BUSINESS WITH PERSONALITY

THE NOTEBOOK HARGREAVES

LANSDOWN’S SUSANNAH STREETER TAKES THE PEN P10

ENERGY

WHY

IT MIGHT BE TIME TO SCRAP THE PRICE CAP P11

LANSDOWN’S SUSANNAH STREETER TAKES THE PEN P10

ENERGY

IT MIGHT BE TIME TO SCRAP THE PRICE CAP P11

FRANK DALLERES

ENGLAND’s World Cup campaign ended in failure yesterday, with the Lionesses losing 1-0 to Spain in the final.

A first half goal from Spain’s Olga Carmona was enough to condemn England to defeat in the country’s first football World Cup final since 1966.

Mary Earps saved a penalty to give England hope but in truth Spain comfortably rode out the second half, and 13 minutes of added time, to secure their first women’s World Cup win.

£ SPORT: PAGES 18-19

THE UK’s oil and gas sector faces the growing prospect of a cash crunch, with the Treasury’s latest attempts to lure lenders back to the North Sea this week likely to fall on deaf ears, City A.M. understands.

The Treasury has invited some of the world’s major banks to a meeting this Friday including multiple British lenders such as Barclays, Natwest and Lloyds, alongside European banks such as BNP Paribas, Deutsche Bank, DNB, ING and Societe Generale, plus the US financial institution Wells Fargo.

However, only a handful are expected to attend the meeting, with dozens of banks already pulling out of investing in domestic fossil fuels due to concerns over the UK’s poor investment climate and growing pressure to fulfil ESG obligations.

Most recently, this included BNP Paribas, which followed in the footsteps of HSBC last year when it committed to stopping new oil and gas financing for freshly approved projects.

The Mail on Sunday first reported the meeting.

While Shell and BP are

sufficiently resourced to fund projects with their own cash flows, the vast majority of producers –which actually make up the lion’s share of North Sea output –are smaller and depend on favourable lending terms from banks to finance projects.

However, the government’s decision to toughen the windfall tax

last year so that it is a six-year policy has weakened investor confidence in the North Sea, with banks considering the levy to be a policy change – making their terms of financing oil and gas exploration more stringent for producers.

The introduction of a price floor for oil and gas from the Treasury has not been sufficient to

boost confidence, with Whitehall not even expecting the mechanism to be triggered over the duration of the Energy Profits Levy.

Meanwhile, recently unveiled plans to consult on the tax regime with the industry will not include the windfall tax.

Further worsening investment appetites is the growing expectation that Labour will win the next election, which will most likely take place next winter, because the party has committed to a de facto 75 per cent tax.

£ CONTINUED ON PAGE 2

NICHOLAS EARLWATER, water everywhere, and not a drop to drink. To be fair to the water companies, they continue to provide us with drinkable stuff out of the tap. Unfortunately it’s everything else they’re failing at.

Over the weekend, a City A.M. reporter took a trip to Whitstable for a sunny(ish) weekend break. The beach was packed with families enjoying the first drop of Vitamin D they’d seen in some

time. And the sea –thanks to parents yelling at their kids to not take another step –went largely untouched. There is something tragic in an island nation’s consciousness when the sea has become a threat, but it became apparent

this weekend that the stories of untreated sewage spewing out into our lakes, rivers and seas have changed the way we think about one of the very defining elements of who we are as Britons.

It’s doing some good for the local economy, admittedly. A souvenir shop has started flogging

“Southern Water: Pumping shit into our seas” t-shirts. But even that is not really much consolation.

The state of our water infrastructure is a national scandal. Over decades, asleep-atthe-wheel regulation of monopoly firms has allowed for a glorious combination of creaking infrastructure and higher bills. Even now Ofwat is notable only by its absence. It is hardly surprising that calls are growing for the entire industry to be nationalised. Now, it is highly likely that such a move would leave us in even

worse shape, as well as doing plenty of damage to the UK’s reputation (such as it is) for having a stable commercial environment. But private companies running monopolies must be held to a higher standard by regulators, and they must hold themselves to a higher standard too. For better or worse, such companies are standard bearers for the private sector in the public imagination. God help us.

CHINESE officials have said they will coordinate financial support across local and central government as a property debt crisis, and concerning growth data, continues to spook global traders. Authorities said they would look to lower financing costs for the economy and reduce the cost of credit for property companies struggling with a slowdown. It comes after Chinese property giant Evergrande filed for chapter 15 bankruptcy protection in New York last week while Country Garden also faces risk of default.

NICHOLAS EARL

HOUSEHOLD energy bills are expected to remain above pre-crisis levels over the next 12 months, despite Ofgem being on course to announce a fall in the price cap this winter.

Cornwall Insight, which oversees a closely-watched market forecast, predicts Ofgem will unveil a more than £250 drop in the mechanism on Friday in accordance with estimates the price cap should slide from £2,074 to £1,823 per year for the fourth quarter this year. However, it does not expect the cap to decline further next year, meaning en-

ergy bills will remain historically elevated deep into 2024.

Cornwall Insight attributes higher prices to spooked investor sentiment causing a gas price surge in Europe, driven by the threat of strikes at LNG facilities in Australia alongside Russia’s sustained supply squeeze on gas flows into the continent.

The forecaster expects this will lead to an increase in the cap for January to March 2024 to £1,979 per year, which it expects to then dip to £1,915 and £1,867 in the following two quarters.

Prior to the domestic energy crisis, the price cap typically hovered between

£1,000 to £1,200 per year. The price cap establishes the maximum a supplier can charge for average energy usage

Dr Craig Lowrey, principal consultant at Cornwall Insight, renewed the group’s calls for more support to be offered to customers – with the support packages that shielded households last winter wrapping up last month.

“While a small decrease in October’s bills is to be welcomed, we once again see energy price forecasts far above precrisis levels, underscoring the limitations of the price cap as a tool for supporting households with their energy bills,” he said.

GERMAN MINISTER SETS OUT TOUGHER RULES ON CHINESE INVESTMENT

Germany’s deputy chancellor has set out proposals to increase scrutiny of Chinese investments as Europe’s largest economy grapples with the geopolitical risks of its biggest trading partner.

THE GUARDIAN EARNED INCOME TAXED TWICE AS HEAVILY AS CAPITAL GAINS FOR SOME A graduate earning £35,000 a year pays almost double the average tax of someone with the same income from rent on property, according to a study of inequality in the UK tax system.

BLOOMBERG

ARGENTINA’S SERGIO MASSA HEADS TO US FOR TALKS WITH IMF ON LOANS

Argentina’s economic minister and presidential candidate Sergio Massa will travel to the US for talks with the IMF on the country’s refinancing disbursements amid the peso’s devaluation.

CONTINUED FROM PAGE 1

The party is also committed to banning any new licences.

City A.M. understands this has contributed to only a few active lenders remaining in the North Sea alongside the push for funding to meet climate change criteria around carbon emissions.

Labour’s green policy is being led by Ed Miliband, who has made no secret of his desire to remove fossil fuels from the energy mix.

This follows projections earlier this year from the North Sea Transition

Authority, exposing that capital expenditure in the industry will decline from £5.42bn to £2.5bn over a 10-year period from 2019 to 2028.

Ithaca Energy and Harbour Energy are both set to unveil their results later this week, which will give further indications of the country’s investment conditions.

Harbour has been a vocal critic of the windfall tax in recent months, warning earlier this year that its profit had been “all but wiped out” by the tax.

The Treasury declined to comment.

ALL EYES ON CHINA The markets are looking for sign of Sino-stability as officials said they would co-ordinate financial support as a property debt crisis spooks global traders

HOMEREIT is set for a fresh showdown with shareholders today as it looks to ditch its homeless investment strategy in a bid to restore its rental income and steady the ship.

