With MSC, you can reach any market around the world. Building on decades of experience, we care for your cargo 24/7 at the port, over the seas, on trucks or on trains. You can rely on our local teams to meet the unique requirements of your supply chain.

April/May 2024 I Vol. 5 I No. 3 $ 10.95

editor ’s note

Britain's first lab-grown meat: it's for cats

Caitlan Mitchell Editor caitlan@reviewmags.com

Caitlan Mitchell Editor caitlan@reviewmags.com

Innovation is the lifeblood of any business, and the ability to evolve and develop is crucial for survival. Cell-cultivated meats epitomise this evolution. Once confined to science fiction, cell-cultivated meats are poised to enter the pet food aisle.

Meatly, a pioneering cultivated meat company has revolutionised the pet food industry by creating pet food that uses cultivated chicken as its protein source. This

contents

groundbreaking product is a result of a collaboration with Omni, a rapidly growing novel protein pet food company in the UK led by veterinarian Dr Guy Sandelowsky.

This development marks a significant step in Meatly's B2B marketing strategy. The company aims to be the first in the world to sell cultivated meat for pets and gain regulatory approval for such products in the UK and Europe.

For Omni, which has already achieved over £2 million in sales with its dog food made from pulse, algae, and yeast protein diets, this venture into the cultivated meat market is represented by canned wet food for cats. The partnership with

Meatly, known for its cruelty-free chicken ingredient, signifies a muchanticipated evolution in the pet food market. Brands like Omni strive to offer ethical and environmentally friendly products that are healthier for pets.

As consumer demand for pet food has doubled in the past decade and is projected to outstrip supply soon, the swift introduction of sustainable protein sources like Meatly's is crucial. Meatly is currently in the process of obtaining regulatory approval. Once granted, their pet food, produced in partnership with retailers and manufacturers like Omni, will be readily available.

Pets at Home, an early investor in

Meatly, is set to be the first retailer to offer these products in its stores. The innovation of cell-cultivated meat for pets represents a groundbreaking shift in how we feed our animals—never having to kill one animal to feed another. This progress promises to pave the way for a new era in pet nutrition. This is definitely a category to watch, as it holds the potential to significantly reduce the environmental footprint of the pet food industry.

5 10 8 13 15 16 29 24

PUBLISHER Tania Walters

GENERAL MANAGER Kieran Mitchell

EDITORIAL DIRECTOR Sarah Mitchell

EDITOR Caitlan Mitchell

EDITORIAL ASSOCIATES Jenelle Sequeira, Sam Francks

ADVERTISING SALES info@reviewmags.com

SENIOR DESIGNER Raymund Sarmiento

GRAPHIC DESIGNER Raymund Santos

Retail 6, Heards Bldg, 2 Ruskin St, Parnell, Auckland. PO Box 37140 Parnell, Auckland Tel (09) 3040142 Email: edit@reviewmags.com

2 I fbtech.co.nz F&B TECHNOLOGY launched to facilitate the connection between food and beverage suppliers of technology, ingredients and packaging across the food and beverage manufacturing sectors for fmcg and foodservice. Copyright 2024

ISSN No. 2744-3566 (ONLINE) - 2744-5895 (PRINT) food grocery & COUNCIL OUR PARTNERS:

TURNING BEER LEFTOVERS INTO PROTEIN

SINGAPORE | Researchers from Nanyang Technological University, Singapore (NTU Singapore), have created a method that extracts over 80 percent of the protein in grain leftovers from brewing beer, commonly known as brewers’ spent grain (BSG).

BSG is the solid residue from malted barley after brewing beer, making up 85 percent of the total waste. While some efforts are made to repurpose BSG, a substantial portion remains in landfills, generating greenhouse gases. After exploring new use cases for the BSG proteins, the researchers

from NTU’s Food Science and Technology programme identified that the extracted proteins could enrich diets and even for cosmetic purposes, feeding into growing consumer preferences towards sustainability.

The researchers extracted up to 200 grams of protein from one kilogram of BSG, indicating its potential as a protein source, safe for human consumption and suitable for direct use in supplements and for enhancing the protein content of plant-based foods.

This would also help mitigate a possible protein shortage due to a

forecast of a 73 per cent increase in meat consumption by the year 20503 following rapid global population growth, according to the Food and Agriculture Organisation of the UN (FAO). The proteins extracted by the NTU researchers were also rich in antioxidants, which could protect human skin from pollutants and extend the shelf life of cosmetics like body lotions and moisturisers. Our study, which presents more sustainable and efficient ways to add value to brewers’ spent grain disposal, is a crucial step towards mitigating its contribution

MIO & TAP DISRUPT ENERGY DRINK INDUSTRY

CHICAGO | Energy drinks are the latest accessory infiltrating younger generations, replacing cell phone chains and micro purses. The category has surged since 2017.

However, some energy drink enthusiasts often wonder why they don’t feel too great after having these drinks and are also concerned about their lack of water intake. Catering to these consumer trends and demands, Kraft Heinz’s mio has introduced TAP, the first-ever faucet that instantly turns tap water into a hydrating energy drink.

“With our TAP launch, we're shaking up the energy drink game and reminding people that sometimes the simplest solution is the best,” said Samantha Mills, Director of Brand Communications at Kraft Heinz.

“We’re here to show the world that energy drinks don’t need to be complicated; they just need to make you feel good. Our vibrant TAP faucets prove you can get that instant boost right from your kitchen sink - without the unwanted side effects.”

TAP works just like a regular faucet. You turn it on, and tap water can be transformed into an energy drink that helps you hydrate.

to greenhouse emissions and reducing environmental strain while enriching the global food supply chain,” said lead author Professor William Chen, director of NTU’s Food Science and Technology (FST) programme.

“Demonstrating that the proteinrich qualities of brewers' spent grain could be successfully extracted and funnelled into supplements and enriching plantbased proteins to make them more attractive to the consumer addresses two global pressure points – food wastage and food shortage.”

The study reflects NTU's commitment to mitigating environmental impact, one of four challenges humanity faces that the university seeks to address through its NTU 2025 strategic plan.

The NTU FST Programme collaborated with Heineken Asia Pacific, the producer of Tiger Beer, using the brewers' spent grain in the study. The NTU FST team will be in discussion with Heineken Asia Pacific to scale up the protein extraction method, and they plan to collaborate with food and beverage and cosmetic companies to implement their technology further.

Introducing mio’s TAP faucets proves you only need tap water and mio to create an energy drink. This is a welcomed addition in a world of energy drinkers who face adverse effects due to high sugar content, artificial additives, and dehydrating ingredients.

These faucets can integrate with any kitchen and offer a solution for those seeking an alternative to traditional energy drinks.

mio's TAP faucet coincides with the brand's first rebrand in nearly a decade. The refreshed packaging, brand colours, and logo are part of mio’s commitment to providing accessible and personalised wellness solutions that meet the evolving needs of its consumers.

4 I fbtech.co.nz news

SODEXO DEPLOYS AUTOMATED KIOSKS WITH ART

USA | To redefine hot food robotic technology, Sodexo has partnered with Automated Retail Technologies (ART) to deploy thousands of kiosks across Sodexoserved facilities in the U.S. This partnership will establish new benchmarks in the automated dining domain.

“Our dedication to innovation in convenience, dining, and the broader evolution of food hinges entirely on technological advancements,” said Husein Kitabwalla, CEO of Tech & Services and Food Transformation, Sodexo North America.

“We’re excited to collaborate with ART and leverage their Just Baked Technology, further expanding our network of partners utilising AI for food production and bringing our clients and consumers foods that transcend conventional norms.”

Just Baked Smart Bistro kiosks can be found at Sodexo client sites.

With a click of a button, they produce giant cinnamon rolls, White Castle Cheeseburger Slider four packs, bao buns, breakfast sandwiches, and other delectable options.

“We are thrilled to partner with Sodexo and its vast network of food service clients. Sodexo’s reputation for quality and commitment to their customers is unparalleled, making them an ideal collaborator for us,” said Ben Porter, CEO of ART.

