A STERLING PERFORMANCE GO CHARLIE GO? THE POUND LOOKS STRONG(ISH) FOR SUMMER

P11

REAL ROPE-A-DOPE ‘ENHANCED’ GAMES SET TO ROCK ATHLETICS P18

Brown bread: Cafe chain in administration

EXCLUSIVE LAURA MCGUIRE

THE OPERATOR of Le Pain Quotidien’s UK stores has fallen into administration, City A.M. can reveal.

The firm collapsed at the back end of last week, with only one store –owned by a different company and based in St Pancras station –remaining open.

PUMPED UP

SUPERMARKETS DID JACK UP FUEL MARGINS, SAYS COMPETITION REGULATOR

last night after the competition watchdog found they pumped up fuel prices last year.

Following a year-long investigation, the watchdog yesterday said that average supermarket fuel margins rose by 6p per litre between 2019 and 2022, with £900m syphoned out of customers’ pockets in total.

The CMA are calling for a plan to help drivers get fairer prices for fuel, including a

on pricing.

Under the new ‘fuel finder’ scheme, customers would be able to see varying pump prices at different sites – through third party apps – to help them find cheaper fuel.

The long-awaited announcement follows weeks of scrutiny, after the CMA announced in May that it would probe whether a “failure in competition” between supermarkets was subjecting

transparency” from supermarkets when cooperating with the investigation and yesterday fined Asda £60,000 for failing to provide relevant information when required.

The chair of the Commons’ business select committee, Darren Jones MP, said the price hikes were “unacceptable” whilst opposition parties and Penny Mordaunt MP, the Conservative leader of the house, also backed the CMA’s findings.

motorists” whilst Morrisons said the firm remained “extremely competitive on fuel pricing and although margins have increase, they remain very low” and that the CMA did not take into account the cost of running a fuel business, including payroll and energy, in their calculations.

The AA claimed drivers have been “convinced” that prices spike when wholesale prices increase but do not come down as quickly on the other side.

The future of the seven closed stores appears gloomy.

Administrators Kroll said the firm had been hit by changing workpatterns.

“Pressures on parts of the hospitality and casual dining sector have been well highlighted.

Brunchco UK Limited which is predominantly located in London has suffered from reduced revenues as a result of decreased footfall in the capital, high rents and increased wage costs,” Sarah Rayment, global co-head of restructuring at Kroll, told City A.M.

“As part of the next steps of the insolvency, we will be looking to realise value from the company’s leasehold interests and other assets,” she added.

Pint of the black stuff, but hold the booze: Diageo ups 0.0 production

DIAGEO is set to almost triple production of its non-alcoholic Guinness after a surge in the booze-free black stuff’s popularity.

The drinks giant has invested just north of £20m in a new

facility at its flagship St James’s Gate brewery in Dublin to meet an increased demand for nonalcoholic stout.

‘Guinness 0.0’ is now the bestselling non-alcoholic beer in four-pack format on the island of Ireland and in Great Britain, Diageo said.

The spike in demand comes amid increased interest in nonalcoholic options, with Diageo estimating its non-alcoholic Guinness will make up 10 per cent of all on-trade sales in the coming years.

Yesterday, Tesco confirmed that sales of so-called ‘no and

low’ beers were 25 per cent higher in June than at the start of the year as more and more Brits trade in the buzz –and the hangover –for the more sensible option this summer.

UK-based non-alcoholic beer brand Lucky Saint has even opened its own London pub.

“This expansion in production capacity at St James’s Gate is a testament to the quality of Guinness 0.0 and the growth of the non-alcoholic category as consumers look for more choice on different occasions,” said Barry O’Sullivan, Diageo Ireland’s managing director.

STANDING UP FOR THE CITY

Fiscal drag is exhibit A of the pernicious, dead hand of statism

FISCAL drag sounds exactly as it is: tedious. As inflation occurs –in wages and everything else –you might expect that tax rates would increase alongside. Of course, you’d be wrong –and in dragging more and more Brits into the higher rate of tax, the government is quietly hiking taxes year on year, albeit without the bother of announcing it. The damage to the economy is just as real, though, as any other

THE CITY VIEW

tax hike that ends up on front pages. The point of progressive taxation is that those with more, pay more; but fiscal drag simply means the tax system is dragging ever more middle-earners into high brackets, and successful higher-earners into rates meant

only for the super-rich. It is, of course, more of a problem for Londoners and those living in the south east than elsewhere. Some estimates over the weekend suggested that a quarter of all of us living in this part of the country are now within the higher rate of income tax –with increases across the country adding up to £241bn. That’s money that could, and should, be left in the pockets of people so they can meet the cost of rising

energy bills and weekly shops. Labour are reportedly fishing around for a ‘retail offer’ on tax –one they can sell on the doorstep. They will probably rule out the wonkish-sounding ‘increase tax thresholds in line with inflation’. But it would be of more value, frankly, than a nominal penny or so off income tax, as well as making the tax system fairer. Perhaps the Tories could get in there first. Either way, the current stealth hit must end.

YOU CARROT BE SERIOUS!? The diehard fans of tennis player Jannik Sinner, the Carota Boys, strut around SW19 on the opening day of the Wimbledon Championships

Javid: Treasury orthodoxy exists for a reason –we don’t want a perma-crisis

JESSICA FRANK-KEYES

LIZ TRUSS “ignored” warnings from Treasury mandarins meaning the country “paid the consequences” for her disastrous mini-budget, Sajid Javid has said.

The former chancellor said the focus in HM Treasury on “balancing the books in the medium term” was a good thing, and without that the UK “would have constant financial crisis”.

WE’RE OPEN FOR BUSINESS...

YOU may have seen reports in other newspapers that City A.M is ‘on the block’ –and they’re right. As we look to invest in a new and better City A.M., we’re holding negotiations about investment and are also open to a sale. We’ve appointed FRP Advisory to handle the process. As a business newspaper, it’s only right we tell you our business news, too. In the meantime, it’s business as usual for all of us at City A.M. towers.

WHAT THE OTHER PAPERS SAY THIS MORNING

THE FINANCIAL TIMES

HSBC SET TO HIRE CREDIT SUISSE’S QATAR TEAM IN BLOW TO UBS

HSBC is in advanced talks to poach a team of senior Middle East wealth managers from Credit Suisse, as it looks to challenge its rival in the Gulf, according to two people with knowledge of the moves.

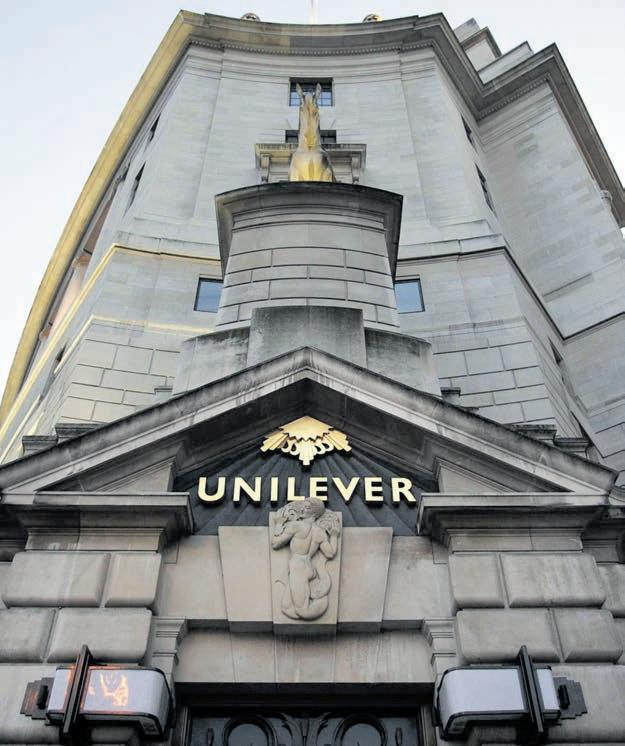

THE GUARDIAN UNILEVER NAMED ‘INTERNATIONAL SPONSOR OF WAR’ BY UKRAINE

Unilever has been named as an sponsor of war by the Ukrainian government after the company became subject to a law in Russia obliging all large firms operating in the country to contribute to its war effort.

THE TIMES

ASTRAZENECA TRIAL FOR LUNG CANCER DRUG LEAVES INVESTORS DEFLATED

Trial results for a potential blockbuster drug developed by Astrazeneca slowed progression of lung cancer but the company’s shares fell as the possible benefits disappointed the City.

