CatMan Do

Reach across aisles to boost center store Page 62

s i 2

Truth and Consequences Exploring the ramifications of deli failures Page 80

r e t t e b

e-Shop Around

Choose the best online model for your company Page 129

! 1 n a th

Page 30

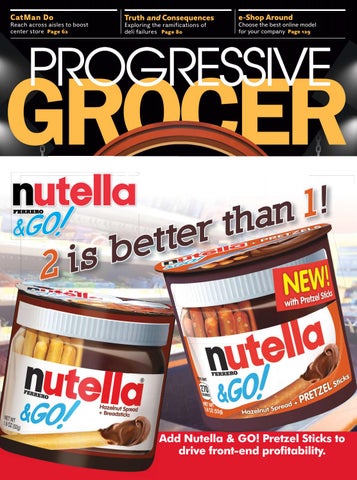

Add Nutella & GO! Pretzel Sticks to drive front-end profitability. April 2015 • Volume 94 Number 4 $10 • www.progressivegrocer.com