Special Edition - 2022 WWW.DEGROOTFRESHGROUP.COM Independent magazine for the fruit and vegetable trade • Since 1986

IN TE RNAT IONAL REFRIGERATION AND FREEZE R T RANSPORT STOR AG E C OLD - FREEZ ER - IN DUSTR IAL GOODS Smederijstraat 2 NL-4814 DB Breda T +31 (0)883 97 70 00 rob@frigorexpress.nl Rue du Champ Lionne 8 B-7601 Peruwelz T +32 (0)69 67 22 70 info@frigorexpress.be WWW.FRIGOREXPRESS.BE 255, Av G. Caustier F-66000 Perpignan T +33 (0)468 21 04 33 frigorexpress@orange.fr 557, Avenue des Vergers F-13750 Plan d’Orgon T +33 (0)0967 08 30 31 sebastien@frigorexpress.fr ZI St. Michel, Rue des Cerises F-82000 Moissac T +33 (0)5 63 04 92 85 jeanluc@frigorexpress.fr Hipokrata iela 21-38 LV-1079 RIGA T +37 (0)127 71 76 49 baltic.office@frigorexpress.lv

4

12

15

20

26

36

Special Edition 2022

“The constant abandonment of citrus fields is a reality and this year it has worsened”

Jorge García Monfort, Commercial Director of García Ballester:

“If Spain could become more productive with its mangoes, we would have greater bargaining power”

José Antonio Alconchel, president of the Tropical Sector at Asociafruit:

“Either we get consumption to increase, or when the expected production arrives we will have a problem”

Luis Aliseda, director of R&D center of the Extremadura-based nursery Viveros Provedo:

“The crisis in maritime and land transport is having a very significant impact on the garlic market, because 70.7% of Spanish garlic was exported in 2020”

Luis Fernando Rubio, director of the Association of Producers and Marketers of Garlic (ANPCA):

“The expected growth of the tomato acreage will come at the expense of other vegetables, and bell peppers may be one of them”

Rafael López, of Hortofrutícola MABE:

“You can make good deals with supermarkets”

Chairman Peter van Dijck, Fossa Eugenia

42 Five years later, 70 cold stores in Europe

Harld Peters about Lineage Logistics’ explosive growth

74

“Especially in the specialist trade I see growth potential for relatively ‘new’ products”

Stefan Lindner (L), Lindner GmbH Fruchtimport und Handelsgesellschaft:

77

“The potato is the first mass product to be fully confronted with cost increases in cultivation”

Georg Kolmhofer

Colofón

AGF-PRIMEUR bv

Stevinweg 2, 4691 SM Tholen

The Netherlands

Tel: +31 (0)166-698200

info@agfprimeur.nl - www.agfprimeur.nl

Freshplaza bv Stevinweg 2, 4691 SM Tholen

The Netherlands

Tel: +31 (0)166-698200

info@freshplaza.com - www.freshplaza.com

Publisher: Pieter Boekhout

Editorial: Joel Pitarch, Izak Heijboer, Aurélie Pintat, Nick Peters, Marieke Hemmes, Jonny Diep, Nicky McGregor, Carolize Jansen, Rossella Gigli, Valeria Ten

Advertising: Andries Gunter

Design & production: Viola van den Hoven, Martijn van Nijnatten Complete or partial reproduction of the contents without written permission of the publisher is prohibited. The editor is not liable for any inaccuracies.

AGF Primeur • Special Edition • 20222

9

102 “What offers peace of mind? Only automation, nothing else”

Johan and Jeroen Deprez of Deprez Handling Solutions

107 “Jalisco’s avocado producers are grateful to APEAM for helping them take this important step in exporting to the United States”

Javier Medina, president of Apeajal

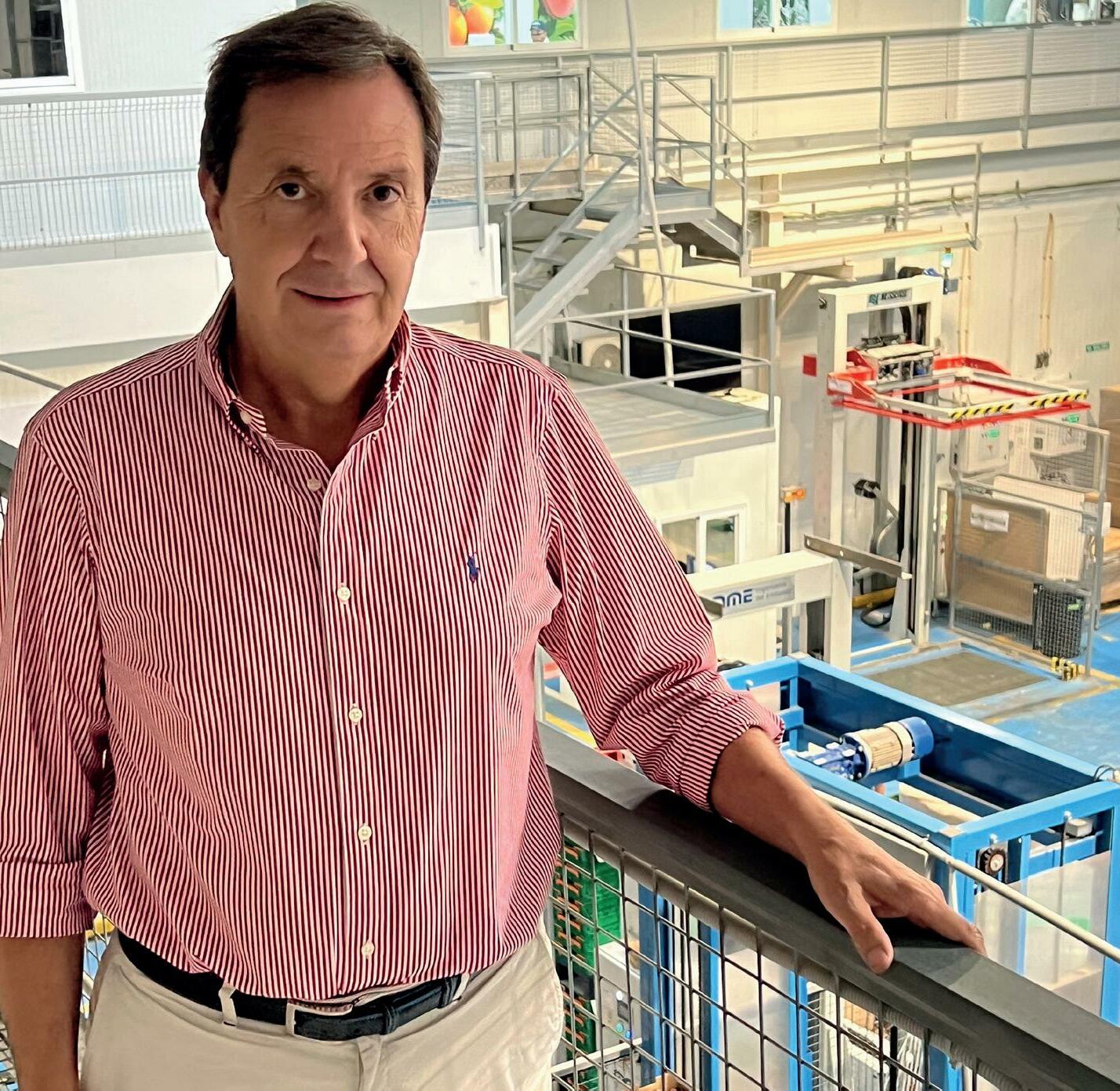

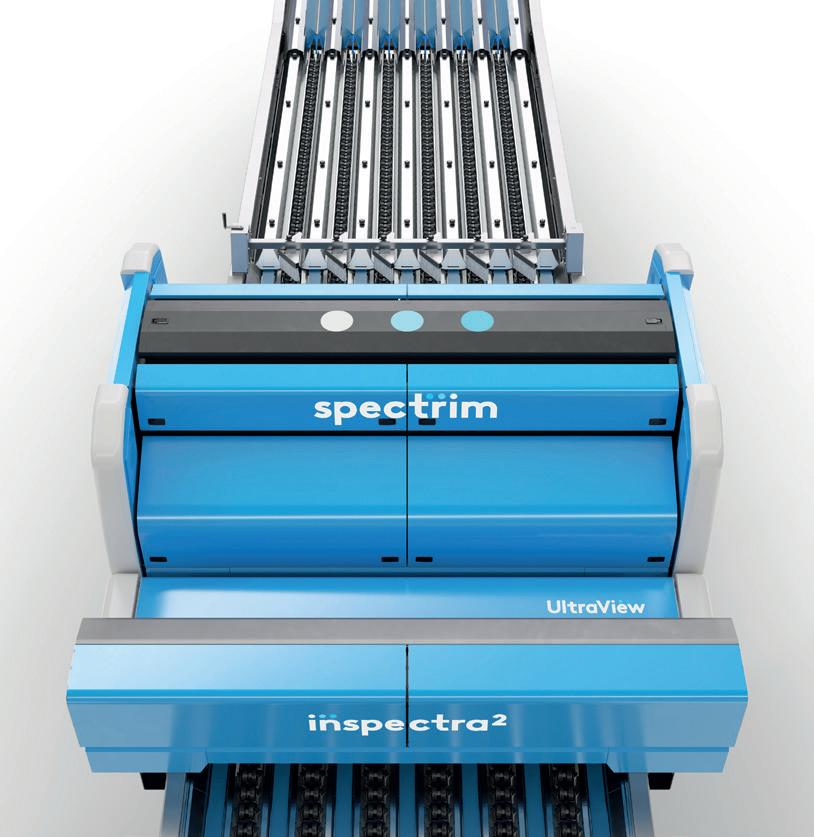

130 “Automation is becoming a fundamental requirement in order to be competitive in the marketplace”

Jaime Mendizábal, Commercial Director, Maf Roda Ibérica:

140 “Our company was born out of a disconnect between growers, marketers, and retailers”

Ricky Chong with World Fresh Exports

24

“Retailers need reliable suppliers now more than ever”

Pieter van Pelt, Commercial Manager of The Greenery International:

“We need to minimize the work in the greenhouse”

Dror Erez, Automato Robotics

30 “A decent market portion remains for specialized reefer ships”

Hans Mol, GreenSea:

34 Summer is on the way! Soft fruit in Finland

47 How the Rotterdam Port Authority stays the fastest, despite everything

50

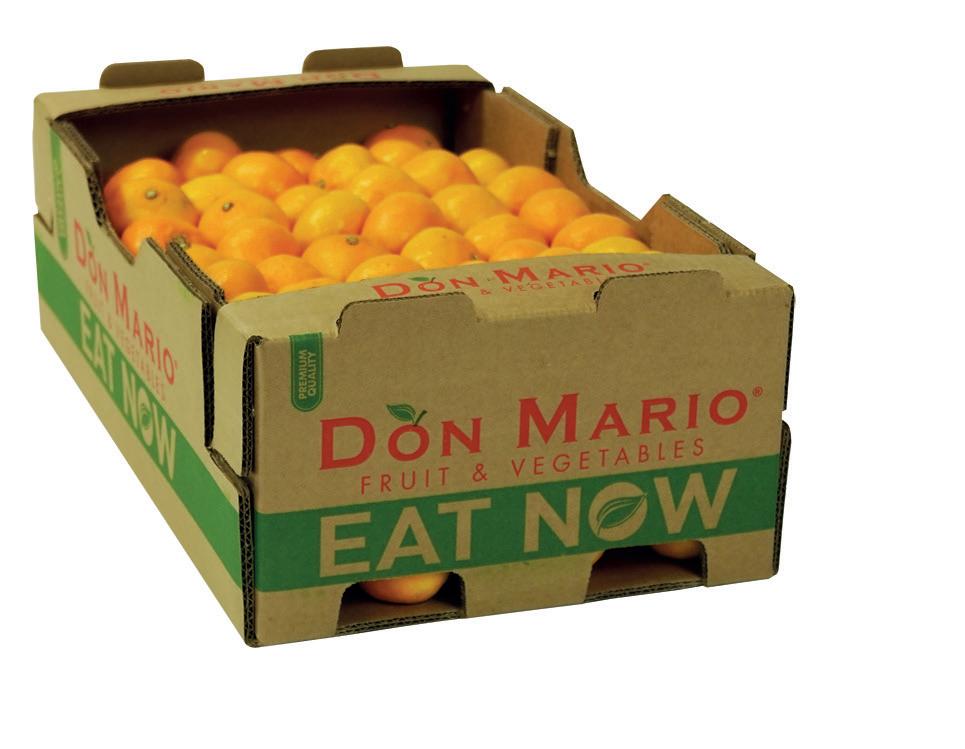

“A recognizable trademark for products that guarantees good flavor and consumer experience was needed, outside of retail”