Sue Gray broke civil service rules with Keir Starmer meet

Speaking at an Institute for Government (IfG) event yesterday, Javid, who is stepping down at the next election after over a decade as an MP, said he believes the so-called ‘Treasury orthodoxy’ criticised by ex-PM Truss and former Chancellor

Kwasi Kwarteng does exist.”

He continued: “I’m certain the Treasury would have told Liz Truss when she was in office that if you go out with a budget that’s going to blow the deficit,

without any narrative of laying the groundwork… the markets are not going to like it and you’ll get a massive negative reaction.”

The former Chancellor is set to quit politics at the next election, having left No 11 after falling out with Boris Johnson’s aide Dominic Cummings.

The former Deutsche Bank man, who enjoyed stints in New York and Singapore whilst a high-flying financier, will return to the private sector.

He has already lined up work with London-based asset management Centricus and is expected to be in further demand.

PATRICK DALY

PARTYGATE investigator Sue Gray broke civil service rules “as a result of the undeclared contact” between her and the Labour Party, according to a Whitehall investigation.

The former senior civil servant is due to take up the role as opposition leader Sir Keir Starmer’s chief of staff after being cleared to start the job in September by the Advisory Committee on Business Appointments (Acoba), the anticorruption watchdog.

But a separate Cabinet Office inquiry found Gray, who refused to give evidence to the probe, broke the civil service code due to contact with Labour ahead of her resignation in March.

Labour branded the investigation “Mickey Mouse nonsense” and said the conclusion is a “political stunt by a Tory government”.

Cabinet Office minister Jeremy Quin said: “This process found that the Civil Service code was prima facie broken as a result of the undeclared contact between Gray and [Starmer].”

Buy to let shop secures £500m Chetwood boost

LENDINVEST, the London-listed property fintech, has received a £500m investment boost from Chetwood Financial to fund some of its future lending

The investment will fund mortgage originations from Lendinvest’s buy-tolet mortgages, aimed at professional landlords, and residential mortgages, for those underserved by high street mortgage providers.

Chetwood, a Wrexham-based digital bank, has become the latest financial firm to support LendInvest’s products.

In May, BNP Paribas joined a £300m funding syndicate alongside HSBC and Barclays to support Lendinvest’s short term mortgage market.

Chief executive of Lendinvest Rod Lockhart said: “We are delighted to receive this funding from Chetwood to support the scaling of our BTL and res-

idential mortgage products. This funding follows our recent sale of a portfolio of residential buy-to-let mortgages to Chetwood for £243m, and further strengthens our partnership with the business.

“The commitment from Chetwood underscores the growing confidence and trust that numerous financial partners have placed in Lendinvest.

“This investment will strengthen our BTL proposition and newly launched residential mortgage product, empowering us to provide competitive products to professional landlords and prospective homeowners across the nation,” Lockhart continued.

The investment follows shortly after Lendinvest sold a £243m buy-to-let portfolio to Chetwood at a loss of £10.5m. Lendinvest said at the time the sale would allow the capital to be redeployed in more profitable places.

JD heads for the Gulf with deal for more than 50 franchise stores

LAURA MCGUIRE

JD SPORTS is set to arrive in the Middle East and the Gulf after agreeing its first ever franchise deal. The accord with Dubai-based GMG will see the athleisure standout expand into the United Arab Emirates, Saudi Arabia, Kuwait and Egypt.

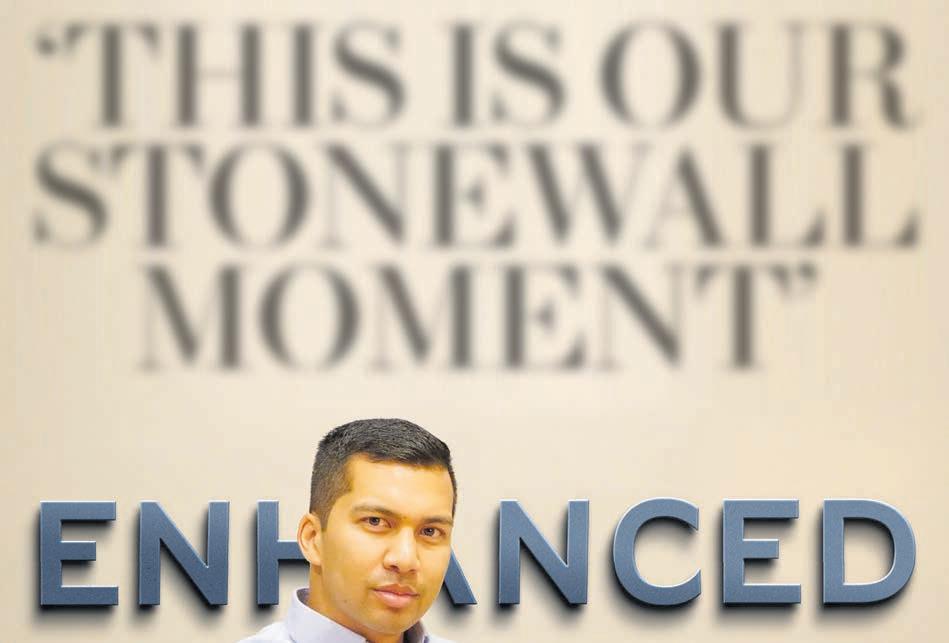

Carillion finance boss struck off for eleven years

JAMES SILVER

A FORMER Carillion boss has been banned from holding any company directorships for 11 years by the Insolvency Service, as the fallout from the construction outfit’s collapse five years ago continues.

Zafar Khan, who served as the firm’s finance chief, was found to have been party to the issuance of misleading financial statements.

Sky News’ Mark Kleinman first broke the story before it was confirmed by the official body.

Litigation is still ongoing against other members of Carillion’s senior team, with a trial set to commence in October.

The trainers and sportswear chain noted that a heightened focus on health and wellness as a result of the Covid-19 pandemic has driven strong growth in the athletic leisure market in the Middle East.

“Through my own career, I have seen firsthand the massive untapped potential for retailers in the Middle East,” JD CEO Régis Schultz said.

The firm’s sudden implosion has led to widespread changes in the audit profession, with KPMG –the firm’s auditor –eventually settling a £1.3bn lawsuit with Carillion’s creditors earlier this year. They were also fined £14m.

The firm’s collapse has been cited as the reason behind the creation of a new audit watchdog, the Audit, Reporting and Governance Authority, which will replace the existing Financial Reporting Council.

FCA: Insurers are failing customers in cost squeeze

CHARLIE CONCHIE

INSURANCE firms are failing vulnerable customers and need to put “wrongs right” as Brits are hammered by a cost of living crunch, the Financial Conduct Authority has warned.

In a statement yesterday, the City watchdog said home and motor insurers must “improve their treatment of vulnerable customers and how they handle customers claims” after it found an uptick in complaints about insurers.

Lengthy complaint handling times and meagre settlements for claimants were among the key complaints to crop up, the FCA said.

“The regulator discovered instances of motor insurance customers being offered a price lower than their car’s fair market value after it had been written off, which is against FCA rules,” the regulator said.

“Relevant firms have been told to put these wrongs right and where necessary provide redress to affected customers.”

The review from the watchdog found that some firms were unable to show

Pressure grows on pension funds to back Hunt’s investment reforms

CHARLIE CONCHIE

PRESSURE is growing on pension schemes to throw their weight behind reform as the Chancellor prepares to unveil a slew of measures to boost investment in private growth firms next week.

loosen restrictions around pension schemes and use retirement cash to fill a growth funding gap facing smaller unlisted companies.

Industry figures told City A.M. yesterday that reform needed to be accelerated.

capital and private equity and reaping the rewards for their members,” a spokesperson for the British Venture Capital Association told City A.M.

they were properly monitoring customer outcomes and better information sharing was needed with middle-men claims intermediaries in the industry.

The FCA’s consumers and competitions chief Sheldon Mills warned firms that “timely and fair” claims were needed “during the cost of living squeeze”.

“While we have seen many firms treating their customers correctly, we found too many examples of customers not receiving the service they’re entitled to,” he added.

Alongside the review, the FCA has issued new guidance for insurance firms about how they should support their customers and identify customers who are in financial trouble.

The warning shots from the watchdog comes after the Bank of England last week told insurers to brace for “claims inflation” and rigorously assess the impact of claims on their solvency.

The BoE said that claims inflation due to factors such as rising wage, medical and raw materials costs is expected to affect all general insurers.

