BUSINESS WITH PERSONALITY

SWEEPING INTO BUSINESS JOS BUTTLER TELLS US WHY HE’S INVESTING IN UK PLC P9

GOING OUT STAYING IN LONDON? HERE’S HOW TO SPEND THE BANK HOLIDAY P18

SWEEPING INTO BUSINESS JOS BUTTLER TELLS US WHY HE’S INVESTING IN UK PLC P9

GOING OUT STAYING IN LONDON? HERE’S HOW TO SPEND THE BANK HOLIDAY P18

DAME ALISON ROSE RECEIVES A £2.4M PAY-OFF AFTER RESIGNING FROM NATWEST AMID FARAGE ‘DEBANKING’ DEBACLE

JESSICA

FORMER NATWEST boss Dame Alison Rose will receive a £2.4m pay-out from the bank after her dramatic resignation last month.

Rose quit her high-profile role after admitting to being the source of a story on Nigel Farage’s finances, with the controversial politician ‘debanked’ by Coutts –owned by Natwest –over his political views.

Natwest confirmed that Rose would receive her salary, shares and pension whilst serving out a 12-month notice period –amounting to an effective £2.4m payout.

The former Ukip leader posted a video on social media platform X, formerly Twitter, claiming: “This is the

corrupt British establishment looking after its own.”

Her shares are payable in Natwest Group shares and released annually on a pro-rata basis over five years from the date of award, the bank said. However, this figure does not include variable remuneration, such as bonuses or variable share allowances which Natwest said would be revealed “when such decisions are made”.

Her salary “remains under continual review” and the bank left open the possibility of tweaking Rose’s package once internal and external investigations into the ‘debanking’ conclude. Rose insists that she did not discuss Farage’s personal

finances when sat next to a BBC journalist, but admitted she may have given the impression Farage lost his account at the private bank due to falling below the lender’s wealth threshold.

Her replacement, Paul Thwaite, will be paid a salary of £1.05m alongside the same in shares.

Rose was paid £1.15m, making this a rare case of a man being paid less than a woman for the same work.

Rose’s £2.4m would be enough to open an account with Coutts, as long as she signalled a willingness to invest at least £1m of it.

Savings accounts require clients to deposit a full £3m.

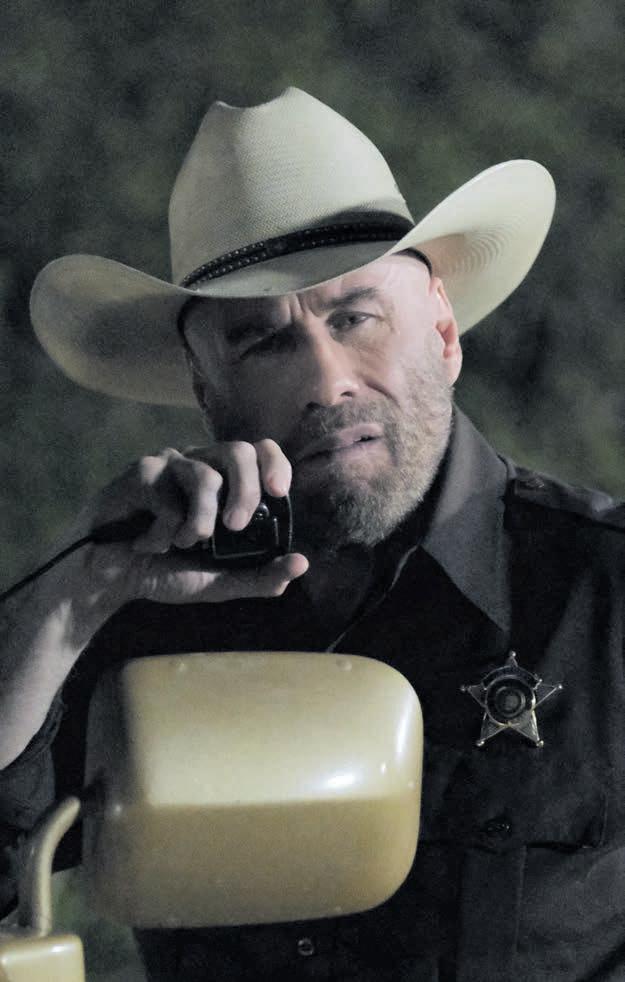

YEVGENY Prigozhin (pictured), the head of the Russian mercenary group and the leader of a short-lived rebellion against Vladimir Putin’s rule earlier this year, has died in a plane crash in Russia according to state media.

The Kremlin ally-turned-critic was on the passenger manifesto of a private jet which crashed north of Moscow.

Russian civil aviation authority Rosaviatsia last night confirmed Prigozhin and Wagner group commander Dmitry Utkin were on board the crashed plane, but western media have few ways to verify the reports independently.

Last night, one social media account linked to Wagner accused Putin of organising the crash, and said it would trigger a second “march of justice” on Moscow.

Critics of the Kremlin leader also pointed the finger of blame at Putin.

Bill Browder, the Londonbased hedge fund manager who has become a leading antiKremlin critic, said Putin “never forgives and never forgets” with reference to Prigozhin’s role in this year’s coup attempt.

A REBEL group of shareholders trying to block the takeover of asset manager GAM have dramatically accused Liontrust boss John Ions (right) of tactics “bordering illegality” and reported him to the Swiss takeover regulator.

Liontrust launched a takeover bid for the ailing Swiss money manager in May but have since come up against fierce resistance from a group of investors calling themselves NewGAMe, which include the French tycoon Xavier Niel.

In an escalation of the spat

yesterday, NewGAMe have reported Ions to the regulator over emails he sent to shareholders suggesting a key third-party manager, Fermat Capital, would sever ties in the event NewGAMe got their way.

“John Seo [Fermat CEO] has also questioned the

integrity of NewGAMe, and, having suffered long enough [as you have] with GAM executive management, is in no mind to lunge straight into a relationship with people he does not trust,” Ions wrote to shareholders.

However, after being

sent the email, Seo said he was “shocked and dismayed” by the suggestions and rang Ions to force him to retract the comments.

“I never wrote those words, and I would never approve of those words,” Seo said in response.

£ CONTINUED ON PAGE 2

IT IS A sad fact of life that war fatigue exists. When the Russians invaded Ukraine in February of last year, it was on our front page day after day. That isn’t the case anymore, even if the daily devastation wrought on Ukraine remains much the same. Indeed sometimes it is easy, almost, to forget that the European continent sits astride a nation run by a paranoid, violent tyrant who thinks nothing of territorial borders or indeed

human life.

And then one is reminded of the fact by a Russian mercenary leader mysteriously going bang in mid-air.

There is of course no proof that Vladimir Putin is behind what happened yesterday but it is

nonetheless worth revisiting why it is imperative that the West sticks together in its so-far, moreor-less united approach to Russia’s invasion of its neighbour. There have been occasional wobbles. As the cost to batteredand-bruised economies mounts –as seen in Europe’s horrible PMI data yesterday –there will likely be more.

Crucial to the West’s response has been the White House’s aggressive, uncompromising

THE UK economy has contracted significantly this month according to a closely-watched index.

S&P Global’s Purchasing Managers’ Index (PMI) for the UK economy came in at 47.9 – far below the 50 reading which indicates flat growth. The PMI assesses the health of an economy’s services and manufacturing sector. Analysts had predicted a reading of 50.3 this month.

The all-important services sector slipped from 51.5 last month, indicating expansion, to a seven-month low of

48.7. Manufacturing meanwhile continued to fall, slumping to a 39-month low of 42.5.

The slowdown in growth will please some in the Bank of England, who are attempting to take the heat out of the UK economy and bring down persistently high inflation.

Many companies recoded a reluctance among clients to spend due to higher interest rates and stretched disposable incomes.

Chris Williamson, chief business economist at S&P Global Market Intelligence, said “the fight against inflation is carrying a heavy cost in terms of

heightened recession risks”.

“A renewed contraction of the economy already looks inevitable, as an increasingly severe manufacturing downturn is accompanied by a further faltering of the service sector’s spring revival. The survey is indicative of GDP declining by 0.2 per cent over the third quarter so far,” he said.

Although the data points to a slowdown in private sector activity, most analysts expect the Bank to send rates higher at its next meeting in September, bringing the rate to 5.5 per cent, though this is likely to be the last hike in the current cycle.

response. Where the US leads, most still follow.

