34 minute read

TITANIUM USA Virtual 2021 Executive Summary

By Michael C. Gabriele

What’s on the minds of people doing business in the titanium industry as we close out 2021 and prepare for 2022? Based on presentations during TITANIUM USA Virtual 2021—the online business and technology conference organized and hosted by the International Titanium Association (ITA)—the titanium industry remains focused on the impact and aftershocks of Covid-19 and how the global pandemic will continue to affect key markets, as well as concerns on the length and strength of the international supply chain.

Front and center on the list of concerns is the business altitude of the global aerospace industry and the damage caused by the pandemic. Based on the consensus of Airbus and Boeing executives, as well as informed analysts and consultants, there is optimism that the aerospace market will see steady improvement in 2022, leading to a recovery to pre-pandemic business levels sometime between 2023 and 2024.

Outlooks for Commercial Aerospace

Laurent Jara, Airbus vice president of metallic material procurement, underlined the ramp-up of the A220 family of single aisle jets, saying that the aerospace OEM’s demand for this category is expected to exceed more than 1,000 metric tons per year by 2025. Jara pointed to that year as a milestone, not only for the A220 family, but for the fleet of Airbus jets. He said by 2025 he expects Airbus’ overall titanium demand to reach 80-100 percent levels.

Jara also envisioned that year as being an inflection point for much need aerospace industry innovations: improved air-traffic management and technology; new jet engine and aircraft designs; and sourcing for sustainable, less-polluting fuels. He based this observation on advances made during the last three decades. “During the last 30 years we’ve made progress in optimized aerodynamic designs of aircraft, the use of advanced materials like titanium and composites, and the development of next-generation aircraft engines.”

Jeff Carpenter, the director of Boeing Commercial Aircraft (BCA), materials and standards, contracts and category management, was equally optimistic and realistic regarding near-term aerospace business trends. He said, for Boeing’s titanium market outlook, Covid-19 significantly impacted the commercial aerospace sector and the titanium industry. Order cancellations and aircraft production cuts created the reduction in titanium demand, resulting in a price decline on all titanium products. However, sponge and scrap prices, in recent months, have seen a quick recovery. Inventories across the supply chain are high, lead times are finally starting to stabilize, with the expectation that titanium prices will climb towards the end of the year. As for excess inventory of titanium in the aerospace sector, Carpenter noted that “participant forecast data indicates inventory burndown for titanium will continue through 2022,” and that the “burndown” of Boeing’s excess inventory will occur from 2023 to 2025.

For 2022, the U.S. aerospace giant will continue to expand its “Boeing Raw Material Strategy” (BRMS) for titanium and aluminum across its enterprise. According to Carpenter, the BRMS expansion will provide improvement in material assurance, costs, agility; help manage inventory available for non-BCA usage; will be extended to aluminum bar and titanium forgings; and enable Boeing to prepare for the anticipated 737 rate ramp-up.

Carpenter and Jara noted that demand for single-aisle aircraft will lead the aerospace industry’s recovery, but they added that orders for twinaisle jets are slated to get a boost once international travel restrictions ease. As reported in the third-quarter edition of TITANIUM TODAY, the focus on single-aisle/narrow-body jets became evident earlier in 2021 when United Airlines and Delta Airlines booked orders for 270 and 30 aircraft.

Richard Aboulafia, the vice president of analysis at the Teal Group Corp., Fairfax, VA, and a closely followed aerospace industry analyst, said he’s observed a “secular shift” toward the production of single aisle aircraft (and away from twin aisle aircraft) in the fleet planning of Boeing and Airbus. Aboulafia, in a presentation for a May 2021 webinar sponsored by Aerospace Manufacturing and Design magazine, stated that Airbus and Boeing are poised to come “roaring back fast,” with an emphasis on single aisle planes demonstrating signs of health. “The trend is towards single aisle jets, and much is riding on this for the supplier base.”

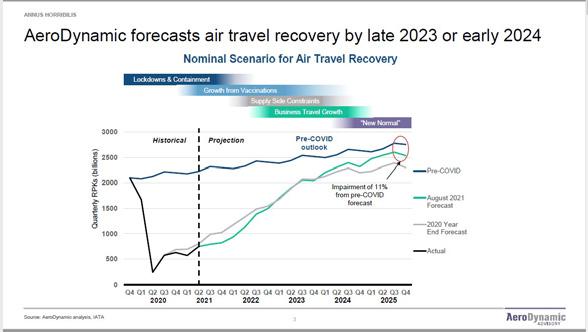

Dr. Kevin Michaels, managing director of AeroDynamic Advisory, offered a blunt assessment of Covid-19’s impact on the commercial aerospace industry. AeroDynamic is a consulting firm focused on the global aerospace and aviation industries. In his presentation, “Implications for OEMs and the Commercial Aerospace Supply Chain,” he described 2020 with the phrase annus horribilis: a year of disaster or misfortune. “AeroDynamic forecasts air travel recovery by late 2023 or early 2024,” Michaels predicted. “A large portion of the global population remains unvaccinated; the coming years will be a race between vaccines and new variants. The recovery of (commercial) air travel will be bifurcated between intra-region and inter-region travel.”

He did identify a bright spot for the aviation industry: air cargo, which is poised to accelerate and recover to pre-Covid-19 levels by late 2022. The COVID-19 pandemic led to an explosion of ecommerce and changes to supply chains which favor air cargo. “The 2,000-plus freight aircraft fleet is operating at 10 to 20 percent higher levels of utilization than before the (pandemic) crisis. Air cargo accounted for about 30 percent of airline revenue in 2020, up from 12 percent in 2019.”

As for commercial jets, Michaels said Boeing needs to launch a smaller version of the “new midsize aircraft as soon as possible. “The (Airbus) A321neo’s advantage in 200-plus seats will reshape the duopoly if Boeing does not respond. The post-Covid world will require a smaller version of the new midsize aircraft; a 200–250 seat aircraft (perhaps a single-aisle) would be ideal.” He added that the service record of China’s Comac C919 in the first few years will be crucial in shaping China’s aviation strategy. The C919 will likely receive Civil Aviation Administration of China authorization and enter service later this year. “The service record of the C919 in the first few years will be crucial in shaping China’s aviation strategy and dependence on Airbus and Boeing.”

