CITY A.M. REPORTERS

DAME ALISON Rose will stay as Natwest chief executive despite a bombshell admission last night that she was the unwitting source of a BBC story into Nigel Farage’s finances.

The BBC reported a senior source had told them that Farage had fallen below the wealth limit required to be a customer of private bank Coutts, after he had claimed that he had been ‘debanked’ by the Natwest-owned lender due to his political views.

However, that proved to be false, with a subject access request revealing Farage’s

LONDON’S BUSINESS NEWSPAPER

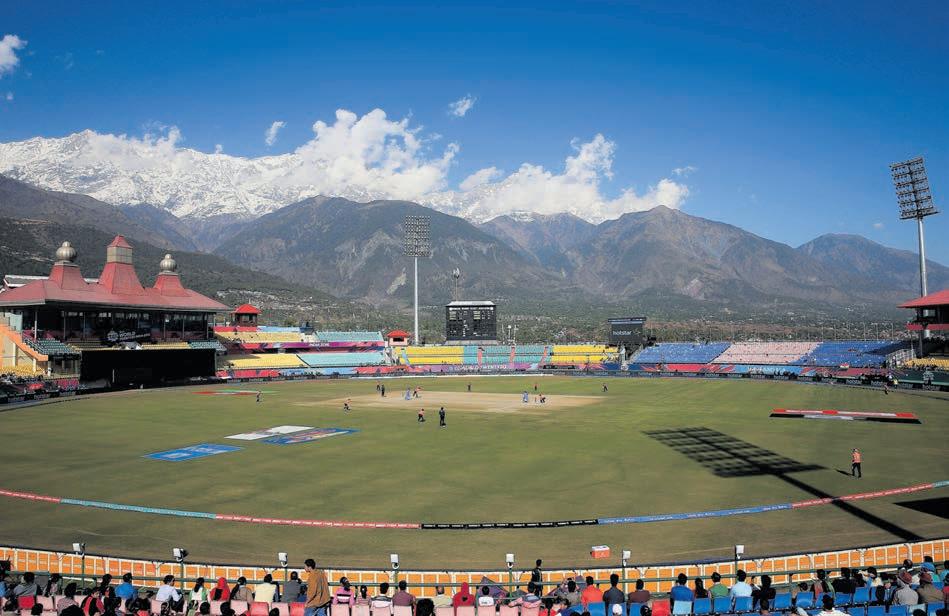

A JAPANESE JEWEL LONDON’S STRICTEST RESTAURANT IS AN EXPERIENCE LIKE NO OTHER P17

politics had been behind the decision.

The error saw the BBC apologise to Farage, and last night Rose confirmed that she had spoken to a reporter at a corporate dinner.

“I confirmed that Mr Farage was a Coutts customer and that he had been offered a Natwest bank account. Alongside this, I repeated what Mr Farage had already stated, that the bank saw this as a commercial decision. I would like to emphasise that in responding to Mr Jack’s questions I did not reveal any personal financial information about Mr Farage.

“In response to a general question about eligibility criteria required to bank

with Coutts and Natwest I said that guidance on both was publicly available on their websites. In doing so, I recognise that I left Mr Jack with the impression that the decision to close Mr Farage’s accounts was solely a commercial one,” she said.

Natwest chairman Howard Davies said in an accompanying statement that whilst Rose’s “regrettable error of judgment” would factor into pay and bonus decisions, the “outstanding leader” would remain in the top job. Davies is set to step down by mid-2024, meaning a sudden Rose departure would have left the bank with a leadership

vacuum at the top.

THE

FORMULA? RACING BOSS BACKS EVENTS IN US AND CHINA P19

TELECOMS CUTS

Virgin Media O2 set to axe 2,000 jobs

JESS JONES

VIRGIN MEDIA O2 yesterday revealed plans to slash 2,000 jobs by the end of the year.

The cuts, which include around 800 previously reported job reductions, will affect over 12 per cent of the company’s current workforce.

Virgin Media O2 is still battling £20.2bn of debt and seeking £350m of annual cost savings following its £31bn merger two years ago.

A Virgin Media O2 spokesperson said the company was “currently consulting on proposals to simplify our operating model to better deliver for customers, which will see a reduction in some roles this year”.

The Financial Conduct Authority last night said it had “raised concerns” with Natwest and Coutts over the raft of allegations and welcomed the announcement of an independent review commissioned by Natwest into the episode.

Nigel Farage last night called for Rose, Davies and Coutts’s chief executive Peter Flavel to all be given the heave. Natwest remains 38.6 per cent owned by the taxpayer, likely plunging the Treasury into a political row over the leak and Natwest’s decision to maintain Rose as the bank’s CEO.

FOR NOW PAGE 2

“There’s no way of dressing this up,” said Paolo Pescatore, independent media analyst at PP Foresight. “It is not good news for UK plc and we can expect to see further cost cutting measures across the industry.”

Rival telecoms giant BT earlier this year announced that it will axe thousands of jobs, aiming to reduce its total workforce from 130,000 to between 90,000 and 75,000 by the end of the decade.

As telecoms firms struggle to generate revenue, “margins continue to be squeezed due to rollout of next generation of networks, and people are reluctant to spend more on connectivity,” Pescatore said.

UK taxpayers to hand over £150bn to Bank of England to cover QE losses

JACK BARNETT

UK TAXPAYERS will have to foot a £150bn bill to cover cumulative losses on the Bank of England’s (BoE) bond buying scheme over the coming decade, a new projection has claimed.

The Treasury is forecast to inject

hundreds of billions of pounds into the central bank’s balance sheet to make up for a shortfall in its quantitative easing (QE) programme. According to a quarterly report by the Bank on its asset purchase facility –the vehicle it uses to hoover up UK debt on financial markets –losses from bond

purchases are poised to balloon by the early 2030s.

After the 2008 financial crisis, the BoE started purchasing UK government and corporate debt from

financial institutions in an effort to stimulate the economy by pushing down yields.

Under the arrangement, the Bank channels any profits made back to the Treasury,

while the taxpayer foots the bill for losses.

The looming £150bn bill will amplify pressure on the UK’s already stretched public finances.

Experts at Fitch warned the UK will now have the highest debt interest burden in the rich world for the first time since records began.

INSIDE IMF WARNING ON UK AND GERMANY P3 HSBC CUTS MORTGAGE RATES P4 UNILEVER POSTS RESULTS P7 LONDON’S NEW SKYSCRAPER P9 MARKETS P13 OPINION P14-15

WEDNESDAY 26 JULY 2023 ISSUE 4,019 FREE CITYAM.COM

NATWEST HAD TO MAKE A CALL AND IT MAKES SENSE TO STICK BY ROSE -

ALISON ROSE TO STAY AS NATWEST CHIEF DESPITE ADMITTING FARAGE LEAK –BUT SAYS SHE DIDN’T DISCUSS PERSONAL INFORMATION WITH THE BEEB

STANDING UP FOR THE CITY

Rose has made a stupid error, but Natwest’s decision is sound for now

POLITICIANS getting grouchy about anonymous leaks –you couldn’t make it up. What Alison Rose has confessed to doing, in the white heat of a media storm, was unwise. Her job at the top of an FCA-regulated entity requires her to be alive to risk, integrity and professionalism, and on that note she has failed.

It’s important to be clear, though, about the scale of that failure. Perfection is an impossible standard. If we take her at her word, this was not a specific discussion of an individual’s finances. It was clumsy, ambiguous and regrettable language that, it’s also possible, an excited reporter with a good scoop may have gone over their skis on. Now, had she offered genuine personal information to a

THE CITY VIEW

reporter, she would be packing her bags, and rightly so. There will be some who say it is a definition without a difference to indicate that eligibility criteria is available online, when talking about a single individual. There will be plenty, with good reason, who will think Rose should go. But, on balance, we think Natwest is right to stick by her. From politics to business, it is becoming the norm for the slightest error to lead to –for want of a better word –‘cancellation’. This is a serious error, but is it enough for Natwest to turn around to their

PORTLAND BARGE Image of the vessel expected to house 500 asylum seekers

shareholders, their employees and their customers and say that they’ve ousted a chief executive who has shown themselves to be perfectly suited to the role? As the bank argued yesterday, the interests of shareholders come first, not least with the hunt on for a new chair.

Natwest, and Rose, are in this invidious position not because of some off-the-cuff remarks over a rubber chicken dinner, but because Coutts decided to put woke virtue-signalling ahead of the most basic of common sense. It is Kafkaesque to, behind closed doors, to debank individuals due to their political beliefs.

If this sorry episode produces one useful outcome, it’s that such absurdities will be purged from the system for good.