Thimo Leukel, commercial director at De Groot Fresh Group:

53 “The true value of bananas has to be reflected in the price”

Caoimhe Buckley, Fyffes on inexpensive bananas:

56 China’s growers sales jump as orchard livestreaming goes big

61

The challenges of plant breeding in the face of climatic and societal changes

67 Peaches and Apricots: Genetics serving the French industry

70 “The sun has healing power”

Arne Aiking, CleanLight:

80 How does the dull pear become hip again? Interpera raises the question

87 The greenhouse industry has become key to food security and survival

93 The three characters that changed the global pineapple market: MD2

Abel Chaves, president of CANAPEP

98 “For early clementines as well as the late varieties like Nadorcott or Tango, there will be less product this year compared to last year”

Juan Llombart Gavaldá

100 Latin American tropical and exotic fruit enthrals European gastronomy

111 Brazil and Argentina collaboration with European counterparts key to grow markets

114

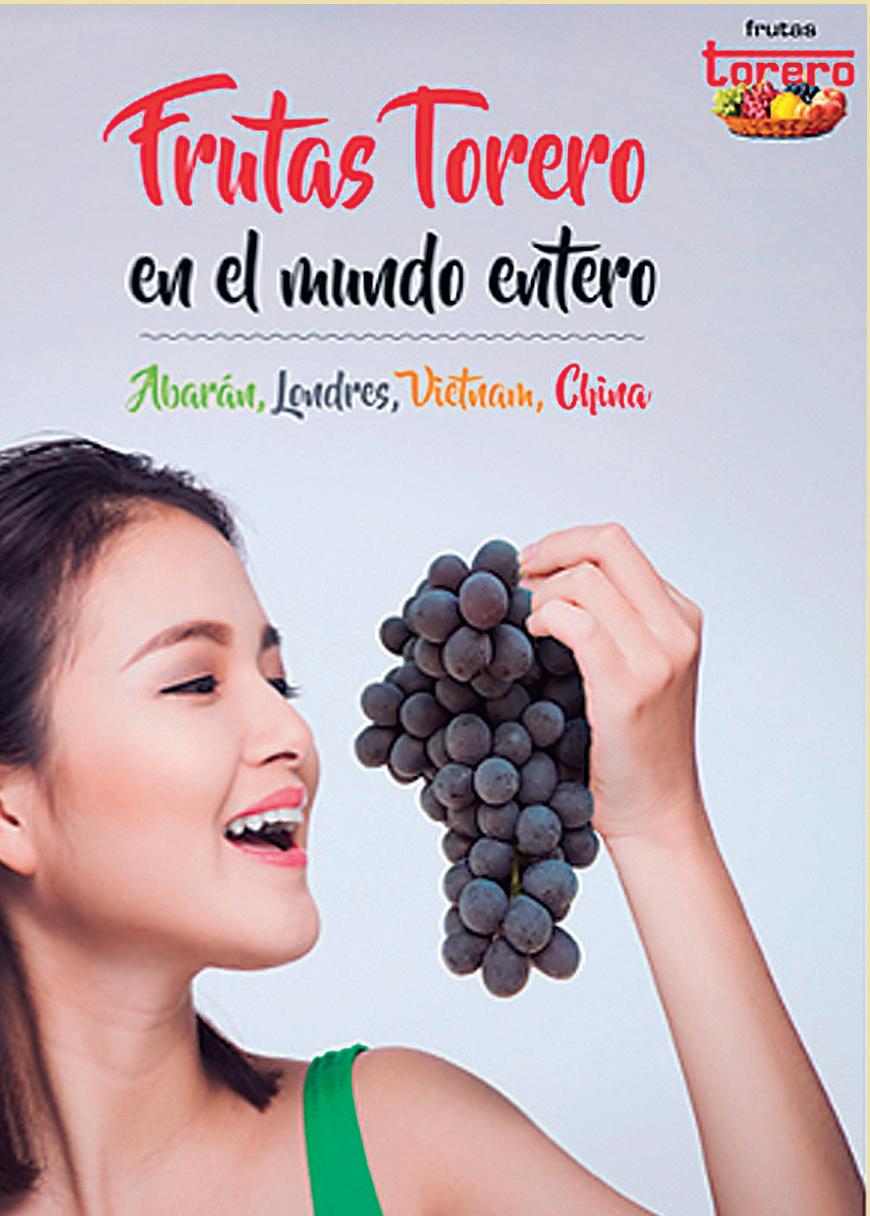

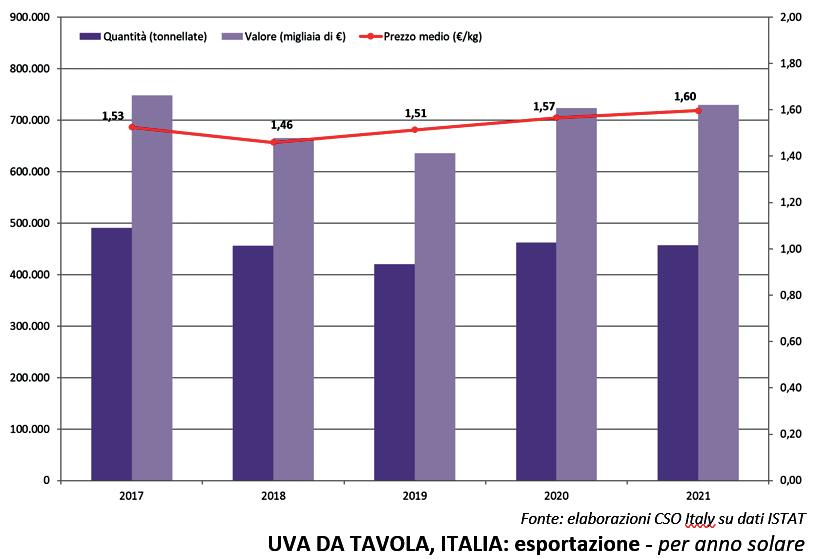

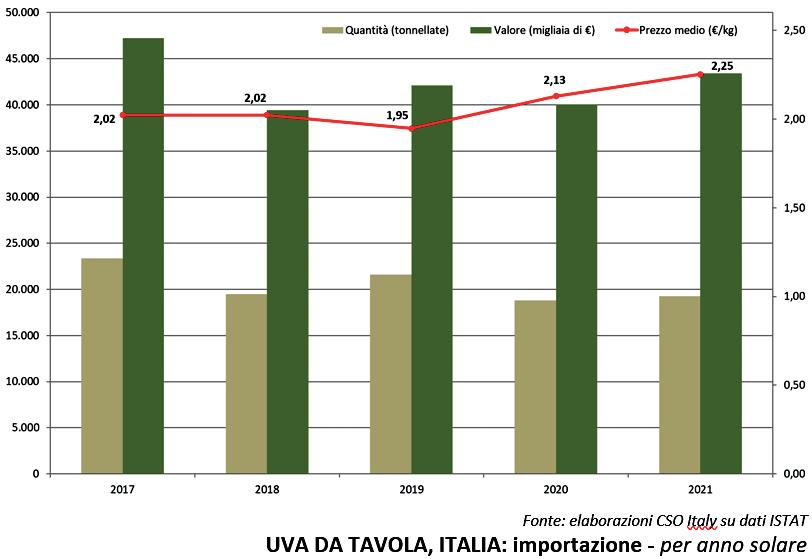

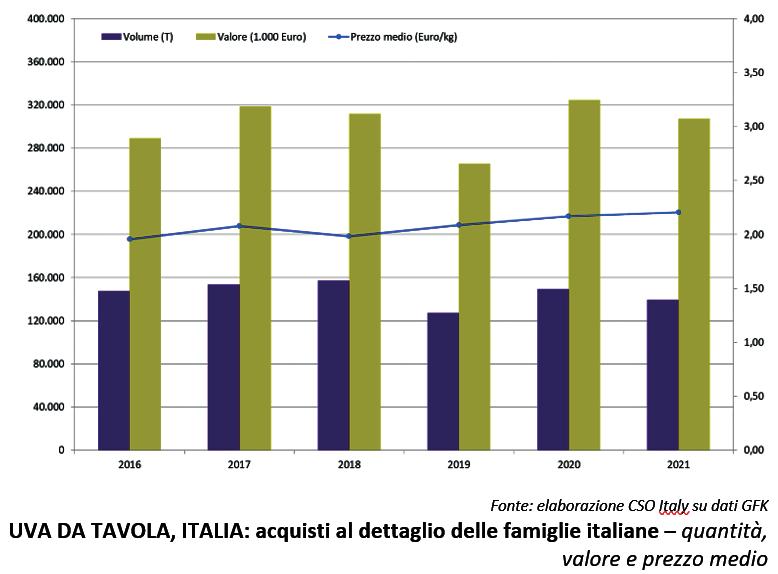

An assessment of the first part of the 2022 grape campaign, and Italy’s trade and consumption trends

120 Italian pears: production on the rebound but impacted by higher raw material prices

125 Belgian growers want to make locally-grown greenhouse melons a permanent segment

128 “India remains a highly competitive source of supply for the European market”

Kaushal Khakhar, Kay Bee Exports:

132 The next Brexit challenge is looming Bed Goodchild, Nationwide Produce

136 Peaches and nectarines, Italy regains its market share

138 “Avocados’ internal quality is crucial”

Jacinto Trigo, Global Category Director, TOMRA Food

144 Efficiency in the blueberry chain Agrovision

146 “The northern part of Greece did not have any issues with drought”

