6 minute read

Boosting your super before retirement

Most people don’t really think about superannuation during their working life, other than making sure their employer makes regular contributions.

Usually, ten to fifteen years before retirement is when people suddenly become interested in their superannuation, especially if they want to find out if they are fully prepared to retire at the retirement age and live off their super.

At least, that’s definitely what Jennifer Langton, Specialist Advice Manager for Aware Super, has seen over the years.

In some cases there may be the realisation that there are not enough funds to live comfortably or be able to retire at the age you would like to. When boosting your super before retirement, you need to consider the three phases of retirement and how that will impact your funds: ◆ Active phase – You are newly retired and are most likely travelling, spending more on the finer things in life and enjoying your new found freedom. ◆ Quiet phase – Where you are spending more time at home, visiting family and the grandkids, and old age issues are slowly starting to creep in. ◆ Frailty or care years phase – You are requiring more health and personal assistance, and this is often the most expensive stage of your life. It’s not just maximising your wealth and travel that you should be thinking about, according to Ms Langton. You also need to take a serious look at what may occur during the frailty years phase of your life, because many older people don’t want to think about the ‘C’ word – Care, or the ‘D’ word – Death. The frailty years, when you might need to be accessing health services, assistance with daily activities and even accessing aged care, can be the most expensive time of your life.

In the lead up to your retirement, Ms Langton suggests sitting down with your partner or family

It’s never too late to plan for retirement

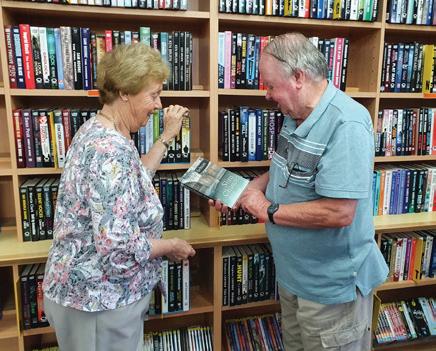

For Janelle and Steve, planning out their retirement wasn’t at the forefront of their mind. Now that they are both soon to be fully retired, they have engaged a financial planner from Aware Super to get themselves on track and living the lifestyle they want to lead. The pair want to become “grey nomads” and travel as much as possible early into their retirement. Steve retired first and he withdrew his superannuation to pay off their mortgage. He also bought a caravan and 4WD with his super to allow the pair to travel around Australia. Janelle is now retiring and wants to sort out their financial situation for retirement. They believe they will be able to fund their lifestyle and meet all of their expenses with $50,000 per year The pair has found benefits from engaging a financial planner as they now have a clear direction with what they need to do to reach that goal while also gaining peace of mind that their retirement will be comfortable. Janelle will withdraw part of her super to allow Steve to make a contribution and they will each have an Individual Account Based Pension of $222,000, drawing an income of $25,000 per year. This will fund their lifestyle and expenses. Steve and Janelle don’t consider themselves as “risk takers” but understand that they need to take on some investment risk to achieve market returns and provide for a hedge against inflation. Aware Super has structured their investments so that the impact of significant market movements, like COVID-19, is softened and their retirement assets match their appetite for risk. The couple feel comfortable knowing that their wealth will provide them independence and ownership in retirement, and they also feel reassured that they may be entitled for the age pension when they reach the qualification age and meet the assets and incomes test. They are hooking the van up and heading off on their travels, secure in the knowledge they have ticked all of the boxes for retirement and have access to guidance into the future. Case study provided by Aware Super. This has been prepared for illustrative purposes only, Janelle and Steve are not real clients. Visit aware.com.au for more information.

and defining what you want your retirement to look like.

She adds that it can be hard to pinpoint your current spending if you don’t map it out properly, so she recommends spending at least a month recording all of your expenditure.

“It is amazing how many people are completely disconnected from their actual day-to-day spending!” says Ms Langton.

Ms Langton explains that once you have a defined amount on day to day spending, you can start calculating how much money you will require per year to live comfortably.

You should also consider paying any outstanding debt you have before you enter retirement, so you can retire with minimal or no debt and with maximum investments.

“The other thing people forget about, particularly if they are looking at their superannuation, is that they need to invest their wealth appropriately to ensure it can actually grow. You should get advice on what spare capital and cash you have and what avenues are available to boost your retirement wealth,” Ms Langton adds.

When maximising your super, you really need to be aware that superannuation legislation is complicated, so a financial advisor can help you increase your wealth growth while reducing your tax. An advisor can direct you to the best option for growing your retirement wealth, including: ◆ Salary sacrificing An arrangement between yourself and your employer, allowing a part of your wage to go to your super. This is on top of your mandatory super guarantee (SG) contribution. ◆ Voluntary contributions One way to increase your super is through concessional (salary sacrificing) or non-concessional (after tax) contributions. There is a contribution cap for concessional contributions of $25,000 (as of 2020/21), anything over this annual amount will be taxed. Nonconcessional contributions have a cap of $100,000 annually or $300,000 over a three-year period. ◆ Investments Investing your super in a particular way can help you grow your retirement wealth before you retire. When you choose a super organisation, you can choose between a variety of low risk to high risk investment types. What investment type you choose depends on your age and what your appetite is for risk. ◆ Compounding If you start retirement planning early, you have time to take advantage of compounding. Compounding is when an asset has accumulated earnings, which you reinvest to build more earnings over time. The investment and its earning both gain more earnings on top of it. ◆ Splitting super between spouses Sometimes, splitting your super contributions with your partner can actually help you save money on tax. Or if you or your partner have retired, it would allow for the couple to have a bigger amount of funds to withdraw without tax being applied. ◆ No debt into retirement Dipping into your super to pay off your debts when retired leaves less money for yourself near the end of your lifetime. That’s why it’s best to have your debt as minimal as possible when entering retirement.

It’s best to get advice for all superannuation related matters because there are guidelines you need to follow and certain thresholds and caps to be aware of when maximising your wealth, or there could be unintended consequences.

A financial advisor can evaluate your current situation, understand and assess your appetite for investment risk, and find the best mix of investments that can bring you the right returns over your expected time frame.

“Nothing stands alone, it’s about using all of the different options available and really maximising your situation. You shouldn’t look at things in isolation,” says Ms Langton.

“By going it alone, not only are you missing out on expert advice to maximise your situation, you are really running the risk of getting things wrong.”

Disclaimer: The information in this article is general in nature and does not constitute legal or financial advice. Readers should seek their own personal legal and financial advice from a suitably qualified practitioner.