IT’S MAA-LUH-BN JOIN THE INFLUX TO MARYLEBONE, THE NEW PROPERTY HOTSPOT P14

CHRIS DORRELL

CHINA’s already “tortuous” recovery from the Covid-19 pandemic continued to stall as fresh data showed that the world’s second largest economy had fallen into deflation.

Figures out yesterday morning showed that China’s consumer price index (CPI) turned negative for the first time since February 2021, with prices falling 0.3 per cent year-on-year.

Producer prices meanwhile, which measures the price of goods at the factory gate, were down 4.4 per cent in July, falling for the tenth consecutive month.

Deflation can be hugely damaging for an economy as it encourages consumers to delay spending, putting further downward pressure on prices.

Runaway Chinese growth, which averaged over nine per cent between 1992 and 2022, has powered much of global

growth over the past few decades –particularly when growth has slowed in the West.

A slowdown in China could hit Western firms, many of which have benefitted significantly from the expansion in consumer spending.

Innes McFee, managing director at Oxford Economics, told City A.M. that the current bout of deflation is “altogether more worrying than previous Chinese deflationary episodes”.

He highlighted weak consumer sentiment and a deteriorating property market as signs that deflation could prove more persistent than previous episodes, which were driven by excess supply.

Yesterday’s figures reinforced an already bleak picture for the Chinese economy, which has struggled to resuscitate domestic demand after a series of draconian Covid-19 lockdowns.

Earlier this week, figures showed that

exports contracted 14.5 per cent in July –the fastest rate of decline in three years –while imports dropped 12.4 per cent, reflecting the weakness of domestic demand.

Some analysts have raised the prospect that China is entering a period of ‘lost growth’ similar to that of Japan in the 1990s when a debt-fuelled property bubble burst, forcing consumers to deleverage rather than spend.

Policymakers may be forced into delivering a major stimulus package in order to boost demand, something they have shunned so far.

While the news will worry policymakers in China, there are some reasons to be cheerful for the rest of the world. Falling prices in China, which produces a large proportion of the world’s goods, could ease inflationary pressure on economies around the world.

Analysts at JP Morgan pointed out that the fall in Chinese exports mainly reflected lower prices rather than volume. “This could have facilitated the disinflation process in major trading partners,” they wrote.

Weather gives hospitality a boost

JAMES SILVER

THE SUN finally emerged above London yesterday, sending vitamin D-starved office workers to the green spaces and beer gardens

of the capital.

Further excellent weather is expected today and into the weekend, giving pubs and restaurants a welcome boost after a miserable start to the school holidays.

NICHOLAS EARL

A LEADING renewable energy boss has warned that Labour’s mixed messages on energy policy risk undermining the UK’s ability to deliver cleaner, affordable power.

Labour have rolled back on a £28bn green spending pledge and

have left investors confused on North Sea energy policy, promising not to issue new licences but saying they wouldn’t reverse the current government’s potential approval of Rosebank, a potentially significant new oil field.

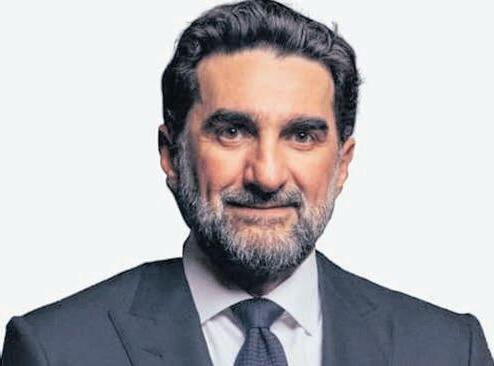

Good Energy boss Nigel Pocklington (right) told City A.M. that the party’s lack of certainty

on green energy in particular would hit investment over the coming year.

Labour are currently 22 points ahead of the Conservatives in the opinion polls, according to this week’s polling from YouGov. Pocklington said he believed investors will “need clarity from the person who

probably will be the next Prime Minister” rather than “flip-flopping on oil and gas commitments”.

“It is unhelpful, isn’t it?

I think most people making longterm investment

decisions or certainly long-term capital decisions will have that in the back of their minds.”

Mood music that Labour would roll back green pledges further “won’t help the sort of investments that we’re championing,” he added.

A spokesperson for Labour said it has set out plans to make Britain “a clean energy superpower”.

GLOBAL growth has been powered for almost two decades by a Chinese consumer spending boom –a boom that might be coming to an end. In previous moments of uncertainty over the Chinese economy, Beijing’s answer has been to build more –but with an already over-supplied property market (see Evergrande) that is no longer an option. It’s a challenge for the Communist Party, but it’s a headache for the rest of the world, too. Perhaps, weaned off the cheap high of somebody else’s growth, the West and indeed the UK may be forced to pay attention to its own economy and start thinking about the structural changes required to breathe new life into it.

The report earlier this week from

the National Institute of Economic and Social Research which predicted sub-one per cent growth for the UK over the next five years has attracted, rightly, plenty of attention. Phrases like ‘lost years’ tend to do that. Such a warning should provoke all manner of concern in Whitehall –the UK’s entire model does not work without solid economic growth and expanding businesses, especially with the spectre of an aging population haunting just about every forward-looking projection of the demand for (expensive) public services.

Yet we are still seeing precious little innovation on that front. Faced with effectively flat growth, the government took the somewhat unconventional route of knocking up the corporate tax rate. It is still dead-set, it seems, on pursuing expensive climate policies which will make precious little real difference to the environment. And the promised regulatory freedoms post-Brexit are most charitably described as works in progress. Labour’s plan for growth, beyond buzzwords like ‘balance’, isn’t much more ambitious. Let’s hope that we are set for more imaginative thinking in the run up to the election campaign, because bumbling along at one per cent in a global economy that’s lost a key driver won’t be all that pretty.

bp’s wider transformation is underway. Whilst today we’re mostly in oil & gas, we’ve increased global investment into our lower carbon & other transition businesses from around 3% in 2019 to around 30% last year.

THERE is still a risk that gas prices could rise this winter despite the recent calming across energy markets, energy supplier Eon warned yesterday.

The warning came alongside robust top line figures, with Eon posting pre-tax earnings of €5.7bn for the first half of the year, up from €4.1bn for the same period last year.

It also hiked its full-year forecast for gross earnings to a range of €8.6bn to €8.8bn, while raising expected annual net income to between €2.7bn to €2.9bn.

Eon, the second largest supplier in the UK, also said that falling prices on wholesale markets will be passed on to customers with power and gas price reductions for millions of customers later this summer.

It added that it has ramped up green investments, spending around €2.4bn on infrastructure in the first half of 2023 — up 36

per cent from a year earlier — while reaffirming its full-year investment plan of roughly €5.8bn.

But while the energy supplier said markets were largely stabilising, it encouraged homes and businesses to put energy-saving plans in place as “there are still very large sources of uncertainty on both the supply and demand sides”.

The warning came before gas prices in Europe skyrocketed later in the day over fears of future supply disruptions after Australian oil and gas workers threatened strike action. UK and Dutch benchmarks rose over 40 per cent hikes yesterday afternoon, with the Dutch TTF Futures closing up 27.8 per cent and UK Natural Gas Futures up 28.1 per cent. The sudden upturn in prices exposes an ongoing nervousness over supplies – even with gas storage topped up at nearly 88 per cent across the European Union ahead of winter.

FIFTY pence coins marking the King’s coronation will start appearing in circulation from today, giving people the opportunity to “find a piece of history” in their change, the Royal Mint has announced. Some 5m of the coins, celebrating King Charles’s coronation earlier this year, will be received by the Post Office and UK bank branches.

CHRIS DORRELL

BROKERS have suggested there could be a “mortgage price war” as lenders continue to reduce rates amid hopes inflation is finally on the way down. Nationwide reduced prices on some of its fixed products by up to 0.55 percentage points while

HSBC reduced rates by up to 0.2 percentage points. TSB also lowered rates by up to 0.4 percentage points.

Halifax also announced a series of updates to its offers which will go live from Friday.

