It’s juicy. It’s tasty. It’s sweet. And because of a touch of lime, it’s the freshest melon on the market.

GEMEINSAM DAS POTENTIAL DER KATEGORIE AUSBAUEN!

Seit über einem Jahrhundert bringen wir beste tropische Früchte von höchster Qualität auf den Markt

· angetrieben von unserem Engagement für natürlichen Geschmack und Nachhaltigkeit sowie · durch Investitionen in unsere Farmen und durch Partnerschaften mit den besten Produzenten Lateinamerikas.

Wir verstehen die Bedürfnisse unserer Kunden und entwickeln mit unserem kontinuierlichen Kundenbindungsprogramm gemeinsam die Kategorie.

Winning together!

LET’S GROW THE CATEGORY TOGETHER!

We’ve been bringing great tasting, top quality tropical fruits to market for over a century, driven by

· our commitment to natural taste and sustainability and

· investment in our farms and by partnering with the best growers in Latin America.

We understand our consumers’ needs and with our ongoing customer engagement programmes, we will grow the category.

Winning together!

4 “Basically, the past open ground season was not satisfactory monetarily”

Christian Berghs-Trienekens, BT Gemüse and Landfrisch AG

6 Apple export the major changes of the last three years

Pierre Gratacos, Cardell Export – Groupe Innatis

8 Exports to Germany a fresh start for French asparagus?

12 “In the first weeks of the campaign we’ve needed an extra push to sell our production”

José Carlos Escobar, of CASI

15 “If people don’t understand what you contribute, you keep running into trouble”

Jelte van Kammen, General manager Harvest House

23 “Our goal is to reach the old levels above 80% and higher”

Andre Jobmann, Maersk

27 “A natural selection or shakeout is taking place”

Ramazan Gülnar, Paris Direkt

31 The 2022 organic apple crop exceeded that of 2021 by 30 percent

Hans-Josef Stärk, BayWa Obst & Co.

34 “We want to remain at the forefront”

Erik van Nieuwenhuijzen, Albert Heijn

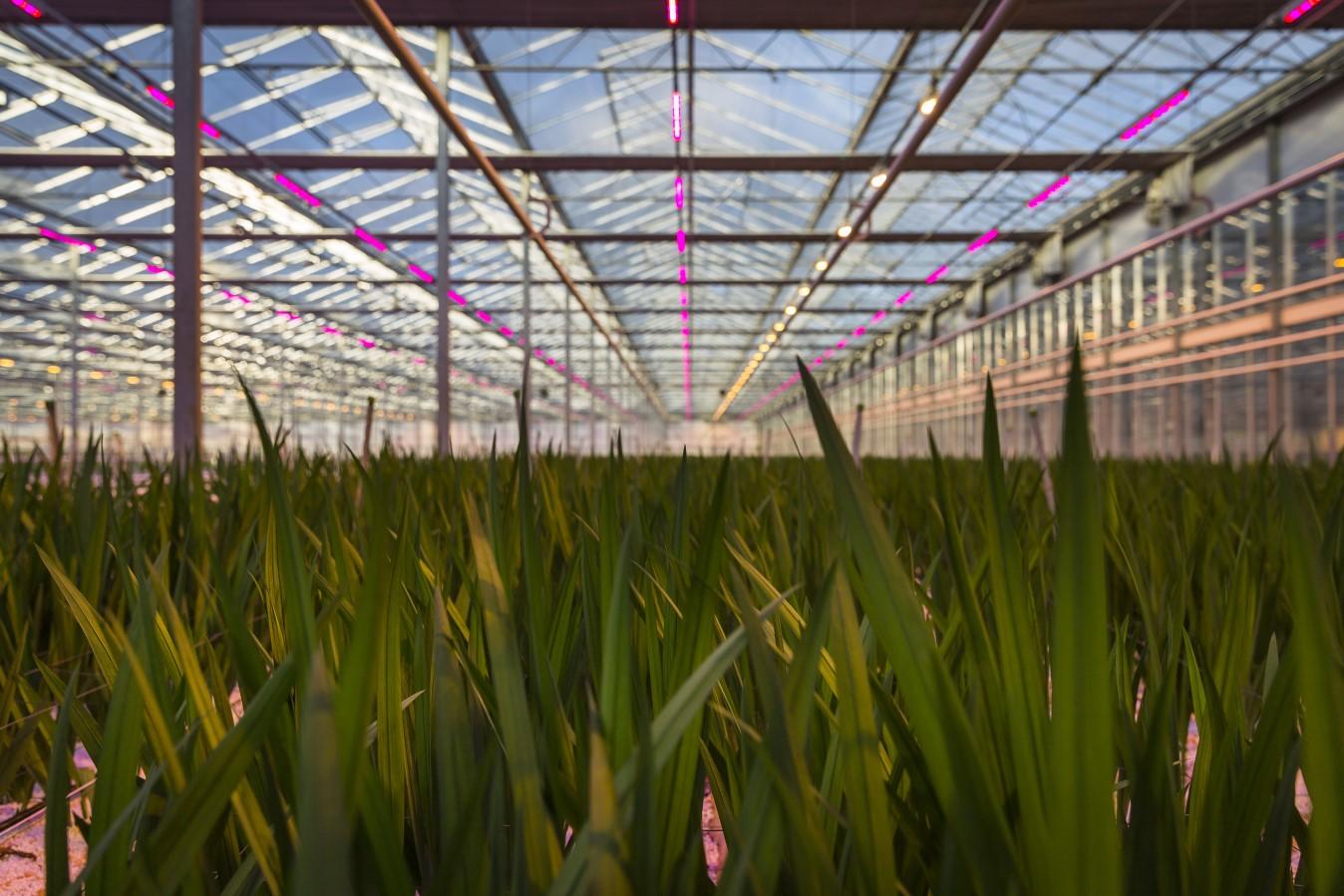

42 40,000 heads of lettuce per day, under glass

Andreas Scherzer from Scherzer Gemüse

46 Europe-wide hub for fresh fruit and vegetables from the Palatinate

49 “Improvement can only be ensured with continued training”

Frits Popma, Popma Fruit Expertise

52 “We welcome more competition from tomato brands”

Margriet en Annelies Looije, Looye Kwekers

64 Extensive, local network in Morocco now bearing fruit for Dutch tomato grower

68 Explosive energy prices How long can growers and traders hold out?

75 “I want to put it behind me as quickly as I can; still, the scars will remain”

Ben de Groot of De Groot Fresh Group

80 People development is the compass by which Suiderland Plase steers

84 Seven Italian regions are home to nearly 80 percent of the national lettuce-growing area

86 “Fruit growers will either have to bulk farm or specialize”

Emanuel Sluis, Service2Fruit

90 “I believe 2023 may become the most challenging year in recent history”

Craig Stauffer, CEO of Vanguard International

92 “Major opportunities for Egyptian citrus can be found in Far-Eastern markets”

Mostafa Ali, commercial manager Rula Farms

95 Visiting herb, date, and grapefruit (and a few more surprising products) companies in Israel

106 Focus on the regionality and nationality of the asparagus and soft fruit

Fred Eickhorst and Frank Saalfeld

108 Spanish citrus campaign marked by a reduction in the supply and great price differences between qualities

111 The trends of 2022 that gave the Vertical Farming industry quite a shock

115 “The blackberry as such is still being underestimated, in my opinion”

Markus Schneider, Frutania Ltd.

121 “It is clear that the organic pomegranates are becoming increasingly established in the trade”

Ziya Sizgin, Uvafruit

125 Emerging stronger from the crisis

130 China fruit shines as Covid-restrictions ends

132 The European greenhouse industry is transforming, but into what?

134 Germany absorbs 25 percent of Italian apples

138 Pears, Italy must catch up. Exports to Germany and France

140 Italy seeks to maintain its ranking in the kiwifruit sector

144 “We must share our story”

Elke Schroevers, Organto Foods

147 “We must consider the problems that the organic market is facing.”

