BATTLE OF THE SUPERCARS IS AUDI’S ELECTRIC COUPE A MATCH FOR PORSCHE? P20

NICHOLAS EARL

WATER suppliers took too long to recognise the problem of storm overflows and failed to predict the scale of the public backlash from sewage polluting Britain’s rivers, lakes and beachfronts, industry body Water UK has admitted.

Stuart Colville, director of policy for the group, which represents suppliers, told City A.M. that for “far too long” water companies “weren’t focused” on the issue.

He revealed that storm overflows –where untreated sewage is discharged into the environment during rainy or stormy weather – were not previously perceived as a priority, with firms instead targeting improvements for beaches and sewage network upgrades.

The policy chief suggested that sewage spills were only responsible for a “a very small amount of the environmental damage” suffered by invertebrates and fish in rivers, but he

recognised that public anger over the issue was “understandable”.

“People just moved faster than the water industry to recognise that it’s unacceptable to have sewage going into rivers in this way in the 21st century. They are horrible things; they are a legacy of Victorian infrastructure, and we’ve got to act on them. We’ve got to get rid of them, tackle them and sort them out,” he said.

His comments come as water companies have been put under increasing pressure to do more to tackle sewage spills.

Water companies released raw sewage into rivers and seas in England for more than 1.75m hours last year, according to Environment Agency data, with an average of 825 sewage spills into waterways per day.

This was down 19 per cent on the previous year, but the watchdog attributed the decline to drier weather, rather than action taken by water companies.

The issue has gained further traction

again this month following reports of sewage dumping in Lake Windermere. Water suppliers have publicly apologised for sewage spills last month and launched an investment plan worth £10bn to combat storm overflows by the end of the decade.

While water suppliers conduct has prompted calls for tougher sanctions, such as bigger financial penalties and even jail time for top bosses, Colville said the issue of investment was just as important as enforcement.

“If a company has done something wrong, then of course the regulator should step in and the regulator should have the powers that it feels it needs to do that effectively,” he said.

“However, it’s also worth remembering that even when we get to that point, that is not going to transform our rivers in terms of good ecological status and environmental health. That is something that will only be transmitted through real investment and that really is something Water UK is focused on,” he added.

GEIGER COUNTER CLICKS UP Retailer set for international push

LONDON-FOUNDED fashion brand Kurt Geiger looks set for a global expansion after securing new funding facilities.

The bags-and-boots retailer –which has more than 70 stores in the UK, including a flagship Covent Garden operation –has worked up the credit line with Wells Fargo Capital Finance UK and credit fund Blazehill Capital.

THE FINANCIAL Conduct Authority

(FCA) has blocked bosses at Odey Asset Management from withdrawing funds as it circles the hedge fund following misconduct allegations made against founder Crispin Odey.

Odey’s eponymous firm has been

in crisis after he was accused of sexual assault by 13 women in an investigation by the Financial Times.

He denies the allegations and has described them as “rubbish”.

The FCA has now placed restrictions on the company that will prevent any staff, including Odey, from pulling cash from the firm without the prior consent of

the watchdog.

“The firm must not, other than in the ordinary course of business or without the prior written consent of the Authority, in any way dispose of, withdraw, transfer, deal with,

or diminish the value of any of its own assets,” the

The restrictions will apply to both Odey Asset Management and Odey Wealth Management and came into force over the weekend,

according to the FCA register. The restrictions apply to the company itself rather than its funds.

The tightened guardrails come after the beleaguered hedge fund was forced to shutter one of its funds and place restrictions on another last week after investors fled the firm in the wake of allegations against Odey.

WELL, that’s clear as mud, then. Labour’s big policy pronouncement yesterday confirmed that the party would stick by its pledge not to allow any further North Sea oil and gas development in the UK but it wouldn’t change any decisions made by the Tories. With a straight face, the party said the triangulation was designed to give ‘certainty’ to operators –despite the fact that,

less than 18 months from the point at which they plan to enter government, there remains precious little idea of what a Starmer-led government would do. There will be some in Labour that balk at this: they’ll say they’ve laid out a business-

friendly plan focused on balancing the public and private sectors, with private capital unleashed to meet Labour’s policy objectives. They will say they can bring order where this is chaos, and give international investors reasons to be cheerful. But detail remains thin on the ground. Would the party, for instance, continue to levy a windfall tax on energy firms? They’ve previously criticised the Tories for not giving

the current cash grab sufficient teeth. There have been noises off from backbenchers about a levy on banks, too, amid high interest rates. The plan for some kind of sovereign wealth fund is a lovely one, but there’s precious little detail on who would run it, where the cash would come from and (crucially) what it would be allowed to invest in. It remains unclear what the party might do on taxation, but it is a fair bet it is not going to include a slashing

A HELPING HAND A police officer gives aid to a member of the Household Cavalry’s Life Guards after they collapsed whilst lining the route ahead of a ceremony in Windsor

JESSICA FRANK-KEYES

BORIS JOHNSON will no longer have a pass to Parliament after MPs late last night voted to back sanctions against him in the apparent final chapter of his parliamentary career.

MPs debated the privileges committee report which ruled the former prime minister had “deliberately misled” and committed “serious contempt”.

It followed an investigation into whether he lied over lockdown-busting parties taking place in No 10 during the pandemic, which Johnson railed against as a “kangaroo court”.

MPs voted 354 in favour of removing the former PM’s pass to the Palace of Westminster, with seven against, suggesting close to 300 MPs abstained or were absent from the vote.

It was widely seen as a key test of Johnson’s remaining support and of Rishi Sunak’s leadership –after he was branded weak for refusing to commit to a vote, and steering clear.

The committee, led by Labour’s Harriet Harman, had recommended a 90day suspension as an MP –but Johnson preemptively quit as Conservative MP for Uxbridge and South Ruislip, triggering a by-election, in protest –leaving the

symbolic pass removal as the sanction.

Commons leader Penny Mordaunt had said MPs were voting to say if the “conclusions and sanctions propose[d] are correct and reasonable” and that she would be voting in favour.

Johnson’s successor in office, Liz Truss, said the judgement was “overly harsh”, while current PM Rishi Sunak said he did “not wish to influence” MPs who were given a free vote. Harman told the House the committee members had faced abuse and warned that such attacks “erode public confidence and thereby undermine our democracy”.

of the headline rate. Spending is all but banned in the Labour leader’s speeches, but many in his party are itching to open the purse strings in the public sector. In short, Labour is asking the country’s businesses to put their trust in a party that is largely yet to outline what it would do in office. Not being the Tories may well have some electoral appeal, but winning over the business community will take a little bit more than that.

The British military is struggling to recruit people with key technological skills, undermining the UK’s ability to fight and win on modern battlegrounds like in Ukraine, an inquiry has shown.

THE GUARDIAN CBI FROZEN OUT OF MEETINGS WITH OTHER LEADING UK LOBBY GROUPS

The Confederation of British Industry has been frozen out of regular meetings with other leading business lobby groups, hampering its fight for survival after a sexual misconduct scandal.

EUROPE KEEPS BREAKING HEAT RECORDS AS FASTESTWARMING CONTINENT Europe had the warmest summer on record last year, contributing to thousands of deaths, marine heat waves and extreme weather, an analysis has found.

JESSICA FRANK-KEYES

DAVID CAMERON has admitted it was a “mistake” for his government to focus too heavily on preparing for an influenza wave rather than a potential coronavirus pandemic.

The former Conservative prime minister yesterday told the official Covid-19 inquiry, which is currently examining the UK’s readiness to respond to a disease outbreak, the decision led to “many consequences” but defended the austerity measures taken under his leadership from 2010 to 2016, following the financial crash.

Speaking under oath, Cameron –the first politician to be quizzed by the inquiry –said the time focusing on flu was “the thing I keep coming back to” amid the horrors of the Covid crisis.

“I think it was a mistake not to look more at the range of different types of pandemic.

“Much more time was spent on the dangers of pandemic flu rather than on potential pandemics of other, more respiratory diseases, like Covid turned out to be,” he said.

Then-chancellor George Osborne will give evidence today.

NEXT’s share price increased almost five per cent yesterday after the retailer raised its sales and profit guidance.

The high-street favourite made the surprise announcement after it was bolstered by recent warm weather – but warned it does not expect the momentum to continue for the rest of the year.

In an unscheduled trading update, Next said it was lifting its full-price sales guidance for the full year by £137m and its full-year profit guidance by £40m to £835m.

The London-listed company told investors it had been trading “marginally better” than predicted this quarter with full-price sales up 9.3 per cent in the seven weeks to the second quarter, compared with a previously anticipated five per cent decline.

