COUNTDOWN ARE LES BLEUS READY FOR THE PRESSURE OF A HOME WORLD CUP? P19

EXCLUSIVE NICHOLAS EARL

THE WORLD’s largest hydrogen conglomerate plans to invest £250m in the UK over the next 12 months – but is heading to Canada rather than London to raise cash on the public markets.

Australian-headquartered United H2 Limited (UHL) is looking to fund more hydrogenrelated startups in the UK and Europe.

UHL invests in and helps create companies that utilise hydrogen technologies, such as hydrogen cars, trucks, boats and planes –with 37 companies currently on its books, and many more planned in the coming years. However, the conglomerate told CityA.M. that it is ultimately aiming to list in the US rather than London, determining that the investment climate in North America would bring more value to shareholders than the London Stock Exchange.

THE BANK of England’s former chief economist has said Threadneedle Street persisted “a little longer than we needed to” with quantitative easing –helping to fuel inflation.

The Bank’s Monetary Policy Committee expanded its quantitative easing programme –effectively, printing money to buy government debt –by £450bn in 2020 and 2021 as the country battled with Covid-19.

But in an interview airing tonight, Andy

Bank “went on printing money for a bit longer than it needed to”.

“With the benefit of hindsight… we probably did a little bit too much for a little too long,” he told Sophy Ridge’s Politics Hub show on Sky News.

The Bank stopped buying bonds in late 2021 and is now actively selling them.

“At the time of Covid-19, [it was needed] to protect

Haldane, now the chief executive of the Royal Society

“But did we persist with that a little longer than we needed to? And did [the Bank] step on the brakes a little too late –and therefore a little harder now than they needed to?”

Wonks at the central bank

inflationary cycle that continues to this day, and there are now questions about whether more than a dozen interest rate hikes in a row will effectively strangle growth as that wave of price hikes dissipates.

Haldane was regarded as the most hawkish of MPC members, pushing for rate hikes before Governor Andrew Bailey.

£ CONTINUED ON PAGE 2

It plans to raise funds for a targeted £150m-plus listing on the Canadian Securities Exchange later this year, with an eye to an eventual initial public offering on the Nasdaq.

£ CONTINUED ON PAGE 2

FORMER BANK ECONOMIST ANDY HALDANE SAYS QUANTITATIVE EASING ‘PERSISTED’ TOO LONG AND FUELLED INFLATION

ACTIONS have consequences appears to be the grown-up lesson to take from the concrete chaos enveloping Britain’s schools, public infrastructure and indeed the Tory party.

The first two are easier to understand: decisions not to push ahead with capital investment eventually lead to things not working.

Governments of all stripes will have no doubt been warned, but

all will have calculated that the chickens were most likely to roost under somebody else’s watch. As a parable for the value of investment (and fixing the literal roof whilst the sun is shining) it takes some beating. It is in that sense possible to have

sympathy with Gillian Keegan, the education secretary. Like most people in today’s Cabinet she’s had precious little time to make any impact of any note at all; transformation takes time, and a combination of ministerial reshuffles and entire governments toppling in much the same way as the local comp’s masonry has left few with the scope to make their mark. In short: it really isn’t her fault. But it is still perhaps unwise to

say that whilst being filmed by the nation’s largest private broadcaster, standing in the middle of 4 Millbank, a building crawling with political journalists.

Whilst Keegan’s hot mic faux pas will go down in political history (for the record, it’s less damaging than Gordon Brown calling one of his own supporters a “bigoted woman” but worse than David Cameron saying the Queen “purred” down the line

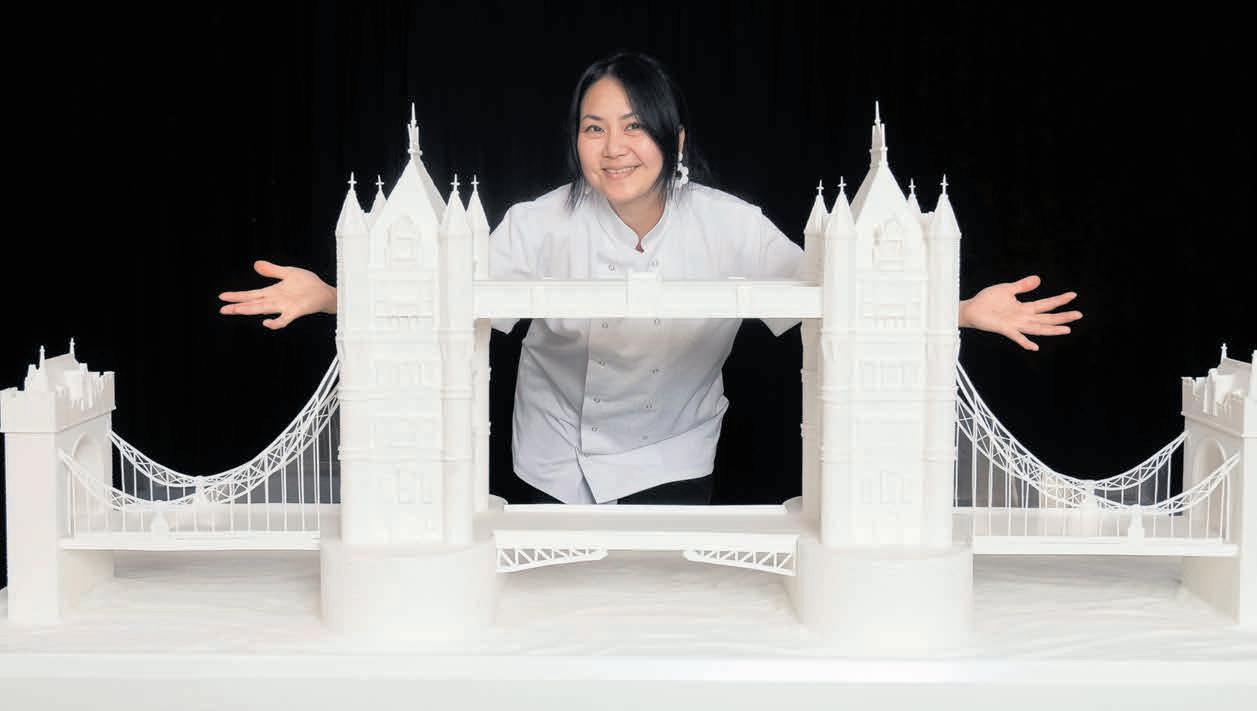

A TOWERING TREAT A sweet recreation of Tower Bridge –made out of 25kg of sugar in a 150-hour marathon –will go on display in London with other edible statues this week

CONTINUED FROM PAGE 1

Richard Allen (pictured), chairman of UHL, said that the huge investment opportunities flowing from the US Inflation Reduction Act, with up to £293bn ($369bn) in green subsidies on offer, meant North America was particularly appealing.

“We believe these favourable business conditions create a strong market capitalisation outlook for UHL ... which is why we are pursuing listings in these markets,” Allen said.

However, he said UHL was still “very open” to London, hinting that its

listing plans could change.

“If an opportunity arose on the London Stock Exchange that would deliver more value for shareholders, we would definitely consider changing course,” he said.

News of the firm’s listing plans comes as the London’s market chiefs and City regulators scramble streamline the listing regime amid fears of an exodus of companies away from the capital towards New York.

The government is targeting 10GW of hydrogen generation in the UK as part of its energy security strategy by the end of the decade, following Russia’s invasion of Ukraine. It is currently home to less than 1GW of hydrogen production. Another London-listed firm looked set for private ownership yesterday, after biopharma firm Ergomed accepted a £730m takeover bid from European private equity shop Permira.

over the Scottish referendum result), the lesson should be that putting off long-term investments for the sake of short-term gain inevitably falls over as a strategy.

For all the furore over the education secretary’s comments, the most insightful comment thus far on the matter comes from the Bank’s former economist Andy Haldane: to paraphrase, we shoulda seen it coming.

NESTLE SELLS PEANUT ALLERGY BUSINESS AFTER INSUFFICIENT DEMAND

Nestle has divested the peanut allergy business it acquired three years ago after the treatment failed to be taken up by doctors and allergy sufferers.