Emilie Daquin and Cécile Perret, Ferme de la Motte

152 The avocado acreage in Spain continues to expand while mangoes are still in need of greater recognition

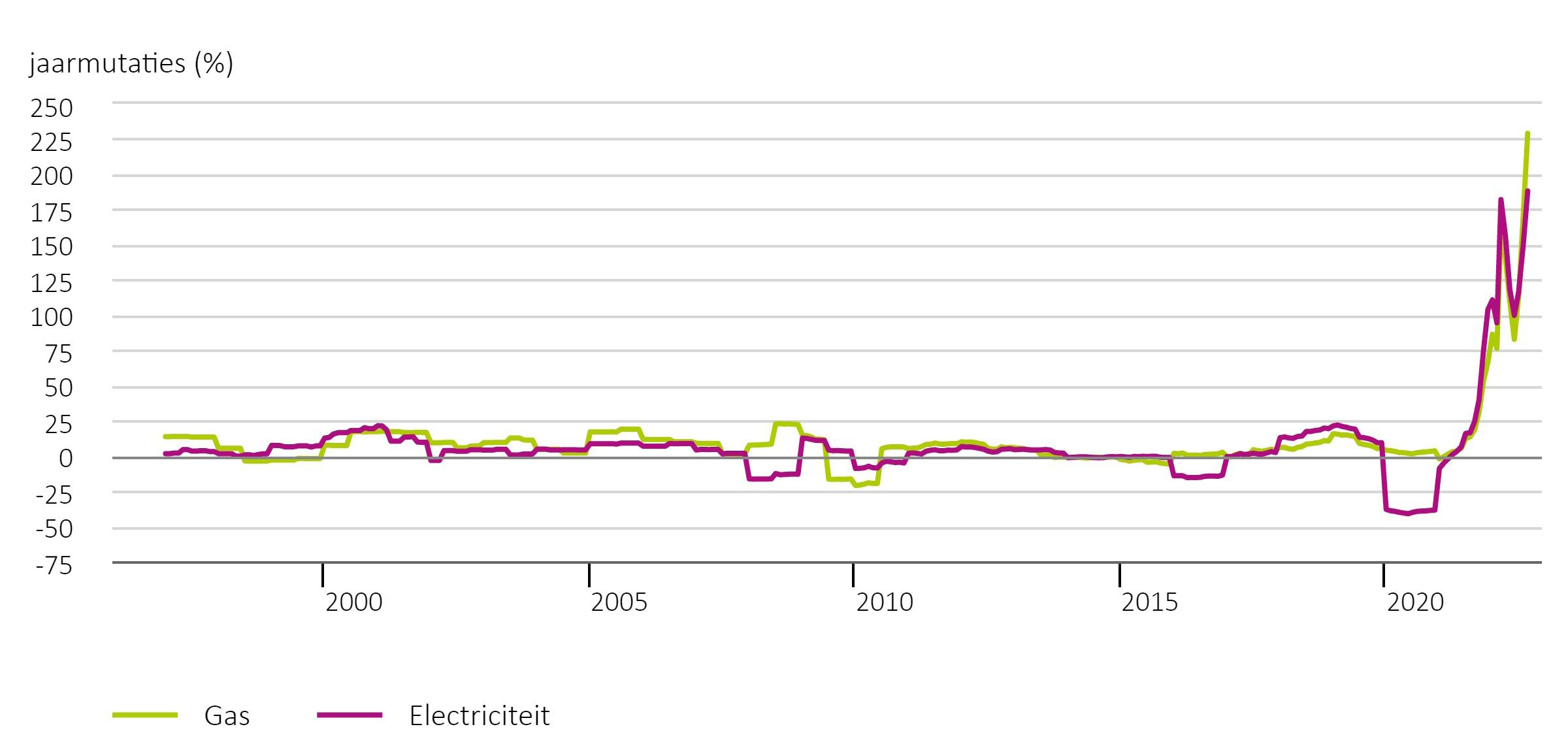

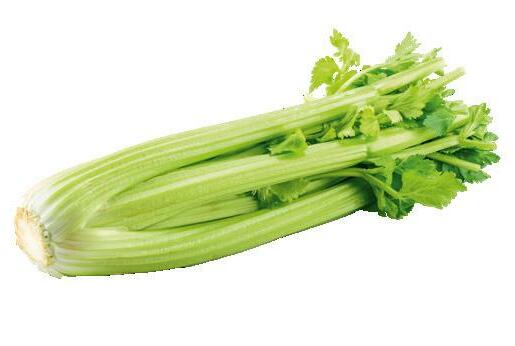

For several reasons, 2022 will be remembered as an eventful and challenging year for German open ground vegetable production. Right away, the first half of the season was characterized by very high supply pressures, which were met with lower demand, compared to previous years.

The resulting supply pressure was due to several developments, first and foremost the late end of the season in Spain and Italy and the simultaneous start of the season in almost all German regions. Added to this was the warm, stimulating weather in May and June, so that the first planting sets were pushed together. "It should also not be forgotten that cultivation was generally expanded due to good demand and prices in the past Corona years. At the same time, the loss of purchasing power, due to the reopening of restaurants and caught-up vacations, led to a noticeable drop in demand," says Christian Berghs-Trienekens, open ground gro-

wer and managing director of BT Gemüse & Verpackung, founded in 2015, and also a member of the supervisory board of Landfrisch AG.

From the second half of the season, the market slowly turned. Due to the persistent heat and drought in Europe, supplies dropped. The demand on the German market remained constant, while exports increased significantly. Berghs-Trienekens: "For lettuces, the second half of the season halfway compensated for the losses from the first half of the season. On the other hand, it was impossible to compensate for other open ground products such

as kohlrabi. With some small exceptions, basically the past open ground season was not satisfactory monetarily."

With regard to yields and revenues, a distinction must be made between piece and bulk goods. For piece goods, yields were very good compared to 2021, which was a wet year with heavy losses. "There were no losses because in our area it was possible to irrigate during the summer, although of course this cost enormous amounts of energy, labor and therefore money. For products sold in bulk, such as industrial goods, we witnessed lower tonnages, particularly during the dry second half of the season," Berghs-Trienekens says. Lettuce crops will generally stand the heat better than other vegetables, provided the plants can be adequately irrigated. Leeks, cabbage, celeriac and carrots, on the oth-

“Basically, the past open ground season was not satisfactory monetarily”

Christian Berghs-Trienekens, BT Gemüse and Landfrisch AG, ends the year with mixed feelings

er hand, have suffered considerable crop losses due to the heat.

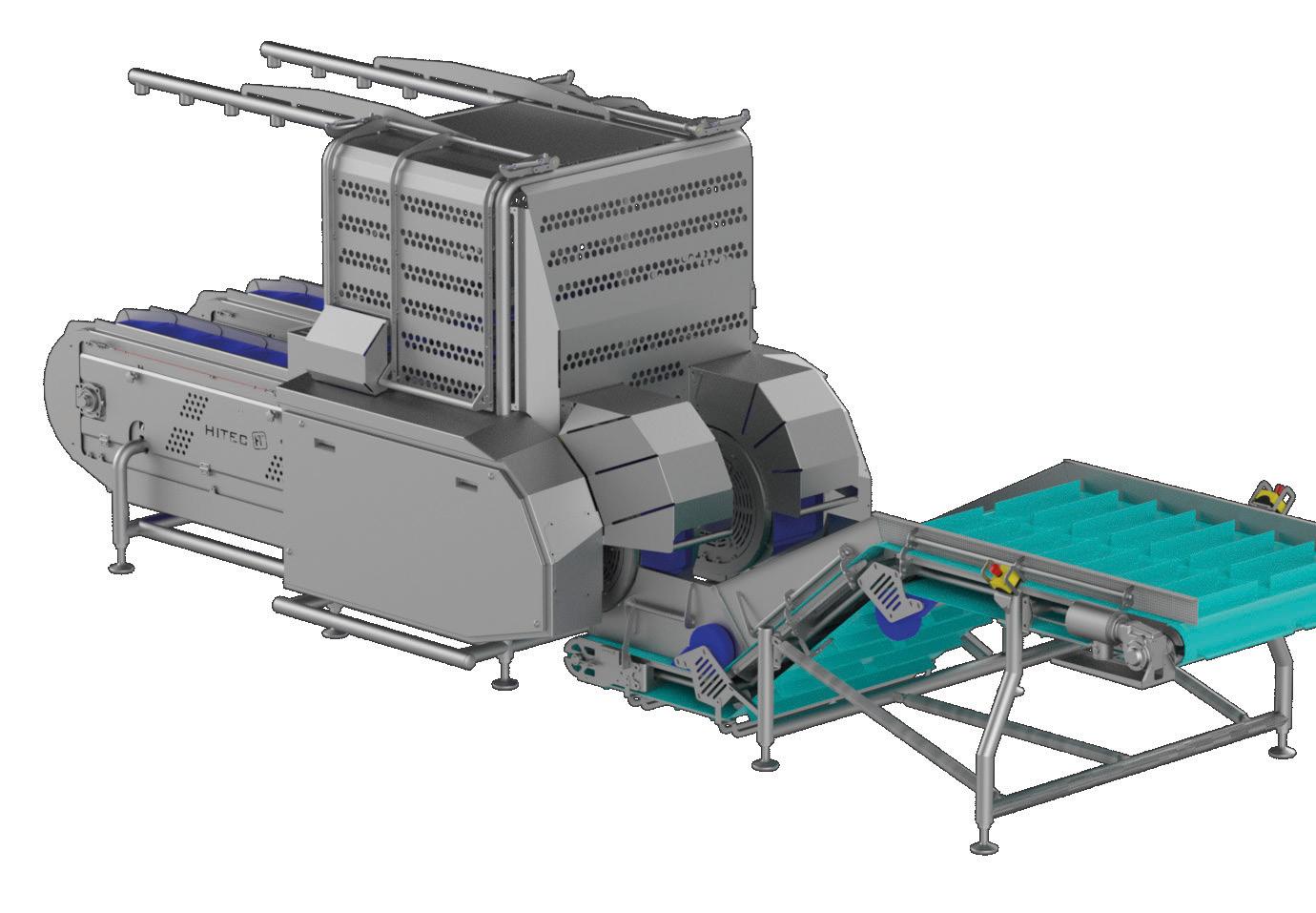

In view of the exponential rise in operating and production costs, Landfrisch AG's open ground growers are trying to find any potential for optimization and savings on the farm and in the field. They are trying to introduce measures to contain the additional costs to some extent. However, the cost increases are also having a broad impact in the field, and in principle there is no cost factor that is unaffected. The main problem in open ground cultivation, however, still revolves around personnel costs, according to Landfrisch AG. While wages have been rising for years, the reliability and the seasonal workers’ willingness to work and perform well is declining at the same time. This means that labor-intensive crops in particular are now under increased scrutiny; mechanization and automation will be a major focus in the near future.

To pass on the additional costs to some extent, everyone will have to pull togeth-

er. "No other business sector is as volatile regarding pricing as the fruit and vegetables segment; supply and demand have a significant impact on pricing. Accordingly, demand-driven production is our greatest lever to best match supply to demand. This is the only way to achieve the prices that our growers need for sustainable production in the long term, and the only way to safeguard production at the same time."

At the moment, tons of cabbage and winter vegetables are being harvested in domestic fields. Berghs-Trienekens: "Overall, the marketing of our winter crops has started well. Despite the comparatively lower supply, prices for some items are at last year's levels. Even better prices are being achieved for carrots and celeriac. Due to increased storage costs, cultivation volumes of some cabbages have already been reduced in advance to keep the storage period as short as possible."