“More lenders are likely to follow this trend, and we may even see further rate reductions

from those lenders who have already lowered rates,” Chris Sykes at Private Finance said. Rob Gill, managing director at mortgage broker Altura Mortgage Finance, said that if next week’s inflation data confirmed a further fall then there could be a “mortgage price war in September”.

bp’s transformation is underway – and you can see it coming to life at our retail sites across the UK. We’re providing our quality fuels to keep drivers moving today, and rolling out bp pulse chargers where people need them – including at up to 180 forecourts by the end of the year – helping with the switch to electric vehicles. And whether our customers are filling up or charging up, they can enjoy a great tasting coffee from Wild Bean Cafe at many of our sites before getting back on the road.

Increasing investment in the transition to lower carbon energy and keeping oil and gas flowing where it’s needed. That’s our strategy.

FTSE 250 finance firm TP Icap’s share price surged after it announced a share buyback programme and upped its dividend.

The interdealer broker announced a £30m share buyback programme and increased its dividend by seven per cent to 4.8p.

The payouts came as pretax profit climbed to £91m in the first half of the year, up from £72m last year, thanks to a five per cent increase in revenue on a

reported basis. Both of these were roughly in line with analyst consensus.

Shares climbed to close up seven per cent after the update.

TP Icap saw a strong performance from its energy and commodities business in particular, with revenue rising 12 per cent as the markets normalised following Russia’s invasion of Ukraine.

“We see continued strong demand for oil and natural gas, key segments for our business,” chief executive Nicolas Breteau said.

CITY AM REPORTERS AND REUTERS

EUROPEAN bank shares began to rebound yesterday after the Italian government watered down plans for a windfall tax on excess profits made by banks thanks to higher interest rates.

Giorgia Meloni’s populist government yesterday clarified that the 40 per cent windfall tax on banks, a oneoff measure which targets gains from banks’ higher interest rates, would not amount to more than 0.1 per cent of their total assets.

It came after the shock news of the tax on Monday night sparked a market sell-off across Europe.

Shares in Intesa Sanpaolo and Unicredit, the nation’s two largest lenders, dropped 8.3 per cent and 6.5 per cent respectively after the announcement on Monday while state-owned Banca Monte dei Paschi di Siena was trading over nine per cent lower. While other European countries, such as Spain and Hungary, have introduced windfall taxes on banks, analysts said Italy’s initial announcement caught the market unawares.

However, news of the cap yesterday saw lenders start to recover, with Intesa Sanpaolo up 2.33 per cent, Unicredit up 4.33 per cent and Banca Monte up 2.47 per cent.

These gains spread across Europe, with BNP Paribas and Societe Generale, along with UK lenders Natwest and Barclays, all finishing in the green.

Analysts at UBS said the cap announced by the economy ministry meant the tax would have an aggregate impact of €1.9bn ($2.1bn). The initial impact of the measure before the cap had been seen at below €3bn, according to sources in Rome and analysts’ calculations.

Despite the market jitters, Italian government figures stood by the measure yesterday.

“Some bankers are regretting [it] but we are talking about an industry that is making billions and billions in profits without lifting a finger," deputy prime minister and infrastructure minister Matteo Salvini told RAI public radio.

Italian Prime Minister Giorgia Meloni

The firm noted it also saw trading in environmental – such as carbon credits and battery metals – as a “significant diversification opportunity” as the energy transition progresses. Analysts at Numis suggested that many brokers have been struggling with a depressed rates market for a number of years due to global quantitative easing. However, as central banks reversed this trend, interdealer brokers like TP Icap could reap the rewards.

GUY TAYLOR

TOUR operator TUI yesterday announced it had swung to profitability for the first time since the pandemic on the back of soaring summer travel demand. Third quarter group revenues surged 19 per cent on the prior year to €5.3bn (£4.55bn), which

AUGUST GRAHAM

ONLINE healthcare business Babylon

Health is fighting for its future as it tries to find enough cash to keep its UK arm going until it can find a buyer. It said the UK part of the business is still “successful” and “sustainable”, but warned that it might have to be put into administration if a solution

cannot be found.

Babylon’s GP at Hand service, which is funded by the NHS, became the first general practitioner in the UK to get a list of more than 100,000 patients in August 2021.

But the digital-first service was criticised for being overwhelmingly used by younger, and therefore likely fitter, patients.

the company said was driven by both the higher volume and higher ticket prices. In total, revenues came in 11 per cent higher than pre-pandemic levels.

The travel operator said its booking forecasts for the summer period remained unaltered at 12.5m – 95 per cent of prepandemic levels.

Chief executive

2019: €18.9bn

2020: €7.9bn

2021: €4.7bn

2022: €16.5bn

2023: €12.2bn* BEFORE SUMMER QUARTER

Sebastian Ebel said “summer 2023 is going very well and demand for holidays remains high,” with the mediterranean remaining the “most sought-after destination for summer holidays”. He added that recent wildfires in southern Europe and the Greek island of Rhodes had only “temporarily dampened”

bookings. Despite the positive update, shares fell almost four per cent yesterday. AJ Bell investment director Russ Mould pointed to the group’s big debt pile along with investor uncertainty over how long the postpandemic travel boom will last as the potential cause of the drop.

Babylon Holdings is struggling. The US-listed business said on Monday that the hopes of combining one of its subsidiaries with fellow healthcare company Mindmaze had fallen through. But Babylon said it was still hopeful about finding a buyer for its UK arm, with it “pursuing the divestiture of its UK business to third parties”.

NICHOLAS EARL AND LAURA MCGUIRE

SHARES in Wework collapsed yesterday after the firm raised “substantial doubt” over its future.

In its second quarter results update, the flexible workspace said its revenues climbed 3.6 per cent to £661m ($844m) during the second quarter, with net losses narrowing from £497m to £311m, but this was not enough to ease its financial woes.

“The company’s ability to continue as a going concern is contingent upon successful execution of management’s plan to improve liquidity and profitability over the next 12 months,” the company said.

Earlier this year, Wework revealed it had struck deals with Softbank and other investors to reduce its debt by around £1.2bn.

The update triggered an avalanche in its share price, which closed down 38 per cent yesterday. Its share price has dropped 90 per cent since the start of the year.

BEN LUCAS

Lubbock Fine shared with City A.M.

could damage client relationships.

Wework has also been hit by a boardroom exodus, with the exits of several top executives including former chief executive and chairman Sandeep Mathrani –with a permanent successor yet to be appointed.

“It is even harder to believe now than it was then that Wework once carried a $47bn valuation,” Russ Mould, investment director at AJ Bell, said.

“The risks with the model

UK LAW firms are being forced to wait over four months to get paid by clients, new data has revealed, spotlighting potential cash flow issues firms could face if the economy nosedives. The average time the UK’s top 100 law firms are waiting to get paid is 124 days, according to

The problem is worse for smaller law firms, with firms listed in the bottom half of the top 100 waiting on average 133 days to get paid. While law firms have traditionally faced long delays to get paid in comparison to other businesses, many lawyers are reticent about pursuing outstanding bills fearing it

Mark Turner, head of professional services at Lubbock Fine, said that having weak cash flow increases the risk of firms getting into financial distress.

“If the economy weakens even further then clients of law firms may be even more careful about sitting on their cash and delaying payments to law firms,” he said.

were always evident (even before its almost evangelical former CEO had to leave) – too much debt, too much space in the event of any unexpected economic slowdown and too much exposure to young, start-up firms that would feel the strain of any downturn in business much more quickly than more mature, larger ones.”

Mould also said Wework is underperforming when compared to its Swedish rival IWG, which doubled its profits in the first half of the year.

CITY A.M. REPORTER

GLOBAL insured losses from natural disasters have reached $50bn (£39bn) so far this year, according to new data.

The main driver in the spike in insured losses was severe thunderstorms in the US, which accounted for 68 per cent (about $34bn) of all global insured natural catastrophe losses in the first half of year, according to data from insurer Swiss Re.

This marked the second highest half-

year global insured losses from natural disasters since 2011.

Overall, economic losses from natural catastrophes for the period amounted to $120bn – 46 per cent above the tenyear average.

Other natural disasters contributing to the insured losses included the February earthquake in Turkey and Syria, which was the single costliest disaster so far this year both in terms of economic and insured losses, totalling $34bn and $5.3bn respectively.

AMAZON is reportedly in discussions to become an anchor investor in Arm as the chip designer gears up to go public in the US.

The technology giant is joining the likes of Alphabet, which owns Google, and semiconductor companies Nvidia and Intel in the queue to become a major investor in Cambridge-based Arm, according to Reuters.

