THE CITY AND ME ONE FINTECH STAR’S RISE TO THE TOP P11

THE CITY AND ME ONE FINTECH STAR’S RISE TO THE TOP P11

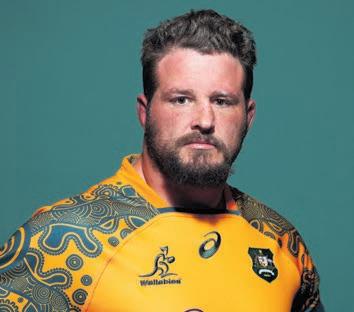

NICHOLAS EARL

FEARS over the future of Thames Water escalated yesterday, with the government drawing up contingency plans for the troubled utilities giant’s potential nationalisation as the supplier scrambled to secure funds amid escalating financial difficulties.

The UK’s largest water company, which serves 15m customers and is owned by consortium Kemble Finance, has been locked in talks with its shareholders in a bid to raise £1bn. Those shareholders include Abu Dhabi and Chinese sovereign wealth funds and a host of pension funds.

In a statement yesterday, Thames

Water revealed it received £500m of new funding from shareholders in March earlier this year, but warned it still needs more money to support its turnaround plans for fixing sewage leaks and creaking pipeline infrastructure.

However, it played down talk of an imminent collapse – confirming it has £4.4bn of liquidity left over.

This follows the abrupt departure of its former chief executive Sarah Bentley on Tuesday as it tackles a hefty £14bn debt pile and nearrecord sewage spills.

If the supplier collapses, Thames Water could end up de-facto nationalised – propped up by taxpayer funds – in the same way Bulb Energy was following its fall

from grace two years ago during the domestic supplier crisis.

Bonds linked to the company slid heavily yesterday.

Kemi Badenoch, secretary of state for business and trade, told Sky News that “we [the government] need to make sure that Thames Water as an entity survives” and criticised Ofwat’s performance, suggesting it had prioritised driving down bills over infrastructure –which risked driving up costs for customers over the long term.

The government confirmed it has been preparing a “range of scenarios” for its regulated industries including the water industry, but said the sector remains “resilient”.

JACK BARNETT

ANDREW BAILEY and the cream of the global central banking crop yesterday warned they may need to keep heaping pressure on the global economy before they can declare victory over high inflation.

Speaking at the European Central

Bank’s (ECB) annual monetary policy conference in Sintra, Portugal, the chiefs of the Bank of England, Federal Reserve and ECB signalled that their respective campaigns to ease price pressures still have legs to run.

Bank governor Andrew Bailey said the drag on the UK economy from

high inflation would be a “worse outcome” than the hit from higher borrowing costs.

He added that stronger-thanexpected wage growth and price rises meant he and the rest of the ninestrong Monetary Policy Committee (MPC) “had to make really quite a strong move” last Thursday.

MPC officials voted 7-2 in favour for a 50 basis point increase to the UK’s official interest rate, taking it up to a near 15-year high of five per cent.

ECB president Christine Lagarde said she and the rest of the governing council are “very likely [to] hike again” at the eurozone central bank’s

next meeting in July.

And Jerome Powell, head of the Federal Reserve, the world’s most influential central bank, said policy “may not be restrictive enough and it has not been restrictive for long enough”.

£ CONTINUED ON P3

I’M BULLISH ON THE CITY WE MEET THE MAN WHO STILL BELIEVES IN A LONDON IPO P10

ASK YOUR average punter whether privatisation of utilities has been a success and you’re unlikely to get a treatise on the relative merits of today’s service compared to the 1970s. What you’ll get is frustration at the way things are today –train networks that seem to treat timetables more as a guideline than a rule, energy companies whose customer service is enough to have you bang your head against your smart meter, and now a water

company that struggles with sewage, leaks, debt and, apparently, keeping hold of a chief executive. But at the risk of sounding like Corbynistas bemoaning that the problem with socialism is that it’s never been tried in its unadulterated form, the problem

with the privatisation of our utilities is that it has managed to replicate some of the worst parts of a nationalised industry: specifically, the lack of competition. In the water industry, competition has a long history.

London’s early water supply was not a public utility –it was for all intents and purposes privately owned, with competing firms battling over every connection. As detailed in Nick Higham’s wonderful book The Mercenary

River, that wasn’t brilliantly efficient for the firms, but it did ensure that the capital became wellserved for water much faster than other European cities. Much of that fell apart when the private firms effectively agreed to end their competition and carve up the capital into geographic areas. Service declined, prices went up, even if it meant roadways weren’t being dug up on a semi-permanent basis to fit new customers with a different water supply. That system

PAW-OUETTE This newly acquired six-month guide dog in-training, Darcey, meets a ballerina from her namesake Dame Darcey Bussell’s former ballet school in Richmond

JESSICA FRANK-KEYES

TORY LONDON mayoral hopeful

Daniel Korski has dropped out of the race to take on Sadiq Khan for City Hall following an allegation of historic sexual assault.

Korski, who has seen support drain away after TV producer Daisy Goodwin accused him of groping her breast during a meeting in No 10 a decade ago, announced the move last night.

In a statement on Twitter, he said: “I have decided, with a heavy heart, to withdraw from the Conservative

mayoral contest.

“I categorically deny the allegation against me. Nothing was ever put to me formally 10 years ago. Nor seven years ago [but this] is becoming a distraction from the race and the Conservative Party.”

Goodwin told PA: “I am glad he has withdrawn – it shows that women can speak out against misbehaviour in the workplace and be believed.

Korski’s withdrawal means the Tory selection process is now a race between former City Hall Tory group leader Susan Hall and barrister Mozammel Hossain.

ended with nationalisation, but has come back in its own way in the form of Thames Water and the other utility companies who, with no competition and long-term contracts, can load themselves up with debt, cream off profits, and generally muddle along with the complacency that erodes all firms that don’t have rivals snapping at their heels. So, no, the problem isn’t returning utilities to the market. It’s not letting the market work that’s the problem.

REES-MOGG AND DORRIES

LIKELY TO BE NAMED IN PARTYGATE REPORT

Boris Johnson’s allies are expected to be named in a report published today about potential “contempts of parliament” committed following the official partygate inquiry.

The BBC’s new acting chair has said the board needs to stand behind its creative output as it re-establishes “the confidence and the ambition” after Richard Sharp’s departure.

BLOOMBERG

OPEC SHUTS BLOOMBERG, REUTERS AND WSJ OUT OF OIL CONFERENCE

Opec has cancelled accreditation for reporters from three major news organisations to cover a conference in Vienna’s Hofberg Palace that will feature the head of BP and the European Union’s top energy official.

TODAY’s performance surpassed the usual antics of lawyer vs tech bro, as both leaders did their best rendition of mid-level insurance accountants.

While there was ample ground to make a bit of noise, the pair drawled on about housing. The lacklustre jostling amounted to Starmer trying to remember which of his MPs had opposed house building in their own constituencies, and Sunak jamming his finger at the T&Cs of the so-called “mortgage charter”.

The Labour leader tried to nail Sunak

down on whether the target of building 300,000 new homes exists or not. Spoiler: it doesn’t, as it’s only “advisory”. Thanks to this skulduggery, Sunak managed to fudge the numbers bragging about a record number of new homes. Instead, he pivoted to the winner line:

“Because of the economic chaos, mortgage holders will be £2,900 poorer.” While, yes, homeowners will be furious their payments have gone up, they’re almost always more angry when someone threatens to “concrete over the greenbelt” as Lisa Nandy has done. But at one point she threw her support behind a local candidate who explicitly ran on a promise to protect the greenbelt.

The government might not be able to keep Thames Water in business, but at least MPs will keep the readership of Full Fact buoyant.

JACK MENDEL

BIG FOUR firm PwC has reportedly told its junior auditors their pay is going to be frozen, amid concerns it will make the industry less attractive.

According to reports in the Financial Times, around 25,000 staff members are set to get lower pay rises, with the accountancy giant citing the challenging market conditions and pay rises’ impact on inflation.