From a longer-term perspective, protected lettuce cultivation, such as hydroponics, is

also noticeably increasing in importance in this country. According to Landfrisch, both protected and time-honored open ground lettuce cultivation have their raison d'être. "Specialties and niche products with small weights and short cultivation times, which cannot be grown outdoors or can only be grown with difficulty, are extremely suitable for hydroponics. As climate change progresses and stricter legislation increasingly burdens open ground cultivation, the product range will expand in the coming years. On the other hand, however, hydroponic cultivation is still too cost- and energy-intensive: crops with large land requirements and long cultivation times will be unable to disappear from the fields anyway."

Visit Landfrisch AG at Fruit Logistica 2023: Hall 20, Booth A-15

info@bt-gemuese.de info@landfrisch.com

Warnez specializes in growing, washing, grading, and packing fresh potatoes, serving different types of customers:

-

- Wholesalers

For inquiries or further information feel free to contact us:

jurgen.duthoo@warnezpotatoes.be

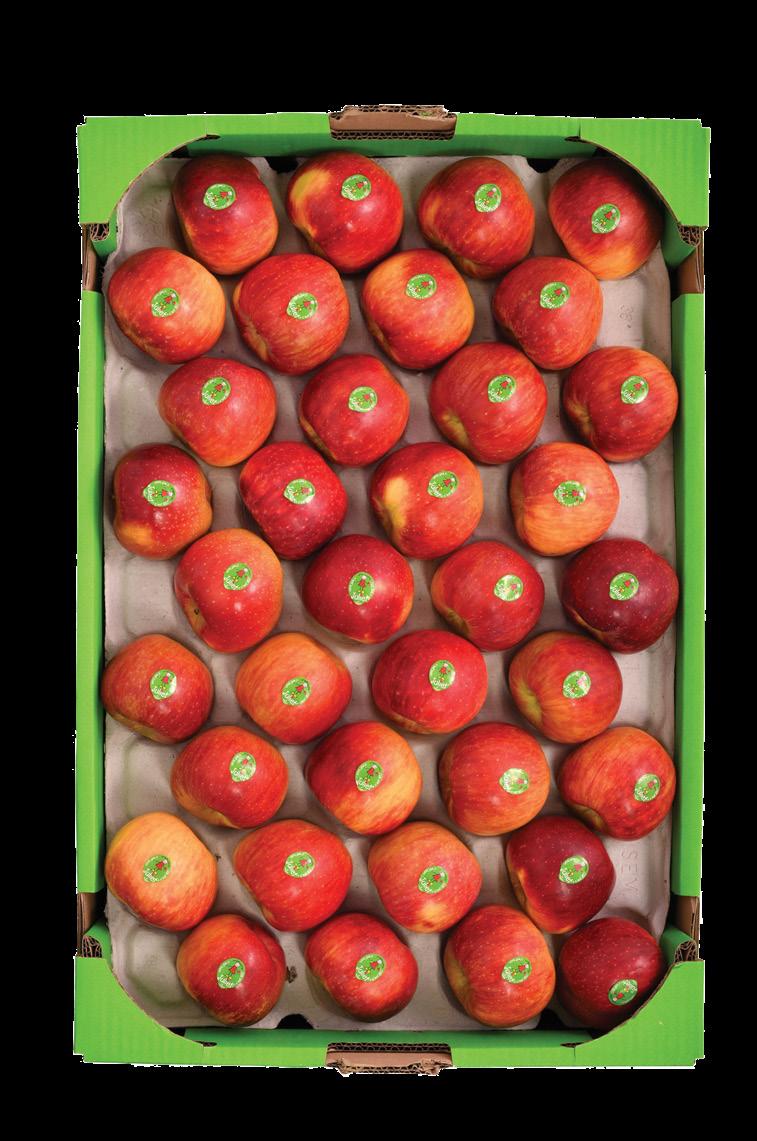

Cardell Export has built a strong reputation in the export of French apples all over the world, mainly because it has been able to adapt to markets with very different expectations. Although an important part of its turnover is made in the French market, Cardell exports to most of the European countries, the Asian continent, the Middle East and some parts of Central and South America. This non-exhaustive list of markets which are already well supplied tends to grow: "We are currently not very present in North America, but we see great opportunities for development in Canada," reports Pierre Gratacos of Cardell.

Since the pandemic, exporters are facing strong constraints to move their goods from one country to another. "The markets where we are active generally have remained the same as before the pandemic. But the big concern now is that we must deal with the lack of containers and rates that have been multiplied by 1.5 or even 2. Such an increase is very difficult to transfer onto the price of apples, which is a product with low added value. The number of available containers is restricted, as they have been reallocated for products that can better absorb these increases in freight rates.

It seems that this rise slows down a little, but far from being significant. "It’s certain that we will never return to the rates we worked with in 2019/2020. Not to mention the incompressible costs that have increased in recent years, such as production costs by 5 cents, packaging costs, representing an additional 15 cents or more, transport rates, etc. Given these data, we fight every day to deliver the programs agreed with our customers.

To continue to evolve in this new context, exporters have had to demonstrate a great capacity for adaptation and anticipation: "Nowadays, we are obliged to start programs much earlier. So we have to be proactive. We also need to ask our customers to commit to the programs we build

together, because by withdrawing, the financial consequences can be very harmful. Given the freight costs for Asia, we also ask our Asian customers for volume commitments, to be able to meet their demand. This is a fact today: customers who do not want to make a commitment, preferring to wait for a return on quality, will be the last to be served. Today, we too have to commit to production. A very delicate task: anticipating in a context of climate change which no longer leaves any room for certainty. "This year, we are forced to deal with a suffering production side. If we want to help producers, we must value every single produced kilo otherwise we take the risk of losing volumes. Without production, obviously, there is no trade.

In addition to these new developments, exporters must also continue to adapt to the requirements of the markets they serve, whose intrinsic behavior is likely to change at any time. "Covid has created an “updraft” in the French market. Consumption was sustained with correct prices, in contrary to other European and Asian countries. People were too preoccupied to consume, whereas the French saw cooking as a way of escaping this oppressive context and enjoying themselves. So we played then our trump card in France, and that worked out quite well for us. The situation is completely reversed today, with

the drop in purchasing power pushing the French to favor quantity over quality. As a result, French consumers are less interested in organic products. By the way a totally Franco-French crisis".

Not all markets are receptive to the French organic certification, but some Asian countries are very sensitive to this label, clearly perceiving it as a guarantee for quality: "Our specifications are much more demanding and it is a real asset for our Asian customers who are well aware that our production meets criteria of excellence. It is therefore a strong entry

In the Middle East, expectations are completely different, and much price-focused. This is a difficult position to maintain for Cardell, which has to face increasing competition: "In this market, for both organic and conventional, only the price counts. All apples in the organic range are perceived in the same way. The stores label products according to variety and color, but not to the origin. This is why we are more and more competing with countries that did not necessarily have good varieties and efficient packing stations in the past, but produce today a quality that is comparable to our apples: very much exportable but at much lower prices. This makes all the difference. For a bicolor apple of the same size, we are now fighting with 5 to 8 competitors. And in this kind of market, it is difficult to justify such a price differ-

ence for the French origin, for a product that at the end tastes very similar. But we are doing everything to maintain a presence in these countries, even if it means

With the decline in North American apple production, it is likely that the Canadian market will look for alternative supplies to meet demand. A market where Cardell would have cards to play: "The French-speaking community in North America is quite receptive to our production methods. Canada is looking for niche markets for organic products that are high quality, both in terms of taste and production. Juliet appears to be the ideal candidate to serve these markets. All the quality certifications of French production are an undeniable asset to meet the requirements of the Canadian market.

The pandemic also marked a turning point in consumption habits in some countries. "Today, there is a philosophy that has supplanted organic: the desire to consume

more locally, regionally and to develop short circuits. We are now asked to supply as close as possible to the place where our customers have a distribution network. In Germany, for example, they consume first local, then regional, then Austrian, and only after that, our customers will come to see us and ask which production area is the closest to them.

Whatever the difficulties encountered in certain markets, Cardell Export seeks to maintain its position in its current markets "at all costs". "As long as the French market does not consume all its production, we must export. In addition to looking for new markets and opportunities, we must continue to develop the markets where we are already present, even if the context has changed so much. We will have to find mechanisms that help us maintain our export share. Today, institutions such as Interfel or the ANPP, which promote and defend the quality of French production, provide us with essential cross-sector support more than ever.

Today, French asparagus are primarily marketed in the domestic market, but this was not always the case. Not so long ago, Germany was the favorite market for France asparagus, with volumes even reaching 11,000 tons in 1987. But over time, exports have eroded to the point of being anecdotal. However, the cause of this decline belongs now to the past. In the current context, where the French origin benefits from the best production techniques, becoming more and more competitive, could the French asparagus sector grab the opportunity to reinvest in export towards Germany and to reclaim the place it once occupied?

The decrease of French asparagus exports towards Germany is directly linked to the erosion of production volumes. Fusarium, which appeared in the 80s and 90s and was caused by an aphid,

destroyed more than 5,000 hectares of asparagus plantations in the space of 15 years. "This problem first affected the South-East of France. And little by little, it spread to all the country's production

areas", explains Christian Befve, an internationally renowned expert on asparagus, founder and manager of the consulting firm Befve & Co. The late identification of this undesired guest causing the hecatomb did not allow to act in time to limit the damage on the crops. Faced with the drastic division of its volumes, the French origin had no choice but to withdraw from the German market in order to satisfy the demand of its own market first.