IG GROUP Derivatives trading firm chief June Felix to take period of medical leave

IG GROUP Holdings yesterday announced that its chief executive June Felix will be stepping aside for a “short period of medical leave”. Felix has been at the helm of IG Group since 2018 following 25 years in leading global financial services firms. In a statement yesterday, IG Group Holdings said she is “taking a short period of medical leave from the business”. Charlie Rozes, chief financial officer, will be taking over her day-to-day responsibilities.

Government urged to go big on investment to unlock £150bn boost

JACK BARNETT

RISHI Sunak and Jeremy Hunt should ramp up government investment spending to unlock a £149bn boost to the UK economy, an influential think tank has urged today.

Spending on quality capital projects like expanding renewable energy infrastructure and improving transport networks could “pay for itself” by yielding tens of billions of pounds in growth and tax revenues, according to a

Tech start-up groups have been lobbying ministers for years to

“Overseas pension funds are investing 16 times more than domestic pensions in British venture

“Whilst investment into the UK is a welcome vote of confidence, relying so heavily on foreign investment to scale up UK companies will hold the UK back.”

report by the Institute for Public Policy Research (IPPR).

Harnessing the government’s capacity to borrow from international investors to raise cash to channel into the economy may “unlock industries of the future, spur technological advances, and thus boost growth,” the report argued.

“The GDP growth benefits can still ensure alignment with falling debt to GDP ratio,” Carsten Jung, senior economist at the IPPR, said.

We need to talk about 1 in 3 children born today having a good chance of living to 100. Let’s start having that conversation. Let’s talk about making the most of living longer.

So Energy back on its feet –but trust must be won back, admits boss

NICHOLAS EARL

THE ENERGY industry needs to win back the trust of customers following the collapse of dozens of suppliers, the boss of a leading challenger firm has admitted.

So Energy chief executive Monica Collings (right) told City A.M. she thought billpayers had a right to feel aggrieved over record energy bills, which have been worsened by the collapse of poorly managed energy firms.

She believed “the wave of supplier failures” has severely impacted customers’ trust in the industry.

“It hasn’t done us any favours, and of course customers are still picking up the cost for those failures, which is impacting bills as well,” Collings said.

Over 30 suppliers have fallen since the rebound in demand for gas after the pandemic exposed firms with

insufficient hedging strategies, while the significant hike in wholesale costs following Russia’s invasion of Ukraine meant the price cap put immense strain on suppliers.

So Energy was one of the companies seemingly under pressure, with concerns growing over its future last winter when it appointed financial advisors in a bid to secure £50m of emergency funding.

However, Collings is looking to ease the concerns of its 300,000 customers –confirming that So Energy’s position in the market is secure.

She revealed the “exploration for funding” was no longer needed following both the decline in wholesale prices –which enabled the supplier to buy gas and electricity at lower costs – and the scale of the government support package for customers.

“The change in those circumstances

and the support from our majority shareholder ESB in combination allowed us to no longer require the additional funding,” she said.

Looking ahead, Collings said she expects So Energy to “punch above [its] weight” on matters that are important to them. This includes matters such as representation in the industry, with Collings the only female chief executive in the retail supplier market, and also further support for ultra-high energy bills.

UK factories slip further into recession territory as spending dries up

JACK BARNETTBRITAIN’s factories have plunged further into recession territory, driven by domestic and foreign buyers reining in spending amid intense economic uncertainty, a closely watched survey out today shows.

S&P Global and the Chartered Institute of Procurement and Supply’s (CIPS) purchasing managers’ index (PMI) for the UK’s manufacturing industry slipped to 46.5 in June from 47.1 in May.

It means the sector has been in the sub 50 point negative growth territory for 11 months in a row, although the reading was upgraded from an initial estimate of 46.2. The revised figure also topped the City’s expectations.

Shrinking homegrown and overseas spending have forced factories to scale

back production, tipping the sector into recessionary conditions.

“Producers are being hit by weak domestic and export market conditions with clients showing a greater reluctance to commit to spending due to market uncertainty, increased competition and elevated costs,” Rob Dobson, director at S&P Global Market Intelligence, said.

Looming economic headwinds are causing companies to think twice about buying capital goods for fear of being unable to sell their products in a softer economy, hitting manufacturers’ bottom lines.

Manufacturing contributes a small chunk to the UK’s overall economic output, which is largely generated by services firms. A separate PMI later this week is expected to show the services economy is motoring ahead.

FACTORIES really are having a tough time of it. The sector was among the first to feel the effects of global supply chains breaking down after lockdowns ended. Then, they were hit by rising raw material prices. Now, they are being crimped by rising interest rates. Global demand is also receding.

It’s hardly surprising then that the manufacturing PMI has been in the sub-50-point negative area for nearly a whole year. Factories’ component mix has either become much harder to source or more expensive to buy.

Manufacturing’s influence on the

CHOO CHOO The Flying Scotsman still glorious in its 100th year

Aslef announce further week of strike action

GUY TAYLORTRAIN drivers are set to stage yet another overtime ban this month, adding five days to an already announced seven.

Aslef drivers will refuse to work overtime from July 8 to 15, and then from July 17 to 22.

UK economy is pretty slim compared to the 1980s. This means that any slowdown in the sector won’t deliver a big blow to aggregate output.

Green campaigns more popular than ever for activist investors

INVESTORS have launched more environmental campaigns than ever before this year, as more companies are coming under pressures from a wave of shareholder activism, a new report has found.

The UK is a top target for activist investors as major firms like Shell, BP, HSBC and The Restaurant Group have faced shareholder rebellions this year.

The number of activist campaigns has grown steadily each month since January, resulting in 25 launched across Europe in May,

Energy bosses told not to puff up bottom lines

according to professional services firm Alvarez & Marsal.

The growing momentum bucks the trend of previous years where new campaigns dipped after annual general meeting (AGM) season, typically in March and April.

Environmental campaigns have become more prominent as activists ramp up calls for corporations to commit to stronger climate policies.

They accounted for 12 per cent of all activist campaigns in 2023, compared to just 4 per cent in 2019.

Energy giants BP and Shell have faced shareholder revolts.

THE UK’s energy watchdog has urged suppliers to retain profits to protect consumers rather than dish it out to investors, as the energy crisis begins to ease.

In a letter to household energy suppliers, Ofgem warned that it would step in and take action if it finds that any companies are abusing its pricing rules. It comes as wholesale energy prices have begun to ease and domestic suppliers are expected to return to profit after five years of losses.

The RMT meanwhile will strike on July 20, 22 and 29, clashing with two men’s Ashes Tests and the Open Championship in Liverpool.

The new ban will affect 15 train operators across the country, which marks a significant escalation of the long-running dispute over pay.

Aslef general secretary Mick Whelan said: “We want to resolve this dispute. Train drivers don’t want to be inconveniencing the public.”

JACK BARNETTThe sector though could be the spark that finally triggers inflation’s descent. Input costs declined to their lowest level since February 2016 last month, reinforcing the Office for National Statistics’s calculations that factory gate prices are rising much slower.

The government said it has facilitated a pay deal which would offer train drivers an average salary of £65,000 a year.

Our best just got better

The height of innovation and elegance in home cleaning. Brilliantly craft ed with superior finish, the AirRAM Platinum combines advanced technology with unrivalled performance.

With a powerful motor optimizing air flow, the AirRAM Platinum effortlessly lifts dirt and dust from your floors, leaving them immaculately clean.

Cordless, lightweight and with a slim profile, glide easily around and underneath furniture, and into tight spaces.

For an even better clean we’ve added an anti-wrap brush bar and hygienic dust collection system.

Emptying your AirRAM is easy too; with no more messy bags, eject the dirt with a simple slide.

Forward Inertia Drive

Enhanced with Forward Inertia Drive, the AirRAM Platinum glides forward effortlessly – cleaning your home has never been easier.

Anti Hair Wrap Technology

The AirRAM Platinum’s built-in comb keeps the brush bar clean, so hair and dust go straight into the bin, keeping your vacuum performing at its best.

Strengthened with Aluminium

We’ve strengthened our AirRAM Platinum with aluminium to help it withstand the extra strain of busy homes and pets.

“With a love for design and a passion for helping people, I started my own company creating lightweight, cordless products, that make life a little bit easier. The AirRAM Platinum is our very latest design, combining beauty and optimum functionality.”

Nick Grey, Inventor

Nick Grey, Inventor

Use code: UH53

SAVE £70 PLUS FREE NEXT DAY DELIVERY WAS £349.99

NOW

£279.99

UH53 Use code:

“Quite a brilliant piece of equipment” Quite a brilliant, and beautiful looking, piece of equipment. It is well thought out and in my view it comes out total tops in every single aspect.”

Terence H

Terence H

"Best Vacuum Ever.”