THE GUARDIAN WILKO: RESCUE DEAL TO SAVE MANY STORES AT RISK OVER SUPPLIER DEBTS

A rescue deal to save the majority of Wilko’s stores has been put at risk as some key suppliers want outstanding debts repaid upfront to guarantee continuing to provide products.

THE TIMES

CHINESE SPIES POSING AS TOURISTS TO ENTER SECRET MILITARY SITES, SAYS US

China has been accused of sending spies masquerading as tourists in an attempt to enter secret military facilities in the US, as efforts to improve relations between the two countries falter.

CONTINUED FROM PAGE 1

Haldane also warned that a “pancakelike” economy that has flatlined for 18 months means the UK is “stuck.”

He rated the risk of recession as “evens” and said “it would take only the tiniest of tilt for us to enter recessionary territory.”

Overnight the Centre for Economics and Business Research warned that almost 30,000 businesses could go bust next year, a 70 per cent increase on pre-pandemic levels.

“Many businesses took on debt during the pandemic in order to

survive, particularly in sectors such as retail and hospitality,” the think tank said. “These businesses saw a post-pandemic boom in demand, but many are likely to still be repaying loans.”

Martin McTague, chair of the Federation of Small Businesses, said the insolvencies forecast should be a “red flag for the Bank of England nudging them to exercise great caution when considering any further rate hikes”. He cautioned: “This is an increasingly punishing climate, where financial pressures are reaching a boiling point.”

BRITISH FIRMS should be forced to ramp up “woefully inadequate” contributions to pension pots in order to boost returns for savers and get money flowing back into London’s beleaguered stock market, a top think tank has said.

In a new report today in partnership with Abrdn and Citi, think tank New Financial called for a “reframing [of] the essay question” on how to breathe life into London’s markets, claiming that the UK should be thinking of how to deliver better returns for savers rather than simply getting cash flowing into listed businesses.

The calls come amid a raging debate in the Square Mile over how to get more retirement cash flowing into domestic companies, after pension funds’ holdings of UK PLC has cratered in the past two decades.

Just four per cent of the UK stock market is now held by pension funds — down from 39 per cent in 2000, according to New Financial.

In its report today, the think tank

said that central to boosting returns and the flagging markets should be an increase in contributions to the pension pool and a focus on increasing participation in pension schemes.

“The minimum pension contribution of eight per cent of eligible earnings for defined contribution [DC] pensions is woefully inadequate compared with other countries,” said William Wright, chief of New Financial, in the report.

“It is also unfairly skewed to individuals rather than employers, and probably needs to double in the longer term.”

The current contribution to DC pots sits at eight per cent, with three per cent of that made up by employers and the remaining five per cent by employees.

Former pensions minister and partner at Lane Clarke and Peacock, Sir Steve Webb, told A.M. that levelling the playing field between

the contributions from employers and employees was key to boosting the size of funds and ultimately the amount of money available to invest.

“Many people may assume that eight per cent was set because it was the ‘right answer’ to how much people need to save; but in reality it was a compromise at the time between how much employers were willing to sign up to and also how much a government could ask of workers,” he said.

“A first step would certainly be to level contribution rates between employee and employer — there are very few countries in the world like the UK where workers pay more than their employers.”

The calls came just after Abrdn chief executive Stephen Bird called for pension contributions to double to 16 per cent. But the Federation of Small Businesses pushed back on the calls and said it would place a higher burden on smaller companies.

LAURA MCGUIRE

LAURA MCGUIRE

MISERABLE summer weather hit hospitality hard in August, with restaurant sales dipping 5.8 per cent, new data from Barclays has revealed.

The wider sector also struggled last month, with spending in bars, pubs and clubs up only 2.8 per cent on July – the lowest rate of growth since October 2022, according to Barclays.

However, spending across the wider

retail sector appeared to hold steady. UK total retail sales increased by 4.1 per cent in August –above the three month average –separate figures from the British Retail Consortium showed.

Abbas Khan, UK economist at Barclays, said the “muted spending” was in line with soft PMIs and suggested “the bite from monetary tightening is starting to be felt more acutely”.

Restaurants hit by August wash out as rainy weatherNew Financial boss William Wright

NEIL LANCEFIELD

MORE than two out of five train services in Britain during the first half of the year were delayed, new figures show.

Some 41 per cent of services in that period were at least one minute late, according to BBC analysis of industry data collated by website On Time Trains.

A further three per cent were cancelled, while only 56 per cent were on time.

Stations in Wales had the highest cancellations rate between January and July, at seven per cent. Across English regions, the highest figure was in the North East (six per cent).

Paul Tuohy, of pressure group Campaign for Better Transport, said: “We want people to travel by train so

high rates of cancellations are unacceptable.

“The government and industry need to sort this out and ensure services run to schedule so that passengers can travel with confidence.”

Reliability of services across Britain has been affected by a series of issues, including infrastructure failures and strikes by staff.

BUY-NOW pay-later giant Klarna will double down on a UK investment drive despite lingering uncertainty around a clampdown on the sector by regulators this year, its global chief has pledged.

Sebastian Siemiatkowski, founder and chief of the Swedish fintech, told City A.M. that the UK remained a key market for the firm despite a push from regulators for firmer rules around the deferred payment tools.

The timelines and eventual framework for planned rules on buy-now pay-later products, which allow shoppers to split up and defer payments, have also been thrown into doubt after ministers reportedly shelved plans over the summer for fear of dissuading investment.

However, Klarna’s boss has committed to continue pumping cash into the market despite the cloud of uncertainty now hanging over its regulatory status.

“You know when Brexit was about to happen, you know I didn’t want you guys to leave and I really miss you guys. I have to say at the same time I find Britain the

most amazing entrepreneurial, ambitious, aspirational place,” he said. “The people that work in Britain are fantastic. So we are going to continue to invest in Britain.”

Siemiatkowski said the firm was “very optimistic about” the UK, which has “an amazing tech and finance sector with a lot of knowledge and deep understanding of banking services, retail banking”.

The pledge to double down on UK investment comes amid a major push towards profitability, pushing it to cut some ten per cent of its staff.

The firm revealed last week that the cost-cutting drive had borne fruit as it closed its losses to SEK 2.12bn (£153m) in the six months to the end of June from SEK 6.37bn last year, as well as touching monthly profitability for the first time.

This has raised questions about whether it would reignite its IPO plans. Siemiatkowski said the “requirements have been met” but said it was “too early to say” where it would float.

But, he added: “You know, it’s very flattering that you have all these countries who want us to list with them.”

REBECCA SPEARE-COLE

GRAFTON Group said the company’s record on climate and gender diversity were among the reasons 21 per cent of shareholders voted against re-electing its non-executive chair.

The Irish DIY retail giant launched a consultation after more than a fifth of investors chose not to support the resolution to re-elect Michael Roney at the firm’s AGM in May.

In a statement yesterday, the FTSE 250

firm said “a mix of factors” were behind the shareholder rebellion.

Two institutional shareholders said they voted against his re-election because the company has not set net zero targets or published Scope 3 greenhouse gas emissions data, the firm said. Two more cited insufficient gender diversity on the board and at senior management, while another two mentioned the number of board appointments held by Roney in listed companies.

CHARLIE CONCHIE

BELEAGUERED social housing investor

Home REIT has said it will soon begin a full clear-out of its board as it scrambles to stabilise its sprawling property portfolio and restore its rental income.

In the first of its monthly updates under new investment adviser AEW, scandal-hit Home REIT yesterday said it had also appointed property firm Jones Lang LaSalle to conduct a fresh valuation of its portfolio after being forced to dramatically write down and offload a swathe of properties in recent weeks.

Investors in the former FTSE 250 firm have been calling for a clear-out of the board since last year after a report from short-seller Viceroy Research blew the whistle on its shaky rental structure and triggered a series of scandals. Shares in the firm have been suspended

since January and the publication of its full year accounts has now been delayed for around 10 months.

In a statement yesterday, Home REIT said the board would likely be completely changed in the next year and before its shares began trading again on the London Stock Exchange.

“Following the appointment of AEW and the commencement of the stabilisation period, as well as consultation with major shareholders, the board has initiated a formal and phased succession process,” Home REIT said.

An individual with “significant listed company expertise” is being weighed up for the role of senior independent director and is “expected to join the board in the coming weeks” to lead the succession process, the firm said. Its delayed accounts are unlikely to be published until late 2023 at the earliest, Home REIT added.