AGF Primeur • Special Edition • 2022 3

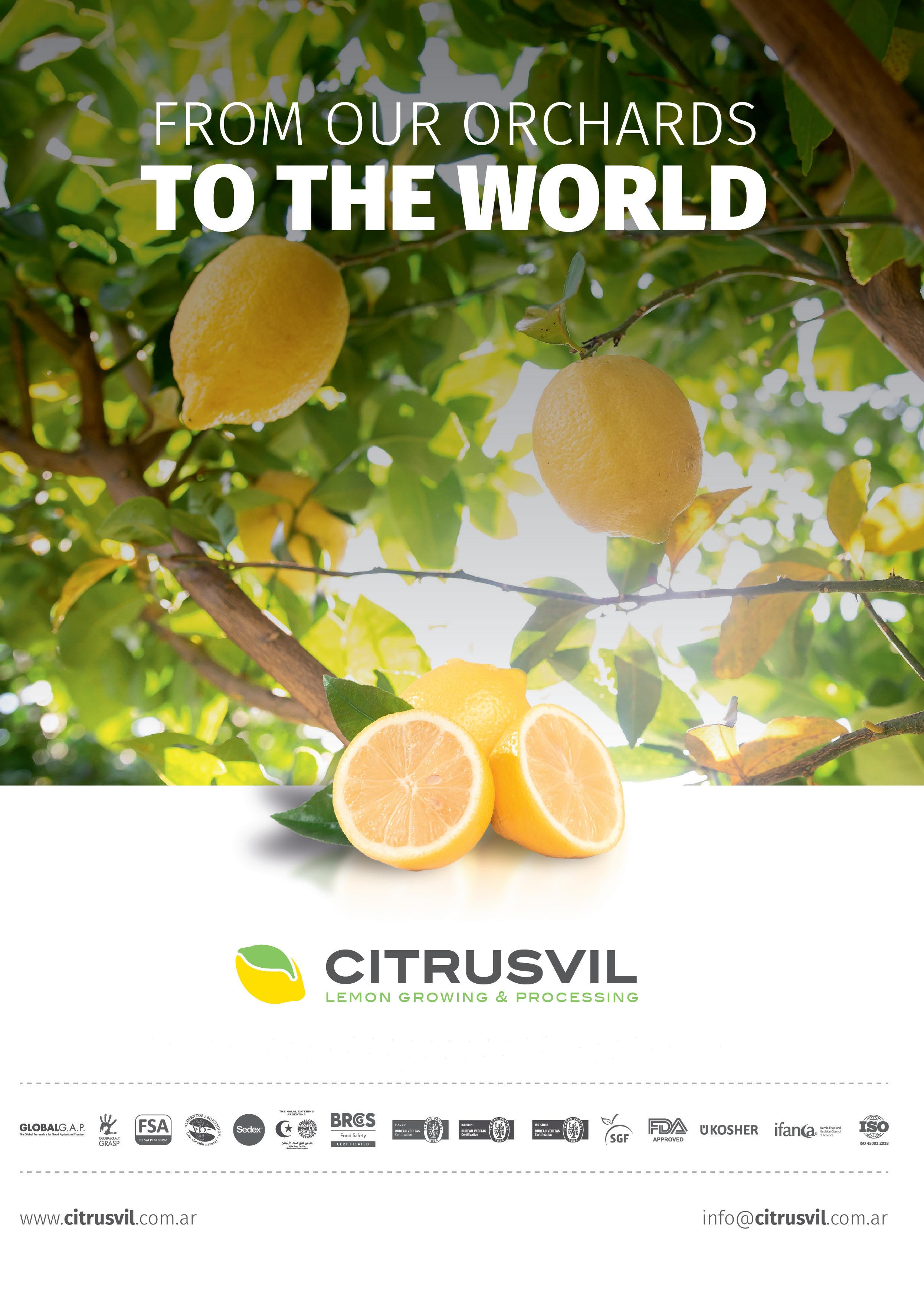

In general, the 2021/2022 citrus season started with good prospects after the good consumption figures and market performance in the previous period. This improvement had much to do with the pandemic and the greater health concerns of the population, given that citrus fruits, and especially oranges, are usually associated with the prevention of diseases due to their high vitamin C content. However, the behavior of the main citrus fruits grown in Spain (oranges, mandarins and lemons) has been different from what was expected.

The orange production was 1.5% gre ater than in the 2020/21 season and 5.6% greater than the average of the five previous production periods. The higher entry of oranges from South Africa in the first months of the season and an increase in the production of small calibers were the main factors that negatively affected the season. Also, the increase in handling costs delayed the harvesting (to avoid sto rage) and put downward pressure on pri ces at origin. To these circumstances we must add a lower demand, as the falling trend of previous years, which had been interrupted by the effect of the pandemic, was resumed.

“The 2021/2022 season has been quite bad for oranges, although the first Navelinas and the last Valencias did somewhat bet ter,” said Jorge Garcia. “Especially from June onwards, orange sales were slightly

reactivated due to the drop in the pro duction from South Africa, which had to comply with the cold treatment protocols imposed by the EU, not to say also that con tainer prices had more than doubled. The few who still had oranges got some relief in a campaign that was still to forget.”

The Spanish mandarin supply in the 2021/22 season was estimated to be -9.9% lower than in the previous season and -3.2% lower when compared to the average of the previous five production periods. This reduction has contributed to average prices not falling as much as in the case of oranges.

“As far as clementines and mandarins are concerned, the situation was not bad in the first part of the campaign, when prices were acceptable because of the lower vol umes available, which was due to the effect

of pests and the weather, as well as the abandonment of lands. However, the situ ation got quite difficult in the second part of the season,” says Jorge García. “The pro duction of Nadorcott and Tango reached a record level in 2022. We could almost say that we harvested twice as much as in the previous year. The high yields coincid ed with the entry into production of new plantations. The market was soon flooded with fruit - not only from Spain, but also from Morocco, whose production was also quite high - and prices fell significant ly compared to what was usual in previ ous years. Orri prices also fell, as market demand was not high enough to absorb all the supply. As a result, the campaign lasted a month and a half longer than usu al, during which time the fruit had to be released gradually and at low prices.

In general, the 2021/2022 citrus season has been quite difficult, with considerably lower sales prices and notoriously higher production costs.

“THE CONSTANT ABANDONMENT OF CITRUS FIELDS IS A REALITY AND THIS YEAR IT HAS WORSENED”

According to the commercial director of Garcia Ballester, the poor results of the previous campaign have been further pro moting the abandonment of land devoted to the cultivation of oranges and clemen tines in the Region of Valencia:

“The constant abandonment of citrus fields is a reality and this year it has worsened”

Jorge García Monfort, Commercial Director of García Ballester:

AGF Primeur • Special Edition • 20224 Citrus

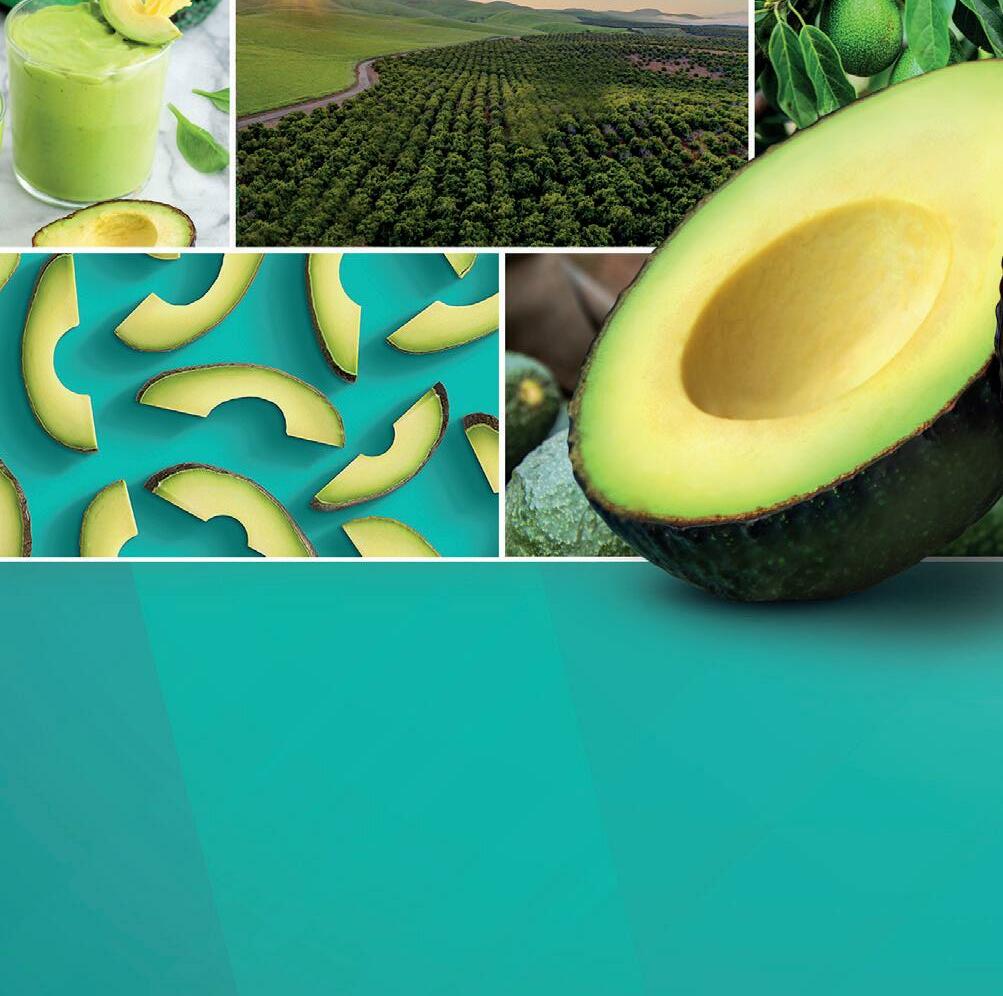

“The most notable case is that of the free variety Clemenules, the most cultivated in the province of Castellon. The acreage devoted to this variety has been declining already for 5 years. The pressure from the supply, concentrated in the months of November and December, causes prices to fall every year, while production costs continue to increase, as more and more treatments are required. Besides, the ‘cotonet’ pest has done tremendous damage to this and other varieties across the Region, especially in Castellon. This year, growers were no longer so unprepared, but there has been a higher incidence of spider mite. Normally, with one or two treatments, the issue is solved; however, twice as many treatments have been needed this year, and the price of these treatments has tripled. There are people who have been unable to treat their fields and this is the first step towards abandonment,” explains Jorge García.

“The constant abandonment of fields is a reality and this year it has worsened. It is especially noticeable in the case of the fields of small growers, as larger companies have more resources to find solutions,” he said.

OPTIMISM WITH THE NEW MANDARIN VARIETY LEANRI

In the 2021/2022 campaign, the company from Castellon has marketed the first volumes of the new Leanri mandarin.

“These are still not very significant volumes, since it is the first harvest, but it has already allowed us to carry out some programs with supermarkets in Germany and Switzerland, where it has been very well

received. It is a very competitive variety in the mandarin category, which includes the Nadorcott, Tango and Orri, and I believe it will gain ground in this segment in the coming years. As for the Leanri, its production schedule in Spain is very broad. Grown from Huelva to Castellon, it can be marketed from the end of December to the end of May and resists for very long both on the tree and in storage. This year we will already reach 3 million kilos and prospects are promising. We are very optimistic.

“Research in new varieties is moving forward with much inertia. We are constantly looking for varieties that bring improvements compared to what we already have at all times of the season. Our company is part of ICCSA (Investigación Citrícola de Castellón, S.A.), a union of the cooperatives that belong to the Professional Association of Fruit Exporters of the Province of Castellon (ASOCIEX). We have some 15,000 varieties under study and at the moment there are 3 mandarin varieties and one blood orange variety at an advanced stage,” said Jorge García.

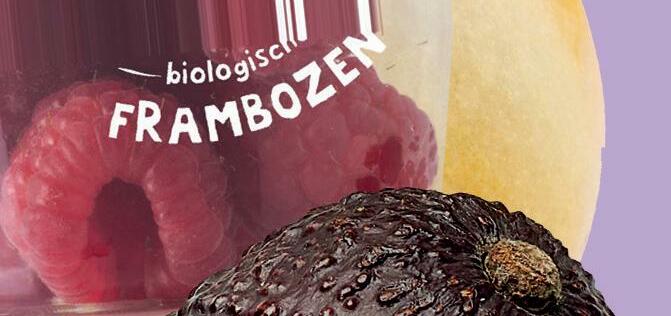

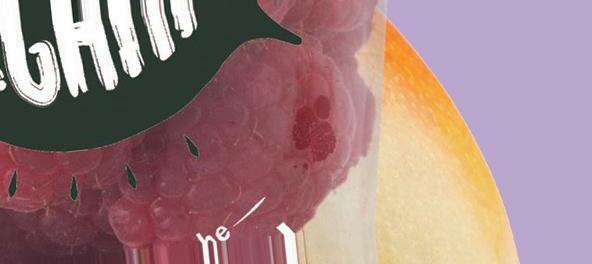

Sweetie berries

Here, in the sweet south-west of Europe, we love and respect the land where we were born, where the fruits that will feed future superheroes around the world sprout and grow.

Jorge García

AGF Primeur • Special Edition • 2022 5

fresmiel.es

Last year, the company opened a warehouse for the handling of organic citrus in the town of Tortosa, in the province of Tarragona. In fact, the firm already has certified plantations in production and others being converted. “This year, we will be able to make the first shipments of organic citrus to different supermarket chains, and we expect to grow quite a lot. It is interesting to be able to have an organic citrus line, but I don’t think you should just jump on the bio bandwagon and go crazy,” warns Jorge García. “When the first organic citrus fruits were launched on the market, they were very popular and sold well, but sales have now stagnated. The fact is that there are consumers willing to pay a higher price for an organic product, but those are actually just a small share of the consumers. The same applies to the fruit with leaves, which is just a niche product.”