Damn this thing’s a beast, it works well on my hard floors and cuts through the carpeted areas with ease, even picking up all the cat hair...love it."

Richard J"It’s the best thing ever!!!”

This is the easiest vacuum cleaner I have ever used it’s like a dream to push over the floor. I wish I had known just how much it was going to save me time and effort earlier.”

Alison TEasy-Empty Bin

The AirRAM Platinum efficiently compresses dirt and hair as you vacuum. All you need to do is remove the bin and empty it with a simple slide.

LED Headlights

With smart LED headlights at the front of the AirRAM Platinum dirt has nowhere to hide. Cover more area for spotless results.

Khan unveils renovated east London studio in boost to UK film industry

JESS JONES

LONDON mayor Sadiq Khan has described the newly renovated 3 Mills Studios in east London as a shining light in the capital’s push into the creative industries during a visit yesterday.

The project, funded with £3m from City Hall, includes upgrades to several historic buildings, the creation of over 10,000 sq ft of creative workspace and improvements in sustainability and “economic viability”.

Visiting 3 Mills yesterday, Khan said the studios, which have been a production location for titles such as The Great and Never Let me Go, have been “pivotal” in London’s success as a “global hub” for film and television.

“The restoration of these historic buildings not only offers much needed space for more industry production to take place in the capital, but also supports over a thousand jobs in the heart of east London,” said Khan.

In the past, London has had to turn

Meta called out as pet scams on Facebook surge

CHRIS DORRELL

FRAUDSTERS on Meta-owned platforms are increasingly taking advantage of British animal lovers, new data shows.

According to research from Lloyds, pet scams were up 24 per cent compared to last year with the average victim losing £307.

Dogs were the most common pet used to scam unsuspecting Brits out of their money with Yorkshire Terriers and Blue Staffordshire Bull Terriers most frequently involved. Across all species, over half of these scams start on Facebook and Instagram, Lloyds said.

Scammers often post adverts for pets that don’t exist on Facebook and Instagram, Lloyds noted, keeping a close eye on which breeds are in high demand. They then demand prepayment from customers interested in viewing the illusionary animal before pulling down the advert.

“Social media companies are making money from these criminals, and those searching for a pet are left heartbroken twice. Once by the

loss of hundreds, or even thousands, of pounds. But also by the realisation and disappointment that a pet won’t be joining the family after all,” Liz Ziegler, fraud prevention director at Lloyds said.

Banks have been hitting out at big tech firms for their lack of action on fraud even though around 78 per cent of authorised push payment (APP) fraud started online last year.

Meta in particular has been targeted by the banks, with both TSB and Lloyds calling out what proportion of APP fraud originates on specifically Metaowned platforms. In TSB’s case, the figure was 80 per cent while with Lloyds it was around two-thirds.

Despite the high level of fraud originating online, plans to force big tech firms to reimburse fraud victims were watered down earlier this year.

A Meta spokesperson said:

“We don’t allow the sale of animals on our platforms and we remove this content when we become aware of it. This is an industry-wide issue and scammers are using increasingly sophisticated methods to defraud people in a range of ways including email, SMS and offline.”

away lucrative US film and TV production deals due to limited studio space. The renovation will allow the studios to expand their offerings to film, TV productions, and theatre, with £3m of the funding provided by the mayor and £3m by the London Legacy Development Corporation.

Adrian Wootton OBE, chief of Film London and the British Film Commission, said the upgrades were “essential to maintaining the UK’s attractiveness to domestic and international productions”.

Apple given a reality check on VR headset

JESS JONES

APPLE has slashed production forecasts for its $3,499-a-piece Vision Pro headset as the firm experiences teething problems in its foray into virtual reality, according to reports. The tech giant has had to halve 2024 shipments for its mixed-reality headsets with predictions down from 900,000 to 400,000 in the first year, according to a Financial Times report.

The report said that Chinese manufacturing company Luxshare,

More headaches for Twitter ad market as Musk imposes daily limit on tweets

JESS JONES

TWITTER advertising troubles may have gone from bad to worse after Elon Musk put his foot in it againthis time by restricting users’ viewing limits over data concerns.

It comes after the billionaire ex-CEO of Twitter imposed a temporary ‘rate limit’ on all users, effectively capping

the number of tweets that accounts can view per day, in order to “address extreme levels of data scraping and system manipulation”.

The move has sparked concerns over the site’s advertising potential, as Twitter users are now unable to see advertisers’ pages once they max out their daily views.

Jasmine Enberg, principal analyst at

Insider Intelligence, said that capping users views could be “catastrophic” for Twitter’s online advertising business, which is already struggling since droves of top advertisers left the platform last year.

“This certainly isn’t going to make it any easier to convince advertisers to return. It’s a hard sell already to bring advertisers back,” she said.

Vision Pro’s only supplier, has experienced setbacks due to manufacturing and design difficulties, mainly with the complicated micro-OLED displays.

Apple and Luxshare were contacted for comment.

It comes following Apple’s historymaking valuation on Friday when it surpassed a towering $3 trillion (£2.36 trillion) valuation at market close – the first publicly traded company to do so.

Apple hit the landmark $3 trillion before in January 2022 but only in

day trading.

Susannah Streeter, Hargeaves Lansdown head of money and markets, said the Vision Pro was “already running up against challenges, given its high price point, and now it’s veered into another potential setback”.But Apple has previously recovered “spectacularly well” from similar situations once users have tested their products, Streeter added.

Shares in Apple have soared 49 per cent since this time last year – their largest half-year gain since 2009.

Many top advertisers have left Twitter since the eccentric billionaire bought the platform

Many top advertisers have left Twitter since the eccentric billionaire bought the platform

Every spring The Lord Mayor’s Appeal hosts their annual We Can Be event, opening the doors for almost 200 young women to 12 businesses and allowing them to experience life in a City office first hand. In many cases this is a first for the young people – the first time they step foot into the swanky offices of a City law firm, the first time they get to meet professional women at all levels in a board room and the first time they share a room with senior leaders candidly telling their career stories. On July 11, they will host an introductory morning for any perspective City businesses interested in taking part in We Can Be 2024 at the Bank of China. Taking place at the end of March, We Can Be 2023 was split into two sessions. The morning workshops varied from introductions to financial services via fun activities to round-table discussions on how to communicate effectively in the workplace. After lunch, the young women from 12 schools came together at 155 Bishopsgate for an interactive afternoon of live talks, activities and goal setting chaired by Vanessa Chiedza Sanyauke, CEO of The Girls Talk and a room of senior leaders, advocates and City role models.

Having spent the morning with girls from Hatch End High School in the London Borough of Harrow, Zariatt Masood from The Duke of Edinburgh’s Award said, “We Can Be is really inspirational because it gives women the opportunity to find role models that look like them, who might have come from the same background and empowers them to forge their own career. They are going to be equipped with skills that will be transferrable when they apply for jobs, do their CVs and university applications. It’s a chance for them to see what life beyond school is like.”

Sponsored by City businesses LGT Wealth Management and Evelyn Partners and supported by The Lord Mayor’s Appeal’s charity partners The Duke of Edinburgh’s Award and Place2Be who onboarded many of the participating schools, the 2023 event was a huge success. The aim of We Can Be is to inspire young people into roles in the City if they want them and to highlight that they already possess many of the skills needed to succeed –from effective personal branding to problem solving to critical thinking.

By empowering these bright young women to see their value, we can raise their aspirations and smash their own stigma around succeeding.

Emma Moffat from Evelyn Partners said on hosting the young women, “If you don’t have access to The City or a role model in The City, it’s really hard to imagine yourself there. Personally, I didn’t have anyone in The City, but I was fortunate enough to do some work experience. Many people don’t have that opportunity. It’s really important just to show these young girls what an average day in the office looks like.”

The organisations that took part got to meet tomorrow’s talent today and to hear first-hand what these young women need to feel confident in their career choices. They were gifted insights into the key drivers and desires of 15–18-year-olds, helping them to shape attractive recruitment strategies for the brightest stars of the next generation. By connecting with young women from a range of London and UK boroughs, those businesses can best understand the need to create equitable and supportive workplace cultures for all employees regardless of background, to not just attrac t the best but retain and get the most

THE LORD MAYOR’S APPEAL TO HOST AN INTRODUCTION TO INITIATIVE WE CAN BE AT THE BANK OF CHINA THIS JULY

think? Young attendees on the day were asked to hand in a pledge to themselves inspired by their We Can Be 2023 journey. Pledges ranged from ‘to increase my confidence and leadership skills’ to ‘be more open-minded with my future job decisions and focus in school.’

