ANOTHER ONE BITES THE DUST

LAURA MCGUIRE

THE PROTRACTED battle to save more than 10,000 jobs across Wilko’s high street stores appeared lost last night after a potential white knight pulled out of a rescue deal.

The discounter has been teetering on the brink for weeks, with administrators PwC almost brokering a deal with Canadian retail entrepreneur Doug Putman, who pulled off a similar bailout with HMV several years ago.

PwC confirmed last night that redundancies will begin this week, with warehousing staff finishing on Friday and most stores closing in September or October.

Zelf Hussain, joint administrator at PwC, said it was still looking for buyers for “different parts” of the business.

“Despite the significant and intensive efforts of both ourselves and Putman Investments – the remaining party interested in buying a significant part of the business as a going concern – a

transaction could not be progressed due to the inability to reduce central infrastructure costs quickly enough to make a deal commercially viable,” he said.

Poundland, owned by London-listed Pepco, is expected to pick up around 100 stores, whilst other high street chains are also said to be interested in buying the brand.

A cocktail of dwindling demand for physical stores and competition in the discount market appeared to mark

Wilko’s card, with savvy shoppers increasingly looking to rivals B&M and Poundland.

Questions will now be asked about the family-owned retailer’s finances. It emerged last week that the firm paid out a total of £77m to directors and shareholders in the decade leading up to its collapse.

Wilko is the latest household name to head for the retail scrapheap –joining Debenhams, Topshop and Woolworth’s amongst a raft of others.

BANG

BANG

City grandees say London at ‘tipping point’

CHRIS DORRELL

CHRIS DORRELL

THE CITY of London is at an “inflection point”, with nearly two thirds of financial services leaders warning that the City’s star will wane without intervention.

According to Lloyds Bank’s financial institutions sentiment survey, 64 per cent of sector leaders think that the City will stagnate as a global financial centre compared to rivals.

Lisa Francis, managing director, institutional at Lloyds Bank Corporate and Institutional Banking, said:

“The City of London’s status as a leading financial centre is at an inflection point.”

A moribund IPO market and concerns about a lack of investment –which some link to Brexit –has created something of a crisis of confidence in what is still, by some distance, Europe’s largest financial hub.

A raft of reforms to listings, pension fund investment and even the research environment are on the way to give fresh energy to the capital.

A spokesperson for UK Finance said the government needed to commit to making the capital as “open” as possible.

TUESDAY 12 SEPTEMBER 2023 ISSUE 4,045 FREE CITYAM.COM

BIG

2.0?

PAPER | ONLINE | AND NOW APP DOWNLOAD YOUR FREE APP TODAY CITY AM'S NEW APP IN YOUR HANDS INSIDE LIME WATCHING IPO MARKET ‘VERY, VERY CLOSELY’ P3 FCA LAUNCHES NEW CLAMPDOWN ON MARKETING P6 MARKETS P13 WE DRIVE THE BUDGET BENTLEY P17 SPORT P19-20 5G CALLING? VODAFONE EXEC AHMED ESSAM REVEALS HIS HOPES FOR THREE TIE-UP P9 BUSINESS WITH PERSONALITY WILKO TO CLOSE AFTER HMV ENTREPRENEUR PULLS OUT OF RESCUE DEAL MILLER TIME CELEBS JOIN TRADERS ON THE FLOOR AT BGC’S 9/11 CHARITY DAY P7

STANDING UP FOR THE CITY

A remarkable effort to turn grim tragedy into something positive

More than two decades on, the sheer visceral terror of the September 11 attacks continues to linger. Few working in the City then, in a world of global finance, did not know someone caught up by the assault on New York in some way. In the world before immediate smartphone communication, those were anxious days waiting for news. For too many, the news, when it came, was awful.

THE CITY VIEW

It is to the eternal credit of the team at BGC Partners that they have turned the darkest day in their firm’s history into a celebration of charity and good causes. Then Cantor Fitzgerald, the firm lost hundreds of people on that awful day. A hundred or

so of those who were on the floor yesterday, joking with celebrities and bantering with footballers both friendly and foe, were on the floor back in 2001, too. As boss Sean Windeatt put it delicately yesterday, the day comes with ‘private thoughts’ –and then it’s all upbeat smiles and cheers as the cash rolls in. The millions BGC have raised since 2001, first for the families of those affected by the tragedy and then for local, smaller charities,

have been transformative.

The role of corporates in UK philanthropy is often overlooked, and the City and Canary Wharf’s contribution doubly so.

But between the Lord Mayor’s Appeal, ICAP’s giving day and of course the BGC spectacular, there are plenty of signs of the Square Mile’s desire to contribute to the communities around them. In a cost of living crisis, that will become only more important.

Of course, the City’s purpose is

ISRAEL PROTESTS Demonstrators yesterday gathered outside the Supreme Court in Israel to protest the nationalist coalition government’s judicial overhaul plan

itself a social good, too. For all the negative headlines, it’s fundamentally a place that millions of people here rely on to provide them banking services, insurance when life takes a turn and a secure retirement. As we head into an election campaign, it’s inevitable that the City will feel a punch or two: but let’s not forget that what happens here, for the most part, is for the greater good –whether people realise it or not.

WHAT THE OTHER PAPERS SAY THIS MORNING

THE TELEGRAPH

AI SUPERCOMPUTERS COULD BOOST TESLA VALUATION BY $480BN, CITY PREDICTS

Tesla shares have surged after a Wall Street bank predicted that the electric car company’s value would rise above $1.2 trillion (£958bn) because of investments in an artificial intelligence supercomputer.

THE GUARDIAN MORE ENGLISH COUNCILS EXPECTED TO FAIL OWING BILLIONS OF POUNDS, WARNS MOODY’S

More English councils are expected to fail, owing billions of pounds in debts, a leading credit rating agency has warned amid an escalating crisis for local government after years of budget cuts and mismanagement.

THE FINANCIAL TIMES SENIOR UK MINISTER SAYS ‘STRONG CASE’ FOR NEW ACTION AGAINST CHINA

A senior UK minister said on Monday there was “a strong case” for tough new action against Beijing, amid cabinet tensions over how to deal with China following a spying scandal at Westminster.

Chancellor Jeremy Hunt: No tax cuts on the cards before next general election

JESSICA FRANK-KEYES

JEREMY HUNT has hinted that tax cuts are unlikely to be on offer before the next general election after warning that inflation had proved “stickier than was forecast”.

The Chancellor told Bloomberg that he did not expect to have more fiscal headroom at the Autumn Statement compared with the Spring Budget.

Speaking to Bloomberg TV, Hunt said:

“I think it’s unlikely because since the Spring Budget, when the last numbers were published, we’ve seen inflation

stickier than was forecast at the time and that means debt interest payments are higher.

“But we don’t have the numbers yet from the Office for Budget Responsibility (OBR) so this is speculation for you and me both.”

His comments come in the wake of reports that the Treasury is considering squeezing benefits in an attempt to pay for tax cuts in a boon to voters –set to spark a Tory row.

In a suggestion that tax cuts were unlikely, he added: “But our priority is bringing down inflation and when

you’re trying to bring down inflation you have to be really careful not to pump extra money into the economy; much as you would like to, not to pump extra money into people’s pockets because that can push up prices and keep inflation higher for longer.

“The one thing I can absolutely say is that our focus at the Autumn Statement will be on

Hunt said there would be little room for cuts

bringing down inflation and delivering both the Prime Minister’s goal to halve inflation and the Bank of England’s target to bring it down to two per cent.”

Hunt also praised the Bank for being one of the first central banks globally to raise interest rates.

The comments also came after face-toface talks with Indian finance minister Nirmala

Sitharaman in Delhi yesterday, with Hunt commenting on the prospects of a UK-India trade deal.

The Chancellor said both sides were keen to “unlock more ability” for investment and cited a “real political momentum”. A deal could be done by the end of 2023, he said, but the next few weeks were critical.

India’s plans for “India’s Silicon Valley” in Bangalore were key collaboration opportunities for the UK, Hunt said, with Indian firms also set to explore listing internationally on the UK’s London Stock Exchange.

CITYAM.COM 02 TUESDAY 12 SEPTEMBER 2023 NEWS

Profitable Lime watching IPO market ‘closely’

THECEO of e-scooter giant Lime has said the company is watching the IPO market “very, very closely” ahead of a potential listing next year or the year after.

Speaking to City A.M., Lime boss Wayne Ting said “what we want to see is tech IPOs happening and going successfully, and there’s great investor interest and they trade well”.

“I think that’s going to create the stage that will allow Lime to go public, hopefully, sometime next year or the year after that.”

Ting’s comments came as the company posted a record financial performance for the first half of 2023.

An unprecedented 40m trips in the

second quarter helped the e-scooter operator drive to $250m (£199m) in gross bookings, up 45 per cent on the same period in 2022.

Lime also reported an adjusted global ebitda of $27m in that time period, with a margin improvement of 29 per cent.