Arm plays a key role in the realm of cloud computing. Amazon Web Services (AWS), the tech titan’s cloud division, uses Arm’s design to craft its own microchip.

Arm has been in talks with an array of tech powerhouses – estimated to be around 11 – to potentially secure investments before the firm’s initial public offering (IPO).

Scheduled for an early September debut on the Nasdaq, Arm is reportedly aiming to rake in $8bn-$10bn

The Softbank-owned company is eyeing up a valuation target of $60bn-$70bn as the firm capitalises on chips status as the ‘new oil’. Investors will not receive any board seat or control, according to sources close to Reuters.

The plans to list in New York comes after a failed charm offensive from the UK, which was keen for the Cambridge-based chipmaker to list on home ground.

The IPO could be extremely valuable for Japanese firm Softbank, which has been grappling with its investment business Vision Fund’s poor performance after several miscalculated gambles on tech startups, though the firm yesterday announced Vision Fund had finally become profitable.

Arm did not immediately respond to City A.M.’s request for confirmation of the reports. Amazon declined to comment.

JESS JONES

JAPANESE tech giant Sony lowered its full-year sales forecast yesterday as it warned that the ongoing Hollywood strikes will wreak havoc with movie production schedules.

In a trading update, Sony revised its annual movie sales forecast down 50bn yen to 1.47 trillion yen (£8bn) after reporting a 35 per cent year-on-

year fall in operating income over the first quarter.

Despite lower expected sales, Sony raised its full-year profit forecast up by 20bn yen to 860bn yen (£4.7bn).

The tech giant blamed the potential lower revenues on the impact of actors and writers staking it out on picket lines in Hollywood, with the strikes expected to delay release dates of upcoming movies and TV shows.

Sony’s music business provided a silver lining, however, with standout releases from SZA, Miley Cyrus and Harry Styles propelling a 50 per cent surge in music sales compares to the same period last year, reaching a total of 358bn yen (£1.96m). Nonetheless, the results did not prove music to investors’ ears, with shares down seven per cent yesterday afternoon.

AN EXCITING new study has shown that artificial intelligence (AI) can help airlines reduce contrails –the white vapour trails seen behind planes –by as much as 50 per cent. Contrails are responsible for approximately 35 per cent of global aviation emissions. The seemingly harmless white lines trap escaping heat within the Earth’s atmosphere that form when carriers fly through layers of humid air.

American Airlines partnered with Google Research and Breakthrough Energy in a first of its kind study, which used a combination of AI and open-source models to predict where contrails would be formed and reroute flight paths accordingly.

Over a six month period, the AIcreated contrail forecast maps enabled 70 pilots participating in the study to reduce their formation by 54 per cent, according to satellite imagery analysed by Google.

Marc Shapiro, director of Breakthrough Energy contrails team, said that “avoiding contrails might be one of the best ways to limit aviation’s climate impact, and now we have a clear demonstration that it’s possible to do so”.

SHARES in Bellway held firm yesterday despite a less than rosy update from the British housebuilder, which reported a fall in completions and announced upcoming job cuts.

The housebuilder said rising interest rates and cost of living pressures had weakened housing demand over the last year , with the average selling price dropping from £314,000 to £310,000. Completions also dropped over the year, with 10,945 homes completed compared to 11,198 the year before.

FLUTTER Entertainment, owner of betting giants including Betfair and Paddy Power, is preparing to co-list in the US as early as this year.

The firm made the announcement alongside its half year results yesterday, where the betting giant reported a 38 per cent surge in revenue to £3.39bn thanks to punters in the US and UK.

Commenting on the gambling giant’s trading update, boss Peter Jackson (pictured) said it was a “pivotal moment” for the company as its US businesses reached profitability.

“We look forward to adding a US listing for Flutter shares later this year or early next year,” Jackson said.

The group’s growth was largely driven by its US market, where revenue grew 28 per cent yearon-year, though the UK and international markets also proved robust, with revenue up 13 per cent.

For the UK in particular, the group noted “strong online momentum” as sports customers lining up to try Flutter’s gaming

proposition hit record levels.

Sisal, Flutter’s fantasy gaming app, has performed well since the group acquired it in August 2022. It helped offset Australian losses due t o “more challenging Covid-19-related comparatives and a changing tax environment”.

“In the UK, we took market share due to ongoing product enhancements,” Jackson explained.

“Our recreational player base increased to over 12m monthly players, and importantly, more players than ever interacting with our safer gambling tools, aided by a £45m investment in our Play Well strategy in the first half of the year,” Jackson explained.

The group’s move towards the US comes after rules to tighten regulations around betting in the UK were announced in April in the government’s long-awaited gambling white paper. The changes include a statutory levy and stricter checks on losses.

Shares in Flutter fell to close down just more than three per cent on the London Stock Exchange after the update yes-

Another sign of London’s impending demise or just an acknowledgment of where the money is? In truth it’s hard to shake the feeling that Flutter’s decision to add a listing in the USA is more the latter than the former. Whilst Brits may like a gamble, our tastes are nothing to that seen over the pond. Profitability has finally arrived in the States, the firm’s expansion push there paying off as state after state liberalises rules around gambling. Analysts, never wanting to let a pun go to waste, filled the City A.M. news inbox yesterday saying that Flutter’s gamble on the US had paid off. But in reality it’s never been that much of a gamble an already thriving black

CHRIS DORRELL

SECURE Trust Bank recorded a significant increase in lending in the first half of the year as it sets its sights on continued expansion over the next few years.

The specialist bank yesterday reported lending growth of 8.2 per cent in the first half of the year,

bringing its lending balances to £3.2bn.

Three of the bank’s four divisions –retail, motor finance and real estate –recorded double digit growth, which helped to offset a 16 per cent drop in commercial finance.

Chief executive David McCreadie told City A.M. the firm had achieved growth despite “action to tighten our

As a result of cost pressures, the group said it was “taking steps to reduce headcount across the group”, with the firm due to start consulting on job cuts next week.

Bellway told City A.M. it could not disclose the number of roles that would be lost, though Sky News earlier this week reported the company was mulling cuts that would represent three per cent of its workforce.

“In light of the current uncertain backdrop, we remain focused on maintaining the group’s strong cost control disciplines and balance sheet

resilience,”Jason Honeyman, group chief executive, said. Despite the negative update, shares only fell 1.3 per cent.

AJ Bell investment director Russ Mould explained: “Analysts are cutting their profit forecasts for the fiscal year to June 2024 and still the shares do not seem to care, so perhaps markets are already pricing in a lot of the bad news.

“After all, Bellway’s shares have almost halved from their pre-pandemic peaks of early 2020 and the difficulties discussed by chief executive Jason Honeyman have not just developed.”

VICKY SHAW

RENTS are likely to continue rising sharply despite the cost of living crisis, surveyors are warning.

Property professionals’ expectations that rents will rise in the next few months are at the strongest levels seen so far this century, the findings from the Royal Institution of Chartered Surveyors (Rics) indicate.

A net balance of 63 per cent of professionals expect rental prices to increase over the three months ahead, marking a fresh record high in records going back to the second quarter of 1999, Rics said.

It said that in the lettings market, tenant demand rose firmly over the three months to July.

market existed in the US, as any regular in any sports bar would know, and being one of the first out the door as that was brought into the light always seemed likely to be a nice little earner.

What we’re starting to see is the maturation of that strategy, with the company closing joint venture Fox Bet and putting more weight behind the growing Fanduel. The challenge for Flutter is something plenty of gamblers know about: good odds don’t stick around for long. As more competition arrives in the US, Flutter will need to work to stay ahead.

Commenting on Rics’ findings, Dan Wilson Craw, deputy chief executive of campaign group Generation Rent said: “In many cases tenants are being priced out of their homes and forced into the lettings market to compete for a new place to live.

“At the same time a lot of people who want to move can’t because rents on new tenancies have risen so rapidly. That has a knock-on effect for the number of homes coming on to the market.

“Long term, the answer is to build many more homes in the places people want to live, including social housing to allow more people to escape private renting.”

credit criteria given the volatility in the market“.

“We’ve got a relatively low market shares in quite large markets, so there’s plenty of opportunity to continue growing,” he added.

