March/April 2024 Walmart’s Brick-and-Mortar Push Construction Trends Focus on Grocery-Anchored Centers NEW STORE STRATEGIES Flexibility, adaptability key to engaging today’s demanding consumers

19

CSA (USPS 054-410; ISSN 0193-1199), is published bimonthly by EnsembleIQ, 8550 W. Bryn Mawr Ave., Suite 225, Chicago, IL 60631, on a controlled basis to qualified retailer titles and architects. Real estate and shopping center owners and developers $75 per year. All other non-qualified in the United States: $96 one year; $186 two year; $17 single issue copy; Canada and Mexico: $138 one year; $258 two year; $19.20 single issue copy; Foreign: $138 one year; $258 two year; $16 single issue copy. Digital edition subscription: $55 one year digital; $105 two year digital. Periodicals postage paid at Chicago, IL and additional mailing offices. POSTMASTER: Please send address changes to CSA, Circulation Fulfillment Director, 8550 W. Bryn Mawr Ave, Suite 225, Chicago, IL 60631. Subscription changes may also be emailed to contact@chainstoreage.com, or call 1-877-687-7321. Vol. 99, No. 2, March/April 2024. Copyright ©2024 by EnsembleIQ. All rights reserved. CHAINSTOREAGE.COM MARCH/APRIL 2024 3 COVER STORY Adaptability and flexibility in store environments are key as retailers look to keep pace with today’s demanding consumers. 10 STORE SPACES 8 A look at how several retailers are driving customer engagement — and sales. 25 Trending Stores: Saks Fifth Avenue’s new West Coast flagship is designed as the ultimate luxury shopping experience. 27 Construction labor shortage shows no signs of stopping anytime soon. 16 Artificial intelligence tops list of facilities management trends.

Lighting rebate trends for 2024

Walmart doublesdown on physical retail with expansion plans. 26 Convenience-store chain J & H Family Stores streamlines maintenance with autonomous robotic floor scrubbers. 28

trends include efficient technology, protective equipment, drones, remote worksites, green building and more.

Tips for incorporating sound into the store include making sure song, artist and genre matches the retail brand.

18

14

Construction

24

Special section on Chain Store Age’s 60th annual SPECS Show features agenda and exhibitor listing.

tech viewpoint: a retail tech column VOL. 99 MARCH/APRIL NO. 2 6 from the editor’s desk Contents

35

31

Grocery-Anchored’s on the Go!

36

Academy Sports + Outdoors optimizes individual allocation and replenishment decisions with artificial intelligence.

37

With available space at an all-time low, a new class of brands (and investors) are heading to the sector that holds more square footage than malls, power centers, and strip centers combined. TECH

Retailers are leveraging technology to promote sustainability across the enterprise.

38

Livestream shopping: Q&A with Qurate’s Brian Beitler

4 MARCH/APRIL 2024 CHAINSTOREAGE.COM

31

REAL ESTATE 36 Contents VOL. 99 MARCH/APRIL NO. 2

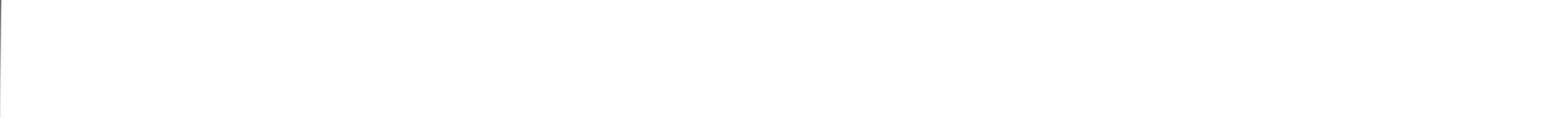

zipwall.com info@zipwall.com 800-718-2255 DUST BARRIER SYSTEM Stay Open for Business During a Renovation! ZipWall ® –A Temporary Dust Barrier in Minutes Up to 20' high Protects store from dust Conceals messy worksite Easy to set up and take down

Expansion-Minded Retailers

As consumers continue to focus on value and finding deals, it’s no big surprise that discounters and quick-serve restaurants have the most aggressive expansion programs in the industry. In fact, it’s been that way for some time — with no signs of stopping anytime soon.

A recent report by JLL found that discounters — primarily dollar stores (or extreme discounters) and other bargain chains — were among the top retailers that signed new leases during 2023, announcing more than 2,300 store openings. It cited Dollar Tree, Five Below, Burlington and TJ Maxx as being among the top 10 retailers for the most square footage signed.

Meanwhile, restaurants — primarily quick serve and fast casual — announced over 1,600 planned new locations.

A similar scenario is playing out this year. Dollar General plans to open 800 stores in 2024 (and remodel another 1,500). Five Below, which opened a record 204 net new stores in 2023, is expected to open about 255 stores as part of its long-term goal of 3,500 stores. With 510 stores, Ollie’s Bargain Outlet is also growing at a fast pace, as it targets a total of 1,050 stores.

Off-price Ross Stores, which opened 97 locations last year, is expected to keep up its aggressive pace — it sees the potential to grow to at least 2,900 Ross and 700 DDs Discounts stores. Another offpricer, Nordstrom Rack, keeps adding to its 2024/2025 new store lineup, with 25 locations announced as of press time.

In the convenience store sector, Wawa will open 70 new stores this year as it also enters three new states. Travel stop and c-store retailer Love’s Travel Stop plans to add 20 to 25 new locations and update 35 to 40 aging stores.

Outdoor and sporting goods retailers are also on an upward trajectory. REI plans to open 10 stores this year. Dick’s Sporting Goods anticipates opening 75 to 100 Dick’s House of Sport stores by 2027, up from its current 12 locations. International retailers also have their sights set on U.S. expansion. U.K.based WHSmith is on track to open more than 50 stores in airports across North America this year. Uniqlo has upped its openings this year to 20-plus. And while it hasn’t released details, China-based, value lifestyle retailer Miniso is gearing up to extend its footprint here after opening its 100th U.S. location. So is another Asian brand, Pop Mart.

Lots of other retailers, including some that may not be household names (at least not yet) also have robust expansion plans in place. Western-styled and work-related apparel and footwear retailer Boot Barn expects about 50 new stores, with the potential to grow to 900. Tractor Supply’s capital plans for 2024 include 80 new namesake stores and 10 to 15 Petsense by Tractor Supply locations.

On the quick-serve and fast-casual restaurant front, the list of expanding companies is too long to mention. It ranges from Playa Bowls, with 75 new shops on tap, to fast-growing drive-thru coffee chain Dutch Bros, which has its sights set on opening 150 to165 locations (on top of 159 last year). Powerhouse chain Chipotle will open 285 to 315 new eateries this year, with the bulk of the openings in the United States.

Finally, the nation’s largest retailer is also back in expansion mode. Walmart, which hasn’t opened a new store since fall 2021, recently announced plans to build or convert more than 150 largerformat stores during the next five years. (See story on pg. 14). The retailer is finalizing construction plans on 12 new projects it intends to start this year.

Marianne Wilson

Marianne Wilson

mwilson@chainstoreage.com

BRAND MANAGEMENT

Vice President & Group Publisher, SPECS Chairman Gary Esposito gesposito@ensembleiq.com

EDITORIAL

Editor Marianne Wilson mwilson@ensembleiq.com

Technology Editor Dan Berthiaume dberthiaume@ensembleiq.com

Real Estate Editor Al Urbanski aurbanski@ensembleiq.com

Online Editor Zachary Russell zrussell@ensembleiq.com

ADVERTISING SALES & BUSINESS

Midwest & South Sales Manager Michael Morrissey mmorrissey@ensembleiq.com

East & West Sales Manager Lise Slaviero Groh lgroh@ensembleiq.com

Real Estate Sales Manager Al Urbanski aurbanski@ensembleiq.com

EVENTS/MARKETING

Program Director Deena AmatoMcCoy damccoy@ensembleiq.com

Event Director Melissa Murphy mmurphy@ensembleiq.com

Event Coordinator Rita Ruzalski rruzalski@ensembleiq.com

Marketing & Event Administration Coordinator Farida Batuta fbatuta@ensembleiq.com

ART/PRODUCTION

Print Designer Catalina Gonzalez Carrasco cgonzalezcarrasco@ensembleiq.com

Production Manager Patricia Wisser pwisser@ensembleiq.com

SUBSCRIPTION SERVICES

List Rental mbriganti@anteriad.com

Subscription Questions contact@chainstoreage.com

CORPORATE OFFICERS

Chief Executive Officer Jennifer Litterick

Chief Financial Officer Jane Volland

Chief People Officer Ann Jadown

Chief Strategy Officer Joe Territo

Chief Operating Officer Derek Estey

FROM THE EDITOR’S DESK 8550 W. Bryn Mawr Ave., Suite 200, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 www.chainstoreage.com 6 MARCH/APRIL 2024 CHAINSTOREAGE.COM

Retail Reinvention

By Lori Zumwinkle

Much of modern retail is about managing constant change. But one thing that remains high on the agenda for retail is the crucial role stores play in driving engagement and sales. In New York City — a city where everything is famously bigger and better — some retailers are reinventing how they create engaging customer experiences to meet what shoppers are looking for — and expect —’ from retail stores.

