WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING MAY 2024 CSNEWS.COM

Protect your business, prevent underage access to tobacco products, and help ensure that retail remains the most trusted place to buy tobacco products with Age Validation Technology (AVT).

AVT reduces the likelihood of selling tobacco products to underage individuals. It’s simpler for associates to execute rather than manually entering in date of birth.

EXECUTE

The AVT system saves on transaction times.

AVT protects the future/viability of innovative products and harm reduction.

Prompt

Verify

POS

Transaction Continues

RF506 | ©2024 Altria Group Distribution Company | For Trade Purposes Only

Tobacco Product Scanned

to Scan for Age Validation

and Scan I.D.

System Validates

EASY TO

NJOY

TO GET INVOLVED CLICK HERE Unfair tobacco regulations could hurt your business. Stand up for your store. Click the button to join store owners across the country who are fighting for fair tobacco policies.

Turning the Spotlight on Foodservice

In

this issue, we serve up a generous helping of new category and consumer insights

THERE IS A REASON WHY every issue of Convenience Store News includes at least one piece of foodservice content. That reason is: Foodservice has become a major part of convenience retailing, and there’s no indication that the category will wane in importance any time soon.

In this month’s issue, you’ll find even more foodservice content than usual, starting with our cover story entitled “The Path to Profitability.” Senior Editor Angela Hanson, who spearheads our foodservice beat, talks with various industry players about tackling the operational issues that chip away at a foodservice program’s success — think inadequate staff training, inefficient workflows, inconsistent execution, high levels of food waste and more (see page 28).

Quality, consistency and value are what keep customers coming back. So, it’s a bit concerning that just 56% of buyers said they were extremely satisfied with their most recent prepared food purchase at a convenience store — a decline of 8 points year over year. The percentage who said they were somewhat satisfied jumped to 37%, while 7% said they were not satisfied, according to the findings of our 2024 Realities of the Aisle Study, which surveyed 1,500-plus consumers who shop a c-store at least once a month (see page 90).

Fast-casual, fast-food and grocery outlets are still perceived as superior alternatives to

EDITORIAL EXCELLENCE AWARDS (2016-2024)

2021 Jesse H. Neal National Business Journalism Award Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards

Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2020 Trade Association Business Publications

Intl. Tabbie Awards

Honorable Mention, Best Single Issue, September 2019

2016 Trade Association Business Publications

Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015

c-store food, indicating a need for operators to continue improving their offerings.

Operational issues aside, other challenges facing convenience foodservice programs today include economic difficulties and concerns about the future prompting consumers to tighten their purse strings, and rising costs slowing profit growth compared to last year. Employee recruitment and retention also remain a struggle despite some easing of the labor crunch.

Nearly three-quarters of the retailers that took part in our 2024 Foodservice Study (73%) pointed to hiring and retaining employees as their biggest obstacle to foodservice success. Although this figure declined 7 points year over year, it is still the most cited challenge by far.

Nonetheless, convenience store operators are bullish about foodservice. Roughly eight in 10 said they expect their foodservice sales to increase in 2024, and 72% expect their foodservice profits to rise (see page 42). The average projected increase for each is 11%.

As Theodore Roosevelt famously said, “Nothing worth having comes easy.” We hope the category and consumer insights in this issue help you execute at the highest level.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

2023 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

EDITORIAL ADVISORY BOARD

Laura Aufleger OnCue Express

Billy Colemire Stinker Stores

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark

Chris Hartman Rutter’s Faheem Jamal CPD Energy Corp./ Chestnut Markets

Ruth Ann Lilly GPM Investments LLC

Vito Maurici McLane Co. Inc.

Jonathan Polonsky Plaid

Pantries Inc. Greg Scriver Kwik Trip Inc. Tony Sparks Curby’s Express Market Roy Strasburger StrasGlobal EDITOR’S NOTE

4 Convenience Store News CSNEWS.com

PON OR H P H P C nv ni nc D • • • R • • • • • F & P : : P : G : : L Y D / 33 -8 -9557 • @ q L D /N 77 - 1 -6 55 • @ q UL L KY P G P U G 917- 6- 117 • @ q • • • • • • L 8 2024 | L V

Secret Sauce Comes in Many Different Varieties

There are several ways to create a distinct competitive advantage in foodservice

SUCCESSFUL FOODSERVICE operators seem to have a secret sauce that keeps their companies outperforming their competition. At first thought, you might think it’s simply the menu or that one signature item that put them on the map and kept them there — like Raising Cane’s chicken tender dominance, Wawa’s hoagie mecca or McDonald’s breakfast domination. But there is much more in the arsenal of competitive tools that sustain their market edge.

Speaking at Convenience Store News’ 2024 Convenience Foodservice Exchange in Tampa, Fla., Liza Salaria of Impact 21 told the audience of convenience foodservice leaders that having an “anchor item” can be the reason customers frequent their restaurant. The “add-ons” become the extra gravy, or the basket builder as we like to commonly call them.

Having a signature item is not the only way to differentiate your foodservice from the competition.

What might surprise you is the most popular item on the menu is often not what you think. For example, did you know that the most popular menu item ordered at Chick-fil-A is not the chicken sandwich? Nope! It’s those irresistible waffle fries.

In the convenience store field, Allsup’s is known for its burritos while at CEFCO, it’s the kolaches and at 7-Eleven’s Laredo Taco Co., it’s the homemade tortillas. But having a signature item is not the only way to differentiate your foodservice from the competition. Some companies stand out through offering unbeatable value to their guests. “Often understated, the competency of procuring raw ingredients in the most cost-efficient manner can be one’s secret sauce,” said Salaria. That is because competent sourcing enables operators to offer great value to their customers while maintaining healthy gross margins.

Unique sourcing strategies — from market overage locks vs. contracts, to manufacturer direct vs. wholesale, to opportunistic buys around “seconds” (i.e., ingredient loads refused by quick-service restaurants [QSRs]) — can be the secret to low food costs. C-store retailers that have differentiated through sourcing include Stripes with commodity sourcing, Casey’s General Stores with self-distribution, Kwik Trip and CEFCO with central commissary, and Jacksons Food Stores with full vertical integration.

C-store retailers also can create a signature point of differentiation through sustainable sourcing. Responsible farming, sustainability and local sourcing is now of top importance to Generation Z consumers. This trend within the QSR and fast-casual segments has made its way into convenience foodservice. A couple of c-store examples: Wawa’s 100% sustainable beverage cups and Stewart’s Shops’ reuseable coffee mug program.

It’s been said that the only real advantage QSRs have over c-stores is their operational knowledge and expertise because that’s what they focus on. “For a c-store retailer, building the most efficient work design for its food production is the starting point to an efficient labor model,” Salaria noted. “But there are other benefits, too, such as a simplified training model, small building footprint, and lower equipment and maintenance costs.”

To achieve operational excellence, one starts with the menu, according to Salaria. C-store chains such as Royal Farms, Fastrac and Rutter’s focus on building the most efficient operating chassis, resulting in high-quality food offerings with some of the best sales-per-labor-hour metrics in the industry.

Finally, she cautions, don’t overlook the old adage, “People make the difference.” Engaged, well-trained team members who are incentivized to deliver high-quality food and reach sales targets can be the difference between mediocre and excellent results. Learn from top retailers that have built some of the best food brand advocates within their companies.

Look for full coverage of the 2024 Convenience Foodservice Exchange in our September issue.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

VIEWPOINT 6 Convenience Store News CSNEWS.com

FEATURES

COVER STORY

28 The Pathway to Profitability Convenience store retailers must tackle the operational issues that chip away at a foodservice program’s success.

DEPARTMENTS

E DITOR’S NOTE

4 Turning the Spotlight on Foodservice

In this issue, we serve up a generous helping of new category and consumer insights.

VIEWPOINT

6 Secret Sauce Comes in Many Different Varieties

There are several ways to create a distinct competitive advantage in foodservice.

SMALL OPERATOR

22 A Gathering Place

Kumbha-Yah Cafe and EV Market Place, a hybrid concept, fuels cars and customers.

LEARNING LAB

70 Strong Collaboration Skills

Drive Strong Results

Convenience Store News’ first Future Leaders Learning Lab webinar provided proven techniques to become a great collaborative leader.

AN EYE ON D&I

72 A CEO’s Take on the ROI of DEI

The Wills Group’s Blackie Wills shares his company’s experience.

INSIDE THE CONSUMER MIND

90 Competing for Share of Stomach Consumers still perceive c-store food as lagging fast-casual and fast-food restaurants.

CONTENTS MAY 24 VOLUME 60 NUMBER 5 8 Convenience Store News CSNEWS.com

12

20

CSNews Online

New Products

22 COVER STORY PAGE 28 72 20

CATEGORY MANAGEMENT

FOODSERVICE STUDY

42 Playing the Long Game Cautiously optimistic, convenience store operators are banking on long-term investments in prepared food and dispensed beverages.

TOBACCO

52 Vapor Woes

Illicit market concerns grow as FDA confusion persists and states fill the void.

CANDY

58 Bubbling Back

Still dealing with setbacks from the COVID-19 pandemic, gum is making a rebound.