Butternut Box provides catered home cooked meal plans for dogs

ANNA MOLONEY

PREMIUM dog food maker Butternut Box is looking to get its paws on more of Europe, with the premium dog food maker yesterday announcing it had raised £280m. New investor General Atlantic led the latest fundraising round, which Butternut Box said it would use to further its presence in Europe.

CHRIS DORRELL

SHARES in Chinese property developer Country Garden yesterday soared after investors backed proposals to restructure its debt, easing pressure on the embattled company.

The struggling developer agreed with investors over the weekend to extend the payment dates on a 3.9bn yuan (£424m) domestic bond, which

Turkish President Tayyip Erdogan said after talks with Russia’s Vladimir Putin yesterday that it would soon be possible to revive the grain deal that the UN says helped to ease a food crisis by getting Ukrainian grain to market. Russia quit the deal in July –a year after it was brokered by the UN and Turkey –complaining that its own food and fertiliser exports faced serious obstacles. Erdogan, who previously played a significant role in convincing Putin to stick with the deal, and the UN are both trying to get Putin to return to the deal. “As Turkey, we believe that we will reach a solution that will meet the expectations in a short time,” Erdogan said after his first face to face meeting with Putin since 2022.

Founded in 2016, Butternut Box produces fresh home cooked meals for dogs, with its offering including the likes of “venison with duck, carrots and a hint of apple”.

Co-founder David Nolan said the funding would help the company “live out [its] mission”.

“Everyone here is driven by a uniting purpose to deliver health and happiness to all dogs, everywhere.”

Workers at a factory which produces KP Nuts have agreed to postpone strike action following a new pay offer. Trade union Unite previously warned that its members at the site in Rotherham would start a week-long walkout today and take two more weeks of strikes from 18 September if the dispute over pay was not resolved. After a meeting with KP Snacks management yesterday, strike action will be suspended while workers vote on the revised pay offer from the company, Unite said. Unite general secretary Sharon Graham previously said workers were “sick of being paid peanuts”.

PA

was due to mature on Saturday. The proposals secured the support of 56.08 per cent of Country Garden’s investors and means it will repay the debt in instalments over three years. Its shares closed 15 per cent higher in Hong Kong.

The move prompted relief among investors, with Hong Kong’s Hang Seng Index closing 2.5 per cent higher thanks to a strong performance from

a number of developers. Country Garden, which was previously considered one of the most reliable developers, has become a bellweather for the state of China’s enormous real estate market, which makes up around a quarter of GDP. Consequently, panic set in last week when Country Garden reported a record $6.7bn (£5.2bn) loss for the first six months of the year.

A downturn in China’s property market has spooked markets globally

PROPOSALS to lift onshore wind out of a de-facto moratorium are unlikely to boost private investment in the sector, trade association Renewable UK has warned.

The warning comes in response to reports that Conservative MP Alok Sharma is planning to put forward an amendment to the Energy Bill, which would prevent onshore wind projects from being vetoed by a tiny minority of residents.

The move represents a U-turn from Prime Minister Rishi Sunak, who first opposed onshore wind developments last summer in his leadership bid.

However, Renewable UK has raised concerns over a clause in Sharma’s proposals to prevent developers from appealing project rejections.

James Robottom, head of onshore wind, told City A.M.: “The feedback we have had from our members is that if the amendment passes, it’s not going to do anything to encourage investment because the development

NICHOLAS EARL

WOOD GROUP has entered a new strategic partnership with Harbour Energy to service its North Sea operations in a $330m (£261.4m) deal – including support to help the company decarbonise.

The consulting and engineering giant will oversee the domestic projects of the largest independent oil and gas producer in British waters through the new master services agreement.

This will feature decarbonisation solutions for a number of Harbour’s offshore assets critical to UK energy security, with the fossil fuel producer already involved in multiple carbon capture projects.

Under the arrangement, Wood will also provide support for engineering, procurement and construction and operations and maintenance alongside digital services.

The deal will run initially for five years, with five one-year extension options covering Harbour’s operated assets, including its J-Area, Greater Britannia Area, Solan and AELE (Armada, Everest, Lomond and Erskine) hubs.

Steve Nicol, Wood’s executive president of operations, said the companies

shared “a commitment to ensuring safe, reliable and sustainable energy production” and was confident the deal would help ensure “the UK continues to have the energy mix it needs”.

Audrey Stewart, Harbour Energy’s vice-president of supply chain, SA, added: “Harbour is excited to develop our relationship with Wood and the signing of this contract is an important step forward in establishing our suite of long-term strategic partnerships across our North Sea assets.”

While Harbour is committed to developing Viking and Acorn CO2 capture and storage projects in the UK, the company is still looking to diversify operations from domestic waters.

Last month, it posted a billion dollar swing in its balance sheet, suffering an $8m loss for the first six months of trading this year weighed down by the higher UK windfall tax rate and falling fossil fuel prices.

As it stands, 85 per cent of Harbour’s business is in the UK, although the company has confirmed that the Zama oil development in Mexico has been approved by the country’s regulator, and a multi-well Andaman Sea exploration drive will begin in Indonesia in October.

expenditure risk is so high. While one person can’t block projects anymore, you now only have one shot.”

The government is thrashing out the final wording of the proposals, with ministers set to put forward the changes to the Energy Bill this week, The Daily Telegraph reported.

The bill will be presented for its third reading in parliament today.

A government spokesperson said it had “consulted on changes to national polity that could give local authorities more flexibility”.

GUY TAYLOR

THE NUMBER of London construction firms going bust has risen by almost a quarter since the pandemic, as the capital’s builders find themselves on the “sharp end” of nationwide delays to major infrastructure projects and soaring inflation.

A total of 884 of London’s

construction businesses have gone bust already this year, up from 710 in the same period of 2019, according to Creditsafe data shared with City A.M.

It comes amid a wider slowdown in the sector, which has struggled against a backdrop of rising raw material costs, a dip in housebuilding and a string of long-delayed major infrastructure projects.

Rico Wojtulewicz, head of housing and planning policy at the National Federation of Builders, told City A.M. London firms are “more exposed as many projects are investor led, where sub-contractors operate on a job-by-job basis rather than knowing there is a pipeline of work”. Consequently, cashflow problems can leave firms with “no option but to cease trading”.

LLOYDS is encouraging employees back into the office as the summer lull comes to an end.

Under current rules, members of staff are expected to work in the office for at least two days a week. The bank is now seeking to ensure that staff meet its expectations with a charm offensive including free food from this week, according to the Financial Times.

In a transcript of a staff briefing in July seen by the outlet, chief executive Charlie Nunn reportedly said: “We need everyone in this together, working at pace, if we are serious about transformation and change. Otherwise we are holding ourselves back.”

“We can only [be competitive] if we collaborate effectively... which is difficult, if a team are below strength on certain days of the week.”

In addition to its working from home policy, the bank offers staff further flexible working options, including job sharing, extended maternity leave

CHRIS DORRELL

ONLINE trading platform CMC Markets, owned by Tory peer Lord Cruddas, has appointed Albert Soleiman as its chief financial officer, replacing Euan Marshall.

UK as global tax director. He rejoined the London-listed firm a year later to lead the launch of CMC Invest, which was a key part of the firm’s plans to diversify its business over the past few years.

and flexible bank holidays. Staff with caring responsibilities are also allowed to compress full-time hours into fewer days. However, in a sign of the tensions surrounding home-working, a number of staff complained when Lloyds announced a review of its compressed hours policy.

Sharon Doherty, Lloyds Banking Group’s chief people and places officer, said: “We have launched ‘Flexibility Works’ to provide an enhanced range of flexible working policies for our people that will help us succeed in driving our ongoing strategic transformation plan.

“We are proud to be a leader in flexible working and we are confident our enhanced approach will continue to help us attract and retain the best and most diverse talent, as well as enhancing our productivity across the organiLloyds joins a growing list of financial services firms attempting to get staff back into the office with HSBC, Citi UK and Goldman Sachs clamping down on excessive remote working.

Soleiman first joined CMC in 2005, remaining at the company until 2019 when he joined blockchain tech company Bitfury

SAM TOBIN AND MANUEL MUCARI

MOZAMBICAN President Filipe Nyusi cannot be sued in Britain over allegations he accepted unlawful payments in the country’s lawsuit against Credit Suisse and others over the $2bn “tuna bond” scandal, London’s High Court ruled yesterday.