However, the retailer still remained cautious about inflation and its impact

on consumer spending.

“During April, annual inflation was running at 8.7 per cent and monthly inflation was 1.2 per cent; if an individual received a pay rise of five per cent, their real income would have risen by 3.8 per cent in that month.” Next said.

“We do not think it is a coincidence that sales stepped forward so markedly at a time of year when many organisations make their annual pay awards.”

“This is why we are not anticipating the current performance to continue at the same level going forward, albeit we have moderately improved our guidance for the rest of the year,” it added.

“A Next update would not be complete without a note of caution,”

Richard Hunter, head of markets at Interactive Investor, said.

He added: “Even so, the update saw the shares spike by up to five per cent , building on a hike of 15 per cent over the last six months.”

REAL estate investor Aermont is likely to join the £4bn race for Center Parcs, according to Sky News. Confirmed bidders include CVC Capital Partners and a consortium led by KSL Capital Partners.

LOOKERS, the car retailer, will confirm a £400m bid from a North American auto group as soon as this morning, according to reports late last night. The dealer has received an initial offer from the Alpha Auto Group of Canada, Sky News’s Mark Kleinman first reported.

AUGUST GRAHAM

ASTRAZENECA, London’s biggest listed company, is looking at plans to spin off its Chinese businesses to protect it from geopolitical tension, according to a report.

Citing people familiar with the situation, the Financial Times said the British-Swedish drugs giant has been in talks with bankers for several months. When contacted by the PA news agency, Astrazeneca did not wish to comment on the report.

The plan would separate Astra’s Chinese operations into a separate company whose shares would be traded on the Hong Kong or Shanghai stock exchanges.

Astra would keep control over the business, the report said.

There is no certainty that a formal bid will be made at this point.

Lookers has performed strongly in recent months, having announced an acquisition in the corporate fleet space just two months ago.

There had been City chatter last year that Lookers would bid for rival Pendragon –before it fell into Swedish hands.

It comes amid increasing geopolitical tension between western countries and China. By separating off its Chinese arm, the drugs giant hopes to be better protected against political reprisals from Beijing against foreign companies.

An Astrazeneca spokesman said: “We do not comment on rumours or speculations around future strategy or M&A.” PA

STARMER’s green transition plan doesn’t appear to have won the support he might have hoped for. His decision to honour oil and gas permits issued under the Conservative government was made in a bid to prevent a cliff edge for investment.

It is also an attempt to scramble for a middle-ground solution as a bitter tug of war between unions, concerned about job losses in the North Sea, and green groups, urging him to speed up the country's journey to net zero, plays out in the background.

But if Starmer was hoping for a fudge to appease all sides, it didn’t work. He has done little to restore

confidence in the North Sea with industry bodies warning of a huge collapse in production, jeopardising some 200,000 jobs.

Robin Allan, chair of Brindex, the body representing smaller UK oil and gas firms, said the sector was still under threat with a Labour government. He argued that without ongoing oil and gas exploration, industry rigs will be shut down prematurely with future supplies increasingly coming from overseas imports.

“On a positive note, this is great news

for Norway. Their state-owned company gets its investment returned on Rosebank and then Labour plans to close down British oil and gas industry whilst continuing to import oil and gas from abroad. Norway 1, Britain 0,” he said. Separately, Labour’s pledge to give £2.5bn in green subsidies to firms manufacturing in the UK pales in comparison to Biden’s Inflation Reduction Act, which offers a package of some $500bn in support over the next decade, according to McKinsey. Will Starmer be forced to go back to the drawing board? Let’s wait and see.

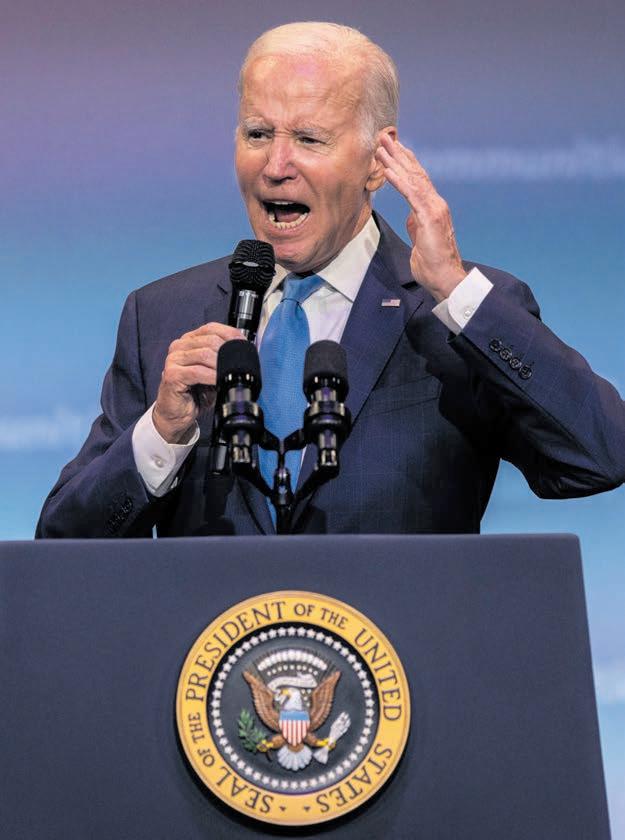

LABOUR would not look to withdraw licences for the UK’s largest prospective oil and gas field, known as Rosebank –if they are approved under the current Conservative government, Keir Starmer said yesterday.

Labour has promised there will be “no cliff edge” caused by the party’s policy to ban new oil and gas extraction licences in the North Sea, with existing licences kept in place.

“It’s very important for investors who are going to invest in UK to know there is continuity,” Starmer said.

In response to a question about Rosebank, ITV reported that Starmer said: “Rosebank is probably up for decision very soon and if it is granted, it falls into the category of existing licences.”

Green Party co-leader Adrian Ramsay called the stance on Rosebank “unforgivable”.

The comments came as Starmer yesterday outlined Labour’s green en-

ergy transition plan for the country, which includes an end to the ban on onshore wind projects and more subsidies for green energy firms.

Labour pledged £2.5bn in direct subsidies to green energy firms manufacturing in the UK in a bid to ensure the clean power revolution powers the UK’s productivity, if elected.

The move is a response to the major subsidies delivered by US president Joe Biden under the Inflation Reduction Act, which has seen huge numbers of multinational firms look to set up projects in the US to take advantage of the generous support package of some $500bn.

Starmer also stressed that the UK and the City of London would continue to be the “world leader” in green finance under a Labour government, which he said was “a massive advantage for us all”.

A Conservative spokesman claimed Labour’s energy plan was “written by Just Stop Oil” and “does nothing for longterm energy security”.

INDIA’s largest airline Indigo yesterday placed the largest aircraft order in the history of commercial aviation, ordering up to 500 of Airbus’s A320 jets. The deal for the narrow body planes takes the number of Airbus aircraft on order from Indigo to 1,330.

SADIQ Khan is set to address the “cost of doing business crisis” today at a crunch summit with firms including Uber, Natwest and KPMG.

The mayor of London will welcome more than 200 CEOs to his annual City Hall business reception at the Crystal in east London today.

He is expected to tell firms the “cost of doing business crisis casts a long shadow over our economy, just as

there’s a cost of living crisis inflicting a heavy price on our communities”.

“This is why I’m more determined than ever to live up to my promise of being the most pro-business mayor London has ever had… by working hard to create the conditions for you to thrive, our people will prosper too,” Khan will say.

It comes amid Labour’s efforts to woo the Square Mile, with the ‘scrambledeggs offensive’ spearheaded Sir Keir Starmer and Rachel Reeves.

JACK BARNETT AND CHRIS DORRELL

PRIME MINISTER Rishi Sunak yesterday ruled out helping struggling mortgage holders despite rates breaching the six per cent mark for the first time since December.

Amid surging mortgage rates, the Prime Minister said the government needed to “stick to the plan” to halve inflation rather than offer support to mortgage holders.

Speaking on ITV’s Good Morning Britain, Sunak said: “I know the anxiety people will have about the mortgage rates, that is why the first priority I set out at the beginning of the year was to halve inflation because that is the best and most important way that we can keep costs and interest rates down for people.

“We’ve got a clear plan to do that; it is delivering; we need to stick to the plan.”

The Liberal Democrats have called for

a £3bn mortgage support fund, although this proposal was slammed as “terrible economics” by experts.

While ruling out mortgage support, Sunak highlighted that there is already support available, such as the mortgage guarantee scheme for first-time buyers.

His comments came as the average rate on a two-year fixed rate mortgage climbed to 6.01 per cent yesterday morning, while the average rate available on a five-year deal was 5.67 per cent, according to data from Moneyfacts.

