DEATH

OF THE GAP YAH?

HOW BREXIT IS KILLING OFF SEASONNAIRE WORK P11

RECORD

TRANSFER CHELSEA CONFIRM £115M MOVE FOR CAICEDO P20

TRANSFER CHELSEA CONFIRM £115M MOVE FOR CAICEDO P20

CHARLIE CONCHIE AND STAFF

MORE LISTED company bosses have joined a growing chorus complaining London’s equity markets are undervaluing firms.

The boss of polling giant YouGov, Stephan Shakespeare, said US markets were “better” at supporting companies like his while Plus500’s chief David Zruia said his retail platform would have a higher valuation on US exchanges.

Both confirmed that they were pondering the possibility of a secondary listing in New York, following the lead of

gambling giant Flutter, but said no moves were planned in the short term.

BT boss Philip Jansen, liberated after announcing his decision to step down, slammed London investors last month for failing to see value.

UK investors “seem to have a focus more on the short term and find it harder to look at the longer term”, especially when compared to the US, he said.

Earlier this year, SCM Direct, a wealth manager, said that London’s largest firms were trading at an around 18 per cent discount compared to their US peers.

“This anomaly ventures to suggest that if the UK companies were quoted in New York their valuation would probably be £460bn higher than it currently is. No wonder investors have become wary,” SCM Direct boss Alan Miller said. A number of theories have been put forward for London’s continued sluggishness, with Brexit often cited as a key moment. Others note that London’s IPO market was still buoyant as recently as 2021, when the UK had already voted to leave the EU even if the finer details were still being

worked out.

Still others have criticised institutional investors and short-sellers for creating uncertainty in London’s investment market.

The Treasury and the City regulator are working on reforms of listing rules and capital markets to boost the capital’s equity trading floors.

A number of large pension funds have promised to put five per cent of their investable funds into the UK stock market in an effort to bolster valuations and reinvigorate a stagnant IPO market.

CHARLIE CONCHIE

THE LONDON Stock Exchange was left red faced yesterday after a fake announcement popped up on its official channel purporting to reveal a $1bn investment into ChatGPT owner OpenAI.

The fictitious press release appeared on the exchange’s news platform, where listed firms post regulated updates, falsely claiming that US private equity firm Ripplewood had made an investment into the West Coast AI outfit.

City A.M. understands the announcement had been pulled onto the platform via one of the bourse’s partner organisations, EQS, and slipped through a vetting process.

The announcement was pulled from the platform after the error was realised.

“We were made aware of a potentially erroneous press release being displayed on the London Stock Exchange website and other news platforms,” an LSEG spokesperson told City A.M. in a statement.

“The non-regulatory press release originated from one of our newswire partners.”

Ripplewood has now called in lawyers to investigate the appearance of the release, the Evening Standard reported. Its CEO and founder Tim Collins told the newspaper: “This is illegal.”

LAURA MCGUIRE

SANTANDER and Barclays have become the latest high street lenders to reduce the rates of their mortgage deals, following a stream of other cuts by fellow banks last week, offering some relief to buyers and re-fixers alike.

At Santander, an 85 per cent ‘loan to value’ deal is now priced at 6.09 per cent, down from 6.27 per cent.

The reductions follow HSBC, Halifax and Nationwide slashing their rates last week.

Nationwide slashed the price of its fixed rate mortgage deal by 0.55

percentage points. TSB also revealed reductions of 0.4 points on some of its deals.

Rates spiralled alongside the Bank of England’s increases to the base rate.

Inflation figures published tomorrow will likely lead to further rate reductions. Markets expect the

headline rate of inflation to fall to 6.7 per cent, down from 7.9 per cent last month.

Rob Gill, managing director at mortgage broker Altura Mortgage Finance, told City A.M. last week that if this week’s data on inflation confirms a further fall then there could be a “mortgage price

war in September”.

“Who saw this coming? It looks more and more like the bigger lenders are fighting for market position, a sure sign that they are well off their respective lending targets,” Ranald Mitchell, director at insurance and mortgage adviser Charwin Private Clients, said.

BETTER VALUE THAN NEW YORK!

THE BBC is struggling for its survival. It sees a hostile government, new agile competition from streamers and social media, and may soon find out what life is like without the guaranteed income of a licence fee. Faced with this dilemma, the BBC announced a new show yesterday sure to change the institution’s fortunes: a podcast in which black queer individuals are matched by their star signs, overseen by the rather

brilliantly named astrologist Celestial Tree.

Now, public interest journalism would be served well by proper insight into what life is like in modern-day Britain for people who identify as black and queer.

As we saw from a homophobic

attack over the weekend in Clapham, there is still plenty of hate to go around. Being black in the capital, too, comes with a financial penalty in work and the seemingly ever-present threat of wrongful arrest. There are no doubt powerful stories to tell, stories that might not be commercially viable. They would be, in fact, what public interest journalism is about and far more in the Reithian spirit that the BBC should be striving for than

the absurd claptrap of a horoscopes podcast. Nobody, it appears, has asked ‘why’ at any point in the process. The BBC is chasing a younger audience, so somebody has decided to do a show that will –in their minds at least –appeal to a younger audience. It’s patronising but clearly somebody felt the need to sign this concoction off. But why is this happening? How does it further anyone’s interests?

Nobody, presumably, asked ‘why’

MAKING HAY Shire horses Bryn and Cosmo harvest the wildflower meadow at King’s College Cambridge pulling a traditional wain, with the bales then offered to local farmers

when the BBC went ahead with lashings of cuts to the World Service, either, at the same time as it “experiments in decentralised social media” on Mastodon, a little known web platform. Nobody has asked why a public service broadcaster needs to expand into ever more hyperlocal coverage, booting out existing commercial players, either. It won’t be long before people start asking why the BBC itself exists.

UBS has agreed to pay $1.4bn to resolve a US regulatory probe into the alleged mis-selling of residential mortgage bonds in the run-up to the 2008 financial crisis, wrapping up the last remaining government-brought case.

DAVID LYNCH

CITIES should look at other options for tackling air pollution instead of schemes like London’s ULEZ (ultra low emission zone), Sir Keir Starmer has suggested.

The Labour leader said no one in the UK should be “breathing dirty air” but added that proposals for reducing air pollution should not have a disproportionate impact on people’s pockets during the cost of living crisis.

London’s ULEZ will be expanded to cover the entirety of Greater London from 29 August, a move overseen by

the city’s Labour mayor Sadiq Khan.

Starmer has asked Khan to reflect on the policy’s impact following last month’s Uxbridge and South Ruislip by-election result.

Labour had hoped to win ex-prime minister Boris Johnson’s seat from the Conservatives, but said ULEZ was a dividing issue that saw the Tories retain the seat.

Asked by broadcasters whether Labour’s policy on clean air zones had changed since his party lost the byelection, Sir Keir said: “Let me tell you what I want to change: I want clean air.

“I don’t think anybody in this coun-

try should be breathing dirty air, any more than I think they should be drinking dirty water.

“What I don’t want is schemes that disproportionately impact on people in the middle of the cost of living crisis, so we need to look at options for achieving what we all need to achieve, which is clean air.

“There are other ways of achieving this, so my driving principle is clean air, absolutely yes, but a proportionate way of getting there and looking at what the options are for other cities, other places doing it in different ways.”

TO SURGE

Ford has said its sees revenue from incar software services, like hands-free driving, surging 1,000 per cent over the next few years as it hired Peter Stern, former vice president of services for Apple, to run a newly-created tech unit.

THE GUARDIAN

Yesterday evening the Bank of England said it had resolved a technical issue that shut down a vital system that processes £1 trillion in transactions daily. The problem hit its real-time highvalue transactions service.

JESSICA

BRITISH taxpayers spent a record amount this year funding government spending, a top think tank has calculated.

Workers have spent more than 60 per cent of 2023 with their incomes going towards paying off the government’s spending and borrowing, according to the Adam Smith Institute (ASI).

Yesterday was 'Cost of Government Day' from which point the average taxpayer keeps their income solely for themselves until the end of the

year and at 227 days into 2023, this year’s is the latest date on record, even when compared to spending during the pandemic, the ASI said. Last year’s cost of government day came a month earlier on 10 July.