The scandal-ridden social housing investor floated in 2020 on the promise of “contributing to the fight against homelessness in the UK” but is now on the cusp of scrapping that policy in favour of more general real estate investment.

“With the issues faced by the company and the need to stabilise matters, the investment manager does not wish to be constrained during the stabilisation period and accordingly requires the flexibility to include any form of residential use,” Home REIT told investors earlier this month.

Shareholders will now get the chance to face down the board and vote on the policy change today at a meeting in Lon-

don. Home REIT is also proposing ditching the 25-year lease approach which has triggered many of the troubles at the firm.

The meeting today marks only the second time that Home REIT shareholders will have a chance to grill the board since its shares were suspended on the London Stock Exchange in January.

Shares in Home REIT cratered beyond 50 per cent in value between November and January after Viceroy Research launched a damning short report raising concerns over the state of its portfolio. A slew of its tenants have since gone bust and stopped paying rent to the company.

Law firm Harcus Parker, which is suing the company on behalf of shareholders, said the move to ditch its homeless focus reflects a “watering down or abandonment of the company’s founding objectives and the basis on which investors bought in to the company”.

THE AVERAGE price of a home fell by 1.9 per cent in August, the biggest dip for the month since 2018, following a season of surging mortgage rates which led sellers to slash the prices of their homes in order to secure a sale.

During the tail end of the summer, the cost of a home fell on average by

Wilko’s sale of its flagship depot has returned to the spotlight as the deal appears to show how the business allegedly missed out on £40m when it was desperately trying to shore up cash. Last November, the high street store offloaded its warehouse in Nottinghamshire for £48m to DHL as the company attempted to improve its “long-term stability”. However, just two months later the delivery giant shifted the property for £88m to Brookfield Asset Management. A source described the decision as a “fire sale”, adding “they needed cash badly”. All eyes remain on Wilko following its collapse into administration last week.

£7,012 to £364,000, according to figures by estate agent Rightmove, with the typical asking price now two per cent lower than its peak in May.

In London, house prices dipped 2.3 per cent, with the average price of a home in the capital now at £672,000.

Rightmove said the “historically constrained” number of available properties had prevented further price falls.

Businesses are being forced to wait an average of 18 months to have their cases heard in the UK’s civil courts as the bulging backlog of claims remains persistent. The wait is longer than the average of 17 months it took cases to be heard in January to March 2022, and 27 per cent longer than the average of 13 months firms had to wait before the pandemic in 2019, according to data from Thomson Reuters. “As a result of delays, UK businesses are facing prolonged legal uncertainty which has a knock-on impact on their ability to operate,” Thomson Reuters said.

THG BOSS Matt Moulding accused regulators and the London Stock Exchange of turning a blind eye to “rogue” hedge funds and short sellers over the weekend, criticising US giant Quintessential for its attack on Darktrace earlier this year.

Quintessential built up a short in the UK tech firm before alleging a host of irregularities in its reporting, including growth rates.

Shares tanked before an EY report,

commissioned by Darktrace, gave the cyber outfit a clean bill of health.

Quintessential hit back, with boss Gabriel Grego defending short sellers as vital to “market efficiency and price discovery”.

Short-selling remains a contentious topic in the City. Moulding and others have previously suggested that the ease with which hedgies can make short bets in the UK has contributed to the recent underperformance of London’s markets.

Moulding told City A.M. that

AHEADof its second quarter results this week, American chip designer Nvidia is riding high after a successful first half, with shares skyrocketing over 200 per cent since January, and analysts foreseeing more gains.

Nvidia, the S&P 500’s star of the year, is anticipated to report a 65 per cent year on year sales surge to $11.1bn (£8.7bn) when it reports its second quarter results on Wednesday.

Earnings per share are predicted to leap 305 per cent to $2.07.

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, sees potential for continued growth. There is “more juice to be squeezed from the Nvidia orange,” she said.

“Of course the flip side of that is that the reaction to any disappointment, even minor ones, will be more dramatic too.”

The firm has found success as a result of the US’s crackdown on tech from politically non-aligned countries – most notably its chief economic rival, China. Last October, the Biden administration introduced export controls on AI chips to curb China’s access to the cuttingedge technology.

More recently, the US Commerce Department (USCD) said it is considering stricter export controls on the Nvidia A100 and H100 chips, which are critical for generative AI systems.

Chinese tech giants like Baidu, Alibaba, and Tencent are reportedly rushing to secure Nvidia chips before embargo impacts. Demand could also come from the Saudis who, it emerged last Monday, are gobbling up thousands of Nvidia’s H100 chips, each worth $40,000, for use in generative AI models.

The UK is also trying to get a piece of the action, putting £100m of public funds towards snapping up some of the high performance chips as it seeks to make a comeback in the global AI race. Investors are cashing in as Nvidia has “become a proxy play for the AI boom and the explosion of ChatGPT”, according to Victoria Scholar, head of investment at Interactive Investor.

The stock’s high valuation, at over 225 price to earnings ratio, “poses problems” for value investors and the Fed’s monetary tightening could “dampen demand” further she said.

Nevertheless, Scholar said there is still reason for optimism as “blockbuster demand” comes from cloud providers like Amazon Web Services.

proponents of short-selling –who argue that they improve the efficiency of markets –are like “burglars robbing homes and then arguing they are helping to declutter”.

The Mancunian entrepreneur said a “lack of action” by regulators contributed to the “sentiment that London is a backwater” and called on the City watchdog, the FCA, to crack down on short selling.

The FCA declined to comment.

THG owns City A.M.

LAWYERS are calling for the UK’s tax authority to expand its whistleblower rewards scheme as new figures show HMRC paid out over £500,000 to those blowing the whistle on tax fraud. HMRC has paid out over £509,000 to individuals providing evidence about tax fraud during the course of the last

financial year, up from £495,000 the previous year and 75 per cent more than the £290,000 paid five years ago, according to research by law firm RPC.

Adam Craggs, head of RPC’s Tax, Financial Crime and Regulatory team, said the scheme should be more publicised and expanded to encourage more people to report wrongdoing.

“More individuals with evidence of

serious tax fraud would come forward if they knew they could be in line for a life-changing amount of money,” he said.

An HMRC spokesperson said it pays out rewards at its “own discretion, based on what is achieved as a direct result”. It did not say whether it was considering expanding or formalising the scheme.

emotional Sunday for fans, but a boon for hospitality as Brits flocked to pubs and bars to watch the World Cup

UK CAR dealerships are increasingly being snapped up by overseas investors on the cheap amid a surge in dealmaking in the sector.

There were around 20 overseas investments into UK dealer groups in the decade prior to 2019, while the three years post-pandemic have already seen 10 transactions, with several more set to be completed this year, according to research from consultancy EY.

A weakened pound has made UK firms attractive takeover targets, EY said.

US car dealership Lithia Motors bought British luxury dealer Jardine Motors as part of a £300m deal earlier this year. Meanwhile Lookers, one of the UK’s biggest car dealers, looks set to be taken over by Canada’s Alpha Auto Group, with the board announcing a £504m take-private deal on Thursday.

THE TOP DOG behind Marks & Spencer’s digital growth is reportedly leaving the retailer just months after being promoted.

partner and director at EY-Parthenon, said the spike in activity had happened in spite of macroeconomic challenges due to the rise of newer, online-focused retailers, which are increasingly “international in nature”.

“Dealer groups may thus believe they also need international footprints to compete,” they said.

Taj Lalli, UK automotive M&A director at KPMG, added: “UK car dealerships have consistently represented good investment value and it’s little surprise to see international ownership interest in them – only fuelled further by some currencies making gains on the pound.”

Experts in the sector believe the upward trend in overseas investment is likely to continue in the coming years.