Analysts were impressed with the results, with Shore Capital predicting upgrades to profit in 2024 and 2025. Shares finished up 2.08 per cent.

THE CYBERATTACK on the Electoral Commission should “serve as a wake-up call to executives”, the boss of a cybersecurity firm has warned.

Suid Adeyanju, chief executive of British cybersecurity company Riversafe, said an underestimation of the threat of cyberattacks meant executives were “sleepwalking into a cyber catastrophe”.

His comments came after the Electoral Commission revealed on Tuesday it had been struck by a “complex cyberattack” in August 2021.

The breach, which went undetected for 14 months, gave “hostile actors” access to voters’ personal data including home addresses, images, email addresses, names and telephone numbers.

ANNOUNCEMENTS

Shaun McNally, chief executive of the Electoral Commission, said the cyber attack is unlikely to influence electoral outcomes, because “the UK’s democratic process is significantly dispersed and key aspects of it remain based on paper documentation and counting”.But he added that organisations involved in elections should “remain vigilant”.

John Hultquist, chief analyst at software firm Mandiant, parented by Google, said intrusions into election networks are “not tantamount to manipulation of the vote” and cautioned over “ascribe[ing] too much meaning to these incidents, which could serve the adversary’s interest”.

The Information Commissioner’s Office has launched an urgent probe into the attack.

SHARES in ride-hailing app Lyft tumbled yesterday as the firm’s aggressive cost-cutting strategy failed to chime with investors.

The bottling company said it had benefitted from price increases

LAURA MCGUIRE

COCA-COLA HBC AG, the bottling company of the soft drink giant, yesterday raised its outlook for the year on the back of rising revenues. The group reported a 19.3 per cent rise in revenues in the first six

months of the year, while operating profit rose 15.9 per cent to €170m (£146m). The firm said it benefitted from price increases in all markets. The group noted impact from the war in Ukraine, with a “high-single ditigs” decline in volumes in Russia since it pulled out of the country.

The firm reported a three per cent rise in revenues to $1.1bn (£798.8m) in the second quarter; however, total revenue per active user dropped five per cent to $47.51.

The drop comes after the firm embarked on a cost-cutting and fare slashing programme implemented by new CEO David Risher in a bid to claw back ground rival Uber and overturn a string of poor financial results.

Investors remained unconvinced, with shares falling ten per cent after the update, which came just a week after Uber reported its first ever quarterly operating profit and issued a bullish forecast.

SPORT Owen Farrell is the only world class player in England’s Rugby World Cup squad

DESPITEplaying a very important role at the heart of London’s reinsurance market, James Milne (pictured), AON’s UK and Ireland head, tells City A.M. doesn’t often hear about insurance around the dinner party table.

But when he does, it’s usually the cost of car insurance, which has gone up significantly over recent months as the price of claims –that is, the cost of completing repairs or replacement cars –have also advanced. The truth is, however, that without reinsurance –where James sits –that insurance would be a lot

more expensive. In short, his job is to act as a broker to diversify the risk taken by motor insurers, allowing them to charge drivers less. But there’s a little more to it than that, as is so often the case in the insurance industry. For instance, it’s unlikely that too many people are grappling with a question occupying James’ time at the moment: is an electric vehicle, which is quieter than a traditional petrol or diesel car, more dangerous to vulnerable road users, despite the fact they tend to come with more advanced safety features as more modern cars? Reinsurance is an increasingly

complex game, with individuals like James working as much like consultants as traditional brokers.

“If you can go to a client and say these are reinsurers’ concerns, how can you articulate why they shouldn’t have these concerns? How could you think about underwriting differently to control these concerns? When you can have that sort of conversation you can create a much more efficient process where you can genuinely make significant savings,” he says.

A lot of the insight which underpins those conversations comes from data, with reinsurance now in many ways an analytical game.

“Reinsurers and brokers have loads of data. Insurers, especially those that are writing just UK policies, don’t have the quantity of data,” he tells me.

“We are there to advise them on things that we see outside –we can spot things and trends that their data set might not allow. We do annual studies based on property, or motor, so that we can identify trends, feedback to them and help them make informed decisions.”

In some ways, James has been at the bleeding edge of the changes to the insurance and reinsurance industry since the turn of the century. He’s seen the way in which data analysis has shaken up a world that was at times built more

on relationships and lunch partners. “Benfield predates me” he says, referring to the broker bought by Aon in 2008. “Benfield was the early mover on analytics in reinsurance, and what I’ll say for Aon is that everything I’ve seen and I’ve worked around has been analytical-led broking,” he tells me.

There is still the last bit of any process which requires the human touch, of course, but that approach has allowed James to be around growing teams offering far more than relationships –instead opening up long-term solutions for insurers looking to de-risk their balance sheets and improve the efficiency of their capital, whilst also offering insight and advice to change the way they write and price policies.

That approach means that brokers are now drawn from a host of different professions, from lawyers to actuaries to catastrophe modellers. “We’re a client representative. Ten per cent of our job and that bit that still pays brokers is the going and finding reinsurance capacity for insurers. But ninety per cent of it is the conversations leading ot that point, led by people with different skill sets. It’s the perfect place to introduce new skill sets.”

One of James’ colleagues referred to reinsurance as the best kept secret in the City? Is that true? James nods, knowingly.

James Milne tells City A.M. how new skills have given the reinsurance industry even more firepower –and why the sector is asking some of the most interesting questions in business

We’ve got bucketloads of data and we can advise and inform insurers on trends and patterns that we’re seeing, but they might not

WANdisco? More like WANfiasco. Within weeks of the AIM-listed data software company letting it be known that it was solidifying its ambitions of pursuing a US stock market listing, the company went into freefall.

The emergence of transactions based on apparently fraudulent sale invoices triggered the immediate suspension of its shares and a frantic battle for survival.

Stephen Kelly, the former Sage Group boss, was drafted in as interim chief. His first task has been accomplished: corralling City investors into a $30m fundraising which ensures it lives to fight another day.

Nonetheless, the slump in WANdisco’s share price in the wake of the resumption of trading tells its own story: a company with a market capitalisation of nearly £900m four months ago is now worth little more than £100m.

So a request to founder and former president and CEO David Richards (pictured), along with former finance chief Erik Miller that they repay nearly £650,000 in cash bonuses awarded last year feels entirely just.

It’s a gross failing that the pair’s contracts were not subject to malus and clawback provisions –something that WANdisco’s next

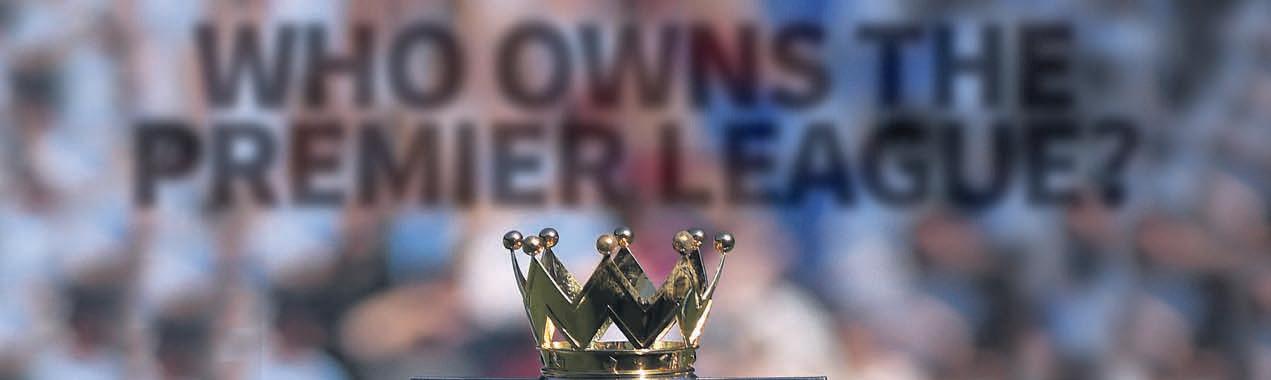

Ping! A hopeful email has been landing in the inboxes of scores of companies in recent weeks, seeking interest in becoming the new shirt sponsor of Chelsea FC.