In a webcast, its junior staff members were told about the pay freeze, while others were told they would get a real-terms pay cut, with a salary increase of between three and six per cent.

After the webcast, a note was reportedly sent round telling employees they would be getting a smaller pay rise, following last year’s major increase, done in a bid to retain staff.

British coal plant operators EDF and Drax, whose plants were available last winter, have confirmed they will be unable to provide back-up power for winter 2023/24, National Grid said yesterday. It comes after the National Grid Electricity System Operator said earlier this month it expects the country to have enough electricity to meet supply in winter, but that it was in discussions about the availability of some coal units.

In a statement to City A.M., PwC said:

“Following record pay increases last year, we have again invested in salary uplifts across our business. Our decisions are informed by the firm’s performance, external market conditions and the investments we make in response to client demand, such as our recent commitment to honouring all graduate roles for the year ahead.”

This comes after the Financial Reporting Council ‘s boss Sir Jan du Plessis called on all four major accountancy firms –PwC, KPMG, Deloitte and EY –to give staff a pay rise. He said there had been a “significant increase in profitability” and that they had the means to pay junior staff more. When asked if they’d be freezing pay for junior staff, EY told City A.M.: “We have not yet announced the results of our UK annual pay review. This is usually communicated to our people in the autumn.”

CONTINUED FROM P1

Powell said the Fed has not been in restrictive territory “very long”, adding that the Fed will be a squeeze on the American economy for as long as “we need to be”.

The trio’s remarks indicate central banks intend to keep interest rates at their peak for an extended period of time to make sure high inflation

doesn’t return – known as a “higher for longer” strategy.

Monetary authorities are at a crossroads after more than a year of jacking up borrowing costs from rockbottom lows in the quickest tightening cycles in recent history.

Experts think they are in the final leg of their respective rate hike campaigns, with the Fed and ECB expected to lift rates 25 basis points

two more times this year. Such moves would take US rates to a range of 5.5 per cent and 5.75 per cent, and European rates to four per cent. However, the Bank is under greater pressure to strain the UK economy further despite already lifting borrowing costs 13 times in a row to five per cent. Financial markets think the Bank could eventually send rates to a peak of more than six per cent.

Energy suppliers could risk losing their licence if they fail to follow new toughened prepayment meter rules, with Ofgem yesterday announcing plans to make its proposed industry reforms permanent. Energy firms will now have to make at least 10 attempts to contact a customer before installing a prepayment meter and will also be given a small allowance in the prepayment price cap to recover bad debts associated with additional support credit.

The Climate Change Committee has warned the UK’s drive to net zero “is being stymied by restrictive planning rules” in its latest annual progress report on tackling carbon emissions. It argued “rapid reform is necessary” to meet the country’s climate goals, with the committee saying its confidence in the UK reaching net zero is now “markedly” lower than it was a year ago.

later

LAURA MCGUIRE

CHANCELLOR Jeremy Hunt has drafted an action plan with authorities to ensure customers are facing fair prices during the cost of living crisis.

Hunt yesterday say down with the Competition and Markets Authority (CMA) and the regulators for the energy, water and communications

sectors to examine whether the groups could use their authority to help keep prices low following accusations that businesses were profiting from the cost of living crisis.

Among the attendees were CEOs from the CMA, the Financial Conduct Authority, Ofcom, Ofgem and Ofwat.

In efforts to help shoppers pay fairer prices, the CMA agreed to bring forward their update of competition

and unit pricing in the grocery sector to earlier in July.

Meanwhile, Ofwat agreed to crack down on water companies “not going far enough” to support customers to pay their bills.

“I am pleased we’ve secured agreement with the regulators to act urgently in areas where consumers need most support to ensure they are treated fairly,” Hunt said.

THE BUILDING sector has been left in a state of confusion after all of the ninemember regulatory board of the Royal Institution of Chartered Surveyors (RICS) suddenly resigned en masse late on Tuesday.

RICS standards and regulation board is responsible for reviewing and investigating surveyors who aren’t following industry standards and has been a key stakeholder addressing the cladding scandal.

In a statement, RICS said board chair Dame Janet Paraskeva suddenly resigned following an internal disagreement over resources, and that the rest of the board quit shortly after.

thephoenixgroup.com/living-longer

RICS said they “gave Dame Janet every opportunity to convey concerns and to discuss issues relating to operational changes RICS was making” and pushed back against suggestions it was removing resources from the board and that this was why its members had resigned.

It said it was now working to appoint a

new interim standards board and that “all regulatory activities remain in full operation”.

The government, however, said it was concerned about the situation and has called on RICS for a full explanation.

A spokesperson for the Department for Levelling Up, Housing and Communities said: “Following their resignations, members from the regulatory board have been in touch with the department to express their dissatisfaction with their treatment within RICS.

“We are concerned that the board feels it cannot continue to perform its role and have asked the RICS president and new CEO elect to explain the situation.”

RICS has been at loggerheads with the government over the bill, which includes a clause that would give the housing secretary the powers to investigate the performance of RICS.

Campaigners at End Our Cladding Scandal said that the round of resignations could be related to this quarrel with the Levelling Up Department. They called the news “shocking, but not surprising”.

INSOLVENCIES are likely to rise amid a “perfect storm” of rising interest rates, higher costs and a slowing economy.

“All the indicators show that insolvencies will rise and I think that our message is that management teams need to be taking advice earlier and recognising the problem earlier,” Sarah Rayment, the new co-lead of global restructuring at Kroll told City AM. Rayment highlighted rising interest

rates would make it difficult for firms to refinance debt over the coming years. Insolvencies have started to rise from very low levels post-pandemic. In the most recent monthly figures, insolvencies were up 40 per cent compared to the year before, with over 2,500 firms declared insolvent.

“It does just feel that we’re at a very difficult time for UK corporates,” she said. The likely surge in insolvencies reflects the unwinding of decades of low interest rates, Rayment suggested.

We need to talk about 1 in 3 children born today having a good chance of living to 100. Let’s start having that conversation.

Let’s talk about making the most of living longer.ELENA SINISCALCO FROM 1 July, Australia’s working holiday visa will extend to include Brits aged 30 to 35, allowing more than 16m young Brits to live and work down under. The change comes as a result of the recently announced Australia-United Kingdom Free Trade Agreement .

LAND OF OZ Australia is set to increase the age of its 18-30 working holiday visa to 35

CHRIS DORRELL

UBS IS reportedly planning to cut over half of Credit Suisse’s workforce as it completes its takeover of the Swiss bank.

The newly-merged banking behemoth is planning on reducing its headcount by as much as 35,000 people in an attempt to cut costs, Bloomberg reported. Credit Suisse currently employs around 45,000 people.

UBS is reportedly aiming to cut costs by $6bn over the coming years. Bankers and support staff in Credit Suisse’s investment banking division – particularly in London, New York and Asia –are expected to be most at risk, although all segments will face cuts.

UBS has repeatedly flagged its intention to “downsize” Credit Suisse’s lossmaking investment banking division, which had been the source of much of its scandals.

At the time of the takeover, the two banks employed around 11,000 people between them in London, with a high concentration in investment banking.

Earlier this month, it was reported that UBS would start cutting Asian-focused investment banking roles from next month.

The first round of cuts will likely leave out the significant overlaps that exist between the pair’s domestic banks.

UBS will make a decision in the third quarter on whether to integrate Credit Suisse’s domestic business or spin it off.

As many as 10,000 jobs would be cut if the Swiss domestic businesses of the two banks are merged, Bloomberg reported.

Chief executive Sergio Ermotti suggested that around 10 per cent of Credit Suisse’s employees have left the bank in the past few months.

Credit Suisse and UBS declined to comment.

JESS JONES

MICROSOFT president Brad Smith has reiterated that the UK needs to prioritise artificial intelligence (AI) safety in its quest to become a global leader in new technologies.

“Let’s get the companies under control”, Smith said, speaking at a packed Chatham House event

JESS JONES

COMPANIES urgently need to train staff how to use artificial intelligence (AI) tools effectively and safely, Salesforce’s UK & Ireland chief told City A.M.