“Combined with the strong dollar… we’ll see further consolidation as larger groups look for greater efficiency and reach,” Ian Plummer, commercial director at Auto Trader, said.

Chief digital and technology officer Jeremy Pee (pictured), who landed the position in January, is understood to be leaving M&S to return to Canada.

According to The Sunday Times, M&S’s co-chief executive officer Katie Bickerstaffe will take on his responsibilities on an interim basis. Pee initially joined the retailer in 2018 as chief digital and data officer, after serving as senior vice president at Canadian retailer Loblaw.

As part of his relocation package, M&S is understood to have forked out for a family home for Pee in the affluent London quarter of Little Venice.

Pee’s exit comes after a positive trading period for M&S, which last week posted increased revenues and raised its profit guidance.

“It has always been my dream to help people with their finances. I am hoping to open up my own accountancy practice with my BSc (Hons) Accounting & Financial Management” Jolanta, 40SKY’s head honcho Dana Strong has pocketed more than $30m (£23.6m) in just two years, despite the broadcaster’s finances taking a nosedive last year with revenues down 11.5 per cent. The pay packet makes Strong one of the UK’s highest paid executives.

THE UK government spent more than £46m on negotiating just two trade deals last year, it has been revealed. Ministers shelled out £46.2m during 2022-23 securing and implementing new trade deals with Australia and New Zealand, according to a recent parliamentary written question.

Concerns have been raised over the expected benefit from the Australian and New Zealand deals, with some Brexit critics contrasting the expected values of the deals to that which would be achieved by full access to the EU single market.

The government itself admitted the Australia deal was only expected to add just 0.02 per cent – now uprated to 0.08 per cent – to the size

of the UK economy over 15 years.

One manufacturing executive told City A.M. the deals represented “minimal benefit at best” and urged ministers to focus on offering support to expand to new markets. A spokesperson for the Department of Business and Trade said: “In 2022 we signed trade deals worth £1.1trn... which will boost exports and cut costs for consumers.”

NICHOLAS EARL

THIS year’s longest rally in oil prices has finally stalled, with both benchmarks faltering for the first time since swingeing Opec cuts drove a market rebound. Oil prices dropped around two per cent last week amid escalating concerns over demand in China, which is suffering from a worsening property crisis that has pushed development giant Country Garden to the brink of collapse.

China is the world’s biggest oil importer, but it reported a 20.8 per cent drop in oil imports last month compared to last year – with the country’s sluggish revival from the pandemic weighing down risk appetite from investors.

As of yesterday, Brent Crude is now priced at $84.80 per barrel and WTI Crude at $81.25 per barrel.

Davide Petrella, portfolio manager at Moneyfarm, argued that China’s decline has also been powered by a contraction in the manufacturing sector, with the Purchasing Managers’ Index for July standing at 49.2 – below the neutral value of 50 –reflecting gloomy short-term expectations for a sector recovery.

“Many analysts agree that the recent oil rally over the past 40 days is not sustainable in the medium term. While the US seems to have averted the risk of a recession, the contraction of the Chinese economy could weigh heavily on the overall global oil demand,” Petrella said.

Edward Moya, senior market analyst at OANDA, said prices would be challenged by the developments: “WTI crude looks poised to consolidate around the $80 region as traders grapple with... headwinds from the world’s two largest economies.”

STRUGGLING motor insurer Direct Line has approached senior Aviva exec Adam Winslow to be its new chief exec, according to reports in Sky News. Direct Line is searching for a successor to former boss Penny James, who stepped down in January shortly after the firm issued a profit warning.

POLYMETAL International plans to sell its Russian business within the next six months, with mining groups from the country and Chinese investors being among the potential suitors.

Once one of the world’s most profitable gold miners, the company is looking to carve out its Russian business despite a Kremlin clampdown on asset sales and stringent Western sanctions.

It follows the Polymetal’s relocation of its domicile from Jersey to Kazakhstan this month, a country categorised by Moscow as “friendly”. Polymetal chief exec Vitaly Nesis told the Financial Times an “inevitable” discount on the sale of its Russian assets would not be “catastrophic”.

“If we had remained in Jersey, the risks of losing the Russian business’s value would have been exceptionally high,” he said.

ICONGRATULATEDmy 40something friends and new parents who took on the daunting task of moving house with their baby last week. It’s a challenge we recklessly took on ourselves, almost 17 years ago –feeding a newborn while trying to remember what was in the boxes piled up in the corner is not an experience I’d like to repeat and I was a decade younger than they are. They’re far from alone in having put off parenthood.

The birth rate in England and Wales has fallen back again to levels not seen in 20 years. If that continues, it will bite the economy hard in decades to come. It’ll mean adults of working age will have to shoulder a bigger tax burden, unless immigration increases or a productivity miracle occurs.

It’s understandable given the very real struggle for many families right now that people are delaying having kids or choosing to be childfree. Financial worries have been exacerbated by housing insecurity and, for younger people, the prospect of getting a foot on the

housing ladder is a distant hope. As ‘Generation Rent’ struggles with higher payments, the number of young adults still living with their parents to avoid punishing accommodation costs has grown sharply. Without a home of their own, or barely managing to scramble the cash together to buy, it’s not surprising that potential parents are putting off the decision to have children.

Childcare in the UK is also super expensive, with only the Czech Republic and Cyprus ahead of the UK in terms of costs. While extra help is being phased in, with 30 hours of free childcare for all children over nine months, it won’t be fully available for another two years. So, there will be little immediate respite from painfully high nursery fees. The increasing demands from firms to see employees back in the office won’t help. Would-be parents need flexible solutions and more familyfriendly policies to encourage them to take the plunge into a lengthy and expensive but ultimately priceless experience.

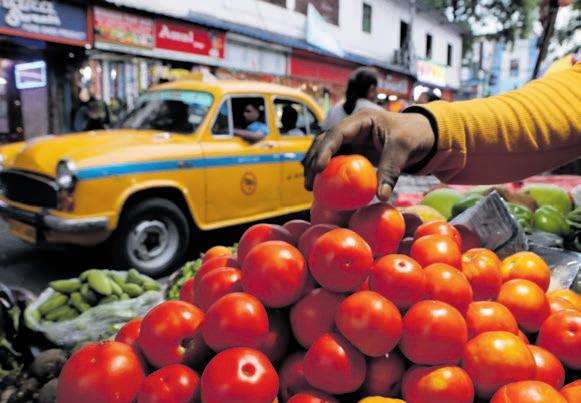

Though high food prices are still problematic for hospitality firms here, we ain’t seen nothing like those seen elsewhere. In India, vegetable prices are up 37 per cent in the year to July, and tomatoes have more than quadrupled in cost –so much so that Burger King has ditched them from its buns. The company isn’t offering a substitute, unlike KFC which swapped lettuce for cabbage after Aussie crops were destroyed by floods. It may not be a whopper of a problem for the chain, but it is just a taste of the disruption we are likely to face, especially if unusual weather patterns persist.

£ Accusations of ‘greedflation’ are circling, as data shows that many companies in the services sector have been able to increase their profit margins this year, despite rapidly rising costs. But this wide snapshot masks the serious challenges that many smaller firms have faced, particularly in the hospitality sector, amid soaring bills. The British Beer and Pub Association warned that the erosion of margins has been crippling the industry at an unprecedented rate. Support with energy bills has been withdrawn, with many small businesses locked into painful contracts for electricity. If more were allowed to renegotiate deals, further rises might be limited, and the inflation headache might lift sooner for the Bank of England.