Here are a few examples.

Exclusivity: The hype and exclusivity built up around Queens-born fashion and lifestyle brand Aime Leon Dore (ALD) can be felt before you even walk into the store. With a waitlist just to enter, customers are prepared to wait between 15 minutes on weekdays or up to two hours on the weekend.

Tucked behind the velvet green curtain lies the world of ALD, with moody lighting, wood paneling, Persian rugs and art that pays a homage to New York, ‘90s hip-hop and sports. The brand has been able to grow its community by capturing the hearts of streetwear aficionados and onlookers through collaborations with the likes of New Balance and Porsche.

An example of a company creating a store that emphasizes experiential elements and a focus on community is Rivian. The electric vehicle manufacturer’s family-friendly “Rivian Spaces” offers fun areas for exploration, from a wall dedicated to the ins-and-outs of EV charging to a map of where Rivian owners have traveled in their vehicles. It also has an area where customers can see customization options for their vehicles.

Destination shopping: Armed with the right data analytics, retailers can better tailor their layouts, in-store services, pricing and product assortments to customers. Key to this is thinking creatively and innovatively about what the future retail store can be — seeing it as not just a place to purchase products but a multipurpose

destination that offers a range of different experiences.

Petco’s flagship in the city’s Union Square area is a great example of a retailer reinventing the pet store concept. It has brought together an amalgamation of Petco’s partnerships and owned brands to create a hub that addresses the holistic needs of a pet.

The store includes a JustFoodForDogs Kitchen featuring fresh, human-grade dog meals; a full-service vet hospital; and a classic barbershop-inspired pet salon offering grooming services tailored to specific needs. The in-store Reddy Shop, dedicated to products from Petco’s owned brand, has a lounge area, fitting station and a customization zone for products. The store also offers dog training and an indoor park.

Apparel brand Reformation’s new high-tech SoHo flagship has only one of each item on display. Screens around the store let shoppers pick which merchandise they’re interested in. Clothing is brought into their fitting room in their size, and customers can use a touch screen to request a different size or item in a different color.

Driving engagement: Stores can also be a source of critical insights into local preferences, behaviors and purchase patterns. Swiss athletic brand On gives its customers and employees the data needed to help select the perfect running shoe by using its hidden gait-cycle analysis technology that compares key run attributes with a database of more than 52,000 runs. There is also custom-built invisible foot scanner to find a customer’s perfect size.

On also operates as a community hub by hosting classes, events and run clubs. These insights can then inform everything from forecasting and replenishing, to marketing campaigns and store design.

Driving sustainability: As more consumers embrace sustainable concepts in

their day-to-day shopping, we are starting to see major retailers sell refurbished or previously used products. Savvy retailers are driving this trend forward by making more refurbished products available in stores while educating shoppers through improved communication and signage.

Coachtopia was founded to advance Coach’s circular fashion system. The innovation lab, which has debuted in stores across the country, features a new line of products made from previously used materials and materials that might otherwise go to a landfill. Along with being a new way to shop, it provides a way for Coach to reduce its carbon footprint and work towards a zero-waste future.

The brand hosted a Coachtopia pop-up at its SoHo store in Aug 2023. It featured architectural elements that highlighted Coach’s “Made Circular” principles, with fixtures and seating made from Coach leather scraps and signage from upcycled materials.

Physical retail is here to stay. But the successful stores of the future are upgrading the in-store experience to retain a crucial role in building relationships, understanding customer behaviors and legitimizing the brand. Remembering that universal truth will be a critical factor as retailers reinvent their businesses for future growth.

STORE SPACES 8 MARCH/APRIL 2024 CHAINSTOREAGE.COM

and Accenture’s

North

lead.

Lori Zumwinkle is senior managing director

Retail

America

Dog grooming is among the services offered at the Petco flagship.

NEW STORE STRATEGIES

Flexibility, adaptability key to engaging today’s demanding consumers

By Debra Hazel

Remember the designs of jewelry stores, banks and even fashion shops, where the racks and cases were fixed to a strict plan? That’s so yesterday.

Driven by a more demanding consumer that expects experiences and not just merchandise in stores and a greater, data-fueled knowledge of consumers, savvy retailers are creating more flexible spaces that can easily adapt to the rollout of departments, services and in-store concepts.

Real estate strategies are also driving the trend. As retailers seek out new and often different types of locations, they have been forced to create more adaptable formats. Target Corp., for example, has had to adapt its model as it opens stores in college towns and urban centers.

“Flexibility is definitely a key component whether you’re doing Store 1 or Store 100,” said Melissa Gonzalez, a principal at MG2 Design.

It’s worth remembering that with so many commodity items available online for delivery to a shopper’s home, the role of a physical store in customers’ lives has changed. But that doesn’t mean its importance has lessened.

Indeed, despite the popularity of e-commerce, physical retail remains the backbone of the industry. By 2028, 72% of total U.S. retail sales will still be happening in a physical store, noted Lori B. Zumwinkle, managing director and North America retail practice lead at Accenture. And the appeal of brick-and-mortar extends to all ages, even the most digitally savvy.

“The younger generation wants to go to a physical store for an experience,” she said. “The store remains a great way to build a relationship with the customer.”

In a March 2022 survey of shoppers by digital signage firm Raydiant, the largest segment of respondents — 27.6% — cited the draw of in-store experiences as their primary reason for shopping in physical stores. But first, the retailer must understand what experiences the shopper wants and figure how to build the community they are seeking. It’s a huge and recent shift in the retail mindset — and one that designers must now accommodate, according to Zumwinkle.

“Before COVID hit, it was all about foot traffic,” she said. “Now, you need data and analytics to know who your customers

are as they enter the store. They may be buying online picking up in store or buying in store for in-home delivery.”

From adding cafés and holding special events to in-store popups and dedicated customization areas, retailers are reimagining stores to attract and engage consumers. All of this, however, makes flexibility more important than ever. It entails rethinking the fixturing and the materials within the store, and also accommodating landlord criteria (see sidebar).

MODULARITY

Among the key elements of a flexible and adaptable store are modular fixtures and displays that can be easily moved and rearranged. Modularity in fixturing can make it easier for a store to host events, display different types of merchandise or simply mix things up. It also can help a retailer maintain the same overall look despite many different configurations within locations.

One shift in retail management is helping retailers with regard to a more flexible layout. Because of home delivery, many stores are keeping less inventory up front, allowing more room for and between displays, as well as including a space for online order pickup.

“Retailers are taking a ‘less is more’ approach, with less merchandise on the floor of the store,” said Cynthia Ortiz, business development manager at MBH Architects. “This leads to a nice clean look, uncluttered, which can be quite an advantage.

You don’t need 50 of every shirt in every size and every color.”

The extra space can help retailers accommodate in-store events to build a sense of community or add new services. The key, say retail designers, is to utilize fixturing and displays that can be shifted as needed.

Gender-free clothing brand The Phluid Project, for example, opened a store in which the merchandise and brands changed every few months, as did the store layout. All the fixtures, including the mannequins, were on casters to make it easy to move to create different configurations, create a runway or to accent an event.

“The space was designed to be very flexible, and every couple of months it could be redesigned,” said Ortiz, who was not involved in the design.

10 MARCH/APRIL 2024 CHAINSTOREAGE.COM COVER STORY

Going one step further, fast-fashion giant H&M in late 2022 opened a temporary “rotating style” destination in Brooklyn, N.Y., that was updated with new fashions, visuals, events and neighborhood partners throughout the year.

Every four to 12 weeks, H&M unveiled a new “chapter,” bringing to life a new store concept “that moves at the speed of style,” the retailer said. At the same time, certain elements of the store remained consistent, such as a designated space for content capture.

Along with flexibility, sustainability has become a key factor in choosing materials — from a store’s concept phase to its going dark.

“More retailers are looking not just for the product to be sustainable but for a recycling program at the end of the store’s life,” Ortiz said. “Certain acrylics can be separated from the fixtures at the end of their life, completely broken down and reassembled into something new.”

BRANDING

But with need for flexibility, how do designers maintain a consistent brand appearance for a regional or national chain?

Color is a major factor. A suburban Target store can and arguably should be different in layout, merchandise offerings and more from an urban store or one in a college town. But the retailer’s signature — and instantly identifiable — red color is a constant. So are Best Buy’s blue-shirted employees. But it’s not always so easy.

MBH partnered with Outform to develop the concept design into the new state of the art Bucherer TimeMachine flagship in New York City. But the store also sells other luxury watches. Creating a unified space that sells an array of different brands was a challenge. But each of the numerous curated brand presentations corresponds to the design developed for Bucherer.

The same can also apply to any retailer that offers in-store shops.

“It’s about utilizing their colors without overutilizing the colors,” Ortiz said. “Your branding can come from many different things, including the imagery on the walls.”