Developing wind farms

+

bp’s wider transformation is underway. Whilst today we’re mostly in oil & gas, we’ve increased global investment into our lower carbon & other transition businesses from around 3% in 2019 to around 30% last year.

&

CITYAM.COM 02 WEDNESDAY 26 JULY 2023 NEWS

Producing oil

gas

AN AERIAL image shows the newly arrived Bibby Stockholm barge in Dorset’s Portland Port where 500 asylum seekers are expected to be housed. The barge, alongside the passing of the Illegal Migration Bill, has sparked controversy.

IMF warns Germany and UK will be G7’s laggards this year

JACK BARNETT

BRITAIN is on course to register the second weakest growth in the clutch of rich countries this year, beaten only by Europe’s economic powerhouse Germany, which will be the only advanced economy to contract this year, the International Monetary Fund (IMF) has signalled.

UK output will expand 0.4 per cent this year, the world’s lender of last resort said in new forecasts out yesterday that confirm an earlier upgrade published in May.

The Washington-based organisation still does not think Britain will slip into recession despite growing economic headwinds of late reigniting slowdown fears.

Other economic institutions canned their recession forecasts earlier this year after UK GDP outperformed expectations.

Greater optimism about the UK economy has been caused by “stronger-than-expected

POPPING OFF Spotify subscribers hit a high as it hikes prices

MORE Spotify listeners are tuning in to the app’s services than ever before as the Swedish streamer cranks up its premium prices looking to bolster profits.

consumption and investment from the confidence effects of falling energy prices, lower post-Brexit uncertainty (following the Windsor Framework agreement), and a resilient financial sector as the March global banking stress dissipates,” the IMF said.

Resilient consumer spending has shocked analysts who had expected rising prices to wipe out living standards and prompt Brits to hunker down.

“Growth in the United Kingdom is projected to decline from 4.1 per cent in 2022 to 0.4 per cent in 2023, then to rise to one per cent in 2024,” the IMF said.

Germany is poised to anchor the G7 growth league, shrinking 0.3 per cent this year. America will top the G7 growth table, expanding 1.8 per cent in 2023.

Pierre-Olivier Gourinchas, IMF director of research, said: “In the near term, the signs of progress [in the world economy] are undeniable.”

Subscribers to the streamer’s premium ad-free service have leaped by 10m since the previous quarter, up to 220m, as reported by Spotify yesterday in their second quarter earnings.

Betting company 888 appoints new chief exec

GUY TAYLOR

WILLIAM HILL owner 888 has appointed Per Widerstrom (pictured) as chief executive, six months after its former boss stepped down amid a money laundering probe. Widerstrom will take

the helm from October, the company announced, with the news prompting shares to spike just over four per cent. It comes after the bookies’ former boss Itai Pazner stepped down in January, following an internal money laundering investigation.

Widerstrom has worked in the online gaming industry for 17 years, most recently holding the role of CEO at Fortuna Entertainment Group.

Lord Jonathan Mendelsohn, 888’s executive chair, noted Widerstrom’s strong “record and reputation on governance and compliance”.

Increasing investment in the transition to lower carbon energy and keeping oil and gas flowing where it’s needed. That’s our strategy. Right now, we’re gathering weather data to help us build offshore wind farms that aim to produce enough power for the equivalent of around 6 million homes, and help the UK reach its goal of fivefold growth in wind power by 2030.

And in the North Sea, we’re currently surveying beneath the seabed to hone in on the remaining oil & gas at one of our existing fields – supporting production at a time of critical demand.

Discover more

03 WEDNESDAY 26 JULY 2023 NEWS CITYAM.COM

And,

or.

not

bp.com/PlansIntoAction

Paragon Bank sees a jump in new deposits as savers seek better rates

CHRIS DORRELL

FTSE 250 challenger Paragon Bank has attracted billions in new deposits over the past year, as customers seek better rates on their savings.

Paragon yesterday said its retail savings balance stood at over £12.3bn by the end of June, up 21.6 per cent on the same period last year.

It noted these deposits were “predominantly fixed term [and] FSCS protected”, providing a “stable and reliable basis of funding for the

business”.

As interest rates have risen, savers have sought to lock up their money longer term with better rates. Fixedterm deposits offer higher rates of interest than easy access accounts or current accounts.

In a trading update covering the nine months to June, Paragon said the net loan book had grown by 4.8 per cent to £14.7bn since June last year.

This, however, masked significant differences within the business,

FTSE execs warn on ‘watering down’ City rules

CHARLIE CONCHIE

CITY WATCHDOGS are at risk of “watering down” standards in London as the government throws its weight behind a slew of reforms to the UK’s listings regime and capital markets, FTSE bosses have warned.

Ministers have been driving ahead with efforts to strip away red tape in the City and last week backed a number of new measures including slimming down the paperwork required from firms before they float.

Regulators have also been scrambling to streamline the listing regime amid fears of an exodus of companies away from the capital towards New York.

The Financial Conduct Authority (FCA) revealed plans in May to merge the two tier structure of the market, which has been blamed by some for deterring firms from listing.

However, a survey of 150 of the country’s top executives at FTSE-listed firms by investment bank Numis suggests nerves are spreading through the City at the scale of the reform.

Some 95 per cent of execs said the “comprehensive regulation” of London’s stock market was its main selling point amid the turmoil of the past 12

months and the same number said they were concerned about the “watering down” of the LSE’s listing rules and standards.

Any sweeping reform may have an impact on tarnishing London’s reputation, executives said, and some 64 per cent of those said they were “very concerned” about potentially watering down the rules.

The FCA closed its initial consultation on reform at the end of June and is currently weighing up its next move.

A spokesperson for the watchdog told City A.M. its focus was trained on attracting “a diverse range of companies to list in and grow in the UK”.

“That’s why we’re consulting on streamlining UK listing rules to bolster UK competitiveness, while maintaining high standards,” the spokesperson said.

“We will continue to engage with issuers, investors and advisers as we progress the reforms.”

The survey also found that 90 per cent of FTSE leaders at UK-listed companies expect London’s competitiveness to rise over the next three years, while 99 per cent roundly welcomed the idea of merging the two segments of the market.

RECHARGE London Metal Exchange names new chief executive for its clearing house

MICHAEL Carty has been appointed to head LME Clear, joining from Euroclear Group. The LME has been at the centre of controversy and currently awaits the outcome of a court hearing heard last month.

where mortgage lending climbed 7.8 per cent but commercial lending fell 8.7 per cent.

Nigel Terrington, chief executive, said: “The group has delivered another strong trading performance with robust new business flows, strong customer retention and good margins. We expect to deliver results for the year in line with expectations.

“This has been achieved despite continuing volatility in the financial markets and higher interest rates,” he added.

HSBC first out the blocks to cut mortgage rates

CHRIS DORRELL

HSBC became the first high street bank to announce they will be reducing rates on a swathe of their fixed-rate products yesterday, sparking hope that mortgage rates might begin to fall.

Mortgage rates have spiralled in recent months as inflation has remained stubbornly above the Bank of England’s target. Traders are now betting that the Bank of England will have to hike the base rate to 6.25 per cent in response.

However, inflation data out earlier this month showed a faster-thanexpected fall, raising hopes that interest rates would not have to rise as high as previously expected.

The binary yes/no of a survey is probably not the best measure of regulatory reform, but the overwhelming scale of jitters indicated in Numis’s latest temperature check may give pause for thought to City officials.

Some 95 per cent of FTSE chiefs surveyed said sweeping rule tweaks risk watering down London’s historic guardrails and, consequently, its standing as a financial hub. The rule of law and the steady security of the capital has always been one of its selling points.

ANALYSIS

The interesting counterpoint to that 95 per cent is the 92 per cent of bosses that indicated they back the FCA’s reform and say it’s a good thing. What emerges from those findings is a picture of the delicate Goldilocks porridge that regulators have to cook up. City firms want reform, but not too fast or too much.

The task is on FCA boss Nikhil Rathi and co to get it juuuust right.

CHARLIE CONCHIE

After falling slightly last week, average rates on two-year and fiveyear mortgages climbed again yesterday, reaching 6.83 per cent and 6.34 per cent respectively.

HSBC did not disclose the size of the decrease, but currently a fiveyear deal with a 90 per cent loan-to-value ratio is priced at 6.04 per cent.

The move prompted hopes that other high street banks would follow, helping to bring rates down from their peaks after stubbornly high inflation

Riz Malik, founder and director at R3 Mortgages, said: “I would not be surprised if more lenders follow this strategy this week, as they will be keen to not fall behind.”

Small business confidence slumps amid rising rates and sticky inflation

CHRIS DORRELL CONFIDENCE among small businesses slumped in the second quarter as the impact of rising rates and a stalling economy hit SMEs.