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT-GROUP PUBLISHERUS GROCERY & CONVENIENCE GROUP Paula Lashinsky (917) 446-4117 - plashinsky@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

ASSOCIATE EDITOR Amanda Koprowski akoprowski@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS

Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR & NORTHEAST SALES MANAGER Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR & WESTERN SALES MANAGER Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (917) 634-7471 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Lauren DiMeo ldimeo@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

SENIOR MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER

Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF PEOPLE OFFICER

CHIEF STRATEGY OFFICER

CHIEF OPERATING OFFICER

Ann Jadown

Joe Territo

Derek Estey

10 Convenience Store News CSNEWS.com CONTENTS MAY 24 VOLUME 60 NUMBER 5

Convenience Store News (ISSN 0194-8733; USPS 515-950) is published 12 times per year, monthly, by EnsembleIQ, 8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631. Subscription rates: Subscription rate in the United States: $150 one year; $276 two year; $14 single issue copy; Canada and Mexico: $204 one year; $390 two year; $17 single issue copy; Foreign: $204 one year; $390 two year; $20.40 single issue copy; Digital One year, digital $87; two year, $161. Periodical postage paid at Chicago, IL 60631, and additional mailing addresses. Copyright 2024 by EnsembleIQ. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. POSTMASTER: send address changes to Convenience Store News, 8550 W. Bryn Mawr Ave. Ste. 225, Chicago, IL 60631. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations. CONVENIENCE STORE NEWS AFFILIATIONS Premier Trade Press Exhibitor 14 INDUSTRY ROUNDUP 14 7-Eleven’s Parent Company Targets North America for Expansion 16 Retailer Groups Say Visa & Mastercard Settlement Is ‘Insufficient’ 18 Retailer Tidbits 18 Eye on Growth 19 Supplier Tidbits TECHNOLOGY 64 In-Store Influence The convenience channel’s frequency and reach offer the perfect opportunity for retail media networks to fulfill their mission.

64

WHEN ZYN ROLLS IN, ZYN ROLLS OUT…FAST 16 of the 20 fastest selling nicotine pouch SKUs are ZYN 5-can Rolls (based on can velocity). STOCK MORE ROLLS, SELL MORE ROLLS. CALL 800-367-3677 OR CONTACT YOUR SWEDISH MATCH REP TO LEARN MORE. *Statistic source: IRI Total US Convenience, 26 Weeks Ending 1-14-24. For Trade Purposes Only. Not for Distribution to Consumers. ©2024 Swedish Match North America LLC WARNING: This product contains nicotine. Nicotine is an addictive chemical.

TOP VIEWED STORIES

Wawa Prepares to Ring Up First North Carolina Customers

The Pennsylvania-based chain announced a grand opening for the first of at least 80 convenience stores it plans to build in the state. The debut is slated for May 16 in Kill Devil Hills.

Wawa Offers Coffee Deal to Celebrate 60 Years

The expected giveaway of nearly 1.5 million cups of any-size coffee was accompanied by special 1960s décor for stores, plus 60-cent deals on certain products.

Pilot Travel Centers Charts Growth Strategy for 2024

The company plans to add 35 travel centers, remodel more than 75 locations and expand its truck maintenance network of Southern Tire Mart at Pilot Flying J shops.

Massachusetts Faces Fallout From Flavored Tobacco Ban

According to the Massachusetts Illicit Tobacco Task Force, the state’s rush to ban flavored tobacco has failed to curb use of these products while inadvertently creating a market for illicit untaxed products and cross-border smuggling.

1 3 4 5 2

Maverik Rebrands 30 Kum & Go Convenience Stores

The retailer completed a slate of rebrands across Utah and Colorado Springs ahead of planned changeovers in the Denver market. Each rebrand receives Maverik signage, panoramic photos and maps of the state’s outdoor destinations on the walls, and adventure videos playing on TVs.

OUT & ABOUT

CDA Marketplace Highlights

Teamwork & Added Value

Speakers at the Convenience Distribution Association’s (CDA) 2024 Marketplace discussed leadership, value and upcoming challenges during the three-day conference in February.

“I think there’s a lot of headwinds that we’ll face. And I like that. I think that makes us stronger,” said introductory speaker and 2024 CDA Chair Bill Stein, who serves as executive vice president of enterprise growth at Core-Mark International.

Stein stressed the importance of working as a team and collaborating in the c-store industry. “You have to reach in and lean on others,” he said. “You’ll be shocked at the similarities and the adversity we face together.”