GERMANY: THE LARGEST INTEREUROPEAN IMPORTER OF ASPARAGUS

In the meantime, Germany’s needs – as the biggest consumer of asparagus in Europe – grew. Faced with the urgency to satisfy its domestic demand, the country turns to other origins such as Spain - at that time a

major producer of white asparagus -, and then Greece, Italy, the Netherlands and Poland. Countries that, with the exception of the Netherlands, benefit from labor costs that are much more competitive than France, up to 2 to 3 times less important. Countries such as Spain, which, without mulching, benefit from a natural earliness, an interesting trump for marketing. Faced with this tough competition, once the aphid problem was solved, France was never able to regain its place as an importer in Germany. In 2021, imports of white asparagus from Greece reached 5,741 tons, 3,188 tons from Italy, 1,946 tons from the Netherlands and 1,160 tons from Poland. A total of 12,000 tons, which almost matches the volume of French exports in the 90’s.

In the past, French asparagus may have lacked competitiveness, but the current context is much more favorable. "Early on, French asparagus production had to deal with a quite expensive workforce. The crop is certainly labor-consuming and it was necessary to find a way to reduce costs. Very quickly, production adapted to this constraint by deploying a higher level of mechanization. In other countries that have benefited from affordable labor costs up to now, this mechanization is still in an early stage. Thus, the notable increase in labor costs in certain European countries such as Germany (€12 per hour) or Spain (€13 per hour for seasonal labor) - now approaching French price levels - allows

French origin becoming competitive again. A RECOGNIZED

Another important asset of French production is the know-how and experience of its asparagus growers: "We have developed techniques that allow us to have a significant control of the earliness and yield, with the use of one, two or three mulches, besides cultivating the crop under advanced mini tunnels. France is one of the few European countries to use these new techniques. Therefore, despite its geographical position, it is one of the first origins to arrive on the market.

The management of precocity is a real strength of French production and creates an opportunity for French asparagus growers in the current context: "With the increase in labor costs, Germany, Italy, Greece and Spain are losing surfaces between 5 and 15% depending on the country. However, as earlier mentioned, imports into Germany have remained at the same level for the last 35 years. This represents a real opportunity for France to integrate German imports, starting its exports from March - while the harvest in Germany has not yet begun – and to become the reference origin in April.

Within a favorable European context

regarding its export, last campaigns underlined the need for the French white asparagus to reach markets beyond the borders. Especially for the South of France: "French production - which represents 5,500 hectares or 20-25,000 tons - covers the needs of its own consumption, and must find other outlets for what the domestic market cannot absorb. Last campaign ended dramatically with the destruction of a large volume of asparagus for some operators, due to a too low demand. The season even stopped for some regions two weeks in advance, which, put together, represented a big loss of earnings for producers. This discrepancy between supply and demand is naturally at the origin of a price drop. This year again, the South-West started too strong and too high, above what the French market can use. Prices were strongly impacted, then recovered by 2 euros per kilo. In fact, prices dropped significantly during the first growth of asparagus in the SouthWest of France at the end of March/beginning of April (+150 kg/ha/day) and rose again when the harvest was smaller from the end of April (-100 kg/ha/day). The same is true for the South-East, which is the second most productive region in France after the South-West. These two regions are actually the most able to export, given the precocity of their production. This looks like a pragmatic and well-designed solution, served on a silver plate".

This potential solution sounds good to a

large majority of French asparagus growers: "When I met the professionals of the sector last July 1, the export to Germany was presented as a way of thinking to get the sector out of the crisis. A proposal that was very well received.

In addition to Germany, other markets can represent an opportunity for French exports, such as the USA, Japan and Swit-

zerland where French asparagus, although still in very limited volumes, are already sold. Switzerland, which does not produce much asparagus, can also be a very interesting market for organic production: "The Swiss are very fond of organic and biodynamic products and they are willing to pay a good price. It is also commonly accepted that the French organic specifications are the most demanding in the world. While the French organic sector is in crisis due to lack of consumption, strengthening exports to Switzerland may prove to be a particularly suitable solution

to help French organic asparagus growers out of the crisis.

Considering all these elements, it seems that the time has come for the French white asparagus to (re)conquer the tables of more distant countries.

www.befve.com

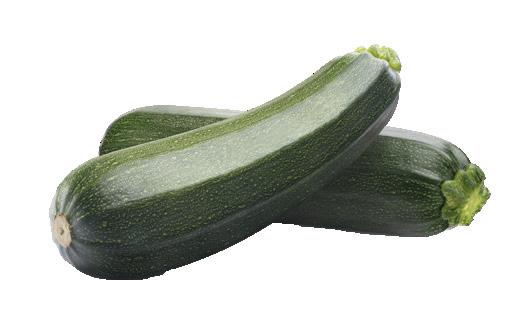

The temperature has been a determining factor at the start of this year’s greenhouse vegetable campaign in Almeria. And not only in this Spanish province, where October and November were “extremely hot”, according to the State Meteorological Agency; the whole of Central Europe recorded what could be called an “autumn heat wave.” The Netherlands, the other major producer of fresh tomatoes in Europe, had tropical nights in September; in fact, October was 2.2ºC warmer than the average for that month, with up to 18.5ºC in the month of November.

This unusual heat allowed Central European growers to extend their summer campaigns, which for many would be their last until well into the spring of 2023; however, in an industry in which, commercially, those involved deal with welldelimited time frames, and who work with live products, for which temperature is a positive catalyst, there were necessarily changes in the initial prospects of Almeria’s producer sector.

“In that period, we have seen an increase in the amount of kilos of tomatoes in our cooperative compared to previous campaigns,” said José Carlos Escobar, commercial director of CASI. “Growers in Europe

have tried to postpone the end of their season as much as possible and in the first few weeks we’ve needed an extra push to sell our production. However, in mid-December we saw that the trend was starting to change.”

“We are aware that there is not going to be a total shutdown of high-tech greenhouses in Central Europe, but the production is going to be greatly reduced.” The fact is that the high cost of energy has not only made producing more expensive, but as confirmed by sources from different countries, it has led producers to sell the gas they had contracted for their greenhouses to the energy companies ahead of

the expected winter shortage and at very attractive prices. “We are living a really unusual moment; we cannot forget that what we are stopping is the production of food.”

The drop in the vegetable productionspecifically tomato production - in Central Europe, which had been predicted since the summer, and which started to become noticeable in mid-December, marked the decisions of Spanish growers. Many of them set their sights on those varieties that would cease to be grown mainly in the Dutch greenhouses. “However, at CASI, we have stayed in line at the varietal level with what was done in previous years. Tomatoes account for ninety percent of our production; that is, some 200 million kilos. We are immensely fortunate to collaborate with many families, some for generations, who have always been devoted to tomato growing and who are specialists in its production; and they, the best growers, are the ones who make us strong.”

“Taking into account the volume we handle, we can afford to bet on specialties, and not spend our energy in the varieties everyone has gone for this campaign,” said José

“In the first weeks of the campaign we’ve needed an extra push to sell our production”

José Carlos Escobar, of CASI:

Carlos. “We have kept our line of commodity tomatoes, but the specialties are what allow us to stand out as a cooperative.” The almost 15 tomato references in CASI’s wide range of varieties are a testament to this.

“At CASI we have been taking all preventive measures against ToBRFV for some time now.”

While only the campaign’s final figures will confirm this projection, the downward trend recorded by tomatoes in Almeria should be reversed this year. Last year, the acreage devoted to its cultivation was again reduced by 3%, although that did not prevent the crop from continuing to be the province’s second most important product in terms of volume and value of the marketed production, only behind bell peppers.

Spanish tomatoes have been facing different challenges in recent years, mainly competition both from within the continent and from third countries of the Mediterranean arc. However, in recent times,

they have also been facing a new threat that isn’t even macroscopic, and which is just a threat, but which has put the entire industry on guard: the tomato brown rugose fruit virus, or ToBRFV.

This pathogen of unknown origin has been detected in almost all European countries, leaving a trail of uneasiness in the production sector, and neither Spain, nor Almeria, has escaped it.

“At CASI, we have been taking every preventive measure possible for some time now, both on the pat of the technical department and on that of our partners, so it is not an issue that has affected us. It is a reality that there are areas affected by ToBRFV, and if we do not take all the necessary measures, one day it could

affect Almeria as a whole,” warns José Carlos. “Until we are certain that there are new resistant varieties performing well in terms of production, we will have to continue implementing prophylactic measures. There is no other choice.”

Besides tomatoes, CASI also grows and markets all of those products that have allowed Almeria to become the leading fruit and vegetable exporter of Andalusia. “In December, cucumbers and peppers recorded good prices,” said the commercial director of the cooperative, “while those of zucchini have, as usual, moved like a roller coaster.” As for watermelon, whose early production could be affected by the positive prospects for first cycle autumn vegetables reported since the beginning of the campaign, “things are not yet clear, but at CASI we are going to keep our production in line with that of previous years.”

jcescobar@casi.es“We are extremely lucky to have the best producers”

Jelte van Kammen, General manager Harvest House:

It could not come at a better time: this fall’s ‘Come out of the greenhouse’ video series by the Dutch Federation of Fruit Vegetable Organizations (FVO) concludes a year in which greenhouse horticulture made many headlines. Not because it wanted to; because it had to. Yet, by chance, the series coincides exactly with that sector’s cries of distress. So says Jelte van Kammen, a general manager at Harvest House, one of the five producer organizations affiliated with the FVO. We discussed that federation’s strike and the actions Harvest House and its growers took with him. The common thread in the tale? Taking responsibility and telling the story of high-tech food horticulture.

“If people don’t understand what you contribute, you keep running into trouble”

When did the idea for a campaign start at both Harvest House and the FVO?

Even before the energy crisis began in the summer of 2021. This fall’s ‘Come out of the greenhouse’ campaign and series of six online videos is entirely coincidental. The situation in Ukraine and the current energy crisis have made our story all the more important. But it wasn’t the trigger. About four years ago, a change started, and our growers, fellow producer organizations, and we became more active. We met and started genuinely talking again. What came out of that was that we were concerned about our image, so we commissioned an image and reputation study. That truly boosted the FVO again.