The Federation of Small Business’s (FSB) Small Business Index fell to minus 14.2 points in the second quarter, down 11.4 points in the first

quarter of the year.

The fall in confidence reflects the downbeat economic conditions small businesses had to navigate.

FSB chair Martin McTague said with “economic growth underwhelming at best, it’s disappointing but perhaps not surprising”.

85 per cent of firms said costs had risen since the same period last year

amid soaring inflation and rising rates. Nearly a third of firms that applied for finance were offered a rate of 11 per cent or more, a new record.

However McTague also highlighted “small firms are survivors and there are positive signs in our findings”. He pointed out that the figures were still significantly more positive than the same period last year.

CITYAM.COM 04 WEDNESDAY 26 JULY 2023 NEWS

The FCA is weighing up its next moves after closing its initial consultation on reform

Paragon chief executive Nigel Terrington praised “robust new business flows”

Rebel investors urge regulator to enter GAM row

CHARLIE CONCHIE

A GROUP of rebel GAM shareholders trying to block the firm’s takeover by Liontrust has called on Swiss regulators to step in and prevent “deceptive” and “misleading information” being spread about its own offer.

Ailing Swiss fund manager GAM has recommended its shareholders accept a £96m bid from London-listed investor Liontrust but the takeover has been met with stiff resistance from one group. This group of rebel investors, called NewGAMe, has campaigned against the deal and last week launched its own partial cash offer for the firm.

In a fresh update yesterday, NewGAMe called on the Swiss Takeover Board (TOB) to step in and stop GAM from “spreading misleading information about the merits of NewGAMe’s partial cash tender offer”.

“GAM states that the NewGAMe offer includes ‘a highly questionable condition that NewGAMe gets full control of the GAM Board’ and ‘requires change of control approvals from various regulators’,”

NewGAMe said in a statement. “What GAM does not say is that the Liontrust offer is subject to similar conditions.”

The group claims GAM has also alleged the takeover board will “need to rule on whether NewGAMe’s offer complies with the Swiss takeover rules and that the timeline for doing so is unknown”.

“This statement is deceptive. Its purpose is to instill doubt about the legality of NewGAMe’s offer,” NewGAMe said.

Liontrust, GAM and the TOB have not raised questions about the legality of the NewGAMe offer, the group added.

NewGAMe has opposed the takeover on the grounds it undervalues the firm and contained a clause on the disposal of the fund management services business which could harm shareholders.

After a back and forth Liontrust has now scrapped the clause and extended the takeover deadline by three days.

The group hit back with a proposal to buy some 28m GAM shares, representing around 17.5 per cent of the firm’s issued share capital, at 49p per share.

GAM declined to comment.

BAGS AND BAGS Demand for leather jets revenues at Louis Vuitton owner to £36.2bn

OFGEM HITS SSE WITH SEARING £9.78M FINE

Ofgem has imposed a hefty £9.78m penalty on SSE Generation for securing excessive payments from the UK’s electricity system operator, which was in breach of its licence and raised costs for customers. The penalty will be paid into its voluntary redress fund, a support kitty for vulnerable households.

SSE’s willingness to settle the case has meant the company qualified for a discount compared to the £11.58m it would otherwise have had to pay.

A spokesperson for SSE said: “We aim to comply with regulations at all times and believed we were doing so in this case. Following the investigation, we are updating our relevant procedures accordingly.”

YU GROUP SHARES JUMP ON BACK OF RAISED TARGETS

Yu Group yesterday saw its shares soar nearly six per cent after announcing it is on course to “substantially” outperform market expectations for revenues and profits this year. The challenger group reported meter points increases from 22,500 in December 2022 to 39,700 just six months later.

Looking ahead, Yu Group said it anticipates an expansion in its profit margins courtesy of its digital by default strategy and smart meter rollout. It consequently lifted its earnings targets, having exceeded its goal of four per cent margins in pretax profits, and set a medium-term goal of £500m revenue with a five per cent margin for its gross earnings.

SIZEWELL C NUCLEAR PLANT GETS £170M CASH BOOST

Sizewell C has been given a fresh cash boost by the government, which has poured a further £170m into the proposed nuclear power plant. The funds will be used to prepare Sizewell C for future construction and expand the project’s workforce.

This is on top of nearly £700m of taxpayers’ money previously allocated to the project for early development work and for buying out China General Nuclear’s stake in the project. No official figure has been disclosed for Sizewell’s costs, but estimates have vary from £20bn-£35bn.

A spokesperson for Sizewell C said the funding “will put us in an even stronger position to begin full construction”.

PROFITS at LVMH reached €42.2bn (£36.2bn) in the first half of the year, as the luxury conglomerate was boosted by demand for leather handbags and fashion goods. The company said revenue was up 15 per cent compared to last year.

Bridgepoint hopes for dealmaking rebound due to exit market woes

CHARLIE CONCHIE

BRIDGEPOINT said it was betting on a rebound in dealmaking in the second half of the year yesterday after its investment income slumped in the first six months amid lingering volatility and a sluggish exit market.

In its first half results, the FTSE 250 investor yesterday said its managed assets had risen to €39.5bn, an uptick on the same period last year and a 48 per cent jump since the firm’s float in 2020.

Management fees for the firm reached €124.6m in the first six months of trading, down from a bumper €140.6m raked in the second half of last year but a near-quarter rise on the first half of last year, when it made €100.9m.

Pre-tax profits meanwhile climbed ten per cent to £53.1m.

Chairman of the firm William Jackson said it had been a “strong” start to the year but the firm was now hoping for a more booming period of dealmaking to in the second half of the year.

05 WEDNESDAY 26 JULY 2023 NEWS CITYAM.COM

IN BRIEF

Jaguar Land Rover well in the black as first quarter profits jump to £435m

GUY TAYLOR

JAGUAR LAND ROVER (JLR) saw its profits for the first quarter surge to £435m, up from £67m in the previous quarter, the firm reported yesterday. Revenues in the three months to June were at £6.9bn, up 57 per cent year-onyear, with the marque’s performance boosted by strong sales and demand. Production was at its “highest level in

Marmite maker results prove palatable

cent yesterday.

New Unilever CEO Hein Schumacher (pictured) who took the reins in June, said: “The task ahead is to leverage [our] core strengths, supported by our simplified operating model.”

Previous management has faced shareholder irritation due to an under-performing share price and a perceived lack of dynamism.

Unilever said volumes were “virtually” flat, with a step-up in performance

scale back due to the economic climate, the company said store-bought ice cream sales volumes only grew slightly and underlying operating margin declined 100bps.

“These results from Unilever are solid but uninspiring,” Charlie Huggins, manager of the Quality Shares Portfolio at Wealth Club, said.

The firm has been under pressure over its unwillingness to surrender its position in the Russian market.

Amazon Warhammer deal spurs Games Workshop to £170m profit

GUY TAYLOR

WARHAMMER-MAKER Games

Workshop yesterday reported bumper profits as it benefitted from a major December deal with Amazon to turn its popular wargame into a TV series. Profits rose from £156m to £170.6m for the year ending in May, which the firm said was the highest it had

generated since flotation 29 years ago. Revenues soared from £414m to £470m, helping the company increase its annual dividend by 76 per cent, with the dividend payout at 415p, up from 235p.

In December, the firm signed a blockbuster deal with Amazon that will see its figurines take to the big screen, prompting shares to skyrocket.

rebound from the lows of the pandemic, which caused havoc for supply chains.

Free cashflow –the amount a company has left over after paying its operating expenses –was £451m, the highest ever recorded by JLR in the first quarter.

The luxury car maker’s results came alongside a first quarter announcement from parent company Tata Motors, which

said that JLR accounted for over 70 per cent of its total revenue.

A 29 per cent jump in JLR’s retail sales drove up the Indian conglomerate’s quarterly revenue by 42.5 per cent to hit £9.7bn.

It comes after a busy few months for the Coventry-based firm, which saw a slew of major announcements including the appointment of new interim CEO Adrian Mardell to a permanent role.

It’s not a bad business, but there are better

UNILEVER’s latest results point to a company that is improving, but still has a long way to go before it can say it has caught up with rivals. On the positive side, sales and profits were better than expected and price rises have delivered a good set of numbers. Furthermore, volumes have been flat, and while that not might be much to write home about, it is far better than it has been for the goods giant.

Especially in Europe, Unilever is seeing consumer weakness hit its bottom line, particularly as that region is more exposed to the likes of the ice cream and food markets. This is ultimately the challenge for the new CEO Hein Schumacher, who has only been in place for three weeks. Unilever is a very big company, with the majority of it not doing very well, and it is losing market shares as other consumer goods giants take advantage of its woes. Some parts of the business are holding things together well but there is a lot to improve.