Over £901.8bn was paid to HMT from employees’ wage packets this year, which amounted to 46.25 per cent of net national income, ASI figures claimed.

“We need urgent fiscal reform," Marlow said. “Taxes must be cut [and] regulations must be slashed The government was approached for comment.

CHINA’s largest private real estate developer Country Garden is seeking to delay payment on a private onshore bond for the first time, the latest sign of a stifling cash crunch in the property sector, piling pressure on Beijing to step in.

Adding to worries about contagion risk, a major Chinese trust company that traditionally had sizable exposure to real estate, Zhongrong International Trust Co, has missed its repayment obligations on some investment products.

Analysts warned that a rise in default by trust companies, also known as shadow banks, which have strong ties to the domestic property sector, will further weigh on the world’s second-largest economy.

Anxiety about contagion risks is spreading through global markets, putting China’s government under mounting pressure to deliver support for the ailing real estate sector, which accounts for roughly a quarter of the economy.

Once considered a more financially sound developer, Country Garden’s woes could also have a chilling effect on homebuyers and financial firms, with more private developers close to a tipping point if

GUY TAYLOR

COMMUTERS are facing a significant rail fare hike, which could add hundreds to the price of their season tickets despite ongoing strike disruption and faltering performance.

be announced.

Beijing’s support does not materialise soon.

The real estate sector has suffered tumbling sales, tight liquidity and a series of developer defaults since late 2021, with China Evergrande Group at the centre of the debt crisis. Weak overseas demand, tepid domestic consumption and persistent problems in the property sector have been major factors in China’s struggles to mount a solid post-Covid recovery.

Concerns about the outsized exposure of China’s shadow banks –a $3 trillion industry –to property developers have grown over the past year.

JP Morgan in a research note yesterday said that rising trust defaults would drag down China’s economic growth by 0.3-0.4 percentage points directly.

“In addition to the apparent financial risks and their transmissions, the latest wave of defaults from wealth management firms on trust-related products is likely to cause some substantial ripple effects for the broader economy through wealth effects,” Nomura said in a separate note. The UK’s exporter-heavy FTSE 100 also edged lower yesterday. Country Garden declined to comment.

On Wednesday, the Retail Price Index (RPI) figures used to set next year’s rail fare increase will

GUY TAYLOR

THE BOSS of Rolls-Royce Motor Cars was handed a bumper £1.77m pay packet, up 72 per cent from last year, after sales and profit at the carmaker hit record levels in 2022.

Rolls-Royce’s latest company filings show the

group delivered a record 6,021 cars in 2022 – with the US, Greater China and European markets the most fruitful.

The BMW-owned carmaker made £887m in revenue, up 12 per cent year-on-year and saw annual operating profit jump 22 per cent to £120m.

As a result, long-time chief Torsten Muller-Otvos saw his pay packet reach over £1.77m, up from a previous £1.04m.

Las year was the first time in 25 years that the government had upped fares by less than inflation though the hike was still the biggest jump in the cost of rail travel over ten years and drew strong criticism from transport bodies and Labour, who described it as a “sick joke”.

But the government now faces a further quandary, having insisted at

the time of last year’s hike that its intervention was for “this year only”.

The most recent figures show the RPI reached 10.7 per cent in June and is forecast to dip to 9.8 in July.

A Department for Transport spokesperson said: “We will not increase next year’s rail fares by as much as the July RPI figure. Any increase will also be delayed until March 2024.”

NEWLY-FORMED London property giant Shaftesbury Capital has agreed a 10-year loan of £200m secured against a portfolio of assets within the Carnaby estate.

The major London landlord said the financing highlights the “attractiveness” of the company’s mainly retail and leisure portfolio to a “broad range of institutional capital”.

The loan will sit alongside the existing loans the group also took out with Aviva Investors of £130m and £120m, which mature in 2030 and 2035 respectively, and share in the asset security of the Carnaby estate.

In March last year, Shaftesbury –which owns a swathe of property around Soho – merged with Covent Garden owner Capco. The two estates now operate under one ownership. The group said that deal would also

help repay secured bonds the business took out last April.

“We are pleased to have extended our relationship with Aviva Investors through the new long-term financing of £200m, which enhances the company’s debt maturity profile and highlights the attractiveness of our exceptional portfolio,” Situl Jobanputra, chief financial officer of Shaftesbury Capital, said.

In its maiden results published earlier this month, the group said net rental income rose to £58.3m in the half year, up from £26.9m in the same period last year, when compared to Capco’s standalone results.

Trading activity across its popular London destinations also rose 15 per cent above 2019 levels on a like-for-like basis, boosted by a resurgence in footfall as international tourists flocked back to the capital in the wake of pandemic-era travel restrictions.

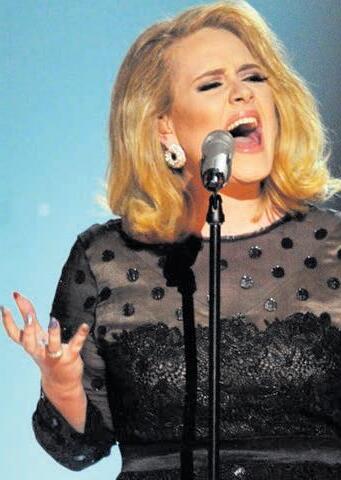

YOU SAY GOODBYE, I SAY HELLO BBC sells iconic Maida Vale Studios, where The Beatles and Adele recorded, to Hans ZimmerTHE BBC has sold its iconic Maida Vale Studios to a partnership of film producers and composer Hans Zimmer for an undisclosed sum. Once echoing with the sounds of artists from The Beatles to Adele, the new partnership says the hub’s legacy will remain intact.

LONDON-LISTED software outfit Glantus is set to go private after receiving a £17.8m offer from the Accel-KKRbacked Basware.

The boards of both companies have reached an agreement on the deal, which values Glantus at around £17.8m and implies a total enterprise value of £29.5m.

Under the proposed deal, Glantus shareholders will receive around 34p per share, almost 200 per cent more than the value the shares had on 4 July 2023.

Shares in Glantus skyrocketed to close up 55 per cent after the news yesterday.

The acquisition will be carried out through a legal framework called a ‘scheme of arrangement’ and is dependent on approval from Glantus shareholders, the High Court and regulators.

Explaining the decision, chief execu-

tive of Glantus Maurice Healy said the firm has “faced an extraordinary challenging period since listing in 2021”.

In 2022 Glantus had to restructure the business and negotiate with its lender due to low levels of cash resources.

“Despite recent challenges, the business has significant scope to further expand its footprint, which we believe will be best achieved in the private arena where Glantus can benefit from the experience and capital of Basware as its partner,” Healy added.

Glantus’s board, advised by Shore Capital, said it considers the acquisition terms “fair and reasonable” and “unanimously recommends” shareholders vote in favour.

Jason Kurtz, chief executive of Basware, said Glantus’s size, focus and business model made it an “exceptional fit” with Basware’s investment strategy.

The deal could complete by the end of 2023, pending regulatory clearance.

own the company, according to Reuters.

JESS JONES

JESS JONES

ANTHROPIC, the US artificial intelligence startup founded by exOpenAI luminaries, is set to receive $100m (£78.7m) in backing from South Korean telecoms company SK Telecom (SKT).

The cash injection will fund the creation of a multilingual large language model (LLM), jointly developed by Anthropic and SKT, according to an announcement made by the telecoms giant late on Sunday. An LLM is an advanced AI system that can understand and generate language-based text.

SOFTBANK is reportedly in talks to buy back the remaining 25 per cent stake of Cambridge-based chip designer Arm from its own investment unit.

In a strategic move ahead of Arm’s impending float in New York next month, Japanese tech company Softbank is looking to regain Vision Fund’s quarter stake in order to fully

Softbank bought Arm in 2016 for $32bn (£25.2bn) and sold a portion of its stake to Vision Fund for $8bn in 2017.

The move could help provide quick returns for Vision Fund investors such as Saudi Arabia’s Public Investment Fund, which have weathered setbacks from the recent investment wobbles.

Working in English, Korean, German, Japanese, Arabic and Spanish, the LLM will allow global telco companies including Deutsche Telekom, e& and Singtel to “offer AI services/apps customised to their respective markets and customers”.