They were also asked what the day helped them think they could be. Some of the best answers included ‘a lawyer at Linklaters’, ‘a successful female in cyber security’ and ‘an ambassador to a European country or a lobbyist for an International company’.

On Tuesday July 11th from 10.30am to 12pm, The Lord Mayor’s Appeal will

We Can Be is a fantastic opportunity for City businesses to showcase the broad range of roles and industries the City of London has to offer and the opportunities available to the young women who visit for the day. They will also have the chance to create a lasting impact on their career readiness journey through longer term engagement. There will be speakers from Augmentum who will talking about their ex-

ment on the benefit of being a We Can Be sponsor.

The We Can Be 2024 Introductory Morning will take place at the Bank of China on July 11th, 2022, from 10.30am-12pm. To grab one of the last spaces available, please email We Can Be Programme Manager, Carla Emmanuel at skills@thelordmayorsappeal.org

We Can Be is really inspirational because it gives women the opportunity to find role models that look like them

BARRELLING around in the piping of the UK economy so far this year has been a sustained pound sterling rally. Britain’s currency in 2023 has been one of the best performers in the rich world. It is up nearly five per cent against the US dollar at $1.26, a far cry from the record low it kissed against the greenback in the days after Liz Truss’s haphazard mini-budget.

Also a world away for people who remember getting $2 for every £1.

Against the euro, sterling’s gained about 2.6 per cent.

Good news for holidaymakers. Good news for households. Good news for investors and good news for a government trying to halve inflation by the end of the year.

There’s some simple economics underlying the pound’s rise.

Britain is suffering from the worst inflation problem in the rich world. It remained unchanged at 8.7 per cent in May. Core inflation rose above seven per cent. Services prices are rising at a similar pace. This is plainly bad for ordinary people. It has also compelled City traders to bet on the Bank of England raising interest rates to more than six per cent. 5.5 per cent or 5.75 per cent is probably more realistic.

As a result, financial markets now think Bank governor Andrew Bailey will outdo his peers at the Federal Reserve and European Central Bank. Markets think US rates will peak around 5.75 per cent and four per cent in Europe.

Investors are faced with a suite of decisions every day on where to park their cash. Their only goal is to make as much money as possible.

With UK rates expected to outstrip the US’s and eurozone’s, there is, in theory, little stopping traders from piling into UK assets.

They need to buy up pounds to get their hands on those assets. That dynamic has been steering the pound’s strong 2023. A strong currency endows well known advantages to an economy. It keeps inflation lower than it would’ve otherwise been by making it cheaper to import goods and services.

Consumers tend to feel more confident in their country’s economic prospects when surrounded by positive currency news.

In the UK, though, it can have damaging effects on the stock market. A large chunk of the FTSE 100 consists of firms who generate their cash overseas.

When the pound strengthens, it crimps the amount of cash these companies can make when exchanging their overseas income (known as foreign exchange arbitrage). UK exporters’ products also become less competitive.

Those factors have partly reversed the FTSE’s rampant start to the year.

But there are signs that the pound’s ascent is being arrested by recession risks reigniting.

Last week, sterling clocked one of its worst days against the dollar in a month,

Like the UK economy, pound sterling suffers from a certainty deficit

WHAT I’M READING

Where has this much-touted recession gone? Pantheon Macroeconomics reckon its disappearance is down to the changing structure of the mortgage market blunting the transmission of the Bank of England’s 13 successive interest rate rises and savers finally getting a decent return on their accounts. As a result, household income “has been boosted by the increase in interest rates so far,” they said in a note to clients.

dropping 0.8 per cent.

“The timidity of sterling’s recent appreciation is puzzling,” according to Samuel Tombs, chief UK economist at Pantheon Macroeconomics. He calculates the currency should be trading at $1.40 and €1.24.

There are other factors traders have to consider if Bank governor Bailey and co kick rates above six per cent.

Such a move would chill the housing market, intensify the real income squeeze and cool business investment, all of which raise the likelihood of a UK recession. No one wants to be left holding the bag in a declining economy. Traders holding UK assets would be left doing so. Reasons to turn their back on the pound are back on the table.

Concerns about high inflation entrenching in the economy have amplified recently, which are partly outweighing any benefits traders expect to receive from steeper interest rates. Inflation is still far above the UK’s nominal interest rate.

This dynamic is what led to Liz Truss’s downfall. Her fiscal strategy was likely to keep inflation higher for longer and provide little stimulus to growth. There were very few incentives for people to pile into UK assets, sinking the pound to its record low. Sterling has done well so far in 2023. But, much like the UK economy as a whole, it has underperformed due to persistent uncertainty about what risks lie around the corner.

Management consultants cash in from AI and cyber hacking boom

external experts lifted the UK management consultancy sector’s income to £18.6bn last year, up from £14.4bn in 2021, according to the sector’s representative body.

Buoyancy is forecast to carry on this year, with revenues in the sector tipped to expand 13 per cent.

Research by the Management Consultancies Association (MCA) and

research firm Savanta found that businesses are trying to erect barriers to avoid being infiltrated by hackers.

They are also seeking to integrate AI tools like ChatGPT into business practices to maximise revenues, steering them toward employing the services of management consultants like McKinsey and Boston Consulting Group.

City A.M.’s economics editor Jack Barnett takes a deep dive into the state of the economy in his weekly column

DORRELL

CHRISTOPHER

BANKS are in the firing line for low savings rates once again after the big four lenders received another letter from the influential Treasury Committee.

Writing to the UK heads of the big four banks, Treasury Committee chair Harriet Baldwin said the Committee was “concerned that banks’ savings rates remain too low, particularly in instant access savings accounts.”

She highlighted that the Bank of England’s base rate has now reached five per cent while the big four banks –HSBC, Barclays, Lloyds and Natwest –offer rates between 0.9 per cent and 1.75 per cent.

Commenting on the letters, Baldwin said: “With interest rates on the rise and our constituents feeling squeezed by rising prices, it is only right that the UK’s biggest banks step up their measly easy access savings rates. The time for action is now.

“The biggest high street banks have a particularly important role to play in encouraging saving. Currently, they are failing on that social duty,” she continued.

Baldwin pointed out that the incoming Consumer Duty, which comes into force at the end of this month, will ask firms to “explain and justify their pricing decisions”, including on savings rates. The regulator will assess whether the products offer ‘fair value’ to consumers.

The banks were asked how the Consumer Duty will change pricing decisions and whether existing offers are consistent with the new regulation. They were also asked whether existing

ANNOUNCEMENTS

BANKS UNDER FIRE OVER ‘MEASLY’ SAVINGS RATES

customers have been given competitive rates in line with base rate changes.

Angela Eagle, member of the Treasury Committee, commented: “This blatant profiteering has been shocking, and it’s clear to me this behaviour is miles away from the incoming requirement for firms to treat their customers fairly and with respect.”

The Committee wrote to the Financial Conduct Authority (FCA) as well, asking how it would measure ‘fair value’ in pricing decisions.

The watchdog was asked whether a

LEGAL AND PUBLIC NOTICES

CITY of LONDON

The PLANNING ACTS and the Orders and Regulations made thereunder This notice gives details of applications registered by the Department of The Built Environment Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission

Crescent House, Golden Lane Estate, London, EC1Y 0SL 23/00466/FULL

Repairs and minor alterations to the existing

Additional Listed Building Consent sought under 1-5 London Wall Buildings, London Wall, London, EC2M 5NS 23/00531/LBC

Replacements of Libor rate risk stability

HUW JONES

THE USE of four dollardenominated alternatives to the now scrapped Libor interest rate need restrictions to avoid threatening financial stability, a global securities watchdog said yesterday.

IOSCO, a global securities watchdog group that includes the US Securities and Exchange Commission as a member, said a review has identified “varying degrees of vulnerability” in these four unnamed rates.

The final dollar-denominated London Interbank Offered Rate or Libor was published last Friday.

251 Lauderdale Tower, Lauderdale Place, Barbican, London, EC2Y 8BY 23/00548/LBC

some new internal stud walls are to be built to

187 Fleet Street, London, EC4A 2AT 23/00554/LBC

bank has changed its rates as a result of its intervention and what enforcement action is available if the rates are not in line with the Consumer Duty.

The letter is the latest in the Treasury Committee’s campaign against the perceived low savings rates offered by banks. More and more politicians have weighed in on the subject, with Chancellor Jeremy Hunt saying the government was working on a “solution” to the issue.

However, lenders have argued that easy access accounts are not the right

place to focus and have repeatedly pointed out that higher rates are available on other savings products, which involve locking up funds for a longer period of time.