Ultimately, these results point to a company that isn’t a bad one, but that there are better ones out there. There is a reason that Nestle trades at a premium to Unilever, particularly if you look at the share price over the long term. Unilever remains in recovery mode and it might be some time yet before it is fully healed.

The firm said inflation and higher interest rates were still an “ongoing concern” but said it was buoyed by the release of a range of new miniatures. Russell Pointon, director of consumer at Edison Group, said: “The company’s proposed rights deal with Amazon, as well as the strong FY23 results, have helped to deliver a good increase in its share price.”

07 WEDNESDAY 26 JULY 2023 NEWS CITYAM.COM

Games Workshop has been lifted by its collaboration with Amazon

VIEW CHRIS BECKETT HEAD OF EQUITY RESEARCH LONDON QUILTER CHEVIOT UNILEVER’S SHARE PRICE HAS DONE PRECIOUS LITTLE OVER THE LAST FIVE YEARS 3,000 3,500 5,000 2019 2020 2021 4,000 4,500 2023 2022

ANALYST

We are rated EXCELLENT Call +44 (0) 333 123 0320 £60K to invest? Start building your property portfolio today. UK Buy to Lets - HMOs - Holiday Lets – STL Scan the code you can earn yields up to 12%

City of London approves new £600m skyscraper in boost for Square Mile

THE SQUARE MILE is set to get a shiny new skyscraper by the end of the decade, following planning approval from the City of London Corporation. At 284m tall, the new skyscraper at 55 Bishopsgate will be one of the tallest buildings in Europe and the third biggest in the City, behind 1 Undershaft scheme (305m) and 22 Bishopsgate (295m).

Sitting next to the Gherkin and Walkie Talkie Building, construction

will begin as early as 2024 with the dismantling of the existing building.

The project is set to cost around £600m.

The project was given approval by the Corporation’s planning application sub-committee on Friday.

With more than 100,000 sq m of office space, the development will space for around 7,000 workers.

The development will have 63 storeys, including 22 of mixed-use space, in addition to a free-to-visit public rooftop which will host a

The Telegraph goes for growth as bidders circle

JESS JONES

THE TELEGRAPH Media Group (TMG) said it is on track to reach 1m subscribers this year as bidders circle to buy the newspaper owner.

The Daily Telegraph and Sunday Telegraph publisher yesterday reported strong subscription figures, up two per cent to 734,000.

TMG said it was “confidently” on target to hit 1m by the end of this year, while digital subscriptions pushed revenue for the year ended December 2022 up four per cent to over £254m. Subscriptions made up over half of TMG’s total revenue in 2022.

The Daily Telegraph and Sunday Telegraph owner said “investment in quality journalism and engaging digital content remains at the heart” of their strategy for growth.

The Telegraph newspapers and Spectator magazine are set to be put up for sale after their parent organisation was forced into receivership due to unpaid debts, reportedly worth over £1bn.

Analysts estimate the newspaper group could fetch between £400m-

£700m with Daily Mail & General Trust (DGMT), owner of various media outlets such as The Mail and Metro, widely considered the leading suitor for the Telegraph titles.

While DGMT would likely face regulatory scrutiny over competition concerns due to its domination in the national media market, leading independent media analyst Ian Whittaker said the group “may have several pluses on its side”.

Whittaker argued the move would attract polit-

biodiverse climate-resilient garden and 360-degree views of London.

Shravan Joshi, chairman of the City of London Corporation Planning and Transport Committee, welcomed the approval of the 55 Bishopsgate scheme, which he said set a good precedent for other projects.

“The site is central to the City’s growth modelling and will make a huge contribution to the office space needed to meet projected economic and employment growth demand,” he said.

AMTE Power buys time with £1m lifeline loan

NICHOLAS EARL

AMTE POWER has announced a fresh loan facility from a US asset manager, an 11th-hour lifeline for the beleaguered battery firm as it scrambles to secure a new equity partnership amid escalating fears over the company’s future.

The UK's only home grown battery cell maker, that provides lithium and sodium ion products for high-end electric vehicles and sports cars, has been given a £1m reprieve from Arena Investors.

Reach said its digital traffic had been hit by changes to Facebook’s news content

Mirror publisher Reach hit by fall in clicks, but print shows promise

JESS JONES

ical support from government benches while Britain’s competition watchdog may see blocking a merger as “outdated”.

Media analyst Claire Enders has previously said Rupert Murdoch’s News Corp could also be tempted by The Spectator. Other media competitors such as Belgian publisher Mediahuis and National World could also join the auction, while private investors including Sir Jim Ratcliff have also been touted.

RETAIL THERAPY Mike Ashley looks to buy Leeds outlet shopping centre for £50m

RETAIL tycoon

Mike Ashley has bid nearly £50m for Junction 32, an outlet shopping centre on the outskirts of Leeds, The Times reported. It comes after the Frasers boss also recently bought a shopping centre in Luton.

REACH, the publisher of the Daily Mirror and Express newspapers, yesterday reported a decline in digital traffic but said print had shown promising signs, as circulation revenue grows and print costs fall.

The company reported revenues of £217m in the six months to 25 June, a 16 per cent drop from the same period last year. Reach cited Facebook’s “deprioritisation” of news content for the group’s declining page views.

The publisher, however, posted a

“strong” print performance, with circulation up 2.4 per cent on the first half of 2022.

“The ongoing resilience and predictability of print underpins continued investment in a strong digital offering, with circulation revenue growing and newsprint costs starting to decline,” Reach boss Jim Mullen said.

The group maintained its full year expectations for 2023.

Investors welcomed the positive signs, with shares surging to close up over 16 per cent.

Chief exec Alan Hollis hopes the injection will tide over the business, as the Highlands-based group looks to close a £2.5m funding deal with an undisclosed equity investor.

Hollis said: “I am very pleased to announce the bridging loan to be provided by Arena, which buys AMTE the time and financial resources to allow the equity investor to complete its due diligence and internal procedures ahead of some much needed further investment in the business.”

This is the second time Arena has come to the rescue, with AMTE securing a £1m facility from the company in April, alongside £580,000 from state-backed vehicle Highlands and Enterprise.

This follows the company announcing a four-week deadline for new funds last month, warning that administration was increasingly likely.

App developers take Apple to court over App Store monopoly concerns

JESS JONES

UK APP developers are suing Apple, alleging that the company’s App Store holds an unfair monopoly.

Brought before London’s Competition Appeal Tribunal by competition law expert Sean Ennis, the lawsuit represents over 1,500 mobile app developers who are

seeking £785m in damages.

Apple charges a 15-30 per cent commission on some payments made through the App Store, which the developers have argued is “abusive pricing”.

Ennis said: “Apple’s charges to app developers are excessive, and only possible due to its monopoly on the distribution of apps onto iPhones

and iPads.”

In 2021, the tech giant settled a similar US lawsuit by introducing a reduced 15 per cent commission rate for smaller developers.

Apple was not immediately available for comment but has previously said that 85 per cent of app developers using the App Store do not pay any commission.

09 WEDNESDAY 26 JULY 2023 NEWS CITYAM.COM

JACK MENDEL

The new skyscraper is set to be the City’s third tallest building at 284m

The newspaper publisher said it was on target for 1m subscribers this year

Meal deal mania boosts sandwich maker Greencore

LAURA MCGUIRE

CONVENIENCE food maker Greencore yesterday said the number of sandwiches sold as part of supermarket meal deals has reached record highs as it reported solid quarterly revenues.

The Irish business, which supplies sandwiches and sushi to the likes of M&S and Waitrose, said 52 per cent of supermarket sandwiches are now bought as part of a meal deal, up from 46 per cent this time last year. The meal deal, which traditionally consists of a sandwich, a snack and a drink, was originally launched by UK pharmacy chain Boots, and is typically associated with being value for money. Their popularity has persisted despite rising food prices amid record food inflation. Last October, Tesco upped the price of its offer from £3.50 to £3.90 –the first price rise in a decade –while other ‘Big Four’ grocers have also upped

the price of deals amid rising costs.

“The meal deal has become a ‘foodie phenomenon’, with over half of sandwiches sold by supermarket chains now being bought as part of a combo,” Andy Parton, chief commercial officer of Greencore, said.

“The growth [is] being driven in particular by soaring demand for ‘premium’ meal deals, which include more luxurious items like premium sandwiches, salads and sushi,” he said.

Greencore yesterday reported revenues of £495.4m for the third quarter, up 1.9 per cent on the same period last year, and said it was trading in line with market expectations.

Greencore chief Dalton Philips said the results reflected the firm’s “resilience” amid the difficult backdrop. He added that the rate of inflation in some categories was starting to slow. Shares bounced to close up over five per cent after the update.