Approximately 80% of the organic citrus produced in Spain is intended for European markets. “The Netherlands is one of the biggest importers of organic citrus in general. Other countries like Germany tend to focus more on the price. In general terms, the current economic climate doesn’t suggest easy times for consumers. Families are paying more and more attention to their expenditure in groceries. It is also worth recalling that the organic and conventional are increasingly closer to one another. More and more sustainable treatments are being used.

DROUGHT TO REDUCE THE HARVEST AND SIZES OF SPANISH CITRUS FRUITS IN THE 2022/2023 SEASON

According to sources in the producing and exporting sector, the first harvest estimates point to a drop of around 10% in the volume and a generalized reduction of sizes that will affect oranges especially. The Clemenules production should recover a little, although the increasing abandonment of fields could counteract that a little.

The sector is facing a disproportionate increase in the production and handling costs, although the impact of this on the supply that will be available is difficult to measure. The impact of drought, which is perhaps the biggest threat, is easier to assess. The water shortage has become a very severe problem in Andalusia, where water reserves have dropped to just 25%; a historically low figure which contrasts with the situation in the Region of Valencia, where reserves are at 54%, while in Murcia they are at 31%, also a historically low figure. In Andalusia, the orange production predominates over other citrus species, which suggests that the greatest impact of the decline in Spanish citrus sizes will be on oranges. In the Region of Murcia, lemon and grapefruit are the predominant citrus crops, while in the Region of Valencia, which has a wider range of species, clementines and mandarins predominate. However, in campaigns in which there is a drop in the supply, there are always fewer discards, so according to industry sources, there should be no problems to meet the market demand.

“Last year, there were already problems with the calibers of oranges. Although there will be less production, it remains to be seen how great the demand will be, as in the last 5 years, with the exception of the year of the pandemic, it has tended to fall. As for the Clemenules, there could be a slightly larger volume compared to last year, when the production fell sharply, while for the second season we expect volumes to fall quite a lot after the great harvest of the 2021/2022 campaign, despite the fact that younger plantations will be coming into production,” says Jorge Garcia.

THE IMPORT OF ORANGES FROM SOUTH AFRICA AND EGYPT HAS FALLEN AND MANDARINS FROM MOROCCO AND TURKEY ARE GAINING GROUND IN THE EU

According to data from the Spanish Ministry of Agriculture, Fisheries and Food,

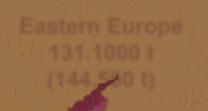

in the first half of 2022, the EU imported 742,894 tons of citrus. This represents a drop of 7.4% (59,200 t) compared to the same period last year, and a 4.6% reduction (-35,400t) compared to the average of the previous five years. The main citrus fruit was mandarins, with 41% of the total, which entails an increase in their share and puts them ahead of oranges (35.4%). All citrus fruits except for lemons, which recorded a significant increase (+104%, 81,300 t), have seen their volumes drop compared to 2021. Compared to the average, oranges have dropped by 26.1% (-89,300 t) and grapefruit by 20.1% (-26,900 t). Meanwhile, mandarins have increased by 9.1% (+18,800 t) and, of course, lemons have grown by +63.5% (+61,900 t).

The main supplying countries have all delivered less, with the exception of Turkey (+36.9%), Argentina (+36.4%), as well as South Africa, whose figures remained stable. Egypt accounted for 30% of imports, although it has lost market share compared to the average. Turkey, on the other hand, has increased its share by seven points due to the growth achieved with clementines and mandarins, but mainly with lemons.

As for mandarins and clementines, Morocco has increased its shipments to the EU by 17.4% compared to the 2020/2021 season, while Turkey has increased its exports by 8.2%, shipping 29% more than the average of the last 5 years.

“I DON’T THINK YOU SHOULD JUST JUMP ON THE BIO BANDWAGON AND GO CRAZY”

AGF Primeur • Special Edition • 20226

AGF Primeur • Special Edition • 2022 7

The door for fresh produce to European consumers

The Greenery International/Hagé imports a wide range of fruit and vegetables, serving (online) retail and trade customers throughout Europe.

Importing fruit and vegetables is in our DNA. For decades, we have been working together with a large number of suppliers from Southern Europe, Central and South America, South Africa and Asia. We focus on the product groups greenhouse vegetables, stone fruit, grapes, melons and open field vegetables, but we also have a strong share in products such as garlic, avocados and kiwi. Due to our

central location near the Rotterdam harbours, we are literally the door to Europe.

Our import experience, combined with our years of retail expertise, is appreciated by our customers. Our working method is always aimed at long-term cooperation with both suppliers and customers. That is the difference we make!

More information

Discover the dynamics of our value chain at thegreenery.com The Greenery bv, PO Box 79, 2990 AB Barendrecht, The Neterherlands, T + 31 (0)180 655 911, info@thegreenery.com Contact Ton Bouw or Frank Ocampo, commercie@hage-international.com, telephone +31 (0)180 648 000.

Consumer

Producer Marketing

Retailer Logistics

Products

Pieter van Pelt, Commercial Manager of The Greenery International:

Consumer

Producer Marketing

Retailer Logistics

Products

Pieter van Pelt, Commercial Manager of The Greenery International:

“Retailers need reliable suppliers now more than ever”

Two years ago, The Greenery chose to increase its focus on its activities with its business units The Greenery Growers, The Greenery Logistics and The Greenery International. The Greenery Growers handles the supply from Dutch growers, The Greenery International imports a wide range of fruit and vegetables, serving (online) retail and trade customers and The Greenery Logistics provides logistics solutions for fresh produce.

What advantages does the new focus bring to the import activities?

Pieter van Pelt, Commercial Manager of The Greenery International: “Part of The Greenery International is Hagé Interna tional, the import branch that for decades has been working with a large number of suppliers from Southern Europe, South America, South Africa and Asia. We are a reliable supplier of a comprehensive, yearround assortment of fruit and vegetables for European retailers. Traditionally, we are quite big in the product group fruit vegetables, stone fruit, grapes, melons and open ground vegetables, but we also have a strong share in products such as garlic, avocados and, of course, kiwis. Because of our central location near the ports of Rot terdam we are literally the doorway into Europe. Our import experience, combined with our years of retail knowledge, is very much appreciated by our customers.”

“The collaboration within the chain is in transition though,” Pieter notes. “Our sup pliers are inching nearer and nearer to the customer. But that doesn't make our

role any less important. With cost price increases and transport delays being the order of the day, the role of a service provider is only becoming more import ant. Retailers need reliable suppliers now more than ever. And suppliers, in turn, want to work with reliable parties who are in touch with retailers in Europe,” Pieter continued. “With a strong focus on the various products, more direct lines of communication with customers and suppliers, and close cooperation across the team, things are handled faster and more efficiently. This allows us to respond quickly to changes in the market. This is appreciated by our customers and suppli ers alike.”

Crops grown under artificial light in Northern Europe seem to be significantly fewer this winter. What does this mean for the Spanish/ Moroccan production? Do fuel prices cancel things out?

Ton Bouw, Senior Purchaser Vegetables: “The rising energy costs are having a seri ous impact on crops grown under artifi

cial light in Northern Europe. We noticed a clear need among European retailers to supplement their program with products from Southern Europe. This resulted in an increased demand. Due to the great uncer tainty about the availability of these crops and the sharp increase in prices, we have taken a timely position and our product availability is guaranteed. However, we have also noticed that not all parties in Spain are equally enthusiastic about mak ing firm agreements. The great uncertain ty about what the development of costs will be, a possible new Corona wave and the corresponding impact on personnel availability, the war in Ukraine, etc.; all this might mean that not everyone wants to commit themselves. But, together with our regular suppliers, we have been able to fulfill almost all programs for our cus tomers.”

What developments are there within European retail. Are online retail sales increasing?

Pieter van Pelt: “We see the same devel opments with many European retail

AGF Primeur • Special Edition • 20229 Company news

Company

ers, namely consolidation, purchasing as close to the source as possible, ensuring product availability, online sales and sustainability. During the pandemic, online sales rose sharply. More and more consumers have dis covered the convenience of ordering online and we are still seeing these sales increase, although less rap idly than in the past two years. It is however uncer tain what the impact of the decline in purchasing power will be on online retail.”

Inflation is sky-high: do you foresee a shift to more basic products?

Pieter: “Inflation is indeed high and we are already seeing a change in consum er buying behavior. Sales of what consumers view as more luxurious products, such as soft fruits and exot ics, are already showing a decline. If inflation remains high, it is likely that con sumers will cut back even more on their fruit and veg etable purchases. A further shift to basic products is therefore not inconceivable.”

To what extent is there understanding among retail customers for the cost increases within the chain?

Pieter: “We are in constant dialogue with our customers and suppliers about all cost increases. There is understanding for all developments; retailers are also faced with rising costs and a changing consump tion pattern. By closely following all devel opments and dealing with the changes in a smart way, we can all get through this period together.”

What are the expectations for the upcoming open ground season? The heat and drought of the past few months has also gripped cultivation areas in southern Europe. Problems regarding availability are not immediately to be expected. However, the increasing cost price of the products is causing suppliers to change their marketing strategy. Jor gen Schatschabel, Senior Purchaser Open Ground: “Due to the rise in cultivation prices, I have noticed that suppliers are increasingly sending selective products, whereby priority is given to the contracts they have concluded. This leaves less product for the daily trade.”

Cost increases are also playing an import ant role in sales in the grape segment. Wil fred Heijstek, Senior Purchaser Grapes: “The cost component of a box of grapes has increased enormously. As with almost all other product groups, grape growers have become more cautious about who they do business with to the financial risks involved. The Greenery International has mostly long-term relationships with its suppliers, giving us sufficient access to products to supply our customers. All of the suppliers we work with have planted many new varieties in recent years, ensur ing they are ready for the future. Taste is the most important criterion when choos ing a new variety and these new varieties also ensure somewhat cheaper produc tion. This is something that is very much needed, given the current inflation rate.”

The overseas melon season started at The Greenery International in week 36 with the arrival of the first melons from Bra zil. Frank Ocampo, responsible for melon sourcing - among other things – predicts a tough season: “The Brazilian growers, like the Spanish growers, have only planted on the basis of committed volumes. There is a shortage of cargo space between Bra zil and Europe. As a result, ocean freight costs have skyrocketed. Growers are therefore opting for targeted programs

where they can ensure con tinuity and pricing. Togeth er with our partner Agricola Famosa, we have revived the so-called Break Bulk. The pallets are transported by truck from the farms to the harbor, loaded onto the ship one by one and they will arrive - chilled - in Rot terdam within two weeks. We will also work with our regular grower Brazil Melon, with whom we will mainly load the container shipments. Because of this unique cooperation in cargo distribution with the best growers in Brazil, we will be able to supply our custom ers with tasty melons and watermelons daily. Starting in January, we expect mel ons from Central America, but with all the uncertain ties it is too early to make any predictions about that now.”

How can you, as The Greenery, distinguish yourself in the European markets?

Pieter: “The Greenery/Hagé has built up a huge network in the decades that it has been doing business in Southern Europe. We've been working for years with renowned parties in the fruit and vegeta ble sector, who stand for quality and avail ability. For a number of products, we have a year-round supply from Southern Europe. We start early (often in late August) and we finish late (often in late June). Import ing fruit and vegetables is in the genes of The Greenery/Hagé. Our methods are always aimed at long-term cooperation and taking care of our customers, deliver ing top quality, for the right price and with the right certifications. That's how we do business!”

Visit The Greenery at Fruit Attraction, booth 10G10.