Mortgage rates have rocketed in recent weeks as inflation has remained unexpectedly high.

As a result markets now expect the Bank of England to hike interest rates to near six per cent by the end of the year, up from 4.5 per cent at the moment.

Economists have warned that the UK economy could slip into recession as a result of homeowners responding to higher mortgage rates by slashing spending.

The Internation al Monetary Fund (IMF) is creating a platform to enable countries to transfer transactions between central bank digital currencies (CBDCs) from different countries.

CHRIS DORRELL

CHRIS DORRELL

THE FINANCIAL Conduct Authority’s (FCA) crypto lead Matthew Long yesterday said regulators could not ignore “the harms that exist” in the market as new rules come into force.

Speaking at London Fintech Week yesterday, Long said regulators around the world needed to be vigilant of the risks the crypto sector

THE BANK of England yesterday launched its first system-wide stress test of the financial sector as it attempts to shed light on the shadow banking sector. Through the tests, the Bank of England hopes to better understand how, during a period of market stress, the behaviour of shadow banks could amplify financial shocks. Shadow banks include a variety of financial institutions that provide similar services to banks but without equivalent regulation. They have played an increasingly important part in the financial sector since the financial crisis and now represent 14 per cent of global assets.

poses to consumers.

“Opportunities can only be utilised if the correct conditions are laid, but we cannot dismiss the harms which exist in this market. They do not discriminate based upon the jurisdiction,” he said.

His comments come as the FCA prepares to bring in tough new rules on marketing crypto products in order to better protect consumers.

Recent events, such as the LDI blow-up following Liz Truss’s minibudget, have demonstrated how shadow banks can be prone to “sudden liquidity stresses” during periods of market volatility.

Deputy governor for financial stability, Jon Cunliffe, said the exercise will “provide valuable insight”.

A final report on the findings is due to be published in 2024.

A bench.

You can find one in just about every park, bus stop and train platform in the UK. They are as functional as they are familiar, but behind their simple design lies something more. An invitation to talk. After all, a bench is made for sharing and when people come together on a bench, it becomes an opportunity for a conversation.

Today, there’s a lot to talk about: energy costs, climate change, the cost of living and of course, the weather. But the one thing no one seems to be talking about is living longer and what that means for retirement. As 1 in 3 children born today have a good chance of living to 100, we need to ask ourselves, are we ready?

With a longer life comes a lot more things to think about. Over half of us aren’t confident we can afford to retire by 65. It’s time we started talking about that. We need to talk about it.

Let’s talk about why almost 18 million people don’t think they can save for the retirement they want. Let’s talk about how more than 750,000 people over 50 are not working but would like to. Let’s talk about the 7 million retirees who expect to rely on financial support from a partner, family or friends. It’s time we started having these conversations.

Let’s talk about savings.

Let’s talk about pensions.

Let’s talk about retirement.

Let’s talk about making the most of living longer. thephoenixgroup.com/living-longer

PRIME Minister Rishi Sunak is set to pile pressure on UK firms to invest in the Ukraine war effort this week as Kyiv mounts its own charm offensive on the private sector globally.

At the Ukraine Recovery Conference in London this week, Sunak will tell business chiefs and world leaders that more private cash is needed to slow the Russian war machine and help rebuild Ukraine’s economy in the years ahead. “Ukraine’s bravery on the battlefield must be matched by the vision of the private sector to help the country rebuild and recover,” Sunak will say.

The summit is a joint initiative hosted by the Ukrainian and British governments, with the aim of mobilising “international support for Ukraine’s economic and

social stabilisation and recovery”.

The calls for fresh private sector backing come as Ukrainian president Volodymyr Zelenskyy calls on business to back the economic rebuilding effort. Kyiv has launched a campaign called Advantage Ukraine to try to tempt investors into the country.

The campaign has been spearheaded by Ukrainian deputy economy minister Oleksandr Gryban, who told City A.M. last month that private sector cash was essential to spurring economic growth in the country.

“While the country is transforming, it is providing a huge amount of opportunities,” Gryban told City A.M. in an interview.

The UK will also roll out a potential £25m expansion to its cyber defence programme in Ukraine.

Sunak will urge businesses to invest in Ukraine

GUY TAYLOR

MUSICMAGPIE yesterday reported a rebound in earnings after a postFebruary rally helped the tech retailer shake off the impact of postal strikes and low consumer confidence.

Underlying earnings shot up 42 per cent to £2m in the second quarter, with the Stockportheadquartered firm seeing pretax earnings rise 7.7 per cent over the entire period, dented by struggles in

December and January.

Musicmagpie –an online retailer specialising in consumer tech and disc media –did however report a dip in revenue in both its key disc and consumer tech segments, down £4.8m and £4.5m respectively. The firm said it had focused “on cost control and increasing gross margins rather than growing revenues”.

Steve Oliver, chief executive officer and co-founder of Musicmagpie, said: “We are pleased

with our performance in what is always the seasonally quieter half of the year for Musicmagpie. It is especially gratifying to see that our profit improvement has been driven by an increased margin.”

Shares in the firm finished up 4.23 per cent on the news yesterday. It comes following a tough start to the year for the used-technology reseller, who said in March that Royal Mail postal strikes had dented its outlook for 2023, despite it narrowing losses.

GUY TAYLOR

GUY TAYLOR

THE UK’s manufacturing sector is set to perform better this year than previously predicted, as the country’s “extremely strong” aerospace sector helps to drive growth, a new report has said.

The country’s manufacturing sector is now only set to contract by 0.3 per cent this year rather than the 3.3 per cent predicted in the previous quarter, according to a quarterly survey by trade association Make UK and accounting firm BDO.

The sector is then set to grow by 0.8 per cent in 2024, the report forecast.

Make UK and BDO’s report said the “positive picture” reflects the continued recovery of the “extremely strong” aerospace sector.

The findings follow an ever-growing increase in aircraft orders from planemakers over the last year and rising passenger demand for aviation more broadly, with airlines looking ahead

to a period of booming traffic and pandemic-related supply chain issues edge towards recovery.

Airbus is hoping to build the UK’s first new helicopter factory in decades, if it beats rivals Lockheed Martin and Leonardo for a Ministry of Defence contract, The Times reported yesterday.

However, James Brougham, senior economist at Make UK, added a word of caution.

“Manufacturers are seeing a gradually improving picture but the word ‘gradually’ is doing a lot of heavy lifting,” he said.

Richard Austin, BDO’s national head of manufacturing, added that supply chain issues continue to be an “endemic issue” for the businesses he talks to.

“These issues cannot be overlooked by policymakers or we run the risk of tepid-at-best growth for UK manufacturing while neighbouring countries outpace us,” he said.

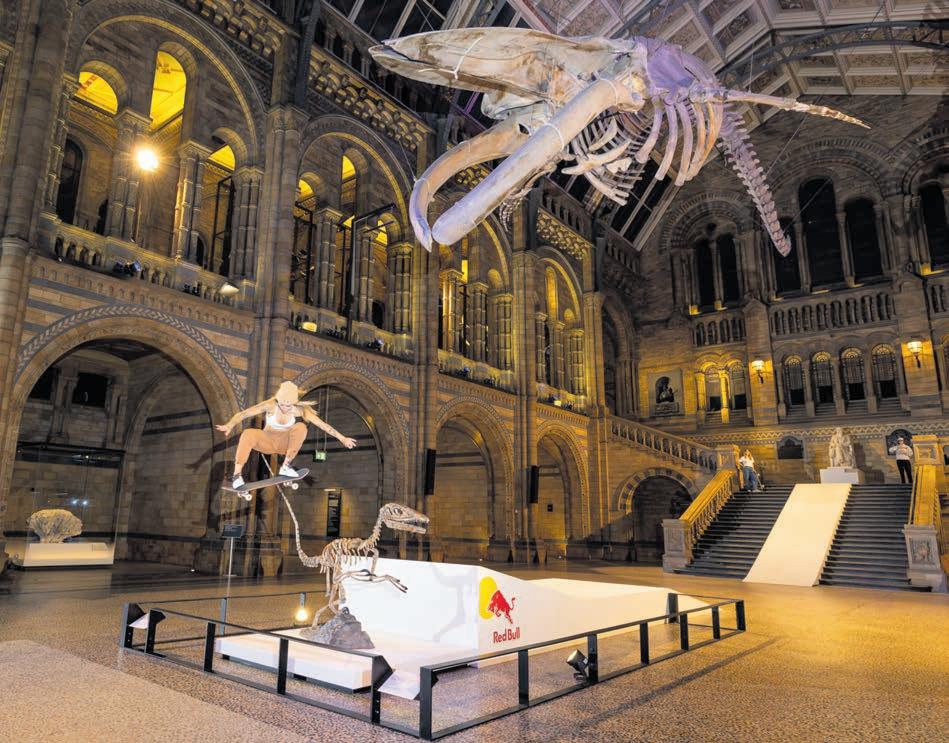

A TRIO of Red Bull female athletes have taken to the Natural History Museum to create a film showing the sport “is for everyone, not just for guys” (presumably not for skeletons though). For this week, between the hours of 10pm and 5am, these usually forbidden areas of one of the capital’s top attractions will serve a new purpose as London’s least conventional skatepark.