THE MEAL DEAL’S RISE SHOULD BE HAILED, NOT MOCKED

I'm a creature of habit so I’m partial to a Tesco meal deal. I like the classic combo of cheese and ham –simple and comforting – with some pickled onion Monster Munch for a bit of spice, and coconut water for health. I travel a lot with work and as a chef I’m in the kitchen at odd hours due to service, so there is real comfort in the consistency of a Tesco meal deal. Wherever you are in the country, the food is exactly the same.

During a busy day it’s the perfect balm when I don't want to think about what I want to eat. That’s the beauty of a meal deal. Bish, bash,

James Cochran Chef

bosh: done.

There’s also the issue of price: everyone is tightening their belts at the moment and eating a good meal out in a restaurant is a treat. That won’t change –nothing will ever beat having a great chef putting their heart and soul into every dish –but people

don’t necessarily want to spend £15 on lunch when you can get something perfectly fine for less than £4.

The meal deal is also a great leveller –when you’re queuing for the self-service checkouts you see a real slice of life, with builders standing next to City workers in suits, all holding a tub of tuna mayo pasta and a can of Fanta.

Life is stressful enough, and you won’t get a nasty surprise at the till either.

£ James is the chef patron at Islington’s 1251 and a regular on TV and radio

CITYAM.COM 10 WEDNESDAY 26 JULY 2023 NEWS

WE DON’T JUST SELL LUXURY LODGES. WE ARE LUXURY LODGES Prices From £250,000 | Flexible Finance | Buy To Let Options | Up To 8% Yield 0800 677 1777 residences.luxurylodges.com/city-am

HOW THE SHIPPING SECTOR LANDED ITSELF IN DEEP WATER

THE DEMAND picture for container shipping is “far worse” than predicted, analysts have warned, as the sector struggles with an oversupply of vessels ordered during a Covid-era boom.

“There’s a really, really punishing demand environment and at the same time, they're just not doing enough to reduce the amount of available capacity in the market,” Simon Heaney, senior manager at the maritime research consultancy Drewry, told City A.M.

“The demand picture is far worse than even we had predicted with some really awful trade stats in terms of double digit losses on key trades,” he added. The container shipping sector boomed

during the pandemic as global supply chain disruption and import demand for manufactured consumer goods sent freight rates into the stratosphere.

But the bonanza faded and now there’s the problem of a huge oversupply of vessels, ordered on the back of bumper profits and a desire for new greener fleets.

By 2025, the containership fleet is expected to be 30 per cent greater than at the start of 2020. As a result, analysts have forecast tanking freight rates and tumbling profits at major ocean carriers.

“You lose your revenues through lower rates, which are now in many cases below breakeven, you lose money, asset values drop and it eats into the massive pile of

cash that you built up over the last few years,” Heaney explained.

In May, Maersk warned of a “radicallychanged business environment” as its profits plunged, while CEO Vincent Clerc said the shipping giant had a “bumpy” road ahead due to the massive number of ships joining the global fleet. Hapag-Lloyd saw profits dive nearly £2bn that month.

Recently, shipping groups have been withdrawing capacity by slowing containership speeds, cancelling voyages and scrapping older vessels.

But Peter Tirschwell, VP at S&P Global Market Intelligence, warned this would not “completely mitigate competition among carriers for cargo and market

share, which will continue to put pressure on rates as reflected in carrier financials”. A push to meet decarbonisation targets has also contributed to oversupply, as companies look to replace older ships.

The International Maritime Organisation has targeted a 70 per cent reduction in the carbon intensity of the global fleet by 2030.

Tristan Smith, associate professor at UCL, warned many carriers had purchased containerships that would not meet increasingly stringent post-2030 requirements. As a result, they could eventually be forced to sell their vessels at a “major devaluation”, Smith said, which would bode more ill for the industry.

City lawyers: Next SFO boss has ‘a massive mountain to climb’

BEN LUCAS

THE NEW director of the Serious Fraud Office (SFO) faces a herculean task in rebuilding the anti-fraud agency’s reputation after a number of failures over the last few years, top City lawyers have warned.

Earlier this month, Nick Ephgrave, the former assistant commissioner of the Metropolitan Police, was appointed as the next director of the agency, taking over from outgoing chief Lisa Osofsky.

During her time at the top, outgoing director Lisa Osofsky oversaw a number of losses and failures.

Osofsky was forced to apologise in parliament last year after it emerged

that shortly after starting as director in late 2018 she met with a representative of the founding family of oil industry services firm Unaoil –which was being investigated for suspected bribery and corruption at the time –who sought to influence the outcome of the investigation. The incident contributed to three convictions from the bribery case being overturned.

The agency was also embarrassed

when the fraud trial of two former Serco executives collapsed in April 2021 after the SFO failed to disclose evidence to the defendants’ lawyers.

“Disclosure, as Nick Ephgrave must know by now, is a problem that the agency has continued to struggle with, leading to failed prosecutions,” Aziz Rahman, a senior partner at law firm Rahman Ravelli, said. “This is arguably one of the most

pressing matters that he has to address.”

But there are other problems he will be forced to tackle.

“There is a massive mountain to climb for the new director,” Barry Vitou, a partner at law firm HFW, said. “This includes increasing morale, filling the vacancies, and in the eyes of the public and corporate boards being a credible deterrent.”

Without a tough enforcer, Vitou said there was a risk that companies and individuals could “exploit a benign enforcement environment”.

As well as moving on from these issues, Ephgrave starts the job with a full in-tray.

“His first test will be how he deals

with challenges like the ENRC litigation and a number of charging decisions,” Sam Tate, head of whitecollar crime at law firm RPC, said.

Tate noted, however, that Ephgrave will be helped by incoming law changes, with parliament planning to make it easier to prosecute large companies and companies of any size that fail to prevent fraud.

An SFO spokesperson said that improving staffing and recruitment is one of the agency’s “main priorities for the year ahead”, alongside pushing for disclosure reform, adding that “progress has been made” on the issue since the government launched a review of the disclosure regime in its new fraud strategy.

11 WEDNESDAY 26 JULY 2023 NEWS CITYAM.COM

Lisa Osofsky will hand over the reins to Ephgrave in September

The demand picture is far worse than we had predicted with some really awful trade stats

AN OVERSUPPLY OF VESSELS IS STIFLING THE SECTOR, WRITES GUY TAYLOR

As record inflation grips the UK, Jack Barnett asks where we should point the finger

Alot of energy has been wasted on finding the source of the near two-year long global inflation surge. It has resembled a cathartic process to help families and businesses come to terms with how damaging the cost of living crisis has been.

First, Bank of England governor Andrew Bailey drew scorn for demanding workers rein in their wage demands.

Then supermarkets bore the brunt of public uproar. Banks have been criticised and the government has judged petrol providers to be overcharging.

Then there are the so-called fat-cat profiteers, who have been using the guise of inflation to beef up their margins.

It shouldn’t be forgotten that Vladimir Putin ultimately holds most of the responsibility for pushing inflation to multi-decade highs.

But just who is at fault? The workers? The greedy companies? And are we in a “wage/price” spiral?

WHAT’S ACTUALLY BEEN HAPPENING TO WAGES?

Inflation is essentially a tax on household finances. Just as a rise in VAT raises the price of products, inflation increases the cost of everything.

In such an environment, consumers can become complacent.

A pay rise is always nice to have. In fact, in the UK, lots of people have been getting some decent ones, with average pay up around six per cent in the first three months of this year, according to the Organisation for Economic Cooperation and Development (OECD).

But workers can suffer from what is known as “money illusion”, when they think a raise makes them better off. Many people may have been conned by this trick over the last couple years.

When accounting for inflation, salaries in the UK actually dropped closer to three per cent. Across the OECD in the first quarter, they shrank around four per cent in the same period.

HOW HAVE PROFITS PERFORMED?

Any company faces the same dilemma: how to select a mix of inputs to make things that maximises profit.

Among the largest components of that mix is labour. Workers often rep-

ARE WAGES OR PROFITS TO BLAME FOR INFLATION SURGE?

bills, and their price has been rising.

Just one country, Ireland, in the OECD group saw labour costs fall when comparing the quarter before the pandemic to the start of 2023. In Britain, labour costs increased a little under 20 per cent over the same period.

What this essentially means is that –holding all else equal –workers are getting a larger share of their respective countries’ income compared to before the pandemic.

All else is rarely equal, though. The share of output allocated to profits in the OECD has actually risen much faster than the share given to workers since the onset of the Covid-19 crisis.