Titanium Industry Trends

Chris D. Olin, the lead analyst for TIER4 Research, was equally candid in his overall assessment for the titanium industry’s “Western World” business trends in the coming year, especially as it relates to the aerospace industry. Olin defined the Western World market as the main regions driving titanium demand, excluding Russia and China. “The drivers of consumption in our model include the United States, Europe, Japan, and Canada. Our surveys primarily cover these regions, giving us near-term less visibility into the Russian and Chinese markets. We estimate current titanium demand at 145 million to 150 million pounds, representing the lowest point on record since 2004/2003. Aerospace is the largest driver of titanium consumption at 40 to 42 percent.”

Olin did say the titanium market outlook is improving. He showed a bar chart for estimated global demand for titanium mill products—encompassing the Western World combined with emerging regions—which indicated that the level for 2025 would reach 400 million pounds, or about equal to the 2019 high point. Most of the growth estimated for 2025 would be generated by the emerging regions, according to his chart.

What’s the bottom line for Olin? “It has been a challenging titanium demand environment over the past two years, with mill volumes looking down 36 to 37 percent versus the 2019 peak. This includes broad-based end-market and regional weakness. Aerospace was already in trouble due to the building of inventories and overestimation of real demand. There is evidence of stabilization, and the industry contact forecasts have been improving all year. Despite some uncertainties related to the (Boeing) 787 program and Covid-19, underlying sentiment seems to be holding, with calendar year 2022 expected to be a positive shipment growth year. We are modeling 8-percent year to year shipment growth for next year and 12-percent year to year (shipment growth) for calendar year 2023. The positive Western World market growth momentum should extend to calendar year 2024 to 2025 if Airbus and Boeing planning is realistic.”

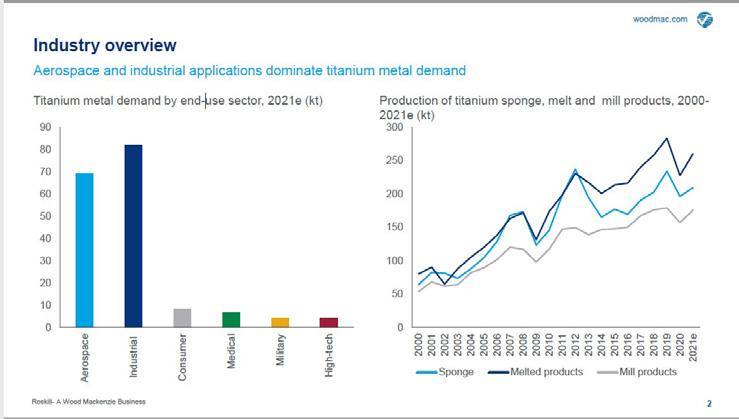

Ross Embleton, an analyst with Roskill/Woods Mackenzie, provided a titanium industry overview. He presented charts that illustrated estimated titanium demand for 2021 in metric tons: 70,000 tons for aerospace; 80,000 tons for industrial; and less than 10,000 tons each for the categories of consumer, medical, military and high-tech. A second chart mapped out the estimated production of titanium sponge, melted and mill products: more than 250,000 tons for melted products; around 200,000 tons for sponge; and 175,000 tons for mill products.

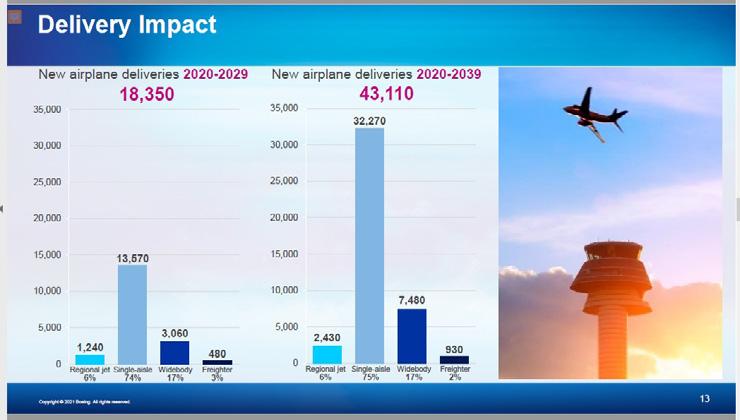

The business outlook for commercial aerospace is bright, however the short-term outlook remains uncertain, according to Embleton. “Boeing’s commercial outlook forecasts 43,110 deliveries by 2039, representing an annual fleet growth of 3.2 percent. The nearterm focus is on fleet renewal, while the long-term focus will be on fleet versatility and growth.”

Embleton also considered the impact of Covid-19 on the aerospace sector. He said 3,000 planes were retired in 2020 due to the fall in passenger demand. “As travel resumes, these planes will need replacing. Increasing fuel efficiency is the key for industry carbon emission targets. China offers significant growth potential. In 2020, China overtook the United States as the largest global airline market. Chinese passenger numbers rose at a compound annual growth rate of over 14 percent from 20082019. Boeing expects China’s annual passenger traffic growth (RPK) to be 5.5 percent over the next 20 years.

The Civil Aviation Administration of China (CAAC) outlined plans to construct 215 new airports by 2035, an average of 14 airports per year, he said. China currently has 1,534 and 143 aircraft on order from Airbus and Boeing respectively. Chinese airlines are looking to purchase 8,600 new airplanes in the next 20 years. “The market influence of the Commercial Aircraft Corporation of China, Ltd. (Comac) will be limited in short term, but could be increased rapidly once performance is proven.”

Regarding the near-term forecast for the titanium industry, Embleton said business recovery from the pandemic “will be primarily driven by the aerospace sector. The recent decline can be largely attributed to the aerospace industry. Aerospace demand forecast to recover to preCovid levels by late 2022. Nonaerospace demand was less severely impacted by the global pandemic, so is expected to recover faster. There will be sustained growth in demand over medium-long term and supply tightness for scrap to remain until aerospace activity picks up.”