As the US election circus kicks into gear, all eyes will be on Donald Trump’s evolving views on the Ukraine invasion, and not just in the Kremlin. For all of Trump’s boastfulness on the economy, not all of it is hot air. But a failure to stand up to violent tyranny would make his achievements, such as they are, only a footnote. He must surely know that, too.

APOLLO SUED OVER $570M

TAX PAYOUT TO TOP EXECS

Apollo Global Management improperly agreed to pay $570m to cover the tax bills of its top executives as part of a shake-up aimed at distancing the PE firm from its scandal-plagued founder , according to a shareholder lawsuit.

THE GUARDIAN POST OFFICE BOSS TO GIVE BACK BONUS LINKED TO HORIZON SCANDAL INQUIRY

The CEO of the Post Office has said he will return a bonus payment linked to the inquiry into the Horizon scandal that led to hundreds of postmasters being wrongfully convicted.

THE TIMES

INDIA MAKES HISTORY WITH SUCCESSFUL LANDING ON THE MOON’S SOUTH POLE India has made history by becoming the first country to land on the moon’s south pole, provoking an outburst of national pride and confirming the nation as a leading space power.

CONTINUED FROM PAGE 1

The spat marks a ramping up of hostilities between the two parties as NewGAMe presses shareholders to block the deal. NewGAMe has now lodged a complaint with the Swiss watchdog and wrote to GAM shareholders accusing Ions of underhand tactics.

“As Liontrust is growing more desperate by the day, John Ions is resorting to more and more aggressive tactics which are bordering illegality to the point where we have to complain directly

to Liontrust’s chairman as I am sure that he, and Liontrust’s compliance department, must be unaware of the kind of emails sent in the name of Liontrust to GAM shareholders,” NewGAMe wrote to GAM shareholders.

Liontrust has already ditched a key element of its initial £96m takeover bid after coming up against resistance for the firm. Liontrust declined to comment. Fermat Capital was contacted for comment.

In theory, the takeover deadline was yesterday.

GOLDMAN SACHS has reminded its employees to come into the office five days a week as banks continue the fight to get staff to cut back on working from home.

The Wall Street giant led the way in demanding that employees come back into work after the pandemic.

Chief executive David Solomon has previously described homeworking as an aberration.

Bloomberg reported that while most of the revenue-generating staff at Goldman had returned to the office, staff in other segments have been less willing to come back.

“While there is flexibility when needed, we are simply reminding our employees of our existing policy,” human resources chief Jacqueline Arthur said.

Arthur stressed that Goldman’s pol-

icy had not actually changed: “We have continued to encourage employees to work in the office five days a week.”

Other US banks have been trying to lure works back into the office, with JP Morgan asking its senior bankers around the world to work from the office five days a week. The investment bank told its top brass they need to “lead by example”.

In the City, Lloyd’s of London boss John Neal said workers needed to move away from working in the office only on Tuesdays, Wednesdays and Thursdays.

The term TWaT, which is in reference to Tuesdays, Wednesdays and Thursdays workers, was first coined by this newspaper.

There is increasing evidence that working from home often proves less productive than working from the office. However, the evidence shows many workers are keen to stay hybrid.

CEO

the

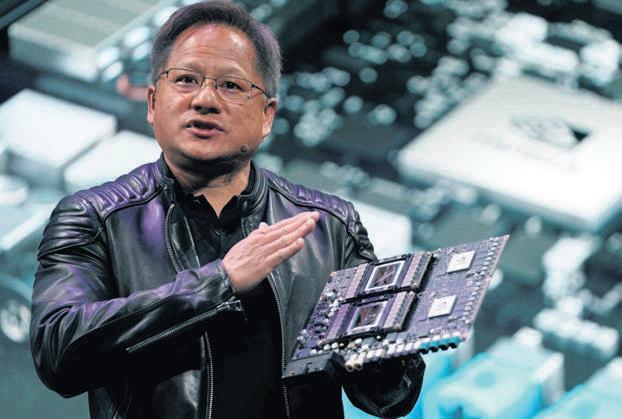

CHIP DESIGNER Nvidia forecast third-quarter revenue above Wall Street targets last night, boosted by soaring demand for its chips that power nearly all the world’s major artificial intelligence apps. Shares of the Santa-Clara, California-based company rose 6.3 per cent in trading after the bell.

LUCY KENNINGHAM

ADMINISTRATORS for Wilko have warned that job losses are “likely” as potential buyers were no longer interested in acquiring the whole group.

Sky News reported last night that Poundland owner Pepco Group is in advanced talks to acquire around 100 stores, with others circling. However, even if deals are struck, this will leave a significant number of Wilko stores – there are 400 –unsupported and likely to face closure.

They have tripled this year, making the company the first ever trilliondollar chip business as investors bet Nvidia will be the key beneficiary of the AI boom. Analysts have estimated that demand for Nvidia’s prized AI chips is exceeding supply by at least 50 per cent.

The company forecast third quarter revenue of about $16bn (£13bn).

Administrators from PwC said in a statement that while there were interested parties for segments of the chain, “the nature of this interest is not focused on the whole group”.

“Sadly, it is therefore likely that there will be redundancies and store closures in the future and it has today been necessary to update employee representatives,” PwC said yesterday.

PwC will make an announcement today outlining any sale agreements and details for Wilko’s 12,500 employees. Reuters

MORGAN STANLEY has been hit with a £5.41m fine by Ofgem after traders were found to be using Whatsapp to discuss deals, pointing to increased regulatory intervention against lenders being caught breaking the rules.

Between January 2018 and March 2020, wholesale energy traders at Morgan Stanley discussed transactions using Whatsapp on private phones.

Ofgem found the bank “did not take sufficient reasonable steps to ensure compliance with its own policies and the requirements of the regulations”.

Morgan Stanley has “taken steps to ensure the breaches do not happen again”, Ofgem said. The fine included a 30 per cent discount for settling, with

Ofgem noting that Morgan Stanley co-

operated with the investigation.

Although fines have been issued before for failures to record messages in other markets, this is the first fine relating to wholesale energy products in Cathryn Scott, regulatory director of enforcement and emerging issues at Ofgem, said: “It is unacceptable MSIP failed to prevent electronic communications which could not be recorded or retained. It risks a significant compromise of the integrity and transparency of wholesale energy markets.”

UK regulators are following the example of the US in investigating private messaging services to discuss deals.

The Prudential Regulation Authority recently censured Wyelands Bank for wide-ranging failings including “poor retention of Whatsapp messages”.

You’d be forgiven for scratching your head and asking why wasn’t a financial or banking regulator taking action here? Yet this fine does technically fall within Ofgem’s jurisdiction as the communications related to trading wholesale energy products. Ofgem has powers to investigate and sanction against market manipulation and insider trading under so-called “Remit Enforcement Regulations”, which are designed to protect consumers and ensure market transparency and integrity. This raises the possibility it could trigger a wider clampdown, with compli-

NICHOLAS EARL

ance experts telling companies to get their ducks in row. But there was only limited scope for Ofgem to get involved. Furthermore, an increasing number of banks and financial services have moved to ban their staff from using encrypted messaging apps such as Whatsapp for work purposes after the slew of fines. For now, Ofgem’s foray into the world of banking feels like a one-off, but it could well go after more energy firms.

Nicholas EarlTHE ROLE of brokers in the business energy supplier market is in urgent need of regulation to protect companies from high prices this winter, Energy UK has warned. Energy UK argued brokers “should be regulated, just as suppliers are”. “Many non-domestic contracts are secured through energy brokers, who are unregulated. The industry has long called for regulatory oversight and higher standards for brokers to properly protect their businesses customers and Ofgem recently called for extra powers to regulate brokers themselves,” a spokesperson told City A.M. Octopus’s research found 3.2m small businesses had a negative broker experience in the past year. Jack Arthur, energy expert at Uswitch for Business, told City A.M., there is a role for brokers, especially in managing the paperwork involved with switching contracts, “which can often be extremely complicated”. A spokesperson for the Department for Energy Security and Net Zero expressed support for Ofgem’s calls to increase transparency.

VENTURE Capital Trusts (VCTs) which allow savers to make tax-savvy earlystage investments, have bucked a funding slowdown this year and boosted the amount of cash they are pushing into startups.