With the new Premier League season kicking off this weekend, the Blues’ struggle to strike a lucrative new deal is emblematic of the club’s travails since last year’s takeover by

Todd Boehly and Clearlake Capital. Now reportedly in talks to raise capital from Ares Management, Chelsea’s sponsorship troubles have included stalled discussions with Paramount (blocked by the Premier League over broadcasting conflict concerns) and Stake (dropped after fans groups objected).

The latest email, from sports

permanent chairman will surely seek to rectify.

A closer glance at the company’s annual report underlines the moral imperative for Richards to agree to the company’s request.

In the related party transactions section of its annual report, it emerged that a company owned by Richards and his wife had agreed a deal to sponsor Sheffield Wednesday, the newly promoted Championship football club. No further detail is provided, but the payments look self-serving, to say the least. Richards owes other shareholders a full explanation –as well as his bonus back. Sadly, as I reported yesterday, both he and Miller have rejected the company’s request to return the funds.

“Whilst the former executives have so far robustly rejected our request for repayment, the board firmly believes this should be the right and fair outcome for shareholders and remains committed to pursuing it,” a WANdisco spokesman said in response.

If they maintain their stance, Richards and Miller risk becoming the latest emblems of a problem all-too familiar on the AIM market: lax governance enforced by guidelines which are unduly lenient, and with few reparations for ordinary investors when things go awry.

agency CAA plumbed new depths –at least one recipient of it was a prerevenue start-up with no consumer-facing audience.

Now reports suggest it may have finally landed a deal with Infinite Athlete, a technology company. Blues fans will hope its expensive array of striking talent finds it easier to score this season than the club’s commercial department.

Few things have been rarer in corporate Britain in the last 15 years than banking M&A. And few things in banking M&A have been more common in the last 15 years than attempts by the Co-operative Bank to sell itself.

This time, it would appear, it’s serious. An auction process due to kick off next month offers would-be suitors a chance to acquire a distinctive, albeit sub-scale, consumer banking franchise which can genuinely claim

to have put a decade of crisis behind it. Shawbrook, the SME lender owned by BC Partners and Pollen Street Capital, is first out of the traps. It is yet to formally confirm my report at the weekend that it has tabled a paper-based proposal to merge with the Co-operative Bank, but this feels like a mere opening gambit.

Shawbrook faces two obstacles: first, the £800m valuation it ascribes to its target (based on a 30 per cent stake that would be handed to Co-operative Bank shareholders) is unlikely to be rich enough for a wily group of investors who include Bain Capital and JC Flowers.

Secondly, it will inevitably have competition. Aldermore Bank, the lender owned by South Africa’s Firstrand, is another logical

bidder, as is Onesavings Bank, although the latter’s recent warning that profits would be hit by mortgage customers chasing cheaper deals may have hampered the M&A ambitions of Andy Golding (left), its widely respected chief executive.

The big high street banks are also expected to look at a bid, although one we can assume will not be the eventual buyer is Barclays, whose investment bankers have signed up to advise Shawbrook.

Type Wilko into Google, and the headlines will paint a picture of a company that’s shutting down stores, nearing administration, and in dire need of rescue: a Woolworths in the making. But if you look at the data, it tells a very different story: one of a wellliked brand handily outperforming the competition.

Since January 2022, YouGov BrandIndex shows that Wilko’s Impression scores (which measure general sentiment) haven’t seen much movement, going from 39.6 to 39.5 as of 31 July 2023 (-0.1). By comparison, the general retailers we track have enjoyed a much lower score, going from 12.7 to 13.0 (+0.3) over the same period.

Wilko hasn’t seen meaningful change in terms of its Value for Money scores,

which went from 40.3 to 40.1 (-0.2) in this timeframe – the most recent sector average was 5.7 – or in the metric tracking perceptions of its quality, which slightly improved from 11.3 to 11.8 (+0.5) compared to a sector average of 10.9.

Customers aren’t less happy with Wilko: in fact, looking at Satisfaction scores, they’re exactly as happy with the brand as they were at the begin-

ning of 2022 (1 January 2022: 43.8; 31 July 2023: 43.8), with general retailers scoring 11.1 as 31 July 2023. Same story with Consideration scores, which measure which brands they’d consider buying from when they are next in the market for retail goods (44.2, compared to a most recent score of 12.2 for the sector).

Analysts have pinned the blame for Wilko’s deterioration on large stores in expensive locations, an emphasis on low-profit goods, and COVID-19, among other things. But whatever’s going wrong under the hood, it’s still a brand that stokes positive feeling in the nation’s consumers. If Wilko can be rescued, the public may well appreciate it.

Stephan Shakespeare is the co-founder and CEO of YouGov

YouGov BrandIndex Index scores: Average of Impression, Quality, Value, Satisfaction, Recommend and Reputation scores (8 week moving average)

To appear in Best of the Brokers, email your research to notes@cityam.com

LONDON’s markets closed higher yesterday as a toning down of Italy’s windfall tax on banks calmed investors despite more negative news from China.

The FTSE 100 closed 0.80 per cent higher at 7,587.30 while the midcap FTSE 250, which is more aligned with the health of the domestic economy, ended 0.51 per cent higher at 18,937.20.

Just a day after reporting a slump in imports and exports, the world’s second largest economy slipped into deflation in another blow for its attempts to recover from the Covid pandemic.

The consumer price index fell to 0.3 per cent, the first year-on-year decline since February 2021. Producer price inflation also fell. The data paints a bleak picture for the Chinese economy and suggests there could be a prolonged downturn.

“China is now witnessing the actual cost of goods both in stores and at the factory gate falling. It is indicative of a significant slowdown in the Chinese economy, which is beset by high levels of indebtedness,” Steve Clayton, head of equity funds at Hargreaves Lansdown said.

While Asian markets fell, European markets were buoyed after the Italian government watered down plans for a windfall tax on excess profits made by banks thanks to higher interest rates.

Natwest and Barclays both climbed on Wednesday as did banks around Europe.

Other climbers included BP, Intercontinental Hotels and Glencore, which increased 2.6 per cent, 2.4 per cent and 1.9 per cent respectively.

Meanwhile, Flutter slumped to the bottom of the FTSE 100 despite recording a 38 per cent increase in revenue.

Analysts

Analysts at Peel Hunt rated Swedish hybrid working provider IWG an “add” after its half year results outperformed US rival Wework. The Spaces owner reported an operating profit of £94m in the six months from June, up from £37m it made last year. This is compared to Wework, which said it had “substantial doubt” over its future, as it raced to secure the funds needed to stay afloat this year. “Wework has been an aggressive price competitor, and any resolution of its difficulties would probably be favourable for IWG,” the analysts said.

“The market has spent so long fretting about inflation it feels discombobulating to suddenly switch attention to deflation. However, that’s what the latest data has revealed in China, raising further questions about the recovery of the world’s second largest economy from its zero-Covid stasis.”

RUSS MOULD, AJ BELL

at Peel Hunt have rated property investment company CLS Holdings a “hold” after it swung to a pre-tax loss in the first half of the year. Analysts said that net asset value was down 11.5 per cent and property valuation declined 5.5 per cent in local currencies.

Powerful real-time thought leadership, insights and news delivery mechanism fuelling the most up-to date reporting, adding critical context for decisions that require consciousness, education and thought leadership. JOIN THE CONVERSATION AND BECOME A PART OF ONE OF LONDON’S MOST TRUSTED NEWS SOURCES VISIT: CITYAM.COM/IMPACT-AM/

BUSINESSES have broadcast a stronger commitment to equality, diversity and the environment. This has often led to changes not just to their marketing, but often to their recruitment and policies too.

Yes, this is partially driven by regulation. But there are also attitudinal shifts. Younger consumers and staff have higher expectations that the companies they buy from or work for are more ethical in the way they do business. They want to see a commitment not just to profit, but purpose, from corporate entities. And companies need this young talent.

They also need young customers. They’re fearful that complaints can be instantly and widely shared via social media, damaging institutional reputations quickly.

That is not to say younger folks, increasingly graduates of a university education, are being indoctrinated into Marxist thinking on campuses. Just before the 2015 general election, High Fliers Research found that almost half of 30 leading universities saw their final- year students most likely to back the Conservatives.