DEALING WITH LANDLORDS

Flexibility in design within a store is all well and good — but designers must also accommodate the criteria set up by the landlords, who have more than one retail use and tenant to worry about.

“Retailers don’t need as much space, but still want a presence,” said Dominick Casale, principal at IMC Architecture. “They’re shrinking their spaces considerably.”

That can mean reconfiguring or adding more HVAC to accommodate a subdivided space, or even pulling a non-retail use into the mix. IMC recently retrofitted a former mailroom at One Dag Hammarskjold Plaza in New York City into a co ee shop to service the o ce building’s many tenants.

Fortunately, landlords have realized that they too have to be flexible in their re-use of space, whether their building is a retail center, o ce building or other.

“Landlords come to us with the tenants’ deliverables for the space,” said Casale. “We try to avoid any hard partitions and hard construction that’s secured to the floors. But in many ways, this fits with the more modern aesthetic — a polished concrete floor, a more neutral design and more exposed ceilings, as opposed to a hard ceiling with lighting.”

Main street retail is a “case by case” basis, according to Melissa Gonzalez, a principal at MG2 Design.

“With best-in-class buildings, they want experiences and storefronts that are more highly designed,” she said.

Retail centers may see one large former tenant, such as a Bed, Bath and Beyond, subdivided into several smaller boutiques. The designer must then deal with both the tenant criteria and the retailer’s needs. But even that must be flexible to deal with future re-leasing.

“Real estate has to think di erently,” said Lori B. Zumwinkle, managing director and North America Retail Practice lead at Accenture.

CHAINSTOREAGE.COM MARCH/APRIL 2024 11 COVER STORY

Bucherer’s new “TimeMachine” flagship in New York City

PHOTO: RICHARD CADAN

For other retailers, the brand is less about a look than about what it means to its customers. Known for its customer service, Nordstrom’s local store concept can change depending on the locale.

“When we were working with Nordstrom on these concepts, we knew these locations could have a nod to community, but the question was how much would be consistent with the brand, and how much could reflect the local aesthetic,” said MG2’s Gonzalez, adding it could be something as simple as the wallpaper in the fitting room.”

Contrary to what many think, being more flexible doesn’t necessarily mean more expensive, according to Gonzalez.

“When you’re building custom, yes,” she said. “But there is so much available off the shelf from companies that are making wonderful items for modularity.”

The key is to spotlight one or two areas amid the minimalist aesthetic, advised Dominick Casale, principal at IMC

Architecture.

“You spend a little more money in a certain area, and it’s more affordable,” he observed.

And it looks as though a more flexible design and point of view is here to stay — with rare exceptions.

“Certain institutional tenants and companies that have a very strong look may still spend that money in creating a more heavy, more rigid design,” Casale said.

For most retailers, however, the ability to change things up will be critical for branding, relationship-building and the bottom line.

“Customers are going to be more selective now than they’ve ever been,” Zumwinkle said. “So put a coffee shop in a store, or have a wine tasting at a grocery store. It’s all about building a relationship.”

Debra Hazel is a Las Vegas-based business writer.

TARGET’S FLEXIBLE STORE STRATEGY

To Target Corp., flexibility means the ability to operate stores in spaces of any size —including where a traditional store may not fit — and tailor them to serve the local community.

Twelve of the new stores featured Target’s larger format, which averages 125,000 sq. ft. and boasts an open layout, expanded assortment and large backrooms to support the chain’s same-day fulfillment services. The retailer went even bigger in Prosper and New Caney, Texas, and Yonkers, N.Y., with stores that averaged 135,000 sq. ft.

For dense city centers or college campuses, Target executed its smaller-format concept. It opened nine of these locations in 2023, ranging from Toomer’s Corner in Auburn, Ala. — a one-stop shop for local college students that came in a little under 20,000 sq.ft. — to a three-story location at Brooklyn Kings Plaza in New York City at just over 92,000 sq. ft.

Regardless of the size, Target’s new stores reflect their neighborhoods through localized assortments and decorative touches such as murals. The chain’s new store in Brooklyn, N.Y., for example, includes a mural of two famed natives, musician The Notorious

B.I.G. and singer and actress Aaliyah. Its store in the Inglewood section of Los Angeles celebrates the vibrant neighborhood.

At Target’s 30,000-sq.-ft. location in New York City’s Times Square, colorful mosaic tiles spell out “Times Square” on the lobby walls, while exposed ceilings and suspended steel panels are meant to channel the industrial vibe of a subway platform.

12 MARCH/APRIL 2024 CHAINSTOREAGE.COM COVER STORY

At nearly 150,000 sq. ft., Target’s larger-format stores are more than 20,000 sq. ft. larger than the chain’s average. (Credit: Target)

PHOTO: TARGET

BoothSPECS2024 #724

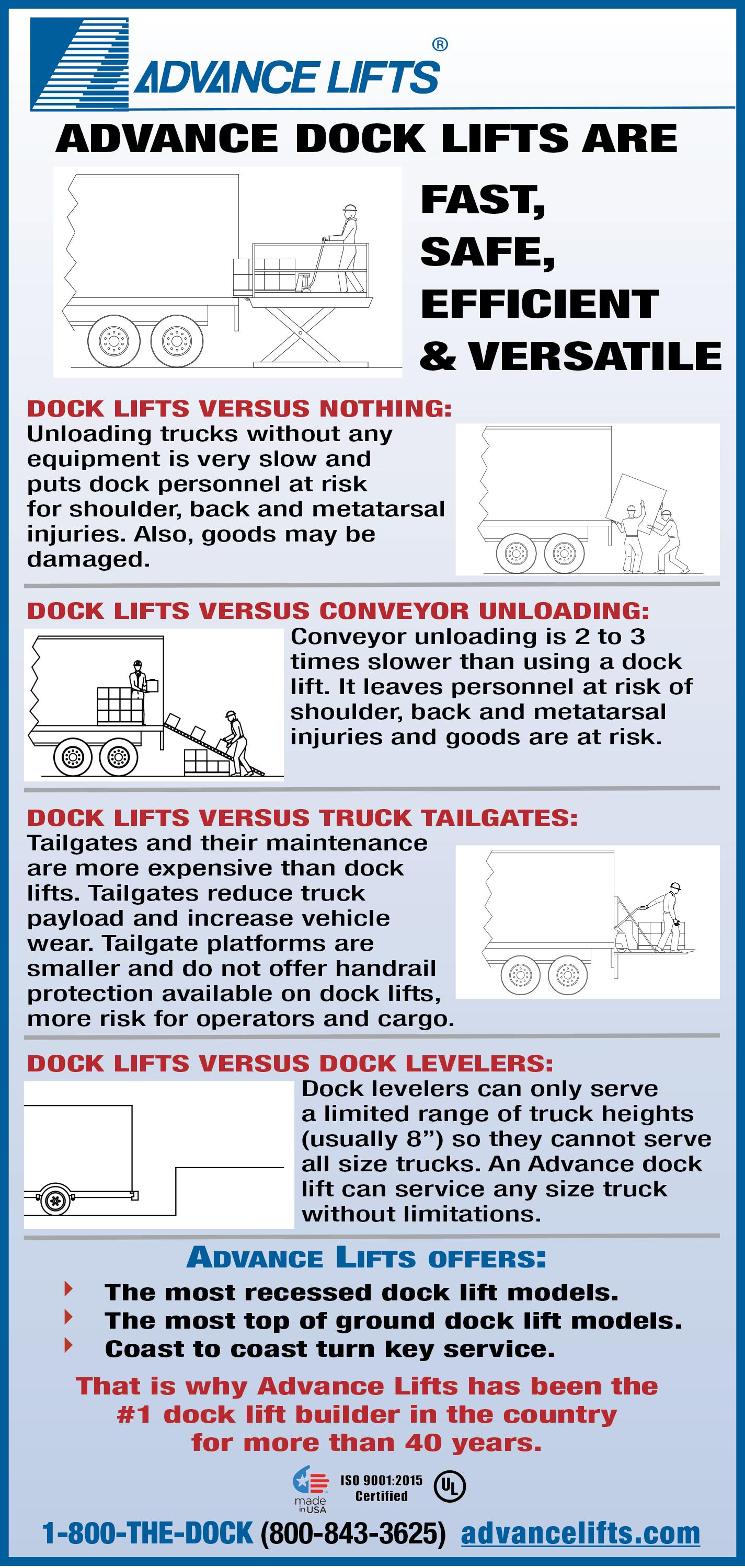

Walmart Doubles Down on Brick-and-Mortar

New builds will reflect ‘store of future’ concept

By Marianne Wilson

Walmart is moving back into brick-andmortar expansion — in a big way.

At a time when other retailers are cutting back, the retail giant is planning to build or convert more than 150 larger-format stores during the next five years, while also continuing its program to remodel existing locations. During the next 12 months, Walmart expects to remodel 650 stores across 47 states and Puerto Rico.

The retailer is finalizing construction plans on 12 new projects it intends to start this year, along with converting one of its smaller locations to a Walmart Supercenter. It also has two Neighborhood Markets set to open this spring, in Santa Rosa Beach, Fla., and Atlanta.