UNSECURED creditors to Mccoll’s are still owed £45m following the collapse of the convenience chain. The high street grocer and newsagent, which first launched as a food stall in the late 1800s, was acquired by Morrisons last May for £182m with an extra £8m to be handed to unsecured creditors.

Now, an administration report seen by The Times shows money owed to unsecured creditors including landlords has not been paid following the businesses collapse – with each of the parties due to receive dividends worth up to £600,000.

Secured creditors such as lenders have, however, been paid the full £164.3m owed to them.

It’s the ‘Big Four’ grocer’s second foray into the local convenience store market having previously launched over 100 smaller sites in 2010.

In 2015, Morrisons announced the sale of its 130 M Local shops to Greybull Capital, to be re-branded as My Local, for £25m; however, the deal subsequently collapsed in 2016. Morrisons was contacted by City A.M. for comment.

HOLLY WILLIAMS

REVOLUTION Beauty’s biggest shareholder, online fashion firm Boohoo, has called for the removal of top bosses at the troubled makeup retailer.

Boohoo – which owns a stake of around 26.6 per cent in Revolution

Beauty – said it plans to vote against the reappointment of Revolution

Beauty’s chief executive Bob Holt, chairman Derek Zissman and chief financial officer Elizabeth Lake at the firm’s upcoming annual general meeting for shareholders on 27 June.

It has also requested a separate general meeting to oust the three bosses and replace them with Boohoo non-executive director and former New Look chairman Alistair McGeorge as interim executive

WETHERSPOON CEO Tim Martin has warned Brits that a pint will “quite probably” hit £8 – but he’ll try to keep prices lower in his own pubs.

Breweries have been upping prices in recent months as a result of higher energy costs and price pressures in the supply chain.

A number of breweries are reportedly watering down beer in order to save on costs, as well as qualify for a tax break.

Martin said he thinks that is a “crazy move.”

“It’s financed by tax because if you bring beer down to 3.4 per cent, which is much lower than almost any beer you’d ever buy in a pub, you get a big tax break on the basis of the incredibly stupid reasoning that people will drink less alcohol if they drink weak beer. That’s just not the way people are.

“So, I think it’s a bad idea. Brewers have jumped on the bandwagon [because] they can’t resist the 25p tax break,” he told Andrew Marr in an interview on LBC.

chairman and ex-Boohoo finance boss Neil Catto as chief financial officer. Problem-hit Revolution Beauty has seen its shares suspended since September last year after auditors refused to sign off its accounts for the last financial year, which sparked an investigation into its finances. Shares in Boohoo closed up over six per cent yesterday. The fashion firm hosts its AGM this Thursday.

Martin, who has been an outspoken critic of politicians in recent years but was an ardent supporter of Boris Johnson, said democracy was “always chaotic and shambolic” and that the former prime minister “struggled” with the administration of the job.

The pub entrepreneur warned that politicians were too led by private polling and not enough by a pro-business agenda.

After the 1970s, Martin said, “all the political parties realised for a successful country, you need to encourage business, you need to encourage entrepreneurs”.

“Now, I think that’s definitely been lost,” he added.

“Now, what it seems to me politicians are doing is private polling, trying to find an idea that appeals that week, and implementing it that week. So, it’s all shooting from the hip. They haven’t got an overarching economic policy that encourages entrepreneurs,” he said.

Martin’s firm is in the process of offloading a small number of its pubs as it rightsizes its pub portfolio.

JESS JONES

GOOGLE is the most popular search engine among advertisers and generates the highest revenues of all major internet companies, a study has found. According to the research, conducted by linkdaddyseo.com, Google held a majority 58 per cent share in the search advertising

market in 2022, beating major competitors such as Amazon, Bing and Yahoo due to its “massive user base and effective internal advertising network”.

Google outperformed rivals in achieving the highest digital advertising revenues of $244bn (£191bn) last year – and it has the potential to grow to $356.71bn by 2026, according to the research.

Facebook and Amazon generated the next largest digital ad revenues, scoring $136bn and $38bn respectively in 2022. Digital advertising spending globally is valued at $626.86bn in 2023 and is forecasted to hit $836bn by 2026, an increase of 47 per cent. Last year, the internet accounted for over 60 per cent of total media ad spend.

THE UK must not let safety concerns about the use of artificial intelligence (AI) fall by the wayside as it pushes for a pro-innovation model for regulating the technology, tech bosses have warned.

Chancellor Jeremy Hunt has reportedly told ministers to speed up the adoption of AI across the private and public sector, including the NHS, to help improve productivity, the Financial Times reported.

But tech bosses have warned that providing clear guidance on the risks AI presents and how to use it safely will be crucial in helping firms adopt the nascent technology.

Chris Downie, co-founder and boss of fraud detection platform Pasabi, told City A.M. the government “needs to help industry strike the balance between productivity and safety”.

“There isn’t a moment to lose,” he added.

The UK is embracing a regulatory framework which prioritises innovation –which the chief of Google in the UK and Ireland, Debbie Weinstein, has labelled the “best in class”, according to

reports in The Times.

However, a pro-innovation regulatory framework cannot work unless it is “rooted in trust and ethics”, Salesforce UK and Ireland boss Zahra Bahrololoumi told City A.M.

“The principles of trust and responsibility must be our guardrails as we bring more of this exciting technology to market,” she said.

Bahrololoumi added that there is still more work to be done to “empower the UK tech sector and British businesses to navigate the rapid innovation that is being seen with generative AI.”

Clarity on how to use AI safely will be crucial for firms, said Asam Malik, head of Mazars technology and digital practice.

“For firms that handle sensitive personal data and use AI to analyse this data, they need to ensure that they understand the risks AI poses, especially around cyber breaches, data theft and data privacy,” Malik said.

“The UK government has to balance pushing AI forwards with sensible legislation in a way that supports innovation but mitigates unnecessary risks,” Malik added.

The government’s new Foundation Model Taskforce, propelled by £100m of public funding, will assess the risk of advanced technologies such as those powering Chat GPT. Newlyannounced chair Ian Hogarth, a prominent tech entrepreneur who has co-authored the State of AI report since 2018, will report to the PM and technology secretary.

LARGE e-commerce stores are likely to crop up as physical stores across the UK high street in the next five to 10 years, according to predictions aided by AI.

Money-saving website Savoo used AI to visualise the future of the British high street and it suggested more than 11,000 chain stores would disappear by 2030, with almost 2,400 gone from London. Online stores like Amazon, ASOS and Etsy using automated tech

could replace some of them.

Ed Fleming, managing director at Savoo, said “with the rise in online shopping... we have seen huge highstreet names buckle”.

The ONS has estimated over 65 per cent of retail cashiers and nearly 72 per cent of shelf fillers are at risk of having their jobs replaced by automated tech. Amazon, ASOS and Etsy were all contacted for comment about whether they have plans to launch high street stores in the near future.

CITY of LONDON

The PLANNING ACTS and the Orders and Regulations made thereunder

This notice gives details of applications registered by the Department of The Built Environment Code: FULL/FULMAJ/FULEIA/FULLR3 – Planning Permission; LBC – Listed Building Consent; TPO – Tree Preservation Order; OUTL – Outline Planning Permission

55 Bishopsgate, London, EC2N 3AS 22/00981/FULEIA

Demolition of the existing building and the erection of a part-63 storey (284.68 AOD) and part-22 storey (112.30 AOD) building a publicly accessible multi-purpose space at community use, exhibition and/or performance generis publicly accessible space including a

The application is accompanied by an

70 St Mary Axe, London, EC3A 8BA 23/00358/FULLR3

and 1.2m(h), for a period of up to 24 months, as part of the 12th edition of Sculpture in the City,

Cunha D’Alo. 134 Aldersgate Street, London, EC1A 4JA 23/00461/FULL & 23/00462/LBC

proposed branch closure Retail Unit 32 Upper Concourse, Liverpool Street Station, Liverpool Street, London, EC2M 7PY 23/00498/LBC

2, 3 & 4.