£ Visiting a village bar while on holiday near Bordeaux, I was surprised by their diversification. As well as serving as the local parcel collection point, it sold everything from stamps to sunglasses, hunting knives and oysters by the kilo. Could this offer a blueprint for how British pubs might survive in these tough conditions? But one thing our boozers could do without right now is another queue. A curious post-lockdown trend seems to have emerged in Britain’s pubs. There is now space at the bar! Punters snake out the door while waiting to order. Although, being little over 5ft tall, I often needed sharp elbows to get served, a crowded bar was always a supremely social place to be. Let’s hope this misguided single file of politeness is a shortlived phenomenon.

‘It doesn’t grow on trees’ is my money quote of the monthfrom my Dad. It took some persuasion to get him in front of the camera to reminisce about teaching me and my sisters all about money. It was for the Hargreaves Lansdown ‘Pass it On’ campaign, showing how parents can give their children a financial helping hand. For us, economising to eventually invest meant a lot of scrimping and saving, which included one holiday backpacking to France. Shame he didn’t invest in a good dictionary on that particular trip. His attempt to buy methylated spirits for our stove saw him presented with an inflatable rubber ring at the camp shop. Though it did nudge me towards studying French at university – there’s always a silver lining to a sliver of embarrassment. Thanks Jeff!

it’s Susannah Streeter, head of money and markets at Hargreaves Lansdown, holding the City A.M. pen

City A.M.’s energy editor Nicholas Earl delves into the sector’s challenges in his column

Ea rough time of it. Over the past couple of years, it has seen 30 suppliers go bust on its watch, all the while seeing household bills spiral to record highs.

There is precious little sign of the latter being resolved anytime soon. Whilst the initial spike seen in the aftermath of Russia’s invasion of Ukraine may have dissipated, analysts expect higher bills to stick around until the country is running on cheap renewables –a worthwhile goal, but one that will be frightfully expensive to achieve in the meantime.

In a normal market, high prices would be passed on to customers. But the energy price cap forbids suppliers from doing that, so Ofgem has been forced to move in a different direction –one that will give them greater confidence suppliers will keep their heads above water, but will do little for competition in the energy sector.

Stung by criticism after the costly collapse of a host of suppliers, Ofgem has pushed forward with capital adequacy requirements, financial resilience tests, net asset value rules and partial ringfencing across the industry.

market became less regulated, and more competitive.

Indeed after a public panic about the power of the Big Six, the market exploded to a high of 70 suppliers in 2018.

That wasn’t a bad thing. For all the weaker players, it was also the climate that enabled new entrants such as Octopus Energy and Ovo Energy to take on bloated incumbents and provide some much-needed competition.

But when prices rose, the price cap hit those smaller, challenger players harder.

Energy firms may have poorly organised their financial affairs, yet the reality remains that it was near impossible for most of the fallen suppliers to survive a situation where they were unable to pass on a sustained hike in wholesale costs to customers.

For instance, Bulb may have pursued an unsustainable growth model to become the seventh largest supplier with 1.5m customers – but the final blow was the rate of the price cap, which meant it could only charge customers 70p per therm despite wholesale prices rising to £4 per therm for supply.

The risk is that unless the price cap is removed, further collapses could happen again – irrespective of how robust Ofgem

What is also noteworthy is that the crisis favoured the biggest suppliers with the deepest pockets, which were able to manage a sustained period of loss making.

Centrica, owner of British Gas, snapped up multiple fallen entrants, with the Big Six’s market share rising to over 90 per cent following Octopus’s takeover of Bulb late last year.

This was the very situation the government desperately sought to avoid when it first made reforms to the domestic supplier market a decade ago.

Ofgem’s tightening financial reforms are laudable but could risk stifling innovation and new entrants to the market.

Combined with the continued existence of the price cap, it is challenging to see how any new supplier could thrive and present a new proposition to customers.

Last week, Ofgem chief exec

the “very broad and crude” mechanism is still fit for purpose.

He is not alone, with Ovo chief executive Raman Bhatia and Good Energy boss Nigel Pocklington also confirming to City A.M. that the cap needs to be either redesigned or abolished.

However, such a decision is not in Ofgem’s gift – with the price cap pushed through parliament in 2018 before being enacted across the industry the following year. This means, irrespective of Ofgem’s handling of the crisis and clean-up operation, one of the chief inhibitors to fixing the market has to be dealt with

With an election coming up next winter, the government is running out of time to address challenges in the energy market.

But the industry must put more pressure on Whitehall to scrap the broken price cap or risk more suppliers collapsing in the face of future market instability as well as less competition and innovation for customers.

A nationwide check on the health of England's water bodies will take six years to complete, despite the government previously providing data on a yearly basis. The assessments, undertaken by the Environment Agency, look at the ecological and chemical condition of rivers, lakes, groundwater, and transitional and coastal waters. In 2019, the last time the assessments took place, just 14 per cent of rivers were in good ecological health, while none met standards for good chemical health. Before 2016 the tests were done annually, but the government has now opted not to deliver a complete update until 2025, the latest permissible under the Water Framework Directive. A Defra spokesperson told City A.M.: “It is completely untrue to suggest that the water body data required to be published has been delayed. The Environment Agency have just this month published another set of sampling results under the Water Framework Directive, going further than legal requirements. This sampling was focused at water bodies with suspected problems so that the government and the EA can get the evidence for investment where it is most needed.”

Russia was still China’s largest crude supplier last month, Chinese government data showed yesterday. This is despite Russian shipments falling from all-time highs on narrower discounts and rising domestic demand slashing exports. Arrivals from Russia were up 13 per cent from the same month last year to 1.9m barrels per day, according to data from the General Administration of Customs. Despite continuing Western sanctions and a price cap on Russian shipments, Kremlin-backed crude has increasingly traded closer to benchmark grades, as strong demand from Indian and Chinese buyers has eroded the sanctions discount. Chinese refiners use intermediary traders to handle shipping and insurance of Russian crude to avoid violating Western sanctions.

Should we scrap the price cap?

Email energy editor

Nicholas Earl at nicholas.earl@cityam.com

To appear in Best of the Brokers, email your research to notes@cityam.com

US rate setters and their overseas counterparts will flock to Wyoming this week to gather for the Jackson Hole Economic Symposium.

Last year, investors were looking to the three-day annual meeting of central bankers for signals on how aggressively central banks, especially the US Federal Reserve, would hike rates to wrestle down inflation.

But this year investors will be asking when rates are going to start coming down. “It doesn’t seem that long ago markets were pricing in rate cuts for later this year. These have now been pushed out into next year, with significant uncertainty as to whether they will come during the first half or the second half of the year,” Michael Hewson, chief market analyst at CMC Markets, said.

Hewson said that Jerome Powell, chair of the Federal Reserve, was “unlikely to

be anywhere near as hawkish” as last year, but it is clear that the world’s most important central bank “believes the fight against inflation is far from over” and it is “unlikely he will deliver any dovish surprises”.

On the corporate front, US chip designer Nvidia, which reports its Q2 results on Wednesday, looks set to continue to cash in on the demand for its chips to power companies' AI ambitions. In May, it raised revenue guidance for the second quarter to $11bn. Its share price has risen 202 per cent since the start of the year.

Video-conferencing service Zoom is set to report its Q2 results today. Its share price has stabilised after a bumpy ride, and it previously raised its full-year revenue guidance to between $4.47bn and $4.49bn. But competition from the likes of Microsoft Teams means it remains under pressure to perform.

Electrolyser specialist ITM Power seems to have regained its spark, with the firm’s final results impressing analysts last week as its £5.2m revenues came in ahead of Peel Hunt’s £2m forecast. Peel Hunt said the firm had made significant progress on its turnaround plan under new CEO Dennis Schultz and that it would be reviewing its forecast. The analysts slapped on a ‘buy’ rating with a target price of 200p.