Rather, we generally see the same commitment to aspiration, hard work and making money - all of which you

can see leading to an economically liberal world view. But younger generations are progressively becoming more socially liberal - on race relations, gender roles and sexuality. In essence, they are more strongly supportive of cultural cosmopolitanism. This points to a greater individualist mindset - both for social identity and economic independence. This should not be mistaken for communalist politics, which foregrounds our social characteristics and pits different social groups against one another, which is being promulgated by a loud but rela-

tively small number of activists. Companies are finding that politics is not just in the domain of their foreign policy, to be dealt with at distance by a cadre of expert professionals and agencies. Politics is increasingly at the heart of everyday company life, especially on cultural and environmental matters. Politics is now very much part of their domestic policy. How to deal with different behaviours and beliefs among employees. What counts as bad behaviour and how it’s dealt with. The climate and environmental policies they adopt. The

people and countries they do business with. Companies are having to deal with clashes that need to be resolved consistently and effectively, before they blow up.

Some companies haven’t got it right, deeply damaging their brand. The denouncement of Nigel Farage’s political views in internal documents has backfired badly for Coutts Bank and its parent company, Natwest, leading to days of bad publicity and executive resignations this summer.

This country’s leading business lobby group, the Confederation of British In-

BREXIT means Brexit,” bellowed former Prime Minister Theresa May, “and we're going to make a success of it.” These words were first spoken in July 2016, amidst the Conservative Party leadership campaign, and are oft-repeated. For many, the tautology raised more questions than it ever answered. What does Brexit mean? How will it be made successful?

In its rawest terms, Brexit only meant ceasing formal membership of the European Union. Whether and how this would be enacted toxified British politics for several years. In the end, we settled on a divorce agreement that would – albeit with major exceptions, particularly for Northern Ireland – allow the UK to set its own path. It would, in the famous words of Vote Leave, “take back control”. We would not, for example, continue membership of the single market, which entailed accepting ‘free movement’ and EU rules without a say in their development.

In the post-Brexit era, the question is

Matthew Leshwhether we will successfully exercise our newfound freedoms. This debate is highlighted by the government’s recent decision to continue recognising “CE” marked goods to be purchased in Britain indefinitely. The CE mark means a product conforms to European health, safety and environmental protection standards. The original intention was to replace the CE mark with a new UKCA. The decision to keep recognising the CE mark has been framed by some, such as the MailOnline, as “another Brexit climbdown”. But this couldn’t be further from the truth. If anything, Brexit means the freedom to decide what products are sold in the British

market – rather than having that imposed by the EU. Our elected representatives have concluded that goods consistent with the CE mark should continue to be sold. This is precisely how Brexit should work.

The merits of this decision can and should be debated, but the case against is particularly weak. Why should British consumers be prevented from purchasing toys, household appliances and medical devices with the CE mark? Is it really necessary to impose the cost of conforming with an alternative system on all British businesses?

Notably, businesses will be able to use the CE or UKCA mark. This creates regulatory competition, which gives companies and consumers more choices and can help drive up trade, productivity and economic growth.

The next step is for the UK government to make sure UKCA standards are the most appealing; while also recognising equivalent standards from other developed economies like Australia, Japan and the United States.

This overall principle – of using Brexit to open up trade rather than as an excuse to be isolationist – can be applied to the other recent decision to delay full customs checks on EU foods. More cumbersome checks on food and animal products entering the UK were meant to start in October but will be delayed till 2024. This is because of concerns over the inflationary impact of slowing down trade.

Considering the precisely zero evidence of a plague of substandard products entering the UK from the EU, it’s unclear why more checks will ever be necessary.

Over the coming years, there will be more decisions about how the UK trades with the EU and the rest of the world. Brexit simply means that British representatives can make these choices, not that they must point in any particular direction. If we make the right choices, then Brexit can both mean Brexit and be a success.

£ Matthew Lesh is director of public policy at the Institute of Economic Affairs

dustry, fell into crisis in the spring when several allegations from women of sexual misconduct by senior staff became public, leading to a withdrawal of political engagement and corporate membership. It survived an Extraordinary General Meeting, but limps on.

The parent company of Bud Light saw a massive drop in sales and its share price earlier this year after a transgender influencer partnered with the beer brand to advertise a personalised can, leading to a huge boycott from more conservative consumers, especially in rural midwestern and southern America.

Costa Coffee is the most recent UK company to face threats of a boycott, after it featured a cartoon of a transgender person in an advertisement. Last year, Brewdog was slammed for its critical campaign of the FIFA World Cup being hosted in Qatar while continuing to show the football at its bars. An open letter from 100 former employees, who damned the toxic working environment at the company, went viral and the trade union Unite declared that they were “one of the worst employers in the brewing industry.” Politics is jeopardous, but it is a risk that corporates increasingly cannot hide from. They have a massive role to play in achieving better social, environmental and economic outcomes. Of course businesses need to behave ethically and responsibly, but they need to reflect the quieter majority, rather than the shoutiest voices. And they need consistency, not stridency, in their policies.

£ Ryan Shorthouse is chief executive of the think tank Bright Blue

£ Ryan Shorthouse is chief executive of the think tank Bright Blue

STURGEON’S

After resigning as leader of the SNP, Nicola Sturgeon has had some extra time on her hands - and she’s been using it to write a book. The ‘deeply personal’ autobiography will be published in 2025, but it’s not clear if it will cover the allegations against her over party finances

[Re: Energy system ‘broken’: Suppliers to rake in £1.7bn profits as millions of Brits grapple with skyhigh bills, August 8]

Hunt has lost the plot. Are the Tories capitalist, or not? The net profits of the oil and gas majors belong to the risktaking shareholders, not to the Treasury. They must be distributed in the form of dividends, the raison d'etre (Americans please note) of every profitable company. The popular press

screaming about “windfall profits” from oil overlook the fact that the post-tax dividends currently being paid by BP and Shell are at little more than preCovid levels.

Shareholders had to endure savage dividend cuts then, during the Covid-19 crisis, with zero help from the government. Having endured such pain, as a private shareholder, why should we now be subject to windfall taxes? There must be an immediate reversal to the 40 per cent tax rate for oil and gas majors. Any higher rate is theft by government. I have to listen to classical music in the dark.

Christopher Truman

REMEMBER the early 2000s?

When the stuffy suits of Wall Street were replaced by the scruffy hoodies of Silicon Valley amongst the corporate elite. Names like Zuckerberg, Spiegel, Page, Brin and Bezos - now the old guard – were synonymous with the golden era of youth entrepreneurship and stratospheric success. Their twenties and thirties were not spent grappling with existential dread, but instead a welcome union with billions of dollars. But now we’re left asking the question: where have all the young billionaires gone?

The early 2000s were an era of digital revolution and internet gold rush, which saw these prodigious talents rise and create empires that fundamentally redefined the way we live and operate to this very day. The spectacle of Facebook's Mark Zuckerberg, donning his now iconic grey t-shirt, going from a Harvard dropout to the world's youngest self-made billionaire was something akin to a modern-day fairy tale. Similarly, Evan Spiegel, the co-

As the cost-of-living crisis pushes summer childcare costs up to £943 per child, more parents are using up holiday time to look after their kids. More than half have resorted to using it, according to research from IWG, the workspace firm.

This week the Electoral Commission admitted it was hacked back in 2021. Suspicions have arisen that Russian hackers might be behind the attack. The Commission only discovered the breach in October 2022. It decided not to disclose the information until now to be able to first stop the hackers, find out more about the attack and put safeguards in place.

It assured the hacking didn’t lead to political interference and is unlikely to have an impact on the next general elections as most

The hackers got access to copies of the electoral registers, meaning around 40 million people might have been affected. The Commission’s email system was also hacked. There is no evidence of direct links to the Kremlin at this stage and the UK security services are refraining from making open accusations. But suspicions are not unfounded, given the prolific activity of Russian hackers in the UK and other countries over the past years.

founder of Snapchat, dazzled us when he entered the billionaire's club in his early twenties, as the youngest CEO of a publicly traded company in the United States.

Larry Page and Sergey Brin had us googling everything under the sun. Jeff Bezos, a poster child of the e-commerce revolution, dared us to dream of a world where shopping could be done from the comfort of our couches. All became billionaires before their 35th birthday.

Fast forward to today and the landscape seems eerily devoid of such stories of youthful achievement. The creation of fresh-faced billionaires appears to have slowed. Could it be that the last generation simply picked all the low-hanging fruit, leaving little for

the following generations? Have we run out of disruptive ideas, or are we simply waiting for the next big wave of innovation in the guise of artificial intelligence, the metaverse and clean energy?