“The value proposition of ART’s cutting-edge technology transcends mere convenience, boasting features such as streamlined operations through automation, advanced analytics powered by machine learning algorithms, and unparalleled food service delivery to end users available round the clock.”

ART is the premier hot food technology supplier for the food

service industry. With a focus on technology-forward solutions, including the Just Baked Smart Bistro, they have automated hot food robotic kiosks and ART partners with leading food service operators and venues to deliver

NEPAL FOCUS FOR WORLD HEALTH ORGANISATION

NEPAL | The World Health Organisation’s Country Office in Nepal has handed over consumables and equipment to the Department of Food Technology and Quality Control (DFTQC), Ministry of Agriculture and Livestock Development.

The provided consumables and equipment will significantly enhance the capability to monitor transfat levels in foods, which will align with new legislation in Nepal regarding the restriction of industrially produced trans-fatty acids and awareness around cardiovascular disease.

“Eliminating trans-fatty acids is a cost-effective measure with great health benefits in preventing premature deaths from cardiovascular diseases,” said Saima Wazed, regional director for the World Health Organisation in South-East Asia.

Prioritising prevention and control of noncommunicable diseases (NCDs) in the South-East Asia Region, the World Health Organisation has supported countries for the elimination of trans-fatty acids from national food supplies, along with other measures. With Nepal’s legislation, nearly 80 percent of the region’s population – 1.6 billion people - will be potentially protected from the harms of trans-fatty acids. By 2022, Thailand, India, and Bangladesh had adopted regulations to eliminate trans-fatty acids in the food supply. Indonesia had complementary policy measures. Sri Lanka issued a regulation in 2023. Nepal issued the legislation on trans-fatty acids in February. The World Health Organisation will also support the Department of

convenience and excellence in North America.

With its small footprint and wide variety of food options, ART is pioneering a new era of convenience and sophistication.

Food Technology and Quality Control in capacity-building initiatives and disseminating advocacy materials. This is expected to reduce trans-fat contents and other harmful products, whilst promoting better health and well-being and coinciding with the Sustainable Development Goal targets to reduce premature mortality from NCDs by one-third before 2030. Globally, 540,000 deaths yearly can be attributed to the intake of industrially produced trans-fatty acids. High trans-fat intake significantly increases the risk of death from cardiovascular diseases.

In the World Health Organisation’s South-East Asia Region, noncommunicable diseases cause 69 percent of the nearly nine million deaths every year. Cardiovascular diseases are a major cause of deaths.

April/May 2024 I 5

UNILEVER INNOVATE LAUNDRY MARKET

UK | A new science-backed product from Unilever has used cutting-edge robotics and AI to develop Wonder Wash, a laundry detergent specifically designed for an elevated 15-minute cycle. The new product has been based on research that indicated a growth in the popularity of malodour-retaining athleisurewear, compounded by hybrid-working patterns adopted since the

pandemic, which has also led to a shift in the type of laundry consumers are doing.

Designed by Unilever scientists, Wonder Wash was developed from a blend of fast-acting ingredients, which activate as soon as the cycle begins, tackling everyday grime and malodour compounds in a matter of minutes, and in the most challenging washing conditions. With 35 patents pending, the

GENOME EDITING PERCEPTION

USA | A study from Arizona State University and the University of Oregon explored how people living in the United States and Switzerland felt about the the use of genome editing in agriculture produced for human consumption.

Lead author, Assistant Professor Caitlin Drummond Otten, said each participant learned about one of the three different applications of genome editing in agriculture: pest-resistant potatoes, gluten-free wheat and cold-resistant soybeans. “Surprisingly, we generally did not find differences in perceptions across these different applications of genome editing. Instead, the strongest effects were those of the country," said Drummond Otten. "American consumers were generally more accepting than Swiss consumers, though a large share of participants from both

countries reported positive feelings about the technology.”

She said that the United States and Switzerland were chosen because of the different regulations for genome editing in agriculture. In the United States, foods produced with genome editing and related techniques are commercially available, whilst in Switzerland, they are regulated as genetically engineered crops and were largely banned.

The study found that American consumers were generally more accepting of genome editing in agriculture than Swiss consumers, but overall, roughly half the consumers surveyed expressed positive feelings about the technology.

The research was important to identify how genome editing could help to address challenges for agriculture and nutrition, such

innovation is set to create a new category of laundry products. Testing has shown that through the product’s revolutionary Pro-S technology, it has performed better than the competition against the four biggest pain points of shortcycle users: malodour removal, absence of residues, freshness and fabric care.

A change in habits, such as a reduction in daily commutes, has meant that while clothing still picks up invisible grease and grime, 70 percent of the clothing consumers wash now contains no visible stains. Instead, it is soiled with invisible sweat, dust and odour-causing body oils. As a result, over two-thirds (78 percent) of washing machine owners choose a cycle that lasts less than 30 minutes at least once a week. This, coupled with the rise of washing machines with cycle

settings as short as 15 minutes, has created a new consumer need – an effective product that can perform even in the shortest cycles and without leaving a sticky residue.

Eduardo Campanella, business group president at Unilever Home Care, said that until recently, laundry detergents have not kept pace with changing consumer behaviours.

“By harnessing people’s enthusiasm for short cycles for everyday stains, we’re opening up the potential for a new category of short cycle products within the laundry,” said Campanella. He added that Unilever was focused on its investment and bringing through bigger and better innovations.

“Using over a century in detergent-development, we’ve overcome a real technical challenge to offer outstanding performance even in the shortest timeframe and the difficult washing conditions of the short cycle.”

as increased disease resistance, longer shelf life or increased nutritional content. As with any new technology, there are risks and uncertainties that need to be weighed against its benefits. Understanding consumers’ sentiments and concerns toward genome editing in agriculture was important for the study, and was vital for informing the regulation of these technologies and communicating their risks and benefits to consumers to help

them make informed decisions.

“While science and technology can improve people’s lives, they can also pose risks, and my research focuses on how people navigate the scientific evidence that’s relevant to their decisions.”

“Through doing research projects like this one, I sought to build an understanding of public responses to scientific and technological issues that can support scientists in facilitating informed public decision-making.”

6 I fbtech.co.nz news

Wednesday 2nd October 2024

2024 NEW ZEALAND

18th September 2024

Wednesday 3rd July - 18th September 2024 2024 AWARDS ANNOUNCED Wednesday 6th November 2024

Wednesday 16th October 2024

DELIVERY DATES Ambient

Frozen

Fresh & Chilled

ENTRIES OPEN

@nzartisanawards

Wednesday

www.supermarketnews.co.nz

Regeneration Rising

HOW SUSTAINABILITY IS SHAPING THE USE OF COLOUR IN FOOD AND DRINK

By Dieuwertje Raaijmakers, Regeneration Rising trend specialist at GNT Group

Global attitudes to sustainability are evolving fast. Consumers of all ages are developing a much deeper appreciation of the natural world and their desire to protect the planet is growing

This “Regeneration Rising” trend is now starting to influence new product development in the food and drink industry. Consumers are increasingly supporting authentic, purposeled brands and intensifying the focus on the origins of raw materials and sustainable production.

To achieve success, manufacturers need to create sustainable products that have instinctive appeal for these eco-conscious consumers.

WHY COLOUR COUNTS

Colour can be used to convey powerful messages about how their food and drink is created. It can help to instantly communicate products’ naturality and sustainability and to celebrate the origins of ingredients.

When developers prioritize colour at the beginning of the innovation process, it acts as a north star, ensuring that each product is visually appealing and tells a compelling story.

KEY COLOUR DIRECTIONS

As a global supplier of plant-based

EXBERRY® colours, GNT is involved in research to identify key trends and developments across the colour marketplace worldwide. We’ve found that an increasing number of manufacturers are now drawing inspiration from the array of rich colours in the natural world, using visually impactful shades that can be found growing on land and in the sea. This allows their products to send out positive signals about their eco-credentials while maintaining a bold, bright, and fun aesthetic.

Working alongside futures research agency FranklinTill, we’ve identified three new colour directions in line with the Regeneration Trend.