The expansion marks a big change for Walmart, which in 2016 said it planned to slow new store openings as its focus turned to boosting online sales. The chain hasn’t opened a new store since fall 2021.

Walmart’s new and remodeled stores will reflect its “store of the future” concept, which feature a more modern

look, with improved layouts, expanded product selections and technology to help employees better support customers and make shopping more convenient. (See sidebar for more details.)

“Customers love this concept in the places we’ve already rolled it out, and we’re excited to transition more and more of our fleet,” said Walmart U.S. president and CEO John Furner in a blog on the company’s website.

In addition, the new stores will be designed with sustainability in mind, including more energy-efficient equipment and lighting, lower impact refrigerants and more. Furner said Walmart it also is working on developing a coast-to-coast network of affordable electric vehicle fast-charging stations in hopes of making EV ownership “a more convenient and accessible choice for Walmart shoppers and associates.”

Sam’s Club: Walmart U.S. isn’t the only division of the company that is investing in brick-and-mortar. Sam’s Club, which hasn’t opened a new location in years, is planning to open more than 30 new locations across the U.S. during the next several years. The new Sam’s Clubs will average approximately 160,000 sq. ft., which is about 20,000 sq. ft. larger than most current locations.

Sustainability will also play a prominent role in Sam’s new locations. The company is designing future clubs with zero-emission strategies built in through electrification of equipment, including electric ovens, HVAC equipment, water heating systems, and low-emissions refrigeration systems.

Sam’s Club said the decision to expand its physical footprint was motivated by historic comparable sales growth and a record rise in membership during the past two years as it “continued to prioritize products and services that drive shopping trips and demonstrate the value of membership.”

Walmart’s Store Upgrade

Walmart’s “store of the future” concept is designed to deliver a more modern and convenient shopping experience, with updates that touch almost every area of the store. The refreshed exteriors and interiors feature new paint, new signs, new fixtures, LED lighting and and even more shopping carts. A new checkout design is based on customer feedback.

The format also boasts “activated” corners featuring novel displays that let customers interact with items. Other departments have pulled big and bulky merchandise from boxes so customers can touch, feel and visualize how the items will fit into their lives. Digital touchpoints are located throughout the store to provide more information on products and services.

The format also has more room. Walmart has created more space for customers to explore and discover what the store has to offer. It also has expanded the areas for its pickup and delivery business.

For easier customer access, many pharmacies are being located toward the front of the store, with new private screening rooms for pharmacist consultations and services.

Other features include a new dollar shop with seasonally relevant products, and a grab & go section that makes it easy for customers to grab a wrap, sandwich or a cold drink.

STORE SPACES 14 MARCH/APRIL 2024 CHAINSTOREAGE.COM

Walmart’s store of the future concept is designed to offer a more modern shopping experience

Every Tuesday

The premier newsletter showcasing technology and multi-channel, seamless retailing.

From e-commerce and mobility to in-store technology and social media, Connected Retail keeps retail executives in the know about the fast-paced, ever-evolving world of retail tech.

Sign up TODAY! www.chainstoreage.com/register

Facilities Management: Trends to Watch

AI, other technologies driving automation

By Brian Prendergast

Innovative technologies, such as artificial intelligence (AI) and machine learning, were center stage in 2023, giving notice to many industries — including facilities management (FM) — that innovation and disruption travel in pairs. While the wider societal impact of AI is under discussion, its future looks promising for facilities management, especially in areas of sustainability, asset management, predictive maintenance and capital replacement.

Technologies are enabling FM teams to do more with less and manage ever-growing work order volumes. In the coming year, such gains in efficiency and productivity will be needed to offset persistent FM problems of material and labor shortages and broken supply chains.

Here are the 2024 industry trends to watch from JLL Technologies’ team of FM experts.

AI AND MACHINE LEARNING WILL DRIVE GREATER EFFICIENCY IN FACILITIES MANAGEMENT

Just to level set, AI is a field of computer science associated with replicating human learning and problem solving. AI software and machines perform human-like tasks and learn from past experiences.

Machine learning (ML) is a subset of AI and generates recommendations that get better over time as data is progressively added to the machine algorithm. ML enables data-driven FM decisions and, in facilities management, creates efficiencies by strategically allocating FM spend for maximum ROI.

Together, the two technologies process vast amounts of data, recognize trends, patterns, and outliers — such as a spike in work order turnaround times. FM software powered by AI can automate time-consuming tasks with little to no human intervention, a welcome feature for understaffed FM teams. Repetitive tasks ready for software automation include:

• Approving work orders;

• Approving vendor quotes;

• Setting up predictive maintenance; and

• Analyzing FM spend

The result is a more efficient use of human resources along with time- and cost-savings and streamlined workflows. The automated self-monitoring of AI and machine learning frees up FM teams for higher priority work. AI insights enable teams to handle potential problems, like ordering replacement parts or equipment, before they grow in cost and complexity.

PREDICTIVE MAINTENANCE WILL GENERATE GREATER ASSET UPTIME AND EFFICIENCY

When IoT sensor data is connected to an FM platform, such as a computer maintenance management system (CMMS), the software automatically creates a work order and dispatches it to a designated service provider for repair or replacement.

IoT sensors track temperature, humidity, occupancy, foot traffic, refrigerant levels, vibration, water leaks, and more. Asset-heavy industries, like restaurant and grocery, use predictive maintenance to keep operations running smoothly by reducing the impact of equipment downtime on store revenue, customer experience, and business brand.

FACILITY MANAGERS WILL EXPECT CMMS INTEGRATIONS WITH OTHER TECHNOLOGIES

CMMS (computerized maintenance management systems) integrations focus on financial software, data management and BI systems, energy management systems and larger proptech platforms, such as ERP, CRM, and IWMS.

Technology also drives integration requests. That’s because technology is now capable of quickly identifying adverse conditions that were largely undetectable in the past, like equipment failure, early-warning wear and tear on motors,

engines, and compressors, refrigerant leaks, energy waste, etc. New access to operational data via innovative technologies enables FM teams to be far more proactive and forward-looking.

Professional FM software must include a flexible, open API for software integrations that generate time and cost savings and more efficient FM. Integrations with common business software programs facilitate financial and operational reporting up to the larger organization.

THE FACILITIES MANAGEMENT JOB ROLE WILL CONTINUE TO BE IN HIGH DEMAND

As technology blazes across many industries, including FM, disruption will be the new normal. Management will expect facility managers to be tech-savvy in order to capitalize on time- and cost-saving opportunities made possible with generative AI, business intelligence, and IoT.

The ever-expanding facility manager job role will grow even more in 2024, obliging FM professionals to keep up with the technologies changing the face of the FM industry. Facility managers should look for hands-on training and best practices from software providers and from colleagues presenting at industry conferences, which generally are more relevant and agile than, say, courses in higher education.

Record numbers of facility managers are taking retirement and exiting the FM workforce, causing an industry wide generational shift and leaving many FM teams understaffed. Meanwhile, work order volumes are returning to pre-pandemic levels, forcing teams to rely more heavily on technology, especially software automation, for keeping up with workloads.

Tech-savvy facility managers are in great demand because technology is enabling understaffed FM teams to be more productive. Younger members of the profession, often more comfortable with and interested in technology, should seize the opportunity to chart the trajectories of their own FM careers by becoming the FM technology experts of tomorrow.

Brian Prendergast is a senior content writer at JLL Technologies.

STORE SPACES 16 MARCH/APRIL 2024 CHAINSTOREAGE.COM

RETAIL’S TOP WOMEN

Call For

NOMINATIONS!

CSA is now accepting nominations for “Retail’s Top Women Awards” program, which is designed to put a spotlight on the achievements of female retail executives in the following categories: • Technology • Supply Chain • Store Development/ Facilities Management

Marketing • Finance

The program encompasses all sectors of the retail industry, including department stores, discounters, grocers, specialty stores, convenience stores, DTC brands and more.

All Retail’s Top Women winners will be recognized at a virtual awards celebration in June.

Only women who work in a senior executive role for a retail company are eligible for consideration.

Deadline for submissions: Friday, April 1, 2024

For more information or to submit your nomination(s), visit: chainstoreage.com/ nominate-retails-top-women

•

Lighting Rebate Trends

Rebate amounts for LEDs still going strong

By Marianne Wilson

Rebates are a win-win solution for retailers looking to offset the initial upfront costs involved in utilizing more energyefficient lighting solutions in existing locations as well as new ones.

During the last 15 years, the availability of commercial lighting rebate programs across the United States has fluctuated as the portion of the country covered by a lighting incentive varied between 42% to 79%.

The good news is that, this year, 78% of the country boasts access to a lighting incentive program, according to BriteSwitch. (The Princeton, N.J-based company helps retailers and other businesses find and take advantage of the many lighting rebate/ incentive programs in effect across the United States and Canada.)

The good news is tempered somewhat by the fact that commercial programs vary by state.

Generally speaking, the Northeast and Northwest are still the areas with the strongest incentives and good coverage, noted BriteSwitch, while California, Florida and Texas still have some of the worst rebate opportunities with very few programs — and the programs are usually very complex. States such as North Dakota and Kansas have no commercial lighting programs at all.