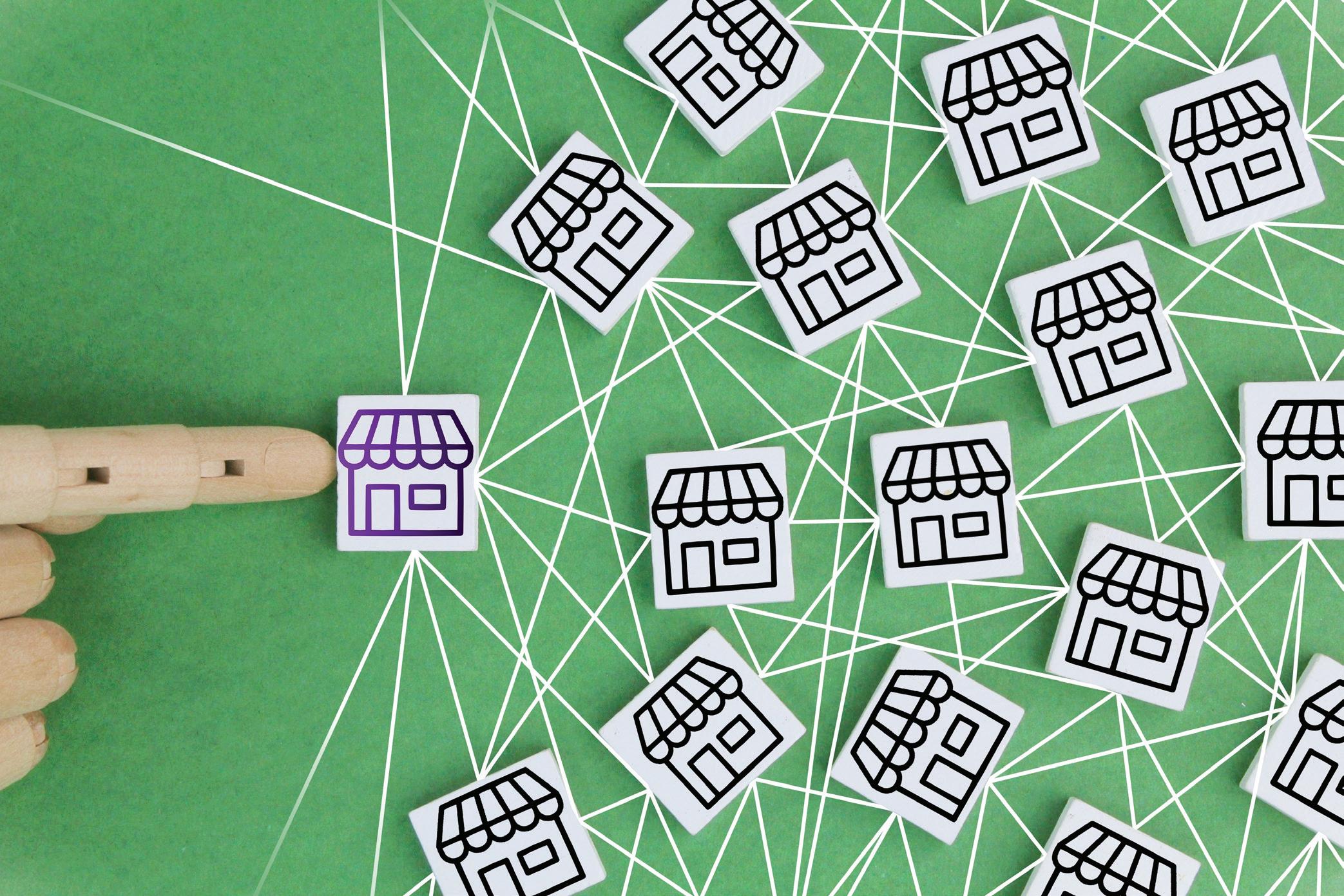

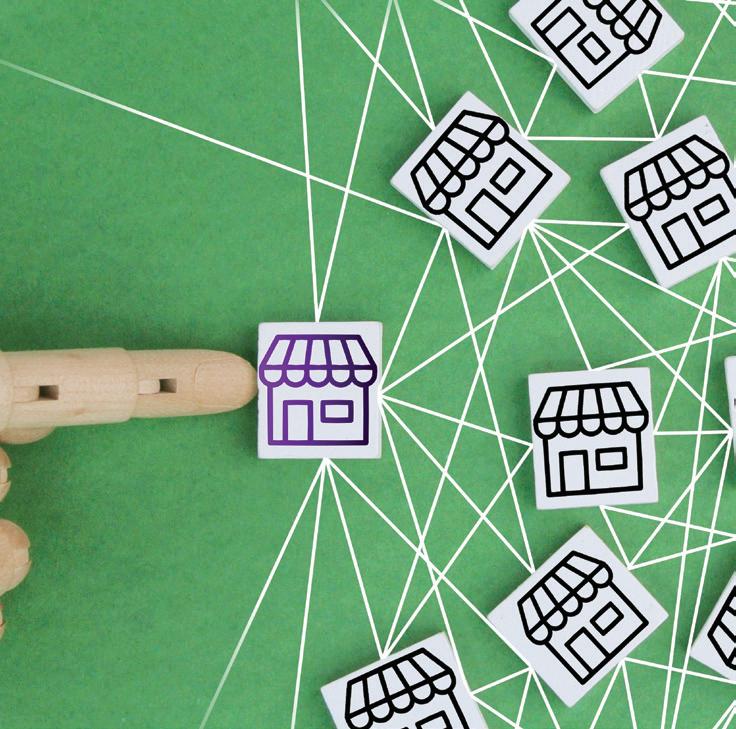

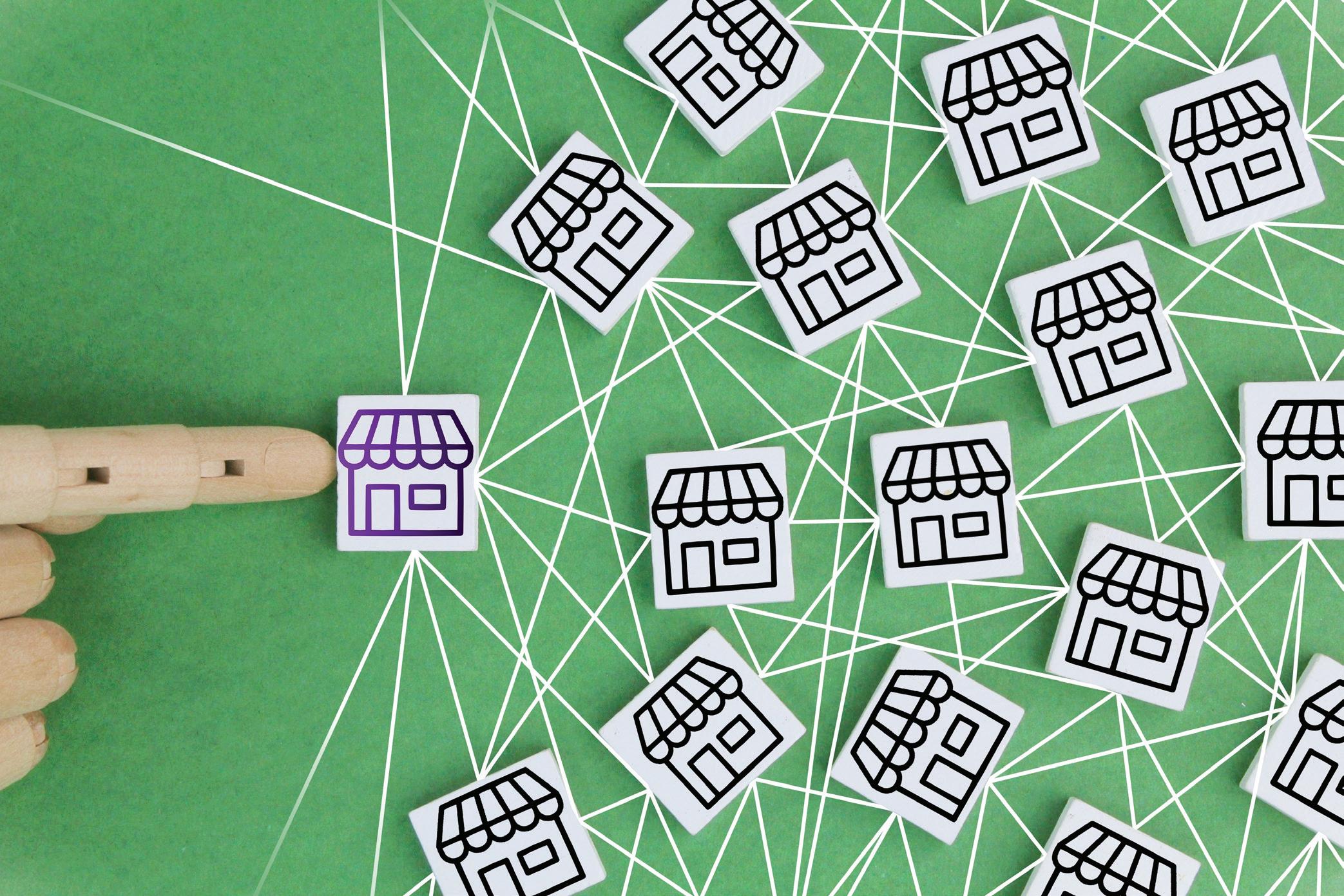

The Calculus of Balancing Brands Post-Merger

Following a major acquisition, is rebranding an inevitable outcome? Not necessarily, according to Lesley Saitta, cofounder/chair of business transformation firm Impact 21, a W. Capra company. Upon a major acquisition such as the Maverik-Kum & Go linkup, it’s most common to take a customer-first approach and use focus groups, market surveys and other methods to determine the strength of each brand by market, or even by store.

“It is critical to fully understand what the impact of changing the name of a brand will be, as well as any ancillary offers such as loyalty programs, foodservice offers, unique proprietary products, etc.,” Saitta told Convenience Store News. “Changing a brand name is not just about changing the sign on the front of the store.”

For more exclusive stories, visit the Special Features section of CSNews.com.

MOST VIEWED NEW PRODUCT

FlexPay 6 Outdoor Payment Terminals

Invenco by GVR launches the FlexPay 6 line of outdoor payment terminals for fuel dispensers, which includes the first payment terminals available factoryinstalled in Gilbarco-Veeder Root Encore 700S dispensers. The FlexPay 6 payment terminals — the M1-15, A2-09 and A1-05 — are available as either all-in-one or modular terminals. All are, or will be, PCI 6 compliant and have native cloud connectivity, along with 2-D barcode readers and contactless as standard features. The FlexPay 6 terminals also integrate PCI P2PE solutions from Bluefin into their design, which can reduce the PCI DSS compliance burden by more than 70% and PCI control scope reduction by more than 90%, according to the company.

CSNEWS ONLINE ONLINE EXCLUSIVE

12 Convenience Store News CSNEWS.com

Invenco by GVR Greensboro, N.C. invenco.com

7-Eleven’s Parent Company Targets North America for Expansion

Seven & i Holdings plans to create a globally integrated structure with unified leadership

SEVEN & I HOLDINGS CO. plans to focus on using mergers and acquisitions in North America to strengthen its convenience store business, the company announced April 10.

The Tokyo-based parent company of 7-Eleven Inc. stated that it will proactively implement strategic investments in its c-store business with a more agile and flexible discipline. It plans to accelerate growth in the North American convenience store market while improving profitability and capital efficiency.

Seven & i’s strategic shift comes nearly a year after longtime activist investor ValueAct Capital made a bid to replace several directors on the company’s board with its own slate of nominees. Although the slate was voted down in May 2023, ValueAct — which has advocated for a spinoff of 7-Eleven Inc. — stated that the

number of votes that went to its nominees signaled a desire for change within the company.

Based on the recommendations of its strategy committee, Seven & i plans to create a globally integrated convenience store management structure, including Japan and North America, with unified leadership.

One week after Seven & i’s announcement, Irving, Texas-based 7-Eleven Inc. closed on a $950 million deal for 204 Stripes and Laredo Taco Co. locations, making the retailer the sole owner and operator of all Stripes stores and Laredo Taco Co. restaurants in the United States.

The Stripes stores are located across west Texas, New Mexico and Oklahoma, and will join the more than 13,000 7-Eleven, Speedway and Stripes locations that 7-Eleven Inc. operates, franchises and/or licenses across the U.S. and Canada.

INDUSTRY ROUNDUP 14 Convenience Store News CSNEWS.com

CA LAW

The sale of tobacco products including e-cigs is prohibited to persons under 21.

Don’t get fined. Scan to learn more.

© 2024 California Department of Public Health PREVE NT A LIFE T IME OF A DDICT ION

Retailer Groups Say Visa & Mastercard Settlement Is ‘Insufficient’

Under the agreement, the credit card companies would reduce swipe fees by at least 4 basis points for three years

NACS AND OTHER RETAIL INDUSTRY groups are pushing back against an estimated $30 billion settlement reached by Visa Inc. and Mastercard Inc. to limit credit and debit card fees for merchants, stating that the antitrust deal does not go far enough.

Under the settlement, the credit card companies would reduce swipe fees by at least 4 basis points for three years and ensure an average rate that is 7 basis points below the current average for five years. Additionally, merchants would have greater discretion in offering discounts or imposing surcharges on cards with higher interchange fees.

The settlement is consolidated with a larger lawsuit brought by NACS and other groups that was first filed in 2005. A previously announced settlement in 2012 was rejected by NACS and a majority of the plaintiffs because it fell short of addressing problems with credit card industry price-fixing, the convenience and fuel retailing association said.

The same is true of the newly announced

settlement, according to NACS, which noted that the settlement is drafted as “mandatory” and would bind all other litigants — including a separate suit being pursued by the association and some of its members — cutting off any future injunctive relief and rules claims.

Additionally, the latest settlement does not address the lack of competition in the marketplace and is not related to the bipartisan Credit Card Competition Act, which would assert that retailers in certain cases have the right to route payments through networks unaffiliated with the credit card providers, potentially lowering the fees they have to pay.

The Merchants Payments Coalition said the settlement would provide “very small relief” and does not end the need for Congress to pass legislation.

The Retail Industry Leaders Association released a statement calling the settlement “an acknowledgment that the credit card payment market has been broken and for decades, Visa and Mastercard have used their duopoly to fleece retailers of all sizes by their abusive interchange fees and card network rules.” It also deemed the settlement “a mere drop in the bucket” compared to what is needed.