Chief executive Zahra Bahrololoumi said the need for “highly skilled people” who can use trustworthy data sources and protect sensitive data has “never been more clear nor urgent”.

The comments come as a survey published by Salesforce today reveals that over 60 per cent of people who use or plan to use generative AI for work say they lack the skills to use it “accurately and safely”.

yesterday, where he argued a licensing regime is necessary on both a national and international level.

The seasoned US tech veteran echoed his calls earlier this month for a licensing regime for AI firms to ensure AI models are used safely.

According to Smith, the UK has a key opportunity to present a “new paradigm” for AI safety management.

The survey also found that seven in 10 workers felt their employer was unable to make the most out of generative AI for their organisation and over half wish to be given proper AI training.

The cloud-based software company, which also owns business messaging platform Slack, has called on the government to increase national access to digital skills training.

Boohoo, which holds a 26.6 per cent stake in Revolution, wanted to boot out Revolution’s chief executive Bob Holt, chairman Derek Zissman and chief financial officer Elizabeth Lake, and replace them with three new directors of its own choosing.

It decided it would take action at the group’s AGM on Tuesday, where the matter was put forward as a motion to be voted on.

Ahead of the meeting, Revolution slammed the plot, arguing the candidates put forward by Boohoo lacked the relevant experience running a beauty business.

Boohoo’s move to oust Holt, Zissman and Lake won the backing of 75 per cent of shareholders. But the trio were then allowed to be reelected by independent director Jeremy Schwartz, as in order for the company to operate, and re-list its shares on the AIM, it needed to have a board of directors in place.

Yesterday was the first time the group’s shares were traded since they were suspended back in September. A positive trading update published on Friday boosted shares.

The market is unsure if the war is over yet. Boohoo is understood to be unimpressed over share awards that have been granted to certain executive directors that shareholders voted off the board. So –what happens next remains in question...

BOOHOO yesterday blasted the board of Revolution Beauty after a chaotic annual general meeting (AGM) saw three senior board members of the beauty brand ousted –and immediately reinstated.

Boohoo, which holds a 26.6 per cent stake in Revolution Beauty, yesterday told investors it had “serious concerns” regarding the AGM and reiterated its call for the removal of the three board members.

The comments came after Boohoo led a successful vote to oust three senior members from the board of Revolution at its AGM on Tuesday, with chief executive Bob Holt, chairman Derek Zissman and chief financial officer Elizabeth Lake voted off by a majority of 75 per cent of shareholders.

However, the trio were then reinstalled after remaining independent director Jeremy Schwartz “promptly used his powers” to reappoint all of the directors who had just been removed.

During the meeting, the troubled makeup brand also allegedly attempted to hold its AGM without letting any

shareholders vote on any matter, including tabled business or otherwise.

A source familiar with the situation told City A.M. that the AGM was completely “self serving” and said if the company had more prominence and greater scale its actions would be “blasted on the front page of every newspaper”.

Plans to kick out the board members have been brewing over the past month, with Boohoo publicly revealing it would vote against them. The brand wishes to draft in New Look executive chairman Alistair McGeorge, Boohoo executive director Neil Catto and former THG beauty director Rachel Horsefield as directors.

Shares in Revolution Beauty, which were restored yesterday after being suspended last autumn due to auditor concerns over the company’s accounts, soared to close up 28 per cent yesterday.

“The return from suspension is welcome news for investors and the shares have surged higher, although, at 29p, it is a long road back to the issue price of 160p from its 2021 IPO,” Russ Mould, investment director at AJ Bell, said. Revolution Beauty was contacted for comment.

RATE MY UPGRADE Uber has announced a host of new offerings for holidaymakers

THE GOVERNMENT should scrap its new Digital Markets, Competitions and Consumers (DMCC) bill because it is already too old, the Centre for Policy Studies (CPS) has warned today.

The report, titled The Unregulated Regulator, alleges that dynamic digital markets have “outpaced” the new legislation.

What’s more, it would weaken investment and grant the CMA

“extensive and unchecked” regulatory powers, which could “undermine” the government’s ambitions of forging the UK into a global science and tech superpower, according to the report.

The DMCC bill is an “expansive blank cheque for the CMA to rewrite digital markets,” Matthew Sinclair, author of the analysis, said.

A Department for Business and Trade spokesperson said the bill “will further drive innovation, boost competition and grow the economy”.

GUY TAYLOR

BUSINESS travel is back and “buoyant”, according to data from the Advantage Travel Partnerships’ Global Business Travel Review, with business people booking more trips for longer periods.

Booking volumes in the UK’s business travel market, covering aviation, rail and accommodation, hit 90.8 per cent of pre-pandemic levels in the first quarter of this year, with business bookings for April pipping 2019 levels by 4.6 per cent.

The report, which analysed 14m travel transactions dating back to 2019, also found travellers are booking business trips

Snelgar said longer trips are ‘more productive’

for longer. The average trip duration increased 1.1 days in 2023 to date to an alltime high of 8.2 days.

The findings come despite a cost of living crisis, as well as strikes causing walkouts at Heathrow and rail closures.

There had been concern within the aviation sector that a slower recovery in business travel, as opposed to the surge in bookings for holidays, could hamper airlines’ profits after summer.

But airlines will be reassured by a significant growth in business class travel, higher than all other cabin classes.

Guy Snelgar, global business travel director of The Advantage Travel Partnership, said: “This matches reports... of a buoyant business travel market, particularly in the SME space.” he said.

Travel experts in the sector have slammed the policy as needlessly damaging for the UK’s aviation sector

GUY TAYLOR

A NEW TRANSIT fee for passengers travelling through UK airports could put the country’s aviation sector at a “competitive disadvantage” as passengers opt to travel via other countries, airline groups have warned.

Visa-exempt travellers passing

LANDSEC has partnered with Hive Curates, a creative studio, and the Eastern City Business Improvement District to launch new affordable art studios just a five minute walk from Liverpool Street Station. Hive, who will run the new studios, is on a mission to widen access to the arts. Landsec is contributing £250,000 to the project.

JESSICA FRANK-KEYES

REPRESENTATIVES from Sony, Universal and Warner were yesterday forced to explain the gender pay gaps in their companies as they were questioned by MPs in parliament yesterday.

Reports on salaries at the organisations in 2022 revealed Warner had an average gender pay gap of just under 38 per cent – a slight rise on the previous year. Sony recorded a 20 per cent gap, an eight per cent drop on 2021, while Universal’s was under 26 per cent, a fall of close to a third.

Isabel Garvey, Warner chief operating officer, told MPs that her label’s gender pay gap figures were a “snapshot” based on “headline numbers”.

“I think ours is the most disappointing,” she told MPs.

“The challenge is about representation in the top quartile. We have fewer women in the top quartile and when you think about it they are the best paid jobs, and have quite long tenure so it takes time for those to change,” she said.

“Had we run our report a month later, we had a restructure and several promotions... that number would have come down by seven per cent,” she said.

Natasha Mann, diversity and inclusion director at Universal, said the label had launched a programme to get female staff to “lane switch” into artist and repertoire (A&R) roles.

“I cannot overstate what a well paid part of the business [A&R] is,” she said. “They might be better paid than the managing director and it’s largely male and we have to address it.”

“It can feel off-putting if you see no one that looks like you,” she said.

Jessica Carsen, senior vice president at Sony, said “our median pay gap is only around one per cent higher than the national average”.

“Obviously I would like there to be no gender pay gap,” she added. It comes amid an inquiry by MPs into misogyny in the music industry, following complaints by artists including pop star Taylor Swift about “power imbalances” and experience of sexual assault.

through Britain will be required to pay a £10 fee and apply for an online permit–called an Electronic Travel Authorisation (ETA).

Passengers may have to wait up to three days for a decision on the ETA, the government has said. ETAs are set to be introduced in November, with the scheme limited to Qatari citizens first.