Luiz Roberto Barcelos (Agricola Famosa) Frank Ocampo (The Greenery) & Carlo Porro (Agricola Famosa)

AGF Primeur • Special Edition • 202210

news

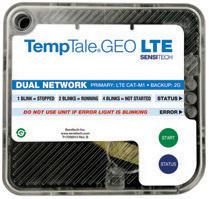

AGF Primeur • Special Edition • 2022 11 End-to-End Cargo Tracking Real-Time Cold Chain and Logistics Visibility Cat-M1 for 4G/5G networks Multimodal support – including air Non-lithium battery options Tracking temperature, location, humidity, light Orders fulfilled within 48 hours globally For more information, please call +31 (0) 252 211 108 or visit us at Fruit Attraction, stand nº 6C05A sensitech.com A Carrier Company 4-6 OCTOBER Meet us in HALL 10 10E04 MEET THE GROWER Hall 10 | Stand E04 Bloedbessen_advertentie_90x132,5mm_v2.indd 1 13-09-2022 10:40

José Antonio Alconchel, president of the Tropical Sector at Asociafruit:

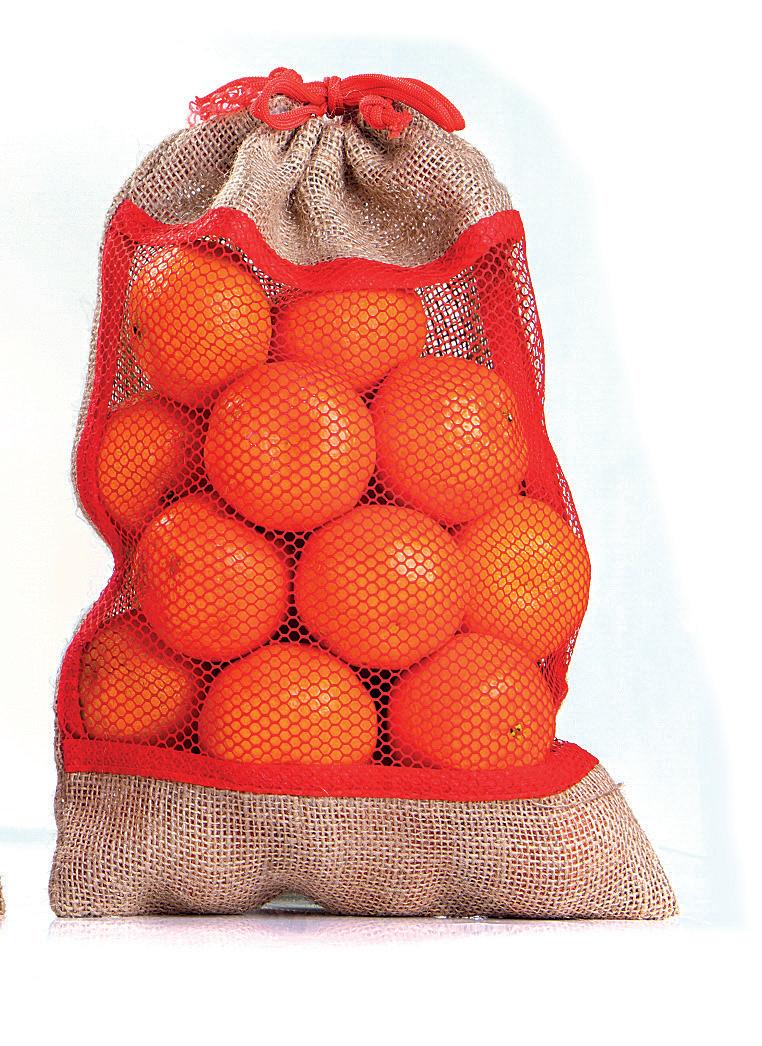

Mangoes have become the second most important subtropical product in Spain, after avocados. The crop has achieved significant growth over the last 20 years, with the acreage currently standing at 4,800 hectares, located mainly on the coast of Malaga (90%). Andalusia accounts for 90% of the cultivated area in Spain and 77% of the production. The rest of the mangoes are produced in the Canary Islands.

According to data from the Prices and Markets Observatory of the Govern ment of Andalusia, the mango acreage has continued to expand slightly in Andalusia each year. In 2021 there were 4,800 hec tares planted, 91% of which were in pro duction. Ninety percent of the area cor responds to the province of Malaga; the rest mainly to Granada, which accounts for 9% of the cultivated area. All in all, the Andalusian production reached 31,915

tons in the 2021 campaign, 86% of which corresponds to Malaga plantations and 13% to Granada’s. The value of the produc tion fell compared to the previous season, due to a 26% drop in the price at origin.

The bulk of the campaign’s marketed volume arrives between September and October, with 42% and 50%, respectively. These are the months in which the main varieties are in production, namely the

Osteen, which accounts for around 78% of the marketed production, and the Keitt, with a share of 17%. Other less represen tative varieties, such as the Kent, Tommy Atkins, Palmer or Irwin, among others, are also in production.

The 2022 season began in mid-August with the first Irwin mangoes, a variety that is not very representative compared to the Osteen, but with a demand that seems to be on the rise, according to some exporters. The estimated production for this year in Andalusia is about 20% higher than last year; however, although there is more fruit per tree, there is an abundance of medium and small sized fruit, with a predominance of calibers 9, 10 and 12.

“It is rumored that Malaga could have achieved an increase of around 15% this campaign, and Granada one of around 30%, but that these figures could have been much higher if there had been more water available. In Granada, the volumes could have grown by more than 50% this year,” said José Antonio, from the Grana da-based company Frutas Fajardo.

Although the production continues to grow, it is still far from the full potential of the area planted. According to Enrique Colilles, CEO of the Malaga-based coop erative Trops, Spain could easily exceed 50,000 tons of mangoes; a volume that it has been unable to reach in recent sea sons due to the impact of weather events, as well as the limited supply of water resources. “With the acreage that we have, we could have a much greater production than the 20,000-30,000 tons we have been obtaining in recent years.

For his part, José Antonio Alconchel, CEO of Grupo Alcoaxarquía and president of the Tropical Sector at Asociafruit, which is part of Fepex, said that “this year we have been able to reduce the amount of irri gation in mango plantations, which have been affected by heat stress and wide spread drought. For the past few years there has been a lack of production in Spain. If we managed to become more pro

“If Spain could become more productive with its mangoes, we would have greater bargaining power”

AGF Primeur • Special Edition • 202212 Mango

ductive with the mangoes, given all that we have planted, we would have greater bargaining power. In Europe, our mangoes stand out from overseas ones thanks to the fact that they can be allowed to ripen in the tree for longer, which gives them superior organoleptic qualities. We have to be able to convey the value of our mangoes to European consumers, and make them aware of the dates during which they are produced.”

That is why producers and exporters such as José Antonio Fajardo remind us that “we shouldn’t rush the harvest, or we will not be able to offer that added value and have that unique competitive advantage. In auction sales in other areas, we have seen, like every year, fruit that had not been harvested ripe, which is very counterproductive for the entire sector. If the marketing season starts with that product and a feeling of dissatisfaction appears among buyers and end consumers at the beginning of the campaign, many cus-

tomers won’t repeat their purchases. The so-called ‘green cut’ is even more damaging in the case of domestic mangoes, a very exclusive product whose campaign takes place in a short period of time and in a context of high international competition.”

The European Union is mainly supplied by mango imports from third countries that arrive either directly, as in the case of Brazil and Peru, or through re-exports, as in the case of the Netherlands and partly Spain. In the case of Spain, both imports and the country’s own production are included.

According to data from the Government of Andalusia, in terms of volume, the main destinations of the mangoes from Malaga and Granada are Portugal, France and Germany, which account for 84% of the total, while in terms of value, France ranks first (32%), followed by Portugal (28%) and Germany (22%). In 2021, the volume and value of imports made by Andalusia

during the Andalusian mango production season (August to December) accounted for 29% of the total season. The main suppliers were Brazil (59% of the volume and 48% of the value) and Peru (18% of the volume and 27% of the value).

“Although mangoes have not recorded such a large and sudden growth in consumption as avocados, with the latter having arguably become a staple product for many European consumers, their demand continues to increase year after year. In general, the tropical and exotic fruit category is gaining market share every year and still has a long way to go,” said José Antonio Alconchel.

AGF Primeur • Special Edition • 2022 13

We speak your language

good food in g ood h a n

Food has to be tasty. And healthy, sustainably grown and carefully packaged. Every day we are committed to cultivating the tastiest and best tomatoes, (pointed) peppers, cucumbers and aubergines. Honest and transparent: good food in good hands. That’s what we stand for!

d s growersunited.nl/en

Spain is the leading European producer of stone fruit and the undisputed leader in its export worldwide, although its supply has been reduced for 3 consecutive seasons due to the impact of frost and hail. Besides the effect of adverse weather conditions, there are also more and more issues with profitability, as production costs are on the rise. This, as well as the market demands for tasty fruit, makes it worth looking into a review of the productive structure at the varietal and marketing level, also in the case of plums.

ura, no crops have been lost due to frosts, but there are increasingly strong heat waves and late rains, as climate change is resulting in more extreme weather events. That is why the sector requires a greater implementation of technical methods to combat these adversities, such as antifreeze systems or anti-hail protection nets, but I think it is very important to make use of the genetic means we have for crop adaptation.”

The Extremadura-based company has been working for about 15 years on materials adapted to the on-going changes in the climate. “Until now, all the material being selected was intended for early flowerings, since we were looking for early varieties. In recent years, this trend has been abandoned and we have been working on a group of varieties which combine low chilling requirements with very late blooms. This ensures that the varieties will be productive in winter, regardless of the conditions, and will be less at risk when flowering a few weeks later,” says Luis Aliseda. “We have already introduced three nectarine varieties with these characteristics and four red peaches and we hope to continue moving along these lines.”

“Flavor is becoming a determining factor in the consumption of stone fruit”

According to Europech data, after a 2021 campaign with a record low stone fruit production in all European countries, in 2022 there will be a generalized recovery, with the exception of Spain. For the second consecutive year, spring frosts have caused significant losses in stone fruit orchards in Spain. While last year Italy and Greece estimated declines of between 35% and 50%, this year they report a recovery of 41% and 64%, respectively, reaching close to average production values. France, in addition to recovering by 47%, is now also 2% above the average. Spain, with around 1.15 million tons, is the country that has been most affected by the frosts, with a 31% reduction in its pro-

duction compared to 2021, when the production was already lower than in 2020 and 42% below average.

“Climate change is taking a very negative toll on the agricultural sector in general, including stone fruit. In recent years, there have been some adversities that have significantly decimated the crops,” says Luis Aliseda, director of the R & D center of the Extremadura-based nursery Viveros Provedo. “Winters tend to be warmer, while springs are colder than usual, with frost occurring later and later in recent seasons. This year we have suffered production losses in the north of the Iberian Peninsula, in Catalonia and Aragon. In Extremad-

“Stone fruit has to get back its flavor. Many products have lost their flavor because productivity has increased exponentially. A season with a lack of fruit and low demand is showing us the very serious problems we will have to face when there is full production. Consumption is clearly driven by flavor. This year, we have seen how consumers have preferred other products when ours did not taste good,” Luis Aliseda says.

Of all the structural problems that the stone fruit sector may have, with its wide range of varieties and species available, many of which do not meet the expectations of consumers, producers and distributors, the case of plums is particularly outstanding. This fruit has already been unprofitable for more than four years. In

Luis Aliseda, director of R&D center of the Extremadura-based nursery Viveros Provedo:

“Either we get consumption to increase, or when the expected production arrives we will have a problem”

Luis Aliseda

AGF Primeur • Special Edition • 202215 Stone fruit

fact, at the end of the 2019 campaign, this led to more than 2,000 hectares being uprooted in a single year, and since then there has continued to be a downward trend. This year, sales have again stalled quite a bit during the month of July, as although old trees have been uprooted in recent years, there still seems to be a surplus of plums in the first stage of the campaign due to their poor quality in terms of flavor.

“It should be kept in mind that plums compete with melon and watermelon, as well as other stone fruit species, in the summer produce range. If consumers buy them and are disappointed, they won’t repeat the purchase and will look for alternatives. This has led to a significant loss of market share in recent years,” explains Luis Aliseda.

In addition to the fact that there is still an abundance of varieties with little flavor on the market, another of the main causes of plums losing value is the premature harvesting of the fruit at times when the market demands it. “It is a recurring problem that, unfortunately, has continued to happen in recent years, and this year it has been exacerbated by the overall shortage of stone fruit in the country, with fruit left in the chambers that has no commercial outlet, because it has been rejected. It is difficult for a producer to say no when the market demands the product and prices are attractive, since during the campaign there is no security or stability in the mar-

ket. The consequence then is a reduction in the market’s purchases, because a lot of bad tasting products accumulate in the chambers and it becomes difficult to sell them,” says the expert.