The firm said it hopes the investment will help it “secure a competitive edge” in the AI market.

Anthropic is also building an AI system called Claude, which is similar to OpenAI’s ChatGPT except it claims it is less likely to give incorrect or harmful answers.

THE GOVERNMENT should expand the upgrade scheme for boilers with higher grants and mandate solar panels in new homes, the UK’s solar standards body has argued.

MCS is calling on Downing Street to make solar panels, heat pumps and battery storage compulsory installations in all new homes from 2025 under the new Future Homes Standard – which sets requirements for construction.

“More consumers have the confidence to invest in small-scale renewables now than ever, but we have to make that transition even easier,” said chief executive Ian Rippin.

A record number of renewable technologies including heat pumps and solar panels were installed in people’s houses during the first six months of this year.

Energy security targets set by the government include 70GW of solar capacity by 2035 and to install 600,000 heat pumps a year by 2028 – which

CHARLIE CONCHIE

SCANDAL-STRICKEN Home REIT is facing fresh calls for overhaul after two tenants run by the same director collapsed into administration this year –with the future of a third uncertain.

Home REIT revealed earlier this month that Redemption CIC, a Wolverhampton-based social housing group that made up around nine per cent of its rental take, had fallen into administration, making it the fourth tenant to fail this year.

The charity is also the second Home REIT tenant run by Gurpal Judge that has failed after Home REIT’s biggest single tenant Lotus Sanctuary called in administrators in early February.

City A.M. revealed in April that a third organisation run by Judge, Eden Safe, had also failed to pay its rent.

The revelations have triggered fresh calls from shareholders for an overhaul of governance at the beleaguered former FTSE 250 firm.

“The issues at Redemption CIC, including the potential circumvention of counterparty limits (set at 15 per cent), RM funds warned the board about circa five months ago,” Pietro Nicholls, chief of shareholder RM Funds, told City A.M.

“What is important now is [that] the new investment manager quickly removes defaulting counterparties, whilst reletting with credible partners; in addition we would welcome an overhaul in corporate governance.

“Shareholders have many unanswered questions but are currently left with a suspended stock, no up to date valuation or audit of annual accounts and no clear line of sight to a recommencement to trading.”

When approached for comment, Judge did not respond to questions over whether Eden Safe was at risk of failing as well. He denied that the three separate vehicles had been set up to skirt rental limits set by Home REIT.

“The different CICs were set up to differ the vulnerable groups we housed,” he told City A.M. over Whatsapp. “Lotus housed single females, were as [sic] Redemption housed vulnerable males. This made sorting referrals and recruiting staff easier. No, it had nothing to do with Home REIT.”

The exposure of Home REIT to single directors and organisations has been at the core of the firm’s troubles since a damning short seller attack from Viceroy Research in November.

Home REIT declined to comment.

the industry remains well short of with 17GW of solar generation and less than 20,000 heat pumps installed last year through the upgrade scheme. A Department for Energy Security and Net Zero spokesperson said not all homes were suitable for a heat pump but pointed to a “500 per cent increase in the UK’s renewable energy capacity since 2010” and stressed “we are fully focused on meeting our aim of 600,000 heat pump installations a year by 2028, having offered grants of £5,000 and £6,000 towards the cost”.

Mastercard has snapped up a minority stake in the fintech arm of South African telecommunications giant MTN in a deal that values the division at more than $5bn. MTN, Africa’s biggest mobile company which has operations across the continent, said the deal would be structured as a partnership on payments and remittance. The size of the stake valued the unit at $5.2bn but the firm said the full size of Mastercard’s stake would not be disclosed until the deal closes. Shares in MTN rose 5.8 per cent on the Johannesburg stock market after the announcement of the tieup. Mastercard has been looking to build its footprint on the continent and previously pumped $100m in the mobile money business of MTN rival Airtel Africa in 2021.

Apple supplier Foxconn beat estimates for second-quarter earnings yesterday thanks to a booming artificial intelligence sector – but the firm retained a cautious outlook for this year due to global economic uncertainties.

The world’s largest contract electronics maker downgraded its outlook for full-year revenue to a slight decline from a previous guidance of flat as it joins other companies grappling with a weak global economy and a sluggish recovery in China. “At present there are many external variables: global monetary policy tightening, geopolitical tensions, inflation and other uncertainties,” chairman Liu Young-way said, describing its outlook as “relatively cautious”.

THE NEW chief of Unilever has vowed to look at the company’s decision to operate in Russia with a “fresh pair of eyes,” after it was criticised for continuing to operate in the country.

Hein Schumacher, who took over as head of the Ben & Jerry’s maker in July, made the claim in a letter to a

Ukrainian war veteran who wrote to the boss in a plea for the business to cease operations in the country.

Following Russia’s invasion of Ukraine a number of global businesses such as McDonald’s and Coca-Cola exited the Russian market. However, Unilever chose to keep its operations open in Russia, selling what it classed as “essential” items.

The Ukrainian government also named Unilever as a sponsor of the war after the business continued to pay taxes in Russia last year.

Schumacher promised to keep its operations in Russian under close review, but argued that trading in the region remained the “best option” to avoid the risk of its business ending up in the hands of the Russian state.

LONDON is losing out on cash from wealthy visitors from the US and the Gulf, as the ‘tourist tax’ drives shoppers to France, Italy and Spain instead, according to new data. The removal of VAT-free shopping for international tourists in 2021 continues to hurt London retailers, with visitors from the US and the Gulf cutting spending in the three months to June by one per cent and 17 per cent, respectively, figures published by

the New West End Company show. The drop off in spending came despite a rise in flights from these regions to London, with flight bookings from the US and the Gulf up 17 per cent and seven per cent, respectively, against the second quarter of 2019, the study said.

The research suggested that spending from these groups was being diverted to other European countries, with spending by American visitors up 183 per cent in France and 174 per cent in Spain, while visitors from the

A FLOOD of so-called ‘tourist’ cash flowing into the venture capital industry has dried up over the past 12 months and helped trigger a plunge in the valuation of UK and European startups, new research has shown.

Startup valuations rocketed to lofty highs in late 2021 as low interest rates and steady markets tempted in a wave of new investors who saw a chance to make bumper returns.

Big name non-traditional investors including corporate venture capital firms, hedge funds and private equity firms, dubbed tourists by some in the industry, edged into the space and helped push up valuations with a wave of new cash.

Firms like storied New York hedge fund Tiger Global were at the forefront but have since suffered mammoth losses as the market soured on lossmaking high-growth startups.

Interlopers have now pulled back from the market en masse and sparked a wave of ‘down rounds’ in the UK, where firms are forced to slash their valuation to raise money, research from investment firm Pitchbook, compiled for City A.M., has shown.

Some 24.5 per cent of UK fundraising so far in 2023 was done at a lower valuation than was previously attached to firms, Pitchbook’s data shows, a marked uptick from 17 per cent a year prior.

Valuations across Europe more widely have been dealt similar haircuts, with the proportion of down rounds ticking upwards to 26.2 per cent from 19.8 per cent in the first quarter of 2023, according to Pitchbook research.

Analysts at the firm said the downturn had in part been caused by the flight of non-venture capital investors. Overall cash put into deals by non-traditional investors across Europe sat at €18.7bn (£16.1bn) in the first six months of this year, compared with €27.8bn in the second half of 2022.

“We note non-traditional investor activity synonymous with peak valuations in recent years, has notably retreated from European [venture capital] markets,” senior private capital analyst Navina Rajan told City A.M. Rajan said that the UK “is no different” and both regions were well ahead of the US where down rounds accounted for just 15.2 per cent of deals in the first half of the year.

JAMES HOLDER, cofounder of clothing firm Superdry, has been banned from the roads after pleading guilty to drinkdriving. The court was told the designer had driven home after a business meeting in a pub.

Gulf spent 118 per cent extra in France and 112 per cent more in Italy.

“It’s plain to see that more tourists are becoming aware of the tax-free shopping issue and choosing to spend their money in European cities other than London,” New West End Company chief exec Dee Corsi said.