Speculation has been mounting over a possible listing, with Ting’s intention for it to be in the US, although a slowdown in the IPO market has delayed that goal and the chief said he was “realistic about the marketplace”.

Lime became the first in its sector to hit profitability earlier this year, on an unadjusted basis.

Ting told City A.M. “people have not figured out how to make money in this business” and said Lime’s success was due to its in-house production of parts.

BMW: Mini production to remain in Oxford

GUY TAYLOR

BMW yesterday announced plans for a major multimillion pound investment in its electric Mini plant in Oxford, securing the long-term future of Mini production in the UK.

The German carmaker will transform its existing factory through a £600m investment, creating 4,000 high-quality jobs in the process, after the government agreed to spend £75m in subsidies.

The new plant will produce two

new next-generation electric car designs, the Mini Cooper and the Mini Aceman, with a third model being made in Germany.

It marks a major U-turn for BMW, which last October confirmed that production of its electric Minis would shift to China, in what was seen as a major blow to the British automotive sector.

Prime Minister Rishi Sunak and business secretary Kemi Badenoch hailed the news, which takes total investment into the UK

automotive sector to £6bn over the last two years.

Rishi Sunak said: “BMW’s investment is another shining example of how the UK is the best place to build cars of the future.”

Mini’s decision joins a string of other victories for the UK automotive sector, with Jaguar owner Tata Group choosing Somerset over Spain for its £4bn gigafactory in July, while Stellantis last week started electric vehicle production at its Ellesmere Port site.

03 TUESDAY 12 SEPTEMBER 2023 NEWS CITYAM.COM

GUY TAYLOR

Mini said it will produce two new electric car designs at its plant in Oxford in a victory for the UK’s automotive industry

John Lewis boss: Fix high street or risk ‘looting grounds’ in city centres

THE BOSS of John Lewis, Sharon White, has warned that UK high streets risk becoming “looting grounds” for criminal activity, as she called for a Royal Commission review of Britain’s ailing town centres.

White, who heads up the ailing department store and

Waitrose chain, has called on the government to launch a Royal Commission investigation into blighted high streets and how to revitalise them.

“Without a comprehensive plan to stop the rise in thefts from stores, high streets risk becoming a looting ground for emboldened shoplifters and organised gangs”, she wrote in The Telegraph.

“High streets are more important to

Vistry shares up as focus shifts to affordable builds

LAURA MCGUIRE

SHARES in Vistry jumped as much as 15 per cent yesterday after the housebuilder said it will now solely focus on building affordable homes.

The group yesterday announced that profits before tax dipped by 8.4 per cent to £174.0m in the first half of the year, despite revenues growing 31.4 per cent to £1.77bn during the period.

But it warned that sales of private homes slowed again in June as high mortgage rates continued to erode demand for new homes.

As a result, the company said it would now focus on its partnership business – which works with the local government authorities to create affordable housing – and will stop building private homes.

“The scale of the social need for affordable mixed tenure housing across the country continues to increase and it is clear that Vistry is uniquely positioned as the leader in partnerships housing,” Greg Fitzgerald, chief executive of Vistry, said.

“The group’s operations will concen-

trate solely on partnerships by merging our housebuilding operations with our partnerships business, enabling sustained growth in housing output, providing greater benefits to our partners, and will deliver maximum value and long-term returns for shareholders,“ he added.

Markets responded well to the firm’s new strategy.

“Affordable housing is much less sensitive to interest rates and the economic backdrop and this should give Vistry some solid foundations,”

us than the sum of their parts; they help define our towns and cities and create civic pride. They are vital to us as a nation, which is why, piecemeal decisions on individual problems will not work,” she added.

According to White, some 6,000 high street stores have closed in the past five years, with the rise of online shopping and economic turbulence battering brick-and-mortar stores.

Last month saw a Tiktok-driven attempted mass shop-lift of JD Sports on Oxford Street.

EARTHQUAKE IN MOROCCO Rescue efforts and the search for survivors continued

yesterday, as the death toll neared 2,700

Russ Mould, investment director at AJ Bell, said.

“It says something stark about the state of the property market that Vistry is going to stop building private homes for the foreseeable future. By doing so it can take costs out of the business by scaling back its workforce and free up capital to such an extent that Vistry is able to commit to paying out £1bn to shareholders over the next three years,” Mould added.

ON MONDAY, the death toll from Morocco’s deadliest earthquake in more than six decades rose to almost 2,700 and rescuers raced against time to find survivors. Search teams from Spain, Britain and Qatar joined Moroccan rescue efforts after a 6.8 magnitude quake struck late on Friday night in the High

AI expected to drive growth at Adobe as firm readies for third quarter results

JESS JONES

PHOTOSHOP owner Adobe is gearing up to post third quarter results on Thursday which, according to analysts, are looking bright for the company as it pins its hopes on artificial intelligence (AI).

Analyst consensus expects revenue for the design software compare to rise to $4.87bn (£3.88bn), up from $4.52bn

in the third quarter last year and at the higher end of its own estimates of $4.83-4.87bn. Profits are also expected to grow annually, rising 17 per cent to $3.97 per share.

According to Mizuho Securities, a Japanese capital markets company, the third quarter is likely to show a “generally healthy” performance, but it will be “much better” in the final three months of 2023.

Meanwhile, Gregg Moskowitz, managing director at Mizuho’s US division, said he was optimistic generative AI could be a “significant growth driver for Adobe”, whose shares are up 68 per cent year to date. Adobe launched Firefly, its generative AI model for creative work, in March. Moskowitz upgraded his rating for Adobe to ‘buy’ and lifted the price target from $520 to $630.

CITYAM.COM 04 TUESDAY 12 SEPTEMBER 2023 NEWS

Adobe launched its generative AI model in March, which is expected to drive growth

Atlas Mountains, with the epicentre 45 miles southwest of Marrakech.

LAURA MCGUIRE

Shoplifting has increased in recent months, causing concern for high streets

Dame Sharon White, John Lewis chair

The housebuilder’s move to stop building private homes was well received

Wizz Air forced to cut capacity by ten per cent

AUGUST GRAHAM

A GLOBAL issue with some Airbus plane engines will reduce the capacity of Wizz Air by around one tenth according to an initial estimate, the business said.

Wizz Air said that its capacity would be 10 per cent lower in the second half of the 2024 financial year, after aerospace supplier RTX said it would have to perform quality control on engines installed in hundreds of planes across the world.

TRG offloads Frankie & Benny’s to Cafe Rouge

THE RESTAURANT Group has confirmed it is offloading its Frankie and Benny’s and Chiquito sites to the owner of Cafe Rouge, The Big Table Group.

As part of the deal, the Wagamama owner will pay a cash contribution of £7.5m to the acquirer to take the 75 underperforming sites off its hands.

The deal is expected to be completed in the fourth quarter of this year, and TRG said it hopes it will improve its adjusted Ebitda margins by 100bps in the first full year.

The two chains have held back TRG’s ability to get its finances back on track, with their sales lagging behind the group’s star performer Wagamama and its pubs and concession business.

Earlier this year, TRG said it would reduce its estate by about 30 per cent, as it looked to cut loss-making sites to boost profit.

The group wants to focus on Wagamama alongside its pubs and concessions businesses.

However, it has plans to open six Wagamama sites during the year and is setting a target to open between eight to

Wandisco loses out on bookings as it tries to swivel fortunes with rebrand

JESS JONES

WANDISCO – soon to be known as

Cirata – has reported a loss in bookings for the first half of the year after the company has battled off crisis after crisis.

Shares in the scandal-stricken firm plunged nearly eight per cent yesterday after it said bookings – the total value of contracts signed during

the first six months of the year – fell to $2.8m (£2.2m) in 2023, down from $7.3m over the same period in 2022.

Chief executive Stephen Kelly said the firm anticipates growth in bookings for the second half.

“We are regaining the trust and confidence of our customers and we are setting a path to ‘business as usual’, with the re-engagement of customers, prospects and partners

having reached a level in line with the ambitions of our turnaround plan,” he explained.

Wandisco announced a rebrand to ‘Cirata’ at the start of September in an attempt to turn a new page on its troubled times.

It comes after top executives were forced to step down in April after an internal investigation found $115m in sales was entirely false.

10 sites per year from 2024 onwards.

“A sale of our Leisure business significantly accelerates our mediumterm strategic plans to increase adjusted Ebitda margins and reduce leverage,” Andy Hornby, chief executive of TRG, said yesterday. Shares in The Restaurant Group climbed after the news, closing up 3.37 per cent yesterday.

RTX yesterday said that a “rare condition in powder metal used to manufacture certain engine parts” had necessitated the checks.

It said 600-700 Pratt & Whitney geared turbofan engines would need to be removed to be examined between 2023 and 2026.

Wizz Air said the issue would end up grounding some of its aircraft.