Woolgate Exchange, 25 Basinghall Street, London, EC2V 5HA 23/00515/LBC

Relocation of listed sculpture (Ritual sculpture

3 Royal Exchange Buildings, London, EC3V 3NL 23/00562/LBC

Lettering applied to exterior stone masonry. consideration of this application.

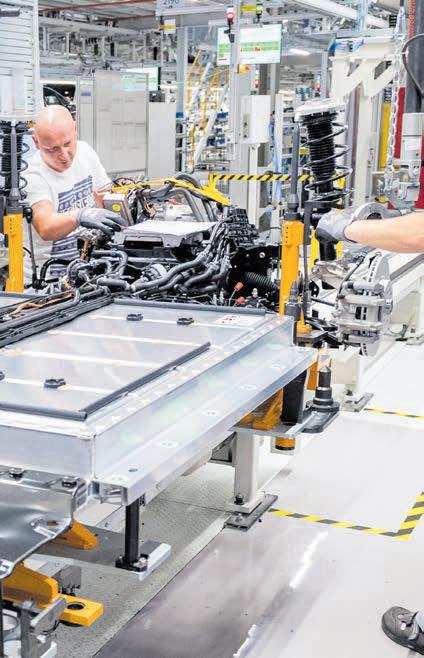

THE FUTURE of Britain’s electric vehicle (EV) sector is far from certain. Automakers were overjoyed this month to read reports that said the UK had likely pipped Spain in the race to secure a multi-billion dollar ‘gigafactory’ in Somerset, built by Jaguar Land Rover owner Tata – touted as vital in changing the fortunes of Britain’s nascent EV industry.

But late last week, AMTE Power – the battery firm with plans to build a £200m gigafactory in Dundee – threatened to move the future plant overseas unless the government offers greater financial incentives to stay.

AMTE’s warning shots were followed just two days later by a dramatic announcement that the firm needed urgent cash in “no less than four weeks” amid a shortfall, which saw its shares plummet 70 per cent and triggered memories of Britishvolt’s collapse earlier this year.

However, amid the ups and downs of Britain’s attempts to bolster its EV manufacturing capacity, another area of concern has crept into the picture: the ability to supply and process the vital minerals used in electric batteries.

Lithium-ion batteries are the most widely used technology as of today, making lithium gold dust in the EV race. 80 to 90 per cent of its demand stems from its use in producing the batteries for electric cars.

Currently, according to energy research firm Rystad, the UK would need between 53,000 and 70,000 tonnes per year of the silvery-white metal to meet EV demand in 2030.

However, it is currently only on track to have only secured around 35,000 tonnes by the end of the decade.

And while the UK published a Critical Minerals Strategy in July last year, the only tangible developments since then have been the launch of a new intelligence centre to study the minerals the UK is sorely lacking and the meeting of a new taskforce which does not appear to have done anything.

Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders, told City A.M. that although the UK has some lithium supply, this is “not enough to sustain our current, or indeed future, electric vehicle battery production ambitions”.

Hawes said that to combat this shortage, the government needs to invest in

the domestic lithium processing capabilities, while also working on developing new trading arrangements with countries that have an abundance of the substance.

“This approach would help shore up UK manufacturing competitiveness at a critical moment, as countries around the world race to secure the future of their automotive sectors as they undergo a massive green industrial transformation,” he said.

Ben Nelmes, who heads up the EV research group Newautomotive, cautioned that “if we’re more reliant on supply chains that are further afield, it’s going to push up the cost of the vehicles because you’re going to have to transport batteries or cells.”

“Not having those supply chains close to home would be really bad [and] it means Britain would miss out on the opportunities of this technology, because it will remain a bit more expen-

sive here than it is in other places,” Nelmes said.

Lithium and minerals experts contacted by City A.M. echoed the automotive sector’s concerns, highlighting Europe-wide challenges in supplying and processing the metal as the bloc faces fierce competition from China, which dominates the market.

Like Hawes, they argue that bolstering trade agreements with big lithium extractors, particularly Australia and South American nations, and boosting home processing capabilities would help the UK handle the competition from China.

James Ley, senior vice president of energy and metals at Rystad, told City A.M. “the problem is that, at the moment, China is the absolute king of processing”. “Around 60 to 90 per cent of their global processing share is in China… China’s doing all this processing and therefore the car plants in Europe and gigafactories in the UK would have to go to China to get the processed material,” he explained.

Dale Ferguson, technical director at Savannah Resources, said the “supplydemand gap” as EV production ramps up “really starts to increase from 2025 onwards”. He argued it was “clear to everybody that there’s probably not enough supply in Europe to “meet all the demand”.

A spokesperson for the Department for Business and Trade said: “We are working hard to increase our critical minerals supply –signing agreements with Canada and Australia on supply chains and engaging with our counterparts on the Minerals Security Partnership, International Energy Agency and the G7.”

The spokesperson added that the government had taken steps to “improve supply chain resilience” and is “supporting several lithium extraction and refining opportunities” through its Automotive Transformation Fund, which supports UK companies such as Cornish Lithium and British Lithium.

Whether or not Somerset gets its much-anticipated gigafactory or AMTE survives and sticks with Dundee, the government is coming under increasing pressure to do more to secure the UK’s lithium supply to help Britain achieve its electric vehicle ambitions.

Lithium is gold dust in the electric vehicle race and the UK must catch up, write Nicholas Earl and Guy Taylor

BACK IN November, the Bank of England took the highly unusual step of explicitly telling financial markets to calm their sky-high bets on where interest rates might end up.

“Should the economy evolve broadly in line with the latest monetary policy report projections, further increases in bank rates may be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets,” the Monetary Policy Committee (MPC) said.

That announcement came alongside the first 75 basis point rate increase in the Bank’s 25 years of independence.

Market exuberance was such that governor Andrew Bailey and co had to guide traders’ expectations lower. And –aided by Chancellor Jeremy Hunt ditching most of Liz Truss’s tax-cutting measures –it worked. Gilt yields settled and the pound recovered.

Yet look where we are now, just a few months later.

Yields on UK debt are above their post-minibudget levels, trading around five per cent. Peak rate expectations are just below six per cent. Mortgages rates are over that threshold.

Over the last month, a string of data has printed much hotter than expected. Wages are racing at the second fastest pace on record, unemployment is falling, core inflation is climbing and the services sector is growing quickly again.

Combine all of that with a pound at its highest level against the dollar in over a year, and these are not the characteristics of an economy wilting under the pressure of 12 successive interest rate rises.

As such, market participants have recalibrated their view on the UK economy to bake in what Samuel Tombs of Pantheon Macroeconomics described last week as a “unique” and “ingrained” problem with high inflation.

Eyes now turn to the Bank’s rate decision on Thursday. Some corners of the market think a 50 basis point rise is coming. Such a move may be interpreted as the MPC panicking, although it would show they are keen to rid inflation from the system.

A 25 point jump to 4.75 per cent is more likely with a nod to more such rises to come.

Existing pressures in the economy –most of which are ripening before being released via the mortgage market in the second half of this year –would amplify if the Bank meets present market expectations and hoists rates much higher.

For the MPC, it’s all about whether they can finally pump up unemployment and ease upward wage pressure.

In that scenario, spending would slow due to consumers losing their job or fretting about whether they’re for the chop. Monetary policy is a tough medicine.

The wave of more than 1m Brits that are poised to remortgage this year onto much steeper rates will have two choices: sell up or be a more prudent homeowner.

Mortgage affordability –whether or not

Experts at investment bank

Nomura have produced a handy primer on what has caused the Japanese economy to be gripped by three decades of sluggish growth after experiencing a postSecond World War upsurge. It’s a useful tapestry that earmarks each policy decision over the past 30 years that have created deflationary dynamics driving the current economic slump. It’s worth remembering the Bank of Japan has ignored the uptick in prices over the last year and a half.

prospective buyers can viably take on home loans –would be crimped even further, sucking demand out of the market.

“Should this scenario materialise, it would have important implications for property markets. On the residential side, our baseline forecast assumes a peak-to-trough fall in house prices of just over nine per cent, with a lengthy period of low activity,” Oxford

Economics said in a note recently. They also estimate the commercial real estate sector –offices and the like –would come under intense pressure, forcing up defaults. That would surely instil greater caution among banks, limiting credit supply to the economy.

Inflation will fall even if the Bank leaves rates at their current level of 4.5 per cent –Threadneedle Street reckons it will be back to the two per cent target by 2025 and then dip below that level if borrowing costs remain unchanged.

But the chances of the MPC making a big mistake and heaping too much pressure on the economy are mounting.

Absent from the MPC’s interactions with the general public and City since they started raising borrowing costs in December 2021 has been effective communications that set out clearly its preferred rate path.