“While it’s reassuring that our capital city hasn’t lost its appeal when it comes to attracting overseas visitors, the widening gap between footfall and spend in Q2 should set alarm bells ringing in Westminster.”

SKINCARE brand L’Occitane saw its share price jump over eight per cent on the Hong Kong Stock Exchange yesterday following news its billionaire owner was mulling plans to take the business private. Investment holding company L’Occitane Groupe, which is headed by Austrian billionaire Reinold Geiger, said on Friday it was contemplating a deal to take the business private, but was still “uncertain”.

GUY TAYLOR

SHIPPING group Hapag-Lloyd has warned that using smaller ships on the Panama Canal could make the group “no longer competitive” as severe droughts continue to disrupt the world’s largest trading route.

One of the driest years ever recorded has led the government to

impose extended restrictions on shipping companies using the route, with water levels dropping to the lowest levels in years.

The canal has capped the daily number of ships that can pass through and added a depth limit for larger ships.

A spokesperson for Hapag-Lloyd told City A.M. the firm has had to “restrict

intake” of cargo by “about 10 per cent”.

It added that even if the rains were to “start soon, it will take a long time before the ships can operate at full capacity again. We don’t expect it before [the end of] August.”

Approximately 13,000-14,000 ships and about six per cent of global trade pass through the channel each year.

grew 12 per cent year-on-year in July, new figures show, topping £597 per week.

According to data from London estate agent Foxtons, July saw an average of 21 rental applicants per new home arriving on the market, an 18 per cent increase month-on-month, though a 12 per cent decrease when compared to 2022. In recent months, a cocktail of shrinking supply and rising living costs has led landlords to increase the rent on their properties.

Red hot mortgage rates have also led many owners to sell their homes, meaning more tenants are competing to secure a place to rent.

“The ferocious run-up in rents in recent

storm,” Myron Jobson, senior personal finance analyst at Interactive Investor, told City A.M.

“Those with modest incomes have found themselves wrestling with escalating rental costs, forcing them to sacrifice a sizeable portion of their hardearned income to keep a roof over their heads. This leaves them with less money for other essential needs or even to indulge in discretionary spending.”

Others suggested the market was cooling slightly.

“Price increases in the lettings market are less extreme than we saw last year,”

Gareth Atkins, managing director of lettings at Foxtons, said.

LONDON rents have seen another big rise this year, compounding the existing crisis. The shortage of available homes to rent means that tenants are competing aggressively for what is left. They are often facing long queues outside of viewings, bidding wars, and properties being let within hours of being advertised. Some are even having to put down a deposit without seeing the property in order to beat the competition.

Cities across the world are facing similar economic challenges, but not everywhere is seeing these rent rises. The difference is largely explained by how poorly London has performed at building new homes compared to other cities – a problem going back decades. Despite a few pockets of development, most places have built very few homes, owing to our highly politicised, unpredictable and often very slow planning process.

For life to get better for renters, London needs to take a serious look at how and where it can meet this need for housing – otherwise we are looking at a cost of living crisis with no end in sight.

Anya Martin is co-director at Pricedout

OIL PRICES are unlikely to hit $100 per barrel this year despite a seven-week rebound and tightening supplies this year, according to experts.

While prices are expected to remain robust, concerns over waning demand next year and China’s slow economic recovery could prevent both major benchmarks from hitting the milestone.

OPEC has managed to prop up oil prices with swingeing cuts of 5m barrels a day, over five per cent of global supplies, with Saudi Arabia and Russia unilaterally expanding their own cuts by a further 1.5m barrels per day.

This has contributed to a hefty price rally, with Brent crude rising from $72.51 per barrel on 27 June to $86.81 per barrel on 11 August.

Ole Hansen, head of commodity strategy at Saxo Bank, told City A.M. he “sincerely doubted” oil prices would hit $100 per barrel, noting that OPEC members would also want to close the 5m barrels per day of spare capacity with higher production revenues.

“The economic slowdown, which we believe will gather momentum in the coming months, and with China accounting for 70 per cent of the demand growth this year, any further deterioration may also reduce demand from the

world’s biggest importer,” he said.

Rania Gule, an analyst at XS.com, argued that the prices may now even be at a buying peak, with bearish momentum over the long term, reflecting the International Energy Agency’s (IEA) expectation of a demand slump next year.

Callum Macpherson, head of commodities at Investec, believed the IEA’s demand estimates for the second half of this year – 2.2m barrels per day (bpd) in 2023 – could be too high, with forecasts reliant on an imminent revival in China’s economy.

In his view, prices were also contingent on whether leading OPEC member Saudi Arabia extended its 1m barrels per day cuts beyond September.

“As that cut has now been extended to the end of September we have a deficit of around 2m bpd to the end of September and 1m-2m bpd deficit in the fourth quarter,” he told City A.M.

There is also a growing possibility of political concerns dictating the actions of the world’s most influential cartel, with concerns US drilling could be stimulated by high prices.

Bjarne Schieldrop, chief commodity analyst at SEB, argued it was likely in Saudi Arabia’s interests to keep oil prices at $85 per barrel rather than cut supplies further and risk annoying the US.

CITY of LONDON

The PLANNING ACTS and the Orders and Regulations made thereunder

This notice gives details of applications registered by the Department of The Built Environment

Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building

Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission

Merchant Taylors Hall, 30 Threadneedle Street, London, EC2R 8JB 23/00722/LBC

Internal and external alterations including:

Partial replacement of the existing entrance doors

Installation of a metal fanlight grille above the external entrance door to replace the existing plain glass fanlight.

New security cameras to entrance passageway, security controls and CCTV at entrance doors

Replacement of lift at entrance doors and upper platform lift.

Replacement of 1950s joinery panels with new English oak panels and text

Replacement of one pair of timber glazed doors and screen near entrance

Unit 1 (Ground Floor), The Courtyard, Royal Exchange, London, EC3V 3LQ 23/00751/LBC

Internal refurbishment of retail unit.

You may inspect copies of the application, the plans and any other documents submitted with it on-line or telephone 020 7332 1710.

Anyone who wishes to make representations about this application should do so online:

Any observations must be received within a period of 21 days beginning with the date of this notice (unless otherwise stated) and will be taken into account in the consideration of this application.

In the event that an appeal against a decision of the Council proceeds by way of the expedited procedure, any representations made about the application will be passed to the Secretary of State and there will be no opportunity to make further representations.

NICHOLAS EARL

INVESTOR sentiment towards multinational miner Rio Tinto (Rio) has not improved in this week’s early trading, despite the FTSE 100 company closing in on plans to extract resources from the world’s largest untapped supply of iron ore.

Rio’s share price was down 1.7 per cent at close of play yesterday, with the Anglo-Australian commodities giant suffering a 27 per cent drop in its share price since late January. This is despite the company announcing an “important milestone” last weekend to develop 375m of railways in Guinea, Africa.

NICHOLAS EARL

THE PRICE of gold has weakened in the face of a strong US dollar, with investor sentiment shifting away from the precious metal as hopes of avoiding a recession rise.

It started trading this week at $1,910 per ounce, falling by $30 per ounce in one week –having neared $2,000 per ounce last month.

The prospect of interest rates rising again in September combined with more appeal for riskier investment strategies means that gold’s appeal as

a safe haven asset has diminished. Fragile investor confidence has enabled gold to hold above the $1,900 threshold since March, but economic data in the US shows inflation tracking downward.

Rupert Rowling, market analyst for Kinesis Money said: “In this environment of high interest rates and market confidence slowly flowing back to encourage a riskier approach among traders and investors, it is hard to see gold making any gains and instead the controlled slide downward looks set to continue.”

Rio effectively owns a 45 per cent stake in two of the mining deposit’s four blocks through its Simfer joint venture. After extensive delays, Rio believes the project may finally be imminent, paving the way for a final investment decision once government approval has been reached.

However, China’s sluggish economic revival and the end of last year’s bumper commodity rallies are still weighing down Rio Tinto’s share price, with the group reporting its lowest first-half profits since the pandemic last month.

Matt Britzman, equity analyst at Hargreaves Lansdown, said Rio Tinto’s exposure to China would continue to plague the firm.

“As long as questions remain around the Chinese demand picture, sentiment and more importantly valuations are likely to have a ceiling,” he said.