ELEVATED EARTH: This colour direction elevates food and drink categories with an organic but premium look and feel. Earthy colours are applied to raw, unfinished, and highly tactile surfaces. Key shades in the palette include textured purples,

8 I fbtech.co.nz sustainability

red-browns, warm oranges, and inky, tealy blues. Product examples might include sourdough loaves coloured with deep reds and teals, and flavored with nutritious earthy ingredients such as algae. Dairy and plant-based ice creams and creamy desserts, meanwhile, feature the flavors and colours of heritage toasted grains. In the beverage space, cloudy cultured brews like kombucha and drinking vinegars utilize murky shades such as dirtied orange.

NATURE LAB: This direction shows natural colour can be bold, bright, intricately textured, and otherworldly. It creates a new realm of extraordinary nature, defying preconceptions with hyper-real hues derived from algae, fruits, berries, and wildflowers. Vibrant greens and blues are key but the palette also encompasses bright, transparent oranges, highly saturated magentas and fuchsias, rich and saturated yellows, and vibrant reds. Product examples include bread doughs coloured with vibrant blue spirulina, dragon fruit, and lovage; tortilla chips reimagined with enticing

jewel-like colours; and RTDs in vibrant, saturated hues verging on neon.

WHOLESOME NOSTALGIA: Found in comforting and reassuring products, the colours, smells, tastes, and textures of this direction evoke past memories and experiences. The palette features hues ranging from velvet-like to milky, translucent, muted, and dreamlike. Key shades include cool, elegant blues; sophisticated, indulgent, and comforting greens; warm, comforting, and retro peach hues; pretty white-pinks; and lemony yellows. Product examples include gentle pastel ice creams, pale translucent sorbets, and creamy blended yogurts; sparkling botanical spritzes and summer cocktails in very faded, translucent neons; and baked cheesecakes with set custards in pale pastel peaches, greens, and pinks.

PLANT-BASED COLOURS

At GNT, we’ve been creating EXBERRY® colours from non-GMO fruits, vegetables,

and plants since 1978. As pioneers in plant-based, sustainable colours, Regeneration Rising is a topic that is very close to our hearts.

We work alongside our customers to devise effective solutions that tap into the latest trends and connect with consumer needs. We can provide support throughout every stage of the product development process, helping brands develop eyecatching, sustainable products that capture the essence of their natural raw materials.

EXBERRY® is the ideal colour solution for the Regeneration Rising era. Suitable for almost any food and beverage application, our colours can be used to create innovative products featuring spectacular shades inspired by the natural world.

For more information about EXBERRY®, visit www.exberry.com

April/May 2024 I 9

trade talks: boogie lab

ACCESSIBLE THROUGH AI Making Sourdough

As the first bakery in North America to incorporate AI fermentation tech, Boogie Bakery’s mission is to make sourdough products more accessible. Boogie Lab’s unique approach to sourdough fermentation has combined artificial intelligence with traditional techniques.

KARLO VULIN Boogie Lab, Co-founder

KARLO VULIN Boogie Lab, Co-founder

This proprietary AI fermentation technology has incorporated smart fermenters and advanced sensors for precise control over the sourdough fermentation process. This results in consistently perfect loaves with an unmistakable artisanal touch and also helps lower the price combined with the broader distribution.

Given that labour is the most significant expense in sourdough products, Boogie Lab had to find a way to produce them at scale. Scaling artisanal products is difficult because sourdough fermentation is quite unpredictable.

With fermentation, automation and AI, these baking methods can produce distinct loaves perfectly baked every time using only three ingredients, so the bread is minimally processed and easy to digest.

“AI also allows us to become the first scalable artisan bakery. Our approach paves the way for fully automatic production lines, allowing us to scale rapidly and reach as many homes as possible. Wholesale distribution within the US has already begun,” said Karlo Vulin, co-founder of Boogie Lab.

Currently, Boogie Lab has only used the technology in its factories. However, it is also in talks with a few of the biggest baking companies to help them produce sourdough products on lines made for conventional products.

“It is the most efficient way to produce sourdough bread, which has a longer shelf life than conventional bakery products.”

Boogie Lab has also produced bread in a parbaked frozen model, which enables quicker and more precise reactions to demand spikes and helps reduce food waste.

According to Vulin, the biggest hurdle in sourdough production is predictability. Regardless of how skilled an artisan baker is, many variables influence sourdough fermentation dynamics that can change daily.

Another issue when opening sourdough bakeries has been the extremely slow transfer of knowledge, which can be problematic for wholesale factories operating as chains.

In addition to all the critical control points of food safety, including the HACCP and IFS certifications, Boogie Lab has its own set of control points crafted to control texture and taste.

During the process, around 15 points of measurement help identify the bread’s taste and texture.

“Implementation is not a challenge at the moment, given that we keep the

technology for our factories for now. Frozen distribution is the challenge, but we are already accustomed to that one.”

Boogie Lab’s best-selling product is the sourdough focaccia line. It also offers classic sourdough loaves (country, rye, and corn) and more advanced versions, such as whole grain with oat porridge.

However, its most unique offering is the Boogie Lab double bread, where customers can buy and give a loaf. This is done through the utilisation of spent brewer grains in the recipe for that bread.

By utilising waste from beer production, Boogie Lab gives the double bread a new shine. For each one sold, one is donated to those in need.

It also has a zero-waste policy, which includes practices that are not typically conventional in a bakery, from minimising

all inedible materials going to waste to upcycling everything edible.

“We also use leftover bread to make flour to feed our starters.”

Boogie Lab focuses on educating people about why sourdough bread is better and connecting with new distributors in different markets.

At the moment, Boogie Lab has two open locations in Croatia, with a third in the finishing stage and one location in the finishing stage in New York, with two more in the pipeline.

“The US market is interesting because customers are already familiar with sourdough products, but there is a big gap in their accessibility. We want Boogie to be a household name worldwide regarding sourdough bread.”

April/May 2024 I 11

trade talks: nutrition from water

MICROALGAE - The New Marine Whey?

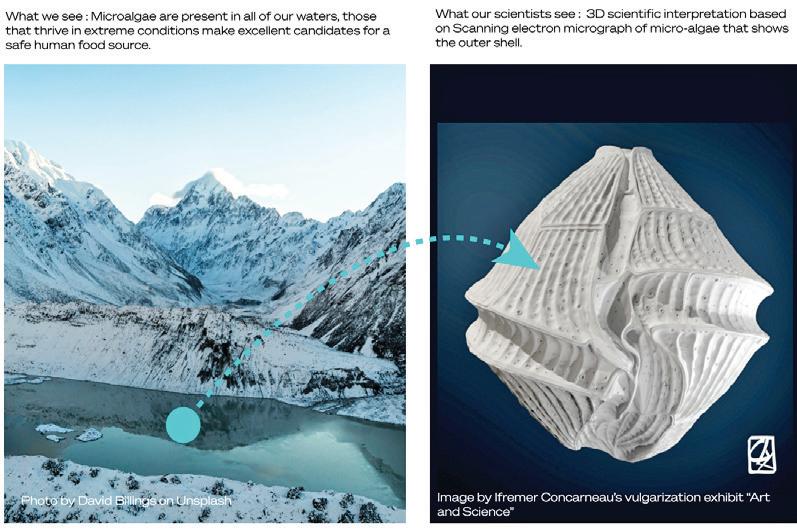

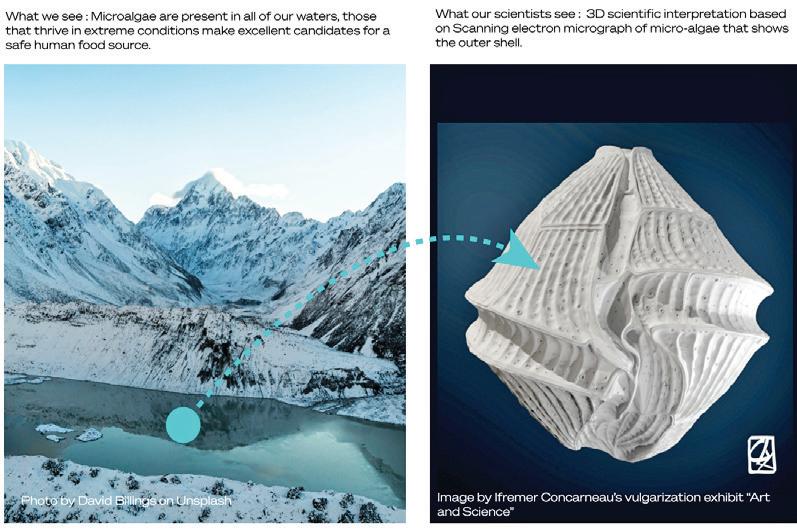

Nutrition From Water (NXW) is a New Zealand-based biotechnology nutrition company that uses microalgae technology to create nutrition without compromise. Formerly known as NewFish, NXW sources microalgae strains from marine and freshwater environments, including species unique to the Pacific region and New Zealand.