As a result, the market has been given “carte blanche” to run wild, as Jagjit Chadha, director of the National Institute of Economics and Social Research put it on Twitter.

Fulfilling market expectations by jacking up rates to as high as six per cent may now be unavoidable.

“This increases the probability of a recession, needlessly,” Chadha warned.

THE FORMER UK chief of Klarna has joined the board of the Treasurybacked Centre for Finance, Innovation and Technology (CFIT) as the group looks to spur an “aggressive” push for the UK’s fintech sector.

Alex Marsh, who stepped down from his role with Klarna last month after

four and a half years, will join the CFIT board alongside Fintech Scotland chair Stephen Ingledew as its first nonexecutive directors.

Marsh stepped back from Klarna in May to spend more time with his family and is now pursuing a “portfolio” career of roles.

Speaking with City A.M., he said ramping up the flow of talent into the

UK fintech sector was top of the agenda in his new position.

“I think there’s so much untapped potential of individuals from different [backgrounds], whether it’s socioeconomic, gender, age, race, ethnicity,” he said.

CFIT, which launched earlier this year, said the two appointments will “strengthen [its] governance”.

City A.M.’s economics editor Jack Barnett takes a deep dive into the state of the economy in his weekly columnMarsh said he hopes to look at untapped talent in the fintech sector in his new role

THE London Metal Exchange will face two financial institutions in court today over market chaos that resulted in billions of dollars of cancelled trades, in a case that could affect the reputation of Britain's capital as a financial centre.

The world’s largest metals market enraged some investors in March last year when it annulled around $12bn in nickel deals after prices erupted in a recordbreaking surge, its first suspension of trading since 1988.

Britain’s Financial Conduct Authority (FCA) in March launched an investigation into the trading halt, its first ever probe of a UK exchange for potential misconduct.

Hedge fund Elliott Associates and market maker Jane Street Global Trading are suing for a combined $472m (£369m), alleging the 146-year old LME woefully

failed in its responsibilities. Elliott and Jane Street allege the LME failed to properly investigate chaotic nickel prices, whether the market was behaving

rationally and what harm the decision to cancel trades would cause some market participants.

The LME has argued it had both the power

and duty to close the market and cancel trades because $19.7bn of margin calls would otherwise have led to the bankruptcy of multiple clearing members and created

systemic market risk.

“The LME maintains that Elliott’s and Jane Street'’s grounds for complaint have no merit and are based on a fundamental misunderstanding of the situation,” the exchange said in a statement.

“All the actions taken on 8 March were lawful and made in the interest of the market as a whole.”

The judicial review of the LME’s decision brought by Elliott and Jane Street will take place over three days beginning on Tuesday. If the exchange were found to be at fault, a second trial would be held to decide on compensation.

Other lawsuits have been filed by other hedge funds, but since those revolve around the same issues, they have agreed to wait until a decision is made in the Elliott and Jane Street case before proceeding.

The impact of the case goes beyond the LME and will delve into when a financial exchange has the right to void trades that were legitimately placed, lawyers said.

“The cancelled trades are really embarrassing for London,” said a lawyer specialising in regulatory issues, who declined to be identified.

“This case could be really important for the City’s reputation as a financial centre.”

Reuters

INTEL will spend more than €30bn

(£25.6bn) to develop two chip-making plants in Magdeburg as part of its expansion push in Europe, a deal chancellor Olaf Scholz hailed yesterday as Germany’s biggest ever foreign investment.

Berlin has agreed subsidies worth nearly €10bn with the US chipmaker, a person familiar with the matter said, more than the €6.8bn it had initially offered Intel to build

two leading-edge facilities in the eastern city.

Intel CEO Pat Gelsinger said he was grateful to the government and the state of Saxony-Anhalt, where Magdeburg is located, for “fulfilling the vision of a vibrant, sustainable, leading-edge semiconductor industry in Germany and the EU”.

Under Gelsinger, Intel has been investing billions in building factories across three continents to restore its dominance in chipmaking and better compete with rivals AMD,

JAMES SILVER

UKRAINE yesterday said it had recaptured an eighth village during its counteroffensive in the Russian-occupied south but that the Kremlin’s forces were trying to regain the initiative in the east by stepping up attacks.

Ukrainian soldiers held up yellow and blue national flags in a video circulated on social media in which they said they were inside Piatykhatky, a settlement on the way to one of the most heavily fortified Russian positions in the south.

“Today, 18 June, the forces of 128 assault brigade chased out the Russians from the village of Piatykhatky. The Russians ran away leaving equipment and ammunition. Glory to Ukraine!” an unidentified soldier said.

Reuters confirmed the video had been filmed in Piatykhatky but was unable to verify the date.

A Russian-installed official in the partially-occupied Zaporizhzhia region had said on Sunday that Kyiv’s troops had retaken Piatykhatky, but

that they had then been pushed out and that the settlement was now located in a “grey” area of control.

Deputy defence minister Hanna Maliar said Ukrainian forces had not only retaken Piatykhatky but had advanced by up to 7km (4.3 miles) into Russian lines in two weeks.

“In the course of two weeks of offensive operations in the Berdiansk and Melitopol directions, eight settlements were liberated,” Maliar wrote on Telegram.

But in a later statement, she said the situation on the eastern front was “difficult”.

“The enemy has pulled up its forces and is actively attacking in the Lyman and Kupiansk directions, trying to seize the initiative from us. High activity of enemy shelling is recorded. Hot fighting continues.”

Maliar said that Russia had concentrated a significant number of units in the east, including air assault troops, but that Ukrainian forces were preventing their advance.

Reuters could not independently verify the battlefield claims.

Nvidia and Samsung.

“Today’s agreement is an important step for Germany as a high-tech production location – and for our resilience,” Scholz said after yesterday’s signing.

“With this investment, we are catching up technologically with the world’s best and expanding our own capacities for the ecosystem development and production of microchips,” he continued.

The deal comes after Intel investments in Poland and Israel.

WESTMINSTER’s high streets are set for a revamp as part of a borough-wide £10m fund designed to improve high streets and ensure key shopping areas away from the West End are not neglected. Locals will be consulted on how the money is spent, with options for more pop-ups and arts venues.

RUSSIAN politician Alexei Navalny announced the start of a new mass campaign against President Vladimir Putin and the war in Ukraine yesterday as he began his latest trial in prison, facing a potential sentence of several decades more behind bars.

Navalny, 47, is already serving sentences totalling 11.5 years, and is

now facing an array of charges linked to alleged “extremist” activity. Acquittals of opposition figures are practically unheard of in Russia.

Journalists who had travelled to the penal colony where Navalny is imprisoned in Melekhovo, about 235 km (145 miles) east of Moscow, were barred from the courtroom but could initially follow proceedings by video from a room nearby, though the

sound was barely intelligible.

Navalny, looking thin with cropped hair and dressed in a black prison uniform, stood and spoke loudly for three minutes. He unsuccessfully demanded access to the courtroom for his elderly parents.

The feed was later cut, and a court spokesperson said further proceedings would take place behind closed doors.

LONDON’SFTSE 100 slipped yesterday ahead of a huge week for the UK economy, pushed lower by a resurgent pound knocking sentiment toward Britain’s biggest companies.

The capital’s premier index fell 0.71 per cent to 7,588.49 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, lost nearly one per cent to trade below the 19,000 point mark.

Shares in the UK’s top blue chips suffered losses yesterday morning which analysts attributed to pound sterling strengthening sharply against the globe’s top currencies. The currency is up nearly six per cent against the US dollar since the beginning of the year.

A large chunk of FTSE 100-listed companies generate their income overseas,

so when the pound strengthens, it knocks the amount of money they can earn from exchanging foreign currencies for the pound.

Financial markets reckon the Bank of England will send borrowing costs to at least 5.75 per cent, putting upward pressure on the pound.

“The news has underpinned a more recent rally for sterling, which has had the unintended consequence of undermining the progress of the premier index,” Richard Hunter, head of markets at Interactive Investor, said.

Industrial giants led losses on the premier index, with miners Antofagasta and Anglo American down more than two per cent, while interestsensitive stocks such as housebuilders Persimmon and Taylor Wimpey also fell. Meanwhile, Next climbed to the top of the FTSE 100 thanks to sunny weather boosting fashion sales.

Packaging firm DS Smith release FY23 results this week. Analysts at Jefferies said focus would be on its FY24 box demand outlook and “reassurance on earnings”. They noted that DS Smith’s scale and market mix in a “fragmented EU containerboard & box market” gives an upside on earnings. They rated it a ‘buy’ with a target price of 400p.