Millions of dollars in incentives are out there and available for projects, said BriteSwitch, whose web-based RebatePro for Lighting solution contains virtually every commercial lighting rebate and incentive across North America.

“For every project, you should look into the potential rebates and see how they will impact the payback of the upgrade,” the company stated.

Here is an update on top lighting rebate trends from BriteSwitch:

LEDs: Rebate amounts for 2024 are up 2% on average for LEDs and 5% for

controls. For most LED products, the average rebate across North America is near the highest recorded levels.

The best rebates are still for LED fixtures replacing HID fixtures such as high bays and pole lights — fixtures which typically cost the most and also offer the highest energy savings.

With the changes from the Energy Independence and Security Act (EISA) that went into effect in July 2023, it was expected that the rebate amounts for A19s, PARs, and downlights would decrease significantly, but to everyone’s surprise, they increased.

Networked Lighting Controls:

There’s been a lot of talk in the lighting industry about the savings potential of networked lighting controls (NLCs). While lighting has become more and more efficient over the years, these controls offer even more energy savings. But the extra cost and complexity of NLCs make them a tougher sell for many contractors and distributors. Thankfully, this year sees some improvement in the structure, availability and amounts of NLC incentives.

In 2024, 8% more utilities are offering a rebate specifically for NLCs. That means a majority of rebate programs in the U.S. have now written these controls specifically into their programs. For the other programs, NLC projects will typically qualify under a performance or custom program.

Standardization of NLC incentives has also increased this year. In 2024, 70%

of the rebates are now paid per fixture, rather than the more complex calculations like kWh saved, sq. ft., or connected watt. The type of rebate has also shifted, with 53% of NLC rebates being prescriptive, up from 44% last year.

In terms of dollar amounts, the average NLC rebate amount increased by 4% over 2023.

With a softer market for commercial lighting retrofits and many in the channel looking to diversify their interests in other markets, rebates are increasingly important. Incentive programs are more stable than ever, with near record-high dollar amounts. Millions of dollars in incentives are out there and available for your projects. For every project, you should look into the potential rebates and see how they will impact the payback of the upgrade.

Funding Stretches

Further: Historically, one of the big issues has been programs running out of funding before the program year is over. However, recent trends indicate a shift towards sustained funding. In 2023, less than 5% of programs ran out of funding before year end. In the late fall, when programs would typically announce their lack of funding, the announcements instead focused on bonus programs. These limited-time spiffs offered increases of 10-100% for some of the most common upgrades.

By the end of 2023, 22% of the programs provided some type of bonus. Some of these bonus programs have even continued into 2024. Right now, over 30 different bonus or trade ally programs are running, which is quite uncommon to see in the first quarter. One example is Georgia Power’s program which is offering a 50% bonus on all standard rebates through June 30.

For more on 2024 rebates, go to https://briteswitch. com/news/2024-lighting-rebate-trends.php

STORE SPACES 18 MARCH/APRIL 2024 CHAINSTOREAGE.COM

REIMAGINE. INNOVATE. EXECUTE.

Chain Store Age’s annual SPECS Show

MARCH 10-12

GAYLORD TEXAN | GRAPEVINE, TX

SPECS is the premier event for store planning, design, construction and facilities professionals. Now in its 60th year, SPECS offers targeted educational sessions, dynamic keynotes, a best-in-class exhibitor floor and networking opportunities.

INSIDE:

SPECS Agenda At-A-Glance

Exhibitor Listing

THE FOREFRONT OF PHYSICAL RETAIL

CHAINSTOREAGE.COM MARCH/APRIL 2024 19

SUNDAY, MARCH 10 1:00 PM - 2:00 PM Exhibitor Welcome Luncheon and Orientation Panel Discussion Tate 3 2:30 PM - 3:00 PM Retailer Orientation Panel Discussion Yellow Rose Ballroom

PM - 4:00 PM Retailer-Only Networking Reception Longhorn Exhibit Hall A Foyer

PM - 4:00 PM Exhibitor-Only Networking Reception Longhorn Exhibit Hall BCD 4:15 PM - 5:45 PM Solution Center/Exhibit Hall Open (Refreshments Served) Longhorn Exhibit Hall BCD 6:00 PM - 7:30 PM SPECS 2024 Welcome Reception Tate Ballroom B-C MONDAY, MARCH 11 7:30 AM - 8:00 AM Networking Breakfast Tate Ballroom B-C

AM - 9:00 AM Keynote Address - Gene Simmons, Rock legend, Hall of Famer and innovative entrepreneur Tate Ballroom B-C

AM - 10:35 AM THE MAIN STAGE presentation - Robert Siciliano, CEO, safr.me Tate 3 9:20 AM - 11:00 AM Face2Face: Retailer/Exhibitor Information Exchange Longhorn Exhibit Hall A 11:00 AM - 2:00 PM Solution Center/Exhibit Hall Open Lunch (12:00 PM - 1:00 PM) & Refreshments Served Longhorn Exhibit Hall BCD 5:30 PM - 6:30 PM Women in Retail Networking Reception Tate 3 6:30 PM - 8:00 PM SPECS 2024 Evening Reception Tate Ballroom B-C TRACKS CONSTRUCTION Mesilla 2 FACILITIES High Plains 1 STORE EXPERIENCES & DESIGN Escondido 2 TALENT High Plains 3 REAL ESTATE Texoma 2 2:20 PM - 3:10 PM RCA: Modular & Panelized Construction in Retail Technology Innovations for Facilities Managers Designing Stores to Deter Theft Creating an Empathetic and Emotionally Healthy Work Environment Top Retail Center Experiences 3:20 PM - 4:10 PM Innovative Materials Sourcing Prioritizing Indoor Air Quality Innovation: ForwardThinking Retail Design - Case Study Women In Store Development Using Non-Traditional Retail to Reinvent Vacant Spaces 4:20 PM - 5:10 PM ADA: Need-to-Know Updates for Retailers Solutions in Waste Reduction and Recycling Innovative Lighting Solutions Embracing Diversity & Inclusion in Retail: Driving Change Through Aligned Partnerships Strategizing Retail Store Growth In Today’s Market

20 MARCH/APRIL 2024 CHAINSTOREAGE.COM

3:00

3:00

8:00

9:20

AGENDA AT-A-GLANCE

AGENDA AT-A-GLANCE

7:30 AM - 8:05 AM

8:05 AM - 8:20 AM Breakout Retailers Awards Presentation Tate Ballroom B-C

8:20 AM - 9:20 AM

9:45 AM - 10:45 AM

Keynote Address - Ron Insana, senior analist and commentator at CNBC Tate Ballroom B-C

THE MAIN STAGE presentationMeet the Breakout Retailers Award Winners High Plains 3

9:45 AM - 11:25 AM Face2Face: Retailer/Exhibitor Information Exchange

11:30 AM - 2:00 PM

Permitting: Negotiating with Municipalities and Zoning Boards

THE

4:20

Store

From Construction to Facilities Using Digital Innovation for In-Store Engagement

Keeping Projects on Track Through Leadership Changes Partnering vs. Hiring: Communicating with Vendors

TUESDAY, MARCH 12

Networking Breakfast Tate Ballroom B-C

Longhorn Exhibit Hall A

PM

4:15 PM Exhibitor Wrap-up Meeting San Saba 4

Solution Center/Exhibit Hall Open Lunch (12:00 PM - 1:00 PM) & Refreshments Served Longhorn Exhibit Hall BCD 3:45

-

PM - 5:10 PM

PM

10:00

TRACKS CONSTRUCTION Mesilla 2 FACILITIES High Plains 1 STORE EXPERIENCES & DESIGN Escondido 2 TALENT High Plains 3 REAL ESTATE Texoma 2

PM

MAIN STAGE presentation - Steve Gilliland, Motivational speaker, businessman and author Tate 3 5:15 PM - 5:45 PM Retailer Wrap-up Meeting San Saba 4 6:30

-

PM SPECS 2024 Appreciation Party The Glass Cactus, on-site

2:20

- 3:10 PM Strategies for Successful Store Renovations

Making the Shift from Natural Gas to Electric: Engineering for the Future What’s New in Flooring Solving the Labor Issue in Store Construction and Maintenance Using Data to Drive Cost Savings and Efficiencies Across Departments 3:20 PM - 4:10 PM

Efficient

Turnover:

CHAINSTOREAGE.COM MARCH/APRIL 2024 21

LIST OF EXHIBITORS 1-800-Got-Junk? 233 1-800-Pack-Rat 831 Abby Solutions Group 600 Academy Fire Life Safety, LLC 232 ACT Construction 524 AD ART 313 Adore Floors, Inc. 118 Advanced Facility Solutions 115 All American Facility Maintenance, Inc. 806 ALL OUT Parking Lots 124 Ameritech Facilities Services 100 Apex Imaging Services 418 Asphalt Solutions, Inc. 101 Atlas Sign Industries 812 Axis Portable Air 813 Basics Group, Inc. 906 Bass Security 919 Benchmark Group 807 Benjamin Moore 303 Ben’s Asphalt, Inc. 330 BlueSky Paving 426 BOSS Facility Services, Inc. 815 Boston Retail Solutions 500 Bradley 930 Branded Group, Inc. 306 BrandPoint Services 527 Brinco Mechanical Management Services, Inc. 929 Broadway National Group 218 Buckeye International 112 Budderfly 326 Carrier Corporation 819 Case FMS 731 Century Fire Protection/Century 360 400 Chain Store Age 501 CleanLife, LLC 120 Colt Facility Maintenance 726 Command7 331 Concept Surfaces 215 Construction Specialties 900 Creative Materials Corporation 932 CS Hudson, LLC 732 Cummings Signs 401 Dedon 126 Direct Construction Company Limited 315 Division 9 Commercial, Inc. 201 DLC Management 131 Driveline Retail Merchandising 430 DW1 601 Dyson 318 EarthCam 912 Ecotrak Facility Management Software 106 EEA Consulting Engineers 625 Elite Facility Professionals, Inc. 200 EMCOR Facilities Services 119 Enterprise Signs 425 ES&A Sign and Awning 333 Excel Dryer 412 Exposed Design Group 833 Ezzi Signs, Inc. 519 Facility Solutions Group 818 Ferrandino & Son 424 FlexPost, Inc. 627 Floor & Decor Commercial 414 Franz Architects, Inc. 613 Freshco Retail Maintenance & Construction 324 G Group Construction Corp. 104 Global Facility Management & Construction, Inc. 512 GPRS 908 Graves Construction 721 Groom Construction Co., Inc. 907 Gsource Technologies 231 H.J. Martin and Son 506 Healy Construction Services, Inc. 803 Helios Service Partners 709 Herc Rentals 207 Heritage Fire Security 624 Hero Facility Services 903 HFA AE, Ltd 719 Identiti 933 IKIO LED Lighting 301 Image National, Inc. 533 Image One Industries 515 Immersion Data Solutions 801 Independent Floor Testing & Inspection, Inc. 433 Inside Edge Commercial Interior Services 618 iVueit 308 KFM 24/7 619 Lakeview Construction, Inc. 715 Laser Facility Management 409 Laticrete International 917 Lavi Industries 221 Legacy Group 700 Lennox Commercial 307 Let’s Pave | Let’s Roof 607 Life Safety Engineered Systems 113 Lightserve Corporation 913 Locknet 431 Madix, Inc. 103 MaintenX International 724 Matworks, The 213 Milliken Flooring 219 MMI Storage Solutions 225 NEST 712 NightFixx 602 N-STORE Services 530 On Target Maintenance 133 Pave America 925 PaveConnect National Paving Services 632 Persona - Triangle 413 Pivotal Retail Group, LLC 832 PMA Construction, LLC 814 PODS 320 PORCELANOSA 730 Principal Sloan 108 Pro Signs Company 327 ProCoat 620 Professional Retail Services 403 Progressive Flooring & Services 901 QDI Surfaces 319 Rabine Group 526 Randal Retail Group 531 Retail Contractors Association 427 RJB Contracting, Inc. 905 Rogers Electric 612 RoofConnect Logistics, LLC 630 Royal Signs & Awnings 918 Rubicon 707 Salzer Products LLC 507 Scopes Facility Services 212 Scout Services 827 SDI 706 ServiceChannel 702 SGA Design Group 203 Sheer Enterprises, Inc. 615 Shields Facilities Maintenance 521 SpaceLinks Enterprises 419 Speciality Lighting Group 130 Springfield Sign 110 Springwise Faciity Management 503 Stantec 825 Stratus 312 Tarkett 518 TCS Building Automation Systems 631 Toolkit Services 332 Total Comfort Group 920 Total Restroom 230 Triad Manufacturing, Inc. 733 TrueLook 924 W Services Group 300 Walker Property Services llc 830 Walton Signage, Ltd. 121 Window Film Depot 915 ZipWall 407 Zurn Elkay 116 First-time exhibitor 22 MARCH/APRIL 2024 CHAINSTOREAGE.COM

INTERESTED

Send

INTERESTED

Send

2025 Visit www.SPECSshow.com Exclusively produced by ChainStoreAge.com March 9-11, 2025 • Gaylord Texan Resort & Convention Center

ATTENEDING THIS EVENT?

IN

your

MMurphy@ChainStoreAge.com

request to

your

RRuzalski@ChainStoreAge.com

request to

EVENT?

IN EXHIBITING AT THIS

Making In-Store Music Count

Tips for incorporating sound into the customer experience

By Radhika Giri

In-store music remains a major driver of the customer shopping experience.

Music can impact shoppers’ moods, with 75% of shoppers noting they felt more relaxed in a retail store that plays music and 71% saying stores that play music have a better atmosphere overall [according to a report by CloudCoverMusic].

The selection and timing of music that retailers play for shoppers can significantly influence customer engagement with the brand, potentially impacting their overall perception and experience — for better or worse. Research from Mood Media found that 77% of Americans are more likely to wait in line to purchase if engaging music is playing.

But the process behind the music that customers hear while shopping is far more complex than plugging in a phone and streaming the retail manager’s personal playlist.

Here are key factors that retailers should consider to create welcoming environments that encourage longer visits and, ultimately, drive sales.

• Consider a reputable commercial music provider to manage licensing, security and more. No matter your business size, it’s illegal to stream music from a personal streaming account for commercial use and it can result in legal issues and fines. In order to play licensed music, you have to get licenses from professional rights organizations (PROs).

In the U.S., the main PROs are ASCAP, BMI and SESAC and each represents different songwriters, composers and music publishers. The terms and license fees can depend on a variety of factors, including the size and type of business, number of locations how often the music is played.

Negotiating terms, making timely payments, keeping extensive records and managing renewals can be complex and time-consuming for retailers. Instead, it’s

more practical for businesses to partner with a music streaming service that caters to businesses. These services typically have existing agreements with PROs, and the cost of licensing is included in their subscription fees. They simplify the process for retailers and ensure compliance and security.

• Ensure your sound experience aligns with your brand ethos: It is critical that the sound choices retailers make match their brand voice and feel authentic to their customers. It is more than just playing catchy tunes that shoppers can sing along to as they peruse the shelves. According to a study by HUI Research, for retail clients, overall sales increased by more than 9% by playing music that matches the brand.

The music played in-store becomes the soundtrack to the brand. Everything from genre to lyrics of the songs played in store should be considered. If a song, artist or style of music doesn’t match what you stand for as a brand, think twice about streaming it in your business.

consider working with a professional musicologist, someone who can ensure what your shoppers hear aligns with the moment and your brand voice.

Musicologists are legends in their field and know music inside and out. Some of the commercial music services have musicologists on staff and work closely with you to curate stations for your business that align with the brand, a mood, and so much more. This tailored human touch combined with the use of the right algorithm to further perfect a brand-specific experience is the best of art and science.

A robust platform offered by a commercial music provider to manage and control the content also helps consolidate a store manager’s many disparate tasks to create a seamless in-store experience. This includes changing stations, adjusting schedules for music, creating and incorporating messaging for in-store announcements, and more — considering one, multiple or all locations of a store at once. A centralized dashboard gives you the ability to keep the tunes going without losing efficiency.

"If a song, artist or style of music doesn’t match what you stand for as a brand, think twice about streaming it in your business."

I’ve heard from my clients directly the importance of music that aligns with their brand. Not having to monitor for explicit lyrics or worry about songs that don’t fit the brand sneaking into their playlist is key. Also, they’ve noted that when music is brand-aligned, the store environment feels more professional and vibrant.

• Make it easy on store managers to deliver a superior experience: It can be cumbersome to curate hundreds of songs for multiple playlists and then continue to keep these playlists updated. To ease this burden on store managers while ensuring an impeccable shopper experience,

• Be contextually relevant with your in-store entertainment: To create the best possible in-store experience, context is everything. The psychology of music is complex and what works with a consumer from one moment to another can shift quickly, so an agile approach to in-store sound that considers contextual factors such as surroundings, time of day and the weather will garner best results. Factors such as genre, tempo, volume and more all go into creating the in-store experience and can impact consumer behavior directly.

STORE SPACES 24 MARCH/APRIL 2024 CHAINSTOREAGE.COM

Radhika Giri is senior VP for emerging business at SiriusXM.