The Board of Airline Representatives said ETAs would boost security and processing but “airlines do not support the principle of implementing a new charge on visa-exempt passengers transiting the UK since they are not crossing the border”.

IATA, Virgin Atlantic and British Airways declined to comment.

The City of London has launched its first destination website dedicated to showcasing the City’s world class culture and heritage, its experiences, its food and drink, its places to stay and most importantly, its best kept secrets…

Looking for the best things to do this summer? Whether you’re a worker, seasoned resident or a first timer visitor, the City is a one stop spot for all things art, culture, history, dining, and more.

For the first time, the City is sharing its top 40 unmissable experiences (including Beerfest pictured), boasting a lively programme of free and paid activities

from spectacular rooftop bars to unique family art trails and extraordinary historic tours. The full website features over 250 businesses, events and attractions across the City this summer and beyond. To find out more about what the City has to offer visit:

thecityofldn.com/ summer-in-the-city

The City Corporation has approved proposals to transform the streets and public realm between the old Museum of London site and St. Paul’s Underground station, through the partial removal of the 1970’s gyratory.

The plans include the closure of the southern section of King Edward Street, which will enable the creation of a large, new public space just over 3000sqm.

The partial removal of the gyratory system sees the introduction of a twoway lane for all vehicles on Newgate

Street and St Martin Le Grand, to its junction with Angel Street.

Improvements for people walking and cycling will be delivered, including better crossing facilities and protected cycle lanes where space permits.

MARK KLEINMAN IS CITY EDITOR AT SKY NEWS | @MARKKLEINMANSKY

MARK KLEINMAN IS CITY EDITOR AT SKY NEWS | @MARKKLEINMANSKY

THIS IS A cost of living crisis, not a banking crisis: if I had a fiver for every time a senior bank executive had said that to me over the last 18 months, I’d never need another mortgage of my own. But as interest rates have steadily crept up during that period, Britain’s biggest lenders have suddenly been thrust back into a political spotlight they hoped they had shimmied out of after an unforgiving decade. The banking industry should be in no doubt that it is back in government crosshairs. Soaring mortgage costs and the withdrawal of hundreds of home-loan deals from the market have combined in the last month to produce a toxic combination that will make the energy price crisis –which began a couple of years ago –seem trivial.

Jeremy Hunt, the Chancellor, didn’t mince his words this week. After trumpeting a series of measures to insulate mortgage customers from the impact of the Bank of England’s latest base rate increase, he turned his fire on the banks over the speed at which they pass on rate increases to savers, particularly those with instant access accounts. He told MPs that his officials were “working on a solution” and that the issue “needs to

UNLIKE most supermarket home deliveries, silly season seems to have arrived on the London Stock Market early this year.

Recent speculation that Ocado might be the subject of takeover interest from Amazon or other “technology heavyweights”, according to one newspaper market report, propelled the shares

over 45 per cent in a single trading session.

Ocado isn’t a microcap penny stock. Its shares have slumped in the past year, the post-Covid doldrums truly having set in, but the market response was barmy.

Goldman Sachs, which reports suggested might be advising a bidder for Ocado, has in fact been a longstanding adviser to... Ocado.

be resolved”.

One bank executive highlighted ‘signposting’ alternative accounts with higher savings rates to customers in lenders’ apps as a possible answer.

But as the Chancellor’s meeting yesterday with economic regulators, including the Competition and Markets Authority and Ofcom, reinforced, he requires bigger victories than internet gimmicks to prove a point.

A government fighting for its political survival cannot afford to take prisoners. Roughly 25 points behind in the polls and acutely aware that halving inflation –one of the PM’s five key targets this year –suddenly looks highly unlikely, banks should not be surprised if they become collateral damage in a bitter 2024 election campaign, particularly if they don’t yield to the current wave of Treasury pressure.

Half-year results in the coming weeks that demonstrate improved profitability and dividends will be welcomed by shareholders, but a dose of enlightened self-interest in bank boardrooms, and a note of caution about future payouts, probably wouldn’t go amiss.

The absence of any corroborating statement was taken as evidence that nothing is going on. But the falseness of the market which existed for several hours in Ocado stock surely makes the case yet again for reforming the rulebook and forcing companies to state explicitly that they know of no reason for such ludicrous gyrations in value.

IT’s A SAFE bet that Alasdair Warren won’t be receiving many Christmas cards this year from his erstwhile colleagues and peers in the City. Rarely has one company captured so many hopes for an entire IPO market as WE Soda, the soda ash producer, which aimed to go public in London at a valuation of around £6bn.

This month, those hopes went up in smoke when investors baulked at the asking price and demanded it be slashed by as much as 20 per cent. The company demurred, and the deal was abandoned, prompting veiled threats about taking it across the Atlantic to list in the US instead.

The fault, according to Warren, a former equity capital markets banker at Deutsche Bank and Goldman Sachs, lay with risk-averse investors who lack the “commitment” to back “local” companies which are cashgenerative and want to list in London.

Leaving aside the fact that WE Soda is Turkish, Warren’s point does contain some merit. The deequitisation of the London market is not a new phenomenon, and neither is the sharply lower allocation of UK equities held in many

pension and other investment funds, leading to a much greater weighting of London-listed shares held by international investors.

It’s the timing of WE Soda’s decision that threatens to do so much damage to sentiment towards the London market. Recent moves by London-quoted CRH, the building materials group, and Flutter Entertainment, the owner of Paddy Power, to list in the US have shaken

confidence in the City, while Arm Holdings’ impending US float came in spite of some rather desperate pleas from UK government ministers.

Next month’s Mansion House dinner, at which the Chancellor, Bank of England governor and Lord mayor of London will speak, presents an opportunity for concrete actions aimed at restoring the City’s equity market to its proper international standing. Those gathered in the room should eschew the grandees’ conventional backslapping –without a firm plan to halt this erosion, the London market faces a real risk of becoming an equity markets backwater.

LONDON’s wealthy are placing their homes up for rent as they struggle to reach their ideal asking price on pads across upmarket boroughs. Following the Bank of England’s decision to hike interest rates by 0.5 per cent, figures from estate agent Knight Frank show affluent sellers in

some of London’s poshest postcodes are struggling to sell their houses.

In June, the combined number of lettings listings in prime central London and prime outer London was the second highest level since September 2021.

Mortgage rates have risen steadily following two consecutive months of high inflation readings, quashing the

dreams of would-be buyers.

“The preference for many owners is still to sell,” said Gary Hall, head of lettings at Knight Frank. “But more are open to the rental option... Tenant demand is strong and yields are healthy.”

Tenants, battling scarcity in the market, now face rents 25 per cent higher than before the pandemic.

Ocado spike one more reason to look at stock market rules

LONDON businesses are being held back by a shortage of staff who have the skills to excel in roles, exclusive research for City A.M. has found.

Just over three in four firms in the capital are running into roadblocks when trying to find staff who have the necessary knowledge to propel their business, according to research from the Open University and the British Chambers of Commerce (BCC).

Difficulties finding appropriate staff are making existing staff less productive and less motivated, with the organisation’s analysis finding 71 per cent of companies in London are heaping more work on staff.

Across the UK, 73 per cent of businesses are grappling with skills shortages, leaving around four in 10 businesses shelving growth plans.

“Skills shortages are biting hard, damaging businesses and holding back our economic growth,” Jane Gratton, head of people policy at the BCC, said. Separate research out on Tuesday from Wall Street investment bank Goldman Sachs found that Brexit has fashioned imbalances in the UK labour market by curbing the flow of workers from the continent.

“Sectors that used to see the highest inflow of EU workers have also seen the largest increase in vacancy rates,” analysis at the firm said in a note to clients.

An upsurge in non-EU national migrants entering the UK helped push net migration to a record high of 606,000 last year, up from 329,000 in 2015. However, Goldman noted that the skills this new group of migrants are bringing to the UK are not those demanded by firms, leading to mismatches in the jobs market.