These unique organisms have fast growth rates and high protein expression. Under the right conditions, the cells rapidly multiply, transforming small microalgae samples into a large population totalling thousands of tonnes of biomass.

Cell disruption technologies break open the microalgae cell walls, releasing the nutrients inside, separated into proteins, fats, and fibres. Marine Whey is the resulting protein, refined to meet a precise specification equivalent to dairy whey protein with price parity and lower environmental impact.

"Our founder, Alex Worker, brings a wealth of experience from Fonterra’s global dairy distribution,” said Eleni Yianna Hogg, NXW's Head of Marketing.

“His drive comes from witnessing the unsustainable economics of large-scale dairy farming in China and recognising the alarming environmental impact of animal agriculture.”

At full-scale production per site of

10,000 tonnes per year, NewFish’s WPC80 equivalent Marine Whey protein powder is a nutritious and environmentally superior substitute for or addition to whey protein.

Marine Whey also empowers food and active nutrition companies to decrease their environmental footprint without compromising taste, nutritional quality, or application functionality.

NXW has licensed its proprietary strain and production technology to partner manufacturing and infrastructure companies that produce microalgae ingredients using it. It has granted these companies access to proprietary application rights, enabling them to create delicious foods globally for athletes, healthconscious individuals, aging elderly, and everyday consumers.

“This assists in mitigating the dairy supply deficit, which is projected to reach 31.1 million tonnes by 2030.”

Since microalgae can double in biomass daily, it has ensured scalability and price stability.

12 I fbtech.co.nz

Over the next two years, NXW’s fermentation and downstream processes will be scaled from the pilot plant to the commercial scale, derisking the technology for production companies at all levels. This will lay the foundation for future-proof nutrition businesses and make nutrition accessible and abundant.

NXW has also been working with GRAS and FDA-approved microalgae strains and measures protein quality using DIAAS, a globally standardised protein quality test. However, financial constraints have been the main challenge NXW faces

in promoting and implementing its technology. Acquiring substantial funding is crucial for team expansion, technology scaling, and market entry.

“We are actively pursuing seed funding of USD 8 million, enabling us to produce thousands of tonnes of Marine Whey, mitigate technological risks, and accelerate global partnerships.”

The company has also been developing a natural nutrition-from-water technology platform, leveraging microalgae’s potential as a primary source of non-GMO nutrition.

“While our current R&D focuses on Marine Whey protein, microalgae harbours various nutrients within its cell walls, including fibres, fats, and bioactive molecules.”

NXW aims to unlock all these nutrients, building upon its technology platform to create other health ingredients from microalgae.

April/May 2024 I 13

trade talks: prefer

FERMENTED BEAN-FREE COFFEE REVOLUTION

What started as a bio-flavour start-up eventually led to a revolution in brewing, as Prefer developed a fermentation technique to create bean-free coffee.

“It all boils down to harnessing the power of microbes to unlock familiar flavours from unexpected sources like upcycled bread, soy pulp, and barley,” said DJ Tan, CTO of

Two things inspired Prefer; a love for a good cup of coffee and the impact of climate change. Since coffee is a thirsty crop, a warming planet threatens its production, and prices have increased over the years. This gap in the market for a

sustainable alternative that wouldn’t compromise on taste or functionality, all while keeping prices and supply stable, was what Prefer aimed to address. The company’s eventual goal is to use fermentation technology to take farming out of the equation in familiar flavours.

Prefer has also partnered with food production companies, offering them a way to transform their by-products into a valuable new revenue stream. This provides companies with a sustainable, cost-effective alternative to traditional ingredients and a stable supply chain.

“Here’s the beauty of our solution - it’s a win-win for businesses and the environment. Think leftover bread crusts or spent barley from brewing - these become the building blocks for our innovative coffee.”

To reduce the environmental footprint of coffee production, Prefer’s process barely requires land, water and energy compared to traditional methods. It also does not rely on heavy or expensive machinery, as the magic of microbes and enzymes takes

14 I fbtech.co.nz

around 48 hours to produce coffee.

By upcycling food waste, Prefer has kept tons of materials out of landfills and cut the need for cultivation.

“Scalability is built into our DNA. Our fermentation process is efficient and requires minimal equipment, making it adaptable to production facilities of all sizes. We can work with large coffee roasters or boutique cafes, customising the solution to their needs.”

This same technology can replicate flavours in other food by-products if similar molecules have been identified and manipulated.

“I’m confident that food production companies will be more than happy to send their by-products wherever we are,” said Jake Berber, CEO of Prefer.

Safety is paramount in food production, and Prefer uses only food-grade microbes and follow strict quality control procedures. The final product undergoes rigorous testing to ensure it meets all safety standards.

“Before we reached our current iteration,

we easily went through over a hundred different prototypes, and we’re still improving our formula today.”

Prefer’s hero product is bean-free coffee, with a taste profile that leans towards nutty and chocolatey notes, mirroring arabica variants, which are the most familiar ones for consumers.

In terms of nutrition, Prefer has focused on replicating the essential components of coffee without the jitters. Its base grounds and cold brews are decaffeinated. Teaderived caffeine has also been introduced and can be adjusted based on partner preferences.

Since bean-free coffee is new to the market and Prefer is the first to do it in Asia, educating consumers about the environmental benefits of bean-free coffee will take time.

“We knew from the

start that not everyone would be our customers. Similar to meat eaters and their take on plant-based meats, there’ll always be coffee purists.”

Some businesses may also be hesitant to take on a new product. However, Prefer is trying to make it a seamless integration process into existing cafe operations and improving its product based on customers’ feedback.

“Our ambitions are big. We envision Prefer as a future-proof flavour company and are looking to develop sustainable alternatives to other climate-vulnerable ingredients like vanilla, cocoa, and citrus.”

The future of food is fermented, and Prefer is at the forefront of this exciting revolution.

April/May 2024 I 15

trade talks: superground

SUSTAINABLY TRANSFORMING UNDERVALUED BONES

SuperGround’s novel food processing technology has transformed undervalued bones and hard tissues from fish and poultry into sustainable and profitable products. This technology has used physical processes and no enzymes or modifications.

SANTTU VEKKELI Founder & Chief Inventor, SuperGround

SANTTU VEKKELI Founder & Chief Inventor, SuperGround

All usable meat can be collected from the hard tissues before the process, but it does not have to be. The processed paste has a relatively light colour and a neutral broth-like taste and smell.

“I have been collecting a list of unsolved problems in the food system, and the underutilisation of bones as food was one of the problems on the list,” said Santtu Vekkeli, founder and chief inventor of SuperGround.

“A few years ago, I discovered that there might be a way to use bones as food by combining modified existing food processing machines.”

feed, or pet food. At the same time, massive amounts were not used at all but discarded as waste.

“It is practically always more efficient for the environment to use material directly as food than to render it back to the food chain and have energy and mass losses”.

Therefore, SuperGround has allowed companies to produce tasty, high-value food materials from low-value or zero/ negative-value materials.

For most companies, hard tissues have little monetary value, and SuperGround concepts allow the use of material in food products such as fish sticks or chicken nuggets.

“Our company has the technology, expertise and experience. Our clients have sources for raw materials, consumer products and market access.”