It was a mixed bag for gambling group Rank as it reported its full-year results last week. While rainy weather provided a boost to its Mecca sites as punters swapped picnics for bingo, more stringent gambling checks saw its Grosvenor casinos lose market share. However, analysts at Peel Hunt said there was scope for positive trading the rest of the year and rated its shares an ‘add’ with a target price of 100p.

“Whether it’s the brewing crisis in the Chinese property market, the surge in US bond yields on fears rates will stay higher for longer or the big drop in UK retail sales, things are starting to look a bit ugly out there.”

RUSS MOULD, AJ BELL

Powerful real-time thought leadership, insights and news delivery mechanism fuelling the most up-to date reporting, adding critical context for decisions that require consciousness, education and thought leadership.

JOIN THE CONVERSATION AND BECOME A PART OF ONE OF LONDON’S MOST TRUSTED NEWS SOURCES

EDITED BY SASCHA O’SULLIVAN

EDITED BY SASCHA O’SULLIVAN

PERHAPS realising that the general election cannot be very far away, the government has abandoned Westminster’s traditionally leisurely silly season. Instead, Rishi Sunak and his ministers have gone on the offensive, setting out a coordinated framework of policy areas on which to promote its new thinking even over the summer.

Last week was “NHS Week”. We are all aware of the squally weather: 7.5 million patients are waiting for hospital treatment; 40 per cent of patients in accident and emergency are waiting more than four hours to be seen; nearly half of cancer patients have to wait more than 62 days for treatment. These are not good statistics, and when you are Steve Barclay, the sixth Conservative health secretary in a row over 13 years, it is hard to avoid all responsibility for the status quo.

The debate over the future of the NHS is not currently at a vaultingly high level. Sir Keir Starmer gave a major speech on health in May, scoring more strongly on staccato emotive declarations than on detailed policy. Both parties have grasped that promising additional spending on health finds little traction, since the electorate is sceptical of these pledges, and

Labour’s recently announced intention to work within the current government’s financial plans has made this a moot point. Instead, the savvy politician dealing with health policy will zoom in on the shibboleth since the days of Tony Blair and Alan Milburn, “reform”.

It is, of course, the absolute core of any practical long-term approach to the NHS. We are operating a system which was created for a population of 50 million, of whom men reached pensionable age at 65 and women at 60, and average life expectancy was just over 68. We now number 67 million, and can expect on average to live to around 82. Those bare figures should

tell you that the system requires more than a financial uplift. While ministers and their shadows will make every effort to seem brave and radical, large areas of policy remain off-limits. While we have admitted that healthcare is inextricably linked with social care, the latter remains a patchwork of provision which is state-funded only for the poorest, and is provided at several different levels of government as well as by charities and the private sector. In 2019, Boris Johnson promised to “fix social care”, but that was before the Covid-19 pandemic, two premierships ago and, in any event, a Johnson promise. Equally, neither party dare compro-

mise the principle—first “compromised” as early as 1951—that treatment remains free at the point of use. And it is a settled truth that major reorganisation is off the table for the time being. The Health and Social Care Act 2012 was the largest structural reform in the NHS’s history but followed substantial programmes of change in 2006, 2001, 1999, 1997, 1990, 1982 and 1974.

Last week, however, Steve Barclay, interviewed by the Daily Telegraph, talked a lot about processes. In particular, with reference to the treatment of cancer, he spoke of “designing out bottlenecks”. Ideas include patients being able to go straight to an NHS diagnostic centre

THIS week marks 100 days until Cop28 meets in Dubai.

The global climate conference will see the finalisation of the first stocktake of progress against the goals of the landmark Paris Agreement of 2015. It will be a global report-card moment and I’m sure the verdict will be “must do better”.

Back in July, we had consecutive days of global record-breaking temperatures, leading UN Secretary General, António Guterres, to conclude that “climate change is out of control”.

So how do we regain control?

The forthcoming global stocktake will shine a light on the very real problems we face.

We will need to confront difficult issues such as fossil fuel use and – unlike at Cop27 – reach a global consensus on how to phase them out. Given the United Arab Emirates’ own oil and gas industry, this will not be straightforward, but we cannot afford to look away, we must grasp the nettle.

We will need to translate promises

Chris Haywardinto actions. It’s no longer enough to talk the talk, we must walk the walk. This has been a core focus of the City of London Corporation.

We will need to ensure that discussions include the private as well as the public sector. There are two sides to the conference: the first is the formal government-led negotiations, the second is the swell of activity on the fringes. We must seize the initiative in this wider context to bring companies and countries with us on along the road to net zero.

On all three of these challenges, the City can play – indeed must play –a vital role.

A recent report by the City of Lon-

don Corporation and Skills for a Sustainable Skyline taskforce, which makes up over 300 organizations, called for urgent reform to the apprenticeship levy to help tackle the growing demand for green jobs.

At present, 76 per cent of the city's greenhouse gas emissions come from buildings. A recent survey by the Construction Industry Training Board (CITB) foresees a substantial rise in the need for construction labor in Central London. This demand, which includes building, retrofitting, and managing sustainable structures, is expected to reach over 250,000 workers by 2027. However, we are far from meeting this increasing demand for green jobs unless we promptly invest in and reform our education system.

The challenge of allocating levy funds for diverse skills training is especially pronounced in the built environment, where creating apprenticeship standards for emerging green job roles has been slow. Apprenticeship numbers have dropped each year since 2016 in construction and plan-

ning, though there was a slight uptick in 2022. The situation is tougher for SMEs, which make up the majority in this sector and often don't qualify for the apprenticeship levy. While the government covers 95 per cent of apprenticeship costs for nonlevy payers, SMEs still bear the remaining 5 per cent along with additional expenses like apprentice wages. This is notable since over 70 per cent of apprentices are trained by SMEs with limited time and funds for their development.

Given London is the leading global centre for green finance, a key part of the solution to tackling climate change is to upskill the workforce. The City, industry and government must all engage in this.

By showcasing what the City can offer at Cop28, we will strengthen the relationship between the City’s financial and professional services sector and the climate.

£ Chris Hayward is the Policy Chair of the City of London Corporation

without a referral from a general practitioner, choosing where possible the location or their treatment and making greater use of the NHS app to speed up access to test results. This could cut large chunks out of the waiting process and make a major difference to accessing care.

This has placed a ministerial fingertip on one of the vital areas of change for a sustainable NHS. In a recent interview, Lord Darzi of Denham, pioneering surgeon, former health minister and guru of systemic reform, talked about using artificial intelligence to analyse test results and have them sent directly to the patient’s smartphone or handheld device; he is already working with Google DeepMind to refine the necessary technology.

Barclay, a solicitor and former financial regulator, is not a stereotypical health visionary. But in his use of the phrase “designing out bottlenecks”, he may have identified a central plank of NHS reform. It is neither panacea nor silver bullet, but a modern NHS will have to reframe our whole notion of where and how healthcare is delivered, treating problems further upstream and in a much more streamlined way than ever before.

The government remains on the backfoot, but a fleeting idea in a brief summer publicity offensive may have identified a policy area which could be the foundation of transformational change. Let us now hope that enthusiasm for “designing out the bottlenecks” remains focused and lively.

£ Eliot Wilson is co-founder of Pivot Point and a columnist at City A.M.

spent the weekend in Australia to watch the Lionesses play in the Fifa World Cup final. During his brief stint, his Australian counterpart, Penny Wong, was gracious enough to meet him even after England knocked Australia out in the semis.

[Re: Glantus: Another listed tech firm set to go private as KKR-Accel vehicle completes raid, August 14]

This is another example of the attractiveness of UK-listed companies for foreign takeovers and take-privates, led by private equity (PE) firms who are ready to take advantage of devalued assets on the public exchange and put their dry powder to work.