‘The Diary Of A CEO’ podcast host Stephen Bartlett is joining UNTIL as marketing co-founder

ENTREPRENEUR and Dragon’s Den star Steven Bartlett has pumped cash into London wellness disruptor UNTIL as he joins the brand in a top executive role to drive its expansion.

The investor joined as the firm’s new marketing co-founder to help fix the “broken” sector, following investment into the industry which is worth £3.5trn.

Founded in 2021 by Vishal Amin and Alex Pellew, UNTIL hosts over

250 self-employed professionals across a range of treatments. Bartlett will help shape the brand and support expansion into the US as part of a recent £4m investment round. With two offices now, the firm is planning an ambitious expansion of 40 facilities in five cities over the next four years. It currently offers 5,000 sessions every month, with the business having doubled its sales in the last year. It is also set to expand into different areas of health and well-

being, including dentistry. Bartlett said: “As an entrepreneur, I have become increasingly obsessed with my health and wellness. Without our physical and mental health in good shape, we have nothing. Yet the health and wellness market is broken.”

Vishal Amin, co-founder and CEO, said Bartlett will “champion the hard-working entrepreneurs in this industry” who have been “overlooked for too long, and it is time for change”.

THE BRITISHseasonnaire –a fixture of the European holiday scene from the mountains to the seas –is under threat.

And it’s more than just a tragedy for perky young Brits looking to combine a lengthy holiday with a bit of paid work. It’s also battering British firms which used to rely on UK staff to provide a home away from home for their guests.

The number of British travel staff working in the European Union (EU) has plummeted by more than two thirds since Brexit.

That near 70 per cent drop-off, revealed by trade bodies the Association for British Travel (ABTA) and Seasonal Businesses in Travel (SBiT) in June, was blamed on the additional cost of obtaining visas, work permits and other post-Brexit bureaucracy.

Interviews conducted by City A.M. with leading UK travel agents reveal groups are slashing the size of their European operations, bumping up costs for consumers, while some are even considering relocating from the UK entirely.

Now the sector is calling for an urgent shift in its arrangements with the EU.

Skiworld is Britain’s largest ski tour operator, running a range of chalets across the European alps. Since 2019, the firm has seen a near-complete wipeout of its operations in Austria.

It now operates only in St Anton, having slashed its operations elsewhere because it simply can’t get the staff.

A collapse in the number of UK seasonaires working in its European resorts, between the 2016/17 and 2022/23 seasons is to blame, it says, with the only saving grace being an increase in European workers in the same period –who have kept its Austrian business alive.

“30 years of building up a programme of accommodation in Austria has pretty much been completely wiped,” Diane Palumbo, sales and marketing director at Skiworld, told City A.M. Covid-19 is also to blame for its struggles, but Skiworld said that any postpandemic recovery has been blocked by Brexit-related problems.

Frustratingly, a “good season last year,” Palumbo said, was capped by the “uncertainty about being able to get our operations going”.

That block on post-Covid recovery, particularly significant this year as travel demand rebounds, was echoed across a number of operators inter-

level of service in a lot of our resorts,”

Chris Wright, managing director at Sunvil, told City A.M.

London-based Sunvil offer a range of package holidays, from group tours to island hopping in Greece and hiking trips on sunny trails around the Med.

The firm has had to up prices for consumers due to additional post-Brexit costs caused by staffing problems and said it has seen a near third drop in the number of UK staff it employs overseas.

ONE EX-SEASONNAIRE TURNED TECH RISING STAR TELLS US IT’S NOT JUST A JOLLY

Asclassmates did law conversions or consultancy grad schemes, I was totally uncomfortable committing myself to a career upon graduation.

viewed by City A.M.

Two thirds of UK travel businesses think Brexit will have a more significant long term impact on their operations than the deadly virus, per an industry survey by ABTA.

SUNNING AND SAILING IN THE GREEK ISLANDS? NO LONGER

“At a time when we were trying to recover from the pandemic, it has taken a lot of hours to come up with new solutions to try to find and recruit. So there’s been a time element to it, a cost element and the customer service element, where we don’t feel that we’ve been able to continue the same sort of

“Any increase in cost will eventually filter its way through to the cost of a holiday and we compete with specialists in the market where we all provide a good service.” Wright explained.

Plans to expand have also been ditched, with Sunvil rowing back on proposals to up the amount of islands it offers holiday on in Croatia.

“We were planning on adding some new destinations into the programme and we’ve gone about it a different way, it’s been a lot smaller,” Wright said. Alongside Sunvil’s sunny offerings, sailing operators –whose boats are often staffed by skilled British instructors who are harder to replace –have also floundered.

Poor staff retention, due to post-Brexit time constraints on Brits working sea-

I signed up to be a seasonnaire in Austria because it sounded interesting. To this day I claim it is the best job I’ve ever had. Rise by 10am, hit the slopes, work from four until midnight, and repeat.

I wasn’t from a skiing family, and I could barely get down a red run at the start of the season but I didn’t feel out of place, surprised by the diversity of people who wanted to earn €230 a month.

I had my EHIC should I damage myself, and even improved my German. A working holiday provided space to think and assess what to do, improving my confidence and sense of responsibility. It would be an incredible shame if today’s youngsters don’t have the same opportunity.

Tanner is now global head of revenue at London data firm BlueOptima

sonally in EU resorts, has been particularly damaging, Barrie Neilson, director at Sailing Holidays, told City A.M.

“In the past, the skilled ones we would keep through the winter. We can’t do that now,” he said.

Neilson said the firm –which offers yacht charter and flotilla holidays in Corfu –had considered relocating to the Greek island in order to sidestep the problems. Neilson said operations would be cut by around 10-15 per cent.

Paul Charles, CEO of travel consultancy The PC Agency, summarised the issues that have seen “too many” travel firms “nursing higher costs”.

“Profitability has been hit by red tape forcing restructurings, the hiring of more local workers in a destination at

higher costs, especially with currency fluctuations, and the need to employ legal experts to advise on different regulations.”

There are a number of policies that could help post-Brexit Britains’ travel groups thrive, according to ABTA, SBIT and travel experts.

Youth mobility schemes, for example, allow young people to work abroad for up to two years. However, despite agreements with countries including New Zealand, Australia and Japan, the UK currently has none with any EU member state.

Tanzer told City A.M. that an extension of the scheme would “allow greater labour mobility for travel jobs without compromising the UK’s approach to immigration”. Similarly, Charles said that “only by enabling more mobile schemes for UK workers can the situation be improved”.

“The government needs to seek the amendment of Brexit rules to enable more free movement between the UK and European member states, otherwise productivity and profitability in some countries will never be improved,” he said.

It’s been a gap year staple for Brits for decades, and kept travel operators well staffed. But Brexit is killing the work-and-play career break, Guy Taylor finds

The UK has youth mobility schemes with Australia and Japan, but none with any EU states

Two thirds of UK travel businesses think Brexit will have a larger impact than Covid

To

LONDON’s FTSE 100 started the week in subdued fashion yesterday, as a quiet earnings day was overshadowed by reports that YouGov is mulling a US listing.

The capital’s premier blue chip index closed the day on 7,495.24 points, down 0.88 per cent, while the FTSE 250 index, which is more aligned with the domestic economy, was also down 0.3 per cent.

Monday was flat with no major economic data or results scheduled, while markets anticipate a much busier week with UK unemployment figures out today and inflation tomorrow.

Cost of living pressures facing households are set to ease, as experts predict inflation will fall below wage growth for the first time since last April.

Official figures out today are tipped to show that wage growth hit 7.4 per cent in the three months to June on an an-

nual basis, up from 7.3 per cent.

The biggest risers on the FTSE 100 were bargain retailer B&M, up three per cent after getting a share price upgrade from Deutsche Bank, and multinational telecoms firm Airtel Africa, which rose 2.94 per cent.

Meanwhile, supermarket Ocado was the biggest faller at 4.33 per cent, followed by global mining company Anglo American, down 3.58 per cent.

While London remained flat overall, there was the prospect of the capital’s embattled equity markets being at risk of another high-profile departure after YouGov’s boss suggested the firm could consider switching its listing to New York.