Vekkeli also highlighted that time was an issue with climate change. There is not much time to wait for a change in consumer behaviour, as changes in food consumption habits are slow, so there should be immediate changes in the climate emissions of existing food products and product classes.

“SuperGround paste is normally used in existing products, lowering climate emissions. No changes in purchase patterns are needed to lower climate emissions.”

Its machinery can also be set up at different production scales, from a few hundred kilos per hour to many tons. The process can be automated or operated manually on any fish or land animal’s hard tissue.

Hard tissues mostly have the same food safety hazards as other animal-based products. SuperGround softens all hard tissues, and no biting hazard remains.

“We have followed heavy metals and other chemical hazards, but no significant findings have been found.”

The nutritional value of hard tissues is also quite close to that of meat. Fish and poultry hard tissues contain approximately 10 to 15 percent protein, 10 to 25 percent fat, and one to two percent calcium. A lot of the protein is collagen.

Examples of such products are rainbow trout fish balls and chicken nuggets. Fish balls can contain about 30 percent of SuperGround paste without significant

changes in taste or smell. The exact number is about 15 to 20 percent for chicken nuggets.

“On average, people have a more precise image of what chicken products such as nuggets should be like when compared to fish balls. This is because chicken products are more standardised than different fish balls.”

Processed fish products can even be made for different kinds of fish, such as Baltic herring and salmon, which have different taste properties. Another important aspect was the taste profile of the paste, which is close to that of broth and is also made from bones.

Vekkeli added that several new products and machinery were in the development pipeline and would be published soon as they continue to learn from their customers.

I have been collecting a list of unsolved problems in the food system, and the underutilisation of bones as food was one of the problems on the list.

SANTTU VEKKELI

SANTTU VEKKELI

April/May 2024 I 17

trade talks: miso robotics

ROBOTS & AUTOMATION IN THE FRY STATION

In the last 50 years, there has been little change in the back of the house of the restaurant and food service industry regarding technology. Innovation is needed to solve the unique challenges that restaurants have been facing.

With the increase in operational costs around labour, food and more, innovation could help support and enhance the existing staff in the restaurant today. A significant part of this is automation.

“Automating the bottlenecks in the food preparation process and leveraging data on these processes is essential for improvement,” said Rob Anderson, vice president of hardware engineering and co-founder of Miso Robotics.

18 I fbtech.co.nz

Initially launched as a burger flipper, Flippy is a smart commercial kitchen robot that fries items from French fries to chicken nuggets. It works alongside humans to enhance quality and consistency while creating substantial, measurable restaurant cost savings.

“We found that the fry station was labourintensive, dangerous, and more frequently used in quick service. Therefore, it decided to go to the fry station.”

Working over a hot fryer or grill is stressful. Trying to work under the pressure of peak times while getting burned is not fun. When Flippy handles these dangerous and repetitive tasks, it establishes a much calmer cadence in the kitchen.

Anderson highlighted that the market gap also included a labour shortage, a low cost of automation, and a rising cost of labour, which translated to Flippy providing more than double the net positive margin impact per month.

Miso Robotics has developed systems that can adapt to existing kitchen environments. Flippy can operate around the existing fryers and hoods that have been installed. This flexibility and minimal installation costs help maintain the same recipe the brands have worked hard to establish.

Flippy can also be trained to identify any food cooked in the fryer. Most orders come

through the dispenser, which automatically portions two different food types.

For any other orders, an employee can put food in Flippy’s Autobin, which Flippy can then see and identify with computer vision. Its intelligence is also used to find the most efficient cooking schedule while maintaining top quality.

Since Miso Robotics was the first to market, Anderson said that the team had to do a lot of inventing since it was challenging to be the first mover. Additionally, there

was very little space available in commercial kitchens.

“We have had to work hard to make it as small as possible while still being able to do everything needed around the fryer. The team has been working nonstop on Flippy Next Gen, which is coming out later this year and will be our smallest system.”

Flippy’s mission is to be the kitchen’s ringleader, automating and adding telemetry to back-of-the-house operations through first-party or third-party integrations.

April/May 2024 I 19

Persimmon

RENAISSANCE CAPTURING ATTENTION THIS WINTER

Persimmons are enjoying a ‘renaissance’ in New Zealand with social media and marketing campaigns set to ramp up during their winter supply window from Anzac day through to early June.

First Fresh Sales and Marketing Director and Persimmon Industry Council Export Representative, Grant Walsh, says research found many New Zealanders don’t know what to do with the fruit, despite its popularity in Asia, so the campaign will educate New Zealanders on the versatility of persimmons and the many ways to eat them.

Efforts to raise their profile in the past three years are starting to pay dividends with awareness growing and sales building.

A new branded punnet containing smaller fruit will be available this season to target the school lunchbox market, and a new cartoon character called ‘Persi the Persimmon’ is being rolled out in domestic marketing campaigns. First Fresh’s digital assets are available for retailers to use, and nationwide competitions will be held to encourage consumers to try the fruit.

“It’s exciting times for persimmons,” Grant says. We are continuing to work hard with our customers and retail partners to educate people about when they’re available, their nutritional value, and how to use them. And it’s working. We’ve seen wider distribution and more people starting to eat them which is great news.”

Gisborne’s Black Ferns rugby star, Renee Holmes, has signed on as First Fresh’s ambassador and will be promoting

persimmons on social media along with other citrus fruit this winter. Renee was part of First Fresh’s social media campaign last year, and the company is excited to take the relationship forward.

Persimmons are a niche crop cultivated by around 30 registered commercial growers in New Zealand, mainly based in Tairāwhiti. Approximately 1300 tonnes are exported annually, with a similar amount being supplied to the domestic market.

“There’s no counter-seasonal supply from overseas so we say to our market and consumers ‘fill your boots. It’s a winter product for New Zealand so get stuck in and make the most of it while you can.’”

Persimmons can be sliced and served with antipasto platters or added to breakfast cereals, smoothies, baking, desserts and even salads. They are technically a berry and are a good source of vitamin A and vitamin C, and also contain dietary fibre, manganese and potassium. Domestic market grading standards have recently been adjusted to ensure Kiwi consumers get top quality fruit. “We’re actually supplying New Zealanders now, through retail and wholesale, a really good product and it’s worked. In the last few years volume has gone up and we’re increasing the value and return for our growers which is really important.”

In terms of retail price, Grant says the market

generally starts quite high due to fruit scarcity. But volume comes on fast in late April/early May and from then on, they represent very good value for money. His advice to retailers is to “find that sweet spot” for retail price where consumers who like persimmons will buy more, and those trying them for the first time won’t see price as a barrier.

Grant says persimmons are a resilient but high value crop because it takes a lot of skill and inputs to grow a good quality, cosmetically clean, good tasting fruit. “I put them up there with high-end IP apple varieties in the sense of the inputs required. So that’s why we need decent returns.”

Persimmons change in colour from yellow to orange as they ripen and should be displayed in store at ambient temperature. Grant suggests retailers offer a mix of colours – similar to bananas – to provide consumers choice about how long they will last post-purchase.

“Persimmons are a sweet and delicious product and we’re excited to see where we can take this fruit category in future.”

20 I fbtech.co.nz column

June

Best Japan's Food Purchasing Show What You Can Do by Visiting

Find and Compare

Discover and compare a variety of Japanese Food & beverages at one place.

Learn and Catch

Learning the latest industry trends and hot topics for your business development.

Grow your Network

Gathering 900 exhibitors from all over Japan. It is the best venue to find suppliers and potential new businesses.

April/May 2024 I 21

@japansfood.exportfair @japansfood_exportfair "JAPAN'S FOOD" EXPORT FAIR

Get Visitor Badge Now

19-21, 2024 Tokyo Big Sight, Japan

https://www.jpfood.jp/en

OIL SHORTAGEManaging the

Oil is an essential ingredient for cooking, whether frying, baking, flavouring, or roasting. Although popular, an oil shortage has sparked concern for the food service industry, largely due to international concerns.

oil

Droughts, wildfires, and the spread of bacteria (Xylella fastidiosa) have subsequently affected the supply shortage of culinary oils in Europe. This has upset local stock as much of New Zealand’s culinary oil stock is imported, particularly olive oils.

