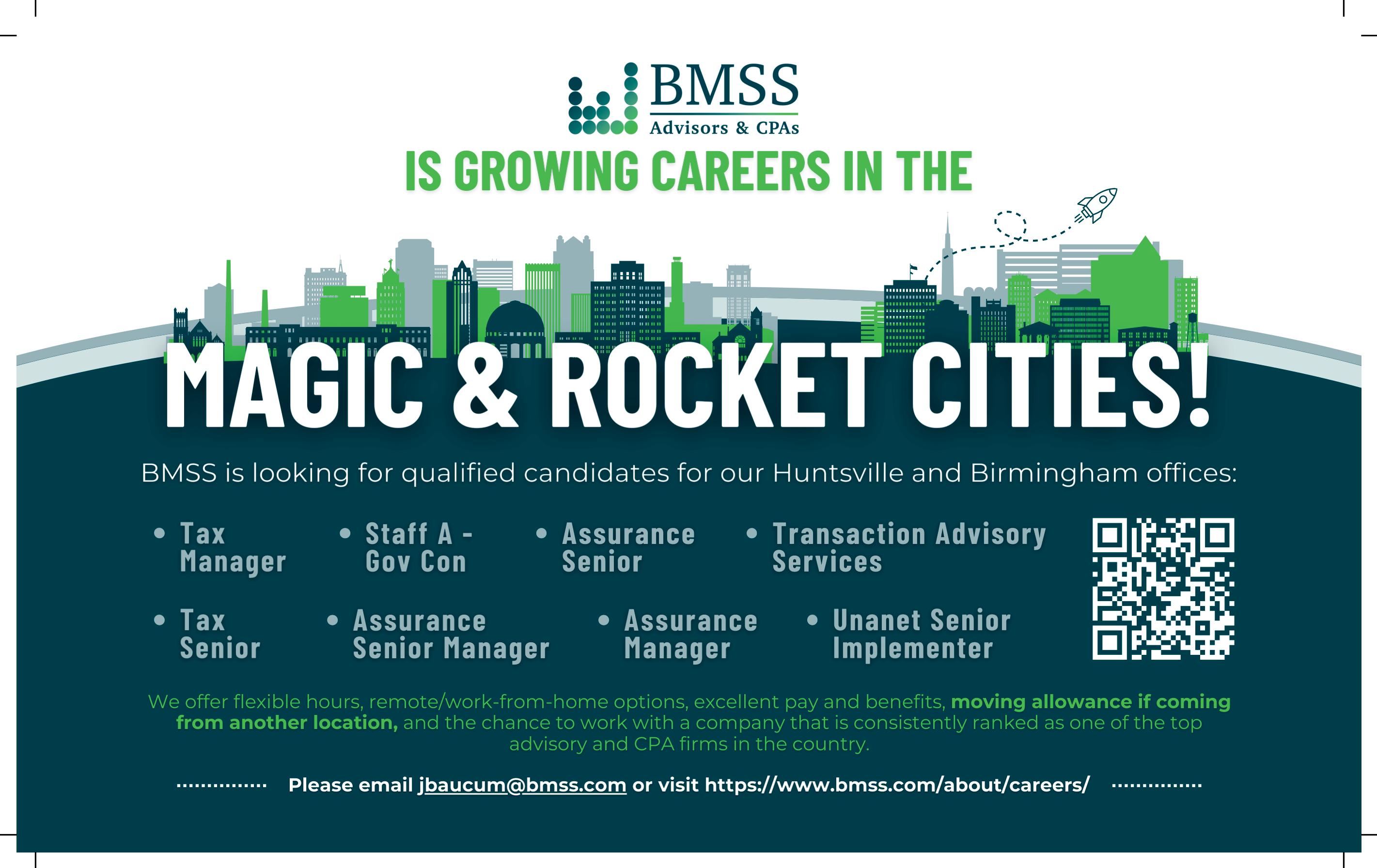

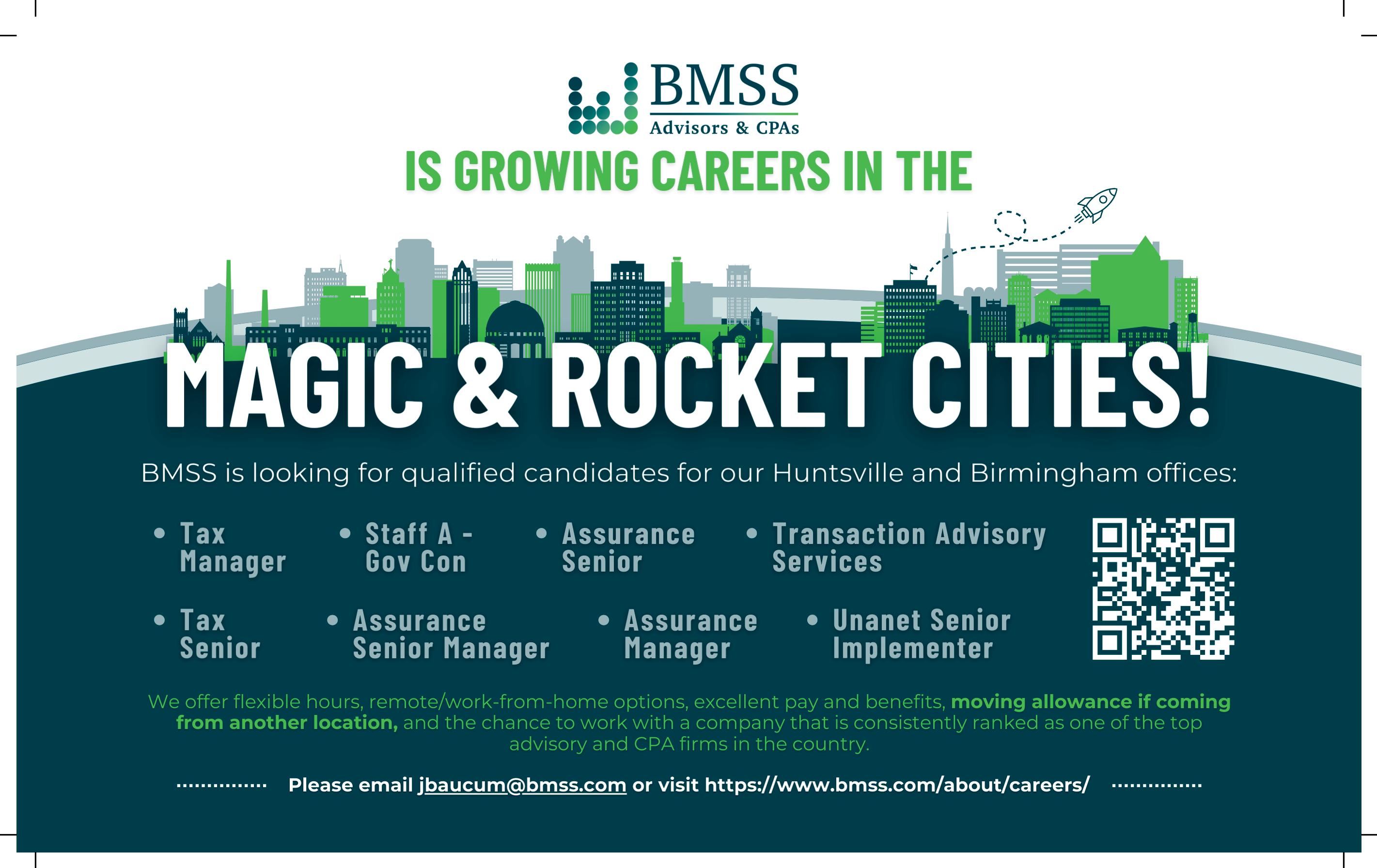

BMSS Advisors & CPAs is proud to share our newly promoted employees:

The following have been promoted to Senior Manager:

Richie Fordham (Birmingham)

Amanda Hunt (Huntsville)

The following have been promoted to Manager:

Whitney Roberson (Huntsville)

Tami Soule (Birmingham)

Joanna Teter (Huntsville)

The following have been promoted to Supervisor:

Brett Blackwood (Huntsville)

Claire Brien (Huntsville)

Peyton Cox (Huntsville)

Madison May (Huntsville)

Hunter Melton (Birmingham)

Cheyenne Sandlin (Huntsville)

Rachel Wilson (Gadsden)

May Cox

The following have been promoted to Senior Accountant: Joseph Calvert (Birmingham)

Jessica Fair (Huntsville)

Bailey Pinkerton (Huntsville)

Anthony Vintson (Huntsville)

Crow Shields Bailey is very proud to announce the promotion of Kirsten Sokom, CPA, to Audit Principal. Kirsten has been with CSB for nearly 10 years and is a member of Eastern Shore Young Professionals, Eastern Shore Chamber of Commerce, and The University of South Alabama Alumni Association. She has also served several years as the official accountant for Distinguished Young Women, along with others from our team.

McDaniel & Associates, P.C. is proud to announce Andrew Brooks, CPA and Emily McDowell Knight, CPA as new partners effective July 1, 2023.

Andrew Brooks joined McDaniel & Associates, P.C. in October of 2010. His extensive experience serving clients in construction, healthcare, real estate, manufacturing, and retail industries enhances each client relationship. He is a member of the Alabama Society of Certified Public Accountants and the American Institute of Certified Public Accountants, as well as a past board member the Southeast Chapter of the Alabama Society of Certified Public Accountants, Flowers Hospital Young Professionals, and Evergreen Preschool Ministries.

Emily Knight has been a member of the firm since 2012. She focuses on tax preparation for both individuals and businesses, specializing in small business accounting, as well as financial statement engagements on all levels. She takes pride in providing tax planning and consulting services to help clients maximize cash flow opportunities in an effort to help grow each business on an individual basis. She has extensive experience in a variety of industries concentrating primarily on manufacturing, agriculture, construction and real estate.

Roberson Teter Soule

Roberson Teter Soule

MDA Professional Group, an accounting and business consulting firm with offices in Albertville, Anniston, Fort Payne, Gadsden, Huntsville, and Roanoke announces the promotions of Kim Stallings to Senior Manager and Seth Stanfield to Manager.

Kim holds a Bachelor of Science in Accounting from Jacksonville State University. She has over nine years of public accounting experience and six years of private accounting experience. As senior manager, her area of focus is non-profit, governmental, and corporate auditing and attest services; and nonprofit, corporate, and individual taxation.

To invest in the clients and communities of Central Florida, Anglin Reichmann Armstrong P.C. (Anglin) has merged in Adamson + Co, P.A., effective August 1, 2023. The combined firms will operate under the name Anglin Reichmann Armstrong and expand the firm’s presence in the U.S. Southeast region and nationally.

This merger strengthens Anglin’s commitment to serve existing and new clients throughout Central Florida and grow with them, adding extensive knowledge and community investment through the Adamson team. With an office in Polk County, centrally located between Tampa and Orlando, Anglin can deliver additional resources, technology and professional career opportunities to several local communities.

Crow Shields Bailey has earned recognition as one of INSIDE Public Accounting’s Top 500 Accounting Firms for 2023. The IPA 500 firms are ranked by U.S. net revenue and are compiled by analyzing the 600 responses received this year for IPA’s survey. This is IPA’s 33rd annual ranking of the largest accounting firms in the nation.

Kassouf recently earned three national awards recognizing both the firm’s business growth and inclusive company culture. The awards include INSIDE Public Accounting’s Top 300 Firms, Accounting Today and Best Companies Group’s Best Firms to Work For, and COLOR Magazine and Best Companies Group’s Inclusive Workplaces.

“We’re thrilled to receive these honors from the accounting industry’s top publications and a top magazine for inclusiveness across industries,”said Managing Director Jonathan Kassouf, CPA, PFS. “Being recognized for both client service and company culture is especially exciting. Our employees feel safe, supported, and empowered at Kassouf, which allows them to succeed professionally and personally.”