That study clearly showed that the outside world considers us in a far more positive

light than we do internally. We questioned politicians and independent parties (non-governmental organizations, NGOs ed.), and they said, “You’re not sharing your story at all.” We’re doing something wrong, we realized, while the general public has begun appreciating us. We had much to tell to explain our positive contribution to society. That’s when we started working on getting our story out there without it becoming a ‘let us tell you how it’s done’ tale.

Is it highly unusual that the FVO went public as a united group?

Even before the reputation survey, the FVO’s five production organizations (Harvest House, Oxin Growers, The Greenery, Growers United, and ZON Fruit&Vegetables) had put their heads together. The

FVO was founded in 2014 because many fruit vegetable growers could no longer innovate, which put our sector’s future under pressure. Cees Veerman was the FVO’s first chairman. Even though we were wary of bundling - that’s something growers need to understand and support well - we did recognize that more cooperation was needed.

I’ve always thought there are too many companies offering fruit vegetables. That doesn’t help growers’ bottom lines. And that’s our mission: to achieve the best possible return for our growers. The FVO hasn’t entered into major mergers, but we’re now genuinely discussing things again. We’ve even set up a think tank to talk about non-competitive issues. That’s good.

As a grower, you always work with reliable and solid partners. Van den Elzen Plants fits this picture; we have been a leading supplier of strawberry, asparagus and raspberry plants for more than sixty years. However, we don’t just sell plants: above all, we sell you successful production. And if you are successful, we will also be successful. We are specialised in:

GroentenFruit Huis seems to be absent from the FVO campaign. Is that right?

Yes, and it’s deliberate. With our high-tech horticulture, we took the lead ourselves this time. GroentenFruit Huis goes broader than greenhouse horticulture and represents other sectors. We’re now taking responsibility for our role. As producers, for years, we’ve forgotten to truly connect with the general public and politicians. I think the years of success made us complacent; now we’re taking up the gauntlet.

Tell us a little more about how the video series came about.

After doing that reputation study, we decided on six themes for which we commissioned videos. We worked with Sugar Rush’s independent journalists - Hidde Boersma, known for ecomodernism, and Karsten de Vreugd. They were already working on a film about land use. That’s a strong greenhouse horticulture point, perhaps our strongest point. Our growers have very high efficiency per square meter.

There’s good reason David Attenborough emphasizes this in a well-known Netflix

documentary. The land use film Paved Paradise very nicely portrays the food system and its challenges and solutions. The entire greenhouse industry put in money to make it. Notably, the film doesn’t presents greenhouse horticulture as the sole solution; strip cropping, for example, is also proposed.

Sugar Rush helped turn those six themes into six videos in which we explain to politicians and the public at large what our high-tech food horticulture is all about. Explaining what we contribute to society often takes some doing. In the videos, we do that just a little differently, in a powerful, catchy way. Two videos were aired at the Floriade Expo in the Netherlands, and all six have been distributed through the FVO members’ online channels. We use the videos when we need to, say, explain how cogeneration systems fit into our sector’s story.

How have people reacted to the videos?

The reactions have been positive. One thing I’ve heard is that people like that we, as producers, are now taking the lead. I’m impressed with the videos’ reach. We’ll

keep promoting and telling our own story in the new year. You should also know that, behind the scenes, the FVO thoroughly enjoyed making these films. We purposefully chose a slightly different style and then gave the filmmakers creative license. Sometimes things got a little out of hand, and we intervened; at other times, we left things exactly as they were. We had to attract attention, and I think we succeeded. The many people who’ve watched these videos can attest to that.

The creative process sounds like it was a bit of team building.

Indeed. You could consider it as such. Making these videos involved all five FVO member companies’ communication staff, as well as the directors. The FVO really worked together a lot over the past year.

Is this campaign the start of the cooperatives joining forces more often?

Not only the cooperatives; the whole greenhouse horticulture sector. As companies, we haven’t genuinely been on the same page for the past decade. The famous golden triangle between government, industry, and research/education, thus,

Truly 100 bar (1450 psi) high pressure fogging for breeding, potted plants, cut flowers, soft fruit and vegetables to have humidity control and to reduce crop stress.Nieuwe Donk 5, 4879 AC Etten-Leur The Netherlands mjtech.nl

no longer worked truly optimally. We’re trying to get back on the same page as companies. It’s about closing ranks. That’s what high-tech greenhouse horticulture is doing.

What are the next campaign steps?

As a whole, the greenhouse sector is committed to communicating its story better and getting people talking. How can we continue feeding the world sustainably, and what’s greenhouse horticulture’s role in that? You can read about things like that on thefoodfight.nl. The guys from Sugar Rush and Food Hub are working on that. The goal is to halt polarized discussions and gain more understanding. The platform’s tongue-in-cheek message is to ‘stop the food fight’. The FVO wants to add to that: we relay how high-tech food horticulture can contribute to the food transition. I have to mention Jos Looije and Hans Harting here. And, it’s not only producers but the entire cluster that’s whole-heartedly participating.

Did you get all the growers, some of whom surely have other current concerns, on board?

Absolutely. Ideas that weren’t taken seri-

ously a few years ago are now being discussed. I remember Harvest House once proposed planting trees near greenhouses to help improve biodiversity. At the time, many growers thought that was going too far. Yet now, when I look around, I see growers have started planting green spaces near their greenhouses.

We consider our role in society as a whole more. We have to get the general public on board: if people don’t understand what you contribute to the whole, you keep running into trouble. That’s why we’re focusing on that. We’re also talking with NGOs to get their perspective. It’s vital to allow other voices in and translate them to our growers, our members. Fortunately, growers have noticeably begun thinking differently and taking their role seriously, for instance, about CO2 reduction. Our growers and we face a considerable CO2 challenge for which we’re seeking solutions. And we’re doing just that. Our Harvest House growers have unanimously agreed that they want climate-neutral cultivation by 2040.

Are you getting government support in this energy crisis?

You’re in the business of growing. We’re in the business of helping you do it as efficiently and productively as possible, by providing the best horticultural technology, services, and solutions. From cultivation optimization to drip irrigation and growing systems, learn why Growtec is simply a better way to grow.

Present policies are far from helping us become more sustainable. Just look at Dutch authorities linking sustainable energy production and climate transition (SDE) to natural gas prices. That sets back innovation. That increasingly leads to government policies bogging business people down. It makes me think of one of our growers, Pieter Wijnen. His company was well on its way toward using sustainable energy. They were 90% there.

The current policy and the energy crisis have set him back; they simply can’t afford it. When one of the political parties asked me to speak at a congress a while back, I let Pieter tell his story. And it hit home; you could see that in the audience’s reactions. They felt for him and knew they couldn’t come up with wishy-washy answers to his questions. Pieter, like many growers, doesn’t like sharing his story with a large audience. But he did it and did it well. His message was, literally, “Help me!”

Our growers make a critical contribution to the food chain. And our sector includes many family businesses. We should be much far proud of that. Such companies genuinely drive our economy. And sus-

tainability, but the government must enable and support that.

Especially in times of crisis, new ideas about how to move forward arise. Is that the case now?

Despite everything, I don’t think sustainability and innovation have stopped. On the contrary, sustainability’s forging full steam ahead. For example, the European Union’s making unprecedented sustainability investments. Our sector’s taking its responsibility, and I’m delighted with our growers’ innovativeness. At Harvest House, we firmly believe growers should take such matters into their own hands. As a producer organization, we focus on marketing greenhouse vegetables; the growers concentrate on cultivation and how they can innovate in that. We show what we can do for energy transition and how greenhouse horticulture can help.

What should the sector do to boost support?

I strongly believe in cooperation, not the usual lobbying, which is why we’re trying to build coalitions with NGOs. We’ll say something like, “We want to achieve this; does that align with your goals? Can we

reach an agreement and make a plan to knock on the government’s door together?” Here, when it comes to politics, public opinion plays an increasingly important role. That’s another way to reach politicians and perhaps gradually bring about some change after all.

The initial effects of the soaring costs are visible. Growers are stopping; greenhouses are standing empty. Does Harvest House see retaining Dutch acreage as its task?

For a healthy sector, you need research and development. That requires a minimum amount of acreage. So it’s crucial for the agriculture and horticulture sectors to retain sufficient acreage. That’s not then Harvest House cooperative’s job. We’ve come to realize that, in that regard, our growers can take care of themselves very well. It’s not a topic within the FVO either. It’s a competitive topic and something we’ve agreed not to discuss.

Your neighbors, Growers United, found a way in which a cooperative can help retain acreage, though. True, and they’ve thus proved that it’s possible. But that’s not what our grow-

ers want; they all decided that they must be eagerly in the driver’s seat at all times when it comes to that kind of thing. That’s also part of growing: entrepreneurship. Where they see opportunities, they take them if they can. And if they can, together. For example, when Agro Care decided to start growing crops in Tunisia, they approached fellow members first. When no one wanted to participate, they went ahead on their own. Cooperation is a big Harvest House thing. Together we achieve more. And if you work together, everyone has to be actively involved. Otherwise, it won’t work.

How does Harvest House view overseas cultivation?

We focus on year-round and local-for-local. Several of our growers can do that, thanks to overseas cultivation. We believe producing year-round, sustainably, is a possible solution. Growers in southern Europe need less energy in the winter. We focus 95% of our efforts on Europe but have cultivation companies in Tunisia and Morocco too. We’re also looking at opportunities in North America and the Middle East. Our trading company, Global Green Team, provides the know-how and network for that.

Horti Footprint enjoys a vital place in Harvest House’s sustainability policy. How is that going?

We use that to calculate our products’ environmental impact. Wageningen University, GroentenFruit Huis, and we set up and put this independent calculation method into practice. We were one of the first chain parties to invest time and people in this. We have a picture of almost all our growers - and thus, our products - footprint. And those differ considerably.