The tuna bond or “hidden debt” case has triggered criminal investigations from Maputo to New York, plus a series of linked lawsuits in London involving

Credit Suisse, shipbuilder Privinvest, its owner Iskandar Safa and many others.

Privinvest and Safa tried to drag Nyusi into the case, arguing he should contribute to any damages they may be ordered to pay if they are found liable to Mozambique.

However, Judge Robin Knowles said in a written ruling yesterday that Nyusi “has immunity from the jurisdiction of this court whilst he is head of state of the republic”. No one in Nyusi’s office was immediately available to comment.

Outgoing CFO Euan

CFO Euan

Marshall announced he would be joining rival Integrafin last June, but will remain at the firm for “the next few months” to support an orderly CMC Markets was among a host of trading platforms to make hay while markets were roiled by Covid-19 but has since struggled amid quieter conditions.

BELVOIR yesterday reported a leap in profits in its half-year results, with the letting agents boosted by the rising demand for rent along with a string of acquisitions.

The listed property firm reported profit of £4.4m for the first six months of the year, an uptick of 10 per cent.

Belvoir Group also reported a small three per cent increase in revenues to £15.9m, up from £15.4m in the same

period last year.

Despite the tough market conditions for the UK’s housing sector, with Belvoir seeing an 18 per cent fall in property transactions due to rapidly rising mortgage rates, strong rental demand boosted the firm.

“The private rental sector continued to be impacted by a perfect storm of an undersupply of properties and strong demand from tenants,”

Dorian Gonsalves, chief executive officer of Belvoir Group, said.

THE GREEN credentials of the carbon capture industry have been called into question after new analysis revealed the huge amount of high-polluting fuel needed to power ships transporting captured carbon dioxide around the world.

Currently, the shipping industry relies on emissions-heavy conventional fuels such as maritime diesel or low-sulphur fuel oil.

Rystad Energy predicts that more than 90m tonnes per year of carbon dioxide will be shipped by the end of the decade, requiring a fleet of roughly 55 ships, as an increasing number of oil and gas firms look to capture more carbon emissions to limit the environmental impacts of their projects.

By the end of the decade, the carbon capture industry could emit as much as five per cent of the total CO2 shipped worldwide, Rystad forecast.

As it stands, onshore pipelines are the most common mode for carbon transportation currently, with 330 expected to be operational by 2030, while off-

shore pipelines will transport captured carbon to underwater storage sites and are expected to play a vital role in the supply chain in the coming years.

However, CO2 shipping is the third piece of the puzzle and the most viable solution for carrying carbon emissions over long distances at a relatively low cost.

Lein Mann Bergsmark, vice president of supply chain research at Rystad Energy, said: “Carbon dioxide

“With 58 per cent of their [franchisees] revenue derived from a strong recurring lettings market, our property franchisees have been able to offset the impact of the reduction in UK housing transactions.”

The company also benefited from two new acquisitions, with the firm snapping up both financial services firm BMA Bristol and mortgage broker MAB for £1m a piece during the term.

Shares in Belvoir rose yesterday to close up 3.9 per cent.

shipping is a nascent market now, but it’s set to play a significant role in the global climate solution in the coming years.

“However, questions remain about the environmental impact of the process. In an ideal world, CO2 tankers would use renewable fuels with no associated emissions. However, these fuels are too expensive now to be economically viable,” he said.

The UK has committed up to £20bn for carbon capture projects and re-

The low-cost carrier reported a record August, despite being forced to cancel over 350 flights due to last week’s air traffic control fault

GUY TAYLOR

RYANAIR flew a record number of passengers for the fourth month in a row in August, despite reporting 350 cancellations due to the recent air traffic control scandal.

The low-cost carrier said it had carried 18.9m passengers in August, up 11 per cent year-on-year and representing an increase from a July record of 18.7m.

The figures provide a fitting end to one of the busiest summer

GUY TAYLOR

THE CHIEF executive of BMW has warned that European Union (EU) plans to ban combustion engine vehicles are forcing European carmakers into a price war with Chinese competitors.

“The base car market segment will either vanish or

will not be done by European manufacturers,” said BMW boss Oliver Zipse, in reference to the rapid rise of Chinese electric car brands such as BYD.

A slew of Chinese brands, primarily made

seasons of travel, with budget rival Wizz Air also reporting a 23.9 per cent year-on-year increase in passengers, with over 6m flying with Wizz Air in August.

Load factor, which refers to the proportion of seats filled by its passengers, also remained strong for both airlines – at 96 per cent and 94.1 per cent for Ryanair and Wizz Air respectively.

However, the bumper summer period has also marred by disruption, with air traffic control

chaos in the UK and France, as well as wildfires in Southern Europe, forcing carriers to cancel thousands of flights.

Ryanair yesterday said the air traffic control failure in the UK had resulted in the cancellation of over 350 flights over the two following days, affecting 63,000 passengers and questioned why the cause had “still not been explained”.

Additionally, it said it had been forced to cancel over 1,700 flights due to industrial action in France.

up of electric carmakers including BYD, Tang, SAIC and Aiways, have been looking to muscle into the EU market.

“I want to send a message: I see that as an imminent risk,” Zipse said, referring to the increasing competition from China, the Financial Times reported.

But, he added: “I am not worried about BMW.”

GRANTShapps will no longer oversee the UK’s energy ambitions, taking up his new role as defence secretary –his fifth ministerial job in under a year at the behest of three separate prime ministers, making the frontbencher’s volatile career path an emblem of historic Downing Street disunity. Every department now appears to be a revolving door, and his successor Claire Coutinho will be the fourth secretary of state to cover energy since this columnist started reporting on the subject less than two years ago.

The East Surrey MP has secured a major promotion with her new role as energy security and net zero secretary, and is the first of the 2019 election intake to join the cabinet – cementing her place as a rising star in the Tory party.

In some ways, she has been compared to Prime Minister Rishi Sunak, who Coutinho has previously worked for as a special adviser.

Both of them were supporters of Brexit, with backgrounds in finance, and they each ascended to their first big jobs from more junior positions – with Coutinho moving from under-secretary of state for children, families and wellbeing to energy security and net zero secretary.

Coutinho will of course be hoping that nothing as historic and as transformative as the Covid-19 pandemic lands on her plate mere weeks into the job, like it did with Sunak, but there’s no doubt her intray will be highly challenging from day one.

With an election little more than a year away, there’s no point pretending the position is a long-term post.

Nevertheless, Coutinho could present a less combative image than Shapps –who was prone to bizarre media grandstanding such as conflating Labour with Just Stop Oil, while also premiering

his showdown with petrol bosses over prices on social media.

Instead, she could ease jitters in an industry shaken by political whiplash from windfall taxes.

Pushing for policies backed by the industry (and many voters), such as planning reform and a stable tax environment would go a long way to bringing the energy sector onside amid growing concerns over the UK’s investment climate.

There also industry hopes she could be more interested in renewables than Shapps, with Coutinho using her first speech in parliament to praise the UK’s role in offshore wind and previously supporting wild belts for nature among new housing developments.

Coutinho will soon face calls from the clean energy sector for more taxpayer money – with the upcoming round for offshore wind projects set to underwhelm, and producers also smarting from the renewables levy on electricity generators.

Over time, it is hard to see how the UK cannot enter the subsidies race with the US and EU – but with taxes at a historic 70year burden, Coutinho will have to approach this matter strategically.

The government has committed funds to technologies such as carbon capture and

However, there also will be areas where the UK will have to depend on others to fund breakthroughs, with continued debates over full-scale nuclear, fusion, hydrogen production and mineral procurement all worth engaging in. This might include extensive diplomacy with allies, and crucially, disappointing some industries hoping for financial backing.

There are further lingering questions over support packages for businesses and households, and the annual challenge to keep Britain’s lights on amid Russia’s supply squeeze on gas.

Household energy bills are likely to remain double previous levels, with Ofgem currently consulting on the idea of a social tariff during the coldest months of the year.

Coutinho should not push for unsustainable financial pledges, which will ultimately be Chancellor Jeremy Hunt’s call, with high energy bills here to stay for a decade, according to Cornwall Insight.

increase storage.