“We have to anticipate what we do. That sounds difficult, but it's extremely simple. The market rules are quite basic, and the

flavorful traditional varieties, but achieving greater hardness at a commercial level. This has been done, for example, with grapes, melons and watermelons, as well as other products, and this puts them in a more advantageous position compared to stone fruit in general. We have just finished with some very tasty plum varieties, with minimum sugar levels reaching 17 Brix degrees, with a strong aromatic component and harvested from the end of June to the end of September, with a gap in the harvesting schedule of one or two weeks between varieties. These are mainly red-fleshed varieties, although there are also some yellow-fleshed ones. When the variety offers an extraordinary flavor, the color of the flesh is not as important,” he says.

rule of thumb is that all parties involved want to get something positive out of it. Growers want more kilos, supermarkets don't want to throw fruit away and want it to have as long a shelf life as possible, and consumers want tasty fruit,” says Luis Aliseda.

“What have we done as breeders? We have developed more vigorous materials, maintaining the sugar levels of the most

“Varieties such as the Black Splendor have even caused the market to collapse due to a lack of flavor, and since they are harvested earlier than they should have been because the prices then are attractive, when they have reached the market they have been rejected, while other good quality products have been sold like hot cakes. Plums are very sour when harvested green. Aware of the behavior of producers, we have obtained new plum varieties that will be juicy even when harvested a little earlier than they should be, so the market will find them edible. We assume that it is difficult to change the behavior of producers and the commercial channel, so we are adapting to them through genet-

Stone fruit

Stone fruit

AGF Primeur • Special Edition • 202216

AGF Primeur • Special Edition • 2022 17 #1 provider of Pulsed Electric Field systems for French fries and chips. Healthier snacks, made from potatoes, vegetables and fruits with less fat, better taste, better colour. www.pulsemaster.us Our compostable nets made of 100% cellulose provide the perfect packaging solution for fruits and vegetables in a complete natural way. We offer a wide range of different colors and sizes. Available on bobbins or as cuffs. Further information at www.compopac.de STILL USING 100% natural sustainable forward-looking climate-friendly perfect fit food-grade certified resilient CONTACT US: www.compopac.de info@compopac.de +49 9823 955 160 PLASTIC PACKAGING FOR FRUITS AND VEGETABLES? Be part of THE CHANGE. Be part of THE FUTURE! Sustainably packed

ics. What we are trying to do is to increase the consumption of stone fruit; the issue of prices is another matter. Either we get consumption to increase, or when the expected production arrives, we will have a problem. We want to bring plum consumption to the same levels as that of table grapes or melons, offering the consumer security in their purchases.”

According to Luis Aliseda, it is normal for growers to be skeptical, because they are not sure if the tastier fruit will be as productive, as they need minimum yields. “Now they have to prove that these new materials, in addition to being productive, offer flavor. We hope that the market will continue to develop and changes will begin to be noticed in the coming seasons.”

The expert also says that “this year, all breeders and nurseries expected nectarine sales to increase, as we have put a lot of effort into this species, as its hairless skin makes it more palatable. However, this year, peaches have been trendier. Since they have hair, their perspiration is different, more porous and, therefore, they are more aromatic and organoleptically superior to nectarines. The market

is clearly looking for flavor and there are many causes for concern, since there is an excess supply of nectarines; mountains

of fruit where there are tasty fruits next to unripe or sour ones, so their price has been levelling up with that of peaches.”

Differentiation will continue to be a challenge in the stone fruit market. “Although tasty varieties are being introduced, it is difficult, at the moment, to achieve differentiation in the stone fruit market. The market is not helping with differentiation, but rather gobbling everything up and placing it all together on the shelves. It will continue to be a challenge to differentiate tasty fruit from tasteless one. Our Extreme® line is giving us the opportunity to stand out. All the tasty varieties are Extreme®, so the name that identifies them will help in differentiation,” concludes Luis Aliseda.

Stone fruit

Stone fruit

AGF Primeur • Special Edition • 202218

focus on premier quality trees comprehensive assortment MAGNUM® trees & numerous club varieties fertile innovations & enhancements patented cultivation techniques pre orders to ensure your specific needs & wishes tailored professional advice AFSCA-licensed supplier inf Heuvelstraat 50 B—3850 Nieuwerkerken +32 (0) 11 68 87 01 sales@carolustrees.com www.carolustrees.com

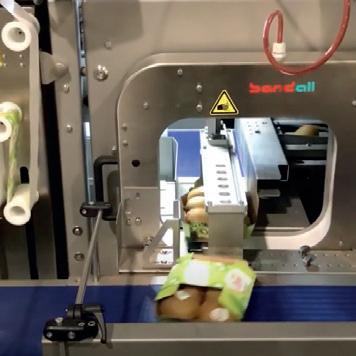

AGF Primeur • Special Edition • 2022 19 100% recyclable paper banding solutions T +31 (0)348 431520 E info@bandall.com I bandall.com › › Printing and coding while banding › Multiple band widths on 1 machine › Fast production speeds possible Stand 10G12 BANDALL Advertentie AGF Primeur.indd 1 08/09/2022 15:15 De doelen 2, 3905 TA VEENENDAAL | Tel:+31(0)318 546474 | Kvk: 30072997 | E-mail: info@ravenswaaij.nl www.ravenswaaij.nl With more than 95 years... of import/export experience in the fresh produce industry

Luis Fernando Rubio, director of the Association of Producers and Marketers of Garlic (ANPCA):

Spain is one of the world's leading exporters of several fruits and vegetables, and that includes garlic. In fact, this product has pushed the country to second place in the ranking of the global export market. According to Luis Fernando Rubio, director of the Association of Producers and Marketers of Garlic (ANPCA), this is to thanks to the value of the Spanish production in the international market; a statement that can be backed by contrasting the available statistics provided by official agencies.

Spain has reached this second place while being only the world’s sixth lar gest garlic producer, behind India, Bangla desh, the Republic of Korea and Egypt, and far behind China, which is in the lead. In 2020, China produced a massive 20.7 mil

lion tons of garlic. Its production capacity is evident if we take into account that the country’s production area is 19 times lar ger than the Spanish one, and produced 77 times more than the 269,000 tons produ ced by Spain, according to FAO data.

This figure is reduced if we consider the quantities exported. With 2.25 million tons traded on the international market, China exported 12 times more garlic than Spain, which shipped 190,400 tons in 2020.

The 2020 statistics, the latest available, will obviously be influenced by the events that turned the world upside down that year; however, despite those unavoidable fluctuations, the data still serve to high light the great value of Spanish garlic in the markets. If we take into account the volume exported and the value of sales, based on the figures provided by Faostat, and with them we calculate the average export price, while Chinese garlic traded at 0.95 dollars/kilo, Spanish garlic traded

“The crisis in maritime and land transport is having a very significant impact on the garlic market, because 70.7% of Spanish garlic was exported in 2020”

AGF Primeur • Special Edition • 202220 Garlic

at 2.52 dollars/kilo; that is, its price was 2.6 times higher.

In the end, this mathematical and sta tistical juggling is only applicable to the computed results, because each new sea son comes with its own uncertainties and challenges, and this year’s, of course, has also brought its own; from the weather to the integrated tariff of the European Union used to classify the goods.

RECORD-BREAKING TEMPERATURES AND THE WORST DROUGHT IN 15 YEARS

“This campaign is, in fact, marked by uncertainty,” says the ANPCA director, who, at the end of July, with the harvest in the country already completed, carried out a detailed analysis of the campaign.

“Regarding the production, there have been some quality issues with the ear liest garlic as a result of the drought and high temperatures recorded from May onwards. The quality loss is not substan tial, but it is noticeable in the dryness of the outer layers. As for purple garlic, there has been a significant reduction in the calibers because the high temperatures, especially at night, accelerated the closing of the garlic cycle and its drying in recent months. However, since there has been no rain, the high temperatures have dried the product very well, in a natural way, and have allowed it to have very good quality, despite the loss of size.”

And the fact is that the weather is causing great difficulties not only to garlic, but to the entire agricultural sector in Spain; also in much of Europe. Whether it is a consequence of variations in the already fluctuating Mediterranean climate or a palpable effect of climate change, the real ity is that the reports of the State Meteo rological Agency leave no room for opti mism, at least in the short term. While the month of April was considered cold over

all, with an average temperature in pen insular Spain 0.3 °C below the average for this month (reference period: 1981-2010), May became “extremely warm”, with 3.0 °C above the average for this month. In June, the temperature also stood 2.0 °C above the average, and July was the warm est since records began in 1961, with 2.7 °C above average.

The memory of the March and April rains became a mirage, as the drought returned with even greater force than when peo ple were talking about it in winter. At the beginning of August, the Spanish water reserve hit rock bottom -metaphorically and almost literally- falling to 39.2% of its total capacity. To be even more specif ic, the Guadalquivir basin, which is vital for agriculture in the region of Andalusia, stood at 24.2%.

“In fact, Andalusia has made an official statement about the drought, given this exceptional situation, which has greatly affected crops and, in the case of garlic, displaced the crop to other regions with a “guaranteed” supply of water for irri gation. We estimate that in crops such as onion the acreage has been reduced by up to 70%. In the case of garlic, the reduc tion has stood at 30%, since the drought was declared after the planting, but the purple garlic has been completely dis placed to the area of Albacete and Ciudad Real. Right now, with the 2023 campaign already being planned, some say that pro ducers in Andalusia are not going to culti vate anything, because they are not going to have water.”

AGF Primeur • Special Edition • 2022 21

“THERE IS NOT ONLY MONETARY INFLATION, ALSO ENERGY INFLATION”

The concerns raised in the sector by the water crisis are obvious; perhaps more evident, but no less unsettling than the ones caused by the energy crisis. “The price of energy has quadrupled in one year and we have to take into account that the supply of water for irrigation is possible thanks to the mechanical extraction of water, which is causing energy costs to skyrocket. From my point of view, it is this energy inflation, and not only monetary inflation, that is affecting us and will continue to affect us all: producers and marketers,” said Luis Fernando.

But not only electricity has become significantly more expensive. The uncontrolled rise in the price of fossil fuels has taken an inevitable toll on international transport, adding to the problems affecting global logistics.

“At ANPCA, we understand the rise in transport costs, given this context, but what is not normal is the increase in international maritime freight expenses, which is affecting a product 70.7% of whose domestic production was exported in 2020. Spanish garlic reaches more than 57 international destinations,” said Luis Fernando Rubio, “but high maritime shipping costs are driving us out of international markets in which we had entered because of the quality of our garlic.”

“The situation is very difficult this season. At national level, there is a very quiet demand and the productions are not as large as we expected, and at international level, we are unable to offer our product at a competitive price, since freight is so

expensive that the costs are almost unaffordable for the operators in various destination countries.”

“Right now, countries like Morocco or Egypt are taking advantage of this situation in some markets, as they can offer their garlic at a lower price, since their production costs are much lower. Wage costs alone are one eighth, or at best even one ninth, of ours.”

“AT TARIFF LEVEL, GARLIC TRANSPORTED AT -4 °C IS FRESH GARLIC”

For the Spanish garlic sector, which produces 70% of all European garlic, it is of the utmost importance that market standards are met in an environment that has become even more competitive than usual.

“For this reason, at ANPCA we are going to ask the Directorate General for Taxation and Customs Union of Europe (DG TAXUD) to ensure that imported garlic products are properly identified under the right tariff headings. This vegetable falls under 6 different TARIC codes, but among them there are two that can create confusion: the code for fresh garlic (CN 07032000) and frozen garlic (CN 07108095),” said Luis. “Fresh garlic is transported at -4 °C, but that does not mean that it is frozen garlic, so customs can make an incorrect interpretation of the tariff heading to which that product corresponds.”

“And there is a big difference. Unlike frozen garlic, fresh garlic is subject to a number of protective tariffs in the European market, precisely to avoid unfair competition from the productions of these third

countries with much lower production and wage costs than Spain.”

“We have said that, if the TARIC code corresponding to frozen garlic cannot be modified, an explanatory note should be included in the tariff headings, so that customs officers know how to properly identify the headings corresponding to each product and the dissuasive measures in place in Europe can be enforced.”