Across the rich country bloc, profits have climbed over 20 per cent while

labour costs have risen about 15 per cent. The respective numbers in the UK are about 24 per cent and 18 per cent. And, when accounting for inflation, workers in nearly every OECD country where data is available are cheaper to

employ than they were three years ago.

ARE WAGES TO BLAME FOR RISING INFLATION?

Rising wages and profits is unusual. Typically, when one increases, the other falls.

It suggests that “profits have made an unusually large contribution to domestic price pressures” as the OECD put it in their latest labour market snapshot. This is especially true in Europe, where the OECD estimates “most of the increase in domestic prices in the second half of 2022 and first quarter of 2023” has been caused by higher profits.

IS A WAGE/PRICE SPIRAL LIKELY?

Accelerating salaries are generally a

why the Bank of England and other monetary authorities have been so keen to caution against excessive pay demands.

They can generate the dreaded “wage/price spiral”, where businesses lift prices in response to higher staff costs, prompting their workforce to demand further compensation.

So far though, there is “no indication of signs of a price-wage spiral” taking hold, according to the OECD. Instead, there may be room for businesses to hand out pay increases –especially to their lowest paid workers –from higher profits “without generating significant additional price pressures,” the rich country group said.

Britons are more positive about the Women’s World Cup than men’s

DESPITE the big time differences, there’s no shortage of excitement for the Fifa Women’s World Cup 2023: our recent survey showed that a majority of fans in England (75 per cent), France (77 per cent), Germany (75 per cent) and Italy (86 per cent) would be pleased if their team won the cup. And YouGov FootballIndex data from the beginning of this year’s tournament, as well as last year’s men’s Fifa World Cup in Qatar, we can see that, in terms of public perception, the women’s competition is beating the men’s contest in some key areas. Looking at the Impression metric, which measures general sentiment, we can see that scores for the Women’s World Cup were at 22.7 on 20 July 2023 – the beginning of the 2023 tournament. At the start of the men’s contest

Stephan Shakespeare

last year, (20 November 2022), the equivalent scores were at -13.4.

It's similar if we look at Value (whether a sporting event represents a good return on investment for those paying to see it live or on TV): the Women’s World Cup had a score of 4.9 on the first day of the tournament, while the men’s had a score of -11.5.

Reputation scores for the women’s tournament (15.6) which measure whether a sporting event has a good or

poor reputation, also exceeded the men’s (-1.7), as did Recommend scores (Women’s World Cup: 9.8; men’s World Cup: 1.5).

This doesn’t necessarily translate to a greater willingness to watch: the women’s competition had Consideration scores of 10.6 compared to 22.8 for the men’s, and Quality scores – 16.5 for the Women’s World Cup; 23.8 for the men’s World Cup – lagged behind as well. The 2022 World Cup in Qatar was also uncommonly controversial; it’s reasonable to assume the next men’s tournament in the US might be better received. None of this should detract from the positivity of the Women’s World Cup this year – the public mood is determinedly enthusiastic.

Stephan Shakespeare is the co-founder and CEO of YouGov

PERCEPTION OF THE FIFA WOMEN’S WORLD CUP AND MEN’S FIFA WORLD CUP AT THE BEGINNING OF EACH TOURNAMENT

CITYAM.COM 12 WEDNESDAY 26 JULY 2023 NEWS

2023 Fifa Women’s World Cup 2022 Fifa Men’s World Cup

World

first day of

22.7 -13.4 -11.5 -1.7 4.9 15.6 9.8 1.5 4.5 13.4 10.6 22.8 16.5 23.8 ImpressionValueReputationRecommendSatisfactionConsiderationQuality YouGov FootballIndex: 20 Nov 2022 - 20 July 2023

YouGov FootballIndex: Scores for Fifa World Cup and FIFA Women’s

Cup on the

each tournament

Profits have made an unusually large contribution to domestic price pressures

CITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

email your research to notes@cityam.com

Unilever helps FTSE 100 squeeze out gains ahead of Fed meeting

LONDON’s FTSE 100 yesterday squeezed out gains in a busy day of company announcements ahead of the annual summer slowdown.

The capital’s premier index edged 0.17 per cent higher to 7,691.81 points, while the domestically-focused mid-cap FTSE 250 index, which is a better reflection of the health of the UK economy, was broadly flat at 19,149.88 points.

Risk sentiment was seemingly muted in the City, likely due to traders hunkering down before key US Federal Reserve and European Central Bank meetings today and tomorrow respectively.

Analysts expect both central banks to lift interest rates 25 basis points in what may be the last increase for each.

Asian shares rose sharply in overnight trading on Monday after Chinese au-

thorities signalled they were prepared to ramp up government support to reverse slowing growth. That indication gave FTSE 100-listed miners a boost, with Rio Tinto, Anglo American and Antofagasta all up four-ish per cent.

China is the globe’s biggest consumer of commodities, meaning an increase in demand should bump raw material producers’ income.

Consumer goods giant Unilever topped the FTSE 100, climbing 4.34 per cent after it posted a better-than-expected set of results. Consumers have been willing to swallow

Unilever’s price hikes, it said, raising its margins.

The City is amid the final round of corporate results before the annual summer slowdown. Topping the billing is UK banks’ second quarter earnings season, which kicks off with Lloyds Bank today.

The

CHINESE CHEER SPREADS TO LONDON MARKETS

Output was just shy of expectations for the second quarter, with Hochschild reporting less-than-expected gold and silver production, but the company appears on the up. It also awaits a key environmental statement for one of its flagship mines in Peru, which could be a major catalyst for further production. Peel Hunt is still saying buy, with a target price of 100p per share.

13 WEDNESDAY 26 JULY 2023 MARKETS CITYAM.COM

P 20 Jul 19 Jul 24 Jul 888 HOLDINGS 25 Jul 110.40 25 Jul 21 Jul 95 115 110 105 100

To appear in Best of the Brokers,

P 25 Jul 74.75 20 Jul 19 Jul 24 Jul HOCHSCHILD MINING 25 Jul 21 Jul 72 80 78 76 74

“Good news from China always makes its way to the UK market in a flash, with commodity producers riding high including gains from Anglo American and Rio Tinto.”

DANNI HEWSON, AJ BELL

JOIN THE CONVERSATION AND BECOME A PART OF

OF LONDON’S MOST TRUSTED NEWS SOURCES VISIT: CITYAM.COM/IMPACT-AM/

gambling giant has taken a safe bet for its new chief executive, snapping up former Fortuna Entertainment head Per Widerstrom to steer its operations. He will begin his new role in October, and has 17 years of experience in the global online betting and gaming industry. Investment specialists Peel Hunt are keen on the decision, taking a buy stance with a target price of 150p per share.

Powerful

real-time thought leadership, insights and news delivery mechanism fuelling the most up-to date reporting, adding critical context for decisions that require consciousness, education and thought leadership.

ONE

OPINION

EDITED BY SASCHA O’SULLIVAN

Welcome to the Great Green Delay, and Khan’s Ulez expansion is the first victim

AIR POLLUTION is the biggest environmental challenge to public health, and in areas close to busy roads, residents and drivers are exposed to disproportionately elevated levels of pollutants.” No, that’s not an excerpt from Sadiq Khan’s new book Breathe but a quote from Grant Shapps, the Energy Secretary, who has spent the last few weeks trying to shut down the expansion of the Ultra Low Emissions Zone (Ulez) in London, in 2020.

When the Conservative majority was whittled down from a massive 7,469 to just under 500 votes in the Uxbridge and South Ruislip by-election, it was spun as a vote against punishing green policies. Many claimed the policy, which charges non-compliant cars £12.50 a day to drive within the zone, was the only thing the voters, living in the shadow of the M25, hated more than the Conservatives. It has since turned into a civil war over green policies within both major parties.

Earlier this month, it looked like Keir Starmer was trying to play down his ambitions for climate policies after claims he said he “hates tree huggers”. The Labour leader backtracked and denied ever turning his ire on the hippies hiding in the forests. But certainly the party slogan of a “greener, fairer future” has barely been seen since it was initially aired in September last year. It seems to have been replaced with “build a better Britain”, a motto eerily reminiscent of Boris Johnson’s allitera-

tive catchphrase “build back better”.

Khan’s expansion of Ulez was a kind of test case for green policies in both parties. There is dissent between the national and local levels of the Labour Party, urging the London Mayor to “reflect on the policy”. For the Conservatives, it has shown them campaigns against climate policies, which look, at least on the surface, like it will cost us all a little more, can win votes, or at the very least, keep them on side.

Even before the Uxbridge ballot kicked off in earnest, Rishi Sunak was sending out emails to the Conservative Party membership with subject lines like “Eco-extremist update.”

Within days of the Uxbridge result, there were rumours swirling that the 2030 target of a ban on new diesel and petrol cars would be pushed back.