Debates over the validity of net zero are also likely to emerge in the coming weeks with COP28 in the UAE on the horizon, while the Energy Bill set to go through parliament could bring up debates on everything from sustainable aviation fuel to Rosebank.

There is no doubt about it, Coutinho faces a baptism of fire in her new position, and all eyes will be on whether this new rising star continues to shine.

What can we do to improve energy security?

The PLANNING ACTS and the Orders and Regulations made thereunder This notice gives details of applications registered by the Department of The Built Environment Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission Guildhall Building Structure, Guildhall Yard, London, EC2V 7HH 23/00611/LBC

Fixing a permanent plaque to the William Beckford monument in the Grade I listed Guildhall. 40 Holborn Viaduct, London, EC1N 2PB 23/00867/FULMAJ

including landscaping of the external area on Holborn Circus.

consideration of this application.

Her first job is to get the industry onside

City A.M.’s energy editor Nicholas Earl delves into the sector’s challenges in his weekly column

Chancellor Jeremy Hunt said inflation is on track to halve this year, albeit with a blip this month after petrol prices increased. While it is still the highest among the G7, inflation has been retreating from October’s 41-year high.

Plus, the UK has enjoyed some positive upgrades to its official growth figures – the UK economy was 0.6 per cent larger in the fourth quarter of 2021 versus the same period in 2019, a major upward revision from a prior estimate that the economy was 1.2 per cent smaller. That means the economy recovered much faster out of the pandemic than previously believed.

Onto the bad. Over the last two years, elevated inflation and rising interest rates have taken their toll. The CEBR estimates the high cost of borrowing will continue to put a major strain on UK companies with around 28,000 business expected to go insolvent next year. It said there were over 6,700 insolvencies in Britain in the second quarter of this

Wetherspoon founder Tim Martin is never shy of making a point, and his latest move to cut prices to what they would be if supermarket taxes applied to pubs fits in that category.

year, more than double pandemic era levels when government schemes supported businesses. The CEBR also expects the UK to tip into recession with a contraction in the fourth quarter of this year and the first quarter of next.

Given the pain that tighter monetary policy has caused, all eyes are on the Bank of England for clues into the future path for interest rates. Money markets expect at least one, possibly two, more rate hikes ahead, lifting the bank rate to either 5.5 or 5.75 per cent. And while there is a chance the central bank could cut interest rates next year, borrowing costs will remain high by historic standards, far from alleviating the burden on businesses and mortgage holders.

August was the worst month of the year for equities in the UK, US and Europe amid rising bond yields and uncertainty in China. But so far, this month has got off to a more positive start, hopefully paving the way for a rebound in September.

“The biggest threat to the hospitality industry is the vast disparity in tax treatment among pubs, restaurants, and supermarkets. Supermarkets pay zero VAT in respect of food sales, whereas pubs and restaurants pay 20 per cent,” he says. He may be unimpressed with government, but investors are enjoying the firm’s 60 per cent share price bump this year.

£ According to the RAC, a litre of petrol rose by 7p on average in August, the fifth highest monthly increase in 23 years, while diesel rose by 8p, the sixth highest increase. This was on the back of oil’s recent rally driven by supply constraints rather than strengthening demand. Russia announced plans to cut its oil exports last week while Saudi Arabia is expected to extend its voluntary output cuts in October. Rising petrol prices won’t help those inflation figures.

£ Ryanair carried over 18.9m passengers in August, a new record high, up 11 per cent versus a year ago. It operated 103 thousand flights during the month with over 350 flights cancelled due to the air traffic control computer failure issues over August bank holiday weekend. Shares in Ryanair have rallied sharply this year, driven by robust post-Covid demand for summer holiday travel and a jump in prices. However the winter could be more challenging as the cost of living weighs on consumer spending.

Robert Gardner, chief economist at Nationwide

Goalhanger Podcasts, behind the hugely successful The Rest is Politics podcast series, brings us a new show, The Rest is Money, presented by well-known broadcast voices Steph McGovern and Robert Peston. The pair aims to “decode all the business jargon that you hear on the airwaves and break it down for you, while also reaching back into the past to revisit some of the biggest financial events of the last half century – to see if there are any lessons we can learn from them today”. The first episode discusses whether we are in the midst of a ‘slow death’ for the British stock market and looks at whether high streets can survive in 2023.

LES BLEUS UNDER ENORMOUS PRESSURE TO PERFORM PAGE 19

Where interesting people say interesting things. Today, it’s Victoria Scholar, head of investment at Interactive investor

A relatively soft landing is still achievable in the UK housing market

WHEN ACTIVISThedge

fund Quintessential launched a short attack against London-listed tech darling Darktrace in January, the charge sheet was a serious one.

Among a lengthy list of misdemeanours, Darktrace, Quintessential said, had seemingly “simulated or anticipated sales to phantom end users”, repeatedly used marketing activities to “channel funds back into its partners” and may have used “shell companies in offshore jurisdictions manned by individuals with ties to organised crime, money-laundering and fraud”.

The once feted tech giant was thrown. Its share price cratered, bosses scrambled to refute the allegations and comms officials were quickly on the phone to fight the fire.

But when it later called in auditors at EY to try and clear its name, the reality seemed to be some way short of the sordid picture painted by Quintessential.

Aside from “a number of areas” where its systems, processes or controls could be improved, Darktrace said it had been given a largely clean bill of health by the Big Four firm. The shares have since recovered.

However, it should be noted it has refused to publish the report in full, and Quintessential has called on the firm to “fully unveil the details of the EY re-

view” and facilitate an “open dialogue” on its findings.

“Given the severity of our allegations, we believe this situation warrants a significantly higher level of transparency, which Darktrace has yet to provide.”

‘IMPORTANT TOOL’

Even as question marks remain, the spat has ignited a debate over the virtues and pitfalls of short selling in the UK just as government embarks on a push to overhaul existing rules.

Ministers have touted short selling as an “important tool” in the market arsenal that facilitates price discovery and allows investors to call out wrongdoing. Under a number of regulatory tweaks, short sellers will have slacker restrictions on disclosures, meaning they do not have to reveal their identity or announce their positions to the market until they cross a slightly higher threshold of 0.2 per cent of issued share capital.

In essence, short selling means investors bet against a company’s share price and rake in hefty profits when it falls. Investors borrow a stock, sell it on and then buy it back on the cheap after the price has plummeted, leaving them with a profit.

Activist short sellers like Quintessential accompany their bets with damning reports seemingly blowing the whistle on things like corporate malfeasance and dodgy accounting.

Many say this leaves the system open to abuse.

But sometimes it’s in those reports that the virtues of short selling often come to the fore.

Take the example of Home REIT last year. Prolific short seller Fraser Perring of Viceroy Research blew the whistle on the social housing investor’s shaky foundations and triggered a monumental corporate crumble that has seen its shares suspended and a total overhaul in strategy.

Home REIT made false statements to the market about social purpose. Viceroy exposed them.

However, often the disputes can slip into more contentious territory. There is no suggestion of nefarious motives in Quintessential’s attack, but some City figures have called for a firmer regulatory hand on some short selling reports that go unproven.

A question lingers, however, over how far the watchdogs can really go in clip-

ping their wings.

“‘Trash and Cash’ is a form of market abuse where the holder of a short position in a security makes or causes to be made a false or misleading negative statement about the issuing company and profits from the resulting fall in share price,” Martin Sandler, a financial services regulatory partner at Eversheds Sutherland, tells City A.M.

“Currently, however, it is extremely difficult for a regulatory or enforcement authority to prove that a statement or report is false or misleading, or even linked to the short seller or that there was any intent to mislead the market.”

It’s also not true that short sellers always do well out of their positions. Many who took positions against Ocado, a perennial favourite of short sellers, have been faced with a stock up 35 per cent on the year.

Advocates too argue that, along with price discovery, shorters provide market liquidity where needed.

The regulator already has a toolbox to deal with the murky world of short attacks. FCA officials can draw on a deep pool of data sources including order book and transaction data when reviewing an allegation of market abuse, while Suspicious Transaction and Order Reports (STORs) filed by regulated firms can also give a glimpse into the structure and nature of any short attacks.

In moments of crisis, too, regulators can put a stop to short selling. The Fed banned short selling of financial stocks during the financial crisis.