“Wizz Air is currently assessing the implications to understand the extent of the impact on its fleet, with initial estimates indicating a potential capacity reduction of 10 per cent for the second half of the 2024 financial year,” the airline said.

Shares dropped to close down 4.38 per cent after the news.

is looking to rebrand after a scandal saw top bosses forced to step down in April

05 TUESDAY 12 SEPTEMBER 2023 NEWS CITYAM.COM

LAURA MCGUIRE

PA

Wandisco

BoE ratesetter signals support for rate hikes

strength of domestic demand which has put pressure on prices.

CATHERINEMann, one of the Bank of England’s rate-setters, has signalled she will back a further interest rate hike at next week’s meeting after warning of the possibility of inflation persistence.

Speaking at the Canadian Association for Business Economics, Mann said “the risk of tightening too little is more salient” than tightening too much.

“To pause or to hold the policy rate lower for longer risks inflation becoming more deeply embedded, which would then require more tightening in total, to both change inflation itself and to wring-out the embedded inflation that comes from the sustained duration above target,” she said.

“This is why I would rather err on the side of over-tightening,” Mann said. Mann, who has been one of the most hawkish members of the Monetary Policy Committee (MPC), argued the Bank’s modelling has underestimated the

Recent research has suggested that behaviours of firms have changed “sufficiently to yield continued inflation persistence,” she said.

Inflation came down to 6.8 per cent in July from 11 per cent last year – but core inflation increased month-on-month. August’s reading is likely to see a slight increase due to rising fuel prices.

The Bank is set to announce its next interest rate decision on 21 September, with markets pricing in a 25 basis point hike taking the base rate to 5.5 per cent.

MPC members have increasingly signalled that they are approaching the end of the current cycle.

Chief economist Huw Pill compared his preferred route for rates to Table Mountain, which would see them plateau for longer at a lower peak, rather than rising rapidly before falling. Mann, however, was firm that rates needed to increase further.

FCA to introduce new marketing rules for firms

THE FINANCIAL Conduct Authority is set for a fresh clampdown on the promotion of financial products to consumers next year with a slew of stringent new rules blocking some firms from signing-off on adverts, City A.M. can reveal.

The City watchdog will this morning unveil a package of new

measures that will force financial firms to “demonstrate they have the necessary skills and expertise to approve adverts” that promote financial products to consumers, according to plans seen by City A.M.

To sign off firms must “understand the product, to ensure the promotion is accurate and fairly balances risk and reward”, the FCA will say.

Firms will now be forced to also

report regularly on what they approve and on any “concerning adverts they cancel approval for” to give the watchdog visibility of rogue actors.

“By introducing these new checks, we will ensure people approving adverts have the right skills and understanding they need to do so,” Sarah Pritchard, executive director of markets at the FCA, will tell firms today.

CITYAM.COM 06 TUESDAY 12 SEPTEMBER 2023 NEWS

CHRIS DORRELL

The fresh measures come amid a wider clampdown from on the way that products are marketed to consumers

CHARLIE CONCHIE

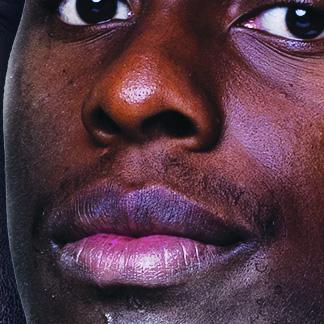

STARS TAKE TO THE PHONES ON TRADING FLOOR

Stars of stage, screen and the sporting arena took to the trading floor of BGC Partners at Canary Wharf yesterday as part of the firm’s annual charity day. The yearly celebration marks the anniversary of the September 11 attacks in 2001. Cantor Fitzgerald, out of which BGC came in 2004, lost more than 600 staff on that fateful day on the east coast of the United States.

Originally the proceeds went to families of those who were lost, but in the years since the firm has handed over the phones to celebrities raising money for smaller, local charities where smaller donations can make a huge amount of difference.

The charity extravaganzas have raised more than $200m over the years.

Stars including Sienna Miller, Gabby Logan and Damian Lewis headlined

this year’s edition.

Another on the floor was Clare Balding. The national treasure told A.M. it was “very exciting –even though I don’t know what any of the letters and numbers mean!”

Sports fans on the floor mobbed the central defender trio of John Terry, Rio Ferdinand and Ledley King whilst the Mayor of London, Sadiq Khan, also joined proceedings.

The Mayor said it was an “honour” to be involved as the Canary Wharf firm looked to make something positive out of the terrible attacks some twenty-two years ago.

JAMES SILVER

“There is such an upbeat vibe, everybody pulling together to make as much money as possible for charity as possible,”

Sean Windeatt –chief operating officer of BGC –told City A.M. yesterday morning as celebs were being wheeled in and out of the trading floor.

For Windeatt, who joined BGC –then Cantor Fitzgerald –in 1997, September 11 is always a difficult day but one that thanks to the charity day has provided much to be proud of.

“We continued it throughout Covid-19, remotely, and for me it’s so important that with the funding challenges, the volunteer challenges, the cost of living crisis, how much charities rely on smaller donations from the general public, now is the time for corporates to really step up.”

The charity day raised cash for some 55 organisations across the UK.

“Everybody’s at their desk earlier than usual, because they want to get their trades done. But I’ll also say, it’s not just about the people here at BGC but our clients are so helpful too. As long as they can get their business done, they’ll make sure they’re supporting charity day today because they know the money is going to good causes.”

On the day itself the firm gives 100 per cent of revenues to the deserving charities.

Stock exchange promotes Walker to number two job as reform continues

CHARLIE CONCHIE

THE LONDON Stock Exchange has promoted its head of primary markets to deputy chief executive today as it looks to push ahead with a reform offensive this year.

Charlie Walker, who has been with the bourse for six years, will continue to oversee the group’s private

markets business and will now join the board of the stock exchange, the firm announced today.

Walker has played a key role in reforming the bourse amid a bruising year in which initial public offerings have fallen sharply.

Chief executive Julia Hoggett said today that Walker had a “passion for ensuring that our markets provide

companies with efficient access to capital across their lifecycle”.

Walker joined the wider London Stock Exchange Group in 2018 after a stint with JP Morgan Cazenove’s equity capital markets team, where he helped raise over £45bn of equity capital for clients. He has been amongst the guiding lights of ongoing listing reforms.

07 TUESDAY 12 SEPTEMBER 2023 NEWS CITYAM.COM

Charlie Walker has been spearheading much of the bourse’s reform work

“Everybody is at their desk even earlier”

Anthony Joshua, Gabby Logan, Sadie Frost and Damian Lewis, Davina McCall (clockwise, top to bottom) and Sienna Miller (inset) on the floor

We are rated EXCELLENT Call +44 (0) 333 123 0320 £60K to invest? Start building your property portfolio today. UK Buy to Lets - HMOs - Holiday Lets – STL Scan the code to can earn yields up to 12%* *FIGURE BASED ON CURRENT SHORT TERM RENT YIELD BEING ACHIEVED IN BIRMINGHAM CITY CENTRE. THE VALUE OF INVESTMENTS CAN GO UP AND DOWN, AND BUYASSOCIATION ALWAYS RECOMMENDS THAT YOU SHOULD SEEK INDEPENDENT FINANCIAL ADVICE.

Vodafone UK boss

CRYSTAL CLEAR

THE BOSSES of customer-facing businesses have good reason to be fearful of social media.

It’s not always a pretty place when an airline delays flights, a train company cancels a late-night service or a mobile provider’s network goes down.

But not the chief executive of Vodafone UK.

The affable Ahmed Essam believes it is actually a “valuable insight” into what is happening on the ground.

“It’s an immediate kind of probe on what’s going on,” he told ting down for an interview the morning after a network outage struck Vodafone users last week – not their fault, it might be added – with his feathers notably unruffled.

“If you use it as such, then it becomes a very valuable tool. You know what’s going on, you know what really matters to your customers and you can act on it straight away,” he explained.

Essam must possess a strong notion of what makes his customers tick as he is something of a Vodafone veteran. His tenure stretches back to 1999 and since then he has flown through a variety of roles, landing at the helm of UK operations in February 2021.

MERGER MANIA

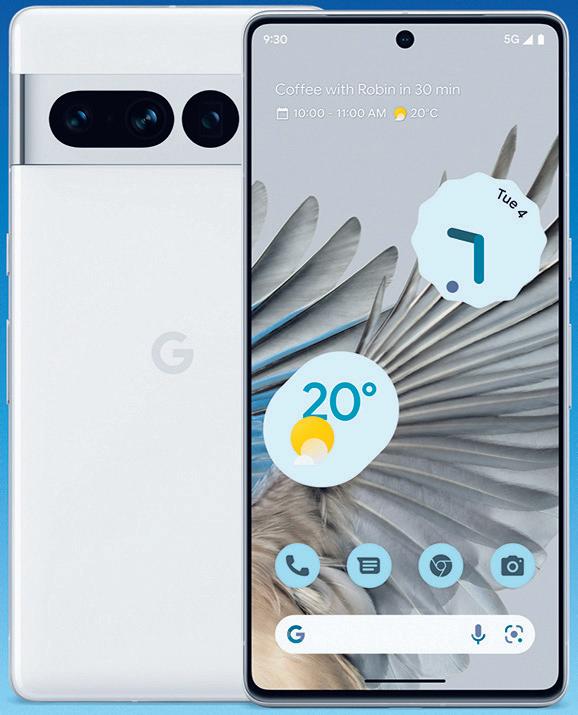

Now, he is piloting the UK telco through what could go down as a game changer in the sector: a major tie-up between Vodafone and Three UK, announced in June, and awaiting approval from Britain’s competition watchdog.

