2019

SPIRITS INDUSTRY MERGERS & ACQUISITIONS

Year in Review

WRITTEN BY KEVIN O’BRIEN

I

WWW.ARTISANSPIRITMAG.COM

47.0%

Total

>$25

$15 - $25

Premium

Ultra

$10 - $15

Mid

Value

<$10

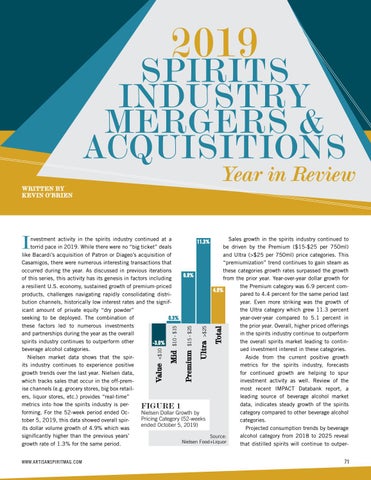

Sales growth in the spirits industry continued to nvestment activity in the spirits industry continued at a 11.3% be driven by the Premium ($15-$25 per 750ml) torrid pace in 2019. While there were no “big ticket” deals and Ultra (>$25 per 750ml) price categories. This like Bacardi’s acquisition of Patron or Diageo’s acquisition of “premiumization” trend continues to gain steam as Casamigos, there were numerous interesting transactions that these categories growth rates surpassed the growth occurred during the year. As discussed in previous iterations 6.9% from the prior year. Year-over-year dollar growth for of this series, this activity has its genesis in factors including the Premium category was 6.9 percent coma resilient U.S. economy, sustained growth of premium-priced 4.9% pared to 4.4 percent for the same period last products, challenges navigating rapidly consolidating distri1.9% year. Even more striking was the growth of bution channels, historically low interest rates and the signifthe Ultra category which grew 11.3 percent icant amount of private equity “dry powder” year-over-year compared to 5.1 percent in seeking to be deployed. The combination of 0.3% the prior year. Overall, higher priced offerings these factors led to numerous investments in the spirits industry continue to outperform and partnerships during the year as the overall the overall spirits market leading to continspirits industry continues to outperform other -3.0% ued investment interest in these categories. beverage alcohol categories. 0.6%positive growth Aside from the current Nielsen market data shows that the spirmetrics for the spirits industry, forecasts its industry continues to experience positive for continued growth are helping to spur growth trends over the last year. Nielsen data, investment activity as well. Review of the which tracks sales that occur in the off-premmost recent IMPACT Databank report, a ise channels (e.g. grocery stores, big box retailTotal Top-25 leading source of beverage alcohol market ers, liquor stores, etc.) provides “real-time” Distilled Brands data, indicates steady growth of the spirits metrics into how the spirits industry is perFIGURE 1 Spirits (without Tito’s) category compared to other beverage alcohol forming. For the 52-week period ended OcNielsen Dollar Growth by Pricing Category (52-weeks categories. tober 5, 2019, this data showed overall spirended October 5, 2019) Projected consumption trends by beverage its dollar volume growth of 4.9% which was alcohol category from 2018 to 2025 reveal significantly higher than the previous years’ Source: Nielsen Food+Liquor that distilled spirits will continue to outpergrowth rate of 1.3% for the same period.

Southern Glazer’s 71 31.8%

-

B