European olive crops are expected to take some time to recover, as some growers struggle to stay in business with repeat failing crops. Two years ago, the global market faced empty shelves following the COVID-19 pandemic and the flow-on effect on international logistical systems.

Pure Oil New Zealand Managing Director Nick Murney said New Zealand must rely less on imported culinary oils.

“We already grow high-quality seed crops for oil production, which provide reliable, high-quality, coldpressed culinary oils for businesses and consumers,” Murney said.

Murney added that locally produced brands, such as Good Oil, are expected to grow sharply as more New Zealand consumers try the product based on price and the fact it has been locally produced.

Although a solution to the local market, Murney added that domestically produced oils are primarily only used by New Zealand customers.

International olive oil pricing is currently the highest in over 26 years, with prices tripling over the past 24 months. These price surges have greatly affected the hospitality industry. The cost of olive oil has increased 60 to 90

percent in the New Zealand market since 2022.

“We are hearing from our hospitality customers that pricing is quickly increasing and putting further strain on their businesses in a time of existing high food inflation. The same trend is seen in the retail market, and pricing will likely continue.”

Olive oil makes up approximately 50 percent of the retail cooking oil market, so the hospitality industry is likely to experience increased demand for alternative, higher-quality cold-pressed oils. Local producers have encouraged businesses to use New Zealand-made products.

Due to the shortage, culinary leaders have suggested businesses use oil wisely to preserve their stock. One way to do this is to limit the amount of oil used when using frying or roasting techniques or to use an alternative.

April/May 2024 I 23

NAVIGATING THE

Zero Zone Revolution

In this day and age, consumers are highly conscious about the choices they make while purchasing products, particularly food. They’re well aware of the ingredients and their health benefits and consider sustainability and other environmental factors.

The surge in health and wellness awareness, combined with a deepened understanding of sustainability, has sparked significant demand for products that are effective, high-quality and offer value for money.

Many people have started consuming snacks that are either free from some ingredients or have reduced levels of those ingredients, supporting the increasing popularity of claims such as low sugar, no added sugar, reduced sugar, low fat, low cholesterol, or low sodium across both sweet and savoury snacks.

These products are sought after for their potential health benefits, whether they avoid harmful additives and preservatives or cater to specific dietary restrictions and allergies.

“We also work with many partners and

suppliers to do what we do, and so in addition to our sustainability initiatives and targets, we have a responsible sourcing program to ensure we promote human rights, sustainable and ethical sourcing, and create productive partnerships throughout our supply chain,” said Lion’s spokesperson.

“We are continually researching and monitoring local and global trends. The trick is to pick the ones you can do well and then get the timing right, which isn’t always easy. An important part of new product development is validating products and ideas with rigorous consumer research.”

Zero Zone is a testament to the power of consumer preferences. It caters to various dietary needs and restrictions, offering dairy-free, gluten-free, nut-free, alcohol-free, sugar-free, and more.

“We plan to evolve the category by

24 I fbtech.co.nz

zero zone

We are continually researching and monitoring local and global trends. The trick is to pick the ones you can do well and then get the timing right, which isn’t always easy. An important part of new product development is validating products and ideas with rigorous consumer research.

pushing our delicious mylk concentrates such as pecan, pistachio, walnut, and pumpkin seed,” said Hayden Booker, CEO and founder of VV Mylk.

This product category has experienced significant growth, particularly in recent years, as consumers have prioritised their health. It continues to expand as consumer awareness and education increase, demonstrating the impact of consumer choices on the market.

“People still want flavour from their non and low-alcohol beers, so the challenge is to give them body and flavours. We expect the category to evolve into the future with more variation in the styles of beers in the non and low-alcohol category,” said Katie Haydock, operations manager of Brothers Beer, an Auckland-based craft brewery.

According to a report from Innova Market

Insights, nearly one-third of consumers limit their snacking habits, while some opt for snacks that boost their health or avoid “bad” ingredients.

One of the main reasons consumers choose these free-from or better alternatives is the perception that foods that highlight their positive attributes are considered healthier. This shows that packaging and branding significantly influence consumers' purchasing behaviour.

“The ‘better’ alternatives make themselves look bad with packaging that is not recyclable, heavily processed, and a watereddown product with added oils, thickeners, stabilisers, etc.,” added Booker.

“They also put little nuts/seeds in the product, usually under five percent, made overseas. Why are we shipping bad packaged products that are mostly water worldwide?”

Looking ahead, the free-from product category will keep growing, and the prebiotic and probiotic categories will also see innovation.

“There is a trend towards functional ingredients like prebiotic fibre. Our Smarts Sweets Gummies are a great example of this sort of product. They taste great, they’re vegan, low in sugar, low calorie, and made with prebiotic fibre,” said Justin Hughes, managing director of Double D, a 100-yearold Sydney-based family business.

The rise of health and wellness trends on social media, such as ‘girl dinner’, ‘protein coffees’ and ‘chlorophyll water’ along with TMI on gut and bowel issues and the spread of misinformation, might also further boost the growth of these better for you options, particularly in the younger generation.

“Consumer perceptions of guilt-free food vary significantly across demographics. For instance, younger generations may prioritise health and wellness trends more prominently, seeking out products that align with their dietary preferences and current trends, such as keto, low-carb, gluten-free, and high-protein options,” said Vitawerx spokesperson.

“On the other hand, older demographics may be more concerned with traditional notions of healthfulness and attracted to products that offer familiar flavours and textures without compromising taste.”

“Younger generations are jam-packing their weekends with social activities that prioritise health as much as they prioritise fun, and unsurprisingly, they’re the key group driving these sober-curious trends,” added Emma Brown, head of innovation at Brown Brothers.

“On a Saturday night out with friends, young people opt for a glass of Prosecco Zero rather than choosing to miss out completely.

Consumers are concerned about their health and sustainability, and brands must prioritise sustainable ingredient sourcing, innovative packaging, taste, and quality.

Moreover, maintaining product quality and consistency while adhering to stringent health and safety standards is paramount.

“Ultimately, by understanding the nuanced differences in consumer perceptions of guilt-free food across demographics and tailoring their offerings accordingly, businesses can effectively meet the diverse needs of their target audience and drive success in the competitive health and wellness market.”

April/May 2024 I 25

trends

3 Key F&B Trends

Driving Australia and New Zealand’s Food & Beverage Industry in 2024

Personal health, sustainability, and enhanced sensorial experiences are the biggest consumer themes that will shape the sector across the region.

By Emma Stride, Business Development Director, Taste, Kerry Australia and New Zealand (ANZ).

Consumer behaviour has changed significantly in recent years and continues to evolve rapidly, influencing food and beverage trends.

Recent Kerry proprietary insights on the future of food and beverages, show that consumers in ANZ continue to prioritise their personal health by placing more importance on self-care. They are also adapting to a more sustainable lifestyle that focuses

on conscious consumption and knowing where their food comes. At the same time, new sensorial experiences, particularly around international flavours, are in demand.

But how can product and menu developers tap on these trends to develop food and beverages people want? Understanding the flavours, ingredients and trends that will shape what we consume, is essential in guiding successful food innovation.

f&b

CONSUMERS LOVE INTERNATIONAL CUISINES

The Asia Pacific consumer is heavily influenced by the region’s diverse cultural traditions and we see this in the rise of international flavours in the ANZ Taste Charts. According to Kerry research, Asia Pacific consumers are rediscovering the magic of their own culinary heritage while looking for unique regional ingredients and flavour profiles. Findings from FMCG Gurus on innovative flavours mirror this, with 55% of consumers worldwide rating traditional flavours as a key influence on their food and drink choices.

According to proprietary insights from Kerry’s 2024 ANZ Taste Charts, international cuisine flavours such as teriyaki is now a key flavour in the savoury category, moving up from the upand-coming list. Other regional flavours that are gaining prominence include matcha and Korean gochujang which are now up-and-coming, having grown the fastest in the past three years. There are also new flavours debuting in the emerging list such as kimchi and bulgogi in Australia, and miso and Jamaican jerk in New Zealand.