A Barclays spokesperson said: “We continue to remain committed to providing our customers with a range of options to help them save for their goals and regularly review our savings product rates.”

Natwest declined to comment.

Lloyds and HSBC were contacted for comment.

Once dubbed the most important number in the world, Libor has been withdrawn after banks were fined for trying to rig a rate referenced in credit cards, business loans and mortgages worth trillions of dollars globally.

Libor has largely been replaced by rates compiled by central banks, such as the dollar-denominated Secured Overnight Funding Rate, or SOFR, from the Federal Reserve. Regulators have previously warned that these alternatives could be vulnerable. Reuters

Crescent House, Golden Lane Estate, London, EC1Y 0SL 23/00650/LBC

Repairs and minor alterations to the existing

Diageo-backed sustainable paper bottle maker

Pulpex set to unveil £20m raise in funding round

A SUSTAINABLE packaging business backed by Diageo is gearing up for a new funding round in efforts to deliver a commercial product line.

Paper bottle maker Pulpex said it has secured financing from CMPC, a Chilean pulp and paper company, to enable the production and supply of over 2bn paper bottles to consumer brands worldwide by 2028.

Sources told Sky News, which first broke the news, that the Series C funding will be between

£20m-£25m.

Pulpex delivered the first Johnnie Walker whisky bottle made entirely from paper products.

The group, which operates from a facility in Cambridgeshire, was launched in 2020 as a joint venture between Diageo and Pilot Line, a venture management company.

“Our technology will enable and accelerate the availability of sustainable fibre packaging for our major brand customers and their packaging suppliers, in turn enabling them to meet consumer demand for more sustainable

packaging and helping them to meet their carbon reduction goals for 2030,” Scott Winston, Pulpex chief executive, said.

Felipe Alcalde, chief competitiveness and innovation officer at CMPC, added: “We are very excited to be partnering with Pulpex and have an enthusiastic, dedicated team of technical, strategic and commercial experts to support Pulpex’s growth to industrial scale, maximising the many synergies to develop more sustainable products based on our pulp.

LAURA MCGUIRE New funding will allow the paper bottle maker to supply 2bn bottles to consumer brands by 2028, Pulpex saidCITY DASHBOARD

YOUR ONE-STOP SHOP FOR BROKER VIEWS AND MARKET REPORTS

LONDON REPORT BEST OF THE BROKERS

To appear in Best of the Brokers, email your research to notes@cityam.com

SUMMER SNOOZES

FTSE 100’s downbeat run extends into second half of 2023

LONDON’s FTSE 100 kicked off the second half of the year in subdued style yesterday, despite a rally among Britain’s largest banks and industrial giants.

The capital’s premier index was up for most of the day, before eventually closing marginally lower, down 0.06 per cent to 7,527.27 points.

The domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, climbed 0.49 per cent to 18,50.77 points

Shares in the UK’s largest listed companies have whipsawed over the first six months of 2023. Initially, the FTSE 100 raced ahead of competitor indexes in the US and Europe and breached the 8,000 point mark.

But, ongoing concerns about the UK’s long term trajectory of economic growth has dragged the premier

index’s gains back down to around 1.2 per cent.

A stronger pound has also pegged back the index. Those concerns seemed to loom over the City on the first trading day of the second half of this year. Advances among Britain’s largest lenders hoisted the FTSE 100 into the black during opening exchanges in the City yesterday. Barclays, Natwest and Lloyds Bank all added more than one per cent to trade near the summit of the index. They largely held on to those gains.

That progress was complemented by miners and raw material producers. Anglo American leapt more than four per cent.

Drugs giant Astrazeneca anchored the FTSE 100, shedding around eight per cent, after it said a new lung cancer drug may not be as effective as first hoped.

Outsourcing supremos Capita has extended the maturity of its rapid credit facility out by 28 months to 31 December 2026. The facility is now set at £284m, reducing to £250m by January 2025. The RCF has been arranged by seven lenders, including two new banking partners. The original terms of the facility are substantially unchanged. Peel Hunt remains bullish with a buy stance and a 48p per share target.

Engineering specialists Wood Group have enjoyed a hefty boost in business after being awarded a two-year $250m contract extension with Brunei Shell Petroleum to 2026. BSP’s offshore assets account for 80 per cent of their production, making this work critically important for the company. Peel Hunt sees this as a positive development and has lefty forecasts unchanged with 200p per share hold rating.

“It’s been a bit of a snoozy start to July for European markets with an initially positive European open giving way to a more mixed session, with US markets only opening for a short time ahead of the US Independence Day holiday.”

MICHAEL HEWSON, CMC MARKETS

Powerful real-time thought leadership, insights and news delivery mechanism fuelling the most up-to date reporting, adding critical context for decisions that require consciousness, education and thought leadership.

JOIN THE CONVERSATION AND BECOME A PART OF ONE OF LONDON’S MOST TRUSTED NEWS SOURCES

VISIT: CITYAM.COM/IMPACT-AM/

OPINION

EDITED BY ELENA SINISCALCOWe need more housing and bigger, better ideas to revive our Square Mile

Adam HawksbeeTHE announcement of HSBC’s departure from Canary Wharf a week ago was a significant moment. In opting for a smaller site in the Square Mile, the international bank followed other employers in downsizing as the workforce goes increasingly remote. The physical footprint of businesses in our cities is rapidly changing, and politicians need to respond.

The City of London has never been bustling at the weekend. Cafes are shut, pavements echo, and flashy urban parklets host more planters than people. Post-pandemic working patterns have extended this stillness into Friday and Monday, hitting spending in restaurants and deterring tourists from exploring the area. It’s not just London’s central business district feeling the pain; Birmingham’s Colmore Row and Manchester’s Spinningfields are eerily quiet when commuters stay away.

There is a way to save our city centres and tackle our housing crisis at the same time. We should be rapidly densifying our urban cores with new homes, turning the problem of underused office space into an opportunity. Without action, the commercial cores of our cities will hollow out. At best they will become distinct corpo-

rate enclaves sitting apart from the bustling and diverse cities around them. At worst they will collapseleisure and retail units will close first, and offices will follow as workers demand a better lunchtime and afterwork offer.

Sixty years ago, the urbanist Jane Jacobs decried the “deathlike stillness” of New York’s financial district on evenings and weekends. Her prescription was simple: the area needed a greater mix of uses at different times of the week to generate sustainable footfall. Today, the southern tip of Manhattan is a tribute to her vision, with hundreds of shops, bars, and

restaurants around a new waterfront development that attracts as many tourists as commuters. Modern research and pricing studies show how Jane Jacobs was right: people prefer mixed use neighbourhoods and will pay more to live and work in them.

Britain’s biggest cities are partially heeding this advice. Microbreweries and independent eateries are popping up in areas that were once dominated by office blocks. New pop-up cultural offers are even drawing weekend crowds to Canary Wharf.

But our central business districts are missing the core ingredient that Jacobs argued for: residents. The footfall

generated by people going about their lives outside of work is the economic lifeblood of a neighbourhood, as their purchases keep local amenities open. Today, too few people call our central business districts home.

This is starting to change - the City of London is planning 1,500 new homes by 2030. But it’s way behind the international pace. Chicago is currently undergoing a rezoning revolution, creating 1,600 homes in a single street in their financial district by re-classifying commercial properties. This redevelopment isn’t just luxury tower blocks for international bankers: around a third of the properties are

We should teach with AI tools in schools so students learn how to use them ethically

THERE is no question that AI is now a feature of life. Not a day goes by without a major announcement of new capabilities. This is why at the London Interdisciplinary School we encourage our students to use generative AI – the range of tools or plug-ins that use largelanguage models to ‘generate’ material mimicking human expression – even in their final assessments.

The reason we do this is simple. Our degrees train students to tackle the world’s most complex problems using a wide range of methods, including data analysis, political theory, visual arts, or linguistics.

Just as we have always taught students to use professional software, generative AI should be a tool at every student’s disposal – so they can learn its strengths and weaknesses, when it’s useful, and when it’s not.

We’ve already heard employers saying they will expect new recruits to have this understanding. But we don’t do this just to boost our students’ employment

Amelia Petersonprospects. Allowing use of AI tools raises the bar of what we can expect students to achieve. We can no longer give credit for a basic synthesis of existing sources; what we expect of their analysis and interpretation skills therefore increases. This doesn’t mean it is a free for all; cheating is still cheating. Students must be transparent about the use of AIs, just as they must be for any other sources. ‘AI declarations’ have become a formal part of submissions, with the accompanying range of guidance, detection, and misconduct procedures already used to manage plagiarism. This will be an evolving space, but it’s important that students learn the grey area of what is

and isn’t acceptable use.