If valuations don’t increase soon, UK-listed companies may continue to be challenged and may consider listing in the US instead to extract more value

out of the stock price abroad. The result of which could mean more de-listings, as well as a decline in the overall value of the UK exchange and appetite for companies to go public.

The longer the UK public and institutions hold off buying shares, the stronger the chance others will swoop in, see the value, and take that company private. Combined with the recent interest rate hike by the Bank of England and predictions of another rate hike in September, investor sentiment within the UK could become even more cautious and generate even more interest in UK-listed companies for foreign takeovers.

Merlin Piscitelli Datasite CRO

YOU HAVE probably seen them around. There might even be one in your tube carriage right now. Adverts for companies which allow people to send money home to their families. According to some rather predictable voices, the idea of immigrants sending funds home is out of control and that those who have moved there simply see the city as a cash cow. These criticisms are misplaced.

To some extent, we all see London as a cash cow whether you were born here or not. I myself am originally from Huddersfield but moved to London to work and have occasionally sent money home. However, this doesn’t mean I see the place in purely economic terms. Despite the high cost of living I love it here and can’t imagine living anywhere else. The same is true for immigrants. As for it being a sign that there are far too many immigrants living in London this is a ridiculous claim. Immigration is a good thing and London needs much more of it. Immigrants work hard, boost productivity, and pay taxes. Immigration is just about the only thing propping up the economy and we’d all be much poorer without it.

Late last week, after a wave of violence and raid attacks, Ukraine finally received some positive news. Anthony Blinken, the US Secretary of State, reached out to his counterparts in the Netherlands and Denmark to reiterate that Ukraine will have access to the F-16 fighter jets as soon as the training programme for Ukrainian pilots is completed.

The American-made jets will enhance Ukraine’s strength in the sky, and could mark a turning point in the war. It’s unclear how long the

training will take. In order to start it, the Ukrainian pilots need to have a good understanding of English. Yet out of the 32 pilots selected to do the training, only 8 already had the language level required, so the others are being sent to the UK to learn the language.

The jets are unlikely to be available this year, so Ukraine won’t be able to use them in the current counter-offensive. But the decision to send these jets to Ukraine is very symbolic, as it deepens the ties between Kyiv and its Western allies.

Remittances themselves are a lifeline to the poorest people on the planet. For example, approximately one billion people rely on remittances. The overwhelming proportion of the money sent home is spent on food, housing, and schooling. Remittances not only help people to survive but also to improve their life chances and get an education, and escape poverty.

Money sent home by immigrants is also vitally important for less economically developed countries. More than 70 countries around the world are dependent on remittances for at least 4 per cent of their GDP with the money being used to fund poverty relief programmes, sanitation, health, and education.

Remittances are also good for UK taxpayers. It is right that the government is generous and supports the world’s poorest people, this means we as a country are helping their economies to develop. However, international aid is obviously costly and there are legitimate concerns with where some of the money goes and what it is spent on. Remittances mean

that money gets directly into the hands of those who need it so that our government can spend less money. In fact, were it not for families working in the UK and supporting their families back home, he international aid bill would be much higher.

Advocates of reducing immigration should actually support these payments. While I would be in favour of workers and students being able to bring their families with them, this is an unpopular opinion. Remittances

mean that immigrants do not need to bring their dependents with them but can still provide for them and give them a better life.

We should in fact marvel at the fact there are so many adverts from different companies for international money transfer. Remittances are complex and often costly but companies competing with each other and using innovative technology have helped to simplify things and keep costs low. Not only are these companies providing an essential service, they are also creating jobs and paying taxes which again benefits London and the rest of the UK.

It is a myth that migrants are sending all of their money home. The vast majority of it is spent in London and so helps to boost the local economy. And either way, any money earnt in the UK is subject to UK taxes, and as a result, helps fund all of the parts of the state we rely on.

£ Ben Ramanauskas is an Oxford University economist and ex-trade advisor

Immigrants sending money home to their families is a sign of a truly global economy in

Immigration is just about the only thing propping up the economy at the moment

OCCUPYINGa slim slice of prime seafront real estate on the sunbaked Riviera, the sovereign citystate of Monaco might be small—Hyde Park and Kensington Gardens are bigger, in terms of square kilometres—but it rarely does things by halves. Here, less is certainly not more and overthe-top is always à la mode, from the old money to the nouveau riche. This summer, the glamourous principality is looking shinier than ever, thanks to a slew of new openings, from ritzy restaurants to bouji beach clubs.

Monaco’s fabled Carre d’Or address, Hotel Metropole, strikes gold with the new restaurant, Les Ambassadeurs by Christophe Cussac. A Belle Époque icon dating back to 1886, the hotel has a long culinary heritage; and while this version of Les Ambassadeurs is a new concept, the name comes from one of the hotel’s former restaurants, a 1920s hotspot for visiting diplomats.

“We thought it was interesting and important to reconnect with this past,” says Chef Christophe Cussac. “We found archives containing photos of the period and menus. They offered fish, sole, and simple dishes that were linked to the Mediterranean…Not necessarily fancy menus, as you might think.” Nowadays, things are very fancy though (we expect nothing less), with Cussac serving modernclassic signatures like gold-topped caviar cannelloni and lobster lasagne.

Regarded as the principality’s best hotel, the iconic grand dame hotel Hôtel de Paris is not giving up the crown any time soon. The old gal is looking better than ever after emerging from her recent multi-millionpound makeover in 2019. The hotel is owned by Monte-Carlo Société des Bains de Mer, which also claims ownership of the (in)famous Monaco casino, located just a few steps away in the Place du Casino.

(While it’s not open yet, Amazónico—the upscale, excessively stylish twist on the rainforest café—is also coming to the Place du Casino, on the rooftop of the Café de Paris Monte-Carlo.)

For the most palatial of pads in the opulent Hôtel de Paris, opt for the newly redressed Princess Grace Suite with its own private swimming pool or the two-level Prince Rainier III Suite—both of which take their names from some of the hotel’s most famous guests. What else not to miss at the Hôtel de Paris? A sunny new outpost of the Beirut-born Em Sherif opened last year and is already a favourite spot for cold mezze plates; fruit chichas; and icy and tropical Beirut Mules–made with arak (distilled spirit flavoured with liquoricey anise), plus rum, and a splash of fresh citrus.

Monte-Carlo Société des Bains de Mer has also been busy adding two new restaurants to their glowing coterie: Nestled in a cicada-filled pine grove above the waves, Club La Vigie is the coolest new daytime beach club. Make sure you book this one in advance; it’s already become the spot to be in the Riviera. The new spot comes fully equipped with so-called love nests, hidden cliffside bungalows, which accommodate up to six people, though they work best for couples. The love nests are deliciously private, but in the main beach club area, it’s all live DJs, caviar bumps, and sugar baby

spritzes (which is similar to an Aperol spritz but features freshly squeezed watermelon juice). It’s very popular with the summer yacht set, as you can imagine. There’s even direct boat access for yacht tenders, which is tres convenient.

If you’re sans superyacht (sad face), don’t fret: Click&Boat is like the Airbnb of boating with a whole slew of yachts, sailboats, and motorboats available for hire.

For Monaco, go for a vintage 1960s Riva boat that has recently been converted to electric, like the Naiade. It’s very much in line with the principality’s goal of achieving carbon neutrality by 2050 and reducing greenhouse gas emissions by 55 per cent by 2030. Gold going green—we can certainly respect that.