VCTs, which are a vehicle for retail investors to access venture capital, ramped up their investment by eight per cent to some £664m into firms in the financial year to April, according to data from the Venture Capital Trust

Association (VCTA).

The figures come despite a major slowdown in the wider venture capital landscape over the past 12 months as investors grapple with rising interest rates and a shuttered IPO market. Figures from KPMG found wider VC funding slumped 23 per cent in Q2.

Will Fraser-Allen, VCTA chair, said the country was “increasingly in need of innovative young businesses to push the economy forwards” and drive the development of technologies like artificial intelligence.

AS THE reshuffle of the FTSE 100 index approaches, several companies are vying for a coveted spot among the UK's star stocks, while others face a demotion to the FTSE 250.

In the reshuffle, to be based on closing prices on 29 August, strict rules prevent a repetitive “hokey-cokey” scenario of the same companies constantly entering and leaving.

Leading the pack of potential newcomers is Marks and Spencer, said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Shoppers have given the Percy Pig creator a “thumbs up” as focus on quality and price has been “a clear advantage”, explained Streeter.

M&S ’s turnaround strategy has paid off and popular click-and-collect services have led to strong sales growth. However, retail’s longer term prospects are “hard to map”.

Technical products supplier Diploma has also caught the eye of investors.

Steady sales growth, bolstered by repeat orders and strategic acquisitions, has propelled the firm into the running for a premier blue-chip position. Similarly, pharmaceutical companies

Dechra and Hikma could join the top ranks, if only briefly in the former’s case due to its imminent £4.5bn takeover by Freya Bidco.

Hikma has benefitted from increased revenues and a summer vote of confidence in its generics drugs business as it hoisted up annual revenue and margin guidance earlier this month.

But several companies are teetering on the edge of demotion.

Catalytic converter maker Johnson Matthey is grappling with a lack of direction following its retreat from battery manufacturing plans.

Meanwhile, developer Persimmon’s shareholders have been spooked by industry data revealing the strain of borrowing costs on the housing market.

A sense of deja vu must be lingering over asset management firm Abrdn as it finds itself at risk of being evicted from the FTSE 100 for the second time in a year after shares plunged by nearly a third in under a month.

Companies must rank within the top 90 by market cap to enter and below the 110th largest to be demoted.

The final changes will be announced after UK markets close on 30 August, revealing the new lineup of Britain's top-tier companies.

VCTs have been the subject of fierce political debate over the past 18 months and are currently due to be wound up by 2025. City minister Andrew Griffith in June refused to commit to extending the trusts beyond the current wind-down date when quizzed by MPs.

“With government policy also looking to bolster UK growth by encouraging investment in fastgrowing companies, the vital role of VCTs in the investment ecosystem has never been clearer,” Fraser-Allen said.

CANNON Street private equity outfit Breal Capital has snapped up Vinoteca, saving the five-strong wine bar chain from imminent closure after it was hit hard by the pandemic. The deal saves all 150 jobs across the business.

LAURA MCGUIRE

LAURA MCGUIRE

CONSUMER goods giant Reckitt has announced the retirement of its chief financial officer, Jeff Carr, drafting in a business veteran from Nike to replace him.

The firm said that Carr will step down next March after nearly four years at the company, with Reckitt praising him for reducing the firm’s net debt and guiding the business through the pandemic.

Reckitt, which makes popular household goods such as Dettol and Nurofen, said that Shannon Eisenhardt, chief financial officer for consumer, market place and brand at Nike, will take on the role once Carr leaves.

Eisenhardt was also finance director at Procter & Gamble which owns Pampers and skincare brand Olay.

She will join Reckitt on 17 October this year as CFO designate to succeed Jeff –and she has also been elected to the board as an executive director.

“We are delighted to announce that Shannon will succeed Jeff as chief financial officer,” Chris Sinclair, chairman of the board, said. He added: “Shannon brings extensive experience across consumer and retail, having worked with some of the most globally recognised brands, and an impressive and highly relevant international background.”

LAURA MCGUIRE

THE WEST END showed signs of “picking up” in July as demand from businesses to secure a spot in London’s premier shopping district led to a cluster of five deals totalling £102.2m. So far this year some 58 property transactions have taken place and turnover year to date has reached

£1.92bn. This is already above its 2019 figure of 51, but still remains below its pre-pandemic average of 94, data from Savills revealed.

But Stephen Down, executive chair of central London and international investment for Savills, said there are signs the West End market is “picking back up” after its pandemic slump with buyer interest from across the

globe, including unlevered, cash rich family offices, along with funds from the US and Europe. He added that £50m and £100m was the “sweet spot” for purchases.

Savills said the biggest deal was of office building Liberty House on 76 & 80 Hammersmith Road, W6 which was acquired for £48m by property investment firm McAleer & Rushe.

ITHACA Energy has announced fresh dividend payments for shareholders, while confirming it expects oil and gas production in 2024 to be lower than this year due to the windfall tax.

To keep shareholders sweet, the North Sea oil and gas producer yesterday revealed a fresh second $133m (£104m) dividend in its halfyear results – taking year to date payouts to $266m. It is now planning a total dividend of $400m for the year.

The FTSE 250 firm also revealed it had taken a $223m hit from the Energy Profits Levy over the first six months of business this year.

Ithaca expects further decisions to slash output and investment in projects will be made as it draws up its medium-term strategy in the second half of this year.

Ithaca said it was “clear that we, like the rest of the industry, will feel the impact of lower investment on our medium-term production outlook below previously guided levels”.

HITACHI’s £1.4bn takeover of Thales’ rail signalling business will not impact competition in the market for supplying signalling systems for the London Underground, the UK’s anti-trust agency said yesterday.

The proposed deal led the Competition and Markets Authority (CMA) to raise competition concerns back in December, as Hitachi and Thales are two of the main suppliers of signalling systems for railway networks in the UK. Siemens and Alstom are the other two leading firms.

The CMA said in June that the deal could drive up prices and reduce service quality for passengers on the London Underground, indicating that the deal could be blocked by the regulator. But the watchdog yesterday said new evidence had led it to reconsider previous concerns.

The CMA said it now believed that Hitachi would “not be a credible bidder” to supply communications-based train control systems for the tube in the

“near to medium term”.

It said Hitachi was unlikely to meet Transport for London’s tendering requirements for two major upcoming projects on the Underground, at Bakerloo and Piccadilly, and would therefore not “be a significant competitor to Thales” in the future.

Stuart McIntosh, chair of the CMA’s independent inquiry group, said “effective competition in the urban and digital mainline sig-

Expansion plans have also been cancelled in domestic operations such as the Greater Stella Area, Montrose Arbroath Area and Elgin Franklin Area. Ithaca warned investors it would also need to pursue more merger opportunities to consolidate its position “until the fiscal is regime is improved”.

Despite the challenges, it revealed pretax profits had risen year-on-year, from $907.4m to $979.7m over the first six months of trading. Shares closed down 5.62 per cent.

PELOTON shares yesterday plummeted over 27 per cent after the exercise bike maker said costs related to product recalls would delay its return to a positive cash flow. The company said it anticipated costs of $40m due to recalls, a figure which “substantially exceeded [its] initial expectations”. The firm hopes to achieve positive cash flow in the second half of fiscal 2024.

nalling markets is essential for ensuring the UK’s rail transport systems are efficient and reliable for passengers who rely on these services”.

McIntosh added, however, that its “provisional view that this merger raises concerns in the supply of digital mainline signalling in Great Britain, is not affected by today’s announcement”.

The CMA’s investigation is ongoing, with a final decision set to be made by 6 October. Both firms were contacted.

ALAN JONESWORKERS at the Civil Aviation Authority (CAA) have voted overwhelmingly in favour of industrial action in a dispute over pay.

Members of the Prospect union backed strikes by 2-1 and by almost 9-1 for other forms of industrial action. The union said the CAA had refused to provide a “fair” pay rise for this year.

Prospect added that an internal

survey of CAA workers found that two in five are considering leaving the organisation because of poor pay and excessive workload.

It was the first time a ballot on industrial action has taken place at the CAA, said Prospect.

Mike Clancy, general secretary of Prospect, said: “More than a decade of real terms pay cuts have left our members at the CAA with no choice but to take industrial action.