This year our students have used AIs to help them identify obscure sources, create apps, generate narratives, make graphics, edit video, and more. None of these tasks replace the core knowledge of their degree; it just helps them develop their ideas to a more professional level even in short projects. In one case, a student has even created a working simulation of a new AI tool aimed at promoting critical thinking.

Universities, employers and students need to be working much more openly on how we can make the most of generative AI. Some have compared it to the arrival of scientific calculators – a new tool that raised questions about what was worth teaching and learning, but was ultimately assimilated quite easily into traditional teaching methods. But AI tools pose more fundamental questions because their outputs are more creative: they are more like games than calculators, with fixed rules but unpredictable outcomes. We could all benefit from sharing more of how we are inte-

grating this capability into how we teach and learn.

A degree is about learning how to think critically and AI only makes this more important. To be informed decision-makers on AI, our students get a grasp of ethics, politics and law, but also natural language processing, which is the method underpinning tools like GPT. Just as they need to be able to write and think for themselves, students need to understand the fundamentals of coding and data science, so in this area they will continue to be assessed without access to AI tools.

AIs are like unruly teenagers – half of what they produce might be nonsense, but half is gloriously creative. Our students need to learn to work with them, challenge them and critique them –just as they would their peers. If we can help them foster that kind of relationship, they can lead the generation who use these new powers for good.

£ Amelia Peterson is Head of Learning at the London Interdisciplinary School

ring fenced for affordable housing.

Residential living in central business districts doesn’t need to be all glass and steel - these areas are packed with heritage assets like Leadenhall Market or the Birmingham Museum that could be anchors for beautiful and humanscale developments. Organisations like Create Streets have set out a practical roadmap toward the liveable, beautiful, ‘gentle’ density that Jane Jacobs wrote about half a century ago.

Local leaders need to be bold. Mayors, councillors and businesses should take radical steps to reclassify the use of city centre buildings and set higher targets for residential density. They also need to make sure licensing and permitting makes life as easy as possible for businesses to set up and stay open.

The London Plan is far too unambitious about house building in the capital, particularly when it comes to densification of the urban core. If local leaders don’t move fast enough, central government should step in and use powers from the Levelling Up Bill to “rezone” urban districts and unlock new homes. Ministers are too often blockers when it comes to new developments - away from the greenbelt it will be easier for them to side with the builders.

Britain’s central business districts need to adapt to survive. Creating thousands of new homes will stop these hubs of economic activity becoming ghost towns and ease our housing crisis. When it comes to our symbolic Square Mile, if Sadiq Khan won’t act, then Michael Gove should.

£ Adam Hawksbee is deputy director of think tank Onward

OOPS! GB NEWS DID IT AGAIN This

time it’s Jacob ReesMogg under the media regulator’s scrutiny, after Ofcom launched an investigation into his GB News programme. The watchdog received 40 complaints about an episode of Rees-Mogg’s show which addressed a court case involving Donald Trump

WE WANT TO HEAR YOUR VIEWS

LETTERS TO THE EDITOR Transitioning to net zero

[Re: Re: Watchdog raises ‘greenwashing’ concerns over sustainable loans – but experts question need for ‘hard laws’, June 30]

The FCA’s letter reinforces the need for a greater level of standardisation as firms begin developing and implementing transition plans.

Whilst firms continue to renew ambitious net zero targets, increasingly these must be backed up with credible transition plans and as the remit of the regulator expands to include these

evolving elements of the transition, more precise SPTs are required to mitigate the likelihood of both accidental and intentional greenwashing.

From our experience, whilst most businesses are willing and enthusiastic to design transition plans, understanding their viability when it comes to operationalising them is a different matter – and over-zealousness can easily result in an innocuous but still damaging form of greenwashing. Last week’s letter is a warning shot to businesses that weak transition plans will be subject to increasingly uncompromising scrutiny.

Ofir Eyal MarakonSUMMER OF CHAOS? Spike in holiday flights could cause summer mayhem

With a new CEO stepping in, Unilever must now do the right thing and exit Russia

WHEN President Putin’s security forces raided the offices of the Russian oligarch and warlord Yevgeny Prigozhin last month, they found millions of banknotes stuffed into a van and two buses.

Prigozhin accumulated his vast wealth in a number of ways, including direct payments from the Russian government, for waging war in Ukraine with his mercenary army. For several years now, Prigozhin and his gang of hired killers have been awarded lucrative defence contracts so they can carry out Putin’s bidding in Ukraine and across the world.

The origins of those payments tell a story that shockingly implicates some British companies.

EXPLAINER-IN-BRIEF: HOW LABOUR PLANS TO MAKE PEACE WITH THE TEACHERS

Labour is focusing on education, with a big speech from Keir Starmer expected later this week on opportunities and access.

Shadow Education Secretary Bridget Philipson was banging the drum for Labour’s education plans yesterday. Speaking on LBC, she said she’s confident a Labour government could turn things around on recruitment and retention of teachers, young people’s mental health, state schools’ funding and much more. Philipson wants to ensure “state schools are so much butter so that parents don’t even consider private education”. Part of this would be achieved

through Labour’s plan to scrap the charitable status for private schools, meaning they would be subject to VAT. She has plans for universal breakfast clubs in every primary school, and wants to make the profession appealing again. More than 30 per cent of teachers who qualified in the last 11 years have left the profession. To improve the general performance of many state schools, Labour also wants to send regional teams of teachers to struggling schools to provide advice and support on things like students’ behaviour and gaps in the curriculum.

Whatever he may boast, Putin’s war in Ukraine is not financed by goodwill and nationalist passion. He is only able to pursue the assault on Ukraine because he has the money required to pay, train and equip the troops and mercenaries he sends to fight on his behalf. So international companies operating in Russia - companies buying oil or goods from the Russian government or oligarch-controlled companies, or companies paying tax into Putin’s coffers - all help to make the continued barbarity possible. After all, an astonishing one in three rubles paid in tax to the Russian government is then spent on the military and security services.

One such company is Unilever, one of Britain’s largest firms. Go into any British supermarket and dozens of Unilever owned brands - from Marmite to PG Tips - can be found on the shelf.

Yesterday, Hein Schumacher started his first week as Unilever’s new CEO. His number one priority should be reassessing Unilever’s business operations in Russia. The company has factories in Moscow, Yekaterinburg and Omsk, where it makes a whole host of products - including mayonnaise, Magnum ice creams and Cornettos for the Russian market. Last year it is estimated the business generated just shy of £1bn revenue in Russia, meaning it paid an estimated £260m in tax to Putin.

For Unilever, this moral offensiveness is deepened by its hypocrisy. The company claims admirable aspirations: in

its human rights strategy it clearly states, "Respect for human rights –within business and society – must be at the heart of efforts to rebuild a better world". After the full-scale invasion of Ukraine last year, the then-CEO condemned the war "as a brutal and senseless act by the Russian state." Unilever even publicly declared it would keep its operations in Russia under ‘close review’. But all of this was hot air: Unilever factories continue to churn out goods across Russia.

The new Unilever boss must tell us how they can demonstrate respect for human rights while continuing to do business in Russia and to pay millions in tax to the Kremlin?

Other large companies use the same excuses as Unilever. They make the rather dubious claim that their products in Russia are essential, and therefore legal and morally legitimate. This is nonsense. Unilever makes Magnum ice creams; their competitor, Mondelez, produces Oreo cookies; fashion brands like Lacoste and Hugo Boss sell expensive luxury clothes. These are not essential goods, and there is no good reason

why they should continue making and selling these products in Russia.

When challenged on their wrongdoing, companies come up with mealymouthed excuses about the operational challenges of closing down a business in Russia. But they have now had more than 16 months to find a solution that would ensure they pull out of the country. They have run out of excuses.

As the new leader of a British business worth almost £100bn, Hein Schumacher will no doubt start his new job at Unilever with a heaving inbox, filled with competing priorities. But cleaning up Unilever’s act and ceasing all operations in Russia should be firmly at the top of his agenda.

Cutting ties with Russia is essential to turning off the money taps for Putin’s war machine, disentangling British business from oligarchs and their dirty money, and it’s simply another way we can support our Ukrainian allies.