Spectris acquired Microstain yesterday, which analysts at Jefferies said was a “very sensible” deal. Microstain has been growing its revenue by double digits and the outlooks is positive, the analysts said. The merger will add complementary technology to Spectris. The analysts rated it a ‘buy’ with a target price of 4,265p.

NOT GOOD NEWS FOR ALL “BoE members who have spoken out about the need for pay restraint might have chosen some pretty inopportune phrasing at times, but the crux of their argument was that if employers put extra money into workers’ pockets they would keep spending it, and Next’s tills aren’t the only ones that have been ringing.”

DANNI HEWSON, AJ BELL

Powerful real-time thought leadership, insights and news delivery mechanism fuelling the most up-to date reporting, adding critical context for decisions that require consciousness, education and thought leadership.

JOIN THE CONVERSATION AND BECOME A PART OF ONE OF LONDON’S MOST TRUSTED NEWS SOURCES VISIT: CITYAM.COM/IMPACT-AM/

Elena Siniscalco

Elena Siniscalco

IN THE UK, we are so used to having highly efficient, easily sourced drugs at hand. We’ve taken for granted the ease at which these drugs are made, who approves them and how they enter the market and eventually end up in our bathroom cabinets.

When clinical trials are run in the UK, either through the NHS, or now more frequently through private firms, we gain the pharma companies’ investment in our R&D infrastructure; we gain new drugs, often at a discounted price; we gain precious data on the illnesses and conditions that run through our society.

When clinical trials aren’t run in the UK, we lose out on all of this; and losing we are indeed. The number of industry clinical trials started in the UK each year has fallen by 41 per cent between 2017 and 2021.

There are different reasons for this.

The NHS is slow, choked by bureaucratic hurdles and delays. Lord James O’Shaughnessy recently led a review into clinical trials, and said that one big pharma company told him that of 18 places in Europe where it did one of its trials, the UK was the second slowest one.

Often when trials are run in hospitals, the data is not centralised and “no

one knows who’s doing well and who’s not”, according to O’Shaughnessy. Overworked clinicians and nurses don’t get involved in trials as there’s no incentive for them to do so.

Private companies have found a market gap to fill. Lindus Health, one of them, uses technology and machine learning to run entire clinical trials. Their pitch is all about affordability. Big pharma spends billions of pounds on trials, and then passes on the costs to the customers, indirectly or directly through more expensive medicines. If the trial costs less, the drug costs less.

Lindus has shiny offices and a young team of professionals. They’ve devel-

oped their own software to run the trials; everything is automated, from emails to reminders to take specific medications. All of the data is easily at hand to see what works and what doesn’t.

They mock-enrol me in one of the trials they’re currently running for type 2 diabetes. It involves a call with their nurse and signing a consent form online. It takes less than half an hour.

Lindus says it can usually sort out recruitment and regulatory approval and start a trial in 2 to 4 weeks while through the NHS, it can take from three to six months.

On top of digitalisation, the other

smart move is running parts of trials that can’t be done remotely in primary care settings. This solution is at the core of O’Shaughnessy’s review: if a patient has to take a blood test, why does it have to be in a hospital? It could easily be done by a GP or in a pharmacy.

Lindus partners with private clinics, and patients seem satisfied. Kevin, who goes to the clinic in Victoria, said: “It doesn’t strike me as a massive inconvenience and it serves a good purpose.”

Certainly the NHS has a lot to learn from how Lindus executes its trials, and a lot to lose in the form of investment from pharmaceutical companies

TO PUT it mildly, it has not been a good few weeks for the integrity of those in elected office. The damning report into Boris Johnson followed the resignation of Tory MP David Warburton over allegations of harassment and drug taking, new charges of sexual misconduct against two Labour MPs, and an SNP MP being suspended from Parliament for flagrant breaches of Covid-19 rules. Councillors don’t fare much better. Away from the eyes of the national press, locally elected officials have the whip withdrawn at an alarming rate for financial impropriety, inappropriate behaviour, or racist and anti-semitic abuse. A recent report into Thurrock Council found that a £1.3bn black hole was a result of a “dereliction” in political leadership. There are still lots of hardworking and upstanding politicians in the UK. But it’s hard to conclude that we are

getting our very best people into politics. There are lots of reasons why this might be the case: long and inflexible hours, a sense that politics can’t really change things, the intrusions of the press and the nightmares of social media. To many, Westminster and our broader political class can seem alien and remote. And pressures on individual politicians can be extreme - earlier this year, Labour MP Stella Creasy was subject to an investigation by children’s services after a vexatious complaint by an online troll.

I would like to add one more suggestion: the stigma attached to simply running for office. Somebody saying they might want to have a run at being a politician, either as a councillor or an MP, is likely to be met with

at least a raised eyebrow and often a stifled laugh.

Even worse is the suspicion that someone could only possibly be doing it for selfish reasons - for power, or money, or fame. In truth, politics offers little of all three. The aggressive Twitter campaign against my colleague Seb Payne as he has tried to get selected as an MP must be off-putting to every journalist considering wanting to trade in their pen for a period of hands-on public service. Suzy Eddie Izzard has faced similar abuse in trying to become a candidate for the left - a warning to anyone on the sidelines considering getting on to the pitch. This is a peculiarly British phenomenon as well. I lived for a few years in the United States, where I attended an international public policy school.

Students from around the world set out their plans to run for office before they finished shaking your hand. The campaigner from Modesto, California, who wanted to return to run for city council. The businessman from Manizales, Colombia, who had dreams to be mayor of his hometown. Fellow British students looked askance at these future leaders, embarrassed for their earnestness, and mumbled something about never having thought about being a politician (although many of them certainly had).

When asked by a journalist recently whether I was looking to enter Parliament, I fudged an answer. Self-consciousness got the better of me as I played down the idea that I could possibly be presumptuous enough to run. But in truth, representing a commu-

who are choosing to go elsewhere. According to Jennifer Harris, Director of Research Policy at the Association of the British Pharmaceutical Industry, clinical trials account for “about 50 per cent of investment in R&D from medical companies”. Pharma companies pay the NHS for each stage of the trial, including the first, research-heavy ones. The benefits of this research go far beyond the trial itself, making the NHS a healthcare system people want to work for as they know they could be doing research on groundbreaking new treatments.

Lord O’Shaughnessy has an almost utopian vision for the NHS’ relationship with clinical trials, a world where expertise and funding are brought back into the regulators to cut down the backlogs of approving the trials, recruitment is swifter, parts of the trials are run not in hospitals but in communities and data is centralised and analysed efficiently.

The government has promised £121m to speed up clinical trials. But we all know how long even minor reform in the NHS takes.

A second scenario would join up the public and private sector and divide the tasks. The public sector, with world-class university researchers, could lead on the first stages of a trial; the private sector could take care of the last ones. “One of the most important things for a pharma company deciding to invest in a country for clinical trials is knowing that every stage lines up in the process”, says Patrick King, a researcher at Reform.

If the best way to achieve that is through cross-sector collaboration, maybe that’s the way forward.

nity in Parliament and properly getting onto the field of British politics would be an honour. I’d love to run for office. And we need more people to harbour that ambition, not less. We have to usher in a complete cultural shift around standing for election. Some of that needs to be backed with policy change, like more family friendly hours for parliament and council chambers. We need more campaigns like the Conservative’s Women2Win and Labour’s MotheRED which support people to stand. And we need businesses to offer the flexibility to support their employees in becoming politicians, seeing it as an act of service to the community.

But most of all we need to change how we talk about becoming a politician. Next time someone says they might want to run for office, we should suppress the instinct to be cynical. Better still, everyone should reach out to the one or two people they think would be a boon to public life and tell them they should run.

We are stuck in a doom loop. People think all politicians are bad so good people shouldn't go into it. This is precisely the wrong logic - and if we don't change, it'll only get worse.

tooAdam Hawksbee

[Re: The UK has an opportunity to walk an international path on tech, June 16]

The prime minister made his big ambitions for UK tech clear in his opening keynote at London Tech Week. Sunak shared why the UK is a great location for tech businesses and the progress that’s been made to date such as the creation of 134 unicorns in the past decade and the UK being the best place to raise capital in Europe.

AI is on everyone’s lips at the moment and Sunak of course mentioned the potential of the technology. It was interesting that he did so in the context

of AI safety regulation. AI has huge potential but it needs to be harnessed carefully and I’m sure many in the industry will respond positively to the government’s safety-first approach. While the UK is clearly in a strong position, it still has a bit of work to do to become a science and technology superpower. Reports today show that US business confidence in the UK has dropped and following a dearth of IPO activity, the UK’s future as a tech superpower isn’t guaranteed. If the UK government is to achieve its lofty ambitions, it needs to play to its strengths, champion the sector, support startups, increase investment, make it easier to do business in the UK and boost digital skills.