Together the companies say they will invest £11bn in the UK over the next ten years to roll out standalone 5G.

When asked if he is confident an increasingly activist Competition and Markets Authority (CMA) will find the merger’s rationale compelling, Essam responds diplomatically.

“We’ve started engagement with the CMA, as you can imagine,” he said.

Vodafone’s case goes something like this: two large networks, BT-owned EE and O2, are able to operate at scales that allow them to operate over and above the cost of capital. Vodafone and Three, the other two mobile network operators (as opposed to virtual network operators, who operate their customer-facing networks through the network operators) do not.

Essam, then, says that the deal isn’t about four-to-three, but two-to-three; increasing competition, not the other way round. He’s honest that without the deal, the finances are not sustainable in the long term.

Despite his conviction, not everyone sees it this way, with some arguing it could rack up prices for consumers.

National security concerns have also been thrown up by the Chinese-owned stake in Three UK, although the telecoms giants were quick to dismiss the political row earlier this summer.

Crucially, the Vodafone boss firmly believes the merger will infuse vitality into the UK’s limping telecoms sector.

Vodafone is not expecting the deal to sail through the CMA’s processes; it is highly likely that the deal will at least be pushed through to a more in-depth ‘Phase 2’ inquiry. But Essam remains chipper nonetheless, and doesn’t wish

to bring to the UK consumers, to the UK businesses, to add to the competition and to elevate the digital infrastructure in the country.”

COMPETITIVE ARGUMENTS

Essam also sees a strong case for the merger from a shareholder perspective, given the industry’s struggle with a cost of capital that outstrips its returns.

“We’re building towards sustainable return, which encourages investment, and the investment is what’s needed to really sustain this business going forward,” Essam explained.

Philip Jansen, outgoing boss of rival

It ranks 39th out of 56 advanced and developing markets in 5G availability, only connected to a dedicated 5G network 10.1 per cent of the time, according to a recent report by research company Opensignal.

However, Vodafone argues the UK needs their merger in order to reap t he rewards from 5G standalone, helping it reach its net-zero goals and become the science and tech superpower it wishes to be.

5G standalone operates separately from the 4G network and allows for the lower latencies (or higher speeds) needed for the vast amounts of energy

chasing the cost of capital and have enough space to invest and build something that everyone in this organisation and hopefully everyone in the UK would be proud of.”

Covering rural areas is also critical, he said, as it stands to benefit customers, businesses, schools and hospitals across the UK who are in need of greater connectivity.

It would probably be good news for Essam too. An avid cyclist, he spent his summer break in the saddle on a lengthy jaunt to Cornwall. If the likable Essam gets his wish, he’ll have 5G coverage no matter which route he takes.

CITYAM.COM

Ahmed Essam tells Jess Jones he wants to take the firm’s operations into a higher gear with a merger with Three

It’s too early to speculate on remedies, but we are interested in increasing competition, not reducing it

Similarly, Essam reckons the UK needs to look beyond the horizon if it aspires to lead the global digital infra-

Give twice the funds to women, says Baroness Helen Morrissey

CHARLIE CONCHIE

MONEY managers in the city are under fire for a lacklustre record on gender equality after a new report released yesterday found progress in hiring female fund chiefs has stalled. Former chair of AJ Bell Baroness Morrissey yesterday urged firms to shift female representation up the agenda after a new report found just

12.1 per cent of more than 18,000 funds tracked worldwide by Citywire were managed either solely or jointly by a woman.

“If firms mean what they say about viewing this [gender equality] as an incredibly important topic,

they should be giving twice as many new funds proportionately to female managers,” Morrissey told The Times. “It would still be a very modest percentage.”

In the new report Margaryta Kirakosian,, project editor at Citywire, said the lack of progress on diversity showed the industry was “stuck in a vicious cycle”.

Transport sec: There is an offer on the table

CITY groups have called for an urgent resolution to rail strikes in the capital after it was revealed the transport secretary and union leaders have not met once in 2023.

Negotiations have reached a near complete deadlock this year, despite repeated calls for a resolution from business groups in the city and the hospitality sector –which has had well over £100m written off as a result of the disruption.

Speaking exclusively to City A.M., transport secretary Mark Harper (pictured) said “I mean, people go on about this, this mythical coming to the table and this table. Well, I’d say there’s an offer on the table.

“The train operating companies have made a fair and reasonable pay offer of five per cent last year and four per cent this year with some necessary reform. It’s on the table, the trade unions need to put it to their members. They haven’t done that yet, for reasons that I don’t understand.”

Harper said he hadn’t met with the opposite

side for “some time since the beginning of the dispute”.

City A.M. understands the last meeting between the Department for Transport and the unions was 9 January. Both Aslef and the RMT said their last interactions with Harper were in late 2022.

Harper told City A.M. he hadn’t met with the unions for so long because the rail negotiations were not for him to resolve.

“They’re between the train operating companies and the union leaders, there is an offer on the table which the union leaders need to put to their members. There isn’t more money available.”

The Rail Delivery Group (RDG), the body representing train companies in the UK, is currently responsible for “negotiating on behalf of rail

The revelations prompted dismay from business groups. Adam Tyndall, programme director for transport at BusinessLDN, urged the both sides to “get around the table and reach an agreement so businesses and Londoners can plan for the future with confidence”.

Digital bank Kroo kicks off £70m fundraise as it targets profitability

CITY A.M. REPORTER

DIGITAL bank Kroo is looking to raise a fresh round of cash from investors as it targets a swing to profit in the coming months, the firm announced yesterday.

In a statement, Kroo, which won its full banking licence in June last year, said it was now looking to raise up to £70m in equity capital and was hoping to be profitable by the time it closed the round.

Bosses said the firm was scoping out

“family offices, institutional investors, venture capitalists and private equity in the UK, US and Europe” as sources of the new cash injection.

“Our growth in the last nine months shows there is an appetite for better banking, and this latest investment round will enable us to support more customers and increase the products and services we offer,” Andrea De Gottardo, Kroo’s chief executive, said.

Launched in 2016, Kroo offers current accounts and overdrafts to customers.

CITYAM.COM 10 TUESDAY 12 SEPTEMBER 2023 NEWS Sign up now Raise funds and save babies’ lives Tommy’s is a registered charity in England and Wales (1060508) and Scotland (SC039280) Walk for Hope this Autumn Battersea Park, London 7 October Join our close community on a mission and Walk for Hope to stop the heartbreak of baby loss. FREE lantern to decorate and bring with

GUY TAYLOR

Industrial action has plagued Britain’s trains over the last year

Dame Helena Morrissey

Rishi Sunak dodges commitment to pensions ‘triple lock’ in manifesto

JESSICA FRANK-KEYES

RISHI SUNAK has dodged a commitment to include the pensions ‘triple lock’ in the next Tory election manifesto.

The Prime Minister now risks a backlash from his own MPs who will worry about turning off older voters in the general election.

It comes amid reports ministers could consider a cut to benefits ahead of voters going to the polls, to free up funds for Chancellor Jeremy Hunt to

offer tax cuts.

Asked about the so-called triple lock, which mandates that state pensions must increase annually by whichever is highest of inflation, earnings growth or 2.5 per cent, Sunak said he was “not going to speculate” on what would be included in the party’s election pledges.

Speaking at the G20 summit in New Delhi, the Prime Minister told the Financial Times: “We’re not going to speculate on the election

manifesto now.

“I’ve got plenty to get on with between now and then. But the triple lock is the government’s policy and has been for a long time.”

Sunak’s comments come after work and pensions secretary Mel Stride said in June that the pledge would “almost certainly” be included in the document, ahead of an election which must be held before January 2025, saying there was a “particular duty” to protect the elderly.