Lehman Brothers boss Dick Fuld believed that came too late for his firm, and blamed short sellers for the investment bank’s demise.

Legally, the watchdog can also demand any information from firms and people it thinks may be connected with market manipulation. It can also initiate both civil and criminal investigations into any suspected manipulation.

But the crux, as Sandler points out, lies in proving any motive to mislead.

For the moment, even with a number of reforms coming through to the UK’s capital markets, short selling will remain as easy to execute as ever.

“The Treasury is proposing a series of technical changes that should reduce the administrative burden for market participants but would not make it harder for short sellers to target UK companies,” Tom Callaby, a financial services Partner with law firm CMS, tells City A.M.

“Taking short positions and then disseminating misleading negative information with a view to decreasing the price continues to be contrary to the UK’s market abuse regime.”

Whether regulators have the desire to go much further than that, however, remains to be seen.

LONDONmarkets ran out of steam yesterday, ending in the red having traded higher for most of the day. The blue-chip FTSE 100 index fell 0.16 per cent at 7,452.76 while the midcap FTSE 250 index fell 0.1 per cent to trade at 18,524.14.

Investors were initially buoyed by hopes that stimulus measures in China for the struggling real estate market were starting to take effect. Ailing developer Country Garden also managed to secure more time to pay off its enormous debts.

However, as the day wore on, traders grew less and less optimistic. “The declines are largely coming from waning optimism about support measures for the struggling Chinese property market,” Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown said.

“Debt payment extensions for property giant Country Garden were taken as a real jolt of positivity earlier today, but the reality that this is likely just a temporary fix has started to set in.” Things did not get any better after a speech from Christine Lagarde, president of the European Central Bank. Speaking at the European Economics & Financial Centre, she said “actions speak louder than words”, raising the prospect of further rate hikes.

The FTSE 100’s top fallers were insurance firm Admiral, which fell 1.9 per cent, and chemicals firm Johnson Matthey, which slipped 2.2 per cent.

HSBC and Standard Chartered, both of which have significant exposure to China, ended lower, falling 0.5 per cent and 1.2 per cent respectively.

US markets were closed yesterday for Labor Day.

Equipment rental firm Ashtead performed well in the first half of the year, with revenue up 57 per cent and pretax profit ahead of expectations. Analysts at Peel Hunt said “acquisitions are integrating well and ahead of expectations” while there was also strong organic growth. They expect to increase estimates for pretax profit for the full year. It was rated a ‘buy’ with a target price of 400p.

“Is

Trading firm CMC Markets appointed Albert Soleiman as its new CFO yesterday morning. Soleiman led the launch of CMC Invest in 2020, which analysts at Peel Hunt described as a “key part of the group's strategy going forward”. They noted that outgoing CFO Euan Marshall will remain with the group for the next few months. CMC Markets is currently under review.

reflation the next buzz word to trouble market sentiment?

Anyone who’s had to fill up their vehicle over the last couple of weeks can be forgiven for feeling slightly punch-drunk at the rapid shift back to high prices at the pump. The question now is how that will add into the inflation equation and from there the next Bank of England interest rate decision.

DANNI HEWSON, AJ BELL

AFTER what seemed like an endless summer recess, Parliament is back on this week, with a distinctive back-toschool feeling. Some MPs look a bit disoriented, like they need some help to remember what’s going to matter in the upcoming months.

People are dead worried about housing, whether they’re young renters, families with mortgages or households pushed into temporary accommodation by the skyrocketing cost of rent.

For young renters - an influential group of voters, which has historically leaned towards Labour and that the Tories always want to win over - things look pretty bleak. In London, the average rent went up to over £2,500 in April, according to Rightmove. People in the capital are spending on average 40 per cent of their household income on rent. Even in other parts of the country where the rental market is less cruel, rental prices are pushed up by a lack of housing. Coastal towns and tourist hotspots are plagued by the Airbnb conundrum, with communities hollowing out because the youth move out to the cities as there is no housing - and no jobs - available for them.

Mortgage holders are not in a much better position. The amount they have to pay has gone up over the last year, together with interest rates, with many forced to sell their home because they

can’t afford to repay their mortgage.

Others who are renting out have hiked their tenants’ rents to pass on the cost to them, creating a spiral of problems.

This group of voters wants the government to do more to help them. In June, Chancellor Jeremy Hunt convinced lenders to provide a 12-month grace period before starting repossession proceedings. Yet the government has been clear that no direct support will be provided.

Labour and the Conservatives have been fighting to take control of the housing narrative, firing announcements and policy ideas at each other.

The Tories have Michael Gove, the Lev-

elling up Secretary, as their trump card. But Labour has been braver in showing resolve on controversial issues like building on the green belt. Whoever comes out of it looking more convincing will have a big advantage at the next elections.

What people are not spending on rent or mortgages, they’re spending on food and heating. Energy prices are another key issue as we move into autumn and winter. The energy price cap has been falling, but Ofgem CEO Jonathan Brearley said days ago that he couldn’t “offer any certainty that things will ease this winter”. Bills will go down, but they’re still higher than they were before the

pandemic and Russia’s invasion of Ukraine, and won’t go back to pre-2020 levels until the end of this decade, according to Cornwall Insight. Meanwhile, the government support schemes for households and businesses were terminated over summer. Keir Starmer has insisted on making oil and gas giants pay extra tax, and on insulating 19 million homes to lower bills, but has been vague on the how and when. One of the two parties will have to reign over this issue to look credible.

Another thing that matters is our strategy, as a country, when it comes to net zero and green energy. The Tory party under Sunak looks increasingly

OVER the last few years, London has been hit by unprecedented challenges, from Brexit and the pandemic to the increasingly worrying effects of climate change and the cost-ofliving crisis. London is obviously not alone in struggling, but its international nature means the effects have been felt even more keenly here.

Institutions and businesses have come up with different strategies to tackle these issues, and business improvement districts have helped wherever they could. As the channel between public and private sectors, and thanks to the business levy they collect, they can deliver tangible actions to support innovation and sustain businesses. But their full potential has yet to be seized.

Over the last 20 years, since the business improvement district legislation was put in place, the UK has gone from zero to more than 330 districts, contributing over £150m every year to their local communities and representing nearly 120,000 businesses across the country. In London alone, there are 74 of them generating £60m of levy in-

Ruth Dustoncome which is re-invested locally, creating greener and safer areas.

As the capital’s business improvement districts meet today for the annual London BIDs Summit, they’ll show once again what a force for good they are in the capital. For businesses, they represent the opportunity to get their voice heard by local, regional and national government, and to ensure their local priorities are acted on. For the public sector, they facilitate dialogue with businesses, and allow neighbourhoods to directly benefit from the millions of pounds generated in levy collection from their local businesses.

Over the last few months, London has welcomed new public spaces which the districts have been instrumental in delivering. Princes Circus in Holborn and

Strand/Aldwych in Westminster, which jointly received over £4m of investment from the Central District Alliance and The Northbank BID respectively, are only two of many. These projects have a tangible impact on their local areas, giving priority back to pedestrians and improving local air quality, with Strand/Aldwych’s rush hour pollution decreasing by 50 per cent. The public realm vision recently published by the Whitehall BID would deliver equally meaningful changes, turning Parliament Square, Whitehall and Victoria Embankment into people-friendly areas.

Business improvement districts can also deliver enlivenment programmes, working with London’s local authorities on exciting projects which support their destination marketing activities for visitors from the UK and abroad.

The five City of London districts, for instance, work closely with the City of London Corporation to support “Destination City”, its leisure and cultural initiative, as well as delivering their own programme of activities which support the City’s ambition to become a world-leading leisure destination and

help drive increased footfall and spend. But there is more that business improvement districts can deliver. In central London in particular, they have the power to do things that have an impact nationally, and positively shape the country’s reputation internationally. By acting at a hyper-local level, business improvement districts have an influence on our capital’s attractiveness for foreign direct investment and business in general, including domestic and international tourism, even helping to attract more international students. This benefits London directly; but when our capital thrives, so does the whole country.

With financially challenging times ahead, a mayoral election and a general election on the horizon, local and national governments should now engage even more closely with business improvement districts and work together to kickstart London’s growth, and support our whole country’s recovery.