TRENDING STORES

The new Saks Fifth Avenue West Coast flagship in Beverly Hills is designed as the ultimate luxury shopping experience. Located in a space formerly home to Barneys New York, the six-level, 136,000-sq.-ft. women’s store features an array of luxury services, including an expanded Fifth Avenue Club for personal shopping and styling, complete with an exclusive outdoor terrace. Customers can refresh themselves while shopping with Californiainspired cocktails and wines, which can be purchased via QR codes located on each floor. The retailer’s store planning and design team collaborated with Arcadis (formerly CallisonRTKL) to transform the space. … Canada Goose has brought its signature “cold room” to Hawaii. The Canadian luxury outerwear and lifestyle brand’s new store at Ala Moana Center in Honolulu contains the company’s “Snow Room,” a dedicated space where customers can put its products to the ultimate test. The room simulates a snowfall with temperatures reaching as low as -10°F. … Asian toy and collectibles brand Pop Mart continues its U.S. expansion, opening at Westfield Valley Fair Mall, Santa Clara, Calif., and Westfield Century City, Los Angeles, with more locations to come. … Design Within Reach’s new 15,000-sq.-ft. outpost in San Francisco features feature rotating galleries that showcase interactive exhibits, special partnerships, new launches and exclusive

collaborations. While visiting the gallery spaces, customers can listen to playlists inspired by the history of progressive independent music from the Bay Area. Curated large-scale digital projects are on view throughout the space. … Digital Brands Group is moving into physical retail. The company, whose portfolio of digital-first lifestyle apparel brands includes Sundry and Bailey 44, plans to open 50 stores during the next several years. … Mattress, bedding and sleep retailer Casper debuted a new immersive format at its revamped store in South Coast Plaza, Costa Mesa, Calif. The reimagined features the brand’s first-ever “pillow lab,” a bedroom design shop and a “bunkhouse getaway” for kids to enjoy while their parents shop.

CHAINSTOREAGE.COM MARCH/APRIL 2024 25

Saks Fifth Avenue, Beverly Hills, Calif.

PHOTO: PETER CHRISTIANSEN VALLI FOR SAKS FIFTH AVENUE

J & H Family Stores Deploy Floor Cleaning Robots

Automated cleaning robots help improve labor retention|

By Dan Berthiaume

J & H Family Stores is streamlining some manual store maintenance tasks with automated robotic scrubbers.

The West Michigan-based convenience store retailer is rolling out autonomous robotic floor scrubbers from ICE Cobotics across its 75-plus stores. The subscription-based Cobi 18 robots can clean 5,000 to 7,000 square feet of floor space per hour and be deployed multiple times per day for cleaning.

The compact design of the robot allows it to navigate small spaces and tight aisles, and to move around objects, including cooler doors, in its path. To date, six Cobi 18 robots have been deployed across J & H locations.

With the rollout, the retailer aims to reduce the time store employees spend performing repetitive and mundane tasks, giving them more time to focus on customer service, stocking coolers and shelves, and making fresh food products for customers.

“Partnering with ICE Cobotics to bring autonomous cleaning into our stores has been a huge success,” said Loren Hoppen, COO, J & H Family Stores, Wyoming, Mich. “It has helped improve customer experience, employee retention, and labor expenses within the stores. Having the Cobi machine in the stores has allowed our team members to spend more time

with customers and improve customer experience. J & H Family Stores is excited to continue partnering with ICE Cobotics on ever more locations in the future.”

The Cobi robots are available through an all-inclusive subscription that includes service, parts, consumables, and technology updates at no additional charge.

J & H Family Stores is not the only convenience retailer to deploy the Cobi 18 robots to automate previously manual floor cleaning tasks. Regional Southeastern convenience retailer RaceTrac, Iowa-based Kum & Go, and Phillips 66 are all using the autonomous floor scrubbers in select store locations.

26 MARCH/APRIL 2024 CHAINSTOREAGE.COM

STORE SPACES

The Cobi 18 robots can navigate small spaces and tight aisles

Construction Labor Shortage

Industry needs more than 500,000 workers

By Marianne Wilson

The construction industry’s labor crunch shows no signs of stopping anytime soon.

The industry will need to attract an estimated 501,000 additional workers on top of the normal pace of hiring in 2024 to meet the demand for labor, according to a proprietary model developed by Associated Builders and Contractors.

Looking ahead to 2025, the industry will need to bring in nearly 454,000 new workers on top of normal hiring to meet construction demand, and that’s presuming that construction spending growth slows significantly next year.

“ABC estimates that the U.S. construction industry needs to attract about a half million new workers in 2024 to balance supply and demand,” said Michael Bellaman, ABC president and CEO. “Not addressing the

shortage through an all-of-the-above approach to workforce development will slow improvements to our shared built environment, worker productivity, living standards and the places where we heal, learn, play, work and gather.”

The U.S. construction industry unemployment rate averaged 4.6% for the second straight year in 2023, matching the secondlowest level on record, while job openings remained historically elevated at an average of 377,000 per month through the first 11 months of 2023. Due to labor shortages, contractors laid off workers at a slower rate than in any year between the start of the data series in 2000 and 2020.

“Broadly, there are two factors shaping the interaction between construction worker supply and demand,” said ABC chief

economist Anirban Basu. “There are structural factors, including outsized retirement levels, mega projects in several private and public construction segments and cultural factors that encourage too few young people to enter the skilled construction trades. There are also structural factors, including those related to interest rates, consumer sentiment and general economic performance.”

More than one-in-five construction workers are 55 or older, meaning that retirement will continue to contract the industry’s workforce.

“These are the most experienced workers, and their departures are especially concerning,” Basu noted.

ABC says its model uses the historical relationship between inflation-adjusted construction spending growth, sourced from the U.S. Census Bureau’s Value of Construction Put in Place Survey, and payroll construction employment, sourced from the U.S. Bureau of Labor Statistics, to convert anticipated increases in construction outlays into demand for labor at a rate of approximately 3,550 jobs per billion dollars of additional spending.

CHAINSTOREAGE.COM MARCH/APRIL 2024 27

STORE SPACES

π SHIPPING SUPPL PECIALISTS HUGE SELECTION ALWA S IN STOC IN 13 LOCATIONS COMPLETE CATALOG 1-800-295-5510 uline.com ORDER B OR SAME DA HIPPING

Construction Trends for 2024

Drones remain one of fastest-growing trends

New technology continues to change the construction site, improve the ability to win projects and increase profit margins.

“Trends and movements are changing the roles of industry professionals and frontline workers,” said Anna Sork, director of marketing at BigRentz, a leading construction industry technology solution and the nation’s largest construction equipment rental company.

Sork shared the following “must-watch” construction trends for 2024.

1PROTECTIVE EQUIPMENT

The COVID-19 pandemic drastically impacted the construction industry, already affecting construction site guidelines by way of updated state regulations emphasizing cleanliness and strict safety protocols. This also includes increased union influence in projects, possibly adding cost and time to projects.

The industry is also witnessing a rise of machines capable of identifying common safety issues and eliminating those threats one at a time. Wearable innovations are making their way to the job site with work boots that connect to Wi-Fi and alert others if a person has fallen.

Material-moving “mules” transport heavy or hazardous materials, and tasked robots construct scaffolding or lay bricks autonomously. Headsets can even actively reduce noise pollution while keeping workers in tune with their surroundings.

Beyond worker gear, we are already seeing robots that fully replace certain human workers. More accurately than “replacing” humans, these robots are changing the jobs humans do — in most cases, they’re augmenting human decision-making (like deciphering and translating data findings into actionable insights) and making room for different, higher-level jobs.

Reliance on 3D printing continues to skyrocket, resulting in decreased transportation risks, and environmental sensors that detect noise, heat and wind at construction sites and provide warnings to evacuate construction workers and move costly construction equipment in the event of an emergency or natural disaster.

2EFFICIENT TECHNOLOGY

The biggest differentiator for builders and developers continues to be technology in construction — specifically, the innovations that can enhance efficiency.

These are a few types of tech that will only increase in popularity going forward:

Smart contracts: Smart contracts offer all organizations in a project a shared system to do business, allowing them to buy, track and pay for services.

Rather than getting contracts and tracking deliverables from separate parties, firms can use smart contacts as an all-in-one tracking system where rules and deadlines are set and the blockchain enforces them. This system will make for faster closeouts, increased security, better project tracking and an automated supply chain.

Construction drones: Drone use in the construction industry continues to be one of the fastest-growing trends. The technology offers far more uses than just aerial photography for real estate commercial efforts.

Today’s drones are used for rapidly mapping large areas over long distances, producing valuable aerial heat maps and thermal images. The advancing drone software provides real-time, actionable data that can be used for rapid decisionmaking, further streamlining the entire construction process.

Personal safety and equipment loss continue to be the biggest liabilities in construction. Drones can perform jobs in place of human workers to prevent injury, such as jobs requiring scaling supertall structures. As on-site security tools, drones can be leveraged to reduce labor costs and minimize the risk of theft, keeping projects on schedule and minimizing hiccups.

More advanced future uses include monitoring equipment depreciation and incorporating artificial intelligence (AI) to organize moving construction equipment.

Augmented reality (AR): On the client front, AR means efficient project-staging, and making preconstruction projects tangible for buyers and tenants.

For builders and developers, AR facilitates the use of wearable technology and 360-degree video to enable:

• 3D visualization of future projects on their surrounding environment;

• Automated measuring of buildings;

• Fast and affordable simulation of architectural and structural changes; and

• Safety training and hazard simulations.

Building information modeling (BIM): BIM technology is helping industry leaders stand out with improved efficiency. It allows users to generate computer renderings of buildings and utilities.