“The employer can still avert this industrial action by coming back to

the table with a meaningful offer that addresses the ongoing cost of living crisis.”

Rob Bishton, CAA interim chief exec, called the vote “disappointing”.

“We recognise the cost of living challenges that colleagues face, which is why we’ve already implemented a five per cent pay rise,” he said.

He added that the CAA did not anticipate any disruption to the sector due to the “modest proportion” of staff which are Prospect members.

THE FUTURE of the proposed Great British Railways (GBR), one of the biggest planned shake-ups of the rail sector in decades, is at a crossroads.

Initially put forward by Boris Johnson in 2021, the plan was to create a stateowned public body to act as a unifying ‘guiding mind’ for Britain’s struggling rail sector. The body would reduce pesky ministerial meddling and provide oversight and accountability for the complex web of different groups which make up Britain's rail network.

It was seen as a fix for a crisis-hit railway service that has never truly recovered from the pandemic, with delays across the network and industrial action now commonplace.

But the reforms have been delayed and have fallen well down the legislative agenda of recent governments.

The government insists it “remains fully committed” to the plans, but recent reports have hinted at attempts to water down or scrap it entirely.

The rail sector believes that bringing GBR legislation forward is the number one priority right now, and are concerned a fast approaching general election could push things back further.

Writing in The Times last month, Iain Stewart, chairman of the Transport Select Committee, warned that “without

legislation soon… the chance to fix Britain’s railways and deliver rapid improvement for the customer is slipping away and alternative reforms could become more salient.”

Stewart told City A.M. that although some of the work on GBR could be done without legislation, bringing it forward would give “passengers and the industry much reassurance”.

In May, 60 business leaders in the rail and infrastructure sector wrote to the PM urging him not to delay legislation that would establish GBR.

Darren Kaplan, chief executive of the

PA

Railway Industry Association – a representative body who organised the letter – told City A.M. the government must push on with the reforms to give “rail customers, businesses and infrastructure investors the certainty they require.”

National Rail said: “GBR is currently the only way on the table to resolve the biggest issues of responsibility and cost on the railway.”

Britain’s railways need an urgent fix and while there is no one solution, the sector is surprisingly unified in backing GBR –it just needs to be delivered.

EXPORTS have slumped, growth has stalled and the economy even slipped into deflation. The youth unemployment figures have gotten so bad that the government has stopped publishing them.

These figures, or their absence, reveals more than an economy struggling to grow after Covid. What they demonstrate is that China’s high-growth model over the past few decades has run out of steam.

Many of China’s immediate problems can be traced back to problems in its enormous property market.

The sector is hugely important to the Chinese economy, making up around 30 per cent of its GDP, with private and state property developers driving the largest spate of urbanisation in history.

This, however, generated a huge bubble, with property developers taking on big debts to build enough houses.

In 2020, the Chinese government attempted to deflate the bubble with its Three Red Lines policy, which tried to regulate the amount of debt developers could take on.

But the policy was too aggressive, effectively bankrupting the country’s largest property developer, Evergrande. This snowballed into a wider crisis in which many smaller developers also defaulted.

The ensuing slowdown in the sector sparked by the panic has hit even developers previously seen as reliable. Country Garden, previously considered one of the most reliable developers, missed payments on some of its bonds at the

beginning of this month, reigniting fears that the property sector could crash the wider economy.

But putting the real estate sector to one side, the Chinese economy faces a set of structural issues that look likely

to hold back growth.

China has pursued an investment-led growth model, which has turbocharged its economy over the past three decades. Investment currently makes up between 40-45 per cent of GDP com-

pared to an average of around 20-25 per cent among the rest of the world. But now the economy is essentially saturated with productive physical assets. Further investment, particularly if directed to physical infrastructure, is

unlikely to improve performance.

In order to generate sustainable growth over the longer term, China is trying to lift domestic consumption, which currently makes up a small proportion of GDP.

“It is the wish of the Chinese government to shift from old style, industrial production and fixed investment to consumption,” Janet Mui, head of market analysis at RBC Brewin Dolphin told City A.M.

Experts argue the state could boost the social safety net, which would encourage citizens to spend rather than save in case they fall on hard times. The savings rate in China is currently much higher than in many Western countries, partly because there is limited state support.

Another impediment to higher domestic consumption is China’s artificially devalued currency, the yuan. Although the devalued yuan supports an export led economy, it also makes imports for domestic consumers more expensive than they would be.

But Mui said it would be “very hard to stimulate consumption meaningfully”.

More broadly, China’s ageing population also poses significant threats to its future growth.

“The big picture is that trend growth has fallen substantially since the start of the pandemic and looks set to decline further over the medium-term,” Julian Evans-Pritchard, head of China economics at Capital Economics, said. While Chinese growth is set to reach nearly five per cent this year, the days of 10 per cent growth look to be well and truly over.

WE WERE basically running insurance companies,” the likable Barry Gale tells City A.M. of his career before joining Aon. Gale was at a Big Four consultancy firm, working on restructuring and insolvency. “But without the front-end, bringing in new clients.”

He and his colleagues soon found out that winding up insurance firms was notably more complicated than other firms. After all, the usual priority is to get the process closed up as soon as possible. In insurance, however, the thorny issue of policies underwritten in the past –and potentially claimable against in the future –made that process more challenging.

“The last thing you can do is shut down too early to prevent someone from making a claim,” he says.

“It’s bad enough in an insolvency that you might not be getting that claim paid in full, but if instead you’ve not even got the opportunity to make that claim, then we’re favouring some creditors over others.”

What that left Gale and his colleagues dealing with was the ‘tail’ –and it’s the tail of insurers’ responsibility that occupies Gale’s time as head of legacy at Aon, where he moved two years ago.

“It’s a bit like a construction project. We do the maintenance,” he says. In short, insurers who underwrote policies a few years ago need to keep a certain amount of

capital on the books in case a claim comes in on that policy. That’s not necessarily the best use of that capital, which is where Gale’s team at Aon comes in, building solutions that work for all sides.

“Just because you built the project in the first place,” he says, returning to the construction metaphor, “doesn’t necessarily mean that you are the right organisation to manage the tail, or the run-off”. Gale is passionate about a little-understood but vital part of the insurance market.

“It matters enormously that that run-off is managed responsibly, and that the policyholders get what they need if they’ve got a claim. So it matters enormously to the insurer that their reputation is protected, but if they have a lot of their resource and capital tied up in stuff they did a few years ago, then it

stops them serving the world today.”

Gale’s advice to youngsters coming into insurance –“listen, and be curious” –is certainly a worthwhile credo for anybody even looking at the industry.

Much of the work of the sector goes under the radar –but without it, not a lot that we take for granted can happen.

“Insurance helps to make the world tick. It helps you to have a mortgage, get in a car or get on a plane or go into an employer’s office because they’ve got the right liability insurance. If we accept all these things, and that the world is changing and the needs of the word are changing, then we have to be able to write new products.”

By freeing up the capital to do that, Gale and his legacy team play their part in keeping the insurance world ticking over –and, crucially, doing right by insurers’ clients.

Insurance helps to make the world tick, and we help to make sure that can happen

WHEN he dips away and scoops a head-scratching fast bowler for six, you might think England cricketer Jos Buttler just spends his spare time dreaming up new ways to hit boundaries.

Over the past decade the one-day supremo has been at the forefront of changing the way that runs can be scored and has been feted as among the greatest to play the white ball game.

But even as he prepares to defend England’s 2019 World Cup in India this year, England’s Somerset-born captain has his mind beyond the boundary: much as fans would like him to go on indefinitely, Buttler is already thinking of life after cricket.

“I’ve always had a bit of an interest in business and no real knowledge, just sort of ‘what is investing and what do people do and how does it work?’,” Buttler tells City A.M

“Obviously as a sports person, your careers are finite and could stop anytime through a loss of form or injury, so it’s always been one eye on what I might do next, or what opportunities are out there, and what skills you can transfer across from your sporting environment.”

The answer for now appears to be venture capital. Buttler, along with team mates Ben Stokes, Jofra Archer and Stuart Broad and Indian batsman KL Rahul, are among a host of big name sports stars and professional investors to plough £40m into a new venture fund called The Players Fund, which both looks to channel cash into young companies and give athletes a glimpse of life beyond sport.