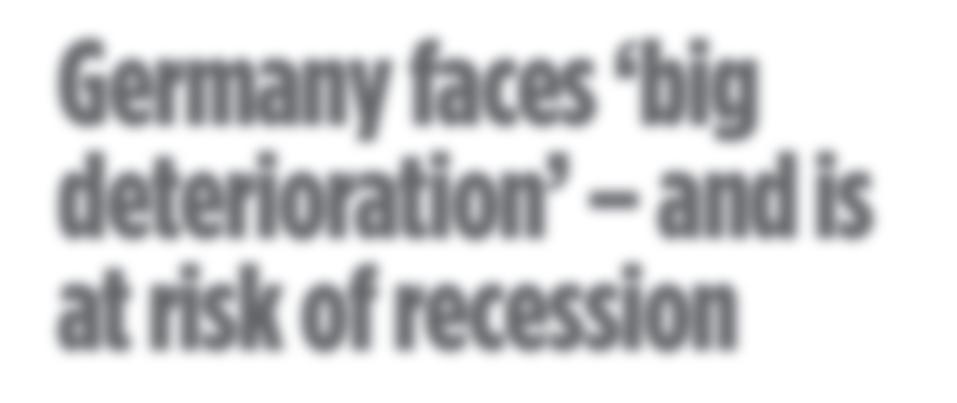

Germany faces ‘big deterioration’ – and is at risk of recession

THE GERMAN economy is facing a “big deterioration” in the second half of the year, with the European Commission (EC) downgrading its forecasts.

The bloc’s largest economy remained stagnant in the second quarter having sunk into a recession over the winter.

While Germany is not currently in recession, the EC now expects the German economy to shrink 0.4 per cent in 2023, making it the only major European nation to do so.

Germany’s economic model has left it vulnerable to changes in the geopolitical order. Before the Ukraine war, Germany sourced around half of its gas from Russia and more than a third of its oil. Rising energy prices means its energy import bill is expected to grow over €124bn (£106bn) across this year and next, up from a combined €7bn for 2020 and 2021.

Experts at the Economist Intelligence Unit said “it will take time for badly affected industries to recover”.

Ties to China also pose challenges. The German economy is almost uniquely dependent on exports for a country of its size – with exports making up nearly 50 per

Germany’s largest trading partner for the last seven years in a row.

Therefore attempts to “reduce critical dependencies” will hit Germany hard.

A third reason is Germany’s unusual dependence on manufacturing.

Over the past few years, manufacturing has been one of the principal engines of its growth. But in the most recent industrial production reading from July, production fell 0.8 per cent from June.

This was the third consecutive fall and more than economists had predicted.

The coalition government recently approved €32bn in corporate tax cuts in an attempt to boost flagging growth.

Chancellor Sholz also pledged to banish the “mildew of bureaucracy” as he called for a ‘Germany pact’ between the central government, federal states and local municipalities to energise the economy. However, economists have not been impressed by the size of the intervention given the scale of the challenges.

Carsten Brzeski, head of macro at ING, said the reforms will not be “a big gamechanger for the German economy”, but said it demonstrated the government’s increased awareness of the challenge.

Russia targeted civilian cargo ship in Black Sea, Sunak tells MPs after G20

THE RUSSIAN military targeted a civilian cargo ship in the Black Sea towards the end of August, the Prime Minister has said.

Declassified UK intelligence suggests missiles were fired from a Russian Black Sea fleet missile carrier on 24 August, but were shot down by the

Ukrainian armed forces. One of the intended targets was reportedly a Libyan-flagged cargo ship.

Rishi Sunak told the Commons about the attack as he updated MPs on his G20 visit in Delhi.

News of the attack comes after Russia withdrew from the Black Sea Grain Initiative, an effort to ship grain out of Ukraine to countries in Africa

and other parts of the world which could otherwise face famine.

Sunak criticised Russian president Vladimir Putin for not attending the G20, and claimed Russia had destroyed enough food to feed 1m people for a year after pulling out of the initiative. The PM also suggested he would have liked the G20’s statement on the war in Ukraine to have been stronger.

11 TUESDAY 12 SEPTEMBER 2023 NEWS CITYAM.COM

Russia’s war in Ukraine has been a central issue at this year’s G20

DAVID LYNCH AND BEN HATTON

Failing to guarantee the triple lock could spark backlash for the Prime Minister

Reuters

Arm: Chip firm expecting to close IPO at top of $50bn-plus range

JESS JONES

BRITISH chip designer Arm is reportedly set to hit the upper range of its valuation target as the year’s largest IPO creeps towards completion.

The Softbank-owned company is closing in on its fully diluted valuation of $54.5bn (£43.5bn), which is towards the higher end of its estimated range and is now urging investors to push it up further due to high demand for its shares,

according to new reports from Reuters.

Unnamed sources close to Reuters said Arm will likely be successful in pricing its IPO at the top of or even above its $47 to $51 per share target.

However, the new reports suggest Arm is apparently also considering keeping its current price range of shares but pricing the IPO above its current valuation. It will keep the amount of shares on offer the same – at 95.5m shares –because Softbank wishes to keep a 90.6 per cent stake in the company post-IPO.

Arm’s bucketload of underwriters, including Raine

CITY of LONDON

Securities, Goldman Sachs and Barclays, are due to wrap up the largest US float in two years on Wednesday. Cambridge’s semiconductor jewel said last week that anchor investors such as Nvidia, Intel, TSMC, Apple and Amazon plan to lock in up to $735m of Arm shares at the IPO price.

A decision on the matter will follow in the next couple of days as the firm awaits several crucial investor orders, although these are not set in stone. Arm and Softbank did not immediately respond to City A.M.’s request for confirmation.

The Wall Street float by the British firm has been seen as a blow to London’s global prestige.

This notice gives details of applications registered by the Department of The Built Environment Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission Exchequer Court, 33 St Mary Axe, London, EC3A 8AA 23/00831/FULL

Erection of plant enclosure on roof and installation of 6no. condenser units within.

60 Fenchurch Street, London, EC3M 4AD 23/00836/FULL

Adelaide House, London Bridge, London, EC4R 9HA 23/00856/LBC

The Counting House Public House, 50 Cornhill, London, EC3V 3PD 23/00913/LBC

15 Old Bailey, London, EC4M 7EF 23/00915/LBC

33 Old Broad Street, London, EC2N 1HW 23/00918/FULL

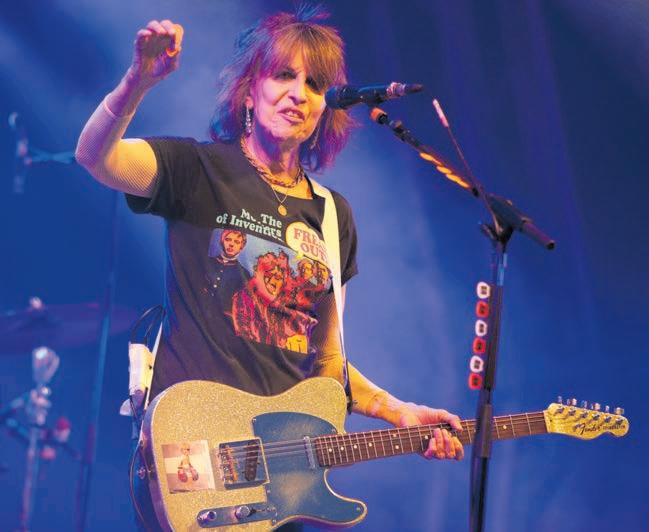

Hipgnosis not likely to replicate RHM buyout deal

JESS JONES

SHARES in Hipgnosis Songs Fund rose as much as 16.5 per cent on Friday after it emerged rival music royalty firm Round Hill Music (RHM) had received a cash offer for a multimillion dollar buyout. But analysts say this does not necessarily mean the same fate awaits Hipgnosis.

2 New Street Square, London, EC4A 3BF 23/00869/FULL

West side of the roof. Middlesex Street Estate, Gravel Lane, London, E1 7AF 23/00882/FULL associated landscaping including erection of garden room, associated 10 - 15 Newgate Street, London, EC1A 7HD 23/00883/FULL

The Mansion House, Mansion House Street, London, EC4N 8BH 23/00909/LBC

alterations, new lighting, and greening on the terrace. 100 Liverpool Street, London, EC2M 2AT 23/00920/FULL

1 Guildhall Yard, London, EC2V 5AE 23/00921/LBC

EC4Y 7HB 23/00923/FULL & 23/00924/LBC

7 Gracechurch Street, London, EC3V 0DR 23/00929/LBC

1 - 3 Frederick’s Place, London, EC2R 8AE 23/00934/FULL

You may inspect copies of the application, the plans and any other documents submitted with it on-line at any representations made about the application will be passed to the Secretary of State and there will be no

After US company RHM failed to reverse a struggling share price, it saw a sudden change in fortune last week when Los Angeles-based Alchemy Copyrights offered to buy it for $469m (£376m).

Some speculated it might mean that Hipgnosis, which like RHM owns the royalties for thousands of popular songs, could also be dug out of a low stock price hole by a potential buyer.

Russ Mould, investment director at AJ Bell, said investors “suddenly perked up, wondering if it too will be rescued... with a bid”. But analysts at Jefferies said this is unlikely due to Hipgnosis’s “ultimately higher portfolio quality”.

A report by the financial services company said there were a num-

ber of obstacles in the way of a bid.