“I think the markets are better at supporting companies like ours there,” the data firm’s chief Stephan Shakespeare said in an interview with the Financial Times.

888 holdings is forecast to deliver half-year revenues of £896m, down five per cent year-on-year. The gambling giant has struggled under the weight of a near £2bn debt pile after the acquisition of the non-US operations of rival William Hill. However, Peel Hunt analysts believe that “investor interest will rise as the debt is paid down” and reiterated their buy recommendation and 150p target price.

Trading firm Plus500 reported $174m (£136.95m) of revenue in its interim results, as it benefitted from higher interest income. Peel Hunt analysts said the firm’s balance sheet “remains strong”, with cash of $849m at the end of June supporting a dividend payment of $60m. They advised buying the stock, at a target price of 2,260p.

“The higher than anticipated rate of US producer price inflation reported on Friday – often a good indicator of the trajectory of consumer prices –is helping to sour sentiment and raises the stakes ahead of UK CPI figures on Wednesday this week.”

RUSS MOULD, AJ BELL

Powerful real-time thought leadership, insights and news delivery mechanism fuelling the most up-to date reporting, adding critical context for decisions that require consciousness, education and thought leadership. JOIN THE CONVERSATION AND BECOME A PART OF ONE OF LONDON’S MOST TRUSTED NEWS SOURCES VISIT: CITYAM.COM/IMPACT-AM/

lowers for my fake account and it cost me less than $1000”, he says. He also wrote a code - jargon for creating a bot - to automatically generate Twitter accounts. It wasn’t that hard, he says.

Since Musk strengthened verification and introduced other checks, Woods’ fake follower count plummeted to 8000 followers.

OUR online spaces are made up of almost infinite interconnected webs. Last week, in the UK, the Electoral Commission was hacked, throwing into sharp relief the security we have for our most important institutions. But outside of those that keep our parliament and our courts functioning, we’ve accepted as part of everyday life the work of thousands of tiny, powerful fraudulent entities on the internet: bots.

We tend to understand bots as fake accounts on social media compulsively sharing information according to the interests of their creators. In reality, a bot is any script or programme that automates a precise task.

It’s not a bad thing per se, but it has gained a negative connotation in our collective imagination because they are so often used for malevolent or criminal purposes.

Bots are everywhere: they have mushroomed as a ghost squad of disinformation spreaders on social media, but they’re also deployed in retail. Last year, chaos unfolded in the world of Taylor Swift fans when bots drove so much traffic that the Ticketmaster website crashed. Bots are often used to purchase high numbers of concert tickets so the buyer can resell them at crazy high prices.

The same happens with limited edi-

tions of sneakers, with products on sale on e-commerce platforms, and even with loyalty programs. Get a free coffee when you sign up with a new account?

Bots will create hundreds of new accounts in a matter of seconds.

Dan Woods, a former CIA and FBI agent who is now head of intelligence at cybersecurity company F5, says many companies he works with have 95 per cent of their traffic automated, meaning bots are driving it. Their execs and marketing teams are shocked when they discover it.

For some companies, there is little financial incentive in getting rid of bots.

The number of daily active users or customers plays a role in their valuation.

“If they suddenly had a tenth of the ac-

counts they thought they had, their company would lose significant value”, Woods says. So they try to look like they’re doing something to avoid bad press, but in the end all it matters is that someone buys their product, whether that’s a customer or a bot being masterminded by someone looking to make a quick buck won’t immediately hit their bottom lines.

Of course, as we saw with the Taylor Swift tickets, it can have significant reputational implicates if fans are constantly losing out or being forced to pay over the market rate. Indeed, to minimise ticket inflation for the superstar’s European tour, Ticketmaster has said any tickets resold via third platforms like Viagogo could be cancelled.

On social media, the situation is slightly different, but no less insidious. Initially, Elon Musk tried to back out of buying Twitter because of the amount of fake accounts on it. Then, he focused all his efforts on eliminating them.

Everyone loves to hate Elon Musk, but Woods says that at least on bots, he’s done a good job. Even still he’s only managed to delete all the “cheap” bots, not the more complex ones. Twitter bots fall into two categories: the obviously fake accounts, which are really cheap to buy, and what Woods calls “sticky followers”: accounts that look dangerously real.

Woods made an experiment: he wanted to see how easy it was to buy followers. “I bought over 100,000 fol-

The dangers are not only commercial, but also political. China has repeatedly been accused of using bots to influence public opinion. Last year, it inundated social media with spam to conceal the coverage of protests about the stringent lockdowns. And of course, there was the Cambridge Analytica scandal in 2016 where the data firm managed to collect data on 50 million Facebook users. According to Cornell University, bots help to infiltrate a given social media platform. Woods says state actors are willing to spend millions of dollars on tools to influence public opinion and shape politics. And they have a key advantage: it’s pretty easy to disguise where the attack comes from. When Woods was at the CIA, they would carry out false flag operations to study how state entities make it look like an attack came from a different place. “If I wanted the attack to look like it came from Russia, then I would do everything Russians do in an attack”, he says.

We have tacitly accepted a world where bots rule the Internet, reaching into almost every part of our online experience. If getting them down to 0 per cent is as hard as Woods describes it, then companies - and governmentsshould at least aim at something in between that and the worryingly high 95 per cent. After all, it’s only the safety of social media users, customers and democracies that’s at stake.

AT THE height of last summer’s Tory leadership election, Rishi Sunak seemed to slip up. In a leaked clip from a Tunbridge Wells garden party, the now Prime Minister described how he changed local government funding to divert investment away from “deprived urban areas”. Many were quick to criticise, but behind these poorly-worded comments is an important point. The government’s approach to investment focuses too much on poverty and not enough on opportunity. It was clumsy, but Sunak was right to call this out.

Last year, half of the students on free school meals in London went to university. That’s more than double the share of the poorest students going on to higher education in the South West or East Midlands; it’s also higher than the overall rate of university admission in every other part of the country. A child

living in poverty in the capital has a greater chance of securing a degree than the average pupil in any other English region - including the mostly affluent South East. London might have some of the highest levels of deprivation, but it’s also an engine of social mobility. The poorest kids in the capital end up doing better than the poorest kids in the Midlands, even if the latter live in towns or suburbs that are more affluent overall.

Governments have not adjusted to this reality. According to new research released by Onward the formulas ministers use to target investment have not been overhauled in almost twenty years, and are based primarily on deprivation. That works for areas such as Blackpool, which sit at the bottom of the rankings for both deprivation and

social mobility. But it misses areas like Newark in the East Midlands, which sits at the bottom of the social mobility rankings but has average levels of poverty. And it prioritises London boroughs like Hackney and Camden, which are more deprived overall but where the poorest young people have some of the best outcomes in England. Reforms to London’s schools started by New Labour and continued by Michael Gove mean they are now some of the best in Europe: 92 per cent of secondary pupils in London attend a school rated good or outstanding by Ofsted, compared to around 75 per cent in the North West and North East. The capital’s social networks also have a greater mix of incomes and backgrounds. Harvard economist Raj Chetty identified this “economic connectedness” as a key

component in upward mobility. The density of professional and managerial jobs in London also provides more room at the top for ambitious young people.

All of these factors are missing in many of England’s towns and rural areas. Schools tend to be of lower quality, struggling to recruit and retain teachers. Poverty is often concentrated in isolated pockets of otherwise affluent areas, with little social mixing. And the decline of traditional employment, whether in manufacturing or agriculture, has hollowed out paths to good jobs. It is in these areas - mainly in the Midlands and the North, or on England’s coast - that prospects for the poorest are most limited.

Alleviating poverty needs to be balanced with increasing opportunityand, yes, that might mean rebalancing

some funding away from inner-city areas and targeting smaller towns where social mobility is lowest. Councils could use the resources to reduce absenteeism and get young people reengaged in education, partnering with youth workers, schools, colleges, and employers. Or they could commission community groups to provide wraparound support to vulnerable families.

Alun Francis, the new Chair of the Social Mobility Commission, has argued that “the upward relative mobility of the few must be matched by the upward absolute mobility of the many”. This means less focus on routes to Russell Group universities or magic circle law firms, which often take talented young people away from their communities, and more on securing a broadbase of good jobs across the country.