Club La Vigie is only open during the day (from noon until 8:00 p.m.) to serve lunch. After that, you can simply hop over

to the new alfresco Maona Monte-Carlo via a direct shuttle service. Named from a portmanteau of two of the Riviera’s bestknown fixtures, the beloved chanteuse Maria Callas and shipping magnate Aristotle Onassis, the vibe here is sultry and tropical, with 60s and 70s energy and a theatrical edge, which the on-again-offagain couple would have appreciated. Live music is also a key feature of the establishment, while the cuisine takes a nostalgic turn (think: lemon meringue tarts and stuffed tomatoes à la monégasque). For something extra lush for those who want to avoid the limelight, Maona also has the Tam-Tam Room, a completely hidden private space for up to fifteen VVIPs.

Both Maona and Club La Vigie are a short stroll from the beachfront, retro-chic hotel Monte-Carlo Beach. Dressed in nautical navy hues and shades of crisp white

A slew of hot new arrivals add some summertime sparkle to one of the world’s wealthiest hotspots.

with an understated, beachy air, the hotel is not new (it dates back to the Roaring Twenties), but the parasol-adorned restaurant Elsa, is still worth a visit—especially with its newest accolade.

Elsa, which takes its name from highsociety gossip columnist Elsa Maxwell, has a new chef at the helm, Mélanie Serre, and was recently awarded La Liste’s Ethical and Environmental Responsibility Prize in the 2023 edition of the Mediterranean Awards. The distinction recognises Serre’s dedication to using only the very best local and sustainable ingredients like vegetables from the highaltitude kitchen garden of the nearby Domaine d’Agerbol and sustainably fished seafood plucked right from the Mediterranean. Even the wine list is laid out by distance to underscore local provenance and highlight nearby vineyards.

On the cultural front, the micro-nation

is also delivering this summer: Newly discovered Renaissance-era frescos are now open for public viewings at the Prince's Palace of Monaco. The frescos are thought to date back the sixteenth century and depict the classical myth of the twelve labours of Hercules, which is fitting, considering the frescos were found in the palace’s Galerie d’Hercule. Also, a series of summer concerts will be filling the courtyard of the palace with music this summer. And lastly, this year’s edition of the always-buzzy Monte-Carlo Summer Festival (running through the end of August) includes stars like Mika; Eros Ramazzotti; and Turkish megastar Tarkan.

Stay: Hôtel de Paris Monte-Carlo and Monte-Carlo Beach. Fly: Monacair/Blade. For more information: visitmonaco.com and montecarlosbm.com

WHERE: Incredibly posh students, a massive Cathedral, and music blaring from behind stately walls to signify where the studying is absolutely not happening. The northern city of Durham can feel subsumed by southern students, but go on a weekend to get more of a local feel and it’s really rather lovely.

WHAT TO DO: I spent a night at the Forty Winks hotel to soak up the city before heading a 20 minute drive towards the coast, to the remote beaches that inspired Lord Byron, for a stay at Seaham Hall. Both hotels are signifiers of how Durham's hospitality scene is flying as high as those cathedral turrets right now. At the Forty Winks, beautifully decorated rooms overlook the Cathedral, and at Seaham Hall, they’re experimenting with their first ever tasting menu. We tried it and it’s worth travelling north of Watford for. But more on that later.

STAY: Forty Winks is a pristinely decorated and intimate townhouse. So intimate, in fact, it’s worryingly easy to wander around like you own the place. Yes, those are my Cathedral views from the bedroom window, and that’s my chaise longue to relax on, thank you very much. I’ll stay

here forever, if you don’t mind? Actually, we had to get a move on, as we had a room booked at Seaham Hall, one of the plushest properties in the north. Lord Byron would agree: he stayed here while courting Ada Lovelace and one morning I took a walk down Lord Byron’s Walk to thenearby beach in homage to the literary great. The Ada Lovelace Suite is allegedly where Byron wooed his lover, but we had an Executive Suite with sea views. One night I sauntered around in a dressing gown and read Byron’s Don Juan to my bemused friend over a glass of champers. (She loved it, I’m convinced.)

Take time to enjoy the hotel’s grand hallway entrance, which has been given modern design touches but mostly just feels exactly like the sort of lobby Lord Byron would have hung around in, with endlessly high ceilings and a sweeping staircase for photo opportunities.

The Dining Room, the hotel’s main restaurant, is celebrating the launch of a rather delicious tasting menu. We ate next to a portrait of the Lord himself, next to a brilliantly high window. The menu changes with the seasons and currently features tempura of Shetlands halibut and duck a l’orange. It’s a little slice of Mayfair in Durham.

THE SPA: When you aren’t eating, head to the spa. Guests traverse a wooden boardwalk over water to get there. If that sounds dramatic, that’s because it is. The boardwalk leads to indoor and outdoor pools, my favorite of which is a steaminghot outdoors spot.

OTHER THINGS TO DO: Don't forget to walk around the grounds, where benches provide great perspectives of the 17th century property. The beach is also a five-minute walk away. Look for shiny pieces of glass that have been rounded by the sea. A glass factory used to inhabit this stretch of the coastline and over 100 years later locals are still finding colourful shards. One local man told me about 'multis': rare pieces of glass that have been dyed two colors rather than just one. Find one of those and the locals will forever be proud. Love Seaham Hall so much that you don’t want to leave? Three Residences with sea views on the hotel’s grounds are up for sale, offering Londoners a permanent, year-round Durham escape.

LNER goes from London to Durham, book at lner.co.uk; rooms at the Forty Winks start from £180; rooms at Seaham Hall start from £295; seaham-hall.co.uk and 40winksdurham.co.uk

If you like great hospitality then now's an excellent time to go to Durham, finds Adam Bloodworth

ENGLAND coach Sarina Wiegman was disappointed but proud of her Lionesses after they suffered Women’s World Cup final heartbreak in a 1-0 defeat to Spain yesterday in Sydney.

Olga Carmona’s first-half goal handed Spain’s women a first senior world title –and revenge for their European Championship exit against eventual winners England last summer.

Goalkeeper Mary Earps kept the Lionesses in the tie with a superb penalty save but at the other end her team-mates struggled to build on Lauren Hemp’s early shot off the bar.

“Of course it feels really bad now, very very disappointing. You go into the final and you want to give everything and then you lose it,” said Wiegman.

“That happens in sports, but what we have done, how we have shown ourselves, who we are, how we want to play as a team, overcoming so many challenges, I think we can be so proud of ourselves now although it doesn't feel like it at the moment.

“I think everyone has seen an incredible

OPINION

game, very open game, both teams who want to play football. After all, Spain were just a little bit better than we were today and they had a great tournament.”

Spain captain Carmona’s 29th-minute strike came after they capitalised on a rare defensive mistake and they increasingly exerted their technical superiority thereafter.

Defeat saw England fail to become just the second women’s team to hold the European Championship and World Cup concurrently, after Germany.

“We’ve been 1-0 down in

England coach Wiegman called the loss “very, very disappointing”

a game before and we bounced back and that was the aim today,” said captain Millie Bright.

“We never give in and it’s hard to take but it’s football. We’re absolutely heartbroken. Unfortunately we just weren’t there today.

“At first you feel you failed because you’ve not won. But to finish second – I think in a couple of weeks when we settle down we’ll be really, really proud. This is not it from us, we’ll bounce back I’m sure, but for now it’s hard to take.”

Forward Hemp scored in both the quarter-final and semi and was again England’s chief threat, hitting the woodwork in the 16th minute and then narrowly failing to convert substitute Chloe Kelly’s low cross shortly after half-time.

Carmona’s precise finish aside, Earps repelled everything, bravely blocking Alba Redondo’s point-blank shot and stretching out a glove to tip wide Maria Caldentey’s long-range effort in the second half. She excelled herself in the 70th minute when she dived the right way to gather Jenni Hermoso’s spot-kick, after Keira Walsh was penalised for handball following a lengthy VAR review, and later received the Golden Glove award for the best goalkeeper of the tournament.