Laurent Descout Neo

LAST autumn there was a tremendous row about the UK’s corporate tax rate being hiked to 25 per cent. Perhaps we were arguing about the wrong thing. The days when headline tax rates dominated the competition for global investment are over.

Last month I pointed out that the UK now shares a rate with almost all advanced OECD economies. The high ones have come down, the US from the heights of the upper 30s to the low to mid 20s. The low ones are coming up to 15 per cent as the global minimum tax (also known as Pillar 2) bites. Money used to flow down that tax gradient like a waterfall. Now the topography of global tax has changed. The playing field is almost level.

So is this the end of tax competition? Quite the opposite. That level playing field is ever more dotted with little undulations and a few gaping sink-holes. Countries are as hungry for foreign investment as ever. But the landscape is different. It’s all about the incentives.

but it might be drier than normal, with 25 per cent of young people now classifying themselves as non-drinkers. According to Togather, there has been a 20 per cent increase in bookings for non-alcohol related events.

Yesterday Keir Starmer launched his bid for a future in which the UK mainly relies on clean energy. Starmer wants to “cut bills, create jobs and provide energy security” with his plans for clean energy. Obviously this is easier said than done. But his commitment to scrap local vetoes on new wind farms is a sign that Labour might finally be going exactly in the right direction on energy - and on much more.

One of his main proposal was to scrap local vetoes on wind farmsa policy previously reintroduced

by Rishi Sunak.

Starmer wants to face off the Nimbys, and believes local communities should be convinced of the need for a wind farm near their homes because the case for it is clear: lower energy bills for the long term. He believes planning approvals times are way too long, and wants to cut them from years to months. It’s a similar strategy to what he has proposed for housing, and if he’s willing to go far enough, it could win him key votes at the next election.

We’ve already witnessed the birth of a more protectionist US industrial strategy dressed up in the language of net zero or national security. Biden’s vast $360bn fiscal stimulus in last year’s Inflation Reduction Act specifically targets investment in renewable energy and green infrastructure. This makes the job of other countries even harder. That massive cross-Atlantic flow of investment in recent decades is in danger of drying up completely, and starting to reverse.

The EU has responded and is actively targeting green investment through its green deal industrial plan even where that means watering down some of its foundational state aid restrictions. China is already throwing tax incentives and credits at renewable energy and green investment.

As for the UK, consider three recent news stories: Labour’s plans, now scaled back but still eye-catching, to spend £28bn per year on green investment; battery maker AMTE warning it may build its new factory overseas unless we can match EU and US subsidy levels, and the latest parliamentary BEIS committee launching an inquiry into the government’s Investment Zones and Freeports. Tax rates are old hat, the action is in incentives.

The traditional low tax countries have most to lose if investment dollars get sucked back into the US. They are adapting. The way Pillar 2 works, topup taxes only kick in if the effective rate on profits falls below 15 per cent: traditional tax rate incentives can cause this drop. But if the tax authority gives a tax credit that is refundable – paid out in cash – and accounted for above the profit before tax line like our R&D Expenditure Credit, then that is almost Pillar-2 proof. Indeed it is positively endorsed by the OECD which calls this type of relief a “Qualifying Refundable Tax Credit (QRTC)”.

We are already seeing several countries consider QRTCs. Expect further proliferation as countries replace low tax rates with more complex ways of spending the same money.

So it won’t be as easy in future to know what locations are the most tax efficient. It will depend massively on

the facts. The downsides are obvious: less transparency about what’s actually being paid where; a heightened risk of government money going into pork-barrel or ideological dead ends; and further slowing of global trade and investment flows, a trend we’ve seen since the financial crisis.

But there are upsides for businesses that are on the ball. There will be money out there looking for a home.

Those with dedicated incentives teams and strong policy engagement will be in a powerful position to work with government to co-invest, and secure sources of funding. When you’re investing, money upfront can be much more useful than a lower tax rate after the profits start coming in.

I’m not sure most in the tax world have clocked this big and rather recent shift, but it’s only going one way.

£ Tim Sarson is Head of Tax Policy at KPMG

THE PORSCHETaycan has been our favourite EV for several years now, so it’s a strong foundation for the first electric Audi with an RS badge. Does the flagship E-Tron GT have the ‘very particular set of skills’ to topple the Taycan? Back in 1995, Audi’s very first RS model also contained Porsche DNA. The RS2 Avant had a 993-inspired styling and a turbocharged five-cylinder engine, plus the Cup alloy wheels and ‘Big Red’ brakes from a 968 Clubsport. However, if this ballistic estate car was an Audi fine-tuned by Porsche, the RS E-Tron GT is the other way around: a Taycan in a svelte new suit. A low-slung and futuristic four-door coupe, it’s certainly handsome – even more arresting than its sibling from Stuttgart, I think. Audi head of design, Marc Lichte, said the 2018 E-Tron

GT concept was “the most beautiful car I have ever drawn”, and this showroom version is almost identical. It looked right at home as Tony Stark’s wheels in Avengers: Endgame, too.

The Audi’s two motors and 93kWh battery (84kWh of which is usable) muster a total of 598hp, or 646hp for 2.5 seconds when you floor it in Dynamic mode or use launch control. In terms of output, that positions the RS E-Tron GT somewhere between the Taycan GTS and Turbo. Alternatively, if £119,950 for the RS seems a bit rich, the regular 476hp E-Tron GT starts from £87,800. Shrugging off its kerb weight of 2.3 tonnes – equivalent to two Volkswagen Polos – the RS feels brutally quick off the mark. Indeed, a 0-62mph time of 3.3 seconds is within an eye-blink of Audi’s outgoing R8 supercar, despite the addition of three

PRICE: £119,950

POWER: 598HP

0-62MPH: 3.3SEC

TOP SPEED: 155MPH

BATTERY SIZE: 93.4KWH

ELECTRIC RANGE: 294MILES

rear seats and a useful 350-litre boot. Equally, while the R8 has a ferocious naturally aspirated V10 that snorts and snarls, turning every journey into an event, the E-Tron gathers speed with a seamless and almost surreal lack of drama. If that sounds like a criticism, it’s not – 90 percent of the time you’ll appreciate its refinement and effortless electric oomph. But there were moments when I wished this glam-

orous GT would come alive a little.

Thankfully, the Audi’s chassis injects some character into the proceedings. It feels very similar to a Taycan (funny, that), with precise steering and finely calibrated body control. Ride comfort is also very good, even on massive 21-inch wheels.

The RS E-tron GT can’t completely defy physics, of course, and you are always conscious of its sheer size (at 2,158mm, it’s almost as wide as a Range Rover). It feels most at home on flowing A-roads and motorways, with an ability to devour distances that matches the very finest GT cars. Until you have to recharge, that is. The Audi has a respectable range of 294 miles, and a charging capacity of 270kW means you can potentially fill the battery to 80 percent in less than 25 minutes. Still, the UK’s

unreliable – and increasingly busy –charging network will be the limiting factor on long journeys.

I’m also not convinced the RS E-Tron GT’s cabin feels special enough to justify a six-figure price tag. There’s no shortage of technology, including a brilliant Bang & Olufsen audio system, and many of the touch-points are swathed in tactile Alcantara (a kind of synthetic suede). Yet it doesn’t feel hugely different to an A5 coupe, and headroom is pretty limited in the back.

On the latter point, it seems odd that Audi hasn’t followed up the Taycan Sport Turismo – and indeed its own heritage –with an electric Avant. Just imagine a more spacious, but equally head-turning estate version of the RS E-Tron GT. Now that really would be our favourite EV.

Tim Pitt writes for motoringresearch.com

MOSTcar storage facilities are just faceless warehouses. Kiklo Spaces is different. This unique venue in Hampshire – an hour away from London – feels more like a dream garage for your moneyno-object car collection.

“Cars are meant to be enjoyed –and this place gives you the ability to enjoy them,” says facility director Luke Rebelo. “We don’t see ourselves as a storage company. This is more like a gallery for important automotive art.”

From the outside, Kiklo Spaces looks like a modernist beach villa. Inside, it's more like a Bond villain's lair, with a huge hydraulic lift connecting two levels of immaculate open space. Up to 50 vehicles are kept

here, many with seven-figure price tags, and the levels of security and fire prevention are as rigorous as you'd hope – including an on-site reservoir for the sprinkler system.

However, Luke says that Kiklo Spaces is about more than just cars. "This is a community for like-minded individuals," he explains, "allowing owners to meet up, see their cars on display, and drive them on local country roads.”