Michael Gove, the Levelling Up Secretary, recommitted to the target yesterday.

On the same day, Sunak’s plans to penalise retailers and manufacturers for their plastic packaging fell victim to the green pushback, with the rules, due to come in October 2024, pushed back by a year - incidentally, well after an election pegged for Autumn next year.

The sad truth of Ulez is it’s not a terrible policy: it only impacts cars that are more than 17 years old, meaning only 1 in 10 drivers in London will have to pay it; it comes with significant support for scrappage schemes for businesses and people on certain benefits eligible for as much as £3,000 for handing in an old car. Crucially, it also seems to work: 95.3 per cent of vehicles driving in the zone are now compliant and early studies by

Imperial College London on central Ulez demonstrate it has helped drive down hospital admissions for airway diseases.

It’s one of the very few green policies which doesn’t rely on a target flung one or two election cycles into the future.

Earlier attempts to lampoon the expansion fell flat, with a majority of local councils voting for Labour despite heavy anti-Ulez leafleting in spring last year. At the time, the animosity towards Boris Johnson was so great, and the cost-of-living crisis yet to set in, that a relatively minor policy failed to find cut through.

In Britain, we’ve been relatively lucky that there has been a consensus on climate change policies. If you speak to either party, they will point to polling showing there is broad support for the pro-environmental policies.

Borrowing a Netflix password? You’re part of a generation of customer frauds

IT IS tempting to think of fraud as a purely criminal endeavour – perpetrated by gangs or sophisticated malicious organisations. Few of us would expect family members, work colleagues, or friends to fall into this category.

But anyone who has falsely claimed a package never arrived, returned an item of clothing to the store after wearing it or shared a subscription has, in effect, committed fraud.

For ecommerce sites, which account for over a third of retail sales in the UK, customer fraud is becoming a big problem. According to a survey published recently, one third of finance leaders at online merchants now describe customer fraud as the number one risk factor facing their business. Only fraud from stolen payment cards – undeniably criminal – ranks higher.

The data on what motivations lie behind customer fraud are scant. Figures from fraud prevention body CIFAS reveal that it is heavily skewed towards

Martin Sweeney

Martin Sweeney

younger people: one in seven adults between 18 and 34 have admitted to carrying out fraudulent acts, twice as many as the rest of the population.

Customer fraud is seen as a soft, victimless crime. Nobody gets hurt, the police won’t be called, and people believe businesses can afford to take the hit. Social media platforms like TikTok are groaning with simple how-to videos which make it look easy to earn ready cash by gaming returns policies or discount vouchers. Each new video or “scam bible” that appears on social media leads to an almost immediate uptick in fraud-like behaviour.

While it’s easy to paint the rise in customer fraud as a rational response to the cost-of-living crisis, the reality is murkier. People aren’t engaging in customer fraud out of necessity, but because the potential gains far outweigh the downsides.

Yet customer fraud is far from victimless, being extremely damaging for businesses but also bad for the economy itself.

It's estimated that 10 per cent of returns are fraudulent. That's many millions of pounds paid out in refunds, plus losses from merchandise that can't be resold. It depresses profits, meaning companies have less to invest in staying competitive and growing. These losses inevitably end up being passed back to consumers through higher prices and more friction.

Responding effectively to fraud –whether from criminals or customers –places companies between a rock and a hard place. They must strike a continual balance between discouraging fraud-

The risk is, as both Sunak and Starmer start to think seriously about the next election, that this gives way because the Tories target policies which can be cast as an attack on the working class and suburbs, and Labour finds themselves unable to defend proposals like Ulez for fear of once again alienating Red Wall voters.

On both sides, pro-climate politicians have found themselves sidelined. Ed Miliband, the Shadow Energy Secretary, has been rumoured to be on the outs with Starmer just when he’s plotting a reshuffle. Those within his office insist this isn’t true and there is unity behind Starmer’s big plan for energy. In the wake of Ulez, the focus for Labour will be on carrots, rather than sticks.

Meanwhile, Alok Sharma, the president of Cop26 who cried at the end of the summit in Glasgow, has effectively disappeared from the limelight and Shapps, known for his support of green policies, was instead running the campaign against Ulez.

Also kicking around in the background is Reform UK, the successor of Nigel Farage’s Brexit Party, who have made it their new mission to oppose green policies and other iterations of “woke politics”, and the Liberal Democrats, who won the by-election in Somerton and Frome, and have expended a huge amount of energy campaigning against changes to farming subsidies to promote more sustainable agriculture practices.

The truth is Ulez probably is an outlier in terms of its timing in the electoral cycle, but if parties see it to be too politically risky to fight for green policies, or even beneficial to fight against them, we could find ourselves caught in the great green delay, rather than a great green future.

CLIMATE CHANGE? HIP HIP HOORAY!

sters and providing a great customer experience for everyone else. Become too lenient, and fraud increases; clamp down too hard, and sales will suffer. Their stock response has been to throw money and resources at the problem. More than 80 per cent of the finance leaders polled in our survey expect fraud budgets and headcounts to increase this year.

However, more and more businesses are using machine learning tools to do the heavy lifting, leaving their human experts to handle exceptions, and keep the rest of the business abreast of the latest fraud trends.

But containing fraud can’t be done through tighter enforcement alone. We need a broader industry dialogue about the impacts of customer fraud – and its causes. As long as the “victims” of customer fraud remain silent, the problem will only continue to grow.

£

Martin Sweeney is the chief executive officer of Ravelin

CITYAM.COM 14 WEDNESDAY 26 JULY 2023 OPINION

Londoners have been protesting over the Ulez expansion

David Frost, the former Brexit minister, has suggested rising temperatures will be good for the UK as more people die from the cold than the heat. A tactful intervention, as half of Europe is either burning or trying to survive temperatures close to 40C...

Sascha O’Sullivan

Comment and features editor at City AM

LETTERS TO THE EDITOR

Gatwick needs to keep flying

[Re:London

business back

Gatwick’s second runway proposal, July 12]

The travel industry is firmly back in business – with London taking a strong lead. Global airlines are increasing routes to the capital, spurred by smart investments in travel infrastructure and capacity expansions.

The total contribution of travel and tourism to the UK’s GDP has increased by around 40 percent compared to the first year of the (COVID-19) pandemic. Despite this growth, the figure remains way below pre-pandemic levels.

Local support for investments in airports, like Gatwick’s second runway,

shows that London businesses understand the positive impact that travel and tourism has on the local economy, and how it can supercharge economic growth. Businesses will be able to meet faceto-face with more of their customers, and airlines will have more opportunity to add routes and deliver more options for travellers. The UK’s investments in travel and tourism are an ideal strategy to help the industry increase its contribution to GDP, invigorate the workforce, and boost trade opportunities. These are all crucial ingredients to come out of the recession standing tall. That’s why I’m applauding London businesses for getting ahead of the curve and putting travel investments first.

Tom Kershaw Travelport

LET’S GO PARTY Barbie dominates cinemas and music streaming charts

A chief exec pay boost won’t make up for ministers failing to stick up for scale-up firms

GOOD news. The problem over why so few businesses are choosing to join the London Stock Exchange has been solved.

All we need to do is stop paying chief executives of listed businesses excessive salaries and pay them obscene ones instead, according to a new survey of London-listed directors.

Whilst I’m sure most were shocked to find a group of senior business leaders, when asked, said they wanted more money, I’m more surprised the LSE’s head honchos somehow agree with this view.

Back in May, the LSE Group’s chief executive Julia Hoggett made the same argument by claiming the UK is behind “global benchmarks” when it comes to executive remuneration.

She believes a level playing field is required to compete with the US, where the average chief executive salary was $15m (£11.7m) for a Fortune 500 firm versus the UK’s paltry £3.4m average for a FTSE 100 boss.

EXPLAINER-IN-BRIEF: ELON MUSK TAKES DOWN TWITTER BIT BY BIT

Elon Musk might have already switched the beloved Twitter bird for his X logo online, but it’s proving a bit harder in real life. Earlier this week, police stopped workers who were removing the Twitter sign from the headquarters in San Francisco. Apparently, Musk had forgotten to notify security or the building owner of his plans. Renaming Twitter is just the last of a string of changes implemented by Musk to redefine the platform. He started with staff cuts and continued restoring banned accounts and modifying how content

moderation works. Musk wants it to become a “super app” similar to WeChat in China, where you can message people, exchange information, but also buy goods and services. In the meantime, the fight between Musk and Meta’s Mark Zuckerberg has reached a new high with the launch of Threads, a sort of Twitter copy tied to Instagram. Despite the high numbers of users who created a profile when the app was launched twenty days ago, engagement has already dropped extensively.