“Its size is one, as the $2.7bn portfolio valuation and market cap of [around] £1bn would easily represent the largest ever music catalogue transaction, if sold.”

Hipgnosis – listed as Song on the FTSE 250 – owns royalties of songs by some of the world’s biggest pop stars such as Justin Bieber, Rihanna and Ed Sheeran.

“Portfolio maturity is another, as Song has a number of relatively new catalogues still subject to a natural initial decay in revenue… which are more difficult to value for the purpose of a bid,” Jefferies said.

They added that the board of RHM rejected several approaches before settling on a “presumably higher” offer from Alchemy Copyrights, which gives Hipgnosis a more positive valuation Merck Mercuriadis, Hipgnosis boss and founder, has said he is “aligned” with shareholders and is working on options to increase value for them.

Societe Generale and Brookfield team up to create €10bn fund

CHRIS DORRELL

FRENCH banking giant Societe Generale has teamed up with Canadian investment manager Brookfield to create a credit fund they hope will raise €10bn (£8.6bn) over four years, launching with €2.5bn of seed funding. Both firms aim to “significantly increase” their financing of the global economy with commitments using different forms of capital.

Societe Generale boss Slawomir

Krupain said the partnership provides an “entirely new answer” to the growing demand for private debt.

Private credit is traditionally provided by non-bank lenders to medium-sized businesses who struggle to access the bond market. Partly as a result of tighter banking regulation, the private credit market has grown from around $250bn in 2010 to over $1.5trn in 2022.

Societe Generale’s expansion into private credit follows a number of similar moves from other finance firms.

CITYAM.COM 12 TUESDAY 12 SEPTEMBER 2023 NEWS

Chrissie Hynde’s back catalogue is amongst Hipgnosis’ sizable library

Wall Street is feeling bullish on Arm’s float ANNOUNCEMENTS LEGAL AND

Merck Mercuriadis, Hipgnosis founder

PUBLIC NOTICES

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

To appear in Best of the Brokers, email your research to notes@cityam.com

London markets given a lift as hopes rise for Chinese recovery

LONDONmarket yesterday closed higher at the start of an important week, as positive figures out from China over the weekend boosted sentiment.

The FTSE 100 ended 0.25 per cent higher, trading at 7,496.87 while the mid-cap FTSE 250, which is more aligned with the health of the domestic economy, rose 0.32 per cent to trade at 18,522.10.

Data out over the weekend showed that China’s consumer price index (CPI) rebounded in August. CPI inflation climbed 0.1 per cent year-on-year, having recorded a 0.3 per cent fall the month before.

A return to inflation will be welcomed by policymakers trying to reignite growth in China’s stumbling economy.

Economists at Capital Economics expect inflation to “rebound further over the coming months, as policy support

drives a modest recovery in China’s economic momentum.”

The news provided a boost to many of the FTSE’s natural resource giants. China is an important market for minerals. Fresnillo topped the index, climbing 4.8 per cent. Rio Tinto rose 3.7 per cent and Antofagasta 3.1 per cent. Glencore and Anglo American also saw gains.

Shares in FTSE 250-listed Vistry soared after it unveiled plans to merge its housebuilding division with its affordable homes business. It was trading over 12 per cent higher. The announcement came despite a 8.4 per cent fall in underlying pretax profit, which was hit thanks to faltering demand.

Fellow housebuilders Persimmon, Barratt Developments and Taylor Wimpey all performed well, rising 1.9 per cent, 1.3 per cent and 1.8 per cent respectively.

Analysts at Peel Hunt have rated Metro Bank a 'hold' for now but have warned that the lender urgently needs more capital. “Metro Bank has the potential to build an attractive, fast-growing bank but needs scale and capital to realise this,” analysts wrote. Peel Hunt gave a target price of 100p, noting there is a speculative upside if the business model can be mobilised. Shares are down 16 per cent year to date.

BUILDING POSITIVITY

The Restaurant Group has agreed to sell its loss-making leisure business, which includes Frankie & Benny's and Chiquito, to Cafe Rouge owner Big Table Group. Peel Hunt wrote: “The disposal of the division is also positive in our view as its performance was going backwards under the Frankie & Benny’s and Chiquito brands.” Analysts say ‘buy’ at a target price of 70p per stock.

THE FUTURE OF CITY AM

13 TUESDAY 12 SEPTEMBER 2023 MARKETS CITYAM.COM

P 11 Sept 101.40 6 Sept 5 Sept 8 Sept METRO BANK 11 Sept 7 Sept 70 80 90 100 110 120 130 140 150

P 6 Sept 5 Sept 8 Sept RESTAURANT GROUP 11 Sept 49.1 11 Sept 7 Sept 42 44 46 48 50

“Miners like Fresnillo, Anglo American and Antofagasta are leading the charge amid optimism towards China after its consumer price index data saw the economy shift away from deflation territory.”

VICTORIA SCHOLAR, INTERACTIVE INVESTOR

IS HERE DOWNLOAD YOUR FREE APP TODAY PAPER | ONLINE | AND NOW APP

OPINION

EDITED BY SASCHA O’SULLIVAN

Birmingham is a city on the cusp, but its economy is at a crossroads moment

IMOVED to Birmingham four years ago, one of a large number of young (or youngish, in my case) inward migrants taking up new jobs in the city. The council’s sudden declaration of bankruptcy means the place I’ve grown to love has hit the headlines for all the wrong reasons. But nobody should mistake the council's failure for the city's failure. Birmingham will bounce back, but only if it signals that it is still open for business.

One of my favourite Birmingham pastimes is hosting friends who have never previously visited the city. Over a few hours, their preconceptions melt away. A long walk in Sutton Park, microbreweries in Stirchley, curry in Sparkbrook or a Sunday roast in a redbricked Jewellery Quarter pub always prompts a barrage of compliments delivered with surprised upward inflections. Attendees at political party conferences in the city can’t help themselves but comment on the area’s transformation in the last decade.

These are the trappings of the city’s economic success. After a Europe-wide search, Goldman Sachs recently opened their second headquarters in Birmingham, joining HSBC and Deutsche Bank. Peaky Blinders writer Stephen Knight is opening a new film

studio in Digbeth and the BBC are moving the Masterchef franchise nearby to the former Typhoo Tea Factory. Thousands of university students contribute to making the city the youngest in Europe and it has secured the most foreign direct investment outside London every year since 2017. Birmingham also benefits from prosperous neighbours, including Solihull which hosts fitness wear unicorn Gymshark, founded by Bromsgroveborn and Aston University-educated Ben Francis.

But there are two Birminghams. A short walk from the city centre are neighbourhoods experiencing crush-

ing deprivation. Four of the ten constituencies in the UK with the highest level of child poverty are in Birmingham. Crime and antisocial behaviour are rife in some areas, rates of unemployment are persistently high and health outcomes among the city's ethnic minority communities are poor. For many young people, local jobs at Goldman Sachs feel more like an insult than an aspiration.

The UK’s second city is moving at two very different speeds - the challenge is keeping its foot on the accelerator to attract investment while making sure residents aren’t left behind. On this front, the people of Birmingham have

been repeatedly let down by central governments who have overlooked the city’s potential and underfunded its institutions. And by the local council who, for over a decade, have been consumed by internal battles and pet projects instead of prioritising the job at hand. Sir Keir Starmer’s forced replacement of the council leader only a few months ago implicitly shows that Labour top brass agree the local leadership was not good enough.

Ministers will focus in the coming days and weeks on securing the delivery of core services across the city. The local authority covers the largest population of any municipal government

It’s a relief we’ve rejoined Horizon, but it is certainly not a victory of post-Brexit Britain

THERE aren’t many examples where taking two steps back before one step forward is deemed a success. But that happened last week, as the UK heartily cheered its reentry into the Horizon Europe programme, the European Union’s flagship science and research scheme.

Horizon is the largest research collaboration on earth, providing £85bn of grant support to academia’s weird, wonderful and (in the short-term) commercially unviable inventions. The programme comprises the EU countries, Israel, New Zealand and Norway and is based on the wise principle that good science is done best when done together, regardless of geography.

Horizon, and its sibling Copernicus which gives countries access to satellite data, became bargaining chips during the Brexit negotiations. Britain’s reentry into both schemes seemed a fait accompli until the rows over the Northern Ireland Protocol. Despite UK universities being some of the biggest

Zoe Peden

beneficiaries of the Horizon programme - since 2014 our researchers received €7 bn, the most of any nation other than Germany - we left in 2020 and have only just rejoined. This was not some bureaucratic exit from a nebulous geopolitical scheme. Researchers up and down the country were left out in the cold, their funding disappearing at a moment’s notice. People had to give up their lives’ work, or leave the UK in search of financial support to continue. The financial, scientific, and reputational damage will be hard to undo.