INDUSTRY ROUNDUP 16 Convenience Store News CSNEWS.com

Give Your Customers the Snacks They Love

© Mondelēz International group

Retailer Tidbits

Sheetz Inc. and GPM Investments LLC kicked off large-scale hiring initiatives ahead of the summer season. Sheetz plans to bring 2,200 new staff members onboard across its six-state footprint, while GPM is adding approximately 1,500 new employees in preparation for its peak selling season.

The first bp pulse Gigahub from bp made its debut in Houston in early April, featuring 24 high-speed charge points with Tritium 150kW DC fast chargers. They will be integrated with the bp pulse app, allowing users to access real-time charging availability and connect to WiFi.

Smith Oil Co. partnered with Liquid Barcodes Inc. to expand its mobile app. The enhanced platform includes digital stamp cards for several popular items, along with fuel pay.

Eye on Growth

Maverik — Adventure’s First Stop rolled out upgrades to Kum & Go’s &Rewards loyalty program. The changes allow for more fuel savings, easier point accumulation and conversion, and better rewards.

Alimentation Couche-Tard Inc. entered into an agreement with RELEX Solutions to implement its unified supply chain and retail planning solutions. The artificial intelligence-powered and machine-learning software includes demand forecasting, replenishment, and advanced space and floor planning.

Onvo rolled out a new hot grab-and-go food program, Food on the Fly. The offering, which includes menu items for breakfast, lunch and dinner, made its debut at an Onvo travel plaza in Dorrance, Pa.

7-Eleven International LLC (7IN) completed its acquisition of 7-Eleven Australia, adding more than 750 convenience stores to its portfolio. 7IN operates or master franchises approximately 48,000 stores in 16 countries and regions.

H&S Energy Products LLC is expanding with the acquisition of Andretti Petroleum Group. The deal includes Andretti’s convenience retail, fuels distribution, cardlock, fleet card, commercial fueling, car wash, lubricants and transportation businesses.

Atlantis Management Group LLC completed an acquisition of various assets of M. Spiegel & Sons Oil Corp. The transaction included three company-controlled, branded gas station and convenience stores, mainly located in New York, as well as more than 70 wholesale motor fuel accounts.

Maverik — Adventure’s First Stop officially expanded into Montana, adding a 13th state to its operating footprint. The 5,900-square-foot store is close to activities and attractions such as Mount Helena, Holter Lake and the MacDonald Pass.

Yesway will significantly grow the Allsup’s banner in Oklahoma with plans to have at least 15 Allsup’s stores in the state by the end of 2024. A Thackerville store, just minutes from WinStar World Casino, will be the company’s first true interstate store.

Propel Fuels opened its first Flex Fuel E85 station in Washington through a partnership with the Road Warrior Travel Center. Beginning with the Wapato location in Yakima Valley, Propel plans to further expand access to the alternative fuel blend in the state.

VP Racing Fuels Inc. signed two new licensing pacts. A deal with Wilcox + Flegel Oil Co. enhances VP Racing Fuels’ presence in the Northwest, while the second deal with Ramos Oil Co. expands its presence in the Southwest and West.

18 Convenience Store News CSNEWS.com INDUSTRY ROUNDUP

The update coincided with a refreshed Kum & Go app and website.

The companies agreed to the $1.1 billion deal in November 2023.

Supplier Tidbits

Mars Inc. is investing more than $70 million in its Hackettstown, N.J., manufacturing site. The major economic development supports an R&D Innovation Studio, which includes a new test kitchen and packaging lab, as well as manufacturing efficiencies and advancements in food safety.

Krispy Krunchy Chicken plans to add more than 700 stores in 2024 as the company aims to exceed 3,500 locations by the end of the calendar year. The expanded footprint is part of the company’s “Core Four” growth strategy.

J&J Snack Foods Corp. is enhancing its snack portfolio with the acquisition of Thinsters. The company intends to

leverage its strengths to expand distribution and introduce Thinsters cookies to a wider audience.

Cooper-Booth Wholesale Co. is nearing the end of a 14-month project to install solar panels on the company’s warehouse and convert the power to a green energy source. The project is part of the distributor’s efforts to reduce its carbon footprint.

Dover Fueling Solutions acquired Bulloch Technologies. The company plans to integrate Bulloch’s point-of-sale technology into its DFS Anthem UX platform on Wayne Ovation fuel dispensers.

INDUSTRY ROUNDUP

MAY 2024 Convenience Store News 19

This development follows the opening of a $42 million Mars Snacking Research and Development Hub in Chicago earlier this year.

Nicotine-Free Djarum Clove Smokes

Kretek International Inc. is rolling out nicotine-free Djarum Bliss clove smokes, including two new flavor styles, across the United States and Canada in 2024. New Djarum Bliss Special and Djarum Bliss Java bring the brand’s nicotine-free, zero-tobacco lineup to six distinct flavor styles. Djarum Bliss Special offers traditional clove-smoking smoothness, built off the brand’s Djarum Special clove-filtered cigars. Djarum Bliss Java is a new offering that blends notes of coffee and clove aromas. All six new filtered styles are available in packs of 20 or 10-pack cartons designed for inline shelf placement. Kretek International introduced the nicotine-free lineup in trial markets in 2023.

KRETEK INTERNATIONAL INC. • MOORPARK, CALIF. • DJARUMBLISS.COM

Rockstar Focus

PepsiCo’s Rockstar Energy introduces Rockstar Focus, a zero sugar, calorie-free beverage that features a boost of caffeine intended to improve focus and cognition. Made with ingredients such as Lion’s Mane, a mushroom used in traditional eastern medicine, and containing 200 milligrams of caffeine, Rockstar Focus comes in three flavors: Lemon Lime, White Peach and Orange Pineapple. Each variety is now available for purchase in 12-ounce cans starting at $2.99 per can.

PEPSICO INC. • PURCHASE, N.Y. • ROCKSTARENERGY.COM

Chex Mix Double Chocolate King Size Bar

General Mills Inc. adds a new flavor to its line of King Size Chex Mix Bars: Double Chocolate. Made with Chex cereal, pretzels and chocolate chips, the new bar aims to meet consumers’ need for a snack that’s both salty and sweet. The 2.2-ounce bar is shelf stable and comes with a suggested retail price of $2.09. King Size Chex Mix Bars are exclusive to the convenience store market and available in a Peanut Butter Chocolate flavor as well. GENERAL MILLS INC. • MINNEAPOLIS • GENERALMILLSCF.COM

Big Sipz Purple Punch

After a successful launch late last year, Patco Brands is officially introducing its Big Sipz Purple Punch cans with the help of rapper Waka Flocka Flame. Known for its bold beverages that are also budget-friendly, the new Big Sipz cocktail is available in 200-milliliter Primary Cups and 330-milliliter Tetras, priced at $2.99 and $3.99, respectively. Both options feature a 16% ABV. Big Sipz Purple Punch is currently available in Circle K stores and independent retailers throughout Alabama, Arizona, California, Colorado, Florida, Georgia, Nevada, North Carolina, Oregon, South Carolina, Tennessee and Texas. Expanded distribution is slated throughout 2024.

PATCO BRANDS • LAS VEGAS • BIGSIPZ.COM

Vynamic Smart Vision/Shrink Reduction Checkout Solution

Diebold Nixdorf Inc. debuts its new artificial intelligence (AI)-based Vynamic Smart Vision/Shrink Reduction checkout solution, which is designed to prevent the most common sources of loss at self-service and traditional point-of-sale registers. Powered by SeeChange’s AI and machine learning cloud platform, the solution complements Diebold Nixdorf’s already live AI-based solutions that reduce friction during both fresh produce scanning and age verification for restricted sales. According to the company, bringing these three technologies together on a single platform will result in one of the most holistic anti-shrink solutions on the market. Vynamic Smart Vision/Shrink Reduction can be deployed without disruption through existing in-store integrations.

DIEBOLD NIXDORF INC. • NEW YORK • DIEBOLDNIXDORF.COM

NEW PRODUCTS 20 Convenience Store News CSNEWS.com

Seagram’s Escapes Jamaican Me Happiness Collection

FIFCO USA’s malt beverage brand Seagram’s Escapes introduces a new variety pack. Inspired by the brand’s No. 1 best-selling flavor, Jamaican Me Happy, the new Jamaican Me Happiness Collection includes three additional flavor options: orangenoted Jamaican Me Smile, tropical pineapple-inspired Jamaican Me Sunny, and passion fruit-infused Jamaican Me Glow. The collection is available year-round in a 12-count variety pack of 11.2-ounce bottles or 12-ounce cans, as well as a 24-count club variety pack of bottles. Additionally, Jamaican Me Sunny will join Jamaican Me Happy as a 7.5-ounce can option to drive sampling and trial. THE SEAGRAM BEVERAGE CO. • ROCHESTER, N.Y. • SEAGRAMSESCAPES.COM

Hillshire Farm Stuffed Croissants & Pierre Melts

Tyson Foodservice launches two new, labor-saving foodservice offerings: Hillshire Farm Stuffed Croissants and Pierre Melts. The croissants come stuffed with premium meats and are available in varieties such as Ham & Cheddar and Pepperoni & Mozzarella Cheese. They can be heated quickly in a TurboChef oven, conventional oven or microwave. The Pierre Melts come preassembled and pretoasted, and can be heated in 45 to 60 seconds in a microwave. They are available in three options — Philly Cheesesteak, Cheesy Bacon or BBQ Pulled Pork — all on buttered Texas Toast.