British handbag giant Mulberry has seen a drop in profit as wealthy tourists travel elsewhere to capitalise on VAT-free shopping

LAURA MCGUIRE

FRESH calls have been made to reinstate VAT-free shopping for international shoppers, after the chief of Mulberry warned its profits have been hit hard as tourists ditch London for Paris and Milan.

Pretax profit at the British handbag maker fell to £13.2m in the year to April, down from £21.3m the year before.

Thierry Andretta, boss of the luxury fashion brand, told the Evening Standard yesterday he had “no doubt” the abolition of VAT-free shopping had impacted his firm’s profits.

“We, along with other British brands, are suffering the consequences of this,” he said.

Prime Minister Rishi Sunak scrapped the policy which saw international shoppers able to claim

20 per cent back with their purchases, instating a so-called ‘tourist tax’.

Dee Corsi, chief executive at the New West End, told City A.M. that the “tourist tax” was a drag on the economy, “undermining the home advantage of great British brands”.

Members of the House of Lords also warned last month that international tourists are spending more in Europe than in the UK.

Cameron House, a five-star resort nestled on the bonnie banks of Loch Lomond, provides a memorable and unique venue to hold the most successful of meetings, events and away days.

• Host from 16 guests up to 400 within state-of-the-art facilities

• New Lomond Wing provides versatile, accessible space

• Unique lochside location with spa and golf courses

AT THE START of June, chances are most in the City hadn’t heard of Bhairav Trivedi and Sutton-based business-to-business money transfer firm CAB Payments.

The suburban fintech was the sort of payments plumbing firm that trundles along successfully in the background, championed by its customers and those in the know but largely untroubling the wider public debate.

Fast forward three weeks, and CAB’s IPO plans are being touted melodramatically as the first shoots of a potential revival in the Square Mile. An arid period of public markets activity has ramped anxiety to fever pitch, and Trivedi and CAB are seen as just the tonic needed.

Still though, calm and collected, he seems unphased by the elevation of his float plans into a totemic City event.

“You know, there’s always a little concern about that, but it’s not overly concerning for us,” he tells City A.M. in an interview.

“I’m very bullish on the geography, on the market, on the investors. We’ve got very, very favourable reactions from the investors. That’s what we’re looking forward to.”

CAB’s IPO plans announced earlier this month appeared after a barren start to the year in which cash raised via IPOs plummeted some 80 per cent in the first quarter. The drip-drip of firms towards New York meanwhile fuelled fears that London was in terminal tech decline.

But Trivedi, the former chief of Middle Eastern payments giant Network International, threw the market some red meat as CAB revealed its plans in early June. London, he said, was the “home for innovative and growing global businesses”.

CAB, however, might not be the immediate flashy fintech image that ‘innovative and growing business’ brings to mind. The firm has sprung out of the 190-year old British lender Crown Agents Bank and now sits above the UKlicensed entity as its parent company. The reason for carving out the holding firm is because it will soon have “other pieces of the pie”, Trivedi says, with CAB Europe, CAB America and CAB Asia Pacific all rolled out under that umbrella.

That international footprint will play into its historic role in the British Empire, which Trivedi says was essentially a precursor to the payment-rails role it performs today.

“We were part of the legacy crown, and we were taken into various colonies to help establish financial infrastructure. So that actually allowed us to lay the payment rails in all of these geographies,” he says. “We set up partnerships with governments, central banks, and we licensed entities. That I think of as a foundation setting.”

While it digitised heavily after an injection of private equity cash from Helios Investment Partners, rolling out an FX trading platform and payments gateway for emerging markets, the fundamentals remain similar to its role 190 years ago: providing the financial infrastructure for the transfer of cash across borders.

CAB’s bread and butter is now payments between businesses in developed and emerging markets with an average ticket size of around £100,000.

That long history might in some part point to why it was always destined for a London listing. But Trivedi says he and the firm feel there are more pressing contemporary reasons too.

London has been plunged into a period of soul searching this year after its attempts to promote the market as a tech hub have fallen on largely deaf ears. While ministers and regulators have rolled out reforms, it is still a fairly threadbare smattering.

“The UK market does need some level of impetus right now,” Trivedi says. “And we want to be the key ingredient that will give it the lift it needs.”

Part of it is also CAB’s “innate bullishness about the UK economy and the UK as a listing venue”, he says.

Trivedi will also look to tap into a pool of hopefully tech-starved investors that

are crying out for a firm like CAB.

British investors, he says, have a “much better understanding of the global impact of where we are and what kinds of things we do”.

It’s a more glowing assessment of London’s investor base than has been dished out recently. CAB’s float plans came alongside those of Turkish soda ash firm WE Soda, which were quickly ditched on the back of what its boss called “extreme investor caution”.

ROADSHOW

The appetite so far has been quite the opposite for CAB, Trivedi claims. He can only squeeze in a 7am call before he embarks on a long day of roadshow shmoozing to build the right investor base for the listing.

The company this week announced it had slapped a £851m price tag on the

firm –a more specific value than the traditional range given to the market –and said it has been “pleased with the investor engagement” so far.

City A.M. has also learned that CAB has ramped up its portion of free float shares, those that will be traded freely by public investors, beyond the minimum 10 per cent to up to 40 per cent in anticipation of demand.

GLASS HALF FULL

It is a bolshy move in a market that has been nothing but gloomy of late. But “bullishness” is a term that comes up repeatedly from Trivedi.

As the firm prepares to step out into a turbulent and rather dangerous-looking public market, Trivedi says that a dose of optimism is exactly what is needed.

“I’ve always been a glass half full kind of guy,” he adds.

RETAIL lenders waste no time in passing on increases in Bank of England base rates to their customers. So is it reasonable to assume that, in this period of rising rates, consumers are less happy with banks and building societies than they used to be?

On the face of it, the answer is ‘no’. Since base rates began to creep up in December 2021, consumer impression of the sector (banks and building society brands tracked as a whole) has actually climbed, from a score of 5.1 in November 2021 to 6.0 for the last full month (May 2023).

The sector’s Value metric (a net score of whether brands offer good or bad value for money) tells a similar story –while it is low compared to other sectors, it’s nevertheless considerably

Stephan Shakespearecally higher than it is among the general population – and not just a little higher either.

higher now than it was before rates started to rise (0.3 In November 2021 vs. 1.4 for May 2023).

So why is this? Is it because savers outnumber borrowers and better saving rates are helping to push up scores?

This doesn’t appear to be the case either. When we filter for those who currently have a mortgage, our data shows similar trends. In fact, impression of the sector among this segment is typi-

Value, meanwhile, tells a similar story while Satisfaction with banking brands is significantly higher among mortgagees than it is among the general public – and hasn’t materially declined since rates started to go up. So far, then, bank and building society brands have been bulletproof when it comes to interest rate raises – even among those they will hurt the most. But should banks need to revert to tougher sanctions on consumers who can’t pay in the coming months, this relatively benign view may well change.

Stephan Shakespeare is the co-founder and CEO of YouGov

Which of the following brands would you say that you are a SATISFIED/DISSATISFIED customer of? (Net score of UK adults)

YouGov Brandindex 1 Nov 2021 - 25 Jun 2023

FAR

As payments firm CAB eyes a £851m float, boss Bhairav Trivedi tells Charlie Conchie why he’s still bullish on London

I’m a cellist and my first job was working on a music course (Musicale Holidays). I spent every Saturday at the Royal College of Music and was always off playing on some kind of music course.

A risk associate at PwC in their transaction services department. I never quite knew what I wanted to do as a career. I studied history at university and, after graduating and going travelling, was lucky enough to be offered the role at PwC, just after 9/11. It was here that one of the partners suggested I study law and offered to sponsor me through my law degree. I will forever be grateful for the opportunities and the support given to me during my time at PwC. And as always happens when you work the sort of hours life in transactions demands, I made some life-long friends.

It was more when I knew I was working with the right people –Harrods Bank. That was where I met Mark Stephens, Allica’s first CEO. I’ve always had huge admiration for Mark, his leadership style and focus on people. I was fortunate to work with him and others from Harrods in a number of places – I believe having the same values and focus on people is key to being not only a successful team and business, but also for job satisfaction.