Our role as Harvest House is to collect the data, make it transparent, and facilitate the discussion about it. Why is one grower succeeding and another not quite yet in certain areas? Together we look at what reduction targets we can set and how those can be achieved. Then, too, the growers’ entrepreneurial spirit emerges. Healthy entrepreneurship has always and will always bring about major changes. Our growers unanimously agreed that by 2040 they want to grow climate-neutral crops. We can help with that from the cooperative’s side and by using the Horti Footprint.

In my experience, it’s a good model. It provides figures for discussion, but otherwise, sustainability remains simply a catch-all term. Our high-tech food horticulture sector is still fine-tuning things. The FVO and GroentenFruit Huis are now seeing how they can further improve the Horti Footprint. This scientific model has been around for 20 years, and the five cooperatives’ quality experts are now checking if all the existing model’s facets fit our sector.

Sometimes, the current, unexplained black-and-white comparison seems a bit strange. For example, a Moroccan cultivation site appeared to score high for land use and biodiversity. After studying the

figures, it turns out that that’s because those greenhouses are in the desert. The greenhouse thus didn’t affect the already low biodiversity. That’s logical. In the Netherlands, there’s much more biodiversity which greenhouse impact more. Water is another point.

Dutch greenhouses score well here. And in North Africa, great strides are being made, and much less water is used than in traditional open-field cultivation. Our growers are making genuine progress. You can see the role of entrepreneurship there again. For instance, one of our growers, Philip van Antwerpen, decided after a year in Tunisia, “We’re going to use hightech greenhouses, after all.” Our growers there are very deliberating working on improvements and sustainability.

Much currently revolves around energy, but there are other challenges. Harvest House’s sustainability policy includes labor.

We promise: we’re the source of a healthy life, and that definitely doesn’t refer to only energy. Our growers invest in sustainability in other ways too. I think Agro Care’s a fantastic example. They grow Fair Trade tomatoes in Tunisia, and provide day and health care to its employees there. They’ve also reduced the number of working days from six to five. When the people there heard about these plans, they were initially up in arms. Working less for the same money; that can’t be right. From Harvest House, we encourage growers in these areas, but we don’t regulate it. Our growers do that. They, again, take responsibility. We also, obviously, take good care of the people who work for the cooperative.

But Harvest House made itself heard by investing in Source. Growers can’t invest that kind of money

on their own. Not at the rate things are going. Source now has 50 people from all sorts of disciplines working on systems that use artificial intelligence to control greenhouses. So, as a producer organization, Harvest House sees a role for itself. You have to do things like that together, with a larger collective. It’s great to see that Growers United has now also joined in. Growers from both cooperatives now meet regularly in a user meeting to share knowledge.

Recently, one of our growers, Dennis Grootscholte of 4Evergreen, sat down with Ernst and Rien from Source. They went deep into the subject matter. I love it when so much expert knowledge comes together. On one side, from the world of artificial intelligence; on the other, from greenhouse horticulture. The trick is to bring these worlds together. Until two years ago, the guys from Source knew next to nothing about greenhouse horticulture. Together, you can make enormous progress.

It is evident that steps are being taken. What if things do not go fast enough? The issues our sector faces won’t be solved overnight. It requires a different approach and somewhat more patience. Sometimes you hear: “It’s taking a long time, isn’t it? Yes, it is, but you also want to do things well. We’re working on things together. Yes, we must be even more sustainable and move towards fossil-free products, for example. We can do that, too. But if it were really that straightforward; it would’ve been done already. We’re working hard on these things.

The last couple of years have seen challenges for shipping companies, what have been the main issues?

The disruption of the global supply chains was caused by two main root causes: First the lockdowns of ports due to corona. Vessels had to wait to berth, booked cargo didn’t make it to the terminals, and the container yards ran full with boxes which could not be picked up. As an aftermath vessel schedules were totally disrupted. The second impact came from hinterland infrastructure bottlenecks, i.e. the closing of factories and shops for several weeks by virtually all governments around the globe. This disrupted the flow of container equipment around the world. We know when and where containers are needed in what quantity. That was not possible anymore, because expected loaded containers were not shipped as planned to countries in demand of the equipment. It was a total mess caused by the pandemic.

How have they been overcome?

Unfortunately, container shipping is like a very fine clockwork and all wheels are connected to each other. It takes a lot of time to get all wheels in place and going

again once the clockwork is stopped. Some vessels were one or two weeks behind their schedule. How do you fix that? The same holds true for the repositioning of containers. It took several weeks to move them to other continents where they were desperately needed by our customers.

Are there still major bottlenecks in the supply chain?

We have seen a very good part of normalization and most bottlenecks are gone. Our schedule reliability improved significantly. We have put great efforts into that and will continue to do so. Our goal is to reach the old levels above 80% and higher. The past three years have been very challenging for our customers as well as demanding for the Maersk colleagues who have done a lot of extra work to mitigate the negative impact on our customers’ supply chains as far as possible.

A lot of new vessels are in the order books of the shipping companies. What does Maersk’s order book look like?

Maersk has a total of 19 container ships

in its order book which are all able to sail on green methanol. This means that the ocean transport on these ships will be climate neutral. One of the orders is a feeder ship to be delivered in 2023, while the other 18 newbuilds are 16,000 and 17,000 TEU vessels that will be delivered in 2024 and 2025. They will all replace existing tonnage in our fleet.

Countries around the Mediterranean are exporting more and more. Will this mean that more routes will become available?

We are in continuous and close dialog with our customers about their plans and needs. If we see growing demand, we are more than happy to get the fresh produce of our customers to existing or new markets. And it is not only about more or new routes. It’s also about facilities like cold storage which is a field we are investing in. We recently opened a new cold storage warehouse in Norway which is catering more towards the fish industry. But another one is planned for Rotterdam. As a leading provider of cold chain logistics we are able to handle temperature sensitive cargo from production site to point of sale. Our integrated solution includes smart tech tools for increased visibility. And we

“Our goal is to reach the old levels above 80% and higher”

can help our fresh produce customers to increase efficiency and resilience in their supply chains – or shorten transit times for longer shelf life.

During Covid ships moved from ultralow steaming to normal due to high demand, will they now return to ultralow steaming? How much of a time difference does this make between South America and Rotterdam?

A short transit time is essential for virtually most of our customers, no matter if we are talking about fresh produce, fast moving consumer goods, car parts or tech articles for end consumers. Therefore, our network and our operational colleagues are always trying to connect port pairs as fast as possible. That’s a competitive edge. However, reliability that the container is delivered within that time is also an important value. For instance, advertising 32 days transit time which is then not reliable doesn’t help the customer. That’s why we always look at both parameters. Furthermore, it doesn’t make sense to speed up a vessel if the next port of call is congested. This would only cause extra emissions and fuel costs, but it wouldn’t deliver any container on board a day faster. Therefore, our colleagues optimize vessel speeds depending on a range of indicators, sometimes switch two ports, or do other things to optimize the cargo flow for our customers. And we may engage in slow steaming where our transit time and reliability definition allow.

The EU has said that big CO2 producers must pay, do shipping lines fall into this category and what are the consequences per container?

The EU has decided recently that shipping will be included in its Emissions Trading System which we really welcome. It is a milestone, but it is also important to ensure that the ETS does not derail the respective work at IMO level as we need a global playing field. As such, the EU ETS must start as an intra-EU system first and it must take into consideration CO2 equivalents and lifecycle assessments of the fuels. We are in a climate crisis, and shipping is a part of it. Therefore, we all need to act now and put climate neutral solutions forward.

How do you perceive the shippers, are they interested in climate neutral solutions?

Many of our customers are interested in climate neutral transport solutions. We as Maersk, Hamburg Süd and Sealand are offering it already today for the ocean leg with our product EcoDelivery. This is achieved by burning bio fuels on cer-

tain ships in our network. The mitigated CO2 emissions are then contributed to a customer’s container which was booked with the EcoDelivery option. Many customers are using it already. In Q3 2022 a total of 3% of our global transport volume was shipped with EcoDelivery. Maersk is aiming to reach net zero emissions by 2040 across the entire business with new technologies, new vessels, and green fuels. All our business areas have ambitious decarbonization short term targets for 2030. Bio fuels and green methanol are two main factors for reaching net zero in our ocean network. Furthermore, we are investing also in landside and airfreight assets, our terminals, and warehouses to become climate neutral by 2040. We aim to decarbonize the entire cold chain where a major building block lies in our cold store network. We are building fully CO2 neutral facilities and aim at completely retrofitting existing sites. Many customers are holding us accountable to have ambitious goals to help them achieve their CO2 targets.

Are there moves to intermodal supply chains and the reduction of the carbon footprint?

Yes, and we are investing a lot of efforts into that. A most recent example is the start of our new rail offering for reefer customers in Spain. We are offering several block trains per week from Valencia to London Barking only dedicated to reefer cargo for UK. This makes the transport of the reefer cargo more reliable, and less CO2 is emitted, because most of these boxes would have been carried by trucks otherwise. On the backhaul journey to Spain we are transporting also dry cargo. For our cold stores we want to move reefer

containers from the terminal to the cold store by EV trucks and the ambition is to expand local distribution as well to battery electric vehicles. Pilots have started in the US and in India, and Europe will follow soon.

How can shipping companies justify the massive increase in costs we have seen in the last couple of years?

The steep increase in freight rates was caused by the disruptions and bottlenecks due to the corona pandemic. Liner shipping has always been cyclical and very volatile. Just remember the year 2010 after the global financial crisis when a shortage of tonnage and containers met a suddenly rising demand for transports. That caused a steep rate increase as well. However, we should not forget all the years in between with low margins for the shipping companies and too little profit to invest in important areas like decarbonization or tech.

How quickly are rates coming down?

As expected by us for the time when the bottlenecks are easing, we have seen a normalization of freights rates as from Q3 2022.

What is the present situation on availability of reefer equipment?

Even though the markets are normalizing in the dry sector due to slowing demand, we see the reefer segment being more robust with still sound demand. Therefore, we see the overall availability is still rather constraint.