The levelling up agenda was grounded in the belief that talent was spread equally but opportunity was not. But public investment is still not reaching the places where opportunities are scarce. Recalculating grants and redirecting investment will always generate political controversy - but if we really want each generation to do better than the last, it’s a fight worth having.

£ Adam Hawksbee is Deputy Director of the think tank Onward

[Re:Electoral Commission hacked: Watchdog sorry for cyber breach amid concern over accessed data, August 8]

The Electoral Commission cyber-attack highlights a concern beyond the usual implications of data breaches – it potentially compromises the safety of individuals who rely on electoral roll opt-outs for protection.

While certain data is public, the breach's significance lies in exposing those who opted out to evade stalkers or abusers. If opt-out addresses were accessible during the attack, this raises a vital concern. Although methods exist

for anonymous voting, they often involve complex processes, and this attack renders that protection fractured.

This breach stretches beyond simple inconvenience, underlining the need for robust cybersecurity and support for vulnerable individuals. Proposing email notifications for breaches is crucial - prompt alerts would empower affected individuals to take appropriate action swiftly.

The incident also underscores that breaches can impact real-world security. Enhancing technical defences and user engagement is essential to protecting both democratic processes and the wellbeing of those who rely on these safeguards.

Chris Boyd, Malwarebytes

DURING what should be the height of summer, I believe we may have seen the arrival of an elusive creature. No, not extended periods of sunshine or even a heatwave, but something else – a Brexit tax benefit in the form of a new excise duty regime for on-trade beer sales, known as the “Brexit Pub Guarantee”.

So yes, this is a Brexit column.

One feature of being a member of the EU is that certain aspects of tax policy are governed by community law. For VAT and customs duty, the legislation and some administration is standardised across the Union. For other taxes the fundamental freedoms of capital, establishment and people impose limits on what Member States can do in their own systems.

Brexit opened up opportunities for what we refer to as divergence. That means allowing UK rules to drift apart from EU rules. In theory it allows us to design a tax system more appropriate to our own economic and social priorities rather than the entire EU bloc. So far we have seen very little.

Yesterday NHS England announced proposals for new cancer targets following a consultation that began last year. Two-thirds of the current targets would be abolished under the new regime.

The NHS says the new system will be easier for patients to understand. The main targets will come down to three. Patients who have suspected cancer will get a diagnosis or an all-clear within 28 days. Historically, the targets have always specified the patient needed to see a specialist.

Patients with a diagnosis will start treatment within nine weeks from the date of referral. And lastly, the timeline to receive the first treatment for cancer patients should be within a month of a decision to treat the diagnosis.

Practitioners in the field disagreed on whether the changes made much of a positive difference, given that cancer targets have been routinely missed for a while. Some praised the move while others said it won’t make a difference because the field is so under-resourced.

Look, for example at the most EU of all taxes, VAT. The entire system is designed, litigated and partly administered at EU level. The UK could now overhaul VAT entirely if it wanted to. So far we have seen a handful of microdivergences: zero VAT on women’s sanitary products and on energy saving home improvements, though not the anticipated VAT cut on domestic fuel. We neglected to reintroduce VAT-free shopping for foreign tourists, doubtless to squeals of delight from shopkeepers in Milan or Paris.

We may see divergence in the interpretation of the rules now the UK is no longer bound by the rulings of the Court of Justice of the European Union.

Given that many of these historically went against the government, it’s possible HMRC are more enthusiastic about this than taxpayers. But wholesale divergence is very unlikely because it creates massive friction to cross-border trade. Like Judith Kerr’s Mog, multinationals generally “don’t like things to be exciting, they like them to be the same”. It’s a common story across most taxes and regulations: post-Brexit divergence means more red tape.

Customs duties are taxes of sorts, but

these inhabit a space far away from the rest and belong more in trade than fiscal policy. They aren’t conceived as revenue raising measures but rather as protecting domestic producers or facilitating international trade.

Even in trade policy we have limited freedom of movement. Take the new Carbon Border Adjustment Mechanism (CBAM) for emissions-intensive imports into the EU. We could choose to ignore it, but that would put at risk our ability to export to the bloc. The UK is already consulting on an equivalent regime.

There’s been more obvious action in corporation tax. This is an area where the commission is very busy so there are ample opportunities for divergence by simply standing still. Since Brexit we already declined to adopt in full the “DAC6” rules, which mandate disclosure of a range of tax planning arrangements involving EU entities; we didn’t copy the so-called “Unshell Directive” on shell companies, and we’re not (yet) adopting Public Country by Country Reporting. Some tax justice campaigners may be upset by this. A few taxpayers will be relieved. Most

will be nonplussed: if they operate in

the EU they have to comply with the rules anyway.

There is some scope to diverge on state aid. The EU regulates and litigates against member states that adopt tax policies favouring specific industries or home-grown investment. Outside the EU we have more leeway to pursue a domestic industrial strategy, within limits set by our international trade agreements including the Brexit Deal itself (aka the Trade and Cooperation Agreement). We’re starting to see some movement. From next year our R&D credit regime will no longer incentivise most activities taking place outside the UK. Before Brexit that would have been unlawful. But guess what, prompted by the Americans’ fiscal splurge in the Inflation Reduction Act, the EU has decided to water down its own state aid rules. Nothing is ever fixed; we’re always diverging against a moving target.

The upshot: if you’re eagerly awaiting the post-Brexit bonfire, tax policy probably isn’t the first place to look.

£ Tim Sarson is head of tax at KPMG

UNTILrecently, the notion of an Alfa Romeo SUV would have seemed like sacrilege to the Italian marque’s passionate fans. Yet today, twothirds of the Italian company's model range is made up of SUVs.

The Stelvio was the first to arrive in 2016, and has recently undergone a facelift to keep it looking fresh. This includes new LED matrix headlights, inspired by the smaller Tonale SUV launched last year.

More SUVs will follow, including battery-powered versions, as Alfa Romeo shifts towards selling EVs only by 2027. For a company famed for its internal combustion engines, it makes for a dramatic road ahead.

For the present, conventional petrol and diesel engines remain on the menu. These include the 280hp 2.0litre turbocharged four-cylinder petrol engine powering our Veloce specifica-

tion test car. There is also a 2.2 diesel, plus a phenomenal Ferrari-built V6 in the Stelvio Quadrifoglio.

As in all Stelvio models, the 2.0 petrol engine is combined with an eightspeed automatic gearbox and Alfa Romeo’s Q4 all-wheel-drive system. The result is a 0-62mph time of just 5.7 seconds and top speed of 143mph. While this turbocharged motor does sound good, it needs to be worked hard to deliver lively performance. Thankfully, the auto ’box shifts quickly, and features large and very tactile steering column-mounted paddles for manual changes.

Making use of the 2.0 engine’s full 280hp has a noticeable effect on fuel consumption, however. Official figures state the Stelvio can average up to 33.2mpg, but the reality is likely to be closer to 25mpg.

The diesel-powered Stelvio is more efficient, averaging up to 46.3mpg. How-

ALFA ROMEO STELVIO VELOCE

PRICE: FROM £54,250

POWER: 280HP

0-62MPH: 5.7SECS

TOP SPEED: 143MPH

FUEL ECONOMY: 33.2MPG

CO2 EMISSIONS: 192G/KM

ever, a plug-in hybrid is noticeable by its absence from the range. Instead, Alfa Romeo is pitching its new electrified Tonale as the choice for fleet buyers, thanks to its much lower Benefit-inKind (BiK) company car tax rates. Whichever engine you choose, the Stelvio remains one of the best handling SUVs on sale. Being based on the impressive Giulia saloon, it has incredibly direct steering and ideal 50:50 front:rear weight distribution.

To say it handles like a higher-riding

version of the Giulia saloon is no exaggeration, such is the level of its ability. Thanks to the Q4 all-wheel-drive system, traction is never an issue, allowing for swift cross-country performance.

The price for such dynamic handling is a firm ride. Lower speeds make this tautness apparent, but it does improve as you up the pace. Larger alloy wheels, like the 20-inch rims on the Veloce, also make the ride feel busier.