But Wiegman’s half-time tactical switch only worked in flashes, such as when sub Lauren James forced Catalina Coll to parry her rising shot over the bar.

Spain midfielder Aitana Bonmati was awarded the Golden Ball for player of the Women’s World Cup after another imperious display.

“I’m on the air right now, I don’t have any words for this moment,” she said. “It is unbelievable. I’m so proud because we did a great tournament. We suffered but also we enjoyed it and we deserve it.”

great credit along the way.

AND SO the hurt goes on. Like other England teams before them, the Lionesses battled bravely in the Women’s World Cup final but ran aground against technically superior opponents who ruthlessly exploited their mistakes. Still, they have earned

Sarina Wiegman’s team had to overcome adversity before the tournament, seeing Euros hero Beth Mead and captain Leah Williamson ruled out by injury, and while at the World Cup, where they battled a numerical disadvantage for more than half an hour to beat Nigeria on penalties, came from behind to knock out Colombia and silenced fervent home support to see off Australia. That the Lionesses got to a first ever World Cup final at all was an achievement in itself.

In the end, however, pre-tournament concerns about England’s lack of cutting edge proved justified. Having found ways to win throughout the knockout rounds, they found Spain too skilful, too wily and too resolute. They kept pounding the Spanish rock

but could not crack it and the chances only became more scarce as the final wore on.

Nonetheless, the Lionesses have rubber-stamped their status as one of the global powers in women’s football a year after winning the European Championship. With the inspirational Wiegman contracted until 2025, this is unlikely to be their last final. From a domestic point of view, the interest generated by

England’s run can only further fuel the growth of the Women’s Super League and grassroots participation alike.

For Spain, it will be interesting to see what World Cup success brings. What now for coach Jorge Vilda, whose well documented dispute with more than a dozen of his players cast a shadow over the campaign? And what about the development of the women’s game in a country that

remains behind England in that respect?

Although Barcelona Femini are the best club team on the planet, on the whole Spain’s women’s top division lags behind the WSL in many respects. Four English clubs are in Europe’s top six for revenue generated, according to Deloitte, while average crowds in England, both for club football and Lionesses games, dwarf those in Spain, says PwC.

Where the Spanish are undoubtedly peerless is in producing gifted and well coached players who have now taken their dominance of under-17, under-19 and under-20 tournaments to its logical conclusion. At last, Spain have arrived on the international as well as club scene. But England, you suspect, will be back.

First cup can help Spanish women’s football make up ground on and off the pitch, writes Frank DalleresFRANK DALLERES Captain Olga Carmona was the match-winner

FRANK DALLERES

KATARINA Johnson-Thompson produced a personal best in the decisive 800m to win heptathlon gold at the World Athletics Championships for a second time.

The Briton, whose career has been ravaged by an Achilles injury since she won this title in 2019, showed remarkable guts to pip American rival Anna Hall today in Budapest.

Johnson-Thompson, 30, knew she had to finish within three seconds of Hall in the final event and clocked two minutes 5.63 seconds, inside two seconds of her opponent.

Gold continues a huge turnaround in fortunes for Commonwealth champion Johnson-Thompson, who will be among the favourites at next

CHELSEA have spent more on players since last summer than it cost to construct West Ham United’s home, the London Stadium. The 3-1 loss of the former at the latter yesterday, even against 10 men for much of the second half, shows the Blues’ rebuild still has a long way to go.

It was a day of mixed fortunes. Hammers defender Nayef Aguerd went from opening goal hero to villain with his second yellow, while Carney Chukwuemeka smashed a fine equaliser for the visitors before limping off.

Chelsea’s British record £115m signing Moises Caicedo had a debut to forget, giving away a penalty after coming on as a substitute, but James WardProwse marked his Premier League bow for West Ham with two assists.

Some things endure, however, like Michail Antonio’s ability to barrel past defenders and lash past goalkeepers, and fate’s way of ensuring Lucas Paqueta, in the news for the wrong reasons last week, had the final say from the spot. Chelsea manager Mauricio Pochettino might have players coming out of his ears but solutions are so far harder to come by.

If last week’s 5-1 drubbing at Newcastle raised questions about Unai Emery’s chances of sustaining the success of his first season with Aston Villa, then normal service resumed yesterday when Everton visited the Midlands and were promptly spanked 4-0.

John McGinn, Douglas Luiz, Leon Bailey and substitute Jhon Duran all made the net ripple as Villa climbed into the top half of the table, got out of negative goal difference and turned the harsh glare of the spotlight onto Sean Dyche and the Toffees instead.

A lesson in not reading too much into the first round of fixtures if ever there was one.

After selling Harry Kane on the eve of the new season, you would have got long odds on Tottenham Hotspur finishing above a Manchester United team who were resurgent last term

summer’s Olympic Games in Paris, provided she can avoid another serious injury.

Sprinter Zharnel Hughes won Britain’s first medal in the men’s 100m for 20 years when he claimed bronze behind American Noah Lyles and Botswana’s Letsile Tobogo.

Hughes finished third to add an individual bronze to his pair of relay medals from the last two World Athletics Championships in Eugene and Doha.

Lyles, who could yet do the 200m double, took gold in 9.83 seconds, with Tebogo, Hughes and Jamaican Oblique Seville all on 9.88 and separated in a photo finish.

FORMER fly-half Danny Cipriani has accused English rugby of “digging its own grave” and appeared to compare coach Steve Borthwick to football manager Sam Allardyce after the national team’s Rugby World Cup plans descended further into disarray.

England lost 29-10 to Ireland on Saturday in their penultimate warm-up match for the tournament and saw Billy Vunipola, the only specialist No8 in the squad, sent off for a high tackle a week after captain Owen Farrell incurred the same fate against Wales.

“English rugby is digging its own grave, led by people that do not understand the art of the game,” mercurial former No10 Cipriani wrote on social media. “It’s steeped in tradition and

heritage which is out dated and the very thing shackling the game.”

In a withering assessment of England’s coaching under Steve Borthwick, Cipriani called for “open discussions where coaches welcome new ideas that feel uncomfortable to them because it’s the only way it will grow. Don’t be Sam Allardyce when you can be Pep Guardiola.”

Borthwick faces another week of uncertainty as he waits to learn how long Vunipola will be banned for, and whether Farrell will be found guilty at a second hearing after World Rugby appealed his initial reprieve last week. “Hopefully we will find a conclusion on both matters this week and it won’t go into another week,” Borthwick said. “It’s another challenge that’s been thrown at us.”

don on Saturday. James Maddison has effortlessly taken up Kane’s mantle as the main man, orchestrating Tottenham’s play from deep.

United, on the other hand, looked like a team still to grapple with its summer trading and showed that last week’s dismal display in a lucky win over Wolves was no freak occurrence.

First European Super Cup? Done. Months-long injury to key man Kevin

nerving ease.

Here, City made light work of neutralising a Magpies team who ran riot on opening weekend, restricting them to one shot on target in a 1-0 win. They also showed that even if Erling Haaland doesn’t score Julian Alvarez will smash one into the top corner.

The champions face Sheffield United, Fulham, West Ham, Nottingham Forest and Wolves in their next five games. What price maximum points?

frequently than they polish a rough diamond and flog him to Chelsea for an enormous profit.

Two of their latest finds, twinkle-toed Kaoru Mitoma and Julio Enciso, caught the eye with mesmerising solo goals and velvet assists respectively as the Seagulls did to Wolves what Seagulls tend to do. Last season’s sixth place was Brighton’s best ever but manager Roberto De Zerbi reckons they can go higher. On this evidence, no one will be arguing with the Italian.

Mauricio Pochettino might have players coming out of his ears but solutions are so far harder to come byRUGBY UNION FOOTBALL