The new fund has been born from a group of athlete collectives across the US and UK, including Forgood, led by former Manchester United defender Chris Smalling, and B-Engaged, headed by Hector Bellerín and Serge Gnabry.

Buttler, Broad, Stokes and Archer meanwhile are members of 4Cast, set up by former pro footballer Fergus Bell and his brother Rory, to begin build-

ing business interests for sports stars and give them something to fall back on beyond retirement.

“In the pandemic we had about 12 athletes come to us and say ‘what happens if the Sky TV money ends? If the central contracts end?’ We decided with Ben, Stuart and Jofra to launch 4Cast,” Bell tells City A.M.

Bell’s pro football career was cut short by injury and he’s now become a sort of fixer for professional sports stars as they grapple with a life outside sport. Buttler is among the newer signatories to the group but it’s perhaps an indication of where his mind is going.

He says he’s already sitting in on business calls and scoping out ways where his cricketing nous can add value.

“[I draw] from my different experiences on the sports field that link into some form of leadership or problem solving, which may help in a certain situation or may help push something forward.

“And it’s stuff I’m interested in –I can add value to it.”

He says he’s already invested in a growing Manchester-based padel business called the Padel Club and is on the hunt for other opportunities that catch his eye.

Finding things that excite and stimulate after a life dedicated to the relentless pursuit of winning is a challenge increasingly troubling the world of professional sport.

Much has been written about the psychological drop-off facing professional footballers for example after their careers come to a premature close. 4Cast and now The Players Fund are positioning themselves as a solution to helping sportspeople learn the wares of business and offering them a vehicle to invest.

“You lose that identity that you’ve had since you were 16 or even younger,” adds Bell. “Maybe you’re always the football guy or the cricket guy, and the Players Fund is there almost solely for that really to prepare

guys and female athletes after sport.”

Venture capital and investing are proving particularly popular routes for post-sport careers. Former F1 star Nico Rosberg is now a prolific investor, quarterback Tom Brady recently was a key player in the purchase of Birmingham City and Lewis Hamilton and Serena Williams both mulled entering consortiums for the Chelsea sale last year.

“We see the story of Wrexham, Tom Brady’s just got involved with Birmingham. People see that and think maybe there’s potential in some way, shape or form… for people to get involved in these things,” Buttler says. So can we expect a new lower league football club purchase from the newly former Players Fund?

“Who knows,” say a chuckling Bell and Buttler.

VIEW FROM THE PAVILION

The cricketing world may also be proving a fruitful ground for a new generation of investors. The fact that four of the biggest names in the England setup of the last four years have thrown their weight behind the new fund is surely no coincidence.

Is there something unique to the English game that is producing it?

“Well, there’s a lot of rain breaks in cricket,” Buttler laughs. “So there’s plenty of dead time where you’re thinking what you would do if you weren’t a cricketer.

“Some people have got no interest in the dressing room and just want to bat and just want to bowl and sort of just blinkered to the finish line. And [say] ‘I'll sort it out when I finish my career’.”

But the team atmosphere of an investment collective has been a draw outside of cricket for Buttler. He’s teaming up with Stokes on the fund just after the news he will be reunited with the test captain out of one-day retirement for November’s world cup.

“It’s an incredible boost for us,” he says. But is his investing like his bazball batting?

“He does things one way –so probably.”

Ttho HE epic recreation of Bar t

see tholomew

y reimagining of the arry a contemporra acles in formances, and unique spect perrf over 30 free events, live air in the City of London will F Fa

oric event. t t his al’s greates capit

September 16 Augustto st Takingplace31 Ta

mber,it r,

omenade thea , a new prro Spectacularr, cus experience; Carnesky’s Showw cirrc

d winne Olivier awarrd y show directed b

t Kit G tisst y arrt d-winning non-binarry awarrd the m y sive experience b yful immer jo 33 the lates 1 ; and 1 Marisa Carnesky

sive the Dinner for All, a major immers al formance on St Paul’s Cathedra perrf tical dan tunning ver t AM, a s st RESURG includes the world-premieres of t6o t aking place 3 k bartholomewfair www.thecityofldn.com/ s, and resid kers s, wor visitors

tination City pr ation’s Des Corporra t of the C It is parrt Saturda rd sda y Thurrs locations ever y

ogramme, a n prro t of the City and y, Friday,

ts out a vision for the Square Mile h se whic

become a world-leading leisure to

ke place at various City a air will tThe F Green. multit winner theatrical Showwomxn theatrical al; dance

, it ofldn.com/ enjoy oy o residents t international

tination for UK and int desst

t iconic bridge will close LONDON’S mos

trians for three da ic and pedesfaf trot

y weekend t Bank Holida over the Augus

allow essential maintenance t o–t

ke place.

o

aised TowerBridgewillremaininther To

ower Bridge will remain in the r

. ted earlier comple t, unless the wor 28 Augus,yMonda t and reopen late on 25 Augus,yridaF 0pm on carried out. It will close at 1 position for long periods while wor

s are asked t or oughout, but visit thr action will remain open or attr The visit

a s fer of and info s,New

o

k is

t in advance and enter ke book their tic

ice on the nor ofkeft only via the tic

owe the T To ot t side, neares

ower of London. th

werbridge.o we

k is long k/eshot.uk/ erbridge.org.uk

ww london.gov tyof.citywww t

August has never felt so –for want of a much better word –Augusty. It’s mighty quiet out there, and that isn’t just because of the City’s long-discussed issues attracting floats and the slowdown in M&A.

Indeed, more and more of my contact book appear to be taking the European approach to the summer months: not quite sell in May and go away, but certainly recharging the batteries for an extended period of time over the August break.

Wellness advocates would no doubt argue that ‘les grandes vacances’ are a fine way for us to wipe off the stress of working life and ready for a full-paced return in September. As a journalist, I can tell you that it’s bloody annoying.

At the heart of my frustration, however, is a bigger question about the UK’s oft-discussed productivity puzzle. Every once in a while a politician unwisely casts doubt on the work ethic of the Great British Worker; Liz Truss is still pilloried for

ADVERTORIAL

saying Brits needed “more graft” when compared to foreign rivals. But to be honest it’s not the hours, or whether we’re all on the beach in August, that’ll dictate the UK’s productivity going forward, but investment in new technologies and learning how to use them in smarter ways.

It’s interesting that one of Britain’s few genuinely worldleading industries –the management consultancy and professional services sector –is doing just that.

One cannot move for news of the latest AI investment by one of the Big Four. PwC partners even took a salary hit so the firm can invest more in labour-saving AI.

The UK has been notoriously bad at investment in recent years, for a host of reasons, not least endless political instability. So next year, enjoy your August –it won’t make much difference to the productivity numbers if you’re away. Just make sure you invest in some new tech before then.

Anovel trend is unfolding in the digital assets space, with the tokenization of realworld assets (RWA) emerging as a powerhouse in financial innovation. Spearheaded by Treasury bills (T-Bills), which has historically offered investors a secure means to earn yields, this progression is transforming asset management and investment dynamics

Tokenization, the process of converting tangible assets such as gold, stocks, and T-bills into digital tokens, presents an exhilarating prospect for financial institutions. Pioneering this wave, Franklin Templeton, launched the first U.S. registered mutual fund on a public blockchain in 2021, later expanding its reach to other platforms in 2023. Notably, the firm managed to amass over $299 million in assets under management for its OnChain U.S. Government Money Fund within a short span.

Recent spikes in U.S. short-term Treasury yields have caused ripples of concern among Wall Street veterans, pushing many to wonder about a looming recession. Historically, events such as the inverted yield curve — where short-term Treasury yields surpass longer-term ones — have signaled impending economic downturns. This inverted yield curve, coupled with other financial indicators, has brought more investors into the fold, particularly to the realm of tokenized treasury bonds. This trend is evidenced by the $500 million collective market capitalization of tokenized money market funds, a whopping 400% increase within a year.

Key financial institutions are acknowledging the value of RWA tokenization. The Bank of America, for instance, sees it as a primary driver for digital asset adoption. This tokenisation wave has already made its mark, with the tokenized gold market alone amassing over $1 billion in investments. Onyx, a bank-led blockchain platform by J.P. Morgan also announced that it will focus on tokeniz-

No story has gripped me in this barren August like the extraordinary tale emerging from the British Museum. One would think that a museum under more than a little pressure to prove to the world that they can look after the world’s treasures would notice its artefacts popping up on Ebay. To be fair to the Museum, management have been up front about the failures. As a troublesome hack, of course, the only disappointment is the famed Parthenon relics remain in place –we’d love to run the ‘lost their marbles’ headline.