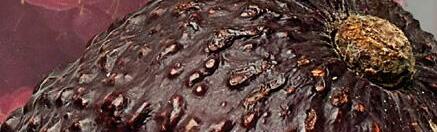

The sharp rise in energy and electricity costs has been extremely hard on the mushroom cultivation sector, not just in Germany but in other European countries as well. The wild mushroom sector is also looking back on a difficult campaign due to the war in Ukraine and the accompanying boycott of Russia. Then there were the longerterm challenges, such as staff shortages and business closures, which affected the mushroom sector as well. Ramazan Gülnar, mushroom wholesaler and managing director of Paris Direkt Ltd, based in Münster, Germany, looks back on an eventful year.

“Overall, it was a very turbulent and sometimes exhausting year,” Gülnar starts off. “A certain measure of flexibility is needed more than ever before. A natural selection or shakeout is taking place, in which the fittest, i.e. those who can adapt to the new situation, will survive.”

Costs, such as those for packaging materials, are still at record levels. “For our popular medicinal mushrooms, we supply corresponding sales displays made out of wood. The materials required for these were previously sourced from Russia. This was of course no longer possible this year due to the boycott. It means that overall, the cost of materials has risen by 100 percent year-on-year.” Similar price developments were observed for other packaging

materials, such as plastic and cardboard.

The war in Ukraine has massively affected not only the procurement of materials, but also the wild mushroom trade, especially the summer trade of the popular Kaluga chanterelles, the trader continues. “Despite the lack of volumes and the tough conditions, we can look back on a good wild mushroom campaign overall. At the moment, we are resorting to chanterelles from Canada as well as supplementary batches from Spain and Portugal, which, due to the high price levels, are mostly well received by upscale restaurateurs. At the same time, we have Moroccan and South African porcini mushrooms in our portfolio: However, high-quality porcini mushrooms are in short supply at the

moment. That is why we mainly offer our customers chanterelles.” Rounding out the wild mushroom season during the cold season are black chanterelles as well as yellowfoot chanterelles from France.

Meanwhile, the marketing of cultivated mushrooms, especially king trumpet mushrooms and shiitake, is in full swing. “We are buying in plenty of goods, as German production is nowhere near enough to meet the demand in the run-up to Christmas. The situation was aggravated by the cold snap in December, which had a particularly negative impact on mushroom cultivation. No matter how well you insulate and heat the halls, you cannot eliminate the kind of temperature fluctuations we had to cope with. In that respect, mushroom growing is extremely weather sensitive when compared to other crops.”

In the case of mushrooms, the German market has already been able to supply itself for many years, with supplementary shipments from neighboring Poland. Gülnar: “Many smaller and medium-sized growers went out of business last year, because they could no longer operate profitably. Around Christmas, there is

“A

indeed an annual supply shortage, as demand will increase tremendously. This year, however, mushrooms are in absolute short supply due to farm closures and the cold snap. Essentially, the supply shortage is more pronounced when compared to previous years.”

From a longer-term perspective, Gülnar also points to the precarious shortage of personnel at the farms. “You can't produce double or quadruple the amount on the same area, even if you completely automate the farm. Some regular suppliers shut down operations in December because they simply don't have the staff. It's also important to remember that cultivated mushrooms are the most energy-intensive crop of all. That, coupled with the strong increase in demand, is presenting us with some extreme challenges right now.” According to Gülnar, this is reflected in the price trends. “Prices in the cultivated mushroom sector have gone up enormously, while prices for wild mushrooms

are at seasonally high levels.”

Traditionally, German Christmas markets specifically ask for fine common white mushrooms, which is reflected in an acute increase in demand. “However, you can't just harvest the fine grade. Medium-grade mushrooms are picked at the same time, and these volumes then also have to be placed in the market. In neighboring countries, this problem has been solved by offering the fine grade at double the price and the medium grade at regular prices. Unfortunately, these pricing policies cannot be implemented in our country.” For fancy mushroom exotics such as the caterpillar mushroom or the Royal Chestnut, the demand is near zero, he said.

Despite all the challenges, the Münster native looks ahead with confidence. “We have been able to develop from a modest market operation into a full-range supplier with over 200 mushroom products today. Our blends and dried mushrooms are find-

ing increasing acceptance, for example at owner-operated food retail stores as well as in the wholesale trade. We have again restructured our dried mushroom range this year, taking out some items and adding others. The total sales of this product line even exceeded my expectations this year. Some items were completely sold out in the run-up to Christmas.”

The year 2023 will be marked by a comprehensive restructuring, the ambitious entrepreneur reveals. “Fortunately, we have been able to conclude a supply contract with a new major customer. Also, our strategy for the future will evolve in such a way that we will gradually switch to larger customers, scaling back the smaller customers somewhat. In short, we want to move more volume with a reduced customer base, making our marketing and logistics structure more efficient, which in turn is what today's market wants.”

rg@paris-direkt.net

Exploring nature never stops

Visit Bejo at Hall 1.2 | Stand C-13

The varieties of Bejo are distinctive in terms of their taste, colour and growing performance. Therefore our varieties lend themselves for innovative applications, processing, and to provide a better eating experience for the consumer. Bejo presents a number of fresh vegetable concepts and brands to inspire the food chain.

MORE THAN 400.000M2 OF OPPORTUNITIES

A FERTILE BREEDING GROUND FOR STRATEGIC AGRI & FOOD HUBS

SUSTAINABLE ENTREPRENEURSHIP

ABC WESTLAND AND FRESH PARK VENLO OFFER

abcwestland.nl/en freshparkvenlo.nl/en

progressive entrepreneurs in the agri and food industry literally and figuratively space: with high quality business space, fast accessibility in a sustainable business park and 24/7 service.

Agri and food clusters in Venlo and Westland with access to 300 million consumers!

“The fruit all comes from the Lake Constance region, mainly from the Ravensburg area,” Stärk says proudly. The farmers are all members of associations, i.e. Bioland, Naturland or Demeter certified. Despite the fact that Poland is still the largest apple producer in Europe, no particular competitive pressure is felt from the Polish side in the organic sector. “The local trade and consumers want the association quality goods, as mentioned. Poland mainly produces the standard ranges, following basic EU organic regulations.” Within the processing sector, on the other hand, there is significantly greater competitive pressure, especially with regard to apple juice and applesauce production.

As a contract marketer for many family farms, BayWa Obst stores, sorts and packs apples, pears, berries and stone fruit at various locations on Lake Constance and the Neckar. Whether from integrated production or organic farming, customers can choose from a wide portfolio of fruit and a wide variety of packaging options. At the exclusive organic fruit wholesale market in Ravensburg, the extensive modernization and expansion of the packing station was completed a few days ago. In an interview, plant manager Hans-Josef Stärk explained the development of the organic sector at BayWa Obst and gave an outlook on this year's marketing campaign.

“Wehad a large apple harvest, so our warehouses are well-stocked. This gives us a good position for the marketing, which will certainly face some challenges in the 2022/2023 season. Nevertheless, we are optimistic. After all, we have a good market right on our doorstep,” says HansJosef Stärk, operations manager of BayWa Obst's exclusive organic packing station at the Ravensburg site.

“We have been able to harvest quite a large crop this year and are about 30 percent above last year's below-average harvest. We get the apples from our 30 organic contract growers, who are members of the Württemberg Fruit Cooperative (WOG). However, collection and marketing is han-

dled by BayWa and Obst vom Bodensee Vertriebsgesellschaft (OvB),” Stärk says. He adds that the annual harvest volume is between 15,000 and 20,000 tons. “Here we are talking about the hanging harvest. Depending on how the quality of the goods develops, a portion of these goods will also be utilized in processing, i.e. by manufacturers of applesauce and apple juices.”

The main customer for the organic apples and pears is the food retail trade, although customers also include specialist retailers, wholesalers, natural food retailers and weekly market vendors. “The main purchase area is southern Germany. At certain times of the year, we also export apples to France, Switzerland, as well as smaller volumes to Denmark.”

“Thanks to our storage technology as well as the existing volumes, we can market the goods almost year-round. In view of the good harvest of 2022, we should be able to deliver year-round again in the current marketing season. This year, we were present in the market two weeks earlier as well, able to again supply the trade as early as mid-August,” Stärk informs us.

Despite the hot summer, water shortages were not a problem for the company. “We had repeated strong thunderstorms with the corresponding precipitation at Lake Constance. Since the apples also received enough sunlight, the fruits are of excellent quality; they have a high sugar content as well as a very pronounced coloring. Also, the size of the apples is well-balanced and in line with the market. This means there is neither a significant proportion of oversized apples nor of apples that are too small,” says Stärk. Brix values range from 14-16, with some varieties even higher, he adds.

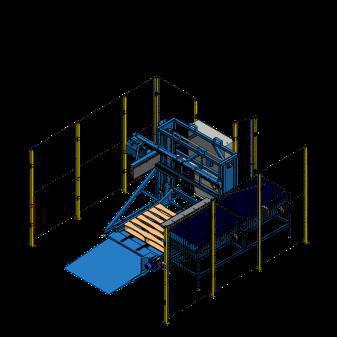

“We have extensively modernized and expanded our packing station this year. Investments were made in a new sorting line, two additional packing lines for plastic-free packaging and a pear sorting machine with connected belts, all stateof-the-art. With the new six-lane sorting machine, both external and internal quality can be measured. We have expanded the packaging line so that we can pack an even higher proportion of the goods completely plastic-free. Cardboard wing

Hans-Josef

2021 by 30 percent

trays and cellulose nets are being used, but the apples and pears are also offered loose. We were able to double capacity in the sorting area and increase it by 30-40 percent in the packing area.”