Seth also holds a Bachelor of Science in Accounting from Jacksonville State University. He has been with the firm for three-and-a-half years of his seven years of public accounting experience. He specializes in the areas of auditing and attestation of corporate, governmental entities, non-profit organizations, and financial institutions, and the areas of individual and corporate taxation.

Mauldin & Jenkins Climbs on INSIDE Public Accounting’s Top 100 Firms List for 2023

Mauldin & Jenkins, a leading assurance and advisory firm, is proud to announce that it has been named one of INSIDE Public Accounting’s Top 100 Firms for 2023. Coming in at number 65, the Firm climbed four spots ahead of the previous year’s ranking of the most successful public accounting firms.

An esteemed industry benchmark, the IPA Top 100 Firms are annually ranked by U.S. net revenue and are compiled after analyzing the responses of 600 firms surveyed across the nation.

Hanson Borders, Managing Partner, is thrilled with this year’s ranking. “Achieving this recognition from INSIDE Public Accounting is a great honor,” said Borders. At the time of this release, the Firm has since surpassed $100 million in revenue.

For the 6th consecutive year, Machen McChesney has been recognized as one of the Top 500 Accounting Firms for 2023 by Inside Public Accounting (IPA).

Mike Machen, the firm’s managing partner, stated, “It has been fantastic to be recognized nationally among the best firms in the U.S. I cannot emphasize enough how grateful the firm is for our clients, team, and community to be part of this group and recognized in the industry. We are incredibly proud of our team.”

IPA recognizes the top U.S.-based accounting firms based on an annual practice management survey and analysis of firms. IPA annually ranks the largest public accounting firms, which range from the Big 4 to the smallest firms across the country. This is the 33rd annual ranking of the nation’s largest accounting firms conducted by IPA.

Pearce, Bevill, Leesburg, Moore, P.C. hosted their very first blood drive and had 28 donors that stepped up to the plate.

Accounting Biz Brokers has been selling CPA firms for over 18 years and we know your market! Our brokers are Certified Business Intermediaries (CBI) specializing in the sale of CPA firms. We are here to help you navigate through the entire sales process. Contact us TODAY to receive a free market analysis. Listings include:

• NEW: Western Knoxville, TN $430K

• NEW: West of Nashville, TN $265K

• Chattanooga, TN Area $2.115M

• W Middle TN $350K

• NEW: North MS/Metro Memphis CPA Firm $1.25M (Sale Pending)

• East Memphis Area $520K - SOLD

• East Memphis Suburb $950K - SOLD

• Knoxville $600K - SOLD

• Bartlett, TN Gross $550K - SOLD

• NE MS Tax & Bookkeeping Firm Gross $850K - SOLD

For more information contact Kathy Brents, CPA, CBI Cell 501.514.4928 | Office 866.260.2793

Kathy@AccountingBizBrokers.com

www.AccountingBizBrokers.com

Thinking about selling your practice? Accounting Practice Sales delivers results, bringing you the best price, optimal terms and a buyer who represents an ideal fit for your clientele. Contact us today for a confidential discussion.

Practices for Sale:

• Montgomery, AL CPA grossing $340K *

• Tuscaloosa, AL CPA grossing $175K *

• Montgomery, AL area CPA grossing $155K *

• Auburn – Opelika CPA grossing $330K *

• Pascagoula, MS area practice grossing $170K *

• East Memphis Suburb CPA grossing $545K *

• Dyersburg, TN area CPA grossing $320K *

• South of Knoxville, TN CPA grossing $425K *

• Southwest TN / Northeast MS practice grossing $160K *Available*

• Panama City Beach, FL CPA grossing $205K *

• Pensacola EA grossing $130K *Available

• Western FL Panhandle CPA grossing $365K *

For more information on these listings or to sell your practice, contact Lori Newcomer, CPA and Tim Price, CPA at (888) 553-1040 or PNgroup@APS.net, or visit www.APS.net.

It May Concern,

To Whom It May Concern,