ELENA SINISCALCO

I struggle to understand how adding an extra zero to the end of a Londonlisted chief’s payslip would solve the problem of why US-listed Apple remains a bigger business by market cap ($3tn) than the entire FTSE 100 list of businesses combined ($2tn).

But perhaps the LSE is taking a leaf out of the government’s playbook, with ministers hunting for easy wins and veering from policy to policy based on whatever story is on the front of the newspapers.

Another favourite of the government, when faced with making a decision, is to call for a review. As expected, the LSE is also in favour of such an approach with several reviews into the future of the market currently ongoing.

Over at the Financial Conduct Author-

ity, they believe the route to a successful future for London listings is by relaxing regulations. Somehow this will be the catalyst to see more money pour in, despite the fact the US has been increasing its regulations in recent times – like banning Chinese-linked firms from listing there – and the FTSE’s junior stock market, AIM, continues to fight off the perception of being more akin to a casino than a gold-standard investment route.

So what, if anything, can the LSE do to genuinely encourage more companies to consider listing here?

I would start by looking at the way UK businesses are nurtured. Too often companies will secure seed funding in the early days and be heralded by ministers and others as future “global leaders” in their sector.

But once they scale up, many are left to their own devices and typically go globe-trotting for funding.

The funding for the bigger-than-a-startup firm typically comes from outside the UK in part because of the UK government’s resistance to offer support for businesses who have passed the seed funding stage.

A mismatch emerges where investors will dip into their pocket but only if the

government can vouch for the business.

Ministers are fearful to be seen “picking winners” and investors turn elsewhere to countries where other governments are willing to play the nationalism card.

But perhaps the biggest issue is more fundamental and looks at the entire premise that getting more companies to list on the stock market is the answer to all our problems.

Investment options today are vast. We live in a world where those with money can choose to put it to work across a whole host of products and services.

Businesses themselves no longer see listing with the same level of importance as they once did – with the added scrutiny attached – and the era of investors just buying shares in their favourite companies is long gone. Ultimately, the incentives are just not worth it.

But until the LSE addresses the incentive deficit for investors, instead of apparent deficits in the pay of chief executives, nothing will change.

£ Simon Neville is head of Media Strategy and Content Director at SECNewgate. He was formerly City Editor at Press Association

St Magnus House, 3 Lower Thames Street, London, EC3R 6HD Tel: 020 3201 8900 Email: news@cityam.com Printed by Iliffe Print Cambridge Ltd., Winship Road, Milton, Cambridge, CB24 6PP Our terms and conditions for external contributors can be viewed at cityam.com/terms-conditions Distribution helpline If you have any comments about the distribution of City A.M. please ring 0203 201 8900, or email distribution@cityam.com Editorial Editor Andy Silvester | News Editor Ben Lucas Comment & Features Editor Sascha O’Sullivan Lifestyle Editor Steve Dinneen | Sports Editor Frank Dalleres Creative Director Billy Breton | Commercial Sales Director Jeremy Slattery 15 WEDNESDAY 26 JULY 2023 OPINION CITYAM.COM

Simon Neville

TO HEAR YOUR VIEWS › E: opinion@cityam.com COMMENT AT: cityam.com/opinion

Businesses themselves no longer see listing with the same level of importance

WE WANT

The FCA has been calling for relaxed regulations to increase London listings

Barbie songs have been streamed 52 million times on Spotify in the opening weekend alone, with Barbie World topping the charts as the most streamed song from the official album.

Certified Distribution from 03/04/2023 till 30/04/2023 is 67,569

WINE-DOWN WEDNESDAY

YOU WILL all, I assume, have yesterday been celebrating one of the highlights of the British calendar: National Cheese and Wine Day. For me it was the perfect opportunity to challenge my cheesemonger friend Jessica Summer, founder of luxury cheese and wine company Mouse & Grape. We know cheese and wine make great bedfellows, but could she give the occasion a national twist? I headed to my local Waitrose to select a few British bottles to see what Summer would pair them with…

CHAFOR ESTATE BACCHUS, BUCKS vs RACHEL, WHITE LAKE DIARY, SOMERSET

Bacchus grows so well in the UK and this still white is full of citrus zest. Summer produced “Rachel”, a hard goat’s milk cheese, claiming the high acidity of the wine would go well with the citrus notes of the cheese and that “fresh wines like Bacchus and Sauvignon Blanc make goats cheese come alive”. This one is a classic pairing and a bit of an easy win.

LECKFORD ESTATE’S 2019 SPARKLING BRUT, HAMPSHIRE vs TUNWORTH, HAMPSHIRE

I smelled the cheese before I saw it, a Tunworth from Hampshire, with a distinctive vegetal honk.

It is not the cheese for a date, or small enclosed spaces. “This might not be fireworks in your mouth,” said Summer, “but it’s a tried and tested match. The creamy cheese is mouthcoating and the bubbles of the wine cleanses your palate and sets you up for another bite”. The wine lifted each bite of the incredibly potent cheese, making for a useful if not magical pairing.

Wine without the snobbery, by Libby Brodie

PERFECT PAIRS: BRITISH WINE AND CHEESE

CHAPEL DOWN’S ROSÉ 2022, KENT vs PECORINO, YORKSHIRE

Wow. The ripe fruitiness of the pink wine alongside the nutty saltiness of the Sardinian style cheese was a game changer. This is the kind of relationship everyone wants: by being together, their best qualities came to the fore, neither one dominating or dismissing the other. Individually both were nice, but combined they shone like stars and had a ridiculously long, tasty finish.

SIMPSON’S PINOT NOIR 2020, KENT vs SAINSBURYS CHEDDAR

The humble cheddar is the UK’s favourite cheese but what happened here was totally unexpected. At first bite I was surprised by a sophisticated smokiness. “You’re trying to achieve different things with a pairing” explained Summer “before we were playing up the fruit, but this makes something savoury, earthy, smoky”. Never has a Sainsburys cheddar seemed so stylish.

BALFOUR HUSH HEATH ROSÉ

2018, KENT vs BEAUVALE, CROPWELL BISHOP, NOTTINGHAMSHIRE.

The creamy gorgonzola style cheese was already exciting, with pockets of blue exploding through its velvety texture.

RIDGEVIEW’S BLOOMSBURY NV, EAST SUSSEX vs HIGHMOOR, OXFORDSHIRE

A richer sparkling but still with a lovely fresh crispness which made the

WINE RECOMMENDATIONS

CLOUDY BAY

PELORUS ROSÉ

£28 SAINSBURYS

If the fact this wine is named after a famous dolphin who guided ships to safety isn’t enough to recommend it, know that it’s also a terrific sparkling rosé from New Zealand’s iconic Cloudy Bay. Complex, sophisticated, with satisfying waves of flint, spice and rose petals.

BLACK CHALK RUMOUR HAS IT 2022 £33

BLACKCHALKWINE.CO.UK

Rumour has it there’s a show-stopping new English wine in town, the first still white from the awardwinning Black Chalk. This slick chardonnay sings of the skill of the winemakers and the quality of the grapes from Kent. An exceptional bottle I’ll be buying repeatedly this summer.

Highmoor, a washed rind cheese, taste fruitier.

The creaminess of the bubbles was echoed by the creaminess of the cheese and with both halves being equally flavourful and powerful it

CHATEAU DES SARRINS BLANC SECRET 2021

£30 WANDERLUST WINE

A beautiful wine, exhibiting a lively balance of flavour and texture, this Vermentino from France shows that Provence shouldn’t just gain acclaim for its rosés. Ripe, round fruits, graceful blossoms and a fresh silkiness in each sip. A wonderful bottle over a leisurely weekend lunchtime.

created a lovechild of deliciousness in the mouth.

As complimentary couplings go, this was extremely good, but it was the next one that really blew my mind...

CHAMPAGNE RUINART

ROSÉ BRUT £75

BERRY BROS & RUDD

The oldest Champagne house, Ruinart has some serious credentials backed up by the phenomenal quality of its wines. Each sip of this rosé is like a summer’s day, with rosehips and wild strawberries vying for attention over the velvet softness of the bubbles. Delicious.

But add in the effervescent complexity of Balfour’s rosé and this was a match that had me looking at Summer with love in my eyes. And not only because we were six glasses deep. I would usually go for a sweet wine with a blue, but my eyes have been opened to sparkling rosé as well as to the excellent cheeses the UK produces.

VASSE FELIX

MARGARET RIVER FILIUS 2019

£14.99 MAJESTIC

This deliciously balanced, bold fruited Cabernet Sauvignon and Merlot blend exhibits both power and elegance. A vibrant red, it is generously rounded, with an assured opulence for the price. A perfect companion to a meaty dinner or to savour over an evening.