£ Ruth Duston is the founder and CEO of Primera, which powers 12 central London business improvement districts

uninterested in, if not sceptical, about the road to net zero. This pisses off many more people than simply Just Stop Oil activists. Sixty-four per cent of adults in the UK say they are somewhat or very worried about the impact of climate change, and numbers are higher for younger demographics. Young people on both sides of the political spectrum see the benefits of transitioning to a green economy in terms of jobs and innovation. Yet the government is making insufficient progress towards net zero, according to the Climate Change Committee.

City investors are equally annoyed at the government's repeated u-turns on green energy and infrastructure. They need Westminster to decide what the course and pace will be, to plan ahead. With Starmer’s City offensive getting a foothold, the government would be foolish not to take the Square Mile’s concerns seriously. In the upcoming months, it will have to determine what its decisive strategy on net zero is. And if it decides to effectively take a step backwards, it will have to deal with the political consequences of such a choice. One last thing to care about? Transport. If the state of a nation is defined by its railways, we’re faring pretty poorly over here. Strikes might be largely past us, but everyone has given up on trains. There will also be the question of TfL funding for the next year as well as more noises about the Ulez scheme. Finding tangible solutions for some of these tensions, instead of simply playing politics with them, will give the last, key advantage to whatever party will prove up to the task.

Former Education

Secretary Gavin

[Re: Re: Banks raised savings rates to avoid ‘robust action’ from watchdog, September 1]

When it comes to passing on savings rate rises, the big traditional banks simply aren’t showing the same level of commitment to their customers as some innovative challengers.

Despite newer players passing on rate rises (we have done it eleven times in the past year) there remains a level of complacency from some of the bigger banks. It seems like they feel they don’t need to pass on rate rises to savers in order to retain their

customers' deposits. So, it’s revealing to see that the regulator feels they need to intervene.

Customers should have confidence that their provider will always have their back by giving them their best rate, rather than being forced to put in work to chase here-today-gonetomorrow better offers.

Rate-chasing discourages long-term wealth building by making the process time-consuming and overly complex in an already stressful financial landscape. All of us in financial services have a responsibility to support our customers in creating long term wealth for the future.

Gina Silvester Chief operating officer, ChipONE evening last week, I watched a friend tuck into a sirloin steak. It looked delicious, if a little overdone, but I knew there was much more to it than met the eye. While the chips and peppercorn sauce it came with were real, the steak itself was a fake. What my friend was actually eating was a 3D-printed steak, made of soy, wheat, rapeseed oil, beetroot, and coconut fat.

The creators of this savoury sleight of hand are Redefine Meat, an Israeli company founded in 2018 that aims to provide consumers with “the full sensory experience of meat” without any moral compromise. Redefine Meat attribute the lifelike quality of their products to time spent investigating the muscular structure of animal meat so that it can be reproduced through 3D printing. I can attest to the unnerving textural similarity of one of their meat cubes that I ate earlier this year. Though it’s been nearly a decade since

It attracts thousands of people from all over - including many Brits - but this year Burning Man, the festival in the Nevada desert, was a disaster as torrential rains stopped the celebrations. One person died and many partygoers are likely to be stranded there for at least two more days.

Yesterday, healthcare company Novo Nordisk launched its weight-loss treatment Wegovy in the UK. Brits will be able to get it through the NHS weight management scheme or private healthcare professionals. The drug is popular in the US, where patients pay as much as $1,350 each month to get the treatment. Various celebrities, including Elon Musk, admitted to taking it and praised its effects. Wegovy can help patients reduce body weight by up to 15 per cent when used

along with exercise and lifestyle changes. It can be prescribed for a maximum of two years. It comes with its complications, however. Most people regained weight after stopping the treatment, prompting the question of how sustainable it is in the long term. A second issue is its price, and the risk it could become a treatment for the rich and famous only. It’s unclear how much it will cost in the UK, but data from Simple Online Pharmacy put it potentially between £199 and £299 per month.

What if you could buy meat that tastes like beef but had the nutritional profile of oily fish?

I stopped eating meat, if I had discovered this fleshy object in my food anywhere else, I would have spat it out indignantly.

My carnivore friend – a man I suspect of travelling to Scotland purely so he can get his favourite pulled pork buns from an Edinburgh takeaway named Oink – demolished his fake steak and declared he would be only too happy to eat it again. You can try it yourself at Unity Diner if you’re interested.

But despite glowing endorsements such as these, the future of fake meat products in the UK looks murky. Last month Beyond Meat, makers of the best vegan burger patty you can get in my opinion, revised their annual forecast down following a 30 per cent drop in revenues in the second quarter of

this year. Earlier this year, another firm called Meatless Farm had to be rescued from administration as its meat substitute product lines were withdrawn from supermarkets.

Various credible explanations have been put forward for these difficulties, from the cost-of-living crisis to a move away from processed foods to an overestimation by businesses of the size of the vegan market in the UK. Whatever the reason behind the British public’s increasing disinterest in these products, and despite Redefine Meat’s spookily good steaks, the innovators who might actually transform our diet will use cellular agriculture, not 3D printers to do so.

The first lab-grown burger, made directly from animal cells, was created in 2013. Because of challenges with producing commercial quantities, such products are yet to hit shelves more widely. With companies experimenting by combining different animal cells, the potential range of creations is vast.

What if you could buy meat that tastes like beef but had the nutritional profile of oily fish? Or eat a lab-grown

steak as good as any cut of Wagyu? Imagination is the limit: in March of this year, a gigantic meatball was unveiled in front of the press in Amsterdam's science museum. What was so special about this meatball? It was made of lab-grown woolly mammoth cells. Disappointingly, nobody was allowed to eat it because of killjoy concerns over how the human immune system might react to a protein not consumed by us for millennia. The relationship between the consumption of animal foods, especially meat and dairy, and greenhouse emissions is crystal clear. By contrast, the world’s most sustainable foods are things like pulses, mushrooms, oats, and seaweed. But even a self-righteous vegan like me struggles to envision a world in which meat-eating friends snub pulled pork buns in favour of a chickpea and portobello porridge. If lab grown meat can lead us away from environmentally harmful and questionable dietary practices better than fake meat can, then I’m all for it.

£ Phoebe Arslanagic-Wakefield is chair of Women in Think Tanks Forum

Twisted Automotive has given the Suzuki Jimny a powerful turbocharged boost. John Redfern gets behind the wheel

NORTHYorkshire’s Twisted Automotive has developed a formidable reputation for building high-performance versions of the classic Land Rover Defender. But now it has turned its attention to something smaller: the Suzuki Jimny.

Choosing the Jimny was a very deliberate decision. Twisted founder Charles Fawcett has long been a fan of Suzuki’s compact off-roaders, making it a natural fit for the company’s portfolio.

Like the Defender, it uses a traditional ladder frame chassis, and comes with rugged utilitarian charm as standard. When launched in 2018, the fourth-generation Jimny became an instant cult classic, and boasted impressive off-road ability.

The weakness in the latest Jimny’s armour has always been its 1.5-litre naturally aspirated four-cylinder petrol engine. Producing 101hp and 130Nm of torque, it made the car feel asthmatic, and woe-

fully underpowered on a motorway. Twisted has removed this Achilles’ heel in classic tuner fashion, by adding a turbocharger. The company spent countless hours investigating the best upgrades, creating a bespoke package of parts for the pint-sized off-roader.

The turbocharger is supported by a performance air filter, new oil feeds and a catch tank, plus a sports exhaust downpipe. Controlling everything is a custom Syvecs ECU, which is mapped to optimise output from the new boosted setup. The result is a total of 165hp, or a 63 percent increase in power compared with the regular Jimny. Torque has jumped significantly, too.

In isolation, 165hp may not sound like a massive amount of power, but the Jimny’s modest mass is the important factor here. Tipping the scales at around 1,090kg, its power-to-weight ratio is certainly into sports car territory.