WHO IS THE BUSINESS FIGURE WHO YOU MOST ADMIRE?

Dame Helena Morrissey

[pictured] for all she has done for women and promoting inclusion and diversity of thought – particularly the 30 Per Cent Club, which pushes for better gender balance at all levels of organisations. Getting to where she did in the environments she was in and how she got there is very inspirational and impressive. She’s also very chic, classy and has nine –yes, nine –children.

WHAT IS ONE THING YOU LOVE ABOUT THE CITY OF LONDON?

When you walk down a random side street and find a great pub or bar.

... AND IS THERE ANY ONE THING YOU WOULD CHANGE?

I look forward to the day that we don’t have to talk about any kind of diversity as the City of London is diverse and inclusive full stop. I hope we have moved on from the days when you –as a female –were rated out of 10 each time you walked across the office/trading floor… But there is still a long way to go (although London isn’t alone in this of course).

When Allica Bank secured its banking licence in September 2019.

When Mark invited me to join Allica back in 2018, I had to find out what it was all about. On learning the vision of the company, I could tell there was something special there. There’s still a huge gap in the market for an SMEfocused, technology-driven bank, which is also able to back that up with real SME lending experience and human relationships. When I arrived at Allica there was a lot to do and no guarantee we would get the licence. It took a lot of hard work. But it was an amazing team effort, and I will never forget when that email came through granting us the licence.

Working in a scale-up bank is pretty intense. I have to remind myself every so often to look up, sit back and appreciate everything Allica has accomplished in the last four to five years – we’re building a bank that truly puts the needs of small businesses front and centre and I’m really proud of every single colleague (past and present) for their part in that and what

FAVOURITE...

FILM: A LOT LIKE LOVE

MUSICIAN: BRANDON FLOWERS FROM THE KILLERS

BOOK: WILD SWANS: THREE DAUGHTERS OF CHINA BY JUNG CHANG

DRINK: TEA OR COFFEE? MY BODY IS A TEMPLE: WATER OR WINE

we’ve been able to achieve together.

Lunch with Nigel Howlett and his

structuring team at Brown’s (not that one). I was in a small team at PwC when I started. Nigel’s team sat next to mine, and they took me under their wing socially. On Fridays we would often go for lunch –the old school type of lunch where you ‘took your time’, shall we say. One Friday I was in a meeting at my boss’s office, Nigel interrupted and said we were going for lunch. My boss said fine, we could continue later and to leave all the papers on his table. We didn’t get back until about six or seven, when we picked up our stuff and went back to the pub. My boss dumped all the papers on my desk...

WE’RE GOING FOR LUNCH AND YOU’RE PICKINGWHERE ARE WE GOING?

Sexy Fish – I know it isn’t technically the City, but great food and great atmosphere.

DO YOU HAVE A FAVOURITE POST-WORK WATERING HOLE?

The Banker.

ARE YOU OPTIMISTIC FOR THE REST OF 2023?

If I think about the economy and politics and the impact on society, no. But if I think about my world yes, really exciting times ahead at Allica. Having become one of the fastest UK fintechs to reach profitability last year as well as having raised £100m led by global investors TCV, we really do have the foundations in place to make a big impact on the huge and undeserved SME banking market.

WHERE’S HOME DURING THE WEEK?

South west London.

YOU’VE A WELLDESERVED TWO WEEKS OFF –WHERE ARE YOU GOING?

Costa Rica. I want to do a coast-tocoast trek –this would mean cycling, trekking and kayaking from one side of the country to the other.

We dig into the memory bank of the City’s great and good: this week, Allica Bank’s general counsel KateValdar tells us about her musical past, a good lunch and Costa Rica dreams

Without aviation insurance, people can’t fly,” says Mark Skilton, Aon’s chairman of Global Speciality within the firm’s Reinsurance Solutions business.

Therein lies the rub of the entire insurance industry - a sector that, often in the background, keeps the world moving. And in doing so, it often has to move at speed: Skilton explains to me how the Lloyd’s insurance market created a new solution, almost overnight, to respond to the changing world of war and Russia’s invasion of Ukraine.

Reinsurance – which is Skilton’s world – exists on a second level, reducing the risk and volatility that insurers take on. “Think about the aviation industry - the airlines, the product manufacturers, the airports. The size of the insurance they require is so huge that no company or group of companies wants to retain all of that risk,” he says.

“So they transfer that risk, through us, to bring the amount they want to retain down to an

acceptable figure. And because there is a high concentration of insurers and insurance brokers in London, there is also a high concentration of reinsurance capital, as well as firms such as ours that can provide access to that reinsurance capital, both in the London Market and around the world.”

Skilton certainly seems to be enjoying what he calls the most interesting market he’s worked in for years. And the sort of things he’s forced to think about show how varied a day in the life of anybody in the insurance and reinsurance industry can be. Take, for instance, nuclear weapons, an area in which evolving technology has caused insurers to reconsider their view

“Generally, there are automatic cancellation provisions within aviation insurance in the event of a nuclear

detonation. But when these policies were designed, everybody was thinking about the five great powers, a great global war, so it made sense that you’d ground all aviation.

“Since then, sadly, there has been the development of nuclear technologies like tactical weapons. So the insurance market has addressed the question: ‘would aviation globally still be grounded?’ If the answer is yes, you’d be grounding aviation that wouldn’t be exposed to the evolving risk, and so insurers and reinsurers responded by developing new products.”

Innovation has always been the way of things in insurance - a creativity and willingness to think laterally to reduce risk that has made London the undisputed global capital of the worldwide insurance industry. But the sector has certainly changed since Skilton entered it years ago, straight out of school at 18. For one thing, there’s a lot more work with clients.

“We spend a lot more time looking at business plans, working with clients to see how they’re utilising and maximising their capital,” he tells me.

But the people have changed, too. “When I came into the industry, some areas were dominated by those from public schools, and that’s not the case anymore.”

Equality of opportunity appeals to Skilton, who says that he is fascinated

by the diverse range of backgrounds of some of the industry’s most prominent characters. John Charman, the industry legend who another newspaper nicknamed the “king of the London insurance market,” came into the job in the same way as Skilton - and indeed from the same school. Others, like Evan Greenberg, followed his iconoclastic father Hank into the industry, but has made his way very much on his own. It’s a place for all, seems to be the point.

“I love the fact that you can look at this industry, whatever your background, and just achieve so much,” he says.

“THE BEST KEPT SECRET”

“I’ve loved it, I’ve loved every minute of it. For me it’s the best kept secret,” Skilton continues. “When we go out for dinner and I say I work in insurance, people tend to switch off. But I’ll sit there and tell them how it’s actually a fascinating people business.”

Skilton certainly has transferred his enthusiasm - his son is making his own way in the industry, too. His advice to the next generation is to sweat the detail, work hard, and take every opportunity you can.

“Places like Aon give you the opportunity for a true career, to work with clients globally and really build something.”

Certainly, if Skilton’s climb up the ranks – and the fun he’s had doing it – is anything to go by, it’s worth listening to those pearls of wisdom.

Mark Skilton tells City A.M. why the insurance industry is still the best kept secret in the business world

I love the fact that you can look at this industry, whatever your background, and just achieve so much

LONDON’sFTSE 100 sprang higher yesterday, aided by the pound clocking a dreadful day. The capital’s premier index jumped 0.52 per cent to 7,500.50 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, leapt 1.98 per cent to 18,412.81 points.

Early advances in the City were driven by a bumper trading day across the pond amplifying investors’ risk appetite.

Wall Street’s top three indices all clocked steep rises by close on Tuesday night. The tech-heavy Nasdaq soared 1.65 per cent, meaning it has now scaled nearly 30 per cent higher since the start of the year. They opened flat yesterday.

Better-than-feared US data has signalled the world’s largest economy may

avoid a recession despite the Federal Reserve hiking interest rates aggressively.

Those early advances in the City were amplified by pound sterling tumbling nearly one per cent against the US dollar, likely due to Fed chair Jerome Powell at the European Central Bank’s monetary policy conference in Portugal signalling more rate rises are coming.