“To curb the fraudulent entry of fresh garlic in Europe we have also launched a study of anti-dumping measures against Chinese frozen garlic, as we have observed that the shipments of frozen garlic entering the European market are priced well below the production costs of frozen garlic produced in the EU. That is why in the latest meeting of the garlic contact group of the Spanish-French-French-Italian-Portuguese Joint Committee, held in April in Toulouse, we asked the different countries to present some cost studies, but the only one that presented it was Spain. We are still waiting for Italy, France and Portugal to submit their studies so that we can develop this anti-dumping protocol together with the entire European garlic industry.”

AGF Primeur • Special Edition • 202222 Garlic

lfrubio@anpca.es

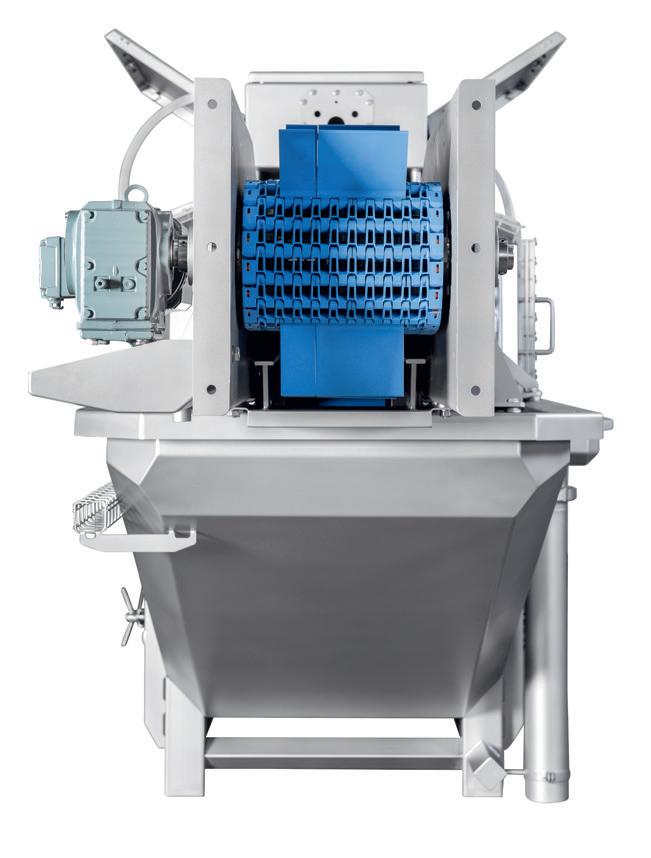

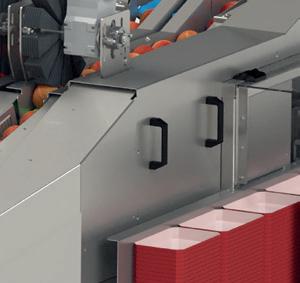

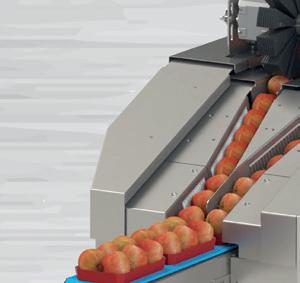

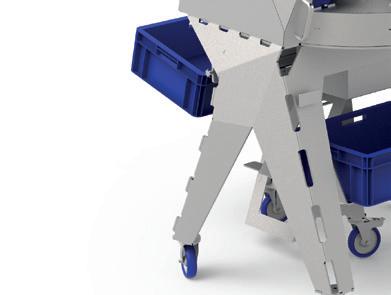

The current trend towards less and less packaging material not only creates more work for packaging designers, but for machine builders as well. For the apple sector, Burg Machinefabriek has designed a tray filler that can also process cardboard wing trays.

“The machine actually evolved from an earlier type we had developed for the UK market,” René Koster explains. “For example, Tesco has a line that packs several apples in one flowpack. Then we were approached to come up with a soluti on for packing apples on a tray with a flow pack. We decided to increase the machine’s functionality by adding cardboard wing trays to the range of automatic packaging options. And that is unique in our industry. Meanwhile, nine of our BTI tray fillers have already been sold. Vogelaar Vredehof from Krabbendijke also has one.”

CAPACITY TRAY FILLER

The tray filler is pretty fast. Every minute,

up to 65 trays can be filled with 4, 6 or 8 apples. “Our competitors can only go as fast as 40 trays per minute,” René Koster emphasizes.

CAPACITY FOR PROCESSING TRAYS AND WING TRAYS IS THE SAME

The stacks of cardboard/plastic trays or wing trays supplied by the operator are automatically de-nested and placed on a belt. The capacity for processing trays or wing trays is the same.

After automatic filling of the tray, two employees will straighten the apples. Together with the operator, who supplies the trays and operates the machine, and

the forklift driver who feeds and empties the crates, they are the only employees needed to process more than 60 trays per minute. The upstream (case emptying) and downstream (folding the wing trays, case packing and palletizing) processes can be automated further as well. “In principle, the machine can be connected to any kind of supply line and to a flowpacker or wing tray folding system.”

r.koster@burgmachinery.com

AGF Primeur • Special Edition • 2022 23 Advertorial

“The capacity for processing trays or wing trays is the same” Burg Machinefabriek supplies tray filler to Dutch packaging company in Zeeland: Advertorial Burg Machinery is present at the Fruit Attraction, stand number: 10C12 WE’RE ADDING VALUE IN PACKHOUSE SOLUTIONS Bin unloading Bin fi lling Bin logistics Complete packaging lines Palletising Bin cleaning More information www.burgmachinery.com or call directly: +31113501373 SCAN/CLICK HERE FOR THE VIDEO OF THIS PROJECT REALISED PROJECT AT: VOGELAAR VREDEHOF B.V.

To combat the labour shortages in the Spanish agricultural industry, the government plans to grant more work visas and relax work permit rules. As companies scramble to find farm workers for harvest, the situation has become stringent and limits companies in their growth options. But adding more workers is not the solution, Dror Erez with Automato Robotics believes. “We need to minimize the work in the greenhouse.” Their robotic platform was tested in Spanish greenhouses earlier this year.

Grover, Sweeper, Kompano, GroW, Gronos; No, these are not the latest Marvel superheroes, nor the list of Songfestival contestants for 2023. These are all robots that hopefully in the future will take care of most of the work in the greenhouse. While logistics are already being taken care of by pipe rail trolley and harvest carts, robotic solutions to harvest fruits, to deleaf plants or to lower plants in the greenhouses are currently being develo-

ped yet are hardly commercially available on large scale. Profitability is one of the biggest challenges as the techniques are new and the robots have to work in a sensitive environment, while they cannot make mistakes since margins are slim.

Every day, steps are being taken towards more automated labour in the greenhouse and at this year’s GreenTech, one of the biggest horticultural shows in the world,

several new solutions were launched. However, most of these robots work in high-tech greenhouses and are developed for the Northern European or Northern American market, as these are the countries where labour is expensive, thus profitability is easier to achieve. At least, that’s what you would think. This is contrary to the believe or Dror Erez with Automato Robotics. He wants to make robotic labour available for growers in passive (unheated) greenhouses as well, a market that Dror explains is dominating the greenhouse agriculture (85% of the area) and is dealing with similar challenges all over the world. “Whether it is Spain, Mexico, or other countries, the labor shortage is getting worse everywhere.”

If it were up to Dror, every grower, whether he owns a small, medium-sized or large company, will soon be able to afford a

“We need to minimize the work in the greenhouse”

Dror Erez, Automato Robotics

AGF Primeur • Special Edition • 202224 Machinery

multi-functional robot tool. This will help growers not to automate their greenhouse completely, but to lower the work in the greenhouse. “A totally autonomous greenhouse seems nice, but we don’t think it will be a reality in the near future. Even for a robotic harvester you still need somebody to supervise it. In other words, there will always be a need for human labor. This also reflects the transition that’s going on globally, we believe. People do not want to do the kind of hard work in greenhouses anymore. We want to help them become machine operators”, Dror explains. “We try to minimize the work needed in the greenhouse and at the same time, make the greenhouse a better place to work in. That’s our main goal rather than making the green house fully autonomous.”

The cornerstone of the Automato Robotics solution is a robot platform that can drive in off-road conditions and operate in passive greenhouses.

“The robot platform itself has several capabilities: mapping, auto-driving in the rows, and in the central passage. “It knows how to operate in the green house. It stays active night and day, and can carry different payloads, thus enabling the grower to streamline his operation and reduce the labor hard ships.”

On this robotic platform, various solu tions can be mounted. Earlier this year, trials were conducted with a pollina tion robot, Polly, developed by Arugga AI Farming. The robot works on the basis of an air pulse system and with cameras. The robot can also use the data it collects to predict the harvest. “We want to partner with all agricul ture robot providers to enable their applications to operate in the passive greenhouse segment”, says Dror.

Applications developed by Automato Robotics itself include a spraying solu tion and their harvest robot. Develop

ing such a robot is a journey, Dror says “To have a robot collect ing tomatoes safely and unloading them in boxes is a long-term project. Initially, we had a prototype, of which we improved the arms, cameras, and algorithms. Then we got to put it on our autonomous platform and started a harvest trial in Israel, after which we entered the next trial phase: a harvesting pilot in a commercial greenhouse in Spain.”

For now, commercial focus is on spraying solution AutoSprayer, which was launched this summer. The autonomous sprayer can drive without rails and each robot frees 2 workers to other tasks. According to Dror and depending on the labor prices, the ROI of such a solution is only one year.

“Our robot will be the first to operate in passive greenhouses, spearheading both autonomous spraying and autonomous tomato harvest. We strongly believe in this strategy because we put affordability as our prime concern. Why bother devel oping a state-of-the-art robot if no one will be able to afford it?”

AGF Primeur • Special Edition • 2022 25

Contact Lorella Maggio +31653285791 info@agridor.com More than 40 years of experience Short lines of communication Reliable global network Good price/quality ratio Global partner in potatoes, onions and carrots. We take care about it. For more than 40 years now... www.agridor.com

Too many factors have pushed the fruit and vegetable sector to be unusually cautious when making predictions. Each season brings new opportunities and also new challenges, some of which can be overcome, but others are unfortunately insurmountable. Last April alone, while many of us were travelling to Germany to meet in Berlin, we saw what Agroseguros would later describe as the most severe loss suffered by Spanish agricultural producers in the four decades in which there has been agricultural insurance, and while at the fair, we learned with dismay about the true impact of the frosts on the fruit sector.

In addition to the uncertainty already generated by the weather, there have been many other factors this year as uncontrollable and as decisive, which will mark one of the most important cam paigns in Europe: the protected fruit and

vegetable campaign in Almeria. The war in Ukraine, far from reaching the expec ted end, seems to have run aground, lea ving no room for a clear recovery of the activities that have been affected since the beginning of the conflict, and rising

AGF Primeur • Special Edition • 202226 Greenhouse vegetables Rafael López, of Hortofrutícola MABE:

costs and inflation have forced everyone to carefully study their expenses, as costs continue to move upward, and there are concerns about the economic sustainabi lity of farms.

However, Almeria’s vegetables are essen tial at this time, as Europe currently depends on the production of the green houses located in this area of southeast ern Spain, and the sector has evolved to become one of the strongest in the region’s agro-food industry.

According to data from Extenda-Anda lucía (the agency devoted to Export and Foreign Investment), in the first half of the year, the region of Andalusia exported a record amount of fruit and vegetables, with 4,424 million and a growth of 11.6%.

“The expected growth of the tomato acreage will come at the expense of other vegetables, and bell peppers may be one of them”

And with 2,239 million, the province of Almeria accounted for 51% of Andalusia’s sales and almost a quarter of those of the whole country. This record was achieved despite having gone through a very dif ficult campaign marked by uncertainty. As rightly noted by Extenda in its report, “Almeria is the undisputed leader and driver of the sector” and, moreover, this is the province in which fruit and vegetable sales grew the most in the first half of the year, with a +17.1% year-on-year increase.

“Everything points to the fact that this year's campaign could be longer than pre vious ones, especially for certain vegeta bles, and in Almeria we are ready for this possible increase”

During Almeria’s 2021/22 campaign, 3.26 million tons of fruit and vegetables have been produced. This represents a 17.5% drop in the volume compared to the pre vious campaign, although the value has increased by 8.5%, according to data shared by Asaja.