£ Dame Margaret Hodge is the Labour MP for Barking and Dagenham

MOTORING

ELECTRIC DREAMS

AIn 1976, a group of upstart winemakers from the Napa Valley, near San Francisco, entered their best bottles of chardonnay and cabernet sauvignon into a blind taste test. In what became known as the Judgement of Paris, a panel of French experts ranked the Californian wines higher than their homegrown Bordeaux and Burgundies. Retold in the 2008 film Bottle Shock, the story challenged preconceptions and overturned the accepted order.

Basking in the Napa Valley sunshine, the Rolls-Royce Spectre aims to achieve something similar. The British marque’s first electric car – and arguably the first true luxury EV – it signals the beginning of the end for the V12 engine. By 2030, every new Rolls-Royce will be electric.

“Frankly, it would have been easier to electrify an existing SUV or saloon,” says director of engineering, Mihiar Ay-

oubi. Instead, his team at Goodwood started afresh, creating an elegant and imposing fastback inspired by the Phantom Coupe. The bruised pink Morganite hue seen here is a bit ‘FAB

1’ for my liking, but design chief Anders Warming says it’s his favourite paint colour. Californians seem to like it, too.

Warming calls the Spectre “generously proportioned”. In reality, it’s enormous – some 423mm longer than a Range Rover – with huge rear-hinged ‘coach doors’ and 23-inch alloy wheels. Nonetheless, a drag coefficient of 0.25 makes this the most aerodynamic Rolls-Royce ever. Even the famous Spirit of Ecstasy bonnet mascot has a sleeker, more streamlined profile.

The Spectre’s 102kWh battery is mounted skateboard-style, underneath the deep-pile lambswool carpets. Driving front and rear electric motors, it serves up 584hp, a mighty 662lb ft of torque and 0-62mph in 4.5 seconds.

ROLLS-ROYCE SPECTRE

PRICE: £350,000 (EST.)

POWER: 584HP

0-62MPH: 4.5SECS

TOP SPEED: 155MPH

BATTERY SIZE: 102KWH

RANGE: 329 MILES

However, a range of 329 miles seems underwhelming, given the MercedesBenz EQS ekes out 453 miles from a 107.8kWh battery. Topping up from 1080 percent takes 95 minutes using a typical 50kW public charging point. Unlike most coupes, the Spectre can accommodate four adults in comfort, even if you’re sitting behind somebody tall. From behind the wheel, there’s little to suggest this is an EV: just the familiar mix of hand-crafted veneers, tactile analogue controls and slick, BMW-derived infotainment. Among

the new options are Starlight Doors, which illuminate your elbows with 4,796 individual fibre optic ‘stars’. No, I didn’t count them all.

In regular Rolls-Royce fashion, the Spectre has a column shifter to engage Drive. But what happens next takes me by surprise: it’s genuinely, uncannily soundless. The venerable V12 was hardly shouty, of course, but this is the quietest car I’ve ever driven. You can select a synthetic, space-age whoosh when you accelerate, but why bother? Just enjoy the silence.

The Spectre is also a fine exponent of Rolls-Royce’s ‘magic carpet ride’, Its Planar suspension system decouples the anti-roll bars when travelling in a straight line, helping the car to resist pitch and squat. Ayoubi talks of the “champagne test”, ensuring passengers don’t spill a drop of Bollinger (or Californian chardonnay, perhaps) when their chauffeur does the driving. On sinuous mountain roads that

climb into the Palisades, though, you can’t completely escape the Spectre’s 2,890kg kerb weight. While the Bentley Continental GT uses 48v electric motors to counteract roll and seemingly defy physics, the Rolls prefers not to be rushed. That’s fine in a Phantom, but I’d expect a coupe to feel more poised and planted. Maybe the forthcoming Black Badge Spectre will redress the balance.

Napa County is still a place where tradition and new thinking collide. Here, battered pickup trucks and brawny muscle cars share space with high-end EVs from Rivian, Lucid and Tesla. The Spectre feels right at home – and will doubtless be popular with the tech millionaires of nearby Silicon Valley. It could have been bolder in terms of its drivetrain and dynamics, but it raises the bar for refinement. It’s the RollsRoyce of electric cars.

Tim Pitt writes for motoringresearch.com

WORLD’S FASTEST TRACK CAR: £1M MCMURTRY SPÉIRLING RETURNS TO GOODWOOD

In search of the ultimate electric two-car garage? The production version of the McMurtry Spéirling will be unveiled at the Goodwood Festival of Speed next week. With a 1,000hp motor and a ground-effect fan system to generate astonishing levels of downforce, the track-only hypercar offers extreme EV performance. It’s the perfect complement to your new Rolls-Royce Spectre.

Only 100 examples of the customerspec Spéirling Pure, seen here, will be produced, priced at £984,000 including taxes. The first finished cars are due for delivery in 2025.

Goodwood is a fitting place for the

updated McMurtry to make its public debut. At last year’s event, with exFormula 1 driver Max Chilton at the wheel, the original Spéirling set a new record on the famous Goodwood hillclimb. A time of just 39.08 seconds made it quicker than a McLaren MP4/13 Formula 1 car and Volkswagen’s ID.R electric racer. Key to the Spéirling Pure’s dizzying speed is the fan system, which literally sucks it to the road. The ‘downforce-on-demand’ setup produces up to 2,000kg of suction –more than twice the weight of the vehicle itself. Wider tyres and revised bodywork mean the Spéirling Pure

can achieve cornering forces of up to 3G, while a revised rear axle allows a top speed of 190mph.

McMurtry has fitted the Spéirling Pure with a 60kWh battery suited to track days. It can cover 10 hard-driven laps of the Silverstone National Circuit, for example, before needing to recharge. The charging process is also ultra-rapid, taking just 20 minutes before this single-seat supercar is ready to go again.

The 2023 Goodwood Festival of Speed runs from 13-16 July. If you are planning a visit, look out for the Spéirling Pure in the Supercar Paddock.

Tim Pitt wafts through California’s wine country in the new Rolls-Royce Spectre – the world’s most luxurious electric car.

‘Don’t put your life in danger’: British GP chiefs warn protestors

FRANK DALLERES

BRITISH Grand Prix organisers have warned Just Stop Oil activists that they will be risking their lives if they seek to protest again during this weekend’s race at Silverstone.

The climate campaigners have disrupted several high-profile sporting events already this year, including the Ashes, Premiership Rugby final and World Snooker Championships.

Five protestors from the group received suspended jail sentences for invading the Silverstone track and sitting down on the tarmac during last year’s Formula 1 race.

“The fundamental difference here is that you are not putting your life in danger when you run on the pitch at Lord’s,” said Silverstone managing director Stuart Pringle.

“You are not putting your life in danger when you sit on a snooker table or protest at a flower show. A motor racing track is not the place to go.

“It is extraordinarily dangerous and people will be putting lives at risk if they go there, and any sensible, rightthinking person can extrapolate what the ultimate risk here is.

“My strong, strong message is: ‘Do not put your life in danger. This is not the place to go and sit on a floor’. It is absolute madness if someone climbs

on to a live racing track.”

Wimbledon chiefs have stepped up their security checks in a bid to thwart would-be protestors at the All England Club this week and Silverstone officials have followed suit.

Close to half a million motorsport fans are expected to flock to the Northamptonshire circuit for British Grand Prix week and are being urged to report any suspected activists.

“We have no specific intelligence, but we will plan for the worst and hope for the best,” Pringle told the PA news agency. “If somebody is minded to invade a flower show then they are probably minded

Brits Burrage, Broady and Choinski win at Wimbledon but American Gauff dumped out

MATT HARDYto invade a motor race because we have many more global viewers. But there are plans in place.

“We will have a much more visible police presence around the event and we hope that fans help us to try and spot people who are planning to disturb people’s fun.”

Today leading Formula 1 representatives will be at 10 Downing Street to discuss the sport’s contribution to the UK economy.

Seven out of the 10 teams are based in the UK and Motorsport Valley –an area between the Midlands and Oxfordshire –sees annual sales turnover of £10bn.

Hodgson stays at Palace and targets top-10 league finish

FRANK DALLERES

MANAGER Roy Hodgson has set his Crystal Palace team the ambitious target of finishing in the top half of the Premier League after signing a new contract at Selhurst Park.

Only once in the last 30 years have Palace ended the season 10th or higher in the top flight, in 2014-15 when then-boss Alan Pardew also led them to the FA Cup final.

Hodgson steered them to 11th place last term after returning to the club in a firefighting role in March and has backed himself to improve on that next season.

“I know what a fantastic squad we

have here.

“It’s a great blend of youth and potential, alongside experienced players with Premier League and international pedigree,” he said.

“I have spoken with the chairman at length and we agreed that we must be ambitious in getting the most out of such talent.