The FTSE 100 often rises when the pound weakens due to a large chunk of the index being made up of firms that generate their income overseas.

Accountancy software group Sage was the best performer on the premier index, soaring more than five per cent after analysts upgraded their judgement of the firm, while Ocado was the biggest faller after Amazon appeared to rule out a bid for the company.

Peel Hunt have rated Lok’nStore a ‘buy’ with trading “buoyant” and store revenue up 10.5 per cent, roughly in line with expectations. Progress is bobbing along well for their 10-store pipeline, which could increase trading space by almost 40 per cent.

Peel Hunt have rated Procook a ‘buy’ after they emerged from a tough year and are going slow and steady. Analysts say they are “cooking up a tasty future” with plans to increase brand recognition, conversion and customer base.

RIPPLES FROM THAMES WATER

“Shares in United Utilities, Severn Trent and Pennon barely moved, suggesting that investors see Thames Water as a company-specific problem (drowning in debt) rather than the start of broader trouble.”

RUSS MOULD, AJ BELL

GOVERNMENTS of the Industrial World, you weary giants of flesh and steel, I come from Cyberspace”, said cyber campaigner John Perry Barlow in his Declaration of the Independence of Cyberspace back in 1996. “On behalf of the future, I ask you of the past to leave us alone. You are not welcome among us. You have no sovereignty where we gather.”

Barlow largely got his wish. Governments around the world acted to exempt internet platforms from laws which apply in the real world of flesh and steel he so despised.

We’ve been living with the consequences ever since. The big platforms operate to largely self-written rules, and the web has gradually become a polluted swamp.

The media is drowning in this swamp. With advertising revenue sucked away, and other revenue sources frustratingly elusive, we now have generative AI entering the fray and with it, fresh concerns for journalism.

Generative AI is already capable of amazing things. But warnings are being sounded too. It feeds off the work of creative humans to produce plausible - if not truthful - content faster and more cheaply than any

human could keep up with. It has no need to witness events, talk to people or check information. Laws like copyright, designed to prevent unauthorised copying and use of other peoples’ work, are routinely ignored on the internet and, so far, by AI systems too.

The implications are profound for publishers, and democracy, which relies on trustworthy news sources to keep us informed. AI systems can easily present fictions as facts. But who can hold the machines to account?

Who is accountable for the truth and legality of their output? Right now, it would seem, nobody.

The media industry is one of many lobbying for better regulations. These

rules should, among other things, defend copyright and outlaw using content to train AI systems without permission, as well as resisting the desire of the tech sector to avoid regula-

tion and set its own rules for AI. As media academic Emily Bell put it, who would set foot on a plane if airlines ran the Federal Aviation Administration?

Regulation may help eventually, but the publishers can’t wait for politicians to wrap their heads around the threat and should act preemptively to minimise the potential harm AI could bring to its revenues.

This will require yet another rethinking of how people discover and consume their content. Can we make it easier to navigate between trusted sources, instead of handing people off, back-and-forth, to search and scroll through social platforms? If we can, we can take advantage of our enormous

ESG or environmental, social and governance investing is facing troubles. Higher bond yields drove an astonishing £304m out of the sector in May. This largely reflects a natural market dynamic – investors are chasing higher returns by moving from shares to bonds. Yet perhaps there should be some deeper angst at play. Is ESG investing really everything it is cracked up to be?

It’s easy to understand the underlying appeal. Putting your savings into “good” companies, rather than those amoral profit-seeking entities, feels righteous. But it’s worth unpacking what that means in practice.

The companies that score the highest on ESG metrics, particularly on the environmental side, are the ones that have a relatively low level of carbon per pound of revenue. That means the likes of financial services, healthcare and digital are “green”. By contrast, companies that produce building materials, fertiliser or energy are “brown”. The result of ESG investing is the transfer of capital from good to bad companies – thus it is

Matthew Leshmeant to incentivise “brown” companies to reduce their emissions.

But, in an ironic twist, a new study indicates that ESG investing is counterproductive in practice. Kelly Shue of Yale University and Samuel M. Hartzmark of Boston College investigated the environmental impact of over 3,000 large companies between 2002 and 2020. They find that green companies’ lower cost of capital does not lead to reduced emissions. This makes sense since the likes of Spotify or a hospital are not particularly heavy emitters and have little capacity to reduce emissions; brown companies produce 260 times higher environmental impact. By contrast, when brown companies are

starved of capital, they become dirtier to avoid bankruptcy. “When you punish brown firms, they become more shorttermist,” Shue writes. This all means much less capital available for green technologies.

The green investing agenda may also have other unintended consequences. For example, there are examples of large oil producers offloading older assets to improve their green credentials, only for their mines and oil rigs to become dirtier in the hands of new owners, who operate them for longer. It’s the same principle for the UK, where efforts to prevent new domestic oil and gas production have only resulted in importing expensive hydrocarbons (often from less-than-democratic places like the Middle East or Russia).

We must be realistic that humanity’s impact on the environment cannot turn to zero overnight. Humanity still needs the goods produced by environmentally unfriendly companies and, even under the most optimistic net zero scenarios, this will be the case for some time. The likes of fertiliser are necessary to feed

billions of people. Building materials are needed to solve our dire housing crisis. Even the “green” companies still need electricity and transport. Meanwhile, according to the World Health Organization, 3.2 million people die yearly from household air pollution caused by burning fuels like kerosene for heating and cooking. That’s because they don’t have electricity. For these people, even dirty coal-fired power stations would be a better alternative.

Ultimately it will take big investments, including by ‘dirty’ industry, energy producers and newer green start-ups to solve our environmental challenges. There is a central role of government in ensuring that pollution costs are properly accounted for in production, particularly to incentivise innovation, through the likes of carbon taxes. But sometimes even the most apparently virtuous behaviour, like investing in ESG funds, may not quite get us to the desired results.

£ Matthew Lesh is Director of Public Policy at the Institute of Economic Affairs

shared network and reduce our dependence on those platforms. Of course, this requires a certain level of working together; camaraderie with competitors is not always a strength of media organisations.

Second, if we’re going to reduce our dependence on advertising, we need to make consumer revenues a reality for any publisher. The subscription model on its own is too limited to achieve this, locking all but the most engaged out on the other side of the paywall.

We need a consumer payment model for the rest of us. This opens the prospect of a digital equivalent to a supermarket, where anyone can access and pay for whatever they want without encountering constant barriers.

Perhaps most urgently in the AI era, publishers must do a much better job of telling us when what we’re reading can be trusted.

What makes legitimate news publishers more trustworthy? For a start, they’re fully accountable for what they publish. They have names, and addresses; they’re corporations with offices. They have journalists who are named. They are accountable to their reputations, to their audiences and to their ethics. Legitimate publishers are fully accountable to their legal systems and courts as well as their readers.

The media’s declaration of independence – from the platforms, from the unwinnable race for ad revenue, from the constant battle to stay afloat and, maybe even from the hope that politicians and regulators will ride to the rescue – can give it back control of its own commercial destiny.

£ Dominic Young is Founder of AxateMELONI’S MALAISE You’d be hardpressed to find anyone with anything good to say about inflation. But Giorgia Meloni really has an axe to grind after ECB President Christine Lagarde suggested rates would keep rising, the Italian PM called inflation a ‘hateful hidden tax’

AI will require yet another rethinking of how people discover and consume content

[Re: Racism, elitism and sexism ‘entrenched’ in English cricket, damning report finds, June 27] Reading in the Frank Dalleres’s piece about the horrific news of the racism, elitism and sexism in our cricket, we should put our heads down in the river of shame. Nothing has changed in two years. In November 2021 Yorkshire cricketer Azeem Rafiq broke into a tears in front of MPs as he recounted how he was abused and discriminated by the other cricketers whose skin colours are different to his. We thought things would change soon after that. But reading the City A.M. I was completely shocked by the real picture of our cricket and cricketers. Cricket is supposed to be a gentleman and

gentlewomen’s game .Where is that ‘gentle’ thing now? Some cricketers clearly don’t care to know the meaning of the word.