Elsewhere in Asia Pacific, there is also growing consumer interest in fermented foods and the health benefits they offer — which include antioxidant to anti-inflammatory properties, leading to innovative dishes like charcoalgrilled skewers with fermented chilli paste. By harnessing the depth and complexity that fermented flavours bring, industry players can create products that satisfy the consumer craving for modern updates of their favourite traditional food.

Continued on page 26.

April/May 2024 I 27

f&b trends

HOT AND SPICY, AND BBQ FLAVOURS ARE ON FIRE

Kerry insights show that consumers are developing sophisticated taste preferences, and bold flavours like hot and spicy as well as those with barbecue taste profiles appeal to many.

Smoke and grill flavours have always had a place in many markets and across different applications. While the demand is widespread across the globe, cooking over a hot grill or barbecue is part of the Aussie and Kiwi DNA.

Kerry’s proprietary insights show that chargrill, barbecue, smoke, and smoky barbecue continue to be mainstream flavours in the ANZ Taste Charts, particularly in the savoury and salty snack space. The use of specific smokes is also gaining popularity in the region, with mesquite, applewood, and hickory smoke emerging on the charts.

Across Asia Pacific, people are replicating ethnic dishes they sampled during their travels — many of which are hot and spicy — resulting in diversity across markets. In ANZ, chilli, ghost chilli, jalapeno chilli, chipotle chilli, and habanero chilli are trending. Meanwhile, consumers in Indonesia enjoy crispy prawn chilli, ghost pepper, Korean buldak sauce, and jalapeno chilli. This reinforces the desire for complex and nuanced heat experiences that offer authentic and exotic flavours, particularly region-specific spices, chillies and hyperlocal flavours. Continued from page 25.

28 I fbtech.co.nz

WELLNESS AND SUSTAINABILITY INFLUENCE DIETARY HABITS

The emphasis on self-care has evolved from mere health-consciousness, to prioritising health in food choices. A FMCG Gurus report on consumer perceptions on health and wellness show that 68% of global consumers have actively sought to improve their diet in the last two years.

The Asia Pacific region is unique in that consumers view sustainability and transparency as inherent to their wellbeing — the source of their food directly influences the quality of their health.

The preference for local ingredients is strong; in ANZ, beverage flavours such as mango, kiwi, peach, passion fruit, pomegranate, grapefruit, blackcurrant, and honeydew are trending, indicating a resurgence of pride in local ingredients. This holds potential for innovation in sustainable flavours and solutions – people want food that supports their health and that they feel good eating.

The data also reveals a rise in functional flavours in beverages. Honey, manuka honey, almond, matcha, turmeric, rosehip, elderflower, and acai are piquing interest for their perceived health benefits, and this is evident in drinks such as lemongrass

tea and turmeric latte; similar preference goes for beverages that boost mental alertness and physical performance.

Fruits such as yuzu and passionfruit are also coming to the fore. Yuzu is gaining traction as an emerging flavour in ANZ, appearing in multiple categories from savoury and salty snacks to hot and cold beverages. Demand can also be seen in recent launches like Yuzu low ABV wines and alcoholic beverages in Australia, and in Yuzu Gose beers in South Africa, and yuzu and pepper mayonnaise in China. Cold beverage passion fruit flavour appeared in 13 different global regions in Kerry’s Taste Charts, with passion fruit already a mainstream ingredient in New Zealand.

When it comes to plant-based products, health and sustainability concerns continue to be driving factors, but now novel flavours in meat and dairy alternatives are capturing consumer tastes. This has led to the launch of foods like jackfruit rendang in Indonesia, mushroom jerky in Australia, and chickpea falafel with a Middle Eastern twist.

Continued on page 28.

f&b trends

Continued from page 27.

UNDERSTANDING AND DELIVERING ON MARKET PREFERENCES

Today’s rapidly changing times often present challenges for food manufacturers and brands trying to deliver food and beverages people value. People have always been led by taste, especially when buying a product. Year on year, Kerry Taste Charts have become a reference tool for various stages of product development, whether brands are looking to add new offerings or check if their current product flavours are still in demand.

Awareness is key; knowing that savoury flavours typically common in food are entering the beverage category for instance, can help influence innovation and development and help manufacturers identify where they can add the most value for their consumers.

To access the 2024 Kerry Taste Charts for the region of your choice, please click here

30 I fbtech.co.nz

Innovate to Win

Global Strength. Local Action.

Put to work our technical ingenuity and industryleading portfolio to create future-forward nutrition solutions with flavours, colours, fibres, plantbased proteins, specialty ingredients and more. We bring more than a century of global expertise to Australia & New Zealand. Your Edge. Our Expertise.

create. adm.com/ADM-Nutrition-ANZ

Let’s

26 I 2024 F+B TECH Buyer’s Guide Supplier A-Z 26 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

Manufactured in New Zealand & exported Worldwide I shop.temprecord.com I sales@temprecord.com I +64 9 274 9825

CONCEPT SOLUTIONS

Concept Solutions offers a comprehensive range of flat belt and plastic modular belt conveyors and equipment. These can be specified to suit virtually any configuration, environment or conveyed product.

• Versatile, reliable and economic conveying solutions

• 3D design for realistic product visualisation

• Hygienic design for ease of sanitation

• Plant layout and flow optimisation

• Safety standard compliant design

• Food grade plastic machining and supply

ECO FOOD PACKAGING

Vacpack is a leading provider of innovative machinery and cardboard base food packaging products to New Zealand, Australia and the Pacific.

Are you looking for eco-friendly packaging that improves the shelf life of your fresh and frozen items? Then, Vacpack’s market leading cardboard base technology is the solution for

you. The systems help reduce plastic by up to 80%, is 100% biodegradable or recyclable and creates an appealing and safe end-product. Call us now to find out more.

or

www.conceptsolutions.co.nz

34 I fbtech.co.nz I 29 fbtech.co.nz

For more information

1172

call 03 216

visist

Ph: +64(9)

6301 Email: info@vacpack.co.nz www.vacpack.co.nz 4/3 Emirali Road, Silverdale, Auckland

443

26 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

April/May 2024 I 35 28 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

STAINLESS STEEL ENGINEERING

At DTS, we specialise in stainless steel engineering solutions for the food, beverage and pharmaceutical industries. Our tank design philosophy is to minimise waste and maximise profit, not only during tank fabrication, but also throughout the tank’s operational life and production. • Food & beverage tanks

• Insulated hazardous pressure vessels

• Hot water recovery / 2205 duplex

• Laser-welded dimple pads / thermal control

• Clean in place and agitation

• Walkways, ladders and handrails

EUROTEC LTD

In the food industry, temperature measurements are part of the daily routine. The quality of food products can only be tested and guaranteed by precise measurements. The Testo range of measuring instruments, available from NZ authorized distributor Eurotec Ltd, a member of Carel Group, can carry out spot-check measurements in seconds.

Whether in the transport and storage of foods, in restaurants or in large kitchens, wherever temperature needs to be recorded, Testo measures up and helps you keep compliant. Testo enables you to guarantee optimal performance in key areas of your business.

Food industry instrumentation for incoming goods: Every item that enters your premises should undergo rigorous checks in order to ensure its quality and safety. Whether that be your weekly delivery of fresh fish, or the daily top up of your fruit and vegetable stocks, food can spend a long time in transit from the wholesaler before it arrives at your door. The testo 831 infrared thermometer is perfect for

dealing with incoming goods, as it allows you to carry out quick and precise temperature measurements of whole pallets of food and smaller individual products from a distance.

Monitor the cold chain and ensure food safety Perishable foods are sensitive to changes in temperature. While fruit and vegetables ripen quickly and barely make it to the supermarket if they are stored and transported in conditions that are too warm, bacteria can multiply in meat and dairy products when heated. These, in turn, can cause serious illnesses. Therefore there must never be any gaps in the cold chain, but this can only be ensured through continuous monitoring. The testo 184 series

of Cool Chain Temperature Loggers can measure the temperature and humidity of your goods while in transit. With up to 150 days of battery life, you’ll be able to keep track of goods over long stretches, measure and analyse temperature and humidity data - arming you with information to implement changes when needed backed by data.