Industrial Markets

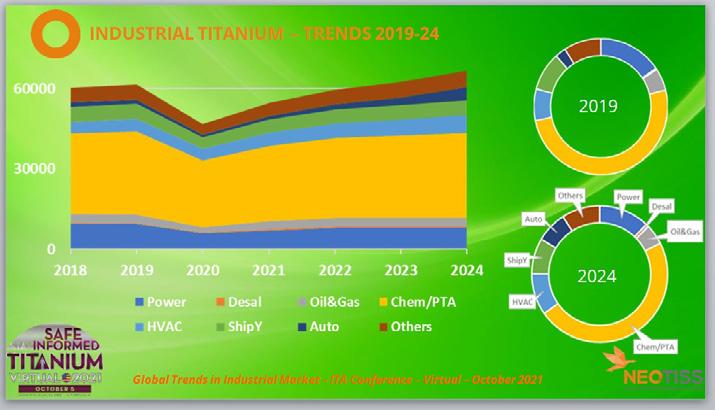

Spurred by growth in the chemical production market, Albert Bruneau, the president of Neotiss, forecasted that industrial demand for titanium will surpass 60,000 tons by 2024, up from an estimated 50,000 tons in 2021.

The production of purified terephthalic acid (PTA) is the main driver in the chemical market. PTA is a precursor for polyester, which has wide usage for fibers, bottles and containers, packaging and consumer products. According to information found online, PTA production is a hot, high-pressure, two-stage process in an acidic environment. PTA producers consider titanium as a material of choice for its excellent correction-resistant properties. Titanium typically is used to clad steel and is used in high-pressure reactors, containment vessels, and heat exchanger tube sheets. Bruneau said trends indicate a 38-percent of PTA capacity growth foreseen between now and 2025. China is leading the field with eight production projects, followed by four in Middle East and one each in Turkey and the United States.

Among other global production markets, titanium is expected to find applications in wastewater treatment systems and finned tubing used for liquid natural gas. As for power generation, demand for titanium will come from nuclear plants and hydrogen used for gas turbines and renewable energy storage.

In his overall observations for the industrial market, Bruneau said that titanium is gaining on nickel alloys for applications in petroleum and chemical markets. In terms of supply chain concerns, “transportation costs have in some cases double and delivery times are out of control. This situation impacts all materials but titanium alternatives are disadvantaged against stainless steel, copper or nickel alloys in regions with weak or incomplete titanium supply chains.”

Bruneau also cited business opportunities in industrial growth niches. Bicycles are a growth market, using special titanium grades seamless tubes. “Electrical bikes are more expensive and are looking for light and resistant material which may support Titanium development. The annual growth rate is 7 percent from 2021 to 2028.”

The titanium market forecast for Russia, Kazakhstan and Ukraine, which includes industrial, aerospace engines and aircraft, is slated to reach a combined annual demand of 11,000 metric tons in 2026 and 2027, compared with an estimated demand of 10,000 tons in 2021, according to projections by VSMPO Avisma. The market segmentation for titanium demand in this region is 44 percent for industrial, 33 percent for engines and 23 percent for aerospace.

Sam Stiller, vice president, commercial, Howmet Engineered Structures (a division of Howmet Aerospace Inc.) tracked titanium demand trends in defense aerostructures. The estimated titanium content, by weight, in the current generation of aerostructures is 20 percent for the Lockheed Martin F-35 fighter jet, 31 percent for the Bell Boeing V-22 Osprey tilt-rotor vertical takeoff and landing aircraft, and 39 percent for the Lockheed Martin F-22 tactical fighter jet.

Stiller said titanium continues to play to the strength of defense aerospace structures, maintaining high strength and stiffness at elevated temperatures. The United States leads the world with an estimated 39 percent in annual global military expenditures, followed by China with 13 percent, and smaller percentages for countries such as India, Russia, the United Kingdom and Saudi Arabia.

The global forces defining the “geopolitical moment” and influencing spending include the categories of political, economic/ supply chain, and climate/ technology trends. Political issues involve the leadership transitions in the United States and Europe, and the future of U.S/China relations. For economic/supply chain the focus is on critical materials, export controls and technology transfers, along with an industrial base policy for “on-shoring” and “re-shoring” manufacturing activities. Clean energy transition will be a matter of industrial and national security policies in the category of climate and technological trends. There also is the potential for an escalation of cyber disruption.

Marcus Lindholm, the global purchasing manager/metals for Alfa Laval turned a spotlight on the importance of titanium demand in industrial markets. The Swedish company is a producer and global supplier of heat transfer and fluid handling components, such as titanium gaskets and welded-plate heat exchangers. Lindholm said Alfa Laval offers energy efficient solutions for our customers, “which is one of the main contributors to our success in the marketplace.” The heat exchanger industry “is all about selling energy efficiency and here we can truly support our customers.”

Lindholm said that Alfa Laval is one of the major industrial titanium buyers, and the industrial market covers at least 25 to 40 percent of the titanium volumes sold. “Traditionally, the titanium producers have directed their attention more towards the aerospace and defense industries. However, the industrial buyers can offer rather stable volumes over the years. Diversification generates stability and flexibility when the market fluctuates as we have seen during the pandemic. It is important to note that you are not only competing amongst yourselves, but other materials also give you a challenge. Producers of other materials actively strive to have a strong footprint within the industrial sector. The ITA is a great forum and a good place for you to share and capture such opportunities to expand your market presence.”

Larry Haubner, vice president of sales and marketing, for TITAN Metal Fabricators, compared the performance of titanium Grade 2 and Super Duplex 2507 used for chemical processing equipment in high-chloride applications. Super Duplex 2507 is a grade of stainless steel with 25 percent chromium, 4 percent molybdenum, and 7 percent nickel, designed for corrosion resistance.

Haubner said that by comparing the prices of solid pressure vessels, solid piping, and shell and tube heat exchangers demonstrates how affordable titanium Grade 2 can be compared to Super Duplex 2507. “Super Duplex 2507 is commonly used in high chloride applications. Titanium Grade 2 preferred in high chloride application, but often considered too expensive as an option.” He said that for pressure vessels, the price difference to upgrade from 2507 to titanium Grade 2 is approximately 19 to 43 percent more than the cost of 2507. For solid pipe spools, the price difference to upgrade from 2507 to titanium Grade 2 is approximately 28 to 55 percent more than the cost of 2507.