£ Today is GCSE results day, begging the interesting question of whether it’s now more common to see social media posts from successful people who cocked theirs up or snarky posts about successful people posting they cocked theirs up. A more worthwhile take might be to ask why we still insist on a system forcing youngsters to choose their academic path before they’ve even sniffed an illicit drink. A more rounded education would be a far better idea.

£ The Rugby World Cup starts in a couple of weeks. It’s supposed to be one of the world’s biggest sporting occasions yet the build-up –certainly here, in part thanks to England’s ongoing struggles –- has been strangely muted. With open mutiny in the grassroots game over new tackle rules and a governing body receiving justified criticism for its remote management of the game, the potential growth of the sport is being strangled. Let’s hope the tournament reminds fans why they love the game.

Elon Musk hints that firing the people who made Twitter / X run properly may have been a rash move

My partner occasionally comments on my not always healthy reading diet: over-loaded with nonfiction, and sorely lacking in the nutrients that come from novels. I’ll admit that a book entitled ‘The Battle of London: 1939-1945’ doesn’t necessarily scream ‘relaxed summer read’, but Jerry White’s no-holdsbarred social history of the capital in wartime has been a delight. For those looking for something a little lighter, though, I can’t recommend a recent re-discovery enough. Kingsley Amis’s Lucky Jim is a perfect comic novel, and contains the finest description of a hangover yet committed to literature. And anyone who hasn’t read the cigarette burns scene before should try and avoid doing so on public transport.

transparency in the tokenization process. This transparency empowers investors to scrutinize financial operations that were traditionally concealed, ensuring the authenticity of the backing real-world assets. By decentralizing this process, tokenization not only fortifies the system against vulnerabilities but also promotes a democratic approach to monitoring, enhancing trust among stakeholders. These protocols also play a significant role in interfacing off-chain and cross-chain assets, acting as vital bridges between traditional financial

ing money-market funds, and will use them as collateral.

Despite these advancements, questions about the legitimacy and security of tokenized RWAs remain. How can investors be certain that a digital token truly represents its real-world

asset counterpart? Trust in this burgeoning digital space is paramount. Chainlink's Proof of Reserve (PoR) mechanism, exemplified by its recent integration with Matrixdock, is a testament to this need for transparency. Through this integration, investors

can confidently verify the authenticity of Matrixdock's Short-term Treasury Bill tokens (STBT).

Protocols like Proof of Reserve (PoR) enable real-time, independent verification of tokenized asset collateralisation, fostering much-needed

markets and burgeoning blockchain ecosystems. They ensure a smooth and secure transition into the digital finance domain.

Looking ahead, the future potential of real-world asset tokenisation is staggering. Predictions suggest it could inject an astounding $16 trillion into the digital asset market by 2030. As we stand at this crossroads of financial evolution, tokenization emerges as a defining trend. It symbolizes a transformative shift in how we perceive and manage assets, emphasizing the indispensable role of trust, transparency, and security in moulding the future of finance. The story of digital finance is as much about breakthroughs as it is about trust, and tokenization stands front and center in this narrative.

Embrace the long break, even if it’s made my job harder

We may fail, as so many have predicted

Key financial institutions are acknowledging the value of RWA tokenization.

Like salt poured in an open wound: that’s the only conceivable metaphor for the corporate governance disgrace delivered by the Post Office in recent weeks.

Consider the facts: thousands of sub-postmasters were the victims of a grotesque cover-up, with many of them left penniless, homeless or wrongfully imprisoned. Their fight for justice was then imperilled by the unfairness of compensation settlements which were either woefully inadequate or squeezed by the funding arrangements which saw large parts of their payouts swallowed by litigation funders.

And now, to make matters worse, the current board of the government-owned company has presided over a shambolic process where it allowed bonuses to be paid to executives for their cooperation with an inquiry into the scandal that is not even complete.

Last week’s report from the law firm Simmons & Simmons, commissioned by business secretary Kemi Badenoch, made dreadful reading. It concluded that the Post Office board had been guilty of “clear failings” in its deliberations and its record-keeping.

In April 2021, Nick Read, the chief executive, set out in a speech to stakeholders his ambition to turn the Post Office into a profit-sharing collective, with sub-postmasters given the chance to benefit from a revamped network.

The chief executive said this could even be in place within a few years: “As we become commercially

Historic England, the V&A, English Heritage –the list goes on. It’s all change at the top of many of Britain’s most prestigious cultural institutions and bodies. Next up is Historic Royal Palaces, where a search has been underway for nearly two years for a new chair of sites

including the Tower of London and Hampton Court Palace.

I hear that this particular crown is soon likely to land on the head of Sir Nicholas Coleridge, the former Conde Nast executive. Confirmation may depend on whether Sir Nicholas secures the provost’s role at Eton, with which

sustainable and no longer reliant on government subsidy, looking for new ways to ensure postmasters share fairly in that success is the right thing to do,” he said.

“For [the] Post Office to be in a position, say by 2025, to make this a credible option for postmasters, their customers and the government would, it seems to me, represent a genuine achievement.”

Those aspirations now look little more than a pipedream. The Post Office’s financial performance is weak, and the Horizon scandal fallout has left its boardroom looking less like a cuddly co-operative than a rapacious school of sharks.

That impression is compounded by Read’s unfathomable refusal to hand back the entirety of last year’s £455,000 bonus. Instead, after weeks of obfuscation by the company, he decided yesterday to increase the sum he would surrender from a measly £13,000 – to a slightly less measly £54,400.

Chief executives fond of virtue-signalling about “the right thing to do” must be prepared to be held accountable when they fail.

The Post Office is years away from an end to government subsidy, or anything like financial sustainability.

The entire board should now consider whether “the right thing to do” involves remaining in their posts. And if Read believes he is the right long-term leader to restore faith among a beleaguered workforce, Badenoch should disabuse him of that notion and advertise for his successor. That seems like the right thing to do.

he has been widely linked. In turn, his departure from the chairmanship of the Victoria and Albert Museum after eight years frees up another prized vacancy in the capital.

With the Science Museum and British

Film Institute also seeking new chairs, headhunters specialising in these appointments cannot echo bankers’ complaints about a moribund summer period.

How about this for a screen test? DAZN, the loss-making streaming service, may finally be getting its house in order under Shay Segev, the ebullient Israeli who became its sole CEO last year after a spell running Entain, the FTSE-100 gambling group.

A $4.3bn recapitalisation by owner Sir Len Blavatnik has provided it with the financial freedom to think big, so it seems logical that it will be among those closely studying Disney’s plans to explore a sale or strategic partnership for ESPN.

Disney has never cracked the streaming market, while DAZN, despite the questionable nature of some of its historic rights deals, has started to generate meaningful international momentum.

DAZN’s presence now in 230 markets and with more than 60m registered users provides a scale that would complement ESPN’s USfocused footprint. Its moves into

gaming and merchandising –particularly the recent deal with US-based Fanatics –also look like sensible diversification plays, assuming the economics stack up.

For the streamer, a tie-up would build credibility with customers and rightsholders in the US, an essential step towards an eventual exit.

The reappearance of Kevin Mayer, until recently DAZN’s

chairman, as an adviser to the Disney chief Bob Iger might prove to be a helpful factor in engineering a deal.

DAZN will face competition, without question: this week, it emerged that Verizon, the US telecoms giant, had initiated talks with Disney about a partnership. It is unlikely to be the only one. For Sir Len and Segev, though, a combination with ESPN may prove that bit more compelling –and with the US sports giant as its centrepiece, a US listing would surely prove too difficult to ignore.

JESSICA FRANK-KEYES

Tory MPs urged the Chancellor to cut taxes after borrowing figures beat forecasts

ECONOMISTS have warned that calls from Conservative MPs for Chancellor Jeremy Hunt to cut taxes after improved borrowing data emerged show “questionable judgement”. Three backbench Conservatives piled the pressure on, according to the Financial Times, with calls for

“personal tax reductions” after July borrowing figures came in lower than forecast by the OBR in March.

But economists have warned against cutting taxes in response, suggesting the government is only just meeting its own fiscal rules, following months of gloomy news for UK plc.