The tech billionaires of yesteryear were masters of timing. They were at the right place, at the right time, with the right idea, capitalising on opportunities that sprung from the dawn of the internet. Today's young entrepreneurs are playing on a field that is much less fluid. Naturally, this makes it harder to carve out their paths, all whilst facing the traditional barriers of regulation and competition that were scarce in the ‘dial-up’ years of the internet.

There's also a change in the nature of innovation. Today’s breakthroughs are increasingly found in much more complex sectors like biotech, artificial intelligence, and quantum computing, which require not only a brilliant idea but also time, expertise, and heavy investment. These fields are not as easily accessible to wunderkids as the digital playground of the past. Mark Zucker-

berg was famously dubbed the “accidental billionaire”. It seems as though becoming a billionaire is no longer that fortuitous.

And maybe, perhaps, the current generation is redefining success. Today’s young entrepreneurs are more concerned with impact than income. They measure achievement in sustainability and social change, not crude pounds and dollars.

The dwindling number of young billionaires may seem alarming or may spark a sense of schadenfreude in some. But let’s not rush to write an obituary for the young billionaire just yet. The Gen-Z wannabes might be playing a longer, more complex game. They may not come as rapidly, or in the same guise as the Zuckerbergs and Bezoses of yesteryear, but come they will, in their own time, in their own way. After all entrepreneurship and success are not limited by age or era, only by the boundaries of innovation.

£Leon Emirali is a communications adviser and Senior Political Counsellor at PLMR

From Larry Page to Jeff Bezos, the billionaires of yesteryear were masters of timing

This stunning property designed by Milanese interiors studio Peregalli looks like it belongs in the Le Palais de Versailles rather than the middle of Marylebone.

The one-of-a-kind flat spans two Georgian townhouses, featuring doubleheight ceilings and intricate plasterwork throughout.

It has an entrance hall; reception room with three huge sash windows; formal dining room complete with fireplace; modern kitchen; huge master bedroom suite with two sash windows; walk-in dressing room; en-suite bathroom with marble tiles and hisand-hers basins; and two guest bedrooms, both with en-suites.

All that within easy walking distance of Marble Arch, Hyde Park, Oxford Street, Baker Street and Marylebone

High Street. The property also comes with access to the exclusive Manchester Square, an 18th-century garden just north of Oxford Street.

“What makes this property unique is its combination of historical elegance and modern luxury,” says Becky Fatemi, director of estate agent Rokstone. “The design by Studio Peregalli is a tribute to Georgian architecture, featuring spacious rooms, high ceilings, and ornate plasterwork, while the modern and well-equipped kitchen, en-suite bathrooms, and walkin dressing room offer all the conveniences of modern living.

“This property would suit buyers who appreciate the beauty of historical architecture, as well as those who value modern luxury and comfort. The spacious rooms, including the impressive reception and dining areas, make it

ideal for entertaining, while the ensuite bathrooms and walk-in dressing room provide ample space and comfort for everyday living.”

This kind of luxury, of course, does not come cheap, with a prohibitive price tag of just shy of £12m attached.

The outre design is a nod to what’s emerging as a serious trend for the 2020s, foregoing the minimalism of the 2010s in favour of a more bombastic maximalism. This is in evidence in everything from the gilt picture frames to the renaissance artworks

and that sumptuous cornicing. Combine this with the parquet flooring, marble fittings, crystal chandeliers and velvet furniture, and you’re left in no doubt this is an opulent abode. And while we at City A.M. were all in favour of the repurposed Victoriana and fleamarket chic of the last decade, we can’t help but look forward to something a little more spectacular. After all, who doesn’t want to feel like a king or queen when they roll out of bed?

Find out more at rokstone.com

Buying and selling your home is always high on the list of the most stressful times in a person’s life, up there with taking exams, getting divorced, and passing (or failing) a driving test.

Estate agents are there to make this job easier, although only the good ones actually do. We asked two of the best what they asked their agents when they were selling up –here are their top suggested questions.

1) WHAT HAVE YOU SOLD THAT IS SIMILAR TO MY PROPERTY?

This is crucial: you are about to entrust your most valuable asset to an agent so it’s important to establish that they have a track record of successful transactions for similar properties.

2) WILL YOU TAKE COMMISSION?

This should be another early conversation. Ask “will you agree to an incremental commission structure based

on the sale price achieved –the higher the sale price, the greater the percentage you will be paid?”

Incentivising an agent really can make a difference. Often clients will increase the commission rate over a certain price and while that higher rate may only be activated at a ‘challenging’ premium, it can certainly remind an agent to bring their A-game when negotiating with a buyer in order to achieve the absolute maximum price.

Don’t forget that the role of an agent is to achieve the best sale price possible regardless of commission –but additional motivation can certainly focus the mind...

3) WHAT IS YOUR MARKETING STRATEGY?

Ask if it involves having an e-brochure prepared with professionally taken photographs, measured floor plans and, where appropriate, a measured site plan. Presentation is key, with buyers often looking in multiple locations, meaning they may well be offered dozens of potential options by agents.

If your agent is not presenting your property to a sufficiently high standard, using sub-par photography or skimping on floor plans, it’s likely to be overlooked by buyers, particularly those searching through property portals and scanning hundreds of potential options.

4) HOW MANY SALES DID YOU TRANSACT LAST YEAR IN THIS POSTCODE?

Clearly a buyer or seller needs to know about the track record of their agent. This question should give you peace of mind –or raise a red flag –that the agent knows the area and is tapped into the value of other, nearby properties. Knowledge is one of the key attributes that separates a good agent from an average one –if they haven’t closed deals in the area before, why would they be able to do it for you?

5) WHAT HAS BEEN YOUR FALL THROUGH RATE THIS YEAR?

The most disappointing aspect of buying and selling properties is the moment when a transaction falls at the last hurdle. Asking about fall-through rates provides an insight into your agent’s chances of success and their experience in getting a deal across the line. Agreeing terms is the easy bit…

6) WHERE DO YOU GET YOUR BUYERS FROM?

Does your agent have a database of buyers for whom the property might be suitable or are they solely relying on the big property portals? In a tough market you really want an agent who is proactive, with a strong database of active buyers with whom they have mutual trust that they can contact directly. Don’t pay an agent to simply put up an advert on Zoopla.

7) WHAT IS YOUR INTERNATIONAL REACH?

With more buyers coming from overseas, it’s imperative an agent has the ability to reach an overseas audience.

Questions 1-3 were provided by Marc Schneiderman, director at Arlington Residential (arlingtonresidential.com);

Questions 4-7 were provided by Simon Tollit, director at Tedworth Property (tedworth.co.uk)

This sumptuous property in the heart of central London could be yours for just £12m. Steve Dinneen explores an opulent abode fit for royalty

What really makes this property unique is its combination of historical elegance and modern luxury

Whether you’re buying or selling, it’s important that you’re on the ball with your agent –here’s what to ask them

PRICED FROM £495,000 - £699,995

CALL NOW TO BOOK YOUR APPOINTMENT TO VIEW OUR STUNNING SHOW APARTMENT

Films about video games used to be box office poison, but times are changing. Super Mario Bros is the most successful film of 2023 so far, while Sonic The Hedgehog and Mortal Kombat have grown into formidable movie franchises. Hoping to succeed where Need For Speed failed is Gran Turismo, a movie based on the long-running racing game.

It's based on real-life racer Jann Mardenborough (Archie Madekwe), an avid Gran Turismo player who enters a Nissan-sponsored competition to find the players best suited to becoming real life racers. Fighting sceptical coaches and unexpected setbacks, Jann looks to prove that he is as good in the driver's seat as he is with a controller.

Orlando Bloom's entertainingly vapid executive spends much of the film gleefully talking about marketing prospects. It proves a rallying cry for the movie, as this underdog tale is as much about selling products as it is inspiring youngsters. If you've seen any sporting movie, you'll recognise the training/setbacks/victory rhythm, which relies on the real life

source material to lend it some legitimacy. This is upended slightly by a sequence involving a fatal crash while racing on the famous Nurburgring. This actually happened, but the film's use of the event (the dates are shifted to suit the narrative) feels uncomfortable.