Terry Perles of U.S. Vanadium discussed “Vanadium Market Fundamentals,” using a bar chart to show that global consumption is expected to reach 170,000 metric tons by 2025, compared with an estimated 120,000 metric tons in 2021. The steel market, by far, is the biggest consumer of vanadium, with only a small percentage going to titanium.

Perles said that about 60 percent of global vanadium consumption occurs in China, and “within China approximately 90 percent of the vanadium consumption occurs in the production of steel reinforcing bars (rebar) used in construction. More than 50 percent of global vanadium consumption occurs in the production of Chinese rebar. Understanding of the Chinese rebar production is critical in determining the near term movement in vanadium market prices.”

China historically exports 8,000 to 10,000 metric tons of vanadium per year to the rest of the world, according to Perles. “Consumption of vanadium outside of China in recent years has outstripped production outside of China, and the Chinese exports have been required to maintain market equilibrium. Global vanadium production and consumption will exhibit strong growth in the coming years as a result of continued growth in specific vanadium consumption rates in the steel industry, and on the back of growing demand for vanadium in energy storage applications. The market is projected to be more or less in balance until 2025 when we envision very strong growth in demand from energy storage resulting in global vanadium demand outstripping global supply.”

Tim Mournian, the president of Titanium Marine technologies Ltd., made the case for “the Commercial Feasibility of Building a Marine Exhaust Gas Scrubber from Titanium Materials.” Mournian was interviewed last year for an article in TITANIUM TODAY on this topic, as the ITA’s Industrial Applications Committee, has set its sights on promoting titanium as a material of choice for marine scrubbers— pollution control devices that are fitted on tankers, bulkers, cruise and intermodal cargo ships.

The opportunity for titanium unfolded due to global regulations established by the International Maritime Organization (IMO). Effective on Jan. 1, 2020, this regulation restricts the amount of sulfur in marine fuel in order to reduce the sulfur oxide (SOx) exhaust gases leaving a ship’s smokestacks. The regulation, originally unveiled several years ago, extends to an estimated 40,000 to 60,000 ocean-going vessels, representing a large and potentially lucrative market for utilizing titanium in marine scrubber construction.

A marine scrubber is a metal cylinder typically measuring 35 feet in length and 6 to 8 feet in diameter. In addition to the cylinder, the scrubber system includes other industrial components such as pipes, tubes, valves and a high-volume water supply system. Specialty stainless steels and nickel alloys have historically been widely used for marine scrubbers, but these metals have a limited service life. By contrast, titanium offers lifecycle advantages in its superior resistance to the sulfur laden exhaust gases, high operating temperatures (660° F and higher) and the corrosive seawater spray used to cool the scrubber system. Henson said titanium Grade 2 and possibly Grade 12 are well suited for marine scrubber fabrications.

There is an extensive service history for titanium in elevated temperature seawater environments as well as in land-based flue-gas desulfurization (FGD) exhaust systems, including petrochemical, refining and power generating services. While titanium has a higher up-front installation cost for a marine scrubber compared with super austenitic stainless steel (SASS), the increased investment for titanium can be shown to provide a considerably longer service life and a lower “total cost of ownership”

Mournian underlined these points in his presentation, saying that SASS has limited service life due to corrosion issues, requiring regular repair and maintenance expenses. The solution, he declared, is the use of titanium exhaust gas scrubbers, given titanium’s corrosion resistant, which results in maintenance and its high temperature tolerance. To demonstrate this, he said the marine industry should calculate capital expenditures and operating expenses. He concluded that, compared with SASS, titanium has lower replacement costs, with less maintenance and repairs and a lower life cycle costs.

Manufacturing Technology Innovations

Colin McCracken Ph.D., the product manager, biomedical, titanium materials, research and development for Oerlikon Metco (Canada) Inc., introduced information on a new titanium brazing alloy manufacturing process in his presentation “Lower Cost Manufacturing Process for Titanium Braze Alloy.”

The titanium brazing alloy manufacturing process involves the use of spherical BTi-1 powders manufactured using either the high-cost powder gas atomization (GA) or the electrode induction gas atomization (EIGA) processes. “A new BTi-1 powder manufacturing process will be introduced using the hydride/dehydride (HDH) process,” he said. “The HDH powder manufacturing process is used in the commercial production of nonspherical titanium thermal spray titanium powders used extensively in the medical thermal spray coating of orthopedic implant devices. The manufacture of titanium alloy powder via the HDH process is significantly more cost effective than the traditional commercialized atomizing processes.”

McCracken explained that brazing is a joining process where two or more metal components are permanently connected using a filler metal. The filler metals melts above 450°C (840°F) but below the melting temperature of the base/substrate metals. If either base/substrate metals melt, then the process is known as welding (below 450°C it’s known as soldering. The filler metals are designed to wet all the joining surfaces, flow and penetrate a gap known as the braze joint. The molten filler metal is also drawn into the braze join by capillary action.

The advantages of brazing include well controlled thermal (furnace) cycles with minimal component distortion. “Base metal dilution is normally very low and can be used to join very thin cross sections. Dissimilar (metal and ceramic ) materials can be joined together. It’s a cost-effective process that does not require highly skilled / specialized labor. The braze metals can be applied either a powder, paste, tape, preform, rope or rods.” Brazing is used for the production of aerospace engines and industrial gas turbines, heat exchangers, medical devices, nuclear fuel rods, and drill bits, cutters, tubes and fittings for the oil and gas industry.

In his concluding remarks, McCracken said it’s been successfully demonstrated that the HDH process can be used to manufacture a BTi-1 titanium braze alloy powder that conforms to the American Welding Society specifications for both chemistry and PSD (140F). “The HDH powder has an angular powder morphology compared to the commercial spherical atomized powders. The HDH BTi-1 alloy powder was homogeneous and comprised a titanium matrix containing expected very finely dispersed Ti2Ni and Ti2Cu phases. The Differential Scanning Calorimetry (DSC) showed that the HDH powder was comparable to both the traditional atomized powder, however the GA powder appeared to have a lower melting point onset. The tee joint brazing test showed that the HDH BTi-1 powder exhibited better wetting and filling of the brazing gap, particularly on the reverse side of the brazing gap.”