Demand for the 4- to 6-pack trays has increased in the organic sector over the past four to five years. Stärk: “Our main product is a smaller packaging containing four apples, weighing about 600 grams. As a promotional product for retailers, there are still apples in 1-kg cellulose nets. As far as these products go, interest in them has grown in recent years. Consumers just want to buy well-protected goods. For this, packaging such as the wing tray, made of solid cardboard, is very suitable.”

The Bio-Obst vom Bodensee private label celebrates its 20th anniversary this year. “The first conversion farms were already on site in 1999. We set the course for organic production at Lake Constance. In the meantime, every fourth tree is managed by WOG growers, according to organic criteria. For 20 years, we have been on a healthy, continuous growth course,” Stärk tells us.

For cost reasons or because of a lack of suitable young talent, some farms in the fruit-growing sector have had to close down, but this does not apply to the organic sector. “Compared to conventional farms, the generational change has already taken place on many organic farms. Also, we're proud to say that not a single farmer has switched back production to conventional farming.” One to two farms have been added annually, he said. Once a conventional farm went out of business, the land was often taken over by an organic farm. Today, the organic farms cooperating with BayWa have an average size of about 20 hectares.

“Obst vom Bodensee-Vertriebsgesellschaft, as a retail marketing partner, is a joint venture of BayWa, Vebo Frucht and VOG Ingelheim. There are two producer cooperatives on Lake Constance: one is the Württemberg Fruit Cooperative. We market 100 percent of their organic apples. Then there is the Marktgemeinschaft Bodensee (Mabo), which cooperates with various private fruit wholesale markets. The organic apples from the Mabo farms

are sorted and packed in Ravensburg, so that about 60-70 percent of the organic apples grown on Lake Constance are prepared, according to customer requirements, at our packing station,” says Stärk. “OvB was founded in 1996 by BayWa and Vebo to increase efficiency at Lake Constance, to combine volumes and to ensure joint logistic advantages.”

hans-josef.staerk@baywa.de

www.elshoforganicfruit.com

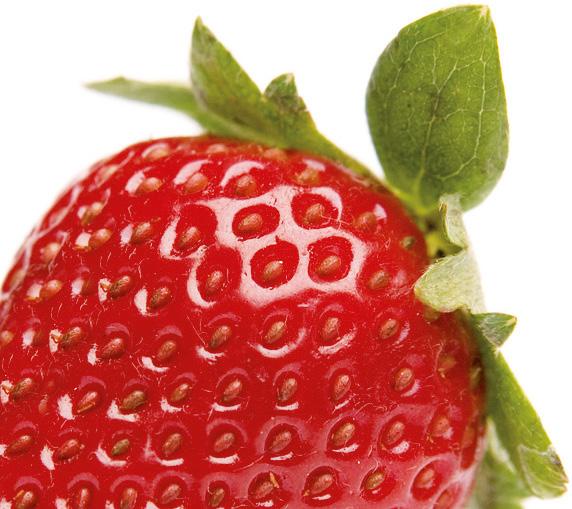

The Netherlands’ largest supermarket chain leads the way in that country regarding fruit and vegetables. Albert Heijn (AH) made things like kiwi, mango, avocado, and blueberries popular among local consumers. These stores have carried processed vegetables since 1970, with plenty of further development in that area. Erik van Nieuwenhuijzen expects great things to happen in the soft fruit category in the coming years. He is Albert Heijn’s fruit & vegetable, convenience & canned goods, flowers & plants, and bakery unit manager. Albert Heijn will also keep bringing a lot of innovation in convenience. “We’ve always taken that role. On to 250 g vegetable packs and two pieces of fruit a day,” Erik begins.

He considers doubling fruit and vegetable consumption as this category’s biggest future opportunity. „The products we offer will stimulate consumption by offering nature’s best, such as new varieties, to our shoppers. In convenience, we’ll keep bringing plenty of new ideas, as we do now with 50 fresh packs and products like new carbohydrate and meat substitutes. Regarding inspiration, we help customers choose, say, vegetarian lunches or cook dinner with potatoes, vegetables, and fruit. Our snack vegetable range helps people eat more of these and fruits throughout

the day. That’s one of the important ways to get in more vegetables and something to which we pay much attention.“

Almost all of this supermarket chain’s fruit and vegetables are house brands. AH has been working with integral chains since the 1980s. As a farmer’s son, Erik feels right at home in the grower - service provider - Albert Heijn triangle. He grew up among his father’s potato and wheat fields but chose to step further up the chain. He spent four years at Bakker Barendrecht,

one of the largest Dutch fruit and vegetable wholesalers.

From there, his predecessor, Gé Happe, brought him into Albert Heijn. That was 14 years ago. “We want to make our customers happy. We offer the best assortment imaginable but that’s sustainable and affordable for everyone. Albert Heijn has always believed the best way to do that is to build strong joint chains. That’s why, as a farmer’s son, I fit in so well here,”Erik confirms.

Erik van Nieuwenhuijzen, Albert Heijn

“We want to remain at the forefront”

Erik van Nieuwenhuijzen

Since Marit van Egmond became CEO, AH has been on a mission to ‘Making better food accessible, together. For everyone’. ‘Better food’ includes tastier, more convenient, and sustainable products via integrated chains. ‘Making food accessible together. For everyone.’ is about being everywhere, for everyone. Albert Heijn has long-term partnerships with 360 potato, vegetable, and fruit growers. With many of these, these relationships span generations; up to 60 years. “In the chains, we work very closely together to continuously improve quality improvement and optimize the chain.”

“Together, we also invest in taste, quality, innovation, climate, and biodiversity. We look for the best cultivation areas, grow the right varieties, and according to client specifications. There’s a strong focus on getting products through the chain as quickly but carefully and freshly as possible. That starts with the growers, passes to the service providers and, then, the stores. Every link in the chain is important to guarantee the correct quality and availability. That applies not only to products from the Netherlands but also to overseas chains,” says Erik.

All of AH’s fruit and vegetables are grown as part of their Beter voor Natuur & Boer (Better for Nature & Farmer) program. “Within that, we make agreements about things like sustainability, innovations, and growers’ earning power. It’s based on fair prices for every farmer and grower in every season. Now and in the future. We developed the Better for Nature & Farmer program together with growers. We’re taking, and investing in, the step toward more sustainable cultivation. We pay more for climate, diversity, and soil health. I wish everyone would move towards an integral closed chain. You can build

together and support each other. A sustainably grown product tastes twice as good, knowing you’re leaving the earth in better condition for the next generation.”

Currently, 50% of this supermarket chain’s range is Dutch-grown, something on which they want to improve. Eric: “There are several reasons for that, including freshness - the fresher, the tastier - and our shoppers love local products. Innovative cultivation and storage techniques make a lot possible.”

In 2021, Albert Heijn managed to include more than 40 million kg of Dutch potatoes, vegetables, and fruit in its range that they would otherwise have imported. “We buy as close to home as possible as much as need be. Quality, sustainability, food safety, cost price, and other factors play a role in the choice between near and far. We have to range farther afield when, say, a product’s not grown in the Netherlands, such as oranges. Or if it becomes too expensive for our shoppers, cost-price

wise.”

“For example, we offer Dutch Conference pears all year round, no longer importing Italian pears during the summer. This year, we managed, for the first time, to supply potatoes from the Netherlands all year round. That’s thanks to improved condensation storage. We’re going to expand that tremendously. These are true volume shifts only possible because of the emergence of innovative techniques. Another example: we sell Dutch-grown ginger on a limited scale. This is usually all imported from China or South America,” Van Nieuwenhuijzen says.

Another way to get more Dutch produce in stores is to extend seasons. In cooperation with growers, that succeeded with Elstar apples two years ago. “By pruning more leaves and growing less fruit, the apples get more sun. That lets us kick off the Dutch season two weeks earlier and use more of the local season.”

This year’s rising energy costs meant they had to make a different choice regarding Dutch winter crops. “New cultivation methods were developed so Dutch growers could cultivate things like tomatoes and strawberries in the winter. That, however, requires the correct LED lighting and also heat. Increased energy costs mean we have to import several products this winter because it costs so much to grow these locally that the local products are no longer affordable for customers. Upon request and proper consultation with our growers, we’re buying some of our tomatoes, cucumbers, and strawberries from Spain this winter,” explains Erik.

AH has sharpened its goal to reduce its chains (Scope 3) CO2 emissions from 2018’s 15% to 45% in 2030. From its ‘Together making better food accessible.

For everyone’ mission, the company continuously takes initiatives to leave the world a better place. Its own operations - stores, distribution centers, and offices - are already fully climate-neutral. Steps are also constantly being taken in the supply chain. For instance, the pork and chicken chains’ emissions have now been precisely mapped. “Sharpening our goal to reduce the entire chain’s CO2 emissions by 2030 with all our (service) suppliers is a major step. We want to actualize our movement towards a liveable earth, and I’m sure if we work together with all our suppliers, we can gradually achieve that goal.”

From a climate perspective, air freight demands a clear choice. Lidl, for example, announced that it will no longer fly in its fruit and vegetables. Albert Heijn wants to do the same. “Albert Heijn buys fruits and vegetables as close to home as possi-

ble and as far away as necessary. Half of its fruit and vegetables are local. That share keeps growing, by, for instance, making even better use of and extending seasons by using new growing and storage techniques. Currently, we only bring in one percent of our unprocessed fruit and vegetables by air. That isn’t sustainable from a climate impact perspective; we’re always looking to, if possible, use other transport modes such as sea containers or road transport. For fruit, 2022’s the last year AH will use air freight,” Erik states.

As a market leader, Albert Heijn has helped popularize several products like kiwi, mango, avocado, and blueberries. Erik expects the most significant future development to be in the soft fruit category. “I remember when I was at Bakker Barendrecht and would order only a few pallets of blueberries. We expect to definitely double the soft fruit category. There’s still great development in better berry varieties. Good examples are Sweet Eve raspberries and Sweet Royalla blackberries.”