This quickly becomes apparent on

SUZUKI JIMNY BY TWISTED

PRICE: FROM £59,400

POWER: 165HP

0-62MPH: 7.0SEC

TOP SPEED: 100MPH

FUEL ECONOMY: N/A

KERB WEIGHT: 1,090KG

the road, with surging acceleration and a feeling that this Jimny is more like a junior hot hatchback than a regular 4x4. There is little turbo lag, and the boost feeds in almost instantly with a pleasing ‘whoosh’. Lift off the throttle and the turbo does an impression of a small owl beneath the bonnet. Such performance, and its aural accompaniment, quickly becomes addictive.The 1.5-litre turbo engine is happy to be revved, and is combined with the Jimny’s light and precise five-speed

manual gearbox. Although the Jimny is four-wheel drive, this is reserved solely for off-road use. On tarmac, the Twisted Jimny remains reardriven, which can bring the traction control into play when the roads are damp. In optimal circumstances, Twisted’s Jimny should halve the 14-second 060mph time of the regular model.

The Jimny will goad you into going faster, despite the slightly surreal experience of sitting so high-up off the floor. Thankfully Twisted has upgraded the car’s suspension, and fitted a rear antiroll bar, but off-road tyres and the laws of physics will be the limiting factors when it comes to cornering.

On the inside, Twisted has transformed the utilitarian Jimny into a far more luxurious place to be. Leather covers most surfaces, with huge amounts of sound deadening added. It means you actually hear the upgraded infotainment system, which incorporates Apple

CarPlay connectivity and a reversing camera. As with all Twisted creations, buyers can fully customise a Jimny to their taste.

Twisted bases its conversion on the twoseat light-commercial vehicle version of the Jimny. The rear bulkhead is removed, creating a more spacious cabin, but the practical load area remains. Classed as a van, businesses can thus reclaim the VAT. Examples of the Jimny with four seats or an automatic gearbox can be supplied as a personal import.

The uprated Jimny starts from £59,400 including VAT. This does seem rather a lot for such a small 4x4, but the end result is brimful of charm. Twisted has removed the Jimny’s shortcomings, but not its character. For those who want the Twisted Defender experience, but on a smaller scale, this is a winner.

John Redfern writes for motoringresearch.comTHEfirst electric Lamborghini isn’t due until 2028, but we’re told the Lanzador concept provides ‘a concrete preview of the production vehicle’. For a car company that, perhaps more than any other, has outrageous combustion engines twisted into its DNA, this radical EV suggests the future will not be dull.

The Lanzador tees up a longanticipated ‘fourth model line’ for Lamborghini, sitting alongside the Urus SUV and two supercars: the new plug-in hybrid Revuelto and smaller, soon-to-be-replaced Huracan. Technical details are sparse, but it uses two electric motors – one for each axle – to deliver ‘peak power of over one megawatt’ (circa. 1,360hp). If the

showroom version follows suit, that would make it the most powerful production Lamborghini ever.

The Lanzador’s wedgy styling was apparently inspired by the Sesto Elemento concept, Murcielago and reborn Countach LPI 800-4. However, as a luxurious GT with two seats and four seats, we’d also draw a direct line to the most glamorous Lamborghini of all: the 1968 Espada.

However you define it, the Lanzador certainly bridges the gap between an SUV and a supercar. Its combination of a raised ride height and low-slung body looks genuinely different. Indeed, at around 1,500mm, the car is no taller than a typical hatchback, despite riding on huge 23-inch wheels.

Underneath all those aggressive angles is an entirely new platform that incorporates tech such as selflevelling air suspension, rear-wheel steering and ‘Wheelspeed Control’ for quicker, more precise cornering. Inside, you’ll find four individual seats, acres of glass and a plethora of sustainable materials, including merino wool and 3D-printed recycled foam.

Can an electric car possibly recapture the visceral, emotional appeal of a voracious V10 or operatic V12? We’ll have to wait five years to find out, but the Lanzador proves that Lamborghini isn’t afraid to embrace EVs. And that not every SUV needs to be big and box-shaped.

PADEL

Spotify co-founder Martin Lorentzon has turned his attention to providing hits of another kind – as the main backer of new high-end padel club Padium in Canary Wharf.

Billionaire Lorentzon has partnered with London-based former banker Houman Ashrafzadeh to launch Padium, which boasts eight courts and opened its doors last week.

Ashrafzadeh decided to set up Padium after falling in love with the fastgrowing racket sport in his native Sweden and discovering, to his dismay, how few courts there were in the UK. After quitting his City career, Ashrafzadeh turned entrepreneur to set up salad bar chain Urban Greens and he believes he can replicate that success in the world of padel with his latest venture.

FOCUS heading into this Rugby World Cup will be on the underwhelming hopes of England and Wales, and the dreams of success for Scotland and Ireland. But in hosts France there are a fascinating series of events that could help make or break their World Cup challenge.

Being hosts in a Rugby World Cup isn’t always easy; Japan reached the last eight in 2019 and England were dumped out in the pool before then, while New Zealand won on home soil in 2011.

The tag of host brings both pressure and excitement. The weight of a nation compresses on every player for every second of every game. But the ability to be a hero on home soil will be an ideal many will want to fulfil.

Les Bleus have already been dealt major blows to the bid for a first William Webb Ellis trophy, however, ahead of their tournament opener against New Zealand on Friday.

Talismanic No10 Romain Ntamack (pictured) has been ruled out having suffered a knee injury in preparation for the tournament, while Jonathan Danty – seen as one of the best centres currently playing the game – will miss the clash with the All Blacks due to a minor injury.

Throw into the mix the absence of lock Paul Willemse due to injury and the potential of being without prop Cyril Baille for much of the tournament and it is beginning to unravel for the hosts.

But in the number of issues they face on the injury front, head coach Fabien Galthie has built up an astonishing level of depth within the squad.

When Ntamack goes Matthieu Jalibert comes in, and the others have capable replacements too.

France are a side who have prepared for this World Cup, and their injuries will have less of an impact than they may have had on other nations. But they’re missing big names and that will be of concern.

And there are issues away from the

“Britain was behind with healthy fast food and the same with padel,” he told City A.M. “That’s when the idea first came to mind: why don’t I do something about this?”

Lorentzon, who founded Spotify with friend Daniel Ek in 2008 and still owns 11 per cent of the £23bn-valued music streaming giant, was quick to spot the potential of Ashrafzadeh’s idea.

Padel has grown rapidly in profile over the last few years, through its popularity with stars such as David Beckham and Andy Murray as well as major investment from Qatar and the US.

Having backed a direct-to-consumer coffee business that Ashrafzadeh es-

tablished, Lorentzon offered to become an equal partner in Padium.

“Padel is growing in the UK. He was equally surprised at how few courts there were here. It has become like a religion in Sweden,” Ashrafzadeh added. “Martin kept his promise and we became partners. It’s definitely a good endorsement. He’s a very respected businessman and adds huge credibility to have him on board. It’s an honour.”

Padium replicates the premium experience of Swedish padel clubs, with 10m-high ceilings, swish changing rooms, a social area and shop — plus coaching from British No1 Jorge Mar-

tinez. But the multi-million-pound club retains a quintessentially Scandinavian democratic accent, with membership optional and booking open to all on a pay-as-you-play basis.

It has already proven popular with players in Canary Wharf and beyond, with Ashrafzadeh reporting that much of September has already been booked up for corporate events.

His ambition is for Padium to host professional tournaments and, in time, spawn more branches.

“We’re building something with scale in mind,” he said. “We are already in talks with other landlords. But before we run, we want to walk.”

month suspended sentence dating back to November 2020 after assaulting two people in what the courts described as a racially motivated attack. Though the now Montpellier player disputes the assault was related to race, his inclusion in the side could cause tensions in an otherwise diverse squad.

“To those people saying he hasn’t got

a place in rugby: Bastien told us about this affair, and he firmly denies what he’s accused of. And we need to let due process take its course,” coach Galthie said of Chalureau’s inclusion.

France is a proud nation, steeped in history of backing its people and being part of major sporting tournaments. But the people want results, and it is something the national team is going to need to deal with.

France have been to World Cup finals but have never come out on the right side of the scoreboard – their millions

of supporters will be hoping for a different outcome this time around.

The tricolour of France was once a nation who couldn’t fill the Stade de France for some rugby fixtures, but now the national team are the hottest ticket in town.

There’s expectation, desire and a love for the team in levels not seen this millennium.

And if France, led by their Petit General Antoine Dupont, can get going on Friday against the might of New Zealand, they’ll be well on their way towards capturing a nation and securing the legacy of rugby within its borders.

and has

There’s an expectation, desire and a love for the team in levels not seen this millennium