This is just the latest setback for a country experiencing decades of technological and economic decline since

World War II. Patriots might point to Britain’s invention of the internet as proof of our digital credentials, but if anything this should be a mark of shame; it was the Americans, with their deep pockets and hunger for risk, who commercialised our invention and used it to turbocharge their economy. Today, we can’t even convince our own companies to list domestically, with ARM choosing the New York Stock Exchange despite courting from the UK government. Proponents of “Silicon Roundabout” - if anyone still uses that moniker - talk about Britain’s world-beating fintech, and yet even in that one vertical we’re so proud of, the US dominates.

This Horizon news is a relief because it reaffirms how much respect our scientists deserve. It’s here that our economy might be able to find its edge. Governmental funding for research allows scientists to take risks without getting bogged down by the kinds of commercial constraints that can get in the way of good ideas. Now if we can just convince our universities to stop

taking 30 per cent of equity in the ideas they foster (and move towards the 10 per cent stake taken by the likes of Harvard, MIT and Stanford), we might soon see a generation of scientists in Britain building transformative, sustainable businesses that are attractive to the deep-pocketed venture capital and private equity communities here.

This type and amount of catalytic funding is crucial if we want to see more innovative companies at scale with deep, defensible moats.

We have such a strong scientific heritage in this country: Newton, Darwin, Hawking, Berners-Lee. With Horizon back in place, combined with the right talent, investment and professional service ingredients that can be found in London, there might just be some cause for optimism about British science and technology.

Then perhaps, we can just take two steps forward, for a change.

£ Zoe Peden is Partner at Ananda Impact Ventures, a Horizon Europe Programme

in Europe - delivering social care and keeping the streets clean is a mammoth task. A bold government would use this moment to radically overhaul service delivery - tackling entrenched trade union interest and digitising antiquated processes. During this period attention must not slip from Birmingham’s economy. Investors will pause before purchasing a new site or exploring a new location for their firm. Reassurance must be swift.

Andy Street, the region’s metro mayor, is best placed to help Birmingham bounce back. To declare an interest - I served as his policy advisor for several years. But it’s hard to deny that, as a former chief executive of John Lewis, he has the private sector’s confidence. While councillors in Birmingham are steadying the ship, they should position Andy as the area’s economic ambassador - temporarily transferring responsibilities for regeneration and investment to him, as opposed to any imposed commissioners from Whitehall.

This could still mark the beginning of Birmingham’s golden decade. When HS2 is (finally) completed, it will further transform the city’s prospectseven now, companies are relocating and hiring in anticipation of its connections. What the city needs to realise this opportunity is better political leadership to steward the city’s growth, support its communities, and stand up to ministers. The city might appear on the back foot, but it’s taught me one lesson above others: it’s always a bad idea to bet against Birmingham.

£ Adam Hawksbee is deputy director of Onward and a City A.M. columnist

ROCKET MAN

North Korean dictator Kim Jong Un is known for his love of flying missiles, always just a little bit too close to home. But this time he’s jetting off himself and visiting President Putin, a fellow authoritarian leader.

King Charles, also unelected, sent President Kim his ‘good wishes’

CITYAM.COM 14 TUESDAY 12 SEPTEMBER 2023 OPINION

Adam Hawksbee

Birmingham’s local authority declared bankruptcy last week

WE WANT TO HEAR YOUR VIEWS

LETTERS TO THE EDITOR Dealing with business rates

[Re: A case for cutting business rates? Look at our high streets, yesterday]

Proposed action on business rates always seems to bring with it a victim, with businesses, taxpayers, and councils interchanging in the role. However, as this political football gets tossed around, left behind in the locker room are the charitable organisations buckling under the financial pressure that business rates avoidance brings.

How to placate these “victim” groups and simultaneously resuscitate our

“gap-toothed” Great British High Street? Ethical rates mitigation, whereby those with empty properties can support charitable initiatives looking for space – and in turn pay reduced rates. What many also don’t know is that a 75 per cent rates reduction is available to retail, leisure, and hospitality businesses, which should be another incentive for landlords to not landbank. We need only look to Scotland and Wales, who have passed legislation to address the issue. With a slight rewording of the law, we can save councils millions, landlords won’t be out of pocket, and charities can better serve their communities.

Shaylesh Patel

SCHOOLYARD SPAT Bill Gates claims Elon

Spare a thought for MPs, they don’t have a chance of succeeding like FTSE execs

Natascha Engel

INDUSTRY often asks why politicians don’t run the country more like businesses run their companies, trading short-term pain for long-term gain.

Having been an MP for 12 years and now running a business in the private sector, I’ve got some ideas about why that is and what we could do about it. It’s true that long term investment thinking is not exactly an embedded characteristic of British political culture. The aerated concrete scandal last week was as a result of savings and short-cuts in the 1960s that left the consequences of crumbling schools, hospitals and prisons for future governments (today) to deal with.

Political incentives are very different from those of the world of business. Ministers are moved every 18 months or so. Public opinion swings dramatically. Well-funded, highly-organised pressure groups exert a powerful influence. The media create or amplify hostile environments. British politicians operate in public, in the full glare of Macmillan’s “events” and have to justify their actions as they take them.

EXPLAINER-IN-BRIEF: RISHI SUNAK’S CHINA PROBLEM

Since he first went for the Tory leadership in summer last year, Rishi Sunak was accused by China hawks of being soft on Beijing.

After a parliamentary staffer was arrested for allegedly spying for Beijing, it will test Sunak’s softlysoftly approach.

Sunak’s premiership has marked a change in relations with China, with James Cleverly, the Foreign Secretary, visiting Beijing last month. Only yesterday, Kemi Badenoch, tipped as a potential successor if Sunak falters at the next election, was adamant we should not call China a “foe”. And

over the summer, the Foreign Office issued a directive saying we shouldn’t call countries such as China “hostile states”.

At the G20 summit in Delhi over the weekend, Sunak met with the Chinese premier Li Qiang after the revelations came out. He said he raised “very strong concerns about any interference in our parliamentary democracy”.

But the prime minister is facing calls to go further than just strong words in his indictment of China’s actions and uninvited delegates from the AI security summit scheduled for later this month.

The primary concern of MPs – and it would be odd if it were not so – is survival. They serve at the pleasure of their voters, not supportive boards who help them construct considered long-term business plans. Politicians and governments have to get reelected. It is a general trend of western politics that governing has become a form of campaigning.

Policy that causes pain through an entire electoral cycle will face stiff opposition as soon as the pain, or the costs, become apparent. For example, when the Ultra Low Emissions Zone became a hinge point in the Uxbridge byelection, it had a knock on impact on the government’s green strategy.

If there is an answer, it is to prepare the public better. To explain why certain infrastructure may be unpopular but essential to secure our future. If we want to electrify, we need to build more grid but who will make the case for more pylons? But to have those conversations, politicians need to understand the issues.

Business does, but public engagement is not their forte. Unlike politicians, business leaders are generally not elected but appointed through rigorous processes where experience, ed-

ucation, aptitude and psychometrics are tested – all predictors of how the candidate will perform, if appointed.

The skills that get you elected are not the skills that you need once you get to parliament. Campaigning, mobilising party volunteers and turning out the vote – abilities so critical to getting elected are of no immediate use in the House of Commons.

This means that a new MP may have no particular professional expertise or even an interest in policy. Yet they are expected immediately, and on an almost daily basis, to take long-term decisions on issues that affect both people and businesses in the long-term.

Business, on the other hand, is full of experts – doctorates, scientists and engineers who have worked in their industries for so long that they understand every nuance and consequence. Their information can sometimes be so specialist that it is difficult for lay people to understand yet this is

exactly what politicians need. It is the only way they can make better-informed decisions.

Politicians need to understand that business works on different timescales, but for a successful economy and for healthier politics, business and politics need to appreciate each other’s challenges and limitations.

And that also means sparing a thought for MPs. They arrive in Westminster’s strange environment with its cryptic rules and processes. They are flooded with information, reports, digests, statistics, representations, petitions. They are faced with the requirements of their whips, the demands of their constituents, and in between they have to make some time for their families.

Despite any appearance to the contrary, they really need all the help they can get.

£ Natascha Engel was MP from 2005 to 2017 and now runs Palace Yard, a think tank

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900 Email: news@cityam.com Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com Editorial Editor Andy Silvester | News Editor Ben Lucas Comment & Features Editor Sascha O’Sullivan Lifestyle Editor Steve Dinneen | Sports Editor Frank Dalleres Creative Director Billy Breton | Commercial Sales Director Jeremy Slattery 15 TUESDAY 12 SEPTEMBER 2023 OPINION CITYAM.COM

› E: opinion@cityam.com COMMENT AT: cityam.com/opinion

MPs are often accused of making short-term plans

Ah the problems of billionaires. Bill Gates has accused Elon Musk of being sour after he discovered the Microsoft tech titan had a short position of US$500m against his electric car firm Tesla.