Aveek Bhattacharya, from the Social Market Foundation, told City A.M.:

“Rushing to cut taxes in response to the first piece of fiscal good news would show questionable judgement and priorities from the government.”

Meanwhile, Carl Emmerson, of the Institute for Fiscal Studies, warned tax cuts now would likely result in bigger tax rises on the other side of the election, with borrowing still much higher than forecast 18 months ago.

Coleridge lined up for the Tower... boardroom

To appear in Best of the Brokers, email your research to notes@cityam.com

LONDONmarkets rose yesterday despite new PMI data showing a significant slump in UK business activity. The FTSE 100 closed up 0.72 per cent after a day in the green, while the FTSE 250, which is more aligned with the health of the UK economy, climbed 1.1 per cent.

S&P Global’s Purchasing Managers’ Index (PMI) for the UK economy came in at 47.9 –far below the 50 reading which indicates flat growth. The PMI assesses the health of an economy’s services and manufacturing sector.

Analysts had predicted a reading of 50.3 this month.

Martin Beck, chief economic advisor to the EY Item Club, said the data will give the Bank of England “food for thought” ahead of its next rate decision in September and “suggests an increase is no longer a certainty”.

The FTSE 100’s top riser was Endeavour Mining, closing up 4.18 per cent by

late afternoon, as miners continued a strong performance this week.

Russ Mould, investment director for AJ Bell told City A.M. yesterday that investors were pivoting to opportunities in mining as a gloomy economic climate meant they were deciding they “no longer want paper assets, and want hard assets instead”.

JD Sports Fashion had a turbulent day, initially rising 2.24 per cent to rebound from yesterday’s sharp fall. The retailer closed down over five per cent though – the FTSE’s biggest faller – after being hit by news from across the pond that US footwear chain Foot Looker had slashed its guidance for the full year.

Oil giants BP and Shell languished near the bottom end of the blue-chip index throughout the day, as oil prices reacted to concerns over demand from the world’s biggest crude importer, China.

“The going is good” at Bank of Georgia, analysts at Peel Hunt wrote after its most recent quarterly results which showed a particularly strong return on equity. While some of its strong performance is unsustainable, the analysts argued it was still “performing above expectations”. It boosted earnings forecasts for the next couple of years. The analysts rated it a ‘buy’ with a target price of 4,200p.

Costain's first half performance came in ahead of expectations with the firm reiterating its medium-term targets. Peel Hunt analysts expected a dividend to be “confirmed shortly”. The analysts maintained a pretax profit estimate of £40m for the full year, marginally ahead of consensus. Costain was rated an ‘add’ with a target price of 60p.

“It’s been another day of disappointing economic data with French, German and UK flash manufacturing and services PMIs coming in well below expectations... Rather perversely this hasn’t been taken as the negative as it might have done as it serves to prove that rate hikes are starting to have the desired effect.”

MICHAEL HEWSON, CMC MARKETS

Michael Martins

Michael Martins

LINKEDIN in 2023 has started to look suspiciously like Twitter in 2016. Although Westminster does not spend nearly as much time on LinkedIn as it does on Twitter (probably because they don’t know that Snoop Dogg recently joined and often responds to comments), the platform has become a part of the long-haul general election campaign in an unexpected way: via the LinkedIn Creator.

Following the pandemic, lockdowns, and amplified by the Musktakeover of Twitter, LinkedIn has started to look a little bit more like Twitter, as people’s platform habits change. Although there is the standard fare of “such a humbling experience to do this great thing for my CV”, there is also a large cohort of so-called LinkedIn Creators i.e., people that have succeeded either in business or in amassing followers, who have the platform’s microphones and try to shape opinion in their own image.

And so, after the Conservatives’ victory in July’s Uxbridge by-election, where the party also managed to find a likely election wedge issue in the form of opposition to “green” policies, many of the LinkedIn Creator crowd seemed to think that a thoughtful, critical, and hyperlink-in-

fused (read: long) post would have the potential to determine the next election result.

This is, and was, surprising. For such a professional platform, there was a fairly large number of people posting critical views of an election result and subsequent policy pivot, even if some of their companies and bosses likely held less firm political views. Even more surprising, though, was the feeling that some of these intellectuals seemed to have missed a key takeaway from the Brexit referendum: the loud-

est critics usually just help to propagate a campaign message they disagree with and, often through their own passionately held beliefs, end up alienating more people in the debate than they convince. A net positive if you’re the one being criticised, which in this case, would be the Conservative party. LinkedIn is obviously different to Twitter. For most people on it, there is an incentive towards moderation or at least self-control, hence why most of the loudest Creators tend to also be

their own boss. But other key differences matter, too.

Firstly, there is little balancing voice on LinkedIn – it is less a forum for debate and more a place to post and try to last on people’s newsfeed for as long as possible. The algorithm determines what you see based on a post’s interaction with its followers, so the more likes, the more eyes, and the longer the post stays in people’s feeds.

Secondly, there is a “show more” barrier that blocks most of a long post, meaning that readers’ eyes are

IN 1930, economist John Maynard Keynes wrote an essay predicting that within a hundred years people would work just 15 hours per week.

Keynes thought greater economic efficiencies would boost our standard of living (around four to eight times) to the point where we would barely have to work to consume everything we needed.

Keynes was not entirely wrong – Brits are around five times wealthier but annual working hours have declined from around 48 down to 34 hours per week. But instead of working 15 hours per week, we have chosen to consume a lot more – modern gadgets, better food, and international holidays, to name a few. We also live much longer, meaning more leisure time across our lives. But that leisure time and consumption is no free lunch, it requires working and saving when younger. Nevertheless, the calls for more leisure are ever-present. Last week, amid the excitement surrounding the Lionesses making it to the Football

Matthew LeshWorld Cup final, there were demands for a victory to be met with a new bank holiday. Labour leader Keir Starmer perhaps jinxed the result by declaring that “there should be a celebratory bank holiday if the Lionesses bring it home”.

Unfortunately, despite how much everyone loves a day off, more bank holidays are a rubbish policy. According to IEA Economics Fellow Julian Jessop, an additional bank holiday for the Lionesses could have cost the economy around £1bn – a big blow to a country teetering on the brink of recession.

“The extra day off work would hit output and incomes, and disrupt public

services, especially as employers would have little time to prepare,” Jessop explains. We could have commemorated a victory at a much lower cost by investing in women’s football, giving a financial bonus to the players, or extending pub opening hours on Sunday, but an expensive bank holiday hardly feels justifiable.

The same applies to the general demand for more bank holidays. In 2017, never afraid to make a nice-sounding but fundamentally dumb promise, Jeremy Corbyn committed to four new permanent bank holidays.

Bank holidays force many businesses to shut down and workers to lose income. They also disrupt projects and workflow, lead to more NHS treatment delays, and cause kids to spend less time in school. By making everyone take time off, they are highly disruptive compared to when individuals are in control of their own holidays. Taken together, bank holidays lower productivity and economic growth. More fundamentally, bank holidays

collectively impose a holiday on everyone rather than leaving individuals free to decide when they take time off. They mean everyone – no matter their religion or lack of religiosity – is forced to take off Easter and Christmas. They increase costs for flights and accommodation for those wanting to travel. In practice, it leaves a select few stuck working; alternatively, shops and restaurants are closed altogether. There’s nothing wrong with wanting more leisure time – and in fact, it has become increasingly normal to negotiate with employers for part-time work or more time off in lieu of pay raises. But not everyone has to take the same time off with you. Keynes was ultimately wrong about the 15-hour workweek because we chose to work harder and become much richer. More holidays should be an option, not something that everyone is forced to do, and certainly not all at the same time.

£ Matthew Lesh is the director of public policy at the Institute of Economic Affairs

generally only exposed to the headline the Creator is seeking to dismantle.

Thirdly, for much of the media and political bubble, LinkedIn is just an afterthought, so there is little curatorial or editorial pushback. And finally, only the truly brave tend to post very critical comments to political or media posts, leading to a “zealot” bias, again making some things seem sensible as the loudest critics often leave little room for nuance amongst the undecideds.