A presentation by Peter Duxson, technical director, and Brad Berven, technical sales manager for Coogee Titanium Pty Ltd. described “Melt Free; A Better Way to Make a Better Titanium.” Coogee Titanium of Australia is majority owned by Coogee Chemicals Pty Ltd, with CSIRO, the Commonwealth Scientific and Industrial Research Organization, an Australian government agency that spearheads scientific research, as a major shareholder. The melt-free technology is based on the TiRO™ “fluidized bed reduction” process. TITANIUM TODAY published articles on Coogee in 2018 and 2019.

Coogee, in Australia, operates a demonstration facility in Perth and a development center in Melbourne, for its process and alloy development and Industrial-scale spheroidization technology. In addition, Coogee is planning a new facility, Ottawa, IL. Coogee is evaluating commercially pure titanium and grades 5 and 23 and Ti6Al4V. The path ahead for Coogee involves low-rate production at demonstration scale; process qualification with prospective partners and customers, and the evaluation of scale-up pathways.

Art Kracke, the president of AAK Consulting L.L.C., who is familiar with the Coogee technology, outlined the importance for titanium powder metal and advanced manufacturing technologies. Kracke, interviewed in 2019, said the potential benefits include: the ability to lower the overall cost of titanium products for a variety of industrial applications; enhanced part performance using the design freedom offered by additive manufacturing; the capability to exploit weight reduction; and consolidate parts into a component with improved performance, lighter weight and lower cost.

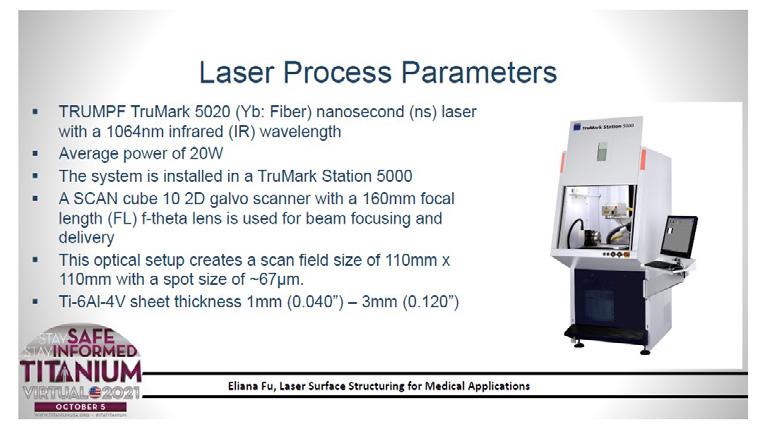

Eliana Fu of Trumpf addressed “Laser Surface Structuring for Medical Applications.” Fu began by pointing out that the Trumpf Group, a diversified manufacturing company best known as a producer of machine tools, Involved in additive manufacturing since 1999. She said titanium is the most widely used metallic for biomedical implants and components due to its biocompatible and decades of proven performance.

Laser surface modification and structuring employs a highly focused laser beam impinges on surface of metal, creating molten pool. The pool solidifies rapidly and structures are created as beam rasters quickly through molten pool. Laser beam parameters can be selected to change shape, pulse, and duration. Tenacious surface oxide layer can be removed with defocused laser beam, producing an “annealing” effect as new oxide layer is formed, with color according to thickness of oxide layer, similar to heat tinting.

Fu listed the laser process parameters for the Trumpf TruMark 5020 (Yb: Fiber) nanosecond (ns) laser with a 1064nm infrared (IR) wavelength, with an average power of 20W. “The system is installed in a TruMark Station 5000,” she said. “A SCAN cube 10 2D galvo scanner with a 160mm focal length (FL) f-theta lens is used for beam focusing and delivery. This optical setup creates a scan field size of 110mm x 110mm with a spot size of (about) 67µm.”

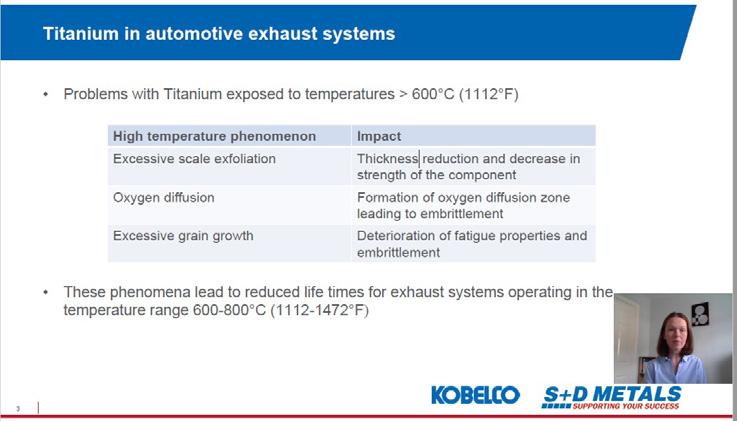

Dr. Tracey Holmes of S&D Metals GmbH, spoke on the topic of “Oxidation-Resistant Titanium Alloys for Automotive and Motorcycle Exhaust Systems.” She began by spelling out the requirements for exhaust system materials, a list that includes high temperature strength, resistance to corrosion by road salts, resistance to exhaust gases, the ability to maintain wall thickness and good room temperature formability.

The challenge for titanium in this application is the long-term exposure to temperatures above 600°C (1112°F). Holes said the high temperature exposure leads to excessive scale exfoliation, which reduces the thickness and decreases the strength of the exhaust system components. In addition, oxygen diffusion leads to embrittlement, while excessive grain growth also results in embrittlement and the deterioration of fatigue properties. “These phenomena lead to reduced life times for exhaust systems, she said.