TYSON FOODSERVICE • SPRINGDALE, ARK. • TYSONFOODSERVICE.COM

Smartfood Chocolate Glazed Donut Frito-Lay North America Inc.’s Smartfood popcorn brand unveils its latest flavor innovation: Chocolate Glazed Donut. The new release combines airpopped kernels with a chocolate-flavored kettle coating, creating a sweet and salty flavor in one crunchy bite. Smartfood Chocolate Glazed Donut is available at retailers nationwide in either 6.5-ounce bags for $5.19 or 2-ounce bags for $2.49. This is the brand’s second doughnut-inspired offering, following its 2021 launch of Krispy Kreme Glazed Doughnut. FRITO-LAY NORTH AMERICA INC. • PLANO, TEXAS • SMARTFOOD.COM

FreeWire Boost Power Pro

Sabert Pulp Hinged Containers & Cups

Pulp hinged containers and pulp portion cups are the newest sustainable and compostable product offerings from food packaging manufacturer Sabert Corp. Both are primarily made with PFAS-free pulp and are commercially compostable. Suitable for a variety of food options, the hinged containers feature an easy opening and closing hinged design; strong locks to prevent leaks and spills during delivery; perforated tearaway lids; durability for transport; and resistance to moisture, oil and grease. The cups, with both clear PET and pulp lid options, come in three sizes to serve an assortment of dips and sauces.

SABERT CORP. • SAYREVILLE, N.J. • SABERT.COM

FreeWire Technologies presents Boost Power Pro, the flagship offering within its latest electric vehicle (EV) charging station product line, the Pro Series. Boost Power Pro uses an integrated battery to turn multiple EV chargers into a single large-scale energy storage system, delivering new features such as blackout charging, site backup power, power sharing, flexible input power and simultaneous charging. With Boost Power Pro, retailers have grid services options, allowing them to send energy back to the utility grid during peak demand or critical events. Units can be reserved today and will begin shipping in North America in the second quarter of 2024. FREEWIRE TECHNOLOGIES • NEWARK, CALIF. • FREEWIRETECH.COM/PRO-SERIES

MAY 2024 Convenience Store News 21

A Gathering Place

Kumbha-Yah Cafe and EV Market Place, a hybrid concept, fuels cars and customers

By Kathleen Furore

“TO FUEL OUR customers’ lives so they can go places and do better things.”

With that mission in mind, owner Srini Kumbha realized a dream when his KumbhaYah Cafe and EV Market Place — a hybrid foodservice/convenience store concept — celebrated its grand opening in Canal Winchester, Ohio, on Aug. 26, 2023.

“About six years ago, I got the idea of building a business in the community that would be a gathering place for people and within that business, I wanted to offer good products and services,” explained Kumbha, an IT consultant by trade who decided to buy the land and work to make his idea a reality with the help of family, friends and community partners. “Now, it’s real — the Market Place and cafe is standing right here!”

The story behind Kumbha’s dream is one of opportunity, resilience and a bit of luck, too. It began in 2003 when he came from India to the United States as a 25-year-old for a job opportunity. “Life was different and in a good way,” he recalled.

The lucky part came when Kumbha, who had polio as a youth, met someone at a local

business who mentioned that a leg brace could help his polio-affected leg. “I was fitted with a custom brace and able to stand and walk upright while carrying grocery bags in my two hands for the first time in my life,” he said. “To this day, I think of that person who approached me about the brace and consider him my godsent guardian angel.”

He eventually met his wife Denise, got married, had their son Teja and 13 years ago, moved the family to Canal Winchester, where Kumbha continued working in IT as the idea for Kumbha-Yah Cafe and EV Market Place began to take shape.

He evaluated the idea “over a period of time” before deciding to move ahead.

“I was originally interested in a real estate investment. Then, once I bought the property, I was doing research and the idea for a c-store and gas station struck the most,” he recounted. “They are such integral parts of American life, and I thought the concept would be a great opportunity for a business and for the community where we are.”

More research on convenience retailing trends convinced Kumbha and his wife to take the foodservice/ convenience store hybrid route.

“We found that, more and more, everyone is offering

SMALL OPERATOR

22 Convenience Store News CSNEWS.com

food. We thought it would be beneficial for our customers to have a smaller footprint, one-stop shop,” he explained. “Most of the traditional c-stores and gas stations rely on the ‘outside in’ concept, meaning come for gas and then get convenience items. However, we want to be ‘inside out,’ meaning come for groceries, food, c-store items and then get gas.”

To gain the information and skills they lacked, the couple visited gas stations, and Kumbha even worked at both a coffee shop and a gas station — short-term jobs that taught him about equipment, menus, the processes involved in running a retail business, and managing customers and employees.

Jumping the Hurdles

Even with all of the preparation and planning, launching Kumbha-Yah Cafe and EV Market Place did not come without challenges. As Kumbha quickly learned, opening and then running a c-store is always challenging, but for small, independent operators, the hurdles are often higher than those the larger chain operators face.

“We hit roadblocks with architecture and engineering for the first three years, and then COVID put us on the backburner for a couple more years,” Kumbha said, noting that the biggest challenge was cost overrun.

“Construction and material costs were doubled compared to pre-COVID and the financing took longer than anticipated.”

All told, from concept ideation to opening, it took six years to come to fruition.

Once Kumbha-Yah Cafe and EV Market Place opened, new hurdles replaced the old ones. Staffing, followed by marketing and then merchandising, pose the biggest challenges.

“Most of the traditional c-stores and gas stations rely on the ‘outside in’ concept, meaning come for gas and then get convenience items. However, we want to be ‘inside out,’ meaning come for groceries, food, c-store items and then get gas.”

— Srini Kumbha, Kumbha-Yah Cafe & EV Market Place

The store boasts a smaller footprint and a larger selection of grocery items to provide a one-stop-shop experience.

MAY 2024 Convenience Store News 23

“We continue to face staffing issues such as no-shows due to illness, as well as gaps caused by major holidays like spring break and Easter,” Kumbha said. “As owners, we step in to cover these gaps whenever possible, and we continue to hire staff on a regular basis.”

On the marketing front, Kumbha mostly relies on Facebook local groups, the Nextdoor app and flyers to get the word out, as well as talking to customers when they stop in the store.

“Even though we’ve spent a decent amount of time and money in advertising, we still get questions from people like, ‘Oh, I didn’t know that you have a full-service coffee bar,’” he said, a fact that underscores the importance of social media and in-person interactions.

Kumbha’s merchandising challenges are those that every small operator can understand. “We do not get the discounts or can’t meet the minimum order requirements, so we are trying to reach out to local wholesalers instead of national distributors,” he noted.

A recent decision to register with Sam’s Club wholesale and Walmart Business is proving worthwhile.

“We bring goods from these stores to help us. This benefits us, as well as the customer,” said Kumbha. “For example, the milk from

Smith’s costs $4.69 for us and sells for $5.99, whereas the milk from Walmart is $2.62 and we sell it for $3.99. 5-hour Energy from a national vendor is $2.50-plus. From Sam’s Club, it is $1.66. We still have a long way to go, but we are realizing and making progress toward bringing cost-effective products to our customers.”

Setting the Business Apart

Much about Kumbha-Yah Cafe and EV Market Place resembles other stores in the area. The c-store stocks traditional items such as candy, chips and beverages, while the cafe serves up freshly made pizzas, subs, salads, specialty coffee drinks, smoothies and broasted chicken.

So far, the c-store is topping the cafe in sales volume. However, foodservice sales are slowly improving. “Our broasted chicken, pizza and smoothies work well and recently, cold subs are selling well, too,” Kumbha reported.

What makes Kumbha-Yah Cafe and EV Market Place stand out?

The most obvious differences are its drive-thru that provides a convenient ordering option for customers and its larger selection of grocery items. But even more so, Kumbha believes it is the subtle ways the family approaches the business that set it apart in the industry.

“I realize there is a retail outlet, convenience store or cafe in almost every corner of every community. So, you may ask how this new establishment is different? First off, we are locally owned and belong to this community where we live,” he pointed out. “We offer job opportunities right within our neighborhood. Many employees walk to work.”

SMALL OPERATOR 24 Convenience Store News CSNEWS.com

Kumbha-Yah Cafe and EV Market Place relies on social media, the Nextdoor app and flyers to market the store.

FREE! CHOOSE YOUR VERSION Help prevent social sourcing of tobacco and vaping products Retail Store Signage Kit Order now, available only while supplies last. wecard.org/Free-Kit

THE TOTAL ROLLER GRILL PACKAGE

“The Nook” is a space customers can reserve for small group gatherings.

The store also features a small, reserved space called “The Nook” that customers can reserve for small group gatherings — serving as a meeting place for the community.

Perhaps most important, Kumbha said, the business reflects the four values the family holds dear:

1. People first. Do unto others as you would have them do unto you.

2. Excellence in all we do. Whatever is true, honorable, just, commendable, worthy of praise and service, do those things.

3. Stronger together. Two are better than one.

4. It’s all about Yah! Thy brand shall be my brand — that is, love god and love your neighbor.

Customers are responding to this personal approach. “We get repeat customers on a daily basis, sometimes the same customer two to three times a day,” Kumbha said.