Given these differences, it is not without a dollop of irony that some of the current government’s loudest Creator critics on LinkedIn are shaping the low-level corporate debate, but likely in a way that detracts from their aims. As a non-driver, I didn’t know the ULEZ price was £12.50 until a LinkedIn Creator pointed it out, for example. So, while Twitter is probably not yet tired of experts in this longhaul election campaign, many of LinkedIn’s Creators should probably think twice about clicking post. They could end up amplifying and extending a debate about whether the UK will achieve its net zero goals because ULEZ expansion might affect 8.7 per cent percent of cars in London, roughly 0.6 per cent of the UK’s total (the new £350m a week for the NHS, some might say). So as good as it might feel to let the feelings out, Creators, you may end up doing your policy opponent’s bidding in the process. Consider yourself warned - feel free to like and repost.

£ Michael Martins is a senior director at 56 Degrees North

YOU NEED TO CALM DOWN It’s always interesting when the famously antagonistic President of China Xi Jinping is the one calling for unity (and not with Taiwan). Sadly, it wasn’t with the West either, but rather the bloc of developing nations known as Brics - Brazil, Russia India and China.

[Re: London SMEs committing over half of annual revenue to tech investment, data reveals, Aug 22]

London’s SMEs are investing in technology like never before and with a national productivity problem that feels like the right decision. However, with budgets under pressure the risks of getting it wrong are growing and SMEs must be considered in their tech investments to truly see the benefits.

When SMEs are competing against enterprises, the FOMO temptation to simply jump on the latest technology is strong. The world of tech is fastpaced, exciting and full of distractions, especially in a new world of AI, but SMEs must keep their feet on the

ground, seeking tech solutions that serve their main goals.

Technology absolutely enables SMEs to level the playing field with their major competitors. But investing in technology is not just about possessing the tools; it’;s about having the right skills and resources to use them effectively – doing otherwise is a productivity drain, not gain. Before hitting the buy button, ensure your business has the skills and infrastructure to effectively manage and use the tech.

Find a partner that you trust to be able to separate “shiny things” from real winners and work closely with them so that you can focus on today’s challenges, and don’t feel the need to jump first. This is the smart path that promises not just a tech-driven future, but a future driven by the right tech.

MattSEVERAL months ago, the UK’s Competition and Markets Authority seemed to be in a tight spot. It had banned Microsoft from completing its $69bn takeover of gaming giant Activision –leading to loud complaints that the CMA was anti-business. And it soon looked like a global outlier. US courts threw out the Federal Trade Commission’s attempt to stop the deal and the European Commission was proudly trumpeting the concessions it extracted to clear the deal. Speculation was rife that the CMA was trying to find a minimally embarrassing way to retreat from its decision. Yet the CMA has done far more than save face. Its tough approach has paid off –while the European Commission has left EU gamers short-changed.

Competition authorities’ concerns focused on cloud gaming: a nascent technology which allows consumers to “stream” games over the internet onto devices like PCs, avoiding the need for a specialised console like a PlayStation or Xbox.

This summer feels a long way off the heatwave of last year, but those blistering 40 degree days of 2022 put our water supply in serious and ‘immediate risk’ according to the Environment Agency. Water levels in some reservoirs were close to ‘dead storage’ where it is no longer treatable.

Boots has been forced to apologise after it automated advertisements promoting infant formula on Google.

The Advertising and Standards Authority said the ads fell foul of rules which prevent retailers pushing products for children under the age of six months old.

While many claim this rule is based on fears advertising for infant formula would encourage women to stop breastfeeding, it actually stems from the International Code of Marketing

Breastmilk Substitutes, developed with the help of the World Health Organisation. It was not driven by fears of a decline in breastfeeding, but after companies actively went into hospitals and told new mothers formula was better than the natural alternative. It’s also as a result of formula being pushed in countries where bottles can’t be sterilised. However the result has created a bizarre situation where supermarkets can’t tell customers if formula is on discount.

Seeing how consumers have jumped on streaming television, this technology could rapidly take off and allow millions more consumers to enjoy gaming. The competition watchdogs, however, are worried that Microsoft would monopolise this technology – it already owns the Windows operating system which many devices use, has one of the few large cloud computing networks necessary for cloud gaming, and would own blockbuster Activision games like Call of Duty.

The European Commission accepted one solution to this problem. Microsoft agreed to allow people who bought an Activision game to use it on another cloud gaming service (a “bring-yourown-game” model). But this remedy was imperfect.

For one thing, gamers want the convenience of using cloud services which already have a portfolio of games ready to play – buying an Activision game first and then moving it to a streaming service is a lot of unnecessary rigmarole. But the Commission could at least boast that its remedy would give consumers more choices than the status quo – Activision games are not available for streaming at all today. The Commission therefore implicitly criticised the CMA for blocking the deal.

Microsoft was initially blocked from acquiring Activision earlier this year

The Commission therefore initially looked more business-friendly and more pragmatic than the CMA. But the CMA has now been vindicated. Microsoft has proposed a new deal, which offers much more for consumers. Under new deal, Activision will sell cloud gaming rights to a third company, Ubisoft. Microsoft would acquire the rest of Activision.

If Microsoft wants cloud gaming licences for Activision games, it will have to negotiate (along with all other cloud gaming providers) with Ubisoft.

The CMA still needs to scrutinise the new proposal – and will want to be certain that Ubisoft will have the incentives and ability to make Activision cloud gaming licences more widely available. If it waves the deal through, then the cloud gaming market should develop competitively. Gaming services will have more freedom to experiment with different business models. And consumers will get more choices.

So: all’s well that ends well… except in the EU. Because Microsoft had already reached a settlement with the European Commission, the old deal would still apply in the Union – mean-

ing Microsoft will still control licensing of Activision games in the EU. EU consumers would be stuck with a worse deal than consumers everywhere else in the world. Brussels’ trust-busters must regret not pushing for stronger concessions. And EU consumers should be fuming.

Brussels has promised for years to make digital markets more competitive. But apart from levying some large antitrust fines, its approach has not yet delivered many visible consumer benefits. The CMA, on the other hand, is developing a reputation for being tough, principled and incisive. The CMA is right to insist on markets which are genuinely competitive, rather than governed by inflexible concessions put in place solely so large tech companies can make megadeals.

Rather than close the UK off for business, the CMA wants to give Microsoft’s competitors more opportunities to succeed, and UK consumers more choices. EU gamers will be looking on jealously.

£ Zach Meyers is a senior research fellow at the Centre for European Reform

DROUGHT WATCH Parts of England

almost ran out of water last summer

Battersea has been dragged kicking and screaming into the high-end property world.

Less than a decade ago it was a strange bubble of industrial wasteland, a place filled with old warehouses and the rusted remnants of esoteric machinery.

Now it’s a gleaming residential and commercial Disneyland, supported by its own underground station and dominated by the hulking chimneys of the redeveloped Power Station.

It is also home to the rather Orwellianlooking American Embassy, occupying a space a few minutes east of the Power

Station, a place once described by Donald Trump as a “lousy location”, which, coming from him, is probably a ringing endorsement of the area.

Taking its naming conventions from its salubrious neighbour is the nearby Ambassador Building at Embassy Gardens, a luxury development famous for its glass swimming pool that bridges two adjoining buildings.

If you’ve ever looked up at that pool and thought “I’d like to live there,” well, now’s your chance. The penthouse in that building is for up sale at £4.5m. For that you’ll get your very own private terrace, access to the Sky

£ 15th Floor

£ 2,023 sq ft with a 1,630 sq ft private roof terrace

£ Views of the city and river

£ Two designated parking spaces

£ 24 hour concierge

£ Residents’ gym and cinema

£ Walking distance to three underground stations

Pool and spectacular views across the Thames and beyond from the comfort of your own bed or living room.

“Embassy Gardens has always been synonymous with luxury living, but this latest offering takes opulence to new heights,” says Jon Johnson, managing director of Johns&Co.

“It features marble work surfaces, floor-to-ceiling windows, and an exquisite spiral staircase leading to a sprawling private terrace. Craftsmanship is evident in every corner. Abundant natural light fills the spacious living areas, highlighting the captivating views.

“This property is tailor-made for those who appreciate urban sophistication and crave unparalleled city vistas. It’s the ideal retreat for professionals seeking a tranquil yet connected lifestyle in the heart of the city.”

Find out more at johnsand.co

Just like painting the door, adding a few attractive planters and pots instantly makes the entrance a feature and hints at a home that is looked after and makes a buyer want to discover what’s inside.