However, new titanium grades have been developed with improved oxidation resistance, preventing embrittlement and grain coarsening without detrimental effect on formability. She pointed to test involving Ti-1.2ASN, developed by Kobe Steel, which has improved oxidation resistance to 800°C (1472°F). Holmes said that tests indicate that Ti-1.2ASN “exhibits almost no thickness reduction with the grain coarsening being effectively suppressed thanks to the addition of silicon. There is negligible decrease in wall thickness, maintaining strength and the fine grain structure results in high fatigue strength".

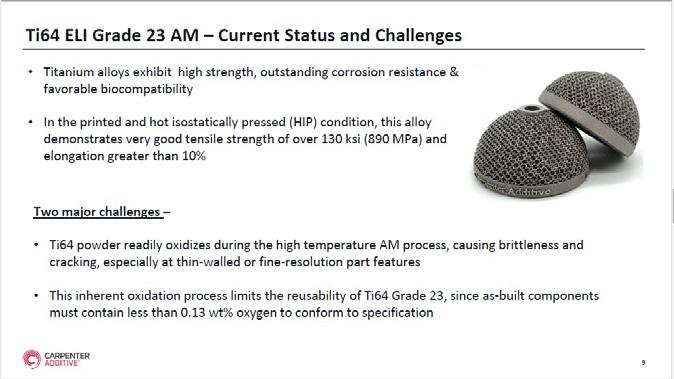

A talk by Gaurav Lalwani, strategic business developer, medical, for Carpenter Technology, examined the use of titanium Grade 23 for advanced additive manufacturing (AM) solutions for the medical device industry. Lalwani manages medical technology portfolio and new product development and has a Ph.D. in biomedical engineering.

“Additive manufacturing has been widely adopted in the medical device design and manufacturing,” he said, noting that there have been more than150 FDA approved AM metallic devices—90 approved in last 2 years. “Orthopedics has been the largest driver of AM. He said AM continues to gain share and acceptance due to improved procedures and clinical outcomes. “Porous surface structure facilitates bone ingrowth. Titanium alloy (Ti 6Al-4V, Grade 23) has been the widely adopted material of choice with more than 90-percent market share.” He pointed out that there also have been significant developments in non-titanium alloys such as stainless steel, cobalt chrome (CCM), and BioDur® 108 Nitinol.

Lalwani said that Ti64 ELI Grade 23 Plus, high-strength titanium AM for complex designs represents an innovation in the next generation of titanium-based medical devices.Ti64 Grade 23 Plus combines controlled powder chemistry with lower oxygen content and optimized print parameters, with a 15-20 percent improvement in mechanical properties He said this grade “enables state-of-the-art device designs through improved mechanical properties coupled with topology optimization, lattice structures, and other advanced geometries.”

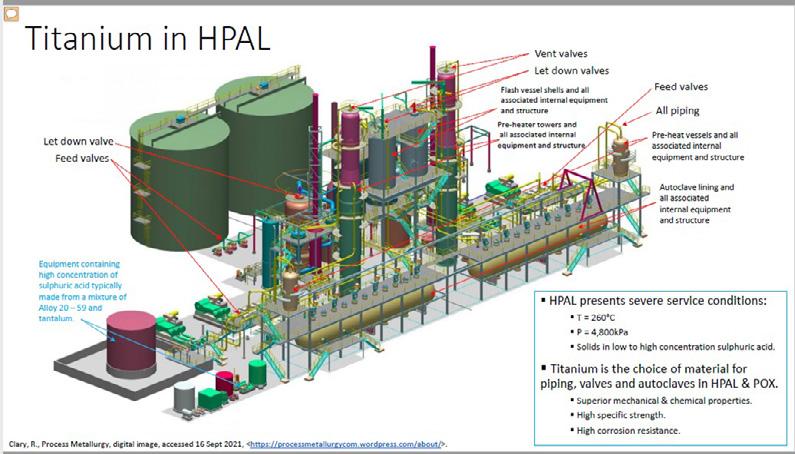

Gary Lantzke, chief executive officer of Callidus Welding Solutions, and Evelyn Ng, Callidus group materials and corrosion engineer, focused their remarks on “Novel Advances in Titanium Nitriding and the Effect on Hardness, Toughness, Wear Resistance and Corrosion,” saying that there are application trials in high pressure acid leach (HPAL) and pressure oxidation (POX) plants.

They said that the estimated cost of titanium and parts containing titanium in an HPAL circuit is $184 million, based on an approximation of an HPAL circuit, consisting of 60-percent titanium and the known total cost of $307 million to build an additional HPAL circuit that feeds into an existing plant. “The aim is to supply reliable components that do not cause unexpected shutdowns.”

Many of the steps in the development of this process has proven to be counter intuitive, according to Lantzke and Ng. “The delivery system for the alloying agents in the TiN-A process was originally laughed off as unachievable. It however provides a very stable platform that works incredibly well for delivering an alloy into a nitride particle. We are currently in process of comparative measurement of copper alloying for a naval defence application, working with another defence force contractor in Australia in the light weight ballistic armour area and also continuing the development of niobium as an alloy of interest. The next step of the process will be to refine the delivery system and also the parameters so that resultant micro structures can be assured for greater production.”

Titanium is the material of choice in hydrometallurgy plant equipment for severe service. Typical failure in severe service is erosion and/ or corrosion. Callidus Welding has been innovating titanium nitrides for a decade in response to client requirements for more reliable, longer lasting equipment. The outcome has been a series of titanium nitride types, all proven in field studies to extend in-service life, and one of which is patented.

Callidus Welding Solutions is involved in the welding and weld repair of exotic metals for mining, oil and gas, marine, mineral process industries, offering engineering solutions to erosion and corrosion challenges.

Michael Marucci and Muktesh Paliwal of Kymera International/ Reading Alloys addressed “3D Printing of Irregularly Shaped Ti6Al-4V Powders Using Laser Powder Bed Fusion.” Kymera HDH titanium powders Ti-6Al-4V, commercially pure (CP) Titanium, and titanium sponge powder. The powders are oxygen controlled to meet ASTM standards, with a particle size range of 45-250 microns. The Kymera powder production has approved quality systems in place for both aerospace and medical applications.