Sharing Advice

In spite of the challenges, Kumbha realizes he is living his dream — and he has some advice for other small operators or anyone considering opening a small, independent c-store.

“It’s going to be a lot of work and many long hours, and that can be frustrating,” he cautioned, acknowledging personal challenges he continues to face while in the midst of ramping up the business. “I am learning to divide the tasks and complete them. I need to listen to my body when to take breaks; my wife when she says I need to be patient. My sister-in-law reminds us that we’ve all been learning, and we’re reflecting on our progress over the past eight months or so.”

When times get tough, you must always “believe in what you are doing,” Kumbha said. CSN

©2024 Johnsonville, LLC *Technomic Roller Grill Consumer Study, August 2020 **IRI 1/7/24

SMALL OPERATOR 26 Convenience Store News CSNEWS.com

THE PATHWAY TO PROFITABILITY THE PATHWAY TO PROFITABILITY

CONVENIENCE STORE RETAILERS MUST TACKLE THE OPERATIONAL ISSUES THAT CHIP AWAY AT A FOODSERVICE PROGRAM’S SUCCESS

BY ANGELA HANSON

COVER STORY 28 Convenience Store News CSNEWS.com

FOR HUNGRY CONVENIENCE STORE SHOPPERS, deciding where to buy a meal or snack is frequently all about the menu. Customers consider which c-stores are nearby, what types of prepared food and beverages they offer, and what they’re in the mood to eat that day.

For convenience store operators, having a successful foodservice program isn’t nearly as simple, and the things that make the biggest difference in profitability can’t be found on the menu at all.

“In a perfect world, a foodservice plan is built, the plan is executed, it is then analyzed, and tweaks are made,” said Wynne Barrett, cofounder and vice president of business development for Supplyit, a SaaS product by Jera Concepts. Regardless of how simple or elaborate the plan is, “the measure of a successful plan is the same for all: to improve profitability by growing sales and minimizing waste. But to do this, you have to ensure proper store-side execution.”

That’s easier said than done, industry experts agree, particularly when a program features fresh-made food and preparation methods that are more involved than heating up a ready-to-serve item. Inconsistency opens the door to problems that negatively affect the bottom line.

“Food is not perfect and it takes a lot of training to recognize this and be able to adjust while cooking,” said Paul Servais, retail foodservice director for La Crosse, Wis.-based Kwik Trip Inc., operator of 870-plus convenience stores in the Midwest. “We want to say, ‘follow the recipe,’ but that is not always enough. Check the product, verify temperature; if it doesn’t look right, it’s not. Sounds easy, but it’s tough to teach.”

The Consistency Conundrum

The root cause of prepared food inconsistency isn’t necessarily something like a particular product type or employee error — things that could be adjusted or corrected once to ensure the desired result from then on, according to Billy Colemire, director of marketing at Stinker Stores. The Boise, Idaho-based chain designed its fresh food program, Pete’s Eats, to incorporate significant redundancy in preparation with similar movements and muscle memory.

“Everything is a version of something else, but with added or removed steps. We really wanted to make it very easy to get right and very difficult to get wrong,” Colemire told Convenience Store News. “However, and I’m directly quoting Taylor Swift here, a master of both consistency and brand, ‘people are people and sometimes we change our minds.’”

A retailer’s goal should be realistic without requiring perfection, he explained.

MAY 2024 Convenience Store News 29

“Food is not perfect and it takes a lot of training to recognize this and be able to adjust while cooking.”

— Paul Servais, Kwik Trip Inc.

“The human/people elements and warmth that make our program so successful must also be considered to ensure we are always driving the highest level of consistency,” Colemire said, citing the example of a team member inadvertently over-portioning the burrito scoop while in a hurry. “We don’t think we can eliminate inconsistency completely, as that would be a fool’s errand. Rather, we want to make sure we minimize inconsistency, such that it’s not obvious … to a tolerable and acceptable amount.”

Getting the consistency level where it needs to be requires a deceptively simple concept: “Training, training, training,” said Servais.

In a labor market where hiring and retention are still challenges, retailers may feel pressure to rush through training new employees in food preparation roles. However, taking the time to ensure they can do their jobs well can be the difference between hitting profit goals or not.

Training doesn’t have to be the sole purview of the foodservice team — Colemire noted that Stinker Stores’

COVER STORY

30 Convenience Store News CSNEWS.com

Kwik Trip's foodservice program is supported by consistent training.

“The measure of a successful plan is the same for all: to improve profitability by growing sales and minimizing waste. But to do this, you have to ensure proper store-side execution.”

— Wynne Barrett, Supplyit

human resources team was instrumental in building rolebased customized training and development programs. “They’ve taken time to partner with all stakeholders to develop training that sticks,” he said.

To ensure effectiveness, training programs should be purpose-built to suit a brand’s individual needs and menu, and scalable to match future growth. The specific steps can vary, but numerous retailers have found success starting with online training modules reinforced by on-the-job training, rather than having new hires jump right into job shadowing.

Regular, early check-ins also help determine whether a training period was effective. “Follow up with teams,” Servais advised.

For convenience store chains, Supplyit’s Barrett recommends reviewing per-store inventory levels to evaluate how well food preparation is being executed.

“To study consistency, you must also consider inventory use to see if products are made the same way in each store. Every retailer or commissary has employees who show personal preference,” he said, noting that some employees might like more or less pepperoni on their pizza, which could bias their production. “If you can match inventory use to what was produced, then it is generally assumed that products were made the same way each day. Too much or too little inventory use indicates you have a consistency issue.”

Waste Not, Want Not

Ordering the right amount of ingredients and other foodservice supplies to avoid either running out or having too much food waste at the end of the day is another major area where retailers can tighten up their operations to boost profits. Whether they team up with a technology partner or go it alone, Barrett suggests retailers build their foodservice plans using time-based sales data.

“While real sales data does not account for shrink, it should give you an accurate set of guardrails of what to build and when,” he said. “To help drive sales, a strong forecast should also allow a retailer to define product minimum offerings at different times of the day. Product minimum requirements help build sales in off-peak times.”

When analyzing customer traffic patterns, operators may discover them to be “consistently inconsistent to the point of being consistent,” Barrett added. “Think about delivery drivers and how they run certain routes on certain days or landscapers who cut lawns in an area on certain days. Those days are the same each week and build the purchase patterns for each store.”

32 Convenience Store News CSNEWS.com COVER STORY

O ou’ll oo. Mac & Cheese Bites Poppers Tots Ravioli Empanadas Arancini Veggie Burgers > Learn more at stuffed-foods.com • Uniquely crispy • Bursting with buffalo flavor • Long hold-times • Vegan 09090CrispyBuffaloCauliflowerWings

Capture the Cravings

Retailers that haven’t updated their backend ordering tools in a few years may find themselves startled at how quickly options are changing — and improving.

As seen at NRF 2024: Retail’s Big Show in January, artificial intelligence (AI) is moving beyond being the latest buzzword, progressing from the theoretical stage to practical application, particularly when it comes to tools for inventory management and production planning.

Operators can now use AI to optimize forecasting, ordering and inventory for both fresh food and the center store. The high level of diversity based on store location and shopper composition means that efficient, effective ordering will look very different for a highway convenience store vs. one that caters to a local neighborhood, according to Mike Weber, chief marketing officer at Upshop, an AI-powered ordering platform whose food and beverage solution features a forecast, a recommended order, and a real-time view of fresh and prepared inventory.

“We’re seeing really smart merchandisers in c-stores that want to make individualized calls based on community, based on types of cohorts they have of stores. So, they need a forecast that helps them do that,” Weber said. Once that forecast is in hand, “they

“We don’t think we can eliminate inconsistency completely, as that would be a fool’s errand. Rather, we want to make sure we minimize inconsistency, such that it’s not obvious … to a tolerable and acceptable amount.”

— Billy Colemire, Stinker Stores

can inform themselves; they can tweak based on what’s their presentation, what’s the safety stock they need in that store, what are their hero items vs. just the everydays. And we enable them to play with those levers to get to this final forecast by store.”

Streamlining the ordering process not only cuts down on backroom waste, but also potentially frees up employees to interact with customers and engage in suggestive selling or other key tasks.

Being able to avoid pre-ordering too much product for fear of running out will also ensure freshness that customers can taste. “You can use technology to forecast but then, more importantly, get the ordering synced up and make sure your on-hand inventory is as optimal as possible. That’s the key,” said Weber.

Rethinking the Kitchen

On a day-to-day basis, the physical space that foodservice employees work in can make a big difference in how well a foodservice program is executed. Retailers with the resources to make foodservice a serious priority can take this into account in new builds but, more often, they have to make the best of what they’ve got with existing stores.

“Having an efficient workflow can lower ticket times, reduce errors and increase throughput,” said Chef Mat Mandeltort, an industry veteran and cofounder of ChefWorthy, which helps operators find the right foodservice equipment through trustworthy reviews and ratings from vetted users. “However, optimal workflows can be constrained by a physical layout that affords little opportunity for change or rearrangement.”

If they can’t change their kitchen space, c-store retailers must lean harder into sourcing the right equipment for their goals. Even if what they currently have works fine, recent innovation centered on reducing labor and streamlining operations makes it worth looking at options.

COVER STORY

34 Convenience Store News CSNEWS.com

Stinker Stores designed its fresh food program to incorporate significant redundancy in preparation.