36 I fbtech.co.nz

PH: 0800 500 387 WWW.DTS.CO.NZ 30 I 2024 F+B TECH Buyer’s Guide Supplier A-Z Contact 09 579 1990 sales@eurotec.co.nz or visit www.eurotec.co.nz or www.testo.nz

26 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

info@easirecycling.co.nz www.easirecycling.co.nz

Freephone: 0800 342 3177

Easi Recycling NZ

FREE TRIAL KIT

Protect your brand solutions that enhance food safety and weight compliance for processing lines.

LEARN MORE ABOUT OUR EQUIPMENT ONLINE

38 I fbtech.co.nz

Bag Metal Detector Gravity Metal Detector 32 I 2024 F+B TECH Buyer’s Guide Supplier A-Z 26 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

Checkweigher Large

Discover the power of plant-based colours

EXBERRY® Colours are the ideal and future-proof solution for food and drink applications matching the recent plant-based, vegan and vegetarian trends.

GROWING COLORS

EXBERRY.COM

40 I fbtech.co.nz Gribbles Scientific providing tailored solutions for all your food, environmental and product testing needs. Analytical chemistry, nutritional analysis, microbiology testing, shelf-life testing, preservatives, additives & more. Talk to us today. 0800 474 225 www.gribblesscientific.co.nz Photo credit: FreePik we add value to honey Phone: +64 3 574 2500 Email: sales@gsfoods.nz Web: www.gsfoods.nz FTR853 Contact us to today for further information foods Honey & Fruit Drying Specialists gs Our Core purpose is to create new food products, through technology, that makes a difference. Our honey powder is bulk supplied and is used in wet and dry food systems, confectionary and health bars, powdered soups, sauces, gravies, custards, cosmetics, pet food, milk products, an alternative to sugar and dry bakery premixes. And there is more... We press our honey powder into lozenges, pack the powder and honey crystals into foil tubes and make beautiful private label products. 34 I 2024 F+B TECH Buyer’s Guide Supplier A-Z 26 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

MANAGING ENERGY EFFICIENTLY

HRS Heat Exchangers operates at the forefront of

Pasteurisation

Sterilisation

Aseptic Filling

Direct Steam Injection

Evaporation

CIP Kitchens

Process Skids

Juice Crushing and Remelting

April/May 2024 I 41

HRS Heat Exchangers | info@anz.hrs-he.com | NZ +64 9889 6045 | AU +613 9489 1866 | www.hrs-heatexchangers.com/an

technology

innovative

effective heat

products worldwide, focusing on

thermal

, offering

and

transfer

managing energy efficiently

42 I fbtech.co.nz C M Y CM MY CY CMY K 36 I 2024 F+B TECH Buyer’s Guide Supplier A-Z 26 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

April/May 2024 I 43 Get the right measurement technology With 35+ years in process measurement applications we can help you apply the correct technology for all measurement solutions. Instrumentation Gas Detection T: 09 526 0096 I www.instrumatics.co.nz 38 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

44 I fbtech.co.nz I 39 fbtech.co.nz 26 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

NZMS Scientific offers specialised solutions to help ensure your products meet the standards you and your customers expect.

Give us a call today to talk about:

• Pathogen testing

• Allergen testing

• Hygiene testing

• Sterility testing

SCANZ is a multi-discipline supply company and manufacturers agent, specialising in technology and equipment for the food industry. It’s primary focus is within three market segments, namely fish (including aquaculture), meat and the dairy industry. High Pressure Processing takes Scanz into other areas, as does a recent involvement in industrial waste water treatment.

SCANZ

April/May 2024 I 45

Processing Solutions for Proteins Since 1987. Talk to us today, info@scanztech.com or 09-520 2544. www.scanztech.com

provides solutions to suit all phases of the production process.

P 09 259 4062 E nzms@nzms.co.nz W www.nzms.co.nz Specialised solutions for in-house food testing

by brands across New

40 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

Trusted

Zealand

a Custom Blends

a Flavours: Sweet, Savoury, Smoke

a Caramel Colours

a Yeast Extracts

a Proteins: Plant & Animal

a Starches: Native & Modified

a Minerals

a Dehydrated Vegetables

a Carrageenan & Gums

a Preservatives

a Clean Label Ingredients

46 I fbtech.co.nz Give your products the X factor with our specialty ingredients. Phone: 09 444 1676 Email: sales@sherratt.co.nz www.sherratt.co.nz

42 I 2024 F+B TECH Buyer’s Guide Supplier A-Z 26 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

Industrial experts in specialty vanilla

For 125 years we’ve been a trusted ingredient partner for iconic vanilla. With a range of bulk and customised solutions for industrial, along with deep manufacturing experience, we can help you find your next flavour solution. Our food industry passion, dedicated technical team and global commitments to sustainable and ethical sourcing can help you achieve your business goals.

BULK FORMATS & CUSTOMISED SOLUTIONS:

Extracts

Pastes

Dried vanilla derivatives

CUSTOMISABLE CLAIMS:

Certified organic

Certified vanilla provenance

To find out more about our industrial solutions contact us NZ 0800 638 536 queenprofessional.co.nz

Urgent Couriers are specialists in temperature -controlled deliveries of chilled small goods.

Fast, reliable, guaranteed sameday services live tracked from despatch all the way to your customer’s door. We provide techforward and innovative solutions to make your life easier.

+64 9 307 3555 P sales@urgent.co.nz E I 45 fbtech.co.nz 26 I 2024 F+B TECH Buyer’s Guide Supplier A-Z

TC TRANSCONTINENTAL PACKAGING NEW ZEALAND

With over 40 years operating experience in New Zealand, TC Transcontinental Packaging New Zealand (TC NZ) is a leading manufacturer of flexible packaging to the FMCG, horticulture, retail and manufacturing markets

TC NZ is both a reputable manufacturer and trader, supplying all forms of flexible packaging made from traditional plastic films recycled blended films, laminated barrier substrates. TC NZ employs over 90 people in New Zealand with centres in Auckland and Christchurch, home to an ultra-modern food grade packaging manufacturing plant, and supported by our global TC Transcontinental research and technology platform from North America.

TC Transcontinental Packaging brings a distinctive blend of science, technology, and art together to create flexible packaging that preserves our customers’ products and accentuates their brands on the store shelf. Our expertise, resources and conversion technology helps us create packaging that gives our customers a competitive advantage. We utilise a widevariety of printing techniques, laminations and converting styles including pouches that help enhance your brand.

We invest in state of the art technology to offer and invest in a sustainable future and are delighted to be recognised for our high quality packaging that we supply to our customers. Globally TC Transcontinental Packaging is committed to a circular approach to plastic. As global signatories to the Ellen MacArthur Foundation, we are working towards our 2025 goal where 100% of our plastic packaging will be reusable, recyclable or compostable, and 10% of our plastic output to be made from recycled plastic waste.

At the 2022 Pride in Print Awards, TC NZ were awarded Gold Sustainability Award in the Flexible Packaging Category for our significant volumes used into industrial, refuse and hygiene packaging. TC NZ are meeting customer requirements by extruding and converting recycled resins of in-house, postindustrial waste, and post-consumer recycled content , Green PE (PE derived from renewable resources such as waste sugar cane), and has the ability to manufacture flexible packaging with other

April/May 2024 I 49

Get in touch with the team and be featured next issue. (09) 304 0142 ext 703 or caroline@reviewmags.com PRINT - DIGITAL - SOCIAL MEDIA - ADVERTISING - CONTENT WHERE IT ALL COMES TOGETHER CUSTOM PLANS FOR ALL SIZE OF BUSINESS

Caitlan Mitchell Editor caitlan@reviewmags.com

Caitlan Mitchell Editor caitlan@reviewmags.com

KARLO VULIN Boogie Lab, Co-founder

KARLO VULIN Boogie Lab, Co-founder

SANTTU VEKKELI Founder & Chief Inventor, SuperGround

SANTTU VEKKELI Founder & Chief Inventor, SuperGround