Traditional medical applications for HDH Titanium Powders are surgical and orthopedic applications such as plasma spray coatings for orthopedic implants, along with hip and knee joints. Advanced industrial applications include high-purity titanium sputtering targets used for thin coating applications, precision sintered filtration components for corrosion resistance and net-shape forming via metal injection molding and extrusion.

Kymera’s study goals and objectives are focused on determining if non-spherical HDH Ti-6Al-4V powder can be successfully printed via laser powder bed fusion and exhibit mechanical properties comparable to spherical Ti-6Al-4V; determining the optimized printing set up to avoid porosity in the finished parts; and evaluating resulting mechanical properties in the “as printed” and in heat-treated conditions.

The speakers said that nonspherical HDH titanium powders can be printed via laser powder bed fusion using normal scan speed and laser power. Mechanical properties of parts printed with HDH Ti6Al-4V with a particle size 20-130 µm meet or exceed components produced using standard spherical powders with a particle size range of 20-63 µm. Work will continue to further optimize the HDH powder and the printing process to reduce as printed porosity.

Rob Mackay of Tube-Mac Piping Technologies spoke about a” Non-Welded Method to Connect Titanium Pipe and Tube” using the company’s titanium PYPLOK® for mechanically attached fittings. MacKay said titanium PYPLOK is tested and available for commercial use. PYPLOK finds applications in marine, petrochemical and industrial markets and corrosive environments. PYPLOK mechanical fittings are received approvals and standards from organizations such as ANSI/ASME (B31.1 and B31.3), NAVSEA, the United States Naval Sea Systems Command, and the U.S. and Canadian coast guards.

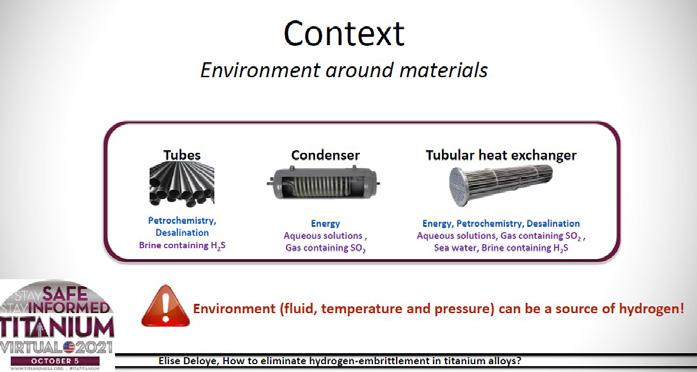

Elise Deloye, currently doing Ph.D. work at La Chance Lepemangoye University shared thoughts on “How to Eliminate Hydrogen Embrittlement in Titanium Alloys.” Deloye said that to eliminate hydrogen embrittlement, the titanium surface layer should be destructured (destroyed grains), an oxide layer could be a barrier, dislocations should be limited (mobility of hydrogen in the material), and the material should have limited residual stresses. She said there are ongoing studies underway, specifically on heat treatment.

Charles Tomonto, Ph.D. an engineering fellow with Johnson & Johnson Services Inc. provided insights into “Titanium 3D Printing at Johnson & Johnson,” explaining where and why the medical company uses titanium and titanium alloys. Tomonto said Ti-6Al-4V and commercially pure titanium Grade 2 are used in orthopedic and trauma implants, as these materials have an excellent track record as a medical implant material, exhibiting superior biocompatibility and good bone osteointegration. He said the predominant titanium-based alloy used by Johnson & Johnson is Ti6Al-4V ELI (extra-low interstitial) and commercially pure titanium Grade 2 has been used for Trauma applications.

Johnson & Johnson remains interested and continues to pursue titanium additive manufacturing as it provides the opportunity to design the internal structure of a device along with the outside geometry and custom tailor an endoprosthesis to the anatomy of a patient—having an implant to match a patient’s unique anatomy. Laser powder bed fusion, binder jet and electron beam melt additive manufacturing are used by Johnson & Johnson, and the company has in-house production capability for laser powder bed fusion and electron beam melt.

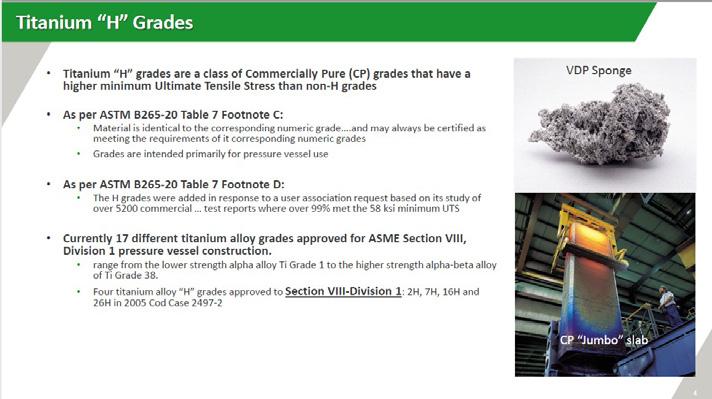

Bill MacDonald of Timet gave an update on titanium “H” grade code—a case for ASME Section VIII Division 2. MacDonald said titanium H grades are a class of commercially pure grades with higher minimum ultimate tensile stress than non-H grades. There are 17 different titanium alloy grades approved for ASME Section VIII Division 1 pressure vessel construction. He said there are four titanium alloy H grades approved: 2H, 7H, 16H and 26H. “The Section VIII Division 2 code case is underway and a proposal is ready for consideration at Section VII Materials.”