SETS UP FAST PAYS OFF FASTER

Set up shoppe fast and see delicious returns on your investment even faster with the #1 c-store pizza brand in the nation.

Scan the code or visit HuntBrothersPizza.com/csn LEARN MORE

“At Stinker, we have been and continue to invest heavily in our equipment. What’s that old saying ... you have to spend money, to make money. I’d paraphrase and say, you have to spend money in the right way, at the right time, to make money, scale and grow,” said Colemire.

Mandeltort recommends that operators consider the nuances of why they are considering new equipment and what they want it to do before they start looking at options.

“The first question retailers (large or small) need to ask themselves is: Why do we need to upgrade this equipment? Is it because of new menu items? Are we looking to deal with increased demand? Did the previous equipment break? Does it help with labor costs? Does it produce better-quality food? Can it help us do more with less?” he explained. “Once they determine the why, they can focus on the what.”

New equipment, though, isn’t necessarily an easy fix to problems in the kitchen and can bring challenges of its own, noted Kwik Trip’s Servais. “New equipment costs and current equipment repair costs/wait times are becoming a roadblock to having a successful food program,” he said. “We have pumped over $1 million into speed-oven repairs in the first 24 weeks of our fiscal year.”

Equipment investments that have been helpful, he added, are those that enable employees to save time and effort. “FOG Tanks can reduce the amount of scrubbing required to keep pans, filters and oven parts clean. Meat shredders can reduce the time and muscle strains when picking chicken. Video screens with cameras on the hot food area to help coworkers know what they need to make saves them steps,” said Servais.

Smart units that can be remotely updated and managed are also a plus for chains. However, Mandeltort warns operators to be cautious about equipment that claims to do too much too well.

“It’s not a given that an upgraded piece of equipment will automatically increase efficiency or streamlining. They may just be trading a headache for a stomachache,” he said. “Surprisingly, not every piece of equipment performs as advertised. It’s essential that retailers do their research and not just fall in love with the latest bright, shiny object that comes their way.”

Players in the convenience foodservice space need to invest time in doing due diligence upfront to reap increased benefits in labor. Often, simplicity is what wins out.

“Lean on equipment [that] can eliminate the artistry

36 Convenience Store News CSNEWS.com COVER STORY

Stinker Stores has found traction highlighting its best offerings on social media.

For more information, please contact: Michael Stremlau, National C-Store Sales Director Email: mstremlau@bar-s.com Scan the QR code for more craveable innovation on our website.

“It’s essential that retailers do their research and not just fall in love with the latest bright, shiny object that comes their way.”

— Mat Mandeltort, ChefWorthy

of foodservice, reducing it to simple, easily repeatable acts,” Mandeltort said. “Many pieces of equipment, like high-speed ovens, can be programmed to produce consistent results. If you’re baking pizza, set the oven to ‘pizza’ and assuming it was programmed correctly at the prescribed temperature and time, out comes a perfectly baked pizza, every time.”

Strengthening the Commitment

While convenience stores were traditionally known as a destination for “Cokes and smokes,” foodservice has emerged as a critical growth category for the future. Still, the act of launching a food program isn’t enough

COVER STORY

Crave consumer trust?

Tamper

for hot food applications Scan to learn more Tamper Protection Proven patented technology gives consumers confidence that food has remained sealed. Great for delivery! Full Transparency Exceptional clarity because shoppers like to see the food they buy. We strongly recommend that customers test products under their specific conditions to determine fitness for use. Sustainability You will be ready as the shift away from black carbon plastics continues.

Evident Polypropylene Packaging

to guarantee profitability — retailers must continually invest time, money and effort into the category.

“Commitment to foodservice is the biggest stumbling block we see with small and independent operators,” Barrett said. “Our advice regardless of size is to invest in the plan. Invest in the food safety and preparation processes and, most importantly, invest in training employees to do things right. This will give them a chance to be successful.”

Investing in a foodservice program also means investing in getting the word out. Marketing efforts should cast a wide net, but do so in areas where the retailer is most likely to get the message out to the consumers it wants to reach.

“You need to do it all if you can: social, digital, billboard, newspaper/shopper, sports, streaming,” Kwik Trip’s Servais said. “You have to get your message where people spend their leisure time, and every person spends their leisure time differently. There are not a lot of people left that watch the 6 a.m. and 10 p.m. news regularly.”

Colemire encourages his fellow marketers to have fun and stay nimble with social media. “We have a true creative behind the helm of our social and digital engagement strategy, James Campbell, category manager of loyalty and digital engagement. He’s so

SATISFACTION IS ALWAYS

THE

Retailers can also benefit from straightforward social media posts that highlight their best offerings. “On social [media], we often post Reelz and videos featuring fresh food. Those tend to get the most traction,” Colemire added. “Stories have been trending with higher clicks recently when compared to comments, likes and shares.”

Foodservice should always be a top focus when entering a new promotional period. “At least 50% of our exterior signage is usually dedicated to fresh food and beverage programs,” Colemire said, pointing out that while Stinker Stores has historically teamed up with consumer packaged goods partners, it has begun doing more bundling with private label products. “Bundling items together that can only be found at Stinker further differentiates us from everyone else and gives our customers another great reason to keep coming back.”

Ultimately, the operational tactics that optimize foodservice profits are links in one connected chain.

“Everybody’s looking for that hero item,” said Upshop’s Weber. “You’ve got to make sure your associate is on point to deliver because those heroes are where you’re going to get tested. So, if you want to scale that, you’ve got to get the ordering right, you’ve got to get the

COVER STORY

40 Convenience Store News CSNEWS.com Gettin’ Fresh Logistics r L oods. r w h LTL oz ws

ON

MENU ’s y oods is pr v hing o w om or oods v 18th Street Fresh r h pr Our s ar h our v micr 18th Street Fresh - Frozen haw v Sandw ox Br oss v ingr or Conv or NuVue Foods ogram allow our brand. his pr o your VISIT NUVUEFOODS.COM OR CALL 1-800-498-DELI TO GET STARTED. 40 YEARS C E LEBRATING NEAR L Y

Playing the Long Game

Cautiously optimistic, convenience store operators are banking on long-term investments in prepared food and dispensed beverages

By Angela Hanson

FROM A DISTANCE, the current state of the foodservice category is rosy, and convenience store operators are doing everything right. Sales and profits are up, with most retailers predicting continued increases throughout 2024, and companies are investing in new technology, equipment and menu innovation to ensure success in the years to come.

However, taking a closer look reveals obstacles that even the best-designed food program can’t ignore. Economic difficulties and concerns about the future are prompting consumers to tighten their purse strings, while rising costs have slowed profit growth compared to last year. Meanwhile, employee recruitment and retention remain a struggle despite some easing of the labor crunch.

Foodservice Segments Offered

FOODSERVICE

SPONSORED BY % OFFERING FOODSERVICE SEGMENT 2024 2023 2022 Prepared food 96% 95% 97% Hot dispensed beverages 87% 97% 99% Cold dispensed beverages 85% 87% 88% Frozen dispensed beverages 66% 72% 78% AVERAGE % OF TOTAL FOODSERVICE SALES 2024 2023 2022 Prepared food 54% 54% 53% Hot dispensed beverages 22% 24% 22% Cold dispensed beverages 25% 21% 22% Frozen dispensed beverages 12% 10% 10% 42 Convenience Store News CSNEWS.com

Upcoming Events

Convenience istribution Business Exchange (C BX)

September 23–26, 2024

Omni Louisville Hotel | Louisville, KY

Convenience istribution Marketplace (C M)

February 17–19, 2025

The Woodlands Waterway Marriott Hotel & Convention Center

The Woodlands, TX

Convenience istribution Business Exchange (C BX)

September 8–11, 2025

Arizona Grand Resort & Spa Phoenix, AZ

Convenience istribution Marketplace (C M)

February 16–18, 2026

Loews Arlington Hotel | Arlington, TX

Convenience istribution Business Exchange (C BX)

September 14–17, 2026

JW Marriott Miami Turnberry Resort & Spa | Aventura, FL

Convenience istribution Marketplace (C M)

February 22–24, 2027

Loews Arlington Hotel | Arlington, TX

THE P 2024 2025 2026 2027

For more information, visit www.cdaweb.net/Events or contact Jenn Finn at 703-208-1649 or JennF@cdaweb.net.

Save the Dates

Prepared Foods O ered

Snacks/appetizers

Hot entrées experienced the most growth in menu presence over the last year, increasing 8 points compared to 2023.

76%

Dispensed Beverages O ered

Large operators are significantly more likely than small operators to have hot cappuccino/ latte/espresso items among their dispensed beverage o erings.

As such, the future of convenience foodservice may depend not on what retailers are doing right, but whether they can overcome the challenges affecting retail overall, according to the findings of the 2024 Convenience Store News Foodservice Study

“Prices have continued to stabilize, and we’re crossing our fingers employee turnover doesn’t have an extreme impact,” one study participant remarked.

Despite the challenges, c-store operators aren’t wavering in their commitment to foodservice as a tentpole of their operation. For the past three years, the

average square footage devoted to the category has stayed consistent at around a quarter of total store size.

Prepared food is fairly ubiquitous among surveyed retailers and draws in 54% of total foodservice revenue, while hot, cold and frozen dispensed beverages are offered in varying degrees but available at the majority of stores. Cold dispensed generates 25% of total foodservice revenue while hot dispensed stands at 22% and frozen dispensed at 12%.