Certified Distribution from 03/07/2023 till 30/07/2023 is 67,600

Musk was ‘super mean’ to him

MOTORING

BUDGET BENTLEY

MANYBrits first heard of the Genesis GV80 after Tiger Woods parked one upside down in a ditch. ‘A little-known luxury SUV loaned to Tiger Woods saved him from almost certain death after his horror crash,’ reported the Daily Mail in 2021. Shortly afterwards, Euro NCAP awarded the GV80 a full five stars for safety. Genesis was making headlines for the right reasons.

After that initial blaze of publicity, the Korean brand – the upmarket division of Hyundai – has quietly sought to establish a foothold in the UK. It sells direct, so you can’t kick tyres in a showroom; just book a test drive via the website and a ‘Genesis Personal Assistant’ will deliver a car to your home or workplace. If you decide to buy, the same GPA is assigned to you for the next five years or 50,000

miles, on call to answer any questions or drop off a courtesy car when your Genesis needs servicing.

This hassle-free approach to ownership is key to the Genesis proposition. Factor in competitive prices, a generous warranty and proven reliability (the marque now battles Lexus for top honours in America’s influential J.D. Power survey), and some might feel inclined to skip the test drive and simply click ‘buy’. However, South Korean cars have always been affordable and painless to own. Genesis also needs to convince as a proper premium brand.

In many respects, the GV80 does just that. Genesis’ flagship SUV is a similar size to a Range Rover Sport and looks rather like a Bentley Bentayga (no surprise, maybe, as chief designer SangYup Lee used to work in Crewe). What it lacks in beauty, it makes up for in imposing presence

PRICE: FROM £58,305

POWER: 304HP

0-62MPH: 7.7SEC

TOP SPEED: 147MPH

FUEL ECONOMY: 30.5-31.4MPG

CO2 EMISSIONS: 241-248G/KM

and glittery chrome garnish.

Interior quality feels the equal of European rivals, with real wood trim, acres of intricately stitched leather and Bentley-style knurling on some of the switches. The touchscreen graphics look sharp and the glass-topped rotary gear selector feels tactile. You can opt for six individual seats in Luxury Plus spec, but my GV80 Sport had the standard rear bench, offering ample space for five adults and a huge 735-litre boot.

Prices start from £58,305 and standard equipment includes super-bright LED headlights, smart navigation and an electric tailgate, plus a whole suite of safety tech: 10 airbags, active cruise control, blind-spot warning, rear crosstraffic alert and more. Want the full budget Bentley experience? You can splash out on massage seats, soft-close doors, heated or cooled cupholders and a noise-cancelling speaker system.

So far, so premium. Unfortunately, the GV80 is less convincing on the road. Genesis has deleted the option of a straight-six diesel engine, leaving just the 304hp four-cylinder petrol. It’s muscular enough to haul 2,145kg of SUV without breaking sweat, but there is no Lexus-style hybrid assistance to help save fuel. Taking the fully-loaded GV80 on a family weekend away in Dorset, I struggled to better 25mpg.

You won’t enjoy much dynamism, ei-

ther. Tackle a winding country road with enthusiasm and the GV80 feels wallowy and out of its depth. Also, despite a camera system that scans the road ahead to prime the electronic dampers for potholes, it doesn’t ride especially well. I suspect the 22-inch wheels fitted to this Sport version are partly culpable (the standard car rides on 20s), but the car feels restless on anything other than smooth tarmac. On balance, then, this is a better car to own than to drive – the exact opposite of a Range Rover Sport, perhaps. If you crave an easy motoring life, or you simply want something different to the premium norm, it’s worth arranging a to-your-door test drive. For me, though, the BMW X5 and Lexus RX both offer a better all-round package in this competitive class.

Tim Pitt writes for motoringresearch.com

ALFA ROMEO CELEBRATES ITS PAST WITH STUNNING 33 STRADALE SUPERCAR

ALFARomeo is paying tribute to its heritage with a retro-styled, £1.7 million remake of the iconic and breathtakingly beautiful 33 Stradale.

Produced between 1967 and 1969, the original 33 Stradale is regarded as one of the world’s first supercars. Now, as Alfa Romeo heads towards an electrified future, a limited production run of the reimagined 33 Stradale celebrates its past and future. Significantly, this will be the last combustion-engined supercar from the Italian marque.

According to Alfa Romeo CEO Jean-Philippe Imparato, the aim with the new 33 Stradale was “to create something that lived up to our past, to serve the brand and to make

the Alfisti fandom proud”. The car was designed in-house, and reinvents the classic model’s dramatic butterfly doors. Unlike the original, however, the latest 33 Stradale is made from a combination of lightweight carbon fibre and aluminium.

More radical is the choice of powertrains on offer. Buyers can choose a 620hp twin-turbocharged 3.0-litre V6 petrol engine or a fully electric version. The EV musters an even more substantial 750hp. Both are said to be capable of 0-62mph in less than three seconds, plus a top speed of 207mph. Opting for battery power means an official range of 280 miles.

Formula One driver Valterri Bottas is responsible for the final chassis

setup. Double wishbone suspension and carbon ceramic brakes with brake-by-wire technology should ensure the 33 Stradale handles and stops like a supercar, too. Buyers can opt for two different interior designs. Tributo honours the late-1960s classic, with aluminium design details, while the track-focused Alfa Corse option features exposed carbon fibre.

The 33 Stradale will be hand-built by Carrozzeria Touring Superleggera, and each of the 33 examples was sold within weeks of potential customers seeing design sketches at the 2022 Monza Grand Prix. The first lucky owners should receive their cars in 2024.

17 TUESDAY 12 SEPTEMBER 2023 LIFE&STYLE CITYAM.COM BY MOTORINGRESEARCH.COM FOR CITY A.M.

GENESIS GV80 2.5T

Tim Pitt drives the Genesis GV80, a luxurious family SUV from the Korean marque that majors on no-hassle customer service.

INVESTOR AIL L RETTA INSTRUMENT

TO AFFORD CAN OU SHOULD CONSIDER Y PROVIDER. 71% OF LEVERAGE. ARE COMPLEX CFDS

THE HIGH RISK TAKE TA

OU UNDER Y WHETHER OSE MONEY S L ACCOUNT WITH AND COME S UR MONEYY.

TR WHEN OSING MONEY L OF HIGHRISK K A WHETHER AND WORK CFDS WITH ADING CFDS

TANDHOWSTA

OUR MONEY Y LOSING OF ISK K

RAPIDL OSINGMONEY Y YOU THIS

TO DUE DLY LY

ITV’s Rugby World Cup coverage is a turn-off

ALOT has been made of this Rugby World Cup potentially being the reset point for a sport that’s in dire need of reinvigoration. So, then, why are we standing by while its broadcast offering in the United Kingdom looks lethargic, dated and lazy?

On the opening night ITV broadcast the wrong scoreline at the end of the match. On day two, George Gregan was branded Sean and much of the ItalyNamibia build-up was spent talking about Ireland despite having Azzurri legend Sergio Parisse on the panel.

And on day three Sir Clive Woodward laboured through his Chile analysis not being able to name players, before the ITV studio pundits – consisting of three Welshmen – only briefly touched on a refereeing performance for a match involving Wales many described as lenient at best. This is the pinnacle of rugby

OPINION

FOOTBALL COMMENT

Wrong scorelines, underwhelming use of pundits and a greenscreen

union and an opportunity to grip thousands of fans to a game which is desperate to fill its stands – and coffers.

Yet there’s no real debate surrounding the inconsistencies in the game, no discussion around the major issues taking away from the quality of rugby and little chatter about the minor nations at the tournament.

ITV has long been a brilliant home for sport; horse racing, the Fifa World Cup and others have been blessed with superb coverage. But this feels dated. And that’s before you get to the general election-style lecterns for pre-match and post-match analysis – perfect for debate, if there were any. To top it all off ITV aren’t on a Parisian rooftop but hun-

leaving me cold, says Matt Hardy

dreds of miles away in a greenscreen studio that – while sleek – offers little warmth. And the point is this: ITV have won the rights to host the biggest tournament in a sport, and they’re underachieving. We deserve the very best quality of production for a tournament that’s hoped to give rugby the foundations to build upon.

LETTING THE SIDE DOWN

David Flatman, former England prop, is wasted as a host when his punditry is some of the best in the

game. Bryan Habana is one of the greatest wingers ever, but he’s stranded in the studio when he could be on cocomms for Springbok matches. And beyond this, there are very few, if any, current players and coaches offering viewpoints. There’s just a sense of shortsightedness here that’s disappointing.

When the same broadcaster televised football matches at this year’s Women’s World Cup, they were graced with the likes of Chelsea manager Emma Hayes. The BBC adopted Jonas Eidevall, Arsenal’s

boss. They provided an insight former players couldn’t and an in-depth tactical masterclass with an often personal knowledge of players.

Sure, the likes of Warren Gatland and Eddie Jones may have been snapped up if they weren’t coaching but instead we’re left with the likes of Woodward who has been out of the coaching game for nearly 20 years.