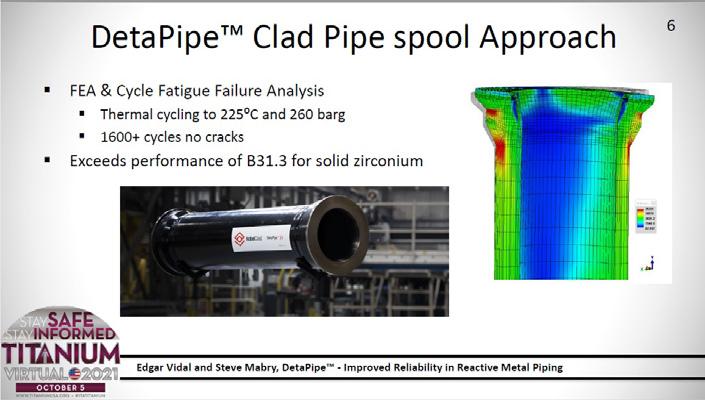

NobelClad executives Edgar Vidal, vice president, marketing and business development, and Steve Mabry, DetaPipeTM product manager, discussed DetaPipe and improved reliability in reactive metal piping. Titanium and zirconium cladding is preferred for reactors, crystallizers, tanks, heat exchangers, tube sheet and piping and elbows. DetaPipe is a fabricated carbon steel pipe spool with either a titanium or zirconium clad surface, which can be straight or an elbow. Applications include geothermal piping and chemical processing operations. The alloy material undergoes the cladding process resulting in a locktight fit, capable of withstanding exposure to ambient and elevated temperatures while at operating pressure in service.

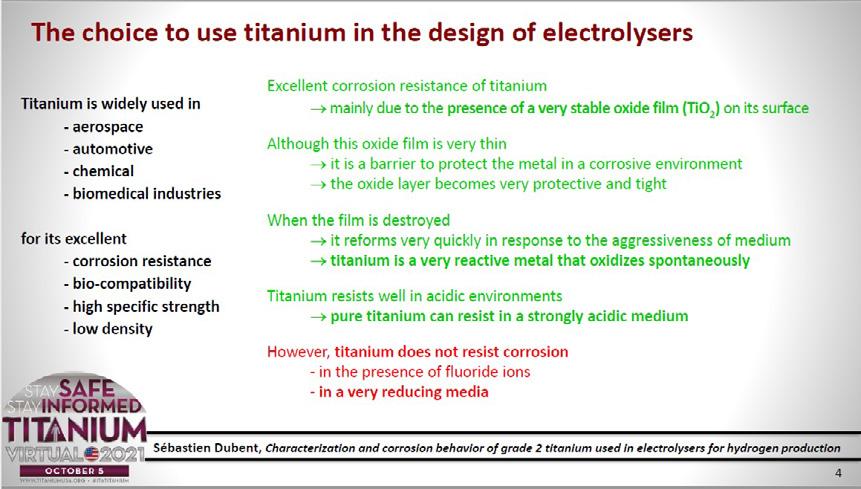

Sebastine Dubent, a research engineer with the industrial materials laboratory of CNAM Paris, described the “Characterization and Corrosion Behavior of Grade 2 Titainum Used in Electrolysers for Hydrogen Production. Dubet began by saying that today in France and in other industrialized countries, hydrogen is an emerging industrial sector leading to an increasing development of electrolysers, for which titanium has a key role in the design. Hydrogen, Dubent said, is viewed as a promising alternative as a clean and sustainable energy source.

Hydrogen can diffuse into the surface oxide film of a titanium substrate, resulting in embrittlement. However, the average corrosion rate of Grade 2 titanium is considered reasonable. According to various test studies, it was determined that titanium Grade 2 was justified for the design of the electrolysers electrodes as the metal’s free potential in sulfuric medium tends to stabilize over time with an acceptable corrosion rate.

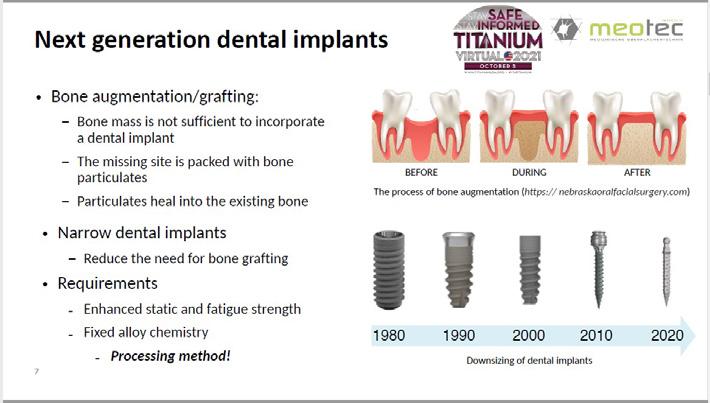

Francesco D’Elia, representing Meotec GmbH, examined the “Combined ECAP (Equal Channel Angular Pressing) and Rotary Swaging Processing of Commercially Pure Titanium for NextGeneration Dental Implants. The next generation of dental implants will encompass bone augmentation and grafting and narrow implants to reduce the need for bone grafting. Rotary swaging is a forging process used to provide rods and tubes.

He stated that the company’s objectives are to investigate the feasibility of combined ECAP and rotary swaging processing to improve the mechanical properties of commercially pure titanium Grade 4 for next-generation implants, as well as investigate the potential for the replacement of Ti6Al4V ELI (Grade 23) with commercially pure titanium Grade 4. D’Elia said Meotec has established a processing technique combining ECAP and rotary swaging to produce high-strength commercially pure titanium Grade 4 alloy rods, which are suitable for next-generation dental implants.

Jens Kroger, a representative of AP&C, discussed titanium powder used for additive manufacturing of orthopedics. The company used Ti6Al4V powder and a concept laser known as DMLM M2 Series 5 and an Arcam EBMQ10plus. Kroger mentioned 4Web Medical has having performed more than 40,000 medical implants during the last five years.

The Performance Titanium Group reviewed the properties of Grade 23 Ti6Al4V ELI, an alloyed grade of titanium. Titanium 6AL4V ELI is considered a higher purity than 6AL-4V Grade 5 due to its lower inclusions of iron, and the interstitial elements, carbon and oxygen. 6AL4V ELI typically comes in the annealed condition, but can be found in beta annealed condition as well. 6AL4V ELI Grade 23 shows high strength and toughness, as well as good corrosion resistance. It is found in aerospace applications where fracture toughness and fatigue strength are important. As a biocompatible grade of titanium, it’s also known for its applications in medical and dental implants.

Looking ahead, the ITA is planning TITANIUM USA 2022, to be held October 9-12 at the Rosen Shingle Creek Golf Resort in Orlando, FL USA.

Advanced booth space and discounted registration rates offered exclusively to ITA Member organizations.