The

Menu Landscape

As they work to overcome category challenges, some

44 Convenience Store News CSNEWS.com FOODSERVICE

2024 2023 Breakfast sandwiches 80% 90% Chicken 73%

Pizza 72%

70%

74%

85% Bakery

67% 76% Other sandwiches 66% 72% Hamburgers 64% 72% Hot dogs 56% 74% Wraps 56% 62% Hot entrées 56% 48% Salads 55% 72% Other roller grill items 38% 53% Soup 36% 48% Tacos/quesadillas 25% 31% Other 8% 7%

2024 2023 Hot coffee 95% 98% Fountain carbonated beverages 87% 84% Hot chocolate 82% 80% Hot cappuccino/latte/espresso 71% 69% Iced coffee 66% 54% Frozen drinks (e.g., slushies) 62% 61% Iced tea 61% 57% Hot tea 56% 59% Fountain noncarbonated beverages 54% 46% Fountain sports drinks/energy drinks 51% 48% Cold brew coffee 48% 34% Iced cappuccino/latte/espresso 38% 28% Milkshakes 36% 25% Juices 23% 28% Smoothies 23% 13% Soft-serve frozen yogurt/ice cream 20% 15% Aguas frescas 15% 12% Kombucha 11% 7%

Foodservice Sales by Daypart

2024 2023 2022

operators believe building a better offer will be what makes a big difference in program profitability.

“We changed our foodservice brand to betterquality food last year,” one study participant shared. “Because of this, I expect sales to continue at this rate.”

Hot entrées experienced the most growth in menu presence over the last year, increasing 8 points compared to 2023. Hot dogs and salads saw the largest declines in presence, both falling 18 points, but are still offered by more than half of surveyed retailers.

Breakfast sandwiches are again the most commonly available prepared food item at c-stores (offered by 80% of retailers) despite dropping 10 points from last year. Chicken (73%) retook its No. 2 slot, with pizza (72%) rounding out the top three prepared food offerings.

Overall, most prepared food items experienced flat growth or declines in availability, indicating that retailers may be making some cuts but are not implementing major changes.

Convenience wholesalers, suppliers and foodservice distributors are the top sources for prepared food. However, use of company commissaries for heat-and-serve items saw a rebound after declining in use in 2023. Prepared food is pretty evenly split between being delivered ready to heat and serve (63%) and assembled in-store (61%).

Foodservice Financial Trends 2023 vs. 2022

Proprietary foodservice programs may generate the most buzz, but retailers aren’t turning their backs on branded partnerships. A sizable minority of study participants (34%) say they have a franchised/licensed concept in-store, up from 26% in last year’s study and 19% in 2022.

On the dispensed beverage side, hot coffee, carbonated fountain drinks and hot chocolate lead in availability, offered

46 Convenience Store News CSNEWS.com FOODSERVICE

OF TOTAL FOODSERVICE SALES

AVERAGE %

SALES COSTS PROFITS Increased Stayed the same Decreased 81% 58% 91% 13% 18% 6% 6% 24% 2% Breakfast Morning snack Lunch Afternoon snack Dinner Evening snack Late night 26% (6-8:59 a.m.) (9-10:59 a.m.) (11 a.m.-1:59 p.m.) (2-3:59 p.m.) (4-6:59 p.m.) (7-9:59 p.m.) (10 p.m. or later) 11% 30% 9% 14% 6% 4%

The brands you trust and customers love.

©2024 Tyson Foods, Inc. Trademarks and registered trademarks are owned by Tyson Foods, Inc. or its subsidiaries, or used under license. Hillshire Farm¨ J p ñ J p ñ Scan to see our products.

Have You Raised Foodservice Prices in the Past Year?

No, but am considering it

Yes, some items

No, and not considering it

94% of surveyed retailers raised their prices on at least some foodservice items in the past year.

by at least eight out of 10 retailers. Iced coffee saw a big jump from last year, increasing 12 points and now offered by approximately two-thirds of study participants. Other cold coffee types saw double-digit growth as well, including cold brew and iced specialty coffees, signaling that consumers are exploring new ways to get their daily java.

Made-to-order, barista-style beverage offerings held steady compared to last year’s Foodservice Study but remain rare, available at just 13% of surveyed retailers. Milkshakes and smoothies saw notable growth in availability year over year, yet they are still in the minority. Meanwhile, energy drink mixers and refreshers are carving out a place among made-to-order beverages.

The Financial Landscape Breakfast and lunch continue to be key dayparts for convenience stores with foodservice, as surveyed retailers estimate that 26% of their category sales come between 6 a.m. and 8:59 a.m. and 30% come between 11 a.m. and 1:59 p.m. Operators report that breakfast

Yes, across the board

saw the biggest sales growth in 2023. However, they predict lunch will see the most growth this year.

In last year’s study, retailers pegged the dinner daypart (4 p.m. to 6:59 p.m.) as the most likely to experience a sales decline. This year, study participants are less certain, with more than a quarter saying they are unsure which daypart is the most likely to struggle.

Eighty-one percent of respondents report that their foodservice sales overall increased in 2023, up from 72% who said the same in last year’s study. Just 13% say their 2023 sales decreased.

Costs, though, were also on the rise, with 91% reporting their costs increased in 2023. This marks the third year in a row that more than 90% of surveyed operators reported rising costs.

It is no surprise then that rising costs ate into foodservice profits last year: 58% of operators say their profits increased, down 8 points from a year ago when 66% reported higher profits.

In response to rising costs, the vast majority of c-store operators have instituted price increases, although not necessarily on everything. Just more than half of study participants (55%) report that they’ve raised prices across the board, while 39% raised prices on only some items.

Looking ahead, operators expect recent financial trends to continue. Nearly eight in 10 expect their foodservice sales to increase in 2024, and 72% expect their foodservice profits to rise. The average projected increase in sales and the average projected increase in profits are both 11%.

Numerous retailers cited economic conditions and rising costs pushing their prices up as reasons they anticipate steady or increased sales and profits this

48 Convenience Store News CSNEWS.com FOODSERVICE

3%

55%

3% 39%

02. GLASS DOOR SYSTEMS Exceptional value, robust performance and quality with superior product visibility for every environment. 01. REFRIGERATION SYSTEMS Complete line of self-contained and remote refrigeration solutions featuring CARB/AIM compliant natural refrigerants. 03. CUSTOM MILLWORK Counters designed to fit your unique foodservice needs and store footprint. 04. SELF-CONTAINED MERCHANDISERS Complete line of R-290 display cases. Just plug in and add merchandising where you need it most. 01 02 03 04 04 04 www.hussmann.com | 12999 Saint Charles Rock Rd., Bridgeton, MO 63044 | (314) 291-2000 contact: foodservice@hussmann.com Scan to explore our complete portfolio of solutions designed to elevate your guest experience Foodservice Partner More than 117 years of refrigerated merchandising innovations. Your Trusted

Anticipated

New limited-time o ers and promotions, and improved internal culture and employee buy-in were cited as reasons retailers have positive expectations for the year ahead.

Biggest Obstacles to Foodservice Success

*Added as a new response

“Prices have continued to stabilize, and we’re crossing our fingers employee turnover doesn’t have an extreme impact.”

— Study participant

year. Other operators, however, noted that they are starting to see improved pricing. Investments in their foodservice program’s menu and marketing are also viewed as contributors to better 2024 results.

“We’ve just launched an entirely new foodservice offer that is made-to-order, scratch recipes,” one study participant shared.

New limited-time offers and promotions, and improved internal culture and employee buy-in were also cited as reasons retailers have positive expectations for the year ahead.

When asked what could thwart their optimism, 73% of study participants pointed to hiring and retaining employees as the biggest obstacle to foodservice success. Although this figure dropped seven points year over year, it is still the most cited challenge by far.

Additionally, more than half of retailers point to supplier price increases (55%) and consumers having less disposable income (52%) as other top obstacles to foodservice success.

In a positive sign, the percentage of surveyed retailers citing the supply chain as a major obstacle dropped significantly, falling from 56% in last year’s study to 21% in this year’s study. Difficulty in finding the right products/programs also fell 10 points to just 18%. CSN

2024 2023 2022 Difficulty in hiring & retaining employees 73% 80% 75% Supplier price increases* 55% -Consumers have less disposable income* 52% -Increasing competition for foodservice business 37% 34% 22% Operational inefficiencies at store level 31% 38% 27% Lower foot traffic in stores 22% 21% 22% Supply chain 21% 56% 84% Finding the right products/programs 18% 28% 33% Negative consumer perceptions of c-store foodservice 12% 15% 19% Lack of alternative shopping options 10% 15% 16% Lack of available funding* 6% 2% -

50 Convenience Store News CSNEWS.com FOODSERVICE

Foodservice

Anticipated 2024

Sales

INCREASE STAY THE SAME DECREASE 72% INCREASE STAY THE SAME DECREASE 79% 15% 19% 6% 9%

2024 Foodservice Profits

Vapor Woes

Illicit market concerns grow as FDA confusion persists and states fill the void

By Renée M. Covino

THE VAPING PRODUCTS category is dimming as the black cloud of increasing illicit activity is overshadowed only by the black hole of continued U.S. Food & Drug Administration (FDA) regulatory confusion. It’s all adding up to blackmarket frustration for law-abiding convenience stores.