All plant species have experienced drops in the production, with the most notewor thy cases being those of zucchini (-22%), watermelon (-38.2%) and melon (-41.7%), although these products have also record ed the greatest value increases (+33%, +77% and +60%, respectively).

Bell peppers account for the most acre age and production in the greenhouses of the province, with 12,627 hectares (+2%) according to data from Asaja, and 896,487 tons (-9.5%); however, the value of the production has fallen by 14.9%, to a total of 708 million Euro.

“The demand for bell peppers has remained mostly stable throughout the campaign, but their price has not been high enough to compensate for the increases in pro duction costs this season,” explains Rafael Lopez, of Hortofrutícola MABE. “In fact, they have fallen below those of last year. Right now, bell peppers are not very prof itable. There is still a profit to be made, but more limited than in previous years, and it will be reduced even further if costs continue to rise. At MABE, peppers are our main product. We produce about 64,000 tons of bell and Palermo peppers. For the next season, we foresee a reduction in bell pepper plantations, although we believe that the demand will continue to be good. In our case, there has been no variation.”

“This year, we are going to introduce vine tomatoes at the request of our partners, coinciding also with the interest shown by our market of influence in the purchase of this product,” says Rafael. This year, toma toes are called to recover the ground they had been losing in the province in recent

campaigns, as it is feared that the high energy costs will put the Central Europe an productions under pressure. For the latter, some are already predicting a dou ble-digit decline.

The recovery of its value would also explain the expected increase. In the 2021/22 sea son, the value of the production increased by 14.5%, to 511 million Euro, driven by prices that were up by 34% compared to the previous season, more than offsetting the 14% drop in the production.

“As far as we are concerned, our bell pep per acreage has not been reduced, but the sector as a whole may have seen such a reduction, as the growth in the tomato acreage will come at the expense of other vegetables, and bell peppers may be one of them.”

“In our case, we are going to see an increase in the production of cucumbers of between 10 and 15%. Apparently, the Netherlands could reduce its vegetable production this season by up to 30% due to the high energy consumption of green houses, and this would mainly affect the winter plantations. If the production that overlaps with ours, such as that of cucum bers, is reduced, Almeria’s sector could gain ground this season. In fact, every thing suggests that this year’s campaign,

AGF Primeur • Special Edition • 2022 27

Eggestraat 35a | 8308 AB Nagele The Netherlands Tel. +31 (0)527-652275 | Fax +31 (0)527-652937 Mobiel +31 (0)6-51084612 info@goproducts.eu | www.goproducts.eu import & export onionsets grading & packing

especially that of certain vegetables, could be longer than in previous years, and in Almeria we are prepared for this possible increase.”

Fortunately, cucumber prices have also improved considerably this past season. Asaja estimates that its average price increased by 29%, reaching 61 cents/ kilo. This is far from the 10 cents/kilo that caused the sector to protest in late 2020.

“Besides the traditional cucumber, last year we introduced the mini cucumber. We can offer about 2,000 tons of that product and the results for the growers supplying

this snack-type cucumber have also been good.”

“Zucchini and eggplant also did very well this season, especially zucchini, which saw its price double compared to the previous season, but we have not observed a level of demand that would motivate us to expand our acreage this year,” says Rafael Lopez.

“The purchase prices of farms in Almeria make the investment in new land unprofitable”

There are close to 37,000 hectares of greenhouses in Almeria and each campaign there are new combinations in the

distribution of that area, which is actually not so extensive, given the magnitude of the production. This is due to the availability of water and the high prices of land, which hinder the expansion of the acreage in production. In fact, in 2021, the price of land for irrigated greenhouse vegetable cultivation in Almeria rose by 5% compared to the previous campaign, according to the Annual Survey of land prices of the Ministry of Agriculture. The price stands at an average of more than 247,700 Euro per hectare, with a maximum value of 313,581 Euro per hectare.

“The current farm purchase prices, together with the prices of vegetables like bell

AGF Primeur • Special Edition • 202228 Greenhouse vegetables

LCL (The Netherlands) www.lclog.com +31 (0)180 460 770 sales@lclog.com Handelsweg 40 2988DB, Ridderkerk COME AND MEET US AT HALL6: STAND 6B06B 4 - 6 OCTOBER | MADRID, SPAIN FRUIT ATTRACTION 2022 YOUR PREFERRED PERISHABLE LOGISTICS SERVICE PROVIDER

peppers, which are our main product, make investing in new land unprofitable. With a profit of about 10,000 Euro per hectare per season, a bell pepper producer has to work in at least 2 hectares to get enough to live on, which leaves very little room to invest or improve. The organic production is currently somewhat more profitable and can make it easier to face the purchase of new farms.”

“There is a clear trend in agriculture of moving towards a more sustainable and environmentally-friendly production. So far, we have been working with conventional crops because our customers had an excess of organic supply, but now we are not ruling out the construction in the near future of new facilities to start producing and processing organic produce,” says Rafael. “For now, the production costs are

still higher, but we are gradually getting them closer to those of the conventional production; however, the lower production volume results in a tighter profitability than we would expect. Some of our growers producing organically have told us that, in the case of cucumbers, you can lose up to 35-40% of the production, and in bell peppers, up to 20%. And if the profitability is not achieved with the volume, you have to do it with the price,” says Rafael Lopez.

rlopez@mabesat.com

Passion for Conference Pears

During the Fruit Attraction in Madrid, we will be present as visitors. Feel free to call us to meet each other during the fair: +32 477-77 77 36

AGF Primeur • Special Edition • 2022 29

Grower of high quality Conference Purchase and sales of pears Packaging according to customer's wishes Kieldrechtsebaan 85 - 9130 Verrebroek Tel: 0032477777736 - Email: info@vanhaelstfruit.be www.vanhaelstfruit.be

“A decent market portion remains for

For years, we've been hearing that reefer container transport is growing relative to specialized reefer ships. Hans Mol, managing director of GreenSea - a Seatrade/Green Reefers partnership with a fleet of 35 reefer vessels active in transporting break bulk goods including seed potatoes, citrus, bananas, and fishery productsconfirms that scenario. He says the sector is, nonetheless, prospering, and prospects for transport by specialized reefer vessels also look good.

“We and other carriers are building and have plans for new ships. Despite this, as the absolute amount of refrigerated transport grows, less and less transport is being done by refrigera ted ship. But there's a decent piece of the market left for the specialized reefer ves sels, where we truly add something. We're optimistic about the future.”

And although rising costs and inflation affect reefer ship transport too, Hans does not see them as problems. Unlike Europe, where demand is expected to level off due to the economic situation, he foresees a

different scenario for Africa. “We do a lot in Africa, and there, inflation and deval uation are nothing new. They're always facing those challenges. We transport products that fulfill basic needs and so are always needed. We don't see volumes decreasing,” he says.

HIGH DEMAND ON SPOT MARKET

Hans does, however, think reefer vessel transport will generally become pricier than reefer container transport. But, local handling costs - loading close to the grow ing areas and direct delivery to cold stores at destination - are lower than for con

tainers. That party compensates for the higher prices, he points out. Plus, the fast transit time has value because it extends products' in-store display lives or can, say, help the strategic interest of controlling a market. Hans does not think inflation will cause container transport prices to fall. “Inflation is high, and consumer con fidence is lower with many signals on red or orange.”

“That's flattening the container market a bit, but not as much as you'd expect. That's due to congestion in ports and terminals and unforeseen circumstances like low water levels and strikes, such as the recent one in Felixstowe. So, capacity will remain limited for some time.” He adds that this makes it beneficial to have tonnage avail able for the spot market. About 60% of GreenSea cargo is shipped on contract; the remaining 40% is for the spot market. “It's been nice to be able to do a good share on the spot market over the past 18 months. There's plenty of demand for both regular and new customers,” Mol explains.

Hans Mol, GreenSea:

AGF Primeur • Special Edition • 202230

Logistics

specialized reefer ships”

He points out that short transit times are one of the benefits of specialized reefer ships. “As container ships grow in size, their access to ports becomes more limit ed, leading to more transshipment points, which negatively affects the transit time.

That's a problem for something like mel ons with a limited shelf life.” Container ships are also afflicted by congestion. “This affects specialized reefer vessels far less, if at all. We dock at the same ports as container ships.”

“But reefer ships have a different termi nal within the port. We can put the prod ucts directly in the cold store, where they can be collected right away. Containers get stuck somewhere, and it's anyone's guess when you can pick it up,” Hans says.

AGF Primeur • Special Edition • 2022 31

Logistics

He adds that reefer ships are especially suitable for niche markets or short-season, high-volume products. For example, GreenSea transports seed potatoes and onions in addition to fish products. And recently also melons from Brazil to Europe.

SHORT TRANSIT

The MD says the short transit time and reliable service were why melon exporter Agricola Famosa - with a roughly 60% market share of Brazilian melon exports - chose to transport part of the melon harvest from Fortaleza by specialized reefer ship instead of, as before, everything by reefer container. “These are large melon volumes and have to be gone in a short time. So, they want reliability, something that's been lacking in recent years but which we can offer them. We've created a customized solution: from week 35 to week 8, it takes us 10, 13, and 14 days to transport melons from Fortaleza to Vigo (Spain), Dover (UK), and Rotterdam (The Netherlands), respectively,” he continues.

There is a weekly sailing that is updated based on a forecast. “In consultation, we adjust the ship's size and sailing day.”

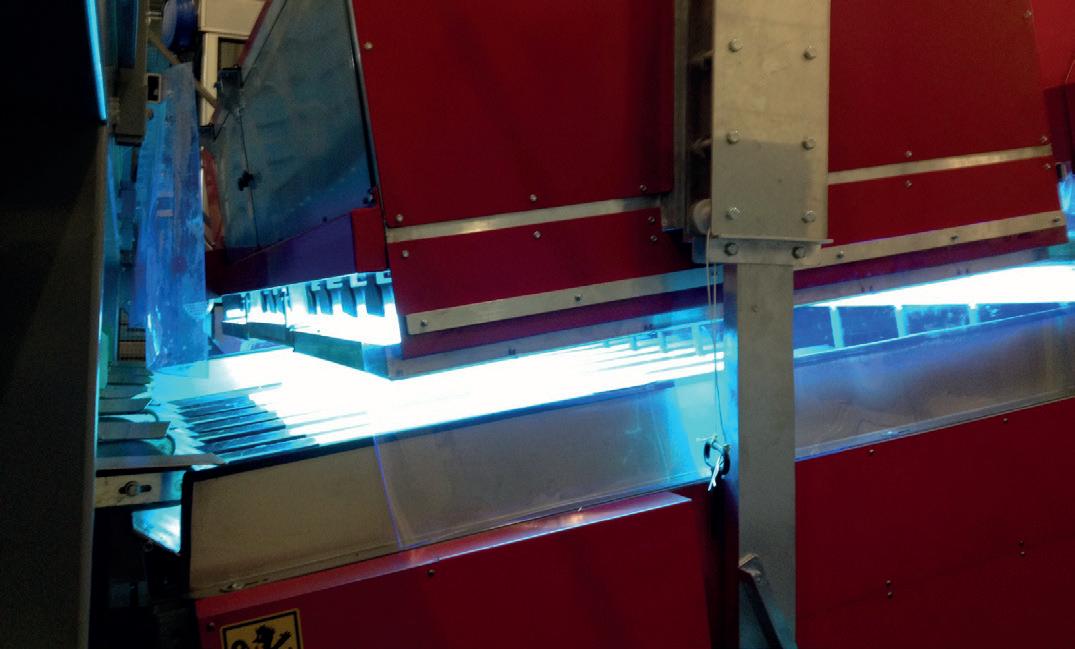

GreenSea can be flexible in this regard, as 70 to 80% of its fleet sails in the Atlantic. “For instance, we do a lot of fish transports to West Africa. We can tap into that fleet, and vessels from Central America. There are always plenty of positions available seven to eight days from the loading port. We link cargo flows. Agricola Famosa's cargo makes us efficient, and we, therefore, make it efficient for them.”