The interior will feel instantly familiar to anyone who has driven an Alfa Romeo Giulia, too. The dashboard layout and controls are almost identical, save for the higher seating position. Although Alfa has improved the perceived quality, it still lags behind premium German rivals.

At least the Stelvio has a decent-sized boot, with a 525-litre luggage capacity and a powered tailgate on Veloce and Competizione models. Space in the front seats is generous, but the sloping

roofline eats into headroom in the rear. Wrestling a child seat into the standard Isofix attachments is actually more awkward than in the Giulia saloon.

Standard specification for the Stelvio is generous, including a 12.3-inch digital dashboard, adaptive cruise control and satellite navigation, plus Apple CarPlay and Android Auto smartphone connectivity. This does help to justify the list prices, which start at £47,355 for a diesel-powered Stelvio in Sprint trim. A 2.0-litre turbo petrol Veloce costs £54,250 before any options are added.

Purists will no doubt remain unconvinced by the idea of an Alfa Romeo SUV, but the Stelvio is more than good enough to justify the badge on its grille. Its styling and driving experience set it apart, even if most competitors do interior quality and practicality better.

Tim Pitt writes for motoringresearch.com

AT THEage of 60, some of us are eligible for a free bus pass, but the Porsche 911 shows no signs of slowing down. Quite the opposite, in fact.

First launched in 1963 as the 901 (Peugeot claimed the trademark, forcing an early name-change) the world’s most famous sports car celebrates its 60th anniversary this September, and the new 911 S/T marks that occasion. It’s the fantasy 911 you’d create if you could combine all the best bits from the configurator: a GT3 RS engine, manual gearbox and subtle Touring-style body.

Porsche will build 1,963 examples of the 911 S/T, in reference to the car’s birth year, with a UK price of £231,600. First deliveries are

expected later this year.

The S/T name is significant. In 1969, Porsche introduced a lightweight racing version of the 911S called the ST. The new S/T is also the lightest 911 in the range, tipping the scales at 1,380kg – 40kg less than a manual 911 GT3 Touring.

Those weight savings come primarily via carbon-fibre-reinforced plastic (CFRP), used for the bonnet, front wings, doors and roof panel, along with the roll cage and rear antiroll bar. Forged magnesium wheels, a lithium-ion starter battery and thinner glass are all standard, while Porsche also removes some sound deadening and the rear-axle steering system.

The beating heart of the 911 S/T is a

525hp 4.0-litre naturally aspirated flatsix shared with the GT3 RS. However, while the bewinged RS only comes with a paddle-shift PDK transmission, the S/T gains a short-ratio manual. The numbers are impressive – 062mph in 3.7 seconds and a top speed of 186mph – but don’t expect any Nurburgring lap records.

Porsche says this car is ‘designed for maximum driving enjoyment on winding country roads’.

With the GT3’s double wishbone front suspension, a more responsive lightweight clutch and carbonceramic brakes, the 911 S/T promises to be intoxicatingly intense. The only of our most-wanted options that you can’t specify is rear seats.

The Alfa Romeo Stelvio is a stylish and dynamic family SUV. But it also has some downsides, says John Redfern

OU SHOULD CONSIDER Y PROVIDER. 71% OF LEVERAGE. ARE COMPLEX CFDS

TO AFFORD CAN

INVESTOR AIL L RETTA INSTRUMENT

THE HIGH RISK TAKE TA

OU UNDER Y WHETHER OSE MONEY S L ACCOUNT WITH AND COME S UR MONEYY.

TR WHEN OSING MONEY L OF HIGHRISK K A WHETHER AND WORK CFDS WITH ADING CFDS

TANDHOWSTA

OUR MONEY Y LOSING OF ISK K

RAPIDL OSINGMONEY Y YOU THIS

TO DUE DLY LY

IT IS already starting to feel like the Rugby World Cup of absentees. First it was the exclusion of the reigning champions Handre Pollard and Lukhanyo Am of South Africa, then it was Australia’s captain Michael Hooper.

Yesterday the star of the home French team Romain Ntamack was ruled out injured, as was his loosehead prop – and one of the best in the world – Cyril Baille and England’s scrum-half Jack van Poortvliet.

And today, at some point this afternoon, England captain Owen Farrell will find out how many matches of next month’s World Cup, if any, he will need to sit out.

It is highly unlikely that the Saracens playmaker will get off scot free; his high tackle on Wales’s Taine Basham in England’s 19-17 win over their rivals from across the Severn Bridge on Saturday is not his first offence of going above the shoulder in defence.

And while there is an argument to say Jamie George pushed Basham off balance, therefore reducing the time Farrell had to wrap around the back row, it’s an argument which is unlikely to stand up in front of the disciplinary hearing.

Farrell has only himself to blame. After all, he had to attend a tackle school to stamp out this very behaviour earlier this year. But in Farrell’s absence in Twickenham on Saturday, there was a silver lining.

Much like the opening 40 minutes in Cardiff in the first leg of this doubleheader, nothing happened and everyone wanted to be somewhere else.

Leading by six points at half-time England offered little again. Unless they’re holding back every attack play, Argentina will be fancying their chances of topping Pool D as the days count down to the clash between the two big guns on 9 September.

In the opening match it was Marcus Smith and on Saturday it was Owen Farrell. Neither managed to show that it’s only a pass here or ruck there holding England

GOLF

entry into their own 22.

George Ford, though, offered a dynamic to England that we hadn’t seen for a long time when he came on to the pitch.

He was the stalwart No10 once upon a time, and started the last World Cup final in 2019, but there was a zip about England with him at the helm and it looked as though there was some meaningful depth to the side’s attack.

Mid-entry point ban in games for the law Farrell has been charged with breaking * 6

So with Smith unable to find form last week and Farrell potentially out for up to the semi-finals, Ford could reemerge as England’s saviour, having played a bit-part role since the last Rugby World Cup.

But the reality is this, there’s a number of superstars who now won’t be at the World Cup for a number of reasons

– Scotland’s Stuart Hogg and world record cap holder Alun Wyn Jones included – and the continued loss of stars to bans or otherwise is sad for the competition.

Farrell will look back in hindsight, though, and wish he tackled lower. But he’s been here before and done similar in the past. Unlike those who are injured, Farrell has only himself to blame and he will undoubtedly suffer the consequences.

What England and Steve Borthwick do from here is unknown, but in Ford there’s a solution to a problem the team didn’t need to have. And in this moment, just weeks away from a World Cup with a squad already named, what else are England to do?

CAMERON Smith has set his sights on being crowned LIV Golf League individual champion after claiming his second win of the season at Bedminster on Sunday.

The Australian romped to a sevenshot victory that lifted him to the top of the standings – and in pole position for an $18m (£14m) champion’s bonus – with just two individual events left to play. Smith only joined the Saudibacked circuit 12 months ago but, having notched one win last year, quickly targeted a run at Dustin Johnson’s overall title.

“It’s something that I’ve worked for,” said the former Open champion. “Something that was a goal of mine at the start of the year was to be up there with at least a chance for the last event.”

The 29-year-old leads the individual standings by 21 points from Talor Gooch, a three-time winner this season, and is the man in form as the sea-

son nears a conclusion.

Smith also won the London leg of the LIV Golf League last month and can put himself out of reach if he wins in Chicago next month and Gooch finishes outside the top three.

Having already banked $13.7m (£10.8m) in individual winnings, plus an estimated $1m (£790,000) in team prize money, Smith is on course to rival Johnson’s 2022 earnings.

The American pocketed more than $35m (£27.6m) last year for topping the individual standings in the inaugural season of LIV Golf and leading his 4Aces to the team championship.

Smith’s performance in Bedminster helped his Ripper GC win their first team title, making up for the bittersweet taste of falling just short at Cen-

turion Club a few weeks ago.

“I won a couple of weeks ago in London, and I wasn’t happy with the way that I won,” he added. “I didn’t want the same thing to happen today.”

The individual title at each LIV Golf event is worth $4m (£3.15m), with a further $3m (£2.36m) divided among the winning team at the captain’s discretion.

Smith set the tone by shooting a three-under-par 68 that extended his four-shot overnight lead and left him way out in front on 12 under.

Anirban Lahiri was his nearest challenger on five under, with Abraham Ancer, Patrick Reed and Dean Burmester a further shot behind.