It will come as no surprise that Gran Turismo is a circus of corporate branding: car logos are everywhere, while the game is talked about like it’s some mystic work of art. What is a surprise is that Neill Blomkamp, the director of District 9, is behind it all. Although he lends some visual flair to the action, it's hard to find much of the style that made him a sci-fi favourite.

He does at least bring out the best in his cast. Madekwe has all the charm and grit you need for this Rocky-onwheels adventure, learning from his two mentors in Djimon Hounsou (playing Jann's father) and David Harbour's gruff racing coach. Both older stars have been better, but bring some humanity to all the engine revving.

Gran Turismo should be applauded for taking a game with no story and making a serviceable film (many others have failed in this endeavour). However, it's difficult to recommend it to anyone other than those who spend hours on the digital track.

BY ADAM BLOODWORTH

BY ADAM BLOODWORTH

We’re still very much living in an era where more LGBTQ representation on screen can only be a good thing, and that is certainly the case with Matthew Lopez’s first feature film, Red, White & Royal Blue. This fantastical story about an unlikely pairing between the son of the President of the United States and a British prince is much-needed, even if it the parts don’t always come together.

Matthew Lopez is most famous for directing West End play The Inheritance, a six-hour epic about the AIDS pandemic that The Telegraph called “play of the 21st century.” So it feels surprising that Lopez’s first feature is a glossy youth romance piece aimed at young adults. There’s nothing wrong with that; in our interview Lopez said he fell in love with the central Puerto Rican, working class character of Alex for how he is a different kind of LGBTQ lead quite unlike one that has been seen on screens before.

Nicholas Galitzine and Taylor Zakhar Perez have decent chemistry as the two lovestruck guys in their midtwenties, and it is enjoyable watching them flirt as their rampant horniness progresses. The film spares no blushes, with Alex losing his same-sex virginity in one passionate love making scene that feels brave and progressive and came together with the help of an intimacy coordinator. The two go from frenemies to lovers, roaring around London together and pursuing each other as they attempt to shake off the paparazzi.

It’s all a little too sugary-sweet, though, the stylish sheen sometimes leaving the film feeling bland instead of ground-breaking. And at two hours, it’s a little overlong. Also, some of the couple’s interactions, like when they fall into a big cake together, feel like the sort of things two teenage lovers would do, rather than two guys in their early-to-mid-twenties. Heartstopper, a Netflix LGBTQ drama, involves younger male leads, but feels like it deals more maturely with these themes, a sign that this film hasn’t quite worked out who its audience is.

Will it be second time lucky for this movie based on a Disneyland ride? We visit the Haunted Mansion to see if it’s filled with thrills, spills and belly-laughs

HAUNTED MANSION DIR. JUSTIN SIMIEN BY VICTORIA LUXFORD

Like Pirates of the Caribbean, Haunted Mansion is a big screen version of a popular Disneyland ride. The similarities don’t end there: both had a film adaptation released in 2003, with the original Haunted Mansion, starring Eddie Murphy, bombing at the box office while Johnny Depp’s Captain Sparrow shambled all the way to the bank. Twenty years later, it’s back for a second bite of the apple, this time bringing an all-star cast.

LaKeith Stanfield stars as Ben, a former astrophysicist who left his job to keep his late wife's New Orleans ghost tour running. Stricken with grief and

directionless, he is approached by a priest (Owen Wilson) to investigate a suspected haunting at the new house of single mother Gabbie (Rosario Dawson). Initially sceptical, Ben soon learns the job is a ruse and he is the latest victim to be trapped in a haunted mansion.

For many years, there was a version of this movie slated with king of fantasy-horror Guillermo Del Toro at the helm. Justin Simien (Dear White People) took over directing duties and his vision is a much safer affair. It's a mix of gags and spooky set pieces in keeping with the ride that inspired it. There's the odd mild jump, and some of the CGI ghosts are unsettling, but nothing that will have little ones running for the exit. The emphasis is on humour, slapstick, and the energy of the cast.

Stanfield leads the charge as the weary sceptic, a mostly sincere presence who’s also funny when the moment requires. He has plenty of talent to work with, chiefly the high energy Tiffany Haddish as a medium, and the always-relaxed Owen as the not-so-holy man. Danny DeVito is a delight as an eccentric author, and recent Oscar winner Jamie Lee Curtis is the height of camp as Madame Leota, a character central to the theme park ride. Jared Leto comes up short as villain The Hat Box Ghost, although that's only half his fault as he voices the CGI character. While short on genuine thrills, Haunted Mansion is a funny and charming family movie that would have been better served being released in October. As it is, it’s an entry-level scare for families looking for something darker than Frozen.

London Bridge’s premier drinking and dining venue Vinegar Yard will be showing all of the games on its huge al fresco screen in The Courtyard. Following a glorious win in the Euros last summer, Vinegar Yard will welcome back England fans as the big screen returns. Guests can enjoy the games while sipping on pints and munching a slice from resident pizza specialists Bad Boy Pizza Society.

For east London football fans, Hackney Wick’s newest outdoor venue Hackney Bridge will be showing all games of the FIFA Women's World Cup on its massive screen in the landscaped garden overlooking the canal. In the event of typically poor British weather, the games will also be shown on the indoor screen in Hackney Bridge's Hanger bar.

Now fully open to the public, Hackney Bridge brings one of London’s biggest beer gardens to the East London neighbourhood with long tables for al fresco drinking and dining, as well as an outdoor bar with street food from a selection of independent traders.

The Prince has an epic outdoor terrace perfect for watching the footy – and it will be screening the semi-final and final when the Lionesses make it through.

Alongside the usual selection of draft beer and wine, guests can splash out on cocktails such as a spicy chilli mango margarita and non-alcoholic tipples including a light and refreshing strawberry cooler. Half-time nibbles include plates from an all-day menu alongside two street-food favourites – Le Bab and Crust Bros.

The Prince is complete with a retractable roof which means, come

rain or shine, a good time is always guaranteed.

The Wigmore at The Langham will be screening the big games, where fans can enjoy cask ales and craft beers (including their own Saison) alongside Michel Roux Jr versions of pub classics including burger, chips with bloody mary salt and the signature XXL cheese toastie. Private rooms are also available to book for larger groups of football fans, who can order special sharing platters.

Football crowds can feel threatening, which is why Baller FC fan collective decided to start setting up inclusive, friendly screening events across London for people who might not feel at home at rowdier events. For the women’s quarter finals (and every match this Women’s World Cup) they’ve teamed up with Signature Brew at their Haggerston bar to screen the games. They’ll also have other things to do, including karaoke and foosball tournaments, if you get tired of staring at the screen. There are also barber shop pop-ups running during the football if you fancy a mid-game cut.

You’re no doubt sick of reading about Barbie and Oppenheimer by now, so we’ve got good news: a new duo of releases are here for you to get excited about. TV series Heartstopper has just dropped its second season on Netflix and so has new Amazon film Red, White & Royal Blue. Unlike Barbenheimer, what connects these two straight-to-streaming releases is their examinations of what young romance looks like today.

“Now we've seen Oppenheimer and Barbie, we have no reason to leave the house,” says Matthew Lopez, director of Amazon Original feature Red, White & Royal Blue. “The bad weather in England might do marvels for my movie.”

Lopez, most famously the writer behind landmark play The Inheritance, says the dual release of two of the biggest dramas about young romance was “totally accidental” rather than a move manufactured to create hype. “You know, it’s Amazon and Netflix, they don’t talk. Warner put out Barbie on the same day as Oppenheimer as a fuck you to Nolan. It worked out just fine for both of them.”

Last year the first season of Heartstopper, the LGBTQ teen romance series, ranked within the top ten mostwatched English language series on Netflix after two days on the platform. The series just missed out on the number one spot on Netflix’s most recent most-watched list, pulling in a huge 6.1 million viewers in its first week.

Into the frenzy falls Red, White & Royal Blue, another romance drama about two men who fall in love. The film, Lopez’s first feature, hopes to cash in on the hype around Heartstopper, providing a chaser LGBTQ drama for fans of the Netflix show. “I'm glad we’re not coming out the same day, that’d be a disaster,” says Lopez. “I know what I’d be watching. Heartstopper, are you kidding me?!”