ECB chairman Richard Thompson apologised for the “completelyunacceptable-to -us” incidents. Fair enough, but how much healing can be achieved from this “apology” ? We have heard many apologies before. We want things to change immediately. Anyone doing anything described in the report should be out of cricket forever. We need strict examples of the punishment which will be implemented in these instances. This, hopefully, will also help with fixing the discrimination towards the women cricketers and cricket. We both enjoy the same game. We have had enough of your apologies— now please fix our cricketers and cricket.

Samuel Farooq Tooting

THE news that HSBC is negotiating a new lease on the former BT Headquarters at 81 Newgate, near St Paul’s Cathedral, is yet another example of the urgent need to retrofit London’s office space.

The negotiations mark the banking giant’s intent to move its world headquarters away from the 45-storey tower in Canary Wharf - where it has been based for over two decades - to an office block that Mace is currently bringing up to modern standards.

The City of London space, at 81 Newgate Street, is representative of a blossoming part of the construction industry – namely, the modernising of existing commercial office space.

It wasn’t that long ago when City types were predicting the death of the office. But, it is becoming clear that the problem we now face is simply a lack of quality office space.

And the authorities agree.

Last week the City of London Corporation predicted they will need up to 20m sq ft of office space in the Square Mile by 2042. They reported that city workers are mostly back at the office on a regular basis, particularly midweek, with latest estimates showing that we’re now at 80 per cent of 2019 levels Tuesday to Thursday. This trend is expected to continue to rise.

Labour based a lot of its offensive in recent months on housing, promising to be the party of homeownership and claiming to have the answers to the housing crisis. Yesterday

Shadow Levelling Up Secretary Lisa Nandy reiterated these points at the Housing Conference in Manchester. But she also went a step further. After condemning the government for wrecking the system, Nandy pointed the finger at her colleagues in opposition who didn’t like her plans for housing. “Frankly I was astonished by the reaction of

some people in my own party who said this was Tory-lite”, said Nandy.

She said some Labour MPs think of homeownership and social housing “as a zero-sum game”, where if you focus on one you’re letting go of the other. “To those people I say you couldn’t be more wrong”, she concluded. Nandy, like Starmer before her, wants to make clear she’s not afraid of ruffling a few feathers to get where she wants. Only when in power, however, her party will be able to prove whether they’re up to the humongous task she’s setting out.

The City Corporation reported a “flight to quality” amongst tenants who are seeking best-in-class office space with the highest sustainability credentials, quality design, and a good provision of meeting spaces. They also anticipate a high proportion of the city’s existing office stock will require investment to meet new energy efficiency regulations, and they recommend interventions to reduce obstacles for older stock to be updated to meet market needs or to convert for other uses.

There are ageing City office buildings with poor energy efficiency, elevators frequently out of use, substandard design and layout, poor lighting and with little access to fresh air. As the cliche goes, the purpose of offices has indelibly changed. It isn’t simply a place for staff to sit in and tap away at their computers all day; it is a representation of the company, and no one wants to be remembered for blue carpets and fluorescent lighting.

Mace recently published our Transform and Renew report in which we revealed that we anticipate 87 per cent of non-residential buildings will need upgrading in some way by 2030 to meet the government’s proposed energy efficiency requirements. Under the proposals, if leased commercial properties don’t have an Energy Performance Certificate (EPC) of B by 2030, they will be unlettable making them “stranded assets”. More urgently, as of April 2023 offices will need to have an EPC of E if they wish to renew their lease, and this will be ratcheted up to EPC C by 2027.

There remains a small window of opportunity for city landlords to upgrade their offices and keep the next HSBC from fleeing their headquarters. Some of this work has already begun. According to the Deloitte Crane Survey for Summer 2023 there was the highest number of London office refurbishments since the survey began in 2005.

But the sector needs much greater certainty around energy efficiency targets, which will almost undoubtedly become increasingly important to office buildings. The government has consulted on proposals for changes to EPC targets, but there has been no response since then. Any potential legislation would likely impact more than a million properties, landlords and developers. So you can see the conundrum. Cities need their buildings redone, but who would pay to do that now, if there’s a chance it will need to be refurbished all over again in less than a decade?

Workers no longer want to commute into London to work in sub-standard offices. They want high-quality, energy efficient and accessible spaces. Developers that can provide this will be able to claim a premium, those who don’t will be left behind.

£ Gareth Lewis is CEO for construction at Mace Group

CRYPTO AM marked the official start of summer with a day of conferences and networking followed by an evening of entertainment at The Boisdale in Canary Wharf.

The third of Crypto AM’s four main annual events, the Solstice Unlocking Summer and Birthday Party was fully sold out for the 150 special guests who gathered to join a day of debates from some of the brightest

thought leaders in the digital assets industry.

Seven panels tackled a series of current hot topics ranging from the UK government’s approach with crypto to the future of banks.

Hosting the day, Crypto AM’s editor-at-large James Bowater began with a speech that resonated with the audience.

“I sincerely believe that the current mood of the crypto world presents a

vital opportunity for the UK,” he told guests.

“With what we’re seeing going on in the US, it would appear the industry could well and truly shoot itself in the foot if things continue the way they are with the SEC on such a rampage.”

He then went on to thank AON, Beacon Media, the City of London Corporation, eTukTuk.io and Jade City as headline partners, as well as

Global Digital Finance and Crypto Mondays as general partners for the hugely successful event.

“And, of course, we also wish to thank Ranald Macdonald, general manager Tony, executive chef Andy Rose and the whole Boisdale team,” he added.

“Not forgetting the wonderfully entertaining Suspiciously Elvis and Cool & the Gang for keeping us dancing and singing along.”

One of the most beloved heroes in cinema history returns for a fifth and final crack of the whip. Normally, nothing is final in Hollywood, but given star Harrison Ford is 81 next month, his claim that he’s done with the character should be taken seriously.

It’s 15 years since audiences last saw him in 2008’s Indiana Jones and The Kingdom of The Crystal Skull, a misfire that left fans reeling. Can the globetrotting archaeologist make up for past sins and go out with a bang?

It’s the late 60s, just after The Moon Landing. Indiana Jones (Ford) is finding life difficult as the world moves on without him. Out of the blue, he is reunited with Helena (Phoebe WallerBridge), the daughter of an old friend and Indy’s god-daughter. She’s after the Archimedes’ Dial, a relic said to find fissures in time. Initially reluctant to help, Jones is soon racing across the globe when a former Nazi (Mads Mikkelsen) is revealed to also be after the device.

For the first time, an Indy movie is in the hands of another director after Steven Spielberg bowed out. Given Spielberg’s cinematic grandeur is what made the series legendary, James Mangold has some big shoes to fill. Happily, the Logan filmmaker crafts an Indy adventure that feels authentic. The bright, colourful cinematography gives

us a sense of place, and offers enough outlandish action to satisfy the most die-hard fans. An opening sequence, featuring a de-aged Ford playing a younger Indy, is a bold and nostalgic gambit, offering a glimpse of what you’ve missed.

After an exciting first act things slow into a familiar rhythm of chases and puzzle solving. It’s entertaining, but stretches out too long and struggles for a signature moment. Most of Crystal Skull’s risks didn’t pay off and there’s a sense this team decided to play things safe.

The real fight on their hands is the bitter truth that this film simply isn't necessary, and while it soars higher than its predecessor, it’s hard to imagine anyone preferring this to the original trilogy.

Co-star Waller-Bridge proves to be inspired casting. She does much of the narrative hard work, keeping Ford on his toes without stealing focus. There’s a father-daughter dynamic that works well, although the script is at pains to emphasise their differences lest anyone think a successor is being prepared. Mikkelsen is an excellent villain, proving his worth from his chilling introductory scene. Some casting choices are a little odd given their prominence in the advertising: Sala (John Rhys Davies) only has a couple of scenes, while Antonio Banderas is barely used as Indy’s sailor ally.