28 MARCH/APRIL 2024 CHAINSTOREAGE.COM

STORE SPACES

The ease of managing these models and sharing data can enable superior prefabrication of parts, leading to on-time and accurate completion.

3GROWING NEED FOR LABORERS

One of the most noticeable construction trends of the past few years is a vast increase in the demand for labor. Quality labor is expensive and competitive, though robots do pick up a lot of the slack.

Despite these robots’ best efforts, we will need more educated workers to manage and interpret the data produced by new technology. Fortunately, women are stepping in to fill more competitive roles.

The industry is also targeting Generation Z, born between 1995 and 2010, in recruiting efforts. In the past, negative perceptions of trade schools were detrimental to efforts to hire new talent in construction.

The COVID-19 pandemic caused a shift in attitudes toward alternative education options and resulted in increased positive attitudes toward trade school, positioning construction firms to show off the career growth potential in their industry and the abundant opportunities to experiment with new technologies.

4REMOTE WORKSITES AND MOBILE ACCESS

Mobile applications in the construction industry allow worksite access

like never before, including real-time inspections, on-site accountability and accurate measurements taken from a mobile phone camera.

COVID-19 mandated that teams continue to collaborate without physical access to materials, spaces or even other teammates. Those without complete mobile connectivity will be at a productivity and sales disadvantage going forward.

5

RISING MATERIAL COSTS

Rising interest rates are likely to compound all types of costs, resulting in further pressure on total construction. Technologies like drones, AR and BIM will be key in helping to maintain project volume and combat this cost pressure.

Innovative living materials may push up costs further, even though they ultimately provide more savings for users in the long run. Some of these innovative materials include self-healing concrete, 3D graphene, transparent aluminum, light emitting concrete and invisible solar cells.

6GREEN BUILDING

Green construction is the expected standard for homebuyers, renters and commercial tenants. Unfortunately, many sustainable and eco-friendly features remain a luxury, despite their long-term savings — though this will change over the next decade as ecotech and sustainable construction become more mainstream.

Green construction includes both the technology to lower a building’s carbon footprint and the use of resources and building models to reduce the use of resources. Perhaps an even greater driver of green building is proof of its value for occupants. Research shows that green buildings can have a positive psychological and physiological impact on inhabitants and even passersby.

Greenscaping, the practice of outfitting rooftops with plant coverings and small parks, is now commonplace in urban centers around the globe, exemplified by Google’s multitiered London headquarters. The developers deemed the

project a “landscraper,” a building with similar dimensions to a skyscraper but built horizontally rather than vertically. This enables vast greenscapes to cover the structure while also improving its resistance to high-powered storms driven by climate change.

7

MODULAR AND OFFSITE CONSTRUCTION

Modular and prefab construction is in the middle of a multiyear boom that isn’t showing signs of slowing down. The modular construction market, led by the residential sector, is predicted to balloon in value to almost $110 billion by 2025, driven by a lack of skilled labor and an increase in cost-cutting technology.

Modular projects offer the ability to better regulate employee safety in climate-controlled, ventilated environments, making them ideal for those who want to maintain social distancing practices.

New technology enables these prefab and modular buildings to grow larger than ever before.

8

CONSTRUCTION MANAGEMENT SOFTWARE

Comprehensive construction management software is a vital tool for remaining competitive, building a valuable business and mastering operational efficiency.

While each software service differs slightly in features and offerings, the best ones tackle end-to-end needs from RFIs to compiling data, sharing files with mobile teams, budgeting, document storage, payroll and HR, and inventory monitoring.

Choosing the right construction management software is important for your firm. Begin with looking at ease of use and integration with other existing software. Look for scalable software that fits right now, but also will help manage your needs as those needs multiply. Evaluate customization options, upgrades and additional features, and check for availability of support and training to get up and running.

CHAINSTOREAGE.COM MARCH/APRIL 2024 29

BUSINESS BRING IT ON. 2

If

Your industry. Your agency.

ensembleiq.com/marketing | brandlab@ensembleiq.com

you’re competing in B2B you need a strategic creative partner that knows your industry inside and out. Only EnsembleIQ’s BrandLab offers full-service marketing capabilities and deep experience across retail, CPG, and technology, infused with industry knowledge and marketing intelligence.

Grocery-Anchored’s on the Go!

With available space at an all-time low, a new class of brands (and investors) are heading to the sector that holds more square footage than malls, power centers, and strip centers combined.

By Al Urbanski

In its 2024 U.S. Real Estate Outlook, CBRE predicted that available retail space in the United States would continue to decline by 20 basis points to 4.6%, the lowest rate recorded since real estate service and research firms began tracking it nearly 20 years ago. That leaves expanding retail chains competing aggressively for spots.

JLL’s recent tally of plans announced by national chains found them aiming to close 4,412 stores in 2024--but opening 6,617 new ones. In February, New Jersey-based Levin Management surveyed store managers in its 125-property portfolio and learned that 30% of them anticipate opening additional locations this year—the highest percentage logged in the annual survey since 2017.

The shopping center sector that many of these brands—mallcentered mainstays like Sephora and quickly growing food-andbeverage players such as Cava—are moving into these days are often grocery-anchored neighborhood centers. Why?

One reason is that they’re everywhere, penetrating any geographic or demographic target a brand is looking to penetrate.

According to JLL, these broadly dispersed centers account for 3 billion sq. ft. of retail space inventory in the U.S. That’s 500 million sq. ft. more of gross leaseable area than the mall, power center, and strip center sectors combined.

JLL reported that, during 2023’s fourth quarter, absorption in its shopping center category—which includes neighborhood, community, and strip centers--surged by 37.5% from the previous quarter. At neighborhood centers, specifically, brands filling the most space included VASA Fitness, Ace Hardware, Hibbett Sports, First Watch, and F45 Fitness.

Investors, too, have taken notice of the upward movement of tenant curations (and rents) in such centers. In the multi-tenant retail space last year, the grocery-anchored sector comprised the largest market share of transaction by volume at just over $7 billion—more than 20% of total volume.

With historic brand activity afoot in in retail real estate’s largest sector, Chain Store Age asked senior executives from some of the biggest owner-operators to reveal to us what new was cooking at grocery-anchored centers.

“Iwas on a tour at one of our Florida assets with an investor. My first comment was that Kmart and Food Lion had long been our anchors at the center. Now they are Trader Joe’s, Home Depot, Ulta, and Nordstrom Rack,” said Alan Roth, COO of Regency Centers, the Jacksonvillebased owner-operator of more than 480 neighborhood and open-air centers nationwide, ranging from the 46,000-sq.ft, Grocery Outlet-anchored Allen Street Shopping Center in Allentown, Pa., to the 360,000-sq.-ft. Applewood Village center in the Denver metro whose key tenants include King Soopers, Hobby Lobby, and HomeGoods.

Regency Centers follows a tenant curation strategy it calls “Fresh Look,” which relies upon local consumer research and interaction with municipal officials to enhance traffic and activity within

REAL ESTATE CHAINSTOREAGE.COM MARCH/APRIL 2024 31

The Cava at Regency Centers’ Belmont Chase center in Virginia. Cava went public last year, raised $318 million, and plans on having 1,000 stores in place by 2032.

“Kmart and Food Lion had long been our anchors at one center. Now they are Trader Joe’s, Home Depot, Ulta, and Nordstrom Rack.”

Alan Roth, Regency Centers

its centers. A good example of how the program works happened at a fairly recent Regency acquisition in the upscale Atlanta suburb of Dunwoody.

The Fresh Market and Walgreens anchors at the 40-year-old Dunwoody Village historically logged high-volume business at the center, but several vacant spaces dotted the interior line of shops. Regency upgraded store façades, a courtyard was created, lighting was improved, and soft seating and music were added. But the biggest re-igniter of Dunwoody Village’s relationship with the community came from one of its members.

Feeling that the town was devoid of hangouts, local restaurateur David Abes approached Regency with a plan to line its new courtyard with food and beverage establishments. His first location, Bar(n), serves up fresh oysters and smoked salmon and puts on wine and whiskey tastings. Folks line up for tables on weekends, and Abes has plans for a second restaurant.

“Funwoody” was born, and Dunwoody Village, whose business had always tended to slow down after 2:00, had a nightlife.

“The biggest thing we’re seeing across our centers is that, during the weekdays, traffic has been higher and we’re seeing more traffic in different dayparts,” noted Roth. “And it’s not just yoga class at 10. It’s more trips and frequency throughout the day.”

When it comes to new uses in groceryanchored centers, no tenant sector seems to be outpacing medical.

“Urgent cares, physical therapy, veterinarians, dentists, orthodontists, chiropractors—so many different medtailers are coming into our centers,” said Ron Meyers, the senior VP of leasing for Cincinnati-based Phillips Edison & Company, which owns and operates more than 300 grocery-anchored neighborhood shopping centers across the U.S.

“I continue to preach that our centers are closest to the neighborhoods with lots of kids and pets. It’s a growing and robust category in which we see great renewal spreads and retention,” Meyers noted.